Item 1. Reports to Stockholders

Annual report

U.S. equity mutual fund

Delaware Value® Fund

November 30, 2016

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Fund’s prospectus and its summary prospectus, which may be obtained by visiting delawareinvestments.com/literature or calling 800 523-1918. Investors should read the prospectus and the summary prospectus carefully before investing.

You can obtain shareholder reports and prospectuses online instead of in the mail.

Visit delawareinvestments.com/edelivery.

Experience Delaware Investments

Delaware Investments is committed to the pursuit of consistently superior asset management and unparalleled client service. We believe in our investment processes, which seek to deliver consistent results, and in convenient services that help add value for our clients.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

You can learn more about Delaware Investments or obtain a prospectus for Delaware Value® Fund at delawareinvestments.com/literature.

Manage your investments online

| ● | | 24-hour access to your account information |

| ● | | Check your account balance and recent transactions |

| ● | | Request statements or literature |

| ● | | Make purchases and redemptions |

Delaware Management Holdings, Inc. and its subsidiaries (collectively known by the marketing name of Delaware Investments) are wholly owned subsidiaries of Macquarie Group Limited, a global provider of banking, financial, advisory, investment, and funds management services.

Neither Delaware Investments nor its affiliates referred to in this document are authorized deposit-taking institutions for the purpose of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited (MBL), a subsidiary of Macquarie Group Limited and an affiliate of Delaware Investments. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise. The Fund is governed by U.S. laws and regulations.

Table of contents

Unless otherwise noted, views expressed herein are current as of Nov. 30, 2016, and subject to change for events occurring after such date.

The Fund is not FDIC insured and is not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Fund’s distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

© 2017 Delaware Management Holdings, Inc.

All third-party marks cited are the property of their respective owners.

| | |

| Portfolio management review | | |

| Delaware Value® Fund | | December 6, 2016 |

| | | | | | | | |

Performance preview (for the year ended November 30, 2016) | | | | | | | | |

Delaware Value Fund (Institutional Class shares) | | | 1-year return | | | | +11.23% | |

Delaware Value Fund (Class A shares) | | | 1-year return | | | | +11.02% | |

Russell 1000® Value Index (benchmark) | | | 1-year return | | | | +12.02% | |

Past performance does not guarantee future results.

For complete, annualized performance for Delaware Value Fund, please see the table on page 4.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible accounts.

The performance of Class A shares excludes the applicable sales charge. Both Institutional Class shares and Class A shares reflect the reinvestment of all distributions.

Please see page 6 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

The economy in the United States continued its slow but steady growth throughout much of the Fund’s fiscal year before quickening as the period came to a close on Nov. 30, 2016. As gauged by the country’s gross domestic product (GDP) – a measure of national economic output – the economy had been growing at a snail’s pace in the first half of 2016. In the third quarter, however, GDP growth accelerated to an average annual rate of 3.5%, up from 0.8% in the first quarter and 1.4% in the second. It was the strongest quarter in two years. The nation’s unemployment rate also showed improvement as the fiscal period closed. Following months of little movement throughout the fiscal year, unemployment moved lower in November, falling to 4.6% after sitting between 4.9% and 5.0% for most of the year. That’s the lowest percentage since August 2007. (Source: Bloomberg.)

Against this mostly sluggish backdrop, the U.S. Federal Reserve increased interest rates by 0.25 percentage points in December 2015, but opted not to follow up with additional rate hikes for the remainder of the Fund’s fiscal year. That said, it appears likely that interest rates will move higher in 2017.

No matter what is happening in the

market and economy, our

approach remains the same: We

try to look past short-term

concerns about companies and

focus on their long-term potential.

| | |

| Portfolio management review | | |

| Delaware Value® Fund | | |

Throughout the Fund’s fiscal period, stock prices experienced some volatility as investors faced questions about the Fed’s pace of rate changes, volatile oil and commodity prices, the United Kingdom’s late-June vote to leave the European Union (EU), and uncertainty surrounding the U.S. presidential election, among other concerns.

Weak demand and worldwide overproduction drove the price of oil down to $34 a barrel at the end of February 2016, causing equity markets generally, and energy-related stocks in particular, to sell off. The price of oil then began an unsteady climb up to $53 in early June before settling back to about $50 at the end of the period.

The equity market finished the Fund’s fiscal year in positive territory, largely on the strength of two rallies. The first, between February and July 2016 – interrupted briefly, albeit sharply, by the U.K.’s unexpected vote to leave the EU – nonetheless enabled equity markets to more than recover from the energy-induced slump that occurred during the opening weeks of 2016.

The second and perhaps even more surprising rally came after the U.S. presidential election. As election returns came in and it became evident that Donald J. Trump would become the nation’s next president, global markets sold off sharply overnight. When trading opened, however, U.S. equities advanced sharply, with investors seemingly buoyed by Trump’s promises to cut corporate taxes, reduce regulation, and increase spending on infrastructure.

The so-called Trump rally persisted through the end of the Fund’s fiscal year, enabling the Dow Jones Industrial Average and the S&P 500® Index to achieve record highs. Banks, in particular, benefited from the possibility that financial regulations could be eased under a Trump administration.

Within the Fund

For the fiscal year ended Nov. 30, 2016, Delaware Value Fund Institutional Class shares returned +11.23%. The Fund’s Class A shares returned +11.02% at net asset value and +4.62% at maximum offer price. These figures reflect all distributions reinvested. During the same period, the Fund’s benchmark, the Russell 1000 Value Index, returned +12.02%. For complete, annualized performance of Delaware Value Fund, please see the table on page 4.

The Fund’s holdings in the industrials sector provided the largest contribution to performance, especially investments in Waste Management (the country’s largest solid-waste disposal business) and defense contractor Northrop Grumman. Waste Management has maintained pricing power while simultaneously improving collection volumes, thus enabling the company to produce favorable revenue and earnings growth. Northrop Grumman benefited from its ability to produce better-than-expected revenue growth, especially in its aerospace business.

Security selection in the financial sector, especially an investment in insurance broker Marsh & McLennan Companies, also made a solid contribution to Fund performance.

Investments in biopharmaceuticals manufacturer Baxalta and clinical laboratory-services provider Quest Diagnostics helped the Fund in the healthcare sector. Baxalta’s shares performed well on news of the company’s potential acquisition by Ireland-based Shire, a transaction formally announced in January 2016. We sold the Fund’s position in Baxalta when the transaction closed in June, as our own internal investment guidelines require us to invest exclusively in U.S. companies. Shares of Quest Diagnostics gained during the fiscal year, as investors became increasingly more optimistic about the longer-term prospects of this medical-testing company.

Some of the Fund’s healthcare investments did not meet our expectations. Express Scripts Holding, a pharmacy benefits manager (PBM), found itself in a protracted contract dispute with Anthem, its largest customer. Despite its short-term difficulties, we see good upside potential with Express Scripts over the long term. A related detractor was CVS Health, which combines a chain of retail pharmacies with a PBM division. Although CVS encountered some challenges during the fiscal period owing to lower levels of drug price inflation, market share losses and higher expenses, we believe it is well positioned for the long term.

In energy, the Fund benefited most by its investment in oil and gas services company Halliburton, which we believe is well positioned to capitalize on a potential rebound in demand for its services. In contrast, the Fund’s position in exploration and production company ConocoPhillips detracted from results. The company made the decision to cut its dividend in February. This, along with the low level of oil prices, put downward pressure on the shares during the fiscal year.

No matter what is happening in the market and economy, our approach remains the same: We try to look past short-term concerns about companies and focus on their long-term potential.

Throughout the fiscal period, we maintained the Fund’s generally defensive positioning and continued to emphasize what we believe are reasonably valued, higher-quality stocks. In our opinion, this approach was well suited to the current environment of sluggish economic growth and uncertainty on the part of investors, especially leading up to the U.S. presidential election in November.

Valuations strike us as high across the market. As it has become more difficult to find stocks that are undervalued on an absolute basis, our investment focus has shifted to stocks that we believe provide good relative value – that is, better value than other available alternatives in the Fund’s investment universe, in our opinion.

During the fiscal year, we made modest changes to the Fund, selling only two holdings – Baxalta and Johnson Controls, both of which were acquired by offshore firms. With the proceeds of the Baxalta sale, we established a new position in Abbott Laboratories, a medical-products company that we liked for what we view as its strong competitive position and attractive relative valuation.

At fiscal year end, we began adding a position in Equity Residential, a real estate investment trust (REIT) that acquires, develops and manages multifamily residential properties. In August, real estate became the 11th sector in the S&P 500 Index and our investment process mandates that we have exposure to all S&P 500 economic sectors. We believed Equity Residential offered attractive relative value, good quality and was exposed to favorable long-term trends in its key markets. At fiscal year end, we were researching options for a new consumer discretionary position to replace the Fund’s previous position in Johnson Controls. We also had an equity research project underway in the information technology sector, a sector in which we found decent relative value.

We continue to emphasize what we view as higher-quality, attractively valued stocks with the potential to offer a good risk-reward trade-off for our shareholders. We remain grateful for their confidence.

| | |

| Performance summary | | |

| Delaware Value® Fund | | November 30, 2016 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data current for the most recent month end by calling 800 523-1918 or visiting our website at delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

| | | | | | | | | | | | | | | | |

| Fund and benchmark performance1,2 | | Average annual total returns through November 30, 2016 | |

| | | | |

| | | 1 year | | | 5 years | | | 10 years | | | Lifetime | |

Class A (Est. Sept. 15, 1998) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +11.02% | | | | +14.56% | | | | +6.66% | | | | +7.52% | |

Including sales charge | | | +4.62% | | | | +13.21% | | | | +6.03% | | | | +7.17% | |

Class C (Est. May 1, 2002) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +10.18% | | | | +13.69% | | | | +5.86% | | | | +6.69% | |

Including sales charge | | | +9.18% | | | | +13.69% | | | | +5.86% | | | | +6.69% | |

Class R (Est. Sept. 1, 2005) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +10.70% | | | | +14.25% | | | | +6.39% | | | | +7.50% | |

Including sales charge | | | +10.70% | | | | +14.25% | | | | +6.39% | | | | +7.50% | |

Institutional Class (Est. Sept. 15, 1998) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | +11.23% | | | | +14.83% | | | | +6.92% | | | | +7.73% | |

Including sales charge | | | +11.23% | | | | +14.83% | | | | +6.92% | | | | +7.73% | |

Class R6 (Est. May 2, 2016) | | | | | | | | | | | | | | | | |

Excluding sales charge | | | n/a | | | | n/a | | | | n/a | | | | +6.83%* | |

Including sales charge | | | n/a | | | | n/a | | | | n/a | | | | +6.83%* | |

Russell 1000 Value Index | | | +12.02% | | | | +14.69% | | | | +5.70% | | | | +9.90%** | |

*Returns are as of the Fund’s Class R6 inception date. Returns for less than one year are not annualized. The benchmark lifetime return was +10.32% and is as of the month-end prior to the Class R6 inception date.

**The benchmark lifetime return is for Institutional Class share comparison only and is calculated using the last business day in the month of the Fund’s Institutional Class inception date.

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund and benchmark performance” table. Expenses for each class are listed on the “Fund expense ratios” table on page 5. Performance

would have been lower had expense limitations not been in effect.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

Class A shares are sold with a maximum front-end sales charge of 5.75%, and have an annual distribution and service fee of 0.25% of average daily net assets. The Board has adopted a formula for calculating 12b-1 plan fees for the Fund’s Class A shares. The Fund’s Class A shares are

currently subject to a blended 12b-1 fee equal to the sum of: (i) 0.10% of average daily net assets representing shares acquired prior to May 2, 1994, and (ii) 0.25% of average daily net assets representing shares acquired on or after May 2, 1994. All Class A shares currently bear 12b-1 fees at the same rate, the blended rate, currently 0.25% of average daily net assets, based on the formula described above. This method of calculating Class A 12b-1 fees may be discontinued at the sole discretion of the Board. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual

distribution and service fee of 1.00% of average daily net assets. Performance for Class C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Class R shares are available only for certain retirement plan products. They are sold without a sales charge and have an annual distribution and service fee of 0.50% of average daily net assets.

Class R6 shares are available only to certain investors.

Holding a relatively concentrated portfolio of a limited number of securities may increase risk because each investment has a greater effect on the Fund’s overall performance than would be the case for a more diversified fund.

2 Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table.

| | | | | | | | | | |

| Fund expense ratios | | Class A | | Class C | | Class R | | Institutional Class | | Class R6 |

Total annual operating expenses | | 0.97% | | 1.72% | | 1.22% | | 0.72% | | 0.62% |

(without fee waivers) | | | | | | | | | | |

Net expenses | | 0.97% | | 1.72% | | 1.22% | | 0.72% | | 0.62% |

(including fee waivers, if any) | | | | | | | | | | |

Type of waiver | | n/a | | n/a | | n/a | | n/a | | n/a |

| | |

| Performance summary | | |

| Delaware Value® Fund | | |

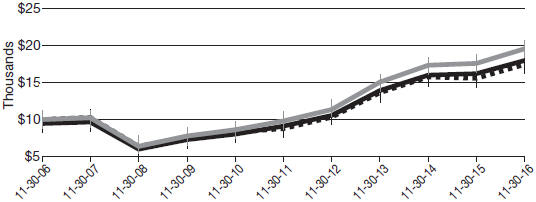

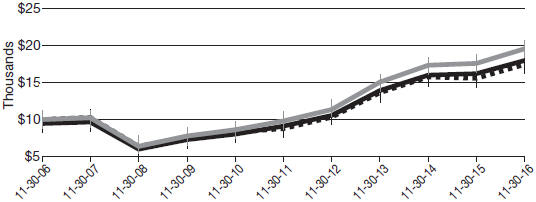

Performance of a $10,000 investment1

Average annual total returns from Nov. 30, 2006 through Nov. 30, 2016

| | | | | | | | | | |

| For the period beginning Nov. 30, 2006 through Nov. 30, 2016 | | Starting value | | | Ending value | |

| | Delaware Value Fund — Institutional Class shares | | | $10,000 | | | | $19,526 | |

| | Delaware Value Fund — Class A shares | | | $9,425 | | | | $17,966 | |

| | Russell 1000 Value Index | | | $10,000 | | | | $17,401 | |

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Institutional Class and Class A shares of the Fund on Nov. 30, 2006, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Expenses are listed in the “Fund expense ratios” table on page 5. Please note additional details on pages 4 through 7.

The graph also assumes $10,000 invested in the Russell 1000 Value Index as of Nov. 30, 2006. The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Russell Investment Group.

The Dow Jones Industrial Average mentioned on page 2, is an often-quoted market indicator that comprises 30 widely held blue-chip stocks.

The S&P 500 Index, mentioned on pages 2 and 3, measures the performance of 500 mostly large-cap stocks weighted by market value, and is often used to represent performance of the U.S. stock market.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance is not a guarantee of future results.

Performance of other Fund classes will vary due to different charges and expenses.

| | | | | | |

| | | | |

| | | Nasdaq symbols | | CUSIPs | | |

Class A | | DDVAX | | 24610C881 | | |

Class C | | DDVCX | | 24610C865 | | |

Class R | | DDVRX | | 245907860 | | |

Institutional Class | | DDVIX | | 24610C857 | | |

Class R6 | | DDZRX | | 24610C840 | | |

| | |

| Disclosure of Fund expenses | | |

| For the six-month period from June 1, 2016 to November 30, 2016 (Unaudited) | | |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period from June 1, 2016 to Nov. 30, 2016.

Actual expenses

The first section of the table shown, “Actual Fund return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the table shown, “Hypothetical 5% return,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The expenses shown in the table assume reinvestment of all dividends and distributions.

Delaware Value® Fund

Expense analysis of an investment of $1,000

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value 6/1/16 | | | Ending Account Value 11/30/16 | | | Annualized Expense Ratio | | | Expenses Paid During Period 6/1/16 to 11/30/16* | |

| | | | |

Actual Fund return† | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,042.90 | | | | 0.97% | | | | $4.95 | |

Class C | | | 1,000.00 | | | | 1,039.20 | | | | 1.72% | | | | 8.77 | |

Class R | | | 1,000.00 | | | | 1,041.70 | | | | 1.22% | | | | 6.23 | |

Institutional Class | | | 1,000.00 | | | | 1,044.20 | | | | 0.72% | | | | 3.68 | |

Class R6 | | | 1,000.00 | | | | 1,045.20 | | | | 0.62% | | | | 3.17 | |

| | |

Hypothetical 5% return (5% return before expenses) | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,020.15 | | | | 0.97% | | | | $4.90 | |

Class C | | | 1,000.00 | | | | 1,016.40 | | | | 1.72% | | | | 8.67 | |

Class R | | | 1,000.00 | | | | 1,018.90 | | | | 1.22% | | | | 6.16 | |

Institutional Class | | | 1,000.00 | | | | 1,021.40 | | | | 0.72% | | | | 3.64 | |

Class R6 | | | 1,000.00 | | | | 1,021.90 | | | | 0.62% | | | | 3.13 | |

* “Expenses Paid During Period” are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

† Because actual returns reflect only the most recent six-month period, the returns shown may differ significantly from fiscal year returns.

| | |

Security type / sector allocation and top 10 equity holdings |

| Delaware Value® Fund | | As of November 30, 2016 (Unaudited) |

Sector designations may be different than the sector designations presented in other Fund materials. The sector designations may represent the investment manager’s internal sector classifications.

| | | | | | |

| Security type / sector | | Percentage of net assets | | | |

Common Stock | | 95.68% | | | | |

Consumer Discretionary | | 2.99% | | | | |

Consumer Staples | | 11.62% | | | | |

Energy | | 15.16% | | | | |

Financials | | 12.55% | | | | |

Healthcare | | 20.53% | | | | |

Industrials | | 9.53% | | | | |

Information Technology | | 10.98% | | | | |

Materials | | 3.18% | | | | |

Real Estate | | 0.32% | | | | |

Telecommunications | | 5.99% | | | | |

Utilities | | 2.83% | | | | |

Short-Term Investments | | 3.78% | | | | |

Total Value of Securities | | 99.46% | | | | |

Receivables and Other Assets Net of Liabilities | | 0.54% | | | | |

Total Net Assets | | 100.00% | | | | |

Holdings are for informational purposes only and are subject to change at any time. They are not a recommendation to buy, sell, or hold any security.

| | | | | | |

| Top 10 equity holdings | | Percentage of net assets | | | |

Halliburton | | 3.58% | | | | |

ConocoPhillips | | 3.55% | | | | |

BB&T | | 3.29% | | | | |

Chevron | | 3.28% | | | | |

Bank of New York Mellon | | 3.23% | | | | |

Northrop Grumman | | 3.21% | | | | |

EI du Pont de Nemours & Co. | | 3.18% | | | | |

Waste Management | | 3.16% | | | | |

Raytheon | | 3.16% | | | | |

Express Scripts Holding | | 3.16% | | | | |

| | |

| Schedule of investments | | |

| Delaware Value® Fund | | November 30, 2016 |

| | | | | | | | |

| | | Number of shares | | | Value (U.S. $) | |

| |

Common Stock – 95.68% | | | | | | | | |

| |

Consumer Discretionary – 2.99% | | | | | | | | |

Lowe’s | | | 5,841,166 | | | $ | 412,094,261 | |

| | | | | | | | |

| | | | | | | 412,094,261 | |

| | | | | | | | |

Consumer Staples – 11.62% | | | | | | | | |

Archer-Daniels-Midland | | | 9,420,837 | | | | 407,262,784 | |

CVS Health | | | 5,376,202 | | | | 413,376,172 | |

Kraft Heinz | | | 4,861,362 | | | | 396,930,207 | |

Mondelez International | | | 9,390,660 | | | | 387,270,818 | |

| | | | | | | | |

| | | | | | | 1,604,839,981 | |

| | | | | | | | |

Energy – 15.16% | | | | | | | | |

Chevron | | | 4,064,024 | | | | 453,382,517 | |

ConocoPhillips | | | 10,111,484 | | | | 490,609,204 | |

Halliburton | | | 9,315,599 | | | | 494,565,151 | |

Marathon Oil | | | 13,458,552 | | | | 243,061,449 | |

Occidental Petroleum | | | 5,768,422 | | | | 411,634,594 | |

| | | | | | | | |

| | | | | | | 2,093,252,915 | |

| | | | | | | | |

Financials – 12.55% | | | | | | | | |

Allstate | | | 5,869,382 | | | | 410,387,189 | |

Bank of New York Mellon | | | 9,412,874 | | | | 446,358,485 | |

BB&T | | | 10,051,923 | | | | 454,849,516 | |

Marsh & McLennan | | | 6,085,087 | | | | 421,757,380 | |

| | | | | | | | |

| | | | | | | 1,733,352,570 | |

| | | | | | | | |

Healthcare – 20.53% | | | | | | | | |

Abbott Laboratories | | | 10,059,600 | | | | 382,968,972 | |

Cardinal Health | | | 5,660,044 | | | | 401,919,724 | |

Express Scripts Holding † | | | 5,752,375 | | | | 436,490,215 | |

Johnson & Johnson | | | 3,502,812 | | | | 389,862,976 | |

Merck & Co. | | | 6,553,242 | | | | 400,992,878 | |

Pfizer | | | 12,507,358 | | | | 401,986,486 | |

Quest Diagnostics | | | 4,808,185 | | | | 420,523,860 | |

| | | | | | | | |

| | | | | | | 2,834,745,111 | |

| | | | | | | | |

Industrials – 9.53% | | | | | | | | |

Northrop Grumman | | | 1,772,632 | | | | 442,537,579 | |

Raytheon | | | 2,919,834 | | | | 436,631,976 | |

Waste Management | | | 6,283,899 | | | | 436,856,659 | |

| | | | | | | | |

| | | | | | | 1,316,026,214 | |

| | | | | | | | |

Information Technology – 10.98% | | | | | | | | |

CA | | | 12,594,977 | | | | 402,535,465 | |

Cisco Systems | | | 13,331,047 | | | | 397,531,822 | |

Intel | | | 11,398,529 | | | | 395,528,956 | |

Xerox | | | 34,206,971 | | | | 319,835,179 | |

| | | | | | | | |

| | | | | | | 1,515,431,422 | |

| | | | | | | | |

| | |

| Schedule of investments | | |

| Delaware Value® Fund | | |

| | | | | | | | |

| | | Number of shares | | | Value (U.S. $) | |

| |

Common Stock (continued) | | | | | | | | |

| |

Materials – 3.18% | | | | | | | | |

EI du Pont de Nemours & Co. | | | 5,972,304 | | | $ | 439,621,297 | |

| | | | | | | | |

| | | | | | | 439,621,297 | |

| | | | | | | | |

Real Estate – 0.32% | | | | | | | | |

Equity Residential | | | 743,146 | | | | 44,596,191 | |

| | | | | | | | |

| | | | | | | 44,596,191 | |

| | | | | | | | |

Telecommunications – 5.99% | | | | | | | | |

AT&T | | | 10,559,908 | | | | 407,929,246 | |

Verizon Communications | | | 8,401,033 | | | | 419,211,547 | |

| | | | | | | | |

| | | | | | | 827,140,793 | |

| | | | | | | | |

Utilities – 2.83% | | | | | | | | |

Edison International | | | 5,672,898 | | | | 390,125,196 | |

| | | | | | | | |

| | | | | | | 390,125,196 | |

| | | | | | | | |

Total Common Stock (cost $10,981,634,956) | | | | | | | 13,211,225,951 | |

| | | | | | | | |

| | |

| | | Principal amount° | | | | |

| |

Short-Term Investments – 3.78% | | | | | | | | |

| |

Discount Notes – 2.69%≠ | | | | | | | | |

Federal Home Loan Bank | | | | | | | | |

0.263% 12/20/16 | | | 32,308,288 | | | | 32,305,219 | |

0.286% 12/21/16 | | | 172,345,422 | | | | 172,328,187 | |

0.325% 1/25/17 | | | 77,799,892 | | | | 77,759,514 | |

0.383% 1/27/17 | | | 59,262,772 | | | | 59,230,889 | |

0.401% 2/3/17 | | | 29,621,240 | | | | 29,597,543 | |

| | | | | | | | |

| | | | | | | 371,221,352 | |

| | | | | | | | |

Repurchase Agreements – 1.09% | | | | | | | | |

Bank of America Merrill Lynch

0.22%, dated 11/30/16, to be repurchased on 12/1/16, repurchase price $55,606,783 (collateralized by U.S. government obligations 2.625% 7/15/17; market value $56,718,580) | | | 55,606,443 | | | | 55,606,443 | |

Bank of Montreal

0.25%, dated 11/30/16, to be repurchased on 12/1/16, repurchase price $92,678,048 (collateralized by U.S. government obligations 1.125%–3.75% 1/15/17–8/15/45; market value $94,530,982) | | | 92,677,404 | | | | 92,677,404 | |

| | | | | | | | |

| | | Principal amount° | | | Value (U.S. $) | |

| |

Short-Term Investments (continued) | | | | | | | | |

| |

Repurchase Agreements (continued) | | | | | | | | |

BNP Paribas

0.27%, dated 11/30/16, to be repurchased on 12/1/16, repurchase price $2,838,174 (collateralized by U.S. government obligations 3.00% 11/15/45; market value $2,894,929) | | | 2,838,153 | | | $ | 2,838,153 | |

| | | | | | | | |

| | | | | | | 151,122,000 | |

| | | | | | | | |

Total Short-Term Investments (cost $522,332,163) | | | | | | | 522,343,352 | |

| | | | | | | | |

| | |

Total Value of Securities – 99.46%

(cost $11,503,967,119) | | | | | | $ | 13,733,569,303 | |

| | | | | | | | |

| ≠ | The rate shown is the effective yield at the time of purchase. |

| ° | Principal amount shown is stated in U.S. dollars unless noted that the security is denominated in another currency. |

| † | Non-income-producing security. |

See accompanying notes, which are an integral part of the financial statements.

| | |

| Statement of assets and liabilities | | |

| Delaware Value® Fund | | November 30, 2016 |

| | | | |

Assets: | | | | |

Investments, at value1 | | $ | 13,211,225,951 | |

Short-term investments, at value2 | | | 522,343,352 | |

Cash | | | 1,181 | |

Receivable for fund shares sold | | | 92,754,718 | |

Dividends and interest receivable | | | 35,932,338 | |

Receivables for securities sold | | | 27,065,240 | |

| | | | |

Total assets | | | 13,889,322,780 | |

| | | | |

Liabilities: | | | | |

Payable for securities purchased | | | 44,740,236 | |

Payable for fund shares redeemed | | | 25,103,247 | |

Dividend disbursing and transfer agent fees and expenses payable to affiliates | | | 223,317 | |

Investment management fees payable to affiliates | | | 5,671,891 | |

Other accrued expenses | | | 4,448,906 | |

Distribution fees payable to affiliates | | | 1,516,595 | |

Trustees’ fees and expenses payable | | | 86,930 | |

Accounting and Administration expense payable to affiliates | | | 51,933 | |

Legal fees payable to affiliates | | | 21,888 | |

Reports and statements to shareholders expenses payable to affiliates | | | 9,980 | |

| | | | |

Total liabilities | | | 81,874,923 | |

| | | | |

Total Net Assets | | $ | 13,807,447,857 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Paid-in capital | | $ | 11,433,691,512 | |

Undistributed net investment income | | | 40,791,084 | |

Accumulated net realized gain on investments | | | 103,363,077 | |

Net unrealized appreciation of investments | | | 2,229,602,184 | |

| | | | |

Total Net Assets | | $ | 13,807,447,857 | |

| | | | |

| | | | |

Net Asset Value | | | | |

Class A: | | | | |

Net assets | | $ | 3,928,981,245 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 200,868,945 | |

Net asset value per share | | $ | 19.56 | |

Sales charge | | | 5.75 | % |

Offering price per share, equal to net asset value per share / (1 – sales charge) | | $ | 20.75 | |

| |

Class C: | | | | |

Net assets | | $ | 818,878,715 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 41,986,013 | |

Net asset value per share | | $ | 19.50 | |

| |

Class R: | | | | |

Net assets | | $ | 184,004,050 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 9,415,512 | |

Net asset value per share | | $ | 19.54 | |

| |

Institutional Class: | | | | |

Net assets | | $ | 8,870,934,395 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 453,436,789 | |

Net asset value per share | | $ | 19.56 | |

| |

Class R6: | | | | |

Net assets | | $ | 4,649,452 | |

Shares of beneficial interest outstanding, unlimited authorization, no par | | | 237,629 | |

Net asset value per share | | $ | 19.57 | |

| | | | | |

1Investments, at cost | | $ | 10,981,634,956 | |

2Short-term investments, at cost | | | 522,332,163 | |

See accompanying notes, which are an integral part of the financial statements.

| | |

| Statement of operations | | |

| Delaware Value® Fund | | Year ended November 30, 2016 |

| | | | |

Investment Income: | | | | |

Dividends | | $ | 299,658,796 | |

Interest | | | 845,020 | |

| | | | |

| | | 300,503,816 | |

| | | | |

| |

Expenses: | | | | |

Management fees | | | 59,429,427 | |

Distribution expenses – Class A | | | 8,047,804 | |

Distribution expenses – Class C | | | 7,173,888 | |

Distribution expenses – Class R | | | 745,684 | |

Dividend disbursing and transfer agent fees and expenses | | | 15,857,346 | |

Accounting and administration expenses | | | 3,686,614 | |

Reports and statements to shareholders expenses | | | 1,284,634 | |

Registration fees | | | 803,696 | |

Trustees’ fees and expenses | | | 562,483 | |

Legal fees | | | 561,140 | |

Custodian fees | | | 393,207 | |

Audit and tax fees | | | 35,338 | |

Other | | | 239,327 | |

| | | | |

| | | 98,820,588 | |

Less expense paid indirectly | | | (12,001 | ) |

| | | | |

Total operating expenses | | | 98,808,587 | |

| | | | |

Net Investment Income | | | 201,695,229 | |

| | | | |

| |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain | | | 134,900,076 | |

Net change in unrealized appreciation (depreciation) of investments | | | 989,092,722 | |

| | | | |

Net Realized and Unrealized Gain | | | 1,123,992,798 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 1,325,688,027 | |

| | | | |

See accompanying notes, which are an integral part of the financial statements.

This page intentionally left blank.

| | |

| Statements of changes in net assets | | |

| Delaware Value® Fund | | |

| | | | | | | | |

| | | Year ended | |

| | | 11/30/16 | | | 11/30/15 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 201,695,229 | | | $ | 144,075,438 | |

Net realized gain | | | 134,900,076 | | | | 189,655,114 | |

Net change in unrealized appreciation (depreciation) | | | 989,092,722 | | | | (246,479,635 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 1,325,688,027 | | | | 87,250,917 | |

| | | | | | | | |

| | |

Dividends and Distributions to Shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Class A | | | (52,421,697 | ) | | | (39,981,313 | ) |

Class C | | | (6,060,192 | ) | | | (3,842,687 | ) |

Class R | | | (1,954,944 | ) | | | (788,390 | ) |

Institutional Class | | | (131,519,196 | ) | | | (84,189,029 | ) |

Class R6 | | | (6,511 | ) | | | — | |

| | |

Net realized gain: | | | | | | | | |

Class A | | | (39,216,908 | ) | | | — | |

Class C | | | (8,476,395 | ) | | | — | |

Class R | | | (1,553,068 | ) | | | — | |

Institutional Class | | | (78,474,741 | ) | | | — | |

| | | | | | | | |

| | | (319,683,652 | ) | | | (128,801,419 | ) |

| | | | | | | | |

| | |

Capital Share Transactions: | | | | | | | | |

Proceeds from shares sold: | | | | | | | | |

Class A | | | 1,634,133,244 | | | | 1,119,589,298 | |

Class C | | | 275,740,101 | | | | 280,748,002 | |

Class R | | | 97,589,836 | | | | 93,383,233 | |

Institutional Class | | | 4,302,655,567 | | | | 2,919,482,321 | |

Class R6 | | | 4,983,453 | | | | — | |

| | |

Net asset value of shares issued upon reinvestment of dividends and distributions: | | | | | | | | |

Class A | | | 87,188,935 | | | | 37,665,649 | |

Class C | | | 13,728,367 | | | | 3,566,975 | |

Class R | | | 3,500,367 | | | | 783,126 | |

Institutional Class | | | 199,069,847 | | | | 80,478,287 | |

Class R6 | | | 6,511 | | | | — | |

| | | | | | | | |

| | | 6,618,596,228 | | | | 4,535,696,891 | |

| | | | | | | | |

| | | | | | | | |

| | | Year ended | |

| | | 11/30/16 | | | 11/30/15 | |

Capital Share Transactions (continued): | | | | | | | | |

Cost of shares redeemed: | | | | | | | | |

Class A | | $ | (989,943,512 | ) | | $ | (630,520,051 | ) |

Class C | | | (148,130,858 | ) | | | (74,692,394 | ) |

Class R | | | (43,426,661 | ) | | | (18,259,126 | ) |

Institutional Class | | | (2,095,731,992 | ) | | | (1,119,769,081 | ) |

Class R6 | | | (472,464 | ) | | | — | |

| | | | | | | | |

| | | (3,277,705,487 | ) | | | (1,843,240,652 | ) |

| | | | | | | | |

Increase in net assets derived from capital share transactions | | | 3,340,890,741 | | | | 2,692,456,239 | |

| | | | | | | | |

Net Increase in Net Assets | | | 4,346,895,116 | | | | 2,650,905,737 | |

| | |

Net Assets: | | | | | | | | |

Beginning of year | | | 9,460,552,741 | | | | 6,809,647,004 | |

| | | | | | | | |

End of year | | $ | 13,807,447,857 | | | $ | 9,460,552,741 | |

| | | | | | | | |

Undistributed net investment income | | $ | 40,791,084 | | | $ | 31,058,395 | |

| | | | | | | | |

See accompanying notes, which are an integral part of the financial statements.

Financial highlights

Delaware Value® Fund Class A

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

| |

|

| |

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income1 |

Net realized and unrealized gain (loss) |

|

Total from investment operations |

|

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

|

Total dividends and distributions |

|

|

Net asset value, end of period |

|

|

Total return2 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income to average net assets prior to fees waived |

Portfolio turnover |

|

|

| 1 | The average shares outstanding method has been applied for per share information. |

| 2 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during some of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended | |

| |

| | | 11/30/16 | | | | | 11/30/15 | | | | | 11/30/14 | | | | | 11/30/13 | | | | | 11/30/12 | |

| |

| | $ | 18.150 | | | | | $ | 18.200 | | | | | $ | 16.060 | | | | | $ | 12.440 | | | | | $ | 10.970 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.304 | | | | | | 0.297 | | | | | | 0.256 | | | | | | 0.233 | | | | | | 0.225 | |

| | | 1.645 | | | | | | (0.079 | ) | | | | | 2.121 | | | | | | 3.728 | | | | | | 1.439 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1.949 | | | | | | 0.218 | | | | | | 2.377 | | | | | | 3.961 | | | | | | 1.664 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.296 | ) | | | | | (0.268 | ) | | | | | (0.237 | ) | | | | | (0.341 | ) | | | | | (0.194 | ) |

| | | (0.243 | ) | | | | | — | | | | | | — | | | | | | — | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.539 | ) | | | | | (0.268 | ) | | | | | (0.237 | ) | | | | | (0.341 | ) | | | | | (0.194 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 19.560 | | | | | $ | 18.150 | | | | | $ | 18.200 | | | | | $ | 16.060 | | | | | $ | 12.440 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 11.02% | | | | | | 1.21% | | | | | | 14.92% | | | | | | 32.41% | | | | | | 15.40% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 3,928,981 | | | | | $ | 2,922,966 | | | | | $ | 2,410,759 | | | | | $ | 1,699,105 | | | | | $ | 988,578 | |

| | | 0.97% | | | | | | 0.98% | | | | | | 0.98% | | | | | | 1.01% | | | | | | 1.09% | |

| | | 0.97% | | | | | | 0.98% | | | | | | 0.98% | | | | | | 1.06% | | | | | | 1.17% | |

| | | 1.64% | | | | | | 1.63% | | | | | | 1.51% | | | | | | 1.61% | | | | | | 1.89% | |

| | | 1.64% | | | | | | 1.63% | | | | | | 1.51% | | | | | | 1.66% | | | | | | 1.81% | |

| | | 9% | | | | | | 12% | | | | | | 7% | | | | | | 6% | | | | | | 13% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Financial highlights

Delaware Value® Fund Class C

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

| |

|

| |

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income1 |

Net realized and unrealized gain (loss) |

|

Total from investment operations |

|

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

|

Total dividends and distributions |

|

|

Net asset value, end of period |

|

|

Total return2 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income to average net assets prior to fees waived |

Portfolio turnover |

|

|

| 1 | The average shares outstanding method has been applied for per share information. |

| 2 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value and does not reflect the impact of a sales charge. Total investment return during some of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended | |

| |

| | | 11/30/16 | | | | | 11/30/15 | | | | | 11/30/14 | | | | | 11/30/13 | | | | | 11/30/12 | |

| |

| | $ | 18.100 | | | | | $ | 18.150 | | | | | $ | 16.010 | | | | | $ | 12.340 | | | | | $ | 10.890 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.165 | | | | | | 0.160 | | | | | | 0.130 | | | | | | 0.126 | | | | | | 0.134 | |

| | | 1.637 | | | | | | (0.080 | ) | | | | | 2.119 | | | | | | 3.713 | | | | | | 1.430 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1.802 | | | | | | 0.080 | | | | | | 2.249 | | | | | | 3.839 | | | | | | 1.564 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.159 | ) | | | | | (0.130 | ) | | | | | (0.109 | ) | | | | | (0.169 | ) | | | | | (0.114 | ) |

| | | (0.243 | ) | | | | | — | | | | | | — | | | | | | — | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.402 | ) | | | | | (0.130 | ) | | | | | (0.109 | ) | | | | | (0.169 | ) | | | | | (0.114 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 19.500 | | | | | $ | 18.100 | | | | | $ | 18.150 | | | | | $ | 16.010 | | | | | $ | 12.340 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 10.18% | | | | | | 0.45% | | | | | | 14.10% | | | | | | 31.38% | | | | | | 14.49% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 818,879 | | | | | $ | 622,246 | | | | | $ | 415,076 | | | | | $ | 199,771 | | | | | $ | 74,407 | |

| | | 1.72% | | | | | | 1.73% | | | | | | 1.74% | | | | | | 1.77% | | | | | | 1.85% | |

| | | 1.72% | | | | | | 1.73% | | | | | | 1.74% | | | | | | 1.77% | | | | | | 1.88% | |

| | | 0.89% | | | | | | 0.88% | | | | | | 0.75% | | | | | | 0.87% | | | | | | 1.13% | |

| | | 0.89% | | | | | | 0.88% | | | | | | 0.75% | | | | | | 0.87% | | | | | | 1.10% | |

| | | 9% | | | | | | 12% | | | | | | 7% | | | | | | 6% | | | | | | 13% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Financial highlights

Delaware Value® Fund Class R

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

| |

|

| |

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income1 |

Net realized and unrealized gain (loss) |

|

Total from investment operations |

|

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

|

Total dividends and distributions |

|

|

Net asset value, end of period |

|

|

Total return2 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income to average net assets prior to fees waived |

Portfolio turnover |

|

|

| 1 | The average shares outstanding method has been applied for per share information. |

| 2 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during some of the periods shown reflects waivers by the manager and/or distributor. Performance would have been lower had the waivers not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended | |

| |

| | | 11/30/16 | | | | | 11/30/15 | | | | | 11/30/14 | | | | | 11/30/13 | | | | | 11/30/12 | |

| |

| | $ | 18.140 | | | | | $ | 18.190 | | | | | $ | 16.050 | | | | | $ | 12.400 | | | | | $ | 10.950 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.258 | | | | | | 0.250 | | | | | | 0.218 | | | | | | 0.197 | | | | | | 0.194 | |

| | | 1.635 | | | | | | (0.079 | ) | | | | | 2.115 | | | | | | 3.735 | | | | | | 1.423 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1.893 | | | | | | 0.171 | | | | | | 2.333 | | | | | | 3.932 | | | | | | 1.617 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.250 | ) | | | | | (0.221 | ) | | | | | (0.193 | ) | | | | | (0.282 | ) | | | | | (0.167 | ) |

| | | (0.243 | ) | | | | | — | | | | | | — | | | | | | — | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.493 | ) | | | | | (0.221 | ) | | | | | (0.193 | ) | | | | | (0.282 | ) | | | | | (0.167 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 19.540 | | | | | $ | 18.140 | | | | | $ | 18.190 | | | | | $ | 16.050 | | | | | $ | 12.400 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 10.70% | | | | | | 0.95% | | | | | | 14.63% | | | | | | 32.17% | | | | | | 14.96% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 184,004 | | | | | $ | 113,080 | | | | | $ | 37,236 | | | | | $ | 11,658 | | | | | $ | 5,219 | |

| | | 1.22% | | | | | | 1.23% | | | | | | 1.24% | | | | | | 1.27% | | | | | | 1.35% | |

| | | 1.22% | | | | | | 1.23% | | | | | | 1.24% | | | | | | 1.35% | | | | | | 1.48% | |

| | | 1.39% | | | | | | 1.38% | | | | | | 1.25% | | | | | | 1.37% | | | | | | 1.63% | |

| | | 1.39% | | | | | | 1.38% | | | | | | 1.25% | | | | | | 1.29% | | | | | | 1.50% | |

| | | 9% | | | | | | 12% | | | | | | 7% | | | | | | 6% | | | | | | 13% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Financial highlights

Delaware Value® Fund Institutional Class

Selected data for each share of the Fund outstanding throughout each period were as follows:

|

| |

|

| |

|

Net asset value, beginning of period |

|

Income (loss) from investment operations: |

Net investment income1 |

Net realized and unrealized gain (loss) |

|

Total from investment operations |

|

|

Less dividends and distributions from: |

Net investment income |

Net realized gain |

|

Total dividends and distributions |

|

|

Net asset value, end of period |

|

|

Total return2 |

|

Ratios and supplemental data: |

Net assets, end of period (000 omitted) |

Ratio of expenses to average net assets |

Ratio of expenses to average net assets prior to fees waived |

Ratio of net investment income to average net assets |

Ratio of net investment income to average net assets prior to fees waived |

Portfolio turnover |

|

|

| 1 | The average shares outstanding method has been applied for per share information. |

| 2 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. Total investment return during some of the periods shown reflects a waiver by the manager. Performance would have been lower had the waiver not been in effect. |

See accompanying notes, which are an integral part of the financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended | |

| |

| | | 11/30/16 | | | | | 11/30/15 | | | | | 11/30/14 | | | | | 11/30/13 | | | | | 11/30/12 | |

| |

| | $ | 18.160 | | | | | $ | 18.210 | | | | | $ | 16.060 | | | | | $ | 12.460 | | | | | $ | 10.990 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 0.350 | | | | | | 0.341 | | | | | | 0.300 | | | | | | 0.272 | | | | | | 0.254 | |

| | | 1.634 | | | | | | (0.078 | ) | | | | | 2.128 | | | | | | 3.724 | | | | | | 1.437 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1.984 | | | | | | 0.263 | | | | | | 2.428 | | | | | | 3.996 | | | | | | 1.691 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.341 | ) | | | | | (0.313 | ) | | | | | (0.278 | ) | | | | | (0.396 | ) | | | | | (0.221 | ) |

| | | (0.243 | ) | | | | | — | | | | | | — | | | | | | — | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (0.584 | ) | | | | | (0.313 | ) | | | | | (0.278 | ) | | | | | (0.396 | ) | | | | | (0.221 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | $ | 19.560 | | | | | $ | 18.160 | | | | | $ | 18.210 | | | | | $ | 16.060 | | | | | $ | 12.460 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | 11.23% | | | | | | 1.47% | | | | | | 15.26% | | | | | | 32.73% | | | | | | 15.66% | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 8,870,934 | | | | | $ | 5,802,261 | | | | | $ | 3,946,576 | | | | | $ | 2,072,765 | | | | | $ | 724,098 | |

| | | 0.72% | | | | | | 0.73% | | | | | | 0.74% | | | | | | 0.77% | | | | | | 0.85% | |

| | | 0.72% | | | | | | 0.73% | | | | | | 0.74% | | | | | | 0.77% | | | | | | 0.88% | |

| | | 1.89% | | | | | | 1.88% | | | | | | 1.75% | | | | | | 1.87% | | | | | | 2.13% | |

| | | 1.89% | | | | | | 1.88% | | | | | | 1.75% | | | | | | 1.87% | | | | | | 2.10% | |

| | | 9% | | | | | | 12% | | | | | | 7% | | | | | | 6% | | | | | | 13% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

Financial highlights

Delaware Value® Fund Class R6

Selected data for each share of the Fund outstanding throughout the period was as follows:

| | | | |

| | | 5/2/161 to 11/30/16 | |

| |

Net asset value, beginning of period | | $ | 18.490 | |

| |

Income from investment operations: | | | | |

Net investment income2 | | | 0.224 | |

Net realized and unrealized gain | | | 1.035 | |

| | | | |

Total from investment operations | | | 1.259 | |

| | | | |

| |

Less dividends and distributions from: | | | | |

Net investment income | | | (0.179 | ) |

| | | | |

Total dividends and distributions | | | (0.179 | ) |

| | | | |

| |

Net asset value, end of period | | $ | 19.570 | |

| | | | |

| |

Total return3 | | | 6.83% | |

| |

Ratios and supplemental data: | | | | |

Net assets, end of period (000 omitted) | | $ | 4,650 | |

Ratio of expenses to average net assets | | | 0.62% | |

Ratio of net investment income to average net assets | | | 2.01% | |

Portfolio turnover | | | 9% | 4 |

| | | | |

| |

| 1 | Date of commencement of operations; ratios and portfolio turnover have been annualized and total return has not been annualized. |

| 2 | The average shares outstanding method has been applied for per share information. |

| 3 | Total investment return is based on the change in net asset value of a share during the period and assumes reinvestment of dividends and distributions at net asset value. |

| 4 | Portfolio turnover is representative of the Fund for the entire year ended Nov. 30, 2016. |

See accompanying notes, which are an integral part of the financial statements.

| | |

| Notes to financial statements | | |

| Delaware Value® Fund | | November 30, 2016 |

Delaware Group® Equity Funds II (Trust) is organized as a Delaware statutory trust and offers one series: Delaware Value Fund (Fund). The Trust is an open-end investment company. The Fund is considered diversified under the Investment Company Act of 1940 (1940 Act), as amended, and offers Class A, Class C, Class R, Institutional Class, and Class R6 shares. Class A shares are sold with a maximum front-end sales charge of 5.75%. Class A share purchases of $1,000,000 or more will incur a contingent deferred sales charge (CDSC) instead of a front-end sales charge of 1.00% if redeemed during the first year and 0.50% during the second year, provided that Delaware Distributors, L.P. (DDLP) paid a financial advisor a commission on the purchase of those shares. Class C shares are sold with a CDSC of 1.00%, if redeemed during the first 12 months. Class R, Institutional Class, and Class R6 shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Class R6 shares do not pay any service fees, sub-accounting fees, and/or sub-transfer agency fees. Class R6 commenced operations on May 2, 2016.

The investment objective of the Fund is to seek long-term capital appreciation.

1. Significant Accounting Policies

The following accounting policies are in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and are consistently followed by the Fund.

Security Valuation – Equity securities, except those traded on the Nasdaq Stock Market LLC (Nasdaq), are valued at the last quoted sales price as of the time of the regular close of the New York Stock Exchange on the valuation date. Equity securities traded on the Nasdaq are valued in accordance with the Nasdaq Official Closing Price, which may not be the last sales price. If, on a particular day, an equity security does not trade, the mean between the bid and ask prices will be used, which approximates fair value. U.S. government and agency securities are valued at the mean between the bid and ask prices, which approximates fair value. Generally, other securities and assets for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Trust’s Board of Trustees (Board). In determining whether market quotations are readily available or fair valuations will be used, various factors will be taken into consideration, such as market closures or suspension of trading in a security.

Federal Income Taxes – No provision for federal income taxes has been made as the Fund intends to continue to qualify for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and make the requisite distributions to shareholders. The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax benefit or expense in the current year. Management has analyzed the Fund’s tax positions taken for all open federal income tax years (Nov. 30, 2013–Nov. 30, 2016), and has concluded that no provision for federal income tax is required in the Fund’s financial statements.

Class Accounting – Investment income, common expenses, and realized and unrealized gain (loss) on investments are allocated to the various classes of the Fund on the basis of daily net assets of each class. Distribution expenses relating to a specific class are charged directly to that class. Class R6

| | |

| Notes to financial statements | | |

| Delaware Value® Fund | | |

1. Significant Accounting Policies (continued)

shares will not be allocated any expenses related to service fees, sub-accounting fees, and/or sub-transfer agency fees paid to brokers, dealers, or other financial intermediaries.

Repurchase Agreements – The Fund may purchase certain U.S. government securities subject to the counterparty’s agreement to repurchase them at an agreed upon date and price. The counterparty will be required on a daily basis to maintain the value of the collateral subject to the agreement at not less than the repurchase price (including accrued interest). The agreements are conditioned upon the collateral being deposited under the Federal Reserve book-entry system with the Fund’s custodian or a third-party sub-custodian. In the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings. All open repurchase agreements as of the date of this report were entered into on Nov. 30, 2016 and matured on the next business day.

Use of Estimates – The Fund is an investment company, whose financial statements are prepared in conformity with U.S. GAAP. Therefore, the Fund follows the accounting and reporting guidelines for investment companies. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the fair value of investments, the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and the differences could be material.

Other – Expenses directly attributable to the Fund are charged directly to the Fund. Other expenses common to various funds within the Delaware Investments® Family of Funds are generally allocated among such funds on the basis of average net assets. Management fees and some other expenses are paid monthly. Security transactions are recorded on the date the securities are purchased or sold (trade date) for financial reporting purposes. Costs used in calculating realized gains and losses on the sale of investment securities are those of the specific securities sold. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Discounts and premiums on debt securities are accreted or amortized to interest income, respectively, over the lives of the respective securities using the effective interest method. The Fund declares and pays distributions from net investment income quarterly and net realized gain on investments, if any, annually. The Fund may distribute more frequently, if necessary for tax purposes. Dividends and distributions, if any, are recorded on the ex-dividend date.

Subject to seeking best execution, the Fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the Fund in cash. In general, best execution refers to many factors, including the price paid or received for a security, the commission charged, the promptness and reliability of execution, the confidentiality and placement accorded the order, and other factors affecting the overall benefit obtained by the Fund on the transaction. There were no commission rebates for the year ended Nov. 30, 2016.

The Fund may receive earnings credits from its custodian when positive cash balances are maintained, which may be used to offset custody fees. There were no such earnings credits for the year ended Nov. 30, 2016.

The Fund receives earnings credits from its transfer agent when positive cash balances are maintained, which may be used to offset transfer agent fees. If the amount earned is greater than $1.00, the expense paid under this arrangement is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses” with the corresponding expense offset shown under “Less expense paid indirectly.” For the year ended Nov. 30, 2016, the Fund earned $12,001 under this agreement.

2. Investment Management, Administration Agreements and Other Transactions with Affiliates

In accordance with the terms of its investment management agreement, the Fund pays Delaware Management Company (DMC), a series of Delaware Management Business Trust and the investment manager, an annual fee which is calculated daily at the rate of 0.65% on the first $500 million of average daily net assets of the Fund, 0.60% on the next $500 million, 0.55% on the next $1.5 billion, and 0.50% on average daily net assets in excess of $2.5 billion.

Delaware Investments Fund Services Company (DIFSC), an affiliate of DMC, provides fund accounting and financial administration oversight services to the Fund. For these services, DIFSC’s fees are calculated based on the aggregate daily net assets of the Delaware Investments® Family of Funds at the following annual rate: 0.0050% of the first $30 billion; 0.0045% of the next $10 billion; 0.0040% of the next $10 billion; and 0.0025% of aggregate average daily net assets in excess of $50 billion. The fees payable to DIFSC under the service agreement described above are allocated among all funds in the Delaware Investments Family of Funds on a relative net asset value (NAV) basis. For the year ended Nov. 30, 2016, the Fund was charged $543,815 for these services. This amount is included on the “Statement of operations” under “Accounting and administrative expenses.”

DIFSC is also the transfer agent and dividend disbursing agent of the Fund. For these services, DIFSC’s fees are calculated based on the aggregate daily net assets of the retail funds within the Delaware Investments Family of Funds at the following annual rate: 0.025% of the first $20 billion; 0.020% of the next $5 billion; 0.015% of the next $5 billion; and 0.013% of average daily net assets in excess of $30 billion. The fees payable to DIFSC under the service agreement described above are allocated among all retail funds in the Delaware Investments Family of Funds on a relative NAV basis. For the year ended Nov. 30, 2016, the Fund was charged $2,364,292 for these services. This amount is included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.” Pursuant to a sub-transfer agency agreement between DIFSC and BNY Mellon Investment Servicing (US) Inc. (BNYMIS), BNYMIS provides certain sub-transfer agency services to the Fund. Sub-transfer agency fees are paid by the Fund and are also included on the “Statement of operations” under “Dividend disbursing and transfer agent fees and expenses.”

Pursuant to a distribution agreement and distribution plan, the Fund pays DDLP, the distributor and an affiliate of DMC, an annual distribution and service (12b-1) fee of 0.25% of the average daily net assets of the Class A shares, 1.00% of the average daily net assets of the Class C shares, and 0.50% of the average daily net assets of the Class R shares. Institutional Class and Class R6 shares pay no 12b-1 fees. The Board has adopted a formula for calculating 12b-1 plan fees for the Fund’s Class A shares. The total 12b-1 fees to be paid by Class A shareholders of the Fund will be the sum of (1) 0.10% of the average daily net assets representing shares that were acquired prior to May 2, 1994 and (2) 0.25% of the average daily net assets representing shares that were acquired on or after May 2, 1994. All Class A

| | |

| Notes to financial statements | | |

| Delaware Value® Fund | | |

2. Investment Management, Administration Agreements and Other Transactions with Affiliates (continued)

shareholders will bear 12b-1 fees at the same rate, the blended rate, currently 0.25% of average daily net assets, based upon the allocation of the rates described above. This method of calculating Class A 12b-1 fees may be discontinued at the sole discretion of the Board.

As provided in the investment management agreement, the Fund bears a portion of the cost of certain resources shared with DMC, including the cost of internal personnel of DMC and/or its affiliates that provide legal, tax, and regulatory reporting services to the Fund. For the year ended Nov. 30, 2016, the Fund was charged $239,070 for internal legal, tax, and regulatory reporting services provided by DMC and/or its affiliates’ employees. This amount is included on the “Statement of operations” under “Legal fees.”

For the year ended Nov. 30, 2016, DDLP earned $434,970 for commissions on sales of the Fund’s Class A shares. For the year ended Nov. 30, 2016, DDLP received gross CDSC commissions of $45,330 and $104,229 on redemptions of the Fund’s Class A and Class C shares, respectively, and these commissions were entirely used to offset up-front commissions previously paid by DDLP to broker/dealers on sales of those shares.

Trustees’ fees include expenses accrued by the Fund for each Trustee’s retainer and meeting fees. Certain officers of DMC, DIFSC, and DDLP are officers and/or Trustees of the Trust. These officers and Trustees are paid no compensation by the Fund.

Cross trades for the year ended Nov. 30, 2016 were executed by the Fund pursuant to procedures adopted by the Board designed to ensure compliance with Rule 17a-7 under the 1940 Act. Cross trading is the buying or selling of portfolio securities between funds of investment companies, or between a fund of an investment company and another entity, that are or could be considered affiliates by virtue of having a common investment advisor (or affiliated investment advisors), common directors/trustees and/ or common officers. At its regularly scheduled meetings, the Board reviews such transactions for compliance with the procedures adopted by the Board. Pursuant to these procedures, for the year ended Nov. 30, 2016, the Fund engaged in securities purchases of $235,072,409 and securities sales of $393,419. There were no realized gains or losses under Rule 17a-7 for the year ended Nov. 30, 2016.

3. Investments

For year ended Nov. 30, 2016, the Fund made purchases and sales of investment securities other than short-term investments as follows:

| | | | |

Purchases | | $ | 3,758,360,403 | |

Sales | | | 1,000,015,108 | |

At Nov. 30, 2016, the cost and unrealized appreciation (depreciation) of investments for federal income tax purposes were as follows:

| | | | |

Cost of investments | | $ | 11,513,804,047 | |

| | | | |

Aggregate unrealized appreciation of investments | | $ | 2,486,562,828 | |

Aggregate unrealized depreciation of investments | | | (266,797,572 | ) |

| | | | |

Net unrealized appreciation of investments | | $ | 2,219,765,256 | |

| | | | |

U.S. GAAP defines fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions. A three-level hierarchy for fair value measurements has been established based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available under the circumstances. The Fund’s investment in its entirety is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-level hierarchy of inputs is summarized on the following page:

| | |

| Level 1 – | | Inputs are quoted prices in active markets for identical investments. (Examples: equity securities, open-end investment companies, futures contracts, exchange-traded options contracts) |

| |

| Level 2 – | | Other observable inputs, including, but not limited to: quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks, and default rates), or other market-corroborated inputs. (Examples: debt securities, government securities, swap contracts, foreign currency exchange contracts, foreign securities utilizing international fair value pricing, broker-quoted securities, fair valued securities) |

| |

| Level 3 – | | Significant unobservable inputs, including the Fund’s own assumptions used to determine the fair value of investments. (Examples: broker-quoted securities, fair valued securities) |

Level 3 investments are valued using significant unobservable inputs. The Fund may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Valuations may also be based upon current market prices of securities that are comparable in coupon, rating, maturity, and industry. The derived value of a Level 3 investment may not represent the value which is received upon disposition and this could impact the results of operations.

The following table summarizes the valuation of the Fund’s investments by fair value hierarchy levels as of Nov. 30, 2016:

| | | | | | | | | | | | |

Securities | | Level 1 | | | Level 2 | | | Total | |

Common Stock | | $ | 13,211,225,951 | | | $ | — | | | $ | 13,211,225,951 | |

Short-Term Investments | | | — | | | | 522,343,352 | | | | 522,343,352 | |

| | | | | | | | | | | | |

Total Value of Securities | | $ | 13,211,225,951 | | | $ | 522,343,352 | | | $ | 13,733,569,303 | |

| | | | | | | | | | | | |

During the year ended Nov. 30, 2016, there were no transfers between Level 1 investments, Level 2 investments, or Level 3 investments that had a significant impact to the Fund. The Fund’s policy is to recognize transfers between levels at the beginning of the reporting period.

| | |

| Notes to financial statements | | |

| Delaware Value® Fund | | |

3. Investments (continued)

A reconciliation of Level 3 investments is presented when the Fund has a significant amount of Level 3 investments at the beginning, interim, or end of the period in relation to net assets. During the year ended Nov. 30, 2016, there were no Level 3 investments.

4. Dividend and Distribution Information