Independent metallurgical test work facilities used over the Project life included SGS Laboratories, Durango, Mexico; SGS in Lakefield, Canada (SGS Lakefield), ALS, Kamloops, British Columbia, Canada; and Corporación Química Platinum S.A. de C.V. located in Silao, Guanajuato, Mexico.

Palmarejo Operations have an on-site analytical and metallurgical laboratory that assays concentrates, in-process samples, and geological samples. The on-site metallurgical laboratory is used for testing flotation reagents, grind analysis, and process characterization of new ores. The on-site laboratories are not independent and are audited with third parties.

There is no international standard of accreditation provided for metallurgical testing laboratories or metallurgical testing techniques and selection of laboratories is based on experience and reputation within the industry.

The focus of the historical test work was to obtain representative metallurgical samples; conduct mineralogy examinations; determine the most favorable processing routes; collect sufficient design information to select equipment that fit the preferred processing flow sheet; and provide guidance for operating performance.

These parameters were used to construct the process plant as outlined in Chapter 14.

Test programs were conducted from 2007–2014. These included mineralogical studies, whole ore bottle roll cyanidation, rougher flotation followed by tailing cyanidation, and gravity separation.

Electrum and native gold were the primary gold species. Acanthite, argentite, and native silver were the primary silver species. Sulfides included sphalerite, galena, chalcopyrite, chalcocite, enargite, bornite, and tennantite–tetrahedrite.

Of the methods tested, the best results were achieved by flotation followed by tailing leaching. Whole ore cyanidation was shown to be less suitable because of lower recoveries. The poorest overall recovery was found with the gravity concentrate method.

The 2013 flotation test results indicated that the Guadalupe ore sample achieved an average gold and silver recovery of 80.4% and 78.3%. Flotation, followed by tails leaching results, indicates that gold and silver recoveries could be improved. The achieved overall recoveries were 94.8% and 95.6%, respectively.

The 2014 test work on Guadalupe North ores were amenable direct agitated cyanidation treatment at nominal P80 = 75 µm feed size with minor conversion of plant parameters required with the transition for Palmarejo ore to Guadalupe. Gold and silver recoveries tended to increase with increasing grade. Gold and silver recoveries were improved significantly after flotation tailings were subjected to whole cyanidation. Global Gold laboratory recoveries for flotation/tailings cyanidation unadjusted for plant solution losses ranged from 94.2% to 98.1% and averaged 95.7%. Global Silver laboratory recoveries for flotation/tailings cyanidation unadjusted for plant solution losses ranged from 93.6% to 97.2% and averaged 97.2%.

Testwork on the Independencia Oeste and Este deposits was conducted from 2014–2015. Work completed included mineralogy, multi-element ICP scan, whole-rock analyses, and carbon and sulfur speciation analyses, BWi, timed grinding series, bulk rougher flotation tests, and bottle roll tests, matching Palmarejo plant specifications.

Independencia Oeste mineralization was found to contain 68% silver–copper sulfide, 19% acanthite/argentite, 6% native silver/electrum, 5% silver–copper–arsenic sulfide, and the remaining 2% comprises various sulfides. The BWi was estimated to be 16.4 kWh/t. This value was considered to be moderate to hard for ball milling and within the operating capabilities of the Palmarejo grinding circuit. The master composite flotation test recovered 90% of the silver and 89% of the gold into a bulk concentrate that pulled 21% of the initial mass. Duplicate bottle roll cyanidation leach tests averaged 81% silver and 86% gold extraction in solution. As is common for cyanidation, silver leached slower than gold.

Independencia Este flotation test results showed the mass pulls were generally 15–23%; silver recoveries were variable. Flotation response demonstrated that flotation could separate silver and gold into a rougher concentrate with low concentrate to bulk ore ratios. The kinetic extraction curves from the bottle roll tests demonstrated typical rapid gold extraction and slower silver extraction. Cyanidation extraction values were better than the flotation lab results. This observation agreed with similar test results using both flotation and cyanidation for the Independencia master composite. Composites responded well to bulk conventional flotation treatment at a P80 minus 106 μm feed size. Combined (flotation + tailings cyanidation) proved to be more effective on recoveries above recoveries obtained by separate whole ore cyanidation or flotation circuits. Leach cyanide consumption rates were low on flotation tailings.

Testwork was performed in 2016–2019, on samples from the La Nación, La Nación Central, and La Nación Sur areas, using the Palmarejo plant specifications and mineralogy, bottle roll tests, head analysis, multi-element ICP scan and carbon sulfur speciation analyses, and whole ore cyanidation tests were performed.

The La Nación composites tested in 2016 were amenable to whole ore milling cyanidation treatment with respect to gold recovery but were more varied with respect to silver extraction and recovery. Silver solution extraction rates were slower than for gold.

La Nación composites tested in 2017 were amenable to whole ore milling cyanidation treatment with respect to gold recovery. Gold leach rates were generally rapid and substantially peaked the first eight hours of leaching. Gold in solution obtained from the 72-hour leach tests ranged from 81.0–99.8% and averaged 94.3%. Composites were more varied with respect to silver extraction in solution by whole ore milling cyanidation. Silver extractions obtained from the 72-hour leach tests ranged from 43.6–96.6% and averaged 86.0%. Whole ore leaching cyanide consumptions were generally high and ranged from 2.8–4.0 kg/t NaCN ore (3.42 kg/t NaCN ore, avg.) for the 72-hour tests. No strong evidence of the high cyanide consumption was related to sulfide content in the evaluated composites. pH control lime requirements were low and averaged 1.08 kg/t ore.

Tests on material from La Nación Central and Sur were conducted in 2019. Eight size fractions from La Nación Central were subject to mineralogical study. The predominant silver mineral in each of the size fractions was argentite, with small quantities of stromeyerite and native silver. Argentite was primarily associated with quartz in each of the size fractions. Silver liberation was not detected in the size fractions >37 µm. Gold was found only in the 44 and 53 µm size fractions, as electrum associated with quartz with a size of <1 µm.

Mineralogy test work on La Nación Sur composites was performed on eight size fractions. The predominant silver mineral in each of the size fractions was argentite. The argentite was primarily associated with quartz with less than 10% associated with pyrite in the coarse size fractions. Liberation was relatively low in the coarse fractions (<5% liberated in particle sizes >53 µm). The liberation increased with reducing particle size with a 70% liberation in the +37-micron size fraction and 98% liberation in the -37 µm fraction. Gold was found only in the +74 and +53 µm size fractions in the form of electrum associated with quartz with a size of <2 µm.

The manganese minerals psilomelane and coronadite were present throughout all size fractions at La Nación Central and Sur. These minerals can potentially lead to lower silver recovery. Sulfide minerals present in minor quantities included galena, sphalerite, and covellite.

A sample from the Palmarejo milling circuit tails stream was submitted to SGS Lakefield for bulk mineralogy, heavy liquid separation preconcentration and silver deportment studies in early 2020. The flotation tails sample contained a relatively high grade at 1.64 g/t Au and 45.6 g/t Ag. Bulk mineralogy was completed using quantitative evaluation of minerals by scanning electron microscopy (QEMSCAN) analysis and supported by X-ray diffraction analysis. The primary minerals were quartz and calcite, with minor amounts of potassium feldspar, clays, iron oxides and trace amounts of dolomite, chlorite.

Results from the preconcentration showed that it would not be an effective method.

The microscopic silver examination of the tails composite sample showed 49.1% of the silver being liberated, 37.6% exposed and 13.2% locked. The primary silver minerals were acanthite, naumannite and jalpaite with minor amounts of electrum, aguilarite, native silver and others. The exposed and locked silver minerals were primarily associated with quartz with moderate amounts associated with lead oxide, and minor amounts associated with willemite, iron oxide, dolomite, and calcite.

A tails slurry sample from the Palmarejo circuit was submitted for solid-–liquid separation, rheology testing, and counter-current decantation washing modeling as part of 2020 testwork conducted by SGS Lakefield. Flocculant scoping tests were performed to match flocculant to sample recovery and thickening/clarification results. Additional dynamic tests were conducted to compare outcomes. Even at higher flocculant dosage the current flocculant could not achieve similar clarity or comparable total suspended solids levels. Other competitive flocculants were tested with variable dosage to test dosage to overflow total suspended solids rates. The solution densities on the underflow and yield stress were also calculated and tracked during the process providing results ranging from 57.1–58.2% solids depending on solids loading and residence time.

The critical solids density was calculated to be approximately 54% solids at a shear stress of 40Pa under unsheared flow conditions and 15 Pa under sheared conditions.

The resulting samples following the previous testwork were used to for various counter-current decantation modeling scenarios, using fixed parameters of cyanide leached discharge at 42% solids, silver and gold tenor in feed solution at 26 mg/L and 1.3mg/L, underflow on thickener at 55% solids, and perfect mixing at each wash stage. The results showed that the best response was achieved using a tested market flocculant at fixed dosage. Underflow slurry characteristics were within specifications for pumping.

Current recovery estimates for each deposit are summarized in Table 10‑1.

The LOM forecast average gold blended recovery is 90%. The LOM forecast average blended silver recovery is 82.5%.

Samples selected for metallurgical testing were representative of the various locations, ore types, and minerology. Additional samples were selected at periods during mining to test or reconcile results. Individual and composite tests were selected and taken to provide sufficient sample mass.

The anticipated gold and silver recoveries could be affected by alteration states. Highly oxidized material is not responsive to the flotation process. Highly oxidized ore will significantly affect recovery if blended at a high ratio. Ores that have a high clay content increase slurry viscosity, which has a detrimental effect on precious metals recovery in flotation.

No other deleterious elements are known from the processing perspective.

Industry-standard studies were performed as part of process development and initial plant designs. Subsequent production experience and focused investigations, as well as marketing requirements, have guided process improvements and changes.

Testwork programs, both internal and external, continue to be performed to support current operations and potential improvements.

Current metallurgical test work confirms the material to be mined as having similar response to the flotation-leach process as historically mined ores. Metal recovery assumptions are derived from past performance of the plant.

The QPs reviewed the information compiled by Coeur, as summarized in this Chapter, and performed a review of the reconciliation data available to verify the information used in the LOM plan.

Based on these checks, in the opinion of the QPs the metallurgical testwork results and production data support the estimation of mineral resources and mineral reserves and can be used in the economic analysis.

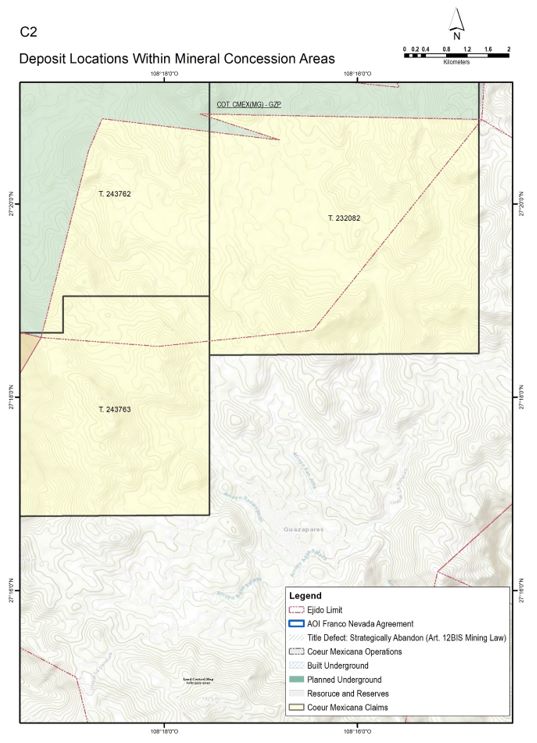

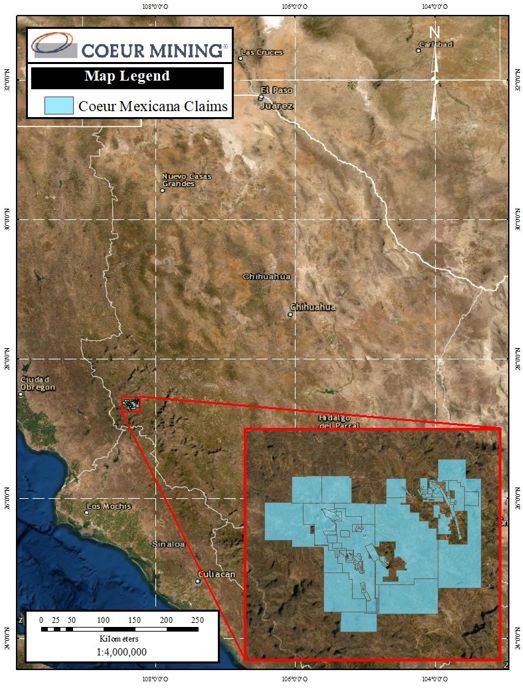

Mineral Resources are estimated for the following deposits. The database closeout date for all estimates was July 13, 2021.

Composites exhibit near log normal distributions. Statistics were compiled and compared for raw drill hole data, length weighted drill holes, composites, declustered composites, and capped declustered composites to ensure that the grade distribution and true mean of the system were documented and conserved through the estimation process. The coefficient of variation was analyzed to determine if domaining produced sufficient stationarity for the estimate.

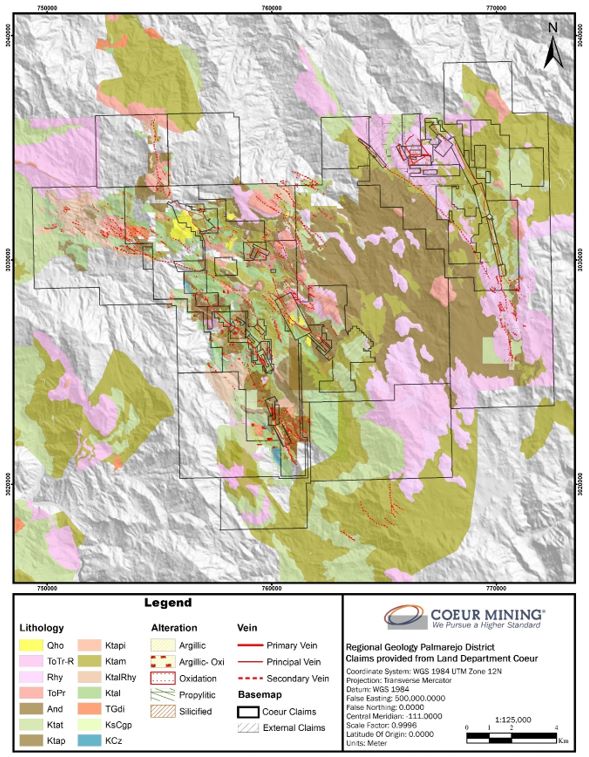

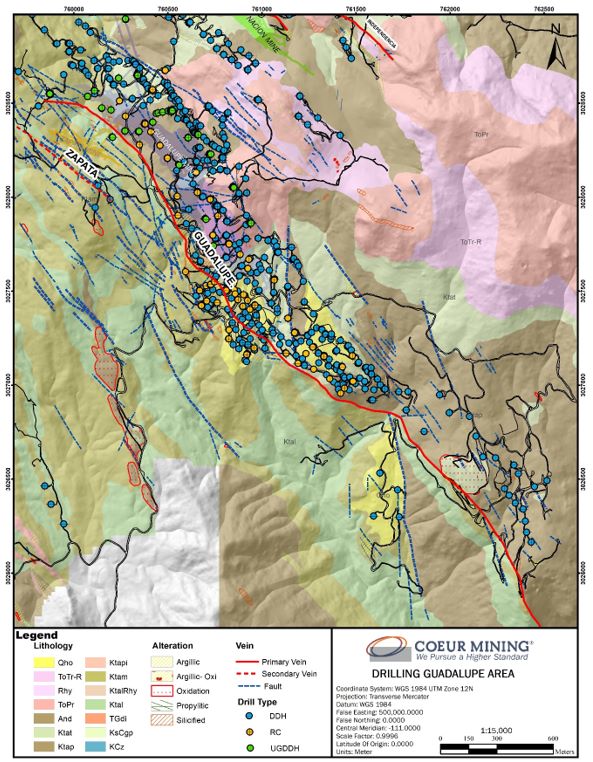

Mineralization is hosted in primary northwest-trending, northeast- and southwest-dipping structures, and secondary diverging structures. The main mineralization type is defined by epithermal quartz vein breccias surrounded by a low-grade halo, consisting of various types of mineralized structures including discontinuous splays and vein arrays. Many of the deposits consist of various anastomosing quartz vein breccias with a sigmoidal geometry. There is also a broad geotechnical domain, used to estimate rock mass rating, or RMR.

The implicit modelling algorithm in Leapfrog Geo software was used to create all the estimation domains through interpretation of relevant intervals of drill data, digitized mapping, and underground production data.

The density determinations discussed in Chapter 8.3 were used in interpolation. Density was estimated using inverse distance weighting to the second power (ID2).

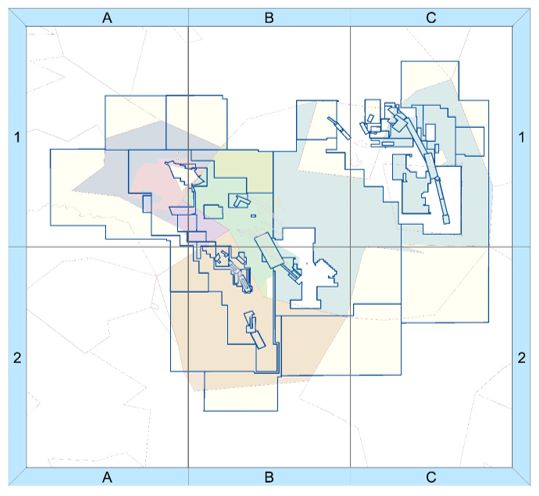

Note: Figure prepared by Coeur, 2021.

Caps for each estimation domain were determined using various methods such as histograms, probability plots and a metal loss calculation. Histograms and probability plots were examined for changes in slope and data distribution, while metal loss was calculated to keep the effect of capping to a maximum metal loss of 10%. The ranges of applied capping values are provided in Table 11‑1. Grade caps ranged from 100–3,500 g/t Ag and from 0.5–70 g/t Au, depending on estimation domain.

Core samples were composited at 2 m intervals by estimation domain for gold and silver. The composite length was chosen as one of the most common sample lengths and reduces the amount of sample splitting during the compositing process. Unsampled intervals were given a value of 0.001 ppm, as these intervals were deemed to be waste by the logging geologist and were not assayed. Composites were broken at domain boundaries, and composites <2 m at boundaries were distributed to the other composites within the domain. Natural rock caverns and drill intervals with no recovery, logged as “voids”, were omitted from the estimate.

Los Bancos, Zapata, and La Bavisa zones are full thickness composites within the domain. This resulted in a single variable length composite per drill hole within the estimation domain. This method of compositing is useful for discrete planar deposits of relatively consistent and narrow width, as it allows for the execution of a two-dimensional estimate.

Variogram searches were oriented along strike of the domains, with the major axis horizontal on-strike, the secondary axis down dip, and the minor axis across the width of the domain. Silver and gold variograms for each of the 12 estimation domains were created. Orthogonal variograms were fitted for gold and silver, consisting of three variograms oriented along the anisotropy. Downhole variograms were also fitted to provide the nugget. Where orthogonal variograms were not possible, omni-directional variograms were used.

Two and three structure, general relative, pairwise relative, and semi-variogram models were fitted to the experimental variograms. The Guadalupe–La Bavisa zone does not employ variography as it was estimated using ID2.

The various deposits were estimated using ordinary kriging (OK), with hard boundaries between geologic units. The enveloping disseminated domain was estimated using ID2. Search orientations were locally adjusted using dynamic anisotropy. The Guadalupe–La Bavisa zone was estimated using ID2.

Block models were constrained using the estimation domains. Models were rotated in two dimensions to represent the general strike and dip of the deposits. The parent block size was 2 x 25 x 25 m (X, Y, Z). The block size was based on the minimum mining width, composite length, and the average drill spacing of 40–50 m in the Y–Z plane. The block size was generally selected as one-half to one-third of the drill spacing. To provide a volumetric fit when filling the wireframes, the block models were sub-celled to a minimum of 1.0 x 2.5 x 2.5 m. Estimation took place in the parent cells, therefore, all sub-cells within a parent cell have the same grade. The estimation used a discretization grid of 1 x 5 x 5, which was based on the discrete dimensions in the X direction, and that a discretization of >5 in the Y and Z dimensions was inefficient and did not improve the block variance.

The full thickness model parent block size was set to the variable width of the vein in the X-dimension, and 30 x 30 m in the Y–Z dimensions. These models are not sub-celled and use a discretization grid of 1 x 3 x 3 m.

The search parameters for the estimate are summarized in Table 11‑2. The maximum number of samples was optimized by minimizing kriging variance while maximizing slope of regression, while attempting to maintain some degree of localization to improve production reconciliation. Each domain was estimated with one set of search ranges in one pass to achieve the optimal number of samples, and to avoid estimation artifacts created when using a multiple-pass method.

A high-grade search ellipse restriction was employed for the Independencia silver estimate, which applied the restriction at 75% of the capping value. Constant search volumes and number of samples were used for each domain.

The block model was depleted using the in-situ variable, proportionally depleting from 100 (in situ) to 0 (completely mined).

The grade estimates were validated visually by stepping through sections and comparing the drill data and composites with the block values. Local bias validation was completed using swath plots. Reconciliation factors for mill to model reconciliation were used for global bias validation, as well as to drive iterative improvements in the estimation parameters. Geologic interpretation was validated and improved through underground mapping, channel sampling, and ore control drilling.

The measured classifications are based on proximity to ore control and production data. This limits the classification of measured material to the area around current mining where there is a very good understanding of the deposit geometry and grade distribution.

Indicated blocks were classified using a script and then manually modified using polygons (in the plane of the domain) based on geologic confidence.

All remaining estimated material is classified as inferred, as the geological solids are considered conservative and do not extrapolate unsupported distances beyond or between data points.

Classification distances are based on variable grade continuity for each zone quantified with variography.

Following analysis that classified the mineral resource estimates into the measured, indicated, and inferred confidence categories, uncertainties regarding sampling and drilling methods, data processing and handling, geological modelling, and estimation were incorporated into the classifications assigned. The areas with the most uncertainty were assigned to the inferred category, and the areas with fewest uncertainties were classified as measured.

For each resource estimate, an initial assessment was undertaken that assessed likely infrastructure, mining, and process plant requirements; mining methods; process recoveries and throughputs; environmental, permitting, and social considerations relating to the proposed mining and processing methods, and proposed waste disposal, and technical and economic considerations in support of an assessment of reasonable prospects of economic extraction.

Mineral resources are confined within conceptual mineable shapes that use the assumptions in Table 11‑4.

Note: Figure prepared by Coeur, 2021. Red is measured, orange is indicated, and blue is inferred. Section looks west.

The gold and silver prices used in resource estimation are based on analysis of three-year rolling averages, long-term consensus pricing, and benchmarks to pricing used by industry peers over the past year. The estimated timeframe used is the eight-year LOM that supports the mineral reserves estimates. The gold price forecast for the mineral resource estimate is US$1,700/oz and the silver price is US$22/oz. The QP reviewed the forecasts as outlined in Chapter 16.

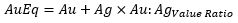

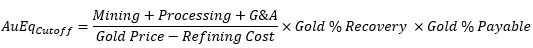

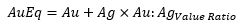

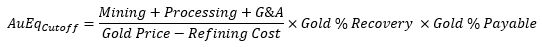

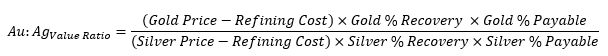

The mineral resources are reported using a cut-off of 1.59 to 2.21 g/t gold equivalent (AuEq). Gold equivalent cut-off grades were calculated for the deposits, with mineral resources estimated and reported above this cut-off. The AuEq cut-off was calculated as follows:

Where mining, processing and G&A are costs expressed as US dollars per tonne, and gold price and refining costs are expressed as US dollars per troy ounce. The payability refers to the percentage of metal payable after refining.

A gold:silver value ratio was used to convert silver grades to gold equivalent grades and is calculated using the following formula:

where AuEq, gold and silver are the gold equivalent grade, gold grade, and silver grade, respectively, in g/t.

The input parameters to the cut-off grades and the resulting grade cut-off for mineral resources reporting was provided in Table 11‑4.

The QP is of the opinion that any issues that arise in relation to relevant technical and economic factors likely to influence the prospect of economic extraction can be resolved with further work. The mineral resource estimates are performed for deposits that are in a well-documented geological setting. Coeur is very familiar with the economic parameters required for successful operations in the Palmarejo area; and Coeur has a history of being able to obtain and maintain permits, social license and meet environmental standards. There is sufficient time in the four-year timeframe considered for the commodity price forecast for Coeur to address any issues that may arise, or perform appropriate additional drilling, testwork and engineering studies to mitigate identified issues with the estimates.

Mineral resources are reported using the mineral resource definitions set out in SK1300 and are reported exclusive of those mineral resources converted to mineral reserves. The reference point for the estimate is in situ.

Measured and indicated mineral resources are summarized in Table 11‑5 and inferred mineral resources in Table 11‑6. Mineral resources are current at December 31, 2021.

The Qualified Person for the estimate is Mr. Joseph Ruffini, RM SME, a Coeur employee.

Table 11‑5: Gold and Silver Measured and Indicated Mineral Resource Statement as at December 31, 2021 (based on US$1,700/oz gold price and US$22/oz silver price)

Table 11‑6: Gold and Silver Inferred Mineral Resource Statement at December 31, 2021 (based on US$1,700/oz gold price and US$22/oz silver price)

| 12.0 | MINERAL RESERVE ESTIMATES |

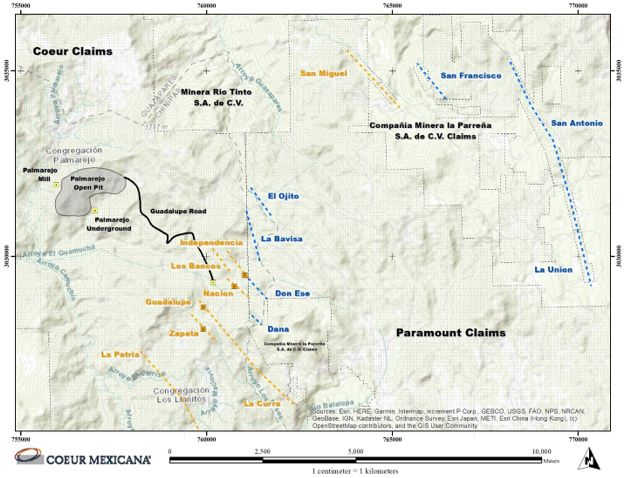

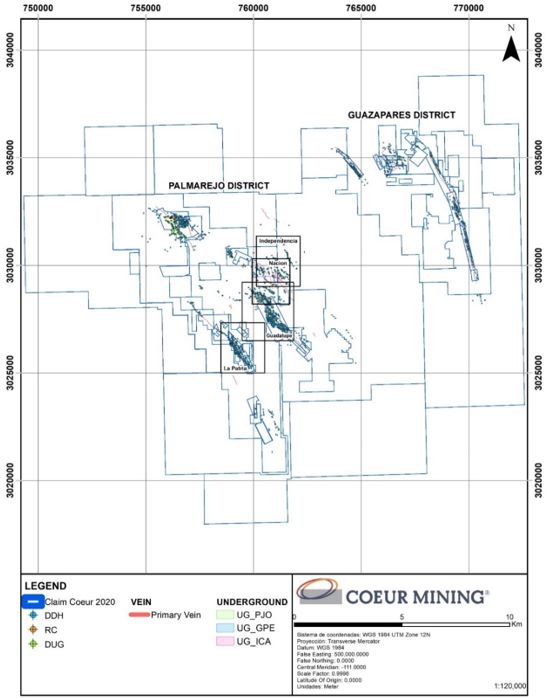

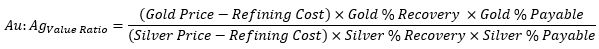

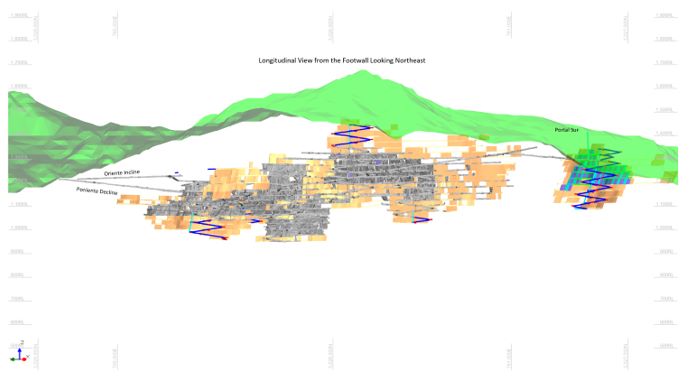

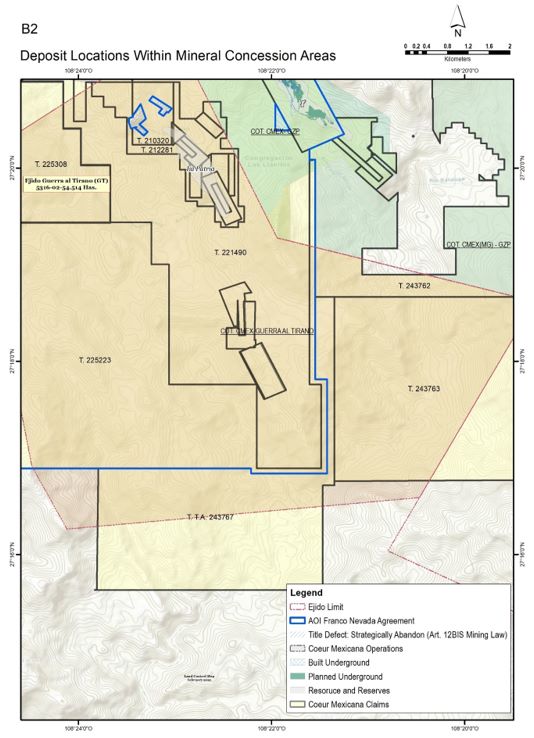

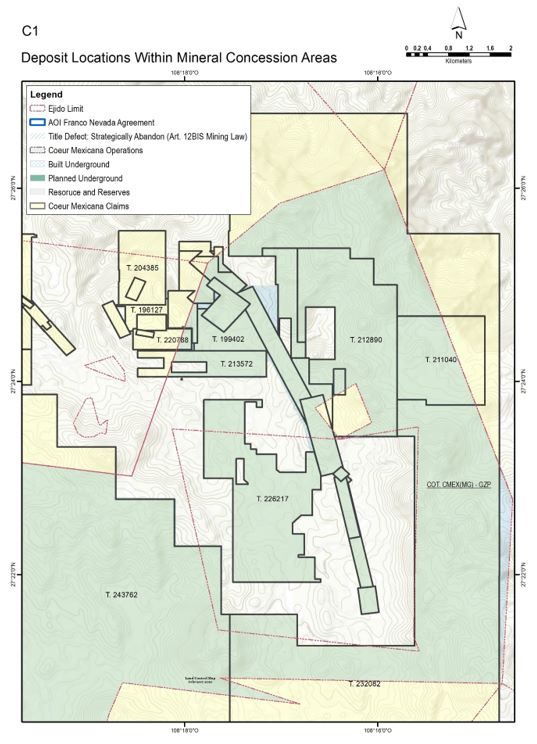

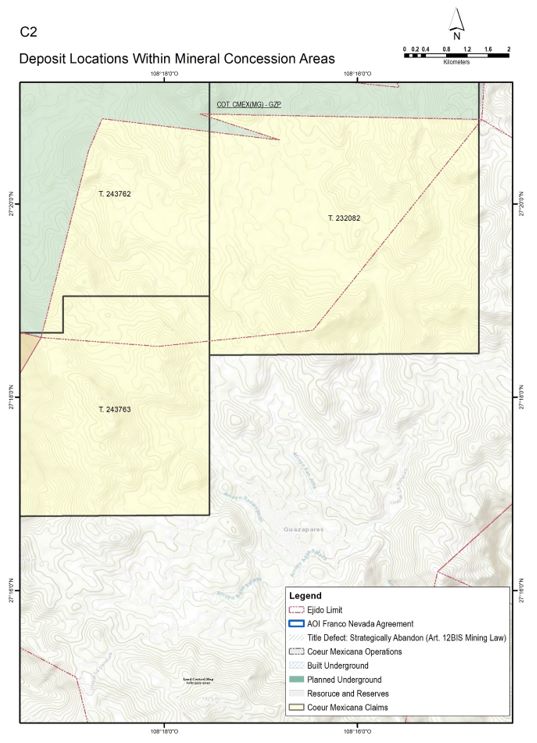

Mineral reserves are estimated at Guadalupe, Independencia, and

La Nación mines (Figure 12‑1 to Figure 12‑9). All estimates envisage underground mining methods. Mineral reserves were converted from measured and indicated mineral resources. Inferred mineral resources were set to waste. The mine plans assume underground mining using longhole open stoping using trackless equipment and cemented rock fill (CRF) backfill. Target mining rates are 150,000 t/month.

| 12.2 | Development of Mining Case |

The mineral reserve estimate is based on the following inputs and considerations:

| • | Mineral resource block model, with estimated tonnage, gold, and silver grades; |

| • | Cut-off grade calculations; |

| • | Stope and development designs; |

| • | Geotechnical and hydrogeological information; |

| • | Estimates for mining recovery and dilution; |

| • | Depletion from previous mining; |

| • | Consideration of other modifying factors. |

Deswik mine planning software was used for the mine design, 3D modeling, and interrogation of the 3D mining model against the block model.

The surveyed “as-built” mining excavations were depleted from the designed solids and the resource block model.

Mining, geotechnical, and hydrological factors were considered in the estimation of the mineral reserves, including the application of dilution and ore recovery factors.

Mining excavations (stopes and ore development) were designed to include mineralized material above the cut-off grade. These excavations were then assessed for economic viability. In addition to the mining cut-off grade, an incremental cut-off grade (excluding the mining cost) was calculated to classify mineralized material mined as a result of essential development to access higher grade mining areas. Mineralized material above this cut-off grade will add value, and is therefore, included as process plant feed. Mineralized material below the incremental cut-off will be disposed of on surface in waste rock storage facilities (WRSFs) or will be used underground as backfill.

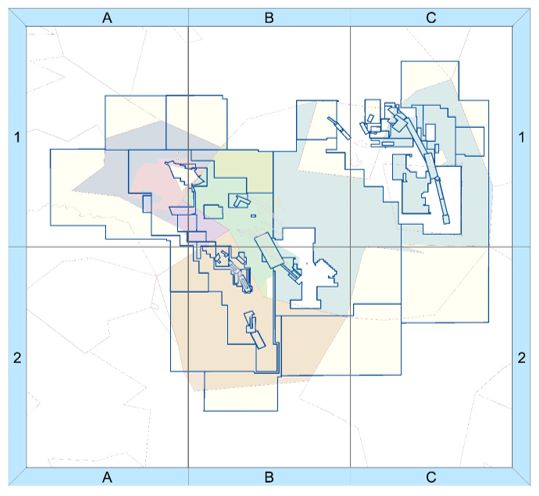

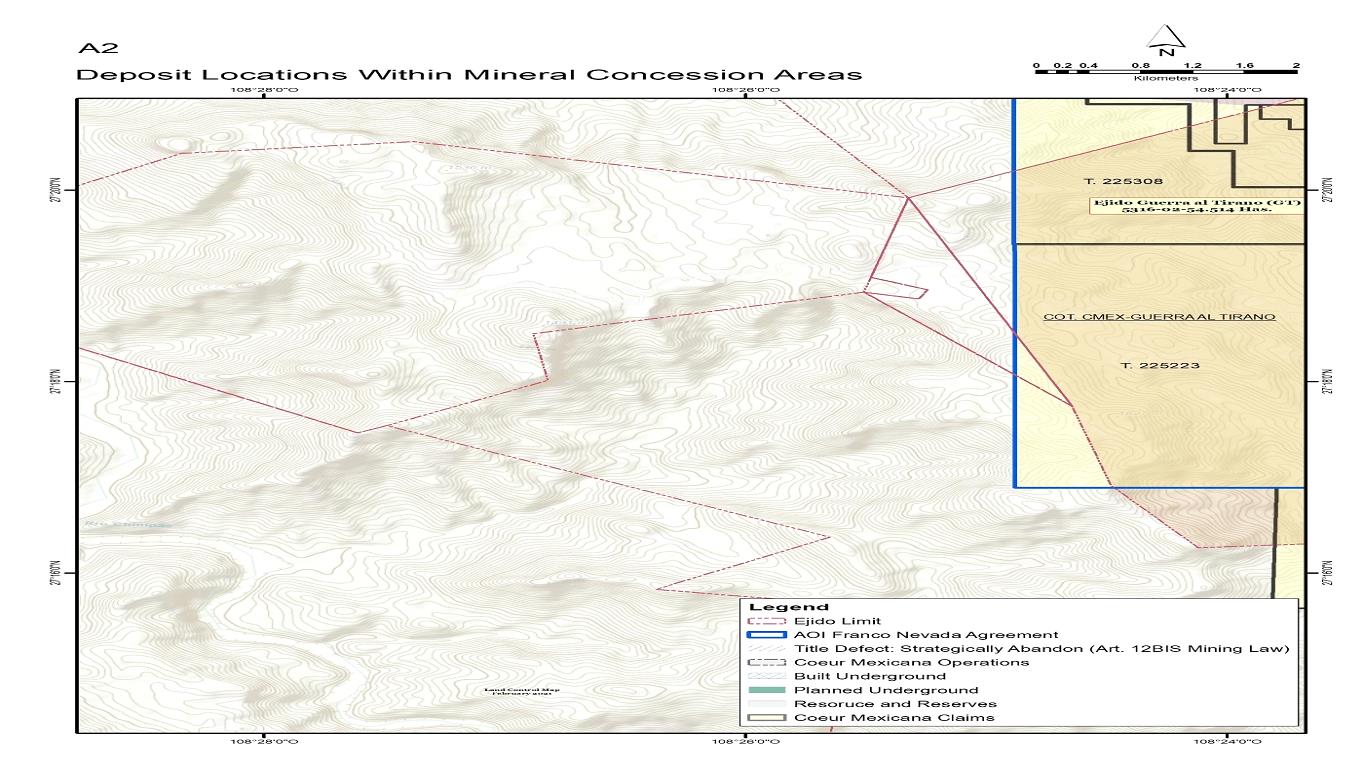

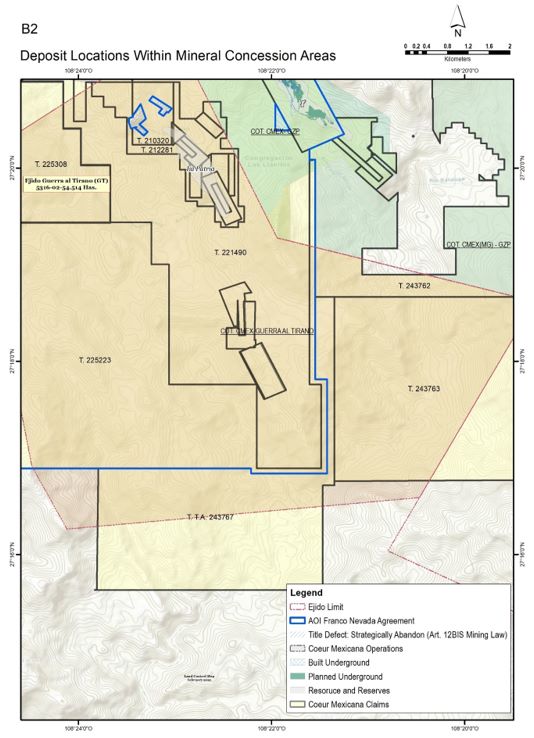

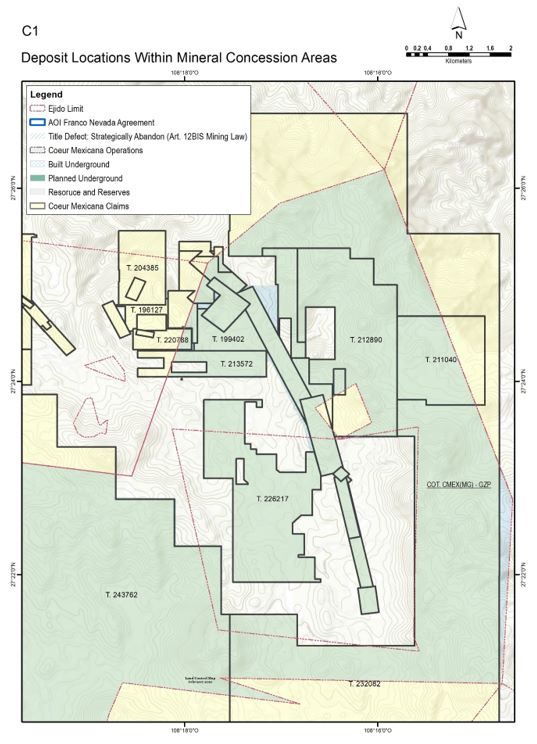

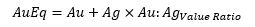

| Figure12‑1: | Deposit Layout Plan |

Note: Figure prepared by Coeur, 2021.

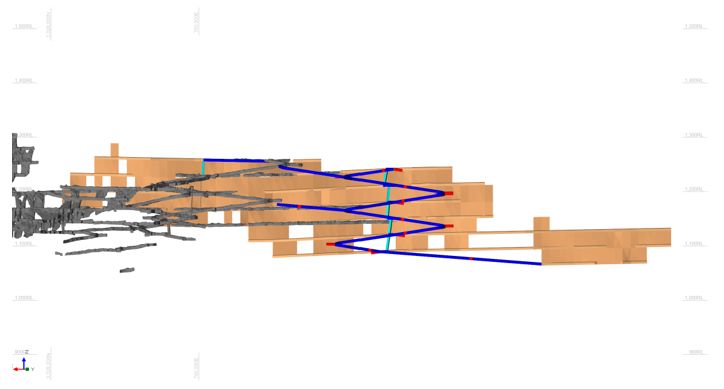

Figure 12‑2: Guadalupe Looking Northeast

Note: Figure prepared by Coeur, 2021. Legend key included as Figure 12‑9.

| Figure 12‑3: | Zapata Looking South |

Note: Figure prepared by Coeur, 2021. Legend key included as Figure 12‑9

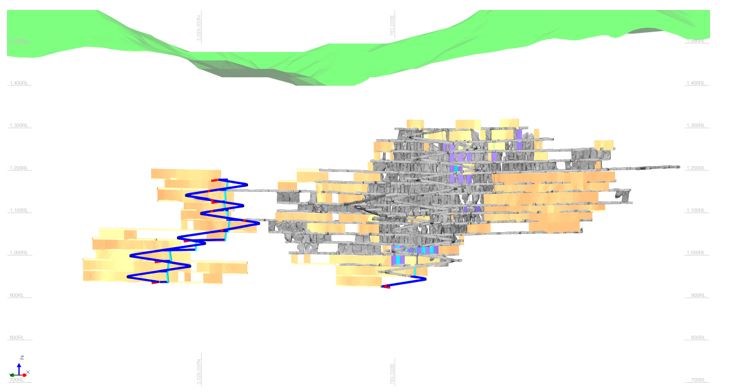

| Figure 12‑4: | Independencia Looking Northeast |

Note: Figure prepared by Coeur, 2021. Legend key included as Figure 12‑9

| Figure 12‑5: | La Bavisa Looking Northeast |

Note: Figure prepared by Coeur, 2021. Legend key included as Figure 12‑9

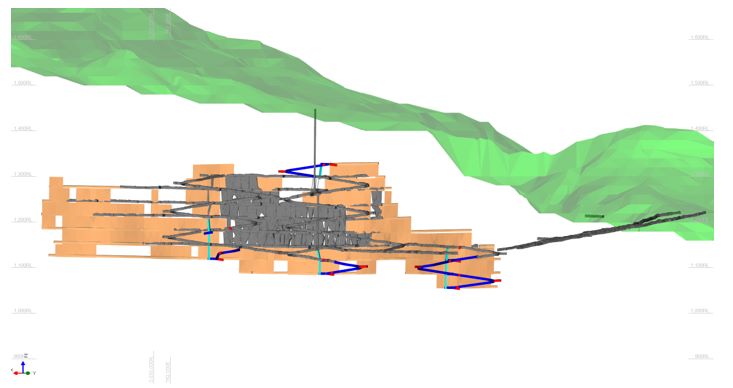

| Figure 12‑6: | La Nación Looking Southwest |

Note: Figure prepared by Coeur, 2021. Legend key included as Figure 12‑9

| Figure 12‑7: | Los Bancos Looking Northeast |

Note: Figure prepared by Coeur, 2021. Legend key included as Figure 12‑9

| Figure 12‑8: | Hidalgo Looking Northeast |

Note: Figure prepared by Coeur, 2020. Legend key included as Figure 12‑9.

| Figure 12‑9: | Mine Layout Legend Key |

Note: Figure prepared by Coeur, 2021.

All designed excavations in the Mineral Reserve meet or exceed the cut-off grade. However, other costs not included in the cut-off grade calculation, will be incurred, such as costs related to capital development, underground infrastructure installations, capital equipment purchases, and sustaining capital. In addition to these costs, there are taxes and royalties that are payable based on net income.

The resulting mine plan was analyzed in a financial model and is economically viable.

Stope designs were generated for the planned mining methods using the cut-off grade to target material for inclusion. Stope designs were completed using the Deswik Stope Optimizer software. Centerlines representing ore development drives were digitized to represent ore development and were used to create a 3D solid model. The stope solids were cut using the ore development solids, using Boolean routines in the planning software. The resulting 3D model formed the basis of the mineral reserve estimate.

Gold equivalent (AuEq) cut-off grades were calculated for the deposits, with mineral reserves estimated and reported above this cut-off. The AuEq cut-off was calculated as follows:

where mining, processing and G&A are costs expressed as US$ per tonne, and gold price and refining costs are expressed as US$ per troy ounce and do not reflect the realized gold price from the Franco-Nevada royalty. The payability refers to the percentage of metal payable after refining.

A gold:silver value ratio was used to convert silver grades to gold equivalent grades and is calculated using the following formula:

Gold equivalent grades were calculated using the following formula:

where AuEq, Au and Ag are the gold equivalent grade, gold grade, and silver grade, respectively, in g/t.

The input parameters to the cut-off grades and the resulting grade cut-off for Mineral Reserves reporting is provided in Table 12‑1.

| 12.5 | Ore Loss and Dilution |

The following sources of dilution were identified:

| • | Overbreak into the hanging wall or footwall rocks following drilling and blasting operations; |

| • | Rock failures (slough) from rock walls adjacent to the stope boundaries as a result of weak rock mass characteristics; |

| • | Unconsolidated rockfill (backfill) from over mucking into the stope floor. |

Operational experience shows that dilution from the cemented rockfill (CRF) material is negligible, and this has not been considered as a dilution source.

Ore dilution factors to account for overbreak and wall slough (waste rock dilution) from the hanging wall and footwall surfaces were estimated based on the consideration of geotechnical information and stope reconciliations and were applied to stope shapes in the stope optimization software. One meter of dilution was applied to the hanging wall, and 0.5 m to the footwall. No dilution is assigned to ore development. No gold or silver grades were assigned to the rockfill (RF) dilution.

CRF and RF are used to backfill mined-out stopes in order to enhance ore recovery, provide mine stability, and eliminate the need for permanent ore pillars to be left.

Ore losses can occur during mining as a result of:

| • | Stope under-break and unrecoverable bridging; |

| • | Unrecovered ore stocks due to flat dipping footwalls and stope draw point geometry; |

| • | Misclassification of material resulting in ore hauled inadvertently to waste dumps; and |

| • | Abandoned ore stocks due to excessive dilution from stope wall failures. |

To account for potential ore losses, a factor of 5% was applied to primary, secondary, and longitudinal stopes, and ore mine development.

| Table 12‑1: | Input Parameters to Cut-off Grade Determination, Mineral Reserves |

| Parameter | Units | Value/Value Range (from/to) |

| Gold price | $/oz | 1,400 |

| Silver price | $/oz | 20.00 |

| Gold mining duty and refining cost | $/oz Au | 0.491 |

| Silver mining duty and refining cost | $/oz Ag | 0.491 |

| Gold recovery | % | 93.1 |

| Silver recovery | % | 81.9 |

| Gold payable | % | 99.88 |

| Silver payable | % | 99.86 |

| Au:Ag value ratio | Au:Ag | 81.59 |

| Mining cost | $/t | 36.01–41.75 |

| Surface ore haulage | $/t | 3.52 |

| Processing | $/t | 27.29 |

| G&A | $/t | 11.00 |

| Other | $/t | 3.19 |

| AuEq cut-off grade | g/t | 1.94–2.51 |

| Marginal development AuEq cut-off grade | g/t | 1.08 |

The gold and silver prices used in mineral reserve estimation are based on analysis of three-year rolling averages, long-term consensus pricing, and benchmarks to pricing used by industry peers over the past year. The estimated timeframe used is the nine-year LOM that supports the mineral reserves estimates. The gold price forecast for the mineral resource estimate is US$1,400/oz, and the silver price forecast is US$20/oz. The QP reviewed the forecast as outlined in Chapter 16.

| 12.7 | Mineral Reserve Statement |

Mineral reserves are reported using the mineral reserve definitions set out in SK1300. The reference point for the mineral reserve estimate is the point of delivery to the process plant. Mineral reserves are reported in Table 12‑2. Mineral reserves are current at December 31, 2021. Estimates are reported on a 100% basis.

The Qualified Person for the estimate is Mr. Peter Haarala, RM SME.

| Table 12‑2: | Gold and Silver Proven and Probable Mineral Reserve Statement as at December 31, 2021 (based on US$1,400/oz gold price and US$20/oz silver price) |

| Zone/Deposit | Mineral Reserve Classification | Tonnes (kt) | Grade | Contained Ounces | Gold Equivalent Cut-off Grade (g/t AuEq) | Metallurgical Recovery |

Ag (g/t) | Au (g/t) | Ag (koz) | Au (koz) | Ag (%) | Au (%) |

| Guadalupe | Proven | 2,005 | 120 | 2.09 | 7,736 | 135 | 1.97–2.51 | 81.9 | 93.1 |

| Probable | 6,527 | 121 | 1.82 | 25,412 | 381 | 1.97–2.51 | 81.9 | 93.1 |

| Subtotal proven and probable | 8,532 | 121 | 1.88 | 33,147 | 516 | 1.97–2.51 | 81.9 | 93.1 |

| Independencia | Proven | 1,044 | 190 | 2.68 | 6,377 | 90 | 1.99–2.07 | 81.9 | 93.1 |

| Probable | 3,551 | 137 | 1.76 | 15,588 | 201 | 1.99–2.07 | 81.9 | 93.1 |

| Subtotal proven and probable | 4,595 | 149 | 1.97 | 21,965 | 291 | 1.99–2.07 | 81.9 | 93.1 |

| La Nación | Proven | 357 | 206 | 1.96 | 2,367 | 22 | 1.94–1.98 | 81.9 | 93.1 |

| Probable | 934 | 162 | 1.81 | 4,876 | 54 | 1.94–1.98 | 81.9 | 93.1 |

| Subtotal proven and probable | 1,291 | 175 | 1.85 | 7,242 | 77 | 1.94–1.98 | 81.9 | 93.1 |

| Total proven and probable mineral reserves | Total proven | 3,405 | 151 | 2.26 | 16,480 | 247 | 1.94–2.51 | 81.9 | 93.1 |

| Total probable | 11,012 | 130 | 1.80 | 45,875 | 637 | 1.94–2.51 | 81.9 | 93.1 |

| Total proven and probable | 14,418 | 135 | 1.91 | 62,355 | 884 | 1.94–2.51 | 81.9 | 93.1 |

Notes to Accompany Mineral Reserves Table:

| 1. | The Mineral Reserve estimates are current as of December 31, 2021 and are reported using the definitions in Item 1300 of Regulation S–K (17 CFR Part 229) (SK1300). |

| 2. | The reference point for the mineral reserve estimate is the point of delivery to the process plant. The estimate is current as at December 31, 2021. The Qualified Person for the estimate is Mr. Peter Haarala, RM SME, a Coeur employee. |

| 3. | The estimate uses the following key input parameters: assumption of conventional underground mining; gold price of US$1,400/oz and silver price of US$20/oz; reported above a gold cut-off grade of 1.94–2.51 gold equivalent and an incremental development cut-off grade of 1.08 g/t AuEq; metallurgical recovery assumption of 93.1% for gold and 81.9% for silver; mining dilution assumes 1 meter of hanging wall waste dilution; mining loss of 5% was applied; variable mining costs that range from US$36.01–US$41.75/t, surface haulage costs of US$3.52/t, process costs of US$27.29/t, general and administrative costs of US$11.00/t, and surface/auxiliary support costs of US$3.19/t. Mineral reserves exclude the impact of the Franco-Nevada gold stream agreement at Palmarejo in estimation. |

| 4. | Rounding of tonnes, grades, and troy ounces, as required by reporting guidelines, may result in apparent differences between tonnes, grades, and contained metal contents. |

| 12.8 | Uncertainties (Factors) That May Affect the Mineral Reserve Estimate |

Factors that may affect the Mineral Reserve estimates include:

| • | Commodity prices: the mineral reserve estimates are most sensitive to metal prices. Coeur’s current strategy is to sell most of the metal production at spot prices, exposing the company to both positive and negative changes in the market, both of which are outside of the company’s control. Gold is subject to a streaming agreement with Franco-Nevada where 50% of the gold ounces produced from a portion of the Project are sold to Franco-Nevada at US$800/oz; |

| • | Metallurgical recovery: long term changes in metallurgical recovery could also have an impact on the mineral reserve estimates. For example, a 10% change in metallurgical recovery has approximately the same impact as a 10% change in metal prices. However, the metallurgy is well understood, and as a result, the mineral reserve estimates are considered to be less sensitive to long-term factors affecting metallurgical recovery, compared to the sensitivity to metal prices, which tend to have greater variances; |

| • | Mining method will change from transverse to longitudinal longhole stoping over time as narrower portions of veins are mined which could result in higher cost, lower productivities and higher dilution quantities which can impact grade. All of these factors could impact cut-off grades, reserve estimates and economics; |

| • | Operating costs: higher or lower operating costs than those assumed could also affect the mineral reserve estimates. While the trend over 2014 to 2020 showed operating cost reductions at the Palmarejo Operations, this trend could reverse and costs could increase over the life of the Project, due to factors outside of the company’s control. However, of the factors discussed in this section, the QP considers the mineral reserve to be least sensitive to changes in operating costs; |

| • | Dilution: additional dilution has the effect of increasing the overall volume of material mined, hauled and processed. This results in an increase in operating costs and could result in mineral reserve losses if broken stocks are diluted to the point where it is uneconomic to muck, haul, and process the material and the broken stocks are abandoned. The operations have developed a number of methods to control dilution, including the installation of stope support, a flexible mine plan with the ability to limit stope wall spans, and good development practices that avoid undercutting the stope hanging wall. To assist in these efforts, site geotechnical reviews are regularly completed by external consultants, and a geotechnical engineer is employed by the mine. In the opinion of the QP, sufficient controls are in place at the Palmarejo Operations to manage dilution, and the risk of material changes to the mineral reserve from dilution above the amounts used in the mineral reserve estimate is low. |

| • | Geotechnical: geotechnical issues could lead to additional dilution, difficulty accessing portions of the ore body, or sterilization of broken or in situ ore. In addition to the controls discussed in the dilution section there are significant management controls in place to effectively mitigate geotechnical risks. Designed openings are evaluated for stability using the Modified Stability Graph method. There is regular underground geotechnical mapping, and comprehensive geotechnical reviews are held on a weekly basis. The QP considers that sufficient controls are in place at the Palmarejo Operations to effectively manage geotechnical risk, and the risk of significant impact on the mineral reserve estimate is low. |

| • | Hydrogeological: unexpected hydrogeological conditions could cause issues with access and extraction of areas of the Mineral Reserve due to higher than anticipated rates of water ingress. The QP considers the risk of encountering hydrogeological conditions that would significantly affect the mineral reserve estimate is low. |

| • | Geological and structural interpretations: changes in the underlying geology model including changes in local interpretations of mineralization geometry and continuity of mineralized zones, changes to geological and mineralization shape and geological and grade continuity assumptions, and density and domain assignments could result in changes to the geology model upon which mineral reserve estimate is based. |

| • | Permitting and social license: inability to maintain, renew, or obtain environmental and other regulatory permits, to retain mineral and surface right titles, to maintain site access, and to maintain social license to operate could result in the inability to extract some or all of the mineral reserves. |

The Guadalupe, Independencia and La Nación mines use conventional underground mining methods and conventional equipment. The overall production rate is approximately 165,000 t/month.

| 13.2 | Geotechnical Considerations |

The Palmarejo Operations technical services department maintains a Ground Control Management Plan that is updated annually and serves to provide mine personnel with operating, monitoring, and quality control/assurance guidance. The Ground Control Management Plan specifies ground support standards and identifies where there are applicable in the mines.

Golder Associates (Golder) performed a geotechnical assessment of the mine area in 2011 and provided guidance on developing RMR logging procedures and calculated rock mass rating (RMR76). Most of the rock types show similar RMR76 values, with the bulk of the values in the range of 40–60, or a “Fair” rock quality.

Ingeroc SpA of Chile (Ingeroc) was commissioned in 2015 to perform additional geotechnical characterizations and provide onsite engineering support. Starting in 2017, this was replaced with an inhouse geotechnical team to support onsite engineering, planning and operations.

Pakalnis and Associates of Canada performed geotechnical design and operations reviews from 2011–2019. In 2019, Ingeroc was contracted to provide operations support with biannual reviews.

Due to highly variable rock mass quality and the intersection of dissolution voids during early development and operations, a geotechnical block model was developed in 2018. This model is continually updated with infill drilling and development mapping to support geotechnical design and mine planning. The model provides RMR ranges demarcated by six quality types which are then matched to minimum support requirements as part of the design and planning process. These ranges are represented by color coded blocks in a three-dimensional computer model and documented in the Ground Control Management Plan, matching minimum ground support requirements to the material classification.

Initial stope dimensions were developed using the Modified Stability Graph method, which predicts equivalent linear overbreak slough values (Pakalnis, 2016). Modifications based on variability and update geotechnical models were made as the mine developed. Updated designs are modelled using two and three-dimensional numerical simulation software to provide final design for each access and stope.

Based on the calculated modified stability number (N’) values, the majority of the planned stope surfaces at Guadalupe are estimated to have equivalent linear overbreak slough values of <1.0 m for unsupported stope hanging wall surfaces and <0.5 m for unsupported stope footwall surfaces for stope spans of up to 14 m along strike. Primary and secondary stope spans range from 10–14 m, and longitudinal stopes can range from 14 m along strike up to 20 m, depending on vein dimensions, structural interpretation, and rock quality locally.

Standard ground support initially consisted of pattern welding wire mesh pinned by rock bolting. With advanced development, and installation of a modernized shotcrete plant in 2020, fibercrete and bolting is currently replacing bolts and mesh in areas of higher quality rock. In poor ground, hanging wall support, or at intersections, the option of 6 m length cable bolts is available and installed in addition to shotcrete and mesh.

The most recent geotechnical review was conducted in June 2021 to review updated support methods, maximum allowable stable stope spans, mining sequence, and overall mine stability.

Pakalnis provided geotechnical inputs for startup design and operation from 2015–2019 with Ingeroc providing ongoing operational review support from 2019 to present. A geotechnical model was developed in 2017 due to poorer overall rock quality encountered in Independencia versus earlier development in Guadalupe.

Most stope surfaces at Independencia were designed to have equivalent linear overbreak slough values of <1.0 m for unsupported stope hanging wall surfaces, and <0.5 m for unsupported stope footwall surfaces. Rock quality in Independencia is considered to range between very low to moderate quality with variability requiring local changes to design to maintain stability. Similar support methods are available between mines following range classification as outlined in the Ground Control Management Plan that covers the operation. Common to Independencia, areas of Very Poor-quality rock typically require installation of horizontal steel spilling bars in advance of development for perimeter control, followed by reinforced shotcrete arches in addition to typical mesh and bolting standard support.

The most recent geotechnical review was conducted in June 2021 to review updated support methods, maximum allowable stable stope spans, mining sequence, and overall mine stability.

The geotechnical conditions at La Nación are classified with rock qualities ranging from Poor to Good. Conditions are similar to Guadalupe with most geotechnical concerns controlled by structure versus Poor rock quality. Pakalnis (2017) provided guidance and approval to increase stope heights from 20 m in Guadalupe and Independencia to 25 m in La Nación based on the orebody geometry and rock quality. This increase in stope height was implemented, and extraction has been proven effective.

Based on the calculated N’ values, stopes at La Nación were designed initially to have equivalent linear overbreak slough values of <1.0 m for unsupported stope hanging wall faces. Transverse stopes have a maximum primary/secondary exposure of 20 m for ore with >55% RMR, and a maximum hanging wall exposure of 32 m for hanging wall material with >65% RMR. Longitudinal stoping has a maximum hanging wall exposure of 32 m for hanging wall material with >65% RMR.

Similar methods of support are available to La Nación as other areas of operation following the Ground Control Management Plan released in 2016 and updated annually.

The most recent geotechnical review was conducted in June 2021 to review updated support methods, maximum allowable stable stope spans, mining sequence, and overall mine stability.

| 13.3 | Hydrogeological Considerations |

Permeability of the volcanic rock units in all mines is low to very low. Persistent inflows generally occur within larger fault structures. Flows increase and decrease seasonally if the structure is connected to the surface. Access ramps encountered significant water inflows from these structural features during early development; however, over time, inflows into the mine have diminished as local storage is removed. Increases in flow currently are directly related to opening new developments laterally or ramping downward to lower levels. A primary sump and pumping station is located on the 1,140 m level and fed by a series of level and ramp sumps that allow final settling before pumping from the mine to the water treatment plant on surface.

GRE prepared a hydrogeological model for the operations in 2017. The largest predicted inflows for Guadalupe will occur in year 2022 and result in a total flow of approximately 800 m3/day coinciding with the maximum lateral development of new mines at Animas and Zapata. Through 2021, flows are matching predicted values.

Water inflows tend to occur mainly where the development intersects larger scale structures, such as faults and shear zones. These structures are typically located in the footwall accesses and ore zones with generally higher flows than other mines due to the higher degree of brittle fracture and permeability along structures. Initial development encountered highest flows that diminished over time as local storage is drained. Outside of structures, similar host rock types of low overall permeability and storage to Guadalupe are present.

The primary sump and a pumping station is located on the 1090 m level to manage these inflows from satellite sumps and pumping systems located on various levels. The central pump station sends the water from settling sumps to the water treatment plant on surface for further sediment removal.

GRE prepared a hydrogeological model for the mine in 2017 with the highest predicted flow expected to be in 2021 of 2,600 m3/day. Actual water inflows in 2021 were slightly off the predicted flow estimate with a peak at 2,100 m3/day. This may increase through to 2023 with the development of the lower levels and Independencia and access development laterally to the north for the Hidalgo mine.

La Nación is located midway between the Guadalupe and Independencia mines. Hydrological conditions in the mine were affected by the development and dewatering of the two adjacent mines. Zones of intermediate inflow into the mine were intercepted along structures similar to those encountered in both Guadalupe and Independencia, but at much lower rates. This had little effect on mine development rates. Mine dewatering in the area is accomplished using satellite sumps on each level that drain down to the 1140 m level entry ramp access. Water collected from the 1140 m level sump is drained back to the primary sump and pump station on the 1090 m level in Independencia for transfer to the water treatment plant.

Primary access to the Guadalupe mine is from surface via two ramps. The West (Poniente) Decline and East (Oriente) Level are located 700 m north of the deposit in the hanging wall. A third portal for primary ventilation is the South Portal (Portal Sur) which is situated on the southern strike extent of the the deposit footwall approximately 2,200 m south–southeast from the main access portals. The West Decline serves as the primary access for haulage, while the East provides both haulage and support access. Both main ramps are used for primary ventilation intake while the main fans at South Portal are in operation. When the South Portal fans are down for maintenance, a secondary system is engaged providing intake on the East and exhaust on the South and West. The South portal is used as a primary exhaust for the mine as well as secondary escapeway for extended work areas of Guadalupe and Animas.

Two new developments at Zapata and Animas are underway as extensions of the Guadalupe mine. The Zapata deposit is located approximately 250 m from the footwall of Guadalupe. Two accesses have been developed to connect the Guadalupe ramp system to the Zapata ramp system. First ore development from Zapata was in 2021. The Animas extension is located at the far south end of the Guadalupe mine and is accessed via a single ramp. Development will have extended to first ore in late 2021. Ventilation and secondary egress will be provided via a ventilation raise to surface and an escapeway.

Mine access drifts were advanced through the ore structure and into the footwall where ramps were developed for vertical access to the level footwall drives. The access ramps are designed at 5.5 m high x 5.0 m wide and have been driven at 15% grades.

Key input parameters to the mine design include mechanized diesel and electric drill, load, and haulage systems. A preliminary production rate of 150,000 t/month was increased to 165,000 t/month in 2021 with the development of new orebodies and accelerated development rates. The material handling system uses a load-haul-dump (LHD) and truck transport system of ore loading and hauling to an interim surface stockpile. Ore is separated at surface into stockpiles to support blending prior to transport to the plant run-of-mine (ROM) stockpile. Waste from development is either directly transported from development to backfilling pockets in active stopes or stockpiled underground for later use as backfill.

Mining methods used at Guadalupe include both transverse and longitudinal sublevel stoping. The operation has changed from principally transverse longhole stoping from startup in 2014 where veins were wider to narrow vein longitudinal stoping in 2021. The continuous nature of the mineralized zones, significant orebody thickness, favorable deposit geometry and generally good ground conditions resulted in productive longhole stoping with low costs.

Access to transverse stoping areas is via footwall drives developed parallel to the orebody strike. Drawpoints are developed perpendicular to the footwall sublevels to access the stopes. A sequence of primary and secondary stopes is developed and extracted in sequence along strike of the vein. The primary stopes (roughly 10 m of strike) are excavated and backfilled with cemented backfill providing pillar support for the extraction of the secondary. The secondaries are then backfilled with waste to support ramping up to the next level. Access to longitudinal stopes is along and within the ore zones where drifts are driven along strike within the vein and extraction is in sequence from level to level in 15–20 m increments depending on ground conditions. The open stope is backfilled, and the extraction continues in sequence. Level or stope heights in Guadalupe are generally 20 m.

Lateral development is completed using conventional mechanized drilling and blasting methods. Drift rounds are drilled using twin boom, electric/hydraulic drill jumbos. Ground support is installed using mechanical/electrical bolting machines and (when required) shotcrete is applied with a shotcrete machine. Mine services (air, water, compressed air, electrical and communication cables) are extended to the working areas.

Longhole production drilling of stopes is completed using electric/hydraulic vertical hammer drill rigs. Production drilling is mainly done in pattern format in a down dip configuration, with the holes drilled parallel to the dip of the orebody.

The North and South declines provide access to the deposit and provide secondary intake (south) and primary exhaust ventilation (north) for the mine. The access ramps are designed at 5.5 m high x 5.0 m wide and have been driven at a grade of -15%. Primary ventilation intake is from a vertical surface raise and fan system constructed in the La Nación Mine and connected via dual ramps to the La Nación orebody on the 1140 and 1260 levels.

The design philosophy and key mine design parameters for the Independencia mine are similar to those described for the Guadalupe mine. Mine access drifts were advanced through the ore structure and into the footwall where ramps were developed for vertical access to the level footwall drives. The access ramps were designed at 5.5 m high x 5.0 m wide and were driven at 15% grade. Starting in 2021, ramps and accesses were reduced to 5.3 x 5.0 m to provide support for increased development rates and reduced unit costs.

Mining methods used at Independencia include both transverse and longitudinal sublevel stoping. The operation transitioned from principally transverse longhole stoping from startup in 2016 where veins were wider to narrow vein longitudinal stoping in 2021. Due to the sinusoidal nature of the mineralized zones, reduced orebody thickness, and generally poorer ground conditions, productive longhole stoping has been achieved, but at higher costs due to slower development and mining rates and increased support requirements. Stope and level heights in Independencia are 20 m.

Preliminary designs were completed for the development of the Hidalgo extension anticipated for production in 2023. The plans call for dual access ramps, one from Independencia along the north extension and the second located from surface approximately 200 m north of Independencia north portal. Current designs are in conceptual, with final designs to be completed in early 2022.

The mine can be accessed from two levels, one from the south decline ramp access on the 1140 level from Independencia, and the other from the footwall drive at the 1260 level.

The two drifts provide access to the deposit along with primary intake and exhaust ventilation for both the La Nación and Independencia mines. The access ramps are designed at 5.5 m high x 5.0 m wide with a gradient of 2%. The access ramps from Independencia are connected via a spiral ramp developed in the footwall of the La Nación orebody to connect the lower and upper part of the orebody and access to the sublevels.

The La Nación deposit is mined using similar equipment, personnel, and mining methods as the adjacent Independencia and Guadalupe mines. Much of the ore mining will be completed using longitudinal sublevel stoping due to the narrow width of the vein. Mine level and stope heights were increased to 25 m following a rock mechanics study supporting increasing the stope heights.

Primary stopes as extracted using transverse sublevel method are filled with cemented rock fill once the ore is drilled, blasted, and extracted. The cemented rock fill is produced on surface directly from a 3000 t/d mixing plant and hauled underground to the stope location. The majority of cemented backfill is used specifically for this method with secondary placement required for sill pillars and curtains where longitudinal retreat extraction method is applied. Sill pillars require the backfill of cemented fill along the entire length of the sublevel. All three active mines have completed sill pillars within the vertical profile of the orebody.

Curtains are designed and backfilled in those areas where longitudinal retreat mining requires the installation of a curtain to allow backfilling of the stope prior to continuing stope extraction. This curtain is required every 15–25 m depending on the design span distance as determined from a calculated hydraulic radius. In areas where the Avoca method is applied, cemented backfill is limited or not required.

Waste rock backfill from development mining is the principal backfill for secondary transverse stopes and for longitudinal stopes. In most cases, the rock fill is loaded on to trucks from waste development headers outside the orebody and delivered directly to the stope. Extra material is stored underground on previously-mined levels to be used later where needed.

The primary ventilation system is powered by two 224 kW central fans located at the South Portal. A second set of fans is installed in the East Portal for contingency and are only activated when the primary is down. When the central fans are active, air is drawn from the East and West portals and vented out the South portal directing air from north to south along the length of the orebody. Secondary ventilation is directed through booster fans installed on levels and directed through sublevel raises vertically and laterally along horizontal drives to the work areas. Vertical raises are installed level to level using a raisebore.

The capacity of the primary ventilation circuit is approximately 250 m3/sec.

The primary ventilation fans consist of two 224 kW fresh air intake fans installed in a ventilation bypass drift developed in the South ramp, and two 224 kW fans installed on the 1260 level in La Nación that pull air from a raisebored shaft connected to surface. The North portal provides a single exhaust exit from the mine for both intake points. Additional booster fans are installed underground to direct intake air to the active mining blocks. Ventilation raises are developed by longhole drill and blast methods or bored with a raisebore machine.

The capacity of the primary ventilation circuit is approximately 300 m3/sec when three of the four primary fans are operating.

The mine ventilation is designed and configured to support both Independencia and La Nación. Two access drifts developed from the Independencia mine provide exhaust routes from the mine. A vertical raise was constructed from the lower 1140 level through to surface as part of early development to support ventilation for the entire mine. The main fans are located on the 1260 level and consist of two 224 kW fans in parallel. During the early stages of development and operation, a single fan is in operation. As both La Nación and Independencia mature, and mining distances increase the second fan will be brought online.

| 13.7 | Blasting and Explosives |

Longhole drilling of stope production holes are completed using electric/hydraulic downhole hammer drills. Drill and blast design is customized to match individual conditions found in each stope and development headings. Blasting is conducted using controlled spacing and timing method via a central electronic timing and detonation system.

| 13.8 | Underground Sampling and Production Monitoring |

Preliminary in situ channel sampling is conducted across the vein intercepts by the geologists to support preliminary ore control. Follow-up samples are taken during and post extraction from individual stope stockpiles on surface to support blending and reconciliation with the plant on a continuous basis as part of day-to-day operations.

| 13.9 | Infrastructure Facilities |

Infrastructure for the operation is discussed in Chapter 15. All underground operations share the same surface infrastructure excluding stockpiles and compressed air and ventilation systems.

Underground maintenance facilities in Guadalupe and Independencia support field and preventative maintenance activities. Primary maintenance is conducted in joint facilities located on surface between the mine portals and a large main facility located at the Palmarejo office and plant site. An additional facility is planned for construction in Zapata in 2023 to support ongoing operations.

Underground magazines in Guadalupe support Zapata and Animas, and in Independencia support La Nación.

The Palmarejo Operations have nine years of mine life remaining overall. The Guadalupe mine has a remaining nine-year mine life with the

expansion components of Zapata and Animas. Independencia has a remaining nine-year mine life with expansions to the north and south and addition of the Hidalgo deposit. La Nación has five years of mine life remaining.

A production schedule is provided in Table 13‑1.

The equipment listed in Table 13‑2 is shared between the three underground mines.

Surface mining equipment consists of trucks, loaders, drills, and dozers. Some ex-open pit equipment is used for ore haulage from the underground mines to the ROM pad; as well as ore blending, backfill operations, road construction, and road maintenance. The main surface equipment assets are listed in Table 13‑3.

The equipment on site is sufficient to meet LOM plan requirements.

Mining operations are forecast to employ approximately 330 persons over the LOM.

| Table 13‑1: | Production Schedule |

| | Units | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | LOM |

| Underground Guadalupe |

| Ore mined | kt | 941 | 962 | 940 | 983 | 1,251 | 1,329 | 1,226 | 681 | 218 | 8,532 |

| Silver grade mined | g/t | 118.5 | 126.1 | 98.6 | 116.4 | 115.2 | 123.4 | 121.4 | 146.2 | 157.5 | 120.8 |

| Gold grade mined | g/t | 1.9 | 2.0 | 1.6 | 1.9 | 2.0 | 2.2 | 2.0 | 1.6 | 0.3 | 1.9 |

| Silver contained metal | koz | 3,583 | 3,903 | 2,980 | 3,679 | 4,637 | 5,273 | 4,786 | 3,199 | 1,106 | 33,147 |

| Gold contained metal | koz | 57 | 61 | 49 | 60 | 79 | 92 | 80 | 34 | 2 | 516 |

| Vent Rise | m | 386 | 275 | 168 | 128 | — | — | — | — | — | 957 |

| Meters capital cost | m | 3,180 | 2,791 | 2,140 | 1,985 | — | 185 | — | — | — | 10,280 |

| Meters operating cost waste | m | 1,157 | 1,091 | 1,773 | 937 | 848 | 673 | 145 | — | — | 6,625 |

| Meters operating cost ore | m | 2,909 | 4,094 | 3,630 | 3,513 | 2,687 | 1,570 | 249 | — | — | 18,652 |

| Waste mined | kt | 303 | 266 | 267 | 197 | 63 | 63 | 13 | — | — | 1,171 |

| Underground Independencia |

| Ore mined | kt | 547 | 516 | 561 | 795 | 511 | 435 | 405 | 573 | 251 | 4,595 |

| Silver grade mined | g/t | 176.2 | 155.0 | 148.7 | 138.1 | 131.6 | 143.9 | 141.6 | 158.7 | 140.5 | 148.7 |

| Gold grade mined | g/t | 2.5 | 2.1 | 2.1 | 1.9 | 2.1 | 2.1 | 1.7 | 1.5 | 1.6 | 2.0 |

| Silver contained metal | koz | 3,102 | 2,570 | 2,680 | 3,532 | 2,164 | 2,015 | 1,845 | 2,923 | 1,135 | 21,965 |

| Gold contained metal | koz | 43 | 35 | 38 | 49 | 34 | 29 | 22 | 27 | 13 | 291 |

| Vent Rise | m | 21 | 141 | 271 | 151 | - | 394 | 515 | 36 | — | 1,528 |

| Meters capital cost | m | 856 | 2,662 | 2,982 | 1,608 | 63 | 836 | 1,012 | 212 | — | 10,230 |

| Meters operating cost waste | m | 396 | 414 | 497 | 1,043 | 352 | 95 | 522 | 51 | — | 3,369 |

| Meters operating cost ore | m | 834 | 1,422 | 2,539 | 2,781 | 748 | 959 | 1,260 | 590 | — | 11,133 |

| Waste mined | kt | 86 | 202 | 230 | 171 | 26 | 77 | 124 | 19 | — | 934 |

| Underground La Nación |

| Ore mined | kt | 313 | 326 | 410 | 156 | 86 | — | — | — | — | 1,291 |

| Silver grade mined | g/t | 141.2 | 187.5 | 200.2 | 182.9 | 108.8 | — | — | — | — | 174.5 |

| | Units | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | LOM |

| Gold grade mined | g/t | 1.5 | 2.1 | 2.2 | 1.6 | 0.7 | — | — | — | — | 1.9 |

| Silver contained metal | koz | 1,420 | 1,967 | 2,641 | 914 | 300 | — | — | — | — | 7,242 |

| Gold contained metal | koz | 15 | 22 | 29 | 8 | 2 | — | — | — | — | 77 |

| Vent Rise | m | 247 | 30 | — | — | — | — | — | — | — | 278 |

| Meters capital cost | m | 1,543 | 189 | — | — | — | — | — | — | — | 1,732 |

| Meters operating cost waste | m | 453 | 81 | — | — | — | — | — | — | — | 534 |

| Meters operating cost ore | m | 1,992 | 422 | — | — | — | — | — | — | — | 2,414 |

| Waste mined | kt | 146 | 19 | — | — | — | — | — | — | — | 165 |

| Underground Total |

| Ore mined | kt | 1,801 | 1,804 | 1,911 | 1,934 | 1,848 | 1,765 | 1,632 | 1,253 | 470 | 14,418 |

| Silver grade mined | g/t | 140.0 | 145.5 | 135.1 | 130.7 | 119.5 | 128.5 | 126.4 | 151.9 | 148.4 | 134.5 |

| Gold grade mined | g/t | 2.0 | 2.0 | 1.9 | 1.9 | 1.9 | 2.1 | 1.9 | 1.5 | 1.0 | 1.9 |

| Silver contained metal | koz | 8,106 | 8,440 | 8,301 | 8,126 | 7,100 | 7,288 | 6,631 | 6,122 | 2,241 | 62,355 |

| Gold contained metal | koz | 116 | 118 | 117 | 118 | 115 | 122 | 102 | 62 | 15 | 884 |

| Vent Rise | m | 654 | 446 | 439 | 279 | - | 394 | 515 | 36 | — | 2,763 |

| Meters capital cost | m | 5,578 | 5,641 | 5,122 | 3,593 | 63 | 1,021 | 1,012 | 212 | — | 22,242 |

| Meters operating cost waste | m | 2,006 | 1,586 | 2,270 | 1,980 | 1,200 | 768 | 667 | 51 | — | 10,529 |

| Meters operating cost ore | m | 5,734 | 5,938 | 6,169 | 6,294 | 3,435 | 2,530 | 1,510 | 590 | — | 32,199 |

| Waste mined | kt | 534 | 487 | 496 | 368 | 89 | 140 | 137 | 19 | — | 2,270 |

Note: numbers have been rounded.

| Table 13‑2: | Underground Mining Equipment |

| Equipment Type | Make/Model | Peak Number |

| Wheel loader | Caterpillar R1700G, R1600G, R1700K; Sandvik Toro 006, Toro 1400; Atlas Copco ST1030 | 21 |

| Articulated truck | Caterpillar AD45B, AD30; Sandvik T40D; | 19 |

| Mine truck | Atlas Copco MT42 | 4 |

| Boltecs | Atlas Copco B235, Boltecs | 11 |

| Boltmaster | Atlas Copco RDH, 200EH | 1 |

| Drills | Atlas Copco 1254, M4CITH, J281, J282, S1D; Redpath 40S; Boart Longyear Stope Mate; Termite AQTK; Ingetrol 60E, 75E, Minitroner | 22 |

| Cabletec | Atlas Copco Cabletec LC | 2 |

| ANFO | Getman A64; RDH 150H | 5 |

| Concrete/shotcrete | EJC concrete mixer, 415; RDH 600R; Normet LF600, SB307, BS7622; Kubota; Transcrete P20 pump; | 21 |

| Auxiliary (pallet, scissor, utili lifts) | Getman A64; Marcotte M40; RDH 600R; Normet MF540 | 12 |

| Motor grader | Caterpillar 120K | 1 |

| Telehandler | Caterpillar TL1255, TL1255D | 11 |

| Backhoe loader | Caterpillar 430D, 450E, 420F | |

| Lube truck | Getman A64; RDH | 3 |

| Pallet handler | Getman A64 | 1 |

| Forklift | Caterpillar R80T | 1 |

| Table 13‑3: | Surface Mining Equipment |

| Item | Manufacturer | Model | Number |

| Loader | Caterpillar | 988H | 2 |

| Loader | Caterpillar | 992G, 992K | 3 |

| Truck | Caterpillar | 777F | 11 |

| Truck | Caterpillar | 740E | 4 |

| Water Truck | Caterpillar | 770F | 1 |

| Lube Truck | Caterpillar | 725E | 1 |

| Grader | Caterpillar | 140H, 140M, 14H | 3 |

| Excavator | Caterpillar | 315D, 330D, 336D2, 365C | 4 |

| Dozer | Caterpillar | D10T, D4G, D5K2, D9T | 7 |

| Compactor | Caterpillar | CS536D, E | 2 |

| Integrated Tool Carrier | Caterpillar | IT62H | 1 |

| Mobile Crusher | Metso | LT106 | 2 |

| Backhoe Loader | Caterpillar | 420F2 | 2 |

| Drill | Atlas Copco | CM780 | 1 |

| Telehandler | Caterpillar, JCB | Various models | 5 |

| Forklift | Caterpillar | DP40K, P5000 | 3 |

| 14.1 | Process Method Selection |

The process design is based on a combination of metallurgical test work, study designs and industry-standard practices, together with debottlenecking and optimization activities through the operational history of the plant since operations startup in 2007. The design is conventional to the silver and gold industry and has no novel parameters.

The processing plant is located immediately south and overlooks the village of Palmarejo at an elevation of approximately 880 m. The plant is designed to operate 365 days per year at 91.3% availability. The plant design mill throughput is 6,000 t/day of ore with upgrades providing a nominal throughput up to 7,000 t/day.

A schematic of the flowsheet is provided as Figure 14‑1.

The flow sheet consists of a standard crushing and grinding circuit (jaw crusher, semi-autogenous grind (SAG) mill and ball mill), followed by flotation circuit, where the flotation concentrate is directed to a sequence of clarification tanks then to agitated cyanidation tanks. Floatation tailings are directed to and treated in agitated cyanidation tanks. A Merrill Crowe circuit is used to recover gold and silver from the leachates of concentrate and tailings solutions through a carbon in leach (CIL)- absorption, desorption, recovery (ADR) system.

Ore is delivered from the underground mines to a ROM stockpile located adjacent to the primary crusher area and feed to the primary crusher dump hopper. The dump hopper has a fixed grizzly on top with an approximate opening of 51 cm and an apron feeder at the discharge. The ROM is fed with a front-end loader with secondary breakage using a rockhammer for oversize to the crusher. The primary crusher is a Nordberg C-140 jaw crusher with an approximate opening of 1.1 m x 1.4 m capable of handling 350 t/hr at a 12.7 cm close side setting.

Crushed ore is discharged vertically from the jaw crusher onto a conveyor and delivered to a 1,250-t capacity interim coarse ore stockpile. Two variable vibrating feeders reclaim the crushed ore through a vertical feed onto a belt conveyor for delivery to the SAG mill for grinding.

| Figure 14‑1: | Process Flowsheet |

Note: Figure prepared by Coeur, 2021.

Coarse ore from the primary crusher is directly fed to the grinding circuit from the interim crushed ore stockpile. The grinding circuit consists of a SAG mill and a ball mill operating in a circuit with a series of cyclones for classification and passing to flotation or return to grind. Both mills are 6.7 m in diameter and 7.5 m long equipped with 2,500 kW motors. The grinding circuit feed and product is controlled and varied depending on ore type and blend from the mines.

The cyclone battery consists of nine 203 cm Krebs cyclones with an apex opening of 10.8 cm and vortex opening of 15.2 cm. Cyclone operational pressure is maintained in a range from 96–110 kPa. The cyclone battery underflow reports to the ball mill to maintain a recirculating load to have better control of the flotation feed size, while the cyclone overflow reports to flotation.

The ball mill cyclone overflows at a nominal P80 minus 75 µm in size with a pulp density of 30% solids flows by gravity to the rougher flotation conditioner tank, where the slurry is conditioned with Aero 404 and potassium amyl xanthate (PAX). The conditioner tank overflows to feed a bank of five 100 m3 capacity rougher flotation cells. Rougher flotation occurs at the first bank of two tank cells, and scavenger flotation occurs sequentially down the bank. Frother and PAX are added to rougher feed and during the scavenging flotation.

Rougher flotation concentrates report either to the cleaner concentrate tank, where they are combined with the cleaner concentrate, or to the scavenger concentrate tank, where they are combined with the scavenger concentrate. Scavenger concentrate reports to a bank of two 17 m3 capacity cells where the first cleaner stage is provided. The first cleaner concentrate reports to a conditioning tank for additional reagents adjustment, and then flows to a bank of three 17 m3 capacity cells, where the final cleaner flotation is obtained. The final cleaner concentrate is pumped to the concentrate thickener for dewatering. The concentrate thickener overflow reports to the grinding circuit as recycled water. The thickener underflow, at approximately 65% solids, is pumped to the concentrate leach circuit for intense cyanide mixing and agitation. The blended solution is passed to the clarifiers for final processing as discussed in Chapter 14.4.4.

Cleaner flotation tailings are recycled to the rougher flotation conditioner tank or alternatively to the 3rd rougher cell for additional treatment.

Flotation underflow is transferred to a thickener for dewatering with the fluid overflow reporting back to the grinding circuit as recycled water. Thickener underflow, at approximately 60% solids, is transferred to an agitated leach circuit for cyanide leaching and dissolution of residual gold and silver values to be recovered in the ADR circuit discussed in Chapter 14.4.6.

| 14.4.4 | Flotation Concentrate Leaching |

The concentrate leaching circuit is located in the leaching/recovery area of the mill facilities and is comprised of four agitated leach tanks, each with a nominal capacity of 200 m3, providing a total average leaching time of roughly 48 hours.

Thickened flotation concentrate is diluted from 65% solids to approximately 50% solids and sodium cyanide solution is added to maintain a concentration of 10 g/L NaCN. The plant switched from air injection using compressors prior to 2019 to liquid oxygen which is injected into the concentrate solution to enhance the silver-CN bonding process at lower cyanidation rates resulting in lower cyanide consumption and reduced power.

The mixed concentrate is pumped from the concentrate leach circuit to a triple stage countercurrent clarification (CCD) circuit to recover the gold and silver bonded to the cyanide in solution. Each stage consists of a high-rate, 9.0 m diameter clarifier-thickener and an inter-stage mixing tank to enhance washing efficiency. Pregnant solution containing the recoverable metal is collected from the overflow at the first CCD thickener. This solution is pumped to the pregnant solution tank for delivery to the Merrill Crowe circuit at the refinery building for metal extraction. Thickened underflow from the final CCD thickener is pumped to an agitated leach circuit with the flotation underflow for additional leaching and potential recovery of residual metal values.

| 14.4.5 | Flotation Tailings Leaching |

The flotation tailings leaching circuit is also located in the leaching/recovery area of the mill facilities.

The leach circuit comprises a total of eight leach tanks. The tanks each have different capacities, ranging from 2,000 m3 to 1,162 m3 for tanks No. 1 and No. 8, respectively, providing an overall retention time of 24 hours.

Activated carbon is introduced to the last four tanks of the circuit (tanks 4 to 8) with the main objective of capture dissolved gold and silver values content in solution before it is transferred to the final tailing thickener. The loaded carbon is washed, bagged, and shipped to an outside refinery facility for processing.

Thickened flotation tails are pumped to the tailings leach circuit. The slurry is combined with the concentrate leached residue; the slurry is diluted to approximately 42% solids, and the sodium cyanide solution and lime slurry are added along with injected oxygen through the agitator shafts in Tank No. 1 and compressed air for tanks No. 2, No. 3, No. 4, No. 5 and No. 7.

Liquid oxygen is injected in tank No. 1. The liquid oxygen has proven success enhancing silver-cyanide leaching reaction resulting in additional silver values extraction and a significant cyanide consumption reduction. The leaching circuit tailings slurry is transferred to the cyanide detoxification circuit.

This circuit was re-introduced the second quarter of 2018. Prior to this the carbon was shipped to external refineries from 2016–2018. The circuit was upgraded with an ADR stripping circuit to support recovery improvement efforts on the flotation tailings circuit.

| 14.4.7 | Carbon Regeneration |

As part of the carbon desorption and ADR project in 2018, a carbon regeneration furnace was added to reduce carbon consumption by reactivating stripped carbon. This system was active through 2021.

| 14.4.8 | Merrill Crowe and Refining |

Pregnant solution from the flotation concentrate leach CCD first thickener overflow is pumped to one of three batch solution tanks, and then pumped to the primary Merrill Crowe system. The primary Merrill Crowe circuit capacity is 83 m3/hr.

A secondary Merrill Crowe unit handles low-grade pregnant solution from the floatation tailings leach circuit. The final tailings thickener overflow is the source of this low-grade pregnant solution, which is pumped throughout the secondary Merrill Crowe circuit. The secondary Merrill Crowe circuit has a capacity of 175 m3/hr. The secondary Merrill Crowe system was designed to handle higher grade pregnant solution from the flotation concentrate leach CCD circuit.