UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-02687 |

Name of Registrant: | Vanguard Municipal Bond Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: October 31 |

Date of reporting period: November 1, 2015 – October 31, 2016 |

Item 1: Reports to Shareholders |

|

| Annual Report | October 31, 2016 |

| |

| Vanguard Municipal Bond Funds |

| Vanguard Short-Term Tax-Exempt Fund |

| Vanguard Limited-Term Tax-Exempt Fund |

| Vanguard Intermediate-Term Tax-Exempt Fund |

| Vanguard Long-Term Tax-Exempt Fund |

| Vanguard High-Yield Tax-Exempt Fund |

A new format, unwavering commitment

As you begin reading this report, you’ll notice that we’ve made some improvements to the opening sections—based on feedback from you, our clients.

Page 1 starts with a new “Your Fund’s Performance at a Glance,” a concise, handy summary of how your fund performed during the period.

In the renamed “Chairman’s Perspective,” Bill McNabb will focus on enduring principles and investment insights.

We’ve modified some tables, and eliminated some redundancy, but we haven’t removed any information.

At Vanguard, we’re always looking for better ways to communicate and to help you make sound investment decisions. Thank you for entrusting your assets to us.

| |

| Contents | |

| |

| Your Fund’s Performance at a Glance | 1 |

| Chairman’s Perspective | 3 |

| Advisor’s Report | 5 |

| Short-Term Tax-Exempt Fund | 7 |

| Limited-Term Tax-Exempt Fund | 50 |

| Intermediate-Term Tax-Exempt Fund | 124 |

| Long-Term Tax-Exempt Fund | 233 |

| High-Yield Tax-Exempt Fund | 269 |

| About Your Fund’s Expenses | 311 |

| Glossary | 313 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and

opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: No matter what language you speak, Vanguard has one consistent message and set of principles. Our primary focus is on you, our clients. We conduct our business

with integrity as a faithful steward of your assets. This message is shown translated into seven languages, reflecting our expanding global presence.

Your Fund’s Performance at a Glance

• For the 12 months ended October 31, 2016, the returns for the five tax-exempt bond funds discussed in this report ranged from 0.64% for Investor Shares of the Short-Term Fund to 6.26% for Admiral Shares of the High-Yield Fund. All five funds outpaced their benchmark indexes and peer groups.

• With investors continuing to reach for yield through much of the fiscal year, the funds added value by having higher weightings than their benchmarks in municipal securities rated A and BBB and in sectors where credit spreads tend to be wider.

• Security selection and an overweight allocation to premium callable bonds were positives for the funds. Overweighting securities at the long end of the yield curve in the longer funds also worked out well.

• For the decade ended October 31, 2016, the funds’ returns ranged from close to 2% to almost 5%. The funds’ returns were higher than their peer-group averages but mixed compared with results for their benchmark indexes.

| | | | | |

| Total Returns: Fiscal Year Ended October 31, 2016 | | | | |

| | 30-Day | Taxable- | | | |

| | SEC | Equivalent | Income | Capital | Total |

| | Yield | Yield1 | Returns | Returns | Returns |

| Vanguard Short-Term Tax-Exempt Fund | | | | | |

| Investor Shares | 0.88% | 1.55% | 0.83% | -0.19% | 0.64% |

| Admiral ™ Shares2 | 1.00 | 1.77 | 0.93 | -0.19 | 0.74 |

| Bloomberg Barclays 1 Year Municipal Bond Index | | | | 0.40 |

| 1–2 Year Municipal Funds Average3 | | | | | 0.25 |

| |

| Vanguard Limited-Term Tax-Exempt Fund | | | | | |

| Investor Shares | 1.08% | 1.91% | 1.49% | -0.18% | 1.31% |

| Admiral Shares 2 | 1.20 | 2.12 | 1.59 | -0.18 | 1.41 |

| Bloomberg Barclays 1–5 Year Municipal Bond Index | | | | 1.09 |

| 1–5 Year Municipal Funds Average3 | | | | | 0.94 |

| |

| Vanguard Intermediate-Term Tax-Exempt Fund | | | | | |

| Investor Shares | 1.50% | 2.65% | 2.78% | 0.85% | 3.63% |

| Admiral Shares 2 | 1.62 | 2.86 | 2.88 | 0.85 | 3.73 |

| Bloomberg Barclays 1–15 Year Municipal Bond Index | | | | 3.10 |

| Intermediate Municipal Funds Average3 | | | | | 3.32 |

| |

| Vanguard Long-Term Tax-Exempt Fund | | | | | |

| Investor Shares | 1.99% | 3.52% | 3.62% | 1.77% | 5.39% |

| Admiral Shares 2 | 2.11 | 3.73 | 3.73 | 1.77 | 5.50 |

| Bloomberg Barclays Municipal Bond Index | | | | | 4.06 |

| General & Insured Municipal Debt Funds Average3 | | | | 4.34 |

| |

| Vanguard High-Yield Tax-Exempt Fund | | | | | |

| Investor Shares | 2.49% | 4.40% | 3.74% | 2.41% | 6.15% |

| Admiral Shares 2 | 2.61 | 4.61 | 3.85 | 2.41 | 6.26 |

| Bloomberg Barclays Municipal Bond Index | | | | | 4.06 |

| General & Insured Municipal Debt Funds Average3 | | | | 4.34 |

1 This calculation, which assumes a typical itemized tax return, is based on the maximum federal income tax rate of 43.4%. State and local

taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

2 Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

3 Derived from data provided by Lipper, a Thomson Reuters Company.

1

| |

| Total Returns: Ten Years Ended October 31, 2016 | |

| | Average Annual |

| | Return |

| Short-Term Tax-Exempt Fund Investor Shares | 1.72% |

| Bloomberg Barclays 1 Year Municipal Bond Index | 1.89 |

| 1–2 Year Municipal Funds Average1 | 0.46 |

| |

| Limited-Term Tax-Exempt Fund Investor Shares | 2.55% |

| Bloomberg Barclays 1–5 Year Municipal Bond Index | 3.02 |

| 1–5 Year Municipal Funds Average1 | 1.89 |

| |

| Intermediate-Term Tax-Exempt Fund Investor Shares | 4.20% |

| Bloomberg Barclays 1–15 Year Municipal Bond Index | 4.28 |

| Intermediate Municipal Funds Average1 | 3.55 |

| |

| Long-Term Tax-Exempt Fund Investor Shares | 4.67% |

| Bloomberg Barclays Municipal Bond Index | 4.57 |

| General & Insured Municipal Debt Funds Average1 | 3.92 |

| |

| High-Yield Tax-Exempt Fund Investor Shares | 4.85% |

| Bloomberg Barclays Municipal Bond Index | 4.57 |

| General & Insured Municipal Debt Funds Average1 | 3.92 |

| 1 Derived from data provided by Lipper, a Thomson Reuters Company. | |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

| | | |

| Expense Ratios1 | | | |

| Your Fund Compared With Its Peer Group | | | |

| |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average2 |

| Short-Term Tax-Exempt Fund | 0.20% | 0.12% | 0.60% |

| Limited-Term Tax-Exempt Fund | 0.20 | 0.12 | 0.69 |

| Intermediate-Term Tax-Exempt Fund | 0.20 | 0.12 | 0.82 |

| Long-Term Tax-Exempt Fund | 0.20 | 0.12 | 0.94 |

| High-Yield Tax-Exempt Fund | 0.20 | 0.12 | 0.94 |

1 The fund expense ratios shown are from the prospectus dated February 26, 2016, and represent estimated costs for the current fiscal year.

For the fiscal year ended October 31, 2016, the funds’ expense ratios were: for the Short-Term Tax-Exempt Fund, 0.19% for Investor Shares

and 0.09% for Admiral Shares; for the Limited-Term Tax-Exempt Fund, 0.19% for Investor Shares and 0.09% for Admiral Shares; for the

Intermediate-Term Tax-Exempt Fund, 0.19% for Investor Shares and 0.09% for Admiral Shares; for the Long-Term Tax-Exempt Fund, 0.19%

for Investor Shares and 0.09% for Admiral Shares; and for the High-Yield Tax-Exempt Fund, 0.19% for Investor Shares and 0.09% for

Admiral Shares.

2 Peer groups are: for the Short-Term Tax-Exempt Fund, 1–2 Year Municipal Funds; for the Limited-Term Tax-Exempt Fund, 1–5 Year

Municipal Funds; for the Intermediate-Term Tax-Exempt Fund, Intermediate Municipal Funds; for the Long-Term Tax-Exempt Fund and

High-Yield Tax-Exempt Fund, General & Insured Municipal Debt Funds. Peer-group values are derived from data provided by Lipper, a

Thomson Reuters Company, and capture information through year-end 2015.

2

Chairman’s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

Over the three years ended August 31, 2016, investors poured more than $1 trillion into index funds. Indexing now accounts for nearly a third of all mutual fund assets—more than double what it did a decade ago and eight times its share two decades ago.1

By contrast, active management’s commercial struggles have reflected its disappointing investment performance. Over the decade ended December 31, 2015, 82% of actively managed stock funds and 81% of active bond funds have either underperformed their benchmarks or shut down.

This subpar performance has fueled the explosion of asset growth in indexing among individual, retirement, and nonprofit investors. So what might the trend mean for the future of actively managed funds?

Our research and experience indicate that active management can survive—and even succeed—but only if it’s offered at much lower expense.

High costs, which limit a manager’s ability to deliver benchmark-beating returns to clients, are the biggest reason why active has lagged. Industrywide as of December 31, 2015, the average expense ratio for all active stock funds is 1.14%, compared with 0.76% for stock index funds. And the expense advantage is even wider for bonds; the average expense ratio for an active bond fund is 0.93%, compared with 0.43% for bond index funds.

But even these big differences understate the real gap. These days, it’s not hard to find an index fund that charges maybe 0.05% or 0.10%. So even if you have identified active managers who are skilled at selecting stocks and bonds, to match the return of a comparable (much cheaper) index fund would require significant outperformance. Think about it. Any fund that charges 1.00% in expenses—not even the high end of the range—will find it extraordinarily difficult to overcome the index fund’s head start.

Active management also has taken a hit from a regulatory environment that has been favorable to low-cost strategies. The U.S. Department of Labor several

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended October 31, 2016 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 4.26% | 8.48% | 13.51% |

| Russell 2000 Index (Small-caps) | 4.11 | 4.12 | 11.51 |

| Russell 3000 Index (Broad U.S. market) | 4.24 | 8.13 | 13.35 |

| FTSE All-World ex US Index (International) | 0.64 | -0.94 | 4.09 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 4.37% | 3.48% | 2.90% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 4.06 | 4.89 | 4.34 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.22 | 0.07 | 0.07 |

| |

| CPI | | | |

| Consumer Price Index | 1.64% | 1.15% | 1.32% |

1 Sources: Wall Street Journal; Morningstar, Inc.; and Investment Company Institute, 2016.

3

years ago mandated greater disclosure of retirement plan fees. And its new fiduciary rule, which is set to take effect in April, requires financial advisors to demonstrate that their recommendations are aligned with their clients’ best interest. Both changes encourage the use of lower-cost investments, including index funds.

The future of active management

In light of all this, people have been asking me whether active management is “dead.” My response is both yes and no. High-cost active management is dead, and rightly so It has never been a winning proposition for investors. Low-cost active funds, though, can potentially play an important role for investors who seek to outperform the market.

Paying less for your funds is the only sure-fire way to improve your odds of achieving success in active management. But even if you have found an active manager with low costs, the odds of outperforming the market are still long. You have to be able to identify talented stock and bond portfolio managers with long time horizons and clear investment

strategies. Look for managers with consistent track records and the discipline to stick closely to their investment strategy.

Know what you own and why

Despite the well-deserved reputation of indexing and the challenges for active managers, there’s still a place for traditional active strategies that are low-cost, diversified, and highly disciplined, and are run by talented managers who focus on the long term.

Vanguard has always applied these principles to our active strategies, and investors have benefited as a majority of our active funds outperformed their benchmarks and bested their peers’ average annual return over the ten years ended September 30, 2016.

But it’s crucial for investors to be patient. Even active managers with the best track records frequently underperform their benchmarks when their investment styles are out of favor. Such periods, though temporary, can persist. So it’s important when entrusting your assets to an active strategy to be in it for the long haul.

Make sure you know what you’re buying and what the risks are. Active strategies are becoming more complex, so it’s important to clearly understand what the investments in your portfolio are designed to accomplish and why you want to hold them. Otherwise, you run the risk of selecting strategies that don’t fit your needs or objectives.

Keeping these considerations in mind can potentially boost your chances of success in identifying active strategies that may be able to help you reach your goals.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 9, 2016

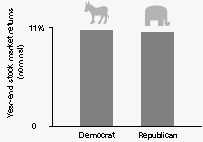

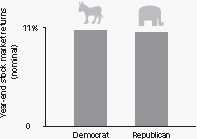

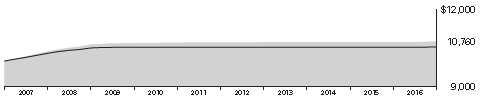

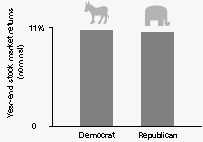

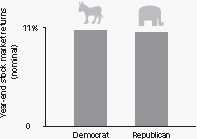

Worried about the election’s impact on your portfolio?

The 2016 presidential election season was one of the most intense and unpredictable in U.S. history. In its aftermath, investors may be left with lingering questions about what the outcome will mean for their portfolios. The answer, based on Vanguard research into decades of historical data, is that presidential elections typically have no long-term effect on market performance.

These findings hold true regardless of the market’s initial reaction. Whether there’s a swoon or bounce immediately after an election, investors shouldn’t extrapolate that performance to the long term.

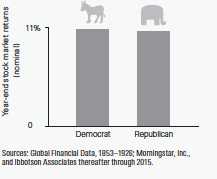

As you can see in the accompanying chart, data going back to 1853 show that stock market returns are virtually identical no matter which party controls the White House. Although headlines out of Washington at any given time may still cause concern, investors

shouldn’t overreact to short-term events. Instead, it’s best to maintain a balanced and diversified portfolio and stay focused on your long-term goals.

Average annual stock market returns based on party control of the White House (1853–2015)

4

Advisor’s Report

For the 12 months ended October 31, 2016, Vanguard’s five national tax-exempt bond funds posted returns that ranged from 0.64% for the Investor Shares of Vanguard Short-Term Tax-Exempt Fund to 6.26% for the Admiral Shares of Vanguard High-Yield Tax-Exempt Fund. All of the funds outpaced their benchmark indexes and peer groups.

With the municipal yield curve flattening, the 30-day SEC yields for Vanguard Short-Term Tax-Exempt Fund and Limited-Term Tax-Exempt Fund rose, while those of Vanguard Intermediate-Term Tax-Exempt Fund, Long-Term Tax-Exempt Fund, and High-Yield Tax-Exempt Fund fell.

Please note that the funds are permitted to invest in securities that would generate income distributions subject to the alternative minimum tax (AMT). During the fiscal year, only the High-Yield Fund owned such securities.

The investment environment

The period began and ended with investors speculating about when, and by how much, the Federal Reserve would raise short-term interest rates.

In December, for the first time in a decade, the Fed increased the target range for the federal funds rate, bumping it to 0.25%–0.50% from near zero. The Fed cited an improving labor market and its confidence that inflation would rise to its 2% objective. Investors interpreted the increase as a signal that the U.S. economy was on sturdy footing and that monetary policy

was normalizing, although rates remained below historical standards. Market expectations were for future hikes to be gradual, with four likely to come in the next year.

Those expectations were dampened in early 2016 as steep declines in commodity prices and unanticipated sluggish global economic growth, especially in China, triggered a move toward less risky assets. In subsequent meetings, the Fed seemed less inclined to raise rates as it became unclear whether inflation and employment targets would be realized, which seemed less likely when the United Kingdom voted in June to leave the European Union. The voting results sparked uncertainty in global financial markets, but by the end of the summer the initial impact was mostly retraced as better economic data led to shifting sentiments at key central banks. Investors were soon anticipating that the next hike would come at the Fed’s December meeting.

That anticipation was bolstered partly by third-quarter GDP. The U.S. economy posted weak results in the early part of your fund’s fiscal year. A strong dollar and soft global economic and financial conditions were likely behind the slow growth. The economy showed a little more steam in the third quarter of 2016, growing 2.9% amid a surge in exports, an uptick in inventory investment, and more government spending. We expect growth to moderate around 2% over the near term.

Employment gains were a bright spot, with payrolls increasing by an average of around 203,000 per month over the trailing 12 months. The unemployment rate dipped as low as 4.7%; at the end of the period it stood at 4.9%. The participation rate, which reflects the percentage of the population working or seeking work, was little changed over the period. Strong employment gains were coupled with a slight increase in wages. That and a rebound in commodity prices could be spurring a rise in inflation, which is nearing the Fed’s 2% objective.

Municipal bond issuance climbed to record monthly levels in the fall as issuers took advantage of low rates before any future rate hikes. Supply was met by strong demand through most of the period. Municipal bond funds saw 54 consecutive weeks of inflows through mid-October as investors looked to improve on low or even negative global bond yields by buying high-quality U.S. bonds.

Although there were some notable pockets of credit weakness, they didn’t spill over to the broader municipal market during the period. Puerto Rico defaulted on bond payments after Congress passed a bill at the end of June to put in place a federal control board to restructure the commonwealth’s debt. That process is likely to unfold slowly and generate more news headlines. The finances of Illinois and Chicago remained strained as well because of structural deficits and pension funding shortfalls.

Management of the funds

We maintained a modestly overweight allocation to the longer end of the yield curve in the longer-dated funds. That added value as the municipal bond yield curve flattened over the period. The yield of the AAA-rated 2-year generic general obligation bond increased 31 basis points to 0.85%, while the yield of the comparable

| | |

| Yields of Municipal Securities | | |

| (AAA-Rated General-Obligation Issues) | | |

| | October 31, | October 31, |

| Maturity | 2015 | 2016 |

| 2 years | 0.54% | 0.85% |

| 5 years | 1.17 | 1.14 |

| 10 years | 2.04 | 1.74 |

| 30 years | 3.07 | 2.56 |

| Source: Vanguard. | | |

5

10-year bond fell 30 basis points to 1.74%, and those of longer-dated bonds fell even more than that.

Being overweighted in A-rated and BBB-rated bonds, which are at the lower end of the investment-grade spectrum, was another positive as investors continued to reach for yield.

Security selection remained a strength for the funds. Our holdings of premium callable bonds performed well. Because these bonds may be redeemed before maturity, exposing investors to reinvestment risk, they offer attractive yields and favorable total return potential across many interest rate scenarios.

Favoring sectors that tend to offer wider credit spreads also played out well. They included hospital, university, corporate-backed, and project finance bonds in the Intermediate-Term and Long-Term Funds. Those segments were also significant contributors to the High-Yield Fund’s return, as were airport/port and transportation bonds.

In all but the High-Yield Fund, our exposure to Puerto Rico debt as of October 31 was either to bonds insured by third parties or to prerefunded bonds backed by high-quality assets in escrow until maturity.

The outlook

We expect the Fed to raise rates gradually, compared with prior periods of economic recovery. The pace of future rate hikes is likely to depend on future economic growth (which we expect to be modest) and inflation (which we expect to remain tame).

The dollar will likely remain strong as long as central banks such as the Bank of Japan and the European Central Bank continue to maintain the accommodative monetary stances that have produced negative interest rates in those regions.

Of course, market conditions could change, especially given the results of the U.S. presidential election and the possibility that job growth and inflation could exceed expectations. But we are confident that our team of experienced managers, analysts, and traders can handle whatever the market brings and find opportunities that will produce competitive returns.

Christopher W. Alwine, CFA, Principal,

Head of Municipal Group

Marlin G. Brown, Portfolio Manager

James M. D’Arcy, CFA, Portfolio Manager

Mathew M. Kiselak, Principal,

Portfolio Manager

Justin A. Schwartz, CFA, Portfolio Manager,

Head of Municipal Money Market Funds

Vanguard Fixed Income Group

November 17, 2016

6

Short-Term Tax-Exempt Fund

Fund Profile

As of October 31, 2016

| | |

| Share-Class Characteristics | | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VWSTX | VWSUX |

| Expense Ratio1 | 0.20% | 0.12% |

| 30-Day SEC Yield | 0.88% | 1.00% |

| | | |

| Financial Attributes | | |

| | | Bloomberg | |

| | | Barclays | Bloomberg |

| | | 1 Year | Barclays |

| | | Municipal | Municipal |

| | | Bond | Bond |

| | Fund | Index | Index |

| Number of Bonds | 1,901 | 4,352 | 49,796 |

| Yield to Maturity | | | |

| (before expenses) | 1.0% | 1.0% | 2.0% |

| Average Coupon | 3.0% | 4.9% | 4.8% |

| Average Duration | 1.2 years | 1.4 years | 5.9 years |

| Average Stated | | | |

| Maturity | 1.4 years | 1.5 years | 12.9 years |

| Short-Term Reserves | 13.4% | — | — |

| |

| Largest Area Concentrations2 | |

| New York | 15.9% |

| Texas | 14.6 |

| California | 9.9 |

| Pennsylvania | 5.3 |

| Massachusetts | 4.4 |

| New Jersey | 4.2 |

| Illinois | 3.7 |

| Florida | 3.7 |

| Connecticut | 3.5 |

| Maryland | 3.3 |

| Top Ten | 68.5% |

| | |

| Volatility Measures | | |

| | Bloomberg | |

| | Barclays | Bloomberg |

| | 1 Year | Barclays |

| | Municipal | Municipal |

| | Bond Index | Bond Index |

| R-Squared | 0.63 | 0.38 |

| Beta | 0.85 | 0.10 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| |

| Distribution by Stated Maturity (% of portfolio) |

| Under 6 Months | 30.2% |

| 6 Months–1 Year | 12.3 |

| 1–2 Years | 25.5 |

| 2–3 Years | 19.1 |

| 3–4 Years | 11.7 |

| 4–5 Years | 1.0 |

| Over 5 Years | 0.2 |

| |

| Distribution by Credit Quality (% of portfolio) |

| AAA | 21.8% |

| AA | 58.3 |

| A | 13.7 |

| BBB | 3.6 |

| BB | 0.3 |

| B or lower | 0.1 |

| Not Rated | 2.2 |

Credit-quality ratings are obtained from Moody’s and S&P, and the higher rating for each issue is shown. “Not Rated” is used to classify securities for which a rating is not available. Not rated securities include a fund’s investment in Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund, each of which invests in high-quality money market instruments and may serve as a cash management vehicle for the Vanguard funds, trusts, and accounts. For more information about these ratings, see the Glossary entry for Credit Quality.

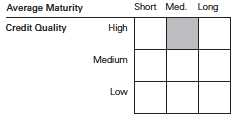

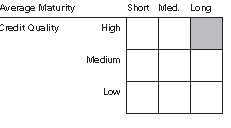

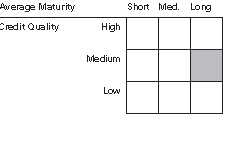

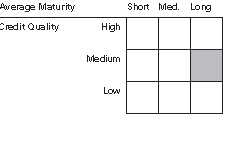

Investment Focus

1 The expense ratios shown are from the prospectus dated February 26, 2016, and represent estimated costs for the current fiscal year. For the fiscal year ended October 31, 2016, the expense ratios Investor Shares and 0.09% for Admiral Shares.

2 Percentage of net assets, excluding any futures contracts.

7

Short-Term Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

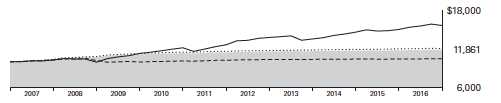

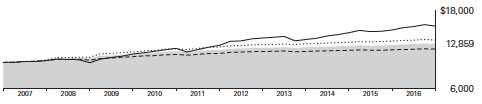

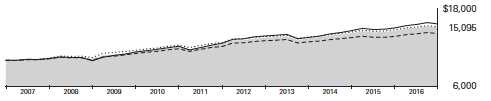

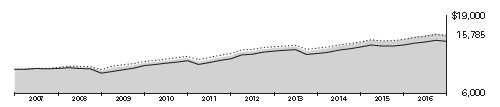

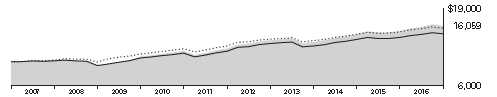

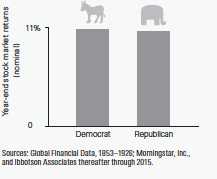

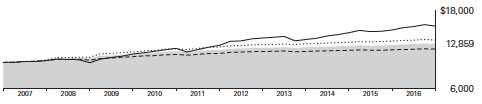

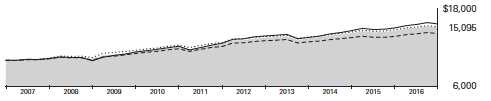

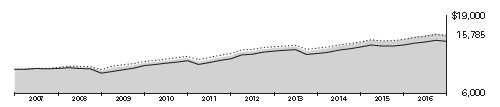

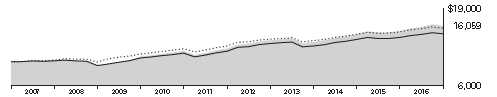

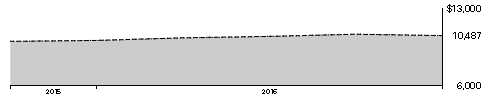

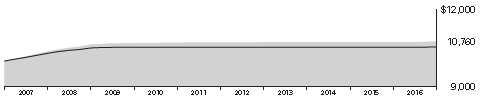

Cumulative Performance: October 31, 2006–October 31, 2016

Initial Investment of $10,000

| | | | |

| | | Average Annual Total Returns | Final Value |

| | | Periods Ended October 31, 2016 | of a $10,000 |

| | One Year | Five Years | Ten Years | Investment |

| Short-Term Tax-Exempt Fund Investor Shares | 0.64% | 0.72% | 1.72% | $11,861 |

| Bloomberg Barclays 1 Year Municipal | | | | |

| Bond Index | 0.40 | 0.72 | 1.89 | 12,061 |

| 1–2 Year Municipal Funds Average1 | 0.25 | 0.44 | 0.46 | 10,469 |

| Bloomberg Barclays Municipal Bond Index | 4.06 | 4.34 | 4.57 | 15,637 |

| | | | |

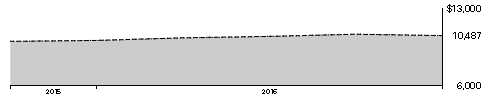

| | | | | Final Value |

| | | | | of a $50,000 |

| | One Year | Five Years | Ten Years | Investment |

| Short-Term Tax-Exempt Fund Admiral Shares | 0.74% | 0.80% | 1.80% | $59,782 |

| Bloomberg Barclays 1 Year Municipal Bond Index | 0.40 | 0.72 | 1.89 | 60,306 |

| Bloomberg Barclays Municipal Bond Index | 4.06 | 4.34 | 4.57 | 78,184 |

1 Derived from data provided by Lipper, a Thomson Reuters Company.

See Financial Highlights for dividend and capital gains information.

8

Short-Term Tax-Exempt Fund

| | | | |

| Fiscal-Year Total Returns (%): October 31, 2006–October 31, 2016 | | | |

| | | | | Bloomberg |

| | | | | Barclays |

| | | | | 1 Year |

| | | | | Municipal |

| | | | Investor Shares | Bond Index |

| | Income | Capital | Total | Total |

| Fiscal Year | Returns | Returns | Returns | Returns |

| 2007 | 3.44% | 0.26% | 3.70% | 3.82% |

| 2008 | 3.30 | 0.38 | 3.68 | 4.22 |

| 2009 | 2.31 | 1.28 | 3.59 | 4.40 |

| 2010 | 1.38 | 0.44 | 1.82 | 1.81 |

| 2011 | 1.23 | -0.31 | 0.92 | 1.18 |

| 2012 | 1.08 | 0.19 | 1.27 | 1.01 |

| 2013 | 0.89 | -0.38 | 0.51 | 0.74 |

| 2014 | 0.72 | -0.06 | 0.66 | 0.72 |

| 2015 | 0.70 | -0.19 | 0.51 | 0.76 |

| 2016 | 0.83 | -0.19 | 0.64 | 0.40 |

Average Annual Total Returns: Periods Ended September 30, 2016

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Investor Shares | 9/1/1977 | 0.73% | 0.70% | 1.60% | 0.15% | 1.75% |

| Admiral Shares | 2/12/2001 | 0.83 | 0.78 | 1.68 | 0.15 | 1.83 |

9

Short-Term Tax-Exempt Fund

Financial Statements

Statement of Net Assets

As of October 31, 2016

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (100.7%) | | | | |

| Alabama (0.8%) | | | | |

| Alabama Special Care Facilities Financing Authority Birmingham Revenue | | | | |

| (Ascension Health Credit Group) PUT | 4.100% | 11/3/16 | 31,500 | 31,506 |

| 1 Alabama Special Care Facilities Financing Authority Birmingham Revenue | | | | |

| (Ascension Health Credit Group) TOB VRDO | 0.660% | 11/7/16 | 12,755 | 12,755 |

| Chatom AL Industrial Development Board Gulf Opportunity Zone Revenue | | | | |

| (Power South Energy Cooperative Projects) PUT | 0.875% | 11/15/16 | 24,945 | 24,945 |

| Chatom AL Industrial Development Board Gulf Opportunity Zone Revenue | | | | |

| (Power South Energy Cooperative Projects) PUT | 0.875% | 12/1/16 | 9,200 | 9,199 |

| Chatom AL Industrial Development Board Gulf Opportunity Zone Revenue | | | | |

| (Power South Energy Cooperative Projects) PUT VRDO | 0.875% | 2/1/17 | 12,100 | 12,095 |

| Jefferson County AL Sewer Revenue | 5.000% | 10/1/17 | 1,625 | 1,676 |

| Jefferson County AL Sewer Revenue | 5.000% | 10/1/18 | 1,500 | 1,580 |

| Mobile AL Industrial Development Board Pollution Control Revenue (Alabama Power Co.) PUT | 1.625% | 10/2/18 | 10,000 | 10,071 |

| Mobile County AL Board of School Commissioners GO | 5.000% | 3/1/19 | 850 | 927 |

| Mobile County AL Board of School Commissioners GO | 5.000% | 3/1/20 | 1,275 | 1,434 |

| | | | | 106,188 |

| Alaska (0.3%) | | | | |

| Alaska Railroad Corp. Capital Grant Receipt Revenue | 5.000% | 8/1/19 | 7,505 | 8,213 |

| Alaska Railroad Corp. Capital Grant Receipt Revenue | 5.000% | 8/1/20 | 6,900 | 7,731 |

| Matanuska-Susitna Borough AK GO | 5.000% | 3/1/18 | 3,775 | 3,982 |

| North Slope Borough AK GO | 4.000% | 6/30/17 | 9,000 | 9,198 |

| North Slope Borough AK GO | 4.000% | 6/30/18 | 1,200 | 1,258 |

| North Slope Borough AK GO | 4.000% | 6/30/18 | 5,340 | 5,600 |

| | | | | 35,982 |

| Arizona (0.9%) | | | | |

| 2 Arizona Board Regents University of Arizona System Revenue | 4.000% | 6/1/18 | 1,000 | 1,048 |

| Arizona Health Facilities Authority Hospital System Revenue (Phoenix Children’s Hospital) | 4.000% | 2/1/17 | 2,000 | 2,015 |

| Arizona Health Facilities Authority Hospital System Revenue (Phoenix Children’s Hospital) | 5.000% | 2/1/18 | 1,000 | 1,047 |

| 1 Arizona Health Facilities Authority Revenue (Banner Health) TOB VRDO | 0.750% | 11/7/16 | 5,000 | 5,000 |

| 3 Arizona Health Facilities Authority Revenue (Phoenix Children’s Hospital) PUT | 2.480% | 2/5/20 | 12,500 | 12,720 |

| Arizona Health Facilities Authority Revenue (Scottsdale Lincoln Hospitals Project) | 5.000% | 12/1/16 | 375 | 376 |

| Arizona Health Facilities Authority Revenue (Scottsdale Lincoln Hospitals Project) | 5.000% | 12/1/17 | 750 | 783 |

| Arizona Health Facilities Authority Revenue (Scottsdale Lincoln Hospitals Project) | 5.000% | 12/1/18 | 500 | 540 |

| Arizona School Facilities Board COP | 5.000% | 9/1/17 | 1,800 | 1,862 |

| Arizona School Facilities Board COP | 5.000% | 9/1/18 | 1,500 | 1,606 |

| Arizona School Facilities Board COP | 5.000% | 9/1/19 | 7,500 | 8,297 |

| Arizona Transportation Board Excise Tax Revenue | 5.000% | 7/1/20 | 2,000 | 2,278 |

| Arizona Transportation Board Excise Tax Revenue (Maricopa County Regional Area) | 5.000% | 7/1/18 | 1,050 | 1,121 |

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/18 | 4,500 | 4,808 |

| Glendale AZ GO | 4.000% | 7/1/19 (4) | 1,600 | 1,708 |

| Glendale AZ GO | 4.000% | 7/1/20 (4) | 2,920 | 3,175 |

| Goodyear Public Improvement Corp. Municipal Facilities Revenue | 5.000% | 7/1/17 | 1,400 | 1,440 |

| Maricopa County AZ COP | 5.000% | 7/1/17 | 15,000 | 15,420 |

| Maricopa County AZ COP | 5.000% | 7/1/18 | 10,000 | 10,661 |

| 2 Maricopa County AZ Industrial Development Authority Health Facilities Revenue | | | | |

| (Banner Health Obligated Group) | 4.000% | 1/1/19 | 3,000 | 3,183 |

| Maricopa County AZ Unified School District No. 4 (Mesa) GO | 4.000% | 7/1/19 | 3,750 | 4,043 |

| Phoenix AZ Civic Improvement Corp. Excise Tax Revenue | 5.000% | 7/1/17 | 4,250 | 4,372 |

| Phoenix AZ Civic Improvement Corp. Excise Tax Revenue | 4.000% | 7/1/18 | 2,690 | 2,825 |

| Phoenix AZ Industrial Development Authority Revenue (Mayo Clinic) VRDO | 0.470% | 11/1/16 | 30,000 | 30,000 |

| Pima County AZ Sewer Revenue | 4.000% | 7/1/17 | 2,000 | 2,044 |

| Pima County AZ Tucson Unified School District No. 1 GO | 4.000% | 7/1/19 (15) | 1,355 | 1,457 |

| Tempe AZ Excise Tax Revenue | 5.000% | 7/1/19 | 2,000 | 2,208 |

| Tucson AZ Water System Revenue | 5.000% | 7/1/19 | 2,050 | 2,264 |

| Yuma AZ Industrial Development Authority Hospital Revenue (Yuma Regional Medical Center) | 5.000% | 8/1/19 | 1,000 | 1,094 |

| | | | | 129,395 |

10

Short-Term Tax-Exempt Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Arkansas (0.2%) | | | | |

| Arkansas Development Finance Authority Healthcare Revenue (Baptist Health) | 3.000% | 12/1/16 | 7,485 | 7,499 |

| Arkansas Development Finance Authority Hospital Revenue | | | | |

| (Washington Regional Medical Center) | 3.000% | 2/1/18 | 1,000 | 1,022 |

| Arkansas Federal Highway Grant Anticipation & Tax Revenue GO | 5.000% | 4/1/17 | 6,980 | 7,105 |

| Arkansas Federal Highway Grant Anticipation & Tax Revenue GO | 5.000% | 10/1/17 | 7,155 | 7,433 |

| Baxter County AR Hospital Revenue | 5.000% | 9/1/18 | 1,000 | 1,064 |

| Baxter County AR Hospital Revenue | 5.000% | 9/1/19 | 620 | 678 |

| Little Rock AR Sewer Revenue | 5.000% | 10/1/17 (Prere.) | 7,500 | 7,788 |

| | | | | 32,589 |

| California (9.9%) | | | | |

| 1 Bakersfield CA Wastewater Revenue TOB VRDO | 0.850% | 11/7/16 | 5,315 | 5,315 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.000% | 4/3/17 | 7,250 | 7,252 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.367% | 8/1/17 | 31,500 | 31,570 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.450% | 8/1/17 | 10,040 | 10,059 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.450% | 8/1/17 | 7,000 | 7,012 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.500% | 4/2/18 | 62,400 | 62,718 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.875% | 4/1/19 | 8,950 | 9,073 |

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 1.875% | 4/1/20 | 7,500 | 7,614 |

| Brea CA Redevelopment Agency Successor Agency Tax Allocation Revenue | | | | |

| (Redevelopment Project AB) | 5.000% | 8/1/17 | 1,150 | 1,186 |

| California County CA Tobacco Securitization Agency Revenue | 4.000% | 6/1/17 | 575 | 584 |

| California County CA Tobacco Securitization Agency Revenue | 4.000% | 6/1/18 | 1,000 | 1,041 |

| 3 California Department of Water Resources Water System Revenue (Central Valley Project) PUT | 1.250% | 9/1/17 | 60,175 | 60,220 |

| 3 California Department of Water Resources Water System Revenue (Central Valley Project) PUT | 0.930% | 12/1/17 | 32,250 | 32,171 |

| 1 California Department of Water resources Water System Revenue (Central Valley Project) | | | | |

| TOB VRDO | 0.660% | 11/7/16 | 11,910 | 11,910 |

| California GO | 5.000% | 9/1/17 | 4,250 | 4,403 |

| California GO | 5.000% | 10/1/17 | 35,000 | 36,381 |

| California GO | 5.000% | 4/1/18 | 10,385 | 11,002 |

| 2 California GO | 5.000% | 8/1/18 | 57,715 | 61,898 |

| California GO | 5.000% | 2/1/19 | 825 | 900 |

| California GO | 5.500% | 4/1/19 | 17,830 | 19,775 |

| California GO | 5.000% | 9/1/19 | 29,690 | 33,052 |

| California GO | 5.000% | 9/1/19 | 5,000 | 5,566 |

| California GO | 5.000% | 9/1/19 | 9,005 | 10,025 |

| California GO | 5.000% | 9/1/19 | 38,795 | 43,188 |

| California GO | 5.000% | 9/1/20 | 5,500 | 6,306 |

| California GO | 5.000% | 9/1/20 | 14,105 | 16,172 |

| 3 California GO PUT | 1.072% | 12/1/17 | 14,250 | 14,278 |

| California GO PUT | 4.000% | 12/1/17 | 8,350 | 8,505 |

| 3 California GO PUT | 1.080% | 5/1/18 | 29,500 | 29,420 |

| 3 California GO PUT | 1.202% | 12/3/18 | 7,600 | 7,641 |

| California GO PUT | 3.000% | 12/1/19 | 28,825 | 30,182 |

| 1 California GO TOB VRDO | 0.750% | 11/7/16 | 33,860 | 33,860 |

| 1 California GO TOB VRDO | 0.810% | 11/7/16 LOC | 16,755 | 16,755 |

| 1 California GO TOB VRDO | 0.810% | 11/7/16 LOC | 14,960 | 14,960 |

| 1 California GO TOB VRDO | 0.830% | 11/7/16 | 15,925 | 15,925 |

| 3 California Health Facilities Financing Authority Revenue (Children’s Hospital of Los Angeles) PUT | 2.430% | 7/1/17 | 8,825 | 8,871 |

| California Health Facilities Financing Authority Revenue (City of Hope Medical Center) | 5.000% | 11/15/16 | 1,005 | 1,007 |

| California Health Facilities Financing Authority Revenue (Memorial Health Services) | 5.000% | 10/1/17 | 1,000 | 1,040 |

| California Health Facilities Financing Authority Revenue | | | | |

| (Providence St. Joseph Health Obligated Group) PUT | 1.250% | 10/1/20 | 6,400 | 6,371 |

| California Health Facilities Financing Authority Revenue (St. Joseph Health System) PUT | 5.000% | 10/17/17 | 9,400 | 9,769 |

| California Health Facilities Financing Authority Revenue (Sutter Health) PUT | 1.000% | 8/15/19 | 6,000 | 5,972 |

| 3 California Infrastructure & Economic Development Bank Revenue | | | | |

| (Index-Museum Art Project) PUT | 2.124% | 8/1/18 | 20,515 | 20,889 |

| 3 California Infrastructure & Economic Development Bank Revenue (J. Paul Getty Trust) PUT | 0.910% | 4/3/17 | 3,925 | 3,921 |

| 3 California Infrastructure & Economic Development Bank Revenue (J. Paul Getty Trust) PUT | 0.910% | 4/3/17 | 22,500 | 22,478 |

| California Municipal Finance Authority | | | | |

| (Community Hospitals of Central California Obligated Group) COP | 5.000% | 2/1/17 | 1,100 | 1,111 |

| California Municipal Finance Authority Multifamily Housing Revenue | | | | |

| (Stevenson House Apartments) | 0.850% | 11/1/17 | 3,000 | 2,997 |

| 3 California Municipal Finance Authority Revenue (Anaheim Electric Utility Distribution System) PUT | 1.130% | 4/2/18 | 14,000 | 13,946 |

| California Municipal Finance Authority Revenue (NorthBay Healthcare Group) | 5.000% | 11/1/16 | 1,610 | 1,610 |

| California Municipal Finance Authority Solid Waste Revenue (Republic Services Inc. Project) PUT | 0.950% | 1/3/17 | 13,000 | 13,000 |

| California Public Works Board Lease Revenue (Department of Corrections) | 5.000% | 6/1/17 | 5,000 | 5,125 |

| California Public Works Board Lease Revenue (Department of Corrections) | 5.000% | 6/1/17 | 8,205 | 8,410 |

| California Public Works Board Lease Revenue (Department of Corrections) | 5.000% | 6/1/18 | 10,650 | 11,333 |

11

Short-Term Tax-Exempt Fund

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value• |

| | | Coupon | Date | ($000) | ($000) |

| | California Public Works Board Lease Revenue (Department of Corrections) | 5.000% | 6/1/18 | 2,500 | 2,660 |

| | California Public Works Board Lease Revenue (Department of State Hospitals) | 4.000% | 6/1/17 | 5,000 | 5,096 |

| | California Public Works Board Lease Revenue (Department of State Hospitals) | 4.000% | 6/1/18 | 5,000 | 5,243 |

| | California Public Works Board Lease Revenue (Judicial Council Projects) | 5.000% | 12/1/16 | 1,500 | 1,505 |

| | California Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 1/1/17 | 6,220 | 6,265 |

| | California Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 4/1/17 | 2,710 | 2,759 |

| | California Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 4/1/18 | 1,000 | 1,058 |

| | California Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 4/1/19 | 8,760 | 9,589 |

| | California State University Systemwide Revenue PUT | 3.000% | 11/1/19 | 21,000 | 21,971 |

| | California Statewide Communities Development Authority Health Facility Revenue | | | | |

| | (Catholic Healthcare West) | 0.880% | 11/4/16 (4) | 30,450 | 30,450 |

| | California Statewide Communities Development Authority Health Facility Revenue | | | | |

| | (Catholic Healthcare West) | 0.890% | 11/4/16 (4) | 3,075 | 3,075 |

| | California Statewide Communities Development Authority Revenue | | | | |

| | (Adventist Health System/West) | 3.000% | 3/1/17 | 350 | 353 |

| | California Statewide Communities Development Authority Revenue | | | | |

| | (Adventist Health System/West) | 3.000% | 3/1/18 | 375 | 386 |

| | California Statewide Communities Development Authority Revenue | | | | |

| | (Adventist Health System/West) | 4.000% | 3/1/19 | 500 | 534 |

| 1 | California Statewide Communities Development Authority Revenue | | | | |

| | (Cottage Health System Obligated Group) TOB VRDO | 0.780% | 11/7/16 | 8,555 | 8,555 |

| 3 | California Statewide Communities Development Authority Revenue (Kaiser Permanente) PUT | 1.580% | 5/1/17 | 1,250 | 1,252 |

| | California Statewide Communities Development Authority Revenue (Kaiser Permanente) PUT | 5.000% | 5/1/17 | 6,380 | 6,513 |

| | California Statewide Communities Development Authority Revenue (Kaiser Permanente) PUT | 5.000% | 5/1/17 | 7,500 | 7,656 |

| 1 | California Statewide Communities Development Authority Revenue (Kaiser Permanente) | | | | |

| | TOB VRDO | 0.830% | 11/7/16 | 10,010 | 10,010 |

| | California Statewide Communities Development Authority Revenue | | | | |

| | (Rady Children’s Hospital - San Diego) | 4.000% | 8/15/18 | 1,565 | 1,649 |

| 1 | California Statewide Communities Development Authority Revenue | | | | |

| | (St. Joseph Health System) TOB VRDO | 0.670% | 11/7/16 (4) | 17,832 | 17,832 |

| | California Statewide Communities Development Authority Senior Living Health Facility Revenue | | | | |

| | (Los Angeles Jewish Home for the Aging) | 2.500% | 8/1/20 | 1,165 | 1,166 |

| | California Statewide Communities Development Authority Student Housing Revenue | | | | |

| | (CHF-Irvine LLC - UCI East Campus Apartments Phase II) | 5.000% | 5/15/19 | 500 | 546 |

| | California Statewide Communities Development Authority Student Housing Revenue | | | | |

| | (CHF-Irvine LLC - UCI East Campus Apartments Phase II) | 5.000% | 5/15/20 | 500 | 559 |

| | Capistrano CA Unified School District Special Tax Revenue | 5.000% | 9/1/17 | 1,500 | 1,549 |

| | Capistrano CA Unified School District Special Tax Revenue | 5.000% | 9/1/18 (15) | 2,000 | 2,147 |

| | Capistrano CA Unified School District Special Tax Revenue | 5.000% | 9/1/19 (15) | 2,080 | 2,310 |

| | Chula Vista CA Industrial Development Revenue (San Diego Gas & Electric Co.) | 1.650% | 7/1/18 | 4,700 | 4,704 |

| | Chula Vista CA Municipal Financing Authority Special Tax Revenue | 5.000% | 9/1/17 | 565 | 584 |

| 1,3 | Eaton Vance California Municipal Bond Fund II | 1.480% | 7/1/19 | 8,250 | 8,251 |

| 2 | El Camino CA Healthcare District GO | 4.000% | 8/1/18 | 2,105 | 2,217 |

| | El Dorado CA Irrigation District Revenue | 4.000% | 3/1/17 (4) | 1,500 | 1,517 |

| 1 | Fontana CA Public Financing Authority Tax Allocation Revenue TOB VRDO | 0.880% | 11/7/16 LOC | 9,000 | 9,000 |

| | Foothill/Eastern Transportation Corridor Agency California Toll Road Revenue PUT | 5.000% | 1/15/18 | 19,485 | 19,959 |

| | Foothill/Eastern Transportation Corridor Agency California Toll Road Revenue PUT | 5.000% | 1/15/20 | 1,475 | 1,594 |

| 1 | Golden State Tobacco Securitization Corp. California Revenue TOB VRDO | 0.840% | 11/7/16 LOC | 9,720 | 9,720 |

| | Jurupa CA Public Financing Authority Special Tax Revenue | 3.500% | 9/1/17 | 425 | 433 |

| | Jurupa CA Public Financing Authority Special Tax Revenue | 4.000% | 9/1/18 | 380 | 399 |

| | Jurupa CA Public Financing Authority Special Tax Revenue | 5.000% | 9/1/19 | 610 | 674 |

| | La Verne CA (Brethren Hillcrest Homes) COP | 3.000% | 5/15/17 | 575 | 580 |

| | La Verne CA (Brethren Hillcrest Homes) COP | 4.000% | 5/15/18 | 235 | 244 |

| | Long Beach CA Finance Authority Natural Gas Purchase Revenue | 5.250% | 11/15/18 | 1,185 | 1,265 |

| | Long Beach CA Harbor Revenue | 5.000% | 11/15/18 | 32,500 | 35,212 |

| | Long Beach CA Unified School District GO | 5.000% | 8/1/19 | 2,740 | 3,042 |

| | Los Angeles CA GO | 5.000% | 9/1/18 | 12,900 | 13,878 |

| | Los Angeles CA Unified School District GO | 5.000% | 7/1/18 | 23,335 | 24,946 |

| | Los Angeles CA Unified School District GO | 5.000% | 7/1/18 | 73,395 | 78,462 |

| | Los Angeles CA Unified School District GO | 5.000% | 7/1/18 | 9,830 | 10,509 |

| | Los Angeles County CA Metropolitan Transportation Authority Sales Tax Revenue | 5.000% | 7/1/18 | 12,750 | 13,639 |

| | Los Angeles County CA Redevelopment Authority Tax Allocation Revenue (Various Project Areas) | 5.000% | 9/1/17 | 3,815 | 3,944 |

| | Los Angeles County CA Redevelopment Authority Tax Allocation Revenue (Various Project Areas) | 5.000% | 9/1/18 | 1,000 | 1,071 |

| 3 | Metropolitan Water District of Southern California Revenue PUT | 0.790% | 7/10/17 | 9,500 | 9,500 |

| 3 | Metropolitan Water District of Southern California Revenue PUT | 0.790% | 7/10/17 | 5,500 | 5,500 |

| 3 | Metropolitan Water District of Southern California Revenue PUT | 0.790% | 7/10/17 | 5,000 | 4,998 |

| 3 | Metropolitan Water District of Southern California Revenue PUT | 1.010% | 3/27/18 | 3,000 | 3,001 |

| 3 | Metropolitan Water District of Southern California Revenue PUT | 1.010% | 3/27/18 | 10,250 | 10,253 |

| 3 | Metropolitan Water District of Southern California Revenue PUT | 1.010% | 3/27/18 | 10,750 | 10,743 |

| 3 | Metropolitan Water District of Southern California Revenue PUT | 1.010% | 3/27/18 | 20,000 | 19,987 |

12

Short-Term Tax-Exempt Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Modesto CA Irrigation District Electric Revenue | 5.000% | 7/1/17 | 1,055 | 1,086 |

| Mount Diablo CA Unified School District GO | 5.000% | 8/1/18 | 1,500 | 1,605 |

| Mount Diablo CA Unified School District GO | 5.000% | 8/1/19 | 650 | 721 |

| North Orange County CA Community College District GO | 4.000% | 8/1/19 | 10,990 | 11,905 |

| Northern California Gas Authority No. 1 Revenue | 1.197% | 7/1/19 | 12,800 | 12,675 |

| 1 Nuveen California AMT-Free Municipal Income Fund VRDP VRDO | 1.100% | 7/1/18 | 14,000 | 14,000 |

| Nuveen Insured California AMT-Free Municipal Income Fund VRDP VRDO | 0.720% | 11/7/16 LOC | 5,000 | 5,000 |

| Oakland CA Redevelopment Agency Tax Allocation Revenue (Central District Project) | 5.000% | 9/1/17 | 3,500 | 3,619 |

| Oakland CA Redevelopment Agency Tax Allocation Revenue (Central District Project) | 5.000% | 9/1/18 | 1,550 | 1,660 |

| Oakland CA Redevelopment Agency Tax Allocation Revenue (Central District Project) | 5.000% | 9/1/19 | 1,500 | 1,658 |

| Palomar Pomerado Health California Revenue | 4.000% | 11/1/18 | 815 | 848 |

| 3 Riverside CA Water Revenue PUT | 0.780% | 2/1/17 | 2,000 | 2,000 |

| Riverside County CA Asset Leasing Corp. Leasehold Revenue (Riverside County Hospital Project) | 4.000% | 6/1/17 | 2,000 | 2,037 |

| Riverside County CA Asset Leasing Corp. Leasehold Revenue (Riverside County Hospital Project) | 5.000% | 6/1/17 | 3,705 | 3,796 |

| Riverside County CA Transportation Commission Sales Tax Revenue | 5.000% | 6/1/18 | 500 | 533 |

| Roseville CA Special Tax Revenue | 3.000% | 9/1/18 | 275 | 283 |

| Roseville CA Special Tax Revenue | 4.000% | 9/1/19 | 875 | 936 |

| 1 Sacramento CA Municipal Utility District Revenue TOB VRDO | 0.960% | 11/7/16 | 4,985 | 4,985 |

| San Joaquin Hills CA Transportation Corridor Agency Toll Road Revenue | 5.000% | 1/15/17 | 12,025 | 12,124 |

| Southern California Public Power Authority Revenue (Canyon Power Project) | 5.000% | 7/1/20 | 1,250 | 1,428 |

| University of California Revenue | 5.000% | 5/15/18 | 3,000 | 3,193 |

| University of California Revenue | 5.000% | 5/15/18 | 8,565 | 9,118 |

| Western CA Municipal Water District Revenue PUT | 1.500% | 10/1/20 | 2,325 | 2,345 |

| | | | | 1,365,838 |

| Colorado (2.2%) | | | | |

| Adams County CO COP | 4.000% | 12/1/19 | 1,250 | 1,356 |

| Colorado Education Loan Program Revenue | 2.000% | 6/29/17 | 79,700 | 80,343 |

| Colorado Education Loan Program Revenue | 5.000% | 6/29/17 | 19,100 | 19,628 |

| Colorado General Fund Revenue | 2.000% | 6/27/17 | 44,050 | 44,403 |

| Colorado Health Facilities Authority Revenue (Catholic Health Initiatives) PUT | 1.875% | 11/6/19 | 6,000 | 6,045 |

| 3 Colorado Health Facilities Authority Revenue (Catholic Health Initiatives) PUT | 1.609% | 11/12/20 | 5,000 | 4,964 |

| 3 Colorado Health Facilities Authority Revenue (Catholic Health Initiatives) PUT | 1.609% | 11/12/20 | 7,500 | 7,445 |

| 1 Colorado Health Facilities Authority Revenue (Catholic Health Initiatives) TOB VRDO | 0.780% | 11/7/16 | 10,000 | 10,000 |

| 1 Colorado Health Facilities Authority Revenue (Catholic Health Initiatives) TOB VRDO | 0.880% | 11/7/16 LOC | 11,805 | 11,805 |

| Colorado Health Facilities Authority Revenue (Christian Living Communities) | 1.250% | 1/1/17 | 175 | 175 |

| Colorado Health Facilities Authority Revenue (Christian Living Communities) | 4.000% | 1/1/18 | 250 | 257 |

| Colorado Health Facilities Authority Revenue (Christian Living Communities) | 4.000% | 1/1/20 | 500 | 530 |

| Colorado Health Facilities Authority Revenue (Covenant Retirement Community Inc.) | 4.000% | 12/1/16 | 1,000 | 1,002 |

| Colorado Health Facilities Authority Revenue (Covenant Retirement Community Inc.) | 3.000% | 12/1/17 | 700 | 713 |

| Colorado Health Facilities Authority Revenue (Covenant Retirement Community Inc.) | 5.000% | 12/1/17 | 1,580 | 1,643 |

| Colorado Health Facilities Authority Revenue (Covenant Retirement Community Inc.) | 3.150% | 12/1/18 | 3,640 | 3,645 |

| Colorado Health Facilities Authority Revenue (Covenant Retirement Community Inc.) | 4.000% | 12/1/18 | 600 | 630 |

| Colorado Health Facilities Authority Revenue | | | | |

| (Evangelical Lutheran Good Samaritan Society Project) | 3.000% | 6/1/17 | 500 | 506 |

| Colorado Health Facilities Authority Revenue | | | | |

| (Evangelical Lutheran Good Samaritan Society Project) | 3.000% | 6/1/18 | 600 | 616 |

| Colorado Health Facilities Authority Revenue | | | | |

| (Evangelical Lutheran Good Samaritan Society Project) | 4.000% | 6/1/19 | 1,000 | 1,061 |

| Denver CO City & County Airport Revenue | 0.850% | 11/3/16 (12) | 14,600 | 14,600 |

| Denver CO City & County Airport Revenue | 0.880% | 11/4/16 (12) | 14,700 | 14,700 |

| Denver CO City & County School District GO | 3.000% | 12/1/16 | 13,515 | 13,542 |

| 3 E-470 Public Highway Authority Colorado Revenue PUT | 1.810% | 8/31/17 | 7,540 | 7,528 |

| 3 E-470 Public Highway Authority Colorado Revenue PUT | 2.380% | 9/1/17 (14) | 7,000 | 7,011 |

| Park Creek CO Metropolitan District Limited Property Tax Revenue | 4.000% | 12/1/18 | 350 | 367 |

| Park Creek CO Metropolitan District Limited Property Tax Revenue | 4.000% | 12/1/20 | 1,055 | 1,144 |

| Regional Transportation District of Colorado Sales Tax Revenue (FasTracks Project) | 5.000% | 11/1/16 (Prere.) | 14,230 | 14,230 |

| Regional Transportation District of Colorado Sales Tax Revenue (FasTracks Project) | 5.000% | 11/1/16 (Prere.) | 11,280 | 11,280 |

| University of Colorado Hospital Authority Revenue | 0.880% | 5/30/17 | 12,500 | 12,500 |

| University of Colorado Hospital Authority Revenue PUT | 0.880% | 5/30/17 | 10,000 | 10,000 |

| | | | | 303,669 |

| Connecticut (3.5%) | | | | |

| Bridgeport CT GO | 5.000% | 8/15/20 (4) | 7,115 | 8,019 |

| Connecticut GO | 5.000% | 11/1/16 | 7,000 | 7,000 |

| Connecticut GO | 0.690% | 11/7/16 | 12,740 | 12,740 |

| Connecticut GO | 0.690% | 11/7/16 | 15,825 | 15,825 |

| Connecticut GO | 0.760% | 11/7/16 | 31,935 | 31,935 |

| Connecticut GO | 5.000% | 12/1/16 | 5,000 | 5,018 |

| 3 Connecticut GO | 0.880% | 1/1/17 | 10,210 | 10,210 |

| 3 Connecticut GO | 0.940% | 3/1/17 | 3,000 | 3,000 |

13

Short-Term Tax-Exempt Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 3 Connecticut GO | 0.970% | 3/1/17 | 7,415 | 7,415 |

| 3 Connecticut GO | 1.310% | 4/15/17 | 4,200 | 4,200 |

| 3 Connecticut GO | 1.400% | 5/15/17 | 3,120 | 3,125 |

| 3 Connecticut GO | 1.330% | 6/15/17 | 25,000 | 25,031 |

| 3 Connecticut GO | 1.330% | 6/15/17 | 35,240 | 35,284 |

| Connecticut GO | 5.000% | 7/15/17 | 5,000 | 5,148 |

| 3 Connecticut GO | 1.150% | 9/15/17 | 1,850 | 1,850 |

| Connecticut GO | 4.000% | 11/15/17 | 7,000 | 7,227 |

| Connecticut GO | 4.000% | 11/15/17 | 40,795 | 42,119 |

| 3 Connecticut GO | 0.980% | 1/1/18 | 4,905 | 4,894 |

| 3 Connecticut GO | 1.510% | 4/15/18 | 2,250 | 2,253 |

| 3 Connecticut GO | 1.550% | 5/15/18 | 10,675 | 10,695 |

| 3 Connecticut GO | 1.400% | 9/15/18 | 4,000 | 4,002 |

| Connecticut GO | 5.000% | 11/15/18 | 8,540 | 9,218 |

| 3 Connecticut GO | 1.730% | 5/15/19 | 5,000 | 5,028 |

| 3 Connecticut GO | 1.550% | 9/15/19 | 1,000 | 1,000 |

| 3 Connecticut GO PUT | 1.280% | 9/15/17 | 10,215 | 10,215 |

| 3 Connecticut GO PUT | 1.980% | 3/1/18 | 17,500 | 17,501 |

| Connecticut Health & Educational Facilities Authority Revenue (Trinity Health Corp.) | 5.000% | 12/1/18 | 350 | 379 |

| Connecticut Health & Educational Facilities Authority Revenue (Trinity Health Corp.) | 3.000% | 12/1/19 | 750 | 793 |

| Connecticut Health & Educational Facilities Authority Revenue (Yale University) PUT | 0.600% | 2/1/17 | 35,000 | 34,995 |

| Connecticut Health & Educational Facilities Authority Revenue (Yale University) PUT | 0.800% | 7/26/17 | 40,000 | 40,021 |

| Connecticut Health & Educational Facilities Authority Revenue (Yale University) PUT | 0.900% | 2/1/18 | 4,000 | 4,002 |

| Connecticut Health & Educational Facilities Authority Revenue (Yale University) PUT | 1.375% | 7/11/18 | 57,000 | 57,422 |

| Connecticut Health & Educational Facilities Authority Revenue (Yale University) PUT | 1.000% | 7/1/19 | 17,550 | 17,509 |

| Connecticut Health & Educational Facilities Authority Revenue (Yale University) PUT | 1.000% | 7/1/19 | 8,450 | 8,428 |

| 1 Connecticut Health & Educational Facilities Authority Revenue (Yale University) TOB VRDO | 0.660% | 11/7/16 | 3,600 | 3,600 |

| Hartford CT GO | 5.000% | 8/15/18 (15) | 3,500 | 3,729 |

| Hartford CT GO | 5.000% | 4/1/19 (ETM) | 2,150 | 2,357 |

| Hartford CT GO | 5.000% | 7/1/19 (4) | 700 | 762 |

| Hartford CT GO | 5.000% | 10/1/19 (ETM) | 1,525 | 1,700 |

| New Britain CT BAN | 2.000% | 3/23/17 | 12,500 | 12,559 |

| New Britain CT GO | 5.000% | 3/1/17 (15) | 600 | 608 |

| New Britain CT GO | 5.000% | 3/1/19 (15) | 1,000 | 1,086 |

| New Britain CT GO | 5.000% | 3/1/20 (15) | 1,175 | 1,314 |

| South Central CT Regional Water Authority Water System Revenue | 5.000% | 8/1/18 (Prere.) | 5,000 | 5,359 |

| | | | | 486,575 |

| Delaware (0.2%) | | | | |

| Delaware GO | 5.000% | 7/1/18 | 2,000 | 2,138 |

| Delaware GO | 5.000% | 2/1/19 | 1,000 | 1,091 |

| Delaware GO | 5.000% | 3/1/19 | 1,000 | 1,094 |

| Delaware Transportation Authority Transportation System Revenue | 5.000% | 7/1/18 | 1,030 | 1,101 |

| Delaware Transportation Authority Transportation System Revenue | 5.000% | 7/1/19 | 3,500 | 3,869 |

| Delaware Transportation Authority Transportation System Revenue | 5.000% | 7/1/20 | 785 | 895 |

| New Castle County DE GO | 5.000% | 7/15/18 | 1,770 | 1,895 |

| 1 University of Delaware Revenue TOB VRDO | 0.720% | 11/7/16 | 8,670 | 8,670 |

| | | | | 20,753 |

| District of Columbia (0.3%) | | | | |

| 3 District of Columbia Income Tax Revenue | 0.830% | 12/1/16 | 6,135 | 6,135 |

| 3 District of Columbia Income Tax Revenue | 0.930% | 12/1/17 | 11,250 | 11,251 |

| District of Columbia Water & Sewer Authority Public Utility Revenue | 5.000% | 10/1/19 | 500 | 557 |

| Metropolitan Washington DC Transit Authority Revenue | 5.000% | 7/1/18 | 12,500 | 13,335 |

| Metropolitan Washington DC Transit Authority Revenue | 4.000% | 7/1/19 | 8,000 | 8,389 |

| | | | | 39,667 |

| Florida (3.7%) | | | | |

| Brevard County FL Health Facilities Authority Revenue (Health First Inc. Project) | 5.000% | 4/1/18 | 425 | 448 |

| Brevard County FL Health Facilities Authority Revenue (Health First Inc. Project) | 5.000% | 4/1/19 | 750 | 815 |

| Broward County FL Airport System Revenue | 5.000% | 10/1/17 | 1,050 | 1,090 |

| Broward County FL Airport System Revenue | 5.000% | 10/1/18 | 700 | 753 |

| Broward County FL School Board COP | 5.000% | 7/1/17 | 5,000 | 5,137 |

| Broward County FL School Board COP | 5.000% | 7/1/18 | 4,415 | 4,701 |

| Broward County FL School Board COP | 5.000% | 7/1/19 | 2,355 | 2,588 |

| Broward County FL School Board COP | 5.000% | 7/1/20 | 5,400 | 6,105 |

| Broward County FL School District TAN | 1.500% | 6/15/17 | 49,000 | 49,218 |

| Cape Coral FL Special Obligation Revenue | 4.000% | 10/1/17 | 1,905 | 1,959 |

| Cape Coral FL Special Obligation Revenue | 4.000% | 10/1/18 | 600 | 634 |

| Central Florida Expressway Authority BAN | 1.625% | 1/1/19 | 54,595 | 54,920 |

| Citizens Property Insurance Corp. Florida Revenue (Coastal Account) | 5.000% | 6/1/18 | 5,555 | 5,799 |

14

Short-Term Tax-Exempt Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Citizens Property Insurance Corp. Florida Revenue | | | | |

| (Personal Lines Account/Commercial Lines Account) | 5.000% | 6/1/17 | 6,260 | 6,415 |

| Citizens Property Insurance Corp. Florida Revenue | | | | |

| (Personal Lines Account/Commercial Lines Account) | 5.000% | 6/1/18 | 36,700 | 38,998 |

| Citizens Property Insurance Corp. Florida Revenue | | | | |

| (Personal Lines Account/Commercial Lines Account) | 5.000% | 6/1/19 | 6,700 | 7,362 |

| Escambia County FL Pollution Control Revenue (Gulf Power Co. Project) PUT | 1.150% | 6/21/18 | 6,000 | 5,992 |

| Escambia County FL Solid Waste Disposal System Revenue (Gulf Power Co. Project) PUT | 1.400% | 12/1/17 | 6,500 | 6,522 |

| Florida Board of Education Public Education Capital Outlay GO | 5.000% | 6/1/18 | 6,845 | 7,294 |

| Florida Board of Education Public Education Capital Outlay GO | 5.000% | 6/1/19 | 8,135 | 8,973 |

| Florida Board of Education Public Education Capital Outlay GO | 5.000% | 6/1/19 | 17,095 | 18,855 |

| Florida Department of Environmental Protection & Preservation Revenue | 5.000% | 7/1/20 | 13,160 | 14,948 |

| Florida Municipal Power Agency Revenue | 5.000% | 10/1/17 | 700 | 726 |

| Florida Municipal Power Agency Revenue | 5.000% | 10/1/18 | 800 | 858 |

| Florida Municipal Power Agency Revenue | 5.000% | 10/1/19 | 800 | 886 |

| Florida Municipal Power Agency Revenue | 5.000% | 10/1/20 | 6,000 | 6,828 |

| Florida Municipal Power Agency Revenue (Stanton II Project) | 4.000% | 10/1/17 | 1,650 | 1,697 |

| Halifax Hospital Medical Center Florida Hospital Revenue | 3.000% | 6/1/17 | 1,000 | 1,011 |

| Halifax Hospital Medical Center Florida Hospital Revenue | 3.000% | 6/1/17 | 1,000 | 1,012 |

| Halifax Hospital Medical Center Florida Hospital Revenue | 4.000% | 6/1/18 | 500 | 522 |

| Halifax Hospital Medical Center Florida Hospital Revenue | 4.000% | 6/1/18 | 2,000 | 2,089 |

| Halifax Hospital Medical Center Florida Hospital Revenue | 5.000% | 6/1/19 | 250 | 273 |

| Halifax Hospital Medical Center Florida Hospital Revenue | 5.000% | 6/1/19 | 825 | 902 |

| Halifax Hospital Medical Center Florida Hospital Revenue | 5.000% | 6/1/20 | 300 | 337 |

| Highlands County FL Health Facilities Authority Hospital Revenue | | | | |

| (Adventist Health System/Sunbelt Obligated Group) | 5.125% | 11/15/16 (Prere.) | 2,075 | 2,074 |

| Hollywood FL Community Redevelopment Agency Tax Allocation Revenue | 5.000% | 3/1/18 | 2,000 | 2,098 |

| Hollywood FL Community Redevelopment Agency Tax Allocation Revenue | 5.000% | 3/1/19 | 2,000 | 2,159 |

| Jacksonville FL Electric Authority Electric System Revenue CP | 0.950% | 11/9/16 | 27,200 | 27,200 |

| Jacksonville FL Electric Authority Water & Sewer Revenue | 4.000% | 10/1/17 | 1,500 | 1,544 |

| Jacksonville FL Special Revenue | 5.000% | 10/1/18 | 500 | 538 |

| Jacksonville FL Special Revenue | 5.000% | 10/1/19 | 2,200 | 2,443 |

| Jacksonville FL Special Revenue | 5.000% | 10/1/20 | 2,500 | 2,854 |

| Jacksonville FL Special Revenue | 5.000% | 10/1/20 | 760 | 868 |

| 3 Lakeland FL Energy System Revenue | 1.380% | 10/1/17 | 10,000 | 10,004 |

| Lakeland FL Energy System Revenue | 5.000% | 10/1/19 | 1,000 | 1,114 |

| Lee County FL Non-Ad Valorem Revenue | 5.000% | 10/1/17 | 1,220 | 1,266 |

| Lee County FL School Board COP | 5.000% | 8/1/17 | 4,000 | 4,128 |

| Lee County FL School Board COP | 5.000% | 8/1/18 | 3,530 | 3,778 |

| Miami Beach FL Health Facilities Authority Revenue (Mount Sinai Medical Center) | 4.000% | 11/15/17 | 1,965 | 2,017 |

| Miami Beach FL Health Facilities Authority Revenue (Mount Sinai Medical Center) | 4.000% | 11/15/18 | 1,125 | 1,179 |

| Miami Beach FL Resort Tax Revenue | 4.000% | 9/1/17 | 1,250 | 1,283 |

| Miami Beach FL Resort Tax Revenue | 5.000% | 9/1/19 | 1,615 | 1,789 |

| Miami Beach FL Resort Tax Revenue | 5.000% | 9/1/20 | 1,135 | 1,293 |

| 1 Miami Beach FL Resort Tax Revenue TOB VRDO | 0.680% | 11/7/16 | 4,620 | 4,620 |

| Miami-Dade County FL Health Facilities Authority Hospital Revenue (Miami Children’s Hospital) | 5.000% | 8/1/17 | 400 | 412 |

| Miami-Dade County FL Health Facilities Authority Hospital Revenue (Miami Children’s Hospital) | 4.000% | 8/1/18 | 505 | 530 |

| Miami-Dade County FL Industrial Development Authority Solid Waste Disposal Revenue | | | | |

| (Waste Management Inc. of Florida Project) PUT | 1.500% | 10/1/18 | 4,500 | 4,530 |

| 1 Miami-Dade County FL Public Facilities Revenue (Jackson Health System) TOB VRDO | 0.660% | 11/7/16 (12) | 10,395 | 10,395 |

| Miami-Dade County FL School Board COP | 5.000% | 2/1/20 | 2,250 | 2,517 |

| 1 Miami-Dade County FL School Board COP TOB VRDO | 0.710% | 11/7/16 (12) | 26,000 | 26,000 |

| 1 Miami-Dade County FL Water & Sewer Revenue TOB VRDO | 0.750% | 11/7/16 | 8,510 | 8,510 |

| Orlando FL Utility Commission Utility System Revenue | 5.000% | 10/1/18 | 12,195 | 13,137 |

| Orlando Utilities Commission Revenue PUT | 0.880% | 5/30/17 | 10,510 | 10,510 |

| Palm Beach County FL Health Facilities Authority Hospital Revenue | | | | |

| (BRRH Corp. Obligated Group) | 3.000% | 12/1/16 | 1,000 | 1,002 |

| Palm Beach County FL Health Facilities Authority Hospital Revenue | | | | |

| (BRRH Corp. Obligated Group) | 3.000% | 12/1/17 | 1,000 | 1,019 |

| Palm Beach County FL Health Facilities Authority Hospital Revenue | | | | |

| (BRRH Corp. Obligated Group) | 4.000% | 12/1/18 | 750 | 790 |

| Palm Beach County FL Health Facilities Authority Revenue (Jupiter Medical Center Inc. Project) | 4.000% | 11/1/17 | 2,095 | 2,143 |

| Palm Beach County FL School Board COP | 5.000% | 8/1/18 | 4,725 | 5,047 |

| Palm Beach County FL School District TAN | 2.000% | 8/31/17 | 37,315 | 37,687 |

| Pasco County FL School Board COP | 1.150% | 11/4/16 (2) | 9,100 | 9,100 |

| Port St. Lucie FL Special Assessment Revenue | 1.000% | 7/1/17 | 475 | 475 |

| Port St. Lucie FL Special Assessment Revenue | 1.125% | 7/1/18 | 680 | 678 |

| Reedy Creek FL Improvement District GO | 4.000% | 6/1/17 | 1,760 | 1,793 |

| Reedy Creek FL Improvement District GO | 5.000% | 6/1/18 | 2,825 | 3,005 |

| Reedy Creek FL Improvement District Utilities Revenue | 5.000% | 10/1/17 | 785 | 814 |

15

Short-Term Tax-Exempt Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 2 Sarasota County FL Health Facilities Authority Revenue (Village of Isle Project) | 4.000% | 1/1/18 | 400 | 413 |

| 2 Sarasota County FL Health Facilities Authority Revenue (Village of Isle Project) | 4.000% | 1/1/19 | 500 | 527 |

| South Broward FL Hospital District Revenue | 5.000% | 5/1/20 | 4,190 | 4,718 |

| South Florida Water Management District COP | 5.000% | 10/1/19 | 1,750 | 1,949 |

| South Florida Water Management District COP | 5.000% | 10/1/20 | 2,000 | 2,293 |

| 1 South Miami FL Health Facilities Authority Hospital Revenue | | | | |

| (Baptist Health South Florida Obligated Group) TOB VRDO | 0.700% | 11/7/16 | 6,350 | 6,350 |

| Tallahassee FL Health Facilities Revenue (Tallahassee Memorial HealthCare Inc. Project) | 5.000% | 12/1/17 | 1,000 | 1,042 |

| Tallahassee FL Health Facilities Revenue (Tallahassee Memorial HealthCare Inc. Project) | 5.000% | 12/1/20 | 1,600 | 1,817 |

| Tampa FL Hospital Revenue | 4.000% | 7/1/17 | 1,525 | 1,554 |

| 2 Tampa FL Hospital Revenue (H. Lee Moffitt Cancer Center Project) | 5.000% | 7/1/17 | 3,425 | 3,514 |

| Volusia County FL School Board COP | 4.000% | 8/1/18 (15) | 400 | 421 |

| Volusia County FL School Board COP | 4.000% | 8/1/19 (15) | 500 | 538 |

| Volusia County FL School Board COP | 5.000% | 8/1/20 (15) | 350 | 398 |

| | | | | 506,544 |

| Georgia (3.2%) | | | | |

| Athens-Clarke County GA Unified Government Water & Sewerage Revenue | 5.000% | 1/1/17 | 2,500 | 2,518 |

| Athens-Clarke County GA Unified Government Water & Sewerage Revenue | 5.000% | 1/1/18 | 3,000 | 3,146 |

| Atlanta GA Airport Revenue | 5.000% | 1/1/18 | 500 | 524 |

| 1 Atlanta GA Airport Revenue TOB VRDO | 0.830% | 11/7/16 (4) | 10,000 | 10,000 |

| 3 Atlanta GA Water & Wastewater Revenue PUT | 1.858% | 11/1/18 | 56,750 | 57,350 |

| Bartow County GA Development Authority Pollution Control Revenue | | | | |

| (Georgia Power Co. Plant Bowen Project) PUT | 2.375% | 8/10/17 | 8,000 | 8,081 |

| Burke County GA Development Authority Pollution Control Revenue | | | | |

| (Georgia Power Co. Plant Vogtle Project) PUT | 1.375% | 4/4/17 | 2,275 | 2,279 |

| Burke County GA Development Authority Pollution Control Revenue | | | | |

| (Georgia Power Co. Plant Vogtle Project) PUT | 1.750% | 6/1/17 | 10,025 | 10,064 |

| Burke County GA Development Authority Pollution Control Revenue | | | | |

| (Georgia Power Co. Plant Vogtle Project) PUT | 1.800% | 4/3/18 | 5,250 | 5,295 |

| Burke County GA Development Authority Pollution Control Revenue | | | | |

| (Georgia Power Co. Plant Vogtle Project) PUT | 1.300% | 5/3/18 | 11,500 | 11,566 |

| Burke County GA Development Authority Pollution Control Revenue | | | | |

| (Georgia Power Co. Plant Vogtle Project) PUT | 2.350% | 12/11/20 | 3,200 | 3,297 |

| 2 Clarke County GA Hospital Authority Revenue (Piedmont Healthcare Inc.) | 5.000% | 7/1/18 | 750 | 797 |

| 2 Clarke County GA Hospital Authority Revenue (Piedmont Healthcare Inc.) | 5.000% | 7/1/19 | 700 | 769 |

| 1 Cobb County GA Development Authority Parking Facilities Lease Revenue | | | | |

| (KSU Central Parking Deck) TOB VRDO | 0.660% | 11/7/16 LOC | 15,075 | 15,075 |

| Dalton GA Development Authority Revenue (Hamilton Health Care System) | 5.000% | 8/15/17 | 1,500 | 1,549 |

| DeKalb County GA Water & Sewer Revenue | 5.000% | 10/1/17 | 1,000 | 1,039 |

| DeKalb County GA Water & Sewer Revenue | 5.000% | 10/1/17 | 500 | 519 |

| DeKalb County GA Water & Sewer Revenue | 5.000% | 10/1/18 | 800 | 863 |

| Forsyth County GA GO | 5.000% | 3/1/18 | 3,580 | 3,779 |

| 2 Fulton County GA Development Authority Revenue (Piedmont Healthcare Inc. Project) | 5.000% | 7/1/18 | 625 | 665 |

| 2 Fulton County GA Development Authority Revenue (Piedmont Healthcare Inc. Project) | 5.000% | 7/1/19 | 700 | 769 |

| Fulton County GA Residential Care Facilities for the Elderly Authority Revenue (Lenbrook Square) | 3.000% | 7/1/19 | 500 | 516 |

| Fulton County GA Residential Care Facilities for the Elderly Authority Revenue (Lenbrook Square) | 3.000% | 7/1/20 | 1,410 | 1,462 |

| 3 Gainesville & Hall County GA Hospital Authority Revenue | | | | |

| (Northeast Georgia Health System Inc. Project) PUT | 1.580% | 2/18/20 | 17,675 | 17,763 |

| Georgia GO | 5.000% | 11/1/16 | 2,400 | 2,400 |

| Georgia GO | 5.000% | 7/1/17 | 5,280 | 5,432 |

| Georgia GO | 5.000% | 2/1/18 | 32,085 | 33,762 |

| Georgia GO | 5.000% | 7/1/18 | 72,620 | 77,621 |

| Georgia GO | 5.000% | 7/1/18 (Prere.) | 3,350 | 3,579 |

| Georgia GO | 4.000% | 1/1/19 | 1,085 | 1,157 |

| Georgia GO | 5.000% | 10/1/19 | 3,765 | 4,203 |

| Georgia Municipal Electric Power Authority Revenue | 5.000% | 1/1/17 | 1,825 | 1,838 |

| Georgia Municipal Electric Power Authority Revenue | 5.000% | 1/1/18 | 1,400 | 1,467 |

| Georgia Municipal Electric Power Authority Revenue | 5.000% | 1/1/18 | 1,825 | 1,912 |

| Georgia Municipal Gas Authority Revenue | 5.000% | 10/1/19 | 5,000 | 5,554 |

| Glynn County GA School District GO | 5.000% | 8/1/18 | 4,000 | 4,284 |

| Glynn County GA School District GO | 5.000% | 8/1/19 | 7,000 | 7,752 |

| Gwinnett County GA School District GO | 3.000% | 8/1/18 | 4,525 | 4,695 |

| Gwinnett County GA School District GO | 3.000% | 2/1/19 | 25,000 | 26,164 |

| Gwinnett County GA School District GO | 3.000% | 8/1/19 | 24,225 | 25,579 |

| Gwinnett County GA School District GO | 4.000% | 2/1/20 | 16,725 | 18,327 |

| Main Street Natural Gas Inc. Georgia Gas Project Revenue | 5.000% | 3/15/17 | 250 | 253 |

| Main Street Natural Gas Inc. Georgia Gas Project Revenue | 5.125% | 9/15/17 | 240 | 247 |

| 3 Metropolitan Atlanta GA Rapid Transportation Authority Georgia Sales Tax Revenue PUT | 0.910% | 7/1/17 | 18,000 | 17,988 |

| 3 Metropolitan Atlanta GA Rapid Transportation Authority Georgia Sales Tax Revenue PUT | 0.930% | 7/1/17 | 17,500 | 17,493 |

16

Short-Term Tax-Exempt Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Monroe County GA Development Authority Pollution Control Revenue | | | | |

| (Georgia Power Co. Plant Scherer Project) PUT | 2.000% | 6/13/19 | 2,000 | 2,031 |

| Monroe County GA Development Authority Pollution Control Revenue | | | | |

| (Georgia Power Co. Plant Scherer Project) PUT | 2.350% | 12/11/20 | 5,700 | 5,872 |

| Municipal Electric Authority Georgia Revenue | 5.000% | 4/1/18 | 3,565 | 3,768 |

| Municipal Electric Authority Georgia Revenue (Combined Cycle Project) | 5.000% | 11/1/16 | 1,325 | 1,325 |

| Municipal Electric Authority Georgia Revenue (Combined Cycle Project) | 5.000% | 11/1/17 | 1,700 | 1,771 |

| | | | | 436,159 |

| Guam (0.0%) | | | | |

| Guam Government Business Privilege Tax Revenue | 5.000% | 11/15/19 | 1,000 | 1,096 |

| |

| Hawaii (0.5%) | | | | |

| Hawaii County HI GO | 4.000% | 9/1/18 | 1,585 | 1,674 |

| Hawaii County HI GO | 5.000% | 9/1/18 | 1,395 | 1,499 |

| Hawaii County HI GO | 5.000% | 9/1/19 | 3,625 | 4,026 |

| Hawaii Department of Budget & Finance Special Purpose Revenue (Queens Health System) PUT | 1.080% | 5/30/17 | 4,855 | 4,855 |

| Hawaii Department of Budget & Finance Special Purpose Revenue (Queens Health System) PUT | 1.080% | 5/30/17 | 2,510 | 2,510 |

| Hawaii GO | 5.000% | 10/1/18 | 15,000 | 16,167 |

| Hawaii GO | 5.000% | 10/1/19 | 4,000 | 4,455 |

| Hawaii GO | 5.000% | 4/1/20 | 10,000 | 11,304 |

| Hawaii GO | 5.000% | 10/1/20 | 2,750 | 3,154 |

| Honolulu HI City & County GO | 5.000% | 11/1/16 | 7,265 | 7,265 |

| Honolulu HI City & County GO | 5.000% | 7/1/17 (Prere.) | 1,000 | 1,028 |

| Honolulu HI City & County GO | 3.000% | 10/1/18 | 1,595 | 1,656 |

| Honolulu HI City & County GO | 4.000% | 10/1/18 | 1,500 | 1,586 |

| Honolulu HI City & County GO | 5.000% | 10/1/18 | 1,815 | 1,954 |

| Honolulu HI City & County GO | 5.000% | 10/1/18 | 3,120 | 3,358 |

| | | | | 66,491 |

| Idaho (0.2%) | | | | |

| Idaho Housing & Finance Association RAN | 5.000% | 7/15/18 | 7,545 | 8,027 |

| Idaho Housing & Finance Association RAN | 5.000% | 7/15/19 | 6,580 | 7,225 |

| Idaho TAN | 2.000% | 6/30/17 | 7,500 | 7,567 |

| | | | | 22,819 |

| Illinois (3.7%) | | | | |

| Chicago IL Board of Education GO | 5.000% | 12/1/16 | 2,855 | 2,852 |

| Chicago IL Board of Education GO | 5.000% | 12/1/17 (4) | 3,000 | 3,082 |

| 3 Chicago IL Board of Education GO PUT | 4.630% | 3/1/17 | 10,000 | 9,990 |

| 1 Chicago IL GO TOB VRDO | 1.030% | 11/7/16 | 15,180 | 15,180 |

| Chicago IL Metropolitan Water Reclamation District GO | 5.000% | 12/1/17 | 5,000 | 5,225 |

| Chicago IL Metropolitan Water Reclamation District GO | 5.000% | 12/1/17 | 4,000 | 4,180 |

| Chicago IL Metropolitan Water Reclamation District GO | 5.000% | 12/1/18 | 5,000 | 5,406 |

| Chicago IL O’Hare International Airport Revenue | 5.250% | 1/1/17 (14) | 4,540 | 4,573 |

| Chicago IL O’Hare International Airport Revenue | 5.000% | 1/1/19 | 4,420 | 4,781 |

| Chicago IL O’Hare International Airport Revenue | 5.000% | 1/1/20 | 4,000 | 4,460 |

| 1 Chicago IL O’Hare International Airport Revenue TOB VRDO | 0.750% | 11/7/16 (4) | 2,500 | 2,500 |

| 1 Chicago IL O’Hare International Airport Revenue TOB VRDO | 0.780% | 11/7/16 (4) | 21,645 | 21,645 |

| Chicago IL Park District Harbor Facilities GO | 5.000% | 1/1/18 | 600 | 624 |

| Chicago IL Park District Harbor Facilities GO | 5.000% | 1/1/19 | 990 | 1,060 |

| 1 Chicago IL Transit Authority Sales Tax Receipts Revenue TOB VRDO | 0.830% | 11/7/16 | 22,895 | 22,895 |

| 1 Chicago IL Transit Authority Sales Tax Receipts Revenue TOB VRDO | 0.830% | 11/7/16 | 25,500 | 25,500 |

| Chicago IL Wastewater Transmission Revenue | 5.000% | 1/1/19 | 1,975 | 2,110 |

| Chicago IL Wastewater Transmission Revenue | 5.000% | 1/1/20 | 1,000 | 1,094 |

| Chicago IL Water Revenue | 5.000% | 11/1/18 | 675 | 720 |

| 1 Chicago IL Water Revenue TOB VRDO | 0.830% | 11/7/16 | 7,495 | 7,495 |

| 1 Chicago IL Water Revenue TOB VRDO | 0.830% | 11/7/16 | 5,250 | 5,250 |