UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01829

Columbia Acorn Trust

(Exact name of registrant as specified in charter)

71 S Wacker Dr.

Suite 2500

Chicago, IL 60606, USA

(Address of principal executive offices) (Zip code)

Ryan C. Larrenaga

c/o Columbia Management

Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

Matthew Litfin

Columbia Acorn Trust

71 S Wacker Dr.

Suite 2500

Chicago, IL 60606, USA

Mary C. Moynihan

Perkins Coie LLP

700 13th Street, NW

Suite 800

Washington, DC 20005

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 634-9200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SemiAnnual Report

June 30, 2020

Columbia

Acorn® Fund

Columbia

Acorn International®

Columbia

Acorn USA®

Columbia

Acorn International SelectSM

Columbia

Acorn SelectSM

Columbia

Thermostat FundSM

Columbia

Acorn Emerging Markets FundSM

Columbia

Acorn European FundSM

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semiannual shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (columbiathreadneedleus.com/investor/), and each time a report is posted you will be notified by mail and provided with a website address to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, for Fund shares held directly with the Funds, by calling 800.345.6611 or by enrolling in “eDelivery” by logging into your account at columbiathreadneedleus.com/investor/.

You may elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can call 800.345.6611 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive paper reports will apply to all Columbia Funds, including the Columbia Acorn Funds, held in your account if you invest through a financial intermediary or all Columbia Funds, including the Columbia Acorn Funds, held with the fund complex if you invest directly with the Funds.

Not Federally Insured • No Financial Institution Guarantee • May Lose Value

| 3 |

| 5 |

| 7 |

| 9 |

| 11 |

| 13 |

| 15 |

| 17 |

| 19 |

| 21 |

| 24 |

| 52 |

| 56 |

| 58 |

| 66 |

| 98 |

| 119 |

| 124 |

| 125 |

| 126 |

Columbia Acorn Family of Funds | Semiannual Report 2020

Fund at a glance

Columbia Acorn® Fund (Unaudited)

Investment objective

Columbia Acorn® Fund (the Fund) seeks long-term capital appreciation.

Portfolio management

Matthew A. Litfin, CFA

Lead Portfolio Manager or Co-Portfolio Manager since 2016

Service with Fund since 2015

Erika K. Maschmeyer, CFA

Co-Portfolio Manager since 2019

Service with Fund since 2016

Richard Watson, CFA

Co-Portfolio Manager since 2019

Service with Fund since 2006

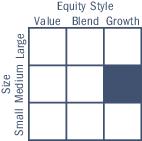

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2020 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2020) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | 0.93 | 5.33 | 8.88 | 12.00 | 13.67 |

| | Including sales charges | | -4.84 | -0.69 | 7.60 | 11.34 | 13.53 |

| Advisor Class | 11/08/12 | 1.03 | 5.57 | 9.12 | 12.28 | 14.02 |

| Class C | Excluding sales charges | 10/16/00 | 0.69 | 4.57 | 8.09 | 11.18 | 12.81 |

| | Including sales charges | | -0.14 | 3.88 | 8.09 | 11.18 | 12.81 |

| Institutional Class | 06/10/70 | 1.01 | 5.52 | 9.15 | 12.30 | 14.03 |

| Institutional 2 Class | 11/08/12 | 1.01 | 5.58 | 9.18 | 12.33 | 14.03 |

| Institutional 3 Class | 11/08/12 | 1.07 | 5.65 | 9.25 | 12.38 | 14.04 |

| Russell 2500 Growth Index | | 2.02 | 9.21 | 9.57 | 14.45 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2020 prospectus (as supplemented), the Fund’s annual operating expense ratio is 0.86% for Institutional Class shares and 1.11% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the investment manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The Russell 2500 Growth Index measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally. Fund performance may be significantly negatively impacted by the economic impact of the COVID-19 pandemic.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 3 |

Fund at a glance (continued)

Columbia Acorn® Fund (Unaudited)

| Portfolio breakdown (%) (at June 30, 2020) |

| Common Stocks | 97.9 |

| Money Market Funds | 1.3 |

| Securities Lending Collateral | 0.8 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at June 30, 2020) |

| Communication Services | 2.7 |

| Consumer Discretionary | 13.0 |

| Consumer Staples | 1.2 |

| Financials | 5.5 |

| Health Care | 34.0 |

| Industrials | 15.1 |

| Information Technology | 23.9 |

| Materials | 1.6 |

| Real Estate | 3.0 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 4 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Fund at a glance

Columbia Acorn International® (Unaudited)

Investment objective

Columbia Acorn International® (the Fund) seeks long-term capital appreciation.

Portfolio management

Louis J. Mendes, CFA*

Co-Portfolio Manager since 2003

Service with Fund since 2001

Tae Han (Simon) Kim, CFA

Co-Portfolio Manager since 2017

Service with Fund since 2011

Hans F. Stege

Co-Portfolio Manager since July 2020

Service with Fund since 2017

*Louis Mendes has announced that, on August 28, 2020, he will retire from the Fund’s Investment Manager.

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2020 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2020) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | -9.12 | -0.53 | 3.54 | 6.82 | 9.18 |

| | Including sales charges | | -14.35 | -6.25 | 2.32 | 6.19 | 8.94 |

| Advisor Class | 11/08/12 | -8.99 | -0.26 | 3.78 | 7.10 | 9.55 |

| Class C | Excluding sales charges | 10/16/00 | -9.46 | -1.26 | 2.76 | 6.02 | 8.37 |

| | Including sales charges | | -10.32 | -2.15 | 2.76 | 6.02 | 8.37 |

| Institutional Class | 09/23/92 | -8.99 | -0.26 | 3.80 | 7.13 | 9.57 |

| Institutional 2 Class | 08/02/11 | -8.97 | -0.20 | 3.85 | 7.17 | 9.57 |

| Institutional 3 Class | 11/08/12 | -8.93 | -0.15 | 3.91 | 7.21 | 9.59 |

| Class R | 08/02/11 | -9.20 | -0.76 | 3.25 | 6.50 | 8.89 |

| MSCI ACWI ex USA SMID Cap Growth Index (Net) | | -6.44 | 1.89 | 4.35 | 6.78 | - |

| MSCI ACWI ex USA SMID Cap Index (Net) | | -12.69 | -5.13 | 2.41 | 5.72 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2020 prospectus (as supplemented), the Fund’s annual operating expense ratio is 0.99% for Institutional Class shares and 1.24% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the investment manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The MSCI ACWI ex USA SMID Cap Growth Index (Net) captures a mid- and small-cap representation across 22 developed market countries and 26 emerging markets countries.

The MSCI ACWI ex USA SMID Cap Index (Net) captures a mid- and small-cap representation across 22 of 23 developed market countries (excluding the United States) and 26 emerging market countries. The index covers approximately 28% of the free float-adjusted market capitalization in each country.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally.Fund performance may be significantly negatively impacted by the economic impact of the COVID-19 pandemic.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 5 |

Fund at a glance (continued)

Columbia Acorn International® (Unaudited)

| Equity sector breakdown (%) (at June 30, 2020) |

| Communication Services | 7.0 |

| Consumer Discretionary | 8.6 |

| Consumer Staples | 4.5 |

| Energy | 1.0 |

| Financials | 7.7 |

| Health Care | 12.1 |

| Industrials | 23.9 |

| Information Technology | 23.4 |

| Materials | 6.5 |

| Real Estate | 5.3 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| Country breakdown (%) (at June 30, 2020) |

| Australia | 5.5 |

| Austria | 0.5 |

| Brazil | 2.3 |

| Cambodia | 0.8 |

| Canada | 4.0 |

| China | 2.2 |

| Cyprus | 0.0(a) |

| Denmark | 1.6 |

| France | 1.2 |

| Germany | 5.8 |

| Hong Kong | 1.3 |

| Country breakdown (%) (at June 30, 2020) |

| India | 1.4 |

| Ireland | 1.6 |

| Israel | 0.6 |

| Italy | 3.5 |

| Japan | 20.2 |

| Malta | 0.8 |

| Mexico | 0.5 |

| Netherlands | 3.8 |

| New Zealand | 1.2 |

| Russian Federation | 0.9 |

| Singapore | 0.9 |

| South Africa | 0.3 |

| South Korea | 2.1 |

| Spain | 2.2 |

| Sweden | 9.0 |

| Switzerland | 3.2 |

| Taiwan | 4.1 |

| Thailand | 0.8 |

| United Kingdom | 11.9 |

| United States(b) | 5.8 |

| Total | 100.0 |

| (a) | Rounds to zero. |

| (b) | Includes investments in Money Market Funds. |

Country breakdown is based primarily on issuer’s place of organization/incorporation. Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 6 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Fund at a glance

Columbia Acorn USA® (Unaudited)

Investment objective

Columbia Acorn USA® (the Fund) seeks long-term capital appreciation.

Portfolio management

Matthew A. Litfin, CFA

Lead Portfolio Manager since 2016

Service with Fund since 2015

Richard Watson, CFA

Co-Portfolio Manager since 2017

Service with Fund since 2006

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2020 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2020) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | -7.66 | 1.11 | 7.84 | 12.17 | 9.98 |

| | Including sales charges | | -12.95 | -4.68 | 6.57 | 11.51 | 9.71 |

| Advisor Class | 11/08/12 | -7.51 | 1.39 | 8.11 | 12.47 | 10.33 |

| Class C | Excluding sales charges | 10/16/00 | -8.15 | 0.30 | 7.02 | 11.34 | 9.17 |

| | Including sales charges | | -8.99 | -0.42 | 7.02 | 11.34 | 9.17 |

| Institutional Class | 09/04/96 | -7.55 | 1.35 | 8.11 | 12.46 | 10.33 |

| Institutional 2 Class | 11/08/12 | -7.57 | 1.38 | 8.20 | 12.53 | 10.36 |

| Institutional 3 Class | 11/08/12 | -7.48 | 1.49 | 8.26 | 12.57 | 10.38 |

| Russell 2000 Growth Index | | -3.06 | 3.48 | 6.86 | 12.92 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2020 prospectus (as supplemented), the Fund’s annual operating expense ratio is 1.16% for Institutional Class shares and 1.41% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the investment manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The Russell 2000 Growth Index, an unmanaged index, measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally.Fund performance may be significantly negatively impacted by the economic impact of the COVID-19 pandemic.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 7 |

Fund at a glance (continued)

Columbia Acorn USA® (Unaudited)

| Portfolio breakdown (%) (at June 30, 2020) |

| Common Stocks | 95.9 |

| Limited Partnerships | 0.5 |

| Money Market Funds | 2.1 |

| Securities Lending Collateral | 1.5 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at June 30, 2020) |

| Consumer Discretionary | 16.4 |

| Consumer Staples | 5.1 |

| Financials | 8.3 |

| Health Care | 32.0 |

| Industrials | 15.6 |

| Information Technology | 18.0 |

| Materials | 1.3 |

| Real Estate | 3.3 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 8 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Fund at a glance

Columbia Acorn International SelectSM (Unaudited)

Investment objective

Columbia Acorn International SelectSM (the Fund) seeks long-term capital appreciation.

Portfolio management

Stephen Kusmierczak, CFA

Lead Portfolio Manager or Co-Portfolio Manager since 2016

Service with Fund since 2001

Hans F. Stege

Co-Portfolio Manager since December 2019

Service with Fund since 2017

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2020 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2020) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | -6.29 | 1.43 | 7.29 | 8.07 | 8.15 |

| | Including sales charges | | -11.67 | -4.39 | 6.03 | 7.43 | 7.86 |

| Advisor Class | 11/08/12 | -6.18 | 1.67 | 7.57 | 8.37 | 8.48 |

| Class C | Excluding sales charges | 10/16/00 | -6.61 | 0.66 | 6.48 | 7.25 | 7.33 |

| | Including sales charges | | -7.54 | -0.27 | 6.48 | 7.25 | 7.33 |

| Institutional Class | 11/23/98 | -6.17 | 1.68 | 7.56 | 8.38 | 8.49 |

| Institutional 2 Class | 11/08/12 | -6.12 | 1.79 | 7.65 | 8.44 | 8.51 |

| Institutional 3 Class | 11/08/12 | -6.12 | 1.80 | 7.71 | 8.47 | 8.53 |

| MSCI ACWI ex USA Growth Index (Net) | | -2.62 | 5.80 | 5.61 | 7.04 | - |

| MSCI ACWI ex USA Index (Net) | | -11.00 | -4.80 | 2.26 | 4.97 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2020 prospectus (as supplemented), the Fund’s annual operating expense ratio is 1.03% for Institutional Class shares and 1.28% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the investment manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The MSCI ACWI ex USA Growth Index (Net) captures a large- and mid-cap representation across 22 developed market countries and 26 emerging market countries.

The MSCI ACWI ex USA Index (Net) captures a large- and mid-cap representation across 22 of 23 developed market countries (excluding the United States) and 26 emerging market countries. The index covers approximately 85% of the global equity opportunity set outside the United States.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally.Fund performance may be significantly negatively impacted by the economic impact of the COVID-19 pandemic.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 9 |

Fund at a glance (continued)

Columbia Acorn International SelectSM (Unaudited)

| Equity sector breakdown (%) (at June 30, 2020) |

| Communication Services | 12.6 |

| Consumer Discretionary | 10.5 |

| Financials | 6.1 |

| Health Care | 17.0 |

| Industrials | 19.2 |

| Information Technology | 30.3 |

| Materials | 4.3 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| Country breakdown (%) (at June 30, 2020) |

| Australia | 2.5 |

| Brazil | 2.0 |

| Canada | 4.3 |

| China | 13.0 |

| Denmark | 2.5 |

| Country breakdown (%) (at June 30, 2020) |

| Germany | 5.0 |

| Italy | 4.0 |

| Japan | 18.8 |

| Netherlands | 5.6 |

| New Zealand | 2.5 |

| South Korea | 4.2 |

| Sweden | 12.9 |

| Switzerland | 7.0 |

| Taiwan | 2.3 |

| United Kingdom | 12.9 |

| United States(a) | 0.5 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

Country breakdown is based primarily on issuer’s place of organization/incorporation. Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 10 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Fund at a glance

Columbia Acorn SelectSM (Unaudited)

Investment objective

Columbia Acorn SelectSM (the Fund) seeks long-term capital appreciation.

Effective July 10, 2020, the Fund was merged with and into Columbia Acorn® Fund.

Portfolio management

David L. Frank, CFA

Co-Portfolio Manager or Portfolio Manager since 2015

Service with Fund since 2002

John L. Emerson, CFA

Co-Portfolio Manager since 2019

Service with Fund since 2003

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2020 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2020) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | 0.38 | 10.94 | 8.27 | 10.46 | 9.60 |

| | Including sales charges | | -5.39 | 4.53 | 7.00 | 9.81 | 9.30 |

| Advisor Class | 11/08/12 | 0.50 | 11.16 | 8.53 | 10.73 | 9.92 |

| Class C | Excluding sales charges | 10/16/00 | -0.01 | 10.15 | 7.46 | 9.63 | 8.78 |

| | Including sales charges | | -0.96 | 9.25 | 7.46 | 9.63 | 8.78 |

| Institutional Class | 11/23/98 | 0.46 | 11.10 | 8.54 | 10.75 | 9.93 |

| Institutional 2 Class | 11/08/12 | 0.51 | 11.23 | 8.60 | 10.79 | 9.95 |

| Institutional 3 Class | 11/08/12 | 0.55 | 11.29 | 8.67 | 10.84 | 9.97 |

| Russell 2500 Growth Index | | 2.02 | 9.21 | 9.57 | 14.45 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2020 prospectus (as supplemented), the Fund’s annual operating expense ratio is 0.92% for Institutional Class shares and 1.17% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the investment manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The Russell 2500 Growth Index measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally. Fund performance may be significantly negatively impacted by the economic impact of the COVID-19 pandemic.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 11 |

Fund at a glance (continued)

Columbia Acorn SelectSM (Unaudited)

| Portfolio breakdown (%) (at June 30, 2020) |

| Common Stocks | 97.3 |

| Money Market Funds | 2.7 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at June 30, 2020) |

| Communication Services | 3.2 |

| Consumer Discretionary | 11.6 |

| Consumer Staples | 1.1 |

| Financials | 9.1 |

| Health Care | 28.0 |

| Industrials | 14.5 |

| Information Technology | 29.1 |

| Real Estate | 3.4 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 12 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Fund at a glance

Columbia Thermostat FundSM (Unaudited)

Investment objective

Columbia Thermostat FundSM (the Fund) seeks long-term capital appreciation.

Portfolio management

Anwiti Bahuguna, Ph.D.

Co-Portfolio Manager since 2018

Service with Fund since 2018

Joshua Kutin, CFA

Co-Portfolio Manager since 2018

Service with Fund since 2018

| Average annual total returns (%) (for the period ended June 30, 2020) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 03/03/03 | 15.02 | 20.72 | 7.51 | 9.00 | 7.50 |

| | Including sales charges | | 8.43 | 13.77 | 6.24 | 8.36 | 7.14 |

| Advisor Class | 11/08/12 | 15.17 | 20.98 | 7.78 | 9.27 | 7.77 |

| Class C | Excluding sales charges | 03/03/03 | 14.59 | 19.77 | 6.70 | 8.18 | 6.70 |

| | Including sales charges | | 13.59 | 18.77 | 6.70 | 8.18 | 6.70 |

| Institutional Class | 09/25/02 | 15.20 | 21.04 | 7.78 | 9.27 | 7.77 |

| Institutional 2 Class | 11/08/12 | 15.22 | 21.08 | 7.82 | 9.30 | 7.79 |

| Institutional 3 Class | 11/08/12 | 15.25 | 21.09 | 7.86 | 9.33 | 7.81 |

| Blended Benchmark | | 1.92 | 8.72 | 7.78 | 9.06 | - |

| S&P 500® Index | | -3.08 | 7.51 | 10.73 | 13.99 | - |

| Bloomberg Barclays U.S. Aggregate Bond Index | | 6.14 | 8.74 | 4.30 | 3.82 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2020 prospectus (as supplemented), the Fund’s annual operating expense ratio is 0.64% for Institutional Class shares and 0.89% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the investment manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The Fund’s performance prior to May 1, 2018 reflects returns achieved following a principal investment strategy pursuant to which day-to-day investment decisions for the Fund were made according to only one potential form of predetermined asset allocation table. Effective May 1, 2018, the Fund follows a principal investment strategy that calls for the Investment Manager, on at least an annual basis, to determine whether the Fund’s assets should be allocated according to one of two different forms of allocation table based on the Investment Manager’s assessment of the equity market. Through April 2020, the asset allocation table in place reflected the Investment Manager’s determination that the equity market was “expensive”. During the most recent annual review, the Fund’s portfolio managers determined the market to be “normal” and therefore, on May 1, 2020, the Fund switched to the "normal" equity market table with a 50% equity floor.

The Blended Benchmark, established by the Fund’s investment manager, is an equally weighted custom composite of Columbia Thermostat Fund’s primary equity and primary debt benchmarks, the S&P 500® Index and the Bloomberg Barclays U.S. Aggregate Bond Index, respectively. The percentage of the Fund’s assets allocated to underlying stock and bond portfolio funds will vary, and accordingly the composition of the Fund’s portfolio will not always reflect the composition of the Blended Benchmark.

The S&P 500® Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 13 |

Fund at a glance (continued)

Columbia Thermostat FundSM (Unaudited)

The Bloomberg Barclays U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment-grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally. Fund performance may be significantly negatively impacted by the economic impact of the COVID-19 pandemic.

| Portfolio breakdown (%) (at June 30, 2020) |

| Equity Funds | 45.1 |

| Exchange-Traded Equity Funds | 5.0 |

| Exchange-Traded Fixed Income Funds | 4.9 |

| Fixed Income Funds | 44.5 |

| Money Market Funds | 0.5 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 14 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Fund at a glance

Columbia Acorn Emerging Markets FundSM (Unaudited)

Investment objective

Columbia Acorn Emerging Markets FundSM (the Fund) seeks long-term capital appreciation.

Effective July 10, 2020, the Fund was merged with and into Columbia Acorn International®.

Portfolio management

Satoshi Matsunaga, CFA

Portfolio Manager or Co-Portfolio Manager since 2015

Service with Fund since 2011

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2020 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2020) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | Life of Fund |

| Class A | Excluding sales charges | 08/19/11 | -14.29 | -6.80 | -1.34 | 1.84 |

| | Including sales charges | | -19.21 | -12.18 | -2.50 | 1.16 |

| Advisor Class | 11/08/12 | -14.18 | -6.56 | -1.07 | 2.14 |

| Class C | Excluding sales charges | 08/19/11 | -14.61 | -7.41 | -2.06 | 1.10 |

| | Including sales charges | | -15.47 | -8.34 | -2.06 | 1.10 |

| Institutional Class | 08/19/11 | -14.19 | -6.59 | -1.08 | 2.12 |

| Institutional 2 Class | 11/08/12 | -14.08 | -6.38 | -0.96 | 2.21 |

| Institutional 3 Class | 06/13/13 | -14.12 | -6.44 | -0.94 | 2.23 |

| MSCI Emerging Markets SMID Cap Index (Net) | | -13.38 | -9.55 | -0.59 | 0.38 |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2020 prospectus (as supplemented), the Fund’s annual operating expense ratio is 1.30% for Institutional Class shares and 1.55% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the investment manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The MSCI Emerging Markets SMID Cap Index (Net) captures a mid- and small-cap representation across 26 emerging market countries. The index covers approximately 29% of the free float-adjusted market capitalization in each country.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally. Fund performance may be significantly negatively impacted by the economic impact of the COVID-19 pandemic.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 15 |

Fund at a glance (continued)

Columbia Acorn Emerging Markets FundSM (Unaudited)

| Equity sector breakdown (%) (at June 30, 2020) |

| Communication Services | 2.8 |

| Consumer Discretionary | 16.9 |

| Consumer Staples | 7.7 |

| Energy | 4.6 |

| Financials | 16.3 |

| Health Care | 5.8 |

| Industrials | 16.5 |

| Information Technology | 24.9 |

| Real Estate | 4.5 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| Country breakdown (%) (at June 30, 2020) |

| Cambodia | 4.2 |

| Canada | 4.2 |

| China | 20.5 |

| Cyprus | 1.9 |

| Hong Kong | 9.6 |

| Indonesia | 0.8 |

| Mexico | 7.2 |

| Russian Federation | 1.7 |

| South Korea | 9.6 |

| Taiwan | 22.8 |

| Thailand | 8.5 |

| United States(a) | 9.0 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

Country breakdown is based primarily on issuer’s place of organization/incorporation. Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 16 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Fund at a glance

Columbia Acorn European FundSM (Unaudited)

Investment objective

Columbia Acorn European FundSM (the Fund) seeks long-term capital appreciation.

Portfolio management

Stephen Kusmierczak, CFA

Portfolio Manager or Co-Portfolio Manager since 2011

Service with Fund since 2011

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2020 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2020) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | Life of Fund |

| Class A | Excluding sales charges | 08/19/11 | -6.50 | 5.33 | 7.58 | 9.62 |

| | Including sales charges | | -11.87 | -0.73 | 6.31 | 8.89 |

| Advisor Class | 06/25/14 | -6.41 | 5.56 | 7.86 | 9.91 |

| Class C | Excluding sales charges | 08/19/11 | -6.88 | 4.49 | 6.78 | 8.81 |

| | Including sales charges | | -7.81 | 3.49 | 6.78 | 8.81 |

| Institutional Class | 08/19/11 | -6.44 | 5.53 | 7.84 | 9.90 |

| Institutional 2 Class | 11/08/12 | -6.37 | 5.62 | 7.91 | 9.93 |

| Institutional 3 Class | 03/01/17 | -6.38 | 5.65 | 7.90 | 9.93 |

| MSCI AC Europe Small Cap Index (Net) | | -15.42 | -5.43 | 3.05 | 7.95 |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2020 prospectus (as supplemented), the Fund’s annual operating expense ratio is 1.20% for Institutional Class shares and 1.45% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the investment manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The MSCI AC Europe Small Cap Index (Net) captures a small-cap representation across 21 markets in Europe. The index covers approximately 14% of the free float-adjusted market capitalization across each market country in Europe.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The COVID-19 pandemic has adversely impacted economies and capital markets around the world in ways that will likely continue and may change in unforeseen ways for an indeterminate period. The COVID-19 pandemic may exacerbate pre-existing political, social and economic risks in certain countries and globally. Fund performance may be significantly negatively impacted by the economic impact of the COVID-19 pandemic.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 17 |

Fund at a glance (continued)

Columbia Acorn European FundSM (Unaudited)

| Equity sector breakdown (%) (at June 30, 2020) |

| Communication Services | 4.2 |

| Consumer Discretionary | 4.2 |

| Consumer Staples | 1.6 |

| Financials | 6.7 |

| Health Care | 16.5 |

| Industrials | 36.6 |

| Information Technology | 23.2 |

| Materials | 4.7 |

| Real Estate | 2.3 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| Country breakdown (%) (at June 30, 2020) |

| Denmark | 4.3 |

| France | 4.1 |

| Germany | 12.0 |

| Ireland | 2.0 |

| Italy | 7.7 |

| Malta | 1.3 |

| Netherlands | 4.6 |

| Spain | 2.8 |

| Sweden | 23.1 |

| Switzerland | 9.4 |

| Ukraine | 0.5 |

| United Kingdom | 24.6 |

| United States(a) | 3.6 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

Country breakdown is based primarily on issuer’s place of organization/incorporation. Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 18 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

2020 Mid-Year Distributions

The following table details the mid-year distributions for the Columbia Acorn Funds. The information is provided on a per share basis for each share class of the Funds.

| Fund | Ordinary

income | Short-term

capital

gain | Long-term

capital

gain | Record

date | Ex-dividend

date | Payable

date |

| Columbia Acorn® Fund | | | | | | |

| Class A | None | None | 0.70274 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Advisor Class | None | None | 0.70274 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Class C | None | None | 0.70274 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional Class | None | None | 0.70274 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 2 Class | None | None | 0.70274 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 3 Class | None | None | 0.70274 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Columbia Acorn International® | | | | | | |

| Class A | 0.19891 | None | 1.36216 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Advisor Class | 0.19891 | None | 1.36216 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Class C | 0.19891 | None | 1.36216 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional Class | 0.19891 | None | 1.36216 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 2 Class | 0.19891 | None | 1.36216 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 3 Class | 0.19891 | None | 1.36216 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Class R | 0.19891 | None | 1.36216 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Columbia Acorn USA® | | | | | | |

| Class A | None | None | 0.33065 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Advisor Class | None | None | 0.33065 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Class C | None | None | 0.33065 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional Class | None | None | 0.33065 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 2 Class | None | None | 0.33065 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 3 Class | None | None | 0.33065 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Columbia Acorn International SelectSM | | | | | | |

| Class A | 0.09198 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Advisor Class | 0.09198 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Class C | 0.09198 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional Class | 0.09198 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 2 Class | 0.09198 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 3 Class | 0.09198 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Columbia Acorn SelectSM | | | | | | |

| Class A | 0.02174 | None | 0.30882 | 4/20/2020 | 4/21/2020 | 4/21/2020 |

| Advisor Class | 0.05462 | None | 0.30882 | 4/20/2020 | 4/21/2020 | 4/21/2020 |

| Class C | 0.00000 | None | 0.30882 | 4/20/2020 | 4/21/2020 | 4/21/2020 |

| Institutional Class | 0.05462 | None | 0.30882 | 4/20/2020 | 4/21/2020 | 4/21/2020 |

| Institutional 2 Class | 0.06383 | None | 0.30882 | 4/20/2020 | 4/21/2020 | 4/21/2020 |

| Institutional 3 Class | 0.07040 | None | 0.30882 | 4/20/2020 | 4/21/2020 | 4/21/2020 |

| Columbia Thermostat FundSM | | | | | | |

| Class A | 0.01036 | 0.09863 | 0.09479 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Advisor Class | 0.01036 | 0.09863 | 0.09479 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Class C | 0.01036 | 0.09863 | 0.09479 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional Class | 0.01036 | 0.09863 | 0.09479 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 2 Class | 0.01036 | 0.09863 | 0.09479 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 3 Class | 0.01036 | 0.09863 | 0.09479 | 6/9/2020 | 6/10/2020 | 6/10/2020 |

Columbia Acorn Family of Funds | Semiannual Report 2020

| 19 |

2020 Mid-Year Distributions (continued)

| Fund | Ordinary

income | Short-term

capital

gain | Long-term

capital

gain | Record

date | Ex-dividend

date | Payable

date |

| Columbia Acorn Emerging Markets FundSM | | | | | | |

| Class A | None | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Advisor Class | None | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Class C | None | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional Class | None | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 2 Class | None | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 3 Class | None | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Columbia Acorn European FundSM | | | | | | |

| Class A | 0.12517 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Advisor Class | 0.12517 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Class C | 0.12517 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional Class | 0.12517 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 2 Class | 0.12517 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| Institutional 3 Class | 0.12517 | None | None | 6/9/2020 | 6/10/2020 | 6/10/2020 |

| 20 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Understanding Your Fund’s Expenses

(Unaudited)

As a shareholder, you incur two types of costs. There are shareholder transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing fund costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees, and other Fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund’s expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Funds during the period. The actual and hypothetical information in the tables is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the “Actual” column is calculated using the Funds’ actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the “Hypothetical” column assumes a 5% annual rate of return before expenses (which is not the Funds’ actual return) and then applies the Funds’ actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See “Compare with other funds” below for details on how to use the hypothetical data.

In addition to the ongoing expenses which the Funds bear directly, Columbia Thermostat Fund’s shareholders indirectly bear the Fund’s allocable share of the costs and expenses of each underlying fund in which the Fund invests. You can also estimate the effective expenses paid during the period, which includes the indirect fees associated with investing in the underlying funds, by using the amounts listed in the effective expenses paid during the period column in the “Fund of Funds” table.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Funds with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

| January 1, 2020 — June 30, 2020 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Columbia Acorn® Fund |

| Class A | 1,000.00 | 1,000.00 | 1,009.30 | 1,019.34 | 5.55 | 5.57 | 1.11 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,010.30 | 1,020.59 | 4.30 | 4.32 | 0.86 |

| Class C | 1,000.00 | 1,000.00 | 1,006.90 | 1,015.61 | 9.28 | 9.32 | 1.86 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,010.10 | 1,020.59 | 4.30 | 4.32 | 0.86 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 1,010.10 | 1,020.79 | 4.10 | 4.12 | 0.82 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,010.70 | 1,020.98 | 3.90 | 3.92 | 0.78 |

Columbia Acorn Family of Funds | Semiannual Report 2020

| 21 |

Understanding Your Fund’s Expenses (continued)

(Unaudited)

| January 1, 2020 — June 30, 2020 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual |

| Columbia Acorn International® |

| Class A | 1,000.00 | 1,000.00 | 908.80 | 1,018.70 | 5.88 | 6.22 | 1.24 |

| Advisor Class | 1,000.00 | 1,000.00 | 910.10 | 1,019.94 | 4.70 | 4.97 | 0.99 |

| Class C | 1,000.00 | 1,000.00 | 905.40 | 1,014.97 | 9.43 | 9.97 | 1.99 |

| Institutional Class | 1,000.00 | 1,000.00 | 910.10 | 1,019.94 | 4.70 | 4.97 | 0.99 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 910.30 | 1,020.29 | 4.37 | 4.62 | 0.92 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 910.70 | 1,020.49 | 4.18 | 4.42 | 0.88 |

| Class R | 1,000.00 | 1,000.00 | 908.00 | 1,017.45 | 7.07 | 7.47 | 1.49 |

| Columbia Acorn USA® |

| Class A | 1,000.00 | 1,000.00 | 923.40 | 1,017.85 | 6.74 | 7.07 | 1.41 |

| Advisor Class | 1,000.00 | 1,000.00 | 924.90 | 1,019.10 | 5.55 | 5.82 | 1.16 |

| Class C | 1,000.00 | 1,000.00 | 918.50 | 1,014.12 | 10.30 | 10.82 | 2.16 |

| Institutional Class | 1,000.00 | 1,000.00 | 924.50 | 1,019.10 | 5.55 | 5.82 | 1.16 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 924.30 | 1,019.49 | 5.17 | 5.42 | 1.08 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 925.20 | 1,019.69 | 4.98 | 5.22 | 1.04 |

| Columbia Acorn International SelectSM |

| Class A | 1,000.00 | 1,000.00 | 937.10 | 1,018.45 | 6.21 | 6.47 | 1.29 |

| Advisor Class | 1,000.00 | 1,000.00 | 938.20 | 1,019.69 | 5.01 | 5.22 | 1.04 |

| Class C | 1,000.00 | 1,000.00 | 933.90 | 1,014.72 | 9.81 | 10.22 | 2.04 |

| Institutional Class | 1,000.00 | 1,000.00 | 938.30 | 1,019.69 | 5.01 | 5.22 | 1.04 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 938.80 | 1,020.09 | 4.63 | 4.82 | 0.96 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 938.80 | 1,020.34 | 4.39 | 4.57 | 0.91 |

| Columbia Acorn SelectSM |

| Class A | 1,000.00 | 1,000.00 | 1,003.80 | 1,018.90 | 5.98 | 6.02 | 1.20 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,005.00 | 1,020.19 | 4.69 | 4.72 | 0.94 |

| Class C | 1,000.00 | 1,000.00 | 999.90 | 1,015.22 | 9.65 | 9.72 | 1.94 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,004.60 | 1,020.14 | 4.73 | 4.77 | 0.95 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 1,005.10 | 1,020.54 | 4.34 | 4.37 | 0.87 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,005.50 | 1,020.89 | 3.99 | 4.02 | 0.80 |

| Columbia Acorn Emerging Markets FundSM |

| Class A | 1,000.00 | 1,000.00 | 857.10 | 1,017.16 | 7.16 | 7.77 | 1.55 |

| Advisor Class | 1,000.00 | 1,000.00 | 858.20 | 1,018.40 | 6.01 | 6.52 | 1.30 |

| Class C | 1,000.00 | 1,000.00 | 853.90 | 1,013.43 | 10.60 | 11.51 | 2.30 |

| Institutional Class | 1,000.00 | 1,000.00 | 858.10 | 1,018.40 | 6.01 | 6.52 | 1.30 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 859.20 | 1,018.75 | 5.69 | 6.17 | 1.23 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 858.80 | 1,018.95 | 5.50 | 5.97 | 1.19 |

| Columbia Acorn European FundSM |

| Class A | 1,000.00 | 1,000.00 | 935.00 | 1,017.65 | 6.98 | 7.27 | 1.45 |

| Advisor Class | 1,000.00 | 1,000.00 | 935.90 | 1,018.90 | 5.78 | 6.02 | 1.20 |

| Class C | 1,000.00 | 1,000.00 | 931.20 | 1,013.92 | 10.56 | 11.02 | 2.20 |

| Institutional Class | 1,000.00 | 1,000.00 | 935.60 | 1,018.90 | 5.78 | 6.02 | 1.20 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 936.30 | 1,019.19 | 5.49 | 5.72 | 1.14 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 936.20 | 1,019.44 | 5.25 | 5.47 | 1.09 |

| 22 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Understanding Your Fund’s Expenses (continued)

(Unaudited)

Fund of Funds—Columbia Thermostat Fund

| January 1, 2020 — June 30, 2020 |

| | Account value at the

beginning of the

period ($) | Account value at the

end of the

period ($) | Expenses paid during

the period ($) | Fund’s annualized

expense ratio (%) | Effective expenses

paid during the

period ($) | Fund’s effective

annualized

expense ratio (%) |

| | Actual | Hypothetical | Actual | Hypothetical | Actual | Hypothetical | Actual | Actual | Hypothetical | Actual |

| Class A | 1,000.00 | 1,000.00 | 1,150.20 | 1,022.38 | 2.67 | 2.51 | 0.50 | 4.81 | 4.53 | 0.90 |

| Advisor Class | 1,000.00 | 1,000.00 | 1,151.70 | 1,023.62 | 1.34 | 1.26 | 0.25 | 3.48 | 3.27 | 0.65 |

| Class C | 1,000.00 | 1,000.00 | 1,145.90 | 1,018.65 | 6.67 | 6.27 | 1.25 | 8.80 | 8.28 | 1.65 |

| Institutional Class | 1,000.00 | 1,000.00 | 1,152.00 | 1,023.62 | 1.34 | 1.26 | 0.25 | 3.48 | 3.27 | 0.65 |

| Institutional 2 Class | 1,000.00 | 1,000.00 | 1,152.20 | 1,023.82 | 1.12 | 1.06 | 0.21 | 3.26 | 3.07 | 0.61 |

| Institutional 3 Class | 1,000.00 | 1,000.00 | 1,152.50 | 1,024.02 | 0.91 | 0.86 | 0.17 | 3.05 | 2.87 | 0.57 |

Expenses paid during the period are equal to the annualized expense ratio, multiplied by the average account value over the period and then multiplied by the number of days in the Fund’s most recent fiscal half year and divided by 366.

Except with respect to Columbia Thermostat Fund, expenses do not include any fees and expenses incurred indirectly by a Fund from the underlying funds in which the Fund may invest (also referred to as “acquired funds”), including affiliated and non-affiliated pooled investments vehicles (including mutual funds and exchange traded funds).

In the case of Columbia Thermostat Fund, effective expenses paid during the period and the Fund’s effective annualized expense ratio include expenses borne directly by the class plus the Fund’s pro rata portion of the ongoing expenses charged by the underlying funds in which it invests using the expense ratio of each class of each underlying fund as of the underlying fund’s most recent shareholder report.

Had the investment manager and/or certain of its affiliates not waived/reimbursed certain fees and expenses for the Funds, account value at the end of the period would have been reduced.

Columbia Acorn Family of Funds | Semiannual Report 2020

| 23 |

Portfolio of Investments

Columbia Acorn® Fund, June 30, 2020 (Unaudited)

(Percentages represent value of investments compared to net assets)

Investments in securities

| Common Stocks 98.4% |

| Issuer | Shares | Value ($) |

| Communication Services 2.6% |

| Entertainment 2.6% |

| Take-Two Interactive Software, Inc.(a) | 382,000 | 53,315,740 |

| Zynga, Inc., Class A(a) | 5,049,000 | 48,167,460 |

| Total | | 101,483,200 |

| Total Communication Services | 101,483,200 |

| Consumer Discretionary 12.8% |

| Diversified Consumer Services 3.4% |

| Bright Horizons Family Solutions, Inc.(a) | 399,432 | 46,813,430 |

| Chegg, Inc.(a) | 721,118 | 48,502,397 |

| Grand Canyon Education, Inc.(a) | 401,887 | 36,382,830 |

| Total | | 131,698,657 |

| Hotels, Restaurants & Leisure 2.5% |

| Chipotle Mexican Grill, Inc.(a) | 21,807 | 22,948,814 |

| DraftKings, Inc., Class A(a),(b) | 571,000 | 18,991,460 |

| Planet Fitness, Inc., Class A(a) | 478,000 | 28,952,460 |

| Wingstop, Inc. | 181,904 | 25,279,199 |

| Total | | 96,171,933 |

| Household Durables 3.2% |

| Helen of Troy Ltd.(a) | 207,197 | 39,069,066 |

| NVR, Inc.(a) | 14,600 | 47,577,750 |

| Skyline Champion Corp.(a) | 1,569,405 | 38,199,318 |

| Total | | 124,846,134 |

| Specialty Retail 3.3% |

| Five Below, Inc.(a) | 336,614 | 35,987,403 |

| Tractor Supply Co. | 393,448 | 51,852,512 |

| Williams-Sonoma, Inc. | 475,000 | 38,954,750 |

| Total | | 126,794,665 |

| Textiles, Apparel & Luxury Goods 0.4% |

| Carter’s, Inc. | 221,900 | 17,907,330 |

| Total Consumer Discretionary | 497,418,719 |

| Consumer Staples 1.1% |

| Household Products 1.1% |

| WD-40 Co. | 221,809 | 43,984,725 |

| Total Consumer Staples | 43,984,725 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Financials 5.4% |

| Banks 0.8% |

| SVB Financial Group(a) | 154,768 | 33,357,147 |

| Capital Markets 3.8% |

| Ares Management Corp., Class A | 1,638,335 | 65,041,899 |

| Hamilton Lane, Inc., Class A | 343,000 | 23,107,910 |

| Houlihan Lokey, Inc. | 456,342 | 25,390,869 |

| Raymond James Financial, Inc. | 472,123 | 32,496,226 |

| Total | | 146,036,904 |

| Consumer Finance 0.8% |

| FirstCash, Inc. | 465,000 | 31,378,200 |

| Total Financials | 210,772,251 |

| Health Care 33.5% |

| Biotechnology 12.7% |

| ACADIA Pharmaceuticals, Inc.(a) | 1,074,882 | 52,099,531 |

| Acceleron Pharma, Inc.(a) | 268,000 | 25,532,360 |

| Anika Therapeutics, Inc.(a) | 648,943 | 24,484,620 |

| Argenx SE, ADR(a) | 240,801 | 54,235,609 |

| CRISPR Therapeutics AG(a) | 782,561 | 57,510,408 |

| Enanta Pharmaceuticals, Inc.(a) | 334,000 | 16,770,140 |

| Exact Sciences Corp.(a) | 546,000 | 47,469,240 |

| Immunomedics, Inc.(a) | 1,143,878 | 40,539,036 |

| Insmed, Inc.(a) | 1,249,000 | 34,397,460 |

| Kiniksa Pharmaceuticals Ltd., Class A(a) | 851,825 | 21,704,501 |

| Mirati Therapeutics, Inc.(a) | 260,255 | 29,713,313 |

| Natera, Inc.(a) | 750,000 | 37,395,000 |

| Sarepta Therapeutics, Inc.(a) | 304,517 | 48,826,256 |

| Total | | 490,677,474 |

| Health Care Equipment & Supplies 8.9% |

| Globus Medical, Inc., Class A(a) | 1,016,000 | 48,473,360 |

| Haemonetics Corp.(a) | 250,000 | 22,390,000 |

| Hill-Rom Holdings, Inc. | 283,800 | 31,155,564 |

| Masimo Corp.(a) | 323,302 | 73,709,623 |

| Penumbra, Inc.(a) | 217,190 | 38,837,916 |

| STERIS PLC | 291,209 | 44,683,109 |

| Tactile Systems Technology, Inc.(a) | 364,687 | 15,108,982 |

The accompanying Notes to Financial Statements are an integral part of this statement.

| 24 | Columbia Acorn Family of Funds | Semiannual Report 2020 |

Portfolio of Investments (continued)

Columbia Acorn® Fund, June 30, 2020 (Unaudited)

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Varian Medical Systems, Inc.(a) | 252,364 | 30,919,637 |

| West Pharmaceutical Services, Inc. | 175,000 | 39,754,750 |

| Total | | 345,032,941 |

| Health Care Providers & Services 4.0% |

| Amedisys, Inc.(a) | 187,300 | 37,186,542 |

| Chemed Corp. | 116,338 | 52,476,582 |

| Encompass Health Corp. | 640,243 | 39,650,249 |

| HealthEquity, Inc.(a) | 415,000 | 24,348,050 |

| Total | | 153,661,423 |

| Health Care Technology 1.2% |

| Livongo Health, Inc.(a),(b) | 639,852 | 48,110,472 |

| Life Sciences Tools & Services 4.5% |

| 10X Genomics, Inc., Class A(a) | 295,000 | 26,346,450 |

| Bio-Rad Laboratories, Inc., Class A(a) | 82,000 | 37,022,180 |

| Bio-Techne Corp. | 179,802 | 47,480,314 |

| Pra Health Sciences, Inc.(a) | 379,340 | 36,905,989 |

| Repligen Corp.(a) | 218,000 | 26,946,980 |

| Total | | 174,701,913 |

| Pharmaceuticals 2.2% |

| Horizon Therapeutics PLC(a) | 629,089 | 34,964,767 |

| Reata Pharmaceuticals, Inc., Class A(a) | 191,871 | 29,935,713 |

| Theravance Biopharma, Inc.(a) | 963,892 | 20,232,093 |

| Total | | 85,132,573 |

| Total Health Care | 1,297,316,796 |

| Industrials 14.9% |

| Aerospace & Defense 2.4% |

| BWX Technologies, Inc. | 709,000 | 40,157,760 |

| Curtiss-Wright Corp. | 415,000 | 37,051,200 |

| HEICO Corp., Class A | 201,272 | 16,351,337 |

| Total | | 93,560,297 |

| Building Products 1.4% |

| Allegion PLC | 542,420 | 55,446,172 |

| Commercial Services & Supplies 1.6% |

| Copart, Inc.(a) | 430,000 | 35,806,100 |

| Unifirst Corp. | 138,000 | 24,695,100 |

| Total | | 60,501,200 |

| Common Stocks (continued) |

| Issuer | Shares | Value ($) |

| Electrical Equipment 0.9% |

| Atkore International Group, Inc.(a) | 1,228,496 | 33,599,366 |

| Machinery 5.5% |