UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | | 811-02806

|

| Exact name of registrant as specified in charter: | | Delaware Group®Cash Reserve

|

| Address of principal executive offices: | | 2005 Market Street |

| | Philadelphia, PA 19103

|

| Name and address of agent for service: | | David F. Connor, Esq. |

| | 2005 Market Street |

| | Philadelphia, PA 19103

|

| Registrant’s telephone number, including area code: | | (800) 523-1918

|

| Date of fiscal year end: | | March 31

|

| Date of reporting period: | | March 31, 2019 |

Item 1. Reports to Stockholders

Fixed income mutual fund

Delaware Investments Ultrashort Fund

March 31, 2019

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Experience Delaware Funds®by Macquarie

Macquarie Investment Management (MIM) is a global asset manager with offices throughout the United States, Europe, Asia, and Australia. We are active managers who prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for our clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 75 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Investments Ultrashort Fund at delawarefunds.com/literature.

Manage your account online

| ● | | Check your account balance and transactions |

| ● | | View statements and tax forms |

| ● | | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, Macquarie Capital Investment Management LLC, and Macquarie Investment Management Europe S.A.

The Fund is distributed byDelaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Fund is governed by US laws and regulations.

Unless otherwise noted, views expressed herein are current as of March 31, 2019, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2019 Macquarie Management Holdings, Inc.

| | |

| Portfolio management review |

| Delaware Investments Ultrashort Fund | | April 9, 2019 |

| | | | | | | | |

Performance preview (for the year ended March 31, 2019) | | | | | | | | |

Delaware Investments Ultrashort Fund (Institutional Class shares) | | | 1-year return | | | | +2.59% | |

Delaware Investments Ultrashort Fund (Class A shares) | | | 1-year return | | | | +2.59% | |

ICE BofAML US6-Month Treasury Bill Index (benchmark) | | | 1-year return | | | | +2.27% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Investments Ultrashort Fund, please see the table on page 3. Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Please see page 7 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

During the Fund’s fiscal year ended March 31, 2019, the economy in the United States continued to expand, with gross domestic product (GDP) growing at an annual rate of about 3.0% for the full12-month period. While that was strong, growth did slow over the course of the fiscal period, starting at 4.2% in the second quarter of 2018 before easing to 3.4% and 2.2% in the third and fourth quarters, respectively.

During the Fund’s fiscal year, the US economy was negatively influenced by the following:US-China trade tensions, slowing global growth, concern about Brexit (due to the fact that the United Kingdom’s parliament has failed multiple times to agree on a formal exit plan), and the waning influence of last year’s federal tax reform.

At the same time, there were signs of continued underlying strength in the economy. The unemployment rate declined from 4.1% at the end of the previous fiscal year to 3.8% in March 2019. Job growth was robust, and consumers saw wage gains for the first time in a decade.

As always, the key economic factor influencing the Fund was the Federal Reserve’s interest rate policy. Throughout 2018, the Fed followed its steady, predictable path of 0.25 percentage-point-rate hikes that had been implemented three times in 2017 and every quarter of 2018. However, when volatility spiked following the Fed’s last hike in the

fourth quarter 2018 – raising concern that economic growth was slowing worldwide – Fed Chairman Jerome Powell made a sharp shift in words and action to a more dovish stance, moving from a forecast of two rate hikes in 2019 to none. In doing so, the Fed joined with its overseas counterparts. Both the Bank of Japan and the European Central Bank adopted dovish positions, stating that they plan to hold rates steady as well.

The Fed’s change in monetary policy sparked a major first-quarter 2019 equity rally as investors seemed to embrace greater risk. For short-term investors, this180-degree turn meant a rapid reassessment of strategies and a move to fixed-rate bonds from floating rate securities, which works well in a rising rate environment by enabling investors to lock in rising rates.

Within the Fund

For the fiscal year ended March 31, 2019, Delaware Investments Ultrashort Fund outperformed its benchmark, the ICE BofAML US6-Month Treasury Bill Index. The Fund’s Institutional Class shares gained 2.59%. The Fund’s Class A shares also gained 2.59% at net asset value and advanced 0.57% at maximum offer price. These figures reflect all distributions reinvested. For the same period, the Fund’s benchmark gained 2.27%. Complete annualized

1

Portfolio management review

Delaware Investments Ultrashort Fund

performance for Delaware Investments Ultrashort Fund is shown in the table on page 3.

For the12-month period, the Fund outperformed its benchmark largely due to contributions from investment grade corporate bonds and floating-rate asset-backed securities (ABS). High-quality investment grade corporate bonds (those rated A or better) provided a higher yield than the index and a stable, predictable source of income. The Fund’s ABS holdings benefited from rising rates as they reset higher with each rate increase based on the1-month London interbank offered rate (LIBOR). AsAAA-rated securities, they experienced less volatility than some other fixed-income asset classes – which was particularly helpful during the turbulent fourth quarter of 2018 – and they provided a steady stream of income throughout the fiscal year.

The Fund is structured into three segments: Money markets (employed largely for liquidity), investment grade corporate bonds (used for higher yield), andAAA-rated floating-rate ABS (used in an effort to respond to rate increases). Additionally, with their shorter maturities, the money market securities can help the Fund quickly capture rate increases and can be used to help manage the portfolio’s average duration. We may tweak the Fund’s allocations to these three segments somewhat as opportunities arise. The goal is to maintain a high-quality portfolio with the potential for competitive returns.

Although the Fund is divided into these three components, our exposure to each does not need to be equal. Given the opportunity to earn higher yield in the investment grade credits, we increased that allocation to 43% of the Fund’s portfolio. Similarly, we increased the Fund’s exposure to ABS to 44% to take advantage of rising yields. Conversely, money market securities as a component was dialed back to 13% of the Fund’s portfolio.

In contrast to the contributions from the other two

major components, the Fund’s money market securities detracted from performance modestly as they earned a slightly lower yield than the benchmark. For instance, commercial paper yielded 2.16% versus the benchmark’s return of 2.27%.

When we assess key risks, our largest concern is the risk of a slowing economy. Historically, recessions or economic slowdowns have been preceded by an inverted yield curve. This is currently in place as yields on shorter securities now exceed those on longer-dated bonds. Based on current economic and market conditions, we think the Fed could extend its pause on interest rate increases for quite some time, holding rates steady as it continues to monitor the delayed effect of recent rate increases. Generally, we believe the US economy is on stable ground — that is, not likely to exceed expectations nor fall below a 2% annual growth rate.

Based on that scenario, we would replace any maturing floating-rate ABS – with the expectation that ABS won’t have an opportunity to reset higher – with a combination of short, fixed-rate government securities and ABS to potentially capture that attractive short-term yield. Likewise, at fiscal year end, we plan to slowly reposition the Fund’s portfolio to be somewhat more conservative after what was a fairly strong recent return. Accordingly, we expect to moderately scale back some more economically sensitive corporate holdings and replace them with short, fixed-rate government securities.

As one would expect in times of stock market stress, the potential safety of ultrashort fixed income products becomes even more attractive, and the benefit of not subjecting investors to redemption fees* and liquidity gates, unlike certain money market funds, is an important additional positive for investors.

*The Fund’s Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months.

2

| | |

| Performance summary | | |

| Delaware Investments Ultrashort Fund | | March 31, 2019 |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800523-1918 or visiting delawarefunds.com/performance.

Fund and benchmark performance1,2

| | | | | | | | | | | | | | | | |

| | | Average annual total returns through March 31, 2019 | |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime | |

| | | | |

Class A (Est. March 10, 1988)* | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +2.59% | | | | +0.94% | | | | +0.50% | | | | +2.75% | |

Including sales charge | | | +0.57% | | | | +0.55% | | | | +0.30% | | | | +2.69% | |

Class C (Est. Nov. 29, 1995) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +2.59% | | | | +0.94% | | | | +0.50% | | | | +1.61% | |

Including sales charge | | | +1.59% | | | | +0.94% | | | | +0.50% | | | | +1.61% | |

Class L (Est. June 30, 1978)* | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +2.59% | | | | +0.94% | | | | +0.50% | | | | +4.62% | |

Including sales charge | | | +2.59% | | | | +0.94% | | | | +0.50% | | | | +4.62% | |

Institutional Class (Est. Jan. 5, 2016) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +2.59% | | | | n/a | | | | n/a | | | | +1.48% | |

Including sales charge | | | +2.59% | | | | n/a | | | | n/a | | | | +1.48% | |

ICE BofAML US6-Month Treasury Bill Index | | | +2.27% | | | | +0.90% | | | | +0.60% | | | | +3.48%** | |

*In conjunction with the conversion, Class A shares became Class L shares and Consultant Class shares became Class A shares.

**The benchmark lifetime return is for Class A share comparison only and is calculated using the last business day in the month of the Fund’s Class A inception date.

1 Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 5. Performance would have been lower had expense limitations not been in effect.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

Class A shares are sold with a maximumfront-end sales charge of 2.00%, and have an annual distribution and service fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that nofront-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average

3

Performance summary

Delaware Investments Ultrashort Fund

daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed. A sales load was not applicable for periods prior to Jan. 5, 2016 for Class A/Class C shares.

The Fund’s distributor, Delaware Distributors, L.P. (Distributor), has also contracted to limit the Fund’s Class A and Class C shares’12b-1 fee to 0.00% of the respective share class’ average daily net assets from April 1, 2018 through March 31, 2019.* These waivers and reimbursements may only be terminated by agreement of the Manager or Distributor, as applicable, and the Fund.

Class L shares are only available to Fund shareholders who held Class A shares of the Fund prior to the conversion of the Fund. Class L shares are closed to all additional purchases.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity, at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

International investments entail risks not ordinarily associated with US investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

Interest payments on inflation-indexed debt securities will vary as the principal and/or interest is adjusted for inflation.

Gross domestic product is a measure of all goods and services produced by a nation in a year.

4

2 The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale and dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations (collectively, nonroutine expenses)) from exceeding 0.40% of the Fund’s average daily net assets during the period from April 1, 2018 to March 31, 2019.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios.

| | | | | | | | | | |

| Fund expense ratios | | Class A | | Class C | | Class L | | Institutional

Class | | |

Total annual operating expenses (without fee waivers) | | 0.92% | | 1.67% | | 0.67% | | 0.67% | | |

Net expenses (including fee waivers, if any) | | 0.40% | | 0.40% | | 0.40% | | 0.40% | | |

Type of waiver | | n/a | | n/a | | n/a | | n/a | | |

*The aggregate contractual waiver period covering this report is from July 29, 2017 through July 29, 2019.

5

Performance summary

Delaware Investments Ultrashort Fund

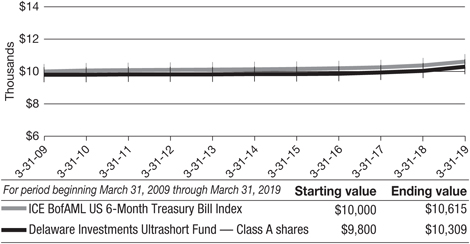

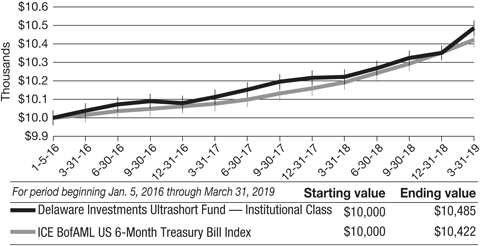

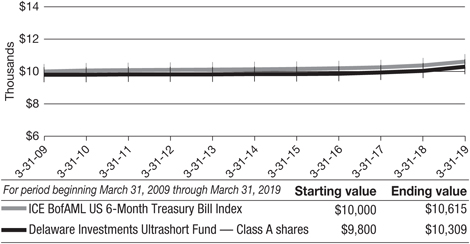

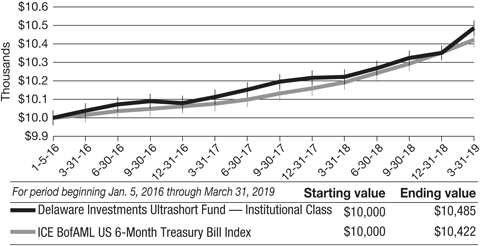

Performance of a $10,000 investment1

Class A shares

Average annual total returns from March 31, 2009 through March 31, 2019

Institutional Class shares

Average annual total returns from Jan. 5, 2016 (inception date) through March 31, 2019

6

1The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on March 31, 2009, and includes the effect of a 2.00%front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the ICE BofAML US6-Month Treasury Bill Index as of March 31, 2009.

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on Jan. 5, 2016, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the ICE BofAML US 6–Month Treasury Bill Index as of Jan. 5, 2016.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 3 through 7.

The ICE BofAML US6-Month Treasury Bill Index tracks the performance of US Treasury bills with a maturity of six months. The index comprises a single Treasury issue purchased at the beginning of the month, which is then sold at the end of the month and rolled into a newly selected issue that matures closest to, but not beyond, six months from the transaction date (known as the rebalancing date).

The London interbank offered rate (LIBOR), mentioned on page 2, is a composite of the rates of interest at which banks borrow from one another in the London market, and it is a widely used benchmark for short-term interest rates.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DLTAX | | 245910609 | | |

Class C | | DLTCX | | 245910708 | | |

Class L | | DLTLX | | 245910807 | | |

Institutional Class | | DULTX | | 245910500 | | |

7

Disclosure of Fund expenses

For thesix-month period from October 1, 2018 to March 31, 2019 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service(12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entiresix-month period from October 1, 2018 to March 31, 2019.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund’s expenses shown in the tables reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

8

Delaware Investments Ultrashort Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

10/1/18 | | | Ending

Account Value

3/31/19 | | | Annualized

Expense Ratio | | | Expenses

Paid During Period

10/1/18 to 3/31/19* | |

| | | | |

Actual Fund return† | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,015.30 | | | | 0.40% | | | | $2.01 | |

Class C | | | 1,000.00 | | | | 1,015.30 | | | | 0.40% | | | | 2.01 | |

Class L | | | 1,000.00 | | | | 1,015.30 | | | | 0.40% | | | | 2.01 | |

Institutional Class | | | 1,000.00 | | | | 1,015.30 | | | | 0.40% | | | | 2.01 | |

| | |

Hypothetical 5% return(5% return before expenses) | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,022.94 | | | | 0.40% | | | | $2.02 | |

Class C | | | 1,000.00 | | | | 1,022.94 | | | | 0.40% | | | | 2.02 | |

Class L | | | 1,000.00 | | | | 1,022.94 | | | | 0.40% | | | | 2.02 | |

Institutional Class | | | 1,000.00 | | | | 1,022.94 | | | | 0.40% | | | | 2.02 | |

*“Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect theone-half year period).

† Because actual returns reflect only the most recentsix-month period, the returns shown may differ significantly from fiscal year returns.

9

| | |

| Security type / sector allocation |

| Delaware Investments Ultrashort Fund | | As of March 31, 2019 (Unaudited) |

Sector designations may be different than the sector designations presented in other fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| | | | | | | | |

| Security type / sector | | Percentage of net assets | |

Agency Collateralized Mortgage Obligations | | | 5.35 | % | | | | |

Agency Commercial Mortgage-Backed Security | | | 0.24 | % | | | | |

Collateralized Debt Obligation | | | 0.05 | % | | | | |

Commercial Paper | | | 5.47 | % | | | | |

Corporate Bonds | | | 45.64 | % | | | | |

Banks | | | 21.34 | % | | | | |

Basic Industry | | | 1.74 | % | | | | |

Capital Goods | | | 1.94 | % | | | | |

Communications | | | 5.54 | % | | | | |

Consumer Cyclical | | | 1.66 | % | | | | |

ConsumerNon-Cyclical | | | 6.16 | % | | | | |

Electric | | | 1.75 | % | | | | |

Insurance | | | 5.51 | % | | | | |

Non-Agency Asset-Backed Securities | | | 43.29 | % | | | | |

Total Value of Securities | | | 100.04 | % | | | | |

Liabilities Net of Receivables and Other Assets | | | (0.04 | %) | | | | |

Total Net Assets | | | 100.00 | % | | | | |

10

| | |

| Schedule of investments |

| Delaware Investments Ultrashort Fund | | March 31, 2019 |

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Agency Collateralized Mortgage Obligations – 5.35% | | | | | | | | |

Fannie Mae Connecticut Avenue Securities | | | | | | | | |

Series2018-C01 1M1 3.086% (LIBOR01M + 0.60%, Floor 0.60%) 7/25/30● | | | 1,363,747 | | | $ | 1,360,632 | |

Series2018-C02 2M1 3.136% (LIBOR01M + 0.65%, Floor 0.65%) 8/25/30● | | | 605,430 | | | | 605,170 | |

Freddie Mac Structured Agency Credit Risk Debt Notes

Series 2015-DNA2 M2 5.086% (LIBOR01M + 2.60%) 12/25/27● | | | 729,174 | | | | 738,268 | |

Silverstone Master Issuer

Series2018-1A 1A 144A 3.166% (LIBOR03M + 0.39%) 1/21/70 #● | | | 1,200,000 | | | | 1,194,774 | |

| | | | | | | | |

Total Agency Collateralized Mortgage Obligations(cost $3,910,829) | | | | | | | 3,898,844 | |

| | | | | | | | |

| | | | | | | | |

Agency Commercial Mortgage-Backed Security – 0.24% | | | | | | | | |

Fannie Mae Multifamily REMIC Trust

Series2015-M12 FA 2.821% (LIBOR01M + 0.34%, Floor 0.34%) 4/25/20● | | | 173,912 | | | | 173,691 | |

| | | | | | | | |

Total Agency Commercial Mortgage-Backed Security(cost $173,858) | | | | | | | 173,691 | |

| | | | | | | | |

| | | | | | | | |

Collateralized Debt Obligation – 0.05% | | | | | | | | |

OZLM Funding

Series2012-1A X 144A 3.661% (LIBOR03M + 0.90%) 7/22/29 #● | | | 37,500 | | | | 37,498 | |

| | | | | | | | |

Total Collateralized Debt Obligation(cost $37,500) | | | | | | | 37,498 | |

| | | | | | | | |

| | | | | | | | |

Commercial Paper – 5.47% | | | | | | | | |

Colleges & Universities – 1.36% | | | | | | | | |

Dartmouth College 2.672% 5/16/19≠ | | | 500,000 | | | | 498,217 | |

Yale University 2.496% 6/17/19≠ | | | 500,000 | | | | 497,235 | |

| | | | | | | | |

| | | | | | | 995,452 | |

| | | | | | | | |

Consumer Cyclical – 3.42% | | | | | | | | |

Toyota Motor Credit 2.773% 4/30/19≠ | | | 2,500,000 | | | | 2,494,627 | |

| | | | | | | | |

| | | | | | | 2,494,627 | |

| | | | | | | | |

Mortgage Bankers & Brokers – 0.69% | | | | | | | | |

Credit Agricole CIB New York 2.441% 4/1/19≠ | | | 500,000 | | | | 500,000 | |

| | | | | | | 500,000 | |

| | | | | | | | |

Total Commercial Paper(cost $3,990,174) | | | | | | | 3,990,079 | |

| | | | | | | | |

| | | | | | | |

Corporate Bonds – 45.64% | | | | | | | | |

Banks – 21.34% | | | | | | | | |

Bank of America 3.779% (LIBOR03M + 1.00%) 4/24/23● | | | 1,250,000 | | | | 1,260,367 | |

Citigroup 3.783% (LIBOR03M + 1.10%) 5/17/24● | | | 1,500,000 | | | | 1,507,163 | |

Citizens Bank 2.20% 5/26/20 | | | 1,250,000 | | | | 1,241,071 | |

11

Schedule of investments

Delaware Investments Ultrashort Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Corporate Bonds(continued) | | | | | | | | |

Banks (continued) | | | | | | | | |

Fifth Third Bank 2.20% 10/30/20 | | | 1,500,000 | | | $ | 1,488,537 | |

Goldman Sachs Group 4.229% (LIBOR03M + 1.60%) 11/29/23● | | | 1,250,000 | | | | 1,278,915 | |

JPMorgan Chase & Co. 3.671% (LIBOR03M + 0.90%) 4/25/23● | | | 1,250,000 | | | | 1,256,593 | |

KeyBank 3.396% (LIBOR03M + 0.66%) 2/1/22● | | | 1,250,000 | | | | 1,255,209 | |

Morgan Stanley 3.958% (LIBOR03M + 1.22%) 5/8/24● | | | 1,250,000 | | | | 1,259,873 | |

Santander UK 2.125% 11/3/20 | | | 1,000,000 | | | | 989,193 | |

UBS 144A 2.45% 12/1/20 # | | | 1,500,000 | | | | 1,492,033 | |

US Bank 3.45% 11/16/21 | | | 1,250,000 | | | | 1,275,337 | |

Zions Bancorporation 3.35% 3/4/22 | | | 1,250,000 | | | | 1,261,681 | |

| | | | | | | | |

| | | | | | | 15,565,972 | |

| | | | | | | | |

Basic Industry – 1.74% | | | | | | | | |

DowDuPont 3.766% 11/15/20 | | | 1,250,000 | | | | 1,272,202 | |

| | | | | | | | |

| | | | | | | 1,272,202 | |

| | | | | | | | |

Capital Goods – 1.94% | | | | | | | | |

Fortive 1.80% 6/15/19 | | | 145,000 | | | | 144,402 | |

United Technologies 3.35% 8/16/21 | | | 1,250,000 | | | | 1,267,523 | |

| | | | | | | | |

| | | | | | | 1,411,925 | |

| | | | | | | | |

Communications – 5.54% | | | | | | | | |

Comcast 3.45% 10/1/21 | | | 1,250,000 | | | | 1,275,468 | |

Deutsche Telekom International Finance 144A 1.50% 9/19/19 # | | | 1,500,000 | | | | 1,490,535 | |

Fox 144A 3.666% 1/25/22 # | | | 1,250,000 | | | | 1,275,554 | |

| | | | | | | | |

| | | | | | | 4,041,557 | |

| | | | | | | | |

Consumer Cyclical – 1.66% | | | | | | | | |

General Motors Financial 3.785% (LIBOR03M + 0.99%) 1/5/23● | | | 1,250,000 | | | | 1,213,660 | |

| | | | | | | | |

| | | | | | | 1,213,660 | |

| | | | | | | | |

ConsumerNon-Cyclical – 6.16% | | | | | | | | |

BAT Capital 2.297% 8/14/20 | | | 1,250,000 | | | | 1,237,996 | |

CVS Health 3.35% 3/9/21 | | | 1,250,000 | | | | 1,260,654 | |

Shire Acquisitions Investments Ireland 1.90% 9/23/19 | | | 2,000,000 | | | | 1,991,585 | |

| | | | | | | | |

| | | | | | | 4,490,235 | |

| | | | | | | | |

Electric – 1.75% | | | | | | | | |

American Electric Power 3.65% 12/1/21 | | | 1,250,000 | | | | 1,275,976 | |

| | | | | | | | |

| | | | | | | 1,275,976 | |

| | | | | | | | |

12

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Corporate Bonds(continued) | | | | | | | | |

Insurance – 5.51% | | | | | | | | |

Aviation Capital Group 144A 3.576% (LIBOR03M + 0.95%) 6/1/21 #● | | | 1,250,000 | | | $ | 1,250,588 | |

Cigna 144A 3.40% 9/17/21 # | | | 1,500,000 | | | | 1,516,678 | |

Principal Life Global Funding II 144A 1.50% 4/18/19 # | | | 1,250,000 | | | | 1,249,363 | |

| | | | | | | | |

| | | | | | | 4,016,629 | |

| | | | | | | | |

Total Corporate Bonds(cost $33,145,405) | | | | | | | 33,288,156 | |

| | | | | | | | |

| | | | | | | | |

Non-Agency Asset-Backed Securities – 43.29% | | | | | | | | |

American Express Credit Account Master Trust | | | | | | | | |

Series2017-2 A 2.934% (LIBOR01M + 0.45%) 9/16/24● | | | 675,000 | | | | 677,943 | |

Series2018-7 A 2.844% (LIBOR01M + 0.36%) 2/17/26● | | | 2,000,000 | | | | 1,990,211 | |

Series2018-9 A 2.864% (LIBOR01M + 0.38%) 4/15/26● | | | 2,150,000 | | | | 2,143,593 | |

Series2019-1 A 2.87% 10/15/24 | | | 1,000,000 | | | | 1,009,385 | |

BMW Floorplan Master Owner Trust

Series2018-1 A2 144A 2.804% (LIBOR01M + 0.32%) 5/15/23 #● | | | 1,000,000 | | | | 999,768 | |

Chase Issuance Trust

Series2017-A1 A 2.784% (LIBOR01M + 0.30%) 1/15/22● | | | 250,000 | | | | 250,340 | |

Chesapeake Funding II | | | | | | | | |

Series2017-2A A2 144A 2.934% (LIBOR01M + 0.45%, Floor 0.45%) 5/15/29 #● | | | 880,409 | | | | 880,084 | |

Series2017-4A A2 144A 2.824% (LIBOR01M + 0.34%) 11/15/29 #● | | | 1,454,677 | | | | 1,452,940 | |

Citibank Credit Card Issuance Trust

Series2017-A5 A5 3.111% (LIBOR01M + 0.62%, Floor 0.62%) 4/22/26● | | | 3,000,000 | | | | 3,014,083 | |

Series2018-A2 A2 2.818% (LIBOR01M + 0.33%) 1/20/25● | | | 1,000,000 | | | | 998,601 | |

Discover Card Execution Note Trust

Series2017-A5 A5 3.084% (LIBOR01M + 0.60%) 12/15/26● | | | 500,000 | | | | 500,700 | |

Evergreen Credit Card Trust

Series2017-1 A 144A 2.744% (LIBOR01M + 0.26%) 10/15/21 #● | | | 800,000 | | | | 800,204 | |

Ford Credit Floorplan Master Owner Trust A

Series2015-2 A2 3.054% (LIBOR01M + 0.57%, Floor 0.57%) 1/15/22● | | | 1,000,000 | | | | 1,002,664 | |

Series2018-3 A1 3.52% 10/15/23 | | | 700,000 | | | | 713,202 | |

13

Schedule of investments

Delaware Investments Ultrashort Fund

| | | | | | | | |

| | | Principal amount° | | | Value (US $) | |

Non-Agency Asset-Backed Securities(continued) | | | | | | | | |

GMF Floorplan Owner Revolving Trust

Series2016-1 A2 144A 3.334% (LIBOR01M + 0.85%) 5/17/21 #● | | | 1,755,000 | | | $ | 1,756,329 | |

Great American Auto Leasing

Series2019-1 A2 144A 2.97% 6/15/21 # | | | 1,000,000 | | | | 1,002,035 | |

Hyundai Auto Lease Securitization Trust

Series2017-B A2B 144A 2.764% (LIBOR01M + 0.28%, Floor 0.28%) 12/16/19 #● | | | 9,765 | | | | 9,765 | |

Invitation Homes Trust

Series 2018-SFR1 A 144A 3.182% (LIBOR01M + 0.70%) 3/17/37 #● | | | 1,962,632 | | | | 1,936,080 | |

Master Credit Card Trust II

Series2018-3A A 144A 2.827% (LIBOR01M + 0.34%) 1/21/22 #● | | | 875,000 | | | | 875,464 | |

Mercedes-Benz Master Owner Trust

Series2016-BA A 144A 3.184% (LIBOR01M + 0.70%, Floor 0.75%) 5/17/21 #● | | | 1,000,000 | | | | 1,000,580 | |

Navistar Financial Dealer Note Master Owner Trust II

Series2017-1 A 144A 3.266% (LIBOR01M + 0.78%) 6/27/22 #● | | | 1,000,000 | | | | 1,001,271 | |

Nissan Master Owner Trust Receivables

Series2017-C A 2.804% (LIBOR01M + 0.32%) 10/17/22● | | | 1,500,000 | | | | 1,500,749 | |

PFS Financing

Series2018-A A 144A 2.884% (LIBOR01M + 0.40%) 2/15/22 #● | | | 2,000,000 | | | | 1,999,625 | |

Trafigura Securitisation Finance

Series2017-1A A1 144A 3.334% (LIBOR01M + 0.85%) 12/15/20 #● | | | 1,000,000 | | | | 1,003,833 | |

Verizon Owner Trust

Series2019-A A1A 2.93% 9/20/23 | | | 1,000,000 | | | | 1,007,569 | |

Volvo Financial Equipment Master Owner Trust

Series2017-A A 144A 2.984% (LIBOR01M + 0.50%) 11/15/22 #● | | | 1,000,000 | | | | 1,002,390 | |

Wheels SPV 2

Series2017-1A A2 144A 1.88% 4/20/26 # | | | 1,054,519 | | | | 1,048,502 | |

| | | | | | | | |

TotalNon-Agency Asset-Backed Securities

(cost $31,581,840) | | | | | | | 31,577,910 | |

| | | | | | | | |

Total Value of Securities – 100.04%

(cost $72,839,606) | | | | | | $ | 72,966,178 | |

| | | | | | | | |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At March 31, 2019, the aggregate value of Rule 144A securities was $26,275,893, which represents 36.03% of the Fund’s net assets. See Note 8 in “Notes to financial statements.” |

| ≠ | The rate shown is the effective yield at the time of purchase. |

14

| ° | Principal amount shown is stated in USD. |

| ● | Variable rate investment. Rates reset periodically. Rate shown reflects the rate in effect at March 31, 2019. For securities based on a published reference rate and spread, the reference rate and spread are indicated in their description above. The reference rate descriptions (i.e. LIBOR03M, LIBOR06M, etc.) used in this report are identical for different securities, but the underlying reference rates may differ due to the timing of the reset period. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their description above. |

Summary of abbreviations:

ICE – Intercontinental Exchange

LIBOR – London Interbank Offered Rate

LIBOR01M – ICE LIBOR USD 1 Month

LIBOR03M – ICE LIBOR USD 3 Month

LIBOR06M – ICE LIBOR USD 6 Month

REMIC – Real Estate Mortgage Investment Conduit

USD – US Dollar

See accompanying notes, which are an integral part of the financial statements.

15

| | |

| Statement of assets and liabilities |

| Delaware Investments Ultrashort Fund | | March 31, 2019 |

| | | | |

Assets: | | | | |

Investments, at value1 | | $ | 72,966,178 | |

Cash | | | 7,404 | |

Interest receivable | | | 256,502 | |

Receivable from investment manager | | | 9,903 | |

Receivable for fund shares sold | | | 846 | |

| | | | |

Total assets | | | 73,240,833 | |

| | | | |

Liabilities: | | | | |

Payable for fund shares redeemed | | | 213,715 | |

Distribution payable | | | 37,021 | |

Reports and statements to shareholders payable | | | 18,842 | |

Other accrued expenses | | | 15,571 | |

Dividend disbursing and transfer agent fees and expenses payable | | | 11,806 | |

Audit and tax fees payable | | | 5,733 | |

Dividend disbursing and transfer agent fees and expenses payable to affiliates | | | 627 | |

Trustees’ fees and expenses payable to affiliates | | | 604 | |

Accounting and administration expenses payable to affiliates | | | 580 | |

Legal fees payable to affiliates | | | 139 | |

Reports and statements to shareholders expenses payable to affiliates | | | 57 | |

| | | | |

Total liabilities | | | 304,695 | |

| | | | |

Total Net Assets | | $ | 72,936,138 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 73,022,200 | |

Total distributable earnings (loss) | | | (86,062 | ) |

| | | | |

Total Net Assets | | $ | 72,936,138 | |

| | | | |

16

| | | | |

Net Asset Value | | | | |

Class A: | | | | |

Net assets | | $ | 12,168,958 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 1,218,235 | |

Net asset value per share | | $ | 9.99 | |

Sales charge | | | 2.00 | % |

Offering price per share, equal to net asset value per share / (1 – sales charge) | | $ | 10.19 | |

| |

Class C: | | | | |

Net assets | | $ | 7,385,543 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 739,412 | |

Net asset value per share | | $ | 9.99 | |

| |

Class L: | | | | |

Net assets | | $ | 51,512,260 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 5,156,274 | |

Net asset value per share | | $ | 9.99 | |

| |

Institutional Class: | | | | |

Net assets | | $ | 1,869,377 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 187,074 | |

Net asset value per share | | $ | 9.99 | |

| |

1Investments, at cost | | $ | 72,839,606 | |

See accompanying notes, which are an integral part of the financial statements.

17

Statement of operations

| | |

| Delaware Investments Ultrashort Fund | | Year ended March 31, 2019 |

| | | | |

Investment Income: | | | | |

Interest | | $ | 1,964,864 | |

| | | | |

Expenses: | | | | |

Management fees | | | 223,614 | |

Distribution expenses – Class A | | | 26,015 | |

Distribution expenses – Class C | | | 56,518 | |

Dividend disbursing and transfer agent fees and expenses | | | 77,933 | |

Registration fees | | | 67,417 | |

Accounting and administration expenses | | | 50,660 | |

Audit and tax fees | | | 38,223 | |

Reports and statements to shareholders expenses | | | 32,370 | |

Legal fees | | | 23,302 | |

Dues and services fees | | | 8,749 | |

Trustees’ fees and expenses | | | 3,904 | |

Custodian fees | | | 2,783 | |

Other | | | 12,268 | |

| | | | |

| | | 623,756 | |

Less expenses waived | | | (240,390 | ) |

Less waived distribution expenses – Class A | | | (26,015 | ) |

Less waived distribution expenses – Class C | | | (56,518 | ) |

Less expenses paid indirectly | | | (2,543 | ) |

| | | | |

Total operating expenses | | | 298,290 | |

| | | | |

Net Investment Income | | | 1,666,574 | |

| | | | |

| |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized loss on investments | | | (58,579 | ) |

Net change in unrealized appreciation (depreciation) of investments | | | 308,555 | |

| | | | |

Net Realized and Unrealized Gain | | | 249,976 | |

| | | | |

| |

Net Increase in Net Assets Resulting from Operations | | $ | 1,916,550 | |

| | | | |

See accompanying notes, which are an integral part of the financial statements.

18

Statements of changes in net assets

Delaware Investments Ultrashort Fund

| | | | | | | | |

| | | Year ended | |

| | | 3/31/19 | | | 3/31/18 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 1,666,574 | | | $ | 1,103,261 | |

Net realized loss | | | (58,579 | ) | | | (33,333 | ) |

Net change in unrealized appreciation (depreciation) | | | 308,555 | | | | (230,358 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,916,550 | | | | 839,570 | |

| | | | | | | | |

| | |

Dividends and Distributions to Shareholders from: | | | | | | | | |

Distributable earnings*: | | | | | | | | |

Class A | | | (237,050 | ) | | | (135,440 | ) |

Class C | | | (128,966 | ) | | | (94,004 | ) |

Class L | | | (1,226,829 | ) | | | (911,841 | ) |

Institutional Class | | | (91,971 | ) | | | (9,040 | ) |

| | | | | | | | |

| | | (1,684,816 | ) | | | (1,150,325 | ) |

| | | | | | | | |

| | |

Capital Share Transactions: | | | | | | | | |

Proceeds from shares sold: | | | | | | | | |

Class A | | | 6,936,250 | | | | 4,946,632 | |

Class C | | | 5,240,123 | | | | 1,016,739 | |

Class L | | | 446 | | | | 5,113 | |

Institutional Class | | | 18,217,457 | | | | 727,933 | |

| | |

Net asset value of shares issued upon reinvestment of dividends: | | | | | | | | |

Class A | | | 231,419 | | | | 131,142 | |

Class C | | | 116,707 | | | | 83,468 | |

Class L | | | 1,209,158 | | | | 883,579 | |

Institutional Class | | | 86,130 | | | | 2,878 | |

| | | | | | | | |

| | | 32,037,690 | | | | 7,797,484 | |

| | | | | | | | |

19

Statements of changes in net assets

Delaware Investments Ultrashort Fund

| | | | | | | | |

| | | Year ended | |

| | | 3/31/19 | | | 3/31/18 | |

Capital Share Transactions (continued): | | | | | | | | |

Cost of shares redeemed: | | | | | | | | |

Class A | | $ | (3,763,409 | ) | | $ | (5,747,844 | ) |

Class C | | | (3,749,806 | ) | | | (2,851,119 | ) |

Class L | | | (8,946,596 | ) | | | (9,680,365 | ) |

Institutional Class | | | (16,849,044 | ) | | | (639,267 | ) |

| | | | | | | | |

| | | (33,308,855 | ) | | | (18,918,595 | ) |

| | | | | | | | |

Decrease in net assets derived from capital share transactions | | | (1,271,165 | ) | | | (11,121,111 | ) |

| | | | | | | | |

Net Decrease in Net Assets | | | (1,039,431 | ) | | | (11,431,866 | ) |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 73,975,569 | | | | 85,407,435 | |

| | | | | | | | |

End of year1 | | $ | 72,936,138 | | | $ | 73,975,569 | |

| | | | | | | | |

| 1 | Net Assets – End of year includes distributions in excess of net investment income of $12,734 in 2018. The Securities and Exchange Commission eliminated the requirement to disclose undistributed (distributions in excess of) net investment income in 2018. |

| * | For the year ended March 31, 2019, the Fund has adopted amendments to RegulationS-X (see Note 10 in “Notes to financial statements”). For the year ended March 31, 2018, the dividends and distributions to shareholders were as follows: |

| | | | | | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class L | | | Institutional

Class | |

Dividends from net investment income | | | $(129,652) | | | | $(90,207) | | | | $(874,578) | | | | $(8,538) | |

Distributions from net realized gain | | | (5,788) | | | | (3,797) | | | | (37,263) | | | | (502) | |

See accompanying notes, which are an integral part of the financial statements.

20

This page intentionally left blank.

Financial highlights

Delaware Investments Ultrashort Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

| Net investment income3 |

| Net realized and unrealized gain (loss) |

| Capital contribution from Advisor |

| Total from investment operations |

|

Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

|

Net asset value, end of period |

|

Total return7 |

|

Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets prior to fees waived |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The Class A shares financial highlights for the periods prior to Jan. 5, 2016 reflect the performance of Delaware Cash Reserve® Fund Consultant Class shares. |

| 2 | On Jan. 5, 2015, the Fund declared a 10 for 1 reverse stock split. The net asset values and per share information listed have been revised/adjusted to reflect the reverse stock split. |

| 3 | The average shares outstanding have been applied for per share information for the years ended March 31, 2019, 2018, 2017 and 2016. |

| 4 | Amount is less than $0.005 per share. |

| 5 | For the year ended March 31, 2016, capital contribution from Advisor of $8,961 was made to the Fund’s Class A shares, which calculated to a de minimis amount of $0.00 per share. |

| 6 | For the year ended March 31, 2015 net investment income distributions of $(1,588) was made by the Fund’s Class A shares, which calculated to a de minimis amount of $0.00 per share. |

| 7 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total return during all of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended | |

| | | | 3/31/19 | | | | | | | | 3/31/18 | | | | | | | | 3/31/17 | | | | | | | | 3/31/161,2 | | | | | | | | 3/31/151,2 | |

| | $ | 9.96 | | | | | | | $ | 10.00 | | | | | | | $ | 10.02 | | | | | | | $ | 10.00 | | | | | | | $ | 10.00 | |

| | | | | | | | | |

| | | 0.22 | | | | | | | | 0.14 | | | | | | | | 0.07 | | | | | | | | 0.01 | | | | | | | | — | 4 |

| | | 0.03 | | | | | | | | (0.03 | ) | | | | | | | — | | | | | | | | 0.02 | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | 5 | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.25 | | | | | | | | 0.11 | | | | | | | | 0.07 | | | | | | | | 0.03 | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.22 | ) | | | | | | | (0.14 | ) | | | | | | | (0.07 | ) | | | | | | | (0.01 | ) | | | | | | | — | 6 |

| | | — | | | | | | | | (0.01 | ) | | | | | | | (0.02 | ) | | | | | | | — | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.22 | ) | | | | | | | (0.15 | ) | | | | | | | (0.09 | ) | | | | | | | (0.01 | ) | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 9.99 | | | | | | | $ | 9.96 | | | | | | | $ | 10.00 | | | | | | | $ | 10.02 | | | | | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 2.59% | | | | | | | | 1.05% | | | | | | | | 0.76% | | | | | | | | 0.32% | | | | | | | | 0.03% | |

| | | | | | | | | |

| | $ | 12,169 | | | | | | | $ | 8,722 | | | | | | | $ | 9,430 | | | | | | | $ | 6,305 | | | | | | | $ | 5,319 | |

| | | 0.40% | | | | | | | | 0.40% | | | | | | | | 0.40% | | | | | | | | 0.19% | | | | | | | | 0.13% | |

| | | 0.97% | | | | | | | | 0.92% | | | | | | | | 1.08% | | | | | | | | 1.03% | | | | | | | | 0.98% | |

| | | 2.24% | | | | | | | | 1.38% | | | | | | | | 0.73% | | | | | | | | 0.14% | | | | | | | | 0.03% | |

| | | 1.67% | | | | | | | | 0.86% | | | | | | | | 0.05% | | | | | | | | (0.70% | ) | | | | | | | (0.82% | ) |

| | | | 53% | | | | | | | | 134% | | | | | | | | 104% | | | | | | | | 123% | | | | | | | | 0% | |

23

Financial highlights

Delaware Investments Ultrashort Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income3 |

Net realized and unrealized gain (loss) |

Capital contribution from Advisor |

Total from investment operations |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

Total dividends and distributions |

|

Net asset value, end of period |

|

Total return7 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income (loss) to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The Class C shares financial highlights for the periods prior to Jan. 5, 2016 reflect the performance of Delaware Cash Reserve® Fund Class C shares. |

| 2 | On Jan. 5, 2015, the Fund declared a 10 for 1 reverse stock split. The net asset values and per share information listed have been revised/adjusted to reflect the reverse stock split. |

| 3 | The average shares outstanding have been applied for per share information for the years ended March 31, 2019, 2018, 2017 and 2016. |

| 4 | Amount is less than $0.005 per share. |

| 5 | For the year ended March 31, 2016, capital contribution from Advisor of $16,212 was made to the Fund’s Class C shares, which calculated to a de minimis amount of $0.00 per share. |

| 6 | For the year ended March 31, 2015, net investment income distributions of $(2,477) was made by the Fund’s Class C shares, which calculated to a de minimis amount of $0.00 per share. |

| 7 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total return during all of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

24

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended | |

| | | | 3/31/19 | | | | | | | | 3/31/18 | | | | | | | | 3/31/17 | | | | | | | | 3/31/161,2 | | | | | | | | 3/31/151,2 | |

| | $ | 9.96 | | | | | | | $ | 10.00 | | | | | | | $ | 10.02 | | | | | | | $ | 10.00 | | | | | | | $ | 10.00 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.22 | | | | | | | | 0.14 | | | | | | | | 0.07 | | | | | | | | 0.01 | | | | | | | | — | 4 |

| | | 0.03 | | | | | | | | (0.03 | ) | | | | | | | — | | | | | | | | 0.02 | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | 5 | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.25 | | | | | | | | 0.11 | | | | | | | | 0.07 | | | | | | | | 0.03 | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.22 | ) | | | | | | | (0.14 | ) | | | | | | | (0.07 | ) | | | | | | | (0.01 | ) | | | | | | | — | 6 |

| | | — | | | | | | | | (0.01 | ) | | | | | | | (0.02 | ) | | | | | | | — | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.22 | ) | | | | | | | (0.15 | ) | | | | | | | (0.09 | ) | | | | | | | (0.01 | ) | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 9.99 | | | | | | | $ | 9.96 | | | | | | | $ | 10.00 | | | | | | | $ | 10.02 | | | | | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 2.59% | | | | | | | | 1.05% | | | | | | | | 0.75% | | | | | | | | 0.32% | | | | | | | | 0.03% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 7,386 | | | | | | | $ | 5,752 | | | | | | | $ | 7,527 | | | | | | | $ | 9,927 | | | | | | | $ | 8,463 | |

| | | 0.40% | | | | | | | | 0.40% | | | | | | | | 0.40% | | | | | | | | 0.19% | | | | | | | | 0.13% | |

| | | 1.72% | | | | | | | | 1.67% | | | | | | | | 1.83% | | | | | | | | 1.78% | | | | | | | | 1.73% | |

| | | 2.24% | | | | | | | | 1.38% | | | | | | | | 0.73% | | | | | | | | 0.14% | | | | | | | | 0.03% | |

| | | 0.92% | | | | | | | | 0.11% | | | | | | | | (0.70% | ) | | | | | | | (1.45% | ) | | | | | | | (1.57% | ) |

| | | | 53% | | | | | | | | 134% | | | | | | | | 104% | | | | | | | | 123% | | | | | | | | 0% | |

25

Financial highlights

Delaware Investments Ultrashort Fund Class L

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income3 |

Net realized and unrealized gain (loss) |

Capital contribution from Advisor |

Total from investment operations |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

Total dividends and distributions |

|

Net asset value, end of period |

|

Total return7 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income (loss) to average net assets prior to fees waived |

Portfolio turnover |

| 1 | The Class L shares financial highlights for the periods prior to Jan. 5, 2016 reflect the performance of Delaware Cash Reserve® Fund Class A shares. |

| 2 | On Jan. 5, 2015, the Fund declared a 10 for 1 reverse stock split. The net asset values and per share information listed have been revised/adjusted to reflect the reverse stock split. |

| 3 | The average shares outstanding have been applied for per share information for the years ended March 31, 2019, 2018, 2017 and 2016. |

| 4 | Amount is less than $0.005 per share. |

| 5 | For the year ended March 31, 2016, capital contribution from Advisor of $305,752 was made to the Fund’s Class L shares, which calculated to a de minimis amount of $0.00 per share. |

| 6 | For the year ended March 31, 2015, net investment income distributions of $(51,769) was made by the Fund’s Class L shares, which calculated to a de minimis amount of $0.00 per share. |

| 7 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

26

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended | |

| | | | 3/31/19 | | | | | | | | 3/31/18 | | | | | | | | 3/31/17 | | | | | | | | 3/31/161,2 | | | | | | | | 3/31/151,2 | |

| | $ | 9.96 | | | | | | | $ | 10.00 | | | | | | | $ | 10.02 | | | | | | | $ | 10.00 | | | | | | | $ | 10.00 | |

| | | | | | | | | |

| | | 0.22 | | | | | | | | 0.14 | | | | | | | | 0.07 | | | | | | | | 0.01 | | | | | | | | — | 4 |

| | | 0.03 | | | | | | | | (0.03 | ) | | | | | | | — | | | | | | | | 0.02 | | | | | | | | — | |

| | | — | | | | | | | | — | | | | | | | | — | | | | | | | | — | 5 | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.25 | | | | | | | | 0.11 | | | | | | | | 0.07 | | | | | | | | 0.03 | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | (0.22 | ) | | | | | | | (0.14 | ) | | | | | | | (0.07 | ) | | | | | | | (0.01 | ) | | | | | | | — | 6 |

| | | — | | | | | | | | (0.01 | ) | | | | | | | (0.02 | ) | | | | | | | — | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.22 | ) | | | | | | | (0.15 | ) | | | | | | | (0.09 | ) | | | | | | | (0.01 | ) | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 9.99 | | | | | | | $ | 9.96 | | | | | | | $ | 10.00 | | | | | | | $ | 10.02 | | | | | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 2.59% | | | | | | | | 1.05% | | | | | | | | 0.75% | | | | | | | | 0.32% | | | | | | | | 0.03% | |

| | | | | | | | | |

| | $ | 51,512 | | | | | | | $ | 59,084 | | | | | | | $ | 68,119 | | | | | | | $ | 83,641 | | | | | | | $ | 175,765 | |

| | | 0.40% | | | | | | | | 0.40% | | | | | | | | 0.40% | | | | | | | | 0.19% | | | | | | | | 0.13% | |

| | | 0.72% | | | | | | | | 0.67% | | | | | | | | 0.83% | | | | | | | | 0.78% | | | | | | | | 0.73% | |

| | | 2.24% | | | | | | | | 1.38% | | | | | | | | 0.73% | | | | | | | | 0.14% | | | | | | | | 0.03% | |

| | | 1.92% | | | | | | | | 1.11% | | | | | | | | 0.30% | | | | | | | | (0.45% | ) | | | | | | | (0.57% | ) |

| | | | 53% | | | | | | | | 134% | | | | | | | | 104% | | | | | | | | 123% | | | | | | | | 0% | |

27

Financial highlights

Delaware Investments Ultrashort Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income2 |

Net realized and unrealized gain (loss) |

Total from investment operations |

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

Total dividends and distributions |

|

Net asset value, end of period |

|

Total return3 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income to average net assets prior to fees waived |

Portfolio turnover |

| 1 | Date of commencement of operations; ratios have been annualized and total return has not been annualized. |

| 2 | The average shares outstanding have been applied for per share information. |

| 3 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

| 4 | Portfolio turnover is representative of the Fund for the year ended March 31, 2016. |

See accompanying notes, which are an integral part of the financial statements.

28

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | 1/5/16 | 1 |

Year ended | | | | to | |

| | | | 3/31/19 | | | | | | | | 3/31/18 | | | | | | | | 3/31/17 | | | | | | | | 3/31/16 | |

| | $ | 9.96 | | | | | | | $ | 10.00 | | | | | | | $ | 10.02 | | | | | | | $ | 10.00 | |

| | | | | | | |

| | | 0.22 | | | | | | | | 0.14 | | | | | | | | 0.07 | | | | | | | | 0.02 | |

| | | 0.03 | | | | | | | | (0.03 | ) | | | | | | | — | | | | | | | | 0.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.25 | | | | | | | | 0.11 | | | | | | | | 0.07 | | | | | | | | 0.04 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | (0.22 | ) | | | | | | | (0.14 | ) | | | | | | | (0.07 | ) | | | | | | | (0.02 | ) |

| | | — | | | | | | | | (0.01 | ) | | | | | | | (0.02 | ) | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.22 | ) | | | | | | | (0.15 | ) | | | | | | | (0.09 | ) | | | | | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | $ | 9.99 | | | | | | | $ | 9.96 | | | | | | | $ | 10.00 | | | | | | | $ | 10.02 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | 2.59% | | | | | | | | 1.05% | | | | | | | | 0.75% | | | | | | | | 0.39% | |

| | | | | | | |

| | $ | 1,869 | | | | | | | $ | 418 | | | | | | | $ | 331 | | | | | | | $ | 303 | |

| | | 0.40% | | | | | | | | 0.40% | | | | | | | | 0.40% | | | | | | | | 0.40% | |

| | | 0.72% | | | | | | | | 0.67% | | | | | | | | 0.83% | | | | | | | | 0.74% | |

| | | 2.24% | | | | | | | | 1.38% | | | | | | | | 0.73% | | | | | | | | 0.36% | |

| | | 1.92% | | | | | | | | 1.11% | | | | | | | | 0.30% | | | | | | | | 0.02% | |

| | | | 53% | | | | | | | | 134% | | | | | | | | 104% | | | | | | | | 123% | 4 |

29

Notes to financial statements

Delaware Investments Ultrashort Fund March 31, 2019 |

Delaware Group® Cash Reserve (Trust) is organized as a Delaware statutory trust and offers one series, Delaware Investments Ultrashort Fund (Fund). The Fund is anopen-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended (1940 Act), and offers Class A, Class C, Class L, and Institutional Class shares. Class A shares are sold with a maximumfront-end sales charge of 2.00%. Class L and Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00%, which will be incurred if redeemed during the first 12 months.

The investment objective of the Fund is to seek total return to the extent consistent with a relatively low volatility of principal.

1. Significant Accounting Policies

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The following accounting policies are in accordance with US generally accepted accounting principles (US GAAP) and are consistently followed by the Fund.

Security Valuation– Debt securities are valued based upon valuations provided by an independent pricing service or broker and reviewed by management. To the extent current market prices are not available, the pricing service may take into account developments related to the specific security, as well as transactions in comparable securities. Valuations for fixed income securities utilize matrix systems, which reflect such factors as security prices, yields, maturities, and ratings, and are supplemented by dealer and exchange quotations. For asset-backed securities, collateralized mortgage obligations, commercial mortgage securities, and US government agency mortgage securities, pricing vendors utilize matrix pricing which considers prepayment speed, attributes of the collateral, yield or price of bonds of comparable quality, coupon, maturity, and type as well as broker/dealer-supplied prices. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Trust’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. Restricted securities are valued at fair value using methods approved by the Board.

Federal Income Taxes– No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are“more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the“more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken or expected to be taken on the Fund’s federal income tax returns through the year ended March 31, 2019 and for all open tax years (years ended March 31, 2016–March 31, 2018), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. If applicable, the Fund recognizes interest accrued on unrecognized tax benefits in interest expense and penalties in other expenses on the “Statement of operations.” During the year ended March 31, 2019, the Fund did not incur any interest or tax penalties.

30

Class Accounting– Investment income and common expenses are allocated to the various classes of the Fund on the basis of “settled shares” of each class in relation to the net assets of the Fund. Realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Use of Estimates– The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other– Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Funds® by Macquarie (Delaware Funds) are generally allocated among such funds on the basis of average net assets. Management fees and certain other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Interest income is recorded on the accrual basis. Discounts and premiums on debt securities are accreted or amortized to interest income, respectively, over the lives of the respective securities using the effective interest method. Realized gains (losses) on paydowns of asset- and mortgage-backed securities are classified as interest income. The Fund declares dividends daily from net investment income and pays the dividends monthly and declares and pays distributions from net realized gain on investments, if any, annually. The Fund may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on theex-dividend date.

The Fund receives earnings credits from its custodian when positive cash balances are maintained, which may be used to offset custody fees. The expenses paid under this arrangement are included on the “Statement of operations” under “Custodian fees” with the corresponding expenses offset included under “Less expenses paid indirectly.” For the year ended March 31, 2019, the Fund earned $2,060 under this arrangement.

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1, the expenses paid under this arrangement are included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding expenses offset included under “Less expenses paid indirectly.” For the year ended March 31, 2019, the Fund earned $483 under this arrangement.

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Macquarie Investment Management Business Trust and the investment manager, an annual fee which is calculated daily and paid monthly at the rate of 0.30% on average daily net assets of the Fund.

31

Notes to financial statements

Delaware Investments Ultrashort Fund

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates (continued)

DMC has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any distribution and service(12b-1) fees, taxes, interest, acquired fund fees and expenses, short sale, dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) in order to prevent total annual fund operating expenses from exceeding 0.40% of the Fund’s average daily net assets from April 1, 2018 through March 31, 2019.* These waivers and reimbursements may only be terminated by agreement of DMC and the Fund.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administration oversight services to the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly based on the aggregate daily net assets of all funds within the Delaware Funds at the following annual rates: 0.00475% of the first $35 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $45 billion (Total Fee). Each fund in the Delaware Funds pays a minimum of $4,000, which, in aggregate, is subtracted from the Total Fee. Each fund then pays its portion of the remainder of the Total Fee on a relative net asset value (NAV) basis. This amount is included on the “Statement of operations” under “Accounting and administrative expenses.” For the year ended March 31, 2019, the Fund was charged $6,823 for these services.

DIFSC is also the transfer agent and dividend disbursing agent of the Fund. For these services, DIFSC’s fees were calculated daily and paid monthly based on the aggregate daily net assets of the retail funds within the Delaware Funds from April 1, 2018 through June 30, 2018 at the following annual rates: 0.025% of the first $20 billion; 0.020% of the next $5 billion; 0.015% of the next $5 billion; and 0.013% of the average daily net assets in excess of $30 billion. Effective July 1, 2018, the Fund as well as the other Delaware Funds entered into an amendment to the DIFSC agreement. Under the agreement to the DIFSC agreement, DIFSC’s fees are calculated daily and paid monthly based on the aggregate daily net assets of the retail funds within the Delaware Funds at the following annual rates: 0.014% of the first $20 billion; 0.011% of the next $5 billion; 0.007% of the next $5 billion; 0.005% of the next $20 billion; and 0.0025% of average daily net assets in excess of $50 billion. The fees payable to DIFSC under the shareholder services agreement described above are allocated among all retail funds in the Delaware Funds on a relative NAV basis. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” For the year ended March 31, 2019, the Fund was charged $9,143 for these services. Pursuant to asub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certainsub- transfer agency services to the Fund.Sub-transfer agency fees are paid by the Fund and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” The fees are calculated daily and paid as invoices are received on a monthly or quarterly basis.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual12b-1 fee of 0.25% of the average daily net assets of the Class A shares, and 1.00% of the average daily net assets of the Class C shares. The fees are calculated daily and paid monthly. Class L and Institutional Class shares do not pay12b-1 fees. DDLP has contracted to limit

32

the12b-1 fees to 0.00% of average daily net assets for Class A and Class C shares from April 1, 2018 through March 31, 2019.*

As provided in the investment management agreement, the Fund bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal, tax, and regulatory reporting services to the Fund. For the year ended March 31, 2019, the Fund was charged $3,036 for internal legal, tax, and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”