Board of Trustees

Overall responsibility for the management of the AFL-CIO Housing Investment Trust, the establishment of policies and the oversight of activities is vested in its Board of Trustees. The list below provides the following information for each of the Trustees: name, age, address, term of Office, length of time served, principal occupations during the past five years and other directorships held.* The Trust’s Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request, by placing a collect call directed to the Trust’s Investor Relations Office at (202) 331-8055.

Richard Ravitch**, age 74; 610 5th Avenue, Ste. 420, New York, NY 10020; Chairman of the Board; term commenced 1991, expires 2008; Principal, Ravitch Rice & Co. LLC; Director, Parsons, Brinckerhoff Inc.; formerly Co-Chair, Millennial Housing Commission; President and Chief Executive Officer, Player Relations Committee of Major League Baseball.

John J. Sweeney**, age 73; 815 16th Street, NW, Washington, DC 20006; Union Trustee; term commenced 1981, expires 2010; President, AFL-CIO.

Richard L. Trumka, age 58; 815 16th Street, NW, Washington, DC 20006; Union Trustee; term commenced 1995, expires 2008; Secretary-Treasurer, AFL-CIO.

John J. Flynn, age 73; 1776 Eye Street, NW, Washington, DC 20006; Union Trustee; term commenced 2000, expires 2009; President, International Union of Bricklayers and Allied Craftworkers (BAC).

Stephen Frank, age 67; 8584 Via Avellino, Lake Worth, FL 33467; Management Trustee; term commenced 2003, expires 2009; Retired; formerly Vice President and Chief Financial Officer, The Small Business Funding Corporation.

Frank Hurt, age 68; 10401 Connecticut Avenue, Kensington, MD 20895; Union Trustee; term commenced 1993, expires 2010; International President, Bakery, Confectionery & Tobacco Workers and Grain Millers International Union.

George Latimer, age 72; 1600 Grand Avenue, St. Paul, MN 55105; Management Trustee; term commenced 1996, expires 2008; Distinguished Visiting Professor of Urban Land Studies at Macalester College; Director, Identix Incorporated; formerly Director, Special Actions Office, Department of Housing and Urban Development.

Jack Quinn, age 56; 700 13th Street, NW, Suite 400, Washington, DC 20005; Management Trustee; term commenced 2005, expires 2008; President, Cassidy & Associates; Director, Kaiser Aluminum Corporation; formerly Member of Congress, 27th District, New York.

Marlyn J. Spear, CFA, age 54; 500 Elm Grove Road, Elm Grove, WI 53122; Management Trustee; term commenced 1995, expires 2009; Chief Investment Officer, Building Trades United Pension Trust Fund (Milwaukee and Vicinity).

Tony Stanley**, age 74; 2221 Stonehaven Road, Port St. Lucie, FL 34952; Management Trustee; term commenced 1983, expires 2010; Director, TransCon Builders, Inc.; formerly Executive Vice President, TransCon Builders, Inc.

Jon F. Walters, age 65; 900 7th Street, NW, Washington, DC 20001; Union Trustee; term commenced 2005, expires 2009; International Secretary-Treasurer, International Brotherhood of Electrical Workers (IBEW); formerly International Vice President, IBEW.

James A. Williams, age 57; 1750 New York Avenue, NW, Washington, DC 20006; Union Trustee; term commenced 2005, expires 2008; General President, International Union of Painters and Allied Trades of the United States and Canada (IUPAT); formerly General Secretary-Treasurer, IUPAT.

Newly Appointed Trustees

At the November meeting of the Board of Trustees, the Union Trustees of the Board elected the following individuals to serve as Trustees, effective as of the date of the first Board meeting in 2008, to serve out the unexpired terms of Linda Chavez-Thompson and Edward C. Sullivan, who resigned their positions as Union Trustees in 2007:

Arlene Holt Baker, age 56; 815 16th Street, NW, Washington, DC 20006; Union Trustee; term to commence 2008, expires 2008, Executive Vice-President, AFL-CIO; formerly President, Voices for Working Families and Executive Assistant to the President, AFL-CIO.

Mark Ayers, age 59; 815 16th Street, NW, Suite 600, Washington, DC 20006; Union Trustee; term to commence 2008, expires 2009; President, Building and Construction Trades Department, AFL-CIO; formerly Director, IBEW Construction & Maintenance Division.

* Only directorships in a corporation or trust having securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, or subject to the requirements of Section 15(d) of such Act or a company registered as an investment company under the Investment Company Act of 1940, as amended, are listed.

** Executive Committee member.

Leadership

All Officers of the Trust are located at 2401 Pennsylvania Avenue, NW, Suite 200, Washington, DC 20037.*

Stephen Coyle,† age 62; Chief Executive Officer, AFL-CIO Housing Investment Trust since 1992.

Helen R. Kanovsky,† age 56; Chief Operating Officer, AFL-CIO Housing Investment Trust since 2002; formerly Chief Operating Officer, AFL-CIO Investment Trust Corporation; Executive Vice President – Finance and Administration, AFL-CIO Housing Investment Trust; Chief of Staff for U.S. Senator John F. Kerry; General Counsel, AFL-CIO Housing Investment Trust.

Erica Khatchadourian,† age 40; Chief Financial Officer (position formerly titled Executive Vice President – Finance and Administration), AFL-CIO Housing Investment Trust since 2001; formerly Controller, Chief of Staff and Director of Operations, AFL-CIO Housing Investment Trust.

Chang Suh,† CFA, age 36; Executive Vice President and Chief Portfolio Manager, AFL-CIO Housing Investment Trust since January 2005; formerly Chief Portfolio Manager, Assistant Portfolio Manager and Senior Portfolio Analyst, AFL-CIO Housing Investment Trust.

Mary C. Moynihan,† age 48; General Counsel, AFL-CIO Housing Investment Trust since April 2004; formerly Chief Counsel and Deputy General Counsel, AFL-CIO Housing Investment Trust; Associate Specialist, Sullivan & Cromwell.

Stephanie H. Wiggins,† age 42; Chief Investment Officer – Multifamily Finance, AFL-CIO Housing Investment Trust since 2001; formerly Director, Prudential Mortgage Capital Company; Vice President/Multifamily Transaction Manager, WMF Capital Corporation.

Marcie Cohen, age 60; Senior Vice President, AFL-CIO Housing Investment Trust since 2002; formerly Director of the New York Office, 2002-2004; Director of Development, AFL-CIO Housing Investment Trust.

Harpreet Peleg,† age 34; Controller, AFL-CIO Housing Investment Trust since 2005; formerly Chief Financial Officer, AFL-CIO Investment Trust Corporation; Supervisor – Gas Settlements, PG&E National Energy Group; Financial Analyst, Goldman Sachs & Co.

Lesyllee White, age 45; Director of Marketing, AFL-CIO Housing Investment Trust since 2004; formerly Regional Marketing Director and Senior Marketing Associate, AFL-CIO Housing Investment Trust.

Christopher Kaiser,† age 43; Associate General Counsel (since February 2007) and Chief Compliance Officer (since June 2007), AFL-CIO Housing Investment Trust; formerly Branch Chief, Division of Investment Management, U.S. Securities and Exchange Commission.

* No officer of the Trust serves as a trustee or director in any corporation or trust having securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended, or subject to the requirements of Section 15(d) of such Act, or any company registered as an investment company under the Investment Company Act of 1940, as amended.

†Board-appointed officer. These officers are appointed annually to a term expiring December 31 of the year appointed, or until their respective successors are appointed and qualify.

| | |

32 | AFL- CIO HOUSING INVESTMENT TRUST | |

Corporate Counsel

Bingham McCutchen LLP

Washington, DC

Securities Counsel

Wilmer Cutler Pickering Hale and Dorr LLP

Washington, DC

Independent Registered Public Accounting Firm

Ernst & Young LLP

McLean, Virginia

Transfer Agent

PFPC Inc.

Wilmington, Delaware

Custodian

PFPC Trust Company

Philadelphia, Pennsylvania

National Office

2401 Pennsylvania Avenue, NW, Suite 200

Washington, DC 20037

(202) 331-8055

New York City Office

Carol Nixon, Director

1270 Avenue of the Americas, Suite 210

New York, New York 10020

(212) 554-2750

San Francisco Office

David Landenwitch, Acting Director

235 Montgomery Street, Suite 1001

San Francisco, California 94104

(415) 433-3044

Boston Office

Paul Barrett, Director

655 Summer Street

Boston, Massachusetts 02210

(617) 261-4444

Gulf Coast Revitalization Program

1100 Poydras Street, Suite 2870

New Orleans, Louisiana 70163

(504) 599-8750

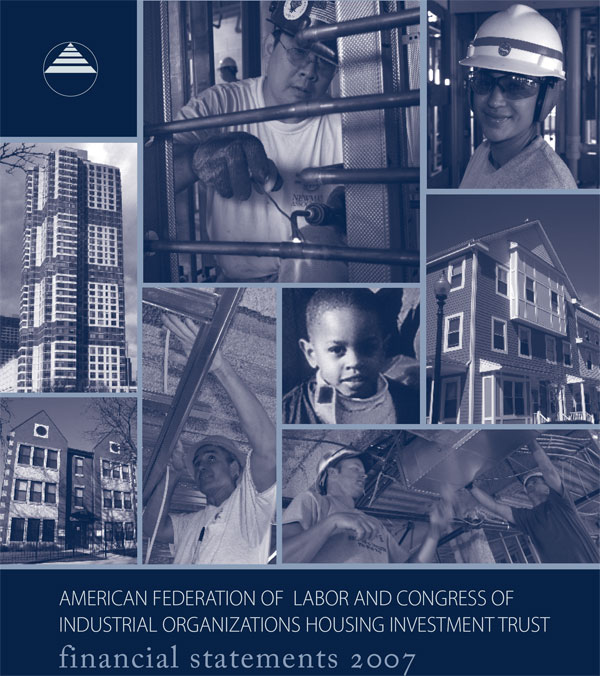

On the Front Cover

| |

1: | Mark Nguyen

Plumbers and Gas Fitters, Local 12 |

| |

2: | Jennifer Carillo

Carpenters, Local 218 |

| |

3: | Maverick Landing

East Boston, MA |

| |

4: | Resident at Woodland Springs

District Heights, MD |

| |

5: | Joe White

Electricians, Local 103 |

| |

6: | Columbus Tower

Jersey City, NJ |

| |

7: | Hearts United

Chicago, IL |

| |

8: | Stephen Pike, Dede Gjoni

Sheet Metal Workers, Local 17 |

AFL-CIO Housing Investment Trust

2401 Pennsylvania Avenue, NW

Suite 200

Washington, DC 20037

Phone: 202-331-8055

www.aflcio-hit.com

Item 2. Code of Ethics.

| | | |

| (a) | The Trust has adopted a Code of Ethics to comply with Section 406 of the Sarbanes-Oxley Act of 2002, as of December 31, 2006. This Code of Ethics applies to the Trust’s principal executive officer, principal financial officer, and principal accounting officer or controller or persons performing similar functions. |

| | | |

| (b) | For purposes of this Item, the term “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote: |

| | | |

| | (1) | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | | |

| | (2) | Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant; |

| | | |

| | (3) | Compliance with applicable governmental laws, rules, and regulations; |

| | | |

| | (4) | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

| | | |

| | (5) | Accountability for adherence to the code. |

| | | |

| (c) | There have been no amendments granted to the Trust’s Code of Ethics during the period covered by the Report. |

| | | |

| (d) | There have been no waivers granted from any provision of the Trust’s Code of Ethics during the period covered by the Report. |

| | | |

| (e) | Not applicable. |

| | | |

| (f) | (1) | A copy of the Trust’s Code of Ethics is filed herewith as an Exhibit pursuant to Item 12(a)(1). |

Item 3. Audit Committee Financial Expert.

| | | |

| (a) | (1) | The Trust’s Board of Trustees has determined that it has two audit committee financial experts serving on its audit committee, Marlyn Spear and Stephen Frank. |

| | | |

| | (2) | Ms. Spear and Mr. Frank are both are independent for purposes of this Item 3. |

Item 4. Principal Accountant Fees and Services.

| | |

| (a) | Audit fees. |

| | |

| | The aggregate fees billed for services provided to the Registrant by its independent auditors for the audit of the Registrant’s annual financial statements and for services normally provided by the independent auditors in connection |

| | |

| | with statutory and regulatory filings or engagements were $261,000 for the fiscal year ended December 31, 2007. |

| | |

| | The aggregate fees billed for services provided to the Registrant by its independent auditors for the audit of the Registrant’s annual financial statements and for services normally provided by the independent auditors in connection with statutory and regulatory filings or engagements were $232,000 for the fiscal year ended December 31, 2006. |

| | |

| (b) | Audit-related fees. |

| | |

| | The aggregate fees billed by the Registrant’s independent auditors for services relating to the performance of the audit of the Registrant’s financial statements and not reported under paragraph (a) of this Item were $0 for the fiscal year ended December 31, 2007. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| | The aggregate fees billed for services relating to the performance of the audit of the financial statements of the Registrant’s investment adviser(s) and other service providers under common control with the adviser(s) and that relate directly to the operations or financial reporting of the Registrant were $0 for the Registrant’s fiscal year ended December 31, 2007. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| | The aggregate fees billed by the Registrant’s independent auditors for services relating to the performance of the audit of the Registrant’s financial statements and not reported under paragraph (a) of this Item were $0 for the fiscal year ended December 31, 2006. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| | The aggregate fees billed by the Registrant’s independent auditors for services relating to the performance of the audit of the financial statements of the Registrant’s investment adviser(s) and other service providers under common control with the adviser(s) and that relate directly to the operations or financial reporting of the Registrant were $0 for the Registrant’s fiscal year ended December 31, 2006. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| (c) | Tax fees. |

| | |

| | The aggregate fees billed by the Registrant’s independent auditors for tax-related services provided to the Registrant were $0 for the fiscal year ended December 31, 2007. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| | The aggregate fees billed by the Registrant’s independent auditors for tax-related services provided to the Registrant’s adviser(s) and other service providers under common control with the adviser(s) and that relate directly to the operations or financial reporting of the Registrant were $0 for the Registrant’s fiscal year ended December 31, 2007. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| | The aggregate fees billed by the Registrant’s independent auditors for tax-related services provided to the Registrant were $16,000 for the fiscal year ended December 31, 2006. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| | The aggregate fees billed by the Registrant’s independent auditors for tax-related services provided to the Registrant’s investment adviser(s) and other service providers under common control with the adviser(s) and that relate directly to the operations or financial reporting of the Registrant were $0 for the Registrant’s fiscal year ended December 31, 2006. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| (d) | All other fees. |

| | |

| | The aggregate fees billed for all services provided by the independent auditors to the Registrant other than those set forth in paragraphs (a), (b) and (c) of this Item were $9,000 for the fiscal year ended December 31, 2007. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| | The aggregate fees billed for all services other than those set forth in paragraphs (b) and (c) of this Item provided by the Registrant’s independent auditors to the Registrant’s adviser(s) and other service providers under common control with the adviser(s) and that relate directly to the operations or financial reporting of the Registrant were $0 for the Registrant’s fiscal year ended December 31, 2007. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | |

| | The aggregate fees billed for all services provided by the independent auditors to the Registrant other than those set forth in paragraphs (a), (b) and (c) of this Item were $8,500 for the fiscal year ended December 31, 2006. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | | |

| | The aggregate fees billed for all services other than those set forth in paragraphs (b) and (c) of this Item provided by the Registrant’s independent auditors to the Registrant’s adviser(s) and other service providers under common control with the adviser(s) and that relate directly to the operations or financial reporting of the Registrant were $0 for the Registrant’s fiscal year ended December 31, 2006. The percentage of these fees relating to services approved by the Registrant’s Audit Committee pursuant to the de minimis exception from the pre-approval requirement in Rule 2-01(c)(7)(i)(C) of Regulation S-X was 0%. |

| | | |

| (e) | (1) | The Charter of the Trust’s Audit Committee provides that the Audit Committee shall review and, if appropriate, approve in advance all audit and non-audit services (as such term may be from time to time defined in the Securities Exchange Act of 1934, as amended) to be provided to the Trust by the Trust’s independent auditor; provided, however, that the Audit Committee shall only approve the following non-audit services: tax preparation and the Association for Investment Management Research (AIMR) Level 2 Compliance Review. In making a determination, the Audit Committee considers whether the services are consistent with maintaining the principal accountant’s independence. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by a majority of the audit committee members at a special meeting called for such purposes or by unanimous written consent. The Audit Committee’s Charter does not permit waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount. |

| | | |

| | (2) | No percentage of the services included in (b)-(d) above were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| | | |

| (f) | For the most recent fiscal year, less than 50 percent of the hours expended by the Trust’s principal accountant were performed by persons other than the accountant’s full-time permanent employees. |

| | | |

| (g) | The Trust’s accountant performed no non-audit services for the Trust’s investment adviser during each of the last two fiscal years. |

| | | |

| (h) | Not applicable. The Trust’s accountant performed no non-audit services for the Trust’s investment adviser during each of the last two fiscal years. |

Item 5. Audit Committee of Listed Registrants.

Not Applicable.

Item 6. Schedule of Investments.

Not Applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not Applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not Applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not Applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

No material changes have been made to the procedures by which participants may recommend nominees to the Board of Trustees of the Trust, where those changes were implemented after the Trust last provided disclosure in response to the requirements of Item 7(d)(2)(ii)(G) of Schedule 14A (17 CFR 240.14a-101) or this Item 10.

Item 11. Controls and Procedures.

| | |

| (a) | The Trust’s Chief Executive Officer (the principal executive officer) and Chief Financial Officer (the principal financial officer) have concluded that the Trust’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a-3(c)), are effective to ensure that material information relating to the Trust is made known to them by appropriate persons, based on their evaluation of such controls and procedures as of December 31, 2007. |

| | |

| (b) | There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) that occurred during the Trust’s last fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting. |

Item 12. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the AFL-CIO Housing Investment Trust has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AFL-CIO HOUSING INVESTMENT TRUST

| |

By: | /s/ Stephen Coyle |

|

|

| Stephen Coyle |

| Chief Executive Officer |

| |

Date: February 28, 2008 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the AFL-CIO Housing Investment Trust and in the capacities and on the dates indicated.

|

/s/ Stephen Coyle |

|

Stephen Coyle |

Chief Executive Officer |

(Principal Executive Officer) |

|

Date: February 28, 2008 |

|

/s/ Erica Khatchadourian |

|

Erica Khatchadourian |

Chief Financial Officer |

(Principal Financial Officer) |

|

Date: February 28, 2008 |