Washington, D.C. 20549

Washington, D.C. 20037

Kenneth G. Lore, Esq.

Item 1. Reports to Stockholders.

A copy of the 2013 Annual Report (the “Report”) of the AFL-CIO Housing Investment Trust (the “Trust” or “Registrant”) transmitted to Trust participants pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (17 CFR 270.30e-1) (the “Act”), is included herewith.

MESSAGE FROM THE

AFL-CIO President

The AFL-CIO Housing Investment Trust embodies in so many ways what working people want in an investment fund. Despite the challenges of the past year, the HIT continues to provide the competitive fixed-income returns its investors expect from a fund that carries the AFL-CIO name – and as seen in this report, it should be well-positioned for success in the period ahead. This is a fund that continues to be a prudent option for investors seeking the diversification of fixed-income and the income advantage that comes from investing in construction-related multifamily securities.

The HIT also responds to our need for investment in America’s communities. The HIT does not just buy and sell securities– it puts pension capital to work in the neighborhoods where union members live. Those investments are generating union work through the HIT’s Construction Jobs Initiative, and they are adding to the stock of housing affordable to low- and middle-income families.

The HIT has been an active supporter of the AFL-CIO’s effort to promote sustainable construction practices. Pension capital invested through the HIT’s Green Jobs Initiative is helping to make our housing infrastructure more energy-efficient. The labor movement takes very seriously its responsibility to the world’s climate and energy resources, and we are proud to point to the $540 million that the HIT has invested since 2011 to retrofit and rehabilitate 13 housing projects. Those investments are saving energy, saving money, and creating union jobs in our communities – jobs that cannot be offshored – while helping the HIT offer competitive returns to its investors. As a fixed-income fund, that track record is unrivaled.

The HIT is helping to build our future the union way – engaging labor’s capital as a partner in local development efforts that improve the lives of working families. The HIT has been a consistent leader in responsible investing, with a long history of competitive returns, community development, and union job creation. That’s an outstanding record, and the HIT’s investors are making it possible. We ask pension trustees who care about responsible, competitive investing to give serious consideration to investing in the HIT.

Richard L. Trumka

President, AFL-CIO

Trustee, AFL-CIO Housing Investment Trust

A N N U A L R E P O R T 2 0 1 3 1

To Our Investors

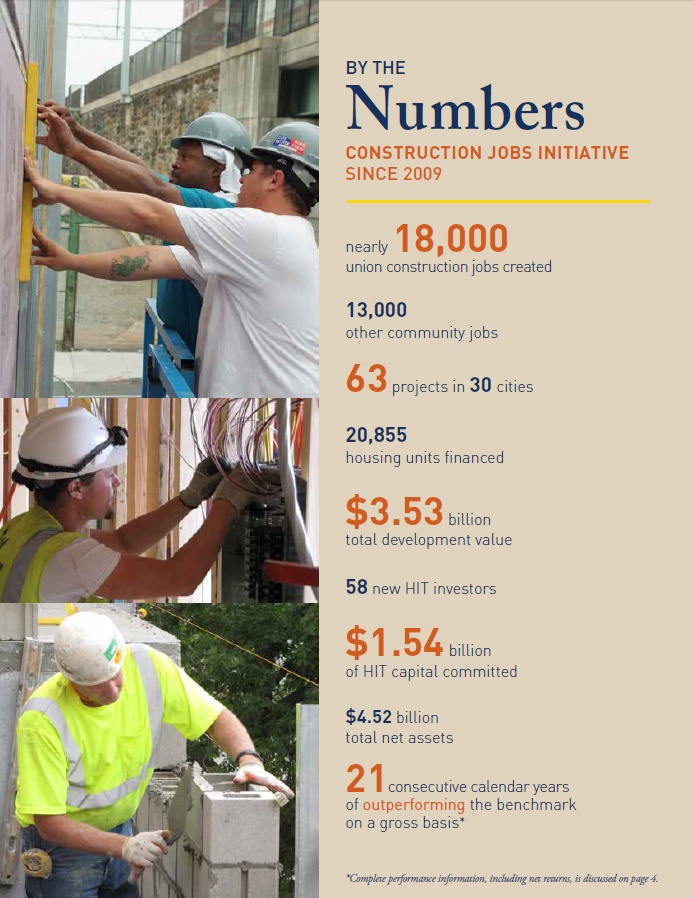

The AFL-CIO Housing Investment Trust’s performance in recent years reflects the dramatic impact of the Construction Jobs Initiative. Since launching the initiative in 2009, at the height of the construction jobs crisis, the HIT has invested $1.54 billion of its capital into a $3.5 billion, 63-project, union-built stimulus program. These construction-related investments helped the HIT generate a competitive cumulative net return of 23.9% for the period 2009-2013. At the same time, the HIT’s net asset value grew by 30%. Investors responded to the initiative with $1.1 billion of new capital for the HIT – including $310 million from 58 new participants. Current HIT participants, with their 90% rate of dividend reinvestment, have also spurred net asset growth. With your continued support, we pledge to work to achieve the HIT’s goal of creating 25,000 union construction jobs by year-end 2015.

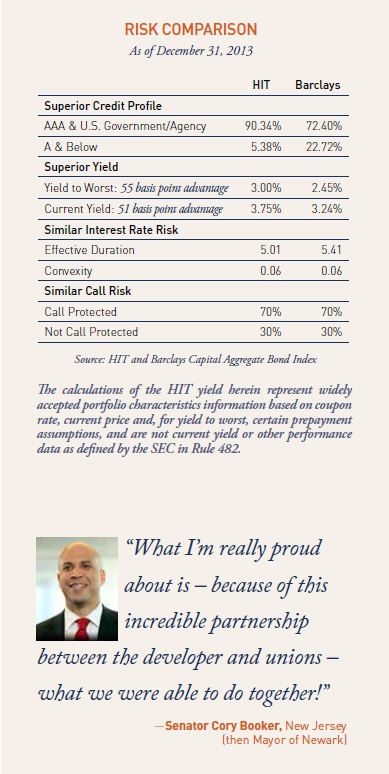

The HIT has the capital, experience, and discipline needed to take advantage of new investment opportunities. With the ongoing market demand for multifamily housing, together with its pipeline of prospective projects, the HIT expects to have attractive opportunities for prudent investments in the multifamily mortgage-backed securities that are its specialty. Going forward, we expect the HIT to continue to offer relative value to participants, with higher yield, higher credit quality, and similar interest rate risk compared to the HIT’s benchmark, as well as desirable diversification benefits.

As we take note of the HIT’s 30th birthday this year, we believe few other fixed-income funds can come close to the HIT’s record of competitive performance, union job creation, and affordable housing financed. What the HIT has achieved, especially in the past five years through the Construction Jobs Initiative, is unmatched. With your continued support, we look forward to further success in investment performance, job creation and rebuilding America’s communities.

Steve Coyle

Chief Executive Officer

2 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T Complete performance information, including net returns, is discussed on page 4.

MESSAGE FROM THE

HIT Chairman

I am pleased to report that the AFL-CIO Housing Investment Trust has completed another successful year, maintaining its competitive returns to investors relative to the benchmark and putting union members back to work building their communities through the Construction Jobs Initiative. Like all fixed-income managers in 2013, the HIT was affected by the sharp jump in interest rates during the year. Nevertheless, with the investment strategy described in this report, the HIT is working to build value and maintain its income advantage relative to the benchmark in this changing interest rate environment as it adds desirable multifamily investments to the portfolio.

The HIT’s Construction Jobs Initiative continues to be a vital part of that investment strategy. This job-generating initiative has demonstrated the power of union pension capital as a stimulus tool by creating close to 18,000 union construction jobs since 2009. The initiative is helping thousands of union families keep food on the table in a time of high construction unemployment, and providing an economic jump-start for local communities. The construction-related investments made through the initiative have had an equally positive impact on the HIT’s performance, helping achieve a competitive cumulative net return over the five-year period since the initiative began.

Investors continue to express their appreciation of the Construction Jobs Initiative by bringing new capital investment to the HIT. We greatly appreciate the confidence of our investors, who have strongly supported this jobs initiative with new investment in the HIT and who made 2013 the HIT’s best year for new capital in more than a decade. With $4.5 billion of total net assets, the HIT has the capacity to consider financing virtually any size project and can selectively invest in those offering the greatest benefits for the portfolio, while creating as many jobs as possible for members of the building and construction trades unions.

We thank our investors for your continuing support, which plays such a vital role in this success.

John J. Sweeney

President Emeritus, AFL-CIO

Chairman, AFL-CIO Housing Investment Trust

A N N U A L R E P O R T 2 0 1 3 3

Discussion of Fund Performance

In a difficult rate environment, the HIT has continued to deliver competitive returns to its investors relative to the benchmark.

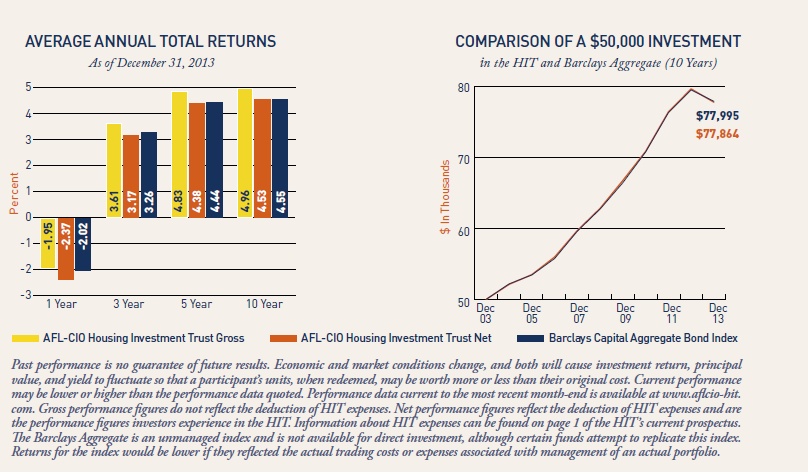

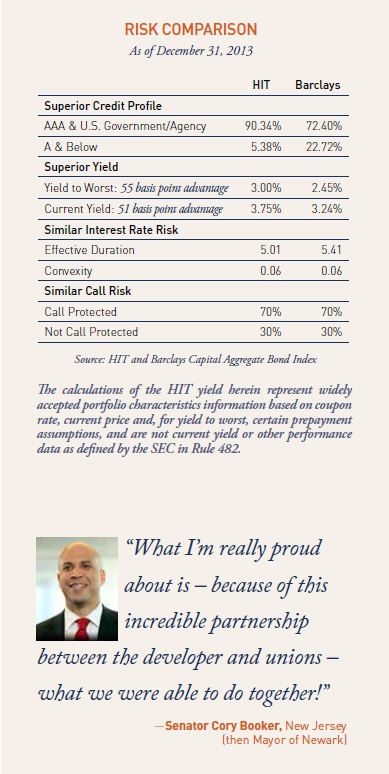

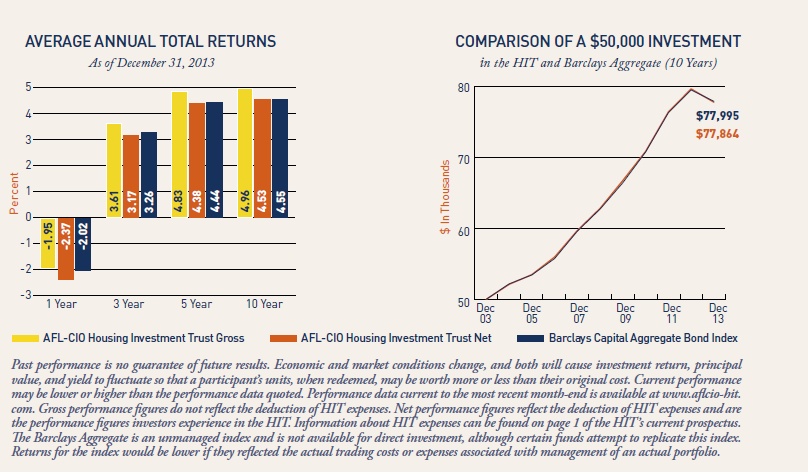

OVERVIEW OF 2013: The AFL-CIO Housing Investment Trust outperformed its benchmark, the Barclays Capital Aggregate Bond Index, on a gross basis for the 21st consecutive calendar year. Its gross one-year return of -1.95% exceeded the benchmark by 7 basis points for the year ended December 31, 2013 – a year of rapid increases in interest rates and mixed signs of economic recovery – and its net return of -2.37% underperformed by 35 basis points, as seen in the chart below. For the fourth quarter, the HIT’s positive returns of 0.21% gross and 0.10% net contrasted with the benchmark’s -0.14% return. Throughout the year, the HIT adhered to its strategy of focusing on the multifamily investments that are its strength. These investments helped produce the HIT’s yield advantage of 55 basis points over the benchmark at December 31, while continuing to generate much-needed affordable housing and union | | construction jobs – nearly 18,000 jobs since 2009 under the HIT’s Construction Jobs Initiative. A large project pipeline, together with a strong influx of capital from investors, positions the HIT to take advantage of higher rates and a favorable multifamily market by adding new construction-related multifamily mortgage-backed securities (MBS) to the portfolio. This investment strategy is designed to offer relative value to participants, with higher yield, higher credit quality, and similar interest rate risk versus the benchmark along with the added benefit of diversification.

Despite the challenging environment, the HIT had its best year for raising capital since 2003 with $431 million of investments from participants. That sum reflected nearly $300 million of new investments, including funds from 14 new participants, and a 90% rate of dividend reinvestment. |

| | | |

4 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

The HIT’s investment strategy is to generate an income advantage by overweighting high credit quality multifamily MBS.

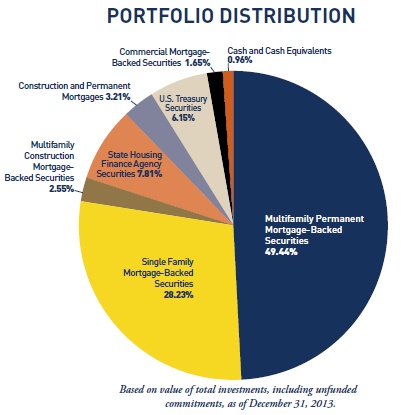

STRATEGY IN A CHALLENGING YEAR: The HIT’s performance relative to its benchmark at December 31, 2013, was enhanced by the yield advantage generated by the multifamily MBS in which it specializes. These high credit quality multifamily securities comprised over 62% of the HIT’s portfolio at year-end. Their performance helped the HIT to surpass the benchmark in gross performance despite a very strong year for corporate bonds, which the HIT does not hold but which comprised 22.3% of the benchmark at December 31.

The HIT managed its duration position to be generally 0.25 to 0.5 years shorter than the benchmark during the year, which also helped its performance as intermediate- and long-term interest rates rose dramatically. Although spreads between U.S. Treasury securities and multifamily MBS widened during the year, the HIT helped mitigate the impact on the portfolio with its positioning in higher coupon securities and in Fannie Mae multifamily securities, both of which outperformed in the multifamily sector during the year.

Drawing on its ability to originate and structure multifamily investments to meet the needs of the portfolio, the HIT made new commitments of $279 million to finance the construction or substantial rehabilitation of six multifamily and healthcare projects. These projects, with total development value of $550 million, should generate approximately 1,685 union construction jobs and 3,924 housing units as part of the HIT’s Construction Jobs Initiative. The new 2013 investments average over $45 million in size, reflecting a growing capacity to finance larger, higher-impact projects.

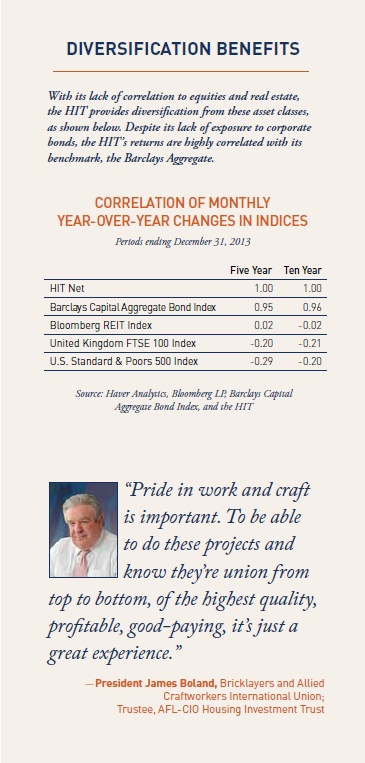

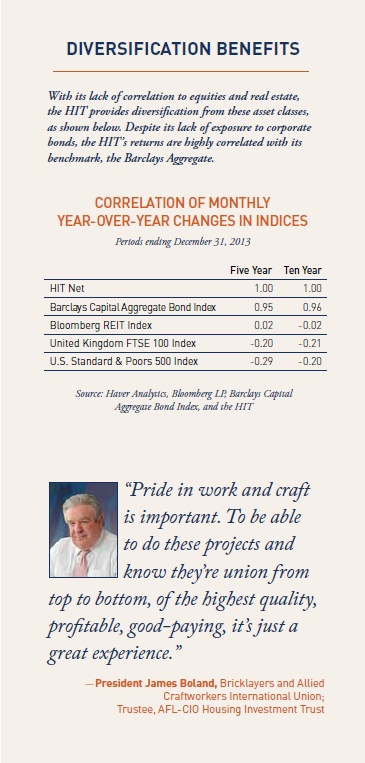

The HIT’s investment objective is to generate competitive risk-adjusted returns versus its benchmark. Its strategy is to overweight high credit quality multifamily MBS. The HIT substitutes these multifamily assets for corporate bonds and some Treasuries in the benchmark. This strategy enables investors to benefit in the long term from high credit quality, an income advantage over the benchmark, and important diversification from equities and other riskier assets. | |  |

| | | |

A N N U A L R E P O R T 2 0 1 3 5

MARKET CONDITIONS: Interest rates rose in 2013 from historic lows, producing negative annual returns for the U.S. investment grade fixed-income market for just the third time in over three decades. The Federal Reserve supported low interest rates to aid the economic recovery through its Quantitative Easing program of bond purchases. When remarks by Fed Chairman Ben Bernanke in the spring caused markets to anticipate the tapering of those bond purchases sooner than previously expected, demand for fixed-income securities fell, causing rates to rise rapidly. The 10-year U.S. Treasury rate was 3.04% at year-end, up from 1.78% a year earlier.

Despite the higher rate environment, inflation remained well below the Fed’s 2% target, and the Fed has pledged to keep the federal funds rate near zero for some time, due to continued concerns about the unsteady pace of recovery. While the national unemployment rate dipped to 6.7% at year-end, the drop reflected both modest job growth and a shrinking workforce.

The large and rapid rise in interest rates in the spring and summer precipitated spread widening, and multifamily spreads widened more than many other sectors. By the fourth quarter, spreads began to tighten. At year-end the spreads for high credit quality multifamily MBS remained attractive by historical standards, and the HIT intends to continue taking advantage of investment opportunities in this sector.

| |  |

6 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

The HIT is an attractive choice for long-term investors seeking income, high credit quality, and diversification benefits.

OPPORTUNITIES AHEAD: The HIT should be well-positioned in this challenging environment to meet its investment objectives going forward. Rising interest rates and the portfolio’s concentration in high credit quality multifamily MBS helped increase the portfolio’s yield to worst by 76 basis points to 3.00% at the end of 2013, up from 2.24% a year earlier. Its investment strategy is to take advantage of higher rates and wider spreads in the high credit quality multifamily MBS that are its area of special expertise. The HIT has a large and diverse pipeline of prospective construction-related investments, and it intends to selectively add these higher-yielding investments to the portfolio to enhance value. These multifamily assets are expected to generate more income than other government-backed securities with similar credit quality and duration, while meeting the HIT’s collateral objectives of creating union jobs and affordable housing. Strong demand for multifamily rental housing is projected to continue, reflecting demographics and the aging of much existing affordable housing stock, and this should generate prudent investment opportunities for the portfolio in the period ahead. The HIT is actively seeking additional capital from participants to support this investment strategy.

Fixed income remains an important asset class for a diversified portfolio. With its multifamily specialization, the HIT should continue to be an attractive choice for long-term investors seeking income, high credit quality, and diversification, together with the ability to generate union jobs and affordable housing at a time when both continue to be in high demand. | |  |

A N N U A L R E P O R T 2 0 1 3 7

Update: Construction Jobs Initiative

| Multifamily investments not only contributed to the HIT’s competitive performance versus the benchmark in 2013, but the underlying projects also continued to help put thousands of union members to work building and rehabilitating much-needed affordable housing and healthcare facilities in their communities. The HIT’s Construction Jobs Initiative continues to be the vehicle for originating these investments. Begun five years ago as a response to the Great Recession, the Construction Jobs Initiative has created nearly 18,000 union construction jobs to date. Supported by substantial new capital from its investors, the HIT has invested more than $1.5 billion into this initiative since 2009. Together with projects financed by the HIT’s wholly owned subsidiary, Building America CDE, Inc., these investments have leveraged more than $3.5 billion of total development investment, creating or preserving 20,855 units of housing at 63 projects in 30 cities. | | In early 2013, the HIT’s Board of Trustees resolved to expand the Construction Jobs Initiative for the third time, setting a new job creation goal of 25,000 union construction jobs. With continued support from its investors, the HIT intends to reach that goal before the end of 2015. Although unemployment in the construction trades is down significantly from the 27.1% peak in 2010, these workers still faced a jobless rate of 11.4% at year-end.

“The AFL-CIO Housing Investment Trust’s investment in Arc Light . . . and in Potrero Launch and then in 333 Harrison helped us through and out of the recession.”

—Secretary-Treasurer Michael Theriault,

San Francisco Building & Construction Trades Council |

| | | |

| | | |

|

Stout Street Health Center, Denver

8 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

Building America is helping broaden the impact of the Construction Jobs Initiative by providing New Markets Tax Credits that it received from the federal government to help close capital gaps for projects in low-income communities. Since 2011, Building America has allocated $85 million of tax credits to 11 projects that are revitalizing neighborhoods, creating union construction jobs and permanent employment, and improving residents’ quality of life through new mixed-use developments and healthcare facilities. During 2013, a total of 26 HIT and Building America projects were under construction, representing $1.7 billion of development activity and an estimated 7,400 union construction jobs. Some notable projects are described below.

| |  Stout Street Health Center, Denver. This $35.3 million development sponsored by the Colorado Coalition for the Homeless will expand health services to some of Denver’s neediest individuals with support from $8.5 million in tax credits from Building America. The project is generating an estimated 210 union construction jobs.

Georgetowne Homes I and II, Boston. HIT financing of $116 million will preserve affordability and make energy-saving retrofits at these aging residential developments in Boston’s Hyde Park neighborhood. The investment in the two projects, with a total of 967 housing units, should create approximately 645 union construction jobs. |

| | | |

Amalgamated Warbasse Houses, Brooklyn. In the wake of Superstorm Sandy, the HIT acted quickly with a short-term direct loan of $89 million to help this 2,585-unit union-developed cooperative make repairs, mitigate future storm damage, and refinance existing debt to produce cost savings for the co-op’s members. 2101 South Michigan, Chicago. With $32 million from the HIT, this aging property on the city’s Near South Side will undergo a $41.8 million rehabilitation to update and preserve 250 units of mixed-income housing. The HIT’s support will help create approximately 245 union construction jobs.

| |  |

A N N U A L R E P O R T 2 0 1 3 9

Other Important Information

EXPENSE EXAMPLE

Participants in the HIT incur ongoing expenses related to the management and distribution activities of the HIT, as well as certain other expenses. The expense example in the table below is intended to help participants understand the ongoing costs (in dollars) of investing in the HIT and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period, July 1, 2013, and held for the entire period ended December 31, 2013.

Actual Expenses: The first line of the table below provides information about actual account values and actual expenses. Participants may use the information in this line, together with the amount they invested, to estimate the expenses that they paid over the period. Simply divide the account value by $1,000 (for example, an $800,000 account value divided by $1,000 = 800), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Six-Month Period Ended December 31, 2013” to estimate the expenses paid on a particular account during this period. Hypothetical Expenses (for Comparison Purposes Only): The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the HIT’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the HIT’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses a participant paid for the period. Participants may use this information to compare the ongoing costs of investing in the HIT and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds. | | Please note that this example is useful in comparing funds’ ongoing costs only. It does not include any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. The HIT does not have such transactional costs, but many other funds do.

AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULES

In addition to disclosure in the Annual and Semi-Annual Reports to Participants, the HIT also files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-Q. The HIT’s reports on Form N-Q are made available on the SEC’s website at http://www. sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information relating to the hours and operation of the SEC’s Public Reference Room may be obtained by calling 800-SEC-0330. Participants may also obtain copies of the HIT’s Form N-Q reports, without charge, upon request, by calling the HIT collect at 202-331-8055. PROXY VOTING

Except for its shares in its wholly owned subsidiary, Building America CDE, Inc., the HIT invests exclusively in non -voting securities and has not deemed it necessary to adopt policies and procedures for the voting of portfolio securities. The HIT has reported information regarding how it voted in matters related to its subsidiary in its most recent filing with the SEC on Form N-PX. This filing is available on the SEC’s website at http://www.sec.gov. Participants may also obtain a copy of the HIT’s report on Form N-PX, without charge, upon request, by calling the HIT collect at 202-331-8055. |

| | | |

| | Beginning | Ending | Expenses Paid During |

| | Account Value | Account Value | Six-Month Period Ended |

| | July 1, 2013 | December 31, 2013 | December 31, 2013* |

| | | | |

| Actual expenses | $ 1,000 | $ 1,002.50 | $ 2.21 |

| Hypothetical expenses | $ 1,000 | $ 1,023.00 | $ 2.23 |

| (5% annual return before expenses) | | | |

*Expenses are equal to the HIT’s annualized expense ratio of 0.44%, as of December 31, 2013, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

2013 HIT PARTICIPANTS MEETING

The 2013 Annual Meeting of Participants was held in Washington, D.C., on Thursday, December 12, 2013. The following matters were put to a vote of the Participants at the meeting through the solicitation of proxies:

John J. Sweeney was elected to chair the Board of Trustees by: votes for 2,344,916.258; votes against 89,892.718; votes abstaining 1,936.869; votes not cast 1,669,038.494.

Tony Stanley was elected as a Class III Management Trustee by: votes for 2,436,745.845; votes against 0.000; votes abstaining 0.000; votes not cast 1,669,038.494. | | The following Trustees were not up for reelection and their terms of office continued after the meeting: Richard L. Trumka, Vincent Alvarez, James Boland, Stephen Frank, Sean McGarvey, Elizabeth Shuler, Jack Quinn, Richard Ravitch, Kenneth E. Rigmaiden, and Marlyn Spear.

Ernst & Young LLP was ratified as the HIT’s Independent Registered Public Accounting Firm by: votes for 2,436,745.845; votes against 0.000; votes abstaining 0.000; votes not cast 1,669,038.494. |

10 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Participants of American Federation of Labor and Congress of

Industrial Organizations Housing Investment Trust:

We have audited the accompanying statement of assets and liabilities of American Federation of Labor and Congress of Industrial Organizations Housing Investment Trust (the Trust), including the schedule of portfolio investments, as of December 31, 2013, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Trust’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2013, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of American Federation of Labor and Congress of Industrial Organizations Housing Investment Trust as of December 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

McLean, Virginia

February 21, 2014

12 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

Statement of Assets and Liabilities

December 31, 2013 (dollars in thousands, except per share data)

Assets

| Investments, at value (cost $4,484,038) | $ | 4,513,333 |

| Cash | | 812 |

| Accrued interest receivable | | 15,854 |

| Receivables for investments sold | | 17 |

| Other assets | | 1,165 |

| Total assets | | 4,531,181 |

| | | |

| Liabilities | | |

| Payables for investments purchased | | 2,655 |

| Redemptions payable | | 7,279 |

| Income distribution and capital gains payable, net of dividends reinvested of $10,693 | | 1,143 |

| Refundable deposits | | 26 |

| Accrued salaries and fringe benefits | | 4,061 |

| Accrued expenses | | 816 |

| Total liabilities | | 15,980 |

| | | |

| Net assets applicable to participants’ equity — | | |

| Certificates of participation—authorized unlimited; | | |

| Outstanding 4,077,108 units | $ | 4,515,201 |

| | | |

| Net asset value per unit of participation (in dollars) | $ | 1,107.45 |

| | | |

| Participants’ equity | | |

| Participants’ equity consisted of the following: | | |

| Amount invested and reinvested by current participants | $ | 4,500,966 |

| Net unrealized appreciation of investments | | 29,295 |

| Distribution in excess of net investment income | | (2,789) |

| Accumulated net realized loss, net of distributions | | (12,271) |

| Total participants’ equity | $ | 4,515,201 |

See accompanying Notes to Financial Statements.

A N N U A L R E P O R T 2 0 1 3 13

SCHEDULE OF PORTFOLIO INVESTMENTS December 31, 2013 (dollars in thousands)

FHA Permanent Securities (3.3% of net assets)

| | Interest Rate | Maturity Date | Face Amount | Amortized Cost | | Value |

| Single Family | 7.75% | Jul-2021 | $ | 15 | $ | 15 | $ | 15 |

Multifamily1 | 3.75% | Aug-2048 | | 4,175 | | 4,171 | | 3,859 |

| | 4.00% | Dec-2053 | | 66,660 | | 66,634 | | 59,386 |

| | 5.35% | Mar-2047 | | 7,582 | | 7,592 | | 8,053 |

| | 5.55% | Aug-2042 | | 8,298 | | 8,301 | | 8,628 |

| | 5.60% | Jun-2038 | | 2,592 | | 2,597 | | 2,618 |

| | 5.62% | Jun-2014 | | 58 | | 59 | | 59 |

| | 5.65% | Oct-2038 | | 2,006 | | 2,046 | | 2,007 |

| | 5.80% | Jan-2053 | | 2,087 | | 2,099 | | 2,274 |

| | 5.87% | Jun-2044 | | 1,843 | | 1,841 | | 2,011 |

| | 5.89% | Apr-2038 | | 4,866 | | 4,873 | | 5,109 |

| | 6.02% | Jun-2035 | | 5,229 | | 5,212 | | 5,347 |

| | 6.20% | Apr-2052 | | 11,775 | | 11,770 | | 12,907 |

| | 6.40% | Aug-2046 | | 3,907 | | 3,910 | | 4,309 |

| | 6.60% | Jan-2050 | | 3,434 | | 3,469 | | 3,799 |

| | 6.75% | Apr-2040 - Jul-2040 | | 5,043 | | 5,025 | | 5,165 |

| | 7.13% | Mar-2040 | | 7,359 | | 7,344 | | 7,515 |

| | 7.20% | Dec-2033 - Oct-2039 | | 9,100 | | 9,108 | | 9,193 |

| | 7.50% | Sep-2032 | | 1,434 | | 1,428 | | 1,608 |

| | 7.93% | Apr-2042 | | 2,754 | | 2,754 | | 3,097 |

| | 8.75% | Aug-2036 | | 3,451 | | 3,455 | | 3,461 |

| | | | | 153,653 | | 153,688 | | 150,405 |

| Total FHA Permanent Securities | | | $ | 153,668 | $ | 153,703 | $ | 150,420 |

Ginnie Mae Securities (24.6% of net assets)

| | | | Commitment | | | | | | |

| | Interest Rate | Maturity Date | | Amount | Face Amount | Amortized Cost | | Value |

| Single Family | 4.00% | Feb-2040 - Jun-2040 | $ | - | $ | 12,132 | $ | 12,311 | $ | 12,627 |

| | 4.50% | Aug-2040 | | - | | 7,165 | | 7,355 | | 7,664 |

| | 5.50% | Jan-2033 - Jun-2037 | | - | | 6,823 | | 6,791 | | 7,529 |

| | 6.00% | Jan-2032 - Aug-2037 | | - | | 4,540 | | 4,539 | | 5,079 |

| | 6.50% | Jul-2028 | | - | | 109 | | 109 | | 125 |

| | 7.00% | Nov-2016 - Jan-2030 | | - | | 1,906 | | 1,920 | | 2,200 |

| | 7.50% | Nov-2014 - Aug-2030 | | - | | 1,178 | | 1,192 | | 1,364 |

| | 8.00% | Jun-2023 - Nov-2030 | | - | | 891 | | 909 | | 1,065 |

| | 8.50% | Jun-2022 - Aug-2027 | | - | | 792 | | 801 | | 936 |

| | 9.00% | Mar-2017 - Jun-2025 | | - | | 253 | | 256 | | 297 |

| | 9.50% | Sep-2021 - Sep-2030 | | - | | 88 | | 89 | | 104 |

| | 10.00% | Jun-2019 | | - | | - | | - | | 1 |

| | | | | - | | 35,877 | | 36,272 | | 38,991 |

Multifamily1 | 2.11% | Apr-2033 | | - | | 12,705 | | 12,805 | | 12,778 |

| | 2.18% | May-2039 | | - | | 21,937 | | 22,163 | | 22,330 |

| | 2.31% | Nov-2051 | | - | | 7,076 | | 7,080 | | 6,257 |

| | 2.34% | Aug-2034 | | - | | 6,279 | | 6,323 | | 6,306 |

| | 2.41% | May-2030 | | - | | 3,298 | | 3,327 | | 3,310 |

| | 2.55% | Feb-2048 | | - | | 23,658 | | 23,885 | | 21,560 |

| | 2.70% | Jul-2048 | | - | | 12,995 | | 13,122 | | 11,969 |

| | 2.70% | Jan-2053 | | - | | 51,015 | | 51,533 | | 44,734 |

| | | | | | | | | | | |

| | | | | | | | | | | continued |

14 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

| Ginnie Mae Securities (24.6% of net assets) continued | | | | |

| | | | Commitment | | | | | | |

| | Interest Rate | Maturity Date | Amount | Face Amount | Amortized Cost | | Value |

| | 2.72% | Feb-2044 | $ | - | $ | 3,943 | $ | 4,089 | $ | 3,958 |

| | 2.82% | Apr-2050 | | - | | 1,500 | | 1,540 | | 1,380 |

| | 2.87% | Feb-2036 - Dec-2043 | | - | | 25,000 | | 25,416 | | 24,502 |

| | 2.89% | Mar-2046 | | - | | 32,000 | | 32,292 | | 30,289 |

| | 3.05% | May-2044 | | - | | 45,500 | | 45,908 | | 44,938 |

| | 3.17% | Oct-2043 | | - | | 20,857 | | 21,143 | | 21,521 |

| | 3.19% | Jan-2049 | | - | | 17,025 | | 17,835 | | 15,712 |

| | 3.26% | Feb-2038 - Nov-2043 | | - | | 25,000 | | 25,221 | | 24,189 |

| | 3.31% | Nov-2037 | | - | | 10,995 | | 11,437 | | 11,375 |

| | 3.34% | Jun-2052 | | - | | 44,248 | | 41,258 | | 42,817 |

| | 3.37% | Dec-2046 | | - | | 19,200 | | 19,530 | | 18,047 |

| | 3.40% | Apr-2017 - Jul-2046 | | - | | 9,275 | | 9,587 | | 8,766 |

| | 3.49% | Mar-2042 | | - | | 28,000 | | 29,369 | | 29,150 |

| | 3.49% | Feb-2044 | | - | | 4,000 | | 4,257 | | 3,947 |

| | 3.55% | May-2042 | | - | | 10,000 | | 10,209 | | 9,779 |

| | 3.64% | Sep-2041 | | - | | 10,000 | | 10,801 | | 10,407 |

| | 3.67% | Oct-2043 | | - | | 25,000 | | 25,216 | | 26,157 |

| | 3.81% | Nov-2053 | | - | | 55,482 | | 56,172 | | 55,521 |

| | 3.81% | Dec-2053 | | - | | 11,047 | | 11,163 | | 11,062 |

| | 3.95% | Jul-2053 | | - | | 6,099 | | 6,115 | | 6,188 |

| | 3.99% | Sep-2043 | | - | | 20,000 | | 20,947 | | 20,950 |

| | 4.00% | Sep-2046 | | - | | 10,000 | | 10,896 | | 10,636 |

| | 4.00% | May-2049 | | - | | 31,500 | | 34,245 | | 33,424 |

| | 4.15% | Apr-2053 | | - | | 69,566 | | 70,985 | | 71,056 |

| | 4.15% | Jun-2053 | | - | | 2,264 | | 2,301 | | 2,296 |

| | 4.22% | Nov-2035 | | - | | 3,748 | | 3,832 | | 3,806 |

| | 4.25% | Sep-2038 | | - | | 39,782 | | 40,075 | | 40,405 |

| | 4.42% | Feb-2031 | | - | | 34,257 | | 34,456 | | 35,082 |

| | 4.43% | Jun-2034 | | - | | 1,948 | | 1,915 | | 1,968 |

| | 4.50% | Aug-2049 | | - | | 2,291 | | 2,301 | | 2,301 |

| | 4.63% | Sep-20372 | | - | | 1,500 | | 1,459 | | 1,399 |

| | 4.73% | Nov-2045 | | - | | 1,154 | | 1,174 | | 1,168 |

| | 4.83% | May-20462 | | - | | 5,175 | | 5,175 | | 4,712 |

| | 4.86% | Jan-2053 | | - | | 42,055 | | 42,377 | | 45,512 |

| | 4.87% | Apr-2042 | | - | | 97,595 | | 98,436 | | 103,915 |

| | 4.90% | Mar-20442 | | - | | 1,000 | | 990 | | 947 |

| | 4.91% | Sep-2034 | | - | | 1,637 | | 1,681 | | 1,663 |

| | 4.92% | May-2034 | | - | | 3,695 | | 3,689 | | 3,717 |

| | 4.94% | Jun-20462 | | - | | 3,735 | | 3,740 | | 3,673 |

| | 4.99% | Mar-2030 | | - | | 3,780 | | 4,044 | | 3,843 |

| | 5.01% | Mar-2038 | | - | | 25,000 | | 25,968 | | 26,247 |

| | 5.05% | Apr-20492 | | - | | 2,840 | | 2,844 | | 2,656 |

| | 5.15% | Dec-2050 | | - | | 15,681 | | 15,520 | | 17,106 |

| | 5.19% | May-2045 | | - | | 1,746 | | 1,707 | | 1,759 |

| | 5.21% | Mar-2053 | | - | | 49,684 | | 49,752 | | 54,341 |

| | 5.25% | Apr-2037 | | - | | 19,750 | | 19,743 | | 21,165 |

| | 5.34% | Jul-2040 | | - | | 18,000 | | 17,713 | | 19,168 |

| | 5.55% | May-20492 | | - | | 10,295 | | 10,298 | | 9,409 |

| | | | | - | | 1,062,812 | | 1,077,059 | | 1,073,273 |

Forward Commitments1 | 5.45% | Feb-2055 | | 2,650 | | - | | - | | 21 |

| Total Ginnie Mae Securities | | | $ | 2,650 | $ | 1,098,689 | $ | 1,113,331 | $ | 1,112,285 |

A N N U A L R E P O R T 2 0 1 3 15

SCHEDULE OF PORTFOLIO INVESTMENTS December 31, 2013 (dollars in thousands)

Ginnie Mae Construction Securities (1.6% of net assets) | | | | |

| | | | | |

| | Interest Rates3 | | Commitment | | | | | | |

| | Permanent | Construction | Maturity Date | Amount | Face Amount | Amortized Cost | | Value |

Multifamily1 | 2.32% | 2.32% | Apr-2054 | $ | 23,500 | $ | 13,584 | $ | 14,292 | $ | 10,312 |

| | 2.35% | 2.35% | Jan-2054 | | 15,850 | | 11,175 | | 11,656 | | 9,257 |

| | 2.87% | 2.87% | Mar-2054 | | 40,943 | | 33,371 | | 34,606 | | 29,730 |

| | 3.20% | 3.20% | Oct-2053 | | 10,078 | | 9,309 | | 9,611 | | 8,798 |

| | 3.95% | 3.95% | Feb-20522 | | 6,600 | | 6,394 | | 6,397 | | 6,275 |

| | 3.85% | 6.70% | Oct-2054 | | 31,865 | | 8,670 | | 8,837 | | 8,210 |

| Total Ginnie Mae Construction Securities | | | $ | 128,836 | $ | 82,503 | $ | 85,399 | $ | 72,582 |

Fannie Mae Securities (39.5% of net assets)

| | Interest Rate | Maturity Date | Face Amount | Amortized Cost | | Value |

| Single Family | 0.42% | | Mar-2037 | $ | 1,126 | $ | 1,111 | $ | 1,122 |

| | 0.47% | 4 | Jul-2043 | | 23,687 | | 23,491 | | 23,355 |

| | 0.55% | | Nov-2042 | | 13,331 | | 13,337 | | 13,238 |

| | 0.57% | 4 | Apr-2037 - Oct-2042 | | 20,325 | | 20,341 | | 20,152 |

| | 0.63% | 4 | Oct-2042 | | 10,907 | | 10,969 | | 10,865 |

| | 0.67% | | Dec-2040 | | 44,083 | | 43,708 | | 44,023 |

| | 0.67% | | Feb-2042 - Feb-2043 | | 38,845 | | 38,890 | | 38,824 |

| | 0.72% | | Mar-2042 | | 21,203 | | 21,274 | | 21,187 |

| | 0.77% | | Mar-2042 - Oct-2043 | | 24,812 | | 24,920 | | 24,938 |

| | 1.93% | | Nov-2033 | | 4,201 | | 4,203 | | 4,368 |

| | 1.98% | | Aug-2033 | | 274 | | 273 | | 285 |

| | 2.22% | | Sep-2035 | | 1,170 | | 1,165 | | 1,235 |

| | 2.24% | | May-2033 - Nov-2034 | | 3,402 | | 3,490 | | 3,599 |

| | 2.31% | | Jul-2033 | | 713 | | 709 | | 752 |

| | 2.32% | | Aug-2033 | | 2,917 | | 2,911 | | 3,077 |

| | 2.34% | | Jul-2033 - Aug-2033 | | 4,654 | | 4,666 | | 4,919 |

| | 2.42% | 4 | Apr-2034 | | 2,231 | | 2,305 | | 2,360 |

| | 3.00% | | Apr-2042 - Dec-2042 | | 19,956 | | 20,676 | | 18,986 |

| | 3.50% | | Mar-2026 - Nov-2042 | | 114,418 | | 119,718 | | 114,595 |

| | 4.00% | | Jun-2018 - Nov-2041 | | 93,736 | | 96,039 | | 97,330 |

| | 4.50% | | Mar-2015 - Sep-2040 | | 65,713 | | 67,500 | | 69,891 |

| | 4.50% | | Dec-2039 | | 19,757 | | 21,170 | | 20,956 |

| | 4.50% | | Feb-2042 | | 19,932 | | 21,267 | | 21,141 |

| | 5.00% | | Sep-2016 - Apr-2041 | | 54,438 | | 56,592 | | 58,742 |

| | 5.50% | | Jul-2017 - Jun-2038 | | 29,884 | | 30,055 | | 32,693 |

| | 6.00% | | Apr-2016 - Nov-2037 | | 15,156 | | 15,255 | | 16,761 |

| | 6.50% | | Nov-2016 - Jul-2036 | | 3,777 | | 3,862 | | 4,162 |

| | 7.00% | | Mar-2015 - May-2032 | | 2,020 | | 2,028 | | 2,308 |

| | 7.50% | | Nov-2016 - Sep-2031 | | 639 | | 623 | | 732 |

| | 8.00% | | Apr-2030 - May-2031 | | 87 | | 88 | | 94 |

| | | | | | | | | | |

| | | | | | | | | | continued |

16 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

Fannie Mae Securities (39.5% of net assets) continued | | | | |

| | | | | |

| | Interest Rate | | Maturity Date | Face Amount | Amortized Cost | | Value |

| | 8.50% | | Mar-2015 - Apr-2031 | $ | 128 | $ | 128 | $ | 140 |

| | 9.00% | | Jan-2024 - May-2025 | | 114 | | 114 | | 135 |

| | | | | | 657,636 | | 672,878 | | 676,965 |

Multifamily1 | 2.21% | | Dec-2022 | | 25,295 | | 25,339 | | 23,584 |

| | 2.21% | | Dec-2022 | | 33,330 | | 33,387 | | 31,075 |

| | 2.24% | | Dec-2022 | | 33,200 | | 33,258 | | 31,018 |

| | 2.26% | | Nov-2022 | | 6,870 | | 6,932 | | 6,437 |

| | 2.71% | | Jan-2021 | | 9,022 | | 9,045 | | 8,970 |

| | 2.84% | | Mar-2022 | | 3,814 | | 3,861 | | 3,796 |

| | 2.85% | | Mar-2022 | | 33,000 | | 33,225 | | 32,494 |

| | 2.99% | | Jun-2025 | | 2,750 | | 2,775 | | 2,568 |

| | 3.36% | | Dec-2023 | | 8,550 | | 8,651 | | 8,514 |

| | 3.41% | | Sep-2023 | | 15,383 | | 15,720 | | 15,577 |

| | 3.46% | | Dec-2023 | | 3,500 | | 3,535 | | 3,478 |

| | 3.54% | | Oct-2021 | | 7,567 | | 7,639 | | 7,902 |

| | 3.61% | | Sep-2023 | | 6,897 | | 7,043 | | 7,010 |

| | 3.66% | | Jul-2021 | | 123,752 | | 124,026 | | 130,753 |

| | 3.66% | | Oct-2023 | | 5,071 | | 5,199 | | 5,164 |

| | 3.87% | | Sep-2023 | | 2,657 | | 2,794 | | 2,749 |

| | 4.00% | | Sep-2021 | | 16,018 | | 16,051 | | 17,271 |

| | 4.02% | 4 | Jun-2020 | | 3,639 | | 3,645 | | 3,629 |

| | 4.03% | | Oct-2021 | | 7,284 | | 7,301 | | 7,802 |

| | 4.06% | | Oct-2025 | | 25,728 | | 25,917 | | 26,002 |

| | 4.15% | | Jun-2021 | | 9,381 | | 9,417 | | 10,113 |

| | 4.22% | | Jul-2018 | | 2,291 | | 2,273 | | 2,451 |

| | 4.25% | | May-2021 | | 4,349 | | 4,354 | | 4,706 |

| | 4.27% | | Nov-2019 | | 6,139 | | 6,138 | | 6,699 |

| | 4.32% | | Nov-2019 | | 3,035 | | 3,040 | | 3,320 |

| | 4.33% | | Nov-2019 - Mar-2021 | | 6,156 | | 6,172 | | 6,712 |

| | 4.33% | | Mar-2020 | | 20,000 | | 20,003 | | 21,567 |

| | 4.38% | | Apr-2020 | | 10,424 | | 10,472 | | 11,385 |

| | 4.44% | | May-2020 | | 6,174 | | 6,191 | | 6,764 |

| | 4.49% | | Jun-2021 | | 999 | | 1,014 | | 1,092 |

| | 4.50% | | Feb-2020 | | 4,317 | | 4,325 | | 4,725 |

| | 4.52% | | Nov-2019 - May-2021 | | 7,325 | | 7,403 | | 8,037 |

| | 4.55% | | Nov-2019 | | 2,893 | | 2,899 | | 3,186 |

| | 4.56% | | Jul-2019 - May-2021 | | 8,590 | | 8,627 | | 9,470 |

| | 4.64% | | Aug-2019 | | 18,452 | | 18,529 | | 20,428 |

| | 4.66% | | Jul-2021 - Sep-2033 | | 7,513 | | 7,565 | | 7,667 |

| | 4.68% | | Jul-2019 | | 13,384 | | 13,370 | | 14,795 |

| | 4.69% | | Jan-2020 - Jun-2035 | | 14,301 | | 14,375 | | 15,752 |

| | 4.71% | | Mar-2021 | | 5,986 | | 6,090 | | 6,600 |

| | 4.73% | | Feb-2021 | | 1,568 | | 1,592 | | 1,731 |

| | 4.80% | | Jun-2019 | | 2,189 | | 2,188 | | 2,431 |

| | 4.86% | | May-2019 | | 1,463 | | 1,464 | | 1,629 |

| | 4.89% | | Nov-2019 - May-2021 | | 2,769 | | 2,841 | | 3,071 |

| | 4.94% | | Apr-2019 | | 3,500 | | 3,503 | | 3,896 |

| | | | | | | | | | continued |

A N N U A L R E P O R T 2 0 1 3 17

SCHEDULE OF PORTFOLIO INVESTMENTS December 31, 2013 (dollars in thousands) | | | | | | |

| | | | | | | |

Fannie Mae Securities (39.5% of net assets) continued | | | | | |

| | | | | | |

| Interest Rate | Maturity Date | Face Amount | Amortized Cost | | Value |

| 5.00% | Jun-2019 | $ | 1,908 | $ | 1,912 | $ | 2,130 |

| 5.02% | Jun-2019 | | 828 | | 831 | | 925 |

| 5.04% | Jun-2019 | | 1,887 | | 1,897 | | 2,110 |

| 5.05% | Jun-2019 - Jul-2019 | | 3,214 | | 3,228 | | 3,596 |

| 5.08% | Apr-2021 | | 40,000 | | 40,004 | | 43,803 |

| 5.09% | Jun-2018 | | 6,412 | | 6,538 | | 7,112 |

| 5.11% | Jul-2019 | | 882 | | 888 | | 986 |

| 5.12% | Jul-2019 | | 8,796 | | 8,792 | | 9,838 |

| 5.13% | Jul-2019 | | 896 | | 895 | | 1,003 |

| 5.15% | Oct-2022 | | 3,270 | | 3,292 | | 3,584 |

| 5.19% | Jan-2018 | | 4,732 | | 4,699 | | 5,088 |

| 5.25% | Jan-2020 | | 6,877 | | 6,888 | | 7,710 |

| 5.29% | May-2022 | | 5,294 | | 5,294 | | 5,904 |

| 5.30% | Aug-2029 | | 6,770 | | 6,618 | | 7,375 |

| 5.34% | Apr-2016 | | 6,007 | | 6,009 | | 6,348 |

| 5.36% | Feb-2016 | | 359 | | 359 | | 360 |

| 5.37% | Jun-2017 | | 1,386 | | 1,418 | | 1,515 |

| 5.43% | Nov-2018 | | 336 | | 336 | | 337 |

| 5.45% | May-2033 | | 2,847 | | 2,860 | | 3,135 |

| 5.46% | Feb-2017 | | 44,933 | | 45,211 | | 49,706 |

| 5.47% | Aug-2024 | | 8,351 | | 8,413 | | 9,282 |

| 5.52% | Mar-2018 | | 591 | | 605 | | 661 |

| 5.53% | Apr-2017 | | 61,775 | | 61,779 | | 68,600 |

| 5.59% | May-2017 | | 6,814 | | 6,814 | | 7,501 |

| 5.60% | Feb-2018 - Jan-2024 | | 11,172 | | 11,172 | | 12,490 |

| 5.63% | Dec-2019 | | 8,025 | | 8,062 | | 8,918 |

| 5.69% | Jun-2041 | | 4,888 | | 5,044 | | 5,348 |

| 5.70% | Jun-2016 | | 1,342 | | 1,355 | | 1,462 |

| 5.75% | Jun-2041 | | 2,368 | | 2,455 | | 2,604 |

| 5.80% | Jun-2018 | | 68,200 | | 68,022 | | 77,360 |

| 5.86% | Dec-2016 | | 153 | | 153 | | 164 |

| 5.91% | Mar-2037 | | 1,988 | | 2,033 | | 2,214 |

| 5.92% | Dec-2016 | | 131 | | 132 | | 141 |

| 5.96% | Jan-2029 | | 405 | | 407 | | 455 |

| 6.03% | Jun-2017 - Jun-2036 | | 5,339 | | 5,452 | | 5,890 |

| 6.06% | Jul-2034 | | 9,495 | | 9,742 | | 10,649 |

| 6.11% | Aug-2017 | | 6,565 | | 6,608 | | 7,420 |

| 6.13% | Dec-2016 | | 1,989 | | 2,028 | | 2,227 |

| 6.14% | Sep-2033 | | 292 | | 307 | | 328 |

| 6.15% | Jan-2019 | | 32,987 | | 32,993 | | 37,837 |

| 6.15% | Jan-2032 - Oct-2032 | | 7,093 | | 7,139 | | 7,844 |

| 6.22% | Aug-2032 | | 1,689 | | 1,720 | | 1,890 |

| 6.23% | Sep-2034 | | 1,385 | | 1,438 | | 1,570 |

| 6.28% | Nov-2028 | | 2,861 | | 3,002 | | 3,240 |

| 6.35% | Aug-2032 | | 10,313 | | 10,349 | | 11,562 |

| 6.38% | Jul-2021 | | 5,423 | | 5,458 | | 6,249 |

| 6.39% | Apr-2019 | | 910 | | 913 | | 1,010 |

| | | | | | | | |

| | | | | | | | continued |

18 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

Fannie Mae Securities (39.5% of net assets) continued | | | | |

| | | | | |

| Interest Rate | Maturity Date | Face Amount | Amortized Cost | | Value |

| 6.44% | Apr-2014 | $ | 3,730 | $ | 3,743 | $ | 3,747 |

| 6.52% | May-2029 | | 5,167 | | 5,533 | | 5,880 |

| 6.63% | Jun-2014 - Apr-2019 | | 3,284 | | 3,284 | | 3,531 |

| 6.80% | Jul-2016 | | 315 | | 315 | | 340 |

| 6.85% | Aug-2014 | | 41,050 | | 41,049 | | 41,251 |

| 7.01% | Apr-2031 | | 3,098 | | 3,102 | | 3,427 |

| 7.07% | Feb-2031 | | 15,566 | | 15,705 | | 17,164 |

| 7.18% | Aug-2016 | | 205 | | 205 | | 222 |

| 7.20% | Aug-2029 | | 862 | | 849 | | 866 |

| 7.26% | Dec-2018 | | 7,212 | | 7,382 | | 7,876 |

| 7.50% | Dec-2014 | | 302 | | 302 | | 312 |

| 7.75% | Dec-2024 | | 1,566 | | 1,566 | | 1,656 |

| 8.40% | Jul-2023 | | 394 | | 387 | | 396 |

| 8.50% | Nov-2019 | | 2,555 | | 2,716 | | 3,023 |

| 8.63% | Sep-2028 | | 5,894 | | 5,894 | | 5,924 |

| | | | 1,037,903 | | 1,042,784 | | 1,107,116 |

| Total Fannie Mae Securities | | $ | 1,695,539 | $ | 1,715,662 | $ | 1,784,081 |

Freddie Mac Securities (14.1% of net assets)

| | Interest Rate | Maturity Date | Commitment Amount | Face Amount | Amortized Cost | Value |

| Single Family | 0.47% | 4 | Feb-2036 | $ | - | $ | 4,425 | $ | 4,425 | $ | 4,438 |

| | 0.52% | | Apr-2036 - Jan-2043 | | - | | 23,855 | | 23,868 | | 23,647 |

| | 0.57% | | Aug-2043 | | - | | 10,042 | | 10,033 | | 9,971 |

| | 0.65% | | Oct-2040 | | - | | 10,237 | | 10,226 | | 10,235 |

| | 0.67% | | Oct-2040 - Nov-2040 | | - | | 38,103 | | 37,952 | | 38,074 |

| | 2.35% | | Jun-2033 - Oct-2033 | | - | | 2,705 | | 2,683 | | 2,857 |

| | 2.52% | | Jul-2035 | | - | | 655 | | 653 | | 696 |

| | 3.00% | | Aug-2042 - Jan-2043 | | - | | 120,283 | | 124,162 | 114,094 |

| | 3.50% | | Jan-2026 - Nov-2042 | | - | | 113,351 | | 117,585 | 113,785 |

| | 4.00% | | May-2014 - Jan-2041 | | - | | 62,876 | | 64,616 | | 65,250 |

| | 4.50% | | Mar-2041 | | - | | 40,001 | | 42,588 | | 42,360 |

| | 4.50% | | Aug-2018 - Feb-2042 | | - | | 93,269 | | 98,180 | | 98,820 |

| | 5.00% | | Jan-2019 - Mar-2041 | | - | | 40,063 | | 41,140 | | 42,955 |

| | 5.50% | | Oct-2017 - Jul-2038 | | - | | 16,013 | | 15,925 | | 17,462 |

| | 6.00% | | Mar-2014 - Feb-2038 | | - | | 12,605 | | 12,800 | | 13,909 |

| | 6.50% | | Jan-2014 - Nov-2037 | | - | | 1,852 | | 1,876 | | 2,057 |

| | 7.00% | | Dec-2015 - Mar-2030 | | - | | 102 | | 95 | | 118 |

| | 7.50% | | Aug-2029 - Apr-2031 | | - | | 110 | | 106 | | 129 |

| | 8.00% | | Jul-2015 - Feb-2030 | | - | | 50 | | 47 | | 58 |

| | 8.50% | | Nov-2018 - Jan-2025 | | - | | 124 | | 124 | | 145 |

| | 9.00% | | Mar-2025 | | - | | 97 | | 97 | | 118 |

| | | | | | - | | 590,818 | | 609,181 | 601,178 |

| | | | | | | | | | | |

| | | | | | | | | | | continued |

| | | | | | | | | | | |

A N N U A L R E P O R T 2 0 1 3 19

SCHEDULE OF PORTFOLIO INVESTMENTS December 31, 2013 (dollars in thousands)

Freddie Mac Securities (14.1% of net assets) continued | | | | |

| | | | | |

| | | | Commitment | | | | | | |

| | Interest Rate | Maturity Date | Amount | Face Amount | Amortized Cost | | Value |

Multifamily1 | 5.38% | Dec-2028 | $ | - | $ | 20,000 | $ | 20,004 | $ | 21,432 |

| | 5.42% | Apr-2016 | | - | | 6,906 | | 6,887 | | 7,355 |

| | 5.65% | Apr-2016 | | - | | 4,801 | | 4,808 | | 5,210 |

| | | | | - | | 31,707 | | 31,699 | | 33,997 |

Forward Commitments1 | 2.95% | Aug-2017 | | 2,585 | | - | | (84) | | 59 |

| Total Freddie Mac Securities | | | $ | 2,585 | $ | 622,525 | $ | 640,796 | $ | 635,234 |

Commercial Mortgage-Backed Securities1 (1.7% of net assets) | | |

| | | |

| Issuer | Interest Rate | Maturity Date | Face Amount | Amortized Cost | | Value |

| Nomura | 2.77% | Dec-2045 | $ | 10,000 | $ | 10,198 | $ | 9,297 |

| Deutsche Bank | 2.94% | Jan-2046 | | 19,070 | | 19,620 | | 17,907 |

| Nomura | 3.19% | Mar-2046 | | 20,000 | | 20,526 | | 19,057 |

| JP Morgan | 3.48% | Jun-2045 | | 10,000 | | 10,543 | | 9,938 |

| Deutsche Bank | 5.00% | Nov-2046 | | 18,990 | | 19,504 | | 20,948 |

| Total Commercial Mortgage-Backed Securities | | $ | 78,060 | $ | 80,391 | $ | 77,147 |

Other Multifamily Investments (2.1% of net assets)

| | Interest Rates4 | | Commitment | | | | | | |

| Issuer | Permanent | Construction | Maturity Date | Amount | Face Amount | Amortized Cost | | Value |

Direct Loans1 | | | | | | | | | | | |

| Amalgamated Warbasse | 2.40% | - | Mar-2015 | $ | 7,590 | $ | 7,590 | $ | 7,590 | $ | 7,584 |

| Amalgamated Warbasse | 2.40% | - | Mar-2015 | | 81,410 | | 48,371 | | 48,371 | | 48,301 |

| Fifth Housing Company, Inc. | 2.70% | - | May-2014 | | 4,500 | | 2,404 | | 2,415 | | 2,400 |

| First Housing Company, Inc. | 2.70% | - | May-2014 | | 8,960 | | 6,081 | | 6,103 | | 6,073 |

| Fourth Housing Company, Inc. | 2.70% | - | May-2014 | | 9,630 | | 5,720 | | 5,744 | | 5,711 |

| Second Housing Company, Inc. | 2.70% | - | May-2014 | | 10,800 | | 5,083 | | 5,110 | | 5,074 |

| Third Housing Company, Inc. | 2.70% | - | May-2014 | | 15,110 | | 9,046 | | 9,083 | | 9,032 |

| | | | | | 138,000 | | 84,295 | | 84,416 | | 84,175 |

| | | | | | | | | | | |

Privately Insured Construction/Permanent Mortgages1,5 | | | | | | | | | | |

| IL Housing Development Authority | 5.40% | 5.40% | Mar-2047 | | 9,000 | | 8,484 | | 8,486 | | 7,817 |

| IL Housing Development Authority | 6.20% | - | Dec-2047 | | 3,325 | | 3,187 | | 3,202 | | 2,999 |

| IL Housing Development Authority | 6.40% | 6.40% | Nov-2048 | | 993 | | 960 | | 973 | | 894 |

| | | | | | 13,318 | | 12,631 | | 12,661 | | 11,710 |

| Total Other Multifamily Investments | | | | $ | 151,318 | $ | 96,926 | $ | 97,077 | $ | 95,885 |

20 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

State Housing Finance Agency Securities (5.7% of net assets)

| | | Interest Rates4 | | | Commitment | | | | | | |

| | Issuer | Permanent | Construction | Maturity Date | | Amount | Face Amount | Amortized Cost | | Value |

Multifamily1 | MassHousing | - | 3.25% | Oct-2015 | 6 | $ | 21,050 | $ | 15,555 | $ | 15,549 | $ | 16,069 |

| | MassHousing | - | 3.45% | Oct-2017 | 6 | | 52,543 | | 15,860 | | 15,592 | | 15,834 |

| | MassHousing | - | 3.50% | Oct-2015 | 6 | | 12,435 | | 8,795 | | 8,789 | | 8,784 |

| | MassHousing | - | 3.83% | Apr-2015 | 6 | | 5,000 | | 5,000 | | 4,982 | | 5,007 |

| | MassHousing | - | 3.98% | Apr-2015 | 6 | | 4,915 | | 4,915 | | 4,897 | | 4,915 |

| | MassHousing | - | 4.30% | Jun-2015 | 6 | | 34,700 | | 16,500 | | 16,500 | | 16,505 |

| | MassHousing | 4.00% | - | Dec-2028 | | | - | | 5,000 | | 5,103 | | 4,809 |

| | NYC Housing Development Corp | 4.04% | - | Nov-2032 | | | - | | 1,305 | | 1,305 | | 1,152 |

| | MassHousing | 4.13% | - | Dec-2036 | | | - | | 5,000 | | 5,000 | | 4,467 |

| | MassHousing | 4.20% | - | Dec-2039 | | | - | | 8,305 | | 8,305 | | 7,257 |

| | NYC Housing Development Corp | 4.25% | - | Nov-2025 | | | - | | 1,150 | | 1,150 | | 1,170 |

| | NYC Housing Development Corp | 4.29% | - | Nov-2037 | | | - | | 1,190 | | 1,190 | | 1,039 |

| | NYC Housing Development Corp | 4.40% | - | Nov-2024 | | | - | | 4,120 | | 4,120 | | 4,232 |

| | NYC Housing Development Corp | 4.44% | - | Nov-2041 | | | - | | 1,120 | | 1,120 | | 979 |

| | NYC Housing Development Corp | 4.49% | - | Nov-2044 | | | - | | 1,000 | | 1,000 | | 870 |

| | NYC Housing Development Corp | 4.50% | - | Nov-2030 | | | - | | 1,680 | | 1,682 | | 1,712 |

| | MassHousing | 4.50% | - | Jun-2056 | | | - | | 45,000 | | 45,000 | | 40,188 |

| | NYC Housing Development Corp | 4.60% | - | Nov-2030 | | | - | | 4,665 | | 4,665 | | 4,693 |

| | NYC Housing Development Corp | 4.70% | - | Nov-2035 | | | - | | 1,685 | | 1,685 | | 1,642 |

| | NYC Housing Development Corp | 4.78% | - | Aug-2026 | | | - | | 12,500 | | 12,505 | | 12,004 |

| | NYC Housing Development Corp | 4.80% | - | Nov-2040 | | | - | | 2,860 | | 2,862 | | 2,798 |

| | NYC Housing Development Corp | 4.90% | - | Nov-2034 - Nov-2041 | | | - | | 8,800 | | 8,800 | | 8,590 |

| | NYC Housing Development Corp | 4.95% | - | Nov-2039 - May-2047 | | | - | | 13,680 | | 13,682 | | 13,599 |

| | MassHousing | 5.55% | - | Nov-2039 | | | - | | 5,000 | | 4,980 | | 5,106 |

| | MassHousing | 5.69% | - | Nov-2018 | | | - | | 4,440 | | 4,443 | | 4,869 |

| | MassHousing | 5.70% | - | Jun-2040 | | | - | | 14,010 | | 14,013 | | 14,147 |

| | NYC Housing Development Corp | 5.92% | - | Dec-2037 | | | - | | 6,145 | | 6,149 | | 6,184 |

| | MassHousing | 6.42% | - | Nov-2039 | | | - | | 22,000 | | 22,000 | | 23,232 |

| | MassHousing | 6.50% | - | Dec-2039 | | | - | | 720 | | 724 | | 704 |

| | MassHousing | 6.58% | - | Dec-2039 | | | - | | 11,385 | | 11,388 | | 11,433 |

| | MassHousing | 6.70% | - | Jun-2040 | | | - | | 11,410 | | 11,410 | | 11,149 |

| Total State Housing Finance Agency Securities | | | | | $ | 130,643 | $ | 260,795 | $ | 260,590 | $ | 255,139 |

A N N U A L R E P O R T 2 0 1 3 21

SCHEDULE OF PORTFOLIO INVESTMENTS December 31, 2013 (dollars in thousands) | | | | |

| | | | | |

United States Treasury Securities (6.3% of net assets) | | | | |

| Interest Rate | Maturity Date | Face Amount | Amortized Cost | | Value |

| 0.63% | Nov-2017 | $ | 20,000 | $ | 19,957 | $ | 19,500 |

| 0.75% | Dec-2017 - Feb-2018 | | 30,000 | | 29,907 | | 29,293 |

| 0.88% | Jan-2018 | | 45,000 | | 45,023 | | 44,142 |

| 1.38% | Jul-2018 | | 15,000 | | 14,882 | | 14,866 |

| 1.38% | Sep-2018 | | 45,000 | | 45,042 | | 44,450 |

| 1.50% | Dec-2018 | | 20,000 | | 19,789 | | 19,775 |

| 2.13% | Aug-2021 | | 35,000 | | 35,155 | | 33,905 |

| 2.75% | Nov-2023 | | 20,000 | | 19,612 | | 19,565 |

| 3.13% | May-2021 | | 40,000 | | 41,790 | | 41,697 |

| 3.75% | Aug-2041 | | 20,000 | | 21,802 | | 19,497 |

| Total United States Treasury Securities | | $ | 290,000 | $ | 292,959 | $ | 286,690 |

| | | | | | | | |

| Total Fixed-Income Investments | | $ | 4,378,705 | $ | 4,439,908 | $ | 4,469,463 |

Equity Investment in Wholly Owned Subsidiary (less than 0.1% of net assets)

| | | | | Amount of Dividends | | |

| Issuer | Number of Shares | Face Amount (Cost) | or Interest | | | Value |

Building America CDE, Inc.7 | 1,000 | $ | 1 | $ | - | $ | (259) |

| Total Equity Investment | 1,000 | $ | 1 | $ | - | $ | (259) |

Short-Term Investments (1.0% of net assets)

| | Issuer | Interest Rate | Maturity Date | Face Amount | Amortized Cost | | Value |

| | Blackrock Federal Funds 30 | 0.01% | January 2, 2014 | $ | 44,129 | $ | 44,129 | $ | 44,129 |

| | Total Short-Term Investments | | | $ | 44,129 | $ | 44,129 | $ | 44,129 |

| | | | | | | | | | |

| | Total Investments | | | $ | 4,422,835 | $ | 4,484,038 | $ | 4,513,333 |

1 Valued by the HIT’s management in accordance with the fair value procedures adopted by the HIT’s Board of Trustees.

2 Tax-exempt bonds collateralized by Ginnie Mae securities.

3 Construction interest rates are the rates charged to the borrower during the construction phase of the project. The permanent interest rates are charged to the borrower during the amortization period of the loan, unless the U.S. Department of Housing and Urban Development requires that such rates be charged earlier.

4 The coupon rate shown on floating or adjustable rate securities represents the rate at period end.

5 Loans insured by Ambac Assurance Corporation, which are additionally backed by a repurchase option from the mortgagee for the benefit of the HIT. The repurchase price is defined as the unpaid principal balance of the loan plus all accrued unpaid interest due through the remittance date. The repurchase option can be exercised by the HIT in the event of a payment failure by Ambac Assurance Corporation.

6 Securities exempt from registration under the Securities Act of 1933. The construction loan notes were privately placed directly by MassHousing (a not-for-profit public agency) with the HIT. The notes are for construction only and will mature on or prior to October 1, 2017. The notes are backed by mortgages and are general obligations of MassHousing, therefore secured by the full faith and credit of MassHousing. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities are considered liquid, under procedures established by and under the general supervsion of the HIT’s Board of Trustees.

7 The HIT holds the shares of Building America CDE, Inc., a wholly owned subsidiary of the HIT. Building America is a Community Development Entity, certified by the Community Development Financial Institutions Fund of the U.S. Department of Treasury, which can facilitate the generation of investments for the HIT or parties other than the HIT. The fair value of the HIT’s investment in Building America approximates its carrying value.

See accompanying Notes to Financial Statements.

22 �� A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

Statement of Operations

For the Year Ended December 31, 2013 (dollars in thousands)

| Investment income | $ | 158,334 |

| | | |

| | | |

| Expenses | | |

| Non-officer salaries and fringe benefits | | 9,071 |

| Officer salaries and fringe benefits | | 4,514 |

| Investment management | | 988 |

| Marketing and sales promotion (12b-1) | | 847 |

| Legal fees | | 588 |

| Consulting fees | | 577 |

| Auditing, tax and accounting fees | | 455 |

| Insurance | | 356 |

| Trustee expenses | | 43 |

| Rental expenses | | 1,017 |

| General expenses | | 1,537 |

| Total expenses | | 19,993 |

| | | |

| Net investment income | | 138,341 |

| Net realized loss on investments | | (2,953) |

| Net change in unrealized depreciation on investments | | (246,928) |

| Net realized and unrealized loss on investments | | (249,881) |

| | | |

| Net decrease in net assets resulting from operations | $ | (111,540) |

See accompanying Notes to Financial Statements.

A N N U A L R E P O R T 2 0 1 3 23

Statements of Changes in Net Assets | | | | |

| For the Years Ended December 31, 2013 and 2012 (dollars in thousands) | | | | |

| | | | | |

| | | | | |

| Increase (decrease) in net assets from operations | | 2013 | | 2012 |

| Net investment income | $ | 138,341 | $ | 145,219 |

| Net realized gain (loss) on investments | | (2,953) | | 38,253 |

| Net change in unrealized appreciation (deprecation) on investments | | (246,928) | | 1,570 |

| Net increase (decrease) in net assets resulting from operations | | (111,540) | | 185,042 |

| | | | | |

| Decrease in net assets from distributions | | | | |

| Distributions to participants or reinvested from: | | | | |

| Net investment income | | (147,330) | | (153,392) |

| Net realized gains on investments | | (28) | | (29,525) |

| Net decrease in net assets from distributions | | (147,358) | | (182,917) |

| | | | | |

| Increase (decrease) in net assets from unit transactions | | | | |

| Proceeds from the sale of units of participation | | 298,322 | | 259,267 |

| Dividend reinvestment of units of participation | | 133,120 | | 164,956 |

| Payments for redemption of units of participation | | (232,978) | | (113,184) |

| Net increase from unit transactions | | 198,464 | | 311,039 |

| | | | | |

| Total increase (decrease) in net assets | | (60,434) | | 313,164 |

| | | | | |

| Net assets | | | | |

| Beginning of period | $ | 4,575,635 | $ | 4,262,471 |

| End of period | $ | 4,515,201 | $ | 4,575,635 |

| | | | | |

| | | | | |

| Distribution in excess of net investment income | $ | (2,789) | $ | (2,828) |

| | | | | |

| Unit information | | | | |

| Units sold | | 259,710 | | 220,270 |

| Distributions reinvested | | 117,425 | | 140,088 |

| Units redeemed | | (206,779) | | (96,091) |

| Increase in units outstanding | | 170,356 | | 264,267 |

See accompanying Notes to Financial Statements.

24 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

Notes to Financial Statements

Note 1. Summary of Significant Accounting Policies

The American Federation of Labor and Congress of Industrial Organizations (AFL- CIO) Housing Investment Trust (HIT) is a common law trust created under the laws of the District of Columbia and is registered under the Investment Company Act of 1940, as amended (the Investment Company Act), as a no-load, open-end investment company. The HIT has obtained certain exemptions from the requirements of the Investment Company Act that are described in the HIT’s Prospectus and Statement of Additional Information.

Participation in the HIT is limited to eligible pension plans and labor organizations, including health and welfare, general, and other funds, that have beneficiaries who are represented by labor organizations.

The following is a summary of significant accounting policies followed by the HIT in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles (GAAP) in the United States.

INVESTMENT VALUATION

Net asset value per share (NAV) is calculated as of the close of business of the major bond markets in New York City on the last business day of each month. A description of the valuation techniques applied to the HIT’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Portfolio securities for which market quotations are readily available (for example, U.S. Treasury securities, government-sponsored enterprise debt securities, single family mortgage-backed securities, and state housing finance agency securities) are valued by using independent pricing services, published prices, market quotes, and bids from dealers who make markets in such securities. For U.S. Treasury securities, pricing services generally base prices on actual transactions as well as dealer supplied prices. For government-sponsored enterprise securities and single family mortgage-backed securities, pricing services generally base prices on discounted cash flow models and examine reference data such as issue name, issue size, ratings, maturity, call type, spread/benchmark yields, and conditional prepayment rates, as well as dealer supplied prices. For state housing finance agency securities, pricing services generally base prices on trading spreads, new issue scales, verified bid information, and credit ratings.

Portfolio investments for which market quotations are not readily available (for example, multifamily mortgage-backed securities, and construction mortgage securities and loans) are valued at their fair value determined in good faith under consistently applied procedures adopted by the HIT’s Board of Trustees using dealer quotes and discounted cash flow models. The respective cash flow models utilize inputs from matrix pricing which consider observable market-based discount and prepayment rates, attributes of the collateral, and yield or price of bonds of comparable quality, coupon, maturity, and type. The market-based discount rate is composed of a risk-free yield (i.e., a U.S. Treasury note) adjusted for an appropriate risk premium. The risk premium reflects premiums in the marketplace over the yield on U.S. Treasury securities of comparable risk and average life to the investment being valued as adjusted for other market considerations, such as significant market or security specific events, changes in interest rates, and credit quality. On investments for which the HIT finances the construction and permanent securities or participation interests, value is determined based upon the total amount, funded and/or unfunded, of the commitment. The HIT has also retained an independent firm to determine the fair market value of securities for which market quotations are not readily available. In accordance with the procedures adopted by the HIT’s Board of Trustees, the monthly third-party valuation is reviewed by the HIT staff to determine whether valuation adjustments would be appropriate based on any material impact on value arising from specific facts and circumstances of the investment (e.g., prepayment speed). All such proposed adjustments must be reviewed and approved by the independent valuation firm prior to incorporation in the NAV.

Commercial mortgage-backed securities are valued using dealer quotes and a discounted cash flow model and/or independent pricing services. Pricing services generally base prices on a single cash flow model, determine a benchmark yield, and utilize available trade information, dealer quotes, and market color.

Real estate mortgage investment conduits are valued using a dealer quote and/or independent pricing services. Pricing services generally base prices on a single cash flow model or an option-adjusted spread model, determine a benchmark yield, and utilize available trade information, dealer quotes, market color, and prepayment speeds.

The HIT holds the shares of Building America CDE, Inc. (Building America), a wholly owned subsidiary of the HIT. The shares of Building America are valued at their fair value determined in good faith under consistently applied procedures adopted by the HIT’s Board of Trustees, which approximates Building America’s carrying value.

Investments in registered open-end investment management companies are valued based upon the NAVs of such investments.

Short-term investments having a maturity of 60 days or less are generally valued at amortized cost which approximates fair market value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. The HIT classifies its assets and liabilities into three levels based on the method used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities, interest rates, prepayment speeds, credit risk, and quoted prices in inactive markets. Level 3 values are based on significant unobservable inputs that reflect the HIT’s determination of assumptions that market participants might reasonably use in valuing the securities.

The following table presents the HIT’s valuation levels as of December 31, 2013:

Investment Securities ($ in thousands)

| | Level 1 | | Level 2 | Level 3 | | Total |

| FHA Permanent Securities | $ | - | $ | 150,405 | $ | 15 | $ | 150,420 |

| Ginnie Mae Securities | | - | | 1,112,264 | | - | | 1,112,264 |

| Ginnie Mae Construction Securities | | - | | 72,582 | | - | | 72,582 |

| Fannie Mae Securities | | - | | 1,784,081 | | - | | 1,784,081 |

| Freddie Mac Securities | | - | | 635,175 | | - | | 635,175 |

| Commercial Mortgage-Backed Securities | | - | | 77,147 | | - | | 77,147 |

| State Housing Finance Agency Securities | | - | | 255,139 | | - | | 255,139 |

| Other Multifamily Investments | | - | | 11,710 | | 84,175 | | 95,885 |

| United States Treasury Securities | | - | | 286,690 | | - | | 286,690 |

| Equity Investments | | - | | - | | (259) | | (259) |

| Short-Term Investments | | 44,129 | | - | | - | | 44,129 |

| Other Financial Instruments* | | - | | 80 | | - | | 80 |

| Total | $ | 44,129 | $ | 4,385,273 | $ | 83,931 | $ | 4,513,333 |

*Other financial instruments include forward commitments, when issued securities, and TBA securities.

A N N U A L R E P O R T 2 0 1 3 25

Notes to Financial Statements

The following table reconciles the valuation of the HIT’s Level 3 investment securities and related transactions for the year ended December 31, 2013.

Investments in Securities ($ in thousands)

| | | Other | | | | |

| | FHA Permanent | Multifamly | Equity | | |

| ($ in thousands) | Securities | Investments | Investment | | Total |

| Beginning Balance, 12/31/2012 | $ 17 | $ | - | $ | (68) | $ | (51) |

| Transfers into Level 3* | - | | 25,324 | | - | $ | 25,324 |

| Cost of Purchases | - | | 58,951 | | - | $ | 58,951 |

| Total Unrealized Gain (Loss)** | - | | (100) | | (191) | $ | (291) |

| Paydowns | (2) | | - | | - | $ | (2) |

| Ending Balance, 12/31/2013 | $ 15 | $ | 84,175 | $ | (259) | $ | 83,931 |

* Transferred from Level 2 to Level 3 because of a lack of observable market data for direct loans.

**Net change in unrealized gain (loss) attributable to Level 3 securities held at December 31, 2013, totaled ($291,000) and is included on the accompanying Statement of Operations.

The HIT’s policy is to recognize transfers between levels as of the beginning of the reporting period. Level 3 investments in securities are not considered a significant portion of the HIT’s portfolio.

Level 3 securities primarily consist of seven direct loans which were valued, in accordance with the Trust’s valuation policies, near par at December 31, 2013, due to: notification of prepayment on two loans and remaining maturities of less than five months as of December 31, 2013, on the other five loans; coupon rates in the range of 2.40%-2.70%; and low loan-to-value estimates.

USE OF ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

FEDERAL INCOME TAXES

The HIT’s policy is to comply with the requirements of the Internal Revenue Code of 1986, as amended (the Internal Revenue Code), that are applicable to regulated investment companies, and to distribute all of its taxable income to its participants. Therefore, no federal income tax provision is required.

Tax positions taken or expected to be taken in the course of preparing the HIT’s tax returns are evaluated to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Management has analyzed for all open years the HIT’s tax positions taken on federal income tax returns and has concluded that no provision for income tax is required in the HIT’s financial statements.

The HIT files U.S. federal, state, and local tax returns as required. The HIT’s tax returns are subject to examination by the relevant tax authorities until the expiration of the applicable statutes of limitations, which is generally three years after the filing of the tax return but could be longer in certain circumstances.

DISTRIBUTIONS TO PARTICIPANTS

At the end of each calendar month, a pro-rata distribution is made to participants of the net investment income earned during the month. This pro-rata distribution is based on the participant’s number of units held as of the immediately preceding month-end and excludes realized gains (losses) which are distributed at year-end.

Participants redeeming their investments are paid their pro-rata share of undistributed net income accrued through the month-end of the month in which they redeem.

The HIT offers an income reinvestment plan that permits current participants automatically to reinvest their income distributions into HIT units of participation. Total reinvestment was approximately 90% of distributed income for the year ended December 31, 2013.

INVESTMENT TRANSACTIONS AND INCOME

For financial reporting purposes, security transactions are accounted for as of the trade date. Gains and losses on securities sold are determined on the basis of amortized cost. Realized gains (losses) on paydowns of mortgage-and asset-backed securities are classified as interest income. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned.

12b-1 PLAN OF DISTRIBUTION

The HIT’s Board of Trustees annually considers a Plan of Distribution under Rule 12b-1 under the Investment Company Act to pay for marketing and sales promotion expenses incurred in connection with the offer and sale of units and related distribution activities (12b-1 expenses). For the year ended December 31, 2013, the HIT was authorized to pay 12b-1 expenses in an annual amount up to $600,000 or 0.05% of its average monthly net assets, whichever is greater. During the year ended December 31, 2013, the HIT incurred approximately $846,500 in 12b-1 expenses.

Note 2. Investment Risks

INTEREST RATE RISK

As with any fixed -income investment, the market value of the HIT’s investments will fall below the principal amount of those investments at times when market interest rates rise above the interest rates of the investments. Rising interest rates may also reduce prepayment rates, causing the average life of the HIT’s investments to increase. This could in turn further reduce the value of the HIT’s portfolio.

PREPAYMENT AND EXTENSION RISK

The HIT invests in certain fixed-income securities whose value is derived from an underlying pool of mortgage loans that are subject to prepayment and extension risk.

Prepayment risk is the risk that a security will pay more quickly than its assumed payment rate, shortening its expected average life. In such an event, the HIT may be required to reinvest the proceeds of such prepayments in other investments bearing lower interest rates. The majority of the HIT’s securities backed by loans for multifamily projects include restrictions on prepayments for specified periods to mitigate this risk.

Extension risk is the risk that a security will pay more slowly than its assumed payment rate, extending its expected average life. When this occurs, the HIT’s ability to reinvest principal repayments in higher returning investments may be limited.

These two risks may increase the sensitivity of the HIT’s portfolio to fluctuations in interest rates and negatively affect the value of the HIT’s portfolio.

26 A F L - C I O H O U S I N G I N V E S T M E N T T R U S T

Notes to Financial Statements

Note 3. Transactions with Related Entities

Building America is a Community Development Entity, certified by the Community Development Financial Institutions Fund (CDFI Fund) of the U.S. Department of the Treasury, which can facilitate the generation of investments for the HIT or parties other than the HIT. Building America is accounted for as an investment of the HIT.

The New Markets Tax Credit (NMTC) program1, which is run by the CDFI Fund, provides tax credits to equity investors that invest in businesses operating in low-income areas, including those that engage in the creation of housing and other construction activities. As of December 31, 2013, Building America had committed or prefunded all of its $50 million in NMTC awards from the 2011 allocation round to qualified transactions. Building America receives fees for committing NMTCs to such qualified transactions and ongoing asset management fees on closed transactions. Building America committed to or prefunded two qualified transactions in 2013, none of which obligates the assets of the HIT.

Summarized financial information for Building America on a historical cost basis is included in the table below:

| | $ in Thousands |

| As of December 31, 2013 | | |

| Assets | $ | 435 |

| Liabilities | $ | 642 |

| Equity | $ | (207) |

| For the year ended December 31, 2013 | | |

| Income | $ | 923 |

| Expenses | | (1,112) |

| Tax Benefit | | 52 |

| Net Loss | $ | (137) |

A rollforward of advances to Building America by the HIT as of December 31, 2013, is included in the table below:

| Advances to Building America by HIT | $ in Thousands |

| Beginning Balance, 12/31/2012 | $ | 546 |

| Advances in 2013 | | 1,133 |

| Repayment by Building America in 2013 | | (1,190) |

| Ending Balance, 12/31/2013 | $ | 489 |

1The NMTC Program, enacted by Congress as part of the Community Renewal Tax Relief Act of 2000, is incorporated as section 45D of the Internal Revenue Code.

Note 4. Commitments

The HIT invests in securities originated under forward commitments, in which the HIT agrees to purchase an investment either in or backed by mortgage loans that have not yet closed and will be delivered in the future. The HIT agrees to an interest rate and purchase price for these securities when the commitment to purchase is originated.

Certain assets of the HIT are invested in liquid investments until they are required to fund these purchase commitments. As of December 31, 2013, the HIT had outstanding unfunded purchase commitments of approximately $151.1 million. The HIT maintains a reserve, in the form of securities, of no less than the total of the outstanding unfunded purchase commitments, less short-term investments. As of December 31, 2013, the value of the publicly traded securities maintained for the reserve in a segregated account was approximately $4.3 billion.