UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-173

DODGE & COX FUNDS

(Exact name of registrant as specified in charter)

| | |

| 555 California Street, 40th Floor | | |

| San Francisco, CA | | 94104 |

| (Address of principal executive offices) | | (Zip code) |

Thomas M. Mistele, Esq.

555 California Street, 40th Floor

San Francisco, CA 94104

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-981-1710

Date of fiscal year end: DECEMBER 31, 2007

Date of reporting period: JUNE 30, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following are the June 30, 2007 semi-annual reports for the Dodge & Cox Funds, a Delaware statutory trust, consisting of four series: Dodge & Cox Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund and Dodge & Cox Income Fund. The reports of each series were transmitted to their respective shareholders on August 7, 2007.

| | | | |

| | | |  |

www.dodgeandcox.com

For Fund literature, transactions and account

information, please visit the Funds’ web site.

or write or call:

DODGE & COX FUNDS

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

INVESTMENT MANAGER

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions and portfolio holdings as of June 30, 2007, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

06/07 SF SAR  Printed on recycled paper

Printed on recycled paper

Semi-Annual Report

June 30, 2007

Stock Fund

ESTABLISHED 1965

(Closed to New Investors)

TO OUR SHAREHOLDERS

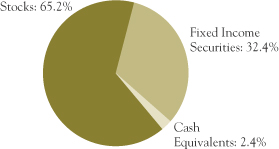

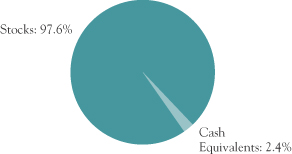

The Dodge & Cox Stock Fund had a total return of 7.2% for the six months ended June 30, 2007, compared to a total return of 7.0% for the Standard & Poor’s 500 Index (S&P 500). Longer-term results can be found on page 3. As of June 30, the Fund had net assets of $72.0 billion with a cash position of 2.4%.

SIX-MONTH PERFORMANCE REVIEW

We begin this letter with a discussion of the Fund’s performance relative to the S&P 500 for the first six months of 2007. However, since we manage the Fund using a three-to-five year investment horizon, we encourage you to use a similar time frame when assessing the Fund.

Key Contributors to Results

| n | | Strong relative returns from the Fund’s Financials holdings (up 3% versus down 1% for the S&P 500 sector) in combination with a lower weighting than the S&P 500 (14% versus 21%) aided results. SLM (Sallie Mae) was a standout performer (up 35%) after agreeing to be acquired. |

| n | | Stronger returns from the Fund’s holdings in Consumer Staples (up 8% versus up 5% for the S&P 500 sector) also contributed to Fund performance. Unilever (up 16%) and Avon Products (up 12%) were notable contributors. |

| n | | Other contributors included: Union Pacific (up 26%), Sony (up 20%) and Chevron (up 16%). |

Key Detractors from Results

| n | | The Fund’s Information Technology holdings (up 6%) underperformed the S&P 500 sector’s 9% return. Motorola, the group’s largest detractor, was down 13%. We discuss our investment thesis on Motorola below. |

| n | | Weaker relative returns from the Fund’s Health Care holdings (up 4% versus up 6% for the S&P 500 sector), in combination with a higher weighting than the S&P 500 (17% versus 12%), hindered performance. Sanofi-Aventis (down 11%) released disappointing news concerning a key pharmaceutical product. |

| n | | Wachovia (down 8%), Honda Motor (down 7%) and Citigroup (down 6%) also had a negative impact on the Fund’s performance. |

INVESTMENT STRATEGY

At Dodge & Cox, individual company analysis drives our investment decisions. The market provides us with the price of a stock each morning. Our fundamental research is focused on assessing a company’s cash flow and profit potential over the next three-to-five years relative to this stock price. We ask ourselves: What is a reasonable expectation if all goes according to management’s plan? How does the competitive environment affect the company’s ability to reach its goals? What could go wrong? It is our job to develop an understanding of a company’s risks and opportunities, and then to determine the price at which we are willing to participate (on our shareholders’ behalf) as equity owners.

While most of our time and energy is spent on fundamental analysis, several important factors and assumptions influence our individual company research and the Fund’s portfolio structure.

The dynamism of the U.S. economy has provided an attractive environment for equity investors. Over the past 60 years, the U.S. economy has expanded on a “real” basis at a better than 2.5% rate, 67% of the time, and has contracted only 13% of the time. Over the past 50 years the S&P 500’s earnings have increased by a factor of 24, while its price has risen by a factor of 30. Over its 42 year history the Fund has benefited as well, returning 12.4% versus 10.5% for the S&P 500, on an annualized basis. While there is no guarantee that the economy will grow continuously, we remain optimistic about the long-term prospects for both earnings growth and equity returns.

We also believe that the U.S. economy will continue to benefit from the emergence of the developing world as a new engine of global economic growth. Thirty years ago, most citizens in developing countries were isolated with limited individual economic and political freedom. The collective labor of the developing world’s citizens was, and remains, the largest under-utilized resource in the world, but the powerful advances of the information economy are gradually ending isolation.

In our view, prospects for global growth are improved by the rapid pace of technological innovation in computing power and electronic communications. Improved knowledge

PAGE 1 § DODGE & COX STOCK FUND

transfer is enabling the citizens of the developing world to “plug into” the global economy, empowering them to produce and consume more. An expanding global economy expands the marketplace in which multinational U.S. companies can sell their goods and services. Today, over 39% of the revenues of the Fund’s holdings come from outside the United States, and we expect that percentage to grow.

How do the above observations and assumptions affect our portfolio strategy? To begin, we have generally stayed close to fully invested; cash in the Fund has seldom been higher than 10%. Next, we look for companies with long-term incremental growth opportunities in areas of technological innovation. We also try to uncover companies that are well positioned to provide products and services to the consumer in the developing world. Importantly, the narrow range of valuations within the equity market today allows us to invest in these types of companies at what we believe are reasonable valuations. Companies in the Fund that may benefit from increased consumption in the developing world include Avon Products, McDonald’s, Hewlett-Packard, Nike, GlaxoSmithKline and Motorola.

MOTOROLA—AN EXAMPLE

(We discuss Motorola not because we think it is more attractive than the other 83 holdings in the Fund, but because it illustrates our investment approach and incorporates two of the assumptions discussed above: continued demand for telecommunications products and services, and increased purchasing power for people in the developing world.)

At the end of the third quarter of 2006, the Fund owned a relatively small position in Motorola (1.2% of the Fund). Unfortunately, the company’s earnings tumbled over the next six months, and the stock’s valuation followed, falling to approximately one times Motorola’s sales (from a high of about 3.5 times sales in 2000). Motorola’s risks include increased competition from other handset manufacturers, dependence on its ability to continue to innovate and lack of market share in next-generation wireless network infrastructure. However, we believe Motorola enjoys a durable position in the extremely competitive global telecommunications market. Further, management appears to be taking meaningful steps towards improving internal operations and profitability in its handset business. Additionally, Motorola has a leading position in broadband network equipment and is a key supplier to operators of cable,

cellular and private two-way radio systems. With strong intellectual property and a solid balance sheet, we believe Motorola has the necessary foundation to execute a turnaround over the long term. Because of the stock’s lower valuation and our analysis of Motorola’s opportunities and risks, we increased the Fund’s position in Motorola to 2.6% as of June 30.

IN CLOSING

Although we are encouraged by long-term opportunities provided by the developing world coupled with advances in the information economy, we close with a few words of caution. First, we do not expect the Fund’s dramatic outperformance of the S&P 500 (14.3% versus 2.2% annualized, since June 30, 2000) to be repeated. While lower valuations among companies in areas of traditional growth (e.g., Technology and Healthcare) have provided us with investment opportunity, these lower valuations also mean that from a valuation perspective the Fund is more comparable to the S&P 500. Next, although we are forecasting neither slower growth nor collapsing margins, at some point there is bound to be a “bump in the road.” Therefore, maintaining a long-term perspective continues to be critical. In fact, with the S&P 500 losing nearly 5% during the week of July 23, we appear to be experiencing one of these bumps as we write this letter. So far, this recent volatility has not changed our long-term optimism on the equity market.

The forces of globalism and technological innovation are unprecedented in human history, and could provide opportunities for the diligent and persistent investor. In that regard, our team of 45 investment professionals will continue to work hard to uncover these attractive investment opportunities on your behalf.

Thank you for your continued confidence in our firm as a shareholder of the Dodge & Cox Stock Fund. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |

|

John A. Gunn, Chairman | | Kenneth E. Olivier, President |

August 1, 2007

| | | | | | |

| | DODGE & COX STOCK FUND § | | PAGE | | 2 |

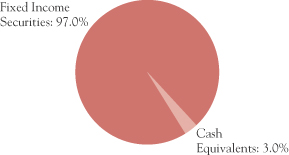

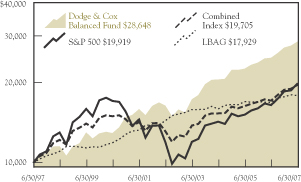

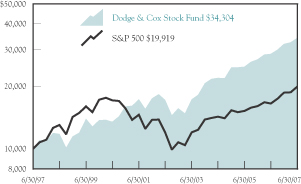

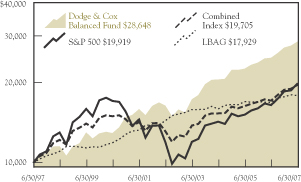

GROWTH OF $10,000 OVER 10 YEARS

FOR AN INVESTMENT MADE ON JUNE 30, 1997

AVERAGE ANNUAL TOTAL RETURN

FOR PERIODS ENDED JUNE 30, 2007

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | 20 Years | |

Dodge & Cox Stock Fund | | 19.72 | % | | 14.80 | % | | 13.12 | % | | 13.79 | % |

S&P 500 | | 20.60 | | | 10.70 | | | 7.13 | | | 10.83 | |

Past performance does not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated above. Performance is updated and published monthly. Visit the Fund’s web site at www.dodgeandcox.com or call 1-800-621-3979 for current performance figures.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions. The Standard & Poor’s 500 (S&P 500) is a broad-based unmanaged measure of common stocks. Index returns include dividends and/or interest income and, unlike Fund returns, do not reflect fees or expenses.

Standard & Poor’s, Standard & Poor’s 500, and S&P 500® are trademarks of The McGraw-Hill Companies, Inc.

FUND EXPENSE EXAMPLE

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and expenses based on the Fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON WITH OTHER MUTUAL FUNDS

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expense Paid During the Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

| | | | | | | | | |

Six Months Ended

June 30, 2007 | | Beginning Account

Value 1/1/2007 | | Ending Account

Value 6/30/2007 | | Expenses Paid

During Period* |

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 1,072.20 | | $ | 2.66 |

Based on Hypothetical 5% Yearly Return | | | 1,000.00 | | | 1,022.23 | | | 2.60 |

| * | | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.52%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. While other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

PAGE 3 § DODGE & COX STOCK FUND

| | |

| FUND INFORMATION | | June 30, 2007 |

| | |

| GENERAL INFORMATION | | |

Net Asset Value Per Share | | $162.09 |

Total Net Assets (billions) | | $72.0 |

Expense Ratio (1/1/07 to 6/30/07, annualized) | | 0.52% |

Portfolio Turnover Rate (1/1/07 to 6/30/07, unannualized) | | 8% |

30-Day SEC Yield(a) | | 1.14% |

Fund Inception | | 1965 |

No sales charges or distribution fees | | |

Investment Manager: Dodge & Cox, San Francisco. Managed by the Investment Policy Committee, whose nine members’ average tenure at Dodge & Cox is 21 years.

| | | | |

| PORTFOLIO CHARACTERISTICS | | Fund | | S&P 500 |

Number of Stocks | | 84 | | 500 |

Median Market Capitalization (billions) | | $31 | | $14 |

Weighted Average Market Capitalization (billions) | | $84 | | $103 |

Price-to-Earnings Ratio(b) | | 14.4x | | 15.2x |

Foreign Stocks(c) | | 19.0% | | 0.0% |

| | | |

| TEN LARGEST HOLDINGS(d) | | Fund | |

Hewlett-Packard Co. | | 3.6 | % |

Comcast Corp., Class A | | 3.5 | |

Wal-Mart Stores, Inc. | | 2.8 | |

Sony Corp. ADR (Japan) | | 2.7 | |

News Corp., Class A | | 2.7 | |

Chevron Corp. | | 2.7 | |

Motorola, Inc. | | 2.6 | |

Time Warner, Inc. | | 2.6 | |

Pfizer, Inc. | | 2.5 | |

Sanofi-Aventis ADR (France) | | 2.4 | |

| | | | | | |

| SECTOR DIVERSIFICATION | | Fund | | | S&P 500 | |

Consumer Discretionary | | 22.2 | % | | 10.2 | % |

Health Care | | 16.6 | | | 11.7 | |

Information Technology | | 15.4 | | | 15.4 | |

Financials | | 13.7 | | | 20.8 | |

Energy | | 10.4 | | | 10.8 | |

Industrials | | 7.6 | | | 11.4 | |

Materials | | 4.3 | | | 3.1 | |

Consumer Staples | | 4.1 | | | 9.3 | |

Telecommunication Services | | 2.9 | | | 3.8 | |

Utilities | | 0.4 | | | 3.5 | |

(a) | SEC yield is an annualization of the Fund’s total net investment income per share for the 30-day period ended on the last day of the month. |

(b) | Price-to-earnings (P/E) ratios are calculated using 12-month forward earnings estimates. |

(c) | Foreign stocks are U.S. dollar-denominated. |

(d) | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. |

DODGE & COX STOCK FUND §PAGE 4

| | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | June 30, 2007 |

| | | | | |

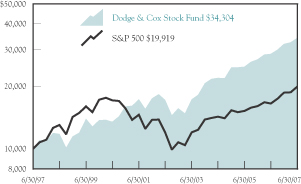

| COMMON STOCKS: 97.6% | | |

| | |

| | | SHARES | | VALUE |

| CONSUMER DISCRETIONARY: 22.2% | | | |

AUTOMOBILES & COMPONENTS: 0.4% | | | |

Honda Motor Co., Ltd. ADR(b) (Japan) | | 9,052,800 | | $ | 328,526,112 |

| | | | | |

CONSUMER DURABLES & APPAREL: 6.2% | | | |

Koninklijke Philips Electronics NV(b) (Netherlands) | | 8,602,100 | | | 364,040,872 |

Matsushita Electric Industrial Co., Ltd. ADR(b) (Japan) | | 79,681,300 | | | 1,578,486,553 |

Nike, Inc., Class B | | 7,111,800 | | | 414,546,822 |

Sony Corp. ADR(b) (Japan) | | 38,500,000 | | | 1,977,745,000 |

Thomson ADR(b) (France) | | 6,586,900 | | | 122,121,126 |

| | | | | |

| | | | | 4,456,940,373 |

CONSUMER SERVICES: 2.4% | | | | | |

McDonald’s Corp. | | 33,761,800 | | | 1,713,748,968 |

| | | | | |

MEDIA: 10.2% | | | | | |

Comcast Corp., Class A(a) | | 90,642,945 | | | 2,548,879,614 |

EchoStar Communications Corp.(a) | | 7,641,870 | | | 331,427,902 |

Interpublic Group of Companies, Inc.(a),(c) | | 28,804,600 | | | 328,372,440 |

Liberty Capital, Series A(a) | | 2,227,080 | | | 262,082,774 |

Liberty Global, Inc., Series A(a) | | 961,907 | | | 39,476,663 |

Liberty Global, Inc., Series C(a) | | 1,569,140 | | | 61,667,202 |

News Corp., Class A | | 91,316,338 | | | 1,936,819,529 |

Time Warner, Inc. | | 87,645,400 | | | 1,844,059,216 |

| | | | | |

| | | | | 7,352,785,340 |

RETAILING: 3.0% | | | | | |

Gap, Inc. | | 26,360,000 | | | 503,476,000 |

Genuine Parts Co.(c) | | 8,834,800 | | | 438,206,080 |

Home Depot, Inc. | | 14,501,000 | | | 570,614,350 |

Liberty Interactive, Series A(a) | | 8,856,900 | | | 197,774,577 |

Macy’s, Inc. | | 10,972,962 | | | 436,504,428 |

| | | | | |

| | | | | 2,146,575,435 |

| | | | | |

| | | | | 15,998,576,228 |

| CONSUMER STAPLES: 4.1% | | | |

FOOD & STAPLES RETAILING: 2.8% | | | |

Wal-Mart Stores, Inc. | | 42,307,500 | | | 2,035,413,825 |

| | | | | |

FOOD, BEVERAGE & TOBACCO: 0.8% | | | |

Unilever NV(b) (Netherlands) | | 18,549,800 | | | 575,414,796 |

| | | | | |

HOUSEHOLD & PERSONAL PRODUCTS: 0.5% |

Avon Products, Inc. | | 9,969,100 | | | 366,364,425 |

| | | | | |

| | | | | 2,977,193,046 |

| ENERGY: 10.4% | | | | | |

Baker Hughes, Inc. | | 14,476,100 | | | 1,217,874,293 |

Chevron Corp. | | 22,960,281 | | | 1,934,174,072 |

ConocoPhillips | | 11,043,100 | | | 866,883,350 |

Exxon Mobil Corp. | | 8,579,400 | | | 719,640,072 |

| | | | | |

| | | |

| | |

| | | SHARES | | VALUE |

Occidental Petroleum Corp. | | 15,210,800 | | $ | 880,401,104 |

Royal Dutch Shell PLC ADR(b) (United Kingdom) | | 10,057,864 | | | 838,322,964 |

Schlumberger, Ltd. | | 9,930,764 | | | 843,519,094 |

Spectra Energy Corp. | | 7,043,500 | | | 182,849,260 |

| | | | | |

| | | | | 7,483,664,209 |

| FINANCIALS: 13.7% | | | | | |

BANKS: 3.8% | | | | | |

HSBC Holdings PLC(b)

(United Kingdom) | | 7,700,500 | | | 706,674,885 |

Wachovia Corp. | | 31,702,735 | | | 1,624,765,169 |

Wells Fargo & Co. | | 11,865,100 | | | 417,295,567 |

| | | | | |

| | | | | 2,748,735,621 |

DIVERSIFIED FINANCIALS: 4.2% | | | |

Capital One Financial Corp. | | 16,436,411 | | | 1,289,272,079 |

Citigroup, Inc. | | 23,680,300 | | | 1,214,562,587 |

SLM Corp. | | 8,200,600 | | | 472,190,548 |

| | | | | |

| | | | | 2,976,025,214 |

INSURANCE: 5.7% | | | | | |

Aegon NV(b) (Netherlands) | | 34,984,991 | | | 687,455,073 |

Chubb Corp. | | 11,249,600 | | | 609,053,344 |

Genworth Financial, Inc., Class A | | 8,695,000 | | | 299,108,000 |

Loews Corp. | | 15,089,800 | | | 769,278,004 |

Safeco Corp. | | 3,913,415 | | | 243,649,218 |

The Travelers Companies, Inc. | | 22,750,350 | | | 1,217,143,725 |

Unum Group | | 11,024,100 | | | 287,839,251 |

| | | | | |

| | | | | 4,113,526,615 |

| | | | | |

| | | | | 9,838,287,450 |

| HEALTH CARE: 16.6% | | | | | |

HEALTH CARE EQUIPMENT & SERVICES: 5.5% |

Becton, Dickinson & Co. | | 4,042,150 | | | 301,140,175 |

Boston Scientific Corp.(a) | | 23,201,500 | | | 355,911,010 |

Cardinal Health, Inc.(c) | | 24,119,250 | | | 1,703,783,820 |

Health Management Associates, Inc.(c) | | 15,306,600 | | | 173,882,976 |

WellPoint, Inc.(a) | | 17,583,800 | | | 1,403,714,754 |

| | | | | |

| | | | | 3,938,432,735 |

PHARMACEUTICALS & BIOTECHNOLOGY: 11.1% |

Bristol-Myers Squibb Co. | | 20,300,350 | | | 640,679,046 |

GlaxoSmithKline PLC ADR(b) (United Kingdom) | | 30,218,900 | | | 1,582,563,793 |

Novartis AG ADR(b) (Switzerland) | | 19,204,200 | | | 1,076,779,494 |

Pfizer, Inc. | | 71,025,600 | | | 1,816,124,592 |

Sanofi-Aventis ADR(b) (France) | | 42,599,600 | | | 1,715,485,892 |

Thermo Fisher Scientific, Inc.(a) | | 9,114,700 | | | 471,412,284 |

Wyeth | | 11,842,800 | | | 679,066,152 |

| | | | | |

| | | | | 7,982,111,253 |

| | | | | |

| | | | | 11,920,543,988 |

| | |

| PAGE 5 § DODGE & COX STOCK FUND | | See accompanying Notes to Financial Statements |

| | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | June 30, 2007 |

| | | | | |

| COMMON STOCKS (continued) | | |

| | |

| | | SHARES | | VALUE |

| INDUSTRIALS: 7.6% | | | | | |

CAPITAL GOODS: 3.1% | | | | | |

General Electric Co. | | 21,166,200 | | $ | 810,242,136 |

Masco Corp. | | 12,912,800 | | | 367,627,416 |

Tyco International, Ltd. | | 31,072,800 | | | 1,049,949,912 |

| | | | | |

| | | | | 2,227,819,464 |

COMMERCIAL SERVICES & SUPPLIES: 0.6% |

Pitney Bowes, Inc. | | 9,275,250 | | | 434,267,205 |

| | | | | |

TRANSPORTATION: 3.9% | | | | | |

FedEx Corp. | | 11,859,250 | | | 1,316,020,973 |

Union Pacific Corp.(c) | | 12,979,600 | | | 1,494,600,940 |

| | | | | |

| | | | | 2,810,621,913 |

| | | | | |

| | | | | 5,472,708,582 |

| INFORMATION TECHNOLOGY: 15.4% |

SOFTWARE & SERVICES: 4.2% | | | | | |

BMC Software, Inc.(a),(c) | | 10,879,200 | | | 329,639,760 |

Citrix Systems, Inc.(a) | | 5,067,702 | | | 170,629,526 |

Computer Sciences Corp.(a),(c) | | 12,762,300 | | | 754,890,045 |

Compuware Corp.(a),(c) | | 19,321,600 | | | 229,154,176 |

EBay, Inc.(a) | | 17,753,400 | | | 571,304,412 |

Electronic Data Systems Corp.(c) | | 34,221,000 | | | 948,948,330 |

| | | | | |

| | | | | 3,004,566,249 |

TECHNOLOGY, HARDWARE & EQUIPMENT: 11.2% |

Avaya, Inc.(a),(c) | | 30,386,224 | | | 511,704,012 |

Dell, Inc.(a) | | 26,746,133 | | | 763,602,097 |

Hewlett-Packard Co. | | 58,399,293 | | | 2,605,776,454 |

Hitachi, Ltd. ADR(b) (Japan) | | 10,342,000 | | | 731,696,500 |

Motorola, Inc. | | 107,157,600 | | | 1,896,689,520 |

NCR Corp.(a) | | 5,895,750 | | | 309,762,705 |

Sun Microsystems, Inc.(a) | | 53,595,300 | | | 281,911,278 |

Xerox Corp.(a),(c) | | 53,804,400 | | | 994,305,312 |

| | | | | |

| | | | | 8,095,447,878 |

| | | | | |

| | | | | 11,100,014,127 |

| MATERIALS: 4.3% | | | | | |

Alcoa, Inc. | | 8,061,583 | | | 326,735,959 |

Cemex SAB de CV ADR(b) (Mexico) | | 10,023,682 | | | 369,873,866 |

Dow Chemical Co. | | 33,396,352 | | | 1,476,786,685 |

International Paper Co. | | 7,575,200 | | | 295,811,560 |

Nova Chemicals Corp.(b),(c) (Canada) | | 4,441,870 | | | 157,997,316 |

Rohm and Haas Co. | | 8,684,700 | | | 474,879,396 |

| | | | | |

| | | | | 3,102,084,782 |

| TELECOMMUNICATION SERVICES: 2.9% |

Sprint Nextel Corp. | | 59,361,900 | | | 1,229,384,949 |

Vodafone Group PLC ADR(b) (United Kingdom) | | 25,404,587 | | | 854,356,261 |

| | | | | |

| | | | | 2,083,741,210 |

| UTILITIES: 0.4% | | | | | |

FirstEnergy Corp. | | 3,836,000 | | | 248,304,280 |

| | | | | |

| | | | | 248,304,280 |

TOTAL COMMON STOCKS

(Cost $49,738,355,189) | | | | $ | 70,225,117,902 |

| | | | | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS: 2.5% | |

| | |

| | | PAR VALUE | | | VALUE | |

Fixed Income Clearing Corporation Repurchase Agreement(d) 5.05%, 7/2/07, maturity value $1,730,305,864 | | $ | 1,729,578,000 | | | $ | 1,729,578,000 | |

SSgA Prime Money Market Fund | | | 72,185,391 | | | | 72,185,391 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $1,801,763,391) | | | $ | 1,801,763,391 | |

| | | | | | | | |

TOTAL INVESTMENTS

(Cost $51,540,118,580) | | | 100.1 | % | | $ | 72,026,881,293 | |

OTHER ASSETS LESS LIABILITIES | | | (0.1 | %) | | | (49,459,516 | ) |

| | | | | | | | |

| TOTAL NET ASSETS | | | 100.0 | % | | $ | 71,977,421,777 | |

| | | | | | | | |

(b) | Security issued by a foreign entity, denominated in U.S. dollars |

(c) | See Note 6 regarding holdings of 5% voting securities |

(d) | Repurchase agreement is collateralized by Freddie Mac 4.125%-5.40%, 6/11/09-3/2/12; Fannie Mae 5.08%-5.30%, 5/14/10-5/7/12; Federal Home Loan Bank 5.25%-5.60%, 6/12/09-5/15/12; and Federal Farm Credit Bank 5.00%-5.25%, 8/3/09-10/23/09. Total collateral value is $1,764,178,143. |

ADR: American Depository Receipt

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND §PAGE 6 |

| | | |

STATEMENT OF ASSETS AND LIABILITIES (unaudited) |

| | | June 30, 2007 |

ASSETS: | | | |

Investments, at value | | | |

Unaffiliated issuers (cost $46,966,058,020) | | $ | 65,455,997,026 |

Affiliated issuers (cost $4,574,060,560) | | | 6,570,884,267 |

| | | |

| | | 72,026,881,293 |

Receivable for investments sold | | | 68,232,668 |

Receivable for Fund shares sold | | | 51,077,342 |

Dividends and interest receivable | | | 138,163,895 |

Prepaid expenses and other assets | | | 95,135 |

| | | |

| | | 72,284,450,333 |

LIABILITIES: | | | |

Payable for investments purchased | | | 131,288,917 |

Payable for Fund shares redeemed | | | 143,543,532 |

Management fees payable | | | 29,920,882 |

Accrued expenses | | | 2,275,225 |

| | | |

| | | 307,028,556 |

| | | |

NET ASSETS | | $ | 71,977,421,777 |

| | | |

NET ASSETS CONSIST OF: | | | |

Paid in capital | | $ | 49,140,366,157 |

Undistributed net investment income | | | 48,065,456 |

Undistributed net realized gain on investments | | | 2,302,227,451 |

Net unrealized appreciation on investments | | | 20,486,762,713 |

| | | |

| | $ | 71,977,421,777 |

| | | |

Fund shares outstanding (par value $0.01 each, unlimited shares authorized) | | | 444,050,891 |

Net asset value per share | | | $162.09 |

|

STATEMENT OF OPERATIONS

(unaudited) |

| | | Six Months Ended

June 30, 2007 |

INVESTMENT INCOME: | | | |

Dividends (net of foreign taxes of $13,329,799) | | | |

Unaffiliated issuers | | $ | 535,265,263 |

Affiliated issuers | | | 178,828,791 |

Interest | | | 73,189,922 |

| | | |

| | | 787,283,976 |

EXPENSES: | | | |

Management fees | | | 173,258,016 |

Custody and fund accounting fees | | | 437,275 |

Transfer agent fees | | | 2,178,693 |

Professional services | | | 61,517 |

Shareholder reports | | | 2,316,088 |

Registration fees | | | 452,411 |

Trustees’ fees | | | 84,188 |

Miscellaneous | | | 705,649 |

| | | |

| | | 179,493,837 |

| | | |

NET INVESTMENT INCOME | | | 607,790,139 |

| |

REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | |

Net realized gain | | | |

Unaffiliated issuers | | | 1,999,025,235 |

Affiliated issuers | | | 303,202,216 |

Net change in unrealized appreciation | | | 1,937,773,051 |

| | | |

Net realized and unrealized gain | | | 4,240,000,502 |

| | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 4,847,790,641 |

| | | |

| | | | | | | | |

STATEMENT OF CHANGES IN NET ASSETS (unaudited) | |

| | | Six Months Ended

June 30, 2007 | | | Year Ended December 31, 2006 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 607,790,139 | | | $ | 865,519,931 | |

Net realized gain | | | 2,302,227,451 | | | | 3,209,367,265 | |

Net change in unrealized appreciation | | | 1,937,773,051 | | | | 5,995,600,442 | |

| | | | | | | | |

Net increase in net assets from operations | | | 4,847,790,641 | | | | 10,070,487,638 | |

| |

DISTRIBUTIONS TO

SHAREHOLDERS FROM: | | | | | |

Net investment income | | | (577,622,043 | ) | | | (850,295,361 | ) |

Net realized gain | | | (462,894,616 | ) | | | (2,847,558,997 | ) |

| | | | | | | | |

Total distributions | | | (1,040,516,659 | ) | | | (3,697,854,358 | ) |

| | |

FUND SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 5,032,416,771 | | | | 10,571,607,422 | |

Reinvestment of distributions | | | 980,191,190 | | | | 3,483,584,887 | |

Cost of shares redeemed | | | (4,027,466,135 | ) | | | (6,427,028,935 | ) |

| | | | | | | | |

Net increase from Fund share transactions | | | 1,985,141,826 | | | | 7,628,163,374 | |

| | | | | | | | |

Total increase in net assets | | | 5,792,415,808 | | | | 14,000,796,654 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 66,185,005,969 | | | | 52,184,209,315 | |

| | | | | | | | |

End of period (including undistributed net investment income of $48,065,456 and $17,897,360, respectively) | | $ | 71,977,421,777 | | | $ | 66,185,005,969 | |

| | | | | | | | |

| |

SHARE INFORMATION: | | | | | |

Shares sold | | | 31,881,995 | | | | 71,830,464 | |

Distributions reinvested | | | 6,269,096 | | | | 22,836,316 | |

Shares redeemed | | | (25,392,890 | ) | | | (43,682,824 | ) |

| | | | | | | | |

Net increase in shares outstanding | | | 12,758,201 | | | | 50,983,956 | |

| | | | | | | | |

| | |

| PAGE 7 § DODGE & COX STOCK FUND | | See accompanying Notes to Financial Statements |

NOTES TO FINANCIAL STATEMENTS (unaudited)

NOTE 1—ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Dodge & Cox Stock Fund (the “Fund”) is one of the series constituting the Dodge & Cox Funds (the “Trust” or the “Funds”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Fund commenced operations on January 4, 1965, and seeks long-term growth of principal and income. Risk considerations and investment strategies of the Fund are discussed in the Fund’s Prospectus. The Fund is closed to new investors.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require the use of estimates and assumptions by management. Significant accounting policies are as follows:

Security valuation The Fund’s net assets are valued as of the close of trading on the New York Stock Exchange (NYSE), generally 4:00 p.m. Eastern Time, each day that the NYSE is open for business. Stocks are valued at the official quoted close price or the last sale of the day at the close of the NYSE or, if not available, at the mean between the exchange listed bid and ask prices for the day. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Security values are not discounted based on the size of the Fund’s position. Securities for which market quotations are not readily available are valued at fair value as determined in good faith by or at the direction of the Board of Trustees. Short-term securities are valued at amortized cost which approximates current value. All securities held by the Fund are denominated in U.S. dollars.

Security transactions, investment income, expenses, and distributions Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Dividend income and corporate action transactions are recorded on the ex-dividend date, except for certain dividends or corporate actions from foreign securities where the ex-dividend date may have passed, which are

recorded as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received in excess of income are recorded as a reduction of cost of investments and/or realized gain. The Fund may estimate the character of distributions received from Real Estate Investment Trusts (“REITs”). Interest income is recorded on the accrual basis.

Expenses are recorded on the accrual basis. Most expenses of the Trust can be directly attributed to a specific series. Expenses which cannot be directly attributed are apportioned among the Funds in the Trust.

Distributions to shareholders are recorded on the ex-dividend date.

Repurchase agreements The Fund may enter into repurchase agreements secured by U.S. government and agency securities which involve the purchase of securities from a counterparty with a simultaneous commitment to resell the securities at an agreed-upon date and price. It is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. In the event of default by the counterparty, the Fund has the contractual right to liquidate the securities and to apply the proceeds in satisfaction of the obligation.

NOTE 2—RELATED PARTY TRANSACTIONS

Management fees Under a written agreement approved by a unanimous vote of the Board of Trustees, the Fund pays an annual management fee of 0.50% of the Fund’s average daily net assets to Dodge & Cox, investment manager of the Fund. The agreement further provides that Dodge & Cox shall waive its fee to the extent that such fee plus all other ordinary operating expenses of the Fund exceed 0.75% of the average daily net assets for the year.

Fund officers and trustees All officers and three of the trustees of the Trust are officers or employees of Dodge & Cox. The Trust pays a fee only to those trustees who are not affiliated with Dodge & Cox.

DODGE & COX STOCK FUND §PAGE 8

NOTES TO FINANCIAL STATEMENTS (unaudited)

Indemnification Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnities to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 3—INCOME TAX INFORMATION

A provision for federal income taxes is not required since the Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. Distributions are determined in accordance with income tax regulations, which may differ from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences.

Book/tax differences are primarily due to differing treatments of net short-term realized gain. At June 30, 2007, the cost of investments for federal income tax purposes was equal to the cost for financial reporting purposes.

Distributions for the six months ended June 30, 2007 and for the year ended December 31, 2006 were characterized as follows for federal income tax purposes:

| | | | |

| | | Six Months Ended

June 30, 2007 | | Year Ended

December 31, 2006 |

Ordinary income | | $623,087,628 | | $952,202,374 |

| | ($1.414 per share) | | ($2.367 per share) |

| | |

Long-term capital gain | | $417,429,031 | | $2,745,651,984 |

| | ($0.951 per share) | | ($6.663 per share) |

At June 30, 2007, the tax basis components of distributable earnings were as follows:

| | | | |

Unrealized appreciation | | $ | 20,798,090,867 | |

Unrealized depreciation | | | (311,328,154 | ) |

| | | | |

Net unrealized appreciation | | | 20,486,762,713 | |

Undistributed ordinary income | | | 268,162,421 | |

Undistributed long-term capital gain | | | 2,082,130,486 | |

NOTE 4—PURCHASES AND SALES OF INVESTMENTS

For the six months ended June 30, 2007, purchases and sales of securities, other than short-term securities, aggregated $8,382,272,233 and $5,657,539,986, respectively.

NOTE 5—ACCOUNTING PRONOUNCEMENTS

In July 2006, the Financial Accounting Standards Board (FASB) issued Interpretation 48, “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 clarifies the accounting for income taxes by prescribing the minimum recognition threshold a tax position must meet before being recognized in the financial statements. FIN 48 was effective for the Fund on June 29, 2007. Implementation of FIN 48 included a review of tax positions taken from January 1, 2003 through June 30, 2007. There was no impact to the Fund’s financial statements as a result of implementing FIN 48.

In September 2006, FASB issued “Statement of Financial Accounting Standards No. 157, Fair Value Measurements” (SFAS 157). SFAS 157 is effective for the Fund beginning January 1, 2008. It defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the Fund’s financial statement disclosures.

PAGE 9 § DODGE & COX STOCK FUND

NOTES TO FINANCIAL STATEMENTS (unaudited)

NOTE 6—HOLDINGS OF 5% VOTING SECURITIES

Each of the companies listed below is considered to be an affiliate of the Fund because the Fund owned 5% or more of the company’s voting securities during the six months ended June 30, 2007. Transactions during the period in securities of affiliated companies were as follows:

| | | | | | | | | | | | | | | | | |

| | | Shares at

Beginning of Period | | Additions | | Reductions | | | Shares at

End of Period | |

| Dividend

Income |

(a) | | | Value at End of Period | |

American Power Conversion Corp. | | 13,409,652 | | — | | (13,409,652 | ) | | — | | $ | — | | | $ | — | |

Avaya, Inc. | | 31,094,924 | | 6,100 | | (714,800 | ) | | 30,386,224 | | | — | (b) | | | 511,704,012 | |

BMC Software, Inc. | | 10,876,500 | | 2,700 | | — | | | 10,879,200 | | | — | (b) | | | 329,639,760 | |

Cardinal Health, Inc. | | 24,264,150 | | 5,100 | | (150,000 | ) | | 24,119,250 | | | 5,078,123 | | | | 1,703,783,820 | |

Computer Sciences Corp. | | 12,858,900 | | 3,400 | | (100,000 | ) | | 12,762,300 | | | — | (b) | | | 754,890,045 | |

Compuware Corp. | | 19,312,600 | | 9,000 | | — | | | 19,321,600 | | | — | (b) | | | 229,154,176 | |

Electronic Data Systems Corp. | | 34,711,300 | | 9,700 | | (500,000 | ) | | 34,221,000 | | | 3,471,465 | | | | 948,948,330 | |

Genuine Parts Co. | | 8,931,300 | | 3,500 | | (100,000 | ) | | 8,834,800 | | | 6,521,382 | | | | 438,206,080 | |

Health Management Associates, Inc. | | 15,303,200 | | 3,400 | | — | | | 15,306,600 | | | 153,055,000 | | | | 173,882,976 | |

Interpublic Group of Companies, Inc. | | 27,499,200 | | 1,305,400 | | — | | | 28,804,600 | | | — | (b) | | | 328,372,440 | |

Nova Chemicals Corp. (Canada) | | 4,740,470 | | 1,400 | | (300,000 | ) | | 4,441,870 | | | 700,101 | | | | 157,997,316 | |

Union Pacific Corp. | | 15,120,650 | | 3,750 | | (2,144,800 | ) | | 12,979,600 | | | 10,002,720 | | | | — | (c) |

Xerox Corp. | | 63,334,900 | | 12,400 | | (9,542,900 | ) | | 53,804,400 | | | — | (b) | | | 994,305,312 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | $ | 178,828,791 | | | $ | 6,570,884,267 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

(a) | Net of foreign taxes, if any |

(c) | Company was not an affiliate at the end of the period |

DODGE & COX STOCK FUND §PAGE 10

FINANCIAL HIGHLIGHTS (unaudited)

| | | | | | | | | | | | | | | | | | |

SELECTED DATA AND RATIOS (for a share outstanding throughout each period) | | Six Months Ended June 30, | | | Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | |

Net asset value, beginning of period | | $153.46 | | | $137.22 | | | $130.22 | | | $113.78 | | | $ 88.05 | | | $100.51 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | |

Net investment income | | 1.38 | | | 2.15 | | | 1.68 | | | 1.54 | | | 1.60 | | | 1.53 | |

Net realized and unrealized gain (loss) | | 9.62 | | | 23.12 | | | 10.36 | | | 20.08 | | | 26.59 | | | (12.06 | ) |

| | | | | | |

Total from investment operations | | 11.00 | | | 25.27 | | | 12.04 | | | 21.62 | | | 28.19 | | | (10.53 | ) |

| | | | | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | | | | |

Net investment income | | (1.31 | ) | | (2.12 | ) | | (1.70 | ) | | (1.53 | ) | | (1.62 | ) | | (1.51 | ) |

Net realized gain | | (1.06 | ) | | (6.91 | ) | | (3.34 | ) | | (3.65 | ) | | (0.84 | ) | | (0.42 | ) |

| | | | | | |

Total distributions | | (2.37 | ) | | (9.03 | ) | | (5.04 | ) | | (5.18 | ) | | (2.46 | ) | | (1.93 | ) |

| | | | | | |

Net asset value, end of period | | $162.09 | | | $153.46 | | | $137.22 | | | $130.22 | | | $113.78 | | | $ 88.05 | |

| | | | | | |

Total return | | 7.22 | % | | 18.54 | % | | 9.36 | % | | 19.16 | % | | 32.35 | % | | (10.52 | )% |

Ratios/supplemental data: | | | | | | | | | | | | | | | | | | |

Net assets, end of period (millions) | | $71,977 | | | $66,185 | | | $52,184 | | | $43,266 | | | $29,437 | | | $14,036 | |

Ratios of expenses to average net assets | | 0.52 | %* | | 0.52 | % | | 0.52 | % | | 0.53 | % | | 0.54 | % | | 0.54 | % |

Ratios of net investment income to average net assets | | 1.75 | %* | | 1.48 | % | | 1.29 | % | | 1.32 | % | | 1.72 | % | | 1.74 | % |

Portfolio turnover rate | | 8 | % | | 14 | % | | 12 | % | | 11 | % | | 8 | % | | 13 | % |

| | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements

PAGE 11 § DODGE & COX STOCK FUND

SHAREHOLDER MEETING RESULTS

A special meeting of Fund shareholders was held on April 17, 2007. The meeting was adjourned in order to permit shareholders further time to respond to the solicitation of proxies and was reconvened on April 27, 2007. At the meeting, the proposals to amend the Fund’s fundamental investment restrictions listed below were approved. The following is a report of the total votes cast by the Fund’s shareholders:

| | | | | | | | |

PROPOSAL | | FOR | | AGAINST | | ABSTAIN | | TOTAL |

1. Amend the Fund’s fundamental investment restrictions with respect to the percentage of the Fund’s assets that are subject to diversification requirements | | 199,406,974 | | 15,579,846 | | 8,763,681 | | 223,750,501 |

| | | | |

2a. Amend the Fund’s fundamental investment restrictions with respect to investments in real estate | | 202,647,924 | | 10,861,276 | | 10,241,304 | | 223,750,504 |

| | | | |

2b. Amend the Fund’s fundamental investment restrictions with respect to investments in commodities and commodity contracts | | 201,967,285 | | 12,823,310 | | 8,959,906 | | 223,750,501 |

| | | | |

3. Amend the Fund’s fundamental investment restrictions with respect to making loans | | 203,031,891 | | 11,676,137 | | 9,042,475 | | 223,750,503 |

| | | | |

4. Eliminate the Fund’s fundamental investment restrictions with respect to investments in oil, gas and mineral leases or other mineral exploration or development programs | | 200,479,179 | | 12,937,848 | | 10,333,472 | | 223,750,499 |

| | | | |

5. Amend the Fund’s fundamental investment restrictions with respect to borrowing and issuing senior securities | | 200,893,655 | | 13,783,940 | | 9,072,770 | | 223,750,365 |

FUND HOLDINGS

The Fund provides a complete list of its holdings four times each fiscal year, as of the end of each quarter. The lists appear in the Fund’s First Quarter, Semi-Annual, Third Quarter and Annual Reports to shareholders. The Fund files the lists with the Securities and Exchange Commission (SEC) on Form N-CSR (second and fourth quarters) and Form N-Q (first and third quarters). Shareholders may view the Fund’s Forms N-CSR and N-Q on the SEC’s website at www.sec.gov. Forms N-CSR and N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by 1-202-942-8090 (direct) or 1-800-732-0330 (general SEC number). A complete list of the Fund’s quarter-end holdings is also available at www.dodgeandcox.com on or about 15 days following each quarter end and remains available on the web site until the list is updated in the subsequent quarter.

PROXY VOTING

For a free copy of the Fund’s proxy voting policies and procedures, please call 1-800-621-3979, visit the Fund’s web site at www.dodgeandcox.com or visit the SEC’s web site at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is also available at www.dodgeandcox.com or at www.sec.gov.

DODGE & COX STOCK FUND §PAGE 12

THIS PAGE INTENTIONALLY LEFT BLANK

PAGE 13 § DODGE & COX STOCK FUND

THIS PAGE INTENTIONALLY LEFT BLANK

DODGE & COX STOCK FUND §PAGE 14

DODGE & COX FUNDS—EXECUTIVE OFFICER & TRUSTEE INFORMATION

| | | | | | |

Name (Age) and

Address* | | Position with Trust

(Year of Election or

Appointment) | | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustees |

| INTERESTED TRUSTEES & OFFICERS |

John A. Gunn (63) | | Chairman and Trustee

(Trustee since 1985) | | Chairman (since 2007), Chief Executive Officer (since 2005) and Director of Dodge & Cox, Portfolio Manager and member of Investment Policy Committee (IPC), Fixed Income Investment Policy Committee (FIIPC) and International Investment Policy Committee (IIPC) | | — |

Kenneth E. Olivier (55) | | President and Trustee

(Trustee since 2005) | | President (since 2005) and Director of Dodge & Cox, Portfolio Manager and member of IPC | | — |

Dana M. Emery (45) | | Vice President and Trustee (Trustee since 1993) | | Executive Vice President (since 2005) and Director of Dodge & Cox, Manager of the Fixed Income Department, Portfolio Manager and member of FIIPC | | — |

| Katherine Herrick Drake (53) | | Vice President (Since 1993) | | Vice President of Dodge & Cox, Portfolio Manager | | — |

| Diana S. Strandberg (47) | | Vice President

(Since 2005) | | Vice President of Dodge & Cox, Portfolio Manager and member of IPC and IIPC | | — |

| Roberta R.W. Kameda (46) | | Assistant Secretary (Since 2007) | | Senior Counsel (since 2006) of Dodge & Cox, Senior Associate General Counsel, Franklin Templeton Investments (1997-2006) | | — |

John M. Loll (40) | | Assistant

Treasurer and Assistant Secretary (Since 2000) | | Vice President and Treasurer of Dodge & Cox | | — |

David H. Longhurst (49) | | Treasurer (Since 2006) | | Fund Administration and Accounting Senior Manager of Dodge & Cox (since 2004); Vice President, Treasurer, Controller and Secretary of Safeco Mutual Funds, Safeco Asset Management Company, Safeco Services, Safeco Securities, and Safeco Investment Services (2000-2004) | | — |

| Thomas M. Mistele (53) | | Secretary (Since 2000) | | Chief Operating Officer (since 2004), Director (since 2005), Secretary and General Counsel of Dodge & Cox | | — |

| Marcia P. Venegas (38) | | Chief Compliance Officer

(Since 2004) | | Chief Compliance Officer of Dodge & Cox (since 2005), Compliance Officer of Dodge & Cox (2003-2004); Compliance and Business Risk Manager of Deutsche Asset Management, Australia Limited (1999-2001) | | — |

| INDEPENDENT TRUSTEES |

William F. Ausfahl (67) | | Trustee (Since 2002) | | CFO, The Clorox Co. (1982-1997); Director, The Clorox Co. (1984-1997) | | — |

L. Dale Crandall (65) | | Trustee (Since 1999) | | President, Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals (2000-2002); Senior Vice President—Finance and Administration & CFO, Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals (1998-2000) | | Director, Union BanCal Corporation (bank holding company) and Union Bank of California (commercial bank) (2001-Present); Director, Covad Communications Group (broadband communications services) (2002-Present); Director, Ansell Limited (medical equipment and supplies) (2002-Present); Director, BEA Systems, Inc. (software and programming) (2003-Present); Director, Coventry Health Care, Inc. (managed healthcare) (2004-Present) |

Thomas A. Larsen (57) | | Trustee (Since 2002) | | Director in Howard, Rice, Nemerovski, Canady, Falk & Rabkin (law firm) | | — |

John B. Taylor (60) | | Trustee (Since 2005) | | Professor of Economics, Stanford University; Senior Fellow, Hoover Institution; Under Secretary for International Affairs, United States Treasury (2001-2005) | | — |

Will C. Wood (67) | | Trustee (Since 1992) | | Principal, Kentwood Associates, Financial Advisers | | Director, Banco Latinoamericano de Exportaciones S.A. (Latin American Foreign Trade Bank) (1999-Present) |

| * | | The address for each Officer and Trustee is 555 California Street, 40th Floor, San Francisco, California 94104. Each Officer and Trustee oversees all four series in the Dodge & Cox Funds complex and serves for an indefinite term. |

Additional information about the Trust’s Trustees and Officers is available in the Trust’s Statement of Additional Information (SAI). You can get a free copy of the SAI by visiting the Funds’ website at www.dodgeandcox.com or calling

1-800-621-3979.

| | | | |

| PAGE | | 15 § DODGE & COX STOCK FUND | | |

| | | | |

| | | |  |

www.dodgeandcox.com

For Fund literature, transactions and account information, please visit the Funds’ web site.

or write or call:

DODGE & COX FUNDS

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

INVESTMENT MANAGER

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions and portfolio holdings as of June 30, 2007, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

06/07 ISF SAR  Printed on recycled paper

Printed on recycled paper

Semi-Annual Report

June 30, 2007

International Stock Fund

ESTABLISHED 2001

TO OUR SHAREHOLDERS

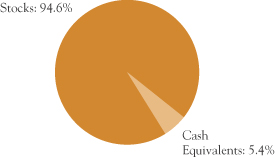

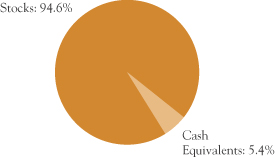

The Dodge & Cox International Stock Fund had a total return of 12.0% for the first six months of 2007, compared to a total return of 10.7% for its benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East Index (MSCI EAFE). Longer-term results can be found on page 3. As of June 30, the Fund had net assets of $46.4 billion with a cash position of 5.4%.

SIX-MONTH PERFORMANCE REVIEW

Global equity markets appreciated strongly during the past six months. U.S. dollar-based investors were helped by the dollar’s depreciation against developed and emerging market currencies. MSCI Japan was a notable exception to this trend: performance lagged and the yen depreciated against the U.S. dollar, resulting in only a 3% return in U.S. dollars.

For the six months ended June 30, 2007, the Fund performed well both on an absolute basis and relative to the MSCI EAFE.

Key Contributors to Results

| n | | The Fund benefited from its overweight position in Information Technology (12% versus 6%) and stock selection. Its holdings averaged a return of 19% compared to 9% for the MSCI EAFE Information Technology sector. Notable performers included LG.Philips (up 50%) and Nokia (up 40%). |

| n | | The Fund benefited from its slightly overweight position in Energy. In addition, the Fund’s investments in this sector returned 23%, outperforming the MSCI EAFE Energy sector, which returned 17%. Significant contributors include Ultrapar Participacoes (up 47%), Schlumberger (up 35%) and Norsk Hydro (up 25%). |

| n | | Other notable performers included Volvo (up 55%), Bayer (up 44%), Imperial Chemical Industries (up 43%), BASF (up 39%) and Vodafone (up 24%). |

Key Detractors from Results

| n | | The Fund is overweight the Pharmaceutical industry, compared to the MSCI EAFE (7% vs. 5%). Its holdings in this area were down 3% (e.g. Sanofi-Aventis was down 10%) compared to a decline of 1% for the MSCI EAFE Pharmaceutical industry. |

| n | | The Fund’s Japanese holdings, which are roughly equal in weight to the MSCI EAFE, were weak in general. Three Japanese bank holdings detracted from performance: Shinsei (down 31%), Mitsubishi Tokyo UFJ (down 11%) and Bank of Yokohama (down 8%). Other weak Japanese holdings included Mediceo Paltac (down 19%) and Toto (down 13%). |

INVESTMENT STRATEGY

As persistent, long-term investors, our team of global industry analysts uses a three-to-five year time frame when evaluating individual companies. We construct the Fund one company at a time after formal written and oral advocacy by a research analyst, intense peer scrutiny and a thorough review by the International Investment Policy Committee. Historically, this approach has resulted in low portfolio turnover.

Our long-term approach does not preclude us from moving opportunistically. This half year was particularly busy as we added 20 new companies to the Fund. We do not have a pre-specified objective for the number of companies in the Fund. While the number of new investments is higher than usual, it reflects our analysts’ response to changes in the market and our evaluation of these companies’ prospects. One change that we have discussed in recent letters is that the market is not differentiating, to the same degree as in years past, between companies with different growth prospects and business franchises (i.e. valuations for companies are much more similar). We believe this creates opportunity in two broad areas in particular: Financials and large-capitalization Pharmaceuticals.

Financials

The past few years have been very profitable for Financials around the globe. Over the next decade, we believe that Financials located in Japan and the developing world have the potential for an even brighter future.

In Japan, concerns over the low interest-rate environment, weak demand for corporate loans and changes to the consumer finance industry have dampened investor enthusiasm toward the sector. As a result, we believe valuations have declined to an attractive level. Going forward, higher interest rates and faster economic growth could lead to better than expected earnings. In

PAGE 1 § DODGE & COX INTERNATIONAL STOCK FUND

addition to increasing the Fund’s position in Mitsubishi UFJ, we have established new holdings in Bank of Yokohama (the largest regional bank in Japan, with a 25% market share in one of the country’s fastest growing and wealthiest prefectures) and Millea (the holding company of the nation’s largest and oldest property and casualty insurer). We use these examples and those below to illustrate our investment process, not to imply that we think they are more attractive than the Fund’s other holdings.

In the developing world, financial institutions should benefit from consumers’ growing affluence and increasing use of financial products. Over the past six months, we have added significantly to the Fund’s holdings of HSBC Holdings and Standard Chartered—two United Kingdom-domiciled banks with substantial franchises in the developing world. We have also initiated investments in several emerging market banks such as Shinhan Financial (the second largest bank in Korea), Bangkok Bank (the largest bank in Thailand) and Haci Omer Sabanci Holdings (a Turkish conglomerate whose primary value is its stake in leading financial institutions).

Pharmaceuticals

Another area of emphasis over the past six months has been large-capitalization, Europe-based pharmaceutical companies. Over the past two years valuations in this group have fallen, resulting in substantial underperformance for these stocks. Some reasons for investor pessimism include: patent expirations, increased competition from generics, pricing pressure and regulatory uncertainty in the United States. Pharmaceutical company valuations are especially sensitive to the forecasted value of their drug development pipelines. As evidence, two of the Fund’s holdings—GlaxoSmithKline and Sanofi-Aventis—have recently experienced share price declines as a result of unforeseen regulatory setbacks.

In the current environment, it is easy to overlook the positive dynamics in the industry. As the developed world ages and the developing world becomes more affluent, the demand for pharmaceuticals should continue to grow strongly. Companies continue to invest aggressively in research and development, and we believe this will result in new products in the years ahead. The industry also has the potential to reduce future expenses through ongoing cost-cutting programs and further consolidation.

Moreover, these companies have strong cash flows and balance sheets, which should enable them to withstand current challenges and still reward shareholders through share buybacks and dividends.

Each company’s fundamentals and valuation are constantly changing. When a holding underperforms, we revisit our investment thesis and, if the long-term opportunity is still attractive, we may add to the position. For example, we have added to the Fund’s Sanofi-Aventis and GlaxoSmithKline positions and initiated a position in Novartis (a leader in hypertension and oncology treatment with a robust product pipeline and limited near-term patent pressure).

IN CLOSING

We are optimistic about the Fund’s portfolio, but caution shareholders to have reasonable expectations for the market and the Fund’s prospective performance.

Current valuations incorporate expectations of continued healthy profit margins and earnings growth. Although we have no indication that global corporate profit margins will fall imminently, they are historically high. In our opinion, the pace of recent earnings growth is not sustainable over the longer term. Consequently, we expect market returns in the years ahead to be more muted than in the recent past.

Thank you for your continued confidence in the Dodge & Cox International Stock Fund. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |

|

John A. Gunn, Chairman | | Diana S. Strandberg, Vice President |

August 1, 2007

Risks of International Investing: Foreign investing, especially in developing countries, has special risks such as currency and market volatility and political and social instability. These and other risk considerations are discussed in the Fund’s prospectus.

DODGE & COX INTERNATIONAL STOCK FUND §PAGE 2

| | |

GROWTH OF $10,000 SINCE INCEPTION FOR AN INVESTMENT MADE ON MAY 1, 2001 | | |

| | Past performance does not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated above. Performance is updated and published monthly. Visit the Fund’s web site at www.dodgeandcox.com or call 1-800-621-3979 for current performance figures. * Expense reimbursements were paid by Dodge & Cox from the Fund’s inception through June 30, 2003 to maintain operating expenses at 0.90%. Accordingly, without the expense reimbursements, the Fund’s returns prior to June 30, 2003 would have been lower. The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable on these distributions. The Morgan Stanley Capital International Europe, Australasia, Far East Index (MSCI EAFE) is a widely recognized benchmark of the world’s stock markets, excluding the United States. Index returns include dividends and, unlike Fund returns, do not reflect fees or expenses. Morgan Stanley®, Morgan Stanley Capital International, and EAFE® are trademarks of Morgan Stanley. |

AVERAGE ANNUAL TOTAL RETURN

FOR PERIODS ENDING JUNE 30, 2007

| | | | | | | | | | | | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | Since

Inception

(5/1/01) | |

Dodge & Cox International Stock Fund | | 28.85 | % | | 26.28 | % | | 22.98 | %* | | 17.29 | %* |

MSCI EAFE | | 27.00 | | | 22.25 | | | 17.73 | | | 10.91 | |

FUND EXPENSE EXAMPLE

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and expenses based on the Fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON WITH OTHER MUTUAL FUNDS

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expense Paid During the Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

| | | | | | | | | |

Six Months Ended June 30, 2007 | | Beginning Account Value 1/1/2007 | | Ending Account Value 6/30/2007 | | Expenses Paid During Period† |

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 1,119.60 | | $ | 3.42 |

Based on Hypothetical 5% Yearly Return | | | 1,000.00 | | | 1,021.57 | | | 3.26 |

| † | | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.65%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. While other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

PAGE 3 § DODGE & COX INTERNATIONAL STOCK FUND

| | |

| FUND INFORMATION | | June 30, 2007 |

GENERAL INFORMATION

| | |

Net Asset Value Per Share | | $48.88 |

Total Net Assets (billions) | | $46.4 |

Expense Ratio (1/1/07 to 6/30/07, annualized) | | 0.65% |

Portfolio Turnover Rate (1/1/07 to 6/30/07, unannualized) | | 4% |

30-Day SEC Yield(a) | | 1.42% |

Fund Inception Date | | 2001 |

No sales charges or distribution fees | | |

Investment Manager: Dodge & Cox, San Francisco. Managed by the International Investment Policy Committee, whose nine members’ average tenure at Dodge & Cox is 17 years.

| | | | |

| PORTFOLIO CHARACTERISTICS | | Fund | | MSCI

EAFE |

Number of Stocks | | 96 | | 1,145 |

Median Market Capitalization (billions) | | $16 | | $6 |

Weighted Average Market Capitalization (billions) | | $65 | | $62 |

Price-to-Earnings Ratio(b) | | 14.2x | | 14.3x |

Countries Represented | | 23 | | 21 |

Emerging Markets (Brazil, Indonesia, Israel, Mexico, South Africa, South Korea, Thailand, Turkey) | | 16.7% | | 0.0% |

| | | |

| TEN LARGEST HOLDINGS(c) | | Fund | |

Nokia Oyj (Finland) | | 2.6 | % |

Sanofi-Aventis (France) | | 2.6 | |

HSBC Holdings PLC (United Kingdom) | | 2.5 | |

GlaxoSmithKline PLC ADR (United Kingdom) | | 2.5 | |

Novartis AG ADR (Switzerland) | | 2.2 | |

Hitachi, Ltd. (Japan) | | 2.1 | |

Matsushita Electric Industrial Co., Ltd. (Japan) | | 2.1 | |

Total SA (France) | | 2.1 | |

Infineon Technologies AG (Germany) | | 2.0 | |

Royal Dutch Shell PLC ADR (United Kingdom) | | 2.0 | |

| | | | | | |

| REGION DIVERSIFICATION | | Fund | | | MSCI

EAFE | |

Europe (excluding United Kingdom) | | 35.2 | % | | 46.5 | % |

Japan | | 19.6 | | | 21.2 | |

United Kingdom | | 16.0 | | | 23.1 | |

Latin America | | 7.1 | | | 0.0 | |

Pacific (excluding Japan) | | 6.6 | | | 9.2 | |

United States | | 5.4 | | | 0.0 | |

Africa | | 2.8 | | | 0.0 | |

Canada | | 1.1 | | | 0.0 | |

Middle East | | 0.8 | | | 0.0 | |

| | | | | | |

| SECTOR DIVERSIFICATION | | Fund | | | MSCI

EAFE | |

Financials | | 22.5 | % | | 28.7 | % |

Consumer Discretionary | | 14.3 | | | 11.8 | |

Information Technology | | 12.1 | | | 5.5 | |

Energy | | 9.6 | | | 7.6 | |

Materials | | 9.5 | | | 9.5 | |

Industrials | | 8.5 | | | 12.1 | |

Health Care | | 8.1 | | | 6.3 | |

Consumer Staples | | 6.0 | | | 7.8 | |

Telecommunication Services | | 3.5 | | | 5.4 | |

Utilities | | 0.5 | | | 5.3 | |

(a) | SEC Yield is an annualization of the Fund’s total net investment income per share for the 30-day period ended on the last day of the month. |

(b) | Price-to-earnings (P/E) ratios are calculated using 12-month forward earnings estimates. |

(c) | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. |

DODGE & COX INTERNATIONAL STOCK FUND §PAGE 4

| | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | June 30, 2007 |

| | | | | |

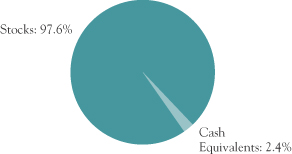

| COMMON STOCKS: 91.7% | | | | |

| | |

| | | SHARES | | VALUE |

| | | | | |

| CONSUMER DISCRETIONARY: 14.3% |

AUTOMOBILES & COMPONENTS: 1.9% |

Honda Motor Co., Ltd. ADR(b) (Japan) | | 21,621,300 | | $ | 784,636,977 |

Yamaha Motor Co., Ltd. (Japan) | | 3,413,700 | | | 99,257,226 |

| | | | | |

| | | | | 883,894,203 |

CONSUMER DURABLES & APPAREL: 7.9% |

Consorcio Ara SAB de CV(c) (Mexico) | | 88,420,000 | | | 142,408,294 |

Corporacion Geo SAB de CV, Series B(a),(c) (Mexico) | | 42,105,400 | | | 231,309,806 |

Fujifilm Holdings Corp. (Japan) | | 7,086,100 | | | 317,111,967 |

Koninklijke Philips Electronics NV (Netherlands) | | 13,935,000 | | | 595,231,528 |

Matsushita Electric Industrial Co., Ltd. (Japan) | | 49,091,000 | | | 974,842,599 |

Sony Corp. (Japan) | | 14,737,600 | | | 757,677,222 |

Thomson(c) (France) | | 17,885,792 | | | 342,052,128 |

Yamaha Corp.(c) (Japan) | | 14,851,000 | | | 308,780,183 |

| | | | | |

| | | | | 3,669,413,727 |

MEDIA: 4.5% |

Grupo Televisa SA ADR(b) (Mexico) | | 20,578,492 | | | 568,172,164 |

Liberty Global, Inc., Series A(a) (United States) | | 1,220,332 | | | 50,082,425 |

Liberty Global, Inc., Series C(a) (United States) | | 1,894,168 | | | 74,440,803 |

Naspers, Ltd.(c) (South Africa) | | 20,800,000 | | | 535,634,949 |

News Corp., Class A (United States) | | 40,944,892 | | | 868,441,159 |

| | | | | |

| | | | | 2,096,771,500 |

| | | | | |

| | | | | 6,650,079,430 |

| CONSUMER STAPLES: 5.5% |

FOOD & STAPLES RETAILING: 1.8% |

Tesco PLC (United Kingdom) | | 98,164,379 | | | 824,963,756 |

| | | | | |

FOOD, BEVERAGE & TOBACCO: 3.2% |

Anadolu Efes Biracilik ve Malt Sanayii AS (Turkey) | | 3,757,696 | | | 150,307,840 |

Cott Corp.(a),(b),(c) (Canada) | | 2,285,530 | | | 32,888,777 |

Fomento Economico Mexicano SAB de CV ADR(b) (Mexico) | | 8,142,174 | | | 320,150,281 |

Nestle SA (Switzerland) | | 1,506,000 | | | 574,536,226 |

Tiger Brands, Ltd. (South Africa) | | 7,552,043 | | | 193,943,517 |

Unilever NV(b) (Netherlands) | | 7,451,700 | | | 231,151,734 |

| | | | | |

| | | | | 1,502,978,375 |

HOUSEHOLD & PERSONAL PRODUCTS: 0.5% |

Aderans Co., Ltd.(c) (Japan) | | 3,680,200 | | | 77,564,419 |

Avon Products, Inc. (United States) | | 4,150,000 | | | 152,512,500 |

| | | | | |

| | | | | 230,076,919 |

| | | | | |

| | | | | 2,558,019,050 |

| | | | | |

| | |

| | | SHARES | | VALUE |

| | | | | |

| ENERGY: 7.8% |

Norsk Hydro ASA (Norway) | | 23,190,500 | | $ | 896,638,771 |

Royal Dutch Shell PLC ADR(b) (United Kingdom) | | 11,428,400 | | | 927,986,080 |

Schlumberger, Ltd. (United States) | | 9,533,000 | | | 809,733,020 |

Total SA (France) | | 11,722,000 | | | 956,032,824 |

| | | | | |

| | | | | 3,590,390,695 |

| FINANCIALS: 21.9% | | | | | |

BANKS: 14.8% | | | | | |

Bangkok Bank PCL Foreign (Thailand) | | 14,261,800 | | | 50,396,513 |

Bangkok Bank PCL NVDR (Thailand) | | 12,850,000 | | | 43,546,705 |

DBS Group Holdings, Ltd. (Singapore) | | 29,042,000 | | | 432,570,701 |

Grupo Financiero Banorte SAB de CV (Mexico) | | 43,834,600 | | | 200,762,346 |

HSBC Holdings PLC (United Kingdom) | | 63,989,200 | | | 1,175,745,317 |

Kasikornbank PCL Foreign (Thailand) | | 96,725,600 | | | 214,323,198 |

Kasikornbank PCL NVDR (Thailand) | | 77,094,600 | | | 165,242,590 |

Kookmin Bank ADR(b) (South Korea) | | 5,978,100 | | | 524,398,932 |

Mitsubishi UFJ Financial Group (Japan) | | 29,800 | | | 329,161,421 |

Mitsubishi UFJ Financial Group ADR(b) (Japan) | | 67,666,500 | | | 745,684,830 |

Royal Bank of Scotland Group PLC (United Kingdom) | | 50,402,916 | | | 640,685,442 |

Shinhan Financial Group Co., Ltd. ADR(b) (South Korea) | | 2,178,784 | | | 266,879,252 |

Shinsei Bank, Ltd.(c) (Japan) | | 74,153,000 | | | 299,924,418 |

Standard Bank Group, Ltd. (South Africa) | | 40,846,234 | | | 568,119,533 |

Standard Chartered PLC (United Kingdom) | | 27,738,506 | | | 907,937,917 |

The Bank of Yokohama, Ltd. (Japan) | | 42,638,000 | | | 299,201,884 |

| | | | | |

| | | | | 6,864,580,999 |

DIVERSIFIED FINANCIALS: 2.2% | | | | | |

Credit Suisse Group (Switzerland) | | 11,448,000 | | | 818,651,494 |

Haci Omer Sabanci Holding AS (Turkey) | | 43,211,180 | | | 215,644,365 |

| | | | | |

| | | | | 1,034,295,859 |

INSURANCE: 4.6% | | | | | |

Aegon NV (Netherlands) | | 19,477,211 | | | 385,931,124 |

Millea Holdings, Inc. (Japan) | | 14,221,500 | | | 584,453,117 |

Standard Life PLC (United Kingdom) | | 13,925,343 | | | 92,349,428 |

Swiss Life Holding (Switzerland) | | 1,285,000 | | | 340,843,225 |

Swiss Reinsurance Co. (Switzerland) | | 7,895,795 | | | 723,323,341 |

| | | | | |

| | | | | 2,126,900,235 |

REAL ESTATE: 0.3% | | | | | |

Hang Lung Group, Ltd. (Hong Kong) | | 18,812,000 | | | 84,927,307 |

Hang Lung Properties, Ltd. (Hong Kong) | | 6,751,000 | | | 23,268,295 |

| | | | | |

| | | | | 108,195,602 |

| | | | | |

| | | | | 10,133,972,695 |

| | |

| PAGE 5 § DODGE & COX INTERNATIONAL STOCK FUND | | See accompanying Notes to Financial Statements |

| | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | June 30, 2007 |

| | | | | |

| COMMON STOCKS (continued) |

| | |

| | | SHARES | | VALUE |

| | | | | |

| HEALTH CARE: 8.1% |

HEALTH CARE EQUIPMENT & SERVICES: 0.8% |

Mediceo Paltac Holdings Co., Ltd.(c) (Japan) | | 23,974,300 | | $ | 367,622,160 |

| | | | | |

PHARMACEUTICALS & BIOTECHNOLOGY: 7.3% |

GlaxoSmithKline PLC ADR(b) (United Kingdom) | | 22,237,200 | | | 1,164,562,164 |

Novartis AG ADR(b) (Switzerland) | | 18,112,850 | | | 1,015,587,499 |

Sanofi-Aventis (France) | | 14,885,500 | | | 1,210,820,759 |

| | | | | |

| | | | | 3,390,970,422 |

| | | | | |

| | | | | 3,758,592,582 |

| INDUSTRIALS: 8.5% |

CAPITAL GOODS: 3.9% |

Nexans SA(c) (France) | | 1,866,440 | | | 312,735,107 |

Schneider Electric SA (France) | | 1,600,000 | | | 225,495,464 |

Toto, Ltd.(c) (Japan) | | 36,657,000 | | | 317,669,190 |

Volvo AB (Sweden) | | 42,058,000 | | | 842,488,303 |

Wienerberger AG (Austria) | | 1,206,362 | | | 89,311,407 |

| | | | | |

| | | | | 1,787,699,471 |

TRANSPORTATION: 4.6% |

Canadian Pacific Railway, Ltd.(b) (Canada) | | 2,838,906 | | | 195,373,511 |

Central Japan Railway Co. (Japan) | | 56,050 | | | 591,796,954 |

Deutsche Post AG (Germany) | | 10,975,000 | | | 356,944,142 |

Nippon Yusen Kabushiki Kaisha (Japan) | | 51,950,000 | | | 477,201,624 |

TNT NV (Netherlands) | | 11,775,249 | | | 532,780,640 |

| | | | | |

| | | | | 2,154,096,871 |

| | | | | |

| | | | | 3,941,796,342 |

| INFORMATION TECHNOLOGY: 12.1% |

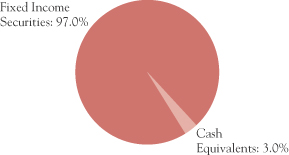

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT: 2.3% |