UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number_811-01608

Franklin High Income Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

_Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 5/31

Date of reporting period: 11/30/15

Item 1. Reports to Stockholders.

Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools.

2 Semiannual Report

franklintempleton.com

Semiannual Report

Franklin High Income Fund

This semiannual report for Franklin High Income Fund covers the period ended November 30, 2015.

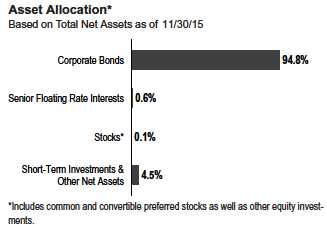

Your Fund’s Goals and Main Investments

The Fund seeks a high level of current income, with a secondary goal of capital appreciation, by investing substantially in high yield, lower rated debt securities and preferred stocks.

Performance Overview

The Fund’s Class A shares had a -10.60% cumulative total return for the six months under review. In comparison, the benchmark Credit Suisse (CS) High Yield Index, which tracks the high yield debt market, returned -6.12%.1 The Fund’s peers had a -5.40% total return, as measured by the Lipper High Yield Funds Classification Average, which consists of funds chosen by Lipper that aim at high relative current yield from fixed income securities.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Economic and Market Overview

U.S. economic growth improved during the six months under review amid healthy consumer spending. The economy strengthened in the second quarter but moderated in the third quarter as businesses cut back on inventories, exports slowed, and state and local governments reduced their spending. Manufacturing activities expanded for most of the period but contracted toward-period end. Non-manufacturing activities, however, increased throughout the six-month period, contributing to new jobs and helping drive down the unemployment rate to 5.0% at period-end, the lowest level in more than seven years.3 Home prices rose as new and existing home sales slowed and mortgage rates remained low. Retail sales grew modestly, driven by automobile and auto component sales. Inflation remained subdued, but after two consecutive declines, monthly inflation, as measured by the Consumer Price Index, rose modestly in October and held steady in November.

During the six-month period, the Federal Reserve (Fed) kept its target interest rate at 0%–0.25% while considering when an increase might be appropriate. Although global financial markets anticipated an increase, the Fed kept interest rates unchanged and said it expected moderate economic expansion, but it would monitor developments domestically and abroad. The Fed’s October meeting minutes indicated that most members acknowledged the possibility of an interest rate increase at their next meeting.

The 10-year Treasury yield, which moves inversely to price, shifted throughout the period. It began at 2.12% in May and rose to a period high of 2.50% in June based partly on upbeat domestic and eurozone economic data as well as Greece’s

1. Source: Credit Suisse Group.

2. Source: Lipper, a Thomson Reuters Company. For the six-month period ended 11/30/15, this category consisted of 677 funds. Lipper calcu-

lations do not include sales charges or expense subsidization by a fund’s manager. Fund performance relative to the average may have dif-

fered if these or other factors had been considered.

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is

not representative of the Fund’s portfolio.

3. Source: Bureau of Labor Statistics.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 17.

franklintempleton.com

Semiannual Report 3

FRANKLIN HIGH INCOME FUND

agreement with its international creditors. However, the yield declined to a period low of 1.99% in early October and ended the period slightly higher at 2.21% as investors sought less risky assets due to the Fed’s possible interest rate increase at its December policy meeting as well as weak Chinese data.

Dividend Distributions*

6/1/15–11/30/15

| Dividend per Share (cents) | |||||

| Advisor | |||||

| Month | Class A | Class C | Class R | Class R6 | Class |

| June | 1.00 | 0.92 | 0.95 | 1.06 | 1.03 |

| July | 1.00 | 0.92 | 0.95 | 1.06 | 1.03 |

| August | 1.00 | 0.92 | 0.95 | 1.06 | 1.03 |

| September | 1.00 | 0.92 | 0.94 | 1.04 | 1.02 |

| October | 1.00 | 0.92 | 0.94 | 1.04 | 1.02 |

| November | 1.00 | 0.92 | 0.94 | 1.04 | 1.02 |

| Total | 6.00 | 5.52 | 5.67 | 6.30 | 6.15 |

*The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income. All Fund distributions will vary depending upon current market conditions, and past distributions are not indicative of future trends.

Investment Strategy

We are disciplined, fundamental investors who mainly rely on our analysts’ in-depth industry expertise to evaluate companies. We examine sectors and individual securities in detail. When evaluating an issuer’s creditworthiness, we consider the issuer’s experience, managerial strength, sensitivity to economic conditions, credit rating, and current and prospective financial condition.

Manager’s Discussion

Over the past six months, financial market volatility rose as investors focused on a slowdown in Chinese economic growth, the prospect for the Fed to begin increasing its target short-term interest rate, and the continued decline in global commodity prices. Market pessimism peaked toward the end of the third calendar quarter as the Fed decided against an expected rate increase, citing concerns over global economic developments. In this environment, fixed income and equity markets rose and fell. Nonetheless, by period-end U.S. equity markets, as measured by the Standard & Poor’s 500 Index, were relatively unchanged, as were longer term U.S. interest rates, with the 10-year Treasury yield at 2.21% at period-end, relatively similar to rates at the beginning of the reporting period.

Focusing on the high yield corporate bond market, commodity price weakness was a significant detractor from high yield market returns, as the energy and metals and mining sectors represented a large portion of the high yield index. Moreover, although new-issue supply was lower than in 2014, redemptions from dedicated high yield mutual funds further pressured pricing levels for the asset class. Overall, yield spreads to comparable Treasuries widened from 5.0 percentage points to 6.8 percentage points by period-end, above their long-term historical average.

Fundamentally, with the continued decline in commodity prices, earnings and credit quality trends for the energy and metals and mining sectors could be challenged going into 2016.4 Even assuming a moderate rebound in select commodity prices over the intermediate term, we expected default rates could rise in commodity-related sectors as companies attempt to reduce debt on their balance sheets and strengthen liquidity in the face of lower cash flow and earnings prospects. However, with the average valuation for issuers in these sectors at what we considered distressed levels (spreads to Treasuries of more than 10 percentage points), we believed much of this negative fundamental outlook had been priced into securities. Therefore, we held a more aggressive positioning, particularly within the energy sector, in the Fund.

In other areas, the fundamental outlook for the remainder of the high yield corporate bond market was more supportive. Although earnings growth and margin improvements may have already peaked and debt ratios have ticked higher over the past few years, given significant refinancing activity and earnings growth over the past several years, non-commodity high yield issuers have experienced below-average default rates. Even though spread valuations were somewhat richer, in our analysis, for these non-commodity related issuers, given the prospect for more stable credit fundamentals, we still judged valuations to be relatively attractive across many of these industries. Outside of energy, our largest industry weightings at period-end were in the health care and financials sectors.5 However, given the Fund’s positioning in energy-related issuers, the Fund held a higher risk stance at period-end.

In terms of the Fund’s performance, during the period the Fund underperformed the CS High Yield Index and the return of peer

4. Metals and mining is part of materials in the SOI.

5. The health care sector comprises health care equipment and services in the SOI. The financials sector comprises banks, diversified finan-

cials and real estate in the SOI.

4 Semiannual Report

franklintempleton.com

FRANKLIN HIGH INCOME FUND

| Top 10 Holdings by Issuer* | ||

| 11/30/15 | ||

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| HCA Inc. | 2.2 | % |

| Health Care Equipment & Services | ||

| First Data Corp. | 2.2 | % |

| Software & Services | ||

| Sprint Communications Inc. | 2.0 | % |

| Telecommunication Services | ||

| Reynolds Group Issuer Inc./LLC/SA | 1.4 | % |

| Materials | ||

| Energy Transfer Equity LP | 1.3 | % |

| Energy | ||

| T-Mobile USA Inc. | 1.3 | % |

| Telecommunication Services | ||

| CIT Group Inc. | 1.3 | % |

| Banks | ||

| Navient Corp. | 1.2 | % |

| Diversified Financials | ||

| CCO Holdings LLC/CCO Holdings Capital Corp. | 1.2 | % |

| Media | ||

| JBS USA LLC/Finance Inc. | 1.2 | % |

| Food, Beverage & Tobacco | ||

| *Securities are listed by issuer, which may appear by another name in the SOI. | ||

funds, as measured by the Lipper High Yield Funds Classification Average.

Looking at sectors that negatively impacted the Fund’s relative peer performance, the Fund’s overweighted allocation and more aggressive positioning within the energy sector was a primary detractor from performance during the period. With oil and natural gas prices declining, the market not only seemed to price in an elevated expectation for defaults and restructurings, but also an expectation for lower recovery rates. Although we anticipated companies will increasingly seek to reduce debt on their balance sheets through distressed exchanges and select outright restructurings, given an outlook toward an intermediate-term increase in oil and gas prices from current levels, we found what we considered attractive value in select energy securities. Similarly, the Fund’s heavier exposure to metals and mining also detracted from performance, given price declines across a number of global commodities. Within our metals and mining exposure, we generally sought out issuers that we assessed could weather a prolonged period of lower commodity prices and/or invested in bonds that provided some degree of downside collateral protection relative to unsecured bonds. Nonetheless, overall securities in this sector underperformed the broader high yield market during the period. Conversely, the Fund held a lower weighting than its peers in the information technology sector, which outperformed, and therefore detracted from our relative returns.6

Certain of the Fund’s weightings in terms of industry positioning favorably impacted relative performance compared to the peer group. For example, the Fund held overweighted exposures compared to its peers in the financials; food, beverage and tobacco; and container and packaging industries.7 As these industries are all considered relatively defensive and either have little exposure to commodities or could actually benefit from lower commodity input prices, the Fund’s heavier weighting in these industries benefited relative performance.

6. The information technology sector comprises software and services, and technology hardware and equipment in the SOI.

7. Containers and packaging is part of materials in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Semiannual Report 5

FRANKLIN HIGH INCOME FUND

Thank you for your continued participation in Franklin High Income Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 Semiannual Report

franklintempleton.com

FRANKLIN HIGH INCOME FUND

Performance Summary as of November 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance tables does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Net Asset Value | ||||||

| Share Class (Symbol) | 11/30/15 | 5/31/15 | Change | |||

| A (FHAIX) | $ | 1.74 | $ | 2.01 | -$ | 0.27 |

| C (FCHIX) | $ | 1.76 | $ | 2.03 | -$ | 0.27 |

| R (FHIRX) | $ | 1.76 | $ | 2.04 | -$ | 0.28 |

| R6 (FHRRX) | $ | 1.74 | $ | 2.01 | -$ | 0.27 |

| Advisor (FVHIX) | $ | 1.74 | $ | 2.01 | -$ | 0.27 |

| Distributions1 (6/1/15–11/30/15) | ||||||

| Dividend | ||||||

| Share Class | Income | |||||

| A | $ | 0.0600 | ||||

| C | $ | 0.0552 | ||||

| R | $ | 0.0567 | ||||

| R6 | $ | 0.0630 | ||||

| Advisor | $ | 0.0615 | ||||

See page 9 for Performance Summary footnotes.

franklintempleton.com

Semiannual Report 7

FRANKLIN HIGH INCOME FUND

PERFORMANCE SUMMARY

Performance as of 11/30/152

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 4.25% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R/R6/Advisor Class: no sales charges.

| Cumulative | Average Annual | Value of | Average Annual | Total Annual | ||||||

| Share Class | Total Return3 | Total Return4 | $ | 10,000 Investment5 | Total Return (12/31/15)6 | Operating Expenses7 | ||||

| A | 0.76 | % | ||||||||

| 6-Month | -10.60 | % | -14.43 | % | $ | 8,557 | ||||

| 1-Year | -9.66 | % | -13.46 | % | $ | 8,654 | -14.62 | % | ||

| 5-Year | +22.69 | % | +3.26 | % | $ | 11,738 | +2.07 | % | ||

| 10-Year | +74.82 | % | +5.30 | % | $ | 16,757 | +4.70 | % | ||

| C | 1.26 | % | ||||||||

| 6-Month | -10.72 | % | -11.59 | % | $ | 8,841 | ||||

| 1-Year | -10.02 | % | -10.87 | % | $ | 8,913 | -11.91 | % | ||

| 5-Year | +20.06 | % | +3.72 | % | $ | 12,006 | +2.44 | % | ||

| 10-Year | +66.47 | % | +5.23 | % | $ | 16,647 | +4.63 | % | ||

| R | 1.11 | % | ||||||||

| 6-Month | -11.10 | % | -11.10 | % | $ | 8,890 | ||||

| 1-Year | -10.34 | % | -10.34 | % | $ | 8,966 | -10.88 | % | ||

| 5-Year | +20.18 | % | +3.74 | % | $ | 12,018 | +2.58 | % | ||

| 10-Year | +67.74 | % | +5.31 | % | $ | 16,774 | +4.82 | % | ||

| R6 | 0.47 | % | ||||||||

| 6-Month | -10.46 | % | -10.46 | % | $ | 8,954 | ||||

| 1-Year | -9.40 | % | -9.40 | % | $ | 9,060 | -10.47 | % | ||

| Since Inception (5/1/13) | -4.50 | % | -1.77 | % | $ | 9,550 | -3.23 | % | ||

| Advisor | 0.61 | % | ||||||||

| 6-Month | -10.53 | % | -10.53 | % | $ | 8,947 | ||||

| 1-Year | -9.53 | % | -9.53 | % | $ | 9,047 | -10.06 | % | ||

| 5-Year | +23.52 | % | +4.31 | % | $ | 12,352 | +3.14 | % | ||

| 10-Year | +76.34 | % | +5.84 | % | $ | 17,634 | +5.35 | % |

| 30-Day Standardized Yield9 | ||||||

| Distribution | ||||||

| Share Class | Rate8 | (with waiver) | (without waiver) | |||

| A | 6.59 | % | 6.97 | % | 6.96 | % |

| C | 6.27 | % | 6.77 | % | 6.77 | % |

| R | 6.41 | % | 7.00 | % | 7.00 | % |

| R6 | 7.17 | % | 7.59 | % | 7.59 | % |

| Advisor | 7.03 | % | 7.45 | % | 7.45 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 9 for Performance Summary footnotes.

8 Semiannual Report

franklintempleton.com

FRANKLIN HIGH INCOME FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. The risks associated with higher yielding, lower rated securities include higher risk of default and loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. In addition, interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust toa rise in interest rates, the Fund’s share price may decline. Investment in foreign securities also involves special risks, including currency fluctuations, and political and economic uncertainty. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: Class R: Class R6: Advisor Class: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. Shares are available to certain eligible investors as described in the prospectus. |

1. The distribution amount is the sum of the dividend payments to shareholders for the period shown and includes only estimated tax-basis net investment income.

2. The Fund has a fee waiver associated with any investment in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end. Fund

investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

3. Cumulative total return represents the change in value of an investment over the periods indicated.

4. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been

annualized.

5. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

6. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

7. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

8. Distribution rate is based on an annualization of the respective class’s November dividend and the maximum offering price (NAV for Classes C, R, R6 and Advisor) per share

on 11/30/15.

9. The 30-day standardized yield for the 30 days ended 11/30/15 reflects an estimated yield to maturity (assuming all portfolio securities are held to maturity). It should be

regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate (which reflects the Fund’s past dividends paid

to shareholders) or the income reported in the Fund’s financial statements.

franklintempleton.com

Semiannual Report 9

FRANKLIN HIGH INCOME FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

10 Semiannual Report

franklintempleton.com

FRANKLIN HIGH INCOME FUND

YOUR FUND’S EXPENSES

| Beginning Account | Ending Account | Expenses Paid During | ||||

| Share Class | Value 6/1/15 | Value 11/30/15 | Period* 6/1/15–11/30/15 | |||

| A | ||||||

| Actual | $ | 1,000 | $ | 894.00 | $ | 3.65 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.15 | $ | 3.89 |

| C | ||||||

| Actual | $ | 1,000 | $ | 892.80 | $ | 6.01 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.65 | $ | 6.41 |

| R | ||||||

| Actual | $ | 1,000 | $ | 889.00 | $ | 5.29 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.40 | $ | 5.65 |

| R6 | ||||||

| Actual | $ | 1,000 | $ | 895.40 | $ | 2.23 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.65 | $ | 2.38 |

| Advisor | ||||||

| Actual | $ | 1,000 | $ | 894.70 | $ | 2.94 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.90 | $ | 3.13 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.77%;

C: 1.27%; R: 1.12%; R6: 0.47%; and Advisor: 0.62%), multiplied by the average account value over the period, multiplied by 183/366 to reflect

the one-half year period.

franklintempleton.com

Semiannual Report 11

| FRANKLIN HIGH INCOME TRUST | ||||||||||||||||||

| Financial Highlights | ||||||||||||||||||

| Franklin High Income Fund | ||||||||||||||||||

| Six Months Ended | ||||||||||||||||||

| November 30, 2015 | Year Ended May 31, | |||||||||||||||||

| (unaudited) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||

| Class A | ||||||||||||||||||

| Per share operating performance | ||||||||||||||||||

| (for a share outstanding throughout the | ||||||||||||||||||

| period) | ||||||||||||||||||

| Net asset value, beginning of period | $ | 2.01 | $ | 2.15 | $ | 2.12 | $ | 1.97 | $ | 2.05 | $ | 1.89 | ||||||

| Income from investment operationsa: | ||||||||||||||||||

| Net investment incomeb | 0.06 | 0.12 | 0.13 | 0.13 | 0.14 | 0.15 | ||||||||||||

| Net realized and unrealized gains (losses) | (0.27 | ) | (0.14 | ) | 0.03 | 0.16 | (0.07 | ) | 0.16 | |||||||||

| Total from investment operations | (0.21 | ) | (0.02 | ) | 0.16 | 0.29 | 0.07 | 0.31 | ||||||||||

| Less distributions from net investment income. | (0.06 | ) | (0.12 | ) | (0.13 | ) | (0.14 | ) | (0.15 | ) | (0.15 | ) | ||||||

| Netassetvalue,endofperiod | $ | 1.74 | $ | 2.01 | $ | 2.15 | $ | 2.12 | $ | 1.97 | $ | 2.05 | ||||||

| Total returnc | (10.60 | )% | (0.83 | )% | 8.01 | % | 15.24 | % | 3.64 | % | 17.15 | % | ||||||

| Ratios to average net assetsd | ||||||||||||||||||

| Expensese | 0.77 | %f | 0.76 | %f | 0.76 | %f | 0.76 | % | 0.76 | % | 0.75 | % | ||||||

| Net investment income | 6.21 | % | 5.76 | % | 6.10 | % | 6.49 | % | 7.16 | % | 7.48 | % | ||||||

| Supplemental data | ||||||||||||||||||

| Netassets,endofperiod(000’s) | $ | 2,959,082 | $ | 3,611,985 | $ | 4,058,942 | $ | 3,920,619 | $ | 2,979,160 | $ | 2,750,251 | ||||||

| Portfolio turnover rate. | 9.87 | % | 34.67 | % | 29.33 | % | 28.89 | % | 22.52 | % | 51.57 | % | ||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

12 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

| FRANKLIN HIGH INCOME TRUST | ||||||||||||||||||

| FINANCIAL HIGHLIGHTS | ||||||||||||||||||

| Franklin High Income Fund (continued) | ||||||||||||||||||

| Six Months Ended | ||||||||||||||||||

| November 30, 2015 | Year Ended May 31, | |||||||||||||||||

| (unaudited) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||

| Class C | ||||||||||||||||||

| Per share operating performance | ||||||||||||||||||

| (for a share outstanding throughout the | ||||||||||||||||||

| period) | ||||||||||||||||||

| Net asset value, beginning of period | $ | 2.03 | $ | 2.17 | $ | 2.13 | $ | 1.99 | $ | 2.07 | $ | 1.90 | ||||||

| Income from investment operationsa: | ||||||||||||||||||

| Net investment incomeb | 0.05 | 0.11 | 0.12 | 0.13 | 0.13 | 0.14 | ||||||||||||

| Net realized and unrealized gains (losses) | (0.26 | ) | (0.14 | ) | 0.04 | 0.14 | (0.07 | ) | 0.17 | |||||||||

| Total from investment operations | (0.21 | ) | (0.03 | ) | 0.16 | 0.27 | 0.06 | 0.31 | ||||||||||

| Less distributions from net investment income. | (0.06 | ) | (0.11 | ) | (0.12 | ) | (0.13 | ) | (0.14 | ) | (0.14 | ) | ||||||

| Netassetvalue,endofperiod | $ | 1.76 | $ | 2.03 | $ | 2.17 | $ | 2.13 | $ | 1.99 | $ | 2.07 | ||||||

| Total returnc | (10.72 | )% | (1.32 | )% | 7.90 | % | 13.99 | % | 3.09 | % | 17.03 | % | ||||||

| Ratios to average net assetsd | ||||||||||||||||||

| Expensese | 1.27 | %f | 1.26 | %f | 1.26 | %f | 1.26 | % | 1.26 | % | 1.25 | % | ||||||

| Net investment income | 5.71 | % | 5.26 | % | 5.60 | % | 5.99 | % | 6.66 | % | 6.98 | % | ||||||

| Supplemental data | ||||||||||||||||||

| Netassets,endofperiod(000’s) | $ | 622,665 | $ | 784,613 | $ | 907,458 | $ | 814,757 | $ | 580,850 | $ | 494,073 | ||||||

| Portfolio turnover rate. | 9.87 | % | 34.67 | % | 29.33 | % | 28.89 | % | 22.52 | % | 51.57 | % | ||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report 13

| FRANKLIN HIGH INCOME TRUST | ||||||||||||||||||

| FINANCIAL HIGHLIGHTS | ||||||||||||||||||

| Franklin High Income Fund (continued) | ||||||||||||||||||

| Six Months Ended | ||||||||||||||||||

| November 30, 2015 | Year Ended May 31, | |||||||||||||||||

| (unaudited) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||

| Class R | ||||||||||||||||||

| Per share operating performance | ||||||||||||||||||

| (for a share outstanding throughout the | ||||||||||||||||||

| period) | ||||||||||||||||||

| Net asset value, beginning of period | $ | 2.04 | $ | 2.18 | $ | 2.14 | $ | 2.00 | $ | 2.08 | $ | 1.91 | ||||||

| Income from investment operationsa: | ||||||||||||||||||

| Net investment incomeb | 0.06 | 0.11 | 0.12 | 0.13 | 0.14 | 0.14 | ||||||||||||

| Net realized and unrealized gains (losses) | (0.28 | ) | (0.14 | ) | 0.04 | 0.14 | (0.08 | ) | 0.18 | |||||||||

| Total from investment operations | (0.22 | ) | (0.03 | ) | 0.16 | 0.27 | 0.06 | 0.32 | ||||||||||

| Less distributions from net investment income. | (0.06 | ) | (0.11 | ) | (0.12 | ) | (0.13 | ) | (0.14 | ) | (0.15 | ) | ||||||

| Netassetvalue,endofperiod | $ | 1.76 | $ | 2.04 | $ | 2.18 | $ | 2.14 | $ | 2.00 | $ | 2.08 | ||||||

| Total returnc | (11.10 | )% | (1.16 | )% | 8.02 | % | 14.05 | % | 3.25 | % | 17.12 | % | ||||||

| Ratios to average net assetsd | ||||||||||||||||||

| Expensese | 1.12 | %f | 1.11 | %f | 1.11 | %f | 1.11 | % | 1.11 | % | 1.10 | % | ||||||

| Net investment income | 5.86 | % | 5.41 | % | 5.75 | % | 6.14 | % | 6.81 | % | 7.13 | % | ||||||

| Supplemental data | ||||||||||||||||||

| Netassets,endofperiod(000’s) | $ | 254,885 | $ | 323,397 | $ | 363,756 | $ | 335,335 | $ | 263,425 | $ | 209,566 | ||||||

| Portfolio turnover rate. | 9.87 | % | 34.67 | % | 29.33 | % | 28.89 | % | 22.52 | % | 51.57 | % | ||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

14 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN HIGH INCOME TRUST

FINANCIAL HIGHLIGHTS

| Franklin High Income Fund (continued) | ||||||||||||

| Six Months Ended | ||||||||||||

| November 30, 2015 | Year Ended May 31, | |||||||||||

| (unaudited) | 2015 | 2014 | 2013 | a | ||||||||

| Class R6 | ||||||||||||

| Per share operating performance | ||||||||||||

| (for a share outstanding throughout the period) | ||||||||||||

| Net asset value, beginning of period | $ | 2.01 | $ | 2.15 | $ | 2.12 | $ | 2.14 | ||||

| Income from investment operationsb: | ||||||||||||

| Net investment incomec | 0.06 | 0.12 | 0.13 | 0.01 | ||||||||

| Net realized and unrealized gains (losses) | (0.27 | ) | (0.13 | ) | 0.04 | (0.03 | ) | |||||

| Total from investment operations | (0.21 | ) | (0.01 | ) | 0.17 | (0.02 | ) | |||||

| Less distributions from net investment income | (0.06 | ) | (0.13 | ) | (0.14 | ) | — | |||||

| Netassetvalue,endofperiod | $ | 1.74 | $ | 2.01 | $ | 2.15 | $ | 2.12 | ||||

| Total returnd | (10.46 | )% | (0.57 | )% | 8.27 | % | (0.93 | )% | ||||

| Ratios to average net assetse | ||||||||||||

| Expensesf | 0.47 | %g | 0.47 | %g | 0.49 | %g | 0.48 | % | ||||

| Net investment income | 6.51 | % | 6.05 | % | 6.37 | % | 6.78 | % | ||||

| Supplemental data | ||||||||||||

| Netassets,endofperiod(000’s) | $ | 81,408 | $ | 81,133 | $ | 35,633 | $ | 298 | ||||

| Portfolio turnover rate | 9.87 | % | 34.67 | % | 29.33 | % | 28.89 | % | ||||

aFor the period May 1, 2013 (effective date) to May 31, 2013.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report 15

| FRANKLIN HIGH INCOME TRUST | ||||||||||||||||||

| FINANCIAL HIGHLIGHTS | ||||||||||||||||||

| Franklin High Income Fund (continued) | ||||||||||||||||||

| Six Months Ended | ||||||||||||||||||

| November 30, 2015 | Year Ended May 31, | |||||||||||||||||

| (unaudited) | 2015 | 2014 | 2013 | 2012 | 2011 | |||||||||||||

| Advisor Class | ||||||||||||||||||

| Per share operating performance | ||||||||||||||||||

| (for a share outstanding throughout the | ||||||||||||||||||

| period) | ||||||||||||||||||

| Net asset value, beginning of period | $ | 2.01 | $ | 2.15 | $ | 2.12 | $ | 1.98 | $ | 2.06 | $ | 1.89 | ||||||

| Income from investment operationsa: | ||||||||||||||||||

| Net investment incomeb | 0.06 | 0.12 | 0.13 | 0.14 | 0.14 | 0.15 | ||||||||||||

| Net realized and unrealized gains (losses) | (0.27 | ) | (0.14 | ) | 0.04 | 0.14 | (0.07 | ) | 0.18 | |||||||||

| Total from investment operations | (0.21 | ) | (0.02 | ) | 0.17 | 0.28 | 0.07 | 0.33 | ||||||||||

| Less distributions from net investment income. | (0.06 | ) | (0.12 | ) | (0.14 | ) | (0.14 | ) | (0.15 | ) | (0.16 | ) | ||||||

| Netassetvalue,endofperiod | $ | 1.74 | $ | 2.01 | $ | 2.15 | $ | 2.12 | $ | 1.98 | $ | 2.06 | ||||||

| Total returnc | (10.53 | )% | (0.69 | )% | 8.15 | % | 14.81 | % | 3.79 | % | 17.89 | % | ||||||

| Ratios to average net assetsd | ||||||||||||||||||

| Expensese | 0.62 | %f | 0.61 | %f | 0.61 | %f | 0.61 | % | 0.61 | % | 0.60 | % | ||||||

| Net investment income | 6.36 | % | 5.91 | % | 6.25 | % | 6.64 | % | 7.31 | % | 7.63 | % | ||||||

| Supplemental data | ||||||||||||||||||

| Netassets,endofperiod(000’s) | $ | 1,088,790 | $ | 1,443,439 | $ | 1,720,196 | $ | 1,275,166 | $ | 857,927 | $ | 362,418 | ||||||

| Portfolio turnover rate. | 9.87 | % | 34.67 | % | 29.33 | % | 28.89 | % | 22.52 | % | 51.57 | % | ||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

16 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN HIGH INCOME TRUST

| Statement of Investments, November 30, 2015 (unaudited) | ||||

| Franklin High Income Fund | ||||

| Shares/ | ||||

| Country | Warrants | Value | ||

| Common Stocks and Other Equity Interests 0.0%† | ||||

| Consumer Services 0.0%† | ||||

| a,bStation Casinos Inc., wts., 6/17/18 | UnitedStates | 136,789 | $ | 213,390 |

| Transportation 0.0%† | ||||

| aCEVAHoldingsLLC | UnitedKingdom | 3,364 | 1,732,574 | |

| Total Common Stocks and Other Equity Interests | ||||

| (Cost $5,172,824) | 1,945,964 | |||

| Convertible Preferred Stocks 0.1% | ||||

| Transportation 0.1% | ||||

| aCEVAHoldingsLLC,cvt.pfd.,A-1. | UnitedKingdom | 134 | 93,800 | |

| aCEVAHoldingsLLC,cvt.pfd.,A-2. | UnitedKingdom | 7,283 | 3,750,549 | |

| Total Convertible Preferred Stocks (Cost $11,036,794) | 3,844,349 | |||

| Principal | ||||

| Amount* | ||||

| Corporate Bonds 94.8% | ||||

| Automobiles & Components 2.4% | ||||

| Fiat Chrysler Automobiles NV, senior note, 5.25%, 4/15/23 | UnitedKingdom | 55,000,000 | 54,656,250 | |

| The Goodyear Tire & Rubber Co., | ||||

| senior bond, 8.25%, 8/15/20 | UnitedStates | 10,000,000 | 10,429,500 | |

| senior note, 6.50%, 3/01/21 | UnitedStates | 25,200,000 | 26,704,188 | |

| senior note, 5.125%, 11/15/23 | UnitedStates | 15,000,000 | 15,412,500 | |

| cInternational Automotive Components Group SA, senior secured note, 144A, 9.125%, | ||||

| 6/01/18. | UnitedStates | 15,000,000 | 13,996,875 | |

| 121,199,313 | ||||

| Banks 4.8% | ||||

| dBank of America Corp., junior sub. bond, M, 8.125% to 5/15/18, FRN thereafter, | ||||

| Perpetual | UnitedStates | 55,000,000 | 57,200,000 | |

| CIT Group Inc., | ||||

| senior note, 5.25%, 3/15/18 | UnitedStates | 9,000,000 | 9,360,000 | |

| senior note, 5.375%, 5/15/20 | UnitedStates | 20,000,000 | 21,150,000 | |

| senior note, 5.00%, 8/15/22 | UnitedStates | 33,650,000 | 34,449,187 | |

| dCitigroup Inc., junior sub. bond, M, 6.30% to 5/15/24, FRN thereafter, Perpetual | UnitedStates | 47,600,000 | 46,886,000 | |

| dJPMorgan Chase & Co., | ||||

| junior sub. bond, R, 6.00% to 8/01/23, FRN thereafter, Perpetual | UnitedStates | 30,000,000 | 30,390,000 | |

| junior sub. bond, V, 5.00% to 7/30/19, FRN thereafter, Perpetual. | UnitedStates | 10,400,000 | 9,997,000 | |

| Royal Bank of Scotland Group PLC, | ||||

| sub. note, 6.125%, 12/15/22. | UnitedKingdom | 15,000,000 | 16,537,500 | |

| sub. note, 5.125%, 5/28/24 | UnitedKingdom | 13,900,000 | 14,308,313 | |

| 240,278,000 | ||||

| Capital Goods 2.7% | ||||

| cBombardier Inc., senior bond, 144A, 7.50%, 3/15/25 | Canada | 55,000,000 | 41,250,000 | |

| cCBC Ammo LLC/CBC FinCo Inc., senior note, 144A, 7.25%, 11/15/21 | Brazil | 25,000,000 | 22,000,000 | |

| cDigitalGlobe Inc., senior note, 144A, 5.25%, 2/01/21 | UnitedStates | 22,000,000 | 18,810,000 | |

| Navistar International Corp., senior bond, 8.25%, 11/01/21 | UnitedStates | 14,000,000 | 10,045,000 | |

| TransDigm Inc., | ||||

| senior sub. bond, 6.50%, 7/15/24 | UnitedStates | 9,500,000 | 9,405,000 | |

| csenior sub. bond, 144A, 6.50%, 5/15/25 | UnitedStates | 4,200,000 | 4,142,250 | |

| senior sub. note, 6.00%, 7/15/22. | UnitedStates | 9,400,000 | 9,282,500 | |

franklintempleton.com

Semiannual Report 17

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | ||||

| Principal | ||||

| Country | Amount* | Value | ||

| Corporate Bonds (continued) | ||||

| Capital Goods (continued) | ||||

| cZachry Holdings Inc., senior note, 144A, 7.50%, 2/01/20 | UnitedStates | 18,750,000 | $ | 18,843,750 |

| 133,778,500 | ||||

| Commercial & Professional Services 1.0% | ||||

| cAcosta Inc., senior note, 144A, 7.75%, 10/01/22 | UnitedStates | 20,000,000 | 18,550,000 | |

| b,eGoss Graphic Systems Inc., senior sub. note, 12.25%, 11/19/05 | UnitedStates | 9,053,899 | 905 | |

| IHS Inc., senior note, 5.00%, 11/01/22 | UnitedStates | 10,700,000 | 10,927,375 | |

| United Rentals North America Inc., senior bond, 5.75%, 11/15/24 | UnitedStates | 20,000,000 | 20,300,000 | |

| 49,778,280 | ||||

| Consumer Durables & Apparel 3.2% | ||||

| D.R. Horton Inc., senior note, 3.75%, 3/01/19 | UnitedStates | 20,000,000 | 20,475,000 | |

| KB Home, | ||||

| senior bond, 7.50%, 9/15/22 | UnitedStates | 25,000,000 | 25,375,000 | |

| senior note, 4.75%, 5/15/19 | UnitedStates | 11,000,000 | 10,835,000 | |

| senior note, 7.00%, 12/15/21 | UnitedStates | 10,000,000 | 10,025,000 | |

| M/I Homes Inc., senior note, 8.625%, 11/15/18 | UnitedStates | 5,500,000 | 5,658,125 | |

| cTaylor Morrison Communities Inc./Monarch Communities Inc., | ||||

| senior note, 144A, 5.25%, 4/15/21 | UnitedStates | 8,100,000 | 8,160,750 | |

| senior note, 144A, 5.875%, 4/15/23 | UnitedStates | 15,000,000 | 15,000,000 | |

| senior note, 144A, 5.625%, 3/01/24 | UnitedStates | 25,000,000 | 24,281,250 | |

| Toll Brothers Finance Corp., senior bond, 5.625%, 1/15/24. | UnitedStates | 20,000,000 | 21,150,000 | |

| Visant Corp., senior note, 10.00%, 10/01/17 | UnitedStates | 20,000,000 | 20,545,000 | |

| 161,505,125 | ||||

| Consumer Services 4.2% | ||||

| c1011778 BC ULC/New Red Finance Inc., | ||||

| secured note, second lien, 144A, 6.00%, 4/01/22 | Canada | 30,000,000 | 31,125,000 | |

| senior secured note, first lien, 144A, 4.625%, 1/15/22 | Canada | 19,800,000 | 20,047,500 | |

| c24 Hour Holdings III LLC, senior note, 144A, 8.00%, 6/01/22 | UnitedStates | 30,000,000 | 25,275,000 | |

| eCaesars Entertainment Operating Co. Inc., | ||||

| senior secured note, first lien, 11.25%, 6/01/17 | UnitedStates | 17,850,000 | 13,833,750 | |

| senior secured note, first lien, 9.00%, 2/15/20 | UnitedStates | 8,450,000 | 6,696,625 | |

| c,eFontainebleau Las Vegas, senior secured bond, first lien, 144A, 11.00%, 6/15/15 | UnitedStates | 20,000,000 | 2,500 | |

| cInternational Game Technology PLC, | ||||

| senior secured bond, 144A, 6.50%, 2/15/25 | UnitedStates | 26,500,000 | 24,462,813 | |

| senior secured note, 144A, 6.25%, 2/15/22 | UnitedStates | 25,000,000 | 23,890,625 | |

| MGM Resorts International, | ||||

| senior note, 6.625%, 12/15/21 | UnitedStates | 10,000,000 | 10,475,000 | |

| senior note, 6.00%, 3/15/23 | UnitedStates | 15,000,000 | 14,896,875 | |

| cWynn Las Vegas LLC/Wynn Las Vegas Capital Corp., senior bond, 144A, 5.50%, | ||||

| 3/01/25. | UnitedStates | 21,000,000 | 18,978,750 | |

| cWynn Macau Ltd., senior note, 144A, 5.25%, 10/15/21 | Macau | 22,500,000 | 20,334,375 | |

| 210,018,813 | ||||

| Diversified Financials 3.9% | ||||

| AerCap Ireland Capital Ltd./AerCap Global Aviation Trust, | ||||

| senior note, 4.25%, 7/01/20 | Netherlands | 9,250,000 | 9,400,313 | |

| senior note, 4.625%, 10/30/20 | Netherlands | 5,800,000 | 5,966,750 | |

| senior note, 5.00%, 10/01/21 | Netherlands | 20,100,000 | 20,866,312 | |

| senior note, 4.625%, 7/01/22 | Netherlands | 15,900,000 | 16,098,750 | |

18 Semiannual Report

franklintempleton.com

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | ||||

| Principal | ||||

| Country | Amount* | Value | ||

| Corporate Bonds (continued) | ||||

| Diversified Financials (continued) | ||||

| fDeutsche Bank AG, sub. bond, 4.296% to 5/24/23, FRN thereafter, 5/24/28 | Germany | 25,000,000 | $ | 23,631,250 |

| E*TRADE Financial Corp., | ||||

| senior note, 5.375%, 11/15/22 | UnitedStates | 10,000,000 | 10,600,000 | |

| senior note, 4.625%, 9/15/23 | UnitedStates | 10,000,000 | 10,300,000 | |

| Navient Corp., | ||||

| senior note, 5.50%, 1/15/19 | UnitedStates | 42,200,000 | 40,701,900 | |

| senior note, 4.875%, 6/17/19 | UnitedStates | 4,000,000 | 3,750,000 | |

| senior note, 5.00%, 10/26/20 | UnitedStates | 12,500,000 | 11,281,250 | |

| senior note, 5.875%, 3/25/21 | UnitedStates | 5,000,000 | 4,593,750 | |

| cNeuberger Berman Group LLC/Finance Corp., senior note, 144A, 5.875%, 3/15/22 | United States | 10,000,000 | 10,460,500 | |

| cOneMain Financial Holdings Inc., senior note, 144A, 7.25%, 12/15/21 | UnitedStates | 24,800,000 | 25,296,000 | |

| 192,946,775 | ||||

| Energy 16.2% | ||||

| c,eAlpha Natural Resources Inc., second lien, 144A, 7.50%, 8/01/20 | UnitedStates | 25,000,000 | 1,625,000 | |

| Atlas Energy Holdings Operating Co. LLC/Atlas Resource Finance Corp., | ||||

| senior note, 7.75%, 1/15/21 | UnitedStates | 25,500,000 | 8,797,500 | |

| senior note, 9.25%, 8/15/21 | UnitedStates | 17,400,000 | 6,177,000 | |

| BreitBurn Energy Partners LP/BreitBurn Finance Corp., senior bond, 7.875%, | ||||

| 4/15/22. | UnitedStates | 45,000,000 | 13,275,000 | |

| California Resources Corp., | ||||

| senior bond, 6.00%, 11/15/24. | UnitedStates | 35,000,000 | 21,021,875 | |

| senior note, 5.50%, 9/15/21 | UnitedStates | 16,900,000 | 10,224,500 | |

| cCalumet Specialty Products Partners LP/Calumet Finance Co., senior note, 144A, | ||||

| 7.75%, 4/15/23 | UnitedStates | 30,100,000 | 28,369,250 | |

| CGG SA, | ||||

| senior note, 6.50%, 6/01/21 | France | 29,000,000 | 15,877,500 | |

| senior note, 6.875%, 1/15/22 | France | 20,800,000 | 11,427,000 | |

| Chaparral Energy Inc., | ||||

| senior bond, 8.25%, 9/01/21 | UnitedStates | 10,000,000 | 2,200,000 | |

| senior bond, 7.625%, 11/15/22 | UnitedStates | 6,700,000 | 1,440,500 | |

| senior note, 9.875%, 10/01/20 | UnitedStates | 15,000,000 | 4,125,000 | |

| CHC Helicopter SA, | ||||

| senior note, 9.375%, 6/01/21 | Canada | 10,000,000 | 3,800,000 | |

| senior secured note, first lien, 9.25%, 10/15/20 | Canada | 40,500,000 | 19,642,500 | |

| Chesapeake Energy Corp., | ||||

| senior note, 6.625%, 8/15/20 | UnitedStates | 35,000,000 | 16,625,000 | |

| senior note, 4.875%, 4/15/22 | UnitedStates | 10,000,000 | 4,281,250 | |

| senior note, 5.75%, 3/15/23 | UnitedStates | 12,700,000 | 5,461,000 | |

| Clayton Williams Energy Inc., senior note, 7.75%, 4/01/19 | UnitedStates | 19,550,000 | 18,377,000 | |

| Compressco Partners LP/Finance Corp., senior note, 7.25%, 8/15/22 | UnitedStates | 12,900,000 | 10,440,938 | |

| CONSOL Energy Inc., | ||||

| senior note, 5.875%, 4/15/22 | UnitedStates | 20,900,000 | 13,794,000 | |

| csenior note, 144A, 8.00%, 4/01/23 | UnitedStates | 37,400,000 | 26,554,000 | |

| cCrestwood Midstream Partners LP/Crestwood Midstream Finance Corp., senior note, | ||||

| 144A, 6.25%, 4/01/23 | UnitedStates | 17,700,000 | 15,133,500 | |

| cDrill Rigs Holdings Inc., secured note, 144A, 6.50%, 10/01/17 | UnitedStates | 25,000,000 | 17,437,500 | |

| Energy Transfer Equity LP, | ||||

| senior bond, 5.875%, 1/15/24. | UnitedStates | 15,000,000 | 13,829,625 | |

| senior note, first lien, 7.50%, 10/15/20 | UnitedStates | 35,000,000 | 36,903,124 | |

| senior secured bond, first lien, 5.50%, 6/01/27 | UnitedStates | 17,900,000 | 15,080,750 | |

franklintempleton.com

Semiannual Report 19

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | |||||

| Principal | |||||

| Country | Amount* | Value | |||

| Corporate Bonds (continued) | |||||

| Energy (continued) | |||||

| Energy XXI Gulf Coast Inc., | |||||

| senior note, 9.25%, 12/15/17 | UnitedStates | 26,000,000 | $ | 7,670,000 | |

| csenior secured note, second lien, 144A, 11.00%, 3/15/20 | UnitedStates | 10,000,000 | 4,493,750 | ||

| cEnQuest PLC, senior note, 144A, 7.00%, 4/15/22 | UnitedKingdom | 25,000,000 | 15,171,875 | ||

| EPL Oil & Gas Inc., senior note, 8.25%, 2/15/18 | UnitedStates | 20,000,000 | 6,500,000 | ||

| cFerrellgas LP/Ferrellgas Finance Corp., senior note, 144A, 6.75%, 6/15/23 | UnitedStates | 33,900,000 | 30,503,220 | ||

| cGoodrich Petroleum Corp., | |||||

| second lien, 144A, 8.00%, 3/15/18 | UnitedStates | 15,000 | g | 6,900,000 | |

| secured note, second lien, 144A, 8.875%, 3/15/18 | UnitedStates | 17,500 | g | 8,750,000 | |

| Halcon Resources Corp., | |||||

| senior note, 9.75%, 7/15/20 | UnitedStates | 20,000,000 | 6,400,000 | ||

| senior note, 8.875%, 5/15/21 | UnitedStates | 5,000,000 | 1,550,000 | ||

| csenior secured note, third lien, 144A, 13.00%, 2/15/22 | UnitedStates | 20,000,000 | 9,350,000 | ||

| cKinder Morgan Inc., senior secured bond, first lien, 144A, 5.625%, 11/15/23 | UnitedStates | 25,000,000 | 23,206,025 | ||

| cLinn Energy LLC/Finance Corp., senior secured note, second lien, 144A, 12.00%, | |||||

| 12/15/20 | UnitedStates | 32,950,000 | 20,593,750 | ||

| Martin Midstream Partners LP/Martin Midstream Finance Corp., senior note, 7.25%, | |||||

| 2/15/21. | UnitedStates | 30,000,000 | 28,612,500 | ||

| Memorial Production Partners LP/Memorial Production Finance Corp., | |||||

| senior note, 7.625%, 5/01/21 | UnitedStates | 30,000,000 | 17,475,000 | ||

| senior note, 6.875%, 8/01/22 | UnitedStates | 14,000,000 | 7,840,000 | ||

| Memorial Resource Development Corp., senior note, 5.875%, 7/01/22 | UnitedStates | 20,000,000 | 18,750,000 | ||

| Midstates Petroleum Co. Inc./LLC, senior note, 9.25%, 6/01/21. | UnitedStates | 25,000,000 | 4,062,500 | ||

| cMurray Energy Corp., secured note, second lien, 144A, 11.25%, 4/15/21 | UnitedStates | 24,500,000 | 5,573,750 | ||

| Oasis Petroleum Inc., senior note, 6.875%, 3/15/22. | UnitedStates | 15,000,000 | 12,862,500 | ||

| cOcean Rig UDW Inc., senior note, 144A, 7.25%, 4/01/19 | UnitedStates | 20,000,000 | 9,500,000 | ||

| PBF Holding Co. LLC, first lien, 8.25%, 2/15/20 | UnitedStates | 15,000,000 | 15,731,250 | ||

| cPeabody Energy Corp., second lien, 144A, 10.00%, 3/15/22 | UnitedStates | 53,000,000 | 12,720,000 | ||

| Penn Virginia Corp., senior note, 8.50%, 5/01/20. | UnitedStates | 25,000,000 | 5,625,000 | ||

| QEP Resources Inc., | |||||

| senior bond, 5.375%, 10/01/22 | UnitedStates | 20,000,000 | 18,100,000 | ||

| senior bond, 5.25%, 5/01/23 | UnitedStates | 10,000,000 | 8,975,000 | ||

| c,e,hQuicksilver Resources Inc., secured note, second lien, 144A, FRN, 7.00%, 6/21/19 | United States | 9,175,000 | 2,798,375 | ||

| Sabine Pass Liquefaction LLC, | |||||

| first lien, 5.625%, 2/01/21 | UnitedStates | 30,000,000 | 29,175,000 | ||

| first lien, 5.625%, 4/15/23 | UnitedStates | 13,300,000 | 12,335,750 | ||

| csenior secured note, first lien, 144A, 5.625%, 3/01/25 | UnitedStates | 10,000,000 | 9,162,500 | ||

| Sanchez Energy Corp., | |||||

| senior note, 7.75%, 6/15/21 | UnitedStates | 10,000,000 | 7,650,000 | ||

| senior note, 6.125%, 1/15/23 | UnitedStates | 20,000,000 | 13,850,000 | ||

| cTriangle USA Petroleum Corp., senior note, 144A, 6.75%, 7/15/22 | UnitedStates | 20,000,000 | 8,500,000 | ||

| cUltra Petroleum Corp., senior bond, 144A, 6.125%, 10/01/24 | UnitedStates | 40,000,000 | 15,200,000 | ||

| Vanguard Natural Resources LLC/Finance Corp., senior note, 7.875%, 4/01/20 | UnitedStates | 20,000,000 | 10,500,000 | ||

| W&T Offshore Inc., senior note, 8.50%, 6/15/19 | UnitedStates | 40,000,000 | 17,200,000 | ||

| WPX Energy Inc., | |||||

| senior note, 6.00%, 1/15/22 | UnitedStates | 35,000,000 | 29,837,500 | ||

| senior note, 8.25%, 8/01/23 | UnitedStates | 5,300,000 | 4,968,750 | ||

| 810,014,307 | |||||

20 Semiannual Report

franklintempleton.com

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | ||||

| Principal | ||||

| Country | Amount* | Value | ||

| Corporate Bonds (continued) | ||||

| Food, Beverage & Tobacco 2.8% | ||||

| Cott Beverages Inc., senior note, 6.75%, 1/01/20 | UnitedStates | 20,000,000 | $ | 20,800,000 |

| cDole Food Co. Inc., senior secured note, 144A, 7.25%, 5/01/19 | UnitedStates | 8,600,000 | 8,621,500 | |

| cJBS USA LLC/Finance Inc., | ||||

| senior bond, 144A, 5.875%, 7/15/24 | UnitedStates | 17,100,000 | 16,875,563 | |

| senior note, 144A, 8.25%, 2/01/20 | UnitedStates | 25,000,000 | 26,312,500 | |

| senior note, 144A, 7.25%, 6/01/21 | UnitedStates | 14,900,000 | 15,607,750 | |

| Post Holdings Inc., | ||||

| senior note, 7.375%, 2/15/22 | UnitedStates | 20,000,000 | 20,893,800 | |

| csenior note, 144A, 6.75%, 12/01/21 | UnitedStates | 25,600,000 | 26,176,000 | |

| csenior note, 144A, 6.00%, 12/15/22 | UnitedStates | 5,400,000 | 5,346,000 | |

| 140,633,113 | ||||

| Health Care Equipment & Services 6.4% | ||||

| Alere Inc., | ||||

| senior note, 7.25%, 7/01/18 | UnitedStates | 20,000,000 | 20,753,200 | |

| senior sub. note, 6.50%, 6/15/20. | UnitedStates | 10,000,000 | 9,950,000 | |

| CHS/Community Health Systems Inc., | ||||

| senior note, 8.00%, 11/15/19 | UnitedStates | 20,000,000 | 20,350,000 | |

| senior note, 7.125%, 7/15/20 | UnitedStates | 13,300,000 | 13,366,500 | |

| senior note, 6.875%, 2/01/22 | UnitedStates | 4,600,000 | 4,473,500 | |

| senior secured note, 5.125%, 8/01/21 | UnitedStates | 4,100,000 | 4,161,500 | |

| senior secured note, first lien, 5.125%, 8/15/18 | UnitedStates | 10,000,000 | 10,250,000 | |

| DaVita HealthCare Partners Inc., | ||||

| senior bond, 5.125%, 7/15/24. | UnitedStates | 17,800,000 | 17,788,875 | |

| senior bond, 5.00%, 5/01/25 | UnitedStates | 17,400,000 | 16,747,500 | |

| senior note, 5.75%, 8/15/22 | UnitedStates | 15,000,000 | 15,600,000 | |

| HCA Inc., | ||||

| senior bond, 5.875%, 5/01/23. | UnitedStates | 50,000,000 | 51,875,000 | |

| senior bond, 5.375%, 2/01/25. | UnitedStates | 7,000,000 | 6,934,375 | |

| senior secured bond, first lien, 5.875%, 3/15/22 | UnitedStates | 20,000,000 | 21,475,000 | |

| senior secured bond, first lien, 5.25%, 4/15/25 | UnitedStates | 11,000,000 | 11,165,000 | |

| senior secured note, first lien, 5.00%, 3/15/24 | UnitedStates | 20,000,000 | 20,200,000 | |

| cHologic Inc., senior note, 144A, 5.25%, 7/15/22 | UnitedStates | 17,400,000 | 18,161,250 | |

| Tenet Healthcare Corp., | ||||

| first lien, 6.00%, 10/01/20 | UnitedStates | 6,700,000 | 7,152,250 | |

| senior note, 5.00%, 3/01/19 | UnitedStates | 10,700,000 | 10,352,250 | |

| senior note, 5.50%, 3/01/19 | UnitedStates | 6,300,000 | 6,142,500 | |

| senior note, 8.125%, 4/01/22 | UnitedStates | 20,000,000 | 20,075,000 | |

| senior note, 6.75%, 6/15/23 | UnitedStates | 13,700,000 | 12,860,875 | |

| 319,834,575 | ||||

| Materials 11.9% | ||||

| ArcelorMittal, | ||||

| senior note, 6.50%, 3/01/21 | Luxembourg | 46,800,000 | 41,067,000 | |

| senior note, 6.125%, 6/01/25 | Luxembourg | 10,800,000 | 8,532,000 | |

| cArdagh Packaging Finance PLC/Ardagh MP Holdings USA Inc., | ||||

| senior note, 144A, 6.25%, 1/31/19 | Luxembourg | 4,100,000 | 4,110,250 | |

| senior note, 144A, 7.00%, 11/15/20 | Luxembourg | 2,647,059 | 2,650,368 | |

| senior note, 144A, 6.00%, 6/30/21 | Luxembourg | 7,000,000 | 6,930,000 | |

| hsenior secured note, 144A, FRN, 3.337%, 12/15/19 | Luxembourg | 22,800,000 | 22,458,000 | |

franklintempleton.com

Semiannual Report 21

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | ||||

| Principal | ||||

| Country | Amount* | Value | ||

| Corporate Bonds (continued) | ||||

| Materials (continued) | ||||

| cBarminco Finance Pty. Ltd., senior note, 144A, 9.00%, 6/01/18. | Australia | 29,000,000 | $ | 23,504,500 |

| cBlue Cube Spinco Inc., senior bond, 144A, 10.00%, 10/15/25. | UnitedStates | 24,400,000 | 27,084,000 | |

| cCemex Finance LLC, senior secured note, first lien, 144A, 6.00%, 4/01/24 | Mexico | 15,800,000 | 14,723,625 | |

| cCemex SAB de CV, | ||||

| first lien, 144A, 5.70%, 1/11/25 | Mexico | 30,000,000 | 26,681,250 | |

| senior secured bond, first lien, 144A, 6.125%, 5/05/25 | Mexico | 10,000,000 | 9,193,750 | |

| cThe Chemours Co., | ||||

| senior bond, 144A, 7.00%, 5/15/25 | UnitedStates | 8,500,000 | 6,375,000 | |

| senior note, 144A, 6.625%, 5/15/23 | UnitedStates | 37,000,000 | 27,935,000 | |

| cEldorado Gold Corp., senior note, 144A, 6.125%, 12/15/20 | Canada | 45,000,000 | 41,681,250 | |

| cFirst Quantum Minerals Ltd., | ||||

| senior note, 144A, 6.75%, 2/15/20 | Canada | 20,000,000 | 13,100,000 | |

| senior note, 144A, 7.00%, 2/15/21 | Canada | 39,882,000 | 25,549,406 | |

| cFMG Resources (August 2006) Pty. Ltd., senior secured note, 144A, 9.75%, 3/01/22 . | Australia | 55,000,000 | 53,040,625 | |

| Novelis Inc., senior note, 8.75%, 12/15/20 | Canada | 20,000,000 | 19,550,000 | |

| cOwens-Brockway Glass Container Inc., | ||||

| senior note, 144A, 5.00%, 1/15/22 | UnitedStates | 14,800,000 | 14,726,000 | |

| senior note, 144A, 5.875%, 8/15/23 | UnitedStates | 16,000,000 | 16,670,000 | |

| cPlatform Specialty Products Corp., senior note, 144A, 6.50%, 2/01/22 | UnitedStates | 27,000,000 | 23,625,000 | |

| cPSPC Escrow II Corp., senior note, 144A, 10.375%, 5/01/21 | UnitedStates | 7,400,000 | 7,566,500 | |

| cRain CII Carbon LLC/CII Carbon Corp., second lien, 144A, 8.25%, 1/15/21 | UnitedStates | 19,700,000 | 15,267,500 | |

| Reynolds Group Issuer Inc./LLC/SA, | ||||

| first lien, 5.75%, 10/15/20 | UnitedStates | 23,600,000 | 24,278,500 | |

| senior note, 8.50%, 5/15/18 | UnitedStates | 10,000,000 | 10,075,000 | |

| senior note, 9.00%, 4/15/19 | UnitedStates | 2,300,000 | 2,340,250 | |

| senior note, 9.875%, 8/15/19 | UnitedStates | 7,500,000 | 7,790,625 | |

| senior note, 8.25%, 2/15/21 | UnitedStates | 20,000,000 | 20,075,000 | |

| senior secured note, 7.875%, 8/15/19 | UnitedStates | 5,000,000 | 5,200,000 | |

| cSealed Air Corp., senior bond, 144A, 5.50%, 9/15/25 | UnitedStates | 19,300,000 | 20,168,500 | |

| Steel Dynamics Inc., | ||||

| senior bond, 5.50%, 10/01/24. | UnitedStates | 15,000,000 | 14,362,500 | |

| senior note, 5.125%, 10/01/21 | UnitedStates | 15,000,000 | 14,662,500 | |

| cU.S. Coatings Acquisition Inc./Flash Dutch 2 BV, senior note, 144A, 7.375%, 5/01/21 . | United States | 12,750,000 | 13,578,750 | |

| cUnivar USA Inc., senior note, 144A, 6.75%, 7/15/23 | UnitedStates | 12,500,000 | 12,109,375 | |

| Verso Paper Holdings LLC/Inc., senior secured note, first lien, 11.75%, 1/15/19 | UnitedStates | 5,406,000 | 824,415 | |

| 597,486,439 | ||||

| Media 9.4% | ||||

| CCO Holdings LLC/CCO Holdings Capital Corp., | ||||

| senior bond, 5.25%, 9/30/22 | UnitedStates | 30,000,000 | 30,225,000 | |

| senior bond, 5.125%, 2/15/23. | UnitedStates | 15,000,000 | 14,954,850 | |

| csenior bond, 144A, 5.375%, 5/01/25 | UnitedStates | 15,000,000 | 14,925,000 | |

| cCCOH Safari LLC, senior bond, 144A, 5.75%, 2/15/26. | UnitedStates | 13,200,000 | 13,299,000 | |

| Clear Channel Worldwide Holdings Inc., | ||||

| senior note, 6.50%, 11/15/22 | UnitedStates | 6,500,000 | 6,418,750 | |

| senior note, 6.50%, 11/15/22 | UnitedStates | 3,500,000 | 3,408,125 | |

| senior sub. note, 7.625%, 3/15/20 | UnitedStates | 15,000,000 | 14,606,250 | |

| senior sub. note, 7.625%, 3/15/20 | UnitedStates | 1,650,000 | 1,581,937 | |

| CSC Holdings LLC, | ||||

| senior note, 6.75%, 11/15/21 | UnitedStates | 10,000,000 | 9,475,000 | |

| senior note, 5.25%, 6/01/24 | UnitedStates | 30,000,000 | 25,500,000 | |

22 Semiannual Report

franklintempleton.com

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | ||||

| Principal | ||||

| Country | Amount* | Value | ||

| Corporate Bonds (continued) | ||||

| Media (continued) | ||||

| DISH DBS Corp., | ||||

| senior bond, 5.00%, 3/15/23 | UnitedStates | 5,000,000 | $ | 4,337,500 |

| senior note, 5.875%, 7/15/22 | UnitedStates | 30,000,000 | 27,937,500 | |

| senior note, 5.875%, 11/15/24 | UnitedStates | 20,000,000 | 17,931,200 | |

| Gannett Co. Inc., | ||||

| senior bond, 6.375%, 10/15/23 | UnitedStates | 10,000,000 | 10,600,000 | |

| senior note, 5.125%, 10/15/19 | UnitedStates | 10,000,000 | 10,425,000 | |

| senior note, 5.125%, 7/15/20 | UnitedStates | 15,000,000 | 15,600,000 | |

| iHeartCommunications Inc., | ||||

| senior secured bond, first lien, 9.00%, 3/01/21 | UnitedStates | 40,000,000 | 27,640,000 | |

| senior secured note, first lien, 9.00%, 9/15/22 | UnitedStates | 15,000,000 | 10,293,750 | |

| cLive Nation Entertainment Inc., | ||||

| senior note, 144A, 7.00%, 9/01/20 | UnitedStates | 7,100,000 | 7,499,375 | |

| senior note, 144A, 5.375%, 6/15/22 | UnitedStates | 8,600,000 | 8,729,000 | |

| cRadio One Inc., senior sub. note, 144A, 9.25%, 2/15/20. | UnitedStates | 20,000,000 | 16,500,000 | |

| cSirius XM Radio Inc., | ||||

| senior bond, 144A, 6.00%, 7/15/24 | UnitedStates | 34,200,000 | 35,439,750 | |

| senior bond, 144A, 5.375%, 4/15/25 | UnitedStates | 13,400,000 | 13,299,500 | |

| cUnitymedia KabelBW GmbH, senior bond, 144A, 6.125%, 1/15/25 | Germany | 25,000,000 | 25,328,125 | |

| cUnivision Communications Inc., | ||||

| senior secured bond, first lien, 144A, 6.75%, 9/15/22 | UnitedStates | 15,000,000 | 15,600,000 | |

| senior secured note, first lien, 144A, 5.125%, 5/15/23 | UnitedStates | 5,000,000 | 4,862,500 | |

| senior secured note, first lien, 144A, 5.125%, 2/15/25 | UnitedStates | 17,700,000 | 17,146,875 | |

| cVirgin Media Secured Finance PLC, | ||||

| senior secured bond, 144A, 5.25%, 1/15/26 | UnitedKingdom | 20,000,000 | 19,625,000 | |

| senior secured bond, first lien, 144A, 5.50%, 1/15/25 | UnitedKingdom | 25,000,000 | 25,187,500 | |

| senior secured note, first lien, 144A, 5.375%, 4/15/21 | UnitedKingdom | 9,810,000 | 10,153,350 | |

| cVTR Finance BV, senior secured note, 144A, 6.875%, 1/15/24 | Chile | 15,000,000 | 14,550,000 | |

| 473,079,837 | ||||

| Pharmaceuticals, Biotechnology & Life Sciences 4.0% | ||||

| cAMAG Pharmaceuticals Inc., senior note, 144A, 7.875%, 9/01/23 | UnitedStates | 30,000,000 | 25,125,000 | |

| cConcordia Healthcare Corp., senior note, 144A, 7.00%, 4/15/23 | Canada | 25,000,000 | 21,625,000 | |

| cEndo Finance LLC/Endo Ltd./Endo Finco Inc., | ||||

| senior bond, 144A, 6.00%, 2/01/25 | UnitedStates | 20,900,000 | 19,959,500 | |

| senior note, 144A, 6.00%, 7/15/23 | UnitedStates | 13,700,000 | 13,374,625 | |

| Grifols Worldwide Operations Ltd., senior note, 5.25%, 4/01/22 | UnitedStates | 16,300,000 | 16,626,000 | |

| cHorizon Pharma Financing Inc., senior note, 144A, 6.625%, 5/01/23 | UnitedStates | 15,200,000 | 13,148,000 | |

| cJaguar Holding Co. II/Pharmaceutical Product Development LLC, senior note, 144A, | ||||

| 6.375%, 8/01/23 | UnitedStates | 17,300,000 | 16,651,250 | |

| cValeant Pharmaceuticals International, senior note, 144A, 6.375%, 10/15/20 | UnitedStates | 42,600,000 | 39,245,250 | |

| cValeant Pharmaceuticals International Inc., | ||||

| senior bond, 144A, 6.125%, 4/15/25 | UnitedStates | 12,500,000 | 10,906,250 | |

| senior note, 144A, 7.50%, 7/15/21 | UnitedStates | 10,000,000 | 9,450,000 | |

| senior note, 144A, 5.625%, 12/01/21. | UnitedStates | 15,000,000 | 13,162,500 | |

| 199,273,375 | ||||

| Real Estate 0.9% | ||||

| Equinix Inc., | ||||

| senior bond, 5.375%, 4/01/23. | UnitedStates | 37,000,000 | 37,878,750 | |

| i senior bond, 5.875%, 1/15/26. | UnitedStates | 7,400,000 | 7,529,500 | |

| 45,408,250 | ||||

franklintempleton.com

Semiannual Report 23

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | ||||

| Principal | ||||

| Country | Amount* | Value | ||

| Corporate Bonds (continued) | ||||

| Retailing 1.3% | ||||

| cArgos Merger Sub Inc., senior note, 144A, 7.125%, 3/15/23 | UnitedStates | 12,700,000 | $ | 12,827,000 |

| cDollar Tree Inc., senior note, 144A, 5.75%, 3/01/23 | UnitedStates | 12,500,000 | 13,062,500 | |

| cNetflix Inc., | ||||

| senior bond, 144A, 5.875%, 2/15/25 | UnitedStates | 15,600,000 | 16,204,500 | |

| senior note, 144A, 5.50%, 2/15/22 | UnitedStates | 24,600,000 | 25,584,000 | |

| 67,678,000 | ||||

| Semiconductors & Semiconductor Equipment 0.5% | ||||

| cQorvo Inc., | ||||

| senior bond, 144A, 7.00%, 12/01/25 | UnitedStates | 8,000,000 | 8,240,000 | |

| senior note, 144A, 6.75%, 12/01/23 | UnitedStates | 16,800,000 | 17,220,000 | |

| 25,460,000 | ||||

| Software & Services 3.6% | ||||

| cBMC Software Finance Inc., senior note, 144A, 8.125%, 7/15/21 | UnitedStates | 45,000,000 | 34,987,500 | |

| cFirst Data Corp., | ||||

| second lien, 144A, 5.75%, 1/15/24 | UnitedStates | 36,450,000 | 36,541,125 | |

| secured note, first lien, 144A, 5.00%, 1/15/24. | UnitedStates | 18,400,000 | 18,446,000 | |

| senior note, 144A, 7.00%, 12/01/23 | UnitedStates | 14,000,000 | 14,227,500 | |

| senior secured bond, second lien, 144A, 8.25%, 1/15/21 | UnitedStates | 37,000,000 | 38,711,250 | |

| cInfor (U.S.) Inc., senior note, 144A, 6.50%, 5/15/22 | UnitedStates | 40,000,000 | 35,600,000 | |

| 178,513,375 | ||||

| Technology Hardware & Equipment 1.5% | ||||

| cBlackboard Inc., senior note, 144A, 7.75%, 11/15/19 | UnitedStates | 25,000,000 | 22,375,000 | |

| c,jCommScope Holdings Co. Inc., senior note, 144A, PIK, 6.625%, 6/01/20 | UnitedStates | 8,000,000 | 8,130,000 | |

| cCommScope Inc., | ||||

| senior bond, 144A, 5.50%, 6/15/24 | UnitedStates | 7,000,000 | 6,746,250 | |

| senior note, 144A, 5.00%, 6/15/21 | UnitedStates | 15,000,000 | 14,568,750 | |

| cCommScope Technologies Finance LLC, senior bond, 144A, 6.00%, 6/15/25 | UnitedStates | 10,200,000 | 9,792,000 | |

| cPlantronics Inc., senior note, 144A, 5.50%, 5/31/23 | UnitedStates | 15,000,000 | 15,300,000 | |

| 76,912,000 | ||||

| Telecommunication Services 9.4% | ||||

| CenturyLink Inc., | ||||

| senior bond, 6.75%, 12/01/23. | UnitedStates | 6,300,000 | 6,004,845 | |

| senior bond, 5.625%, 4/01/25. | UnitedStates | 17,800,000 | 15,374,750 | |

| senior note, 5.80%, 3/15/22 | UnitedStates | 30,000,000 | 27,937,500 | |

| cDigicel Group Ltd., senior note, 144A, 8.25%, 9/30/20 | Bermuda | 18,000,000 | 15,716,250 | |

| cDigicel Ltd., | ||||

| senior note, 144A, 6.00%, 4/15/21 | Bermuda | 24,400,000 | 22,082,000 | |

| senior note, 144A, 6.75%, 3/01/23 | Bermuda | 8,100,000 | 7,193,084 | |

| Frontier Communications Corp., | ||||

| senior bond, 7.625%, 4/15/24. | UnitedStates | 4,800,000 | 4,080,000 | |

| senior bond, 7.875%, 1/15/27. | UnitedStates | 22,775,000 | 19,131,000 | |

| senior note, 7.125%, 1/15/23 | UnitedStates | 3,775,000 | 3,199,313 | |

| Intelsat Jackson Holdings SA, | ||||

| senior bond, 6.625%, 12/15/22 | Luxembourg | 20,000,000 | 12,200,000 | |

| senior bond, 5.50%, 8/01/23 | Luxembourg | 15,000,000 | 11,212,500 | |

| senior note, 7.25%, 10/15/20 | Luxembourg | 10,000,000 | 8,400,000 | |

| senior note, 7.50%, 4/01/21 | Luxembourg | 25,000,000 | 20,875,000 | |

24 Semiannual Report

franklintempleton.com

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | ||||

| Principal | ||||

| Country | Amount* | Value | ||

| Corporate Bonds (continued) | ||||

| Telecommunication Services (continued) | ||||

| cMillicom International Cellular SA, senior note, 144A, 6.625%, 10/15/21 | Luxembourg | 31,900,000 | $ | 30,883,187 |

| cNeptune Finco Corp., senior bond, 144A, 10.875%, 10/15/25 | UnitedStates | 8,600,000 | 9,083,750 | |

| b,eRSL Communications PLC, | ||||

| senior discount bond, 10.125%, 3/01/08 | UnitedKingdom | 44,500,000 | — | |

| senior note, 12.00%, 11/01/08 | UnitedKingdom | 6,250,000 | — | |

| Sprint Communications Inc., | ||||

| senior note, 8.375%, 8/15/17 | UnitedStates | 25,000,000 | 25,000,000 | |

| senior note, 6.00%, 11/15/22 | UnitedStates | 12,500,000 | 9,375,000 | |

| csenior note, 144A, 9.00%, 11/15/18 | UnitedStates | 53,000,000 | 57,372,500 | |

| csenior note, 144A, 7.00%, 3/01/20 | UnitedStates | 9,800,000 | 10,026,625 | |

| Sprint Corp., | ||||

| senior bond, 7.875%, 9/15/23. | UnitedStates | 4,700,000 | 3,795,250 | |

| senior bond, 7.125%, 6/15/24. | UnitedStates | 10,900,000 | 8,454,312 | |

| senior note, 7.625%, 2/15/25 | UnitedStates | 27,000,000 | 21,279,375 | |

| T-Mobile USA Inc., | ||||

| senior bond, 6.50%, 1/15/24 | UnitedStates | 7,400,000 | 7,474,000 | |

| senior bond, 6.375%, 3/01/25. | UnitedStates | 22,400,000 | 22,400,000 | |

| senior note, 6.542%, 4/28/20 | UnitedStates | 11,700,000 | 12,109,500 | |

| senior note, 6.633%, 4/28/21 | UnitedStates | 9,000,000 | 9,382,500 | |

| senior note, 6.125%, 1/15/22 | UnitedStates | 4,200,000 | 4,296,642 | |

| senior note, 6.731%, 4/28/22 | UnitedStates | 9,000,000 | 9,337,500 | |

| cWind Acquisition Finance SA, | ||||

| senior note, 144A, 7.375%, 4/23/21 | Italy | 42,000,000 | 40,425,000 | |

| senior secured note, first lien, 144A, 4.75%, 7/15/20 | Italy | 15,000,000 | 14,990,625 | |

| 469,092,008 | ||||

| Transportation 2.1% | ||||

| cFlorida East Coast Holdings Corp., | ||||

| secured note, first lien, 144A, 6.75%, 5/01/19. | UnitedStates | 15,000,000 | 14,737,500 | |

| senior note, 144A, 9.75%, 5/01/20 | UnitedStates | 9,300,000 | 8,137,500 | |

| Hertz Corp., | ||||

| senior note, 6.75%, 4/15/19 | UnitedStates | 26,800,000 | 27,470,000 | |

| senior note, 5.875%, 10/15/20 | UnitedStates | 10,000,000 | 10,350,000 | |

| senior note, 6.25%, 10/15/22 | UnitedStates | 10,000,000 | 10,450,000 | |

| cStena AB, senior bond, 144A, 7.00%, 2/01/24 | Sweden | 16,200,000 | 14,215,500 | |

| cStena International SA, secured bond, 144A, 5.75%, 3/01/24 | Sweden | 20,000,000 | 17,685,000 | |

| 103,045,500 | ||||

| Utilities 2.6% | ||||

| Calpine Corp., | ||||

| senior bond, 5.75%, 1/15/25 | UnitedStates | 15,400,000 | 14,476,000 | |

| senior note, 5.375%, 1/15/23 | UnitedStates | 18,300,000 | 17,156,250 | |

| csenior secured bond, first lien, 144A, 5.875%, 1/15/24 | UnitedStates | 10,000,000 | 10,375,000 | |

| cInterGen NV, secured bond, 144A, 7.00%, 6/30/23 | Netherlands | 45,000,000 | 37,575,000 | |

| NGL Energy Partners LP/NGL Energy Finance Corp., senior note, 5.125%, 7/15/19 | United States | 3,600,000 | 3,222,000 | |

| NRG Yield Operating LLC, senior bond, 5.375%, 8/15/24 | UnitedStates | 20,000,000 | 18,230,000 | |

| cPPL Energy Supply LLC, senior bond, 144A, 6.50%, 6/01/25 | UnitedStates | 13,500,000 | 11,559,375 | |

| c,eTexas Competitive Eletric Holdings Co. LLC/Texas Competitive Eletric Holdings | ||||

| Finance Inc., senior secured note, first lien, 144A, 11.50%, 10/01/20 | UnitedStates | 50,000,000 | 17,750,000 | |

| 130,343,625 | ||||

| Total Corporate Bonds (Cost $5,565,171,708) | 4,746,279,210 | |||

franklintempleton.com

Semiannual Report 25

FRANKLIN HIGH INCOME TRUST

STATEMENT OF INVESTMENTS (UNAUDITED)

| Franklin High Income Fund (continued) | ||||

| Principal | ||||

| Country | Amount* | Value | ||

| Senior Floating Rate Interests (Cost $30,147,536) 0.6% | ||||

| Household & Personal Products 0.6% | ||||

| h,kSun Products Corp., Tranche B Term Loan, 5.50%, 3/23/20 | UnitedStates | 30,350,265 | $ | 29,009,785 |

| Shares | ||||

| Litigation Trusts (Cost $—) 0.0% | ||||

| a,bNewPage Corp., Litigation Trust | UnitedStates | 30,000,000 | — | |

| Total Investments before Short Term Investments | ||||

| (Cost $5,611,528,862) | 4,781,079,308 | |||

| Short Term Investments (Cost $159,631,297) 3.2% | ||||

| Money Market Funds 3.2% | ||||

| a,lInstitutional Fiduciary Trust Money Market Portfolio | UnitedStates | 159,631,297 | 159,631,297 | |

| Total Investments (Cost $5,771,160,159) 98.7%. | 4,940,710,605 | |||

| Other Assets, less Liabilities 1.3% | 66,119,764 | |||

| Net Assets 100.0% | $ | 5,006,830,369 | ||

See Abbreviations on page 38.

†Rounds to less than 0.1% of net assets.

*The principal amount is stated in U.S. dollars unless otherwise indicated.

aNon-income producing.

bSecurity has been deemed illiquid because it may not be able to be sold within seven days. At November 30, 2015, the aggregate value of these securities was $214,295,

representing less than 0.01% of net assets.

cSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers

or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At

November 30, 2015, the aggregate value of these securities was $2,315,443,266, representing 46.25% of net assets.

dPerpetual security with no stated maturity date.

eSee Note 7 regarding defaulted securities.

fA portion or all of the security purchased on a delayed delivery basis. See Note 1c.

gPrincipal amount is stated in 1,000 Units.

hThe coupon rate shown represents the rate at period end.

iSecurity purchased on a when-issued basis. See Note 1c.

jIncome may be received in additional securities and/or cash.

kSee Note 1d regarding senior floating rate interests.

lSee Note 3f regarding investments in affiliated management investment companies.

26 Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

FRANKLIN HIGH INCOME TRUST

Financial Statements

Statement of Assets and Liabilities

November 30, 2015 (unaudited)

| Franklin High Income Fund | |||

| Assets: | |||

| Investments in securities: | |||

| Cost - Unaffiliated issuers | $ | 5,611,528,862 | |

| Cost - Non-controlled affiliates (Note 3f) | 159,631,297 | ||

| Total cost of investments | $ | 5,771,160,159 | |

| Value - Unaffiliated issuers | $ | 4,781,079,308 | |

| Value - Non-controlled affiliates (Note 3f) | 159,631,297 | ||

| Total value of investments | 4,940,710,605 | ||

| Cash. | 201,218 | ||

| Receivables: | |||