UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-02884

Barrett Opportunity Fund, Inc.

(Exact name of registrant as specified in charter)

90 Park Avenue

New York, NY 10016

(Address of principal executive offices) (Zip code)

Peter Shriver

90 Park Avenue

New York, NY 10016

(Name and address of agent for service)

(212) 983-5080

Registrant's telephone number, including area code

Date of fiscal year end: August 31

Date of reporting period: February 29, 2016

Item 1. Reports to Stockholders.

Semi-Annual Report

February 29, 2016

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

BARRETT

OPPORTUNITY FUND, INC.

Semi-Annual Report • February 29, 2016

| Fund Objectives | The Fund seeks to achieve above average long-term capital appreciation. Current income is a secondary objective. The Fund invests primarily in common stocks and securities convertible into or exchangeable for common stock such as convertible preferred stock or convertible debt securities. |

| What's Inside | Letter from the Chairperson | | | 1 |

| | | | | |

| | Manager Overview | | | 1 |

| | | | | |

| | Fund at a Glance | | | 4 |

| | | | | |

| | Fund Expenses | | | 5 |

| | | | | |

| | Schedule of Investments | | | 6 |

| | | | | |

| | Statement of Assets & Liabilities | | | 8 |

| | | | | |

| | Statement of Operations | | | 9 |

| | | | | |

| | Statements of Changes in Net Assets | | | 10 |

| | | | | |

| | Financial Highlights | | | 11 |

| | | | | |

| | Notes to Financial Statements | | | 12 |

| | | | | |

| | Additional Information | | | 20 |

| | | | | |

| | Important Tax Information | | | 22 |

BARRETT

OPPORTUNITY FUND, INC.

| | |

| | |

| | |

| Letter from the | Dear Shareholder, |

| Chairperson | |

| | We are pleased to provide the semi-annual report of the Barrett Opportunity Fund, Inc. (the “Fund”) for the six-month period ended February 29th, 2016. |

| | |

| | The management team at Barrett Asset Management, LLC has prepared the enclosed Manager’s Overview, which includes a brief market overview, as well as a performance review. I urge you to read it as well as the accompanying financial statements. A detailed summary of the Fund’s performance and other pertinent information are also included in this report. I am sure you will find this report informative and useful. |

| | |

| | On behalf of the Directors and the Officers of the Fund, I thank you for your ongoing confidence in the Fund and its investment policies. |

| | |

| | Sincerely, |

| | |

| |  |

| | |

| | Rosalind A. Kochman |

| | Chairperson |

| | March 7, 2016 |

| Manager | Market Overview |

| Overview | |

| | The ongoing volatility in the market reflected the overall lack of conviction many investors have for the outlook of global economics and politics today. The sharp recovery last October was soon erased in the first weeks of 2016. Lingering concerns about commodity prices, along with negative revisions to global earnings projections have weighed on the overall market. Yet, despite the volatility, limited investment alternatives to equities have left valuation levels above long-term averages. |

| | |

| | In December of last year, the U.S. Federal Reserve increased its target for federal fund rates for the first time in nearly a decade. While many pundits believed this would be the first of several increases over the next twelve month period, the growing concern for the health of the global economy has led many to temper those initial forecasts. Current sentiment would suggest one, maybe two, additional rate hikes during calendar year 2016. |

| | |

| | Looking forward, we expect market instability to remain at elevated levels. Geopolitical risks are consuming the international markets, from Europe to Asia and Latin America. Domestically, the negativity generated from the political campaign trail has clouded an otherwise improving economic environment. Any upside may |

BARRETT

OPPORTUNITY FUND, INC.

| | come from a reversal in some of these more negative trends. Additionally, the headwind coming from a strong dollar on earnings may weaken the second half of 2016, improving earnings comparisons. |

| | |

| | Portfolio and Performance Review |

| | |

| | For the six months ended February 29, 2016, the Fund declined -4.19% compared to a loss of -3.84% for the Lipper Large Cap Value Fund Index and -0.92% for the Standard & Poor’s 500 Index. The Fund remains significantly overweighted in the energy and financial sectors, even after receiving half of the proceeds from ACE Limited’s acquisition of Chubb in cash. The largest underweighted sectors are the healthcare, technology and consumer sectors. As a concentrated portfolio, focused on asset values, the Fund’s top five positions represent roughly 57% of the total Fund. Even with recent changes in the portfolio, The Fund’s largest exposure remains hard assets, such as energy and real estate. |

| | |

| | During the reported six month period, the best performing major segments of the broader market were the telecommunications, utilities, and consumer staples sectors. The Fund’s two largest sectors, energy and financials, were the worst performing S&P 500 Index sectors, down -11% and -9%, respectively. The worst performers in the Fund were, not surprisingly, also in the energy and financial sectors, Murphy Oil and Leucadia National. The Fund’s largest holding, Chubb gained some +6%. Several other companies held by the fund also beat the market by a wide margin, including Alphabet, 3M Company, Automatic Data, and Murphy USA. |

| | |

| | The Fund’s portfolio saw significant changes during the six month period ending February 29, 2016. In January of this year, ACE Limited completed the acquisition of Chubb, the Fund’s previously largest position. The proceeds from the transaction, which was fully taxable for shareholders of Chubb, came in the form of approximately half cash and half in shares of Chubb Ltd., the name of the newly merged entity. |

| | |

| | With some of the cash proceeds, we had an opportunity to identify attractive, long-term investments that would help further diversify the Fund’s holdings away from commodities and other hard assets. As a result, the Fund initiated positions in Alphabet, Apple, Berkshire Hathaway, Home Depot, Microsoft, Nike and Pfizer. |

| | |

| | Thank you for your continued interest in the Fund. |

| | |

| | Sincerely, |

| | |

| |  |  |

| | Robert Milnamow | E. Wells Beck, CFA |

| | Portfolio Manager | Portfolio Manager |

BARRETT

OPPORTUNITY FUND, INC.

| | Past performance is not a guarantee of future results. |

| | |

| | The outlook, views, and opinions presented are those of the Adviser as of February 29, 2016. These are not intended to be a forecast of future events, a guarantee of future results, or investment advice. |

| | |

| | Must be preceded or accompanied by a prospectus. |

| | |

| | Mutual fund investing involves risk. Principal loss is possible. The Fund is non-diversified, which means that it can invest a higher percentage of its assets in any one issuer. Investing in a non-diversified fund may entail greater risks than is normally associated with more widely diversified funds. Small- and Medium- capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investing in foreign securities is subject to certain risks not associated with domestic investing, such as currency fluctuations and changes in political and economic conditions. These risks are magnified in emerging or developing markets. Some securities held by the fund may be illiquid and can be difficult to value and sell. |

| | |

| | The Lipper Large-Cap Value Funds Index includes funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three year weighted basis) above Lipper’s U.S. Diversified Equity large-cap floor. The S&P 500® Index is a capitalization weighted index of five hundred large capitalization stocks, which is designed to measure broad domestic securities markets. |

| | |

| | Investors cannot invest directly in an index. |

| | |

| | Diversification does not assure a profit nor protect against loss in a declining market. |

| | |

| | Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of portfolio holdings, please refer to the Schedule of Investments provided in this report. |

| | |

| | The Barrett Opportunity Fund is distributed by Quasar Distributors, LLC. |

BARRETT

OPPORTUNITY FUND, INC.

Fund at a Glance (Unaudited)

| Top Ten Holdings - as of 2/29/2016 | |

(As a percentage of Total Investments) | |

| | | | | |

| General Dynamics Corp. | | | 16.9 | % |

| Bank of New York Mellon Corp. | | | 14.2 | % |

| Chubb Ltd. – ADR | | | 10.6 | % |

| Royal Dutch Shell PLC – Class A – ADR | | | 9.6 | % |

| Koninklijke Philips Electronics NV – | | | | |

| NY Registered Shares – ADR | | | 5.6 | % |

| Forest City Realty Trust, Inc. – Class B | | | 4.0 | % |

| Monsanto Co. | | | 3.1 | % |

| 3M Co. | | | 3.0 | % |

| Forest City Realty Trust, Inc. – Class A | | | 2.7 | % |

| Murphy USA, Inc. | | | 2.6 | % |

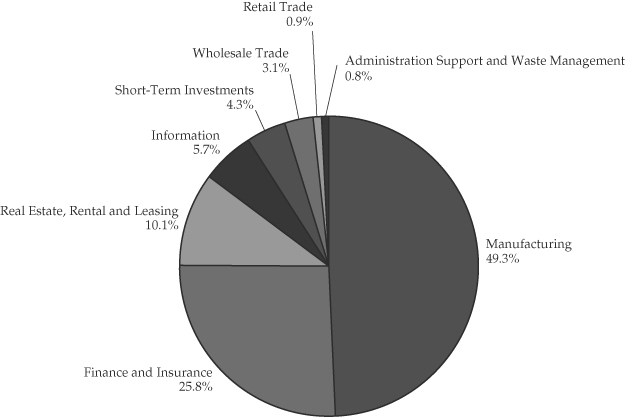

Sector Weightings - as of 2/29/2016

(As a percentage of Total Investments)

BARRETT

OPPORTUNITY FUND, INC.

Fund Expenses (Unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on September 1, 2015 and held for the six months ended February 29, 2016.

Actual Expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | Expenses Paid |

| | Beginning | Ending | During the Period* |

| | Account | Account | September 1, 2015 to |

| | Value | Value | February 29, 2016 |

| Actual Barrett Opportunity Fund, Inc. Expenses | $1,000.00 | $ 958.10 | $6.09 |

| | | | |

| Hypothetical Expenses | | | |

| (5% return per year before expenses) | $1,000.00 | $1,018.65 | $6.27 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.25%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). |

BARRETT

OPPORTUNITY FUND, INC.

Schedule of Investments

February 29, 2016 (Unaudited)

| Shares | | | | Value | |

| | | COMMON STOCKS - 86.96% | | | |

| | | | | | |

| | | Beverage and | | | |

| | | Tobacco Product | | | |

| | | Manufacturing - 1.86% | | | |

| | 10,000 | | PepsiCo., Inc. | | $ | 978,200 | |

| | | | | | | | |

| | | | Building Material and | | | | |

| | | | Garden Equipment and | | | | |

| | | | Supplies Dealers - 0.94% | | | | |

| | 4,000 | | The Home Depot, Inc. | | | 496,480 | |

| | | | | | | | |

| | | | Chemical | | | | |

| | | | Manufacturing - 3.98% | | | | |

| | 12,000 | | Abbott Laboratories | | | 464,880 | |

| | 12,000 | | AbbVie, Inc. | | | 655,320 | |

| | 5,000 | | Johnson & Johnson | | | 526,050 | |

| | 15,000 | | Pfizer, Inc. | | | 445,050 | |

| | | | | | | 2,091,300 | |

| | | | | | | | |

| | | | Computer and | | | | |

| | | | Electronic Product | | | | |

| | | | Manufacturing - 6.49% | | | | |

| | 5,000 | | Apple, Inc. | | | 483,450 | |

| | 115,710 | | Koninklijke Philips Electronics | | | | |

| | | | NV - NY Registered | | | | |

| | | | Shares - ADR | | | 2,930,934 | |

| | | | | | | 3,414,384 | |

| | | | | | | | |

| | | | Credit Intermediation and | | | | |

| | | | Related Activities - 14.23% | | | | |

| | 211,471 | | The Bank of New York | | | | |

| | | | Mellon Corp. | | | 7,483,959 | |

| | | | | | | | |

| | | | Data Processing, Hosting | | | | |

| | | | and Related Services - 2.42% | | | | |

| | 15,000 | | Automatic Data | | | | |

| | | | Processing, Inc. | | | 1,270,350 | |

| | | | | | | | |

| | | | Insurance Carriers and | | | | |

| | | | Related Activities - 11.60% | | | | |

| | 4,000 | | Berkshire Hathaway, Inc. - | | | | |

| | | | Class B (a) | | | 536,680 | |

| | 48,152 | | Chubb Ltd. - ADR | | | 5,563,001 | |

| | | | | | | 6,099,681 | |

| | | | | | | | |

| | | | Leather and Allied Product | | | | |

| | | | Manufacturing - 1.00% | | | | |

| | 8,500 | | NIKE, Inc. | | | 523,515 | |

| | | | | | | | |

| | | | Merchant Wholesalers, | | | | |

| | | | Nondurable Goods - 3.12% | | | | |

| | 18,242 | | Monsanto Co. | | | 1,641,598 | |

| | | | | | | | |

| | | | Miscellaneous | | | | |

| | | | Manufacturing - 2.98% | | | | |

| | 10,000 | | 3M Co. | | | 1,568,700 | |

| | | | | | | | |

| | | | Other Information | | | | |

| | | | Services - 2.32% | | | | |

| | 1,750 | | Alphabet, Inc. (a) | | | 1,221,097 | |

| | | | | | | | |

| | | | Petroleum and Coal Products | | | | |

| | | | Manufacturing - 14.23% | | | | |

| | 60,600 | | Murphy Oil Corp. | | | 1,041,108 | |

| | 21,825 | | Murphy USA, Inc. (a) | | | 1,390,034 | |

| | 111,100 | | Royal Dutch Shell PLC - | | | | |

| | | | Class A - ADR | | | 5,052,828 | |

| | | | | | | 7,483,970 | |

| | | | | | | | |

| | | | Publishing Industries | | | | |

| | | | (except Internet) - 0.97% | | | | |

| | 10,000 | | Microsoft Corp. | | | 508,800 | |

| | | | | | | | |

| | | | Real Estate - 1.12% | | | | |

| | 17,500 | | Alexander & Baldwin, Inc. | | | 586,600 | |

The accompanying notes are an integral part of these financial statements.

BARRETT

OPPORTUNITY FUND, INC.

Schedule of Investments

February 29, 2016 (Unaudited)

| Shares | | | | Value | |

| | | | | | |

| | | Transportation Equipment | | | |

| | | Manufacturing - 16.94% | | | |

| | 65,400 | | General Dynamics Corp. | | $ | 8,912,058 | |

| | | | | | | | |

| | | | Waste Management and | | | | |

| | | | Remediation Services - 0.84% | | | | |

| | 66,850 | | TRC Cos., Inc. (a) | | | 444,552 | |

| | | | | | | | |

| | | | Wood Product | | | | |

| | | | Manufacturing - 1.92% | | | | |

| | 70,000 | | Leucadia National Corp. | | | 1,011,500 | |

| | | | | | | | |

| | | | Total Common Stocks | | | | |

| | | | (Cost $14,693,790) | | | 45,736,744 | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT | | | | |

| | | | TRUSTS (REITS) - 9.01% | | | | |

| | | | | | | | |

| | | | Real Estate - 9.01% | | | | |

| | 77,400 | | Forest City Realty Trust, Inc. - | | | | |

| | | | Class A (a) | | | 1,443,510 | |

| | 112,500 | | Forest City Realty Trust, Inc. - | | | | |

| | | | Class B (a)(b) | | | 2,095,313 | |

| | 54,985 | | Rayonier, Inc. | | | 1,200,323 | |

| | | | Total Real Estate Investment | | | | |

| | | | Trusts (Cost $585,503) | | | 4,739,146 | |

| | | | | | | | |

| | | | SHORT-TERM | | | | |

| | | | INVESTMENTS - 4.26% | | | | |

| | | | | | | | |

| | | | Money Market Funds - 4.26% | | | | |

| | 2,241,504 | | Fidelity Institutional Money | | | | |

| | | | Market Fund - Government | | | | |

| | | | Portfolio - Class I, 0.21% (c) | | | 2,241,504 | |

| | | | Total Short-Term Investments | | | | |

| | | | (Cost $2,241,504) | | | 2,241,504 | |

| | | | Total Investments | | | | |

| | | | (Cost $17,520,797) - 100.23% | | | 52,717,394 | |

| | | | Liabilities in Excess | | | | |

| | | | of Other Assets - (0.23)% | | | (118,498 | ) |

| | | | Total Net Assets - 100.00% | | $ | 52,598,896 | |

Percentages stated are a percentage of net assets.

ADR American Depository Receipt

| (a) | Non-income producing security. |

| (b) | Convertible into Forest City Realty Trust, Inc. - Class A shares. |

| (c) | Variable rate security. The rate listed is as of February 29, 2016. |

The accompanying notes are an integral part of these financial statements.

BARRETT

OPPORTUNITY FUND, INC.

Statement of Assets & Liabilities

February 29, 2016 (Unaudited)

| ASSETS: | | | |

| Investments, at value (cost $17,520,797) | | $ | 52,717,394 | |

| Dividend and interest receivable | | | 134,344 | |

| Other assets | | | 17,352 | |

| Total Assets | | | 52,869,090 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable to Adviser | | | 28,781 | |

| Payable for funds shares redeemed | | | 183,837 | |

| Payable to Directors | | | 5,835 | |

| Other accrued expenses | | | 51,741 | |

| Total Liabilities | | | 270,194 | |

| | | | | |

| NET ASSETS | | $ | 52,598,896 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | $ | 4,546,455 | |

| Accumulated undistributed net investment income | | | 130,315 | |

| Accumulated undistributed net realized gain | | | 12,725,529 | |

| Net unrealized appreciation on: | | | | |

| Investments | | | 35,196,597 | |

| Total Net Assets | | $ | 52,598,896 | |

| | | | | |

| Shares outstanding | | | 1,947,275 | |

| Net asset value, offering price and redemption price | | | | |

| per share (15,000,000 shares authorized, $0.01 par value) | | $ | 27.01 | |

The accompanying notes are an integral part of these financial statements.

BARRETT

OPPORTUNITY FUND, INC.

Statement of Operations

Period Ended February 29, 2016 (Unaudited)

| INVESTMENT INCOME: | | | |

| Dividend income* | | $ | 633,589 | |

| Interest income | | | 687 | |

| | | | 634,276 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees (see Note 2) | | | 197,610 | |

| Legal fees | | | 30,851 | |

| Administration fees | | | 23,547 | |

| Directors’ fees and expenses | | | 20,792 | |

| Transfer agent fees and expenses | | | 18,697 | |

| Fund accounting fees | | | 14,061 | |

| Federal and state registration fees | | | 13,452 | |

| Audit fees | | | 8,598 | |

| Reports to shareholders | | | 5,837 | |

| Custody fees | | | 2,350 | |

| Other | | | 16,731 | |

| Net expenses | | | 352,526 | |

| Net investment income | | | 281,750 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | |

| Net realized gain on: | | | | |

| Investments | | | 12,690,436 | |

| Options Written | | | 46,007 | |

| Total net realized gain | | | 12,736,443 | |

| Net change in unrealized depreciation on: | | | | |

| Investments | | | (15,360,527 | ) |

| Options Written | | | (12,757 | ) |

| Total net change in unrealized depreciation | | | (15,373,284 | ) |

| Net realized and unrealized loss on investments | | | (2,636,841 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (2,355,091 | ) |

| * | Net of $31,330 of foreign taxes withheld. |

The accompanying notes are an integral part of these financial statements.

BARRETT

OPPORTUNITY FUND, INC.

Statements of Changes in Net Assets

| | | Period Ended | | | | |

| | | February 29, 2016 | | | Year Ended | |

| | | (Unaudited) | | | August 31, 2015 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 281,750 | | | $ | 537,612 | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | 12,690,436 | | | | 5,901,397 | |

| In-kind redemptions | | | — | | | | 1,337,006 | |

| Options Written | | | 46,007 | | | | (43,205 | ) |

| Change in net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | (15,360,527 | ) | | | (9,759,914 | ) |

| Options Written | | | (12,757 | ) | | | 9,706 | |

| Net decrease in net assets resulting from operations | | | (2,355,091 | ) | | | (2,017,398 | ) |

| | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Net investment income | | | (510,673 | ) | | | (760,568 | ) |

| Net realized losses on investments | | | (5,538,413 | ) | | | (6,130,171 | ) |

| Total dividends and distributions | | | (6,049,086 | ) | | | (6,890,739 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Shares sold | | | 3,161 | | | | 18,605 | |

| Shares issued in reinvestment of dividends | | | 3,658,269 | | | | 3,970,623 | |

| Shares redeemed | | | | | | | | |

| Cash redemptions | | | (1,229,073 | ) | | | (3,163,788 | ) |

| In-kind redemptions | | | — | | | | (1,474,375 | ) |

| Net increase (decrease) in net assets from capital share transactions | | | 2,432,357 | | | | (648,935 | ) |

| TOTAL DECREASE IN NET ASSETS | | | (5,971,820 | ) | | | (9,557,072 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 58,570,716 | | | | 68,127,788 | |

| End of period (including accumulated undistributed net | | | | | | | | |

| investment income of $130,315 and $359,238, respectively) | | $ | 52,598,896 | | | $ | 58,570,716 | |

The accompanying notes are an integral part of these financial statements.

BARRETT

OPPORTUNITY FUND, INC.

Financial Highlights

| | | Period Ended | | | | | | | | | | | | | | | | |

| | | February 29, | | | Year Ended August 31, | |

| | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | | | | |

| beginning of period | | $ | 31.52 | | | $ | 36.34 | | | $ | 33.53 | | | $ | 31.65 | | | $ | 31.87 | | | $ | 30.53 | |

| Income (loss) from | | | | | | | | | | | | | | | | | | | | | | | | |

| investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.15 | | | | 0.29 | | | | 0.38 | | | | 0.48 | | | | 0.40 | | | | 0.47 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (1.37 | ) | | | (1.40 | ) | | | 5.38 | | | | 4.98 | | | | 2.41 | | | | 3.09 | |

| Total from | | | | | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | (1.22 | ) | | | (1.11 | ) | | | 5.76 | | | | 5.46 | | | | 2.81 | | | | 3.56 | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.28 | ) | | | (0.41 | ) | | | (0.30 | ) | | | (0.56 | ) | | | (0.30 | ) | | | (0.44 | ) |

| Net realized gain | | | | | | | | | | | | | | | | | | | | | | | | |

| on investments | | | (3.01 | ) | | | (3.30 | ) | | | (2.65 | ) | | | (3.02 | ) | | | (2.73 | ) | | | (1.78 | ) |

| Total distributions | | | (3.29 | ) | | | (3.71 | ) | | | (2.95 | ) | | | (3.58 | ) | | | (3.03 | ) | | | (2.22 | ) |

| Net asset value, end of period | | $ | 27.01 | | | $ | 31.52 | | | $ | 36.34 | | | $ | 33.53 | | | $ | 31.65 | | | $ | 31.87 | |

Total return1 | | | (4.19 | )%2 | | | (3.27 | )% | | | 18.06 | % | | | 18.51 | % | | | 9.40 | % | | | 11.07 | % |

| | |

| Supplemental data and ratios: | |

| Net assets, end | | | | | | | | | | | | | | | | | | | | | | | | |

| of period (000,000’s) | | $ | 53 | | | $ | 59 | | | $ | 68 | | | $ | 64 | | | $ | 61 | | | $ | 64 | |

| Ratio of net expenses | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.25 | %4 | | | 1.17 | % | | | 1.16 | % | | | 1.19 | % | | | 1.19 | %3 | | | 1.10 | %3 |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.00 | %4 | | | 0.84 | % | | | 1.07 | % | | | 1.38 | % | | | 1.25 | %3 | | | 1.32 | %3 |

| Portfolio turnover rate | | | 6 | %2 | | | 2 | % | | | 1 | % | | | 0 | % | | | 4 | % | | | 0 | % |

| 1 | Performance figures may reflect compensating balance arrangements fee waivers and/or expense reimbursements. In the absence of these arrangements, total returns would have been lower. |

| 2 | Not annualized for the six months ended February 29, 2016. |

| 3 | Such percentages are after advisory fee waiver. Effective April 29, 2011, the adviser voluntarily agreed to waive 0.05% of average net assets of its advisory fee for the period of one year, this equals 0.03% and 0.02% of average net assets for the years ended August 31, 2012 and August 31, 2011, respectively. In the absence of these waivers, the ratio of net expenses to average net assets would be 0.03% and 0.02% higher for the years ended August 31, 2012 and August 31, 2011, respectively. |

| 4 | Annualized for the six months ended February 29, 2016. |

The accompanying notes are an integral part of these financial statements.

BARRETT

OPPORTUNITY FUND, INC.

Notes to Financial Statements (Unaudited)

| 1. | ORGANIZATION | Barrett Opportunity Fund, Inc. (the “Fund”), a Maryland corporation organized in 1978, is registered as a non-diversified, open-end |

| | AND | management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment |

| | SIGNIFICANT | objective is to achieve above average long-term capital appreciation. Current income is a secondary objective. |

| | ACCOUNTING | |

| | POLICIES | The following are significant accounting policies consistently followed by the Fund and are in conformity with generally accepted accounting principles in the United States of America (“GAAP”). |

| | | |

| | | (a) Investment Valuation |

| | | |

| | | Equity securities, including common stocks and REITs, for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. |

| | | |

| | | Redeemable securities issued by open-end, registered investment companies, including money market funds, are valued at the net asset value (“NAV”) of such companies for purchase and / or redemption orders placed on that day. |

| | | |

| | | Exchange traded options, including options written, are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options marketplace. Specifically, composite pricing looks at the last trades on the exchanges where the options are traded. If there are no trades for the option on a given business day, composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. |

| | | |

| | | When prices are not readily available, or are determined not to reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities at fair value as determined in accordance with procedures approved by the Fund’s Board of Directors. |

| | | |

| | | The Fund uses valuation techniques to measure fair value that are consistent with the market approach and / or income approach, depending on the type of the security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value. |

| | | |

| | | Financial Accounting Standards Board (“FASB”) Accounting Standards Codification, “Fair Value Measurements and Disclosures” Topic 820 (“ASC Topic 820”), establishes a single definition of fair value, creates a three-tier hierarchy as |

BARRETT

OPPORTUNITY FUND, INC.

| | | a framework for measuring fair value based on inputs used to value the Fund’s investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below: |

| | | • Level 1 – | quoted prices in active markets for identical investments as of the measurement date |

| | | | |

| | | • Level 2 – | other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | | | |

| | | • Level 3 – | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| | | Inputs refer broadly to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument. |

| | | |

| | | Investments whose values are based on quoted market prices in active markets include listed equities, including common stocks and REITs, and certain money market securities, and are classified within Level 1. Instruments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs, are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all. |

| | | |

| | | The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value as of the period ended February 29, 2016. The inputs and methodologies used to value securities may not be an indication of the risk associated with investing in these securities. |

BARRETT

OPPORTUNITY FUND, INC.

| | | | | | | Other | | | | | | | |

| | | | | | | Significant | | | Significant | | | | |

| | | | Quoted | | | Observable | | | Unobservable | | | | |

| | | | Prices | | | Inputs | | | Inputs | | | | |

| | Description | | (Level 1) | | | (Level 2) | | | (Level 3) | | | Total | |

| | Assets | | | | | | | | | | | | |

| | Common Stocks | | | | | | | | | | | | |

| | Administration | | | | | | | | | | | | |

| | Support and Waste | | | | | | | | | | | | |

| | Management | | $ | 444,552 | | | $ | — | | | $ | — | | | $ | 444,552 | |

| | Finance & Insurance | | | 13,583,639 | | | | — | | | | — | | | | 13,583,639 | |

| | Information | | | 3,000,247 | | | | — | | | | — | | | | 3,000,247 | |

| | Manufacturing | | | 25,983,628 | | | | — | | | | — | | | | 25,983,628 | |

| | Real Estate, | | | | | | | | | | | | | | | | |

| | Rental & Leasing | | | 586,600 | | | | — | | | | — | | | | 586,600 | |

| | Retail Trade | | | 496,480 | | | | — | | | | — | | | | 496,480 | |

| | Wholesale Trade | | | 1,641,598 | | | | — | | | | — | | | | 1,641,598 | |

| | Total Common Stocks | | | 45,736,744 | | | | — | | | | — | | | | 45,736,744 | |

| | REITs | | | 2,643,833 | | | | 2,095,313 | | | | — | | | | 4,739,146 | |

| | Money Market Funds | | | 2,241,504 | | | | — | | | | — | | | | 2,241,504 | |

| | Total Assets | | $ | 50,622,081 | | | $ | 2,095,313 | | | $ | — | | | $ | 52,717,394 | |

| | | There were no transfers of securities between levels during the reporting period. The Fund did not hold any Level 3 securities during the year. It is the Fund’s policy to record transfers between levels as of the end of the reporting period. |

| | | |

| | | Derivative Instruments |

| | | The Fund may invest in derivative instruments. The Fund traded written options for the period ended February 29, 2016. The Fund did not hold any derivative instruments as of February 29, 2016. |

| | | |

| | | The effect of derivative instruments on the Statement of Operations for the period ended February 29, 2016: |

| | | |

| | Derivatives not accounted | Amount of Realized Losses |

| | for as hedging instruments | on Derivatives Transactions |

| | | |

| | | Options |

| | Equity Contracts | $46,007 |

| | | |

| | | |

| | Derivatives not accounted | Change in Net Unrealized Appreciation |

| | for as hedging instruments | on Derivatives Recognized in Income |

| | | |

| | | Options |

| | Equity Contracts | ($12,757) |

| | | |

| | | |

BARRETT

OPPORTUNITY FUND, INC.

| | | The Fund is not subject to any Master Netting Agreements; therefore, the Fund was not required to offset any assets or liabilities. |

| | | |

| | | (b) Options |

| | | |

| | | GAAP requires enhanced disclosures about the Fund’s derivative activities, including how such activities are accounted for and their effect on the Fund’s financial position and results of operations. |

| | | |

| | | The Fund is subject to equity price risk in the normal course of pursuing its investment objective. The Fund enters into written call options to hedge against changes in the value of equities. The Fund’s option component of the overall investment strategy is often referred to as a “buy-write” strategy (also called a “covered call” strategy), in which the Adviser (as defined below) writes (sells) a call option contract while at the same time owning an equivalent number of shares of the underlying stock to generate moderate current income. The writing of call options is intended to reduce the volatility of the portfolio and to earn premium income. Written call options expose the Fund to minimal counterparty credit risk since they are exchange traded and the exchange’s clearing house guarantees the options against default. |

| | | |

| | | As the writer of a call option, the Fund has the obligation to sell the security at the exercise price during the exercise period in the event the option is exercised. |

| | | |

| | | When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from options written. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or a loss. The Fund as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option. |

| | | Transactions in options written during the period ended February 29, 2016 were as follows: |

| | Call Options | | Contracts | | | Premiums | |

| | Outstanding, beginning of period | | | 300 | | | $ | 46,007 | |

| | Options written | | | — | | | | — | |

| | Options terminated in closing transactions | | | — | | | | — | |

| | Options exercised | | | — | | | | — | |

| | Options expired | | | (300 | ) | | | (46,007 | ) |

| | Outstanding, end of period | | | — | | | $ | — | |

BARRETT

OPPORTUNITY FUND, INC.

| | | (c) Security Transactions and Investment Income |

| | | |

| | | Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Under applicable tax laws, a withholding tax may be imposed on interest, dividends, and capital gains at various rates and withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. The cost of investments sold is determined by use of the specific identification method for computing the gain/loss on the transaction. It is the Fund’s policy to recognize a loss on a worthless security once it is determined beyond a reasonable doubt that there is no possibility of future worth. Proceeds from bankruptcy settlements will generally be recognized as a realized gain if the security is no longer held and as a return of capital if the security is still held. |

| | | |

| | | (d) Distributions to Shareholders |

| | | |

| | | The Fund will distribute any net investment income and any net realized long- or short-term capital gains at least annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. Distributions to shareholders are recorded on the ex-dividend date. The Fund may also pay a special distribution at the end of the calendar year to comply with federal tax requirements. |

| | | |

| | | (e) REIT Distributions |

| | | |

| | | The character of distributions received from REITs held by the Fund is generally comprised of net investment income, capital gains, and return of capital. It is the policy of the Fund to estimate the character of distributions received from underlying REITs based on historical data provided by the REITs. After each calendar year end, REITs report the actual tax character of these distributions. Differences between the estimated and actual amounts reported by the REITs are reflected in the Fund’s records in the year in which they are reported by the REITs by adjusted related investment cost basis, capital gains and income, as necessary. |

| | | |

| | | (f) Federal Income Taxes |

| | | |

| | | It is the Fund’s policy to comply with the federal income and excise tax requirements of subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), necessary to qualify as a regulated investment company. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal income tax provision is provided in the Fund’s financial statements. |

| | | |

| | | As of and during the year ended August 31, 2015, the Fund did not have a liability of any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to uncertain tax benefits as income tax expense in the |

BARRETT

OPPORTUNITY FUND, INC.

| | | Statement of Operations. During the period, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. taxing authorities for tax periods prior to 2011. |

| | | |

| | | (g) Use of Estimates |

| | | |

| | | The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. |

| | | |

| | | (h) Indemnification |

| | | |

| | | In the normal course of business the Fund enters into contracts that contain general indemnification clauses. The Fund’s maximum exposure under these agreements is unknown, as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote. |

| | | |

| | | (i) In-Kind Redemptions |

| | | |

| | | Net capital gains or losses resulting from in-kind redemptions are excluded from the Barrett Opportunity Fund’s taxable gains and are not distributed to shareholders. |

| | | |

| | | A redemption-in-kind is the process of making a distribution to shareholders through assets and cash rather than cash alone. During the year ended August 31, 2015, the Fund recorded redemptions for securities redeemed in-kind at a fair value of $1,474,375. The Fund recognized a realized gain in the amount of $1,337,006 on this transaction, which is reflected in the Statement of Operations. |

| | | |

| | | During the period ended February 29, 2016, the Fund did not record redemptions for securities redeemed in-kind. |

| 2. | INVESTMENT | The Fund has an Investment Advisory Agreement with Barrett Asset Management, LLC (“Barrett Asset Management” or the “Adviser”). |

| | ADVISER | Under the Investment Advisory Agreement, the Fund pays an advisory fee, calculated daily and paid monthly, in accordance with |

| | AGREEMENT | the following breakpoint schedule: |

| | AND OTHER | |

| | TRANSACTIONS | |

| | WITH AFFILIATES | |

| Average Daily Net Assets | Annual Rate |

| | First $1 billion | 0.700% |

| | Next $1 billion | 0.675% |

| | Next $3 billion | 0.650% |

| | Next $5 billion | 0.625% |

| | Over $10 billion | 0.600% |

| | | For the period ended February 29, 2016, the advisory fee totaled $197,610. |

| | | |

| | | The officers of the Fund are also officers and employees of Barrett Asset Management and do not receive compensation from the Fund. |

BARRETT

OPPORTUNITY FUND, INC.

| 3. | INVESTMENTS | During the period ended February 29, 2016, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments and including in-kind redemptions) were as follows: |

| | Purchases | Sales |

| | $3,213,074 | $3,109,318 |

| 4. | CAPITAL SHARES | At February 29, 2016, the Fund had 15,000,000 shares of capital stock authorized with a par value of $0.01 per share. Transactions in shares of the Fund were as follows: |

| | | | Period Ended | | | Year Ended | |

| | | | February 29, 2016 | | | August 31, 2015 | |

| | Shares sold | | | 109 | | | | 566 | |

| | Shares issued on reinvestment | | | 131,451 | | | | 123,311 | |

| | Shares redeemed | | | (42,404 | ) | | | (95,035 | ) |

| | In-kind redemptions | | | — | | | | (45,548 | ) |

| | Net increase (decrease) | | | 89,156 | | | | (16,706 | ) |

| 5. | INCOME TAX | The tax character of distributions paid during the fiscal years ended August 31 were as follows: | |

| | INFORMATION | | | | | | | |

| | AND | | | | 2015 | | | | 2014 | |

| | DISTRIBUTIONS | Distributions Paid From: | | | | | | | | |

| | TO | Ordinary income | | $ | 957,545 | | | $ | 561,062 | |

| | SHAREHOLDERS | Net long-term capital gains | | | 5,933,194 | | | | 4,936,179 | |

| | | Total distributions paid | | $ | 6,890,739 | | | $ | 5,497,241 | |

| | | The Fund designated as long-term capital gain dividends, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended August 31, 2015. |

| | | |

| | | The amounts designated as long-term capital gain for the fiscal years ended August 31, 2015 and 2014 were $0 and $0, respectively. |

| | | |

| | | At August 31, 2015, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows: |

| | | Tax cost of investments | | $ | 7,985,952 | |

| | | Gross unrealized appreciation | | | 50,622,727 | |

| | | Gross unrealized depreciation | | | (52,846 | ) |

| | | Net unrealized appreciation | | $ | 50,569,881 | |

BARRETT

OPPORTUNITY FUND, INC.

| | | As of August 31, 2015, the components of accumulated earnings on a tax basis were as follows: |

| | | Undistributed operating income | | $ | 383,645 | |

| | | | | | | |

| | | Undistributed long-term gains | | | 5,527,499 | |

| | | Distributable earnings | | | 5,911,144 | |

| | | Unrealized appreciation | | | 50,569,881 | |

| | | Other accumulated losses* | | | (24,407 | ) |

| | | Total accumulated gains | | $ | 56,456,618 | |

| | | * Other temporary differences are primarily attributable to the timing of certain expenses. |

| | | Additionally, U.S. generally accepted accounting principles require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended August 31, 2015, the following table shows the reclassifications made: |

| | | Undistributed Net | Accumulated Net | Paid-In |

| | | Investment Loss | Realized Loss | Capital |

| | | $(8) | $(1,336,998) | $1,337,006 |

BARRETT

OPPORTUNITY FUND, INC.

Additional Information (Unaudited)

| 1. | INFORMATION ABOUT DIRECTORS AND OFFICERS |

The business and affairs of the Fund are conducted by management under the supervision and subject to the direction of its Board of Directors. The business address of each Director is c/o Barrett Asset Management, LLC, the Fund’s investment manager (“Barrett Asset Management”), 90 Park Avenue, 34th Floor, New York, New York, 10016. Information pertaining to the Directors and officers of the Fund is set forth below.

The Statement of Additional Information includes additional information about Directors and is available, without charge, upon request by calling the Fund at 1-877-363-6333.

| | | | | Number of | |

| | | | | Portfolios | |

| | | | | in Fund | Other Board |

| | Position(s) | Term of Office* | | Complex | Memberships |

| Name, Address | Held with | and Length of | Principal Occupation(s) | Overseen | Held by |

and Birth Year | Fund | Time Served** | During Past 5 Years | by Director | Director |

| | | | | | |

INDEPENDENT DIRECTORS†: | | | | | |

| | | | | | |

| Barry Handel, CPA | Director | Since 2005 | Partner, Shalik, Morris & | 1 | None |

| Birth Year: 1951 | | | Company, LLP | | |

| | | | (accounting firm) | | |

| | | | | | |

David H. Kochman(1) | Director | Since 2011 | Member, Harris Beach PLLC | 1 | None |

| Birth Year: 1959 | | | (law firm) | | |

| | | | | | |

Rosalind A. Kochman(2) | Director | Since 1990 | Retired (since 2002); formerly, | 1 | None |

| Birth Year: 1937 | | | Chief Executive Officer, | | |

| Chairperson | Since 2005 | Brooklyn Eye Surgery Center, | | |

| | | | and Administrator, Kochman, | | |

| | | | Lebowitz & Mogil, MDs | | |

| | | | | | |

| William Morris, Jr., CPA | Director | Since 2005 | President, William Morris & | 1 | None |

| Birth Year: 1948 | | | Associates P.C. (accounting | | |

| | | | firm) | | |

| | | | | | |

| OFFICERS: | | | | | |

| | | | | | |

| Peter H. Shriver, CFA | President | Since 2006 | Chief Executive Officer | | |

| Barrett Asset Management | and Chief | | of Barrett Asset Management | N/A | N/A |

| 90 Park Avenue | Executive | | (since 2011); President of | | |

| New York, NY 10016 | Officer | | Barrett Asset Management | | |

| Birth Year: 1952 | | | (2011-2014) President of | | |

| | | | Barrett Associates, Inc. | | |

| | | | (2004-2011) | | |

| (1) | Mr. Kochman is Ms. Kochman’s son. |

| (2) | Ms. Kochman is Mr. Kochman’s mother. |

BARRETT

OPPORTUNITY FUND, INC.

| | | | | Number of | |

| | | | | Portfolios | |

| | | | | in Fund | Other Board |

| | Position(s) | Term of Office* | | Complex | Memberships |

| Name, Address | Held with | and Length of | Principal Occupation(s) | Overseen | Held by |

and Birth Year | Fund | Time Served** | During Past 5 Years | by Director | Director |

| | | | | | |

| OFFICERS (Continued): | | | | | |

| | | | | | |

| E. Wells Beck, CFA | Vice | Since 2010 | Managing Director and | N/A | N/A |

| Barrett Asset Management | President | | Director of Research, Barrett | | |

| 90 Park Avenue | and | | Asset Management (since | | |

| New York, NY 10016 | Investment | | 2011); Managing Director, | | |

| Birth Year: 1968 | Officer | | Barrett Associates (2006-2011); | | |

| | | | Analyst and Portfolio | | |

| | | | Manager at Haven Capital | | |

| | | | Management (2001-2006) | | |

| | | | | | |

| Robert J. Milnamow | Vice | Since 2014 | President and Chief | N/A | N/A |

| Barrett Asset Management | President | | Investment Officer of | | |

| 90 Park Avenue | and Chief | | Barrett Asset Management | | |

| New York, NY 10016 | Investment | | (since 2011); Executive Vice | | |

| Birth Year: 1950 | Officer | | President, Barrett Asset | | |

| | | | Management (2006-2014); | | |

| | | | Managing Director, Barrett | | |

| | | | Associates (2003-2011) | | |

| | | | | | |

| Madeleine Morreale | Chief | Since 2011 | Chief Compliance Officer, | N/A | N/A |

| Barrett Asset Management | Compliance | | Barrett Asset Management | | |

| 90 Park Avenue | Officer | | (2011-Present); Compliance | | |

| New York, NY 10016 | and | | Officer, Barrett Associates | | |

| Birth Year: 1956 | Anti-Money | | (2010-2011); Head Trader, | | |

| | Laundering | | Barrett Associates | | |

| | Officer | | (2003-2010) | | |

| | | | | | |

| John G. Youngman | Chief | Since 2011 | Managing Director, | N/A | N/A |

| Barrett Asset Management | Financial | | Barrett Asset Management | | |

| 90 Park Avenue | Officer, | | (2011-Present); Managing | | |

| New York, NY 10016 | Treasurer | | Director, Barrett Associates | | |

| Birth Year: 1968 | and | | (2010-2011); Managing | | |

| | Investment | | Director, Griffin Asset | | |

| | Officer | | Management (1994-2010) | | |

† | Directors who are not “interested persons” of the Fund within the meaning of Section 2(a)(19) of the 1940 Act. |

| * | Each Director and officer serves until his respective successor has been duly elected and qualified or until his earlier death, resignation, retirement or removal. |

| ** | Indicates the earliest year in which the Director became a board member or the officer took such office. |

BARRETT

OPPORTUNITY FUND, INC.

| 2. | IMPORTANT TAX INFORMATION |

The following information is provided with respect to the distributions paid during the taxable year ended August 31, 2015:

| Record Date: | 12/16/14 |

| Payable Date: | 12/17/14 |

| Ordinary Income: | |

| Qualified Dividend Income for Individuals | 100.00% |

| Dividends Qualifying for the Dividends Received Deduction for Corporations | 97.03% |

| Long-Term Capital Gain Dividend | $3.30103 |

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions is 20.57%.

Please retain this information for your records.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. To obtain information on Form N-Q from the Fund, shareholders can call the Fund at 1-877-363-6333.

Information on how the Fund voted proxies relating to portfolio securities during the prior 12-month period ended June 30th of each year and a description of the policies and procedures that the Fund uses to determine how to vote proxies related to portfolio transactions are available (1) without charge, upon request, by calling the Fund at 1-877-363-6333 and (2) on the SEC’s website at www.sec.gov.

(This Page Intentionally Left Blank.)

BARRETT OPPORTUNITY FUND, INC.

c/o U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

DIRECTORS

Barry Handel, CPA

David H. Kochman

Rosalind A. Kochman, Chairperson

William Morris, Jr., CPA

INVESTMENT MANAGER

Barrett Asset Management, LLC

90 Park Avenue

New York, NY 10016

ADMINISTRATOR, FUND ACCOUNTANT & TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 E. Michigan Street

Milwaukee, WI 53202

DISTRIBUTOR

Quasar Distributors, LLC

615 E. Michigan Street

Milwaukee, WI 53202

CUSTODIAN

U.S. Bank, N.A.

Custody Operations

1555 River Center Drive, Suite 302

Milwaukee, WI 53212

LEGAL COUNSEL

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, NY 10017

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

This report is transmitted to the shareholders of Barrett Opportunity Fund, Inc. for their information. This is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report.

This report must be preceded or accompanied by a free prospectus. Investors should consider the Fund’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Fund. Please read the prospectus carefully before investing.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not applicable. |

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certifications pursuant to Section 906 of the Sarbanes‑Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Barrett Opportunity Fund, Inc.

By (Signature and Title)* /s/ Peter Shriver

Peter Shriver, President

Date May 2, 2016

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Peter Shriver

Peter Shriver, President

Date May 2, 2016

By (Signature and Title)* /s/ John Youngman

John Youngman, Treasurer

Date April 28, 2016

* Print the name and title of each signing officer under his or her signature.