UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-02201

Insight Select Income Fund

(Exact name of registrant as specified in charter)

200 Park Avenue, 7th Floor

New York, NY 10166

(Address of principal executive offices) (Zip code)

Gautam Khanna

200 Park Avenue, 7th Floor

New York, NY 10166

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-527-1800

Date of fiscal year end: March 31

Date of reporting period: March 31, 2021

Item 1. Reports to Stockholders.

| | (a) | The Report to Shareholders is attached herewith. |

Online:

Visit www.computershare.com/investor to log into your account and select “Communication Preferences” to set your preference.

Telephone:

Contact the Fund at 866-333-6685

Overnight Mail:

Computershare Investor Services, 462 South 4th Street, Suite 1600, Louisville, KY, 40202

Regular Mail:

Computershare Investor Services, PO Box 505000, Louisville, KY, 40233-5000

1

INSIGHT SELECT INCOME FUND SHAREHOLDER LETTER

For the one-year Period Ended 03/31/21

April 17, 2021

DEAR SHAREHOLDERS:

The period under review was dominated by the global pandemic and the extraordinary monetary and fiscal response to contain the resulting economic disruption. This response led to a sharp recovery in risk assets and an impressive rebound in economic activity. Markets also paid close attention to the results of the presidential election, Senate races and the rapid distribution of new COVID-19 vaccines.

In its initial response to the pandemic, the Federal Reserve (Fed) eclipsed the scale of the entire past quantitative easing (QE) programs in weeks, committing to potentially unlimited purchases indefinitely. Additionally, the Fed purchased corporate bonds for the first time, although it did so in relatively low amounts and later ceased the purchases by the end of the period.

This helped support markets following a dramatic sell-off in March and April 2020. During this period, companies generally took advantage of the low interest rate environment to shore up their balance sheets, and markets readily absorbed elevated issuance. Stability in markets, ready access to liquidity and the forceful policy response resulted in a strong rebound in risk assets.

On the fiscal side, the CARES Act continued to work through the real economy and following the election of President Biden, with unexpected (albeit slim) majorities in both chambers of Congress, more aggressive fiscal stimulus entered the political agenda. The administration passed the $1.9 billion American Rescue Plan in February 2021, which included $1,400 stimulus checks, enhanced jobless benefits and funding for vaccines. Biden’s appointment of former Federal Reserve chair Janet Yellen as Secretary of the Treasury also hinted at heightened collaboration between monetary and fiscal authorities.

The FDA approved the first COVID-19 vaccines in late 2020, and close to 40% of the adult population received at least one dose of a vaccine by the end of the period.

This was all particularly good news for the real economy. Activity appeared to bottom in April 2020, when the country experienced its broadest shutdowns. Subsequently, payroll metrics largely beat expectations and the unemployment rate fell from 14.7% at the peak down to 6.2%. Longer-dated Treasuries sold off materially in the final months of the period under review as economic projections continued to improve.

Looking ahead, as our conviction around the level of economic activity and growth expectations has evolved, we have revised our forecasts accordingly. Our 2021 US GDP forecast now stands at 6.4%, up from 5%. We expect the unemployment rate to decline further from 6.2% at an accelerating pace. US GDP is likely to pass its pre-COVID levels during Q2 2021 and pass what would have been its pre-COVID trend level during Q2 2022. We anticipate inflation measures, due to base effects, to be temporarily elevated in the summer of 2021. However, we do not anticipate these elevated headline inflation numbers to be sustainable through 2022 and beyond. We do not forecast the first Fed rate hike until 2023 and maintain a 12-month forecast of 1.80% for the 10-year Treasury.

Due to these factors we remain constructive on corporate credit for the foreseeable future. Additionally, demand and supply dynamics remain constructive as we expect corporate issuance to slow while we expect demand to increase given interest rate stability and higher absolute yields. Yield-seeking foreign buyers, who face a dearth of income outside of the US, also remain a consistent buyer within our markets. Still, selectivity among the winners and losers

2

remains key along with discipline over valuations. We feel we are careful to rely on income generation from a variety of sources and we are therefore seeking what we believe are the most attractive opportunities across a range of sectors.

As a result, the Fund increased its allocation to high yield corporates during the reporting period based upon improving fundamentals and what we considered to be attractive value relative to other available income opportunities. While generally being overweight to the credit markets, we continue to adjust positioning to focus on the parts of the credit curve that we believe provide the best tradeoff between risk and reward, in a potentially volatile interest rate environment. We also continue to seek selective opportunities within emerging market debt, which has somewhat lagged developed markets for similar levels of risk. Balance remains paramount as there are risks on both sides of any forecast. Our performance was a function of navigating a difficult rate environment while positioning the Fund to effectively target durable and high-quality sources of predictable income from the now higher level of prevailing interest rates. We continue to resist the temptation to sacrifice portfolio liquidity in the hunt for yield, and we want to own assets we see exhibiting good visibility into the credit worthiness of issuers, stability of balance sheets, and overall staying power.

As of March 31, 2021, the Fund had a net asset value (NAV) of $21.25 per share. This represents an 8.03% increase from $19.67 per share on March 31, 2020. On March 31, 2021, the Fund’s closing price on the New York Stock Exchange was $20.45 per share, representing a 3.76% discount to NAV per share, compared with a 0.36% premium as of March 31, 2020. One of the primary objectives of the Fund is to maintain a high level of income. On March 10, 2021, the Board of Trustees declared a dividend payment of $0.20 per share payable on April 15, 2021 to shareholders of record on April 8, 2021. On an annualized basis, including the pending dividend, the annual dividend payment from ordinary income equates to a total of $0.80 per share, representing a 4.02% dividend yield based on the market price on April 16, 2021 of $19.92 per share. The dividend is evaluated on a quarterly basis and is based on the income generation capability of the portfolio and is not guaranteed for any period of time.

Total Return-Percentage Change (Annualized for periods longer than 1 year)

In Net Asset Value Per Share with All Distributions Reinvested1

| | | | | | | | | | | | | | | | | | | | |

| | | 6 Months

to

3/31/21 | | | 1 Year

to

3/31/21 | | | 3 Years

to

3/31/21 | | | 5 Years

to

3/31/21 | | | 10 Years

to

3/31/21 | |

Insight Select Income Fund | | | 1.17 | % | | | 14.71 | % | | | 6.76 | % | | | 6.41 | % | | | 6.15 | % |

Bloomberg Barclays U.S. Credit Index2 | | | -1.79 | % | | | 7.88 | % | | | 5.95 | % | | | 4.67 | % | | | 4.83 | % |

1 – Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. The total investment return, if for less than a full year, is not annualized. Past performance is not a guarantee of future results

2 – Source: Bloomberg Barclays as of March 31, 2021. Comprised primarily of US investment grade corporate bonds (Fund’s Benchmark).

Yield represents the major component of return in most fixed income portfolios. Given this Fund’s emphasis on income and the dividend, we generally will not have material exposure to low-yielding US Treasuries and will maintain meaningful exposure to corporate bonds. When it comes to management of credit risk, we try to look through periods of volatility to focus on an investment’s long-term creditworthiness to assess whether it will provide an attractive yield to the Fund over time.

3

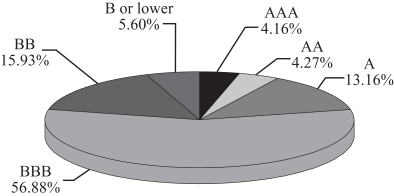

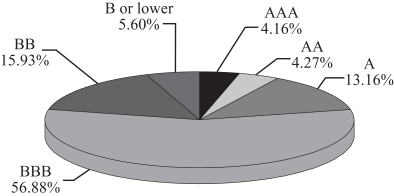

The Fund’s performance will continue to be subject to trends in long-term interest rates and to corporate yield spreads. Consistent with our investment discipline, we continue to emphasize diversification and risk management within the bounds of income stability. The pie chart below summarizes the portfolio quality of the Fund’s assets as of March 31, 2021:

Percent of Total Investment (Lower of S&P and Moody’s Ratings)3

| 3 | For financial reporting purposes, credit quality ratings shown above reflect the lowest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service (“Moody’s”) if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated NR are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings and the Fund’s allocation to the ratings categories are subject to change at any time without notice. |

We would like to remind shareholders of the opportunities presented by the Fund’s dividend reinvestment plan

referred to in the Shareholder Information section of this report. The dividend reinvestment plan affords shareholders a price advantage by allowing them to purchase shares at NAV or market price, whichever is lower. This means that the reinvestment price is at market price when the Fund is trading at a discount to NAV, as is currently the situation, or at NAV per share when market trading is at a premium to that value. To participate in the plan, please contact Computershare Investor Services, the Fund’s Transfer Agent and Dividend Paying Agent, at 1-866-333-6685. The Fund’s investment adviser, Insight North America LLC, may be reached at 1-212-527-1800.

Gautam Khanna

President

Mr. Khanna’s comments reflect the investment adviser’s views generally regarding the market and the economy, and are compiled from the investment adviser’s research. These comments reflect opinions as of the date written and are subject to change at any time.

Opinions expressed herein are current opinions of Insight, and are subject to change without notice. Insight assumes no responsibility to update such information or to notify a client of any changes. Any outlooks, forecasts or portfolio weightings presented herein are as of the date appearing on this material only and are also subject to change without notice. Insight disclaims any responsibility to update such views. No forecasts can be guaranteed.

4

Information herein may contain, include or is based upon forward-looking statements within the meaning of the federal securities laws, specifically Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements, other than statements of historical fact, that address future activities, events or developments, including without limitation, business or investment strategy or measures to implement strategy, competitive strengths, goals expansion and growth of our business, plans, prospects and references to future or success. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Words such as ‘anticipate,’ ‘estimate,’ ‘expect,’ ‘project,’ ‘intend,’ ‘plan,’ ‘believe,’ and other similar words are intended to identify these forward-looking statements. Forward-looking statements can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining our actual future results or outcomes. Consequently, no forward-looking statement can be guaranteed. Our actual results or outcomes may vary materially. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Past performance is not a guide to future performance, which will vary. The value of investments and any income from them will fluctuate and is not guaranteed (this may partly be due to exchange rate changes). Future returns are not guaranteed and a loss of principal may occur.

The quoted benchmarks within this presentation do not reflect deductions for fees, expenses or taxes. These benchmarks are unmanaged and cannot be purchased directly by investors. Benchmark performance is shown for illustrative purposes only and does not predict or depict the performance of any investment. There may be material factors relevant to any such comparison such as differences in volatility, and regulatory and legal restrictions between the indices shown and the strategy.

5

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and

Board of Trustees of

Insight Select Income Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Insight Select Income Fund (the “Fund”), including the schedule of investments, as of March 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2021, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 2003.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of March 31, 2021 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

May 10, 2021

6

SCHEDULE OF INVESTMENTS March 31, 2021

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

CORPORATE DEBT SECURITIES (85.61%) | |

|

AUTOMOTIVE (2.73%) | |

Allison Transmission Inc., Co. Gty., 3.75%, 01/30/31, 144A(b) | | Ba3/NA | | $ | 220 | | | $ | 213,125 | |

Ford Holdings LLC, Co. Gty., 9.30%, 03/01/30 | | Ba2/BB+ | | | 1,000 | | | | 1,320,000 | |

Ford Motor Co., Sr. Unsec. Notes, 8.50%, 04/21/23 | | Ba2/BB+ | | | 904 | | | | 1,007,960 | |

Ford Motor Co., Sr. Unsec. Notes, 8.90%, 01/15/32 | | Ba2/BB+ | | | 500 | | | | 666,723 | |

Ford Motor Credit Co. LLC, Sr. Unsec. Notes, 4.542%, 08/01/26(b) | | Ba2/BB+ | | | 1,356 | | | | 1,434,919 | |

General Motors Co., Sr. Unsec. Notes, 6.80%, 10/01/27(b) | | Baa3/BBB | | | 405 | | | | 502,171 | |

General Motors Financial Co. Inc., Sr. Unsec. Notes, 3.60%, 06/21/30(b) | | Baa3/BBB | | | 1,027 | | | | 1,082,566 | |

| | | | | | | | | | |

| | | | | | | | | 6,227,464 | |

| | | | | | | | | | |

CHEMICALS (3.25%) | |

Alpek SAB de CV, Co. Gty., 3.25%, 02/25/31, 144A(b) | | Baa3/BB+ | | | 418 | | | | 413,402 | |

Axalta Coating Systems LLC, Co. Gty., 4.75%, 06/15/27, 144A(b) | | B1/BB- | | | 150 | | | | 156,795 | |

Braskem Idesa SAPI, Sr. Sec. Notes, 7.45%, 11/15/29, 144A(b) | | NA/B | | | 473 | | | | 469,748 | |

Braskem Netherlands Finance BV, Co. Gty., 4.50%, 01/31/30, 144A | | NA/BB+ | | | 1,249 | | | | 1,254,833 | |

Braskem Netherlands Finance BV, Co. Gty., 5.875%, 01/31/50, 144A | | NA/BB+ | | | 1,181 | | | | 1,186,066 | |

INEOS Quattro Finance 2 Plc, Sr. Sec. Notes, 3.375%, 01/15/26, 144A(b) | | Ba3/BB | | | 200 | | | | 200,000 | |

Kraton Polymers LLC, Co. Gty., 4.25%, 12/15/25, 144A(b) | | B2/BB- | | | 290 | | | | 291,088 | |

Nutrition & Biosciences, Inc., Co. Gty., 1.832%, 10/15/27, 144A(b) | | Baa3/BBB | | | 267 | | | | 260,911 | |

Trinseo Materials Operating SCA, Co. Gty., 5.125%, 04/01/29, 144A(b) | | B2/B- | | | 105 | | | | 108,281 | |

Union Carbide Corp., Sr. Unsec. Notes, 7.75%, 10/01/96 | | Baa2/BBB- | | | 2,000 | | | | 3,051,369 | |

| | | | | | | | | | |

| | | | | | | | | 7,392,493 | |

| | | | | | | | | | |

COMMERCIAL SERVICES (0.10%) | |

Atento Luxco 1 SA, Sr. Sec. Notes, 8.00%, 02/10/26, 144A(b) | | Ba3/NA | | | 208 | | | | 217,975 | |

| | | | | | | | | | |

DIVERSIFIED FINANCIAL SERVICES (11.76%) | |

AerCap Ireland Capital DAC, Co. Gty., 6.50%, 07/15/25(b) | | Baa3/BBB | | | 560 | | | | 652,600 | |

AIB Group PLC, Sr. Unsec. Notes, (3M LIBOR +1.874%), 4.263%, 04/10/25, 144A(b),(c) | | Baa2/BBB- | | | 582 | | | | 632,876 | |

Citigroup Inc., Jr. Sub. Notes, (H15T5Y +3.597%), 4.00%, 12/10/25(b),(c),(d) | | Ba1/BB+ | | | 635 | | | | 641,191 | |

Citigroup, Inc., Sr. Unsec. Notes, (3M LIBOR +1.563%), 3.887%, 01/10/28(b),(c) | | A3/BBB+ | | | 1,100 | | | | 1,208,494 | |

Citigroup, Inc., Sr. Unsec. Notes, 8.125%, 07/15/39 | | A3/BBB+ | | | 70 | | | | 114,700 | |

Citigroup, Inc., Sub. Notes, 4.60%, 03/09/26 | | Baa2/BBB | | | 988 | | | | 1,114,883 | |

Citigroup, Inc., Sub. Notes, 5.30%, 05/06/44 | | Baa2/BBB | | | 926 | | | | 1,168,932 | |

Credit Agricole SA, Sub. Notes, (5Yr Swap +1.644%), 4.00%, 01/10/33, 144A(b),(c) | | Baa1/BBB+ | | | 1,025 | | | | 1,098,205 | |

Credit Suisse Group AG, Sr. Unsec. Notes, (SOFRRATE +1.56%),

2.593%, 09/11/25, 144A(b),(c) | | Baa1/BBB+ | | | 1,242 | | | | 1,287,813 | |

Danske Bank AS, Sr. Unsec. Notes, (H15T1Y +1.73%), 5.00%, 01/12/23, 144A(b),(c) | | Baa3/BBB+ | | | 739 | | | | 762,362 | |

GE Capital International Funding, Co. Gty., 4.418%, 11/15/35 | | Baa1/BBB+ | | | 588 | | | | 673,916 | |

General Electric Co., Sr. Unsec. Notes, 3.625%, 05/01/30(b) | | Baa1/BBB+ | | | 599 | | | | 643,999 | |

General Electric Co., Sr. Unsec. Notes, 6.875%, 01/10/39 | | Baa1/BBB+ | | | 287 | | | | 402,527 | |

General Electric Co., Sr. Unsec. Notes, 4.125%, 10/09/42 | | Baa1/BBB+ | | | 75 | | | | 80,469 | |

Goldman Sachs Group, Inc., Sr. Unsec. Notes, (3M LIBOR +1.75%),

1.969%, 10/28/27(b),(e) | | A2/BBB+ | | | 550 | | | | 575,568 | |

HSBC Capital Funding LP, Co. Gty., (3M LIBOR +4.98%),

10.176%, 06/30/30, 144A(b),(c),(d) | | Baa2/BB+ | | | 2,180 | | | | 3,566,654 | |

HSBC Holdings PLC, Sr. Unsec. Notes, 4.95%, 03/31/30 | | A2/A- | | | 499 | | | | 582,238 | |

LSEGA Financing PLC, Co. Gty., 1.375%, 04/06/26, 144A(b) | | A3/A | | | 612 | | | | 606,121 | |

LSEGA Financing PLC, Co. Gty., 2.50%, 04/06/31, 144A(b) | | A3/A | | | 264 | | | | 260,371 | |

Morgan Stanley, Jr. Sub. Notes, (3M LIBOR +3.61%), 3.851%, 07/15/21(b),(d),(e) | | Baa3/BB+ | | | 876 | | | | 877,309 | |

Morgan Stanley, Sub. Notes, 4.35%, 09/08/26 | | Baa1/BBB | | | 1,500 | | | | 1,695,563 | |

PNC Financial Services Group, Inc., Jr. Sub. Notes, (3M LIBOR +3.30%), 5.00%, 11/01/26(b),(c),(d) | | Baa2/BBB- | | | 757 | | | | 826,076 | |

SAFG Retirement Services, Inc., Sr. Unsec. Notes, 8.125%, 04/28/23 | | Baa1/BBB+ | | | 1,800 | | | | 2,040,584 | |

Truist Financial Corp., Jr. Sub. Notes, (H15T5Y +3.003%), 4.80%, 09/01/24(b),(c),(d) | | Baa2/BBB- | | | 1,136 | | | | 1,191,175 | |

The accompanying notes are an integral part of these financial statements.

7

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

CORPORATE DEBT SECURITIES (Continued) | |

|

DIVERSIFIED FINANCIAL SERVICES (Continued) | |

UBS AG, Sub. Notes, 7.625%, 08/17/22 | | NR/BBB+ | | $ | 2,000 | | | $ | 2,179,930 | |

Wells Fargo & Co., Jr. Sub. Notes, (H15T5Y +3.453%), 3.90%, 03/15/26(b),(c),(d) | | Baa2/BB+ | | | 1,162 | | | | 1,173,504 | |

Westpac Banking Corp., Sub. Notes, (H15T5Y +1.750%), 2.668%, 11/15/35(b),(c) | | Baa1/BBB+ | | | 753 | | | | 714,522 | |

| | | | | | | | | | |

| | | | | | | | | 26,772,582 | |

| | | | | | | | | | |

ENERGY (10.33%) | |

Cleveland-Cliffs Inc., Co. Gty., 4.625%, 03/01/29, 144A(b) | | B3/NA | | | 323 | | | | 322,451 | |

Ecopetrol SA, Sr. Unsec. Notes, 6.875%, 04/29/30(b) | | Baa3/BBB- | | | 440 | | | | 535,656 | |

Enbridge, Inc., Sub. Notes, (3M LIBOR +3.89%), 6.00%, 01/15/77(b),(c) | | Ba1/BBB- | | | 750 | | | | 800,625 | |

Energy Transfer LP, Co. Gty., 3.75%, 05/15/30(b) | | Baa3/BBB- | | | 398 | | | | 410,050 | |

Enterprise Products Operating LLC, Co. Gty., (3M LIBOR +2.57%),

5.375%, 02/15/78(b),(c) | | Baa2/BBB- | | | 342 | | | | 342,627 | |

Exxon Mobil Corp., Sr. Unsec. Notes, 4.227%, 03/19/40(b) | | Aa2/AA- | | | 1,402 | | | | 1,579,914 | |

Florida Gas Transmission Co. LLC, Sr. Unsec. Notes, 9.19%, 11/01/24, 144A | | Baa2/BBB+ | | | 40 | | | | 43,096 | |

Global Partners LP, Co. Gty., 7.00%, 08/01/27(b) | | B2/B+ | | | 1,076 | | | | 1,135,180 | |

Kinder Morgan, Inc., Co. Gty., 8.05%, 10/15/30 | | Baa2/BBB | | | 1,000 | | | | 1,354,962 | |

Kinder Morgan, Inc., Co. Gty., 5.55%, 06/01/45(b) | | Baa2/BBB | | | 1,755 | | | | 2,082,565 | |

Leviathan Bond Ltd., Sr. Sec. Notes, 6.125%, 06/30/25, 144A(b) | | Ba3/BB- | | | 912 | | | | 987,240 | |

MPLX LP, Sr. Unsec. Notes, 4.25%, 12/01/27(b) | | Baa2/BBB | | | 901 | | | | 1,011,857 | |

MPLX LP, Sr. Unsec. Notes, 5.50%, 02/15/49(b) | | Baa2/BBB | | | 694 | | | | 813,183 | |

MPLX LP, Sr. Unsec. Notes, 4.90%, 04/15/58(b) | | Baa2/BBB | | | 561 | | | | 595,761 | |

NGPL PipeCo LLC, Sr. Unsec. Notes, 7.768%, 12/15/37, 144A | | Baa3/BBB- | | | 880 | | | | 1,165,565 | |

Panhandle Eastern Pipe Line Co. LP, Sr. Unsec. Notes, 7.00%, 07/15/29 | | Baa3/BBB- | | | 1,000 | | | | 1,222,111 | |

Parkland Corp., Sr. Unsec. Notes, 4.50%, 10/01/29, 144A(b) | | Ba3/BB | | | 667 | | | | 669,301 | |

Petrobras Global Finance BV, Co. Gty., 5.60%, 01/03/31(b) | | Ba2/BB- | | | 413 | | | | 435,219 | |

Petroleos del Peru SA, Sr. Unsec. Notes, 5.625%, 06/19/47, 144A | | NA/BBB- | | | 793 | | | | 832,412 | |

Petroleos Mexicanos, Co. Gty., 5.95%, 01/28/31(b) | | Ba2/BBB | | | 552 | | | | 529,920 | |

Petroleos Mexicanos, Co. Gty., 6.35%, 02/12/48 | | Ba2/BBB | | | 702 | | | | 584,485 | |

Petroleos Mexicanos, Co. Gty., 6.95%, 01/28/60(b) | | Ba2/BBB | | | 195 | | | | 168,188 | |

Saudi Arabian Oil Co., Sr. Unsec. Notes, 2.25%, 11/24/30, 144A(b) | | A1/NA | | | 853 | | | | 816,249 | |

Targa Resources Partners LP, Co. Gty., 5.50%, 03/01/30(b) | | Ba3/BB | | | 1,177 | | | | 1,235,850 | |

Transcontinental Gas Pipe Line Co. LLC, Sr. Unsec. Notes, 3.95%, 05/15/50(b) | | Baa2/BBB | | | 384 | | | | 391,545 | |

Valero Energy Corp., Co. Gty., 8.75%, 06/15/30 | | Baa2/BBB | | | 1,000 | | | | 1,403,417 | |

Valero Energy Corp., Sr. Unsec. Notes, 10.50%, 03/15/39 | | Baa2/BBB | | | 500 | | | | 842,035 | |

Williams Cos., Inc., Sr. Unsec. Notes, 7.50%, 01/15/31 | | Baa3/BBB | | | 911 | | | | 1,204,854 | |

| | | | | | | | | | |

| | | | | | | | | 23,516,318 | |

| | | | | | | | | | |

FOOD AND BEVERAGE (1.34%) | |

Albertsons Cos., Inc., Co. Gty., 3.50%, 03/15/29, 144A(b) | | B1/BB- | | | 698 | | | | 664,245 | |

Anheuser-Busch InBev Worldwide, Inc., Co. Gty., 4.70%, 02/01/36(b) | | Baa1/BBB+ | | | 645 | | | | 755,086 | |

Anheuser-Busch InBev Worldwide, Inc., Co. Gty., 4.90%, 02/01/46(b) | | Baa1/BBB+ | | | 446 | | | | 528,252 | |

Anheuser-Busch InBev Worldwide, Inc., Co. Gty., 8.20%, 01/15/39 | | Baa1/BBB+ | | | 27 | | | | 43,111 | |

Kraft Heinz Foods Co., Co. Gty., 5.50%, 06/01/50(b) | | Baa3/BB+ | | | 346 | | | | 424,944 | |

Kroger Co., Sr. Unsec. Notes, 5.40%, 01/15/49(b) | | Baa1/BBB | | | 68 | | | | 86,731 | |

MARB BondCo PLC, Co. Gty., 3.95%, 01/29/31, 144A(b) | | NA/BB- | | | 478 | | | | 455,295 | |

SEG Holding LLC, Sr. Sec. Notes, 5.625%, 10/15/28, 144A(b) | | B2/B+ | | | 80 | | | | 83,800 | |

| | | | | | | | | | |

| | | | | | | | | 3,041,464 | |

| | | | | | | | | | |

GAMING, LODGING & LEISURE (0.65%) | |

International Game Technology PLC, Sr. Sec. Notes, 4.125%, 04/15/26, 144A(b) | | Ba3/BB | | | 236 | | | | 242,509 | |

Lions Gate Capital Holdings LLC, Co. Gty., 5.50%, 04/15/29, 144A(b) | | B3/CCC+ | | | 386 | | | | 386,042 | |

Marriott International, Inc., Sr. Unsec. Notes, 5.75%, 05/01/25(b) | | Baa3/BBB- | | | 489 | | | | 560,928 | |

Travel + Leisure Co., Sr. Sec. Notes, 6.625%, 07/31/26, 144A(b) | | Ba3/BB- | | | 250 | | | | 283,838 | |

| | | | | | | | | | |

| | | | | | | | | 1,473,317 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

8

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

CORPORATE DEBT SECURITIES (Continued) | |

|

HEALTHCARE (2.58%) | |

AbbVie Inc., Sr. Unsec. Notes, 4.05%, 11/21/39(b) | | Baa2/BBB+ | | $ | 615 | | | $ | 686,556 | |

Bausch Health Cos., Inc., Co. Gty., 5.00%, 02/15/29, 144A(b) | | B3/B | | | 24 | | | | 23,700 | |

Bausch Health Cos., Inc., Co. Gty., 5.25%, 01/30/30, 144A(b) | | B3/B | | | 87 | | | | 87,349 | |

Bausch Health Cos., Inc., Co. Gty., 6.25%, 02/15/29, 144A(b) | | B3/B | | | 73 | | | | 77,471 | |

CommonSpirit Health, Sr. Sec. Notes, 2.782%, 10/01/30(b) | | Baa1/BBB+ | | | 432 | | | | 436,793 | |

DaVita, Inc., Co. Gty., 3.75%, 02/15/31, 144A(b) | | Ba3/B+ | | | 1,134 | | | | 1,086,599 | |

Endo Luxembourg Finance Co I Sarl, Sr. Sec. Notes, 6.125%, 04/01/29, 144A(b) | | B2/B+ | | | 278 | | | | 280,841 | |

Royalty Pharma PLC, Co. Gty., 2.20%, 09/02/30, 144A(b) | | Baa3/BBB- | | | 930 | | | | 886,825 | |

STERIS Irish FinCo UnLtd Co., Co. Gty., 2.70%, 03/15/31(b) | | Baa2/BBB- | | | 329 | | | | 326,281 | |

Takeda Pharmaceutical Co. Ltd., Sr. Unsec. Notes, 3.175%, 07/09/50(b) | | Baa2/BBB+ | | | 684 | | | | 648,093 | |

Takeda Pharmaceutical Co. Ltd., Sr. Unsec. Notes, 5.00%, 11/26/28(b) | | Baa2/BBB+ | | | 500 | | | | 591,401 | |

Tenet Healthcare Corp., Sr. Sec. Notes, 4.625%, 06/15/28, 144A(b) | | B1/BB- | | | 99 | | | | 101,473 | |

Teva Pharmaceutical Finance Netherlands III BV, Co. Gty., 7.125%, 01/31/25(b) | | Ba2/BB- | | | 577 | | | | 637,412 | |

| | | | | | | | | | |

| | | | | | | | | 5,870,794 | |

| | | | | | | | | | |

HOME BUILDERS (0.56%) | |

Meritage Homes Corp., Sr. Unsec. Notes, 3.875%, 04/15/29, 144A(b) | | Ba1/BB+ | | | 1,280 | | | | 1,280,000 | |

| | | | | | | | | | |

INDUSTRIAL (5.21%) | |

Altria Group, Inc., Co. Gty., 4.80%, 02/14/29(b) | | A3/BBB | | | 97 | | | | 111,610 | |

Altria Group, Inc., Co. Gty., 5.95%, 02/14/49(b) | | A3/BBB | | | 329 | | | | 409,178 | |

Ardagh Metal Packaging Finance USA LLC, Sr. Unsec. Notes,

4.00%, 09/01/29, 144A(b) | | B3/B+ | | | 200 | | | | 199,500 | |

BAT Capital Corp., Co. Gty, 3.984%, 09/25/50(b) | | Baa2/BBB+ | | | 1,274 | | | | 1,193,004 | |

BAT International Finance PLC, Co. Gty., 1.668%, 03/25/26(b) | | Baa2/BBB+ | | | 425 | | | | 420,506 | |

Boeing Co., Sr. Unsec. Notes, 4.875%, 05/01/25(b) | | Baa2/BBB- | | | 1,657 | | | | 1,844,331 | |

Boeing Co., Sr. Unsec. Notes, 5.805%, 05/01/50(b) | | Baa2/BBB- | | | 648 | | | | 817,133 | |

Carrier Global Corp., Sr. Unsec. Notes, 2.722%, 02/15/30(b) | | Baa3/BBB | | | 852 | | | | 859,162 | |

Cemex SAB de CV, Sr. Sec. Notes, 5.20%, 09/17/30, 144A(b) | | NA/BB | | | 907 | | | | 982,735 | |

Cemex SAB de CV, Sr. Sec. Notes, 3.875%, 07/11/31, 144A(b) | | NA/BB | | | 724 | | | | 706,624 | |

Cemex SAB de CV, Sr. Sec. Notes, 7.375%, 06/05/27, 144A(b) | | NA/BB | | | 200 | | | | 226,434 | |

GFL Environmental Inc., Sr. Sec. Notes, 3.50%, 09/01/28, 144A(b) | | Ba3/BB- | | | 338 | | | | 327,860 | |

Heathrow Funding, Ltd., Sr. Sec. Notes, 4.875%, 07/15/21, 144A | | NA/BBB+ | | | 200 | | | | 201,654 | |

Hillenbrand Inc., Co. Gty., 3.75%, 03/01/31(b) | | Ba1/BB+ | | | 499 | | | | 488,541 | |

Masco Corp., Sr. Unsec. Notes, 1.50%, 02/15/28(b) | | Baa2/BBB | | | 647 | | | | 620,929 | |

Northrop Grumman Space & Mission Systems Corp., Co. Gty., 7.75%, 06/01/29 | | Baa1/BBB+ | | | 500 | | | | 659,968 | |

Raytheon Technologies Corp., Sr. Unsec. Notes, 3.75%, 11/01/46(b) | | Baa1/A- | | | 700 | | | | 743,948 | |

Sensata Technologies BV, Co. Gty., 4.00%, 04/15/29, 144A(b) | | Ba3/BB+ | | | 200 | | | | 203,606 | |

SRM Escrow Issuer LLC, Sr. Sec. Notes, 6.00%, 11/01/28, 144A(b) | | B1/B+ | | | 397 | | | | 416,056 | |

Sydney Airport Finance Co. Property, Ltd., Sr. Sec. Notes, 3.375%, 04/30/25, 144A(b) | | Baa1/BBB+ | | | 400 | | | | 425,578 | |

| | | | | | | | | | |

| | | | | | | | | 11,858,357 | |

| | | | | | | | | | |

INSURANCE (9.71%) | |

Allianz SE, Jr. Sub. Notes, (H15T5Y +2.973%), 3.50%, 04/30/26, 144A(b),(c),(d) | | Baa1/A | | | 800 | | | | 812,000 | |

Allstate Corp., Jr. Sub. Notes, (3M LIBOR +2.12%), 6.50%, 05/15/57(b),(c) | | Baa1/BBB | | | 2,200 | | | | 2,821,500 | |

American International Group, Inc., Jr. Sub. Notes, (3M LIBOR +4.195%),

8.175%, 05/15/58(b),(c) | | Baa2/BBB- | | | 2,500 | | | | 3,461,751 | |

Brighthouse Financial, Inc., Sr. Unsec. Notes, 5.625%, 05/15/30(b) | | Baa3/BBB+ | | | 383 | | | | 447,702 | |

Farmers Exchange Capital, Sub. Notes, 7.20%, 07/15/48, 144A | | Baa2/BBB+ | | | 2,250 | | | | 2,968,741 | |

Guardian Life Insurance Co. of America, Sub. Notes, 4.85%, 01/24/77, 144A | | A1/AA- | | | 148 | | | | 171,305 | |

Liberty Mutual Group, Inc., Co. Gty., 3.951%, 10/15/50, 144A(b) | | Baa2/BBB | | | 250 | | | | 257,106 | |

Liberty Mutual Group, Inc., Co. Gty., (3M LIBOR +7.12%),

10.75%, 06/15/58, 144A(b),(c) | | Baa3/BB+ | | | 1,000 | | | | 1,416,400 | |

Massachusetts Mutual Life Insurance Co., Sub. Notes, 4.90%, 04/01/77, 144A | | A2/AA- | | | 980 | | | | 1,158,943 | |

The accompanying notes are an integral part of these financial statements.

9

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

CORPORATE DEBT SECURITIES (Continued) | |

|

INSURANCE (Continued) | |

Massachusetts Mutual Life Insurance Co., Sub. Notes, 3.729%, 10/15/70, 144A | | A2/AA- | | $ | 243 | | | $ | 236,261 | |

MetLife, Inc., Jr. Sub. Notes, 9.25%, 04/08/38, 144A(b) | | Baa2/BBB | | | 1,059 | | | | 1,551,496 | |

MetLife, Inc., Jr. Sub. Notes, 6.40%, 12/15/36(b) | | Baa2/BBB | | | 637 | | | | 798,713 | |

MetLife, Inc., Jr. Sub. Notes, 10.75%, 08/01/39(b) | | Baa2/BBB | | | 1,000 | | | | 1,670,889 | |

Nationwide Mutual Insurance Co., Sub. Notes, 8.25%, 12/01/31, 144A | | A3/A- | | | 500 | | | | 671,212 | |

Nationwide Mutual Insurance Co., Sub. Notes, 9.375%, 08/15/39, 144A | | A3/A- | | | 215 | | | | 350,684 | |

New York Life Insurance Co., Sub. Notes, 6.75%, 11/15/39, 144A | | Aa2/AA- | | | 103 | | | | 146,704 | |

Principal Financial Group, Inc., Co. Gty., (3M LIBOR +3.044%), 3.242%, 05/15/55(b),(c) | | Baa2/BBB | | | 1,135 | | | | 1,115,138 | |

Prudential Financial, Inc., Jr. Sub. Notes, (3M LIBOR +3.92%), 5.625%, 06/15/43(b),(c) | | Baa1/BBB+ | | | 600 | | | | 642,856 | |

Prudential Financial, Inc., Jr. Sub. Notes, (3M LIBOR +2.665%), 5.70%, 09/15/48(b),(c) | | Baa1/BBB+ | | | 1,241 | | | | 1,417,280 | |

| | | | | | | | | | |

| | | | | | | | | 22,116,681 | |

| | | | | | | | | | |

MEDIA (9.42%) | |

AMC Networks Inc., Co. Gty., 4.25%, 02/15/29(b) | | Ba3/BB | | | 1,198 | | | | 1,165,055 | |

CCO Holdings LLC, Sr. Unsec. Notes, 4.25%, 02/01/31, 144A(b) | | B1/BB | | | 75 | | | | 75,167 | |

CCO Holdings LLC, Sr. Unsec. Notes, 4.50%, 05/01/32, 144A(b) | | B1/BB | | | 1,017 | | | | 1,029,713 | |

Charter Communications Operating LLC, Sr. Sec. Notes, 5.75%, 04/01/48(b) | | Ba1/BBB- | | | 774 | | | | 941,304 | |

Comcast Corp., Co. Gty., 7.05%, 03/15/33 | | A3/A- | | | 2,000 | | | | 2,851,116 | |

Cox Communications, Inc., Sr. Unsec. Notes, 6.80%, 08/01/28 | | Baa2/BBB | | | 1,500 | | | | 1,854,346 | |

Cox Enterprises, Inc., Sr. Unsec. Notes, 7.375%, 07/15/27, 144A | | Baa2/BBB | | | 500 | | | | 646,307 | |

CSC Holdings LLC, Co. Gty., 3.375%, 02/15/31, 144A(b) | | Ba3/BB | | | 636 | | | | 599,430 | |

CSC Holdings LLC, Co. Gty., 4.125%, 12/01/30, 144A(b) | | Ba3/BB | | | 448 | | | | 444,989 | |

CSC Holdings LLC, Co. Gty., 6.50%, 02/01/29, 144A(b) | | Ba3/BB | | | 954 | | | | 1,054,170 | |

CSC Holdings LLC, Sr. Unsec. Notes, 4.625%, 12/01/30, 144A(b) | | B3/B | | | 1,336 | | | | 1,314,110 | |

Gray Television Inc., Co. Gty., 4.75%, 10/15/30, 144A(b) | | B3/B+ | | | 21 | | | | 20,816 | |

Grupo Televisa SAB, Sr. Unsec. Notes, 5.00%, 05/13/45(b) | | Baa1/BBB+ | | | 557 | | | | 610,071 | |

Grupo Televisa SAB, Sr. Unsec. Notes, 6.625%, 01/15/40 | | Baa1/BBB+ | | | 159 | | | | 203,899 | |

Lamar Media Corp., Co. Gty., 3.625%, 01/15/31, 144A(b) | | B1/BB- | | | 211 | | | | 202,562 | |

Radiate Holdco LLC, Sr. Sec. Notes, 4.50%, 09/15/26, 144A(b) | | B1/B | | | 124 | | | | 125,395 | |

RELX, Inc., Sr. Unsec. Notes, 8.875%, 06/01/22 | | WR/BBB+ | | | 2,000 | | | | 2,187,642 | |

Scripps Escrow II Inc., Sr. Sec. Notes, 3.875%, 01/15/29, 144A(b) | | Ba3/BB- | | | 42 | | | | 41,265 | |

Time Warner Entertainment Co. LP, Sr. Sec. Notes, 8.375%, 07/15/33 | | Ba1/BBB- | | | 1,360 | | | | 1,966,848 | |

ViacomCBS, Inc., Sr. Unsec. Notes, 4.20%, 05/19/32(b) | | Baa2/BBB | | | 641 | | | | 718,505 | |

ViacomCBS, Inc., Sr. Unsec. Notes, 6.875%, 04/30/36 | | Baa2/BBB | | | 179 | | | | 246,991 | |

Virgin Media Finance PLC, Co. Gty., 5.00%, 07/15/30, 144A(b) | | B2/B | | | 200 | | | | 199,750 | |

VTR Finance NV, Sr. Unsec. Notes, 6.375%, 07/15/28, 144A(b) | | B1/B | | | 443 | | | | 478,440 | |

Walt Disney Co., Co. Gty., 7.90%, 12/01/95 | | A2/BBB+ | | | 1,400 | | | | 2,464,120 | |

| | | | | | | | | | |

| | | | | | | | | 21,442,011 | |

| | | | | | | | | | |

MINING (1.12%) | |

Anglo American Capital PLC, Co. Gty., 2.625%, 09/10/30, 144A(b) | | Baa2/BBB | | | 567 | | | | 555,360 | |

AngloGold Ashanti Holdings PLC, Co. Gty., 3.75%, 10/01/30(b) | | Baa3/BB+ | | | 339 | | | | 342,506 | |

FMG Resources August 2006 Pty Ltd., Co. Gty., 4.375%, 04/01/31, 144A(b) | | Ba1/BB+ | | | 366 | | | | 372,863 | |

IAMGOLD Corp., Co. Gty., 5.75%, 10/15/28, 144A(b) | | B2/B+ | | | 701 | | | | 709,973 | |

Newcrest Finance Pty Ltd., Co. Gty., 3.25%, 05/13/30, 144A(b) | | Baa2/BBB | | | 319 | | | | 333,565 | |

Volcan Cia Minera SAA, Sr. Unsec. Notes, 4.375%, 02/11/26, 144A(b) | | B1/NA | | | 222 | | | | 227,883 | |

| | | | | | | | | | |

| | | | | | | | | 2,542,150 | |

| | | | | | | | | | |

PAPER (0.70%) | |

Celulosa Arauco y Constitucion SA, Sr. Unsec. Notes, 4.20%, 01/29/30, 144A(b) | | Baa3/BBB- | | | 579 | | | | 623,149 | |

Inversiones CMPC SA, Co. Gty., 3.85%, 01/13/30, 144A(b) | | Baa3/BBB- | | | 580 | | | | 615,960 | |

Suzano Austria GmbH, Co. Gty., 3.75%, 01/15/31(b) | | NA/BBB- | | | 351 | | | | 362,846 | |

| | | | | | | | | | |

| | | | | | | | | 1,601,955 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

10

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

CORPORATE DEBT SECURITIES (Continued) | |

|

REAL ESTATE INVESTMENT TRUST (REIT) (1.41%) | |

Iron Mountain, Inc., Co. Gty., 5.00%, 07/15/28, 144A(b) | | Ba3/BB- | | $ | 59 | | | $ | 60,328 | |

Iron Mountain, Inc., Co. Gty., 4.875%, 09/15/29, 144A(b) | | Ba3/BB- | | | 398 | | | | 402,955 | |

Iron Mountain, Inc., Co. Gty., 5.25%, 07/15/30, 144A(b) | | Ba3/BB- | | | 578 | | | | 596,380 | |

Scentre Group Trust 2, Co. Gty., (H15T5Y +4.379%), 4.75%, 09/24/26, 144A(b),(c) | | Baa1/BBB+ | | | 2,007 | | | | 2,109,859 | |

WEA Finance LLC, Co. Gty., 4.625%, 09/20/48, 144A(b) | | Baa2/BBB+ | | | 36 | | | | 35,394 | |

| | | | | | | | | | |

| | | | | | | | | 3,204,916 | |

| | | | | | | | | | |

RETAIL & RESTAURANT (1.19%) | |

Lowe’s Cos Inc., Sr. Unsec. Notes, 3.00%, 10/15/50(b) | | Baa1/BBB+ | | | 385 | | | | 357,428 | |

Macy’s Retail Holdings LLC, Co. Gty., 5.875%, 04/01/29, 144A(b) | | B1/B | | | 78 | | | | 79,985 | |

Murphy Oil USA Inc., Co. Gty., 3.75%, 02/15/31, 144A(b) | | Ba2/BB+ | | | 119 | | | | 116,968 | |

Starbucks Corp., Sr. Unsec. Notes, 4.45%, 08/15/49(b) | | Baa1/BBB+ | | | 1,781 | | | | 2,060,365 | |

Superior Plus LP, Sr. Unsec. Notes, 4.50%, 03/15/29, 144A(b) | | Ba3/BB- | | | 98 | | | | 99,000 | |

| | | | | | | | | | |

| | | | | | | | | 2,713,746 | |

| | | | | | | | | | |

TECHNOLOGY (3.71%) | |

Broadcom, Inc., Co. Gty., 4.75%, 04/15/29(b) | | Baa3/BBB- | | | 1,109 | | | | 1,245,878 | |

Broadcom, Inc., Co. Gty., 3.75%, 02/15/51, 144A(b) | | Baa3/BBB- | | | 166 | | | | 159,425 | |

Broadcom, Inc., Sr. Unsec. Notes, 3.469%, 04/15/34, 144A(b) | | NA/BBB- | | | 1,655 | | | | 1,664,951 | |

Dell International LLC, Sr. Sec. Notes, 5.85%, 07/15/25, 144A(b) | | Baa3/BBB- | | | 342 | | | | 398,555 | |

Dell International LLC, Sr. Sec. Notes, 8.35%, 07/15/46, 144A(b) | | Baa3/BBB- | | | 845 | | | | 1,282,678 | |

Oracle Corp., Sr. Unsec. Notes, 2.30%, 03/25/28(b) | | Baa2/A | | | 1,130 | | | | 1,142,552 | |

Oracle Corp., Sr. Unsec. Notes, 3.60%, 04/01/40(b) | | Baa2/A | | | 2,331 | | | | 2,340,210 | |

Seagate HDD Cayman, Co. Gty., 3.125%, 07/15/29, 144A(b) | | Ba1/BB+ | | | 210 | | | | 202,823 | |

| | | | | | | | | | |

| | | | | | | | | 8,437,072 | |

| | | | | | | | | | |

TELECOMMUNICATIONS (4.94%) | |

AT&T, Inc., Sr. Unsec. Notes, 3.30%, 02/01/52(b) | | Baa2/BBB | | | 2,321 | | | | 2,097,829 | |

AT&T, Inc., Sr. Unsec. Notes, 4.50%, 05/15/35(b) | | Baa2/BBB | | | 515 | | | | 580,313 | |

AT&T, Inc., Sr. Unsec. Notes, 4.75%, 05/15/46(b) | | Baa2/BBB | | | 425 | | | | 485,740 | |

Consolidated Communications Inc., Sr. Sec. Notes, 5.00%, 10/01/28, 144A(b) | | B2/B+ | | | 194 | | | | 195,513 | |

Deutsche Telekom International Finance BV, Co. Gty., 8.75%, 06/15/30(f) | | Baa1/BBB | | | 2,000 | | | | 2,963,329 | |

Frontier Communications Corp., Sr. Sec. Notes, 5.00%, 05/01/28, 144A(b) | | B3/(P)B+ | | | 255 | | | | 259,463 | |

T-Mobile USA Inc., Co. Gty., 3.375%, 04/15/29(b) | | Ba3/BB | | | 1,108 | | | | 1,119,412 | |

Verizon Communications, Inc., Sr. Unsec. Notes, 2.55%, 03/21/31(b) | | Baa1/BBB+ | | | 457 | | | | 455,781 | |

Verizon Communications, Inc., Sr. Unsec. Notes, 3.55%, 03/22/51(b) | | Baa1/BBB+ | | | 674 | | | | 671,015 | |

Verizon Communications, Inc., Sr. Unsec. Notes, 4.812%, 03/15/39 | | Baa1/BBB+ | | | 1,898 | | | | 2,266,508 | |

Windstream Escrow LLC, Sr. Sec. Notes, 7.75%, 08/15/28, 144A(b) | | B3/B | | | 146 | | | | 148,373 | |

| | | | | | | | | | |

| | | | | | | | | 11,243,276 | |

| | | | | | | | | | |

TRANSPORTATION (6.17%) | |

Air Canada, Pass Through Certs., Series 2020-2, Class A, 5.25%, 04/01/29, 144A | | NA/A | | | 278 | | | | 298,678 | |

American Airlines Inc., Sr. Sec. Notes, 5.50%, 04/20/26, 144A | | Ba2/NA | | | 354 | | | | 369,045 | |

American Airlines Inc., Sr. Sec. Notes, 5.75%, 04/20/29, 144A | | Ba2/NA | | | 162 | | | | 172,660 | |

American Airlines, Pass Through Certs., Series 2017-1, Class AA, 3.65%, 02/15/29 | | Baa1/NA | | | 887 | | | | 893,755 | |

American Airlines, Pass Through Certs., Series 2017-2, Class AA, 3.35%, 10/15/29 | | Baa1/NA | | | 1,372 | | | | 1,385,155 | |

American Airlines, Pass Through Certs., Series 2019-1, Class AA, 3.15%, 02/15/32 | | Baa1/A | | | 770 | | | | 765,846 | |

Ashtead Capital, Inc., Co. Gty., 4.00%, 05/01/28, 144A(b) | | Baa3/BBB- | | | 555 | | | | 579,775 | |

Ashtead Capital, Inc., Co. Gty., 4.25%, 11/01/29, 144A(b) | | Baa3/BBB- | | | 200 | | | | 214,422 | |

Avis Budget Car Rental LLC, Co. Gty., 5.375%, 03/01/29, 144A(b) | | B3/B | | | 595 | | | | 615,483 | |

BNSF Funding Trust I, Co. Gty., (3M LIBOR +2.35%), 6.613%, 12/15/55(b),(c) | | Baa2/A- | | | 250 | | | | 286,452 | |

British Airlines, Pass Through Certs., Series 2020-1, Class A, Sr. Sec. Notes,

4.25%, 11/15/32, 144A | | NA/A | | | 197 | | | | 206,572 | |

Continental Airlines, Pass Through Certs., Series 2000-2, Class A1, 7.707%, 04/02/21 | | Baa1/BBB- | | | 72 | | | | 72,279 | |

The accompanying notes are an integral part of these financial statements.

11

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

CORPORATE DEBT SECURITIES (Continued) | |

|

TRANSPORTATION (Continued) | |

Delta Air Lines, Inc., Sr. Sec. Notes, 4.50%, 10/20/25, 144A | | Baa1/NA | | $ | 120 | | | $ | 127,783 | |

Delta Air Lines, Inc., Sr. Sec. Notes, 4.75%, 10/20/28, 144A | | Baa1/NA | | | 209 | | | | 227,157 | |

ERAC USA Finance LLC, Co. Gty., 7.00%, 10/15/37, 144A | | Baa1/A- | | | 1,500 | | | | 2,158,616 | |

Hidrovias International Finance SARL, Sr. Unsec. Notes, 4.95%, 02/08/31, 144A(b) | | Ba3/NA | | | 200 | | | | 200,000 | |

JetBlue Airlines, Pass Through Certs., Series 2020-1, Class A, Sr. Sec. Notes,

4.00%, 11/15/32 | | A2/NA | | | 1,074 | | | | 1,157,868 | |

Prime Security Services Borrower LLC, Sr. Sec. Notes, 3.375%, 08/31/27, 144A(b) | | Ba3/BB- | | | 559 | | | | 542,230 | |

Simpar Europe SA, Co. Gty., 5.20%, 01/26/31, 144A(b) | | NA/BB- | | | 544 | | | | 532,755 | |

Union Pacific Corp., Sr. Unsec. Notes, 3.839%, 03/20/60(b) | | Baa1/A- | | | 503 | | | | 526,595 | |

United Airlines, Pass Through Certs., Series 2013-1, Class B, 5.375%, 08/15/21 | | NA/BB | | | 201 | | | | 203,375 | |

United Airlines, Pass Through Certs., Series 2018-1, Class B, 4.60%, 03/01/26 | | Baa2/NA | | | 699 | | | | 706,907 | |

United Airlines, Pass Through Certs., Series 2019-1, Class AA, 4.15%, 08/25/31 | | A1/NA | | | 397 | | | | 423,040 | |

United Airlines, Pass Through Certs., Series 2019-2, Class AA, 2.70%, 05/01/32 | | A1/NA | | | 1,077 | | | | 1,045,212 | |

United Airlines, Pass Through Certs., Series 2020-1, Class A, 5.875%, 10/15/27 | | A3/A | | | 310 | | | | 343,990 | |

| | | | | | | | | | |

| | | | | | | | | 14,055,650 | |

| | | | | | | | | | |

UTILITIES (8.73%) | |

AES Gener SA., Jr. Sub. Notes, (H15T5Y +4.917%), 6.35%, 10/07/79, 144A(b),(c) | | Ba2/BB | | | 878 | | | | 940,558 | |

AES Panama Generation Holdings SRL, Sr. Sec. Notes, 4.375%, 05/31/30, 144A(b) | | Baa3/NA | | | 549 | | | | 568,050 | |

Black Hills Corp., Sr. Unsec. Notes, 3.875%, 10/15/49(b) | | Baa2/BBB+ | | | 1,175 | | | | 1,175,246 | |

CMS Energy Corp., Jr. Sub. Notes, (H15T5Y +2.900%), 3.75%, 12/01/50(b),(c) | | Baa2/BBB- | | | 238 | | | | 235,620 | |

Consolidated Edison Co. of New York, Inc., Sr. Unsec. Notes, 3.95%, 04/01/50(b) | | Baa1/A- | | | 449 | | | | 483,512 | |

Consorcio Transmantaro SA, Sr. Unsec. Notes, 4.70%, 04/16/34, 144A | | Baa3/NA | | | 200 | | | | 225,752 | |

Edison International, Jr. Sub. Notes, (H15T5Y +4.698%), 5.375%, 03/15/26(b),(c),(d) | | Ba2/BB+ | | | 638 | | | | 649,165 | |

Edison International, Sr. Unsec. Notes, 3.55%, 11/15/24(b) | | Baa3/BBB- | | | 575 | | | | 617,776 | |

Enel Finance International NV, Co. Gty., 4.625%, 09/14/25, 144A | | Baa1/BBB+ | | | 1,458 | | | | 1,650,344 | |

Evergy Metro, Inc., Sr. Sec. Notes, 4.20%, 06/15/47(b) | | A2/A+ | | | 917 | | | | 1,017,917 | |

FirstEnergy Corp., Sr. Unsec. Notes, 5.35%, 07/15/47(b),(f) | | Ba1/BB | | | 1,570 | | | | 1,763,380 | |

Hydro-Quebec, 8.25%, 04/15/26 | | Aa2/AA- | | | 1,550 | | | | 2,034,120 | |

IPALCO Enterprises, Inc., Sr. Sec. Notes, 4.25%, 05/01/30, 144A(b) | | Baa3/BBB- | | | 462 | | | | 502,952 | |

MidAmerican Funding LLC, Sr. Sec. Notes, 6.927%, 03/01/29 | | A2/A- | | | 500 | | | | 656,510 | |

NiSource, Inc., Jr. Sub. Notes, (H15T5Y +2.843%), 5.65%, 06/15/23(b),(c),(d) | | NA/BBB- | | | 696 | | | | 718,620 | |

Pacific Gas and Electric Co., 2.10%, 08/01/27(b) | | Baa3/BBB- | | | 391 | | | | 382,714 | |

Pacific Gas and Electric Co., 3.50%, 08/01/50(b) | | Baa3/BBB- | | | 617 | | | | 537,546 | |

Piedmont Natural Gas Co. Inc., Sr. Unsec. Notes, 3.50%, 06/01/29(b) | | A3/BBB+ | | | 1,120 | | | | 1,207,527 | |

Southern Co. Gas Capital Corp., Co. Gty., 5.875%, 03/15/41(b) | | Baa1/A- | | | 992 | | | | 1,307,916 | |

Southern Co. Gas Capital Corp., Co. Gty., 3.95%, 10/01/46(b) | | Baa1/A- | | | 539 | | | | 556,246 | |

Southern Co. Gas Capital Corp., Co. Gty., 4.40%, 05/30/47(b) | | Baa1/A- | | | 1,164 | | | | 1,283,760 | |

Transelec SA, Sr. Unsec. Notes, 4.25%, 01/14/25, 144A(b) | | Baa1/BBB | | | 750 | | | | 817,500 | |

Transelec SA, Sr. Unsec. Notes, 3.875%, 01/12/29, 144A(b) | | Baa1/BBB | | | 490 | | | | 533,684 | |

| | | | | | | | | | |

| | | | | | | | | 19,866,415 | |

| | | | | | | | | | |

TOTAL CORPORATE DEBT SECURITIES (Cost of $175,169,042) | | | | | | | | | 194,874,636 | |

| | | | | | | | | | |

ASSET BACKED SECURITIES (6.60%) | |

Antares CLO Ltd., Series 2017-1, Class A, (3M LIBOR +2.70%),

2.893%, 04/20/33, 144A(b),(e) | | NA/A | | | 1,093 | | | | 1,091,943 | |

BCC Funding XVII LLC, Series 2020-1, Class A2, 0.91%, 08/20/25, 144A(b) | | Aaa/NA | | | 205 | | | | 205,776 | |

CF Hippolyta LLC, Series 2020-1, Class A1, 1.69%, 07/15/60, 144A(b) | | NA/AA- | | | 649 | | | | 653,682 | |

DB Master Finance LLC, Series 2017-1A, Class A2I, 3.629%, 11/20/47, 144A(b) | | NA/BBB | | | 326 | | | | 331,861 | |

DRB Prime Student Loan Trust, Series 2016-B, Class A2, 2.89%, 06/25/40, 144A(b) | | Aaa/NA | | | 73 | | | | 73,661 | |

DRB Prime Student Loan Trust, Series 2017-A, Class A2B, 2.85%, 05/27/42, 144A(b) | | Aaa/NA | | | 582 | | | | 587,622 | |

DT Auto Owner Trust, Series 2018-2A, Class C, 3.67%, 03/15/24, 144A(b) | | NA/AAA | | | 11 | | | | 11,481 | |

The accompanying notes are an integral part of these financial statements.

12

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | Principal

Amount (000’s) | | | Value

(Note 1) | |

ASSET BACKED SECURITIES (Continued) | |

Fortress Credit Opportunities IX CLO, Ltd., Series 2017-9A, Class A1T,

(3M LIBOR +1.55%), 1.744%, 11/15/29, 144A(b),(e) | | Aaa/AAA | | $ | 600 | | | $ | 598,944 | |

Golub Capital Partners Ltd., Series 2017-19RA, Class B, (3M LIBOR +2.55%),

2.765%, 07/26/29, 144A(b),(e) | | A2/NA | | | 1,935 | | | | 1,934,033 | |

Golub Capital Partners Ltd., Series 2018-36A, Class C, (3M LIBOR +2.10%),

2.295%, 02/05/31, 144A(b),(e) | | NA/A | | | 2,250 | | | | 2,167,922 | |

ITE Rail Fund Levered LP, Series 2021-1A, Class A, 2.25%, 02/28/51, 144A(b) | | NA/A | | | 202 | | | | 201,676 | |

IVY Hill Middle Market Credit Fund Ltd., Series 12A, Class B, (3M LIBOR +3.00%), 3.224%, 07/20/29, 144A(b),(e) | | A3/NR | | | 866 | | | | 858,807 | |

LoanCore Issuer, Ltd., Series 2018-CRE1, Class A, (1M LIBOR +1.13%),

1.236%, 05/15/28, 144A(b),(e) | | Aaa/NA | | | 240 | | | | 240,049 | |

Navient Private Education Refi Loan Trust, Series 2021-A, Class A,

0.84%, 05/15/69, 144A(b) | | NA/AAA | | | 224 | | | | 223,701 | |

PMT Issuer Trust, Series 2021-FT1, Class A, (1M LIBOR +3.00%),

2.992%, 03/25/26, 144A(b),(e) | | NA/NA | | | 566 | | | | 565,836 | |

Small Business Administration Participation Certificates, Series 2010-20F, Class 1,

3.88%, 06/01/30 | | Aaa/AA+ | | | 77 | | | | 83,006 | |

SMB Private Education Loan Trust, Series 2017-B, Class A2B, (1M LIBOR +0.75%), 0.856%, 10/15/35, 144A(b),(e) | | Aaa/AAA | | | 541 | | | | 542,983 | |

Sofi Consumer Loan Program Trust, Series 2018-1, Class B, 3.65%, 02/25/27, 144A(b) | | NA/AAA | | | 739 | | | | 751,812 | |

Sofi Professional Loan Program LLC, Series 2017-C, Class B,

3.56%, 07/25/40, 144A(b),(e) | | NA/AA+ | | | 1,099 | | | | 1,137,563 | |

Textainer Marine Containers VII Ltd., Series 2021-1A, Class A,

1.68%, 02/20/46, 144A(b) | | NA/A | | | 1,023 | | | | 992,683 | |

TIF Funding II LLC, Series 2021-1A, Class A, 1.65%, 02/20/46, 144A(b) | | NA/A | | | 544 | | | | 523,678 | |

Willis Engine Structured Trust IV, Series 2018-A, Class A, 4.75%, 09/15/43, 144A(b),(g) | | NA/NA | | | 1,252 | | | | 1,245,451 | |

| | | | | | | | | | |

TOTAL ASSET BACKED SECURITIES (Cost of $15,094,886) | | | | | | | | | 15,024,170 | |

| | | | | | | | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (1.23%) | |

Angel Oak Mortgage Trust I LLC, Series 2019-2, Class A1,

3.628%, 03/25/49, 144A(b),(e) | | NA/NA | | | 121 | | | | 122,939 | |

CGMS Commercial Mortgage Trust, Series 2017-MDRB, Class A, (1M LIBOR +1.10%), 1.206%, 07/15/30, 144A(e) | | NA/AAA | | | 54 | | | | 53,710 | |

Citigroup Commercial Mortgage Trust, Series 2016-P6, Class C, 4.279%, 12/10/49(b),(e) | | NR/NA | | | 367 | | | | 354,154 | |

Lanark Master Issuer PLC, Series 2019-1A, Class 1A1, (3M LIBOR +0.77%),

0.952%, 12/22/69, 144A(b),(e) | | Aaa/AAA | | | 313 | | | | 313,249 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Series 2012-CKSV, Class C, 4.284%, 10/15/30, 144A(b),(e) | | NA/BBB- | | | 2,710 | | | | 1,948,389 | |

| | | | | | | | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost of $3,548,306) | | | | | | | | | 2,792,441 | |

| | | | | | | | | | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES (0.14%) | |

FHLMC Pool # A15675, 6.00%, 11/01/33 | | Aaa/AA+ | | | 65 | | | | 77,909 | |

FHLMC Pool # G00182, 9.00%, 09/01/22(h) | | Aaa/AA+ | | | — | | | | 1 | |

FNMA Pool # 754791, 6.50%, 12/01/33 | | Aaa/AA+ | | | 128 | | | | 147,636 | |

FNMA Pool # 763852, 5.50%, 02/01/34 | | Aaa/AA+ | | | 80 | | | | 92,921 | |

GNSF Pool # 307527, 9.00%, 06/15/21(h) | | Aaa/AA+ | | | — | | | | 99 | |

GNSF Pool # 417239, 7.00%, 02/15/26 | | Aaa/AA+ | | | 3 | | | | 2,786 | |

GNSF Pool # 780374, 7.50%, 12/15/23 | | Aaa/AA+ | | | 1 | | | | 919 | |

| | | | | | | | | | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES

(Cost of $262,500) | | | | | | | | | 322,271 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

13

SCHEDULE OF INVESTMENTS — continued

| | | | | | | | | | | | |

| | | Moody’s/

Standard &

Poor’s

Rating(a) | | | Principal

Amount (000’s) | | | Value

(Note 1) | |

MUNICIPAL BONDS (1.14%) | |

San Francisco City & County Public Utilities Commission, Water Revenue, Build America Bonds, 6.00%, 11/01/40 | | | Aa2/AA- | | | $ | 145 | | | $ | 194,277 | |

State of California, Build America Bonds, GO, 7.625%, 03/01/40 | | | Aa2/AA- | | | | 1,500 | | | | 2,405,505 | |

| | | | | | | | | | | | |

TOTAL MUNICIPAL BONDS (Cost of $1,677,743) | | | | | | | | | | | 2,599,782 | |

| | | | | | | | | | | | |

U.S. TREASURY SECURITIES (1.09%) | |

United States Treasury Bond, 0.875%, 11/15/30 | | | Aaa/AA+ | | | | 165 | | | | 152,445 | |

United States Treasury Bond, 1.25%, 05/15/50 | | | Aaa/AA+ | | | | 600 | | | | 451,266 | |

United States Treasury Bond, 1.375%, 08/15/50 | | | Aaa/AA+ | | | | 615 | | | | 477,970 | |

United States Treasury Bond, 1.625%, 11/15/50 | | | Aaa/AA+ | | | | 597 | | | | 495,593 | |

United States Treasury Bond, 1.875%, 02/15/51 | | | Aaa/AA+ | | | | 1,024 | | | | 904,695 | |

| | | | | | | | | | | | |

TOTAL U.S. TREASURY SECURITIES (Cost of $2,529,348) | | | | | | | | | | | 2,481,969 | |

| | | | | | | | | | | | |

GOVERNMENT BONDS (1.96%) | |

Egypt Government International Bond, Sr. Unsec. Notes, 7.625%, 05/29/32, 144A | | | B2/B | | | | 526 | | | | 537,940 | |

Egypt Government International Bond, Sr. Unsec. Notes, 5.875%, 02/16/31, 144A | | | B2/B | | | | 380 | | | | 355,718 | |

Ghana Government International Bond, Sr. Unsec. Notes, 8.625%, 04/07/34, 144A | | | B3/B- | | | | 655 | | | | 643,276 | |

Mexico Government International Bond, Sr. Unsec. Notes, 5.00%, 04/27/51(b) | | | Baa1/BBB | | | | 711 | | | | 767,297 | |

Morocco Government International Bond, Sr. Unsec. Notes, 3.00%, 12/15/32, 144A | | | Ba1/BBB- | | | | 764 | | | | 716,088 | |

Oman Government International Bond, Sr. Unsec. Notes, 7.00%, 01/25/51, 144A | | | Ba3/NA | | | | 350 | | | | 344,750 | |

Peruvian Government International Bond, Sr. Unsec. Notes, 2.783%, 01/23/31(b) | | | A3/BBB+ | | | | 548 | | | | 547,457 | |

Ukraine Government International Bond, Sr. Unsec. Notes, 7.253%, 03/15/33, 144A | | | NA/B | | | | 551 | | | | 548,135 | |

| | | | | | | | | | | | |

TOTAL GOVERNMENT BOND (Cost of $4,443,472) | | | | | | | | | | | 4,460,661 | |

| | | | | | | | | | | | |

| | | | | | Shares | | | | |

PREFERRED STOCK (0.92%) | |

CoBank ACB, Series F, 6.250%, (3M LIBOR +4.557%)(b),(c),(d) | | | NA/BBB+ | | | | 20,000 | | | | 2,105,000 | |

| | | | | | | | | | | | |

TOTAL PREFERRED STOCK (Cost of $2,085,000) | | | | | | | | | | | 2,105,000 | |

| | | | | | | | | | | | |

TOTAL INVESTMENTS (98.69%) | | | | | |

(Cost $204,810,297) | | | | | | | | | | | 224,660,930 | |

| | | | | | | | | | | | |

OTHER ASSETS AND LIABILITIES (1.31%) | | | | | | | | | | | 2,976,189 | |

| | | | | | | | | | | | |

NET ASSETS (100.00%) | | | | | | | | | | $ | 227,637,119 | |

| | | | | | | | | | | | |

At March 31, 2021, the Fund had the following open futures contracts:

| | | | | | | | | | | | | | | | | | | | |

| Long Futures Outstanding | | Expiration

Month | | | Number of

Contracts | | | Notional

Amount | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

U.S. Treasury 5-Year Notes | | | 06/21 | | | | 62 | | | $ | 7,686,575 | | | $ | 7,650,703 | | | $ | (35,872 | ) |

U.S. Treasury 2-Year Notes | | | 06/21 | | | | 7 | | | | 1,546,664 | | | | 1,545,086 | | | | (1,578 | ) |

U.S. Treasury Long Bonds | | | 06/21 | | | | 94 | | | | 15,183,377 | | | | 14,531,813 | | | | (651,564 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | (689,014 | ) |

| | | | | | | | | | | | | | | | | | | | |

| Short Futures Outstanding | | | | | | | | | | | | | | | |

U.S. Treasury 10-Year Notes | | | 06/21 | | | | 89 | | | | (11,834,118 | ) | | | (11,653,438 | ) | | | 180,680 | |

U.S. Treasury 10-Year Ultra Bonds | | | 06/21 | | | | 169 | | | | (24,936,173 | ) | | | (24,283,188 | ) | | | 652,985 | |

U.S. Treasury Ultra Bonds | | | 06/21 | | | | 7 | | | | (1,312,218 | ) | | | (1,268,531 | ) | | | 43,687 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 877,352 | |

| | | | | | | | | | | | | | | | | | | | |

Net unrealized appreciation on open futures contracts | | | | | | | | | | | | | | $ | 188,338 | |

| | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

14

SCHEDULE OF INVESTMENTS — continued

| (a) | Ratings for debt securities are unaudited. All ratings are as of March 31, 2021 and may have changed subsequently. |

| (b) | This security is callable. |

| (c) | Fixed to floating rate security. Fixed rate indicated is rate effective at March 31, 2021. Security will convert at a future date to a floating rate of reference rate and spread in the description above. |

| (d) | Security is perpetual. Date shown is next call date. |

| (e) | Variable rate security. Rate indicated is rate effective at March 31, 2021. |

| (f) | Multi-Step Coupon. Rate disclosed is as of March 31, 2021. |

| (g) | Denotes a step-up bond. The rate indicated is the current coupon as of March 31, 2021. |

| (h) | Principal amount less than $1,000. |

| 144A | Securities were purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. At March 31, 2021, these securities amounted to $86,686,717 or 38.08% of net assets. |

Legend

Certs. - Certificates

CLO - Collateralized Loan Obligation

Co. Gty. - Company Guaranty

FHLMC - Federal Home Loan Mortgage Corp.

FNMA - Federal National Mortgage Association

GNSF - Government National Mortgage Association (Single Family)

GO - General Obligation

H15T5Y - US Treasury Yield Curve Rate T Note Constant Maturity 5 Year

Jr. - Junior

LIBOR - London Interbank Offered Rate

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

PLC - Public Limited Company

REIT - Real Estate Investment trust

Sec. - Secured

SOFRRATE - Secured Overnight Financing Rate

Sr. - Senior

Sub. - Subordinated

Unsec. - Unsecured

The accompanying notes are an integral part of these financial statements.

15

SCHEDULE OF INVESTMENTS — continued

Following is a description of the valuation techniques applied to the Fund’s major categories of assets measured at fair value on a recurring basis as of March 31, 2021.

| | | | | | | | | | | | | | | | |

| Assets: | | Total Market

Value at

3/31/21 | | | Level 1

Quoted

Price | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | |

CORPORATE DEBT SECURITIES | | $ | 194,874,636 | | | $ | — | | | $ | 194,874,636 | | | $ | — | |

ASSET BACKED SECURITIES | | | 15,024,170 | | | | — | | | | 15,024,170 | | | | — | |

COMMERCIAL MORTGAGE-BACKED SECURITIES | | | 2,792,441 | | | | — | | | | 2,792,441 | | | | — | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES | | | 322,271 | | | | — | | | | 322,271 | | | | — | |

MUNICIPAL BONDS | | | 2,599,782 | | | | — | | | | 2,599,782 | | | | — | |

U.S. TREASURY SECURITIES | | | 2,481,969 | | | | — | | | | 2,481,969 | | | | — | |

GOVERNMENT BONDS | | | 4,460,661 | | | | — | | | | 4,460,661 | | | | — | |

PREFERRED STOCK | | | 2,105,000 | | | | 2,105,000 | | | | — | | | | — | |

FUTURES CONTRACTS | | | 877,352 | | | | 877,352 | | | | — | | | | — | |

TOTAL ASSETS | | $ | 225,538,282 | | | $ | 2,982,352 | | | $ | 222,555,930 | | | $ | — | |

| | | | |

| Liabilities: | | | | | | | | | | | | |

FUTURES CONTRACTS | | $ | 689,014 | | | $ | 689,014 | | | $ | — | | | $ | — | |

The accompanying notes are an integral part of these financial statements.

16

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2021

| | | | |

Assets: | | | | |

Investment in securities, at value (amortized cost $204,810,297) (Note 1) | | $ | 224,660,930 | |

Cash | | | 1,430,681 | |

Interest receivable | | | 2,456,282 | |

Receivables for investments sold | | | 2,874,847 | |

Receivable from broker—variation margin on open futures contracts | | | 877,352 | |

Dividend receivable | | | 31,250 | |

Deposits with brokers for open futures contracts | | | 321,468 | |

Prepaid expenses | | | 36,491 | |

| | | | |

TOTAL ASSETS | | | 232,689,301 | |

| | | | |

Liabilities: | | | | |

Securities purchased | | | 4,185,602 | |

Payable to broker variation on open futures contracts | | | 689,014 | |

Payable to the Adviser | | | 85,777 | |

Payable to administration and accounting | | | 16,969 | |

Payable to custodian | | | 9,655 | |

Payable to transfer agency | | | 4,496 | |

Accrued expenses payable | | | 60,669 | |

| | | | |

TOTAL LIABILITIES | | | 5,052,182 | |

| | | | |

Net assets: (equivalent to $21.25 per share based on 10,710,035 shares of capital stock outstanding) | | $ | 227,637,119 | |

| | | | |

NET ASSETS consisted of: | | | | |

Par value | | $ | 107,100 | |

Capital paid-in | | | 206,576,087 | |

Distributable earnings | | | 20,953,932 | |

| | | | |

| | $ | 227,637,119 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

17

STATEMENT OF OPERATIONS

For the year ended March 31, 2021

| | | | | | | | |

Investment Income: | |

Interest | | | $ | 9,917,871 | |

Dividends | | | | 125,000 | |

| | | | | | | | |

Total Investment Income | | | | 10,042,871 | |

| | | | | | | | |

Expenses: | |

Investment advisory fees (Note 4) | | $ | 1,025,509 | | | | | |

Administration fees | | | 194,648 | | | | | |

Trustees’ fees (Note 4) | | | 119,500 | | | | | |

Legal fees and expenses | | | 116,925 | | | | | |

Proxy fee | | | 99,066 | | | | | |

Reports to shareholders | | | 54,100 | | | | | |

Custodian fees | | | 41,925 | | | | | |

Transfer agent fees | | | 34,247 | | | | | |

Audit fees | | | 30,500 | | | | | |

Insurance | | | 28,828 | | | | | |

NYSE fee | | | 22,933 | | | | | |

ICI fees | | | 18,042 | | | | | |

Miscellaneous | | | 84,819 | | | | | |

| | | | | | | | |

Total Expenses | | | | 1,871,042 | |

| | | | | |

Expense reimbursement from the Adviser (Note 4) | | | | (49,533 | ) |

| | | | | | | | |

Net Expenses | | | | 1,821,509 | |

| | | | | |

Net Investment Income | | | | 8,221,362 | |

| | | | | | | | |

Realized and unrealized gain (loss) from: | |

Net realized gain (loss) from: | | | | | | | | |

Investment securities | | | | | | | 5,536,752 | |

Futures contracts | | | | | | | (146,294 | ) |

| | | | | | | | |

Net Realized Gain | | | | | | | 5,390,458 | |

| | | | | | | | |

Change in net unrealized appreciation (depreciation) of: | | | | | | | | |

Investment securities | | | | | | | 17,175,044 | |

Futures contracts | | | | | | | 57,093 | |

| | | | | | | | |

Change in Net Unrealized Appreciation | | | | | | | 17,232,137 | |

| | | | | | | | |

Net gain on investments and futures contracts | | | | | | | 22,622,595 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | | | | $ | 30,843,957 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

18

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year ended

March 31, 2021 | | | Year ended

March 31, 2020 | |

Increase (decrease) in net assets: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 8,221,362 | | | $ | 8,518,770 | |

Net realized gain | | | 5,390,458 | | | | 4,564,465 | |

Change in unrealized appreciation (depreciation) | | | 17,232,137 | | | | (9,998,855 | ) |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 30,843,957 | | | | 3,084,380 | |

| | | | | | | | |

Distributions: | | | | | | | | |

From distributed earnings | | | (13,838,436 | ) | | | (12,808,131 | ) |

| | | | | | | | |

Total Distributions | | | (13,838,436 | ) | | | (12,808,131 | ) |

| | | | | | | | |

Increase (decrease) in net assets | | | 17,005,521 | | | | (9,723,751 | ) |

Net Assets: | | | | | | | | |

Beginning of year | | | 210,631,598 | | | | 220,355,349 | |

| | | | | | | | |

End of year | | $ | 227,637,119 | | | $ | 210,631,598 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

19

FINANCIAL HIGHLIGHTS

The table below sets forth financial data for a share of capital stock outstanding throughout each period presented.

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended March 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | |

Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of year | | $ | 19.67 | | | $ | 20.57 | | | $ | 20.55 | | | $ | 20.75 | | | $ | 20.20 | |

| | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.77 | | | | 0.79 | | | | 0.85 | | | | 0.87 | | | | 0.88 | |

Net gain (loss) on investments and futures contracts | | | 2.10 | | | | (0.50 | ) | | | (0.03 | ) | | | (0.03 | ) | | | 0.57 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 2.87 | | | | 0.29 | | | | 0.82 | | | | 0.84 | | | | 1.45 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Dividends from net investment income | | | (0.80 | ) | | | (0.97 | ) | | | (0.67 | ) | | | (0.80 | ) | | | (0.90 | ) |

Distributions from net realized gains | | | (0.49 | ) | | | (0.22 | ) | | | (0.13 | ) | | | (0.24 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.29 | ) | | | (1.19 | ) | | | (0.80 | ) | | | (1.04 | ) | | | (0.90 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 21.25 | | | $ | 19.67 | | | $ | 20.57 | | | $ | 20.55 | | | $ | 20.75 | �� |

| | | | | | | | | | | | | | | | | | | | |

Per share market price, end of year | | $ | 20.45 | | | $ | 19.74 | | | $ | 19.22 | | | $ | 19.37 | | | $ | 19.16 | |

| | | | | | | | | | | | | | | | | | | | |

Total Investment Return(1) | | | | | | | | | | | | | | | | | | | | |

Based on net asset value | | | 14.71 | % | | | 1.51 | % | | | 4.52 | % | | | 4.26 | % | | | 7.48 | % |

Based on market value | | | 10.00 | % | | | 9.03 | % | | | 3.60 | % | | | 6.43 | % | | | 4.75 | % |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (in 000’s) | | $ | 227,637 | | | $ | 210,632 | | | $ | 220,355 | | | $ | 220,141 | | | $ | 222,258 | |

Ratio of expenses to average net assets (gross of waivers/reimbursements) | | | 0.81 | % | | | 0.76 | % | | | 0.80 | % | | | 0.75 | % | | | 0.75 | % |

Ratio of expenses to average net assets (net of waivers/reimbursements) | | | 0.79 | % | | | 0.76 | % | | | 0.77 | % | | | 0.74 | % | | | 0.75 | % |

Ratio of net investment income to average net assets | | | 3.56 | % | | | 3.76 | % | | | 4.24 | % | | | 4.15 | % | | | 4.24 | % |

Portfolio turnover rate | | | 88.81 | % | | | 59.99 | % | | | 63.00 | % | | | 55.62 | % | | | 44.32 | % |

Number of shares outstanding at the end of the year (in 000’s) | | | 10,710 | | | | 10,710 | | | | 10,710 | | | | 10,710 | | | | 10,710 | |

| (1) | Total investment return is calculated assuming a purchase of common shares at the market price on the first day and a sale at the market price on the last day of the period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. The total investment return, if for less than a full year, is not annualized. Past performance is not a guarantee of future results. |

The accompanying notes are an integral part of these financial statements.

20

NOTES TO FINANCIAL STATEMENTS

Note 1 – Significant Accounting Policies – The Insight Select Income Fund (the “Fund”), a Delaware statutory trust, is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a diversified closed-end, management investment company. The Fund’s investment objective is to seek a high rate of return, primarily from interest income and trading activity, from a portfolio principally consisting of debt securities. The Fund follows the accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies”. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements. The policies are in conformity with generally accepted accounting principles within the United States of America (“GAAP”).

| A. | Security Valuation – In valuing the Fund’s net assets, all securities for which representative market quotations are available will be valued at the last quoted sales price on the security’s principal exchange on the day of valuation. If there are no sales of the relevant security on such day, the security will be valued at the bid price at the time of computation. For securities traded in the over-the-counter market, including listed debt and preferred securities, whose primary market is believed to be over-the-counter, the Fund uses recognized industry pricing services – approved by the Board of Trustees (“Board”) and unaffiliated with Insight North America LLC (“INA” or the “Adviser”) – and uses broker quotes provided by market makers of securities not valued by these and other recognized pricing sources. |

In the event that market quotations are not readily available, or when such quotations are deemed not to reflect current market value, the securities will be valued at their respective fair value as determined in good faith by the Adviser pursuant to certain procedures and reporting requirements established by the Board. The Adviser considers all relevant facts that are reasonably available when determining the fair value of a security, including but not limited to the last sale price or initial purchase price (if a when issued security) and subsequently adjusting the value based on changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves are utilized. At March 31, 2021, there were no securities valued using fair value procedures.

Fair Value Measurements – The Fund has adopted authoritative fair value accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value, a discussion in changes in valuation techniques and related inputs during the period and expanded disclosure of valuation levels for major security types. These inputs are summarized in the three broad levels listed below:

| | |

• Level 1 – | | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| |

• Level 2 – | | Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| |

• Level 3 – | | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

21

NOTES TO FINANCIAL STATEMENTS — continued

At the end of each calendar quarter, management evaluates the Level 1, 2 and 3 assets and liabilities for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates Level 1 and 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Fund’s investments may fluctuate from period to period. Additionally, the fair value of investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values the Fund may ultimately realize. Further, such investments may be subject to legal and other restrictions on resale or otherwise less liquid than publicly traded securities.

Level 3 investments are categorized as Level 3 with values derived utilizing prices from prior transactions or third party pricing information without adjustment (broker quotes, pricing services and net asset values). A significant change in third party pricing information could result in a significantly lower or higher value in such Level 3 investments. As of March 31, 2021, the Fund did not hold any Level 3 securities.

When-Issued Securities – The Fund may enter into commitments to purchase securities on a forward or when-issued basis. When-issued securities are securities purchased for delivery beyond the normal settlement date at a stated price and yield. In the Fund’s case, these securities are subject to settlement within 45 days of the purchase date. The interest rate realized on these securities is fixed as of the purchase date. The Fund does not pay for such securities prior to the settlement date and no interest accrues to the Fund before settlement. These securities are subject to market fluctuation due to changes in market interest rates. The Fund will enter into these commitments with the intent of buying the security but may dispose of such security prior to settlement. At the time the commitment is entered into, the Fund will establish and maintain a segregated account in an amount sufficient to cover the obligation under the when-issued contract. At the time the Fund makes the commitment to purchase securities on a when-issued basis, it will record the transaction and thereafter reflect the value of such security purchased in determining its net asset value (“NAV”). At the time of delivery of the security, its value may be more or less than the fixed purchase price.

Futures Contracts – The Fund uses futures contracts generally to gain exposure to, or hedge against, changes in interest rates or gain exposure to, or hedge against, changes in certain asset classes. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date.