SCHEDULE 14A INFORMATION

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

COMARCO, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

COMARCO, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held

June 20, 2006

To the Shareholders of COMARCO, Inc.:

The 2006 Annual Meeting of the Shareholders of COMARCO, Inc., a California corporation (the “Company”), will be held on June 20, 2006 at 10:00 o’clock, local time, at the Company’s corporate offices, which are located at 2 Cromwell Drive, Irvine, CA 92618 (949) 599-7400, for the following purposes:

1. To elect five Directors;

2. To approve the adoption of the Company’s 2005 Equity Incentive Plan.

3. To ratify the appointment by the Company’s Audit Committee of BDO Seidman, LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2007; and

4. To transact such other business as may properly come before the meeting or any adjournment thereof.

Only holders of record of the Company’s Common Stock at the close of business on May 9, 2006 are entitled to notice of and to vote at the Annual Meeting.

The Board of Directors of the Company intends to present Don M. Bailey, Thomas A. Franza, Gerald D. Griffin, Jeffrey R. Hultman, and Erik H. van der Kaay as nominees for election as Directors at the Annual Meeting.

Each shareholder is cordially invited to attend and vote in person at the meeting. TO ASSURE REPRESENTATION AT THE MEETING, HOWEVER, SHAREHOLDERS ARE URGED TO COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE PREPAID ENVELOPE. Shareholders who attend the meeting may still vote in person, even if they have previously voted by proxy.

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

| |

Peggy L. Vessell, Secretary |

Irvine, California

May 16, 2006

TABLE OF CONTENTS

i

COMARCO, INC.

2 Cromwell Drive

Irvine, CA 92618

(949) 599-7450

PROXY STATEMENT

For Annual Meeting of Shareholders

To Be Held

June 20, 2006

GENERAL INFORMATION

The Board of Directors (the “Board”) of COMARCO, Inc., a California corporation (the “Company”), furnishes this Proxy Statement in connection with the solicitation of proxies to be used at the 2006 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on June 20, 2006 at 10:00 o’clock a.m., local time, at the Company’s corporate offices, which are located at 2 Cromwell Drive, Irvine, CA 92618, or any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting. This Proxy Statement and the accompanying form of proxy are first being mailed to shareholders on or about May 16, 2006.

A shareholder giving a proxy has the power to revoke it at any time before it is exercised by (1) filing with the Secretary of the Company an instrument in writing revoking the proxy; (2) filing with the Secretary of the Company a duly executed proxy bearing a later date; or (3) attending the Annual Meeting and voting the shares in person. In the absence of such revocation, all shares represented by a properly executed proxy received in time for the Annual Meeting will be voted as specified therein.

The cost of preparing, assembling, printing and mailing this Proxy Statement and the accompanying form of proxy and the cost of soliciting proxies will be borne by the Company. The Company may make arrangements with various brokerage houses or other nominees to send proxy materials to the beneficial owners of stock and may reimburse them for their reasonable expenses in connection therewith.

The Company’s officers, employees and directors may supplement the original solicitation of proxies by telephone, facsimile, e-mail and personal contact. We will pay no additional compensation to such persons for any of these activities.

VOTING RIGHTS

The Company’s only outstanding class of voting securities is its Common Stock. Only shareholders of record at the close of business on May 9, 2006 will be entitled to vote at the Annual Meeting. At May 9, 2006, there were outstanding 7,428,767 shares of Common Stock. The holders of record of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting, present in person or by proxy, will constitute a quorum for the transaction of business. Each share is entitled to one vote, except that each shareholder is entitled to cumulate his shares in the election of Directors, provided that at least one shareholder has given notice, prior to the voting, of the shareholder’s intention to do so. If cumulative voting is in effect, each shareholder may cumulate votes for one or more candidates. To cumulate votes, a shareholder may vote for any one candidate a number of votes equal to the number of Directors to be elected multiplied by the number of shares held by the shareholder, or alternatively distribute any such votes among as many of the candidates as the shareholder thinks fit.

With respect to shares of Common Stock held by brokers in street name for the beneficial owners thereof, (1) the election of Directors and (2) ratification of the appointment of BDO Seidman as the Company’s independent registered public accounting firm for the fiscal year ending January 31, 2007 are “routine” matters upon which the brokers, as the holders of record, may vote these shares for which the beneficial owners have not provided them specific instructions. On the other hand, a broker is not entitled to vote shares held for a beneficial owner on certain

1

non-routine items, such as the shareholder approval of the 2005 Equity Incentive Plan, absent instructions from the beneficial owner of such shares. Broker non-votes count for purposes of determining whether a quorum exists, but are not counted as shares present and entitled to be voted with respect to the proposal on which the broker has expressly not voted.

With respect to the election of directors, the five nominees each receiving the greatest number of votes at the Annual Meeting shall be elected a Director. Votes withheld will have no effect on the election of any Director.

An affirmative vote of the holders of a majority of shares of Common Stock present, or represented by proxy at the Annual Meeting, will be required to ratify the appointment of BDO Seidman, LLP as the Company’s registered public accounting firm. Abstentions count as votes cast and have the effect of a vote against the proposal.

An affirmative vote of the holders of a majority of shares of Common Stock present, or represented by proxy at the Annual Meeting, will be required to approve the 2005 Equity Incentive Plan. Abstentions count as votes cast and have the effect of a vote against the proposal.

Item 1 on Proxy Card

ELECTION OF DIRECTORS

Five Directors will be elected at the Annual Meeting. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board nominated Don M. Bailey, Thomas A. Franza, Gerald D. Griffin, Jeffrey R. Hultman and Erik H. van der Kaay for election as Directors. Each nominee has consented to be named in the Proxy Statement as a nominee and has agreed to serve as a Director if elected. Each Director elected at the Annual Meeting will hold office until the next annual meeting of shareholders and until his successor is duly elected and qualified. It is intended that the shares represented by the enclosed proxy will be voted, unless otherwise instructed, for the election of the five nominees of the Board. While the Company has no reason to believe that any of the nominees will be unable to serve as a Director, it is intended that if such an event should occur, such shares will be voted for the remainder of the nominees and for such substitute nominee or nominees as may be selected by the Board, unless a shareholder withholds authority to vote his shares (i) for all of the nominees by so indicating on the enclosed proxy card or (ii) for any one or more of the nominees by checking their names in the space provided on such card, in which case his shares will not be voted for such nominee or nominees. If cumulative voting is in effect for the election of Directors, the proxy holders will have the discretion to cumulate votes as provided by California law (see “VOTING RIGHTS” above) and to distribute such votes among all or any of the nominees in such manner as they deem appropriate.

All of the nominees are currently serving as Directors of the Company. The term of office of each of the current Directors expires on the date of the Annual Meeting. All of the nominees were elected at the 2005 annual meeting of shareholders.

2

THE BOARD RECOMMENDS A VOTE FOR EACH OF THE BOARD’S NOMINEES

The following table sets forth information concerning the nominees and is followed by a brief biography of each nominee.

| | | | | | | | |

Name | | Age | | Principal Occupation | | Year

First

Elected

Director | | Other Public Company Directorships |

| Don M. Bailey | | 60 | | Chairman of the Board | | 1991 | | Chairman of the Board of Staar Surgical Company |

| | | | |

| Thomas A. Franza | | 63 | | President and Chief Executive Officer | | 1998 | | None |

| | | | |

| Gerald D. Griffin | | 71 | | Executive Consultant | | 1986 | | None |

| | | | |

| Jeffrey R. Hultman | | 66 | | Chief Executive Officer and Director of Network Installation Corporation | | 2000 | | Network Installation Corporation |

| | | | |

| Erik H. van der Kaay | | 66 | | Retired Chairman of the Board of Symmetricom, Inc. | | 2001 | | RF MicroDevices; TransSwitch Corp.; Ball Corporation |

Mr. Bailey has served as Chairman of the Board of the Company since 1998 and has been employed by the Company since 1980. He also served as President and Chief Executive Officer of the Company from June 1990 to April 2000. From November 1988 until May 1990, he served as Senior Vice President of the Company. From January 1986 until October 1988, he served as Vice President, Corporate Development. From 1980 to 1986, Mr. Bailey served in various other positions with the Company. Mr. Bailey also serves as Chairman of the Board of Staar Surgical Company.

Mr. Franza has been President and Chief Executive Officer of the Company since April 2000. He is also currently President of Comarco Wireless Technologies, Inc. and Comarco Wireless International, Inc. Mr. Franza served as Executive Vice President of the Company from 1995 to April 2000, as Senior Vice President of the Company from 1992 to 1995, and before then, as a Vice President from 1990 until 1992. Mr. Franza joined the Company in 1985.

Mr. Griffin has been an executive consultant since 1992. From 1988 to 1992 Mr. Griffin was Managing Director of the Houston Office of Korn/Ferry International. From 1988 to 1998, Mr. Griffin was the non-executive Chairman of the Board of the Company. From 1986 to 1988, he was President and Chief Executive Officer of the Houston Chamber of Commerce. From 1982 to 1986, he was Director of NASA’s Johnson Space Center in Houston, Texas. Mr. Griffin currently serves on the board of directors of Bank of the Hills, N.A. and is a member of such board’s audit committee.

Mr. Hultman is currently the Chief Executive Officer and a Director of Network Installation Corporation (NIC), a company that designs, installs and deploys wireless technology and specialty communication systems, a position he has held since March 7, 2005. From November 2002 to May 2004, Mr. Hultman was CEO of EdgeFocus, Inc., a high speed wireless internet company. From 1998 to March 2002, Mr. Hultman was a partner in Big Bear Sports Ranch, a sports summer camp for school-age children. From 1991 through 1997, he was Chief Executive Officer of Dial Page, Inc., a provider of wireless telecommunications throughout the Southeastern United States. From 1987 through 1991, he was Chief Executive Officer of PacTel Cellular. Prior to 1987, Mr. Hultman was an executive with Pacific Bell.

Mr. van der Kaay is former Chairman of the Board of Symmetricom, Inc., a position he held from November 2002 to August 2003. From April 1998 to October 2002, he served as President and Chief Executive Officer of Datum, Inc. From 1990 to 1998, he held various positions with Allen Telecom, a leading supplier of wireless equipment to the global telecommunications infrastructure market. Mr. van der Kaay currently serves as a director of RF Micro Devices, TranSwitch Corporation, and Ball Corporation.

3

No arrangement or understanding exists between any nominee and any other persons pursuant to which any nominee was or is to be selected as a director. No nominee has any family relationship with any other nominee or with any of the Company’s executive officers.

BOARD MEETINGS AND COMMITTEES

During the fiscal year ended January 31, 2006, the Company’s Board met 7 times. Each of the Company’s Directors attended at least 75% of the total number of meetings of the Board and the total number of meetings of the committees on which he served during the Company’s last fiscal year.

The Board, after consultation with the Nominating and Corporate Governance Committee, determined that Messrs. Griffin, Hultman and van der Kaay, who represent a majority of the members of the Board, are “independent,” as defined under the rules of the National Association of Securities Dealers, Inc., or the NASD. The standing committees of the Board are each comprised of independent directors under the rules of the NASD and consist of the following:

| | | | |

Name of Committee and Members | | Primary Responsibilities | | Number of

Meetings in

fiscal 2006 |

Audit and Finance Committee Gerald D. Griffin (Chair) Jeffrey R. Hultman Erik H. van der Kaay | | • Monitors the quality and integrity of the Company’s financial statements, accounting and financial reporting processes, internal controls, risk management and legal and regulatory compliance. • Selects, determines the compensation of, evaluates and, when appropriate, replaces the Company’s independent auditor; pre-approves all audit and permitted non-audit services. • Monitors the qualifications and independence of the independent auditor and performance of the Company’s independent auditor; reviews the scope and results of each fiscal year’s outside audit. • Reviews all related party transactions. | | 7 |

| | |

Compensation Erik H. van der Kaay (Chair) Gerald D. Griffin Jeffrey R. Hultman | | • Reviews the Company’s executive compensation philosophy. • Annually reviews and approves corporate goals and objectives relevant to the compensation of the CEO and evaluates the CEO’s performance in light of these goals. • Reviews and determines the compensation of the Company’s executive officers, including the Company’s CEO, and key members of management. • Administers the Company’s incentive and equity based-compensation plans. • Reviews and assists the Board in establishing compensation policies for Directors and committees of the Board. | | 4 |

| | |

Nominating and Corporate Governance Jeffrey R. Hultman (Chair) Gerald D. Griffin Erik H. van der Kaay | | • Assists the board in identifying, evaluating and recommending candidates for election to the Board and its Committees. • Establishes procedures and provides oversight for evaluating the Board and management. • Develops, recommends and reassesses the Company’s corporate governance guidelines and overall corporate governance of the Company. • Evaluates the size, structure and composition of the Board and its Committees. | | 2 |

The Company’s board has adopted written charters for the Audit and Finance Committee and the Nominating and Corporate Governance Committees setting forth the roles and responsibilities of each committee. Each of the charters is available on the Company’s website at www.comarco.com.

4

CORPORATE GOVERNANCE

Executive Sessions of Independent Directors

It is the policy of the Board that the Company’s independent directors meet separately without management directors at least twice each year, before or after regularly scheduled Board meetings, to discuss such matters as the independent directors consider appropriate. During the fiscal year ended January 31, 2006, the Company’s independent directors met separately 5 times. In 2004, the Board appointed Mr. Jeffrey Hultman Lead Director. As Lead Director, he is the presiding director at these meetings.

Shareholder and Interested Party Communications with the Board of Directors

Shareholders who desire to communicate with the Company regarding any matter pertinent to the Company’s business or affairs may do so by writing (not via email) to the Chairman of the Board at 2 Cromwell Drive, Irvine, CA 92618, Attention: Chairman of the Board.

The Company also has established a Compliance Hotline operated by CCBN (an independent company) as a means of receiving and directing concerns from employees and any other persons relating to complaints regarding any accounting, internal audit controls or auditing matters. Confidential, anonymous reports of accounting and audit concerns may be made 24 hours a day, seven days a week. Communications may be confidential or anonymous, and may be communicated by calling the Compliance Hotline at: (800) 792-8138.

In addition, anyone who has a concern about the conduct of the Company or any of its officers or employees, or about the Company’s accounting, internal controls, disclosure controls and procedures, auditing, compensation and governance matters may communicate that concern directly to the Audit and Finance Committee, the Nominating and Corporate Governance Committee, or the Compensation Committee, as appropriate in light of the specific concern involved. Any concerns relating to accounting, internal controls, disclosure controls and procedures, auditing, corporate conduct or conduct of any corporate officer or employee shall be forwarded to the Chair of the Audit and Finance Committee. The Company’s policies prohibit retaliation or adverse action against anyone for raising or helping to resolve an integrity concern.

The Company has a policy that each member of the Board should make every reasonable effort to attend each annual meeting of shareholders.

Shareholder Recommendations of Director Candidates

The Nominating and Corporate Governance Committee considers candidates for nomination as director proposed by any shareholder of the Company. Any shareholder of the Company is entitled to recommend a candidate for nomination by submitting, not less than 60 nor more than 90 days prior to the annual meeting of shareholders at which directors are to be elected, the name of the candidate to: Corporate Secretary, Comarco, Inc., 2 Cromwell Drive, Irvine, CA 92618. Any shareholder recommendation is forwarded to the Chairman of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee encourages selection of directors who will contribute to the Company’s overall corporate goals of technology leadership, effective execution, high customer satisfaction, superior employee working environment, and creation and preservation of shareholder value. At a minimum, candidates recommended by the Nominating and Corporate Governance Committee must possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company’s shareholders.

In evaluating the suitability of individual candidates for election or re-election to the Board, the Nominating and Corporate Governance Committee considers many factors, including (1) the candidate’s understanding of technology, manufacturing, sales and marketing, finance and other elements relevant to the Company’s business, (2) the candidate’s educational and professional background, experience as a director of a public company and past performance as a board member and (3) familiarity with current corporate governance,

5

account and similar issues impacting public companies (4) consistency with the other provisions of the Nominating and Corporate Governance Committee Charter relating to the composition of the Board and eligibility for Board membership. Additionally, in determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee takes into account the director’s past attendance at, and participation in, meetings of the Board and its committees and contributions to their activities.

A shareholder must provide the following supporting information to recommend a candidate for nomination: name, age, business and residence addresses, principal occupation or employment, the number of shares of the Company’s common stock held by the candidate, a resume of his or her business and educational background, the information that would be required under SEC rules in a proxy statement soliciting proxies for the election of such nominee as a director, and a signed consent of the candidate to serve as a director, if nominated and elected. The Nominating and Corporate Governance Committee, after reviewing this information, will determine whether the candidate meets the qualifications for committee-recommended candidates, including the objectives for the composition of the Board as a whole. The Nominating and Corporate Governance Committee does not evaluate any candidate for nomination as director any differently because the candidate was recommended by a shareholder.

Code of Ethics for Senior Financial Officers

The Audit and Finance Committee has adopted a Code of Ethics for Senior Financial Officers to promote and provide for the honest and ethical conduct by the Company’s Senior Financial Officers, as well as for full, fair, accurate and timely financial management and reporting. The Company’s Senior Financial Officers include the Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer or Controller and Treasurer. The Company expects all of these financial officers to act in accordance with the highest standards of professional integrity, to provide full and accurate disclosure in reports and other documents filed with the SEC and other regulators and in any public communications, to comply with all applicable laws, rules and regulations and to deter wrongdoing. A complete copy of the Code of Ethics for Senior Financial Officers is available on the Company’s website at www.comarco.com.

Non-Employee Director Compensation

Each non-employee Director of the Company receives the following compensation as a director:

| | | |

Board Participation | | Retainer Fee |

Annual - all members | | $ | 24,000 |

Attendance at each Board Meeting | | $ | 2,000 |

If Attendance is Telephonic | | $ | 1,000 |

Attendance at each Committee Meeting | | $ | 1,250 |

Additional Committee Chair Fee Per Meeting | | $ | 750 |

Mr. Franza and Mr. Bailey receive no compensation other than that received as officers of the Company.

Under the Company’s Director Stock Option Plan, non-qualified stock options may be granted to non-employee directors. The number of shares authorized for issuance shares under the plan is 637,500 shares. Under the plan, the option exercise price is the fair market of a share of Common Stock, which is determined by the closing price of a share of the Company’s Common Stock on the date of the grant. Options vest in equal annual increments of 25% over the four-year period following their grant date, provided that on and after the second anniversary of a Director’s election to the Board, all unvested options previously granted are accelerated and all options granted thereafter become exercisable six months following the date of grant. In fiscal year ended January 31, 2006, each non-employee Director of the Company received 7,500 stock options from the Director Stock Option Plan.

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information concerning the beneficial ownership of the Company’s Common Stock as of May 9, 2006 by:

| | • | | each member of the Company’s Board; |

| | • | | each of the Company’s executive officers named in the “Summary Compensation Table” included in the “Executive Compensation” section of this Proxy Statement; |

| | • | | all Directors and executive officers as a group; and |

| | • | | each person or entity known to the Company that beneficially owns more than 5% of the Company’s Common Stock. |

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, or SEC. Unless otherwise indicated below, the address of each beneficial owner is c/o Comarco, Inc., 2 Cromwell Drive, Irvine, California, 92618. Unless otherwise indicated below, the Company believes that each of the persons listed in the table (subject to applicable community property laws) has the sole power to vote and to dispose of the shares listed opposite the shareholder’s name.

The percentages of Common Stock beneficially owned are based on 7,428,767 shares of Common Stock outstanding at May 9, 2006.

| | | | | |

Name and Address of Beneficial Owner | | Number of Shares

Beneficially Owned | | Percent of Class | |

Don M. Bailey (1) | | 179,938 | | 2.38 | % |

| | |

Thomas A. Franza (2) | | 233,721 | | 3.07 | % |

| | |

Gerald D. Griffin (3) | | 73,573 | | * | |

| | |

Jeffrey R. Hultman (4) | | 51,500 | | * | |

| | |

Erik van der Kaay (5) | | 46,500 | | * | |

| | |

Daniel R. Lutz (2) | | 53,328 | | * | |

| | |

Gregory W. Maton (2) | | 18,000 | | * | |

| | |

John McMunn (2) | | 5,000 | | * | |

| | |

Thomas J. Schmidt (2) | | 10,000 | | * | |

| | |

All Directors and Executive Officers as a group (11 persons) (6) | | 750,234 | | 9.34 | % |

7

| | | | | |

T. Rowe Price Associates (7) T. Rowe Price Small-Cap Value Fund 100 East Pratt Street Baltimore, MD 21202 | | 711,800 | | 9.6 | % |

| | |

Grueber & McBaine (8) 50 Osgood Place, Penthouse San Francisco, CA 94133 | | 690,624 | | 9.3 | % |

| | |

Dimensional Fund Advisors, Inc. (9) 1299 Ocean Avenue 11th Floor Santa Monica, CA 90401 | | 307,346 | | 4.1 | % |

| | |

Laurence W. Lytton (10) 28 Sherwood Place Scarsdale, NY 10583 | | 325,813 | | 4.4 | % |

| | |

Special Situations Funds (11) Austin W. Marxe and David M. Greenhouse 153 East 53rd St. 55th Floor New York, NY 10022 | | 1,044,294 | | 14.1 | % |

| | |

Elkhorn Partners Limited Partnership (12) P. O. Box 818 Elkhorn, NE 68022 | | 686,298 | | 9.2 | % |

| * | Indicates less than one percent of the outstanding shares of Common Stock. |

| (1) | Includes 115,750 shares that Mr. Bailey has the right to acquire within 60 days of May 9, 2006, by stock option exercise. |

| (2) | Includes shares subject to options beneficially owned and exercisable within 60 days of May 9, 2006 by the following persons: Mr. Franza — 147,644 shares; Mr. Lutz — 50,000 shares; Mr. Maton — 15,000 shares; Mr. McMunn – 5,000; and Mr. Schmidt —10,000 shares; |

| (3) | Includes 66,500 shares that Mr. Griffin has a right to acquire within 60 days of May 9, 2006, by stock option exercise. |

| (4) | Includes 51,500 shares that Mr. Hultman has a right to acquire within 60 days of May 9, 2006, by stock option exercise. |

| (5) | Includes 41,500 shares that Mr. van der Kaay has a right to acquire within 60 days of May 9, 2006, by stock option exercise. |

| (6) | Includes an aggregate of 574,144 shares held by the Company’s executive officers and Directors that are subject to options exercisable within 60 days of May 9, 2006. |

| (7) | Based on a Schedule 13G (Amendment 13) filed with the SEC on February 14, 2006. |

| (8) | Based on a Schedule 13G (Amendment 3) filed with the SEC on February 6, 2006 on behalf of Grueber & McBaine Capital Management, LLC (GMCM) and certain reporting persons. GMCM is a registered investment advisor. Jon Gruber and J. Patterson McBaine are managers, controlling persons and portfolio managers of GMCM and constitute a group with GMCM and the other reporting persons. |

8

| (9) | Based on a Schedule 13G filed with the SEC by Dimensional Fund Advisors, Inc. on February 1, 2006. Dimensional Fund Advisors is an investment advisor and furnishes advice to four investment companies and serves as investment manager to certain other commingled funds. |

| (10) | Based on a Schedule 13G (Amendment 2) filed with the SEC on behalf of Laurence W. Lytton on December 23, 2005. |

| (11) | Based on a Form 4 filed with the SEC by Austin Marxe and David Greenhouse on February 21, 2006 with respect to shares owned by various Special Situations funds. |

| (12) | Based on a Schedule 13D (Amendment 4) filed with the SEC on behalf of Elkhorn Partners Limited Partnership on May 5, 2006. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934 and the rules issued thereunder, the Company’s executive officers, Directors and persons that own more than 10% of the Company’s Common Stock are required to file with the SEC reports of ownership and changes in ownership of Common Stock and furnish the Company copies of all such reports. The Company believes that, during the fiscal year ended January 31, 2006, its executive officers, Directors and persons that owned more than 10% of the Company’s Common Stock complied with the Section 16(a) reporting requirements on a timely basis, based on the reports received by the Company or written certifications received by the Company from its executive officers and directors.

INFORMATION CONCERNING EXECUTIVE OFFICERS

The following table sets forth information at May 9, 2006 concerning the executive officers of the Company (other than Messrs. Bailey and Franza, whose biographical information appears in the table under the Election of Directors section above) and its principal subsidiary, Comarco Wireless Technologies, Inc.

| | | | |

Name | | Age | | Position |

| | |

Sebastian E. Gutierrez | | 44 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Daniel R. Lutz | | 42 | | Vice President and Chief Financial Officer of the Company and Comarco Wireless Technologies, Inc. |

| | |

Gregory W. Maton | | 58 | | Sr. Vice President, Comarco Wireless Technologies, Inc. |

| | |

John McMunn | | 56 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Bahram Nazardad | | 50 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Thomas J. Schmidt | | 43 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Peggy L. Vessell | | 61 | | Vice President, Comarco Wireless Technologies, Inc. and Corporate Secretary, the Company, Inc. |

Mr. Gutierrez joined Comarco Wireless Technologies in 1996 as Director of Business Development and was promoted to Vice President of the Company’s Call Box Division in 1998. Before joining the Company, he spent eight years at Pacific Bell from 1987 to 1996 working in various management positions as a member of their Accelerated Management Program. He also held engineering positions at TRW’s Space and Technology Division from 1984 to 1987.

9

Mr. Lutz joined the Company as Vice President and Chief Financial Officer in June 2000. He also serves as Vice President and Chief Financial Officer of Comarco Wireless Technologies, Inc. From February 1997 to December 1999, Mr. Lutz served as a Vice President of Sunstone Hotel Investors, Inc., formerly a publicly traded real estate investment trust. Prior to Sunstone, Mr. Lutz was a manager with Ernst & Young LLP. He is also a Certified Public Accountant in the state of California.

Mr. Maton joined Comarco Wireless Technologies as Sr. Vice President of Wireless Test Solutions in October 2002. From 1988 to 2002, Mr. Maton was Executive Board Director, Executive Vice President, Business Director, and Sales & Marketing Director at Racal. From 1969 to 1988, Mr. Maton held various management positions at Marconi Instruments Ltd.

Mr. McMunn joined Comarco Wireless Technologies as Vice President of Supply Chain Management in October 2004. Mr. McMunn has more than 15 years of senior management experience. From 2002 to 2004 Mr. McMunn was Vice President of Transceiver Operation for Picolight. From 1999 to 2002, he was the President and General Manager of the Test and Measurement division of Xyratex. From 1996 to 1999, Mr. McMunn was Director of Test and Process Engineering at Western Digital.

Mr. Nazardad joined Comarco Wireless Technologies as Vice President of Corporate Quality in February 2005. Prior to this position from 1999 to 2004, he was responsible for Quality Engineering, Quality Systems, and Configuration Management at Powerwave Technologies Inc. From 1994 to 1999, he was Director of Quality & Reliability at Valor Electronics. From 1984 to 1994, Mr. Nazardad was with Northern Telecom holding several management positions.

Mr. Schmidt joined the Company April 2004 as the new head of ChargeSource mobile power products operations. Mr. Schmidt has more than 15 years of senior management experience and joins Comarco Wireless Technologies from The Sandstone Group where he was a Managing Partner from 2002 to 2004. Prior to this position, Mr. Schmidt co-founded and was a Managing Partner at ideaEdge Ventures, a venture management company. From 1999 to 2000, Mr. Schmidt also served as the President and Chief Executive Officer of Gateway, Inc.’s Information Appliances Division. From 1995 through 1999, Mr. Schmidt served as the General Manager of two divisions of AlliedSignal, Inc., the Hardware Product Group and the Airsupply Operations.

Ms. Vessell joined the Company in 1987 and has served as Vice President of Administration for Comarco Wireless Technologies since 2000 and Corporate Secretary of the Company since 2001. From 1995 to 2000, Ms. Vessell served as Director of Administration where she oversaw Comarco Wireless Technologies’ Health and Welfare Programs and Employee Relations. From 1987 to 1995, Ms. Vessell held various Accounting and Human Resource positions.

There are no family relationships among any of the Company’s executive officers.

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth compensation information for the periods indicated for the Company’s Chief Executive Officer and the four most highly compensated executive officers at the end of the last fiscal year whose salary and bonus exceeded $100,000. These individuals are referred to as the named executive officers.

| | | | | | | | | | | |

Annual Compensation | | Long Term Compensation |

| | | | | |

Name and

Principal

Position | | Fiscal

Year | | Salary ($)(1) | | Bonus ($) | | Shares of

Common

Stock

Underlying Options # | | | All Other

Compensation

($)(2) |

Thomas A. Franza President & Chief Executive Officer | | 2006

2005

2004 | | 350,916

337,400

327,600 | | 302,000

0

0 | | 0

25,000

25,000 |

| | 10,500

10,250

10,000 |

| | | | | |

Don M. Bailey Chairman of the Board | | 2006

2005

2004 | | 75,000

75,000

75,000 | | 0

0

0 | | 0

7,500

7,500 |

| | 10,500

10,250

10,000 |

| | | | | |

Daniel R. Lutz Vice President & Chief Financial Officer | | 2006

2005

2004 | | 216,930

206,000

200,000 | | 115,000

0

0 | | 0

0

20,000 |

| | 10,500

(3) 39,696

10,000 |

| | | | | |

Gregory Maton Sr. Vice President Comarco Wireless Technologies, Inc. | | 2006

2005

2004 | | 225,000

216,300

210,000 | | 110,000

0

0 | | (4) 16,500

0

0 | *

| | 10,500

10,250

10,000 |

| | | | | |

John McMunn (5) Vice President Comarco Wireless Technologies, Inc. | | 2006

2005

2004 | | 190,000

175,000

0 | | 90,000

0

0 | | 0

20,000

0 |

| | 9,413

337

0 |

| | | | | |

Thomas J. Schmidt (6) Vice President Comarco Wireless Technologies, Inc. | | 2006

2005

2004 | | 256,667

187,500

0 | | 0

0

0 | | 0

20,000

0 |

| | 10,500

8,990

0 |

Notes:

| (1) | “Salary” includes base salary and compensation deferred during the current year. |

| (2) | “All Other Compensation” consists primarily of the Company’s matching contributions to its 401(k) plan. |

| (3) | Includes vacation payouts for Mr. Lutz in fiscal 2005 of $29,513. |

11

| (4) | Options granted under the 2005 Plan, respectively, subject to shareholder approval of the 2005 Plan. |

| (5) | Mr. McMunn joined the Company in fiscal 2005. |

| (6) | Mr. Schmidt joined the Company in fiscal 2005. |

Option Grants in Fiscal Year Ended January 31, 2006

The following table sets forth information concerning options granted in fiscal year ended January 31, 2006 to each of the Company’s named executive officers.

| | | | | | | | | | | | | | | | |

| | | Individual Grants | | | | |

Name | | Number of

Securities

Underlying

Options

Granted(1) | | % of Total

Options

Granted to

Employees

in Fiscal

2006 | | | Exercise

Price(2) | | Expiration

Date | | Potential Realizable

Value at Assumed

Rates of Price

Appreciation for

Option Term(3) |

| | | | | | 5% | | 10% |

Gregory Maton | | 16,500 | | 24 | % | | $ | 8.64 | | 12/6/2015 | | $ | 89,655 | | $ | 227,204 |

| (1) | The options vest in equal annual increments of 25% over a four-year period following their date of grant. . Options granted under the 2005 Plan, respectively, subject to shareholder approval of the 2005 Plan. |

| (2) | Represents the fair market value of an underlying share of Common Stock on the date of grant |

| (3) | Represents the potential realizable value assuming the stated rates of price appreciation compounded annually for the entire ten-year term, with the aggregate exercise price deducted from the final appreciated value. Such annual rates of appreciation are for illustrative purposes only, are based on requirements of the SEC, and do not reflect the Company’s estimate of future stock appreciation. No assurance can be given that such rates of appreciation, or any appreciation, will be achieved. |

Aggregated Option Exercises and Fiscal Year-End Option Values

The following table sets forth information with respect to the Company’s named executive officers concerning the exercisable and unexercisable stock options held as of January 31, 2006. There were no option exercises by the named executive officers in fiscal year ended January 31, 2006.

| | | | | | | | | | | | | | |

Name | | Shares

Acquired

on Exercise | | Value

Realized | | Number of Underlying

Options at January 31, 2006 | | Value of In-The-Money

Options at January 31,

2006(1) |

| | | | Exercisable | | Un-exercisable | | Exercisable | | Un-exercisable |

| | | | | | |

Thomas A. Franza | | 0 | | 0 | | 147,644 | | 37,500 | | $ | 170,357 | | $ | 176,250 |

| | | | | | |

Don M. Bailey | | 0 | | 0 | | 153,250 | | 10,750 | | $ | 137,045 | | $ | 50,508 |

| | | | | | |

Daniel R. Lutz | | 0 | | 0 | | 50,000 | | 10,000 | | $ | 40,100 | | $ | 37,650 |

| | | | | | |

Thomas J. Schmidt | | 0 | | 0 | | 10,000 | | 10,000 | | $ | 17,225 | | $ | 51,675 |

| | | | | | |

Gregory W. Maton | | 0 | | 0 | | 15,000 | | 21,500 | | $ | 45,975 | | $ | 68,208 |

| | | | | | |

John McMunn | | 0 | | 0 | | 5,000 | | 15,000 | | $ | 18,975 | | $ | 56,925 |

| (1) | These values are calculated using the January 31, 2006 closing price of Common Stock on the Nasdaq National Market of $11.845 per share, less the exercise price of the options, multiplied by the number of shares to which the options relate. |

12

Severance Agreements

The Company and each of Messrs. Franza and Lutz are parties to a severance agreement that provides that if, within 24 months following a change of control of the Company, he is terminated or constructively terminated without cause, or ceases to be employed by the Company for reasons other than because of death, disability or retirement, then he is entitled to receive a lump sum cash payment equal to two-times the sum of his annual base salary plus his annual incentive compensation bonus that would be payable assuming 100% satisfaction of all performance goals thereunder. In addition, each of Messrs. Franza and Lutz would be entitled to continued participation and coverage under the Company’s health plans and insurance program and the acceleration of all of his options and restricted stock, if any. Each severance agreement has a term that continues until three years after any notice of non-renewal or termination is given by the executive or the Company.

The Company and Mr. Maton are parties to a severance agreement that is substantially similar to the severance agreements with Messrs. Franza and Lutz, except that Mr. Maton is entitled to a lump sum cash payment equal to the sum of his annual base salary plus his annual incentive compensation bonus that would be payable assuming 100% satisfaction of all performance goals thereunder.

13

Item 2 on Proxy Card

APPROVAL OF THE ADOPTION OF THE 2005 EQUITY INCENTIVE PLAN

We are requesting that the shareholders approve the Company’s 2005 Equity Incentive Plan (the “2005 Plan”), which was adopted by the Board on December 7, 2005 and subsequently amended and restated by the Board on March 20, 2006, subject to shareholder approval, to expand the types of awards that can be granted thereunder.

The 2005 Plan is being presented for shareholder approval because the Company’s 1995 Stock Option Plan has expired and, accordingly, no further options may be granted thereunder. The Company operates in a competitive marketplace in which success depends on its ability to attract and retain employees of the highest caliber. One of the tools the Board regards as essential in addressing these human resource challenges is a competitive equity incentive program. The Board proposes to adopt the 2005 Plan to enable the Company to provide appropriate equity incentives to its employees, directors and consultants.

The proposal to approve the adoption of the 2005 Plan will require approval by a majority of the votes cast by the holders of the shares of Common Stock voting in person or by proxy at the Annual Meeting. Withholding authority to vote for approval of the 2005 Plan will have the effect of a vote against the approval of the adoption of the 2005 Plan.

A summary of the 2005 Plan is set forth below. The discussion below is qualified in its entirety by reference to the 2005 Plan, a copy of which, as amended, is attached asAppendix A to this proxy statement.

Purpose. The 2005 Plan is intended to retain and reward highly qualified employees (including contract employees, consultants, and directors) and encourage their ownership of Common Stock.

Administration. The Board has designated the Compensation Committee (the “Committee”) to administer the 2005 Plan. Subject to the provisions of the 2005 Plan, the Committee has discretion to determine the employee, consultant or director to receive an award, the form of award and any acceleration or extension of an award. Further, the Committee has complete authority to interpret the 2005 Plan, to prescribe, amend and rescind rules and regulations relating to it, to determine the terms and provisions of the respective award agreements (which need not be identical), and to make all other determinations necessary or advisable for the administration of the 2005 Plan.

Eligibility. Awards may be granted to any employee of or consultant to one or more of the Company and its subsidiaries or to directors of the Company or of any board of directors (or similar governing authority) of any subsidiary.

Shares Subject to the 2005 Plan. The shares issued or to be issued under the 2005 Plan are authorized but unissued shares of the Company’s common stock (the “Common Stock”). The maximum number of shares of Common Stock which may be issued or made subject to awards under the 2005 Plan is 450,000. As of May 9, 2006, the Company has previously granted non-qualified options to two executive officers, Gregory Maton and Bahram Nazardad and one non-officer employee to purchase 16,500, 22,000 and 11,000 shares under the 2005 Plan, respectively, subject to shareholder approval. These option grants provide that they will terminate if the shareholders do not approve the 2005 Plan. The 2005 Plan contains the following limitations on the certain types of awards:

| | • | | No more than 25% of the shares of Common Stock covered by the 2005 Plan may be covered by options or other awards issued to any one person in any one calendar year. |

| | • | | No “qualified performance-based award” (described below) may cover more than 450,000 shares or their cash equivalent at the date of grant of the award. |

Types of Awards. Awards under the 2005 Plan may include Incentive Stock Options, Nonstatutory Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units and Performance Units, Qualified Performance-Based Awards, and Stock Grants. Each award will be evidenced by an instrument in such form as the Committee may prescribe, setting forth applicable terms such as the exercise price and term of any option or

14

applicable forfeiture conditions or performance requirements for any Restricted Stock or Restricted Stock Units. Except as noted below, all relevant terms of any award will be set by the Committee in its discretion.

| | • | | Nonstatutory Stock Options and Incentive Stock Options (together, “Stock Options”) are rights to purchase Common Stock of the Company. A Stock Option may be immediately exercisable or become exercisable in such installments, cumulative or non-cumulative, as the Committee may determine. A Stock Option may be exercised by the recipient giving written notice to the Company, specifying the number of shares with respect to which the Stock Option is then being exercised, and accompanied by payment of an amount equal to the exercise price of the shares to be purchased. The purchase price may be paid by cash, check, any other lawful means authorized by the Committee, or through and under the terms and conditions of any formal cashless exercise program authorized by the Company. |

Incentive Stock Options may be granted only to eligible employees of the Company or any parent or subsidiary corporation and must have an exercise price of not less than 100% of the fair market value of the Company’s Common Stock on the date of grant (110% for Incentive Stock Options granted to any 10% stockholder of the Company). In addition, the term of an Incentive Stock Option may not exceed 10 years (five years, if granted to any 10% stockholder. Nonstatutory Stock Options must have an exercise price of not less than 100% of the fair market value of the Company’s Common Stock on the date of grant and the term of any Nonstatutory Stock Option may not exceed 10 years. In the case of an Incentive Stock Option, the amount of the aggregate fair market value of Common Stock (determined at the time of grant) with respect to which Incentive Stock Options are exercisable for the first time by an employee during any calendar year (under all such plans of his or her employer corporation and its parent and subsidiary corporations) may not exceed $100,000.

| | • | | Stock Appreciation Rights (“SARs”) are rights to receive (without payment to the Company) cash, property or other forms of payment, or any combination thereof, as determined by the Committee, based on the increase in the value of the number of shares of Common Stock specified in the SAR. The base price (above which any appreciation is measured) will in no event be less than the fair market value of the Company’s stock on the date of grant of the SAR or, if the SAR is granted in tandem with a Stock Option (that is, so that the recipient has the opportunity to exercise either the Stock Option or the SAR, but not both), the exercise price under the associated Stock Option. |

| | • | | Awards of Restricted Stock are grants or sales of Common Stock which are subject to a risk of forfeiture, such as a requirement of the continued performance of services for stated term or the achievement of individual or Company performance goals. Except as otherwise provided in the 2005 Plan or the applicable award documentation for Restricted Stock, at all times prior to lapse of any forfeiture restrictions applicable to the award, the recipient shall have all of the rights of a stockholder of the Company, including the right to vote, and the right to receive any dividends with respect to, the shares of Restricted Stock. However, the Committee may determine at the time of the award, to permit or require the payment of cash dividends to be deferred, or reinvested in additional Restricted Stock to the extent shares are available for issuance under the 2005 Plan. |

| | • | | Awards of Restricted Stock Units and Performance Units are grants of rights to receive either shares of Common Stock (in the case of Restricted Stock Units) or the appreciation over a base value (as specified by the Committee) of a number of shares of Common Stock (in the case of Performance Stock Units) subject to satisfaction of service or performance requirements established by the Committee in connection with the award. Such awards may include the right to the equivalent to any dividends on the shares covered by the award, which amount may in the discretion of the Committee be deferred and paid if and when the award vests. |

| | • | | Qualified Performance-Based Awards are awards which include performance criteria intended to satisfy Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Section 162(m) of the Code limits the Company’s federal income tax deduction for compensation to certain specified senior executives to $1 million dollars, but excludes from that limit “performance-based compensation.” Qualified Performance-Based Awards may be in the form of Stock Options, Restricted Stock, Restricted Stock Units or Performance Units, but in each case will be subject to satisfaction of one of the following criteria, either individually, alternatively or in any combination, applied to either the Company as a whole or to a business unit or affiliate, either individually, alternatively, or in any combination, and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, in each case as specified by the Committee in the award: |

15

| | |

| cash flow (before or after dividends) | | earnings per share (including, without limitation, earnings before interest, taxes, depreciation and amortization) |

| stock price | | return on equity |

| stockholder return or total stockholder return | | return on capital (including without limitation return on total capital or return on invested capital) |

| return on investment | | return on assets or net assets |

| market capitalization | | economic value added |

| debt leverage (debt to capital) | | revenue |

| sales or net sales | | backlog |

| income, pre-tax income or net income | | operating income or pre-tax profit |

| operating profit, net operating profit or economic profit | | gross margin, operating margin or profit margin |

| return on operating revenue or return on operating assets | | cash from operations |

| operating ratio | | operating revenue |

| market share improvement | | general and administrative expenses |

| customer service | | new production introductions |

| product line enhancements | | strategic acquisitions |

Qualified Performance-Based Awards in the form of Stock Options must have an exercise price which is not less than 100% of the fair market value of the Company’s Common Stock on the date of grant. No payment or other amount will be available to a recipient of a Qualified Performance-Based Award except upon the Committee’s determination that particular goal or goals established by the Committee for the criteria (from among those specified above) selected by the Committee have been satisfied.

| | • | | A Stock Grant is a grant of shares of Common Stock not subject to restrictions or other forfeiture conditions. Stock Grants may be awarded only in recognition of significant contributions to the success of the Company or its affiliates, in lieu of compensation otherwise already due, or in other limited circumstances which the Committee deems appropriate. |

Effect of Termination of Employment or Association. Unless the Committee determines otherwise in connection with any particular award under the 2005 Plan, Stock Options and SARs will generally terminate one year following the recipient’s termination of employment or other association on account of disability (within the meaning of Section 22(e)(3) of the Code) or death and three (3) months following the recipient’s termination of employment or other association in other circumstances. The effect of termination on other awards will depend on the terms of those awards.

Transferability. In general, no award under the 2005 Plan may be transferred by the recipient and during the life of the recipient all rights under an award may be exercised only by the recipient or his or her legal representative. However, the Committee may approve the transfer, without consideration, of an award of a Nonstatutory Option or Restricted Stock to a family member.

Effect of Significant Corporate Event. In the event of any change in the outstanding shares of Common Stock through merger, consolidation, sale of all or substantially all the property of the Company, reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split, or other distribution with respect to such shares of Common Stock, an appropriate and proportionate adjustment will be made in (i) the maximum numbers and kinds of shares subject to the 2005 Plan and the Prior Plan limits, (ii) the numbers and kinds of shares or other securities subject to the then outstanding awards, (iii) the exercise or hurdle price for each share or other unit of any other securities subject to then outstanding Stock Options or SARs (without change in the aggregate purchase or hurdle price as to which Stock Options or SARs remain exercisable), and (iv) the repurchase price of each share of Restricted Stock then subject to a risk of forfeiture in the form of a Company repurchase right. In the event of a change in control, awards subject only to the requirement of continued employment or other service will generally continue to vest in accordance with their terms, unless the recipient’s employment or other association is terminated by the Company or an Affiliate (other than for cause) within one year of the change of control (in which event they will fully vest on such termination); awards subject to performance criteria will generally vest in full on the change of control but only as to a pro rata portion of the shares subject to the award (and the balance will then be

16

forfeited). Upon dissolution or liquidation of the Company, other than as part of an acquisition or similar transaction, each outstanding Stock Option or SAR shall terminate, but the participant shall have the right, immediately prior to the dissolution or liquidation, to exercise the Stock Option or SAR to the extent exercisable on the date of dissolution or liquidation.

Amendments to the 2005 Plan. The Board may amend or modify the 2005 Plan at any time subject to the rights of holders of outstanding awards on the date of amendment or modification; provided, however, that the Board may not, without the approval of shareholders, reprice outstanding awards.

Summary of Tax Consequences. The following is a brief and general discussion of the United States federal income tax consequences to recipients of awards granted under the 2005 Plan. This summary is not comprehensive and is based upon laws and regulations in effect on January 1, 2006. Such laws and regulations are subject to change. This summary is intended for the information of shareholders considering how to vote and not as tax guidance to participants in the 2005 Plan. Participants in the 2005 Plan should consult their own tax advisors as to the tax consequences of participation.

| | • | | NonstatutoryStockOptions. Generally, there are no federal income tax consequences to the participants upon grant of Nonstatutory Stock Options. Upon the exercise of such an Option, the participant will recognize ordinary income in an amount equal to the amount by which the fair market value of the Common Stock acquired upon the exercise of such Option exceeds the exercise price, if any. A sale of Common Stock so acquired will give rise to a capital gain or loss equal to the difference between the fair market value of the Common Stock on the exercise and sale dates. |

| | • | | IncentiveStockOptions. Except as noted at the end of this paragraph, there are no federal income tax consequences to the participant upon grant or exercise of an Incentive Stock Option. If the participant holds shares of Common Stock purchased pursuant to the exercise of an Incentive Stock Option for at least two years after the date the Option was granted and at least one year after the exercise of the Option, the subsequent sale of Common Stock will give rise to a long-term capital gain or loss to the participant and no deduction will be available to the Company. If the participant sells the shares of Common Stock within two years after the date an Incentive Stock Option is granted or within one year after the exercise of an Option, the participant will recognize ordinary income in an amount equal to the difference between the fair market value at the exercise date and the Option exercise price, and any additional gain or loss will be a capital gain or loss. Some participants may have to pay alternative minimum tax in connection with exercise of an Incentive Stock Option, however. |

| | • | | RestrictedStock. A participant will generally recognize ordinary income on receipt of an award of Restricted Stock when his or her rights in that award become substantially vested, in an amount equal to the amount by which the then fair market value of the Common Stock acquired exceeds the price he or she has paid for it, if any. Recipients of Restricted Stock may, however, within 30 days of receiving an award of Restricted Stock, choose to have any applicable risk of forfeiture disregarded for tax purposes by making an “83(b) election.” If the participant makes an 83(b) election, he or she will have to report compensation income equal to the difference between the value of the shares and the price paid for the shares, if any, at the time of the transfer of the Restricted Stock. |

| | • | | StockAppreciationRights. A participant will generally recognize ordinary income on receipt of cash or other property pursuant to the exercise of an award of Stock Appreciation Rights. |

| | • | | RestrictedStockUnits,PerformanceUnitsandStockGrants. A participant will generally recognize ordinary income on receipt of any shares of Common Stock, cash or other property in satisfaction of any of these awards under the 2005 Plan. |

| | • | | PotentialDeferredCompensation. For purposes of the foregoing summary of federal income tax consequences, we assumed that no award under the 2005 Plan will be considered “deferred compensation” as that term is defined for purposes of recent federal tax legislation governing nonqualified deferred compensation arrangements, Section 409A of the Code, or, if any award were considered to any extent to constitute deferred compensation, its terms would comply with the requirements of that legislation (in general, by limiting any flexibility in the time of payment). For example, the award of an SAR at less than 100% of the market value of the Company’s Common Stock, would constitute deferred compensation. If an award includes deferred compensation, and its |

17

| | terms do not comply with the requirements of the legislation, then any deferred compensation component of an award under the 2005 Plan will be taxable when it is earned and vested (even if not then payable) and the recipient will be subject to a 20% additional tax. |

| | • | | Section 162(m)LimitationsontheCompany’sTaxDeduction. In general, whenever a recipient is required to recognize ordinary income in connection with an award, the Company will be entitled to a corresponding tax deduction. However, the Company will not be entitled to deductions in connection with awards under the 2005 Plan to certain senior executive officers to the extent that the amount of deductible income in a year to any such officer, together with his or her other compensation from the Company exceeds the $1 million dollar limitation of Section 162(m) of the Code. Compensation which qualifies as “performance-based” is not subject to this limitation, however. |

Awards to Particular Officers, Etc. The future benefits or amounts that will be received under the 2005 Plan by or allocated to each of (i) the officers listed in the Summary Compensation Table, (ii) each of the nominees for election as a director, (iii) all directors of the company who are not executive officers of the company as a group, (iv) all present executive officers of the Company as a group, and (v) all employees of the Company, including all other current officers, as a group are not determinable. The Company has previously granted non-qualified options to two executive officers, Gregory Maton and Bahram Nazardad and one non-officer employee to purchase 16,500, 22,000 and 11,000 shares under the 2005 Plan, respectively, subject to shareholder approval. These option grants provide that they will terminate if the shareholders do not approve the 2005 Plan.

THE BOARD RECOMMENDS A VOTE FOR THE APPROVAL OF THE ADOPTION OF THE 2005

EQUITY INCENTIVE PLAN

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of May 9, 2006 with respect to shares of Common Stock that may be issued under the Company’s equity compensation plans.

| | | | | | | |

Plan Category | | Number of Securities

to be Issued Upon

Exercise of

Outstanding

Options, warrants

and Rights | | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights | | Number of Securities Remaining

Available for Future Issuance

Under Equity Compensation Plans

(excluding securities reflected in

the first column) |

Equity compensation plans approved by security holders | | 861,520 | | $ | 12.43 | | 8,125 |

Equity compensation plans not approved by security holders | | 0 | | | 0 | | 0 |

Total | | 861,520 | | $ | 12.43 | | 8,125 |

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board (the “Compensation Committee”) administers the Company’s executive compensation program and establishes the salaries of the Company’s executive officers. The Compensation Committee consists of only non-employee Directors, who are appointed by the Board.

18

Compensation Philosophy

The general philosophy of the Compensation Committee is to provide executive compensation designed to enhance shareholder value, including annual compensation, consisting of salary and bonus awards, and long-term compensation, consisting of stock options. To this end, the Compensation Committee designs compensation plans and incentives to link the financial interests of the Company’s executive officers to the interests of its shareholders, to encourage support of the Company’s long-term goals, to tie executive compensation to the Company’s performance, to attract, motivate and retain talented leadership and to encourage significant ownership of the Company’s common stock by executive officers.

In making decisions affecting executive compensation, the Compensation Committee reviews the nature and scope of the executive officer’s responsibilities as well as his or her effectiveness in supporting the Company’s short and long-term goals. The Compensation Committee also considers the compensation practices of other United States and international corporations that compete with the Company as well as various professional compensation surveys. Based upon these and other factors which it considers relevant, and in light of the Company’s overall long-term performance, the Committee has considered it appropriate, and in the best interest of the shareholders, to set the overall executive compensation so as to compete with companies in the comparison group to enable the Company to continue to attract, retain and motivate the highest level of executive personnel.

There are two primary types of compensation provided to the Company’s executive officers:

| | • | | Annual compensation, which includes a base salary intended to provide a stable annual salary at a level consistent with individual contributions, and annual performance bonuses intended to link officers’ compensation to the Company’s performance. |

| | • | | Long-term compensation, which includes stock option awards, to encourage actions to maximize long-term shareholder value. |

Annual Compensation

Base Salary

Consistent with its stated philosophy, the Compensation Committee aims to position base salaries for the Company’s executive officers annually at levels that are consistent within the industry, with consideration of the performance of the Company, individual performance of each executive and the executive’s scope of responsibility in relation to other officers and key executives within the Company. In selected cases, other factors may also be considered.

Annual Incentive Bonuses

The Company’s Incentive Bonus Plan provides for the payment of cash bonuses based on the Company’s performance in relation to predetermined objectives and individual executive performance for the year then ended. Prior to the beginning of fiscal year 2006, the Compensation Committee established objectives related to the Company’s earnings, revenue and long-term growth and shareholder value. Based on the Company’s performance during fiscal year 2006 against these objectives, bonuses were paid under the Incentive Bonus Plan as reported in the summary compensation table elsewhere in this proxy statement.

Long-Term Compensation—Equity Based Compensation

The Compensation Committee is committed to long-term incentive programs for executives that promote the long-term growth of the Company. The Compensation Committee believes that the management employees should be rewarded with a proprietary interest in the Company to promote and enhance long-term performance and to attract, motivate and retain qualified and capable executives.

19

The Compensation Committee grants to executive officers options to purchase shares of the Company’s common stock under the Company’s 1995 stock option plan that was adopted by the Company and its shareholders in 1995, which expired by its terms in May 2005. The Board has adopted the 2005 Equity Incentive Plan, subject to shareholder approval. In fiscal year ended January 31, 2006, the Compensation Committee granted 16,500 non-qualified options to Gregory Maton and 22,000 non-qualified options to Bahram Nazardad subject to shareholder approval.

Compensation of Chief Executive Officer

During fiscal year 2006, the Company’s Chief Executive Officer received a base annual salary of $350,916, which represents a 4% increase over the annual base salary paid to the Chief Executive Officer during fiscal 2005.

The Company’s Chief Executive Officer is eligible to participate in all of the Company’s long-term incentive programs. During fiscal 2006 the Chief Executive Officer received no stock options to purchase shares of the Company’s common stock as shown on the Summary Compensation Table. The Summary Compensation Table includes additional information regarding the other compensation and benefits paid to the Company’s Chief Executive Officer.

Internal Revenue Code Section 162(m)

The Compensation Committee also considers the potential impact of Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”). Section 162(m) disallows a tax deduction for any publicly held Company for individual compensation exceeding $1 million in any taxable year for the Chief Executive Officer and the other senior executive officers, other than compensation that is performance-based under a plan that is approved by the shareholders of the Company and that meets certain other technical requirements. Based on these requirements, the Compensation Committee has determined that Section 162(m) will not prevent the Company from receiving a tax deduction for any of the compensation paid to executive officers.

Submitted on May 16, 2006 by the members of the Compensation Committee.

Erik van der Kaay, Chairman

Gerald D. Griffin

Jeffrey R. Hultman

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the Company’s executive officers currently serves on the compensation committee of any other company or board of directors of any other company of which any member of our Compensation Committee is an executive officer.

PERFORMANCE COMPARISON

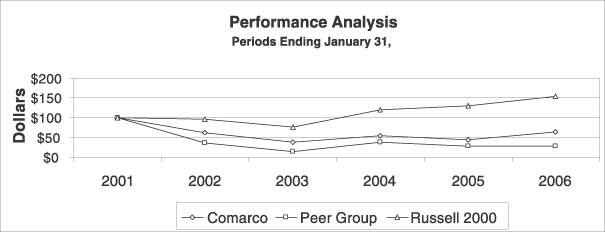

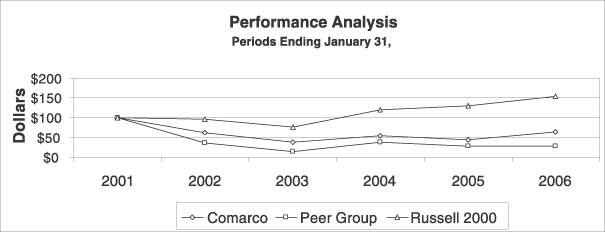

Set forth below is a line graph comparing the cumulative total shareholders return on the Company Common Stock against the cumulative total return of the Russell 2000 Composite Stock Index and a peer group of companies discussed below (the “Peer Group”) for the periods indicated. The presentation assumes $100 was invested on January 31, 2001 in the Company’s Common Stock, the Russell 2000 Composite Stock Index, and the common stock of the Peer Group.

The Peer Group consists of five companies of similar business focus as the Company. The returns of each company within the Peer Group have been averaged assuming an equal dollar investment in each company at the beginning of the time period or at the time they became publicly traded. Dividends paid by those peer companies that pay dividends are assumed to be reinvested at the end of the ex-dividend month without any transaction cost.

The Peer Group consists of LLC International, Inc., Agilent Technologies, Inc., Wireless Facilities, Inc., LM Ericsson Telephone Co., and Ascom. The following graph depicts the relative performance of the Company in relation to the Peer Group and to the Russell 2000 Stock index for the periods indicated.

20

| | | | | | | | | | | | |

| | | 1/31/2001 | | 1/31/2002 | | 1/31/2003 | | 1/31/2004 | | 1/31/2005 | | 1/31/2006 |

Comarco | | 100 | | 61.66 | | 37.80 | | 54.28 | | 43.49 | | 64.26 |

Peer Group | | 100 | | 35.61 | | 14.57 | | 38.64 | | 27.74 | | 28.38 |

Russell 2000 Index | | 100 | | 96.40 | | 75.32 | | 119.02 | | 129.35 | | 153.78 |

Item 3 on Proxy Card

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM FOR FISCAL 2007

The Audit Committee has appointed BDO Seidman, LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 3l, 2007, and has requested the Board to submit this appointment for ratification by our shareholders at the Annual Meeting.

A representative of BDO Seidman, LLP is expected to be present at the Annual Meeting, will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions from shareholders.

In the event that the shareholders do not ratify the appointment of BDO Seidman, LLP as the Company’s registered public accounting firm for the fiscal year ending January 31, 2007, the appointment will be reconsidered by the Audit Committee. Even if the appointment is ratified by the shareholders, the Audit Committee in its discretion may dismiss BDO Seidman, LLP as the Company’s independent registered public accounting firm and appoint a different independent accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of the Company and its shareholders.

THE BOARD RECOMMENDS A VOTE FOR THE RATIFICATION OF APPOINTMENT OF BDO SEIDMAN, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JANUARY 31, 2007

21

Audit Fees

The aggregate fees incurred and payable to BDO Seidman, LLP for professional services rendered in connection with the audit and quarterly reviews of the Company’s financial statements during the fiscal year ending January 31, 2006 were approximately $270,000. The aggregate fees incurred and payable to BDO Seidman, LLP for professional services rendered in connection with the audit and third quarter review of the Company’s financial statements during fiscal year 2005 were $205,000.

Additionally, KPMG LLP has billed the Company $30,000 for the re-issuance of KPMG’s audit opinion on and consent relating to the Company’s consolidated financial statements for the fiscal year ended January 31, 2004, which are included in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2006.

Audit-Related Fees

No audit-related fees were paid to BDO Seidman, LLP or KPMG, LLP for fiscal years ended January 31, 2006 and January 31, 2005 respectively.

Tax Fees

The aggregate fees incurred and payable to KPMG, LLP for professional services rendered during the fiscal years ended January 31, 2006 and January 31, 2005 in connection with tax advice, return preparation and planning were $61,755 and $76,565 respectively. The aggregate bills incurred and payable to Ernst & Young, LLP for professional services rendered for the year ending January 31, 2006 in connection with tax advice, return preparation and planning were $26,207.

All Other Fees

No other fees were paid to BDO Seidman, LLP or KPMG LLP during the fiscal years ended January 31, 2006 and January 31, 2005 respectively.

Indemnification

In connection with KPMG LLP’s re-issuance of their audit opinion and consent relating to the Company’s consolidated financial statements for the fiscal year ended January 31, 2004 in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2006, the Company has agreed to indemnify and hold KMPG LLP harmless against legal costs and expenses incurred by KPMG LLP in the successful defense of any legal action or proceeding that arises as a result of KPMG LLP’s consent to the inclusion (or incorporation by reference) of its audit report on the Company’s past financial statements included (or incorporated by reference) in the Company’s Annual Report on Form 10-K for the Company’s fiscal year ended January 31, 2006 and certain registration statements filed by the Company under the federal securities laws.

Change in Independent Registered Public Accounting Firm

On September 21, 2004, the Audit Committee approved the dismissal of KPMG LLP as the Company’s independent registered public accounting firm, and appointed BDO Seidman, LLP as the Company’s new independent registered public accounting firm.

KPMG LLP’s reports on the Company’s consolidated financial statements as of and for the fiscal year ended January 31, 2004, the last fiscal year audited by KPMG LLP, did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal year ended January 31, 2004, or fiscal year 2004, there were no disagreements between the Company and KPMG LLP on any matter of accounting principles or practices, financial statement disclosure, or

22

auditing scope or procedure which, if not resolved to KPMG LLP’s satisfaction, would have caused KPMG LLP to make reference to the matter of the disagreement in connection with its reports.