UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02737

Fidelity Summer Street Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | April 30 |

|

|

Date of reporting period: | October 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Women's Leadership Fund Fidelity® Women's Leadership Fund : FWOMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Women's Leadership Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Women's Leadership Fund | $ 34 | 0.66% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $148,487,329 | |

| Number of Holdings | 113 | |

| Portfolio Turnover | 26% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 30.0 | |

| Financials | 13.2 | |

| Health Care | 13.0 | |

| Industrials | 11.5 | |

| Consumer Discretionary | 11.3 | |

| Communication Services | 6.1 | |

| Materials | 3.8 | |

| Consumer Staples | 3.2 | |

| Energy | 2.9 | |

| Real Estate | 1.9 | |

| Utilities | 1.0 | |

| |

| Common Stocks | 97.6 |

| Preferred Stocks | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 93.8 |

| China | 1.3 |

| Belgium | 1.3 |

| Australia | 1.0 |

| Germany | 0.8 |

| Italy | 0.8 |

| Canada | 0.5 |

| Norway | 0.4 |

| United Kingdom | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 4.4 | |

| NVIDIA Corp | 3.7 | |

| Microsoft Corp | 3.6 | |

| Amazon.com Inc | 2.6 | |

| Accenture Capital Inc Class A | 2.1 | |

| Walt Disney Co/The | 2.0 | |

| Salesforce Inc | 1.8 | |

| Hologic Inc | 1.7 | |

| JPMorgan Chase & Co | 1.7 | |

| Progressive Corp/The | 1.6 | |

| | 25.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915099.100 3396-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® High Income Fund Fidelity Advisor® High Income Fund Class Z : FGUMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 31 | 0.60% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $2,767,692,910 | |

| Number of Holdings | 926 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 2.5 |

| A | 0.3 |

| BBB | 2.5 |

| BB | 32.9 |

| B | 37.4 |

| CCC,CC,C | 15.4 |

| Not Rated | 3.9 |

| Equities | 3.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

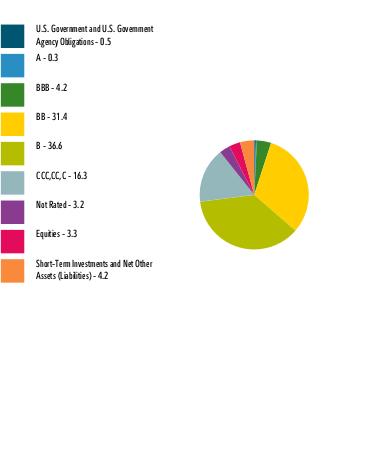

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 86.1 |

| Bank Loan Obligations | 4.3 |

| U.S. Treasury Obligations | 2.5 |

| Common Stocks | 1.9 |

| Preferred Securities | 1.7 |

| Alternative Funds | 1.1 |

| Asset-Backed Securities | 0.2 |

| CMOs and Other Mortgage Related Securities | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 81.7 |

| Canada | 3.7 |

| United Kingdom | 2.4 |

| France | 1.3 |

| Germany | 0.9 |

| Ireland | 0.9 |

| Luxembourg | 0.9 |

| Netherlands | 0.7 |

| Tanzania | 0.6 |

| Others | 6.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 2.5 | |

| CHS/Community Health Systems Inc | 1.3 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.3 | |

| Fidelity Private Credit Company LLC | 1.1 | |

| TransDigm Inc | 1.1 | |

| MPT Operating Partnership LP / MPT Finance Corp | 1.0 | |

| Tenet Healthcare Corp | 0.9 | |

| Carnival Corp | 0.9 | |

| Vistra Operations Co LLC | 0.8 | |

| NRG Energy Inc | 0.8 | |

| | 11.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915059.100 3316-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Short Duration High Income Fund Fidelity Advisor® Short Duration High Income Fund Class I : FSFHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Short Duration High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 39 | 0.75% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $249,300,191 | |

| Number of Holdings | 487 | |

| Portfolio Turnover | 47% | |

What did the Fund invest in?

(as of October 31, 2024)

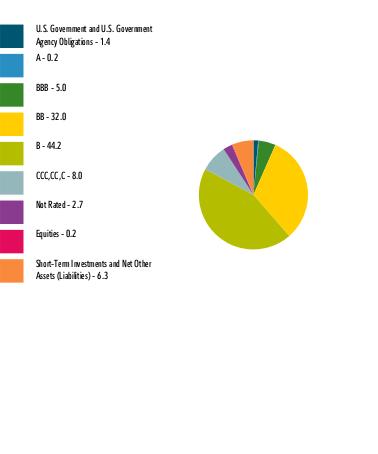

| U.S. Government and U.S. Government Agency Obligations | 1.4 |

| A | 0.2 |

| BBB | 5.0 |

| BB | 32.0 |

| B | 44.2 |

| CCC,CC,C | 8.0 |

| Not Rated | 2.7 |

| Equities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

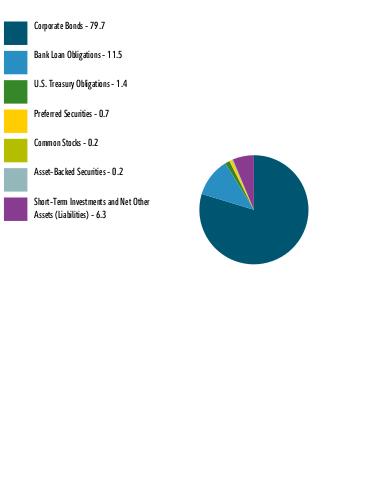

| Corporate Bonds | 79.7 |

| Bank Loan Obligations | 11.5 |

| U.S. Treasury Obligations | 1.4 |

| Preferred Securities | 0.7 |

| Common Stocks | 0.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

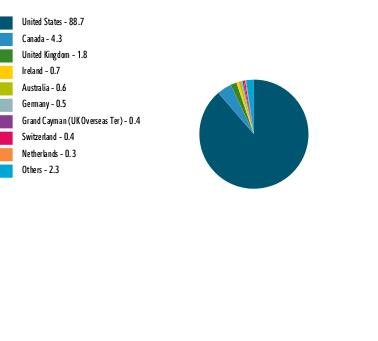

| United States | 88.7 |

| Canada | 4.3 |

| United Kingdom | 1.8 |

| Ireland | 0.7 |

| Australia | 0.6 |

| Germany | 0.5 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Switzerland | 0.4 |

| Netherlands | 0.3 |

| Others | 2.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| TransDigm Inc | 2.2 | |

| US Treasury Notes | 1.4 | |

| Univision Communications Inc | 1.2 | |

| DISH Network Corp | 1.2 | |

| Carnival Corp | 1.2 | |

| Royal Caribbean Cruises Ltd | 1.1 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.0 | |

| Venture Global LNG Inc | 1.0 | |

| OneMain Finance Corp | 0.9 | |

| Tenet Healthcare Corp | 0.9 | |

| | 12.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915081.100 2584-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Focused High Income Fund Fidelity® Focused High Income Fund : FHIFX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Focused High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Focused High Income Fund | $ 39 | 0.75% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $198,767,721 | |

| Number of Holdings | 394 | |

| Portfolio Turnover | 28% | |

What did the Fund invest in?

(as of October 31, 2024)

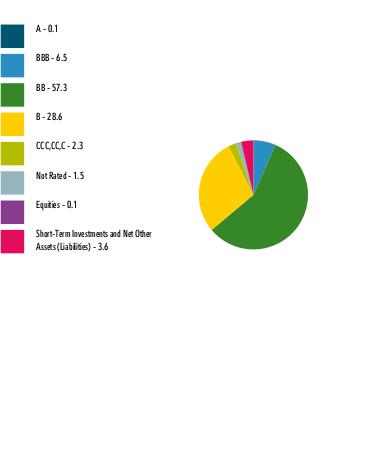

| A | 0.1 |

| BBB | 6.5 |

| BB | 57.3 |

| B | 28.6 |

| CCC,CC,C | 2.3 |

| Not Rated | 1.5 |

| Equities | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.6 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

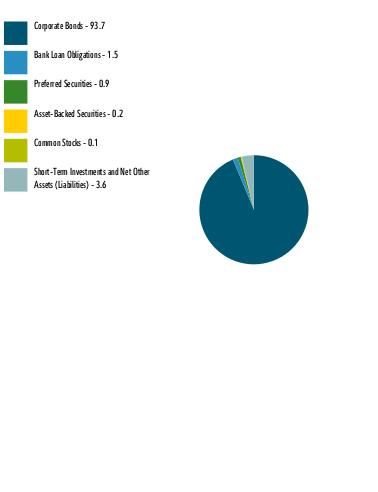

| Corporate Bonds | 93.7 |

| Bank Loan Obligations | 1.5 |

| Preferred Securities | 0.9 |

| Asset-Backed Securities | 0.2 |

| Common Stocks | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 3.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

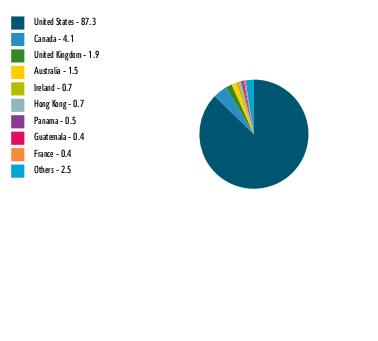

| United States | 87.3 |

| Canada | 4.1 |

| United Kingdom | 1.9 |

| Australia | 1.5 |

| Ireland | 0.7 |

| Hong Kong | 0.7 |

| Panama | 0.5 |

| Guatemala | 0.4 |

| France | 0.4 |

| Others | 2.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 2.0 | |

| Hilton Domestic Operating Co Inc | 1.9 | |

| Hess Midstream Operations LP | 1.7 | |

| Royal Caribbean Cruises Ltd | 1.4 | |

| OneMain Finance Corp | 1.4 | |

| Iron Mountain Inc | 1.3 | |

| Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC | 1.3 | |

| Vistra Operations Co LLC | 1.3 | |

| Yum! Brands Inc | 1.2 | |

| Sirius XM Radio Inc | 1.1 | |

| | 14.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915068.100 1366-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® SAI High Income Fund Fidelity® SAI High Income Fund : FSHGX |

| | | |

This semi-annual shareholder report contains information about Fidelity® SAI High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-3455 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® SAI High Income Fund | $ 29 | 0.55% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $1,614,908,129 | |

| Number of Holdings | 820 | |

| Portfolio Turnover | 62% | |

What did the Fund invest in?

(as of October 31, 2024)

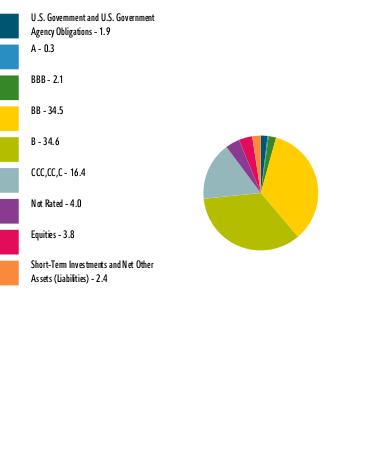

| U.S. Government and U.S. Government Agency Obligations | 1.9 |

| A | 0.3 |

| BBB | 2.1 |

| BB | 34.5 |

| B | 34.6 |

| CCC,CC,C | 16.4 |

| Not Rated | 4.0 |

| Equities | 3.8 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.4 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

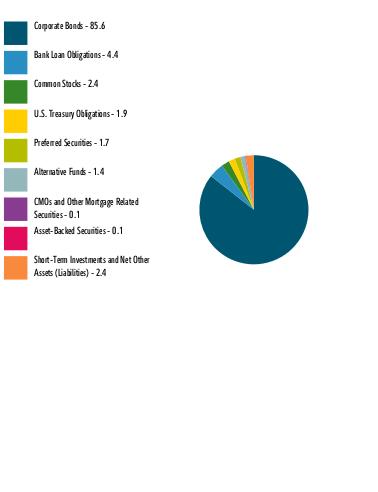

| Corporate Bonds | 85.6 |

| Bank Loan Obligations | 4.4 |

| Common Stocks | 2.4 |

| U.S. Treasury Obligations | 1.9 |

| Preferred Securities | 1.7 |

| Alternative Funds | 1.4 |

| CMOs and Other Mortgage Related Securities | 0.1 |

| Asset-Backed Securities | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

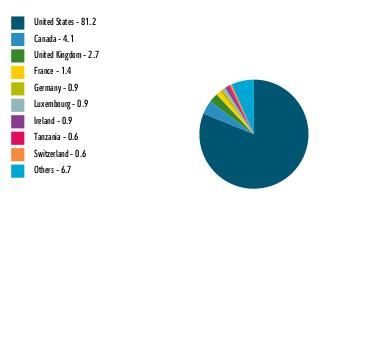

| United States | 81.2 |

| Canada | 4.1 |

| United Kingdom | 2.7 |

| France | 1.4 |

| Germany | 0.9 |

| Luxembourg | 0.9 |

| Ireland | 0.9 |

| Tanzania | 0.6 |

| Switzerland | 0.6 |

| Others | 6.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 1.9 | |

| CHS/Community Health Systems Inc | 1.5 | |

| Fidelity Private Credit Company LLC | 1.4 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.2 | |

| Mesquite Energy Inc | 1.1 | |

| MPT Operating Partnership LP / MPT Finance Corp | 1.0 | |

| Tenet Healthcare Corp | 0.9 | |

| TransDigm Inc | 0.9 | |

| PG&E Corp | 0.9 | |

| Cloud Software Group Inc | 0.8 | |

| | 11.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915107.100 6345-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Women's Leadership Fund Fidelity Advisor® Women's Leadership Fund Class M : FWOEX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Women's Leadership Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 63 | 1.21% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $148,487,329 | |

| Number of Holdings | 113 | |

| Portfolio Turnover | 26% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 30.0 | |

| Financials | 13.2 | |

| Health Care | 13.0 | |

| Industrials | 11.5 | |

| Consumer Discretionary | 11.3 | |

| Communication Services | 6.1 | |

| Materials | 3.8 | |

| Consumer Staples | 3.2 | |

| Energy | 2.9 | |

| Real Estate | 1.9 | |

| Utilities | 1.0 | |

| |

| Common Stocks | 97.6 |

| Preferred Stocks | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 93.8 |

| China | 1.3 |

| Belgium | 1.3 |

| Australia | 1.0 |

| Germany | 0.8 |

| Italy | 0.8 |

| Canada | 0.5 |

| Norway | 0.4 |

| United Kingdom | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 4.4 | |

| NVIDIA Corp | 3.7 | |

| Microsoft Corp | 3.6 | |

| Amazon.com Inc | 2.6 | |

| Accenture Capital Inc Class A | 2.1 | |

| Walt Disney Co/The | 2.0 | |

| Salesforce Inc | 1.8 | |

| Hologic Inc | 1.7 | |

| JPMorgan Chase & Co | 1.7 | |

| Progressive Corp/The | 1.6 | |

| | 25.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915102.100 3399-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® High Income Fund Fidelity Advisor® High Income Fund Class M : FGRMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 50 | 0.95% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $2,767,692,910 | |

| Number of Holdings | 926 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 2.5 |

| A | 0.3 |

| BBB | 2.5 |

| BB | 32.9 |

| B | 37.4 |

| CCC,CC,C | 15.4 |

| Not Rated | 3.9 |

| Equities | 3.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

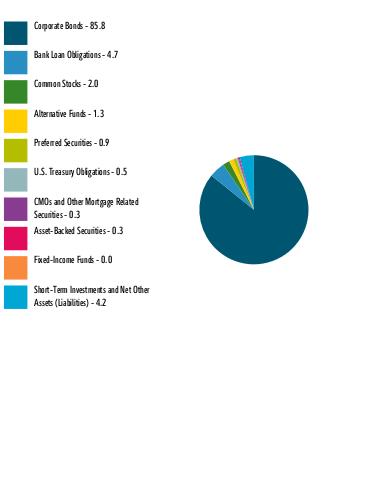

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 86.1 |

| Bank Loan Obligations | 4.3 |

| U.S. Treasury Obligations | 2.5 |

| Common Stocks | 1.9 |

| Preferred Securities | 1.7 |

| Alternative Funds | 1.1 |

| Asset-Backed Securities | 0.2 |

| CMOs and Other Mortgage Related Securities | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 81.7 |

| Canada | 3.7 |

| United Kingdom | 2.4 |

| France | 1.3 |

| Germany | 0.9 |

| Ireland | 0.9 |

| Luxembourg | 0.9 |

| Netherlands | 0.7 |

| Tanzania | 0.6 |

| Others | 6.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 2.5 | |

| CHS/Community Health Systems Inc | 1.3 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.3 | |

| Fidelity Private Credit Company LLC | 1.1 | |

| TransDigm Inc | 1.1 | |

| MPT Operating Partnership LP / MPT Finance Corp | 1.0 | |

| Tenet Healthcare Corp | 0.9 | |

| Carnival Corp | 0.9 | |

| Vistra Operations Co LLC | 0.8 | |

| NRG Energy Inc | 0.8 | |

| | 11.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915056.100 3312-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Short Duration High Income Fund Fidelity Advisor® Short Duration High Income Fund Class M : FSEHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Short Duration High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 52 | 1.00% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $249,300,191 | |

| Number of Holdings | 487 | |

| Portfolio Turnover | 47% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 1.4 |

| A | 0.2 |

| BBB | 5.0 |

| BB | 32.0 |

| B | 44.2 |

| CCC,CC,C | 8.0 |

| Not Rated | 2.7 |

| Equities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 79.7 |

| Bank Loan Obligations | 11.5 |

| U.S. Treasury Obligations | 1.4 |

| Preferred Securities | 0.7 |

| Common Stocks | 0.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 88.7 |

| Canada | 4.3 |

| United Kingdom | 1.8 |

| Ireland | 0.7 |

| Australia | 0.6 |

| Germany | 0.5 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Switzerland | 0.4 |

| Netherlands | 0.3 |

| Others | 2.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| TransDigm Inc | 2.2 | |

| US Treasury Notes | 1.4 | |

| Univision Communications Inc | 1.2 | |

| DISH Network Corp | 1.2 | |

| Carnival Corp | 1.2 | |

| Royal Caribbean Cruises Ltd | 1.1 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.0 | |

| Venture Global LNG Inc | 1.0 | |

| OneMain Finance Corp | 0.9 | |

| Tenet Healthcare Corp | 0.9 | |

| | 12.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915080.100 2583-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® High Income Fund Fidelity Advisor® High Income Fund Class I : FGTMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 37 | 0.70% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $2,767,692,910 | |

| Number of Holdings | 926 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 2.5 |

| A | 0.3 |

| BBB | 2.5 |

| BB | 32.9 |

| B | 37.4 |

| CCC,CC,C | 15.4 |

| Not Rated | 3.9 |

| Equities | 3.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

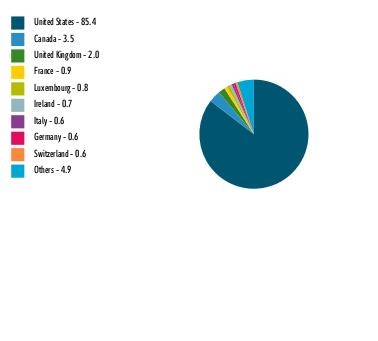

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 86.1 |

| Bank Loan Obligations | 4.3 |

| U.S. Treasury Obligations | 2.5 |

| Common Stocks | 1.9 |

| Preferred Securities | 1.7 |

| Alternative Funds | 1.1 |

| Asset-Backed Securities | 0.2 |

| CMOs and Other Mortgage Related Securities | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 81.7 |

| Canada | 3.7 |

| United Kingdom | 2.4 |

| France | 1.3 |

| Germany | 0.9 |

| Ireland | 0.9 |

| Luxembourg | 0.9 |

| Netherlands | 0.7 |

| Tanzania | 0.6 |

| Others | 6.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 2.5 | |

| CHS/Community Health Systems Inc | 1.3 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.3 | |

| Fidelity Private Credit Company LLC | 1.1 | |

| TransDigm Inc | 1.1 | |

| MPT Operating Partnership LP / MPT Finance Corp | 1.0 | |

| Tenet Healthcare Corp | 0.9 | |

| Carnival Corp | 0.9 | |

| Vistra Operations Co LLC | 0.8 | |

| NRG Energy Inc | 0.8 | |

| | 11.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915058.100 3314-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® High Income Fund Fidelity® High Income Fund : SPHIX |

| | | |

This semi-annual shareholder report contains information about Fidelity® High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® High Income Fund | $ 35 | 0.66% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $2,767,692,910 | |

| Number of Holdings | 926 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 2.5 |

| A | 0.3 |

| BBB | 2.5 |

| BB | 32.9 |

| B | 37.4 |

| CCC,CC,C | 15.4 |

| Not Rated | 3.9 |

| Equities | 3.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 86.1 |

| Bank Loan Obligations | 4.3 |

| U.S. Treasury Obligations | 2.5 |

| Common Stocks | 1.9 |

| Preferred Securities | 1.7 |

| Alternative Funds | 1.1 |

| Asset-Backed Securities | 0.2 |

| CMOs and Other Mortgage Related Securities | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 81.7 |

| Canada | 3.7 |

| United Kingdom | 2.4 |

| France | 1.3 |

| Germany | 0.9 |

| Ireland | 0.9 |

| Luxembourg | 0.9 |

| Netherlands | 0.7 |

| Tanzania | 0.6 |

| Others | 6.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 2.5 | |

| CHS/Community Health Systems Inc | 1.3 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.3 | |

| Fidelity Private Credit Company LLC | 1.1 | |

| TransDigm Inc | 1.1 | |

| MPT Operating Partnership LP / MPT Finance Corp | 1.0 | |

| Tenet Healthcare Corp | 0.9 | |

| Carnival Corp | 0.9 | |

| Vistra Operations Co LLC | 0.8 | |

| NRG Energy Inc | 0.8 | |

| | 11.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915060.100 455-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® High Income Fund Fidelity Advisor® High Income Fund Class C : FGSMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 88 | 1.69% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $2,767,692,910 | |

| Number of Holdings | 926 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 2.5 |

| A | 0.3 |

| BBB | 2.5 |

| BB | 32.9 |

| B | 37.4 |

| CCC,CC,C | 15.4 |

| Not Rated | 3.9 |

| Equities | 3.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 86.1 |

| Bank Loan Obligations | 4.3 |

| U.S. Treasury Obligations | 2.5 |

| Common Stocks | 1.9 |

| Preferred Securities | 1.7 |

| Alternative Funds | 1.1 |

| Asset-Backed Securities | 0.2 |

| CMOs and Other Mortgage Related Securities | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 81.7 |

| Canada | 3.7 |

| United Kingdom | 2.4 |

| France | 1.3 |

| Germany | 0.9 |

| Ireland | 0.9 |

| Luxembourg | 0.9 |

| Netherlands | 0.7 |

| Tanzania | 0.6 |

| Others | 6.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 2.5 | |

| CHS/Community Health Systems Inc | 1.3 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.3 | |

| Fidelity Private Credit Company LLC | 1.1 | |

| TransDigm Inc | 1.1 | |

| MPT Operating Partnership LP / MPT Finance Corp | 1.0 | |

| Tenet Healthcare Corp | 0.9 | |

| Carnival Corp | 0.9 | |

| Vistra Operations Co LLC | 0.8 | |

| NRG Energy Inc | 0.8 | |

| | 11.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915057.100 3313-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® U.S. Low Volatility Equity Fund Fidelity® U.S. Low Volatility Equity Fund : FULVX |

| | | |

This semi-annual shareholder report contains information about Fidelity® U.S. Low Volatility Equity Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® U.S. Low Volatility Equity Fund | $ 37 | 0.70% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $42,811,441 | |

| Number of Holdings | 138 | |

| Portfolio Turnover | 58% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Health Care | 19.3 | |

| Information Technology | 18.2 | |

| Financials | 15.1 | |

| Consumer Staples | 12.9 | |

| Industrials | 9.0 | |

| Communication Services | 8.7 | |

| Utilities | 5.1 | |

| Consumer Discretionary | 4.1 | |

| Materials | 3.0 | |

| Energy | 2.5 | |

| Real Estate | 1.0 | |

| |

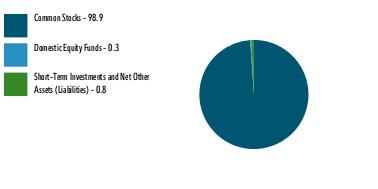

| Common Stocks | 98.9 |

| Domestic Equity Funds | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

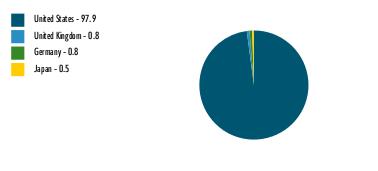

| United States | 97.9 |

| United Kingdom | 0.8 |

| Germany | 0.8 |

| Japan | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Walmart Inc | 1.2 | |

| CACI International Inc | 1.2 | |

| Cboe Global Markets Inc | 1.2 | |

| Exelixis Inc | 1.2 | |

| Marsh & McLennan Cos Inc | 1.1 | |

| The Travelers Companies, Inc. | 1.1 | |

| Philip Morris International Inc | 1.1 | |

| T-Mobile US Inc | 1.1 | |

| Linde PLC | 1.1 | |

| Southern Co/The | 1.1 | |

| | 11.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915106.100 5029-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Healthy Future Fund Fidelity Advisor® Healthy Future Fund Class A : FAPJX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Healthy Future Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 69 | 1.31% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $12,720,521 | |

| Number of Holdings | 69 | |

| Portfolio Turnover | 48% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Health Care | 33.0 | |

| Consumer Staples | 20.4 | |

| Consumer Discretionary | 14.5 | |

| Financials | 12.3 | |

| Information Technology | 9.8 | |

| Industrials | 4.8 | |

| Real Estate | 1.4 | |

| Communication Services | 0.9 | |

| Utilities | 0.9 | |

| |

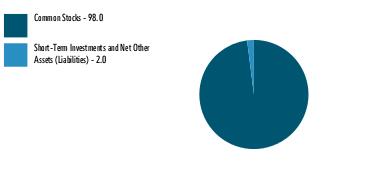

| Common Stocks | 98.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

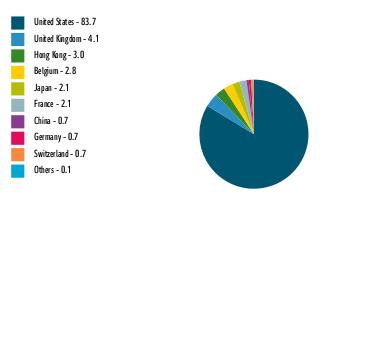

| United States | 83.7 |

| United Kingdom | 4.1 |

| Hong Kong | 3.0 |

| Belgium | 2.8 |

| Japan | 2.1 |

| France | 2.1 |

| China | 0.7 |

| Germany | 0.7 |

| Switzerland | 0.7 |

| Others | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| NVIDIA Corp | 8.4 | |

| Procter & Gamble Co/The | 5.5 | |

| Tesla Inc | 4.6 | |

| Thermo Fisher Scientific Inc | 3.8 | |

| Vertex Pharmaceuticals Inc | 3.6 | |

| UnitedHealth Group Inc | 3.5 | |

| Unilever PLC | 3.5 | |

| Danaher Corp | 3.4 | |

| Apollo Global Management Inc | 3.0 | |

| AIA Group Ltd | 3.0 | |

| | 42.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915109.100 6554-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Healthy Future Fund Fidelity Advisor® Healthy Future Fund Class I : FAPMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Healthy Future Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 56 | 1.06% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $12,720,521 | |

| Number of Holdings | 69 | |

| Portfolio Turnover | 48% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Health Care | 33.0 | |

| Consumer Staples | 20.4 | |

| Consumer Discretionary | 14.5 | |

| Financials | 12.3 | |

| Information Technology | 9.8 | |

| Industrials | 4.8 | |

| Real Estate | 1.4 | |

| Communication Services | 0.9 | |

| Utilities | 0.9 | |

| |

| Common Stocks | 98.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 83.7 |

| United Kingdom | 4.1 |

| Hong Kong | 3.0 |

| Belgium | 2.8 |

| Japan | 2.1 |

| France | 2.1 |

| China | 0.7 |

| Germany | 0.7 |

| Switzerland | 0.7 |

| Others | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| NVIDIA Corp | 8.4 | |

| Procter & Gamble Co/The | 5.5 | |

| Tesla Inc | 4.6 | |

| Thermo Fisher Scientific Inc | 3.8 | |

| Vertex Pharmaceuticals Inc | 3.6 | |

| UnitedHealth Group Inc | 3.5 | |

| Unilever PLC | 3.5 | |

| Danaher Corp | 3.4 | |

| Apollo Global Management Inc | 3.0 | |

| AIA Group Ltd | 3.0 | |

| | 42.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915112.100 6557-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Women's Leadership Fund Fidelity Advisor® Women's Leadership Fund Class Z : FWOZX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Women's Leadership Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 29 | 0.55% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $148,487,329 | |

| Number of Holdings | 113 | |

| Portfolio Turnover | 26% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 30.0 | |

| Financials | 13.2 | |

| Health Care | 13.0 | |

| Industrials | 11.5 | |

| Consumer Discretionary | 11.3 | |

| Communication Services | 6.1 | |

| Materials | 3.8 | |

| Consumer Staples | 3.2 | |

| Energy | 2.9 | |

| Real Estate | 1.9 | |

| Utilities | 1.0 | |

| |

| Common Stocks | 97.6 |

| Preferred Stocks | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 93.8 |

| China | 1.3 |

| Belgium | 1.3 |

| Australia | 1.0 |

| Germany | 0.8 |

| Italy | 0.8 |

| Canada | 0.5 |

| Norway | 0.4 |

| United Kingdom | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 4.4 | |

| NVIDIA Corp | 3.7 | |

| Microsoft Corp | 3.6 | |

| Amazon.com Inc | 2.6 | |

| Accenture Capital Inc Class A | 2.1 | |

| Walt Disney Co/The | 2.0 | |

| Salesforce Inc | 1.8 | |

| Hologic Inc | 1.7 | |

| JPMorgan Chase & Co | 1.7 | |

| Progressive Corp/The | 1.6 | |

| | 25.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915104.100 3401-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Short Duration High Income Fund Fidelity Advisor® Short Duration High Income Fund Class Z : FIJWX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Short Duration High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 34 | 0.66% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $249,300,191 | |

| Number of Holdings | 487 | |

| Portfolio Turnover | 47% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 1.4 |

| A | 0.2 |

| BBB | 5.0 |

| BB | 32.0 |

| B | 44.2 |

| CCC,CC,C | 8.0 |

| Not Rated | 2.7 |

| Equities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 79.7 |

| Bank Loan Obligations | 11.5 |

| U.S. Treasury Obligations | 1.4 |

| Preferred Securities | 0.7 |

| Common Stocks | 0.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 88.7 |

| Canada | 4.3 |

| United Kingdom | 1.8 |

| Ireland | 0.7 |

| Australia | 0.6 |

| Germany | 0.5 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Switzerland | 0.4 |

| Netherlands | 0.3 |

| Others | 2.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| TransDigm Inc | 2.2 | |

| US Treasury Notes | 1.4 | |

| Univision Communications Inc | 1.2 | |

| DISH Network Corp | 1.2 | |

| Carnival Corp | 1.2 | |

| Royal Caribbean Cruises Ltd | 1.1 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.0 | |

| Venture Global LNG Inc | 1.0 | |

| OneMain Finance Corp | 0.9 | |

| Tenet Healthcare Corp | 0.9 | |

| | 12.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915082.100 3289-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Healthy Future Fund Fidelity Advisor® Healthy Future Fund Class C : FAPKX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Healthy Future Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 109 | 2.06% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $12,720,521 | |

| Number of Holdings | 69 | |

| Portfolio Turnover | 48% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Health Care | 33.0 | |

| Consumer Staples | 20.4 | |

| Consumer Discretionary | 14.5 | |

| Financials | 12.3 | |

| Information Technology | 9.8 | |

| Industrials | 4.8 | |

| Real Estate | 1.4 | |

| Communication Services | 0.9 | |

| Utilities | 0.9 | |

| |

| Common Stocks | 98.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 83.7 |

| United Kingdom | 4.1 |

| Hong Kong | 3.0 |

| Belgium | 2.8 |

| Japan | 2.1 |

| France | 2.1 |

| China | 0.7 |

| Germany | 0.7 |

| Switzerland | 0.7 |

| Others | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| NVIDIA Corp | 8.4 | |

| Procter & Gamble Co/The | 5.5 | |

| Tesla Inc | 4.6 | |

| Thermo Fisher Scientific Inc | 3.8 | |

| Vertex Pharmaceuticals Inc | 3.6 | |

| UnitedHealth Group Inc | 3.5 | |

| Unilever PLC | 3.5 | |

| Danaher Corp | 3.4 | |

| Apollo Global Management Inc | 3.0 | |

| AIA Group Ltd | 3.0 | |

| | 42.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915110.100 6555-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Short Duration High Income Fund Fidelity Advisor® Short Duration High Income Fund Class A : FSBHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Short Duration High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 52 | 1.00% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $249,300,191 | |

| Number of Holdings | 487 | |

| Portfolio Turnover | 47% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 1.4 |

| A | 0.2 |

| BBB | 5.0 |

| BB | 32.0 |

| B | 44.2 |

| CCC,CC,C | 8.0 |

| Not Rated | 2.7 |

| Equities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 79.7 |

| Bank Loan Obligations | 11.5 |

| U.S. Treasury Obligations | 1.4 |

| Preferred Securities | 0.7 |

| Common Stocks | 0.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 88.7 |

| Canada | 4.3 |

| United Kingdom | 1.8 |

| Ireland | 0.7 |

| Australia | 0.6 |

| Germany | 0.5 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Switzerland | 0.4 |

| Netherlands | 0.3 |

| Others | 2.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| TransDigm Inc | 2.2 | |

| US Treasury Notes | 1.4 | |

| Univision Communications Inc | 1.2 | |

| DISH Network Corp | 1.2 | |

| Carnival Corp | 1.2 | |

| Royal Caribbean Cruises Ltd | 1.1 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.0 | |

| Venture Global LNG Inc | 1.0 | |

| OneMain Finance Corp | 0.9 | |

| Tenet Healthcare Corp | 0.9 | |

| | 12.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915078.100 2581-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® High Income Fund Fidelity Advisor® High Income Fund Class A : FGQMX |

| | | |

This semi-annual shareholder report contains information about Fidelity® High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 50 | 0.95% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $2,767,692,910 | |

| Number of Holdings | 926 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 2.5 |

| A | 0.3 |

| BBB | 2.5 |

| BB | 32.9 |

| B | 37.4 |

| CCC,CC,C | 15.4 |

| Not Rated | 3.9 |

| Equities | 3.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 86.1 |

| Bank Loan Obligations | 4.3 |

| U.S. Treasury Obligations | 2.5 |

| Common Stocks | 1.9 |

| Preferred Securities | 1.7 |

| Alternative Funds | 1.1 |

| Asset-Backed Securities | 0.2 |

| CMOs and Other Mortgage Related Securities | 0.1 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 81.7 |

| Canada | 3.7 |

| United Kingdom | 2.4 |

| France | 1.3 |

| Germany | 0.9 |

| Ireland | 0.9 |

| Luxembourg | 0.9 |

| Netherlands | 0.7 |

| Tanzania | 0.6 |

| Others | 6.9 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| US Treasury Notes | 2.5 | |

| CHS/Community Health Systems Inc | 1.3 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.3 | |

| Fidelity Private Credit Company LLC | 1.1 | |

| TransDigm Inc | 1.1 | |

| MPT Operating Partnership LP / MPT Finance Corp | 1.0 | |

| Tenet Healthcare Corp | 0.9 | |

| Carnival Corp | 0.9 | |

| Vistra Operations Co LLC | 0.8 | |

| NRG Energy Inc | 0.8 | |

| | 11.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915055.100 3311-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Women's Leadership Fund Fidelity Advisor® Women's Leadership Fund Class I : FWMNX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Women's Leadership Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 35 | 0.67% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $148,487,329 | |

| Number of Holdings | 113 | |

| Portfolio Turnover | 26% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 30.0 | |

| Financials | 13.2 | |

| Health Care | 13.0 | |

| Industrials | 11.5 | |

| Consumer Discretionary | 11.3 | |

| Communication Services | 6.1 | |

| Materials | 3.8 | |

| Consumer Staples | 3.2 | |

| Energy | 2.9 | |

| Real Estate | 1.9 | |

| Utilities | 1.0 | |

| |

| Common Stocks | 97.6 |

| Preferred Stocks | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 93.8 |

| China | 1.3 |

| Belgium | 1.3 |

| Australia | 1.0 |

| Germany | 0.8 |

| Italy | 0.8 |

| Canada | 0.5 |

| Norway | 0.4 |

| United Kingdom | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 4.4 | |

| NVIDIA Corp | 3.7 | |

| Microsoft Corp | 3.6 | |

| Amazon.com Inc | 2.6 | |

| Accenture Capital Inc Class A | 2.1 | |

| Walt Disney Co/The | 2.0 | |

| Salesforce Inc | 1.8 | |

| Hologic Inc | 1.7 | |

| JPMorgan Chase & Co | 1.7 | |

| Progressive Corp/The | 1.6 | |

| | 25.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915103.100 3400-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Women's Leadership Fund Fidelity Advisor® Women's Leadership Fund Class C : FWOCX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Women's Leadership Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 89 | 1.71% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $148,487,329 | |

| Number of Holdings | 113 | |

| Portfolio Turnover | 26% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Information Technology | 30.0 | |

| Financials | 13.2 | |

| Health Care | 13.0 | |

| Industrials | 11.5 | |

| Consumer Discretionary | 11.3 | |

| Communication Services | 6.1 | |

| Materials | 3.8 | |

| Consumer Staples | 3.2 | |

| Energy | 2.9 | |

| Real Estate | 1.9 | |

| Utilities | 1.0 | |

| |

| Common Stocks | 97.6 |

| Preferred Stocks | 0.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 93.8 |

| China | 1.3 |

| Belgium | 1.3 |

| Australia | 1.0 |

| Germany | 0.8 |

| Italy | 0.8 |

| Canada | 0.5 |

| Norway | 0.4 |

| United Kingdom | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Apple Inc | 4.4 | |

| NVIDIA Corp | 3.7 | |

| Microsoft Corp | 3.6 | |

| Amazon.com Inc | 2.6 | |

| Accenture Capital Inc Class A | 2.1 | |

| Walt Disney Co/The | 2.0 | |

| Salesforce Inc | 1.8 | |

| Hologic Inc | 1.7 | |

| JPMorgan Chase & Co | 1.7 | |

| Progressive Corp/The | 1.6 | |

| | 25.2 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915101.100 3398-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Short Duration High Income Fund Fidelity® Short Duration High Income Fund : FSAHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Short Duration High Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Short Duration High Income Fund | $ 39 | 0.75% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $249,300,191 | |

| Number of Holdings | 487 | |

| Portfolio Turnover | 47% | |

What did the Fund invest in?

(as of October 31, 2024)

| U.S. Government and U.S. Government Agency Obligations | 1.4 |

| A | 0.2 |

| BBB | 5.0 |

| BB | 32.0 |

| B | 44.2 |

| CCC,CC,C | 8.0 |

| Not Rated | 2.7 |

| Equities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

| Corporate Bonds | 79.7 |

| Bank Loan Obligations | 11.5 |

| U.S. Treasury Obligations | 1.4 |

| Preferred Securities | 0.7 |

| Common Stocks | 0.2 |

| Asset-Backed Securities | 0.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 88.7 |

| Canada | 4.3 |

| United Kingdom | 1.8 |

| Ireland | 0.7 |

| Australia | 0.6 |

| Germany | 0.5 |

| Grand Cayman (UK Overseas Ter) | 0.4 |

| Switzerland | 0.4 |

| Netherlands | 0.3 |

| Others | 2.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| TransDigm Inc | 2.2 | |

| US Treasury Notes | 1.4 | |

| Univision Communications Inc | 1.2 | |

| DISH Network Corp | 1.2 | |

| Carnival Corp | 1.2 | |

| Royal Caribbean Cruises Ltd | 1.1 | |

| CCO Holdings LLC / CCO Holdings Capital Corp | 1.0 | |

| Venture Global LNG Inc | 1.0 | |

| OneMain Finance Corp | 0.9 | |

| Tenet Healthcare Corp | 0.9 | |

| | 12.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915077.100 2580-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Healthy Future Fund Fidelity® Healthy Future Fund : FAPHX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Healthy Future Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Healthy Future Fund | $ 56 | 1.06% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $12,720,521 | |

| Number of Holdings | 69 | |

| Portfolio Turnover | 48% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Health Care | 33.0 | |

| Consumer Staples | 20.4 | |

| Consumer Discretionary | 14.5 | |

| Financials | 12.3 | |

| Information Technology | 9.8 | |

| Industrials | 4.8 | |

| Real Estate | 1.4 | |

| Communication Services | 0.9 | |

| Utilities | 0.9 | |

| |

| Common Stocks | 98.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 83.7 |

| United Kingdom | 4.1 |

| Hong Kong | 3.0 |

| Belgium | 2.8 |

| Japan | 2.1 |

| France | 2.1 |

| China | 0.7 |

| Germany | 0.7 |

| Switzerland | 0.7 |

| Others | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| NVIDIA Corp | 8.4 | |

| Procter & Gamble Co/The | 5.5 | |

| Tesla Inc | 4.6 | |

| Thermo Fisher Scientific Inc | 3.8 | |

| Vertex Pharmaceuticals Inc | 3.6 | |

| UnitedHealth Group Inc | 3.5 | |

| Unilever PLC | 3.5 | |

| Danaher Corp | 3.4 | |

| Apollo Global Management Inc | 3.0 | |

| AIA Group Ltd | 3.0 | |

| | 42.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915108.100 6553-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Capital & Income Fund Fidelity® Capital & Income Fund : FAGIX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Capital & Income Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Capital & Income Fund | $ 33 | 0.63% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $13,387,526,690 | |

| Number of Holdings | 745 | |

| Portfolio Turnover | 18% | |

What did the Fund invest in?

(as of October 31, 2024)

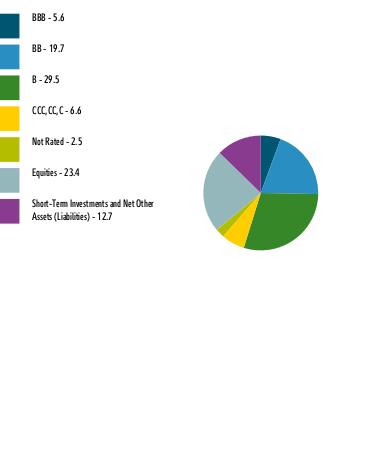

| BBB | 5.6 |

| BB | 19.7 |

| B | 29.5 |

| CCC,CC,C | 6.6 |

| Not Rated | 2.5 |

| Equities | 23.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 12.7 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| |

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

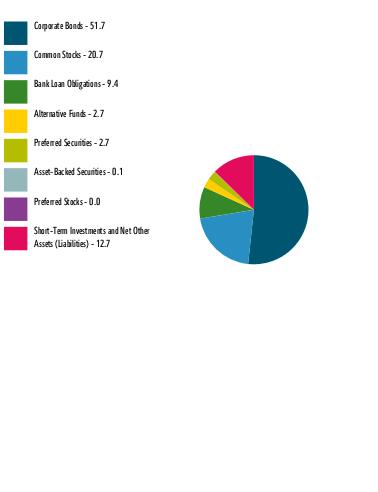

| Corporate Bonds | 51.7 |

| Common Stocks | 20.7 |

| Bank Loan Obligations | 9.4 |

| Alternative Funds | 2.7 |

| Preferred Securities | 2.7 |

| Asset-Backed Securities | 0.1 |

| Preferred Stocks | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 12.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

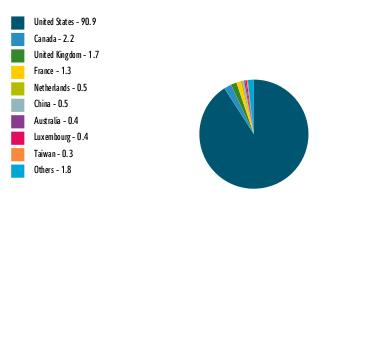

| United States | 90.9 |

| Canada | 2.2 |

| United Kingdom | 1.7 |

| France | 1.3 |

| Netherlands | 0.5 |

| China | 0.5 |

| Australia | 0.4 |

| Luxembourg | 0.4 |

| Taiwan | 0.3 |

| Others | 1.8 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS(% of Fund's net assets) | | |

| Fidelity Private Credit Company LLC | 2.7 | |

| TransDigm Inc | 2.3 | |

| Ally Financial Inc | 1.4 | |

| NVIDIA Corp | 1.4 | |

| Energy Transfer LP | 1.2 | |

| Tenet Healthcare Corp | 1.1 | |

| Altice France SA | 1.1 | |

| DISH Network Corp | 1.1 | |

| Meta Platforms Inc Class A | 1.1 | |

| LBM Acquisition LLC | 1.1 | |

| | 14.5 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915046.100 38-TSRS-1224 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF OCTOBER 31, 2024 | |

| | Fidelity® Healthy Future Fund Fidelity Advisor® Healthy Future Fund Class M : FAPLX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Healthy Future Fund for the period May 1, 2024 to October 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 82 | 1.55% | |

Key Fund Statistics(as of October 31, 2024)

KEY FACTS | | |

| Fund Size | $12,720,521 | |

| Number of Holdings | 69 | |

| Portfolio Turnover | 48% | |

What did the Fund invest in?

(as of October 31, 2024)

MARKET SECTORS (% of Fund's net assets) | | |

| Health Care | 33.0 | |

| Consumer Staples | 20.4 | |

| Consumer Discretionary | 14.5 | |

| Financials | 12.3 | |

| Information Technology | 9.8 | |

| Industrials | 4.8 | |

| Real Estate | 1.4 | |

| Communication Services | 0.9 | |

| Utilities | 0.9 | |

| |

| Common Stocks | 98.0 |