U. S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2918

(Exact Name of Registrant as Specified in Charter)

|

125 South Mill Street, Bluegrass Corporate Center, Suite 100 Lexington, Kentucky 40507 |

(Address of Principal Executive Offices) (Zip Code)

|

Thomas P. Dupree 125 South Mill Street, Bluegrass Corporate Center, Suite 100 Lexington, Kentucky 40507 |

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code (859) 254-7741

Date of fiscal year end: June 30, 2013

Date of reporting period: July 1, 2012 through June 30, 2013

Item 1. Report to Stockholders

June 30, 2013

ANNUAL REPORT

TO SHAREHOLDERS

ABOUT DUPREE MUTUAL FUNDS

In 1941, Dupree & Company, Inc. began business in Harlan, Kentucky as a small securities brokerage firm specializing in tax-exempt municipal bonds.

Over the years the firm, which in 1963 moved its offices to Lexington, Kentucky, grew to become a regional leader in public finance, helping to structure complex and innovative municipal bond financing for some of the largest public projects in the Commonwealth of Kentucky.

In 1979, Dupree & Company began what is now Dupree Mutual Funds with the Kentucky Tax-Free Income Series and became the Fund’s investment adviser. The Fund was one of the first single-state municipal bond funds in the country, and the first mutual fund to invest solely in Kentucky municipal bonds. Since then, several new offerings have been added to the Dupree Mutual Funds family:

Kentucky Tax-Free Short-to-Medium Series in 1987;

Intermediate Government Bond Series in 1992;

Tennessee Tax-Free Income Series in 1993;

Tennessee Tax-Free Short-to-Medium Series in 1994;

North Carolina Tax-Free Income Series in 1995;

North Carolina Tax-Free Short-to-Medium Series in 1995;

Alabama Tax-Free Income Series in 2000;

Mississippi Tax-Free Income Series in 2000; and

Taxable Municipal Bond Series in 2010.

Today, after more than 60 years in business, Dupree continues to be a pioneer in the industry. Our Kentucky, Tennessee, and Mississippi Series are currently the ONLY 100% “no-load” municipal bond funds available in those states. No-load means simply that shares of the funds are offered directly to investors with no front or back-end sales charges, as opposed to load funds which are sold through brokerage firms or other institutions.

At Dupree Mutual Funds, our goal is a simple one: to offer investors a high-quality, low-cost way to invest in municipal and government bonds while providing superior service to our shareholders. We encourage you to let us know how we’re doing.

TABLE OF CONTENTS

Management’s Discussion of Fund Performance: | Unaudited |

Twelve Months Ended June 30, 2013i

The investment objective of our tax-free municipal bond funds is to provide a high level of tax-free income derived from state-specific municipal bonds without incurring undue risk to principal. The investment objectives of our government bond fund and taxable municipal bond fund are to provide a high level of taxable income derived from securities of the U.S. government and its agencies and taxable municipal securities, respectively, without incurring undue risk to principal.

This report covers the 12-month period from July 1, 2012 through June 30, 2013 (the “reporting period”). During the first six months of the reporting period the economy grew at a modest pace. Real gross domestic product (GDP) increased at a 3.1 percent annual rate during the third quarter of 2012, but slowed dramatically during the fourth quarter of 2012 with real GDP growing at an anemic 0.4% annual rate. Economic growth picked up somewhat during the first quarter of 2013 with real GDP increasing at a 1.1 percent annual rate. Real GDP for the second quarter of 2013 increased at a 1.7 percent annual rate (advance estimate). Historically, the average growth rate in the United States has been around 3.5 percent. The staff at the Federal Reserve is currently projecting that real GDP will accelerate gradually through 2015, supported by accommodative monetary policy, easing credit conditions, and rising consumer and business sentiment.

In the labor market, the unemployment rate remained elevated during the reporting period. The seasonally adjusted national unemployment rate stood at 7.6 percent at the end of the reporting period. The labor market continued to show signs of improvement during the reporting period, albeit at a gradual pace. The underemployment rate, which includes part-time workers who would prefer a full-time position and people that want to work but have given up looking, ended the reporting period at a four month high at 14.3 percent. The Federal Reserve’s central tendency estimate (which excludes the three highest and three lowest projections) for the unemployment rate is 7.2 to 7.3 percent in 2013; 6.5 to 6.8 percent in 2014; and 5.8 to 6.2 percent in 2015.

Key measures of inflation remained subdued during the reporting period. The Federal Reserve’s preferred inflation index, the personal consumption expenditure core price index (PCE), increased 1.2 percent on a year-over-year basis through June which is substantially below the 2 percent target rate set by the Federal Reserve. The consumer price index (CPI) increased 1.8 percent on a year-over-year basis through June. Excluding food and energy, the core CPI increased 1.6 percent year-over-year, the least since June 2011. Near-term and long-term inflation expectations have remained stable. The Federal Reserve’s central tendency estimate for core PCE is 1.2 to 1.3 percent for 2013; 1.5 to 1.8 percent for 2014; and 1.7 to 2.0 percent for 2015.

Against this backdrop, the Federal Open Market Committee (FOMC) continued to maintain a highly accommodative monetary policy. The FOMC kept the federal funds target rate at 0 to 1/4 percent during the reporting period and through its forward guidance conditionally pledged to keep the target rate at exceptionally low levels through mid-2015. In September, the FOMC announced that it would continue its program to extend the average maturity of its Treasury holdings and would begin purchasing additional agency-guaranteed mortgage-backed securities at a pace of $40 billion per month. In December, the FOMC announced that in addition to continuing its purchases of mortgage-backed securities, it would purchase longer-term Treasury securities at a pace of $45 billion per month. The FOMC also indicated that it expected the fed funds target rate to remain at exceptionally low levels so long as the unemployment rate remains above 6.5 percent, inflation between one and two years ahead is projected to be no more than 1/2 percentage point above the FOMC’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored.

State and local governments continued to successfully address ongoing fiscal challenges during the reporting period. According to data compiled by The Nelson A. Rockefeller Institute of Government (“Rockefeller”), state tax revenue grew by 5.2 percent in the fourth quarter of 2012. This was the twelfth consecutive quarter that states reported growth in collections on a year-over-year basis. Overall, inflation adjusted state tax revenues are now above pre-recession levels. Preliminary data collected by Rockefeller from 47 states suggest that overall tax collections increased approximately 9.3 percent in nominal terms in the first quarter of 2013 compared to the same quarter of 2012. Tax collections in the first quarter were driven primarily by strong growth in personal income tax collections reflecting taxpayer actions to accelerate income due to rising marginal tax rates and a gradually improving economy. However, notwithstanding the positive revenue trend, states and local governments continue to face tough choices in connection with balancing their budgets.

In contrast to states, local governments rely primarily on property taxes. According to data compiled by Rockefeller, local property tax revenues grew by a modest 0.1 percent in the fourth quarter of 2012. Tax collections at the local level continue to be negatively impacted by lower home prices and real property assessments. On a positive note, it should be noted that housing prices appear to have stabilized in many geographic markets and have actually rebounded sharply in some areas that previously experienced large price declines.

i

State, local, and federal government spending and investment continued to fall during the reporting period reflecting efforts to reduce budget deficits, the scaling back of overseas military activities, and the effects of automatic sequestration cuts. The Congressional Budget Office estimates that deficit reduction policies in current law will slow the pace of economic growth by approximately 1.5 percent this year.

Returns in the municipal bond market were essentially flat for the 12-month period under review. The Barclays Capital Municipal Bond Index, which tracks investment grade municipal securities across all sectors and maturities, had a total return of 0.236 percent for the twelve month period ended June 30, 2013.

During the second half of 2012, the municipal bond market performed relatively well with yields grinding lower (prices higher) all along the yield curve. For example, the yield on a 10-year AAA rated municipal bond at the beginning of the reporting period was approximately 1.85 percent and finished calendar year 2012 at approximately 1.72 percent. Favorable supply and demand patterns and highly accommodative monetary policies by the Fed helped fuel the performance of the municipal bond market during the third and fourth quarters of 2012.

The municipal bond market entered 2013 on strong footing and continued to perform relatively well during the first quarter with yields mostly remaining in a tight trading range. However, the story changed dramatically during the second quarter. Beginning in May of 2013, municipal bond and Treasury yields began slowly moving higher as part of a general correction of historically low interest rates. This rate adjustment quickly escalated in June and resulted in a massive sell-off in bonds that was precipitated when the Fed hinted at its June meeting for the first time that it was considering “tapering” its bond purchase program. The sell-off lasted approximately 6-7 weeks and caused yields in the Treasury and municipal markets to spike (and prices to fall) to levels not seen since 2011. Bond markets eventually stabilized at the very end of the reporting period, but not before wiping out most of the gains of the previous three quarters.

The municipal bond market also continued to experience some “headline risk” during the review period. A good example of this is in Detroit where a state-appointed emergency manager was hired to restructure the city’s debts in an effort to avoid a bankruptcy filing. Notwithstanding a few high profile distressed credit situations like Detroit, the default rate for investment grade municipal bonds during the past twelve months has continued to be below historical averages.

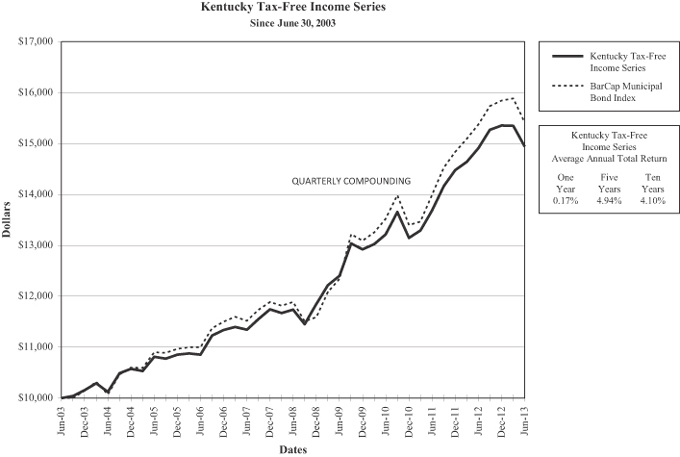

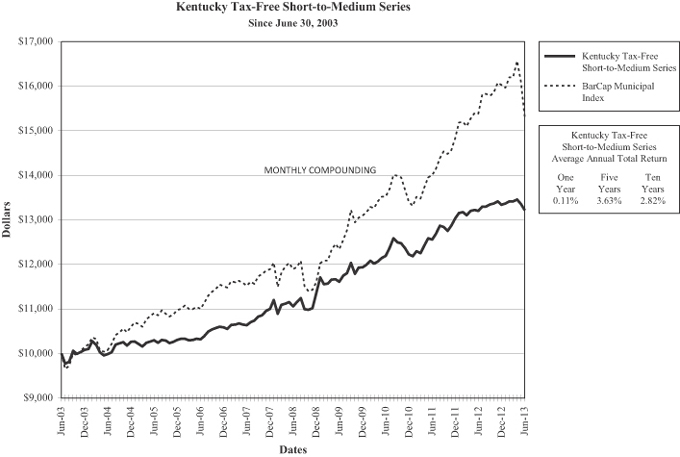

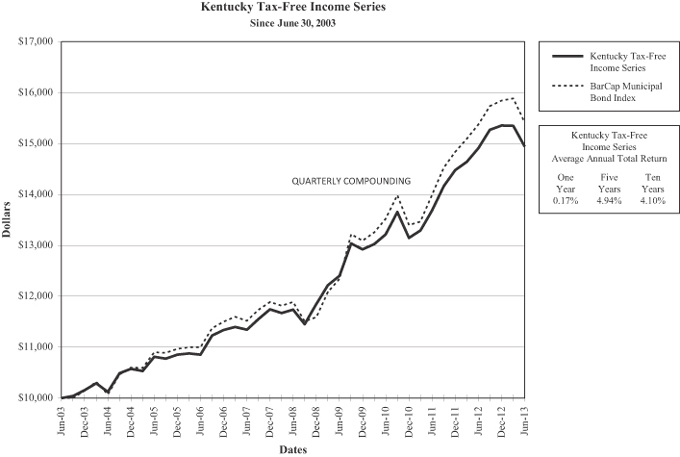

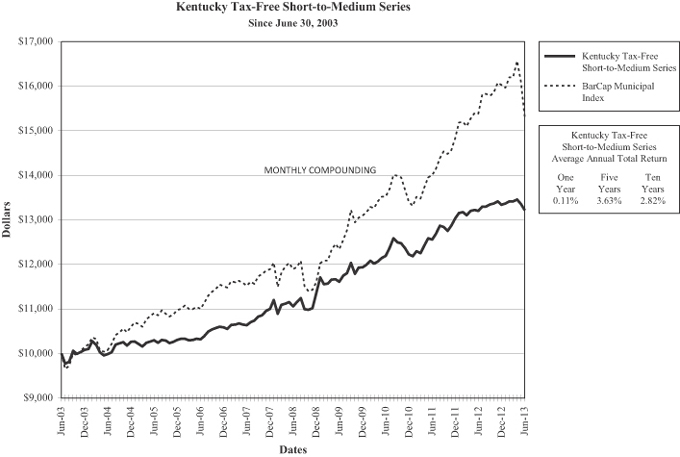

The Kentucky Tax-Free Income Series provided shareholders a total return of 0.17 percent for the twelve months ended June 30, 2013. The Kentucky Tax-Free Short-to-Medium Series provided shareholders with a total return of 0.11 percent during the period under review. Both funds performed in line with the index.

Kentucky’s economy is still recovering from the national recession that ended in June 2009. For the fiscal year that ended June 30, 2013, General Fund receipts were 2.8 percent higher than FY 12 tax collections. This was the third consecutive year of increased tax collections, following two years of decline due to the national recession. Final FY 13 General Fund revenues were $40.5 million, or 0.4 percent, more than the official revenue estimate which projected 2.4 percent growth. The state’s annual average unemployment rate at the end of June stood at 8.1 percent. In 2012, Kentucky had a per capita personal income of $35,041 which ranked 44th in the nation.

The state’s appropriation supported debt was rated Aa3 by Moody’s and A+ by Standard & Poor’s as of June 30, 2013. Kentucky had net tax-supported debt per capita of $1,998 as of calendar year-end 2012, which was substantially above the national net tax-supported debt median of $1,074 (Source: Moody’s Investors Services, 2013 State Debt Medians Report, May 29, 2013).

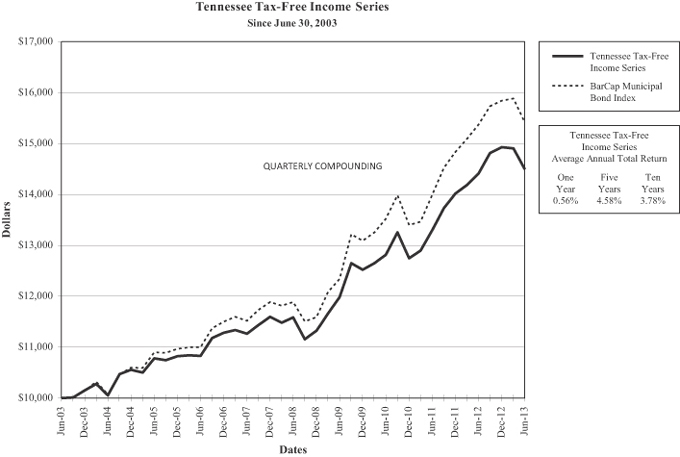

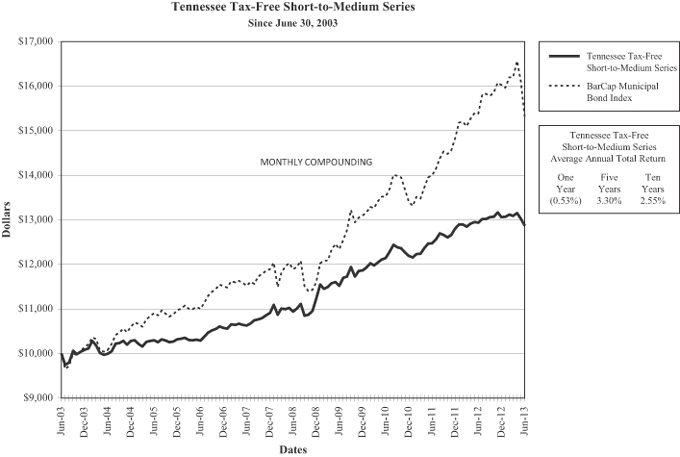

The Tennessee Tax-Free Income Series provided shareholders with a total return of 0.56 percent for the twelve months ended June 30, 2013. The Tennessee Tax-Free Short-to-Medium Series had a total return of -0.53 percent for the period under review. The average maturity of the Tennessee Tax-Free Income Series was slightly longer than the index, and that portion of the curve outperformed the index during the reporting period. The Tennessee Tax-Free Short-to-Medium Series holds bonds significantly shorter than the average maturity and duration of the index, which led to its relative underperformance compared to the index.

Tennessee’s economy has also continued to slowly recover from the national recession. During the recession the state experienced a severe contraction in the manufacturing and construction sectors. However, both of these sectors showed continued signs of stabilization during the period under review. The state’s annual average unemployment rate at the end of June was 8.3 percent. In 2012, the state had a per capita personal income of $37,678 which ranked 34th in the nation.

Tennessee relies on a combination of a state sales tax, corporate income taxes, and the Hall income tax for its revenue. The state’s fiscal condition improved considerably during the period under review. Total state revenue collections through June (the 11th month of the state’s fiscal year) were $322.8 million more than the budgeted estimate. Tax collections in June marked the 11th consecutive month in which total collections have experienced positive growth.

ii

Tennessee’s general obligation (G.O.) bonds were rated Aaa by Moody’s and AA+ by Standard & Poor’s as of June 30, 2013. Tennessee had net tax-supported debt per capita of $343 as of calendar year-end 2012, which was substantially below the national net tax-supported debt median of $1,074 (Source: Moody’s Investors Services, 2013 State Debt Medians Report, May 29, 2013).

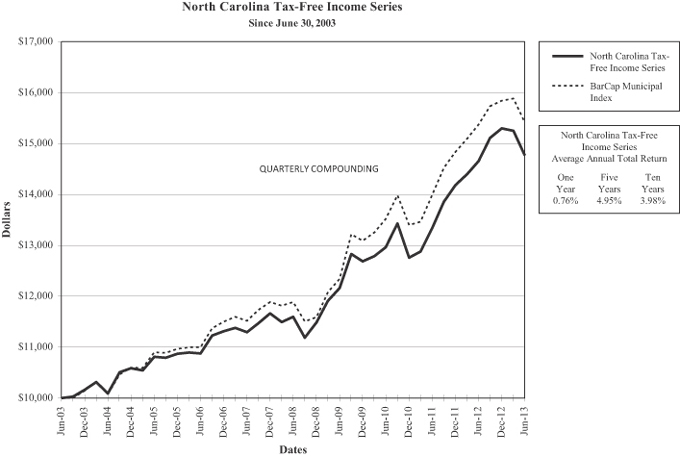

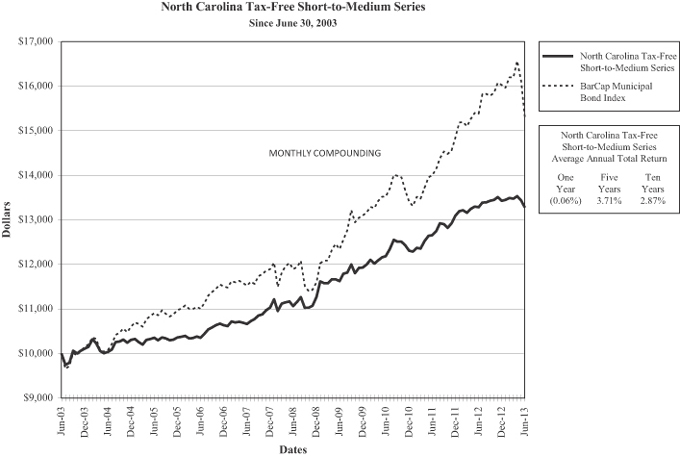

The North Carolina Tax-Free Income Series provided shareholders with a total return of 0.76 percent for the twelve months ended June 30, 2013. The North Carolina Tax-Free Short-to-Medium Series provided shareholders with a total return of -0.06 percent for the period under review. The average maturity of the North Carolina Tax-Free Income Series was slightly longer than the index, and that portion of the curve outperformed the index during the reporting period. The North Carolina Tax-Free Short-to-Medium Series performed in line with the index.

North Carolina’s economy has continued to gradually recover from the national recession. The state experienced modest, but below trend, economic growth throughout 2012. The strongest growth occurred in the fourth quarter of 2012 and the pickup in economic activity continued through the first half of 2013. The real (inflation adjusted) growth rate for 2013 is forecast to increase by 1.9 percent. Business and professional services, mining, educational and health services, and the hospitality and leisure sectors continue to be the biggest contributors to growth. The state continues to have one of the highest unemployment rates in the nation. The state’s average annual unemployment rate at the end of June was 8.8 percent. In 2012, North Carolina had a per capita personal income of $37,049 which ranked 38th in the nation.

North Carolina’s G.O. bonds were rated Aaa by Moody’s and AAA by Standard & Poor’s as of June 30, 2013. North Carolina had net tax-supported debt per capita of $853 as of calendar year-end 2012, which was below the national net tax-supported debt median of $1,074 (Source: Moody’s Investors Services, 2013 State Debt Medians Report, May 29, 2013).

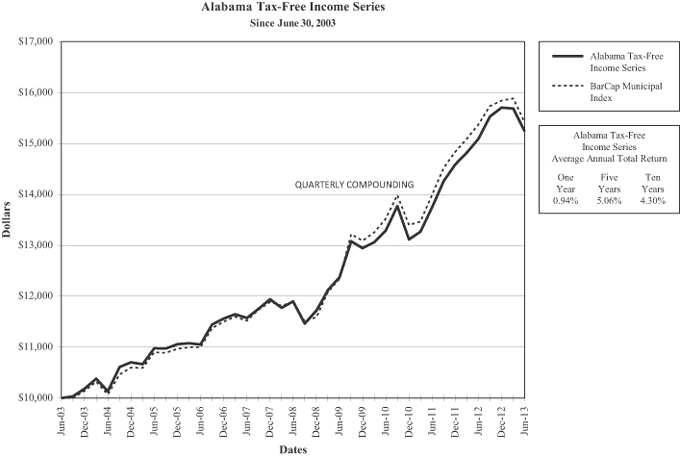

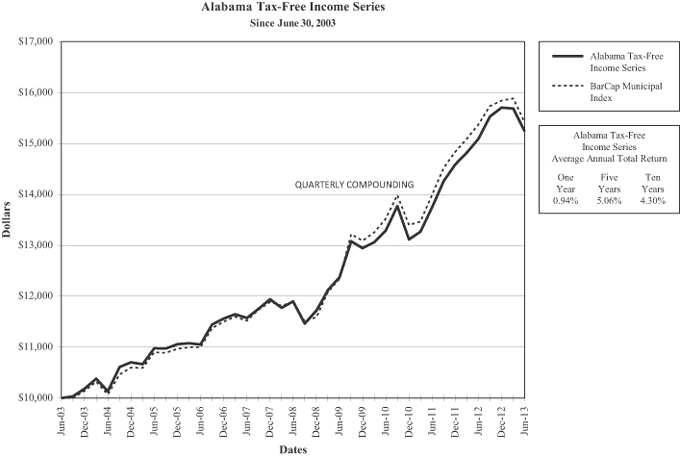

The Alabama Tax-Free Income Series provided shareholders with a total return of 0.94 percent for the twelve months ended June 30, 2013. The average maturity of the Alabama Tax-Free Income Series was slightly longer than the index, and that portion of the curve outperformed the index during the reporting period.

Alabama’s economy fell into recession later than the national recession that began in December 2007. However, the state’s economy was hit hard — 38,500 jobs were lost from 2008 to 2010 and output contracted by 2.1 percent in 2009. The manufacturing sector has continued to contract with many mass-production operations moving overseas. The textile and apparel industries have been particularly hard hit. The automobile industry continues to be an important driver of growth and the state has been successful in growing the economy through foreign direct investment. A key development strategy for the state is the promotion of industry clusters which consist of a geographic concentration of interconnected companies in sectors such as biotechnology, transportation, aerospace, and automotive.

Alabama’s job market contracted more sharply than the national economy but has showed signs of stabilization. The state’s average annual unemployment rate at the end of June stood at 6.8 percent. In 2012, Alabama had a per capita personal income of $35,625 which ranked 42nd in the nation.

Alabama’s G.O. bonds were rated Aa1 by Moody’s and AA by Standard & Poor’s as of June 30, 2013. Alabama had net tax-supported debt per capita of $867 as of calendar year-end 2012, which was lower than the national net tax-supported debt median of $1,074 (Source: Moody’s Investors Services, 2013 State Debt Medians Report, May 29, 2013).

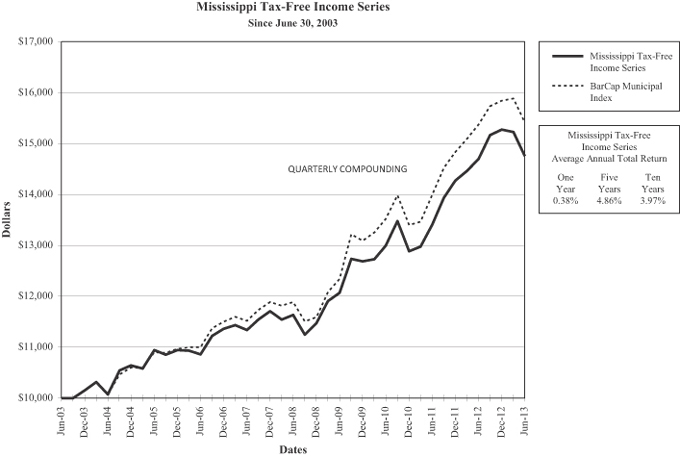

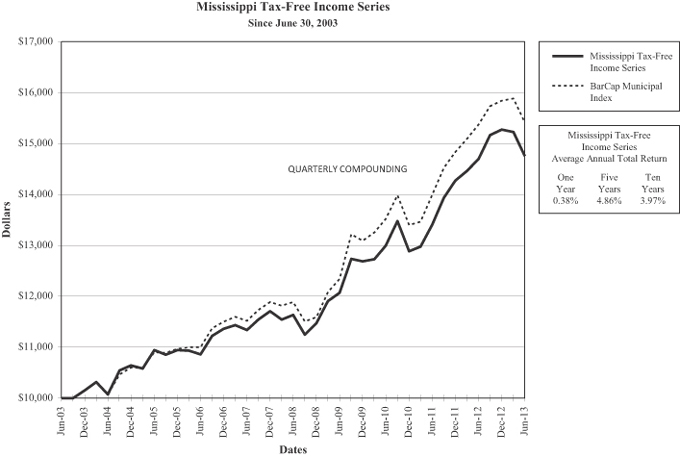

The Mississippi Tax-Free Income Series had a total return of 0.38 percent for the twelve month period ended June 30, 2013. During the reporting period, the Mississippi Tax-Free Income Series performed in line with the index.

Mississippi’s economy is dominated by manufacturing and service industries which were hit hard by the national recession. During the review period, the state’s economy continued to grow (at a 2.2 percent annual rate for all of 2012), but at a slightly slower pace than the national economy. Most economists are forecasting a slower growth rate in 2013 — somewhere in the range of 1.8 percent as the effects of the federal sequester and payroll tax hikes are felt. The state’s average annual unemployment rate at the end of June was 9.1 percent. In 2012, Mississippi had a per capita personal income of $33,073 which was the lowest in the nation.

The state’s G.O. bonds were rated Aa2 by Moody’s and AA by Standard & Poor’s as of June 30, 2013. Mississippi has net tax-supported debt per capita of $1,735 as of calendar year-end 2012, which was higher than the national net tax-supported debt median of $1,074 (Source: Moody’s Investors Services, 2013 State Debt Medians Report, May 29, 2013).

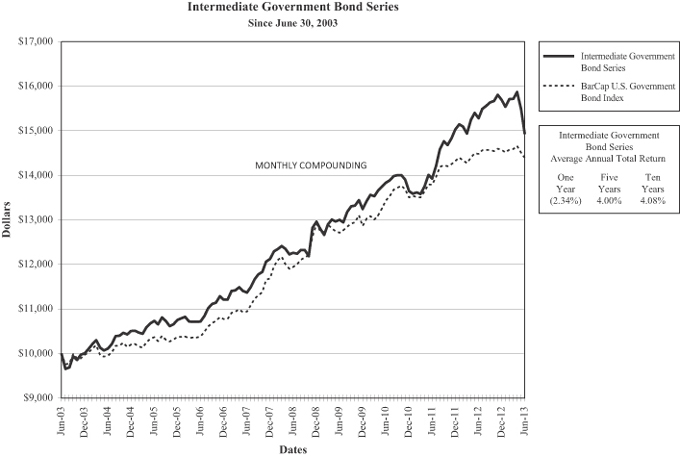

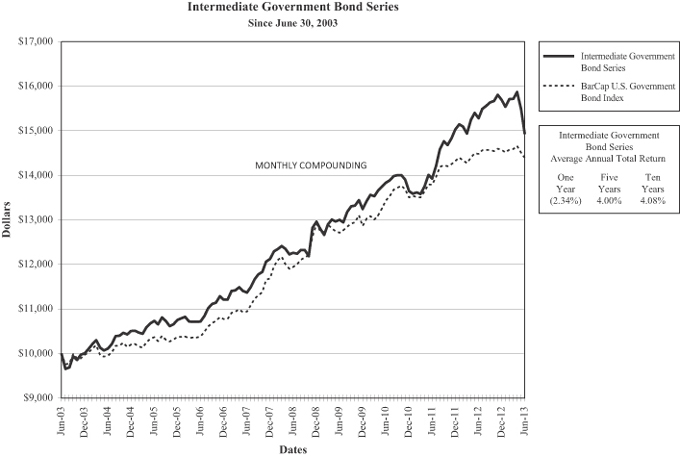

The Intermediate Government Bond Series had a total return of -2.34 percent for the twelve months ended June 30, 2013. The Barclays Capital U.S. Intermediate Government Bond Index had a total return of -0.587 percent for the one year period ended June 30, 2013. The underperformance of the Intermediate Government Bond Series is primarily due to the longer average maturity of the fund as compared to the index. Shorter-dated agency securities outperformed longer bonds similar to those held in the fund during the reporting period.

iii

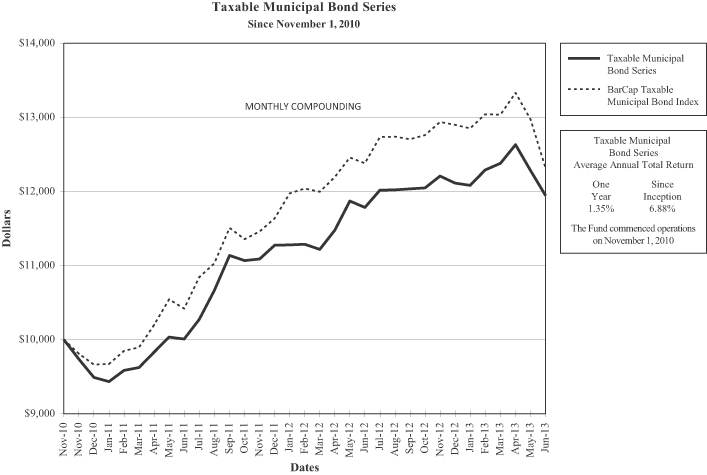

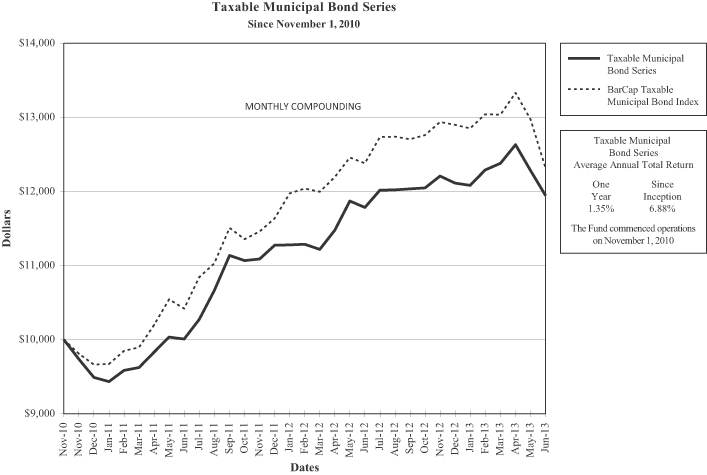

The Taxable Municipal Bond Series had a total return of 1.35 percent for the twelve month period ended June 30, 2013. The Barclays Capital Municipal Bond Taxable Index had a total return of -0.560 percent for the same period. The Taxable Municipal Bond Series outperformed the index during the reporting period. More than 90 percent of the fund’s bonds are rated AA- or better by at least one nationally recognized statistical rating agency, while the index represents the entire credit market including highly rated and lower rated bonds. The fund outperformed the index due to the fund’s relatively high credit quality as compared to the index during the reporting period.

Please note that index information is provided for reference only. No index can perfectly match the investments that make up a fund’s portfolio. In making investment decisions for our portfolios we do not attempt to track indices. The Barclays Capital Municipal Bond index is national in scope and does not necessarily reflect the performance of state-specific municipal bond funds. Indices do not take into account any operating expenses or transaction costs. An investment cannot be made directly in an index.

i Data are from the Bureau of Economic Analysis, the U.S. Department of Labor Bureau of Labor Statistics, and various other sources management deems to be reliable. Some of the quoted data are preliminary in nature and may be subject to revision. Any opinions expressed herein are those of the funds’ portfolio management and are current as of June 30, 2013. They are not guarantees of performance or investment results and should not be taken as investment advice. Past performance is not a guarantee of future performance and you may lose money investing in the funds.

iv

| | | | | | |

| | The illustrations below provide each Fund’s sector allocation and summarize key information about each Fund’s investments. | | | UNAUDITED | |

| | | | |

Kentucky Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 5.07% | |

Aa/AA | | | 85.75% | |

A | | | 7.90% | |

Not Rated | | | 1.28% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Miscellaneous Public Improvement | | | 25.36% | |

Prerefunded | | | 14.36% | |

Municipal Utility Revenue | | | 13.91% | |

Turnpikes and Toll Roads Revenue | | | 11.73% | |

Refunded | | | 9.62% | |

University Consolidated Education and Building Revenue | | | 5.44% | |

Hospital and Healthcare Revenue | | | 5.02% | |

School Improvements | | | 3.87% | |

Escrowed to Maturity | | | 3.45% | |

State and Local Mortgage Revenue | | | 3.43% | |

Public Facilities Revenue | | | 3.04% | |

Airport Revenue | | | 0.42% | |

Other Assets Less Liabilities | | | 0.35% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Kentucky Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 2.61% | |

Aa/AA | | | 91.25% | |

A | | | 6.14% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Miscellaneous Public Improvement | | | 28.92% | |

Turnpikes and Toll Roads Revenue | | | 15.38% | |

School Improvements | | | 14.29% | |

Refunded | | | 10.87% | |

University Consolidated Education and Building Revenue | | | 9.85% | |

Municipal Utility Revenue | | | 7.49% | |

Hospital and Healthcare Revenue | | | 3.61% | |

Public Facilities Revenue | | | 3.61% | |

State and Local Mortgage Revenue | | | 2.57% | |

Prerefunded | | | 1.72% | |

Other Assets Less Liabilities | | | 1.69% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Alabama Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.16% | |

Aa/AA | | | 83.78% | |

A | | | 7.99% | |

Baa/BBB | | | 0.65% | |

Not Rated | | | 4.42% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

School Improvement Revenue | | | 24.26% | |

University Consolidated Education and Building Revenue | | | 23.76% | |

Municipal Utility Revenue | | | 18.49% | |

Miscellaneous Public Improvement | | | 10.33% | |

Public Facilities Revenue | | | 10.01% | |

Prerefunded | | | 8.40% | |

Escrowed to Maturity | | | 1.41% | |

Refunded | | | 1.05% | |

State and Local Mortgage Revenue | | | 0.67% | |

Industrial Revenue | | | 0.10% | |

Other Assets Less Liabilities | | | 1.52% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Mississippi Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 0.38% | |

Aa/AA | | | 80.45% | |

A | | | 18.84% | |

Not Rated | | | 0.33% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 27.67% | |

Public Facilities Revenue | | | 17.72% | |

Turnpikes and Toll Roads Revenue | | | 14.68% | |

Municipal Utility Revenue | | | 10.99% | |

Miscellaneous Public Improvement | | | 8.28% | |

Prerefunded | | | 4.75% | |

Refunded | | | 4.13% | |

School Improvement Revenue | | | 3.79% | |

Hospital and Healthcare Revenue | | | 3.20% | |

Airport Revenue | | | 2.12% | |

State and Local Mortgage Revenue | | | 0.37% | |

Escrowed to Maturity | | | 0.32% | |

Other Assets Less Liabilities | | | 1.98% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

v

| | | | | | |

| | The illustrations below provide each Fund’s sector allocation and summarize key information about each Fund’s investments. | | | UNAUDITED | |

| | | | |

Tennessee Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 7.40% | |

Aa/AA | | | 81.62% | |

A | | | 8.78% | |

Baa/BBB | | | 0.50% | |

Not Rated | | | 1.70% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Municipal Utility Revenue | | | 35.04% | |

University Consolidated Education and Building Revenue | | | 13.95% | |

Prerefunded | | | 10.67% | |

Public Facilities Revenue | | | 10.52% | |

Hospital and Healthcare Revenue | | | 7.99% | |

Refunded | | | 7.17% | |

State and Local Mortgage Revenue | | | 5.58% | |

School Improvement Revenue | | | 4.38% | |

Miscellaneous Public Improvement | | | 2.08% | |

Escrowed to Maturity | | | 1.19% | |

Industrial Revenue | | | 0.88% | |

Other Assets Less Liabilities | | | 0.55% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Tennessee Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.43% | |

Aa/AA | | | 76.30% | |

A | | | 19.90% | |

Baa/BBB | | | 0.37% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Refunded | | | 18.07% | |

Municipal Utility Revenue | | | 16.73% | |

Miscellaneous Public Improvement | | | 14.03% | |

Prerefunded | | | 13.84% | |

School Improvement Revenue | | | 9.20% | |

Hospital and Healthcare Revenue | | | 6.62% | |

State and Local Mortgage Revenue | | | 6.49% | |

University Consolidated Education and Building Revenue | | | 5.01% | |

Public Facilities Revenue | | | 5.00% | |

Airport Revenue | | | 2.36% | |

Other Assets Less Liabilities | | | 2.65% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

North Carolina Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.98% | |

Aa/AA | | | 78.35% | |

A | | | 16.41% | |

Baa/BBB | | | 1.26% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Municipal Utility Revenue | | | 20.52% | |

University Consolidated Education and Building Revenue | | | 16.96% | |

School Improvement Revenue | | | 16.91% | |

Hospital and Healthcare Revenue | | | 9.55% | |

Refunded | | | 9.08% | |

Public Facility Revenue | | | 8.64% | |

Miscellaneous Public Improvement | | | 6.49% | |

Airport Revenue | | | 4.64% | |

Prefunded | | | 4.14% | |

Turnpikes and Toll Roads Revenue | | | 2.15% | |

Other Assets Less Liabilities | | | 0.92% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

North Carolina Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 0.06% | |

Aa/AA | | | 81.17% | |

A | | | 17.21% | |

Not Rated | | | 1.56% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

School Improvement Revenue | | | 20.21% | |

Municipal Utility Revenue | | | 19.78% | |

Public Facilities Revenue | | | 12.03% | |

Prerefunded | | | 11.96% | |

Refunded | | | 9.09% | |

Miscellaneous Public Improvement | | | 7.38% | |

University Consolidated Education and Building Revenue | | | 6.67% | |

Hospital and Healthcare Revenue | | | 5.34% | |

Airport Revenue | | | 2.31% | |

Turnpikes and Toll Roads Revenue | | | 1.35% | |

Lease Revenue | | | 1.01% | |

State and Local Mortgage Revenue | | | 0.54% | |

Other Assets Less Liabilities | | | 2.33% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

vi

| | | | | | |

| | The illustrations below provide each Fund’s sector allocation and summarize key information about each Fund’s investments. | | | UNAUDITED | |

| | | | |

Intermediate Government Bond Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Federal Farm Credit | | | 65.80% | |

Federal Home Loan Bank | | | 21.21% | |

Federal National Mortgage Association | | | 5.75% | |

Federal Home Loan Mortgage Corp | | | 3.95% | |

Other Assets Less Liabilities | | | 3.29% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Taxable Municipal Bond Series | |

| CREDIT QUALITY (reflects highest credit rating) | | % of Net Assets

at Fair Value | |

Aa/AA | | | 91.32% | |

A | | | 8.68% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Public Facilities Revenue | | | 30.24% | |

Municipal Utility Revenue | | | 28.50% | |

School Improvement Revenue | | | 15.45% | |

Miscellaneous Public Improvement | | | 9.36% | |

University Consolidated Education and Building Revenue | | | 6.19% | |

Turnpikes and Toll Roads Revenue | | | 2.14% | |

Refunded | | | 1.81% | |

Hospital and Healthcare Revenue | | | 1.76% | |

State and Local Mortgage Revenue | | | 1.27% | |

Other Assets Less Liabilities | | | 3.28% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

vii

PERFORMANCE COMPARISON (Unaudited)

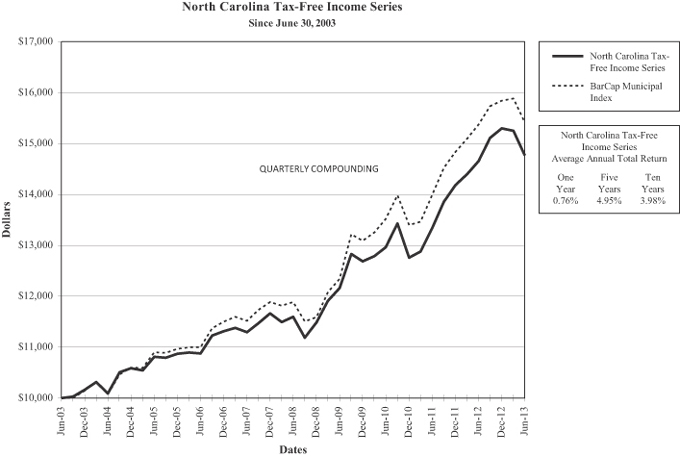

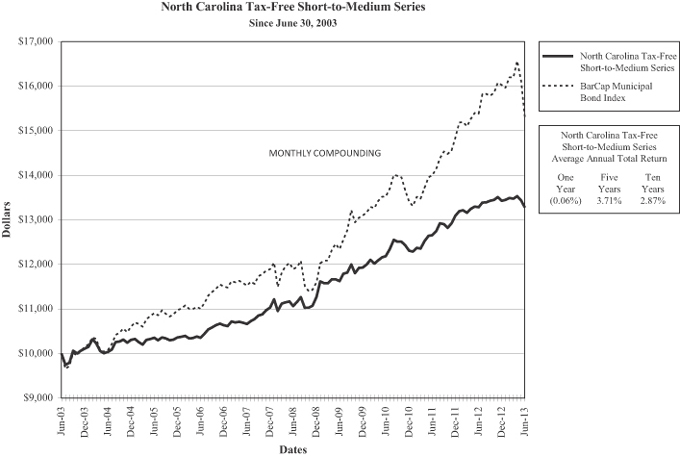

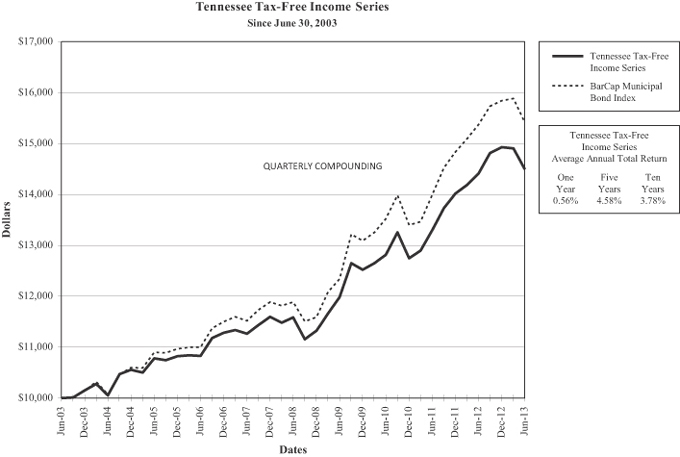

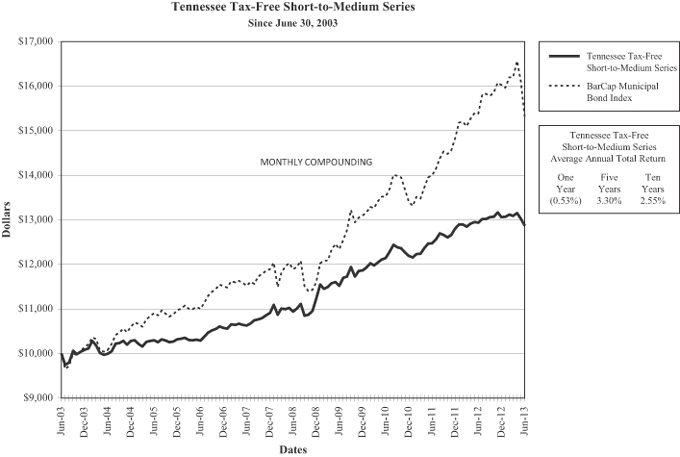

The following graphs compare the change in value of a $10,000 investment in each series of Dupree Mutual Funds with the change in value of a $10,000 investment in a comparable index. The comparisons are made over 10 years or since the inception of the series, if shorter than ten years. Results are for the fiscal years ended June 30.

viii

ix

x

xi

xii

xiii

xiv

xv

xvi

xvii

xviii

Notes on Graphs:

Results reflect reinvestment of all dividend and capital gain distributions. No index can perfectly match the investments that make up a fund’s portfolio. For each series, we have selected an index that we believe gives the most accurate picture of how the series performed during the reporting period. The investor should understand that an index is a mathematical hypothesis and does not reflect a real market situation. For example, the portfolio of each index is replaced with an entirely different portfolio each year without reflecting operating expenses or transaction costs, an impossibility in reality. On the other hand, the fund’s performance reflects not only these factors but management costs as well. Past performance is not indicative of future results.

The performance tables and the graphs above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Please note that all legacy Lehman Brothers benchmark indices were rebranded as Barclays Capital (“BarCap”) indices in November 2008.

xix

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds — 100% of Net Assets

June 30, 2013

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| SCHOOL IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 24.26% of Net Assets | | | | | | | | | | | | | | | | | | |

AL State Public Schools & College Authority Capital Improvement | | | 5.000 | % | | | 12/01/2024 | | | Aa1/AA* | | $ | 100,000 | | | $ | 112,147 | |

AL State Public School & College Authority Capital Improvement | | | 5.000 | | | | 12/01/2025 | | | Aa1/AA* | | | 640,000 | | | | 716,877 | |

AL State Public School & College Authority Refinancing Series A | | | 5.000 | | | | 05/01/2024 | | | Aa1/AA*/AA+@ | | | 125,000 | | | | 140,006 | |

Elmore County AL Public Education Cooperative | | | 5.000 | | | | 08/01/2032 | | | Aa3 | | | 50,000 | | | | 52,796 | |

Etowah County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 09/01/2037 | | | A+* | | | 200,000 | | | | 209,120 | |

Madison County AL Board of Education Capital Outlay Tax | | | 4.950 | | | | 09/01/2025 | | | Aa3/AA-* | | | 100,000 | | | | 107,934 | |

Madison County AL Board of Education Capital Outlay Tax | | | 5.100 | | | | 09/01/2028 | | | Aa3/AA-* | | | 285,000 | | | | 305,982 | |

Madison County AL Board of Education Capital Outlay Tax | | | 5.125 | | | | 09/01/2034 | | | Aa3/AA-* | | | 505,000 | | | | 530,568 | |

Mobile AL Public Education Building Authority | | | 5.000 | | | | 03/01/2033 | | | A3/AA-*/AA-@ | | | 200,000 | | | | 210,970 | |

Montgomery County AL Warrants | | | 5.000 | | | | 03/01/2028 | | | Aa1/AA* | | | 175,000 | | | | 190,201 | |

Morgan County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 03/01/2035 | | | AA-* | | | 800,000 | | | | 842,967 | |

Opelika AL Warrants | | | 5.000 | | | | 11/01/2031 | | | Aa2/AA* | | | 400,000 | | | | 432,236 | |

Phenix City AL School Warrants Series B | | | 5.000 | | | | 08/01/2024 | | | AA-* | | | 80,000 | | | | 82,379 | |

Scottsboro AL Warrants | | | 5.000 | | | | 07/01/2028 | | | A+* | | | 250,000 | | | | 265,403 | |

Shelby County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 02/01/2031 | | | Aa2/A* | | | 890,000 | | | | 942,964 | |

Shelby County AL Board of Education Special Tax School Warrats | | | 5.000 | | | | 02/01/2025 | | | Aa3/A+* | | | 300,000 | | | | 315,612 | |

Sumter County AL Limited Obligation School Warrants | | | 5.100 | | | | 02/01/2034 | | | A* | | | 100,000 | | | | 102,337 | |

Sumter County AL Limited Obligation School Warrants | | | 5.200 | | | | 02/01/2039 | | | A* | | | 95,000 | | | | 97,402 | |

Troy AL Public Educational Building Authority Educational | | | 5.250 | | | | 12/01/2036 | | | A2/AA-* | | | 225,000 | | | | 238,016 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,895,917 | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | | | | | | | | | | | |

| 23.76% of Net Assets | | | | | | | | | | | | | | | | | | |

AL State Private Colleges & Universities Tuskegee University | | | 4.750 | | | | 09/01/2026 | | | AA-* | | | 500,000 | | | | 510,035 | |

AL State Board Education Bishop State Community College | | | 4.600 | | | | 01/01/2021 | | | A1 | | | 100,000 | | | | 100,126 | |

AL State University Revenue General Tuition and Fee | �� | | 5.250 | | | | 09/01/2034 | | | A2/AA-* | | | 75,000 | | | | 80,207 | |

Auburn University AL General Fee Revenue Series A | | | 5.000 | | | | 06/01/2032 | | | Aa2/AA-* | | | 45,000 | | | | 47,839 | |

Auburn University AL General Fee Revenue — Series A | | | 5.000 | | | | 06/01/2027 | | | Aa2/AA-* | | | 300,000 | | | | 329,400 | |

Auburn University AL General Fee Revenue Series A | | | 5.000 | | | | 06/01/2033 | | | Aa2/AA-* | | | 420,000 | | | | 452,651 | |

Auburn University AL General Fee Revenue Series A | | | 5.000 | | | | 06/01/2038 | | | Aa2/AA-* | | | 600,000 | | | | 644,796 | |

Auburn University AL General Fee Revenue | | | 5.000 | | | | 06/01/2022 | | | Aa2/AA-* | | | 50,000 | | | | 56,450 | |

Auburn University General FeeRevenue Series A | | | 5.000 | | | | 06/01/2036 | | | Aa2/AA-* | | | 150,000 | | | | 160,413 | |

Jacksonville AL State University Revenue Tuition and Fee | | | 5.125 | | | | 12/01/2033 | | | AA-* | | | 450,000 | | | | 467,780 | |

Mobile AL Spring Hill CollegeEducational Building | | | 5.100 | | | | 09/01/2019 | | | Baa3 | | | 120,000 | | | | 120,130 | |

Tuscaloosa AL Public Education Building Authority Student Housing | | | 6.375 | | | | 07/01/2028 | | | AA-* | | | 250,000 | | | | 285,593 | |

Tuscaloosa AL Public Education Building Authority Student Housing | | | 6.750 | | | | 07/01/2033 | | | AA-* | | | 495,000 | | | | 561,751 | |

University of AL General Revenue Series A | | | 5.000 | | | | 07/01/2028 | | | Aa2/AA-*/AA+@ | | | 325,000 | | | | 351,644 | |

University of AL General Revenue Series A | | | 5.000 | | | | 07/01/2032 | | | Aa2/AA-*/AA+@ | | | 500,000 | | | | 535,105 | |

University of Alabama GeneralRevenue Series A | | | 5.000 | | | | 07/01/2034 | | | Aa2/AA-* | | | 250,000 | | | | 271,395 | |

University South AL University Revenues Refunding Tuition | | | 5.000 | | | | 12/01/2029 | | | Aa1/AA+* | | | 105,000 | | | | 113,384 | |

University of Southern AL University Revenues Facilities | | | 5.000 | | | | 08/01/2029 | | | Aa1/AA+* | | | 550,000 | | | | 581,581 | |

University of South AL University Revenues Facilities Capital | | | 4.750 | | | | 08/01/2033 | | | Aa1/AA+* | | | 100,000 | | | | 103,235 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,773,515 | |

| MUNICIPAL UTILITY REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 18.49% of Net Assets | | | | | | | | | | | | | | | | | | |

AL Drinking Water Finance Authority Revolving Fund Loan | | | 4.750 | | | | 08/15/2027 | | | NR | | | 75,000 | | | | 75,158 | |

Bessemer AL Governmental Utility Services Water Supply | | | 4.750 | | | | 06/01/2033 | | | A2 | | | 100,000 | | | | 102,587 | |

Birmingham AL Waterworks Board Water Revenue Series A | | | 5.000 | | | | 01/01/2026 | | | Aa2/AA* | | | 80,000 | | | | 86,927 | |

Birmingham AL Waterworks BoardWater Revenue | | | 4.750 | | | | 01/01/2036 | | | Aa2/AA* | | | 215,000 | | | | 218,803 | |

Birmingham AL Waterworks Board Water Revenue Series B | | | 5.000 | | | | 01/01/2038 | | | Aa2/AA* | | | 100,000 | | | | 103,598 | |

Chatom AL Industrial Board Gulf Opportunity Zone | | | 5.000 | | | | 08/01/2037 | | | A3/AA-*/A-@ | | | 150,000 | | | | 157,289 | |

Cullman AL Utility Board Water Revenue | | | 4.750 | | | | 09/01/2037 | | | Aa3/AA-* | | | 650,000 | | | | 671,509 | |

Cullman County AL Water Revenue | | | 5.000 | | | | 05/01/2021 | | | Baa1/A+* | | | 125,000 | | | | 131,118 | |

Fort Payne AL Waterworks Board Water Revenue | | | 4.750 | | | | 07/01/2034 | | | AA-* | | | 100,000 | | | | 104,350 | |

Huntsville AL Water Systems Revenue Bonds | | | 5.000 | | | | 11/01/2033 | | | Aa1/AAA* | | | 300,000 | | | | 325,011 | |

Jasper AL Water Works and Sewer Board Utility Revenue | | | 5.000 | | | | 06/01/2030 | | | A+* | | | 455,000 | | | | 489,393 | |

Limestone County AL Water and Sewer Authority Water Revenue | | | 5.000 | | | | 12/01/2029 | | | A+* | | | 275,000 | | | | 280,272 | |

The accompanying footnotes are an integral part of the financial statements.

1

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds — 100% of Net Assets

June 30, 2013

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Muscle Shoals AL Utilities Board Water and Sewer Revenue | | | 5.750 | % | | | 12/01/2033 | | | AA-* | | $ | 430,000 | | | $ | 474,290 | |

North Marshall AL Utilities Board Water Revenue | | | 5.100 | | | | 10/01/2030 | | | AA-* | | | 375,000 | | | | 400,226 | |

Opelika AL Water Board Revenue | | | 5.000 | | | | 06/01/2037 | | | Aa3/AA-* | | | 250,000 | | | | 264,905 | |

Opelika AL Water Board Revenue | | | 5.250 | | | | 06/01/2036 | | | Aa3/A+* | | | 70,000 | | | | 74,116 | |

Phenix City AL Water and Sewer Revenue | | | 5.000 | | | | 08/15/2034 | | | A3/AA-*/AA-@ | | | 275,000 | | | | 290,265 | |

Tallassee AL Water Gas and Sewer Warrants | | | 5.125 | | | | 05/01/2036 | | | A2/AA-* | | | 75,000 | | | | 79,772 | |

Trussville AL Warrants | | | 4.800 | | | | 10/01/2021 | | | Aa2 | | | 85,000 | | | | 85,856 | |

West Morgan East Lawrence AL Water and Sewer Revenue | | | 4.750 | | | | 08/15/2030 | | | AA-* | | | 75,000 | | | | 77,750 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 4,493,195 | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 10.33% of Net Assets | | | | | | | | | | | | | | | | | | |

AL Incentives Financing Authority Special Obligation | | | 5.000 | | | | 09/01/2029 | | | AA-* | | | 125,000 | | | | 133,606 | |

AL State Incentives Financing Authority Special Obligation Series A | | | 5.000 | | | | 09/01/2037 | | | Aa3/A+* | | | 800,000 | | | | 840,800 | |

Daphne AL Warrants | | | 5.000 | | | | 04/01/2023 | | | Aa2/AA* | | | 250,000 | | | | 273,408 | |

Enterprise AL Warrants General Obligation | | | 5.000 | | | | 10/01/2019 | | | NR | | | 55,000 | | | | 56,941 | |

Enterprise AL Warrants General Obligation | | | 5.000 | | | | 10/01/2023 | | | NR | | | 450,000 | | | | 463,775 | |

Mobile AL Refunding Warrants Series A | | | 5.000 | | | | 02/15/2027 | | | Aa2/AA-* | | | 335,000 | | | | 360,641 | |

Mobile AL Limited Obligation Tax Warrants | | | 5.500 | | | | 02/15/2023 | | | Baa3 | | | 35,000 | | | | 35,049 | |

Tuscaloosa AL Warrants SeriesA | | | 5.000 | | | | 10/15/2034 | | | Aa1/AA+* | | | 175,000 | | | | 186,961 | |

Tuscaloosa AL Warrants — Series A | | | 5.125 | | | | 01/01/2039 | | | Aa1/AA+* | | | 150,000 | | | | 159,794 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 2,510,975 | |

| PUBLIC FACILITIES REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 10.01% of Net Assets | | | | | | | | | | | | | | | | | | |

AL State — Series A | | | 4.625 | | | | 09/01/2022 | | | Aa1/AA* | | | 100,000 | | | | 102,111 | |

Anniston AL Public Building Authority DHR Project | | | 5.250 | | | | 05/01/2030 | | | AA-* | | | 50,000 | | | | 54,834 | |

Anniston AL Public Building Authority Revenue | | | 5.500 | | | | 05/01/2033 | | | AA-* | | | 200,000 | | | | 216,670 | |

Anniston AL Public Building Authority | | | 5.000 | | | | 03/01/2032 | | | A2/AA-* | | | 400,000 | | | | 423,748 | |

Bessemer AL Public Educational Building Authority Revenue | | | 5.000 | | | | 07/01/2030 | | | AA-* | | | 250,000 | | | | 269,423 | |

Huntsville AL Public BuildingAuthority Lease Revenue | | | 5.000 | | | | 10/01/2027 | | | Aa1/AA+* | | | 375,000 | | | | 407,996 | |

Huntsville AL Public BuildingAuthority Lease Revenue | | | 5.000 | | | | 10/01/2033 | | | Aa1/AA+* | | | 175,000 | | | | 186,895 | |

Lowndes County AL Warrants | | | 5.250 | | | | 02/01/2037 | | | A2/AA-* | | | 250,000 | | | | 260,465 | |

Montgomery AL Warrants — Series A | | | 5.000 | | | | 02/01/2030 | | | NR | | | 300,000 | | | | 324,990 | |

Montgomery County AL Public Building Authority Revenue Bond | | | 5.000 | | | | 03/01/2031 | | | Aa2/AA-* | | | 175,000 | | | | 184,664 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 2,431,796 | |

| PREREFUNDED BONDS | | | | | | | | | | | | | | | | | | |

| 8.40% of Net Assets | | | | | | | | | | | | | | | | | | |

Albertville AL Warrants | | | 5.000 | | | | 02/01/2035 | | | AA-* | | | 110,000 | | | | 129,991 | |

Auburn AL Capital ImprovementSchool Warrants | | | 5.000 | | | | 08/01/2030 | | | Aa2/AA+* | | | 260,000 | | | | 283,800 | |

Baldwin County AL Water and Sewer Series A General Obligation | | | 5.000 | | | | 01/01/2016 | | | Aa1/AA+* | | | 295,000 | | | | 325,087 | |

Huntsville AL Health Care Authority — Series A | | | 5.000 | | | | 06/01/2024 | | | A1/A* | | | 100,000 | | | | 108,328 | |

Montgomery AL Warrants | | | 5.000 | | | | 01/01/2023 | | | Aa2/AA+* | | | 80,000 | | | | 88,243 | |

Montgomery AL Waterworks and Sanitation Sewer Board Revenue | | | 5.000 | | | | 03/01/2025 | | | Aa1/AAA* | | | 250,000 | | | | 268,828 | |

Morgan County AL Water and Sewer General Obligation Warrants | | | 5.000 | | | | 04/01/2028 | | | Aa3 | | | 100,000 | | | | 103,573 | |

Morgan County AL Warrants | | | 5.000 | | | | 04/01/2029 | | | Aa3 | | | 25,000 | | | | 25,893 | |

Oxford AL Warrants Series A | | | 5.000 | | | | 10/01/2036 | | | Aa2 | | | 50,000 | | | | 55,493 | |

Phenix City AL School Warrants Series B | | | 5.000 | | | | 02/01/2017 | | | NR | | | 120,000 | | | | 135,982 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 01/01/2030 | | | Aa1/AA+* | | | 150,000 | | | | 155,111 | |

University of AL General Revenue Series A | | | 5.000 | | | | 07/01/2034 | | | Aa2/AA-*/AA+@ | | | 350,000 | | | | 359,825 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 2,040,154 | |

| ESCROWED TO MATURITY BONDS | | | | | | | | | | | | | | | | | | |

| 1.41% of Net Assets | | | | | | | | | | | | | | | | | | |

West Morgan — East Lawrence Water Authority AL Water Revenue | | | 5.000 | | | | 08/15/2025 | | | A2/AA-* | | | 300,000 | | | | 342,768 | |

| | | | | | | | | | | | | | | | | | |

| REFUNDING BONDS | | | | | | | | | | | | | | | | | | |

| 1.05% of Net Assets | | | | | | | | | | | | | | | | | | |

Muscle Shoals AL Refunded Warrants | | | 4.600 | | | | 08/01/2024 | | | Aa3 | | | 250,000 | | | | 256,240 | |

| | | | | | | | | | | | | | | | | | |

The accompanying footnotes are an integral part of the financial statements.

2

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds — 100% of Net Assets

June 30, 2013

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| STATE AND LOCAL MORTGAGE/HOUSING BONDS | | | | | | | | | | | | | | | | | | |

| .67% of Net Assets | | | | | | | | | | | | | | | | | | |

AL Housing Finance Authority Single Family Mortgage Revenue | | | 5.375 | % | | | 10/01/2033 | | | Aaa | | $ | 155,000 | | | $ | 162,090 | |

| | | | | | | | | | | | | | | | | | |

| INDUSTRIAL REVENUE/POLLUTION CONTROL BONDS | | | | | | | | | | | | | | | | | | |

| .10% of Net Assets | | | | | | | | | | | | | | | | | | |

Auburn AL Industrial Development Board Facilities Revenue | | | 6.200 | | | | 11/01/2020 | | | A* | | | 25,000 | | | | 25,011 | |

| | | | | | | | | | | | | | | | | | |

Total Investments 98.48% of Net Assets (cost $23,276,944)(See (a) below for further explanation) | | | | | | | | | $ | 23,931,661 | |

| | | | | | | | | | | | | | | | | | |

| Other assets in excess of liabilities 1.52% | | | | | | | | | | | | | | | | | 368,214 | |

| | | | | | | | | | | | | | | | | | |

| Net Assets 100% | | | | | | | | | | | | | | | | $ | 24,299,875 | |

| | | | | | | | | | | | | | | | | | |

| | * | | Standard and Poor’s Corporation |

| | @ | | Fitch’s Investors Service |

| | | | (All other ratings by Moody’s Investors Service, Inc.) |

| | # | | Bond ratings are unaudited and not covered by Report of Independent Registered Public Accounting Firm. |

| (a) | | Cost for federal income tax purposes is $23,276,854 and net unrealized appreciation of investments is as follows: |

| | | | | | |

| | Unrealized appreciation | | $ | 899,167 | |

| | Unrealized depreciation | | | (244,360 | ) |

| | | | | | |

| | Net unrealized appreciation | | $ | 654,807 | |

| | | | | | |

Other Information

The following is a summary of the inputs used, as of June 30, 2013 involving the Fund’s investments in securities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

| | | | | | |

| | | Valuation Inputs | | Municipal Bonds | |

Level 1 | | Quoted Prices | | $ | — | |

Level 2 | | Other Significant Observable Inputs | | | 23,931,661 | |

Level 3 | | Significant Unobservable Inputs | | | — | |

| | | | | | |

| | | | $ | 23,931,661 | |

| | | | | | |

The accompanying footnotes are an integral part of the financial statements.

3

ALABAMA TAX-FREE INCOME SERIES

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2013

| | | | | | | | |

ASSETS: | | | | | | | | |

Investments in securities, at fair value (Cost: $23,276,944) | | | | | | $ | 23,931,661 | |

Cash | | | | | | | 313,648 | |

Interest receivable | | | | | | | 345,586 | |

| | | | | | | | |

Total assets | | | | | | | 24,590,895 | |

LIABILITIES: | | | | | | | | |

Payable for: | | | | | | | | |

Distributions to shareholders | | | 116,422 | | | | | |

Fund shares redeemed | | | 152,348 | | | | | |

Investment advisory fee | | | 8,679 | | | | | |

Transfer agent fee | | | 3,706 | | | | | |

Trustee fees | | | 586 | | | | | |

Accrued expenses | | | 9,279 | | | | | |

| | | | | | | | |

Total liabilities | | | | | | | 291,020 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Capital | | | | | | | 23,615,795 | |

Accumulated net investment income | | | | | | | 90 | |

Net accumulated realized gain on investment transactions | | | | | | | 29,273 | |

Net unrealized appreciation in value of investments | | | | | | | 654,717 | |

| | | | | | | | |

Net assets at value | | | | | | $ | 24,299,875 | |

| | | | | | | | |

NET ASSET VALUE, offering price and redemption price per share

($24,299,875 -:- 2,007,501 shares outstanding; unlimited number of shares authorized; no par value) | | | | | | $ | 12.10 | |

| | | | | | | | |

STATEMENT OF OPERATIONS

For the year ended June 30, 2013

| | | | |

Net investment income: | | | | |

Interest income | | $ | 1,016,240 | |

| | | | |

Expenses: | | | | |

Investment advisory fee | | | 123,872 | |

Transfer agent fee | | | 36,713 | |

Custodian expense | | | 8,007 | |

Professional fees | | | 1,529 | |

Trustee fees | | | 3,196 | |

Other expenses | | | 20,503 | |

| | | | |

Total expenses | | | 193,820 | |

Fees waived by Adviser | | | (19,538 | ) |

Custodian expense reduction | | | (144 | ) |

| | | | |

Net expenses | | | 174,138 | |

| | | | |

Net investment income | | | 842,102 | |

| | | | |

Realized and unrealized gain/(loss) on investments: | | | | |

Net realized gain | | | 30,045 | |

Net change in unrealized appreciation/depreciation | | | (687,104 | ) |

| | | | |

Net realized and unrealized loss on investments | | | (657,059 | ) |

| | | | |

Net increase in net assets resulting from operations | | $ | 185,043 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

4

ALABAMA TAX-FREE INCOME SERIES

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended June 30, 2013 and 2012

| | | | | | | | |

| | | 2013 | | | 2012 | |

Operations: | | | | | | | | |

Net investment income | | $ | 842,102 | | | $ | 781,652 | |

Net realized gain on investments | | | 30,045 | | | | 64,847 | |

Net change in unrealized appreciation/depreciation | | | (687,104 | ) | | | 1,168,601 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 185,043 | | | | 2,015,100 | |

Distributions from net investment income | | | (842,439 | ) | | | (781,225 | ) |

Distributions from capital gains | | | (16,538 | ) | | | (12,037 | ) |

Net fund share transactions (Note 4) | | | 2,062,926 | | | | 454,495 | |

| | | | | | | | |

Total increase | | | 1,388,992 | | | | 1,676,333 | |

Net assets: | | | | | | | | |

Beginning of period | | | 22,910,883 | | | | 21,234,550 | |

| | | | | | | | |

End of year | | $ | 24,299,875 | | | $ | 22,910,883 | |

| | | | | | | | |

Accumulated Net Investment Income | | $ | 90 | | | $ | 427 | |

| | | | | | | | |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding: | | For the years ended June 30, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

Net asset value, beginning of period | | | $12.41 | | | | $11.72 | | | | $11.77 | | | | $11.40 | | | | $11.43 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.43 | | | | 0.44 | | | | 0.45 | | | | 0.46 | | | | 0.46 | |

Net gains/(losses) on securities, both realized and unrealized | | | (0.30 | ) | | | 0.70 | | | | (0.05 | ) | | | 0.37 | | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.13 | | | | 1.14 | | | | 0.40 | | | | 0.83 | | | | 0.43 | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.43 | ) | | | (0.44 | ) | | | (0.45 | ) | | | (0.46 | ) | | | (0.46 | ) |

Distributions from capital gains | | | (0.01 | ) | | | (0.01 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.44 | ) | | | (0.45 | ) | | | (0.45 | ) | | | (0.46 | ) | | | (0.48 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | | $12.10 | | | | $12.41 | | | | $11.72 | | | | $11.77 | | | | $11.40 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 0.94% | | | | 9.81% | | | | 3.45% | | | | 7.40% | | | | 3.95% | |

Net assets, end of period (in thousands) | | | $24,300 | | | | $22,911 | | | | $21,235 | | | | $19,853 | | | | $14,262 | |

Ratio of net expenses to average net assets (a) | | | 0.70% | | | | 0.68% | | | | 0.60% | | | | 0.47% | | | | 0.45% | |

Ratio of net investment income to average net assets | | | 3.40% | | | | 3.59% | | | | 3.83% | | | | 3.94% | | | | 4.14% | |

Portfolio turnover | | | 6.46% | | | | 7.80% | | | | 4.70% | | | | 15.73% | | | | 14.06% | |

| (a) | | Percentages are after expenses waived by Adviser and Custodian. No recovery of these waivers and reductions will be sought. Expenses waived by Adviser and Custodian were: .08% and 0% for 2013; .10% and 0% for 2012;.18% and 0% for 2011; .33% and 0% for 2010; and .37% and .03% for 2009, respectively. |

The accompanying notes are an integral part of the financial statements.

5

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds — 100% of Net Assets

June 30, 2013

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | | | | | | | | | | | | | | | | | | |

| 25.36% of Net Assets | | | | | | | | | | | | | | | | | | |

Pendleton County KY Multi-County Lease Revenue | | | 6.400 | % | | | 03/01/2019 | | | B* | | $ | 3,000,000 | | | $ | 3,307,664 | |

Ky State Property & Building #106 | | | 5.000 | | | | 10/01/2033 | | | Aa3/A+*/A+@ | | | 4,870,000 | | | | 5,150,074 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2032 | | | Aa3/A+*/A+@ | | | 6,000,000 | | | | 6,350,160 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2031 | | | Aa3/A+*/A+@ | | | 4,910,000 | | | | 5,221,687 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2033 | | | A1/A+*/A@ | | | 2,310,000 | | | | 2,378,977 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2032 | | | A1/A+*/A@ | | | 2,205,000 | | | | 2,272,627 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2031 | | | A1/A+*/A@ | | | 2,110,000 | | | | 2,179,799 | |

KY State Property & Building #83 | | | 5.000 | | | | 10/01/2017 | | | Aa3/A+*/A+@ | | | 5,000,000 | | | | 5,725,850 | |

KY State Property & Building #91 | | | 5.750 | | | | 04/01/2029 | | | A1/A+*/A@ | | | 210,000 | | | | 231,307 | |

KY State Property & Building #90 | | | 5.500 | | | | 11/01/2028 | | | Aa3/A+*/A+@ | | | 24,805,000 | | | | 27,610,446 | |

KY State Property & Building #90 | | | 5.375 | | | | 11/01/2023 | | | Aa3/A+*/A+@ | | | 1,200,000 | | | | 1,372,116 | |

KY State Property & Building #89 | | | 5.000 | | | | 11/01/2027 | | | Aa3/AA-*/A+@ | | | 4,900,000 | | | | 5,337,227 | |

KY State Property & Building #89 | | | 5.000 | | | | 11/01/2026 | | | Aa3/AA-*/A+@ | | | 13,390,000 | | | | 14,681,332 | |

KY State Property & Building #89 | | | 5.000 | | | | 11/01/2025 | | | Aa3/AA-*/A+@ | | | 5,000,000 | | | | 5,515,950 | |

KY State Property & Building #76 | | | 5.500 | | | | 08/01/2021 | | | Aa3/A+*/A+@ | | | 1,400,000 | | | | 1,676,444 | |

KY State Property & Building #88 | | | 4.750 | | | | 11/01/2027 | | | Aa3/A+*/A+@ | | | 5,800,000 | | | | 6,144,578 | |

KY State Property & Building #88 | | | 5.000 | | | | 11/01/2024 | | | Aa3/A+*/A+@ | | | 1,355,000 | | | | 1,481,828 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2027 | | | Aa3/A+*/A+@ | | | 10,290,000 | | | | 10,941,666 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2026 | | | Aa3/A+*/A+@ | | | 8,230,000 | | | | 8,798,364 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2025 | | | Aa3/A+*/A+@ | | | 14,835,000 | | | | 15,918,400 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2023 | | | Aa3/A+*/A+@ | | | 5,175,000 | | | | 5,598,005 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2022 | | | Aa3/A+*/A+@ | | | 1,665,000 | | | | 1,812,669 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2019 | | | Aa3/A+*/A+@ | | | 3,000,000 | | | | 3,347,760 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2031 | | | Aa3/A+*/A+@ | | | 5,100,000 | | | | 5,463,987 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2030 | | | Aa3/A+*/A+@ | | | 7,980,000 | | | | 8,578,101 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2029 | | | Aa3/A+*/A+@ | | | 2,500,000 | | | | 2,698,175 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2028 | | | Aa3/A+*/A+@ | | | 4,000,000 | | | | 4,366,480 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2027 | | | Aa3/A+*/A+@ | | | 1,710,000 | | | | 1,884,266 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2026 | | | Aa3/A+*/A+@ | | | 2,000,000 | | | | 2,221,660 | |

KY State Property & Building #98 | | | 5.000 | | | | 08/01/2021 | | | Aa3/A+*/A+@ | | | 2,505,000 | | | | 2,911,386 | |

KY State Property & Building #96 | | | 5.000 | | | | 11/01/2029 | | | Aa3/A+*/A+@ | | | 5,000,000 | | | | 5,414,150 | |

KY State Property & Building #93 | | | 5.250 | | | | 02/01/2029 | | | Aa3/AA-*/A+@ | | | 22,640,000 | | | | 24,173,181 | |

KY State Property & Building #93 | | | 5.000 | | | | 02/01/2029 | | | Aa3/AA-*/A+@ | | | 500,000 | | | | 531,245 | |

KY State Property & Building #93 | | | 5.250 | | | | 02/01/2028 | | | Aa3/AA-*/A+@ | | | 10,500,000 | | | | 11,397,750 | |

KY State Property & Building #93 | | | 4.875 | | | | 02/01/2028 | | | Aa3/AA-*/A+@ | | | 500,000 | | | | 527,605 | |

Ky State Property & Building #93 | | | 5.250 | | | | 02/01/2025 | | | Aa3/AA-*/A+@ | | | 7,250,000 | | | | 8,056,200 | |

KY Bond Corporation Finance Program | | | 5.500 | | | | 02/01/2031 | | | AA-* | | | 1,115,000 | | | | 1,209,095 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2035 | | | AA-* | | | 995,000 | | | | 1,042,103 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2032 | | | AA-* | | | 1,000,000 | | | | 1,042,360 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2030 | | | AA-* | | | 625,000 | | | | 653,806 | |

KY Asset Liability Commission | | | 5.000 | | | | 05/01/2025 | | | Aa3/A+*/A+@ | | | 1,000,000 | | | | 1,048,750 | |

KY Asset Liability CommissionGeneral Fund | | | 5.000 | | | | 05/01/2024 | | | Aa3/A+*/A+@ | | | 5,880,000 | | | | 6,181,938 | |

KY Asset Liability CommissionProject Notes | | | 5.000 | | | | 05/01/2023 | | | Aa3/A+*/A+@ | | | 5,600,000 | | | | 5,922,000 | |

KY Asset Liability CommissionGeneral Fund | | | 5.000 | | | | 05/01/2020 | | | Aa3/A+*/A+@ | | | 2,000,000 | | | | 2,127,020 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 240,506,188 | |

| PREREFUNDED BONDS | | | | | | | | | | | | | | | | | | |

| 14.36% of Net Assets | | | | | | | | | | | | | | | | | | |

Ballard County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2020 | | | Aa3 | | | 1,240,000 | | | | 1,292,960 | |

Barren County KY School District Finance Corporation | | | 4.750 | | | | 08/01/2022 | | | Aa3 | | | 3,085,000 | | | | 3,232,062 | |

Boone County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2023 | | | Aa3 | | | 4,070,000 | | | | 4,232,800 | |

Boone County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2024 | | | Aa3 | | | 4,265,000 | | | | 4,435,600 | |

Bullitt County KY School District Finance Corporation | | | 4.750 | | | | 07/01/2022 | | | Aa3 | | | 2,440,000 | | | | 2,549,995 | |

Bullitt County KY School District Finance Corporation | | | 4.500 | | | | 10/01/2024 | | | Aa3 | | | 2,720,000 | | | | 2,863,018 | |

Davies County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2021 | | | Aa3 | | | 1,155,000 | | | | 1,205,439 | |

Eastern Kentucky University Consolidated Educational Building | | | 5.000 | | | | 05/01/2021 | | | Baa1/A* | | | 1,580,000 | | | | 1,642,094 | |

Fayette County KY School District Finance Corporation | | | 5.000 | | | | 04/01/2024 | | | Aa2/AA-* | | | 6,985,000 | | | | 7,528,084 | |

The accompanying footnotes are an integral part of the financial statements.

6

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds — 100% of Net Assets

June 30, 2013

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Fayette County KY School District Finance Corporation | | | 5.000 | % | | | 04/01/2025 | | | Aa2/AA-* | | $ | 7,340,000 | | | $ | 7,910,685 | |

Jefferson County KY School District Finance Corporation | | | 4.500 | | | | 07/01/2023 | | | Aa2/AA-* | | | 2,500,000 | | | | 2,766,525 | |

Jefferson County KY School District Finance Corporation | | | 4.625 | | | | 07/01/2025 | | | Aa2/AA-* | | | 7,545,000 | | | | 8,377,289 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 07/01/2026 | | | Aa2/AA-* | | | 5,025,000 | | | | 5,635,136 | |

Kenton County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2021 | | | Aa3 | | | 4,055,000 | | | | 4,232,082 | |

Kenton County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2023 | | | Aa3 | | | 4,465,000 | | | | 4,659,987 | |

Kenton County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2024 | | | Aa3 | | | 4,665,000 | | | | 4,868,721 | |

KY State Property & Building #81 | | | 5.000 | | | | 11/01/2018 | | | A1/A+*/A+@ | | | 1,720,000 | | | | 1,748,242 | |

KY State Property & Building #81 | | | 5.000 | | | | 11/01/2020 | | | A1/A+*/A+@ | | | 3,560,000 | | | | 3,618,455 | |

KY State Property & Building #85 | | | 5.000 | | | | 08/01/2020 | | | Aa3/AA-* | | | 5,760,000 | | | | 6,288,538 | |

KY State Property & Building #85 | | | 5.000 | | | | 08/01/2022 | | | Aa3/AA-* | | | 8,200,000 | | | | 8,952,432 | |

KY State Property & Building #85 | | | 5.000 | | | | 08/01/2024 | | | Aa3/AA-* | | | 8,300,000 | | | | 9,061,608 | |

KY State Property & Building #85 | | | 5.000 | | | | 08/01/2025 | | | Aa3/AA-* | | | 2,500,000 | | | | 2,728,850 | |

Knox County General Obligation | | | 5.625 | | | | 06/01/2036 | | | NR | | | 2,490,000 | | | | 2,785,638 | |

Letcher County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2022 | | | Aa3 | | | 1,755,000 | | | | 1,830,132 | |

Letcher County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2024 | | | Aa3 | | | 1,930,000 | | | | 2,012,623 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2026 | | | Aa3/AA*/AA-@ | | | 14,000,000 | | | | 14,964,460 | |

Louisville & Jefferson CountyKY Metropolitan Sewer District | | | 5.000 | | | | 05/15/2015 | | | Aa3/AA-* | | | 1,880,000 | | | | 2,034,442 | |

Louisville & Jefferson CountyKY Metropolitan Sewer District | | | 5.000 | | | | 05/15/2015 | | | Aa3/AA-* | | | 1,970,000 | | | | 2,131,836 | |

Louisville & Jefferson CountyKY Metropolitan Sewer District | | | 5.000 | | | | 05/15/2015 | | | Aa3/AA-* | | | 2,065,000 | | | | 2,234,640 | |

Louisville & Jefferson CountyKY Metropolitan Sewer District | | | 5.000 | | | | 05/15/2015 | | | Aa3/AA-* | | | 2,165,000 | | | | 2,342,855 | |

Louisville & Jefferson CountyMetropolitan Health — St. Marys | | | 6.125 | | | | 02/01/2037 | | | NR | | | 1,300,000 | | | | 1,571,583 | |

Marshall County KY School District Finance Corporation | | | 5.000 | | | | 06/01/2022 | | | Aa3 | | | 1,400,000 | | | | 1,460,872 | |

Shelby County KY School District Finance Corporation | | | 5.000 | | | | 05/01/2022 | | | Aa3 | | | 1,815,000 | | | | 1,888,072 | |

Spencer County KY School District Finance Corporation | | | 5.000 | | | | 07/01/2023 | | | Aa3 | | | 1,000,000 | | | | 1,047,600 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 136,135,355 | |

| MUNICIPAL UTILITY REVENUE BONDS | | | | | | | | | | | | | | | | | | |

| 13.91% of Net Assets | | | | | | | | | | | | | | | | | | |

Boone County KY Pollution Control Revenue — Dayton Power | | | 4.700 | | | | 01/01/2028 | | | A3/BBB-* | | | 6,195,000 | | | | 6,233,905 | |

Campbell and Kenton CountiesSanitary District No. 1 | | | 5.000 | | | | 08/01/2025 | | | Aa2/AA* | | | 2,395,000 | | | | 2,630,357 | |

Campbell and Kenton Counties Sanitary Sewer | | | 5.000 | | | | 08/01/2026 | | | Aa2/AA* | | | 4,175,000 | | | | 4,524,281 | |

Campbell and Kenton Counties Sanitary Sewer | | | 5.000 | | | | 08/01/2027 | | | Aa2/AA* | | | 4,385,000 | | | | 4,718,479 | |

Campbell and Kenton Counties Sanitary District No. 1 | | | 5.000 | | | | 08/01/2037 | | | Aa2/AA* | | | 11,220,000 | | | | 11,856,062 | |

KY Infrastructure Authority Wastewater and Drinking Water | | | 5.000 | | | | 02/01/2027 | | | Aaa/AAA*/AAA@ | | | 2,500,000 | | | | 2,811,275 | |

KY Infrastructure Authority Wastewater and Drinking Water | | | 5.000 | | | | 02/01/2028 | | | Aaa/AAA*/AAA@ | | | 2,000,000 | | | | 2,229,980 | |

KY Rural Water Financial Corporation Public Project Revenue | | | 5.375 | | | | 02/01/2020 | | | A+* | | | 395,000 | | | | 395,636 | |

Kentucky Rural Water FinancingCorporation | | | 4.500 | | | | 02/01/2023 | | | A+* | | | 1,085,000 | | | | 1,190,343 | |

Kentucky Rural Water FinancingCorporation | | | 4.500 | | | | 02/01/2024 | | | A+* | | | 880,000 | | | | 960,142 | |

KY Rural Water Finance Corporation | | | 5.125 | | | | 02/01/2035 | | | A+* | | | 525,000 | | | | 551,765 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2025 | | | Aa3/AA*/AA-@ | | | 3,270,000 | | | | 3,508,972 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2026 | | | Aa3/AA*/AA-@ | | | 3,230,000 | | | | 3,466,985 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2032 | | | Aa3/AA*/AA-@ | | | 4,590,000 | | | | 4,818,031 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2036 | | | Aa3/AA*/AA-@ | | | 2,000,000 | | | | 2,074,780 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2024 | | | Aa3/AA* | | | 7,000,000 | | | | 7,746,200 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2025 | | | Aa3/AA* | | | 5,185,000 | | | | 5,741,765 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2021 | | | Aa3/AA* | | | 2,865,000 | | | | 3,312,341 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2023 | | | Aa3/AA* | | | 2,500,000 | | | | 2,849,025 | |

Louisville & Jefferson CountyMetropolitan Sewer | | | 5.000 | | | | 05/15/2034 | | | Aa3/AA*/AA-@ | | | 23,380,000 | | | | 25,064,295 | |

Louisville & Jefferson CountyKY Metropolitan Sewer District | | | 5.000 | | | | 05/15/2022 | | | Aa3 | | | 975,000 | | | | 1,032,788 | |

Louisville & Jefferson CountyKY Metropolitan Sewer District | | | 5.000 | | | | 05/15/2023 | | | Aa3 | | | 1,020,000 | | | | 1,079,089 | |

Louisville & Jefferson CountyKY Metropolitan Sewer District | | | 5.000 | | | | 05/15/2024 | | | Aa3 | | | 1,070,000 | | | | 1,129,952 | |

Louisville & Jefferson CountyKY Metropolitan Sewer District | | | 5.000 | | | | 05/01/2025 | | | Aa3 | | | 1,120,000 | | | | 1,176,582 | |

Louisville & Jefferson CountyWaterworks | | | 5.000 | | | | 11/15/2027 | | | Aaa/AAA* | | | 2,000,000 | | | | 2,183,480 | |

Louisville & Jefferson CountyWaterworks | | | 5.000 | | | | 11/15/2031 | | | Aaa/AAA* | | | 10,695,000 | | | | 11,534,664 | |

Northern KY Water District | | | 4.125 | | | | 02/01/2021 | | | Aa3 | | | 1,380,000 | | | | 1,382,346 | |

Northern KY Water District | | | 4.500 | | | | 02/01/2022 | | | Aa3 | | | 1,385,000 | | | | 1,422,797 | |

Northern KY Water District | | | 6.000 | | | | 02/01/2028 | | | Aa3 | | | 1,010,000 | | | | 1,143,896 | |

Northern KY Water District | | | 6.000 | | | | 02/01/2031 | | | Aa3 | | | 1,000,000 | | | | 1,118,110 | |

The accompanying footnotes are an integral part of the financial statements.

7

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds — 100% of Net Assets

June 30, 2013

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Northern KY Water District | | | 6.500 | % | | | 02/01/2033 | | | Aa3 | | $ | 1,585,000 | | | $ | 1,775,897 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2033 | | | Aa3 | | | 3,580,000 | | | | 3,821,936 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2026 | | | Aa3 | | | 1,000,000 | | | | 1,108,100 | |

Northern Ky Water District | | | 5.000 | | | | 02/01/2027 | | | Aa3 | | | 4,315,000 | | | | 4,731,139 | |

Owensboro Water Revenue | | | 5.000 | | | | 09/15/2025 | | | A1 | | | 545,000 | | | | 596,399 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 131,921,794 | |

| TURNPIKES/TOLLROAD/HIGHWAY BONDS | | | | | | | | | | | | | | | | | | |

| 11.73% of Net Assets | | | | | | | | | | | | | | | | | | |

KY Asset Liability CommissionFederal Highway | | | 5.250 | | | | 09/01/2019 | | | Aa3/AA*/A+@ | | | 1,765,000 | | | | 2,089,848 | |

KY Asset Liability Project | | | 5.000 | | | | 09/01/2021 | | | Aa3/AA*/A+@ | | | 1,570,000 | | | | 1,825,172 | |

Kentucky Asset Liability Highway Trust | | | 5.000 | | | | 09/01/2022 | | | Aa3/AA*/A+@ | | | 3,500,000 | | | | 4,011,945 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2022 | | | Aa2/AA+*/A+@ | | | 1,625,000 | | | | 1,739,774 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2023 | | | Aa2/AA+*/A+@ | | | 4,325,000 | | | | 4,606,514 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2024 | | | Aa2/AA+*/A+@ | | | 3,770,000 | | | | 4,006,153 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2025 | | | Aa2/AA+*/A+@ | | | 2,000,000 | | | | 2,122,420 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2026 | | | Aa2/AA+*/A+@ | | | 4,720,000 | | | | 5,095,523 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2020 | | | Aa2/AA+*/A+@ | | | 1,000,000 | | | | 1,148,980 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2025 | | | Aa2/AA+*/A+@ | | | 3,225,000 | | | | 3,605,550 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2027 | | | Aa2/AA+*/A+@ | | | 9,530,000 | | | | 10,461,367 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2028 | | | Aa2/AA+*/A+@ | | | 2,460,000 | | | | 2,689,592 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2026 | | | Aa2/AA+*/A+@ | | | 4,440,000 | | | | 4,953,308 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2027 | | | Aa2/AA+*/A+@ | | | 3,080,000 | | | | 3,421,726 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa2/AA+*/A+@ | | | 10,035,000 | | | | 10,997,959 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2025 | | | Aa2/AA+*/A+@ | | | 3,775,000 | | | | 4,271,601 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa2/AA+*/A+@ | | | 5,165,000 | | | | 5,667,968 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2030 | | | Aa2/AA+*/A+@ | | | 1,845,000 | | | | 2,007,249 | |

Kentucky State Turnpike Economic Development | | | 5.000 | | | | 07/01/2024 | | | Aa2/AA+*/A+@ | | | 1,500,000 | | | | 1,740,405 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2028 | | | Aa2/AA+*/A+@ | | | 4,930,000 | | | | 5,489,062 | |

KY State Turnpike Economic Developement Road Revenue | | | 5.000 | | | | 07/01/2030 | | | Aa2/AA+*/A+@ | | | 1,465,000 | | | | 1,602,725 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2031 | | | Aa2/AA+*/A+@ | | | 9,350,000 | | | | 10,184,207 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa2/AA+*/A+@ | | | 7,235,000 | | | | 7,973,259 | |

Ky State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2032 | | | Aa2/AA+*/A+@ | | | 8,755,000 | | | | 9,515,284 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 111,227,591 | |

| REFUNDED BONDS | | | | | | | | | | | | | | | | | | |

| 9.62% of Net Assets | | | | | | | | | | | | | | | | | | |

KY State Property & Building #80 | | | 5.250 | | | | 05/01/2018 | | | Aa3/A+*/A+@ | | | 2,940,000 | | | | 3,418,603 | |

KY State Property & Building #80 | | | 5.250 | | | | 05/01/2020 | | | Aa3/A+*/A+@ | | | 1,000,000 | | | | 1,182,950 | |

KY State Property & Building #83 | | | 5.000 | | | | 10/01/2018 | | | Aa3/A+*/A+@ | | | 17,750,000 | | | | 20,596,745 | |

KY State Property & Building #83 | | | 5.250 | | | | 10/01/2020 | | | Aa3/A+*/A+@ | | | 24,220,000 | | | | 28,738,968 | |

KY State Property & Building #84 | | | 5.000 | | | | 08/01/2019 | | | Aa3/A+*/A+@ | | | 10,000,000 | | | | 11,643,700 | |

KY State Property & Building #84 | | | 5.000 | | | | 08/01/2021 | | | Aa3/A+*/A+@ | | | 310,000 | | | | 360,040 | |

KY State Property & Building #84 | | | 5.000 | | | | 08/01/2022 | | | Aa3/A+*/A+@ | | | 18,000,000 | | | | 20,907,720 | |

KY State Property & Building #104 | | | 5.000 | | | | 11/01/2021 | | | A1/A+*/A@ | | | 2,085,000 | | | | 2,437,574 | |

KY State Property & Building #104 | | | 5.000 | | | | 11/01/2022 | | | A1/A+*/A@ | | | 1,290,000 | | | | 1,499,922 | |

KY State Property & Building #102 | | | 5.000 | | | | 05/01/2024 | | | Aa3/A+*/A+@ | | | 405,000 | | | | 461,344 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 91,247,566 | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | | | | | | | | | | | |