UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-2687

Name of Registrant: Vanguard Municipal Bond Funds

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 194482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2009 – October 31, 2010

Item 1: Reports to Shareholders

|

| Vanguard Municipal Bond Funds |

| Annual Report |

|

| October 31, 2010 |

|

| |

| Vanguard Tax-Exempt Money Market Fund |

| Vanguard Short-Term Tax-Exempt Fund |

| Vanguard Limited-Term Tax-Exempt Fund |

| Vanguard Intermediate-Term Tax-Exempt Fund |

| Vanguard Long-Term Tax-Exempt Fund |

| Vanguard High-Yield Tax-Exempt Fund |

> For the 12 months ended October 31, 2010, Vanguard Tax-Exempt Money Market Fund returned 0.14%, reflecting Federal Reserve policy that kept short-term interest rates low throughout the period.

> Vanguard’s longer-term Municipal Bond Funds posted returns ranging from almost 2% for the Short-Term Tax-Exempt Fund to close to 9% for the High-Yield Tax-Exempt Fund.

> Yields on municipal bonds slipped to historically low levels because of strong demand.

| |

| Contents | |

| Your Fund’s Total Returns | 1 |

| Chairman’s Letter | 2 |

| Advisor’s Report | 6 |

| Tax-Exempt Money Market Fund | 8 |

| Short-Term Tax-Exempt Fund | 34 |

| Limited-Term Tax-Exempt Fund | 42 |

| Intermediate-Term Tax-Exempt Fund | 50 |

| Long-Term Tax-Exempt Fund | 58 |

| High-Yield Tax-Exempt Fund | 66 |

| About Your Fund’s Expenses | 75 |

| Glossary | 77 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Cover photograph: Jean Maher.

| | | | | | |

| Your Fund’s Total Returns | | | | |

| |

| |

| |

| |

| Fiscal Year Ended October 31, 2010 | | | | | |

| | | | | | | Taxable- |

| | Ticker | Total | Income | Capital | | Equivalent |

| Vanguard Tax-Exempt Fund | Symbol | Returns | Return | Return | Yield1 | Yield2 |

| Money Market | VMSXX | 0.14% | 0.14% | 0.00% | 0.15% | 0.23% |

| Short-Term | | | | | | |

| Investor Shares | VWSTX | 1.82 | 1.38 | 0.44 | 0.57 | 0.88 |

| Admiral™ Shares3 | VWSUX | 1.90 | 1.46 | 0.44 | 0.65 | 1.00 |

| Limited-Term | | | | | | |

| Investor Shares | VMLTX | 4.04 | 2.40 | 1.64 | 1.05 | 1.62 |

| Admiral Shares3 | VMLUX | 4.12 | 2.48 | 1.64 | 1.13 | 1.74 |

| Intermediate-Term | | | | | | |

| Investor Shares | VWITX | 6.95 | 3.81 | 3.14 | 2.47 | 3.80 |

| Admiral Shares3 | VWIUX | 7.03 | 3.89 | 3.14 | 2.55 | 3.92 |

| Long-Term | | | | | | |

| Investor Shares | VWLTX | 7.52 | 4.50 | 3.02 | 3.17 | 4.88 |

| Admiral Shares3 | VWLUX | 7.61 | 4.59 | 3.02 | 3.25 | 5.00 |

| High-Yield | | | | | | |

| Investor Shares | VWAHX | 8.76 | 4.76 | 4.00 | 3.57 | 5.49 |

| Admiral Shares3 | VWALX | 8.85 | 4.85 | 4.00 | 3.65 | 5.62 |

Your Fund’s Performance at a Glance

October 31, 2009–October 31, 2010

| | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| Vanguard Tax-Exempt Fund | Share Price | Share Price | Dividends | Gains |

| Money Market | $1.00 | $1.00 | $0.001 | $0.000 |

| Short-Term | | | | |

| Investor Shares | 15.88 | 15.95 | 0.217 | 0.000 |

| Admiral Shares | 15.88 | 15.95 | 0.230 | 0.000 |

| Limited-Term | | | | |

| Investor Shares | 10.97 | 11.15 | 0.259 | 0.000 |

| Admiral Shares | 10.97 | 11.15 | 0.268 | 0.000 |

| Intermediate-Term | | | | |

| Investor Shares | 13.38 | 13.80 | 0.495 | 0.000 |

| Admiral Shares | 13.38 | 13.80 | 0.506 | 0.000 |

| Long-Term | | | | |

| Investor Shares | 10.92 | 11.25 | 0.475 | 0.000 |

| Admiral Shares | 10.92 | 11.25 | 0.484 | 0.000 |

| High-Yield | | | | |

| Investor Shares | 10.26 | 10.67 | 0.470 | 0.000 |

| Admiral Shares | 10.26 | 10.67 | 0.479 | 0.000 |

1 7-day SEC yield for the Tax-Exempt Money Market Fund; 30-day SEC yield for the other funds.

2 This calculation, which assumes a typical itemized tax return, is based on the maximum federal income tax rate of 35%. State and local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

3 Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

1

Chairman’s Letter

Dear Shareholder,

With the exception of our Tax-Exempt Money Market Fund, Vanguard’s municipal bond funds achieved solid returns for the fiscal year ended October 31, 2010. As I’m sure you know, both taxable and tax-exempt money market funds have been hobbled by Federal Reserve policy that has pushed their returns virtually to zero.

Steady demand for tax-exempt bonds, fueled in part by investors seeking higher yields than money market funds could provide, helped produce returns ranging from 1.82% for the Short-Term Tax-Exempt Fund to 8.76% for the High-Yield Tax-Exempt Fund (both figures are for Investor Shares). The latter fund, which can invest up to a fifth of its assets in below-investment-grade bonds, also benefited from the greater appetite for risk that has characterized many investors’ decisions since early 2009. The funds’ fiscal 2010 returns weren’t as strong as those a year earlier, when unsettled markets snapped back from the global credit crunch.

Investors’ interest in municipals hasn’t been dampened by the much-publicized budgetary stress being experienced by state and local governments. These recession-induced strains, which are expected to linger for the immediate future, underscore longer-term challenges, such as the financing of promised retiree benefits. We believe that states and municipalities have the capability to close budgetary and financing gaps, although the process will certainly be difficult and some aspects of it may take time. Please be assured that our experienced credit analysts will be closely monitoring developments and their implications for our portfolios.

Yields declined over the past 12 months for all of the bond funds. Indeed, municipal bond yields in general declined to historical lows. As of October 31, the funds’ yields ranged from 0.57% for the Short-Term Fund’s Investor Shares to 3.65% for the High-Yield Fund’s Admiral Shares. Note that, on a taxable-equivalent basis, the yields were higher, as shown on page 1.

Please note that on October 6, Vanguard broadened the availability of our lower-cost Admiral Shares. We reduced the Admiral minimums on most of our actively managed funds to $50,000 from $100,000 as part of our ongoing efforts to lower the cost of investing for our clients.

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended October 31, 2010 |

| | One Year | Three Years | Five Years |

| Bonds | | | |

| Barclays Capital U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 8.01% | 7.23% | 6.45% |

| Barclays Capital Municipal Bond Index | | | |

| (Broad tax-exempt market) | 7.78 | 5.79 | 5.20 |

| Citigroup 3-Month Treasury Bill Index | 0.12 | 0.89 | 2.41 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 17.67% | –6.14% | 1.99% |

| Russell 2000 Index (Small-caps) | 26.58 | –3.91 | 3.07 |

| Dow Jones U.S. Total Stock Market Index | 19.04 | –5.55 | 2.52 |

| MSCI All Country World Index ex USA (International) | 13.08 | –7.62 | 6.21 |

| |

| CPI | | | |

| Consumer Price Index | 1.17% | 1.54% | 1.89% |

2

Despite shrinking yields, bonds attracted investors’ dollars

Although fixed income yields have fallen to generational lows, investors have continued to bid up bond prices. The broad taxable U.S. bond market produced a 12-month return of about 8%, with the overall tax-exempt market only slightly behind. Meanwhile, the yield of the 10-year U.S. Treasury note fell from 3.39% at the start of the period to 2.61% at the close.

Bond prices and yields move in opposite directions, of course, so abundant returns built on rising prices could mean leaner pickings in the years ahead.

Stock market performance was better than it felt

Global stock prices rallied at the start of the period, but struggled through the spring and summer, weighed down by Europe’s sovereign debt crisis and the slow pace of economic recovery in the United States. In the fiscal year’s final months, the mood turned. Stock prices climbed on continued strength in corporate earnings. In the United States, stocks also seemed to get a boost from the Federal Reserve Board’s hints that it would try to stimulate the economy with a second round of U.S. Treasury bond purchases. (In early November, the Fed announced that it would buy as much as $600 billion in Treasuries.)

For the 12 months, the broad U.S. stock market returned about 19%, a performance that was better than it felt in a year of ups and downs. Small-capitalization stocks did even better. International stocks returned about 13% on the strength of a powerful rally in emerging markets and solid single-digit gains in developed markets in Europe and the Pacific region.

Yield-hungry investors helped support bond prices

Some of the same themes that character- ized our funds’ performance a year ago were again in evidence during fiscal 2010.

At the short end, Vanguard Tax-Exempt Money Market Fund returned a paltry 0.14%, the lowest annual return in the fund’s 30-year history, but still above the average return of 0% posted by peer-group funds. Our fund stayed ahead largely because of its very low expense ratio, an important advantage given that expenses are deducted from returns. You can see the significant difference in expense ratios between the Vanguard funds and their peer-group averages in the table on page 5.

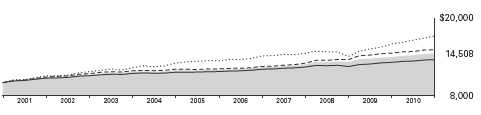

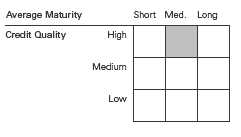

Muni investors seeking higher yields instead flocked to bond funds, especially those with average maturities in the one- to six-year range. These include the Short-Term Tax-Exempt Fund (which returned +1.82%), the Limited-Term Tax-Exempt Fund (+4.04%), and the Intermediate-Term Tax-Exempt Fund (+6.95%). (All returns are for Investor Shares.) Astute bond selection and lower expense ratios helped the funds to stay a few steps ahead of the average returns for their peers.

During the year, several factors outside the tax-exempt market stoked demand for muni bonds. One of these was the possibility of higher federal income tax rates after 2010; another was fear that some European nations would default on their bonds, a concern that sent many investors to the perceived safety of municipals and U.S. Treasuries. Whatever its source, demand for bonds has the dual effect of raising their prices and lowering their yields. Over the past 12 months this strong demand, coupled with the tardy pace of the U.S. economy’s emergence from recession, sent municipal bond market yields to historic lows.

For the longest-maturity municipal bonds, such as those held by our Long-Term Tax-Exempt Fund, yet another factor lifted prices: a shrinking supply of traditional tax-exempt bonds. States and local governments have been favoring federally subsidized Build America Bonds, created in 2009 as part of the federal economic stimulus package, as their source of long-term funding. Build America Bonds, which are taxable, have widened the municipal market to investors worldwide and account for perhaps a quarter of new municipal bond issuance. The Long-Term Tax-Exempt Fund returned 7.52% for Investor Shares, roughly in line with the average return of peer funds. (Authority to issue Build America Bonds is scheduled to expire on December 31, 2010. It’s not certain whether a subsidized bond option will continue to be available to states and local governments after that date.)

The High-Yield Tax-Exempt Fund returned 8.76% for Investor Shares. The fund trailed the average return of its peers by about three percentage points, not an unusual result during market upswings when investors typically favor riskier assets. High-yield funds typically invest in the riskiest bonds, but our fund is more conservative than many of its competitors. The advisor can invest no more than a fifth of the fund’s assets in below-investment-grade bonds; at least 80% of the fund’s assets must be in investment-grade issues—a strategy that has worked to the fund’s benefit in periods of greater risk-aversion.

3

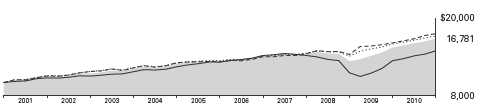

A ten-year perspective highlights successful results

We believe that investing should be a long-term proposition. Moreover, a long-term view allows you to gauge how a fund has performed through a variety of market cycles and economic conditions.

Over the long term, Vanguard’s advantages—skilled advisors, insightful credit analysis, low costs, and an emphasis on high-quality investments—show up particularly strongly. As you can see in the table on page 5, the Vanguard tax-exempt funds have outpaced their competitive peers by significant margins in average annual returns over the past ten years.

Insightful credit analysis is an important investor resource

State and local governments are going through a difficult period. The deep down-turn has undercut the normal sources of operating revenue, such as income, sales, and real estate taxes, and has highlighted poor spending choices or underfunded promises. We’re confident that muni issuers can do what’s necessary to make ends meet and shore up their financial foundations for the future.

Of course, progress may not be smooth. Moreover, historical circumstances and the uniqueness of individual regions make each governmental entity’s situation unique. That is why we perform our own careful and thorough credit analysis, independent of credit-rating agencies.

Even with such careful analysis, the financial markets can be full of surprises. That is why we believe an effective strategy for individual investors is to develop a low-cost portfolio that is balanced among asset classes, such as stocks, bonds, and cash investments, in proportions suited to one’s personal risk tolerance, time horizon, and goals. Equally important is diversification within asset classes. Particularly for investors in higher tax brackets, the Vanguard Municipal Bond Funds can play a useful role in such a portfolio.

As always, thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 12, 2010

4

Total Returns

Fiscal Year Ended October 31, 2010

| | |

| | Vanguard | Peer-Group |

| Tax-Exempt Fund Investor Shares | Fund | Average1 |

| Money Market | 0.14% | 0.00% |

| Short-Term | 1.82 | 1.46 |

| Limited-Term | 4.04 | 3.20 |

| Intermediate-Term | 6.95 | 6.69 |

| Long-Term | 7.52 | 7.60 |

| High-Yield | 8.76 | 11.46 |

Total Returns

Ten Years Ended October 31, 2010

| | |

| | Average Annual Return |

| | Vanguard | Peer-Group |

| Tax-Exempt Fund Investor Shares | Fund | Average1 |

| Money Market | 1.90% | 1.39% |

| Short-Term | 2.93 | 1.60 |

| Limited-Term | 3.79 | 3.09 |

| Intermediate-Term | 4.86 | 4.38 |

| Long-Term | 5.33 | 4.46 |

| High-Yield | 5.31 | 4.08 |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

Expense Ratios2

Your Fund Compared With Its Peer Group

| | | |

| | Investor | Admiral | Peer-Group |

| Tax-Exempt Fund | Shares | Shares | Average1 |

| Money Market | 0.17% | — | 0.65% |

| Short-Term | 0.20 | 0.12% | 0.66 |

| Limited-Term | 0.20 | 0.12 | 0.80 |

| Intermediate-Term | 0.20 | 0.12 | 0.88 |

| Long-Term | 0.20 | 0.12 | 1.04 |

| High-Yield | 0.20 | 0.12 | 1.15 |

1 Peer groups are: for the Tax-Exempt Money Market Fund, Tax-Exempt Money Market Funds; for the Short-Term Tax-Exempt Fund, 1–2 Year Municipal Funds; for the Limited-Term Tax-Exempt Fund, 1–5 Year Municipal Funds; for the Intermediate-Term Tax Exempt Fund, Intermediate Municipal Funds; for the Long-Term Tax-Exempt Fund, General Municipal Funds; and for the High-Yield Tax-Exempt Fund, High Yield Municipal Funds. Peer-group values are derived from data provided by Lipper Inc. and capture data through year-end 2009.

2 The fund expense ratios shown are from the prospectus dated April 22, 2010, and represent estimated costs for the current fiscal year. For the fiscal year ended October 31, 2010, expense ratios were: for the Tax-Exempt Money Market Fund, 0.17%; for the Short-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; for the Limited-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; for the Intermediate-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; for the Long-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares; for the High-Yield Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares.

5

Advisor’s Report

For the fiscal year ended October 31, 2010, the Vanguard Municipal Bond Funds posted returns that ranged from 0.14% for the Tax-Exempt Money Market Fund to 8.85% for the Admiral Shares of the High-Yield Tax-Exempt Fund. Four of the six funds outperformed their peer-group averages, while the Long-Term and High-Yield Tax-Exempt Funds trailed the average returns of their peers.

The investment environment

In many ways, the investing environment during fiscal 2010—including questions about the impact of some market-shaping events—represented a continuation of the themes from the prior fiscal year.

At the short-maturity end of the yield curve, the Federal Reserve maintained its 22-month-old near-zero target for the federal funds rate in an effort to quicken the pace of economic recovery. This drove returns offered by money market and short-duration funds to historic lows. As the pace of economic recovery remained sluggish, the Federal Reserve took another step to lower rates. With no further room to maneuver in the short end of the yield curve, the Fed ended months of speculation on November 3 by announcing that it would buy Treasury bonds, concentrating on purchasing securities with maturities of less than 10 years. Historically, municipal bond yields can be influenced by the movement in Treasury prices.

The intermediate-term portion of the muni yield curve had already been under pressure as money market and shorter-maturity investors, in fiscal 2009 and more so in fiscal 2010, turned to securities with slightly longer maturities for higher levels of tax-exempt income, which eventually drove yields down further in response to the greater demand. As in the prior fiscal year, investors were also willing to invest in lower-rated securities in an effort to increase the level of tax-exempt income.

At the longest-term portion of the muni yield curve, the 19-month-old Build America Bonds program continued to have an impact on supply and yields. These bonds are the taxable and federally subsidized municipal securities that were created as part of American Recovery and Reinvestment Act of 2009 to help fiscally stressed state and local governments reduce debt-financing costs. Bond issuance has exceeded expectations: Since the subsidy program began, states and local governments have floated more than $150 billion of the bonds as of October, concentrated in long-duration issues. This has had the effect of reducing the supply of traditional long-term tax-exempts, pushing down their yields in the face of persistent demand for them. The Build America Bonds program is set to expire on December 31, 2010, but there is a chance that it could be extended by Congress.

The clock was also ticking for federal tax rates under “sunset” provisions of current tax law. Unless Congress takes action, tax rates will rise after the end of calendar 2010. The possibility of higher tax rates in the future supported demand for municipals in the period, with an additional boost from investors who were concerned about Europe’s sovereign debt crisis. Although much-discussed in Washington, the future direction of federal tax policy, especially in light of the midterm elections, remained unknown at the end of the fiscal year.

The confluence of these demand factors drove the municipal bond yield curve to historical lows in August and September. For our municipal bond funds, the slide in yields over the year ended October 31 ranged from 26 basis points for our Short-Term Tax-Exempt Bond Fund (to 0.57% for Investor Shares) to 57 basis

Yields of Municipal Bonds

(AAA-Rated General-Obligation Issues)

| | |

| | October 31, | October 31, |

| Maturity | 2009 | 2010 |

| 2 years | 0.70% | 0.46% |

| 5 years | 1.85 | 1.20 |

| 10 years | 3.03 | 2.51 |

| 30 years | 4.23 | 3.86 |

Source: Vanguard.

6

points for the High-Yield Tax-Exempt Fund (to 3.47% for Investor Shares). Because of the Fed’s policy on short-term interest rates, the Vanguard Tax-Exempt Money Market Fund’s yield stood at 0.15%, essentially unchanged from a year earlier.

Management of the funds

In carrying out our investment activities, we have, as always, relied on our own independent analysis, a practice that assumes even greater importance because of the fiscal stress that states and local governments have been under amid the worst recession since the Depression. The recession was declared to have officially ended in June 2009, but—as in previous economic recoveries—it takes time for higher personal and business income to flow through the tax system.

Given the depth of the most recent recession, we would expect any improvement in the municipal sector to be uneven and lag behind the general economic recovery. There is natural concern among investors about the health of municipal securities. Keep in mind that our staff of highly experienced analysts weighs in on potential additions to our portfolios and rejects those that don’t meet our high quality standards. We expect that states and local governments will make the tough decisions about taxes and service levels necessary to balance their budgets in the short term and address longer-term challenges, such as adequately funding retiree benefits. It’s a process that, in the give-and-take of the political arena, will admittedly be bumpy at best.

Among specific areas of interest during the fiscal year, we have continued to add health care credits from across the investment-grade credit spectrum. We have also focused on airport bonds as an area of relative value. This is because another provision of the recovery act temporarily lifted the alternative minimum tax on “private-activity” municipal bonds, which are normally taxable because they help finance private projects.

In response to the level of uncertainty about the pace of the economic recovery, we maintained a neutral average weighted duration in each fund compared with its benchmark. As a consequence, interest rate positioning had no meaningful impact on performance.

Christopher W. Alwine, CFA, Principal, Head of Municipal Bond Group

Marlin G. Brown, Portfolio Manager

Mathew M. Kiselak, Principal, Portfolio Manager

Michael G. Kobs, Portfolio Manager

Pamela Wisehaupt Tynan, Principal, Portfolio Manager

Vanguard Fixed Income Group

November 17, 2010

7

Tax-Exempt Money Market Fund

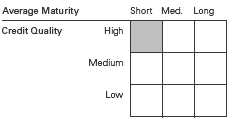

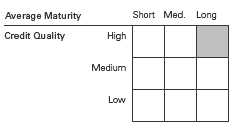

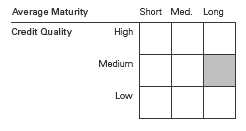

Fund Profile

As of October 31, 2010

| |

| Financial Attributes | |

| |

| Yield1 | 0.15% |

| Average Weighted Maturity | 33 days |

| Expense Ratio2 | 0.17% |

| |

| Largest Area Concentrations | |

| |

| Texas | 13.8% |

| Illinois | 4.8 |

| North Carolina | 4.5 |

| Florida | 4.2 |

| Georgia | 4.2 |

| New York | 3.6 |

| Washington | 3.4 |

| Tennessee | 3.4 |

| Michigan | 3.1 |

| Indiana | 3.0 |

| Top Ten | 48.0% |

| |

| Distribution by Credit Quality (% of portfolio) |

| |

| First Tier | 100.0% |

| Second Tier | 0.0 |

| For information about these ratings, see the Glossary entry for Credit Quality. |

| |

1 7-day SEC yield. See the Glossary.

2 The expense ratio shown is from the prospectus dated April 22, 2010, and represents estimated costs for the current fiscal year. For the fiscal year ended October 31, 2010, the expense ratio was 0.17%.

8

Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

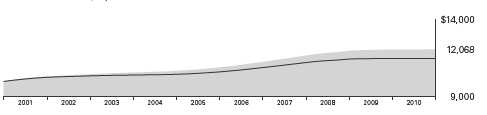

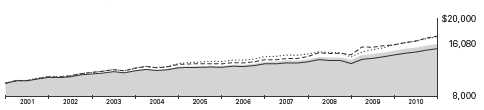

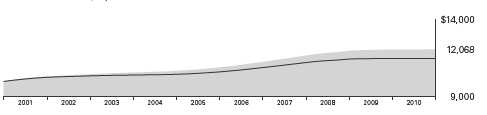

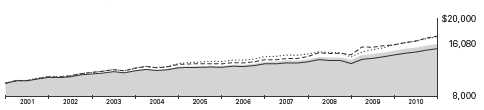

Cumulative Performance: October 31, 2000–October 31, 2010

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | Final Value |

| | | Periods Ended October 31, 2010 | of a $10,000 |

| | One Year | Five Years | Ten Years | Investment |

| Tax-Exempt Money Market Fund | 0.14% | 2.05% | 1.90% | $12,068 |

| Tax-Exempt Money Market Funds Average1 | 0.00 | 1.58 | 1.39 | 11,479 |

1 Derived from data provided by Lipper Inc.

See Financial Highlights for dividend information.

9

| | |

| Tax-Exempt Money Market Fund | | |

| |

| |

| |

| |

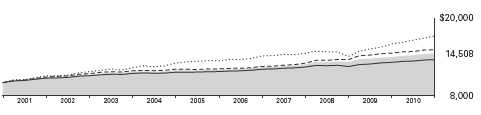

| Fiscal-Year Total Returns (%): October 31, 2000–October 31, 2010 | | |

| |

| | Tax-Exempt | |

| Fiscal | Money Market | Peer-Group |

| Year | Fund | Average1 |

| 2001 | 3.2% | 2.7% |

| 2002 | 1.5 | 0.9 |

| 2003 | 1.0 | 0.5 |

| 2004 | 1.0 | 0.5 |

| 2005 | 2.1 | 1.5 |

| 2006 | 3.3 | 2.6 |

| 2007 | 3.6 | 3.0 |

| 2008 | 2.6 | 2.0 |

| 2009 | 0.6 | 0.3 |

| 2010 | 0.1 | 0.0 |

| 7-day SEC yield (10/31/2010): 0.15% | | |

Average Annual Total Returns: Periods Ended September 30, 2010

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Capital | Income | Total |

| Tax-Exempt Money Market | 6/10/1980 | 0.14% | 2.09% | 0.00% | 1.93% | 1.93% |

1 Average return for Tax-Exempt Money Market Funds is derived from data provided by Lipper Inc.

10

Tax-Exempt Money Market Fund

Financial Statements

Statement of Net Assets

As of October 31, 2010

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information). In addition, the fund publishes its holdings on a monthly basis at vanguard.com.

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (96.1%) | | | | |

| Alabama (0.6%) | | | | |

| 1 Alabama Housing Finance Auth. TOB VRDO | 0.340% | 11/5/10 LOC | 8,700 | 8,700 |

| 1 Alabama Public School & College Auth. TOB VRDO | 0.280% | 11/5/10 | 16,450 | 16,450 |

| 1 Alabama Public School & College Auth. TOB VRDO | 0.290% | 11/5/10 | 9,000 | 9,000 |

| 1 Alabama Special Care Fac. Financing Auth. (Ascension Health) TOB VRDO | 0.280% | 11/5/10 | 6,775 | 6,775 |

| Birmingham AL Public Educ. Building Student Housing Rev. (Univ. Alabama Project) VRDO | 0.280% | 11/5/10 LOC | 4,400 | 4,400 |

| Homewood Alabama Educ. Building Auth. Rev. (Samford Univ.) VRDO | 0.300% | 11/5/10 LOC | 25,000 | 25,000 |

| Mobile AL IDR (Kimberly-Clark Tissue Co.) VRDO | 0.300% | 11/5/10 | 33,550 | 33,550 |

| Mobile AL Infirmary Health System Special Care Fac. Financing Auth. Rev. | | | | |

| (Infirmary Health System, Inc.) | 0.250% | 11/5/10 LOC | 3,000 | 3,000 |

| | | | | 106,875 |

| Alaska (0.2%) | | | | |

| 1 Alaska Housing Finance Corp. TOB VRDO | 0.270% | 11/5/10 LOC | 5,015 | 5,015 |

| 1 Alaska State International Airports System Rev. TOB VRDO | 0.570% | 11/5/10 | 1,910 | 1,910 |

| 1 Anchorage AK Water Rev. TOB VRDO | 0.330% | 11/5/10 | 15,295 | 15,295 |

| North Slope Borough AK GO | 2.000% | 6/30/11 | 9,800 | 9,907 |

| | | | | 32,127 |

| Arizona (2.3%) | | | | |

| Arizona Health Fac. Auth. Rev. (Banner Health) VRDO | 0.260% | 11/5/10 LOC | 45,255 | 45,255 |

| Arizona Health Fac. Auth. Rev. (Banner Health) VRDO | 0.260% | 11/5/10 LOC | 24,505 | 24,505 |

| Arizona Health Fac. Auth. Rev. (Banner Health) VRDO | 0.270% | 11/5/10 LOC | 73,790 | 73,790 |

| Arizona Health Fac. Auth. Rev. (Banner Health) VRDO | 0.270% | 11/5/10 LOC | 51,220 | 51,220 |

| Arizona Transp. Board Highway Rev. | 5.000% | 7/1/11 | 5,675 | 5,851 |

| 1 Arizona Transp. Board Highway Rev. TOB VRDO | 0.280% | 11/5/10 | 7,860 | 7,860 |

| 1 Arizona Transp. Board Highway Rev. TOB VRDO | 0.280% | 11/5/10 | 7,900 | 7,900 |

| 1 Gilbert AZ GO TOB VRDO | 0.270% | 11/5/10 | 27,590 | 27,590 |

| 1 Maricopa County AZ Public Finance Corp. Lease Rev. TOB VRDO | 0.270% | 11/5/10 | 11,675 | 11,675 |

| 1 Phoenix AZ Civic Improvement Corp. Transit Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 30,770 | 30,770 |

| 1 Phoenix AZ Civic Improvement Corp. Transit Rev. TOB VRDO | 0.290% | 11/5/10 (13) | 7,700 | 7,700 |

| 1 Phoenix AZ Civic Improvement Corp. Wastewater System Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 20,565 | 20,565 |

| 1 Phoenix AZ Civic Improvement Corp. Water System Rev. TOB VRDO | 0.280% | 11/5/10 | 8,240 | 8,240 |

| 1 Phoenix AZ Civic Improvement Corp. Water System Rev. TOB VRDO | 0.280% | 11/5/10 | 4,995 | 4,995 |

| 1 Phoenix AZ GO TOB VRDO | 0.270% | 11/5/10 | 16,930 | 16,930 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.270% | 11/5/10 | 6,500 | 6,500 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.280% | 11/5/10 | 8,500 | 8,500 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.280% | 11/5/10 | 4,635 | 4,635 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.280% | 11/5/10 | 6,450 | 6,450 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.280% | 11/5/10 | 4,995 | 4,995 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.280% | 11/5/10 | 7,085 | 7,085 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.280% | 11/5/10 | 4,560 | 4,560 |

| 1 Salt River Project Arizona Agricultural Improvement & Power Dist. Rev. TOB VRDO | 0.280% | 11/5/10 | 16,000 | 16,000 |

| Tempe AZ Transit Excise Tax Rev. VRDO | 0.280% | 11/5/10 | 14,045 | 14,045 |

| | | | | 417,616 |

| California (2.4%) | | | | |

| California GO VRDO | 0.250% | 11/5/10 LOC | 23,150 | 23,150 |

| California Housing Finance Agency Home Mortgage Rev. VRDO | 0.270% | 11/5/10 LOC | 1,600 | 1,600 |

| East Bay CA Muni. Util. Dist. Water System Rev. PUT | 0.280% | 12/1/10 | 19,720 | 19,720 |

| Kern County CA TRAN | 1.500% | 6/30/11 | 50,000 | 50,339 |

| 1 Los Angeles CA Dept. of Water & Power Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 6,230 | 6,230 |

| Los Angeles CA TRAN | 2.000% | 3/31/11 | 80,000 | 80,476 |

| Los Angeles CA TRAN | 2.000% | 4/21/11 | 24,000 | 24,157 |

| Los Angeles County CA TRAN | 2.000% | 6/30/11 | 85,000 | 85,641 |

| 1 Nuveen California Select Quality Municipal Fund VRDP VRDO | 0.530% | 11/5/10 LOC | 26,000 | 26,000 |

| Riverside County CA TRAN | 2.000% | 3/31/11 | 22,200 | 22,343 |

| San Bernardino County CA TRAN | 2.000% | 6/30/11 | 25,000 | 25,263 |

11

Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| San Francisco CA City & County International Airport Rev. VRDO | 0.280% | 11/5/10 LOC | 15,000 | 15,000 |

| South Coast CA Local Educ. Agencies TRAN | 2.000% | 8/9/11 | 20,000 | 20,211 |

| Turlock CA Irrigation Dist. Rev. BAN | 0.750% | 8/12/11 | 50,000 | 50,000 |

| | | | | 450,130 |

| Colorado (2.8%) | | | | |

| 1 Board of Governors of the Colorado State University System Rev. TOB VRDO | 0.270% | 11/29/10 LOC | 21,995 | 21,995 |

| Castle Rock CO COP VRDO | 0.300% | 11/5/10 LOC | 10,600 | 10,600 |

| Colorado Educ. & Cultural Fac. Auth. Rev. (National Jewish Federation Bond Program) VRDO | 0.280% | 11/1/10 LOC | 29,780 | 29,780 |

| Colorado Educ. & Cultural Fac. Auth. Rev. (National Jewish Federation Bond Program) VRDO | 0.280% | 11/1/10 LOC | 10,380 | 10,380 |

| Colorado Educ. & Cultural Fac. Auth. Rev. (National Jewish Federation Bond Program) VRDO | 0.280% | 11/1/10 LOC | 15,315 | 15,315 |

| Colorado Educ. & Cultural Fac. Auth. Rev. (Nature Conservancy Project) VRDO | 0.260% | 11/5/10 | 11,164 | 11,164 |

| Colorado Health Fac. Auth. Rev. (Evangelical) VRDO | 0.270% | 11/5/10 LOC | 3,100 | 3,100 |

| Colorado Health Fac. Auth. Rev. (Exempla Inc.) VRDO | 0.280% | 11/5/10 LOC | 6,815 | 6,815 |

| 1 Colorado Health Fac. Auth. Rev. (Sisters of Charity of Leavenworth Health System) TOB VRDO | 0.280% | 11/5/10 | 4,000 | 4,000 |

| 1 Colorado Housing & Finance Auth. (Single Family Mortgage) TOB VRDO | 0.380% | 11/5/10 (7) | 2,755 | 2,755 |

| Colorado Housing & Finance Auth. Multi-Family Mortgage Bonds Rev VRDO | 0.270% | 11/5/10 | 10,700 | 10,700 |

| Colorado Housing & Finance Auth. Multi-Family Mortgage Bonds Rev VRDO | 0.340% | 11/5/10 | 11,800 | 11,800 |

| Colorado Housing & Finance Auth. Multi-Family Mortgage Bonds Rev. VRDO | 0.270% | 11/5/10 | 19,825 | 19,825 |

| Colorado Housing & Finance Auth. Multi-Family Mortgage Bonds Rev. VRDO | 0.310% | 11/5/10 | 59,510 | 59,510 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.250% | 11/5/10 LOC | 7,825 | 7,825 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.260% | 11/5/10 LOC | 22,730 | 22,730 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.260% | 11/5/10 LOC | 17,690 | 17,690 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.270% | 11/5/10 | 25,025 | 25,025 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.270% | 11/5/10 | 31,000 | 31,000 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.280% | 11/5/10 LOC | 9,500 | 9,500 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.290% | 11/5/10 | 12,500 | 12,500 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.290% | 11/5/10 | 10,355 | 10,355 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.300% | 11/5/10 | 23,000 | 23,000 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.310% | 11/5/10 LOC | 12,000 | 12,000 |

| Colorado Housing & Finance Auth. Single Family Mortgage Bonds Rev. VRDO | 0.310% | 11/5/10 | 16,095 | 16,095 |

| 1 Colorado Regional Transp. Dist. Sales Tax Rev. TOB VRDO | 0.300% | 11/5/10 | 11,445 | 11,445 |

| Colorado Springs CO Util. System Rev. VRDO | 0.260% | 11/5/10 | 11,000 | 11,000 |

| Denver CO Urban Renewal Auth. Tax Increment Rev. (Stapleton) VRDO | 0.280% | 11/5/10 LOC | 14,735 | 14,735 |

| 1 El Paso CO TOB VRDO | 0.270% | 11/5/10 LOC | 11,135 | 11,135 |

| Moffat County CO PCR (PacifiCorp) VRDO | 0.270% | 11/5/10 LOC | 14,900 | 14,900 |

| Univ. of Colorado Hosp. Auth. Rev. VRDO | 0.270% | 11/5/10 LOC | 16,140 | 16,140 |

| Univ. of Colorado Hosp. Auth. Rev. VRDO | 0.270% | 11/5/10 LOC | 40,995 | 40,995 |

| | | | | 525,809 |

| Connecticut (0.2%) | | | | |

| Connecticut GO BAN | 2.000% | 5/19/11 | 25,000 | 25,212 |

| 1 Connecticut State Health & Educ. Fac. Auth. (Yale Univ.) TOB VRDO | 0.250% | 11/5/10 | 5,000 | 5,000 |

| 1 Connecticut State Health & Educ. Fac. Auth. (Yale Univ.) TOB VRDO | 0.280% | 11/5/10 | 7,300 | 7,300 |

| 1 Connecticut State Health & Educ. TOB VRDO | 0.250% | 11/5/10 | 2,700 | 2,700 |

| | | | | 40,212 |

| Delaware (0.2%) | | | | |

| Delaware Health Fac. Auth. Rev. (Bay Health Medical) VRDO | 0.250% | 11/5/10 LOC | 4,845 | 4,845 |

| 1 Delaware Housing Auth. Rev. TOB VRDO | 0.340% | 11/5/10 | 6,950 | 6,950 |

| 1 Delaware Housing Auth. Single Family Mortgage Rev. TOB VRDO | 0.520% | 11/5/10 | 3,880 | 3,880 |

| New Castle County DE Airport Fac. Rev. (FlightSafety) VRDO | 0.300% | 11/5/10 | 24,665 | 24,665 |

| | | | | 40,340 |

| District of Columbia (1.4%) | | | | |

| 1 District of Columbia COP TOB VRDO | 0.270% | 11/5/10 LOC | 17,490 | 17,490 |

| 1 District of Columbia GO TOB VRDO | 0.270% | 11/5/10 LOC | 22,810 | 22,810 |

| District of Columbia GO VRDO | 0.320% | 11/5/10 LOC | 7,700 | 7,700 |

| District of Columbia Rev. (Center for Strategic and International Studies, Inc. Issue) VRDO | 0.250% | 11/5/10 LOC | 6,730 | 6,730 |

| District of Columbia Rev. (Council Foreign Relations) VRDO | 0.290% | 11/5/10 LOC | 37,680 | 37,680 |

| District of Columbia Rev. (Family & Child Services) VRDO | 0.500% | 11/5/10 LOC | 6,160 | 6,160 |

| District of Columbia Rev. (Henry J. Kaiser Family Foundation) VRDO | 0.280% | 11/5/10 | 12,000 | 12,000 |

| District of Columbia Rev. (John F. Kennedy Center) VRDO | 0.300% | 11/5/10 LOC | 9,900 | 9,900 |

| District of Columbia Rev. (Society for Neuroscience) VRDO | 0.350% | 11/5/10 LOC | 12,000 | 12,000 |

| District of Columbia Rev. (The Pew Charitable Trust) VRDO | 0.250% | 11/5/10 LOC | 31,000 | 31,000 |

| District of Columbia Rev. (Washington Drama Society) VRDO | 0.260% | 11/5/10 LOC | 13,900 | 13,900 |

| District of Columbia Rev. (Wesley Theological) VRDO | 0.270% | 11/5/10 LOC | 4,900 | 4,900 |

| District of Columbia Rev. (World Wildlife Fund) VRDO | 0.260% | 11/5/10 LOC | 11,000 | 11,000 |

| District of Columbia TRAN | 2.000% | 9/30/11 | 10,000 | 10,147 |

| 1 District of Columbia Water & Sewer Auth. Public Util. Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 12,860 | 12,860 |

| 1 District of Columbia Water & Sewer Auth. Public Util. Rev. TOB VRDO | 0.270% | 11/5/10 (12) | 8,330 | 8,330 |

| 1 District of Columbia Water & Sewer Auth. Public Util. Rev. TOB VRDO | 0.330% | 11/5/10 | 11,865 | 11,865 |

12

Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Metro. Washington DC/VA Airports Auth. Airport System Rev. TOB VRDO | 0.430% | 11/5/10 (4) | 3,495 | 3,495 |

| Metro. Washington DC/VA Airports Auth. Airport System Rev. VRDO | 0.260% | 11/5/10 LOC | 15,000 | 15,000 |

| 1 Washington DC Airport Auth. System TOB VRDO | 0.430% | 11/5/10 | 4,000 | 4,000 |

| | | | | 258,967 |

| Florida (4.2%) | | | | |

| 1 Brevard County FL School Board COP TOB VRDO | 0.270% | 11/5/10 LOC | 13,865 | 13,865 |

| 1 Broward County FL GO TOB VRDO | 0.270% | 11/5/10 | 8,210 | 8,210 |

| 1 Broward County FL Professional Sports Fac. Tax Rev. TOB VRDO | 0.330% | 11/5/10 (4) | 8,975 | 8,975 |

| 1 Broward County FL School Board COP TOB VRDO | 0.270% | 11/5/10 LOC | 34,635 | 34,635 |

| Broward County FL School Dist. TAN | 1.000% | 1/13/11 | 35,000 | 35,046 |

| 1 Broward County FL Water & Sewer Util. Rev. TOB VRDO | 0.280% | 11/5/10 | 5,660 | 5,660 |

| Florida Board of Educ. Capital Outlay | 5.000% | 6/1/11 | 1,500 | 1,540 |

| 1 Florida Board of Educ. Public Educ. Capital Outlay TOB VRDO | 0.280% | 11/5/10 | 15,000 | 15,000 |

| 1 Florida Board of Educ. Public Educ. TOB VRDO | 0.270% | 11/5/10 | 12,845 | 12,845 |

| 1 Florida Board of Educ. Public Educ. TOB VRDO | 0.300% | 11/5/10 | 10,310 | 10,310 |

| 1 Florida Board of Educ. TOB VRDO | 0.280% | 11/5/10 | 3,995 | 3,995 |

| Florida Dept. of Environmental Protection & Preservation Rev. VRDO | 0.250% | 11/5/10 (12) | 15,600 | 15,600 |

| Florida Dept. of Environmental Protection & Preservation Rev. VRDO | 0.270% | 11/5/10 (12) | 34,760 | 34,760 |

| 1 Florida Dept. of Management Services COP TOB VRDO | 0.280% | 11/5/10 | 6,955 | 6,955 |

| 1 Florida Housing Finance Corp. Rev. TOB VRDO | 0.340% | 11/5/10 | 7,745 | 7,745 |

| 1 Florida Housing Finance Corp. Rev. TOB VRDO | 0.340% | 11/5/10 | 9,835 | 9,835 |

| 1 Florida Housing Finance Corp. Rev. TOB VRDO | 0.340% | 11/5/10 | 7,280 | 7,280 |

| 1 Florida Housing Finance Corp. Rev. TOB VRDO | 0.340% | 11/5/10 | 3,415 | 3,415 |

| 1 Florida State Dept. Transp. Rev. TOB VRDO | 0.280% | 11/5/10 | 8,225 | 8,225 |

| 1 Greater Orlando Aviation Auth. Orlando FL Airport Fac. Rev. TOB VRDO | 0.280% | 11/5/10 | 12,000 | 12,000 |

| 1 Greater Orlando Aviation Auth. Orlando FL Airport Fac. Rev. TOB VRDO | 0.290% | 11/5/10 | 6,665 | 6,665 |

| 1 Hernando County FL Water & Sewer Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 10,300 | 10,300 |

| Highlands County FL Health Fac. Auth. Rev. (Adventist/Sunbelt) VRDO | 0.250% | 11/5/10 LOC | 14,890 | 14,890 |

| Highlands County FL Health Fac. Auth. Rev. (Adventist/Sunbelt) VRDO | 0.270% | 11/5/10 LOC | 10,000 | 10,000 |

| Highlands County FL Health Fac. Auth. Rev. (Adventist/Sunbelt) VRDO | 0.280% | 11/5/10 LOC | 14,000 | 14,000 |

| Highlands County FL Health Fac. Auth. Rev. (Adventist/Sunbelt) VRDO | 0.280% | 11/5/10 LOC | 10,000 | 10,000 |

| Highlands County FL Health Rev. (Adventist Health System) VRDO | 0.260% | 11/5/10 LOC | 13,500 | 13,500 |

| Highlands County FL Health Rev. (Adventist Health System) VRDO | 0.300% | 11/5/10 LOC | 5,000 | 5,000 |

| Jacksonville FL Electric Auth. Electric System Rev. VRDO | 0.290% | 11/5/10 | 30,435 | 30,435 |

| Jacksonville FL Health Fac. Auth. Hosp. Rev. (Baptist Medical Center) VRDO | 0.290% | 11/5/10 LOC | 5,385 | 5,385 |

| 1 Lee Memorial Health System Florida Hosp. Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 14,505 | 14,505 |

| Martin County FL Health Fac. Auth. Hosp. Rev. (Martin Medical Center) VRDO | 0.280% | 11/5/10 LOC | 13,730 | 13,730 |

| Miami FL Health Fac. Auth. (Catholic Health East) VRDO | 0.240% | 11/5/10 LOC | 11,460 | 11,460 |

| 1 Miami-Dade County FL Educ. Fac. Auth. Rev. (Univ. of Miami) TOB VRDO | 0.290% | 11/5/10 (13) | 22,985 | 22,985 |

| 1 Miami-Dade County FL School Board COP TOB VRDO | 0.270% | 11/5/10 LOC | 13,575 | 13,575 |

| 1 Miami-Dade County FL School Board COP TOB VRDO | 0.290% | 11/5/10 (13) | 36,630 | 36,630 |

| 1 Miami-Dade County FL School Board COP TOB VRDO | 0.290% | 11/5/10 (13) | 9,600 | 9,600 |

| 1 Miami-Dade County FL School Board COP TOB VRDO | 0.380% | 11/5/10 (12) | 5,800 | 5,800 |

| Miami-Dade County FL Sports Franchise Fac. Tax Rev. VRDO | 0.270% | 11/5/10 LOC | 35,000 | 35,000 |

| 1 Miami-Dade County FL Water & Sewer Rev. TOB VRDO | 0.380% | 11/5/10 (4) | 3,000 | 3,000 |

| Monroe County FL Airport Rev. (Var-Key West International Airport) VRDO | 0.330% | 11/5/10 LOC | 10,980 | 10,980 |

| Orange County FL Health Fac. Auth. Rev. (Nemours Foundation Project) VRDO | 0.260% | 11/5/10 | 25,555 | 25,555 |

| Orange County FL Health Fac. Auth. Rev. (Nemours Foundation Project) VRDO | 0.260% | 11/5/10 | 4,145 | 4,145 |

| Orange County FL Health Fac. Auth. Rev. (Orlando Regional Healthcare) VRDO | 0.300% | 11/5/10 LOC | 4,630 | 4,630 |

| 1 Orange County FL Health Fac. Auth. TOB VRDO | 0.280% | 11/5/10 | 6,660 | 6,660 |

| 1 Orange County FL Housing Finance Auth. Homeowner Rev. TOB VRDO | 0.340% | 11/5/10 | 2,935 | 2,935 |

| 1 Orange County FL School Board COP TOB VRDO | 0.270% | 11/5/10 LOC | 9,160 | 9,160 |

| Orlando FL Util. Comm. Util. System Rev. | 2.500% | 5/1/11 | 13,000 | 13,131 |

| Palm Beach County FL Rev. (Children’s Home Society Project) VRDO | 0.350% | 11/5/10 LOC | 11,905 | 11,905 |

| Palm Beach County FL Rev. (Community Foundation Palm Beach Project) VRDO | 0.340% | 11/5/10 LOC | 5,700 | 5,700 |

| 1 Palm Beach County FL TOB VRDO | 0.270% | 11/5/10 | 8,545 | 8,545 |

| 1 Palm Beach County FL Water & Sewer TOB VRDO | 0.280% | 11/5/10 | 5,535 | 5,535 |

| Pembroke Pines FL Charter School Rev. VRDO | 0.290% | 11/5/10 (12) | 11,210 | 11,210 |

| Pembroke Pines FL Charter School Rev. VRDO | 0.290% | 11/5/10 (12) | 29,410 | 29,410 |

| Pinellas County FL Health Fac. Auth. Rev. (Bayfront Hosp.) VRDO | 0.270% | 11/5/10 LOC | 15,975 | 15,975 |

| Polk County FL Ind. Dev. Auth. Healthcare Fac. Rev. (Winter Haven Hospital) VRDO | 0.260% | 11/5/10 LOC | 9,800 | 9,800 |

| 1 South Florida Water Management Dist. TOB VRDO | 0.330% | 11/5/10 | 9,800 | 9,800 |

| 1 Tampa Bay FL Water Util. System Rev. TOB VRDO | 0.330% | 11/5/10 | 4,505 | 4,505 |

| 1 Univeristy of North Florida Financing Corp. Capital Improvement Rev. TOB VRDO | 0.290% | 11/5/10 LOC | 5,255 | 5,255 |

| 1 Volusia County FL Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 28,570 | 28,570 |

| West Orange Healthcare Dist. FL Rev. VRDO | 0.280% | 11/5/10 LOC | 13,400 | 13,400 |

| | | | | 779,162 |

13

Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Georgia (4.2%) | | | | |

| 1 Atlanta GA Airport Passenger Charge Rev. TOB VRDO | 0.300% | 11/5/10 (4) | 12,500 | 12,500 |

| Atlanta GA Airport Rev. CP | 0.300% | 11/9/10 LOC | 75,000 | 75,000 |

| Atlanta GA Dev. Auth. Rev. (Georgia Aquarium, Inc. Project) VRDO | 0.280% | 11/5/10 LOC | 10,000 | 10,000 |

| Dalton County GA Dev. Auth. (Hamilton Health Care System) VRDO | 0.290% | 11/5/10 LOC | 16,005 | 16,005 |

| DeKalb County GA Private Hosp. Auth. RAN (Children’s Healthcare) | 3.000% | 11/15/10 | 5,500 | 5,505 |

| 1 DeKalb County GA Water & Sewer Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 16,565 | 16,565 |

| 1 DeKalb County GA Water & Sewer Rev. TOB VRDO | 0.280% | 11/5/10 | 11,990 | 11,990 |

| Floyd County GA Dev. Auth. Rev. (Berry College) VRDO | 0.280% | 11/5/10 LOC | 33,500 | 33,500 |

| Floyd County GA Dev. Auth. Rev. (Berry College) VRDO | 0.280% | 11/5/10 LOC | 42,705 | 42,705 |

| Fulton County GA Dev. Auth. (Lovett School Project) VRDO | 0.280% | 11/5/10 LOC | 700 | 700 |

| Fulton County GA Dev. Auth. (Lovett School Project) VRDO | 0.280% | 11/5/10 LOC | 27,500 | 27,500 |

| Fulton County GA Dev. Auth. (Piedmont Healthcare Inc. Project) VRDO | 0.280% | 11/5/10 LOC | 69,415 | 69,415 |

| Fulton County GA Dev. Auth. (Robert A. Woodruff Arts Center) VRDO | 0.280% | 11/5/10 LOC | 22,000 | 22,000 |

| Fulton County GA Dev. Auth. (Woodward Academy Project) VRDO | 0.280% | 11/5/10 LOC | 32,000 | 32,000 |

| Fulton County GA Dev. Auth. (Woodward Academy Project) VRDO | 0.280% | 11/5/10 LOC | 20,595 | 20,595 |

| Fulton County GA Dev. Auth. (Woodward Academy Project) VRDO | 0.280% | 11/5/10 LOC | 10,200 | 10,200 |

| Fulton County GA Dev. Auth. (Woodward Academy Project) VRDO | 0.280% | 11/5/10 LOC | 13,000 | 13,000 |

| 1 Fulton County GA Dev. Auth. TOB VRDO | 0.280% | 11/5/10 | 11,420 | 11,420 |

| Gainesville GA Redev. Auth. Rev. (Brenau Univ.) VRDO | 0.300% | 11/5/10 LOC | 10,800 | 10,800 |

| 1 Georgia GO TOB VRDO | 0.310% | 11/5/10 | 9,365 | 9,365 |

| Gwinnett County GA Hosp. Auth. Rev. (Gwinnett Hosp. System Inc.) VRDO | 0.280% | 11/5/10 LOC | 46,025 | 46,025 |

| Gwinnett County GA School Dist. GO | 5.000% | 2/1/11 | 2,500 | 2,529 |

| 1 Gwinnett County GA School Dist. GO TOB VRDO | 0.270% | 11/5/10 | 12,290 | 12,290 |

| Macon-Bibb County GA Hosp. Auth. (Medical Center of Central Georgia) VRDO | 0.280% | 11/5/10 LOC | 15,775 | 15,775 |

| Macon-Bibb County GA Hosp. Auth. (Medical Center of Central Georgia) VRDO | 0.280% | 11/5/10 LOC | 19,390 | 19,390 |

| Macon-Bibb County GA Hosp. Auth. (Medical Center of Central Georgia) VRDO | 0.300% | 11/5/10 LOC | 5,800 | 5,800 |

| Macon-Bibb County GA Hosp. Auth. (Medical Center of Central Georgia) VRDO | 0.300% | 11/5/10 LOC | 17,100 | 17,100 |

| 1 Macon-Bibb County GA Hosp. Auth. TOB VRDO | 0.280% | 11/5/10 | 4,995 | 4,995 |

| Main Street Natural Gas Inc. Georgia Gas Project Rev. VRDO | 0.280% | 11/5/10 | 90,000 | 90,000 |

| Metro. Atlanta GA Rapid Transp. Auth. Georgia Sales Tax Rev. VRDO | 0.260% | 11/5/10 LOC | 38,950 | 38,950 |

| Metro. Atlanta GA Rapid Transp. Auth. Georgia Sales Tax Rev. VRDO | 0.260% | 11/5/10 LOC | 23,000 | 23,000 |

| 1 Private Colleges & Univ. Auth. of Georgia Rev. (Emory Univ.) TOB VRDO | 0.270% | 11/5/10 | 15,270 | 15,270 |

| 1 Private Colleges & Univ. Auth. of Georgia Rev. (Emory Univ.) TOB VRDO | 0.280% | 11/5/10 | 4,440 | 4,440 |

| 1 Private Colleges & Univ. Auth. of Georgia Rev. (Emory Univ.) TOB VRDO | 0.280% | 11/5/10 | 5,630 | 5,630 |

| Savannah GA Econ. Dev. Auth. Rev. (SSU Foundation) VRDO | 0.270% | 11/5/10 LOC | 8,900 | 8,900 |

| Thomasville GA Hosp. Rev. (John D Archbold Memorial Hosp., Inc. Project) VRDO | 0.300% | 11/5/10 LOC | 2,550 | 2,550 |

| Thomasville GA Hosp. Rev. (John D Archbold Memorial Hosp., Inc. Project) VRDO | 0.300% | 11/5/10 LOC | 3,900 | 3,900 |

| Valdosta & Lowndes County GA Hosp. Auth. Rev. (South GA Medical Center Project) VRDO | 0.300% | 11/5/10 LOC | 5,035 | 5,035 |

| | | | | 772,344 |

| Hawaii (0.7%) | | | | |

| 1 Hawaii State GO TOB VRDO | 0.280% | 11/5/10 | 11,245 | 11,245 |

| 1 Honolulu HI City & County Board Water Supply TOB VRDO | 0.270% | 11/5/10 LOC | 7,000 | 7,000 |

| Honolulu HI City & County GO CP | 0.290% | 11/9/10 | 15,000 | 15,000 |

| Honolulu HI City & County GO CP | 0.290% | 12/6/10 | 30,500 | 30,500 |

| Honolulu HI City & County GO CP | 0.290% | 12/6/10 | 10,000 | 10,000 |

| 1 Honolulu HI City & County TOB VRDO | 0.280% | 11/5/10 | 14,995 | 14,995 |

| 1 Honolulu HI City & County TOB VRDO | 0.280% | 11/5/10 | 7,715 | 7,715 |

| 1 Univ. of Hawaii Rev. TOB VRDO | 0.290% | 11/5/10 (13) | 19,800 | 19,800 |

| 1 University of Hawaii Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 12,865 | 12,865 |

| | | | | 129,120 |

| Idaho (2.5%) | | | | |

| Idaho Housing & Finance Assn. (College of Idaho Project) VRDO | 0.270% | 11/5/10 LOC | 6,330 | 6,330 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.270% | 11/5/10 LOC | 12,600 | 12,600 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.270% | 11/5/10 LOC | 6,325 | 6,325 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.270% | 11/5/10 LOC | 9,860 | 9,860 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.270% | 11/5/10 LOC | 13,000 | 13,000 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 7,305 | 7,305 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 5,310 | 5,310 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 9,610 | 9,610 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 7,355 | 7,355 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 7,090 | 7,090 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 10,190 | 10,190 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 9,455 | 9,455 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 9,935 | 9,935 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 10,210 | 10,210 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 10,855 | 10,855 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 14,110 | 14,110 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 13,320 | 13,320 |

14

Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 15,220 | 15,220 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 16,085 | 16,085 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 6,500 | 6,500 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 10,925 | 10,925 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 29,505 | 29,505 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 | 24,000 | 24,000 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 | 28,750 | 28,750 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 6,100 | 6,100 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 | 12,760 | 12,760 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 | 13,185 | 13,185 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 | 8,000 | 8,000 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 13,510 | 13,510 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 LOC | 13,590 | 13,590 |

| Idaho Housing & Finance Assn. Single Family Mortgage Rev. VRDO | 0.310% | 11/5/10 | 27,000 | 27,000 |

| Idaho State Building Auth. Rev. (Prison Fac. Project) VRDO | 0.280% | 11/5/10 | 16,560 | 16,560 |

| Idaho TAN | 2.000% | 6/30/11 | 52,000 | 52,544 |

| | | | | 457,094 |

| Illinois (4.8%) | | | | |

| Bartlett IL Special Services Area (Bluff City LLC) VRDO | 0.340% | 11/5/10 LOC | 12,920 | 12,920 |

| Channahon IL Rev. (Morris Hosp.) VRDO | 0.260% | 11/5/10 LOC | 4,195 | 4,195 |

| 1 Chicago IL Board of Educ. GO TOB VRDO | 0.330% | 11/5/10 (4) | 4,995 | 4,995 |

| Chicago IL Board of Educ. GO VRDO | 0.280% | 11/5/10 LOC | 17,400 | 17,400 |

| Chicago IL Board of Educ. GO VRDO | 0.280% | 11/5/10 LOC | 5,900 | 5,900 |

| 1 Chicago IL GO TOB VRDO | 0.280% | 11/5/10 | 10,830 | 10,830 |

| 1 Chicago IL GO TOB VRDO | 0.280% | 11/5/10 (12) | 6,600 | 6,600 |

| 1 Chicago IL GO TOB VRDO | 0.290% | 11/5/10 | 5,500 | 5,500 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.270% | 11/5/10 | 18,890 | 18,890 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.270% | 11/5/10 | 5,000 | 5,000 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.280% | 11/5/10 | 5,005 | 5,005 |

| 1 Chicago IL Metro. Water Reclamation Dist. GO TOB VRDO | 0.300% | 11/5/10 | 8,710 | 8,710 |

| 1 Chicago IL O’Hare International Airport Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 29,705 | 29,705 |

| 1 Chicago IL O’Hare International Airport Rev. TOB VRDO | 0.290% | 11/5/10 LOC | 13,660 | 13,660 |

| 1 Chicago IL O’Hare International Airport Rev. TOB VRDO | 0.300% | 11/5/10 (4) | 14,645 | 14,645 |

| 1 Chicago IL O’Hare International Airport Rev. TOB VRDO | 0.380% | 11/5/10 (4) | 7,495 | 7,495 |

| 1 Chicago IL Wastewater Transmission Rev. TOB VRDO | 0.300% | 11/5/10 LOC | 16,960 | 16,960 |

| Chicago IL Water Rev. VRDO | 0.310% | 11/5/10 LOC | 19,720 | 19,720 |

| Chicago IL Water Rev. VRDO | 0.310% | 11/5/10 LOC | 5,325 | 5,325 |

| Cook County IL Community Consolidated School Dist. Rev. | 2.000% | 12/1/10 | 8,530 | 8,541 |

| 1 Cook County IL GO TOB VRDO | 0.270% | 11/5/10 LOC | 6,850 | 6,850 |

| 1 Cook County IL GO TOB VRDO | 0.330% | 11/5/10 | 7,460 | 7,460 |

| 1 Hoffman Estates IL TOB VRDO | 0.290% | 11/5/10 | 7,295 | 7,295 |

| Illinois Dev. Finance Auth. Rev. (Chicago Horticultural Society) VRDO | 0.340% | 11/5/10 LOC | 20,000 | 20,000 |

| Illinois Dev. Finance Auth. Rev. (Loyola Academy) VRDO | 0.340% | 11/5/10 LOC | 16,245 | 16,245 |

| Illinois Educ. Fac. Auth. Rev. (Columbia College Chicago) VRDO | 0.260% | 11/5/10 LOC | 12,650 | 12,650 |

| Illinois Educ. Fac. Auth. Rev. (Univ. of Chicago) PUT | 0.460% | 5/4/11 | 20,000 | 20,000 |

| 1 Illinois Educ. Fac. Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.300% | 11/5/10 | 9,185 | 9,185 |

| 1 Illinois Educ. Fac. Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.300% | 11/5/10 | 4,165 | 4,165 |

| Illinois Finance Auth. IDR (Guesto Packing Company Inc. Project) Rev. VRDO | 0.500% | 11/5/10 LOC | 6,710 | 6,710 |

| 1 Illinois Finance Auth. Rev. (Advocate Health Care) TOB VRDO | 0.280% | 11/5/10 | 16,010 | 16,010 |

| Illinois Finance Auth. Rev. (Advocate Health) PUT | 0.350% | 2/1/11 | 25,000 | 25,000 |

| Illinois Finance Auth. Rev. (Advocate Health) VRDO | 0.250% | 11/5/10 | 29,605 | 29,605 |

| Illinois Finance Auth. Rev. (Bradley Univ.) VRDO | 0.250% | 11/5/10 LOC | 3,750 | 3,750 |

| 1 Illinois Finance Auth. Rev. (Central DuPage Health) TOB VRDO | 0.280% | 11/5/10 | 8,750 | 8,750 |

| Illinois Finance Auth. Rev. (Chicago Horticulture Project) VRDO | 0.340% | 11/5/10 LOC | 12,000 | 12,000 |

| 1 Illinois Finance Auth. Rev. (Chicago Univ.) TOB VRDO | 0.280% | 11/5/10 | 13,330 | 13,330 |

| Illinois Finance Auth. Rev. (Evangelical Project) VRDO | 0.280% | 11/5/10 LOC | 5,000 | 5,000 |

| Illinois Finance Auth. Rev. (Hosp. Sister Services Inc.) CP | 0.360% | 11/2/10 | 24,000 | 24,000 |

| Illinois Finance Auth. Rev. (Hosp. Sister Services Inc.) CP | 0.300% | 11/15/10 | 20,000 | 20,000 |

| Illinois Finance Auth. Rev. (Hosp. Sister Services Inc.) CP | 0.300% | 12/3/10 | 4,500 | 4,500 |

| Illinois Finance Auth. Rev. (Hosp. Sister Services Inc.) CP | 0.350% | 2/3/11 | 26,970 | 26,970 |

| Illinois Finance Auth. Rev. (Institute of Chicago) VRDO | 0.240% | 11/5/10 LOC | 2,175 | 2,175 |

| Illinois Finance Auth. Rev. (Northwest Community Hosp.) VRDO | 0.270% | 11/5/10 LOC | 12,935 | 12,935 |

| Illinois Finance Auth. Rev. (Northwest Community Hosp.) VRDO | 0.270% | 11/5/10 LOC | 5,340 | 5,340 |

| 1 Illinois Finance Auth. Rev. (Northwestern Memorial Hosp.) TOB VRDO | 0.280% | 11/5/10 | 11,200 | 11,200 |

| 1 Illinois Finance Auth. Rev. (Northwestern Memorial Hosp.) TOB VRDO | 0.280% | 11/5/10 | 6,000 | 6,000 |

| Illinois Finance Auth. Rev. (Northwestern Univ.) PUT | 0.400% | 3/1/11 | 20,000 | 20,000 |

| Illinois Finance Auth. Rev. (Northwestern Univ.) PUT | 0.400% | 3/1/11 | 20,000 | 20,000 |

| 1 Illinois Finance Auth. Rev. (Northwestern Univ.) TOB VRDO | 0.280% | 11/5/10 | 8,165 | 8,165 |

| Illinois Finance Auth. Rev. (Proctor Hosp.) VRDO | 0.250% | 11/5/10 LOC | 3,275 | 3,275 |

15

Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Illinois Finance Auth. Rev. (Rush Univ. Medical Center) VRDO | 0.260% | 11/5/10 LOC | 4,000 | 4,000 |

| Illinois Finance Auth. Rev. (Southern Illinois Healthcare) VRDO | 0.270% | 11/5/10 LOC | 9,525 | 9,525 |

| Illinois Finance Auth. Rev. (Trinity International Univ.) VRDO | 0.280% | 11/5/10 LOC | 12,870 | 12,870 |

| 1 Illinois Finance Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.270% | 11/5/10 | 20,500 | 20,500 |

| 1 Illinois Finance Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.280% | 11/5/10 | 3,000 | 3,000 |

| 1 Illinois Finance Auth. Rev. (Univ. of Chicago) TOB VRDO | 0.290% | 11/5/10 | 10,265 | 10,265 |

| Illinois Finance Auth. Rev. (Univ. of Chicago) VRDO | 0.240% | 11/5/10 | 4,800 | 4,800 |

| Illinois Finance Auth. Rev. (Wesleyan Univ.) VRDO | 0.260% | 11/5/10 LOC | 14,130 | 14,130 |

| Illinois Finance Auth. Rev. (Xavier Univ.) VRDO | 0.350% | 11/5/10 LOC | 3,700 | 3,700 |

| Illinois Finance Auth. Rev. (YMCA Metro. Chicago Project) VRDO | 0.280% | 11/5/10 LOC | 4,600 | 4,600 |

| 1 Illinois GO TOB VRDO | 0.270% | 11/5/10 LOC | 18,110 | 18,110 |

| 1 Illinois Health Fac. (Northshore Univ. Health System) TOB VRDO | 0.280% | 11/5/10 | 8,750 | 8,750 |

| Illinois Health Fac. Auth. Rev. (Advocate Health Care Network) PUT | 0.400% | 3/25/11 | 9,305 | 9,305 |

| Illinois Health Fac. Auth. Rev. (Elmhurst Memorial Hosp.) VRDO | 0.240% | 11/5/10 LOC | 8,600 | 8,600 |

| 1 Illinois Health Fac. Auth. Rev. (Ingalls Memorial Hosp.) VRDO | 0.270% | 11/5/10 LOC | 13,800 | 13,800 |

| 1 Illinois Housing Dev. Auth. TOB VRDO | 0.380% | 11/5/10 | 19,500 | 19,500 |

| 1 Illinois Regional Transp. Auth. Rev. TOB VRDO | 0.270% | 11/5/10 (13) | 11,340 | 11,340 |

| 1 Illinois Regional Transp. Auth. Rev. TOB VRDO | 0.270% | 11/5/10 | 21,280 | 21,280 |

| 1 Illinois Regional Transp. Auth. Rev. TOB VRDO | 0.270% | 11/5/10 | 14,335 | 14,335 |

| Illinois State Build Rev. | 3.000% | 6/15/11 | 5,000 | 5,073 |

| 1 Illinois State Toll Highway Auth. Toll Highway Rev. TOB VRDO | 0.280% | 11/5/10 | 5,330 | 5,330 |

| 1 Illinois State Toll Highway Auth. Toll Highway Rev. TOB VRDO | 0.280% | 11/5/10 | 14,430 | 14,430 |

| 1 Lake, Cook, Kane & McHenry Counties IL Community USD TOB VRDO | 0.280% | 11/5/10 (4) | 10,355 | 10,355 |

| 1 Metro. Pier & Exposition Auth. Illinois Dedicated Sales Tax Rev. TOB VRDO | 0.270% | 11/5/10 (4) | 9,260 | 9,260 |

| 1 Metro. Pier & Exposition Auth. Illinois Dedicated Sales Tax Rev. TOB VRDO | 0.280% | 11/5/10 | 12,640 | 12,640 |

| 1 Schaumburg IL GO TOB VRDO | 0.280% | 11/5/10 (13) | 6,130 | 6,130 |

| | | | | 886,189 |

| Indiana (3.0%) | | | | |

| Indiana Bond Bank Rev. Advance Funding Program Notes TAN | 2.000% | 1/6/11 LOC | 66,000 | 66,187 |

| Indiana Dev. Finance Auth. Rev. (Children’s Museum) VRDO | 0.280% | 11/5/10 | 29,200 | 29,200 |

| Indiana Dev. Finance Auth. Rev. (Indianapolis Museum of Art) VRDO | 0.280% | 11/5/10 LOC | 18,000 | 18,000 |

| Indiana Educ. Fac. Auth. (Wabash College) VRDO | 0.280% | 11/5/10 LOC | 29,940 | 29,940 |

| Indiana Finance Auth. Health System Rev. (Sisters St. Francis) VRDO | 0.270% | 11/5/10 LOC | 5,000 | 5,000 |

| Indiana Finance Auth. Health System Rev. (Sisters St. Francis) VRDO | 0.270% | 11/5/10 LOC | 7,900 | 7,900 |

| Indiana Finance Auth. Health System Rev. (Sisters St. Francis) VRDO | 0.280% | 11/5/10 LOC | 4,365 | 4,365 |

| Indiana Finance Auth. Hosp. Rev. (Clarian Health Partners, Inc. Obligated Group) VRDO | 0.240% | 11/5/10 LOC | 33,755 | 33,755 |

| Indiana Finance Auth. Hosp. Rev. (Clarian Health Partners, Inc. Obligated Group) VRDO | 0.240% | 11/5/10 LOC | 14,215 | 14,215 |

| Indiana Finance Auth. Rev. (Columbus Regional Hosp.) VRDO | 0.270% | 11/5/10 LOC | 6,900 | 6,900 |

| Indiana Finance Auth. Rev. (DePauw Univ. Project) VRDO | 0.270% | 11/5/10 LOC | 36,910 | 36,910 |

| Indiana Finance Auth. Rev. (Lease Appropriation) VRDO | 0.240% | 11/5/10 | 25,300 | 25,300 |

| Indiana Finance Auth. Rev. (Lease Appropriation) VRDO | 0.250% | 11/5/10 | 20,000 | 20,000 |

| Indiana Finance Auth. Rev. (State Revolving Fund) | 1.500% | 2/1/11 | 7,465 | 7,487 |

| Indiana Finance Auth. Rev. VRDO | 0.290% | 11/5/10 LOC | 18,280 | 18,280 |

| 1 Indiana Health & Educ. Fac. Financing Auth. Health System Rev. | | | | |

| (Sisters of St. Francis Health Services, Inc. Obligated Group) TOB VRDO | 0.330% | 11/5/10 (4) | 3,300 | 3,300 |

| 1 Indiana Health & Educ. Fac. Financing Auth. Rev. (Ascension Health Credit Group) TOB VRDO | 0.270% | 11/5/10 | 19,275 | 19,275 |

| Indiana Health & Educ. Fac. Financing Auth. Rev. (Clarian Health Obligated Group) VRDO | 0.260% | 11/5/10 LOC | 5,500 | 5,500 |

| Indiana Health & Educ. Fac. Financing Auth. Rev. (Clarian Health Obligated Group) VRDO | 0.270% | 11/5/10 LOC | 15,100 | 15,100 |

| Indiana Health & Educ. Fac. Financing Auth. Rev. (Marian College) VRDO | 0.280% | 11/5/10 LOC | 5,400 | 5,400 |

| 1 Indiana Health & Educ. Fac. Financing Auth. Rev. TOB VRDO | 0.300% | 11/1/10 | 11,225 | 11,225 |

| Indiana Health Fac. Auth. Finance Auth. Rev. (Ascension Health Credit Group) PUT | 5.000% | 11/1/10 | 2,500 | 2,500 |

| 1 Indiana Health Fac. Fin. Auth. Hosp. Rev. (Community Hosp. Project) Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 6,420 | 6,420 |

| 1 Indiana Health Fac. Finance Auth. Rev. (Sisters of St. Francis Health Services, Inc.) TOB VRDO | 0.290% | 11/5/10 (4) | 8,085 | 8,085 |

| 1 Indiana Housing & Community Dev. Auth. Single Family Mortgage Rev. TOB VRDO | 0.340% | 11/5/10 | 2,355 | 2,355 |

| Indiana Housing & Community Dev. Auth. Single Family Mortgage Rev. VRDO | 0.290% | 11/5/10 LOC | 20,845 | 20,845 |

| 1 Indianapolis IN Local Public Improvement Bond Bank Notes | | | | |

| (PILOT Infrastructure Project) TOB VRDO | 0.290% | 11/5/10 | 10,615 | 10,615 |

| 1 Indianapolis IN Local Public Improvement Bond Bank Notes TOB VRDO | 0.290% | 11/5/10 (4) | 12,490 | 12,490 |

| Lawrenceburg IN Pollution Control Rev. VRDO | 0.270% | 11/5/10 LOC | 13,000 | 13,000 |

| Lawrenceburg IN Pollution Control Rev. VRDO | 0.330% | 11/5/10 LOC | 10,000 | 10,000 |

| 1 New Albany Floyd County IN School Building Corp. TOB VRDO | 0.290% | 11/5/10 (4) | 5,345 | 5,345 |

| Noblesville IN Econ. Dev. Rev. (Greystone Apartments Project) VRDO | 0.320% | 11/5/10 LOC | 10,990 | 10,990 |

| Purdue IN Univ. CP | 0.290% | 11/15/10 | 13,145 | 13,145 |

| Purdue IN Univ. CP | 0.290% | 11/30/10 | 25,000 | 25,000 |

| Purdue Univ. Indiana Univ. Student Fac. System Rev. VRDO | 0.260% | 11/5/10 | 3,675 | 3,675 |

| 1 Wayne Township IN School Building Corp. Marion County TOB VRDO | 0.270% | 11/5/10 LOC | 25,620 | 25,620 |

| | | | | 553,324 |

16

Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Iowa (0.3%) | | | | |

| 1 Des Moines IA Metro. Wastewater Reclamation Auth. Sewer. Rev. TOB VRDO | 0.270% | 11/5/10 LOC | 12,835 | 12,835 |

| Iowa Finance Auth. Single Family Rev. VRDO | 0.270% | 11/5/10 | 11,800 | 11,800 |

| Iowa Finance Auth. Single Family Rev. VRDO | 0.290% | 11/5/10 | 5,330 | 5,330 |

| Iowa Finance Auth. Single Family Rev. VRDO | 0.290% | 11/5/10 | 3,800 | 3,800 |

| Iowa Finance Auth. Single Family Rev. VRDO | 0.290% | 11/5/10 | 10,800 | 10,800 |

| 1 Iowa Special Obligation TOB VRDO | 0.290% | 11/5/10 | 11,200 | 11,200 |

| 1 Iowa Special Obligation TOB VRDO | 0.290% | 11/5/10 | 3,800 | 3,800 |

| | | | | 59,565 |

| Kansas (0.3%) | | | | |

| 1 Kansas Dept. of Transp. Highway Rev. TOB VRDO | 0.270% | 11/5/10 | 6,245 | 6,245 |

| Sedgwick County KS Airport Fac. Rev. (FlightSafety) VRDO | 0.340% | 11/5/10 | 34,000 | 34,000 |

| Wichita KS Airport Fac. Rev. VRDO | 0.300% | 11/5/10 | 11,170 | 11,170 |

| | | | | 51,415 |

| Kentucky (1.4%) | | | | |

| Boyle County KY Hosp. Rev. (Ephraim McDowell Health) VRDO | 0.290% | 11/5/10 LOC | 11,975 | 11,975 |

| Jeffersontown KY Lease Program (Kentucky League of Cities Funding) VRDO | 0.260% | 11/5/10 LOC | 2,600 | 2,600 |

| Kenton County KY Airport Board Special Fac. Rev. (Flightsafety International Inc.) VRDO | 0.300% | 11/5/10 (13) | 17,900 | 17,900 |

| Kenton County KY Airport Board Special Fac. Rev. (Flightsafety International Inc.) VRDO | 0.300% | 11/5/10 (13) | 4,600 | 4,600 |

| Kentucky Econ. Dev. Finance Auth. Hosp. Fac. Rev. (Baptist Healthcare System) VRDO | 0.260% | 11/5/10 LOC | 22,655 | 22,655 |

| Kentucky Econ. Dev. Finance Auth. Hosp. Fac. Rev. (Baptist Healthcare System) VRDO | 0.290% | 11/5/10 LOC | 12,000 | 12,000 |

| Kentucky Econ. Dev. Finance Auth. Hosp. Fac. Rev. (St. Elizabeth Medical) VRDO | 0.260% | 11/5/10 LOC | 5,500 | 5,500 |

| Kentucky Econ. Dev. Finance Auth. Medical Center Rev. (Ashland Hosp. Corp.) VRDO | 0.270% | 11/5/10 LOC | 5,000 | 5,000 |

| Kentucky Econ. Dev. Finance Auth. Medical Center Rev. (Ashland Hosp. Corp.) VRDO | 0.270% | 11/5/10 LOC | 35,000 | 35,000 |

| Kentucky Higher Educ. Student Loan Corp. Student Loan Rev. VRDO | 0.350% | 11/5/10 LOC | 37,400 | 37,400 |

| 1 Kentucky Housing Corp. Housing Rev. TOB VRDO | 0.330% | 11/5/10 | 9,110 | 9,110 |

| 1 Kentucky Housing Corp. Housing Rev. TOB VRDO | 0.380% | 11/5/10 | 2,425 | 2,425 |

| 1 Kentucky Turnpike Auth. Econ. Dev. Road Rev. (Revitalization Project) TOB VRDO | 0.270% | 11/5/10 | 10,415 | 10,415 |

| 1 Lexington-Fayette Urban County Airport KY TOB VRDO | 0.280% | 11/5/10 | 6,660 | 6,660 |

| 1 Louisville & Jefferson County KY Metro. Sewer Dist. Sewer and Drainage System Rev. TOB VRDO | 0.330% | 11/5/10 (12) | 7,330 | 7,330 |

| 1 Louisville & Jefferson County KY Metro. Govt. Parking Rev. TOB VRDO | 0.280% | 11/5/10 | 7,455 | 7,455 |

| Louisville KY Water Works Board Rev. | 5.250% | 11/15/10 (Prere.) | 1,600 | 1,603 |

| Richmond KY League of Cities Funding Lease Program Rev. VRDO | 0.270% | 11/5/10 LOC | 9,000 | 9,000 |

| Warren County KY Rev. (Western Kentucky Univ. Student Life) VRDO | 0.250% | 11/5/10 LOC | 8,020 | 8,020 |

| Warren County KY Rev. (Western Kentucky Univ. Student Life) VRDO | 0.280% | 11/5/10 LOC | 28,740 | 28,740 |

| Williamstown KY League of Cities VRDO | 0.270% | 11/5/10 LOC | 4,750 | 4,750 |

| Williamstown KY League of Cities VRDO | 0.270% | 11/5/10 LOC | 4,700 | 4,700 |

| | | | | 254,838 |

| Louisiana (1.5%) | | | | |

| Ascension Parish LA Ind. Dev. Board Rev. (Geismar Project) VRDO | 0.280% | 11/5/10 LOC | 17,000 | 17,000 |

| Louisiana GO VRDO | 0.250% | 11/5/10 LOC | 26,200 | 26,200 |

| Louisiana Public Fac. Auth. Hosp. Rev. (Franciscan Missionaries) VRDO | 0.280% | 11/5/10 LOC | 13,900 | 13,900 |

| Louisiana Public Fac. Auth. Rev. (Christus Health) VRDO | 0.290% | 11/5/10 LOC | 12,000 | 12,000 |

| Louisiana Public Fac. Auth. Rev. (Tiger Athletic) VRDO | 0.270% | 11/5/10 LOC | 20,900 | 20,900 |

| 1 Louisiana Public Fac. Auth. Rev. TOB VRDO | 0.330% | 11/5/10 LOC | 44,345 | 44,345 |

| 1 Louisiana Public Fac. Auth. Rev. TOB VRDO | 0.330% | 11/5/10 LOC | 42,645 | 42,645 |

| Louisiana Public Fac. Auth. Rev. VRDO | 0.280% | 11/5/10 LOC | 30,000 | 30,000 |

| Louisiana Public Fac. Auth. Rev. VRDO | 0.280% | 11/5/10 LOC | 34,000 | 34,000 |

| St. James Parish LA Rev. (Nustar Logistics LP Project) VRDO | 0.280% | 11/5/10 LOC | 12,500 | 12,500 |

| St. James Parish LA Rev. (Nustar Logistics LP Project) VRDO | 0.280% | 11/5/10 LOC | 17,500 | 17,500 |

| | | | | 270,990 |

| Maine (0.3%) | | | | |

| 1 Maine Health & Higher Educ. Fac. Auth. Rev. TOB VRDO | 0.330% | 11/5/10 | 12,805 | 12,805 |

| 1 Maine Housing Auth. Mortgage Rev. TOB VRDO | 0.340% | 11/5/10 | 3,720 | 3,720 |

| 1 Maine Housing Auth. Mortgage Rev. TOB VRDO | 0.340% | 11/5/10 | 5,510 | 5,510 |

| Maine Housing Auth. Mortgage Rev. VRDO | 0.300% | 11/5/10 | 20,000 | 20,000 |

| Maine Housing Auth. Mortgage Rev. VRDO | 0.300% | 11/5/10 | 9,000 | 9,000 |

| | | | | 51,035 |

| Maryland (2.1%) | | | | |

| Baltimore County MD Metro. Dist. CP | 0.320% | 11/23/10 | 23,000 | 23,000 |

| Howard County MD CP | 0.290% | 11/9/10 | 28,500 | 28,500 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.340% | 11/5/10 | 5,095 | 5,095 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.340% | 11/5/10 | 7,550 | 7,550 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.340% | 11/5/10 | 6,325 | 6,325 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.380% | 11/5/10 | 4,245 | 4,245 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.380% | 11/5/10 | 7,520 | 7,520 |

| 1 Maryland Dept. of Housing & Community Dev. Rev. TOB VRDO | 0.380% | 11/5/10 | 4,430 | 4,430 |

| Maryland Dept. of Housing & Community Dev. Rev. VRDO | 0.300% | 11/5/10 | 6,350 | 6,350 |

17

Tax-Exempt Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Maryland Health & Higher Educ. Fac. Auth. (Johns Hopkins Univ.) CP | 0.290% | 11/5/10 | 15,000 | 15,000 |

| Maryland Health & Higher Educ. Fac. Auth. (Johns Hopkins Univ.) CP | 0.290% | 11/9/10 | 15,141 | 15,141 |

| Maryland Health & Higher Educ. Fac. Auth. (Johns Hopkins Univ.) CP | 0.310% | 11/12/10 | 16,765 | 16,765 |

| 1 Maryland Health & Higher Educ. Fac. Auth. Rev. (John Hopkins Univ.) TOB VRDO | 0.270% | 11/5/10 | 7,670 | 7,670 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Johns Hopkins Hosp.) VRDO | 0.250% | 11/5/10 LOC | 8,100 | 8,100 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Johns Hopkins Univ.) CP | 0.300% | 11/3/10 | 22,988 | 22,988 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Johns Hopkins Univ.) CP | 0.310% | 11/9/10 | 15,150 | 15,150 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Johns Hopkins Univ.) CP | 0.300% | 2/10/11 | 25,900 | 25,900 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Johns Hopkins Univ.) CP | 0.310% | 3/8/11 | 9,000 | 9,000 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Johns Hopkins Univ.) VRDO | 0.250% | 11/5/10 LOC | 5,085 | 5,085 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Univ. of Maryland Medical System) VRDO | 0.250% | 11/5/10 LOC | 5,000 | 5,000 |

| Maryland Health & Higher Educ. Fac. Auth. Rev. (Suburban Hosp.) VRDO | 0.250% | 11/5/10 LOC | 9,775 | 9,775 |

| 1 Maryland State Transp. Auth. Rev. TOB VRDO | 0.270% | 11/5/10 (4) | 15,490 | 15,490 |

| Maryland Transp. Auth. Passenger Fac. Charge Rev. VRDO | 0.260% | 11/5/10 LOC | 18,150 | 18,150 |

| 1 Maryland Transp. Auth. Rev. TOB VRDO | 0.270% | 11/5/10 (4) | 8,800 | 8,800 |

| 1 Maryland Transp. Auth. Rev. TOB VRDO | 0.290% | 11/5/10 (4) | 13,860 | 13,860 |

| Montgomery County MD CP | 0.280% | 11/18/10 | 11,000 | 11,000 |

| Montgomery County MD CP | 0.350% | 2/10/11 | 30,500 | 30,500 |

| Montgomery County MD CP | 0.350% | 2/10/11 | 6,000 | 6,000 |

| Montgomery County MD GO | 2.000% | 11/1/10 | 7,800 | 7,800 |

| Washington Suburban Sanitation Dist. Maryland VRDO | 0.280% | 11/5/10 | 29,000 | 29,000 |

| | | | | 389,189 |

| Massachusetts (2.6%) | | | | |

| Boston MA GO | 2.000% | 4/1/11 | 5,005 | 5,039 |

| 1 Massachusetts Department of Transportation TOB VRDO | 0.260% | 11/5/10 | 4,625 | 4,625 |

| Massachusetts Dept. of Transp. Metro Highway System Rev. VRDO | 0.250% | 11/5/10 | 33,000 | 33,000 |

| Massachusetts Dev. Finance Agency Rev. (Cushing Academy Issue) VRDO | 0.260% | 11/5/10 LOC | 12,115 | 12,115 |

| Massachusetts Dev. Finance Agency Rev. (Fay School Issue) VRDO | 0.260% | 11/5/10 LOC | 5,400 | 5,400 |

| Massachusetts Dev. Finance Agency Rev. (Shady Hill) VRDO | 0.260% | 11/5/10 LOC | 10,000 | 10,000 |

| Massachusetts Dev. Finance Agency Rev. (Wentworth Institute of Technology) VRDO | 0.300% | 11/5/10 LOC | 16,600 | 16,600 |

| 1 Massachusetts Educ. Finance Auth. Educ. Loan Rev. TOB VRDO | 0.340% | 11/5/10 (12) | 4,390 | 4,390 |

| Massachusetts GO | 5.000% | 1/1/11 (Prere.) | 4,000 | 4,030 |

| Massachusetts GO CP | 0.300% | 11/4/10 | 60,000 | 60,000 |

| Massachusetts GO RAN | 2.000% | 5/26/11 | 20,000 | 20,191 |

| Massachusetts GO RAN | 2.000% | 6/23/11 | 41,875 | 42,324 |

| 1 Massachusetts GO TOB VRDO | 0.270% | 11/5/10 | 31,235 | 31,235 |

| 1 Massachusetts GO TOB VRDO | 0.270% | 11/5/10 | 23,935 | 23,935 |

| 1 Massachusetts GO TOB VRDO | 0.270% | 11/5/10 | 36,740 | 36,740 |