UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-173

DODGE & COX FUNDS

(Exact name of registrant as specified in charter)

555 California Street, 40th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Thomas M. Mistele, Esq.

555 California Street, 40th Floor

San Francisco, CA 94104

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-981-1710

Date of fiscal year end: DECEMBER 31, 2009

Date of reporting period: JUNE 30, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following are the June 30, 2009 semi-annual reports for the Dodge & Cox Funds, a Delaware statutory trust, consisting of five series: Dodge & Cox Stock Fund, Dodge & Cox Global Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund and Dodge & Cox Income Fund. The reports of each series were transmitted to their respective shareholders on August 11, 2009.

| | | | |

| | | |  |

www.dodgeandcox.com

For Fund literature, transactions, and account

information, please visit the Funds’ web site.

or write or call:

DODGE & COX FUNDS

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

INVESTMENT MANAGER

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions, and portfolio holdings as of June 30, 2009, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

6/09 SF SAR  Printed on recycled paper

Printed on recycled paper

Semi-Annual Report

June 30, 2009

Stock Fund

ESTABLISHED 1965

TICKER: DODGX

TO OUR SHAREHOLDERS

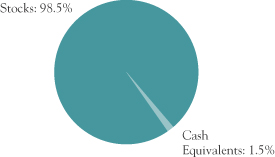

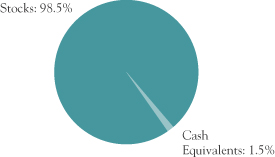

The Dodge & Cox Stock Fund had a total return of 4.8% for the six months ending June 30, 2009, compared to a total return of 3.2% for the Standard & Poor’s 500 Index (S&P 500). Longer-term results can be found on page three. As of June 30, the Fund had net assets of $33.5 billion with a cash position of 1.5%. While the six-month results were solid, the Fund is still down 29.4% from one year ago, compared to down 26.2% for the S&P 500.

MARKET COMMENTARY

VOLATILE MARKETS REQUIRE PERSISTENCE

The first half of 2009 illustrates the importance of persistence for long-term investors. The S&P 500 fell 25% from January 1 through the recent market trough on March 9 (and the Fund fell 29%). During this time, the U.S. government and others around the world pledged fiscal and monetary stimulus. Management at many companies took dramatic actions to reduce costs and inventories in response to rapidly shrinking demand. Some companies even increased productivity in this time period. With capital markets stabilizing and the rate of economic decline moderating, investors began to anticipate the nadir and eventual upturn of the economy. We do not know why the shift in investor sentiment began on March 10, but since then the S&P 500 rose by 37% (and the Fund rose 47%) through June 30.1

Our investment experience and belief in the favorable long-term prospects of the individual companies in our diversified portfolio lead us to be optimistic and persistent in staying fully invested. Looking back over the last six months, it would be difficult to identify the time to invest by observing daily news reports. Even now, the recent signs of potential improvement (such as increased consumer confidence, increasing auto sales, and increasing new home starts) are balanced by countervailing forces (such as increased unemployment, continued decline in housing prices, and increased foreclosures).

Underlying the Fund’s fully invested position is our optimism for economic recovery and the prospects for long-term growth in the global economy. There are three reasons for our view:

| 1. | The pace of technological innovation remains rapid. Companies have the opportunity not only to create |

| | new products and services, but also to improve the old ones and cut costs through increasing productivity. |

| 2. | The developing world is likely to lead global growth. The powerful tools of increased computing power, the internet, and wireless communication enable the citizens in the developing world to plug into the global economy. Multinational companies in the U.S. will benefit from opportunities provided by increased demand from the developing world. |

| 3. | The U.S. economy is resilient and has recovered from many past challenges. In the first 50 years of the S&P 500 from 1956 to 2006, corporate profits increased 25-fold. Behind that performance were companies innovating and achieving productivity gains. Overall, the Fund is positioned to take advantage of innovation and economic growth. For example, consumer electronics and technology companies represent 23% of the Fund’s holdings, and pharmaceutical and biotechnology companies 18%. |

INVESTMENT STRATEGY

TRAVELING ON THE MARKET ROLLERCOASTER

While we continue to be encouraged by the broad investment backdrop of low valuations and strong long-term growth drivers, the “story” year-to-date has been volatility and the re-introduction of some investor confidence. Within the Fund’s diversified portfolio of 81 stocks, the companies that experienced the greatest drop and subsequent rise during the first six months were those companies with significant operational and financial leverage: two examples are Dow Chemical Company and SLM Corporation (also known as Sallie Mae).

Dow is an asset-intensive, multinational chemical company that experienced a rapid increase in energy costs during 2008 and a dramatic drop in demand into early 2009. The company faced additional distress when financial markets froze as it was completing the $16 billion purchase of Rohm and Haas. The stock dropped 58% from the end of 2008 through March 9, then rallied 162% through midyear, and ended the six-month period up 10%. Although the near-term profit outlook is bleak, we hold it in the Fund because this multinational is well positioned to participate in global growth over the next

PAGE 1 § DODGE & COX STOCK FUND

five years. As investors turn from fear of operational and financial risks toward confidence in the future earnings of this strong, global franchise, we believe it remains an attractive long-term investment opportunity.

Sallie Mae is the largest student loan lender in the United States and is subject to credit risk, as well as financing and regulatory risks. Liquidity and funding were difficult for Sallie Mae to obtain during the financial crisis of the last year. In addition, Congress and the White House are taking steps to change the roles of participants in the student lending industry and replace the Federal Family Educational Loan Program with the government-run Direct Loan Program. With regulatory uncertainty and increasing credit losses, the stock dropped 64% from year-end 2008 through March 9. Sallie Mae’s business must transition away from lending and more toward loan servicing which will utilize the skills and scale it has established. It has proven successful in financing itself during the capital market challenges of the last year. From March 10, the stock rallied 222% to finish the first half up 15%. We continue to believe in its long-term investment potential due to the value of its current portfolio and the prospect of increased servicing revenue, as student loan volume grows in the future.

Both Dow and Sallie Mae hold significant market share, have capable and experienced management, and trade at attractive valuations. We use these examples to illustrate our long-term thinking and persistence in the face of dramatic short-term volatility in the stock market, not to imply that we think Sallie Mae and Dow are more attractive than the Fund’s other holdings. We cannot predict whether Sallie Mae or Dow will ultimately prove profitable for the Fund.

We have found in decades of investing that share prices can change much more in the short term than underlying business fundamentals. In a difficult environment, when companies are under pressure and share prices are down, we often see indiscriminate selling of companies perceived as risky. We believe our investment process gives us the tools to make informed decisions: an independent research team with detailed knowledge of the companies the Fund holds, an eye on long-term value across economic cycles, and the patience to hold on to investments that we believe are sound.

IN CLOSING

Despite a strong rebound since March, the S&P 500 is still down significantly from its peak nearly two years ago. While there is much consideration of the short-term macroeconomic data by many investors, we continue to focus on long-term investment opportunities. The Fund remains fully invested in a diversified portfolio of companies that should broadly benefit when economic expansion resumes.

We appreciate the confidence you have placed in our firm and the patience you have demonstrated as a shareholder of the Dodge & Cox Stock Fund. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |  |

John A. Gunn, Chairman | | Kenneth E. Olivier, President |

August 11, 2009

| 1 | | Past performance does not guarantee future results. |

| | | | | | |

| | DODGE & COX STOCK FUND § | | PAGE | | 2 |

PERFORMANCE REVIEW

Key Contributors to Relative Results

| | § | | Returns from holdings in the Energy sector (up 12% versus down 2% for the S&P 500 sector) contributed to relative returns. Schlumberger (up 29%) and Occidental Petroleum (up 11%) were strong. | |

| | § | | Sprint Nextel was a standout performer (up 163%) in relation to the Telecommunication Services S&P 500 sector return (down 4%). | |

| | § | | A lower average weighting in the Consumer Staples sector (2% versus 13% for the S&P 500 sector) was beneficial, as the sector was weak. | |

| | § | | Individual contributors included Motorola (up 50%), Maxim Integrated Products (up 41%), Wyeth (up 23%, being acquired by Pfizer), WellPoint (up 21%), and Sony (up 19%). | |

Key Detractors from Relative Results

| | § | | Weak returns from holdings in the Financials sector (down 13% versus down 2% for the S&P 500 sector) detracted. Citigroup (down 45% to date of sale) and Capital One (down 29%) were weak. | |

| | § | | A higher average weighting in the Health Care sector (28% versus 15% for the S&P 500 sector) hurt relative results, as the sector was weak. Novartis (down 15%) and Amgen (down 8%) lagged. | |

| | § | | Individual detractors included General Electric (down 25%), Xerox (down 17%), Comcast (down 14%), and FedEx (down 13%). | |

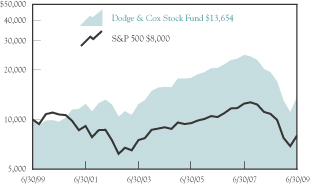

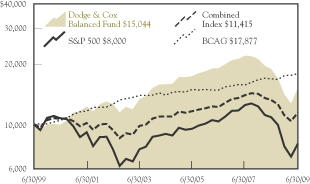

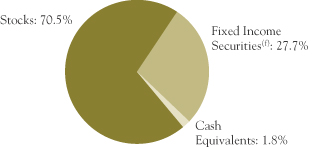

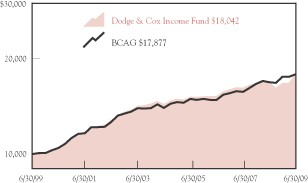

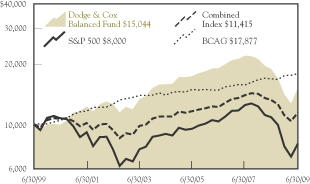

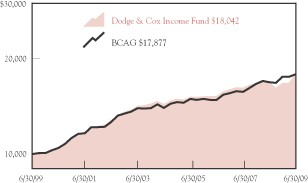

GROWTH OF $10,000 OVER 10 YEARS

FOR AN INVESTMENT MADE ON JUNE 30, 1999

AVERAGE ANNUAL TOTAL RETURN

FOR PERIODS ENDED JUNE 30, 2009

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | 20 Years | |

Dodge & Cox Stock Fund | | -29.38 | % | | -2.82 | % | | 3.16 | % | | 9.87 | % |

S&P 500 | | -26.22 | | | -2.24 | | | -2.22 | | | 7.77 | |

Past performance does not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated. Performance is updated and published monthly. Visit the Fund’s web site at www.dodgeandcox.com or call 1-800-621-3979 for current performance figures.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions. The Standard & Poor’s 500 (S&P 500) is a broad-based unmanaged measure of common stocks. Index returns include dividends and/or interest income but, unlike Fund returns, do not reflect fees or expenses.

Standard & Poor’s, Standard & Poor’s 500, and S&P 500® are trademarks of The McGraw-Hill Companies, Inc.

PAGE 3 § DODGE & COX STOCK FUND

FUND EXPENSE EXAMPLE

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and expenses based on the Fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON WITH OTHER MUTUAL FUNDS

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expense Paid During the Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

| | | | | | | | | |

Six Months Ended

June 30, 2009 | | Beginning Account Value

1/1/2009 | | Ending Account Value

6/30/2009 | | Expenses Paid

During Period* |

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 1,048.00 | | $ | 2.68 |

Based on Hypothetical 5% Yearly Return | | | 1,000.00 | | | 1,022.17 | | | 2.65 |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.53%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. While other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

DODGE & COX STOCK FUND §PAGE 4

| | |

| FUND INFORMATION | | June 30, 2009 |

| | |

| GENERAL INFORMATION |

Net Asset Value Per Share | | $77.13 |

Total Net Assets (billions) | | $33.5 |

Expense Ratio (1/1/09 to 6/30/09, annualized) | | 0.53% |

Portfolio Turnover Rate (1/1/09 to 6/30/09, unannualized) | | 12% |

30-Day SEC Yield(a) | | 1.38% |

Fund Inception | | 1965 |

No sales charges or distribution fees | | |

Investment Manager: Dodge & Cox, San Francisco. Managed by the Investment Policy Committee, whose nine members’ average tenure at Dodge & Cox is 23 years.

| | | | |

| PORTFOLIO CHARACTERISTICS | | Fund | | S&P 500 |

Number of Stocks | | 81 | | 500 |

Median Market Capitalization (billions) | | $14 | | $7 |

Weighted Average Market

Capitalization (billions) | | $48 | | $71 |

Price-to-Earnings Ratio(b) | | 12.1x | | 20.9x |

Foreign Stocks(c) | | 18.1% | | 0.0% |

| | | |

| TEN LARGEST HOLDINGS(d) | | Fund | |

Hewlett-Packard Co. | | 4.8 | % |

Schlumberger, Ltd. | | 4.0 | |

Wells Fargo & Co. | | 3.2 | |

Comcast Corp. | | 3.2 | |

Novartis AG (Switzerland) | | 3.2 | |

WellPoint, Inc. | | 3.0 | |

GlaxoSmithKline PLC (United Kingdom) | | 2.9 | |

Amgen, Inc. | | 2.9 | |

Merck & Co., Inc. | | 2.9 | |

Motorola, Inc. | | 2.9 | |

| | | | | | |

| SECTOR DIVERSIFICATION | | Fund | | | S&P 500 | |

Health Care | | 26.9 | % | | 14.0 | % |

Information Technology | | 19.6 | | | 18.4 | |

Consumer Discretionary | | 17.2 | | | 9.0 | |

Financials | | 11.2 | | | 13.6 | |

Energy | | 11.0 | | | 12.4 | |

Industrials | | 6.9 | | | 9.8 | |

Materials | | 2.2 | | | 3.2 | |

Telecommunication Services | | 1.8 | | | 3.5 | |

Consumer Staples | | 1.7 | | | 12.0 | |

Utilities | | 0.0 | | | 4.1 | |

| (a) | SEC yield is an annualization of the Fund’s total net investment income per share for the 30-day period ended on the last day of the month. |

| (b) | Price-to-earnings (P/E) ratios are calculated using 12-month forward earnings estimates. |

| (c) | Foreign stocks are U.S. dollar-denominated. |

| (d) | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell, or hold any particular security. |

PAGE 5 § DODGE & COX STOCK FUND

| | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | June 30, 2009 |

| | | | | |

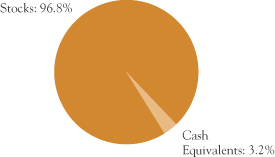

| COMMON STOCKS: 98.5% | | | | |

| | |

| | | SHARES | | VALUE |

| CONSUMER DISCRETIONARY: 17.2% | | | |

CONSUMER DURABLES & APPAREL: 3.4% |

Panasonic Corp. ADR(b) (Japan) | | 34,433,474 | | $ | 461,064,217 |

Sony Corp. ADR(b) (Japan) | | 26,779,350 | | | 692,513,991 |

| | | | | |

| | | | | 1,153,578,208 |

MEDIA: 10.7% |

Comcast Corp., Class A | | 74,495,497 | | | 1,079,439,751 |

DISH Network Corp., Class A(a) | | 6,842,870 | | | 110,922,923 |

Interpublic Group of Companies, Inc.(a) | | 20,421,293 | | | 103,127,529 |

Liberty Entertainment, Series A(a) | | 3,647,500 | | | 97,570,625 |

Liberty Global, Inc., Series A(a) | | 764,210 | | | 12,143,297 |

Liberty Global, Inc., Series C(a) | | 1,301,653 | | | 20,579,134 |

News Corp., Class A | | 93,207,526 | | | 849,120,562 |

Time Warner Cable, Inc.(a) | | 13,185,610 | | | 417,588,269 |

Time Warner, Inc. | | 35,222,732 | | | 887,260,619 |

| | | | | |

| | | | | 3,577,752,709 |

RETAILING: 3.1% |

CarMax, Inc.(a),(c) | | 11,807,200 | | | 173,565,840 |

Genuine Parts Co. | | 1,090,118 | | | 36,584,360 |

Home Depot, Inc. | | 21,005,300 | | | 496,355,239 |

Liberty Interactive, Series A(a) | | 37,923,375 | | | 189,996,109 |

Macy’s, Inc. | | 11,090,092 | | | 130,419,482 |

| | | | | |

| | | | | 1,026,921,030 |

| | | | | |

| | | | | 5,758,251,947 |

| CONSUMER STAPLES: 1.7% | | | | | |

FOOD & STAPLES RETAILING: 1.5% |

Wal-Mart Stores, Inc. | | 7,922,950 | | | 383,787,698 |

Walgreen Co. | | 4,512,075 | | | 132,655,005 |

| | | | | |

| | | | | 516,442,703 |

HOUSEHOLD & PERSONAL PRODUCTS: 0.2% |

Avon Products, Inc. | | 2,120,680 | | | 54,671,130 |

| | | | | |

| | | | | 571,113,833 |

| ENERGY: 11.0% | | | | | |

Baker Hughes, Inc.(c) | | 15,854,194 | | | 577,726,830 |

Chevron Corp. | | 8,830,680 | | | 585,032,550 |

Occidental Petroleum Corp. | | 13,826,900 | | | 909,948,289 |

Royal Dutch Shell PLC ADR(b) (United Kingdom) | | 5,312,564 | | | 270,197,005 |

Schlumberger, Ltd. | | 24,558,012 | | | 1,328,834,029 |

| | | | | |

| | | | | 3,671,738,703 |

| FINANCIALS: 11.2% | | | | | |

BANKS: 4.8% |

BB&T Corp. | | 12,062,844 | | | 265,141,311 |

HSBC Holdings PLC ADR(b) (United Kingdom) | | 6,129,229 | | | 256,017,895 |

Wells Fargo & Co. | | 44,911,741 | | | 1,089,558,837 |

| | | | | |

| | | | | 1,610,718,043 |

| | | | | |

| | |

| | | SHARES | | VALUE |

DIVERSIFIED FINANCIALS: 4.6% |

Bank of New York Mellon Corp. | | 7,056,624 | | $ | 206,829,650 |

Capital One Financial Corp.(c) | | 31,943,611 | | | 698,926,209 |

Credit Suisse Group AG ADR(b) (Switzerland) | | 4,202,700 | | | 192,189,471 |

Legg Mason, Inc. | | 4,656,700 | | | 113,530,346 |

SLM Corp.(a),(c) | | 26,185,882 | | | 268,929,008 |

State Street Corp. | | 1,263,975 | | | 59,659,620 |

| | | | | |

| | | | | 1,540,064,304 |

INSURANCE: 1.8% |

AEGON NV(a),(b) (Netherlands) | | 26,858,988 | | | 165,451,366 |

Genworth Financial, Inc., Class A(a) | | 6,905,200 | | | 48,267,348 |

Loews Corp. | | 3,908,000 | | | 107,079,200 |

The Travelers Companies, Inc. | | 6,511,750 | | | 267,242,220 |

| | | | | |

| | | | | 588,040,134 |

| | | | | |

| | | | | 3,738,822,481 |

| HEALTH CARE: 26.9% |

HEALTH CARE EQUIPMENT & SERVICES: 8.9% |

Boston Scientific Corp.(a) | | 47,269,500 | | | 479,312,730 |

Cardinal Health, Inc.(c) | | 21,269,750 | | | 649,790,863 |

Covidien PLC(b) (Ireland) | | 5,563,291 | | | 208,289,615 |

Health Management Associates, Inc.(a),(c) | | 6,989,060 | | | 34,525,956 |

UnitedHealth Group, Inc. | | 24,788,500 | | | 619,216,730 |

WellPoint, Inc.(a) | | 19,574,849 | | | 996,164,066 |

| | | | | |

| | | | | 2,987,299,960 |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES: 18.0% |

Amgen, Inc.(a) | | 18,161,300 | | | 961,459,222 |

GlaxoSmithKline PLC ADR(b) (United Kingdom) | | 27,824,300 | | | 983,310,762 |

Merck & Co., Inc. | | 34,380,900 | | | 961,289,964 |

Novartis AG ADR(b) (Switzerland) | | 26,065,500 | | | 1,063,211,745 |

Pfizer, Inc. | | 51,012,864 | | | 765,192,960 |

Sanofi-Aventis ADR(b) (France) | | 19,368,600 | | | 571,180,014 |

Thermo Fisher Scientific, Inc.(a) | | 614,115 | | | 25,037,468 |

Wyeth | | 14,861,400 | | | 674,558,946 |

| | | | | |

| | | | | 6,005,241,081 |

| | | | | |

| | | | | 8,992,541,041 |

| INDUSTRIALS: 6.9% | | | | | |

CAPITAL GOODS: 4.3% |

Caterpillar, Inc. | | 4,500,200 | | | 148,686,608 |

Eaton Corp. | | 5,798,200 | | | 258,657,702 |

General Electric Co. | | 63,198,175 | | | 740,682,611 |

Koninklijke Philips Electronics NV(b) (Netherlands) | | 2,508,600 | | | 46,208,412 |

Tyco International, Ltd.(b) (Switzerland) | | 9,660,775 | | | 250,986,934 |

| | | | | |

| | | | | 1,445,222,267 |

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND §PAGE 6 |

| | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | June 30, 2009 |

| | | | | |

| COMMON STOCKS (continued) |

| | |

| | | SHARES | | VALUE |

COMMERCIAL SERVICES & SUPPLIES: 0.6% |

Pitney Bowes, Inc. | | 10,286,950 | | $ | 225,592,814 |

|

TRANSPORTATION: 2.0% |

FedEx Corp. | | 11,883,599 | | | 660,965,776 |

| | | | | |

| | | | | 2,331,780,857 |

| INFORMATION TECHNOLOGY: 19.6% |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT: 1.1% |

Maxim Integrated Products, Inc.(c) | | 24,348,800 | | | 382,032,672 |

|

SOFTWARE & SERVICES: 6.7% |

Adobe Systems, Inc.(a) | | 2,848,579 | | | 80,614,786 |

Autodesk, Inc.(a) | | 1,880,700 | | | 35,695,686 |

BMC Software, Inc.(a) | | 8,050,940 | | | 272,041,263 |

Cadence Design Systems, Inc.(a),(c) | | 23,282,600 | | | 137,367,340 |

Citrix Systems, Inc.(a),(c) | | 12,427,022 | | | 396,297,731 |

Computer Sciences Corp.(a),(c) | | 11,781,972 | | | 521,941,360 |

Compuware Corp.(a),(c) | | 22,088,112 | | | 151,524,448 |

EBay, Inc.(a) | | 29,173,300 | | | 499,738,629 |

Symantec Corp.(a) | | 442,317 | | | 6,882,452 |

Synopsys, Inc.(a) | | 6,822,369 | | | 133,104,419 |

| | | | | |

| | | | | 2,235,208,114 |

TECHNOLOGY, HARDWARE & EQUIPMENT: 11.8% |

Hewlett-Packard Co. | | 41,553,595 | | | 1,606,046,447 |

Hitachi, Ltd. ADR(a),(b) (Japan) | | 6,105,000 | | | 189,071,850 |

Kyocera Corp. ADR(b) (Japan) | | 549,848 | | | 41,073,646 |

Molex, Inc. | | 2,547,600 | | | 39,615,180 |

Molex, Inc., Class A | | 8,724,330 | | | 125,455,865 |

Motorola, Inc.(a),(c) | | 143,005,211 | | | 948,124,549 |

Telefonaktiebolaget LM Ericsson ADR(b) (Sweden) | | 17,020,500 | | | 166,460,490 |

Tyco Electronics, Ltd.(b) (Switzerland) | | 20,289,775 | | | 377,186,917 |

Xerox Corp.(c) | | 67,997,300 | | | 440,622,504 |

| | | | | |

| | | | | 3,933,657,448 |

| | | | | |

| | | | | 6,550,898,234 |

| MATERIALS: 2.2% | | | | | |

Cemex SAB de CV ADR(a),(b) (Mexico) | | 13,650,591 | | | 127,496,520 |

Domtar Corp.(a) | | 1,370,959 | | | 22,730,500 |

Dow Chemical Co. | | 30,845,345 | | | 497,843,868 |

Vulcan Materials Co. | | 2,046,548 | | | 88,206,219 |

| | | | | |

| | | | | 736,277,107 |

| TELECOMMUNICATION SERVICES: 1.8% |

Sprint Nextel Corp.(a),(c) | | 127,825,739 | | | 614,841,805 |

| | | | | |

TOTAL COMMON STOCKS

(Cost $42,322,276,320) | | | | $ | 32,966,266,008 |

| | | | | |

| | | | | | | |

| SHORT-TERM INVESTMENTS: 1.3% |

| | |

| | | PAR VALUE | | | VALUE |

MONEY MARKET FUND: 0.3% |

SSgA Prime Money Market Fund | | $ | 101,333,086 | | | $ | 101,333,086 |

|

REPURCHASE AGREEMENT: 1.0% |

Fixed Income Clearing Corporation(d) 0.03%, 7/1/09, maturity value $331,944,277 | | | 331,944,000 | | | | 331,944,000 |

| | | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $433,277,086) | | | | 433,277,086 |

| | | | | | | |

TOTAL INVESTMENTS (Cost $42,755,553,406) | | | 99.8 | % | | $ | 33,399,543,094 |

OTHER ASSETS LESS LIABILITIES | | | 0.2 | % | | | 65,274,267 |

| | | | | | | |

| NET ASSETS | | | 100.0 | % | | $ | 33,464,817,361 |

| | | | | | | |

| (b) | Security denominated in U.S. dollars |

| (c) | See Note 8 regarding holdings of 5% voting securities |

| (d) | Repurchase agreement is collateralized by Fannie Mae 2.00%-2.05%, 4/1/11; and Freddie Mac, 2.00%-2.125, 3/9/11-3/16/11. Total collateral value is $338,586,117. |

ADR: American Depositary Receipt

| | |

| PAGE 7 § DODGE & COX STOCK FUND | | See accompanying Notes to Financial Statements |

| | | | |

STATEMENT OF ASSETS AND LIABILITIES (unaudited) | |

| |

| | | June 30, 2009 | |

ASSETS: | | | | |

Investments, at value | | | | |

Unaffiliated issuers (cost $34,428,042,317) | | $ | 28,052,693,740 | |

Affiliated issuers (cost $8,327,511,089) | | | 5,346,849,354 | |

| | | | |

| | | 33,399,543,094 | |

Receivable for investments sold | | | 45,037,403 | |

Receivable for Fund shares sold | | | 28,326,760 | |

Dividends and interest receivable | | | 72,441,733 | |

Prepaid expenses and other assets | | | 102,343 | |

| | | | |

| | | 33,545,451,333 | |

| | | | |

LIABILITIES: | | | | |

Payable for investments purchased | | | 388,435 | |

Payable for Fund shares redeemed | | | 63,895,779 | |

Management fees payable | | | 13,888,472 | |

Accrued expenses | | | 2,461,286 | |

| | | | |

| | | 80,633,972 | |

| | | | |

NET ASSETS | | $ | 33,464,817,361 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

Paid in capital | | $ | 49,418,984,791 | |

Undistributed net investment income | | | 8,033,729 | |

Accumulated net realized loss on investments | | | (6,606,190,847 | ) |

Net unrealized depreciation on investments | | | (9,356,010,312 | ) |

| | | | |

| | $ | 33,464,817,361 | |

| | | | |

Fund shares outstanding (par value $0.01 each, unlimited shares authorized) | | | 433,887,302 | |

Net asset value per share | | | $77.13 | |

|

STATEMENT OF OPERATIONS

(unaudited) | |

| |

| | | Six Months Ended

June 30, 2009 | |

INVESTMENT INCOME: | | | | |

Dividends (net of foreign taxes of $13,114,560) | | | | |

Unaffiliated issuers | | $ | 338,041,185 | |

Affiliated issuers | | | 37,602,434 | |

Interest | | | 703,095 | |

| | | | |

| | | 376,346,714 | |

| | | | |

EXPENSES: | | | | |

Management fees | | | 75,450,253 | |

Custody and fund accounting fees | | | 221,598 | |

Transfer agent fees | | | 2,315,666 | |

Professional services | | | 68,393 | |

Shareholder reports | | | 1,100,498 | |

Registration fees | | | 91,056 | |

Trustees’ fees | | | 73,000 | |

Miscellaneous | | | 436,174 | |

| | | | |

| | | 79,756,638 | |

| | | | |

NET INVESTMENT INCOME | | | 296,590,076 | |

| | | | |

REALIZED AND UNREALIZED GAIN/ (LOSS) ON INVESTMENTS: | | | | |

Net realized loss | | | | |

Unaffiliated issuers | | | (5,583,132,045 | ) |

Affiliated issuers | | | (523,122,740 | ) |

Net change in unrealized depreciation | | | 7,158,127,372 | |

| | | | |

Net realized and unrealized gain | | | 1,051,872,587 | |

| | | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 1,348,462,663 | |

| | | | |

| | | | | | | | |

STATEMENT OF CHANGES IN NET ASSETS | |

| | | Six Months Ended

June 30, 2009

(unaudited) | | | Year Ended

December 31, 2008 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 296,590,076 | | | $ | 871,266,747 | |

Net realized loss | | | (6,106,254,785 | ) | | | (490,239,002 | ) |

Net change in unrealized appreciation/depreciation | | | 7,158,127,372 | | | | (27,280,798,157 | ) |

| | | | | | | | |

Net increase/(decrease) in net assets from operations | | | 1,348,462,663 | | | | (26,899,770,412 | ) |

| | | | | | | | |

| |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | |

Net investment income | | | (318,530,089 | ) | | | (841,293,005 | ) |

Net realized gain | | | — | | | | (1,851,869,071 | ) |

| | | | | | | | |

Total distributions | | | (318,530,089 | ) | | | (2,693,162,076 | ) |

| | | | | | | | |

| | |

FUND SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 3,104,421,927 | | | | 10,316,815,718 | |

Reinvestment of distributions | | | 300,702,027 | | | | 2,558,867,110 | |

Cost of shares redeemed | | | (3,691,437,518 | ) | | | (13,852,190,915 | ) |

| | | | | | | | |

Net decrease from Fund share transactions | | | (286,313,564 | ) | | | (976,508,087 | ) |

| | | | | | | | |

| | | | | | | | |

Total increase/(decrease) in net assets | | | 743,619,010 | | | | (30,569,440,575 | ) |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 32,721,198,351 | | | | 63,290,638,926 | |

| | | | | | | | |

End of period (including undistributed net investment income of $8,033,729 and $29,973,742, respectively) | | $ | 33,464,817,361 | | | $ | 32,721,198,351 | |

| | | | | | | | |

| | |

SHARE INFORMATION: | | | | | | | | |

Shares sold | | | 44,861,727 | | | | 96,421,753 | |

Distributions reinvested | | | 4,276,915 | | | | 22,845,911 | |

Shares redeemed | | | (55,216,615 | ) | | | (137,061,296 | ) |

| | | | | | | | |

Net decrease in shares outstanding | | | (6,077,973 | ) | | | (17,793,632 | ) |

| | | | | | | | |

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND §PAGE 8 |

NOTES TO FINANCIAL STATEMENTS (unaudited)

NOTE 1—ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Dodge & Cox Stock Fund (the “Fund”) is one of the series constituting the Dodge & Cox Funds (the “Trust” or the “Funds”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Fund commenced operations on January 4, 1965, and seeks long-term growth of principal and income. Risk considerations and investment strategies of the Fund are discussed in the Fund’s Prospectus.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require the use of estimates and assumptions by management. Significant accounting policies are as follows:

Security valuation The Fund’s net assets are valued as of the close of trading on the New York Stock Exchange (NYSE), generally 4:00 p.m. Eastern Time, each day that the NYSE is open for business. Stocks are valued at the official quoted close price or the last sale of the day at the close of the NYSE or, if not available, at the mean between the exchange listed bid and ask prices for the day. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Security values are not discounted based on the size of the Fund’s position. Securities for which market quotations are not readily available are valued at fair value as determined in good faith by or at the direction of the Board of Trustees. Short-term securities are valued at amortized cost which approximates current value. All securities held by the Fund are denominated in U.S. dollars.

Security transactions, investment income, expenses, and distributions Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Dividend income and corporate action transactions are recorded on the ex-dividend date, except for certain dividends or corporate actions from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date.

Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Distributions received in excess of income are recorded as a reduction of cost of investments and/or realized gain. Interest income is recorded on the accrual basis.

Expenses are recorded on the accrual basis. Most expenses of the Trust can be directly attributed to a specific series. Expenses which cannot be directly attributed are allocated among the Funds in the Trust.

Distributions to shareholders are recorded on the ex-dividend date.

Repurchase agreements The Fund may enter into repurchase agreements, secured by U.S. government or agency securities, which involve the purchase of securities from a counterparty with a simultaneous commitment to resell the securities at an agreed-upon date and price. It is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. In the event of default by the counterparty, the Fund has the contractual right to liquidate the collateral securities and to apply the proceeds in satisfaction of the obligation.

NOTE 2—VALUATION MEASUREMENTS

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| § | | Level 1: Quoted prices in active markets for identical securities |

| § | | Level 2: Other significant observable inputs (including quoted prices for similar securities, market indices, interest rates, credit risk, etc.) |

| § | | Level 3: Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

PAGE 9 § DODGE & COX STOCK FUND

NOTES TO FINANCIAL STATEMENTS (unaudited)

The following is a summary of the inputs used to value the Fund’s holdings as of June 30, 2009:

| | | | | | |

| Security Classification(a) | | LEVEL 1

(Quoted Prices) | | LEVEL 2

(Other Significant

Observable Inputs) |

Common Stocks(b) | | $ | 32,966,266,008 | | $ | — |

Money Market Investments | | | 101,333,086 | | | — |

Repurchase Agreements | | | — | | | 331,944,000 |

| | | | | | |

Total | | $ | 33,067,599,094 | | $ | 331,944,000 |

| | | | | | |

| | | | | | | |

| (a) | At June 30, 2009 the Fund held no securities that were considered to be “Level 3” securities (those valued using significant unobservable inputs). |

| (b) | All common stocks held in the Fund are Level 1 securities. For a detailed break-out of common stocks by major industry classification, please refer to the Portfolio of Investments. |

NOTE 3—RELATED PARTY TRANSACTIONS

Management fees Under a written agreement approved by a unanimous vote of the Board of Trustees, the Fund pays an annual management fee of 0.50% of the Fund’s average daily net assets to Dodge & Cox, investment manager of the Fund. The agreement further provides that Dodge & Cox shall waive its fee to the extent that such fee plus all other ordinary operating expenses of the Fund exceed 0.75% of the average daily net assets for the year.

Fund officers and trustees All officers and three of the trustees of the Trust are officers or employees of Dodge & Cox. The Trust pays a fee only to those trustees who are not affiliated with Dodge & Cox.

Indemnification Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnities to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 4—INCOME TAX INFORMATION

A provision for federal income taxes is not required since the Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal

Revenue Code and distribute all of its taxable income to shareholders. Distributions are determined in accordance with income tax regulations, which may differ from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character.

Book/tax differences are primarily due to differing treatments of wash sales, in-kind redemptions and net short-term realized gain/(loss). During the period, the Fund recognized net capital gain of $9,265,340 from the delivery of appreciated securities in an in-kind redemption transaction. For federal income tax purposes, this gain is not recognized as taxable income to the Fund and therefore will not be distributed to shareholders. At June 30, 2009, the cost of investments for federal income tax purposes was $42,827,213,185.

Distributions during the six months ended June 30, 2009 and for the year ended December 31, 2008 were characterized as follows for federal income tax purposes:

| | | | |

| | | Six Months Ended June 30, 2009 | | Year Ended December 31, 2008 |

Ordinary income | | $318,530,089 | | $863,451,970 |

| | ($0.740 per share) | | ($1.889 per share) |

| | |

Long-term capital gain | | — | | $1,829,710,106 |

| | | | ($4.079 per share) |

At June 30, 2009, the tax basis components of distributable earnings were as follows:

| | | | |

Unrealized appreciation | | $ | 2,977,006,166 | |

Unrealized depreciation | | | (12,404,676,257 | ) |

| | | | |

Net unrealized depreciation | | | (9,427,670,091 | ) |

Undistributed ordinary income | | | 8,033,729 | |

Accumulated capital loss(a) | | | (6,504,450,990 | ) |

Capital loss carryforward(b) | | | (30,080,078 | ) |

| (a) | Represents capital loss realized for tax purposes during the period from January 1, 2009 to June 30, 2009. |

| (b) | Represents accumulated capital loss as of December 31, 2008 which may be carried forward to offset future capital gains. If not utilized, the capital loss carryforward will expire in 2016. |

Fund management has reviewed the tax positions for open periods (for Federal purposes, three years from the date of filing and for State purposes, four years from the date of filing) as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements.

DODGE & COX STOCK FUND §PAGE 10

NOTES TO FINANCIAL STATEMENTS (unaudited)

NOTE 5—COMMITTED LINE OF CREDIT

The Fund participates with the Funds in a $200 million committed credit facility (“Line of Credit”) with State Street Bank and Trust Company to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. Interest on borrowings is charged at the prevailing rate. There were no borrowings on the Line of Credit during the period.

NOTE 6—PURCHASES AND SALES OF INVESTMENTS

For the six months ended June 30, 2009, purchases and sales

of securities, other than short-term securities, aggregated $3,434,582,301 and $3,537,640,022, respectively.

NOTE 7—SUBSEQUENT EVENTS

Fund management has determined that no material events or transactions occurred subsequent to June 30, 2009 and through August 11, 2009, the date of the Fund’s financial statements issuance, which require additional disclosure in the Fund’s financial statements.

NOTE 8—HOLDINGS OF 5% VOTING SECURITIES

Each of the companies listed below was considered to be an affiliate of the Fund because the Fund owned 5% or more of the company’s voting securities during all or part of the six-month period ended June 30, 2009. Purchase and sale transactions and dividend income earned during the period on these securities were as follows:

| | | | | | | | | | | | | | | | | |

| | | Shares at

Beginning of Period | | Additions | | Reductions | | | Shares at

End of Period | | Dividend

Income(a) | | | Value at

End of Period | |

Baker Hughes, Inc. | | 15,061,494 | | 808,500 | | (15,800 | ) | | 15,854,194 | | $ | 4,638,448 | | | $ | 577,726,830 | |

Cadence Design Systems, Inc. | | 23,293,600 | | 12,300 | | (23,300 | ) | | 23,282,600 | | | — | (b) | | | 137,367,340 | |

Capital One Financial Corp. | | 26,304,011 | | 5,665,900 | | (26,300 | ) | | 31,943,611 | | | 11,177,890 | | | | 698,926,209 | |

Cardinal Health, Inc. | | 21,868,375 | | 10,900 | | (609,525 | ) | | 21,269,750 | | | 6,701,413 | | | | 649,790,863 | |

CarMax, Inc. | | 11,812,400 | | 6,600 | | (11,800 | ) | | 11,807,200 | | | — | (b) | | | 173,565,840 | |

Citrix Systems, Inc. | | 12,014,741 | | 424,681 | | (12,400 | ) | | 12,427,022 | | | — | (b) | | | 396,297,731 | |

Computer Sciences Corp. | | 13,462,172 | | 5,700 | | (1,685,900 | ) | | 11,781,972 | | | — | (b) | | | 521,941,360 | |

Compuware Corp. | | 22,096,012 | | 14,200 | | (22,100 | ) | | 22,088,112 | | | — | (b) | | | 151,524,448 | |

Health Management Associates, Inc. | | 15,334,500 | | — | | (8,345,440 | ) | | 6,989,060 | | | — | (b) | | | — | (c) |

Maxim Integrated Products, Inc. | | 24,360,200 | | 12,900 | | (24,300 | ) | | 24,348,800 | | | 9,739,220 | | | | 382,032,672 | |

Motorola, Inc. | | 155,139,211 | | 20,900 | | (12,154,900 | ) | | 143,005,211 | | | — | (b) | | | 948,124,549 | |

SLM Corp. | | 26,195,782 | | 16,200 | | (26,100 | ) | | 26,185,882 | | | — | (b) | | | 268,929,008 | |

Sprint Nextel Corp. | | 109,849,239 | | 30,069,100 | | (12,092,600 | ) | | 127,825,739 | | | — | (b) | | | — | (c) |

Xerox Corp. | | 57,778,300 | | 10,278,600 | | (59,600 | ) | | 67,997,300 | | | 5,345,463 | | | | 440,622,504 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | $ | 37,602,434 | | | $ | 5,346,849,354 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| (a) | Net of foreign taxes, if any |

| (c) | Company was not an affiliate at the end of the period |

PAGE 11 § DODGE & COX STOCK FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | |

SELECTED DATA AND RATIOS (for a share outstanding throughout each period) | | Six Months

Ended June 30, | | | Year Ended December 31, | |

| | | 2009(a) | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | |

Net asset value, beginning of period | | $74.37 | | | $138.26 | | | $153.46 | | | $137.22 | | | $130.22 | | | $113.78 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | |

Net investment income | | 0.69 | | | 1.91 | | | 2.30 | | | 2.15 | | | 1.68 | | | 1.54 | |

Net realized and unrealized gain/(loss) | | 2.81 | | | (59.83 | ) | | (1.90 | ) | | 23.12 | | | 10.36 | | | 20.08 | |

| | | | | | |

Total from investment operations | | 3.50 | | | (57.92 | ) | | 0.40 | | | 25.27 | | | 12.04 | | | 21.62 | |

| | | | | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | | | | |

Net investment income | | (0.74 | ) | | (1.84 | ) | | (2.34 | ) | | (2.12 | ) | | (1.70 | ) | | (1.53 | ) |

Net realized gain | | — | | | (4.13 | ) | | (13.26 | ) | | (6.91 | ) | | (3.34 | ) | | (3.65 | ) |

| | | | | | |

Total distributions | | (0.74 | ) | | (5.97 | ) | | (15.60 | ) | | (9.03 | ) | | (5.04 | ) | | (5.18 | ) |

| | | | | | |

Net asset value, end of period | | $77.13 | | | $74.37 | | | $138.26 | | | $153.46 | | | $137.22 | | | $130.22 | |

| | | | | | |

Total return | | 4.80 | % | | (43.31 | )% | | 0.14 | % | | 18.54 | % | | 9.36 | % | | 19.16 | % |

Ratios/supplemental data: | | | | | | | | | | | | | | | | | | |

Net assets, end of period (millions) | | $33,465 | | | $32,721 | | | $63,291 | | | $66,185 | | | $52,184 | | | $43,266 | |

Ratio of expenses to average net assets | | 0.53 | %(b) | | 0.52 | % | | 0.52 | % | | 0.52 | % | | 0.52 | % | | 0.53 | % |

Ratio of net investment income to average net assets | | 1.97 | %(b) | | 1.75 | % | | 1.44 | % | | 1.48 | % | | 1.29 | % | | 1.32 | % |

Portfolio turnover rate | | 12 | % | | 31 | % | | 27 | % | | 14 | % | | 12 | % | | 11 | % |

See accompanying Notes to Financial Statements

DODGE & COX STOCK FUND §PAGE 12

FUND HOLDINGS

The Fund provides a complete list of its holdings four times each fiscal year, as of the end of each quarter. The lists appear in the Fund’s First Quarter, Semi-Annual, Third Quarter and Annual Reports to shareholders. The Fund files the lists with the Securities and Exchange Commission (SEC) on Form N-CSR (second and fourth quarters) and Form N-Q (first and third quarters). Shareholders may view the Fund’s Forms N-CSR and N-Q on the SEC’s website at www.sec.gov. Forms N-CSR and N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by 1-202-942-8090 (direct) or 1-800-732-0330 (general SEC number). A complete list of the Fund’s quarter-end holdings is also available at www.dodgeandcox.com on or about 15 days following each quarter end and remains available on the web site until the list is updated in the subsequent quarter.

PROXY VOTING

For a free copy of the Fund’s proxy voting policies and procedures, please call 1-800-621-3979, visit the Fund’s web site at www.dodgeandcox.com or visit the SEC’s web site at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is also available at www.dodgeandcox.com or at www.sec.gov.

PAGE 13 § DODGE & COX STOCK FUND

THIS PAGE INTENTIONALLY LEFT BLANK

DODGE & COX STOCK FUND §PAGE 14

DODGE & COX FUNDS—EXECUTIVE OFFICER & TRUSTEE INFORMATION

| | | | | | |

Name (Age) and

Address* | | Position with Trust

(Year of Election or

Appointment) | | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustees |

| INTERESTED TRUSTEES & OFFICERS |

| John A. Gunn (65) | | Chairman and Trustee

(Trustee since 1985) | | Chairman (since 2007), Chief Executive Officer (since 2005) and Director of Dodge & Cox, Portfolio Manager and member of Investment Policy Committee (IPC), Global Investment Policy Committee (GIPC) (since 2008), and International Investment Policy Committee (IIPC) | | — |

| Kenneth E. Olivier (57) | | President and Trustee

(Trustee since 2005) | | President (since 2005) and Director of Dodge & Cox, Portfolio Manager, and member of IPC | | — |

| Dana M. Emery (47) | | Senior Vice President and Trustee (Trustee since 1993) | | Executive Vice President (since 2005) and Director of Dodge & Cox, Manager of the Fixed Income Department, Portfolio Manager, and member of Fixed Income Investment Policy Committee (FIIPC) | | — |

| Charles F. Pohl (51) | | Senior Vice President (Officer since 2004) | | Senior Vice President and Director of Dodge & Cox, Chief Investment Officer (since 2007), Director of Credit Research, Portfolio Manager, Investment Analyst, and member of IPC, GIPC (since 2008), IIPC (since 2007), and FIIPC | | — |

| Diana S. Strandberg (49) | | Senior Vice President

(Officer since 2005) | | Vice President of Dodge & Cox, Portfolio Manager, and member of IPC, GIPC (since 2008), and IIPC | | — |

| David H. Longhurst (52) | | Treasurer (Officer since 2006) | | Vice President and Assistant Treasurer of Dodge & Cox (since 2008); Vice President, Treasurer, Controller and Secretary of Safeco Mutual Funds, Safeco Asset Management Company, Safeco Services, Safeco Securities, and Safeco Investment Services (2000-2004) | | — |

| Thomas M. Mistele (55) | | Secretary

(Officer since 2000) | | Chief Operating Officer (since 2004), Director (since 2005), Secretary, and General Counsel of Dodge & Cox | | — |

| Marcia P. Venegas (40) | | Chief Compliance Officer

(Officer since 2004) | | Associate Chief Compliance Officer of Dodge & Cox (since 2008), Chief Compliance Officer of Dodge & Cox (2005-2008), Compliance Officer of Dodge & Cox (2003-2004) | | — |

| INDEPENDENT TRUSTEES |

| William F. Ausfahl (69) | | Trustee (Since 2002) | | CFO, The Clorox Co. (1982-1997); Director, The Clorox Co. (1984-1997) | | — |

| L. Dale Crandall (67) | | Trustee (Since 1999) | | President, Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals (2000-2002); Senior Vice President—Finance and Administration & CFO, Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals (1998-2000) | | Director, Ansell Limited (medical equipment and supplies) (2002-Present); Director, Coventry Health Care, Inc. (managed health care) (2004-Present); Director, Metavante Technologies, Inc. (software) (2007 to present) |

| Thomas A. Larsen (59) | | Trustee (Since 2002) | | Director in Howard, Rice, Nemerovski, Canady, Falk & Rabkin (law firm) | | — |

John B. Taylor (62) | | Trustee (Since 2005) | | Professor of Economics, Stanford University; Senior Fellow, Hoover Institution; Under Secretary for International Affairs, United States Treasury (2001-2005) | | — |

| Will C. Wood (69) | | Trustee (Since 1992) | | Principal, Kentwood Associates, Financial Advisers | | Director, Banco Latinoamericano de Exportaciones S.A. (Latin American foreign trade bank) (1999-Present) |

| * | | The address for each Officer and Trustee is 555 California Street, 40th Floor, San Francisco, California 94104. Each Officer and Trustee oversees all five series in the Dodge & Cox Funds complex and serves for an indefinite term. |

Additional information about the Trust’s Trustees and Officers is available in the Trust’s Statement of Additional Information (SAI). You can get a free copy of the SAI by visiting the Funds’ website at www.dodgeandcox.com or calling 1-800-621-3979.

PAGE 15 § DODGE & COX STOCK FUND

| | | | |

| | | |  |

www.dodgeandcox.com

For Fund literature, transactions, and account information, please visit the Funds’ web site.

or write or call:

DODGE & COX FUNDS

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

INVESTMENT MANAGER

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions, and portfolio holdings as of June 30, 2009, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

6/09 GSF SAR  Printed on recycled paper

Printed on recycled paper

Semi-Annual Report

June 30, 2009

Global Stock

Fund

ESTABLISHED 2008

TICKER: DODWX

TO OUR SHAREHOLDERS

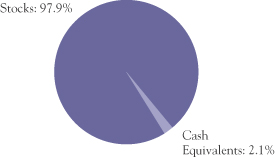

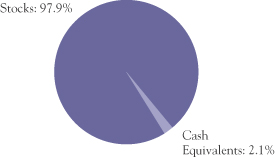

The Dodge & Cox Global Stock Fund had a total return of 13.5% for the first half of 2009, compared to a return of 6.4% for the MSCI World Index (MSCI World). Returns since the inception of the Fund appear on page three. At June 30, the Fund had net assets of $515 million with a cash position of 2.1%. While the six-month results were solid, the Fund is still down 30.2% from one year ago, compared to down 29.5% for the MSCI World.

MARKET COMMENTARY

The last six months have been volatile ones in the financial markets. Global stock markets (as measured by the MSCI World) fell 25% from the start of the year to their low on March 9, and then rallied to rise 42% to June 30. Returns for individual investments have been even more tumultuous, with some stocks falling and then rising by dramatic amounts. Throughout this turbulence, Dodge & Cox has remained steady in our focus on the fundamentals of the individual companies in which we invest and the long-term outlook for their growth and profitability.

INVESTMENT STRATEGY

For us, a long-term perspective means viewing the Fund as part-owner of a business. We focus our research efforts on the issues that would matter to a business owner—competitive position, management, growth prospects, and risks in relation to current valuation. We do not let short-term issues dictate our long-term strategy, though we do pay close attention to immediate risks. For example, with the length of the current downturn uncertain, we want to have a great degree of confidence that the companies the Fund holds are able to withstand a difficult external environment. In a recent commentary, we highlighted how our fixed income and equity research teams work together to analyze and stress-test the debt levels and access to cash for many of the Fund’s holdings.

Historically our investment team has found that share prices can change much more in the short term than underlying business fundamentals. In a difficult environment, when companies are under pressure and share prices are down, we often see indiscriminate selling of companies perceived as risky. We believe our

investment process gives us the tools to make more informed decisions: an independent research team with detailed knowledge of the companies the Fund holds, an eye on long-term value across economic cycles, and the patience to hold on to investments that appear sound. In some cases, selling by other investors has provided the opportunity for the Fund to increase its holdings in companies where we see an attractive future. In other cases, where our analysis indicates that the risks outweigh the potential returns, the Fund has sold positions. Sales in the first half included Citigroup and American International Group (AIG).

PERSISTENCE MATTERS

One of the lessons we hope investors take to heart watching the current year unfold is that persistence matters greatly to long-term returns. The holdings that have helped the portfolio—selected Financials, construction materials, and information technology companies—are essentially the same ones that caused the greatest concern in the first months of 2009. For example, there were 24 companies in the Fund whose total returns exceeded 100% between March 9 and June 30. Of those 24, 18 declined at least 40% between December 31 and March 9. Without persistence, the Fund would not have benefited from the sharp appreciation in those investments.

One example of our investment process is Capital One, a leading U.S. credit card company. Capital One has historically grown market share in the credit card business while achieving a high return on capital through an innovative, information-based strategy. In 2005 and 2006, the company diversified its business and strengthened its sources of funding by acquiring two retail banks. In the current recession, Capital One’s business has come under pressure as defaults have risen, consumer spending has dropped, and traditional funding sources have dried up. In addition, regulatory changes recently passed by Congress are likely to affect the future profitability of the credit card business. Our analysis of the company recognizes all these challenges, but also the strengths of the company: a strong capital base, stable funding sources, and a talented, prudent management team led by founder Richard

PAGE 1 § DODGE & COX GLOBAL STOCK FUND

Fairbanks. Our investment analysis also takes into account the valuation the market places on the company, which fell as low as 0.2 times book value during the February–April period before rebounding sharply by the end of June (though still down 29% for the six-month period). The Fund significantly increased its holding of Capital One during the first half of the year. Importantly, we use this example to illustrate our investment process, not to imply that we think it is more attractive than the Fund’s other holdings.

LOOKING FORWARD

Despite the recent rebound, stock markets are still down significantly over the last two years. The MSCI World is 40% below the peak it reached on October 31, 2007. We believe valuation levels are attractive and continue to find opportunities for new investments that we think will provide good returns in the years ahead. Two areas that we find particularly attractive at present are companies positioned to take advantage of growth in the developing world and companies that benefit from research-driven innovation. Some of our holdings in the first group include Net Servicos, a Brazilian pay-TV operator, and Standard Chartered, a British bank with operations throughout Asia. Examples of companies benefiting from innovation include Roche, a Swiss pharmaceutical company added to the Fund during 2009, and Philips Electronics, a Dutch manufacturer of advanced lighting and medical systems.

IN CLOSING

Thank you for your continued confidence in our firm as a shareholder of the Dodge & Cox Global Stock Fund. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |  |

John A. Gunn, Chairman | | Diana S. Strandberg, Senior Vice President |

August 11, 2009

PERFORMANCE REVIEW

Key Contributors to Relative Results

| | § | | A strong relative return from the Fund’s Energy holdings (up 20%) versus the MSCI World sector (up 6%) contributed to relative performance. In particular, Petrobras (up 65%), Lukoil Holdings (up 42%), and Schlumberger (up 29%) helped performance. | |

| | § | | A strong relative return from the Fund’s Telecommunication Services holdings (up 51%) versus the MSCI World sector (down 4%) contributed to relative performance. In particular, Sprint Nextel (up 163%) was a strong performer. | |

| | § | | Lower average weightings in Utilities (0% versus 5% in the MSCI World sector) and Consumer Staples (2% versus 11% in the MSCI World sector) were beneficial, as these sectors underperformed other areas of the market. | |

| | § | | Notable contributors included Credit Suisse (up 71%) and Naspers (up 46%). | |

Key Detractors from Relative Results

| | § | | A poor return from the Fund’s Industrial holdings (down 4%) versus the MSCI World sector (up 2%) detracted from relative performance. In particular, General Electric (down 25%) and FedEx (down 13%) hurt performance. | |

| | § | | The Fund’s higher average weighting in the Health Care sector (15% versus 11% for the MSCI World) detracted from results, as the Health Care sector underperformed other sectors. Weak returns from Novartis (down 15%) and Amgen (down 8%) detracted from performance. | |

| | § | | Capital One (down 29%) and Swiss Re (down 30%) hindered the Fund’s relative performance. | |

DODGE & COX GLOBAL STOCK FUND §PAGE 2

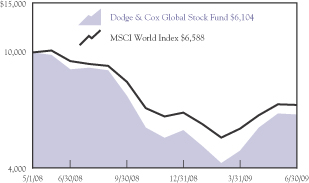

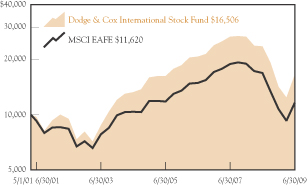

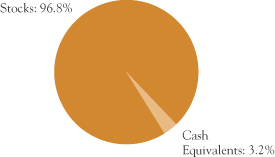

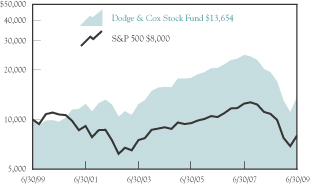

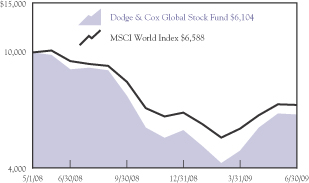

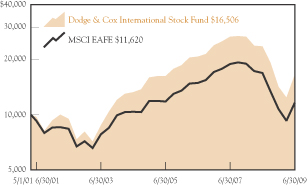

GROWTH OF $10,000 SINCE INCEPTION

FOR AN INVESTMENT MADE ON MAY 1, 2008

AVERAGE ANNUAL TOTAL RETURN

FOR PERIODS ENDED JUNE 30, 2009

| | | | |

| | | 1 Year | | Since Inception

(05/01/08) |

Dodge & Cox Global Stock Fund | | -30.16% | | -34.50% |

MSCI World Index | | -29.49 | | -30.08 |

Past performance does not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated. Performance is updated and published monthly. Visit the Fund’s web site at www.dodgeandcox.com or call 1-800-621-3979 for current performance figures.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions. The MSCI World Index is a widely recognized benchmark of the world’s stock markets, including the United States. Index returns include dividends and/or interest income but, unlike Fund returns, do not reflect fees or expenses.

MSCI World Index® is a trademark of MSCI Barra.

Risks of international investing: Foreign investing, especially in developing countries, has special risks such as currency and market volatility and political and social instability. These and other risk considerations are discussed in the Fund’s prospectus.

FUND EXPENSE EXAMPLE

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and expenses based on the Fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON WITH OTHER MUTUAL FUNDS

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expense Paid During the Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

| | | | | | | | | |

Six Months Ended June 30, 2009 | | Beginning Account Value

1/1/2009 | | Ending Account Value

6/30/2009 | | Expenses Paid During Period* |

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 1,134.80 | | $ | 4.33 |

Based on Hypothetical 5% Yearly Return | | | 1,000.00 | | | 1,020.74 | | | 4.10 |

| * | | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.82%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. While other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

PAGE 3 § DODGE & COX GLOBAL STOCK FUND

| | |

| FUND INFORMATION | | June 30, 2009 |

| | |

| GENERAL INFORMATION |

Net Asset Value Per Share | | $6.06 |

Total Net Assets (millions) | | $515 |

Expense Ratio (1/1/09 to 6/30/09, annualized) | | 0.82% |

Portfolio Turnover Rate (1/1/09 to 6/30/09, unannualized) | | 15% |

30-Day SEC Yield(a) | | 1.34% |

Fund Inception Date | | May 1, 2008 |

No sales charges or distribution fees | | |

Investment Manager: Dodge & Cox, San Francisco. Managed by the Global Investment Policy Committee, whose six members’ average tenure at Dodge & Cox is 18 years.

| | | | |

| PORTFOLIO CHARACTERISTICS | | Fund | | MSCI

World |

Number of Stocks | | 91 | | 1,656 |

Median Market Capitalization (billions) | | $17 | | $5 |

Weighted Average Market

Capitalization (billions) | | $41 | | $53 |

Price-to-Earnings Ratio(b) | | 12.0x | | 13.9x |

Countries Represented | | 23 | | 23 |

Emerging Markets (Brazil, India, Indonesia, Mexico, Russia, South Africa, Thailand, Turkey) | | 13.2% | | 0.0% |

| | | |

| TEN LARGEST HOLDINGS(c) | | Fund | |

Schlumberger, Ltd. (United States) | | 3.0 | % |

Hewlett-Packard Co. (United States) | | 2.8 | |

Novartis AG (Switzerland) | | 2.4 | |

Capital One Financial Corp. (United States) | | 2.4 | |

Lafarge SA (France) | | 2.2 | |

Naspers, Ltd. (South Africa) | | 2.1 | |

Swiss Reinsurance Co. (Switzerland) | | 2.1 | |

Unicredit SPA (Italy) | | 1.9 | |

Schneider Electric SA (France) | | 1.9 | |

Merck & Co., Inc. (United States) | | 1.9 | |

| | | | | | |

| REGION DIVERSIFICATION | | Fund | | | MSCI

World | |

United States | | 38.6 | % | | 48.2 | % |

Europe (excluding United Kingdom) | | 36.2 | | | 20.5 | |

United Kingdom | | 7.0 | | | 9.9 | |

Latin America | | 4.8 | | | 0.0 | |

Japan | | 4.6 | | | 11.3 | |

Pacific (excluding Japan) | | 4.1 | | | 5.4 | |

Africa | | 2.6 | | | 0.0 | |

Canada | | 0.0 | | | 4.7 | |

| | | | | | |

| SECTOR DIVERSIFICATION | | Fund | | | MSCI

World | |

Financials | | 20.9 | % | | 19.7 | % |

Health Care | | 14.7 | | | 10.7 | |

Information Technology | | 13.7 | | | 11.7 | |

Consumer Discretionary | | 12.9 | | | 9.3 | |

Energy | | 11.5 | | | 11.4 | |

Materials | | 9.8 | | | 6.8 | |

Industrials | | 9.5 | | | 10.3 | |

Telecommunication Services | | 3.3 | | | 4.6 | |

Consumer Staples | | 1.6 | | | 10.5 | |

Utilities | | 0.0 | | | 5.0 | |

| (a) | SEC yield is an annualization of the Fund’s total net investment income per share for the 30-day period ended on the last day of the month. |

| (b) | Price-to-earnings (P/E) ratios are calculated using 12-month forward earnings estimates. |

| (c) | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell, or hold any particular security. |

DODGE & COX GLOBAL STOCK FUND §PAGE 4

| | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | June 30, 2009 |

| | | | | |

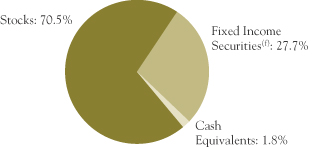

| COMMON STOCKS: 95.0% | | | | |

| | |

| | | SHARES | | VALUE |

| CONSUMER DISCRETIONARY: 11.8% | | | |

AUTOMOBILES & COMPONENTS: 1.0% | | | |

Bayerische Motoren Werke AG (Germany) | | 73,300 | | $ | 2,768,327 |

Yamaha Motor Co., Ltd. (Japan) | | 211,400 | | | 2,334,697 |

| | | | | |

| | | | | 5,103,024 |

CONSUMER DURABLES & APPAREL: 1.9% | | | |

Panasonic Corp. (Japan) | | 273,300 | | | 3,665,795 |

Sony Corp. (Japan) | | 246,600 | | | 6,370,276 |

| | | | | |

| | | | | 10,036,071 |

MEDIA: 7.7% | | | | | |

Comcast Corp., Class A (United States) | | 593,300 | | | 8,596,917 |

Grupo Televisa SA ADR (Mexico) | | 190,500 | | | 3,238,500 |

Naspers, Ltd. (South Africa) | | 414,100 | | | 10,913,856 |

News Corp., Class A (United States) | | 617,100 | | | 5,621,781 |

Television Broadcasts, Ltd. (Hong Kong) | | 366,700 | | | 1,432,033 |

Time Warner Cable, Inc.(a) (United States) | | 75,671 | | | 2,396,501 |

Time Warner, Inc. (United States) | | 286,466 | | | 7,216,079 |

| | | | | |

| | | | | 39,415,667 |

RETAILING: 1.2% | | | | | |

Liberty Interactive, Series A(a) (United States) | | 887,057 | | | 4,444,155 |

Macy’s, Inc. (United States) | | 164,700 | | | 1,936,872 |

| | | | | |

| | | | | 6,381,027 |

| | | | | |

| | | | | 60,935,789 |

| CONSUMER STAPLES: 1.6% | | | | | |

FOOD, BEVERAGE & TOBACCO: 1.5% | | | | | |

Anadolu Efes Biracilik ve Malt Sanayii AS (Turkey) | | 881,700 | | | 7,923,175 |

| |

HOUSEHOLD & PERSONAL PRODUCTS: 0.1% | | | |

Avon Products, Inc. (United States) | | 9,600 | | | 247,488 |

| | | | | |

| | | | | 8,170,663 |

| ENERGY: 9.7% | | | | | |

Baker Hughes, Inc. (United States) | | 167,987 | | | 6,121,446 |

Chevron Corp. (United States) | | 61,100 | | | 4,047,875 |

OAO Lukoil ADR (Russia) | | 141,100 | | | 6,304,099 |

Occidental Petroleum Corp. (United States) | | 118,900 | | | 7,824,809 |

Royal Dutch Shell PLC ADR (United Kingdom) | | 127,600 | | | 6,404,244 |

Schlumberger, Ltd. (United States) | | 289,100 | | | 15,643,201 |

Total SA (France) | | 64,000 | | | 3,466,378 |

| | | | | |

| | | | | 49,812,052 |

| FINANCIALS: 20.9% | | | | | |

BANKS: 9.7% | | | | | |

HSBC Holdings PLC (United Kingdom) | | 1,023,207 | | | 8,494,273 |

ICICI Bank, Ltd. ADR (India) | | 172,400 | | | 5,085,800 |

Kasikornbank PCL Foreign (Thailand) | | 1,641,100 | | | 3,459,978 |

Royal Bank of Scotland Group PLC(a) (United Kingdom) | | 4,896,684 | | | 3,113,927 |

Standard Bank Group, Ltd. (South Africa) | | 240,500 | | | 2,770,772 |

| | | | | |

| | |

| | | SHARES | | VALUE |

Standard Chartered PLC (United Kingdom) | | 455,954 | | $ | 8,587,707 |

Unicredit SPA (Italy) | | 3,928,608 | | | 10,064,960 |

Wells Fargo & Co. (United States) | | 341,573 | | | 8,286,561 |

| | | | | |

| | | | | 49,863,978 |

DIVERSIFIED FINANCIALS: 5.9% | | | | | |

Bank of New York Mellon Corp. (United States) | | 73,600 | | | 2,157,216 |

Capital One Financial Corp. (United States) | | 564,700 | | | 12,355,636 |

Credit Suisse Group AG (Switzerland) | | 149,000 | | | 6,801,800 |

Haci Omer Sabanci Holding AS (Turkey) | | 1,120,788 | | | 3,004,554 |

Legg Mason, Inc. (United States) | | 233,700 | | | 5,697,606 |

State Street Corp. (United States) | | 9,800 | | | 462,560 |

| | | | | |

| | | | | 30,479,372 |

INSURANCE: 4.0% | | | | | |

AEGON NV(a) (Netherlands) | | 1,278,374 | | | 7,862,814 |

Swiss Reinsurance Co. (Switzerland) | | 328,400 | | | 10,865,258 |

Tokio Marine Holdings, Inc. (Japan) | | 71,300 | | | 1,958,232 |

| | | | | |

| | | | | 20,686,304 |

REAL ESTATE: 1.3% | | | | | |

Hang Lung Group, Ltd. (Hong Kong) | | 1,127,500 | | | 5,329,165 |

Hang Lung Properties, Ltd. (Hong Kong) | | 381,700 | | | 1,237,892 |

| | | | | |

| | | | | 6,567,057 |

| | | | | |

| | | | | 107,596,711 |

| HEALTH CARE: 14.7% | | | | | |

HEALTH CARE EQUIPMENT & SERVICES: 2.5% | | | |

Covidien PLC (Ireland) | | 158,700 | | | 5,941,728 |

UnitedHealth Group, Inc. (United States) | | 146,400 | | | 3,657,072 |

WellPoint, Inc.(a) (United States) | | 62,900 | | | 3,200,981 |

| | | | | |

| | | | | 12,799,781 |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES: 12.2% |

Amgen, Inc.(a) (United States) | | 139,900 | | | 7,406,306 |

Bayer AG (Germany) | | 92,000 | | | 4,940,035 |

GlaxoSmithKline PLC ADR (United Kingdom) | | 264,700 | | | 9,354,498 |

Merck & Co., Inc. (United States) | | 350,200 | | | 9,791,592 |

Novartis AG ADR (Switzerland) | | 306,000 | | | 12,481,740 |

Roche Holding AG (Switzerland) | | 39,700 | | | 5,401,135 |

Sanofi-Aventis (France) | | 110,100 | | | 6,475,112 |

Thermo Fisher Scientific, Inc.(a) (United States) | | 4,500 | | | 183,465 |

Wyeth (United States) | | 156,500 | | | 7,103,535 |

| | | | | |

| | | | | 63,137,418 |

| | | | | |

| | | | | 75,937,199 |

| INDUSTRIALS: 9.5% | | | | | |

CAPITAL GOODS: 8.3% | | | | | |

Eaton Corp. (United States) | | 31,900 | | | 1,423,059 |

General Electric Co. (United States) | | 720,700 | | | 8,446,604 |

| | |

| PAGE 5 § DODGE & COX GLOBAL STOCK FUND | | See accompanying Notes to Financial Statements |

| | |

| PORTFOLIO OF INVESTMENTS (unaudited) | | June 30, 2009 |

| | | | | |

| COMMON STOCKS (continued) |

| | |

| | | SHARES | | VALUE |

Koninklijke Philips Electronics NV (Netherlands) | | 322,700 | | $ | 5,967,146 |

Mitsubishi Electric Corp.(a) (Japan) | | 1,082,000 | | | 6,808,105 |

Schneider Electric SA (France) | | 130,389 | | | 9,972,103 |

Tyco International, Ltd. (Switzerland) | | 321,600 | | | 8,355,168 |

Wienerberger AG(a) (Austria) | | 161,200 | | | 2,004,078 |

| | | | | |

| | | | | 42,976,263 |

TRANSPORTATION: 1.2% | | | | | |

FedEx Corp. (United States) | | 109,400 | | | 6,084,828 |

| | | | | |

| | | | | 49,061,091 |

| INFORMATION TECHNOLOGY: 13.7% | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT: 1.0% |

Infineon Technologies AG(a) (Germany) | | 590,200 | | | 2,142,621 |

Maxim Integrated Products, Inc. (United States) | | 200,000 | | | 3,138,000 |

| | | | | |

| | | | | 5,280,621 |

SOFTWARE & SERVICES: 3.2% | | | | | |

Cadence Design Systems, Inc.(a) (United States) | | 670,000 | | | 3,953,000 |

Computer Sciences Corp.(a) (United States) | | 58,500 | | | 2,591,550 |

Compuware Corp.(a) (United States) | | 171,400 | | | 1,175,804 |

EBay, Inc.(a) (United States) | | 352,400 | | | 6,036,612 |

Symantec Corp.(a) (United States) | | 8,700 | | | 135,372 |

Synopsys, Inc.(a) (United States) | | 118,900 | | | 2,319,739 |

| | | | | |

| | | | | 16,212,077 |

TECHNOLOGY, HARDWARE & EQUIPMENT: 9.5% |

Alcatel-Lucent(a) (France) | | 2,234,400 | | | 5,630,252 |

Hewlett-Packard Co. (United States) | | 372,000 | | | 14,377,800 |

Kyocera Corp. (Japan) | | 32,600 | | | 2,445,471 |

Motorola, Inc.(a) (United States) | | 779,100 | | | 5,165,433 |

Nokia Oyj (Finland) | | 515,800 | | | 7,527,412 |

Telefonaktiebolaget LM Ericsson (Sweden) | | 206,700 | | | 2,021,786 |

Tyco Electronics, Ltd. (Switzerland) | | 398,800 | | | 7,413,692 |

Xerox Corp. (United States) | | 694,200 | | | 4,498,416 |

| | | | | |

| | | | | 49,080,262 |

| | | | | |

| | | | | 70,572,960 |

| MATERIALS: 9.8% | | | | | |

Akzo Nobel NV (Netherlands) | | 140,000 | | | 6,160,707 |

Arkema (France) | | 255,916 | | | 6,013,180 |

Cemex SAB de CV ADR(a) (Mexico) | | 746,593 | | | 6,973,179 |