QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.1(C)(1)

• DECEMBER ECONOMIC AND FISCAL UPDATE 2001 •

18 DECEMBER 2001

© Crown Copyright Reserved

ISBN 0-478-11822-8

Typeset by the Treasury

Printed and bound by PrintLink

(A division of Blue Star Print Group Ltd)

Wellington

Internet

This document will be made available on the New Zealand Treasury's Internet site.

The URL for this site is http://www.treasury.govt.nz

December Economic and Fiscal Update

| | | |

| Statement of Responsibility | | |

| Economic and Fiscal Overview | | |

| | Economic Outlook | | |

| | Fiscal Outlook | | |

| | Summary Tables | | |

Economic Outlook |

|

|

| | Short-term outlook | | |

| | Longer term outlook—2003/04 and beyond | | |

Fiscal Outlook |

|

|

| | Introduction | | |

| | Influences on the Operating Balance | | |

| | Tax Revenue | | |

| | Expenses | | |

| | SOE and Crown Entity Surpluses | | |

| | Influences on Net Worth and Debt | | |

| | Fiscal Indicators—Comparison with 2001 Budget | | |

| | Operating Balance Changes Since the 2001 Budget | | |

| | Budget Policy Decisions | | |

| | Capital Provisions | | |

| | New Zealand Superannuation Fund Contributions | | |

| | Full line-by-line consolidation | | |

Risks and Scenarios |

|

|

| | Introduction | | |

| | Economic Risks | | |

| | Economic Scenarios | | |

| | Fiscal Scenarios | | |

| | Fiscal Sensitivities | | |

Specific Fiscal Risks |

|

|

| | Introduction | | |

| | Contingent liabilities | | |

| | Specific fiscal risks | | |

Generally Accepted Accounting Practice (GAAP) Series Tables |

|

|

| | Forecast Financial Statements | | |

| | Reporting Entity as at 26 November 2001 | | |

| | Statement of Accounting Policies and Forecast Assumptions | | |

| | Notes to the Forecast Financial Statements | | |

Annex A: Tax Revenue Tables |

|

|

Annex B: Expense Tables |

|

|

Glossary of Terms |

|

|

Statement of Responsibility

On the basis of the economic and fiscal information available to it, the Treasury has used its best professional judgement in supplying the Minister of Finance with this Economic and Fiscal Update. The Update incorporates the fiscal and economic implications both of Government decisions and circumstances as at 26 November 2001 that were communicated to me, and of other economic and fiscal information available to the Treasury in accordance with the provisions of the Fiscal Responsibility Act 1994.

Dr Alan Bollard

Secretary to the Treasury

12 December 2001

This Economic and Fiscal Update has been prepared in accordance with the Fiscal Responsibility Act 1994. I accept overall responsibility for the integrity of the disclosures contained in this Update, and the consistency and completeness of the Update information in accordance with the requirements of the Fiscal Responsibility Act 1994.

To enable the Treasury to prepare this Update, I have ensured that the Secretary to the Treasury has been advised of all Government decisions and other circumstances as at 26 November 2001 of which I was aware and that had material economic or fiscal implications.

Hon Dr Michael Cullen

Treasurer and Minister of Finance

12 December 2001

1

Economic and Fiscal Overview

Economic Outlook

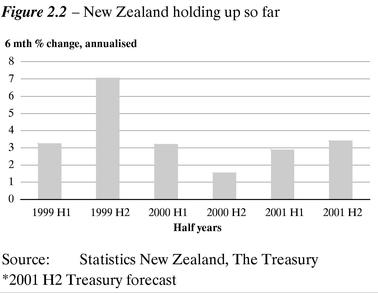

Despite the slowing global economy, New Zealand has continued to hold up well...

- •

- The extent of the global slowdown has been greater than anticipated. Despite this, the New Zealand economy has performed well through 2001.

- •

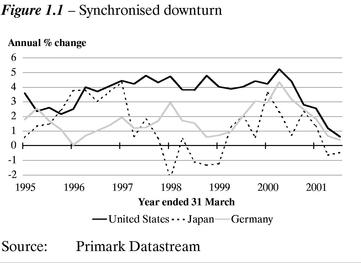

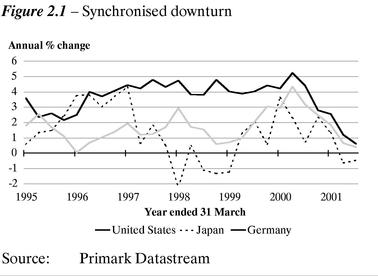

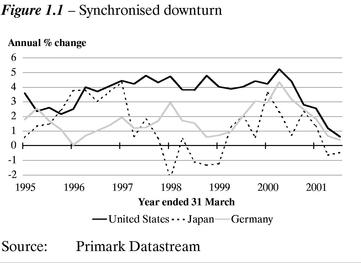

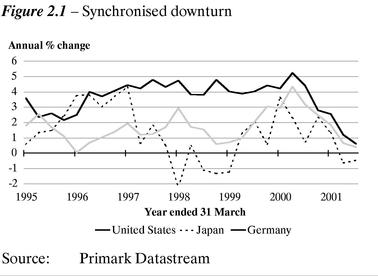

- Underlying the global weakness is the synchronised nature of the downturn, with both the US and Japanese economies slipping into recession, and growth slowing markedly across the Euro-zone. Following the terrorist attacks, sentiment around global growth prospects changed markedly for the worse.

- •

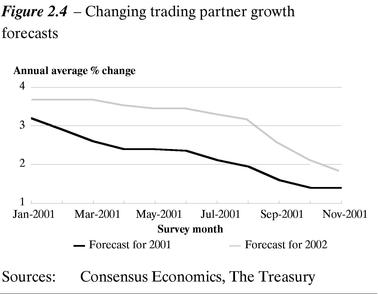

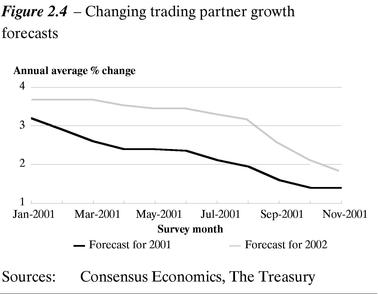

- Since the 2001 Budget was published, trading partner growth prospects have been revised down from 2.4% to 1.4% in 2001, and from 3.6% to 1.9% in 2002.

- •

- Consensus forecasts project a recovery in global growth in the second half of 2002.

- •

- Importantly for New Zealand, downward revisions to Australian growth prospects have been more moderate.

- •

- Looking forward, the New Zealand economy seems somewhat better positioned than in past downturns to cope with weaker world growth. Recent export success and employment and wage growth have led to strong farm and household income gains. Export commodity prices have held up well, the exchange rate is competitive, interest rates have been cut, and oil prices have fallen.

- •

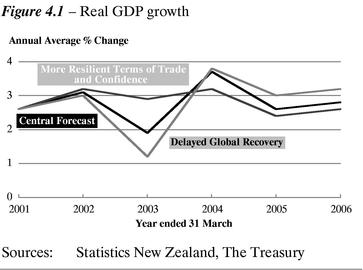

- In the year to March 2002, we expect New Zealand's GDP growth of 3.1% to outperform the OECD average.

...although weaker world growth will affect export prices, volumes and domestic confidence

- •

- Nevertheless, New Zealand is beginning to feel the impact of weaker world growth with lower tourist arrivals, weaker export prices, and negative shocks to domestic business and consumer confidence.

- •

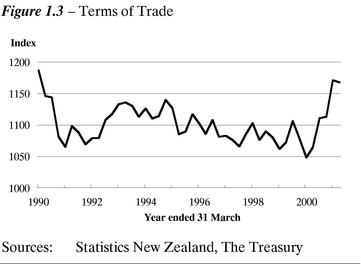

- Looking forward, we expect export demand and prices will continue to weaken over the short term, and for this drop in export income to flow through into the domestic economy. Underlying our Central Forecast is a considerable deterioration in the terms of trade as prices for our commodity exports are expected to fall away quicker than import prices.

- •

- Going into the first half of 2002, greater uncertainty and softening incomes have an impact on the willingness of both businesses and households to employ, spend and invest.

- •

- Firms may re-evaluate their investment decisions in light of increased uncertainty and expected lower income growth, and defer investment projects until global growth picks up from mid-2002. We therefore expect a fall in business investment over the next few quarters. However, recent high levels of capacity utilisation, healthy balance sheets, lower interest rates and the expectation of a recovery all provide some offset.

- •

- We also expect firms to be more cautious about taking on additional employees over the short term. However, the extent of the slowing in employment growth is likely to be more modest than in previous downturns given the relatively tight labour market. The unemployment rate is expected to peak at just under 6% in late 2002 and early 2003.

- •

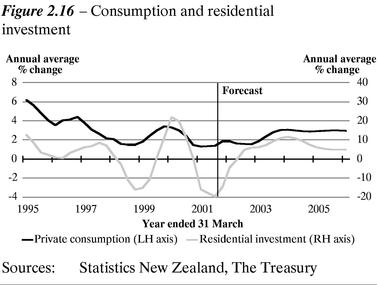

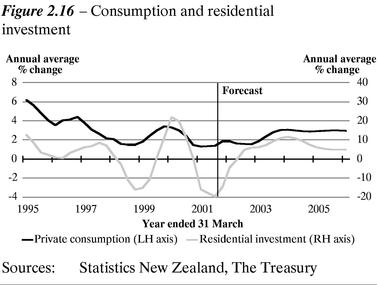

- Households also adopt a "wait and see" attitude and consumption is expected to remain subdued throughout 2002 as the labour market weakens. However, recent income gains, falling interest rates and falling oil prices suggest that consumption should remain positive.

Growth is expected to pick up towards the end of 2002, as global growth recovers

- •

- As global growth begins to recover in the second half of 2002, the New Zealand economy regains momentum in late 2002 as export growth resumes and business investment picks up. While domestic confidence rebounds, we still expect firms to tread cautiously, and growth in market investment remains modest until 2003. As firms resume hiring, consumption also picks up strongly in 2003, reinforced by low interest rates. Together with inward migration, this provides support to residential investment.

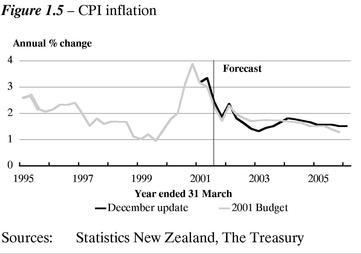

The inflation outlook remains relatively benign

- •

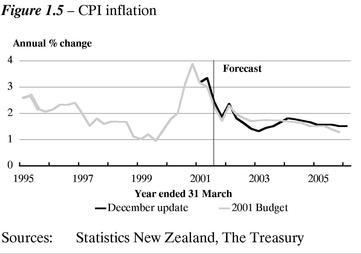

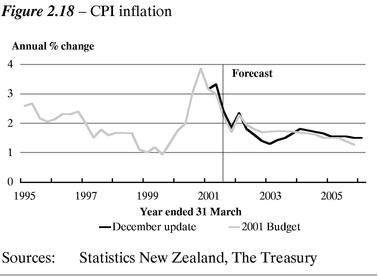

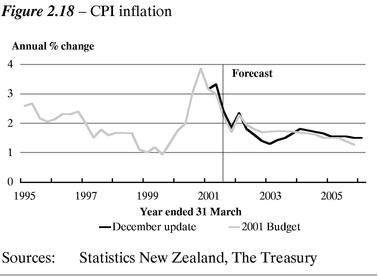

- With reduced growth and weaker global price pressures (including for oil) the outlook for inflation in the short term is relatively benign. Our Central Forecast has CPI inflation falling back to the mid-point of the Reserve Bank's target range by the end of 2002, as pricing pressures ease on the back of weaker unit labour costs and softer world export and import prices.

- •

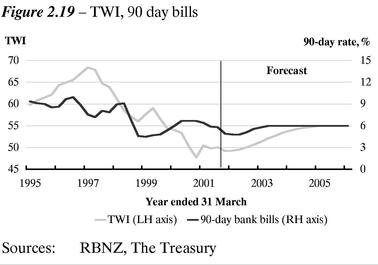

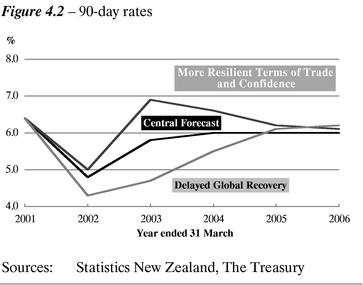

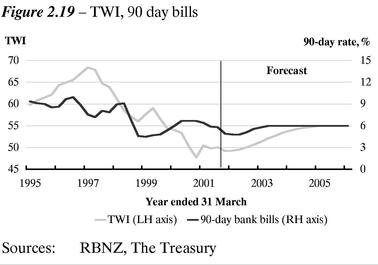

- As growth picks up over 2002/03, the Reserve Bank is expected to steadily return the Official Cash Rate to our assumed neutral level of around 6.0%.

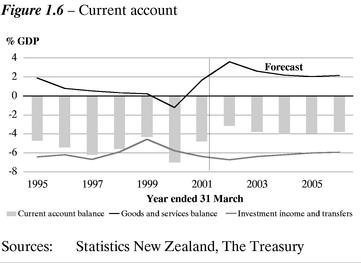

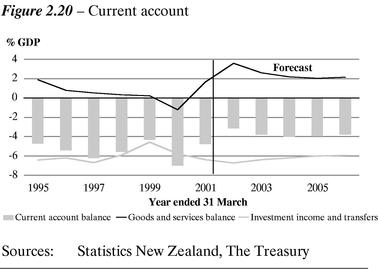

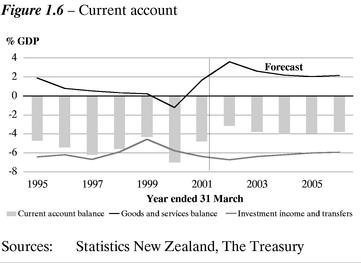

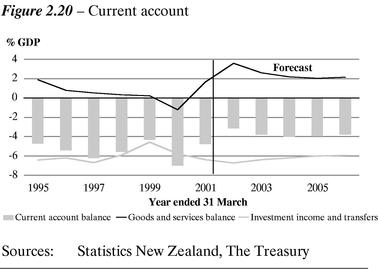

The rate of improvement slows in the current account deficit

- •

- Slower export volume growth in the short term, together with the expected fall in the terms of trade, sees a modest reversal in recent improvements in the current account deficit. The deficit is expected to improve to about 3% of GDP in the year to March 2002, largely on the back of recent good export volume and price growth. However, as weaker world growth begins to impact on export volumes and prices and investment flows, the current account deficit deteriorates, although this is slightly offset by lower imports as a result of weaker domestic demand. The deficit is expected to be about 4% of GDP in 2004 and 2005. Further out, a continued steady improvement in service exports underpins an improvement in the current account balance at the end of the forecast.

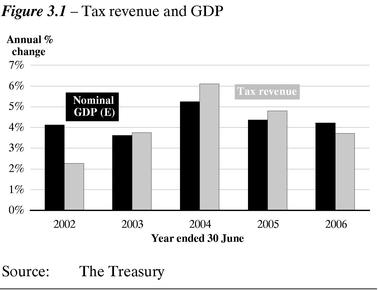

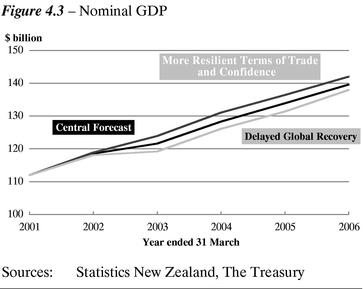

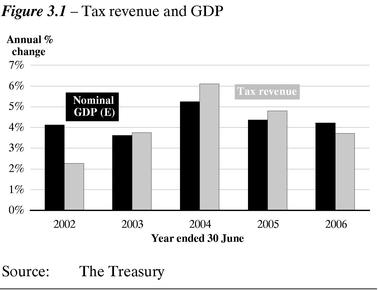

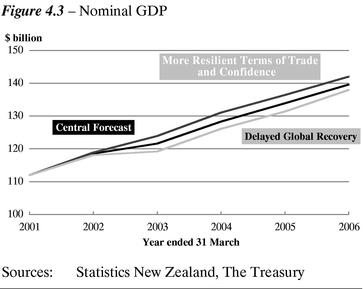

Nominal GDP growth is more cyclical in the short term

- •

- The profile for nominal GDP growth is more cyclical than in the 2001 Budget. Nominal growth in the year to March 2002 is forecast to be 5.9%, partly as a result of the strong June quarter outturn. In the year to March 2003, lower real growth and inflation leads nominal growth to fall to 2.6%, before picking up to solid growth of 4% to 5% further out. This increased cyclical nature of nominal GDP flows through to the profile for tax revenue.

Fiscal Outlook

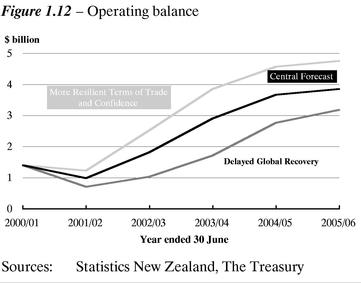

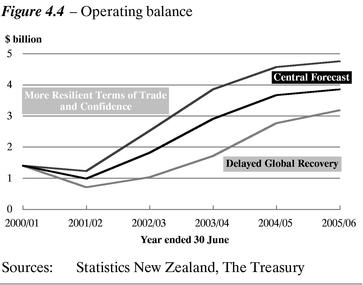

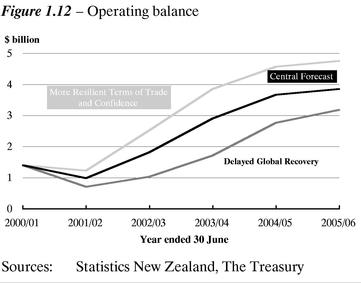

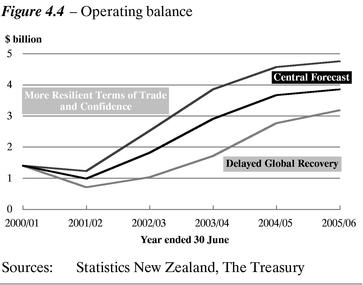

Operating balance rises over the forecast horizon...

- •

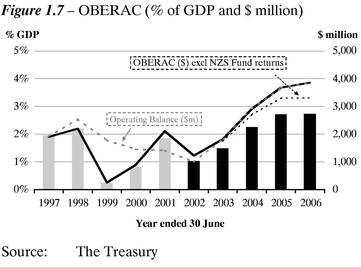

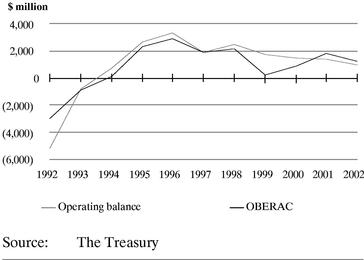

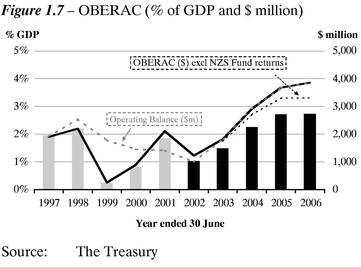

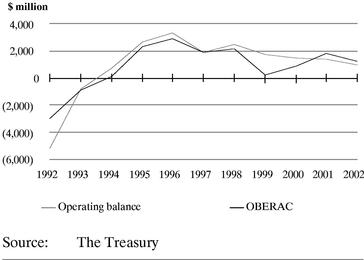

- The forecast 2001/02 operating balance is $1.0 billion (0.8% of GDP), including ACC and Government Superannuation Fund (GSF) liability movements of $200 million and $40 million respectively.

- •

- Excluding the ACC and GSF valuations, the OBERAC (operating balance excluding revaluations and accounting policy changes) for 2001/02 is $1.2 billion (1.0% of GDP).

- •

- While the operating balance decreases from 2000/01, over the forecast period, the operating balance is expected to rise to 2.7% of GDP in 2005/06 ($3.8 billion).

- •

- Updated operating balance forecasts are lower than 2001 Budget, with the biggest change occurring in 2002/03.

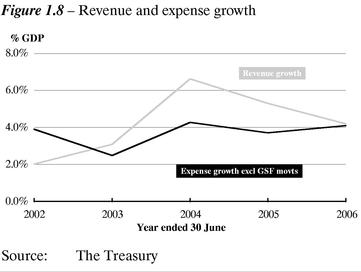

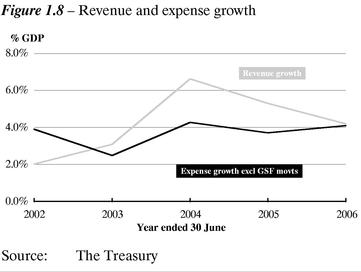

...due to tax revenue growth remaining higher than expense growth despite an economic downturn...

- •

- The forecast increase in tax revenue has reduced across all years relative to the 2001 Budget owing to lower forecast economic growth.

- •

- Lower tax revenue has been partly offset by lower benefit expenses of an average of around $250 million across all years, owing largely to lower unemployment benefit payments.

- •

- Health expenses are a key feature of the December Update with an extra $2.4 billion committed over the next three years. This is in addition to funding to meet demographic and other forecast changes.

- •

- Total revenue growth averages around 5% per annum, while expense growth averages around 4% per annum over the forecast period.

...enabling the Government to continue to apply surplus cash to its investment programme

- •

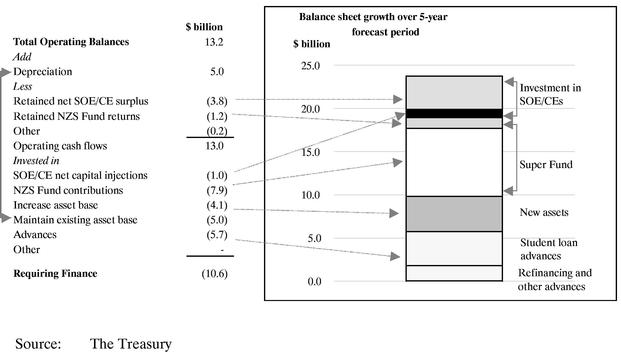

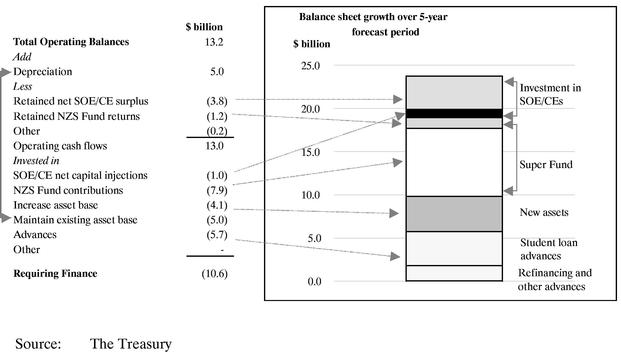

- The rising operating surplus translates to a similar level of cash flows from operations, generating approximately $13.2 billion operating cash surpluses over the forecast period to fund investing activity.

- •

- Investment outlays of $23.6 billion outweigh operating cash surpluses by $10.6 billion. These outlays include: maintaining and improving the existing asset base ($9.1 billion) and providing injections of around $1 billion (mostly related to hospitals and the establishment of Kiwibank); investing in the New Zealand Superannuation Fund ($7.9 billion); and funding advances ($5.7 billion). The advances comprise student loans of $3.9 billion with the remaining $1.8 billion relating to refinancing Crown entity private sector debt (DHBs and Housing New Zealand Corporation) and other miscellaneous advance activity.

- •

- Relative to the 2001 Budget, the forecast cash outflows for the period 2000/01 to 2004/05 have increased by around $1.5 billion. This primarily reflects the Air New Zealand recapitalisation package (around $1 billion), higher student loan advances and refinancing of DHB debt (around $0.7 billion combined), partially offset by higher than expected surplus cash position of $0.5 billion in 2000/01.

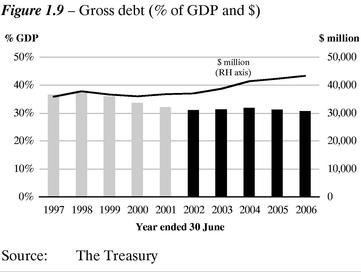

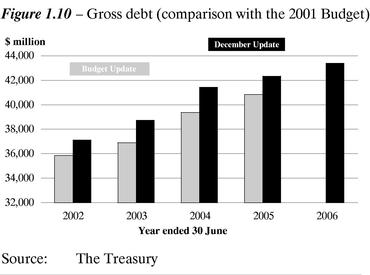

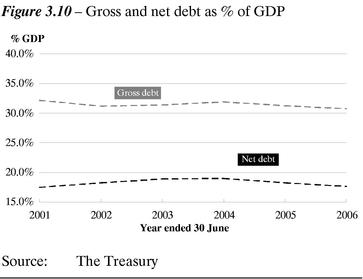

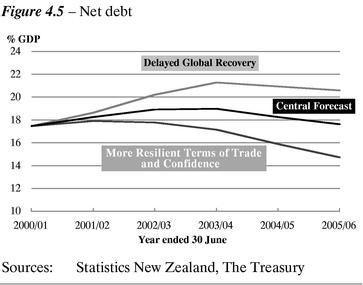

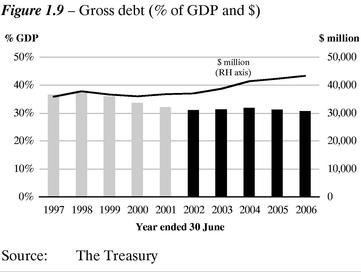

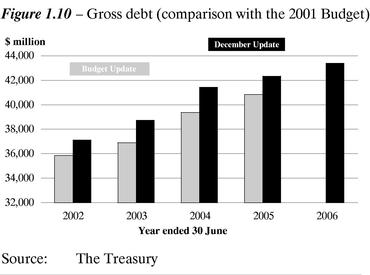

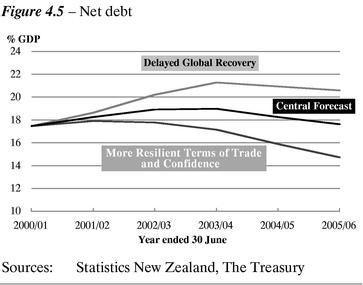

Debt as a percentage of GDP rises slightly, before falling again

- •

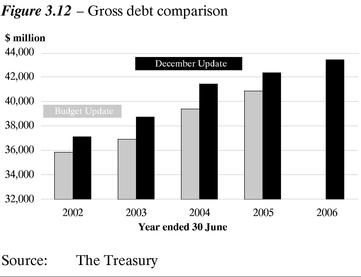

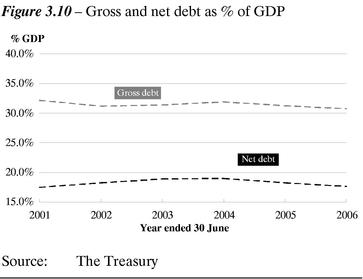

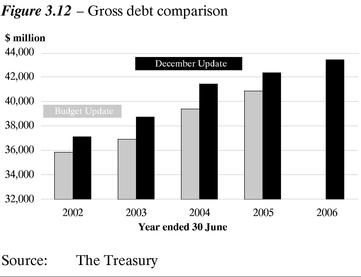

- Gross debt increases by $6.6 billion in nominal terms over the forecast period. This, in conjunction with a decrease in marketable securities and deposits of $3.9 billion, will fund the shortfall between operating cash flows and investment outlays.

- •

- Over the period, gross debt falls as a percentage of GDP from around 32% at the start of the forecast period to slightly under 31% by 2005/06. For the same period, net debt starts at 17.5% of GDP and is 17.6% by 2005/06.

- •

- Gross and net debt rise slightly in the middle of the forecast period. This is mainly due to lower economic growth in earlier years and bringing forward capital spending to better meet expected demands (refer to page 54 for a fuller description).

- •

- Both gross and net debt increase relative to the 2001 Budget. The key changes in funding requirements for the comparable period (2001/02 to 2004/05) are due mainly to lower forecast cash generated from operating surpluses, higher than forecast student loans and the increase in the capital provisions to accommodate the Air New Zealand recapitalisation package.

- •

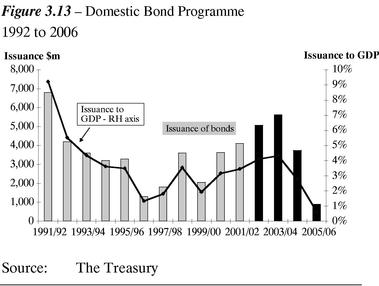

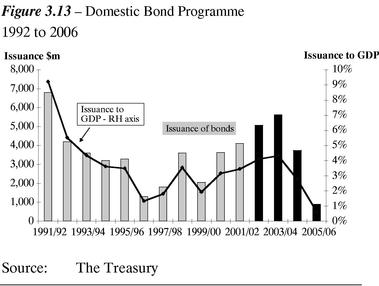

- The domestic bond programme has been revised from $3.5 billion to $4.1 billion for 2001/02. For a full explanation of the revision refer to page 56 of the Fiscal Outlook chapter.

Government policy decisions

- •

- In addition to the Health package mentioned earlier, the Government has allocated a further $176 million of the $6.126 billion three-year fiscal provision since the 2001 Budget. Table 1.1 provides a breakdown of the Government's three-year fiscal provision since 1999/2000 to 2002/03:

Table 1.1—Fiscal provisions

Fiscal provisions ($ million, GST inclusive)

| | 1999/2000

| | 2000/01

| | 2001/02

| | 2002/03

| | Total

|

|---|

| Budget 2000 decisions | | 420 | | 1,050 | | 1,060 | | 1,120 | | 3,650 |

| 2000 contingency decisions | | — | | 99 | | 74 | | 78 | | 251 |

| Budget 2001 decisions | | — | | 52 | | 532 | | 526 | | 1,110 |

| 2001 contingency decisions | | — | | — | | 51 | | 125 | | 176 |

| December 2001 Health package | | — | | — | | — | | 400 | | 400 |

| Budget 2002 provision1 | | — | | — | | 89 | | 450 | | 539 |

| | |

| |

| |

| |

| |

|

| Total | | 420 | | 1,201 | | 1,806 | | 2,699 | | 6,126 |

| | |

| |

| |

| |

| |

|

- 1

- $20 million of the Budget 2002 provision has been rephased from 2001/02 to 2002/03.

- •

- As part of the 2001 Budget, the Government set capital provisions of $850 million for 2003/04 and 2004/05 (and $550 million has been set for the new 2005/06 financial year). In addition, a further $1 billion has been added to the capital provisions to accommodate the Air New Zealand recapitalisation package.

- •

- Spending in 2004/05 and 2005/06 has, however, been rephased into 2002/03 and 2003/04 to better reflect planned commitments. The key capital pressures are in the social sector (hospitals and schools), prisons, developing the Government's transport strategy, re-equipping the Defence Force and recapitalising Air New Zealand.

Table 1.2—Capital provisions

Capital provisions ($ million, GST inclusive)

| | 2001/02

| | 2002/03

| | 2003/04

| | 2004/05

| | 2005/06

| | Total

|

|---|

| Capital provision—Budget 2001 | | 315 | | 360 | | 850 | | 850 | | — | | 2,375 |

| Establish 2005/06 provision | | | | | | | | | | 550 | | 550 |

| December Update decisions | | 76 | | 27 | | 1 | | — | | 5 | | 109 |

| | |

| |

| |

| |

| |

| |

|

| Remaining provision | | 239 | | 333 | | 849 | | 850 | | 545 | | 2,816 |

| Increase to provision for Air New Zealand | | 1,035 | | — | | — | | — | | — | | 1,035 |

| December Update rephasing of provision | | — | | 413 | | 89 | | (387 | ) | (115 | ) | — |

| | |

| |

| |

| |

| |

| |

|

| Capital provision—December Update | | 1,274 | | 746 | | 938 | | 463 | | 430 | | 3,851 |

| | |

| |

| |

| |

| |

| |

|

NOTE:

The amount of capital provision in Table 1.2 does not exactly reconcile to the level of capital provision contained in the fiscal forecasts due to rounding.

The fiscal forecasts are highly sensitive to risks around the economic forecasts

- •

- Underpinning our Central Forecast are the international assumptions of Consensus forecasts, and key judgements made about the "transmission mechanisms" through which weaker global growth is transmitted to New Zealand, including through lower export volumes and prices, and weaker confidence feeding into domestic demand.

- •

- However, events may turn out differently from our Central Forecast.

- •

- World growth may evolve differently from that currently built into Consensus forecasts. Growth may not rebound as quickly as expected and remain sub-trend for most of 2002, with a more accelerated pick-up in 2003 and 2004. In this scenario, weaker world demand would negatively affect export volumes and prices, with the lower export income feeding through into the domestic economy.

- •

- Alternatively, weaker world growth may have a less pronounced impact on the New Zealand economy. In this case, our export prices may not fall as much, and domestic confidence could rebound quickly, feeding into stronger domestic demand.

- •

- These effects will flow through into the Government's operating balance. Weaker world growth will lead to a lower operating balance, as lower economic growth and inflation both reduce nominal GDP relative to the Central Forecast, and expenses increase with higher unemployment.

However, if stronger domestic demand occurs the operating balance will be higher throughout the forecast period.

- •

- The changes in the operating balance will also have an impact on debt. A lower operating balance resulting from weaker world growth would lead to higher gross and net debt as a percentage of GDP, because both GDP and the operating surpluses would be lower. The converse is true in the case of stronger domestic demand.

Summary Tables

Table 1.3—Economic indicators1

| | 2001

Actual

| | 2002

Forecast

| | 2003

Forecast

| | 2004

Forecast

| | 2005

Forecast

| | 2006

Forecast

| |

|---|

| | (Annual Average % change, March years)

| |

|---|

| Consumption | | 0.3 | | 2.1 | | 1.7 | | 3.2 | | 2.4 | | 2.6 | |

| Investment | | (0.4 | ) | 4.5 | | (1.1 | ) | 7.4 | | 5.8 | | 3.3 | |

| | |

| |

| |

| |

| |

| |

| |

| Stock change2 | | (0.3 | ) | (1.1 | ) | 0.7 | | 0.1 | | 0.0 | | 0.0 | |

| Gross National Expenditure | | (0.2 | ) | 1.4 | | 1.7 | | 4.2 | | 3.1 | | 2.7 | |

| | |

| |

| |

| |

| |

| |

| |

| Exports | | 6.8 | | 2.9 | | 2.3 | | 7.3 | | 5.4 | | 4.5 | |

| Imports | | 0.4 | | 0.2 | | 1.4 | | 9.8 | | 7.3 | | 4.7 | |

| | |

| |

| |

| |

| |

| |

| |

| GDP (Production Measure) | | 2.6 | | 3.1 | | 1.9 | | 3.7 | | 2.6 | | 2.8 | |

| | |

| |

| |

| |

| |

| |

| |

| — annual % change | | 1.1 | | 2.8 | | 3.1 | | 3.2 | | 2.6 | | 2.8 | |

| Employment3 | | 2.2 | | 1.5 | | (0.1 | ) | 2.3 | | 1.5 | | 1.3 | |

| Unemployment4 | | 5.4 | | 5.6 | | 5.7 | | 5.2 | | 5.2 | | 5.2 | |

| Wages5 | | 2.4 | | 3.7 | | 3.7 | | 3.4 | | 3.5 | | 3.1 | |

| CPI inflation6 | | 3.1 | | 2.4 | | 1.3 | | 1.8 | | 1.6 | | 1.5 | |

| Current account balance7 | | (4.8 | ) | (3.1 | ) | (3.8 | ) | (4.0 | ) | (4.0 | ) | (3.8 | ) |

| TWI8 | | 50.5 | | 49.3 | | 51.3 | | 53.9 | | 55.0 | | 55.0 | |

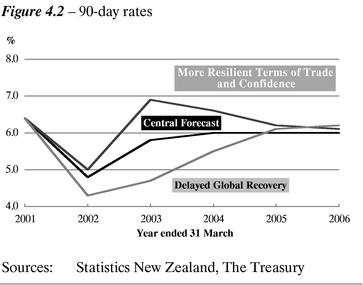

| 90 day bank bill rate8 | | 6.4 | | 4.8 | | 5.8 | | 6.0 | | 6.0 | | 6.0 | |

Sources: Statistics New Zealand, Primark Datastream, The Treasury

- 1

- Finalised 21 November 2001.

- 2

- Contribution to GDP growth.

- 3

- Household Labour Force Survey, full-time equivalent employment.

- 4

- Household Labour Force Survey, percentage of the labour force, March quarter, seasonally adjusted.

- 5

- Quarterly Employment Survey, average hourly ordinary time earnings.

- 6

- This is the CPI-consistent series targeted by the Reserve Bank. Annual percentage change, March quarter.

- 7

- Year to 31 March, percentage of GDP.

- 8

- Average for the March quarter.

Table 1.4—Fiscal indicators

| | 2001

Actual

| | 2002

Forecast

| | 2003

Forecast

| | 2004

Forecast

| | 2005

Forecast

| | 2006

Forecast

| |

|---|

| | ($ million)

| |

|---|

| Operating Balance | | | | | | | | | | | | | |

| Revenue | | 39,492 | | 40,290 | | 41,531 | | 44,283 | | 46,630 | | 48,582 | |

| Expenses | | | | | | | | | | | | | |

| Allocated expenses | | (38,186 | ) | (39,513 | ) | (40,097 | ) | (41,301 | ) | (42,368 | ) | (43,263 | ) |

| Unallocated provisions for future initiatives | | — | | (90 | ) | (450 | ) | (975 | ) | (1,475 | ) | (2,376 | ) |

| SOE/CE surpluses | | 103 | | 298 | | 839 | | 901 | | 883 | | 911 | |

| | |

| |

| |

| |

| |

| |

| |

| Operating Balance | | 1,409 | | 985 | | 1,823 | | 2,908 | | 3,670 | | 3,854 | |

| Less revaluations | | 698 | | 243 | | — | | — | | — | | — | |

| | |

| |

| |

| |

| |

| |

| |

OBERAC |

|

2,107 |

|

1,228 |

|

1,823 |

|

2,908 |

|

3,670 |

|

3,854 |

|

| Less contributions and returns on NZS Fund | | — | | (614 | ) | (1,291 | ) | (2,010 | ) | (2,472 | ) | (2,709 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Available after NZS Fund Requirements | | 2,107 | | 614 | | 532 | | 898 | | 1,198 | | 1,145 | |

Less |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unallocated capital provisions | | — | | (1,269 | ) | (740 | ) | (938 | ) | (463 | ) | (435 | ) |

| | Physical asset purchases and other | | (682 | ) | (1,077 | ) | (1,391 | ) | (1,285 | ) | (806 | ) | (878 | ) |

| Movement in Net Debt | | 1,425 | | (1,732 | ) | (1,599 | ) | (1,325 | ) | (71 | ) | (168 | ) |

| Net Debt | | 19,971 | | 21,703 | | 23,302 | | 24,627 | | 24,698 | | 24,866 | |

| Net Debt (% of GDP) | | 17.5 | % | 18.2 | % | 18.9 | % | 19.0 | % | 18.2 | % | 17.6 | % |

| Domestic Bond Programme1 | | 3,572 | | 4,100 | | 5,070 | | 5,620 | | 3,730 | | 874 | |

| Nominal GDP | | 114,275 | | 118,980 | | 123,271 | | 129,725 | | 135,373 | | 141,076 | |

| | |

| |

| |

| |

| |

| |

| |

| Fiscal Indicators as a % of GDP | | | | | | | | | | | | | |

| Gross debt | | 32.2 | % | 31.2 | % | 31.4 | % | 31.9 | % | 31.3 | % | 30.7 | % |

| Net debt | | 17.5 | % | 18.2 | % | 18.9 | % | 19.0 | % | 18.2 | % | 17.6 | % |

| Net worth | | 10.0 | % | 10.5 | % | 11.6 | % | 13.2 | % | 15.4 | % | 17.5 | % |

| Revenue | | 34.6 | % | 33.9 | % | 33.7 | % | 34.1 | % | 34.4 | % | 34.4 | % |

| Expense | | 33.4 | % | 33.3 | % | 32.9 | % | 32.6 | % | 32.4 | % | 32.4 | % |

| OBERAC | | 1.8 | % | 1.0 | % | 1.5 | % | 2.2 | % | 2.7 | % | 2.7 | % |

| Operating balance | | 1.2 | % | 0.8 | % | 1.5 | % | 2.2 | % | 2.7 | % | 2.7 | % |

| | |

| |

| |

| |

| |

| |

| |

| New Zealand Superannuation Fund | | | | | | | | | | | | | |

| Fund asset returns (after tax)2 | | — | | 14 | | 91 | | 210 | | 372 | | 559 | |

| Fund assets (year end) | | — | | 614 | | 1,904 | | 3,914 | | 6,379 | | 9,091 | |

| % of GDP | | 0.0 | % | 0.5 | % | 1.5 | % | 3.0 | % | 4.7 | % | 6.4 | % |

- 1

- The figure for 2002 is the face value of the bond programme. The actual cash raised by the programme is forecast to be $4,156 million, as the bonds are forecast to be issued at a premium. Further out the bond programme is an estimate of the cash expected to be raised. For the reconciliation between the bond programme and operating cash flows see the Statement of Cash Flows.

- 2

- Returns on fund assets are recorded as revenue from investments in the operating balance (see Note 3 of the fiscal forecasts). However only the "after tax" portion of investment income accumulates in the NZS Fund.

Stop press—additional policy decisions

Since the finalisation of the fiscal forecasts on 26 November 2001 the decisions outlined below have been finalised by the Government. These decisions have not been incorporated into the forecasts.

- •

- Paid Parental Leave—On 3 December, the Government formalised the arrangements for Paid Parental Leave, which will be implemented from 1 July 2002. The costs are expected to be around $40 million per year from 2002/03, which will be met by from the remaining fiscal provision (which is included in the forecasts and therefore have no impact on the operating balance or debt.

- •

- Teachers Pay Settlement—Agreement was reached on 6 December with the Post Primary Teachers Association on a new Secondary schools teachers collective employment contract. Although the costs have yet to be finalised they are expected to be around $30 million per year from 2002/03. The costs will be met from the remaining fiscal provision and therefore have no impact on the operating balance or debt.

2

Economic Outlook

Since our Budget forecasts global growth has been weaker than expected...

At the time the 2001 Budget was finalised, global growth was projected to ease but then recover. In the event, world growth will be considerably weaker than expected over the second half of 2001. The US economy has decelerated further and contracted in the September quarter. Japan recorded consecutive falls in GDP in the June and September quarters. Growth also slowed markedly across the Euro area, with Germany recording two quarters of modest falls in GDP up to the September quarter.

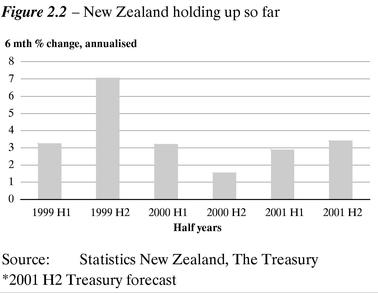

...but New Zealand has outperformed

While the world has tracked more in line with the "weaker world growth" scenario contained in the 2001 Budget, the New Zealand economy has developed in line with, or turned out better than, our Central Forecast:

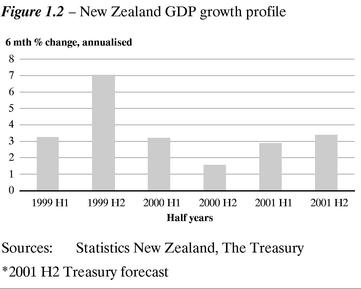

- •

- GDP growth averaged just over 1% per quarter in the first half of 2001.

- •

- Unemployment fell to a 13-year low of 5.2% in the June quarter and remained there in the September quarter.

- •

- The annual current account deficit fell to 4% of GDP in the June 2001 quarter with a further fall expected in the September quarter.

- •

- The nominal economy grew by 6.4% over the year to June 2001, indicating strong income growth.

Table 2.1—Economic Outlook: Central Forecast1

| | 2001

Actual

| | 2002

Forecast

| | 2003

Forecast

| | 2004

Forecast

| | 2005

Forecast

| | 2006

Forecast

| |

|---|

| | (Annual Average % change, March years)

| |

|---|

| Private consumption | | 0.3 | | 1.9 | | 1.9 | | 3.1 | | 2.9 | | 3.0 | |

| Public consumption2 | | (3.0 | ) | 2.8 | | 1.0 | | 3.7 | | 0.8 | | 1.4 | |

| | |

| |

| |

| |

| |

| |

| |

| Total Consumption | | 0.3 | | 2.1 | | 1.7 | | 3.2 | | 2.4 | | 2.6 | |

| | |

| |

| |

| |

| |

| |

| |

| Residential investment | | (15.9 | ) | (4.6 | ) | 6.2 | | 11.6 | | 6.2 | | 4.9 | |

| Market Investment | | 7.2 | | 7.2 | | (3.7 | ) | 6.5 | | 5.8 | | 2.8 | |

| Non-Market Investment | | (6.6 | ) | (1.9 | ) | 3.3 | | 2.8 | | 2.8 | | 2.8 | |

| Total Investment | | (0.4 | ) | 4.5 | | (1.1 | ) | 7.4 | | 5.8 | | 3.3 | |

| | |

| |

| |

| |

| |

| |

| |

| Stocks3 | | (0.3 | ) | (1.1 | ) | 0.7 | | 0.1 | | 0.0 | | 0.0 | |

| Gross National Expenditure | | (0.2 | ) | 1.4 | | 1.7 | | 4.2 | | 3.1 | | 2.7 | |

| | |

| |

| |

| |

| |

| |

| |

| Exports | | 6.8 | | 2.9 | | 2.3 | | 7.3 | | 5.4 | | 4.5 | |

| Imports | | 0.4 | | 0.2 | | 1.4 | | 9.8 | | 7.3 | | 4.7 | |

| | |

| |

| |

| |

| |

| |

| |

| GDP (Production Measure) | | 2.6 | | 3.1 | | 1.9 | | 3.7 | | 2.6 | | 2.8 | |

| | |

| |

| |

| |

| |

| |

| |

| —annual % change, March qtr | | 1.1 | | 2.8 | | 3.1 | | 3.2 | | 2.6 | | 2.8 | |

| Nominal GDP (expenditure basis) | | 5.5 | | 5.9 | | 2.6 | | 5.5 | | 4.4 | | 4.2 | |

| GDP deflator | | 3.6 | | 3.6 | | 0.6 | | 1.9 | | 1.8 | | 1.5 | |

| Employment4 | | 2.2 | | 1.5 | | (0.1 | ) | 2.3 | | 1.5 | | 1.3 | |

| Unemployment5 | | 5.4 | | 5.6 | | 5.7 | | 5.2 | | 5.2 | | 5.2 | |

| Wages6 | | 2.4 | | 3.7 | | 3.7 | | 3.4 | | 3.5 | | 3.1 | |

| CPI inflation7 | | 3.1 | | 2.4 | | 1.3 | | 1.8 | | 1.6 | | 1.5 | |

| Export prices8 | | 19.6 | | 2.5 | | (8.2 | ) | (3.6 | ) | (1.4 | ) | (0.1 | ) |

| Import prices8 | | 15.3 | | (0.1 | ) | (2.9 | ) | (3.5 | ) | (2.6 | ) | (0.4 | ) |

Current account balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

| —$million | | (5338 | ) | (3725 | ) | (4612 | ) | (5174 | ) | (5304 | ) | (5297 | ) |

| —% of GDP | | (4.8 | ) | (3.1 | ) | (3.8 | ) | (4.0 | ) | (4.0 | ) | (3.8 | ) |

| TWI9 | | 50.5 | | 49.3 | | 51.3 | | 53.9 | | 55.0 | | 55.0 | |

| 90 day bank bill rate9 | | 6.4 | | 4.8 | | 5.8 | | 6.0 | | 6.0 | | 6.0 | |

| 10 year bond rate9 | | 6.0 | | 6.3 | | 6.5 | | 6.2 | | 6.2 | | 6.2 | |

Sources: Statistics New Zealand, Primark Datastream, The Treasury

NOTES:

- 1

- Finalised 21 November 2001.

- 2

- The forecast profile for public consumption is influenced by government defence spending.

- 3

- Contribution to GDP growth.

- 4

- Household Labour Force Survey, full-time equivalent employment.

- 5

- Household Labour Force Survey, percentage of the labour force, March quarter, seasonally adjusted.

- 6

- Quarterly Employment Survey, average hourly ordinary time earnings.

- 7

- This is the CPI-consistent series targeted by the Reserve Bank. Annual percentage change, March quarter.

- 8

- Overseas Trade Index basis, annual average percentage change, March quarter.

- 9

- Average for the March quarter.

Assumptions Underlying the Central Forecast

Global economic activity is assumed to evolve in a politically benign environment where any future political or military actions do not have significant negative effects on the overall economic climate.

The international outlook conforms to that presented in the October and November Consensus forecasts, and Asia-Pacific Consensus forecasts.

Recent events leading to lower confidence and heightened uncertainty are assumed to result in temporary "wait and see" attitudes among both consumers and businesses.

The 2001/02 agricultural season is assumed to be an average or "normal" growing season.

Our forecasts assume an equilibrium exchange rate of 55 on a Trade Weighted Index (TWI) basis, and an equilibrium short-term interest rate of 6.0%.

We have assumed no change in announced Government policy as of 21 November 2001.

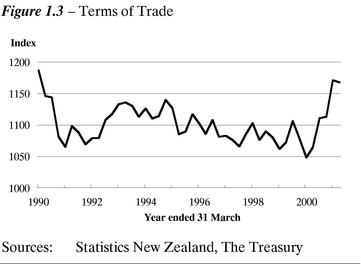

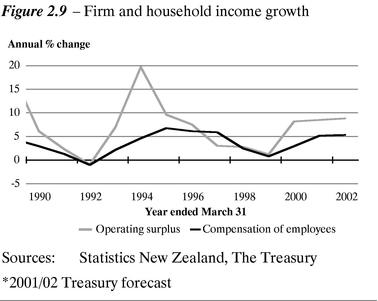

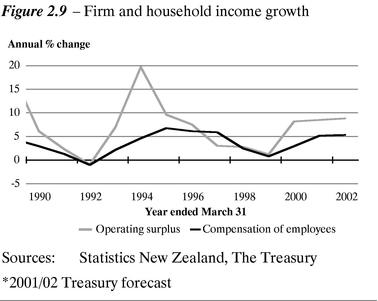

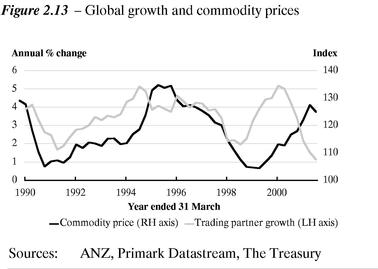

One of the principal reasons why New Zealand growth has not followed the world down and tracked the weaker world growth scenario outlined in the 2001 Budget has been our robust terms of trade. Throughout much of the year New Zealand export prices have remained at high levels, rather than fallen in line with world growth. With export volumes also holding up, this has provided an important offset to weaker world growth as the income gains have fed through into the broader economy. This has supported investment, employment and consumption over the first half of calendar 2001, and led to a lower current account deficit.

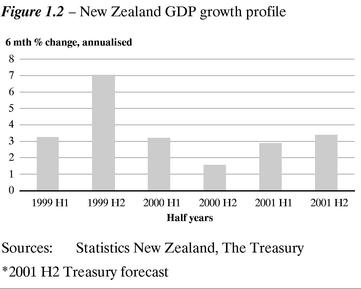

Overall, in the year to June 2001, New Zealand GDP grew at 3.2%. This was better than expected in the 2001 Budget forecast, largely as a result of the very strong growth of 2% in the June quarter. Some of this may reflect volatility in the data, particularly in business investment, given that the March quarter figure was surprisingly weak and at odds with most qualitative assessments of the underlying strength of the economy.

We estimate growth continued in the September quarter, although at a slower rate than in the June quarter. Private consumption and residential investment look to have made positive contributions to growth over the quarter, with market investment providing a negative offset while the contribution from net exports will likely be modest either way. Our estimate is for 0.6% growth for the September 2001 quarter, but an outturn slightly above or below this (perhaps reflecting some bringing forward of activity in the June quarter outturn) would not materially alter our underlying Central Forecast profile.

Looking forward, weak world growth also dominates the short-term outlook

Even before the events of 11 September, US and global growth prospects were being consistently revised down. Between the 2001 Budget in early May and September (compiled just prior to 11 September), forecast growth in our major trading partners was revised down 0.4 percentage points in calendar 2001 and 0.5 percentage points in calendar 2002.

While there were signs in some economies the slowdown could be reaching a turning point prior to 11 September, it was also becoming clear that the expected recovery of trading partner growth was not underway in the second half of 2001. Following the terrorist attacks, sentiment around short-term global growth prospects changed markedly for the worse.

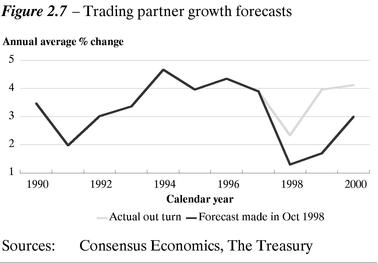

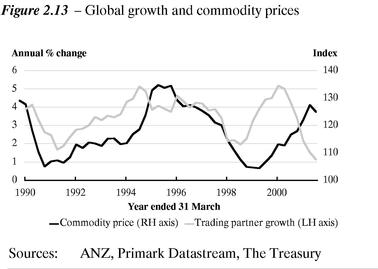

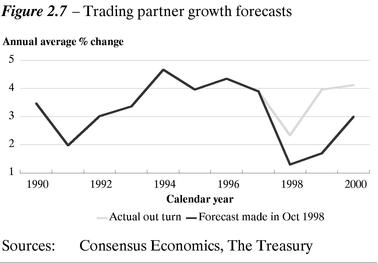

Altogether, since the 2001 Budget trading partner growth prospects have been revised down from 2.4% to 1.4% in 2001, and from 3.6% to 1.9% in 2002. Underlying this fall are the significant downward revisions to growth prospects in the US and Japan.

US economy a major driver

At the time the 2001 Budget was finalised in early May, Consensus forecasts were expecting economic recovery in the US in the second half of 2001, with a further pick-up in growth in 2002. Spending by US consumers was continuing to hold up, and marked reductions in interest rates together with impending tax cuts were expected to provide the basis for a recovery in growth.

A stream of weak economic data pointed to the end of the long-running US economic expansion prior to 11 September. At the same time, however, there were some signs of the economy nearing a turning point. The impact of the shock of 11 September on business and consumer confidence has led forecasters to significantly downgrade their outlook for the US economy, which is now expected to continue to contract in the final months of 2001. Little improvement is expected in the first quarter of 2002 before the economy begins to recover as the substantial monetary and fiscal stimulus put in place begins to take effect. The most recent Consensus forecasts have the US economy growing at 1.1% in calendar 2001 and 0.7% in calendar 2002. Growth in calendar 2003 is expected to return to over 3%.

The outlook for other countries has also weakened...

Consensus forecasts for Japan have been revised down sharply and are for annual contractions of -0.5% in calendar 2001 and -0.6% in calendar 2002. There is little sign of the world's second largest economy emerging from recession in the short term.

Elsewhere in the Asia-Pacific region, forecasts for most economies have been scaled back sharply, with the notable exception of China. Those countries with large electronic export sectors have been hit particularly hard by the global slowdown and the shake-out in the technology sector worldwide. Downward revisions have been particularly marked for Hong Kong, Singapore, South Korea and Taiwan, with an outright contraction in 2001 expected for all of these economies with the exception of South Korea.

Growth forecasts have also fallen across the Euro-zone amidst rising concern the region may not avoid recession as business confidence wanes, industrial production weakens and unemployment rises. Like many other central banks, the European Central Bank has cut interest rates by 150 basis points.

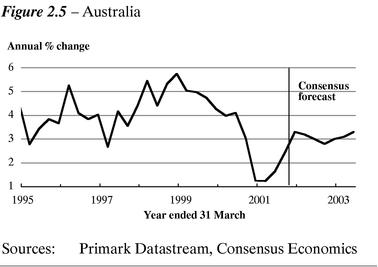

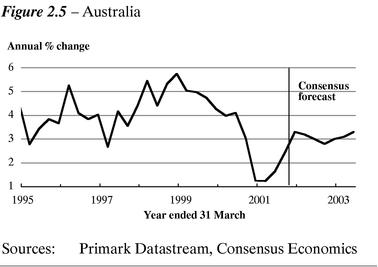

...although Australia continues to hold up in the short term

Importantly for New Zealand, revisions to Australian growth prospects have been more moderate in the wake of recent global events. Relatively robust growth is forecast to continue at 2.1% in 2001 and 3.2% in 2002, down from September mean growth forecasts of 2.5% in 2001 and 4.0% in 2002. The weaker world economy is expected to have an impact on growth, particularly through the external sector. Domestic demand, however, is expected to hold up in the short term on the back of buoyancy in the housing sector, despite a deterioration in confidence and weakening labour markets. Steady growth in our largest trading partner is likely to provide some offset to the downturn elsewhere.

World Growth

The world growth assumptions underpinning the Central Forecast are based on an average of private sector forecasts from Consensus Economics. As we noted in the body of the chapter, Consensus forecasts have declined significantly over the past year. Forecasts of global activity from the Organisation for Economic Cooperation and Development (OECD) and the International Monetary Fund (IMF), have similarly declined.

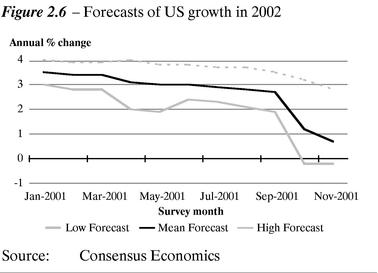

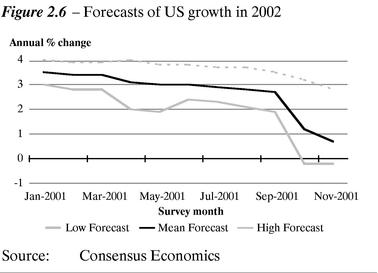

Despite this our reading of the current international data suggests that further falls in forecasts for 2002, albeit more modest than seen this year, cannot be ruled out. One illustration of this is the wide range of views on the outlook for growth in the US in 2002. Figure 2.6 tracks the low and high forecasts, as well as the average from Consensus. As can be seen, recent events have seen a greater range of views develop around the short-term outlook despite 2002 being upon us.

There are also downside risks to trading partner growth beyond 2002. The Consensus view implies a recovery in global growth to more satisfactory levels in the second half of 2002 and continuing into 2003. Even a short delay of a few quarters in US growth returning to around trend would likely see trading partner growth turn out materially lower. This possibility underpins the weaker world growth scenario in the Risks and Scenarios chapter.

The risks around global growth are not one way, however, particularly once the contraction in activity comes to a halt. Our current Consensus forecast assumptions of growth in calendar 2003 are essentially analysts' views of trend growth in trading partners—as such they do not build in any significant period of above-trend cyclical growth despite the current period of weakness.

Moreover just as the Consensus has lagged the slowdown in global growth over the past year, Consensus forecasts may also lag any upturn in global growth. Figure 2.7 shows Consensus forecasts from October 1998 at the bottom of the Asian financial crisis for the period 1998–2000 against the eventual outturns.

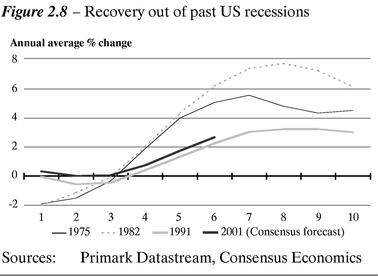

Given the substantial fiscal and monetary stimulus injected into the US and other economies, we do expect to see economic recovery next year. The key uncertainty is the pace of the upturn. For the US, the 6 November 0.5% cut in the Federal Funds Rate by the Federal Reserve takes the benchmark US interest rate to its lowest level in 40 years, with further reductions possible. In terms of fiscal policy, the additional stimulus in 2002 could be in the order of 1.5%–2% of GDP.

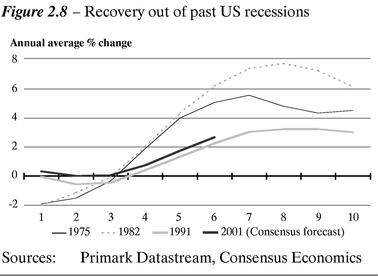

Figure 2.8 tracks the pace of recovery in US growth coming out of past recessions and compares this with the track implied by Consensus forecasts. Whether or not the US does recover more quickly will likely hinge on the extent of turnaround in investment and inventories.

New Zealand is well positioned to cope with weaker world growth...

While the size of the external shock is significant, the actual impact on New Zealand of developments offshore is still uncertain. While New Zealand is unlikely to be immune to these external forces, a number of factors suggest the economy is somewhat better positioned to cope than it has been in similar instances in the past:

- •

- Many parts of the economy have recorded a second year of good income growth, while employment and wage growth has increased household incomes.

- •

- Firm's balance sheets appear healthy.

- •

- Unlike in some economies, there are few signs of any investment overhang, with residential investment at a cyclical low and capacity utilisation high.

- •

- New Zealand manufacturing exports have not been heavily exposed to the technology sector, which has driven the downturn in global industrial production.

- •

- The fall in oil prices is providing support to real income growth compared with a year ago.

- •

- The real exchange rate is at levels which provide stimulus to the export sector.

...and policy has also adjusted

Faced with a large external shock to demand, macroeconomic policy has also moved to a more accommodative stance since the beginning of the year. The current monetary policy cycle peaked over the second half of 2000 when the Official Cash Rate (OCR) stood at 6.5%. Since March this year the Reserve Bank has cut the OCR five times and 1.75% in total, initially in a series of 0.25% cuts before 11 September, followed by an unscheduled cut of 0.5% on 19 September, and another 0.5% cut in mid-November. At 4.75% the level of the OCR is significantly lower than projected in the 2001 Budget and is close to levels when it was first introduced in early 1999. Reflecting this, mortgage rates are close to 30-year lows.

With respect to fiscal policy, the progress made in fiscal consolidation over the past decade means automatic stabilisers are being allowed to operate fully.

Nevertheless, New Zealand is beginning to feel the effect of the global slowdown

The impact of the global slowdown is starting to affect New Zealand through recent falls in tourism numbers, export prices, and business and consumer confidence.

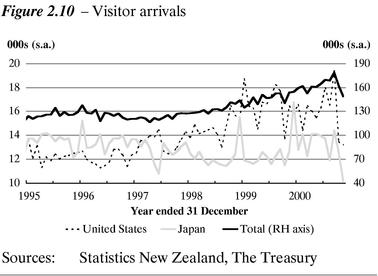

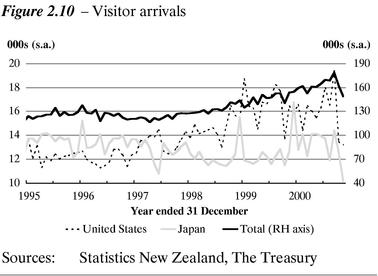

Monthly visitor arrivals have fallen in both September and October, with the fall in arrivals greatest among the high-spending US and Japanese visitors.

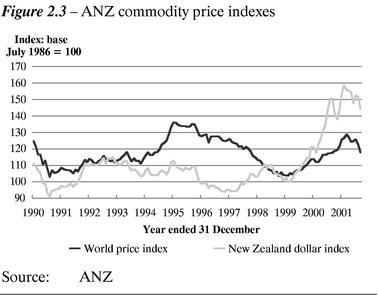

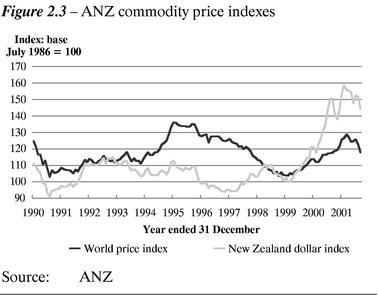

World prices for some of New Zealand's commodities are showing the effects of slowing demand. Nevertheless, while New Zealand export commodity prices have fallen from historic high levels, given that the global economy has been slowing since the start of the year these prices have surprised with their resilience. Furthermore, falls in world prices have been somewhat offset by the weakness of the New Zealand dollar. Import prices, notably for oil, have also weakened.

The picture around confidence has been a little more mixed. This is perhaps understandable given the difficulty of forming judgements about how shocks like 11 September will affect people's actions. The initial impact is of a strong negative shock to confidence and security, reinforced by the possibility of further terrorist attacks.

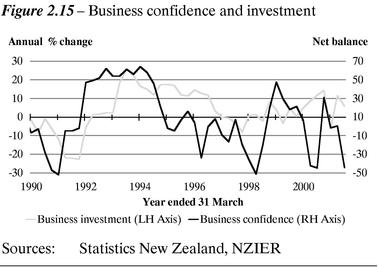

In times of greater uncertainty and insecurity, households and firms become more cautious and postpone spending decisions. During our business talks firms indicated that while they were still relatively optimistic, they had become more cautious since the events of 11 September. More formal surveys of consumer and business confidence show sharp falls since the events of 11 September. Businesses' own activity expectations and investment and employment intentions, are falling but remain in positive territory.

Short-term outlook

New Zealand is not immune from weaker world growth...

We expect the New Zealand economy to slow over the short term before picking up later in 2002 with the rebound in the global economy.

There are a number of direct and indirect "transmission channels" through which we expect weaker world growth to impact on New Zealand. Amongst the key ones are:

- •

- lower demand for New Zealand exports (including tourism)

- •

- lower export prices, only partially offset by lower import prices

- •

- heightened uncertainty and weaker sentiment over the short term leading to a lower domestic spending profile.

The key judgements in this set of forecasts concern the mechanisms through which the shock is transmitted to New Zealand, and the size and timing of the impact.

...as the global downturn hits export growth...

We expect the immediate impact of weak global growth to show up in weaker demand for exports, most notably for services as a result of declining tourist numbers. The negative effect of weaker global growth on incomes together with an aversion to international travel, particularly among American and Japanese tourists, is assumed to have a significant negative impact on total arrivals in New Zealand, relative to previous expectations, until mid-to-late 2002. This is in spite of a competitive exchange rate.

Visitor arrivals fell sharply in September and October, with US and Japanese arrivals clearly showing an impact from 11 September. Going forward into 2002, we expect this weakness to continue despite some potential offset from greater numbers of Australian and Asian tourists, which is helped by the perception of New Zealand as a safe travel destination. Service exports are expected to fall in both the December and March quarters. From the second half of 2002 we expect tourism numbers to pick up as incomes recover on the back of a rebound in global growth, and as people feel more comfortable about international air travel.

Merchandise export volumes are also expected to contract mildly in late 2001 and early 2002, with the global slowdown particularly impacting on the more demand-sensitive non-commodity manufacturing, crude materials and forestry export sectors. Nevertheless, robust growth in the Australian economy—our largest export destination—provides a significant offset to weak activity elsewhere. In particular, very strong growth in Australian residential investment is expected to provide support for New Zealand manufactured and forestry exports.

New Zealand's agricultural export volumes are largely driven by supply-side factors and hence tend to be less sensitive to fluctuations in international demand. Dairy exports are projected to ease in the near term as climatic conditions are assumed to return to "normal" this year following the rapid growth of the past two seasons. Meat exports also decline in the near term, partially reflecting the recent increase in slaughtering earlier in 2001 as a result of last season's dry conditions, before returning to steady growth.

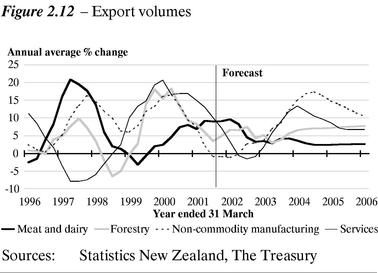

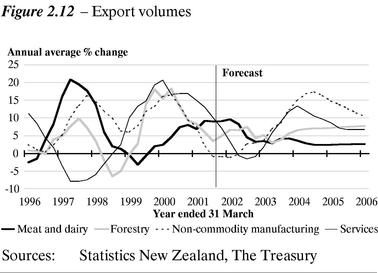

Overall, we expect total export volumes to fall marginally over the short term, largely as a result of falling services and flat non-commodity manufactured exports. As trading partner growth recovers mid-2002, exports are expected to pick up from the end of 2002. Recovery in global growth will reinforce the competitive effect of the exchange rate for non-commodity manufactured exports. The lack of international demand over the past year is likely to be one of the reasons why manufacturing export growth has not performed as strongly over the past year, as might have been expected given the New Zealand exchange rate. Bilateral exchange rate movements are another.

Should weaker world growth continue throughout most of 2002, then there is downside risk to our Central Forecast, which is explored in one of our scenarios in the Risks and Scenarios chapter.

...and prices

Weaker world demand is also expected to have a significant negative impact on world prices for New Zealand exports towards the end of 2001 and throughout most of calendar 2002, before gradually recovering further out. However, we assumed that export prices would decline in the 2001 Budget, and so far they have held up surprisingly well.

Compared with previous downturns, New Zealand's world export prices have remained relatively strong in the face of slow world economic growth. This is primarily due to meat and dairy prices holding up at historically high levels owing to market specific factors like: constraints on lamb supply in the UK following the BSE and foot-and-mouth disease outbreaks; stronger beef prices in the US reflecting recent supply-driven US beef price rises; and higher dairy prices owing to cuts in European export subsidy rates. While our Central Forecast is based on a fall in export prices, one of the scenarios maps out the possibility of a more modest fall in export prices.

Consistent with previous global downturns, our Central Forecast therefore assumes that world export prices will fall, although not to the same extent due in part to the market specific factors discussed above. Overall, world prices for New Zealand exports are expected to fall by about 8% in the year to March 2003.

As global demand weakens import prices are also expected to moderate across the board. The fall in import prices reflects the historical relationship between weaker global growth and softer import prices. However, import prices are not expected to fall to the same extent as export prices. A larger import price fall would provide an important offset to export price falls.

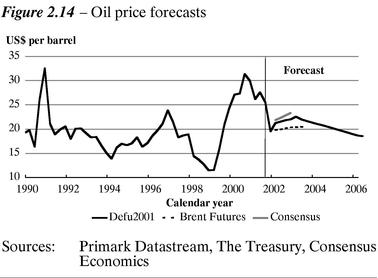

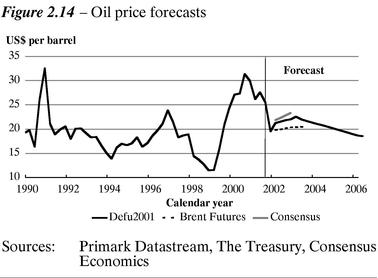

Oil Prices

Oil prices have fallen dramatically since the 11 September attacks, from around US$27 a barrel in early September to US$19 a barrel more recently. The future oil price profile is a major uncertainty in our forecasts.

The methodology underlying the Treasury's oil price attempts to capture information from Consensus forecasts, Brent crude futures prices, and the perceived long-run equilibrium price of oil. Reflecting the trends shown by both the Consensus view and Brent Futures prices, our profile is for prices to steadily recover to around US$22.50 over the next 18 months before easing back towards our assumed "equilibrium" level for crude prices of US$18.50 (based on an historical average).

There are clear risks to this profile both on the upside and downside. Should OPEC prove successful in moving oil prices to the middle of its target range of US$22–28 per barrel, oil prices could rise considerably higher than our forecasts. Conversely, further deterioration in the world economic outlook, and consequently weaker demand for oil, could lead to prices remaining at or below current levels for some quarters to come.

In our Central Forecast we expect the terms of trade to deteriorate sharply going into the first half of 2002 as our prices for exports fall away quicker than import prices. Despite these falls, the terms of trade remain slightly above the lows reached in 1990/91 and 1997/98, supported by structural factors impacting New Zealand's key agricultural prices, as well as oil prices remaining below recent highs. The terms of trade subsequently recover over 2002/03 as global growth picks up and commodity prices recover.

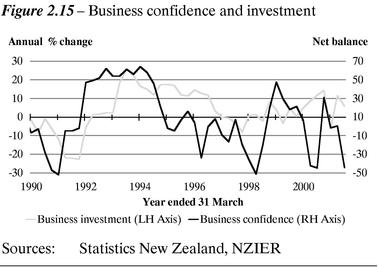

Greater uncertainty negatively affects business confidence and feeds into investment...

The third principal channel we see operating over the short-term is from domestic confidence to spending. We see weaker confidence having an impact on the willingness of both firms and households to employ, spend and invest. However, it is very hard to quantify this impact. Assuming that further political or military actions do not have any significant effects on the international economic climate, we expect to see some of the uncertainty, insecurity and risk aversion associated with 11 September dissipate over time as firms and households become clearer about its lasting impacts, even if these are negative for a period of time.

In light of greater uncertainty around the outlook, firms will be more cautious about undertaking new investment. This will be reinforced by expectations of slower income growth over the short term as export growth falls away and domestic demand moderates. However, good balance sheets, lower interest rates, recent high levels of capacity utilisation, and the expectation of a recovery means that we do not expect to see large declines in investment. Overall, we expect market investment to fall around 4% in the year to March 2003 with a couple of negative quarters of investment spending in the December 2001 and the March 2002 quarters.

Going into 2003 investment growth begins to pick up as profit growth, and the need to undertake investment as the economy nears capacity, plus a relatively tight labour market going forward all provide support to business investment as deferred projects are brought back on line.

...the labour market...

We also expect firms to be more cautious about taking on additional employees. As a result, employment growth stops over the short term and for much of 2002 as firms delay hiring, and seasonal employment is more muted in selected industries, notably tourism. However, the extent of the slowing in employment growth is expected to be more modest than in previous downturns as firms look to maintain the bulk of their workforce given the relatively tight labour market. Demand for skilled labour is likely to hold up as firms seek to fill skilled vacancies as the opportunity arises.

As a consequence we therefore expect the unemployment rate to rise moderately until mid-2002, although continuing to remain under 6% as a softening in the labour participation rate offsets some of the impact of weaker employment growth.

As the economy regains momentum over 2002/03, firms resume hiring, employment growth resumes from mid-2002 leading to a pick-up in the labour market and a rise in the participation rate. Unemployment begins to fall towards 5.5% by the end of 2003.

...and households.

The "wait and see" attitude of firms is expected to be mirrored by households. Greater uncertainty leads households to be more cautious about their expenditure patterns over the short term as a weaker labour market, and slower global growth and aggregate demand lead to more modest farm and entrepreneurial income growth. With household net wealth also remaining flat, consumption growth is expected to moderate and remain subdued over the first half of 2002.

However, the turnaround in migration and the moderate pick-up in residential investment are expected to provide some support to consumption.

Activity in the housing sector and residential construction is expected to continue to increase modestly over the short term, as lower consumer confidence provides some offset to lower interest rates. Once consumer confidence turns around, lower interest rates and net inward migration should all provide support to a pick-up in residential investment in 2002/03, although not to the levels of the Auckland housing boom of the mid-1990s. The pick-up in the housing market also provides support for house prices, which in turn, bolsters household wealth.

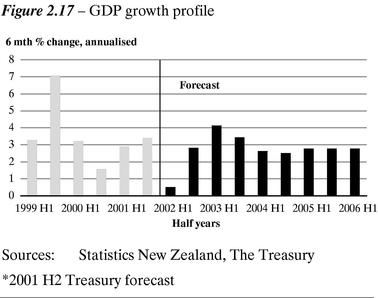

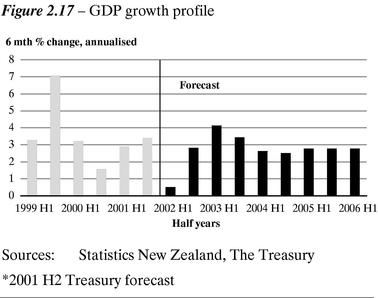

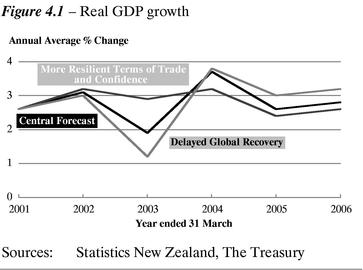

GDP growth profile is more cyclical than expected in the 2001 Budget

Overall, the short-term profile for real GDP growth is considerably more cyclical than forecast in the 2001 Budget. On an annual percent change basis growth falls to around 1.0% in the first half of calendar 2002 before rebounding to 3% in early 2003 and rising to 4% towards the end of 2003. Growth is expected to be weakest over the period December quarter 2001 to June quarter 2002—on average only slightly positive. Thereafter, growth recovers to above trend rates on a quarterly basis by the end of 2002 and in early 2003. In annual average terms, this sees real GDP growth of 3.1% in the year to March 2002 and 1.9% in the year to March 2003.

Such outturns would see New Zealand GDP growth matching or outperforming the OECD average over the period 1999-2003.

The profile for nominal GDP growth is also more cyclical, which has implications for our fiscal forecasts in the next chapter. Nominal growth in the year to March 2002 is forecast to be 5.9%, partly as a result of the strong June quarter outturn. In the year to March 2003, lower real growth and lower inflation leads nominal growth to fall to 2.6%, before picking up further out as growth rebounds.

The inflation outlook looks benign over the short term

With reduced growth and weaker global price pressures (including for oil) the outlook for inflation in the short term is more moderate than we had assumed in the 2001 Budget. In the labour market, short-term wage pressure is diluted by concerns about the world economy and a rise in the unemployment rate. Our projections have CPI inflation falling back to the middle of the Reserve Bank's target range by the December 2002 quarter as pricing pressures ease on the back of weaker unit labour costs and weaker world export and import prices. Weaker demand also makes it more difficult for firms to pass on price rises.

As growth picks up over 2002/03, the Reserve Bank is assumed to steadily return the Official Cash Rate to around 6.0%, our current estimate of neutral short-term interest rates, to lean against any emerging inflationary pressures. This is also helped by a modest appreciation in the exchange rate.

The current account will continue to improve in the short run, but weaker world demand will see it decline moderately in 2002/03

The current account has improved more than expected throughout the year, although slower export growth in the year ahead, together with the forecast fall in the terms of trade slows down the extent of further improvement. However, declines in business investment and consumption expenditure lead to a fall in imports. As global growth slows, profits from New Zealand subsidiaries offshore are expected to fall. In the year to March 2002, the current account is expected to fall to around 3% of GDP, before deteriorating in 2002/03 as the goods and services surplus retraces some of the recent gains. Government defence spending adds to imports over most of the forecast period.

Longer term outlook—2003/04 and beyond

Over the medium term the economy continues to post good growth

In the year to March 2004, the economy is forecast to enjoy growth of 3.7% as export growth accelerates markedly, and as the domestic economy recovers strongly. The forecast resumption of business investment growth, and the improvement in the labour market see a strong pickup in domestic demand. However, as economic growth and business investment recovers, imports also increase so that net exports make a negative contribution to growth towards the end of the forecast horizon.

The outer years of the forecast period see some slowing of the economy, with average annual growth falling back to around trend growth of around 2.75%. Rising interest rates from late 2002 slow some components of domestic demand and help close an emerging positive output gap, while a gradual appreciation of the TWI to its expected long term equilibrium level moderates export growth.

Exports continue to recover...

Over the medium term, exports continue to recover. In volume terms, agricultural exports are expected to steadily increase over the forecast horizon due to increased stock numbers as well as productivity improvements. Non-commodity exports continue to do well on the back of continuing world growth and the exchange rate converging to its assumed equilibrium level.

...as does domestic demand

Business investment remains fairly strong further out in the forecast period given a continued tight labour market. To overcome capacity and labour market constraints firms are expected to meet more of their output growth from capital rather than labour. This will also serve to underpin average labour productivity of around 1.5% over the forecast period.

Consistent with rising economic growth over the medium term, labour demand also picks up. Employment growth is expected to gain momentum going into 2003/04 with the unemployment rate returning to around current levels of just over 5% as the higher participation rate and continued moderate net migration inflows offset further employment growth.

Monetary conditions

In late 2003 and early 2004, inflation tracks marginally above the mid-point of the target band as unit labour costs pickup somewhat and a slightly positive output gap emerges. However, the impact of rising interest rates leans against any emerging inflation pressures and inflation tracks down toward the mid-point of the Reserve Bank's target inflation band.

Current account improves further out

Following the deterioration in the current account deficit to 3.8% of GDP in 2003, the deficit falls further to 4.0% of GDP as imports increase on the back of the pick-up in investment spending and domestic consumption. Further out, continued steady improvement in service exports underpins an improvement in the current account balance at the end of the forecast horizon.

Growth in the nominal economy rebounds

Over the last three years of the forecast horizon the nominal economy is forecast to record solid growth of 4% to 5%, owing to the combined contribution of relatively steady GDP growth and stable inflation around the middle of the Reserve Bank's target band. This growth in nominal GDP underpins solid revenue growth in our fiscal forecasts.

3

Fiscal Outlook

Introduction

This chapter discusses the trends, influences and assumptions behind the outlook for the Crown's finances. The discussion covers:

- •

- key components of the operating balance including tax revenue, expenses, and state-owned enterprises' and Crown entities' surpluses

- •

- net worth and net debt, including the relation between the operating balance and net worth and net debt, and details of revisions to the 2001/02 bond programme.

Following these sections are technical tables and information including fiscal indicators, OBERAC methodology, a reconciliation of the operating balance since the 2001 Budget, the Government's operating and capital provisions, the relationship between the operating balance and net debt, the Air New Zealand recapitalisation package and the NZS Fund assumptions.

Page 70 outlines the impending change to how the Crown will prepare its fiscal forecasts and Crown financial statements through the introduction of line-by-line consolidation of SOEs and Crown entities

Influences on the Operating Balance

Operating surpluses will continue to rise over the forecast period.

In 2001/02, the OBERAC is $1.2 billion once the operating balance is adjusted for ACC and GSF revaluations of around $250 million. Thereafter, both the OBERAC (see page 61) and operating balance grow from $1.8 billion in 2002/03 (1.5% of GDP) to $3.9 billion in 2005/06 (2.7% of GDP).

The following sections discuss the trends in the three main operating balance components (revenue, expenses and SOE/CE surpluses) and any significant changes in these components since the 2001 Budget.

For a detailed comparison of key fiscal indicators with the 2001 Budget, see Table 3.4 on pages 58 and 59.

Tax Revenue

The main driver of tax revenue is nominal economic growth

Tax revenue is expected to grow broadly in line with growth in nominal GDP, apart from in 2001/02.

An expected drop in corporate tax in 2001/02 is the major factor behind total tax revenue growth of 2.3% in 2001/02.

Tax forecasts across all years are lower compared with the 2001 Budget, with by far the biggest reduction ($840 million) occurring in 2002/03.

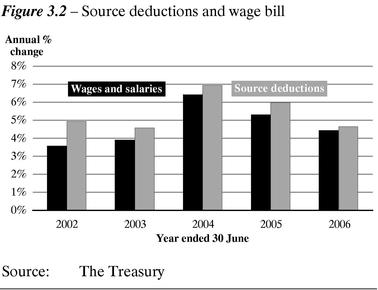

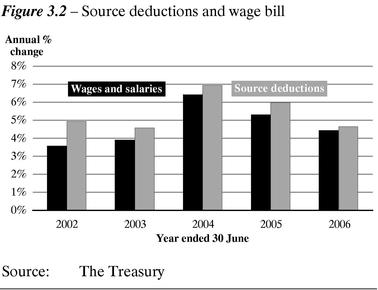

PAYE forecasts largely track wages and salaries, but...

Source deductions (PAYE) is tax paid on wages and salary income and is the largest single component of tax revenue.

Source deductions' growth is usually slightly above growth in wages and salaries owing to the "fiscal drag" effect, where income growth over time moves more people into higher tax brackets.

However, in 2001/02, the gap between the two growth rates is larger than usual. This is because PAYE is also paid on social welfare benefits and NZ Superannuation and, in 2001/02, growth in benefits is expected to be slightly ahead of growth in wages and salaries.

...GST growth is well in excess of growth in domestic consumption

A substantial shift in GST revenue from the latter part of 2000/01 into the early part of 2001/02 has boosted growth in GST above growth in underlying domestic consumption.

This revenue shift prompted an increase to the GST forecast for 2001/02.

This increase in the forecast continues through later years as GST grows in line with domestic consumption.

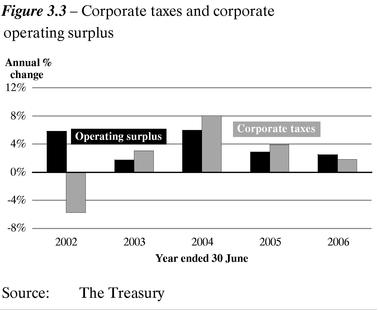

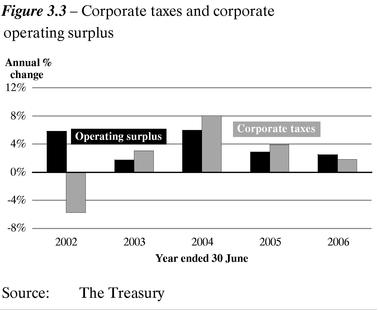

Corporate tax dips, but recovers

There is some downward pressure on the corporate tax forecast for 2001/02, with tax from the savings and investment sector expected to be lower than 2000/01 as a result of poor investment returns.

It is also expected that many large companies will reduce their estimates of tax liability, which is likely to have a negative effect on tax revenue in terms of both provisional tax and terminal tax.

On the other hand, the tax revenue of small companies to date is higher than last year's level, which puts upward pressure on the forecast.

On balance, corporate tax revenue is expected to decline by nearly 6% in 2001/02.

With profits expected to stagnate in 2003, corporate tax growth in the 2002/03 year is expected to be slight. However, tax growth recovers again in 2003/04 on the back of strong profit growth.

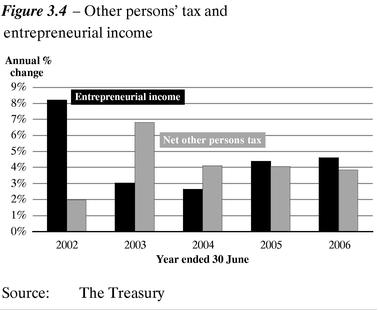

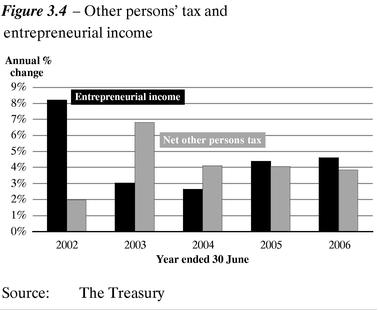

Other persons' tax is affected by fluctuations in terminal tax and refund payments

Net other persons' tax is tax paid mainly by the self-employed, farmers and investors, less refunds paid to all individuals.

The increased level of other persons' refunds to date in 2001/02 has a flow on to the level of terminal tax. This is likely to be down compared to last year, particularly since terminal tax was unusually high in 2000/01 when there was a great deal of terminal tax paid by individuals who had shifted income into the 2000 tax year to minimise the effects of the tax rate rise. Consequently, growth in net other persons' tax is well below growth in entrepreneurial income for 2001/02.

Terminal tax, mostly from farmers, is expected to boost other persons' tax growth in 2002/03, aided by a fall in refunds.

For the remainder of the forecast horizon, net other persons' tax is expected to grow broadly in line with growth in entrepreneurial income.

Risks around the tax forecasts from judgements made

As always, the main risks around the tax forecasts are economic. The macroeconomic forecasts are the primary input into the tax forecasts, which means that the accuracy of the tax forecasts depends, to a large extent, on the accuracy of the economic forecasts.

However, when formulating tax forecasts, many judgements need to be made. Having to make these judgements introduces further risks to the accuracy of the tax forecasts.

Particular risks in these forecasts stem from:

- •

- reconciling tensions between recent tax data and economic data, particularly for PAYE and GST

- •

- determining the incidence of revenue recognition, particularly in self-assessed tax types such as other persons and companies, where terminal tax and refunds can shift tax revenue between years

- •

- deciding how much of an effect tax losses will have on tax revenue over the next few years in corporate and other persons' tax.

Inland Revenue's Forecasts

In line with established practice, the Inland Revenue Department has prepared an independent set of tax forecasts, based in the short term on more detailed analysis of taxpayer information, and in the longer term reflecting the same underlying macroeconomic trends.

Aggregate differences between the two sets of forecasts in the 2001/02 and 2002/03 fiscal years are negligible. Over subsequent years, Inland Revenue projects total tax revenue to be somewhat lower than the Treasury's estimates. However, the differences between the total tax forecasts are less than 1%.

The two sets of forecasts are compared in Table A.1.

Expenses

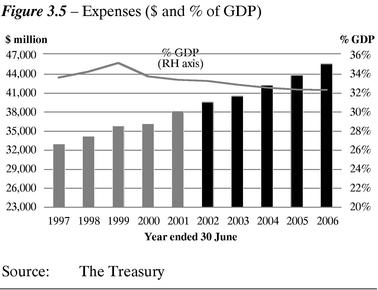

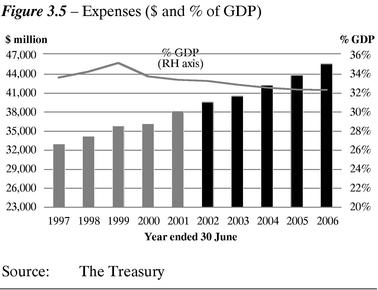

Expenses as a percentage of GDP continue to trend down

Expenses fall as a percentage of GDP from 33.4% in 2000/01 to 32.4% in 2005/06.

Over the same period, nominal expenses grow by around 4% each year, owing to both policy spending and demand-driven factors. This represents an increase of around $7.4 billion from $38.2 billion in 2000/01 to $45.6 billion in 2005/06.

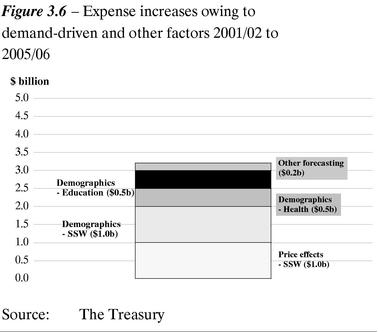

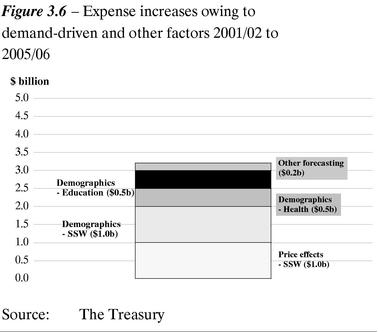

Demand-driven factors outlined in Figure 3.6 account for around 40% ($3.2 billion) of the expense increase. These factors include demographic impacts and CPI indexation of benefits. They are not met from the fiscal provisions, as the Government has little direct influence over their movement.

Over the five year forecast period:

- •

- CPI indexation averages 1.6%, increasing benefits expenses by around $1 billion

- •

- population growth increases the number of invalids and superannuitants by 47,500, this being the main demographic drivers for Social Security and Welfare (SSW) expenses

- •

- population ageing is the main driver for health demographics

- •

- school and tertiary rolls increase by around 25,000.

Other expense categories remain relatively static, except finance costs which increase slightly reflecting higher nominal debt levels.

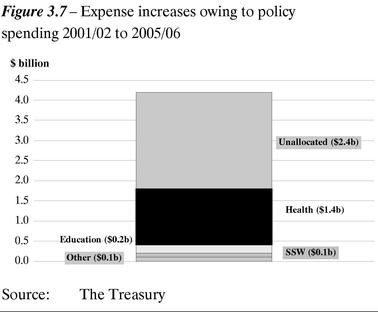

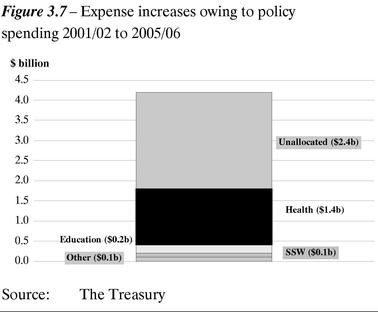

Around 60% ($4.2 billion) of increases in expenses is policy driven, comprising the Government's operating provisions (see Figure 3.7).

The bulk of the expenses allocated to date from the provisions has been directed towards Education, Health and Social Security and Welfare ($1.8 billion1). Around $2.4 billion remains unallocated. These amounts are intended to fund new initiatives, while managing cost pressures the Government can directly influence.

- 1

- Comprises $0.6 billion allocated in the 2001 Budget package, and $1.2 billion for the health package announced in December 2001.

Table 3.8 outlines the policy decisions affecting expenses since Budget 2001.

Health spending the key feature of expense growth since the 2001 Budget

The Government has announced an increase in cumulative health spending of $2.4 billion over the next three financial years, over and above funding for existing demographic and other forecasting items. The announcement represents a health package of $400 million growth in each year of 2002/03, 2003/04 and 2004/05.

Table 3.1 shows the growth of health spending year on year.

Table 3.1—Growth in health expenses

| | 2000/01

Actual1

| | 2001/02

Forecast

| | 2002/03

Forecast

| | 2003/04

Forecast

| | 2004/05

Forecast

| | 2005/06

Forecast

| |

|---|

| | ($ million)

| |

|---|

| Health spending | | 7,342 | | 7,797 | | 8,225 | | 8,744 | | 9,264 | | 9,385 | |

Sources of growth |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demographic adjustment | | | | 92 | | 94 | | 96 | | 98 | | 100 | |

| Budget 2000 initiatives profile difference | | | | 8 | | 30 | | 20 | | — | | — | |

| 2000 contingency (DEFU 2000) | | | | (22 | ) | 1 | | — | | — | | — | |

| Previous Budget decisions | | | | (14 | ) | 31 | | 20 | | — | | — | |

| Health payments to ACC | | | | 173 | | (17 | ) | 9 | | 22 | | 22 | |

| Expense transfers between years2 | | | | 62 | | (62 | ) | | | | | | |

| Budget 2001 initiatives | | | | 246 | | (7 | ) | — | | — | | — | |

| Health package announcement | | | | — | | 400 | | 400 | | 400 | | — | |

| Other (includes forecasting)1 | | | | (104 | ) | (11 | ) | (6 | ) | — | | (1 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Total growth | | | | 455 | | 428 | | 519 | | 520 | | 121 | |

| | |

| |

| |

| |

| |

| |

| |

Source: The Treasury

NOTES:

- 1

- Included in 2000/01 is unappropriated expenditure on pharmaceuticals and laboratory services which does not flow through to future outyears.

- 2

- Expense transfers of $30 million were made from 2000/01 to 2001/02 which do not flow through to future outyears.

SOE and Crown Entity Surpluses

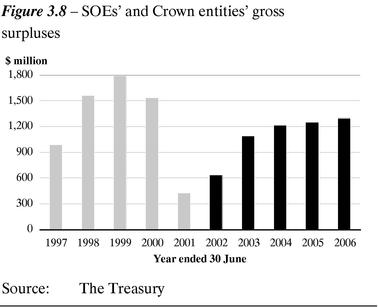

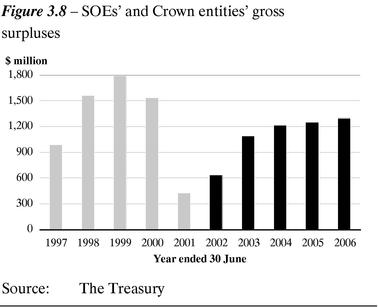

SOE and Crown entity surpluses have generally decreased from prior years (excluding 2000/01). In 2000/01 and 2001/02, the surplus is affected by increases in the ACC outstanding claims liability ($420 million and $205 million respectively).

Abstracting from the ACC liability valuation impacts, gross SOE and Crown entity surpluses are around $850 million in 2001/02, rising over the forecast period to $1.3 billion in 2005/06.

SOE and Crown entity surpluses are lower than the 2001 Budget forecasts for 2001/02. This is primarily due to two factors:

- •

- forecast revisions to the deficits for the DHBs. The current forecasts include a combined net deficit of $220 million. DHB deficits are forecast to be around zero by 2003/04

- •

- ACC valuation changes have resulted in an increase in the outstanding claims liability of around $205 million.

Surpluses are higher than those forecast in the 2001 Budget for the remainder of the forecast period owing to additional deficits in the DHBs being more than offset by improved surpluses from SOEs.

Influences on Net Worth and Debt

Operating surpluses increase net worth and generate cash...

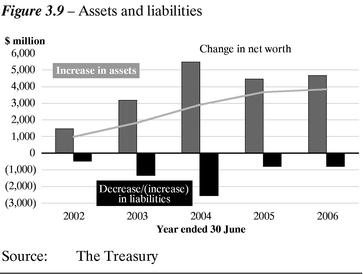

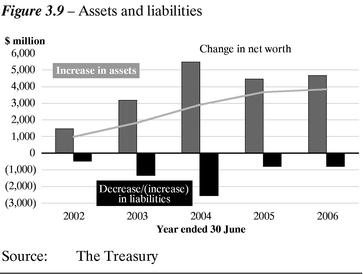

Net worth increases by $13.2 billion from $11.5 billion to $24.7 billion between 2000/01 and 2005/06. This increase reflects the level of operating balances over the forecast period of around $13.2 billion.

Table 3.2 shows how the forecast operating surpluses flow through to the Statement of Financial Position over the five-year forecast period.

Some portions of the operating surplus are non-cash in nature, including:

- •

- depreciation of $5.0 billion, for which a broadly equivalent amount of cash is earmarked for maintaining existing physical asset levels; offset by

- •

- SOE and Crown entity net surpluses of $3.8 billion, which are retained by the SOEs and Crown entities and increase the Crown's investment in these entities

- •

- NZS Fund returns (after tax) of $1.2 billion, which are retained by the NZS Fund, and increase the Crown's investment in this asset.

Adjusting for these items, the rising operating surplus profile generates a similar level of operating cash flows ($13.0 billion). The Crown can use this cash to either invest in assets or repay debt.

Table 3.2—Impact of operating surpluses on the balance sheet from 2001/02 to 2005/06

In the 2001 Budget, the forecast financing requirement for the years 2000/01 to 2004/05 was $7.6 billion. The updated financing requirement for the comparative period is now around $1.5 billion higher. This primarily reflects the Air New Zealand recapitalisation package (around $1 billion), higher student loan advances and refinancing of DHB debt (around $0.7 billion combined), partially offset by a higher than expected surplus cash position of $0.5 billion in 2000/01.

...though investment claims outweigh available cash surpluses

The Crown invests $23.6 billion cash—$10.6 billion more than its operating cash flows over the forecast period, including2:

- 2

- The capital provisions are allocated across purchases of assets, SOE/Crown entity capital injections, and advances (see Tables 3.9 and 3.10 on pages 65 and 66).

- •

- maintaining and improving the existing asset base ($9.1 billion) and providing injections of $1 billion to DHBs and for establishing Kiwibank

- •

- investing in the NZS Fund ($7.9 billion)

- •

- funding advances ($5.7 billion). The advances comprise student loans of $3.9 billion with the remaining $1.8 billion relating to refinancing Crown entity private sector debt (DHBs and Housing New Zealand Corporation) and other miscellaneous advance activity.

To fund the difference of $10.6 billion between operating cash flows and investment programme requirements, existing levels of marketable securities and deposits (MSDs) will be run down and new debt will be required.

Gross debt increases by around $6.6 billion and MSDs decrease by around $3.9 billion over the forecast horizon. The change in these financial assets and liabilities, together with other working capital movements (for example, movements in accounts payable), funds the $10.6 billion additional investment in the balance sheet.

The increase in net debt over the forecast period is $4.9 billion, lower than the total funding requirement of $10.6 billion mentioned above. Net debt is not influenced by movements in advances (mainly student loans and refinancing Crown entity debt) or foreign exchange revaluations of overseas debt (which is fully hedged by movements in foreign currency denominated financial assets)3.

- 3

- Table 3.11 on page 66 outlines the relationship between the operating balance and net debt in detail.

Debt as a percentage of GDP rises slightly in the middle of the forecast period before falling again

While both gross and net debt increase in nominal terms over the forecast period, of more relevance is how debt tracks with growth in the economy.

The Government's debt objective is established at a gross debt constraint of 30% of GDP. The associated net debt indicator is 20% of GDP.

Gross debt falls as a percentage of GDP from around 32% at the start of the forecast period to slightly below 31% by 2005/06.

Net debt increases from 17.5% in 2001 to 19% in 2003/04, before dropping back to 17.6% at the end of the forecast period.