UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number 811-173 |

DODGE & COX FUNDS

|

| (Exact name of registrant as specified in charter) |

| | |

555 California Street, 40th Floor San Francisco, CA | | 94104 |

| (Address of principal executive offices) | | (Zip code) |

Thomas M. Mistele, Esq.

555 California Street, 40th Floor

San Francisco, CA 94104

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 415-981-1710

Date of fiscal year end: DECEMBER 31, 2008

Date of reporting period: DECEMBER 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following are the December 31, 2008 annual reports for the Dodge & Cox Funds, a Delaware statutory trust, consisting of five series: Dodge & Cox Stock Fund, Dodge & Cox Global Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund and Dodge & Cox Income Fund. The reports of each series were transmitted to their respective shareholders on February 18, 2009.

| | | | |

| | | |  |

www.dodgeandcox.com

For Fund literature, transactions, and account

information, please visit the Funds’ web site.

or write or call:

DODGE & COX FUNDS

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

INVESTMENT MANAGER

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions, and portfolio holdings as of December 31, 2008, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

12/08 SF AR  Printed on recycled paper

Printed on recycled paper

Annual Report

December 31, 2008

Stock Fund

ESTABLISHED 1965

TICKER: DODGX

TO OUR SHAREHOLDERS

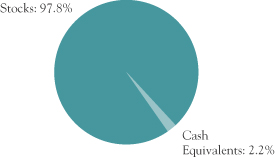

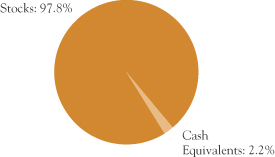

The Dodge & Cox Stock Fund had a total return of negative 43.3% for 2008, compared to a total return of negative 37.0% for the Standard & Poor’s 500 Index (S&P 500). At year end, the Fund had net assets of $32.7 billion with a cash position of 2.2%. Longer-term results appear on page four.

LOOKING BACK

The past year was the most disappointing in the Stock Fund’s 43-year history and the worst year for the broad market since 1931. As we reflect on 2008, we clearly underestimated the worsening credit crisis, the likelihood of government interventions, the depth and breadth of the ongoing economic problems, and the combined effect of these on many of the Fund’s holdings, particularly within the Financials sector.

While the returns resulting from a number of our investment decisions were disappointing during 2008, we are confident in the Fund’s holdings. The Fund has experienced periods of underperformance in the past. We have learned from these past periods just as we are learning from this one, and are incorporating these lessons into our strategy and outlook on an ongoing basis.

For example, during this unique period of extreme volatility and limited liquidity, our equity and fixed income research analysts have reviewed, updated, and stress-tested our financial projections for each of the Fund’s holdings, paying particular attention to potential vulnerabilities to the challenging credit market. We review this work with our analysts while continually monitoring relative values across our investment universe in order to determine the best long-term opportunities on behalf of the Fund’s shareholders. As a result of this review, we sold General Motors and Ford during the fourth quarter.

While we have made refinements, maintaining the essence of our investment approach through previous challenging periods has been crucial to the Fund’s long-term success. That approach—constructing a diversified portfolio through in-depth, independent research, a three-to-five year investment horizon, and a focus on valuation relative to underlying fundamentals—continues to guide us through this period as well. As we learn and make

adjustments, we remain confident that our enduring value-oriented approach will benefit our shareholders in the years ahead.

Founded in 1930, our firm has weathered past financial storms and we are confident we will weather this one as well. We are independently owned by our current employees, have no debt, and have kept our employee count low. We have no need for layoffs, and in fact have continued to invest in our most important resource—people—by maintaining a pattern of hiring one or two new analysts per year. Our independence gives us the staying power to stick with our convictions and maintain our focus on the long term. Our firm’s foremost objective is to provide high quality investment management service to our clients.

LOOKING FORWARD

While the economic landscape has clearly worsened with rising unemployment, declining home values, and continuing uncertainty within the Financials sector, there are a number of factors which build our convictions about the positive prospects for equity returns over the long term.

First, government officials and companies’ management teams have been actively addressing and responding to the economic downturn. Unlike some past recessions or the Great Depression, when policy makers either did nothing or raised barriers, the U.S. and foreign governments have implemented large programs to support the financial system and stimulate the economy, and have largely maintained free-market principles. Government involvement, though, can be a double-edged sword for the equity investor, as we’ve learned since September. As regulators take a more active role addressing problems in the banking system, but also take on health care, telecommunications, energy, and environmental policy, we are working to expand our understanding of where public policy is heading and its potential impact on the Fund’s investments.

In our regular discussions with management teams, we hear how they are also rapidly responding to the downturn. Many companies are reducing costs, improving processes, reconsidering strategies, and looking for growth and market share opportunities as competitors struggle.

PAGE 1 § DODGE & COX STOCK FUND

The survivors should be better positioned and more profitable when the economy does turn around. Examples of Fund holdings gaining market share and/or aggressively cutting costs include Hewlett-Packard, Comcast, Pfizer, FedEx, Schlumberger, and Wal-Mart.

Second, the U.S. economy has been through difficult periods before—it has survived wars, flu pandemics, inflation, labor unrest, and terrorist attacks. Pessimism during these periods—just like optimism during upturns—can become pervasive. Stock market volatility during this crisis has been at record levels with prices moving as much as 10% in a day—certainly beyond any changes in the underlying fundamentals of the companies these stocks represent. The U.S. and global economies are resilient and, while setbacks have occurred throughout history, equity investors have been rewarded over the long term. In the first 52 years of the S&P 500 (from early 1957 to the end of 2008) the annualized total return was 9.5% (including dividends). This return was driven primarily by the expansion in earnings of the companies that comprise the S&P 500. Earnings expansion in turn has come from companies focusing on their relative strength, expanding productivity, and, in the last few decades, taking advantage of overseas opportunities. While companies are currently under extreme profit pressure, there is nothing to indicate to us that the experience of the past 52 years is no longer relevant to the future.

Third, valuations for companies have obviously come down dramatically, and in our opinion are even more attractive today. As a whole, the stock market is selling at depressed valuations, and select companies are selling at very low multiples to sales and earnings potential. When the global economy stabilizes and recovers, attractive nominal returns could be achieved. Furthermore, companies perceived by investors as being more defensive—generally in the Utilities, Telecommunication Services, and Consumer Staples sectors—now trade at premium valuations, while companies viewed as riskier—generally those in the Consumer Discretionary, Information Technology, Industrials, and Financials sectors—have been discounted. The “flight to safety” strategy could prove successful in the near term. We, however, do not believe it will prove to be successful over the long term.

And finally, the powerful forces behind accelerated global economic growth over the past five years remain in place—namely, technological innovation and the growth in developing countries. While emerging markets growth has slowed, we believe the long-term outlook is good. The 5.5 billion people in the developing world now account for 30% to 40% of the global economy, and increasingly their growth is being created by demand from their own markets, not just by exports to the West—creating potential opportunities for multinational companies. As of year end, 20% of the Fund was invested in multinational foreign companies, and another 24% invested in U.S.-based companies that have at least 50% of their sales coming from overseas—much of it from emerging markets.

Two sectors in the crosshairs of technological innovation and growth in the developing world are Health Care and Information Technology. At year end, the Fund had 28% of its assets in Health Care stocks, primarily in global pharmaceutical companies (e.g., Novartis and GlaxoSmithKline). Pharmaceuticals are faced with many regulatory challenges, but are trading at historically low valuations and are in financially strong condition. They continue to innovate, and should benefit from increased demand as discretionary income in the developing world increases. Another 18% of the Fund was invested in Information Technology stocks, including a number of software and services companies (e.g., BMC Software, Citrix Systems, and Computer Sciences), that have solid balance sheets and high recurring revenues from clients who are dependent on them to maintain their businesses.

A THOUGHT ON FINANCIALS

As you will read in the box below, the performance of several of the Fund’s holdings in the Financials sector was breathtakingly bad. And given that the root of today’s economic turmoil lies in the banking system, it is not an unfair question to ask why one would invest in this area at all. As of year end, 11% of the Fund was invested in Financials compared to 13% of the S&P 500. Despite the continued sell-off during the fourth quarter and still lower valuations, we decided not to add significantly to positions in acknowledgement of the industry’s disruptions. At the same time, we did not sell the Fund’s positions with the

| | | | | | |

| | DODGE & COX STOCK FUND § | | PAGE | | 2 |

rationale that banks and other financial services firms provide a necessary long-term role in the global economy, and the survivors of this crisis will eventually return to profitability with stronger market positions and higher stock valuations. As we discussed earlier, we are fully cognizant of the challenges and risks in this area and are monitoring all of the Fund’s finance holdings.

IN CLOSING

Investing can be a humbling endeavor. This past year has been humbling for us twofold. First, a number of our investment decisions—made based on considerable research, discussion, and debate—proved to be wrong. Second, we have been humbled by the loyalty and confidence our shareholders have displayed through this difficult period. While the Fund did experience net outflows during the year, the outflows were manageable and represented a small percentage of the Fund’s asset base. By and large what we have heard from shareholders is not only disappointment with our recent returns, but confidence in Dodge & Cox and our investment approach. As fellow shareholders in the Fund, we share in these sentiments.

Our experienced investment team is working hard to take advantage of the attractive opportunities being created during this period of economic stress and volatility. Although it is impossible to predict the short-term direction of stock prices, our experience has taught us that persistence in the face of significant market dislocations can potentially be rewarding for patient investors with long-term investment horizons.

We appreciate your continued patience and confidence in our firm as a shareholder of the Dodge & Cox Stock Fund. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |

|

John A. Gunn, Chairman | | Kenneth E. Olivier, President |

February 13, 2009

2008 PERFORMANCE REVIEW

The Fund lagged the S&P 500 by 6.3 percentage points for the year.

Key Detractors from Relative Results

| | § | | The Fund’s Financials holdings (down 72% versus down 55% for the S&P 500 sector) had the largest negative impact on performance. American International Group (AIG, down 97%), Fannie Mae (down 97% to date of sale), Wachovia (down 85%, acquired by Wells Fargo), and Citigroup (down 76%) were notable detractors. | |

| | § | | The Fund’s higher average weighting in the Consumer Discretionary sector (22% versus 8% for the S&P 500 sector), in combination with the underperformance of the Fund’s holdings (down 41% versus down 33%), detracted. Sony (down 59%) and News Corp. (down 55%) lagged. | |

| | § | | The Fund’s lower average weighting in the Consumer Staples sector (3% versus 11% for the S&P 500 sector) detracted, as the sector declined less than the market. | |

| | § | | Individual detractors included Sprint Nextel (down 86%), Motorola (down 72%), Dow Chemical (down 59%), Schlumberger (down 56%), General Electric (down 54%), and Cardinal Health (down 40%). | |

Key Contributors to Relative Results

| | § | | The Fund’s higher average weighting in the Health Care sector (23% versus 13% for the S&P 500 sector) was beneficial, as both the Fund’s holdings and the S&P 500 sector (both down 23%) declined less than the overall market. Amgen (up 24%) and Novartis (down 6%) were strong contributors. | |

| | § | | Individual contributors included Rohm and Haas (up 42% to date of sale, potentially being acquired by Dow Chemical), Wal-Mart (up 20%), Electronic Data Systems (up 18% to date of sale, acquired by Hewlett-Packard), Union Pacific (up 10% to date of sale), Sherwin-Williams (up 10%, from initial purchase), and Wells Fargo (up 2%). | |

PAGE 3 § DODGE & COX STOCK FUND

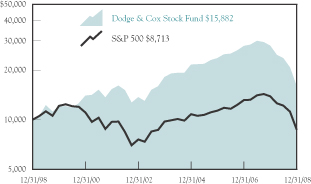

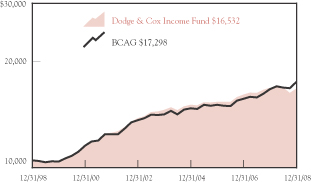

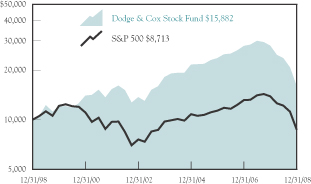

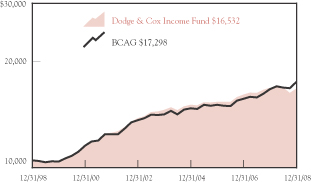

GROWTH OF $10,000 OVER 10 YEARS

FOR AN INVESTMENT MADE ON DECEMBER 31, 1998

AVERAGE ANNUAL TOTAL RETURN

FOR PERIODS ENDED DECEMBER 31, 2008

| | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | 20 Years | |

Dodge & Cox Stock Fund | | –43.31 | % | | –2.59 | % | | 4.73 | % | | 10.27 | % |

S&P 500 | | –36.99 | | | –2.19 | | | –1.38 | | | 8.43 | |

Past performance does not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated. Performance is updated and published monthly. Visit the Fund’s web site at www.dodgeandcox.com or call 1-800-621-3979 for current performance figures.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions. The Standard & Poor’s 500 (S&P 500) is a broad-based unmanaged measure of common stocks. Index returns include dividends and/or interest income but, unlike Fund returns, do not reflect fees or expenses.

Standard & Poor’s, Standard & Poor’s 500, and S&P 500® are trademarks of The McGraw-Hill Companies, Inc.

FUND EXPENSE EXAMPLE

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and expenses based on the Fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON WITH OTHER MUTUAL FUNDS

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expense Paid During the Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

| | | | | | | | | |

Six Months Ended

December 31, 2008 | | Beginning Account Value

7/1/2008 | | Ending Account Value

12/31/2008 | | Expenses Paid

During Period* |

Based on Actual Fund Return | | $ | 1,000.00 | | $ | 673.80 | | $ | 2.19 |

Based on Hypothetical 5% Yearly Return | | | 1,000.00 | | | 1,022.52 | | | 2.64 |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.52%, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. While other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

DODGE & COX STOCK FUND §PAGE 4

| | |

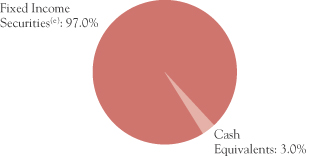

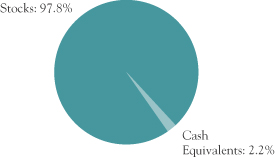

| FUND INFORMATION | | December 31, 2008 |

| | |

| GENERAL INFORMATION | | |

Net Asset Value Per Share | | $74.37 |

Total Net Assets (billions) | | $32.7 |

2008 Expense Ratio | | 0.52% |

2008 Portfolio Turnover Rate | | 31% |

30-Day SEC Yield(a) | | 2.43% |

Fund Inception | | 1965 |

No sales charges or distribution fees | | |

Investment Manager: Dodge & Cox, San Francisco. Managed by the Investment Policy Committee, whose nine members’ average tenure at Dodge & Cox is 23 years.

| | | | |

| PORTFOLIO CHARACTERISTICS | | Fund | | S&P 500 |

Number of Stocks | | 77 | | 500 |

Median Market Capitalization (billions) | | $12 | | $7 |

Weighted Average Market

Capitalization (billions) | | $55 | | $80 |

Price-to-Earnings Ratio(b) | | 11.0x | | 15.6x |

Foreign Stocks(c) | | 20.1% | | 0.0% |

| | | |

| TEN LARGEST HOLDINGS(d) | | Fund | |

Comcast Corp. | | 5.1 | % |

Hewlett-Packard Co. | | 4.9 | |

Novartis AG (Switzerland) | | 4.2 | |

Sanofi-Aventis (France) | | 3.6 | |

Amgen, Inc. | | 3.3 | |

GlaxoSmithKline PLC (United Kingdom) | | 3.3 | |

Time Warner, Inc. | | 3.3 | |

WellPoint, Inc. | | 3.0 | |

Schlumberger, Ltd. | | 2.7 | |

News Corp. | | 2.7 | |

| | | | | | |

| SECTOR DIVERSIFICATION | | Fund | | | S&P 500 | |

Health Care | | 28.1 | % | | 14.8 | % |

Consumer Discretionary | | 18.9 | | | 8.4 | |

Information Technology | | 18.0 | | | 15.3 | |

Financials | | 11.1 | | | 13.3 | |

Energy | | 9.7 | | | 13.3 | |

Industrials | | 6.5 | | | 11.1 | |

Consumer Staples | | 2.7 | | | 12.9 | |

Materials | | 2.2 | | | 2.9 | |

Telecommunication Services | | 0.6 | | | 3.8 | |

Utilities | | 0.0 | | | 4.2 | |

(a) | SEC yield is an annualization of the Fund’s total net investment income per share for the 30-day period ended on the last day of the month. |

(b) | Price-to-earnings (P/E) ratios are calculated using 12-month forward earnings estimates. |

(c) | Foreign stocks are U.S. dollar-denominated. |

(d) | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. |

PAGE 5 § DODGE & COX STOCK FUND

| | |

| PORTFOLIO OF INVESTMENTS | | December 31, 2008 |

| | | | | |

| COMMON STOCKS: 97.8% | | | | |

| | |

| | | SHARES | | VALUE |

| CONSUMER DISCRETIONARY: 18.9% | | | |

CONSUMER DURABLES & APPAREL: 3.7% | | | |

Panasonic Corp. ADR(b) (Japan) | | 42,484,674 | | $ | 528,509,345 |

Sony Corp. ADR(b) (Japan) | | 31,729,550 | | | 693,925,258 |

Thomson ADR(a),(b) (France) | | 5,988,000 | | | 8,083,800 |

| | | | | |

| | | | | 1,230,518,403 |

MEDIA: 11.8% | | | | | |

Comcast Corp., Class A(c) | | 99,057,632 | | | 1,672,092,828 |

DISH Network Corp., Class A(a) | | 6,045,670 | | | 67,046,480 |

Interpublic Group of Companies, Inc.(a),(c) | | 20,429,193 | | | 80,899,604 |

Liberty Entertainment, Series A(a) | | 3,648,160 | | | 63,769,837 |

Liberty Global, Inc., Series A(a) | | 763,410 | | | 12,153,487 |

Liberty Global, Inc., Series C(a) | | 1,301,753 | | | 19,760,611 |

News Corp., Class A | | 96,431,826 | | | 876,565,299 |

Time Warner, Inc. | | 105,719,400 | | | 1,063,537,164 |

| | | | | |

| | | | | 3,855,825,310 |

RETAILING: 3.4% | | | | | |

CarMax, Inc.(a),(c) | | 11,812,400 | | | 93,081,712 |

Genuine Parts Co. | | 2,643,927 | | | 100,099,076 |

Home Depot, Inc. | | 24,516,700 | | | 564,374,434 |

Liberty Interactive, Series A(a) | | 27,524,472 | | | 85,876,353 |

Macy’s, Inc. | | 11,093,094 | | | 114,813,523 |

The Sherwin-Williams Co. | | 2,434,919 | | | 145,486,410 |

| | | | | |

| | | | | 1,103,731,508 |

| | | | | |

| | | | | 6,190,075,221 |

| CONSUMER STAPLES: 2.7% | | | | | |

FOOD & STAPLES RETAILING: 2.7% | | | |

Wal-Mart Stores, Inc. | | 13,557,850 | | | 760,053,071 |

Walgreen Co. | | 5,014,375 | | | 123,704,631 |

| | | | | |

| | | | | 883,757,702 |

| ENERGY: 9.7% | | | | | |

Baker Hughes, Inc. | | 15,061,494 | | | 483,022,113 |

Chevron Corp. | | 8,834,717 | | | 653,504,016 |

Occidental Petroleum Corp. | | 13,933,400 | | | 835,864,666 |

Royal Dutch Shell PLC ADR(b) (United Kingdom) | | 6,587,864 | | | 338,813,846 |

Schlumberger, Ltd. | | 20,774,712 | | | 879,393,559 |

| | | | | |

| | | | | 3,190,598,200 |

| | | | | |

| | | | | |

| | |

| | | SHARES | | VALUE |

| FINANCIALS: 11.1% | | | | | |

BANKS: 3.9% | | | | | |

HSBC Holdings PLC ADR(b) (United Kingdom) | | 4,691,050 | | $ | 228,313,403 |

Wachovia Corp. | | 56,415,122 | | | 312,539,776 |

Wells Fargo & Co. | | 24,740,000 | | | 729,335,200 |

| | | | | |

| | | | | 1,270,188,379 |

DIVERSIFIED FINANCIALS: 5.0% | | | |

Capital One Financial Corp.(c) | | 26,304,011 | | | 838,834,911 |

Citigroup, Inc. | | 50,108,800 | | | 336,230,048 |

Credit Suisse Group AG ADR(b) (Switzerland) | | 4,905,300 | | | 138,623,778 |

Legg Mason, Inc. | | 4,358,600 | | | 95,496,926 |

SLM Corp.(a),(c) | | 26,195,782 | | | 233,142,460 |

| | | | | |

| | | | | 1,642,328,123 |

INSURANCE: 2.2% | | | | | |

AEGON NV(b) (Netherlands) | | 26,882,488 | | | 162,639,052 |

American International Group, Inc.(a) | | 74,057,387 | | | 116,270,098 |

Genworth Financial, Inc., Class A(a) | | 6,909,800 | | | 19,554,734 |

Loews Corp. | | 3,910,100 | | | 110,460,325 |

The Travelers Companies, Inc. | | 6,914,650 | | | 312,542,180 |

| | | | | |

| | | | | 721,466,389 |

| | | | | |

| | | | | 3,633,982,891 |

| HEALTH CARE: 28.1% | | | | | |

HEALTH CARE EQUIPMENT & SERVICES: 9.7% |

Boston Scientific Corp.(a) | | 47,792,300 | | | 369,912,402 |

Cardinal Health, Inc.(c) | | 21,868,375 | | | 753,802,886 |

Covidien, Ltd. | | 6,351,750 | | | 230,187,420 |

Health Management Associates, Inc.(a),(c) | | 15,334,500 | | | 27,448,755 |

UnitedHealth Group, Inc. | | 29,768,600 | | | 791,844,760 |

WellPoint, Inc.(a) | | 23,419,243 | | | 986,652,708 |

| | | | | |

| | | | | 3,159,848,931 |

PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES: 18.4% |

Amgen, Inc.(a) | | 19,011,800 | | | 1,097,931,450 |

GlaxoSmithKline PLC ADR(b) (United Kingdom) | | 28,938,300 | | | 1,078,530,441 |

Novartis AG ADR(b) (Switzerland) | | 27,778,700 | | | 1,382,268,112 |

Pfizer, Inc. | | 42,425,604 | | | 751,357,447 |

Sanofi-Aventis ADR(b) (France) | | 36,306,700 | | | 1,167,623,472 |

Wyeth | | 14,868,600 | | | 557,721,186 |

| | | | | |

| | | | | 6,035,432,108 |

| | | | | |

| | | | | 9,195,281,039 |

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND §PAGE 6 |

| | |

| PORTFOLIO OF INVESTMENTS | | December 31, 2008 |

| | | | | |

| COMMON STOCKS (continued) | | |

| | |

| | | SHARES | | VALUE |

| INDUSTRIALS: 6.5% | | | | | |

CAPITAL GOODS: 3.4% | | | | | |

Eaton Corp. | | 395,502 | | $ | 19,660,404 |

General Electric Co. | | 52,779,900 | | | 855,034,380 |

Koninklijke Philips Electronics NV(b) (Netherlands) | | 2,509,100 | | | 49,855,817 |

Tyco International, Ltd. | | 8,631,425 | | | 186,438,780 |

| | | | | |

| | | | | 1,110,989,381 |

COMMERCIAL SERVICES & SUPPLIES: 0.8% |

Pitney Bowes, Inc. | | 10,291,750 | | | 262,233,790 |

| | |

TRANSPORTATION: 2.3% | | | | | |

FedEx Corp. | | 11,547,400 | | | 740,765,710 |

| | | | | |

| | | | | 2,113,988,881 |

| INFORMATION TECHNOLOGY: 18.0% |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT: 0.8% |

Maxim Integrated Products, Inc.(c) | | 24,360,200 | | | 278,193,484 |

| |

SOFTWARE & SERVICES: 5.2% | | | |

Autodesk, Inc.(a) | | 516,800 | | | 10,155,120 |

BMC Software, Inc.(a),(c) | | 9,356,040 | | | 251,771,037 |

Cadence Design Systems, Inc.(a),(c) | | 23,293,600 | | | 85,254,576 |

Citrix Systems, Inc.(a),(c) | | 12,014,741 | | | 283,187,445 |

Computer Sciences Corp.(a),(c) | | 13,462,172 | | | 473,060,724 |

Compuware Corp.(a),(c) | | 22,096,012 | | | 149,148,081 |

EBay, Inc.(a) | | 22,987,400 | | | 320,904,104 |

Synopsys, Inc.(a) | | 6,825,369 | | | 126,405,834 |

| | | | | |

| | | | | 1,699,886,921 |

TECHNOLOGY, HARDWARE & EQUIPMENT: 12.0% |

Hewlett-Packard Co. | | 44,475,608 | | | 1,614,019,814 |

Hitachi, Ltd. ADR(b) (Japan) | | 7,409,800 | | | 290,019,572 |

Kyocera Corp. ADR(b) (Japan) | | 3,351,098 | | | 242,518,962 |

Molex, Inc. | | 2,550,100 | | | 36,950,949 |

Molex, Inc., Class A | | 8,727,930 | | | 113,026,694 |

Motorola, Inc.(c) | | 155,139,211 | | | 687,266,705 |

Sun Microsystems, Inc.(a) | | 10,111,794 | | | 38,627,053 |

Telefonaktiebologet LM Ericsson ADR(b) (Sweden) | | 23,936,500 | | | 186,944,065 |

Tyco Electronics, Ltd. | | 15,899,925 | | | 257,737,784 |

Xerox Corp.(c) | | 57,778,300 | | | 460,493,051 |

| | | | | |

| | | | | 3,927,604,649 |

| | | | | |

| | | | | 5,905,685,054 |

| MATERIALS: 2.2% | | | | | |

Cemex SAB de CV ADR(b) (Mexico) | | 13,132,572 | | | 120,031,708 |

Domtar Corp.(a) | | 16,420,300 | | | 27,421,901 |

Dow Chemical Co. | | 29,260,445 | | | 441,540,115 |

Vulcan Materials Co. | | 1,655,048 | | | 115,158,240 |

| | | | | |

| | | | | 704,151,964 |

| TELECOMMUNICATION SERVICES: 0.6% |

Sprint Nextel Corp.(a) | | 109,849,239 | | | 201,024,107 |

| | | | | |

TOTAL COMMON STOCKS

(Cost $48,532,682,743) | | $ | 32,018,545,059 |

| | | | | | | |

| SHORT-TERM INVESTMENTS: 1.6% | | | |

| | |

| | | PAR VALUE | | | VALUE |

MONEY MARKET FUND: 0.3% | | | | |

SSgA Prime Money Market Fund | | $ | 97,385,042 | | | $ | 97,385,042 |

| |

REPURCHASE AGREEMENT: 1.3% | | | | |

Fixed Income Clearing Corporation(d) 0.01%, 1/2/09,

maturity value $413,681,230 | | | 413,681,000 | | | | 413,681,000 |

| | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $511,066,042) | | | $ | 511,066,042 |

| | | | | | | |

TOTAL INVESTMENTS

(Cost $49,043,748,785) | | | 99.4 | % | | $ | 32,529,611,101 |

OTHER ASSETS LESS LIABILITIES | | | 0.6 | % | | | 191,587,250 |

| | | | | | | |

| NET ASSETS | | | 100.0 | % | | $ | 32,721,198,351 |

| | | | | | | |

(b) | Security issued by a foreign entity, denominated in U.S. dollars |

(c) | See Note 8 regarding holdings of 5% voting securities |

(d) | Repurchase agreement is collateralized by Fannie Mae 2.875%-5.5%, 7/9/10-10/12/10; Federal Home Loan Bank 2.48%-3.5%, 6/18/10-7/16/10; and Freddie Mac, 2.875%-6.875%, 6/28/10-9/15/10. Total collateral value is $421,959,300. |

ADR: American Depositary Receipt

| | |

| PAGE 7 § DODGE & COX STOCK FUND | | See accompanying Notes to Financial Statements |

| | | | |

STATEMENT OF ASSETS AND LIABILITIES | |

| |

| | | December 31, 2008 | |

ASSETS: | | | | |

Investments, at value | | | | |

Unaffiliated issuers (cost $40,708,509,783) | | $ | 28,166,696,311 | |

Affiliated issuers (cost $8,335,239,002) | | | 4,362,914,790 | |

| | | | |

| | | 32,529,611,101 | |

Receivable for investments sold | | | 138,956,473 | |

Receivable for Fund shares sold | | | 108,065,543 | |

Dividends and interest receivable | | | 95,803,628 | |

Prepaid expenses and other assets | | | 307,030 | |

| | | | |

| | | 32,872,743,775 | |

| | | | |

LIABILITIES: | | | | |

Payable for investments purchased | | | 7,147,222 | |

Payable for Fund shares redeemed | | | 129,060,442 | |

Management fees payable | | | 13,251,516 | |

Accrued expenses | | | 2,086,244 | |

| | | | |

| | | 151,545,424 | |

| | | | |

NET ASSETS | | $ | 32,721,198,351 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

Paid in capital | | $ | 49,696,033,015 | |

Undistributed net investment income | | | 29,973,742 | |

Accumulated net realized loss on investments | | | (490,670,722 | ) |

Net unrealized depreciation on investments | | | (16,514,137,684 | ) |

| | | | |

| | $ | 32,721,198,351 | |

| | | | |

Fund shares outstanding (par value $0.01 each, unlimited shares authorized) | | | 439,965,275 | |

Net asset value per share | | | $74.37 | |

|

STATEMENT OF OPERATIONS | |

| |

| | | Year Ended December 31, 2008 | |

INVESTMENT INCOME: | | | | |

Dividends (net of foreign taxes of $21,825,998) | | | | |

Unaffiliated issuers | | $ | 969,975,316 | |

Affiliated issuers | | | 141,626,173 | |

Interest | | | 19,004,780 | |

| | | | |

| | | 1,130,606,269 | |

| | | | |

EXPENSES: | | | | |

Management fees | | | 249,277,593 | |

Custody and fund accounting fees | | | 670,536 | |

Transfer agent fees | | | 5,088,894 | |

Professional services | | | 133,294 | |

Shareholder reports | | | 1,934,642 | |

Registration fees | | | 360,052 | |

Trustees’ fees | | | 151,187 | |

Miscellaneous | | | 1,723,324 | |

| | | | |

| | | 259,339,522 | |

| | | | |

NET INVESTMENT INCOME | | | 871,266,747 | |

| | | | |

REALIZED AND UNREALIZED LOSS

ON INVESTMENTS: | | | | |

Net realized loss | | | | |

Unaffiliated issuers | | | (18,602,562 | ) |

Affiliated issuers | | | (471,636,440 | ) |

Net change in unrealized appreciation/depreciation | | | (27,280,798,157 | ) |

| | | | |

Net realized and unrealized loss | | | (27,771,037,159 | ) |

| | | | |

NET DECREASE IN NET ASSETS

FROM OPERATIONS | | $ | (26,899,770,412 | ) |

| | | | |

| | | | | | | | |

STATEMENT OF CHANGES IN NET ASSETS | |

| | |

| | | Year Ended

December 31, 2008 | | | Year Ended

December 31, 2007 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 871,266,747 | | | $ | 989,709,132 | |

Net realized gain/(loss) | | | (490,239,002 | ) | | | 6,995,198,039 | |

Net change in unrealized appreciation/depreciation | | | (27,280,798,157 | ) | | | (7,782,329,189 | ) |

| | | | | | | | |

Net increase/(decrease) in net assets from operations | | | (26,899,770,412 | ) | | | 202,577,982 | |

| | | | | | | | |

| |

DISTRIBUTIONS TO

SHAREHOLDERS FROM: | | | | | |

Net investment income | | | (841,293,005 | ) | | | (1,007,606,492 | ) |

Net realized gain | | | (1,851,869,071 | ) | | | (5,606,655,304 | ) |

| | | | | | | | |

Total distributions | | | (2,693,162,076 | ) | | | (6,614,261,796 | ) |

| | | | | | | | |

| | |

FUND SHARE

TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 10,316,815,718 | | | | 8,202,384,871 | |

Reinvestment of distributions | | | 2,558,867,110 | | | | 6,303,311,198 | |

Cost of shares redeemed | | | (13,852,190,915 | ) | | | (10,988,379,298 | ) |

| | | | | | | | |

Net increase/(decrease) from Fund share transactions | | | (976,508,087 | ) | | | 3,517,316,771 | |

| | | | | | | | |

Total decrease in net assets | | | (30,569,440,575 | ) | | | (2,894,367,043 | ) |

| | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 63,290,638,926 | | | | 66,185,005,969 | |

| | | | | | | | |

End of year (including undistributed net investment income of $29,973,742 and $0, respectively) | | $ | 32,721,198,351 | | | $ | 63,290,638,926 | |

| | | | | | | | |

| |

SHARE INFORMATION: | | | | | |

Shares sold | | | 96,421,753 | | | | 52,502,799 | |

Distributions reinvested | | | 22,845,911 | | | | 44,317,981 | |

Shares redeemed | | | (137,061,296 | ) | | | (70,354,563 | ) |

| | | | | | | | |

Net increase/(decrease) in shares outstanding | | | (17,793,632 | ) | | | 26,466,217 | |

| | | | | | | | |

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND §PAGE 8 |

NOTES TO FINANCIAL STATEMENTS

NOTE 1—ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Dodge & Cox Stock Fund (the “Fund”) is one of the series constituting the Dodge & Cox Funds (the “Trust” or the “Funds”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The Fund commenced operations on January 4, 1965, and seeks long-term growth of principal and income. Risk considerations and investment strategies of the Fund are discussed in the Fund’s Prospectus.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require the use of estimates and assumptions by management. Significant accounting policies are as follows:

Security valuation The Fund’s net assets are valued as of the close of trading on the New York Stock Exchange (NYSE), generally 4:00 p.m. Eastern Time, each day that the NYSE is open for business. Stocks are valued at the official quoted close price or the last sale of the day at the close of the NYSE or, if not available, at the mean between the exchange listed bid and ask prices for the day. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Security values are not discounted based on the size of the Fund’s position. Securities for which market quotations are not readily available are valued at fair value as determined in good faith by or at the direction of the Board of Trustees. Short-term securities are valued at amortized cost which approximates current value. All securities held by the Fund are denominated in U.S. dollars.

Security transactions, investment income, expenses, and distributions Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Dividend income and corporate action transactions are recorded on the ex-dividend date, except for certain dividends or corporate actions from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Non-cash dividends included in dividend income, if any, are recorded

at the fair market value of the securities received. Distributions received in excess of income are recorded as a reduction of cost of investments and/or realized gain. Interest income is recorded on the accrual basis.

Expenses are recorded on the accrual basis. Most expenses of the Trust can be directly attributed to a specific series. Expenses which cannot be directly attributed are allocated among the Funds in the Trust.

Distributions to shareholders are recorded on the ex-dividend date.

Repurchase agreements The Fund may enter into repurchase agreements, secured by U.S. government or agency securities, which involve the purchase of securities from a counterparty with a simultaneous commitment to resell the securities at an agreed-upon date and price. It is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. In the event of default by the counterparty, the Fund has the contractual right to liquidate the collateral securities and to apply the proceeds in satisfaction of the obligation.

NOTE 2—VALUATION MEASUREMENTS

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| § | | Level 1: Quoted prices in active markets for identical securities |

| § | | Level 2: Other significant observable inputs (including quoted prices for similar securities, market indices, interest rates, credit risk, etc.) |

| § | | Level 3: Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s net assets as of December 31, 2008:

| | | |

| Valuation Inputs | | Investments in Securities |

Level 1: Quoted Prices | | $ | 32,115,930,101 |

Level 2: Other Significant Observable Inputs | | | 413,681,000 |

Level 3: Significant Unobservable Inputs | | | — |

| | | |

Total | | $ | 32,529,611,101 |

| | | |

PAGE 9 § DODGE & COX STOCK FUND

NOTES TO FINANCIAL STATEMENTS

NOTE 3—RELATED PARTY TRANSACTIONS

Management fees Under a written agreement approved by a unanimous vote of the Board of Trustees, the Fund pays an annual management fee of 0.50% of the Fund’s average daily net assets to Dodge & Cox, investment manager of the Fund. The agreement further provides that Dodge & Cox shall waive its fee to the extent that such fee plus all other ordinary operating expenses of the Fund exceed 0.75% of the average daily net assets for the year.

Fund officers and trustees All officers and three of the trustees of the Trust are officers or employees of Dodge & Cox. The Trust pays a fee only to those trustees who are not affiliated with Dodge & Cox.

Indemnification Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnities to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 4—INCOME TAX INFORMATION

A provision for federal income taxes is not required since the Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. Distributions are determined in accordance with income tax regulations, which may differ from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character.

Book/tax differences are primarily due to differing treatments of wash sales and net short-term realized gain/(loss). At December 31, 2008, the cost of investments for federal income tax purposes was $49,080,153,958.

Distributions for the years ended December 31, 2008 and 2007 were characterized as follows for federal income tax purposes:

| | | | |

| | | Year Ended December 31, 2008 | | Year Ended December 31, 2007 |

Ordinary income | | $863,451,970 | | $1,382,138,076 |

| | ($1.889 per share) | | ($3.197 per share) |

| | |

Long-term capital gain | | $1,829,710,106 | | $5,232,123,720 |

| | ($4.079 per share) | | ($12.403 per share) |

At December 31, 2008, the tax basis components of distributable earnings were as follows:

| | | | |

Unrealized appreciation | | $ | 2,567,345,419 | |

Unrealized depreciation | | | (19,117,888,276 | ) |

| | | | |

Net unrealized depreciation | | | (16,550,542,857 | ) |

Undistributed ordinary income | | | 29,973,742 | |

Capital loss carryforward* | | | (30,080,078 | ) |

Deferred loss** | | | (424,185,471 | ) |

| * | Represents accumulated capital loss which may be carried forward to offset future capital gains. If not utilized, the capital loss carryforward will expire in 2016. |

| ** | Represents net realized loss incurred between November 1, 2008 and December 31, 2008. As permitted by tax regulations, the Fund has elected to treat this loss as arising in 2009. |

NOTE 5—COMMITTED LINE OF CREDIT

The Fund participates with the Funds in a $200 million committed credit facility (“Line of Credit”) with State Street Bank and Trust Company to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. Interest on borrowings is charged at the prevailing rate. There were no borrowings on the Line of Credit during the year.

NOTE 6—PURCHASES AND SALES OF INVESTMENTS

For the year ended December 31, 2008, purchases and sales of securities, other than short-term securities, aggregated $15,352,408,063 and $18,013,028,628, respectively.

NOTE 7—ACCOUNTING PRONOUNCEMENTS

Effective June 29, 2007, the Fund adopted the Financial Accounting Standards Board (FASB) Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (FIN 48). FIN 48 clarifies the accounting for income taxes by prescribing the minimum recognition threshold a tax position must meet before being recognized in the financial statements. At December 31, 2008, FIN 48 was applied to the period from January 1, 2005 through December 31, 2008, the open tax years subject to regulatory examination. There was no impact to the Fund’s financial statements as a result of applying FIN 48.

Effective January 1, 2009, the Fund will adopt “Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities” (FAS 161). FAS 161 requires enhanced disclosures about the Fund’s derivative and hedging activities. Management expects that implementation of FAS 161 will not significantly impact the Fund’s financial statement disclosures.

DODGE & COX STOCK FUND §PAGE 10

NOTES TO FINANCIAL STATEMENTS

NOTE 8—HOLDINGS OF 5% VOTING SECURITIES

Each of the companies listed below was considered to be an affiliate of the Fund because the Fund owned 5% or more of the company’s voting securities during all or part of the year ended December 31, 2008. Purchase and sale transactions and dividend income earned during the year on these securities were as follows:

| | | | | | | | | | | | | | | | | |

| | | Shares at

Beginning of Year | | Additions | | Reductions | | | Shares at

End of Year | | Dividend

Income(a) | | | Value at End of Year | |

BMC Software, Inc. | | 10,602,400 | | 2,862,140 | | (4,108,500 | ) | | 9,356,040 | | $ | — | (b) | | $ | — | (c) |

Cadence Design Systems, Inc. | | — | | 23,293,600 | | — | | | 23,293,600 | | | — | (b) | | | 85,254,576 | |

Capital One Financial Corp. | | 22,303,074 | | 4,000,937 | | — | | | 26,304,011 | | | 39,454,104 | | | | 838,834,911 | |

Cardinal Health, Inc. | | 23,396,450 | | 13,400 | | (1,541,475 | ) | | 21,868,375 | | | 12,195,803 | | | | 753,802,886 | |

CarMax, Inc. | | 6,800,400 | | 5,012,000 | | — | | | 11,812,400 | | | — | (b) | | | 93,081,712 | |

Citrix Systems, Inc. | | 7,219,622 | | 4,795,119 | | — | | | 12,014,741 | | | — | (b) | | | 283,187,445 | |

Comcast Corp., Class A | | 138,558,560 | | 639,072 | | (40,140,000 | ) | | 99,057,632 | | | 23,698,650 | | | | — | (c) |

Computer Sciences Corp. | | 11,677,300 | | 3,510,400 | | (1,725,528 | ) | | 13,462,172 | | | — | (b) | | | 473,060,724 | |

Compuware Corp. | | 19,325,400 | | 2,770,612 | | — | | | 22,096,012 | | | — | (b) | | | 149,148,081 | |

Electronic Data Systems Corp. | | 34,224,100 | | 17,200 | | (34,241,300 | ) | | — | | | 3,423,435 | | | | — | |

General Motors Corp. | | — | | 29,957,700 | | (29,957,700 | ) | | — | | | 9,160,121 | | | | — | |

Health Management Associates, Inc. | | 15,307,700 | | 26,800 | | — | | | 15,334,500 | | | — | (b) | | | 27,448,755 | |

Interpublic Group of Companies, Inc. | | 28,806,600 | | 40,400 | | (8,417,807 | ) | | 20,429,193 | | | — | (b) | | | — | (c) |

Maxim Integrated Products, Inc. | | 12,167,100 | | 12,193,100 | | — | | | 24,360,200 | | | 15,557,741 | | | | 278,193,484 | |

Motorola, Inc. | | 116,820,111 | | 38,319,100 | | — | | | 155,139,211 | | | 29,738,047 | | | | 687,266,705 | |

SLM Corp. | | 7,201,100 | | 20,694,682 | | (1,700,000 | ) | | 26,195,782 | | | — | (b) | | | 233,142,460 | |

Xerox Corp. | | 48,387,700 | | 11,190,600 | | (1,800,000 | ) | | 57,778,300 | | | 8,398,272 | | | | 460,493,051 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | $ | 141,626,173 | | | $ | 4,362,914,790 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

(a) | Net of foreign taxes, if any |

(c) | Company was not an affiliate at the end of the year |

PAGE 11 § DODGE & COX STOCK FUND

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | |

SELECTED DATA AND RATIOS (for a share outstanding throughout each year) | | Year Ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | |

Net asset value, beginning of year | | $138.26 | | | $153.46 | | | $137.22 | | | $130.22 | | | $113.78 | |

Income from investment operations: | | | | | | | | | | | | | | | |

Net investment income | | 1.91 | | | 2.30 | | | 2.15 | | | 1.68 | | | 1.54 | |

Net realized and unrealized gain (loss) | | (59.83 | ) | | (1.90 | ) | | 23.12 | | | 10.36 | | | 20.08 | |

| | | |

Total from investment operations | | (57.92 | ) | | 0.40 | | | 25.27 | | | 12.04 | | | 21.62 | |

| | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | |

Net investment income | | (1.84 | ) | | (2.34 | ) | | (2.12 | ) | | (1.70 | ) | | (1.53 | ) |

Net realized gain | | (4.13 | ) | | (13.26 | ) | | (6.91 | ) | | (3.34 | ) | | (3.65 | ) |

| | | |

Total distributions | | (5.97 | ) | | (15.60 | ) | | (9.03 | ) | | (5.04 | ) | | (5.18 | ) |

| | | |

Net asset value, end of year | | $74.37 | | | $138.26 | | | $153.46 | | | $137.22 | | | $130.22 | |

| | | |

Total return | | (43.31 | )% | | 0.14 | % | | 18.54 | % | | 9.36 | % | | 19.16 | % |

Ratios/supplemental data: | | | | | | | | | | | | | | | |

Net assets, end of year (millions) | | $32,721 | | | $63,291 | | | $66,185 | | | $52,184 | | | $43,266 | |

Ratio of expenses to average net assets | | 0.52 | % | | 0.52 | % | | 0.52 | % | | 0.52 | % | | 0.53 | % |

Ratio of net investment income to average net assets | | 1.75 | % | | 1.44 | % | | 1.48 | % | | 1.29 | % | | 1.32 | % |

Portfolio turnover rate | | 31 | % | | 27 | % | | 14 | % | | 12 | % | | 11 | % |

See accompanying Notes to Financial Statements

DODGE & COX STOCK FUND §PAGE 12

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of Dodge & Cox Funds and Shareholders of Dodge & Cox Stock Fund

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Dodge & Cox Stock Fund (the “Fund”, one of the series constituting Dodge & Cox Funds) at December 31, 2008, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2008, by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

February 13, 2009

PAGE 13 § DODGE & COX STOCK FUND

SPECIAL 2008 TAX INFORMATION (unaudited)

The following information is provided pursuant to provisions of the Internal Revenue Code:

The Fund designates up to a maximum amount of $841,293,005 of its distributions paid to shareholders in 2008 as qualified dividends (treated for federal income tax purposes in the hands of shareholders as taxable at a maximum rate of 15%).

For shareholders that are corporations, the Fund designates 88% of its ordinary dividends (including short-term gains) paid to shareholders in 2008 as dividends from domestic corporations eligible for the corporate dividends received deduction, provided that the shareholder otherwise satisfies applicable requirements to claim that deduction.

BOARD APPROVAL OF FUNDS’ INVESTMENT MANAGEMENT AGREEMENTS AND MANAGEMENT FEES (unaudited)

The Board of Trustees is responsible for overseeing the performance of the Dodge & Cox Funds’ investment manager and determining whether to continue the Investment Management Agreements between the Funds and Dodge & Cox each year (the “Agreements”). At a meeting of the Board of Trustees of the Trust held on December 15, 2008, the Trustees, by a unanimous vote (including a separate vote of those Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940) (the “Independent Trustees”)), approved the renewal of the Agreements for an additional one-year term through December 31, 2009. During the course of the year, the Board received a wide variety of materials relating to the services provided by Dodge & Cox and the performance of the Funds.

INFORMATION RECEIVED

In advance of the meeting, the Board, including each of the Independent Trustees, requested, received and reviewed materials relating to the Agreements. The Independent Trustees retained Morningstar® to prepare an independent expense and performance summary for each Fund and comparable funds managed by other advisers identified by Morningstar®. The Morningstar® materials

included information regarding advisory fee rates, expense ratios, and transfer agency, custodial and distribution expenses, as well as appropriate performance comparisons to an index or combination of indices. The materials reviewed by the Board also included information concerning Dodge & Cox’s profitability, financial results and condition, including advisory fee revenue and separate account advisory fee schedules. The Board additionally considered the Funds’ brokerage commissions, turnover rates and sales and redemption data for the Funds, including “soft dollar” payments made for research benefiting the Funds and other accounts managed by Dodge & Cox, and brokerage commissions and expenses paid by Dodge & Cox. Other aspects of Dodge & Cox’s services to the Funds which were reviewed included compliance and supervision of third-party service providers (e.g., custodian, fund accountant, transfer agent and state registration administrator), shareholder servicing, accounting and administrative services, web services, the character of non-advisory services, the record of compliance with the Funds’ investment policies and restrictions and the Funds’ Code of Ethics, investment management staffing and biographies, information furnished to investors and shareholders (including the Funds’ Prospectus, Statement of Additional Information, shareholder reports, and quarterly reports), and third-party retirement plan administrator reimbursements by Dodge & Cox for the same periods.

The Board received copies of the Agreements and a memorandum from the Independent Legal Counsel to the Independent Trustees, discussing the factors generally regarded as appropriate to consider in evaluating advisory arrangements. The Trust’s Contract Review Committee, consisting solely of Independent Trustees, met with the Independent Legal Counsel on December 3, 2008, and again on December 15, 2008, to discuss whether to renew the Agreements. The Board, including the Independent Trustees, subsequently concluded that the existing Agreements are fair and reasonable and voted to approve the Agreements.

In considering the Agreements, the Board, including the Independent Trustees, did not identify any single factor or particular information as all-important or controlling. In reaching the decision to approve the

DODGE & COX STOCK FUND §PAGE 14

Agreements, the Board, which was advised by Independent Legal Counsel, considered the following factors, among others, and reached the conclusions described below.

NATURE, QUALITY, AND EXTENT OF THE SERVICES

The Board considered that Dodge & Cox provides a wide range of services to the Funds in addition to portfolio management and that the quality of these services has been excellent in all respects. The extensive nature of services provided by Dodge & Cox has been documented in materials provided to the Board and in presentations made to the Board throughout the year. In particular, the Board considered the nature, quality and extent of portfolio management, administrative and shareholder services performed by Dodge & Cox, including: Dodge & Cox’s established long-term history of care and conscientiousness in the management of the Funds; demonstrated consistency in investment approach and depth, background and experience of the Dodge & Cox Investment Policy Committee, International Investment Policy Committee, Global Investment Policy Committee, Fixed Income Investment Policy Committee and research analysts responsible for managing the Funds; Dodge & Cox’s organizational structure; Dodge & Cox’s performance in the areas of compliance, administration and shareholder communication and services, supervision of Fund operations and general oversight of other service providers; peer group comparisons of expense ratios, management fee comparisons, expenses (e.g., transfer agent, custody and other fees and expenses) and asset comparisons and performance and risk summaries prepared independently by Morningstar® and favorable stewardship ratings and “Star” rankings by Morningstar®. The Board concluded that it was satisfied with the nature, extent and quality of investment management and other services provided to the Funds by Dodge & Cox.

INVESTMENT PERFORMANCE

The Board considered short-term and long-term investment performance for each Fund (including periods of outperformance or underperformance) as compared to both relevant indices and the performance of such Fund’s

peer group. In light of recent market volatility, the Board also reviewed recent performance in the context of long-term investment goals. The Board noted that the shorter-term performance of the Funds has been disappointing, particularly with respect to the Stock Fund, which performed below its peer group median. The performance information prepared by Morningstar® and Dodge & Cox demonstrated more favorable performance over the long term in keeping with the stated goals in the Prospectus. The Board considered that the performance of the Funds is the result of a team-oriented investment management process that emphasizes a long-term investment horizon, independence, comprehensive research, price discipline and focus. The Board also noted that the investment performance delivered by Dodge & Cox to the Funds appeared to be consistent with the relevant performance delivered for other (non-fund) clients of Dodge & Cox. The Board concluded that Dodge & Cox has delivered favorable long-term performance for Fund investors consistent with the long-term investment strategies being pursued by the Funds.

COSTS AND ANCILLARY BENEFITS

Costs of Services to Funds: Fees and Expenses. The Board considered each Fund’s management fee rates and expense ratios relative to industry averages for similar mutual funds and relative to management fees charged by Dodge & Cox to other (non-fund) clients. The Board evaluated the operating structures of the Funds and Dodge & Cox, including the following: Dodge & Cox has a centralized focus on investment management operations and derives revenue solely from management fees; its outsourcing of non-advisory support services to unaffiliated third-party service providers is efficient and less costly to investors; Dodge & Cox does not charge front-end sales commissions or distribution fees and bears all third party research and distribution-related costs as well as reimbursements to third-party retirement plan administrators; the Funds receive numerous administrative, regulatory compliance, and shareholder support services from Dodge & Cox without any additional administrative fee; and the fact that the Funds have relatively low transaction costs and portfolio turnover rates. The Board noted that the Funds are

PAGE 15 § DODGE & COX STOCK FUND

substantially below peer group averages in expense ratios and management fee rates and that many media and industry reports specifically comment on the low expense ratios of Dodge & Cox, which along with solid long-term performance, has been a defining characteristic of Dodge & Cox for many years. The Board also noted that the range of services under the Agreements is much more extensive than under Dodge & Cox’s separate advisory (non-fund) client agreements and that many of the separate accounts were opened decades ago when fees were lower, and considered that, when coupled with the greater risks and regulatory burdens associated with the high profile mutual fund business, there is reasonable justification for differences in fee rates charged between the two lines of business. The Board concluded that costs incurred by the Funds for the services they receive (including the management fee paid to Dodge & Cox) are reasonable and that the fees are acceptable based upon the qualifications, experience, reputation and performance of Dodge & Cox and the low overall expense ratios of the Funds.

Profitability and Costs of Services to Dodge & Cox; “Fall-out” Benefits. The Board reviewed reports of Dodge & Cox’s financial position, profitability and estimated overall value, and they considered Dodge & Cox’s overall profitability within its context as a private, employee-owned S-Corporation and relative to the favorable services provided. The Board noted that net revenues for 2008 reflect a decline in assets under management compared with 2007. The Board recognized the importance of Dodge & Cox’s profitability—which is derived solely from management fees and does not include other business ventures—to maintain its independence, stability, company culture and ethics, and management continuity. The Board also considered that revenues reflect the continued success of the Funds and that such revenues are not generated by fees that are high compared to its peers. They noted that Dodge & Cox’s profitability is enhanced due to its efficient internal business model, and that the compensation/profit structure at Dodge & Cox is vital for remaining independent and facilitating retention of its management and investment professionals. The Board considered potential “fall-out” benefits (including the receipt of research from unaffiliated brokers) that

Dodge & Cox might receive in its association with the Funds. The Board also noted the extent of additional administrative services performed by Dodge & Cox for the Funds, and that the magnitude of costs and risks borne by Dodge & Cox in rendering advisory services to the Funds (including risks in the compliance, securities valuation and investment management processes) are continuing to increase. The Board concluded that the profitability of Dodge & Cox’s relationship with the Funds (including fall-out benefits) was fair and reasonable.

THE BENEFIT OF ECONOMIES OF SCALE

The Board considered whether there have been economies of scale with respect to the management of each Fund, whether the Funds have appropriately benefited from any economies of scale, and whether the management fee rate is reasonable in relation to the Fund assets and any economies of scale that may exist. In the Board’s view, any consideration of economies of scale must take account of the Funds’ low fee structure and the considerable efficiencies of the Funds’ organization and fee structure that has been realized by shareholders at the outset of their investment (i.e., from the first dollar). Shareholders also realize efficiencies from the outset of their investment due to organizational efficiencies derived from Dodge & Cox’s investment management process (e.g., low portfolio turnover) and the avoidance of distribution and marketing structures whose costs would ultimately be borne by shareholders of the Funds. The Board noted that Dodge & Cox has shared economies of scale by adding or enhancing services to the Funds over time, and that the internal costs of providing investment management, administrative and compliance services to the Funds are continuing to increase. Thus, the Funds provide access by small investors to top-rank investment management at a relatively low cost. The Board’s decision to renew the Agreements was made after consideration of economies of scale and review of comparable fund expense ratios and historical expense ratio patterns for the Funds. Their review also included consideration of the desirability of adding breakpoints to the Funds’ fee schedules. The Board concluded that the current Dodge & Cox fee structure is fair and reasonable and adequately reflects economies of scale.

DODGE & COX STOCK FUND §PAGE 16

CONCLUSION

Based on their evaluation of all material factors and assisted by the advice of Independent Legal Counsel to the Independent Trustees, the Board, including the Independent Trustees, concluded that the advisory fee structure was fair and reasonable, that each Fund was paying a competitive fee for the services provided, that the scope and quality of Dodge & Cox’s services has provided substantial value for Fund shareholders over the long term, and that approval of the Agreements was in the best interests of each Fund and its shareholders.

FUND HOLDINGS

The Fund provides a complete list of its holdings four times each fiscal year, as of the end of each quarter. The lists appear in the Fund’s First Quarter, Semi-Annual, Third Quarter and Annual Reports to shareholders. The Fund files the lists with the Securities and Exchange Commission (SEC) on Form N-CSR (second and fourth quarters) and Form N-Q (first and third quarters).

Shareholders may view the Fund’s Forms N-CSR and N-Q on the SEC’s website at www.sec.gov. Forms N-CSR and N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by 1-202-942-8090 (direct) or 1-800-732-0330 (general SEC number). A complete list of the Fund’s quarter-end holdings is also available at www.dodgeandcox.com on or about 15 days following each quarter end and remains available on the web site until the list is updated in the subsequent quarter.

PROXY VOTING

For a free copy of the Fund’s proxy voting policies and procedures, please call 1-800-621-3979, visit the Fund’s web site at www.dodgeandcox.com or visit the SEC’s web site at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is also available at www.dodgeandcox.com or at www.sec.gov.

PAGE 17 § DODGE & COX STOCK FUND

THIS PAGE INTENTIONALLY LEFT BLANK

DODGE & COX STOCK FUND §PAGE 18

DODGE & COX FUNDS—EXECUTIVE OFFICER & TRUSTEE INFORMATION

| | | | | | |

Name (Age) and

Address* | | Position with Trust

(Year of Election or

Appointment) | | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustees |

| INTERESTED TRUSTEES & OFFICERS |

John A. Gunn

(65) | | Chairman and Trustee

(Trustee since 1985) | | Chairman (since 2007), Chief Executive Officer (since 2005) and Director of Dodge & Cox, Portfolio Manager and member of Investment Policy Committee (IPC), Global Investment Policy Committee (GIPC) (since 2008), and International Investment Policy Committee (IIPC) | | — |

| Kenneth E. Olivier (56) | | President and Trustee

(Trustee since 2005) | | President (since 2005) and Director of Dodge & Cox, Portfolio Manager, and member of IPC | | — |

| Dana M. Emery (47) | | Senior Vice President and Trustee (Trustee since 1993) | | Executive Vice President (since 2005) and Director of Dodge & Cox, Manager of the Fixed Income Department, Portfolio Manager, and member of Fixed Income Investment Policy Committee (FIIPC) | | — |

Charles F. Pohl

(50) | | Senior Vice President (Officer since 2004) | | Senior Vice President and Director of Dodge & Cox, Chief Investment Officer (since 2007), Director of Credit Research, Portfolio Manager, Investment Analyst, and member of IPC, GIPC (since 2008), IIPC (since 2007), and FIIPC | | — |

| Diana S. Strandberg (49) | | Senior Vice President

(Officer since 2005) | | Vice President of Dodge & Cox, Portfolio Manager, and member of IPC, GIPC (since 2008), and IIPC | | — |

David H. Longhurst (51) | | Treasurer (Officer since 2006) | | Vice President and Assistant Treasurer of Dodge & Cox (since 2008); Vice President, Treasurer, Controller and Secretary of Safeco Mutual Funds, Safeco Asset Management Company, Safeco Services, Safeco Securities, and Safeco Investment Services (2000-2004) | | — |

| Thomas M. Mistele (55) | | Secretary

(Officer since 2000) | | Chief Operating Officer (since 2004), Director (since 2005), Secretary, and General Counsel of Dodge & Cox | | — |

| Marcia P. Venegas (40) | | Chief Compliance Officer

(Officer since 2004) | | Associate Chief Compliance Officer of Dodge & Cox (since 2008), Chief Compliance Officer of Dodge & Cox (2005-2008), Compliance Officer of Dodge & Cox (2003-2004) | | — |

| INDEPENDENT TRUSTEES |

| William F. Ausfahl (68) | | Trustee (Since 2002) | | CFO, The Clorox Co. (1982-1997); Director, The Clorox Co. (1984-1997) | | — |

| L. Dale Crandall (67) | | Trustee (Since 1999) | | President, Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals (2000-2002); Senior Vice President—Finance and Administration & CFO, Kaiser Foundation Health Plan, Inc. and Kaiser Foundation Hospitals (1998-2000) | | Director, Ansell Limited (medical equipment and supplies) (2002-Present); Director, Coventry Health Care, Inc. (managed health care) (2004-Present); Director, Metavante Technologies, Inc. (software) (2007 to present) |

| Thomas A. Larsen (59) | | Trustee (Since 2002) | | Director in Howard, Rice, Nemerovski, Canady, Falk & Rabkin (law firm) | | — |

John B. Taylor

(62) | | Trustee (Since 2005) | | Professor of Economics, Stanford University; Senior Fellow, Hoover Institution; Under Secretary for International Affairs, United States Treasury (2001-2005) | | — |

Will C. Wood

(69) | | Trustee (Since 1992) | | Principal, Kentwood Associates, Financial Advisers | | Director, Banco Latinoamericano de Exportaciones S.A. (Latin American foreign trade bank) (1999-Present) |

| * | | The address for each Officer and Trustee is 555 California Street, 40th Floor, San Francisco, California 94104. Each Officer and Trustee oversees all five series in the Dodge & Cox Funds complex and serves for an indefinite term. |

Additional information about the Trust’s Trustees and Officers is available in the Trust’s Statement of Additional Information (SAI). You can get a free copy of the SAI by visiting the Funds’ website at www.dodgeandcox.com or calling 1-800-621-3979.

PAGE 19 § DODGE & COX STOCK FUND

| | | | |

| | | |  |

www.dodgeandcox.com

For Fund literature, transactions, and account information, please visit the Funds’ web site.

or write or call:

DODGE & COX FUNDS

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

INVESTMENT MANAGER

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions, and portfolio holdings as of December 31, 2008, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

12/08 GSF AR  Printed on recycled paper

Printed on recycled paper

Annual Report

December 31, 2008

Global Stock

Fund

ESTABLISHED 2008

TICKER: DODWX

TO OUR SHAREHOLDERS

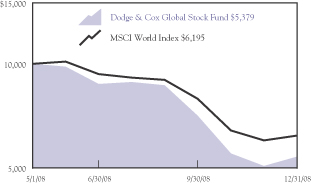

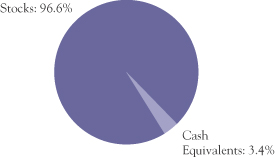

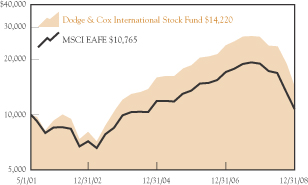

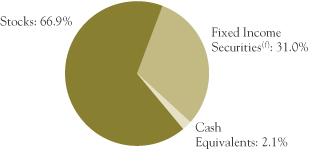

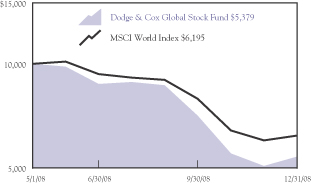

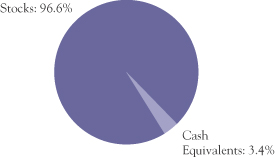

The Dodge & Cox Global Stock Fund had a total return of negative 46.2% since its inception on May 1, 2008, compared to a total return of negative 38.1% for the MSCI World Index (MSCI World) over the same time period. At year end, the Fund had net assets of $468 million with a cash position of 3.4%. Longer-term results appear on page three.

The fourth quarter completed what turned out to be one of the worst years for global equity markets since the Great Depression, as companies and investors incorporated expectations of lower revenue and profits caused by recession. Stock markets in every region around the world suffered meaningful losses, essentially erasing the MSCI World’s gains of the past ten years.

LOOKING BACK

The financial crisis intensified throughout 2008 and manifested itself in falling consumer confidence and declining economic activity around the world. In hindsight, we clearly underestimated the worsening credit crisis, the likelihood of government interventions, the depth and breadth of the ongoing economic problems, and the combined effect of these on many of the Fund’s holdings, particularly within the Financials sector.

In this environment of fear and uncertainty, we saw a flight to safety and shunning of risk. For example, there has been extreme pessimism associated with companies with economic sensitivity or financing needs. Thus, the share prices of companies in the Materials, Industrials, and Information Technology sectors performed poorly, while the share prices of companies in the less economically sensitive areas of the market—Consumer Staples (e.g., food), Telecommunication Services, Utilities, and Health Care—held up relatively well.

LOOKING FORWARD

While the returns resulting from a number of our investment decisions were disappointing since the Fund’s launch in May 2008, we are confident in the Fund’s holdings. Over the past 78 years, our firm has experienced periods of underperformance. We have learned from those past periods just as we are learning from this one, and are incorporating these lessons into our strategy and outlook on an ongoing basis.

During this unique period of extreme volatility and limited liquidity, our equity and fixed income research analysts have reviewed, updated, and stress-tested our financial projections for each of the Fund’s holdings, paying particular attention to potential vulnerabilities to the challenging credit market. We review this work with our analysts while continually monitoring relative values across our investment universe in order to determine the best long-term opportunities on behalf of the Fund’s shareholders. As a result of this review, we trimmed or sold several positions (e.g., Ford, General Motors, and Nortel Networks).

While we have made refinements, maintaining the essence of our investment approach through our firm’s previous challenging periods has been crucial to our long-term success. That approach—using a stable investment team to analyze company fundamentals over a three-to-five year investment horizon in relation to valuations—continues to guide us through this period as well. As we learn and make adjustments, we remain confident that our enduring value-oriented approach will benefit our shareholders in the years ahead.

FINDING OPPORTUNITIES

In light of economic uncertainty, investors are understandably pessimistic about the earnings prospects of businesses whose earnings are economically sensitive, thus severely depressing the valuations of those companies. We continue to find opportunities among these economically sensitive companies that we believe are likely to withstand the current downturn. When the global economy stabilizes, the investment returns from owning these companies may prove to be attractive.