Item 1. Reports to Stockholders

Annual report

Fixed income mutual fund

Delaware Investments Ultrashort Fund

March 31, 2017

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Investments Ultrashort Fund at delawarefunds.com/literature.

Manage your investments online

| ● | | 24-hour access to your account information |

| ● | | Check your account balance and recent transactions |

| ● | | Request statements or literature |

| ● | | Make purchases and redemptions |

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment, and funds management services.

Neither Delaware Investments nor its affiliates referred to in this document are authorized deposit-taking institutions for the purpose of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited (MBL), a subsidiary of Macquarie Group Limited and an affiliate of Delaware Investments. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Fund is governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of March 31, 2017, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2017 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

| | |

| Portfolio management review | | |

| Delaware Investments Ultrashort Fund | | April 11, 2017 (Unaudited) |

| | | | | | | | |

| Performance preview (for the year ended March 31, 2017) | | | | | | |

Delaware Investments Ultrashort Fund (Institutional Class shares) | | | 1-year return | | | | +0.75% | |

Delaware Investments Ultrashort Fund (Class A shares) | | | 1-year return | | | | +0.76% | |

BofA Merrill Lynch US 6-Month Treasury Bill Index (benchmark) | | | 1-year return | | | | +0.58% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Investments Ultrashort Fund, please see the table on page 3. Institutional Class Shares are available without sales or asset-based distribution charges only to certain eligible accounts. The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Please see page 7 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Market overview

The lengthy period of historically low short-term interest rates — during which the US Federal Reserve held its federal funds rate at zero — ended in December 2015 with a 0.25 percentage point increase. After a year of steadily improving economic data, the Fed raised rates again in December 2016, little more than a month after Donald Trump’s surprising victory in the US presidential election.

Those two events had a significant effect on US financial markets, including the money market and short-term bond market. The prospect of Trump’s aggressive pro-growth and pro-business policies on tax reform, deregulation, and infrastructure spending, and their potential effects on the financial market, led to a strong rally in US stocks. Equities, investors reasoned, stood to gain broadly from lower corporate taxes and less regulation. In addition, government spending on, or tax credits related to, infrastructure projects could potentially benefit firms in the construction and materials industries.

Accompanying the stock rally was a selloff in bonds, with interest rates pushed even higher by another rate hike in March 2017. Combined, the recent rate increases — generated at two out of the Fed’s last three meetings held during the

Fund’s fiscal year — boosted expectations for further normalization of US short-term interest rates in the near term. This is widely expected to include two more 0.25 percentage point increases by the end of 2017.

The stock rally paused, and the bond selloff and rate increases reversed direction in March 2017, when the Trump administration’s failure to execute on various initiatives, including the effort to repeal and replace the Affordable Care Act (ACA), seemed to cast doubt on other Trump agenda items, including tax reform, deregulation, and infrastructure spending.

Fund performance

For the fiscal year ended March 31, 2017, Delaware Investments Ultrashort Fund Institutional Class shares returned +0.75%. The Fund’s Class A shares returned +0.76% at net asset value and -1.22% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the BofA Merrill Lynch US 6-Month Treasury Bill Index, returned +0.58%. For complete, annualized performance of Delaware Investments Ultrashort Fund, please see the table on page 3.

The Fund outperformed its benchmark as interest rates rose during the fiscal year, particularly after the election of President Trump in November and

1

Portfolio management review

Delaware Investments Ultrashort Fund

the market rally that followed. The Fund’s return improved in absolute and relative terms from November 2016 through the end of the fiscal period.

The Fund is structured into three roughly evenly divided segments: money markets (employed largely for liquidity), investment grade corporate bonds (used for yield), and AAA-rated floating-rate asset-backed securities (ABS) (used in an effort to respond to rate increases). Additionally, with their shorter maturities, the money market securities can help the Fund quickly capture rate increases and can be used to help manage the portfolio’s average duration. We may tweak the Fund’s allocations to these three segments slightly, but generally allocation remains at one-third for each segment. The goal is to maintain a high-quality portfolio.

The Fund maintains an average duration of less than 18 months; at the end of the fiscal year it was neutral at roughly nine months. The benefit of a shorter duration is faster responsiveness in an effort to capture interest rate increases. However, longer durations are generally accompanied by the potential for higher yields. We believe that in this rising rate environment, a neutral duration is prudent. We might extend the duration once the Fed has finished raising interest rates.

Financial sector commercial paper and corporate bonds were the largest contributors to the Fund’s results. The Fund’s AAA-rated ABS segment was also positive because of its floating-rate nature. New issues, in high demand, also performed well for the Fund overall.

Asset allocation and sector selection played a large positive role for the Fund. Within money markets, holding some longer-maturing commercial paper helped, particularly in the bank and finance sector. Asset-backed floating-rate issues contributed 1.26 percentage points to Fund returns, while corporate bonds added

1.32 percentage points and money markets added 0.77 percentage points in absolute terms.

The Fund uses a barbell approach, balancing the responsiveness and high liquidity of money markets with relatively longer-term corporate bonds. That approach served the Fund well during its fiscal year.

The largest factor detracting from the Fund’s performance was the portfolio’s focus on higher-quality but generally lower-yielding securities, which can put the Fund at a relative disadvantage against certain competitors. For instance, the Fund only holds AAA-rated ABS, tier-1 (highest-rated) commercial paper in the money market segment, and investment grade corporate bonds, typically rated higher than BBB. Accordingly, it is more difficult to compete on yield relative to lower-quality portfolios.

The federal funds rate increases have been a long time coming. Recent statements by Fed governors indicate that the market could still be about five years away from seeing normalized rates. The pace of rate increases could depend, in part, on whether Trump’s fiscal policies and tax reforms are implemented (and how quickly and effectively they are executed). If economic growth accelerates further, and inflation picks up, more rate increases could occur sooner.

For now, the Fund remains at a neutral duration. With the expectation that the Fed will likely continue to raise rates slowly and deliberately, we plan to choose what we believe to be the most suitable duration extensions for the Fund as we go forward. For example, as money market instruments mature, we could replace 3-month paper with 6- and 9-month maturities. Although that wouldn’t affect the Fund’s overall duration significantly, it could help position the Fund to pick up some incremental yield. A similar approach could be applied to the corporate sector, allowing the Fund the opportunity to capture some yield as rates rise.

2

| | |

| Performance summary | | |

| Delaware Investments Ultrashort Fund | | March 31, 2017 (Unaudited) |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawarefunds.com/performance. Current performance may be lower or higher than the performance data quoted.

Fund and benchmark performance1,2

| | | | | | | | | | | | | | |

| | | Average annual total returns through March 31, 2017 |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime |

| | | | |

Class A (Est. March 10, 1988)* | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.76% | | | | +0.25% | | | | +0.66% | | | +2.82% |

Including sales charge | | | -1.22% | | | | -0.15% | | | | +0.47% | | | +2.75% |

Class C (Est. Nov. 29, 1995) | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.75% | | | | +0.25% | | | | +0.53% | | | +1.60% |

Including sales charge | | | -0.24% | | | | +0.25% | | | | +0.53% | | | +1.60% |

Class L (Est. June 30, 1978)* | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.75% | | | | +0.24% | | | | +0.71% | | | +4.77% |

Including sales charge | | | +0.75% | | | | +0.24% | | | | +0.71% | | | +4.77% |

Institutional Class (Est. Jan. 5, 2016) | | | | | | | | | | | | | | |

Excluding sales charge | | | +0.75% | | | | n/a | | | | n/a | | | +0.93% |

Including sales charge | | | +0.75% | | | | n/a | | | | n/a | | | +0.93% |

BofA Merrill Lynch US 6-Month Treasury Bill Index | | | +0.58% | | | | +0.30% | | | | +1.05% | | | +3.61%** |

*In conjunction with the conversion, Class A shares became Class L shares and Consultant Class shares became Class A shares.

**The benchmark lifetime return is for Class A share comparison only and is calculated using the last business day in the month of the Fund’s Class A inception date.

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 5. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible accounts.

Class A shares are sold with a maximum front-end sales charge of 2.00%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

3

Performance summary

Delaware Investments Ultrashort Fund

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed. A sales load was not applicable for periods prior to Jan. 5, 2016 for Class A/Class C shares.

The Fund’s distributor, Delaware Distributors, L.P. (Distributor), has also contracted to limit the Fund’s Class A and Class C shares’ 12b-1 fee to 0.00% of the respective share class’ average daily net assets from April 1, 2016 through July 29, 2017.* These waivers and reimbursements may only be terminated by agreement of the Manager or Distributor, as applicable, and the Fund.

Class L shares are only available to Fund shareholders who held Class A shares of the Fund prior to the conversion of the Fund. Class L shares are closed to all additional purchases.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

Interest payments on inflation-indexed debt securities will vary as the principal and/or interest is adjusted for inflation.

4

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.40% of the Fund’s average daily net assets during the period from April 1, 2016 through March 31, 2017.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

| | | | | | | | |

| Fund expense ratios | | Class A | | Class C | | Class L | | Institutional Class |

Total annual operating expenses | | 0.89% | | 1.64% | | 0.64% | | 0.64% |

(without fee waivers) | | | | | | | | |

Net expenses | | 0.40% | | 0.40% | | 0.40% | | 0.40% |

(including fee waivers, if any) | | | | | | | | |

Type of waiver* | | Contractual | | Contractual | | Contractual | | Contractual |

*The aggregate contractual waiver period covering this report is from Jan. 4, 2016, through July 29, 2017.

5

Performance summary

Delaware Investments Ultrashort Fund

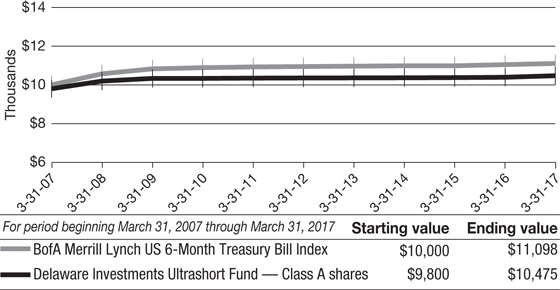

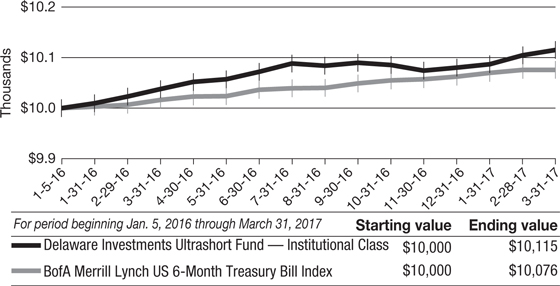

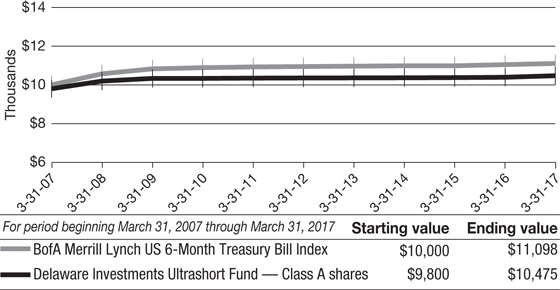

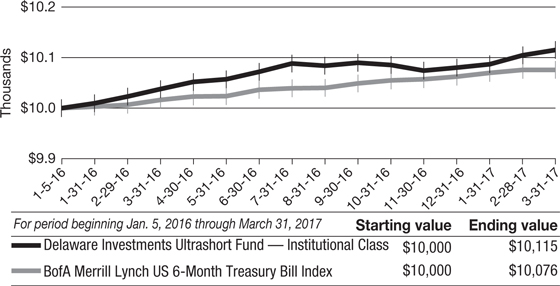

Performance of a $10,000 investment1

Class A shares

Average annual total returns from March 31, 2007 through March 31, 2017

Institutional Class shares

Average annual total returns from Jan. 5, 2016 (inception date) through March 31, 2017

6

1The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on March 31, 2007, and includes the effect of a 2.00% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the BofA Merrill Lynch US 6-Month Treasury Bill Index as of March 31, 2007.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Jan. 5, 2016, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the BofA Merrill Lynch US 6-Month Treasury Bill Index as of Jan. 5, 2016.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 4 through 7.

The BofA Merrill Lynch US 6-Month Treasury Bill Index tracks the performance of US Treasury bills with a maturity of six months. The index comprises a single Treasury issue purchased at the beginning of the month, which is then sold at the end of the month and rolled into a newly selected issue that matures closest to, but not beyond, six months from the transaction date (known as the rebalancing date).

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

| Class A | | DLTAX | | 245910609 | | |

| Class C | | DLTCX | | 245910708 | | |

| Class L | | DLTLX | | 245910807 | | |

Institutional Class | | DULTX | | 245910500 | | |

7

Disclosure of Fund expenses

For the six-month period from October 1, 2016 to March 31, 2017 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from Oct. 1, 2016 to March 31, 2017.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the table reflect fee waivers in effect. The expenses shown in the table assume reinvestment of all dividends and distributions.

8

Delaware Investments Ultrashort Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning Account Value 10/1/16 | | Ending Account Value 3/31/17 | | Annualized Expense Ratio | | Expenses Paid During Period 10/1/16 to 3/31/17* |

Actual Fund return† | | | | | | | | | | | | | | | | | | | | |

Class A | | | | $1,000.00 | | | | | $1,002.30 | | | | | 0.40% | | | | | $2.00 | |

Class C | | | | 1,000.00 | | | | | 1,002.30 | | | | | 0.40% | | | | | 2.00 | |

Class L | | | | 1,000.00 | | | | | 1,002.30 | | | | | 0.40% | | | | | 2.00 | |

Institutional Class | | | | 1,000.00 | | | | | 1,002.30 | | | | | 0.40% | | | | | 2.00 | |

Hypothetical 5% return (5% return before expenses) | | | | | | | | | | | | | | | | | | | | |

Class A | | | | $1,000.00 | | | | | $1,022.94 | | | | | 0.40% | | | | | $2.02 | |

Class C | | | | 1,000.00 | | | | | 1,022.94 | | | | | 0.40% | | | | | 2.02 | |

Class L | | | | 1,000.00 | | | | | 1,022.94 | | | | | 0.40% | | | | | 2.02 | |

Institutional Class | | | | 1,000.00 | | | | | 1,022.94 | | | | | 0.40% | | | | | 2.02 | |

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

| † | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

9

Security type / sector allocation

| | |

| Delaware Investments Ultrashort Fund | | As of March 31, 2017 (Unaudited) |

Sector designations may be different than the sector designations presented in other fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| | | | | |

Security type / sector | | Percentage of net assets |

Certificate of Deposit | | 1.75% |

Commercial Paper | | 29.72% |

Banks | | 12.53% |

Colleges & Universities | | 13.09% |

Diversified Financial Services | | 4.10% |

| |

Corporate Bonds | | 39.10% |

Banks | | 21.17% |

Basic Industry | | 0.71% |

Capital Goods | | 4.39% |

Communications | | 1.73% |

Consumer Cyclical | | 2.93% |

Consumer Non-Cyclical | | 2.32% |

Electric | | 1.47% |

Energy | | 1.48% |

Insurance | | 1.45% |

Natural Gas | | 1.45% |

Non-Agency Asset-Backed Securities | | 28.73% |

Sovereign Bond | | 1.76% |

Total Value of Securities | | 101.06% |

Liabilities Net of Receivables and Other Assets | | (1.06%) |

Total Net Assets | | 100.00% |

10

| | |

| Schedule of investments | | |

| Delaware Investments Ultrashort Fund | | March 31, 2017 |

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Certificate of Deposit – 1.75% | | | | | | | | |

| |

Banco Estado Chile | | | | | | | | |

1.21% 7/28/17 | | | 1,500,000 | | | $ | 1,500,000 | |

| | | | | | | | |

Total Certificate of Deposit (cost $1,500,000) | | | | | | | 1,500,000 | |

| | | | | | | | |

| |

Commercial Paper – 29.72% | | | | | | | | |

| |

Banks – 12.53% | | | | | | | | |

Abbey National Treasury Services 0.81% 4/3/17 ≠ | | | 2,250,000 | | | | 2,249,899 | |

Bank of New York Mellon 0.90% 4/10/17 ≠ | | | 3,000,000 | | | | 2,999,299 | |

BNP Paribas New York Branch 0.80% 4/3/17 ≠ | | | 1,710,000 | | | | 1,709,924 | |

DNB Bank 1.167% 6/19/17 ≠> | | | 1,500,000 | | | | 1,496,617 | |

JPMorgan Securities 1.247% 7/10/17 ● | | | 1,000,000 | | | | 1,000,721 | |

Wells Fargo Bank 1.207% 8/4/17 ≠ | | | 1,250,000 | | | | 1,244,792 | |

| | | | | | | | |

| | | | | | | 10,701,252 | |

| | | | | | | | |

Colleges & Universities – 13.09% | | | | | | | | |

Cornell University | | | | | | | | |

0.718% 4/5/17 ≠ | | | 1,000,000 | | | | 999,960 | |

0.781% 5/3/17 ≠ | | | 750,000 | | | | 749,423 | |

0.902% 5/23/17 ≠ | | | 750,000 | | | | 748,867 | |

1.002% 6/8/17 ≠ | | | 390,000 | | | | 389,208 | |

Dartmouth College 0.851% 5/18/17 ≠ | | | 1,300,000 | | | | 1,298,284 | |

Duke University | | | | | | | | |

0.802% 5/10/17 ≠ | | | 500,000 | | | | 499,516 | |

0.832% 4/12/17 ≠ | | | 753,000 | | | | 752,795 | |

0.902% 6/12/17 ≠ | | | 1,500,000 | | | | 1,497,156 | |

Princeton University | | | | | | | | |

0.82% 5/16/17 ≠ | | | 750,000 | | | | 749,940 | |

0.90% 5/15/17 ≠ | | | 1,000,000 | | | | 1,000,023 | |

University of California 0.751% 4/10/17 ≠ | | | 1,500,000 | | | | 1,499,745 | |

University of Chicago 1.003% 6/20/17 ≠ | | | 1,000,000 | | | | 997,720 | |

| | | | | | | | |

| | | | | | | 11,182,637 | |

| | | | | | | | |

Diversified Financial Services – 4.10% | | | | | | | | |

CPPIB Capital 0.892% 4/20/17 ≠> | | | 3,500,000 | | | | 3,498,380 | |

| | | | | | | | |

| | | | | | | 3,498,380 | |

| | | | | | | | |

Total Commercial Paper (cost $25,381,895) | | | | | | | 25,382,269 | |

| | | | | | | | |

|

| |

Corporate Bonds – 39.10% | | | | | | | | |

Banks – 21.17% | | | | | | | | |

Abbey National Treasury Services 1.573% 10/17/17 • | | | 1,500,000 | | | | 1,500,000 | |

Bank of America 6.10% 6/15/17 | | | 1,500,000 | | | | 1,513,812 | |

Branch Banking & Trust 1.45% 5/10/19 | | | 1,000,000 | | | | 989,860 | |

Citizens Bank 2.25% 3/2/20 | | | 1,000,000 | | | | 999,255 | |

Fifth Third Bank 2.30% 3/15/19 | | | 1,000,000 | | | | 1,006,960 | |

11

Schedule of investments

Delaware Investments Ultrashort Fund

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Corporate Bonds (continued) | | | | | | | | |

| |

Banks (continued) | | | | | | | | |

Goldman Sachs Group 2.30% 12/13/19 | | | 1,250,000 | | | $ | 1,251,417 | |

Huntington National Bank 2.375% 3/10/20 | | | 1,250,000 | | | | 1,255,107 | |

JPMorgan Securities 1.425% 10/19/17 ● | | | 1,500,000 | | | | 1,502,562 | |

Morgan Stanley 6.25% 8/28/17 | | | 1,500,000 | | | | 1,528,891 | |

Toronto-Dominion Bank 1.423% 10/17/17 ● | | | 1,500,000 | | | | 1,500,000 | |

US Bank 2.00% 1/24/20 | | | 1,250,000 | | | | 1,255,009 | |

Wells Fargo Bank | | | | | | | | |

1.652% 9/7/17 ● | | | 500,000 | | | | 501,086 | |

2.15% 12/6/19 | | | 1,250,000 | | | | 1,255,011 | |

5.75% 6/15/17 | | | 2,000,000 | | | | 2,017,532 | |

| | | | | | | | |

| | | | | | | 18,076,502 | |

| | | | | | | | |

Basic Industry – 0.71% | | | | | | | | |

Dow Chemical 8.55% 5/15/19 | | | 535,000 | | | | 606,730 | |

| | | | | | | | |

| | | | | | | 606,730 | |

| | | | | | | | |

Capital Goods – 4.39% | | | | | | | | |

Fortive 144A 1.80% 6/15/19 # | | | 1,250,000 | | | | 1,242,646 | |

Rockwell Collins 1.95% 7/15/19 | | | 1,250,000 | | | | 1,251,503 | |

Siemens Financieringsmat 144A 2.20% 3/16/20 # | | | 1,250,000 | | | | 1,255,884 | |

| | | | | | | | |

| | | | | | | 3,750,033 | |

| | | | | | | | |

Communications – 1.73% | | | | | | | | |

Deutsche Telekom International Finance 144A | | | | | | | | |

1.50% 9/19/19 # | | | 1,500,000 | | | | 1,476,337 | |

| | | | | | | | |

| | | | | | | 1,476,337 | |

| | | | | | | | |

Consumer Cyclical – 2.93% | | | | | | | | |

BMW US Capital 144A 2.15% 4/6/20 # | | | 1,250,000 | | | | 1,250,917 | |

General Motors Financial 2.35% 10/4/19 | | | 1,250,000 | | | | 1,252,213 | |

| | | | | | | | |

| | | | | | | 2,503,130 | |

| | | | | | | | |

Consumer Non-Cyclical – 2.32% | | | | | | | | |

Shire Acquisitions Investments Ireland 1.90% 9/23/19 | | | 2,000,000 | | | | 1,985,238 | |

| | | | | | | | |

| | | | | | | 1,985,238 | |

| | | | | | | | |

Electric – 1.47% | | | | | | | | |

Great Plains Energy 2.50% 3/9/20 | | | 1,250,000 | | | | 1,257,860 | |

| | | | | | | | |

| | | | | | | 1,257,860 | |

| | | | | | | | |

Energy – 1.48% | | | | | | | | |

BP Capital Markets 2.315% 2/13/20 | | | 1,250,000 | | | | 1,260,820 | |

| | | | | | | | |

| | | | | | | 1,260,820 | |

| | | | | | | | |

Insurance – 1.45% | | | | | | | | |

Principal Life Global Funding II 144A 1.50% 4/18/19 # | | | 1,250,000 | | | | 1,239,696 | |

| | | | | | | | |

| | | | | | | 1,239,696 | |

| | | | | | | | |

Natural Gas – 1.45% | | | | | | | | |

Sempra Energy 1.625% 10/7/19 | | | 1,250,000 | | | | 1,238,169 | |

| | | | | | | | |

12

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Corporate Bonds (continued) | | | | | | | | |

| |

Natural Gas (continued) | | | | | | | | |

Sempra Energy 1.625% 10/7/19 | | | 1,250,000 | | | | 1,238,169 | |

| | | | | | | 1,238,169 | |

| | | | | | | | |

Total Corporate Bonds (cost $33,404,119) | | | | 33,394,515 | |

| | | | | | | | |

|

| |

Non-Agency Asset-Backed Securities – 28.73% | | | | | | | | |

| |

American Express Credit Account Master Trust | | | | | | | | |

Series 2012-1 A 1.182% 1/15/20 ● | | | 1,130,000 | | | | 1,130,500 | |

Series 2013-2 A 1.332% 5/17/21 ● | | | 510,000 | | | | 512,216 | |

American Express Credit Account Secured Note Trust | | | | | | | | |

Series 2012-4 A 1.152% 5/15/20 ● | | | 2,000,000 | | | | 2,001,879 | |

Bank of America Credit Card Trust | | | | | | | | |

Series 2014-A2 A 1.182% 9/16/19 ● | | | 730,000 | | | | 730,000 | |

Series 2014-A3 A 1.202% 1/15/20 ● | | | 1,000,000 | | | | 1,000,919 | |

Series 2015-A1 A 1.242% 6/15/20 ● | | | 1,160,000 | | | | 1,162,289 | |

BMW Floorplan Master Owner Trust | | | | | | | | |

Series 2015-1A A 144A 1.412% 7/15/20 #● | | | 1,000,000 | | | | 1,002,129 | |

BMW Vehicle Lease Trust | | | | | | | | |

Series 2016-1 A2B 1.478% 1/22/18 ● | | | 515,784 | | | | 516,251 | |

Chase Issuance Trust | | | | | | | | |

Series 2012-A10 A10 1.172% 12/16/19 �� | | | 1,000,000 | | | | 1,001,439 | |

Series 2013-A7 A 1.342% 9/15/20 ● | | | 1,000,000 | | | | 1,004,130 | |

Series 2015-A6 A6 1.162% 5/15/19 ● | | | 750,000 | | | | 750,156 | |

Series 2016-A1 A 1.322% 5/17/21 ● | | | 2,000,000 | | | | 2,011,032 | |

Series 2017-A2 A 1.291% 3/15/24 ● | | | 1,000,000 | | | | 1,002,422 | |

Citibank Credit Card Issuance Trust | | | | | | | | |

Series 2013-A2 A2 1.264% 5/26/20 ● | | | 1,000,000 | | | | 1,002,000 | |

Discover Card Execution Note Trust | | | | | | | | |

Series 2013-A1 A1 1.212% 8/17/20 ● | | | 1,400,000 | | | | 1,402,451 | |

Series 2015-A1 A1 1.262% 8/17/20 ● | | | 1,860,000 | | | | 1,864,103 | |

Ford Credit Floorplan Master Owner Trust A | | | | | | | | |

Series 2015-2 A2 1.482% 1/15/22 ● | | | 1,000,000 | | | | 1,007,266 | |

Hyundai Auto Lease Securitization Trust | | | | | | | | |

Series 2016-A A2B 144A 1.462% 7/16/18 #● | | | 662,970 | | | | 664,017 | |

Mercedes-Benz Master Owner Trust | | | | | | | | |

Series 2015-AA A 144A 1.232% 4/15/19 #● | | | 2,000,000 | | | | 2,000,162 | |

Nissan Auto Receivables Owner Trust | | | | | | | | |

Series 2016-A A2B 1.262% 2/15/19 ● | | | 597,137 | | | | 597,750 | |

Nissan Master Owner Trust Receivables | | | | | | | | |

Series 2015-A A1 1.312% 1/15/20 ● | | | 1,175,000 | | | | 1,176,858 | |

Toyota Auto Receivables | | | | | | | | |

Series 2016-C A2A 1.00% 1/15/19 | | | 1,000,000 | | | | 998,934 | |

| | | | | | | | |

Total Non-Agency Asset-Backed Securities | | | | | | | | |

(cost $24,481,825) | | | | | | | 24,538,903 | |

| | | | | | | | |

13

Schedule of investments

Delaware Investments Ultrashort Fund

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Sovereign Bond – 1.76%D | | | | | | | | |

| |

Austria – 1.76% | | | | | | | | |

Oesterreichische Kontrollbank 1.214% 8/10/17 ● | | | 1,500,000 | | | $ | 1,500,527 | |

| | | | | | | | |

Total Sovereign Bond (cost $1,500,000) | | | | | | | 1,500,527 | |

| | | | | | | | |

| | | | | | | | |

Total Value of Securities – 101.06% | | | | | | | | |

(cost $86,267,839) | | | | | | $ | 86,316,214 | |

| | | | | | | | |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At March 31, 2017, the aggregate value of Rule 144A securities was $10,131,788, which represents 11.86% of the Fund’s net assets. See Note 8 in “Notes to financial statements.” |

| ≠ | The rate shown is the effective yield at the time of purchase. |

| > | Commercial paper exempt from registration under Section 4(2) and/or Rule 144A of the Securities Act of 1933, as amended, and may be resold in transactions exempt from registration only to dealers in that program or other “accredited investors”. At March 31, 2017, the aggregate value of these securities was $4,994,997, which represented 5.85% of the Fund’s net assets. See Note 8 in “Notes to financial statements.” |

| ° | Principal amount shown is stated in US dollars. |

| D | Securities have been classified by country of origin. |

| ● | Variable rate security. Each rate shown is as of March 31, 2017. Interest rates reset periodically. |

See accompanying notes, which are an integral part of the financial statements.

14

This page intentionally left blank.

| | | | |

| Statement of assets and liabilities | | | |

| Delaware Investments Ultrashort Fund | | | March 31, 2017 | |

| | | | |

Assets: | | | | |

Investments, at value1 | | $ | 86,316,214 | |

Cash | | | 38,960 | |

Receivable for securities sold | | | 1,494,504 | |

Interest receivable | | | 201,806 | |

Receivable from investment manager | | | 17,136 | |

Receivable for fund shares sold | | | 16,639 | |

| | | | |

Total assets | | | 88,085,259 | |

| | | | |

Liabilities: | | | | |

Payable for securities purchased | | | 2,497,100 | |

Payable for fund shares redeemed | | | 82,559 | |

Income distribution payable | | | 20,017 | |

Other accrued expenses | | | 75,831 | |

Dividend disbursing and transfer agent fees and expenses payable to affiliates | | | 1,455 | |

Accounting and administration expenses payable to affiliates | | | 339 | |

Legal fees payable to affiliates | | | 182 | |

Trustees’ fees and expenses payable | | | 229 | |

Reports and statements to shareholders expenses payable to affiliates | | | 112 | |

| | | | |

Total liabilities | | | 2,677,824 | |

| | | | |

Total Net Assets | | $ | 85,407,435 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 85,414,476 | |

Distributions in excess of net investment income | | | (20,017 | ) |

Accumulated net realized loss on investments | | | (35,399 | ) |

Net unrealized appreciation of investments | | | 48,375 | |

| | | | |

Total Net Assets | | $ | 85,407,435 | |

| | | | |

16

| | | | |

Net Asset Value | | | | |

Class A: | | | | |

Net assets | | $ | 9,430,500 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 943,122 | |

Net asset value per share | | $ | 10.00 | |

Sales charge | | | 2.00 | % |

Offering price per share, equal to net asset value per share / (1 – sales charge) | | $ | 10.20 | |

| |

Class C: | | | | |

Net assets | | $ | 7,526,977 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 752,847 | |

Net asset value per share | | $ | 10.00 | |

| |

Class L: | | | | |

Net assets | | $ | 68,118,773 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 6,812,479 | |

Net asset value per share | | $ | 10.00 | |

| |

Institutional Class: | | | | |

Net assets | | $ | 331,185 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 33,120 | |

Net asset value per share | | $ | 10.00 | |

| |

1Investments, at cost | | $ | 86,267,839 | |

See accompanying notes, which are an integral part of the financial statements.

17

| | | | |

| Statement of operations | | | |

| Delaware Investments Ultrashort Fund | | | Year ended March 31, 2017 | |

| | | | |

Investment Income: | | | | |

Interest | | $ | 1,042,100 | |

| | | | |

Expenses: | | | | |

Management fees | | | 276,094 | |

Distribution expenses – Class A | | | 20,408 | |

Distribution expenses – Class C | | | 89,866 | |

Legal fees | | | 137,097 | |

Registration fees | | | 117,415 | |

Dividend disbursing and transfer agent fees and expenses | | | 95,462 | |

Reports and statements to shareholders expenses | | | 44,365 | |

Audit and tax fees | | | 37,138 | |

Accounting and administration expenses | | | 28,934 | |

Dues and services fees | | | 8,432 | |

Custodian fees | | | 7,980 | |

Trustees’ fees and expenses | | | 4,678 | |

Other | | | 8,659 | |

| | | | |

| | | 876,528 | |

Less expenses waived | | | (396,897 | ) |

Less waived distribution expenses – Class A | | | (20,408 | ) |

Less waived distribution expenses – Class C | | | (89,866 | ) |

Less expense paid indirectly | | | (451 | ) |

| | | | |

Total operating expenses | | | 368,906 | |

| | | | |

Net Investment Income | | | 673,194 | |

| | | | |

| |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain on investments | | | 106,163 | |

Net change in unrealized appreciation (depreciation) of investments | | | (120,718 | ) |

| | | | |

Net Realized and Unrealized Loss | | | (14,555 | ) |

| | | | |

| |

Net Increase in Net Assets Resulting from Operations | | $ | 658,639 | |

| | | | |

See accompanying notes, which are an integral part of the financial statements.

18

This page intentionally left blank.

Statements of changes in net assets

Delaware Investments Ultrashort Fund

| | | | | | | | |

| | | Year ended | |

| | | 3/31/17 | | | 3/31/16 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 673,194 | | | $ | 148,994 | |

Net realized gain | | | 106,163 | | | | 45,656 | |

Net change in unrealized appreciation (depreciation) | | | (120,718 | ) | | | 169,093 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 658,639 | | | | 363,743 | |

| | | | | | | | |

| | |

Dividends and Distributions to Shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Class A* | | | (61,714 | ) | | | (7,362 | ) |

Class C | | | (65,331 | ) | | | (11,987 | ) |

Class L* | | | (541,122 | ) | | | (129,757 | ) |

Institutional Class | | | (2,302 | ) | | | (288 | ) |

| | |

Net realized gain: | | | | | | | | |

Class A* | | | (19,826 | ) | | | — | |

Class C | | | (28,823 | ) | | | — | |

Class L* | | | (159,652 | ) | | | — | |

Institutional Class | | | (720 | ) | | | — | |

| | | | | | | | |

| | | (879,490 | ) | | | (149,394 | ) |

| | | | | | | | |

Capital Share Transactions**: | | | | | | | | |

Proceeds from shares sold: | | | | | | | | |

Class A* | | | 15,259,316 | | | | 3,892,557 | |

Class C | | | 6,744,579 | | | | 9,487,356 | |

Class L* | | | 829 | | | | 43,840,979 | |

Institutional Class | | | 137,599 | | | | 396,270 | |

| | |

Net asset value of shares issued upon reinvestment of dividends: | | | | | | | | |

Class A* | | | 78,351 | | | | 6,292 | |

Class C | | | 84,439 | | | | 9,623 | |

Class L* | | | 684,797 | | | | 116,454 | |

Institutional Class | | | 2,393 | | | | 251 | |

| | |

Capital contribution from Advisor***: | | | | | | | | |

Class A* | | | — | | | | 8,961 | |

Class C | | | — | | | | 16,212 | |

Class L* | | | — | | | | 305,752 | |

| | | | | | | | |

| | | 22,992,303 | | | | 58,080,707 | |

| | | | | | | | |

20

| | | | | | | | |

| | | Year ended | |

| | | 3/31/17 | | | | 3/31/16 | |

Capital Share Transactions** (continued): | | | | | | | | |

Cost of shares redeemed: | | | | | | | | |

Class A* | | $ | (12,188,279 | ) | | $ | (2,934,654 | ) |

Class C | | | (9,189,104 | ) | | | (8,070,529 | ) |

Class L* | | | (16,052,118 | ) | | | (136,565,673 | ) |

Institutional Class | | | (110,808 | ) | | | (94,427 | ) |

| | | | | | | | |

| | | (37,540,309 | ) | | | (147,665,283 | ) |

| | | | | | | | |

Decrease in net assets derived from capital share transactions | | | (14,548,006 | ) | | | (89,584,576 | ) |

| | | | | | | | |

Net Decrease in Net Assets | | | (14,768,857 | ) | | | (89,370,227 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 100,176,292 | | | | 189,546,519 | |

| | | | | | | | |

End of year | | $ | 85,407,435 | | | $ | 100,176,292 | |

| | | | | | | | |

| | |

Undistributed (distributions in excess of) net investment income | | $ | (20,017 | ) | | $ | 519 | |

| | | | | | | | |

*In conjunction with the Fund’s conversion from a money market fund to an ultrashort, non-money

market fund, Class A shares became Class L shares and Consultant Class shares became

Class A shares.

**See Note 6 in “Notes to the financial statements.”

***See Note 2 in “Notes to financial statements.”

See accompanying notes, which are an integral part of the financial statements.

21

Financial highlights

Delaware Investments Ultrashort Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income from investment operations: |

|

Net investment income3 |

|

Net realized and unrealized gain |

Capital contribution from Advisor |

Total from investment operations |

|

|

Less dividends and distributions from: |

|

Net investment income |

Net realized gain |

Total dividends and distributions |

|

|

Net asset value, end of period |

|

Total return4 |

|

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income (loss) to average net assets prior to fees waived |

Portfolio turnover |

|

| 1 | The Class A shares financial highlights for the periods prior to Jan. 5, 2016 reflect the performance of the Delaware Cash Reserve® Fund Consultant Class shares. |

| 2 | On Jan. 5, 2015, the Fund declared a 10 for 1 reverse stock split. The net asset values and per share information listed have been revised/adjusted to reflect the reverse stock split. |

| 3 | The average shares outstanding have been applied for per share information for years ended March 31, 2016 and 2017. |

| 4 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Year ended |

| | | 3/31/17 | | | | 3/31/161,2 | | | | 3/31/151,2 | | | | 3/31/141,2 | | | | 3/31/131,2 |

| | | | | | | $ | 10.020 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | 0.073 | | | | | | | 0.009 | | | | | | | 0.003 | | | | | | | 0.003 | | | | | | | 0.010 | |

| | | | | | | | 0.002 | | | | | | | 0.018 | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | | | | | — | | | | | | | 0.002 | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | 0.075 | | | | | | | 0.029 | | | | | | | 0.003 | | | | | | | 0.003 | | | | | | | 0.010 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | (0.073 | ) | | | | | | (0.009 | ) | | | | | | (0.003 | ) | | | | | | (0.003 | ) | | | | | | (0.010 | ) |

| | | | | | | | (0.022 | ) | | | | | | — | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | (0.095 | ) | | | | | | (0.009 | ) | | | | | | (0.003 | ) | | | | | | (0.003 | ) | | | | | | (0.010 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | $ | 10.000 | | | | | | $ | 10.020 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | 0.76% | | | | | | | 0.32% | | | | | | | 0.03% | | | | | | | 0.03% | | | | | | | 0.09% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | $ | 9,430 | | | | | | $ | 6,305 | | | | | | $ | 5,319 | | | | | | $ | 6,675 | | | | | | $ | 7,200 | |

| | | | | | | | 0.40% | | | | | | | 0.19% | | | | | | | 0.13% | | | | | | | 0.15% | | | | | | | 0.15% | |

| | | | | | | | 1.08% | | | | | | | 1.03% | | | | | | | 0.98% | | | | | | | 0.97% | | | | | | | 0.99% | |

| | | | | | | | 0.73% | | | | | | | 0.14% | | | | | | | 0.03% | | | | | | | 0.03% | | | | | | | 0.09% | |

| | | | | | | | 0.05% | | | | | | | (0.70% | ) | | | | | | (0.82% | ) | | | | | | (0.79% | ) | | | | | | (0.75% | ) |

| | | | | | | | 104% | | | | | | | 123% | | | | | | | 0% | | | | | | | 0% | | | | | | | 0% | |

23

Financial highlights

Delaware Investments Ultrashort Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income from investment operations: |

|

Net investment income3 |

|

Net realized and unrealized gain |

Capital contribution from Advisor |

Total from investment operations |

|

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

Total dividends and distributions |

|

Net asset value, end of period |

|

Total return4 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment loss to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The Class C shares financial highlights for the periods prior to Jan. 5, 2016 reflect the performance of the Delaware Cash Reserve® Fund Class C shares. |

| 2 | On Jan. 5, 2015, the Fund declared a 10 for 1 reverse stock split. The net asset values and per share information listed have been revised/adjusted to reflect the reverse stock split. |

| 3 | The average shares outstanding have been applied for per share information for years ended March 31, 2016 and 2017. |

| 4 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during all of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

24

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| |

| | | | | | | | | | | Year ended | | | | | | | | |

| | | 3/31/17 | | | | 3/31/161,2 | | | | 3/31/151,2 | | | | 3/31/141,2 | | | | 3/31/131,2 |

| | | $ | 10.020 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 0.073 | | | | | | | 0.009 | | | | | | | 0.003 | | | | | | | 0.003 | | | | | | | 0.010 | |

| | | | 0.002 | | | | | | | 0.018 | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | — | | | | | | | 0.002 | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 0.075 | | | | | | | 0.029 | | | | | | | 0.003 | | | | | | | 0.003 | | | | | | | 0.010 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | (0.073 | ) | | | | | | (0.009 | ) | | | | | | (0.003 | ) | | | | | | (0.003 | ) | | | | | | (0.010 | ) |

| | | | (0.022 | ) | | | | | | — | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | (0.095 | ) | | | | | | (0.009 | ) | | | | | | (0.003 | ) | | | | | | (0.003 | ) | | | | | | (0.010 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 10.000 | | | | | | $ | 10.020 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | 0.75% | | | | | | | 0.32% | | | | | | | 0.03% | | | | | | | 0.03% | | | | | | | 0.09% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 7,527 | | | | | | $ | 9,927 | | | | | | $ | 8,463 | | | | | | $ | 10,430 | | | | | | $ | 9,544 | |

| | | | 0.40% | | | | | | | 0.19% | | | | | | | 0.13% | | | | | | | 0.15% | | | | | | | 0.15% | |

| | | | 1.83% | | | | | | | 1.78% | | | | | | | 1.73% | | | | | | | 1.69% | | | | | | | 1.69% | |

| | | | 0.73% | | | | | | | 0.14% | | | | | | | 0.03% | | | | | | | 0.03% | | | | | | | 0.09% | |

| | | | (0.70% | ) | | | | | | (1.45% | ) | | | | | | (1.57% | ) | | | | | | (1.51% | ) | | | | | | (1.45% | ) |

| | | | 104% | | | | | | | 123% | | | | | | | 0% | | | | | | | 0% | | | | | | | 0% | |

25

Financial highlights

Delaware Investments Ultrashort Fund Class L

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income from investment operations: |

Net investment income3 |

Net realized and unrealized gain |

Capital contribution from Advisor |

Total from investment operations |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

Total dividends and distributions |

|

Net asset value, end of period |

|

Total return4 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income (loss) to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The Class L shares financial highlights for the periods prior to Jan. 5, 2016 reflect the performance of the Delaware Cash Reserve® Fund Class A shares. |

| 2 | On Jan. 5, 2015, the Fund declared a 10 for 1 reverse stock split. The net asset values and per shares information listed have been revised/adjusted to reflect the reverse stock split. |

| 3 | The average shares outstanding have been applied for per share information for years ended March 31, 2016 and 2017. |

| 4 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

26

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| Year ended |

| | | 3/31/17 | | | | 3/31/161,2 | | | | 3/31/151,2 | | | | 3/31/141,2 | | | | 3/31/131,2 |

| | | | | | | $ | 10.020 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | 0.073 | | | | | | | 0.009 | | | | | | | 0.003 | | | | | | | 0.003 | | | | | | | 0.010 | |

| | | | | | | | 0.002 | | | | | | | 0.018 | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | | | | | — | | | | | | | 0.002 | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | 0.075 | | | | | | | 0.029 | | | | | | | 0.003 | | | | | | | 0.003 | | | | | | | 0.010 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | (0.073 | ) | | | | | | (0.009 | ) | | | | | | (0.003 | ) | | | | | | (0.003 | ) | | | | | | (0.010 | ) |

| | | | | | | | (0.022 | ) | | | | | | — | | | | | | | — | | | | | | | — | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | (0.095 | ) | | | | | | (0.009 | ) | | | | | | (0.003 | ) | | | | | | (0.003 | ) | | | | | | (0.010 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | $ | 10.000 | | | | | | $ | 10.020 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | | | | | | $ | 10.000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | 0.75% | | | | | | | 0.32% | | | | | | | 0.03% | | | | | | | 0.03% | | | | | | | 0.09% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | $ | 68,119 | | | | | | $ | 83,641 | | | | | | $ | 175,765 | | | | | | $ | 224,475 | | | | | | $ | 229,809 | |

| | | | | | | | 0.40% | | | | | | | 0.19% | | | | | | | 0.13% | | | | | | | 0.15% | | | | | | | 0.15% | |

| | | | | | | | 0.83% | | | | | | | 0.78% | | | | | | | 0.73% | | | | | | | 0.69% | | | | | | | 0.69% | |

| | | | | | | | 0.73% | | | | | | | 0.14% | | | | | | | 0.03% | | | | | | | 0.03% | | | | | | | 0.09% | |

| | | | | | | | 0.30% | | | | | | | (0.45% | ) | | | | | | (0.57% | ) | | | | | | (0.51% | ) | | | | | | (0.45% | ) |

| | | | | | | | 104% | | | | | | | 123% | | | | | | | 0% | | | | | | | 0% | | | | | | | 0% | |

27

Financial highlights

Delaware Investments Ultrashort Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income from investment operations: |

Net investment income2 |

Net realized and unrealized gain |

Total from investment operations |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

Total dividends and distributions |

|

Net asset value, end of period |

|

Total return3 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income to average net assets prior to fees waived |

Portfolio turnover |

|

| 1 | Date of commencement of operations; ratios have been annualized and total return has not been annualized. |

| 2 | The average shares outstanding has been applied for per share information. |

| 3 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| 4 | Portfolio turnover is representative of the Fund for the entire year. |

See accompanying notes, which are an integral part of the financial statements.

28

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | 1/5/161 | | | | | | | | | | |

| | | Year ended | | | | to | | | | | | | | | | |

| | | 3/31/17 | | | | 3/31/16 | | | | | | | | | | |

| | | $ | 10.020 | | | | | | $ | 10.000 | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 0.073 | | | | | | | 0.019 | | | | | | | | | | | | | | | | | |

| | | | 0.002 | | | | | | | 0.020 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 0.075 | | | | | | | 0.039 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | (0.073 | ) | | | | | | (0.019 | ) | | | | | | | | | | | | | | | | |

| | | | (0.022 | ) | | | | | | — | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | (0.095 | ) | | | | | | (0.019 | ) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 10.000 | | | | | | $ | 10.020 | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | 0.75% | | | | | | | 0.39% | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 331 | | | | | | $ | 303 | | | | | | | | | | | | | | | | | |

| | | | 0.40% | | | | | | | 0.40% | | | | | | | | | | | | | | | | | |

| | | | 0.83% | | | | | | | 0.74% | | | | | | | | | | | | | | | | | |

| | | | 0.73% | | | | | | | 0.36% | | | | | | | | | | | | | | | | | |

| | | | 0.30% | | | | | | | 0.02% | | | | | | | | | | | | | | | | | |

| | | | 104% | | | | | | | 123% | 4 | | | | | | | | | | | | | | | | |

29

Notes to financial statements

| | |

| Delaware Investments Ultrashort Fund | | March 31, 2017 |

Delaware Group® Cash Reserve (Trust) is organized as a Delaware statutory trust and offers one series, Delaware Investments Ultrashort Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940 (1940 Act), as amended, and offers Class A (formerly Consultant Class), Class C, Class L (formerly Class A), and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of 2.00%. Class L and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00%, if redeemed during the first 12 months.

Following the close of business on Jan. 4, 2016, pursuant to a Plan of Reorganization (Reorganization), the Fund received all of the assets and liabilities of Delaware Cash Reserve® Fund (Portfolio). The shareholders of the Portfolio received Class A shares, Class C shares, and Class L shares of the Fund with an aggregate net asset value equal to the aggregate net asset value of their shares in the Portfolio immediately prior to the Reorganization. The Reorganization was treated as a tax-free reorganization for federal income purposes and, accordingly, the basis of the assets of the Fund reflected the historical basis of the assets of the Portfolio as of the date of the Reorganization. For financial reporting purposes, the Portfolio’s operating history prior to the Reorganization is reflected in the Fund’s financial statements and financial highlights.

The investment objective of the Fund is to seek total return to the extent consistent with a relatively low volatility of principal.

1. Significant Accounting Policies

The following accounting policies are in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and are consistently followed by the Fund.

Security Valuation – Debt securities are valued based upon valuations provided by an independent pricing service or broker and reviewed by management. To the extent current market prices are not available, the pricing service may take into account developments related to the specific security, as well as transactions in comparable securities. Valuations for fixed income securities utilize matrix systems, which reflect such factors as security prices, yields, maturities, and ratings, and are supplemented by dealer and exchange quotations. For asset-backed securities, pricing vendors utilize matrix pricing which considers prepayment speed, attributes of the collateral, yield or price of bonds of comparable quality, coupon, maturity, and type as well as broker/dealer-supplied prices. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Trust’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security.

Federal Income Taxes – No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of

30

being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken for all open federal income tax years (March 31, 2014–March 31, 2017), and has concluded that no provision for federal income tax is required in the Fund’s financial statements.

Class Accounting – Investment income and common expenses are allocated to the various classes of the Fund on the basis of “settled shares” of each class in relation to the net assets of the Fund. Realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Use of Estimates – This Fund is an investment company, whose financial statements are prepared in conformity with U.S. GAAP. Therefore, the Fund follows the accounting and reporting guidelines for investment companies. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other – Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Investments® Family of Funds are generally allocated among such funds on the basis of average net assets. Management fees and certain other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Interest income is recorded on the accrual basis. Discounts and premiums on debt securities are accreted or amortized to interest income, respectively, over the lives of the respective securities using the effective interest method. The Fund declares dividends daily from net investment income and pays the dividends monthly and declares and pays distributions from net realized gain on investments, if any, annually. The Fund may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

The Fund may receive earnings credits from its custodian when positive cash balances are maintained, which may be used to offset custody fees. There were no such earnings credits for the year ended March 31, 2017.

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1.00, the expense paid under this arrangement is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding expense offset shown under “Less expense paid indirectly.” For the year ended March 31, 2017, the Fund earned $451 under this agreement.

31

Notes to financial statements

Delaware Investments Ultrashort Fund

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Delaware Management Business Trust and the investment manager, an annual fee which is calculated daily at the rate of 0.30% on average daily net assets of the Fund.

DMC has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any distribution and service (12b-1) fees, taxes, interest, acquired fund fees and expenses, short sale and dividend interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) in order to prevent total annual fund operating expenses from exceeding 0.40% of the Fund’s average daily net assets from April 1, 2016 through March 31, 2017.* These waivers and reimbursements may only be terminated by agreement of DMC and the Fund.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administration oversight services to the Fund. For these services, DIFSC’s fees are calculated based on the aggregate daily net assets of the Delaware Investments® Family of Funds at the following annual rate: 0.0050% of the first $30 billion; 0.0045% of the next $10 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $50 billion. The fees payable to DIFSC under the service agreement described above are allocated among all funds in the Delaware Investments Family of Funds on a relative net asset value (NAV) basis. For the year ended March 31, 2017, the Fund was charged $4,319 for these services. This amount is included on the “Statement of operations” under “Accounting and administration expenses.”

DIFSC is also the transfer agent and dividend disbursing agent of the Fund. For these services, DIFSC’s fees are calculated based on the aggregate daily net assets of the retail funds within the Delaware Investments Family of Funds at the following annual rate: 0.025% of the first $20 billion; 0.020% of the next $5 billion; 0.015% of the next $5 billion; and 0.013% on average daily net assets in excess of $30 billion. The fees payable to DIFSC under the service agreement described above are allocated among all retail funds in the Delaware Investments Family of Funds on a relative NAV basis. For the year ended March 31, 2017, the Fund was charged $18,627 for these services. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” Pursuant to a sub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certain sub-transfer agency services to the Fund. Sub-transfer agency fees are passed on to and paid by the Fund and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.”

Pursuant to a distribution agreement and distribution plan, the Fund pays Delaware Distributors, L.P. (DDLP), the distributor and an affiliate of DMC, an annual 12b-1 fee of 0.25% of the average daily net assets of the Class A shares, and 1.00% of the average daily net assets of the Class C shares. Class L and Institutional Class shares pay no 12b-1 fees. DDLP has contracted to limit the 12b-1 fees to 0.00% of average daily net assets for Class A and Class C shares from April 1, 2016 through March 31, 2017.*

32

As provided in the investment management agreement, the Fund bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal, tax, and regulatory reporting services to the Fund. For the year ended March 31, 2017, the Fund was charged $2,046 for internal legal, tax, and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”

For the year ended March 31, 2017, DDLP earned $1,086 for commissions on sales of the Fund’s Class A shares. For the year ended March 31, 2017, DDLP received gross CDSC commissions of $12,311 and $3,262 on redemption of the Fund’s Class A and Class C shares, respectively, and these commissions were entirely used to offset upfront commissions previously paid by DDLP to broker/dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DIFSC, and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

On July 9, 2015, DMC made a capital contribution of $305,752, $16,212, and $8,961 to the Fund’s Class A, Class C and Class L, respectively, in order to facilitate the conversion of the Fund from a money market fund to an ultrashort-term bond fund while avoiding any capital gain or loss being recognized by the Fund’s shareholders.

*The aggregate contractual waiver period covering this report is from Jan. 4, 2016 through July 29, 2017.

3. Investments

For the year ended March 31, 2017, the Fund made purchases and sales of investment securities other than short-term investments as follows:

| | | | |

Purchases | | $ | 63,095,732 | |

Sales | | | 76,091,449 | |

At March 31, 2017, the cost and unrealized appreciation (depreciation) of investments for federal income tax purposes for the fund were as follows:

| | | | |

Cost of investments | | $ | 86,267,839 | |

| | | | |

Aggregate unrealized appreciation of investments | | $ | 119,773 | |

Aggregate unrealized depreciation of investments | | | (71,398 | ) |

| | | | |

Net unrealized appreciation of investments | | $ | 48,375 | |

| | | | |

U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three-level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity.

33

Notes to financial statements

Delaware Investments Ultrashort Fund

3. Investments (continued)

Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available under the circumstances. The Fund’s investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-level hierarchy of inputs is summarized below.

| | |

| Level 1 – | | Inputs are quoted prices in active markets for identical investments. (Examples: equity securities, open-end investment companies, futures contracts, exchange-traded options contracts) |

| |