Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. For the most recent month-end performance call 800.668.0434 (or 800.525.3713 if you hold shares directly with Janus Henderson) or visit janushenderson.com/performance (or janushenderson.com/allfunds if you hold shares directly with Janus Henderson).

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

Returns include reinvestment of all dividends and distributions.

The yield more closely reflects the current earnings of the money market fund than the total return.

Class D Shares of the Fund commenced operations on February 16, 2010. Performance shown for periods prior to February 16, 2010, reflects the performance of the Fund’s former Class J Shares, the initial share class (renamed Class T Shares effective February 16, 2010), calculated using the fees and expenses in effect during the periods shown, net of any applicable fee and expense limitations or waivers.

If Class D Shares of the Fund had been available during periods prior to February 16, 2010, the performance shown may have been different. The performance shown for periods following the Fund’s commencement of Class D Shares reflects the fees and expenses of Class D Shares, net of any applicable fee and expense limitations or waivers. Please refer to the Fund’s prospectuses for further details concerning historical performance.

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements.

‡ As stated in the prospectus. See Financial Highlights for actual expense ratios during the reporting period.

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in either share class or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. These fees are fully described in the Fund’s prospectuses. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Money market funds may hold securities with stated maturities of greater than 397 days when those securities have features that allow a fund to “put” back the security to the issuer or to a third party within 397 days of acquisition. The maturity dates shown in the security descriptions are the stated maturity dates.

Janus Henderson Money Market Fund (the “Fund”) is a series fund. The Fund is part of Janus Investment Fund (the “Trust”), which is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The Trust offers 38 Funds which include multiple series of shares, with differing investment objectives and policies. The Fund seeks capital preservation and liquidity with current income as a secondary objective. Janus Henderson Investors US LLC (formerly Janus Capital Management LLC) is the investment adviser (the “Adviser”) to the Fund.

The Fund offers two classes of shares in order to meet the needs of various types of investors. Each class represents an interest in the same portfolio of investments. Certain financial intermediaries may not offer both classes of shares.

The Fund is classified as a “retail money market fund,” as such term is defined in or interpreted under the rules governing money market funds. A retail money market fund is a money market fund that has policies and procedures reasonably designed to limit all beneficial owners of the Fund to natural persons, which means that the Fund’s Shares can only be held through individual investors. In order to make an initial investment in the Fund, the Fund requires that a shareholder provide certain information (e.g., Social Security number or government-issued identification) that confirms your eligibility to invest in the Fund. Accounts that are not beneficially owned by natural persons, such as business and limited liability company accounts, charitable or financial organizations, and corporate and S-Corp accounts, are not eligible to invest in the Fund, and will be involuntarily redeemed from the Fund after having been provided sufficient notice.

As a retail money market fund, the Fund may be subject to liquidity fees and/or redemption gates on fund redemptions if the Fund’s liquidity falls below required minimums because of market conditions or other factors. Liquidity fees and redemption gates are most likely to be imposed during times of extraordinary market stress. Pursuant to Rule 2a-7 under the 1940 Act, the Trustees are permitted to impose a liquidity fee on redemptions from the Fund (up to 2%) or a redemption gate to temporarily restrict redemptions from the Fund for up to 10 business days (in any 90-day period) in the event that the Fund’s weekly liquid assets fall below certain designated thresholds.

If the Fund’s weekly liquid assets fall below 30% of the Fund’s total assets, the Trustees are permitted, but not required, to (i) impose a liquidity fee of no more than 2% of the amount redeemed and/or (ii) impose a redemption gate to temporarily suspend the right of redemption. If the Fund’s weekly liquid assets fall below 10% of the Fund’s total assets, the Fund will impose, generally as of the beginning of the next business day, a liquidity fee of 1% of the amount redeemed unless the Trustees determine that such a fee would not be in the best interests of the Fund or determines that a lower or higher fee (subject to the 2% limit) would be in the best interests of the Fund. A liquidity fee or redemption gate may be imposed as early as the same day that the Fund's weekly liquid assets fall below the 30% or 10% thresholds.

Shareholders, including individuals, accounts, as well as the Fund’s portfolio manager(s) and/or investment personnel, may from time to time own (beneficially or of record) a significant percentage of the Fund’s Shares and can be considered to “control” the Fund when that ownership exceeds 25% of the Fund’s assets (and which may differ from control as determined in accordance with United States of America generally accepted accounting principles ("US GAAP")).

Effective July 6, 2020, Class D Shares are available to new investors, subject to any closed fund policies for a Fund, as applicable. Previously, Class D Shares were only available to investors who already had a direct account with the Janus Henderson funds; immediate family members or members of the same household of an eligible individual investor; and existing beneficial owners of sole proprietorships or partnerships that hold accounts directly with the Janus Henderson funds.

Class T Shares are available through certain financial intermediary platforms including, but not limited to, mutual fund wrap fee programs, managed account programs, asset allocation programs, bank trust platforms, as well as certain retirement platforms. In addition, Class T Shares may be available through certain financial intermediaries who have an agreement with the Adviser or its affiliates to offer Class T Shares on their supermarket platforms.

The following accounting policies have been followed by the Fund and are in conformity with US GAAP.

The Fund has adopted liquidity requirements (measured at the time of purchase) as noted:

The Fund will limit its investments in illiquid securities to 5% or less of its total assets.

Securities held by the Fund are valued in accordance with policies and procedures established by and under the supervision of the Trustees (the “Valuation Procedures”). Investments held by the Fund are valued utilizing the amortized cost method of valuation permitted in accordance with Rule 2a-7 under the 1940 Act and certain conditions therein. Under the amortized cost method, which does not take into account unrealized capital gains or losses, an instrument is initially valued at its cost and thereafter assumes a constant accretion/amortization to maturity of any discount or premium.

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements regarding fair value measurements. This standard emphasizes that fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability and establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. These inputs are summarized into three broad levels:

Level 1 – Unadjusted quoted prices in active markets the Fund has the ability to access for identical assets or liabilities.

Level 2 – Observable inputs other than unadjusted quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Assets or liabilities categorized as Level 2 in the hierarchy generally include: debt securities fair valued in accordance with the evaluated bid or ask prices supplied by a pricing service; securities traded on OTC markets and listed securities for which no sales are reported that are fair valued at the latest bid price (or yield equivalent thereof) obtained from one or more dealers transacting in a market for such securities or by a pricing service approved by the Fund’s Trustees; certain short-term debt securities with maturities of 60 days or less that are fair valued at amortized cost; and equity securities of foreign issuers whose fair value is determined by using systematic fair valuation models provided by independent third parties in order to adjust for stale pricing which may occur between the close of certain foreign exchanges and the close of the NYSE.

Periodic review and monitoring of the valuation of short-term securities is performed in an effort to ensure that amortized cost approximates market value. Other securities that may be categorized as Level 2 in the hierarchy include, but are not limited to, preferred stocks, bank loans, swaps, investments in unregistered investment companies, options, and forward contracts.

Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

There have been no significant changes in valuation techniques used in valuing any such positions held by the Fund since the beginning of the fiscal year.

The inputs or methodology used for fair valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used as of June 30, 2022 to fair value the Fund’s investments in securities and other financial instruments is included in the “Valuation Inputs Summary” in the Notes to Schedule of Investments and Other Information.

The Fund bears expenses incurred specifically on its behalf. Each class of shares bears a portion of general expenses, which are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of total net assets. Expenses directly attributable to a specific class of shares are charged against the operations of such class.

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

In the normal course of business, the Fund may enter into contracts that contain provisions for indemnification of other parties against certain potential liabilities. The Fund’s maximum exposure under these arrangements is unknown, and would involve future claims that may be made against the Fund that have not yet occurred. Currently, the risk of material loss from such claims is considered remote.

Dividends, if any, are declared daily and distributed monthly for the Fund. Realized capital gains, if any, are declared and distributed in December. The Fund may treat a portion of the amount paid to redeem shares as a distribution of investment company taxable income and realized capital gains that are reflected in the net asset value. This practice, commonly referred to as “equalization,” has no effect on the redeeming shareholder or the Fund’s total return, but may reduce the amounts that would otherwise be required to be paid as taxable dividends to the remaining shareholders. It is possible that the Internal Revenue Service (IRS) could challenge the Fund's equalization methodology or calculations, and any such challenge could result in additional tax, interest, or penalties to be paid by the Fund.

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income in accordance with the requirements of Subchapter M of the Internal Revenue Code. Management has analyzed the Fund’s tax positions taken for all open federal income tax years, generally a three-year period, and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

2. Other Investments and Strategies

In response to the COVID-19 pandemic, the U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, have taken extraordinary actions to support local and global economies and the

financial markets, including reducing interest rates to record-low levels. Extremely low or negative interest rates may become more prevalent or may not work as intended. As there is little precedent for this situation, the impact on various markets that interest rate or other significant policy changes may have is unknown. The withdrawal of this support, a failure of measures put in place in response to such economic uncertainty, or investor perception that such efforts were not sufficient could each negatively affect financial markets generally, and the value and liquidity of specific securities. In addition, policy and legislative changes in the United States and in other countries continue to impact many aspects of financial regulation.

Widespread disease, including pandemics and epidemics, and natural or environmental disasters, including those which may be attributable to global climate change, such as earthquakes, fires, floods, hurricanes, tsunamis and weather-related phenomena generally, have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of a Fund’s investments. Economies and financial markets throughout the world have become increasingly interconnected, which increases the likelihood that events or conditions in one region or country will adversely affect markets or issuers in other regions or countries, including the United States. These disruptions could prevent a Fund from executing advantageous investment decisions in a timely manner and negatively impact a Fund’s ability to achieve its investment objective(s). Any such event(s) could have a significant adverse impact on the value of a Fund. In addition, these disruptions could also impair the information technology and other operational systems upon which the Fund’s service providers, including the Adviser or the subadviser (as applicable), rely, and could otherwise disrupt the ability of employees of the Fund’s service providers to perform essential tasks on behalf of the Fund. Adverse weather conditions may also have a particularly significant negative effect on issuers in the agricultural sector and on insurance and reinsurance companies that insure or reinsure against the impact of natural disasters.

Fund transactions involving a counterparty are subject to the risk that the counterparty or a third party will not fulfill its obligation to the Fund (“counterparty risk”). Counterparty risk may arise because of the counterparty’s financial condition (i.e., financial difficulties, bankruptcy, or insolvency), market activities and developments, or other reasons, whether foreseen or not. A counterparty’s inability to fulfill its obligation may result in significant financial loss to the Fund. The Fund may be unable to recover its investment from the counterparty or may obtain a limited recovery, and/or recovery may be delayed. The extent of the Fund’s exposure to counterparty risk with respect to financial assets and liabilities approximates its carrying value. See the "Offsetting Assets and Liabilities" section of this Note for further details.

The Fund may be exposed to counterparty risk through its investments in certain securities, including, but not limited to, repurchase agreements and debt securities. The Fund intends to enter into financial transactions with counterparties that the Adviser believes to be creditworthy at the time of the transaction. There is always the risk that the Adviser’s analysis of a counterparty’s creditworthiness is incorrect or may change due to market conditions. To the extent that the Fund focuses its transactions with a limited number of counterparties, it will have greater exposure to the risks associated with one or more counterparties.

The Fund presents gross and net information about transactions that are either offset in the financial statements or subject to an enforceable master netting arrangement or similar agreement with a designated counterparty, regardless of whether the transactions are actually offset in the Statement of Assets and Liabilities.

The Offsetting Assets and Liabilities table located in the Schedule of Investments presents gross amounts of recognized assets and/or liabilities and the net amounts after deducting collateral that has been pledged by counterparties or has been pledged to counterparties (if applicable). For corresponding information grouped by type of instrument, see the Fund's Schedule of Investments.

All repurchase agreements are transacted under legally enforceable master repurchase agreements that give the Fund, in the event of default by the counterparty, the right to liquidate securities held and to offset receivables and payables with the counterparty. For financial reporting purposes, the Fund does not offset financial instruments' payables and receivables and related collateral on the Statement of Assets and Liabilities. Repurchase agreements held by the Fund are fully collateralized, and such collateral is in the possession of the Fund’s custodian or, for tri-party agreements, the custodian designated by the agreement. The collateral is evaluated daily to ensure its market value exceeds the current market value of the repurchase agreements, including accrued interest.

The Fund and other funds advised by the Adviser or its affiliates may transfer daily uninvested cash balances into one or more joint trading accounts. Assets in the joint trading accounts are invested in money market instruments and the proceeds are allocated to the participating funds on a pro rata basis.

Repurchase agreements held by the Fund are fully collateralized, and such collateral is in the possession of the Fund’s custodian or, for tri-party agreements, the custodian designated by the agreement. The collateral is evaluated daily to ensure its market value exceeds the current market value of the repurchase agreements, including accrued interest. In the event of default on the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

The Fund may invest in U.S. and non-U.S. government debt securities (“sovereign debt”). Some investments in sovereign debt, such as U.S. sovereign debt, are considered low risk. However, investments in sovereign debt, especially the debt of less developed countries, can involve a high degree of risk, including the risk that the governmental entity that controls the repayment of sovereign debt may not be willing or able to repay the principal and/or to pay the interest on its sovereign debt in a timely manner. A sovereign debtor’s willingness or ability to satisfy its debt obligation may be affected by various factors including, but not limited to, its cash flow situation, the extent of its foreign currency reserves, the availability of foreign exchange when a payment is due, the relative size of its debt position in relation to its economy as a whole, the sovereign debtor’s policy toward international lenders, and local political constraints to which the governmental entity may be subject. Sovereign debtors may also be dependent on expected disbursements from foreign governments, multilateral agencies, and other entities. The failure of a sovereign debtor to implement economic reforms, achieve specified levels of economic performance, or repay principal or interest when due may result in the cancellation of third party commitments to lend funds to the sovereign debtor, which may further impair such debtor’s ability or willingness to timely service its debts. The Fund may be requested to participate in the rescheduling of such sovereign debt and to extend further loans to governmental entities, which may adversely affect the Fund’s holdings. In the event of default, there may be limited or no legal remedies for collecting sovereign debt and there may be no bankruptcy proceedings through which the Fund may collect all or part of the sovereign debt that a governmental entity has not repaid. In addition, to the extent the Fund invests in non-U.S. sovereign debt, it may be subject to currency risk.

The Fund also may purchase variable and floating rate demand notes of corporations and other entities, which are unsecured obligations redeemable upon not more than 30 days’ notice. The Fund may purchase variable and floating rate demand notes of U.S. Government issuers or commercial banks. These obligations include master demand notes that permit investment of fluctuating amounts at varying rates of interest pursuant to direct arrangements with the issuer of the instrument. The issuer of these obligations often has the right, after a given period, to prepay the outstanding principal amount of the obligations upon a specified number of days’ notice. These obligations generally are not traded, nor generally is there an established secondary market for these obligations. To the extent a demand note

does not have a seven day or shorter demand feature and there is no readily available market for the obligation, it is treated as an illiquid investment. The rate of interest on securities purchased by the Fund may be tied to short-term Treasury or other government securities or indices on securities that are permissible investments of the Fund, as well as other money market rates of interest. The Fund will not purchase securities whose values are tied to interest rates or indices that are not appropriate for the duration and volatility standards of a money market fund.

3. Investment Advisory Agreements and Other Transactions with Affiliates

The Fund pays the Adviser an investment advisory fee which is calculated daily and paid monthly. The Fund’s contractual investment advisory fee rate (expressed as an annual rate) is 0.20% of its average daily net assets.

The Adviser may waive and/or reimburse additional fees to the extent necessary to assist the Fund in attempting to maintain a yield of at least 0.00%. These waivers and reimbursements are voluntary and could change or be terminated at any time at the discretion of the Adviser. There is no guarantee that the Fund will maintain a positive yield. If applicable, amounts waived and/or reimbursed to the Fund by the Adviser are disclosed as “Excess Expense Reimbursement” on the Statement of Operations.

Class D Shares and Class T Shares of the Fund compensate the Adviser at an annual rate of 0.36% and 0.38%, respectively, of average daily net assets for providing certain administration services including, but not limited to, oversight and coordination of the Fund’s service providers, recordkeeping and registration functions and also to pay for costs such as shareholder servicing and custody. These amounts are disclosed as “Administration services fees” on the Statement of Operations. A portion of the Fund’s administration fee is paid to BNP Paribas Financial Services ("BPFS"). BPFS provides certain administrative services to the Fund, including services related to Fund accounting, calculation of the Fund’s daily NAV, and Fund audit, tax, and reporting obligations, pursuant to a sub-administration agreement with the Adviser on behalf of the Fund. The Adviser does not receive any additional compensation, beyond the administration services fee for serving as administrator.

The Board of Trustees has adopted a deferred compensation plan (the “Deferred Plan”) for independent Trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. All deferred fees are credited to an account established in the name of the Trustees. The amounts credited to the account then increase or decrease, as the case may be, in accordance with the performance of one or more of the Janus Henderson funds that are selected by the Trustees. The account balance continues to fluctuate in accordance with the performance of the selected fund or funds until final payment of all amounts are credited to the account. The fluctuation of the account balance is recorded by the Fund as unrealized appreciation/(depreciation) and is included as of June 30, 2022 on the Statement of Assets and Liabilities in the asset, “Trustees’ deferred compensation,” and liability, “Trustees’ deferred compensation fees.” Additionally, the recorded unrealized appreciation/(depreciation) is included in “Total distributable earnings (loss)” on the Statement of Assets and Liabilities. Deferred compensation expenses for the year ended June 30, 2022 are included in “Trustees’ fees and expenses” on the Statement of Operations. Trustees are allowed to change their designation of mutual funds from time to time. Amounts will be deferred until distributed in accordance with the Deferred Plan. Deferred fees of $431,326 were paid by the Trust to the Trustees under the Deferred Plan during the year ended June 30, 2022.

4. Federal Income Tax

The tax components of capital shown in the table below represent: (1) distribution requirements the Fund must satisfy under the income tax regulations; (2) losses or deductions the Fund may be able to offset against income and gains realized in future years; and (3) unrealized appreciation or depreciation of investments for federal income tax purposes.

Other book to tax differences primarily consist of deferred compensation. The Fund has elected to treat gains and losses on forward foreign currency contracts as capital gains and losses, if applicable. Other foreign currency gains and losses on debt instruments are treated as ordinary income for federal income tax purposes pursuant to Section 988 of the Internal Revenue Code.

Income and capital gains distributions are determined in accordance with income tax regulations that may differ from US GAAP. These differences are due to differing treatments for items such as net short-term gains, deferral of wash sale losses, and capital loss carryovers. Certain permanent differences such as tax returns of capital and net investment losses noted below have been reclassified to capital.

Permanent book to tax basis differences may result in reclassifications between the components of net assets. These differences have no impact on the results of operations or net assets. The following reclassifications have been made to the Fund:

Capital has been adjusted by $5,251, all of which is long-term capital gain, for distributions in connection with Fund share redemptions (tax equalization).

5. Capital Share Transactions

6. Subsequent Event

Management has evaluated whether any events or transactions occurred subsequent to June 30, 2022 and through the date of issuance of the Fund’s financial statements and determined that there were no material events or transactions that would require recognition or disclosure in the Fund’s financial statements.

To the Board of Trustees of Janus Investment Fund and Shareholders of Janus Henderson Money Market Fund

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

We have served as the auditor of one or more investment companies in Janus Henderson Funds since 1990.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to its portfolio securities is available without charge: (i) upon request, by calling 1-800-525-1093; (ii) on the Fund’s website at janushenderson.com/proxyvoting; and (iii) on the SEC’s website at http://www.sec.gov. Additionally, information regarding the Fund’s proxy voting record for the most recent twelve-month period ended June 30 is also available, free of charge, through janushenderson.com/proxyvoting and from the SEC’s website at http://www.sec.gov.

The Fund files its complete holdings in a monthly report on Form N-MFP within 5 business days after each month end. These reports (i) are available on the SEC’s website at http://www.sec.gov; (ii) may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (information on the Public Reference Room may be obtained by calling 1-800-SEC-0330); and (iii) are available without charge, upon request, by calling a Janus Henderson representative at 1-877-335-2687 (toll free) (or 1-800-525-3713 if you hold Class D Shares).

The Trustees of Janus Aspen Series, each of whom serves as an “independent” Trustee (the “Trustees”), oversee the management of each portfolio of Janus Aspen Series (each, a “VIT Portfolio,” and collectively, the “VIT Portfolios”), as well as each fund of Janus Investment Fund (each, a “Fund,” and collectively, the “Funds” and together with the VIT Portfolios, the “Janus Henderson Funds,” and each, a “Janus Henderson Fund”). As required by law, the Trustees determine annually whether to continue the investment advisory agreement for each Janus Henderson Fund and the subadvisory agreement for each Janus Henderson Fund that utilizes a subadviser.

In connection with their most recent consideration of those agreements for each Janus Henderson Fund, the Trustees received and reviewed information provided by Janus Henderson Investors US LLC (formerly, Janus Capital Management LLC) (the “Adviser”) and the subadviser in response to requests of the Trustees and their independent legal counsel. They also received and reviewed information and analysis provided by, and in response to requests of, their independent fee consultant. Throughout their consideration of the agreements, the Trustees were advised by their independent legal counsel. The Trustees met with management to consider the agreements, and also met separately in executive session with their independent legal counsel and their independent fee consultant.

At meetings held on November 3-4, 2021 and December 7-8, 2021, the Trustees’ evaluated the information provided by the Adviser, the subadviser, and the independent fee consultant, as well as other information addressed during the year. Following such evaluation, the Trustees determined that the overall arrangements between each Janus Henderson Fund and the Adviser and each subadviser, as applicable, were fair and reasonable in light of the nature, extent and quality of the services provided by the Adviser, its affiliates and the subadviser, the fees charged for those services, and other matters that the Trustees considered relevant in the exercise of their business judgment and unanimously approved the continuation of the investment advisory agreement for each Janus Henderson Fund and the subadvisory agreement for each subadvised Janus Henderson Fund, for the period from February 1, 2022 through February 1, 2023, subject to earlier termination as provided for in each agreement.

In considering the continuation of those agreements, the Trustees reviewed and analyzed various factors that they determined were relevant, including the factors described below, none of which by itself was considered dispositive. However, the material factors and conclusions that formed the basis for the Trustees’ determination to approve the continuation of the agreements are discussed separately below. Also included is a summary of the independent fee consultant’s conclusions and opinions that arose during, and were included as part of, the Trustees’ consideration of the agreements. “Management fees,” as used herein, reflect actual annual advisory fees and, for the purpose of peer comparisons any administration fees (excluding out of pocket costs), net of any waivers, paid by a fund as a percentage of average net assets.

The Trustees reviewed the nature, extent and quality of the services provided by the Adviser and the subadviser to the Janus Henderson Funds, taking into account the investment objective, strategies and policies of each Janus Henderson Fund, and the knowledge the Trustees gained from their regular meetings with management on at least a quarterly basis and their ongoing review of information related to the Janus Henderson Funds. In addition, the Trustees reviewed

the resources and key personnel of the Adviser and the subadviser, particularly noting those employees who provide investment and risk management services to the Janus Henderson Funds. The Trustees also considered other services provided to the Janus Henderson Funds by the Adviser or the subadviser, such as managing the execution of portfolio transactions and the selection of broker-dealers for those transactions. The Trustees considered the Adviser’s role as administrator to the Janus Henderson Funds, noting that the Adviser generally does not receive a fee for its services as administrator, but is reimbursed for its out-of-pocket costs. The Trustees considered the role of the Adviser in monitoring adherence to the Janus Henderson Funds’ investment restrictions, providing support services for the Trustees and Trustee committees, and overseeing communications with shareholders and the activities of other service providers, including monitoring compliance with various policies and procedures of the Janus Henderson Funds and with applicable securities laws and regulations.

In this regard, the independent fee consultant noted that the Adviser provides a number of different services for the Janus Henderson Funds and fund shareholders, ranging from investment management services to various other servicing functions, and that, in its view, the Adviser is a capable provider of those services. The independent fee consultant also provided its belief that the Adviser has developed a number of institutional competitive advantages that should enable it to provide superior investment and service performance over the long term.

The Trustees concluded that the nature, extent and quality of the services provided by the Adviser and the subadviser to each Janus Henderson Fund were appropriate and consistent with the terms of the respective advisory and subadvisory agreements, and that, taking into account steps taken to address those Janus Henderson Funds whose performance lagged that of their peers for certain periods, the Janus Henderson Funds were likely to benefit from the continued provision of those services. They also concluded that the Adviser and the subadviser had sufficient personnel, with the appropriate education and experience, to serve the Janus Henderson Funds effectively and each had demonstrated its ability to attract well-qualified personnel.

The Trustees considered the performance results of each Janus Henderson Fund over various time periods. They noted that they considered Janus Henderson Fund performance data throughout the year, including periodic meetings with each Janus Henderson Fund’s portfolio manager(s), and also reviewed information comparing each Janus Henderson Fund’s performance with the performance of comparable funds and peer groups identified by Broadridge Financial Solutions, Inc. (“Broadridge”), an independent data provider, and with the Janus Henderson Fund’s benchmark index. In this regard, the independent fee consultant found that the overall Janus Henderson Funds’ performance has been reasonable: for the 36 months ended September 30, 2021, approximately 55% of the Janus Henderson Funds were in the top two quartiles of performance versus Broadridge peers, and for the 12 months ended September 30, 2021, approximately 45% of the Janus Henderson Funds were in the top two quartiles of performance versus Broadridge peers.

The Trustees considered the performance of each Fund, noting that performance may vary by share class, and noted the following:

Broadridge quartile for the 12 months ended May 31, 2021. The Trustees noted the reasons for the Fund’s underperformance and the steps the Adviser had taken or was taking to improve performance.

Multi-Asset U.S. Equity Funds

ended May 31, 2021. The Trustees noted the reasons for the Fund’s underperformance, and the steps the Adviser had taken or was taking to improve performance.

U.S. Equity Funds

In consideration of each Janus Henderson Fund’s performance, the Trustees concluded that, taking into account the factors relevant to performance, as well as other considerations, including steps taken to improve performance, the Janus Henderson Fund’s performance warranted continuation of such Janus Henderson Fund’s investment advisory and subadvisory agreement(s).

The Trustees examined information regarding the fees and expenses of each Janus Henderson Fund in comparison to similar information for other comparable funds as provided by Broadridge, an independent data provider. They also reviewed an analysis of that information provided by their independent fee consultant and noted that the rate of management fees (investment advisory fees and any administration fees but excluding out-of-pocket costs) for many of the Janus Henderson Funds, after applicable waivers, was below the average management fee rate of the respective peer group of funds selected by an independent data provider. The Trustees also examined information regarding the subadvisory fees charged for subadvisory services, as applicable, noting that all such fees were paid by the Adviser out of its management fees collected from such Janus Henderson Fund.

The independent fee consultant provided its belief that the management fees charged by the Adviser to each of the Janus Henderson Funds under the current investment advisory and administration agreements are reasonable in relation to the services provided by the Adviser. The independent fee consultant found: (1) the total expenses and management fees of the Janus Henderson Funds to be reasonable relative to other comparable mutual funds; (2) the total expenses, on average, were 8% under the average total expenses of the respective Broadridge Expense Group peers; and (3) and the management fees for the Janus Henderson Funds, on average, were 6% under the average management fees for the respective Broadridge Expense Group. The Trustees also considered the total expenses for each share class of each Janus Henderson Fund compared to the average total expenses for its Broadridge Expense Group and to average total expenses for its Broadridge Expense Universe.

For certain Janus Henderson Funds, the independent fee consultant also performed a systematic “focus list” analysis of expenses which assessed fund fees in the context of fund performance being delivered. Based on this analysis, the independent fee consultant found that the combination of service quality/performance and expenses on these individual Janus Henderson Funds was reasonable in light of performance trends, performance histories, and existence of performance fees, breakpoints, and/or expense waivers on such Janus Henderson Funds.

The Trustees considered the methodology used by the Adviser and subadviser in determining compensation payable to portfolio managers, the competitive environment for investment management talent, and the competitive market for mutual funds in different distribution channels.

The Trustees also reviewed management fees charged by the Adviser and subadviser to comparable separate account clients and to comparable non-affiliated funds subadvised by the Adviser or subadviser (for which the Adviser or the subadviser provides only or primarily portfolio management services). Although in most instances subadvisory and separate account fee rates for various investment strategies were lower than management fee rates for Janus Henderson Funds having a similar strategy, the Trustees considered that the Adviser noted that, under the terms of the management agreements with the Janus Henderson Funds, the Adviser performs significant additional services for the Janus Henderson Funds that it does not provide to those other clients, including administration services, oversight of the Janus Henderson Funds’ other service providers, trustee support, regulatory compliance and numerous other services, and that, in serving the Janus Henderson Funds, the Adviser assumes many legal risks and other costs that it does not assume in servicing its other clients. Moreover, the Trustees noted that the independent fee consultant found that: (1) the management fees the Adviser charges to the Janus Henderson Funds are reasonable in relation to the management fees the Adviser charges to funds subadvised by the Adviser and to the fees the Adviser charges to its institutional separate account clients; (2) these subadvised and institutional separate accounts have different service and infrastructure needs and operate in markets very distinct relative to retail funds; (3) Janus Henderson mutual fund investors enjoy reasonable fees relative to the fees charged to Janus Henderson subadvised fund and separate account investors; and (4) as part of its 2020 review, 9 of 10 Janus Henderson Funds have lower management fees than similar funds subadvised by the Adviser.

The Trustees considered the fees for each Janus Henderson Fund for its fiscal year ended in 2020, including the VIT Portfolios, and noted the following with regard to each VIT Portfolio’s total expenses, net of applicable fee waivers (the VIT Portfolio’s “total expenses”):

Multi-Asset U.S. Equity Funds

that the Adviser has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

U.S. Equity Funds

The Trustees reviewed information on the overall profitability to the Adviser and its affiliates from their relationships with the Janus Henderson Funds, and considered profitability data of other publicly traded mutual fund advisers. The Trustees recognized that profitability comparisons among fund managers are difficult because of the variation in the type of comparative information that is publicly available, and the profitability of any fund manager is affected by

numerous factors, including the organizational structure of the particular fund manager, differences in complex size, difference in product mix, difference in types of business (mutual fund, institutional and other), differences in the types of funds and other accounts it manages, possible other lines of business, the methodology for allocating expenses and the fund manager’s capital structure and cost of capital.

Additionally, the Trustees considered the estimated profitability to the Adviser from the investment management services it provided to each Janus Henderson Fund. In their review, the Trustees considered whether the Adviser and subadviser receive adequate incentives and resources to manage the Janus Henderson Funds effectively. In reviewing profitability, the Trustees noted that the estimated profitability for an individual Janus Henderson Fund is necessarily a product of the allocation methodology utilized by the Adviser to allocate its expenses as part of the estimated profitability calculation. In this regard, the Trustees noted that the independent fee consultant found that (1) the expense allocation methodology and rationales utilized by the Adviser were reasonable and (2) no clear correlation exists between expense allocations and operating margins. The Trustees also considered that the estimated profitability for an individual Janus Henderson Fund was influenced by a number of factors, including not only the allocation methodology selected, but also the presence of fee waivers and expense caps, and whether the Janus Henderson Fund’s investment management agreement contained breakpoints or a performance fee component. The Trustees determined, after taking into account these factors, among others, that the Adviser’s estimated profitability with respect to each Janus Henderson Fund was not unreasonable in relation to the services provided, and that the variation in the range of such estimated profitability among the Janus Henderson Funds was not a material factor in the Board’s approval of the reasonableness of any Janus Henderson Fund’s investment management fees.

The Trustees concluded that the management fees payable by each Janus Henderson Fund to the Adviser and its affiliates, as well as the fees paid by the Adviser to the subadviser of subadvised Janus Henderson Funds, were reasonable in relation to the nature, extent, and quality of the services provided, taking into account the fees charged by other advisers for managing comparable mutual funds with similar strategies, the fees the Adviser and the subadviser charge to other clients, and, as applicable, the impact of fund performance on management fees payable by the Janus Henderson Funds. The Trustees also concluded that each Janus Henderson Fund’s total expenses were reasonable, taking into account the size of the Janus Henderson Fund, the quality of services provided by the Adviser and subadviser, the investment performance of the Janus Henderson Fund, and any expense limitations agreed to or provided by the Adviser.

The Trustees considered information about the potential for the Adviser to realize economies of scale as the assets of the Janus Henderson Funds increase. They noted that their independent fee consultant published a report to the Trustees in November 2019 which provided its research and analysis into economies of scale. They also noted that, although many Janus Henderson Funds pay advisory fees at a fixed base rate as a percentage of net assets, without any breakpoints or performance fees, their independent fee consultant concluded that 75% of these Janus Henderson Funds’ have contractual management fees (gross of waivers) below their Broadridge Expense Group averages. The Trustees also noted the following: (1) that for those Janus Henderson Funds whose expenses are being reduced by the contractual expense limitations of the Adviser, the Adviser is subsidizing certain of these Janus Henderson Funds because they have not reached adequate scale; (2) performance fee structures have been implemented for various Janus Henderson Funds that have caused the effective rate of advisory fees payable by such Janus Henderson Fund to vary depending on the investment performance of the Janus Henderson Fund relative to its benchmark index over the measurement period; and (3) a few Janus Henderson Funds have fee schedules with breakpoints and reduced fee rates above certain asset levels. The Trustees also noted that the Janus Henderson Funds share directly in economies of scale through the significant investments made by the Adviser and its affiliates related to services provided to the Funds and the lower charges of third-party service providers that are based in part on the combined scale of all of the Janus Henderson Funds.

The Trustees also considered the independent fee consultant’s conclusion that, given the limitations of various analytical approaches to economies of scale and their conflicting results, it is difficult to analytically confirm or deny the existence of economies of scale in the Janus Henderson complex. In this regard, the independent consultant concluded that (1) to the extent there were economies of scale at the Adviser, the Adviser’s general strategy of setting fixed management fees below peers appeared to share any such economies with investors even on smaller Janus Henderson Funds which have not yet achieved those economies and (2) by setting lower fixed fees from the start on these Janus Henderson Funds, the Adviser appeared to be investing to increase the likelihood that these Janus

Henderson Funds will grow to a level to achieve any economies of scale that may exist. Further, the independent fee consultant provided its belief that Janus Henderson Fund investors are well-served by the fee levels and performance fee structures in place on the Janus Henderson Funds in light of any economies of scale that may be present at the Adviser.

Based on all of the information reviewed, including the recent and past research and analysis conducted by the Trustees’ independent fee consultant, the Trustees concluded that the current fee structure of each Janus Henderson Fund was reasonable and that the current rates of fees do reflect a sharing between the Adviser and the Janus Henderson Fund of any economies of scale that may be present at the current asset level of the Janus Henderson Fund.

The Trustees also considered benefits that accrue to the Adviser and its affiliates and subadviser to the Janus Henderson Funds from their relationships with the Janus Henderson Funds. They recognized that two affiliates of the Adviser separately serve the Janus Henderson Funds as transfer agent and distributor, respectively, and the transfer agent receives compensation directly from the non-money market funds for services provided, and that such compensation contributes to the overall profitability of the Adviser and its affiliates that results from their relationship with the Janus Henderson Funds. The Trustees also considered the Adviser’s past and proposed use of commissions paid by the Janus Henderson Funds on portfolio brokerage transactions to obtain proprietary and third-party research products and services benefiting the Janus Henderson Fund and/or other clients of the Adviser and/or the Adviser, and/or subadviser to a Janus Henderson Fund. The Trustees concluded that the Adviser’s and the subadviser’s use of these types of client commission arrangements to obtain proprietary and third-party research products and services was consistent with regulatory requirements and guidelines and was likely to benefit each Janus Henderson Fund. The Trustees also concluded that, other than the services provided by the Adviser and its affiliates and subadviser pursuant to the agreements and the fees to be paid by each Janus Henderson Fund therefor, the Janus Henderson Funds and the Adviser and the subadviser may potentially benefit from their relationship with each other in other ways. They concluded that the Adviser and its affiliates share directly in economies of scale through the lower charges of third-party service providers that are based in part on the combined scale of the Janus Henderson Funds and other clients serviced by the Adviser and its affiliates. They also concluded that the Adviser and the subadviser benefit from the receipt of research products and services acquired through commissions paid on portfolio transactions of the Janus Henderson Funds and that the Janus Henderson Funds benefit from the Adviser’s and/or the subadviser’s receipt of those products and services as well as research products and services acquired through commissions paid by other clients of the Adviser and/or other clients of the subadviser. They further concluded that the success of any Janus Henderson Fund could attract other business to the Adviser, the subadviser or other Janus Henderson funds, and that the success of the Adviser and the subadviser could enhance the Adviser’s and the subadviser’s ability to serve the Janus Henderson Funds.

Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Liquidity Rule”), requires open-end funds (but not money market funds) to adopt and implement a written liquidity risk management program (the “LRMP”) that is reasonably designed to assess and manage liquidity risk, which is the risk that a fund could not meet redemption requests without significant dilution of remaining investors’ interest in the fund. The Fund has implemented a LRMP, which incorporates the following elements: (i) assessment, management, and periodic review of liquidity risk; (ii) classification of portfolio holdings; (iii) the establishment and monitoring of a highly liquid investment minimum, as applicable; (iv) a 15% limitation on a Fund’s illiquid investments; (v) redemptions in-kind; and (vi) board oversight.

The Trustees of the Fund (the “Trustees”) have designated Janus Henderson Investors US LLC, the Fund’s investment adviser (the “Adviser”), as the Program Administrator for the LRMP responsible for administering the LRMP and carrying out the specific responsibilities of the LRMP. A working group comprised of various teams within the Adviser’s business is responsible for administering the LRMP and carrying out the specific responsibilities of different aspects of the LRMP (the “Liquidity Risk Working Group”). In assessing each Fund’s liquidity risk, the Liquidity Risk Working Group periodically considers, as relevant, factors including (i) the liquidity of a Fund’s portfolio investments during normal and reasonably foreseeable stressed conditions; (ii) whether a Fund’s investment strategy is appropriate for an open-end fund; (iii) the extent to which a Fund’s strategy involves a relatively concentrated portfolio or large positions in any issuer; (iv) a Fund’s use of borrowing for investment purposes; and (v) a Fund’s use of derivatives.

The Liquidity Rule requires the Trustees to review at least annually a written report provided by the Program Administrator that addresses the operation of the LRMP and assesses its adequacy and the effectiveness of its implementation, including, if applicable, the operation of the highly liquid investment minimum, and any material changes to the LRMP (the “Program Administrator Report”). At a meeting held on March 16, 2022, the Adviser provided the Program Administrator Report to the Trustees which covered the operation of the LRMP from January 1, 2021 through December 31, 2021 (the “Reporting Period”).

The Program Administrator Report discussed the operation and effectiveness of the LRMP during the Reporting Period. It noted that the Fund was able to meet redemptions during the normal course of business during the Reporting Period. The Program Administrator Report also stated that the Fund did not exceed the 15% limit on illiquid assets during the Reporting Period, that the Fund held primarily highly liquid assets, and was considered to be a primarily highly liquid fund during the Reporting Period. In addition, the Adviser expressed its belief in the Program Administrator Report that the LRMP is reasonably designed and adequate to assess and manage the Fund’s liquidity risk, considering the Fund’s particular risks and circumstances, and includes policies and procedures reasonably designed to implement each required component of the Liquidity Rule.

There can be no assurance that the LRMP will achieve its objectives in the future. Please refer to your Fund’s prospectus for more information regarding the risks to which an investment in the Fund may be subject.

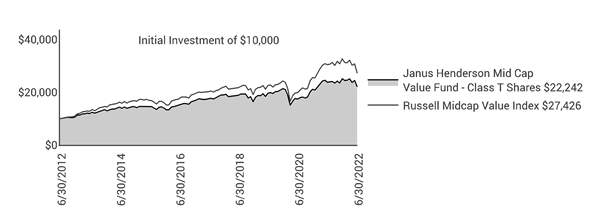

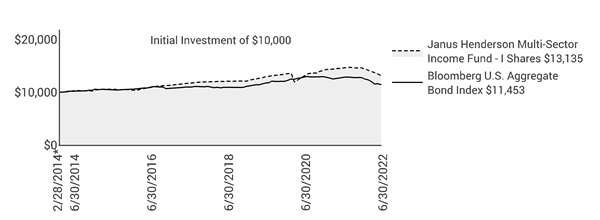

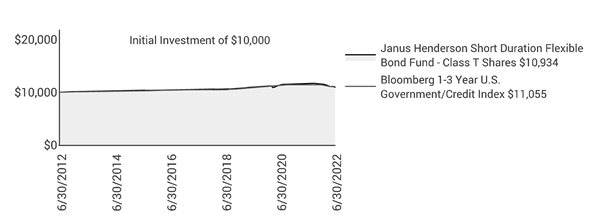

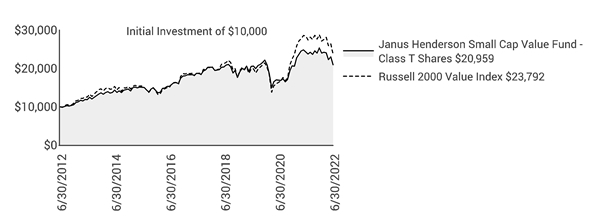

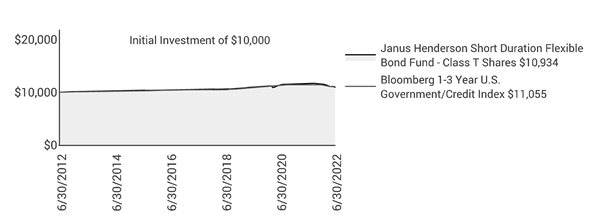

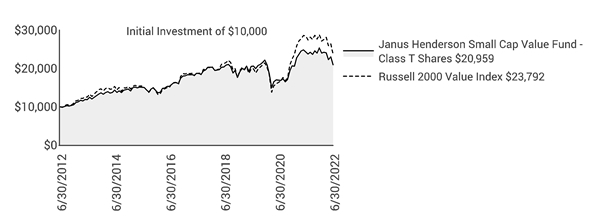

Average annual total returns are quoted for a Fund with more than one year of performance history. Average annual total return is calculated by taking the growth or decline in value of an investment over a period of time, including reinvestment of dividends and distributions, then calculating the annual compounded percentage rate that would have produced the same result had the rate of growth been constant throughout the period. Average annual total return does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Pursuant to federal securities rules, expense ratios shown in the performance chart reflect subsidized (if applicable) and unsubsidized ratios. The total annual fund operating expenses ratio is gross of any fee waivers, reflecting the Fund’s unsubsidized expense ratio. The net annual fund operating expenses ratio (if applicable) includes contractual waivers of Janus Capital and reflects the Fund’s subsidized expense ratio. Ratios may be higher or lower than those shown in the “Financial Highlights” in this report.

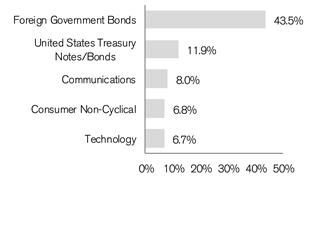

Following the performance overview section is the Fund’s Schedule of Investments. This schedule reports the types of securities held in the Fund on the last day of the reporting period. Securities are usually listed by type (common stock, corporate bonds, U.S. Government obligations, etc.) and by industry classification (banking, communications, insurance, etc.). Holdings are subject to change without notice.

The value of each security is quoted as of the last day of the reporting period. The value of securities denominated in foreign currencies is converted into U.S. dollars.

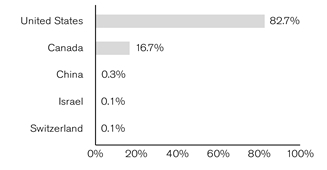

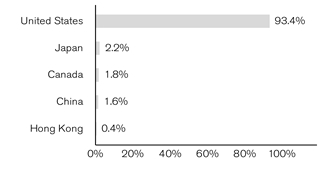

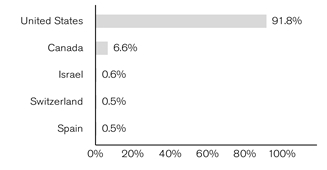

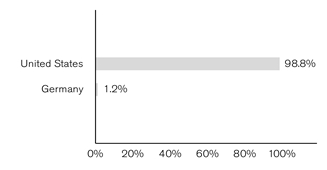

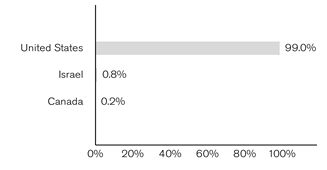

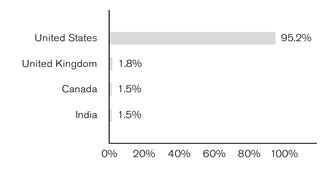

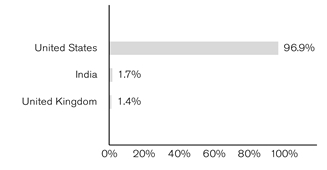

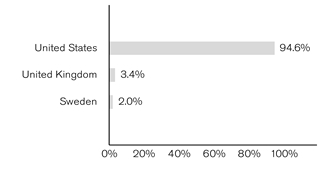

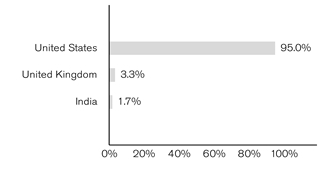

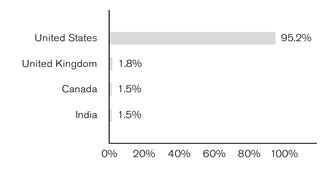

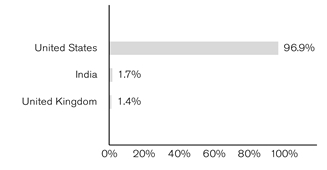

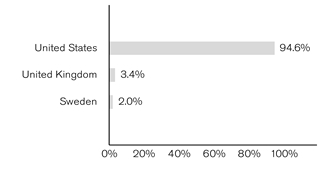

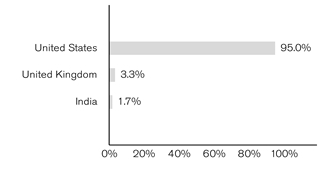

If the Fund invests in foreign securities, it will also provide a summary of investments by country. This summary reports the Fund exposure to different countries by providing the percentage of securities invested in each country. The country of each security represents the country of risk. The Fund’s Schedule of Investments relies upon the industry group and country classifications published by Bloomberg and/or MSCI Inc.

Tables listing details of individual forward currency contracts, futures, written options, swaptions, and swaps follow the Fund’s Schedule of Investments (if applicable).

This statement is often referred to as the “balance sheet.” It lists the assets and liabilities of the Fund on the last day of the reporting period.

The Fund’s assets are calculated by adding the value of the securities owned, the receivable for securities sold but not yet settled, the receivable for dividends declared but not yet received on securities owned, and the receivable for Fund shares sold to investors but not yet settled. The Fund’s liabilities include payables for securities purchased but not yet settled, Fund shares redeemed but not yet paid, and expenses owed but not yet paid. Additionally, there may be other assets and liabilities such as unrealized gain or loss on forward currency contracts.

The section entitled “Net Assets Consist of” breaks down the components of the Fund’s net assets. Because the Fund must distribute substantially all earnings, you will notice that a significant portion of net assets is shareholder capital.

The last section of this statement reports the net asset value (“NAV”) per share on the last day of the reporting period. The NAV is calculated by dividing the Fund’s net assets for each share class (assets minus liabilities) by the number of shares outstanding.

This statement details the Fund’s income, expenses, realized gains and losses on securities and currency transactions, and changes in unrealized appreciation or depreciation of Fund holdings.

The first section in this statement, entitled “Investment Income,” reports the dividends earned from securities and interest earned from interest-bearing securities in the Fund.

The next section reports the expenses incurred by the Fund, including the advisory fee paid to the investment adviser, transfer agent fees and expenses, and printing and postage for mailing statements, financial reports and prospectuses. Expense offsets and expense reimbursements, if any, are also shown.

The last section lists the amounts of realized gains or losses from investment and foreign currency transactions, and changes in unrealized appreciation or depreciation of investments and foreign currency-denominated assets and liabilities. The Fund will realize a gain (or loss) when it sells its position in a particular security. A change in unrealized gain (or loss) refers to the change in net appreciation or depreciation of the Fund during the reporting period. “Net Realized and Unrealized Gain/(Loss) on Investments” is affected both by changes in the market value of Fund holdings and by gains (or losses) realized during the reporting period.

These statements report the increase or decrease in the Fund’s net assets during the reporting period. Changes in the Fund’s net assets are attributable to investment operations, dividends and distributions to investors, and capital share transactions. This is important to investors because it shows exactly what caused the Fund’s net asset size to change during the period.

The first section summarizes the information from the Statement of Operations regarding changes in net assets due to the Fund’s investment operations. The Fund’s net assets may also change as a result of dividend and capital gains distributions to investors. If investors receive their dividends and/or distributions in cash, money is taken out of the Fund to pay the dividend and/or distribution. If investors reinvest their dividends and/or distributions, the Fund’s net assets will not be affected.

The reinvestment of dividends and distributions is included under “Capital Share Transactions.” “Capital Shares” refers to the money investors contribute to the Fund through purchases or withdrawals via redemptions. The Fund’s net assets will increase and decrease in value as investors purchase and redeem shares from the Fund.

This schedule provides a per-share breakdown of the components that affect the Fund’s NAV for current and past reporting periods as well as total return, asset size, ratios, and portfolio turnover rate.

The Fund’s expenses may be reduced through expense offsets and expense reimbursements. The ratios shown reflect expenses before and after any such offsets and reimbursements.

The ratio of net investment income/(loss) summarizes the income earned less expenses, divided by the average net assets of the Fund during the reporting period. Do not confuse this ratio with the Fund’s yield. The net investment income ratio is not a true measure of the Fund’s yield because it does not take into account the dividends distributed to the Fund’s investors.

The next figure is the portfolio turnover rate, which measures the buying and selling activity in the Fund. Portfolio turnover is affected by market conditions, changes in the asset size of the Fund, fluctuating volume of shareholder purchase and redemption orders, the nature of the Fund’s investments, and the investment style and/or outlook of the portfolio manager(s) and/or investment personnel. A 100% rate implies that an amount equal to the value of the entire portfolio was replaced once during the fiscal year; a 50% rate means that an amount equal to the value of half the portfolio is traded in a year; and a 200% rate means that an amount equal to the value of the entire portfolio is traded every six months.

For federal income tax purposes, the Fund designated the following for the year ended June 30, 2022:

The following are the Trustees and officers of the Trust, together with a brief description of their principal occupations during the last five years (principal occupations for certain Trustees may include periods over five years). The Fund’s Statement of Additional Information includes additional information about the Trustees and officers and is available, without charge, by calling 1-877-335-2687.

Each Trustee has served in that capacity since he or she was originally elected or appointed. The Trustees do not serve a specified term of office. Each Trustee will hold office until the termination of the Trust or his or her earlier death, resignation, retirement, incapacity, or removal. Under the Fund’s Governance Procedures and Guidelines, the policy is for Trustees to retire no later than the end of the calendar year in which the Trustee turns 75. The Trustees review the Fund’s Governance Procedures and Guidelines from time to time and may make changes they deem appropriate. The Fund’s Nominating and Governance Committee will consider nominees for the position of Trustee recommended by shareholders. Shareholders may submit the name of a candidate for consideration by the Committee by submitting their recommendations to the Trust’s Secretary. Each Trustee is currently a Trustee of one other registered investment company advised by the Adviser: Janus Aspen Series. Collectively, these two registered investment companies consist of 50 series or funds referred to herein as the Fund Complex.

The Trust’s officers are elected annually by the Trustees for a one-year term. Certain officers also serve as officers of Janus Aspen Series. Certain officers of the Fund may also be officers and/or directors of the Adviser. Except as otherwise disclosed, Fund officers receive no compensation from the Fund, except for the Fund’s Chief Compliance Officer, as authorized by the Trustees.

| | | |

| | | |

| | | ANNUAL REPORT June 30, 2022 |

| | |

| | Janus Henderson Multi-Sector Income Fund |

| | |

| | Janus Investment Fund |

| |

| | | |

| | | HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund performance, characteristics

and holdings |

Table of Contents

Janus Henderson Multi-Sector Income Fund

Janus Henderson Multi-Sector Income Fund (unaudited)

| | | | | | |

FUND SNAPSHOT This multi-sector income fund seeks high current income with a secondary focus on capital appreciation. Our approach leverages dynamic allocation and a bottom-up, fundamentally driven process that focuses on identifying the best risk-adjusted opportunities across fixed income sectors. | | |

John Kerschner co-portfolio manager |

John Lloyd co-portfolio manager |

Seth Meyer co-portfolio manager |

| | | |

PERFORMANCE OVERVIEW

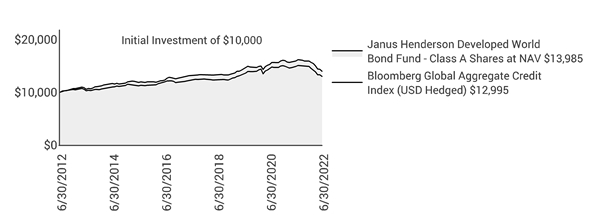

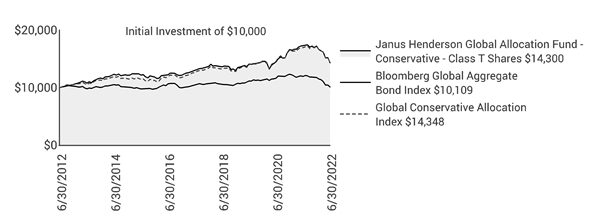

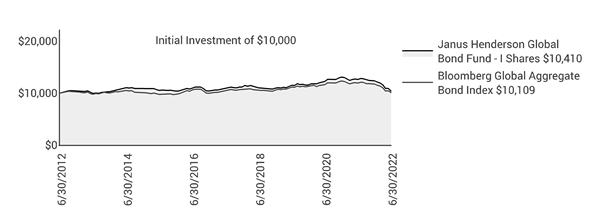

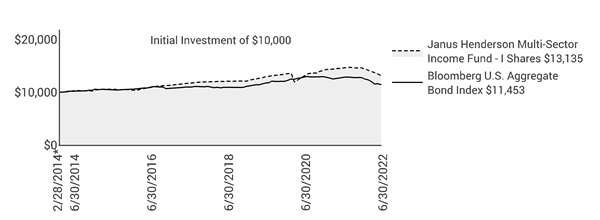

For the 12-month period ended June 30, 2022, the Janus Henderson Multi-Sector Income Fund’s Class I shares returned -9.99% compared with a -10.29% return for the Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index.

MARKET ENVIRONMENT

The period commenced with strengthening economic conditions and improving consumer sentiment. Following record stimulus in response to the COVID pandemic, economic growth was strong, asset prices had recovered, and the unemployment rate was trending down steadily. Despite the emergence of new COVID variants during the first half of the period – that slowed the gains in spending and labor market participation – the recovery continued, largely due to ongoing accommodative monetary policy. While COVID continued to be a nagging factor, the main story of the period turned out to be the rapid rise of inflation, the Federal Reserve’s (Fed) slow but increasingly aggressive response to taming it, and the sharp repricing of risk assets in expectation of a higher rate environment.

Inflation continued to rise, with the Fed initially communicating that inflation was “transitory” and would abate once supply chain disruptions were alleviated. In hindsight, this turned out to be a policy error on the Fed’s part: With each passing month, inflation continued to rise, the anticipated peak did not materialize, and it became increasingly difficult for the transitory thesis to hold. Credit markets held steady through the end of 2021, but with Russia’s invasion of Ukraine early in 2022, oil, gas and commodities prices spiked, signaling further upward pressure on inflation. At this point the Fed finally acknowledged inflation was not transitory and made a hawkish pivot, raising rates 1.50% through the end of the period. Further, it communicated it was committed to bringing down inflation with future hikes. Markets repriced aggressively and risk assets recorded significantly negative returns in response.

Toward period end, we witnessed deterioration in economic growth and consumer sentiment, with an economic slowdown or recession seeming more likely as a result of tighter monetary policy. Both credit and interest rate sectors recorded negative returns, with most of the move occurring in the second half of the period. The yield on the 10-year U.S. Treasury rose from 1.47% to 3.01% during the period, while credit spreads simultaneously widened across all sectors.

PERFORMANCE DISCUSSION

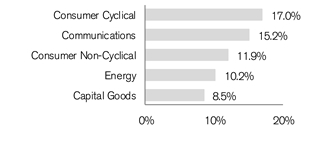

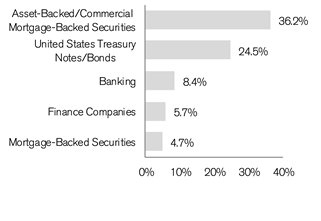

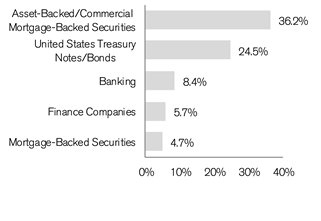

Our favorable view on the U.S. economy early in the period, and the belief that the Fed likely would remain accommodative, led us at first to maintain our overweight exposure to credit markets broadly, including a material out-of-index position in high-yield corporate bonds. We also focused on maintaining a diversified portfolio, decreasing our overall corporate bond allocation and raising exposure to certain structured securities such as asset-backed securities, commercial mortgage-backed securities and both non-agency residential mortgages and agency mortgage-backed securities (MBS). We held the view that these sectors could provide additional sources of income while diversifying our risk factors.

The Fed’s hawkish pivot early in 2022 and the promise of more aggressive rate hikes prompted us to significantly reduce the Fund’s exposure to interest rates across the portfolio in March, while expectations for continued uncertainty surrounding the Russia/Ukraine conflict led us to reduce corporate risk, primarily through lower exposure to the high-yield corporate bond market. As the period continued, central banks become more aggressive in their efforts to tame inflation and we witnessed some deterioration in the macro environment, we continued our efforts to raise the overall credit quality of the Fund. We selectively added exposure to investment-grade corporate bonds, believing they offered increasingly attractive valuations and would provide greater stability to the overall portfolio in the event higher interest rates and/or

Janus Henderson Multi-Sector Income Fund (unaudited)

geopolitical factors raised fears of the U.S. economy entering a recession.

Our consistent duration underweight was a strong contributor to relative outperformance during the fiscal year. By period end, we felt much of the rise in rates had already occurred and we moved to increase duration in the Fund, though we remained underweight. Security selection decisions were also additive overall, with particular strength in our MBS holdings. Despite reducing our exposure to the high-yield corporate bond market over the period, this out-of-index allocation was the largest drag on performance, particularly amid the broad sell-off in risk assets in 2022. Our out-of-index allocations to non-agency mortgages and collateralized loan obligations also detracted from relative performance.

DERIVATIVES USAGE

Please see the Derivative Instruments section in the “Notes to Financial Statements” for a discussion of derivatives used by the Fund.

OUTLOOK

High inflation – and the Fed’s late but increasingly aggressive response to taming it – has been the story of the year, and it will likely continue to be until inflation trends back meaningfully to the central bank’s target range. The Fed has struck a far more austere tone of late, making it clear that it is intent on preventing the short-term inflation problem from becoming a long-term one. We do not believe that the Fed is bluffing at this juncture: We expect it will act in line with its narrative by tightening monetary conditions until inflation is on a clear path back to where it should be.

Of course, the key risk in the Fed’s eleventh-hour crusade is that it overtightens and tips the U.S. economy into at best a growth slowdown but more likely a recession. This is a risk the Fed appears willing to take, thanks in part to the strength of the economy – unemployment is back to pre-pandemic lows and both consumer and corporate balance sheets are strong. Essentially the Fed believes the consumer and corporates are in good enough shape to handle a recession if one transpires due to monetary tightening.

While the economic situation is sobering, we believe that being well positioned is key. Following the repricing in much of the fixed income market, bonds are now offering some of the most attractive yields we’ve seen since the Global Financial Crisis. Even as the likelihood of an economic slowdown or recession grows, we think that slowing growth is likely to place a ceiling on intermediate and long-term rates in the near term, which should provide some support for assets with exposure to interest rate risk. Within credit spread products, any continued deterioration in the macro environment is likely to place further pressure on credit spreads. We therefore remain cautiously positioned within our spread sector allocation, while being prepared to take advantage of market weakness to add risk to the portfolio should spreads widen significantly from current levels.

Thank you for investing in the Janus Henderson Multi-Sector Income Fund.

Janus Henderson Multi-Sector Income Fund (unaudited)

Fund At A Glance

June 30, 2022

| | | |

Fund Profile | | |

30-day SEC Yield* | Without

Reimbursement | With

Reimbursement |

Class A Shares NAV | 3.69% | 3.69% |

Class A Shares MOP | 3.51% | 3.51% |

Class C Shares** | 2.92% | 2.92% |

Class D Shares | 3.85% | 3.85% |

Class I Shares | 3.91% | 3.91% |

Class N Shares | 4.01% | 4.01% |

Class S Shares | 3.25% | 3.48% |

Class T Shares | 3.76% | 3.76% |

Weighted Average Maturity | 5.7 Years |

Average Effective Duration*** | 4.1 Years |

* Yield will fluctuate. | | |

** Does not include the 1.00% contingent deferred sales charge. |

*** A theoretical measure of price volatility. | |

| | |

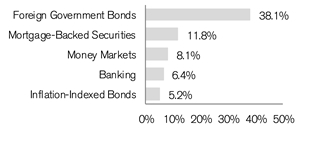

Ratings† Summary - (% of Total Investments) | |

AAA | 22.6% |

AA | 3.5% |

A | 2.5% |

BBB | 13.4% |

BB | 14.6% |

B | 10.7% |

CCC | 5.4% |

CC | 0.1% |

Not Rated | 45.9% |

Other | -18.7% |