UNITED STATES

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02794

MFS SERIES TRUST III

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199 (Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111Huntington Avenue Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant's telephone number, including area code: (617) 954-5000

Date of fiscal year end: January 31

Date of reporting period: January 31, 2024

ITEM 1. REPORTS TO STOCKHOLDERS.

Item 1(a):

Annual Report

January 31, 2024

| 1 |

| 3 |

| 5 |

| 8 |

| 10 |

| 24 |

| 26 |

| 28 |

| 29 |

| 35 |

| 50 |

| 52 |

| 56 |

| 56 |

| 56 |

| 56 |

| 56 |

| 57 |

The report is prepared for the general information of shareholders. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Portfolio structure (i)

Top five industries (i)

| Cable TV | 7.9% |

| Medical & Health Technology & Services | 5.7% |

| Midstream | 4.6% |

| Financial Institutions | 4.3% |

| Consumer Services | 4.1% |

Composition including fixed income credit quality (a)(i)

| BBB | 1.2% |

| BB | 39.5% |

| B | 40.2% |

| CCC | 12.9% |

| CC | 0.2% |

| U.S. Government | 0.5% |

| Not Rated | 0.2% |

| Non-Fixed Income | 0.1% |

| Cash & Cash Equivalents | 5.0% |

| Other | 0.2% |

Portfolio facts

| Average Duration (d) | 3.1 |

| Average Effective Maturity (m) | 4.4 yrs. |

| (a) | For all securities other than those specifically described below, ratings are assigned to underlying securities utilizing ratings from Moody’s, Fitch, and Standard & Poor’s rating agencies and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). Securities rated BBB or higher are considered investment grade. All ratings are subject to change. Not Rated includes fixed income securities and fixed income derivatives that have not been rated by any rating agency. Non-Fixed Income includes equity securities (including convertible bonds and equity derivatives), ETFs and Options on ETFs, and/or commodity-linked derivatives. The fund may or may not have held all of these instruments on this date. The fund is not rated by these agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value due to the interest rate move. The Average Duration calculation reflects the impact of the equivalent exposure of derivative positions, if any. |

Portfolio Composition - continued

| (i) | For purposes of this presentation, the components include the value of securities, and reflect the impact of the equivalent exposure of derivative positions, if any. These amounts may be negative from time to time. Equivalent exposure is a calculated amount that translates the derivative position into a reasonable approximation of the amount of the underlying asset that the portfolio would have to hold at a given point in time to have the same price sensitivity that results from the portfolio’s ownership of the derivative contract. When dealing with derivatives, equivalent exposure is a more representative measure of the potential impact of a position on portfolio performance than value. The bond component will include any accrued interest amounts. |

| (m) | In determining each instrument’s effective maturity for purposes of calculating the fund’s dollar-weighted average effective maturity, MFS uses the instrument’s stated maturity or, if applicable, an earlier date on which MFS believes it is probable that a maturity-shortening feature (such as a put, pre-refunding or prepayment) will cause the instrument to be repaid. Such an earlier date can be substantially shorter than the instrument’s stated maturity. |

Where the fund holds convertible bonds, they are treated as part of the equity portion of the portfolio.

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Other includes equivalent exposure from currency derivatives and/or any offsets to derivative positions and may be negative.

Percentages are based on net assets as of January 31, 2024.

The portfolio is actively managed and current holdings may be different.

Management Review

Summary of Results

For the twelve months ended January 31, 2024, Class A shares of the MFS High Income Fund (fund) provided a total return of 8.13%, at net asset value. This compares with a return of 9.28% for the fund’s benchmark, the Bloomberg U.S. Corporate High-Yield 2% Issuer Capped Index.

Market Environment

During the reporting period, central banks around the world had to combat the strongest inflationary pressures in four decades, fueled by the global fiscal response to the pandemic, disrupted supply chains and the dislocations to energy markets stemming from the war in Ukraine. Interest rates rose substantially, but the effects of a tighter monetary policy may not have been fully experienced yet, given that monetary policy works with long and variable lags. Strains resulting from the abrupt tightening of monetary policy began to affect some parts of the economy, most acutely among small and regional US banks, which suffered from deposit flight as depositors sought higher yields on their savings. Additionally, activity in the US housing sector has slowed as a result of higher mortgage rates. China’s abandonment of its Zero-COVID policy ushered in a brief uptick in economic activity in the world’s second-largest economy in early 2023, although its momentum soon stalled as the focus turned to the country’s highly indebted property development sector. In developed markets, consumer demand for services remained stronger than the demand for goods.

Despite the challenging macroeconomic and geopolitical environment, central banks focused on controlling price pressures while also confronting increasing financial stability concerns. Central banks had to juggle achieving their inflation mandates while using tools aimed at safeguarding the stability of the financial system to keep banking systems liquid as banks grappled with exposures to commercial real estate. As inflationary pressures eased toward the end of the period, financial conditions loosened in anticipation of easier monetary policy, boosting the market’s appetite for risk as near-term recession risks diminished. Rapid advancements in artificial intelligence were a focus for investors.

Normalizing supply chains, low levels of unemployment across developed markets and signs that inflation levels have peaked were supportive factors for the macroeconomic backdrop.

Detractors from Performance

Relative to the Bloomberg U.S. Corporate High-Yield 2% Issuer Capped Index, the fund’s underweight allocation to “CC” rated(r) bonds and overweight allocation to “BBB” rated bonds detracted from performance. Security selection within the “B” and “CCC” rated credit quality segments also hindered relative returns.

From a sector perspective, bond selection within both the technology and finance sectors also weakened relative performance.

The fund's yield curve(y) positioning further detracted from relative performance.

Management Review - continued

Top individual detractors for the reporting period included the fund’s overweight positions in graphite electrode manufacturer GrafTech Finance (basic industry) and media and entertainment services provider iHeartMedia(h) (communications).

The fund’s cash and/or cash equivalents position during the period was also a detractor from relative performance.

Contributors to Performance

From a quality perspective, favorable bond selection within the “BB” rated credit quality segment contributed to the fund’s relative performance.

From a sector perspective, the fund’s overweight allocation to the brokerage sector and underweight allocation to the transportation sector boosted relative returns. Bond selection within the insurance sector also supported relative results.

Top individual contributors for the reporting period included the fund’s overweight positions in American Irish-domiciled mass customization business operator Cimpress (communications) and British telecommunications company Virgin Media Finance (communications).

Respectfully,

Portfolio Manager(s)

David Cole and Michael Skatrud

| (h) | Security was not held in the portfolio at period end. |

| (r) | Securities rated “BBB”, “Baa”, or higher are considered investment grade; securities rated “BB”, “Ba”, or below are considered non-investment grade. Ratings are assigned to underlying securities utilizing ratings from Moody's, Fitch, and Standard & Poor's and applying the following hierarchy: If all three agencies provide a rating, the middle rating (after dropping the highest and lowest ratings) is assigned; if two of the three agencies rate a security, the lower of the two is assigned. If none of the 3 rating agencies above assign a rating, but the security is rated by DBRS Morningstar, then the DBRS Morningstar rating is assigned. If none of the 4 rating agencies listed above rate the security, but the security is rated by the Kroll Bond Rating Agency (KBRA), then the KBRA rating is assigned. Ratings are shown in the S&P and Fitch scale (e.g., AAA). For securities that are not rated by any of the rating agencies, the security is considered Not Rated. |

| (y) | A yield curve graphically depicts the yields of different maturity bonds of the same credit quality and type; a normal yield curve is upward sloping, with short-term rates lower than long-term rates. |

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

Performance Summary THROUGH 1/31/24

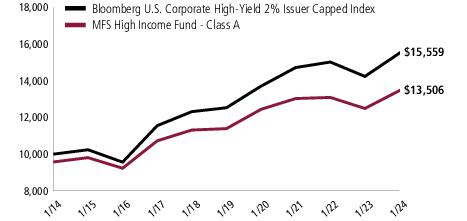

The following chart illustrates a representative class of the fund’s historical performance in comparison to its benchmark(s). Performance results include the deduction of the maximum applicable sales charge and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. The performance of other share classes will be greater than or less than that of the class depicted below. Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect sales charges, commissions or expenses. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your shares, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on fund distributions or the redemption of fund shares.

Growth of a Hypothetical $10,000 Investment

Performance Summary - continued

Total Returns through 1/31/24

Average annual without sales charge

| Share Class | Class Inception Date | 1-yr | 5-yr | 10-yr |

| A | 2/17/1978 | 8.13% | 3.46% | 3.50% |

| B | 9/27/1993 | 7.34% | 2.69% | 2.73% |

| C | 1/03/1994 | 7.32% | 2.70% | 2.73% |

| I | 1/02/1997 | 8.41% | 3.72% | 3.75% |

| R1 | 4/01/2005 | 7.33% | 2.69% | 2.73% |

| R2 | 10/31/2003 | 7.88% | 3.07% | 3.17% |

| R3 | 4/01/2005 | 8.14% | 3.39% | 3.46% |

| R4 | 4/01/2005 | 8.39% | 3.72% | 3.76% |

| R6 | 6/01/2012 | 8.52% | 3.84% | 3.86% |

Comparative benchmark(s)

| Bloomberg U.S. Corporate High-Yield 2% Issuer Capped Index (f) | 9.28% | 4.43% | 4.52% |

Average annual with sales charge

| | | | |

A

With Initial Sales Charge (4.25%) | 3.54% | 2.57% | 3.05% |

B

With CDSC (Declining over six years from 4% to 0%) (v) | 3.34% | 2.36% | 2.73% |

C

With CDSC (1% for 12 months) (v) | 6.32% | 2.70% | 2.73% |

CDSC – Contingent Deferred Sales Charge.

Class I, R1, R2, R3, R4, and R6 shares do not have a sales charge.

| (f) | Source: FactSet Research Systems Inc. |

| (v) | Assuming redemption at the end of the applicable period. |

Benchmark Definition(s)

Bloomberg U.S. Corporate High-Yield 2% Issuer Capped Index(a) – a component of the Bloomberg U.S. Corporate High-Yield Index, which measures performance of non-investment grade, fixed rate debt. The index limits the maximum exposure to any one issuer to 2%.

It is not possible to invest directly in an index.

| (a) | Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith. |

Performance Summary - continued

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund's performance results would be less favorable. Please see the prospectus and financial statements for complete details.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

Expense Table

Fund expenses borne by the shareholders during the period,

August 1, 2023 through January 31, 2024

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on certain purchase or redemption payments, and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period August 1, 2023 through January 31, 2024.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Expense Table - continued

Share

Class | | Annualized

Expense

Ratio | Beginning

Account Value

8/01/23 | Ending

Account Value

1/31/24 | Expenses

Paid During

Period (p)

8/01/23-1/31/24 |

| A | Actual | 0.87% | $1,000.00 | $1,057.93 | $4.51 |

| Hypothetical (h) | 0.87% | $1,000.00 | $1,020.82 | $4.43 |

| B | Actual | 1.62% | $1,000.00 | $1,050.52 | $8.37 |

| Hypothetical (h) | 1.62% | $1,000.00 | $1,017.04 | $8.24 |

| C | Actual | 1.62% | $1,000.00 | $1,053.92 | $8.39 |

| Hypothetical (h) | 1.62% | $1,000.00 | $1,017.04 | $8.24 |

| I | Actual | 0.62% | $1,000.00 | $1,059.35 | $3.22 |

| Hypothetical (h) | 0.62% | $1,000.00 | $1,022.08 | $3.16 |

| R1 | Actual | 1.62% | $1,000.00 | $1,050.51 | $8.37 |

| Hypothetical (h) | 1.62% | $1,000.00 | $1,017.04 | $8.24 |

| R2 | Actual | 1.12% | $1,000.00 | $1,053.27 | $5.80 |

| Hypothetical (h) | 1.12% | $1,000.00 | $1,019.56 | $5.70 |

| R3 | Actual | 0.87% | $1,000.00 | $1,054.49 | $4.51 |

| Hypothetical (h) | 0.87% | $1,000.00 | $1,020.82 | $4.43 |

| R4 | Actual | 0.62% | $1,000.00 | $1,055.69 | $3.21 |

| Hypothetical (h) | 0.62% | $1,000.00 | $1,022.08 | $3.16 |

| R6 | Actual | 0.51% | $1,000.00 | $1,059.83 | $2.65 |

| Hypothetical (h) | 0.51% | $1,000.00 | $1,022.63 | $2.60 |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses paid do not include any applicable sales charges (loads). If these transaction costs had been included, your costs would have been higher. |

Portfolio of Investments

1/31/24

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| Issuer | | | Shares/Par | Value ($) |

| Bonds – 93.3% |

| Aerospace & Defense – 3.5% |

| Bombardier, Inc., 7.125%, 6/15/2026 (n) | | $ | 2,800,000 | $2,823,332 |

| Bombardier, Inc., 7.5%, 2/01/2029 (n) | | | 2,639,000 | 2,689,822 |

| Bombardier, Inc., 8.75%, 11/15/2030 (n) | | | 1,861,000 | 1,953,041 |

| F-Brasile S.p.A./F-Brasile U.S. LLC, 7.375%, 8/15/2026 (n) | | | 5,985,000 | 5,917,669 |

| Moog, Inc., 4.25%, 12/15/2027 (n) | | | 6,263,000 | 5,864,172 |

| Spirit AeroSystems, Inc., 9.75%, 11/15/2030 (n) | | | 8,610,000 | 9,036,715 |

| TransDigm, Inc., 6.25%, 3/15/2026 (n) | | | 5,592,000 | 5,553,968 |

| TransDigm, Inc., 5.5%, 11/15/2027 | | | 6,679,000 | 6,498,057 |

| TransDigm, Inc., 6.75%, 8/15/2028 (n) | | | 5,455,000 | 5,544,260 |

| TransDigm, Inc., 4.625%, 1/15/2029 | | | 5,570,000 | 5,208,340 |

| TransDigm, Inc., 6.875%, 12/15/2030 (n) | | | 10,590,000 | 10,837,912 |

| | | | | $61,927,288 |

| Airlines – 0.8% |

| Air Canada, 3.875%, 8/15/2026 (n) | | $ | 8,791,000 | $8,360,933 |

| American Airlines, Inc./AAdvantage Loyalty IP Ltd., 5.75%, 4/20/2029 (n) | | | 5,921,219 | 5,814,814 |

| | | | | $14,175,747 |

| Apparel Manufacturers – 0.2% |

| Wolverine World Wide, Inc., 4%, 8/15/2029 (n) | | $ | 4,307,000 | $3,470,581 |

| Asset-Backed & Securitized – 0.0% |

| COBALT CMBS Commercial Mortgage Trust, 2006-2A, “F”, CDO, FLR, 5.627% ((SOFR - 3mo. + 0.26161%) + 1.3% Cash or PIK) to 4/26/2050 (a)(n)(p) | | $ | 858,042 | $86 |

| COBALT CMBS Commercial Mortgage Trust, 2006-2A, “G”, CDO, FLR, 5.827% ((SOFR - 3mo. + 0.26161%) + 1.5% Cash or PIK) to 4/26/2050 (a)(n)(p) | | | 2,734,631 | 273 |

| | | | | $359 |

| Automotive – 1.7% |

| Clarios Global LP/Clarios U.S. Finance Co., 8.5%, 5/15/2027 (n) | | $ | 5,579,000 | $5,563,708 |

| Clarios Global LP/Clarios U.S. Finance Co., 6.75%, 5/15/2028 (n) | | | 2,546,000 | 2,579,785 |

| Dana, Inc., 5.375%, 11/15/2027 | | | 4,884,000 | 4,766,296 |

| Dana, Inc., 4.25%, 9/01/2030 | | | 3,189,000 | 2,788,366 |

| Dornoch Debt Merger Sub, Inc., 6.625%, 10/15/2029 (n) | | | 5,301,000 | 4,811,816 |

| Real Hero Merger Sub 2, Inc., 6.25%, 2/01/2029 (n) | | | 4,358,000 | 3,780,826 |

| Wabash National Corp., 4.5%, 10/15/2028 (n) | | | 5,922,000 | 5,389,020 |

| | | | | $29,679,817 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Broadcasting – 0.8% |

| AMC Networks, Inc., 4.75%, 8/01/2025 | | $ | 1,614,000 | $1,555,132 |

| Banijay Group S.A.S., 8.125%, 5/01/2029 (n) | | | 5,697,000 | 5,890,683 |

| Midas OpCo Holdings LLC, 5.625%, 8/15/2029 (n) | | | 7,317,000 | 6,695,494 |

| | | | | $14,141,309 |

| Brokerage & Asset Managers – 1.9% |

| AG TTMT Escrow Issuer LLC, 8.625%, 9/30/2027 (n) | | $ | 4,740,000 | $4,920,773 |

| Aretec Escrow Issuer 2, Inc., 10%, 8/15/2030 (n) | | | 5,294,000 | 5,717,637 |

| Aretec Escrow Issuer, Inc., 7.5%, 4/01/2029 (n) | | | 4,781,000 | 4,450,258 |

| LPL Holdings, Inc., 4%, 3/15/2029 (n) | | | 3,699,000 | 3,409,069 |

| LPL Holdings, Inc., 4.375%, 5/15/2031 (n) | | | 5,239,000 | 4,762,199 |

| NFP Corp., 4.875%, 8/15/2028 (n) | | | 5,810,000 | 5,762,939 |

| NFP Corp., 6.875%, 8/15/2028 (n) | | | 4,582,000 | 4,607,682 |

| | | | | $33,630,557 |

| Building – 3.8% |

| ABC Supply Co., Inc., 3.875%, 11/15/2029 (n) | | $ | 3,452,000 | $3,075,891 |

| Foundation Building Materials LLC, 6%, 3/01/2029 (n) | | | 6,382,000 | 5,608,182 |

| GYP Holding III Corp., 4.625%, 5/01/2029 (n) | | | 8,115,000 | 7,517,006 |

| Interface, Inc., 5.5%, 12/01/2028 (n) | | | 6,297,000 | 5,892,984 |

| MIWD Holdco II LLC/MIWD Finance Co., 5.5%, 2/01/2030 (n) | | | 5,263,000 | 4,789,330 |

| New Enterprise Stone & Lime Co., Inc., 5.25%, 7/15/2028 (n) | | | 6,907,000 | 6,636,245 |

| New Enterprise Stone & Lime Co., Inc., 9.75%, 7/15/2028 (n) | | | 2,174,000 | 2,185,621 |

| Patrick Industries, Inc., 7.5%, 10/15/2027 (n) | | | 7,298,000 | 7,334,490 |

| SRM Concrete, 8.875%, 11/15/2031 (n) | | | 7,309,000 | 7,678,552 |

| Standard Industries, Inc., 4.75%, 1/15/2028 (n) | | | 3,317,000 | 3,172,455 |

| Standard Industries, Inc., 4.375%, 7/15/2030 (n) | | | 8,162,000 | 7,417,237 |

| White Cap Buyer LLC, 6.875%, 10/15/2028 (n) | | | 6,517,000 | 6,378,970 |

| | | | | $67,686,963 |

| Business Services – 1.2% |

| Entegris Escrow Corp., 5.95%, 6/15/2030 (n) | | $ | 2,890,000 | $2,854,674 |

| Iron Mountain, Inc., 4.875%, 9/15/2027 (n) | | | 4,410,000 | 4,261,425 |

| Iron Mountain, Inc., 5.25%, 3/15/2028 (n) | | | 4,853,000 | 4,706,471 |

| Verscend Escrow Corp., 9.75%, 8/15/2026 (n) | | | 8,785,000 | 8,820,008 |

| | | | | $20,642,578 |

| Cable TV – 7.7% |

| Cable One, Inc., 4%, 11/15/2030 (n) | | $ | 9,956,000 | $8,014,580 |

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.125%, 5/01/2027 (n) | | | 3,761,000 | 3,627,545 |

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.75%, 3/01/2030 (n) | | | 20,365,000 | 18,096,488 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Cable TV – continued |

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.5%, 8/15/2030 (n) | | $ | 10,984,000 | $9,552,347 |

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.25%, 2/01/2031 (n) | | | 5,651,000 | 4,778,182 |

| CCO Holdings LLC/CCO Holdings Capital Corp., 4.25%, 1/15/2034 (n) | | | 4,218,000 | 3,353,742 |

| CSC Holdings LLC, 5.375%, 2/01/2028 (n) | | | 8,240,000 | 7,078,860 |

| CSC Holdings LLC, 7.5%, 4/01/2028 (n) | | | 3,000,000 | 1,997,033 |

| CSC Holdings LLC, 11.75%, 1/31/2029 (n) | | | 3,339,000 | 3,391,523 |

| CSC Holdings LLC, 5.75%, 1/15/2030 (n) | | | 7,090,000 | 3,752,666 |

| CSC Holdings LLC, 4.125%, 12/01/2030 (n) | | | 2,725,000 | 1,968,813 |

| DIRECTV Financing LLC, 8.875%, 2/01/2030 (n) | | | 1,308,000 | 1,334,233 |

| DISH DBS Corp., 7.75%, 7/01/2026 | | | 3,815,000 | 2,247,893 |

| DISH DBS Corp., 5.25%, 12/01/2026 (n) | | | 4,675,000 | 3,681,586 |

| DISH DBS Corp., 5.125%, 6/01/2029 | | | 3,990,000 | 1,528,365 |

| DISH Network Corp., 11.75%, 11/15/2027 (n) | | | 2,540,000 | 2,651,013 |

| LCPR Senior Secured Financing DAC, 6.75%, 10/15/2027 (n) | | | 7,318,000 | 7,049,149 |

| LCPR Senior Secured Financing DAC, 5.125%, 7/15/2029 (n) | | | 1,905,000 | 1,676,514 |

| Sirius XM Radio, Inc., 4%, 7/15/2028 (n) | | | 3,246,000 | 2,947,719 |

| Sirius XM Radio, Inc., 5.5%, 7/01/2029 (n) | | | 10,470,000 | 9,946,500 |

| Sirius XM Radio, Inc., 3.875%, 9/01/2031 (n) | | | 4,977,000 | 4,149,320 |

| Videotron Ltd., 5.125%, 4/15/2027 (n) | | | 4,027,000 | 3,966,595 |

| Videotron Ltd., 3.625%, 6/15/2029 (n) | | | 3,653,000 | 3,333,180 |

| Virgin Media Finance PLC, 5%, 7/15/2030 (n) | | | 9,220,000 | 8,234,472 |

| Virgin Media Vendor Financing Notes IV DAC, 5%, 7/15/2028 (n) | | | 8,403,000 | 7,910,191 |

| Ziggo Bond Finance B.V., 5.125%, 2/28/2030 (n) | | | 13,965,000 | 11,781,775 |

| | | | | $138,050,284 |

| Chemicals – 2.4% |

| Axalta Coating Systems Ltd., 4.75%, 6/15/2027 (n) | | $ | 5,414,000 | $5,211,570 |

| Axalta Coating Systems Ltd., 3.375%, 2/15/2029 (n) | | | 2,331,000 | 2,071,418 |

| Element Solutions, Inc., 3.875%, 9/01/2028 (n) | | | 5,613,000 | 5,127,757 |

| LSF11 A5 HoldCo LLC, 6.625%, 10/15/2029 (n) | | | 6,382,000 | 5,403,233 |

| SCIH Salt Holdings, Inc., 6.625%, 5/01/2029 (n) | | | 6,408,000 | 5,820,733 |

| SCIL IV LLC/SCIL USA Holdings LLC, 9.5%, 7/15/2028 (n) | | EUR | 3,080,000 | 3,591,512 |

| SNF Group SACA, 3.375%, 3/15/2030 (n) | | $ | 9,169,000 | 7,874,940 |

| Windsor Holdings III, LLC, 8.5%, 6/15/2030 (n) | | | 7,879,000 | 8,111,465 |

| | | | | $43,212,628 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Computer Software – 0.6% |

| Central Parent LLC/CDK Global II LLC/CDK Financing Co., Inc., 8%, 6/15/2029 (n) | | $ | 5,344,000 | $5,484,654 |

| Dun & Bradstreet Corp., 5%, 12/15/2029 (n) | | | 5,809,000 | 5,400,274 |

| | | | | $10,884,928 |

| Computer Software - Systems – 1.6% |

| Fair Isaac Corp., 5.25%, 5/15/2026 (n) | | $ | 10,153,000 | $10,026,088 |

| Sabre GLBL, Inc., 8.625%, 6/01/2027 (n) | | | 3,349,000 | 3,131,316 |

| Sabre GLBL, Inc., 11.25%, 12/15/2027 (n) | | | 2,577,000 | 2,580,221 |

| SS&C Technologies Holdings, Inc., 5.5%, 9/30/2027 (n) | | | 10,611,000 | 10,416,163 |

| Virtusa Corp., 7.125%, 12/15/2028 (n) | | | 3,340,000 | 2,928,909 |

| | | | | $29,082,697 |

| Conglomerates – 3.1% |

| BWX Technologies, Inc., 4.125%, 6/30/2028 (n) | | $ | 4,184,000 | $3,928,023 |

| BWX Technologies, Inc., 4.125%, 4/15/2029 (n) | | | 10,769,000 | 9,975,540 |

| Chart Industries, Inc., 9.5%, 1/01/2031 (n) | | | 3,579,000 | 3,817,101 |

| Emerald Debt Merger, 6.625%, 12/15/2030 (n) | | | 7,608,000 | 7,684,613 |

| Gates Global LLC, 6.25%, 1/15/2026 (n) | | | 4,509,000 | 4,509,451 |

| Griffon Corp., 5.75%, 3/01/2028 | | | 6,482,000 | 6,352,360 |

| Madison IAQ LLC, 5.875%, 6/30/2029 (n) | | | 5,538,000 | 4,921,011 |

| Regal Rexnord Corp., 6.3%, 2/15/2030 (n) | | | 4,286,000 | 4,405,535 |

| TriMas Corp., 4.125%, 4/15/2029 (n) | | | 11,496,000 | 10,235,129 |

| | | | | $55,828,763 |

| Construction – 0.7% |

| Mattamy Group Corp., 5.25%, 12/15/2027 (n) | | $ | 2,630,000 | $2,537,616 |

| Mattamy Group Corp., 4.625%, 3/01/2030 (n) | | | 4,490,000 | 4,093,523 |

| Weekley Homes LLC/Weekley Finance Corp., 4.875%, 9/15/2028 (n) | | | 6,179,000 | 5,758,927 |

| | | | | $12,390,066 |

| Consumer Products – 1.5% |

| Energizer Gamma Acquisition B.V., 3.5%, 6/30/2029 | | EUR | 3,000,000 | $2,869,820 |

| Energizer Holdings, Inc., 4.375%, 3/31/2029 (n) | | $ | 6,560,000 | 5,938,178 |

| HFC Prestige Products, Inc./HFC Prestige International US LLC, 6.625%, 7/15/2030 (n) | | | 7,451,000 | 7,589,365 |

| Prestige Consumer Healthcare, Inc., 5.125%, 1/15/2028 (n) | | | 6,333,000 | 6,198,867 |

| Prestige Consumer Healthcare, Inc., 3.75%, 4/01/2031 (n) | | | 4,484,000 | 3,888,421 |

| | | | | $26,484,651 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Consumer Services – 4.0% |

| Allied Universal Holdco LLC, 9.75%, 7/15/2027 (n) | | $ | 7,641,000 | $7,471,299 |

| Allied Universal Holdco LLC, 6%, 6/01/2029 (n) | | | 3,155,000 | 2,619,565 |

| Arches Buyer, Inc., 6.125%, 12/01/2028 (n) | | | 5,863,000 | 5,064,518 |

| Cushman & Wakefield PLC, 6.75%, 5/15/2028 (n) | | | 5,435,000 | 5,360,649 |

| GoDaddy, Inc., 3.5%, 3/01/2029 (n) | | | 10,458,000 | 9,468,672 |

| GW B-CR Security Corp., 9.5%, 11/01/2027 (n) | | | 6,499,000 | 6,538,225 |

| Match Group Holdings II LLC, 5%, 12/15/2027 (n) | | | 5,498,000 | 5,319,230 |

| Match Group Holdings II LLC, 4.625%, 6/01/2028 (n) | | | 8,030,000 | 7,558,800 |

| Match Group Holdings II LLC, 4.125%, 8/01/2030 (n) | | | 2,010,000 | 1,808,518 |

| Match Group Holdings II LLC, 3.625%, 10/01/2031 (n) | | | 1,095,000 | 936,225 |

| Realogy Group LLC/Realogy Co-Issuer Corp., 5.75%, 1/15/2029 (n) | | | 4,578,000 | 3,400,401 |

| Realogy Group LLC/Realogy Co-Issuer Corp., 5.25%, 4/15/2030 (n) | | | 4,445,000 | 3,125,183 |

| TriNet Group, Inc., 3.5%, 3/01/2029 (n) | | | 9,278,000 | 8,188,303 |

| WASH Multi-Family Acquisition, Inc., 5.75%, 4/15/2026 (n) | | | 5,068,000 | 4,871,970 |

| | | | | $71,731,558 |

| Containers – 2.8% |

| ARD Finance S.A., 6.5% (6.5% Cash or 7.25% PIK), 6/30/2027 (n)(p) | | $ | 2,167,000 | $1,047,073 |

| Ardagh Metal Packaging Finance USA LLC, 3.25%, 9/01/2028 (n) | | | 6,515,000 | 5,693,896 |

| Ardagh Metal Packaging Finance USA LLC, 4%, 9/01/2029 (n) | | | 7,475,000 | 6,058,274 |

| Ardagh Packaging Finance PLC/Ardagh MP Holdings USA, Inc., 5.25%, 8/15/2027 (n) | | | 7,614,000 | 5,691,326 |

| Can-Pack S.A./Eastern PA Land Investment Holding LLC, 3.875%, 11/15/2029 (n) | | | 11,149,000 | 9,825,725 |

| Crown Americas LLC, 5.25%, 4/01/2030 | | | 3,061,000 | 2,957,691 |

| Crown Americas LLC/Crown Americas Capital Corp. V, 4.25%, 9/30/2026 | | | 7,168,000 | 6,908,662 |

| Crown Americas LLC/Crown Americas Capital Corp. VI, 4.75%, 2/01/2026 | | | 3,345,000 | 3,275,349 |

| Crown European Holdings S.A., 4.75%, 3/15/2029 (n) | | EUR | 3,375,000 | 3,695,690 |

| Trivium Packaging Finance B.V., 8.5%, 8/15/2027 (n) | | $ | 4,618,000 | 4,506,235 |

| | | | | $49,659,921 |

| Electronics – 1.2% |

| Entegris, Inc., 4.375%, 4/15/2028 (n) | | $ | 4,307,000 | $4,061,852 |

| Entegris, Inc., 3.625%, 5/01/2029 (n) | | | 3,723,000 | 3,358,183 |

| Sensata Technologies B.V., 5%, 10/01/2025 (n) | | | 8,322,000 | 8,284,342 |

| Sensata Technologies B.V., 5.875%, 9/01/2030 (n) | | | 3,585,000 | 3,542,960 |

| Sensata Technologies, Inc., 4.375%, 2/15/2030 (n) | | | 1,548,000 | 1,426,396 |

| | | | | $20,673,733 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Energy - Independent – 3.6% |

| Callon Petroleum Co., 8%, 8/01/2028 (n) | | $ | 4,709,000 | $4,870,383 |

| Callon Petroleum Co., 7.5%, 6/15/2030 (n) | | | 1,575,000 | 1,659,177 |

| Civitas Resources, Inc., 8.375%, 7/01/2028 (n) | | | 4,997,000 | 5,255,405 |

| Civitas Resources, Inc., 8.625%, 11/01/2030 (n) | | | 1,555,000 | 1,658,500 |

| Civitas Resources, Inc., 8.75%, 7/01/2031 (n) | | | 3,169,000 | 3,368,977 |

| Comstock Resources, Inc., 6.75%, 3/01/2029 (n) | | | 9,001,000 | 8,265,159 |

| CrownRock LP/CrownRock Finance, Inc., “F”, 5%, 5/01/2029 (n) | | | 6,102,000 | 6,026,152 |

| Matador Resources Co., 6.875%, 4/15/2028 (n) | | | 5,936,000 | 6,078,583 |

| Moss Creek Resources Holdings, Inc., 7.5%, 1/15/2026 (n) | | | 4,570,000 | 4,553,006 |

| Permian Resources Operating LLC, 7.75%, 2/15/2026 (n) | | | 985,000 | 1,000,758 |

| Permian Resources Operating LLC, 5.875%, 7/01/2029 (n) | | | 8,270,000 | 8,088,718 |

| Permian Resources Operating LLC, 7%, 1/15/2032 (n) | | | 3,370,000 | 3,479,197 |

| Sitio Royalties Operating Partnership, LP, 7.875%, 11/01/2028 (n) | | | 6,385,000 | 6,547,658 |

| SM Energy Co., 6.5%, 7/15/2028 | | | 4,121,000 | 4,121,000 |

| | | | | $64,972,673 |

| Energy - Integrated – 0.3% |

| Citgo Petroleum Corp., 8.375%, 1/15/2029 (n) | | $ | 5,468,000 | $5,681,070 |

| Entertainment – 3.2% |

| Carnival Corp. PLC, 7.625%, 3/01/2026 (n) | | $ | 4,869,000 | $4,945,828 |

| Carnival Corp. PLC, 5.75%, 3/01/2027 (n) | | | 9,275,000 | 9,137,750 |

| Carnival Corp. PLC, 4%, 8/01/2028 (n) | | | 3,434,000 | 3,176,492 |

| Carnival Corp. PLC, 6%, 5/01/2029 (n) | | | 4,339,000 | 4,202,656 |

| Merlin Entertainments, 7.375%, 2/15/2031 (n) | | | 4,554,000 | 4,560,186 |

| NCL Corp. Ltd., 5.875%, 3/15/2026 (n) | | | 4,912,000 | 4,789,544 |

| NCL Corp. Ltd., 7.75%, 2/15/2029 (n) | | | 3,229,000 | 3,260,304 |

| Royal Caribbean Cruises Ltd., 5.375%, 7/15/2027 (n) | | | 4,580,000 | 4,506,773 |

| Royal Caribbean Cruises Ltd., 5.5%, 4/01/2028 (n) | | | 6,463,000 | 6,380,755 |

| SeaWorld Parks & Entertainment, 5.25%, 8/15/2029 (n) | | | 4,257,000 | 3,964,629 |

| Viking Cruises Ltd. Co., 5.875%, 9/15/2027 (n) | | | 2,142,000 | 2,064,502 |

| Viking Ocean Cruises Ship VII Ltd., 5.625%, 2/15/2029 (n) | | | 3,750,000 | 3,651,563 |

| VOC Escrow Ltd., 5%, 2/15/2028 (n) | | | 3,091,000 | 2,951,595 |

| | | | | $57,592,577 |

| Financial Institutions – 5.2% |

| Avation Capital S.A., 8.25% (8.25% Cash or 9% PIK), 10/31/2026 (n)(p) | | $ | 5,615,454 | $4,808,232 |

| Castlelake Aviation Finance Designated Activity Co., 5%, 4/15/2027 (n) | | | 1,295,000 | 1,229,270 |

| Credit Acceptance Corp., 6.625%, 3/15/2026 | | | 711,000 | 710,853 |

| Credit Acceptance Corp., 9.25%, 12/15/2028 (n) | | | 5,410,000 | 5,680,538 |

| Freedom Mortgage Corp., 7.625%, 5/01/2026 (n) | | | 4,284,000 | 4,266,553 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Financial Institutions – continued |

| Freedom Mortgage Holdings LLC, 9.25%, 2/01/2029 (n) | | $ | 1,344,000 | $1,360,934 |

| FTAI Aviation Ltd., 5.5%, 5/01/2028 (n) | | | 3,132,000 | 3,034,850 |

| FTAI Aviation Ltd., 7.875%, 12/01/2030 (n) | | | 3,624,000 | 3,822,548 |

| Global Aircraft Leasing Co. Ltd., 6.5% (6.5% Cash or 7.25% PIK), 9/15/2024 (n)(p) | | | 12,822,310 | 12,327,084 |

| Howard Hughes Corp., 4.125%, 2/01/2029 (n) | | | 7,819,000 | 7,051,546 |

| Jefferson Capital Holdings LLC, 9.5%, 2/15/2029 (n)(w) | | | 4,758,000 | 4,792,134 |

| Macquarie AirFinance Holdings Ltd., 8.375%, 5/01/2028 (n) | | | 6,644,000 | 6,979,190 |

| Macquarie AirFinance Holdings Ltd., 8.125%, 3/30/2029 (n) | | | 1,171,000 | 1,214,994 |

| Nationstar Mortgage Holdings, Inc., 6%, 1/15/2027 (n) | | | 9,253,000 | 9,072,761 |

| OneMain Finance Corp., 6.875%, 3/15/2025 | | | 5,245,000 | 5,264,669 |

| OneMain Finance Corp., 7.125%, 3/15/2026 | | | 7,359,000 | 7,459,329 |

| OneMain Finance Corp., 5.375%, 11/15/2029 | | | 3,690,000 | 3,414,197 |

| PRA Group, Inc., 8.375%, 2/01/2028 (n) | | | 2,152,000 | 2,049,865 |

| Rocket Mortgage Co-Issuer, Inc., 3.625%, 3/01/2029 (n) | | | 4,371,000 | 3,885,195 |

| Rocket Mortgage Co-Issuer, Inc., 3.875%, 3/01/2031 (n) | | | 1,597,000 | 1,395,475 |

| SLM Corp., 3.125%, 11/02/2026 | | | 3,280,000 | 3,071,130 |

| | | | | $92,891,347 |

| Food & Beverages – 3.0% |

| B&G Foods, Inc., 5.25%, 9/15/2027 | | $ | 2,662,000 | $2,401,001 |

| B&G Foods, Inc., 8%, 9/15/2028 (n) | | | 3,117,000 | 3,249,130 |

| Chobani LLC/Chobani Finance Corp., 7.625%, 7/01/2029 (n) | | | 537,000 | 543,692 |

| Fiesta Purchaser, Inc., 7.875%, 3/01/2031 (n)(w) | | | 4,314,000 | 4,364,344 |

| Performance Food Group Co., 5.5%, 10/15/2027 (n) | | | 6,580,000 | 6,417,468 |

| Post Holdings, Inc., 5.625%, 1/15/2028 (n) | | | 5,488,000 | 5,400,754 |

| Post Holdings, Inc., 4.625%, 4/15/2030 (n) | | | 8,465,000 | 7,784,826 |

| Primo Water Holding, Inc., 4.375%, 4/30/2029 (n) | | | 9,420,000 | 8,575,991 |

| TreeHouse Foods, Inc., 4%, 9/01/2028 | | | 5,855,000 | 5,222,660 |

| U.S. Foods Holding Corp., 4.75%, 2/15/2029 (n) | | | 7,476,000 | 7,092,985 |

| United Natural Foods, Inc., 6.75%, 10/15/2028 (n) | | | 3,487,000 | 2,929,080 |

| | | | | $53,981,931 |

| Gaming & Lodging – 3.2% |

| Caesars Entertainment, Inc., 4.625%, 10/15/2029 (n) | | $ | 3,038,000 | $2,777,090 |

| Caesars Entertainment, Inc., 7%, 2/15/2030 (n) | | | 5,461,000 | 5,611,991 |

| Caesars Entertainment, Inc., 6.5%, 2/15/2032 (n) | | | 1,614,000 | 1,631,853 |

| Caesars Resort Collection LLC/CRC Finco, Inc., 8.125%, 7/01/2027 (n) | | | 6,032,000 | 6,190,316 |

| CCM Merger, Inc., 6.375%, 5/01/2026 (n) | | | 5,550,000 | 5,481,072 |

| CDI Escrow Issuer, Inc., 5.75%, 4/01/2030 (n) | | | 7,479,000 | 7,235,407 |

| Penn National Gaming, Inc., 4.125%, 7/01/2029 (n) | | | 6,953,000 | 5,944,709 |

| Wyndham Hotels & Resorts, Inc., 4.375%, 8/15/2028 (n) | | | 6,868,000 | 6,412,332 |

| Wynn Macau Ltd., 5.5%, 10/01/2027 (n) | | | 7,053,000 | 6,631,245 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Gaming & Lodging – continued |

| Wynn Macau Ltd., 5.625%, 8/26/2028 (n) | | $ | 2,744,000 | $2,553,844 |

| Wynn Resorts Finance LLC/Wynn Resorts Capital Corp., 5.125%, 10/01/2029 (n) | | | 7,059,000 | 6,668,683 |

| | | | | $57,138,542 |

| Industrial – 1.3% |

| Albion Financing 1 S.à r.l., 6.125%, 10/15/2026 (n) | | $ | 2,500,000 | $2,455,820 |

| Albion Financing 2 S.à r.l., 8.75%, 4/15/2027 (n) | | | 3,835,000 | 3,830,950 |

| APi Escrow Corp., 4.75%, 10/15/2029 (n) | | | 8,917,000 | 8,349,165 |

| Williams Scotsman International, Inc., 4.625%, 8/15/2028 (n) | | | 8,219,000 | 7,779,900 |

| | | | | $22,415,835 |

| Insurance - Property & Casualty – 2.9% |

| Acrisure LLC/Acrisure Finance, Inc., 8.25%, 2/01/2029 (n) | | $ | 3,241,000 | $3,249,307 |

| Acrisure LLC/Acrisure Finance, Inc., 4.25%, 2/15/2029 (n) | | | 1,719,000 | 1,541,414 |

| Acrisure LLC/Acrisure Finance, Inc., 6%, 8/01/2029 (n) | | | 3,207,000 | 2,941,897 |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 6.75%, 10/15/2027 (n) | | | 4,238,000 | 4,137,644 |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 5.875%, 11/01/2029 (n) | | | 7,935,000 | 7,514,683 |

| Alliant Holdings Intermediate LLC/Alliant Holdings Co-Issuer, 7%, 1/15/2031 (n) | | | 4,222,000 | 4,266,753 |

| AmWINS Group Benefits, Inc., 4.875%, 6/30/2029 (n) | | | 6,388,000 | 5,962,224 |

| AssuredPartners, Inc., 5.625%, 1/15/2029 (n) | | | 5,395,000 | 5,095,127 |

| GTCR (AP) Finance, Inc., 8%, 5/15/2027 (n) | | | 3,620,000 | 3,626,838 |

| Hub International Ltd., 5.625%, 12/01/2029 (n) | | | 5,322,000 | 5,021,891 |

| Hub International Ltd., 7.25%, 6/15/2030 (n) | | | 4,319,000 | 4,442,813 |

| Hub International Ltd., 7.375%, 1/31/2032 (n) | | | 3,927,000 | 4,021,624 |

| | | | | $51,822,215 |

| Machinery & Tools – 0.9% |

| Husky Injection Molding Systems Ltd., 9%, 2/15/2029 (n)(w) | | $ | 537,000 | $537,000 |

| Ritchie Bros Holdings, Inc., 7.75%, 3/15/2031 (n) | | | 8,681,000 | 9,148,211 |

| Terex Corp., 5%, 5/15/2029 (n) | | | 6,081,000 | 5,746,556 |

| | | | | $15,431,767 |

| Major Banks – 0.5% |

| Toronto-Dominion Bank, 8.125% to 10/31/2027, FLR (CMT - 5yr. + 4.075%) to 10/31/2082 | | $ | 8,275,000 | $8,594,655 |

| Medical & Health Technology & Services – 5.6% |

| 180 Medical, Inc., 3.875%, 10/15/2029 (n) | | $ | 6,625,000 | $5,921,692 |

| Avantor Funding, Inc., 4.625%, 7/15/2028 (n) | | | 9,162,000 | 8,722,600 |

| Bausch & Lomb Escrow Corp., 8.375%, 10/01/2028 (n) | | | 5,625,000 | 5,836,331 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Medical & Health Technology & Services – continued |

| Charles River Laboratories International, Inc., 3.75%, 3/15/2029 (n) | | $ | 10,993,000 | $9,997,816 |

| CHS/Community Health Systems, Inc., 8%, 12/15/2027 (n) | | | 3,888,000 | 3,828,825 |

| CHS/Community Health Systems, Inc., 6.125%, 4/01/2030 (n) | | | 7,174,000 | 4,669,362 |

| CHS/Community Health Systems, Inc., 5.25%, 5/15/2030 (n) | | | 7,934,000 | 6,568,743 |

| Encompass Health Corp., 5.75%, 9/15/2025 | | | 2,365,000 | 2,349,938 |

| Encompass Health Corp., 4.75%, 2/01/2030 | | | 6,387,000 | 5,990,149 |

| Encompass Health Corp., 4.625%, 4/01/2031 | | | 1,030,000 | 946,289 |

| IQVIA, Inc., 5%, 5/15/2027 (n) | | | 9,830,000 | 9,607,202 |

| IQVIA, Inc., 6.5%, 5/15/2030 (n) | | | 3,700,000 | 3,774,259 |

| Legacy LifePoint Health LLC, 4.375%, 2/15/2027 (n) | | | 5,340,000 | 4,973,249 |

| Star Parent, Inc., 9%, 10/01/2030 (n) | | | 4,757,000 | 5,002,001 |

| Tenet Healthcare Corp., 6.125%, 10/01/2028 | | | 4,454,000 | 4,437,609 |

| Tenet Healthcare Corp., 4.375%, 1/15/2030 | | | 3,572,000 | 3,305,240 |

| Tenet Healthcare Corp., 6.125%, 6/15/2030 | | | 6,413,000 | 6,410,610 |

| Tenet Healthcare Corp., 6.75%, 5/15/2031 (n) | | | 2,577,000 | 2,635,852 |

| U.S. Acute Care Solutions LLC, 6.375%, 3/01/2026 (n) | | | 5,111,000 | 4,466,043 |

| | | | | $99,443,810 |

| Medical Equipment – 1.2% |

| Embecta Corp., 5%, 2/15/2030 (n) | | $ | 6,305,000 | $5,159,255 |

| Garden SpinCo Corp., 8.625%, 7/20/2030 (n) | | | 5,624,000 | 6,017,680 |

| Medline Borrower LP, 5.25%, 10/01/2029 (n) | | | 7,985,000 | 7,445,287 |

| Teleflex, Inc., 4.625%, 11/15/2027 | | | 3,116,000 | 3,022,925 |

| | | | | $21,645,147 |

| Metals & Mining – 3.2% |

| Baffinland Iron Mines Corp./Baffinland Iron Mines LP, 8.75%, 7/15/2026 (n) | | $ | 5,859,000 | $5,361,024 |

| FMG Resources Ltd., 4.375%, 4/01/2031 (n) | | | 15,311,000 | 13,779,797 |

| GrafTech Finance, Inc., 4.625%, 12/15/2028 (n) | | | 7,423,000 | 4,914,984 |

| GrafTech Finance, Inc., 9.875%, 12/15/2028 (n) | | | 1,727,000 | 1,290,604 |

| Kaiser Aluminum Corp., 4.625%, 3/01/2028 (n) | | | 7,475,000 | 6,888,169 |

| Kaiser Aluminum Corp., 4.5%, 6/01/2031 (n) | | | 3,924,000 | 3,350,268 |

| Novelis Corp., 3.25%, 11/15/2026 (n) | | | 5,176,000 | 4,846,413 |

| Novelis Corp., 4.75%, 1/30/2030 (n) | | | 6,187,000 | 5,738,416 |

| Novelis Corp., 3.875%, 8/15/2031 (n) | | | 2,807,000 | 2,434,614 |

| Petra Diamonds US$ Treasury PLC, 9.75%, 3/08/2026 (n) | | | 3,109,340 | 2,518,565 |

| Taseko Mines Ltd., 7%, 2/15/2026 (n) | | | 5,045,000 | 4,956,712 |

| | | | | $56,079,566 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Midstream – 4.6% |

| DT Midstream, Inc., 4.125%, 6/15/2029 (n) | | $ | 5,904,000 | $5,424,287 |

| DT Midstream, Inc., 4.375%, 6/15/2031 (n) | | | 8,290,000 | 7,425,947 |

| EQM Midstream Partners LP, 5.5%, 7/15/2028 | | | 11,896,000 | 11,787,675 |

| Kinetik Holdings, Inc., 5.875%, 6/15/2030 (n) | | | 7,337,000 | 7,206,806 |

| NuStar Logistics, LP, 6.375%, 10/01/2030 | | | 5,234,000 | 5,260,170 |

| Tallgrass Energy Partners LP, 5.5%, 1/15/2028 (n) | | | 9,016,000 | 8,679,433 |

| Tallgrass Energy Partners LP, 7.375%, 2/15/2029 (n) | | | 3,176,000 | 3,168,102 |

| Venture Global Calcasieu Pass LLC, 3.875%, 8/15/2029 (n) | | | 7,487,000 | 6,691,605 |

| Venture Global Calcasieu Pass LLC, 6.25%, 1/15/2030 (n) | | | 2,732,000 | 2,734,169 |

| Venture Global Calcasieu Pass LLC, 4.125%, 8/15/2031 (n) | | | 5,430,000 | 4,801,863 |

| Venture Global LNG, Inc., 8.125%, 6/01/2028 (n) | | | 5,484,000 | 5,542,616 |

| Venture Global LNG, Inc., 9.5%, 2/01/2029 (n) | | | 6,091,000 | 6,468,880 |

| Venture Global LNG, Inc., 8.375%, 6/01/2031 (n) | | | 6,238,000 | 6,299,359 |

| | | | | $81,490,912 |

| Network & Telecom – 0.5% |

| Iliad Holding S.A.S., 6.5%, 10/15/2026 (n) | | $ | 1,907,000 | $1,869,351 |

| Iliad Holding S.A.S., 7%, 10/15/2028 (n) | | | 7,862,000 | 7,799,364 |

| | | | | $9,668,715 |

| Oil Services – 0.4% |

| Nabors Industries Ltd., 7.25%, 1/15/2026 (n) | | $ | 4,036,000 | $3,935,382 |

| Nabors Industries Ltd., 9.125%, 1/31/2030 (n) | | | 2,567,000 | 2,612,051 |

| | | | | $6,547,433 |

| Oils – 1.1% |

| Parkland Corp., 4.625%, 5/01/2030 (n) | | $ | 11,354,000 | $10,460,668 |

| PBF Holding Co. LLC/PBF Finance Corp., 6%, 2/15/2028 | | | 6,066,000 | 5,928,719 |

| Puma International Financing S.A., 5%, 1/24/2026 | | | 2,433,000 | 2,304,440 |

| | | | | $18,693,827 |

| Personal Computers & Peripherals – 0.6% |

| NCR Corp., 5%, 10/01/2028 (n) | | $ | 6,858,000 | $6,465,505 |

| NCR Corp., 5.125%, 4/15/2029 (n) | | | 4,146,000 | 3,879,109 |

| | | | | $10,344,614 |

| Pharmaceuticals – 1.0% |

| 1375209 BC Ltd., 9%, 1/30/2028 (n) | | $ | 3,603,000 | $3,494,910 |

| Bausch Health Co., Inc., 11%, 9/30/2028 (n) | | | 3,989,000 | 2,713,717 |

| Bausch Health Co., Inc., 14%, 10/15/2030 (n) | | | 799,000 | 446,668 |

| Grifols S.A., 3.2%, 5/01/2025 | | EUR | 1,610,000 | 1,656,950 |

| Organon Finance 1 LLC, 4.125%, 4/30/2028 (n) | | $ | 4,302,000 | 3,936,113 |

| Organon Finance 1 LLC, 5.125%, 4/30/2031 (n) | | | 6,184,000 | 5,312,840 |

| | | | | $17,561,198 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Pollution Control – 1.1% |

| GFL Environmental, Inc., 4.25%, 6/01/2025 (n) | | $ | 2,160,000 | $2,122,091 |

| GFL Environmental, Inc., 4%, 8/01/2028 (n) | | | 6,063,000 | 5,561,364 |

| GFL Environmental, Inc., 4.75%, 6/15/2029 (n) | | | 1,935,000 | 1,816,476 |

| GFL Environmental, Inc., 4.375%, 8/15/2029 (n) | | | 2,355,000 | 2,159,827 |

| GFL Environmental, Inc., 6.75%, 1/15/2031 (n) | | | 1,190,000 | 1,217,106 |

| Stericycle, Inc., 3.875%, 1/15/2029 (n) | | | 7,781,000 | 7,073,162 |

| | | | | $19,950,026 |

| Precious Metals & Minerals – 0.7% |

| Coeur Mining, Inc., 5.125%, 2/15/2029 (n) | | $ | 3,783,000 | $3,443,477 |

| Eldorado Gold Corp., 6.25%, 9/01/2029 (n) | | | 3,880,000 | 3,700,490 |

| IAMGOLD Corp., 5.75%, 10/15/2028 (n) | | | 6,778,000 | 5,964,640 |

| | | | | $13,108,607 |

| Printing & Publishing – 0.3% |

| Cimpress PLC, 7%, 6/15/2026 | | $ | 5,918,000 | $5,829,230 |

| Real Estate - Other – 0.8% |

| RHP Hotel Properties, LP/RHP Finance Corp., 7.25%, 7/15/2028 (n) | | $ | 9,008,000 | $9,285,491 |

| XHR LP, REIT, 4.875%, 6/01/2029 (n) | | | 5,108,000 | 4,711,159 |

| | | | | $13,996,650 |

| Restaurants – 0.3% |

| Fertitta Entertainment LLC, 6.75%, 1/15/2030 (n) | | $ | 6,482,000 | $5,827,623 |

| Retailers – 1.7% |

| Asbury Automotive Group, Inc., 4.625%, 11/15/2029 (n) | | $ | 5,003,000 | $4,609,195 |

| Lithia Motors, Inc., 3.875%, 6/01/2029 (n) | | | 5,273,000 | 4,732,518 |

| Macy's Retail Holdings LLC, 5.875%, 4/01/2029 (n) | | | 6,227,000 | 6,040,190 |

| NMG Holding Co. Inc./Neiman Marcus Group LLC, 7.125%, 4/01/2026 (n) | | | 4,569,000 | 4,454,842 |

| Penske Automotive Group Co., 3.75%, 6/15/2029 | | | 7,145,000 | 6,367,803 |

| Victoria's Secret & Co., 4.625%, 7/15/2029 (n) | | | 5,550,000 | 4,692,408 |

| | | | | $30,896,956 |

| Specialty Stores – 1.0% |

| Global Auto Holdings Ltd./Aag FH UK Ltd., 8.375%, 1/15/2029 (n) | | $ | 5,375,000 | $5,067,976 |

| Michael Cos., Inc., 5.25%, 5/01/2028 (n) | | | 3,600,000 | 2,827,696 |

| Michael Cos., Inc., 7.875%, 5/01/2029 (n) | | | 3,830,000 | 2,449,643 |

| PetSmart, Inc./PetSmart Finance Corp., 7.75%, 2/15/2029 (n) | | | 7,620,000 | 7,366,119 |

| | | | | $17,711,434 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Bonds – continued |

| Supermarkets – 0.7% |

| KeHE Distributors LLC/KeHE Finance Corp., 9%, 2/15/2029 (n) | | $ | 4,328,000 | $4,352,345 |

| Ocado Group PLC, 3.875%, 10/08/2026 | | GBP | 3,890,000 | 4,270,437 |

| Picard Bondco S.A., 5.375%, 7/01/2027 | | EUR | 3,770,000 | 3,870,119 |

| | | | | $12,492,901 |

| Telecommunications - Wireless – 1.0% |

| Altice France S.A., 5.5%, 1/15/2028 (n) | | $ | 2,680,000 | $2,092,443 |

| Altice France S.A., 6%, 2/15/2028 (n) | | | 3,359,000 | 1,499,530 |

| Altice France S.A., 5.125%, 7/15/2029 (n) | | | 1,913,000 | 1,398,584 |

| SBA Communications Corp., 3.875%, 2/15/2027 | | | 5,075,000 | 4,843,179 |

| SBA Communications Corp., 3.125%, 2/01/2029 | | | 9,720,000 | 8,662,784 |

| | | | | $18,496,520 |

| U.S. Treasury Obligations – 0.5% |

| U.S. Treasury Notes, 3%, 6/30/2024 | | $ | 8,912,000 | $8,833,324 |

| Utilities - Electric Power – 3.4% |

| Calpine Corp., 4.5%, 2/15/2028 (n) | | $ | 7,722,000 | $7,343,368 |

| Calpine Corp., 5.125%, 3/15/2028 (n) | | | 5,692,000 | 5,431,398 |

| Clearway Energy Operating LLC, 4.75%, 3/15/2028 (n) | | | 4,823,000 | 4,591,991 |

| Clearway Energy Operating LLC, 3.75%, 2/15/2031 (n) | | | 12,478,000 | 10,816,327 |

| Clearway Energy Operating LLC, 3.75%, 1/15/2032 (n) | | | 1,626,000 | 1,381,040 |

| NextEra Energy, Inc., 4.25%, 7/15/2024 (n) | | | 1,521,000 | 1,504,956 |

| NextEra Energy, Inc., 4.25%, 9/15/2024 (n) | | | 728,000 | 711,620 |

| NextEra Energy, Inc., 4.5%, 9/15/2027 (n) | | | 6,004,000 | 5,637,976 |

| NextEra Energy, Inc., 7.25%, 1/15/2029 (n) | | | 6,346,000 | 6,536,406 |

| TerraForm Global Operating LLC, 6.125%, 3/01/2026 (n) | | | 5,065,000 | 4,998,635 |

| TerraForm Power Operating LLC, 5%, 1/31/2028 (n) | | | 8,444,000 | 8,138,496 |

| TerraForm Power Operating LLC, 4.75%, 1/15/2030 (n) | | | 3,754,000 | 3,466,106 |

| | | | | $60,558,319 |

| Total Bonds (Identified Cost, $1,715,293,706) | | $1,663,053,852 |

| Common Stocks – 0.2% |

| Cable TV – 0.1% | |

| Intelsat Emergence S.A. (a) | | 59,284 | $1,556,205 |

| Oil Services – 0.1% | |

| LTRI Holdings LP (a)(u) | | 3,250 | $1,645,052 |

| Total Common Stocks (Identified Cost, $3,122,016) | | $3,201,257 |

Portfolio of Investments – continued

| Issuer | | | Shares/Par | Value ($) |

| Convertible Bonds – 0.1% |

| Utilities - Electric Power – 0.1% | |

| Pacific Gas and Electric Corp., 4.25%, 12/01/2027 (n) (Identified Cost, $2,464,000) | | $ | 2,464,000 | $2,507,120 |

| | Strike

Price | First

Exercise | | |

| Warrants – 0.0% | | | | |

| Other Banks & Diversified Financials – 0.0% |

Avation Capital S.A. (1 share for 1 warrant, Expiration 10/31/26) (a)

(Identified Cost, $0) | GBP 1.14 | 6/24/22 | 62,563 | $11,893 |

| | | | | |

| Investment Companies (h) – 5.7% |

| Money Market Funds – 5.7% | |

| MFS Institutional Money Market Portfolio, 5.4% (v) (Identified Cost, $100,703,210) | | | 100,698,538 | $100,708,608 |

| Underlying/Expiration Date/Exercise Price | Put/Call | Counterparty | Notional

Amount | Par Amount/

Number of

Contracts | |

| Purchased Options – 0.0% | |

| Market Index Securities – 0.0% | |

| Russell 2000 Index – December 2024 @ $1,500 (Premiums Paid, $1,267,143) | Put | Exchange Traded | $ 34,467,948 | 177 | $490,290 |

|

|

| Other Assets, Less Liabilities – 0.7% | | 12,846,223 |

| Net Assets – 100.0% | $1,782,819,243 |

| (a) | Non-income producing security. | | | |

| (h) | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $100,708,608 and $1,669,264,412, respectively. | | | |

| (n) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in the ordinary course of business in transactions exempt from registration, normally to qualified institutional buyers. At period end, the aggregate value of these securities was $1,482,267,557, representing 83.1% of net assets. | | | |

| (p) | Payment-in-kind (PIK) security for which interest income may be received in additional securities and/or cash. | | | |

| (u) | The security was valued using significant unobservable inputs and is considered level 3 under the fair value hierarchy. For further information about the fund’s level 3 holdings, please see Note 2 in the Notes to Financial Statements. | | | |

| (v) | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. | | | |

Portfolio of Investments – continued

| The following abbreviations are used in this report and are defined: |

| CDI | Interbank Deposit Certificates |

| CDO | Collateralized Debt Obligation |

| CMT | Constant Maturity Treasury |

| FLR | Floating Rate. Interest rate resets periodically based on the parenthetically disclosed reference rate plus a spread (if any). The period-end rate reported may not be the current rate. All reference rates are USD unless otherwise noted. |

| REIT | Real Estate Investment Trust |

| SOFR | Secured Overnight Financing Rate |

| Abbreviations indicate amounts shown in currencies other than the U.S. dollar. All amounts are stated in U.S. dollars unless otherwise indicated. A list of abbreviations is shown below: |

| EUR | Euro |

| GBP | British Pound |

Derivative Contracts at 1/31/24

| Forward Foreign Currency Exchange Contracts |

Currency

Purchased | Currency

Sold | Counterparty | Settlement

Date | Unrealized

Appreciation

(Depreciation) |

| Asset Derivatives |

| GBP | 364,436 | USD | 461,658 | State Street Bank Corp. | 4/19/2024 | $450 |

| USD | 18,908,607 | EUR | 17,322,616 | State Street Bank Corp. | 4/19/2024 | 126,557 |

| USD | 4,423,371 | GBP | 3,468,421 | State Street Bank Corp. | 4/19/2024 | 25,375 |

| | | | | | | $152,382 |

| Liability Derivatives |

| EUR | 1,759,116 | USD | 1,921,919 | HSBC Bank | 4/19/2024 | $(14,596) |

| EUR | 1,453,155 | USD | 1,583,139 | JPMorgan Chase Bank N.A. | 4/19/2024 | (7,556) |

| | | | | | | $(22,152) |

See Notes to Financial Statements

Financial Statements

Statement of Assets and Liabilities

At 1/31/24

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| Assets | |

| Investments in unaffiliated issuers, at value (identified cost, $1,722,146,865) | $1,669,264,412 |

| Investments in affiliated issuers, at value (identified cost, $100,703,210) | 100,708,608 |

| Cash | 556,580 |

| Receivables for | |

| Forward foreign currency exchange contracts | 152,382 |

| Investments sold | 7,659,846 |

| Fund shares sold | 11,292,793 |

| Interest and dividends | 25,400,377 |

| Other assets | 5,688 |

| Total assets | $1,815,040,686 |

| Liabilities | |

| Payables for | |

| Distributions | $116,486 |

| Forward foreign currency exchange contracts | 22,152 |

| Investments purchased | 19,247,785 |

| When-issued investments purchased | 9,646,551 |

| Fund shares reacquired | 2,742,309 |

| Payable to affiliates | |

| Investment adviser | 42,882 |

| Administrative services fee | 1,438 |

| Shareholder servicing costs | 220,360 |

| Distribution and service fees | 9,727 |

| Payable for independent Trustees' compensation | 506 |

| Accrued expenses and other liabilities | 171,247 |

| Total liabilities | $32,221,443 |

| Net assets | $1,782,819,243 |

| Net assets consist of | |

| Paid-in capital | $2,062,177,339 |

| Total distributable earnings (loss) | (279,358,096) |

| Net assets | $1,782,819,243 |

| Shares of beneficial interest outstanding | 582,820,290 |

Statement of Assets and Liabilities – continued

| | Net assets | Shares

outstanding | Net asset value

per share (a) |

| Class A | $659,654,202 | 215,541,567 | $3.06 |

| Class B | 2,314,593 | 755,367 | 3.06 |

| Class C | 9,778,006 | 3,185,397 | 3.07 |

| Class I | 127,671,880 | 41,849,011 | 3.05 |

| Class R1 | 774,960 | 253,003 | 3.06 |

| Class R2 | 1,484,740 | 487,837 | 3.04 |

| Class R3 | 908,961 | 297,698 | 3.05 |

| Class R4 | 414,608 | 135,410 | 3.06 |

| Class R6 | 979,817,293 | 320,315,000 | 3.06 |

| (a) | Maximum offering price per share was equal to the net asset value per share for all share classes, except for Class A, for which the maximum offering price per share was $3.20 [100 / 95.75 x $3.06]. On sales of $100,000 or more, the maximum offering price of Class A shares is reduced. A contingent deferred sales charge may be imposed on redemptions of Class A, Class B, and Class C shares. Redemption price per share was equal to the net asset value per share for Classes I, R1, R2, R3, R4, and R6. |

See Notes to Financial Statements

Financial Statements

Statement of Operations

Year ended 1/31/24

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| Net investment income (loss) | |

| Income | |

| Interest | $107,777,045 |

| Dividends from affiliated issuers | 4,112,659 |

| Other | 215,532 |

| Dividends | 193,360 |

| Total investment income | $112,298,596 |

| Expenses | |

| Management fee | $7,821,802 |

| Distribution and service fees | 1,723,499 |

| Shareholder servicing costs | 1,143,029 |

| Administrative services fee | 256,513 |

| Independent Trustees' compensation | 31,846 |

| Custodian fee | 101,470 |

| Shareholder communications | 110,846 |

| Audit and tax fees | 98,652 |

| Legal fees | 9,244 |

| Miscellaneous | 233,003 |

| Total expenses | $11,529,904 |

| Fees paid indirectly | (939) |

| Reduction of expenses by investment adviser and distributor | (220,979) |

| Net expenses | $11,307,986 |

| Net investment income (loss) | $100,990,610 |

Statement of Operations – continued

| Realized and unrealized gain (loss) |

| Realized gain (loss) (identified cost basis) | |

| Unaffiliated issuers | $(69,412,443) |

| Affiliated issuers | 6,151 |

| Futures contracts | (1,846,390) |

| Forward foreign currency exchange contracts | 175,388 |

| Foreign currency | (8,283) |

| Net realized gain (loss) | $(71,085,577) |

| Change in unrealized appreciation or depreciation | |

| Unaffiliated issuers | $108,525,307 |

| Affiliated issuers | (2,520) |

| Futures contracts | (35,170) |

| Forward foreign currency exchange contracts | 184,762 |

| Translation of assets and liabilities in foreign currencies | (4,078) |

| Net unrealized gain (loss) | $108,668,301 |

| Net realized and unrealized gain (loss) | $37,582,724 |

| Change in net assets from operations | $138,573,334 |

See Notes to Financial Statements

Financial Statements

Statements of Changes in Net Assets

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | Year ended |

| | 1/31/24 | 1/31/23 |

| Change in net assets | | |

| From operations | | |

| Net investment income (loss) | $100,990,610 | $86,712,586 |

| Net realized gain (loss) | (71,085,577) | (58,003,285) |

| Net unrealized gain (loss) | 108,668,301 | (119,528,825) |

| Change in net assets from operations | $138,573,334 | $(90,819,524) |

| Total distributions to shareholders | $(104,124,037) | $(94,049,766) |

| Change in net assets from fund share transactions | $(5,174,694) | $(30,606,598) |

| Total change in net assets | $29,274,603 | $(215,475,888) |

| Net assets | | |

| At beginning of period | 1,753,544,640 | 1,969,020,528 |

| At end of period | $1,782,819,243 | $1,753,544,640 |

See Notes to Financial Statements

Financial Statements

Financial Highlights

The financial highlights table is intended to help you understand the fund's financial performance for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| Class A | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $3.00 | $3.31 | $3.44 | $3.44 | $3.30 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.17 | $0.14 | $0.13 | $0.14 | $0.15 |

| Net realized and unrealized gain (loss) | 0.06 | (0.30) | (0.11) | 0.01 | 0.15 |

| Total from investment operations | $0.23 | $(0.16) | $0.02 | $0.15 | $0.30 |

| Less distributions declared to shareholders |

| From net investment income | $(0.17) | $(0.15) | $(0.15) | $(0.15) | $(0.16) |

| Net asset value, end of period (x) | $3.06 | $3.00 | $3.31 | $3.44 | $3.44 |

| Total return (%) (r)(s)(t)(x) | 8.13 | (4.60) | 0.48 | 4.71 | 9.24 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.88 | 0.89 | 0.90 | 0.93 | 0.94 |

| Expenses after expense reductions (f) | 0.87 | 0.87 | 0.89 | 0.91 | 0.92 |

| Net investment income (loss) | 5.68 | 4.69 | 3.88 | 4.34 | 4.46 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $659,654 | $625,602 | $679,622 | $612,075 | $552,035 |

See Notes to Financial Statements

Financial Highlights – continued

| Class B | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $3.00 | $3.31 | $3.44 | $3.45 | $3.30 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.15 | $0.12 | $0.11 | $0.12 | $0.13 |

| Net realized and unrealized gain (loss) | 0.06 | (0.30) | (0.12) | 0.00(w) | 0.15 |

| Total from investment operations | $0.21 | $(0.18) | $(0.01) | $0.12 | $0.28 |

| Less distributions declared to shareholders |

| From net investment income | $(0.15) | $(0.13) | $(0.12) | $(0.13) | $(0.13) |

| Net asset value, end of period (x) | $3.06 | $3.00 | $3.31 | $3.44 | $3.45 |

| Total return (%) (r)(s)(t)(x) | 7.34 | (5.31) | (0.28) | 3.62 | 8.74 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.63 | 1.64 | 1.65 | 1.68 | 1.69 |

| Expenses after expense reductions (f) | 1.62 | 1.62 | 1.64 | 1.67 | 1.68 |

| Net investment income (loss) | 4.93 | 3.91 | 3.15 | 3.63 | 3.72 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $2,315 | $2,986 | $4,729 | $6,914 | $10,650 |

| Class C | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $3.01 | $3.32 | $3.45 | $3.45 | $3.31 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.15 | $0.12 | $0.11 | $0.12 | $0.13 |

| Net realized and unrealized gain (loss) | 0.06 | (0.30) | (0.12) | 0.01 | 0.14 |

| Total from investment operations | $0.21 | $(0.18) | $(0.01) | $0.13 | $0.27 |

| Less distributions declared to shareholders |

| From net investment income | $(0.15) | $(0.13) | $(0.12) | $(0.13) | $(0.13) |

| Net asset value, end of period (x) | $3.07 | $3.01 | $3.32 | $3.45 | $3.45 |

| Total return (%) (r)(s)(t)(x) | 7.32 | (5.29) | (0.27) | 3.93 | 8.42 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.63 | 1.64 | 1.65 | 1.68 | 1.69 |

| Expenses after expense reductions (f) | 1.62 | 1.62 | 1.64 | 1.67 | 1.68 |

| Net investment income (loss) | 4.93 | 3.92 | 3.15 | 3.61 | 3.72 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $9,778 | $11,888 | $16,636 | $21,918 | $27,415 |

See Notes to Financial Statements

Financial Highlights – continued

| Class I | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $2.99 | $3.30 | $3.43 | $3.43 | $3.29 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.17 | $0.15 | $0.14 | $0.15 | $0.16 |

| Net realized and unrealized gain (loss) | 0.07 | (0.30) | (0.11) | 0.01 | 0.15 |

| Total from investment operations | $0.24 | $(0.15) | $0.03 | $0.16 | $0.31 |

| Less distributions declared to shareholders |

| From net investment income | $(0.18) | $(0.16) | $(0.16) | $(0.16) | $(0.17) |

| Net asset value, end of period (x) | $3.05 | $2.99 | $3.30 | $3.43 | $3.43 |

| Total return (%) (r)(s)(t)(x) | 8.41 | (4.38) | 0.71 | 4.97 | 9.52 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.63 | 0.63 | 0.65 | 0.68 | 0.69 |

| Expenses after expense reductions (f) | 0.62 | 0.62 | 0.64 | 0.66 | 0.68 |

| Net investment income (loss) | 5.91 | 4.93 | 4.13 | 4.55 | 4.67 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $127,672 | $189,210 | $208,682 | $216,905 | $147,591 |

| Class R1 | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $3.00 | $3.31 | $3.44 | $3.44 | $3.30 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.15 | $0.12 | $0.11 | $0.12 | $0.13 |

| Net realized and unrealized gain (loss) | 0.06 | (0.30) | (0.12) | 0.01 | 0.14 |

| Total from investment operations | $0.21 | $(0.18) | $(0.01) | $0.13 | $0.27 |

| Less distributions declared to shareholders |

| From net investment income | $(0.15) | $(0.13) | $(0.12) | $(0.13) | $(0.13) |

| Net asset value, end of period (x) | $3.06 | $3.00 | $3.31 | $3.44 | $3.44 |

| Total return (%) (r)(s)(t)(x) | 7.33 | (5.32) | (0.28) | 3.92 | 8.43 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.63 | 1.64 | 1.65 | 1.68 | 1.69 |

| Expenses after expense reductions (f) | 1.62 | 1.62 | 1.64 | 1.67 | 1.68 |

| Net investment income (loss) | 4.93 | 3.94 | 3.14 | 3.60 | 3.71 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $775 | $695 | $946 | $957 | $963 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R2 | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $2.98 | $3.29 | $3.43 | $3.44 | $3.30 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.16 | $0.13 | $0.13 | $0.14 | $0.14 |

| Net realized and unrealized gain (loss) | 0.07 | (0.29) | (0.13) | (0.01) | 0.15 |

| Total from investment operations | $0.23 | $(0.16) | $0.00 | $0.13 | $0.29 |

| Less distributions declared to shareholders |

| From net investment income | $(0.17) | $(0.15) | $(0.14) | $(0.14) | $(0.15) |

| Net asset value, end of period (x) | $3.04 | $2.98 | $3.29 | $3.43 | $3.44 |

| Total return (%) (r)(s)(t)(x) | 7.88 | (4.90) | (0.09) | 4.14 | 8.96 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 1.13 | 1.14 | 1.16 | 1.18 | 1.19 |

| Expenses after expense reductions (f) | 1.12 | 1.12 | 1.15 | 1.17 | 1.18 |

| Net investment income (loss) | 5.43 | 4.44 | 3.67 | 4.10 | 4.21 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $1,485 | $1,606 | $2,029 | $13,943 | $15,270 |

| Class R3 | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $2.99 | $3.30 | $3.43 | $3.44 | $3.30 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.17 | $0.14 | $0.13 | $0.14 | $0.15 |

| Net realized and unrealized gain (loss) | 0.06 | (0.30) | (0.11) | 0.00(w) | 0.15 |

| Total from investment operations | $0.23 | $(0.16) | $0.02 | $0.14 | $0.30 |

| Less distributions declared to shareholders |

| From net investment income | $(0.17) | $(0.15) | $(0.15) | $(0.15) | $(0.16) |

| Net asset value, end of period (x) | $3.05 | $2.99 | $3.30 | $3.43 | $3.44 |

| Total return (%) (r)(s)(t)(x) | 8.14 | (4.63) | 0.46 | 4.40 | 9.23 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.88 | 0.89 | 0.90 | 0.93 | 0.94 |

| Expenses after expense reductions (f) | 0.87 | 0.87 | 0.89 | 0.92 | 0.93 |

| Net investment income (loss) | 5.68 | 4.60 | 3.90 | 4.31 | 4.47 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $909 | $1,295 | $2,574 | $2,929 | $2,255 |

See Notes to Financial Statements

Financial Highlights – continued

| Class R4 | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $3.00 | $3.31 | $3.44 | $3.44 | $3.30 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.18 | $0.15 | $0.14 | $0.15 | $0.16 |

| Net realized and unrealized gain (loss) | 0.06 | (0.30) | (0.11) | 0.01 | 0.15 |

| Total from investment operations | $0.24 | $(0.15) | $0.03 | $0.16 | $0.31 |

| Less distributions declared to shareholders |

| From net investment income | $(0.18) | $(0.16) | $(0.16) | $(0.16) | $(0.17) |

| Net asset value, end of period (x) | $3.06 | $3.00 | $3.31 | $3.44 | $3.44 |

| Total return (%) (r)(s)(t)(x) | 8.39 | (4.35) | 0.72 | 4.97 | 9.51 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.63 | 0.64 | 0.65 | 0.68 | 0.69 |

| Expenses after expense reductions (f) | 0.62 | 0.62 | 0.64 | 0.67 | 0.68 |

| Net investment income (loss) | 5.93 | 4.95 | 4.15 | 4.63 | 4.68 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $415 | $362 | $371 | $555 | $796 |

| Class R6 | Year ended |

| | 1/31/24 | 1/31/23 | 1/31/22 | 1/31/21 | 1/31/20 |

| Net asset value, beginning of period | $3.00 | $3.31 | $3.44 | $3.44 | $3.30 |

| Income (loss) from investment operations |

| Net investment income (loss) (d) | $0.18 | $0.15 | $0.15 | $0.16 | $0.16 |

| Net realized and unrealized gain (loss) | 0.06 | (0.30) | (0.12) | 0.00(w) | 0.15 |

| Total from investment operations | $0.24 | $(0.15) | $0.03 | $0.16 | $0.31 |

| Less distributions declared to shareholders |

| From net investment income | $(0.18) | $(0.16) | $(0.16) | $(0.16) | $(0.17) |

| Net asset value, end of period (x) | $3.06 | $3.00 | $3.31 | $3.44 | $3.44 |

| Total return (%) (r)(s)(t)(x) | 8.52 | (4.25) | 0.84 | 5.08 | 9.63 |

Ratios (%) (to average net assets)

and Supplemental data: |

| Expenses before expense reductions (f) | 0.52 | 0.52 | 0.54 | 0.57 | 0.58 |

| Expenses after expense reductions (f) | 0.51 | 0.51 | 0.53 | 0.56 | 0.57 |

| Net investment income (loss) | 6.04 | 5.05 | 4.25 | 4.69 | 4.82 |

| Portfolio turnover | 48 | 33 | 64 | 50 | 58 |

| Net assets at end of period (000 omitted) | $979,817 | $919,902 | $1,048,137 | $1,123,867 | $942,482 |

See Notes to Financial Statements

Financial Highlights – continued

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. See Note 2 in the Notes to Financial Statements for additional information. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (t) | Total returns do not include any applicable sales charges. |

| (w) | Per share amount was less than $0.01. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

Notes to Financial Statements

(1) Business and Organization

MFS High Income Fund (the fund) is a diversified series of MFS Series Trust III (the trust). The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies.

(2) Significant Accounting Policies

General — The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund invests in high-yield securities rated below investment grade. Investments in below investment grade quality securities can involve a substantially greater risk of default or can already be in default, and their values can decline significantly. Below investment grade quality securities tend to be more sensitive to adverse news about the issuer, or the market or economy in general, than higher quality debt instruments. The fund invests in foreign securities. Investments in foreign securities are vulnerable to the effects of changes in the relative values of the local currency and the U.S. dollar and to the effects of changes in each country’s market, economic, industrial, political, regulatory, geopolitical, environmental, public health, and other conditions.