UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-173

DODGE & COX FUNDS

(Exact name of registrant as specified in charter)

555 California Street, 40th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Thomas M. Mistele, Esq.

555 California Street, 40th Floor

San Francisco, CA 94104

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-981-1710

Date of fiscal year end: DECEMBER 31, 2005

Date of reporting period: June 30, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following are the June 30, 2005 semi-annual reports for the Dodge & Cox Funds, a Delaware statutory trust, consisting of four series: Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund, and Dodge & Cox Income Fund. The reports of each series were transmitted to their respective shareholders on August 9, 2005.

Stock Fund

Established 1965

(Closed to New Investors)

Semi-Annual Report

June 30, 2005

2005

Stock Fund

www.dodgeandcox.com

For Fund literature, transactions and account

information, please visit the Funds’ web site.

or write or call:

Dodge & Cox Funds

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

Investment Manager

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions and portfolio holdings as of June 30, 2005, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

06/05 SF SAR  Printed on recycled paper

Printed on recycled paper

To Our Shareholders

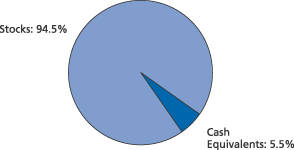

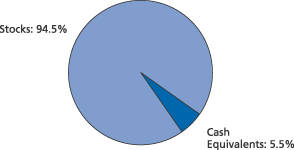

The Dodge & Cox Stock Fund had a total return of 0.7% for the six months ended June 30, 2005, compared to a total return of -0.8% for the Standard & Poor’s 500 (S&P 500). Longer-term results for the Fund can be found on the following page. On June 30, the Fund had net assets of $46.3 billion and a cash position of 5.5%.

Semi-Annual Performance Review

The Fund outperformed the S&P 500 for the six months ended June 30, 2005. During this period, the Fund benefited from a higher relative weighting (10% versus 8%) in Energy stocks. Strong performers in the Fund’s Energy holdings included Unocal (up 52%) and ConocoPhillips (up 34%). In addition, the Fund’s investments in the Health Care sector performed better than those in the S&P 500 (e.g., HCA up 43% and WellPoint up 21%). Conversely, the weak performance from the Fund’s Consumer Discretionary holdings, combined with a higher weighting (21% versus 11%) than the S&P 500 in this sector, detracted from relative results. Particularly weak stocks included Delphi (down 48%), Time Warner, (down 14%) and McDonald’s (down 13 %).

Morningstar® Address

In June, I, Harry Hagey, in my capacity as Chairman and CEO of Dodge & Cox was invited to speak at Morningstar’s Investment Conference. I thought it would be helpful to share an excerpt of that speech with our shareholders:

So, how did the small, local firm founded in the 1930s, which I joined in the late 1960s, become the firm we are today? What I would like to do now is to summarize for you what I think are the key components that make Dodge & Cox a successful money management firm.

First and Most Important—Our Current Clients

We are in the business of providing continuous high-quality investment management service to our existing clients. We decided a long time ago that we are not in business to provide a series of financial products to the investment market place. Another way to look at this is that we are in the investment business and not in the money gathering business. We do not advertise, we do not have a marketing department and no one at our firm is paid commissions or compensated directly for bringing in new business. We concluded that if we did a good job, the word would get around. We

have relatively low expense ratios with no 12b-1 or other fees. In general, our firm’s investment objective is to first preserve and then enhance the future purchasing power of our clients’ wealth over the long-term*. Please note that I did not say to beat a particular benchmark or to have low tracking error. If we believe that a significant part of the market is unattractive, we will not be in it. Finally, ethical considerations are paramount—we work hard to maintain our reputation.

Second—Our Employees

With regard to our own people, we insist on respect for each individual employee as well as for the entire firm. We work within a collegial and team-work environment with the goal of having everyone at the firm think as owners, not just as employees. Dodge & Cox has a long history, but it is still a small firm and its vitality is maintained by diplomatic entrepreneurship.

We also want all of our employees to share in the firm’s success. Our compensation structure provides salary and bonus for each member of our firm. The bonus is based on how well the firm has done and an employee’s contribution over time. We avoid any quantitative measurement of our research analysts’ performance because we make decisions as a group—we don’t believe in a “star system” or the reliance on any one individual. We try to create an environment where our analysts will not overly worry about making bad recommendations, and will be rewarded for sharing information with their peers.

Importantly, our independence, culture and compensation structure have led to low employee turnover which, in our opinion, is crucial to maintaining a consistent investment approach in difficult investment environments.

Third—Dodge & Cox

With regard to the firm, probably the most important characteristic is our independence. We require that shareholders of the firm be active employees. The firm is held widely with about one-third of employees being shareholders. We also believe it is important to have control of the investment service to our clients so we have no joint ventures. The only planning that we do is to make sure that we have assets in place, most important being people, so that we can continue to do a good job for our existing clients.

| | |

| 1 / Dodge & Cox Stock Fund | | |

For Dodge & Cox, issues of ethics, independence, a focused teamwork investment approach, respect for the individual, and an absence of a marketing mindset are all key determinants in what makes us who we are.

One of my individual clients recently sent me a book by James P. Owen, called Cowboy Ethics—What Wall Street Can Learn from the Code of the West. The pictures in the book are fantastic and I also believe that the book has real wisdom. In the book Mr. Owen summarized the Code with ten rules. The ones that resonated with me most are: 1) Take Pride in Your Work, 2) Ride for the Brand, 3) Remember That Some Things Aren’t for Sale, and 4) Know Where to Draw the Line.

I think Dodge & Cox as a firm has lived by this Code.

In Closing

In spite of rising short-term interest rates and energy prices, we continue to be optimistic about the long-term prospects for the global economy. We are also optimistic about corporate earnings over the next three-to-five years; nevertheless, we are cautious about returns from the broad market given current valuations.

As always, Dodge & Cox’s investment approach remains focused on intensive “bottom-up” fundamental analysis, while maintaining a strong price discipline and long-term view. Increasingly, this approach has led us to find selected opportunities in global companies that are domiciled outside the U.S. The Fund’s 19 foreign investments are all listed on U.S. exchanges and now represent almost 17% of the Fund—near the 20% maximum limit allowed by the Fund’s prospectus.

Thank you for your continued confidence in the Dodge & Cox Stock Fund. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |

|

| |

| Harry R. Hagey, Chairman | | John A. Gunn, President |

August 3, 2005

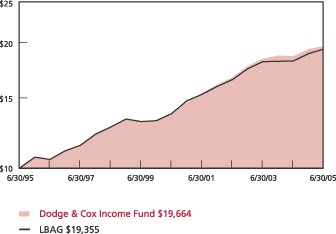

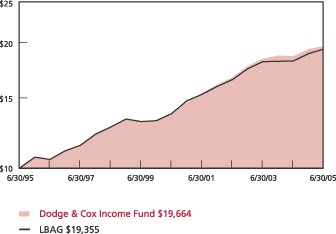

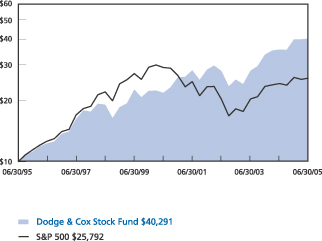

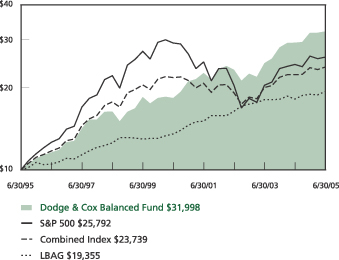

Ten Years of Investment Performance

through June 30, 2005 (in thousands)

Average annual total return for periods ended June 30, 2005

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | 20 Years | |

| Dodge & Cox Stock Fund | | 13.12 | % | | 13.00 | % | | 14.94 | % | | 15.23 | % |

| S&P 500 | | 6.29 | | | (2.37 | ) | | 9.94 | | | 12.28 | |

Past performance does not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated above. Performance is updated and published monthly. Visit the Fund’s web site at www.dodgeandcox.com or call 800-621-3979 for current performance figures.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions. The Standard & Poor’s 500 (S&P 500) is a broad-based unmanaged measure of common stocks. Index returns include dividends and/or interest income and, unlike Fund returns, do not reflect fees or expenses.

Standard & Poor’s, Standard & Poor’s 500, and S&P 500® are trademarks of The McGraw-Hill Companies, Inc.

| * | | Please refer to the Fund’s prospectus for its investment objectives, policies and restrictions. |

| | |

| | | Dodge & Cox Stock Fund / 2 |

Fund Expenses

As a Fund shareholder, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one). Operating expenses, which are deducted from a Fund’s gross income, directly reduce the investment return of the Fund. The following example is intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with those of other mutual funds. The example is based on an investment of $1,000 made at the beginning of the most recent six-month period and held for the entire period.

The table below illustrates the Fund’s costs in two ways:

Actual Fund Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid on your account over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period”.

Hypothetical Example for Comparison

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expense Paid During the Period” shows the hypothetical expense your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

| | | | | | |

Six Months Ended

June 30, 2005 | | Beginning Account

Value 1/1/05 | | Ending Account

Value 6/30/05 | | Expenses Paid

During Period* |

| Based on Actual Fund Return | | $1,000.00 | | $1,006.80 | | $2.62 |

| Based on Hypothetical 5% Yearly Return | | 1,000.00 | | 1,022.39 | | 2.64 |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.53%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional costs or account maintenance fees. While other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

| | |

| 3 / Dodge & Cox Stock Fund | | |

Fund Information | June 30, 2005 |

General Information

| | |

Net Asset Value Per Share | | $129.49 |

Total Net Assets (millions) | | $46,346 |

2004 Expense Ratio | | 0.53% |

2004 Portfolio Turnover | | 11% |

30-Day SEC Yield1 | | 1.26% |

Fund Inception | | 1965 |

Investment Manager: Dodge & Cox, San Francisco. Managed by the Investment Policy Committee, whose nine members’ average tenure at Dodge & Cox is 22 years.

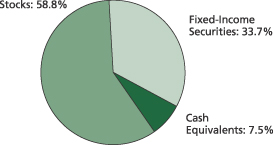

Asset Allocation

| | | | |

| Stock Characteristics | | Fund | | S&P 500 |

Number of Stocks | | 93 | | 500 |

Median Market Capitalization (billions) | | $17 | | $11 |

Weighted-Avg. Market Capitalization (billions) | | $43 | | $89 |

Price-to-Earnings Ratio2 | | 15.4x | | 16.2x |

Price-to-Book Value Ratio | | 2.0x | | 2.8x |

Foreign Stocks3 (% of Fund) | | 16.8% | | 0.0% |

| | |

| Ten Largest Holdings4 | | % of Fund |

Hewlett-Packard | | 3.3 |

Comcast Class A | | 3.1 |

Cardinal Health | | 2.5 |

Time Warner, Inc. | | 2.5 |

HCA, Inc. | | 2.5 |

News Corp. Class A | | 2.4 |

McDonald’s | | 2.2 |

Union Pacific | | 2.1 |

Sony ADR (Japan) | | 2.1 |

Matsushita Electric Industrial ADR (Japan) | | 2.1 |

| | | | | | |

| Sector Diversification | | Fund | | | S&P 500 | |

Consumer Discretionary | | 20.3 | % | | 11.4 | % |

Financials | | 18.4 | | | 20.4 | |

Health Care | | 14.7 | | | 13.4 | |

Information Technology | | 12.4 | | | 15.1 | |

Energy | | 9.5 | | | 8.8 | |

Materials | | 7.2 | | | 2.9 | |

Industrials | | 6.0 | | | 11.2 | |

Utilities | | 3.0 | | | 3.5 | |

Consumer Staples | | 2.0 | | | 10.1 | |

Telecommunication Services | | 1.0 | | | 3.2 | |

| 1 | | SEC Yield is an annualization of the Fund’s total net investment income per share for the 30-day period ended on the last day of the month. |

| 2 | | The Fund’s price-to-earnings (P/E) ratio is calculated using Dodge & Cox’s estimated forward earnings and excludes extraordinary items. The S&P 500’s P/E ratio is calculated by Standard & Poor’s and uses an aggregated estimate of forward earnings. |

| 3 | | Foreign stocks are U.S. dollar-denominated. |

| 4 | | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. |

| | |

| | | Dodge & Cox Stock Fund / 4 |

Portfolio of Investments (unaudited) | June 30, 2005 |

| | | | | |

| COMMON STOCKS: 94.5% |

| | |

| | | SHARES | | VALUE |

| CONSUMER DISCRETIONARY: 20.3% | | | |

| AUTOMOBILES & COMPONENTS: 0.7% | | | |

Delphi Corp.(c) | | 36,051,632 | | $ | 167,640,089 |

Honda Motor Co., Ltd. ADR(b) (Japan) | | 7,670,400 | | | 188,768,544 |

| | | | |

|

|

| | | | | | 356,408,633 |

| CONSUMER DURABLES & APPAREL: 5.5% | | | |

Matsushita Electric Industrial Co., Ltd. ADR(b) (Japan) | | 62,884,200 | | | 954,582,156 |

Sony Corp. ADR(b) (Japan) | | 27,840,800 | | | 958,837,152 |

Thomson S.A. ADR(b) (France) | | 5,200,000 | | | 124,540,000 |

VF Corp. | | 3,467,900 | | | 198,433,238 |

Whirlpool Corp.(c) | | 4,388,050 | | | 307,646,185 |

| | | | |

|

|

| | | | | | 2,544,038,731 |

| CONSUMER SERVICES: 2.2% | | | |

McDonald’s Corp. | | 36,530,400 | | | 1,013,718,600 |

| | | | |

|

|

| MEDIA: 8.9% | | | |

Comcast Corp. Class A(a) | | 46,214,330 | | | 1,418,779,931 |

Interpublic Group of Companies, Inc.(a) | | 5,728,200 | | | 69,769,476 |

Liberty Media Corp. Series A(a) | | 33,502,700 | | | 341,392,513 |

News Corp. Ltd., Class A | | 69,579,238 | | | 1,125,792,071 |

Time Warner, Inc.(a) | | 70,114,600 | | | 1,171,614,966 |

| | | | |

|

|

| | | | | | 4,127,348,957 |

| RETAILING: 3.0% | | | |

Dillard’s, Inc. Class A(c) | | 5,177,500 | | | 121,257,050 |

Gap, Inc. | | 8,972,500 | | | 177,206,875 |

Genuine Parts Co.(c) | | 8,953,800 | | | 367,911,642 |

May Department Stores Co.(c) | | 17,894,400 | | | 718,639,104 |

| | | | |

|

|

| | | | | | 1,385,014,671 |

| | | | |

|

|

| | | | | | 9,426,529,592 |

| CONSUMER STAPLES: 2.0% | | | |

| FOOD & STAPLES RETAILING: 0.2% | | | |

Wal-Mart Stores, Inc. | | 2,023,300 | | | 97,523,060 |

| | | | |

|

|

| FOOD, BEVERAGE & TOBACCO: 1.8% | | | |

Unilever N.V.(b) (Netherlands) | | 12,564,000 | | | 814,524,120 |

| | | | |

|

|

| | | | | | 912,047,180 |

| ENERGY: 9.5% | | | |

Amerada Hess Corp. | | 3,571,400 | | | 380,389,814 |

Baker Hughes, Inc. | | 9,717,750 | | | 497,160,090 |

ChevronTexaco Corp. | | 13,960,128 | | | 780,650,358 |

ConocoPhillips | | 11,286,800 | | | 648,878,132 |

Occidental Petroleum Corp. | | 5,153,100 | | | 396,427,983 |

Schlumberger Ltd.(b) (Netherlands Antilles) | | 3,170,400 | | | 240,760,176 |

Shell Transport & Trading Co. PLC ADR(b) (United Kingdom) | | 12,111,400 | | | 703,187,884 |

Unocal Corp. | | 11,456,400 | | | 745,238,820 |

| | | | |

|

|

| | | | | | 4,392,693,257 |

| | | | | |

| | |

| | | SHARES | | VALUE |

| FINANCIALS: 18.4% | | | |

| BANKS: 3.8% | | | |

Golden West Financial Corp. | | 8,898,600 | | $ | 572,891,868 |

Wachovia Corp. | | 16,600,300 | | | 823,374,880 |

Wells Fargo & Co. | | 6,046,600 | | | 372,349,628 |

| | | | |

|

|

| | | | | | 1,768,616,376 |

| DIVERSIFIED FINANCIALS: 4.7% | | | |

Capital One Financial Corp. | | 10,876,000 | | | 870,188,760 |

CIT Group, Inc. | | 8,507,403 | | | 365,563,107 |

Citigroup, Inc. | | 11,557,400 | | | 534,298,602 |

JPMorgan Chase & Co. | | 11,317,128 | | | 399,720,961 |

| | | | |

|

|

| | | | | | 2,169,771,430 |

| INSURANCE: 7.4% | | | |

AEGON N.V. ADR(b) (Netherlands) | | 33,899,542 | | | 436,287,106 |

Chubb Corp. | | 5,738,750 | | | 491,294,387 |

Genworth Financial, Inc. Class A | | 8,869,300 | | | 268,118,939 |

Loews Corp. | | 7,518,900 | | | 582,714,750 |

MBIA, Inc. | | 1,767,000 | | | 104,800,770 |

Safeco Corp. | | 5,058,600 | | | 274,884,324 |

St. Paul Travelers Companies, Inc. | | 22,806,550 | | | 901,542,921 |

Torchmark Corp. | | 3,125,434 | | | 163,147,655 |

UnumProvident Corp. | | 11,748,800 | | | 215,238,016 |

| | | | |

|

|

| | | | | | 3,438,028,868 |

| REAL ESTATE: 2.5% | | | |

Equity Office Properties Trust(c) | | 23,060,300 | | | 763,295,930 |

Equity Residential Properties Trust | | 11,143,500 | | | 410,303,670 |

| | | | |

|

|

| | | | | | 1,173,599,600 |

| | | | |

|

|

| | | | | | 8,550,016,274 |

| HEALTH CARE: 14.7% | | | |

| HEALTH CARE EQUIPMENT & SERVICES: 7.8% | | | |

Becton, Dickinson & Co. | | 4,222,350 | | | 221,546,704 |

Cardinal Health, Inc. | | 20,507,450 | | | 1,180,818,971 |

HCA, Inc.(c) | | 20,539,000 | | | 1,163,945,130 |

Thermo Electron Corp.(a),(c) | | 8,633,400 | | | 231,979,458 |

WellPoint, Inc.(a) | | 11,611,900 | | | 808,652,716 |

| | | | |

|

|

| | | | | | 3,606,942,979 |

| PHARMACEUTICALS & BIOTECHNOLOGY: 6.9% | | | |

Bristol-Myers Squibb Co. | | 8,105,050 | | | 202,464,149 |

GlaxoSmithKline PLC ADR(b)

(United Kingdom) | | 13,198,900 | | | 640,278,639 |

Pfizer, Inc. | | 27,167,925 | | | 749,291,372 |

sanofi-aventis ADR(b) (France) | | 10,250,000 | | | 420,147,500 |

Schering-Plough Corp. | | 37,202,100 | | | 709,072,026 |

Wyeth | | 10,868,800 | | | 483,661,600 |

| | | | |

|

|

| | | | | | 3,204,915,286 |

| | | | |

|

|

| | | | | | 6,811,858,265 |

| | |

| 5 / Dodge & Cox Stock Fund | | See accompanying Notes to Financial Statements |

Portfolio of Investments (unaudited) | June 30, 2005 |

| | | | | |

| COMMON STOCKS (continued) |

| | |

| | | SHARES | | VALUE |

| INDUSTRIALS: 6.0% | | | |

| CAPITAL GOODS: 1.7% | | | |

American Power Conversion Corp. | | 4,862,281 | | $ | 114,701,209 |

Fluor Corp.(c) | | 4,375,550 | | | 251,987,925 |

Masco Corp. | | 9,510,900 | | | 302,066,184 |

Volvo A.B. ADR(b) (Sweden) | | 3,360,200 | | | 136,279,631 |

| | | | |

|

|

| | | | | | 805,034,949 |

| COMMERCIAL SERVICES & SUPPLIES: 0.6% | | | |

Pitney Bowes, Inc. | | 6,157,150 | | | 268,143,882 |

| | | | |

|

|

| TRANSPORTATION: 3.7% | | | |

FedEx Corp. | | 9,129,900 | | | 739,613,199 |

Union Pacific Corp.(c) | | 14,860,950 | | | 962,989,560 |

| | | | |

|

|

| | | | | | 1,702,602,759 |

| | | | |

|

|

| | | | | | 2,775,781,590 |

| INFORMATION TECHNOLOGY: 12.4% | | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT: 0.3% |

Freescale Semiconductor, Inc.

Class A(a) | | 5,982,700 | | | 125,696,527 |

Freescale Semiconductor, Inc.

Class B(a) | | 1,621,547 | | | 34,344,366 |

| | | | |

|

|

| | | | | | 160,040,893 |

| SOFTWARE & SERVICES: 3.6% | | | |

BMC Software, Inc.(a),(c) | | 15,487,600 | | | 278,002,420 |

Compuware Corp.(a),(c) | | 19,357,100 | | | 139,177,549 |

Computer Sciences Corp.(a),(c) | | 12,893,600 | | | 563,450,320 |

Electronic Data Systems Corp.(c) | | 34,804,400 | | | 669,984,700 |

| | | | |

|

|

| | | | | | 1,650,614,989 |

| TECHNOLOGY, HARDWARE & EQUIPMENT: 8.5% | | | |

Avaya, Inc.(a),(c) | | 30,646,400 | | | 254,978,048 |

Hewlett-Packard Co. | | 66,027,163 | | | 1,552,298,602 |

Hitachi Ltd. ADR(b) (Japan) | | 470,200 | | | 28,503,524 |

Motorola, Inc. | | 37,292,900 | | | 680,968,354 |

NCR Corp.(a) | | 7,423,800 | | | 260,723,856 |

Storage Technology Corp.(a),(c) | | 7,511,200 | | | 272,581,448 |

Xerox Corp.(a),(c) | | 64,316,500 | | | 886,924,535 |

| | | | |

|

|

| | | | | | 3,936,978,367 |

| | | | |

|

|

| | | | | | 5,747,634,249 |

| MATERIALS: 7.2% | | | |

Akzo Nobel N.V. ADR(b),(c) (Netherlands) | | 17,856,759 | | | 701,592,061 |

Alcoa, Inc. | | 3,671,983 | | | 95,948,916 |

Bayer A.G. ADR(b) (Germany) | | 116,900 | | | 3,890,432 |

Dow Chemical Co. | | 17,793,114 | | | 792,327,366 |

Engelhard Corp.(c) | | 8,291,100 | | | 236,710,905 |

International Paper Co. | | 5,989,300 | | | 180,936,753 |

Lubrizol Corp. | | 929,100 | | | 39,031,491 |

NOVA Chemicals Corp.(b),(c) (Canada) | | 4,752,570 | | | 145,238,539 |

| | | | | | |

| | |

| | | SHARES | | VALUE |

Rio Tinto PLC ADR(b) (United Kingdom) | | | 4,630,831 | | $ | 564,590,916 |

Rohm and Haas Co. | | | 6,784,500 | | | 314,393,730 |

Syngenta A.G. ADR(b) (Switzerland) | | | 12,651,800 | | | 257,970,202 |

| | | | | |

|

|

| | | | | | | 3,332,631,311 |

| TELECOMMUNICATION SERVICES: 1.0% | | | |

AT&T Corp.(c) | | | 13,024,550 | | | 247,987,432 |

Vodafone Group PLC ADR(b)

(United Kingdom) | | | 8,673,000 | | | 210,927,360 |

| | | | | |

|

|

| | | | | | | 458,914,792 |

| UTILITIES: 3.0% | | | |

American Electric Power Co., Inc. | | | 7,630,910 | | | 281,351,652 |

Duke Energy Corp. | | | 23,919,300 | | | 711,120,788 |

FirstEnergy Corp. | | | 4,486,500 | | | 215,845,515 |

Scottish Power PLC ADR(b)

(United Kingdom) | | | 4,586,800 | | | 163,290,080 |

| | | | | |

|

|

| | | | | | | 1,371,608,035 |

| | | | | |

|

|

TOTAL COMMON STOCKS (Cost $34,038,805,499) | | | 43,779,714,545 |

| | | | | |

|

|

| |

| SHORT-TERM INVESTMENTS: 5.5% | | |

| | |

| | | PAR VALUE | | VALUE |

SSgA Prime Money Market Fund | | $ | 232,852,792 | | $ | 232,852,792 |

State Street Repurchase Agreement, 2.65%, 7/1/05, maturity value $1,453,731,003 (collateralized by U.S. Treasury Securities, value $1,482,704,155 2.25%-7.00%, 11/15/05-6/30/07) | | | 1,453,624,000 | | | 1,453,624,000 |

U.S. Treasury Bills | | | | | | |

8/4/05 | | | 225,000,000 | | | 224,393,431 |

9/1/05 | | | 125,000,000 | | | 124,373,542 |

9/8/05 | | | 200,000,000 | | | 198,876,833 |

9/15/05 | | | 350,000,000 | | | 347,812,889 |

| | | | | |

|

|

TOTAL SHORT-TERM INVESTMENTS

(Cost $2,581,933,487) | | | 2,581,933,487 |

| | | | | |

|

|

| | | | | | | |

| | | | | | | | |

TOTAL INVESTMENTS

(Cost $36,620,738,986) | | 100.0 | % | | | 46,361,648,032 | |

OTHER ASSETS LESS LIABILITIES | | — | | | | (15,193,257 | ) |

| | |

|

| |

|

|

|

TOTAL NET ASSETS | | 100.0 | % | | $ | 46,346,454,775 | |

| | |

|

| |

|

|

|

| (b) | | Foreign security denominated in U.S. dollars |

| (c) | | See Note 5 regarding holdings of 5% voting securities |

| | |

| See accompanying Notes to Financial Statements | | Dodge & Cox Stock Fund / 6 |

Statement of Assets and Liabilities (unaudited)

| | | | |

|

| June 30, 2005 | |

| Assets: | | | | |

Investments, at value | | | | |

Unaffiliated issuers (cost $28,824,468,001) | | $ | 38,458,838,113 | |

Affiliated issuers (cost $7,796,270,985) | | | 7,902,809,919 | |

| | |

|

|

|

| | | | 46,361,648,032 | |

Receivable for investments sold | | | 53,216,139 | |

Receivable for Fund shares sold | | | 95,201,428 | |

Dividends and interest receivable | | | 66,494,983 | |

Prepaid expenses and other assets | | | 87,085 | |

| | |

|

|

|

| | | | 46,576,647,667 | |

| | |

|

|

|

| Liabilities: | | | | |

Payable for investments purchased | | | 179,317,029 | |

Payable for Fund shares redeemed | | | 28,808,722 | |

Management fees payable | | | 19,104,334 | |

Accounts payable | | | 2,962,807 | |

| | |

|

|

|

| | | | 230,192,892 | |

| | |

|

|

|

| Net Assets | | $ | 46,346,454,775 | |

| | |

|

|

|

| Net Assets Consist of: | | | | |

Paid in capital | | $ | 36,403,025,838 | |

Undistributed net investment income | | | 24,494,959 | |

Undistributed net realized gain on investments | | | 178,024,932 | |

Net unrealized appreciation on investments | | | 9,740,909,046 | |

| | |

|

|

|

| | | $ | 46,346,454,775 | |

| | |

|

|

|

Fund shares outstanding (par value

$0.01 each, unlimited shares authorized) | | | 357,918,177 | |

Net asset value per share | | | $129.49 | |

|

| Statement of Operations (unaudited) | |

|

Six Months Ended

June 30, 2005 | |

| Investment Income: | | | | |

Dividends (net of foreign taxes of $8,748,135) | | | | |

Unaffiliated issuers | | $ | 302,849,945 | |

Affiliated issuers | | | 94,926,706 | |

Interest | | | 33,173,065 | |

| | |

|

|

|

| | | | 430,949,716 | |

| | |

|

|

|

| Expenses: | | | | |

Management fees | | | 110,855,237 | |

Custody and fund accounting fees | | | 338,316 | |

Transfer agent fees | | | 3,878,742 | |

Professional services | | | 56,265 | |

Shareholder reports | | | 763,730 | |

Registration fees | | | 561,339 | |

Trustees’ fees | | | 58,126 | |

Miscellaneous | | | 175,628 | |

| | |

|

|

|

| | | | 116,687,383 | |

| | |

|

|

|

| Net Investment Income | | | 314,262,333 | |

| | |

|

|

|

Realized and Unrealized Gain (Loss) on Investments: | | | | |

Net realized gain (loss) | | | | |

Unaffiliated issuers | | | 216,588,294 | |

Affiliated issuers | | | (38,563,362 | ) |

Net change in unrealized appreciation | | | (154,643,387 | ) |

| | |

|

|

|

Net realized and unrealized gain | | | 23,381,545 | |

| | |

|

|

|

| Net Increase in Net Assets from Operations | | $ | 337,643,878 | |

| | |

|

|

|

Statement of Changes in Net Assets (unaudited)

| | | | | | | | |

| | |

| | | Six Months Ended June 30, 2005 | | | Year Ended

December 31, 2004 | |

| Operations: | | | | | | | | |

Net investment income | | $ | 314,262,333 | | | $ | 474,852,317 | |

Net realized gain | | | 178,024,932 | | | | 1,417,766,177 | |

Net change in unrealized appreciation | | | (154,643,387 | ) | | | 4,726,648,936 | |

| | |

|

|

| |

|

|

|

Net increase in net assets from operations | | | 337,643,878 | | | | 6,619,267,430 | |

| | |

|

|

| |

|

|

|

| | |

Distributions to

Shareholders from: | | | | | | | | |

Net investment income | | | (298,690,274 | ) | | | (469,055,741 | ) |

Net realized gain | | | (259,138,331 | ) | | | (1,173,587,700 | ) |

| | |

|

|

| |

|

|

|

Total distributions | | | (557,828,605 | ) | | | (1,642,643,441 | ) |

| | |

|

|

| |

|

|

|

| | |

| Fund Share Transactions: | | | | | | | | |

Proceeds from sale of shares | | | 5,220,551,916 | | | | 11,863,567,462 | |

Reinvestment of distributions | | | 512,402,310 | | | | 1,513,787,692 | |

Cost of shares redeemed | | | (2,432,658,120 | ) | | | (4,524,858,539 | ) |

| | |

|

|

| |

|

|

|

Net increase from Fund

share transactions | | | 3,300,296,106 | | | | 8,852,496,615 | |

| | |

|

|

| |

|

|

|

Total increase in net assets | | | 3,080,111,379 | | | | 13,829,120,604 | |

| | |

| Net Assets: | | | | | | | | |

Beginning of period | | | 43,266,343,396 | | | | 29,437,222,792 | |

| | |

|

|

| |

|

|

|

End of period (including undistributed net investment income of $24,494,959 and

$8,922,900, respectively) | | $ | 46,346,454,775 | | | $ | 43,266,343,396 | |

| | |

|

|

| |

|

|

|

| | |

| Share Information: | | | | | | | | |

Shares sold | | | 40,552,063 | | | | 99,334,591 | |

Distributions reinvested | | | 4,004,565 | | | | 11,920,322 | |

Shares redeemed | | | (18,884,680 | ) | | | (37,725,900 | ) |

| | |

|

|

| |

|

|

|

Net increase in

shares outstanding | | | 25,671,948 | | | | 73,529,013 | |

| | |

|

|

| |

|

|

|

| | |

| 7 / Dodge & Cox Stock Fund | | See accompanying Notes to Financial Statements |

Notes to Financial Statements (unaudited)

Note 1 — Organization and Significant Accounting Policies

Dodge & Cox Stock Fund (the “Fund”) is one of the series constituting the Dodge & Cox Funds (the “Trust” or the “Funds”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Fund commenced operations on January 4, 1965, and seeks long-term growth of principal and income. Risk considerations and investment strategies of the Fund are discussed in the Fund’s Prospectus. The Fund is closed to new investors.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require the use of estimates and assumptions by management. Significant accounting policies are as follows:

Security valuation. The Fund’s net assets are valued as of the close of trading on the New York Stock Exchange (the “NYSE”), generally 4:00 p.m. Eastern Time, each day that the NYSE is open for business. Stocks are valued at the official quoted close price or the last sale of the day at the close of the NYSE or, if not available, at the mean between the exchange listed bid and ask prices for the day. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Security values are not discounted based on the size of the Fund’s position. Securities for which market quotations are not readily available are valued at fair value as determined in good faith by or at the direction of the Board of Trustees. Short-term securities are valued at amortized cost which approximates current value. All securities held by the Fund are denominated in U.S. dollars.

Security transactions, investment income, expenses, and distributions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Dividend income and corporate action transactions are recorded on the ex-dividend date, except for certain dividends or corporate actions from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received in excess of income are recorded as a reduction of cost of investments and/or realized gain. The Fund may estimate the character of distributions received from Real Estate Investment Trusts (“REITs”). Interest income is recorded on the accrual basis.

Expenses are recorded on the accrual basis. Most expenses of the Trust can be directly attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the Funds in the Trust.

Distributions to shareholders are recorded on the ex-dividend date.

Repurchase agreements. The Fund may enter into repurchase agreements secured by U.S. government securities which involve the purchase of securities from a counterparty with a simultaneous commitment to resell the securities at an agreed-upon date and price. It is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. In the event of default by the counterparty, the Fund has the contractual right to liquidate the securities and to apply the proceeds in satisfaction of the obligation.

Note 2 — Related Party Transactions

Management fees. Under a written agreement, the Fund pays an annual management fee of 0.50% of the Fund’s average daily net assets to Dodge & Cox, investment manager of the Fund. The agreement further provides that Dodge & Cox shall waive its fee to the extent that such fee plus all other ordinary operating expenses of the Fund exceed 0.75% of the average daily net assets for the year.

Fund officers and trustees. All officers and three of the trustees of the Trust are officers or employees of Dodge & Cox. The Trust pays a fee only to those trustees who are not affiliated with Dodge & Cox.

Indemnifications. Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnifications to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

Note 3 — Income Tax Information

A provision for federal income taxes is not required since the Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. Distributions are determined in accordance with income tax regulations, which may differ from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences.

| | |

| | | Dodge & Cox Stock Fund / 8 |

Notes to Financial Statements (unaudited) (continued)

Book/tax differences are primarily due to differing treatment of short-term realized gains. At June 30, 2005, the cost of investments for federal income tax purposes was equal to the cost for financial reporting purposes.

Distributions during the period ended June 30, 2005 were characterized as follows for federal income tax purposes:

| | | |

Ordinary income ($0.996 per share) | | $ | 348,999,029 |

Long-term capital gain ($0.604 per share) | | | 208,829,576 |

| | |

|

|

Total distributions ($1.600 per share) | | $ | 557,828,605 |

| | |

|

|

At June 30, 2005, the tax basis components of net assets were as follows:

| | | | |

Unrealized appreciation | | $ | 10,169,974,745 | |

Unrealized depreciation | | | (429,065,699 | ) |

| | |

|

|

|

Net unrealized appreciation | | | 9,740,909,046 | |

Undistributed ordinary income | | | 53,904,369 | |

Undistributed long-term capital gain | | | 148,615,522 | |

Paid-in capital | | | 36,403,025,838 | |

| | |

|

|

|

Net assets | | $ | 46,346,454,775 | |

| | |

|

|

|

Note 4 — Purchase and Sales of Investments

For the period ended June 30, 2005, purchases and sales of securities, other than short-term securities, aggregated $5,567,704,152 and $2,322,351,504, respectively.

Note 5 — Holdings of 5% Voting Securities

Each of the companies listed below is considered to be an affiliate of the Fund because the Fund owned 5% or more of the company’s voting securities during the period ended June 30, 2005. Transactions during the period in securities of affiliated companies were as follows:

| | | | | | | | | | | | | | | |

| | | Shares at

Beginning

of Period | | Additions | | Reductions | | | Shares at

End of

Period | | Dividend

Income 1 | | Value at

June 30, 2005 |

AT&T Corp. | | 52,008,200 | | — | | (38,983,650 | ) | | 13,024,550 | | $ | 12,245,210 | | | $— 3 |

| | | | | | |

Akzo Nobel N.V. ADR (Netherlands) | | 18,186,723 | | — | | (329,964 | ) | | 17,856,759 | | | 15,758,795 | | | 701,592,061 |

| | | | | | |

Avaya Inc. | | 12,229,400 | | 18,417,000 | | — | | | 30,646,400 | | | — 2 | | | 254,978,048 |

| | | | | | |

BMC Software, Inc. | | 11,787,600 | | 3,700,000 | | — | | | 15,487,600 | | | — 2 | | | 278,002,420 |

| | | | | | |

Computer Science Corp. | | 12,893,600 | | — | | — | | | 12,893,600 | | | — 2 | | | 563,450,320 |

| | | | | | |

Compuware Corp. | | 19,357,100 | | — | | — | | | 19,357,100 | | | — 2 | | | — 3 |

| | | | | | |

Delphi Corp. | | 36,051,632 | | — | | — | | | 36,051,632 | | | 1,622,323 | | | 167,640,089 |

| | | | | | |

Dillard's Inc. Class A | | 5,177,500 | | — | | — | | | 5,177,500 | | | 414,200 | | | 121,257,050 |

| | | | | | |

Electronic Data Systems Corp. | | 33,204,400 | | 1,600,000 | | — | | | 34,804,400 | | | 3,400,440 | | | 669,984,700 |

| | | | | | |

Engelhard Corp. | | 6,266,100 | | 2,025,000 | | — | | | 8,291,100 | | | 1,866,864 | | | 236,710,905 |

| | | | | | |

Equity Office Properties Trust | | 22,260,300 | | 800,000 | | — | | | 23,060,300 | | | 23,060,300 | | | 763,295,930 |

| | | | | | |

Fluor Corp. | | 4,375,550 | | — | | — | | | 4,375,550 | | | 1,400,176 | | | 251,987,925 |

| | | | | | |

Genuine Parts Co. | | 8,953,800 | | — | | — | | | 8,953,800 | | | 5,596,125 | | | 367,911,642 |

| | | | | | |

HCA, Inc. | | 26,418,400 | | 200,000 | | (6,079,400 | ) | | 20,539,000 | | | 7,453,152 | | | — 3 |

| | | | | | |

May Department Stores Co. | | 17,894,400 | | — | | — | | | 17,894,400 | | | 8,768,256 | | | 718,639,104 |

| | | | | | |

NOVA Chemicals Corp. (Canada) | | 4,752,570 | | — | | — | | | 4,752,570 | | | 650,572 | | | 145,238,539 |

| | | | | | |

Storage Technology Corp. | | 7,511,200 | | — | | — | | | 7,511,200 | | | — 2 | | | 272,581,448 |

| | | | | | |

Thermo Electron | | 7,433,400 | | 1,200,000 | | — | | | 8,633,400 | | | — 2 | | | 231,979,458 |

| | | | | | |

Union Pacific Corp. | | 13,860,950 | | 1,000,000 | | — | | | 14,860,950 | | | 8,916,570 | | | 962,989,560 |

| | | | | | |

Whirlpool Corp. | | 4,388,050 | | — | | — | | | 4,388,050 | | | 3,773,723 | | | 307,646,185 |

| | | | | | |

Xerox Corp. | | 45,764,500 | | 18,552,000 | | — | | | 64,316,500 | | | — 2 | | | 886,924,535 |

| | | | | | | | | | | |

|

| |

|

|

| | | | | | | | | | | | $ | 94,926,706 | | $ | 7,902,809,919 |

| | | | | | | | | | | |

|

| |

|

|

| 1 | | Net of foreign taxes, if any |

| 3 | | Company was not an affiliate at the end of the period |

| | |

| 9 / Dodge & Cox Stock Fund | | |

Financial Highlights (unaudited)

| | | | | | | | | | | | | | | | | | | | | | |

SELECTED DATA AND RATIOS

(for a share outstanding throughout each period) | | | | Six Months

Ended June 30, | | | | | Year Ended December 31, | |

| | | | | 2005 | | | | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | |

Net asset value, beginning of period | | | | $130.22 | | | | | $113.78 | | | $ 88.05 | | | $100.51 | | | $ 96.67 | | | $100.52 | |

| | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | 0.89 | | | | | 1.54 | | | 1.60 | | | 1.53 | | | 1.72 | | | 2.06 | |

Net realized and unrealized gain (loss) | | | | (0.02 | ) | | | | 20.08 | | | 26.59 | | | (12.06 | ) | | 7.05 | | | 13.28 | |

| | | | |

|

|

Total from investment operations | | | | 0.87 | | | | | 21.62 | | | 28.19 | | | (10.53 | ) | | 8.77 | | | 15.34 | |

| | | | |

|

|

Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | | (0.85 | ) | | | | (1.53 | ) | | (1.62 | ) | | (1.51 | ) | | (1.73 | ) | | (2.09 | ) |

Net realized gain | | | | (0.75 | ) | | | | (3.65 | ) | | (0.84 | ) | | (0.42 | ) | | (3.20 | ) | | (17.10 | ) |

| | | | |

|

|

Total distributions | | | | (1.60 | ) | | | | (5.18 | ) | | (2.46 | ) | | (1.93 | ) | | (4.93 | ) | | (19.19 | ) |

| | | | |

|

|

Net asset value, end of period | | | | $129.49 | | | | | $130.22 | | | $113.78 | | | $ 88.05 | | | $100.51 | | | $ 96.67 | |

| | | | |

|

|

Total return | | | | 0.68 | % | | | | 19.16 | % | | 32.35 | % | | (10.52 | )% | | 9.33 | % | | 16.30 | % |

Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (millions) | | | | $46,346 | | | | | $43,266 | | | $29,437 | | | $14,036 | | | $9,396 | | | $5,728 | |

Ratios of expenses to average net assets | | 0.53 | %* | | | | 0.53 | % | | 0.54 | % | | 0.54 | % | | 0.54 | % | | 0.54 | % |

Ratios of net investment income to average net assets | | 1.42 | %* | | | | 1.32 | % | | 1.72 | % | | 1.74 | % | | 1.80 | % | | 2.13 | % |

Portfolio turnover rate | | | | 6 | % | | | | 11 | % | | 8 | % | | 13 | % | | 10 | % | | 32 | % |

Fund’s Holdings

The Funds provide a complete list of their holdings four times in each fiscal year, as of the end of each quarter. The lists appear in the Funds’ First Quarter, Semi-Annual, Third Quarter and Annual Reports to shareholders. The Funds file the lists with the Securities and Exchange Commission (SEC) on Form N-CSR (second and fourth quarters) and Form N-Q (first and third quarters). Shareholders may view the Funds’ Forms N-CSR and N-Q on the SEC’s website at www.sec.gov. Forms N-CSR and N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling 1-202-942-8090 (direct) or 1-800/SEC-0330 (general SEC number). A complete list of the Funds’ quarter-end holdings are also available at www.dodgeandcox.com on or about 15 days following each quarter-end and remains available on the web site until the list is updated for the subsequent quarter.

Proxy Voting

For a free copy of the Fund’s proxy voting policies and procedures, please call (800) 621-3979, visit www.dodgeandcox.com, or visit the Securities and Exchange Commission’s web site at www.sec.gov. Beginning August 31, 2005, information regarding how Dodge & Cox, on behalf of the Fund, voted proxies relating to the Fund’s portfolio securities for the most recent twelve-month period ending June 30 will be available at www.dodgeandcox.com or the SEC’s web site at www.sec.gov.

| | |

| | | Dodge & Cox Stock Fund / 10 |

Officers and Trustees

Harry R. Hagey, Chairman & Trustee

Chairman & Chief Executive Officer, Dodge & Cox

John A. Gunn, President & Trustee

President, Dodge & Cox

Dana M. Emery, Vice President & Trustee

Senior Vice President, Dodge & Cox

William F. Ausfahl, Trustee

Former Chief Financial Officer and member of Board of Directors, The Clorox Company

L. Dale Crandall, Trustee

Former President, Kaiser Foundation Health Plan and Hospitals

Thomas A. Larsen, Trustee

Director, Howard, Rice, Nemerovski, Canady, Falk & Rabkin

Will C. Wood, Trustee

Principal, Kentwood Associates, Financial Advisers

A. Horton Shapiro, Executive Vice President

Senior Vice President, Dodge & Cox

Katherine Herrick Drake, Vice President

Vice President, Dodge & Cox

Kenneth E. Olivier, Vice President

Executive Vice President, Dodge & Cox

Diana S. Strandberg, Vice President

Vice President, Dodge & Cox

John M. Loll, Treasurer & Asst. Secretary

Vice President & Treasurer, Dodge & Cox

Thomas M. Mistele, Secretary & Asst. Treasurer

Chief Operating Officer, Secretary & General Counsel, Dodge & Cox

Marcia P. Venegas, Chief Compliance Officer

Chief Compliance Officer, Dodge & Cox

International

Stock Fund

Established 2001

Semi-Annual Report

June 30, 2005

2005

International Stock Fund

www.dodgeandcox.com

For Fund literature, transactions and account

information, please visit the Funds’ web site.

or write or call:

Dodge & Cox Funds

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

Investment Manager

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions and portfolio holdings as of June 30, 2005, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

06/05 ISF SAR  Printed on recycled paper

Printed on recycled paper

To Our Shareholders

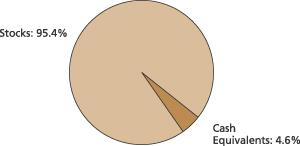

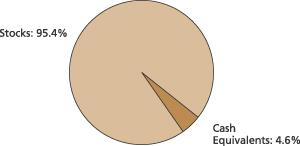

The Dodge & Cox International Stock Fund had a total return of 1.7% for the six months ended June 30, 2005, compared to a total return of -1.2% for the Morgan Stanley Capital International Europe, Australasia, Far East Index (MSCI EAFE) benchmark. Longer-term results for the Fund can be found on the following page. On June 30, the Fund had net assets of $8.2 billion and a cash position of 4.6%.

Performance Review

The stronger U.S. dollar was a detriment to the performance of both the Fund and the market for the first six months of 2005. The EAFE was up 8.1% in local currency terms, but the stronger dollar more than offset this, resulting in a return of -1.2%. There was a similar currency headwind in the Fund as well. During the first half of 2005 the Fund benefited from its investments in Energy stocks which were up an average of 19%, compared to a 12% return for the Energy sector of the MSCI EAFE. Strong individual performers included Petrobras (up 32%) and Norsk Hydro (up 19%). The Fund’s investments in Latin America also contributed strongly to results as investments were up an average of 20%, including Corporacion Geo (up 25%.) Latin American stocks represented 8.4% of the Fund, but are not included in the MSCI EAFE. Additional strong performers included Rinker (up 29%), LG.Philips LCD (up 27%) and Fresenius Medical (up 22%).

Conversely, the biggest area of disappointment during this period was in the Financials sector as the Fund’s investments returned -5% (e.g., Shinsei Bank down 21%) compared to -3% on average for the MSCI EAFE’s Financial stocks. Additional detractors from performance included Nova Chemicals (down 35%) and Seiko Epson (down 25%).

A Home for Fallen Angels

Four years ago, companies in the Technology, Media and Telecom (TMT) sectors were trading at extremely rich valuations based on the expectation that their strong growth would continue indefinitely. Due to our concerns about these high expectations, on June 30, 2001 (the Fund’s first quarter-end) only 13% of the Fund was invested in the TMT sectors compared to 22% for the MSCI EAFE.

With the collapse of the TMT “bubble” and intensified concerns about the lack of European and Japanese economic growth, valuations have generally become more reasonable. Some of the very same attributes that were viewed as desirable competitive advantages several years ago are today greeted with skepticism as investors have recognized that high growth and profitability are difficult to sustain. Given the dramatic shift in valuations, we have selectively been finding more opportunities in these sectors on a bottom-up basis. The Fund’s weighting in TMT stocks has gradually increased since 2001 to 24%, compared to 17% for the MSCI EAFE.

One example of a former darling that we recently added to the Fund is Nokia, a leader in cellular phones and wireless networks. During the height of the internet bubble, Nokia was valued above 100 times earnings. After the collapse of the TMT bubble and several operational missteps, Nokia lost over 80% of its market value.

Clearly, the competitive environment has intensified for Nokia and there are legitimate concerns behind Nokia’s lower valuation. However, we believe that the current valuation of 19 times earnings does not accurately reflect the company’s global leadership position, strong balance sheet, healthy cash flow generation, nor a management that has learned from its mistakes and is intent on fixing them. Of course, we discuss Nokia to illustrate our investment approach, not because we think it is more attractive than the Fund’s other holdings.

Morningstar® Address

In June, I, Harry Hagey, in my capacity as Chairman and CEO of Dodge & Cox, was invited to speak at Morningstar’s Investment Conference. I thought it would be helpful to share an excerpt of that speech with all of our shareholders:

So, how did the small, local firm founded in the 1930s, which I joined in the late 1960s, become the firm we are today? What I would like to do now is to summarize for you what I think are the key components that make Dodge & Cox a successful money management firm.

First and Most Important—Our Current Clients

We are in the business of providing continuous high-quality investment management service to our existing clients. We decided a long time ago that we are not in business to provide a series of financial products to the investment market place. Another way to look at this is that we are in the investment business and not in the money gathering business. We do not advertise, we do not have a marketing department and no one at our firm is paid commissions or compensated directly for bringing in new business. We concluded that if we did a good job, the word would get around. We have relatively low expense ratios with no 12b-1 or other fees. In general, our firm’s investment objective is to first preserve and then enhance the future purchasing power of our clients’ wealth over the long-term1. Please note that I did not say to beat a particular benchmark or to have low tracking error. If we believe that a significant part of the market is unattractive, we will not be in it. Finally, ethical considerations are paramount—we work hard to maintain our reputation.

Second—Our Employees

With regard to our own people, we insist on respect for each individual employee as well as for the entire firm. We work within a collegial and team-work environment with the goal of having everyone at the firm think as owners, not just as employees. Dodge & Cox has a long history, but it is still a small firm and its vitality is maintained by diplomatic entrepreneurship.

We also want all of our employees to share in the firm’s success. Our compensation structure provides salary and bonus for each member of our firm. The bonus is based on how well the firm has done and an employee’s contribution over time. We avoid any quantitative measurement of our research analysts’ performance because we make decisions as a group—we don’t believe in a “star system” or the reliance on any one individual. We try to create an

| | |

| 1 / Dodge & Cox International Stock Fund | | |

environment where our analysts will not overly worry about making bad recommendations, and will be rewarded for sharing information with their peers.

Importantly, our independence, culture and compensation structure have led to low employee turnover which, in our opinion, is crucial to maintaining a consistent investment approach in difficult investment environments.

Third—Dodge & Cox

With regard to the firm, probably the most important characteristic is our independence. We require that shareholders of the firm be active employees. The firm is held widely with about one-third of employees being shareholders. We also believe it is important to have control of the investment service to our clients so we have no joint ventures. The only planning that we do is to make sure that we have assets in place, most important being people, so that we can continue to do a good job for our existing clients.

For Dodge & Cox, issues of ethics, independence, a focused teamwork investment approach, respect for the individual, and an absence of a marketing mindset are all key determinants in what makes us who we are.

One of my individual clients recently sent me a book by James P. Owen, called Cowboy Ethics—What Wall Street Can Learn from the Code of the West. The pictures in the book are fantastic and I also believe that the book has real wisdom. In the book Mr. Owen summarized the Code with ten rules. The ones that resonated with me most are: 1) Take Pride in Your Work, 2) Ride for the Brand, 3) Remember That Some Things Aren’t for Sale, and 4) Know Where to Draw the Line.

I think Dodge & Cox as a firm has lived by this Code.

In Closing

We continue to caution shareholders that the Fund’s future returns are likely to be more in line with those of the broader market. Returns over the past two years have been high and uncharacteristic of historical long-term international equity returns. Moreover, the value of the U.S. dollar can be highly volatile and difficult to forecast in the short term, adding an additional layer of uncertainty to returns.

Thank you for your confidence in our firm as a shareholder of the Dodge & Cox International Stock Fund. As always, we welcome your comments and questions.

Sincerely,

| | |

| |  |

Harry R. Hagey

Chairman August 3, 2005 | | Diana S. Strandberg Vice President |

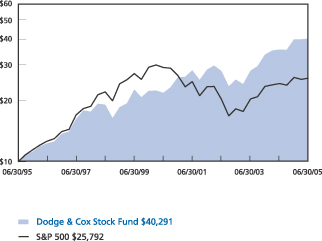

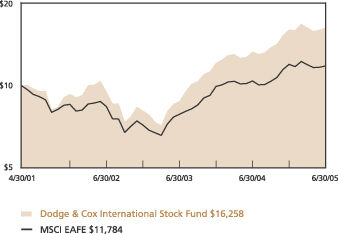

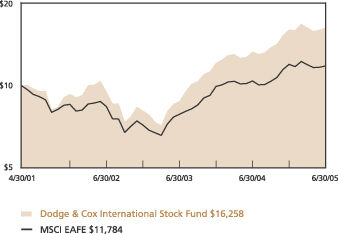

Total return for periods ended June 30, 2005

Average Annual Total return for periods ending June 30, 2005

| | | | | | | | | |

| | | 1 Year | | | 3 Years | | | Since

Inception

(5/1/01) | |

| Dodge & Cox International Stock Fund* | | 22.45 | % | | 19.60 | % | | 12.37 | % |

| MSCI EAFE | | 13.65 | | | 12.06 | | | 4.02 | |

Past performance does not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated above. Performance is updated and published monthly. Visit the Fund’s web site at www.dodgeandcox.com or call 800-621-3979 for current performance figures.

| * | | Expense reimbursements were paid by Dodge & Cox from the Fund’s inception through June 30, 2003 to maintain operating expenses at 0.90%. Accordingly, without the expense reimbursements, the Fund’s returns prior to June 30, 2003 would have been lower. |

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable on these distributions. The Morgan Stanley Capital International Europe, Australasia, Far East Index (MSCI EAFE) is a widely recognized benchmark of the world’s stock markets, excluding the United States. Index returns include dividends and, unlike Fund returns, do not reflect fees or expenses.

Morgan Stanley®, Morgan Stanley Capital International, and EAFE® are trademarks of Morgan Stanley.

| 1 | | Please refer to the Fund’s prospectus for its investment objectives, policies and restrictions. |

Risks of International Investing: Foreign investing, especially in developing countries,

has special risks such as currency and market volatility and political and social instability.

These and other risk considerations are

discussed in the Fund’s prospectus.

| | |

| | | Dodge & Cox International Stock Fund / 2 |

Fund Expenses

As a Fund shareholder, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one). Operating expenses, which are deducted from a Fund’s gross income, directly reduce the investment return of the Fund. The following example is intended to help you understand the ongoing costs (in dollars) of investing in the Fund and to compare these costs with those of other mutual funds. The example is based on an investment of $1,000 made at the beginning of the most recent six-month period and held for the entire period.

The table below illustrates the Fund’s costs in two ways:

Actual Fund Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid on your account over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period”.

Hypothetical Example for Comparison

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expense Paid During the Period” shows the hypothetical expense your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

| | | | | | |

Six Months Ended

June 30, 2005 | | Beginning Account

Value 1/1/05 | | Ending Account

Value 6/30/05 | | Expenses Paid

During Period* |

| Based on Actual Fund Return | | $1,000.00 | | $1,017.30 | | $3.60 |

| Based on Hypothetical 5% Yearly Return | | 1,000.00 | | 1,021.43 | | 3.61 |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.72%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional costs or account maintenance fees. While other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

| | |

| 3 / Dodge & Cox International Stock Fund | | |

Fund Information | June 30, 2005 |

General Information

| | |

Net Asset Value Per Share | | $31.17 |

Total Net Assets (millions) | | $8,231 |

2004 Expense Ratio | | 0.77% |

2004 Turnover Ratio | | 6% |

30-Day SEC Yield1 | | 1.38% |

Fund Inception Date | | May 1, 2001 |

Investment Manager: Dodge & Cox, San Francisco. Managed by the International Investment Policy Committee, whose seven members’ average tenure at Dodge & Cox is 16 years.

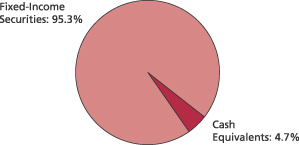

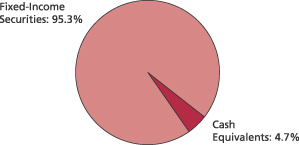

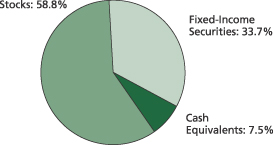

Asset Allocation

| | | | |

| Portfolio Characteristics | | Fund | | MSCI

EAFE |

Number of Stocks | | 73 | | 1,147 |

Median Market Capitalization (billions) | | $12 | | $3 |

Weighted-Avg Market Capitalization (billions) | | $39 | | $44 |

Price-to-Earnings Ratio2 | | 14x | | 16x |

Price-to-Book Value Ratio | | 1.7x | | 2.1x |

Countries Represented | | 21 | | 21 |

Emerging Markets (South Africa, Mexico, Brazil, South Korea, Israel) | | 15.1% | | 0.0% |

| | |

| Ten Largest Holdings4 | | % of Fund |

Matsushita Electric Industrial (Japan) | | 3.0 |

Royal Dutch Petroleum (Netherlands) | | 2.9 |

News Corp. Class A (United States)3 | | 2.8 |

GlaxoSmithKline PLC ADR (United Kingdom) | | 2.8 |

Sony ADR (Japan) | | 2.7 |

Seiko Epson (Japan) | | 2.5 |

Norsk Hydro A.S.A. ADR (Norway) | | 2.4 |

Mitsubishi Tokyo Financial Group ADR (Japan) | | 2.4 |

KT Corp. ADR (South Korea) | | 2.4 |

sanofi-aventis (France) | | 2.3 |

| | | | | | |

| Region Diversification | | Fund | | | MSCI

EAFE | |

Europe (excluding United Kingdom) | | 38.8 | % | | 44.9 | % |

Japan | | 23.1 | | | 21.8 | |

United Kingdom | | 11.0 | | | 25.0 | |

Latin America | | 8.4 | | | 0.0 | |

Pacific (excluding Japan) | | 8.4 | | | 8.3 | |

United States3 | | 2.8 | | | 0.0 | |

Africa | | 1.3 | | | 0.0 | |

Middle East | | 1.0 | | | 0.0 | |

Canada | | 0.6 | | | 0.0 | |

| | | | | | |

| Sector Diversification | | Fund | | | MSCI

EAFE | |

Consumer Discretionary | | 18.9 | % | | 12.1 | % |

Financials | | 18.8 | | | 27.3 | |

Materials | | 12.3 | | | 7.2 | |

Energy | | 10.6 | | | 9.0 | |

Information Technology | | 8.9 | | | 6.0 | |

Health Care | | 7.9 | | | 8.2 | |

Consumer Staples | | 6.3 | | | 8.1 | |

Telecommunication Services | | 4.6 | | | 6.7 | |

Industrials | | 4.3 | | | 10.0 | |

Utilities | | 2.8 | | | 5.4 | |

| 1 | | SEC Yield is an annualization of the Fund’s total net investment income per share for the 30-day period ended on the last day of the month. |

| 2 | | The Fund’s price-to-earnings (P/E) ratio is calculated using fiscal year-end earnings and excludes extraordinary items. |

| 3 | | In the fourth quarter of 2004 News Corp. reincorporated as a Delaware corporation (formerly New South Wales, Australia) headquartered in New York, NY (formerly Sydney, Australia). |

| 4 | | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security |

Dodge & Cox International Stock Fund / 4

Portfolio of Investments (unaudited) | June 30, 2005 |

| | | | | |

| COMMON STOCKS: 89.4% |

| | |

| | | SHARES | | VALUE |

| CONSUMER DISCRETIONARY: 18.9% |

| AUTOMOBILES & COMPONENTS: 2.8% |

Fiat SPA ADR(a),(b) (Italy) | | 4,960,700 | | $ | 35,717,040 |

Honda Motor Co., Ltd. ADR(b) (Japan) | | 6,801,700 | | | 167,389,837 |

Suzuki Motor Corp. (Japan) | | 1,893,000 | | | 29,774,841 |

| | | | |

|

|

| | | | | | 232,881,718 |

| CONSUMER DURABLES & APPAREL: 12.6% |

Consorcio Ara S.A. de C.V. (a),(c) (Mexico) | | 20,068,100 | | | 69,419,130 |

Corporacion Geo S.A. de C.V. Series B(a),(c)

(Mexico) | | 42,105,400 | | | 106,457,674 |

Electrolux A.B. Series B (Sweden) | | 6,783,100 | | | 144,578,083 |

Makita Corp. (Japan) | | 1,383,000 | | | 27,206,966 |

Matsushita Electric Industrial Co., Ltd. (Japan) | | 15,991,000 | | | 242,862,907 |

Sony Corp. ADR(b) (Japan) | | 6,376,500 | | | 219,606,660 |

Thomson S.A. (France) | | 5,851,000 | | | 140,160,837 |

Yamaha Corp. (Japan) | | 5,232,100 | | | 81,681,478 |

| | | | |

|

|

| | | | | | 1,031,973,735 |

| CONSUMER SERVICES: 0.7% |

Elior (France) | | 5,000,321 | | | 59,709,912 |

| | | | |

|

|

| MEDIA: 2.8% |

News Corp., Class A (United States) | | 14,142,492 | | | 228,825,521 |

| | | | |

|

|

| | | | | | 1,553,390,886 |

| CONSUMER STAPLES: 6.3% |

| FOOD, BEVERAGE & TOBACCO: 5.5% |

Fomento Economico Mexicano, S.A. de C.V. ADR(b) (Mexico) | | 2,714,058 | | | 161,676,435 |

Kikkoman Corp. (Japan) | | 2,891,000 | | | 25,592,844 |

Nestle S.A. (Switzerland) | | 546,000 | | | 139,737,827 |

Tiger Brands (South Africa) | | 307,407 | | | 5,267,854 |

Unilever N.V.(b) (Netherlands) | | 1,943,900 | | | 126,023,037 |

| | | | |

|

|

| | | | | | 458,297,997 |

| HOUSEHOLD & PERSONAL PRODUCTS: 0.8% |

Aderans Co.(c) (Japan) | | 2,733,200 | | | 64,744,394 |

| | | | |

|

|

| | | | | | 523,042,391 |

| ENERGY: 8.6% |

Norsk Hydro A.S.A. ADR(b) (Norway) | | 2,186,500 | | | 198,359,280 |

Royal Dutch Petroleum Co.(b) (Netherlands) | | 3,615,000 | | | 234,613,500 |

Schlumberger Ltd.(b) (Netherlands Antilles) | | 1,900,000 | | | 144,286,000 |

Total S.A. (France) | | 538,500 | | | 126,587,232 |

| | | | |

|

|

| | | | | | 703,846,012 |

| FINANCIALS: 17.4% |

| BANKS: 13.5% |

Banco Santander Central Hispano, S.A. (Spain) | | 14,320,000 | | | 166,147,198 |

DBS Group Holdings Ltd. (Singapore) | | 20,142,000 | | | 170,907,613 |

Kookmin Bank ADR(a),(b) (South Korea) | | 1,947,900 | | | 88,785,282 |

Mitsubishi Tokyo Financial Group, Inc. ADR(b) (Japan) | | 23,249,200 | | | 197,153,216 |

Royal Bank of Scotland Group PLC

(United Kingdom) | | 5,920,972 | | | 178,756,407 |

| | | | | |

| | |

| | | SHARES | | VALUE |

Shinsei Bank, Ltd. (Japan) | | 31,215,000 | | $ | 168,448,044 |

Standard Bank Group Limited

(South Africa) | | 10,096,234 | | | 98,116,727 |

Standard Chartered PLC (United Kingdom) | | 2,555,000 | | | 46,666,165 |

| | | | |

|

|

| | | | | | 1,114,980,652 |

| DIVERSIFIED FINANCIALS: 2.0% |

Credit Suisse Group (Switzerland) | | 4,075,000 | | | 160,729,752 |

| | | | |

|

|

| INSURANCE: 1.9% |

AEGON N.V. (Netherlands) | | 7,666,666 | | | 99,340,744 |

Converium Holdings A.G.(c) (Switzerland) | | 7,389,852 | | | 59,967,588 |

| | | | |

|

|

| | | | | | 159,308,332 |

| | | | |

|

|

| | | | | | 1,435,018,736 |

| HEALTH CARE: 6.3% |

| HEALTH CARE EQUIPMENT & SERVICES: 1.2% |

MEDICEO Holdings Co., Ltd. (Japan) | | 7,596,000 | | | 101,380,535 |

| | | | |

|

|

| PHARMACEUTICALS & BIOTECHNOLOGY: 5.1% |

GlaxoSmithKline PLC ADR(b) (United Kingdom) | | 4,705,000 | | | 228,239,550 |

sanofi-aventis (France) | | 2,309,000 | | | 189,681,556 |

| | | | |

|

|

| | | | | | 417,921,106 |

| | | | |

|

|

| | | | | | 519,301,641 |

| INDUSTRIALS: 4.3% |

| CAPITAL GOODS: 2.9% |

CNH Global N.V.(b) (Netherlands) | | 1,108,520 | | | 20,939,943 |

Nexans S.A.(c) (France) | | 1,616,440 | | | 65,514,253 |

Sulzer A.G. (Switzerland) | | 170,500 | | | 70,376,482 |

Volvo A.B. (Sweden) | | 1,986,600 | | | 80,871,883 |

| | | | |

|

|

| | | | | | 237,702,561 |

| TRANSPORTATION: 1.4% |

Central Japan Railway Co. (Japan) | | 15,550 | | | 120,257,636 |

| | | | |

|

|

| | | | | | 357,960,197 |

| INFORMATION TECHNOLOGY: 8.9% |

| TECHNOLOGY, HARDWARE & EQUIPMENT: 8.9% |

Brother Industries, Ltd.(c) (Japan) | | 16,113,000 | | | 147,876,379 |

Canon, Inc. (Japan) | | 1,114,700 | | | 58,745,188 |

EPCOS A.G.(a) (Germany) | | 2,770,000 | | | 34,719,297 |

Hitachi Ltd. (Japan) | | 6,230,000 | | | 37,892,163 |

LG.Philips LCD Co., Ltd. ADR(a),(b) (South Korea) | | 3,400,000 | | | 77,724,000 |

Nokia Oyj (Finland) | | 4,200,000 | | | 70,376,953 |

Oce N.V.(c) (Netherlands) | | 6,622,000 | | | 97,581,583 |

Seiko Epson Corp. (Japan) | | 6,270,000 | | | 209,348,915 |

| | | | |

|

|

| | | | | | 734,264,478 |

| MATERIALS: 12.3% |

Akzo Nobel N.V. (Netherlands) | | 1,591,100 | | | 62,716,231 |

BASF A.G. (Germany) | | 1,975,400 | | | 131,446,532 |

Bayer A.G. (Germany) | | 2,772,000 | | | 92,528,670 |

BHP Billiton Ltd. (Australia) | | 6,785,078 | | | 93,624,138 |

| | |

| 5 / Dodge & Cox International Stock Fund | | See accompanying Notes to Financial Statements |

Portfolio of Investments (unaudited) | June 30, 2005 |

| | | | | |

| COMMON STOCKS (continued) |

| | |

| | | SHARES | | VALUE |

Givaudan S.A. (Switzerland) | | 43,100 | | $ | 25,071,044 |

Imperial Chemical Industries PLC (United Kingdom) | | 13,978,000 | | | 63,575,501 |

Kemira GrowHow Oyj(a) (Finland) | | 1,757,393 | | | 14,351,724 |

Kemira Oyj (Finland) | | 2,672,990 | | | 34,408,866 |

Lafarge S.A. (France) | | 1,192,825 | | | 108,740,515 |

LANXESS A.G.(a) (Germany) | | 2,844,700 | | | 63,739,529 |

Makhteshim-Agan Industries, Ltd. (Israel) | | 14,800,000 | | | 80,963,897 |

NOVA Chemicals Corp. (Canada) | | 1,587,900 | | | 48,396,594 |

Rinker Group Ltd. (Australia) | | 6,550,000 | | | 69,714,914 |

Rio Tinto PLC (United Kingdom) | | 1,884,400 | | | 57,633,103 |

Yara International A.S.A.(a) (Norway) | | 4,118,710 | | | 65,523,357 |

| | | | |

|

|

| | | | | | 1,012,434,615 |

| TELECOMMUNICATION SERVICES: 4.6% |

KT Corp. ADR(b) (South Korea) | | 9,088,400 | | | 195,400,600 |

Vodafone Group PLC ADR(b) (United Kingdom) | | 7,455,000 | | | 181,305,600 |

| | | | |

|

|

| | | | | | 376,706,200 |

| UTILITIES: 1.8% |

National Grid Transco PLC (United Kingdom) | | 8,300,000 | | | 80,405,618 |

Scottish Power PLC ADR(b) (United Kingdom) | | 1,840,600 | | | 65,525,360 |

| | | | |

|

|

| | | | | | 145,930,978 |

| | | | |

|

|

TOTAL COMMON STOCKS (cost $6,918,759,795) | | | 7,361,896,134 |

| | | | |

|

|

|

| PREFERRED STOCKS: 6.0% |

| ENERGY: 2.0% |

Petroleo Brasileiro S.A. ADR(b) (Brazil) | | 3,645,700 | | | 167,848,028 |

|

| FINANCIALS: 1.4% |

| BANKS: 1.4% |

Uniao de Bancos Brasileiros Sponsored GDR(b) (Brazil) | | 2,916,500 | | | 112,635,230 |

|

| HEALTH CARE: 1.6% |

| HEALTH CARE EQUIPMENT & SERVICES: 1.6% |

Fresenius Medical Care A.G. (Germany) | | 1,892,275 | | | 131,867,609 |

|

| UTILITIES: 1.0% |

Ultrapar Participacoes S.A. ADR(b) (Brazil) | | 4,665,085 | | | 81,872,242 |

| | | | |

|

|

TOTAL PREFERRED STOCKS (cost $337,541,841) | | | 494,223,109 |

| | | | |

|

|

| | | | | | | | |

| SHORT-TERM INVESTMENTS: 4.6% | |

| | |

| | | PAR VALUE | | | VALUE | |

SSgA Prime Money Market Fund | | $ | 40,982,790 | | | $ | 40,982,789 | |

State Street Repurchase Agreement, 2.65%, 7/1/05, maturity value $334,661,633 (collateralized by U.S. Treasury Securities, value $341,331,109 3.625%-4.75%, 6/30/07-5/15/13) | | | 334,637,000 | | | | 334,637,000 | |

| | | | | | |

|

|

|

TOTAL SHORT-TERM INVESTMENTS

(cost $375,619,789) | | | | 375,619,789 | |

| | | | | | |

|

|

|

TOTAL INVESTMENTS (Cost $7,631,921,425) | | | 100.0 | % | | | 8,231,739,032 | |

OTHER ASSETS LESS LIABILITIES | | | — | | | | (454,942 | ) |

| | |

|

|

| |

|

|

|

TOTAL NET ASSETS | | | 100.0 | % | | $ | 8,231,284,090 | |

| | |

|

|

| |

|

|

|

| (b) | | Foreign security denominated in U.S. dollars |

| (c) | | See Note 5 regarding holdings of 5% voting securities |

| | |

| See accompanying Notes to Financial Statements | | Dodge & Cox International Stock Fund / 6 |

| | | | |

Statement of Assets and Liabilities (unaudited)

| |

|

| June 30, 2005 | |

| Assets: | | | | |

Investments, at value | | | | |

Unaffiliated issuers (cost $7,071,550,394) | | $ | 7,620,178,031 | |

Affiliated issuers (cost $560,371,031) | | | 611,561,001 | |

| | |

|

|

|

| | | | 8,231,739,032 | |

Cash denominated in foreign currency (cost $25,873,501) | | | 25,873,501 | |

Receivable for investment sold | | | 3,958,429 | |

Receivable for Fund shares sold | | | 39,326,472 | |

Dividends and interest receivable | | | 18,755,063 | |

Prepaid expenses and other assets | | | 3,588 | |

| | |

|

|

|

| | | | 8,319,656,085 | |

| | |

|

|

|

| Liabilities: | | | | |

Payable for investments purchased | | | 78,511,586 | |

Payable for Fund shares redeemed | | | 4,185,527 | |

Management fees payable | | | 3,905,881 | |

Accounts payable | | | 1,769,001 | |

| | |

|

|

|

| | | | 88,371,995 | |

| | |

|

|

|

| Net Assets | | $ | 8,231,284,090 | |

| | |

|

|

|

| Net Assets Consist of: | | | | |

Paid in capital | | $ | 7,459,131,772 | |

Undistributed net investment income | | | 86,159,797 | |

Undistributed net realized gain on investments | | | 86,147,627 | |

Net unrealized appreciation on investments | | | 599,844,894 | |

| | |

|

|

|

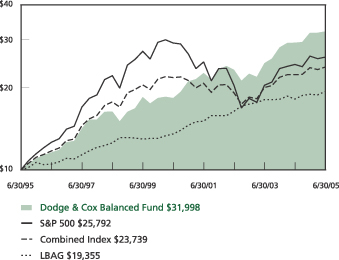

| | | $ | 8,231,284,090 | |