U. S.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-2918

DUPREE MUTUAL FUNDS

(Exact Name of Registrant as Specified in Charter)

125 South Mill Street, Vine Center, Suite 100

Lexington, Kentucky 40507

(Address of Principal Executive Offices) (Zip Code)

Allen E. Grimes, III

125 South Mill Street, Vine Center, Suite 100

Lexington, Kentucky 40507

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code (859) 254-7741

Date of fiscal year end: June 30, 2015

Date of reporting period: July 1, 2014 through June 30, 2015

Item 1. Report to Stockholders

June 30, 2015

ANNUAL REPORT

TO SHAREHOLDERS

ABOUT DUPREE MUTUAL FUNDS

In 1941, Dupree & Company, Inc. began business in Harlan, Kentucky as a small securities brokerage firm specializing in tax-exempt municipal bonds.

Over the years the firm, which in 1963 moved its offices to Lexington, Kentucky, grew to become a regional leader in public finance, helping to structure complex and innovative municipal bond financing for some of the largest public projects in the Commonwealth of Kentucky.

In 1979, Dupree & Company began what is now Dupree Mutual Funds with the Kentucky Tax-Free Income Series and became the Fund’s investment adviser. The Fund was one of the first single-state municipal bond funds in the country, and the first mutual fund to invest solely in Kentucky municipal bonds. Since then, several new offerings have been added to the Dupree Mutual Funds family:

Kentucky Tax-Free Short-to-Medium Series in 1987;

Intermediate Government Bond Series in 1992;

Tennessee Tax-Free Income Series in 1993;

Tennessee Tax-Free Short-to-Medium Series in 1994;

North Carolina Tax-Free Income Series in 1995;

North Carolina Tax-Free Short-to-Medium Series in 1995;

Alabama Tax-Free Income Series in 2000;

Mississippi Tax-Free Income Series in 2000; and

Taxable Municipal Bond Series in 2010.

Today, after more than 60 years in business, Dupree continues to be a pioneer in the industry. Our Kentucky, Tennessee, and Mississippi Series are currently the ONLY 100% “no-load” municipal bond funds available in those states. No-load means simply that shares of the funds are offered directly to investors with no front or back-end sales charges, as opposed to load funds, which are sold through brokerage firms or other institutions that typically carry sales charges.

At Dupree Mutual Funds, our goal is a simple one: to offer investors a high-quality, low-cost way to invest in municipal and government bonds while providing superior service to our shareholders. We encourage you to let us know how we’re doing.

TABLE OF CONTENTS

Management’s Discussion of Fund Performance: | Unaudited |

Twelve Months Ended June 30, 2015i

The investment objective of our tax-free municipal bond funds is to provide a high level of tax-free income derived from state-specific municipal bonds without incurring undue risk to principal. The investment objective of our government bond fund is to provide a high level of taxable income derived from securities of the U.S. government and its agencies without incurring undue risk to principal. Similarly, the investment objective of the taxable municipal bond fund is to provide a high level of taxable income derived from taxable municipal securities without incurring undue risk to principal.

This report covers the 12-month period from June 30, 2014 through June 30, 2015 (the “reporting period”). During the first six months of the reporting period the economy grew at a moderate pace. Real gross domestic product (GDP) increased at a 5.0 percent annual rate during the third quarter of 2014 and then slowed during the fourth quarter of 2014 with real GDP growing at a 2.2 percent annual rate that quarter. The slowdown in economic growth was much more pronounced during the first quarter of 2015 with real GDP increasing at an anemic 0.6 percent annual rate. The downturn in growth in the first quarter appears to have been the result of a deceleration in exports, nonresidential fixed investment, and state and local government spending. Real GDP for the second quarter of 2015 increased at a 2.3 percent annual rate (advance estimate).

The national unemployment rate continued to trend down during the reporting period. The seasonally adjusted unemployment rate was 5.3 percent at the end of June. Even though the unemployment rate has declined gradually, job growth has been slow by historical standards. According to data compiled by the Nelson A. Rockefeller Institute of Government (“Rockefeller Institute”), seven and one half years after the start of the recession employment is only 2.4 percent above its prior peak, compared to 3.3 percent at this point after the 2001 recession, and more than 12 percent for each of the three prior recessions. The labor participation rate, which measures the number of people actively seeking employment, has also remained elevated by historical standards. Average hourly earnings grew at a 2.0 percent annual rate through June which is below trend.

Key measures of inflation for the most part remained subdued during the reporting period. The consumer price index (CPI) increased 0.1 percent on a year-over-year basis through June. Excluding food and energy, the core CPI increased 1.8 percent year-over-year. The Federal Reserve’s preferred inflation index, the personal consumption expenditure price index (PCE), increased 0.3 percent on a year-over-year basis through June. The core PCE increased 1.3 percent year-over year. All major inflation indices remained at or below the 2 percent target rate set by the Federal Reserve. Near-term and long-term inflation expectations have also remained stable.

Against this backdrop, the Federal Open Market Committee (FOMC) continued to maintain a highly accommodative monetary policy. The FOMC kept the federal funds target rate at 0 to 1/4 percent during the reporting period and also kept the Federal Reserve’s holdings of longer-term securities at an elevated level to help maintain accommodative financial conditions. In its most recent statement, the FOMC indicated that if the economy continues to evolve as it expects economic conditions likely would make it appropriate to raise the federal funds target rate at some point this year.

State and local governments have continued to successfully address ongoing fiscal challenges. However, the slow economic recovery has contributed to weak growth in state tax revenues. According to data compiled by the Rockefeller Institute, seven and one half years after the start of the recession inflation-adjusted state government tax revenue is only 5 percent above its pre-recession level. In the four preceding recoveries, inflation-adjusted state tax revenue by this point had grown several times as much, ranging from 15 percent to 25 percent above prerecession revenue. The sales tax has been the weakest of the major taxes which reflects the slow growth in personal consumption expenditures. Income tax revenues have remained relatively strong despite lower capital gains tax receipts.

In this environment, state budgets in most jurisdictions have shifted away from capital intensive construction and infrastructure repairs and have focused primarily on health care and benefit payments to retired public employees. State and local governments have continued to cut public employment as they have reduced spending. A surge in Medicaid enrollments in a number of states (including Kentucky) that opted to expand Medicaid under the Affordable Care Act has recently caused several states to significantly raise their Medicaid cost estimates.

Returns in the municipal bond market were positive for the 12-month period under review. The Barclays Capital Municipal Bond Index, which tracks investment grade municipal securities across all sectors and maturities, had a total return of 3.00 percent for the twelve month period ended June 30, 2015.

i

Municipal bonds turned in a strong performance during the second half of 2014. A number of factors including declining interest rates, improving credit quality, and favorable supply/demand patterns led to lower yields and higher bond prices at the end of 2014. The strong performance was driven by credit and duration. Lower-rated investment grade bonds performed better than higher-rated credits and bonds with longer maturities outperformed those with shorter maturities.

The first half of 2015 was a slightly different story with municipal bonds turning in mostly a flat performance for the first six months of this year. Improving economic indicators, expectations that the Federal Reserve would start raising short-term interest rates, a significant increase in the supply of municipal bonds, and lower demand all acted to push yields higher and prices lower. The increase in yields was more pronounced on the long end of the yield curve with yields on the shorter end of the yield curve remaining relatively stable.

The municipal bond market experienced some “headline risk” during the review period. The Detroit Chapter 9 bankruptcy filing occurred during the second half of 2014. While the outcome was mixed for Detroit bondholders, fortunately it did not lead to any significant negative spillover in the general municipal bond market. The situation in Puerto Rico continued to deteriorate during the first half of 2015 and Puerto Rico’s governor surprised the market when he announced plans to implement a policy shift and undertake a broad restructuring that includes all Commonwealth debt. Notwithstanding these credit-specific events, the default rate on investment grade municipal bonds remained at very low levels. The default rate of the S&P Municipal Bond Index, which tracks 84,000 bonds from more than 22,000 issuers, was 0.17 percent in 2014, compared with about 0.11 percent in 2013.

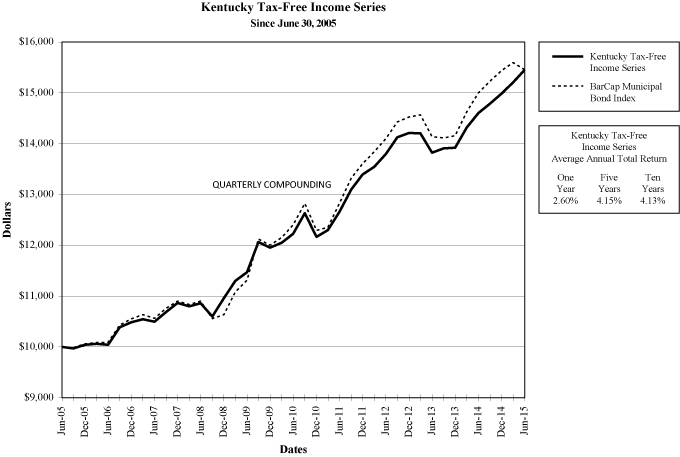

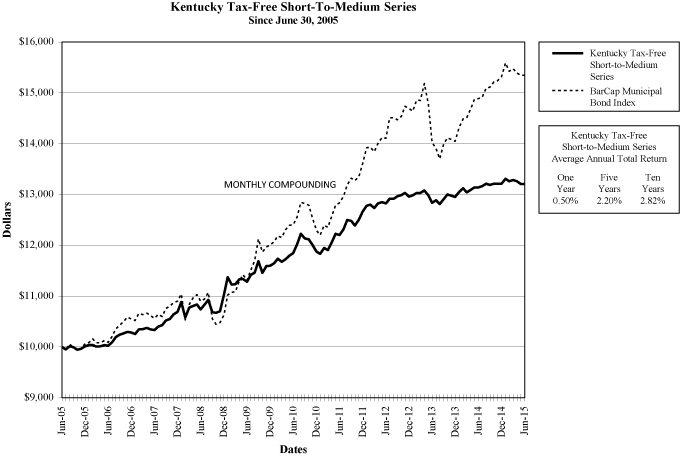

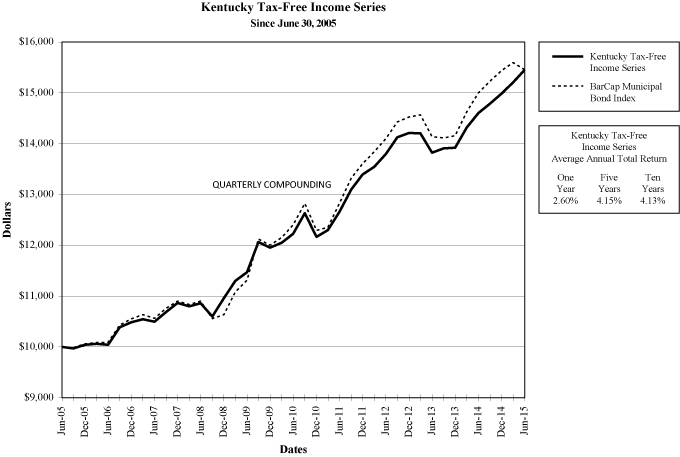

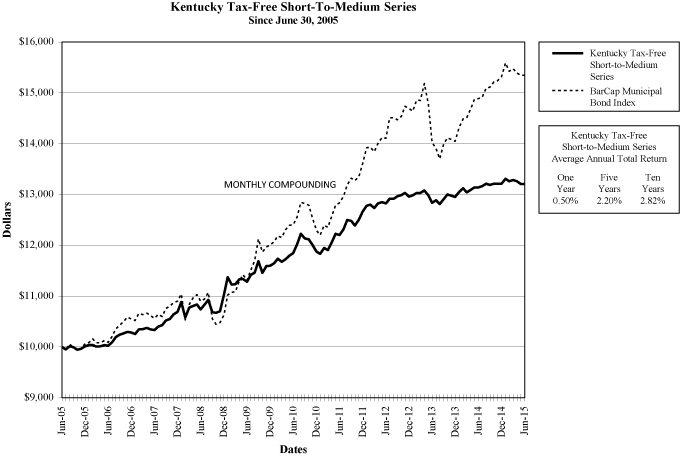

The Kentucky Tax-Free Income Series provided shareholders a total return of 2.60 percent for the twelve months ended June 30, 2015. The Kentucky Tax-Free Short-to-Medium Series provided shareholders with a total return of 0.50 percent during the period under review. The shorter duration of the funds as compared to the index led to the relative underperformance of the funds during the reporting period.

Kentucky’s economy is still recovering from the national recession that ended in June 2009. For the fiscal year that ended June 30, 2015, General Fund receipts which totaled $9.9 billion were 5.3 percent higher than FY 14 tax collections. Fiscal year 2011 was the last time the General Fund grew by more than 5 percent. Final FY 15 General Fund revenues exceeded the official revenue estimate by $165.4 million. Road Fund collections for FY 15 totaled $1,526.7 million, a decrease of 2.2 percent from the previous fiscal year. Road Fund revenue for FY 15 fell short of the official estimate by $20.0 million. The state’s annual average unemployment rate declined during the reporting period and stood at 5.1 percent at the end of June. In 2014, Kentucky had a per capita personal income of $37,654 which was below the national average of $46,129.

The state’s appropriation supported debt was rated Aa3 by Moody’s and A+ by Standard & Poor’s as of June 30, 2015. Kentucky had net tax-supported debt per capita of $1,921 as of calendar year-end 2014, which was substantially above the state net tax-supported debt median of $1,012 (Source: Moody’s Investors Services, 2015 State Debt Medians: Total Debt Falls for First Time in Almost 30 Years, June 24, 2015).

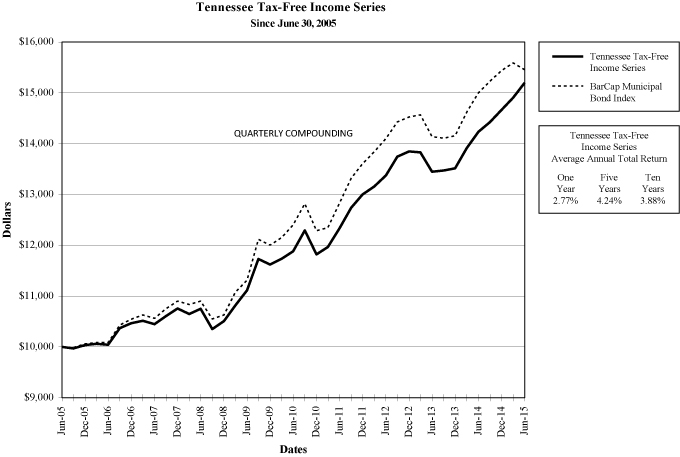

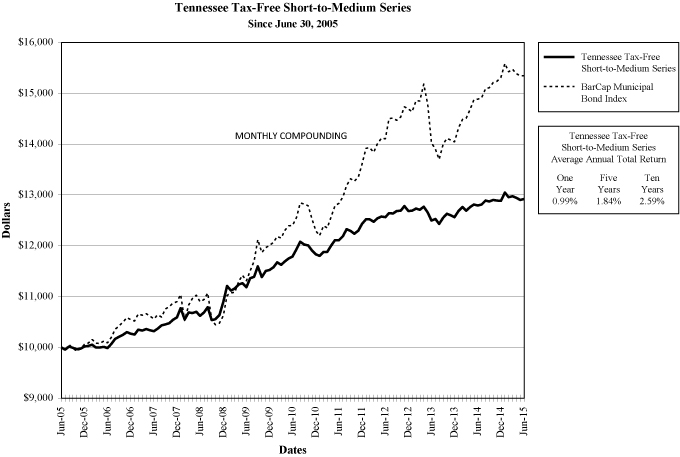

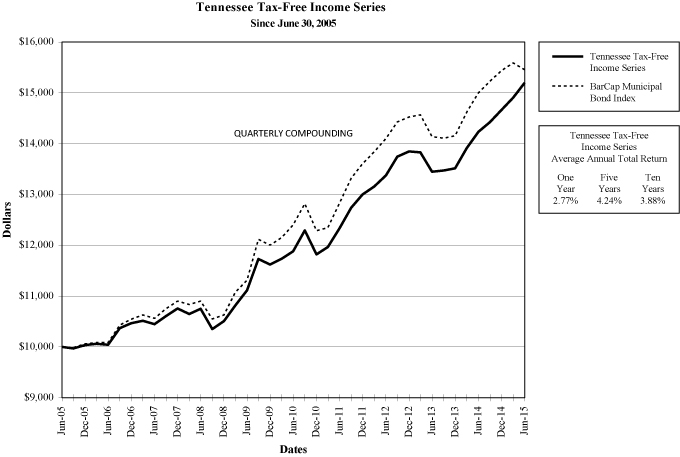

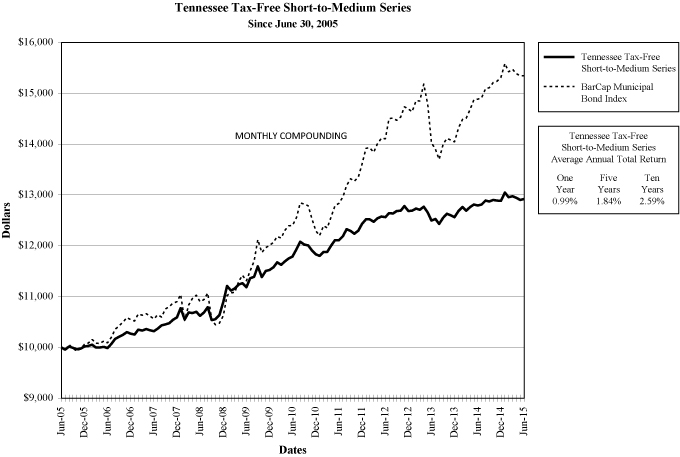

The Tennessee Tax-Free Income Series provided shareholders with a total return of 2.77 percent for the twelve months ended June 30, 2015. The Tennessee Tax-Free Short-to-Medium Series had a total return of 0.99 percent for the period under review. The shorter duration of the funds as compared to the index led to the relative underperformance of the funds during the reporting period.

Tennessee’s economy gained considerable strength in 2014 and during the first half of 2015. The state has continued to diversify its strong manufacturing base by adding high-tech employers. A new manufacturing innovation hub is being established around Knoxville where a consortium of companies, universities, and the Department of Energy are expected to invest more than $250 million. Nashville’s economy is also a bright spot for the state with the tourism and entertainment sectors continuing to propel the region’s economy. Demand for automobiles manufactured in the state remains strong and exports are up on a year-over-year basis. The state’s annual average unemployment rate at the end of June was 5.7 percent. In 2014, the state had a per capita personal income of $40,654 which was below the national average of $46,129.

Tennessee relies on a combination of a state sales tax, corporate income taxes, and the Hall income tax for its revenue. Total state revenue collections through June (on an accrual basis June is the eleventh month in the 2014-2015 fiscal year) were $551.3 million more than the budgeted estimate.

Tennessee’s general obligation (G.O.) bonds were rated Aaa by Moody’s and AA+ by Standard & Poor’s as of June 30, 2015. Tennessee had net tax-supported debt per capita of $327 as of calendar year-end 2014, which was substantially below the state net tax-supported debt median of $1,012 (Source: Moody’s Investors Services, 2015 State Debt Medians: Total Debt Falls for First Time in Almost 30 Years, June 24, 2015).

ii

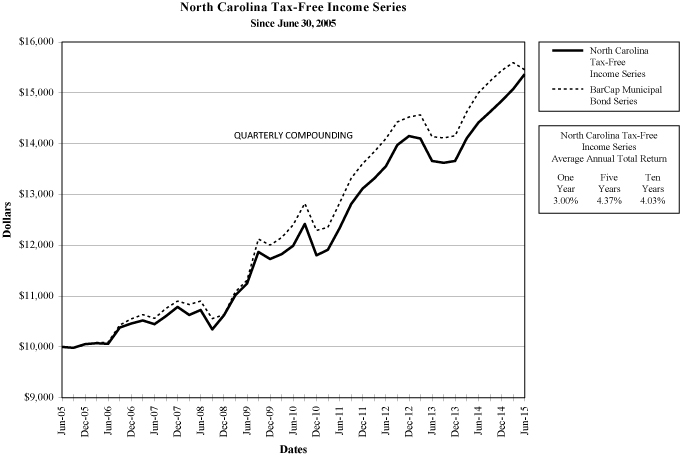

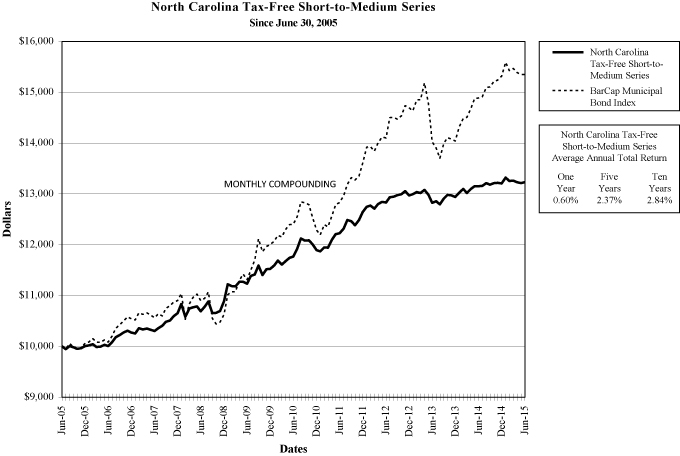

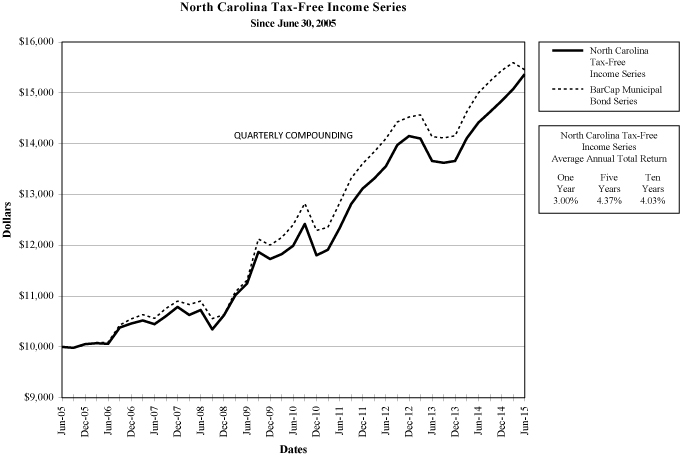

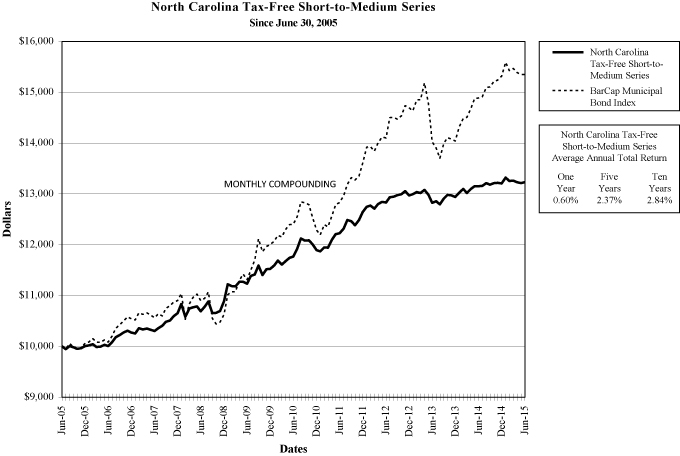

The North Carolina Tax-Free Income Series provided shareholders with a total return of 3.00 percent for the twelve months ended June 30, 2015. The North Carolina Tax-Free Short-to-Medium Series provided shareholders with a total return of 0.60 percent for the period under review. The North Carolina Tax-Free Income Series performed in line with the index while the shorter duration of the North Carolina Tax-Free Short-to-Medium Series led to its underperformance versus the index.

North Carolina’s economy has rebounded strongly from the national recession. The pace of economic activity picked up significantly during the reporting period with technology related jobs, particularly in Raleigh and Charlotte, leading the way. Hiring in the construction and manufacturing sectors has been relatively robust. Aerospace is an area of growing importance with recent growth driven primarily by General Electric Aviation which operates several plants around the state and Honda Aircraft which is headquartered in Greensboro. Conditions have also improved considerably over the past few years in the textile, apparel, and furniture sectors. The state finished FY 15 with a budget surplus of approximately $400 million. The state’s average annual unemployment rate at the end of June was 5.8 percent. In 2014, North Carolina had a per capita personal income of $39,646 which was below the national average of $46,129.

North Carolina’s G.O. bonds were rated Aaa by Moody’s and AAA by Standard & Poor’s as of June 30, 2015. North Carolina had net tax-supported debt per capita of $739 as of calendar year-end 2014, which was below the state net tax-supported debt median of $1,012 (Source: Moody’s Investors Services, 2015 State Debt Medians: Total Debt Falls for First Time in Almost 30 Years, June 24, 2015).

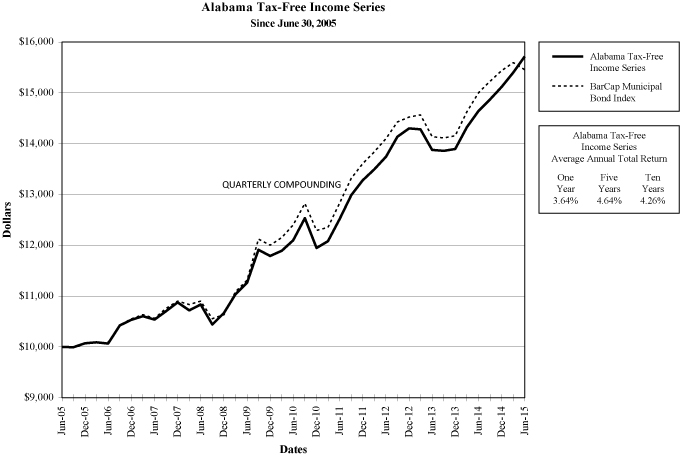

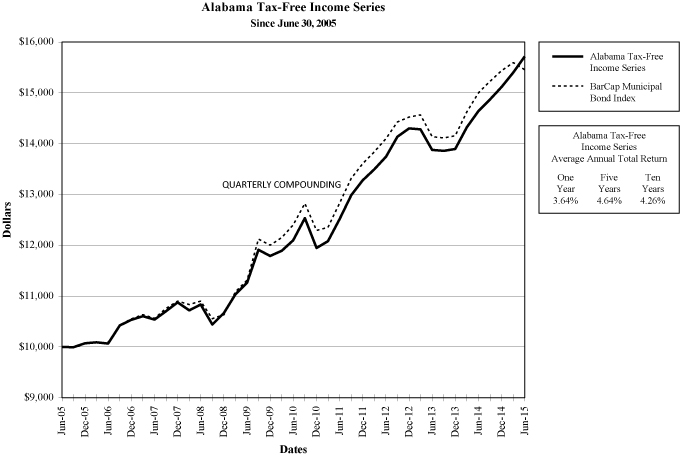

The Alabama Tax-Free Income Series provided shareholders with a total return of 3.64 percent for the twelve months ended June 30, 2015. The slightly longer duration of the fund as compared to the index led to the fund’s outperformance during the reporting period.

Alabama is finally beginning to see growth accelerate following years of relatively subdued recovery. Manufacturing, professional, and business services have led the recent improvement. Tuscaloosa is a bright spot for the state as it is home to the University of Alabama and a Mercedes plant that has recently undergone an expansion. An Airbus jetliner plant is being built in Mobile which will help the state’s manufacturing sector to continue to grow. The state’s average annual unemployment rate at the end of June stood at 6.1 percent. In 2014, Alabama had a per capita personal income of $37,493 which was below the national average of $46,129.

Alabama’s G.O. bonds were rated Aa1 by Moody’s and AA by Standard & Poor’s as of June 30, 2015. Alabama had net tax-supported debt per capita of $824 as of calendar year-end 2014, which was lower than the state net tax-supported debt median of $1,012 (Source: Moody’s Investors Services, 2015 State Debt Medians: Total Debt Falls for First Time in Almost 30 Years, June 24, 2015).

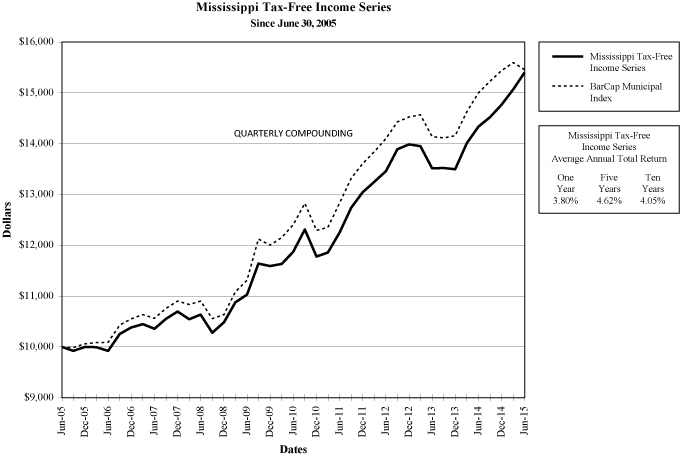

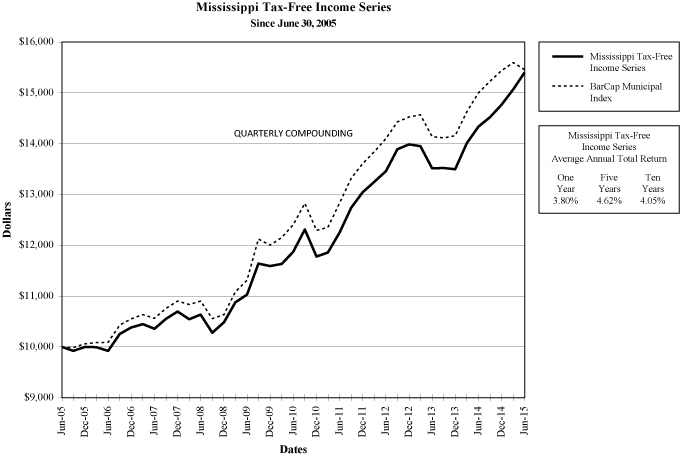

The Mississippi Tax-Free Income Series had a total return of 3.80 percent for the twelve month period ended June 30, 2015. The slightly longer duration of the fund as compared to the index led to its outperformance during the reporting period.

Mississippi’s economic recovery has also continued to lag behind the nation. Employment across all levels of government, the largest employer of Mississippians, has remained relatively flat. Out-migration has weighed on local industries, most notably retail, financial services and construction. The manufacturing sector has showed some signs of improvement. The shipbuilding industry continues to be negatively impacted by policies that would allow more competition for U.S. shipbuilding. The state’s average annual unemployment rate at the end of June was 6.6 percent. In 2014, Mississippi had a per capita personal income of $34,333 which was the lowest in the nation.

The state’s G.O. bonds were rated Aa2 by Moody’s and AA by Standard & Poor’s as of June 30, 2015. Mississippi has net tax-supported debt per capita of $1,747 as of calendar year-end 2014, which was higher than the state net tax-supported debt median of $1,012 (Source: Moody’s Investors Services, 2015 State Debt Medians: Total Debt Falls for First Time in Almost 30 Years, June 24, 2015).

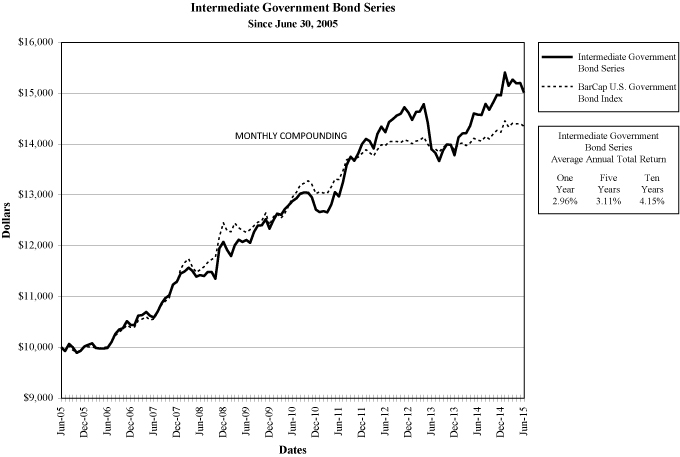

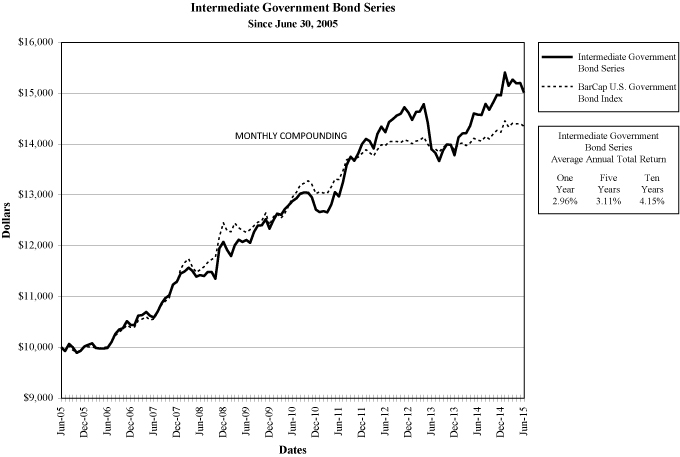

The Intermediate Government Bond Series had a total return of 2.96 percent for the twelve months ended June 30, 2015. The Barclays Capital U.S. Intermediate Government Bond Index had a total return of 1.79 percent for the one year period ended June 30, 2015. The longer nominal maturity and duration of the Intermediate Government Bond Series led to its relative outperformance as compared to the index during the reporting period.

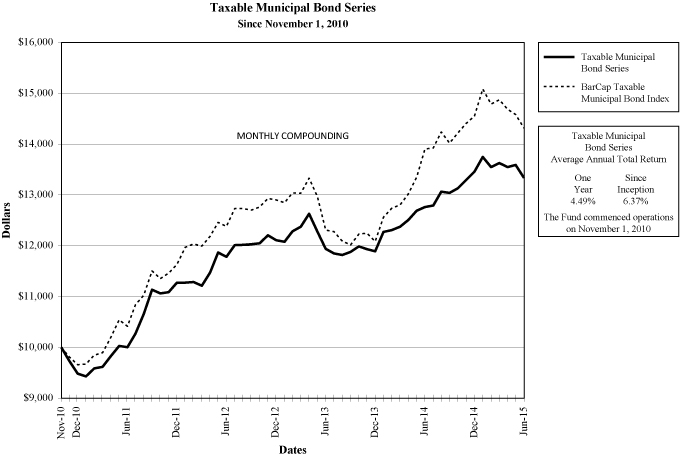

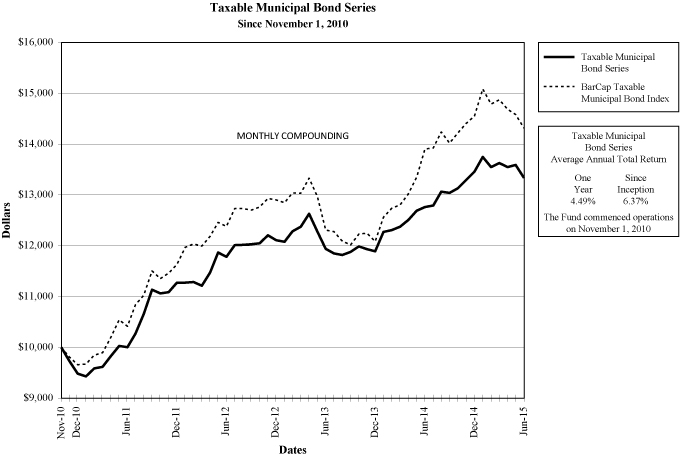

The Taxable Municipal Bond Series had a total return of 4.49 percent for the twelve month period ended June 30, 2015. The Barclays Capital Municipal Bond Taxable Index had a total return of 2.96 percent for the same period. The slightly longer duration of the fund compared to the index led to the out performance of the fund during the reporting period.

iii

Please note that index information is provided for reference only. No index can perfectly match the investments that make up a fund’s portfolio. In making investment decisions for our portfolios we do not attempt to track indices. The Barclays Capital Municipal Bond index is national in scope and does not necessarily reflect the performance of state-specific municipal bond funds. Indices do not take into account any operating expenses or transaction costs. An investment cannot be made directly in an index.

i Data are from the Bureau of Economic Analysis, the U.S. Department of Labor Bureau of Labor Statistics, and various other sources management deems to be reliable. Some of the quoted data are preliminary in nature and may be subject to revision. Any opinions expressed herein are those of the funds’ portfolio management and are current as of June 30, 2015. They are not guarantees of performance or investment results and should not be taken as investment advice. Past performance is not a guarantee of future performance and you may lose money investing in the funds.

iv

The illustrations below provide each Fund’s sector allocation and Unaudited |

summarize key information about each Fund’s investments.

| | | | |

Kentucky Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.08% | |

Aa/AA | | | 87.75% | |

A | | | 8.01% | |

Not Rated | | | 1.16% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Miscellaneous Public Improvement | | | 23.83% | |

Prerefunded | | | 15.17% | |

Municipal Utility Revenue | | | 12.74% | |

Turnpikes and Toll Roads Revenue | | | 11.04% | |

Refunded | | | 9.39% | |

School Improvements | | | 6.87% | |

Hospital and Healthcare Revenue | | | 6.04% | |

University Consolidated Education and Building Revenue | | | 5.71% | |

Public Facilities Revenue | | | 3.79% | |

Escrowed to Maturity | | | 2.43% | |

State and Local Mortgage Revenue | | | 1.53% | |

Airport Revenue | | | 0.79% | |

Miscellaneous Revenue | | | 0.23% | |

Other Assets Less Liabilities | | | 0.44% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Kentucky Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 2.04% | |

Aa/AA | | | 90.94% | |

A | | | 7.02% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Miscellaneous Public Improvement | | | 23.52% | |

School Improvements | | | 19.21% | |

Prerefunded | | | 13.28% | |

Refunded | | | 13.04% | |

Turnpikes and Toll Roads Revenue | | | 9.91% | |

Municipal Utility Revenue | | | 7.75% | |

University Consolidated Education and Building Revenue | | | 4.88% | |

Public Facilities Revenue | | | 3.90% | |

State and Local Mortgage Revenue | | | 1.75% | |

Hospital and Healthcare Revenue | | | 1.31% | |

Escrowed to Maturity | | | 0.22% | |

Other Assets Less Liabilities | | | 1.23% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Alabama Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 1.76% | |

Aa/AA | | | 89.39% | |

A | | | 6.05% | |

Baa/BBB | | | 0.00% | |

Not Rated | | | 2.80% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

School Improvement Revenue | | | 22.18% | |

Prerefunded | | | 18.22% | |

Municipal Utility Revenue | | | 17.04% | |

University Consolidated Education and Building Revenue | | | 14.46% | |

Public Facilities Revenue | | | 13.04% | |

Miscellaneous Public Improvement | | | 8.39% | |

Refunded | | | 5.17% | |

State and Local Mortgage Revenue | | | 0.47% | |

Industrial Revenue | | | 0.10% | |

Other Assets Less Liabilities | | | 0.93% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Mississippi Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 0.24% | |

Aa/AA | | | 82.49% | |

A | | | 16.47% | |

Baa/BBB | | | 0.65% | |

Not Rated | | | 0.15% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 27.64% | |

Municipal Utility Revenue | | | 15.83% | |

Public Facilities Revenue | | | 15.70% | |

Turnpikes and Toll Roads Revenue | | | 12.33% | |

Prerefunded | | | 11.29% | |

School Improvement Revenue | | | 5.54% | |

Miscellaneous Public Improvement | | | 4.08% | |

Hospital and Healthcare Revenue | | | 3.53% | |

Refunded | | | 1.95% | |

Airport Revenue | | | 0.65% | |

State and Local Mortgage Revenue | | | 0.23% | |

Other Assets Less Liabilities | | | 1.23% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

v

The illustrations below provide each Fund’s sector allocation and Unaudited |

summarize key information about each Fund’s investments.

| | | | |

Tennessee Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 5.39% | |

Aa/AA | | | 86.10% | |

A | | | 8.08% | |

Baa/BBB | | | 0.18% | |

Not Rated | | | 0.25% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Municipal Utility Revenue | | | 40.68% | |

Prerefunded | | | 15.53% | |

Public Facilities Revenue | | | 12.57% | |

Hospital and Healthcare Revenue | | | 8.71% | |

University Consolidated Education and Building Revenue | | | 6.94% | |

Refunded | | | 5.90% | |

State and Local Mortgage Revenue | | | 3.32% | |

Miscellaneous Public Improvement | | | 2.08% | |

School Improvement Revenue | | | 2.05% | |

Industrial Revenue | | | 0.87% | |

Escrowed to Maturity | | | 0.11% | |

Other Assets Less Liabilities | | | 1.24% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Tennessee Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.35% | |

Aa/AA | | | 72.83% | |

A | | | 20.37% | |

Not Rated | | | 3.45% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Public Facilities Revenue | | | 17.89% | |

Municipal Utility Revenue | | | 16.12% | |

Refunded | | | 13.11% | |

Prerefunded | | | 12.31% | |

Public Facilities Revenue | | | 11.52% | |

School Improvement Revenue | | | 10.51% | |

Hospital and Healthcare Revenue | | | 6.58% | |

University Consolidated Education and Building Revenue | | | 6.11% | |

State and Local Mortgage Revenue | | | 4.54% | |

Escrowed to Maturity | | | 0.24% | |

Other Assets Less Liabilities | | | 1.07% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

North Carolina Tax-Free Income Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 3.04% | |

Aa/AA | | | 79.51% | |

A | | | 15.45% | |

Baa/BBB | | | 0.92% | |

Not Rated | | | 1.08% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

University Consolidated Education and Building Revenue | | | 18.98% | |

Municipal Utility Revenue | | | 17.43% | |

Prefunded | | | 16.60% | |

Hospital and Healthcare | | | 13.22% | |

Refunded | | | 9.26% | |

Public Facilities Revenue | | | 6.92% | |

Miscellaneous Public Improvement | | | 4.95% | |

Airport Revenue | | | 3.81% | |

School Improvement Revenue | | | 3.73% | |

Turnpikes and Toll Roads Revenue | | | 1.90% | |

Lease Revenue | | | 1.39% | |

Miscellaneous Revenue | | | 0.46% | |

Other Assets Less Liabilities | | | 1.35% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

North Carolina Tax-Free Short-to-Medium Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 0.62% | |

Aa/AA | | | 86.98% | |

A | | | 12.20% | |

Not Rated | | | 0.20% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Prefunded | | | 21.46% | |

Municipal Utility Revenue | | | 21.24% | |

Refunded | | | 15.52% | |

Public Facilities Revenue | | | 11.57% | |

School Improvement Revenue | | | 8.37% | |

Hospital and Healthcare Revenue | | | 5.55% | |

Miscellaneous Public Improvement | | | 5.26% | |

University Consolidated Education and Building Revenue | | | 4.86% | |

Airport Revenue | | | 2.32% | |

Turnpikes and Toll Roads Revenue | | | 1.43% | |

Lease Revenue | | | 1.10% | |

State and Local Mortgage Revenue | | | 0.46% | |

Escrowed to Maturity | | | 0.20% | |

Other Assets Less Liabilities | | | 0.66% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

vi

Unaudited The illustrations below provide each Fund’s sector allocation and |

summarize key information about each Fund’s investments.

| | | | |

Intermediate Government Bond Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 100.00% | |

| | | | | |

| | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Federal Farm Credit | | | 55.16% | |

Federal Home Loan Bank | | | 34.90% | |

Federal National Mortgage Association | | | 6.72% | |

Other Assets Less Liabilities | | | 3.22% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| | | | |

Taxable Municipal Bond Series | |

| CREDIT QUALITY (reflects highest credit rating)* | | % of Net Assets

at Fair Value | |

Aaa/AAA | | | 0.38% | |

Aa/AA | | | 82.91% | |

A | | | 16.71% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| COMPOSITION | | | |

| | | % of Net Assets | |

Public Facilities Revenue | | | 32.92% | |

Municipal Utility Revenue | | | 27.05% | |

School Improvement Revenue | | | 14.17% | |

Miscellaneous Public Improvement | | | 10.89% | |

Turnpikes and Toll Roads Revenue | | | 5.21% | |

Hospital and Healthcare Revenue | | | 2.48% | |

Marina and Port Authority Revenue | | | 2.21% | |

University Consolidated Education and Building Revenue | | | 1.12% | |

Other Assets Less Liabilities | | | 3.95% | |

| | | | | |

| | | | 100.00% | |

| | | | | |

| * | | Bond ratings reflect the highest credit quality rating assigned to a specific bond by a Nationally Recognized Statistical Rating Organization (NRSRO) as of June 30, 2015. |

vii

PERFORMANCE COMPARISON (Unaudited)

The following graphs compare the change in value of a $10,000 investment in each series of Dupree Mutual Funds with the change in value of a $10,000 investment in a comparable index. The comparisons are made over 10 years or since the inception of the series, if shorter than ten years. Results are for the fiscal years ended June 30.

Notes on Graphs:

Results reflect reinvestment of all dividend and capital gain distributions. No index can perfectly match the investments that make up a fund’s portfolio. For each series, we have selected an index that we believe gives the most accurate picture of how the series performed during the reporting period. The investor should understand that an index is a mathematical hypothesis and does not reflect a real market situation. For example, the portfolio of each index is replaced with an entirely different portfolio each year without reflecting operating expenses or transaction costs, an impossibility in reality. On the other hand, the fund’s performance reflects not only these factors but management costs as well. Past performance is not indicative of future results.

The performance tables and the graphs above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Please note that all legacy Lehman Brothers benchmark indices were rebranded as Barclays Capital (“BarCap”) indices in November 2008.

viii

ix

x

xi

xii

xiii

xiv

xv

xvi

xvii

xviii

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2015

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| SCHOOL IMPROVEMENT BONDS | | | | | | | | | | | |

| 22.18% of Net Assets | | | | | | | | | | | | | | | | | | |

Alabaster AL Board of Education Special Tax Warrants | | | 5.000 | % | | | 09/01/2039 | | | A1/AA* | | $ | 250,000 | | | $ | 274,045 | |

Etowah County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 09/01/2037 | | | A+* | | | 200,000 | | | | 218,072 | |

Jasper AL Warrants | | | 5.000 | | | | 03/01/2032 | | | A2/AA* | | | 450,000 | | | | 496,890 | |

Limestone County AL Board of Education | | | 5.000 | | | | 07/01/2033 | | | AA* | | | 255,000 | | | | 282,864 | |

Madison County AL Board of Education Capital Outlay Tax | | | 4.950 | | | | 09/01/2025 | | | Aa3/AA* | | | 100,000 | | | | 110,343 | |

Madison County AL Board of Education Capital Outlay Tax | | | 5.100 | | | | 09/01/2028 | | | Aa3/AA* | | | 285,000 | | | | 314,492 | |

Madison County AL Board of Education Capital Outlay Tax | | | 5.125 | | | | 09/01/2034 | | | Aa3/AA* | | | 505,000 | | | | 554,525 | |

Mobile AL Public Education Building Authority | | | 5.000 | | | | 03/01/2033 | | | A3/AA*/AA-@ | | | 200,000 | | | | 215,408 | |

Montgomery County AL Board of Education Capital Outlay School Warrants | | | 5.000 | | | | 09/01/2039 | | | AA* | | | 150,000 | | | | 163,644 | |

Montgomery County AL Warrants | | | 5.000 | | | | 03/01/2028 | | | Aa1/AA* | | | 175,000 | | | | 185,715 | |

Morgan County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 03/01/2035 | | | AA-* | | | 1,050,000 | | | | 1,152,880 | |

Opelika AL Warrants | | | 5.000 | | | | 11/01/2031 | | | Aa2/AA* | | | 150,000 | | | | 170,525 | |

Phenix City AL School Warrants | | | 5.000 | | | | 08/01/2024 | | | AA-* | | | 80,000 | | | | 84,853 | |

Shelby County AL Board of Education Capital Outlay Warrants | | | 5.000 | | | | 02/01/2031 | | | Aa2/A* | | | 615,000 | | | | 674,495 | |

Shelby County AL Board of Education Special Tax School Warrants | | | 5.000 | | | | 02/01/2025 | | | Aa3/A+* | | | 300,000 | | | | 307,584 | |

Sumter County AL Limited Obligation School Warrants | | | 5.100 | | | | 02/01/2034 | | | NR | | | 100,000 | | | | 102,395 | |

Sumter County AL Limited Obligation School Warrants | | | 5.200 | | | | 02/01/2039 | | | NR | | | 95,000 | | | | 98,224 | |

Troy AL Public Educational Building Authority Educational | | | 5.250 | | | | 12/01/2036 | | | A2/AA* | | | 225,000 | | | | 253,136 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 5,660,090 | |

| PREREFUNDED BONDS | | | | | | | | | | | |

| 18.22% of Net Assets | | | | | | | | | | | | | | | | | | |

AL State Public School & College Authority Capital Improvement | | | 5.000 | | | | 12/01/2025 | | | Aa1/AA* | | | 640,000 | | | | 702,330 | |

AL State Public School & College Authority Refinancing | | | 5.000 | | | | 05/01/2024 | | | Aa1/AA*/AA+@ | | | 125,000 | | | | 142,704 | |

AL State Public School & College Authority Capital Improvement | | | 5.000 | | | | 12/01/2024 | | | Aa1/AA* | | | 100,000 | | | | 109,739 | |

Albertville AL Warrants | | | 5.000 | | | | 02/01/2035 | | | AA* | | | 110,000 | | | | 124,670 | |

Auburn University AL General Fee Revenue | | | 5.000 | | | | 06/01/2027 | | | Aa2/AA* | | | 300,000 | | | | 324,312 | |

Auburn University AL General Fee Revenue | | | 5.000 | | | | 06/01/2032 | | | Aa2/AA* | | | 45,000 | | | | 46,872 | |

Auburn University AL General Fee Revenue | | | 5.000 | | | | 06/01/2033 | | | Aa2/AA* | | | 420,000 | | | | 453,701 | |

Auburn University AL General Fee Revenue | | | 5.000 | | | | 06/01/2038 | | | Aa2/AA* | | | 600,000 | | | | 648,144 | |

Elmore County AL Public Education Cooperative | | | 5.000 | | | | 08/01/2032 | | | Aa3 | | | 50,000 | | | | 54,368 | |

Huntsville AL Public Building Authority Lease Revenue | | | 5.000 | | | | 10/01/2027 | | | Aa1/AA-* | | | 130,000 | | | | 139,720 | |

Huntsville AL Public Building Authority Lease Revenue | | | 5.000 | | | | 10/01/2033 | | | Aa1/AA-* | | | 65,000 | | | | 69,860 | |

Montgomery County AL Public Building Authority | | | 5.000 | | | | 03/01/2031 | | | Aa2/AA-* | | | 105,000 | | | | 108,218 | |

Montgomery County AL Public Building Authority | | | 5.000 | | | | 03/01/2031 | | | Aa2 | | | 70,000 | | | | 72,174 | |

Muscle Shoals AL Utilities Board Water & Sewer | | | 5.750 | | | | 12/01/2033 | | | NR | | | 330,000 | | | | 379,794 | |

North Marshall AL Utilities Board Water Revenue | | | 5.100 | | | | 10/01/2030 | | | AA* | | | 375,000 | | | | 423,180 | |

Oxford AL Warrants | | | 5.000 | | | | 10/01/2036 | | | Aa2 | | | 50,000 | | | | 51,075 | |

Phenix City AL School Warrants | | | 5.000 | | | | 02/01/2017 | | | NR | | | 120,000 | | | | 128,124 | |

University of AL General Revenue | | | 5.000 | | | | 07/01/2028 | | | Aa2/AA-* | | | 325,000 | | | | 339,879 | |

West Morgan — East Lawrence Water Authority AL Water Revenue | | | 5.000 | | | | 08/15/2025 | | | A2/AA* | | | 300,000 | | | | 330,369 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 4,649,233 | |

| MUNICIPAL UTILITY REVENUE BONDS | | | | | | | | | | | |

| 17.04% of Net Assets | | | | | | | | | | | | | | | | | | |

Bessemer AL Governmental Utility Services Water Supply | | | 4.750 | | | | 06/01/2033 | | | A2 | | | 100,000 | | | | 105,404 | |

Birmingham AL Waterworks Board Water Revenue | | | 5.000 | | | | 01/01/2026 | | | Aa2/AA* | | | 80,000 | | | | 91,282 | |

Birmingham AL Waterworks Board Water Revenue | | | 4.750 | | | | 01/01/2036 | | | Aa2/AA* | | | 215,000 | | | | 227,573 | |

Birmingham AL Waterworks Board Water Revenue | | | 5.000 | | | | 01/01/2038 | | | Aa2/AA* | | | 550,000 | | | | 602,883 | |

Chatom AL Industrial Board Gulf Opportunity Zone | | | 5.000 | | | | 08/01/2037 | | | A3/AA*/A-@ | | | 150,000 | | | | 163,607 | |

Cullman AL Utility Board Water Revenue | | | 4.750 | | | | 09/01/2037 | | | A1/AA* | | | 400,000 | | | | 423,828 | |

Cullman County AL Water Revenue | | | 5.000 | | | | 05/01/2021 | | | A3/AA-* | | | 125,000 | | | | 125,276 | |

Fort Payne AL Waterworks Board Water Revenue | | | 4.750 | | | | 07/01/2034 | | | AA-* | | | 100,000 | | | | 109,719 | |

Huntsville AL Water Systems Revenue Bonds | | | 5.000 | | | | 11/01/2033 | | | Aa1/AAA* | | | 300,000 | | | | 326,073 | |

Jasper AL Water Works and Sewer Board Utility Revenue | | | 5.000 | | | | 06/01/2030 | | | A+* | | | 455,000 | | | | 508,904 | |

Limestone County AL Water & Sewer Authority | | | 5.000 | | | | 12/01/2029 | | | A+* | | | 50,000 | | | | 51,145 | |

Limestone County AL Water & Sewer Authority | | | 5.000 | | | | 12/01/2033 | | | A+* | | | 300,000 | | | | 332,412 | |

The accompanying notes are an integral part of the financial statements.

1

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2015

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Limestone County AL Water & Sewer Authority | | | 5.000 | % | | | 12/01/2034 | | | A+* | | $ | 250,000 | | | $ | 287,153 | |

Muscle Shoals AL Utilities Board Water & Sewer | | | 5.750 | | | | 12/01/2033 | | | AA-* | | | 100,000 | | | | 112,970 | |

Opelika AL Water Board Revenue | | | 5.000 | | | | 06/01/2037 | | | Aa3/AA* | | | 250,000 | | | | 276,433 | |

Opelika AL Water Board Revenue | | | 5.250 | | | | 06/01/2036 | | | Aa3/A+* | | | 70,000 | | | | 78,410 | |

Phenix City AL Water and Sewer Revenue | | | 5.000 | | | | 08/15/2034 | | | A3/AA*/AA-@ | | | 90,000 | | | | 97,880 | |

Tallassee AL Water Gas and Sewer Warrants | | | 5.125 | | | | 05/01/2036 | | | A2/AA* | | | 75,000 | | | | 81,593 | |

West Morgan East Lawrence AL Water & Sewer Revenue | | | 4.850 | | | | 08/15/2035 | | | AA* | | | 250,000 | | | | 265,940 | |

West Morgan East Lawrence AL Water and Sewer Revenue | | | 4.750 | | | | 08/15/2030 | | | AA* | | | 75,000 | | | | 79,796 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 4,348,281 | |

| UNIVERSITY CONSOLIDATED EDUCATION AND BUILDING REVENUE BONDS | | | | | | | | | | | |

| 14.46% of Net Assets | | | | | | | | | | | | | | | | | | |

AL State Private Colleges & Universities Tuskegee University | | | 4.750 | | | | 09/01/2026 | | | AA* | | | 500,000 | | | | 504,705 | |

Auburn University AL General Fee Revenue | | | 5.000 | | | | 06/01/2022 | | | Aa2/AA-* | | | 50,000 | | | | 55,071 | |

Auburn University AL General Fee Revenue | | | 5.000 | | | | 06/01/2036 | | | Aa2/AA-* | | | 150,000 | | | | 165,131 | |

Jacksonville AL State University Revenue Tuition and Fee | | | 5.125 | | | | 12/01/2033 | | | AA* | | | 450,000 | | | | 493,434 | |

Troy University AL Facilities Revenue | | | 5.000 | | | | 11/01/2028 | | | A1/AA* | | | 250,000 | | | | 282,300 | |

Tuscaloosa AL Public Education Building Authority Student Housing | | | 6.375 | | | | 07/01/2028 | | | AA* | | | 250,000 | | | | 282,973 | |

Tuscaloosa AL Public Education Building Authority Student Housing | | | 6.750 | | | | 07/01/2033 | | | AA* | | | 495,000 | | | | 563,973 | |

University of AL Birmingham | | | 5.000 | | | | 10/01/2037 | | | Aa2/AA-* | | | 225,000 | | | | 249,849 | |

University of Alabama General Revenue | | | 5.000 | | | | 07/01/2034 | | | Aa2/AA-* | | | 250,000 | | | | 273,360 | |

University of South AL University Revenues Facilities Capital | | | 4.750 | | | | 08/01/2033 | | | Aa1/AA+* | | | 100,000 | | | | 107,753 | |

University of South AL University Revenues Facilities | | | 5.000 | | | | 08/01/2029 | | | Aa1/AA+* | | | 550,000 | | | | 599,995 | |

University of South AL University Revenues Refunding Tuition | | | 5.000 | | | | 12/01/2029 | | | Aa1/AA+* | | | 105,000 | | | | 110,506 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 3,689,050 | |

| PUBLIC FACILITIES REVENUE BONDS | | | | | | | | | | | |

| 13.04% of Net Assets | | | | | | | | | | | | | | | | | | |

Anniston AL Public Building Authority | | | 5.000 | | | | 03/01/2032 | | | A2/AA* | | | 400,000 | | | | 434,020 | |

Anniston AL Public Building Authority DHR Project | | | 5.250 | | | | 05/01/2030 | | | AA-* | | | 50,000 | | | | 56,738 | |

Anniston AL Public Building Authority Revenue | | | 5.500 | | | | 05/01/2033 | | | AA-* | | | 200,000 | | | | 228,930 | |

Bessemer AL Public Educational Building Authority Revenue | | | 5.000 | | | | 07/01/2030 | | | AA* | | | 250,000 | | | | 278,225 | |

Huntsville AL Public Building Authority Lease Revenue | | | 5.000 | | | | 10/01/2027 | | | Aa1/AA+* | | | 245,000 | | | | 260,521 | |

Huntsville AL Public Building Authority Lease Revenue | | | 5.000 | | | | 10/01/2033 | | | Aa1/AA+* | | | 110,000 | | | | 116,201 | |

Lowndes County AL Warrants | | | 5.250 | | | | 02/01/2037 | | | A2/AA* | | | 250,000 | | | | 275,750 | |

Montgomery AL Warrants | | | 5.000 | | | | 02/01/2030 | | | A1/AA* | | | 300,000 | | | | 335,196 | |

Trussville AL Warrants | | | 5.000 | | | | 10/01/2039 | | | Aa2/AA+* | | | 1,220,000 | | | | 1,340,036 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 3,325,617 | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | | | | | | | | | | | |

| 8.39% of Net Assets | | | | | | | | | | | | | | | | | | |

AL Incentives Financing Authority Special Obligation | | | 5.000 | | | | 09/01/2029 | | | AA-* | | | 125,000 | | | | 140,353 | |

Daphne AL Warrants | | | 5.000 | | | | 04/01/2023 | | | Aa2/AA+* | | | 250,000 | | | | 258,208 | |

Jasper AL Warrants | | | 5.000 | | | | 03/01/2031 | | | A2/AA* | | | 250,000 | | | | 277,625 | |

Madison AL Warrants | | | 5.000 | | | | 04/01/2035 | | | Aa2/AA+* | | | 350,000 | | | | 392,123 | |

Mobile AL Refunding Warrants | | | 5.000 | | | | 02/15/2027 | | | Aa2/A+* | | | 335,000 | | | | 375,331 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 10/15/2034 | | | Aa1/AA+* | | | 175,000 | | | | 192,551 | |

Tuscaloosa AL Warrants | | | 5.125 | | | | 01/01/2039 | | | Aa1/AA+* | | | 150,000 | | | | 165,513 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 07/01/2034 | | | Aa1/AA+* | | | 300,000 | | | | 337,950 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 2,139,654 | |

| REFUNDING BONDS | | | | | | | | | | | |

| 5.17% of Net Assets | | | | | | | | | | | | | | | | | | |

Enterprise AL Warrants | | | 4.500 | | | | 11/01/2032 | | | Aa3/AA-* | | | 115,000 | | | | 120,858 | |

Northport AL Warrants | | | 5.000 | | | | 08/01/2040 | | | AA-* | | | 735,000 | | | | 800,444 | |

Tuscaloosa AL Warrants | | | 5.000 | | | | 01/01/2032 | | | Aa1/AA+* | | | 350,000 | | | | 396,855 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 1,318,157 | |

| STATE AND LOCAL MORTGAGE/HOUSING BONDS | | | | | | | | | | | |

| .47% of Net Assets | | | | | | | | | | | | | | | | | | |

AL Housing Finance Authority Single Family Mortgage Revenue | | | 5.375 | | | | 10/01/2033 | | | Aaa | | | 115,000 | | | | 119,318 | |

| | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

2

DUPREE MUTUAL FUNDS — ALABAMA TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Alabama Municipal Bonds

June 30, 2015

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| INDUSTRIAL REVENUE/POLLUTION CONTROL BONDS | | | | | | | | | | | |

| .10% of Net Assets | | | | | | | | | | | | | | | | | | |

Auburn AL Industrial Development Board Facilities Revenue | | | 6.200 | % | | | 11/01/2020 | | | A* | | $ | 25,000 | | | $ | 25,006 | |

| | | | | | | | | | | | | | | | | | |

Total Investments 99.07% of Net Assets (cost $24,124,100) (See (a) below for further explanation) | | | $ | 25,274,406 | |

| | | | | | | | | | | | | | | | | | |

Other assets in excess of liabilities 0.93% | | | | | | | | | | | | | | | | | 236,171 | |

| | | | | | | | | | | | | | | | | | |

Net Assets 100% | | | | | | | | | | | | | | | | $ | 25,510,577 | |

| | | | | | | | | | | | | | | | | | |

| | * | | Standard and Poor’s Corporation |

| | @ | | Fitch’s Investors Service |

| | | | (All other ratings by Moody’s Investors Service, Inc.) |

| | # | | Bond ratings are unaudited and not covered by Report of Independent Registered Public Accounting Firm. |

| (a) | | Cost for federal income tax purposes is $24,123,968 and net unrealized appreciation of investments is as follows: |

| | | | | | |

| | Unrealized appreciation | | $ | 1,206,661 | |

| | Unrealized depreciation | | | (56,223 | ) |

| | | | | | |

| | Net unrealized appreciation | | $ | 1,150,438 | |

| | | | | | |

Other Information

The following is a summary of the inputs used, as of June 30, 2015, involving the Fund’s investments in securities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in the accompanying Notes to Financial Statements.

| | | | | | |

| | | Valuation Inputs | | Municipal Bonds | |

Level 1 | | Quoted Prices | | $ | — | |

Level 2 | | Other Significant Observable Inputs | | | 25,274,406 | |

Level 3 | | Significant Unobservable Inputs | | | — | |

| | | | | | |

| | | | $ | 25,274,406 | |

| | | | | | |

The accompanying notes are an integral part of the financial statements.

3

ALABAMA TAX-FREE INCOME SERIES

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2015

| | | | | | | | |

ASSETS: | | | | | | | | |

Investments in securities, at fair value (Cost: $24,124,100) | | | | | | $ | 25,274,406 | |

Cash | | | | | | | 37,045 | |

Interest receivable | | | | | | | 342,934 | |

| | | | | | | | |

Total assets | | | | | | | 25,654,385 | |

LIABILITIES: | | | | | | | | |

Payable for: | | | | | | | | |

Distributions to shareholders | | | 105,643 | | | | | |

Fund shares redeemed | | | 11,781 | | | | | |

Investment advisory fee | | | 9,054 | | | | | |

Transfer agent fee | | | 3,687 | | | | | |

Trustee fees | | | 521 | | | | | |

Accrued expenses | | | 13,122 | | | | | |

| | | | | | | | |

Total liabilities | | | | | | | 143,808 | |

| | | | | | | | |

NET ASSETS: | | | | | | | | |

Capital | | | | | | | 24,403,561 | |

Accumulated net investment income | | | | | | | 132 | |

Accumulated net realized loss on investment transactions | | | | | | | (43,422 | ) |

Net unrealized appreciation in value of investments | | | | | | | 1,150,306 | |

| | | | | | | | |

Net assets at value | | | | | | $ | 25,510,577 | |

| | | | | | | | |

NET ASSET VALUE, offering price and redemption price per share

(2,063,296 shares outstanding; unlimited number of shares authorized; no par value) | | | | | | $ | 12.36 | |

| | | | | | | | |

STATEMENT OF OPERATIONS

For the year ended June 30, 2015

| | | | |

Net investment income: | | | | |

Interest income | | $ | 1,005,889 | |

| | | | |

Expenses: | | | | |

Investment advisory fee | | | 126,790 | |

Transfer agent fee | | | 36,430 | |

Custodian expense | | | 9,517 | |

Professional fees | | | 7,501 | |

Trustees fees | | | 2,521 | |

Other expenses | | | 16,496 | |

| | | | |

Total expenses | | | 199,255 | |

Fees waived by Adviser | | | (19,345 | ) |

Custodian expense reduction | | | (16 | ) |

| | | | |

Net expenses | | | 179,894 | |

| | | | |

Net investment income | | | 825,995 | |

| | | | |

Realized and unrealized gain on investments: | | | | |

Net realized gain | | | 60,994 | |

Net change in unrealized appreciation/depreciation | | | 16,768 | |

| | | | |

Net realized and unrealized gain on investments | | | 77,762 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 903,757 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

4

ALABAMA TAX-FREE INCOME SERIES

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended June 30, 2015 and 2014

| | | | | | | | |

| | | 2015 | | | 2014 | |

Operations: | | | | | | | | |

Net investment income | | $ | 825,995 | | | $ | 776,635 | |

Net realized gain/(loss) on investments | | | 60,994 | | | | (104,413 | ) |

Net change in unrealized appreciation/depreciation | | | 16,768 | | | | 478,821 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 903,757 | | | | 1,151,043 | |

Distributions from net investment income | | | (825,972 | ) | | | (776,616 | ) |

Distributions from capital gains | | | — | | | | (29,276 | ) |

Net Fund share transactions (Note 4) | | | 2,074,414 | | | | (1,286,648 | ) |

| | | | | | | | |

Total increase/(decrease) | | | 2,152,199 | | | | (941,497 | ) |

Net assets: | | | | | | | | |

Beginning of year | | | 23,358,378 | | | | 24,299,875 | |

| | | | | | | | |

End of year | | $ | 25,510,577 | | | $ | 23,358,378 | |

| | | | | | | | |

Accumulated Net Investment Income | | $ | 132 | | | $ | 109 | |

| | | | | | | | |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding: | | For the years ended June 30, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

Net asset value, beginning of year | | | $12.32 | | | | $12.10 | | | | $12.41 | | | | $11.72 | | | | $11.77 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.41 | | | | 0.42 | | | | 0.43 | | | | 0.44 | | | | 0.45 | |

Net gains/(losses) on securities | | | 0.04 | | | | 0.23 | | | | (0.30 | ) | | | 0.70 | | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.45 | | | | 0.65 | | | | 0.13 | | | | 1.14 | | | | 0.40 | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

Distributions from net investment income | | | (0.41 | ) | | | (0.42 | ) | | | (0.43 | ) | | | (0.44 | ) | | | (0.45 | ) |

Distributions from capital gains | | | — | | | | (0.01 | ) | | | (0.01 | ) | | | (0.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (0.41 | ) | | | (0.43 | ) | | | (0.44 | ) | | | (0.45 | ) | | | (0.45 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | | $12.36 | | | | $12.32 | | | | $12.10 | | | | $12.41 | | | | $11.72 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | 3.64% | | | | 5.56% | | | | 0.94% | | | | 9.81% | | | | 3.45% | |

Net assets, end of year (in thousands) | | | $25,511 | | | | $23,358 | | | | $24,300 | | | | $22,911 | | | | $21,235 | |

Ratio of net expenses to average net assets (a) | | | 0.71% | | | | 0.72% | | | | 0.70% | | | | 0.68% | | | | 0.60% | |

Ratio of gross expenses to average net assets | | | 0.79% | | | | 0.81% | | | | 0.78% | | | | 0.78% | | | | 0.78% | |

Ratio of net investment income to average net assets | | | 3.26% | | | | 3.48% | | | | 3.40% | | | | 3.59% | | | | 3.83% | |

Portfolio turnover | | | 9.65% | | | | 10.48% | | | | 6.46% | | | | 7.80% | | | | 4.70% | |

| (a) | | Percentages are after expense waivers and reductions by the Adviser and Custodian. The Adviser and Custodian have agreed not to seek recovery of these waivers and reductions. |

The accompanying notes are an integral part of the financial statements.

5

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2015

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

| MISCELLANEOUS PUBLIC IMPROVEMENT BONDS | | | | | | | | | | | |

| 23.83% of Net Assets | | | | | | | | | | | | | | | | | | |

KY Association of Counties | | | 5.000 | % | | | 02/01/2030 | | | AA-* | | $ | 625,000 | | | $ | 698,225 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2032 | | | AA-* | | | 1,000,000 | | | | 1,114,640 | |

KY Association of Counties | | | 5.000 | | | | 02/01/2035 | | | AA-* | | | 995,000 | | | | 1,107,057 | |

KY Bond Corporation Finance Program | | | 5.500 | | | | 02/01/2031 | | | AA-* | | | 1,115,000 | | | | 1,293,400 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2026 | | | Aa3/A+*/A+@ | | | 2,000,000 | | | | 2,305,020 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2027 | | | Aa3/A+*/A+@ | | | 1,710,000 | | | | 1,963,456 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2028 | | | Aa3/A+*/A+@ | | | 4,000,000 | | | | 4,588,000 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2029 | | | Aa3/A+*/A+@ | | | 2,500,000 | | | | 2,859,875 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2030 | | | Aa3/A+*/A+@ | | | 9,980,000 | | | | 11,398,443 | |

KY State Property & Building #100 | | | 5.000 | | | | 08/01/2031 | | | Aa3/A+*/A+@ | | | 5,100,000 | | | | 5,812,470 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2031 | | | A1/A+*/A@ | | | 2,110,000 | | | | 2,287,620 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2032 | | | A1/A+*/A@ | | | 2,205,000 | | | | 2,382,855 | |

KY State Property & Building #105 | | | 4.750 | | | | 04/01/2033 | | | A1/A+*/A@ | | | 2,310,000 | | | | 2,494,685 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2029 | | | Aa3/A+*/A+@ | | | 4,130,000 | | | | 4,665,248 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2030 | | | Aa3/A+*/A+@ | | | 7,165,000 | | | | 8,060,410 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2031 | | | Aa3/A+*/A+@ | | | 4,910,000 | | | | 5,508,480 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2032 | | | Aa3/A+*/A+@ | | | 6,275,000 | | | | 7,020,658 | |

KY State Property & Building #106 | | | 5.000 | | | | 10/01/2033 | | | Aa3/A+*/A+@ | | | 4,870,000 | | | | 5,433,800 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2026 | | | Aa3/A+*/A+@ | | | 955,000 | | | | 1,115,622 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2028 | | | Aa3/A+*/A+@ | | | 2,670,000 | | | | 3,061,582 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2030 | | | Aa3/A+*/A+@ | | | 5,000,000 | | | | 5,664,400 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2031 | | | Aa3/A+*/A+@ | | | 6,290,000 | | | | 7,102,920 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2032 | | | Aa3/A+*/A+@ | | | 5,320,000 | | | | 5,978,669 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2033 | | | Aa3/A+*/A+@ | | | 5,270,000 | | | | 5,903,454 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2034 | | | Aa3/A+*/A+@ | | | 4,900,000 | | | | 5,471,389 | |

KY State Property & Building #76 | | | 5.500 | | | | 08/01/2021 | | | Aa3/A+*/A+@ | | | 1,400,000 | | | | 1,666,182 | |

KY State Property & Building #83 | | | 5.000 | | | | 10/01/2017 | | | Aa3/A+*/A+@ | | | 5,000,000 | | | | 5,449,050 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2019 | | | Aa3/AA-* | | | 35,000 | | | | 37,372 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2022 | | | Aa3/AA-* | | | 30,000 | | | | 31,997 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2023 | | | Aa3/AA-* | | | 95,000 | | | | 101,275 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2025 | | | Aa3/AA-* | | | 270,000 | | | | 287,693 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2026 | | | Aa3/AA-* | | | 170,000 | | | | 181,140 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2027 | | | Aa3/AA-* | | | 165,000 | | | | 175,415 | |

KY State Property & Building #88 | | | 4.750 | | | | 11/01/2027 | | | Aa3/AA-*/A+@ | | | 5,800,000 | | | | 6,222,704 | |

KY State Property & Building #89 | | | 5.000 | | | | 11/01/2025 | | | Aa3/AA*/A+@ | | | 5,000,000 | | | | 5,553,450 | |

KY State Property & Building #89 | | | 5.000 | | | | 11/01/2026 | | | Aa3/AA*/A+@ | | | 13,390,000 | | | | 14,812,286 | |

KY State Property & Building #89 | | | 5.000 | | | | 11/01/2027 | | | Aa3/AA*/A+@ | | | 4,900,000 | | | | 5,393,675 | |

KY State Property & Building #90 | | | 5.375 | | | | 11/01/2023 | | | Aa3/A+*/A+@ | | | 1,200,000 | | | | 1,352,412 | |

KY State Property & Building #90 | | | 5.500 | | | | 11/01/2028 | | | Aa3/A+*/A+@ | | | 24,805,000 | | | | 27,943,577 | |

KY State Property & Building #91 | | | 5.750 | | | | 04/01/2029 | | | A1/A+*/A@ | | | 210,000 | | | | 233,312 | |

KY State Property & Building #93 | | | 5.250 | | | | 02/01/2025 | | | Aa3/AA*/A+@ | | | 7,250,000 | | | | 8,109,415 | |

KY State Property & Building #93 | | | 4.875 | | | | 02/01/2028 | | | Aa3/AA*/A+@ | | | 500,000 | | | | 544,965 | |

KY State Property & Building #93 | | | 5.250 | | | | 02/01/2028 | | | Aa3/AA*/A+@ | | | 10,500,000 | | | | 11,717,475 | |

KY State Property & Building #93 | | | 5.000 | | | | 02/01/2029 | | | Aa3/AA*/A+@ | | | 500,000 | | | | 551,285 | |

KY State Property & Building #93 | | | 5.250 | | | | 02/01/2029 | | | Aa3/AA*/A+@ | | | 22,640,000 | | | | 25,215,300 | |

KY State Property & Building #96 | | | 5.000 | | | | 11/01/2029 | | | Aa3/A+*/A+@ | | | 5,000,000 | | | | 5,556,150 | |

KY State Property & Building #98 | | | 5.000 | | | | 08/01/2021 | | | Aa3/A+*/A+@ | | | 2,505,000 | | | | 2,879,748 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2028 | | | Aa2/AA* | | | 820,000 | | | | 959,162 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2029 | | | Aa2/AA* | | | 345,000 | | | | 401,373 | |

Lexington Fayette Urban County Government | | | 5.000 | | | | 01/01/2033 | | | Aa2/AA* | | | 1,685,000 | | | | 1,928,870 | |

Pendleton County KY Multi-County Lease Revenue | | | 6.400 | | | | 03/01/2019 | | | B* | | | 3,000,000 | | | | 3,192,690 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 235,790,351 | |

| PREREFUNDED BONDS | | | | | | | | | | | |

| 15.17% of Net Assets | | | | | | | | | | | | | | | | | | |

Campbell County KY School District Finance Corporation | | | 4.500 | | | | 08/01/2023 | | | Aa3 | | | 980,000 | | | | 1,022,512 | |

Hardin County School DistrictFinance Corporation | | | 4.750 | | | | 06/01/2027 | | | Aa3 | | | 1,250,000 | | | | 1,344,350 | |

The accompanying notes are an integral part of the financial statements.

6

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2015

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Jefferson County KY School District Finance Corporation | | | 4.500 | % | | | 07/01/2023 | | | Aa2/AA* | | $ | 2,500,000 | | | $ | 2,600,925 | |

Jefferson County KY School District Finance Corporation | | | 4.625 | | | | 07/01/2025 | | | Aa2/AA* | | | 7,545,000 | | | | 7,856,684 | |

Jefferson County KY School District Finance Corporation | | | 5.000 | | | | 07/01/2026 | | | Aa2/AA* | | | 5,025,000 | | | | 5,251,427 | |

Jefferson County KY School District Finance Corporation | | | 4.750 | | | | 12/01/2026 | | | Aa2/AA* | | | 3,770,000 | | | | 3,989,678 | |

Jefferson County KY School District Finance Corporation | | | 4.750 | | | | 06/01/2027 | | | Aa2/AA-* | | | 3,000,000 | | | | 3,224,070 | |

Knox County General Obligation | | | 5.625 | | | | 06/01/2036 | | | NR | | | 2,490,000 | | | | 2,544,133 | |

KY Asset Liability CommissionUniversity of KY Project Note | | | 5.000 | | | | 10/01/2023 | | | Aa2/AA* | | | 8,075,000 | | | | 8,169,962 | |

KY Asset Liability CommissionUniversity of KY Project Note | | | 5.000 | | | | 10/01/2024 | | | Aa2/AA* | | | 7,405,000 | | | | 7,492,083 | |

KY Asset Liability CommissionUniversity of KY Project Note | | | 5.000 | | | | 10/01/2024 | | | Aa2/AA* | | | 5,445,000 | | | | 5,957,048 | |

KY Asset Liability CommissionUniversity of KY Project Note | | | 5.000 | | | | 10/01/2025 | | | Aa2/AA* | | | 3,700,000 | | | | 3,743,512 | |

KY Asset Liability CommissionUniversity of KY Project Note | | | 5.000 | | | | 10/01/2026 | | | Aa2/AA* | | | 6,090,000 | | | | 6,659,841 | |

KY State Property & Building #85 | | | 5.000 | | | | 08/01/2020 | | | Aa3/AA* | | | 5,760,000 | | | | 5,782,867 | |

KY State Property & Building #85 | | | 5.000 | | | | 08/01/2022 | | | Aa3/AA* | | | 5,200,000 | | | | 5,220,644 | |

KY State Property & Building #85 | | | 5.000 | | | | 08/01/2024 | | | Aa3/AA* | | | 8,300,000 | | | | 8,332,951 | |

KY State Property & Building #85 | | | 5.000 | | | | 08/01/2025 | | | Aa3/AA* | | | 2,500,000 | | | | 2,509,925 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2019 | | | Aa3/AA-* | | | 2,965,000 | | | | 3,177,235 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2022 | | | Aa3/AA-* | | | 1,635,000 | | | | 1,752,033 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2023 | | | Aa3/AA-* | | | 5,080,000 | | | | 5,443,626 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2025 | | | Aa3/AA-* | | | 14,565,000 | | | | 15,607,563 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2026 | | | Aa3/AA-* | | | 8,060,000 | | | | 8,636,935 | |

KY State Property & Building #87 | | | 5.000 | | | | 03/01/2027 | | | Aa3/AA-* | | | 10,125,000 | | | | 10,849,748 | |

KY State Property & Building #88 | | | 5.000 | | | | 11/01/2024 | | | Aa3/AA-*/A+@ | | | 1,355,000 | | | | 1,488,427 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2022 | | | Aa2/AA*/A+@ | | | 1,625,000 | | | | 1,625,211 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2023 | | | Aa2/AA*/A+@ | | | 575,000 | | | | 575,075 | |

Laurel County KY School District Finance Corporation | | | 4.625 | | | | 08/01/2026 | | | Aa3 | | | 3,150,000 | | | | 3,294,081 | |

Laurel County KY School District Finance Corporation | | | 4.750 | | | | 06/01/2026 | | | Aa3 | | | 1,000,000 | | | | 1,076,280 | |

Louisville & Jefferson County Metropolitan Health — St. Marys | | | 6.125 | | | | 02/01/2037 | | | NR | | | 1,300,000 | | | | 1,471,444 | |

Louisville & Jefferson County Waterworks | | | 5.000 | | | | 11/15/2027 | | | Aaa/AAA* | | | 2,000,000 | | | | 2,119,740 | |

Louisville & Jefferson County Waterworks | | | 5.000 | | | | 11/15/2031 | | | Aaa/AAA* | | | 10,695,000 | | | | 11,335,310 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 150,155,320 | |

| MUNICIPAL UTILITY REVENUE BONDS | | | | | | | | | | | |

| 12.74% of Net Assets | | | | | | | | | | | | | | | | | | |

Campbell and Kenton Counties Sanitary District No. 1 | | | 5.000 | | | | 08/01/2025 | | | Aa2/AA* | | | 2,395,000 | | | | 2,580,373 | |

Campbell and Kenton Counties Sanitary District No. 1 | | | 5.000 | | | | 08/01/2037 | | | Aa2/AA* | | | 11,220,000 | | | | 11,932,694 | |

Campbell and Kenton Counties Sanitary Sewer | | | 5.000 | | | | 08/01/2026 | | | Aa2/AA* | | | 4,175,000 | | | | 4,492,759 | |

Campbell and Kenton Counties Sanitary Sewer | | | 5.000 | | | | 08/01/2027 | | | Aa2/AA* | | | 4,385,000 | | | | 4,717,778 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2034 | | | AA* | | | 695,000 | | | | 779,589 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2035 | | | AA* | | | 725,000 | | | | 810,746 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2036 | | | AA* | | | 760,000 | | | | 844,672 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2037 | | | AA* | | | 800,000 | | | | 889,128 | |

Frankfort KY Electric & Water | | | 4.750 | | | | 12/01/2038 | | | AA* | | | 835,000 | | | | 923,769 | |

Kentucky Rural Water Financing Corporation | | | 4.500 | | | | 02/01/2023 | | | A+* | | | 1,085,000 | | | | 1,229,273 | |

Kentucky Rural Water Financing Corporation | | | 4.500 | | | | 02/01/2024 | | | A+* | | | 880,000 | | | | 986,058 | |

KY Infrastructure Authority Wastewater and Drinking Water | | | 5.000 | | | | 02/01/2027 | | | Aaa/AAA*/AAA@ | | | 2,500,000 | | | | 2,850,600 | |

KY Infrastructure Authority Wastewater and Drinking Water | | | 5.000 | | | | 02/01/2028 | | | Aaa/AAA*/AAA@ | | | 2,000,000 | | | | 2,278,580 | |

KY Rural Water Financial Corporation Public Project Revenue | | | 5.125 | | | | 02/01/2035 | | | A+* | | | 525,000 | | | | 569,877 | |

KY Rural Water Financial Corporation Public Project Revenue | | | 5.375 | | | | 02/01/2020 | | | A+* | | | 295,000 | | | | 295,679 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2034 | | | Aa3/AA* | | | 2,230,000 | | | | 2,475,545 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2035 | | | Aa3/AA* | | | 2,245,000 | | | | 2,484,586 | |

Louisville & Jefferson County Metropolitan Sewer | | | 4.750 | | | | 05/15/2036 | | | Aa3/AA* | | | 2,795,000 | | | | 3,083,835 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2025 | | | Aa3/AA*/AA-@ | | | 3,270,000 | | | | 3,397,399 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2026 | | | Aa3/AA*/AA-@ | | | 3,230,000 | | | | 3,353,515 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2031 | | | Aa3/AA*/AA-@ | | | 2,465,000 | | | | 2,780,767 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2032 | | | Aa3/AA*/AA-@ | | | 4,590,000 | | | | 4,744,178 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2036 | | | Aa3/AA*/AA-@ | | | 2,000,000 | | | | 2,066,460 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2021 | | | Aa3/AA* | | | 2,865,000 | | | | 3,282,803 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2023 | | | Aa3/AA* | | | 2,500,000 | | | | 2,857,725 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2024 | | | Aa3/AA* | | | 7,000,000 | | | | 7,645,050 | |

The accompanying notes are an integral part of the financial statements.

7

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2015

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | % | | | 05/15/2025 | | | Aa3/AA* | | $ | 5,185,000 | | | $ | 5,701,374 | |

Louisville & Jefferson County Metropolitan Sewer | | | 5.000 | | | | 05/15/2034 | | | Aa3/AA*/AA-@ | | | 27,730,000 | | | | 31,233,686 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2026 | | | Aa3 | | | 1,000,000 | | | | 1,140,490 | |

Northern Ky Water District | | | 5.000 | | | | 02/01/2027 | | | Aa3 | | | 4,315,000 | | | | 4,904,472 | |

Northern KY Water District | | | 6.000 | | | | 02/01/2028 | | | Aa3 | | | 1,010,000 | | | | 1,149,835 | |

Northern KY Water District | | | 6.000 | | | | 02/01/2031 | | | Aa3 | | | 1,000,000 | | | | 1,138,120 | |

Northern KY Water District | | | 6.500 | | | | 02/01/2033 | | | Aa3 | | | 1,585,000 | | | | 1,818,962 | |

Northern KY Water District | | | 5.000 | | | | 02/01/2033 | | | Aa3 | | | 3,580,000 | | | | 4,010,137 | |

Owensboro Water Revenue | | | 5.000 | | | | 09/15/2025 | | | A1 | | | 545,000 | | | | 601,811 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 126,052,325 | |

| TURNPIKES/TOLLROAD/HIGHWAY BONDS | | | | | | | | | | | |

| 11.04% of Net Assets | | | | | | | | | | | | | | | | | | |

KY Asset Liability Commission Federal Highway Trust | | | 5.000 | | | | 09/01/2022 | | | A2/AA*/A+@ | | | 3,500,000 | | | | 4,003,895 | |

KY Asset Liability Commission Federal Highway Trust | | | 5.250 | | | | 09/01/2019 | | | A2/AA*/A+@ | | | 1,765,000 | | | | 2,031,515 | |

KY Asset Liability Commission Federal Highway Trust | | | 5.250 | | | | 09/01/2025 | | | A2/AA*/A+@ | | | 3,400,000 | | | | 4,039,914 | |

KY Asset Liability Project | | | 5.000 | | | | 09/01/2021 | | | A2/AA*/A+@ | | | 1,570,000 | | | | 1,806,018 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2024 | | | Aa2/AA*/A+@ | | | 1,500,000 | | | | 1,763,760 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2025 | | | Aa2/AA*/A+@ | | | 3,225,000 | | | | 3,556,208 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2025 | | | Aa2/AA*/A+@ | | | 3,775,000 | | | | 4,398,668 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2026 | | | Aa2/AA*/A+@ | | | 4,720,000 | | | | 4,927,302 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2026 | | | Aa2/AA*/A+@ | | | 4,440,000 | | | | 5,017,511 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2027 | | | Aa2/AA*/A+@ | | | 9,530,000 | | | | 10,485,097 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2027 | | | Aa2/AA*/A+@ | | | 3,080,000 | | | | 3,478,090 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2028 | | | Aa2/AA*/A+@ | | | 4,930,000 | | | | 5,659,246 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2028 | | | Aa2/AA*/A+@ | | | 2,460,000 | | | | 2,700,465 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa2/AA*/A+@ | | | 10,035,000 | | | | 11,278,036 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa2/AA*/A+@ | | | 5,165,000 | | | | 5,923,997 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2029 | | | Aa2/AA*/A+@ | | | 7,235,000 | | | | 8,255,642 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2030 | | | Aa2/AA*/A+@ | | | 1,465,000 | | | | 1,666,672 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2030 | | | Aa2/AA*/A+@ | | | 1,845,000 | | | | 2,113,909 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2031 | | | Aa2/AA*/A+@ | | | 9,350,000 | | | | 10,586,257 | |

KY State Turnpike Economic Development Road Revenue** | | | 5.000 | | | | 07/01/2032 | | | Aa2/AA*/A+@ | | | 8,755,000 | | | | 9,888,948 | |

KY State Turnpike Economic Development Road Revenue | | | 5.000 | | | | 07/01/2033 | | | Aa2/AA*/A+@ | | | 5,000,000 | | | | 5,657,400 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 109,238,550 | |

| REFUNDING BONDS | | | | | | | | | | | |

| 9.39% of Net Assets | | | | | | | | | | | | | | | | | | |

KY State Property & Building #80 | | | 5.250 | | | | 05/01/2018 | | | Aa3/AA-*/A+@ | | | 2,940,000 | | | | 3,280,599 | |

KY State Property & Building #80 | | | 5.250 | | | | 05/01/2020 | | | Aa3/AA-*/A+@ | | | 1,000,000 | | | | 1,161,600 | |

KY State Property & Building #83 | | | 5.000 | | | | 10/01/2018 | | | Aa3/A+*/A+@ | | | 17,750,000 | | | | 19,840,773 | |

KY State Property & Building #83 | | | 5.250 | | | | 10/01/2020 | | | Aa3/A+*/A+@ | | | 24,220,000 | | | | 28,296,710 | |

KY State Property & Building #84 | | | 5.000 | | | | 08/01/2019 | | | Aa3/AA-*/A+@ | | | 10,000,000 | | | | 11,390,600 | |

KY State Property & Building #84 | | | 5.000 | | | | 08/01/2021 | | | Aa3/AA-*/A+@ | | | 310,000 | | | | 359,950 | |

KY State Property & Building #84 | | | 5.000 | | | | 08/01/2022 | | | Aa3/AA-*/A+@ | | | 18,000,000 | | | | 21,058,200 | |

KY State Property & Building #102 | | | 5.000 | | | | 05/01/2024 | | | Aa3/A+*/A+@ | | | 405,000 | | | | 470,995 | |

KY State Property & Building #104 | | | 5.000 | | | | 11/01/2021 | | | A1/A+*/A@ | | | 2,085,000 | | | | 2,424,438 | |

KY State Property & Building #104 | | | 5.000 | | | | 11/01/2022 | | | A1/A+*/A@ | | | 1,290,000 | | | | 1,504,901 | |

KY State Property & Building #108 | | | 5.000 | | | | 08/01/2025 | | | Aa3/A+*/A+@ | | | 2,690,000 | | | | 3,183,454 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | 92,972,220 | |

| SCHOOL IMPROVEMENT BONDS | | | | | | | | | | | |

| 6.87% of Net Assets | | | | | | | | | | | | | | | | | | |

Fayette County School District Finance Corporation | | | 5.000 | | | | 06/01/2031 | | | A1/A+* | | | 3,705,000 | | | | 4,108,326 | |

Fayette County School District Finance Corporation | | | 5.000 | | | | 10/01/2028 | | | A1/A+* | | | 2,875,000 | | | | 3,263,211 | |

Fayette County School District Finance Corporation | | | 5.000 | | | | 10/01/2029 | | | A1/A+* | | | 3,660,000 | | | | 4,125,845 | |

Fayette County School District Finance Corporation | | | 5.000 | | | | 10/01/2032 | | | A1/A+* | | | 3,615,000 | | | | 4,022,483 | |

Fayette County School District Finance Corporation | | | 5.000 | | | | 10/01/2033 | | | A1/A+* | | | 4,385,000 | | | | 4,856,037 | |

Fayette County School District Finance Corporation | | | 4.750 | | | | 11/01/2031 | | | Aa3/A+* | | | 1,730,000 | | | | 1,934,503 | |

Fayette County School District Finance Corporation^ | | | 5.000 | | | | 08/01/2034 | | | Aa3/A+* | | | 8,500,000 | | | | 9,483,535 | |

Franklin County School Building Revenue | | | 4.750 | | | | 05/01/2027 | | | Aa3 | | | 3,570,000 | | | | 3,775,953 | |

The accompanying notes are an integral part of the financial statements.

8

DUPREE MUTUAL FUNDS — KENTUCKY TAX-FREE INCOME SERIES

SCHEDULE OF PORTFOLIO INVESTMENTS

Kentucky Municipal Bonds

June 30, 2015

| | | | | | | | | | | | | | | | | | |

| Bond Description | | Coupon | | | Maturity

Date | | | Rating# | | Par Value | | | Fair Value | |

Hardin County School District Finance Corporation | | | 5.000 | % | | | 05/01/2030 | | | Aa3 | | $ | 450,000 | | | $ | 504,747 | |

Hardin County School District Finance Corporation | | | 5.000 | | | | 05/01/2031 | | | Aa3 | | | 470,000 | | | | 528,261 | |

Jefferson County School District Finance Corporation | | | 5.000 | | | | 05/01/2033 | | | Aa2/AA-* | | | 5,145,000 | | | | 5,856,914 | |

Jefferson County School District Finance Corporation | | | 5.000 | | | | 05/01/2034 | | | Aa2/AA-* | | | 5,405,000 | | | | 6,130,621 | |

Jefferson County School District Finance Corporation | | | 5.000 | | | | 04/01/2030 | | | Aa2/AA-* | | | 975,000 | | | | 1,118,345 | |

Jefferson County School District Finance Corporation | | | 5.000 | | | | 04/01/2031 | | | Aa2/AA-* | | | 1,025,000 | | | | 1,171,083 | |

Jefferson County School District Finance Corporation | | | 4.750 | | | | 04/01/2034 | | | Aa2/AA-* | | | 1,165,000 | | | | 1,291,496 | |