SCHEDULE 14A INFORMATION

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | |

| | | |

¨ | | Preliminary Proxy Statement | | ¨ | | | Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

x | | Definitive Proxy Statement | | | | | |

| | | |

¨ | | Definitive Additional Materials | | | | | |

| |

¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

COMARCO, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | |

| |

x | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

|

| | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

|

| | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

|

| | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

|

| | |

| | | (5) | | Total fee paid: |

| | |

| | | | |

|

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | | (1) | | Amount Previously Paid: |

| | | | |

|

| | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

|

| | |

| | | (3) | | Filing Party: |

| | | | |

|

| | |

| | | (4) | | Date Filed: |

| | | | |

|

COMARCO, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held

June 22, 2004

To the Shareholders of COMARCO, Inc.:

The Annual Meeting of the Shareholders of COMARCO, Inc., a California corporation (the “Company”), will be held on Tuesday, June 22, 2004 at 10:00 A.M., local time, at the offices of Comarco Wireless Technologies, Inc. 2 Cromwell Drive, Irvine, CA 92618 (949) 599-7400, for the following purposes:

1. To elect five Directors; and

2. To transact such other business as may properly come before the meeting or any adjournment thereof.

Only holders of record of the Company’s Common Stock at the close of business on May 6, 2004 are entitled to notice of and to vote at the Annual Meeting.

The Board of Directors of the Company intends to present Don M. Bailey, Thomas A. Franza, Gerald D. Griffin, Jeffrey R. Hultman, and Erik van der Kaay as nominees for election as Directors at the Annual Meeting.

Each shareholder is cordially invited to be present and to vote in person at the meeting. TO ASSURE REPRESENTATION AT THE MEETING, HOWEVER, SHAREHOLDERS ARE URGED TO SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE PREPAID ENVELOPE. Shareholders who attend the meeting may still vote in person, even if they have previously voted by proxy.

BY ORDER OF THE BOARD OF DIRECTORS

Peggy L. Vessell, Secretary

Irvine, California

May 25, 2004

TABLE OF CONTENTS

2

COMARCO, INC.

2 Cromwell Drive

Irvine, CA 92618

PROXY STATEMENT

For Annual Meeting of Shareholders

To Be Held

June 22, 2004

GENERAL INFORMATION

The Board of Directors of COMARCO, Inc., a California corporation (“COMARCO” or the “Company”), furnishes this Proxy Statement in connection with the solicitation of proxies to be used at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, June 22, 2004 at 10:00 A.M., local time, at the offices of Comarco Wireless Technologies, Inc. 2 Cromwell Drive, Irvine, CA 92618 (949) 599-7400, or any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting. This Proxy Statement and the accompanying form of proxy are first being mailed to shareholders on or about May 25, 2004.

A shareholder giving a proxy has the power to revoke it at any time before it is exercised by (1) filing with the Secretary of the Company an instrument in writing revoking the proxy; (2) filing with the Secretary of the Company a duly executed proxy bearing a later date; or (3) attending the Annual Meeting and voting the shares in person. In the absence of such revocation, all shares represented by a properly executed proxy received in time for the Annual Meeting will be voted as specified therein.

The cost of preparing, assembling, printing and mailing this Proxy Statement and the accompanying form of proxy and the cost of soliciting proxies will be borne by the Company. The Company may make arrangements with various brokerage houses or other nominees to send proxy materials to the beneficial owners of stock and may reimburse them for their reasonable expenses in connection therewith.

Our officers, employees and directors may supplement the original solicitation of proxies by telephone, facsimile, e-mail and personal contact. We will pay no additional compensation to such persons for any of these activities.

VOTING RIGHTS

The Company’s only outstanding class of voting securities is its Common Stock. Only shareholders of record at the close of business on May 6, 2004 will be entitled to vote at the Annual Meeting. At May 6, 2004, there were outstanding 7,291,772 shares of Common Stock. The holders of record of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting, present in person or by proxy, will constitute a quorum for the transaction of business. Each share is entitled to one vote, except that each shareholder is entitled to cumulate his shares in the election of Directors, provided that at least one shareholder has given notice, prior to the voting, of the shareholder’s intention to do so. If cumulative voting is in effect, each shareholder may give one candidate a number of votes equal to the number of Directors to be elected multiplied by the number of shares held by the shareholder, or the shareholder may distribute the votes on the same principle among as many candidates as the shareholder thinks fit.

3

With respect to shares of Common Stock held by brokers in street name for the beneficial owners thereof, the election of Directors is a “routine” matter upon which the brokers, as the holders of record, may vote these shares for which the beneficial owners have not provided them specific instructions.

With respect to the election of directors, the five nominees each receiving the greatest number of votes at the Annual Meeting shall each be elected a Director. If cumulative voting is in effect, shareholders may cumulate their votes for one or more candidates in the manner and upon satisfaction of the conditions described above. Votes against, votes withheld, and abstentions have no effect on voting for the election of Directors.

Item 1 on Proxy Card

ELECTION OF DIRECTORS

Five Directors will be elected at the Annual Meeting. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors nominated Don M. Bailey, Thomas A. Franza, Gerald D. Griffin, Jeffrey R. Hultman and Erik H. van der Kaay for election as Directors. Each Director elected at the Annual Meeting will hold office until the next annual meeting of shareholders and until his successor is duly elected and qualified. It is intended that the shares represented by the enclosed proxy will be voted, unless otherwise instructed, for the election of the five nominees of the Board of Directors. While the Company has no reason to believe that any of the nominees will be unable to serve as Director, it is intended that if such an event should occur, such shares will be voted for the remainder of the nominees and for such substitute nominee or nominees as may be selected by the Board of Directors, unless a shareholder withholds authority to vote his shares (i) for all of the nominees by so indicating on the enclosed proxy card or (ii) for any one or more of the nominees by checking their names in the space provided on such card, in which case his shares will not be voted for such nominee or nominees. If cumulative voting is in effect for the election of Directors, the proxy holders will have the discretion to cumulate votes as provided by California law (see “VOTING RIGHTS” above) and to distribute such votes among all the nominees or, if authority to vote for any nominee or nominees has been withheld, among the remaining nominees, in such manner as they deem appropriate.

All the nominees are currently serving as Directors of the Company. The term of office of each of the current Directors expires on the date of the Annual Meeting. All the nominees were elected at the last annual meeting.

4

The following table sets forth information concerning the nominees at May 25, 2004 and is followed by a brief biography of each nominee.

| | | | | | | | |

Name

| | Age

| | Principal Occupation

| | Year

First

Elected

Director

| | Other Directorships

|

Don M. Bailey | | 58 | | Chairman of the Board | | 1991 | | None |

Thomas A. Franza | | 61 | | President and Chief Executive Officer Of the Company | | 1998 | | None |

Gerald D. Griffin (1) (2)** (3) | | 69 | | Executive Consultant | | 1986 | | None |

Jeffrey R. Hultman (1) (2) (3)*** | | 64 | | CEO EdgeFocus, Inc. | | 2000 | | None |

Erik H. van der Kaay (1)* (2) (3) | | 64 | | Retired Chairman of the Board of Symmetricom, Inc. | | 2001 | | RF MicroDevices TransSwitch Corp. Ball Corporation |

(1) Member of Compensation Committee—*Chairman

(2) Member of Audit and Finance Committee—**Chairman

(3) Member of Nominating and Corporate Governance Committee—***Chairman

Mr. Bailey has been Chairman of the Board since 1998. He also served as President and Chief Executive Officer of the Company from June 1990 to April 2000. From November of 1988 until May 1990, he served as Senior Vice President of the Company and, from January 1986 until October 1988, he served as Vice President, Corporate Development. He has been employed by the Company since May 1980.

Mr. Franza has been President and Chief Executive Officer of the Company since April 2000. He is also currently President of Comarco Wireless Technologies, Inc. and Comarco Wireless International, Inc. Mr. Franza served as Executive Vice President of the Company from 1995 to April 2000, as Senior Vice President of the Company from 1992 to 1995, and before then, as a Vice President from 1990 until 1992. He joined the Company in 1985.

Mr. Griffin was the non-executive Chairman of the Board of the Company from 1988 until July 1998. Mr. Griffin currently serves on the Audit Committee of Bank of the Hills, N.A. In addition, Mr. Griffin has been an executive consultant since 1992. Previously, he was Managing Director of the Houston Office of Korn/Ferry International. From 1986 to 1988, he was President and Chief Executive Officer of the Houston Chamber of Commerce. Between 1982 and 1986 he was Director of NASA’s Johnson Space Center in Houston, Texas.

5

Mr. Hultman is currently the CEO of EdgeFocus, Inc., a high speed wireless internet company a position he has held since November 2002. From 1998 to 2002 Mr. Hultman was a partner in Big Bear Sports Ranch, a sports summer camp for school-age children. From 1991 through 1997, he was CEO of Dial Page, Inc. (a provider of wireless telecommunications throughout the Southeastern United States) until its merger with Nextel Communications, Inc. From 1987 through 1991, he was CEO of PacTel Cellular, which became AirTouch Communications. Prior to that, Mr. Hultman was an executive with Pacific Bell.

Mr. van der Kaay is former Chairman of the Board of Symmetricom, Inc. from November, 2002 to August, 2003. From 1998 to 2002, he served as President and Chief Executive Officer of Datum, Inc. Datum merged with Symmetricom in October 2002. He is a Director of RF Micro Devices in Greensboro, North Carolina since 1996, a Director of TranSwitch Corporation in Shelton, Connecticut since 1997 and a Director of Ball Corporation in Bloomfield, Colorado effective January 2004. From 1990 to 1998, he held various positions with Allen Telecom (leading supplier of wireless equipment to the global telecommunications infrastructure market), acquired in 2003 by Andrew Corporation.

No arrangement or understanding exists between any nominee and any other persons pursuant to which any nominee was or is to be selected as a director. No nominee has any family relationship with any other nominee or with any of our executive officers or directors.

BOARD ORGANIZATION AND COMMITTEE MEETINGS

During the fiscal year ended January 31, 2004, the Company’s Board of Directors met six times and the committees of the Board listed below met, in the aggregate, a total of eleven times. Each of the Company’s Directors attended at least 75% of the total number of meetings of the Board of Directors and the total number of meetings of the committees on which he served during the Company’s last fiscal year. The Board of Directors, after consultation with the Nominating and Corporate Governance Committee, determined that Messrs. Griffin, Hultman and van der Kaay, who represent a majority of the members of the Board of Directors, are “independent,” as defined under the rules of the National Association of Securities Dealers, Inc., or the NASD.

The standing committees of the Board of Directors are each comprised of independent directors under the rules of the NASD and consist of the following:

Audit and Finance Committee. The Audit and Finance Committee’s primary purpose is to aid the Board of Directors in undertaking and fulfilling their responsibilities for financial reporting to the shareholders. It also supports and encourages efforts to improve the financial controls exercised by management and to ensure their adequacy for purposes of public reporting; and to select, compensate and evaluate the Company’s independent auditors and review with such accountants the scope and results of their annual audit of the Company. The Audit and Finance Committee operates under a written charter, a copy of which is attached as Appendix A. The current members of the Audit and Finance Committee are Messrs. Griffin, Hultman and van der Kaay, each of whom is “independent” under Rule 10A-3(b) of the Securities Exchange Act of 1934. The Board of Directors has determined that Mr. van der Kaay is an “audit committee financial expert,” as defined in Item 401(h) of Regulation S-K. The Audit and Finance Committee met six times during the last fiscal year.

Compensation Committee. The Compensation Committee reviews, and recommends to the Board of Directors for determination, the compensation of officers, including the Company’s Chief Executive Officer, and key employees, and makes awards under the Company’s 1982 and 1995 Employee Stock Option Plans and the Stock Option Plan for the Company’s subsidiary, Comarco Wireless Technologies, Inc. The Compensation Committee also reviews and assists the Board in establishing appropriate compensation policies for directors on the Board and its committees. The current members of

6

the Compensation Committee are Messrs. Griffin, Hultman and van der Kaay. The Compensation Committee met five times during the last fiscal year.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee assists the Board of Directors (i) in identifying candidates for membership on the Board and submission of nominees to the shareholders for election at each year’s annual meeting, (ii) reviews the qualifications of candidates for Board and committee membership, and (iii) evaluates the appropriate composition of the Board of Directors and committees of the Board. In addition, the Nominating and Corporate Governance Committee oversees the implementation and monitoring of the effectiveness of the Company’s Corporate Governance Guidelines and, on a regular basis, the overall corporate governance of the Company, including recommending improvements when necessary. The Nominating and Corporate Governance Committee operates under a Nominating and Corporate Governance Committee Charter, a copy of which is available on the Company’s website atwww.comarco.com. In February 2004, the Board of Directors established the Nominating and Corporate Governance Committee. Accordingly, the Nominating and Corporate Governance Committee did not meet during the last fiscal year.

The Nominating and Corporate Governance Committee encourages selection of directors who will contribute to the Company’s overall corporate goals of technology leadership, effective execution, high customer satisfaction, superior employee working environment, and creation and preservation of shareholder value. At a minimum, candidates recommended by the Nominating and Corporate Governance Committee must possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company’s shareholders.

In evaluating the suitability of individual candidates for election or re-election to the Board, the Nominating and Corporate Governance Committee considers many factors, including (1) whether a candidate possesses an understanding of technology, manufacturing, sales and marketing, finance and other elements relevant to the Company’s business, (2) the candidate’s educational and professional background, age and past performance as a Board member and (3) consistency with the other provisions of the Nominating and Corporate Governance Committee Charter relating to the composition of the Board and eligibility for Board membership. Additionally, in determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee takes into account the director’s past attendance at, and participation in, meetings of the Board and its committees and contributions to their activities.

The Nominating and Corporate Governance Committee considers candidates for nomination as director proposed by any shareholder of the Company. Any shareholder of the Company is entitled to recommend a candidate for nomination by submitting, not less than 60 nor more than 90 days prior to the annual meeting of shareholders at which directors are to be elected, the name of the candidate to: Corporate Secretary, Comarco, Inc., 2 Cromwell Drive, Irvine, CA 92618. Any shareholder recommendation is forwarded to the Chairman of the Nominating and Corporate Governance Committee. A shareholder also must provide the following supporting information to recommend a candidate: name, age, business and residence addresses, principal occupation or employment, the number of shares of the Company’s common stock held by the candidate, a resume of his or her business and educational background, the information that would be required under SEC rules in a proxy statement soliciting proxies for the election of such nominee as a director, and a signed consent of the candidate to serve as a director, if nominated and elected. The Nominating and Corporate Governance Committee, after reviewing this information, will determine whether the candidate meets the qualifications for committee-recommended candidates, including the objectives for the composition of the Board as a whole. The Nominating and Corporate Governance Committee does not evaluate any candidate for nomination as director any differently because the candidate was recommended by a shareholder.

7

CORPORATE GOVERNANCE

Executive Sessions of Independent Directors

It is the policy of the Board of Directors that the Company’s independent directors meet separately without management directors at least twice each year, before or after regularly scheduled Board meetings, to discuss such matters as the independent directors consider appropriate. For 2004, the Company’s independent directors are scheduled to meet separately in April and September. As Lead Director, Mr. Jeffrey Hultman is the presiding director at these meetings.

Shareholder and Interested Party Communications with the Board of Directors

The Company has established a Compliance Hotline operated by CCBN (an independent company) as a means of receiving and directing concerns from employees and any other persons relating to complaints regarding any accounting, internal audit controls or auditing matters. Confidential, anonymous reports of accounting and audit concerns may be made 24 hours a day, seven days a week. Communications may be confidential or anonymous, and may be communicated by calling the Compliance Hotline at: (800) 792-8138. In addition, anyone who has a concern about the conduct of the Company or any of its officers or employees, or about the Company’s accounting, internal controls, disclosure controls and procedures, auditing, compensation and governance matters may communicate that concern directly to the Audit and Finance Committee, the Nominating and Corporate Governance Committee, or the Compensation Committee, as appropriate in light of the specific concern involved Any concerns relating to accounting, internal controls, disclosure controls and procedures, auditing, corporate conduct or conduct of any corporate officer or employee shall be forwarded to the Chair of the Audit and Finance Committee. The Company’s policies prohibit retaliation or adverse action against anyone for raising or helping to resolve an integrity concern.

In addition, shareholders who desire to communicate with the Company regarding any matter pertinent to the Company’s business or affairs may do so by writing to the Chairman of the Board (not via email) at 2 Cromwell Drive, Irvine, CA 92618, Attention: Chairman of the Board.

The Company has a policy that each member of the Board of Directors should make every reasonable effort to attend each annual meeting of shareholders. At the Company’s 2003 annual meeting of shareholders, all directors were in attendance.

Code of Ethics for Senior Financial Officers

The Audit and Finance Committee has adopted a Code of Ethics for Senior Financial Officers to promote and provide for the honest and ethical conduct by the Company’s Senior Financial Officers, as well as for full, fair, accurate and timely financial management and reporting. The Company’s Senior Financial Officers include the Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer or Controller and Treasurer. The Company expects all of these financial officers to act in accordance with the highest standards of professional integrity, to provide full and accurate disclosure in reports and other documents filed with the SEC and other regulators and in any public communications, to comply with all applicable laws, rules and regulations and to deter wrongdoing. A complete copy of the Code of Ethics for Senior Financial Officers is available on the Company’s website atwww.comarco.com.

8

DIRECTOR COMPENSATION

Each director (other than Mr. Franza and Mr. Bailey) of the Company receives compensation of $2,000 per month, $2,000 per attended Board meeting and $1,000 per telephonic Board meeting. In addition, members of the committees receive $1,250 per Committee meeting, and the Committee Chairmen receive an additional $750 per meeting. Mr. Franza and Mr. Bailey receive no compensation other than that received as officers of the Company.

In 1987, the Company’s shareholders approved the Company’s Director Stock Option Plan, under which non-qualified stock options may be granted to non-employee directors. The maximum number of authorized shares is 637,500. The Board of Directors administers the plan. The Board determines the number of shares with respect to which options are granted under the plan, the date on which the options will be exercisable, and the installment provisions and other terms of the options. The option exercise price per share is the fair market value based on the closing price of a share of the Company’s common stock on the date of the grant. Options vest in equal annual increments of 25% over the four-year period following their grant date. On and after the second anniversary of a Director’s election to the Board, the vesting schedule of all options previously granted is accelerated and all options granted thereafter become exercisable six months following the date of grant.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934 and the rules issued thereunder, the Company’s executive officers, Directors and persons that own more than 10% of the Company’s Common Stock are required to file with the Securities and Exchange Commission reports of ownership and changes in ownership of Common Stock and furnish the Company copies of all such reports. The Company believes that, during the fiscal year ended January 31, 2004, its executive officers, Directors and persons that owned more than 10% of the Company’s Common Stock complied with the Section 16(a) reporting requirements on a timely basis, based on the reports received by the Company or written certifications received by the Company from its executive officers and directors, except that one Form 4 reporting one option award was not timely filed by Ms. Cobb, one Form 4 reporting one purchase of shares was not timely filed by Mr. Franza, one Form 5 reporting 401(k) holding at end of the fiscal year was not timely filed by Mr. Lutz, one Form 4 reporting one option award and one Form 5 reporting 40l(k) holdings at end of the fiscal year was not timely filed by Mr. Gutierrez, one Form 4 reporting one option award and one Form 5 reporting 40l(k) holdings at end of the fiscal year was not timely filed by Mr. Lanni and one Form 4 reporting one option award was not timely filed by Ms. Vessell.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information concerning the beneficial ownership of the Company’s outstanding Common Stock as of May 6, 2004 by each person or entity known by the Company that owns more than five percent of its outstanding Common Stock, each director, each executive officer named in the “Summary Compensation Table” included in the “Executive Compensation” section below, and all directors and executive officers of the Company as a group. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. Unless otherwise indicated below, the address of each beneficial owner is c/o COMARCO, Inc., 2 Cromwell Drive, Irvine, California. 92618. Unless otherwise indicated below, the Company believes that each of the persons listed in the table (subject to applicable community property laws) has the sole power to vote and to dispose of the shares listed opposite the shareholder’s name.

9

| | | | | | | | | | |

Name and Address of Beneficial Owner

| | Office, If Any

| | Number of Shares

Beneficially Owned

| | Percent

of Class

| | | Notes

| |

Don M. Bailey | | Chairman of the Board | | 240,261 | | 3.3 | % | | (1 | ) |

| | | | |

Thomas A. Franza | | President and Chief Executive Officer | | 207,471 | | 2.9 | % | | (2 | )(3) |

| | | | |

Gerald D. Griffin | | Director | | 75,250 | | * | | | (4 | ) |

| | | | |

Jeffrey R. Hultman | | Director | | 36,500 | | * | | | (5 | ) |

| | | | |

Erik van der Kaay | | Director | | 28,500 | | * | | | (6 | ) |

| | | | |

Daniel R. Lutz | | Vice President and Chief Financial Officer | | 32,746 | | * | | | (7 | ) |

| | | | |

Sebastian E. Gutierrez | | Vice President | | 39,784 | | * | | | (8 | ) |

| | | | |

Craig M. Hayes | | Vice President | | 0 | | * | | | | |

| | | | |

Gregory Maton | | Sr. Vice President | | 0 | | * | | | | |

| | | | |

Directors and Executive Officers as a

Group (13 persons) | | | | 23,030 | | 10.0 | % | | (9 | ) |

| | | | |

COMARCO, Inc. Employee Savings and Retirement Trust | | | | 182,072 | | 2.5 | % | | (10 | ) |

| | | | |

T. Rowe Price Associates 100 East Pratt Street Baltimore, MD 21202 | | | | 694,200 | | 9.5 | % | | (11 | ) |

| | | | |

Columbia Wagner Asset Management, L.P. 227 West Monroe Street, Suite 3000 Chicago, IL 60606 | | | | 526,050 | | 7.21 | % | | (12 | ) |

| | | | |

Columbia Acorn Trust (“Acorn”) 227 West Monroe Street, Suite 3000 Chicago, IL 60606 | | | | 316,900 | | 4.35 | % | | (13 | ) |

| | | | |

Grueber & McBaine 50 Osgood Place, Penthouse San Francisco, CA 94133 | | | | 479,200 | | 6.6 | % | | (14 | ) |

| | | | |

Dimensional Fund Advisors, Inc. 1299 Ocean Avenue 11th Floor Santa Monica, CA 90401 | | | | 426,300 | | 5.9 | % | | (15 | ) |

| | | | |

Stadium Capital Management, LLC 19785 Village Office Court, Suite 101 Bend, OR 97702 | | | | 688,500 | | 9.5 | % | | (16 | ) |

| | | | |

Kern Capital Management, LLC 114 West 47th Street Suite 1926 New York, NY 10036 | | | | 809,700 | | 11.10 | % | | (17 | ) |

| | | | |

Elkhorn Partners Limited Partnership 2222 Skyline Drive Elkhorn, Nebraska 68022 | | | | 431,943 | | 5.92 | % | | (18 | ) |

10

* Indicates less than one percent of the outstanding shares of Common Stock.

| (1) | Includes 182,875 shares that Mr. Bailey has the right to acquire within 60 days after May 6, 2004, by stock option exercise. |

| (2) | Does not include options to acquire shares in the Company’s subsidiary, Comarco Wireless Technologies, Inc. See section entitled “Stock Options”. |

| (3) | Includes 121,394 shares that Mr. Franza has the right to acquire within 60 days after May 6, 2004, by stock option exercise. Does not include options to acquire shares in the Company’s subsidiary, Comarco Wireless Technologies, Inc. See section entitled “Stock Options”. |

| (4) | Includes 66,500 shares that Mr. Griffin has a right to acquire within 60 days after May 6, 2004, by stock option exercise. |

| (5) | Includes 36,500 shares that Mr. Hultman has a right to acquire within 60 days after May 6, 2004, by stock option exercise. |

| (6) | Includes 26,500 shares that Mr. van der Kaay has a right to acquire within 60 days after May 6, 2004, by stock option exercise. |

| (7) | Includes 31,250 shares that Mr. Lutz has a right to acquire within 60 days after May 6, 2004, by stock option exercise. |

| (8) | Includes 35,000 shares that Mr. Gutierrez has a right to acquire within 60 days after May 6, 2004, by stock option exercise. |

| (9) | Includes an aggregate of 560,769 shares held by the Company’s executive officers and Directors that are subject to options exercisable within 60 days after May 6, 2004. |

| (10) | Represents shares held in the Employee Savings and Retirement Trust (the “Trust”), of which the Company is the administrator. Under the beneficial ownership rules promulgated by the Securities and Exchange Commission, the Company could be deemed to be a beneficial owner of such shares. All such shares are allocated to the accounts of Plan participants and are subject to and voted in accordance with the direction of the participants. The assets of the Trust are under the trusteeship of Smith Barney Corporate Trust Company. The number of shares listed is as of May 6, 2004. |

| (11) | Based on a Schedule 13G (Amendment 11) filed with the Securities and Exchange Commission on February 13, 2004. These securities are owned by various individual and institutional investors for which T. Rowe Price Associates, Inc. and T. Rowe Price Small Cap Value Fund, Inc. (“Price Associates”) serve as investment adviser with power to direct investments and/or sole power to vote the securities. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, beneficial owner of such securities. The reported ownership data is as of December 31, 2003. |

| (12) | Based on a Schedule 13GA (Amendment 10) filed with the Securities and Exchange Commission on May 14, 2004 on behalf of Columbia Wanger Asset Management, L.P (WAM). WAM is an investment adviser registered under section 203 of the Investment Advisers Act of 1940. WAM Acquisition GP, Inc. is the general partner of the investment adviser. |

| (13) | Base on a Schedule 13GA (Amendment 10) filed with the Securities and Exchange Commission on May 14, 2004 on behalf of Columbia Acorn Trust (“Acorn”). Acorn is an Investment Company under section 8 of the Investment Company Act. |

11

| (14) | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 11, 2004 on behalf of Grueber & McBaine Capital Management, LLC (GMCM). GMCM is a registered investment advisor. The reported ownership data is as of December 31, 2003. |

| (15) | Based on a Schedule 13G (Amendment 10) filed with the Securities and Exchange Commission on behalf of Dimensional Fund Advisors, Inc. on February 6, 2004. The reported ownership data is as of December 31, 2003. |

| (16) | Based on a Schedule 13G (Amendment 2) filed with the Securities and Exchange Commission on behalf of Stadium Capital Management, LLC on January 20, 2004. The reported ownership data is as of December 31, 2003. |

| (17) | Based on a Schedule 13G filed with the Securities and Exchange Commission on behalf of Kern Capital Management, LLC. on May 10, 2004. The reported ownership data is as of April 30, 2004. |

| (18) | Based on a Schedule 13D filed with the Securities and Exchange Commission on behalf of Elkhorn Partners Limited Partnership on May 17, 2004. The reported ownership data is as of May 14, 2004. |

EXECUTIVE COMPENSATION

The Company’s executive compensation structure consists of salaries, cash incentive awards and stock option awards. The Compensation Committee administers this structure. The Company’s CEO recommends compensation levels for the Company’s officers, except for himself, to the Compensation Committee. The Committee reviews these recommendations and approves final compensation levels for these officers. In addition, the Compensation Committee sets the compensation level for the CEO. Incentive compensation is based upon pre-established quantitative goals, typically earnings, profitability, and asset utilization, as well as qualitative goals, such as customer satisfaction.

The information on compensation set forth below is furnished for the fiscal year ended January 31, 2004 for the Chief Executive Officer, and the four most highly compensated executive officers whose cash compensation exceeded $100,000.

12

SUMMARY COMPENSATION TABLE

| | | | | | | | | | |

| | | | | Annual

Compensation

| | Long Term Compensation

|

Name and Principal Position

| | Fiscal

Year

| | Salary

($)(1)

| | Bonus

($)

| | Shares of

Common Stock

Underlying Options (#)

| | All Other

Compensation

($)(2)

|

Thomas A. Franza President & Chief Executive Officer | | 2004

2003

2002 | | 327,600

315,000

315,000 | | 0

0

239,000 | | 25,000

25,000

25,000 | | 10,000

349,354

8,500 |

| | | | | |

Daniel R. Lutz Vice President & Chief Financial Officer | | 2004

2003

2002 | | 200,000

157,500

157,500 | | 0

110,250

120,000 | | 20,000

0

25,000 | | 10,000

10,000

8,500 |

| | | | | |

Sebastian Gutierrez Vice President Comarco Wireless Technologies, Inc. | | 2004

2003

2002 | | 138,500

133,000

213,000 | | 20,000

93,100

50,000 | | 10,000

0

10,000 | | 10,000

10,000

8,500 |

| | | | | |

Gregory Maton Vice President Comarco Wireless Technologies, Inc. | | 2004

2003

2002 | | 210,000

40,000

0 | | 0

0

0 | | 0

20,000

0 | | 10,000

808

0 |

| | | | | |

Craig M. Hayes Vice President Comarco Wireless Technologies, Inc. | | 2004

2003

2002 | | 104,000

0

0 | | 50,000

0

0 | | 20,000

0

0 | | 4,308

0

0 |

Notes:

| (1) | “Salary” includes commissions as well as base salary and compensation deferred during the current year. |

| (2) | “All Other Compensation” consists of the Company’s matching contributions to its 401(k) plan and vacation payout. |

Severance Agreements

The Company and each of Messrs. Franza and Lutz are parties to a severance agreement that provides that if, within 24 months following a change of control, he is terminated or constructively terminated without cause, or ceases to be employed by the Company for reasons other than because of death, disability or retirement, within 24 months following a change in control of the Company, then he is entitled to receive a lump sum cash payment equal to two-times the sum of his annual base salary plus his annual incentive compensation bonus that would be payable assuming 100% satisfaction of all performance goals thereunder. In addition, each of Messrs. Franza and Lutz would be entitled to continued participation and coverage under the Company’s health plans and insurance program and the acceleration of all of his options and restricted stock, if any. Each severance agreement has a term that continues until three years after any notice of non-renewal or termination is given by the executive of the Company.

13

The Company and each of Messrs. Maton and Hayes are parties to a severance agreement that is substantially similar to the severance agreements with Messrs. Franza and Lutz, except that Messrs. Maton and Hayes are entitled to a lump sum cash payment equal to one-times the sum of his annual base salary plus his annual incentive compensation bonus that would be payable assuming 100% satisfaction of all performance goals thereunder.

STOCK OPTIONS

The following tables set forth for each person named in the executive compensation table above, information concerning (i) options granted by the Company during the fiscal year ended January 31, 2004 and (ii) information concerning fiscal year end option values. No Options were exercised by such persons during the fiscal year ended January 31, 2004.

Option Grants for Fiscal Year Ended January 31, 2004

| | | | | | | | | | | | | | | |

| Name | | Options

Granted (1) | | Percent of Total

Options Granted

to Employees | | Exercise

Price (2) | | Expiration

Date (3) | | Potential Realizable

Value at Assumed Rates

of Price Appreciation

for Option Term (4) 5% 10% |

|

Thomas A. Franza | | 25,000 | | 24% | | $ | 7.11 | | 6/24/2013 | | $ | 111,786 | | $ | 283,288 |

|

Craig M. Hayes | | 20,000 | | 19% | | $ | 7.62 | | 7/14/2013 | | $ | 95,844 | | $ | 242,886 |

|

Daniel R. Lutz | | 20,000 | | 19% | | $ | 8.08 | | 9/09/2013 | | $ | 101,629 | | $ | 257,549 |

|

Notes:

| (1) | The options vest in equal annual increments of 25% over the four-year period following their date of grant. |

| (2) | Represents the fair market value of an underlying share of Common Stock on the date of grant. |

| (3) | All options terminate ninety days after termination of employment other than by reason of death or disability. |

| (4) | Represents the potential realizable value assuming the stated rates of price appreciation compounded annually for the entire ten-year term, with the aggregate exercise price deducted from the final appreciated value. Such annual rates of appreciation are for illustrative purposes only, are based on requirements of the Securities and Exchange Commission, and do not reflect the Company’s estimate of future stock appreciation. No assurance can be given that such rates of appreciation, or any appreciation, will be achieved. |

14

Option Exercises and Values for Fiscal Year Ended January 31, 2004

| | | | | | | | | | | | | | | |

| Name | | Shares

Acquired

on Exercise | | Value

Realized | | Number of Options Vested Unvested | | Value of Options (1)

Vested Unvested |

|

| | | | | | |

Thomas A. Franza(2) | | 86,077 | | $ | 430,024 | | 96,394 | | 63,750 | | $ | 14,750 | | $ | 116,750 |

| | | | | | |

Sebastian Gutierrez | | 0 | | | N/A | | 29,000 | | 11,000 | | $ | 0 | | $ | 0 |

| | | | | | |

Craig Hayes | | 0 | | | N/A | | 0 | | 20,000 | | $ | 0 | | $ | 47,800 |

| | | | | | |

Daniel R. Lutz | | 0 | | | N/A | | 23,750 | | 36,250 | | $ | 0 | | $ | 38,600 |

| | | | | | |

Gregory Maton | | 0 | | | N/A | | 5,000 | | 15,000 | | $ | 6,150 | | $ | 18,450 |

| (1) | These values are calculated using the January 31, 2004 closing price of Common Stock on the Nasdaq National Market of $10.01 per share, less the exercise price of the options, multiplied by the number of shares to which the options relate. |

| (2) | Mr. Franza has been granted options to purchase 15,000 shares of common stock of one of the Company’s subsidiaries, Comarco Wireless Technologies, Inc., under its stock option plan. All of the options are fully vested. Based on an appraisal as of January 31, 2004, the shares underlying the vested options are valued at $51,150. |

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of January 31, 2004 with respect to shares of Common Stock that may be issued under the equity compensation plans.

| | | | | | | | |

| | | (a)

| | (b)

| | (c)

| |

Plan Category

| | Number of securities to be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding

options, warrants and rights

| | Number of securities

remaining available

for future issuance

under equity

compensation plans excluding

securities reflected

in column (a)

| |

Equity compensation plans approved by securities holders | | 797,519 | | $ | 12.86 | | 188,187 | (1) |

| | | |

Equity compensation plans not approved by security holders | | 0 | | | N/A | | 0 | |

| | | |

Total | | 797,519 | | $ | 12.86 | | 188,187 | |

| (1) | Consists of Employee Stock Option Plan and Director Stock Option Plan. |

15

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

| To: | The Board of Directors |

As members of the Compensation Committee, it is our duty to approve and administer compensation programs involving the Company’s senior executives. Compensation may include a base salary, a variable incentive bonus, and stock options.

The Committee adheres to the following philosophy regarding compensation of the Company’s executive officers:

| | • | to provide competitive total pay opportunities in order to attract, retain, and motivate high quality executive talent critical to the Company’s success; |

| | • | to pay for performance through a compensation mix that emphasizes competitive cash incentives and merit-based salary increases and de-emphasizes entitlements and perquisites; |

| | • | to create a mutuality of interest between executives and shareholders through a stock option program; and |

| | • | to focus the executive’s attention on overall corporate objectives as well as the maximization of shareholder value. |

Compensation is designed to fall in the median to high range of that paid to comparable executives in other similarly sized and like industry corporations. The Committee also considers the performance of its competitors and general economic market conditions. The Committee’s policies with respect to each of these elements, including the basis for the compensation paid and awarded to Mr. Franza, the Company’s President and CEO during fiscal year 2004, are described below. While the elements of compensation are considered separately, the Committee takes into account the total compensation package afforded by the Company to the individual.

Base Salaries

Base pay is baseline cash compensation and is determined by the competitive market and individual performance. Base pay for each executive officer is established each year based on a salary range, which corresponds to the executive officer’s job responsibilities and overall job performance.

Concerning Mr. Franza, the Company’s President and CEO, the Committee took into account a comparison of base salaries of chief executive officers of the other companies contained in a national salary survey. It also considered the Company’s success in meeting several financial goals, including return on capital employed and earnings per share, and the assessment of Mr. Franza’s individual performance, including his progress on the execution of long-term strategies to enhance shareholder value. Consistent with these criteria, Mr. Franza received a salary of $327,600 in the fiscal year ended January 31, 2004.

Incentive Compensation

The Company’s officers and other key employees are eligible for annual cash incentive compensation, based upon individual and corporate performance goals that are established at the beginning of each fiscal year. Corporate performance consists primarily of the financial results and new business development achieved by the Company for such fiscal year.

16

The Committee takes into account a number of criteria in determining Mr. Franza’s annual incentive compensation, which include financial indicators such as net income and earnings per share. In addition, Mr. Franza’s role in positioning the Company for sustainable long-term growth is considered. Goals for determining Mr. Franza’s annual incentive compensation are set at the beginning of each fiscal year. The Committee determined not to award Mr. Franza annual incentive compensation for the last fiscal year.

Stock Options

Stock options are designed to align the interests of the Company’s executives with those of its shareholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the Company. The sizes of the option awards are entirely at the discretion of the Committee. The Committee takes into account the total compensation offered to its executives when considering the number of options awarded each year.

Stock option awards to officers and employees were made in the last fiscal year based upon the criteria described above. The awards to the Company’s CEO, CFO and the other four most highly compensated executive officers are shown in the preceding section entitled “Stock Options”.

The Compensation Committee continuously reviews the Company’s executive compensation policies and plans to determine if revisions may be necessary due to Section 162 of the Internal Revenue Code of 1986, which limits the deductibility of compensation paid to certain executives to $1 million. It is the current policy of the Compensation Committee to preserve, to the extent reasonably possible, the Company’s ability to obtain a corporate tax deduction for compensation paid to executive officers of the Company to the extent consistent with the best interests of the Company and its shareholders.

Submitted by the Committee:

Erik van der Kaay, Chairman

Gerald D. Griffin

Jeffrey R. Hultman

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the Compensation Committee served as an officer or employee of the Company or its subsidiaries during the last fiscal year.

The Company did not engage in any transactions that required disclosure under Item 404 of Regulation S-K during the last fiscal year.

There were no compensation committee interlocks with other companies within the meaning of the Securities and Exchange Commission’s rules during the last fiscal year.

PERFORMANCE COMPARISON

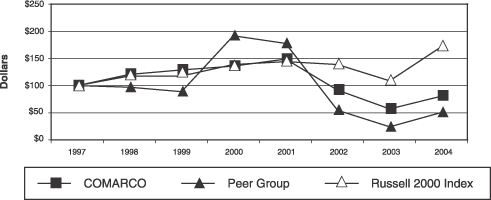

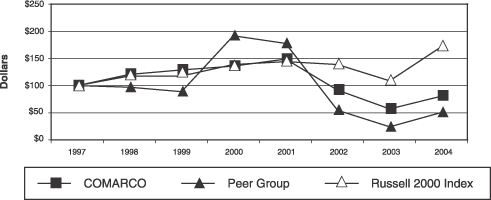

The following table and graph show a comparison of total shareholder returns for COMARCO’s Common Stock, the Russell 2000 Composite Stock Index and a peer group of companies discussed below (the “Peer Group”). The presentation assumes $100 was invested on January 31, 1997 in COMARCO Common Stock, the Russell 2000 Composite Stock Index, and the Common Stock of the Peer Group.

As a result of the many mergers and acquisitions taking place in the wireless, telecommunications industry, the Peer Group was modified in 2001 to reflect the changes in the market. The Peer Group

17

consists of six companies of similar business focus as COMARCO. The returns of each company within the Peer Group have been averaged assuming an equal dollar investment in each company at the beginning of the time period or at the time they became publicly traded. Dividends paid by those peer companies that pay dividends are assumed to be reinvested at the end of the ex-dividend month without any transaction cost.

The Peer Group consists of LLC International, Inc., Agilent Technologies, Inc., Wireless Facilities, Inc., LM Ericsson Telephone Co. and Ascom. Allen Telecom was not included in this years peer group because of a merger and price history for the stock through year end was not available. As shown on the following graph, an investment of $100 in COMARCO Common Stock on January 31, 1997 would be worth $81 as of January 31, 2004. For the five-year period ending January 31, 2004, the total cumulative loss for holders of COMARCO Common Stock amounted to 37.11% or the equivalent of -9.93% per year compounded annually. By comparison, $100 invested in the Peer Group composite would be worth $51 as of January 31, 2004. For the five-year period ending January 31, 2004, the total cumulative return for the Peer Group composite was -43.32% or the equivalent of -10.73% compounded annually.

The following graph depicts the relative performance of COMARCO in relation to the Peer Group and to the Russell 2000 Stock Index for the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | 1/31/97 | | 1/31/98 | | 1/31/99 | | 1/31/00 | | 1/31/01 | | 1/31/02 | | 1/31/03 | | 1/31/04 |

|

COMARCO | | $ | 100 | | $ | 121 | | $ | 129 | | $ | 136 | | $ | 149 | | $ | 92 | | $ | 57 | | $ | 81 |

Peer Group | | $ | 100 | | $ | 97 | | $ | 89 | | $ | 192 | | $ | 178 | | $ | 55 | | $ | 24 | | $ | 51 |

Russell 2000 Index | | $ | 100 | | $ | 118 | | $ | 118 | | $ | 139 | | $ | 144 | | $ | 139 | | $ | 109 | | $ | 172 |

|

18

EXECUTIVE OFFICERS

The following table sets forth information concerning the executive officers (who are not Directors) of the Company and its principal subsidiary, Comarco Wireless Technologies, Inc., at May 6, 2004.

| | | | |

Name

| | Age

| | Capacity

|

Patricia Cobb | | 47 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Sebastian E. Gutierrez | | 42 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Craig Hayes | | 43 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Daniel R. Lutz | | 40 | | Vice President and Chief Financial Officer, COMARCO, Inc. |

| | |

Gregory Maton | | 56 | | Sr. Vice President, Comarco Wireless Technologies, Inc. |

| | |

Thomas J. Schmidt | | 41 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Peggy L. Vessell | | 59 | | Vice President, Comarco Wireless Technologies, Inc. and Corporate Secretary, COMARCO, Inc. |

Ms. Cobb joined Comarco Wireless Technologies as Vice President of Manufacturing in January 2001 and became Vice President of Quality Assurance in 2003. Before joining Comarco, Ms. Cobb was Vice President of Operations for MGE UPS Systems, a global provider of power quality solutions. She also provided key leadership in various management positions throughout Square D Company in quality, engineering, manufacturing and after-sales service (1980-1993).

Mr. Gutierrez joined Comarco Wireless Technologies in 1996 as Director of Business Development and was promoted to Vice President of the Company’s Call Box Division in 1998. Before joining COMARCO, he spent eight years at Pacific Bell (1987 – 1996) working in various management positions as a member of their Accelerated Management Program. He also held engineering positions at TRW’s Space and Technology Division (1984 – 1987).

Mr. Hayes joined Comarco Wireless Technologies in July 2003 as Vice President of Supply Chain Management. Mr. Hayes has more than 15 years of international manufacturing senior management experience, and joins Comarco from Ingram Micro where he was the Vice President of Operations. Mr. Hayes joined Ingram Micro in 1997 and was responsible for all aspects of operations at four manufacturing facilities in the United States. Ingram Micro is the largest global wholesale provider of technology products and supply chain management services. Prior to Ingram Micro, Mr. Hayes held several domestic and international management assignments at AST Computer, and Teradata, NRC.

Mr. Lutz joined the Company as Vice President and Chief Financial Officer in June 2000. He also serves as Vice President and Chief Financial Officer of Comarco Wireless Technologies, Inc. Before joining the Company, Mr. Lutz was Vice President of Sunstone Hotel Investors, Inc., formerly a publicly traded real estate investment trust. Prior to Sunstone, Mr. Lutz was a manager with Ernst & Young LLP. He is also a Certified Public Accountant in the state of California.

19

Mr. Maton joined Comarco Wireless Technologies as Sr. Vice President of Wireless Test Solutions in October 2002. From 1988 to 2002, Mr. Maton was Executive Board Director, Executive Vice President, Business Director, and Sales & Marketing Director at Racal. From 1969 to 1988, Mr. Maton held various management positions at Marconi Instruments Ltd.

Mr. Schmidt joined the Company April 2004 as the new head of ChargeSource mobile power products operations. Mr. Schmidt has more than 15 years of senior management experience and joins Comarco from The Sandstone Group where he was a Managing Partner. Prior to this position, Mr. Schmidt co-founded and was a Managing Partner at ideaEdge Ventures, a venture management company. Mr. Schmidt also served as the President and Chief Executive Officer of Gateway, Inc.’s Information Appliances Division. From 1995 through 1999 Mr. Schmidt served as the General Manager of two divisions of AlliedSignal, Inc., the Hardware Product Group and the Airsupply Operations.

Ms. Vessell has been with the Company since 1987. Ms. Vessell has served as Vice President of Administration for CWT since 2000 and became the Corporate Secretary in 2001. Between l995 and 2000 as Director of Administration she oversaw CWT’s Health and Welfare Programs and Employee Relations. Before joining CWT she spent nine years at COMARCO, Inc. in various Accounting and Human Resource positions.

AUDIT AND FINANCE COMMITTEE REPORT

The Board of Directors has established an Audit and Finance Committee comprised of three of the Company’s outside directors. The Board of Directors has determined that each member of the Audit and Finance Committee is an “independent director,” as defined under the rules of the NASD and Rule 10A-3(b) of the Exchange Act. In accordance with the written charter of the Audit and Finance Committee adopted by the Board of Directors, the Audit and Finance Committee assists the Board in fulfilling its responsibility for management oversight of the quality and integrity of the accounting, auditing, and financial reporting practices of COMARCO, Inc.

It is not the duty or responsibility of the Audit and Finance Committee to conduct auditing or accounting reviews or procedures. In performing their oversight responsibility, members of the Audit and Finance Committee rely without independent verification on the information provided to them and on the representations made by management and the independent accountants. Accordingly, the Audit and Finance Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit and Finance Committee’s considerations and discussions do not assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the financial statements are presented in accordance with generally accepted accounting principles.

The Committee discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees”, and with and without management present, discussed and reviewed the results of the independent auditors’ examination of the Company’s financial statements. The Committee received from the independent auditors the written disclosure and letter required by Independence Standards Board Standard No. 1 and discussed with the independent auditors, their independence.

20

The Committee reviewed the audited financial statements of COMARCO, Inc. as of and for the year ended January 31, 2004, with management and independent auditors. Management has the responsibility for the preparation of the financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above-mentioned review and discussions with management and the independent auditors, the Committee recommended to the Board that COMARCO, Inc.’s financial statements be included in its Annual Report on Form 10-K for the year ended January 31, 2004, for filing with the Securities and Exchange Commission.

The Audit and Finance Committee has considered whether the provision by KPMG LLP of non-audit services is compatible with maintaining the independence of KPMG LLP, as the Company’s principal accounting firm, and has determined that the provision of the non-audit services is compatible with the firm’s independence.

Submitted by the Audit and Finance Committee

Gerald D. Griffin, Chairman

Erik H. van der Kaay, Member

Jeffrey A. Hultman, Member

21

AUDIT FEES

Fees to Independent Auditors

Audit Fees

The aggregate fees incurred and payable to KPMG LLP for professional services rendered in connection with the audit and quarterly review of our financial statements during fiscal year 2004 and 2003 were approximately $170,000 and $174,500 respectively.

Audit-Related Fee

The aggregate fees incurred and payable to KPMG LLP for professional services rendered in connection with the statutory audit of our foreign branch during fiscal year 2004 and 2003 were approximately $0 and $12,150, respectively. The branch was closed during fiscal year 2004 and will no longer require audits.

The aggregate fees incurred and payable to Lesley, Thomas, Schwarz and Postma, Inc. for professional services rendered in connection with the audit of our Employee Benefits Plan for the calendar years 2004 and 2003 were approximately $8,000 and $8,000, respectively.

Tax Fees

The aggregate fees incurred and payable to KPMG LLP for professional services during fiscal year 2004 and 2003 in connection with tax advice or tax planning were approximately $78,500 and $67,600, respectively.

All Other Fees

No other fees were paid to KPMG LLP during fiscal years 2004 and 2003.

The Audit Committee pre-approved in writing 100% of the professional services rendered by both KPMG LLP as well as Lesley, Thomas, Schwarz and Postma, Inc. and the fees incurred in connection therewith described above. The Company has a written policy consistent with the Audit Committee’s past practices to require the Audit Committee to pre-approve all audit and permissible non-audit services provided by the independent auditors.

SELECTION OF AUDITORS

KPMG LLP (“KPMG”) is currently engaged to review the Company’s financial statements for the quarters ending April 30, July 31, and September 30, 2004. The Company’s audit and Finance Committee intends to solicit competitive proposals from a number of accounting firms, including KPMG, to audit the Company’s consolidated financial statements for the year ending January 31, 2005. It is anticipated that the Company will select an independent accountant and auditor from those submitting proposals on or before July 31, 2004. Representatives of KPMG are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they so desire and to respond to appropriate questions from shareholders.

22

SHAREHOLDER PROPOSALS FOR SUBMISSION AT 2005 ANNUAL MEETING

If a shareholder desires to submit a proposal at the Company’s 2005 Annual Meeting to be included in the proxy statement for that meeting, such proposal must be received by the Secretary in writing at the Company’s corporate office no later than January 25, 2005. The proposal must also comply with applicable regulations in order to be included in the Proxy Statement for that meeting. If a shareholder notifies the Company in writing prior to April 10, 2005 that he or she intends to present a proposal at the Company’s 2005 Annual Meeting, the proxy-holders designated by the Board of Directors may exercise their discretionary voting authority with regard to the shareholder’s proposal only if the Company’s proxy statement discloses the nature of the shareholder’s proposal and the proxyholder’s intentions with respect to the proposal. If the stockholder does not notify the Company by such date, the proxyholders may exercise their discretionary voting authority with respect to the proposal without such discussion in the proxy statement.

OTHER MATTERS

The Board of Directors of the Company does not know of any matter to be acted upon at the meeting other than the matters described above. If other matters properly come before the meeting, the holders of the proxies will vote on such matters in accordance with their judgment.

The Company’s 2004 Annual Report on Form 10K to Shareholders is enclosed with this Proxy Statement.

IN ORDER TO AVOID ADDED EXPENSE OR ADDITIONAL SOLICITATION OF PROXIES, YOU ARE URGED TO DATE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED, TO WHICH NO POSTAGE NEED BE AFFIXED.

BY ORDER OF THE BOARD OF DIRECTORS

Peggy L. Vessell, Secretary

May 25, 2004

23

APPENDIX A

AUDIT AND FINANCE COMMITTEE CHARTER

| A. | The Audit and Finance Committee (the “Committee”) of the Board of Directors (the “Board”) of COMARCO, Inc. (together with its subsidiaries, the “Company”) shall consist of at least three directors whose qualifications include financial literacy, independence and accounting or related financial expertise as determined under the Sarbanes-Oxley Act (the “Act”) and applicable rules of the National Association of Securities Dealers, Inc. (“NASD”) and the Securities and Exchange Commission (“SEC”). At least one member of the Committee must be a “financial expert” as determined under the requirements of the rules of the SEC. No member of the Committee may serve on the audit committee of more than three public companies, including the Company, unless the Board determines that such simultaneous service will not impair the ability of such member to effectively serve on the committee. |

| B. | No member of the Committee shall receive compensation other than for service as a director of the Company, including reasonable compensation for serving on the Committee and other benefits applicable to all directors of the Company. |

| A. | The Committee serves as the representative of the Board for the general oversight of Company affairs relating to: |

| | 1. | The quality and integrity of the Company’s financial statements, |

| | 2. | The Company’s compliance with legal and regulatory requirements, |

| | 3. | The accounting and financial reporting processes and the audits of the Company’s financial statements, |

| | 4. | The independent auditor’s qualifications and independence, and |

| | 5. | The performance of the Company’s independent auditors. |

| B. | Through its activities, the Committee facilitates open communication among directors, independent auditors and management by meeting in private session regularly with these parties. |

| C. | The Committee also provides oversight regarding significant financial matters, including borrowings, currency exposures; dividends, share issuance and repurchases, and the financial aspects of the Company’s benefit plans. |

| III. | MEETINGS AND PROCEDURES |

| A. | The Committee shall convene at least four times each year. |

| B | The Committee shall endeavor to determine that auditing procedures and controls are adequate to safeguard Company assets and to assess compliance with Company policies and legal requirements, including the Company’s Code of Ethics for Senior Financial Officers, a copy of which is attached hereto asExhibit A. |

Appendix A

1

| C. | The Committee shall be given full access to the Company’s Board Chairman, Company executives and independent auditors. When any audit has been prepared by the Company’s independent auditor, the Committee shall timely receive a report from the independent auditor on (1) all critical accounting policies and practices; (2) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management officials of the Company, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor; and (3) other material written communications between the independent auditor and Company management, such as any management letter or schedule of unadjusted differences. |

The Committee shall:

| | 1. | Have the sole authority to select, compensate, oversee, evaluate and, where appropriate, replace the independent auditor. |

| | 2. | Annually review and approve the proposed scope of each fiscal year’s outside audit at the beginning of each new fiscal year. |

| | 3. | Inform the independent auditor performing work for the Company that such firm shall report directly to the Committee. |

| | 4. | Oversee the work of any independent auditor employed by the Company, including the resolution of any disagreement between management and the independent auditor regarding financial reporting, for the purpose of preparing or issuing an audit opinion or related work. |

| | 5. | Review and approve in advance any audit and non-audit services and fees to be provided by the Company’s independent auditor, other than prohibited non-auditing services and audit services for de minimus amounts, as provided in the Act. The Committee has the sole authority to make these approvals, although such approval may be delegated to any committee member so long as the approval is presented to the full Committee at its next scheduled meeting. |

| | 6. | At, or shortly after the end of each fiscal year, review with the independent auditor and Company management, the audited financial statements and related opinion, related disclosures, including the MD&A portion of the Company’s filings and review the effectiveness of the independent audit, including costs of the audit of that year. |

| | 7. | Review funding and investment policies, implementation of funding policies and investment performance of the Company’s benefit plans. |

| | 8. | Provide any recommendations, certifications and reports that may be required by the NASD or the SEC, including the report of the Committee that must be included in the Company’s annual proxy statement. |

| | 9. | Review and discuss the annual audited financial statements and quarterly financial statements with management and the independent auditor. |

Appendix A

2

| | 10. | Establish and oversee procedures for (a) the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters; and (b) the confidential anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. The Company’s policy for complaints regarding Accounting and Audit Concerns is attached hereto asExhibit B. |

| | 11. | Have the authority to engage independent counsel and other advisers as it determines necessary to carry out its duties. The Company shall provide for appropriate funding, as determined by the Committee, in its capacity as a committee of the Board, for payment of (a) compensation to the independent auditor engaged by the Company for the purpose of rendering or issuing the audit report or performing other services approved by the Committee; (b) compensation to outside advisers retained by the Committee; and (c) ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties. |

| | 12. | Ensure the rotation of the lead audit partner at least every five years. |

| | 13. | Confirm with any independent auditor retained to provide audit services for any fiscal year that the lead (or coordinating) audit partner (having primary responsibility for the audit), or the audit partner responsible for reviewing the audit, has not performed audit services for the Company in each of the five previous fiscal years of the Company and that the firm meets all legal and professional requirements for independence. |

| | 14. | Obtain on an annual basis a formal written statement from the independent auditor delineating all relationships between the independent auditor and the Company, consistent with the Independence Standards Board Standard 1, and review and discuss with the independent auditor all significant relationships the independent auditor has with the Company which may affect the independent auditor’s objectivity and independence. |

| | 15. | Discuss with management and the independent auditor the Company’s policies with respect to risk assessment and risk management. |

| | 16. | Meet separately and periodically with management and with the independent auditor to discuss various topics and events that may have significant financial impact on the Company or that are the subject of discussions between management and the independent auditor. |

| | 17. | In consultation with the independent auditor and management, review the integrity of the Company’s financial reporting process. |

| | 18. | Review periodically the effect of regulatory and accounting initiatives, issues, changes, estimates, judgments, unusual items, and off-balance sheet structures, on the financial statements of the Company and review the report of the independent auditor on such subjects delivered to the Committee pursuant to Section 10A(k) of the Act. |

| | 19. | Review with the independent auditor (a) any audit problems or other difficulties encountered by the independent auditor in the course of the audit process, including any restrictions on the scope of the independent auditor’s activities or on access to requested information, and any significant disagreements with management and (b) management’s responses to such matters. |

Appendix A

3

| | 20. | Set clear employee hiring policies for any former employee of the independent auditor. At a minimum, these policies should provide that any independent auditor engaged by the Company may not provide audit services to the Company if the Chief Executive Officer, Controller, Chief Financial Officer, Chief Accounting Officer or any person serving in an equivalent capacity for the Company, was employed by the independent auditor and participated in the audit of the Company within one year of the initiation of the current audit. |

| | 21. | Review all related party transactions, as defined under the applicable rules of the NASD, to which the Company is a party. |

| | 22. | Report regularly to the Board. Such report to the Board may take the form of an oral report by the Chairman of the Committee or any other member of the Committee designated by the Committee to make such report. |

| | 23. | Perform a review and evaluation, at least annually, of the performance of the Committee. In addition, the Committee shall review and reassess, at least annually, the adequacy of this Charter and recommend to the Board any improvements to this Charter that the Committee considers necessary or valuable. The Committee shall conduct such evaluations and reviews in such manner as it deems appropriate. |

Appendix A

4

EXHIBIT A

CODE OF ETHICS

FOR

SENIOR FINANCIAL OFFICERS

OF COMARCO, INC.

This Code of Ethics applies to the Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer or Controller, and Treasurer (individually, a “Senior Financial Officer” and collectively, the “Senior Financial Officers”) of COMARCO, Inc. (together with its subsidiaries, the “Company”). The purpose of this Code of Ethics is to promote honest and ethical conduct and compliance with the law, particularly as related to the maintenance of the Company’s financial records and the preparation of financial statements filed with the Securities and Exchange Commission (the “SEC”). The obligations of this Code of Ethics supplement, but do not replace, the Company’s Code of Business Conduct and Ethics applicable to all employees, officers and directors.

| | 1. | Senior Financial Officers are expected to carry out their responsibilities honestly and with the highest standards of professional integrity, exercising at all times their best independent judgment. |

| | 2. | Senior Financial Officers shall comply with the Company’s Code of Business Conduct and Ethics, including but not limited to its provisions relating to: |

| | (a) | the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | (b) | the full, fair, accurate, timely and understandable disclosure in reports and documents the Company files with or submits to the SEC and any other regulator and in other public communications; |

| | (c) | compliance with applicable governmental laws, rules and regulations; |

| | (d) | the prompt internal reporting of violations of the Code of Business Conduct and Ethics to the person or persons designated in the Code of Business Conduct and Ethics; and |

| | (e) | accountability for adherence to the Code of Business Conduct and Ethics. |

| | 3. | Each Senior Financial Officer must avoid taking any action to fraudulently influence, coerce, manipulate or mislead any independent public auditor of the Company for the purpose of rendering the financial statements of the Company misleading. |

| | 4. | The Senior Financial Officers are responsible for promptly bringing to the attention of the Chairman of the Audit Committee or the full Board of Directors: |

| | (a) | Any matters that could compromise the integrity of the Company’s financial reports; |

| | (b) | Any disagreement with respect to any material accounting matter; and |

| | (c) | Any violation of this Code of Ethics or of any law or regulation related to the Company’s accounting or financial affairs. |

Appendix A

5

| | 5. | No Senior Financial Officer may discharge, demote, suspend, threaten, harass, or in any other manner discriminate against an employee in the terms and conditions of employment because of any lawful act done by the employee (i) to provide information, cause information to be provided or otherwise assist in an investigation regarding any conduct which the employee reasonably believes constitutes a violation of law, including any rule or regulation of the SEC, or any provision of federal law relating to fraud against shareholders; (ii) to file, cause to be filed, testify, participate in, or otherwise assist in a proceeding filed or about to be filed (with any knowledge of the employer) relating to an alleged violation of law, including any rule or regulation of the SEC, or any provision of federal law relating to fraud against shareholders; or (iii) to make any report pursuant to the Company’s Procedures for Reporting Complaints About Accounting and Auditing Matters. |

| | 6. | Any waiver of this Code of Ethics may be made only by our Board of Directors and will be promptly disclosed as required by law or the applicable rules of the National Association of Securities Dealers, Inc. |

| | 7. | The Board of Directors will investigate or cause to be investigated alleged violations of this Code of Ethics. The Board will provide any Senior Financial Officer who is alleged to have violated this Code of Ethics a fair opportunity to be heard regarding his or her alleged conduct. The Board will take appropriate action if the Board determines as a result of its investigation that a violation of this Code of Ethics occurred. |