UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01829

Columbia Acorn Trust

(Exact name of registrant as specified in charter)

71 S Wacker Dr.

Suite 2500

Chicago, IL 60606,USA

(Address of principal executive offices) (Zip code)

Ryan C. Larrenaga

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, Massachusetts 02210

Daniel J. Beckman

c/o Columbia Management Investment Advisers, LLC

290 Congress Street

Boston, Massachusetts 02210

Mary C. Moynihan

Perkins Coie LLP

700 13th Street, NW

Suite 800

Washington, DC 20005

(Name and address of agent for service)

Registrant's telephone number, including area code: (312) 634-9200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

December 31, 2022

Columbia

Acorn® Fund

Columbia

Acorn International®

Columbia

Acorn USA®

Columbia

Acorn International SelectSM

Columbia

Thermostat FundSM

Columbia

Acorn European FundSM

Not FDIC or NCUA Insured • No Financial Institution Guarantee • May Lose Value

| 3 |

| 5 |

| 7 |

| 9 |

| 11 |

| 13 |

| 15 |

| 17 |

| 19 |

| 21 |

| 23 |

| 25 |

| 27 |

| 30 |

| 51 |

| 55 |

| 58 |

| 64 |

| 88 |

| 108 |

| 109 |

| 110 |

| 113 |

Columbia Acorn Family of Funds | Annual Report 2022

Fund at a glance

Columbia Acorn® Fund (Unaudited)

Investment objective

Columbia Acorn® Fund (the Fund) seeks long-term capital appreciation.

Portfolio management

Erika K. Maschmeyer, CFA

Lead Portfolio Manager since February 2023

Service with Fund since 2016

John L. Emerson, CFA

Portfolio Manager since 2021

Service with Fund since 2003

Effective February 10, 2023, Daniel Cole no longer serves as a Portfolio Manager of the Fund.

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2023 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended December 31, 2022) |

| | | Inception | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | -34.01 | 2.10 | 6.98 | 12.79 |

| | Including sales charges | | -37.80 | 0.89 | 6.35 | 12.67 |

| Advisor Class | 11/08/12 | -33.79 | 2.36 | 7.24 | 13.14 |

| Class C | Excluding sales charges | 10/16/00 | -34.48 | 1.34 | 6.19 | 11.94 |

| | Including sales charges | | -35.10 | 1.34 | 6.19 | 11.94 |

| Institutional Class | 06/10/70 | -33.78 | 2.35 | 7.27 | 13.15 |

| Institutional 2 Class | 11/08/12 | -33.83 | 2.38 | 7.29 | 13.15 |

| Institutional 3 Class | 11/08/12 | -33.77 | 2.44 | 7.35 | 13.17 |

| Russell 2500 Growth Index | | -26.21 | 5.97 | 10.62 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2022 prospectus, the Fund’s annual operating expense ratio is 0.83% for Institutional Class shares and 1.08% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the Columbia Wanger Asset Management, LLC (the Investment Manager) and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s Institutional Class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The Russell 2500 Growth Index measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Columbia Acorn Family of Funds | Annual Report 2022

| 3 |

Fund at a glance (continued)

Columbia Acorn® Fund (Unaudited)

The Growth of a $10,000 Investment in Columbia Acorn® Fund Institutional Class Shares

December 31, 2012 through December 31, 2022

This chart shows the change in value of a hypothetical $10,000 investment in Institutional Class shares of the Fund during the stated time period. Although the index is provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Portfolio breakdown (%) (at December 31, 2022) |

| Common Stocks | 97.0 |

| Money Market Funds | 3.0 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at December 31, 2022) |

| Communication Services | 2.7 |

| Consumer Discretionary | 19.1 |

| Consumer Staples | 2.4 |

| Energy | 3.8 |

| Financials | 6.9 |

| Health Care | 19.0 |

| Industrials | 20.7 |

| Information Technology | 19.9 |

| Materials | 2.5 |

| Real Estate | 3.0 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 4 | Columbia Acorn Family of Funds | Annual Report 2022 |

Manager Discussion of Fund Performance

Columbia Acorn® Fund (Unaudited)

Columbia Acorn® Fund Institutional Class shares returned -33.78% for the 12-month period ended December 31, 2022, trailing the -26.21% return of the Fund’s primary benchmark, the Russell 2500 Growth Index for the same period.

Market overview

In 2022, global markets took a pummeling, as looser monetary policies and stimulus spending from the previous two years came home to roost. At the start of the year, the rhetoric from the Federal Reserve (Fed) on inflation amid a tight labor market and supply chain bottlenecks had primed the market for interest rate hikes. The unexpected Russian invasion of Ukraine in February 2022 added further inflationary pressure on energy and food prices, dampening market sentiment. The Fed subsequently embarked on an interest rate-raising trajectory that extended through the year with seven interest rate raises, resulting in, by June 2022, consumer sentiment reaching its lowest point in over a year. Following this, bearish investor sentiment continued to prevail despite a rollover in energy prices and an easing in supply chain disruptions. Markets rebounded in the fourth quarter on more benign economic data and expectations of a Fed pivot on interest rate hikes. Unfortunately, this was not substantial enough to reverse the damage of the previous nine months.

Small-cap stocks trailed large-cap stocks, and growth stocks considerably underperformed value stocks during the year due to their greater sensitivity to rising interest rates. In other words, higher rates reduce the value of companies’ future earnings when measured in today’s dollars. Also, less economically-sensitive companies that trade at lower valuations provide more defense in a volatile and uncertain environment. From a sector perspective, the poorest performing sectors in the Russell 2500 Growth Index were the communication services, real estate, health care, consumer discretionary and information technology sectors. While interest rates had a bearing on information technology and smaller cap names, tight labor costs had an impact on services names. Energy benefited from high inflation, the only sector in the benchmark with positive returns for the year.

Factor correlations were skewed because of extreme volatility of inflation data, coupled with extreme market reaction to that data. Company fundamentals were additionally lost in the upheaval. Stocks, especially among longer duration names, suffered declines from a compression of multiples and the types of higher quality, profitable growers we seek were most severely impacted in a backdrop of rising rates. In response, we remain focused on investing in growing companies that we believe have outstanding business models and competitive advantages. We are selective across sectors, looking for opportunities that, from a bottom-up perspective, have the ability to stand on their own and relatively detach from the surrounding macro environment.

The Fund’s notable detractors during the period

| • | Kornit Digital Ltd. is an Israeli-American international company that manufactures, markets and services a range of digital printing applications for the textile industry. Prior to 2022, Kornit benefited from several years of robust demand for its equipment as customers scrambled to meet sky-rocketing demand from end-customers. However, the re-calibration of e-commerce growth in a post-COVID scenario, coupled with macro headwinds, resulted in a greater-than-expected pause in demand. |

| • | The Trade Desk, Inc., is a technology platform company, enabling real-time programmatic advertising designed to personalize digital content delivery to users. Higher interest rates and fears that a recession would disproportionately hurt programmatic advertising weighed on investor sentiment. |

| • | 10x Genomics, Inc. is an American biotechnology company designing, and manufacturing gene sequencing technology used in scientific research. The stock lost ground amid the broader downturn in companies with high future-earnings expectations that saw near term impact to operating profits, coupled with supply chain disruptions from China and Europe. We sold the position during the period. |

The Fund’s notable contributors during the period

| • | Wingstop, Inc. is a multinational chain of restaurants specializing in chicken wings. Following a temporary slower COVID period, Wingstop boosted Fund performance with re-accelerating sales as customers began to re-prioritize going out to restaurants. |

Columbia Acorn Family of Funds | Annual Report 2022

| 5 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn® Fund (Unaudited)

| • | Axon Enterprise, Inc. is the manufacturer of Tasers and market leading provider of law enforcement technology including body and vehicle cameras. The company utilized its monopolistic position to make market expansions into judiciary, corrections, federal agency and other governmental affairs. Revenue, along with international contract wins and strong revenue forecasts, helped to separate Axon Enterprise from an uncertain and challenging macro environment. |

| • | Enphase Energy, Inc., a global energy management company that is a leading provider of solar technologies in the information technology sector, benefited from strong performance and positive guidance and is improving its long-term prospects as it expands into Europe. This company is strongly positioned to capitalize on growing demand for solar energy. Rising energy prices were also a tailwind as it resulted in solar energy being seen as more attractively valued. We sold the position during the period. |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. Foreign investments subject the Fund to political, economic, market, social and other risks within a particular country, as well as to potential currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to specific securities should not be construed as a recommendation or investment advice.

| 6 | Columbia Acorn Family of Funds | Annual Report 2022 |

Fund at a glance

Columbia Acorn International® (Unaudited)

Investment objective

Columbia Acorn International® (the Fund) seeks long-term capital appreciation.

Portfolio management

Tae Han (Simon) Kim, CFA

Co-Portfolio Manager since 2017

Service with Fund since 2011

Hans F. Stege

Co-Portfolio Manager since 2020

Service with Fund since 2017

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2023 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended December 31, 2022) |

| | | Inception | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | -33.81 | -1.46 | 3.19 | 8.17 |

| | Including sales charges | | -37.61 | -2.62 | 2.58 | 7.96 |

| Advisor Class | 11/08/12 | -33.62 | -1.21 | 3.43 | 8.53 |

| Class C | Excluding sales charges | 10/16/00 | -34.30 | -2.20 | 2.42 | 7.36 |

| | Including sales charges | | -34.94 | -2.20 | 2.42 | 7.36 |

| Institutional Class | 09/23/92 | -33.63 | -1.21 | 3.46 | 8.54 |

| Institutional 2 Class | 08/02/11 | -33.60 | -1.15 | 3.51 | 8.56 |

| Institutional 3 Class | 11/08/12 | -33.58 | -1.11 | 3.56 | 8.58 |

| Class R | 08/02/11 | -33.96 | -1.71 | 2.88 | 7.89 |

| MSCI ACWI ex USA SMID Cap Growth Index (Net) | | -25.66 | 0.01 | 4.57 | - |

| MSCI ACWI ex USA SMID Cap Index (Net) | | -19.49 | 0.16 | 4.56 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2022 prospectus, the Fund’s annual operating expense ratio is 0.98% for Institutional Class shares and 1.23% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the Investment Manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s Institutional Class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The MSCI ACWI ex USA SMID Cap Growth Index (Net) captures a mid- and small-cap representation across 22 developed market countries and 24 emerging market countries.

The MSCI ACWI ex USA SMID Cap Index (Net) captures a mid- and small-cap representation across 22 of 23 developed market countries (excluding the United States) and 24 emerging market countries. The index covers approximately 28% of the free float-adjusted market capitalization in each country.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Columbia Acorn Family of Funds | Annual Report 2022

| 7 |

Fund at a glance (continued)

Columbia Acorn International® (Unaudited)

The Growth of a $10,000 Investment in Columbia Acorn International® Institutional Class Shares

December 31, 2012 through December 31, 2022

This chart shows the change in value of a hypothetical $10,000 investment in Institutional Class shares of the Fund during the stated time period. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Equity sector breakdown (%) (at December 31, 2022) |

| Communication Services | 6.1 |

| Consumer Discretionary | 7.8 |

| Consumer Staples | 2.7 |

| Energy | 1.1 |

| Financials | 5.9 |

| Health Care | 17.3 |

| Industrials | 25.4 |

| Information Technology | 24.9 |

| Materials | 4.1 |

| Real Estate | 4.7 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| Country breakdown (%) (at December 31, 2022) |

| Australia | 6.4 |

| Austria | 0.5 |

| Brazil | 1.0 |

| Canada | 4.6 |

| China | 2.3 |

| Denmark | 2.8 |

| Country breakdown (%) (at December 31, 2022) |

| Finland | 2.1 |

| France | 0.8 |

| Germany | 5.9 |

| Italy | 3.6 |

| Japan | 14.5 |

| Mexico | 2.1 |

| Netherlands | 3.5 |

| New Zealand | 2.1 |

| South Korea | 4.4 |

| Spain | 0.6 |

| Sweden | 9.6 |

| Switzerland | 4.0 |

| Taiwan | 5.3 |

| United Kingdom | 17.5 |

| United States(a) | 4.9 |

| Vietnam | 1.5 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

Country breakdown is based primarily on issuer’s place of organization/incorporation. Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 8 | Columbia Acorn Family of Funds | Annual Report 2022 |

Manager Discussion of Fund Performance

Columbia Acorn International® (Unaudited)

Columbia Acorn International® Institutional Class shares returned -33.63% for the 12-month period ended December 31, 2022, underperforming the -25.66% return of the Fund’s primary benchmark, the MSCI ACWI ex USA SMID Cap Growth Index (Net) for the same period. The Fund’s secondary benchmark, the MSCI ACWI ex USA SMID Cap Index (Net), ended the 12-month period with a return of -19.49%.

Market overview

In 2022, international equities experienced steep declines in a reversal of the previous year’s robust return trajectory. Geopolitical headwinds, high inflation levels and hawkish global central bank responses underscored the period. At the start of the year, our more positive outlook was quickly dampened by Russia’s unexpected invasion of Ukraine, which exacerbated the still lingering COVID-era effects of a tight labor market, high commodity and food prices, and supply chain disruptions. Global central banks pivoted towards monetary tightening and by the start of the second half of the year, fears of a recession were at a peak. This was particularly true for Europe, where uncertainty over gas supplies for the impending winter combined with a weak Euro and weighed on investor sentiment. However, in the fourth quarter, more benign inflation data, easing energy supplies in Europe and a China-reopening fueled a rally in stocks that mitigated declines from the previous nine months.

Also in 2022, international small-cap growth stocks underperformed value stocks. This divergence was most prevalent in the information technology sector, as more richly valued software and services names were pummeled. Amid economic uncertainty and higher interest rates, more defensive large caps outperformed small caps. During the majority of the year, high profitability growth companies we favored provided less of a shield as they declined along with other growth stocks. This trend reversed in the fourth quarter when quality growth companies generated positive returns, following an inflation reversal in Europe.

As we enter 2023, in what continues to be an uncertain environment, we believe that capable management teams in higher quality businesses will be better able to navigate this period of unique disruption. We are somewhat more optimistic circumstances in Europe than we were mid-year 2022. Natural gas prices underlying much higher electricity prices for most of 2022 have retreated to pre-Ukraine war levels, providing relief for European consumers. The European Central Bank is not raising rates as aggressively as is the U.S. Federal Reserve. In most of Europe excluding the U.K., labor shortages and wage pressures have not been as salient a factor in driving inflation as in the United States. Multi-year labor bargaining agreements help dampen inflationary pressures. We are also hopeful that China’s reversal on its COVID policy will trigger an acceleration of GDP after the first quarter. German exports, for example, have typically benefited from a vibrant Chinese economy. We recognize that Russia’s war on Ukraine continues to weigh on the macro environment and poses an exogenous risk to the markets.

The Fund’s notable detractors during the period

| • | Parade Technologies Ltd. is a fabless semiconductor company offering high-speed interface and display systems used in computers, consumer electronics, and display panels. In 2022, the company was negatively impacted as the semiconductor industry entered a downturn driven by a destocking in personal computers. Parade is a leader in technology and has consistently retained the largest market share in the display segment. We expect that it will be able to replicate that success in high-speed applications relating to servers, driven by structural growth of high-performance computing. |

| • | Hypoport provides technology platforms that support the German credit, real estate and insurance industries through EUROSPACE, the largest B2B marketplace for loan products in Germany. 2022 saw large shifts in Germany’s property market, as prices fell amid higher interest rates. Beyond the challenges of higher mortgage rates, banks have been tightening lending conditions as they have become more risk-cognizant on real estate loans. However, the company remains fundamentally sound and continues to gain market share, which we believe should enable strong growth even in a higher interest rate environment. |

| • | Silergy Corp. designs and manufactures a broad range of high performance analog integrated circuits. The company’s stock price declined as the semiconductor industry headed into a downcycle driven by weakening demand and a |

Columbia Acorn Family of Funds | Annual Report 2022

| 9 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn International® (Unaudited)

| | reduction in inventory in consumer electronics. The company is actively expanding into new applications with higher margins and longer growth trajectory such as automotives. It is also reducing its exposure to more cyclical consumer applications. We maintain our position due to a more favorable long-term outlook. |

The Fund’s notable contributors during the period

| • | Munters Group is a Swedish company that provides stand-alone dehumidification and air treatment solutions to the food, pharma, agriculture and electronics industries. Munters has consistently won large de-humidification contracts, causing it to report several quarters of consecutive record order book increases. Its energy-saving cooling solutions for data centers and de-humidification equipment for electric vehicle lithium-ion battery plants are in high demand.We are watching carefully if the company can overcome recent supply chain challenges to meet its target profitability level. |

| • | Corporacion Inmobiliaria Vesta SAB de CV is a real estate owner, developer and asset administrator of industrial buildings and distribution centers in Mexico. Vesta’s competitive advantage is in anticipating demand given its proximity to customers. The company outperformed in 2022 as it benefited from an acceleration in nearshoring (outsourcing business to a neighboring country or region) demand. This, coupled with relatively limited supply due to high construction costs, led to a surge in leasing spreads. We believe that Vesta will continue to benefit from a favorable supply-demand environment. |

| • | Jeisys Medical, Inc. is a manufacturer of high-end medical aesthetic devices for aestheticians, plastic surgeons, physicians and health care professionals. During the year, earnings were buoyed by strong demand, particularly in the United States and Japan. In addition, the company benefited from its synergies with U.S. laser manufacturer Cynosure, underscoring brisk growth in the aesthetic market that is being propelled forward by an aging population. Continued product innovation driven by a strong competitive market in South Korea has also had a bearing on performance. |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. International investing involves certain risks and volatility due to potential political, economic or currency instabilities and different, potentially less stringent, financial and accounting standards than those generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to specific securities should not be construed as a recommendation or investment advice.

| 10 | Columbia Acorn Family of Funds | Annual Report 2022 |

Fund at a glance

Columbia Acorn USA® (Unaudited)

Investment objective

Columbia Acorn USA® (the Fund) seeks long-term capital appreciation.

Portfolio management

Erika K. Maschmeyer, CFA

Lead Portfolio Manager since February 2023

Service with Fund since 2016

John L. Emerson, CFA

Portfolio Manager since 2021

Service with Fund since 2003

Effective February 10, 2023, Daniel Cole no longer serves as a Portfolio Manager of the Fund.

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2023 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended December 31, 2022) |

| | | Inception | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | -33.75 | 2.68 | 7.51 | 8.84 |

| | Including sales charges | | -37.57 | 1.47 | 6.87 | 8.60 |

| Advisor Class | 11/08/12 | -33.55 | 2.95 | 7.79 | 9.18 |

| Class C | Excluding sales charges | 10/16/00 | -34.23 | 1.90 | 6.73 | 8.05 |

| | Including sales charges | | -34.86 | 1.90 | 6.73 | 8.05 |

| Institutional Class | 09/04/96 | -33.60 | 2.92 | 7.77 | 9.18 |

| Institutional 2 Class | 11/08/12 | -33.51 | 3.00 | 7.87 | 9.21 |

| Institutional 3 Class | 11/08/12 | -33.56 | 3.03 | 7.91 | 9.23 |

| Russell 2500 Growth Index | | -26.21 | 5.97 | 10.62 | - |

| Russell 2000 Growth Index | | -26.36 | 3.51 | 9.20 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2022 prospectus, as supplemented, the Fund’s annual operating expense ratio is 0.83% for Institutional Class shares and 1.08% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the Investment Manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s Institutional Class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

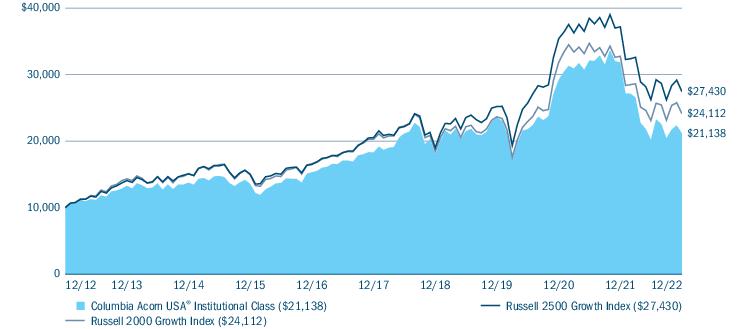

The Russell 2500 Growth Index, an unmanaged index, measures the performance of those Russell 2500 companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 2000 Growth Index, an unmanaged index, measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Effective May 1, 2022, the Fund increased the market capitalization range of the companies in which it invests a majority of its assets and began comparing its performance to that of the Russell 2500 Growth Index. The Investment Manager believes that the Russell 2500 Growth Index provides a more appropriate comparison than the Russell 2000 Growth Index for investors measuring the Fund’s relative performance. Information on both the Russell 2000 Growth Index and the Russell 2500 Growth Index will be shown for a one-year transition period. The Fund’s performance prior to May 1, 2022 reflects returns achieved pursuant to a strategy with a different market capitalization limit on the companies in which the Fund invests a majority of its assets. If the Fund’s current strategies had been in place for the prior periods, results shown would have been different.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Columbia Acorn Family of Funds | Annual Report 2022

| 11 |

Fund at a glance (continued)

Columbia Acorn USA® (Unaudited)

The Growth of a $10,000 Investment in Columbia Acorn USA® Institutional Class Shares

December 31, 2012 through December 31, 2022

This chart shows the change in value of a hypothetical $10,000 investment in Institutional Class shares of the Fund during the stated time period. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Portfolio breakdown (%) (at December 31, 2022) |

| Common Stocks | 96.8 |

| Money Market Funds | 2.9 |

| Securities Lending Collateral | 0.3 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| Equity sector breakdown (%) (at December 31, 2022) |

| Communication Services | 2.7 |

| Consumer Discretionary | 19.0 |

| Consumer Staples | 2.4 |

| Energy | 3.8 |

| Financials | 6.9 |

| Health Care | 19.2 |

| Industrials | 20.7 |

| Information Technology | 19.8 |

| Materials | 2.5 |

| Real Estate | 3.0 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| 12 | Columbia Acorn Family of Funds | Annual Report 2022 |

Manager Discussion of Fund Performance

Columbia Acorn USA® (Unaudited)

In December 2022, the Board of Trustees of Columbia Acorn USA determined that a reorganization of the Fund is in the best interest of the Fund and its shareholders and voted to approve an Agreement and Plan of Reorganization to reorganize the Fund with and into Columbia Acorn Fund, another series of Columbia Acorn Trust with substantially similar principal investment strategies and the same portfolio management as the Fund. Pursuant to applicable law (including the Investment Company Act of 1940) the reorganization will be implemented without shareholder approval. The reorganization is expected to occur in the second quarter of 2023 and is expected to be a tax-free reorganization for U.S. federal income tax purposes. Additional information about the reorganization has been made available to shareholders in a combined Information Statement/Prospectus that is also available at www.sec.gov.

The Fund’s performance during 2022 includes the impact of companies held by the Fund prior to changes that became effective May 1, 2022, including an increase in the market capitalization range of the companies in which the Fund invests a majority of its assets and a corresponding change in the Fund’s primary benchmark.

Columbia Acorn USA® Institutional Class shares returned -33.60% for the 12-month period ended December 31, 2022, trailing the -26.21% return of the Fund’s primary benchmark, the Russell 2500 Growth Index for the same period. The Russell 2000 Growth Index, the Fund’s former primary benchmark, returned -26.36% for the same time period.

Market overview

In 2022, global markets took a pummeling, as looser monetary policies and stimulus spending from the previous two years came home to roost. At the start of the year, the rhetoric from the Federal Reserve (Fed) on inflation amid a tight labor market and supply chain bottlenecks had primed the market for interest rate hikes. The Russian invasion of Ukraine in February 2022 added further inflationary pressure on energy and food prices, dampening market sentiment. The Fed subsequently embarked on an interest rate-raising trajectory that extended through the year with seven interest rate raises, resulting in, by June 2022, consumer sentiment reaching its lowest point in over a year. Following this, bearish investor sentiment continued to prevail despite a rollover in energy prices and an easing in supply chain disruptions. Markets rebounded in the fourth quarter on more benign economic data and expectations of a Fed pivot on interest rate hikes. Unfortunately, this was not substantial enough to reverse the damage of the previous nine months.

Small-cap stocks trailed large-cap stocks, and growth stocks considerably underperformed value stocks during the year due to their greater sensitivity to rising interest rates. In other words, higher rates reduce the value of companies’ future earnings when measured in today’s dollars. Also, less economically-sensitive companies that trade at lower valuations provide more defense in a volatile and uncertain environment. From a sector perspective, the poorest performing sectors in the Russell 2500 Growth Index were the communication services, real estate, health care, consumer discretionary and information technology sectors. While interest rates had a bearing on information technology and smaller cap names, tight labor costs had an impact on services names. Energy benefited from high inflation, the only sector within the benchmark with positive returns for the year.

Factor correlations were skewed because of extreme volatility of inflation data, coupled with extreme market reaction to that data. Company fundamentals were additionally lost in the upheaval. Stocks, especially among longer duration names, suffered declines from a compression of multiples and the types of higher quality, profitable growers we seek were most severely impacted in a backdrop of rising rates. In response, we remain focused on investing in growing companies that we believe have outstanding business models and competitive advantages. We are selective across sectors, looking for opportunities that, from a bottom-up perspective, have the ability to stand on their own and relatively detach from the surrounding macro environment.

The Fund’s notable detractors during the period

| • | Kornit Digital Ltd. is an Israeli-American international company that manufactures, markets and services a range of digital printing applications for the textile industry. Prior to 2022, Kornit benefited from several years of robust demand for its equipment as customers scrambled to meet sky-rocketing demand from end-customers. However, the re-calibration of e-commerce growth in a post-COVID scenario, coupled with macro headwinds, resulted in a greater-than-expected pause in demand. |

Columbia Acorn Family of Funds | Annual Report 2022

| 13 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn USA® (Unaudited)

| • | SiteOne Landscape Supply, Inc. is the largest and only national wholesale distributor of landscape supplies. While the fundamentals of SiteOne remain sound, the company was impacted by broader exogenous factors including global supply chain issues, product inflation and economic uncertainty. |

| • | Amedisys, Inc. is a leading provider of home health, hospice and personal care. During the year, the U.S. Centers for Medicaid & Medicare Services (CMS) proposed new reimbursement guidelines for home health services, adding to an increasingly complex backdrop for the home health sector. The proposed adjustment was at the lower end of investor expectations. This caused angst over future potential EBITDA (earnings before interest, taxes, depreciation and amortization) revisions and earnings forecasts for the company. |

The Fund’s notable contributors during the period

| • | CoStar Group is a company that provides commercial real estate information, analytics, and online marketplaces. The company’s top three products (CoStar, Apartments.com and LoopNet) had strong sales growth based off consistent, subscription based recurring revenues that beat expectations. CoStar has done a good job of articulating its strategy for moving into the residential marketplace business. Improving multi-family market conditions also provided tailwinds during the year. |

| • | Stock selection in the consumer discretionary sector was a significant positive contributor, much of which is attributable to Wingstop, Inc., a multinational chain of restaurants specializing in chicken wings. Following a temporary slower COVID period, Wingstop boosted Fund performance with re-accelerating sales as customers began to re-prioritize going out to restaurants. |

| • | Axon Enterprise is the manufacturer of Tasers and market leading provider of law enforcement technology including body and vehicle cameras. The company utilized its monopolistic position to make market expansions into judiciary, corrections, federal agency and other governmental affairs. Revenue along with international contract wins and strong revenue forecasts helped to separate Axon Enterprise from an uncertain and challenging macro environment. |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Investments in small- and mid-cap companies involve risks and volatility greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to specific securities should not be construed as a recommendation or investment advice.

| 14 | Columbia Acorn Family of Funds | Annual Report 2022 |

Fund at a glance

Columbia Acorn International SelectSM (Unaudited)

Investment objective

Columbia Acorn International SelectSM (the Fund) seeks long-term capital appreciation.

Portfolio management

Stephen Kusmierczak, CFA

Lead Portfolio Manager or Co-Portfolio Manager since 2016

Service with Fund since 2001

Hans F. Stege

Co-Portfolio Manager since 2019

Service with Fund since 2017

Morningstar style boxTM

The Morningstar Style Box is based on a fund’s portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2023 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| Average annual total returns (%) (for the period ended December 31, 2022) |

| | | Inception | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 10/16/00 | -36.80 | -0.73 | 3.28 | 6.71 |

| | Including sales charges | | -40.43 | -1.90 | 2.67 | 6.45 |

| Advisor Class | 11/08/12 | -36.63 | -0.48 | 3.55 | 7.03 |

| Class C | Excluding sales charges | 10/16/00 | -37.29 | -1.48 | 2.50 | 5.91 |

| | Including sales charges | | -37.89 | -1.48 | 2.50 | 5.91 |

| Institutional Class | 11/23/98 | -36.65 | -0.49 | 3.55 | 7.04 |

| Institutional 2 Class | 11/08/12 | -36.57 | -0.39 | 3.63 | 7.07 |

| Institutional 3 Class | 11/08/12 | -36.56 | -0.35 | 3.68 | 7.09 |

| MSCI ACWI ex USA Growth Index (Net) | | -23.05 | 1.49 | 4.68 | - |

| MSCI ACWI ex USA Index (Net) | | -16.00 | 0.88 | 3.80 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2022 prospectus, the Fund’s annual operating expense ratio is 0.99% for Institutional Class shares and 1.24% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the Investment Manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s Institutional Class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The MSCI ACWI ex USA Growth Index (Net) captures a large- and mid-cap representation across 22 developed market countries and 24 emerging market countries.

The MSCI ACWI ex USA Index (Net) captures a large- and mid-cap representation across 22 of 23 developed market countries (excluding the United States) and 24 emerging market countries. The index covers approximately 85% of the global equity opportunity set outside the United States.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Columbia Acorn Family of Funds | Annual Report 2022

| 15 |

Fund at a glance (continued)

Columbia Acorn International SelectSM (Unaudited)

The Growth of a $10,000 Investment in Columbia Acorn International SelectSM Institutional Class Shares

December 31, 2012 through December 31, 2022

This chart shows the change in value of a hypothetical $10,000 investment in Institutional Class shares of the Fund during the stated time period. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Equity sector breakdown (%) (at December 31, 2022) |

| Communication Services | 5.1 |

| Consumer Discretionary | 9.3 |

| Financials | 9.5 |

| Health Care | 19.2 |

| Industrials | 31.8 |

| Information Technology | 23.2 |

| Materials | 1.9 |

| Total | 100.0 |

Percentages indicated are based upon total equity investments. The Fund’s portfolio composition is subject to change.

| Country breakdown (%) (at December 31, 2022) |

| Australia | 4.1 |

| Brazil | 2.8 |

| Canada | 1.9 |

| China | 7.0 |

| Denmark | 1.7 |

| Finland | 4.0 |

| Germany | 2.4 |

| Italy | 3.9 |

| Japan | 13.1 |

| Netherlands | 4.0 |

| New Zealand | 3.9 |

| South Korea | 2.4 |

| Sweden | 11.3 |

| Switzerland | 13.5 |

| Taiwan | 5.9 |

| United Kingdom | 17.2 |

| United States(a) | 0.9 |

| Total | 100.0 |

| (a) | Includes investments in Money Market Funds. |

Country breakdown is based primarily on issuer’s place of organization/incorporation. Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 16 | Columbia Acorn Family of Funds | Annual Report 2022 |

Manager Discussion of Fund Performance

Columbia Acorn International SelectSM (Unaudited)

Columbia Acorn International SelectSM Institutional Class shares returned -36.65% for the 12-month period ended December 31, 2022, underperforming the -23.05% return of the Fund’s primary benchmark, the MSCI ACWI ex USA Growth Index (Net) for the same period. The Fund’s secondary benchmark, the MSCI ACWI ex USA Index (Net), ended the 12-month period with a return of -16.00%.

Market overview

In 2022, international equities experienced steep declines in a reversal of the previous year’s robust return trajectory. Geopolitical headwinds, high inflation levels and hawkish global central bank responses underscored the period. At the start of the year, our more positive outlook was quickly dampened by Russia’s unexpected invasion of Ukraine, which exacerbated the still lingering COVID-era effects of a tight labor market, high commodity and food prices and supply chain disruptions. Global central banks pivoted towards monetary tightening and by the start of the second half of the year, fears of a recession were at a peak. This was particularly true for Europe, where uncertainty over gas supplies for the impending winter combined with a weak Euro and weighed on investor sentiment. However, in the fourth quarter, more benign inflation data, easing energy supplies in Europe and a China-reopening fueled a rally in stocks that mitigated declines from the previous nine months.

Also in 2022, international small-cap growth stocks underperformed value stocks. This divergence was most prevalent in the information technology sector, as more richly valued software and services names were pummeled. Amid economic uncertainty and higher interest rates, more defensive large caps outperformed small caps. During the majority of the year, high profitability growth companies we favored provided less of a shield as they declined along with other growth stocks. This trend reversed in the fourth quarter when quality growth companies generated positive returns, following an inflation reversal in Europe.

As we enter 2023 in what continues to be an uncertain environment, we believe that capable management teams in higher quality businesses will be better able to navigate this period of unique disruption. We are somewhat more optimistic about circumstances in Europe than we were mid-year 2022. Natural gas prices underlying much higher electricity prices for most of 2022 have retreated to pre-Ukraine war levels. This provides relief for European consumers. The European Central Bank is not raising rates as aggressively as is the U.S. Federal Reserve. In most of Europe excluding the U.K., labor shortages and wage pressures have not been as salient a factor in driving inflation as in the United States. Multi-year labor bargaining agreements help dampen inflationary pressures. We are also hopeful that China’s reversal on its COVID policy will trigger an acceleration of GDP after the first quarter. German exports, for example, have typically benefited from a vibrant Chinese economy. We recognize that Russia’s war on Ukraine continues to weigh on the macro environment and poses an exogenous risk to the markets.

The Fund’s notable detractors during the period

| • | Parade Technologies Ltd. is a fabless semiconductor company offering high-speed interface and display systems used in computers, consumer electronics and display panels. In 2022, the company was negatively impacted as the semiconductor industry entered a downturn driven by a destocking in personal computers. Parade is a leader in technology and has consistently retained the largest market share in the display segment. We expect that Parade will be able to replicate that success in high-speed applications relating to servers, driven by structural growth of high-performance computing. |

| • | Dechra Pharmaceuticals PLC is a U.K.-based company that is involved in the development and marketing of veterinary products. During the period, investors had concerns over generic competition mostly because of two competing Indian manufacturers, Cronos Pharma and Felix Generics, that are more aggressively pursuing animal pharma markets in the United States. We believe these concerns are exaggerated. Most of Dechra’s generics portfolio addresses relatively niche markets. These small markets will likely prove to be uneconomical for new generic entrants which do not enjoy the scale benefits of a large group like Dechra. |

| • | Nemetschek SE is a Germany-based company that develops and sells its software into the architecture, engineering and construction verticals (construction that is built vertically, such as skyscrapers or high rises). While still a largely underpenetrated field, the company’s share price weakened in 2022 amid concerns of a slowing residential and commercial construction market. The company has also seen some management turnover as it undergoes the next |

Columbia Acorn Family of Funds | Annual Report 2022

| 17 |

Manager Discussion of Fund Performance (continued)

Columbia Acorn International SelectSM (Unaudited)

| | stages of brand harmonization and transitioning of products into license to subscription models. We continue to monitor the effect of recent management changes, but are optimistic regarding the business growth prospects for the Nemetschek in the fast-evolving ‘design, build and manage’ software space in which our team has particular expertise. |

The Fund’s notable contributors during the period

| • | Disco Corporation, headquartered in Japan, is one of the world’s largest manufacturers of specialized cutting and polishing equipment, such as wafer saws, used in semiconductor manufacturing. During the year, the company managed to buck the downcycle in semiconductors and posted double digit returns. This was supported by new growth in the area of silicon carbide (a version of the traditional semiconductor that has significantly higher breakdown strength and hardness) and expansion into the areas of power semiconductors and wafer transport. |

| • | HOSHIZAKI Corp. is a Japanese manufacturer of ‘cold’ commercial kitchen equipment, including ice machines, water filters, freezers, prep tables and refrigerated display cases. The company had strong returns in 2022 as a result of robust demand for their products that was boosted by a post-COVID recovery in restaurant businesses. Other factors that buttressed performance were a resolution of production issues in Japan as supply chain disruptions eased, as well as the positive effect from price hikes globally, which came through during the year. |

| • | Spirax-Sarco Engineering PLC is a global manufacturer of a wide range of applications for industrial and commercial steam systems, electric thermal solutions and peristaltic pumps used across multiple industries. The company has benefited from the strong demand for pressure reducing valves in a backdrop of solid global demand for oil and gas, chemicals and power. In addition, during the year, strong growth from its Watson Marlow division (based off strength in the biopharmaceutical industry) and acquisitions of thermal solutions companies, Vulcanic Group and Durex International Corporation, helped to boost performance. |

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Foreign investments subject the Fund to political, economic, market, social and other risks within a particular country, as well as to potential currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to specific securities should not be construed as a recommendation or investment advice.

| 18 | Columbia Acorn Family of Funds | Annual Report 2022 |

Fund at a glance

Columbia Thermostat FundSM (Unaudited)

Investment objective

Columbia Thermostat FundSM (the Fund) seeks long-term capital appreciation.

Portfolio management

Anwiti Bahuguna, Ph.D.

Lead or Co-Portfolio Manager since 2018

Service with Fund since 2018

Alex M. Rivas

Portfolio Manager since May 2022

Service with Fund since 2018

| Average annual total returns (%) (for the period ended December 31, 2022) |

| | | Inception | 1 Year | 5 Years | 10 Years | Life of Fund |

| Class A | Excluding sales charges | 03/03/03 | -13.14 | 6.47 | 5.62 | 6.73 |

| | Including sales charges | | -18.14 | 5.22 | 5.00 | 6.42 |

| Advisor Class | 11/08/12 | -12.89 | 6.74 | 5.89 | 7.00 |

| Class C | Excluding sales charges | 03/03/03 | -13.75 | 5.68 | 4.84 | 5.94 |

| | Including sales charges | | -14.60 | 5.68 | 4.84 | 5.94 |

| Institutional Class | 09/25/02 | -12.92 | 6.73 | 5.89 | 7.00 |

| Institutional 2 Class | 11/08/12 | -12.88 | 6.78 | 5.93 | 7.02 |

| Institutional 3 Class | 11/08/12 | -12.82 | 6.82 | 5.97 | 7.04 |

| Blended Benchmark | | -15.26 | 5.03 | 6.94 | - |

| S&P 500® Index | | -18.11 | 9.42 | 12.56 | - |

| Bloomberg U.S. Aggregate Bond Index | | -13.01 | 0.02 | 1.06 | - |

Performance numbers reflect all Fund expenses. Returns for Class A shares are shown with and without the maximum initial sales charge of 5.75%. Returns for Class C shares are shown with and without the maximum contingent deferred sales charge of 1.00% for the first year after purchase. The Fund’s other share classes are not subject to sales charges, but may be subject to other fees and expenses, and have limited eligibility. Please see the Fund’s prospectus for details. Performance for different share classes will vary based on differences in sales charges and certain fees and expenses associated with each share class.

As stated in the May 1, 2022 prospectus, the Fund’s annual operating expense ratio is 0.61% for Institutional Class shares and 0.86% for Class A shares.

All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of fee waivers or reimbursements of Fund expenses by the Investment Manager and/or its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results may have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedleus.com/investor/ or calling 800.922.6769.

The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund’s Institutional Class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investor/investment-products/mutual-funds/appended-performance for more information.

The Fund’s performance prior to May 1, 2018 reflects returns achieved following a principal investment strategy pursuant to which day-to-day investment decisions for the Fund were made according to only one potential form of predetermined asset allocation table. Since May 1, 2018, the Fund has followed a principal investment strategy that calls for the Investment Manager, on at least an annual basis, to determine whether the Fund’s assets should be allocated according to one of two different forms of allocation table based on the Investment Manager’s assessment of the equity market.

From the Fund’s inception through April 2020, the asset allocation table in place reflected the Investment Manager’s determination that the equity market was “expensive”. For a one-year period from May 1, 2020 through April 30, 2021, the Fund switched to the "normal" equity market table with a 50% equity floor because the Fund’s portfolio managers determined the market to be "normal." On May 1, 2021, the Fund moved back to the asset allocation table that was in place from the Fund’s inception in 2002 through April 30, 2020 based on the portfolio managers’ determination that the equity market is currently "expensive." On May 2, 2022 (since May 1, 2022 fell on a Sunday), based on the S&P 500® Index’s cyclically adjusted price-to-earnings ratio, the Investment Manager determined that the Fund will remain in an “expensive market” classification, with stock allocations ranging from 10% -90%.

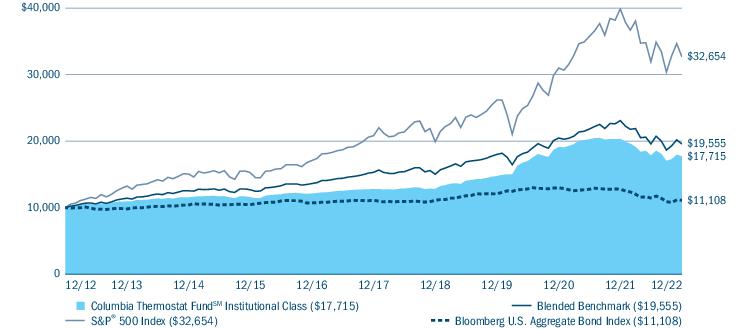

The Blended Benchmark, established by the Investment Manager, is an equally weighted custom composite of the Fund’s primary equity and primary debt benchmarks, the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index, respectively. The percentage of the Fund’s assets allocated to underlying stock and bond portfolio funds will vary, and accordingly the composition of the Fund’s portfolio will not always reflect the composition of the Blended Benchmark.

The S&P 500® Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

Columbia Acorn Family of Funds | Annual Report 2022

| 19 |

Fund at a glance (continued)

Columbia Thermostat FundSM (Unaudited)

The Bloomberg U.S. Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment-grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

Unlike mutual funds, indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

The Growth of a $10,000 Investment in Columbia Thermostat FundSM Institutional Class Shares

December 31, 2012 through December 31, 2022

This chart shows the change in value of a hypothetical $10,000 investment in Institutional Class shares of the Fund during the stated time period. Although the indexes are provided for use in assessing the Fund’s performance, the Fund’s holdings may differ significantly from those in an index. Performance numbers reflect all Fund expenses.

| Portfolio breakdown (%) (at December 31, 2022) |

| Equity Funds | 13.5 |

| Exchange-Traded Equity Funds | 1.5 |

| Exchange-Traded Fixed Income Funds | 8.5 |

| Fixed Income Funds | 76.2 |

| Money Market Funds | 0.3 |

| Total | 100.0 |

Percentages indicated are based upon total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

| 20 | Columbia Acorn Family of Funds | Annual Report 2022 |

Manager Discussion of Fund Performance

Columbia Thermostat FundSM (Unaudited)

Columbia Thermostat FundSM Institutional Class shares returned -12.92% for the 12-month period ended December 31, 2022. During the same time period, the Fund’s primary equity benchmark, the S&P 500® Index, returned -18.11%, and the Fund’s primary debt benchmark, the Bloomberg U.S. Aggregate Bond Index, returned -13.01%. The Fund outperformed its custom Blended Benchmark, which returned -15.26% during 2022.

Market overview

U.S. equities declined in 2022, posting the worst annual performance, as measured by the S&P 500® Index, since the global financial crisis in 2008 and the dot-com meltdown in 2002. In stark contrast to the previous calendar year, in which U.S. equities accelerated to 70 record highs throughout the period and all 11 economic sectors delivered double-digit gains, 2022 saw a choppy but steady downward trajectory as investor sentiment wavered between worry and hope. Six of the 11 sectors within the S&P 500® Index fell by double-digits. Energy stocks performed best, continuing the post-pandemic momentum driven by rising oil prices. Utilities stocks were the only other broad category to produce positive results, but just barely, as investors sought stability and at least some certainty about future earnings.

Results were driven largely by expectations around the course of inflation and corresponding action by the U.S. Federal Reserve (Fed), which hiked rates seven times by a combined 4.25 percentage points over the course of the year. Some upside during the period was sparked by investors’ interpretation of Fed Chair Jerome Powell’s remarks after the Federal Open Market Committee announced an anticipated 75-basis point rate hike at the end of July 2022. (A basis point is 1/100 of a percent.) What many seemingly heard were hints that rate hikes would slow in concert with softening economic growth. That takeaway evaporated a month later when Powell spoke at Jackson Hole and prioritized fighting inflation no matter how much pain the economy might suffer. His inflation-fighting resolve was confirmed by an additional 75-basis point hike in September, along with a forecast showing no expectations for rate cuts until 2024.

A similar about-face was repeated near year-end as sentiment abruptly turned positive to start the fourth quarter but stalled in mid-December when the Fed raised rates by 50 basis points. Although the hike was widely anticipated and marked a step down from the previous 75-basis point increases, it disappointed investors who had hoped for softening language about future increases. Slowing global growth and China’s COVID-19 lockdown policy compounded rate worries, as did an increasing realization that earnings estimates had been implausibly optimistic for much of the year.

Credit-related sectors produced negative absolute returns and negative excess returns relative to U.S Treasuries during the 12-month period that ended December 31, 2022. On an excess returns basis, high-yield corporates performed the worst, followed by emerging market bonds and agency mortgage-backed securities. Asset-backed securities, federal agencies, and commercial mortgage-backed securities outperformed other sectors, although the sectors still generated negative excess returns. Shorter duration bonds outperformed longer duration bonds. Within the short-term investment-grade corporate market, lower rated securities generated positive excess returns and outperformed higher quality securities. The trend was reversed in the longer term investment-grade corporate market, with higher rated securities outperforming lower quality securities and excess returns for all ratings buckets being negative.

Contributors and detractors

The Fund’s equity portfolio had a weighted average return of -19.84% in 2022. All seven underlying equity funds posted negative returns for the period. Columbia Select Mid Cap Value Fund was the equity portfolio’s top performer, returning -9.02% for the year. Columbia Acorn® Fund was the equity portfolio’s worst performer, with a return of -33.77% for the year.

The Fund’s bond portfolio ended the year with a weighted average return of -13.31%. All six underlying bond funds posted negative returns for the period. Columbia Short Term Bond Fund was the strongest performer, returning -4.59% for the year. Columbia Total Return Bond Fund was the worst performer in the bond portfolio, returning -17.37% for the year.

Columbia Acorn Family of Funds | Annual Report 2022

| 21 |

Manager Discussion of Fund Performance (continued)

Columbia Thermostat FundSM (Unaudited)

Portfolio reallocations

The Fund’s allocation table is updated annually. Based on the S&P 500® Index’s cyclically adjusted price-to-earnings ratio, the Fund will remain in an “expensive market” classification, with stock allocations ranging from 10% -90%. On May 2, 2022 (since May 1, 2022 fell on a Sunday), the Fund moved from an allocation of 10% stocks and 90% fixed income to an allocation of 15% stocks and 85% bonds. There were 16 rebalancings of the Fund’s portfolio during the period, ending with the Fund at an allocation of 15% stocks and 85% bonds.

The Fund’s investments in the underlying funds may present certain risks, including the following: Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The Fund’s investment in other funds subjects it to the investment performance (positive or negative), risks and expenses of these underlying funds. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than ininvestments in larger, more established companies. There are risks associated with fixed-income investments, including credit risk, market risk, interest rate risk and prepayment and extension risk. In general, bond prices fall when interest rates rise and vice versa. This effect is more pronounced for longer term securities. Non-investment-grade(high-yield or junk) securities present greater price volatility and more risk to principal and income than higher rated securities. Foreign investments subject the Fund to political, economic, market, social and other risks within a particular country, as well as to potential currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Acorn Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Acorn Fund. References to specific securities should not be construed as a recommendation or investment advice.