peers; and (3) and the management fees for the Janus Henderson Funds, on average, were 7% under the average management fees for their Expense Groups. The Trustees also considered the total expenses for each share class of each Janus Henderson Fund compared to the average total expenses for its Broadridge Expense Group peers and to average total expenses for its Broadridge Expense Universe.

For certain Janus Henderson Funds, the independent fee consultant also performed a systematic “focus list” analysis of expenses which assessed fund fees in the context of fund performance being delivered. Based on this analysis, the independent fee consultant found that the combination of service quality/performance and expenses on these individual Janus Henderson Funds was reasonable in light of performance trends, performance histories, and existence of performance fees, breakpoints, and/or expense waivers on such Janus Henderson Funds.

The Trustees considered the methodology used by Janus Capital and each subadviser in determining compensation payable to portfolio managers, the competitive environment for investment management talent, and the competitive market for mutual funds in different distribution channels.

The Trustees also reviewed management fees charged by Janus Capital and each subadviser to comparable separate account clients and to comparable non-affiliated funds subadvised by Janus Capital or by a subadviser (for which Janus Capital or the subadviser provides only or primarily portfolio management services). Although in most instances subadvisory and separate account fee rates for various investment strategies were lower than management fee rates for Janus Henderson Funds having a similar strategy, the Trustees considered that Janus Capital noted that, under the terms of the management agreements with the Janus Henderson Funds, Janus Capital performs significant additional services for the Janus Henderson Funds that it does not provide to those other clients, including administration services, oversight of the Janus Henderson Funds’ other service providers, trustee support, regulatory compliance and numerous other services, and that, in serving the Janus Henderson Funds, Janus Capital assumes many legal risks and other costs that it does not assume in servicing its other clients. Moreover, they noted that the independent fee consultant found that: (1) the management fees Janus Capital charges to the Janus Henderson Funds are reasonable in relation to the management fees Janus Capital charges to funds subadvised by Janus Capital and to the fees Janus Capital charges to its institutional separate account clients; (2) these subadvised and institutional separate accounts have different service and infrastructure needs; and (3) Janus Henderson mutual fund investors enjoy reasonable fees relative to the fees charged to Janus Henderson subadvised fund and separate account investors; (4) 11 of 12 Janus Henderson Funds have lower management fees than similar funds subadvised by Janus Capital; and (5) six of nine Janus Henderson Funds have lower management fees than similar separate accounts managed by Janus Capital.

The Trustees considered the fees for each Fund for its fiscal year ended in 2018, and noted the following with regard to each Fund’s total expenses, net of applicable fee waivers (the Fund’s “total expenses”):

Janus Henderson Asia Equity Fund

Additional Information (unaudited)

Fixed-Income Funds

· For Janus Henderson Absolute Return Income Opportunities Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Developed World Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Flexible Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson High-Yield Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Multi-Sector Income Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Short-Term Bond Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for all share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

Global and International Equity Funds

· For Janus Henderson Asia Equity Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Emerging Markets Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson European Focus Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Equity Income Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Life Sciences Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Real Estate Fund, the Trustees noted although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Research Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Global Select Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Technology Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Janus Henderson Asia Equity Fund

Additional Information (unaudited)

· For Janus Henderson Global Value Fund, the Trustees noted that although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable.

· For Janus Henderson International Opportunities Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson International Small Cap Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson International Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Overseas Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Money Market Funds

· For Janus Henderson Government Money Market Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for both share classes.

· For Janus Henderson Money Market Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable.

Multi-Asset Funds

· For Janus Henderson Adaptive Global Allocation Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Dividend & Income Builder Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Value Plus Income Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Multi-Asset U.S. Equity Funds

· For Janus Henderson Balanced Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Contrarian Fund, the Trustees noted that the Fund’s total expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Enterprise Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Forty Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Growth and Income Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Research Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

Janus Henderson Asia Equity Fund

Additional Information (unaudited)

· For Janus Henderson Triton Fund, the Trustees noted that, although the Fund’s expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson U.S. Growth Opportunities Fund, that Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Venture Fund, the Trustees noted that, although the Fund’s expenses exceeded the peer group average for one share class, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

Quantitative Equity Funds

· For Janus Henderson Emerging Markets Managed Volatility Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson Global Income Managed Volatility Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson International Managed Volatility Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

· For Janus Henderson U.S. Managed Volatility Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

U.S. Equity Funds

· For Janus Henderson Large Cap Value Fund, the Trustees noted that the Fund’s total expenses were below the peer group average for all share classes.

· For Janus Henderson Mid Cap Value Fund, the Trustees noted that, although the Fund’s expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital had contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Small Cap Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses, although this limit did not apply because the Fund’s total expenses were already below the applicable fee limit.

· For Janus Henderson Small-Mid Cap Value Fund, the Trustees noted that, although the Fund’s total expenses exceeded the peer group average for certain share classes, overall the Fund’s total expenses were reasonable. The Trustees also noted that Janus Capital has contractually agreed to limit the Fund’s expenses.

The Trustees reviewed information on the overall profitability to Janus Capital and its affiliates of their relationship with the Janus Henderson Funds, and considered profitability data of other publicly traded mutual fund advisers. The Trustees recognized that profitability comparisons among fund managers are difficult because of the variation in the type of comparative information that is publicly available, and the profitability of any fund manager is affected by numerous factors, including the organizational structure of the particular fund manager, differences in complex size, difference in product mix, difference in types of business (mutual fund, institutional and other), differences in the types of funds and other accounts it manages, possible other lines of business, the methodology for allocating expenses, and the fund manager’s capital structure and cost of capital.

Additionally, the Trustees considered the estimated profitability to Janus Capital from the investment management services it provided to each Janus Henderson Fund. In their review, the Trustees considered whether Janus Capital and each subadviser receive adequate incentives and resources to manage the Janus Henderson Funds effectively. In reviewing profitability, the Trustees noted that the estimated profitability for an individual Janus Henderson Fund is

Janus Henderson Asia Equity Fund

Additional Information (unaudited)

necessarily a product of the allocation methodology utilized by Janus Capital to allocate its expenses as part of the estimated profitability calculation. In this regard, the Trustees noted that the independent fee consultant found that (1) the expense allocation methodology and rationales utilized by Janus Capital were reasonable and (2) no clear correlation between expense allocations and operating margins. The Trustees also considered that the estimated profitability for an individual Janus Henderson Fund was influenced by a number of factors, including not only the allocation methodology selected, but also the presence of fee waivers and expense caps, and whether the Janus Henderson Fund’s investment management agreement contained breakpoints or a performance fee component. The Trustees determined, after taking into account these factors, among others, that Janus Capital’s estimated profitability with respect to each Janus Henderson Fund was not unreasonable in relation to the services provided, and that the variation in the range of such estimated profitability among the Janus Henderson Funds was not a material factor in the Board’s approval of the reasonableness of any Janus Henderson Fund’s investment management fees.

The Trustees concluded that the management fees payable by each Janus Henderson Fund to Janus Capital and its affiliates, as well as the fees paid by Janus Capital to the subadvisers of subadvised Janus Henderson Funds, were reasonable in relation to the nature, extent, and quality of the services provided, taking into account the fees charged by other advisers for managing comparable mutual funds with similar strategies, the fees Janus Capital and the subadvisers charge to other clients, and, as applicable, the impact of fund performance on management fees payable by the Janus Henderson Funds. The Trustees also concluded that each Janus Henderson Fund’s total expenses were reasonable, taking into account the size of the Janus Henderson Fund, the quality of services provided by Janus Capital and any subadviser, the investment performance of the Janus Henderson Fund, and any expense limitations agreed to or provided by Janus Capital.

Economies of Scale

The Trustees considered information about the potential for Janus Capital to realize economies of scale as the assets of the Janus Henderson Funds increase. They noted that their independent fee consultant published a report to the Trustees in November 2019 which provided its research and analysis into economies of scale. They also noted that, although many Janus Henderson Funds pay advisory fees at a base fixed rate as a percentage of net assets, without any breakpoints or performance fees, their independent fee consultant concluded that 64% of these Janus Henderson Funds’ share classes have contractual management fees (gross of waivers) below their Broadridge expense group averages. They also noted the following: (1) that for those Janus Henderson Funds whose expenses are being reduced by the contractual expense limitations of Janus Capital, Janus Capital is subsidizing certain of these Janus Henderson Funds because they have not reached adequate scale; (2) as the assets of some of the Janus Henderson Funds have declined in the past few years, certain Janus Henderson Funds have benefited from having advisory fee rates that have remained constant rather than increasing as assets declined; (3) performance fee structures have been implemented for various Janus Henderson Funds that have caused the effective rate of advisory fees payable by such a Janus Henderson Fund to vary depending on the investment performance of the Janus Henderson Fund relative to its benchmark index over the measurement period; and (4) a few Janus Henderson Funds have fee schedules with breakpoints and reduced fee rates above certain asset levels. The Trustees also noted that the Janus Henderson Funds share directly in economies of scale through the lower charges of third-party service providers that are based in part on the combined scale of all of the Janus Henderson Funds.

The Trustees also considered the independent fee consultant’s conclusion that, given the limitations of various analytical approaches to economies of scale and their conflicting results, it is difficult to analytically confirm or deny the existence of economies of scale in the Janus Henderson complex. In this regard, the independent consultant concluded that (1) to the extent there were economies of scale at Janus Capital, Janus Capital’s general strategy of setting fixed management fees below peers appeared to share any such economies with investors even on smaller Janus Henderson Funds which have not yet achieved those economies and (2) by setting lower fixed fees from the start on these Janus Henderson Funds, Janus Capital appeared to be investing to increase the likelihood that these Janus Henderson Funds will grow to a level to achieve any scale economies that may exist. Further, the independent fee consultant provided its belief that Janus Henderson Fund investors are well-served by the fee levels and performance fee structures in place on the Janus Henderson Funds in light of any economies of scale that may be present at Janus Capital.

Based on all of the information reviewed, including the recent and past research and analysis conducted by the Trustees’ independent fee consultant, the Trustees concluded that the current fee structure of each Janus Henderson Fund was reasonable and that the current rates of fees do reflect a sharing between Janus Capital and the Janus

Janus Henderson Asia Equity Fund

Additional Information (unaudited)

Henderson Fund of any economies of scale that may be present at the current asset level of the Janus Henderson Fund.

Other Benefits to Janus Capital

The Trustees also considered benefits that accrue to Janus Capital and its affiliates and subadvisers to the Janus Henderson Funds from their relationships with the Janus Henderson Funds. They recognized that two affiliates of Janus Capital separately serve the Janus Henderson Funds as transfer agent and distributor, respectively, and the transfer agent receives compensation directly from the non-money market funds for services provided, and that such compensation contributes to the overall profitability of Janus Capital and its affiliates that results from their relationship with the Janus Henderson Funds. The Trustees also considered Janus Capital’s past and proposed use of commissions paid by the Janus Henderson Funds on portfolio brokerage transactions to obtain proprietary and third-party research products and services benefiting the Janus Henderson Fund and/or other clients of Janus Capital and/or Janus Capital, and/or a subadviser to a Janus Henderson Fund. The Trustees concluded that Janus Capital’s and the subadvisers’ use of these types of client commission arrangements to obtain proprietary and third-party research products and services was consistent with regulatory requirements and guidelines and was likely to benefit each Janus Henderson Fund. The Trustees also concluded that, other than the services provided by Janus Capital and its affiliates and subadvisers pursuant to the agreements and the fees to be paid by each Janus Henderson Fund therefor, the Janus Henderson Funds and Janus Capital and the subadvisers may potentially benefit from their relationship with each other in other ways. They concluded that Janus Capital and its affiliates share directly in economies of scale through the lower charges of third-party service providers that are based in part on the combined scale of the Janus Henderson Funds and other clients serviced by Janus Capital and its affiliates. They also concluded that Janus Capital and/or the subadvisers benefit from the receipt of research products and services acquired through commissions paid on portfolio transactions of the Janus Henderson Funds and that the Janus Henderson Funds benefit from Janus Capital’s and/or the subadvisers’ receipt of those products and services as well as research products and services acquired through commissions paid by other clients of Janus Capital and/or other clients of the subadvisers. They further concluded that the success of any Janus Henderson Fund could attract other business to Janus Capital, the subadvisers or other Janus Henderson funds, and that the success of Janus Capital and the subadvisers could enhance Janus Capital’s and the subadvisers’ ability to serve the Janus Henderson Funds.

LIQUIDITY RISK MANAGEMENT PROGRAM

Janus Henderson Funds (other than the money market funds) have adopted and implemented a written liquidity risk management program (the “LRMP”) as required by Rule 22e-4 under the Investment Company Act of 1940, as amended (the “Liquidity Rule”). Rule 22e-4, requires open-end funds to adopt and implement a written liquidity risk management program that is reasonably designed to assess and manage liquidity risk, which is the risk that a fund could not meet redemption requests without significant dilution of remaining investors’ interest in the fund. The LRMP incorporates the following elements: (i) assessment, management, and periodic review of liquidity risk; (ii) classification of portfolio investments; (iii) the establishment and monitoring of a highly liquid investment minimum, as applicable; (iv) a 15% limitation on a Fund’s illiquid investments; (v) redemptions in-kind; and (vi) board oversight.

The Trustees have designated Janus Capital Management LLC, the Fund’s investment adviser (“Janus Capital”), as the Program Administrator for the LRMP responsible for administering the LRMP and carrying out the specific responsibilities of the LRMP. A working group comprised of various groups within Janus Capital’s business is responsible for administering the LRMP and carrying out the specific responsibilities of different aspects of the LRMP.

The Liquidity Rule requires the Trustees to review at least annually a written report provided by the Program Administrator that addresses the operation of the LRMP and assesses its adequacy and the effectiveness of its implementation, including, if applicable, the operation of the highly liquid investment minimum, and any material changes to the LRMP (the “Program Administrator Report”). During the annual period ended September 30, 2020, the Program Administrator provided the Program Administrator Report to the Trustees which covered the operation of the LRMP from December 1, 2018 through December 31, 2019 (the “Reporting Period”). No significant liquidity events impacting the Fund were noted in the Program Administrator Report, and the Fund was able to process redemptions during the normal course of business during the Reporting Period. In addition, the Program Administrator expressed its belief in the Program Administrator Report that:

Janus Henderson Asia Equity Fund

Additional Information (unaudited)

· the LRMP is reasonably designed and adequate to assess and manage the Fund’s liquidity risk, taking into account the Fund’s particular risks and circumstances, and includes policies and procedures reasonably designed to implement each required component of the Liquidity Rule; and

· the LRMP, including the Highly Liquid Investment Minimum where applicable, was implemented and operated effectively to achieve the goal of assessing and managing the Fund’s liquidity risk.

There can be no assurance that the LRMP will achieve its objectives in the future. Please refer to your Fund’s prospectus for more information regarding the risks to which an investment in the Fund may be subject.

Janus Henderson Asia Equity Fund

Useful Information About Your Fund Report (unaudited)

Management Commentary

The Management Commentary in this report includes valuable insight as well as statistical information to help you understand how your Fund’s performance and characteristics stack up against those of comparable indices.

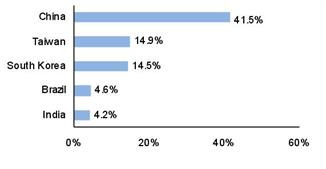

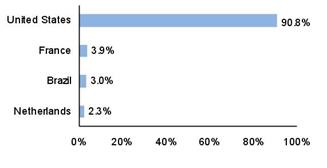

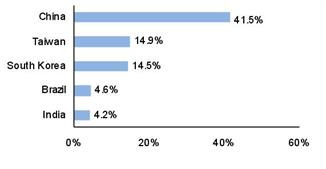

If the Fund invests in foreign securities, this report may include information about country exposure. Country exposure is based primarily on the country of risk. A company may be allocated to a country based on other factors such as location of the company’s principal office, the location of the principal trading market for the company’s securities, or the country where a majority of the company’s revenues are derived.

Please keep in mind that the opinions expressed in the Management Commentary are just that: opinions. They are a reflection based on best judgment at the time this report was compiled, which was September 30, 2020. As the investing environment changes, so could opinions. These views are unique and are not necessarily shared by fellow employees or by Janus Henderson in general.

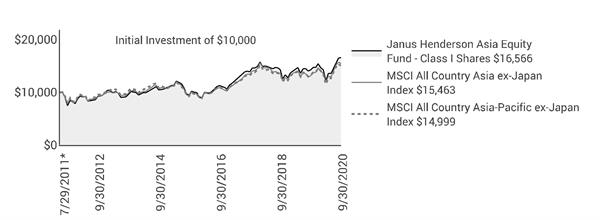

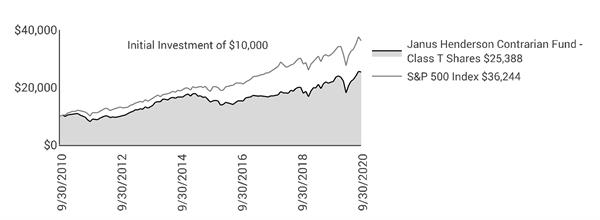

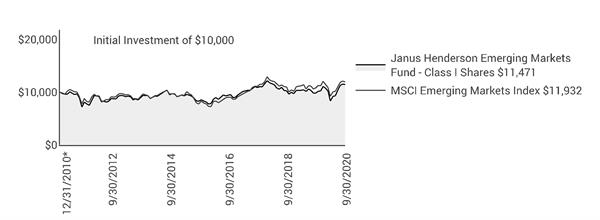

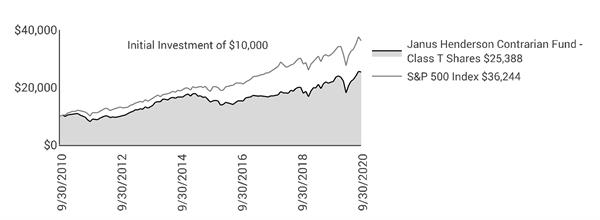

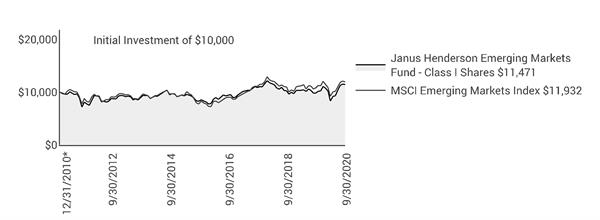

Performance Overviews

Performance overview graphs compare the performance of a hypothetical $10,000 investment in the Fund with one or more widely used market indices. When comparing the performance of the Fund with an index, keep in mind that market indices are not available for investment and do not reflect deduction of expenses.

Average annual total returns are quoted for a Fund with more than one year of performance history. Average annual total return is calculated by taking the growth or decline in value of an investment over a period of time, including reinvestment of dividends and distributions, then calculating the annual compounded percentage rate that would have produced the same result had the rate of growth been constant throughout the period. Average annual total return does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Cumulative total returns are quoted for a Fund with less than one year of performance history. Cumulative total return is the growth or decline in value of an investment over time, independent of the period of time involved. Cumulative total return does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

Pursuant to federal securities rules, expense ratios shown in the performance chart reflect subsidized (if applicable) and unsubsidized ratios. The total annual fund operating expenses ratio is gross of any fee waivers, reflecting the Fund’s unsubsidized expense ratio. The net annual fund operating expenses ratio (if applicable) includes contractual waivers of Janus Capital and reflects the Fund’s subsidized expense ratio. Ratios may be higher or lower than those shown in the “Financial Highlights” in this report.

Schedule of Investments

Following the performance overview section is the Fund’s Schedule of Investments. This schedule reports the types of securities held in the Fund on the last day of the reporting period. Securities are usually listed by type (common stock, corporate bonds, U.S. Government obligations, etc.) and by industry classification (banking, communications, insurance, etc.). Holdings are subject to change without notice.

The value of each security is quoted as of the last day of the reporting period. The value of securities denominated in foreign currencies is converted into U.S. dollars.

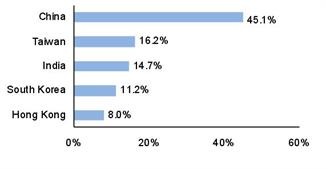

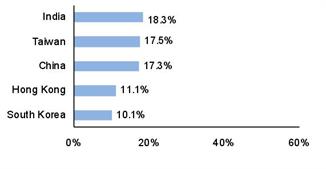

If the Fund invests in foreign securities, it will also provide a summary of investments by country. This summary reports the Fund exposure to different countries by providing the percentage of securities invested in each country. The country of each security represents the country of risk. The Fund’s Schedule of Investments relies upon the industry group and country classifications published by Barclays and/or MSCI Inc.

Tables listing details of individual forward currency contracts, futures, written options, swaptions, and swaps follow the Fund’s Schedule of Investments (if applicable).

Statement of Assets and Liabilities

This statement is often referred to as the “balance sheet.” It lists the assets and liabilities of the Fund on the last day of the reporting period.

Janus Henderson Asia Equity Fund

Useful Information About Your Fund Report (unaudited)

The Fund’s assets are calculated by adding the value of the securities owned, the receivable for securities sold but not yet settled, the receivable for dividends declared but not yet received on securities owned, and the receivable for Fund shares sold to investors but not yet settled. The Fund’s liabilities include payables for securities purchased but not yet settled, Fund shares redeemed but not yet paid, and expenses owed but not yet paid. Additionally, there may be other assets and liabilities such as unrealized gain or loss on forward currency contracts.

The section entitled “Net Assets Consist of” breaks down the components of the Fund’s net assets. Because the Fund must distribute substantially all earnings, you will notice that a significant portion of net assets is shareholder capital.

The last section of this statement reports the net asset value (“NAV”) per share on the last day of the reporting period. The NAV is calculated by dividing the Fund’s net assets for each share class (assets minus liabilities) by the number of shares outstanding.

Statement of Operations

This statement details the Fund’s income, expenses, realized gains and losses on securities and currency transactions, and changes in unrealized appreciation or depreciation of Fund holdings.

The first section in this statement, entitled “Investment Income,” reports the dividends earned from securities and interest earned from interest-bearing securities in the Fund.

The next section reports the expenses incurred by the Fund, including the advisory fee paid to the investment adviser, transfer agent fees and expenses, and printing and postage for mailing statements, financial reports and prospectuses. Expense offsets and expense reimbursements, if any, are also shown.

The last section lists the amounts of realized gains or losses from investment and foreign currency transactions, and changes in unrealized appreciation or depreciation of investments and foreign currency-denominated assets and liabilities. The Fund will realize a gain (or loss) when it sells its position in a particular security. A change in unrealized gain (or loss) refers to the change in net appreciation or depreciation of the Fund during the reporting period. “Net Realized and Unrealized Gain/(Loss) on Investments” is affected both by changes in the market value of Fund holdings and by gains (or losses) realized during the reporting period.

Statements of Changes in Net Assets

These statements report the increase or decrease in the Fund’s net assets during the reporting period. Changes in the Fund’s net assets are attributable to investment operations, dividends and distributions to investors, and capital share transactions. This is important to investors because it shows exactly what caused the Fund’s net asset size to change during the period.

The first section summarizes the information from the Statement of Operations regarding changes in net assets due to the Fund’s investment operations. The Fund’s net assets may also change as a result of dividend and capital gains distributions to investors. If investors receive their dividends and/or distributions in cash, money is taken out of the Fund to pay the dividend and/or distribution. If investors reinvest their dividends and/or distributions, the Fund’s net assets will not be affected. If you compare the Fund’s “Net Decrease from Dividends and Distributions” to “Reinvested Dividends and Distributions,” you will notice that dividends and distributions have little effect on the Fund’s net assets. This is because the majority of the Fund’s investors reinvest their dividends and/or distributions.

The reinvestment of dividends and distributions is included under “Capital Share Transactions.” “Capital Shares” refers to the money investors contribute to the Fund through purchases or withdrawals via redemptions. The Fund’s net assets will increase and decrease in value as investors purchase and redeem shares from the Fund.

Financial Highlights

This schedule provides a per-share breakdown of the components that affect the Fund’s NAV for current and past reporting periods as well as total return, asset size, ratios, and portfolio turnover rate.

The first line in the table reflects the NAV per share at the beginning of the reporting period. The next line reports the net investment income/(loss) per share. Following is the per share total of net gains/(losses), realized and unrealized. Per share dividends and distributions to investors are then subtracted to arrive at the NAV per share at the end of the period. The next line reflects the total return for the period. The total return may include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes. As a result, the

Janus Henderson Asia Equity Fund

Useful Information About Your Fund Report (unaudited)

total return may differ from the total return reflected for individual shareholder transactions. Also included are ratios of expenses and net investment income to average net assets.

The Fund’s expenses may be reduced through expense offsets and expense reimbursements. The ratios shown reflect expenses before and after any such offsets and reimbursements.

The ratio of net investment income/(loss) summarizes the income earned less expenses, divided by the average net assets of the Fund during the reporting period. Do not confuse this ratio with the Fund’s yield. The net investment income ratio is not a true measure of the Fund’s yield because it does not take into account the dividends distributed to the Fund’s investors.

The next figure is the portfolio turnover rate, which measures the buying and selling activity in the Fund. Portfolio turnover is affected by market conditions, changes in the asset size of the Fund, fluctuating volume of shareholder purchase and redemption orders, the nature of the Fund’s investments, and the investment style and/or outlook of the portfolio manager(s) and/or investment personnel. A 100% rate implies that an amount equal to the value of the entire portfolio was replaced once during the fiscal year; a 50% rate means that an amount equal to the value of half the portfolio is traded in a year; and a 200% rate means that an amount equal to the value of the entire portfolio is traded every six months.

Janus Henderson Asia Equity Fund

Designation Requirements (unaudited)

For federal income tax purposes, the Fund designated the following for the year ended September 30, 2020:

| | |

| | |

Foreign Taxes Paid | $63,769 |

Foreign Source Income | $462,830 |

Dividends Received Deduction Percentage | 30% |

Qualified Dividend Income Percentage | 100% |

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

The Fund’s Statement of Additional Information includes additional information about the Trustees and officers and is available, without charge, by calling 1-877-335-2687.

The following are the Trustees and officers of the Trust, together with a brief description of their principal occupations during the last five years (principal occupations for certain Trustees may include periods over five years).

Each Trustee has served in that capacity since he or she was originally elected or appointed. The Trustees do not serve a specified term of office. Each Trustee will hold office until the termination of the Trust or his or her earlier death, resignation, retirement, incapacity, or removal. Under the Fund’s Governance Procedures and Guidelines, the policy is for Trustees to retire no later than the end of the calendar year in which the Trustee turns 75. The Trustees review the Fund’s Governance Procedures and Guidelines from time to time and may make changes they deem appropriate. The Fund’s Nominating and Governance Committee will consider nominees for the position of Trustee recommended by shareholders. Shareholders may submit the name of a candidate for consideration by the Committee by submitting their recommendations to the Trust’s Secretary. Each Trustee is currently a Trustee of one other registered investment company advised by Janus Capital: Janus Aspen Series. Collectively, these two registered investment companies consist of 56 series or funds referred to herein as the Fund Complex.

The Trust’s officers are elected annually by the Trustees for a one-year term. Certain officers also serve as officers of Janus Aspen Series. Certain officers of the Fund may also be officers and/or directors of Janus Capital. Except as otherwise disclosed, Fund officers receive no compensation from the Fund, except for the Fund’s Chief Compliance Officer, as authorized by the Trustees.

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Independent Trustees | | | | |

William F. McCalpin

151 Detroit Street

Denver, CO 80206

DOB: 1957 | Chairman

Trustee | 1/08-Present

6/02-Present | Independent Consultant, Formerly, Managing Partner, Impact Investments, Athena Capital Advisors (independent registered investment advisor) (2016-2019), Managing Director, Holos Consulting LLC (provides consulting services to foundations and other nonprofit organizations) (2009-2016), Chief Executive Officer, Imprint Capital Advisors (impact investment firm) (2013-2015), and Executive Vice President and Chief Operating Officer of The Rockefeller Brothers Fund (a private family foundation) (1998-2006). | 56 | Director of Mutual Fund Directors Forum (a non-profit organization serving independent directors of U.S. mutual funds) (since 2016), Chairman of the Board and Trustee of The Investment Fund for Foundations Investment Program (TIP) (consisting of 2 funds) (since 2008), and Director of the F.B. Heron Foundation (a private grantmaking foundation) (since 2006). |

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Independent Trustees | | | | |

Alan A. Brown

151 Detroit Street

Denver, CO 80206

DOB: 1962 | Trustee | 1/13-Present | Principal, Curam Holdings LLC (since 2018). Formerly, Executive Vice President, Institutional Markets, of Black Creek Group (private equity real estate investment management firm) (2012-2018), Executive Vice President and Co-Head, Global Private Client Group (2007-2010), Executive Vice President, Mutual Funds (2005-2007), and Chief Marketing Officer (2001-2005) of Nuveen Investments, Inc. (asset management). | 56 | Advisory Board Member of AEW Core Property Trust (open-end property fund) (since 2020), and Director of WTTW (PBS affiliate) (since 2003). Formerly, Director of MotiveQuest LLC (strategic social market research company) (2003-2016), Director of Nuveen Global Investors LLC (2007-2011), Director of Communities in Schools (2004-2010), and Director of Mutual Fund Education Alliance (until 2010). |

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Independent Trustees | | | | |

William D. Cvengros

151 Detroit Street

Denver, CO 80206

DOB: 1948 | Trustee | 1/11-Present | Chief Executive Officer of SJC Capital, LLC (a personal investment company and consulting firm) (since 2002). Formerly, Venture Partner for The Edgewater Funds (a middle market private equity firm) (2002-2004), Chief Executive Officer and President of PIMCO Advisors Holdings L.P. (a publicly traded investment management firm) (1994-2000), and Chief Investment Officer (1987-1994) and Vice Chairman and Director (1990-1994) of Pacific Life Insurance Company (a mutual life insurance and annuity company) (1987-1994). | 56 | Advisory Board Member, RevOZ Fund LP and related funds (real estate investments for opportunity zones) (since 2020), and Advisory Board Member, Innovate Partners Emerging Growth and Equity Fund I (early stage venture capital fund) (since 2014). Formerly, Managing Trustee of National Retirement Partners Liquidating Trust (2013-2016), Chairman, National Retirement Partners, Inc. (formerly a network of advisors to 401(k) plans) (2005-2013), Director of Prospect Acquisition Corp. (a special purpose acquisition corporation) (2007-2009), Director of RemedyTemp, Inc. (temporary help services company) (1996-2006), and Trustee of PIMCO Funds Multi-Manager Series (1990-2000) and Pacific Life Variable Life & Annuity Trusts (1987-1994). |

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Independent Trustees | | | | |

Raudline Etienne

151 Detroit Street

Denver, CO 80206

DOB: 1965 | Trustee | 6/16-Present | Founder, Daraja Capital (advisory and investment firm) (since 2016), and Senior Advisor, Albright Stonebridge Group LLC (global strategy firm) (since 2016). Formerly, Senior Vice President (2011-2015), Albright Stonebridge Group LLC, and Deputy Comptroller and Chief Investment Officer, New York State Common Retirement Fund (public pension fund) (2008-2011). | 56 | Board Member, Van Alen Institute (nonprofit architectural and design organization) (since 2019), and Director of Brightwood Capital Advisors, LLC (since 2014). |

William M.

Fitzgerald, Sr.

151 Detroit Street

Denver, CO 80206

DOB: 1964 | Trustee | 9/19-Present | Founder, Fitzgerald Asset Management LLC (since 2012). Formerly, Founder and Chief Investment Officer, Global Infrastructure Asset Management LLC (2008-2017), Chief Investment Officer of Nuveen Asset Management (2000-2007), and Managing Director, Nuveen Investment LLC (1988-2007). | 56 | Board of Directors, Municipal Securities Rulemaking Board (since 2017). Formerly, Board of Directors of Syncora Holdings Ltd, Syncora Guarantee Inc., and Syncora Capital Assurance Inc. (2009-2016), and Trustee, Destra Investment Trust (2010-2014). |

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Independent Trustees | | | | |

Gary A. Poliner

151 Detroit Street

Denver, CO 80206

DOB: 1953 | Trustee | 6/16-Present | Retired. Formerly, President (2010-2013) of Northwestern Mutual Life Insurance Company. | 56 | Director of MGIC Investment Corporation (private mortgage insurance) (since 2013) and West Bend Mutual Insurance Company (property/casualty insurance) (since 2013). Formerly, Trustee of Northwestern Mutual Life Insurance Company (2010-2013), and Director of Frank Russell Company (global asset management firm) (2008-2013). |

Diane L. Wallace

151 Detroit Street

Denver, CO 80206

DOB: 1958 | Trustee | 6/17-Present | Retired. | 56 | Formerly, Independent Trustee, Henderson Global Funds (13 portfolios) (2015-2017), Independent Trustee, State Farm Associates' Funds Trust, State Farm Mutual Fund Trust, and State Farm Variable Product Trust (28 portfolios) (2013-2017), Chief Operating Officer, Senior Vice President-Operations, and Chief Financial Officer for Driehaus Capital Management, LLC (1988-2006), and Treasurer for Driehaus Mutual Funds (1996-2002). |

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

| | | | | | |

TRUSTEES |

Name, Address, and Age | Positions Held with the Trust | Length of Time Served | Principal Occupations During the Past Five Years | Number of Portfolios/Funds in Fund Complex Overseen by Trustee | Other Directorships Held by Trustee During the Past Five Years |

Independent Trustees | | | | |

Linda S. Wolf

151 Detroit Street

Denver, CO 80206

DOB: 1947 | Trustee | 11/05-Present | Retired. Formerly, Chairman and Chief Executive Officer of Leo Burnett (Worldwide) (advertising agency) (2001-2005). | 56 | Director of Chicago Community Trust (Regional Community Foundation), Lurie Children’s Hospital (Chicago, IL), Shirley Ryan Ability Lab and Wrapports, LLC (digital communications company). Formerly, Director of Chicago Council on Global Affairs (until 2019), InnerWorkings (until 2019), Director of Walmart (until 2017), Director of Chicago Convention & Tourism Bureau (until 2014), and The Field Museum of Natural History (Chicago, IL) (until 2014). |

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

| | | | |

OFFICERS |

Name, Address, and Age | Positions Held with the Trust | Term of Office* and Length of Time Served | Principal Occupations During the Past Five Years |

Andrew Gillan

151 Detroit Street

Denver, CO 80206

DOB: 1977 | Executive Vice President and Co-Portfolio Manager Janus Henderson Asia Equity Fund | 6/17-Present | Head of Asia (ex-Japan) Equities of Janus Henderson Investors and Portfolio Manager for other Janus Henderson accounts. |

Mervyn Koh

151 Detroit Street

Denver, CO 80206

DOB: 1979 | Executive Vice President and Co-Portfolio Manager Janus Henderson Asia Equity Fund | 6/17-Present | Portfolio Manager on the Asia Equity strategy of Janus Henderson Investors and Portfolio Manager for other Janus Henderson accounts. Formerly, Vice President of Emerging Markets Group of Franklin Templeton Investments (2010-2015). |

Bruce L. Koepfgen

151 Detroit Street

Denver, CO 80206

DOB: 1952 | President and Chief Executive Officer | 7/14-Present | Executive Vice President, Head of North America at Janus Henderson Investors and Janus Capital Management LLC (since 2017), Executive Vice President and Director of Janus International Holding LLC (since 2011), Executive Vice President of Janus Distributors LLC (since 2011), Vice President and Director of Intech Investment Management LLC (since 2011), Executive Vice President and Director of Perkins Investment Management LLC (since 2011), and President and Director of Janus Management Holdings Corporation (since 2011). Formerly, President of Janus Capital Group Inc. and Janus Capital Management LLC (2013-2017), Executive Vice President of Janus Services LLC (2011-2015), Janus Capital Group Inc. and Janus Capital Management LLC (2011-2013), and Chief Financial Officer of Janus Capital Group Inc., Janus Capital Management LLC, Janus Distributors LLC, Janus Management Holdings Corporation, and Janus Services LLC (2011-2013). |

* Officers are elected at least annually by the Trustees for a one-year term and may also be elected from time to time by the Trustees for an interim period. |

Janus Henderson Asia Equity Fund

Trustees and Officers (unaudited)

| | | | |

OFFICERS |

Name, Address, and Age | Positions Held with the Trust | Term of Office* and Length of Time Served | Principal Occupations During the Past Five Years |

Kristin Mariani

151 Detroit Street

Denver, CO 80206

DOB: 1966 | Vice President, Chief Compliance Officer, and Anti-Money Laundering Officer | 7/20-Present | Chief Compliance Officer for Janus Capital Management LLC (since September 2017), Global Head of Investment Management Compliance for Janus Henderson Investors (since 2019). Formerly, Vice President, Head of Global Distribution Compliance and Chief Compliance Officer of Janus Henderson Distributors (May 2017 – September 2017), Vice President, Compliance at Janus Capital Group Inc., Janus Capital Management LLC, and Janus Distributors LLC (2009-2017). |

Jesper Nergaard 151 Detroit Street Denver, CO 80206 DOB: 1962 | Chief Financial Officer

Vice President, Treasurer, and Principal Accounting Officer

| 3/05-Present

2/05-Present

| Vice President of Janus Capital and Janus Services LLC. |

Byron D. Hittle

151 Detroit Street

Denver, CO 80206

DOB: 1974 | Interim Vice President, Chief Legal Counsel, and Secretary | 8/20-Present | Managing Counsel (2017-present). Formerly, Assistant Vice President and Senior Legal Counsel, Janus Capital Management LLC (2012-2016). |

* Officers are elected at least annually by the Trustees for a one-year term and may also be elected from time to time by the Trustees for an interim period. |

Knowledge Shared

At Janus Henderson, we believe in the sharing of expert insight for better investment and business decisions. We call this ethos Knowledge Shared.

Learn more by visiting janushenderson.com.

| | | | | | | | | |

| | | | | |

| | | | |

This report is submitted for the general information of shareholders of the Fund. It is not an offer or solicitation for the Fund and is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. |

Janus Henderson, Janus, Henderson, Perkins, Intech and Knowledge Shared are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc Janus Henderson Distributors |

| | | | | 125-02-93036 11-20 |

| | | | |

| | | |

| | | ANNUAL REPORT September 30, 2020 |

| | |

| | Janus Henderson Balanced Fund |

| | |

| | Janus Investment Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or your plan sponsor, broker-dealer, or financial intermediary, or if you invest directly with the Fund, by contacting a Janus Henderson representative. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your plan sponsor, broker-dealer, or financial intermediary, or if you invest directly with the Fund, by visiting janushenderson.com/edelivery. You may elect to receive all future reports in paper free of charge. If you do not invest directly with the Fund, you should contact your plan sponsor, broker-dealer, or financial intermediary, to request to continue receiving paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-525-3713 to let the Fund know that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Janus Henderson mutual funds where held (i.e., all Janus Henderson mutual funds held in your account if you invest through your financial intermediary or all Janus Henderson mutual funds held with the fund complex if you invest directly with a fund). |

| | | HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your fund · Fund performance, characteristics

and holdings |

| | | |

| | |

|

Table of Contents

Janus Henderson Balanced Fund

Janus Henderson Balanced Fund (unaudited)

| | | | | | |

FUND SNAPSHOT We believe a dynamic approach to asset allocation that leverages our bottom-up, fundamental equity and fixed income research will allow us to outperform our peers over time. Our integrated equity and fixed income team seeks an optimal balance of asset class opportunities across market cycles. | |

Marc Pinto co-portfolio manager |

Jeremiah Buckley co-portfolio manager |

Michael Keough co-portfolio manager |

Greg Wilensky co-portfolio manager |

| | | |

PERFORMANCE SUMMARY

Janus Henderson Balanced Fund’s Class I Shares returned 12.53% for the 12-month period ended September 30, 2020. That compares with 15.15% for the Fund’s primary benchmark, the S&P 500® Index, and 6.98% for the Bloomberg Barclays U.S. Aggregate Bond Index. The Balanced Index, an internally calculated benchmark composed of a 55% weighting in the S&P 500 Index and a 45% weighting in the Bloomberg Barclays U.S. Aggregate Bond Index, returned 12.11%.

INVESTMENT ENVIRONMENT

The period began with a generally positive backdrop for U.S. equities. The relatively strong U.S. economy, benign interest rate environment and progress in U.S.-China trade relations all contributed to positive investor sentiment. However, in March, U.S. stocks faced an unprecedented sell-off, with speed and magnitude of historic proportion. The exogenous shock of the COVID-19 coronavirus ushered in a period of severe economic uncertainty and market volatility as governments around the world restricted travel and social activity to help contain the virus. Central bank and government stimulus action was swift and aggressive. Equity markets recovered at a brisk pace, spurred on by signs that the stimulus measures were having positive impact on the real economy. Late in the period, the increasing likelihood of a vaccine being available in 2021 led to additional optimism. The S&P 500 ultimately generated a strong return, but performance across sectors varied significantly. Information technology stocks, especially those businesses benefiting from stay-at-home measures, led the index higher. Consumer discretionary and health care stocks also performed well. Energy stocks plummeted when the price of crude oil futures briefly went negative intra-period and ended the year with sharp losses. Financials, real estate and utilities stocks also generated negative returns.

The bond market ultimately fared well, despite a dramatic sell-off in credit sectors during the COVID correction. The Federal Reserve’s (Fed) aggressive stimulus measures, including open-ended quantitative easing, contributed to a rapid improvement in debt market liquidity and a successful primary market for companies looking to issue debt. Valuations made up considerable ground over the summer and both investment-grade and high-yield bonds finished the period with positive returns. Rates fell across the yield curve as the Fed cut policy rates to zero and investors sought safety in U.S. Treasuries in the height of the correction. The yield on the 10-year Treasury note ended September at 0.69%, down from 1.66% one year ago.

PERFORMANCE DISCUSSION

At the start of the period, the Fund’s asset allocation was roughly 63% in equities and 37% fixed income. Heading into March’s precipitous decline in risk markets, we trimmed equity exposure – particularly in travel and leisure, energy and rate-sensitive financials – and adopted a more defensive stance within the fixed income sleeve. By late March, over half the portfolio was allocated to fixed income, with an increased allocation to 30-year Treasuries to provide some hedge against volatility in risk assets. Later in the period, robust monetary and fiscal stimulus, the reopening of economies and progress in treating the virus gave us confidence to begin shifting the portfolio toward a more aggressive stance. Our equity-to-fixed income allocation ended the period approximately 61% equities, 38% fixed income and a small position in cash. The Fund’s asset allocation is dynamic, based on market conditions and the investment opportunities our teams identify across asset classes, a feature which allowed us to outperform the Balanced Index in this volatile period.

The Fund’s equity sleeve outperformed the S&P 500 Index. Contributing to relative results was our sector positioning, including a material underweight to energy – the worst-performing benchmark sector during the period – and an overweight to the strong-performing information technology sector. The COVID-19 pandemic radically

Janus Henderson Balanced Fund (unaudited)

accelerated the digital transformation, and companies offering services and products relevant to this shift in technology and capital spending were rewarded by the market. Positions in Adobe, Microsoft and Nvidia were among the sleeve’s top performers.

Weakness in travel was a common thread among the sleeve’s largest detractors. Boeing and Norwegian Cruise Line faced severe declines in business activity due to social distancing constraints, resulting in concerns around future liquidity. We exited both positions. A position in aerospace company General Dynamics was further impacted by U.S. election-related concerns given its defense contract exposure. However, we believe demand for the company’s defense portfolio will prove resilient, and we expect an eventual recovery and market share opportunities for its Gulfstream franchise in the business jet market.

The Fund’s fixed income sleeve outperformed the Bloomberg Barclays U.S. Aggregate Bond Index. We adjusted our allocations throughout the period to account for the levels of risk and reward we were identifying across fixed income sectors, reducing our credit allocations into the height of the market sell-off and adding risk back to the sleeve as the Fed’s backstop solidified. Our allocation decisions, including an overweight to corporate credit, contributed to relative performance. As the period progressed, moving further underweight agency mortgage-backed securities and U.S. Treasuries also aided results. A modest allocation to asset-backed securities detracted from relative returns, largely due to security selection.

At the issuer level, food services company Sysco was a top contributor, performing well after an attractive new issue was launched in March. However, a position in Continental Resources weighed on results when its credit ratings were downgraded, reflecting reduced profitability and cash flows amid highly volatile oil prices.

OUTLOOK

We expect the economic recovery to continue, led largely by the Fed’s commitment to keep interest rates low. Fiscal policy around the globe has also been supportive, and we are hopeful for another fiscal stimulus package in the U.S. The direct fiscal support that individuals received via enhanced unemployment benefits and stimulus checks along with this summer’s bounce in equity prices and strength in home values have created a positive wealth impact for many consumers, which we expect to support spending. Additionally, the increasing likelihood that treatments and vaccines in development for COVID-19 will be brought to fruition globally in the next nine to 18 months offers optimism to some of the sectors most challenged by the pandemic. Still, we know that uncertainties will remain high and volatility could spike at any time.

We do expect politics-driven volatility to rise as the U.S. elections approach. While we will continue to monitor for potential changes to the regulatory and tax landscapes in which our holdings operate, we do not believe the outcomes of the elections will be the primary driver of returns in capital markets in the year ahead. We are focused on populating both sleeves of the portfolio with business models we think can thrive regardless of political outcomes.

Equity valuations have increased and are concerning in select parts of the market but we are comfortable with our overweight, believing that, in aggregate, equity valuations remain favorable – particularly amid the modest recovery and low interest-rate environment. In the equity sleeve, we remain focused on high-quality growth companies with strong balance sheets and significant free cash flow that return value to shareholders. The sleeve remains positioned with considerable exposure to secular trends that are gaining momentum as the pandemic lingers, including cloud services, Software as a Service (SaaS) and health care innovation.

In the fixed income sleeve, we remain constructive on credit sectors, and equally focused on corporate issuers exhibiting strength across balance sheets, cash flows and long-term competitive advantages. We are also seeking securitized credit opportunities that offer attractive risk-adjusted return profiles. As the recovery takes hold, we expect corporate fundamentals to improve as companies work through balance sheet repair, and the resulting decline in credit risk should be favorable for valuations. Further, we anticipate low yields broadly will encourage both foreign (given lower hedged costs) and domestic investors to seek returns from higher-yielding securities and asset classes.

As always, we will dynamically adjust the Fund’s asset allocation based on market conditions and the investment opportunities our equity and fixed income teams identify through their bottom-up, fundamental research.

Thank you for investing in Janus Henderson Balanced Fund.

Janus Henderson Balanced Fund (unaudited)

Fund At A Glance

September 30, 2020

| | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| 5 Top Contributors - Equity Sleeve Holdings | 5 Top Detractors - Equity Sleeve Holdings |

| | Average

Weight | | Relative

Contribution | | | Average

Weight | | Relative

Contribution |

| Adobe Inc | 2.79% | | 1.03% | | Boeing Co | 1.39% | | -1.60% |

| Microsoft Corp | 7.41% | | 0.73% | | LyondellBasell Industries NV | 0.89% | | -0.93% |

| NVIDIA Corp | 1.26% | | 0.61% | | General Dynamics Corp | 1.92% | | -0.78% |

| UnitedHealth Group Inc | 3.14% | | 0.48% | | Norwegian Cruise Line Holdings Ltd | 0.34% | | -0.69% |

| Lam Research Corp | 1.72% | | 0.41% | | US Bancorp | 1.43% | | -0.66% |

| | | | | | | |

| 5 Top Contributors - Equity Sleeve Sectors* | | | | | |

| | | Relative | | Equity Sleeve | S&P 500 Index |

| | | Contribution | | Average Weight | Average Weight |

| Information Technology | | 2.47% | | 29.36% | 25.18% |

| Energy | | 1.73% | | 0.80% | 3.34% |

| Financials | | 0.79% | | 10.89% | 11.41% |

| Utilities | | 0.59% | | 0.19% | 3.29% |

| Health Care | | 0.39% | | 14.24% | 14.44% |

| | | | | | |

| | | | | | |

| 5 Top Detractors - Equity Sleeve Sectors* | | | | | |

| | | Relative | | Equity Sleeve | S&P 500 Index |

| | | Contribution | | Average Weight | Average Weight |

| Industrials | | -2.10% | | 8.48% | 8.54% |

| Consumer Discretionary | | -1.36% | | 14.07% | 10.35% |

| Other** | | -0.85% | | 1.57% | 0.00% |

| Materials | | -0.82% | | 1.13% | 2.57% |

| Communication Services | | -0.63% | | 7.57% | 10.72% |

| | | | | | | |

| Relative contribution reflects how the portolio's holdings impacted return relative to the benchmark. Cash and securities not held in the portfolio are not shown. For equity portfolios, relative contribution compares the performance of a security in the portfolio to the benchmark's total return, factoring in the difference in weight of that security in the benchmark. Returns are calculated using daily returns and previous day ending weights rolled up by ticker, excluding fixed income securities, gross of advisory fees, may exclude certain derivatives and will differ from actual performance.

Performance attribution reflects returns gross of advisory fees and may differ from actual returns as they are based on end of day holdings. Attribution is calculated by geometrically linking daily returns for the portfolio and index. |

* | Based on sector classification according to the Global Industry Classification Standard (“GICS”) codes, which are the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

** | Not a GICS classified sector. |

Janus Henderson Balanced Fund (unaudited)

Fund At A Glance

September 30, 2020

| | |

5 Largest Equity Holdings - (% of Net Assets) |

Microsoft Corp | |

Software | 4.8% |

Apple Inc | |

Technology Hardware, Storage & Peripherals | 3.5% |

Amazon.com Inc | |

Internet & Direct Marketing Retail | 3.1% |

Mastercard Inc | |

Information Technology Services | 2.5% |

Alphabet Inc - Class C | |

Interactive Media & Services | 2.3% |

| | 16.2% |

| | | | | | |

Asset Allocation - (% of Net Assets) |

Common Stocks | | 61.1% |

Corporate Bonds | | 22.2% |

Mortgage-Backed Securities | | 6.2% |

Asset-Backed/Commercial Mortgage-Backed Securities | | 5.2% |

United States Treasury Notes/Bonds | | 4.1% |

Investment Companies | | 2.6% |

Preferred Stocks | | 0.3% |

Bank Loans and Mezzanine Loans | | 0.1% |

Other | | (1.8)% |

| | | 100.0% |

| | |

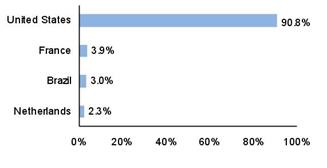

Top Country Allocations - Long Positions - (% of Investment Securities) |

As of September 30, 2020

| As of September 30, 2019

|

Janus Henderson Balanced Fund (unaudited)

Performance

| |

See important disclosures on the next page. |

| | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

Average Annual Total Return - for the periods ended September 30, 2020 | | | Expense Ratios |

| | One

Year | Five

Year | Ten

Year | Since

Inception* | | | Total Annual Fund

Operating Expenses‡ |

Class A Shares at NAV | | 12.26% | 10.95% | 9.49% | 9.78% | | | 0.93% |

Class A Shares at MOP | | 5.81% | 9.65% | 8.84% | 9.55% | | | |

Class C Shares at NAV | | 11.46% | 10.19% | 8.71% | 9.09% | | | 1.65% |

Class C Shares at CDSC | | 10.46% | 10.19% | 8.71% | 9.09% | | | |

Class D Shares | | 12.47% | 11.19% | 9.73% | 9.88% | | | 0.72% |

Class I Shares | | 12.53% | 11.26% | 9.80% | 9.91% | | | 0.65% |

Class N Shares | | 12.62% | 11.34% | 9.83% | 9.92% | | | 0.58% |

Class R Shares | | 11.80% | 10.52% | 9.07% | 9.39% | | | 1.32% |

Class S Shares | | 12.08% | 10.80% | 9.34% | 9.62% | | | 1.08% |

Class T Shares | | 12.35% | 11.08% | 9.61% | 9.84% | | | 0.83% |

S&P 500 Index | | 15.15% | 14.15% | 13.74% | 9.90% | | | |

Bloomberg Barclays U.S. Aggregate Bond Index | | 6.98% | 4.18% | 3.64% | 5.47% | | | |

Balanced Index | | 12.11% | 9.87% | 9.35% | 8.19% | | | |

Morningstar Quartile - Class T Shares | | 1st | 1st | 1st | 1st | | | |

Morningstar Ranking - based on total returns for Allocation - 50% to 70% Equity Funds | | 84/680 | 30/652 | 64/520 | 14/183 | | | |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 800.668.0434 (or 800.525.3713 if you hold shares directly with Janus Henderson) or visit janushenderson.com/performance (or janushenderson.com/allfunds if you hold shares directly with Janus Henderson).

Maximum Offering Price (MOP) returns include the maximum sales charge of 5.75%. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

CDSC returns include a 1% contingent deferred sales charge (CDSC) on Shares redeemed within 12 months of purchase. Net Asset Value (NAV) returns exclude this charge, which would have reduced returns.

Performance may be affected by risks that include those associated with non-diversification, portfolio turnover, short sales, potential conflicts of interest, foreign and emerging markets, initial public offerings (IPOs), high-yield and high-risk securities, undervalued, overlooked and smaller capitalization

Janus Henderson Balanced Fund (unaudited)

Performance

companies, real estate related securities including Real Estate Investment Trusts (REITs), derivatives, and commodity-linked investments. Each product has different risks. Please see the prospectus for more information about risks, holdings and other details.

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

Class A Shares, Class C Shares, Class R Shares, and Class S Shares commenced operations on July 6, 2009. Performance shown for each class for periods prior to July 6, 2009, reflects the performance of the Fund’s Class J Shares, the initial share class (renamed Class T Shares effective February 16, 2010), calculated using the fees and expenses of each respective class, without the effect of any fee and expense limitations or waivers.

Class D Shares commenced operations on February 16, 2010. Performance shown for periods prior to February 16, 2010, reflects the performance of the Fund’s former Class J Shares, calculated using the fees and expenses in effect during the periods shown, net of any applicable fee and expense limitations or waivers.

Class I Shares commenced operations on July 6, 2009. Performance shown for periods prior to July 6, 2009, reflects the performance of the Fund’s former Class J Shares, calculated using the fees and expenses of Class J Shares, net of any applicable fee and expense limitations or waivers.

Class N Shares commenced operations on May 31, 2012. Performance shown for periods prior to May 31, 2012, reflects the performance of the Fund’s Class T Shares, calculated using the fees and expenses of Class T Shares, net of any applicable fee and expense limitations or waivers.

If each share class of the Fund had been available during periods prior to its commencement, the performance shown may have been different. The performance shown for periods following the Fund’s commencement of each share class reflects the fees and expenses of each respective share class, net of any applicable fee and expense limitations or waivers. Please refer to the Fund’s prospectuses for further details concerning historical performance.

Ranking is for the share class shown only; other classes may have different performance characteristics. When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2020 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

See “Useful Information About Your Fund Report.”

Effective February 1, 2020, Jeremiah Buckley, Michael Keough, Marc Pinto, and Greg Wilensky are Co-Portfolio Managers of the Fund.

Portfolio Manager Marc Pinto has announced his retirement effective April 2, 2021.

*The Fund’s inception date – September 1, 1992

‡ As stated in the prospectus. See Financial Highlights for actual expense ratios during the reporting period.

Janus Henderson Balanced Fund (unaudited)

Expense Examples

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as sales charges (loads) on purchase payments (applicable to Class A Shares only); and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes