UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811 02995

Exact name of registrant as specified in charter: NRM Investment Company

Address of principal executive offices: NRM Investment Company, 280 Abrahams Lane, Villanova, Pennsylvania 19085

Name and address of agent for service: John H. McCoy, President, NRM Investment Company, 280 Abrahams Lane, Villanova, Pennsylvania 19085

Registrant’s Telephone Number: (610) 995-0322

Date of fiscal year end: August 31

Date of Reporting Period: Period ending February 28, 2010

ITEM 1 – REPORTS TO STOCKHOLDERS

A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act is attached hereto.

ITEM 2 – CODE OF ETHICS

This is a semi-annual report. A response is not required.

ITEM 3 – AUDIT COMMITTEE FINANCIAL EXPERT

The Board of Directors does not have an audit committee and accordingly the entire board oversees the Registrant’s accounting and financial reporting processes including the audits of its financial statements. The board employs an outside accountant responsible for normal bookkeeping, tax preparation and recordkeeping, and employs a firm of independent auditors to report on internal controls and certify its financial records on an annual basis. The bookkeeper and outside auditor both qualify as financial experts. The outside accountant and auditor are engaged on behalf of the Registrant by the Company’s president and their engagements are ratified yearly by the shareholders. The outside auditor provides no services for the Registrant’s investment adviser. Note: two members of the five-member board of directors own 89.8% of its shares. Registrant has no salaried employees to otherwise fulfill the role of financial expert.

ITEM 4 – ACCOUNTANT FEES AND SERVICES

This is a semi-annual report. A response is not required.

ITEM 5 Registrant is not a listed issuer.

ITEM 6 – SCHEDULE OF INVESTMENTS

The information is included as part of the report to shareholders filed under Item 1 of this report and attached hereto.

ITEM 10 – SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

The registrant does not have a nominating committee. John H. McCoy, the Company's president and chairman of the board owns beneficially and of record approximately 80% of the Company's outstanding shares, he controls the Company, and is entitled to vote for every board member. Five shareholders, including Mr. McCoy, own beneficially approximately 99.7% of the Company’s outstanding shares. These circumstances obviate a nominating committee. All of the Board members, John H. McCoy, George Connell, Raymond Welsh, Anthony Fisher and Joseph Fabrizio routinely participate in the nomination of the directors at the annual shareholders meeting and by consensus accept the board members heretofore elected and currently serving.

ITEM 11 – CONTROLS AND PROCEDURES

The Fund operates through its five-member board of directors sitting as an executive committee of the whole; the board members receive only nominal director’s fees. The Fund has no employees other than its officers none of whom receives compensation in such role. (The Assistant Secretary to the Fund is its counsel who receives compensation only for legal work, not in his role as a Fund officer.) The Fund engages independent contractors to provide investment, financial and custodial services. The Fund’s principal executive and financial officer is its major shareholder and one of the five directors. In his view the following controls and procedures are effective to comply with the Regulations under the Investment Company Act.

Portfolio Procedures

1. The Investment Advisor has discretion in investing the Fund’s portfolio but only within the guidelines established by the Board of Directors, and those authorized to execute investment transactions act only on direction by the Board or Advisor.

2. Any significant inflows or outflows of cash will be brought to the President’s attention to confirm that a related purchase or sale of securities or other disbursement was authorized by him.

Investment Custody and Shareholder Services

All transactions with shareholders and the custody of the Fund’s securities are performed by an independent corporate custodian. Any changes to these functions must be authorized by the Board of Directors.

Accounting and Reporting

1. The recording, summarizing and reporting of all financial data will be performed by a CPA who is independent of the buying and selling of securities as well as the disbursement of the Fund’s cash and transfer of the Fund’s assets.

2. Upon discovery, the CPA will bring any unusual transaction directly to the President and/or Board’s attention.

3. The CPA will provide directly to the Board of Directors a Statement of Net Assets and a Statement of Operations in accordance with generally accepted accounting principles within ten business days of each month end.

ITEM 12 – EXHIBITS

The required certifications are attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant: NRM Investment Company

| By: | /s/ John H. McCoy | ||

| John H. McCoy, President and Treasurer | |||

| Date: | 4/30/10 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ John H. McCoy | ||

| John H. McCoy, President and Treasurer | |||

| Date: | 4/30/10 | ||

| By: | /s/ Edward Fackenthal | ||

| Edward Fackenthal, Counsel and Assistant Secretary | |||

| Date: | 4/30/10 | ||

Semi-annual Report

February 28, 2010

| Table of Contents | ||

| Page No. | ||

| Total Returns | 1 | |

| Performance at a Glance | 1 | |

| Advisor’s Report | 1 | |

| Performance Summary | 2 | |

| Financial Statements: | ||

| Statement of Assets and Liabilities | 5 | |

| Schedule of Investments | 6 | |

| Statement of Operations | 9 | |

| Statement of Changes in Net Assets | 10 | |

| Financial Highlights | 11 | |

| Notes to Financial Statements | 12 | |

| Fund’s Expenses | 17 | |

| Matters Submitted to Shareholders’ Vote | 18 |

NRM INVESTMENT COMPANY

Total Returns

Six Months Ended February 28, 2010

| Total Return | ||||

| NRM Investment Company | 8.47 | % | ||

Composite Index1 | 7.61 | % | ||

1 60% Barclays 5 Yr Muni / 40% ML PFD Stock DRD Eligible

Performance at a Glance

| Distributions Per Share | ||||||||||||||||

| Starting Share Price | Ending Share Price | Income Dividends | Capital Gains | |||||||||||||

| NRM Investment Company | $ | 3.07 | $ | 3.26 | $ | 0.065 | $ | 0.00 | ||||||||

Advisor’s Report

The portfolio was able to keep pace with the performance of the Municipal bond market, essentially matching the performance of the benchmark index for the 6 month period. The Municipal market continued to benefit from strong demand from investors for tax-exempt income. The portfolio has kept its interest rate sensitivity as measured by duration to a modest level to limit vulnerability to future increases in interest rates.

The portfolio also benefitted from the continued strong performance on the part of the preferred stock market. Preferred stocks represent the significant asset class in the portfolio in addition to municipal bonds.

1

NRM INVESTMENT COMPANY

Performance Summary

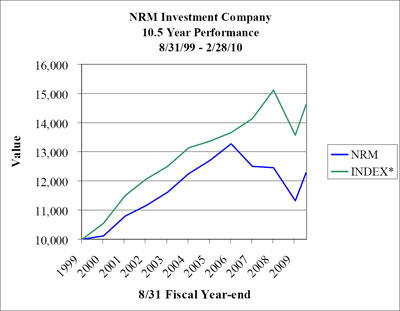

The following is a line graph that compares the initial and subsequent account values at the end of each of the most recently completed ten fiscal years of the Fund and the six months ended February 28,2010. It assumes a $10,000 initial investment at the beginning of the first fiscal year and an appropriate broad-based securities market index for the same period.

2

NRM INVESTMENT COMPANY

Performance Summary - Continued

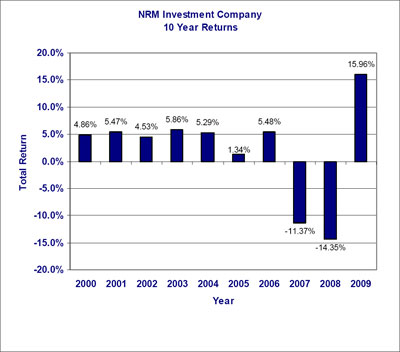

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing how the Fund’s average annual returns for 1, 5, and 10 years compared with those of broad-based securities market indexes. How the Fund has performed in the past (both before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Annual Total Returns

| During the 10 year period shown in the bar chart, the highest annual return was 15.96% (year ended 12/31/09) and the lowest annual return was -14.35% (year ended 12/31/08). | |||||||

| During the 10 year period shown in the bar chart, the highest quarterly return was 17.36% (quarter ended 6/30/09) and the lowest quarterly return was -14.87% (quarter ended 9/30/08). |

3

NRM INVESTMENT COMPANY

Performance Summary - Continued

Average Annual Total returns for Periods Ended December 31, 2009

| 1 year | 5 years | 10 years | ||||||||||

| Return Before Taxes | 15.96 | % | -1.21 | % | 1.94 | % | ||||||

| Return After Taxes on Distributions | 15.27 | % | -1.79 | % | 1.50 | % | ||||||

| Return After Taxes on Distributions and redemption of Fund Shares | 23.19 | % | -16.86 | % | -13.44 | % | ||||||

Comparative indexes (reflecting no deductions for fees, expenses or taxes) | ||||||||||||

| Barclays 5 year Municipal Bond Index | 7.40 | % | 4.50 | % | 5.24 | % | ||||||

| Merrill Lynch Preferred Stock DRD Eligible Index | 12.38 | % | -12.00 | % | -3.29 | % | ||||||

Composite Index 1 | 9.39 | % | -1.50 | % | 2.18 | % | ||||||

1. 60% Barclays 5 Yr Muni / 40% ML PFD Stock DRD Eligible. These indexes were used to compare the Company’s results with established benchmarks for asset categories similar to the Company’s investments. The results were blended to reflect the proportions of like-kind investments the Company held in its 2008 portfolio forward. Prior to 2008 the benchmark was 100% Barclays 5 Yr Muni. The Company selected Merrill Lynch Preferred DRD (Dividend Received Deduction) Eligible as a benchmark as the nearest equivalent to the pass-through treatment the Company shareholders received for QDI (Qualified Dividend Income) from the bulk of its preferred shares.

After Tax returns are calculated using the historical highest individual federal marginal income tax rates that do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown and are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as 401K plans or individual retirement accounts.

4

| NRM Investment Company |

Statement of Assets and Liabilities

February 28, 2010

Unaudited

| Assets | ||||

| Investments at fair value (cost $12,585,176) | $ | 11,446,728 | ||

| Interest and dividends receivable | 118,388 | |||

| Prepaid expenses | 2,600 | |||

| Total Assets | 11,567,716 | |||

| Liabilities | ||||

| Dividends payable | 66,850 | |||

| Accrued expenses and other liabilities | 25,376 | |||

| Total Liabilities | 92,226 | |||

| Net Assets, Applicable to 3,518,442 Outstanding Shares, Equivalent to $3.26 a Share | $ | 11,475,490 |

| See notes to financial statements. |

5

| NRM Investment Company |

Schedule of Investments

February 28, 2010

Unaudited

Principal Amount or Shares | Fair Value | |||||||

| Municipal Bonds –54.7% | ||||||||

General Obligation Bonds – 9.5% | ||||||||

| Pittsburgh, Pennsylvania, 5.00%, due 9/1/12, callable 3/1/12 at 100 (AMBAC) | 250,000 | $ | 268,908 | |||||

| Philadelphia, Pennsylvania School District, 5.625%, due 8/1/15, callable 8/1/12 at 100 (FGIC) | 300,000 | 334,572 | ||||||

| Pittsburgh, Pennsylvania, Refunding, 5.25%, due 9/1/16 | 100,000 | 111,563 | ||||||

| Puerto Rico, 5.50%, due 7/1/17 | 250,000 | 265,442 | ||||||

| Will County, Illinois, 5.0%, due 11/15/24 | 100,000 | 105,777 | ||||||

| Total General Obligation Bonds | 1,086,262 |

Housing Finance Agency Bonds - 1.9% | ||||||||

| California Housing Finance Agency, Home Mortgage, 10.25%, due 2/1/14, callable 2/1/99 at 100 | 30,000 | 25,109 | ||||||

| Louisana LOC Government Environmental Facilities Community Development Authority, Multi-family Housing, 4.25%, due 4/15/39, put 4/15/16 at 100.00 | 195,000 | 195,932 | ||||||

| Total Housing Finance Agency Bonds | 221,041 |

Other Revenue Bonds – 43.3% | ||||||||

| Parkland, Pennsylvania School District, 5.375%, due 9/1/15 (FGIC) | 170,000 | 198,269 | ||||||

| Montgomery County, Pennsylvania Industrial Development Authority, 5.00%, due 11/1/10 | 250,000 | 255,562 | ||||||

| Allegheny County, Pennsylvania Industrial Development Authority, 5.00%, due 11/1/11 (MBIA) | 100,000 | 106,110 | ||||||

Philadelphia, Pennsylvania Gas Works, 18th Series, 5.00%, due 8/1/11 (CIFG) | 300,000 | 305,967 | ||||||

| Pennsylvania Infrastructure Investment Authority, 5.00%, due 9/1/12 | 500,000 | 552,550 | ||||||

See Notes to financial statements

6

| NRM Investment Company |

Schedule of Investments (Continued)

February 28, 2010

Unaudited

Principal Amount or Shares | Fair Value | |||||||

| Municipal Bonds – 54.7% (Continued) | ||||||||

Other Revenue Bonds – 43.3% (Continued) | ||||||||

| Pennsylvania State Higher Educational Facilities Authority, 5.50%, prerefunded 1/01/16 | 350,000 | 395,269 | ||||||

| Harrisburg, Pennsylvania Recovery Facilities, 5.00%, mandatory put 12/1/33 | 425,000 | 431,196 | ||||||

| Philadelphia, Pennsylvania Wastewater, 5.00%, due 7/1/14 | 250,000 | 278,303 | ||||||

| Pennsylvania State Turnpike Commission, 5.25%, due 12/1/14, callable 12/1/08 at 101 (AMBAC) | 155,000 | 157,409 | ||||||

| St. Louis Missouri Municipal Finance Corporation, Leasehold Revenue (County Justice Center), 5.25%, due 2/15/15, callable 2/15/12 at 100 (AMBAC) | 50,000 | 51,874 | ||||||

| Pennsylvania State Turnpike Commission, 5.25%, due 12/1/15, callable 12/1/08 at 101 (AMBAC) | 140,000 | 142,159 | ||||||

Allegheny County Sanitation Authority, Sewer Revenue, 5.00%, due 12/1/23, callable 12/1/15 at 100 | 300,000 | 312,117 | ||||||

| Allegheny County, Pennsylvania Higher Educational Building Authority, 5.50%, due 3/15/16, callable 6/15/12 at 100 (AMBAC) | 150,000 | 166,095 | ||||||

| Pennsylvania State Higher Educational Facilities Authority, 5.00%, due 6/15/16, callable 6/15/12 at 100 (AMBAC) | 100,000 | 105,694 | ||||||

| Philadelphia, Pennsylvania Gas Works, Fourth Series, 5.25%, due 8/1/16, callable 8/1/13 at 100 | 250,000 | 285,633 | ||||||

| Chester County, Pennsylvania Health and Educational Authority (Devereux), 5.00%, due 11/1/18 | 405,000 | 411,160 | ||||||

| Tobacco Settlement Financial Corporation, New Jersey, 5.00%, due 6/1/19 , callable 6/1/17 at 100 | 200,000 | 196,216 | ||||||

| Pennsylvania State Higher Educational Facilities Authority (University of Pennsylvania Health System), 4.75%, due 8/15/22, callable 8/15/19 at 100 | 150,000 | 155,312 | ||||||

| North Carolina Medical Care Community Mortgage Revenue (Chatham Hospital), 5.25%, due 8/1/26, callable 2/1/17 at 100 (MBIA) | 250,000 | 237,294 | ||||||

| Pennsylvania State Higher Educational Facilities Authority, 6.00%, due 1/15/31 | 200,000 | 203,936 | ||||||

| Total Other Revenue Bonds | 4,948,125 | |||||||

| Total Municipal Bonds (Cost $6,105,539) | 6,255,428 |

See Notes to financial statements

7

| NRM Investment Company |

Schedule of Investments (Continued)

February 28, 2010

Unaudited

| Principal Amount or Shares | Fair Value | |||||||

| Preferred Stocks – 36.5% | ||||||||

| RBS Capital Trust VI, 6.25% | 15,000 | 193,800 | ||||||

| Aegon NV , 6.50% | 15,000 | 293,100 | ||||||

| Aegon NV, 6.875% | 10,000 | 202,300 | ||||||

| Barclays Bank, PLC ADR | 20,000 | 431,790 | ||||||

| Deutsche Bank Contingent Cap Tr, 6.55% | 15,000 | 327,000 | ||||||

| Goldman Sachs Group, Inc. 1/1000 B | 15,000 | 375,900 | ||||||

| HSBC USA, Inc., 1/40 Series H | 20,000 | 485,000 | ||||||

| ING Groep NV, 7.05% | 10,000 | 198,500 | ||||||

| ING Groep NV, Perpetual Debt Security | 6,000 | 106,437 | ||||||

| Metlife, Inc., 6.50% | 17,500 | 431,375 | ||||||

| PNC Financial Group, 8.25% , Floating Rate | 300,000 | 313,653 | ||||||

| Prudential PLC, 6.50% | 12,500 | 291,375 | ||||||

| Royal Bank of Scotland Group PLC ADR Series R | 5,000 | 66,100 | ||||||

| Royal Bank of Scotland Group PLC ADR Series Q | 20,000 | 266,400 | ||||||

| Santander Financial SA, 6.41% | 9,000 | 193,410 | ||||||

| Total Preferred Stocks (Cost $4,995,220) | 4,176,140 | |||

| Common Stocks – 4.9% | ||||||||

| General Electric Co. | 15,000 | 240,900 | ||||||

| US Bancorp | 13,000 | 319,930 | ||||||

| Total Common Stocks (Cost $383,240) | 560,830 |

| Real Estate Investment Trusts – 1.0% | ||||||||

| Capital Trust, Inc. (Cost $765,147) | 70,000 | 118,300 | ||||||

| Short-Term Investments - at Cost Approximating Fair Value - 2.9% | ||||||||

| Federated Pennsylvania Municipal Cash Trust #8 – (Cost $336,030) | 336,030 | 336,030 | ||||||

| Total Investments - 100% (Cost $12,585,176) | $ | 11,446,728 |

See Notes to financial statements

8

| NRM Investment Company |

Statement of Operations

Period Ended February 28, 2010

Unaudited

| Investment Income | ||||

| Interest | $ | 129,471 | ||

| Dividends | 177,271 | |||

| $ | 306,742 | |||

| Expenses | ||||

| Investment advisory fees | 16,769 | |||

| Custodian fees | 8,150 | |||

| Transfer and dividend disbursing agent fees | 950 | |||

| Legal and professional fees | 46,420 | |||

| Directors’ fees | 3,600 | |||

| Insurance | 750 | |||

| Capital stock tax | 3,457 | |||

| Miscellaneous | 5,533 | |||

| Total Expenses | 86,029 |

| Net Investment Income | 220,713 |

| Realized and Unrealized Gain(Loss) on Investments | ||||

| Net realized loss from investment transactions | (142,853 | ) | ||

| Net unrealized appreciation of investments | 829,544 | |||

| Net Realized and Unrealized Gain on Investments | 686,691 |

| Net Increase in Net Assets Resulting from Operations | $ | 907,404 |

See Notes to financial statements

9

| NRM Investment Company |

Statements of Changes in Net Assets

Six Months Ended February 28, 2010 and Year Ended August 31, 2009

2/28/2010 Unaudited | 8/31/2009 | |||||||

| Increase in Net Assets from Operations | ||||||||

| Net investment income | $ | 220,713 | $ | 486,420 | ||||

| Net realized loss from investment transactions | (142,853 | ) | (985,094 | ) | ||||

| Net unrealized appreciation(depreciation) of investments | 829,544 | (684,194 | ) | |||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | 907,404 | (1,182,868 | ) | |||||

| Distributions to Shareholders | (228,697 | ) | (335,957 | ) | ||||

| Capital Share Transactions | 35 | (241,182 | ) | |||||

| Total Increase (Decrease) in Net Assets | 678,742 | (1,760,007 | ) | |||||

| Net Assets – Beginning of Year | 10,796,748 | 12,556,755 | ||||||

| Net Assets - End of Period/Year | $ | 11,475,490 | $ | 10,796,748 | ||||

See Notes to financial statements

10

| NRM Investment Company |

| February 28, 2010 |

| Financial Highlights |

Period Ended February 28, 2010,August 31, 2009, 2008, 2007, 2006, and 2005

| 2/28/10 | ||||||||||||||||||||||||

| Unaudited | 2009 | 2008 | 2007 | 2006 | 2005 | |||||||||||||||||||

| Per Share Data (for a share outstanding throughout the indicated period) | ||||||||||||||||||||||||

| Net asset value, beginning of year | $ | 3.069 | $ | 3.480 | $ | 3.551 | $ | 3.938 | $ | 3.900 | $ | 3.931 | ||||||||||||

| Net investment income (loss) | .063 | .138 | .321 | (.131 | ) | .110 | .070 | |||||||||||||||||

| Net realized and unrealized gain (loss) on investments | .195 | (.454 | ) | (.336 | ) | (.088 | ) | .059 | .097 | |||||||||||||||

| Total from Investment Operations | .258 | (.316 | ) | (.015 | ) | (.219 | ) | .169 | .167 | |||||||||||||||

| Less distributions: | ||||||||||||||||||||||||

| Dividends from capital gains | - | - | - | (.025 | ) | (.021 | ) | (.130 | ) | |||||||||||||||

| Dividends from net tax-exempt income | (.027 | ) | (.045 | ) | (.024 | ) | (.064 | ) | (.086 | ) | (.061 | ) | ||||||||||||

| Dividends from net taxable income | (.038 | ) | (.050 | ) | (.032 | ) | (.079 | ) | (.024 | ) | (.007 | ) | ||||||||||||

| Total Distributions | (.065 | ) | (.095 | ) | (.056 | ) | (.168 | ) | (.131 | ) | (.198 | ) | ||||||||||||

| Net Asset Value, End of Period | $ | 3.262 | $ | 3.069 | $ | 3.480 | $ | 3.551 | $ | 3.938 | $ | 3.900 | ||||||||||||

| Total Return (Loss) | 8.47 | % | (9.20 | %) | (0.37 | %) | (5.79 | %) | 4.40 | % | 3.76 | % | ||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

| Net assets, end of period/year (in thousands) | $ | 11,475 | $ | 10,797 | $ | 12,557 | $ | 12,815 | $ | 14,209 | $ | 15,397 | ||||||||||||

| Ratio of expenses to average net assets | .77 | % | 1.40 | % | 1.33 | %* | 8.62 | % | 1.05 | % | 1.23 | % | ||||||||||||

| Ratio of net investment income (loss) to average net assets | 1.98 | % | 4.70 | % | 9.23 | % | (3.43 | %) | 2.77 | % | 1.75 | % | ||||||||||||

| Portfolio turnover rate | 0.00 | % | 17.27 | % | 9.27 | % | 18.00 | % | 88.85 | % | 56.38 | % | ||||||||||||

* Excludes the recovery of environmental claims and related costs.

See Notes to financial statements

11

| NRM Investment Company |

| February 28, 2010 |

Notes to Financial Statements

| Note 1 - Nature of Business and Significant Accounting Policies |

| Nature of Business |

NRM Investment Company (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The investment objective of the Fund is to maximize and distribute income and gains on a current basis. Its secondary objective is preservation of capital. The Fund generally invests in both bond and equity markets and is subject to the risks and uncertainty inherent therein. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

| Valuation of Investments |

Investments in securities (other than debt securities maturing in 60 days or less) traded in the over-the-counter market, and listed securities for which no sale was reported on the last business day of the year, are valued based on prices furnished by a pricing service. This service determines the valuations using a matrix pricing system based on common bond features such as coupon rate, quality and expected maturity dates. Securities for which market quotations are not readily available are valued by the investment advisor under the supervision and responsibility of the Fund’s Board of Directors. Investments in securities that are traded on a national securities exchange are valued at the closing prices. Short-term investments are valued at amortized cost, which approximates fair value.

| Investment Transactions and Related Investment Income |

Investment transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on the basis of identified cost for both financial and federal income tax purposes. Interest income is recorded on the accrual basis for both financial and income tax reporting. Dividend income is recognized on the ex-dividend date. In computing investment income, the Fund amortizes premiums over the life of the security, unless said premium is in excess of any call price, in which case the excess is amortized to the earliest call date. Discounts are accreted over the life of the security.

| Transactions with Shareholders |

Fund shares are sold and redeemed at the net asset value. Transactions of these shares are recorded on the trade date. Dividends and distributions are recorded by the Fund on the ex-dividend date.

| Federal Income Taxes |

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and distribute substantially all of its net investment income and realized net gain from investment transactions to its shareholders and, accordingly, no provision has been made for federal income taxes.

12

| NRM Investment Company |

| February 28, 2010 |

| Notes to Financial Statements |

| Note 1 - Nature of Business and Significant Accounting Policies - Continued |

| Estimates |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| Note 2 - Investment Advisor and Management Fees and Other Transactions with Affiliates |

The Fund has an investment advisory agreement which provides that the Fund pays to the investment advisor, as compensation for services provided and expenses assumed, a fee at the annual rate of .30% of the Fund’s net asset value. The chief executive officer of the investment advisor is on the Board of Directors of the Fund. Furthermore, the Fund’s president and chairman of the Board owns 80.1% of the Fund’s outstanding shares as of February 28, 2010.

| Note 3 - Cost, Purchases and Sales of Investment Securities |

Cost of purchases and proceeds from sales and maturities of investment securities, other than short-term investments, aggregated $-0- and $179,372, respectively, during the period ended February 28, 2010.

At February 28, 2010, the cost of investment securities owned is the same for financial reporting and federal income tax purposes. Net unrealized depreciation of investment securities is $1,138,448 (aggregate gross unrealized appreciation of $390,064, less aggregate unrealized depreciation of ($1,528,512).

| Note 4 –Fair Value Measurements |

In September 2006, the Financial Accounting Standards Board (“FASB”) issued guidance, now codified as FASB Accounting Standards Codification (“ASC”) Topic 820, “Fair Value Measurements and Disclosures”. FASB ASC Topic 820 establishes a framework for measuring fair value and expands disclosures of fair value measurements in financial statements.

ASC 820-10 establishes a fair value hierarchy that proprirtizes the inputs to valuation methods used to measure fair value. The hierachy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of fair value hierarchy under ASC 820-10 are as follows:

Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical unrestricted assets or liabilites.

Level 2- Quoted prices in markets that are not active, or inputs that are observable either directly or indirectly, for substantially the full term of the asset or liability.

Level 3- Prices or valuation techniques that require inputs that are both significant to fair value measurement and unobservable (i.e. support with little or no market value activity).

13

| NRM Investment Company |

| February 28, 2010 |

| Notes to Financial Statements |

| Note 4 –Fair Value Measurements - Continued |

For financial assets measured at fair value on a recurring basis, the fair value measurement by the level within the fair value hierarchy used as at February 28, 2010 are as follows:

| Valuation Inputs | Municipal Bonds | Preferred Stocks | Common Stocks | Real Estate Investment Trusts | Temporary Cash | Total | ||||||||||||||||||

| Level 1 - Quoted prices | - | $ | 4,176,140 | $ | 560,830 | $ | 118,300 | $ | 336,030 | $ | 5,191,300 | |||||||||||||

| Level 2 - Other significant observable inputs | $ | 6,255,428 | - | - | - | - | $ | 6,255,428 | ||||||||||||||||

| Level 3 - Significant unobservable inputs | - | - | - | - | - | - | ||||||||||||||||||

| Total | $ | 6,255,428 | $ | 4,176,140 | $ | 560,830 | $ | 118,300 | $ | 336,030 | $ | 11,446,728 | ||||||||||||

| Note 5 - Environmental Liability |

The Fund operated a steel processing factory between 1974 and 1979. During this period, it disposed of a relatively harmless chemical waste product consisting of a weak ferrous chloride solution. The independent transporters represented that its destination was at an approved site. Following various investigations beginning in the 1980’s and continuing to the present, the United States Environmental Protection Agency (EPA) determined that property on Broad Street in Doylestown, Pa. was used as an unapproved disposal site for many hazardous chemicals. In March 2008, it designated the site, called Chem-Fab, a National Priority “Super Fund” site requiring environmental remediation. Among the chemicals supposedly deposited there was ferrous chloride. Operations at Chem-Fab included ferrous chloride of greater strength than the Fund’s waste product. The EPA, supported by what it deems to be relevant documents and a witness statement, determined that the Fund and three others were responsible parties for disposal at Chem-Fab, and pursuant to statutory authorization, invited the four to participate in investigation and remediation. The expected cleanup cost for the site is uncertain but has been estimated at $5,000,000.

The Fund believes the EPA evidence of the Fund’s connection with the Chem-Fab site is weak and that any ferrous chloride of the kind the Fund produced and that may have been taken there caused no environmental harm. Based thereon, the Fund’s board of directors declined the invitation to remediate. On July 10, 2009, EPA acknowledged the refusal (as well as the refusals of the other three), indicating it would conduct an investigation and remediation study without outside participation.

14

| NRM Investment Company |

| February 28, 2010 |

| Notes to Financial Statements |

| Note 5 - Environmental Liability – Continued |

The EPA, if it persists in its position that the Fund was in any way responsible, may bring formal action for reimbursement. Although the Fund will defend vigorously any such action that might be brought, counsel, at this early stage of the investigation, is unable to evaluate the risk other than to say it is serious and for the indefinite future should be regarded as material.

| Note 6 - Transactions in Capital Stock and Components of Net Assets |

Transactions in fund shares were as follows:

| Period Ended | Year Ended | |||||||||||||

| February 28, 2010-Unaudited | August 31, 2009 | |||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||

| Shares issued | - | $ | - | - | $ | - | ||||||||

| Shares issued in reinvestment of dividends | 11 | 35 | 9 | 25 | ||||||||||

| Shares redeemed | - | (90,003 | ) | (241,207 | ) | |||||||||

| Net Increase (Decrease) | 11 | $ | 35 | (89,994 | ) | ($ | 241,182 | ) | ||||||

The components of net assets at February 28, 2010 and August 31, 2009 are as follows:

| February 28, 2010 | ||||||||

| Unaudited | August 31, 2009 | |||||||

| Capital shares, par value $.01 per share, 3,518,442 shares and 3,608,431 shares issued and outstanding at February 28, 2010 and August 31, 2009 (10,000,000 full and fractional shares authorized); and capital paid-in | $ | 13,758,459 | $ | 13,758,424 | ||||

Net realized loss on sale of investments* | (1,139,998 | ) | (997,145 | ) | ||||

| Unrealized depreciation of investments | (1,138,448 | ) | (1,267,992 | ) | ||||

| (Overdistributed) undistributed net investment income | (4,523 | ) | 3,461 | |||||

| Net Assets | $ | 11,475,490 | $ | 10,796,748 |

| * | Realized losses are the same for federal income tax purposes. Realized losses can be carried forward until the year ended August 31, 2016 ($12,051) ,August 31, 2017 ($985,094), and August 31, 2018 ($142,853). |

15

| NRM Investment Company |

| February 28, 2010 |

| Notes to Financial Statements |

| Note 7 - Distributions to Shareholders |

The tax character of distributions paid are as follows during the period/year ended February 28, 2010 and August 31, 2009:

2010 | 2009 | ||||||||

| Distributions paid from: | |||||||||

Tax-exempt interest and dividends | $ | 96,529 | $ | 166,097 | |||||

Taxable qualified dividends | 132,168 | 168,506 | |||||||

Taxable ordinary dividends | - | 1,354 | |||||||

Long-term capital gains | - | - | |||||||

| $ | 228,697 | $ | 335,957 | ||||||

| Note 8 – Subsequent Events |

The FASB issued guidance now codified as FASB ASC Topic 855, “Subsequent Events”. Under FASB ASC Topic 855, the Fund is required to evaluate the events and transactions that occur after the balance sheet date but before the date the financial statements are issued, or available to be issued in the case of non-public entities. FASB ASC Topic 855 requires entities to recognize in the financial statements the effect of all events or transactions that provide additional evidence of conditions that existed at the balance sheet date including the estimates inherent in the financial preparation process. Entities shall not recognize the impact of events or transactions that provide evidence about conditions that did not exists at the balance sheet date but arose after that date. FASB ASC Topic 855 also requires entities to disclose the date through which subsequent events have been evaluated. FASB ASC Topic 855 was effective for interim and annual reporting periods ending after June 15, 2009. The Fund adopted the provisions of FASB ASC Topic 855 for the twelve months ended August 31, 2009. Management has reviewed events occurring through April 25, 2010 the date the financial statements were issued, and has concluded that no additional subsequent events have occurred requiring accrual or disclosure.

16

NRM Investment Company

Fund’s Expenses

Fees and Expenses

The following table describes the fees and expenses you may pay if you by and hold shares of the Fund. As is the case with all mutual funds, transaction costs incurred by the Fund for buying and selling securities are not reflected in the table. However, these costs are reflected in the investment performance figures included in the prospectus. The expenses shown in the following table are based on those incurred in the fiscal year ended August 31, 2009:

Shareholder Fees

| (Fees paid directly from your investment) | |||

| Sales Charge (Load) imposed on Purchases | None | ||

| Purchase Fee | None | ||

| Sales Charge (Load) imposed on Reinvested Dividends | None | ||

| Redemption Fees | None | ||

| Account Service Fees | None |

| Annual Fund Operating Expenses | |||

| (Expenses deducted from the Fund’s assets) | |||

| Management Expenses | .29 | %1 | |

| 12b-1 Distribution Fees | None | ||

| Other Expenses | 1.11 | % | |

| Total Annual Fund Operating Expenses | 1.40 | % |

1. The percentage generally corresponds to the Fund’s contract with its investment advisor at an annual rate of .30% of the Fund’s portfolio value, payable quarterly, the -.01% difference in the chart being accounted for by value changes from quarter to quarter within the year and the differences between portfolio and net asset values.

Example: This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| One Year | Three Years | Five Years | Ten Years | ||||||||||||

| $ | 147 | $ | 457 | $ | 789 | $ | 1,727 | ||||||||

17

NRM INVESTMENT COMPANY

Matters Submitted to Shareholders

The following items were submitted to the Company’s shareholders at their annual meeting on December 17, 2009:

Election of Directors

The Board of Directors (John H. McCoy, George W. Connell, Joseph Fabrizio, Anthony B. Fisher, and Raymond H. Welsh) were unanimously elected by the votes of all shareholders present.

Ethics Code

Based upon the Compliance Officer’s communications with the SEC staff, he recommended adoption of a restatement of the Company’s Ethics Code to assure full compliance with the mandate of SEC Rule 17j-1 under the Investment Company Act. Included in the expanded code are disclosure procedures by access persons and reporting to the Board of quarterly activity. Based upon this information the shareholders present RESOLVED unanimously to adopt the restated Ethics Code.

Compliance Code

Following a conference with the staff of the SEC, noting its recommendations and in compliance with the current requirements of SEC Rule 38a-1 under the Investment Company Act, the Compliance Officer redrafted the Company’s compliance program. It was designed to prevent violations of the federal securities laws. The program was tailored to the Company’s normal, low volume operations and addressed what the Officer perceived to be limited areas of conflicts and other compliance factors that would create risk exposure for the Company. Based upon this information the shareholders present RESOLVED unanimously to adopt the restated Compliance Code.

AML Program

Consistent with the Bank Secrecy Act as modified by the U.S. Patriot Act and the regulations adopted thereunder, the Company is required to continue an anti-money laundering program (“BSA/AML”) reasonably designed to prevent the Company from being used for money laundering or the financing of terrorist activities and to achieve and monitor compliance with the applicable requirements.

18

NRM INVESTMENT COMPANY

Matters Submitted to Shareholders- Continued

By reason of the experience of the Company’s independent agents with receipts and disbursements of Company money (involving no “red flag” items), and within the framework of the Company’s present and future operations, its BSA/AML program is designed to rely upon the AML1, CIP2 and SAR3 programs carried out by the independent agents to the fullest extent consistent with regulations. It will be the duty of a Company’s AML Officer (appointed at this meeting) and certain other service providers to monitor such activities through ongoing permitted communications among the AML Officer, other service providers, and the independent agents. The Compliance Officer recommended the adoption of the AML program. Based thereon, the shareholders present RESOLVED unanimously to adopt the restated AML Program.

Fidelity Bond

The Company acquired a fidelity bond from Chubb & Sons effective as of February 3, 2009 covering the officers of the Company. SEC Rule 17g-1 under the Investment Company Act requires the Board’s disinterested directors to review and adopt a resolution approving the bond with each annual renewal. They did so and recommended to the shareholders that they ratify the Board’s action in this respect. Based thereon, the shareholders present RESOLVED unanimously to adopt the bond.

19