UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01829

Columbia Acorn Trust

(Exact name of registrant as specified in charter)

227 W. Monroe Street

Suite 3000

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mary C. Moynihan

Perkins Coie LLP

700 13th Street, NW

Suite 600

Washington, DC 20005

Paul B. Goucher, Esq.

Columbia Management Investment Advisers, LLC

100 Park Avenue

New York, New York 10017

P. Zachary Egan

Columbia Acorn Trust

227 West Monroe Street, Suite 3000

Chicago, Illinois 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 634-9200

Date of fiscal year end: December 31

Date of reporting period: June 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SemiAnnual Report

June 30, 2017

Columbia Acorn® Fund

Columbia Acorn International®

Columbia Acorn USA®

Columbia Acorn International SelectSM

Columbia Acorn SelectSM

Columbia Thermostat FundSM

Columbia Acorn Emerging Markets FundSM

Columbia Acorn European FundSM

Not FDIC Insured • No bank guarantee • May lose value

| | |

| | Stay informed with Columbia Threadneedle Investments

Columbia Acorn funds have moved away from producing quarterly shareholder reports and are now offering a semiannual and annual report to shareholders. To find economic and market commentary, investment videos, white papers, quarterly mutual fund commentary, distribution information and more, visit our website at investor.columbiathreadneedleus.com. Subscribe to the latest information from Columbia Threadneedle. Register your information online at investor.columbiathreadneedleus.com/subscribe and select the publications you would like to receive, including: • Columbia Threadneedle Investor Newsletter, highlighting the latest macro- and micro-economic trends, investment themes, products, service changes and other items of interest to our investors • White papers that delve deep into a variety of investment topics • Quarterly portfolio manager commentary and fund fact sheets • Perspectives blog at investor.columbiathreadneedleus.com Read timely posts by our investment team. Update your subscriptions at any time by accessing the email subscription center.

We offer you multiple ways to access our market commentary and investment insights. • Twitter.com/CTinvest_US Follow us on Twitter for quick, up-to-the-minute comments on market news and more. • Youtube.com/CTInvestUS View our commentaries on the economy, markets and current investment opportunities. • Linkedin.com/company/Columbia-Threadneedle-Investments-US Connect with us on LinkedIn for updates from our thought leaders. |

| | |

| Not part of the shareholder report | | CT-MK/113388 A (02/17) 5JA9/1705026 |

| 4 |

| 7 |

| 9 |

| 12 |

| 14 |

| 16 |

| 18 |

| 21 |

| 23 |

| 25 |

| 27 |

| 29 |

| 31 |

| 34 |

| 36 |

| 39 |

| 41 |

| 43 |

| 46 |

| 84 |

| 88 |

| 90 |

| 98 |

| 128 |

| 143 |

| 148 |

| 150 |

Columbia Acorn Family of Funds | Semiannual Report 2017

Fund at a glance

Columbia Acorn® Fund (Unaudited)

Investment objective

Columbia Acorn® Fund (the Fund) seeks long-term capital appreciation.

Portfolio management

P. Zachary Egan, CFA

Co-manager

With Fund since 1999

Matthew A. Litfin, CFA

Co-manager

With Fund since 2015

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2017 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2017) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life |

| Class A | Excluding sales charges | 10/16/00 | 12.27 | 24.02 | 11.40 | 6.28 | 13.88 |

| | Including sales charges | | 5.84 | 16.89 | 10.08 | 5.65 | 13.74 |

| Class C | Excluding sales charges | 10/16/00 | 11.84 | 23.14 | 10.60 | 5.49 | 13.02 |

| | Including sales charges | | 10.84 | 22.35 | 10.60 | 5.49 | 13.02 |

| Class R4 | 11/08/12 | 12.37 | 24.25 | 11.64 | 6.55 | 14.24 |

| Class R5 | 11/08/12 | 12.34 | 24.29 | 11.73 | 6.60 | 14.25 |

| Class Y | 11/08/12 | 12.33 | 24.35 | 11.78 | 6.62 | 14.26 |

| Class Z | 06/10/70 | 12.35 | 24.24 | 11.71 | 6.58 | 14.25 |

| Russell 2500 Growth Index | | 10.63 | 21.44 | 14.33 | 8.18 | N/A |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each class.

As stated in the May 1, 2017, prospectus, the Fund’s annual operating expense ratio is 0.86% for Class Z shares and 1.11% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results may reflect the effect of any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information.

Effective May 1, 2017, the Fund compares its performance to that of the Russell 2500 Growth Index. Prior to this date, the Fund compared its performance to that of the Russell 2500 Index. The Investment Manager believes that the Fund’s portfolio will generally be more closely aligned with the Russell 2500 Growth Index than with the former core benchmark from an investment style perspective. Information on the Russell 2500 Index will be included for a one-year transition period.

The Russell 2500 Growth Index measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 17% of the total market capitalization of the Russell 3000 Index.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

| 4 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Fund at a glance (continued)

Columbia Acorn® Fund (Unaudited)

The Growth of a $10,000 Investment in Columbia Acorn® Fund Class Z Shares

June 10, 1970 (Fund inception) through June 30, 2017

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period. A $10,000 investment in Columbia Acorn® Fund at inception appreciated to $117,142 on December 31, 1985, the inception date of the Russell 2500 Growth Index. A $10,000 investment in Columbia Acorn® Fund at inception appreciated to $31,777 on December 31, 1978, the inception date of the Russell 2500 Index. For comparison with the indices, we assigned each index the same value as the Fund at each index’s respective inception date. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Top ten holdings (%) (at June 30, 2017) | |

Align Technology, Inc.

Designs, manufactures, and markets the Invisalign System | 2.0 |

HealthSouth Corp.

Inpatient rehabilitative healthcare services | 1.7 |

Pra Health Sciences, Inc.

Global contract research organization | 1.7 |

ANSYS, Inc.

Software solutions for design analysis and optimization | 1.5 |

IPG Photonics Corp.

High-power fiber lasers and amplifiers | 1.5 |

CDW Corp.

IT products and services | 1.5 |

Celanese Corp., Class A

Global integrated producer of chemicals and advanced materials | 1.3 |

Raymond James Financial, Inc.

Financial services to individuals, corporations, and municipalities | 1.3 |

GoDaddy, Inc., Class A

Cloud-based web platform for small businesses, web design professionals and individuals | 1.3 |

Oshkosh Corp.

Fire and emergency apparatuses and specialty commercial, and military trucks | 1.3 |

Percentages indicated are based upon total investments (excluding Money Market Funds and Securities Lending Collateral)

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 5 |

Fund at a glance (continued)

Columbia Acorn® Fund (Unaudited)

| Portfolio breakdown (%) (at June 30, 2017) |

| Common Stocks | 94.5 |

| Money Market Funds | 3.0 |

| Securities Lending Collateral | 2.5 |

| Total | 100.0 |

Percentages indicated are based upon total investments. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at June 30, 2017) |

| Consumer Discretionary | 19.5 |

| Consumer Staples | 1.6 |

| Energy | 2.3 |

| Financials | 8.4 |

| Health Care | 22.0 |

| Industrials | 17.5 |

| Information Technology | 21.7 |

| Materials | 1.3 |

| Real Estate | 4.8 |

| Telecommunication Services | 0.9 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 6 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Manager Discussion of Fund Performance

Columbia Acorn® Fund

P. Zachary Egan, CFA

Co-Portfolio Manager

Matthew A. Litfin, CFA

Co-Portfolio Manager

Columbia Acorn Fund Class Z shares gained 5.26% during the second quarter of 2017, outperforming the Fund’s primary benchmark, the Russell 2500 Growth Index, which gained 4.13%. Fund returns for the semiannual period were 12.35% versus a gain of 10.63% for the benchmark.

Through the first half of 2017, U.S. equity markets delivered solid and steady gains with very little in the way of interruptions. Growth stocks strengthened against value stocks in a sharp reversal from 2016. Economic growth remained strong enough to fuel positive market performance, yet not so robust as to raise concerns that the U.S. Federal Reserve would need to take a more aggressive approach to raising interest rates. Corporate results were also supportive, highlighted by strength in earnings, rising revenues and profit margins, and generally positive guidance for the remainder of 2017. A meaningful decline in the U.S. dollar acted as an additional tailwind for equities by making the products and services of U.S. companies more competitive overseas.

In terms of stronger market sectors, information technology and health care continued their strong run of performance and were the best performing sectors in the benchmark during the period. The only two sectors with negative absolute returns were energy and consumer staples. The drop in oil prices from over $50 per barrel to below $43 was a primary driver of the fall in energy stocks, resulting in this sector being the standout underperformer.

The Fund’s sector allocations detracted from relative returns due to an overweight in the hard-hit energy sector. This was offset by strong stock selection in consumer discretionary as Fund holdings more than doubled benchmark returns. Stock selection in health care was also a strong contributor to the Fund’s outperformance relative to the benchmark.

Two positions that were new to the Fund during the year were the Fund’s top contributors. Consumer stock Wayfair is a popular online home furnishing store. The company’s stock rallied in the period as its online sales grew more than investors expected and the company showed a faster path toward profitability. Shares of Kite Pharma, a biotech company focused on novel treatments for cancer, flew high during the period. We believe Kite Pharma has a great management team, strong drug pipeline and one of the most advanced infrastructures for manufacturing drugs.

Among the Fund’s detractors from performance were Carrizo Oil and Gas and Tractor Supply Company. Though an efficient exploration company, it was not surprising that Carrizo’s stock declined along with the drop in crude oil prices. Tractor Supply Company engages in the sale of farm and ranch products. Its stock declined on earnings weakness and fear that online sellers would eat into its market share. We remain cognizant of the competitive risks, but we believe this retailer is more resilient than the market is anticipating, due to its appealing retail concept, its rural geographic footprint, and its strong culture and management team.

Two additional new positions during the year were iRhythm Technologies and Dave & Buster’s Entertainment. iRhythm offers the Zio ambulatory monitor and associated reporting services for detection of cardiac arrhythmias. We believe the company is strongly positioned to take significant market share by displacing traditional Holter and event monitors that have poor detection rates, are less cost-effective, and suffer from poor patient compliance. Dave & Buster’s owns and operates high volume entertainment and dining complexes. Their facilities offer a differentiated approach combining dining, gaming and sports watching. We are attracted to the company’s appeal to family members of all ages for an affordable entertainment destination. On the surface, these are very different businesses; however, both exhibit many of the characteristics we seek in new ideas for the portfolio. They offer differentiated products that have an advantage over their nearest competitors, both are in segments poised for growth and currently trade at valuations we believe are reasonable relative to their quality and future growth potential.

Global stocks markets have rewarded investors thus far in 2017. At the end of the period, averages remained at robust levels and there was sustained economic expansion around the world. However, growth was slower than in previous recoveries. Interest rates and volatility also remained low. We are

Columbia Acorn Family of Funds | Semiannual Report 2017

| 7 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn® Fund

realistic about the potential risks after a global surge in stock valuations and the potential for increased volatility. In this market environment, we continue to focus on identifying exciting growth companies with sustainable competitive advantages trading at reasonable valuations.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. Foreign investments subject the Fund to political, economic, market, social and other risks within a particular country, as well as to potential currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger fund. References to specific securities should not be construed as a recommendation or investment advice.

| 8 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Fund at a glance

Columbia Acorn International® (Unaudited)

Investment objective

Columbia Acorn International® (the Fund) seeks long-term capital appreciation.

Portfolio management

P. Zachary Egan, CFA

Co-manager

With Fund since 1999

Louis J. Mendes, CFA

Co-manager

With Fund since 2001

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2017 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2017) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life |

| Class A | Excluding sales charges | 10/16/00 | 18.43 | 17.12 | 8.11 | 3.35 | 9.92 |

| | Including sales charges | | 11.62 | 10.37 | 6.84 | 2.74 | 9.66 |

| Class B | Excluding sales charges | 10/16/00 | 18.21 | 16.60 | 7.33 | 2.65 | 9.20 |

| | Including sales charges | | 13.21 | 11.60 | 7.02 | 2.65 | 9.20 |

| Class C | Excluding sales charges | 10/16/00 | 18.01 | 16.24 | 7.30 | 2.56 | 9.11 |

| | Including sales charges | | 17.01 | 15.24 | 7.30 | 2.56 | 9.11 |

| Class R | 08/02/11 | 18.30 | 16.82 | 7.72 | 3.03 | 9.63 |

| Class R4 | 11/08/12 | 18.56 | 17.37 | 8.35 | 3.65 | 10.31 |

| Class R5 | 08/02/11 | 18.58 | 17.42 | 8.44 | 3.69 | 10.32 |

| Class Y | 11/08/12 | 18.62 | 17.47 | 8.49 | 3.72 | 10.34 |

| Class Z | 09/23/92 | 18.57 | 17.38 | 8.41 | 3.68 | 10.32 |

| MSCI ACWI ex USA SMID Cap Index (Net) | | 15.39 | 19.88 | 9.32 | 2.26 | N/A |

| MSCI ACWI ex USA SMID Cap Growth Index (Net) | | 16.50 | 16.87 | 9.11 | 1.75 | N/A |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class B shares are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C shares are shown with and without the maximum CDSC of 1.00% for the first year after purchase. The Fund’s other classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each class.

As stated in the May 1, 2017, prospectus, the Fund’s annual operating expense ratio is 1.01% for Class Z shares and 1.26% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results may reflect the effect of any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information.

The MSCI ACWI ex USA SMID Cap Index (Net) captures a mid- and small-cap representation across 22 of 23 developed market countries (excluding the U.S.) and 24 emerging market countries. The index covers approximately 28% of the free float-adjusted market capitalization in each country.

The MSCI ACWI ex USA SMID Cap Growth Index (Net) captures mid-and small cap representation across 22 developed markets countries and 24 emerging markets countries.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 9 |

Fund at a glance (continued)

Columbia Acorn International® (Unaudited)

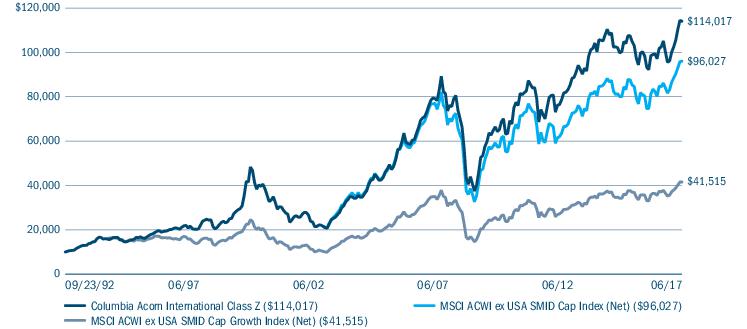

The Growth of a $10,000 Investment in Columbia Acorn International® Class Z Shares

September 23, 1992 (Fund inception) through June 30, 2017

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period. A $10,000 investment in Columbia Acorn International® at inception appreciated to $21,562 on January 31, 2003, the inception date of the MSCI ACWI ex USA SMID Cap Index. A $10,000 investment in Columbia Acorn International® at inception appreciated to $15,870 on May 31, 1994, the inception date of the MCSI ACWI ex USA SMID Cap Growth Index. For comparison with the indices, we assigned each index the same value as the Fund at each index’s respective inception date. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Top ten holdings (%) (at June 30, 2017) | |

CCL Industries, Inc. (Canada)

Manufacturing services and specialty packaging products for the non-durable consumer products market | 2.9 |

Partners Group Holding AG (Switzerland)

Global private markets asset management firm | 2.9 |

Hexagon AB, Class B (Sweden)

Design, measurement and visualisation technologies | 2.6 |

Brembo SpA (Italy)

Braking systems and components | 2.0 |

Wirecard AG (Germany)

Internet payment and processing services | 2.0 |

Kindred Group PLC (Malta)

Online gambling services | 1.7 |

Aalberts Industries NV (Netherlands)

Industrial services and flow control systems | 1.7 |

Grupo Aeroportuario del Sureste SAB de CV, ADR (Mexico)

Operates airports in Mexico | 1.7 |

Spirax-Sarco Engineering PLC (United Kingdom)

Consultation, service and products for the control and efficient management of steam and industrial fluids | 1.6 |

Zee Entertainment Enterprises Ltd. (India)

Hindi films, serials, game shows and children’s programs | 1.6 |

Percentages indicated are based upon total investments (excluding Money Market Funds and Securities Lending Collateral)

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| 10 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Fund at a glance (continued)

Columbia Acorn International® (Unaudited)

| Equity sector breakdown (%) (at June 30, 2017) |

| Consumer Discretionary | 23.6 |

| Consumer Staples | 3.9 |

| Energy | 1.6 |

| Financials | 10.0 |

| Health Care | 7.7 |

| Industrials | 21.4 |

| Information Technology | 17.2 |

| Materials | 10.2 |

| Real Estate | 4.4 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| Country breakdown (%) (at June 30, 2017) |

| Australia | 1.5 |

| Brazil | 0.5 |

| Canada | 7.0 |

| Cayman Islands | 0.9 |

| China | 3.1 |

| Denmark | 3.3 |

| France | 1.7 |

| Germany | 6.4 |

| Hong Kong | 0.5 |

| India | 2.5 |

| Indonesia | 0.8 |

| Ireland | 0.6 |

| Italy | 2.4 |

| Japan | 21.0 |

| Malta | 1.6 |

| Mexico | 1.6 |

| Netherlands | 1.6 |

| New Zealand | 0.6 |

| Philippines | 0.5 |

| Singapore | 1.5 |

| South Africa | 1.4 |

| South Korea | 3.5 |

| Spain | 2.9 |

| Sweden | 4.5 |

| Switzerland | 4.1 |

| Taiwan | 1.9 |

| Thailand | 1.0 |

| United Kingdom | 14.4 |

| United States(a) | 6.7 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

Country breakdown is based primarily on issuer’s place of organization/incorporation. Percentages indicated are based upon total investments. The Fund’s portfolio composition is subject to change.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 11 |

Manager Discussion of Fund Performance

Columbia Acorn International®

P. Zachary Egan, CFA

Co-Portfolio Manager

Louis J. Mendes, CFA

Co-Portfolio Manager

Columbia Acorn International Class Z shares gained 8.06% during the second quarter of 2017, outperforming the Fund’s primary benchmark, the MSCI ACWI ex USA SMID Cap Index (Net), which gained 6.32%. That brought Fund gains to 18.57% for the semiannual period versus a return of 15.39% for the primary benchmark.

The second quarter of 2017 continued the strong global equity market performance enjoyed during the first quarter. European equity performance led the charge in the first half and was aided by strong currency gains relative to the US Dollar. Also strong were markets closest to China, where a super-sized Chinese stimulus package in the second half of 2016 led to surprisingly strong growth. On the other hand, the markets that performed the worst during the period were those geared to commodity prices.

Information technology and health care, classic growth sectors where the Fund is presently overweight compared to its primary benchmark, continued their strong run and were among the top performing sectors during the first half of the year. In fact, positive performance was broadly based across sectors, with the notable exception of the energy sector, where the Fund has been underweight both its primary and secondary benchmarks. Energy was the standout underperformer during the first half of the year — the only sector not in positive territory — with the drop in oil prices from over $50 per barrel to below $43 a primary driver of this sector’s underperformance.

Fund allocations to broad regions had a minimal impact on relative performance during the first half of the year. The majority of outperformance during the period came from stock selection. The Fund outperformed in all major regions with the exception of the United Kingdom where results were roughly in line with those of the benchmark. Continental Europe, Japan, and Asia ex-Japan represented approximately 70% of Fund assets at period-end and stock selection in those regions drove first half performance versus the benchmark. From a sector perspective, relative outperformance was driven by favorable results in information technology, materials and health care. Stock selection was weak in energy, consumer staples and consumer discretionary holdings.

In Asia ex-Japan, Fund holdings in South Korea were among the top performers. Despite their small 3.3% average weight in the portfolio during the first half of the year, South Korean stocks in the Fund more than doubled the return of those in the primary benchmark, in both local and USD currencies, adding 74 basis points to performance versus the primary benchmark. The Fund underperformed relative to the primary benchmark in Australia, losing 28 basis points, and in the United Kingdom. In the latter market, the Fund has not been rewarded for holding a number of turnaround ideas within a consumer sector challenged by a weakened British Pound, rising inflation, negative or stalled real wage growth, online competition, and increasing anxiety around the Brexit process.

Two top contributors for the period were South Korean holdings Medy-Tox and Korea Investment Holdings. Medy-Tox is a pharmaceutical company that provides botulinum toxin (i.e. “Botox”) and fillers to South Korea and 40+ countries worldwide. Its products are priced well below those of U.S. market leader Allergan and take advantage of aging populations that are seeking a more youthful looking appearance. In Asian markets, this trend is not just for baby-boomers; the company has also seen tremendous growth in younger customers looking to stay ahead of the curve in competitive job (and marriage) markets. Korea Investment Holdings is the second largest broker and asset manager in South Korea. Despite geopolitical tensions emanating from its northern neighbor, Korea’s equity market has been buoyant, lifted by a new government and hopes for corporate governance reform. Rising asset values and the corresponding surge in investor activity have driven strong earnings growth at both brokerage and investment arms of the company.

Notable stock detractors included Next, a UK home retailer, and Domino’s Pizza Enterprises, an Australian pizza chain. Next over ordered inventory heading into the year which led to steeper discounting and lower margins. We decided to exit the position in favor of ideas with less challenging conditions in their end markets. Domino’s Pizza Enterprises has been a strong performer over the last

| 12 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn International®

two years, but declined during the period amid complaints that franchisees were underpaying employees in violation of wage laws. Domino’s Pizza Enterprises’ headquarters has revoked several Australian franchisee licenses and is further reviewing the claims. We believe the issue will be resolved, but trimmed the position to reflect an increasing risk that the company may have to share with franchisees the burden of rising labor costs.

International equities exhibited strong performance in the first half of the year. At the close of the period, prospects in Continental Europe were brightening — though it remains to be seen whether French President Emmanuel Macron can translate a seemingly decisive electoral mandate into labor market reforms capable of invigorating the economy and reducing unemployment. Japanese corporates continued to respond to policy initiatives designed to improve return on capital in an aging society that requires this to fund pension obligations. Emerging market valuations ended the period in line with historical averages and below those of slower growing developed markets. In all regions, we continue to search for exciting growth companies with sustainable competitive advantages trading at reasonable valuations.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. International investing involves certain risks and volatility due to potential political, economic or currency instabilities and different, potentially less stringent, financial and accounting standards than those generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger fund. References to specific securities should not be construed as a recommendation or investment advice.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 13 |

Fund at a glance

Columbia Acorn USA® (Unaudited)

Investment objective

Columbia Acorn USA® (the Fund) seeks long-term capital appreciation.

Portfolio management

Matthew A. Litfin, CFA

Lead manager

With Fund since 2015

William J. Doyle, CFA

Co-manager

With Fund since 2006

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2017 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2017) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life |

| Class A | Excluding sales charges | 10/16/00 | 11.27 | 24.38 | 12.70 | 6.52 | 10.24 |

| | Including sales charges | | 4.88 | 17.20 | 11.38 | 5.89 | 9.93 |

| Class C | Excluding sales charges | 10/16/00 | 10.89 | 23.54 | 11.93 | 5.75 | 9.44 |

| | Including sales charges | | 9.89 | 22.75 | 11.93 | 5.75 | 9.44 |

| Class R4 | 11/08/12 | 11.46 | 24.75 | 12.99 | 6.81 | 10.60 |

| Class R5 | 11/08/12 | 11.46 | 24.88 | 13.07 | 6.85 | 10.62 |

| Class Y | 11/08/12 | 11.49 | 24.91 | 13.13 | 6.88 | 10.64 |

| Class Z | 09/04/96 | 11.42 | 24.76 | 12.99 | 6.81 | 10.60 |

| Russell 2000 Growth Index | | 9.97 | 24.40 | 13.98 | 7.82 | 6.83 |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each class.

As stated in the May 1, 2017, prospectus, the Fund’s annual operating expense ratio is 1.17% for Class Z shares and 1.42% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results may reflect the effect of any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information.

Effective May 1, 2017, the Fund compares its performance to that of the Russell 2000 Growth Index. Prior to this date, the Fund compared its performance to that of the Russell 2000 Index. The Investment Manager believes that the Fund’s portfolio will generally be more closely aligned with the Russell 2000 Growth Index than with the former core benchmark from an investment style perspective. Information on the Russell 2000 Index will be included for a one-year transition period.

The Russell 2000 Growth Index, an unmanaged index, measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index, an unmanaged index, measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

| 14 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Fund at a glance (continued)

Columbia Acorn USA® (Unaudited)

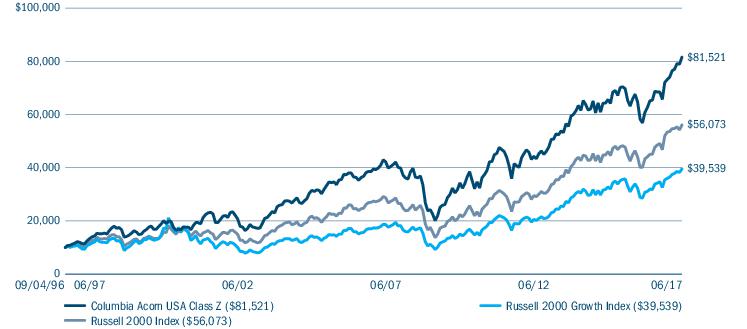

The Growth of a $10,000 Investment in Columbia Acorn USA® Class Z Shares

September 4, 1996 (Fund inception) through June 30, 2017

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Top ten holdings (%) (at June 30, 2017) | |

HealthSouth Corp.

Inpatient rehabilitative healthcare services | 2.3 |

LCI Industries

Recreational vehicles and equipment | 2.2 |

MAXIMUS, Inc.

Program management and consulting services to state and local governments | 2.0 |

OM Asset Management PLC

Domestic and international equities, fixed income, and alternative investments | 1.7 |

WNS Holdings Ltd., ADR

Business process outsourcing services | 1.7 |

Texas Roadhouse, Inc.

Moderately priced, full service restaurant chain | 1.6 |

Lakeland Financial Corp.

Bank holding company | 1.5 |

LegacyTexas Financial Group, Inc.

Bank holding company | 1.5 |

Toro Co. (The)

Turf equipment | 1.5 |

Qualys, Inc.

Information technology security risk and compliance management solutions | 1.5 |

Percentages indicated are based upon total investments (excluding Money Market Funds and Securities Lending Collateral)

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Portfolio breakdown (%) (at June 30, 2017) |

| Common Stocks | 94.6 |

| Money Market Funds | 3.9 |

| Securities Lending Collateral | 1.5 |

| Total | 100.0 |

Percentages indicated are based upon total investments. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at June 30, 2017) |

| Consumer Discretionary | 23.1 |

| Consumer Staples | 1.0 |

| Energy | 1.9 |

| Financials | 10.9 |

| Health Care | 22.1 |

| Industrials | 14.7 |

| Information Technology | 23.4 |

| Materials | 0.7 |

| Real Estate | 2.2 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 15 |

Manager Discussion of Fund Performance

Columbia Acorn USA®

Matthew A. Litfin, CFA

Lead Portfolio Manager

William J. Doyle, CFA

Co-Portfolio Manager

Columbia Acorn USA Fund Class Z shares gained 5.83% during the second quarter of 2017, outperforming the Fund’s primary benchmark, the Russell 2000 Growth Index, which gained 4.39%. Fund returns for the semiannual period were 11.42% versus a gain of 9.97% for the benchmark.

Through the first half of 2017, U.S. equity markets delivered solid and steady gains with very little in the way of interruptions. Growth stocks outperformed versus value stocks in a sharp reversal from 2016. Economic growth remained strong enough to fuel positive market performance, yet not so robust as to raise concerns that the U.S. Federal Reserve would need to take a more aggressive approach to raising interest rates. Corporate results were also supportive, highlighted by strength in earnings, rising revenues and profit margins, and generally positive guidance for the remainder of 2017. A meaningful decline in the U.S. dollar acted as an additional tailwind for U.S. equities by making the products and services of U.S. companies more competitive overseas.

In terms of strong market sectors, health care and information technology were the highest contributing sectors to performance during the period in the benchmark. The only two sectors with negative absolute returns were energy and consumer staples. The drop in oil prices from over $50 per barrel to below $43 was a primary driver of the fall in energy stocks, resulting in this sector being the standout underperformer.

In terms of allocation to sectors, overweight positions in energy, financials and consumer discretionary all detracted from Fund performance. This was offset by strong stock selection in consumer discretionary as Fund holdings in that sector more than tripled benchmark returns. Stock selection in health care and information technology also helped. Selection within energy and financials was a detractor.

Top contributors during the period were health care holding Exact Sciences and consumer company iRobot. Exact’s stock more than doubled on the strength of Cologuard, a stool-based screen for the early detection of colon cancer that we believe strikes a balance of accuracy, cost-effectiveness and convenience. We took advantage of the stock’s strength to trim our position. iRobot is the global leader in robotic floor care. The attraction for us is the company’s technological lead over the competition due to more robust R&D efforts combined with a growing marketplace for its core products. The company also is pushing into other areas and could soon be a leader in robotic lawn mowing.

Among the Fund’s detractors were Carrizo Oil and Gas and Knoll. Though an efficient exploration company, it was not surprising that Carrizo’s stock declined along with the drop in crude oil prices. Knoll manufactures and sells office furniture. Non-residential construction has been softer than expected causing the company to report softer sales and an earnings miss.

We added several new positions to the portfolio during the first half of the year, including Extended Stay America and Orasure. Extended Stay owns and operates branded hotels in the extended stay segment of the lodging industry. Over the last five years the company has renovated over 600 hotels, refinanced its balance sheet, and laid out a plan to return to unit growth. We believe investors are under-appreciating the company’s multi-faceted strategy. Orasure develops, markets and sells oral fluid specimen collection devices. The burgeoning consumer genomics market is benefiting the company’s molecular collection segment and global efforts to eradicate HIV and other epidemics are benefiting their diagnostics business. We are attracted to its highly entrenched presence in these rapidly growing areas. On the surface, these are very different businesses; however, both exhibit many of the characteristics we seek in new ideas for the Fund’s portfolio. Both offer differentiated products that we believe have an advantage over their nearest competitors, operate in segments poised for growth, and currently trade at valuations we believe are reasonable relative to their quality and future growth potential.

| 16 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn USA®

Global stocks markets have rewarded investors thus far in 2017. At the end of the period, averages remained at robust levels and there was sustained economic expansion around the world. However, growth was slower than in previous recoveries. Interest rates and volatility also remained low. We are realistic about the potential risks after a global surge in stock valuations and the potential for increased volatility. In this market environment, we continue to focus on identifying exciting growth companies with sustainable competitive advantages trading at reasonable valuations.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments in small- and mid-cap companies involve risks and volatility greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger Fund. References to specific securities should not be construed as a recommendation or investment advice.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 17 |

Fund at a glance

Columbia Acorn International SelectSM (Unaudited)

Investment objective

Columbia Acorn International SelectSM (the Fund) seeks long-term capital appreciation.

Portfolio management

Stephen Kusmierczak, CFA

Co-manager

With Fund since 2001

Andreas Waldburg-Wolfegg*

Co-manager

With Fund since 2002

*Effective September 30, 2017, Mr. Waldburg-Wolfegg will no longer serve as a Portfolio Manager of the Fund.

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2017 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2017) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life |

| Class A | Excluding sales charges | 10/16/00 | 20.13 | 23.53 | 7.09 | 3.38 | 8.30 |

| | Including sales charges | | 13.24 | 16.41 | 5.84 | 2.77 | 7.96 |

| Class C | Excluding sales charges | 10/16/00 | 19.71 | 22.66 | 6.27 | 2.58 | 7.49 |

| | Including sales charges | | 18.71 | 21.66 | 6.27 | 2.58 | 7.49 |

| Class R4 | 11/08/12 | 20.30 | 23.85 | 7.38 | 3.70 | 8.65 |

| Class R5 | 11/08/12 | 20.36 | 23.98 | 7.45 | 3.74 | 8.67 |

| Class Y | 11/08/12 | 20.38 | 24.04 | 7.49 | 3.76 | 8.68 |

| Class Z | 11/23/98 | 20.31 | 23.86 | 7.40 | 3.72 | 8.65 |

| MSCI ACWI ex USA Index (Net) | | 14.10 | 20.45 | 7.22 | 1.13 | N/A |

| MSCI ACWI ex USA Growth Index (Net) | | 17.38 | 17.38 | 8.04 | 1.89 | N/A |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each class.

As stated in the May 1, 2017, prospectus, the Fund’s annual operating expense ratio is 1.15% for Class Z shares and 1.40% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results may reflect the effect of any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information.

The MSCI ACWI ex USA Index (Net) captures a large- and mid-cap representation across 22 of 23 developed market countries (excluding the U.S.) and 24 emerging market countries. The index covers approximately 85% of the global equity opportunity set outside the United States.

The MSCI ACWI ex USA Growth Index (Net) captures large-and mid-cap representation across 22 developed markets countries and 24 emerging markets countries.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

| 18 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Fund at a glance (continued)

Columbia Acorn International SelectSM (Unaudited)

The Growth of a $10,000 Investment in Columbia Acorn International SelectSM Class Z Shares

November 23, 1998 (Fund inception) through June 30, 2017

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period. A $10,000 investment in Columbia Acorn International SelectSM at inception appreciated to $11,000 on December 31, 1998, the month-end of the inception date of the MSCI ACWI ex USA Growth Index (Net) and the MSCI ACWI ex USA Index (Net). For comparison with the indices, we assigned each index the same value as the Fund at month-end of the inception date of the indices. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Top ten holdings (%) (at June 30, 2017) | |

CCL Industries, Inc. (Canada)

Manufacturing services and specialty packaging products for the non-durable consumer products market | 5.9 |

Hexagon AB, Class B (Sweden)

Design, measurement and visualisation technologies | 5.3 |

Partners Group Holding AG (Switzerland)

Global private markets asset management firm | 5.1 |

Wirecard AG (Germany)

Internet payment and processing services | 5.0 |

MTU Aero Engines AG (Germany)

Develops and manufactures engines and offers commercial engine services and support | 4.1 |

NetEase, Inc., ADR (China)

Internet technology company that develops applications, services and Internet technologies | 4.1 |

Naspers Ltd., Class N (South Africa)

Electronic and print media industries | 4.1 |

Hoya Corp. (Japan)

Electro-optics products | 3.8 |

Geberit AG (Switzerland)

Water supply pipes and fittings, installation systems, drainage and flushing systems | 3.5 |

Novozymes AS, Class B (Denmark)

Enzymes for industrial use | 3.4 |

Percentages indicated are based upon total investments (excluding Money Market Funds and Securities Lending Collateral)

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 19 |

Fund at a glance (continued)

Columbia Acorn International SelectSM (Unaudited)

| Equity sector breakdown (%) (at June 30, 2017) |

| Consumer Discretionary | 16.9 |

| Consumer Staples | 3.0 |

| Financials | 8.4 |

| Health Care | 7.0 |

| Industrials | 22.5 |

| Information Technology | 25.6 |

| Materials | 13.5 |

| Real Estate | 3.1 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| Country breakdown (%) (at June 30, 2017) |

| Australia | 3.5 |

| Canada | 5.6 |

| China | 3.9 |

| Denmark | 3.3 |

| France | 3.4 |

| Germany | 8.7 |

| India | 2.8 |

| Ireland | 2.7 |

| Japan | 22.0 |

| Mexico | 2.4 |

| South Africa | 3.9 |

| South Korea | 1.9 |

| Sweden | 5.0 |

| Switzerland | 8.1 |

| Taiwan | 3.2 |

| United Kingdom | 14.4 |

| United States(a) | 5.2 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

Country breakdown is based primarily on issuer’s place of organization/incorporation. Percentages indicated are based upon total investments. The Fund’s portfolio composition is subject to change.

| 20 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Manager Discussion of Fund Performance

Columbia Acorn International SelectSM

Stephen Kusmierczak, CFA

Co-Portfolio Manager

Andreas Waldburg-Wolfegg

Co-Portfolio Manager

Columbia Acorn International Select Class Z shares gained 8.29% during the second quarter of 2017, outperforming the Fund’s primary benchmark, the MSCI ACWI ex USA Index (Net), which gained 5.78%. That brought Fund gains to 20.31% for the semiannual period versus a return of 14.10% for the benchmark.

The second quarter of 2017 continued the strong global equity market performance experienced in the first quarter. The strongest returns came from markets closest to China, where a major stimulus package in the second half of 2016 quieted worries about a sharp economic downturn. European equities also had strong returns aided by currency gains versus the US Dollar. On the other hand, the markets geared to commodity prices were the worst performers during the period.

Positive performance was broadly based across sectors. Information technology and industrials, areas where the Fund is overweight relative to the benchmark, continued their strong run and were top contributors to relative returns during the first half of the year. Energy was the notable detractor, and the Fund continues to maintain an underweight position in this sector. Energy was the only declining sector in the first half, explained largely by the drop in oil prices from over $50 per barrel to below $43.

Fund allocations across regions, specifically underweights in Greater China and South Korea and an overweight in Japan, detracted from performance. From a sector perspective, Fund positioning had a positive effect. Both the underweight in energy and the overweight in information technology contributed to Fund performance.

The Fund’s holdings and position sizes are determined through fundamental stock analysis not top-down allocations to geographies and sectors. These allocations may contribute to or detract from our relative returns over time, but our goal is to deliver a better return than the Fund’s benchmark by focusing on company fundamentals and valuations.

Top contributors for the first half were Wirecard and CCL Industries. German-based Wirecard provides payment solutions to online merchants globally. Growth is correlated with e-commerce, the rise of the retail “omni-channel”, cashless transactions, and emerging global technical standards, all of which we believe have considerable runway. Canadian company CCL Industries is a global provider of labels. The company has been an efficient consolidator of the industry, and has successfully focused on the fastest growing product categories like personal care and premium beverages. The company has consistently surprised by achieving higher synergies than expected following its acquisitions.

Notable stock detractors included Next, a UK home retailer, and Vermillion Energy, a Canadian oil and gas producer. Next over-ordered inventory heading into the year which led to steeper discounting to move items and lower margins. We decided to exit the position in favor of ideas with less challenging conditions in their end markets. Not surprisingly, Vermillion declined due to the drop in crude oil prices and we sold the position.

International equities exhibited strong performance in the first half of the year. At the close of the period, prospects in Continental Europe were brightening ? though it remains to be seen whether French President Emmanuel Macron can translate a seemingly decisive electoral mandate into labor market reforms capable of invigorating the economy and reducing unemployment. Japanese corporates continued to respond to policy initiatives designed to improve return on capital in an aging society that requires this to fund pension obligations. Emerging market valuations ended the period in line with historical averages and below those of slower growing developed markets. In all regions, we continue to search for exciting growth companies with sustainable competitive advantages trading at reasonable valuations.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Foreign investments subject the Fund to political, economic, market, social and other risks within a particular country, as well as to potential currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater

Columbia Acorn Family of Funds | Semiannual Report 2017

| 21 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn International SelectSM

than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger fund. References to specific securities should not be construed as a recommendation or investment advice.

| 22 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Fund at a glance

Columbia Acorn SelectSM (Unaudited)

Investment objective

Columbia Acorn SelectSM (the Fund) seeks long-term capital appreciation.

Portfolio management

David L. Frank, CFA

Co-manager

With Fund since 2002

Matthew S. Szafranski, CFA

Co-manager

With Fund since 2008

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2017 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended June 30, 2017) |

| | | Inception | 6 Months

cumulative | 1 Year | 5 Years | 10 Years | Life |

| Class A | Excluding sales charges | 10/16/00 | 11.66 | 26.22 | 12.90 | 4.69 | 9.79 |

| | Including sales charges | | 5.25 | 18.94 | 11.58 | 4.07 | 9.44 |

| Class C | Excluding sales charges | 10/16/00 | 11.29 | 25.38 | 12.08 | 3.89 | 8.97 |

| | Including sales charges | | 10.30 | 24.39 | 12.08 | 3.89 | 8.97 |

| Class R4 | 11/08/12 | 11.77 | 26.51 | 13.17 | 4.97 | 10.12 |

| Class R5 | 11/08/12 | 11.79 | 26.64 | 13.26 | 5.01 | 10.14 |

| Class Y | 11/08/12 | 11.83 | 26.75 | 13.31 | 5.03 | 10.16 |

| Class Z | 11/23/98 | 11.77 | 26.58 | 13.23 | 4.99 | 10.13 |

| Russell 2500 Growth Index | | 10.63 | 21.44 | 14.33 | 8.18 | 8.45 |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each class.

As stated in the May 1, 2017, prospectus, the Fund’s annual operating expense ratio is 0.93% for Class Z shares and 1.18% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results may reflect the effect of any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information.

Effective May 1, 2017, the Fund compares its performance to that of the Russell 2500 Growth Index. Prior to this date, the Fund compared its performance to that of the S&P MidCap 400® Index. The Investment Manager believes that the Fund’s portfolio will generally be more closely aligned with the Russell 2500 Growth Index than with the former core benchmark from an investment style perspective. Information on the S&P MidCap 400® Index will be included for a one-year transition period.

The Russell 2500 Growth Index measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

The S&P MidCap 400® Index is a market value-weighted index that tracks the performance of 400 mid-cap U.S. companies.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 23 |

Fund at a glance (continued)

Columbia Acorn SelectSM (Unaudited)

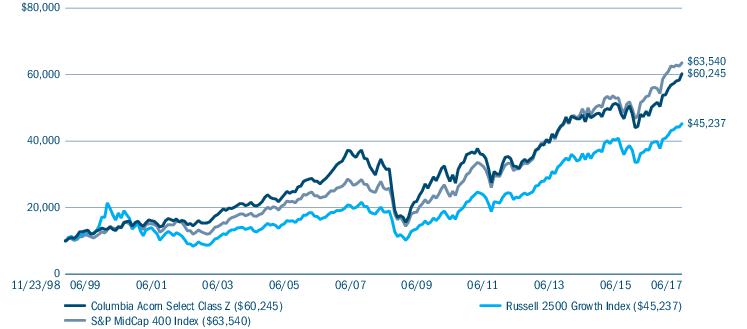

The Growth of a $10,000 Investment in Columbia Acorn SelectSM Class Z Shares

November 23, 1998 (Fund inception) through June 30, 2017

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Top ten holdings (%) (at June 30, 2017) | |

HealthSouth Corp.

Inpatient rehabilitative healthcare services | 5.3 |

Wabtec Corp.

Technology products and services for the rail industry | 4.6 |

JB Hunt Transport Services, Inc.

Logistics services | 4.5 |

Vail Resorts, Inc.

Operates resorts globally | 4.4 |

Align Technology, Inc.

Designs, manufactures, and markets the Invisalign System | 4.4 |

Snap-On, Inc.

Tool and equipment solutions | 4.4 |

GoDaddy, Inc., Class A

Cloud-based web platform for small businesses, web design professionals and individuals | 4.3 |

AMERCO

Rental of trucks, trailers, and self storage space, as well as property and casualty and life insurance products | 4.0 |

Oshkosh Corp.

Fire and emergency apparatuses and specialty commercial, and military trucks | 3.8 |

LKQ Corp.

Automotive products and services | 3.8 |

Percentages indicated are based upon total investments (excluding Money Market Funds).

For further detail about these holdings, please refer to the section entitled “Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

| Portfolio breakdown (%) (at June 30, 2017) |

| Common Stocks | 98.3 |

| Money Market Funds | 1.7 |

| Total | 100.0 |

Percentages indicated are based upon total investments. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at June 30, 2017) |

| Consumer Discretionary | 18.3 |

| Financials | 13.0 |

| Health Care | 17.2 |

| Industrials | 27.0 |

| Information Technology | 14.4 |

| Materials | 3.4 |

| Real Estate | 6.7 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 24 | Columbia Acorn Family of Funds | Semiannual Report 2017 |

Manager Discussion of Fund Performance

Columbia Acorn SelectSM

David L. Frank, CFA

Co-Portfolio Manager

Matthew S. Szafranski, CFA

Co-Portfolio Manager

Columbia Acorn Select Fund Class Z shares gained 5.09% during the second quarter of 2017, outperforming the Fund’s primary benchmark, the Russell 2500 Growth Index, which gained 4.13%. That propelled Fund gains to 11.77% for the semiannual period versus a return of 10.63% for the benchmark.

Through the first half of 2017, U.S. equity markets delivered solid and steady gains with very little in the way of interruptions. Economic growth remained strong enough to fuel positive market performance, yet not so robust as to raise concerns that the U.S. Federal Reserve would need to take a more aggressive approach to raising interest rates. Corporate results were also supportive, highlighted by strength in earnings, rising revenues and profit margins, and generally positive guidance for the remainder of 2017. A meaningful decline in the U.S. dollar acted as an additional tailwind for equities by making the products and services of U.S. companies more competitive overseas. Growth stocks strengthened against value stocks, reversing course from prior quarters.

In terms of stronger market sectors, information technology and healthcare continued their strong run of performance and were the best performing sectors in the benchmark during the period. The only two sectors with negative absolute returns were energy and consumer staples. The drop in oil prices from over $50 per barrel to below $43 was a primary driver of the fall in energy stocks, resulting in this sector being the standout underperformer.

Fund positioning as a whole relative to benchmark was negligible to relative returns. The Fund had no exposure to energy and consumer staples during the first half of 2017 as we had not found any companies with compelling business models that appeared to have a clear path to the value creation that we seek. However, the boost this provided was largely offset by the Fund’s large overweight to industrials, where the FUnd lagged the benchmark due to poor stock selection, and its underexposure to the information technology sector, the highest performing sector in the benchmark during the first half of the year.

As should be the case with a focused fund, returns relative to the benchmark were driven by our selection of individual stocks, especially in the consumer discretionary, healthcare and financial sectors. Together, stock selection in these sectors combined to contribute over 300 basis points, which was somewhat offset by poor selection in the industrials sector.

The top contributors for the first half were Align Technology and Vail Resorts. Align Technology designs, manufactures and markets the Invisalign system, an alternative method to bracket and wire braces for treating crooked teeth. The stock rose during the period as it reported a large profit surge and beat expectations on greater adoption of its products. Vail Resorts operates a number of premier ski resorts. The company had strong earnings as it has been able to both increase season pass renewals and draw more first time customers to its slopes.

The largest detractor for the period was pizza chain Papa John’s International. The firm continues to take share in the fragmented U.S. pizza industry, but the company has lost ground to leading rival Domino’s and there was renewed concern about an ongoing turnaround at laggard Pizza Hut. Nevertheless, Papa John’s premium “clean” pizza and technology platform resonate with millennials, so we added to the position on weakness. Industrial holding Snap-On, a marketer of hand and power tools, was also a negative contributor. The stock retreated due to concerns over the company’s credit portfolio. We believe those fears are overblown and added to this position as well.

Global stocks markets have rewarded investors thus far in 2017. At the end of the period, averages remained at robust levels and there was sustained economic expansion around the world. However, growth was slower than in previous recoveries. Interest rates and volatility also remained low. We are realistic about the potential risks after a global surge in stock valuations and the potential for increased volatility. In this market environment, we continue to focus on identifying exciting growth companies with sustainable competitive advantages trading at reasonable valuations.

Columbia Acorn Family of Funds | Semiannual Report 2017

| 25 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn SelectSM