UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-02806 |

| |

| Exact name of registrant as specified in charter: | Delaware Group® Cash Reserve |

| |

| Address of principal executive offices: | 610 Market Street |

| Philadelphia, PA 19106 |

| |

| Name and address of agent for service: | David F. Connor, Esq. |

| 610 Market Street |

| Philadelphia, PA 19106 |

| |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| |

| Date of fiscal year end: | March 31 |

| |

| Date of reporting period: | March 31, 2022 |

Item 1. Reports to Stockholders

Annual report

Fixed income mutual fund

Delaware Investments Ultrashort Fund

March 31, 2022

Carefully consider the Fund's investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund's prospectus and its summary prospectus, which may be obtained by visiting delawarefunds.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawarefunds.com/edelivery.

Table of Contents

Experience Delaware Funds by Macquarie®

Macquarie Asset Management (MAM) is a global asset manager that aims to deliver positive impact for everyone. MAM Public Investments traces its roots to 1929 and partners with institutional and individual clients to deliver specialist active investment capabilities across global equities, fixed income, and multi-asset solutions using a conviction-based, long-term approach to investing. In the US, retail investors recognize our Delaware Funds by Macquarie family of funds as one of the oldest mutual fund families.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Funds or obtain a prospectus for Delaware Investments Ultrashort Fund at delawarefunds.com/literature.

Manage your account online| ● | Check your account balance and transactions |

| ● | View statements and tax forms |

| ● | Make purchases and redemptions |

Visit delawarefunds.com/account-access.

Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is a full-service asset manager offering a diverse range of products across public and private markets including fixed income, equities, multi-asset solutions, private credit, infrastructure, renewables, natural assets, real estate, and asset finance. The Public Investments business is a part of MAM and includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

The Fund is distributed by Delaware Distributors, L.P. (DDLP), an affiliate of MIMBT and Macquarie Group Limited.

Other than Macquarie Bank Limited ABN 46 008 583 542 ("Macquarie Bank"), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Fund is governed by US laws and regulations.

Table of contents

Unless otherwise noted, views expressed herein are current as of March 31, 2022, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor.

All third-party marks cited are the property of their respective owners.

© 2022 Macquarie Management Holdings, Inc.

Table of Contents

| Portfolio management review | |

| Delaware Investments Ultrashort Fund | March 31, 2022 (Unaudited) |

| | | | | |

| Performance preview (for the year ended March 31, 2022) | | | | | |

| Delaware Investments Ultrashort Fund (Institutional Class shares) | | 1-year return | | -0.39 | % |

| Delaware Investments Ultrashort Fund (Class A shares) | | 1-year return | | -0.39 | % |

| ICE BofA US 6-Month Treasury Bill Index (benchmark) | | 1-year return | | -0.05 | % |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Investments Ultrashort Fund, please see the table on page 4.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 8 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks total return to the extent consistent with a relatively low volatility of principal.

Market review

During the Fund’s fiscal year ended March 31, 2022, fixed-income markets fared poorly, faced with the challenges of high inflation, the likelihood of more restrictive central bank monetary policy, and rising geopolitical risk, which shook financial markets towards the end of the period as Russia invaded Ukraine.

Throughout the fiscal year and as far back as last spring, budding optimism about an economic reopening faded as new COVID-19 variants repeatedly caused setbacks to normalization, along with ongoing supply-chain disruptions. The US Federal Reserve initially held to its view that the elevated rate of inflation was transitory. Later in the fiscal period, the Fed acknowledged high inflation would linger. By the fall of 2021, expectations had shifted regarding the speed and extent of changes to central bank monetary policy in the US and elsewhere.

Managing the Fund during the fiscal period involved the challenge of balancing the risk protection offered by less-volatile securities, including Treasury bills, with the additional yields available through spread products.

1

Table of Contents

Portfolio management review

Delaware Investments Ultrashort Fund

By late 2021, it was clear the Fed would have to act in an effort to curb persistent inflation. As a result, markets anticipated that 2022 would be a year of rising interest rates and quantitative tightening. The onset of more restrictive monetary policy, dovetailed with rising geopolitical risks that emerged from Europe as Russia invaded Ukraine in late February, prompted large-scale sanctions and further disruptions to international trade and to the availability of commodities exported by Russia and Ukraine.

Those events resulted in a significant repricing and reshaping of the yield curve. The yield curve flattened as short-term yields rose more than longer-term yields and, for a brief time, the 2-year relative to 10-year yield curve briefly inverted. Historically, yield curve inversions, in which shorter-term yields are higher than longer-term yields, have been a harbinger of an economic recession.

Within the Fund

For the fiscal year ended March 31, 2022, Delaware Investments Ultrashort Fund underperformed its benchmark, the ICE BofA US 6-Month Treasury Bill Index. The Fund’s Institutional Class shares declined 0.39%. The Fund’s Class A shares fell 0.39% at net asset value and 2.34% at maximum offer price (both figures reflect all distributions reinvested). For the same time period, the benchmark declined 0.05%. For complete, annualized performance of Delaware Investments Ultrashort Fund, please see the table on page 4.

In anticipation of and response to the change in the Fed’s monetary policy stance, we shortened the portfolio duration relative to the benchmark in an effort to help offset some interest-rate-related volatility. Specifically, we sold investment-grade corporate bonds and redeployed the funds into short-duration commercial paper holdings along with government securities, such as Treasury bills. That was a timely defensive move to ensure the Fund’s duration was shorter than that of the benchmark, mitigating some of the effects of the interest rate curve repositioning.

Selling investment-grade corporate bonds also helped to reduce the Fund’s exposure to credit market volatility, which began to rise in the second half of 2021.

Asset backed securities (ABS), primarily floating-rate collateralized loan obligations, contributed to the Fund’s performance relative to the benchmark during the fiscal year. Our short-duration, AAA-rated ABS holdings also contributed to Fund performance, along with shorter-duration, investment-grade corporates.

Detractors from relative performance were select lower yielding money market holdings, short maturity commercial paper, and Treasury bills.

Managing the Fund during the fiscal period involved the challenge of balancing the risk protection offered by less-volatile securities, including Treasury bills, with the additional yields available through spread products, such as investment-grade corporate bonds, ABS, and collateralized loan obligations. This was particularly true late in 2021 and early 2022, when the prospect of the anticipated Fed rate hike weighed against geopolitical risks and concern that economic growth was diminishing.

We have sought to reduce risk the Fund in a methodical fashion, reinvesting bonds as they matured while attempting to keep transaction costs low as we gradually repositioned the Fund. Given the rising challenges related to a more restrictive Fed interest rate policy, we advocate a measured approach to help mitigate current market risks.

2

Table of Contents

If we were to move too quickly or too slowly in de-risking or adding risk back into the Fund, there is the possibility of either a greater capital loss or needlessly sacrificing potential yield.

At fiscal year end, we think a key risk is the potential for stagflation and its possible impact on global economies and on US corporate earnings. Although it is a very real risk, we believe there is enough fundamental strength in the economy to weather that scenario for the next year or so. Stagflation is something we’re concerned about, however, and we are monitoring the situation closely.

We see a growing chance the Fed will be unable to orchestrate a soft landing through its restrictive monitory policy. Historically, the Fed does not have a successful track record of executing soft landings—raising interest rates to slow down inflation without going into a recession. With these concerns in mind, we are adopting a defensive-oriented posture for the intermediate term.

3

Table of Contents

| Performance summary | |

| Delaware Investments Ultrashort Fund | March 31, 2022 (Unaudited) |

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800 523-1918 or visiting delawarefunds.com/performance.

| Fund and benchmark performance1,2 | | Average annual total returns through March 31, 2022 |

| | 1 year | | 5 year | | 10 year | | Lifetime |

| Class A (Est. March 10, 1988)* | | | | | | | | | | | | |

| Excluding sales charge | | -0.39 | %** | | +1.28 | % | | +0.76 | % | | +2.59 | % |

| Including sales charge | | -2.34 | % | | +0.88 | % | | +0.56 | % | | +2.53 | % |

| Class C (Est. November 28, 1995) | | | | | | | | | | | | |

| Excluding sales charge | | -0.39 | % | | +1.28 | % | | +0.76 | % | | +1.54 | % |

| Including sales charge | | -1.39 | % | | +1.28 | % | | +0.76 | % | | +1.54 | % |

| Class L (Est. June 30, 1978)* | | | | | | | | | | | | |

| Excluding sales charge | | -0.29 | % | | +1.30 | % | | +0.77 | % | | +4.37 | % |

| Including sales charge | | -0.29 | % | | +1.30 | % | | — | | | +4.37 | % |

| Institutional Class (Est. January 5, 2016) | | | | | | | | | | | | |

| Excluding sales charge | | -0.39 | % | | +1.30 | % | | — | | | +1.23 | % |

| Including sales charge | | -0.39 | % | | +1.30 | % | | — | | | +1.23 | % |

| ICE BofA US 6-Month Treasury Bill Index | | -0.05 | % | | +1.27 | % | | +0.78 | % | | +3.26 | %*** |

| * | In conjunction with the conversion, Class A shares became Class L shares and Consultant Class shares became Class A shares. |

| ** | Total returns for the report period presented in the table differs from the return in “Financial highlights.” The total returns presented in the above table are calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total returns presented in “Financial highlights” are calculated in the same manner, but also takes into account certain adjustments that are necessary under US generally accepted accounting principles (US GAAP) required in the annual report. |

| *** | The benchmark lifetime return is for Class A share comparison only and is calculated using the last business day in the month of the Fund’s Class A inception date. |

| 1 | Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares. |

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 6. Performance would have been lower had expense limitations not been in effect.

4

Table of Contents

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service (12b-1) fee.

Class A shares are sold with a maximum front-end sales charge of 2.00%, and have an annual 12b-1 fee of 0.25% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge (CDSC) of 1.00% if redeemed during the first 12 months. They are also subject to an annual 12b-1 fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that CDSCs did not apply or that the investment was not redeemed. A sales load was not applicable for periods prior to January 5, 2016 for Class A and Class C shares.

The Fund’s distributor, Delaware Distributors, L.P. (Distributor), has also contracted to limit the Fund’s Class A and Class C shares’ 12b-1 fee to 0.00% of the respective share class’s average daily net assets from April 1, 2021 through March 31, 2022.* These waivers and reimbursements may only be terminated by agreement of the Manager or Distributor, as applicable, and the Fund.

Class L shares are available only to Fund shareholders who held Class A shares of the Fund prior to the conversion of the Fund. Class L shares are closed to all additional purchases.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. This includes prepayment risk, the risk that the principal of a bond that is held by a portfolio will be prepaid prior to maturity at the time when interest rates are lower than what the bond was paying. A portfolio may then have to reinvest that money at a lower interest rate.

International investments entail risks including fluctuation in currency values, differences in accounting principles, or economic or political instability. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility, lower trading volume, and higher risk of market closures. In many emerging markets, there is substantially less publicly available information and the available information may be incomplete or misleading. Legal claims are generally more difficult to pursue.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivatives transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

Interest payments on inflation-indexed debt securities will vary as the principal and/or interest is adjusted for inflation.

IBOR risk is the risk that changes related to the use of the London interbank offered rate (LIBOR) or similar rates (such as EONIA) could have adverse impacts on financial instruments that reference these rates. The abandonment of these rates and transition to alternative rates could affect the value and liquidity of instruments that reference them and could affect investment strategy performance.

5

Table of Contents

Performance summary

Delaware Investments Ultrashort Fund

The disruptions caused by natural disasters, pandemics, or similar events could prevent the Fund from executing advantageous investment decisions in a timely manner and could negatively impact the Fund’s ability to achieve its investment objective and the value of the Fund’s investments.

| 2 | The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total annual fund operating expenses (excluding any 12b-1 fees, acquired fund fees and expenses, taxes, interest, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) from exceeding 0.40% of the Fund’s average daily net assets from April 1, 2021 to March 31, 2022.* Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements. Please see the “Financial highlights” section in this report for the most recent expense ratios. |

| | | | | | | | Institutional |

| Fund expense ratios | | Class A | | Class C | | Class L | | Class |

| Total annual operating expenses | | | | | | | | |

| (without fee waivers) | | 0.97% | | 1.72% | | 0.72% | | 0.72% |

| Net expenses (including fee | | | | | | | | |

| waivers, if any) | | 0.40% | | 0.40% | | 0.40% | | 0.40% |

| |

| Type of waiver | | Contractual | | Contractual | | Contractual | | Contractual |

| * | The aggregate contractual waiver period covering this report is from July 26, 2020 through July 29, 2022. |

6

Table of Contents

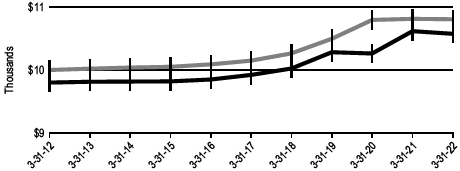

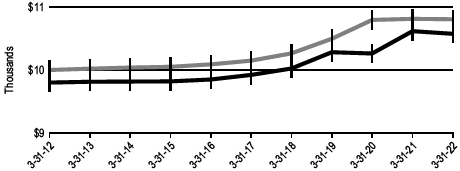

Performance of a $10,000 investment1

Class A shares

Average annual total returns from March 31, 2012 through March 31, 2022

| For period beginning March 31, 2012 through March 31, 2022 | | Starting value | | Ending value |

| ICE BofA US 6-Month Treasury Bill Index | | | $10,000 | | | | $10,808 | |

| Delaware Investments Ultrashort Fund — Class A shares | | | $9,800 | | | | $10,576 | |

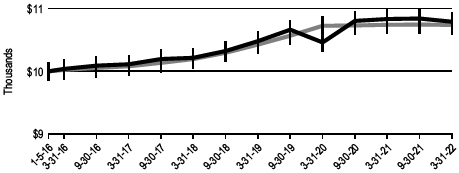

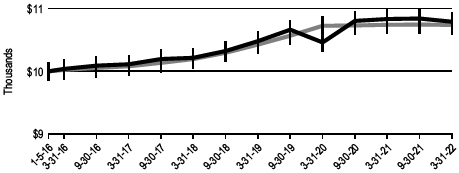

Institutional Class shares

Average annual total returns from January 5, 2016 (inception date) through March 31, 2022

| For period beginning January 5, 2016 through March 31, 2022 | | Starting value | | Ending value |

| Delaware Investments Ultrashort Fund — Institutional Class shares | | | $10,000 | | | | $10,789 | |

| ICE BofA US 6-Month Treasury Bill Index | | | $10,000 | | | | $10,738 | |

7

Table of Contents

Performance summary

Delaware Investments Ultrashort Fund

| 1 | The “Performance of a $10,000 investment” graph for Class A shares assumes $10,000 invested in Class A shares of the Fund on March 31, 2012, and includes the effect of a 2.00% front-end sales charge and the reinvestment of all distributions. The graph also assumes $10,000 invested in the ICE BofA US 6–Month Treasury Bill Index as of March 31, 2012. |

The “Performance of a $10,000 investment” graph for Institutional Class shares assumes $10,000 invested in Institutional Class shares of the Fund on January 5, 2016, and includes the reinvestment of all distributions. The graph also assumes $10,000 invested in the ICE BofA US 6–Month Treasury Bill Index as of December 31, 2015.

The graphs do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 6. Please note additional details on pages 4 through 8.

The ICE BofA US 6–Month Treasury Bill Index tracks the performance of US Treasury bills with a maturity of six months. The index comprises a single Treasury issue purchased at the beginning of the month, which is then sold at the end of the month and rolled into a newly selected issue that matures closest to, but not beyond, six months from the transaction date (known as the rebalancing date).

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | Nasdaq symbols | | CUSIPs |

| Class A | | DLTAX | | 245910609 |

| Class C | | DLTCX | | 245910708 |

| Class L | | DLTLX | | 245910807 |

| Institutional Class | | DULTX | | 245910500 |

8

Table of Contents

Disclosure of Fund expenses

For the six-month period from October 1, 2021 to March 31, 2022 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from October 1, 2021 to March 31, 2022.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Fund's expenses shown in the table reflect fee waivers in effect and assume reinvestment of all dividends and distributions.

9

Table of Contents

Disclosure of Fund expenses

For the six-month period from October 1, 2021 to March 31, 2022 (Unaudited)

Delaware Investments Ultrashort Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 10/1/21 | | 3/31/22 | | Expense Ratio | | 10/1/21 to 3/31/22* |

| Actual Fund return† | |

| Class A | | | $ | 1,000.00 | | | | $ | 995.30 | | | | 0.40 | % | | | | $ | 1.99 | |

| Class C | | | | 1,000.00 | | | | | 995.30 | | | | 0.40 | % | | | | | 1.99 | |

| Class L | | | | 1,000.00 | | | | | 995.30 | | | | 0.40 | % | | | | | 1.99 | |

| Institutional Class | | | | 1,000.00 | | | | | 995.30 | | | | 0.40 | % | | | | | 1.99 | |

| Hypothetical 5% return (5% return before expenses) | |

| Class A | | | $ | 1,000.00 | | | | $ | 1,022.94 | | | | 0.40 | % | | | | $ | 2.02 | |

| Class C | | | | 1,000.00 | | | | | 1,022.94 | | | | 0.40 | % | | | | | 2.02 | |

| Class L | | | | 1,000.00 | | | | | 1,022.94 | | | | 0.40 | % | | | | | 2.02 | |

| Institutional Class | | | | 1,000.00 | | | | | 1,022.94 | | | | 0.40 | % | | | | | 2.02 | |

| * | “Expenses Paid During Period” are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| ��� | Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns. |

10

Table of Contents

| Security type / sector allocation | | |

| Delaware Investments Ultrashort Fund | | As of March 31, 2022 (Unaudited) |

Sector designations may be different from the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| Security type / sector | | Percentage of net assets |

| Agency Collateralized Mortgage Obligations | | | 2.53 | % | |

| Agency Commercial Mortgage-Backed Security | | | 1.86 | % | |

| Collateralized Debt Obligations | | | 2.23 | % | |

| Corporate Bonds | | | 25.25 | % | |

| Banks | | | 9.41 | % | |

| Capital Goods | | | 1.22 | % | |

| Communications | | | 1.57 | % | |

| Consumer Cyclical | | | 3.37 | % | |

| Consumer Non-Cyclical | | | 3.54 | % | |

| Energy | | | 1.21 | % | |

| Insurance | | | 3.38 | % | |

| Real Estate Investment Trusts | | | 1.55 | % | |

| Non-Agency Asset-Backed Securities | | | 24.41 | % | |

| Commercial Paper | | | 43.87 | % | |

| Total Value of Securities | | | 100.15 | % | |

| Liabilities Net of Receivables and Other Assets | | | (0.15 | %) | |

| Total Net Assets | | | 100.00 | % | |

11

Table of Contents

| Schedule of investments | | |

| Delaware Investments Ultrashort Fund | | March 31, 2022 |

| | | | | Principal | | | |

| | | | amount | | | Value (US $) |

| Agency Collateralized Mortgage Obligations – 2.53% | | | | | |

| Freddie Mac Structured Agency Credit Risk REMIC Trust | | | | | |

| | Series 2020-DNA6 M1 144A 0.999% (SOFR + 0.90%) | | | | | |

| | 12/25/50 #, ● | | 732,818 | | $ | 731,252 |

| | Series 2021-DNA1 M1 144A 0.749% (SOFR + 0.65%) | | | | | |

| | 1/25/51 #, ● | | 67,918 | | | 67,777 |

| | Series 2021-DNA5 M1 144A 0.749% (SOFR + 0.65%) | | | | | |

| | 1/25/34 #, ● | | 88,972 | | | 88,811 |

| | Series 2021-HQA1 M1 144A 0.799% (SOFR + 0.70%) | | | | | |

| | 8/25/33 #, ● | | 348,041 | | | 346,191 |

| | Series 2021-HQA2 M1 144A 0.799% (SOFR + 0.70%) | | | | | |

| | 12/25/33 #, ● | | 808,589 | | | 801,113 |

| Total Agency Collateralized Mortgage Obligations (cost $2,044,201) | | | | | 2,035,144 |

| | | | | | | | |

| Agency Commercial Mortgage-Backed Security – 1.86% | | | | | |

| FREMF Mortgage Trust | | | | | |

| | Series 2015-K720 B 144A 3.425% 7/25/22 #, ● | | 1,500,000 | | | 1,502,611 |

| Total Agency Commercial Mortgage-Backed Security (cost $1,503,701) | | | | | 1,502,611 |

| | | | | | | | |

| Collateralized Debt Obligations – 2.23% | | | | | |

| Ares LVIII CLO | | | | | |

| | Series 2020-58A XR 144A 0.931% (TSFR3M + 0.75%, | | | | | |

| | Floor 0.75%) 1/15/35 #, ● | | 1,000,000 | | | 999,950 |

| Symphony | | | | | |

| | Series 2020-24A X 144A 1.059% (LIBOR03M + 0.80%, | | | | | |

| | Floor 0.80%) 1/23/32 #, ● | | 800,000 | | | 799,651 |

| Total Collateralized Debt Obligations (cost $1,800,000) | | | | | 1,799,601 |

| | | | | | | | |

| Corporate Bonds – 25.25% | | | | | |

| Banks – 9.41% | | | | | |

| Bank of America 1.259% (LIBOR03M + 1.00%) 4/24/23 ● | | 1,500,000 | | | 1,500,407 |

| Citigroup 4.05% 7/30/22 | | 1,890,000 | | | 1,906,218 |

| Goldman Sachs Group 2.108% (LIBOR03M + 1.60%) | | | | | |

| | 11/29/23● | | 1,250,000 | | | 1,266,506 |

| JPMorgan Chase & Co. 1.158% (LIBOR03M + 0.90%) | | | | | |

| | 4/25/23● | | 1,410,000 | | | 1,410,393 |

| Truist Bank 1.00% (SOFR + 0.73%) 3/9/23 ● | | 1,500,000 | | | 1,502,675 |

| | | | | | | | 7,586,199 |

| Capital Goods – 1.22% | | | | | |

| Teledyne Technologies 0.65% 4/1/23 | | 1,000,000 | | | 983,479 |

| | | | | | | 983,479 |

12

Table of Contents

| | | | | Principal | | | |

| | | | amount | | Value (US $) |

| Corporate Bonds (continued) | | | | | |

| Communications – 1.57% | | | | | |

| Verizon Communications 1.606% (LIBOR03M + 1.10%) | | | | | |

| | 5/15/25 ● | | 1,250,000 | | $ | 1,266,834 |

| | | | | | | 1,266,834 |

| Consumer Cyclical – 3.37% | | | | | |

| 7-Eleven 144A 0.625% 2/10/23 # | | 1,500,000 | | | 1,477,260 |

| General Motors Financial 1.017% (SOFR + 0.76%) 3/8/24 ● | | 1,250,000 | | | 1,241,784 |

| | | | | | | 2,719,044 |

| Consumer Non-Cyclical – 3.54% | | | | | |

| AbbVie 1.13% (LIBOR03M + 0.65%) 11/21/22 ● | | 1,405,000 | | | 1,408,505 |

| Gilead Sciences 3.25% 9/1/22 | | 1,440,000 | | | 1,446,474 |

| | | | | | | 2,854,979 |

| Energy – 1.21% | | | | | |

| Pioneer Natural Resources 0.55% 5/15/23 | | 1,000,000 | | | 978,336 |

| | | | | | | 978,336 |

| Insurance – 3.38% | | | | | |

| Athene Global Funding 144A 0.931% (SOFR + 0.70%) | | | | | |

| | 5/24/24 #, ● | | 1,490,000 | | | 1,472,758 |

| Brighthouse Financial Global Funding 144A 1.051% (SOFR | | | | | |

| | + 0.76%) 4/12/24 #, ● | | 1,250,000 | | | 1,253,413 |

| | | | | | | 2,726,171 |

| Real Estate Investment Trusts – 1.55% | | | | | |

| Public Storage 0.613% (SOFR + 0.47%) 4/23/24 ● | | 1,250,000 | | | 1,250,102 |

| | | | | | | 1,250,102 |

| Total Corporate Bonds (cost $20,458,293) | | | | | 20,365,144 |

| | | | | | | | |

| Non-Agency Asset-Backed Securities – 24.41% | | | | | |

| Carvana Auto Receivables Trust | | | | | |

| | Series 2021-P1 A2 0.28% 3/11/24 | | 342,336 | | | 341,933 |

| Dell Equipment Finance Trust | | | | | |

| | Series 2021-2 A2 144A 0.33% 12/22/26 # | | 1,500,000 | | | 1,481,165 |

| | Series 2022-1 A2 144A 2.11% 8/23/27 # | | 1,000,000 | | | 995,687 |

| Dryden 83 | | | | | |

| | Series 2020-83A X 144A 0.991% (LIBOR03M + 0.75%, | | | | | |

| | Floor 0.75%) 1/18/32 #, ● | | 1,600,000 | | | 1,599,309 |

| Enterprise Fleet Financing | | | | | |

| | Series 2020-2 A2 144A 0.61% 7/20/26 # | | 1,710,150 | | | 1,681,012 |

| Honda Auto Receivables Owner Trust | | | | | |

| | Series 2019-4 A3 1.83% 1/18/24 | | 494,628 | | | 495,414 |

13

Table of Contents

Schedule of investments

Delaware Investments Ultrashort Fund

| | | | | Principal | | | |

| | | | amount | | Value (US $) |

| Non-Agency Asset-Backed Securities (continued) | | | | | |

| Hyundai Auto Lease Securitization Trust | | | | | |

| | Series 2020-A A3 144A 1.95% 7/17/23 # | | 185,359 | | $ | 185,423 |

| | Series 2021-A B 144A 0.61% 10/15/25 # | | 1,500,000 | | | 1,465,686 |

| Hyundai Auto Receivables Trust | | | | | |

| | Series 2022-A A2A 1.81% 2/18/25 | | 2,000,000 | | | 1,991,944 |

| John Deere Owner Trust 2022 | | | | | |

| | Series 2022-A A2 1.90% 11/15/24 | | 2,000,000 | | | 1,993,380 |

| JPMorgan Chase Bank | | | | | |

| | Series 2020-2 B 144A 0.84% 2/25/28 # | | 954,056 | | | 941,727 |

| MMAF Equipment Finance | | | | | |

| | Series 2020-BA A2 144A 0.38% 8/14/23 # | | 1,144,220 | | | 1,138,638 |

| PFS Financing | | | | | |

| | Series 2020-B A 144A 1.21% 6/15/24 # | | 2,000,000 | | | 1,998,841 |

| Tesla Auto Lease Trust | | | | | |

| | Series 2021-B A2 144A 0.36% 9/22/25 # | | 2,000,000 | | | 1,991,589 |

| Verizon Owner Trust | | | | | |

| | Series 2019-C A1A 1.94% 4/22/24 | | 1,080,504 | | | 1,081,895 |

| Volvo Financial Equipment | | | | | |

| | Series 2020-1A A2 | | | | | |

| | 144A 0.37% 4/17/23 # | | 300,735 | | | 300,544 |

| Total Non-Agency Asset-Backed Securities (cost $19,825,126) | | | | | 19,684,187 |

| | |

| Commercial Paper – 43.87% | | | | | |

| Banks – 4.09% | | | | | |

| Bayerische Landesbank | | | | | |

| | 0.34% 4/1/22 | | 500,000 | | | 499,996 |

| | 0.351% 5/12/22 | | 350,000 | | | 349,775 |

| BPCE 0.561% 5/6/22 | | 700,000 | | | 699,625 |

| ING US Funding 0.501% 5/17/22 | | 250,000 | | | 249,818 |

| National Bank of Canada 0.20% 6/23/22 | | 500,000 | | | 498,986 |

| Toronto-Dominion 0.20% 6/28/22 | | 1,000,000 | | | 997,785 |

| | | | | | | 3,295,985 |

| Capital Goods – 3.78% | | | | | |

| Stanley Black & Decker | | | | | |

| | 0.30% 4/6/22 | | 500,000 | | | 499,973 |

| | 0.37% 5/2/22 | | 1,000,000 | | | 999,559 |

| | 0.55% 4/26/22 | | 550,000 | | | 549,820 |

| | 0.601% 5/23/22 | | 500,000 | | | 499,418 |

| | 0.902% 6/1/22 | | 500,000 | | | 499,196 |

| | | | | | | 3,047,966 |

14

Table of Contents

| | | | | Principal | | | |

| | | | amount | | Value (US $) |

| Commercial Paper (continued) | | | | | |

| Electric – 1.24% | | | | | |

| Rockwell Automation 0.33% 4/6/22 | | 1,000,000 | | $ | 999,938 |

| | | | | | | 999,938 |

| Financials – 32.25% | | | | | |

| Alberta Province 0.24% 5/24/22 | | 400,000 | | | 399,675 |

| Australia & New Zealand Banking Group | | | | | |

| | 0.401% 7/15/22 | | 250,000 | | | 249,271 |

| | 0.50% 4/26/22 | | 1,000,000 | | | 999,695 |

| Bank Nova Scotia | | | | | |

| | 0.20% 7/13/22 | | 500,000 | | | 498,507 |

| | 0.205% 9/16/22 | | 1,500,000 | | | 1,490,670 |

| | 0.397% 7/20/22 | | 500,000 | | | 498,392 |

| Bank of Montreal Chicago 0.33% 5/13/22 | | 500,000 | | | 499,712 |

| Charles Schwab 1.206% 8/9/22 | | 148,000 | | | 147,401 |

| Commonwealth Bank of Australia | | | | | |

| | 0.23% 5/18/22 | | 500,000 | | | 499,634 |

| | 0.271% 10/17/22 | | 1,300,000 | | | 1,289,773 |

| | 0.40% 4/6/22 | | 250,000 | | | 249,988 |

| Credit Agricole Corporate and Investment Bank 0.33% | | | | | |

| | 5/3/22 | | 325,000 | | | 324,855 |

| DNB Bank 0.23% 5/26/22 | | 500,000 | | | 499,630 |

| DZ Bank | | | | | |

| | 0.30% 4/1/22 | | 250,000 | | | 250,000 |

| | 0.701% 5/24/22 | | 650,000 | | | 649,414 |

| Goldman Sachs Group | | | | | |

| | 0.21% 7/5/22 | | 1,000,000 | | | 997,397 |

| | 0.875% 11/10/22 | | 500,000 | | | 494,988 |

| HSBC | | | | | |

| | 0.281% 8/2/22 | | 250,000 | | | 248,958 |

| | 1.407% 7/15/22 | | 250,000 | | | 249,170 |

| JP Morgan Securities | | | | | |

| | 0.20% 7/15/22 | | 500,000 | | | 498,457 |

| | 0.50% 4/4/22 | | 500,000 | | | 499,982 |

| | 1.267% 8/23/22 | | 1,000,000 | | | 995,062 |

| Lloyds Bank Corporate Markets | | | | | |

| | 0.24% 4/1/22 | | 150,000 | | | 149,999 |

| | 0.28% 5/26/22 | | 400,000 | | | 399,617 |

| NatWest Markets | | | | | |

| | 0.251% 7/18/22 | | 1,000,000 | | | 995,940 |

| | 0.35% 4/22/22 | | 400,000 | | | 399,810 |

| | 0.651% 5/3/22 | | 500,000 | | | 499,613 |

15

Table of Contents

Schedule of investments

Delaware Investments Ultrashort Fund

| | | | | Principal | | | |

| | | | amount | | Value (US $) |

| Commercial Paper (continued) | | | | | |

| Financials (continued) | | | | | |

| Royal Bank of Canada 0.21% 9/23/22 | | 2,000,000 | | $ | 1,985,255 |

| Skandinaviska Enskilda Banken | | | | | |

| | 0.64% 4/12/22 | | 796,000 | | | 795,913 |

| | 0.744% 8/5/22 | | 750,000 | | | 747,053 |

| Societe Generale | | | | | |

| | 0.281% 10/19/22 | | 2,000,000 | | | 1,982,549 |

| | 0.701% 5/10/22 | | 250,000 | | | 249,876 |

| | 0.902% 5/31/22 | | 750,000 | | | 749,043 |

| Svenska Handelsbanken 0.401% 9/15/22 | | 3,000,000 | | | 2,981,114 |

| Westpac Banking Corporation | | | | | |

| | 0.21% 9/29/22 | | 400,000 | | | 397,139 |

| | 0.375% 9/9/22 | | 500,000 | | | 497,041 |

| Westpac Securities | | | | | |

| | 0.30% 4/28/22 | | 400,000 | | | 399,853 |

| | 0.751% 5/23/22 | | 250,000 | | | 249,765 |

| | | | | | | 26,010,211 |

| Utilities – 2.51% | | | | | |

| National Rural Utilities Cooperative Finance Corporation | | | | | |

| | 0.44% 4/11/22 | | 500,000 | | | 499,952 |

| Virginia Electric & Power Company 0.65% 4/6/22 | | 500,000 | | | 499,966 |

| Wisconsin Power & Light Company 0.40% 4/1/22 | | 1,025,000 | | | 1,025,000 |

| | | | | | | 2,024,918 |

| Total Commercial Paper (cost $35,463,248) | | | | | 35,379,018 |

| Total Value of Securities–100.15% | | | | | |

| (cost $81,094,569) | | | | $ | 80,765,705 |

| # | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. At March 31, 2022, the aggregate value of Rule 144A securities was $23,320,408, which represents 28.92% of the Fund's net assets. See Note 8 in “Notes to financial statements.” |

| ● | Variable rate investment. Rates reset periodically. Rate shown reflects the rate in effect at March 31, 2022. For securities based on a published reference rate and spread, the reference rate and spread are indicated in their descriptions. The reference rate descriptions (i.e. LIBOR03M, LIBOR06M, etc.) used in this report are identical for different securities, but the underlying reference rates may differ due to the timing of the reset period. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions, or for mortgage-backed securities, are impacted by the individual mortgages which are paying off over time. These securities do not indicate a reference rate and spread in their descriptions. |

16

Table of Contents

Summary of abbreviations:

CLO – Collateralized Loan Obligation

FREMF – Freddie Mac Multifamily

ICE – Intercontinental Exchange, Inc.

LIBOR03M – ICE LIBOR USD 3 Month

LIBOR06M – ICE LIBOR USD 6 Month

REMIC – Real Estate Mortgage Investment Conduit

SOFR – Secured Overnight Financing Rate

See accompanying notes, which are an integral part of the financial statements.

17

Table of Contents

| Statement of assets and liabilities | |

| Delaware Investments Ultrashort Fund | March 31, 2022 |

| Assets: | | | | |

| | Investments, at value** | | $ | 80,765,705 | |

| Receivable for fund shares sold | | | 305,866 | |

| Interest receivable | | | 61,647 | |

| Other assets | | | 555 | |

| Total Assets | | | 81,133,773 | |

| Liabilities: | | | | |

| Due to custodian | | $ | 35,083 | |

| Payable for fund shares redeemed | | | 331,312 | |

| Audit and tax fees payable | | | 34,992 | |

| Reports and statements to shareholders expenses payable to non-affiliates | | | 25,553 | |

| Accounting and administration expenses payable to non-affiliates | | | 20,813 | |

| Dividend disbursing and transfer agent fees and expenses payable to | | | | |

| non-affiliates | | | 11,411 | |

| Pricing fees payable | | | 9,614 | |

| Registration fees payable to affiliates | | | 9,175 | |

| Investment management fees payable to affiliates | | | 5,721 | |

| Other accrued expenses | | | 2,913 | |

| Legal fees payable to non-affiliates | | | 742 | |

| Dividend disbursing and transfer agent fees and expenses payable to | | | | |

| affiliates | | | 647 | |

| Accounting and administration expenses payable to affiliates | | | 534 | |

| Trustees' fees and expenses payable | | | 391 | |

| Legal fees payable to affiliates | | | 205 | |

| Distribution payable | | | 112 | |

| Reports and statements to shareholders expenses payable to affiliates | | | 41 | |

| Total Liabilities | | | 489,259 | |

| Total Net Assets | | $ | 80,644,514 | |

| | |

| Net Assets Consist of: | | | | |

| Paid-in capital | | $ | 81,409,129 | |

| Total distributable earnings (loss) | | | (764,615 | ) |

| Total Net Assets | | $ | 80,644,514 | |

18

Table of Contents

| Net Asset Value | | | | |

| Class A: | | | | |

| Net assets | | $ | 32,607,063 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 3,282,039 | |

| Net asset value per share | | $ | 9.94 | |

| Sales charge | | | 2.00 | % |

| Offering price per share, equal to net asset value per share / (1 - sales | | | | |

| charge) | | $ | 10.14 | |

| Class C: | | | | |

| Net assets | | $ | 5,116,504 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 515,076 | |

| Net asset value per share | | $ | 9.93 | |

| Class L: | | | | |

| Net assets | | $ | 40,047,261 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 4,030,364 | |

| Net asset value per share | | $ | 9.94 | |

| Institutional Class: | | | | |

| Net assets | | $ | 2,873,686 | |

| Shares of beneficial interest outstanding, unlimited authorization, no par | | | 289,132 | |

| Net asset value per share | | $ | 9.94 | |

| ____________________ | | | | |

| *Investments, at cost | | $ | 81,094,569 | |

See accompanying notes, which are an integral part of the financial statements.

19

Table of Contents

| Statement of operations | |

| Delaware Investments Ultrashort Fund | Year ended March 31, 2022 |

| Investment Income: | | | | |

| | Interest | | $ | 513,440 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 253,832 | |

| Distribution expenses — Class A | | | 81,974 | |

| Distribution expenses — Class C | | | 55,429 | |

| Registration fees | | | 77,084 | |

| Dividend disbursing and transfer agent fees and expenses | | | 76,390 | |

| Accounting and administration expenses | | | 52,216 | |

| Reports and statements to shareholders expenses | | | 37,710 | |

| Audit and tax fees | | | 34,992 | |

| Legal fees | | | 19,384 | |

| Dues and services fees | | | 9,508 | |

| Custodian fees | | | 4,306 | |

| Trustees’ fees and expenses | | | 2,466 | |

| Other | | | 17,852 | |

| | | | 723,143 | |

| Less expenses waived | | | (247,100 | ) |

| Less waived distribution expenses — Class A | | | (81,974 | ) |

| Less waived distribution expenses — Class C | | | (55,429 | ) |

| Total operating expenses | | | 338,640 | |

| Net Investment Income | | | 174,800 | |

| Net Realized and Unrealized Gain (Loss): | | | | |

| Net realized gain on investments | | | 36,909 | |

| Net change in unrealized appreciation (depreciation) of investments | | | (506,655 | ) |

| Net Realized and Unrealized Loss | | | (469,746 | ) |

| Net Decrease in Net Assets Resulting from Operations | | $ | (294,946 | ) |

See accompanying notes, which are an integral part of the financial statements.

20

Table of Contents

Statements of changes in net assets

Delaware Investments Ultrashort Fund

| | | | | Year ended |

| | | | 3/31/22 | | 3/31/21 |

| Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

| Net investment income | | $ | 174,800 | | | $ | 539,274 | |

| Net realized gain (loss) | | | 36,909 | | | | (118,765 | ) |

| Net change in unrealized appreciation (depreciation) | | | (506,655 | ) | | | 2,098,241 | |

| Net increase (decrease) in net assets resulting from | | | | | | | | |

| | operations | | | (294,946 | ) | | | 2,518,750 | |

| | | |

| Dividends and Distributions to Shareholders from: | | | | | | | | |

| Distributable earnings: | | | | | | | | |

| | Class A | | | (135,118 | ) | | | (166,815 | ) |

| | Class C | | | (23,018 | ) | | | (53,025 | ) |

| | Class L | | | (175,611 | ) | | | (339,492 | ) |

| | Institutional Class | | | (16,255 | ) | | | (22,001 | ) |

| | | | | (350,002 | ) | | | (581,333 | ) |

| | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| | Class A | | | 15,699,399 | | | | 39,045,324 | |

| | Class C | | | 1,430,599 | | | | 2,560,209 | |

| | Class L | | | 4,345 | | | | 49,622 | |

| | Institutional Class | | | 941,794 | | | | 4,307,804 | |

| Net asset value of shares issued upon reinvestment of | | | | | | | | |

| | dividends and distributions: | | | | | | | | |

| | Class A | | | 133,363 | | | | 166,733 | |

| | Class C | | | 22,898 | | | | 54,649 | |

| | Class L | | | 171,778 | | | | 346,023 | |

| | Institutional Class | | | 15,988 | | | | 23,467 | |

| | | | | 18,420,164 | | | | 46,553,831 | |

21

Table of Contents

Statements of changes in net assets

Delaware Investments Ultrashort Fund

| | | | | Year ended |

| | | | 3/31/22 | | 3/31/21 |

| Capital Share Transactions (continued): | | | | | | | | |

| Cost of shares redeemed: | | | | | | | | |

| | Class A | | $ | (19,081,490 | ) | | $ | (19,247,657 | ) |

| | Class C | | | (2,310,661 | ) | | | (4,160,176 | ) |

| | Class L | | | (4,215,056 | ) | | | (3,771,416 | ) |

| | Institutional Class | | | (2,370,690 | ) | | | (4,117,049 | ) |

| | | | | (27,977,897 | ) | | | (31,296,298 | ) |

| Increase (decrease) in net assets derived from capital | | | | | | | | |

| | share transactions | | | (9,557,733 | ) | | | 15,257,533 | |

| Net Increase (Decrease) in Net Assets | | | (10,202,681 | ) | | | 17,194,950 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 90,847,195 | | | | 73,652,245 | |

| End of year | | $ | 80,644,514 | | | $ | 90,847,195 | |

See accompanying notes, which are an integral part of the financial statements.

22

Table of Contents

Financial highlights

Delaware Investments Ultrashort Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets prior to fees waived |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total return during all of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

24

Table of Contents

| Year ended | |

| 3/31/22 | | 3/31/21 | | 3/31/20 | | 3/31/19 | | 3/31/18 | |

| | $ | 10.01 | | | $ | 9.75 | | | $ | 9.99 | | | $ | 9.96 | | | $ | 10.00 | | |

| | |

| | |

| | 0.02 | | | | 0.07 | | | | 0.22 | | | | 0.22 | | | | 0.14 | | |

| | (0.05 | ) | | | 0.26 | | | | (0.24 | ) | | | 0.03 | | | | (0.03 | ) | |

| | (0.03 | ) | | | 0.33 | | | | (0.02 | ) | | | 0.25 | | | | 0.11 | | |

| | |

| | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.14 | ) | |

| | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.15 | ) | |

| | |

| $ | 9.94 | | | $ | 10.01 | | | $ | 9.75 | | | $ | 9.99 | | | $ | 9.96 | | |

| | |

| | (0.29% | ) | | | 3.42% | | | | (0.21% | ) | | | 2.59% | | | | 1.05% | | |

| | |

| | |

| $ | 32,607 | | | $ | 36,109 | | | $ | 15,718 | | | $ | 12,169 | | | $ | 8,722 | | |

| | 0.40% | | | | 0.40% | | | | 0.40% | | | | 0.40% | | | | 0.40% | | |

| | 0.94% | | | | 0.97% | | | | 0.97% | | | | 0.97% | | | | 0.92% | | |

| | 0.21% | | | | 0.66% | | | | 2.21% | | | | 2.24% | | | | 1.38% | | |

| | (0.33% | ) | | | 0.09% | | | | 1.64% | | | | 1.67% | | | | 0.86% | | |

| | 53% | | | | 83% | | | | 82% | | | | 53% | | | | 134% | | |

25

Table of Contents

Financial highlights

Delaware Investments Ultrashort Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets prior to fees waived |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total return during all of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

26

Table of Contents

| Year ended | |

| 3/31/22 | | 3/31/21 | | 3/31/20 | | 3/31/19 | | 3/31/18 | |

| | $ | 10.01 | | | $ | 9.75 | | | $ | 9.99 | | | $ | 9.96 | | | $ | 10.00 | | |

| | |

| | |

| | 0.02 | | | | 0.07 | | | | 0.22 | | | | 0.22 | | | | 0.14 | | |

| | (0.06 | ) | | | 0.26 | | | | (0.24 | ) | | | 0.03 | | | | (0.03 | ) | |

| | (0.04 | ) | | | 0.33 | | | | (0.02 | ) | | | 0.25 | | | | 0.11 | | |

| | |

| | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.14 | ) | |

| | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.15 | ) | |

| | |

| $ | 9.93 | | | $ | 10.01 | | | $ | 9.75 | | | $ | 9.99 | | | $ | 9.96 | | |

| | |

| | (0.39% | ) | | | 3.42% | | | | (0.21% | ) | | | 2.59% | | | | 1.05% | | |

| | |

| | |

| $ | 5,117 | | | $ | 6,015 | | | $ | 7,364 | | | $ | 7,386 | | | $ | 5,752 | | |

| | 0.40% | | | | 0.40% | | | | 0.40% | | | | 0.40% | | | | 0.40% | | |

| | 1.69% | | | | 1.72% | | | | 1.72% | | | | 1.72% | | | | 1.67% | | |

| | 0.21% | | | | 0.66% | | | | 2.21% | | | | 2.24% | | | | 1.38% | | |

| | (1.08% | ) | | | (0.66% | ) | | | 0.89% | | | | 0.92% | | | | 0.11% | | |

| | 53% | | | | 83% | | | | 82% | | | | 53% | | | | 134% | | |

27

Table of Contents

Financial highlights

Delaware Investments Ultrashort Fund Class L

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios to average net assets: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets prior to fees waived |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

28

Table of Contents

| Year ended | |

| 3/31/22 | | 3/31/21 | | 3/31/20 | | 3/31/19 | | 3/31/18 | |

| | $ | 10.01 | | | $ | 9.75 | | | $ | 9.99 | | | $ | 9.96 | | | $ | 10.00 | | |

| | | |

| | | |

| | 0.02 | | | | 0.07 | | | | 0.22 | | | | 0.22 | | | | 0.14 | | |

| | (0.05 | ) | | | 0.26 | | | | (0.24 | ) | | | 0.03 | | | | (0.03 | ) | |

| | (0.03 | ) | | | 0.33 | | | | (0.02 | ) | | | 0.25 | | | | 0.11 | | |

| | | |

| | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.14 | ) | |

| | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.15 | ) | |

| | | |

| $ | 9.94 | | | $ | 10.01 | | | $ | 9.75 | | | $ | 9.99 | | | $ | 9.96 | | |

| | | |

| | (0.29% | ) | | | 3.42% | | | | (0.21% | ) | | | 2.59% | | | | 1.05% | | |

| | | |

| | | |

| $ | 40,047 | | | $ | 44,409 | | | $ | 46,517 | | | $ | 51,512 | | | $ | 59,084 | | |

| | 0.40% | | | | 0.40% | | | | 0.40% | | | | 0.40% | | | | 0.40% | | |

| | 0.69% | | | | 0.72% | | | | 0.72% | | | | 0.72% | | | | 0.67% | | |

| | 0.21% | | | | 0.66% | | | | 2.21% | | | | 2.24% | | | | 1.38% | | |

| | (0.08% | ) | | | 0.34% | | | | 1.89% | | | | 1.92% | | | | 1.11% | | |

| | 53% | | | | 83% | | | | 82% | | | | 53% | | | | 134% | | |

29

Table of Contents

Financial highlights

Delaware Investments Ultrashort Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

| Net asset value, beginning of period |

| |

| Income (loss) from investment operations: |

| Net investment income1 |

| Net realized and unrealized gain (loss) |

| Total from investment operations |

| |

| Less dividends and distributions from: |

| Net investment income |

| Net realized gain |

| Total dividends and distributions |

| |

| Net asset value, end of period |

| |

| Total return2 |

| |

| Ratios and supplemental data: |

| Net assets, end of period (000 omitted) |

| Ratio of expenses to average net assets |

| Ratio of expenses to average net assets prior to fees waived. |

| Ratio of net investment income to average net assets |

| Ratio of net investment income (loss) to average net assets prior to fees waived |

| Portfolio turnover |

| 1 | Calculated using average shares outstanding. |

| 2 | Total return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total return during all of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

30

Table of Contents

| Year ended | |

| | 3/31/22 | | 3/31/21 | | 3/31/20 | | 3/31/19 | | 3/31/18 | |

| $ | 10.02 | | | $ | 9.75 | | | $ | 9.99 | | | $ | 9.96 | | | $ | 10.00 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | 0.02 | | | | 0.07 | | | | 0.22 | | | | 0.22 | | | | 0.14 | | |

| | (0.06 | ) | | | 0.27 | | | | (0.24 | ) | | | 0.03 | | | | (0.03 | ) | |

| | (0.04 | ) | | | 0.34 | | | | (0.02 | ) | | | 0.25 | | | | 0.11 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.14 | ) | |

| | — | | | | — | | | | — | | | | — | | | | (0.01 | ) | |

| | (0.04 | ) | | | (0.07 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.15 | ) | |

| | | | | | | | | | | | | | | | | | | | | |

| $ | 9.94 | | | $ | 10.02 | | | $ | 9.75 | | | $ | 9.99 | | | $ | 9.96 | | |

| | | | | | | | | | | | | | | | | | | | | |

| | (0.39% | ) | | | 3.52% | | | | (0.21% | ) | | | 2.59% | | | | 1.05% | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| $ | 2,874 | | | $ | 4,314 | | | $ | 4,053 | | | $ | 1,869 | | | $ | 418 | | |

| | 0.40% | | | | 0.40% | | | | 0.40% | | | | 0.40% | | | | 0.40% | | |

| | 0.69% | | | | 0.72% | | | | 0.72% | | | | 0.72% | | | | 0.67% | | |

| | 0.21% | | | | 0.66% | | | | 2.21% | | | | 2.24% | | | | 1.38% | | |

| | (0.08% | ) | | | 0.34% | | | | 1.89% | | | | 1.92% | | | | 1.11% | | |

| | 53% | | | | 83% | | | | 82% | | | | 53% | | | | 134% | | |

31

Table of Contents

| Notes to financial statements | |

| Delaware Investments Ultrashort Fund | March 31, 2022 |

Delaware Group® Cash Reserve (Trust) is organized as a Delaware statutory trust and offers one series, Delaware Investments Ultrashort Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940, as amended, and offers Class A, Class C, Class L, and Institutional Class shares. Class A shares are sold with a maximum front-end sales charge of 2.00%. There is no front-end sales charge when you purchase $1,000,000 or more of Class A shares. However, if Delaware Distributors, L.P. (DDLP) paid your financial intermediary a commission on your purchase of $1,000,000 or more of Class A shares, for shares purchased prior to July 1, 2020, you will have to pay a limited contingent deferred sales charge (Limited CDSC) of 1.00% if you redeem these shares within the first year after your purchase and 0.50% if you redeem these shares within the second year; and for shares purchased on or after July 1, 2020, you will have to pay a Limited CDSC of 1.00% if you redeem these shares within the first 18 months after your purchase, unless a specific waiver of the Limited CDSC applies. Class C shares are sold with a contingent deferred sales charge (CDSC) CDSC of 1.00%, which will be incurred if redeemed during the first 12 months.

1. Significant Accounting Policies

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services — Investment Companies. The following accounting policies are in accordance with US generally accepted accounting principles (US GAAP) and are consistently followed by the Fund.

Security Valuation — Debt securities are valued based upon valuations provided by an independent pricing service or broker and reviewed by management. To the extent current market prices are not available, the pricing service may take into account developments related to the specific security, as well as transactions in comparable securities. Valuations for fixed income securities utilize matrix systems, which reflect such factors as security prices, yields, maturities, and ratings, and are supplemented by dealer and exchange quotations. For asset-backed securities, collateralized mortgage obligations (CMOs), commercial mortgage securities, and US government agency mortgage securities, pricing vendors utilize matrix pricing which considers prepayment speed, attributes of the collateral, yield or price of bonds of comparable quality, coupon, maturity, and type as well as broker/dealer-supplied prices. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Trust’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuation will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security. Restricted securities are valued at fair value using methods approved by the Board.

Federal Income Taxes — No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund's tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not

32

Table of Contents

deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund's tax positions taken or expected to be taken on the Fund's federal income tax returns through the year ended March 31, 2022, and for all open tax years (years ended March 31, 2019–March 31, 2021), and has concluded that no provision for federal income tax is required in the Fund's financial statements. If applicable, the Fund recognizes interest accrued on unrecognized tax benefits in interest expense and penalties in “Other” on the “Statement of operations.” During the year ended March 31, 2022, the Fund did not incur any interest or tax penalties.

Class Accounting — Investment income and common expenses are allocated to the various classes of the Fund on the basis of “settled shares” of each class in relation to the net assets of the Fund. Realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class.

Use of Estimates — The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other — Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Funds by Macquarie® (Delaware Funds) are generally allocated among such fund on the basis of average net assets. Management fees and certain other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Interest income is recorded on the accrual basis. Discounts and premiums on debt securities are accreted or amortized to interest income, respectively, over the lives of the respective securities using the effective interest method. Premiums on callable debt securities are amortized to interest income to the earliest call date using the effective interest method. Realized gains (losses) on paydowns of asset- and mortgage-backed securities are classified as interest income. The Fund declares dividends daily from net investment income and pays the dividends monthly and declares and pays distributions from net realized gain on investments, if any, annually. The Fund may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

The Fund receives earnings credits from its custodian when positive cash balances are maintained, which may be used to offset custody fees.

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1, the expenses paid under this arrangement are included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding

33

Table of Contents

Notes to financial statements

Delaware Investments Ultrashort Fund

1. Significant Accounting Policies (continued)

expenses offset included under “Less expenses paid indirectly.” For the year ended March 31, 2022, the Fund earned $261 under this arrangement.

2. Investment Management, Administration Agreements, and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Macquarie Investment Management Business Trust and the investment manager, an annual fee which is calculated daily and paid monthly at the rate of 0.30% on average daily net assets of the Fund.

DMC has contractually agreed to waive all or a portion of its investment advisory fees and/or pay/reimburse expenses (excluding any distribution and service (12b-1) fees, taxes, interest, acquired fund fees and expenses, short sale dividend and interest expenses, brokerage fees, certain insurance costs, and nonroutine expenses or costs, including, but not limited to, those relating to reorganizations, litigation, conducting shareholder meetings, and liquidations) in order to prevent total annual fund operating expenses from exceeding 0.40% of the Fund’s average daily net assets from April 1, 2021 through March 31, 2022.* These waivers and reimbursements may only be terminated by agreement of DMC and the Fund.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administrative oversight services to the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly, based on the aggregate daily net assets of all funds within the Delaware Funds at the following annual rates: 0.00475% of the first $35 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $45 billion (Total Fee). Each fund in the Delaware Funds pays a minimum of $4,000, which, in aggregate, is subtracted from the Total Fee. Each fund then pays its portion of the remainder of the Total Fee on a relative net asset value (NAV) basis. This amount is included on the “Statement of operations” under “Accounting and administration expenses.” For the year ended March 31, 2022, the Fund was charged $6,949 for these services.

DMC may seek investment advice and recommendations from its affiliates: Macquarie Investment Management Europe Limited, Macquarie Investment Management Austria Kapitalanlage AG, and Macquarie Investment Management Global Limited (together, the “Affiliated Sub-Advisors”). The Manager may also permit these Affiliated Sub-Advisors to execute Fund security trades on behalf of the Manager and exercise investment discretion for securities in certain markets where DMC believes it will be beneficial to utilize an Affiliated Sub-Advisor’s specialized market knowledge. Although the Affiliated Sub-Advisors serve as sub-advisors, DMC has ultimate responsibility for all investment advisory services. For these services, DMC, not the Fund, may pay each Affiliated Sub-Advisor a portion of its investment management fee.

DIFSC is also the transfer agent and dividend disbursing agent of the Fund. For these services, DIFSC’s fees are calculated daily and paid monthly, based on the aggregate daily net assets of the retail funds within the Delaware Funds at the following annual rates: 0.014% of the first

34

Table of Contents

$20 billion; 0.011% of the next $5 billion; 0.007% of the next $5 billion; 0.005% of the next $20 billion; and 0.0025% of average daily net assets in excess of $50 billion. The fees payable to DIFSC under the shareholder services agreement described above are allocated among all retail funds in the Delaware Funds on a relative NAV basis. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” For the year ended March 31, 2022, the Fund was charged $7,300 for these services. Pursuant to a sub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certain sub- transfer agency services to the Fund. Sub-transfer agency fees are paid by the Fund and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” The fees are calculated daily and paid as invoices are received on a monthly or quarterly basis.

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual 12b-1 fee of 0.25% of the average daily net assets of the Class A shares, and 1.00% of the average daily net assets of the Class C shares. The fees are calculated daily and paid monthly. Class L and Institutional Class shares do not pay 12b-1 fees. DDLP has contracted to limit the 12b-1 fees to 0.00% of average daily net assets for Class A and Class C shares from April 1, 2021 through March 31, 2022.*

As provided in the investment management agreement, the Fund bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal and regulatory reporting services to the Fund. For the year ended March 31, 2022, the Fund was charged $2,805 for internal legal and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”

For the year ended March 31, 2022, DDLP earned $2,221 for commissions on sales of the Fund’s Class A shares. For the year ended March 31, 2022, DDLP received gross CDSC commissions of $244 on redemptions of the Fund’s Class C shares, respectively, and these commissions were entirely used to offset upfront commissions previously paid by DDLP to broker/dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DIFSC, and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

___________________

* | The aggregate contractual waiver period covering this report is from July 26, 2020 through July 29, 2022. |

35

Table of Contents

Notes to financial statements

Delaware Investments Ultrashort Fund

3. Investments

For the year ended March 31, 2022, the Fund made purchases and sales of investment securities other than short-term investments as follows:

| Purchases other than US government securities | | $ | 29,123,329 |

| Purchases of US government securities | | | 4,712,285 |

| Sales other than US government securities | | | 58,462,305 |

| Sales of US government securities | | | 6,400,000 |

The tax cost of investments includes adjustments to net unrealized appreciation (depreciation), which may not necessarily be the final tax cost basis adjustments but which approximate the tax basis unrealized gains and losses that may be realized and distributed to shareholders. At March 31, 2022, the cost and unrealized appreciation (depreciation) of investments for federal income tax purposes for the Fund were as follows:

| Cost of investments | | $ | 81,094,569 | |

| Aggregate unrealized appreciation of investments | | $ | 14,715 | |

| Aggregate unrealized depreciation of investments | | | (343,579 | ) |

| Net unrealized depreciation of investments | | $ | (328,864 | ) |

US GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three-level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available under the circumstances. The Fund's investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-level hierarchy of inputs is summarized as follows:

| Level 1 | – | Inputs are quoted prices in active markets for identical investments. (Examples: equity securities, open-end investment companies, futures contracts, and exchange-traded options contracts) |

| | | |

| Level 2 | – | Other observable inputs, including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, and default rates) or other market-corroborated inputs. (Examples: debt securities, government securities, swap contracts, foreign currency exchange contracts, foreign securities utilizing international fair value pricing, broker-quoted securities, and fair valued securities) |

36

Table of Contents