Kensington Gold Operations

Alaska

Technical Report Summary

Prepared for: Coeur Mining, Inc. | Prepared by: Mr. Christopher Pascoe, RM SME Ms. Rae Keim, P. Geo Mr. Peter Haarala, RM SME |

| |

Report current as at: December 31, 2021 |

Date and Signature Page

The following Qualified Persons, who are employees of Coeur Mining, Inc or its subsidiaries, prepared this technical report summary, entitled “Kensington Gold Operations, Alaska, Technical Report Summary” and confirm that the information in the technical report summary is current as at December 31, 2021 and filed on February 16, 2022.

/s/ Christopher Pascoe

Christopher Pascoe, RM SME

/s/ Rae Keim

Rae Keim, P. Geo

/s/ Peter Haarala

Peter Haarala, RM SME

| 1.0 | EXECUTIVE SUMMARY | 1-1 |

| 1.1 | Introduction | 1-1 |

| 1.2 | Terms of Reference | 1-1 |

| 1.3 | Property Setting | 1-1 |

| 1.4 | Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements | 1-2 |

| 1.5 | Geology and Mineralization | 1-3 |

| 1.6 | History and Exploration | 1-4 |

| 1.7 | Drilling and Sampling | 1-4 |

| 1.8 | Data Verification | 1-5 |

| 1.9 | Metallurgical Testwork | 1-6 |

| 1.10 | Mineral Resource Estimation | 1-7 |

| 1.10.1 | Estimation Methodology | 1-7 |

| 1.10.2 | Mineral Resource Statement | 1-8 |

| 1.10.3 | Factors That May Affect the Mineral Resource Estimate | 1-8 |

| 1.11 | Mineral Reserve Estimation | 1-9 |

| 1.11.1 | Estimation Methodology | 1-9 |

| 1.11.2 | Mineral Reserve Statement | 1-10 |

| 1.11.3 | Factors That May Affect the Mineral Reserve Estimate | 1-11 |

| 1.12 | Mining Methods | 1-12 |

| 1.13 | Recovery Methods | 1-13 |

| 1.14 | Infrastructure | 1-14 |

| 1.15 | Markets and Contracts | 1-15 |

| 1.15.1 | Market Studies | 1-15 |

| 1.15.2 | Commodity Pricing | 1-15 |

| 1.15.3 | Contracts | 1-15 |

| 1.16 | Environmental, Permitting and Social Considerations | 1-16 |

| 1.16.1 | Environmental Studies and Monitoring | 1-16 |

| 1.16.2 | Closure and Reclamation Considerations | 1-16 |

| 1.16.3 | Permitting | 1-16 |

| 1.16.4 | Social Considerations, Plans, Negotiations and Agreements | 1-16 |

| 1.17 | Capital Cost Estimates | 1-16 |

| 1.18 | Operating Cost Estimates | 1-17 |

| 1.19 | Economic Analysis | 1-17 |

| 1.19.1 | Forward-Looking Information Caution | 1-17 |

| 1.19.2 | Methodology and Assumptions | 1-19 |

| 1.19.3 | Economic Analysis | 1-19 |

| 1.19.4 | Sensitivity Analysis | 1-20 |

| 1.20 | Risks and Opportunities | 1-20 |

| 1.20.1 | Risks | 1-20 |

| 1.20.2 | Opportunities | 1-21 |

| 1.21 | Conclusions | 1-21 |

| 1.22 | Recommendations | 1-21 |

| 2.0 | INTRODUCTION | 2-1 |

| 2.1 | Registrant | 2-1 |

| 2.2 | Terms of Reference | 2-1 |

| 2.2.1 | Report Purpose | 2-1 |

| 2.2.2 | Terms of Reference | 2-1 |

| 2.3 | Qualified Persons | 2-4 |

| 2.4 | Site Visits and Scope of Personal Inspection | 2-4 |

| 2.5 | Report Date | 2-4 |

| 2.6 | Information Sources and References | 2-4 |

| 2.7 | Previous Technical Report Summaries | 2-4 |

| 3.0 | PROPERTY DESCRIPTION | 3-1 |

| 3.1 | Introduction | 3-1 |

| 3.2 | Ownership | 3-1 |

| 3.3 | Mineral Title | 3-1 |

| 3.3.1 | Tenure Holdings | 3-1 |

| 3.3.2 | Tenure Maintenance Requirements | 3-1 |

| 3.4 | Surface Rights | 3-5 |

| 3.5 | Water Rights | 3-5 |

| 3.6 | Agreements and Royalties | 3-5 |

| 3.6.1 | Hyak Agreement | 3-5 |

| 3.6.2 | Hyak Working Agreement | 3-7 |

| 3.6.3 | Hyak Upland Mining Lease | 3-7 |

| 3.6.4 | Stoll/Mydske Lease | 3-7 |

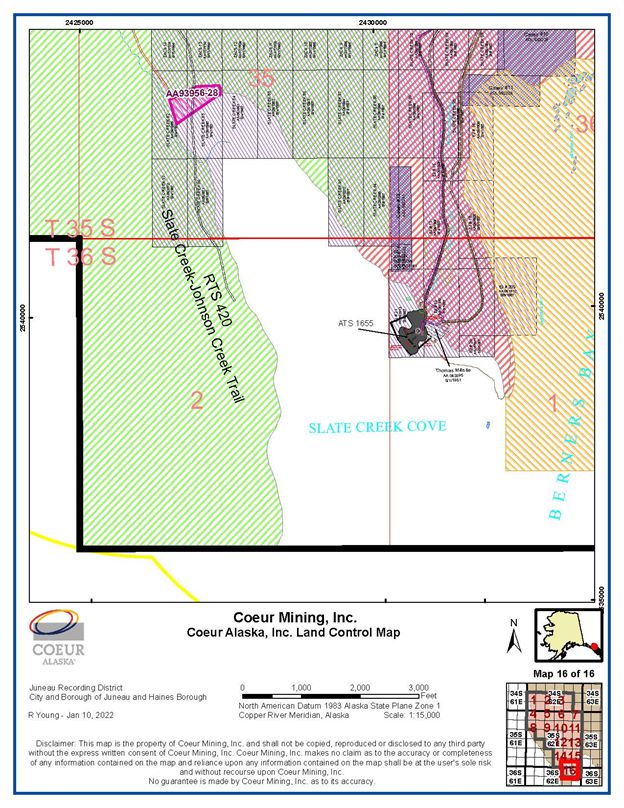

| 3.6.5 | Slate Creek Cove Tideland Lease | 3-8 |

| 3.6.6 | Yankee Cove Lease | 3-9 |

| 3.6.7 | Comet Beach Right-of-Way | 3-9 |

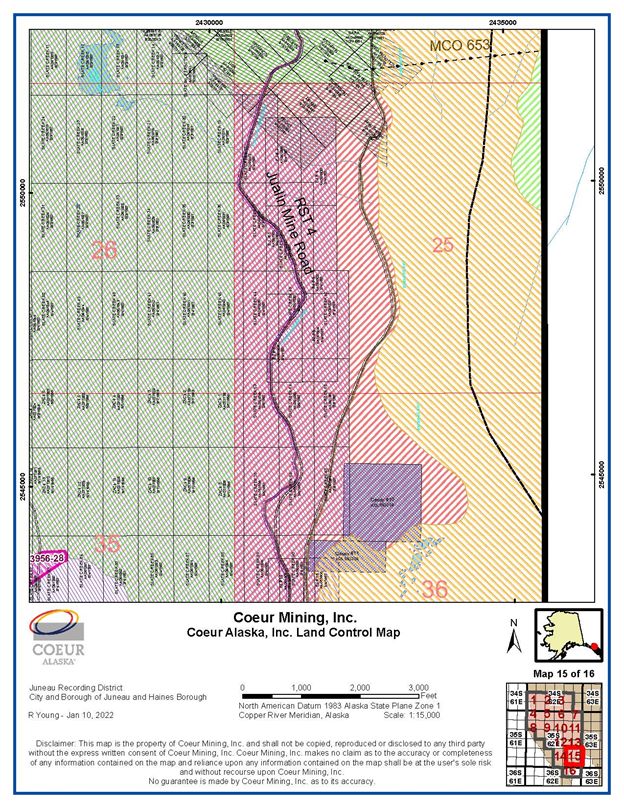

| 3.6.8 | Jualin Mine Road Right-of-Way | 3-9 |

| 3.6.9 | Echo Bay | 3-9 |

| 3.7 | Encumbrances | 3-10 |

| 3.7.1 | Permitting Requirements | 3-10 |

| 3.7.2 | Permitting Timelines | 3-10 |

| 3.7.3 | Violations and Fines | 3-10 |

| 3.8 | Significant Factors and Risks That May Affect Access, Title or Work Programs | 3-11 |

| 4.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 4-1 |

| 4.1 | Physiography | 4-1 |

| 4.2 | Accessibility | 4-1 |

| 4.3 | Climate | 4-1 |

| 4.4 | Infrastructure | 4-1 |

| 5.0 | HISTORY | 5-1 |

| 6.0 | GEOLOGICAL SETTING, MINERALIZATION, AND DEPOSIT | 6-1 |

| 6.1 | Deposit Type | 6-1 |

| 6.2 | Regional Geology | 6-1 |

| 6.3 | Local Geology | 6-1 |

| 6.3.1 | Lithologies | 6-3 |

| 6.3.2 | Structure | 6-3 |

| 6.3.3 | Alteration | 6-4 |

| 6.3.4 | Mineralization | 6-4 |

| 6.3.4.1 | Discrete Veins | 6-4 |

| 6.3.4.2 | Extension Veins | 6-5 |

| 6.3.4.3 | Horizontal Veins | 6-5 |

| 6.3.4.4 | Mineralization | 6-6 |

| 6.4 | Property Geology | 6-6 |

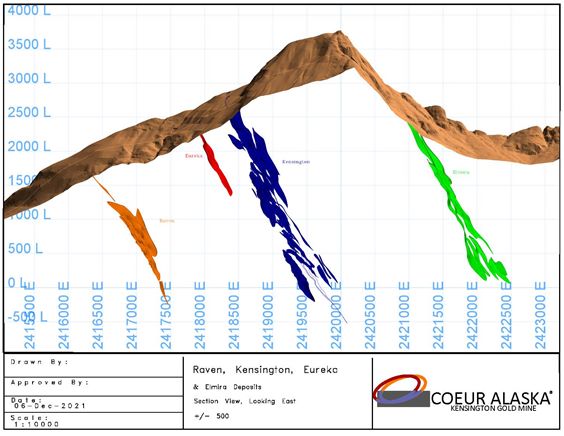

| 6.4.1 | Kensington | 6-6 |

| 6.4.1.1 | Deposit Dimensions | 6-6 |

| 6.4.1.2 | Lithologies | 6-6 |

| 6.4.1.3 | Structure | 6-6 |

| 6.4.1.4 | Alteration | 6-6 |

| 6.4.1.5 | Mineralization | 6-7 |

| 6.4.2 | Eureka | 6-7 |

| 6.4.2.1 | Deposit Dimensions | 6-7 |

| 6.4.2.2 | Lithologies | 6-8 |

| 6.4.2.3 | Structure | 6-8 |

| 6.4.2.4 | Alteration | 6-8 |

| 6.4.2.5 | Mineralization | 6-8 |

| 6.4.3 | Raven | 6-8 |

| 6.4.3.1 | Deposit Dimensions | 6-8 |

| 6.4.3.2 | Lithologies | 6-9 |

| 6.4.3.3 | Structure | 6-9 |

| 6.4.3.4 | Alteration | 6-9 |

| 6.4.3.5 | Mineralization | 6-9 |

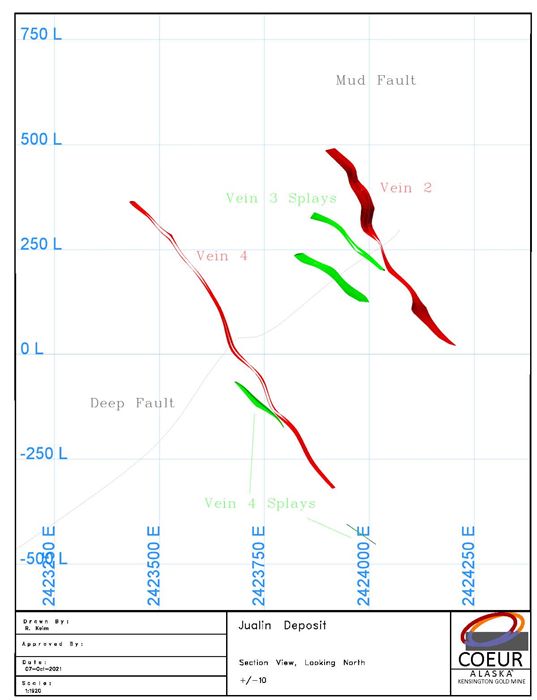

| 6.4.4 | Jualin | 6-9 |

| 6.4.4.1 | Deposit Dimensions | 6-9 |

| 6.4.4.2 | Lithologies | 6-9 |

| 6.4.4.3 | Structure | 6-11 |

| 6.4.4.4 | Alteration | 6-11 |

| 6.4.4.5 | Mineralization | 6-11 |

| 6.4.5 | Elmira | 6-11 |

| 6.4.5.1 | Deposit Dimensions | 6-11 |

| 6.4.5.2 | Lithologies | 6-11 |

| 6.4.5.3 | Structure | 6-11 |

| 6.4.5.4 | Alteration | 6-12 |

| 6.4.5.5 | Mineralization | 6-12 |

| 7.0 | EXPLORATION | 7-1 |

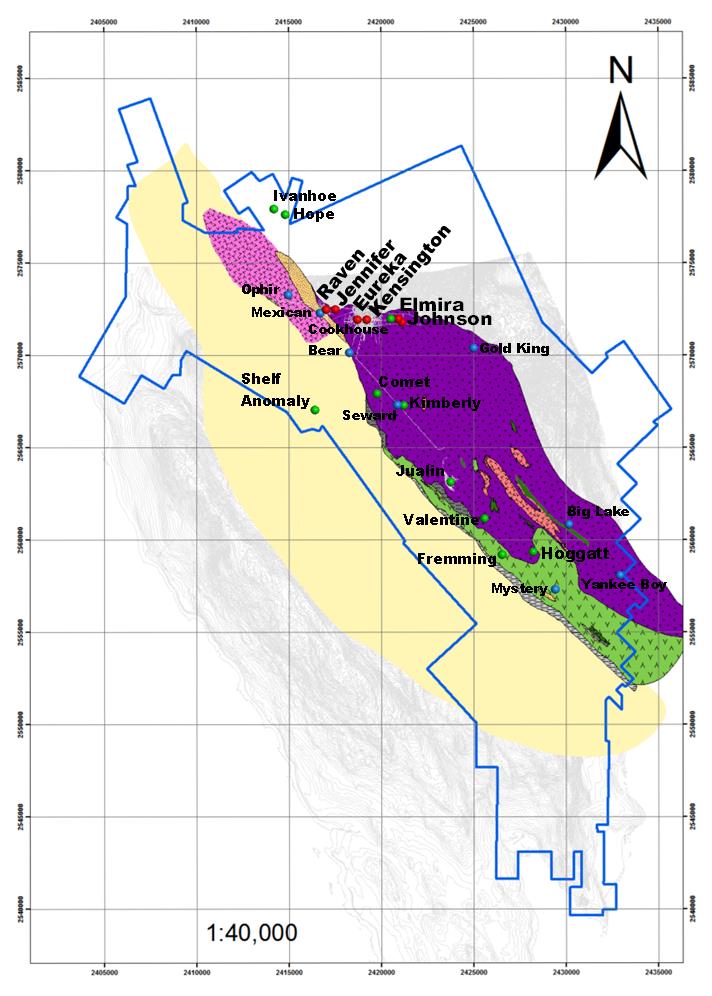

| 7.1 | Exploration | 7-1 |

| 7.1.1 | Grids and Surveys | 7-1 |

| 7.1.2 | Geological Mapping | 7-1 |

| 7.1.3 | Geochemistry | 7-1 |

| 7.1.4 | Geophysics | 7-1 |

| 7.1.5 | Qualified Person’s Interpretation of the Exploration Information | 7-2 |

| 7.1.6 | Exploration Potential | 7-2 |

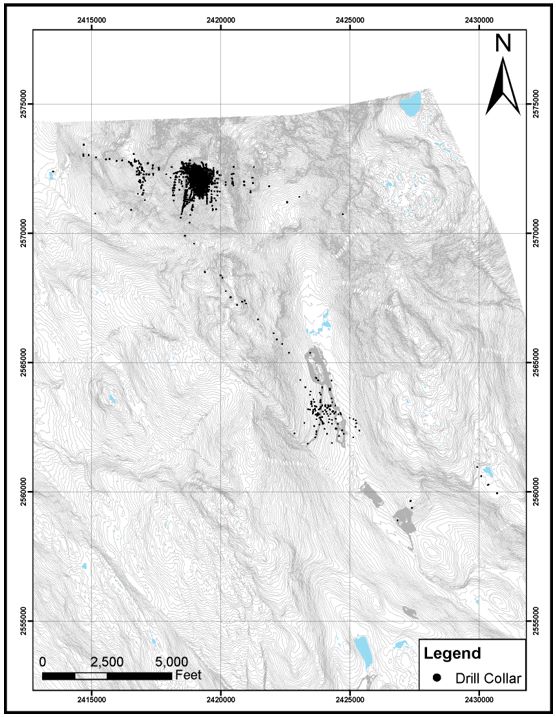

| 7.2 | Drilling | 7-4 |

| 7.2.1 | Overview | 7-4 |

| 7.2.2 | Drilling Excluded for Estimation Purposes | 7-4 |

| 7.2.3 | Drilling Completed Since Database Close-out Date | 7-4 |

| 7.2.4 | Drill Methods | 7-4 |

| 7.2.5 | Logging | 7-15 |

| 7.2.6 | Recovery | 7-16 |

| 7.2.7 | Collar Surveys | 7-16 |

| 7.2.8 | Down Hole Surveys | 7-16 |

| 7.2.9 | Comment on Material Results and Interpretation | 7-16 |

| 7.3 | Hydrogeology | 7-17 |

| 7.3.1 | Sampling Methods and Laboratory Determinations | 7-17 |

| 7.3.2 | Comment on Results | 7-17 |

| 7.4 | Geotechnical | 7-17 |

| 7.4.1 | Sampling Methods and Laboratory Determinations | 7-17 |

| 7.4.2 | Comment on Results | 7-17 |

| 8.0 | SAMPLE PREPARATION, ANALYSES, AND SECURITY | 8-1 |

| 8.1 | Sampling Methods | 8-1 |

| 8.1.1 | Muck | 8-1 |

| 8.1.2 | Channel | 8-1 |

| 8.1.3 | Core | 8-1 |

| 8.2 | Sample Security Methods | 8-2 |

| 8.3 | Density Determinations | 8-2 |

| 8.4 | Analytical and Test Laboratories | 8-2 |

| 8.5 | Sample Preparation | 8-4 |

| 8.6 | Analysis | 8-4 |

| 8.7 | Quality Assurance and Quality Control | 8-5 |

| 8.8 | Database | 8-6 |

| 8.9 | Qualified Person’s Opinion on Sample Preparation, Security, and Analytical Procedures | 8-6 |

| 9.0 | DATA VERIFICATION | 9-1 |

| 9.1 | Internal Data Verification | 9-1 |

| 9.2 | External Data Verification | 9-1 |

| 9.3 | Data Verification by Qualified Person | 9-2 |

| 9.4 | Qualified Person’s Opinion on Data Adequacy | 9-2 |

| 10.0 | MINERAL PROCESSING AND METALLURGICAL TESTING | 10-1 |

| 10.1 | Test Laboratories | 10-1 |

| 10.2 | Metallurgical Testwork | 10-1 |

| 10.2.1 | Historical Testwork | 10-1 |

| 10.2.2 | Jualin Testwork | 10-1 |

| 10.3 | Recovery Estimates | 10-2 |

| 10.4 | Metallurgical Variability | 10-3 |

| 10.5 | Deleterious Elements | 10-3 |

| 10.6 | Qualified Person’s Opinion on Data Adequacy | 10-3 |

| 11.0 | MINERAL RESOURCE ESTIMATES | 11-1 |

| 11.1 | Introduction | 11-1 |

| 11.2 | Exploratory Data Analysis | 11-1 |

| 11.3 | Geological Models | 11-1 |

| 11.4 | Density Assignment | 11-8 |

| 11.5 | Grade Capping/Outlier Restrictions | 11-8 |

| 11.6 | Composites | 11-8 |

| 11.7 | Variography | 11-9 |

| 11.8 | Estimation/Interpolation Methods | 11-9 |

| 11.9 | Validation | 11-10 |

| 11.10 | Confidence Classification of Mineral Resource Estimate | 11-11 |

| 11.10.1 | Mineral Resource Confidence Classification | 11-11 |

| 11.10.2 | Uncertainties Considered During Confidence Classification | 11-12 |

| 11.11 | Reasonable Prospects of Economic Extraction | 11-12 |

| 11.11.1 | Input Assumptions | 11-12 |

| 11.11.2 | Commodity Price | 11-12 |

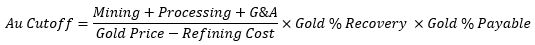

| 11.11.3 | Cut-off | 11-12 |

| 11.11.4 | QP Statement | 11-13 |

| 11.12 | Mineral Resource Statement | 11-13 |

| 11.13 | Uncertainties (Factors) That May Affect the Mineral Resource Estimate | 11-16 |

| 12.0 | MINERAL RESERVE ESTIMATES | 12-1 |

| 12.1 | Introduction | 12-1 |

| 12.2 | Development of Mining Case | 12-1 |

| 12.3 | Designs | 12-1 |

| 12.4 | Input Assumptions | 12-2 |

| 12.5 | Ore Loss and Dilution | 12-2 |

| 12.6 | Cut-off Grades | 12-2 |

| 12.7 | Commodity Price | 12-4 |

| 12.8 | Mineral Reserve Statement | 12-4 |

| 12.9 | Uncertainties (Factors) That May Affect the Mineral Reserve Estimate | 12-4 |

| 13.0 | MINING METHODS | 13-1 |

| 13.1 | Introduction | 13-1 |

| 13.2 | Geotechnical Considerations | 13-1 |

| 13.3 | Hydrogeological Considerations | 13-1 |

| 13.4 | Mine Access | 13-2 |

| 13.5 | Mining Method Selection | 13-2 |

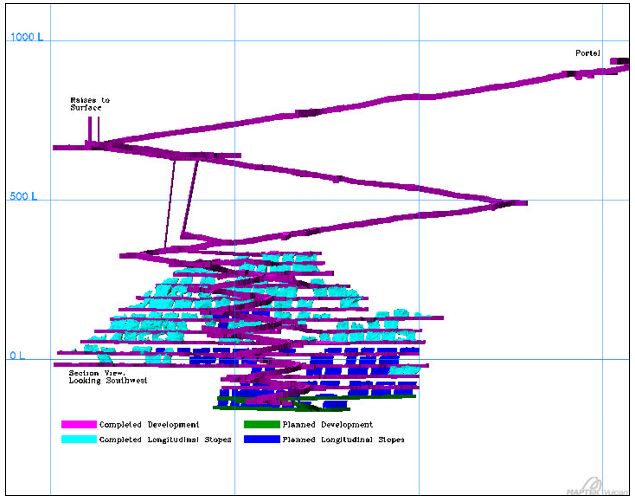

| 13.5.1 | Kensington | 13-2 |

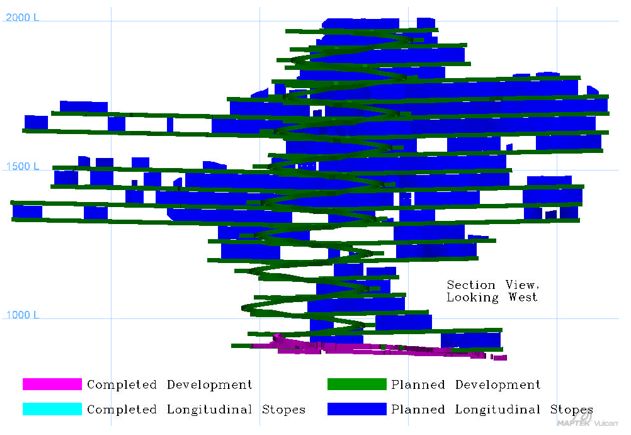

| 13.5.2 | Raven | 13-3 |

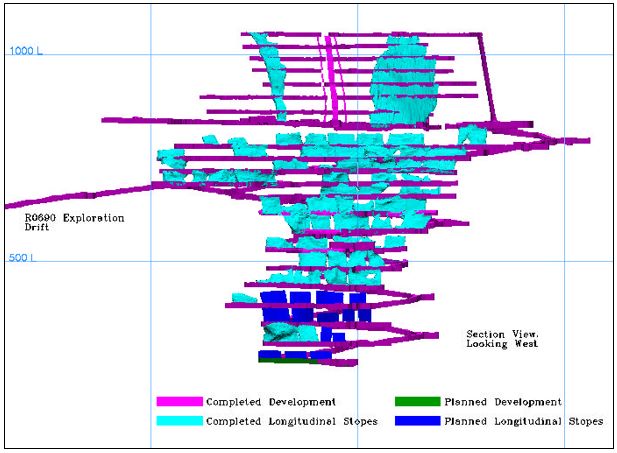

| 13.5.3 | Jualin | 13-3 |

| 13.5.4 | Elmira | 13-6 |

| 13.6 | Blasting and Explosives | 13-7 |

| 13.7 | Underground Sampling and Production Monitoring | 13-7 |

| 13.8 | Production Schedule | 13-8 |

| 13.9 | Backfill | 13-8 |

| 13.10 | Ventilation | 13-8 |

| 13.11 | Underground Infrastructure Facilities | 13-10 |

| 13.12 | Equipment | 13-10 |

| 13.13 | Personnel | 13-10 |

| 14.0 | RECOVERY METHODS | 14-1 |

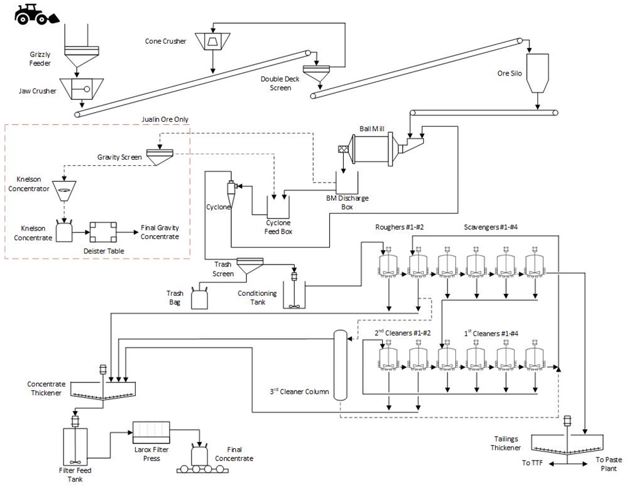

| 14.1 | Process Method Selection | 14-1 |

| 14.2 | Flowsheet | 14-1 |

| 14.3 | Plant Design | 14-1 |

| 14.3.1 | Ore Sorting | 14-2 |

| 14.3.2 | Crushing | 14-3 |

| 14.3.3 | Grinding | 14-3 |

| 14.3.4 | Flotation | 14-3 |

| 14.3.5 | Dewatering | 14-3 |

| 14.3.6 | Tailings | 14-4 |

| 14.4 | Equipment | 14-4 |

| 14.5 | Power and Consumables | 14-4 |

| 14.5.1 | Power | 14-4 |

| 14.5.2 | Water | 14-4 |

| 14.5.3 | Consumables | 14-5 |

| 14.6 | Personnel | 14-5 |

| 15.0 | INFRASTRUCTURE | 15-6 |

| 15.1 | Introduction | 15-6 |

| 15.2 | Dumps and Leach Pads | 15-6 |

| 15.2.1 | Existing Waste Rock Stockpiles | 15-6 |

| 15.2.2 | Additional Waste Rock Stockpiles | 15-8 |

| 15.2.3 | Waste Rock Barged Offsite | 15-8 |

| 15.3 | Tailings Treatment Facility | 15-8 |

| 15.4 | Water Management | 15-9 |

| 15.4.1 | Domestic Water/Wastewater Plants Overview | 15-9 |

| 15.4.2 | Comet Water Treatment Facility and Process Background | 15-10 |

| 15.5 | Camps and Accommodation | 15-10 |

| 15.6 | Power and Electrical | 15-10 |

| 15.7 | Fuel | 15-10 |

| 16.0 | MARKET STUDIES AND CONTRACTS | 16-1 |

| 16.1 | Markets | 16-1 |

| 16.2 | Commodity Price Forecasts | 16-1 |

| 16.3 | Contracts | 16-1 |

| 16.4 | QP Statement | 16-2 |

| 17.0 | ENVIRONMENTAL STUDIES, PERMITTING, AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS | 17-1 |

| 17.1 | Baseline and Supporting Studies | 17-1 |

| 17.2 | Environmental Considerations/Monitoring Programs | 17-1 |

| 17.3 | Closure and Reclamation Considerations | 17-1 |

| 17.4 | Permitting | 17-2 |

| 17.5 | Social Considerations, Plans, Negotiations and Agreements | 17-2 |

| 17.6 | Qualified Person’s Opinion on Adequacy of Current Plans to Address Issues | 17-4 |

| 18.0 | CAPITAL AND OPERATING COSTS | 18-1 |

| 18.1 | Introduction | 18-1 |

| 18.2 | Capital Cost Estimates | 18-1 |

| 18.2.1 | Basis of Estimate | 18-1 |

| 18.2.2 | Capital Cost Summary | 18-2 |

| 18.3 | Operating Cost Estimates | 18-2 |

| 18.3.1 | Basis of Estimate | 18-2 |

| 18.3.2 | Operating Cost Summary | 18-2 |

| 18.4 | QP Statement | 18-2 |

| 19.0 | ECONOMIC ANALYSIS | 19-1 |

| 19.1 | Forward-looking Information Caution | 19-1 |

| 19.2 | Methodology Used | 19-1 |

| 19.3 | Financial Model Parameters | 19-1 |

| 19.3.1 | Mineral Resource, Mineral Reserve, and Mine Life | 19-1 |

| 19.3.2 | Metallurgical Recoveries | 19-1 |

| 19.3.3 | Smelting and Refining Terms | 19-2 |

| 19.3.4 | Metal Prices | 19-2 |

| 19.3.5 | Capital and Operating Costs | 19-2 |

| 19.3.6 | Taxes and Royalties | 19-2 |

| 19.3.7 | Closure Costs and Salvage Value | 19-3 |

| 19.3.8 | Financing | 19-3 |

| 19.3.9 | Inflation | 19-3 |

| 19.4 | Economic Analysis | 19-3 |

| 19.5 | Sensitivity Analysis | 19-3 |

| 20.0 | ADJACENT PROPERTIES | 20-1 |

| 21.0 | OTHER RELEVANT DATA AND INFORMATION | 21-1 |

| 22.0 | INTERPRETATION AND CONCLUSIONS | 22-1 |

| 22.1 | Introduction | 22-1 |

| 22.2 | Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements | 22-1 |

| 22.3 | Geology and Mineralization | 22-1 |

| 22.4 | Exploration, Drilling, and Sampling | 22-1 |

| 22.5 | Data Verification | 22-2 |

| 22.6 | Metallurgical Testwork | 22-2 |

| 22.7 | Mineral Resource Estimates | 22-3 |

| 22.8 | Mineral Reserve Estimates | 22-3 |

| 22.9 | Mining Methods | 22-3 |

| 22.10 | Recovery Methods | 22-4 |

| 22.11 | Infrastructure | 22-4 |

| 22.12 | Market Studies | 22-5 |

| 22.13 | Environmental, Permitting and Social Considerations | 22-5 |

| 22.14 | Capital Cost Estimates | 22-6 |

| 22.15 | Operating Cost Estimates | 22-6 |

| 22.16 | Economic Analysis | 22-6 |

| 22.17 | Risks and Opportunities | 22-6 |

| 22.17.1 | Risks | 22-6 |

| 22.17.2 | Opportunities | 22-7 |

| 22.18 | Conclusions | 22-7 |

| 23.0 | RECOMMENDATIONS | 23-1 |

| 24.0 | REFERENCES | 24-1 |

| 24.1 | Bibliography | 24-1 |

| 24.2 | Abbreviations and Units of Measure | 24-2 |

| 24.3 | Glossary of Terms | 24-4 |

| 25.0 | RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT | 25-1 |

| 25.1 | Introduction | 25-1 |

| 25.2 | Macroeconomic Trends | 25-1 |

| 25.3 | Markets | 25-1 |

| 25.4 | Legal Matters | 25-1 |

| 25.5 | Environmental Matters | 25-1 |

| 25.6 | Stakeholder Accommodations | 25-2 |

| 25.7 | Governmental Factors | 25-2 |

| 25.8 | Internal Controls | 25-2 |

| 25.8.1 | Exploration and Drilling | 25-2 |

| 25.8.2 | Mineral Resource and Mineral Reserve Estimates | 25-3 |

| 25.8.3 | Risk Assessments | 25-3 |

| Table 1‑1: | Summary of Gold Measured and Indicated Mineral Resources at December 31, 2021 (based on US$1,700/oz gold price) | 1-9 |

| Table 1‑2: | Summary of Gold Inferred Mineral Resource Statement at December 31, 2021 (based on US$1,700/oz gold price) | 1-9 |

| Table 1‑3: | Summary of Gold Proven and Probable Mineral Reserve Statement at December 31, 2021 (based on US$1,400/oz gold price) | 1-12 |

| Table 1‑4: | LOM Capital Cost Estimate (US$ M) | 1-19 |

| Table 1‑5: | LOM Operating Cost Estimate (US$ M) | 1-19 |

| Table 1‑6: | Annualized Cashflow Statement | 1-20 |

| Table 1‑7: | NPV Sensitivity | 1-21 |

| Table 2‑1: | QP Chapter Responsibilities | 2-5 |

| Table 3‑1: | Mineral Tenure Summary Table | 3-2 |

| Table 3‑2: | Water Rights | 3-6 |

| Table 5‑1: | Exploration and Development History Summary Table | 5-2 |

| Table 6‑1: | Stratigraphic Column | 6-3 |

| Table 7‑1: | Project Drill Summary Table, Pre-Coeur Drilling | 7-5 |

| Table 7‑2: | Project Drill Summary Table, Coeur Drilling | 7-6 |

| Table 7‑3: | Drill Summary Table Supporting Mineral Resource Estimates, Kensington | 7-7 |

| Table 7‑4: | Drill Summary Table Supporting Mineral Resource Estimates, Eureka | 7-8 |

| Table 7‑5: | Drill Summary Table Supporting Mineral Resource Estimates, Raven | 7-8 |

| Table 7‑6: | Drill Summary Table Supporting Mineral Resource Estimates, Jualin | 7-9 |

| Table 7‑7: | Drill Summary Table Supporting Mineral Resource Estimates, Elmira | 7-10 |

| Table 8‑1: | Analytical and Sample Preparation Laboratories | 8-3 |

| Table 10‑1: | Historical Metallurgical Testwork | 10-2 |

| Table 11‑1: | Input Parameters to Cut-off Grade Determination, Mineral Resources | 11-13 |

| Table 11‑2: | Gold Measured and Indicated Mineral Resource Statement at December 31, 2021 (based on US$1,700/oz gold price) | 11-14 |

| Table 11‑3: | Gold Inferred Mineral Resource Statement at December 31, 2021 (based on US$1,700/oz gold price) | 11-15 |

| Table 12‑1: | Dilution Rate and Dilution Grade | 12-3 |

| Table 12‑2: | Input Parameters to Cut-off Grade Determination, Mineral Reserves | 12-3 |

| Table 12‑3: | Gold Proven and Probable Mineral Reserve Statement at December 31, 2021 (based on US$1,400/oz gold price) | 12-6 |

| Table 13‑1: | LOM Production Schedule | 13-9 |

| Table 13‑2: | Equipment List | 13-11 |

| Table 14‑1: | Process Equipment List | 14-5 |

| Table 17‑1: | Key Permits and Approvals | 17-3 |

| Table 18‑1: | LOM Capital Projects | 18-2 |

| Table 18‑2: | LOM Capital Cost Estimate (US$ M) | 18-3 |

| Table 18‑3: | LOM Operating Cost Estimate (US$ M) | 18-3 |

| Table 19‑2: | Annualized Cashflow Statement | 19-4 |

| Table 19‑3: | NPV Sensitivity | 19-4 |

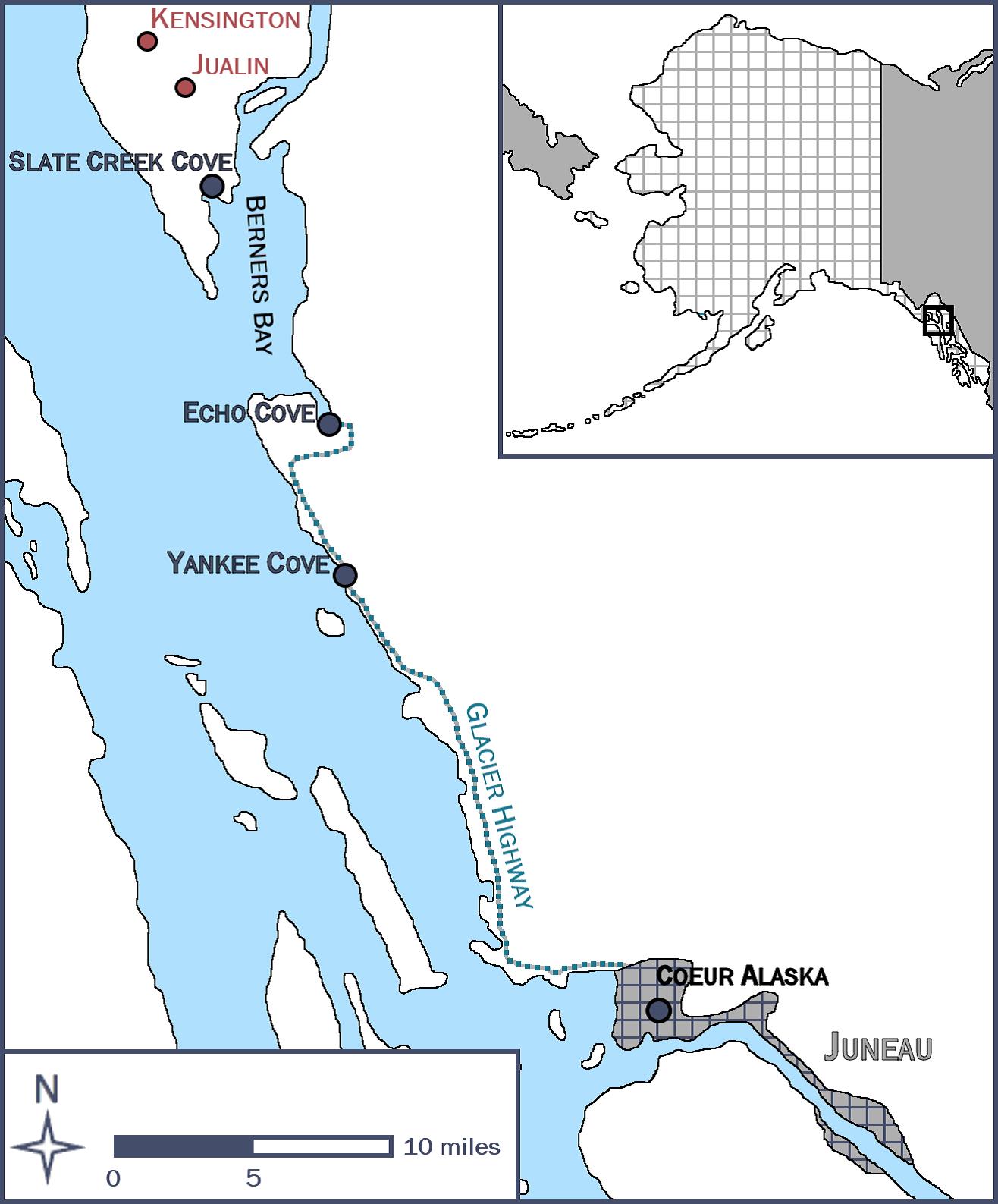

| Figure 2‑1: | Project Location Plan | 2-2 |

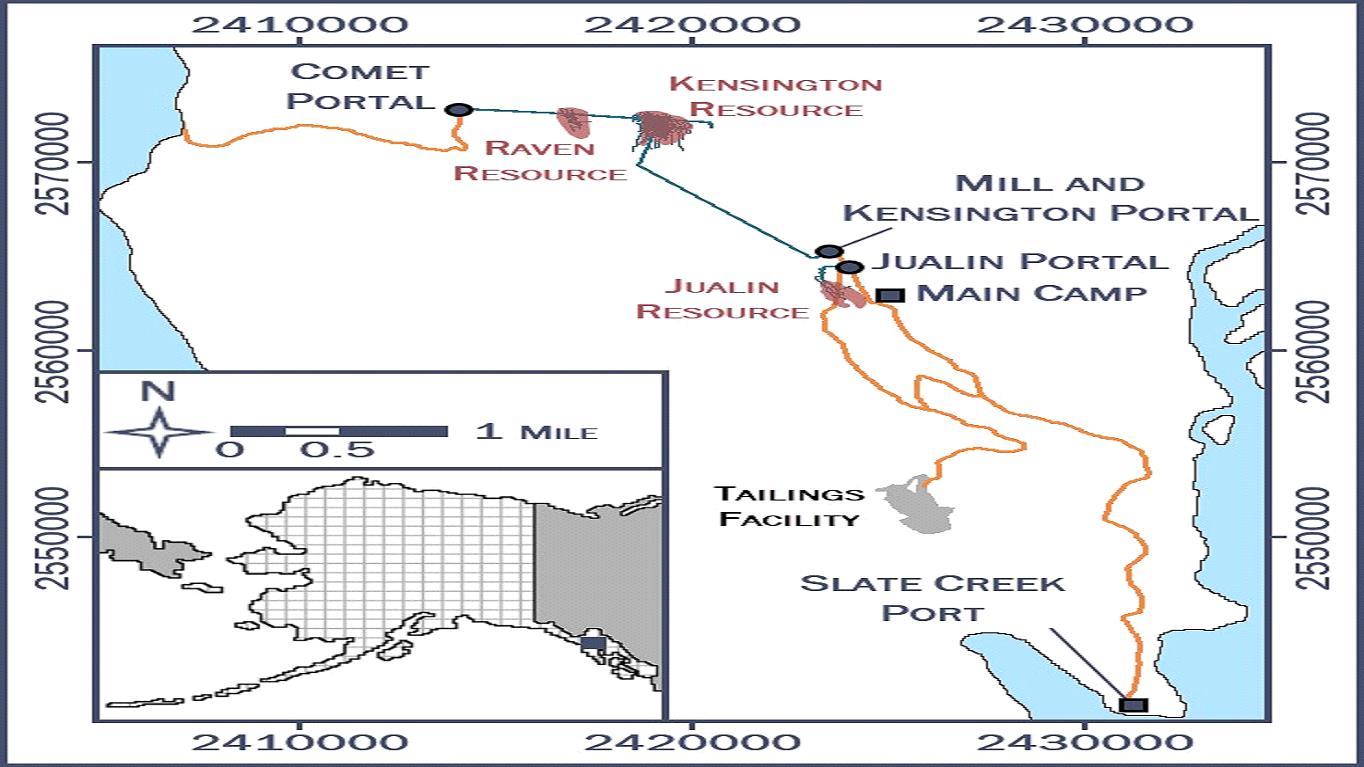

| Figure 2‑2: | Mining Operations Layout Map | 2-3 |

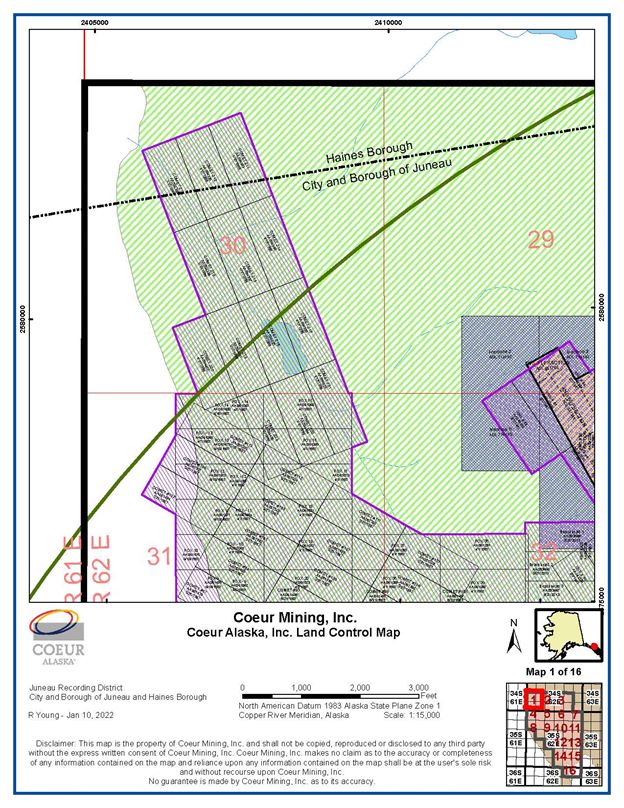

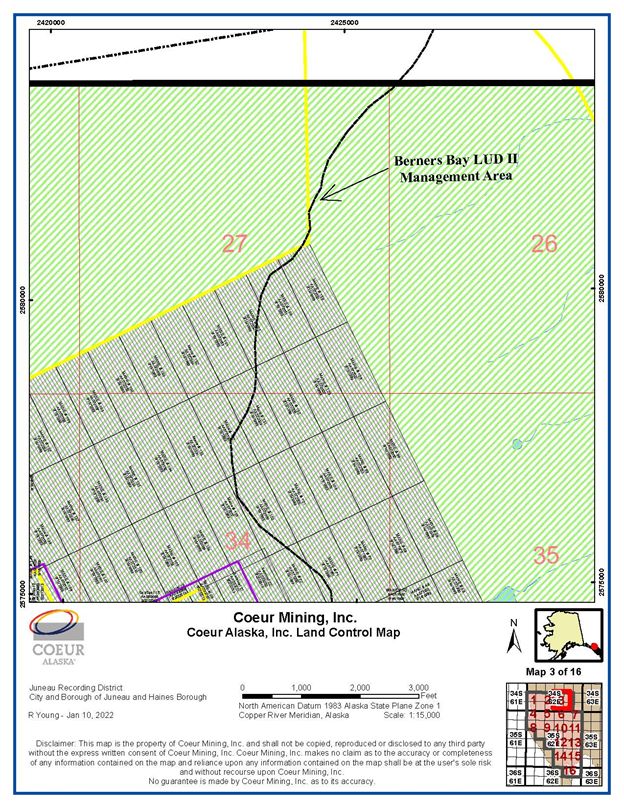

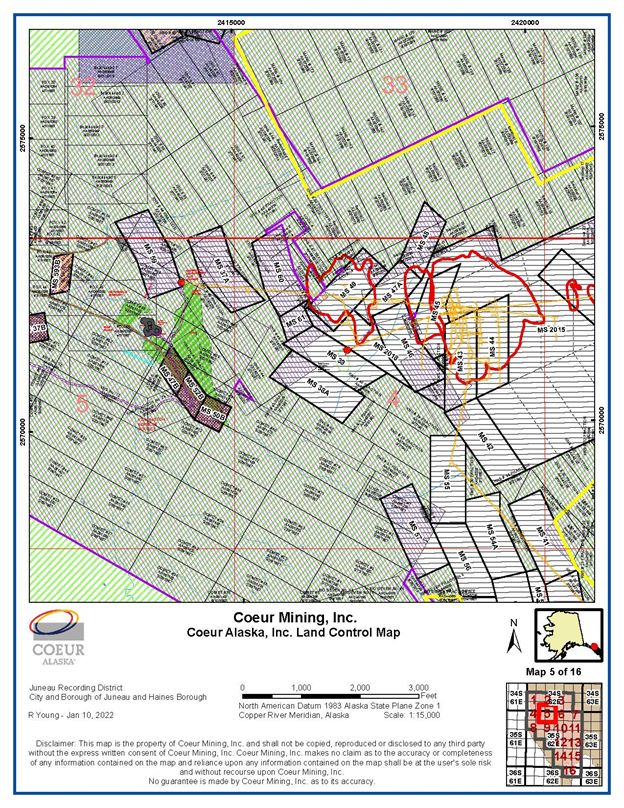

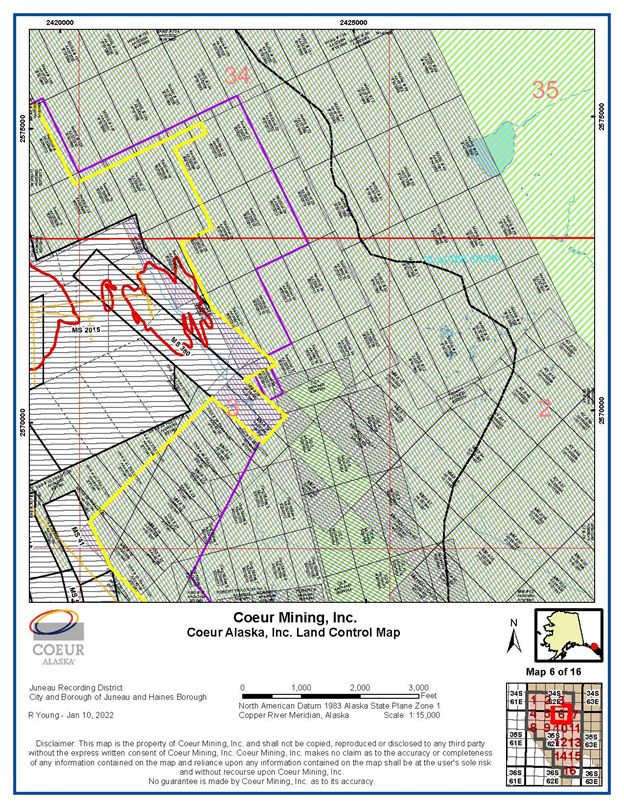

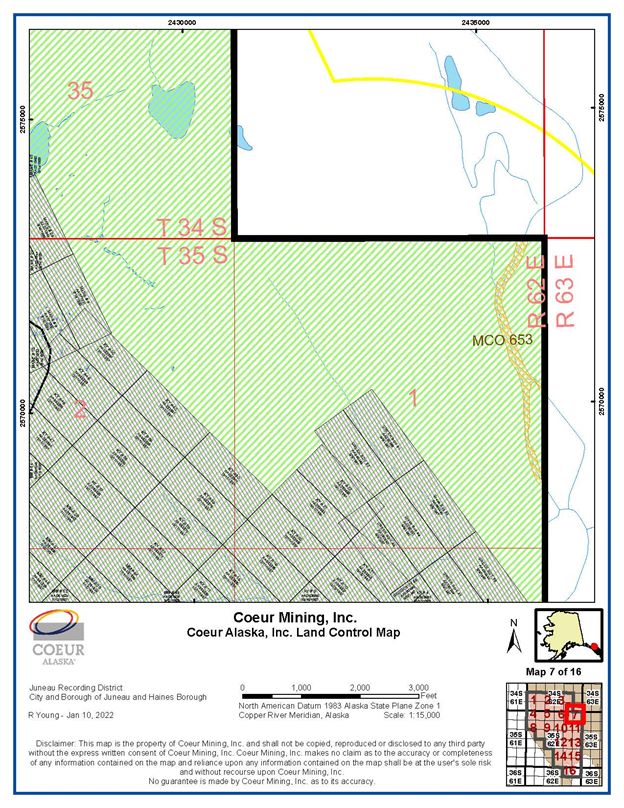

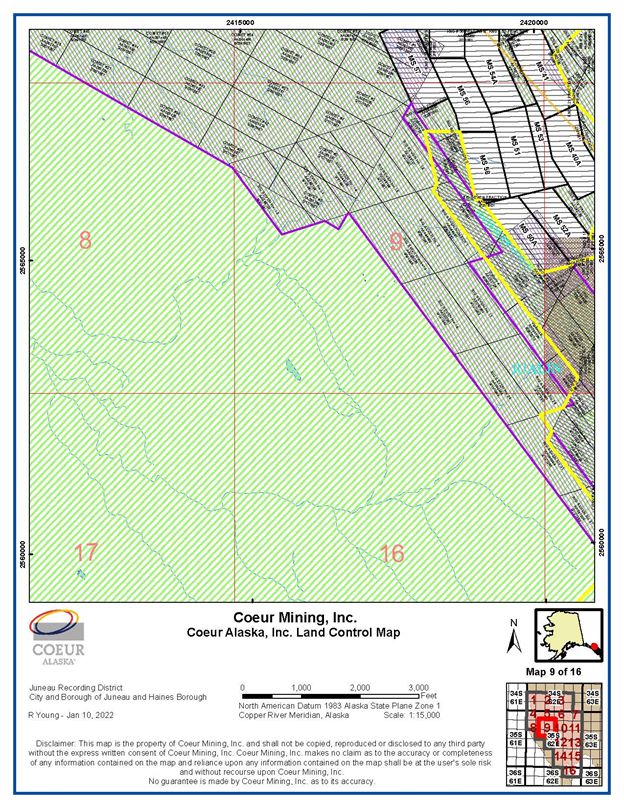

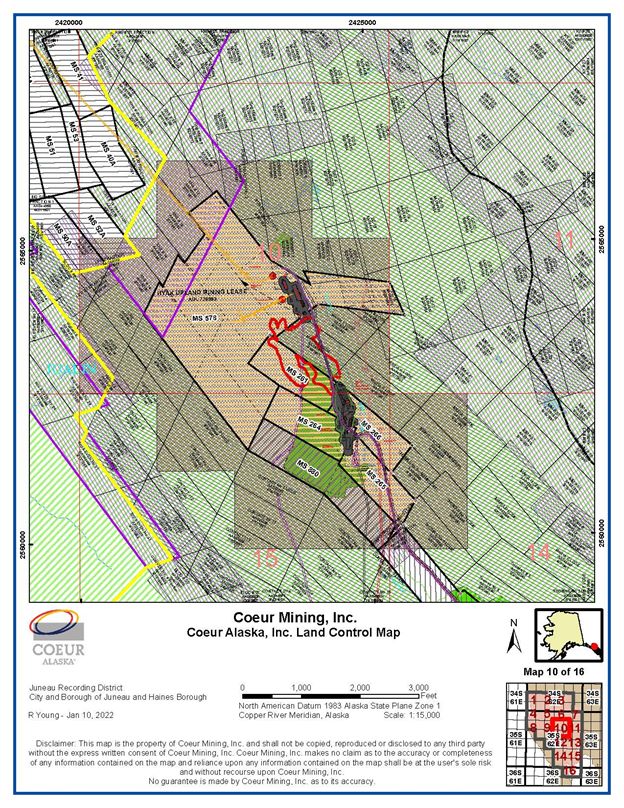

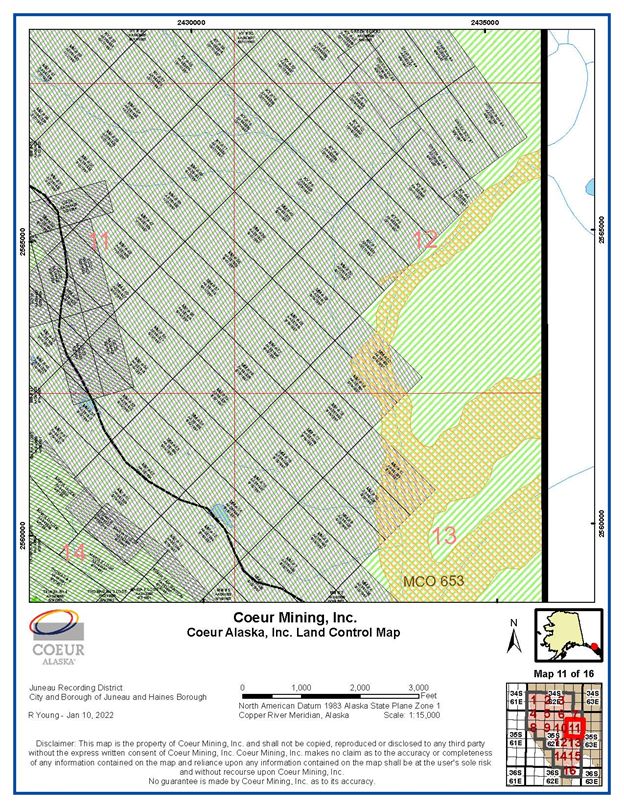

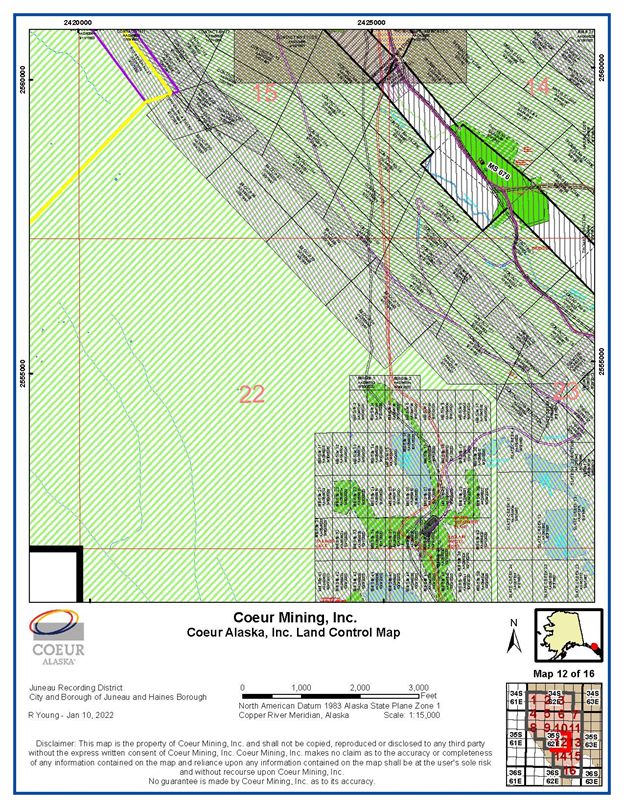

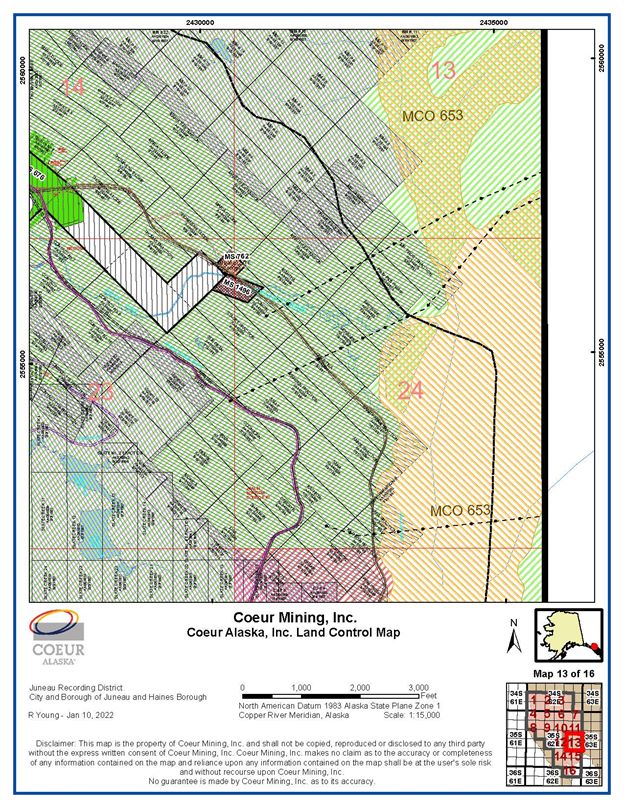

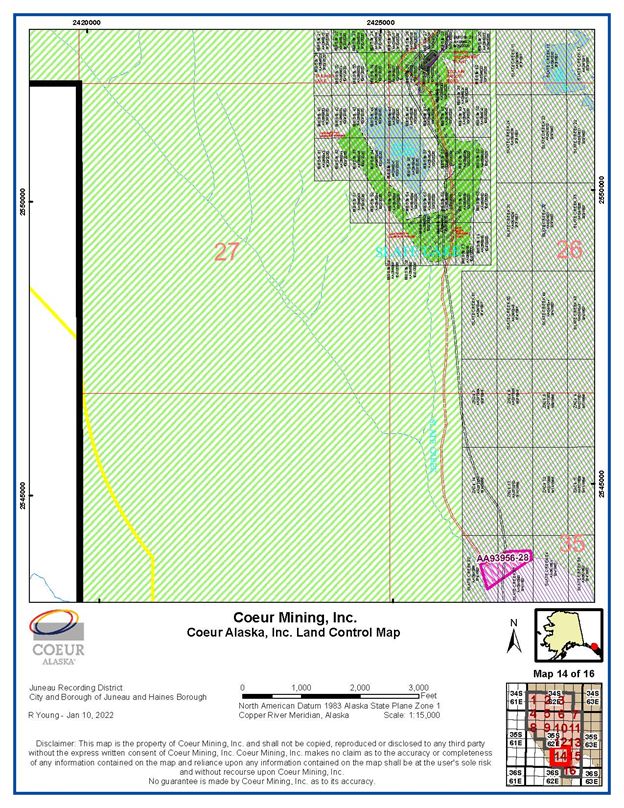

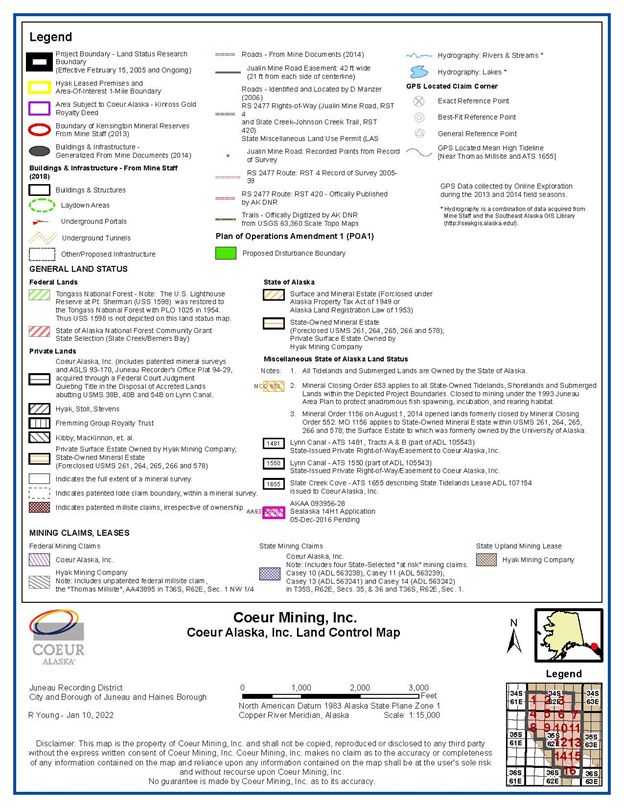

| Figure 3‑1: | Mineral Tenure Overview Location Map | 3-3 |

| Figure 3‑2: | Mineral Tenure Location Map | 3-4 |

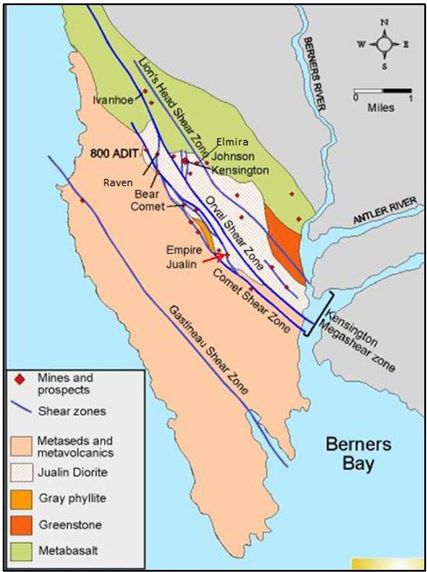

| Figure 6‑1: | Regional Geology Map | 6-2 |

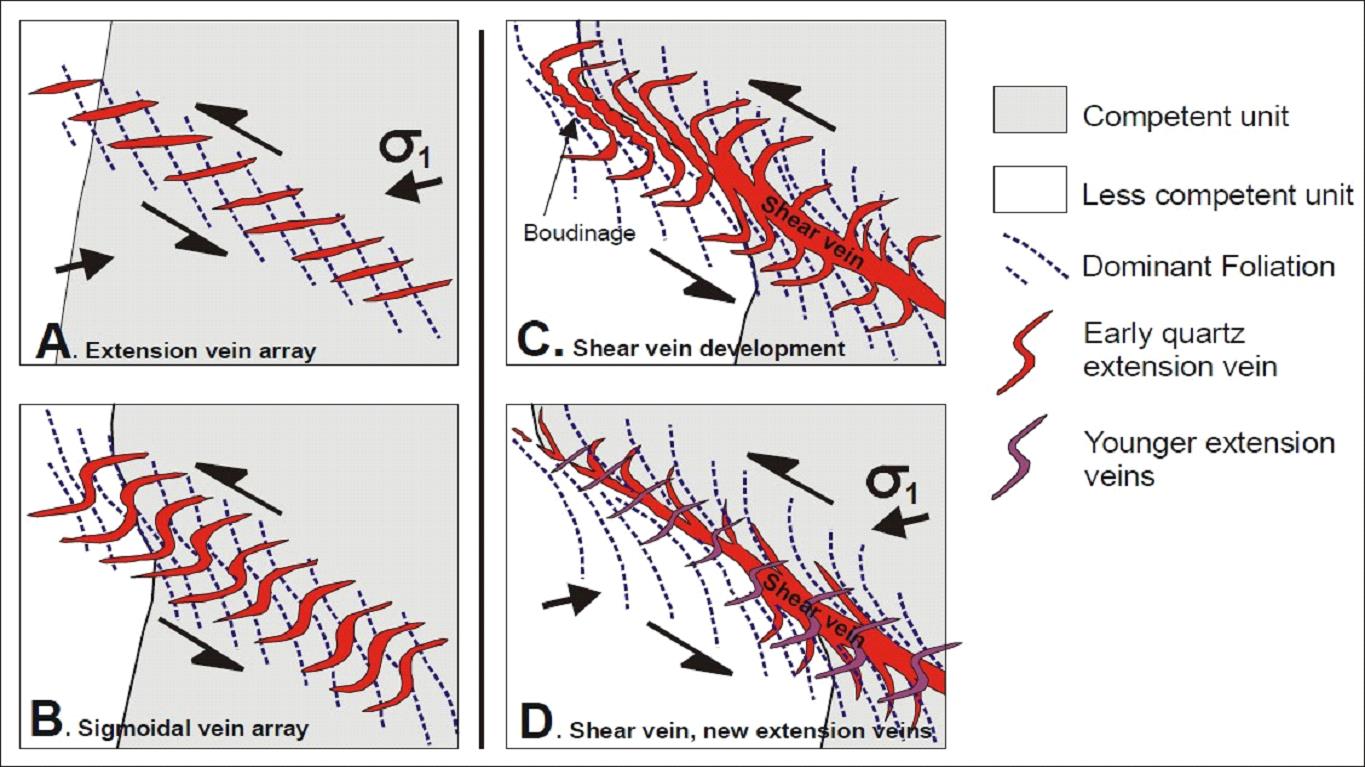

| Figure 6‑2: | Schematic Showing Development of Discrete and Extensional Vein Arrays | 6-5 |

| Figure 6‑3: | Mineralization Cross-Section, Kensington, Eureka, Raven, and Elmira | 6-7 |

| Figure 6‑4: | Mineralization Cross-Section, Jualin Deposit | 6-10 |

| Figure 7‑1: | Exploration Areas | 7-3 |

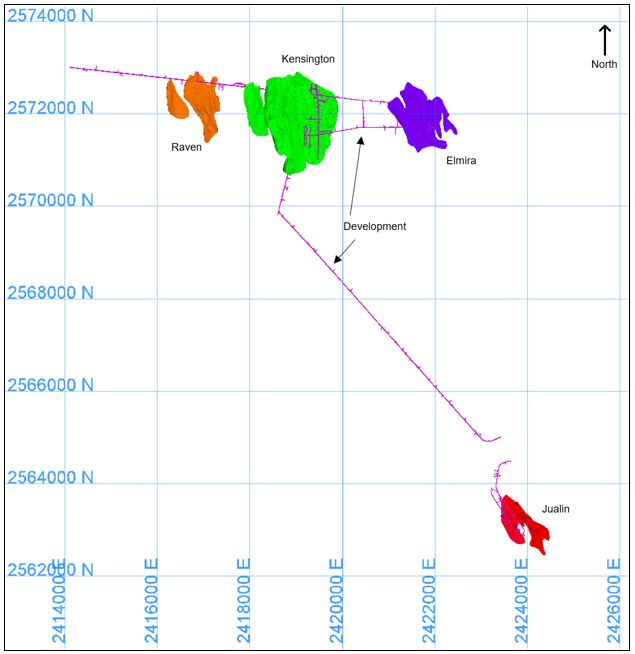

| Figure 7‑2: | Project Drill Collar Location Plan | 7-11 |

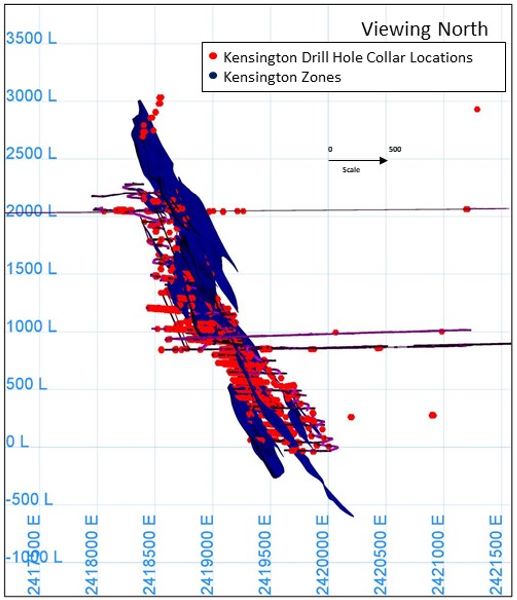

| Figure 7‑3: | Drill Section, Section, Kensington | 7-12 |

| Figure 7‑4: | Drill Collar Location Section, Raven | 7-13 |

| Figure 7‑5: | Drill Collar Location Section, Jualin | 7-14 |

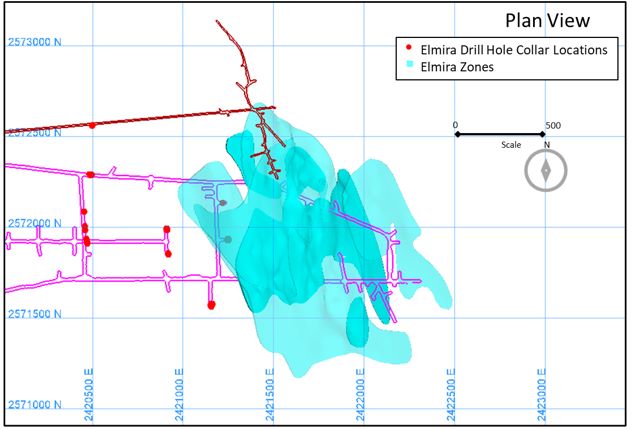

| Figure 7‑6: | Drill Collar Location Plan, Elmira | 7-15 |

| Figure 11‑1: | Kensington and Raven Model Areas | 11-2 |

| Figure 11‑2: | Kensington Model | 11-3 |

| Figure 11‑3: | Eureka Model | 11-4 |

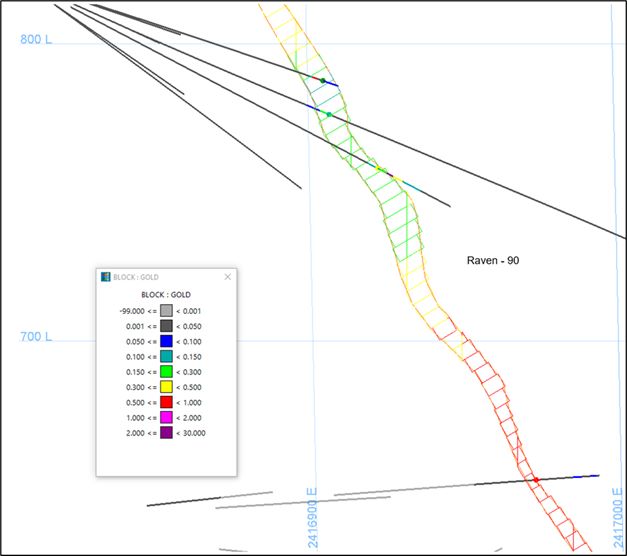

| Figure 11‑4: | Raven Model | 11-5 |

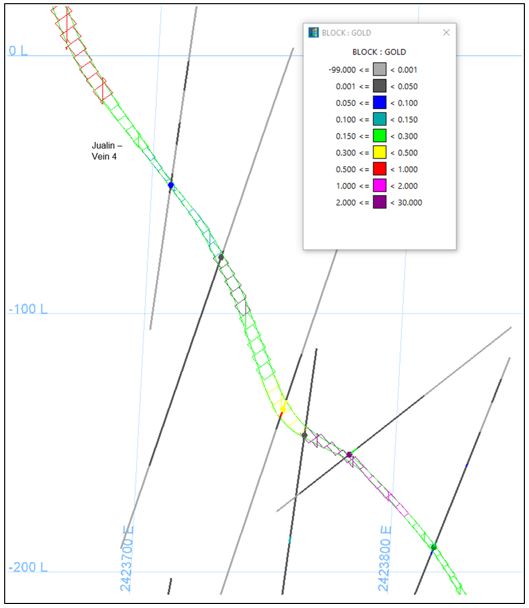

| Figure 11‑5: | #4 Vein Model, Jualin | 11-6 |

| Figure 11‑6: | Elmira Model | 11-7 |

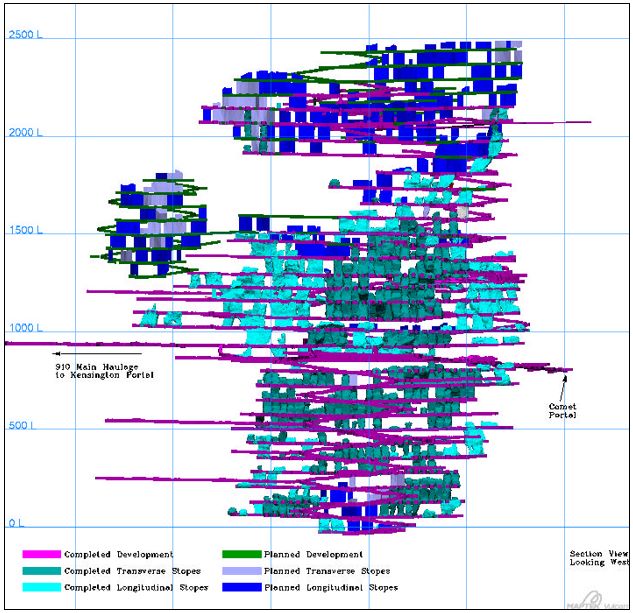

| Figure 13‑1: | Cross-Section, Kensington | 13-4 |

| Figure 13‑2: | Cross-Section, Raven | 13-5 |

| Figure 13‑3: | Cross-Section, Jualin | 13-6 |

| Figure 13‑4: | Cross-Section, Elmira | 13-7 |

| Figure 14‑1: | Process Flowsheet | 14-2 |

| Figure 15‑1: | Infrastructure Layout Plan | 15-7 |

Appendix A: Detailed Mineral Tenure Tables and Figures

Mr. Christopher Pascoe, RM SME, Ms. Rae Keim, P.Geo., and Mr. Peter Haarala, RM SME, prepared a technical report summary (the Report) for Coeur Mining, Inc. (Coeur), on the Kensington Gold Operations (the Kensington Operations or the Project), located in Alaska, USA.

Coeur’s wholly-owned subsidiary, Coeur Alaska, Inc. (Coeur Alaska), is the operating entity.

The Report was prepared to be attached as an exhibit to support mineral property disclosure, including mineral resource and mineral reserve estimates, for the Kensington Operations in Coeur’s Form 10-K for the year ended December 31, 2021.

Mineral resources are reported for Kensington, Eureka, Raven, Jualin, and Elmira Zones. Mineral reserves are reported for Kensington, Eureka, Raven, Jualin, and Elmira Zones. Mineral reserves are also estimated for material in stockpiles.

Unless otherwise indicated, all financial values are reported in United States (US) currency (US$) including all operating costs, capital costs, cash flows, taxes, revenues, expenses, and overhead distributions. Unless otherwise indicated, the US Customary unit system is used in this Report. Mineral resources and mineral reserves are reported using the definitions in Item 1300 of Regulation S–K (17 CFR Part 229) (SK1300) of the United States Securities and Exchange Commission. Illustrations, where specified in SK1300, are provided in the relevant Chapters of report where that content is requested. The Report uses US English.

The Kensington Operations are located within the Berners Bay Mining District, approximately 48 miles northwest of the capital city of Juneau, Alaska.

Access to the Kensington Operations is by aircraft (helicopter or float plane) or boat from Juneau. The mine, mill, and camp complex at Jualin is accessed by boat from Auke Bay, Yankee Cove, or Echo Cove to the Slate Creek Cove dock facility (north side of Berners Bay), then five miles by an all-weather gravel road. Kensington is reached via Lynn Canal to the support facilities near the 850 Portal on the eastern shore of Lynn Canal or by transit through the mine. Access to existing mine workings (850 Level Portal) is by three miles of all-weather gravel road from Comet Beach or from the Jualin side of the property. Heavy equipment and supplies can be brought to both sides of the Project directly from Juneau by barge.

The climate in the Project vicinity is maritime with a mean annual precipitation of about 85 inches at the lower mine elevations. Annual snowfall varies from a few feet at sea level to greater than 10 feet at the 2050 Level Portal. Mining operations are conducted year-round. Snow removal equipment is required to keep site roads open during winter months.

Topographic relief ranges from moderate, near sea level, to rugged at the base of Lions Head Mountain.

Vegetation ranges from dense coniferous forest at sea level to dense brush and bare rock. The tree line is between 3,000–3,500 ft in elevation, depending on slope aspect.

| 1.4 | Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements |

Coeur Alaska controls two contiguous claims groups: the Kensington group and Jualin group. The area covered under the Kensington group claims is 3,969 net acres, and under the Jualin group is 8,366 net acres. Fourteen of the 23 patented lode claims in the Jualin group cover private surface estate only. The mineral estate to these 14 patented lode claims located within the U.S. Mineral Surveys is owned by the State of Alaska, the mineral rights to which are secured by a State of Alaska upland mining lease. Coeur Alaska also controls the properties comprising the Jualin group, under a lease agreement with Hyak Mining Company.

The federal unpatented lode claims are maintained by the timely annual payment of claim maintenance fees, which are $165.00 per claim, payable to the United States Department of the Interior, Bureau of Land Management on or before September 1. State of Alaska mining claims and upland mining leases are maintained with fees and filings to the Alaska Department of Natural Resources, Division of Mining, Land and Water and the Juneau Recorder’s Office. These fees range from $35–$680 per claim, depending on the size and age of the claim. Annual labor in the amount of $100 or $400 per State mining claim, depending on the size of the claim, must be performed or a cash payment in-lieu of the performance of that labor must be paid to the State each year. The patented lode claims are private land and therefore not subject to federal claim maintenance requirements. However, as private land, they are subject to property taxes assessed by the Borough and City of Juneau, Alaska, which are due annually on or before September 30 each year.

The Kensington Operations hold all necessary surface and water rights to support the life-of-mine (LOM) plan.

Coeur Alaska has an agreement with the Hyak Mining Company (Hyak), as amended August 5, 2005, and further amended July 1, 2009, and October 24, 2013 over the Jualin group claims area (the Hyak Lease). The current Hyak Lease period, which is the second term of the lease, commenced on August 5, 2020 and ends on August 5, 2035. If production occurs from the leased premises, a 5% net returns royalty on production as defined by the Hyak Lease, is due, unless the amount of the net returns royalty is less than the adjusted advance minimum royalty. If the net returns royalty is less, then the advance minimum royalty is paid instead of the net returns royalty. The Hyak Lease will continue after 2035, provided mining and production are actively occurring within and from the leased premises.

Hyak entered into a working agreement, with an option to purchase, dated July 14, 1982, with Benjamin D. Fremming, Douglas L. Gregg, Thomas E. Schultz, William A. Wondriska, and Mr. and Mrs. Merrill J. Zay over certain patented lode mining claims, Federal unpatented lode and mill site claims and State of Alaska mining claims. The Hyak Lease incorporates the Hyak working agreement, and the rights awarded under the working agreement apply to the Hyak Lease. Coeur Alaska has an agreement with Hyak covering a State of Alaska Upland Mining Lease and separate agreements with individuals over a portion of the Falls and Diana patented lode claims within the Jualin group.

Rights for ancillary infrastructure at Slate Creek Cove are secured through a 25-year State of Alaska Tideland Lease, granted in 2011. Coeur Alaska controls a 7.2-acre parcel of land, consisting of a lodge and marine moorage facilities, under a lease agreement, as amended, with Yankee Cove Development, LLC, a Nevada limited liability company.

The State of Alaska granted a right-of-way permit to the Comet Beach facility on April 15, 1995; this was amended on August 15, 1995. The permit had a 30-year term on grant, expiring 2025, and is subject to an annual payment that is due on or before April 15.

Coeur Alaska holds a 10-year public, non-exclusive easement and right-of-way, granted in 2016, from the State of Alaska, Department of Transportation and Public Facilities and Department of Natural Resources authorizing construction and operation of the Jualin Mine Road from Slate Creek Cove to the Jualin Mine site for purposes of limiting public access and improving access to the Kensington operations.

Coeur Alaska acquired 100% ownership of the Kensington Group on July 7, 1995 from Echo Bay Mines Ltd. and Echo Bay Alaska (collectively Echo Bay). Under the acquisition agreement, Coeur Alaska is obligated to pay Echo Bay or its successors a scaled net smelter return royalty on 1 M troy ounces of gold production, after Coeur Alaska recoups the $32.5 million purchase price, plus (i) its construction and development expenditures incurred after July 7, 1995 in connection with placing the property into commercial production, and (ii) certain operating exploration and development costs thereafter. The royalty ranges from 1% at $400/oz gold prices to a maximum of 2½% at gold prices above $475/oz.

A credit agreement between Coeur, certain subsidiaries of Coeur (including Coeur Alaska), and Bank of America, N.A., was entered into on September 29, 2017, as amended (the “Credit Agreement”), under which a security interest in the Kensington property was granted securing a loan of up to $300M.

| 1.5 | Geology and Mineralization |

The deposits that comprise the Kensington Operations are considered to be examples of mesothermal vein-style, or orogenic-style gold deposits.

The Berners Bay mining district forms the northern end of the approximately 200-km-long Juneau gold belt and is situated along the western margin of the Coast Mountains. The district is underlain by Triassic mafic metavolcanic rocks of the Wrangellia Terrane. A Cretaceous stock, the Jualin diorite, intrudes the western margin of the Wrangellia Terrane. Both the Triassic metavolcanic rocks and the Jualin diorite are overlain by Cretaceous-aged metasedimentary and metavolcanic rocks of the Treadwell Formation of the Gravina Belt to the southwest. The unconformity between the Jualin diorite and the Gravina Belt metasedimentary rocks is marked by a Cretaceous conglomerate.

All significant gold vein deposits are hosted in the Jualin diorite between the northwest-trending, first-order Coastal Shear Zone, a broad chlorite-bearing ductile, and syn-metamorphic shear zone that passes through tonalite of the Coast Plutonic complex approximately 1.2 miles east of the diorite, and the Gastineau Shear Zone, which is the largest of a set of ductile shear zones that pass through the Gravina belt to the southwest. A zone of second- and third-order shears, termed the Kensington Megashear zone, appears to be the most significant influence on mineralized vein systems in the district. Brittle faults and third-order shear zones host discrete extensional quartz–carbonate veins and gold mineralization.

Discrete vein systems are defined by one or more through-going, fault-filling quartz veins. Discrete veins typically host the highest-grade gold mineralization, dip moderately to steeply east, and typically range between a few inches to several feet in width. Extensional veins consist of zones of numerous veins that mostly dip steeply to moderately west, but are contained within an overall east-dipping system, and occur adjacent to, or at, terminations of fault-fill veins.

Vein mineralization is characterized by gold and gold–silver telluride minerals with minor associated native gold. Most of the gold is contained in calaverite (AuTe2), which occurs in association with native gold as inclusions in and interstitial to pyrite grains and in microfractures in pyrite.

| 1.6 | History and Exploration |

Prior to Coeur’s acquisition of a 100% interest in the Project, the following companies were active in the area between 1978–1993: Hyak, Homestake Mining Co.; Placid Oil Company (Placid Oil); Bear Creek Mining Company (Bear Creek); International Curator Resources (Curator); Granges Exploration Inc.; Kensington Joint Venture (Coeur Alaska and Echo Bay); and Placer Dome U.S. Inc. (Placer). Work conducted included claim staking, geologic mapping and sampling, core drilling, construction of an access road, and completion of a feasibility study.

Coeur acquired its 100% interest in 1995. Work completed since the acquisition includes surveying and aerial photography, airborne magnetic geophysical survey, helicopter magnetic survey feasibility studies, studies in aid of permitting, mine and facility construction, and mine operations.

The Project area is a target-rich environment given that it is an orogenic gold system and the volcanic feeder at the bottom of the system has not been discovered. This means that veins likely continue deeper than is currently drilled. Using this interpretation, it becomes necessary to test offsetting relationships whenever it appears that a vein is closed down dip. Currently there are plans to continue resource infill and expansion drilling on all the current mining prospects. Two prospects are waiting on the most recent drilling results and subsequent interpretation but will likely require additional testwork.

The drill database for the Project area contains 7,182 core drill holes (2,386,698 ft). Drilling that supports the mineral resource estimates consists of 4,600 core holes (2,119,138 ft).

Drilling that is excluded from estimation support includes production stope and utility holes, drill holes that have known spatial issues due to missing survey data, and drill holes that did not reach final depth.

Core loggers visually collect lithological intercepts, alteration type and intensity, mineralization type and concentration, vein composition, style, density, and structural type and intensity. Maximum and minimum intercept angles are collected for all planar features. During core logging core recovery and rock quality designation (RQD) measurements are collected. Core is photographed before sampling but after logging.

Surface collar surveys are taken using an RTK global positioning system (GPS) SPS 985 instrument. Underground surveys are recorded using a Trimble SPS 930. Before the widespread adoption of GPS for collar surveying, some collar shots were taken by triangulating off the AK NAD 27 SP Z21 grid topographic map. Downhole surveys were performed with Sperry Sun-type, Fotobor, Reflex Maxibor, Reflex Gyro, Axis Champ, and most recently IDS Gyromaster tools.

Drilling is oriented as practicable to intersect the vein systems, given the underground development available to act as drill stations. Typically, the drilled intercept width is longer than the true width.

Channel sampling has been conducted since 2014, taking one or two 1 ft horizontal samples from rib-to-rib. Core sample intervals are based on the distribution of vein density, vein type, mineralization, and any other geological feature needing assay definition. The geologist marks sample intervals, ranging from 1–5 ft in length. Whole core samples are taken from production drill holes (infill and stope holes). Half-core samples are taken from all exploration drill holes, where geologically warranted.

Density data determinations were collected using both water submersion (2010 drilling program) and more recent gas pycnometer (2020–present).

Independent primary and umpire laboratories used include Barringer, Bondar-Clegg, Cone Geochemical, ALS Chemex, American Assay Laboratories, Inspectorate America Corporation, Pinnacle Analytical Laboratories, Acme Laboratories, McClelland Laboratories and Bureau Veritas Commodities Canada, Ltd. Laboratories used early in Project exploration and development programs were not accredited; later laboratories had ISO9001 or ISO17025 accreditations. The non-independent Kensington mine assay laboratory was also used.

Sample preparation for channel and stope definition drill samples consisted of crushing to 80% passing a 12-mesh screen and pulverizing to 90% passing a 140-mesh screen. Core samples were initially crushed to 80% passing 10 mesh (2 mm), later to 70% passing 10 mesh (2 mm), and pulverized to 85% passing 200 mesh.

Gold analyses included 30 g fire assay with gravimetric finish or 30 g fire assay with atomic absorption spectroscopy (AAS) finish. Over-limit assays (>0.292 oz/st Au) were by fire assay with a gravimetric finish. Over-limit assays >1 oz/st were run by metallic screening until August 2018 when this practice was discontinued. Multi-element analyses included: four-acid digestion with inductively-coupled plasma atomic emission spectroscopy (ICP-AES) finish, 33-element suite; and four-acid digestion with ICP-mass spectrometry (ICP-MS) finish, 48-element suite, and multi-acid digest with ICP-MS/emission spectroscopy finish, 45 element suite.

Historically, quality assurance and quality control (QA/QC) procedures consisted of routine check assays of original pulps, check assays of duplicate pulps from coarse rejects and use of geochemical blanks to determine contamination during sample preparation. Metallic-screen analysis was performed prior to August 2018 to check for coarse gold. Current procedures include insertion of custom certified reference materials (CRMs), blanks, and duplicates (field, crush, pulp, and analytical). Field duplicates are taken only for exploration core. Insertion rates are as follows: insertion rates of 5% for standards, 5% for blanks, and 2.5% for duplicates. Check assays were selected at 5–10% of sample assays received monthly and were sent to an independent ISO certified secondary analytical laboratory for analysis. The QA/QC data are acceptable to support mineral resource estimation.

Data collected are stored in an acQuire Geologic Information Management System. The system stored traditional drill hole data (collar location, orientation, downhole survey, assay, and documentation), but was also used to store mine development sampling, surface exploration sampling, and channel sampling. Data are subject to regular backup.

Data verification included internal and external database audits. Drill collar surveys and downhole surveys are viewed in plan and section and checked against development workings. Contractor shift reports are compared to actual total drill hole footages. Core logging data and core photos are checked for completeness. Assay data and QA/QC data are reviewed. Data that have not been reviewed and passed QA/QC analysis do not pass the verification process. Once all data are complete and have been reviewed by the responsible persons, they are reviewed by a senior geologist and signed off on by the Chief Geologist or their designate and locked to further editing.

The QP

personally undertook QA/QC verification, participated in programs to verify drill data prior to mineral resource estimation, checked selected gold assay data, conducted drill hole lockdown, including checks of assay certificates, collar and downhole surveys, geology, and QA/QC reports, and signed off on 2015–present definition drill holes and the 2021 drilling.

The QP is of the opinion that the data verification programs for Project data adequately support the geological interpretations, the analytical and database quality, and therefore support the use of the data in mineral resource and mineral reserve estimation, and in mine planning.

| 1.9 | Metallurgical Testwork |

Independent metallurgical testwork facilities used over the Project life, where recorded, included Pittsburgh Minerals and Environmental Technology, Inc., Cannon Microprobe, SGS Vancouver, Colorado Minerals and Research Institute, Maxim Technologies, Inc., Dawson Metallurgical Laboratories, Inc., Knelson Research & Technology Center, Hazen Research, Inc., and G & T Metallurgical Services Ltd. The Kensington Operations have an on-site analytical laboratory that assays concentrates, in-process samples, and geological samples. The on-site metallurgical laboratory is used for testing flotation reagents, grind analysis, and characterizing the behavior of new ores. The laboratory is not independent.

Gold in the Kensington deposit is present as calaverite (AuTe2), and in the form of free gold or microscopic, “invisible” gold. The relationship of calaverite to pyrite is either as a rind, an inclusion, or a separate, discrete particle. Particles range from 3–20 µm in size. Prior to mill construction at Kensington, six different companies conducted extensive metallurgical testing, including comminution gravity separation, flotation (flash flotation, locked-cycle testing, and various reagent additions) and cyanidation of concentrates. Test results were used as a guideline for plant design. Metallurgical test results were consistent in the recommended methods of process design, extraction and recovery estimates.

Gold in the Jualin deposit is in the form of native gold and highly liberated gold minerals, and exhibits high gold–sulfide associations. Tests included flotation using similar operating conditions to those in use in the Kensington plant flotation circuit, and gravity testwork. Flotation recovery results that averaged 95.8% recovery indicated that the existing circuit could recover the Jualin material with minimal gold losses. However, it was decided to refurbish the existing Knelson concentrator in the plant in case material from Jualin did not mirror the results obtained from the Jualin Vein #4 mineralization.

Recovery factors estimated are based on appropriate metallurgical test work and confirmed with production data. Recovery factors are appropriate to the mineralization types and the selected process route. The LOM gold recovery forecast is 95.3%.

Based on extensive operating experience and testwork, there are no known processing factors of deleterious elements that could have a significant effect on the economic extraction of the mineral reserve estimates.

| 1.10 | Mineral Resource Estimation |

| 1.10.1 | Estimation Methodology |

All deposits were subject to exploratory data analysis, which could include histograms, cumulative probability plots, box and whisker plots, and contact analysis.

The Kensington resource model currently contains a total of 36 estimation domains that were based on combination of lithology and mineralization. The Eureka resource model has two estimation domains. The Raven resource model has five estimation domains. The Jualin resource model has four estimation domains. The Elmira resource model has three estimation domains. Each estimation domain is based on lithology and mineralization.

The estimation domains that inform the Elmira, Raven, and Jualin resource estimates are generated by selecting quartz vein intercepts regardless of the grade. Each lithological intercept is visually checked by reviewing photos of the drill core. Boundaries of each domain are snapped as close to the lithological breaks as possible. Each domain and the diorite host rock have a respective density factor. If the block is outside of a mineral estimation domain, the block is given the density determined for the diorite host rock. If inside the domain, it is given the determined density for that estimation domain.

Grade caps were determined by a study of the exploratory data analysis, general statistics, histograms, log normal probability plots, and reconciliation data. Depending on the domain, caps could range from 0.3–6 oz/st. For the Kensington and Eureka resource models, drill data were composited at 5 ft down-the-hole intervals by estimation domain using the run-length method. When compositing for Elmira, Raven, and Jualin, full vein width composites were created using the run-length method to accurately represent the full vein grade.

For the Kensington deposit, variograms were calculated for separate groupings of domains or zones because individual domains had insufficient number of samples to construct a valid variogram model. The resulting variogram for each zone was applied during estimation for all domains within each zone. Downhole variograms for the narrow vein deposits at Elmira, Jualin, and Raven were not possible due to the use of single, vein-width composites.

The Kensington model was sub-blocked. Gold grades were estimated into parent blocks using ordinary kriging (OK). Blocks within each domain were estimated using only composites from within that domain. Eureka was estimated using inverse distance weighting to the second power (ID2). Elmira, Jualin, and Raven, being narrow vein deposits using single vein-width composites, required a seam model (2D) to better represent each of the estimation domains. These deposits were estimated using ID2.

The block models were validated using some or all of the following methods: visually by stepping through sections and comparing the raw drill data and composite data with the block values; comparison of model statistics to drill data; swath plots; and mill to model reconciliation.

For all deposits other than the #4 Vein at Jualin, the classification of blocks as measured, indicated and inferred was based on drill hole spacing, and set numbers of informing drill holes and samples. All of the #4 Vein was classified as indicated because of the consistent geology of the discrete vein and the available production and reconciliation data.

For each resource estimate, an initial assessment was completed that assessed likely infrastructure, mining, and process plant requirements; mining methods; process recoveries and throughputs; environmental, permitting, and social considerations relating to the proposed mining and processing methods; proposed waste disposal; and technical and economic considerations in support of an assessment of reasonable prospects of economic extraction. Mineral resources are confined within conceptual underground mineable shapes. The estimate assumed that the preferred mining method will be longhole stoping, and that the minimum mining width was 5 ft.

The gold price used in resource estimation is based on long-term analyst and bank forecasts, supplemented with research by Coeur’s internal specialists. The estimated timeframe used is the three-year LOM that supports the mineral reserve estimates. The forecast is US$1,700/oz for the mineral resource estimate. The QP considers this price to be reasonable.

The mineral resources are reported using variable gold cut-off grades that range from 0.120–0.175 oz/st Au.

| 1.10.2 | Mineral Resource Statement |

Mineral resources are reported using the mineral resource definitions set out in SK1300 and are reported exclusive of those mineral resources converted to mineral reserves. The reference point for the estimate is in situ. All models were depleted through 2021, planned mining shapes were used for the month of December as depletion was run on December 7, 2021.

Measured and indicated mineral resources are summarized in Table 1‑1 and inferred mineral resources in Table 1‑2.

The Qualified Person for the estimate is Ms. Rae Keim, P.Geo., a Coeur Alaska employee.

| 1.10.3 | Factors That May Affect the Mineral Resource Estimate |

Factors that may affect the mineral resource estimates include: metal price and exchange rate assumptions; changes to the assumptions used to generate the gold cut-off grade; changes in local interpretations of mineralization geometry and continuity of mineralized zones; changes to geological and mineralization shape and geological and grade continuity assumptions; density and domain assignments; changes to geotechnical, mining and metallurgical recovery assumptions; changes to the input and design parameter assumptions that pertain to the assumptions for underground mining constraining the estimates; assumptions as to the continued ability to access the site, retain mineral and surface rights titles, maintain environment and other regulatory permits, and maintain the social license to operate.

Table 1‑1: Summary of Gold Measured and Indicated Mineral Resources at December 31, 2021 (based on US$1,700/oz gold price)

Confidence Category | Tons

(st x

1,000) | Gold

Grade

(oz/st) | Contained Ounces

(oz x 1,000) | Gold Cut-off

Grades

(oz/st) | Metallurgical

Recovery

(%) |

| Measured | 2,860 | 0.23 | 660 | 0.120–0.175 | 95 |

| Indicated | 1,263 | 0.26 | 323 | 0.120–0.175 | 95 |

| Total measured and indicated | 4,124 | 0.24 | 983 | 0.120–0.175 | 95 |

Table 1‑2: Summary of Gold Inferred Mineral Resource Statement at December 31, 2021 (based on US$1,700/oz gold price)

Confidence Category | Tons

(st x

1,000) | Gold

Grade

(oz/st) | Contained

Ounces

(oz x 1,000) | Gold Cut-off

Grades

(oz/st) | Metallurgical

Recovery

(%) |

| Inferred | 1,915 | 0.24 | 455 | 0.120–0.175 | 95 |

Notes to accompany mineral resource tables:

| 1. | The mineral resource estimates are current as of December 31, 2021 and are reported using the definitions in Item 1300 of Regulation S–K (17 CFR Part 229) (SK1300). |

| 2. | The reference point for the mineral resource estimate is in situ. The Qualified Person for the estimate is Ms. Rae Keim, P.Geo., a Coeur Alaska employee. |

| 3. | Mineral resources are reported exclusive of the mineral resources converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| 4. | The estimate uses the following key input parameters: assumption of conventional longhole underground mining; gold price of US$1,700/oz; reported above a variable gold cut-off grade that ranges from 0.120–0.175 oz/st Au; metallurgical recovery assumption of 95%; gold payability of 97.5%, variable mining costs that range from US$90.91–150.73/st mined, process costs of US$46.93/t processed, general and administrative costs of US$38.83/t processed, and concentrate refining and shipping costs of US$60.00/oz sold. |

| 5. | Rounding of short tons, grades, and troy ounces, as required by reporting guidelines, may result in apparent differences between tons, grades, and contained metal contents. |

| 1.11 | Mineral Reserve Estimation |

| 1.11.1 | Estimation Methodology |

Mineral reserves were converted from measured and indicated mineral resources. Inferred mineral resources were set to waste. The mine plans assume underground mining using longhole open stoping, trackless equipment and combination of cemented rock fill (CRF), waste, and paste backfill. Target mining rates are capped at approximately 2,000 tons per day, which is the permitted capacity limit.

Estimates of development rate are based on measured advance rates in Kensington, Raven, Jualin, and Elmira and any expected variation from manpower or equipment considerations. Stope production rates are based on measured values of production since the start of operations.

Transverse stoping is the main extraction method used in the Main Kensington center area. Stope outlines are created on 40 ft centers using the standard level spacing (75 ft in Kensington, 35–50 ft in Raven, 35 ft in Jualin, and 60 ft in Elmira) and the reserve model. Longitudinal stope designs exist in the fringe regions of Zone 10, much of Zones 12, 30, 35, and 50, much of Elmira, and all of Raven area and represent a majority of the tons in the LOM plan. These areas of longitudinal stoping are too narrow (>30 ft) to convert to transverse stoping, based on the requisite infrastructure required. Together with the conventional transverse and longitudinal stopes, there are also some blind back stopes, depending on the reserve model and stoping horizon.

For Kensington and Elmira, a dilution factor of 15% was used by for mine planning purposes. For Jualin and Raven, a dilution factor of 15% for development and 20% for mining was used in the mine plans to account for expected narrow vein longitudinal stoping. Unintentional mining of paste backfill or CRF has not been excessive to date, though instances of sloughing of material during and post blast have been observed in secondary stopes, adding 1–3% additional waste dilution in a few select stopes. A dilution grade of 0.063 oz/st Au was calculated and has subsequently been used for external dilution applications for the Kensington and Elmira stopes. A dilution grade of 0.0 oz/st was used for stopes at Raven and Jualin due to minimal or no mineralization extending past the vein itself.

Cut-off grades are determined through historical costing for Kensington, Raven, and Jualin. Mineral reserve cut-off grades range from 0.142–0.201 oz/st Au. Some blocks are classed as incremental material, which does not include the G&A or mining costs, as those costs are incurred regardless of what the resource classification may be. As such, this material must be removed from the mine and the consideration is whether it goes to the waste pile or to a low-grade stockpile that only carries the mining and refining costs. The intent of this material handling designation is for the material to only be processed when mill tonnage needs to be sustained, but where it does not offset other above cut-off grade material.

The gold price used in mineral reserve estimation is based on analysis of three-year rolling averages, long-term consensus pricing, and benchmarks of what other peer companies used for pricing over the past year. The price used is US$1,400/oz for gold for the mineral reserve estimate. The QP considers this price to be reasonable.

| 1.11.2 | Mineral Reserve Statement |

Mineral reserves have been classified using the mineral reserve definitions set out in SK1300. The reference point for the mineral reserve estimate is the point of delivery to the process plant. Mineral reserves are reported in Table 1‑3 that are current as at December 31, 2021. Estimates are reported on a 100% ownership basis.

The Qualified Person for the estimate is Mr. Peter Haarala, RM SME, a Coeur employee.

| 1.11.3 | Factors That May Affect the Mineral Reserve Estimate |

Factors that may affect the mineral reserve estimates include variations to the following assumptions: the commodity price; metallurgical recoveries; operating cost estimates; geotechnical conditions; hydrogeological conditions; geological and structural interpretations; changes to the input and design parameter assumptions that pertain to the assumptions for the mineable shapes constraining the estimates; changes to dilution assumptions that can impact grade and operating costs; the inability to maintain, renew, or obtain environmental and other regulatory permits, to retain mineral and surface right titles, to maintain site access, and to maintain the social license to operate.

Table 1‑3: Summary of Gold Proven and Probable Mineral Reserve Statement at December 31, 2021 (based on US$1,400/oz gold price)

Confidence Category | Tons

(st x 1,000) | Gold Grade

(oz/st) | Contained ounces

(oz x 1,000) | Gold Cut-off

Grades

(oz/st) | Metallurgical

Recovery

(%) |

| Proven | 656 | 0.19 | 125 | 0.142–0.201 | 95 |

| Probable | 690 | 0.20 | 136 | 0.142–0.201 | 95 |

| Total proven and probable | 1,346 | 0.19 | 261 | 0.142–0.201 | 95 |

Notes to accompany mineral reserve tables:

| 1. | The Mineral reserve estimates are current as of December 31, 2021 and are reported using the definitions in Item 1300 of Regulation S–K (17 CFR Part 229) (SK1300). |

| 2. | The reference point for the mineral reserve estimate is the point of deliver to the process plant. The Qualified Person for the estimate is Mr. Peter Haarala, RM SME, a Coeur employee. |

| 3. | The estimate uses the following key input parameters: assumption of conventional underground mining; gold price of US$1,400/oz; reported above a gold cut-off grade of 0.142-0.201 oz/st Au; metallurgical recovery assumption of 95%; gold payability of 97.5%, variable mining costs that range from US$90.91–150.73/st mined, process costs of US$46.93/st processed, general and administrative costs of US$38.83/st processed, and concentrate refining and shipping costs of US$60.00/oz sold. |

| 4. | Rounding of short tons, grades, and troy ounces, as required by reporting guidelines, may result in apparent differences between tons, grades, and contained metal contents. |

The Kensington Operations use conventional underground equipment and mining methods. The mine has been operating since July 2010. The remaining mine life is three years, to 2024.

Geotechnical conditions underground at Kensington are excellent. The interaction of the mining sequence on the overall stability of the hanging wall has been investigated by an outside geotechnical expert. Minor non-reportable occurrences have taken place within open stopes where personnel are not exposed. Regular additional evaluations by an outside geotechnical expert are ongoing.

Raven workings have been extended, using guidance from an outside geotechnical expert, with excellent results to date. The existing ground support guidelines were confirmed to be appropriate for use in the Jualin deposit.

There are few hydrogeological aspects to be considered beyond natural inflow of water to the workings within the Kensington and Raven orebodies. This inflow is monitored, and the water is captured within the workings to be either treated, or discharged, as per Coeur’s permit requirements. The Jualin deposit is near surface, with several faults and mineralized veins having surface expression. These structures collect runoff water and, together with the historic Jualin mine workings acting as a reservoir, channel water to the areas under mining development.

The primary access to the Kensington and Raven underground mine areas is via the Kensington Portal at the 964 elevation. This portal is the primary ingress/egress point for all equipment and personnel to access the Kensington and Raven workings. There is a secondary portal at 792-elevation on what is known as the Comet Beach side, geographically located on the Lynn Canal side of the mountain. The Jualin deposit is currently accessed by a decline collared from surface at the 926 elevation.

Stoping and paste backfill mining methods were selected and implemented based on the orebody location, ground conditions, and geological settings. Mining design assumptions for each mining region are typically standardized for each area and mining method assumed. Offsets from the ore, required infrastructure, and support are based on industry standards and best practices, modified by specific location required needs, and operational requirements to safely advance development and production in each area with a minimum of wasted development to maximize efficiency.

The mine production schedule is based on a maximum mill throughput rate of 2,000 st per day. Coeur typically processes between 1,750–1,950 st/day with a waste stream of about 10% rejected as a coarse pebble reject, which is then passed through a sorter to further extract ore grade material for re-feed back into the mill.

Primary ventilation in the Kensington and Raven mine areas is controlled by two fans located in the Comet drift, which pull air from the Kensington/process plant side, near the mill bench, straight through the mountain and exhaust out the Comet side. Ventilation raises throughout the mine assist in distributing airflow. Primary ventilation of the Jualin mine area is accomplished with a duct-mounted fan located at the Jualin portal and an in-line booster at the J0625 level, which direct air through to the working areas. The air exhausts out though the workings back to the portal via the ramp and up through a series of vent/escape raises exhausting through a 10 ft diameter bored raise to surface.

Backfill is a combination of cemented paste fill, CRF, and straight waste fill.

The Kensington underground infrastructure consists of the main underground shop, the paste plant, and electrical infrastructure. The Raven and Elmira deposits share underground infrastructure and portal access with Kensington. Jualin shares surface infrastructure with Kensington. However, Jualin is accessed from its own portal.

Major mining equipment includes the following equipment types: loaders, haul trucks, jumbo drills, longhole drills, and bolters. Ancillary support equipment consists of Getman and MacClean flatbeds, explosives loading vehicles, zoom boom forklifts, Kubota RTV’s and tractors, pickups, compressors, and other standard support equipment.

The mining/maintenance personnel requirement for the remaining LOM averages 169 persons.

The process plant design was based on a combination of metallurgical testwork, study designs, and industry standard practices, together with debottlenecking and optimization activities once the mill was operational. The design is conventional to the gold industry and has no novel parameters.

The Kensington Operations use a flotation mill to recover gold from sulfide-bearing rock. Crushing and milling facilities are located directly south of the Jualin Portal. On the portal bench, ore is segregated by grade and blended before being fed to the two-stage, closed-circuit crushing plant. Once crushed, ore is fed to a ball mill and then to a flotation circuit consisting of two rougher cells and four scavenger cells. Final cleaner concentrate reports to a concentrate thickener; flotation concentrates are thickened and filtered to approximately 10% moisture. The final product is a gold concentrate. The mill throughput was increased from a previous maximum of 69 st/hr in 2012 to 84 st/hr.

The mill requires approximately 1.5 to 2.0 MW of power to operate at full capacity. Currently, there is no expectation for this power demand to increase. Recycled water for use in the process plant is sent from the paste plant, the concentrate and tailings thickeners, and water reclaimed from the tailings treatment facility (TTF). Johnson Creek is a back-up fresh water source for the mine site, but extraction is subject to permit conditions.

Consumables used in processing include potassium amyl xanthate; methyl isobutyl carbinol (MIBC); AERO 3894 (promoter); MaxGold 900 (promoter); steel (grinding media); and Z-Flocc 2525.

The Slate Creek Cove Marine Terminal Facility and a 5.7-mile all-weather access road from the terminal to the mine provides all personnel and materials access to the mine. The Slate Creek Cove Marine Terminal Facility includes docking capabilities for main line ocean-going barges, personnel ferries, float planes, ramp barges, and landing craft.

Site infrastructure is located at both the Kensington and Jualin deposit areas:

| • | Surface facilities at Kensington include 2.3 miles of all-weather access road from Comet Beach to the Comet Portal (850 Level), the mine water treatment facility with two settling ponds, and a development rock storage facility. Underground infrastructure includes a paste backfill plant, maintenance shop, warehouse, explosive storage, dewatering, and ventilation. |

| • | Surface facilities at Jualin include a 375-person accommodation camp, dining facility, administration building with medical clinic, warehouse, run-of-mine ore stockpile, crusher and flotation mill, and the TTF at Lower Slate Lake. The Kensington Tunnel, completed in July 2007, connects the Jualin mill facilities to the orebody. The tunnel is the primary artery for ore haulage, materials transport, and personnel access. The tunnel includes 9,660 ft of development from the Kensington Portal to the Kensington ramp system. |

Kensington has several existing waste rock stockpiles onsite including at Comet, Pit 1, Pit 4, Pit 7, and the Portal Pad. With the approval of Coeur Alaska’s Plan of Operations Amendment 1 (POA-1), expected in early 2022, Coeur will be allowed to expand the existing Comet, Portal, and Pit 4 stockpiles and create one new stockpile.

The existing TTF is currently operating at Stage 3. Coeur has initiated engineering work for a possible Stage 4 dam raise if additional reserves are added. The current Stage 3 TTF has capacity to accommodate the remaining LOM storage requirements. Tailings will continue to be backfilled underground as paste to reduce the need for additional storage capacity at the TTF

Groundwater captured in the underground mine workings is conveyed to the Comet mine water treatment plant and treated and discharged to Sherman Creek. Surface water runoff and mill process waters that enter the tailings treatment facility are treated and discharged to the east fork of Slate Creek. The Comet water treatment facility consists of two water plants and a tertiary plant that supports the primary plants during high treatment demand periods.

Electrical power at Kensington is generated by four diesel engines located inside the powerhouse building on the north end of the mill bench. Power use continues to increase with current peak winter loads at 90–92% of three-generator capacity. Power capacity is sufficient for the LOM.

| 1.15 | Markets and Contracts |

The Kensington Operations produce flotation concentrate containing both gold and silver. The concentrate is highly desirable due to its elevated gold content and lack of deleterious elements. Concentrate is exported out of Seattle, Washington and delivered to smelters in Europe and Asia where it is consumed, processed, and the valuable metals extracted.

Concentrate is sold directly to international commodity traders, who then sell onto smelters in Europe and Asia. Subject to the gold and silver content, gold is typically payable around 98%, and silver payable around 80%. There are typically no penalties for deleterious elements. Treatment charges, refining charges, and all other terms and conditions are typical and consistent with standard industry practice for such gold concentrates.

Coeur uses a combination of analysis of three-year rolling averages, long-term consensus pricing, and benchmarks to pricing used by industry peers over the past year when considering long-term commodity price forecasts.

Higher metal prices are used for the mineral resource estimates to ensure the mineral reserves are a sub-set of, and not constrained by, the mineral resources, in accordance with industry-accepted practice.

The long-term gold price forecasts are:

The economic evaluation uses gold price forecasts of US$1,750/oz for 2022 and 2023, and US$1,700/oz in 2024.

The QP considers the price forecasts to be reasonable.

Concentrate is barged in bags in containers from Slate Creek Cove in Berners Bay, Alaska to Seattle, Washington. The bags are then transloaded from barge containers into international containers for export out of Seattle to Europe and Asia. The typical cost to transport concentrate from Slate Creek Cove to Europe and Asia is around US$220 per wet metric tonne, subject to the destination and international ocean freight market conditions.

There are numerous contracts in place at the Project to support mine development or processing. Currently there are contracts in place to provide supply for all major commodities used in mining and processing, such as equipment vendors, power, explosives, cyanide, tire suppliers, contract mining, ground support suppliers, and drilling contractors. The terms and rates for these contracts are within industry norms. The contracts are periodically put up for bid or re-negotiated as required.

| 1.16 | Environmental, Permitting and Social Considerations |

| 1.16.1 | Environmental Studies and Monitoring |

Numerous baseline studies were performed in support of Project permitting. These included air, water, aquatic resources, geology, wildlife, soil, vegetation, wetlands, and cultural resources. Four environmental impact statement (EIS) documents were prepared, the most recent being a supplemental EIS in 2021.

Environmental monitoring at the site includes water quality, aquatic resource, tailings and waste rock geochemistry, wildlife, and stormwater.

| 1.16.2 | Closure and Reclamation Considerations |

A reclamation and closure plan has been prepared and approved by the governing agencies for the Project. The current plan was updated in 2021 and reflects current mining, mitigation, and site facilities.

Coeur conducts an annual review of its potential reclamation responsibilities company-wide. The total LOM cost for physical reclamation and long-term monitoring of the Kensington Operations is currently estimated to be US$23.7 M. Reclamation is anticipated to be completed three years following cessation of mining. Closure-related activities will continue until about 2055.

All required local, state, and federal permits for operation have been issued. Plan of Operations Amendment 1 (POA-1) was submitted to the Forest Service in 2018 and is currently under review by the local, state, and federal agencies. POA-1 will provide 5 Mst of additional waste rock storage and 4 Mst of additional tailings storage at site. A Final Supplemental Impact Statement was completed in July 2021 and the Final Record of Decision (ROD) is expected in early 2022.

| 1.16.4 | Social Considerations, Plans, Negotiations and Agreements |

Coeur has had a long and positive relationship with the community of Juneau and southeast Alaska. Coeur partners with many stakeholders, including national, regional, and state mining associations; trade organizations; fishing organizations; state and local chambers of commerce; economic development organizations; non-government organizations; and state and federal governments.

| 1.17 | Capital Cost Estimates |

Capital cost estimates are at a minimum at a pre-feasibility level of confidence, having an accuracy level of ±25% and a contingency range not exceeding 15%.

The cost estimates are based on a combination of first principal estimates, historic performance, and quotations.

All major capital construction projects needed to maintain consistent production and extraction of mineral reserves at the Kensington Operations were completed in 2013. Additional capital projects have been completed since 2013 to improve mill throughput, enhance power generation, and increase tailings capacity.

Capital development is a concurrent allocation of costs that are derived by taking the number of capital feet driven times the recorded weighted costs to drive those feet in the period they were driven. Both types of capital expenditures are sustaining and or improvement capital projects. Each project is selected for the current year of operation, based on the annual allocation of corporate capital funds, the effect the project has on production and or the internal rate of return.

Exploration capital is the cost associated with activities involving resource infill drilling and the conversion of those mineral resources to mineral reserves.

Capital projects envisaged in the LOM include: Elmira paste booster station engineering; heat recovery detailed design; TTF stage 4 engineering; POA1 construction of WRSFs; and water treatment plant sulfate removal

The total LOM capital cost estimate is US$47.6 M (Table 1‑4).

| 1.18 | Operating Cost Estimates |

Operating cost estimates are at a minimum at a pre-feasibility level of confidence, having an accuracy level of ±25% and a contingency range not exceeding 15%.

Operating costs are based on actual costs seen during operations and are projected through the LOM plan. Historical costs are used as the basis for operating cost forecasts for supplies and services unless there are new contract terms for these items. Labor and energy costs are based on budgeted rates applied to headcounts and energy consumption estimates.

The total LOM operating cost estimate is US$274.4 M (Table 1‑5).

| 1.19.1 | Forward-Looking Information Caution |

Results of the economic analysis represent forward- looking information that is subject to several known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those presented here.

Other forward-looking statements in this Report include, but are not limited to: statements with respect to future metal prices and concentrate sales contracts; the estimation of mineral reserves and mineral resources; the realization of mineral reserve estimates; the timing and amount of estimated future production; costs of production; capital expenditures; costs and timing of the development of new ore zones; permitting time lines; requirements for additional capital; government regulation of mining operations; environmental risks; unanticipated reclamation expenses; title disputes or claims; and limitations on insurance coverage.

Factors that may cause actual results to differ from forward-looking statements include: actual results of current reclamation activities; results of economic evaluations; changes in Project parameters as mine and process plans continue to be refined, possible variations in mineral reserves, grade or recovery rates; geotechnical considerations during mining; failure of plant, equipment or processes to operate as anticipated; shipping delays and regulations; accidents, labor disputes, and other risks of the mining industry; and delays in obtaining governmental approvals.

Table 1‑4: LOM Capital Cost Estimate (US$ M)

| Cost | 2022 | 2023 | 2024 | LOM |

| Capital mine development | 14.8 | 15.6 | 0 | 30.4 |

| Capital equipment (fixed and mobile) | 6.5 | 0.9 | 0 | 7.4 |

| Capital projects | 3.7 | 6.2 | 0 | 9.8 |

| Total Capital Expenditures | 25.0 | 22.6 | 0 | 47.6 |

Note: Numbers have been rounded.

Table 1‑5: LOM Operating Cost Estimate (US$ M)

| Cost | 2022 | 2023 | 2024 | 2025–2055 | LOM |

| Mining | 59.1 | 41.0 | 35.4 | 0 | 135.5 |

| Processing | 28.7 | 20.7 | 13.6 | 0 | 62.9 |

| G&A | 23.7 | 17.1 | 11.4 | 0 | 52.3 |

| Reclamation and closure | 7.4 | 6.4 | 3.6 | 6.2 | 23.7 |

| Total Operating Expenditures | 118.8 | 85.2 | 64.1 | 6.2 | 274.4 |

Note: Numbers have been rounded.

| 1.19.2 | Methodology and Assumptions |

Coeur records its financial costs on an accrual basis and adheres to U.S. Generally Accepted Accounting Principles (GAAP).

The financial costs used for this analysis are based on the 2022 LOM budget model. The economic analysis is based on 100% equity financing and is reported on a 100% project ownership basis. The economic analysis assumes constant prices with no inflationary adjustments.

The mineral reserves support a mine life of three years to 2024.

The NPV at a discount rate of 5% is $83.7 M. As the cashflows are based on existing operations where all costs are considered sunk, considerations of payback and internal rate of return are not relevant.

An annualized cashflow statement is provided in Table 1‑6. The active mining operation ceases in 2024. Closure costs are estimated to 2055; however, for presentation purposes, closure costs are shown in Table 1‑6 as occurring within 2025.

Table 1‑6: Annualized Cashflow Statement

| Summary | Units | 2022 | 2023 | 2024 | 2025–2055 | LOM Total |

| Gold price | US$/oz | 1,750 | 1,750 | 1,700 | 0.0 | 1,738 |

| Net revenue | US$ M | 183.2 | 128.6 | 94.9 | 0.0 | 406.7 |

| Total operating cost | US$ M | 118.8 | 85.2 | 64.1 | 6.2 | 274.4 |

| Operating cashflow | US$ M | 64.3 | 43.4 | 30.8 | (6.2) | 135.1 |

| Total capital expense | US$ M | 25.0 | 22.6 | 0.0 | 0.0 | 47.6 |

| Net cashflow | US$ M | 39.3 | 20.8 | 30.8 | (6.2) | 87.5 |

| Net present value | US$ M | 83.7 | | | | |

Note: Numbers have been rounded.

| 1.19.4 | Sensitivity Analysis |

The sensitivity of the Project to changes in metal prices, operating cost, capital cost, and grade assumptions was tested.

The Project is most sensitive to metal price and grade, less sensitive to operating costs, and least sensitive to capital costs (Table 1‑7).

| 1.20 | Risks and Opportunities |

Factors that may affect the mineral resource and mineral reserve estimates were identified in Chapter 1.10 and Chapter 1.11.3 respectively and discussed in more detail in Chapter 11 and Chapter 12.

Risks include:

| • | Commodity price increases for key consumables such diesel, electricity, tires and consumables would negatively impact the stated mineral reserves and mineral resources; |

| • | Labor cost increases or productivity decreases could also impact the stated mineral reserves and mineral resources, or impact the economic analysis that supports the mineral reserves; |

| • | Geotechnical and hydrological assumptions used in mine planning are based on historical performance, and to date historical performance has been a reasonable predictor of current conditions. Any changes to the geotechnical and hydrological assumptions could affect mine planning, affect capital cost estimates if any major rehabilitation is required due to a geotechnical or hydrological event, affect operating costs due to mitigation measures that may need to be imposed, and impact the economic analysis that supports the mineral reserve estimates; |

| • | The mineral resource estimates are sensitive to metal prices. Lower metal prices require revisions to the mineral resource estimates; |

| • | Assumptions that the long-term reclamation and mitigation of the Kensington Operations can be appropriately managed within the estimated closure timeframes and closure cost estimates; |

Table 1‑7: NPV Sensitivity

| Parameter | -30% | -20% | -10% | -5% | 0% | 5% | 10% | 20% | 30% |

| Metal price | 0 | 2.6 | 43.2 | 63.4 | 83.7 | 104.0 | 124.3 | 164.9 | 205.4 |

| Operating cost | 162.2 | 136.0 | 109.9 | 96.8 | 83.7 | 70.7 | 57.6 | 31.4 | 5.3 |

| Capital cost | 97.7 | 93.2 | 88.4 | 86.1 | 83.7 | 81.4 | 79.1 | 74.4 | 69.8 |

| Grade | 0 | 5.4 | 44.6 | 64.1 | 83.7 | 103.3 | 122.9 | 162.1 | 201.2 |

Note: Numbers have been rounded.

| • | Political risk from challenges to: |

| o | Coeur’s right to operate; |

| • | Changes to assumptions as to governmental tax or royalty rates, such as taxation rate increases or new taxation or royalty imposts. |

Opportunities include:

| • | Conversion of some or all of the measured and indicated mineral resources currently reported exclusive of mineral reserves to mineral reserves, with appropriate supporting studies; |

| • | Upgrade of some or all of the inferred mineral resources to higher-confidence categories, such that such better-confidence material could be used in mineral reserve estimation; |

| • | Higher metal prices than forecast could present upside sales opportunities and potentially an increase in predicted Project economics; |

| • | Ability to define additional mineralization around known veins through exploration; |

| • | Discovery and development of new exploration targets across the district; |

| • | Potential to find or gain access to new mineralization sources that could be processed at the existing Kensington process facilities. |

Under the assumptions in this Report, the operations evaluated show a positive cash flow over the remaining LOM. The mine plan is achievable under the set of assumptions and parameters used.

As the Kensington Operations is an operating mine, the QPs have no material recommendations to make.