UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-01829 |

|

Columbia Acorn Trust |

(Exact name of registrant as specified in charter) |

|

227 W. Monroe Street Suite 3000 Chicago, IL | | 60606 |

(Address of principal executive offices) | | (Zip code) |

|

Mary C. Moynihan Perkins Coie LLP 700 13th Street, NW Suite 600 Washington, DC 20005 Paul B. Goucher, Esq. Columbia Management Investment Advisers, LLC 100 Park Avenue New York, New York 10017 P. Zachary Egan Columbia Acorn Trust 227 West Monroe Street, Suite 3000 Chicago, Illinois 60606 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 634-9200 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2016 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

June 30, 2016

COLUMBIA ACORN FAMILY OF FUNDS

Class A, B, C, I, R, R4, R5, Y and Z Shares

Managed by Columbia Wanger Asset Management, LLC

Columbia Acorn® Fund

Columbia Acorn International®

Columbia Acorn USA®

Columbia Acorn International SelectSM

Columbia Acorn SelectSM

Columbia Thermostat FundSM

Columbia Acorn Emerging Markets FundSM

Columbia Acorn European FundSM

COLUMBIA ACORN FAMILY OF FUNDS

>NET ASSET VALUE PER SHARE as of 6/30/16

| | Columbia

Acorn Fund® | | Columbia

Acorn

International® | | Columbia

Acorn

USA® | | Columbia

Acorn

International

SelectSM | | Columbia

Acorn

SelectSM | | Columbia

Thermostat

FundSM | | Columbia

Acorn

Emerging

Markets

FundSM | | Columbia

Acorn

European

FundSM | |

Class A | | $ | 15.57 | | | $ | 38.28 | | | $ | 17.80 | | | $ | 20.93 | | | $ | 12.58 | | | $ | 14.50 | | | $ | 10.36 | | | $ | 14.16 | | |

Class B | | | N/A | | | $ | 36.88 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | |

Class C | | $ | 11.07 | | | $ | 36.73 | | | $ | 13.46 | | | $ | 19.51 | | | $ | 9.15 | | | $ | 14.55 | | | $ | 10.28 | | | $ | 14.00 | | |

Class I | | $ | 17.40 | | | $ | 38.42 | | | $ | 20.01 | | | $ | 21.22 | | | $ | 14.01 | | | | N/A | | | $ | 10.41 | | | $ | 14.17 | | |

Class R | | | N/A | | | $ | 38.20 | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | |

Class R4 | | $ | 17.80 | | | $ | 38.64 | | | $ | 20.44 | | | $ | 21.36 | | | $ | 14.33 | | | $ | 14.39 | | | $ | 10.46 | | | $ | 14.24 | | |

Class R5 | | $ | 17.89 | | | $ | 38.36 | | | $ | 20.50 | | | $ | 21.35 | | | $ | 14.38 | | | $ | 14.41 | | | $ | 10.46 | | | $ | 14.31 | | |

Class Y | | $ | 17.97 | | | $ | 38.68 | | | $ | 20.61 | | | $ | 21.34 | | | $ | 14.47 | | | $ | 14.39 | | | $ | 10.37 | | | | N/A | | |

Class Z | | $ | 17.31 | | | $ | 38.37 | | | $ | 19.78 | | | $ | 21.21 | | | $ | 13.88 | | | $ | 14.32 | | | $ | 10.39 | | | $ | 14.18 | | |

Class I shares are available only to the Columbia funds, such as Columbia Thermostat Fund, and are not available to individual investors. Class R, R4, R5, Y and Z shares are sold at net asset value and have limited eligibility. Please see the Funds' prospectuses for details. The Columbia Acorn Family of Funds offer multiple share classes, not all necessarily available through all financial intermediaries, and the ratings assigned to the various share classes by mutual fund rating agencies may vary. Contact us for details.

2016 MID-YEAR DISTRIBUTIONS

The following table lists the mid-year distributions for the Columbia Acorn Family of Funds. The record date was June 6, 2016, and the ex-dividend and payable date was June 7, 2016. The information provided for each Fund applies to all share classes of the Fund.

| Fund (all share classes) | | Short-Term

Capital Gain | | Long-Term

Capital Gain | | Ordinary

Income | |

Columbia Acorn Fund | | | None | | | | 2.05420 | | | | None | | |

Columbia Acorn International | | | None | | | | 0.25773 | | | | None | | |

Columbia Acorn USA | | | None | | | | 2.67186 | | | | None | | |

Columbia Acorn International Select | | | None | | | | None | | | | None | | |

Columbia Acorn Select | | | None | | | | 1.22021 | | | | None | | |

Columbia Thermostat Fund | | | None | | | | 0.27114 | | | | 0.04997 | | |

Columbia Acorn Emerging Markets Fund | | | None | | | | None | | | | None | | |

Columbia Acorn European Fund | | | None | | | | None | | | | 0.02638 | | |

The views expressed in the report commentaries reflect the current views of the respective authors. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective authors disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to a specific company's securities should not be construed as a recommendation or investment advice and there can be no assurance that as of the date of publication of this report, the securities mentioned in each Fund's portfolio are still held or that the securities sold have not been repurchased.

Acorn®, Acorn USA® and Acorn International® are service marks owned and registered by Columbia Acorn Trust.

Global equity markets were caught on the back foot by the outcome of the UK referendum on continued European Union (EU) membership. The long-term political and economic implications of this decision are potentially vast and impossible to discern at this stage, not least because they will be shaped by how policymakers respond. As investors globally reprice risk and reposition portfolios in light of currency sensitivity and how they expect this outcome to bear differently on sectors, countries and companies, there will be mispricing opportunities. This is good for stock pickers and we expect to be active. We will be looking closely at how strong players in diverse industries might improve their competitive positions, as growth opportunities become more scarce and costs of capital among competitors more differentiated. We expect the relatively high balance sheet and business model quality of the stocks that we hold in the Columbia Acorn Funds to prove helpful in coming quarters because the risk premium has gone up, as evidenced by increased volatility, compressed multiples in some pockets of the market such as European banks, and sharp currency swings.

This political development is nonetheless clearly a negative one. The United Kingdom is the fifth largest economy in the world and the second largest within the EU. It has been a member of the European Economic Community (precursor to the EU) since 1973.i The UK exit raises uncertainties about global growth, heightens risk aversion, and it will preoccupy European policymakers at a time when they are already challenged by anemic growth, high unemployment, refugee immigration flows, and international and domestic security concerns.

While many market observers view the outcome of the referendum as a comment on, and existential threat to, the overall European integration project, it may, rather, reflect a larger process at work, namely increasing middle-class discontent with the perceived consequences of globalization in industrialized democracies. Rising populism and nativist resentments in Europe and the United States could be harbingers of future policy regimes that place less value on minimizing trade friction, and the mobility of capital and labor, all of which have contributed to global prosperity. The evolving framework for global trade and investment over the last 25 years has been an enormous engine of global growth. During this period, a substantial percentage of the world's population once living within largely economically isolated communist states was integrated into the modern global economy as producers and consumers. This has

raised standards of living in emerging markets and reduced the cost of consumer goods in industrialized countries, while creating new and growing markets for the sort of technologically sophisticated exports that support high-paying jobs in industrialized countries.

The Columbia Acorn Funds have benefited meaningfully from these trends. With Brexit, the EU will lose its strongest advocate of economic liberalism, which has served as an important counterpoint to statist perspectives in Germany and France. At a minimum, it appears that domestic policies are poised to pivot toward the populist issue of economic inequality, which in Europe may manifest itself in a slowdown or reversal of structural reforms in EU labor markets, with negative consequences for productivity and, with it, standards of living. Fiscal tightening, where necessary, could be scaled back as a salve to populists, and it seems likely that industrialized countries will see increased constraints on immigration, even where demographically driven labor shortages exist.

While this could well be regarded as overall bad news for asset owners, opportunities will likely present themselves. For many years, the Columbia Acorn Funds have explored how factory automation is deployed to reduce labor costs or to replace labor altogether, trends which could be accelerated by a reduction in immigration. London will fight hard to retain its role as the center of European finance, but bank chiefs are already talking about decamping elsewhere, which could create opportunity in continental European real estate and construction. As corporate investment decision-making and household spending slow amidst the uncertainty, fiscal stimulus could be sought via public infrastructure projects, which would be good for constructors and suppliers of building materials. Public policy that increases labor's share of income would benefit consumer companies oriented to a lower middle class demographic. Other policy interventions could result in continued ultra-low interest rates, with implications for interest-rate sensitive businesses. In any case, it seems that earnings growth will continue to be a scarce factor in a low-growth world.

P. Zachary Egan

President and Global Chief Investment Officer

Columbia Wanger Asset Management, LLC

i http://ukandeu.ac.uk/fact-figures/when-did-britain-decide-to-join-the-european-union/

COLUMBIA ACORN FAMILY OF FUNDS

TABLE OF CONTENTS

Description of Indexes | | | 1 | | |

Share Class Performance | | | 2 | | |

Fund Performance vs. Benchmarks | | | 3 | | |

Columbia Acorn® Fund | |

In a Nutshell | | | 4 | | |

At a Glance | | | 5 | | |

Statement of Investments | | | 23 | | |

Columbia Acorn International® | |

In a Nutshell | | | 6 | | |

At a Glance | | | 7 | | |

Statement of Investments | | | 30 | | |

Portfolio Diversification | | | 36 | | |

Columbia Acorn USA® | |

In a Nutshell | | | 8 | | |

At a Glance | | | 9 | | |

Statement of Investments | | | 37 | | |

Columbia Acorn International SelectSM | |

In a Nutshell | | | 10 | | |

At a Glance | | | 11 | | |

Statement of Investments | | | 42 | | |

Portfolio Diversification | | | 45 | | |

Columbia Acorn SelectSM | |

In a Nutshell | | | 12 | | |

At a Glance | | | 13 | | |

Statement of Investments | | | 46 | | |

Columbia Thermostat FundSM | |

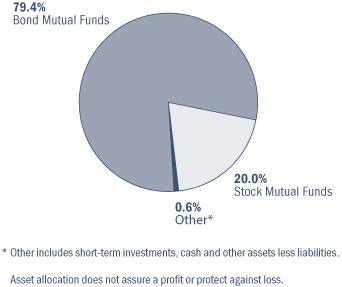

In a Nutshell | | | 14 | | |

At a Glance | | | 15 | | |

Statement of Investments | | | 49 | | |

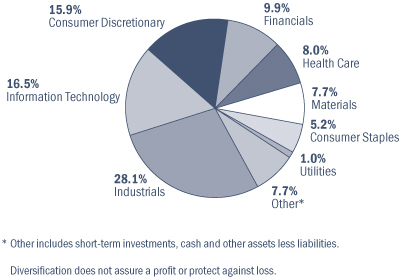

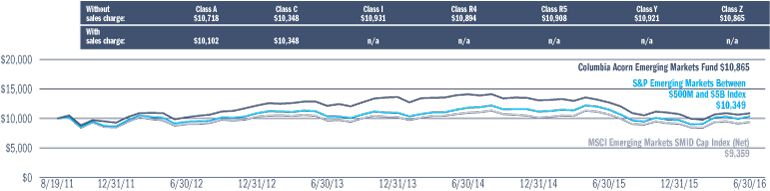

Columbia Acorn Emerging Markets FundSM | |

In a Nutshell | | | 16 | | |

At a Glance | | | 17 | | |

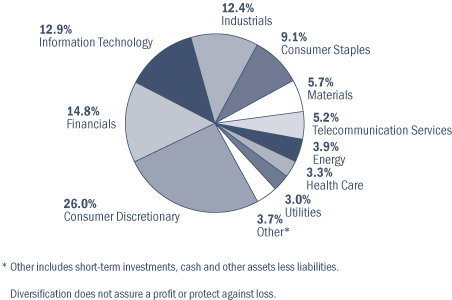

Statement of Investments | | | 51 | | |

Portfolio Diversification | | | 55 | | |

Columbia Acorn European FundSM | |

In a Nutshell | | | 18 | | |

At a Glance | | | 19 | | |

Statement of Investments | | | 56 | | |

Portfolio Diversification | | | 59 | | |

Understanding Your Expenses | | | 20 | | |

Columbia Acorn Family of Funds | |

Statements of Assets and Liabilities | | | 60 | | |

Statements of Operations | | | 62 | | |

Statements of Changes in Net Assets | | | 64 | | |

Financial Highlights | | | 70 | | |

Notes to Financial Statements | | | 86 | | |

Board Approval of the Advisory Agreement | | | 97 | | |

Expense Information | | | 102 | | |

COLUMBIA ACORN FAMILY OF FUNDS

DESCRIPTIONS OF INDEXES INCLUDED IN THIS REPORT

• 50/50 Blended Benchmark, established by the Fund's investment manager, is an equally weighted custom composite of Columbia Thermostat Fund's primary equity and primary debt benchmarks, the S&P 500® Index and the Barclays U.S. Aggregate Bond Index, respectively. The percentage of the Fund's assets allocated to underlying stock and bond portfolio funds will vary, and accordingly the composition of the Fund's portfolio will not always reflect the composition of the 50/50 Blended Benchmark.

• Barclays U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

• MSCI AC Europe Small Cap Index (Net) captures a small-cap representation across 21 markets in Europe. The index covers approximately 14% of the free float-adjusted market capitalization across each market country in Europe.

• MSCI ACWI ex USA Index (Net) captures a large- and mid-cap representation across 22 of 23 developed market countries (excluding the U.S.) and 23 emerging market countries. The index covers approximately 85% of the global equity opportunity set outside the United States.

• MSCI ACWI ex USA SMID Cap Index (Net) captures a mid- and small-cap representation across 22 of 23 developed market countries (excluding the U.S.) and 23 emerging market countries. The index covers approximately 28% of the free float-adjusted market capitalization in each country.

• MSCI Emerging Markets SMID Cap Index (Net) captures a mid- and small-cap representation across 23 emerging market countries. The index covers approximately 29% of the free float-adjusted market capitalization in each country.

• Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

• Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, which represents approximately 17% of the total market capitalization of the Russell 3000 Index.

• Standard & Poor's (S&P) 500® Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

• S&P Developed Ex-U.S. Between $2B and $10B® Index is a subset of the broad market selected by the index sponsor that represents the mid-cap developed market, excluding the United States.

• S&P Emerging Markets Between $500M and $5B® Index represents the institutionally investable capital of 22 emerging market countries, as determined by S&P, with market caps ranging between $500 million to $5 billion. The index currently consists of the following emerging market country indexes: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

• S&P Europe Between $500M and $5B® Index represents the institutionally investable capital of 16 European countries, as determined by S&P, with market caps ranging between $500 million to $5 billion. The index consists of the following European countries: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

• S&P Global Ex-U.S. Between $500M and $5B® Index is a subset of the broad market selected by the index sponsor that represents the mid- and small-cap developed and emerging markets, excluding the United States.

• S&P MidCap 400® Index is a market value-weighted index that tracks the performance of 400 mid-cap U.S. companies.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

1

COLUMBIA ACORN FAMILY OF FUNDS

SHARE CLASS PERFORMANCE Average Annual Total Returns through 6/30/16

| | Class A | | Class B | | Class C | | Class I | | Class R | | Class R4 | | Class R5 | | Class Y | | Class Z | |

| | Without

Sales

Charge | | With

Sales

Charge | | Without

Sales

Charge | | With

Sales

Charge | | Without

Sales

Charge | | With

Sales

Charge | | | | | | | | | | | | | |

Columbia Acorn® Fund | |

Year to date* | | | -0.37 | % | | | -6.13 | % | | | N/A | | | | N/A | | | | -0.74 | % | | | -1.58 | % | | | -0.18 | % | | | N/A | | | | -0.23 | % | | | -0.18 | % | | | -0.18 | % | | | -0.18 | % | |

| 1 year | | | -8.16 | % | | | -13.44 | % | | | N/A | | | | N/A | | | | -8.82 | % | | | -9.24 | % | | | -7.82 | % | | | N/A | | | | -8.01 | % | | | -7.85 | % | | | -7.83 | % | | | -7.84 | % | |

| 5 years | | | 6.05 | % | | | 4.80 | % | | | N/A | | | | N/A | | | | 5.28 | % | | | 5.28 | % | | | 6.42 | % | | | N/A | | | | 6.30 | % | | | 6.37 | % | | | 6.41 | % | | | 6.36 | % | |

| 10 years | | | 5.96 | % | | | 5.34 | % | | | N/A | | | | N/A | | | | 5.16 | % | | | 5.16 | % | | | 6.31 | % | | | N/A | | | | 6.24 | % | | | 6.28 | % | | | 6.30 | % | | | 6.27 | % | |

Columbia Acorn International® | |

Year to date* | | | -1.42 | % | | | -7.08 | % | | | -1.78 | % | | | -6.66 | % | | | -1.79 | % | | | -2.77 | % | | | -1.24 | % | | | -1.60 | % | | | -1.33 | % | | | -1.26 | % | | | -1.23 | % | | | -1.29 | % | |

| 1 year | | | -7.65 | % | | | -12.96 | % | | | -8.49 | % | | | -12.90 | % | | | -8.33 | % | | | -9.21 | % | | | -7.30 | % | | | -8.01 | % | | | -7.46 | % | | | -7.34 | % | | | -7.30 | % | | | -7.40 | % | |

| 5 years | | | 2.65 | % | | | 1.44 | % | | | 1.85 | % | | | 1.51 | % | | | 1.89 | % | | | 1.89 | % | | | 3.04 | % | | | 2.28 | % | | | 2.90 | % | | | 2.99 | % | | | 3.02 | % | | | 2.96 | % | |

| 10 years | | | 4.79 | % | | | 4.17 | % | | | 4.06 | % | | | 4.06 | % | | | 3.99 | % | | | 3.99 | % | | | 5.18 | % | | | 4.46 | % | | | 5.10 | % | | | 5.14 | % | | | 5.16 | % | | | 5.13 | % | |

Columbia Acorn USA® | |

Year to date* | | | 0.82 | % | | | -5.00 | % | | | N/A | | | | N/A | | | | 0.46 | % | | | -0.38 | % | | | 1.01 | % | | | N/A | | | | 0.90 | % | | | 0.94 | % | | | 1.03 | % | | | 0.92 | % | |

| 1 year | | | -7.40 | % | | | -12.72 | % | | | N/A | | | | N/A | | | | -8.05 | % | | | -8.57 | % | | | -7.02 | % | | | N/A | | | | -7.21 | % | | | -7.10 | % | | | -7.03 | % | | | -7.18 | % | |

| 5 years | | | 6.97 | % | | | 5.72 | % | | | N/A | | | | N/A | | | | 6.23 | % | | | 6.23 | % | | | 7.40 | % | | | N/A | | | | 7.25 | % | | | 7.30 | % | | | 7.35 | % | | | 7.24 | % | |

| 10 years | | | 5.75 | % | | | 5.13 | % | | | N/A | | | | N/A | | | | 4.97 | % | | | 4.97 | % | | | 6.12 | % | | | N/A | | | | 6.04 | % | | | 6.07 | % | | | 6.09 | % | | | 6.04 | % | |

Columbia Acorn International SelectSM | |

Year to date* | | | -1.88 | % | | | -7.51 | % | | | N/A | | | | N/A | | | | -2.25 | % | | | -3.23 | % | | | -1.62 | % | | | N/A | | | | -1.75 | % | | | -1.70 | % | | | -1.70 | % | | | -1.71 | % | |

| 1 year | | | -6.61 | % | | | -11.98 | % | | | N/A | | | | N/A | | | | -7.37 | % | | | -8.28 | % | | | -6.21 | % | | | N/A | | | | -6.35 | % | | | -6.29 | % | | | -6.24 | % | | | -6.36 | % | |

| 5 years | | | 1.76 | % | | | 0.57 | % | | | N/A | | | | N/A | | | | 0.97 | % | | | 0.97 | % | | | 2.14 | % | | | N/A | | | | 2.05 | % | | | 2.10 | % | | | 2.13 | % | | | 2.07 | % | |

| 10 years | | | 4.28 | % | | | 3.66 | % | | | N/A | | | | N/A | | | | 3.45 | % | | | 3.45 | % | | | 4.66 | % | | | N/A | | | | 4.60 | % | | | 4.63 | % | | | 4.64 | % | | | 4.61 | % | |

Columbia Acorn SelectSM | |

Year to date* | | | -1.32 | % | | | -7.00 | % | | | N/A | | | | N/A | | | | -1.77 | % | | | -2.64 | % | | | -1.13 | % | | | N/A | | | | -1.17 | % | | | -1.17 | % | | | -1.17 | % | | | -1.21 | % | |

| 1 year | | | -7.56 | % | | | -12.86 | % | | | N/A | | | | N/A | | | | -8.25 | % | | | -8.79 | % | | | -7.21 | % | | | N/A | | | | -7.33 | % | | | -7.27 | % | | | -7.24 | % | | | -7.28 | % | |

| 5 years | | | 5.48 | % | | | 4.24 | % | | | N/A | | | | N/A | | | | 4.70 | % | | | 4.70 | % | | | 5.89 | % | | | N/A | | | | 5.75 | % | | | 5.80 | % | | | 5.83 | % | | | 5.78 | % | |

| 10 years | | | 5.17 | % | | | 4.55 | % | | | N/A | | | | N/A | | | | 4.36 | % | | | 4.36 | % | | | 5.54 | % | | | N/A | | | | 5.46 | % | | | 5.49 | % | | | 5.50 | % | | | 5.48 | % | |

Columbia Thermostat FundSM | |

Year to date* | | | 3.57 | % | | | -2.37 | % | | | N/A | | | | N/A | | | | 3.20 | % | | | 2.20 | % | | | N/A | | | | N/A | | | | 3.67 | % | | | 3.74 | % | | | 3.74 | % | | | 3.69 | % | |

| 1 year | | | 2.53 | % | | | -3.37 | % | | | N/A | | | | N/A | | | | 1.74 | % | | | 0.75 | % | | | N/A | | | | N/A | | | | 2.75 | % | | | 2.82 | % | | | 2.81 | % | | | 2.76 | % | |

| 5 years | | | 6.21 | % | | | 4.96 | % | | | N/A | | | | N/A | | | | 5.42 | % | | | 5.42 | % | | | N/A | | | | N/A | | | | 6.45 | % | | | 6.48 | % | | | 6.51 | % | | | 6.46 | % | |

| 10 years | | | 5.88 | % | | | 5.25 | % | | | N/A | | | | N/A | | | | 5.08 | % | | | 5.08 | % | | | N/A | | | | N/A | | | | 6.13 | % | | | 6.15 | % | | | 6.16 | % | | | 6.13 | % | |

Columbia Acorn Emerging Markets FundSM | |

Year to date* | | | 1.17 | % | | | -4.60 | % | | | N/A | | | | N/A | | | | 0.78 | % | | | -0.22 | % | | | 1.46 | % | | | N/A | | | | 1.36 | % | | | 1.36 | % | | | 1.37 | % | | | 1.27 | % | |

| 1 year | | | -14.75 | % | | | -19.63 | % | | | N/A | | | | N/A | | | | -15.39 | % | | | -16.23 | % | | | -14.33 | % | | | N/A | | | | -14.46 | % | | | -14.37 | % | | | -14.35 | % | | | -14.52 | % | |

Life of Fund | | | 1.44 | % | | | 0.21 | % | | | N/A | | | | N/A | | | | 0.71 | % | | | 0.71 | % | | | 1.84 | % | | | N/A | | | | 1.77 | % | | | 1.80 | % | | | 1.83 | % | | | 1.72 | % | |

Columbia Acorn European FundSM | |

Year to date* | | | -3.84 | % | | | -9.37 | % | | | N/A | | | | N/A | | | | -4.14 | % | | | -5.10 | % | | | -3.70 | % | | | N/A | | | | -3.75 | % | | | -3.73 | % | | | N/A | | | | -3.70 | % | |

| 1 year | | | -6.08 | % | | | -11.49 | % | | | N/A | | | | N/A | | | | -6.74 | % | | | -7.67 | % | | | -5.78 | % | | | N/A | | | | -5.82 | % | | | -5.83 | % | | | N/A | | | | -5.84 | % | |

Life of Fund | | | 8.27 | % | | | 6.96 | % | | | N/A | | | | N/A | | | | 7.48 | % | | | 7.48 | % | | | 8.59 | % | | | N/A | | | | 8.56 | % | | | 8.55 | % | | | N/A | | | | 8.55 | % | |

*Not annualized.

Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class B shares are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C shares are shown with and without the maximum CDSC of 1.00% for the first year after purchase. The Funds' other classes are not subject to sales charges and have limited eligibility. Please see the Funds' prospectuses for details. Performance for different share classes will vary based on differences in sales charges and certain fees associated with each class.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results may reflect the effect of any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower. Please see Note 4, "Fees and Other Transactions With Affiliates" in the Notes to Financial Statements of this report for information on contractual fee waiver and expense reimbursement agreements in place on June 30, 2016, for Columbia Acorn International, Columbia Acorn Select, Columbia Thermostat Fund, Columbia Acorn Emerging Markets Fund and Columbia Acorn European Fund and voluntary fee waiver and expense reimbursement arrangements in place for Columbia Acorn International, Columbia Acorn International Select and Columbia Acorn Select.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting investor.columbiathreadneedleus.com or calling 800.922.6769.

The returns shown include the returns of each Fund's Class Z shares, each Fund's oldest share class, in cases where the inception date of the Fund is earlier than the inception date of the particular share class or where a period shown dates to before the inception date of the share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

Continued on Page 3.

2

FUND PERFORMANCE VS. BENCHMARKS Class Z Average Annual Total Returns through 6/30/16

| Class Z Shares | | 2nd

quarter* | | Year to

date* | | 1 year | | 5 years | | 10 years | | Life of

Fund | |

| Columbia Acorn® Fund (ACRNX) (6/10/70) | | | 2.58 | % | | | -0.18 | % | | | -7.84 | % | | | 6.36 | % | | | 6.27 | % | | | 14.04 | % | |

Russell 2500 Index | | | 3.57 | % | | | 3.98 | % | | | -3.67 | % | | | 9.48 | % | | | 7.32 | % | | | N/A | | |

S&P 500 Index** | | | 2.46 | % | | | 3.84 | % | | | 3.99 | % | | | 12.10 | % | | | 7.42 | % | | | 10.80 | % | |

| Columbia Acorn International® (ACINX) (9/23/92) | | | -1.41 | % | | | -1.29 | % | | | -7.40 | % | | | 2.96 | % | | | 5.13 | % | | | 10.04 | % | |

MSCI ACWI Ex USA SMID Cap Index (Net) | | | -1.32 | % | | | -0.31 | % | | | -6.13 | % | | | 1.76 | % | | | 3.43 | % | | | N/A | | |

S&P Global Ex-U.S. Between $500M and $5B Index | | | 0.24 | % | | | 1.98 | % | | | -5.35 | % | | | 2.49 | % | | | 4.76 | % | | | 7.86 | % | |

| Columbia Acorn USA® (AUSAX) (9/4/96) | | | 7.41 | % | | | 0.92 | % | | | -7.18 | % | | | 7.24 | % | | | 6.04 | % | | | 9.93 | % | |

Russell 2000 Index | | | 3.79 | % | | | 2.22 | % | | | -6.73 | % | | | 8.35 | % | | | 6.20 | % | | | 7.88 | % | |

| Columbia Acorn Int'l SelectSM (ACFFX) (11/23/98) | | | 0.19 | % | | | -1.71 | % | | | -6.36 | % | | | 2.07 | % | | | 4.61 | % | | | 7.85 | % | |

MSCI ACWI Ex USA Index (Net) | | | -0.64 | % | | | -1.02 | % | | | -10.24 | % | | | 0.10 | % | | | 1.87 | % | | | N/A | | |

S&P Developed Ex-U.S. Between $2B and $10B Index | | | -1.12 | % | | | -0.29 | % | | | -4.03 | % | | | 3.58 | % | | | 3.66 | % | | | 6.98 | % | |

| Columbia Acorn SelectSM (ACTWX) (11/23/98) | | | -0.89 | % | | | -1.21 | % | | | -7.28 | % | | | 5.78 | % | | | 5.48 | % | | | 9.27 | % | |

S&P MidCap 400 Index | | | 3.99 | % | | | 7.93 | % | | | 1.33 | % | | | 10.55 | % | | | 8.55 | % | | | 10.01 | % | |

| Columbia Thermostat FundSM (COTZX) (9/25/02) | | | 1.81 | % | | | 3.69 | % | | | 2.76 | % | | | 6.46 | % | | | 6.13 | % | | | 7.40 | % | |

S&P 500 Index | | | 2.46 | % | | | 3.84 | % | | | 3.99 | % | | | 12.10 | % | | | 7.42 | % | | | 9.29 | % | |

Barclays U.S. Aggregate Bond Index | | | 2.21 | % | | | 5.31 | % | | | 6.00 | % | | | 3.76 | % | | | 5.13 | % | | | 4.59 | % | |

50/50 Blended Benchmark | | | 2.34 | % | | | 4.68 | % | | | 5.25 | % | | | 8.07 | % | | | 6.60 | % | | | 7.20 | % | |

| Columbia Acorn Emerging Markets FundSM (CEFZX) (8/19/11) | | | 1.86 | % | | | 1.27 | % | | | -14.52 | % | | | — | | | | — | | | | 1.72 | % | |

MSCI Emerging Markets SMID Cap Index (Net) | | | 0.15 | % | | | 3.21 | % | | | -12.19 | % | | | — | | | | — | | | | -1.35 | % | |

S&P Emerging Markets Between $500M and $5B Index | | | 1.96 | % | | | 6.78 | % | | | -10.01 | % | | | — | | | | — | | | | 0.71 | % | |

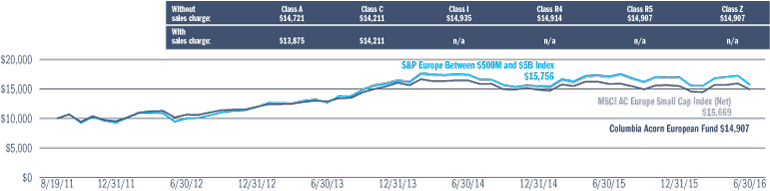

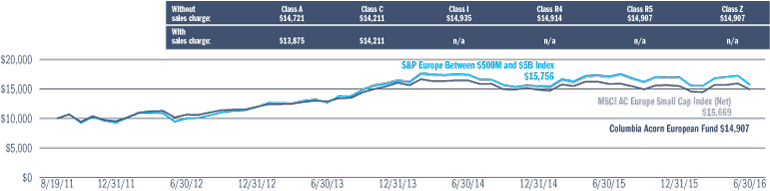

| Columbia Acorn European FundSM (CAEZX) (8/19/11) | | | -4.80 | % | | | -3.70 | % | | | -5.84 | % | | | — | | | | — | | | | 8.55 | % | |

MSCI AC Europe Small Cap Index (Net) | | | -6.71 | % | | | -7.52 | % | | | -7.58 | % | | | — | | | | — | | | | 9.66 | % | |

S&P Europe Between $500M and $5B Index | | | -6.07 | % | | | -7.22 | % | | | -7.87 | % | | | — | | | | — | | | | 9.79 | % | |

The inception dates for Class A, B and C shares (if offered) are as follows: Columbia Acorn Fund, Columbia Acorn International, Columbia Acorn USA, Columbia Acorn International Select and Columbia Acorn Select, 10/16/00; Columbia Thermostat Fund, 3/3/03; Columbia Acorn Emerging Markets Fund and Columbia Acorn European Fund, 8/19/11. The inception dates for Class I shares are as follows: Columbia Acorn Fund, Columbia Acorn International, Columbia Acorn USA, Columbia Acorn International Select and Columbia Acorn Select, 9/27/10; Columbia Acorn Emerging Markets Fund and Columbia Acorn European Fund, 8/19/11. The inception date for Class R shares for Columbia Acorn International is 8/2/11. The inception date for Class R4, R5 and Y shares (if offered) is as follows: Columbia Acorn Fund, Columbia Acorn USA, Columbia Acorn International Select, Columbia Acorn Select, Columbia Thermostat Fund, Columbia Acorn Emerging Markets Fund and Columbia Acorn European Fund, 11/8/12, except that Class Y shares of Columbia Acorn Emerging Markets Fund commenced operations on 6/13/13 and Class R4 shares of Columbia Acorn European Fund commenced operations on 6/25/14. The inception date for Class R5 shares of Columbia Acorn International is 8/2/11. The inception date for Class R4 and Y shares of Columbia Acorn International is 11/8/12. The inception date for Class Z shares is as follows: Columbia Acorn Fund, 6/10/70; Columbia Acorn International, 9/23/92; Columbia Acorn USA, 9/4/96; Columbia Acorn International Select and Columbia Acorn Select, 11/23/98; Columbia Thermostat Fund, 9/25/02; Columbia Acorn Emerging Markets Fund and Columbia Acorn European Fund, 8/19/11. Class Y shares for Columbia Acorn European Fund are not currently available for purchase.

*Not annualized.

**Although the Fund typically invests in small- and mid-sized companies, the comparison to the S&P 500® Index is presented to show performance against a widely recognized market index over the life of the Fund.

Please see Page 1 for a description of the indexes listed above.

3

COLUMBIA ACORN® FUND

IN A NUTSHELL

| |

| |

P. Zachary Egan

Co-Portfolio Manager | | Fritz Kaegi

Co-Portfolio Manager | |

| |

Matthew A. Litfin

Co-Portfolio Manager | |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. Foreign investments subject the Fund to political, economic, market, social and other risks within a particular country, as well as to potential currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector.

Columbia Acorn Fund Class Z shares gained 2.58% in the second quarter of 2016, compared to a 3.57% gain of the Fund's primary benchmark, the Russell 2500 Index. For the first six months of the year, the Fund posted a slight loss of 0.18%, while the benchmark gained 3.98%. During the second quarter, U.S. small-cap stocks outpaced global equities, as smaller U.S. companies were aided by their lower sensitivity to both a rising U.S. dollar and concerns about the potential fallout from the Brexit vote.†

The Fund's relative performance in the quarter was negatively impacted by its overweight in the transportation and biotech industries, and its long-standing underweight in real estate investment trusts and utilities during a quarter in which a global search for yield fueled dividend-paying stocks. The more growth-oriented, profitable names that the Fund typically owns were out of favor in the second quarter, as value continued to outperform growth, as it did year to date. While these market shifts were not ideal for our growth-at-a reasonable-price approach, market leadership ebbs and flows over time, and we were pleased to see that, while sector allocation detracted from overall performance, strong stock selection added over 100 basis points to Fund returns in the quarter. We view this as confirmation that our recent repositioning efforts are taking the Fund in the right direction. We added 22 new positions in the second quarter and sold 20 names. We continue to move away from lower-conviction, sub-scale positions, and toward meaningful exposure to higher-quality names that we believe have significant future growth potential and strong prospects for outsized return on capital profiles.

The Fund's top two contributors to performance in the second quarter were IT stocks that had strong gains on acquisition news. Demandware, an e-commerce website platform for retailers, gained 91% after agreeing to be acquired by Salesforce.com. Cvent, a provider of software used by corporate event planners and hotels, saw its stock rise 60% following the announcement of its agreement to be acquired by Vista Equity Partners. We sold both positions, capturing nice gains for the Fund.

We shifted assets toward health care equipment names, increasing the Fund's overweight in the health care sector. We believe this area of the health care industry offers solid growth potential through companies with good reinvestment possibilities and high rates of return. We also increased the Fund's exposure to diversified financial services companies in the quarter, although the market has punished companies like Lazard and Jones Lang

LaSalle for a slowdown in transaction-oriented business. These holdings were the top two detractors from performance in the quarter, with Lazard, a provider of corporate advisory and asset management services, falling 22% and Jones Lang LaSalle, a provider of real estate services, declining 17%. We took advantage of the declines to add to both positions in the first half of the year, as we believe both companies are high-quality franchises with strong long-term outlooks.

We are excited about the potential that we feel exists in the Fund's newly repositioned portfolio. Looking at trailing three-year weighted average earnings per share (EPS) growth in the portfolio at quarter end, the portfolio showed EPS growth of 18%, which is significantly higher than the benchmark's 10%. Last year at this time, the same number was 12% for the Fund, so we have tilted the portfolio toward faster growers. Our renewed emphasis on high-quality growth names in the Fund has led us to companies that we believe not only have high rates of return, but that are industry leaders with consistent long-term performance, future growth potential, and that have the ability to reinvest new capital at above-average rates of return.

†The Russell 2500 Index gained 3.57% in the second quarter, which compares to a 2.46% return for the U.S. large-cap S&P 500 Index and a 1.46% decline of the MSCI EAFE Index (Net), a measure of large-cap international equity performance. The S&P Global Ex-U.S. Small Cap Index, which is made up of the bottom 20% of institutionally investable capital outside the United States, was down 0.69% in the second quarter.

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

4

COLUMBIA ACORN® FUND

AT A GLANCE

Total Net Assets of the Fund:

$5.7 billion

Performance data shown below represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Performance data reflects fee waivers or reimbursements of Fund expenses, if any; in their absence, performance results would have been lower. Indexes are unmanaged; their results do not reflect the effect of expenses or sales charges. Securities in the Fund may not match those in an index. Please visit investor.columbiathreadneedleus.com for performance data current to the most recent month-end.

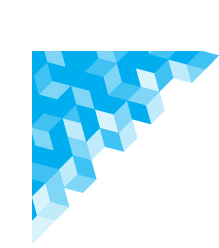

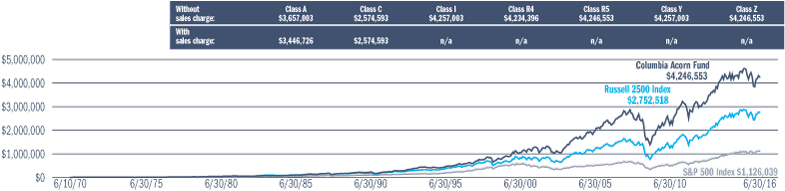

The Growth of a $10,000 Investment in Columbia Acorn® Fund Class Z Shares

June 10, 1970 (Fund inception) through June 30, 2016

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period. A $10,000 investment in Columbia Acorn Fund at inception appreciated to $31,777 on December 31, 1978, the inception date of the Russell 2500 Index. For comparison with the Russell 2500 Index, we assigned the index the same value as the Fund at index inception. Although the Fund typically invests in small- and mid-sized companies, the comparison to the S&P 500 Index is presented to show performance against a widely recognized market index over the life of the Fund.

Average Annual Total Returns for period ended June 30, 2016

| | | 2nd

quarter | | Year to

date | | 1 year | | 5 years | | 10 years | | Life of

Fund | |

| Class Z (6/10/70 inception) | | | 2.58 | % | | | -0.18 | % | | | -7.84 | % | | | 6.36 | % | | | 6.27 | % | | | 14.04 | % | |

| Class A (10/16/00 inception) | |

without sales charge | | | 2.47 | | | | -0.37 | | | | -8.16 | | | | 6.05 | | | | 5.96 | | | | 13.67 | | |

with sales charge | | | -3.44 | | | | -6.13 | | | | -13.44 | | | | 4.80 | | | | 5.34 | | | | 13.53 | | |

Russell 2500 Index* | | | 3.57 | | | | 3.98 | | | | -3.67 | | | | 9.48 | | | | 7.32 | | | | N/A | | |

Results for other share classes can be found on Page 2.

*The Fund's primary benchmark. Please see Page 1 for index descriptions.

Returns for Class A shown with and without the maximum initial sales charge of 5.75%. As stated in the May 1, 2016, prospectus, as supplemented June 27, 2016, the Fund's annual operating expense ratio is 0.82% for Class Z shares and 1.07% for Class A shares. The returns shown for periods prior to the inception of the Fund's Class A shares append the returns of the Fund's Class Z shares, the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

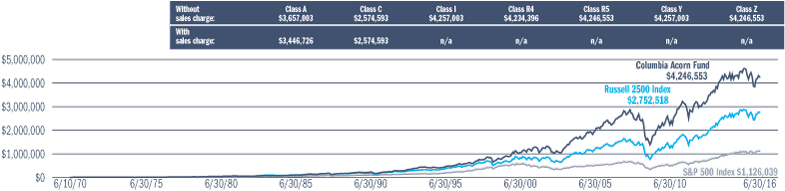

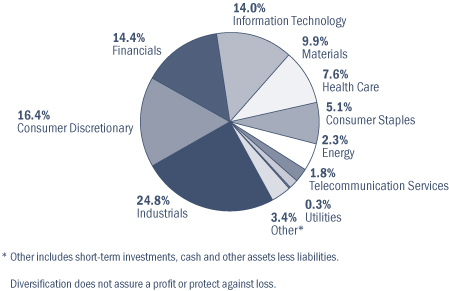

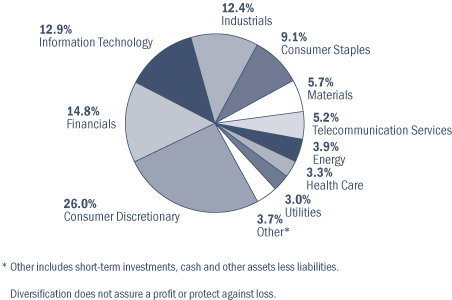

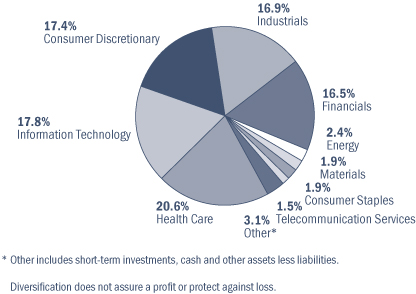

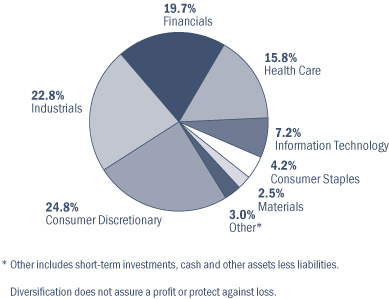

Portfolio Diversification

as a percentage of net assets, as of 6/30/16

Top 10 Holdings

as a percentage of net assets, as of 6/30/16

1. | | Align Technology

Invisalign System to Correct Malocclusion

(Crooked Teeth) | | | 2.6

| % | |

2. | | EdR

Student Housing | | | 1.6

| % | |

3. | | Expeditors International of Washington

International Freight Forwarder | | | 1.6

| % | |

4. | | Vail Resorts

Ski Resort Operator & Developer | | | 1.5

| % | |

5. | | VWR

Distributor of Lab Supplies | | | 1.4

| % | |

6. | | Robert Half International

Temporary & Permanent Staffing in Finance,

Accounting & Other Professions | | | 1.4

| % | |

7. | | HealthSouth

Inpatient Rehabilitation Facilities &

Home Health Care | | | 1.3

| % | |

8. | | Acuity Brands

Commercial Lighting Fixtures | | | 1.2

| % | |

9. | | Lazard

Corporate Advisory & Asset Management | | | 1.2

| % | |

10. | | Toro

Turf Maintenance Equipment | | | 1.2

| % | |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

5

COLUMBIA ACORN INTERNATIONAL®

IN A NUTSHELL

| |

| |

P. Zachary Egan

Co-Portfolio Manager | | Louis J. Mendes

Co-Portfolio Manager | |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. International investing involves certain risks and volatility due to potential political, economic or currency instabilities and different, potentially less stringent, financial and accounting standards than those generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies.

Columbia Acorn International Class Z shares ended the second quarter down 1.41%, performing in line with the Fund's primary benchmark, the MSCI ACWI Ex USA SMID Cap Index (Net), which was down 1.32%. For the semiannual period, the Fund declined 1.29% versus a 0.31% drop for the benchmark. Major factors impacting markets in the quarter were the surprise outcome of the Brexit vote in the United Kingdom, continued strong performance from the commodities sector, and signs of strength in a number of developing economies, particularly in Southeast Asia.

As discussed in our letter at the front of this report, the United Kingdom's decision to exit the European Union was somewhat unexpected by global markets and triggered a short-term flight to safety as investors considered the potential consequences of this action. The immediate reaction was a rise in the U.S. dollar and the Japanese yen, while the UK pound fell to its lowest levels in the last 30 years. Renewed discussions of a prolonged low interest rate environment in most developed economies provided a positive jolt to many emerging markets with economies sensitive to global rates. While the Fund declined nearly 9% over the two trading days following the Brexit vote, it regained over half of this drop within a week. As long-term investors, our focus remained on the medium-term impacts this decision could have on Fund holdings, and the adjustments we made to the portfolio were modest. We did exit low-cost airline EasyJet, as we believe Brexit could impair business prospects on a two-year-plus view. Brexit makes it unclear how regulation might bear on EasyJet's ability to operate in and out of the United Kingdom, and also raises concerns about potential constraints on labor mobility, as continental Europeans working in the United Kingdom constitute an important part of EasyJet's customer base. Its stock declined 39% in the quarter. We took advantage of the short-term price volatility around the Brexit vote to add to the Fund's position in Rightmove soon after the quarter end. Rightmove is a UK provider of real estate listings via the Internet, and we struggle to see how Brexit will materially change prospects for the company going forward. In continental Europe, the Fund's long-standing strategic underweight in European banks proved positive, as the uncertainty raised by the referendum weighed heavily on these stocks.

One area that continued to perform well in the second quarter was commodities. Year to date, the energy and basic materials sectors of the benchmark were up over 13% in U.S. dollars (USD). Continued stable economic growth and very low interest rates across developed economies, combined with the positive effects of China's stimulus policies enacted in 2015, have reignited confidence in the underlying price for a number of basic materials. Those emerging markets dependent upon

commodity exports outperformed, but were modest weights within the Fund and benchmark. Year to date within the Fund's small- to mid-cap equity benchmark, Brazil (+49% in USD), Russia (+38% in USD) and South Africa (+20% in USD) all rallied with strengthening currencies after mostly dismal 2015 performance. Tahoe Resources, a low-cost silver miner based in Guatemala, was the Fund's top contributor to performance, rising 50% in the quarter on the rebound in silver prices.

Current political uncertainty appears likely to drive a continuation of loose monetary policy in Japan and Europe for the near term. The low interest rate environment is fueling a global search for yield, buoying the prices of stable, cash-generative and dividend-paying stocks. Unprecedented intervention to keep interest rates low will eventually reverse, which we believe will make current valuations assigned to these "safe haven" securities hard to justify, particularly where there is little earnings growth. Accordingly, we have worked hard over recent quarters to increase the Fund's exposure to companies with solid earnings growth. We expect these businesses to prove more resilient should interest rates normalize. If this mean reversion takes longer than expected, this will likely be because of ongoing weak demand globally, in which case companies with growing earnings should command a valuation premium, also not a bad outcome for long-term growth investors. New Fund positions that reflect this focus on growth include DIP, an operator of online websites and mobile applications for temporary job listings in Japan. DIP is capitalizing on an aging Japanese population that is driving a labor shortage; a corporate preference for temporary workers to maintain flexibility and curb costs; and increased user preference for Internet and mobile job listings. Since 2009, full-time workers in Japan have declined by 2.35 million, while part-time jobs have increased by 1.17 million. Another new idea during the first half of 2016 was Actelion, a Swiss-based biopharmaceutical company focused on the discovery, development and commercialization of drugs for orphan diseases. Actelion is in the early innings of what we believe to be a strong and sustainable growth cycle fueled by two new drug therapies that are rapidly gaining share in the $5 billion-plus pulmonary hypertension market.

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

6

COLUMBIA ACORN INTERNATIONAL®

AT A GLANCE

Total Net Assets of the Fund:

$5.7 billion

Performance data shown below represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Performance data reflects fee waivers or reimbursements of Fund expenses, if any; in their absence, performance results would have been lower. Indexes are unmanaged; their results do not reflect the effect of expenses or sales charges. Securities in the Fund may not match those in an index. Please visit investor.columbiathreadneedleus.com for performance data current to the most recent month-end.

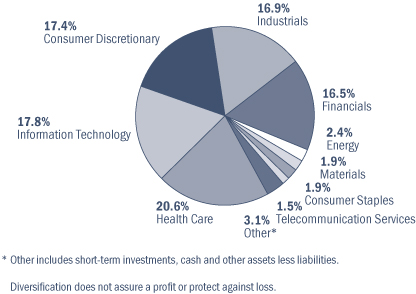

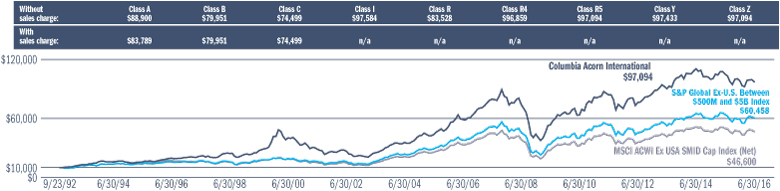

The Growth of a $10,000 Investment in Columbia Acorn International® Class Z Shares

September 23, 1992 (Fund inception) through June 30, 2016

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period. A $10,000 investment in Columbia Acorn International at inception appreciated to $15,870 on May 31, 1994, the inception date of the MSCI ACWI Ex USA SMID Cap Index (Net). For comparison with the MSCI ACWI Ex USA SMID Cap Index (Net), we assigned the index the same value as the Fund at index inception.

Average Annual Total Returns for period ended June 30, 2016

| | | 2nd

quarter | | Year to

date | | 1 year | | 5 years | | 10 years | | Life of

Fund | |

| Class Z (9/23/92 inception) | | | -1.41 | % | | | -1.29 | % | | | -7.40 | % | | | 2.96 | % | | | 5.13 | % | | | 10.04 | % | |

| Class A (10/16/00 inception) | |

without sales charge | | | -1.47 | | | | -1.42 | | | | -7.65 | | | | 2.65 | | | | 4.79 | | | | 9.63 | | |

with sales charge | | | -7.14 | | | | -7.08 | | | | -12.96 | | | | 1.44 | | | | 4.17 | | | | 9.35 | | |

MSCI ACWI Ex USA SMID Cap

Index (Net)* | | | -1.32 | | | | -0.31 | | | | -6.13 | | | | 1.76 | | | | 3.43 | | | | N/A | | |

S&P Global Ex-U.S.

Between $500M and $5B | | | 0.24 | | | | 1.98 | | | | -5.35 | | | | 2.49 | | | | 4.76 | | | | 7.86 | | |

Results for other share classes can be found on Page 2.

*The Fund's primary benchmark effective January 1, 2016. Prior to January 1, 2016, the S&P Global Ex-U.S. Between $500M and $5B Index was the Fund's primary benchmark. Please see Page 1 for index descriptions.

Returns for Class A shown with and without the maximum initial sales charge of 5.75%. As stated in the May 1, 2016, prospectus, as supplemented June 27, 2016, the Fund's annual operating expense ratio is 0.99% for Class Z shares and 1.24% for Class A shares. The returns shown for periods prior to the inception of the Fund's Class A shares append the returns of the Fund's Class Z shares, the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

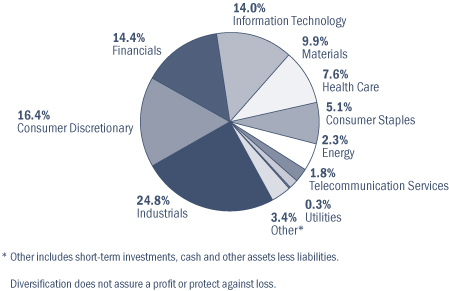

Portfolio Diversification

as a percentage of net assets, as of 6/30/16

Top 10 Holdings

as a percentage of net assets, as of 6/30/16

1. | | Novozymes (Denmark)

Industrial Enzymes | | | 2.4

| % | |

| 2. | | CCL Industries (Canada)

Global Label Converter | | | 2.1

| % | |

3. | | Wirecard (Germany)

Online Payment Processing & Risk Management | | | 1.6

| % | |

4. | | Hexagon (Sweden)

Design, Measurement & Visualization

Software & Equipment | | | 1.5

| % | |

5. | | Partners Group (Switzerland)

Private Markets Asset Management | | | 1.5

| % | |

6. | | Domino's Pizza Enterprise (Australia)

Domino's Pizza Operator in Australia & New Zealand | | | 1.4

| % | |

7. | | Trelleborg (Sweden)

Manufacturer of Sealing, Dampening &

Protective Solutions for Industry | | | 1.4

| % | |

8. | | Halma (United Kingdom)

Health & Safety Sensor Technology | | | 1.4

| % | |

9. | | Rightmove (United Kingdom)

Internet Real Estate Listings | | | 1.3

| % | |

10. | | Recruit Holdings (Japan)

Recruitment & Media Services | | | 1.3

| % | |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

7

COLUMBIA ACORN USA®

IN A NUTSHELL

| |

| |

Matthew A. Litfin

Lead Portfolio Manager | | William J. Doyle

Co-Portfolio Manager | |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector.

Columbia Acorn USA Class Z shares gained 7.41% in the second quarter of 2016, strongly outperforming the 3.79% gain of the Fund's primary benchmark, the Russell 2000 Index. The quarter's large lead over its benchmark was the result of strong individual stock performance across nearly all industry sectors. Year to date, the Fund's 0.92% gain was behind the benchmark's 2.22% return. Value stocks outpaced growth stocks during the semiannual period, holding back the relative performance of the Fund's growth-oriented portfolio.

Our analysts have been working hard for Fund shareholders and we have, in recent months, found many new opportunities to add higher-quality names to the Fund's portfolio. As noted above, our efforts paid off in the second quarter, as strong stock selection drove the Fund's performance more than three full percentage points above the benchmark's positive return. When we looked at the stock selection portion of Columbia Acorn USA's performance, we found that our analyst team had its best stock-picking quarter of the past decade in the second quarter for the Fund. We believe the portfolio that we established (and that we will continue to monitor and strive to improve upon) in the first half of 2016 should allow us to focus even more tightly on value creation and risk-adjusted performance for shareholders.

On an industry and sector basis in the quarter, real estate investment trusts (REITs) and utilities were strong performers within the benchmark, as investors went searching for yield. Material stocks were also strong in the Russell 2000, benefiting from the quarter's recovery in commodity prices. The Fund's underweight in these sectors detracted from performance; however, its overweight positions in the health care and information technology (IT) sectors contributed to relative outperformance in the quarter. The Fund has little exposure to REITs and utilities because many do not fit its growth-oriented style.

Within the IT sector in the Fund, Demandware, an e-commerce website platform for retailers and apparel manufacturers, and Cvent, a developer of software used by corporate event planners and hotels, gained 91% and 65% during the quarter, respectively, both on acquisition news. Demandware agreed to be acquired by Salesforce.com, and Cvent announced it was to be acquired by Vista Equity Partners. We sold both positions on the news. SPS Commerce, a provider of supply chain management software, was a large detractor in the first quarter but rebounded in the second, gaining 41%, as previous concerns related to a temporary disruption in its sales force abated.

The Fund participated in the June 23, 2016, initial public offering (IPO) of Twilio, a business software company offering an in-application communications software platform. Our analysis of the stock suggested the company had a competitive advantage in its market niche and would enjoy strong revenue growth for the long term. The market agreed with our assessment, and the stock rose dramatically following the IPO, gaining 139% in just one week. Applying our valuation discipline, we sold the position.

On the downside, Fiesta Restaurant Group, an owner/operator of two restaurant chains, was the top detractor in the quarter, falling 34%. The company experienced a slower start to the year, but we believe significant opportunity remains to expand its high-volume and differentiated Pollo Tropical restaurants. Virtu Financial, a high-speed trader, was also among the detractors, declining 18% in the quarter on disappointing year-over-year results. IPG Photonics fell 17% in the quarter; while IPG's position in fiber lasers remains solid, the company cut its outlook for 2016 due to weak demand from auto-related customers in Japan and on currency concerns. We will continue to monitor the performance of these companies and their stocks.

During the second quarter, Fund shareholders enjoyed the benefits of some of the repositioning that we implemented earlier in the year. We believe the companies that Columbia Acorn USA holds have strong prospects for solid earnings growth and stock price performance as we move into the second half of the year. Applying our time-tested valuation discipline, we will continue to scour the landscape to find the very best small-cap companies across industries.

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

8

COLUMBIA ACORN USA®

AT A GLANCE

Total Net Assets of the Fund:

$679.3 million

Performance data shown below represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Performance data reflects fee waivers or reimbursements of Fund expenses, if any; in their absence, performance results would have been lower. Indexes are unmanaged; their results do not reflect the effect of expenses or sales charges. Securities in the Fund may not match those in an index. Please visit investor.columbiathreadneedleus.com for performance data current to the most recent month-end.

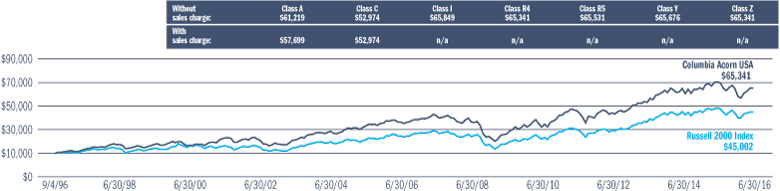

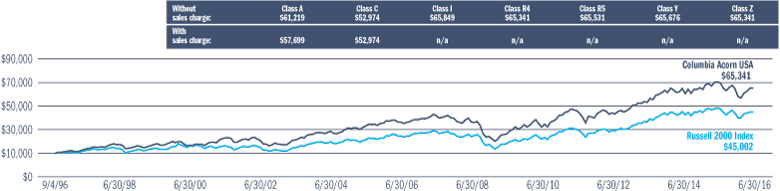

The Growth of a $10,000 Investment in Columbia Acorn USA® Class Z Shares

September 4, 1996 (Fund inception) through June 30, 2016

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period.

Average Annual Total Returns for period ended June 30, 2016

| | | 2nd

quarter | | Year to

date | | 1 year | | 5 years | | 10 years | | Life of

Fund | |

| Class Z (9/4/96 inception) | | | 7.41 | % | | | 0.92 | % | | | -7.18 | % | | | 7.24 | % | | | 6.04 | % | | | 9.93 | % | |

| Class A (10/16/00 inception) | |

without sales charge | | | 7.40 | | | | 0.82 | | | | -7.40 | | | | 6.97 | | | | 5.75 | | | | 9.57 | | |

with sales charge | | | 1.22 | | | | -5.00 | | | | -12.72 | | | | 5.72 | | | | 5.13 | | | | 9.24 | | |

Russell 2000 Index* | | | 3.79 | | | | 2.22 | | | | -6.73 | | | | 8.35 | | | | 6.20 | | | | 7.88 | | |

Results for other share classes can be found on Page 2.

*The Fund's primary benchmark. Please see Page 1 for index descriptions.

Returns for Class A shown with and without the maximum initial sales charge of 5.75%. As stated in the May 1, 2016, prospectus, as supplemented June 27, 2016, the Fund's annual operating expense ratio is 1.18% for Class Z shares and 1.43% for Class A shares. The returns shown for periods prior to the inception of the Fund's Class A shares append the returns of the Fund's Class Z shares, the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

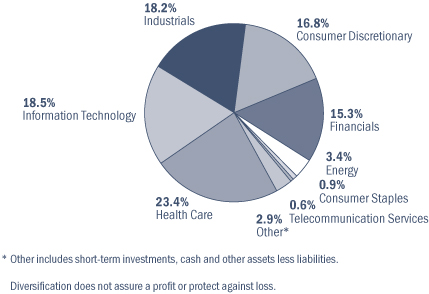

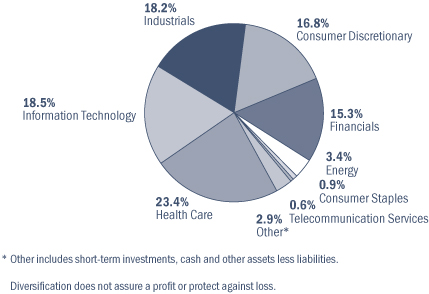

Portfolio Diversification

as a percentage of net assets, as of 6/30/16

Top 10 Holdings

as a percentage of net assets, as of 6/30/16

1. | | Toro

Turf Maintenance Equipment | | | 2.4

| % | |

2. | | Drew Industries

RV & Manufactured Home Components | | | 2.1

| % | |

3. | | VWR

Distributor of Lab Supplies | | | 1.9

| % | |

4. | | Papa John's International

Franchisor of Pizza Restaurants | | | 1.9

| % | |

5. | | HealthSouth

Inpatient Rehabilitation Facilities & Home

Health Care | | | 1.8

| % | |

6. | | MarketAxess

Bond Exchange | | | 1.8

| % | |

7. | | Medidata Solutions

Cloud-based Software for Drug Studies | | | 1.8

| % | |

8. | | UniFirst

Uniform Rental | | | 1.6

| % | |

9. | | CoStar Group

Commercial Real Estate Data Aggregator & Web

Marketing for Retail Landlords | | | 1.6

| % | |

10. | | Ligand Pharmaceuticals

Royalties from Licensing Drug Delivery Technology | | | 1.6

| % | |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

9

COLUMBIA ACORN INTERNATIONAL SELECTSM

IN A NUTSHELL

| |

| |

Stephen Kusmierczak

Co-Portfolio Manager | | Andreas Waldburg-Wolfegg

Co-Portfolio Manager | |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Foreign investments subject the Fund to political, economic, market, social and other risks within a particular country, as well as to potential currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector.

Columbia Acorn International Select Class Z shares ended the second quarter of 2016 up 0.19%, while the Fund's primary benchmark, the MSCI ACWI Ex USA Index (Net), fell 0.64%. Year to date through June 30, the Fund was down 1.71% versus a benchmark decline of 1.02%. The Fund's stock performance in the Asia ex Japan region helped to drive outperformance in the second quarter, as did stock selection and a modest overweight in Europe. Not surprising given the Brexit vote results, the Fund's exposure to the United Kingdom and Ireland was the largest regional detractor in the quarter, though we were underweight versus the benchmark in these markets.

On a sector basis, the Fund had strong performance in the information technology (IT) sector, benefiting from both its overweight exposure to the sector and its stock selection. The Fund had a U.S. dollar-adjusted gain of 9% in the IT sector, compared to a benchmark gain of 0.3%. The Fund's overweight in the consumer discretionary sector detracted from relative performance but returns benefited from good stock selection in the sector. We took advantage of weakness in the consumer discretionary sector to add to select, high-quality names that we believe have strong, long-term prospects.

Reflecting the Fund's IT strength, its three top contributors to performance in the quarter were IT names. NetEase.com, a Chinese provider of online gaming services, gained 35%. The company continued to deliver solid gaming revenue growth and improving e-commerce margins in the second quarter after gaining exclusive Chinese operating rights to such blockbuster games as Activision's "Overwatch" and Microsoft's "Minecraft." Wirecard, a German provider of online payment processing risk management services, declined in the first quarter on allegations of criminal misconduct. We did not believe the allegations had merit and added to the Fund's position on the decline. The market echoed our skepticism in the second quarter, driving a 16% rebound in the stock. Taiwan's Largan Precision, a manufacturer of mobile device camera lenses and modules, continued to dominate the high-end miniature lens business used in handsets and mobile devices, expanding its operating margin from 50% to 57% and enjoying a 19% gain in its stock in the quarter.

Other top contributors in the quarter included Japan's Bandai Namco, a maker of branded toys and related content. Up 18% in the quarter, the company continues to leverage its strong toy brands to enter new categories, such as mobile, and geographies beyond Japan. Up 13% in the quarter, KDDI, a mobile and fixed-line communication services provider in Japan, delivered steady growth by improving its average revenue per user, and its outlook remains stable.

On the downside, Eutelsat, a French provider of fixed satellite services, issued a profit warning for the current year, sending its stock down 42% in the quarter. Down 22%, Ryanair, a European low-cost airline based in Ireland, fell on uncertainties created by the Brexit decision. CCL Industries, a Canadian global label converter, was a strong outperformer last year, but so far this year a large rotation in the Canadian market toward energy and basic materials and out of the consumer space has hurt the stock, leading to an 8% decline in the second quarter. Fundamentals remain strong at CCL, and we expect that synergies following its acquisition of Checkpoint Systems will be substantially higher than official guidance. Rightmove, a UK provider of Internet real estate listings, fell 18% in the second quarter, moving sharply downward in the wake of Brexit.

In the second quarter, we saw a continuation of economic uncertainty around the world and increased political nervousness. We expect that there will continue to be uncertainties over the next 18 months, as some of the world's large democracies elect new presidents, and investors reposition portfolios in light of how they expect Brexit to impact different sectors, countries and companies. We have positioned the Fund defensively in the United Kingdom, focusing on companies that stand to benefit from pound weakness and taking advantage of market weakness to build exposure to select, high-quality consumer names. The Fund's more mid-cap focus allows us to fish in a pond where liquidity is high, making it possible for us to trade to take advantage of market volatility.

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

10

COLUMBIA ACORN INTERNATIONAL SELECTSM

AT A GLANCE

Total Net Assets of the Fund:

$110.0 million

Performance data shown below represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. Performance data reflects fee waivers or reimbursements of Fund expenses, if any; in their absence, performance results would have been lower. Indexes are unmanaged; their results do not reflect the effect of expenses or sales charges. Securities in the Fund may not match those in an index. Please visit investor.columbiathreadneedleus.com for performance data current to the most recent month-end.

The Growth of a $10,000 Investment in Columbia Acorn International SelectSM Class Z Shares

November 23, 1998 (Fund inception) through June 30, 2016

This chart shows the change in value of a hypothetical $10,000 investment in Class Z shares of the Fund during the stated time period. A $10,000 investment in Columbia Acorn International Select at inception appreciated to $17,309 on December 31, 2000, the month-end of the inception date of the MSCI ACWI Ex USA Index (Net). For comparison with the MSCI ACWI Ex USA Index (Net), we assigned the index the same value as the Fund at month-end of the index inception date.

Average Annual Total Returns for period ended June 30, 2016

| | | 2nd

quarter | | Year to

date | | 1 year | | 5 years | | 10 years | | Life of

Fund | |

| Class Z (11/23/98 inception) | | | 0.19 | % | | | -1.71 | % | | | -6.36 | % | | | 2.07 | % | | | 4.61 | % | | | 7.85 | % | |

| Class A (10/16/00 inception) | |

without sales charge | | | 0.14 | | | | -1.88 | | | | -6.61 | | | | 1.76 | | | | 4.28 | | | | 7.50 | | |

with sales charge | | | -5.64 | | | | -7.51 | | | | -11.98 | | | | 0.57 | | | | 3.66 | | | | 7.14 | | |

MSCI ACWI Ex USA Index (Net)* | | | -0.64 | | | | -1.02 | | | | -10.24 | | | | 0.10 | | | | 1.87 | | | | N/A | | |

S&P Developed Ex-U.S.

Between $2B and $10B Index | | | -1.12 | | | | -0.29 | | | | -4.03 | | | | 3.58 | | | | 3.66 | | | | 6.98 | | |

Results for other share classes can be found on Page 2.

*The Fund's primary benchmark effective January 1, 2016. Prior to January 1, 2016, the S&P Developed Ex-U.S. Between $2B and $10B Index was the Fund's primary benchmark. Please see Page 1 for index descriptions.

Returns for Class A shown with and without the maximum initial sales charge of 5.75%. As stated in the May 1, 2016, prospectus, as supplemented June 27, 2016, the Fund's annual operating expense ratio is 1.15% for Class Z shares and 1.40% for Class A shares. The returns shown for periods prior to the inception of the Fund's Class A shares append the returns of the Fund's Class Z shares, the Fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit investor.columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

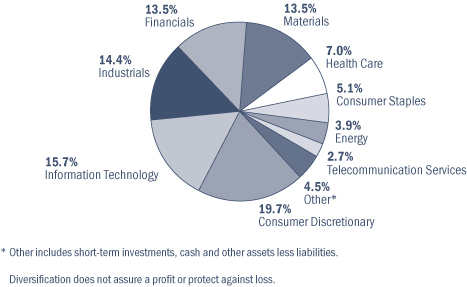

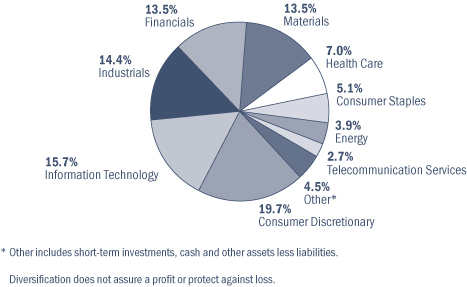

Portfolio Diversification

as a percentage of net assets, as of 6/30/16

Top 10 Holdings

as a percentage of net assets, as of 6/30/16

1. | | Novozymes (Denmark)

Industrial Enzymes | | | 5.2

| % | |

2. | | CCL Industries (Canada)

Global Label Converter | | | 5.2

| % | |

3. | | Partners Group (Switzerland)

Private Markets Asset Management | | | 4.5

| % | |

4. | | Wirecard (Germany)

Online Payment Processing & Risk Management | | | 4.1

| % | |

5. | | Hexagon (Sweden)

Design, Measurement & Visualization

Software & Equipment | | | 3.5

| % | |

6. | | Aeon Mall (Japan)

Suburban Shopping Mall Developer,

Owner & Operator | | | 3.5

| % | |

7. | | Largan Precision (Taiwan)

Mobile Device Camera Lenses & Modules | | | 3.4

| % | |

| 8. | | Amcor (Australia)

Flexible & Rigid Packaging | | | 3.1

| % | |

9. | | NetEase.com (China)

Chinese Online Gaming Services | | | 3.0

| % | |

10. | | Bandai Namco (Japan)

Branded Toys & Related Content | | | 3.0

| % | |

The Fund's top 10 holdings and portfolio diversification vary with changes in portfolio investments. See the Statement of Investments for a complete list of the Fund's holdings.

11

COLUMBIA ACORN SELECTSM

IN A NUTSHELL

| |

| |

David L. Frank

Co-Portfolio Manager | | Matthew S. Szafranski

Co-Portfolio Manager | |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. Foreign investments subject the Fund to risks, including political, economic, market, social and other risks, within a particular country, as well as to potential currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector.

Columbia Acorn Select Class Z shares ended the second quarter of 2016 down 0.89%, underperforming the 3.99% gain of the Fund's primary benchmark, the S&P MidCap 400 Index. For the first half of the year, the Fund was down 1.21%, while the benchmark gained 7.93%. The Fund's growth-oriented portfolio struggled in an investment environment that favored value during much of the six-month period. In the second quarter, we saw a continuation of the move toward more defensive areas of the market like utility and material stocks, which were top-performing sectors within the benchmark but are significant underweights in the Fund. At the end of the second quarter, the United Kingdom's vote to exit the European Union negatively impacted three Fund holdings with European exposure and detracted approximately 1.5% from Fund performance in the quarter. CWAM's global chief investment officer offers additional thoughts on Brexit at the beginning of this report.

The biggest detractor from performance in the second quarter and year to date was Union Agriculture, a farmland operator in Uruguay. Down 36% in the quarter, we decided to exit the position. For the sixth months ended June 30, this stock was down 55% and detracted 1.5% from performance.

As mentioned, the Fund owned stock in three U.S. companies that were hurt in the quarter by their exposure to Europe and the United Kingdom. Lazard, a provider of corporate advisory and asset management services, ended the quarter down 16%. The company's merger advisory services in Europe are expected to see sharp declines through the rest of 2016, and a strong dollar could negatively impact its asset management business in the near term. Jones Lang LaSalle, a provider of commercial real estate services worldwide, fell 17% on concerns of a decline in commercial real estate transaction and leasing volumes in China. Following the Brexit vote, these concerns expanded to include the United Kingdom and Europe. Liberty Global, a provider of cable TV franchises outside of the United States, fell 14%, as roughly 40% of its revenue is generated in the United Kingdom and the rest is generated in Europe. We do not believe that Brexit has diminished the long-term value of these companies.

Leading performance in the quarter, pizza franchisor Papa John's International gained 26%, as the company proved its ability to drive solid earnings in a promotional pizza environment. Communications towers owner Crown Castle International gained 18% in the quarter. The company benefited from both an increase in mobile data usage and, as a real estate investment trust, from the popularity of dividend-paying stocks among yield-hungry investors.

Nordson, a manufacturer of dispensing systems for adhesives and coatings, ended the quarter up 10%. After experiencing lackluster sales in 2015 like many industrials dependent on overseas revenues, Nordson returned to growth in the first half of 2016, benefiting from launches in new technology like mobile phones that utilize the company's cutting edge dispensing and testing technologies.

While we are disappointed with the Fund's underperformance in the first two quarters of the year, we believe it is important to remember that in a concentrated portfolio like Columbia Acorn Select's returns can fluctuate. As we've reshaped and concentrated the Fund's portfolio in the first half of the year, we have moved away from owning more speculative names, and we have focused on creating a portfolio of our analyst team's current top ideas. Eight of the Fund's 10 largest detractors from performance year to date were sold during the first half of the year, making way for higher-quality, higher-conviction stocks. At June 30, the Fund held 34 names, nearly half of which were added to the portfolio in the first six months of the year. The Fund's tilt toward the consumer discretionary and industrial sectors continues. Most importantly, we have refocused on durable, growth-at-a-reasonable price businesses that we believe will outperform over time.

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

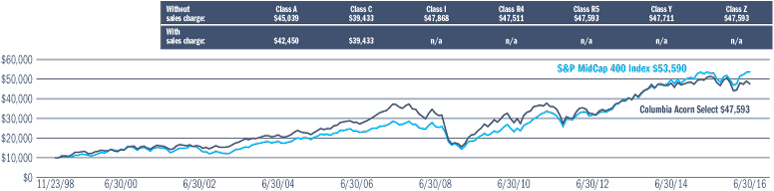

12

COLUMBIA ACORN SELECTSM

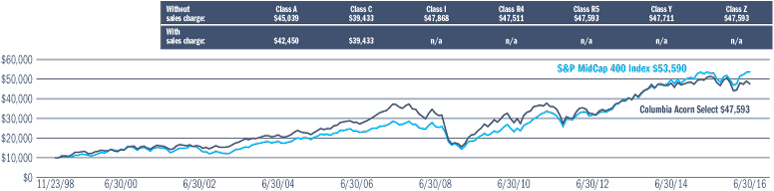

AT A GLANCE

Total Net Assets of the Fund:

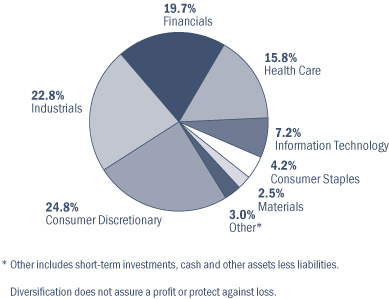

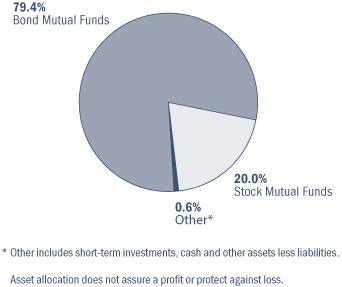

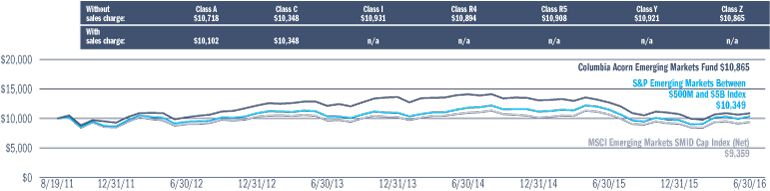

$335.7 million