UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-02688

Name of Fund: BlackRock Municipal Bond Fund, Inc.

BlackRock High Yield Municipal Fund

BlackRock National Municipal Fund

BlackRock Short-Term Municipal Fund

Fund Address: 100 Bellevue Parkway, Wilmington, DE 19809

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Municipal Bond

Fund, Inc., 55 East 52nd Street, New York, NY 10055

Registrant’s telephone number, including area code: (800) 441-7762

Date of fiscal year end: 06/30/2017

Date of reporting period: 12/31/2016

Item 1 – Report to Stockholders

DECEMBER 31, 2016

SEMI-ANNUAL REPORT (UNAUDITED)

|  |

BlackRock Municipal Bond Fund, Inc.

| Ø | BlackRock High Yield Municipal Fund |

| Ø | BlackRock National Municipal Fund |

| Ø | BlackRock Short-Term Municipal Fund |

BlackRock Multi-State Municipal Series Trust

| Ø | BlackRock New York Municipal Opportunities Fund |

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| Table of Contents | ||||

| Page | ||||

| 3 | ||||

Semi-Annual Report: | ||||

| 4 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| Financial Statements: | ||||

| 19 | ||||

| 52 | ||||

| 54 | ||||

| 55 | ||||

| 59 | ||||

| 79 | ||||

| 93 | ||||

| 94 | ||||

| 2 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

| The Markets in Review |

Dear Shareholder,

The year 2016 started on a fraught note with worries about slowing growth in China, plunging oil prices and sliding share prices. Then reflationary expectations in the United States helped drive a second-half global growth pick-up and big market reversals. As such, higher-quality asset classes such as Treasury bonds, municipals and investment grade credit prevailed in the first half of the year, only to struggle in the second. In contrast, risk assets sold off at the start of the year and rebounded in the latter half, with some asset classes posting strong year-end returns.

A key takeaway from 2016’s market performance is that economics can trump politics. The global reflationary theme — governments taking policy action to support growth — was the dominant driver of 2016 asset returns, outweighing significant political upheavals and uncertainty. This trend accelerated after the U.S. election on expectations for an extra boost to U.S. growth via fiscal policy.

Markets were remarkably resilient during the year. Spikes in equity volatility after big surprises such as the U.K.’s vote to leave the European Union and the outcome of the U.S. presidential election were short-lived. Instead, political surprises and initial sell-offs were seized upon as buying opportunities. We believe this reinforces the case for taking the long view rather than reacting to short-term market noise.

Asset returns varied widely in 2016. Perceived safe assets such as government bonds and low-volatility shares underperformed the higher-risk areas of the market. And the reversal of longstanding trends created opportunities, such as in the recovery of value stocks and commodities.

We expect some of these trends to extend into 2017 and see the potential for more flows into risk assets this year. Learn more by reading our market insights at blackrock.com.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of December 31, 2016 | ||||||||

| 6-month | 12-month | |||||||

U.S. large cap equities | 7.82 | % | 11.96 | % | ||||

U.S. small cap equities | 18.68 | 21.31 | ||||||

International equities | 5.67 | 1.00 | ||||||

Emerging market equities (MSCI Emerging Markets Index) | 4.49 | 11.19 | ||||||

3-month Treasury bills | 0.18 | 0.33 | ||||||

U.S. Treasury securities | (7.51 | ) | (0.16 | ) | ||||

U.S. investment grade bonds | (2.53 | ) | 2.65 | |||||

Tax-exempt municipal bonds (S&P Municipal Bond Index) | (3.43 | ) | 0.77 | |||||

U.S. high yield bonds (Bloomberg Barclays U.S. Corporate High Yield 2% Issuer Capped Index) | 7.40 | 17.13 | ||||||

| Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||||||

| THIS PAGE NOT PART OF YOUR FUND REPORT | 3 |

| Fund Summary as of December 31, 2016 | BlackRock High Yield Municipal Fund | |||

| Investment Objective |

BlackRock High Yield Municipal Fund’s (the “Fund”) investment objective is to provide shareholders with as high a level of income exempt from Federal income taxes as is consistent with the investment policies of the Fund.

| Portfolio Management Commentary |

How did the Fund perform?

| • | For the six-month period ended December 31, 2016, the Fund underperformed its primary benchmark, the S&P® Municipal Bond Index, and its secondary benchmark, the Custom High Yield Index. The following discussion of relative performance pertains to the Fund’s secondary benchmark, the Custom High Yield Index. |

What factors influenced performance?

| • | Municipal bonds lost ground in the second half of 2016. After producing slightly positive returns through August, municipal bonds began to move lower in September and October due to rising yields in the U.S. Treasury market and a pick-up in new tax-exempt issuance. The weakness accelerated in November once Donald Trump’s election victory caused investors to factor a backdrop of stronger growth and tighter U.S. Federal Reserve policy into market prices. The municipal market stabilized and retraced some of its losses in December as the relative attractiveness of the asset class brought in new investors, but the modest rally was insufficient to make up for the earlier downturn. High-yield municipals underperformed the investment-grade market for the semi-annual period. |

| • | The Fund’s exposure to long-dated bonds with maturities of 25 years and above, which lagged the broader market, detracted from results. A higher-quality bias also hurt performance, as the Fund’s holdings in lower-rated investment-grade bonds (such as those rated BBB and A) trailed non-investment grade securities. Sector concentrations in transportation, health care and tobacco detracted as well. A continued underweight in Puerto Rico-related bonds, which gained ground in the period, also represented a headwind. |

| • | Having an underweight position in unrated securities, which lagged, was a positive for relative performance. An underweight in the local tax-backed sector was an additional contributor, as was an overweight in bonds in the seven- to 12-year maturity range. |

| • | The Fund sought to manage interest rate risk using U.S. Treasury futures. Given that Treasury yields rose, as prices fell, this aspect of the Fund’s positioning had a modestly positive effect on returns. |

Describe recent portfolio activity.

| • | When necessary, the Fund sold certain holdings to maintain an appropriate level of cash reserves. The Fund’s sales also reflected the investment adviser’s efforts to maintain the portfolio’s desired credit and duration profile, while seeking to target securities less affected by the market decline. (Duration is a measure of interest-rate sensitivity.) The Fund also employed tax-loss selling late in the year as a means to realize losses, using the proceeds to add similar securities at higher yields. |

Describe portfolio positioning at period end.

| • | The Fund’s duration posture was close to that of the secondary benchmark at year end. The Fund maintained its higher-quality bias and underweight in unrated securities. At the sector level, the Fund was overweight in transportation and tobacco issues, and it was underweight in state and local tax-backed bonds. The Fund also held an underweight position in school districts. The Fund’s leverage was somewhat lower on December 31, 2016 compared to its level of six months ago, while its risk profile was increased given the possibility of higher interest rates. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 4 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

| BlackRock High Yield Municipal Fund | ||||||

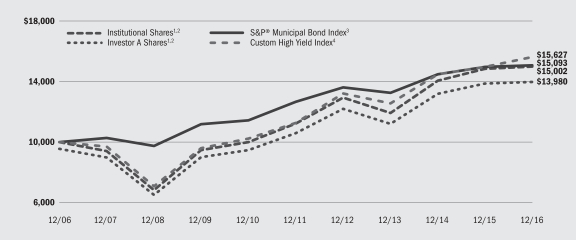

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal circumstances, the Fund seeks to achieve its objective by investing at least 80% of its assets in municipal bonds and may invest in municipal bonds rated in any rating category or in unrated municipal bonds. The Fund will usually invest in municipal bonds that have a maturity of five years or longer. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| 4 | The Custom High Yield Index is a customized benchmark that reflects the returns of the S&P® Customized High Yield Municipal Bond Index for periods prior to January 1, 2013, and the returns of only those bonds in the S&P® Customized High Yield Municipal Bond Index that have maturities greater than five years for periods subsequent to January 1, 2013. |

| Performance Summary for the Period Ended December 31, 2016 |

| Average Annual Total Returns5 | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||

Institutional | 4.13 | % | 4.07 | % | (5.54 | )% | 1.03 | % | N/A | 5.96 | % | N/A | 4.14 | % | N/A | |||||||||||||||||||||

Investor A | 3.72 | 3.69 | (5.78 | ) | 0.66 | (3.61 | )% | 5.67 | 4.75 | % | 3.86 | 3.41 | % | |||||||||||||||||||||||

Investor C | 3.14 | 3.10 | (6.02 | ) | 0.02 | (0.95 | ) | 4.89 | 4.89 | 3.09 | 3.09 | |||||||||||||||||||||||||

S&P® Municipal Bond Index | — | — | (3.43 | ) | 0.77 | N/A | 3.55 | N/A | 4.20 | N/A | ||||||||||||||||||||||||||

Custom High Yield Index | — | — | (3.03 | ) | 4.40 | N/A | 6.74 | N/A | 4.57 | N/A | ||||||||||||||||||||||||||

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 16 for a detailed description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results |

| Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| Expense Example |

| Actual | Hypothetical8 | |||||||||||||||||||||||||||||||||||

| During the Period | Including Interest Expense and Fees | Excluding Interest Expense and Fees | ||||||||||||||||||||||||||||||||||

| Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Including Interest Expense and Fees6 | Excluding Interest Expense and Fees7 | Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Expenses Paid During the Period6 | Ending Account Value December 31, 2016 | Expenses Paid During the Period7 | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 944.60 | $ | 3.23 | $ | 2.79 | $ | 1,000.00 | $ | 1,021.88 | $ | 3.36 | $ | 1,022.33 | $ | 2.91 | ||||||||||||||||||

Investor A | $ | 1,000.00 | $ | 942.20 | $ | 4.45 | $ | 4.01 | $ | 1,000.00 | $ | 1,020.62 | $ | 4.63 | $ | 1,021.07 | $ | 4.18 | ||||||||||||||||||

Investor C | $ | 1,000.00 | $ | 939.80 | $ | 8.12 | $ | 7.68 | $ | 1,000.00 | $ | 1,016.84 | $ | 8.44 | $ | 1,017.29 | $ | 7.98 | ||||||||||||||||||

| 6 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class (0.66% for Institutional, 0.91% for Investor A and 1.66% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 7 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class (0.57% for Institutional, 0.82% for Investor A and 1.57% for Investor C), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 8 | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| See “Disclosure of Expenses” on page 17 for further information on how expenses were calculated. |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2016 | 5 |

| BlackRock High Yield Municipal Fund | ||||

| Overview of the Fund’s Total Investments* |

| Sector Allocation | Percent of Total Investments |

Health | 19 | % | ||

Tobacco | 19 | |||

Transportation | 17 | |||

County/City/Special District/School District | 12 | |||

Education | 11 | |||

Utilities | 8 | |||

Corporate | 7 | |||

State | 6 | |||

Housing | 1 |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Call/Maturity Schedule3 | Percent of Total Investments |

| Calendar Year Ended December 31, | ||||

2017 | 15 | % | ||

2018 | 3 | |||

2019 | 4 | |||

2020 | 7 | |||

2021 | 9 |

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| Credit Quality Allocation1 | Percent of Total Investments |

AAA/Aaa | 4 | % | ||

AA/Aa | 14 | |||

A | 6 | |||

BBB/Baa | 22 | |||

BB/Ba | 11 | |||

B | 12 | |||

CCC | 1 | |||

N/R2 | 30 |

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of December 31, 2016, the market value of unrated securities deemed by the investment adviser to be investment grade represents 5% of the Fund’s total investments. |

| 6 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

| Fund Summary as of December 31, 2016 | BlackRock National Municipal Fund | |||

| Investment Objective |

BlackRock National Municipal Fund’s (the “Fund”) investment objective is to provide shareholders with as high a level of income exempt from Federal income taxes as is consistent with the investment policies of the Fund.

| Portfolio Management Commentary |

How did the Fund perform?

| • | For the six-month period ended December 31, 2016, all of the Fund’s Shares outperformed the primary benchmark, the S&P® Municipal Bond Index, except for Investor B Shares performed in line and Investor C Shares underperformed. The Fund outperformed its secondary benchmark, the Custom National Index. The following discussion of relative performance pertains to the Fund’s secondary benchmark, the Custom National Index. |

What factors influenced performance?

| • | Municipal bonds lost ground in the second half of 2016. After producing slightly positive returns through August, municipal bonds began to move lower in September and October due to a pick-up in new tax-exempt issuance and rising yields in the U.S. Treasury market. The weakness accelerated in November once Donald Trump’s election victory caused investors to factor a backdrop of stronger growth and tighter Fed policy into market prices. The municipal market stabilized and retraced some of its losses in December as the relative attractiveness of the asset class brought in new investors, but the modest rally was insufficient to make up for the earlier downturn. |

| • | Although the Fund finished the period with a negative absolute return, as would be expected given the broader market environment, several factors contributed to its outperformance versus the benchmark. First, the Fund kept its duration (interest-rate sensitivity) below that of the index, a positive at a time in which yields rose and prices fell. The Fund also maintained an above-average level of cash reserves. In taking this approach, the investment adviser’s goal was not to express a view on market direction, but rather to maintain sufficient liquidity to handle redemptions and provide the flexibility to capitalize on the volatility that usually occurs at year end. However, given the market’s poor performance, the cash weighting had a favorable effect on results. In addition, it enabled the investment adviser to take advantage of the volatility that occurred in the wake of the election. The Fund’s low use of leverage also helped minimize the impact of weak market performance. |

| • | At a time of heightened investor risk aversion, higher-quality bonds generally outpaced their lower-quality counterparts. In this environment, |

the Fund’s high average credit quality of A+ (based on the Standard & Poor’s rating system) helped shield it from the weaker performance of lower-rated issues. |

| • | The Fund sought to manage interest rate risk using U.S. Treasury futures. Given that Treasury yields rose, as prices fell, this aspect of the Fund’s positioning had a modestly positive effect on returns. In the latter part of the period, the investment adviser increased the extent of the position to help offset the risk of rising rates. |

| • | On the negative side, the Fund’s exposure to longer-maturity securities detracted from performance. Since longer maturities have higher interest-rate sensitivity, they typically underperform shorter-dated securities during times of rising rates. |

| • | The Fund’s exposure to the tobacco sector, though modest, was an additional detractor. Yield spreads for tobacco-related debt widened as rising redemptions among high-yield municipal bond funds led to selling in the sector. |

Describe recent portfolio activity.

| • | The Fund received strong inflows early in the period, and the investment adviser built up significant cash reserves rather than putting the cash to work immediately. As rates rose towards year end, some of these reserves were pared down. The Fund’s purchases were concentrated in higher-quality securities, with a mix of primary and secondary market opportunities. |

| • | At the close of the year, the Fund held overweight positions in the pre-refunded, transportation and utilities sectors. The Fund’s weighting in pre-refunded securities increased during the period, as lower rates prompted municipal issuers to refinance older, higher-yielding debt. |

Describe portfolio positioning at period end.

| • | The Fund continued to have a defensive positioning, with an above-average cash weighting, a high average credit quality, low leverage and a duration below that of the benchmark. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| SEMI-ANNUAL REPORT | DECEMBER 31, 2016 | 7 |

| BlackRock National Municipal Fund |

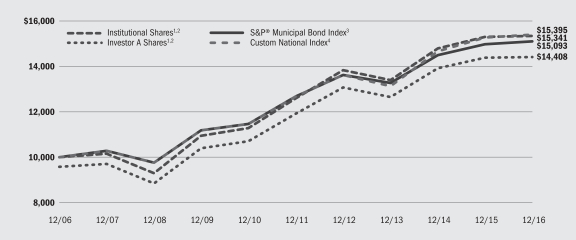

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal circumstances, the Fund seeks to achieve its objective by investing at least 80% of its assets in municipal bonds and may invest in municipal bonds rated in any rating category or in unrated municipal bonds. The Fund will usually invest in municipal bonds that have a maturity of five years or longer. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| 4 | The Custom National Index is a customized benchmark that reflects the returns of the S&P® Municipal Bond Index for periods prior to January 1, 2013, and the returns of only those bonds in the S&P® Municipal Bond Index that have maturities greater than five years for periods subsequent to January 1, 2013. |

| Performance Summary for the Period Ended December 31, 2016 |

| Average Annual Total Returns5 | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||

Institutional | 2.26 | % | 2.11 | % | (3.08 | )% | 0.31 | % | N/A | 4.03 | % | N/A | 4.37 | % | N/A | |||||||||||||||||||||

Service | 2.01 | 1.92 | (3.10 | ) | 0.20 | N/A | 3.74 | N/A | 4.11 | N/A | ||||||||||||||||||||||||||

Investor A | 1.92 | 1.80 | (3.17 | ) | 0.15 | (4.11 | )% | 3.87 | 2.97 | 4.17 | 3.72 | % | ||||||||||||||||||||||||

Investor B | 1.52 | 1.39 | (3.42 | ) | (0.36 | ) | (4.26 | ) | 3.35 | 3.00 | 3.65 | 3.65 | ||||||||||||||||||||||||

Investor C | 1.27 | 1.20 | (3.54 | ) | (0.60 | ) | (1.57 | ) | 3.09 | 3.09 | 3.39 | 3.39 | ||||||||||||||||||||||||

Investor C1 | 1.47 | 1.41 | (3.36 | ) | (0.40 | ) | N/A | 3.31 | N/A | 3.60 | N/A | |||||||||||||||||||||||||

Class K | 2.31 | 2.23 | (2.95 | ) | 0.51 | N/A | 4.16 | N/A | 4.50 | N/A | ||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | — | (3.43 | ) | 0.77 | N/A | 3.55 | N/A | 4.20 | N/A | ||||||||||||||||||||||||||

Custom National Index | — | — | (4.40 | ) | 0.82 | N/A | 3.96 | N/A | 4.41 | N/A | ||||||||||||||||||||||||||

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 16 for a detailed description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results. |

| Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| Expense Example |

| Actual | Hypothetical8 | |||||||||||||||||||||||||||||||||||

| During the Period | Including Interest Expense and Fees | Excluding Interest Expense and Fees | ||||||||||||||||||||||||||||||||||

| Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Expenses Including Interest Expense and Fees6 | Excluding Interest Expense and Fees7 | Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Expenses Paid During the Period6 | Ending Account Value December 31, 2016 | Expenses Paid During the Period7 | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 969.20 | $ | 2.58 | $ | 2.58 | $ | 1,000.00 | $ | 1022.61 | $ | 2.65 | $ | 1022.61 | $ | 2.65 | ||||||||||||||||||

Service Class | $ | 1,000.00 | $ | 969.00 | $ | 3.67 | $ | 3.62 | $ | 1,000.00 | $ | 1021.51 | $ | 3.77 | $ | 1021.51 | $ | 3.72 | ||||||||||||||||||

Investor A | $ | 1,000.00 | $ | 968.30 | $ | 3.52 | $ | 3.52 | $ | 1,000.00 | $ | 1021.61 | $ | 3.62 | $ | 1021.61 | $ | 3.62 | ||||||||||||||||||

Investor B | $ | 1,000.00 | $ | 965.80 | $ | 6.04 | $ | 6.00 | $ | 1,000.00 | $ | 1019.11 | $ | 6.21 | $ | 1019.11 | $ | 6.16 | ||||||||||||||||||

Investor C | $ | 1,000.00 | $ | 964.60 | $ | 7.23 | $ | 7.23 | $ | 1,000.00 | $ | 1017.81 | $ | 7.43 | $ | 1017.91 | $ | 7.43 | ||||||||||||||||||

Investor C1 | $ | 1,000.00 | $ | 966.40 | $ | 6.25 | $ | 6.25 | $ | 1,000.00 | $ | 1018.81 | $ | 6.41 | $ | 1018.91 | $ | 6.41 | ||||||||||||||||||

Class K | $ | 1,000.00 | $ | 970.50 | $ | 2.11 | $ | 2.09 | $ | 1,000.00 | $ | 1022.66 | $ | 2.16 | $ | 1023.11 | $ | 2.14 | ||||||||||||||||||

| 6 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class (0.43% for BlackRock, 0.52% for Institutional, 0.74% for Service, 0.71% for Investor A, 1.22% for Investor B, 1.46% for Investor C and 1.26% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 7 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class (0.42% for BlackRock, 0.52% for Institutional, 0.73% for Service, 0.71% for Investor A, 1.21% for Investor B, 1.46% for Investor C and 1.26% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 8 | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| See “Disclosure of Expenses” on page 17 for further information on how expenses were calculated. |

| 8 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

| BlackRock National Municipal Fund |

| Overview of the Fund’s Total Investments* |

| Sector Allocation | Percent of Total Investments |

Transportation | 27 | % | ||

Utilities | 20 | |||

Health | 17 | |||

County/City/Special District/School District | 12 | |||

State | 10 | |||

Education | 8 | |||

Corporate | 3 | |||

Tobacco | 3 |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Call/Maturity Schedule3 | Percent of Total Investments |

| Calendar Year Ended December 31, | ||||

2017 | 6 | % | ||

2018 | 12 | |||

2019 | 17 | |||

2020 | 9 | |||

2021 | 13 |

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| Credit Quality Allocation1 | Percent of Total Investments |

AAA/Aaa | 12 | % | ||

AA/Aa | 49 | |||

A | 23 | |||

BBB/Baa | 7 | |||

BB/Ba | 2 | |||

B | 3 | |||

N/R2 | 4 |

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of December 31, 2016, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1% of the Fund’s total investments. |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2016 | 9 |

| Fund Summary as of December 31, 2016 | BlackRock Short-Term Municipal Fund | |||

| Investment Objective |

BlackRock Short-Term Municipal Fund’s (the “Fund”) investment objective is to provide shareholders with as high a level of income exempt from Federal income taxes as is consistent with the investment policies of the Fund.

| Portfolio Management Commentary |

How did the Fund perform?

| • | For the six-month period ended December 31, 2016, the Fund outperformed its primary benchmark, the S&P® Municipal Bond Index, but it underperformed its secondary benchmark, the S&P® Limited Maturity Municipal Bond Index. The following discussion of relative performance pertains to the Fund’s secondary benchmark, the S&P® Limited Maturity Municipal Bond Index. |

What factors influenced performance?

| • | Municipal bonds lost ground in the second half of 2016, reflecting heavy new issuance and expectations for more aggressive Fed policy in the year ahead. Short-term municipal bonds, while finishing in negative territory, nonetheless outpaced longer-term issues. |

| • | The Fund’s relative performance was pressured by its overweight positions in the health care, transportation and utilities sectors. These sectors had longer average maturities than the benchmark, a negative at a time of rising yields. |

| • | The Fund’s yield curve positioning aided performance. The Fund held a large cash position and an overweight in shorter maturities, which cushioned the downturn in the broader market. An underweight to duration (in other words, lower interest-rate sensitivity than the benchmark) was an additional positive. The Fund’s underweight position in pre-refunded bonds contributed, as did an overweight in the corporate sector. Security selection in the latter group also helped performance. |

Describe recent portfolio activity.

| • | Throughout the second half of 2016, the investment adviser made a concerted effort to structure the portfolio to match its benchmark more |

closely. The goal of this strategy was to help insulate the portfolio from potential volatility surrounding key events such as Fed meetings, the advent of money market reform in October and the U.S Presidential election in November. The investment adviser built cash reserves to shorten duration and increase liquidity, as the markets began to debate the implications of these events. |

| • | Entering the fourth quarter, issuers’ attempts to access the new-issue market prior to the U.S. Presidential election led to an influx of new supply that started to push yields higher. Municipal yields climbed further in line with U.S. Treasury securities following the election, as expectations for higher growth and rising inflation led to elevated mutual fund redemptions. In response, the investment adviser continued to increase the portfolio’s cash reserves. Near the end of the period, the Fund began to add to its fixed-rate positions as the confluence of rising yields, a slowdown in mutual fund selling and lower new issue supply provided a solid entry point to reduce the cash position and lock in higher yields. |

Describe portfolio positioning at period end.

| • | The Fund closed the year with an above-average cash position and an overweight in the tax-backed state and local sectors, especially in high-tax states. Within these sectors, the investment adviser maintained a higher-quality bias. The Fund also held an overweight in the utilities, transportation and health care sectors because of their additional yield and ability to augment diversification. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| 10 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

| BlackRock Short-Term Municipal Fund |

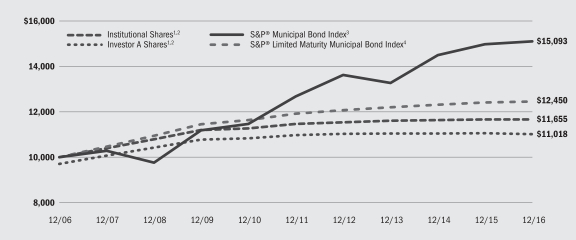

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charge, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal circumstances, the Fund seeks to achieve its objective by investing at least 80% of its assets in municipal bonds and invests primarily in investment grade municipal bonds or municipal notes, including variable rate demand obligations. The Fund will maintain a dollar-weighted maturity of no more than two years. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| 4 | The S&P® Limited Maturity Municipal Bond Index includes all bonds in the S&P® Municipal Bond Index with a remaining maturity of less than four years. |

| Performance Summary for the Period Ended December 31, 2016 |

| Average Annual Total Returns5 | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||

Institutional | 0.94 | % | 0.81 | % | (0.88 | )% | (0.06 | )% | N/A | 0.33 | % | N/A | 1.54 | % | N/A | |||||||||||||||||||||

Investor A | 0.67 | 0.57 | (0.92 | ) | (0.34 | ) | (3.32 | )% | 0.08 | (0.53 | )% | 1.28 | 0.97 | % | ||||||||||||||||||||||

Investor A1 | 0.84 | 0.75 | (0.94 | ) | (0.17 | ) | N/A | 0.23 | N/A | 1.43 | N/A | |||||||||||||||||||||||||

Investor C | (0.05 | ) | (0.15 | ) | (1.37 | ) | (1.07 | ) | (2.06 | ) | (0.71 | ) | (0.71 | ) | 0.50 | 0.50 | ||||||||||||||||||||

Class K | 0.99 | 0.87 | (0.88 | ) | (0.06 | ) | N/A | 0.33 | N/A | 1.53 | N/A | |||||||||||||||||||||||||

S&P® Municipal Bond Index | — | — | (3.43 | ) | 0.77 | N/A | 3.55 | N/A | 4.20 | N/A | ||||||||||||||||||||||||||

S&P® Limited Maturity Municipal Bond Index | — | — | (0.64 | ) | 0.37 | N/A | 0.88 | N/A | 2.22 | N/A | ||||||||||||||||||||||||||

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 16 for a detailed description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results. |

| Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| Expense Example |

| Actual | Hypothetical7 | |||||||||||||||||||||||||||

| Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Expenses Paid During the Period6 | Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Expenses Paid During the Period6 | Annualized Expense Ratio | ||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 991.20 | $ | 1.91 | $ | 1,000.00 | $ | 1023.29 | $ | 1.94 | 0.38 | % | ||||||||||||||

Investor A | $ | 1,000.00 | $ | 990.80 | $ | 3.26 | $ | 1,000.00 | $ | 1021.93 | $ | 3.31 | 0.65 | % | ||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 990.60 | $ | 2.46 | $ | 1,000.00 | $ | 1022.74 | $ | 2.50 | 0.49 | % | ||||||||||||||

Investor C | $ | 1,000.00 | $ | 986.30 | $ | 7.11 | $ | 1,000.00 | $ | 1018.05 | $ | 7.22 | 1.42 | % | ||||||||||||||

Class K | $ | 1,000.00 | $ | 991.20 | $ | 1.91 | $ | 1,000.00 | $ | 1023.29 | $ | 1.94 | 0.38 | % | ||||||||||||||

| 6 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 7 | Hypothetical 5% return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| See “Disclosure of Expenses” on page 17 for further information on how expenses were calculated. |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2016 | 11 |

| BlackRock Short-Term Municipal Fund | ||||

| Overview of the Fund’s Total Investments* |

| Sector Allocation | Percent of Total Investments |

County/City/Special District/School District | 26 | % | ||

State | 23 | |||

Utilities | 21 | |||

Education | 10 | |||

Transportation | 9 | |||

Health | 6 | |||

Banks | 3 | |||

Tobacco | 1 | |||

Housing | 1 |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Call/Maturity Schedule2 | Percent of Total Investments |

| Calendar Year Ended December 31, | ||||

2017 | 20 | % | ||

2018 | 36 | |||

2019 | 30 | |||

2020 | 12 |

| 2 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| Credit Quality Allocation1 | Percent of Total Investments |

AAA/Aaa | 28 | % | ||

AA/Aa | 47 | |||

A | 14 | |||

BBB/Baa | 1 | |||

N/R | 10 |

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 12 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

| Fund Summary as of December 31, 2016 | BlackRock New York Municipal Opportunities Fund | |||

| Investment Objective |

BlackRock New York Municipal Opportunities Fund’s (the “Fund”) investment objective is to provide shareholders with income exempt from Federal income tax and New York State and New York City personal income taxes.

| Portfolio Management Commentary |

How did the Fund perform?

| • | For the six-month period ended December 31, 2016, the Fund underperformed its primary benchmark, the S&P® Municipal Bond Index, as well as its secondary benchmark, the S&P® New York Municipal Bond Index. The following discussion of relative performance pertains to the Fund’s secondary benchmark, the S&P® New York Municipal Bond Index. |

What factors influenced performance?

| • | Municipal bonds lost ground in the second half of 2016. After producing slightly positive returns through August, municipals began to move lower in September and October due to rising yields in the U.S. Treasury market and a pick-up in new tax-exempt issuance. (Prices and yields move in opposite directions.) The weakness accelerated in November once Donald Trump’s election victory caused investors to factor in a backdrop of stronger growth and tighter Fed policy. The municipal market stabilized and retraced some of its losses in December as the relative attractiveness of the asset class brought in new investors, but the modest rally was insufficient to make up for the earlier downturn. |

| • | The Fund’s duration positioning was a significant detractor from performance at a time in which yields rose. (Duration is a measure of interest-rate sensitivity.) Overweight positions in the transportation, education and tobacco sectors, which lagged the broader market, also detracted. Investments in lower-coupon bonds detracted from results since such bonds tend to have greater interest-rate sensitivity and more price volatility than bonds with larger coupons. As a result, they underperformed in the rising-rate environment. In terms of credit quality, the Fund’s over- |

weight exposure to lower-rated market segments (bonds rated A and BBB) hurt relative performance given that investors responded to the weak market conditions by gravitating to higher-quality issues. |

| • | The Fund sought to manage interest rate risk using U.S. Treasury futures. At a time when Treasury yields rose, as prices fell, this aspect of the Fund’s positioning made a meaningful contribution to performance. |

| • | The Fund’s overweight in housing bonds, which traditionally outperform during rising rate environments due to their strong credit quality and attractive yields, also helped performance. Holdings in pre-refunded and escrowed bonds — which were aided by their above-average credit quality — contributed positively, as well. The Fund’s cash position, though modest, was an additional positive at a time of falling prices. |

Describe recent portfolio activity.

| • | Early in the period, the new-issue market provided opportunities for the Fund to diversify into different credits and structures on an opportunistic basis. These purchases proved premature, however, as the increase in rates accelerated late in the year. As rates continued to rise, portfolio activity turned to managing cash flows, effecting tax-loss swaps and improving yield. |

Describe portfolio positioning at period end.

| • | Relative to the S&P® New York Municipal Bond Index, the Fund was slightly biased toward the long end of the yield curve to capture additional yield and capitalize on the positive supply-and-demand factors that typically affect the market near year end. |

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| SEMI-ANNUAL REPORT | DECEMBER 31, 2016 | 13 |

| BlackRock New York Municipal Opportunities Fund |

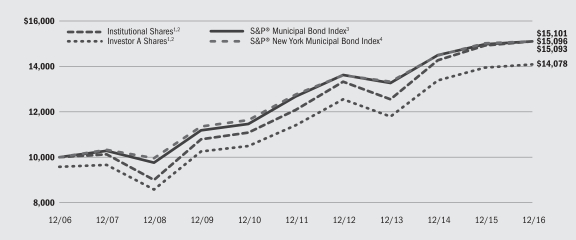

| Total Return Based on a $10,000 Investment |

| 1 | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including advisory fees. Institutional Shares do not have a sales charge. |

| 2 | Under normal circumstances, the Fund will invest at least 80% of its assets in investment grade New York municipal bonds. The Fund’s total returns prior to February 18, 2015 are the returns of the Fund when it followed different investment strategies under the name BlackRock New York Municipal Bond Fund. |

| 3 | The S&P® Municipal Bond Index is composed of bonds held by managed municipal bond fund customers of Standard & Poor’s Securities Pricing, Inc. that are priced daily. Bonds in the S&P® Municipal Bond Index must have an outstanding par value of at least $2 million and a remaining maturity of not less than one month. |

| 4 | The S&P® New York Municipal Bond Index includes all New York bonds in the S&P® Municipal Bond Index. |

| Performance Summary for the Period Ended December 31, 2016 |

| Average Annual Total Returns2,5 | ||||||||||||||||||||||||||||||||||||

| 1 Year | 5 Years | 10 Years | ||||||||||||||||||||||||||||||||||

| Standardized 30-Day Yields | Unsubsidized 30-Day Yields | 6-Month Total Returns | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | w/o sales charge | w/sales charge | ||||||||||||||||||||||||||||

Institutional | 3.08 | % | 2.96 | % | (3.71 | )% | 1.22 | % | N/A | 4.56 | % | N/A | 4.20 | % | N/A | |||||||||||||||||||||

Investor A | 2.72 | 2.63 | (3.83 | ) | 0.97 | (3.32 | )% | 4.29 | 3.39 | % | 3.93 | 3.48 | % | |||||||||||||||||||||||

Investor A1 | 2.87 | 2.78 | (3.76 | ) | 1.10 | N/A | 4.45 | N/A | 4.08 | N/A | ||||||||||||||||||||||||||

Investor C | 2.09 | 2.00 | (4.19 | ) | 0.22 | (0.77 | ) | 3.54 | 3.54 | 3.17 | 3.17 | |||||||||||||||||||||||||

Investor C1 | 2.49 | 2.43 | (4.00 | ) | 0.61 | N/A | 3.94 | N/A | 3.57 | N/A | ||||||||||||||||||||||||||

S&P® Municipal Bond Index | — | — | (3.43 | ) | 0.77 | N/A | 3.55 | N/A | 4.20 | N/A | ||||||||||||||||||||||||||

S&P® New York Municipal Bond Index | — | — | (3.49 | ) | 0.56 | N/A | 3.43 | N/A | 4.21 | N/A | ||||||||||||||||||||||||||

| 5 | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” on page 16 for a detailed description of share classes, including any related sales charges and fees. |

| N/A — Not applicable as share class and index do not have a sales charge. |

| Past performance is not indicative of future results. |

| Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| Expense Example |

| Actual | Hypothetical8 | |||||||||||||||||||||||||||||||||||

| Expenses Paid During the Period | Including Interest Expense and Fees | Excluding Interest Expense and Fees | ||||||||||||||||||||||||||||||||||

| Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Including Interest Expense and Fees6 | Excluding Interest Expense and Fees7 | Beginning Account Value July 1, 2016 | Ending Account Value December 31, 2016 | Expenses Paid During the Period6 | Ending Account Value December 31, 2016 | Expenses Paid During the Period7 | ||||||||||||||||||||||||||||

Institutional | $ | 1,000.00 | $ | 962.90 | $ | 3.17 | $ | 2.67 | $ | 1,000.00 | $ | 1,021.98 | $ | 3.26 | $ | 1,022.48 | $ | 2.75 | ||||||||||||||||||

Investor A | $ | 1,000.00 | $ | 961.70 | $ | 4.40 | $ | 3.91 | $ | 1,000.00 | $ | 1,020.72 | $ | 4.53 | $ | 1,021.22 | $ | 4.02 | ||||||||||||||||||

Investor A1 | $ | 1,000.00 | $ | 962.40 | $ | 3.71 | $ | 3.22 | $ | 1,000.00 | $ | 1,021.42 | $ | 3.82 | $ | 1,021.93 | $ | 3.31 | ||||||||||||||||||

Investor C | $ | 1,000.00 | $ | 958.10 | $ | 8.09 | $ | 7.60 | $ | 1,000.00 | $ | 1,016.94 | $ | 8.34 | $ | 1,017.44 | $ | 7.83 | ||||||||||||||||||

Investor C1 | $ | 1,000.00 | $ | 960.00 | $ | 6.13 | $ | 5.63 | $ | 1,000.00 | $ | 1,018.95 | $ | 6.31 | $ | 1,019.46 | $ | 5.80 | ||||||||||||||||||

| 6 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class (0.64% for Institutional, 0.89% for Investor A, 0.75% for Investor A1, 1.64% for Investor C and 1.24% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 7 | For each class of the Fund, expenses are equal to the annualized net expense ratio for the class (0.54% for Institutional, 0.79% for Investor A, 0.65% for Investor A1, 1.54% for Investor C and 1.14% for Investor C1), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). |

| 8 | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. |

| See “Disclosure of Expenses” on page 17 for further information on how expenses were calculated. |

| 14 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

| BlackRock New York Municipal Opportunities Fund |

| Overview of the Fund’s Total Investments* |

| Sector Allocation | Percent of Total Investments | |||

County/City/Special District/School District | 23 | % | ||

Transportation | 23 | |||

Education | 14 | |||

Utilities | 11 | |||

Health | 9 | |||

State | 8 | |||

Tobacco | 6 | |||

Housing | 3 | |||

Corporate | 3 | |||

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease.

| Call/Maturity Schedule3 | Percent of Total Investments | |||

| Calendar Year Ended December 31, | ||||

2017 | 9 | % | ||

2018 | 3 | |||

2019 | 8 | |||

2020 | 5 | |||

2021 | 9 | |||

| 3 | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| * | Excludes short-term securities. |

| Credit Quality Allocation1 | Percent of Total Investments |

AAA/Aaa | 15 | % | ||

AA/Aa | 32 | |||

A | 27 | |||

BBB/Baa | 7 | |||

BB/Ba | 3 | |||

B | 3 | |||

CCC | 1 | |||

N/R2 | 12 |

| 1 | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P or Moody’s if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| 2 | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of December 31, 2016, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1% of the Fund’s total investments. |

| SEMI-ANNUAL REPORT | DECEMBER 31, 2016 | 15 |

| About Fund Performance | ||||

| • | Institutional and Class K Shares (Class K Shares are available in BlackRock National Municipal Fund and BlackRock Short-Term Municipal Fund) are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors. On the close of business on August 15, 2016, all of the issued and outstanding BlackRock Shares of BlackRock National Municipal Fund were redesignated as Class K Shares. Prior to July 18, 2011 for BlackRock National Municipal Fund, Class K Share performance results are those of the Institutional Shares restated to reflect Class K Share fees. On the close of business on September 1, 2015, all of the issued and outstanding BlackRock Shares of BlackRock Short-Term Municipal Fund were redesignated as Class K Shares. |

| • | Service Shares (available only in BlackRock National Municipal Fund) are not subject to any sales charge (front-end load) or deferred sales charge. These shares are subject to a service fee of 0.25% per year (but no distribution fee) and are only available to certain eligible investors. Prior to July 18, 2011, Service Share performance results are those of the Institutional Shares restated to reflect Service Share fees. |

| • | Investor A Shares are subject to a maximum initial sales charge (front-end load) of 4.25% for all Funds except BlackRock Short-Term Municipal Fund, which incurs a 3.00% maximum initial sales charge, and all Funds incur a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are generally available through financial intermediaries. |

| • | Investor A1 Shares (available only in BlackRock Short-Term Municipal Fund and BlackRock New York Municipal Opportunities Fund) are subject to a maximum initial sales charge (front-end load) of 1.00% for BlackRock Short-Term Municipal Fund and 4.00% for BlackRock New York Municipal Opportunities Fund; and a service fee of 0.10% per year (but no distribution fee). The maximum initial sales charge does not apply to current eligible investors of Investor A1 Shares of the Funds. Certain redemptions of these shares may be subject to a CDSC where no initial sales charge was paid at the time of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans or to redemptions of shares acquired through reinvestment of dividends and capital gains by existing shareholders. |

| • | Investor B Shares (available only in BlackRock National Municipal Fund) are subject to a maximum CDSC of 4.00%, declining to 0% after six years. In addition, these shares are subject to a distribution fee of 0.50% per year and a service fee of 0.25% per year. These shares automatically convert to Investor A Shares after approximately 10 years. (There is no initial sales charge for automatic share conversions.) |

| • | Investor C Shares are subject to a 1.00% CDSC if redeemed within one year of purchase. In addition, these shares are subject to a distribution fee of 0.75% per year and a service fee of 0.25% per year. These shares are generally available through financial intermediaries. |

| • | Investor C1 Shares (available only in BlackRock National Municipal Fund and BlackRock New York Municipal Opportunities Fund) are subject to a 1.00% CDSC if redeemed within one year of purchase. However, the CDSC does not apply to redemptions by certain employer-sponsored retirement plans and, for BlackRock National Municipal Fund only, fee based programs previously approved by the Fund, or to redemptions of shares acquired through reinvestment of dividends and capital gains by existing shareholders. In addition, these shares are subject to a distribution and service fees per year as follows: |

| Distribution Fee | Service Fee | |||||||

BlackRock National Municipal Fund | 0.55 | % | 0.25 | % | ||||

BlackRock New York Municipal Opportunities Fund | 0.35 | % | 0.25 | % | ||||

Investor B Shares of the BlackRock National Municipal Fund are only available through exchanges and dividend and capital gain reinvestments by existing shareholders, and for purchase by certain employer-sponsored retirement plans.

Investor A1 and Investor C1 Shares of their respective Funds are only available for dividend and capital gain reinvestments by existing shareholders, and for purchase by certain employer-sponsored retirement plans, and for BlackRock National Municipal Fund only, fee based programs previously approved by the Fund.

Performance information reflects past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. Refer to www.blackrock.com/funds to obtain performance data current to the most recent month end. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Figures shown in each of the performance tables on the previous pages assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date/payable date. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Funds’ investment adviser, voluntarily waived and/or reimbursed a portion of the Funds’ expenses. Without such waiver and/or reimbursement, the Funds’ performance would have been lower. The Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver and/or reimbursement may be reduced or discontinued at any time. See Note 6 of the Notes to Financial Statements for additional information on reimbursements.

The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements.

| 16 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

| Disclosure of Expenses |

Shareholders of these Funds may incur the following charges:

(a) transactional expenses such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees including 12b-1 fees, acquired fund fees and expenses and other fund expenses. The expense examples on the previous pages (which are based on a hypothetical investment of $1,000 invested on July 1, 2016 and held through December 31, 2016) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the headings entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect any transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only, and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| SEMI-ANNUAL REPORT | DECEMBER 31, 2016 | 17 |

| The Benefits and Risks of Leveraging | ||||

The Funds may utilize leverage to seek to enhance returns and NAV. However, these objectives cannot be achieved in all interest rate environments.

Each Fund, other than the Short-Term Municipal Fund, may leverage its assets through the use of proceeds received in tender option bond (“TOB”) transactions, as described in the Notes to Financial Statements. In a TOB Trust transaction, the Funds transfer municipal bonds or other municipal securities into a special purpose entity (a “TOB Trust”). TOB investments generally provide the Funds with economic benefits in periods of declining short-term interest rates, but expose the Funds to risks during periods of rising short-term interest rates. Additionally, fluctuations in the market value of municipal bonds deposited into a TOB Trust may adversely affect the Funds’ NAV per share.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by each Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of each Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Funds’ shareholders benefit from the incremental net income.

The interest earned on securities purchased with the proceeds from leverage is distributed to the Funds’ shareholders, and the value of these portfolio holdings is reflected in the Funds’ per share NAV. However, in order to benefit shareholders, the return on assets purchased with

leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other ongoing costs of leverage exceed a Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Funds had not used leverage.

Furthermore, the value of each Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can also influence the value of portfolio investments. As a result, changes in interest rates can influence each Fund’s NAV positively or negatively in addition to the impact on each Fund’s performance from leverage. Changes in the direction of interest rates are difficult to predict accurately, and there is no assurance that a Fund’s leveraging strategy will be successful.

The use of leverage also generally causes greater changes in each Fund’s NAV and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV of a Fund’s shares than if the Fund were not leveraged. In addition, each Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of the leverage instruments, which may cause the Funds to incur losses. The use of leverage may limit a Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. Each Fund incurs expenses in connection with the use of leverage, all of which are borne by the Funds’ shareholders and may reduce income.

| Derivative Financial Instruments | ||||

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other asset without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the

transaction or illiquidity of the instrument. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| 18 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

BlackRock High Yield Municipal Fund (Percentages shown are based on Net Assets) |

| Investment Companies — 0.2% | Shares | Value | ||||||

| VanEck Vectors High-Yield Municipal Index ETF | 50,000 | $ | 1,484,000 | |||||

| Municipal Bonds | Par (000) | |||||||

Alabama — 1.6% | ||||||||

Alabama Special Care Facilities Financing Authority-Birmingham, RB, Methodist Home For The Aging: | ||||||||

5.75%, 6/01/35 | $ | 200 | 212,230 | |||||

5.75%, 6/01/45 | 355 | 373,158 | ||||||

6.00%, 6/01/50 | 450 | 479,628 | ||||||

County of Jefferson Alabama Sewer, Refunding RB: | ||||||||

Senior Lien, Series A (AGM), 5.00%, 10/01/44 | 365 | 403,453 | ||||||

Sub-Lien, Series D, 7.00%, 10/01/51 | 2,355 | 2,849,126 | ||||||

Sub-Lien, Series D, 6.50%, 10/01/53 | 3,465 | 4,090,641 | ||||||

Lower Alabama Gas District, RB, Series A, 5.00%, 9/01/46 | 1,900 | 2,091,102 | ||||||

State of Alabama Docks Department, Refunding RB, 6.00%, 10/01/40 | 710 | 806,851 | ||||||

|

| |||||||

| 11,306,189 | ||||||||

Alaska — 0.3% | ||||||||

Northern Tobacco Securitization Corp., Refunding RB, Tobacco Settlement, Asset-Backed, Series A: | ||||||||

4.63%, 6/01/23 | 735 | 745,488 | ||||||

5.00%, 6/01/32 | 1,510 | 1,403,183 | ||||||

|

| |||||||

| 2,148,671 | ||||||||

Arizona — 1.4% | ||||||||

City of Phoenix Arizona IDA, ERB, Eagle College Prep Project, Series A, 5.00%, 7/01/43 | 1,445 | 1,411,808 | ||||||

City of Phoenix Arizona IDA, RB: | ||||||||

Great Hearts Academies — Veritas Project, 6.40%, 7/01/47 | 415 | 445,436 | ||||||

Legacy Traditional Schools Project, Series A, 6.50%, 7/01/34 (a) | 465 | 517,717 | ||||||

Legacy Traditional Schools Project, Series A, 6.75%, 7/01/44 (a) | 810 | 909,994 | ||||||

City of Phoenix Arizona IDA, Refunding RB (a): | ||||||||

Basis Schools, Inc. Projects, 5.00%, 7/01/35 | 300 | 303,312 | ||||||

Basis Schools, Inc. Projects, 5.00%, 7/01/45 | 895 | 895,000 | ||||||

Basis Schools, Inc. Projects, Series A, 5.00%, 7/01/35 | 295 | 298,257 | ||||||

Basis Schools, Inc. Projects, Series A, 5.00%, 7/01/46 | 325 | 324,402 | ||||||

Legacy Traditional School Projects, 5.00%, 7/01/35 | 315 | 309,406 | ||||||

Legacy Traditional School Projects, 5.00%, 7/01/45 | 250 | 237,978 | ||||||

| Municipal Bonds | Par (000) | Value | ||||||

Arizona (continued) | ||||||||

City of Phoenix Industrial Development Authority, RB, Legacy Traditional Schools Projects, Series A (a): | ||||||||

5.00%, 7/01/36 | $ | 1,225 | $ | 1,208,487 | ||||

5.00%, 7/01/41 | 1,685 | 1,629,547 | ||||||

Town of Florence, Inc. Arizona, IDA, ERB, Legacy Traditional School Project, Queen Creek and Casa Grande Campuses, 6.00%, 7/01/43 | 1,375 | 1,451,312 | ||||||

|

| |||||||

| 9,942,656 | ||||||||

Arkansas — 0.3% | ||||||||

Arkansas Development Finance Authority, RB, Series A, 4.00%, 7/01/39 | 1,365 | 1,226,152 | ||||||

County of Benton Arkansas Public Facilities Board, RB, BCCSO Project, Series A, 6.00%, 6/01/40 | 750 | 800,430 | ||||||

|

| |||||||

| 2,026,582 | ||||||||

California — 8.1% | ||||||||

Alameda Corridor Transportation Authority, Refunding RB, Series B, 5.00%, 10/01/35 | 5,210 | 5,706,357 | ||||||

California Health Facilities Financing Authority, RB: | ||||||||

St. Joseph Health System, Series A, 5.75%, 7/01/39 | 1,000 | 1,089,050 | ||||||

Sutter Health, Series B, 6.00%, 8/15/42 | 1,000 | 1,136,170 | ||||||

California Health Facilities Financing Authority, Refunding RB, Catholic Healthcare West, Series A, 6.00%, 7/01/19 (b) | 265 | 294,601 | ||||||

California Municipal Finance Authority, RB, Urban Discovery Academy Project (a): | ||||||||

5.50%, 8/01/34 | 310 | 315,558 | ||||||

6.00%, 8/01/44 | 655 | 670,975 | ||||||

6.13%, 8/01/49 | 570 | 584,569 | ||||||

California School Finance Authority, RB, Value Schools: | ||||||||

6.65%, 7/01/33 | 295 | 327,485 | ||||||

6.90%, 7/01/43 | 650 | 726,934 | ||||||

California Statewide Communities Development Authority, RB, Series A: | ||||||||

Loma Linda University Medical Center, 5.00%, 12/01/46 (a) | 1,260 | 1,274,099 | ||||||

Sutter Health, 6.00%, 8/15/42 | 400 | 457,780 | ||||||

California Statewide Communities Development Authority, Refunding RB, American Baptist Homes of the West, 6.25%, 10/01/39 | 2,575 | 2,820,835 | ||||||

California Statewide Financing Authority, RB, Asset-Backed, Tobacco Settlement: | ||||||||

Series A, 6.00%, 5/01/43 | 2,500 | 2,536,925 | ||||||

Series B, 6.00%, 5/01/43 | 3,485 | 3,506,189 | ||||||

City & County of San Francisco Redevelopment Agency, Tax Allocation Bonds, Mission Bay South Redevelopment Project (a): | ||||||||

0.00%, 8/01/23 (c) | 1,000 | 694,550 | ||||||

0.00%, 8/01/31 (c) | 1,155 | 488,496 | ||||||

Series D, 3.00%, 8/01/21 | 675 | 672,070 | ||||||

| Portfolio Abbreviations | ||

| ACA | American Capital Access Holding Ltd. | EDC | Economic Development Corp. | LRB | Lease Revenue Bonds | |||||

| AGC | Assured Guarantee Corp. | ERB | Education Revenue Bonds | M/F | Multi-Family | |||||

| AGM | Assured Guaranty Municipal Corp. | ETF | Exchange-Traded Fund | MRB | Mortgage Revenue Bonds | |||||

| AMBAC | American Municipal Bond Assurance Corp. | GARB | General Airport Revenue Bonds | NPFGC | National Public Finance Guarantee Corp. | |||||

| AMT | Alternative Minimum Tax (subject to) | GO | General Obligation Bonds | OTC | Over-the-Counter | |||||

| ARB | Airport Revenue Bonds | GTD | Guaranteed | PSF | Permanent School Fund | |||||

| BHAC | Berkshire Hathaway Assurance Corp. | HDA | Housing Development Authority | RB | Revenue Bonds | |||||

| CAB | Capital Appreciation Bonds | HFA | Housing Finance Agency | S/F | Single-Family | |||||

| COP | Certificates of Participation | IDA | Industrial Development Authority | |||||||

| EDA | Economic Development Authority | IDB | Industrial Development Board |

See Notes to Financial Statements.

| SEMI-ANNUAL REPORT | DECEMBER 31, 2016 | 19 |

Schedule of Investments (continued) | BlackRock High Yield Municipal Fund |

| Municipal Bonds | Par (000) | Value | ||||||

California (continued) | ||||||||

City of Chula Vista California, Refunding RB, San Diego Gas & Electric, Series A, 5.88%, 2/15/34 | $ | 500 | $ | 543,985 | ||||

City of San Jose California Hotel Tax, RB, Convention Center Expansion & Renovation Project: | ||||||||

6.50%, 5/01/36 | 310 | 359,126 | ||||||

6.50%, 5/01/42 | 760 | 878,750 | ||||||

City of Stockton California Public Financing Authority, RB, Delta Water Supply Project, Series A, 6.25%, 10/01/40 | 240 | 283,606 | ||||||

County of California Tobacco Securitization Agency, RB (d): | ||||||||

5.45%, 6/01/28 | 500 | 501,670 | ||||||

Asset-Backed, Los Angeles County Securitization Corp., 5.60%, 6/01/36 | 1,385 | 1,406,648 | ||||||

County of California Tobacco Securitization Agency, Refunding RB, Golden Gate Tobacco Funding Corp., Series A, 5.00%, 6/01/36 | 1,665 | 1,552,230 | ||||||

County of Los Angeles California Tobacco Securitization Agency, RB, Asset-Backed, Los Angeles County Securitization Corp., 5.70%, 6/01/46 (d) | 4,260 | 4,326,669 | ||||||

County of Riverside California Transportation Commission, RB, Senior Lien, Series A, 5.75%, 6/01/48 | 2,115 | 2,368,356 | ||||||

County of San Francisco California City & Redevelopment Agency, Tax Allocation Bonds, Mission Bay South Redevelopment Project, 0.00%, 8/01/26 (a)(c) | 580 | 331,087 | ||||||

Golden State Tobacco Securitization Corp., Refunding RB, Asset-Backed, Series A-1: | ||||||||

Senior, 5.75%, 6/01/47 | 5,455 | 5,227,581 | ||||||

5.13%, 6/01/47 | 3,060 | 2,696,747 | ||||||

Lammersville School District Community Facilities District, Special Tax Bonds, District No. 2002, Mountain House, 5.13%, 9/01/35 | 325 | 299,566 | ||||||

Palomar Health, Refunding RB: | ||||||||

5.00%, 11/01/36 | 325 | 338,884 | ||||||

5.00%, 11/01/39 | 310 | 324,124 | ||||||

Successor Agency to the San Francisco City & County Redevelopment Agency, Special Tax Bonds, Community Facilities District No. 6 (Mission Bay South Public Improvements), Series C, CAB, 0.00%, 8/01/43 (c) | 3,000 | 676,500 | ||||||

Temecula Public Financing Authority, Refunding, Special Tax Bonds, Harveston, Sub-Series B, 5.10%, 9/01/36 | 165 | 166,165 | ||||||

Tobacco Securitization Authority of Southern California, Refunding RB, Tobacco Settlement, Asset-Backed, Senior Series A-1: | ||||||||

4.75%, 6/01/25 | 880 | 899,430 | ||||||

5.00%, 6/01/37 | 7,410 | 7,039,500 | ||||||

5.13%, 6/01/46 | 3,590 | 3,271,818 | ||||||

|

| |||||||

| 56,795,085 | ||||||||

Colorado — 2.0% | ||||||||

Castle Oaks Metropolitan District No. 3, GO, 6.25%, 12/01/44 | 535 | 548,011 | ||||||

Colorado Educational & Cultural Facilities Authority, RB, Littleton Preparatory Charter School Project: | ||||||||

5.00%, 12/01/33 | 450 | 452,038 | ||||||

5.00%, 12/01/42 | 545 | 529,555 | ||||||

| Municipal Bonds | Par (000) | Value | ||||||

Colorado (continued) | ||||||||

Colorado Health Facilities Authority, Refunding RB, Series A (a): | ||||||||

6.13%, 12/01/45 | $ | 375 | $ | 389,055 | ||||

6.25%, 12/01/50 | 1,235 | 1,282,869 | ||||||

Copperleaf Metropolitan District No. 2, GO, Refunding, 5.75%, 12/01/45 | 780 | 793,931 | ||||||

Foothills Metropolitan District, Special Assessment Bonds, 6.00%, 12/01/38 | 3,705 | 3,837,306 | ||||||

Green Gables Metropolitan District No. 1, GO, Series A, 5.30%, 12/01/46 | 1,000 | 923,210 | ||||||

Leyden Rock Metropolitan District No 10, GO, Series A, 5.00%, 12/01/45 | 1,250 | 1,155,050 | ||||||

Regional Transportation District, RB, Denver Transit Partners Eagle P3 Project: | ||||||||

6.00%, 1/15/34 | 1,500 | 1,665,570 | ||||||

6.00%, 1/15/41 | 1,000 | 1,108,590 | ||||||

Tallyns Reach Metropolitan District No 3, GO, 6.75%, 11/01/38 | 1,220 | 1,174,872 | ||||||

|

| |||||||

| 13,860,057 | ||||||||

Connecticut — 0.7% | ||||||||

Mohegan Tribal Finance Authority, RB, 7.00%, 2/01/45 (a) | 1,515 | 1,550,178 | ||||||

Mohegan Tribe of Indians of Connecticut, RB, Series A, 6.75%, 2/01/45 (a) | 1,435 | 1,450,541 | ||||||

Mohegan Tribe of Indians of Connecticut, Refunding RB, Public Improvement, Priority Distribution, Series C, 6.25%, 2/01/30 (a) | 2,045 | 2,020,624 | ||||||

|

| |||||||

| 5,021,343 | ||||||||

Delaware — 0.9% | ||||||||

Delaware State Economic Development Authority, RB, 5.00%, 6/01/46 | 1,000 | 971,900 | ||||||

State of Delaware EDA, RB, Exempt Facilities, Indian River Power LLC Project, 5.38%, 10/01/45 | 5,115 | 5,251,570 | ||||||

|

| |||||||

| 6,223,470 | ||||||||

District of Columbia — 0.6% | ||||||||

District of Columbia Tobacco Settlement Financing Corp., Refunding RB, Asset-Backed, 6.75%, 5/15/40 | 385 | 397,809 | ||||||

Metropolitan Washington Airports Authority, Refunding RB: | ||||||||

CAB, 2nd Senior Lien, Series B (AGC), 0.00%, 10/01/30 (c) | 3,005 | 1,721,624 | ||||||

Dulles Toll Road, 1st Senior Lien, Series A, 5.00%, 10/01/39 | 185 | 197,249 | ||||||

Dulles Toll Road, 1st Senior Lien, Series A, 5.25%, 10/01/44 | 1,610 | 1,725,566 | ||||||

|

| |||||||

| 4,042,248 | ||||||||

Florida — 5.6% | ||||||||

Boggy Creek Improvement District, Refunding RB, Special Assessment Bonds, 5.13%, 5/01/43 | 1,405 | 1,403,890 | ||||||

Capital Trust Agency, Inc., RB, Silver Creek St. Augustine Project, Series A: | ||||||||

5.75%, 1/01/50 | 570 | 514,112 | ||||||

1st Mortgage, 8.25%, 1/01/44 (e)(f) | 445 | 360,392 | ||||||

1st Mortgage, 8.25%, 1/01/49 (e)(f) | 950 | 767,999 | ||||||

Celebration Pointe Community Development District, Special Assessment Bonds: | ||||||||

4.75%, 5/01/24 | 625 | 613,994 | ||||||

5.00%, 5/01/34 | 1,250 | 1,210,612 | ||||||

City of Tallahassee Florida, RB, Tallahassee Memorial HealthCare, Inc. Project, 5.00%, 12/01/55 | 2,600 | 2,696,460 | ||||||

See Notes to Financial Statements.

| 20 | SEMI-ANNUAL REPORT | DECEMBER 31, 2016 |

Schedule of Investments (continued) | BlackRock High Yield Municipal Fund |

| Municipal Bonds | Par (000) | Value | ||||||

Florida (continued) | ||||||||

County of Alachua Florida Health Facilities Authority, RB: | ||||||||

5.00%, 12/01/44 | $ | 2,720 | $ | 2,882,139 | ||||

East Ridge Retirement Village, Inc. Project, 6.25%, 11/15/44 | 2,000 | 2,156,900 | ||||||

County of Collier Florida IDA, Refunding RB, Arlington of Naples Project, Series A, 8.13%, 5/15/44 (a) | 1,490 | 1,694,473 | ||||||

County of Martin Florida Health Facilities Authority, RB, 5.50%, 11/15/42 | 1,000 | 1,072,660 | ||||||

County of Palm Beach Florida Health Facilities Authority, Refunding RB, Sinai Residences Boca Raton Project, 7.50%, 6/01/49 | 1,000 | 1,168,800 | ||||||

Florida Development Finance Corp., RB, Renaissance Charter School, Series A: | ||||||||

5.75%, 6/15/29 | 695 | 694,979 | ||||||

6.00%, 6/15/34 | 835 | 835,969 | ||||||

6.13%, 6/15/44 | 3,185 | 3,149,424 | ||||||

Greater Orlando Aviation Authority Florida, Refunding RB, Special Purpose, Jetblue Airways Corp. Project, AMT, 5.00%, 11/15/36 | 2,000 | 2,047,540 | ||||||