UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02737

Fidelity Summer Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | December 31 |

Date of reporting period: | December 31, 2022 |

Item 1.

Reports to Stockholders

Contents

| Average Annual Total Returns | |||

Periods ended December 31, 2022 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl.4.00% sales charge) | -18.69% | -3.31% | 0.44% |

| Class M (incl.4.00% sales charge) | -18.62% | -3.29% | 0.45% |

Class C (incl. contingent deferred sales charge) | -16.72% | -3.09% | 0.55% |

| Fidelity® New Markets Income Fund | -15.04% | -2.26% | 0.99% |

| Class I | -15.11% | -2.28% | 0.97% |

| Class Z | -14.96% | -2.20% | 1.02% |

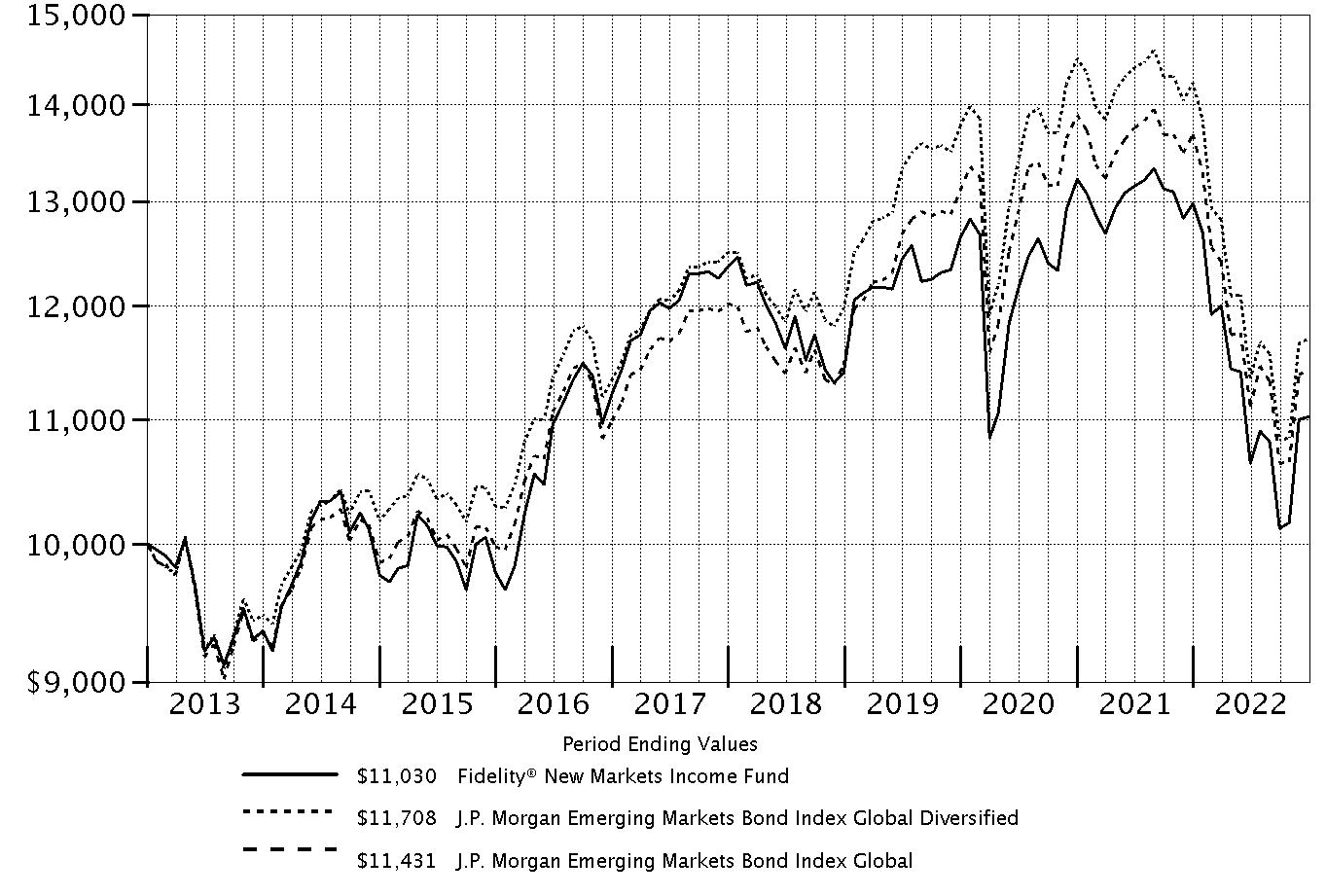

| $10,000 Over 10 Years |

Let's say hypothetically that $10,000 was invested in Fidelity® New Markets Income Fund, a class of the fund, on December 31, 2012. The chart shows how the value of your investment would have changed, and also shows how the J.P. Morgan Emerging Markets Bond Index Global Diversified and J.P. Morgan Emerging Markets Bond Index Global performed over the same period. |

|

| Top Bond Issuers (% of Fund's net assets) | ||

(with maturities greater than one year) | ||

| Petroleos Mexicanos | 4.9 | |

| State of Qatar | 3.6 | |

| Turkish Republic | 3.6 | |

| Dominican Republic | 3.4 | |

| Indonesian Republic | 3.0 | |

| Sultanate of Oman | 2.9 | |

| Arab Republic of Egypt | 2.8 | |

| Colombian Republic | 2.8 | |

| U.S. Treasury Obligations | 2.7 | |

| Saudi Arabian Oil Co. | 2.5 | |

| 32.2 | ||

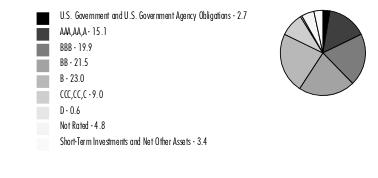

Quality Diversification (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

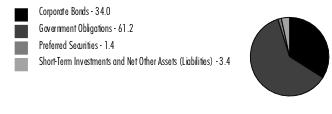

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 91.6% |

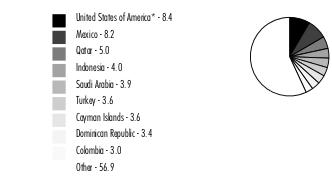

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| Nonconvertible Bonds - 34.0% | |||

Principal Amount (a) | Value ($) | ||

| Argentina - 0.5% | |||

| YPF SA: | |||

| 8.5% 3/23/25 (b) | 10,999,375 | 9,987,433 | |

| 8.75% 4/4/24 (b) | 14,063,700 | 13,288,439 | |

TOTAL ARGENTINA | 23,275,872 | ||

| Azerbaijan - 1.3% | |||

| Southern Gas Corridor CJSC 6.875% 3/24/26 (b) | 36,439,000 | 37,231,548 | |

| State Oil Co. of Azerbaijan Republic: | |||

| 4.75% 3/13/23 (Reg. S) | 5,000,000 | 4,968,125 | |

| 6.95% 3/18/30 (Reg. S) | 11,845,000 | 12,180,362 | |

TOTAL AZERBAIJAN | 54,380,035 | ||

| Bahrain - 1.5% | |||

| The Oil and Gas Holding Co.: | |||

| 7.5% 10/25/27 (b) | 28,868,000 | 29,450,773 | |

| 7.625% 11/7/24 (b) | 35,150,000 | 35,727,778 | |

TOTAL BAHRAIN | 65,178,551 | ||

| Bailiwick of Jersey - 0.4% | |||

| Galaxy Pipeline Assets BidCo Ltd.: | |||

| 2.16% 3/31/34 (b) | 9,796,773 | 8,315,011 | |

| 2.625% 3/31/36 (b) | 10,620,000 | 8,511,266 | |

TOTAL BAILIWICK OF JERSEY | 16,826,277 | ||

| Bermuda - 0.5% | |||

| Investment Energy Resources Ltd. 6.25% 4/26/29 (b) | 6,260,000 | 5,858,186 | |

| Qtel International Finance Ltd. 2.625% 4/8/31 (b) | 11,930,000 | 10,229,975 | |

| Tengizchevroil Finance Co. International Ltd. 3.25% 8/15/30 (b) | 7,000,000 | 4,964,750 | |

TOTAL BERMUDA | 21,052,911 | ||

| Brazil - 0.3% | |||

| BRF SA 4.875% 1/24/30 (b) | 2,590,000 | 2,184,267 | |

| Natura Cosmeticos SA 4.125% 5/3/28 (b) | 13,090,000 | 10,666,714 | |

TOTAL BRAZIL | 12,850,981 | ||

| British Virgin Islands - 1.2% | |||

| 1MDB Global Investments Ltd. 4.4% 3/9/23 | 41,100,000 | 40,157,269 | |

| ENN Clean Energy International Investment Ltd. 3.375% 5/12/26 (b) | 12,435,000 | 10,585,294 | |

TOTAL BRITISH VIRGIN ISLANDS | 50,742,563 | ||

| Canada - 0.2% | |||

| Gcm Mining Corp. 6.875% 8/9/26 (b) | 6,230,000 | 4,841,167 | |

| MEGlobal Canada, Inc. 5% 5/18/25 (b) | 3,000,000 | 2,938,688 | |

TOTAL CANADA | 7,779,855 | ||

| Cayman Islands - 2.6% | |||

| Baidu, Inc.: | |||

| 1.72% 4/9/26 | 9,665,000 | 8,534,872 | |

| 2.375% 10/9/30 | 7,240,000 | 5,735,745 | |

| DP World Crescent Ltd.: | |||

| 3.7495% 1/30/30 (b) | 8,060,000 | 7,411,674 | |

| 3.875% 7/18/29 (Reg. S) | 21,172,000 | 19,753,476 | |

| ENN Energy Holdings Ltd. 4.625% 5/17/27 (b) | 10,930,000 | 10,552,915 | |

| IHS Holding Ltd. 5.625% 11/29/26 (b) | 5,980,000 | 4,962,653 | |

| Lamar Funding Ltd. 3.958% 5/7/25 (b) | 6,200,000 | 5,850,475 | |

| Meituan: | |||

| 2.125% 10/28/25 (b) | 13,535,000 | 11,926,027 | |

| 3.05% 10/28/30 (b) | 10,295,000 | 7,851,868 | |

| NagaCorp Ltd. 7.95% 7/6/24 (Reg. S) | 8,460,000 | 7,607,655 | |

| SA Global Sukuk Ltd. 1.602% 6/17/26 (b) | 14,175,000 | 12,627,267 | |

| Termocandelaria Power Ltd. 7.875% 1/30/29 (b) | 5,965,300 | 5,453,776 | |

TOTAL CAYMAN ISLANDS | 108,268,403 | ||

| Chile - 0.8% | |||

| Corporacion Nacional del Cobre de Chile (Codelco): | |||

| 3.15% 1/14/30 (b) | 7,740,000 | 6,802,976 | |

| 3.15% 1/15/51 (b) | 8,130,000 | 5,651,874 | |

| 3.7% 1/30/50 (b) | 14,035,000 | 10,547,303 | |

| VTR Comunicaciones SpA: | |||

| 4.375% 4/15/29 (b) | 4,050,000 | 2,348,494 | |

| 5.125% 1/15/28 (b) | 16,142,000 | 9,940,445 | |

TOTAL CHILE | 35,291,092 | ||

| Colombia - 0.2% | |||

| Oleoducto Central SA 4% 7/14/27 (b) | 8,725,000 | 7,660,550 | |

| Georgia - 0.1% | |||

| JSC Georgian Railway 4% 6/17/28 (b) | 6,755,000 | 5,871,784 | |

| Guatemala - 0.2% | |||

| CT Trust 5.125% 2/3/32 (b) | 8,720,000 | 7,656,160 | |

| Hong Kong - 0.1% | |||

| Lenovo Group Ltd. 3.421% 11/2/30 (b) | 5,500,000 | 4,327,125 | |

| Indonesia - 1.0% | |||

| PT Adaro Indonesia 4.25% 10/31/24 (b) | 12,520,000 | 11,990,248 | |

| PT Freeport Indonesia: | |||

| 4.763% 4/14/27 (b) | 4,870,000 | 4,669,648 | |

| 5.315% 4/14/32 (b) | 8,260,000 | 7,579,459 | |

| 6.2% 4/14/52 (b) | 5,635,000 | 4,888,982 | |

| PT Indonesia Asahan Aluminium Tbk 5.45% 5/15/30 (b) | 13,335,000 | 12,720,757 | |

TOTAL INDONESIA | 41,849,094 | ||

| Ireland - 0.3% | |||

| C&W Senior Financing Designated Activity Co. 6.875% 9/15/27 (b) | 5,000,000 | 4,630,625 | |

| LCPR Senior Secured Financing DAC 5.125% 7/15/29 (b) | 9,500,000 | 7,869,878 | |

TOTAL IRELAND | 12,500,503 | ||

| Israel - 0.9% | |||

| Energean Israel Finance Ltd. 4.875% 3/30/26 (Reg. S) (b) | 15,080,000 | 13,917,332 | |

| Leviathan Bond Ltd.: | |||

| 5.75% 6/30/23 (Reg. S) (b) | 6,755,000 | 6,726,737 | |

| 6.125% 6/30/25 (Reg. S) (b) | 16,920,000 | 16,539,300 | |

| 6.5% 6/30/27 (Reg. S) (b) | 2,365,000 | 2,288,374 | |

TOTAL ISRAEL | 39,471,743 | ||

| Kazakhstan - 0.3% | |||

| KazMunaiGaz National Co.: | |||

| 3.5% 4/14/33 (b) | 10,395,000 | 7,652,019 | |

| 5.75% 4/19/47 (b) | 5,240,000 | 3,999,758 | |

TOTAL KAZAKHSTAN | 11,651,777 | ||

| Luxembourg - 1.3% | |||

| Adecoagro SA 6% 9/21/27 (b) | 6,168,000 | 5,795,222 | |

| B2W Digital Lux SARL 4.375% 12/20/30 (b) | 15,775,000 | 9,965,856 | |

| EIG Pearl Holdings SARL 3.545% 8/31/36 (b) | 17,815,000 | 14,940,104 | |

| MC Brazil Downstream Trading SARL 7.25% 6/30/31 (b) | 13,410,000 | 11,004,581 | |

| Millicom International Cellular SA 4.5% 4/27/31 (b) | 8,640,000 | 7,253,820 | |

| VM Holding SA 6.5% 1/18/28 (b) | 4,920,000 | 4,761,023 | |

TOTAL LUXEMBOURG | 53,720,606 | ||

| Malaysia - 0.9% | |||

| GENM Capital Labuan Ltd. 3.882% 4/19/31 (b) | 15,305,000 | 11,555,275 | |

| MISC Capital Two (Labuan) Ltd.: | |||

| 3.625% 4/6/25 (b) | 3,770,000 | 3,584,563 | |

| 3.75% 4/6/27 (b) | 12,315,000 | 11,220,504 | |

| Petronas Capital Ltd.: | |||

| 3.404% 4/28/61 (b) | 5,500,000 | 3,757,325 | |

| 3.5% 4/21/30 (b) | 8,990,000 | 8,198,341 | |

TOTAL MALAYSIA | 38,316,008 | ||

| Mauritius - 0.5% | |||

| AXIAN Telecom 7.375% 2/16/27 (b) | 5,500,000 | 4,767,125 | |

| CA Magnum Holdings 5.375% (b)(c) | 8,295,000 | 7,508,053 | |

| HTA Group Ltd. 7% 12/18/25 (b) | 5,270,000 | 4,837,860 | |

| MTN (Mauritius) Investments Ltd. 4.755% 11/11/24 (b) | 4,995,000 | 4,838,282 | |

TOTAL MAURITIUS | 21,951,320 | ||

| Mexico - 5.7% | |||

| Axtel S.A.B. de CV 6.375% 11/14/24 (b) | 710,000 | 579,005 | |

| CEMEX S.A.B. de CV 5.45% 11/19/29 (b) | 5,805,000 | 5,552,120 | |

| Comision Federal de Electricid: | |||

| 3.348% 2/9/31 (b) | 2,970,000 | 2,313,444 | |

| 4.688% 5/15/29 (b) | 12,425,000 | 10,932,447 | |

| Petroleos Mexicanos: | |||

| 4.625% 9/21/23 | 3,250,000 | 3,185,488 | |

| 4.875% 1/18/24 | 35,888,000 | 35,134,352 | |

| 6.5% 3/13/27 | 9,810,000 | 8,914,838 | |

| 6.5% 6/2/41 | 11,163,000 | 7,222,461 | |

| 6.625% 6/15/35 | 65,174,000 | 47,036,076 | |

| 6.7% 2/16/32 | 18,989,000 | 14,882,629 | |

| 6.875% 10/16/25 | 11,570,000 | 11,253,994 | |

| 6.875% 8/4/26 | 2,780,000 | 2,642,390 | |

| 6.95% 1/28/60 | 35,910,000 | 22,722,053 | |

| 7.69% 1/23/50 | 80,500,000 | 55,645,625 | |

| TV Azteca SA de CV 8.25% 8/9/24 (Reg. S) (d) | 27,098,000 | 12,431,208 | |

TOTAL MEXICO | 240,448,130 | ||

| Mongolia - 0.0% | |||

| Development Bank of Mongolia 7.25% 10/23/23 (b) | 2,475,000 | 2,200,120 | |

| Morocco - 0.4% | |||

| OCP SA: | |||

| 3.75% 6/23/31 (b) | 14,540,000 | 12,116,364 | |

| 5.125% 6/23/51 (b) | 4,000,000 | 3,009,500 | |

TOTAL MOROCCO | 15,125,864 | ||

| Multi-National - 0.3% | |||

| GEMS MENASA Cayman Ltd. 7.125% 7/31/26 (b) | 6,960,000 | 6,652,455 | |

| JBS U.S.A. Lux SA / JBS Food Co. 2.5% 1/15/27 (b) | 5,950,000 | 5,204,584 | |

TOTAL MULTI-NATIONAL | 11,857,039 | ||

| Netherlands - 1.0% | |||

| Embraer Netherlands Finance BV 5.05% 6/15/25 | 5,500,000 | 5,336,031 | |

| Equate Petrochemical BV 4.25% 11/3/26 (b) | 5,000,000 | 4,771,250 | |

| Nostrum Oil & Gas Finance BV 8% 12/31/49 (b)(d) | 42,004,000 | 10,920,620 | |

| Prosus NV: | |||

| 3.061% 7/13/31 (b) | 6,215,000 | 4,816,376 | |

| 3.832% 2/8/51 (b) | 7,355,000 | 4,497,123 | |

| 4.193% 1/19/32 (b) | 14,100,000 | 11,683,613 | |

| VimpelCom Holdings BV 7.25% 4/26/23 (b) | 2,410,000 | 2,108,750 | |

TOTAL NETHERLANDS | 44,133,763 | ||

| Nigeria - 0.1% | |||

| Access Bank PLC 6.125% 9/21/26 (b) | 5,825,000 | 4,479,061 | |

| Panama - 0.6% | |||

| Aeropuerto Internacional de Tocumen SA: | |||

| 4% 8/11/41 (b) | 11,735,000 | 9,661,572 | |

| 5.125% 8/11/61 (b) | 5,020,000 | 4,107,929 | |

| Cable Onda SA 4.5% 1/30/30 (b) | 11,160,000 | 9,939,375 | |

TOTAL PANAMA | 23,708,876 | ||

| Paraguay - 0.1% | |||

| Telefonica Celular del Paraguay SA 5.875% 4/15/27 (b) | 4,000,000 | 3,858,250 | |

| Peru - 0.1% | |||

| Camposol SA 6% 2/3/27 (b) | 4,435,000 | 2,649,358 | |

| Qatar - 1.4% | |||

| Qatar Petroleum: | |||

| 1.375% 9/12/26 (b) | 12,840,000 | 11,379,938 | |

| 2.25% 7/12/31 (b) | 26,625,000 | 21,970,617 | |

| 3.3% 7/12/51 (b) | 36,535,000 | 26,745,903 | |

TOTAL QATAR | 60,096,458 | ||

| Saudi Arabia - 2.5% | |||

| Saudi Arabian Oil Co.: | |||

| 1.625% 11/24/25 (b) | 16,675,000 | 15,146,111 | |

| 3.5% 4/16/29 (b) | 74,226,000 | 67,768,338 | |

| 4.25% 4/16/39 (b) | 14,375,000 | 12,760,508 | |

| 4.375% 4/16/49 (b) | 11,864,000 | 10,049,550 | |

TOTAL SAUDI ARABIA | 105,724,507 | ||

| Singapore - 0.3% | |||

| Medco Laurel Tree PTE Ltd. 6.95% 11/12/28 (b) | 15,125,000 | 13,379,008 | |

| South Africa - 1.2% | |||

| Eskom Holdings SOC Ltd.: | |||

| 6.35% 8/10/28 (b) | 13,265,000 | 12,236,963 | |

| 6.75% 8/6/23 (b) | 10,218,000 | 9,804,810 | |

| 7.125% 2/11/25 (b) | 22,975,000 | 20,846,941 | |

| 8.45% 8/10/28 (b) | 8,165,000 | 7,164,788 | |

TOTAL SOUTH AFRICA | 50,053,502 | ||

| Spain - 0.2% | |||

| EnfraGen Energia Sur SA 5.375% 12/30/30 (b) | 10,455,000 | 7,291,474 | |

| United Arab Emirates - 0.4% | |||

| Abu Dhabi National Energy Co. PJSC: | |||

| 4% 10/3/49 (b) | 4,435,000 | 3,823,247 | |

| 4.875% 4/23/30 (b) | 1,990,000 | 2,045,098 | |

| MDGH GMTN RSC Ltd.: | |||

| 2.875% 11/7/29 (b) | 5,705,000 | 5,130,221 | |

| 3.375% 3/28/32 (Reg. S) | 2,140,000 | 1,933,758 | |

| 5.5% 4/28/33 (b) | 5,925,000 | 6,251,986 | |

TOTAL UNITED ARAB EMIRATES | 19,184,310 | ||

| United Kingdom - 1.4% | |||

| Antofagasta PLC: | |||

| 2.375% 10/14/30 (b) | 15,695,000 | 12,524,610 | |

| 5.625% 5/13/32 (b) | 5,445,000 | 5,349,713 | |

| Endeavour Mining PLC 5% 10/14/26 (b) | 6,000,000 | 5,046,750 | |

| Liquid Telecommunications Financing PLC 5.5% 9/4/26 (b) | 9,060,000 | 6,488,093 | |

| NAK Naftogaz Ukraine: | |||

| 7.375% 7/19/24 (Reg. S) (d) | 12,720,000 | 2,416,800 | |

| 7.625% 11/8/26 (b) | 7,055,000 | 1,128,800 | |

| Oschadbank Via SSB #1 PLC 9.375% 3/10/23 (b) | 1,201,700 | 844,044 | |

| The Bidvest Group UK PLC 3.625% 9/23/26 (b) | 6,255,000 | 5,601,353 | |

| Tullow Oil PLC 10.25% 5/15/26 (b) | 23,935,000 | 19,028,325 | |

TOTAL UNITED KINGDOM | 58,428,488 | ||

| United States of America - 2.3% | |||

| Azul Investments LLP: | |||

| 5.875% 10/26/24 (b) | 22,223,000 | 17,789,512 | |

| 7.25% 6/15/26 (b) | 6,345,000 | 3,887,502 | |

| DAE Funding LLC 1.55% 8/1/24 (b) | 6,275,000 | 5,846,731 | |

| Kosmos Energy Ltd. 7.125% 4/4/26 (b) | 38,909,000 | 33,031,309 | |

| NBM U.S. Holdings, Inc. 6.625% 8/6/29 (b) | 7,195,000 | 6,942,276 | |

| Sasol Financing U.S.A. LLC: | |||

| 4.375% 9/18/26 | 16,375,000 | 14,469,359 | |

| 5.875% 3/27/24 | 7,025,000 | 6,849,375 | |

| Stillwater Mining Co. 4% 11/16/26 (b) | 8,215,000 | 7,220,472 | |

TOTAL UNITED STATES OF AMERICA | 96,036,536 | ||

| Uzbekistan - 0.1% | |||

| Uzbekneftegaz JSC 4.75% 11/16/28 (b) | 4,640,000 | 3,723,600 | |

| Venezuela - 0.8% | |||

| Petroleos de Venezuela SA: | |||

| 5.375% 4/12/27 (d) | 152,515,000 | 6,863,175 | |

| 5.5% 4/12/37 (d) | 184,250,000 | 8,297,830 | |

| 6% 5/16/24 (b)(d) | 105,540,000 | 5,013,150 | |

| 6% 11/15/26 (Reg. S) (d) | 89,700,000 | 4,036,500 | |

| 8.5% 12/31/99 (Reg. S) (d) | 20,540,000 | 3,902,600 | |

| 9% 12/31/49 (Reg. S) (d) | 48,700,000 | 2,069,750 | |

| 9.75% 5/17/35 (b)(d) | 71,700,000 | 3,405,750 | |

| 12.75% 12/31/49 (b)(d) | 53,000,000 | 2,385,439 | |

TOTAL VENEZUELA | 35,974,194 | ||

| TOTAL NONCONVERTIBLE BONDS (Cost $1,960,470,428) | 1,438,975,748 | ||

| Government Obligations - 61.2% | |||

Principal Amount (a) | Value ($) | ||

| Angola - 1.8% | |||

| Angola Republic: | |||

| 8% 11/26/29 (b) | 17,800,000 | 15,664,000 | |

| 8.25% 5/9/28 (b) | 18,775,000 | 16,991,375 | |

| 8.75% 4/14/32 (b) | 9,205,000 | 7,962,325 | |

| 9.125% 11/26/49 (b) | 7,695,000 | 5,993,924 | |

| 9.375% 5/8/48 (b) | 13,330,000 | 10,499,874 | |

| 9.5% 11/12/25 (b) | 18,525,000 | 19,080,750 | |

TOTAL ANGOLA | 76,192,248 | ||

| Argentina - 1.7% | |||

| Argentine Republic: | |||

| 0.5% 7/9/30 (e) | 78,813,473 | 21,319,044 | |

| 1% 7/9/29 | 30,551,997 | 8,096,279 | |

| 1.5% 7/9/35 (e) | 65,085,665 | 16,401,588 | |

| 3.875% 1/9/38 (e) | 53,139,088 | 16,732,170 | |

| Buenos Aires Province 5.25% 9/1/37 (b)(e) | 13,320,000 | 4,595,400 | |

| Provincia de Cordoba 6.875% 12/10/25 (b) | 5,865,241 | 4,692,193 | |

TOTAL ARGENTINA | 71,836,674 | ||

| Armenia - 0.1% | |||

| Republic of Armenia 3.6% 2/2/31 (b) | 6,510,000 | 5,170,568 | |

| Azerbaijan - 0.2% | |||

| Azerbaijan Republic 3.5% 9/1/32 (b) | 8,235,000 | 6,834,021 | |

| Bahrain - 0.2% | |||

| Bahrain Kingdom 5.625% 5/18/34 (b) | 11,770,000 | 10,131,763 | |

| Barbados - 0.3% | |||

| Barbados Government 6.5% 10/1/29 (b) | 11,985,000 | 11,039,683 | |

| Benin - 0.2% | |||

| Republic of Benin 4.875% 1/19/32 (b) | EUR | 11,755,000 | 9,689,018 |

| Bermuda - 0.5% | |||

| Bermuda Government: | |||

| 2.375% 8/20/30 (b) | 5,325,000 | 4,472,334 | |

| 3.375% 8/20/50 (b) | 5,015,000 | 3,520,843 | |

| 3.717% 1/25/27 (b) | 7,900,000 | 7,565,731 | |

| 5% 7/15/32 (b) | 3,830,000 | 3,799,599 | |

TOTAL BERMUDA | 19,358,507 | ||

| Brazil - 1.9% | |||

| Brazilian Federative Republic: | |||

| 3.875% 6/12/30 | 15,660,000 | 13,553,730 | |

| 5% 1/27/45 | 14,450,000 | 10,691,194 | |

| 5.625% 1/7/41 | 9,434,000 | 7,955,810 | |

| 5.625% 2/21/47 | 8,822,000 | 6,976,548 | |

| 7.125% 1/20/37 | 8,510,000 | 8,833,380 | |

| 8.25% 1/20/34 | 11,336,000 | 12,687,818 | |

| 12.25% 3/6/30 | 13,881,000 | 18,846,060 | |

TOTAL BRAZIL | 79,544,540 | ||

| Cameroon - 0.3% | |||

| Cameroon Republic 5.95% 7/7/32 (b) | EUR | 14,070,000 | 11,096,362 |

| Chile - 1.1% | |||

| Chilean Republic: | |||

| 2.45% 1/31/31 | 31,325,000 | 25,937,100 | |

| 2.75% 1/31/27 | 6,865,000 | 6,297,779 | |

| 3.5% 1/31/34 | 7,100,000 | 6,038,550 | |

| 4% 1/31/52 | 3,960,000 | 3,048,705 | |

| 4.34% 3/7/42 | 5,555,000 | 4,679,393 | |

TOTAL CHILE | 46,001,527 | ||

| Colombia - 2.8% | |||

| Colombian Republic: | |||

| 3% 1/30/30 | 36,130,000 | 27,603,320 | |

| 3.125% 4/15/31 | 19,000,000 | 14,081,375 | |

| 3.875% 2/15/61 | 6,730,000 | 3,751,134 | |

| 4.125% 5/15/51 | 6,805,000 | 4,080,023 | |

| 4.5% 3/15/29 | 8,305,000 | 7,159,429 | |

| 5% 6/15/45 | 34,965,000 | 23,990,361 | |

| 5.2% 5/15/49 | 16,120,000 | 11,009,960 | |

| 6.125% 1/18/41 | 6,410,000 | 5,099,155 | |

| 7.375% 9/18/37 | 3,680,000 | 3,450,690 | |

| 8% 4/20/33 | 16,815,000 | 16,781,370 | |

TOTAL COLOMBIA | 117,006,817 | ||

| Costa Rica - 0.5% | |||

| Costa Rican Republic: | |||

| 5.625% 4/30/43 (b) | 13,473,000 | 10,945,128 | |

| 6.125% 2/19/31 (b) | 7,000,000 | 6,773,813 | |

| 7% 4/4/44 (b) | 4,575,000 | 4,294,209 | |

TOTAL COSTA RICA | 22,013,150 | ||

| Dominican Republic - 3.4% | |||

| Dominican Republic: | |||

| 4.5% 1/30/30 (b) | 29,255,000 | 24,817,382 | |

| 4.875% 9/23/32 (b) | 10,930,000 | 9,036,378 | |

| 5.3% 1/21/41 (b) | 6,000,000 | 4,617,375 | |

| 5.875% 1/30/60 (b) | 18,130,000 | 13,249,631 | |

| 5.95% 1/25/27 (b) | 24,724,000 | 24,125,988 | |

| 6% 7/19/28 (b) | 18,101,000 | 17,352,071 | |

| 6.4% 6/5/49 (b) | 6,013,000 | 4,841,592 | |

| 6.5% 2/15/48 (b) | 17,655,000 | 14,502,479 | |

| 6.85% 1/27/45 (b) | 16,129,000 | 13,939,488 | |

| 7.45% 4/30/44 (b) | 20,824,000 | 19,331,180 | |

TOTAL DOMINICAN REPUBLIC | 145,813,564 | ||

| Ecuador - 1.3% | |||

| Ecuador Republic: | |||

| 2.5% 7/31/35 (b)(e) | 48,400,000 | 22,136,950 | |

| 5.5% 7/31/30 (b)(e) | 52,330,000 | 33,288,421 | |

TOTAL ECUADOR | 55,425,371 | ||

| Egypt - 2.8% | |||

| Arab Republic of Egypt: | |||

| 5.8% 9/30/27 (b) | 6,390,000 | 5,271,750 | |

| 7.0529% 1/15/32 (b) | 4,740,000 | 3,447,758 | |

| 7.5% 1/31/27 (b) | 33,344,000 | 29,842,880 | |

| 7.5% 2/16/61 (b) | 13,095,000 | 7,987,950 | |

| 7.6003% 3/1/29 (b) | 34,319,000 | 27,969,985 | |

| 7.903% 2/21/48 (b) | 11,740,000 | 7,308,150 | |

| 8.5% 1/31/47 (b) | 34,441,000 | 22,731,060 | |

| 8.7002% 3/1/49 (b) | 22,940,000 | 15,083,050 | |

TOTAL EGYPT | 119,642,583 | ||

| El Salvador - 0.2% | |||

| El Salvador Republic: | |||

| 6.375% 1/18/27 (b) | 2,515,000 | 1,088,995 | |

| 7.1246% 1/20/50 (b) | 8,578,000 | 3,258,568 | |

| 7.625% 2/1/41 (b) | 11,695,000 | 4,479,185 | |

TOTAL EL SALVADOR | 8,826,748 | ||

| Gabon - 0.4% | |||

| Gabonese Republic: | |||

| 6.95% 6/16/25 (b) | 9,000,000 | 8,460,000 | |

| 7% 11/24/31 (b) | 13,095,000 | 10,715,802 | |

TOTAL GABON | 19,175,802 | ||

| Georgia - 0.3% | |||

| Georgia Republic 2.75% 4/22/26 (b) | 15,425,000 | 13,890,213 | |

| Ghana - 0.6% | |||

| Ghana Republic: | |||

| 7.75% 4/7/29 (b) | 12,265,000 | 4,446,063 | |

| 8.125% 1/18/26 (b) | 6,566,924 | 2,577,518 | |

| 8.125% 3/26/32 (b) | 17,605,000 | 6,227,769 | |

| 8.627% 6/16/49 (b) | 12,885,000 | 4,413,113 | |

| 10.75% 10/14/30 (b) | 11,025,000 | 7,717,500 | |

TOTAL GHANA | 25,381,963 | ||

| Guatemala - 0.6% | |||

| Guatemalan Republic: | |||

| 3.7% 10/7/33 (b) | 2,500,000 | 2,052,813 | |

| 4.9% 6/1/30 (b) | 2,500,000 | 2,358,281 | |

| 5.25% 8/10/29 (b) | 9,000,000 | 8,633,250 | |

| 5.375% 4/24/32 (b) | 5,270,000 | 5,135,944 | |

| 6.125% 6/1/50 (b) | 5,650,000 | 5,296,169 | |

TOTAL GUATEMALA | 23,476,457 | ||

| Hungary - 0.6% | |||

| Hungarian Republic: | |||

| 2.125% 9/22/31 (b) | 11,240,000 | 8,259,995 | |

| 3.125% 9/21/51 (b) | 7,415,000 | 4,420,267 | |

| 5.25% 6/16/29 (b) | 6,100,000 | 5,799,956 | |

| 5.5% 6/16/34 (b) | 6,365,000 | 5,928,600 | |

TOTAL HUNGARY | 24,408,818 | ||

| Indonesia - 3.0% | |||

| Indonesian Republic: | |||

| 3.85% 10/15/30 | 14,805,000 | 13,882,463 | |

| 4.1% 4/24/28 | 17,280,000 | 16,910,640 | |

| 5.125% 1/15/45 (b) | 20,042,000 | 19,317,682 | |

| 5.95% 1/8/46 (b) | 6,230,000 | 6,497,890 | |

| 6.625% 2/17/37 (b) | 15,086,000 | 17,048,839 | |

| 6.75% 1/15/44 (b) | 6,465,000 | 7,249,592 | |

| 7.75% 1/17/38 (b) | 17,722,000 | 21,219,880 | |

| 8.5% 10/12/35 (b) | 19,301,000 | 24,353,037 | |

TOTAL INDONESIA | 126,480,023 | ||

| Iraq - 0.1% | |||

| Republic of Iraq 5.8% 1/15/28 (Reg. S) | 6,608,250 | 6,070,504 | |

| Ivory Coast - 0.8% | |||

| Ivory Coast: | |||

| 5.875% 10/17/31 (b) | EUR | 10,110,000 | 9,045,371 |

| 6.125% 6/15/33 (b) | 8,860,000 | 7,885,400 | |

| 6.375% 3/3/28 (b) | 18,040,000 | 17,453,700 | |

TOTAL IVORY COAST | 34,384,471 | ||

| Jamaica - 0.3% | |||

| Jamaican Government: | |||

| 6.75% 4/28/28 | 4,255,000 | 4,491,153 | |

| 7.875% 7/28/45 | 7,490,000 | 8,394,886 | |

TOTAL JAMAICA | 12,886,039 | ||

| Jordan - 0.7% | |||

| Jordanian Kingdom: | |||

| 4.95% 7/7/25 (b) | 15,855,000 | 15,129,634 | |

| 5.85% 7/7/30 (b) | 3,945,000 | 3,506,858 | |

| 6.125% 1/29/26 (b) | 4,385,000 | 4,315,936 | |

| 7.75% 1/15/28 (b) | 6,645,000 | 6,696,083 | |

TOTAL JORDAN | 29,648,511 | ||

| Kenya - 1.0% | |||

| Republic of Kenya: | |||

| 6.3% 1/23/34 (b) | 13,130,000 | 10,142,925 | |

| 6.875% 6/24/24 (b) | 18,000,000 | 16,627,500 | |

| 7% 5/22/27 (b) | 18,115,000 | 16,235,569 | |

TOTAL KENYA | 43,005,994 | ||

| Lebanon - 0.1% | |||

| Lebanese Republic: | |||

| 5.8% 12/31/49 (d) | 8,540,000 | 489,171 | |

| 6% 12/31/49 (d) | 5,256,000 | 298,278 | |

| 6.1% 12/31/49 (d) | 22,896,000 | 1,311,483 | |

| 6.2% 2/26/25 (Reg. S) (d) | 5,669,000 | 321,716 | |

| 6.375% 12/31/49 (d) | 35,061,000 | 2,038,447 | |

| 6.65% 11/3/28(Reg. S) (d) | 3,000,000 | 170,250 | |

| 6.75% 11/29/27 (Reg. S) (d) | 3,000,000 | 170,250 | |

TOTAL LEBANON | 4,799,595 | ||

| Mexico - 2.1% | |||

| United Mexican States: | |||

| 3.25% 4/16/30 | 19,910,000 | 17,306,768 | |

| 3.75% 1/11/28 | 18,765,000 | 17,676,630 | |

| 4.5% 4/22/29 | 10,460,000 | 9,989,300 | |

| 4.75% 4/27/32 | 5,375,000 | 5,026,633 | |

| 5.75% 10/12/2110 | 10,595,000 | 8,911,719 | |

| 6.05% 1/11/40 | 30,348,000 | 29,452,734 | |

TOTAL MEXICO | 88,363,784 | ||

| Mongolia - 0.2% | |||

| Mongolia Government: | |||

| 3.5% 7/7/27 (b) | 6,000,000 | 4,770,660 | |

| 5.125% 4/7/26 (b) | 4,015,000 | 3,453,342 | |

TOTAL MONGOLIA | 8,224,002 | ||

| Morocco - 0.5% | |||

| Moroccan Kingdom: | |||

| 2.375% 12/15/27 (b) | 14,200,000 | 12,298,975 | |

| 4% 12/15/50 (b) | 3,385,000 | 2,297,146 | |

| 5.5% 12/11/42 (b) | 5,750,000 | 4,897,563 | |

TOTAL MOROCCO | 19,493,684 | ||

| Nigeria - 1.9% | |||

| Republic of Nigeria: | |||

| 6.125% 9/28/28 (b) | 13,115,000 | 10,098,550 | |

| 6.5% 11/28/27 (b) | 20,043,000 | 16,109,561 | |

| 7.143% 2/23/30 (b) | 6,415,000 | 4,899,456 | |

| 7.625% 11/21/25 (b) | 30,927,000 | 28,336,864 | |

| 7.625% 11/28/47 (b) | 18,415,000 | 11,808,619 | |

| 7.696% 2/23/38 (b) | 3,500,000 | 2,366,438 | |

| 7.875% 2/16/32 (b) | 9,000,000 | 6,750,000 | |

TOTAL NIGERIA | 80,369,488 | ||

| Oman - 2.9% | |||

| Sultanate of Oman: | |||

| 4.75% 6/15/26 (b) | 4,238,000 | 4,078,545 | |

| 5.375% 3/8/27 (b) | 18,189,000 | 17,737,685 | |

| 5.625% 1/17/28 (b) | 21,625,000 | 21,277,648 | |

| 6% 8/1/29 (b) | 11,510,000 | 11,490,577 | |

| 6.25% 1/25/31 (b) | 6,340,000 | 6,355,058 | |

| 6.5% 3/8/47 (b) | 27,725,000 | 25,160,438 | |

| 6.75% 10/28/27 (b) | 6,520,000 | 6,735,160 | |

| 6.75% 1/17/48 (b) | 30,140,000 | 28,054,689 | |

TOTAL OMAN | 120,889,800 | ||

| Pakistan - 0.5% | |||

| Islamic Republic of Pakistan: | |||

| 6% 4/8/26 (b) | 24,660,000 | 9,866,713 | |

| 6.875% 12/5/27 (b) | 5,510,000 | 2,121,956 | |

| 7.375% 4/8/31 (b) | 775,000 | 273,273 | |

| 8.25% 4/15/24 (b) | 14,680,000 | 7,782,015 | |

TOTAL PAKISTAN | 20,043,957 | ||

| Panama - 2.0% | |||

| Panamanian Republic: | |||

| 2.252% 9/29/32 | 22,155,000 | 16,405,778 | |

| 3.16% 1/23/30 | 14,515,000 | 12,462,942 | |

| 3.298% 1/19/33 | 21,210,000 | 17,164,193 | |

| 3.87% 7/23/60 | 17,120,000 | 11,029,560 | |

| 4.3% 4/29/53 | 7,000,000 | 5,093,813 | |

| 4.5% 5/15/47 | 8,025,000 | 6,153,169 | |

| 4.5% 4/16/50 | 10,760,000 | 8,115,730 | |

| 6.4% 2/14/35 | 9,790,000 | 9,929,508 | |

TOTAL PANAMA | 86,354,693 | ||

| Paraguay - 0.8% | |||

| Republic of Paraguay: | |||

| 2.739% 1/29/33 (b) | 5,873,000 | 4,688,489 | |

| 4.95% 4/28/31 (b) | 21,130,000 | 20,394,412 | |

| 5.4% 3/30/50 (b) | 9,115,000 | 7,826,367 | |

| 5.6% 3/13/48 (b) | 2,315,000 | 2,013,037 | |

TOTAL PARAGUAY | 34,922,305 | ||

| Peru - 1.5% | |||

| Peruvian Republic: | |||

| 2.783% 1/23/31 | 29,735,000 | 24,583,411 | |

| 3% 1/15/34 | 21,165,000 | 16,664,792 | |

| 3.3% 3/11/41 | 33,390,000 | 24,328,789 | |

TOTAL PERU | 65,576,992 | ||

| Philippines - 0.6% | |||

| Philippine Republic: | |||

| 2.65% 12/10/45 | 7,890,000 | 5,287,168 | |

| 2.95% 5/5/45 | 3,200,000 | 2,296,352 | |

| 5.609% 4/13/33 | 6,190,000 | 6,531,131 | |

| 5.95% 10/13/47 | 9,890,000 | 10,632,838 | |

TOTAL PHILIPPINES | 24,747,489 | ||

| Qatar - 3.6% | |||

| State of Qatar: | |||

| 3.75% 4/16/30 (b) | 47,140,000 | 45,484,208 | |

| 4% 3/14/29 (b) | 24,755,000 | 24,272,278 | |

| 4.4% 4/16/50 (b) | 19,070,000 | 17,357,276 | |

| 4.5% 4/23/28 (b) | 10,970,000 | 11,038,892 | |

| 4.817% 3/14/49 (b) | 38,811,000 | 37,544,791 | |

| 5.103% 4/23/48 (b) | 11,510,000 | 11,508,561 | |

| 9.75% 6/15/30 (b) | 3,827,000 | 5,094,215 | |

TOTAL QATAR | 152,300,221 | ||

| Romania - 1.2% | |||

| Romanian Republic: | |||

| 3% 2/27/27 (b) | 10,504,000 | 9,275,032 | |

| 3% 2/14/31 (b) | 34,824,000 | 27,288,957 | |

| 3.375% 1/28/50 (Reg. S) | EUR | 5,550,000 | 3,406,048 |

| 3.625% 3/27/32 (b) | 10,504,000 | 8,329,672 | |

| 4% 2/14/51 (b) | 3,535,000 | 2,321,611 | |

TOTAL ROMANIA | 50,621,320 | ||

| Russia - 0.2% | |||

| Ministry of Finance of the Russian Federation: | |||

| 4.375% 3/21/29(Reg. S) (d)(f) | 12,600,000 | 3,276,000 | |

| 5.1% 3/28/35(Reg. S) (d)(f) | 12,200,000 | 3,538,000 | |

TOTAL RUSSIA | 6,814,000 | ||

| Rwanda - 0.2% | |||

| Rwanda Republic 5.5% 8/9/31 (b) | 12,780,000 | 9,667,271 | |

| Saudi Arabia - 1.4% | |||

| Kingdom of Saudi Arabia: | |||

| 2.25% 2/2/33 (b) | 18,170,000 | 14,675,682 | |

| 3.625% 3/4/28 (b) | 9,976,000 | 9,514,111 | |

| 3.75% 1/21/55 (b) | 19,480,000 | 15,258,928 | |

| 4.5% 10/26/46 (b) | 14,169,000 | 12,489,088 | |

| 4.5% 4/22/60 (b) | 10,670,000 | 9,424,944 | |

TOTAL SAUDI ARABIA | 61,362,753 | ||

| Senegal - 0.3% | |||

| Republic of Senegal: | |||

| 6.25% 5/23/33 (b) | 9,965,000 | 8,182,511 | |

| 6.75% 3/13/48 (b) | 5,110,000 | 3,589,136 | |

TOTAL SENEGAL | 11,771,647 | ||

| Serbia - 0.2% | |||

| Republic of Serbia 2.125% 12/1/30 (b) | 11,740,000 | 8,392,633 | |

| South Africa - 1.0% | |||

| South African Republic: | |||

| 4.85% 9/30/29 | 8,535,000 | 7,573,746 | |

| 5% 10/12/46 | 3,190,000 | 2,222,633 | |

| 5.65% 9/27/47 | 22,135,000 | 16,269,225 | |

| 5.75% 9/30/49 | 22,085,000 | 16,177,263 | |

TOTAL SOUTH AFRICA | 42,242,867 | ||

| Sri Lanka - 0.5% | |||

| Democratic Socialist Republic of Sri Lanka: | |||

| 6.2% 5/11/27 (b)(d) | 14,360,000 | 4,144,655 | |

| 6.825% 7/18/26 (b)(d) | 11,470,000 | 3,572,980 | |

| 6.85% 11/3/25 (b)(d) | 9,145,000 | 2,745,215 | |

| 7.55% 3/28/30 (b)(d) | 8,530,000 | 2,483,296 | |

| 7.85% 3/14/29 (b)(d) | 26,015,000 | 7,492,320 | |

TOTAL SRI LANKA | 20,438,466 | ||

| Tunisia - 0.1% | |||

| Tunisia Republic of 5.75% 1/30/25 (b) | 4,685,000 | 3,177,894 | |

| Turkey - 3.6% | |||

| Turkish Republic: | |||

| 4.25% 3/13/25 | 12,305,000 | 11,505,175 | |

| 4.75% 1/26/26 | 15,150,000 | 13,786,500 | |

| 4.875% 4/16/43 | 21,540,000 | 13,964,651 | |

| 5.125% 2/17/28 | 14,310,000 | 12,342,375 | |

| 5.6% 11/14/24 | 12,070,000 | 11,738,075 | |

| 5.75% 3/22/24 | 11,335,000 | 11,195,438 | |

| 5.75% 5/11/47 | 16,250,000 | 11,022,578 | |

| 6% 3/25/27 | 10,000,000 | 9,137,500 | |

| 6% 1/14/41 | 22,183,000 | 16,027,218 | |

| 6.125% 10/24/28 | 8,780,000 | 7,815,846 | |

| 6.35% 8/10/24 | 6,500,000 | 6,407,781 | |

| 6.375% 10/14/25 | 17,175,000 | 16,488,000 | |

| 7.375% 2/5/25 | 10,509,000 | 10,535,273 | |

TOTAL TURKEY | 151,966,410 | ||

| Ukraine - 0.9% | |||

| Ukraine Government: | |||

| 0% 8/1/41 (b)(g) | 8,905,000 | 2,536,812 | |

| 6.876% 5/21/31 (b) | 7,670,000 | 1,451,548 | |

| 7.253% 3/15/35 (b) | 15,850,000 | 2,955,034 | |

| 7.375% 9/25/34 (b) | 11,640,000 | 2,155,583 | |

| 7.75% 9/1/24 (b) | 29,964,000 | 7,281,252 | |

| 7.75% 9/1/25 (b) | 43,671,000 | 9,793,222 | |

| 7.75% 9/1/26 (b) | 35,377,000 | 7,435,803 | |

| 7.75% 9/1/27 (b) | 7,275,000 | 1,508,653 | |

| 7.75% 9/1/28 (b) | 7,360,000 | 1,571,360 | |

| 7.75% 9/1/29 (b) | 10,846,000 | 2,303,419 | |

| 9.75% 11/1/30 (b) | 3,105,000 | 667,187 | |

TOTAL UKRAINE | 39,659,873 | ||

| United Arab Emirates - 2.0% | |||

| Emirate of Abu Dhabi: | |||

| 1.7% 3/2/31 (b) | 7,910,000 | 6,509,930 | |

| 3.125% 9/30/49 (b) | 42,178,000 | 31,048,280 | |

| 3.875% 4/16/50 (b) | 34,465,000 | 29,043,225 | |

| Emirate of Dubai 3.9% 9/9/50 (Reg. S) | 15,155,000 | 10,767,628 | |

| United Arab Emirates 4.05% 7/7/32 (b) | 5,420,000 | 5,331,248 | |

TOTAL UNITED ARAB EMIRATES | 82,700,311 | ||

| United States of America - 2.7% | |||

| U.S. Treasury Bonds 2.875% 5/15/52 | 141,960,000 | 114,255,543 | |

| Uruguay - 0.6% | |||

| Uruguay Republic 5.1% 6/18/50 | 24,210,000 | 23,871,060 | |

| Uzbekistan - 0.7% | |||

| Republic of Uzbekistan: | |||

| 3.7% 11/25/30 (b) | 7,400,000 | 6,145,700 | |

| 3.9% 10/19/31 (b) | 18,255,000 | 14,898,362 | |

| 4.75% 2/20/24 (b) | 6,095,000 | 5,939,958 | |

| 5.375% 2/20/29 (b) | 4,250,000 | 3,929,391 | |

TOTAL UZBEKISTAN | 30,913,411 | ||

| Venezuela - 1.1% | |||

| Venezuelan Republic: | |||

| 6% 12/31/49 (d) | 17,250,000 | 1,078,125 | |

| 7% 3/31/38 (d) | 18,925,000 | 1,561,313 | |

| 7.65% 4/21/25 (d) | 34,825,000 | 2,786,000 | |

| 7.75% 12/31/49 (Reg. S) (d) | 29,380,000 | 2,130,050 | |

| 8.25% 10/13/24 (d) | 30,860,000 | 2,468,800 | |

| 9% 5/7/23 (Reg. S) (d) | 43,195,000 | 3,455,600 | |

| 9.25% 9/15/27 (d) | 62,675,000 | 5,484,063 | |

| 9.25% 5/7/28 (Reg. S) (d) | 70,265,000 | 5,796,863 | |

| 9.375% 1/13/34 (d) | 46,005,000 | 3,795,413 | |

| 11.75% 10/21/26 (Reg. S) (d) | 65,000,000 | 5,525,000 | |

| 11.95% 8/5/31 (Reg. S) (d) | 87,250,000 | 7,634,375 | |

| 12.75% 12/31/49 (d) | 42,425,000 | 3,287,938 | |

TOTAL VENEZUELA | 45,003,540 | ||

| Zambia - 0.1% | |||

| Republic of Zambia: | |||

| 8.5% 4/14/24 (b) | 2,190,000 | 985,500 | |

| 8.97% 7/30/27 (b) | 10,325,000 | 4,543,000 | |

TOTAL ZAMBIA | 5,528,500 | ||

| TOTAL GOVERNMENT OBLIGATIONS (Cost $3,361,527,006) | 2,588,905,448 | ||

| Preferred Securities - 1.4% | |||

Principal Amount (a) | Value ($) | ||

| Cayman Islands - 1.0% | |||

| Banco Mercantil del Norte SA 6.75% (b)(c)(g) | 13,000,000 | 12,673,375 | |

| Cosan Overseas Ltd. 8.25% (c) | 14,470,000 | 14,562,392 | |

| DP World Salaam 6% (Reg. S) (c)(g) | 13,905,000 | 14,148,338 | |

TOTAL CAYMAN ISLANDS | 41,384,105 | ||

| Ireland - 0.0% | |||

| Tinkoff Credit Systems 6% (b)(c)(g) | 6,660,000 | 2,573,258 | |

| Mexico - 0.4% | |||

| CEMEX S.A.B. de CV 5.125% (b)(c)(g) | 16,320,000 | 15,361,707 | |

| TOTAL PREFERRED SECURITIES (Cost $65,600,889) | 59,319,070 | ||

| Money Market Funds - 1.9% | |||

| Shares | Value ($) | ||

Fidelity Cash Central Fund 4.37% (h) (Cost $81,116,512) | 81,128,674 | 81,144,900 | |

| TOTAL INVESTMENT IN SECURITIES - 98.5% (Cost $5,468,714,835) | 4,168,345,166 |

NET OTHER ASSETS (LIABILITIES) - 1.5% | 63,904,700 |

| NET ASSETS - 100.0% | 4,232,249,866 |

| EUR | - | European Monetary Unit |

| (a) | Amount is stated in United States dollars unless otherwise noted. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,659,284,480 or 62.8% of net assets. |

| (c) | Security is perpetual in nature with no stated maturity date. |

| (d) | Non-income producing - Security is in default. |

| (e) | Security initially issued at one coupon which converts to a higher coupon at a specified date. The rate shown is the rate at period end. |

| (f) | Level 3 security |

| (g) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

| (h) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.37% | 384,422,886 | 3,271,592,732 | 3,574,870,719 | 2,550,946 | - | 1 | 81,144,900 | 0.2% |

| Total | 384,422,886 | 3,271,592,732 | 3,574,870,719 | 2,550,946 | - | 1 | 81,144,900 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Corporate Bonds | 1,438,975,748 | - | 1,438,975,748 | - |

| Government Obligations | 2,588,905,448 | - | 2,582,091,448 | 6,814,000 |

| Preferred Securities | 59,319,070 | - | 59,319,070 | - |

| Money Market Funds | 81,144,900 | 81,144,900 | - | - |

| Total Investments in Securities: | 4,168,345,166 | 81,144,900 | 4,080,386,266 | 6,814,000 |

| Investments in Securities: | |||

| Beginning Balance | $ | - | |

| Net Realized Gain (Loss) on Investment Securities | (11,365,490) | ||

| Net Unrealized Gain (Loss) on Investment Securities | (21,667,500) | ||

| Cost of Purchases | - | ||

| Proceeds of Sales | (9,563,250) | ||

| Amortization/Accretion | (54,140) | ||

| Transfers into Level 3 | 49,464,380 | ||

| Transfers out of Level 3 | - | ||

| Ending Balance | $ | 6,814,000 | |

| The change in unrealized gain (loss) for the period attributable to Level 3 securities held at December 31, 2022 | $ | (21,667,500) | |

| The information used in the above reconciliation represents fiscal year to date activity for any Investments in Securities identified as using Level 3 inputs at either the beginning or the end of the current fiscal period. Cost of purchases and proceeds of sales may include securities received and/or delivered through in-kind transactions. Transfers into Level 3 were attributable to a lack of observable market data resulting from decreases in market activity, decreases in liquidity, security restructurings or corporate actions. Transfers out of Level 3 were attributable to observable market data becoming available for those securities. Transfers in or out of Level 3 represent the beginning value of any Security or Instrument where a change in the pricing level occurred from the beginning to the end of the period. The cost of purchases and the proceeds of sales may include securities received or delivered through corporate actions or exchanges. Realized and unrealized gains (losses) disclosed in the reconciliation are included in Net Gain (Loss) on the Fund's Statement of Operations. | |||

| Statement of Assets and Liabilities | ||||

| December 31, 2022 | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | $ | |||

Unaffiliated issuers (cost $5,387,598,323) | 4,087,200,266 | |||

Fidelity Central Funds (cost $81,116,512) | 81,144,900 | |||

| Total Investment in Securities (cost $5,468,714,835) | $ | 4,168,345,166 | ||

| Cash | 626,602 | |||

| Foreign currency held at value (cost $988) | 626 | |||

| Receivable for investments sold | 250,000 | |||

| Receivable for fund shares sold | 2,400,449 | |||

| Interest receivable | 81,636,557 | |||

| Distributions receivable from Fidelity Central Funds | 382,431 | |||

| Prepaid expenses | 5,076 | |||

Total assets | 4,253,646,907 | |||

| Liabilities | ||||

| Payable for investments purchased | $4,709,349 | |||

| Payable for fund shares redeemed | 11,431,017 | |||

| Distributions payable | 2,333,804 | |||

| Accrued management fee | 2,329,165 | |||

| Distribution and service plan fees payable | 33,701 | |||

| Other affiliated payables | 469,711 | |||

| Other payables and accrued expenses | 90,294 | |||

| Total Liabilities | 21,397,041 | |||

| Net Assets | $ | 4,232,249,866 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 6,477,405,307 | ||

| Total accumulated earnings (loss) | (2,245,155,441) | |||

| Net Assets | $ | 4,232,249,866 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($78,302,070 ÷ 6,803,185 shares) (a) | $ | 11.51 | ||

| Maximum offering price per share (100/96.00 of $11.51) | $ | 11.99 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($25,746,827 ÷ 2,235,639 shares) (a) | $ | 11.52 | ||

| Maximum offering price per share (100/96.00 of $11.52) | $ | 12.00 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($12,908,073 ÷ 1,121,353 shares) (a) | $ | 11.51 | ||

| Fidelity New Markets Income Fund : | ||||

Net Asset Value , offering price and redemption price per share ($1,613,198,359 ÷ 140,111,079 shares) | $ | 11.51 | ||

| Class I : | ||||

Net Asset Value , offering price and redemption price per share ($769,764,726 ÷ 66,860,720 shares) | $ | 11.51 | ||

| Class Z : | ||||

Net Asset Value , offering price and redemption price per share ($1,732,329,811 ÷ 150,468,788 shares) | $ | 11.51 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Year ended December 31, 2022 | ||||

| Investment Income | ||||

| Dividends | $ | 5,362,848 | ||

| Interest | 284,181,851 | |||

| Income from Fidelity Central Funds | 2,550,946 | |||

| Income before foreign taxes withheld | 292,095,645 | |||

| Less foreign taxes withheld | (349,440) | |||

| Total Income | 291,746,205 | |||

| Expenses | ||||

| Management fee | $ | 30,266,654 | ||

| Transfer agent fees | 5,045,459 | |||

| Distribution and service plan fees | 471,207 | |||

| Accounting fees and expenses | 1,158,548 | |||

| Custodian fees and expenses | 21,223 | |||

| Independent trustees' fees and expenses | 16,521 | |||

| Registration fees | 129,250 | |||

| Audit | 101,980 | |||

| Legal | 75,960 | |||

| Miscellaneous | 23,077 | |||

| Total expenses before reductions | 37,309,879 | |||

| Expense reductions | (90,077) | |||

| Total expenses after reductions | 37,219,802 | |||

| Net Investment income (loss) | 254,526,403 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (418,419,382) | |||

| Foreign currency transactions | (248,859) | |||

| Total net realized gain (loss) | (418,668,241) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (696,400,393) | |||

| Fidelity Central Funds | 1 | |||

| Assets and liabilities in foreign currencies | 92,945 | |||

| Total change in net unrealized appreciation (depreciation) | (696,307,447) | |||

| Net gain (loss) | (1,114,975,688) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (860,449,285) | ||

| Statement of Changes in Net Assets | ||||

Year ended December 31, 2022 | Year ended December 31, 2021 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 254,526,403 | $ | 260,200,730 |

| Net realized gain (loss) | (418,668,241) | 22,526,700 | ||

| Change in net unrealized appreciation (depreciation) | (696,307,447) | (402,911,391) | ||

| Net increase (decrease) in net assets resulting from operations | (860,449,285) | (120,183,961) | ||

| Distributions to shareholders | (228,839,655) | (244,835,872) | ||

| Share transactions - net increase (decrease) | (469,842,710) | (390,241,057) | ||

| Total increase (decrease) in net assets | (1,559,131,650) | (755,260,890) | ||

| Net Assets | ||||

| Beginning of period | 5,791,381,516 | 6,546,642,406 | ||

| End of period | $ | 4,232,249,866 | $ | 5,791,381,516 |

| Fidelity Advisor® New Markets Income Fund Class A |

| Years ended December 31, | 2022 | 2021 | 2020 | 2019 | 2018 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 14.24 | $ | 15.09 | $ | 15.07 | $ | 14.27 | $ | 14.31 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .621 | .575 | .649 | .748 | .054 | |||||

| Net realized and unrealized gain (loss) | (2.796) | (.888) | (.062) | .740 | (.043) | |||||

| Total from investment operations | (2.175) | (.313) | .587 | 1.488 | .011 | |||||

| Distributions from net investment income | (.555) | (.497) | (.556) | (.688) | (.051) | |||||

| Distributions from net realized gain | - | (.040) | (.011) | - | - | |||||

| Total distributions | (.555) | (.537) | (.567) | (.688) | (.051) | |||||

| Net asset value, end of period | $ | 11.51 | $ | 14.24 | $ | 15.09 | $ | 15.07 | $ | 14.27 |

Total Return D,E,F | (15.30)% | (2.09)% | 4.19% | 10.56% | .07% | |||||

Ratios to Average Net Assets C,G,H | ||||||||||

| Expenses before reductions | 1.13% | 1.12% | 1.13% | 1.12% | 1.15% I | |||||

| Expenses net of fee waivers, if any | 1.13% | 1.12% | 1.13% | 1.12% | 1.15% I | |||||

| Expenses net of all reductions | 1.13% | 1.12% | 1.13% | 1.12% | 1.14% I | |||||

| Net investment income (loss) | 5.12% | 3.93% | 4.51% | 5.01% | 5.58% I | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 78,302 | $ | 118,896 | $ | 136,626 | $ | 193,262 | $ | 162,757 |

Portfolio turnover rate J | 26% | 30% | 91% | 79% K | 60% L |

| Fidelity Advisor® New Markets Income Fund Class M |

| Years ended December 31, | 2022 | 2021 | 2020 | 2019 | 2018 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 14.24 | $ | 15.10 | $ | 15.08 | $ | 14.27 | $ | 14.31 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .621 | .576 | .647 | .749 | .054 | |||||

| Net realized and unrealized gain (loss) | (2.786) | (.898) | (.059) | .748 | (.044) | |||||

| Total from investment operations | (2.165) | (.322) | .588 | 1.497 | .010 | |||||

| Distributions from net investment income | (.555) | (.498) | (.557) | (.687) | (.050) | |||||

| Distributions from net realized gain | - | (.040) | (.011) | - | - | |||||

| Total distributions | (.555) | (.538) | (.568) | (.687) | (.050) | |||||

| Net asset value, end of period | $ | 11.52 | $ | 14.24 | $ | 15.10 | $ | 15.08 | $ | 14.27 |

Total Return D,E,F | (15.23)% | (2.15)% | 4.20% | 10.63% | .07% | |||||

Ratios to Average Net Assets C,G,H | ||||||||||

| Expenses before reductions | 1.13% | 1.12% | 1.13% | 1.13% | 1.14% I | |||||

| Expenses net of fee waivers, if any | 1.13% | 1.11% | 1.13% | 1.13% | 1.14% I | |||||

| Expenses net of all reductions | 1.13% | 1.11% | 1.12% | 1.13% | 1.14% I | |||||

| Net investment income (loss) | 5.11% | 3.94% | 4.51% | 5.01% | 5.59% I | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 25,747 | $ | 38,589 | $ | 44,941 | $ | 53,609 | $ | 55,047 |

Portfolio turnover rate J | 26% | 30% | 91% | 79% K | 60% L |

| Fidelity Advisor® New Markets Income Fund Class C |

| Years ended December 31, | 2022 | 2021 | 2020 | 2019 | 2018 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 14.24 | $ | 15.09 | $ | 15.07 | $ | 14.27 | $ | 14.31 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .536 | .471 | .542 | .641 | .047 | |||||

| Net realized and unrealized gain (loss) | (2.798) | (.891) | (.063) | .737 | (.044) | |||||

| Total from investment operations | (2.262) | (.420) | .479 | 1.378 | .003 | |||||

| Distributions from net investment income | (.468) | (.390) | (.448) | (.578) | (.043) | |||||

| Distributions from net realized gain | - | (.040) | (.011) | - | - | |||||

| Total distributions | (.468) | (.430) | (.459) | (.578) | (.043) | |||||

| Net asset value, end of period | $ | 11.51 | $ | 14.24 | $ | 15.09 | $ | 15.07 | $ | 14.27 |

Total Return D,E,F | (15.91)% | (2.81)% | 3.43% | 9.75% | .02% | |||||

Ratios to Average Net Assets C,G,H | ||||||||||

| Expenses before reductions | 1.85% | 1.86% | 1.86% | 1.86% | 1.86% I | |||||

| Expenses net of fee waivers, if any | 1.85% | 1.85% | 1.86% | 1.86% | 1.86% I | |||||

| Expenses net of all reductions | 1.85% | 1.85% | 1.86% | 1.85% | 1.86% I | |||||

| Net investment income (loss) | 4.39% | 3.20% | 3.77% | 4.28% | 4.88% I | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 12,908 | $ | 23,000 | $ | 44,401 | $ | 64,290 | $ | 87,713 |

Portfolio turnover rate J | 26% | 30% | 91% | 79% K | 60% L |

| Fidelity® New Markets Income Fund |

| Years ended December 31, | 2022 | 2021 | 2020 | 2019 | 2018 | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 14.24 | $ | 15.10 | $ | 15.07 | $ | 14.27 | $ | 16.22 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) A,B | .658 | .624 | .693 | .795 | .698 | |||||

| Net realized and unrealized gain (loss) | (2.796) | (.899) | (.050) | .738 | (1.937) | |||||

| Total from investment operations | (2.138) | (.275) | .643 | 1.533 | (1.239) | |||||

| Distributions from net investment income | (.592) | (.545) | (.602) | (.733) | (.667) | |||||

| Distributions from net realized gain | - | (.040) | (.011) | - | (.044) | |||||

| Total distributions | (.592) | (.585) | (.613) | (.733) | (.711) | |||||

| Net asset value, end of period | $ | 11.51 | $ | 14.24 | $ | 15.10 | $ | 15.07 | $ | 14.27 |

Total Return C | (15.04)% | (1.84)% | 4.60% | 10.89% | (7.78)% | |||||

Ratios to Average Net Assets B,D,E | ||||||||||

| Expenses before reductions | .82% | .80% | .81% | .82% | .83% | |||||

| Expenses net of fee waivers, if any | .82% | .79% | .81% | .82% | .83% | |||||

| Expenses net of all reductions | .82% | .79% | .80% | .82% | .83% | |||||

| Net investment income (loss) | 5.43% | 4.26% | 4.83% | 5.32% | 4.59% | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 1,613,198 | $ | 2,313,928 | $ | 3,430,477 | $ | 4,227,156 | $ | 4,520,911 |

Portfolio turnover rate F | 26% | 30% | 91% | 79% G | 60% H |

| Fidelity Advisor® New Markets Income Fund Class I |

| Years ended December 31, | 2022 | 2021 | 2020 | 2019 | 2018 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 14.25 | $ | 15.10 | $ | 15.08 | $ | 14.27 | $ | 14.31 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .659 | .620 | .690 | .798 | .057 | |||||

| Net realized and unrealized gain (loss) | (2.808) | (.890) | (.059) | .743 | (.043) | |||||

| Total from investment operations | (2.149) | (.270) | .631 | 1.541 | .014 | |||||

| Distributions from net investment income | (.591) | (.540) | (.600) | (.731) | (.054) | |||||

| Distributions from net realized gain | - | (.040) | (.011) | - | - | |||||

| Total distributions | (.591) | (.580) | (.611) | (.731) | (.054) | |||||

| Net asset value, end of period | $ | 11.51 | $ | 14.25 | $ | 15.10 | $ | 15.08 | $ | 14.27 |

Total Return D,E | (15.11)% | (1.80)% | 4.50% | 10.95% | .10% | |||||

Ratios to Average Net Assets C,F,G | ||||||||||

| Expenses before reductions | .83% | .83% | .83% | .83% | .82% H | |||||

| Expenses net of fee waivers, if any | .83% | .83% | .83% | .82% | .82% H | |||||

| Expenses net of all reductions | .83% | .83% | .83% | .82% | .82% H | |||||

| Net investment income (loss) | 5.42% | 4.22% | 4.80% | 5.31% | 5.90% H | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 769,765 | $ | 1,148,584 | $ | 1,665,050 | $ | 2,081,780 | $ | 3,727,909 |

Portfolio turnover rate I | 26% | 30% | 91% | 79% J | 60% K |

| Fidelity Advisor® New Markets Income Fund Class Z |

| Years ended December 31, | 2022 | 2021 | 2020 | 2019 | 2018 A | |||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 14.24 | $ | 15.10 | $ | 15.08 | $ | 14.27 | $ | 14.31 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .666 | .628 | .698 | .800 | .060 | |||||

| Net realized and unrealized gain (loss) | (2.793) | (.893) | (.057) | .756 | (.045) | |||||

| Total from investment operations | (2.127) | (.265) | .641 | 1.556 | .015 | |||||

| Distributions from net investment income | (.603) | (.555) | (.610) | (.746) | (.055) | |||||

| Distributions from net realized gain | - | (.040) | (.011) | - | - | |||||

| Total distributions | (.603) | (.595) | (.621) | (.746) | (.055) | |||||

| Net asset value, end of period | $ | 11.51 | $ | 14.24 | $ | 15.10 | $ | 15.08 | $ | 14.27 |

Total Return D,E | (14.96)% | (1.77)% | 4.61% | 11.06% | .10% | |||||

Ratios to Average Net Assets C,F,G | ||||||||||

| Expenses before reductions | .73% | .72% | .73% | .73% | .74% H | |||||

| Expenses net of fee waivers, if any | .73% | .72% | .73% | .73% | .74% H | |||||

| Expenses net of all reductions | .73% | .72% | .73% | .73% | .74% H | |||||

| Net investment income (loss) | 5.52% | 4.33% | 4.91% | 5.40% | 5.97% H | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 1,732,330 | $ | 2,148,384 | $ | 1,225,147 | $ | 1,523,041 | $ | 2,878 |

Portfolio turnover rate I | 26% | 30% | 91% | 79% J | 60% K |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $65,786,447 |

| Gross unrealized depreciation | (1,260,088,866) |

| Net unrealized appreciation (depreciation) | $(1,194,302,419) |

| Tax Cost | $5,362,647,585 |

| Capital loss carryforward | $(1,050,159,173) |

| Net unrealized appreciation (depreciation) on securities and other investments | $(1,194,259,840) |

| Short-term | $(254,753,194) |

| Long-term | (795,405,979 ) |

| Total capital loss carryforward | $(1,050,159,173) |

| December 31, 2022 | December 31, 2021 | |

| Ordinary Income | $ 228,839,655 | $ 227,620,231 |

| Long-term Capital Gains | - | 17,215,641 |

| Total | $ 228,839,655 | $ 244,835,872 |

| Purchases ($) | Sales ($) | |

| Fidelity New Markets Income Fund | 1,032,754,815 | 1,320,668,371 |

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | % | .25% | $233,534 | $2,159 |

| Class M | % | .25% | 73,874 | 237 |

| Class C | .75% | .25% | 163,799 | 3,004 |

| $471,207 | $5,400 |

| Retained by FDC | |

| Class A | $1,618 |

| Class M | 600 |

Class C A | 44 |

| $2,262 |

| Amount | % of Class-Level Average Net Assets | |

| Class A | $185,608 | .20 |

| Class M | 59,833 | .20 |

| Class C | 28,191 | .17 |

| Fidelity New Markets Income Fund | 2,546,009 | .14 |

| Class I | 1,300,619 | .15 |

| Class Z | 925,199 | .05 |

| $5,045,459 |

| % of Average Net Assets | |

| Fidelity New Markets Income Fund | .02 |

| Amount | |

| Fidelity New Markets Income Fund | $8,712 |

Year ended December 31, 2022 | Year ended December 31, 2021 | |

| Fidelity New Markets Income Fund | ||

| Distributions to shareholders | ||

| Class A | $4,248,201 | $4,694,469 |

| Class M | 1,339,887 | 1,533,896 |

| Class C | 618,004 | 962,511 |

| Fidelity New Markets Income Fund | 88,479,584 | 119,678,897 |

| Class I | 41,747,477 | 55,182,528 |

| Class Z | 92,406,502 | 62,783,571 |

| Total | $228,839,655 | $244,835,872 |

| Shares | Shares | Dollars | Dollars | |

| Year ended December 31, 2022 | Year ended December 31, 2021 | Year ended December 31, 2022 | Year ended December 31, 2021 | |

| Fidelity New Markets Income Fund | ||||

| Class A | ||||

| Shares sold | 591,073 | 1,246,248 | $7,300,290 | $18,278,571 |

| Reinvestment of distributions | 345,079 | 306,991 | 4,099,396 | 4,472,610 |

| Shares redeemed | (2,481,382) | (2,256,378) | (29,869,528) | (32,945,485) |

| Net increase (decrease) | (1,545,230) | (703,139) | $(18,469,842) | $(10,194,304) |

| Class M | ||||

| Shares sold | 115,764 | 218,733 | $1,419,990 | $3,211,359 |

| Reinvestment of distributions | 107,226 | 96,463 | 1,273,571 | 1,405,975 |

| Shares redeemed | (696,377) | (582,447) | (8,560,601) | (8,521,446) |

| Net increase (decrease) | (473,387) | (267,251) | $(5,867,040) | $(3,904,112) |

| Class C | ||||

| Shares sold | 29,717 | 49,454 | $352,288 | $725,658 |

| Reinvestment of distributions | 51,370 | 64,933 | 611,425 | 947,843 |

| Shares redeemed | (574,893) | (1,440,747) | (6,993,345) | (21,144,225) |

| Net increase (decrease) | (493,806) | (1,326,360) | $(6,029,632) | $(19,470,724) |

| Fidelity New Markets Income Fund | ||||

| Shares sold | 10,866,723 | 41,460,398 | $130,733,436 | $607,919,848 |

| Reinvestment of distributions | 6,458,932 | 7,199,371 | 76,787,954 | 105,029,522 |

| Shares redeemed | (39,674,593) | (113,413,966) | (480,538,182) | (1,666,698,190) |

| Net increase (decrease) | (22,348,938) | (64,754,197) | $(273,016,792) | $(953,748,820) |

| Class I | ||||

| Shares sold | 11,069,631 | 21,843,778 | $133,449,712 | $319,323,695 |

| Reinvestment of distributions | 3,415,651 | 3,677,368 | 40,686,129 | 53,608,984 |

| Shares redeemed | (28,254,755) | (55,169,703) | (347,139,307) | (804,247,172) |

| Net increase (decrease) | (13,769,473) | (29,648,557) | $(173,003,466) | $(431,314,493) |

| Class Z | ||||

| Shares sold | 45,004,654 | 102,739,743 | $560,436,966 | $1,511,525,229 |

| Reinvestment of distributions | 6,100,146 | 1,918,186 | 72,079,274 | 27,704,401 |

| Shares redeemed | (51,477,102) | (34,967,406) | (625,972,178) | (510,838,234) |

| Net increase (decrease) | (372,302) | 69,690,523 | $6,544,062 | $1,028,391,396 |

| Strategic Advisers Fidelity Core Income Fund | |

| Fidelity New Markets Income Fund | 26% |

| Fund | % of shares held |

| Fidelity New Markets Income Fund | 27% |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2022 to December 31, 2022). |

Annualized Expense Ratio- A | Beginning Account Value July 1, 2022 | Ending Account Value December 31, 2022 | Expenses Paid During Period- C July 1, 2022 to December 31, 2022 | |||||||

| Fidelity® New Markets Income Fund | ||||||||||

| Class A | 1.12% | |||||||||

| Actual | $ 1,000 | $ 1,034.80 | $ 5.74 | |||||||

Hypothetical- B | $ 1,000 | $ 1,019.56 | $ 5.70 | |||||||

| Class M | 1.13% | |||||||||

| Actual | $ 1,000 | $ 1,034.80 | $ 5.80 | |||||||

Hypothetical- B | $ 1,000 | $ 1,019.51 | $ 5.75 | |||||||

| Class C | 1.82% | |||||||||

| Actual | $ 1,000 | $ 1,031.10 | $ 9.32 | |||||||

Hypothetical- B | $ 1,000 | $ 1,016.03 | $ 9.25 | |||||||

| Fidelity® New Markets Income Fund | .82% | |||||||||

| Actual | $ 1,000 | $ 1,036.40 | $ 4.21 | |||||||

Hypothetical- B | $ 1,000 | $ 1,021.07 | $ 4.18 | |||||||

| Class I | .82% | |||||||||

| Actual | $ 1,000 | $ 1,036.40 | $ 4.21 | |||||||

Hypothetical- B | $ 1,000 | $ 1,021.07 | $ 4.18 | |||||||

| Class Z | .73% | |||||||||

| Actual | $ 1,000 | $ 1,036.90 | $ 3.75 | |||||||

Hypothetical- B | $ 1,000 | $ 1,021.53 | $ 3.72 | |||||||

|

Item 2.

Code of Ethics

As of the end of the period, December 31, 2022, Fidelity Summer Street Trust (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer and its Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3.

Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Donald F. Donahue is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Donahue is independent for purposes of Item 3 of Form N-CSR.

Item 4.

Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by PricewaterhouseCoopers LLP (“PwC”) in each of the last two fiscal years for services rendered to Fidelity New Markets Income Fund (the “Fund”):

Services Billed by PwC

December 31, 2022 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity New Markets Income Fund | $75,600 | $6,300 | $9,300 | $2,200 |

December 31, 2021 FeesA

Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees | |

Fidelity New Markets Income Fund | $73,500 | $6,800 | $17,200 | $2,200 |

A Amounts may reflect rounding.

The following table(s) present(s) fees billed by PwC that were required to be approved by the Audit Committee for services that relate directly to the operations and financial reporting of the Fund(s) and that are rendered on behalf of Fidelity Management & Research Company LLC ("FMR") and entities controlling, controlled by, or under

common control with FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) that provide ongoing services to the Fund(s) (“Fund Service Providers”):

Services Billed by PwC

December 31, 2022A | December 31, 2021A | |

Audit-Related Fees | $7,914,600 | $8,522,600 |

Tax Fees | $1,000 | $354,200 |

All Other Fees | $- | $- |

A Amounts may reflect rounding.

“Audit-Related Fees” represent fees billed for assurance and related services that are reasonably related to the performance of the fund audit or the review of the fund's financial statements and that are not reported under Audit Fees.

“Tax Fees” represent fees billed for tax compliance, tax advice or tax planning that relate directly to the operations and financial reporting of the fund.

“All Other Fees” represent fees billed for services provided to the fund or Fund Service Provider, a significant portion of which are assurance related, that relate directly to the operations and financial reporting of the fund, excluding those services that are reported under Audit Fees, Audit-Related Fees or Tax Fees.

Assurance services must be performed by an independent public accountant.

* * *

The aggregate non-audit fees billed by PwC for services rendered to the Fund(s), FMR (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any Fund Service Provider for each of the last two fiscal years of the Fund(s) are as follows:

Billed By | December 31, 2022A | December 31, 2021A |

PwC | $12,900,800 | $14,145,700 |

A Amounts may reflect rounding.

The trust's Audit Committee has considered non-audit services that were not pre-approved that were provided by PwC to Fund Service Providers to be compatible with maintaining the independence of PwC in its(their) audit of the Fund(s), taking into

account representations from PwC, in accordance with Public Company Accounting Oversight Board rules, regarding its independence from the Fund(s) and its(their) related entities and FMR’s review of the appropriateness and permissibility under applicable law of such non-audit services prior to their provision to the Fund(s) Service Providers.

Audit Committee Pre-Approval Policies and Procedures

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by a fund’s independent registered public accounting firm relating to the operations or financial reporting of the fund. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of non-audit services by the audit firms that audit the Fidelity funds. The policies and procedures require that any non-audit service provided by a fund audit firm to a Fidelity fund and any non-audit service provided by a fund auditor to a Fund Service Provider that relates directly to the operations and financial reporting of a Fidelity fund (“Covered Service”) are subject to approval by the Audit Committee before such service is provided.

All Covered Services must be approved in advance of provision of the service either: (i) by formal resolution of the Audit Committee, or (ii) by oral or written approval of the service by the Chair of the Audit Committee (or if the Chair is unavailable, such other member of the Audit Committee as may be designated by the Chair to act in the Chair’s absence). The approval contemplated by (ii) above is permitted where the Treasurer determines that action on such an engagement is necessary before the next meeting of the Audit Committee.

Non-audit services provided by a fund audit firm to a Fund Service Provider that do not relate directly to the operations and financial reporting of a Fidelity fund are reported to the Audit Committee periodically.

Non-Audit Services Approved Pursuant to Rule 2-01(c)(7)(i)(C) and (ii) of Regulation S-X (“De Minimis Exception”)

There were no non-audit services approved or required to be approved by the Audit Committee pursuant to the De Minimis Exception during the Fund’s(s’) last two fiscal years relating to services provided to (i) the Fund(s) or (ii) any Fund Service Provider that relate directly to the operations and financial reporting of the Fund(s).

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable.

Item 7.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the trust’s Board of Trustees.

Item 11.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the trust’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the trust’s internal control over financial reporting.

Item 12.

Disclosure of Securities Lending Activities for Closed-End Management

Investment Companies

Not applicable.

Item 13.

Exhibits

(a) | (1) | Code of Ethics pursuant to Item 2 of Form N-CSR is filed and attached hereto as EX-99.CODE ETH. |

(a) | (2) | |

(a) | (3) | Not applicable. |

(b) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Summer Street Trust

By: | /s/Stacie M. Smith |

Stacie M. Smith | |

President and Treasurer | |

Date: | February 21, 2023 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/Stacie M. Smith |

Stacie M. Smith | |

President and Treasurer | |

Date: | February 21, 2023 |

By: | /s/John J. Burke III |

John J. Burke III | |

Chief Financial Officer | |

Date: | February 21, 2023 |