UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORMN-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-02781

Templeton Funds

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (954)527-7500

Date of fiscal year end: 8/31

Date of reporting period: 2/28/19

Item 1. Reports to Stockholders.

Internet Delivery of Fund Reports Unless You Request Paper Copies:Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800)632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800)632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

Franklin Templeton

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Dear Shareholder:

During the six months ended February 28, 2019, the global economy generally expanded and many companies reported solid revenues and earnings. Global markets were pressured by concerns about increased technology company regulation, U.S. and European Union political uncertainties, major central banks’ interest-rate policies and the impact of the U.S.-China trade dispute on global growth and corporate earnings. Nearperiod-end, the U.S. Federal Reserve’s indications of a cautious approach to its monetary policy decisions and investor optimism about U.S.-China trade negotiations supported markets. In this environment, stocks in global developed and emerging markets excluding the U.S. had negative returns, as measured by the MSCI All Country World Index ex USA Index.

We are committed to our long-term perspective and disciplined investment approach as we conduct a rigorous, fundamental analysis of securities with a regular emphasis on investment risk management.

Historically, patient investors have achieved rewarding results by evaluating their goals, diversifying their assets globally and maintaining a disciplined investment program, all hallmarks of the Templeton investment philosophy developed more than 60 years ago. We continue to recommend investors consult their financial advisors and review their portfolios to design a long-term strategy and portfolio allocation that meet their individual needs, goals and risk tolerance.

Templeton Foreign Fund’s semiannual report includes more detail about prevailing conditions and a discussion about investment decisions during the period. Please remember all securities markets fluctuate, as do mutual fund share prices.

We thank you for investing with Franklin Templeton, welcome your questions and comments, and look forward to serving your investment needs in the years ahead.

Sincerely,

Norman J. Boersma, CFA

President and Chief Executive Officer –

Investment Management

Templeton Funds

This letter reflects our analysis and opinions as of February 28, 2019, unless otherwise indicated. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

CFA® is a trademark owned by CFA Institute.

|

Not FDIC Insured | May Lose Value | No Bank Guarantee |

| | | | |

| | | |

| franklintempleton.com | | Not part of the semiannual report | | 1 |

Visitfranklintempleton.comfor fund updates, to access your account, or to find helpful financial planning tools.

| | | | |

| | | |

2 | | Semiannual Report | | franklintempleton.com |

Semiannual Report

Templeton Foreign Fund

This semiannual report for Templeton Foreign Fund covers the period ended February 28, 2019.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital growth. Under normal market conditions, the Fund invests at least 80% of its net assets in “foreign securities,” as described in the prospectus. These securities are predominantly equity securities of companies located outside the U.S., including developing markets.

Performance Overview

The Fund’s Class A shares had a-3.05% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the MSCI All Country World Index (ACWI) ex USA Index, which measures stock performance in global developed and emerging markets excluding the U.S., had a-2.34% total return.1 For the10-year period ended February 28, 2019, the Fund’s Class A shares posted a +157.42% cumulative total return, compared with the MSCI ACWI ex USA Index’s +162.35% cumulative total return for the same period.1 Please note index performance information is provided for reference and we do not attempt to track the index but rather undertake investments on the basis of fundamental research. You can find more performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go tofranklintempleton.comor call(800)342-5236.

Economic and Market Overview

The global economy expanded during the six months under review, despite weakness in certain regions. Global developed and emerging market stocks were aided at certain points during the period by upbeat economic data in some regions,

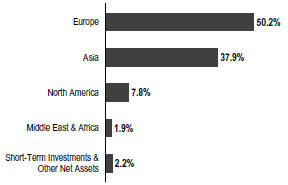

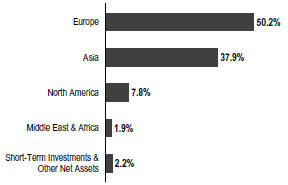

Geographic Composition

Based on Total Net Assets as of 2/28/19

encouraging corporate earnings reports, the U.S. Federal Reserve’s (Fed’s) indications of a cautious approach to its monetary policy decisions and optimism about a potential U.S.-China trade deal.

However, various factors weighed on global markets at certain points during the period, including concerns about tighter regulation of technology companies, political uncertainties in the U.S. and the European Union, the Fed’s interest-rate path and the European Central Bank’s (ECB’s) unwinding of its bond purchase program. Markets were further pressured by U.S. trade disputes with China and other trading partners, and their impact on global growth and corporate earnings. In this environment, global stocks, as measured by the MSCI ACWI, had a-2.70% total return for the six months ended February 28, 2019.1

The U.S. economy grew in 2018’s fourth quarter, though at a slower pace from the previous quarter partly due to a decline in housing investment. The unemployment rate was 3.8% in August 2018, and though it varied during the period, it remained unchanged atperiod-end.2 The annual inflation rate, as measured by the Consumer Price Index, decreased from 2.7% in August 2018 to 1.5% atperiod-end.2 The Fed raised its target range for the federal funds rate twice during the period,

1. Source: Morningstar. As of 2/28/19, the Fund’s Class A10-year average annual total return not including the maximum sales charge was +9.92%, compared with the MSCI ACWI ex USA Index’s10-year average annual total return of +10.13%.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. Source: U.S. Bureau of Labor Statistics.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 15.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 3 |

TEMPLETON FOREIGN FUND

to 2.25%–2.50%, and continued reducing its balance sheet as part of its plan to normalize monetary policy. At its January meeting, the Fed held its target range for the federal funds rate unchanged and mentioned it would be patient in deciding further rate adjustments. Furthermore, the Fed’s January meeting minutes indicated that most policymakers favored announcing the end of balance sheet normalization by the end of 2019.

In Europe, the U.K.’s quarterly gross domestic product (GDP) growth accelerated in 2018’s third quarter but moderated in the fourth quarter. The Bank of England kept its key policy rate unchanged during the period. After moderating in 2018’s third quarter, the eurozone’s quarterly GDP grew in the fourth quarter. The bloc’s annual inflation rate ended the period lower than in August 2018. The ECB kept its benchmark interest rate unchanged during the period and concluded its bond purchase program at the end of 2018. In January 2019, the ECB reiterated that it expected key interest rates to remain unchanged through at least the summer of 2019 and intended to reinvest principal payments from maturing bonds for an extended period of time.

In Asia, Japan’s quarterly GDP contracted in 2018’s third quarter but grew in the fourth quarter. The Bank of Japan left its benchmark interest rate unchanged during the period and continued its monetary stimulus measures.

In emerging markets, Brazil’s quarterly GDP growth accelerated in 2018’s third quarter but moderated in the fourth quarter. The Central Bank of Brazil kept its benchmark interest rate unchanged during the period. Russia’s annual GDP growth stabilized in 2018��s third quarter and accelerated in the fourth quarter. The Bank of Russia increased its key rate twice during the period to curtail inflation risks. China’s annual GDP growth moderated in 2018’s third and fourth quarters. The People’s Bank of China left its benchmark interest rate unchanged during the period, but it took measures to improve financial liquidity to mitigate the negative effects of the U.S.-China trade dispute and support economic growth. Overall, emerging market stocks, as measured by the MSCI Emerging Markets Index, posted a +0.46% total return during thesix-month period.1

Investment Strategy

Our investment strategy employs abottom-up, value-oriented, long-term approach. We focus on the market price of a

Top 10 Sectors/Industries

2/28/19

| | |

| | | % of Total

Net Assets |

Banks | | 17.3% |

Pharmaceuticals | | 12.4% |

Oil, Gas & Consumable Fuels | | 11.3% |

Metals & Mining | | 4.8% |

Diversified Telecommunication Services | | 4.2% |

Technology Hardware, Storage & Peripherals | | 3.8% |

Semiconductors & Semiconductor Equipment | | 3.0% |

Insurance | | 2.9% |

Chemicals | | 2.7% |

Wireless Telecommunication Services | | 2.3% |

company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. Our analysis includes an assessment of the potential impacts of material environmental, social and governance (ESG) factors on the long-term risk and return profile of a company. We also consider the company’s price/earnings ratio, price/cash flow ratio, profit margins and liquidation value.

Manager’s Discussion

During the six months under review, stock-specific issues in the underweighted financials sector detracted significantly from the Fund’s performance relative to its benchmark, the MSCI ACWI ex USA Index.3 Irish lender Bank of Ireland Group was one of the sector’s biggest detractors as its stock declined amid Brexit concerns and mixed earnings results. We continue to believe the market is not currently pricing in Bank of Ireland’s ability to generate returns above its cost of capital in an attractive banking market. Conversely, the financials sector also delivered one of the Fund’s top contributors: Chinese life insurer China Life Insurance. Its shares rallied as China’s increased stimulus measures buoyed regional markets and the firm announced well-received changes to its management team and corporate strategy.

Stock selection in the overweighted health care sector also detracted, pressured by Israeli pharmaceuticals firm Teva Pharmaceutical Industries, the Fund’s biggest detractor.4 Teva’s share price declined amid weakness in the U.S. generic drug market and slumping sales of one of the firm’s aging blockbuster drugs. Yet, we believe such headwinds are well discounted by a share price hovering neartwo-decade lows, and

3. The financials sector comprises banks, capital markets and insurance in the SOI.

4. The health care sector comprises health care providers and services, life sciences tools and services, and pharmaceuticals in the SOI.

| | | | |

| | | |

4 | | Semiannual Report | | franklintempleton.com |

TEMPLETON FOREIGN FUND

we are encouraged by the company’s ongoing efforts to reduce debt, cut costs and stabilize declining sales.

Elsewhere, Chinese internet search firm Baidu also finished among the Fund’s biggest detractors. Broad-based concerns about economic uncertainty in China hurt the stock, offsetting the firm’s better-than-expected sales growth and rapid increase in users.

Top 10 Holdings

2/28/19

| | | | |

| |

Company Sector/Industry, Country | | % of Total

Net Assets | |

Samsung Electronics Co. Ltd. | | | 3.9% | |

Technology Hardware, Storage & Peripherals, South Korea | | | | |

BP PLC | | | 3.2% | |

Oil, Gas & Consumable Fuels, U.K. | | | | |

Roche Holding AG | | | 2.8% | |

Pharmaceuticals, Switzerland | | | | |

BNP Paribas SA | | | 2.7% | |

Banks, France | | | | |

Standard Chartered PLC | | | 2.7% | |

Banks, U.K. | | | | |

Royal Dutch Shell PLC | | | 2.7% | |

Oil, Gas & Consumable Fuels, U.K. | | | | |

Sanofi | | | 2.2% | |

Pharmaceuticals, France | | | | |

Eni SpA | | | 2.2% | |

Oil, Gas & Consumable Fuels, Italy | | | | |

Wheaton Precious Metals Corp. | | | 2.1% | |

Metals & Mining, Canada | | | | |

ING Groep NV | | | 2.1% | |

Banks, Netherlands | | | | |

Turning to contributors, stock selection in the modestly overweighted materials sector notably contributed to relative performance.5 The sector delivered the Fund’s top contributor: Canadian precious metals firm Wheaton Precious Metals. Wheaton benefited from a favorable settlement related to a Canadian tax audit that had weighed on its shares for years. We have long believed Wheaton was likely to prevail in this matter and believe the removal of uncertainty could pave the way for wider appreciation of Wheaton’s unique, asset-light precious metals streaming model.

Stock selection and a favorable overweighting in the energy sector also contributed to relative results.6 Dutch oil services

Top 10 Countries

2/28/19

| | | | |

| | | % of Total

Net Assets | |

U.K. | | | 16.6% | |

Japan | | | 11.4% | |

France | | | 10.2% | |

China | | | 10.1% | |

South Korea | | | 8.2% | |

Netherlands | | | 6.0% | |

Germany | | | 5.9% | |

Canada | | | 5.8% | |

Switzerland | | | 4.6% | |

Italy | | | 2.7% | |

firm SBM Offshore (not part of the index) was the sector’s top contributor. Shares of the manufacturer of floating oil platforms rallied after the company announced a strong order book, raised its dividend and initiated a share buyback program. Conversely, the energy sector also included one of the Fund’s biggest detractors: Canadian exploration and production firm Husky Energy. Its shares declined during the period as operational, strategic and regulatory concerns compounded the weak oil price backdrop. We view Husky’s price decline as excessive (due to thin liquidity and high oil price sensitivity) and expect most of the company’s issues to be favorably resolved. We believe Husky’s shares represent compelling long-term value based on what we consider a lowprice-to-cash flow ratio, which represents a significant discount to their long-term average valuation.

Elsewhere, shares of Chinese telecommunication services firm China Telecom advanced after the company confirmed its entry into the Philippine market as the country’s third major service provider. We continue to think broader industry concerns are overshadowing the solid operating performance and attractive valuation of China Telecom, and we remain holders in anticipation of further potential share price appreciation.

From a regional standpoint, the Middle East and Africa region notably detracted from relative results due to our single holding in the area: the aforementioned Israeli pharmaceuticals firm Teva. In Europe, weakness in the U.K. and Ireland partially offset strength in the Netherlands and Denmark. Asia and North America notably contributed, buoyed by stock selection in Japan and Canada, respectively.

5. The materials sector comprises chemicals, construction materials, and metals and mining in the SOI.

6. The energy sector comprises energy equipment and services and oil, gas and consumable fuels in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 5 |

TEMPLETON FOREIGN FUND

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the six months ended February 28, 2019, the U.S. dollar rose in value relative to many currencies in which the Fund’s investments were traded. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities withnon-U.S. currency exposure.

Thank you for your continued participation in Templeton Foreign Fund. We look forward to serving your future investment needs.

| | |

| |

Tucker Scott, CFA Co-Lead Portfolio Manager |

| |

| |

Christopher James Peel, CFA Co-Lead Portfolio Manager Norman J. Boersma, CFA Heather Arnold, CFA Herbert J. Arnett, Jr. Peter Moeschter, CFA Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| | | |

6 | | Semiannual Report | | franklintempleton.com |

TEMPLETON FOREIGN FUND

Performance Summary as of February 28, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 2/28/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%.Class A:5.50% maximum initial sales charge;Advisor Class:no sales charges. For other share classes, visitfranklintempleton.com.

| | | | | | | | |

| Share Class | | Cumulative

Total Return2 | | | Average Annual

Total Return3 | |

| | |

A4 | | | | | | | | |

| | |

6-Month | | | -3.05% | | | | -8.41% | |

| | |

1-Year | | | -6.11% | | | | -11.25% | |

| | |

5-Year | | | -0.89% | | | | -1.31% | |

| | |

10-Year | | | +157.42% | | | | +9.31% | |

| | |

Advisor | | | | | | | | |

| | |

6-Month | | | -2.97% | | | | -2.97% | |

| | |

1-Year | | | -5.94% | | | | -5.94% | |

| | |

5-Year | | | +0.44% | | | | +0.09% | |

| | |

10-Year | | | +163.92% | | | | +10.19% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, go tofranklintempleton.comor call(800)342-5236.

See page 8 for Performance Summary footnotes.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 7 |

TEMPLETON FOREIGN FUND

PERFORMANCE SUMMARY

Distributions(9/1/18–2/28/19)

| | | | |

| Share Class | | Net Investment

Income | |

| |

A | | | $0.1774 | |

| |

C | | | $0.0213 | |

| |

R | | | $0.1597 | |

| |

R6 | | | $0.2093 | |

| |

Advisor | | | $0.1956 | |

Total Annual Operating Expenses5

| | | | | | | | |

| Share Class | | With Fee Waiver | | | Without Fee Waiver | |

A | | | 1.10% | | | | 1.15% | |

| Advisor | | | 0.85% | | | | 0.90% | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments; investments in developing markets involve heightened risks related to the same factors. Currency rates may fluctuate significantly over short periods of time, and can reduce returns. Because the Fund may invest its assets in companies in a specific region, including Europe, it is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Current political and financial uncertainty surrounding the European Union may increase market volatility and the economic risk of investing in companies in Europe. Derivatives, including currency management strategies, involve costs and can create economic leverage in the portfolio which may result in significant volatility and cause the Fund to participate in losses (as well as enable gains) on an amount that exceeds the Fund’s initial investment. The Fund may not achieve the anticipated benefits, and may realize losses when a counterparty fails to perform as promised. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 12/31/19. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

| | | | |

| | | |

8 | | Semiannual Report | | franklintempleton.com |

TEMPLETON FOREIGN FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (ofcourse, your account value and expenses will differ from those in this illustration):Divide your account value by $1,000 (ifyour account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (ifActual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | |

| | | | | Actual (actual return after expenses) | | Hypothetical (5% annual return before expenses) | | |

| | | | | | | | |

Share

Class | | Beginning

Account

Value 9/1/18 | | Ending

Account

Value 2/28/19 | | Expenses

Paid During

Period

9/1/18–2/28/191,2

| | Ending

Account

Value 2/28/19 | | Expenses Paid During Period 9/1/18–2/28/191,2 | | Net

Annualized

Expense

Ratio2 |

| | | | | | |

A | | $1,000 | | $969.50 | | $5.18 | | $1,019.54 | | $5.31 | | 1.06% |

C | | $1,000 | | $965.70 | | $8.82 | | $1,015.82 | | $9.05 | | 1.81% |

R | | $1,000 | | $967.50 | | $6.39 | | $1,018.30 | | $6.56 | | 1.31% |

R6 | | $1,000 | | $971.00 | | $3.27 | | $1,021.47 | | $3.36 | | 0.67% |

Advisor | | $1,000 | | $970.30 | | $3.96 | | $1,020.78 | | $4.06 | | 0.81% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 9 |

TEMPLETON FUNDS

Financial Highlights

Templeton Foreign Fund

| | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

February 28, 2019 | | | Year Ended August 31, |

| | | (unaudited) | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 |

| | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $ 7.69 | | | | $ 7.81 | | | | $ 6.87 | | | | $ 6.74 | | | | $ 8.58 | | | $ 7.67 |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.07 | | | | 0.12 | | | | 0.11 | | | | 0.11 | | | | 0.12 | | | 0.20c |

Net realized and unrealized gains (losses) | | | (0.32 | ) | | | (0.13 | ) | | | 0.96 | | | | 0.11 | | | | (1.52 | ) | | 1.12 |

| | | | | | |

Total from investment operations | | | (0.25 | ) | | | (0.01 | ) | | | 1.07 | | | | 0.22 | | | | (1.40 | ) | | 1.32 |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.18 | ) | | | (0.11 | ) | | | (0.13 | ) | | | (0.09 | ) | | | (0.21 | ) | | (0.11) |

Net realized gains | | | — | | | | — | | | | — | | | | (— | )d | | | (0.23 | ) | | (0.30) |

| | | | | | |

Total distributions | | | (0.18 | ) | | | (0.11 | ) | | | (0.13 | ) | | | (0.09 | ) | | | (0.44 | ) | | (0.41) |

| | | | | | |

Net asset value, end of period | | | $ 7.26 | | | | $ 7.69 | | | | $ 7.81 | | | | $ 6.87 | | | | $ 6.74 | | | $ 8.58 |

| | | | | | |

Total returne | | | (3.05)% | | | | (0.15)% | | | | 15.83% | | | | 3.46% | | | | (16.46)% | | | 17.61% |

| | | | | | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver and payments by affiliates | | | 1.14% | | | | 1.16% | | | | 1.21% | | | | 1.22% | | | | 1.18% | | | 1.16% |

Expenses net of waiver and payments by affiliates | | | 1.06% | | | | 1.11% | g | | | 1.21% | g,h | | | 1.22% | g,h | | | 1.18% | h | | 1.16% |

Net investment income | | | 2.06% | | | | 1.54% | | | | 1.55% | | | | 1.66% | | | | 1.54% | | | 2.39%c |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $2,802,526 | | | | $2,929,181 | | | | $3,287,394 | | | | $3,644,336 | | | | $4,165,454 | | | $4,524,854 |

Portfolio turnover rate | | | 13.83% | | | | 23.01% | | | | 42.56% | | | | 22.89% | | | | 29.12% | | | 30.82% |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.07 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.57%.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| | | | |

| | | |

10 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON FUNDS

FINANCIAL HIGHLIGHTS

Templeton Foreign Fund(continued)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

February 28, 2019 | | | Year Ended August 31, |

| | | (unaudited) | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 |

| | | | | | |

Class C | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $ 7.49 | | | | $ 7.60 | | | | $ 6.69 | | | | $ 6.56 | | | | $ 8.35 | | | $ 7.48 |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.04 | | | | 0.06 | | | | 0.05 | | | | 0.06 | | | | 0.05 | | | 0.13c |

Net realized and unrealized gains (losses) | | | (0.30 | ) | | | (0.12 | ) | | | 0.94 | | | | 0.11 | | | | (1.46 | ) | | 1.10 |

| | | | | | |

Total from investment operations | | | (0.26 | ) | | | (0.06 | ) | | | 0.99 | | | | 0.17 | | | | (1.41 | ) | | 1.23 |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.02 | ) | | | (0.05 | ) | | | (0.08 | ) | | | (0.04 | ) | | | (0.15 | ) | | (0.06) |

Net realized gains | | | — | | | | — | | | | — | | | | (— | )d | | | (0.23 | ) | | (0.30) |

| | | | | | |

Total distributions | | | (0.02 | ) | | | (0.05 | ) | | | (0.08 | ) | | | (0.04 | ) | | | (0.38 | ) | | (0.36) |

| | | | | | |

Net asset value, end of period | | | $ 7.21 | | | | $ 7.49 | | | | $ 7.60 | | | | $ 6.69 | | | | $ 6.56 | | | $ 8.35 |

| | | | | | |

Total returne | | | (3.43)% | | | | (0.79)% | | | | 14.92% | | | | 2.64% | | | | (17.04)% | | | 16.72% |

| | | | | | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver and payments by affiliates | | | 1.89% | | | | 1.91% | | | | 1.96% | | | | 1.97% | | | | 1.93% | | | 1.91% |

Expenses net of waiver and payments by affiliates | | | 1.81% | | | | 1.86% | g | | | 1.96% | g,h | | | 1.97% | g,h | | | 1.93% | h | | 1.91% |

Net investment income | | | 1.31% | | | | 0.79% | | | | 0.80% | | | | 0.91% | | | | 0.79% | | | 1.64%c |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $118,768 | | | | $281,640 | | | | $346,032 | | | | $397,512 | | | | $468,128 | | | $617,421 |

Portfolio turnover rate | | | 13.83% | | | | 23.01% | | | | 42.56% | | | | 22.89% | | | | 29.12% | | | 30.82% |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.07 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been (0.82)%.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 11 |

TEMPLETON FUNDS

FINANCIAL HIGHLIGHTS

Templeton Foreign Fund(continued)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

February 28, 2019 | | | Year Ended August 31, |

| | | (unaudited) | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 |

| | | | | | |

Class R | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $ 7.53 | | | | $ 7.65 | | | | $ 6.73 | | | | $ 6.61 | | | | $ 8.42 | | | $ 7.54 |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.06 | | | | 0.10 | | | | 0.09 | | | | 0.09 | | | | 0.09 | | | 0.18c |

Net realized and unrealized gains (losses) | | | (0.32 | ) | | | (0.12 | ) | | | 0.94 | | | | 0.10 | | | | (1.48 | ) | | 1.09 |

| | | | | | |

Total from investment operations | | | (0.26 | ) | | | (0.02 | ) | | | 1.03 | | | | 0.19 | | | | (1.39 | ) | | 1.27 |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.16 | ) | | | (0.10 | ) | | | (0.11 | ) | | | (0.07 | ) | | | (0.19 | ) | | (0.09) |

Net realized gains | | | — | | | | — | | | | — | | | | (— | )d | | | (0.23 | ) | | (0.30) |

| | | | | | |

Total distributions | | | (0.16 | ) | | | (0.10 | ) | | | (0.11 | ) | | | (0.07 | ) | | | (0.42 | ) | | (0.39) |

| | | | | | |

Net asset value, end of period | | | $ 7.11 | | | | $ 7.53 | | | | $ 7.65 | | | | $ 6.73 | | | | $ 6.61 | | | $ 8.42 |

| | | | | | |

Total returne | | | (3.25)% | | | | (0.32)% | | | | 15.57% | | | | 3.10% | | | | (16.63)% | | | 17.22% |

| | | | | | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver and payments by affiliates | | | 1.39% | | | | 1.41% | | | | 1.46% | | | | 1.47% | | | | 1.43% | | | 1.41% |

Expenses net of waiver and payments by affiliates | | | 1.31% | | | | 1.36% | g | | | 1.46% | g,h | | | 1.47% | g,h | | | 1.43% | h | | 1.41% |

Net investment income | | | 1.81% | | | | 1.29% | | | | 1.30% | | | | 1.41% | | | | 1.29% | | | 2.14%c |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $138,287 | | | | $148,638 | | | | $153,516 | | | | $159,802 | | | | $174,865 | | | $207,738 |

Portfolio turnover rate | | | 13.83% | | | | 23.01% | | | | 42.56% | | | | 22.89% | | | | 29.12% | | | 30.82% |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.07 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.32%.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| | | | |

| | | |

12 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON FUNDS

FINANCIAL HIGHLIGHTS

Templeton Foreign Fund(continued)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

February 28, 2019 | | | Year Ended August 31, |

| | | (unaudited) | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 |

| | | | | | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $ 7.58 | | | | $ 7.70 | | | | $ 6.78 | | | | $ 6.66 | | | | $ 8.49 | | | $ 7.59 |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.09 | | | | 0.15 | | | | 0.16 | | | | 0.14 | | | | 0.15 | | | 0.25c |

Net realized and unrealized gains (losses) | | | (0.33 | ) | | | (0.12 | ) | | | 0.93 | | | | 0.11 | | | | (1.50 | ) | | 1.10 |

| | | | | | |

Total from investment operations | | | (0.24 | ) | | | 0.03 | | | | 1.09 | | | | 0.25 | | | | (1.35 | ) | | 1.35 |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.21 | ) | | | (0.15 | ) | | | (0.17 | ) | | | (0.13 | ) | | | (0.25 | ) | | (0.15) |

Net realized gains | | | — | | | | — | | | | — | | | | (— | )d | | | (0.23 | ) | | (0.30) |

| | | | | | |

Total distributions | | | (0.21 | ) | | | (0.15 | ) | | | (0.17 | ) | | | (0.13 | ) | | | (0.48 | ) | | (0.45) |

| | | | | | |

Net asset value, end of period | | | $ 7.13 | | | | $ 7.58 | | | | $ 7.70 | | | | $ 6.78 | | | | $ 6.66 | | | $ 8.49 |

| | | | | | |

Total returne | | | (2.90)% | | | | 0.24% | | | | 16.52% | | | | 3.92% | | | | (16.08)% | | | 18.16% |

| | | | | | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver and payments by affiliates | | | 0.76% | | | | 0.73% | | | | 0.74% | | | | 0.72% | | | | 0.72% | | | 0.72% |

Expenses net of waiver and payments by affiliates | | | 0.67% | | | | 0.68% | g | | | 0.73% | g | | | 0.72% | g,h | | | 0.72% | h | | 0.72% |

Net investment income | | | 2.45% | | | | 1.97% | | | | 2.03% | | | | 2.16% | | | | 2.00% | | | 2.83%c |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $1,467,791 | | | | $1,496,328 | | | | $1,757,902 | | | | $880,092 | | | | $816,746 | | | $666,249 |

Portfolio turnover rate | | | 13.83% | | | | 23.01% | | | | 42.56% | | | | 22.89% | | | | 29.12% | | | 30.82% |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.07 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 2.01%.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 13 |

TEMPLETON FUNDS

FINANCIAL HIGHLIGHTS

Templeton Foreign Fund(continued)

| | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

February 28, 2019 | | | Year Ended August 31, |

| | | (unaudited) | | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 |

| | | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $ 7.58 | | | | $ 7.70 | | | | $ 6.78 | | | | $ 6.66 | | | | $ 8.49 | | | $ 7.59 |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | |

Net investment incomeb | | | 0.08 | | | | 0.14 | | | | 0.13 | | | | 0.12 | | | | 0.13 | | | 0.22c |

Net realized and unrealized gains (losses) | | | (0.32 | ) | | | (0.12 | ) | | | 0.94 | | | | 0.11 | | | | (1.50 | ) | | 1.11 |

| | | | | | |

Total from investment operations | | | (0.24 | ) | | | 0.02 | | | | 1.07 | | | | 0.23 | | | | (1.37 | ) | | 1.33 |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.20 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.11 | ) | | | (0.23 | ) | | (0.13) |

Net realized gains | | | — | | | | — | | | | — | | | | (— | )d | | | (0.23 | ) | | (0.30) |

| | | | | | |

Total distributions | | | (0.20 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.11 | ) | | | (0.46 | ) | | (0.43) |

| | | | | | |

Net asset value, end of period | | | $ 7.14 | | | | $ 7.58 | | | | $ 7.70 | | | | $ 6.78 | | | | $ 6.66 | | | $ 8.49 |

| | | | | | |

Total returne | | | (2.97)% | | | | 0.16% | | | | 16.10% | | | | 3.65% | | | | (16.25)% | | | 17.93% |

| | | | | | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | | | | | | | |

Expenses before waiver and payments by affiliates | | | 0.89% | | | | 0.91% | | | | 0.96% | | | | 0.97% | | | | 0.93% | | | 0.91% |

Expenses net of waiver and payments by affiliates | | | 0.81% | | | | 0.86% | g | | | 0.96% | g,h | | | 0.97% | g,h | | | 0.93% | h | | 0.91% |

Net investment income | | | 2.31% | | | | 1.79% | | | | 1.80% | | | | 1.91% | | | | 1.79% | | | 2.64%c |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000’s) | | | $1,270,356 | | | | $1,627,827 | | | | $1,717,937 | | | | $1,125,431 | | | | $1,206,146 | | | $1,727,057 |

Portfolio turnover rate | | | 13.83% | | | | 23.01% | | | | 42.56% | | | | 22.89% | | | | 29.12% | | | 30.82% |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.07 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.82%.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| | | | |

| | | |

14 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON FUNDS

Statement of Investments, February 28, 2019 (unaudited)

Templeton Foreign Fund

| | | | | | | | | | |

| | | Industry | | Shares | | | Value | |

Common Stocks 97.8% | | | | | | | | | | |

Canada 5.8% | | | | | | | | | | |

Alamos Gold Inc., A | | Metals & Mining | | | 13,422,620 | | | $ | 64,965,481 | |

Cenovus Energy Inc. | | Oil, Gas & Consumable Fuels | | | 4,747,382 | | | | 43,512,256 | |

Goldcorp Inc. | | Metals & Mining | | | 4,322,900 | | | | 45,666,750 | |

Husky Energy Inc. | | Oil, Gas & Consumable Fuels | | | 4,945,010 | | | | 54,982,137 | |

Wheaton Precious Metals Corp. | | Metals & Mining | | | 5,719,860 | | | | 124,412,824 | |

| | | |

| | | | | | | | | 333,539,448 | |

China 10.1% | | | | | | | | | | |

aBaidu Inc., ADR | | Interactive Media & Services | | | 570,020 | | | | 92,651,051 | |

China Life Insurance Co. Ltd., H | | Insurance | | | 33,667,000 | | | | 92,640,810 | |

China Mobile Ltd. | | Wireless Telecommunication Services | | | 8,343,920 | | | | 87,799,967 | |

China Telecom Corp. Ltd., H | | Diversified Telecommunication Services | | | 210,770,042 | | | | 114,114,804 | |

Kunlun Energy Co. Ltd. | | Oil, Gas & Consumable Fuels | | | 6,373,280 | | | | 6,998,653 | |

NetEase Inc., ADR | | Entertainment | | | 201,290 | | | | 44,931,954 | |

Shanghai Pharmaceuticals Holding Co. Ltd., H | | Health Care Providers & Services | | | 21,234,930 | | | | 47,719,248 | |

Sinopec Engineering Group Co. Ltd. | | Construction & Engineering | | | 52,748,630 | | | | 47,912,065 | |

Sinopharm Group Co. Ltd., H | | Health Care Providers & Services | | | 11,638,200 | | | | 51,743,454 | |

| | | |

| | | | | | | | | 586,512,006 | |

Denmark 2.1% | | | | | | | | | | |

A.P. Moeller-Maersk AS, B | | Marine | | | 48,300 | | | | 65,084,219 | |

Vestas Wind Systems AS | | Electrical Equipment | | | 700,880 | | | | 58,332,771 | |

| | | |

| | | | | | | | | 123,416,990 | |

France 10.2% | | | | | | | | | | |

AXA SA | | Insurance | | | 2,964,662 | | | | 75,182,193 | |

BNP Paribas SA | | Banks | | | 3,107,673 | | | | 159,261,439 | |

Cie Generale des Etablissements Michelin SCA | | Auto Components | | | 415,600 | | | | 49,872,407 | |

Compagnie de Saint-Gobain | | Building Products | | | 1,273,630 | | | | 45,865,541 | |

Sanofi | | Pharmaceuticals | | | 1,532,345 | | | | 128,107,991 | |

Total SA | | Oil, Gas & Consumable Fuels | | | 1,313,070 | | | | 74,662,640 | |

Veolia Environnement SA | | Multi-Utilities | | | 2,749,470 | | | | 60,358,525 | |

| | | |

| | | | | | | | | 593,310,736 | |

Germany 5.9% | | | | | | | | | | |

Bayer AG | | Pharmaceuticals | | | 1,139,775 | | | | 91,113,600 | |

E.ON SE | | Multi-Utilities | | | 6,230,840 | | | | 68,640,202 | |

Gerresheimer AG | | Life Sciences Tools & Services | | | 524,020 | | | | 40,233,143 | |

Merck KGaA | | Pharmaceuticals | | | 625,928 | | | | 64,631,894 | |

Siemens AG | | Industrial Conglomerates | | | 266,292 | | | | 29,117,185 | |

Telefonica Deutschland Holding AG | | Diversified Telecommunication Services | | | 14,562,250 | | | | 47,803,219 | |

| | | |

| | | | | | | | | 341,539,243 | |

Hong Kong 2.3% | | | | | | | | | | |

CK Hutchison Holdings Ltd. | | Industrial Conglomerates | | | 9,733,820 | | | | 103,603,384 | |

Swire Pacific Ltd., A | | Real Estate Management & Development | | | 899,500 | | | | 10,696,942 | |

Value Partners Group Ltd. | | Capital Markets | | | 25,533,870 | | | | 20,753,029 | |

| | | |

| | | | | | | | | 135,053,355 | |

India 0.8% | | | | | | | | | | |

Hero Motocorp Ltd. | | Automobiles | | | 1,053,000 | | | | 39,065,349 | |

Jain Irrigation Systems Ltd. | | Machinery | | | 6,520,634 | | | | 5,232,891 | |

| | | |

| | | | | | | | | 44,298,240 | |

| | | | |

| | | |

| franklintempleton.com | | Semiannual Report | | 15 |

TEMPLETON FUNDS

STATEMENT OF INVESTMENTS (UNAUDITED)

| | | | | | | | | | |

| Templeton Foreign Fund(continued) | |

| | | Industry | | Shares | | | Value | |

| | | |

Common Stocks(continued) | | | | | | | | | | |

Ireland 1.7% | | | | | | | | | | |

Bank of Ireland Group PLC | | Banks | | | 9,577,030 | | | $ | 62,255,741 | |

CRH PLC | | Construction Materials | | | 1,224,170 | | | | 38,765,313 | |

| | | |

| | | | | | | | | 101,021,054 | |

Israel 1.9% | | | | | | | | | | |

aTeva Pharmaceutical Industries Ltd., ADR | | Pharmaceuticals | | | 6,488,260 | | | | 109,197,416 | |

Italy 2.7% | | | | | | | | | | |

Eni SpA | | Oil, Gas & Consumable Fuels | | | 7,257,844 | | | | 125,201,926 | |

Tenaris SA | | Energy Equipment & Services | | | 2,367,530 | | | | 31,588,269 | |

| | | |

| | | | | | | | | 156,790,195 | |

Japan 11.4% | | | | | | | | | | |

Astellas Pharma Inc. | | Pharmaceuticals | | | 3,988,480 | | | | 61,503,009 | |

Ezaki Glico Co. Ltd. | | Food Products | | | 765,190 | | | | 38,724,677 | |

Mitsui Fudosan Co. Ltd. | | Real Estate Management & Development | | | 2,376,620 | | | | 56,245,998 | |

Panasonic Corp. | | Household Durables | | | 8,532,800 | | | | 78,479,250 | |

Seven & i Holdings Co. Ltd. | | Food & Staples Retailing | | | 1,518,540 | | | | 66,685,224 | |

Sumitomo Metal Mining Co. Ltd. | | Metals & Mining | | | 1,522,370 | | | | 44,587,157 | |

Sumitomo Mitsui Financial Group Inc. | | Banks | | | 1,509,810 | | | | 53,404,558 | |

Sumitomo Rubber Industries Ltd. | | Auto Components | | | 3,811,550 | | | | 48,941,882 | |

Suntory Beverage & Food Ltd. | | Beverages | | | 1,224,050 | | | | 53,928,714 | |

Taiheiyo Cement Corp. | | Construction Materials | | | 1,803,511 | | | | 61,576,198 | |

Takeda Pharmaceutical Co. Ltd. | | Pharmaceuticals | | | 2,398,710 | | | | 96,189,465 | |

| | | |

| | | | | | | | | 660,266,132 | |

Luxembourg 0.4% | | | | | | | | | | |

SES SA, IDR | | Media | | | 1,093,647 | | | | 21,974,709 | |

Netherlands 6.0% | | | | | | | | | | |

Flow Traders | | Capital Markets | | | 1,637,407 | | | | 47,492,950 | |

ING Groep NV | | Banks | | | 9,050,058 | | | | 119,739,677 | |

NXP Semiconductors NV | | Semiconductors & Semiconductor Equipment | | | 953,320 | | | | 87,057,183 | |

SBM Offshore NV | | Energy Equipment & Services | | | 4,855,024 | | | | 91,615,740 | |

| | | |

| | | | | | | | | 345,905,550 | |

Singapore 1.4% | | | | | | | | | | |

Singapore Telecommunications Ltd. | | Diversified Telecommunication Services | | | 37,106,420 | | | | 82,882,577 | |

Singapore Telecommunications Ltd., ADR | | Diversified Telecommunication Services | | | 31,720 | | | | 705,612 | |

| | | |

| | | | | | | | | 83,588,189 | |

South Korea 8.2% | | | | | | | | | | |

Hana Financial Group Inc. | | Banks | | | 2,117,210 | | | | 73,058,469 | |

KB Financial Group Inc. | | Banks | | | 1,891,567 | | | | 74,512,814 | |

Korea Electric Power Corp. | | Electric Utilities | | | 1,172,650 | | | | 36,298,343 | |

Lotte Chemical Corp. | | Chemicals | | | 239,460 | | | | 67,848,347 | |

Samsung Electronics Co. Ltd. | | Technology Hardware, Storage & Peripherals | | | 5,573,860 | | | | 223,279,170 | |

| | | |

| | | | | | | | | 474,997,143 | |

Switzerland 4.6% | | | | | | | | | | |

Landis+Gyr Group AG | | Electronic Equipment, Instruments & Components | | | 505,600 | | | | 32,089,125 | |

Roche Holding AG | | Pharmaceuticals | | | 591,540 | | | | 164,338,067 | |

UBS Group AG | | Capital Markets | | | 5,313,970 | | | | 67,612,502 | |

| | | |

| | | | | | | | | 264,039,694 | |

| | | | |

| | | |

16 | | Semiannual Report | | franklintempleton.com |

TEMPLETON FUNDS

STATEMENT OF INVESTMENTS (UNAUDITED)

Templeton Foreign Fund(continued)

| | | | | | | | | | |

| | | Industry | | Shares | | | Value | |

| | | |

Common Stocks(continued) | | | | | | | | | | |

Taiwan 1.5% | | | | | | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | Semiconductors & Semiconductor Equipment | | | 10,960,090 | | | | $ 84,975,719 | |

Thailand 2.2% | | | | | | | | | | |

Bangkok Bank PCL, fgn | | Banks | | | 4,493,860 | | | | 30,447,555 | |

Bangkok Bank PCL, NVDR | | Banks | | | 8,789,130 | | | | 58,158,245 | |

Kasikornbank PCL, fgn | | Banks | | | 5,897,730 | | | | 36,971,681 | |

| | | |

| | | | | | | | | 125,577,481 | |

United Kingdom 16.6% | | | | | | | | | | |

BAE Systems PLC | | Aerospace & Defense | | | 7,724,400 | | | | 47,737,501 | |

Barclays PLC | | Banks | | | 34,469,980 | | | | 75,044,244 | |

BP PLC | | Oil, Gas & Consumable Fuels | | | 26,126,400 | | | | 185,163,352 | |

aCobham PLC | | Aerospace & Defense | | | 22,045,509 | | | | 34,397,040 | |

HSBC Holdings PLC (GBP Traded) | | Banks | | | 11,227,170 | | | | 91,257,577 | |

HSBC Holdings PLC (HKD Traded) | | Banks | | | 950,940 | | | | 7,771,305 | |

Johnson Matthey PLC | | Chemicals | | | 2,128,006 | | | | 87,289,455 | |

Kingfisher PLC | | Specialty Retail | | | 22,946,174 | | | | 73,673,972 | |

Royal Dutch Shell PLC, B | | Oil, Gas & Consumable Fuels | | | 4,964,660 | | | | 155,681,800 | |

Standard Chartered PLC | | Banks | | | 19,871,115 | | | | 158,540,082 | |

Vodafone Group PLC | | Wireless Telecommunication Services | | | 27,077,955 | | | | 48,221,000 | |

| | | |

| | | | | | | | | 964,777,328 | |

United States 2.0% | | | | | | | | | | |

Oracle Corp. | | Software | | | 2,260,980 | | | | 117,864,887 | |

| | | |

Total Common Stocks

(Cost $5,421,620,989) | | | | | | | | | 5,668,645,515 | |

| | | |

| | | | | Principal

Amount | | | | |

Short Term Investments (Cost $101,000,000) 1.7% | | | | | | | | |

| | | |

Time Deposits 1.7% | | | | | | | | | | |

United States 1.7% | | | | | | | | | | |

Royal Bank of Canada, 2.35%, 3/01/19 | | | | $ | 101,000,000 | | | | 101,000,000 | |

| | | | | | | | | | |

| | | |

Total Investments (Cost $5,522,620,989) 99.5% | | | | | | | | | 5,769,645,515 | |

Other Assets, less Liabilities 0.5% | | | | | | | | | 28,082,693 | |

| | | | | | | | | | |

| | | |

Net Assets 100.0% | | | | | | | | | $5,797,728,208 | |

| | | | | | | | | | |

See Abbreviations on page 29.

aNon-income producing.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 17 |

TEMPLETON FUNDS

Financial Statements

Statement of Assets and Liabilities

February 28, 2019 (unaudited)

Templeton Foreign Fund

| | | | |

Assets: | | | | |

Investments in securities: | | | | |

Cost - Unaffiliated issuers | | | $5,522,620,989 | |

| | | | |

| |

Value - Unaffiliated issuers | | | $5,769,645,515 | |

Cash | | | 668,867 | |

Foreign currency, at value (cost $112,406) | | | 112,406 | |

Receivables: | | | | |

Investment securities sold | | | 18,614,431 | |

Capital shares sold | | | 3,887,265 | |

Dividends | | | 30,314,275 | |

European Union tax reclaims | | | 5,816,520 | |

Other assets | | | 6,338 | |

| | | | |

| |

Total assets | | | 5,829,065,617 | |

| | | | |

| |

Liabilities: | | | | |

Payables: | | | | |

Capital shares redeemed | | | 25,619,171 | |

Management fees | | | 2,831,899 | |

Distribution fees | | | 679,088 | |

Transfer agent fees | | | 1,539,087 | |

Accrued expenses and other liabilities | | | 668,164 | |

| | | | |

| |

Total liabilities | | | 31,337,409 | |

| | | | |

| |

Net assets, at value | | | $5,797,728,208 | |

| | | | |

Net assets consist of: | | | | |

Paid-in capital | | | $5,835,388,399 | |

Total distributable earnings (loss) | | | (37,660,191 | ) |

| | | | |

| |

Net assets, at value | | | $5,797,728,208 | |

| | | | |

| | | | |

| | | |

18 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON FUNDS

FINANCIAL STATEMENTS

Statement of Assets and Liabilities(continued)

February 28, 2019 (unaudited)

Templeton Foreign Fund

| | | | |

Class A: | | | | |

Net assets, at value | | | $2,802,525,751 | |

| | | | |

Shares outstanding | | | 386,284,656 | |

| | | | |

Net asset value per sharea | | | $7.26 | |

| | | | |

Maximum offering price per share (net asset value per share ÷ 94.50%) | | | $7.68 | |

| | | | |

Class C: | | | | |

Net assets, at value | | | $ 118,768,096 | |

| | | | |

Shares outstanding | | | 16,482,284 | |

| | | | |

Net asset value and maximum offering price per sharea | | | $7.21 | |

| | | | |

Class R: | | | | |

Net assets, at value | | | $ 138,286,828 | |

| | | | |

Shares outstanding | | | 19,452,932 | |

| | | | |

Net asset value and maximum offering price per share | | | $7.11 | |

| | | | |

Class R6: | | | | |

Net assets, at value | | | $1,467,791,078 | |

| | | | |

Shares outstanding | | | 205,943,501 | |

| | | | |

Net asset value and maximum offering price per share | | | $7.13 | |

| | | | |

Advisor Class: | | | | |

Net assets, at value | | | $1,270,356,455 | |

| | | | |

Shares outstanding | | | 177,984,782 | |

| | | | |

Net asset value and maximum offering price per share | | | $7.14 | |

| | | | |

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 19 |

TEMPLETON FUNDS

FINANCIAL STATEMENTS

Statement of Operations

for the six months ended February 28, 2019 (unaudited)

Templeton Foreign Fund

| | | | |

Investment income: | | | | |

Dividends: (net of foreign taxes)* | | | | |

Unaffiliated issuers | | | $ 89,774,155 | |

Interest: | | | | |

Unaffiliated issuers | | | 1,902,042 | |

Income from securities loaned: | | | | |

Unaffiliated issuers (net of fees and rebates) | | | 15,652 | |

Non-controlled affiliates (Note 3f) | | | 74,868 | |

| | | | |

| |

Total investment income | | | 91,766,717 | |

| | | | |

| |

Expenses: | | | | |

Management fees (Note 3a) | | | 20,271,172 | |

Distribution fees: (Note 3c) | | | | |

Class A | | | 3,460,817 | |

Class C | | | 812,845 | |

Class R | | | 344,641 | |

Transfer agent fees: (Note 3e) | | | | |

Class A | | | 2,384,060 | |

Class C | | | 139,998 | |

Class R | | | 119,115 | |

Class R6 | | | 269,714 | |

Advisor Class | | | 1,174,929 | |

Custodian fees (Note 4) | | | 371,832 | |

Reports to shareholders | | | 251,208 | |

Registration and filing fees | | | 85,050 | |

Professional fees | | | 88,558 | |

Trustees’ fees and expenses | | | 101,080 | |

Other | | | 70,789 | |

| | | | |

| |

Total expenses | | | 29,945,808 | |

Expenses waived/paid by affiliates (Note 3f and 3g) | | | (2,477,146) | |

| | | | |

| |

Net expenses | | | 27,468,662 | |

| | | | |

| |

Net investment income | | | 64,298,055 | |

| | | | |

Realized and unrealized gains (losses): | | | | |

Net realized gain (loss) from: | | | | |

Investments: | | | | |

Unaffiliated issuers | | | (3,084,439) | |

Foreign currency transactions | | | 827,488 | |

| | | | |

| |

Net realized gain (loss) | | | (2,256,951) | |

| | | | |

| |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments: | | | | |

Unaffiliated issuers | | | (271,507,575) | |

Translation of other assets and liabilities denominated in foreign currencies | | | 4,495 | |

| | | | |

| |

Net change in unrealized appreciation (depreciation) | | | (271,503,080) | |

| | | | |

| |

Net realized and unrealized gain (loss) | | | (273,760,031 | ) |

| | | | |

| |

Net increase (decrease) in net assets resulting from operations | | $ | (209,461,976 | ) |

| | | | |

| |

*Foreign taxes withheld on dividends | | $ | 5,016,037 | |

| | | | |

| | | |

20 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

TEMPLETON FUNDS

FINANCIAL STATEMENTS

��

Statements of Changes in Net Assets

Templeton Foreign Fund

| | | | | | | | |

| | | Six Months Ended

February 28, 2019

(unaudited) | | | Year Ended

August 31, 2018 | |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | | $ 64,298,055 | | | | $ 118,425,714 | |

Net realized gain (loss) | | | (2,256,951 | ) | | | 177,918,320 | |

Net change in unrealized appreciation (depreciation) | | | (271,503,080 | ) | | | (265,947,803 | ) |

| | | | |

| | |

Net increase (decrease) in net assets resulting from operations | | | (209,461,976 | ) | | | 30,396,231 | |

| | | | |

| | |

Distributions to shareholders: (Note 1e) | | | | | | | | |

Class A | | | (68,149,995) | | | | (45,938,794) | |

Class C | | | (366,884 | ) | | | (2,307,223 | ) |

Class R | | | (3,143,046 | ) | | | (2,044,262 | ) |

Class R6 | | | (42,923,314 | ) | | | (38,039,633 | ) |

Advisor Class | | | (34,608,197 | ) | | | (28,775,654 | ) |

| | | | |

| | |

Total distributions to shareholders | | | (149,191,436 | ) | | | (117,105,566 | ) |

| | | | |

| | |

Capital share transactions: (Note 2) | | | | | | | | |

Class A | | | 36,713,285 | | | | (318,451,833 | ) |

Class C | | | (151,427,642 | ) | | | (60,908,186 | ) |

Class R | | | (2,192,999 | ) | | | (2,801,703 | ) |

Class R6 | | | 53,449,164 | | | | (241,696,462 | ) |

Advisor Class | | | (263,773,760 | ) | | | (68,600,065 | ) |

| | | | |

| | |

Total capital share transactions | | | (327,231,952 | ) | | | (692,458,249 | ) |

| | | | |

| | |

Net increase (decrease) in net assets | | | (685,885,364 | ) | | | (779,167,584 | ) |

Net assets: | | | | | | | | |

Beginning of period | | | 6,483,613,572 | | | | 7,262,781,156 | |

| | | | |

| | |

End of period (Note 1e) | | | $5,797,728,208 | | | | $6,483,613,572 | |

| | | | |

| | | | |

| | | |

| franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 21 |

TEMPLETON FUNDS

Notes to Financial Statements (unaudited)

Templeton Foreign Fund

1. Organization and Significant Accounting Policies

Templeton Funds (Trust) is registered under the Investment Company Act of 1940 (1940 Act) as anopen-end management investment company, consisting of three separate funds and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). Templeton Foreign Fund (Fund) is included in this report. The Fund offers five classes of shares: Class A, Class C, Class R, Class R6 and Advisor Class. Beginning on October 19, 2018, Class C shares automatically convert to Class A shares after they have been held for 10 years. Each class of shares may differ by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share each business day as of 4 p.m. Eastern time or the regularly scheduled close of the New York Stock Exchange (NYSE), whichever is earlier. Under compliance policies and procedures approved by the Trust’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation Committee (VC). The Fund may utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or as of 4 p.m. Eastern time. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at 4 p.m. Eastern time on the day that the value of the security is determined.Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple

exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities.

Investments inopen-end mutual funds are valued at the closing NAV. Investments in time deposits are valued at cost, which approximates fair value.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the Fund primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before 4 p.m. Eastern time. In addition, trading in certain foreign markets may not take place on every Fund’s business day. Occasionally, events occur between the time at which trading in a foreign security is completed and 4 p.m. Eastern time that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at 4 p.m. Eastern time. In order to minimize the potential for these differences, the VC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

| | | | |

| | | |

22 | | Semiannual Report | | franklintempleton.com |

TEMPLETON FUNDS

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

Templeton Foreign Fund(continued)

When the last day of the reporting period is anon-business day, certain foreign markets may be open on those days that the Fund’s NAV is not calculated, which could result in differences between the value of the Fund’s portfolio securities on the last business day and the last calendar day of the reporting period. Any significant security valuation changes due to an open foreign market are adjusted and reflected by the Fund for financial reporting purposes.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments in the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Securities Lending

The Fund participates in an agency based securities lending program to earn additional income. The Fund receives cash collateral against the loaned securities in an amount equal to at

least 102% of the fair value of the loaned securities. Collateral is maintained over the life of the loan in an amount not less than 100% of the fair value of loaned securities, as determined at the close of Fund business each day; any additional collateral required due to changes in security values is delivered to the Fund on the next business day. The collateral is deposited into a joint cash account with other funds and is used to invest in a money market fund managed by Franklin Advisers, Inc., an affiliate of the Fund. The Fund may receive income from the investment of cash collateral, in addition to lending fees and rebates paid by the borrower. Income from securities loaned, net of fees paid to the securities lending agent and/or third-party vendor, is reported separately in the Statement of Operations. The Fund bears the market risk with respect to the collateral investment, securities loaned, and the risk that the agent may default on its obligations to the Fund. If the borrower defaults on its obligation to return the securities loaned, the Fund has the right to repurchase the securities in the open market using the collateral received. The securities lending agent has agreed to indemnify the Fund in the event of default by a third party borrower. At February 28, 2019, the Fund had no securities on loan.

d. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.