SCHEDULE 14A INFORMATION

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | | |

| | | |

¨ | | Preliminary Proxy Statement | | ¨ | | | Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

x | | Definitive Proxy Statement | | | | | |

| | | |

¨ | | Definitive Additional Materials | | | | | |

| |

¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

COMARCO, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | |

| |

x | | No fee required. |

| |

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

|

| | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

|

| | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

|

| | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

|

| | |

| | | (5) | | Total fee paid: |

| | |

| | | | |

|

| |

¨ | | Fee paid previously with preliminary materials. |

| |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | | (1) | | Amount Previously Paid: |

| | | | |

|

| | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

|

| | |

| | | (3) | | Filing Party: |

| | | | |

|

| | |

| | | (4) | | Date Filed: |

| | | | |

|

COMARCO, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held

June 21, 2005

To the Shareholders of COMARCO, Inc.:

The Annual Meeting of the Shareholders of COMARCO, Inc., a California corporation (the “Company”), will be held on Tuesday, June 21, 2005 at 10:00 A.M., local time, at the offices of Comarco Wireless Technologies, Inc., which are located at 2 Cromwell Drive, Irvine, CA 92618 (949) 599-7400, for the following purposes:

1. To elect five Directors;

2. To ratify the appointment by the Company’s Audit Committee of BDO Seidman, LLP as the Company’s independent registered public accounting firm for the year ending January 31, 2006; and

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

Only holders of record of the Company’s Common Stock at the close of business on May 5, 2005 are entitled to notice of and to vote at the Annual Meeting.

The Board of Directors of the Company intends to present Don M. Bailey, Thomas A. Franza, Gerald D. Griffin, Jeffrey R. Hultman, and Erik H. van der Kaay as nominees for election as Directors at the Annual Meeting.

Each shareholder is cordially invited to attend and vote in person at the meeting. TO ASSURE REPRESENTATION AT THE MEETING, HOWEVER, SHAREHOLDERS ARE URGED TO COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE PREPAID ENVELOPE. Shareholders who attend the meeting may still vote in person, even if they have previously voted by proxy.

|

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| |

Peggy L. Vessell, Secretary |

Irvine, California

May 25, 2005

TABLE OF CONTENTS

About Comarco:

Comarco is a leading provider of wireless test solutions for field test applications, wireless emergency call box systems, and ChargeSource universal mobile power products for laptop computers, cellular telephones, and other handheld devices.

- 2 -

COMARCO, INC.

2 Cromwell Drive

Irvine, CA 92618

(949) 599-7450

PROXY STATEMENT

For Annual Meeting of Shareholders

To Be Held

June 21, 2005

GENERAL INFORMATION

The Board of Directors of COMARCO, Inc., a California corporation (“COMARCO” or the “Company”), furnishes this Proxy Statement in connection with the solicitation of proxies to be used at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, June 21, 2005 at 10:00 A.M., local time, at the offices of Comarco Wireless Technologies, Inc., which are located at 2 Cromwell Drive, Irvine, CA 92618, or any adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting. This Proxy Statement and the accompanying form of proxy are first being mailed to shareholders on or about May 25, 2005.

A shareholder giving a proxy has the power to revoke it at any time before it is exercised by (1) filing with the Secretary of the Company an instrument in writing revoking the proxy; (2) filing with the Secretary of the Company a duly executed proxy bearing a later date; or (3) attending the Annual Meeting and voting the shares in person. In the absence of such revocation, all shares represented by a properly executed proxy received in time for the Annual Meeting will be voted as specified therein.

The cost of preparing, assembling, printing and mailing this Proxy Statement and the accompanying form of proxy and the cost of soliciting proxies will be borne by the Company. The Company may make arrangements with various brokerage houses or other nominees to send proxy materials to the beneficial owners of stock and may reimburse them for their reasonable expenses in connection therewith.

The Company’s officers, employees and directors may supplement the original solicitation of proxies by telephone, facsimile, e-mail and personal contact. We will pay no additional compensation to such persons for any of these activities.

VOTING RIGHTS

The Company’s only outstanding class of voting securities is its Common Stock. Only shareholders of record at the close of business on May 5, 2005 will be entitled to vote at the Annual Meeting. At May 5, 2005, there were outstanding 7,422,042 shares of Common Stock. The holders of record of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting, present in person or by proxy, will constitute a quorum for the transaction of business. Each share is entitled to one vote, except that each shareholder is entitled to cumulate his shares in the election of Directors, provided that at least one shareholder has given notice, prior to the voting, of the shareholder’s intention to do so. If cumulative voting is in effect, each shareholder may cumulate votes for one or more candidates. To cumulate votes, a shareholder may vote for any one candidate a number of votes equal to the number of Directors to be elected multiplied by the number of shares held by the shareholder, or alternatively distribute any such votes among as many of the candidates as the shareholder thinks fit.

- 3 -

With respect to shares of Common Stock held by brokers in street name for the beneficial owners thereof, (1) the election of Directors and (2) ratification of the appointment of BDO Seidman as the Company’s independent registered public accounting firm are “routine” matters upon which the brokers, as the holders of record, may vote these shares for which the beneficial owners have not provided them specific instructions.

With respect to the election of directors, the five nominees each receiving the greatest number of votes at the Annual Meeting shall be elected a Director. Votes withheld will have no effect on the election of any Director.

An affirmative vote of the holders of a majority of shares of Common Stock present, or represented by proxy, will be required to ratify the appointment of BDO Seidman, LLP as the Company’s registered public accounting firm. Abstentions count as votes cast and have the effect of a vote against the proposal.

Item 1 on Proxy Card

ELECTION OF DIRECTORS

Five Directors will be elected at the Annual Meeting. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors nominated Don M. Bailey, Thomas A. Franza, Gerald D. Griffin, Jeffrey R. Hultman and Erik H. van der Kaay for election as Directors. Each nominee has consented to be named in the Proxy Statement as a nominee and has agreed to serve as a Director if elected. Each Director elected at the Annual Meeting will hold office until the next annual meeting of shareholders and until his successor is duly elected and qualified. It is intended that the shares represented by the enclosed proxy will be voted, unless otherwise instructed, for the election of the five nominees of the Board of Directors. While the Company has no reason to believe that any of the nominees will be unable to serve as a Director, it is intended that if such an event should occur, such shares will be voted for the remainder of the nominees and for such substitute nominee or nominees as may be selected by the Board of Directors, unless a shareholder withholds authority to vote his shares (i) for all of the nominees by so indicating on the enclosed proxy card or (ii) for any one or more of the nominees by checking their names in the space provided on such card, in which case his shares will not be voted for such nominee or nominees. If cumulative voting is in effect for the election of Directors, the proxy holders will have the discretion to cumulate votes as provided by California law (see “VOTING RIGHTS” above) and to distribute such votes among all or any of the nominees in such manner as they deem appropriate.

All of the nominees are currently serving as Directors of the Company. The term of office of each of the current Directors expires on the date of the Annual Meeting. All of the nominees were elected at the 2004 annual meeting of shareholders.

- 4 -

THE BOARD RECOMMENDS A VOTEFOR EACH OF THE BOARD’S NOMINEES

The following table sets forth information concerning the nominees at May 25, 2005 and is followed by a brief biography of each nominee.

| | | | | | | | |

Name

| | Age

| | Principal Occupation

| | Year

First

Elected

Director

| | Other Public Company Directorships

|

Don M. Bailey | | 59 | | Chairman of the Board | | 1991 | | Chairman of the Board of Staar Surgical Company |

| | | | |

Thomas A. Franza | | 62 | | President and Chief Executive Officer | | 1998 | | None |

| | | | |

Gerald D. Griffin | | 70 | | Executive Consultant | | 1986 | | None |

| | | | |

Jeffrey R. Hultman | | 65 | | Chief Executive Officer and Director of Network Installation Corporation | | 2000 | | Network Installation Corporation |

| | | | |

Erik H. van der Kaay | | 65 | | Retired Chairman of the Board of Symmetricom, Inc. | | 2001 | | RF MicroDevices TransSwitch Corp. Ball Corporation |

Mr. Bailey has served as Chairman of the Board of the Company since 1998 and has been employed by the Company since 1980. He also served as President and Chief Executive Officer of the Company from June 1990 to April 2000. From November 1988 until May 1990, he served as Senior Vice President of the Company. From January 1986 until October 1988, he served as Vice President, Corporate Development. From 1980 to 1986, Mr. Bailey served in various other positions with the Company. Mr. Bailey also serves as Chairman of the Board of Staar Surgical Company.

Mr. Franza has been President and Chief Executive Officer of the Company since April 2000. He is also currently President of Comarco Wireless Technologies, Inc. and Comarco Wireless International, Inc. Mr. Franza served as Executive Vice President of the Company from 1995 to April 2000, as Senior Vice President of the Company from 1992 to 1995, and before then, as a Vice President from 1990 until 1992. Mr. Franza joined the Company in 1985.

Mr. Griffin has been an executive consultant since 1992. From 1988 to 1992 Mr. Griffin was Managing Director of the Houston Office of Korn/Ferry International. From 1988 to 1998, Mr. Griffin was the non-executive Chairman of the Board of the Company. From 1986 to 1988, he was President and Chief Executive Officer of the Houston Chamber of Commerce. From 1982 to 1986, he was Director of NASA’s Johnson Space Center in Houston, Texas. Mr. Griffin currently serves on the board of directors of Bank of the Hills, N.A. and is a member of such board’s audit committee.

- 5 -

Mr. Hultman is currently the Chief Executive Officer and a Director of Network Installation Corporation (NIC), a company that designs, installs and deploys wireless technology and specialty communication systems, a position he has held since March 7, 2005. From November 2002 to May 2004, Mr. Hultman was CEO of EdgeFocus, Inc., a high speed wireless internet company. From 1998 to March 2002, Mr. Hultman was a partner in Big Bear Sports Ranch, a sports summer camp for school-age children. From 1991 through 1997, he was Chief Executive Officer of Dial Page, Inc., a provider of wireless telecommunications throughout the Southeastern United States. From 1987 through 1991, he was Chief Executive Officer of PacTel Cellular. Prior to 1987, Mr. Hultman was an executive with Pacific Bell.

Mr. van der Kaay is former Chairman of the Board of Symmetricom, Inc., a position he has held from November 2002 to August 2003. From April 1998 to October 2002, he served as President and Chief Executive Officer of Datum, Inc. From 1990 to 1998, he held various positions with Allen Telecom, a leading supplier of wireless equipment to the global telecommunications infrastructure market. Mr. van der Kaay currently serves as a director of RF Micro Devices, a director of TranSwitch Corporation, and a director of Ball Corporation.

No arrangement or understanding exists between any nominee and any other persons pursuant to which any nominee was or is to be selected as a director. No nominee has any family relationship with any other nominee or with any of the Company’s executive officers.

BOARD MEETINGS AND COMMITTEES

During the fiscal year ended January 31, 2005, or fiscal 2005 the Company’s Board of Directors met six times. Each of the Company’s Directors attended at least 75% of the total number of meetings of the Board of Directors and the total number of meetings of the committees on which he served during the Company’s last fiscal year.

- 6 -

The Board of Directors, after consultation with the Nominating and Corporate Governance Committee, determined that Messrs. Griffin, Hultman and van der Kaay, who represent a majority of the members of the Board of Directors, are “independent,” as defined under the rules of the National Association of Securities Dealers, Inc., or the NASD. The standing committees of the Board of Directors are each comprised of independent directors under the rules of the NASD and consist of the following:

| | | | |

Name of Committee and

Members

| | Primary Responsibilities

| | # of Meetings in fiscal 2005

|

Audit and Finance Committee Gerald D. Griffin (Chair) Jeffrey R. Hultman Erik H. van der Kaay | | • Monitors the quality and integrity of the Company’s financial statements, accounting and financial reporting processes, internal controls, risk management and legal and regulatory compliance. • Selects, determines the compensation of, evaluates and, when appropriate, replaces the Company’s independent auditor; pre-approves all audit and permitted non-audit services. • Monitors the qualifications and independence of the independent auditor and performance of the Company’s independent auditor; reviews the scope and results of each fiscal year’s outside audit. • Reviews all related party transactions. | | 10 |

| | |

Compensation Erik H. van der Kaay (Chair) Gerald D. Griffin Jeffrey R. Hultman | | • Reviews the Company’s executive compensation philosophy. • Annually reviews and approves corporate goals and objectives relevant to the compensation of the CEO and evaluates the CEO’s performance in light of these goals. • Reviews and recommends to the Board for determination the compensation of the Company’s executive officers, including the Company’s CEO, and key members of management. • Administers the Company’s incentive and equity based-compensation plans. • Reviews and assists the Board in establishing compensation policies for Directors and committees of the Board. | | 4 |

| | |

Nominating and Corporate Governance Jeffrey R. Hultman (Chair) Gerald D. Griffin Erik H. van der Kaay | | • Assists the board in identifying, evaluating and recommending candidates for election to the Board and its Committees. • Establishes procedures and provides oversight for evaluating the Board and management. • Develops, recommends and reassesses the Company’s corporate governance guidelines and overall corporate governance of the Company. • Evaluates the size, structure and composition of the Board and its Committees. | | 3 |

The Company’s board has adopted written charters for the Audit and Finance Committee and the Nominating and Corporate Governance Committees setting forth the roles and responsibilities of each committee. Each of the charters is available on the Company’s website at www.comarco.com.

- 7 -

CORPORATE GOVERNANCE

Executive Sessions of Independent Directors

It is the policy of the Board of Directors that the Company’s independent directors meet separately without management directors at least twice each year, before or after regularly scheduled Board meetings, to discuss such matters as the independent directors consider appropriate. During fiscal 2005 the Company’s independent directors met separately four times. In 2004 the Board of Directors appointed Mr. Jeffrey Hultman Lead Director. As Lead Director, he is the presiding director at these meetings.

Shareholder and Interested Party Communications with the Board of Directors

Shareholders who desire to communicate with the Company regarding any matter pertinent to the Company’s business or affairs may do so by writing to the Chairman of the Board (not via email) at 2 Cromwell Drive, Irvine, CA 92618, Attention: Chairman of the Board.

The Company also has established a Compliance Hotline operated by CCBN (an independent company) as a means of receiving and directing concerns from employees and any other persons relating to complaints regarding any accounting, internal audit controls or auditing matters. Confidential, anonymous reports of accounting and audit concerns may be made 24 hours a day, seven days a week. Communications may be confidential or anonymous, and may be communicated by calling the Compliance Hotline at: (800) 792-8138.

In addition, anyone who has a concern about the conduct of the Company or any of its officers or employees, or about the Company’s accounting, internal controls, disclosure controls and procedures, auditing, compensation and governance matters may communicate that concern directly to the Audit and Finance Committee, the Nominating and Corporate Governance Committee, or the Compensation Committee, as appropriate in light of the specific concern involved. Any concerns relating to accounting, internal controls, disclosure controls and procedures, auditing, corporate conduct or conduct of any corporate officer or employee shall be forwarded to the Chair of the Audit and Finance Committee. The Company’s policies prohibit retaliation or adverse action against anyone for raising or helping to resolve an integrity concern.

The Company has a policy that each member of the Board of Directors should make every reasonable effort to attend each annual meeting of shareholders. At the Company’s 2004 annual meeting of shareholders, all directors were in attendance.

Shareholder Recommendations of Director Candidates

The Nominating and Corporate Governance Committee considers candidates for nomination as director proposed by any shareholder of the Company. Any shareholder of the Company is entitled to recommend a candidate for nomination by submitting, not less than 60 nor more than 90 days prior to the annual meeting of shareholders at which directors are to be elected, the name of the candidate to: Corporate Secretary, COMARCO, Inc., 2 Cromwell Drive, Irvine, CA 92618. Any shareholder recommendation is forwarded to the Chairman of the Nominating and Corporate Governance Committee.

The Nominating and Corporate Governance Committee encourages selection of directors who will contribute to the Company’s overall corporate goals of technology leadership, effective execution, high customer satisfaction, superior employee working environment, and creation and preservation of shareholder value. At a minimum, candidates recommended by the Nominating and Corporate Governance Committee must possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company’s shareholders.

- 8 -

In evaluating the suitability of individual candidates for election or re-election to the Board, the Nominating and Corporate Governance Committee considers many factors, including (1) whether a candidate possesses an understanding of technology, manufacturing, sales and marketing, finance and other elements relevant to the Company’s business, (2) the candidate’s educational and professional background, age and past performance as a Board member and (3) consistency with the other provisions of the Nominating and Corporate Governance Committee Charter relating to the composition of the Board and eligibility for Board membership. Additionally, in determining whether to recommend a director for re-election, the Nominating and Corporate Governance Committee takes into account the director’s past attendance at, and participation in, meetings of the Board and its committees and contributions to their activities.

A shareholder must provide the following supporting information to recommend a candidate for nomination: name, age, business and residence addresses, principal occupation or employment, the number of shares of the Company’s common stock held by the candidate, a resume of his or her business and educational background, the information that would be required under SEC rules in a proxy statement soliciting proxies for the election of such nominee as a director, and a signed consent of the candidate to serve as a director, if nominated and elected. The Nominating and Corporate Governance Committee, after reviewing this information, will determine whether the candidate meets the qualifications for committee-recommended candidates, including the objectives for the composition of the Board as a whole. The Nominating and Corporate Governance Committee does not evaluate any candidate for nomination as director any differently because the candidate was recommended by a shareholder.

Code of Ethics for Senior Financial Officers

The Audit and Finance Committee has adopted a Code of Ethics for Senior Financial Officers to promote and provide for the honest and ethical conduct by the Company’s Senior Financial Officers, as well as for full, fair, accurate and timely financial management and reporting. The Company’s Senior Financial Officers include the Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer or Controller and Treasurer. The Company expects all of these financial officers to act in accordance with the highest standards of professional integrity, to provide full and accurate disclosure in reports and other documents filed with the SEC and other regulators and in any public communications, to comply with all applicable laws, rules and regulations and to deter wrongdoing. A complete copy of the Code of Ethics for Senior Financial Officers is available on the Company’s website at www.comarco.com.

Non-Employee Director Compensation

Each non-employee Director of the Company receives the following compensation as a director:

| | | |

Board Participation

| | Retainer Fee

|

Annual - all members | | $ | 24,000 |

Attendance at each Board Meeting | | $ | 2,000 |

If Attendance is Telephonic | | $ | 1,000 |

Attendance at each Committee Meeting | | $ | 1,250 |

Additional Committee Chair Fee Per Meeting | | $ | 750 |

Mr. Franza and Mr. Bailey receive no compensation other than that received as officers of the Company.

- 9 -

Under the Company’s Director Stock-Option Plan, non-qualified stock options may be granted to non-employee directors. The number of shares authorized for issuance shares under the plan is 637,500 shares. Under the plan, the option exercise price is the fair market of a share of Common Stock, which is determined by the closing price of a share of the Company’s Common Stock on the date of the grant. Options vest in equal annual increments of 25% over the four-year period following their grant date, provided that on and after the second anniversary of a Director’s election to the Board, all unvested options previously granted are accelerated and all options granted thereafter become exercisable six months following the date of grant. In fiscal 2005 each non-employee Director of the Company received 7,500 stock options from the Director Stock Option Plan.

Item 2 on Proxy Card

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM FOR FISCAL 2006

The Audit Committee has appointed BDO Seidman, LLP as the Company’s independent registered public accounting firm for the year ending January 3l, 2006, or fiscal 2006, and has requested the Board to submit this appointment for ratification by our shareholders at the Annual Meeting.

A representative of BDO Seidman, LLP is expected to be present at the Annual Meeting, will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions from shareholders.

In the event that the shareholders do not ratify the appointment of BDO Seidman, LLP as the Company’s registered public accounting firm for fiscal 2006, the appointment will be reconsidered by the Audit Committee. Even if the appointment is ratified by the shareholders, the Audit Committee in its discretion may dismiss BDO Seidman, LLP as the Company’s independent registered public accounting firm and appoint a different independent accounting firm at any time during the year if the Audit Committee believes that such a change would be in the best interests of the Company and its shareholders.

Audit Fees

The aggregate fees incurred and payable to BDO Seidman, LLP for professional services rendered in connection with the audit and third quarter review of the Company’s financial statements during fiscal 2005 was approximately $205,000. The aggregate fees incurred and payable to KPMG LLP for professional services rendered in connection with the audit and quarterly reviews of the Company’s financial statements during fiscal year 2004 were $255,500. The actual fees paid to KPMG LLP for the audit of the Company’s consolidated financial statements in fiscal 2004 increased by $85,500 from the amount disclosed in the proxy statement for the 2004 annual meeting of shareholders. After the proxy statement was filed, the Audit Committee approved an invoice for $85,500 relating to the fiscal 2004 audit.

Additionally, the Company expects that KPMG LLP will bill the Company for approximately $30,000 in services provided in connection with the re-issuance of KPMG’s audit opinion and consent for the consolidated financial statements for the year ended January 31, 2004, which were included in the Company’s annual report on Form 10-K for the year ended January 31, 2005.

- 10 -

Audit-Related Fees

No audit-related fees were paid to BDO Seidman, LLP or KPMG LLP for fiscal years 2005 and 2004.

Tax Fees

The aggregate fees incurred and payable to KPMG LLP for professional services rendered during fiscal 2005 and fiscal 2004 in connection with tax advice, return preparation and planning were $76,565 and $67,600 respectively.

All Other Fees

No other fees were paid to BDO Seidman, LLP or KPMG LLP for fiscal years 2005 and 2004.

Change in Independent Accountants

On September 21, 2004, the Audit Committee approved the dismissal of KPMG LLP as the Company’s independent accountants, and appointed BDO Seidman, LLP as the Company’s new independent accountants.

KPMG LLP’s reports on the Company’s consolidated financial statements as of and for the two most recent fiscal years or any subsequent interim period, did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles, except that: (1) KPMG LLP’s report on the Company’s fiscal 2004 consolidated financial statements contained explanatory paragraphs indicating the Company’s fiscal 2003 and fiscal 2002 consolidated financial statements were restated and that the Company changed its method of accounting for goodwill and other intangible assets effective February 1, 2002, and (2) KPMG LLP’s report on the Company’s fiscal 2003 consolidated financial statements contained an explanatory paragraph indicating that the Company changed its method of accounting for goodwill and other intangible assets effective February 1, 2002.

During the Company’s two most recent fiscal years and any subsequent interim period preceding KPMG LLP’s dismissal, there were no disagreements between the Company and KPMG LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to KPMG LLP’s satisfaction, would have caused KPMG LLP to make reference to the matter of the disagreement in connection with its reports.

During the Company’s two most recent fiscal years and any subsequent interim period preceding KPMG LLP’s dismissal, none of the reportable events required to be disclosed under Item 304(a)(1)(v) of SEC Regulation S-K has occurred, except that as the Company has previously disclosed, KPMG LLP identified the following internal control issues that KPMG LLP considered to be material weaknesses (as defined under standards established by the American Institute of Certified Public Accountants):

| | • | | a lack of suitable documentation or analysis of reserves for contingencies which consider the application of the “probable” and “reasonably estimable” criteria of Statement of Financial Accounting Standards (“FASB”) No. 5 “Accounting for Contingencies.” |

| | • | | a lack of suitable documentation or analysis to support the Company’s estimate of the percentage of wireless test system revenues which should be deferred for first year maintenance. |

| | • | | a failure to follow the subsequent event rules with respect to Company’s bonus accruals. |

- 11 -

During the two most recent fiscal years and the subsequent interim period prior to KPMG LLP’s dismissal, the Company did not consult with BDO Seidman, LLP regarding any of the matters or events required to be disclosed under applicable SEC regulations.

The Company has provided KPMG LLP and BDO Seidman, LLP with a copy of this disclosure.

AUDIT AND FINANCE COMMITTEE REPORT

The Board of Directors has determined that each member of the Audit and Finance Committee is an “independent director,” as defined under the rules of the NASD and Rule 10A-3(b) of the Exchange Act. The Board of Directors has determined that Mr. van der Kaay is an “audit committee financial expert,” as defined in Item 401(h) of Regulation S-K. In accordance with the written charter of the Audit and Finance Committee adopted by the Board of Directors, the Audit and Finance Committee assists the Board in fulfilling its responsibility for management oversight of the quality and integrity of the accounting, auditing, and financial reporting practices of the Company.

It is not the duty or responsibility of the Audit and Finance Committee to conduct auditing or accounting reviews or procedures. In performing their oversight responsibility, members of the Audit and Finance Committee rely without independent verification on the information provided to them and on the representations made by management and the independent accountants. Accordingly, the Audit and Finance Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit and Finance Committee’s considerations and discussions do not assure that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the financial statements are presented in accordance with generally accepted accounting principles.

The Audit and Finance Committee discussed and reviewed with the Company’s independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees”, and with and without management present, discussed and reviewed the results of the independent auditors’ examination of the Company’s financial statements. The Committee received from the independent auditors the written disclosure and letter required by Independence Standards Board Standard No. 1 and discussed with the independent auditors, their independence.

The Audit and Finance Committee reviewed the audited financial statements of the Company as of and for the year ended January 31, 2005, with the Company’s management and independent auditors. Management has the responsibility for the preparation of the financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above-mentioned review and discussions with management and the independent auditors, the Audit and Finance Committee recommended to the Board that the Company’s financial statements be included in its Annual Report on Form 10-K for the year ended January 31, 2005, for filing with the SEC.

Submitted by the Audit and Finance Committee

Gerald D. Griffin, Chairman

Erik H. van der Kaay, Member

Jeffrey A. Hultman, Member

- 12 -

THE BOARD RECOMMENDS A VOTEFOR THE RATIFICATION OF APPOINTMENT OF BDO SEIDMAN, LLP AS THE COMPANY’S INDEPENDENT REGISTER PUBLIC

ACCOUNTING FIRM FOR FISCAL 2006

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth information concerning the beneficial ownership of the Company’s Common Stock as of May 5, 2005 by:

| | • | | each member of the Company’s Board of Directors; |

| | • | | each of the Company’s executive officers named in the “Summary Compensation Table” included in the “Executive Compensation” section of this Proxy Statement; |

| | • | | all Directors and executive officers as a group; and |

| | • | | each person or entity known to the Company that beneficially owns more than 5% of the Company’s Common Stock. |

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, or SEC. Unless otherwise indicated below, the address of each beneficial owner is c/o COMARCO, Inc., 2 Cromwell Drive, Irvine, California. 92618. Unless otherwise indicated below, the Company believes that each of the persons listed in the table (subject to applicable community property laws) has the sole power to vote and to dispose of the shares listed opposite the shareholder’s name.

- 13 -

The percentages of Common Stock beneficially owned are based on 7,422,042 shares of Common Stock outstanding at May 5, 2005.

| | | | |

Name and Address of Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percent

of Class

|

| Don M. Bailey (1) | | 204,636 | | 2.7% |

| | |

| Thomas A. Franza (2)(3) | | 213,721 | | 2.8% |

| | |

| Gerald D. Griffin (4) | | 72,850 | | * |

| | |

| Jeffrey R. Hultman (5) | | 44,000 | | * |

| | |

| Erik van der Kaay (6) | | 36,000 | | * |

| | |

| Daniel R. Lutz (3) | | 44,682 | | * |

| | |

| Gregory W. Maton (3) | | 13,000 | | * |

| | |

| Thomas J. Schmidt (3) | | 5,000 | | * |

| | |

| Peggy L. Vessell (3) | | 21,436 | | * |

| | |

All Directors and Executive Officers as a group (12 persons) (7) | | 743,817 | | 9.3% |

| | |

T. Rowe Price Associates (8) T. Rowe Price Small-Cap Value Fund 100 East Pratt Street Baltimore, MD 21202 | | 711,800 | | 9.6% |

| | |

Grueber & McBaine (9) 50 Osgood Place, Penthouse San Francisco, CA 94133 | | 681,774 | | 9.2% |

| | |

Dimensional Fund Advisors, Inc. (10) 1299 Ocean Avenue 11th Floor Santa Monica, CA 90401 | | 381,352 | | 5.1% |

| | |

Laurence W. Lytton (11) 28 Sherwood Place Scarsdale, NY 10583 | | 394,681 | | 5.3% |

| | |

Special Situations Funds (12) Austin W. Marxe and David M. Greenhouse 153 East 53rd St. 55th Floor New York, NY 10022 | | 1,099,338 | | 14.8% |

| | |

Elkhorn Partners Limited Partnership (13) P. O. Box 818 Elkhorn, NE 68022 | | 704,700 | | 9.5% |

| | |

Esopus Creek Partners, LLC (14) 500 Fifth Avenue Suite 2620 New York, NY 10110 | | 464,405 | | 6.3% |

| * | Indicates less than one percent of the outstanding shares of Common Stock. |

- 14 -

| (1) | Includes 147,250 shares that Mr. Bailey has the right to acquire within 60 days of May 5, 2005, by stock option exercise. |

| (2) | Does not include Mr. Franza’s options to purchase 15,000 shares of Common Stock of Comarco Wireless Technologies, Inc., a subsidiary of the Company. |

| (3) | Includes shares subject to options beneficially owned and exercisable within 60 days of May 5, 2005 by the following persons: Mr. Franza — 127,644 shares; Mr. Lutz — 37,000 shares; Mr. Maton — 10,000 shares; Mr. Schmidt — 5,000 shares; and Ms. Vessell — 21,250 shares. |

| (4) | Includes 66,500 shares that Mr. Griffin has a right to acquire within 60 days of May 5, 2005, by stock option exercise. |

| (5) | Includes 44,000 shares that Mr. Hultman has a right to acquire within 60 days of May 5, 2005, by stock option exercise. |

| (6) | Includes 34,000 shares that Mr. van der Kaay has a right to acquire within 60 days of May 5, 2005, by stock option exercise. |

| (7) | Includes an aggregate of 560,769 shares held by the Company’s executive officers and Directors that are subject to options exercisable within 60 days of May 5, 2005. |

| (8) | Based on a Schedule 13G (Amendment 12) filed with the SEC on February 9, 2005. |

| (9) | Based on a Schedule 13G filed with the SEC on February 10, 2005 on behalf of Grueber & McBaine Capital Management, LLC (GMCM) and certain reporting persons. GMCM is a registered investment advisor. Jon Gruber and J. Patterson McBaine are managers, controlling persons and portfolio managers of GMCM and constitute a group with GMCM and the other reporting persons. |

| (10) | Based on a Schedule 13G (Amendment 2) filed with the SEC by Dimensional Fund Advisors, Inc. on February 9, 2005. Dimensional Fund Advisors is an investment advisor and furnishes advice to four investment companies and serves as investment manager to certain other commingled funds. |

| (11) | Based on a Schedule 13G (Amendment 1) filed with the SEC on behalf of Laurence W. Lytton on February 9, 2005. |

| (12) | Based on a Schedule 13G (Amendment 1) filed with the SEC by Austin Marxe and David Greenhouse on February 22, 2005 with respect to shares owned by various Special Situations funds. |

| (13) | Based on a Schedule 13D (Amendment 3) filed with the SEC on behalf of Elkhorn Partners Limited Partnership on September 22, 2004. |

| (14) | Based on a Schedule 13G (Amendment 2) filed with the SEC on behalf of Esopus Creek Partners, LLC and certain other reporting persons on March 23, 2005. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Pursuant to Section 16(a) of the Securities Exchange Act of 1934 and the rules issued thereunder, the Company’s executive officers, Directors and persons that own more than 10% of the Company’s Common Stock are required to file with the SEC reports of ownership and changes in ownership of Common Stock and furnish the Company copies of all such reports. The Company believes that, during the fiscal year ended January 31, 2005, its executive officers, Directors and persons that owned more than 10% of the Company’s Common Stock complied with the Section 16(a) reporting requirements on a timely basis, based on the reports received by the Company or written certifications received by the Company from its executive officers and directors.

- 15 -

INFORMATION CONCERNING EXECUTIVE OFFICERS

The following table sets forth information at May 5, 2005 concerning the executive officers of the Company (other than Messrs. Bailey and Franza, whose biographical information appears in the table under the Election of Directors section above) and its principal subsidiary, Comarco Wireless Technologies, Inc.

| | | | |

Name

| | Age

| | Position

|

Sebastian E. Gutierrez | | 43 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Daniel R. Lutz | | 41 | | Vice President and Chief Financial Officer of the Company and Comarco Wireless Technologies, Inc. |

| | |

Gregory W. Maton | | 57 | | Sr. Vice President, Comarco Wireless Technologies, Inc. |

| | |

John McMunn | | 55 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Bahram Nazardad | | 49 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Thomas J. Schmidt | | 42 | | Vice President, Comarco Wireless Technologies, Inc. |

| | |

Peggy L. Vessell | | 60 | | Vice President, Comarco Wireless Technologies, Inc. and Corporate Secretary, COMARCO, Inc. |

Mr. Gutierrez joined Comarco Wireless Technologies in 1996 as Director of Business Development and was promoted to Vice President of the Company’s Call Box Division in 1998. Before joining COMARCO, he spent eight years at Pacific Bell from 1987 to 1996 working in various management positions as a member of their Accelerated Management Program. He also held engineering positions at TRW’s Space and Technology Division from 1984 to 1987.

Mr. Lutz joined the Company as Vice President and Chief Financial Officer in June 2000. He also serves as Vice President and Chief Financial Officer of Comarco Wireless Technologies, Inc. From February 1997 to December 1999, Mr. Lutz served as a Vice President of Sunstone Hotel Investors, Inc., formerly a publicly traded real estate investment trust. Prior to Sunstone, Mr. Lutz was a manager with Ernst & Young LLP. He is also a Certified Public Accountant in the state of California.

Mr. Maton joined Comarco Wireless Technologies as Sr. Vice President of Wireless Test Solutions in October 2002. From 1988 to 2002, Mr. Maton was Executive Board Director, Executive Vice President, Business Director, and Sales & Marketing Director at Racal. From 1969 to 1988, Mr. Maton held various management positions at Marconi Instruments Ltd.

Mr. McMunn joined Comarco Wireless Technologies as Vice President of Supply Chain Management in October 2004. Mr. McMunn has more than 15 years of senior management experience. From 2002 to 2004 Mr. McMunn was Vice President of Transceiver Operation for Picolight. From 1999 to 2002, he was the President and General Manager of the Test and Measurement division of Xyratex. From 1996 to 1999, Mr. McMunn was Director of Test and Process Engineering at Western Digital.

Mr. Nazardad joined Comarco Wireless Technologies as Vice President of Corporate Quality in February 2005. Prior to this position from 1999 to 2004, he was responsible for Quality Engineering, Quality Systems, and Configuration Management at Powerwave Technologies Inc. From 1994 to 1999, he was Director of Quality & Reliability at Valor Electronics. From 1984 to 1994, Mr. Nazardad was with Northern Telecom holding several management positions.

- 16 -

Mr. Schmidt joined the Company April 2004 as the new head of ChargeSource mobile power products operations. Mr. Schmidt has more than 15 years of senior management experience and joins Comarco Wireless Technologies from The Sandstone Group where he was a Managing Partner from 2002 to 2004. Prior to this position, Mr. Schmidt co-founded and was a Managing Partner at ideaEdge Ventures, a venture management company. From 1999 to 2000, Mr. Schmidt also served as the President and Chief Executive Officer of Gateway, Inc.’s Information Appliances Division. From 1995 through 1999, Mr. Schmidt served as the General Manager of two divisions of AlliedSignal, Inc., the Hardware Product Group and the Airsupply Operations.

Ms. Vessell joined the Company in 1987 and has served as Vice President of Administration for Comarco Wireless Technologies since 2000 and Corporate Secretary of the Company since 2001. From l995 to 2000, Ms. Vessell served as Director of Administration where she oversaw Comarco Wireless Technologies’ Health and Welfare Programs and Employee Relations. From 1987 to 1995, Ms. Vessell held various Accounting and Human Resource positions.

There are no family relationships among any of the Company’s executive officers.

- 17 -

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth compensation information for the periods indicated for the Company’s Chief Executive Officer and the four most highly compensated executive officers at the end of the last fiscal year whose salary and bonus exceeded $100,000. These individuals are referred to as the named executive officers.

| | | | | | | | | | |

Name and Principal Position

| | Annual Compensation

| | Long Term Compensation

|

| | Fiscal

Year

| | Salary ($)(1)

| | Bonus ($)

| | Shares of

Common Stock

Underlying Options (#)

| | All Other

Compensation ($)(2)

|

Thomas A. Franza President & Chief Executive Officer | | 2005

2004

2003 | | 337,400

327,600

315,000 | | 0

0

0 | | 25,000

25,000

25,000 | | 10,250

10,000

(3)349,354 |

Don M. Bailey Chairman of the Board | | 2005

2004

2003 | | 75,000

75,000

75,000 | | 0

0

0 | | 7,500

7,500

7,500 | | 10,250

10,000

10,000 |

Daniel R. Lutz Vice President & Chief Financial Officer | | 2005

2004

2003 | | 206,000

200,000

157,500 | | 0

0

110,250 | | 0

20,000

0 | | (3)39,696

10,000

8,500 |

Gregory Maton Sr. Vice President Comarco Wireless Technologies, Inc. | | 2005

2004

2003 | | 216,300

210,000

40,000 | | 0

0

0 | | 0

0

20,000 | | 10,250

10,000

808 |

Thomas J. Schmidt (4) Vice President Comarco Wireless Technologies, Inc. | | 2005 | | 187,500 | | 0 | | 20,000 | | 8,990 |

Peggy L. Vessell Vice President & Corporate Secretary | | 2005

2004

2003 | | 150,000

128,960

124,000 | | 0

0

86,800 | | 10,000

0

0 | | 7,042

10,000

9,760 |

Notes:

| (1) | “Salary” includes base salary and compensation deferred during the current year. |

| (2) | “All Other Compensation” consists primarily of the Company’s matching contributions to its 401(k) plan. |

| (3) | Includes vacation payouts for Mr. Lutz in fiscal 2005 of $29,513 and for Mr. Franza in fiscal 2003 of $302,880. |

| (4) | Mr. Schmidt joined the Company in fiscal 2005. |

- 18 -

Option Grants in Fiscal 2005

The following table sets forth information concerning options granted in fiscal 2005 to each of the Company’s named executive officers.

Individual Grants

| | | | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted (1)

| | % of Total

Options Granted

to Employees

in Fiscal 2005

| | | Exercise

Price (2)

| | Expiration

Date

| | Potential Realizable

Value at Assumed Rates of Price

Appreciation for Option Term (3)

|

| | | | | | 5%

| | 10%

|

Thomas A. Franza | | 25,000 | | 22 | % | | $ | 7.00 | | 6/21/2014 | | $ | 110,057 | | $ | 278,905 |

Don M. Bailey | | 7,500 | | 7 | % | | $ | 7.00 | | 6/21/2014 | | $ | 33,017 | | $ | 83,671 |

Thomas J. Schmidt | | 20,000 | | 18 | % | | $ | 8.40 | | 4/13/2014 | | $ | 105,654 | | $ | 267,749 |

Peggy L. Vessell | | 10,000 | | 9 | % | | $ | 9.89 | | 2/3/2014 | | $ | 62,198 | | $ | 157,621 |

| (1) | The options vest in equal annual increments of 25% over a four-year period following their date of grant. |

| (2) | Represents the fair market value of an underlying share of Common Stock on the date of grant. |

| (3) | Represents the potential realizable value assuming the stated rates of price appreciation compounded annually for the entire ten-year term, with the aggregate exercise price deducted from the final appreciated value. Such annual rates of appreciation are for illustrative purposes only, are based on requirements of the SEC, and do not reflect the Company’s estimate of future stock appreciation. No assurance can be given that such rates of appreciation, or any appreciation, will be achieved. |

Aggregated Option Exercises and Fiscal Year-End Option Values

The following table sets forth information with respect to the Company’s named executive officers concerning the exercisable and unexercisable stock options held as of January 31, 2005. There were no option exercises by the named executive officers in fiscal year ended January 31, 2005.

| | | | | | | | | | | | | | |

Name

| | Shares

Acquired

on

Exercise

| | Value Realized

| | Number of Underlying Options at January 31, 2005

| | Value of In-The-Money Options at

January 31, 2005 (1)

|

| | | | Exercisable

| | Un-exercisable

| | Exercisable

| | Un-exercisable

|

Thomas A. Franza(2) | | 0 | | N/A | | 122,644 | | 62,500 | | $ | 2,688 | | $ | 21,563 |

Don M. Bailey | | 0 | | N/A | | 146,000 | | 18,000 | | $ | 2,866 | | $ | 13,474 |

Daniel R. Lutz | | 0 | | N/A | | 38,750 | | 21,250 | | $ | 0 | | $ | 0 |

Thomas J. Schmidt | | 0 | | N/A | | 0 | | 20,000 | | $ | 0 | | $ | 0 |

Gregory W. Maton | | 0 | | N/A | | 10,000 | | 10,000 | | $ | 0 | | $ | 0 |

Peggy L. Vessell | | 0 | | N/A | | 18,750 | | 12,500 | | $ | 0 | | $ | 0 |

| (1) | These values are calculated using the May 5, 2005 closing price of Common Stock on the Nasdaq National Market of $7.54 per share, less the exercise price of the options, multiplied by the number of shares to which the options relate. |

- 19 -

| (2) | Mr. Franza has been granted options to purchase 15,000 shares of common stock of one of the Company’s subsidiaries, Comarco Wireless Technologies, Inc. All of the options are fully vested. Based on an evaluation as of January 31, 2005, the shares underlying the vested options are valued at $3,300. |

Severance Agreements

The Company and each of Messrs. Franza and Lutz are parties to a severance agreement that provides that if, within 24 months following a change of control of the Company, he is terminated or constructively terminated without cause, or ceases to be employed by the Company for reasons other than because of death, disability or retirement, then he is entitled to receive a lump sum cash payment equal to two-times the sum of his annual base salary plus his annual incentive compensation bonus that would be payable assuming 100% satisfaction of all performance goals thereunder. In addition, each of Messrs. Franza and Lutz would be entitled to continued participation and coverage under the Company’s health plans and insurance program and the acceleration of all of his options and restricted stock, if any. Each severance agreement has a term that continues until three years after any notice of non-renewal or termination is given by the executive or the Company.

The Company and each of Mr. Maton and Ms. Vessell are parties to a severance agreement that is substantially similar to the severance agreements with Messrs. Franza and Lutz, except that Mr. Maton and Ms. Vessell, are entitled to a lump sum cash payment equal to one-times the sum of their annual base salary plus their annual incentive compensation bonus that would be payable assuming 100% satisfaction of all performance goals thereunder.

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of January 31, 2005 with respect to shares of Common Stock that may be issued under the Company’s equity compensation plans.

| | | | | | | |

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in the first column)

|

Equity compensation plans approved by security holders | | 859,019 | | $ | 12.60 | | 81,687 |

Equity compensation plans not approved by security holders | | 0 | | | N/A | | 0 |

Total | | 859,019 | | $ | 12.60 | | 81,687 |

- 20 -

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors (the “Compensation Committee”) administers COMARCO’s executive compensation program and establishes the salaries of COMARCO’s executive officers. The Compensation Committee consists of only non-employee Directors, who are appointed by the Board.

Compensation Philosophy

The general philosophy of the Compensation Committee is to provide executive compensation designed to enhance shareholder value, including annual compensation, consisting of salary and bonus awards, and long-term compensation, consisting of stock options. To this end, the Compensation Committee designs compensation plans and incentives to link the financial interests of COMARCO’s executive officers to the interests of its shareholders, to encourage support of COMARCO’s long-term goals, to tie executive compensation to COMARCO’s performance, to attract and retain talented leadership and to encourage significant ownership of COMARCO’s common stock by executive officers.

In making decisions affecting executive compensation, the Compensation Committee reviews the nature and scope of the executive officer’s responsibilities as well as his or her effectiveness in supporting COMARCO’s long-term goals. The Compensation Committee also considers the compensation practices of other major United States and international corporations that compete with COMARCO as well as various professional compensation surveys. Based upon these and other factors which it considers relevant, and in light of COMARCO’s overall long-term performance, the Committee has considered it appropriate, and in the best interest of the shareholders, to set the overall executive compensation so as to compete with companies in the comparison group to enable COMARCO to continue to attract, retain and motivate the highest level of executive personnel.

There are two primary types of compensation provided to COMARCO’s executive officers:

| | • | | Annual compensation, which includes base salary intended provide a stable annual salary at a level consistent with individual contributions, and annual performance bonuses intended to link officers’ compensation to COMARCO’s performance. |

| | • | | Long-term compensation, which includes stock option awards, to encourage actions to maximize shareholder value. |

Annual Compensation

Base Salary

Consistent with its stated philosophy, the Compensation Committee aims to position base salaries for COMARCO’s executive officers annually at levels that are consistent within the industry, with consideration of the performance of COMARCO, individual performance of each executive and the executive’s scope of responsibility in relation to other officers and key executives within COMARCO. In selected cases, other factors may also be considered.

Annual Incentive Bonuses

COMARCO’s Incentive Bonus Plan provides for the payment of cash bonuses based on COMARCO’s performance in relation to predetermined objectives and individual executive performance for the year then ended. Prior to the beginning of fiscal year, the Compensation Committee established objectives related to COMARCO’s earnings, revenue and shareholder value. Based on COMARCO’s performance during fiscal 2005 against these objectives, no bonuses were paid under the Incentive Bonus Plan.

- 21 -

Long-Term Compensation—Equity Based Compensation

The Compensation Committee is committed to long-term incentive programs for executives that promote the long-term growth of COMARCO. The Compensation Committee believes that the management employees should be rewarded with a proprietary interest in COMARCO for continued long-term performance and to attract, motivate and retain qualified and capable executives.

The Compensation Committee grants to executive officers options to purchase shares of COMARCO’s common stock under COMARCO’s stock option plan that was adopted by COMARCO and its shareholders in 1995. In fiscal 2005, the Compensation Committee granted options to the executives of COMARCO to purchase an aggregate of 112,500 shares of COMARCO’s common stock. These options were granted at an exercise price equal to the fair market value of the common stock on the date of grant, become exercisable in four cumulative annual installments commencing one year after the date of grant and expire ten years from the date of grant.

Compensation of Chief Executive Officer

During fiscal 2005 COMARCO’s Chief Executive Officer received base annual salary of $337,400, which represents a 3% increase over the annual base salary paid to the Chief Executive Officer during fiscal 2004.

COMARCO’s Chief Executive Officer is eligible to participate in all of COMARCO’s long-term incentive programs. During fiscal 2005 the Chief Executive Officer received stock options to purchase 25,000 shares of COMARCO’s common stock as shown on the Summary Compensation Table. The Summary Compensation Table includes additional information regarding the other compensation and benefits paid to COMARCO’s Chief Executive Officer.

Internal Revenue Code Section 162(m)

The Compensation Committee also considers the potential impact of Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”). Section 162(m) disallows a tax deduction for any publicly held COMARCO for individual compensation exceeding $1 million in any taxable year for the Chief Executive Officer and the other senior executive officers, other than compensation that is performance-based under a plan that is approved by the shareholders of COMARCO and that meets certain other technical requirements. Based on these requirements, the Compensation Committee has determined that Section 162(m) will not prevent COMARCO from receiving a tax deduction for any of the compensation paid to executive officers.

Submitted on May 25, 2005 by the members of the Compensation Committee.

Erik van der Kaay, Chairman

Gerald D. Griffin

Jeffrey R. Hultman

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the Company’s executive officers currently serves on the compensation committee of any other company or board of directors of any other company of which any member of our Compensation Committee is an executive officer.

- 22 -

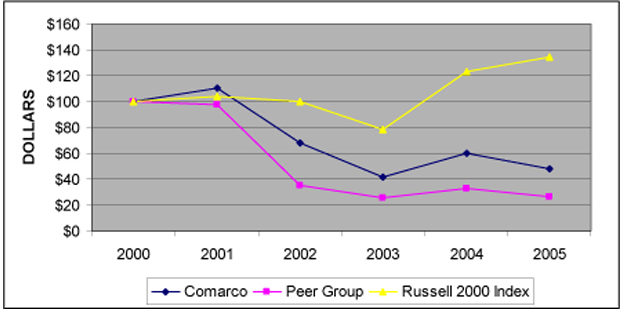

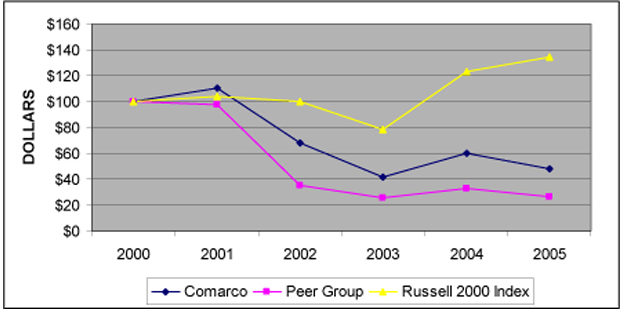

PERFORMANCE COMPARISON

Set for below is a line graph comparing the cumulative total shareholders return on COMARCO Common Stock against the cumulative total return of the Russell 2000 Composite Stock Index and a peer group of companies discussed below (the “Peer Group”) for the periods indicated. The presentation assumes $100 was invested on January 31, 2000 in the Company’s Common Stock, the Russell 2000 Composite Stock Index, and the common stock of the Peer Group.

The Peer Group consists of five companies of similar business focus as the Company. The returns of each company within the Peer Group have been averaged assuming an equal dollar investment in each company at the beginning of the time period or at the time they became publicly traded. Dividends paid by those peer companies that pay dividends are assumed to be reinvested at the end of the ex-dividend month without any transaction cost.

The Peer Group consists of LLC International, Inc., Agilent Technologies, Inc., Wireless Facilities, Inc., LM Ericsson Telephone Co., and Ascom. The following graph depicts the relative performance of COMARCO in relation to the Peer Group and to the Russell 2000 Stock index for the periods indicated.

| | | | | | | | | | | | |

| | | 1/31/2000

| | 1/31/2001

| | 1/31/2002

| | 1/31/2003

| | 1/31/2004

| | 1/31/2005

|

COMARCO | | 100 | | 110.07 | | 67.88 | | 41.61 | | 59.76 | | 47.88 |

Peer Group | | 100 | | 97.34 | | 35.07 | | 25.30 | | 32.89 | | 26.26 |

Russell 2000 Index | | 100 | | 103.69 | | 99.96 | | 78.10 | | 123.41 | | 134.12 |

- 23 -

SHAREHOLDER PROPOSALS FOR SUBMISSION AT 2006 ANNUAL MEETING

If a shareholder desires to submit a proposal at the Company’s 2006 Annual Meeting of Shareholders to be included in the proxy statement for that meeting, such proposal must be received by the Corporate Secretary in writing at the Company’s corporate office no later than January 24, 2006. The proposal must also comply with applicable regulations in order to be included in the Proxy Statement for that meeting. If a shareholder notifies the Company in writing prior to April 9, 2006 that he or she intends to present a proposal at the Company’s 2006 Annual Meeting of Shareholders, the proxy-holders designated by the Board of Directors may exercise their discretionary voting authority with regard to the shareholder’s proposal only if the Company’s proxy statement discloses the nature of the shareholder’s proposal and the proxyholder’s intentions with respect to the proposal. If the stockholder does not notify the Company by such date, the proxyholders may exercise their discretionary voting authority with respect to the proposal without such discussion in the proxy statement.

OTHER MATTERS

The Board of Directors of the Company does not know of any matter to be acted upon at the meeting other than the matters described above. If other matters properly come before the meeting, the holders of the proxies will vote on such matters in accordance with their judgment.

The Company’s 2005 Annual Report on Form 10-K to Shareholders is enclosed with this Proxy Statement.

IN ORDER TO AVOID ADDED EXPENSE OR ADDITIONAL SOLICITATION OF PROXIES, YOU ARE URGED TO DATE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED, TO WHICH NO POSTAGE NEED BE AFFIXED.

|

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| |

Peggy L. Vessell, Secretary |

Irvine, California

May 25, 2005

- 24 -

COMARCO, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING OF SHAREHOLDERS CALLED FOR JUNE 21, 2005

The undersigned shareholder(s) of COMARCO, Inc. a California corporation, having received the Notice of Annual Meeting of Shareholders and Proxy Statement dated May 25, 2005, hereby appoints Don M. Bailey and Peggy L. Vessell as Proxies, each with the power to appoint a substitute, and hereby authorizes them to represent the undersigned at the Annual Meeting of Shareholders of COMARCO, Inc. to be held at the offices of Comarco Wireless Technologies, Irvine, CA, (949) 599-7400, on June 21, 2005 at 10:00 A.M., local time and at any adjournments thereof, and to vote all shares of Common Stock which the undersigned would be entitled to vote thereat on all matters set forth below, as described in the accompanying Proxy Statement:

IMPORTANT—PLEASE SIGN ON THE OTHER SIDE

Please Detach Here

You Must Detach This Portion of the Proxy Card Before Returning it in the Enclosed Envelope

(continued from other side)

(1) ELECTION OF DIRECTORS:

FOR all nominees listed below

WITHHOLD AUTHORITY to vote for all nominees

(INSTRUCTION: To withhold authority to vote for any individual nominee, mark the box next to the nominee’s name below. Names not marked will receive a vote FOR)

Don M. Bailey

Jeffrey R. Hultman

Thomas A. Franza

Erik H. van der Kaay

Gerald D. Griffin

2. TO RATIFY THE APPOINTMENT BY THE COMPANY’S AUDIT COMMITTEE OF BDO SEIDMAN, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING JANUARY 31, 2006.

FOR

AGAINST

ABSTAIN

3. IN THEIR DISCRETION, THE PROXIES ARE AUTHORIZED TO VOTE UPON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING.

FOR

AGAINST

ABSTAIN

In the event the Directors are to be elected by cumulative voting, the Proxies will have the discretion to cumulate votes and to distribute such votes among all nominees (or if authority to vote for any nominee or nominees has been withheld, among the remaining nominees, if any) in whatever manner they deem appropriate.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR ALL OF THE DIRECTORS NOMINATED BY THE BOARD AND THE RATIFICATION OF THE APPOINTMENT BY THE COMPANY’S AUDIT COMMITTEE OF BDO SEIDMAN, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING JANUARY 31, 2006.

Dated: , 2005

(Signature)

(Signature)

(Please sign exactly as name appears hereon. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please set forth your full title. If signer is a corporation, please sign the full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.)

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY IN THE ACCOMPANYING PREPAID ENVELOPE.