UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2794

MFS SERIES TRUST III

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: January 31

Date of reporting period: January 31, 2010

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

MFS® High Income Fund

SIPC Contact Information:

You may obtain information about the Securities Investor Protection Corporation (“SIPC”), including the SIPC Brochure, by contacting SIPC either by telephone (202-371-8300) or by accessing SIPC’s website address (www.sipc.org).

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ

NO BANK GUARANTEE

1/31/10

MFH-ANN

LETTER FROM THE CEO

Dear Shareholders:

Most global financial markets, after suffering the biggest declines since the Great Depression, experienced an impressive resurgence during 2009. Despite this turnaround, the U.S. Federal Reserve Board and central banks around the world continued to hold interest rates at historical lows. As most asset prices rebounded in the second half of 2009 and the demand for liquidity waned, the debate over the existence of asset bubbles and the need for monetary policy changes grew louder, creating added uncertainty about the timing and amount of any future interest rate changes.

Even with the significant market gains of 2009, many analysts seem to be predicting one of two likely scenarios for the U.S. economy. More conservative pundits say the recession for large areas of the country will continue to “moderate” — meaning the economy will continue to deteriorate, but at a slower pace. The more optimistic scenario is that a broader recovery will take hold and continue to gain momentum gradually.

Regardless of which recovery scenario plays out, the approximately 15 million Americans who are currently unemployed are almost certain to feel excluded — at least until significant job creation occurs. Meanwhile, an overleveraged global financial system continues to raise doubts about a prolonged upturn. Although progress has been made in recapitalizing U.S. and European banks, financial instability remains the biggest threat to sustainable growth.

While there remains lingering skepticism among many economists, MFS® believes that worldwide markets will stabilize with potential for growth. We are also mindful of the many challenges still facing our global economy, and we want to take this opportunity to remind investors about the merits of maintaining a long-term view, adhering to basic investing principles such as asset allocation and diversification, and working closely with advisors to identify and research investment opportunities.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

March 15, 2010

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

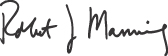

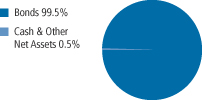

PORTFOLIO COMPOSITION

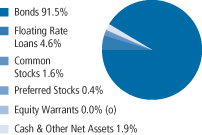

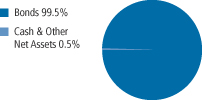

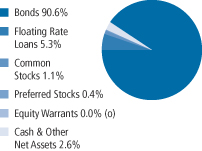

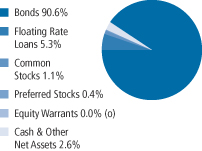

Portfolio structure (i)

| | |

| Top five industries (i) | | |

| Medical & Health Technology & Services | | 7.4% |

| Energy — Independent | | 6.9% |

| Gaming & Lodging | | 6.1% |

| Broadcasting | | 5.6% |

| Utilities — Electric Power | | 5.4% |

| | |

| Credit quality of long-term debt securities (a)(r) |

| AAA | | 0.9% |

| AA | | 0.2% |

| BBB | | 3.0% |

| BB | | 27.3% |

| B | | 42.1% |

| CCC | | 19.6% |

| CC | | 2.2% |

| C | | 0.5% |

| D | | 1.0% |

| Not Rated | | 3.2% |

| |

| Portfolio facts | | |

| Average Duration (d)(i) | | 4.1 |

| Average Effective Maturity (i)(m) | | 6.0 yrs. |

| Average Credit Quality of Rated Securities (long-term) (a)(b) | | B |

| (a) | Includes debt securities that either have long-term public ratings or are U.S. Government-Related Securities. U.S. Government-Related Securities consist of U.S. Treasury securities, and certain securities issued by certain U.S. Government agencies or U.S. Government-Sponsored entities. U.S. Government-Related Securities are assigned a “AAA” rating. Each long-term rated security is assigned a rating in accordance with the following ratings hierarchy: If a security is rated by Moody’s, then that rating is used; if not rated by Moody’s, then a Standard & Poor’s rating is used; if not rated by S&P, then a Fitch rating is used. Securities that do not have a long-term public rating (with the exception of U.S. Government-Related Securities) are excluded from the average credit quality calculation and are included in the above credit quality of long-term debt securities table as “Not Rated”, subject to the next sentence. Convertible bonds, currencies, futures, options, swaps, cash, and cash-equivalents are excluded from both the above credit quality of long-term debt securities table and the average credit quality calculation. Average ratings are converted to the S&P scale and are subject to change. |

| (b) | The average credit quality of rated securities is a market weighted average (using a linear scale) of debt securities that either have long-term public ratings or are U.S. Government-Related securities. All securities that do not have a long-term public rating (with the exception of U.S. Government-Related securities) are excluded from the average credit quality calculation. |

2

Portfolio Composition – continued

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (i) | For purposes of this presentation, the bond component includes accrued interest amounts and may be positively or negatively impacted by the equivalent exposure from derivative holdings, if applicable. Equivalent Exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than market value. |

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

| (r) | Percentages are based on the total market value of long-term debt securities as of 1/31/10. |

Percentages are based on net assets as of 1/31/10, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

3

MANAGEMENT REVIEW

Summary of Results

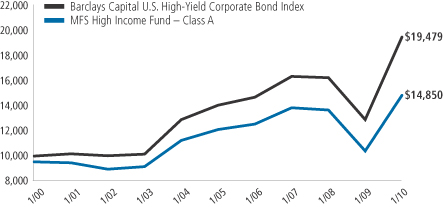

For the twelve months ended January 31, 2010, Class A shares of the MFS High Income Fund (the “fund”) provided a total return of 42.99%, at net asset value. This compares with a return of 51.15% for the fund’s benchmark, the Barclays Capital U.S. High-Yield Corporate Bond Index.

Market Environment

After having suffered through one of the largest and most concentrated downturns since the 1930s, most asset markets staged a remarkable rebound during 2009. During the early stages of the period, the fallout from a series of tumultuous financial events pushed global equity and credit markets to their lowest points during the crisis. Not only did Europe and Japan fall into very deep recessions, but an increasingly powerful engine of global growth – emerging markets – also contracted almost across the board. The subsequent recovery in global activity has been similarly synchronized, led importantly by emerging Asian economies, but broadening to include most of the global economy to varying degrees. Primary drivers of the recovery included an unwinding of the inventory destocking that took place earlier, as well as massive fiscal and monetary stimulus.

During the first half of the reporting period, with the policy rate having been cut almost to 0%, the Fed continued to use its new lending facilities to alleviate ever-tightening credit markets. On the fiscal front, the U.S. Treasury designed and began implementing a massive fiscal stimulus package. As inflationary concerns diminished in the face of global deleveraging and equity and credit markets deteriorated more sharply, central banks around the world also cut interest rates dramatically. By the middle of the period, several central banks had approached their lower bound on policy rates and were examining the implementation and ramifications of quantitative easing as a means to further loosen monetary policy to offset the continuing fall in global economic activity.

However, by the end of the period, there were ever-broadening signs that the global macroeconomic deterioration had passed, which caused the subsequent rise in asset valuations. As most asset prices rebounded in the second half of the period and the demand for liquidity waned, the debate concerning the existence of asset bubbles and the need for monetary exit strategies had begun, creating added uncertainty regarding the forward path of policy rates.

Detractors from Performance

Relative to the Barclays Capital U.S. High-Yield Corporate Bond Index, the fund’s lesser exposure to “BB” and “CCC” rated (r) securities detracted from performance. Bonds in these quality segments performed exceptionally well

4

Management Review – continued

over the reporting period as investors appeared to be recovering their appetite for risk in an improving economy.

The fund’s return from yield, which was less than that of the index, was another negative factor for relative performance.

Security selection also held back relative returns. Debt holdings of power generation companies NRG Energy, Edison Mission, and Texas Competitive Electric Holdings, hospital operators Hospital Corporation of America and Community Health Systems, and funeral, cremation and cemetery services provider Service Corporation International were among the fund’s top relative detractors.

Contributors to Performance

The fund’s greater exposure to “B” rated securities contributed to performance as credit spreads narrowed and lower-quality securities outperformed higher-quality issues over the reporting period.

Yield curve (y) positioning, particularly a lesser exposure to the long end of the curve, was another positive factor for performance.

Top individual contributors during the reporting period included the fund’s debt holdings of Spanish-language network television operator Univision Communications, auto maker Ford Motor Company, oil and natural gas company Chaparral Energy, flash memory products maker Spansion (h), television station operator Local TV LLC, used car auction company KAR Holdings, and television broadcaster Allbritton Communications.

Respectfully,

| | |

| John Addeo | | David Cole |

| Portfolio Manager | | Portfolio Manager |

| (h) | Security was not held in the portfolio at period end. |

| (r) | Bonds rated “BBB”, “Baa”, or higher are considered investment grade; bonds rated “BB”, “Ba”, or below are considered non-investment grade. The primary source for bond quality ratings is Moody’s Investors Service. If not available, ratings by Standard & Poor’s are used. For securities which are not rated by either of the two agencies, the security is considered Not Rated. |

| (y) | A yield curve graphically depicts the yields of different maturity bonds of the same credit quality and type; a normal yield curve is upward sloping, with short-term rates lower than long-term rates. |

The views expressed in this report are those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

5

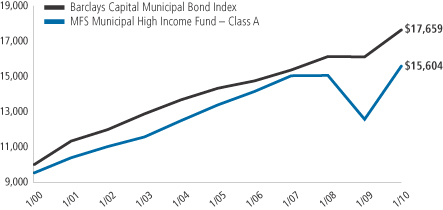

PERFORMANCE SUMMARY THROUGH 1/31/10

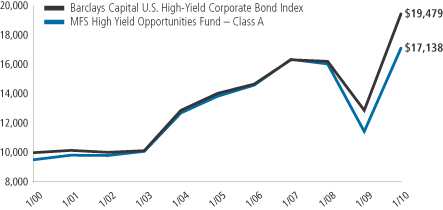

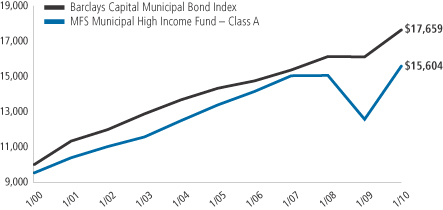

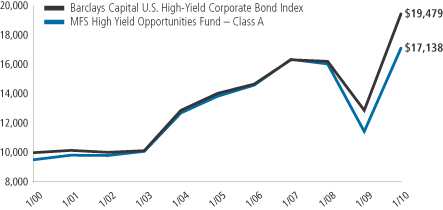

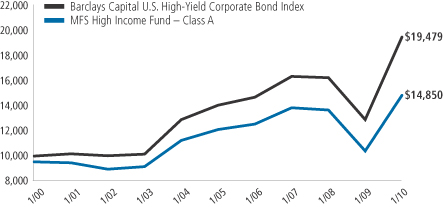

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

6

Performance Summary – continued

Total Returns through 1/31/10

Average annual without sales charge

| | | | | | | | | | | | | | |

| | | Share class | | Class inception date | | 1-yr | | 5-yr | | 10-yr | | Life (t) | | |

| | | A | | 2/17/78 | | 42.99% | | 4.16% | | 4.54% | | N/A | | |

| | | B | | 9/27/93 | | 41.40% | | 3.38% | | 3.79% | | N/A | | |

| | | C | | 1/03/94 | | 41.82% | | 3.39% | | 3.77% | | N/A | | |

| | | I | | 1/02/97 | | 42.90% | | 4.40% | | 4.80% | | N/A | | |

| | | R1 | | 4/01/05 | | 41.39% | | N/A | | N/A | | 3.73% | | |

| | | R2 | | 10/31/03 | | 42.65% | | 3.84% | | N/A | | 5.10% | | |

| | | R3 | | 4/01/05 | | 42.55% | | N/A | | N/A | | 4.48% | | |

| | | R4 | | 4/01/05 | | 43.33% | | N/A | | N/A | | 4.84% | | |

| | | 529A | | 7/31/02 | | 42.40% | | 3.85% | | N/A | | 7.40% | | |

| | | 529B | | 7/31/02 | | 41.40% | | 3.22% | | N/A | | 6.70% | | |

| | | 529C | | 7/31/02 | | 41.26% | | 3.17% | | N/A | | 6.70% | | |

| Comparative benchmark | | | | | | | | | | |

| | | Barclays Capital U.S. High-Yield

Corporate Bond Index (f) | | 51.15% | | 6.76% | | 6.90% | | N/A | | |

| Average annual with sales charge | | | | | | | | | | |

| | | A

With Initial Sales Charge (4.75%) | | 36.20% | | 3.15% | | 4.03% | | N/A | | |

| | | B

With CDSC (Declining over six years from 4% to 0%) (x) | | 37.40% | | 3.09% | | 3.79% | | N/A | | |

| | | C

With CDSC (1% for 12 months) (x) | | 40.82% | | 3.39% | | 3.77% | | N/A | | |

| | | 529A

With Initial Sales Charge (4.75%) | | 35.64% | | 2.85% | | N/A | | 6.71% | | |

| | | 529B

With CDSC (Declining over six years from 4% to 0%) (x) | | 37.40% | | 2.93% | | N/A | | 6.70% | | |

| | | 529C

With CDSC (1% for 12 months) (x) | | 40.26% | | 3.17% | | N/A | | 6.70% | | |

Class I, R1, R2, R3, and R4 shares do not have a sales charge.

CDSC – Contingent Deferred Sales Charge.

| (f) | Source: FactSet Reasearch Systems Inc. |

| (t) | For the period from the class’ inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (x) | Assuming redemption at the end of the applicable period. |

7

Performance Summary – continued

Benchmark Definition

Barclays Capital U.S. High-Yield Corporate Bond Index – a market capitalization-weighted index that measures the performance of non-investment grade, fixed rate debt. Eurobonds and debt issues from countries designated as emerging markets (e.g., Argentina, Brazil, Venezuela, etc.) are excluded.

It is not possible to invest directly in an index.

Notes to Performance Summary

Class 529 shares are only available in conjunction with qualified tuition programs, such as the MFS 529 Savings Plan. There also is an additional fee, which is detailed in the program description, on qualified tuition programs. If this fee was reflected, the performance for Class 529 shares would have been lower. This annual fee is waived for Oregon residents and for those accounts with assets of $25,000 or more.

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund’s share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

8

EXPENSE TABLE

Fund expenses borne by the shareholders during the period,

August 1, 2009 through January 31, 2010

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period August 1, 2009 through January 31, 2010.

The expenses include the payment of a portion of the transfer-agent-related expenses of MFS funds that invest in the fund. For further information, please see the Notes to the Financial Statements.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

Expense Table – continued

| | | | | | | | | | |

Share

Class | | | | Annualized

Expense

Ratio | | Beginning

Account Value

8/1/09 | | Ending

Account Value

1/31/10 | | Expenses

Paid During

Period (p)

8/1/09-1/31/10 |

| A | | Actual | | 0.96% | | $1,000.00 | | $1,146.16 | | $5.19 |

| | Hypothetical (h) | | 0.96% | | $1,000.00 | | $1,020.37 | | $4.89 |

| B | | Actual | | 1.71% | | $1,000.00 | | $1,138.18 | | $9.22 |

| | Hypothetical (h) | | 1.71% | | $1,000.00 | | $1,016.59 | | $8.69 |

| C | | Actual | | 1.71% | | $1,000.00 | | $1,141.60 | | $9.23 |

| | Hypothetical (h) | | 1.71% | | $1,000.00 | | $1,016.59 | | $8.69 |

| I | | Actual | | 0.71% | | $1,000.00 | | $1,144.05 | | $3.84 |

| | Hypothetical (h) | | 0.71% | | $1,000.00 | | $1,021.63 | | $3.62 |

| R1 | | Actual | | 1.71% | | $1,000.00 | | $1,138.15 | | $9.22 |

| | Hypothetical (h) | | 1.71% | | $1,000.00 | | $1,016.59 | | $8.69 |

| R2 | | Actual | | 1.21% | | $1,000.00 | | $1,144.77 | | $6.54 |

| | Hypothetical (h) | | 1.21% | | $1,000.00 | | $1,019.11 | | $6.16 |

| R3 | | Actual | | 0.96% | | $1,000.00 | | $1,142.67 | | $5.18 |

| | Hypothetical (h) | | 0.96% | | $1,000.00 | | $1,020.37 | | $4.89 |

| R4 | | Actual | | 0.71% | | $1,000.00 | | $1,147.52 | | $3.84 |

| | Hypothetical (h) | | 0.71% | | $1,000.00 | | $1,021.63 | | $3.62 |

| 529A | | Actual | | 1.06% | | $1,000.00 | | $1,142.11 | | $5.72 |

| | Hypothetical (h) | | 1.06% | | $1,000.00 | | $1,019.86 | | $5.40 |

| 529B | | Actual | | 1.81% | | $1,000.00 | | $1,137.96 | | $9.75 |

| | Hypothetical (h) | | 1.81% | | $1,000.00 | | $1,016.08 | | $9.20 |

| 529C | | Actual | | 1.81% | | $1,000.00 | | $1,137.62 | | $9.75 |

| | Hypothetical (h) | | 1.81% | | $1,000.00 | | $1,016.08 | | $9.20 |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid is equal to each class’ annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

10

PORTFOLIO OF INVESTMENTS

1/31/10

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | |

| Bonds - 88.8% | | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Aerospace - 0.9% | | | | | | |

| Bombardier, Inc., 6.3%, 2014 (n) | | $ | 2,025,000 | | $ | 2,035,125 |

| Bombardier, Inc., 7.45%, 2034 (z) | | | 670,000 | | | 614,725 |

| Hawker Beechcraft Acquisition Co. LLC, 8.5%, 2015 | | | 3,883,000 | | | 2,669,563 |

| Spirit AeroSystems Holdings, Inc., 7.5%, 2017 (n) | | | 1,295,000 | | | 1,304,713 |

| Vought Aircraft Industries, Inc., 8%, 2011 | | | 1,680,000 | | | 1,667,400 |

| | | | | | |

| | | | | | $ | 8,291,526 |

| Airlines - 1.8% | | | | | | |

| American Airlines Pass-Through Trust, 6.817%, 2011 | | $ | 3,745,000 | | $ | 3,698,188 |

| AMR Corp., 7.858%, 2011 | | | 2,300,000 | | | 2,317,250 |

| Continental Airlines, Inc., 7.339%, 2014 | | | 5,719,000 | | | 5,447,348 |

| Continental Airlines, Inc., 6.9%, 2017 | | | 592,700 | | | 564,547 |

| Continental Airlines, Inc., 6.748%, 2017 | | | 1,152,807 | | | 1,072,110 |

| Delta Air Lines, Inc., 7.111%, 2011 | | | 2,425,000 | | | 2,449,250 |

| Delta Air Lines, Inc., 7.711%, 2011 | | | 1,345,000 | | | 1,331,550 |

| | | | | | |

| | | | | | $ | 16,880,243 |

| Apparel Manufacturers - 0.3% | | | | | | |

| Hanes Brand, Inc., 8%, 2016 | | $ | 830,000 | | $ | 850,750 |

| Levi Strauss & Co., 9.75%, 2015 | | | 1,880,000 | | | 1,964,600 |

| | | | | | |

| | | | | | $ | 2,815,350 |

| Asset Backed & Securitized - 2.2% | | | | | | |

| Airlie Ltd., CDO, FRN, 2.151%, 2011 (a)(p)(z) | | $ | 2,452,690 | | $ | 1,201,818 |

| Anthracite Ltd., CDO, 6%, 2037 (z) | | | 5,148,000 | | | 257,400 |

| Babson Ltd., CLO, “D”, FRN, 1.751%, 2018 (n) | | | 2,385,000 | | | 1,353,488 |

| Banc of America Commercial Mortgage, Inc., FRN, 5.811%, 2017 | | | 1,843,262 | | | 1,464,064 |

| Citigroup Commercial Mortgage Trust, FRN, 5.7%, 2017 | | | 2,948,120 | | | 567,899 |

| Credit Suisse Mortgage Capital Certificate, 5.343%, 2039 | | | 1,967,534 | | | 1,530,996 |

| CWCapital Cobalt Ltd., CDO, “E2”, 6%, 2045 (z) | | | 1,061,364 | | | 21,227 |

| CWCapital Cobalt Ltd., CDO, “F”, FRN, 1.549%, 2050 (z) | | | 612,466 | | | 12,249 |

| CWCapital Cobalt Ltd., CDO, “G”, FRN, 1.749%, 2050 (z) | | | 1,898,608 | | | 37,972 |

| Falcon Franchise Loan LLC, FRN, 3.67%, 2025 (i)(z) | | | 10,928,295 | | | 763,888 |

| First Union National Bank Commercial Mortgage Trust, 6.75%, 2032 | | | 2,000,000 | | | 1,776,995 |

| JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 6.062%, 2051 | | | 2,285,000 | | | 725,261 |

| Lehman Brothers Commercial Conduit Mortgage Trust, FRN, 1.002%, 2030 (i) | | | 10,167,103 | | | 307,115 |

11

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Asset Backed & Securitized - continued | | | | | | |

| Merrill Lynch Mortgage Trust, FRN, 5.828%, 2050 | | $ | 2,285,000 | | $ | 638,904 |

| Merrill Lynch/Countrywide Commercial Mortgage Trust, FRN, 5.204%, 2049 | | | 5,320,927 | | | 4,173,756 |

| Merrill Lynch/Countrywide Commercial Mortgage Trust, FRN, 5.747%, 2050 | | | 1,366,000 | | | 924,980 |

| Merrill Lynch/Countrywide Commercial Mortgage Trust, FRN, 5.747%, 2050 | | | 3,115,000 | | | 2,687,594 |

| Morgan Stanley Capital I, Inc., 1.269%, 2039 (i)(z) | | | 20,517,431 | | | 326,022 |

| TIERS Beach Street Synthetic, CLO, FRN, 6.787%, 2011 (z) | | | 2,750,000 | | | 2,234,100 |

| Wachovia Bank Commercial Mortgage Trust, FRN, 5.753%, 2047 | | | 1,738,692 | | | 285,070 |

| Wachovia Credit, CDO, FRN, 1.601%, 2026 (z) | | | 1,320,000 | | | 52,800 |

| | | | | | |

| | | | | | $ | 21,343,598 |

| Automotive - 3.2% | | | | | | |

| Accuride Corp., 8.5%, 2015 (d) | | $ | 1,380,000 | | $ | 1,259,250 |

| Allison Transmission, Inc., 11%, 2015 (n) | | | 5,350,000 | | | 5,644,250 |

| Allison Transmission, Inc., 11.25%, 2015 (n)(p) | | | 1,939,800 | | | 2,041,640 |

| FCE Bank PLC, 7.125%, 2012 | | EUR | 4,600,000 | | | 6,346,011 |

| Ford Motor Credit Co. LLC, 12%, 2015 | | $ | 8,973,000 | | | 10,304,315 |

| Goodyear Tire & Rubber Co., 9%, 2015 | | | 2,440,000 | | | 2,513,200 |

| Goodyear Tire & Rubber Co., 10.5%, 2016 | | | 1,985,000 | | | 2,153,725 |

| | | | | | |

| | | | | | $ | 30,262,391 |

| Basic Industry - 0.1% | | | | | | |

| TriMas Corp., 9.75%, 2017 (n) | | $ | 565,000 | | $ | 563,588 |

| | |

| Broadcasting - 4.7% | | | | | | |

| Allbritton Communications Co., 7.75%, 2012 | | $ | 4,255,000 | | $ | 4,223,088 |

| Bonten Media Acquisition Co., 9%, 2015 (p)(z) | | | 4,861,454 | | | 1,765,721 |

| Inmarsat Finance PLC, 7.375%, 2017 (n) | | | 2,070,000 | | | 2,124,338 |

| Intelsat Jackson Holdings Ltd., 9.5%, 2016 | | | 7,695,000 | | | 8,118,225 |

| Lamar Media Corp., 6.625%, 2015 | | | 3,830,000 | | | 3,686,375 |

| Lamar Media Corp., “C”, 6.625%, 2015 | | | 1,485,000 | | | 1,414,463 |

| LBI Media, Inc., 8.5%, 2017 (z) | | | 1,450,000 | | | 1,232,500 |

| LIN TV Corp., 6.5%, 2013 | | | 3,220,000 | | | 3,075,100 |

| Local TV Finance LLC, 9.25%, 2015 (p)(z) | | | 5,429,812 | | | 2,873,276 |

| Newport Television LLC, 13%, 2017 (n)(p) | | | 4,536,531 | | | 2,119,883 |

| Nexstar Broadcasting Group, Inc., 0.5% to 2011, 7% to 2014 (n)(p) | | | 4,026,839 | | | 3,220,465 |

| Nexstar Broadcasting Group, Inc., 7%, 2014 | | | 1,328,000 | | | 1,062,400 |

| Salem Communications Corp., 9.625%, 2016 (n) | | | 970,000 | | | 1,023,350 |

| Sinclair Broadcast Group, Inc., 9.25%, 2017 (n) | | | 1,540,000 | | | 1,586,200 |

| Univision Communications, Inc., 12%, 2014 (n) | | | 1,540,000 | | | 1,663,200 |

12

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Broadcasting - continued | | | | | | |

| Univision Communications, Inc., 10.5%, 2015 (n)(p) | | $ | 6,036,087 | | $ | 5,068,804 |

| Young Broadcasting, Inc., 8.75%, 2014 (d) | | | 1,640,000 | | | 11,480 |

| | | | | | |

| | | | | | $ | 44,268,868 |

| Brokerage & Asset Managers - 0.6% | | | | | | |

| Janus Capital Group, Inc., 6.95%, 2017 | | $ | 4,410,000 | | $ | 4,366,032 |

| Nuveen Investments, Inc., 10.5%, 2015 | | | 1,555,000 | | | 1,438,375 |

| | | | | | |

| | | | | | $ | 5,804,407 |

| Building - 2.1% | | | | | | |

| Associated Materials, Inc., 11.25%, 2014 | | $ | 2,360,000 | | $ | 2,360,000 |

| Building Materials Corp. of America, 7.75%, 2014 | | | 1,990,000 | | | 2,067,113 |

| CEMEX Finance Europe B.V., 9.625%, 2017 (n) | | EUR | 1,765,000 | | | 2,483,851 |

| Norcraft Cos., LP, 10.5%, 2015 (n) | | $ | 1,105,000 | | | 1,149,200 |

| Nortek, Inc., 11%, 2013 | | | 4,730,933 | | | 4,967,480 |

| Owens Corning, 9%, 2019 | | | 3,510,000 | | | 4,035,422 |

| Ply Gem Industries, Inc., 11.75%, 2013 | | | 1,855,000 | | | 1,887,463 |

| USG Corp., 9.75%, 2014 (n) | | | 555,000 | | | 588,300 |

| | | | | | |

| | | | | | $ | 19,538,829 |

| Business Services - 2.7% | | | | | | |

| First Data Corp., 9.875%, 2015 | | $ | 8,650,000 | | $ | 7,720,125 |

| First Data Corp., 11.25%, 2016 | | | 4,295,000 | | | 3,586,325 |

| Iron Mountain, Inc., 6.625%, 2016 | | | 3,045,000 | | | 2,953,650 |

| Iron Mountain, Inc., 8.375%, 2021 | | | 1,790,000 | | | 1,857,125 |

| SunGard Data Systems, Inc., 9.125%, 2013 | | | 3,970,000 | | | 4,039,475 |

| SunGard Data Systems, Inc., 10.25%, 2015 | | | 3,253,000 | | | 3,374,988 |

| Terremark Worldwide, Inc., 12%, 2017 (n) | | | 2,000,000 | | | 2,215,000 |

| | | | | | |

| | | | | | $ | 25,746,688 |

| Cable TV - 3.4% | | | | | | |

| CCO Holdings LLC, 8.75%, 2013 | | $ | 8,620,000 | | $ | 8,738,525 |

| Charter Communications Holding Co., LLC, 8.375%, 2014 (n) | | | 2,255,000 | | | 2,294,463 |

| Charter Communications Holding Co., LLC, 10.875%, 2014 (n) | | | 2,725,000 | | | 3,052,000 |

| CSC Holdings, Inc., 6.75%, 2012 | | | 456,000 | | | 474,240 |

| CSC Holdings, Inc., 8.5%, 2014 (n) | | | 4,275,000 | | | 4,531,500 |

| DIRECTV Holdings LLC, 7.625%, 2016 | | | 2,750,000 | | | 3,011,250 |

| Mediacom LLC, 9.125%, 2019 (n) | | | 1,560,000 | | | 1,560,000 |

| Videotron LTEE, 6.875%, 2014 | | | 1,860,000 | | | 1,850,700 |

| Virgin Media Finance PLC, 9.125%, 2016 | | | 4,528,000 | | | 4,709,120 |

| Virgin Media Finance PLC, 9.5%, 2016 | | | 1,900,000 | | | 2,014,000 |

| | | | | | |

| | | | | | $ | 32,235,798 |

13

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Chemicals - 3.0% | | | | | | |

| Ashland, Inc., 9.125%, 2017 (n) | | $ | 5,595,000 | | $ | 6,098,550 |

| Hexion Finance Escrow LLC, 8.875%, 2018 (z) | | | 2,205,000 | | | 2,125,069 |

| Hexion Specialty Chemicals, Inc., 9.75%, 2014 | | | 2,660,000 | | | 2,573,550 |

| Huntsman International LLC, 5.5%, 2016 (n) | | | 2,115,000 | | | 1,845,338 |

| Innophos Holdings, Inc., 8.875%, 2014 | | | 3,800,000 | | | 3,876,000 |

| Lumena Resources Corp., 12%, 2014 (n) | | | 4,192,000 | | | 3,690,236 |

| Momentive Performance Materials, Inc., 12.5%, 2014 (n) | | | 3,765,000 | | | 4,216,800 |

| Momentive Performance Materials, Inc., 11.5%, 2016 | | | 1,785,000 | | | 1,548,488 |

| Nalco Co., 8.875%, 2013 | | | 2,090,000 | | | 2,147,475 |

| | | | | | |

| | | | | | $ | 28,121,506 |

| Computer Software - Systems - 0.3% | | | | | | |

| DuPont Fabros Technology, Inc., 8.5%, 2017 (n) | | $ | 2,805,000 | | $ | 2,875,125 |

| | |

| Construction - 0.2% | | | | | | |

| Lennar Corp., 12.25%, 2017 | | $ | 1,285,000 | | $ | 1,567,700 |

| | |

| Consumer Products - 0.9% | | | | | | |

| ACCO Brands Corp., 10.625%, 2015 (n) | | $ | 395,000 | | $ | 432,525 |

| ACCO Brands Corp., 7.625%, 2015 | | | 1,275,000 | | | 1,195,313 |

| Jarden Corp., 7.5%, 2017 | | | 3,450,000 | | | 3,467,250 |

| Libbey Glass, Inc., 10%, 2015 (z) | | | 235,000 | | | 237,938 |

| Scotts Miracle-Gro Co., 7.25%, 2018 | | | 685,000 | | | 696,988 |

| Visant Holding Corp., 8.75%, 2013 | | | 2,170,000 | | | 2,224,250 |

| | | | | | |

| | | | | | $ | 8,254,264 |

| Consumer Services - 2.2% | | | | | | |

| Corrections Corp. of America, 6.25%, 2013 | | $ | 2,330,000 | | $ | 2,335,825 |

| Corrections Corp. of America, 7.75%, 2017 | | | 1,400,000 | | | 1,438,500 |

| KAR Holdings, Inc., 10%, 2015 | | | 2,400,000 | | | 2,544,000 |

| KAR Holdings, Inc., FRN, 4.249%, 2014 | | | 1,660,000 | | | 1,535,500 |

| Service Corp. International, 7.375%, 2014 | | | 2,670,000 | | | 2,696,700 |

| Service Corp. International, 7%, 2017 | | | 6,380,000 | | | 6,300,250 |

| Ticketmaster Entertainment, Inc., 10.75%, 2016 | | | 3,555,000 | | | 3,883,838 |

| | | | | | |

| | | | | | $ | 20,734,613 |

| Containers - 1.4% | | | | | | |

| Crown Americas LLC, 7.625%, 2013 | | $ | 1,223,000 | | $ | 1,261,219 |

| Graham Packaging Holdings Co., 9.875%, 2014 | | | 4,840,000 | | | 4,979,150 |

| Greif, Inc., 6.75%, 2017 | | | 3,415,000 | | | 3,355,238 |

| Owens-Brockway Glass Container, Inc., 8.25%, 2013 | | | 980,000 | | | 999,600 |

| Owens-Illinois, Inc., 7.375%, 2016 | | | 1,760,000 | | | 1,830,400 |

| Reynolds Group, 7.75%, 2016 (n) | | | 1,260,000 | | | 1,269,450 |

| | | | | | |

| | | | | | $ | 13,695,057 |

14

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Defense Electronics - 0.4% | | | | | | |

| L-3 Communications Corp., 6.125%, 2014 | | $ | 3,320,000 | | $ | 3,361,500 |

| | |

| Electronics - 1.0% | | | | | | |

| Avago Technologies Ltd., 11.875%, 2015 | | $ | 2,260,000 | | $ | 2,502,950 |

| Flextronics International Ltd., 6.25%, 2014 | | | 925,000 | | | 918,063 |

| Freescale Semiconductor, Inc., 8.875%, 2014 | | | 3,285,000 | | | 2,923,650 |

| Jabil Circuit, Inc., 7.75%, 2016 | | | 2,740,000 | | | 2,918,100 |

| | | | | | |

| | | | | | $ | 9,262,763 |

| Emerging Market Sovereign - 0.1% | | | | | | |

| Republic of Argentina, FRN, 0.943%, 2012 | | $ | 1,291,763 | | $ | 1,107,471 |

| | |

| Energy - Independent - 6.8% | | | | | | |

| Chaparral Energy, Inc., 8.875%, 2017 | | $ | 3,465,000 | | $ | 3,014,550 |

| Chesapeake Energy Corp., 7%, 2014 | | | 1,245,000 | | | 1,254,338 |

| Chesapeake Energy Corp., 9.5%, 2015 | | | 785,000 | | | 855,650 |

| Chesapeake Energy Corp., 6.375%, 2015 | | | 3,885,000 | | | 3,807,300 |

| Forest Oil Corp., 8.5%, 2014 | | | 595,000 | | | 624,750 |

| Forest Oil Corp., 7.25%, 2019 | | | 1,520,000 | | | 1,527,600 |

| Hilcorp Energy I LP, 9%, 2016 (n) | | | 4,515,000 | | | 4,684,313 |

| Mariner Energy, Inc., 8%, 2017 | | | 2,875,000 | | | 2,810,313 |

| McMoRan Exploration Co., 11.875%, 2014 | | | 1,825,000 | | | 1,989,250 |

| Newfield Exploration Co., 6.625%, 2014 | | | 2,080,000 | | | 2,100,800 |

| Newfield Exploration Co., 6.625%, 2016 | | | 1,070,000 | | | 1,070,000 |

| OPTI Canada, Inc., 8.25%, 2014 | | | 3,355,000 | | | 2,952,400 |

| Penn Virginia Corp., 10.375%, 2016 | | | 5,160,000 | | | 5,682,450 |

| Petrohawk Energy Corp., 10.5%, 2014 | | | 2,230,000 | | | 2,464,150 |

| Pioneer Natural Resources Co., 6.875%, 2018 | | | 2,900,000 | | | 2,848,937 |

| Pioneer Natural Resources Co., 7.5%, 2020 | | | 1,960,000 | | | 1,990,174 |

| Plains Exploration & Production Co., 7%, 2017 | | | 5,740,000 | | | 5,661,075 |

| Quicksilver Resources, Inc., 8.25%, 2015 | | | 4,690,000 | | | 4,830,700 |

| Range Resources Corp., 8%, 2019 | | | 4,375,000 | | | 4,659,375 |

| SandRidge Energy, Inc., 9.875%, 2016 (n) | | | 895,000 | | | 950,938 |

| SandRidge Energy, Inc., 8%, 2018 (n) | | | 5,405,000 | | | 5,377,975 |

| Southwestern Energy Co., 7.5%, 2018 | | | 2,905,000 | | | 3,093,825 |

| | | | | | |

| | | | | | $ | 64,250,863 |

| Entertainment - 0.8% | | | | | | |

| AMC Entertainment, Inc., 11%, 2016 | | $ | 2,935,000 | | $ | 3,155,125 |

| AMC Entertainment, Inc., 8.75%, 2019 | | | 2,575,000 | | | 2,665,125 |

| Cinemark USA, Inc., 8.625%, 2019 | | | 2,155,000 | | | 2,246,588 |

| | | | | | |

| | | | | | $ | 8,066,838 |

15

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Financial Institutions - 2.6% | | | | | | |

| CIT Group, Inc., 7%, 2017 | | $ | 4,650,000 | | $ | 3,964,125 |

| GMAC, Inc., 6.875%, 2011 | | | 3,373,000 | | | 3,373,000 |

| GMAC, Inc., 7%, 2012 | | | 1,745,000 | | | 1,731,913 |

| GMAC, Inc., 6.75%, 2014 | | | 6,260,000 | | | 6,087,850 |

| GMAC, Inc., 8%, 2031 | | | 3,553,000 | | | 3,401,998 |

| International Lease Finance Corp., 5.625%, 2013 | | | 7,620,000 | | | 6,270,102 |

| | | | | | |

| | | | | | $ | 24,828,988 |

| Food & Beverages - 1.8% | | | | | | |

| ARAMARK Corp., 8.5%, 2015 | | $ | 2,151,000 | | $ | 2,156,378 |

| B&G Foods, Inc., 7.625%, 2018 | | | 1,110,000 | | | 1,121,100 |

| Dean Foods Co., 7%, 2016 | | | 3,190,000 | | | 3,110,250 |

| Del Monte Foods Co., 6.75%, 2015 | | | 3,920,000 | | | 4,008,200 |

| Michael Foods, Inc., 8%, 2013 | | | 3,105,000 | | | 3,170,981 |

| Pinnacle Foods Finance LLC, 9.25%, 2015 | | | 3,580,000 | | | 3,597,900 |

| | | | | | |

| | | | | | $ | 17,164,809 |

| Forest & Paper Products - 2.5% | | | | | | |

| Buckeye Technologies, Inc., 8.5%, 2013 | | $ | 3,448,000 | | $ | 3,508,340 |

| Cascades, Inc., 7.75%, 2017 (n) | | | 1,870,000 | | | 1,907,400 |

| Georgia-Pacific Corp., 7.125%, 2017 (n) | | | 3,480,000 | | | 3,567,000 |

| Georgia-Pacific Corp., 8%, 2024 | | | 2,860,000 | | | 2,974,400 |

| Georgia-Pacific Corp., 7.25%, 2028 | | | 865,000 | | | 834,725 |

| Graphic Packaging International Corp., 9.5%, 2013 | | | 2,705,000 | | | 2,779,388 |

| Jefferson Smurfit Corp., 8.25%, 2012 (d) | | | 1,095,000 | | | 914,325 |

| JSG Funding PLC, 7.75%, 2015 | | | 690,000 | | | 672,750 |

| Millar Western Forest Products Ltd., 7.75%, 2013 | | | 4,885,000 | | | 3,956,850 |

| Smurfit Kappa Group PLC, 7.75%, 2019 (n) | | EUR | 1,920,000 | | | 2,648,770 |

| | | | | | |

| | | | | | $ | 23,763,948 |

| Gaming & Lodging - 5.2% | | | | | | |

| Ameristar Casinos, Inc., 9.25%, 2014 (n) | | $ | 1,380,000 | | $ | 1,424,850 |

| Boyd Gaming Corp., 6.75%, 2014 | | | 3,940,000 | | | 3,644,500 |

| Firekeepers Development Authority, 13.875%, 2015 (n) | | | 1,450,000 | | | 1,660,250 |

| Fontainebleau Las Vegas Holdings LLC, 10.25%, 2015 (d)(n) | | | 3,300,000 | | | 33,000 |

| Harrah’s Operating Co., Inc., 11.25%, 2017 | | | 3,715,000 | | | 3,947,188 |

| Harrah’s Operating Co., Inc., 10%, 2018 | | | 571,000 | | | 453,945 |

| Harrah’s Operating Co., Inc., 10%, 2018 | | | 4,971,000 | | | 3,951,945 |

| Host Hotels & Resorts, Inc., 7.125%, 2013 | | | 1,155,000 | | | 1,163,663 |

| Host Hotels & Resorts, Inc., 6.75%, 2016 | | | 3,645,000 | | | 3,562,988 |

| Host Hotels & Resorts, Inc., 9%, 2017 (n) | | | 2,455,000 | | | 2,626,850 |

| MGM Mirage, 6.75%, 2013 | | | 3,410,000 | | | 3,103,100 |

| MGM Mirage, 10.375%, 2014 (n) | | | 1,520,000 | | | 1,668,200 |

16

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Gaming & Lodging - continued | | | | | | |

| MGM Mirage, 7.5%, 2016 | | $ | 1,835,000 | | $ | 1,532,225 |

| MGM Mirage, 11.125%, 2017 (n) | | | 1,280,000 | | | 1,440,000 |

| MGM Mirage, 11.375%, 2018 (n) | | | 400,000 | | | 378,000 |

| Penn National Gaming, Inc., 8.75%, 2019 (n) | | | 2,915,000 | | | 2,973,300 |

| Pinnacle Entertainment, Inc., 7.5%, 2015 | | | 3,935,000 | | | 3,639,875 |

| Royal Caribbean Cruises Ltd., 7%, 2013 | | | 2,105,000 | | | 2,089,213 |

| Royal Caribbean Cruises Ltd., 11.875%, 2015 | | | 3,765,000 | | | 4,395,638 |

| Starwood Hotels & Resorts Worldwide, Inc., 6.75%, 2018 | | | 1,565,000 | | | 1,561,088 |

| Station Casinos, Inc., 6%, 2012 (d) | | | 4,027,000 | | | 684,590 |

| Station Casinos, Inc., 6.5%, 2014 (d) | | | 6,495,000 | | | 32,475 |

| Station Casinos, Inc., 6.875%, 2016 (d) | | | 7,690,000 | | | 38,450 |

| Station Casinos, Inc., 7.75%, 2016 (d) | | | 1,413,000 | | | 250,808 |

| Wyndham Worldwide Corp., 6%, 2016 | | | 3,585,000 | | | 3,471,176 |

| | | | | | |

| | | | | | $ | 49,727,317 |

| Industrial - 1.1% | | | | | | |

| Altra Holdings, Inc., 8.125%, 2016 (n) | | $ | 1,925,000 | | $ | 1,987,563 |

| Aquilex Corp., 11.125%, 2016 (n) | | | 730,000 | | | 759,200 |

| Baldor Electric Co., 8.625%, 2017 | | | 3,660,000 | | | 3,724,050 |

| Great Lakes Dredge & Dock Corp., 7.75%, 2013 | | | 2,325,000 | | | 2,325,000 |

| Johnsondiversey Holdings, Inc., 8.25%, 2019 (n) | | | 1,910,000 | | | 1,981,625 |

| | | | | | |

| | | | | | $ | 10,777,438 |

| Insurance - 0.8% | | | | | | |

| ING Groep N.V., 5.775% to 2015, FRN to 2049 | | $ | 5,180,000 | | $ | 4,075,883 |

| MetLife, Inc., 9.25% to 2038, FRN to 2068 (n) | | | 3,400,000 | | | 3,808,000 |

| | | | | | |

| | | | | | $ | 7,883,883 |

| Insurance - Property & Casualty - 0.8% | | | | | | |

| Liberty Mutual Group, Inc., 10.75% to 2038, FRN to 2088 (n) | | $ | 3,440,000 | | $ | 3,784,000 |

| USI Holdings Corp., 9.75%, 2015 (z) | | | 3,165,000 | | | 2,935,538 |

| ZFS Finance USA Trust II, 6.45% to 2016, FRN to 2065 (z) | | | 1,481,000 | | | 1,332,900 |

| | | | | | |

| | | | | | $ | 8,052,438 |

| Machinery & Tools - 0.6% | | | | | | |

| Case New Holland, Inc., 7.125%, 2014 | | $ | 1,975,000 | | $ | 1,975,000 |

| Rental Service Corp., 9.5%, 2014 | | | 3,625,000 | | | 3,670,313 |

| | | | | | |

| | | | | | $ | 5,645,313 |

| Major Banks - 1.6% | | | | | | |

| Bank of America Corp., 8% to 2018, FRN to 2049 | | $ | 7,780,000 | | $ | 7,386,721 |

| JPMorgan Chase & Co., 7.9% to 2018, FRN to 2049 | | | 6,505,000 | | | 6,663,137 |

| Royal Bank of Scotland Group PLC, FRN, 7.648%, 2049 | | | 1,745,000 | | | 1,359,163 |

| | | | | | |

| | | | | | $ | 15,409,021 |

17

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Medical & Health Technology & Services - 7.2% | | | | | | |

| Biomet, Inc., 10%, 2017 | | $ | 2,740,000 | | $ | 2,979,750 |

| Biomet, Inc., 11.625%, 2017 | | | 2,645,000 | | | 2,909,500 |

| Community Health Systems, Inc., 8.875%, 2015 | | | 6,075,000 | | | 6,280,031 |

| Cooper Cos., Inc., 7.125%, 2015 | | | 2,045,000 | | | 2,009,213 |

| DaVita, Inc., 6.625%, 2013 | | | 1,454,000 | | | 1,457,635 |

| DaVita, Inc., 7.25%, 2015 | | | 3,720,000 | | | 3,724,650 |

| Fresenius Medical Care AG & Co. KGaA, 9%, 2015 (n) | | | 2,540,000 | | | 2,844,800 |

| HCA, Inc., 6.375%, 2015 | | | 4,325,000 | | | 3,989,813 |

| HCA, Inc., 9.25%, 2016 | | | 14,535,000 | | | 15,334,425 |

| HCA, Inc., 8.5%, 2019 (n) | | | 2,055,000 | | | 2,173,163 |

| HealthSouth Corp., 8.125%, 2020 | | | 4,215,000 | | | 4,130,700 |

| Psychiatric Solutions, Inc., 7.75%, 2015 | | | 1,775,000 | | | 1,699,563 |

| Psychiatric Solutions, Inc., 7.75%, 2015 (n) | | | 950,000 | | | 885,875 |

| Tenet Healthcare Corp., 9.25%, 2015 | | | 3,120,000 | | | 3,229,200 |

| U.S. Oncology, Inc., 10.75%, 2014 | | | 3,480,000 | | | 3,627,900 |

| United Surgical Partners International, Inc., 8.875%, 2017 | | | 840,000 | | | 863,100 |

| United Surgical Partners International, Inc., 9.25%, 2017 (p) | | | 1,325,000 | | | 1,379,656 |

| Universal Hospital Services, Inc., 8.5%, 2015 (p) | | | 3,330,000 | | | 3,255,075 |

| Universal Hospital Services, Inc., FRN, 3.859%, 2015 | | | 1,015,000 | | | 867,825 |

| VWR Funding, Inc., 10.25%, 2015 (p) | | | 4,996,063 | | | 5,220,885 |

| | | | | | |

| | | | | | $ | 68,862,759 |

| Metals & Mining - 2.7% | | | | | | |

| Arch Western Finance LLC, 6.75%, 2013 | | $ | 3,570,000 | | $ | 3,534,300 |

| Cloud Peak Energy, Inc., 8.25%, 2017 (n) | | | 2,330,000 | | | 2,388,250 |

| Cloud Peak Energy, Inc., 8.5%, 2019 (n) | | | 2,330,000 | | | 2,423,200 |

| FMG Finance Ltd., 10.625%, 2016 (n) | | | 3,590,000 | | | 4,065,675 |

| Freeport-McMoRan Copper & Gold, Inc., 8.375%, 2017 | | | 6,390,000 | | | 6,949,125 |

| Freeport-McMoRan Copper & Gold, Inc., FRN, 3.881%, 2015 | | | 1,088,000 | | | 1,081,972 |

| Peabody Energy Corp., 5.875%, 2016 | | | 3,065,000 | | | 3,003,700 |

| Peabody Energy Corp., 7.375%, 2016 | | | 2,185,000 | | | 2,321,563 |

| | | | | | |

| | | | | | $ | 25,767,785 |

| Natural Gas - Distribution - 0.8% | | | | | | |

| AmeriGas Partners LP, 7.125%, 2016 | | $ | 4,165,000 | | $ | 4,217,063 |

| Inergy LP, 6.875%, 2014 | �� | | 3,625,000 | | | 3,615,938 |

| | | | | | |

| | | | | | $ | 7,833,001 |

| Natural Gas - Pipeline - 1.8% | | | | | | |

| Atlas Pipeline Partners LP, 8.125%, 2015 | | $ | 3,565,000 | | $ | 3,297,625 |

| Atlas Pipeline Partners LP, 8.75%, 2018 | | | 2,775,000 | | | 2,566,875 |

| Deutsche Bank (El Paso Performance-Linked Trust, CLN), 7.75%, 2011 (n) | | | 2,085,000 | | | 2,170,679 |

18

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Natural Gas - Pipeline - continued | | | | | | |

| El Paso Corp., 8.25%, 2016 | | $ | 2,575,000 | | $ | 2,774,563 |

| El Paso Corp., 7%, 2017 | | | 1,440,000 | | | 1,472,265 |

| El Paso Corp., 7.75%, 2032 | | | 1,440,000 | | | 1,431,199 |

| MarkWest Energy Partners LP, 6.875%, 2014 | | | 2,520,000 | | | 2,469,600 |

| MarkWest Energy Partners LP, 8.75%, 2018 | | | 815,000 | | | 847,600 |

| | | | | | |

| | | | | | $ | 17,030,406 |

| Network & Telecom - 2.3% | | | | | | |

| Cincinnati Bell, Inc., 8.375%, 2014 | | $ | 6,315,000 | | $ | 6,362,363 |

| Citizens Communications Co., 9%, 2031 | | | 1,140,000 | | | 1,128,600 |

| Nordic Telephone Co. Holdings, 8.875%, 2016 (n) | | | 3,965,000 | | | 4,222,725 |

| Qwest Communications International, Inc., 8%, 2015 (n) | | | 1,290,000 | | | 1,335,150 |

| Qwest Communications International, Inc., 7.125%, 2018 (z) | | | 2,790,000 | | | 2,720,250 |

| Qwest Corp, 8.375%, 2016 | | | 1,220,000 | | | 1,335,900 |

| Windstream Corp., 8.625%, 2016 | | | 5,065,000 | | | 5,197,956 |

| | | | | | |

| | | | | | $ | 22,302,944 |

| Oil Services - 0.7% | | | | | | |

| Allis-Chalmers Energy, Inc., 8.5%, 2017 | | $ | 2,645,000 | | $ | 2,380,500 |

| Basic Energy Services, Inc., 7.125%, 2016 | | | 1,055,000 | | | 907,300 |

| Expro Finance Luxembourg, 8.5%, 2016 (n) | | | 860,000 | | | 855,700 |

| McJunkin Red Man Holding Corp., 9.5%, 2016 (z) | | | 1,455,000 | | | 1,451,363 |

| Trico Shipping A.S., 11.875%, 2014 (n) | | | 900,000 | | | 945,000 |

| | | | | | |

| | | | | | $ | 6,539,863 |

| Oils - 0.2% | | | | | | |

| Holly Corp., 9.875%, 2017 (n) | | $ | 1,020,000 | | $ | 1,081,200 |

| Petroplus Holdings AG, 9.375%, 2019 (n) | | | 1,275,000 | | | 1,262,250 |

| | | | | | |

| | | | | | $ | 2,343,450 |

| Other Banks & Diversified Financials - 0.4% | | | | | | |

| Capital One Financial Corp., 10.25%, 2039 | | $ | 1,670,000 | | $ | 1,911,831 |

| LBG Capital No. 1 PLC, 7.875%, 2020 (z) | | | 2,075,000 | | | 1,826,000 |

| | | | | | |

| | | | | | $ | 3,737,831 |

| Precious Metals & Minerals - 0.9% | | | | | | |

| Teck Resources Ltd., 9.75%, 2014 | | $ | 1,665,000 | | $ | 1,902,263 |

| Teck Resources Ltd., 10.25%, 2016 | | | 810,000 | | | 925,425 |

| Teck Resources Ltd., 10.75%, 2019 | | | 4,485,000 | | | 5,281,088 |

| | | | | | |

| | | | | | $ | 8,108,776 |

| Printing & Publishing - 1.0% | | | | | | |

| American Media Operations, Inc., 9%, 2013 (p)(z) | | $ | 271,299 | | $ | 170,444 |

19

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Printing & Publishing - continued | | | | | | |

| American Media Operations, Inc., 14%, 2013 (p)(z) | | $ | 2,900,166 | | $ | 1,784,972 |

| Nielsen Finance LLC, 10%, 2014 | | | 4,365,000 | | | 4,539,600 |

| Nielsen Finance LLC, 11.5%, 2016 | | | 2,020,000 | | | 2,262,400 |

| Nielsen Finance LLC, 0% to 2011, 12.5% to 2016 | | | 421,000 | | | 385,215 |

| Tribune Co., 5.25%, 2015 (d) | | | 2,550,000 | | | 714,000 |

| | | | | | |

| | | | | | $ | 9,856,631 |

| Railroad & Shipping - 0.4% | | | | | | |

| Kansas City Southern Railway, 8%, 2015 | | $ | 3,610,000 | | $ | 3,713,788 |

| TFM S.A. de C.V., 9.375%, 2012 | | | 238,000 | | | 243,950 |

| | | | | | |

| | | | | | $ | 3,957,738 |

| Real Estate - 0.1% | | | | | | |

| CB Richard Ellis Group, Inc., 11.625%, 2017 | | $ | 1,020,000 | | $ | 1,147,500 |

| | |

| Retailers - 3.1% | | | | | | |

| Couche-Tard, Inc., 7.5%, 2013 | | $ | 705,000 | | $ | 713,813 |

| Dollar General Corp., 11.875%, 2017 (p) | | | 1,318,000 | | | 1,515,700 |

| Federated Retail Holdings, Inc., 5.9%, 2016 | | | 3,460,000 | | | 3,304,300 |

| Limited Brands, Inc., 5.25%, 2014 | | | 2,480,000 | | | 2,393,200 |

| Limited Brands, Inc., 6.95%, 2033 | | | 1,150,000 | | | 994,750 |

| Macy’s Retail Holdings, Inc., 5.75%, 2014 | | | 4,065,000 | | | 4,075,163 |

| Neiman Marcus Group, Inc., 10.375%, 2015 | | | 3,205,000 | | | 3,140,900 |

| Sally Beauty Holdings, Inc., 10.5%, 2016 | | | 4,520,000 | | | 4,836,400 |

| Toys “R” Us, Inc., 7.625%, 2011 | | | 1,185,000 | | | 1,223,513 |

| Toys “R” Us, Inc., 10.75%, 2017 (n) | | | 4,665,000 | | | 5,166,488 |

| Toys “R” Us, Inc., 8.5%, 2017 (n) | | | 1,775,000 | | | 1,828,250 |

| | | | | | |

| | | | | | $ | 29,192,477 |

| Specialty Chemicals - 0.2% | | | | | | |

| Airgas, Inc., 7.125%, 2018 (z) | | $ | 1,790,000 | | $ | 1,879,500 |

| | |

| Specialty Stores - 0.3% | | | | | | |

| Payless ShoeSource, Inc., 8.25%, 2013 | | $ | 2,922,000 | | $ | 2,984,093 |

| | |

| Supermarkets - 0.2% | | | | | | |

| SUPERVALU, Inc., 8%, 2016 | | $ | 1,850,000 | | $ | 1,850,000 |

| | |

| Telecommunications - Wireless - 3.7% | | | | | | |

| Cricket Communications, Inc., 7.75%, 2016 | | $ | 2,040,000 | | $ | 2,052,750 |

| Crown Castle International Corp., 9%, 2015 | | | 2,705,000 | | | 2,931,544 |

| Crown Castle International Corp., 7.75%, 2017 (n) | | | 1,265,000 | | | 1,363,038 |

| Crown Castle International Corp., 7.125%, 2019 | | | 4,420,000 | | | 4,386,850 |

20

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Bonds - continued | | | | | | |

| Telecommunications - Wireless - continued | | | | | | |

| Digicel Group Ltd., 12%, 2014 (n) | | $ | 560,000 | | $ | 621,600 |

| Digicel Group Ltd., 8.25%, 2017 (n) | | | 3,050,000 | | | 2,950,875 |

| Nextel Communications, Inc., 6.875%, 2013 | | | 2,845,000 | | | 2,652,963 |

| NII Holdings, Inc., 10%, 2016 (n) | | | 2,645,000 | | | 2,764,025 |

| SBA Communications Corp., 8%, 2016 (n) | | | 935,000 | | | 970,063 |

| SBA Communications Corp., 8.25%, 2019 (n) | | | 795,000 | | | 834,750 |

| Sprint Nextel Corp., 8.375%, 2017 | | | 3,795,000 | | | 3,700,125 |

| Sprint Nextel Corp., 8.75%, 2032 | | | 4,410,000 | | | 3,969,000 |

| Wind Acquisition Finance S.A., 12%, 2015 (n) | | | 5,690,000 | | | 6,130,975 |

| | | | | | |

| | | | | | $ | 35,328,558 |

| Telephone Services - 0.3% | | | | | | |

| Frontier Communications Corp., 8.125%, 2018 | | $ | 3,150,000 | | $ | 3,173,625 |

| | |

| Tobacco - 0.4% | | | | | | |

| Alliance One International, Inc., 10%, 2016 (n) | | $ | 3,285,000 | | $ | 3,482,100 |

| | |

| Transportation - Services - 1.1% | | | | | | |

| Commercial Barge Line Co., 12.5%, 2017 | | $ | 3,220,000 | | $ | 3,356,850 |

| Hertz Corp., 8.875%, 2014 | | | 4,510,000 | | | 4,543,825 |

| Navios Maritime Holdings, Inc., 8.875%, 2017 (n) | | | 2,910,000 | | | 3,011,850 |

| | | | | | |

| | | | | | $ | 10,912,525 |

| Utilities - Electric Power - 4.9% | | | | | | |

| AES Corp., 8%, 2017 | | $ | 6,450,000 | | $ | 6,498,375 |

| Calpine Corp., 8%, 2016 (n) | | | 2,690,000 | | | 2,743,800 |

| Dynegy Holdings, Inc., 7.5%, 2015 (n) | | | 2,160,000 | | | 1,922,400 |

| Dynegy Holdings, Inc., 7.5%, 2015 | | | 3,080,000 | | | 2,756,600 |

| Dynegy Holdings, Inc., 7.75%, 2019 | | | 1,280,000 | | | 1,024,000 |

| Edison Mission Energy, 7%, 2017 | | | 5,640,000 | | | 4,455,600 |

| Energy Future Holdings, 10%, 2020 (z) | | | 1,920,000 | | | 1,972,800 |

| Mirant North America LLC, 7.375%, 2013 | | | 1,830,000 | | | 1,820,850 |

| NRG Energy, Inc., 7.375%, 2016 | | | 12,045,000 | | | 11,984,775 |

| RRI Energy, Inc., 7.875%, 2017 | | | 1,496,000 | | | 1,424,940 |

| Texas Competitive Electric Holdings LLC, 10.25%, 2015 | | | 13,290,000 | | | 10,399,425 |

| | | | | | |

| | | | | | $ | 47,003,565 |

| Total Bonds (Identified Cost, $851,923,586) | | | | | $ | 845,597,268 |

| | |

| Floating Rate Loans (g)(r) - 5.3% | | | | | | |

| Aerospace - 0.2% | | | | | | |

| Hawker Beechcraft Acquisition Co. LLC, Term Loan B, 10.5%, 2014 | | $ | 1,966,304 | | $ | 1,846,359 |

21

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Floating Rate Loans (g)(r) - continued | | | | | | |

| Automotive - 1.5% | | | | | | |

| Accuride Corp., Term Loan B, 10%, 2012 | | $ | 450,714 | | $ | 450,231 |

| Federal Mogul Corp., Term Loan B, 2.16%, 2014 | | | 4,186,196 | | | 3,542,569 |

| Ford Motor Co., Term Loan B, 3.25%, 2013 | | | 11,265,400 | | | 10,523,089 |

| | | | | | |

| | | | | | $ | 14,515,889 |

| Broadcasting - 0.8% | | | | | | |

| Gray Television, Inc., Term Loan B, 3.75%, 2014 | | $ | 1,680,290 | | $ | 1,541,666 |

| Local TV Finance LLC, Term Loan B, 2.26%, 2013 | | | 1,371,349 | | | 1,193,074 |

| Young Broadcasting, Inc., Term Loan B, 4.75%, 2012 (d) | | | 4,655,104 | | | 3,654,257 |

| Young Broadcasting, Inc., Term Loan B-1, 4.75%, 2012 (d) | | | 1,350,054 | | | 1,059,792 |

| | | | | | |

| | | | | | $ | 7,448,789 |

| Building - 0.1% | | | | | | |

| Building Materials Corp., Term Loan B, 3%, 2014 | | $ | 1,387,924 | | $ | 1,350,912 |

| | |

| Business Services - 0.0% | | | | | | |

| First Data Corp., Term Loan B-2, 2.99%, 2014 | | $ | 341,648 | | $ | 295,193 |

| | |

| Chemicals - 0.8% | | | | | | |

| LyondellBasell, Dutch Tranche Revolving Credit Loan, 3.73%, 2014 | | $ | 120,558 | | $ | 87,179 |

| LyondellBasell, Dutch Tranche Term Loan A, 3.73%, 2014 | | | 272,889 | | | 197,334 |

| LyondellBasell, German Term Loan B-1, 3.98%, 2014 | | | 346,110 | | | 250,282 |

| LyondellBasell, German Term Loan B-2, 3.98%, 2014 | | | 346,110 | | | 250,282 |

| LyondellBasell, German Term Loan B-3, 3.98%, 2014 | | | 346,110 | | | 250,282 |

| LyondellBasell, Second Priority DIP Term Loan, 5.79%, 2010 (o) | | | 1,931,144 | | | 2,019,252 |

| LyondellBasell, Super Priority DIP Term Loan, 9.16%, 2010 (q) | | | 568,664 | | | 592,406 |

| LyondellBasell, Term Loan B-1, 7%, 2014 | | | 1,501,867 | | | 1,086,045 |

| LyondellBasell, Term Loan B-2, 7%, 2014 | | | 1,501,867 | | | 1,086,045 |

| LyondellBasell, Term Loan B-3, 7%, 2014 | | | 1,501,867 | | | 1,086,045 |

| LyondellBasell, U.S. Tranche Revolving Credit Loan, 3.73%, 2014 | | | 452,092 | | | 326,921 |

| LyondellBasell, U.S. Tranche Term Loan A, 3.76%, 2014 | | | 861,362 | | | 622,877 |

| | | | | | |

| | | | | | $ | 7,854,950 |

| Gaming & Lodging - 0.7% | | | | | | |

| Green Valley Ranch Gaming LLC, Second Lien Term Loan, 3.5%, 2014 | | $ | 4,910,923 | | $ | 720,270 |

| MGM Mirage, Term Loan B, 6%, 2011 (o) | | | 3,721,575 | | | 3,578,295 |

| Motorcity Casino, Term Loan B, 8.5%, 2012 | | | 1,911,660 | | | 1,883,782 |

| | | | | | |

| | | | | | $ | 6,182,347 |

| Printing & Publishing - 0.3% | | | | | | |

| Ascend Media LLC, Term Loan, 10.25%, 2012 (d) | | $ | 458,900 | | $ | 8 |

| Tribune Co., Term Loan B, 6.5%, 2014 (d) | | | 5,696,035 | | | 3,246,740 |

| | | | | | |

| | | | | | $ | 3,246,748 |

22

Portfolio of Investments – continued

| | | | | | |

| Issuer | | Shares/Par | | Value ($) |

| | | | | | |

| Floating Rate Loans (g)(r) - continued | | | | | | |

| Real Estate - 0.1% | | | | | | |

| CB Richard Ellis Services, Term Loan B, 6%, 2013 | | $ | 715,530 | | $ | 699,431 |

| | |

| Specialty Stores - 0.4% | | | | | | |

| Michaels Stores, Inc., Term Loan B, 2.56%, 2013 | | $ | 1,608,727 | | $ | 1,449,363 |

| Michaels Stores, Inc., Term Loan B-2, 4.81%, 2016 | | | 2,121,222 | | | 2,016,928 |

| | | | | | |

| | | | | | $ | 3,466,291 |

| Utilities - Electric Power - 0.4% | | | | | | |

| TXU Corp., Term Loan B-2, 3.73%, 2014 | | $ | 421,960 | | $ | 344,952 |

| TXU Corp., Term Loan B-3, 3.73%, 2014 | | | 3,631,949 | | | 2,948,438 |

| | | | | | |

| | | | | | $ | 3,293,390 |

| Total Floating Rate Loans (Identified Cost, $52,820,866) | | | | | $ | 50,200,299 |

| | |

| Common Stocks - 1.1% | | | | | | |

| Automotive - 0.0% | | | | | | |

| Oxford Automotive, Inc. (a) | | | 1,087 | | $ | 0 |

| | |

| Broadcasting - 0.0% | | | | | | |

| Supermedia, Inc. (a) | | | 2,828 | | $ | 102,685 |

| | |

| Cable TV - 0.3% | | | | | | |

| Cablevision Systems Corp. (a) | | | 41,600 | | $ | 869,440 |

| Comcast Corp., “A” | | | 93,700 | | | 1,483,271 |

| Time Warner Cable, Inc. | | | 19,833 | | | 864,520 |

| | | | | | |

| | | | | | $ | 3,217,231 |

| Construction - 0.2% | | | | | | |

| Nortek, Inc. (a) | | | 48,660 | | $ | 1,897,749 |

| | |

| Energy - Integrated - 0.1% | | | | | | |

| Chevron Corp. | | | 9,500 | | $ | 685,140 |

| | |

| Entertainment - 0.0% | | | | | | |

| Madison Square Garden Inc., “A” (a) | | | 10,400 | | $ | 203,840 |

| | |

| Gaming & Lodging - 0.1% | | | | | | |

| Ameristar Casinos, Inc. | | | 35,000 | | $ | 518,350 |

| Pinnacle Entertainment, Inc. (a) | | | 107,700 | | | 878,832 |

| | | | | | |

| | | | | | $ | 1,397,182 |

| Printing & Publishing - 0.2% | | | | | | |

| American Media, Inc. (a) | | | 49,687 | | $ | 142,603 |

23

Portfolio of Investments – continued

| | | | | | | | | | |

| Issuer | | | | | | Shares/Par | | Value ($) |

| | | | | | | | | | |

| Common Stocks - continued | | | | | | | | | | |

| Printing & Publishing - continued | | | | | |

| Dex One Corp. (a) | | | | | | | 39,052 | | $ | 1,310,587 |

| Golden Books Family Entertainment, Inc. (a) | | 206,408 | | | 0 |

| World Color Press, Inc. (a) | | 15,138 | | | 174,244 |

| | | | | | | | | | |

| | | | | $ | 1,627,434 |

| Special Products & Services - 0.0% | | | | | |

| Mark IV Industries LLC, Common Units, “A” (a) | | 2,318 | | $ | 34,770 |

| | |

| Telephone Services - 0.2% | | | | | |

| Windstream Corp. | | 151,600 | | $ | 1,562,996 |

| Total Common Stocks (Identified Cost, $20,792,361) | | | | $ | 10,729,027 |

| | |

| Preferred Stocks - 0.4% | | | | | |

| Broadcasting - 0.0% | | | | | |

| Spanish Broadcasting Systems, Inc., “B”, 10.75% (p) | | 2,088 | | $ | 313,200 |

| | |

| Financial Institutions - 0.2% | | | | | |

| GMAC, Inc., 7% (z) | | 1,826 | | $ | 1,305,019 |

| | |

| Major Banks - 0.2% | | | | | |

| Bank of America Corp., 8.625% | | 78,950 | | $ | 1,937,433 |

| Total Preferred Stocks (Identified Cost, $5,379,900) | | | | $ | 3,555,652 |

| | | | |

| | | Strike Price | | First Exercise | | | | |

| Warrants - 0.0% | | | | | | | | | | |

| Construction - 0.0% | | | | | | | | | | |

Building Materials Holding Corp.

(1 share for 1 warrant) (a) | | $ | 0.47 | | 10/24/08 | | 4,362 | | $ | 0 |

| | | | |

| Printing & Publishing - 0.0% | | | | | | | | | | |

World Color Press, Inc.

(1 share for 1 warrant) (a) | | $ | 13.00 | | 8/26/09 | | 8,580 | | $ | 47,190 |

World Color Press, Inc.

(1 share for 1 warrant) (a) | | | 16.30 | | 8/26/09 | | 8,580 | | | 32,605 |

| Total Warrants (Identified Cost, $398,977) | | | | | | $ | 79,795 |

24

Portfolio of Investments – continued

| | | | | |

| Issuer | | Shares/Par | | Value ($) |

| Money Market Funds (v) - 2.7% | | | | | |

MFS Institutional Money Market Portfolio, 0.14%,

at Cost and Net Asset Value | | 25,282,620 | | $ | 25,282,620 |

| Total Investments (Identified Cost, $956,598,310) | | | | $ | 935,444,661 |

| | |

| Other Assets, Less Liabilities - 1.7% | | | | | 16,575,763 |

| Net Assets - 100.0% | | | | $ | 952,020,424 |

| (a) | Non-income producing security. |

| (d) | Non-income producing security - in default. |

| (g) | The rate shown represents a weighted average coupon rate on settled positions at period end, unless otherwise indicated. |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $172,156,497, representing 18.1% of net assets. |

| (o) | All or a portion of this position has not settled. Upon settlement date, interest rates for unsettled amounts will be determined. The rate shown represents the weighted average coupon rate for settled amounts. |

| (p) | Payment-in-kind security. |

| (q) | All or a portion of this position represents an unfunded loan commitment. The rate shown represents a weighted average coupon rate on the full position, including the unfunded loan commitment which has no current coupon rate. |

| (r) | Remaining maturities of floating rate loans may be less than stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. These loans may be subject to restrictions on resale. Floating rate loans generally have rates of interest which are determined periodically by reference to a base lending rate plus a premium. |

| (v) | Underlying fund that is available only to investment companies managed by MFS. The rate quoted is the annualized seven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| | | | | | |

| Restricted Securities | | Acquisition

Date | | Cost | | Current

Market

Value |

| Airgas, Inc., 7.125%, 2018 | | 1/26/10 | | $1,892,851 | | $1,879,500 |

| Airlie Ltd., CDO, FRN, 2.151%, 2011 | | 10/13/06-12/22/09 | | 2,452,690 | | 1,201,818 |

| American Media Operations, Inc., 9%, 2013 | | 1/30/09-11/02/09 | | 186,155 | | 170,444 |

| American Media Operations, Inc., 14%, 2013 | | 1/30/09-11/02/09 | | 1,730,455 | | 1,784,972 |

| Anthracite Ltd., CDO, 6%, 2037 | | 5/14/02 | | 4,459,609 | | 257,400 |

| Bombardier, Inc., 7.45%, 2034 | | 1/25/10 | | 621,436 | | 614,725 |

| Bonten Media Acquisition Co., 9%, 2015 | | 5/22/07-12/01/09 | | 4,869,505 | | 1,765,721 |

| CWCapital Cobalt Ltd., CDO, “E2”, 6%, 2045 | | 3/20/06-11/25/09 | | 1,020,247 | | 21,227 |

25

Portfolio of Investments – continued

| | | | | | |

| Restricted Securities - continued | | Acquisition

Date | | Cost | | Current

Market

Value |

| CWCapital Cobalt Ltd., CDO, “F”, FRN, 1.549%, 2050 | | 4/12/06-1/28/10 | | $612,466 | | $12,249 |

| CWCapital Cobalt Ltd., CDO, “G”, FRN, 1.749%, 2050 | | 4/12/06-1/28/10 | | 1,898,608 | | 37,972 |

| Energy Future Holdings, 10%, 2020 | | 1/07/10 | | 1,949,028 | | 1,972,800 |

| Falcon Franchise Loan LLC, FRN, 3.67%, 2025 | | 1/29/03 | | 1,154,111 | | 763,888 |

| GMAC, Inc., 7% (Preferred Stock) | | 12/29/08 | | 1,406,020 | | 1,305,019 |

| Hexion Finance Escrow LLC, 8.875%, 2018 | | 1/14/10-1/26/10 | | 2,164,530 | | 2,125,069 |

| LBG Capital No. 1 PLC, 7.875%, 2020 | | 1/08/10 | | 1,868,092 | | 1,826,000 |

| LBI Media, Inc., 8.5%, 2017 | | 7/18/07 | | 1,430,322 | | 1,232,500 |

| Libbey Glass, Inc., 10%, 2015 | | 1/28/10 | | 230,493 | | 237,938 |

| Local TV Finance LLC, 9.25%, 2015 | | 11/09/07-12/15/09 | | 5,270,302 | | 2,873,276 |

| McJunkin Red Man Holding Corp., 9.5%, 2016 | | 1/21/10-1/22/10 | | 1,476,752 | | 1,451,363 |

| Morgan Stanley Capital I, Inc., 1.269%, 2039 | | 7/20/04 | | 559,957 | | 326,022 |

| Qwest Communications International, Inc., 7.125%, 2018 | | 1/07/10-1/08/10 | | 2,750,213 | | 2,720,250 |

| TIERS Beach Street Synthetic, CLO, FRN, 6.787%, 2011 | | 5/17/06 | | 2,750,000 | | 2,234,100 |

| USI Holdings Corp., 9.75%, 2015 | | 4/26/07-6/08/07 | | 3,193,812 | | 2,935,538 |

| Wachovia Credit, CDO, FRN, 1.601%, 2026 | | 6/08/06 | | 1,320,000 | | 52,800 |

| ZFS Finance USA Trust II, 6.45% to 2016, FRN to 2065 | | 12/16/09-1/05/10 | | 1,315,576 | | 1,332,900 |

| Total Restricted Securities | | | | | | $31,135,491 |

| % of Net Assets | | | | | | 3.3% |

Derivative Contracts at 1/31/10

Forward Foreign Currency Exchange Contracts at 1/31/10

| | | | | | | | | | | | | | |

| Type | | Currency | | Counterparty | | Contracts

to

Deliver/

Receive | | Settlement

Date Range | | In

Exchange

for | | Contracts

at Value | | Net

Unrealized

Appreciation

(Depreciation) |

| Asset Derivatives | | | | | | | | | | |

| SELL | | EUR | | HSBC Bank | | 2,596,651 | | 3/15/10 | | $3,703,534 | | $3,599,901 | | $103,633 |

| SELL | | EUR | | UBS AG | | 5,957,956 | | 3/15/10 | | 8,685,925 | | 8,259,892 | | 426,033 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $529,666 |

| | | | | | | | | | | | | | |

At January 31, 2010, the fund had sufficient cash and/or securities to cover any commitments under these derivative contracts.

The following abbreviations are used in this report and are defined:

| CDO | | Collateralized Debt Obligation |

| CLO | | Collateralized Loan Obligation |

26

Portfolio of Investments – continued

| FRN | | Floating Rate Note. Interest rate resets periodically and may not be the rate reported at period end. |

| PLC | | Public Limited Company |

Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below:

See Notes to Financial Statements

27

Financial Statements

STATEMENT OF ASSETS AND LIABILITIES

At 1/31/10

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | |

| Assets | | | |

Investments- | | | |

Non-affiliated issuers, at value (identified cost, $931,315,690) | | $910,162,041 | |

Underlying funds, at cost and value | | 25,282,620 | |

Total investments, at value (identified cost, $956,598,310) | | $935,444,661 | |

Cash | | 1,882,830 | |

Receivables for | | | |

Forward foreign currency exchange contracts | | 529,666 | |

Investments sold | | 9,560,417 | |

Fund shares sold | | 896,744 | |

Interest | | 17,946,716 | |

Other assets | | 12,758 | |

Total assets | | $966,273,792 | |

| Liabilities | | | |

Payables for | | | |

Distributions | | $1,277,962 | |

Investments purchased | | 7,066,091 | |

Fund shares reacquired | | 5,452,040 | |

Payable to affiliates | | | |

Investment adviser | | 47,983 | |

Shareholder servicing costs | | 217,462 | |

Distribution and service fees | | 28,470 | |

Administrative services fee | | 1,674 | |

Program manager fees | | 17 | |

Payable for independent Trustees’ compensation | | 82,994 | |

Accrued expenses and other liabilities | | 78,675 | |

Total liabilities | | $14,253,368 | |

Net assets | | $952,020,424 | |

| Net assets consist of | | | |

Paid-in capital | | $1,371,414,763 | |

Unrealized appreciation (depreciation) on investments and translation

of assets and liabilities in foreign currencies | | (20,626,465 | ) |

Accumulated net realized gain (loss) on investments and foreign currency transactions | | (394,686,210 | ) |

Accumulated distributions in excess of net investment income | | (4,081,664 | ) |

Net assets | | $952,020,424 | |

Shares of beneficial interest outstanding | | 292,356,924 | |

See Notes to Financial Statements

28

Statement of Assets and Liabilities – continued

| | | | | | |

| | | Net assets | | Shares

outstanding | | Net asset value

per share (a) |

Class A | | $531,989,546 | | 163,419,075 | | $3.26 |

Class B | | 46,689,876 | | 14,306,737 | | 3.26 |

Class C | | 73,474,540 | | 22,471,876 | | 3.27 |

Class I | | 283,704,278 | | 87,195,707 | | 3.25 |

Class R1 | | 1,199,852 | | 368,005 | | 3.26 |

Class R2 | | 5,250,912 | | 1,611,626 | | 3.26 |

Class R3 | | 7,928,644 | | 2,436,403 | | 3.25 |

Class R4 | | 147,560 | | 45,312 | | 3.26 |

Class 529A | | 858,396 | | 263,806 | | 3.25 |

Class 529B | | 315,077 | | 96,818 | | 3.25 |

Class 529C | | 461,743 | | 141,559 | | 3.26 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Classes A and 529A, for which the maximum offering prices per share were $3.42 and $3.41, respectively. On sales of $50,000 or more, the maximum offering prices of Class A and Class 529A shares are reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, Class C, Class 529B, and Class 529C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and 529A. |

See Notes to Financial Statements

29

Financial Statements

STATEMENT OF OPERATIONS

Year ended 1/31/10

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | |

| Net investment income | | | |

Income | | | |

Interest | | $77,490,656 | |

Dividends | | 939,863 | |

Dividends from underlying funds | | 63,077 | |

Foreign taxes withheld | | (18,524 | ) |

Total investment income | | $78,475,072 | |

Expenses | | | |

Management fee | | $3,723,242 | |

Distribution and service fees | | 2,248,009 | |

Program manager fees | | 1,255 | |

Shareholder servicing costs | | 1,562,139 | |

Administrative services fee | | 146,824 | |

Independent Trustees’ compensation | | 49,631 | |

Custodian fee | | 131,947 | |

Shareholder communications | | 64,617 | |

Auditing fees | | 70,598 | |

Legal fees | | 58,653 | |

Miscellaneous | | 230,384 | |

Total expenses | | $8,287,299 | |

Fees paid indirectly | | (24,562 | ) |

Reduction of expenses by investment adviser | | (4,750 | ) |

Net expenses | | $8,257,987 | |

Net investment income | | $70,217,085 | |

Realized and unrealized gain (loss) on investments

and foreign currency transactions | | | |

Realized gain (loss) (identified cost basis) | | | |

Investment transactions | | $(16,941,862 | ) |

Swap transactions | | (11,352,995 | ) |

Foreign currency transactions | | (105,700 | ) |

Net realized gain (loss) on investments

and foreign currency transactions | | $(28,400,557 | ) |

Change in unrealized appreciation (depreciation) | | | |

Investments | | $235,096,645 | |

Swap transactions | | 9,483,556 | |

Translation of assets and liabilities in foreign currencies | | (243,946 | ) |

Net unrealized gain (loss) on investments

and foreign currency translation | | $244,336,255 | |

Net realized and unrealized gain (loss) on investments

and foreign currency | | $215,935,698 | |

Change in net assets from operations | | $286,152,783 | |

See Notes to Financial Statements

30

Financial Statements

STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | |

| | | Years ended 1/31 | |

| | | 2010 | | | 2009 | |

| Change in net assets | | | | | | |

| From operations | | | | | | |

Net investment income | | $70,217,085 | | | $66,750,841 | |

Net realized gain (loss) on investments and

foreign currency transactions | | (28,400,557 | ) | | (69,846,251 | ) |

Net unrealized gain (loss) on investments and

foreign currency translation | | 244,336,255 | | | (201,411,630 | ) |

Change in net assets from operations | | $286,152,783 | | | $(204,507,040 | ) |

| Distributions declared to shareholders | | | | | | |

From net investment income | | $(70,778,121 | ) | | $(68,512,369 | ) |

From tax return of capital | | — | | | (507,505 | ) |

Total distributions declared to shareholders | | $(70,778,121 | ) | | $(69,019,874 | ) |

Change in net assets from fund share transactions | | $86,914,666 | | | $(39,014,000 | ) |

Total change in net assets | | $302,289,328 | | | $(312,540,914 | ) |

| Net assets | | | | | | |

At beginning of period | | 649,731,096 | | | 962,272,010 | |

At end of period (including accumulated distributions in excess of net investment income of $4,081,664 and undistributed net investment income of $2,067,418) | | $952,020,424 | | | $649,731,096 | |

See Notes to Financial Statements

31

Financial Statements

FINANCIAL HIGHLIGHTS