UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02794

MFS SERIES TRUST III

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: January 31

Date of reporting period: January 31, 2013*

| * | MFS High Yield Pooled Portfolio, a series of the Registrant, did not commence investment operations during the reporting period. |

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

MFS High Yield Pooled Portfolio, a series of the Registrant, did not have any shareholders as of period end. For further information please see the introductory footnote.

ANNUAL REPORT

January 31, 2013

MFS® HIGH INCOME FUND

MFH-ANN

MFS® HIGH INCOME FUND

CONTENTS

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK GUARANTEE

LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholders:

Global financial markets began 2013 with greater optimism. U.S. and Asian economic trends have turned more positive. Europe continues to struggle through its economic

slump. However, even there, sentiment has improved. The U.S. Congress averted its year-end fiscal cliff, but a degree of uncertainty remains regarding upcoming negotiations over spending cuts and the debt ceiling. The U.S. Federal Reserve Board is continuing its accommodative monetary easing, while the U.S. housing and job markets have made steady gains. Corporate profits have been resilient, and investors have demonstrated increased tolerance for risk.

Overseas, the eurozone remains in a broad contraction, with economic output receding in France as well as Italy and Spain. However, large-scale early repayments of European Central

Bank loans by banks and Germany’s strong rebound in manufacturing activity are encouraging signs. In Asia, both China and Japan appear to be in the early stages of a turnaround. China’s economic activity has picked up from last year’s relative slowdown, and Japan’s sharp devaluation of the yen, an important anti-deflationary measure, seems to be having its desired impact: Japanese stocks have soared, corporate profits are rising and confidence is returning among consumers, businesses and investors.

As always, managing risk in the face of uncertainty remains a top priority for investors. At MFS®, our uniquely collaborative investment process employs global research and active risk management. Our global team of investment professionals shares ideas and evaluates opportunities across continents, investment disciplines and asset classes — all with a goal of building better insights, and ultimately better results, for our clients.

We remain mindful of the many economic challenges investors face today, and believe it is more important than ever to maintain a long-term view and employ time-tested principles, such as asset allocation and diversification. We also remain confident that our unique approach can serve investors well as they work with their financial advisors to identify and pursue the most suitable opportunities.

Respectfully,

Robert J. Manning

Chairman and Chief Executive Officer

MFS Investment Management®

March 18, 2013

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

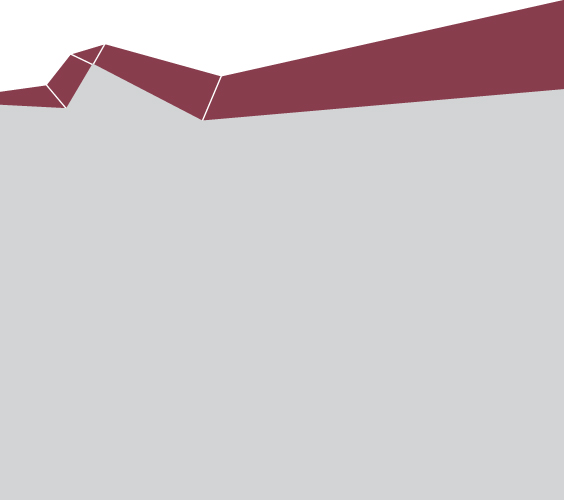

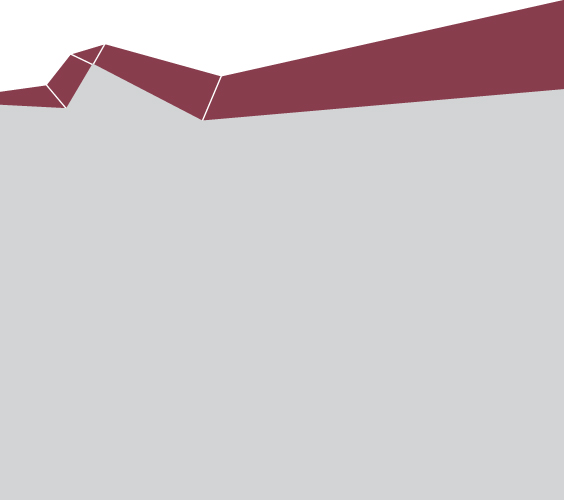

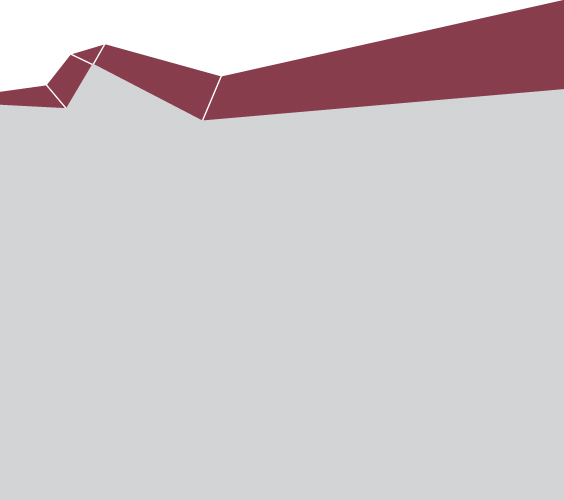

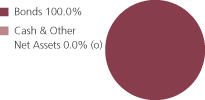

PORTFOLIO COMPOSITION

Portfolio structure (i)

| | | | |

| Top five industries (i) | | | | |

| Energy-Independent | | | 8.2% | |

| Broadcasting | | | 5.7% | |

| Medical & Health Technology & Services | | | 4.9% | |

| Utilities-Electric Power | | | 4.4% | |

| Telecommunications-Wireless | | | 4.2% | |

| | | | |

| Composition including fixed income credit quality (a)(i) | |

| A | | | 0.3% | |

| BBB | | | 5.9% | |

| BB | | | 32.2% | |

| B | | | 41.8% | |

| CCC | | | 13.9% | |

| C (o) | | | 0.0% | |

| D | | | 0.1% | |

| Not Rated (o) | | | 0.0% | |

| Non-Fixed Income | | | 3.9% | |

| Cash & Other | | | 1.9% | |

| |

| Portfolio facts (i) | | | | |

| Average Duration (d) | | | 3.7 | |

| Average Effective Maturity (m) | | | 7.0 yrs. | |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities, including fixed income futures contracts, which have not been rated by any rating agency. Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives) and commodities. Cash & Other includes cash, other assets less liabilities, offsets to derivative positions, and short-term securities. The fund may not hold all of these instruments. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. |

| (i) | For purposes of this presentation, the components include the market value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. The bond component will include any accrued interest amounts. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than market value. Where the fund holds convertible bonds, these are treated as part of the equity portion of the portfolio. |

2

Portfolio Composition – continued

| (m) | In determining an instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening device (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

Percentages are based on net assets as of 1/31/13.

The portfolio is actively managed and current holdings may be different.

3

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended January 31, 2013, Class A shares of the MFS High Income Fund (“fund”) provided a total return of 12.05%, at net asset value. This compares with a return of 13.87% for the fund’s benchmark, the Barclays U.S. High-Yield Corporate Bond 2% Issuer Capped Index.

Market Environment

The beginning of the period was characterized by a risk-on sentiment as a result of additional liquidity measures by the Federal Reserve Bank (“Fed”) and the European Central Bank (“ECB”) as well as a commensurate improvement in macroeconomic conditions. During this time, global equity valuations rose, credit spreads contracted, and high-quality sovereign yields increased modestly.

During the middle of the period, however, conditions worsened, driven by broadly weaker global macroeconomic indicators, as well as renewed concerns over the eurozone’s capacity and determination to address its ongoing crisis. Despite this deterioration, broad market sentiment remained relatively resilient as equity markets generally maintained gains and credit spreads did not indicate deterioration.

However, this renewed weakness in the fundamentals precipitated a further round of monetary easing by both the Fed (through a third round of quantitative easing) and the ECB (through a new bond purchase facility) in the second half of the period, which soon instilled additional confidence in risk markets. Nonetheless, towards the end of the period, weaker equity earnings reports and declining forward guidance caused market sentiment to soften. In addition, as we moved toward year end, the fiscal cliff negotiations between the Republicans in the U.S. Congress and President Obama were a particular source of market attention, where uncertainty surrounding the fiscal negotiations continued right up to the end-of-year deadline.

Detractors from Performance

The portion of the fund’s return derived from yield, which was less than that of the Barclays U.S. High-Yield Corporate Bond 2% Issuer Capped Index, was a primary factor that detracted from relative results.

The fund’s lesser exposure to “BB” and “B” rated (r) securities was another negative factor for relative results as these credit quality sectors outperformed higher-quality issues. The fund’s lesser exposure to the telecommunications sector also detracted from performance as this market segment outperformed the benchmark over the reporting period.

Among individual securities, the fund’s holdings of energy companies OGX Petroleo e Gas Participacoes (h) and ATP Oil & Gas (h), and chemical company Momentive Performance Materials (h), were among the fund’s top relative detractors for the reporting period.

Contributors to Performance

The fund’s greater exposure to bonds in the financial sector benefited relative performance as this sector outperformed the benchmark for the period. In addition, a greater exposure to “BBB” rated securities contributed to performance as spreads narrowed.

4

Management Review – continued

Top individual contributors during the reporting period included the fund’s debt holdings of insurance company American International Group and financial firms Abbey National Capital and Royal Bank of Scotland.

Respectfully,

| | |

| William Adams | | David Cole |

| Portfolio Manager | | Portfolio Manager |

| (h) | Security was not held in the portfolio at period end. |

| (r) | Bonds rated “BBB”, “Baa”, or higher are considered investment grade; bonds rated “BB”, “Ba”, or below are considered non-investment grade. The source for bond quality ratings is Moody’s Investors Service, Standard & Poor’s and Fitch, Inc. and are applied using the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). For securities which are not rated by any of the three agencies, the security is considered Not Rated. |

The views expressed in this report are those of the portfolio managers only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

5

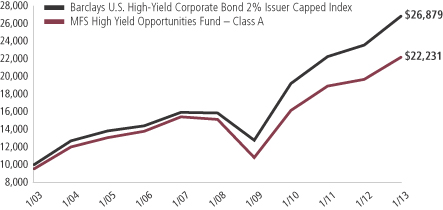

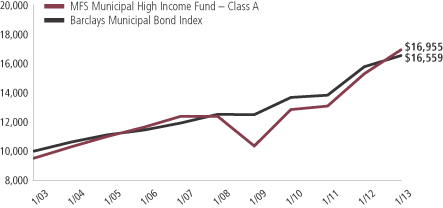

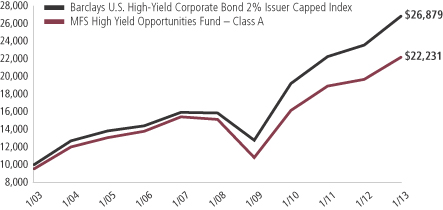

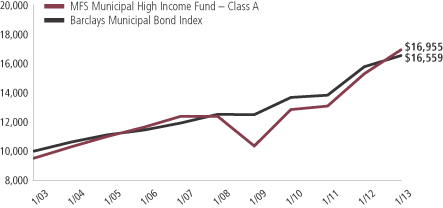

PERFORMANCE SUMMARY THROUGH 1/31/13

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

6

Performance Summary – continued

Total Returns through 1/31/13

Average annual without sales charge

| | | | | | | | | | | | | | |

| | | Share class | | Class inception date | | 1-yr | | 5-yr | | 10-yr | | Life (t) | | |

| | | A | | 2/17/78 | | 12.05% | | 8.18% | | 8.27% | | N/A | | |

| | | B | | 9/27/93 | | 11.22% | | 7.33% | | 7.46% | | N/A | | |

| | | C | | 1/03/94 | | 11.21% | | 7.33% | | 7.45% | | N/A | | |

| | | I | | 1/02/97 | | 12.02% | | 8.40% | | 8.53% | | N/A | | |

| | | R1 | | 4/01/05 | | 11.22% | | 7.33% | | N/A | | 6.12% | | |

| | | R2 | | 10/31/03 | | 11.77% | | 7.92% | | N/A | | 6.87% | | |

| | | R3 | | 4/01/05 | | 12.05% | | 8.19% | | N/A | | 6.94% | | |

| | | R4 | | 4/01/05 | | 12.33% | | 8.46% | | N/A | | 7.23% | | |

| | | R5 | | 6/01/12 | | N/A | | N/A | | N/A | | 10.74% | | |

| | | 529A | | 7/31/02 | | 12.33% | | 8.07% | | 8.04% | | N/A | | |

| | | 529B | | 7/31/02 | | 11.17% | | 7.30% | | 7.30% | | N/A | | |

| | | 529C | | 7/31/02 | | 11.17% | | 7.23% | | 7.27% | | N/A | | |

Comparative benchmark

| | | | | | | | | | | | | | |

| | | Barclays U.S. High-Yield Corporate

Bond 2% Issuer Capped Index (f) | | 13.87% | | 11.08% | | 10.39% | | N/A | | |

| Average annual with sales charge | | | | | | |

| | | A

With Initial Sales Charge (4.75%) | | 6.73% | | 7.13% | | 7.75% | | N/A | | |

| | | B

With CDSC (Declining over six years

from 4% to 0%) (x) | | 7.22% | | 7.03% | | 7.46% | | N/A | | |

| | | C

With CDSC (1% for 12 months) (x) | | 10.21% | | 7.33% | | 7.45% | | N/A | | |

| | | 529A

With Initial Sales Charge (4.75%) | | 6.99% | | 7.03% | | 7.52% | | N/A | | |

| | | 529B

With CDSC (Declining over six years

from 4% to 0%) (x) | | 7.17% | | 6.99% | | 7.30% | | N/A | | |

| | | 529C

With CDSC (1% for 12 months) (x) | | 10.17% | | 7.23% | | 7.27% | | N/A | | |

Class I, R1, R2, R3, R4 and R5 shares do not have a sales charge.

CDSC – Contingent Deferred Sales Charge.

| (f) | Source: FactSet Research Systems Inc. |

7

Performance Summary – continued

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

| (x) | Assuming redemption at the end of the applicable period. |

Benchmark Definition

Barclays U.S. High-Yield Corporate Bond 2% Issuer Capped Index – a component of the Barclays U.S. High-Yield Corporate Bond Index, which measures performance of non-investment grade, fixed rate debt. The index limits the maximum exposure to any one issuer to 2%.

It is not possible to invest directly in an index.

Notes to Performance Summary

Class 529 shares are only available in conjunction with qualified tuition programs, such as the MFS 529 Savings Plan. There also is an additional fee, which is detailed in the program description, on qualified tuition programs. If this fee was reflected, the performance for Class 529 shares would have been lower. This annual fee is waived for Oregon residents and for those accounts with assets of $25,000 or more.

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund’s share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

8

EXPENSE TABLE

Fund expenses borne by the shareholders during the period,

August 1, 2012 through January 31, 2013

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period August 1, 2012 through January 31, 2013.

The expenses include the payment of a portion of the transfer-agent-related expenses of MFS funds that invest in the fund. For further information, please see the Notes to the Financial Statements.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

Expense Table – continued

| | | | | | | | | | | | | | | | | | |

Share

Class | | | | Annualized Expense Ratio | | | Beginning

Account Value

8/01/12 | | | Ending Account Value

1/31/13 | | | Expenses Paid During

Period (p) 8/01/12-1/31/13 | |

| A | | Actual | | | 0.93% | | | | $1,000.00 | | | | $1,064.86 | | | | $4.83 | |

| | Hypothetical (h) | | | 0.93% | | | | $1,000.00 | | | | $1,020.46 | | | | $4.72 | |

| B | | Actual | | | 1.68% | | | | $1,000.00 | | | | $1,057.92 | | | | $8.69 | |

| | Hypothetical (h) | | | 1.68% | | | | $1,000.00 | | | | $1,016.69 | | | | $8.52 | |

| C | | Actual | | | 1.68% | | | | $1,000.00 | | | | $1,057.84 | | | | $8.69 | |

| | Hypothetical (h) | | | 1.68% | | | | $1,000.00 | | | | $1,016.69 | | | | $8.52 | |

| I | | Actual | | | 0.68% | | | | $1,000.00 | | | | $1,063.27 | | | | $3.53 | |

| | Hypothetical (h) | | | 0.68% | | | | $1,000.00 | | | | $1,021.72 | | | | $3.46 | |

| R1 | | Actual | | | 1.68% | | | | $1,000.00 | | | | $1,057.93 | | | | $8.69 | |

| | Hypothetical (h) | | | 1.68% | | | | $1,000.00 | | | | $1,016.69 | | | | $8.52 | |

| R2 | | Actual | | | 1.18% | | | | $1,000.00 | | | | $1,060.54 | | | | $6.11 | |

| | Hypothetical (h) | | | 1.18% | | | | $1,000.00 | | | | $1,019.20 | | | | $5.99 | |

| R3 | | Actual | | | 0.93% | | | | $1,000.00 | | | | $1,064.86 | | | | $4.83 | |

| | Hypothetical (h) | | | 0.93% | | | | $1,000.00 | | | | $1,020.46 | | | | $4.72 | |

| R4 | | Actual | | | 0.68% | | | | $1,000.00 | | | | $1,063.18 | | | | $3.53 | |

| | Hypothetical (h) | | | 0.68% | | | | $1,000.00 | | | | $1,021.72 | | | | $3.46 | |

| R5 | | Actual | | | 0.63% | | | | $1,000.00 | | | | $1,066.46 | | | | $3.27 | |

| | Hypothetical (h) | | | 0.63% | | | | $1,000.00 | | | | $1,021.97 | | | | $3.20 | |

| 529A | | Actual | | | 0.98% | | | | $1,000.00 | | | | $1,064.64 | | | | $5.09 | |

| | Hypothetical (h) | | | 0.98% | | | | $1,000.00 | | | | $1,020.21 | | | | $4.98 | |

| 529B | | Actual | | | 1.73% | | | | $1,000.00 | | | | $1,060.70 | | | | $8.96 | |

| | Hypothetical (h) | | | 1.73% | | | | $1,000.00 | | | | $1,016.44 | | | | $8.77 | |

| 529C | | Actual | | | 1.73% | | | | $1,000.00 | | | | $1,057.69 | | | | $8.95 | |

| | Hypothetical (h) | | | 1.73% | | | | $1,000.00 | | | | $1,016.44 | | | | $8.77 | |

| (h) | 5% class return per year before expenses. |

| (p) | Expenses paid are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by the number of days in the period, divided by the number of days in the year. Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

10

PORTFOLIO OF INVESTMENTS

1/31/13

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Bonds - 92.2% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Aerospace - 2.1% | | | | | | | | |

| Bombardier, Inc., 4.25%, 2016 (z) | | $ | 715,000 | | | $ | 736,450 | |

| Bombardier, Inc., 7.5%, 2018 (n) | | | 4,875,000 | | | | 5,484,375 | |

| Bombardier, Inc., 7.75%, 2020 (n) | | | 2,770,000 | | | | 3,137,025 | |

| CPI International, Inc., 8%, 2018 | | | 3,135,000 | | | | 3,135,000 | |

| Heckler & Koch GmbH, 9.5%, 2018 (z) | | EUR | 1,753,000 | | | | 2,106,498 | |

| Huntington Ingalls Industries, Inc., 7.125%, 2021 | | $ | 5,390,000 | | | | 5,929,000 | |

| Kratos Defense & Security Solutions, Inc., 10%, 2017 | | | 4,230,000 | | | | 4,642,425 | |

| | | | | | | | |

| | | | | | | $ | 25,170,773 | |

| Apparel Manufacturers - 1.0% | | | | | | | | |

| Hanesbrands, Inc., 6.375%, 2020 | | $ | 2,990,000 | | | $ | 3,236,675 | |

| Jones Group, Inc., 6.875%, 2019 | | | 2,720,000 | | | | 2,839,000 | |

| PVH Corp., 7.375%, 2020 | | | 3,895,000 | | | | 4,406,219 | |

| PVH Corp., 4.5%, 2022 | | | 2,120,000 | | | | 2,109,400 | |

| | | | | | | | |

| | | | | | | $ | 12,591,294 | |

| Asset-Backed & Securitized - 0.4% | | | | | | | | |

| Citigroup Commercial Mortgage Trust, FRN, 5.702%, 2049 | | $ | 2,948,120 | | | $ | 568,984 | |

| CWCapital Cobalt Ltd., CDO, “E2”, 6%, 2045 (z) | | | 1,268,985 | | | | 12,690 | |

| CWCapital Cobalt Ltd., CDO, “F”, FRN, 1.6%, 2050 (z) | | | 644,319 | | | | 1,611 | |

| CWCapital Cobalt Ltd., CDO, “G”, FRN, 1.801%, 2050 (z) | | | 2,009,514 | | | | 5,024 | |

| Falcon Franchise Loan LLC, FRN, 6.542%, 2025 (i)(z) | | | 2,114,515 | | | | 332,402 | |

| First Union National Bank Commercial Mortgage Trust, 6.75%, 2032 | | | 1,461,820 | | | | 731,422 | |

| G-Force LLC, CDO, “A2”, 4.83%, 2036 (z) | | | 1,746,526 | | | | 1,755,259 | |

| JPMorgan Chase Commercial Mortgage Securities Corp., “C”, FRN, 6.002%, 2051 | | | 2,285,000 | | | | 666,306 | |

| LB Commercial Conduit Mortgage Trust, FRN, 1.218%, 2030 (i) | | | 4,203,445 | | | | 77,209 | |

| Morgan Stanley Capital I, Inc., FRN, 1.384%, 2039 (i)(z) | | | 6,918,013 | | | | 134,901 | |

| | | | | | | | |

| | | | | | | $ | 4,285,808 | |

| Automotive - 3.5% | | | | | | | | |

| Accuride Corp., 9.5%, 2018 | | $ | 3,695,000 | | | $ | 3,648,813 | |

| Allison Transmission, Inc., 7.125%, 2019 (n) | | | 6,085,000 | | | | 6,602,225 | |

| Continental Rubber of America Corp., 4.5%, 2019 (n) | | | 815,000 | | | | 835,375 | |

| Ford Motor Credit Co. LLC, 8%, 2014 | | | 1,965,000 | | | | 2,131,261 | |

| Ford Motor Credit Co. LLC, 12%, 2015 | | | 5,848,000 | | | | 7,134,560 | |

| Ford Motor Credit Co. LLC, 8.125%, 2020 | | | 1,320,000 | | | | 1,662,334 | |

| General Motors Financial Co., Inc., 4.75%, 2017 (n) | | | 1,815,000 | | | | 1,896,829 | |

11

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Automotive - continued | | | | | | | | |

| General Motors Financial Co., Inc., 6.75%, 2018 | | $ | 2,670,000 | | | $ | 3,090,525 | |

| Goodyear Tire & Rubber Co., 8.25%, 2020 | | | 770,000 | | | | 845,075 | |

| Goodyear Tire & Rubber Co., 7%, 2022 | | | 1,340,000 | | | | 1,437,150 | |

| Jaguar Land Rover PLC, 7.75%, 2018 (n) | | | 1,385,000 | | | | 1,520,038 | |

| Jaguar Land Rover PLC, 8.125%, 2021 (n) | | | 6,910,000 | | | | 7,756,475 | |

| Jaguar Land Rover PLC, 5.625%, 2023 (z) | | | 1,055,000 | | | | 1,076,100 | |

| Lear Corp., 8.125%, 2020 | | | 1,737,000 | | | | 1,941,098 | |

| Lear Corp., 4.75%, 2023 (z) | | | 885,000 | | | | 880,575 | |

| | | | | | | | |

| | | | | | | $ | 42,458,433 | |

| Broadcasting - 5.4% | | | | | | | | |

| Allbritton Communications Co., 8%, 2018 | | $ | 1,575,000 | | | $ | 1,704,938 | |

| AMC Networks, Inc., 7.75%, 2021 | | | 3,211,000 | | | | 3,668,568 | |

| Clear Channel Communications, Inc., 9%, 2021 | | | 3,497,000 | | | | 3,252,210 | |

| Clear Channel Worldwide Holdings, Inc., 6.5%, 2022 (n) | | | 830,000 | | | | 875,650 | |

| Clear Channel Worldwide Holdings, Inc., 6.5%, 2022 (n) | | | 2,225,000 | | | | 2,369,625 | |

| Clear Channel Worldwide Holdings, Inc., “A”, 7.625%, 2020 | | | 170,000 | | | | 175,950 | |

| Clear Channel Worldwide Holdings, Inc., “B”, 7.625%, 2020 | | | 2,425,000 | | | | 2,534,125 | |

| Hughes Network Systems LLC, 7.625%, 2021 | | | 1,920,000 | | | | 2,198,400 | |

| IAC/InterActiveCorp, 4.75%, 2022 (n) | | | 490,000 | | | | 486,325 | |

| Inmarsat Finance PLC, 7.375%, 2017 (n) | | | 2,735,000 | | | | 2,940,125 | |

| Intelsat Bermuda Ltd., 11.25%, 2017 | | | 5,420,000 | | | | 5,745,200 | |

| Intelsat Bermuda Ltd., 11.5%, 2017 (p) | | | 6,915,000 | | | | 7,329,900 | |

| Intelsat Jackson Holdings Ltd., 6.625%, 2022 (n) | | | 2,700,000 | | | | 2,743,875 | |

| LBI Media, Inc., 13.5% to 2015, 11.5% to 2020 (p)(z) | | | 921,000 | | | | 377,610 | |

| Liberty Media Corp., 8.5%, 2029 | | | 4,285,000 | | | | 4,777,775 | |

| Liberty Media Corp., 8.25%, 2030 | | | 40,000 | | | | 44,200 | |

| Local TV Finance LLC, 9.25%, 2015 (p)(z) | | | 2,931,123 | | | | 2,953,106 | |

| Netflix, Inc., 5.375%, 2021 (z) | | | 1,765,000 | | | | 1,756,175 | |

| Nexstar Broadcasting Group, Inc., 8.875%, 2017 | | | 1,340,000 | | | | 1,477,350 | |

| Nexstar Broadcasting Group, Inc., 6.875%, 2020 (n) | | | 490,000 | | | | 510,825 | |

| Sinclair Broadcast Group, Inc., 9.25%, 2017 (n) | | | 1,540,000 | | �� | | 1,682,450 | |

| Sinclair Broadcast Group, Inc., 8.375%, 2018 | | | 430,000 | | | | 478,375 | |

| SIRIUS XM Radio, Inc., 8.75%, 2015 (n) | | | 2,805,000 | | | | 3,176,662 | |

| SIRIUS XM Radio, Inc., 7.625%, 2018 (n) | | | 2,705,000 | | | | 3,002,550 | |

| SIRIUS XM Radio, Inc., 5.25%, 2022 (n) | | | 1,515,000 | | | | 1,541,512 | |

| Univision Communications, Inc., 6.875%, 2019 (n) | | | 3,455,000 | | | | 3,627,750 | |

| Univision Communications, Inc., 7.875%, 2020 (n) | | | 2,280,000 | | | | 2,468,100 | |

| Univision Communications, Inc., 8.5%, 2021 (n) | | | 2,090,000 | | | | 2,225,850 | |

| | | | | | | | |

| | | | | | | $ | 66,125,181 | |

| Brokerage & Asset Managers - 0.4% | | | | | | | | |

| E*TRADE Financial Corp., 6.375%, 2019 | | $ | 5,275,000 | | | $ | 5,472,813 | |

12

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Building - 2.6% | | | | | | | | |

| Boise Cascade LLC/Finance Corp., 6.375%, 2020 (n) | | $ | 1,510,000 | | | $ | 1,577,950 | |

| Building Materials Holding Corp., 6.875%, 2018 (n) | | | 2,125,000 | | | | 2,295,000 | |

| Building Materials Holding Corp., 7%, 2020 (n) | | | 1,150,000 | | | | 1,253,500 | |

| Building Materials Holding Corp., 6.75%, 2021 (n) | | | 2,235,000 | | | | 2,464,088 | |

| CEMEX Espana S.A., 9.25%, 2020 | | | 2,785,000 | | | | 2,993,875 | |

| Gibraltar Industries, Inc., 6.25%, 2021 (z) | | | 500,000 | | | | 519,375 | |

| HD Supply, Inc., 13.5%, 2015 | | | 2,225,000 | | | | 2,294,531 | |

| HD Supply, Inc., 8.125%, 2019 (n) | | | 1,545,000 | | | | 1,749,712 | |

| HD Supply, Inc., 11.5%, 2020 (n) | | | 1,295,000 | | | | 1,492,487 | |

| HD Supply, Inc., 10.5%, 2021 (z) | | | 260,000 | | | | 265,850 | |

| Masonite International Corp., 8.25%, 2021 (n) | | | 3,060,000 | | | | 3,366,000 | |

| Nortek, Inc., 8.5%, 2021 | | | 4,375,000 | | | | 4,954,687 | |

| Roofing Supply Group LLC/Roofing Supply Finance, Inc., 10%, 2020 (n) | | | 1,035,000 | | | | 1,169,550 | |

| USG Corp., 6.3%, 2016 | | | 3,295,000 | | | | 3,467,987 | |

| USG Corp., 7.875%, 2020 (n) | | | 1,570,000 | | | | 1,789,800 | |

| | | | | | | | |

| | | | | | | $ | 31,654,392 | |

| Business Services - 1.8% | | | | | | | | |

| Ceridian Corp., 12.25%, 2015 (p) | | $ | 1,250,000 | | | $ | 1,268,750 | |

| Ceridian Corp., 8.875%, 2019 (n) | | | 725,000 | | | | 808,375 | |

| Fidelity National Information Services, Inc., 7.625%, 2017 | | | 1,345,000 | | | | 1,452,600 | |

| Fidelity National Information Services, Inc., 5%, 2022 | | | 2,295,000 | | | | 2,484,338 | |

| iGATE Corp., 9%, 2016 | | | 4,863,000 | | | | 5,343,221 | |

| Iron Mountain, Inc., 8.375%, 2021 | | | 3,635,000 | | | | 4,007,588 | |

| Legend Acquisition Sub, Inc., 10.75%, 2020 (n) | | | 2,185,000 | | | | 1,922,800 | |

| Lender Processing Services, Inc., 5.75%, 2023 | | | 1,835,000 | | | | 1,945,100 | |

| Neustar, Inc., 4.5%, 2023 (z) | | | 1,400,000 | | | | 1,400,000 | |

| SunGard Data Systems, Inc., 7.375%, 2018 | | | 1,255,000 | | | | 1,333,437 | |

| | | | | | | | |

| | | | | | | $ | 21,966,209 | |

| Cable TV - 3.5% | | | | | | | | |

| Bresnan Broadband Holdings LLC, 8%, 2018 (n) | | $ | 675,000 | | | $ | 729,000 | |

| CCO Holdings LLC, 7.875%, 2018 | | | 2,885,000 | | | | 3,083,344 | |

| CCO Holdings LLC, 8.125%, 2020 | | | 6,665,000 | | | | 7,481,463 | |

| CCO Holdings LLC, 7.375%, 2020 | | | 1,305,000 | | | | 1,451,813 | |

| CCO Holdings LLC, 5.125%, 2023 | | | 1,195,000 | | | | 1,177,075 | |

| Cequel Communications Holdings, 6.375%, 2020 (n) | | | 2,310,000 | | | | 2,419,725 | |

| DISH DBS Corp., 6.75%, 2021 | | | 3,410,000 | | | | 3,819,200 | |

| DISH DBS Corp., 5%, 2023 (n) | | | 1,240,000 | | | | 1,224,500 | |

| EchoStar Corp., 7.125%, 2016 | | | 2,585,000 | | | | 2,882,275 | |

| Telenet Finance Luxembourg, 6.375%, 2020 (n) | | EUR | 1,290,000 | | | | 1,874,171 | |

| Unitymedia Hessen, 5.5%, 2023 (n) | | $ | 365,000 | | | | 372,300 | |

13

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Cable TV - continued | | | | | | | | |

| UPC Holding B.V., 9.875%, 2018 (n) | | $ | 2,170,000 | | | $ | 2,452,100 | |

| UPCB Finance III Ltd., 6.625%, 2020 (n) | | | 5,403,000 | | | | 5,767,702 | |

| Virgin Media Finance PLC, 8.375%, 2019 | | | 865,000 | | | | 978,531 | |

| Virgin Media Finance PLC, 4.875%, 2022 | | | 425,000 | | | | 423,937 | |

| Virgin Media Finance PLC, 5.25%, 2022 | | | 3,190,000 | | | | 3,333,550 | |

| Ziggo Bond Co. B.V., 8%, 2018 (n) | | EUR | 2,225,000 | | | | 3,268,836 | |

| | | | | | | | |

| | | | | | | $ | 42,739,522 | |

| Chemicals - 2.2% | | | | | | | | |

| Celanese U.S. Holdings LLC, 6.625%, 2018 | | $ | 2,955,000 | | | $ | 3,235,725 | |

| Flash Dutch 2 B.V./U.S. Coatings Acquisition, 7.375%, 2021 (z) | | | 520,000 | | | | 535,600 | |

| Hexion U.S. Finance Corp./Hexion Nova Scotia Finance, 8.875%, 2018 | | | 3,550,000 | | | | 3,585,500 | |

| Hexion U.S. Finance Corp./Hexion Nova Scotia Finance, 9%, 2020 | | | 2,145,000 | | | | 1,994,850 | |

| Huntsman International LLC, 8.625%, 2021 | | | 3,780,000 | | | | 4,328,100 | |

| INEOS Finance PLC, 8.375%, 2019 (n) | | | 3,075,000 | | | | 3,367,125 | |

| INEOS Group Holdings PLC, 8.5%, 2016 (n) | | | 2,765,000 | | | | 2,785,737 | |

| LyondellBasell Industries N.V., 5%, 2019 | | | 1,450,000 | | | | 1,598,625 | |

| LyondellBasell Industries N.V., 6%, 2021 | | | 3,230,000 | | | | 3,795,250 | |

| Polypore International, Inc., 7.5%, 2017 | | | 1,560,000 | | | | 1,696,500 | |

| | | | | | | | |

| | | | | | | $ | 26,923,012 | |

| Computer Software - 1.1% | | | | | | | | |

| Infor U.S., Inc., 11.5%, 2018 | | $ | 2,545,000 | | | $ | 2,996,737 | |

| Nuance Communications, Inc., 5.375%, 2020 (n) | | | 2,635,000 | | | | 2,714,050 | |

| Seagate HDD Cayman, 6.875%, 2020 | | | 1,411,000 | | | | 1,530,935 | |

| Syniverse Holdings, Inc., 9.125%, 2019 | | | 4,215,000 | | | | 4,583,812 | |

| TransUnion Holding Co., Inc., 9.625%, 2018 | | | 1,325,000 | | | | 1,414,437 | |

| TransUnion LLC/TransUnion Financing Corp., 11.375%, 2018 | | | 635,000 | | | | 734,219 | |

| | | | | | | | |

| | | | | | | $ | 13,974,190 | |

| Computer Software - Systems - 1.0% | | | | | | | | |

| Audatex North America, Inc., 6.75%, 2018 (n) | | $ | 2,705,000 | | | $ | 2,901,113 | |

| CDW LLC/CDW Finance Corp., 12.535%, 2017 | | | 2,145,000 | | | | 2,295,150 | |

| CDW LLC/CDW Finance Corp., 8.5%, 2019 | | | 3,795,000 | | | | 4,202,963 | |

| DuPont Fabros Technology, Inc., REIT, 8.5%, 2017 | | | 2,930,000 | | | | 3,179,050 | |

| | | | | | | | |

| | | | | | | $ | 12,578,276 | |

| Conglomerates - 1.2% | | | | | | | | |

| Amsted Industries, Inc., 8.125%, 2018 (n) | | $ | 5,470,000 | | | $ | 5,839,225 | |

| BC Mountain LLC, 7%, 2021 (z) | | | 375,000 | | | | 384,375 | |

| Dynacast International LLC, 9.25%, 2019 | | | 2,295,000 | | | | 2,449,913 | |

| Griffon Corp., 7.125%, 2018 | | | 4,075,000 | | | | 4,411,187 | |

14

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Conglomerates - continued | | | | | | | | |

| Silver II Borrower, 7.75%, 2020 (n) | | $ | 1,555,000 | | | $ | 1,628,862 | |

| | | | | | | | |

| | | | | | | $ | 14,713,562 | |

| Consumer Products - 1.0% | | | | | | | | |

| Easton-Bell Sports, Inc., 9.75%, 2016 | | $ | 2,295,000 | | | $ | 2,475,754 | |

| Elizabeth Arden, Inc., 7.375%, 2021 | | | 3,216,000 | | | | 3,577,800 | |

| Jarden Corp., 7.5%, 2020 | | | 3,195,000 | | | | 3,482,550 | |

| Libbey Glass, Inc., 6.875%, 2020 | | | 1,035,000 | | | | 1,113,919 | |

| Prestige Brands, Inc., 8.125%, 2020 | | | 300,000 | | | | 336,000 | |

| Spectrum Brands Escrow Corp., 6.375%, 2020 (n) | | | 1,020,000 | | | | 1,085,025 | |

| Spectrum Brands Escrow Corp., 6.625%, 2022 (n) | | | 260,000 | | | | 280,800 | |

| | | | | | | | |

| | | | | | | $ | 12,351,848 | |

| Consumer Services - 0.8% | | | | | | | | |

| QVC, Inc., 7.375%, 2020 (n) | | $ | 1,995,000 | | | $ | 2,202,199 | |

| Service Corp. International, 6.75%, 2015 | | | 930,000 | | | | 1,020,675 | |

| Service Corp. International, 7%, 2017 | | | 5,080,000 | | | | 5,835,650 | |

| Service Corp. International, 7%, 2019 | | | 115,000 | | | | 126,356 | |

| | | | | | | | |

| | | | | | | $ | 9,184,880 | |

| Containers - 2.5% | | | | | | | | |

| Ardagh Packaging Finance PLC , 7%, 2020 (z) | | $ | 1,210,000 | | | $ | 1,219,075 | |

| Ardagh Packaging Finance PLC, 7.375%, 2017 (n) | | | 2,530,000 | | | | 2,779,838 | |

| Ardagh Packaging Finance PLC, 9.125%, 2020 (n) | | | 400,000 | | | | 439,000 | |

| Ardagh Packaging Finance PLC, 9.125%, 2020 (n) | | | 4,110,000 | | | | 4,490,175 | |

| Ball Corp., 5%, 2022 | | | 1,624,000 | | | | 1,721,440 | |

| Berry Plastics Group, Inc., 9.5%, 2018 | | | 1,190,000 | | | | 1,329,825 | |

| Crown Americas LLC, 4.5%, 2023 (z) | | | 2,030,000 | | | | 1,999,550 | |

| Greif, Inc., 6.75%, 2017 | | | 3,415,000 | | | | 3,807,725 | |

| Greif, Inc., 7.75%, 2019 | | | 795,000 | | | | 922,200 | |

| Reynolds Group, 7.125%, 2019 | | | 2,925,000 | | | | 3,122,437 | |

| Reynolds Group, 9.875%, 2019 | | | 1,030,000 | | | | 1,125,275 | |

| Reynolds Group, 5.75%, 2020 | | | 1,760,000 | | | | 1,799,600 | |

| Reynolds Group, 8.25%, 2021 | | | 6,090,000 | | | | 6,379,275 | |

| | | | | | | | |

| | | | | | | $ | 31,135,415 | |

| Defense Electronics - 0.5% | | | | | | | | |

| Ducommun, Inc., 9.75%, 2018 | | $ | 3,256,000 | | | $ | 3,573,460 | |

| MOOG, Inc., 7.25%, 2018 | | | 2,560,000 | | | | 2,675,200 | |

| | | | | | | | |

| | | | | | | $ | 6,248,660 | |

| Electrical Equipment - 0.2% | | | | | | | | |

| Avaya, Inc., 9.75%, 2015 | | $ | 2,175,000 | | | $ | 2,071,688 | |

| Avaya, Inc., 7%, 2019 (n) | | | 805,000 | | | | 768,775 | |

| | | | | | | | |

| | | | | | | $ | 2,840,463 | |

15

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Electronics - 0.9% | | | | | | | | |

| Freescale Semiconductor, Inc., 9.25%, 2018 (n) | | $ | 4,260,000 | | | $ | 4,686,000 | |

| Nokia Corp., 5.375%, 2019 | | | 1,075,000 | | | | 1,029,312 | |

| Nokia Corp., 6.625%, 2039 | | | 770,000 | | | | 719,950 | |

| NXP B.V., 9.75%, 2018 (n) | | | 100,000 | | | | 115,000 | |

| NXP B.V., 5.75%, 2021 (z) | | | 870,000 | | | | 870,000 | |

| Sensata Technologies B.V., 6.5%, 2019 (n) | | | 3,770,000 | | | | 4,043,325 | |

| | | | | | | | |

| | | | | | | $ | 11,463,587 | |

| Energy - Independent - 8.0% | | | | | | | | |

| BreitBurn Energy Partners LP, 8.625%, 2020 | | $ | 1,395,000 | | | $ | 1,531,013 | |

| BreitBurn Energy Partners LP, 7.875%, 2022 (n) | | | 3,450,000 | | | | 3,648,375 | |

| Carrizo Oil & Gas, Inc., 8.625%, 2018 | | | 995,000 | | | | 1,072,113 | |

| Chaparral Energy, Inc., 7.625%, 2022 | | | 2,445,000 | | | | 2,640,600 | |

| Chesapeake Energy Corp., 6.875%, 2020 | | | 3,685,000 | | | | 4,053,500 | |

| Concho Resources, Inc., 8.625%, 2017 | | | 1,700,000 | | | | 1,836,000 | |

| Concho Resources, Inc., 6.5%, 2022 | | | 4,690,000 | | | | 5,112,100 | |

| Continental Resources, Inc., 8.25%, 2019 | | | 3,180,000 | | | | 3,573,525 | |

| Denbury Resources, Inc., 8.25%, 2020 | | | 4,860,000 | | | | 5,418,900 | |

| Denbury Resources, Inc., 4.625%, 2023 | | | 1,245,000 | | | | 1,220,100 | |

| Energy XXI Gulf Coast, Inc., 9.25%, 2017 | | | 4,980,000 | | | | 5,670,975 | |

| EP Energy LLC, 9.375%, 2020 | | | 9,115,000 | | | | 10,208,800 | |

| EPL Oil & Gas, Inc., 8.25%, 2018 (n) | | | 1,860,000 | | | | 1,957,650 | |

| EXCO Resources, Inc., 7.5%, 2018 | | | 1,175,000 | | | | 1,113,313 | |

| Harvest Operations Corp., 6.875%, 2017 | | | 4,585,000 | | | | 5,095,081 | |

| Hilcorp Energy I/Hilcorp Finance Co., 8%, 2020 (n) | | | 1,870,000 | | | | 2,071,025 | |

| Laredo Petroleum, Inc., 9.5%, 2019 | | | 1,955,000 | | | | 2,209,150 | |

| LINN Energy LLC, 6.5%, 2019 | | | 1,245,000 | | | | 1,268,344 | |

| LINN Energy LLC, 8.625%, 2020 | | | 2,075,000 | | | | 2,287,688 | |

| LINN Energy LLC, 7.75%, 2021 | | | 2,621,000 | | | | 2,804,470 | |

| MEG Energy Corp., 6.5%, 2021 (n) | | | 1,030,000 | | | | 1,081,500 | |

| Newfield Exploration Co., 6.875%, 2020 | | | 3,155,000 | | | | 3,411,344 | |

| Plains Exploration & Production Co., 8.625%, 2019 | | | 2,885,000 | | | | 3,288,900 | |

| Plains Exploration & Production Co., 6.5%, 2020 | | | 1,200,000 | | | | 1,327,500 | |

| Plains Exploration & Production Co., 6.75%, 2022 | | | 2,940,000 | | | | 3,311,175 | |

| QEP Resources, Inc., 6.875%, 2021 | | | 4,980,000 | | | | 5,764,350 | |

| Range Resources Corp., 8%, 2019 | | | 2,910,000 | | | | 3,230,100 | |

| Range Resources Corp., 5%, 2022 | | | 1,040,000 | | | | 1,092,000 | |

| Samson Investment Co., 9.75%, 2020 (n) | | | 2,510,000 | | | | 2,670,012 | |

| SandRidge Energy, Inc., 8%, 2018 (n) | | | 2,850,000 | | | | 2,992,500 | |

| SM Energy Co., 6.5%, 2021 | | | 2,765,000 | | | | 2,944,725 | |

| Whiting Petroleum Corp., 6.5%, 2018 | | | 2,035,000 | | | | 2,182,537 | |

| | | | | | | | |

| | | | | | | $ | 98,089,365 | |

16

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Energy - Integrated - 0.1% | | | | | | | | |

| Pacific Rubiales Energy Corp., 7.25%, 2021 (n) | | $ | 934,000 | | | $ | 1,089,044 | |

| | |

| Engineering - Construction - 0.2% | | | | | | | | |

| BakerCorp International, Inc., 8.25%, 2019 | | $ | 2,760,000 | | | $ | 2,794,500 | |

| | |

| Entertainment - 1.2% | | | | | | | | |

| AMC Entertainment, Inc., 8.75%, 2019 | | $ | 1,860,000 | | | $ | 2,055,300 | |

| AMC Entertainment, Inc., 9.75%, 2020 | | | 2,124,000 | | | | 2,474,460 | |

| Cedar Fair LP, 9.125%, 2018 | | | 1,875,000 | | | | 2,100,000 | |

| Cinemark USA, Inc., 8.625%, 2019 | | | 3,230,000 | | | | 3,577,225 | |

| Cinemark USA, Inc., 5.125%, 2022 (n) | | | 635,000 | | | | 642,938 | |

| NAI Entertainment Holdings LLC, 8.25%, 2017 (n) | | | 1,161,000 | | | | 1,271,295 | |

| Six Flags Entertainment Corp., 5.25%, 2021 (n) | | | 2,455,000 | | | | 2,442,725 | |

| | | | | | | | |

| | | | | | | $ | 14,563,943 | |

| Financial Institutions - 4.6% | | | | | | | | |

| Aviation Capital Group, 4.625%, 2018 (z) | | $ | 985,000 | | | $ | 997,889 | |

| CIT Group, Inc., 5.25%, 2014 (n) | | | 3,940,000 | | | | 4,107,450 | |

| CIT Group, Inc., 5.25%, 2018 | | | 3,330,000 | | | | 3,563,100 | |

| CIT Group, Inc., 6.625%, 2018 (n) | | | 5,369,000 | | | | 6,013,280 | |

| CIT Group, Inc., 5.5%, 2019 (n) | | | 3,347,000 | | | | 3,581,290 | |

| Credit Acceptance Corp., 9.125%, 2017 | | | 2,555,000 | | | | 2,791,338 | |

| Icahn Enterprises LP, 8%, 2018 | | | 4,406,000 | | | | 4,719,928 | |

| International Lease Finance Corp., 4.875%, 2015 | | | 1,300,000 | | | | 1,356,875 | |

| International Lease Finance Corp., 8.625%, 2015 | | | 1,345,000 | | | | 1,528,256 | |

| International Lease Finance Corp., 7.125%, 2018 (n) | | | 3,601,000 | | | | 4,213,170 | |

| Nationstar Mortgage LLC/Capital Corp., 10.875%, 2015 | | | 4,265,000 | | | | 4,542,225 | |

| Nationstar Mortgage LLC/Capital Corp., 9.625%, 2019 (n) | | | 1,130,000 | | | | 1,288,200 | |

| Nationstar Mortgage LLC/Capital Corp., 7.875%, 2020 (n) | | | 990,000 | | | | 1,079,100 | |

| PHH Corp., 9.25%, 2016 | | | 2,190,000 | | | | 2,567,775 | |

| PHH Corp., 7.375%, 2019 | | | 1,890,000 | | | | 2,121,525 | |

| SLM Corp., 8.45%, 2018 | | | 2,865,000 | | | | 3,413,241 | |

| SLM Corp., 8%, 2020 | | | 5,450,000 | | | | 6,308,375 | |

| SLM Corp., 7.25%, 2022 | | | 1,410,000 | | | | 1,575,675 | |

| | | | | | | | |

| | | | | | | $ | 55,768,692 | |

| Food & Beverages - 0.9% | | | | | | | | |

| ARAMARK Corp., 8.5%, 2015 | | $ | 2,151,000 | | | $ | 2,164,465 | |

| B&G Foods, Inc., 7.625%, 2018 | | | 3,015,000 | | | | 3,252,431 | |

| Constellation Brands, Inc., 7.25%, 2016 | | | 1,410,000 | | | | 1,614,450 | |

| Pinnacle Foods Finance LLC, 8.25%, 2017 | | | 780,000 | | | | 829,725 | |

| TreeHouse Foods, Inc., 7.75%, 2018 | | | 2,455,000 | | | | 2,657,537 | |

| | | | | | | | |

| | | | | | | $ | 10,518,608 | |

17

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Forest & Paper Products - 1.2% | | | | | | | | |

| Boise, Inc., 8%, 2020 | | $ | 2,770,000 | | | $ | 3,067,775 | |

| Clearwater Paper Corp., 4.5%, 2023 (z) | | | 500,000 | | | | 496,250 | |

| Georgia-Pacific Corp., 8%, 2024 | | | 263,000 | | | | 366,761 | |

| Graphic Packaging Holding Co., 7.875%, 2018 | | | 1,840,000 | | | | 2,019,400 | |

| Millar Western Forest Products Ltd., 8.5%, 2021 | | | 595,000 | | | | 575,662 | |

| Sappi Papier Holding GmbH, 7.75%, 2017 (n) | | | 1,525,000 | | | | 1,715,625 | |

| Smurfit Kappa Group PLC, 4.875%, 2018 (n) | | | 1,825,000 | | | | 1,879,750 | |

| Smurfit Kappa Group PLC, 7.75%, 2019 (n) | | EUR | 1,920,000 | | | | 2,854,639 | |

| Tembec Industries, Inc., 11.25%, 2018 | | $ | 1,615,000 | | | | 1,780,537 | |

| | | | | | | | |

| | | | | | | $ | 14,756,399 | |

| Gaming & Lodging - 3.3% | | | | | | | | |

| Boyd Gaming Corp., 9%, 2020 (n) | | $ | 1,265,000 | | | $ | 1,283,975 | |

| Caesars Entertainment Operating Co., Inc., 8.5%, 2020 | | | 3,495,000 | | | | 3,512,475 | |

| Choice Hotels International, Inc., 5.75%, 2022 | | | 520,000 | | | | 577,200 | |

| CityCenter Holdings LLC, 10.75%, 2017 (p) | | | 1,240,000 | | | | 1,368,650 | |

| FelCor Lodging LP, 5.625%, 2023 (n) | | | 485,000 | | | | 489,244 | |

| Fontainebleau Las Vegas Holdings LLC, 10.25%, 2015 (a)(d)(n) | | | 3,300,000 | | | | 2,063 | |

| GWR Operating Partnership LLP, 10.875%, 2017 | | | 1,305,000 | | | | 1,484,438 | |

| Host Hotels & Resorts, Inc., REIT, 5.25%, 2022 | | | 1,725,000 | | | | 1,880,250 | |

| Isle of Capri Casinos, Inc., 8.875%, 2020 | | | 3,480,000 | | | | 3,801,900 | |

| MGM Mirage, 6.625%, 2015 | | | 1,760,000 | | | | 1,900,800 | |

| MGM Resorts International, 11.375%, 2018 | | | 3,485,000 | | | | 4,338,825 | |

| MGM Resorts International, 6.625%, 2021 | | | 1,265,000 | | | | 1,302,950 | |

| Penn National Gaming, Inc., 8.75%, 2019 | | | 4,595,000 | | | | 5,238,300 | |

| Pinnacle Entertainment, Inc., 8.75%, 2020 | | | 1,435,000 | | | | 1,556,975 | |

| Seven Seas Cruises S. DE R.L., 9.125%, 2019 | | | 3,660,000 | | | | 3,879,600 | |

| Viking Cruises Ltd., 8.5%, 2022 (n) | | | 1,985,000 | | | | 2,188,462 | |

| Wyndham Worldwide Corp., 7.375%, 2020 | | | 1,670,000 | | | | 2,038,886 | |

| Wynn Las Vegas LLC, 7.75%, 2020 | | | 2,830,000 | | | | 3,190,825 | |

| | | | | | | | |

| | | | | | | $ | 40,035,818 | |

| Industrial - 0.9% | | | | | | | | |

| Dematic S.A., 7.75%, 2020 (z) | | $ | 2,195,000 | | | $ | 2,244,388 | |

| Hyva Global B.V., 8.625%, 2016 (n) | | | 1,989,000 | | | | 1,929,330 | |

| Mueller Water Products, Inc., 8.75%, 2020 | | | 1,952,000 | | | | 2,220,400 | |

| Rexel S.A., 6.125%, 2019 (n) | | | 2,040,000 | | | | 2,182,800 | |

| SPL Logistics Escrow LLC, 8.875%, 2020 (n) | | | 2,325,000 | | | | 2,487,750 | |

| Unifrax I LLC, 7.5%, 2019 (z) | | | 510,000 | | | | 510,000 | |

| | | | | | | | |

| | | | | | | $ | 11,574,668 | |

18

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Insurance - 1.1% | | | | | | | | |

| American International Group, Inc., 8.25%, 2018 | | $ | 2,765,000 | | | $ | 3,589,006 | |

| American International Group, Inc., 8.175% to 2038, FRN to 2068 | | | 5,895,000 | | | | 7,663,500 | |

| MetLife, Inc., 9.25% to 2038, FRN to 2068 (n) | | | 1,300,000 | | | | 1,787,500 | |

| | | | | | | | |

| | | | | | | $ | 13,040,006 | |

| Insurance - Property & Casualty - 0.8% | | | | | | | | |

| Liberty Mutual Group, Inc., 10.75% to 2038, FRN to 2088 (n) | | $ | 3,430,000 | | | $ | 5,213,600 | |

| XL Group PLC, 6.5% to 2017, FRN to 2049 | | | 5,275,000 | | | | 5,070,594 | |

| | | | | | | | |

| | | | | | | $ | 10,284,194 | |

| International Market Quasi-Sovereign - 0.1% | | | | | | | | |

| Electricite de France, FRN, 5.25%, 2049 (n) | | $ | 331,000 | | | $ | 323,125 | |

| Exportfinans ASA, 5.5%, 2016 | | | 1,090,000 | | | | 1,137,890 | |

| | | | | | | | |

| | | | | | | $ | 1,461,015 | |

| Machinery & Tools - 2.0% | | | | | | | | |

| Case New Holland, Inc., 7.875%, 2017 | | $ | 5,625,000 | | | $ | 6,651,563 | |

| CNH America LLC, 7.25%, 2016 | | | 2,140,000 | | | | 2,391,450 | |

| CNH Capital LLC, 3.875%, 2015 (n) | | | 650,000 | | | | 667,875 | |

| CNH Capital LLC, 6.25%, 2016 | | | 785,000 | | | | 865,463 | |

| H&E Equipment Services LLC, 7%, 2022 (n) | | | 3,655,000 | | | | 3,993,087 | |

| NESCO LLC/NESCO Holdings Corp., 11.75%, 2017 (n) | | | 3,465,000 | | | | 3,776,850 | |

| RSC Equipment Rental, Inc., 8.25%, 2021 | | | 2,910,000 | | | | 3,310,125 | |

| United Rentals North America, Inc., 5.75%, 2018 | | | 1,420,000 | | | | 1,526,500 | |

| United Rentals North America, Inc., 7.625%, 2022 | | | 1,412,000 | | | | 1,574,380 | |

| | | | | | | | |

| | | | | | | $ | 24,757,293 | |

| Major Banks - 1.1% | | | | | | | | |

| Bank of America Corp., 5.65%, 2018 | | $ | 2,900,000 | | | $ | 3,348,601 | |

| Barclays Bank PLC, 7.625%, 2022 | | | 2,360,000 | | | | 2,327,550 | |

| Royal Bank of Scotland Group PLC, 6.99% to 2017, FRN to 2049 (n) | | | 1,370,000 | | | | 1,287,800 | |

| Royal Bank of Scotland Group PLC, 7.648% to 2031, FRN to 2049 | | | 5,670,000 | | | | 5,981,850 | |

| | | | | | | | |

| | | | | | | $ | 12,945,801 | |

| Medical & Health Technology & Services - 4.8% | | | | | | | | |

| AmSurg Corp., 5.625%, 2020 (n) | | $ | 1,635,000 | | | $ | 1,708,575 | |

| CDRT Holding Corp., 9.25%, 2017 (n)(p) | | | 750,000 | | | | 774,375 | |

| Davita, Inc., 6.375%, 2018 | | | 5,225,000 | | | | 5,590,750 | |

| Davita, Inc., 6.625%, 2020 | | | 4,515,000 | | | | 4,921,350 | |

| Fresenius Medical Care AG & Co. KGaA, 9%, 2015 (n) | | | 2,540,000 | | | | 2,895,600 | |

| Fresenius Medical Care Capital Trust III, 5.625%, 2019 (n) | | | 2,410,000 | | | | 2,608,825 | |

| Fresenius Medical Care Capital Trust III, 5.875%, 2022 (z) | | | 1,015,000 | | | | 1,108,888 | |

| HCA, Inc., 8.5%, 2019 | | | 8,245,000 | | | | 9,172,562 | |

| HCA, Inc., 7.5%, 2022 | | | 4,995,000 | | | | 5,769,225 | |

| HCA, Inc., 5.875%, 2022 | | | 2,180,000 | | | | 2,370,750 | |

19

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Medical & Health Technology & Services - continued | | | | | | | | |

| HealthSouth Corp., 8.125%, 2020 | | $ | 4,915,000 | | | $ | 5,394,213 | |

| IASIS Healthcare LLC/IASIS Capital Corp., 8.375%, 2019 | | | 3,945,000 | | | | 4,004,175 | |

| Select Medical Corp., 7.625%, 2015 | | | 449,000 | | | | 449,561 | |

| Tenet Healthcare Corp., 9.25%, 2015 | | | 1,805,000 | | | | 2,044,162 | |

| Tenet Healthcare Corp., 8%, 2020 | | | 2,165,000 | | | | 2,354,437 | |

| Tenet Healthcare Corp., 4.5%, 2021 (z) | | | 1,250,000 | | | | 1,229,687 | |

| Universal Health Services, Inc, 7.625%, 2020 | | | 2,615,000 | | | | 2,804,587 | |

| Universal Health Services, Inc., 7%, 2018 | | | 2,130,000 | | | | 2,348,325 | |

| Universal Hospital Services, Inc., FRN, 3.902%, 2015 | | | 1,015,000 | | | | 1,011,194 | |

| Vanguard Health Systems, Inc., 0%, 2016 | | | 7,000 | | | | 5,355 | |

| | | | | | | | |

| | | | | | | $ | 58,566,596 | |

| Medical Equipment - 0.7% | | | | | | | | |

| Biomet, Inc., 6.5%, 2020 (n) | | $ | 2,760,000 | | | $ | 2,898,000 | |

| Hologic, Inc., 6.25%, 2020 (n) | | | 1,030,000 | | | | 1,107,250 | |

| Physio-Control International, Inc., 9.875%, 2019 (n) | | | 1,860,000 | | | | 2,083,200 | |

| Teleflex, Inc., 6.875%, 2019 | | | 2,645,000 | | | | 2,869,825 | |

| | | | | | | | |

| | | | | | | $ | 8,958,275 | |

| Metals & Mining - 1.8% | | | | | | | | |

| Arch Coal, Inc., 7.25%, 2020 | | $ | 2,715,000 | | | $ | 2,429,925 | |

| Cloud Peak Energy, Inc., 8.25%, 2017 | | | 5,780,000 | | | | 6,141,250 | |

| Cloud Peak Energy, Inc., 8.5%, 2019 | | | 380,000 | | | | 413,250 | |

| Consol Energy, Inc., 8%, 2017 | | | 1,985,000 | | | | 2,143,800 | |

| Consol Energy, Inc., 8.25%, 2020 | | | 2,055,000 | | | | 2,224,538 | |

| First Quantum Minerals Ltd., 7.25%, 2019 (n) | | | 1,783,000 | | | | 1,814,203 | |

| Fortescue Metals Group Ltd., 8.25%, 2019 (n) | | | 2,310,000 | | | | 2,477,475 | |

| Peabody Energy Corp., 6%, 2018 | | | 2,295,000 | | | | 2,404,012 | |

| Peabody Energy Corp., 6.25%, 2021 | | | 1,295,000 | | | | 1,353,275 | |

| | | | | | | | |

| | | | | | | $ | 21,401,728 | |

| Municipals - 0.2% | | | | | | | | |

| New Jersey Tobacco Settlement Financing Corp., “1-A”, 4.5%, 2023 | | $ | 2,330,000 | | | $ | 2,320,354 | |

| | |

| Natural Gas - Distribution - 0.4% | | | | | | | | |

| AmeriGas Finance LLC, 6.75%, 2020 | | $ | 2,385,000 | | | $ | 2,587,725 | |

| Ferrellgas LP/Ferrellgas Finance Corp., 6.5%, 2021 | | | 1,735,000 | | | | 1,752,350 | |

| | | | | | | | |

| | | | | | | $ | 4,340,075 | |

| Natural Gas - Pipeline - 3.1% | | | | | | | | |

| Access Midstream Partners Co., 4.875%, 2023 | | $ | 1,200,000 | | | $ | 1,194,000 | |

| Atlas Pipeline Partners LP, 8.75%, 2018 | | | 4,520,000 | | | | 4,845,440 | |

| Atlas Pipeline Partners LP, 5.875%, 2023 (z) | | | 1,865,000 | | | | 1,860,338 | |

20

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Natural Gas - Pipeline - continued | | | | | | | | |

| Crosstex Energy, Inc., 8.875%, 2018 | | $ | 5,455,000 | | | $ | 5,857,306 | |

| El Paso Corp., 7%, 2017 | | | 3,790,000 | | | | 4,344,765 | |

| El Paso Corp., 7.75%, 2032 | | | 4,425,000 | | | | 5,202,827 | |

| Energy Transfer Equity LP, 7.5%, 2020 | | | 3,590,000 | | | | 4,137,475 | |

| Enterprise Products Partners LP, 8.375% to 2016, FRN to 2066 | | | 1,721,000 | | | | 1,966,243 | |

| Enterprise Products Partners LP, 7.034% to 2018, FRN to 2068 | | | 1,047,000 | | | | 1,198,815 | |

| Inergy Midstream LP, 6%, 2020 (n) | | | 2,815,000 | | | | 2,906,487 | |

| MarkWest Energy Partners LP, 5.5%, 2023 | | | 2,150,000 | | | | 2,268,250 | |

| Rockies Express Pipeline LLC, 5.625%, 2020 (n) | | | 949,000 | | | | 892,060 | |

| Sabine Pass Liquefaction, 5.625%, 2021 (z) | | | 805,000 | | | | 808,019 | |

| | | | | | | | |

| | | | | | | $ | 37,482,025 | |

| Network & Telecom - 1.8% | | | | | | | | |

| Centurylink, Inc., 7.65%, 2042 | | $ | 3,030,000 | | | $ | 3,118,179 | |

| Cincinnati Bell, Inc., 8.25%, 2017 | | | 850,000 | | | | 912,688 | |

| Citizens Communications Co., 9%, 2031 | | | 1,795,000 | | | | 1,947,575 | |

| Eileme 2 AB, 11.625%, 2020 (n) | | | 2,149,000 | | | | 2,530,448 | |

| Frontier Communications Corp., 8.125%, 2018 | | | 2,940,000 | | | | 3,403,050 | |

| Qwest Communications International, Inc., 7.125%, 2018 (n) | | | 3,990,000 | | | | 4,162,388 | |

| TW Telecom Holdings, Inc., 5.375%, 2022 | | | 1,280,000 | | | | 1,344,000 | |

| Windstream Corp., 8.125%, 2018 | | | 570,000 | | | | 625,575 | |

| Windstream Corp., 7.75%, 2020 | | | 2,615,000 | | | | 2,843,812 | |

| Windstream Corp., 7.75%, 2021 | | | 1,265,000 | | | | 1,382,012 | |

| | | | | | | | |

| | | | | | | $ | 22,269,727 | |

| Oil Services - 1.3% | | | | | | | | |

| Bristow Group, Inc., 6.25%, 2022 | | $ | 1,295,000 | | | $ | 1,398,600 | |

| Chesapeake Energy Corp., 6.625%, 2019 (n) | | | 1,035,000 | | | | 1,024,650 | |

| Dresser-Rand Group, Inc., 6.5%, 2021 | | | 1,300,000 | | | | 1,378,000 | |

| Edgen Murray Corp., 8.75%, 2020 (n) | | | 2,620,000 | | | | 2,678,950 | |

| Pioneer Energy Services Corp., 9.875%, 2018 | | | 2,210,000 | | | | 2,397,850 | |

| Shale-Inland Holdings LLC/Finance Co., 8.75%, 2019 (n) | | | 2,810,000 | | | | 2,950,500 | |

| Unit Corp., 6.625%, 2021 | | | 4,060,000 | | | | 4,212,250 | |

| | | | | | | | |

| | | | | | | $ | 16,040,800 | |

| Other Banks & Diversified Financials - 2.4% | | | | | | | | |

| Ally Financial, Inc., 5.5%, 2017 | | $ | 7,745,000 | | | $ | 8,326,479 | |

| Ally Financial, Inc., 6.25%, 2017 | | | 1,680,000 | | | | 1,869,156 | |

| GMAC, Inc., 8%, 2031 | | | 540,000 | | | | 682,425 | |

| Groupe BPCE S.A., 12.5% to 2019, FRN to 2049 (n) | | | 2,865,000 | | | | 3,504,554 | |

| LBG Capital No. 1 PLC, 7.875%, 2020 (n) | | | 5,525,000 | | | | 6,055,400 | |

| Santander UK PLC, 8.963% to 2030, FRN to 2049 | | | 6,666,000 | | | | 7,699,230 | |

| UBS AG, 7.625%, 2022 | | | 1,460,000 | | | | 1,604,162 | |

| | | | | | | | |

| | | | | | | $ | 29,741,406 | |

21

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Pharmaceuticals - 0.7% | | | | | | | | |

| Capsugel FinanceCo. SCA, 9.875%, 2019 (n) | | EUR | 1,370,000 | | | $ | 2,078,758 | |

| Valeant Pharmaceuticals International, Inc., 7%, 2020 (n) | | $ | 3,750,000 | | | | 3,975,000 | |

| Valeant Pharmaceuticals International, Inc., 7.25%, 2022 (n) | | | 2,800,000 | | | | 3,010,000 | |

| | | | | | | | |

| | | | | | | $ | 9,063,758 | |

| Pollution Control - 0.3% | | | | | | | | |

| Heckmann Corp., 9.875%, 2018 | | $ | 2,300,000 | | | $ | 2,443,750 | |

| Heckmann Corp., 9.875%, 2018 (z) | | | 765,000 | | | | 807,075 | |

| | | | | | | | |

| | | | | | | $ | 3,250,825 | |

| Precious Metals & Minerals - 0.5% | | | | | | | | |

| Eldorado Gold Corp., 6.125%, 2020 (n) | | $ | 2,785,000 | | | $ | 2,927,731 | |

| IAMGOLD Corp., 6.75%, 2020 (n) | | | 3,587,000 | | | | 3,515,260 | |

| | | | | | | | |

| | | | | | | $ | 6,442,991 | |

| Printing & Publishing - 0.4% | | | | | | | | |

| American Media, Inc., 13.5%, 2018 (z) | | $ | 297,449 | | | $ | 260,268 | |

| Nielsen Finance LLC, 7.75%, 2018 | | | 2,760,000 | | | | 3,073,950 | |

| Nielsen Finance LLC, 4.5%, 2020 (n) | | | 1,520,000 | | | | 1,497,200 | |

| | | | | | | | |

| | | | | | | $ | 4,831,418 | |

| Railroad & Shipping - 0.1% | | | | | | | | |

| Kansas City Southern de Mexico S.A. de C.V., 6.125%, 2021 | | $ | 1,295,000 | | | $ | 1,456,875 | |

| | |

| Real Estate - 1.2% | | | | | | | | |

| CB Richard Ellis Group, Inc., 11.625%, 2017 | | $ | 1,680,000 | | | $ | 1,831,200 | |

| CNL Lifestyle Properties, Inc., REIT, 7.25%, 2019 | | | 1,300,000 | | | | 1,290,250 | |

| Entertainment Properties Trust, REIT, 7.75%, 2020 | | | 3,050,000 | | | | 3,558,697 | |

| Entertainment Properties Trust, REIT, 5.75%, 2022 | | | 815,000 | | | | 857,801 | |

| Kennedy Wilson, Inc., 8.75%, 2019 | | | 1,220,000 | | | | 1,293,200 | |

| MPT Operating Partnership LP, REIT, 6.875%, 2021 | | | 2,435,000 | | | | 2,672,412 | |

| MPT Operating Partnership LP, REIT, 6.375%, 2022 | | | 3,215,000 | | | | 3,448,087 | |

| | | | | | | | |

| | | | | | | $ | 14,951,647 | |

| Retailers - 2.3% | | | | | | | | |

| Academy Ltd., 9.25%, 2019 (n) | | $ | 1,565,000 | | | $ | 1,744,975 | |

| Burlington Coat Factory Warehouse Corp., 10%, 2019 | | | 3,540,000 | | | | 3,849,750 | |

| J. Crew Group, Inc., 8.125%, 2019 | | | 3,160,000 | | | | 3,389,100 | |

| Limited Brands, Inc., 6.9%, 2017 | | | 1,960,000 | | | | 2,258,900 | |

| Limited Brands, Inc., 7%, 2020 | | | 1,520,000 | | | | 1,748,000 | |

| Limited Brands, Inc., 6.95%, 2033 | | | 1,080,000 | | | | 1,112,400 | |

| Pantry, Inc., 8.375%, 2020 (n) | | | 1,285,000 | | | | 1,374,950 | |

| Rite Aid Corp., 9.25%, 2020 | | | 2,530,000 | | | | 2,814,625 | |

| Sally Beauty Holdings, Inc., 6.875%, 2019 | | | 1,285,000 | | | | 1,419,925 | |

22

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Retailers - continued | | | | | | | | |

| Toys “R” Us Property Co. II LLC, 8.5%, 2017 | | $ | 1,466,000 | | | $ | 1,542,965 | |

| Toys “R” Us, Inc., 10.75%, 2017 | | | 4,665,000 | | | | 5,014,875 | |

| Yankee Acquisition Corp., 8.5%, 2015 | | | 21,000 | | | | 21,053 | |

| YCC Holdings LLC/Yankee Finance, Inc., 10.25%, 2016 (p) | | | 1,260,000 | | | | 1,297,813 | |

| | | | | | | | |

| | | | | | | $ | 27,589,331 | |

| Specialty Chemicals - 0.2% | | | | | | | | |

| Eagle Spinco, Inc., 4.625%, 2021 (z) | | $ | 625,000 | | | $ | 628,906 | |

| Georgia Gulf Corp., 4.875%, 2023 (z) | | | 255,000 | | | | 256,913 | |

| Koppers, Inc., 7.875%, 2019 | | | 1,835,000 | | | | 2,020,794 | |

| | | | | | | | |

| | | | | | | $ | 2,906,613 | |

| Specialty Stores - 0.4% | | | | | | | | |

| Gymboree Corp., 9.125%, 2018 | | $ | 1,305,000 | | | $ | 1,226,700 | |

| Michaels Stores, Inc., 11.375%, 2016 | | | 1,249,000 | | | | 1,303,656 | |

| Michaels Stores, Inc., 7.75%, 2018 | | | 1,980,000 | | | | 2,165,625 | |

| | | | | | | | |

| | | | | | | $ | 4,695,981 | |

| Telecommunications - Wireless - 4.1% | | | | | | | | |

| Clearwire Corp., 12%, 2015 (n) | | $ | 3,140,000 | | | $ | 3,402,975 | |

| Cricket Communications, Inc., 7.75%, 2016 | | | 2,040,000 | | | | 2,147,100 | |

| Cricket Communications, Inc., 7.75%, 2020 | | | 2,670,000 | | | | 2,770,125 | |

| Crown Castle International Corp., 7.125%, 2019 | | | 4,420,000 | | | | 4,911,725 | |

| Crown Castle International Corp., 5.25%, 2023 (n) | | | 1,655,000 | | | | 1,737,750 | |

| Digicel Group Ltd., 12%, 2014 (n) | | | 560,000 | | | | 603,400 | |

| Digicel Group Ltd., 8.25%, 2017 (n) | | | 3,050,000 | | | | 3,233,000 | |

| Digicel Group Ltd., 10.5%, 2018 (n) | | | 2,540,000 | | | | 2,832,100 | |

| MetroPCS Wireless, Inc., 7.875%, 2018 | | | 2,455,000 | | | | 2,657,537 | |

| Sprint Capital Corp., 6.875%, 2028 | | | 3,280,000 | | | | 3,312,800 | |

| Sprint Nextel Corp., 6%, 2016 | | | 4,115,000 | | | | 4,433,912 | |

| Sprint Nextel Corp., 8.375%, 2017 | | | 3,611,000 | | | | 4,175,219 | |

| Sprint Nextel Corp., 9%, 2018 (n) | | | 1,350,000 | | | | 1,670,625 | |

| Sprint Nextel Corp., 6%, 2022 | | | 3,600,000 | | | | 3,618,000 | |

| Wind Acquisition Finance S.A., 11.75%, 2017 (n) | | | 3,205,000 | | | | 3,445,375 | |

| Wind Acquisition Finance S.A., 7.25%, 2018 (n) | | | 4,710,000 | | | | 4,957,275 | |

| | | | | | | | |

| | | | | | | $ | 49,908,918 | |

| Telephone Services - 0.5% | | | | | | | | |

| Cogent Communications Group, Inc., 8.375%, 2018 (n) | | $ | 1,240,000 | | | $ | 1,373,300 | |

| Level 3 Financing, Inc., 9.375%, 2019 | | | 2,095,000 | | | | 2,367,350 | |

| Level 3 Financing, Inc., 7%, 2020 (n) | | | 770,000 | | | | 816,200 | |

| Level 3 Financing, Inc., 8.625%, 2020 | | | 1,315,000 | | | | 1,472,800 | |

| | | | | | | | |

| | | | | | | $ | 6,029,650 | |

23

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Bonds - continued | | | | | | | | |

| Transportation - 0.2% | | | | | | | | |

| Navios South American Logistics, Inc., 9.25%, 2019 | | $ | 2,457,000 | | | $ | 2,457,000 | |

| | |

| Transportation - Services - 2.9% | | | | | | | | |

| ACL I Corp., 10.625%, 2016 (p) | | $ | 3,174,052 | | | $ | 3,051,168 | |

| Aguila American Resources Ltd., 7.875%, 2018 (n) | | | 2,765,000 | | | | 2,930,900 | |

| Avis Budget Car Rental LLC, 8.25%, 2019 | | | 1,980,000 | | | | 2,192,850 | |

| Avis Budget Car Rental LLC, 9.75%, 2020 | | | 1,130,000 | | | | 1,307,975 | |

| CEVA Group PLC, 8.375%, 2017 (n) | | | 5,780,000 | | | | 5,910,050 | |

| Commercial Barge Line Co., 12.5%, 2017 | | | 6,370,000 | | | | 6,991,075 | |

| HDTFS, Inc., 5.875%, 2020 (n) | | | 585,000 | | | | 621,563 | |

| Navios Maritime Acquisition Corp., 8.625%, 2017 | | | 3,385,000 | | | | 3,207,287 | |

| Navios Maritime Holdings, Inc., 8.875%, 2017 | | | 3,200,000 | | | | 3,160,000 | |

| Swift Services Holdings, Inc., 10%, 2018 | | | 5,170,000 | | | | 5,835,637 | |

| | | | | | | | |

| | | | | | | $ | 35,208,505 | |

| Utilities - Electric Power - 4.3% | | | | | | | | |

| AES Corp., 8%, 2017 | | $ | 4,225,000 | | | $ | 4,879,875 | |

| AES Corp., 7.375%, 2021 | | | 1,265,000 | | | | 1,410,475 | |

| Calpine Corp., 8%, 2016 (n) | | | 2,690,000 | | | | 2,837,950 | |

| Calpine Corp., 7.875%, 2020 (n) | | | 4,162,000 | | | | 4,588,605 | |

| Covanta Holding Corp., 7.25%, 2020 | | | 3,565,000 | | | | 3,927,222 | |

| Covanta Holding Corp., 6.375%, 2022 | | | 850,000 | | | | 927,658 | |

| EDP Finance B.V., 6%, 2018 (n) | | | 4,590,000 | | | | 4,853,925 | |

| Energy Future Holdings Corp., 10%, 2020 | | | 9,606,000 | | | | 11,022,885 | |

| Energy Future Holdings Corp., 10%, 2020 (z) | | | 3,565,000 | | | | 4,081,925 | |

| Energy Future Holdings Corp., 11.75%, 2022 (n) | | | 2,510,000 | | | | 2,858,263 | |

| GenOn Energy, Inc., 9.875%, 2020 | | | 4,555,000 | | | | 5,238,250 | |

| NRG Energy, Inc., 8.25%, 2020 | | | 3,950,000 | | | | 4,463,500 | |

| Texas Competitive Electric Holdings Co. LLC, 11.5%, 2020 (n) | | | 1,345,000 | | | | 1,062,550 | |

| | | | | | | | |

| | | | | | | $ | 52,153,083 | |

| Total Bonds (Identified Cost, $1,070,331,598) | | | | | | $ | 1,127,625,245 | |

| | |

| Floating Rate Loans (g)(r) - 0.2% | | | | | | | | |

| Financial Institutions - 0.1% | | | | | | | | |

| Springleaf Finance Corp., Term Loan, 5.5%, 2017 | | $ | 1,315,949 | | | $ | 1,318,251 | |

| | |

| Utilities - Electric Power - 0.1% | | | | | | | | |

| Dynegy Holdings, Inc., Term Loan B, 9.25%, 2016 | | $ | 426,339 | | | $ | 444,154 | |

| Dynegy Holdings, Inc., Term Loan B1, 9.25%, 2016 | | | 322,338 | | | | 334,425 | |

| | | | | | | | |

| | | | | | | $ | 778,579 | |

| Total Floating Rate Loans (Identified Cost, $2,048,643) | | | | | | $ | 2,096,830 | |

24

Portfolio of Investments – continued

| | | | | | | | |

| Common Stocks - 0.1% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| Automotive - 0.0% | | | | | | | | |

| Accuride Corp. (a) | | | 65,068 | | | $ | 244,656 | |

| | |

| Broadcasting - 0.1% | | | | | | | | |

| New Young Broadcasting Holding Co., Inc. (a) | | | 213 | | | $ | 798,750 | |

| | |

| Chemicals - 0.0% | | | | | | | | |

| LyondellBasell Industries N.V., “A” | | | 198 | | | $ | 12,557 | |

| | |

| Printing & Publishing - 0.0% | | | | | | | | |

| American Media Operations, Inc. (a) | | | 76,223 | | | $ | 362,059 | |

| Total Common Stocks (Identified Cost, $2,582,143) | | | | | | $ | 1,418,022 | |

| | |

| Convertible Preferred Stocks - 0.2% | | | | | | | | |

| Automotive - 0.2% | | | | | | | | |

| General Motors Co., 4.75% (Identified Cost, $2,883,804) | | $ | 59,470 | | | $ | 2,576,240 | |

| | |

| Convertible Bonds - 0.3% | | | | | | | | |

| Network & Telecom - 0.3% | | | | | | | | |

Nortel Networks Corp., 2.125%, 2014

(Identified Cost, $4,289,100) (a)(d) | | $ | 4,345,000 | | | $ | 4,323,275 | |

| | |

| Preferred Stocks - 0.4% | | | | | | | | |

| Other Banks & Diversified Financials - 0.4% | | | | | | | | |

| Ally Financial, Inc., 7% (z) | | | 2,489 | | | $ | 2,429,186 | |

| GMAC Capital Trust I, 8.125% | | | 90,100 | | | | 2,402,967 | |

| Total Preferred Stocks (Identified Cost, $4,658,622) | | | | | | $ | 4,832,153 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Strike Price | | | First Exercise | | | | | | | |

| Warrants - 0.1% | | | | | | | | | | | | | |

| Broadcasting - 0.1% | | | | | | | | | |

| New Young Broadcasting Holding Co., Inc. (1 share for 1 warrant) (Identified Cost, $513,055) (a) | | $ | 0.01 | | | | 7/14/10 | | | | 263 | | | $ | 986,250 | |

| | |

| Issuer/Expiration Date/Strike Price | | | Number

of

Contracts | | | | |

| Call Options Purchased - 0.1% | | | | | | | | | |

| Russell 2000 Index - March 2013 @ 925 (Premiums Paid, $949,774) | | | | 1,253 | | | $ | 1,105,146 | |

25

Portfolio of Investments – continued

| | | | | | | | |

| Money Market Funds - 5.1% | | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

MFS Institutional Money Market Portfolio, 0.14%,

at Cost and Net Asset Value (v) | | | 62,312,638 | | | $ | 62,312,638 | |

| Total Investments (Identified Cost, $1,150,569,377) | | | | | | $ | 1,207,275,799 | |

| | |

| Other Assets, Less Liabilities - 1.3% | | | | | | | 15,754,346 | |

| Net Assets - 100.0% | | | | | | $ | 1,223,030,145 | |

| (a) | Non-income producing security. |

| (d) | In default. Interest and/or scheduled principal payment(s) have been missed. |

| (g) | The rate shown represents a weighted average coupon rate on settled positions at period end, unless otherwise indicated. |

| (i) | Interest only security for which the fund receives interest on notional principal (Par amount). Par amount shown is the notional principal and does not reflect the cost of the security. |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $322,153,135 representing 26.3% of net assets. |

| (p) | Payment-in-kind security. |

| (r) | Remaining maturities of floating rate loans may be less than stated maturities shown as a result of contractual or optional prepayments by the borrower. Such prepayments cannot be predicted with certainty. These loans may be subject to restrictions on resale. Floating rate loans generally have rates of interest which are determined periodically by reference to a base lending rate plus a premium. |

| (v) | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

| (z) | Restricted securities are not registered under the Securities Act of 1933 and are subject to legal restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are subsequently registered. Disposal of these securities may involve time-consuming negotiations and prompt sale at an acceptable price may be difficult. The fund holds the following restricted securities: |

| | | | | | | | | | |

| Restricted Securities | | Acquisition Date | | Cost | | | Value | |

| Ally Financial, Inc., 7% (Preferred Stock) | | 4/13/11-11/27/12 | | | $2,370,188 | | | | $2,429,186 | |

| American Media, Inc., 13.5%, 2018 | | 12/28/10 | | | 301,291 | | | | 260,268 | |

| Ardagh Packaging Finance PLC , 7%, 2020 | | 1/16/13 | | | 1,210,000 | | | | 1,219,075 | |

| Atlas Pipeline Partners LP, 5.875%, 2023 | | 1/28/13 | | | 1,865,000 | | | | 1,860,338 | |

| Aviation Capital Group, 4.625%, 2018 | | 1/14/13 | | | 985,000 | | | | 997,889 | |

| BC Mountain LLC, 7%, 2021 | | 1/25/13 | | | 375,000 | | | | 384,375 | |

| Bombardier, Inc., 4.25%, 2016 | | 1/09/13 | | | 715,000 | | | | 736,450 | |

| CWCapital Cobalt Ltd., CDO, “E2”, 6%, 2045 | | 3/20/06-11/25/12 | | | 1,228,919 | | | | 12,690 | |

| CWCapital Cobalt Ltd., CDO, “F”, FRN, 1.6%, 2050 | | 4/12/06-1/26/13 | | | 644,319 | | | | 1,611 | |

| CWCapital Cobalt Ltd., CDO, “G”, FRN, 1.801%, 2050 | | 4/12/06-1/26/13 | | | 2,009,514 | | | | 5,024 | |

26

Portfolio of Investments – continued

| | | | | | | | | | |

| Restricted Securities - continued | | Acquisition Date | | Cost | | | Value | |

| Clearwater Paper Corp., 4.5%, 2023 | | 1/17/13 | | | $500,000 | | | | $496,250 | |

| Crown Americas LLC, 4.5%, 2023 | | 1/03/13 | | | 2,030,000 | | | | 1,999,550 | |

| Dematic S.A., 7.75%, 2020 | | 12/13/12 | | | 2,195,000 | | | | 2,244,388 | |

| Eagle Spinco, Inc., 4.625%, 2021 | | 1/17/13 | | | 625,000 | | | | 628,906 | |

| Energy Future Holdings Corp., 10%, 2020 | | 1/07/10-9/10/12 | | | 3,774,580 | | | | 4,081,925 | |

| Falcon Franchise Loan LLC, FRN, 6.542%, 2025 | | 1/29/03 | | | 169,898 | | | | 332,402 | |

| Flash Dutch 2 B.V./U.S. Coatings Acquisition, 7.375%, 2021 | | 1/16/13 | | | 520,000 | | | | 535,600 | |

| Fresenius Medical Care Capital Trust III, 5.875%, 2022 | | 1/24/13 | | | 1,121,496 | | | | 1,108,888 | |

| G-Force LLC, CDO, “A2”, 4.83%, 2036 | | 1/20/11-2/14/11 | | | 1,697,035 | | | | 1,755,259 | |

| Georgia Gulf Corp., 4.875%, 2023 | | 1/17/13 | | | 255,000 | | | | 256,913 | |

| Gibraltar Industries, Inc., 6.25%, 2021 | | 1/18/13 | | | 500,000 | | | | 519,375 | |

| HD Supply, Inc., 10.5%, 2021 | | 1/09/13 | | | 260,000 | | | | 265,850 | |

| Heckler & Koch GmbH, 9.5%, 2018 | | 5/06/11-1/02/13 | | | 2,350,479 | | | | 2,106,498 | |

| Heckmann Corp., 9.875%, 2018 | | 10/26/12 | | | 766,847 | | | | 807,075 | |

| Jaguar Land Rover PLC, 5.625%, 2023 | | 1/23/13 | | | 1,055,000 | | | | 1,076,100 | |

| LBI Media, Inc., 13.5% to 2015, 11.5% to 2020 | | 1/02/13 | | | 390,656 | | | | 377,610 | |

| Lear Corp., 4.75%, 2023 | | 1/14/13 | | | 885,000 | | | | 880,575 | |

| Local TV Finance LLC, 9.25%, 2015 | | 12/10/07-12/06/12 | | | 2,921,390 | | | | 2,953,106 | |

| Morgan Stanley Capital I, Inc., FRN, 1.384%, 2039 | | 7/20/04 | | | 180,416 | | | | 134,901 | |

| NXP B.V., 5.75%, 2021 | | 1/31/13 | | | 870,000 | | | | 870,000 | |

| Netflix, Inc., 5.375%, 2021 | | 1/29/13-1/30/13 | | | 1,767,356 | | | | 1,756,175 | |

| Neustar, Inc., 4.5%, 2023 | | 1/11/13-1/16/13 | | | 1,399,645 | | | | 1,400,000 | |

| Sabine Pass Liquefaction, 5.625%, 2021 | | 1/29/13 | | | 805,000 | | | | 808,019 | |

| Tenet Healthcare Corp., 4.5%, 2021 | | 1/22/13 | | | 1,250,000 | | | | 1,229,687 | |

| Unifrax I LLC, 7.5%, 2019 | | 1/31/13 | | | 510,000 | | | | 510,000 | |

| Total Restricted Securities | | | | $37,041,958 | |

| % of Net assets | | | | 3.0% | |

The following abbreviations are used in this report and are defined:

| CDO | | Collateralized Debt Obligation |

| FRN | | Floating Rate Note. Interest rate resets periodically and may not be the rate reported at period end. |

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below:

27