UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811 02955

Exact name of registrant as specified in charter: NRM Investment Company

Address of principal executive offices: NRM Investment Company, 280 Abrahams Lane, Villanova, Pa., 19085

Name and address of agent for service: John H. McCoy, President, NRM Investment Company, 280 Abrahams Lane, Villanova, Pa., 19085

Registrant’s Telephone Number: (610) 995-0322

Date of fiscal year end: August 31

Date of Reporting Period: Period ending February 29, 2012

ITEM 1 - REPORTS TO STOCKHOLDERS

A copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act is attached hereto.

ITEM 2 - CODE OF ETHICS

This is a semi-annual report. A response is not required.

ITEM 3. - AUDIT COMMITTEE FINANCIAL EXPERT

This is a semi-annual report. A response is not required.

ITEM 4. ACCOUNTANT FEES AND SERVICES

This is a semi-annual report. A response is not required.

ITEM 5. - Registrant is not a listed issuer.

ITEM 6 - SCHEDULE OF INVESTMENTS

The information is included as part of the report to shareholders filed under Item 1 of this report and attached hereto.

ITEMS 7, 8, 9 – PROXY VOTING POLICIES AND PURCHASES OF EQUITY SECURITIES

The information requested is not applicable to this open-end company.

ITEM 10 – SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

The registrant does not have shareholder nominating procedures in place and has had no such procedures in the past.

ITEM – 11 CONTROLS AND PROCEDURES

The Fund’s President -Treasurer and the Fund’s regularly employed accountant have concluded that the Fund’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Fund is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

Item 12 – Exhibits

The required certifications are attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant: NRM Investment Company

| By: | /s/ John H. McCoy | |||

| John H. McCoy, President and Treasurer | ||||

| Date: | 4/25/12 | |||

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. | ||||

| By: | /s/ John H. McCoy | |||

| John H. McCoy, President and Treasurer | ||||

| Date: | 4/25/12 | |||

| By: | /s/ Edward Fackenthal | |||

| Edward Fackenthal, Counsel and Assistant Secretary | ||||

| Date: | 4/25/12 | |||

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

Table of Contents

| Page No. | |

Total Returns | 2 |

| Performance at a Glance | 2 |

| Advisor’s Report | 2 |

| Performance Summary | 4 |

| Financial Statements: | |

| Schedule of Investments | 6 |

| Statement of Assets and Liabilities | 10 |

| Statement of Operations | 11 |

| Statement of Changes in Net Assets | 12 |

| Financial Highlights | 13 |

| Notes to Financial Statements | 14 |

| Fund’s Expenses | 20 |

| Statement Regarding Availability of Proxy Voting Policies and Procedures | 22 |

| Selection of Investment Advisor | 23 |

1

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

Total Returns

Six Months Ended February 29, 2012

| Total Return | ||||

| NRM Investment Company | 3.83 | % | ||

Composite Index1 | 6.69 | % | ||

1 60% Barclays 5 Yr Muni / 40% ML PFD Stock DRD Eligible (9/1/09 to 7/31/10)

60% Barclays 5 Yr Muni / 20% S&P 500/ 20% CPI (8/1/09 to 2/29/12)

Performance at a Glance

| Distributions Per Share | ||||||||||||||||

Starting Share Price | Ending Share Price | Income Dividends | Capital Gains | |||||||||||||

| NRM Investment Company | $ | 3.53 | $ | 3.61 | $ | 0.054 | $ | 0.00 | ||||||||

Advisor’s Report

The portfolio performance for the six month period ended February 28, 2011 was positively impacted by the portfolio’s municipal bond holdings. The municipal bond holdings returned 3.46% compared to 2.76% for the benchmark Barclays Capital 5-year Municipal Bond Index. State and local governments continued to see increases in tax collections and other revenues. Market demand for tax-exempt bonds improved as a result of these fundamentals. Concerns over future income tax rates also contributed to demand, helping to support the market. We expect the municipal bond market to be subject to volatility as a result of increasing campaign rhetoric regarding tax policies as we approach the November election. We continue to believe that tax-exempt municipal bonds are attractively valued on an after-tax basis relative to other sectors of the bond market.

The Fund’s total portfolio performance for the six month period was 3.83%. The portfolio’s equity holdings returned 9.36% for the six month period. This performance lagged the S&P 500 Index performance of 13.31% for the period primarily due to the portfolio’s exposure to stocks and funds tied to the metals, mining and natural resources sector. As an indication of that sector’s performance for the period, the spot market price of Gold declined 7.1% from $1825.72/oz to $1696.85/oz. In our opinion, current valuations on the high quality, dividend-paying stocks in the portfolio remain attractive and are supported by continued strength in corporate earnings as well as their dividend payments. Despite the valuation positives, the market may still be subject to continued volatility as a result of the US elections and concerns regarding Europe.

Looking forward, we believe the portfolio’s combination of a defensively postured bond portfolio and an equity portfolio comprised of high quality, dividend-paying stocks and stocks with exposure to natural resources will result in performance consistent with the objectives of the Board of Directors.

2

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

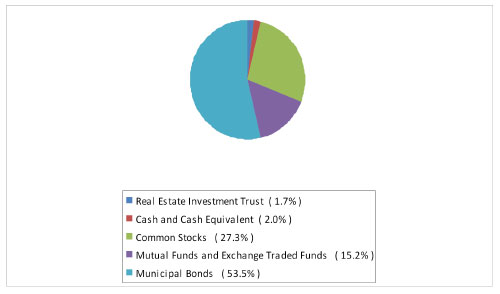

The Asset Allocation as of February 29, 2012 is presented below:

Availability of Quarterly Portfolio Schedule

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commissions website at http://www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

3

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

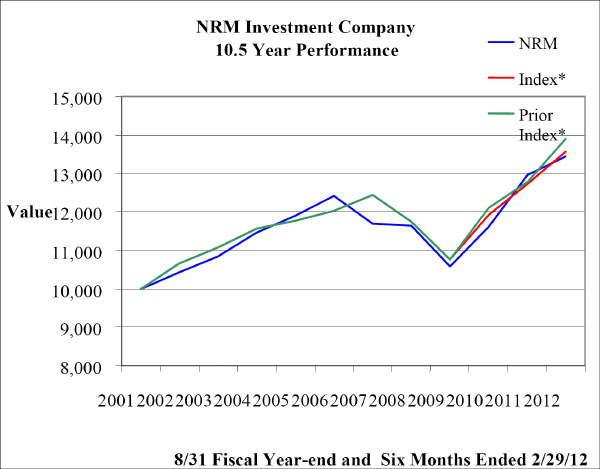

Performance Summary

All of the returns in this report represent past performance which is not a guarantee of future results that may be achieved by the Fund.( Current performance may be lower or higher than the performance data cited.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or the sale of Fund shares.

4

| NRM Investment Company |

| Semi-Annual Report |

| February 29, 2012 |

| PERIOD | ACTUAL | CURRENT INDEX | PRIOR INDEX |

| 08/31/02 | 4.40% | 6.69% | 6.69% |

| 08/31/03 | 3.96% | 3.70% | 3.70% |

| 08/31/04 | 5.59% | 4.49% | 4.49% |

| 08/31/05 | 3.76% | 1.76% | 1.76% |

| 08/31/06 | 4.40% | 2.27% | 2.27% |

| 08/31/07 | -5.79% | 3.46% | 3.46% |

| 08/31/08 | -.37% | -5.62% | -5.62% |

| 08/31/09 | -9.20% | -8.45% | -8.45% |

| 08/31/10 | 9.71% | 10.92% | 12.65% |

| 08/31/11 | 11.59% | 6.64% | 5.48% |

| 02/29/12 | 3.83% | 6.69% | 8.83% |

5

| NRM Investment Company |

| Schedule of Investments |

| February 29, 2012 |

Principal Amount or Shares | Fair Value | |||||||

| Municipal Bonds –53.5% | ||||||||

General Obligation Bonds –11.1% | ||||||||

| Pittsburgh, Pennsylvania, 5.00%, due 9/1/12, callable 3/1/12 at 100 (AMBAC) | 250,000 | $ | 250,000 | |||||

| Philadelphia, Pennsylvania School District, 5.625%, due 8/1/15, callable 8/1/12 at 100 (FGIC) | 300,000 | 306,630 | ||||||

Pittsburgh, Pennsylvania, Refunding, 5.25%, due 9/1/16 | 100,000 | 115,467 | ||||||

| Puerto Rico, 5.50%, due 7/1/17 | 250,000 | 284,875 | ||||||

| Will County, Illinois, 5.0%, due 11/15/24 | 100,000 | 107,474 | ||||||

| Richland County, South Carolina Broad River Sewer System, 5.375%, due 3/1/30, callable 3/1/13 | 250,000 | 260,230 | ||||||

Total General Obligation Bonds | 1,324,676 | |||||||

Housing Finance Agency Bonds - 1.6% | ||||||||

| Louisiana LOC Government Environmental Facilities Community Development Authority, Multi-family Housing, 4.25%, due 4/15/39, put 4/15/16 at 100.00 | 180,000 | 190,001 | ||||||

Total Housing Finance Agency Bonds | 190,001 | |||||||

Other Revenue Bonds – 40.8% | ||||||||

| Parkland, Pennsylvania School District, 5.375%, due 9/1/15 (FGIC) | 170,000 | 196,199 | ||||||

| Pennsylvania Infrastructure Investment Authority, 5.00%, due 9/1/12 | 500,000 | 511,845 | ||||||

| Pennsylvania State Higher Educational Facilities Authority, 5.50%, prerefunded 1/01/16 | 350,000 | 365,201 | ||||||

| Philadelphia, Pennsylvania Wastewater, 5.00%, due 7/1/14 | 250,000 | 273,257 | ||||||

| Pennsylvania State Turnpike Commission, 5.25%, due 12/1/14, callable 12/1/10 at 100 (AMBAC) | 155,000 | 155,518 | ||||||

| Pennsylvania State Turnpike Commission, 5.25%, due 12/1/15, callable 12/1/10 at 100 (AMBAC) | 140,000 | 140,462 | ||||||

| Allegheny County Sanitation Authority, Sewer Revenue, 5.00%, due 12/1/23, callable 12/1/15 at 100 | 300,000 | 328,851 | ||||||

| Allegheny County, Pennsylvania Higher Educational Building Authority, 5.50%, due 3/1/16, callable 6/15/12 at 100 (AMBAC) | 150,000 | 171,270 | ||||||

| Pennsylvania State Higher Educational Facilities Authority, 5.0%, due 6/15/16, callable 6/15/12 at 100 (AMBAC) | 100,000 | 101,201 | ||||||

The accompanying Notes are an integral part of these financial statements.

6

| NRM Investment Company |

| Schedule of Investments (Continued) |

| February 29, 2012 |

Principal Amount or Shares | Fair Value | |||||||

| Municipal Bonds – 53.5% (Continued) | ||||||||

Other Revenue Bonds – 40.8% (Continued) | ||||||||

| Chester County, Pennsylvania Health and Educational Authority (Devereux), 5.00%, due 11/1/18 | 405,000 | $ | 435,922 | |||||

New York State Dorm Authority, 5.00%, due 7/01/17, Callable 7/01/16 at 100 (SIENA) | 200,000 | 224,814 | ||||||

| Pennsylvania State Public School Building Authority, 5.00%, due 5/15/22 | 150,000 | 158,019 | ||||||

| Pennsylvania State Higher Educational Facilities Authority (University of Pennsylvania Health System), 4.75%, due 8/15/22, callable 8/15/19 at 100 | 150,000 | 167,500 | ||||||

| Allegheny County, Pennsylvania Hospital Development Authority (University of Pittsburgh Medical School), 5.00%, due 8/15/23, callable 8/15/19 at 100 | 100,000 | 112,331 | ||||||

| Jefferson County, Kentucky Capital Projects Corporation, 4.375%, due 6/01/26, callable 6/1/17 at 100 | 100,000 | 107,824 | ||||||

| Spring Texas Independent School District, 5.00%, due 8/15/26, callable 08/15/14 | 280,000 | 302,590 | ||||||

| North Carolina Medical Care Community Mortgage Revenue (Chatham Hospital), 5.25%, due 8/1/26, callable 2/1/17 at 100 (MBIA) | 230,000 | 242,682 | ||||||

| Virginia Port Facilities Authority, 4.50%, due 7/1/30, callable 7/1/19 at 100 | 200,000 | 215,220 | ||||||

| Pennsylvania State Higher Educational Facilities Authority (St. Joseph University), 5.75%, due 11/1/30, callable 11/1/20 at 100 | 400,000 | 443,824 | ||||||

| Delaware Valley, Pennsylvania Regional Finance Authority, 5.75%, due 7/01/32 | 200,000 | 229,280 | ||||||

| Total Other Revenue Bonds | 4,883,810 | |||||||

| �� | ||||||||

| Total Municipal Bonds (Cost $6,135,887) | 6,398,487 | |||||||

| Common Stocks – 27.3% | ||||||||

| Consumer Discretionary – 4.7% | ||||||||

| Genuine Parts Co. | 1,700 | 106,556 | ||||||

| Heinz, HJ | 2,875 | 151,541 | ||||||

| Home Depot Inc. | 2,400 | 114,168 | ||||||

| McDonalds Corp. | 1,100 | 109,208 | ||||||

| Pepsico | 1,300 | 81,822 | ||||||

| Total Consumer Discretionary | 563,295 | |||||||

The accompanying Notes are an integral part of these financial statements.

7

| NRM Investment Company |

| Schedule of Investments (Continued) |

| February 29, 2012 |

| Common Stocks (Continued) – 27.3% | ||||||||

| Consumer Staples – 3.3% | ||||||||

| Altria Group, Inc. | 5,600 | $ | 168,560 | |||||

| Kimberly Clark Corp. | 1,950 | 142,116 | ||||||

| Procter & Gamble Co. | 1,250 | 84,525 | ||||||

| Total Consumer Staples | 395,201 | |||||||

| Energy – 3.5% | ||||||||

| Conocophillips | 1,550 | 118,653 | ||||||

| Royal Dutch Shell, PLC, ADR | 2,000 | 146,180 | ||||||

| Total Fina Elf SA, ADR | 2,750 | 154,192 | ||||||

| Total Energy | 419,025 | |||||||

| Financials – 2.6% | ||||||||

| Blackrock, Inc. | 500 | 99,500 | ||||||

| M&T Bank Corp. | 800 | 65,296 | ||||||

| NYSE Euronext | 5,100 | 151,827 | ||||||

| Total Financials | 316,623 | |||||||

| Health Care – 3.9% | ||||||||

| Bristol Myers Squibb Co. | 3,250 | 104,553 | ||||||

| Glaxosmithkline PLC, ADR | 3,200 | 141,792 | ||||||

| Johnson & Johnson | 1,200 | 78,096 | ||||||

| Merck & Co., Inc. | 3,700 | 141,229 | ||||||

| Total Health Care | 465,670 | |||||||

| Industrials – 3.7% | ||||||||

| Caterpillar, Inc. | 1,000 | 114,210 | ||||||

| Eaton Corp. | 2,500 | 130,475 | ||||||

| General Electric Co. | 3,600 | 68,580 | ||||||

| United Parcel Service, Inc. Class B | 150 | 11,548 | ||||||

| Waste Management Inc. | 3,400 | 118,932 | ||||||

| Total Industrials | 443,745 | |||||||

| Information Technology – 1.4% | ||||||||

| Automatic Data Processing, Inc. | 800 | 43,456 | ||||||

| Intel Corp. | 4,500 | 120,960 | ||||||

| Total Information Technology | 164,416 | |||||||

The accompanying Notes are an integral part of these financial statements.

8

| NRM Investment Company |

| Schedule of Investments (Continued) |

| February 29, 2012 |

| Common Stocks (Continued) – 27.3% | ||||||||

| Materials – 1.0% | ||||||||

| Air Products & Chemicals, Inc. | 500 | $ | 45,120 | |||||

| DuPont E.I. DeNemours & Co. | 1,500 | 76,275 | ||||||

| Total Materials | 121,395 | |||||||

| Telecommunications – 1.3% | ||||||||

| AT & T, Inc. | 2,800 | 85,652 | ||||||

| Verizon Communications | 1,900 | 72,409 | ||||||

| Total Telecommunications | 158,061 | |||||||

| Utilities – 1.9% | ||||||||

| Consolidated Edison, Inc. | 2,350 | 136,535 | ||||||

| Exelon Corp. | 2,250 | 87,908 | ||||||

| Total Utilities | 224,443 | |||||||

Total Common Stocks (Cost $2,726,418) | 3,271,874 | |||||||

| Exchange Traded Funds – 9.2% | ||||||||

| Ishares Comex Gold Trust* | 28,040 | 462,099 | ||||||

| SPDR Gold Trust* | 2,875 | 472,322 | ||||||

| JPMorgan Chase & Co Aleran ML ETN | 4,100 | 167,280 | ||||||

| Total Exchange Traded Funds (Cost $803,815) | 1,101,701 | |||||||

| Mutual Funds – 6.0% | ||||||||

| Pimco Real Return Strategy Fund | 45,538 | 321,504 | ||||||

| Vanguard Precious Metals & Mining Fund | 18,368 | 401,517 | ||||||

| Total Mutual Funds (Cost $713,736) | 723,021 | |||||||

| Real Estate Investment Trusts – 2.0% | ||||||||

| Capital Trust, Inc.* (Cost $765,147) | 70,000 | 238,000 | ||||||

Short-Term Investments - at Cost Approximating Fair Value - 2.0% | ||||||||

| Federated Pennsylvania Municipal Cash Trust #8 – (Cost $241,822) | 241,822 | 241,822 | ||||||

Total Investments - 100% (Cost $11,386,825) | $ | 11,974,905 | ||||||

* Represents non-income producing security during the period.

The accompanying Notes are an integral part of these financial statements.

9

| NRM Investment Company |

| Statement of Assets and Liabilities |

| February 29, 2012 |

| Assets | ||||

| Investments at fair value (cost $11,386,825) | $ | 11,974,905 | ||

| Cash | 1,400 | |||

| Interest and dividends receivable | 96,648 | |||

| Prepaid expenses | 1,500 | |||

Total Assets | 12,074,453 | |||

| Liabilities | ||||

| Dividends payable | 69,686 | |||

| Due to advisor | 5,667 | |||

| Accrued expenses and other liabilities | 19,371 | |||

Total Liabilities | 94,724 | |||

Net Assets, Applicable to 3,318,376 outstanding Shares, Equivalent to $3.61 a Share | $ | 11,979,729 | ||

Net Assets consist of: | ||||

| Capital Stock ( par value $.01/share, 10,000,000 shares authorized, 3,318,376 issued and outstanding) | $ | 33,184 | ||

| Paid-in capital | 13,067,037 | |||

| Accumulated undistributed net investment income | 11,620 | |||

| Accumulated realized loss on investments | (1,720,192 | ) | ||

| Unrealized appreciation of investments | 588,080 | |||

Net Assets | $ | 11,979,729 | ||

The accompanying Notes are an integral part of these financial statements.

10

| NRM Investment Company |

| Statement of Operations |

| Six-Month Period Ended February 29, 2011 |

| Investment Income | ||||

| Interest | $ | 121,235 | ||

| Dividends ( net of $1,035 foreign taxes withheld) | 129,448 | |||

| 250,683 | ||||

| Expenses | ||||

| Investment advisory fees | 17,063 | |||

| Custodian fees | 8,925 | |||

| Transfer and dividend disbursing agent fees | 3,550 | |||

| Legal and professional fees | 22,200 | |||

Directors’ fees 1 | 5,333 | |||

| Insurance | 175 | |||

Capital stock tax2 | 5,667 | |||

| Miscellaneous | 3,333 | |||

| Total Expenses | 66,246 | |||

| Net Investment Income | 184,437 | |||

| Realized and Unrealized Gain (Loss) on Investments | ||||

| Net realized gain from investment transactions | 85,903 | |||

| Capital gain distributions received from portfolio companies | 26,557 | |||

| Net unrealized appreciation of investments | 150,016 | |||

| Net Realized and Unrealized Gain on Investments | 262,476 | |||

| Net Increase in Net Assets Resulting from Operations | $ | 446,913 | ||

1. Includes amounts paid and accrued to all directors and there are no other payments to directors and officers or other persons serving in that capacity.

2. Capital stock tax represents the amounts due the State of Pennsylvania , by statue, based on a two-part formula:1.) based on a fixed amount per million dollars of net asset value; and 2.) a percentage applied to undistributed gross income applicable to Pennsylvania residents.

The accompanying Notes are an integral part of these financial statements.

11

| NRM Investment Company |

| Statements of Changes in Net Assets |

| Period Year Ended February 29, 2012 and August 31, 2011 |

February 29, 2012 | August 31,2011 | |||||||

| Increase (Decrease) in Net Assets from Operations | ||||||||

| Net investment income | $ | 184,437 | $ | 312,135 | ||||

| Net realized gain(loss) from investment transactions | 85,903 | 145,865 | ||||||

| Capital gain distributions received from portfolio companies | 26,557 | 4,345 | ||||||

| Net unrealized appreciation (depreciation) of investments | 150,016 | 783,362 | ||||||

| Net Increase (Decrease) in Net Assets Resulting from Operations | 446,913 | 1,245,707 | ||||||

| Distributions to Shareholders from Net Investment Income | (179,205 | ) | (311,933 | ) | ||||

| Capital Share Transactions | (130 | ) | (658,126 | ) | ||||

| Total Increase in Net Assets | 267,578 | 275,648 | ||||||

| Net Assets - Beginning of Year | 11,712,151 | 11,436,503 | ||||||

| Net Assets - End of Year ( includes undistributed net investment income $11,620 and $6,388, respectively) | $ | 11,979,729 | $ | 11,712,151 | ||||

The accompanying Notes are an integral part of these financial statements.

12

| NRM Investment Company |

| Financial Highlights |

| Period Ended February 29, 2012, August 31, 2011, 2010, 2009, 2008, and 2007 |

| 2/29/12 | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||

| Per Share Data (for a share outstanding throughout the indicated period) | ||||||||||||||||||||||||

| Net asset value, beginning of year | $ | 3.53 | $ | 3.25 | $ | 3.069 | $ | 3.480 | $ | 3.551 | $ | 3.938 | ||||||||||||

Net investment income (loss) (a) | .055 | .094 | .114 | .138 | (.321 | ) | (.131 | ) | ||||||||||||||||

| Net realized and unrealized gain (loss) on investments | .079 | .279 | (.181 | ) | (.454 | ) | (.336 | ) | (.088 | ) | ||||||||||||||

| Total from Investment Operations | .134 | .373 | .295 | (.316 | ) | (.015 | ) | (.219 | ) | |||||||||||||||

Less distributions: | ||||||||||||||||||||||||

| Dividends from capital gains | - | - | - | - | - | (.025 | ) | |||||||||||||||||

| Dividends from net tax-exempt income | (.026 | ) | (.053 | ) | (.052 | ) | (.045 | ) | (.024 | ) | (.064 | ) | ||||||||||||

| Dividends from net taxable income | (.028 | ) | (.041 | ) | (.062 | ) | (.050 | ) | (.032 | ) | (.079 | ) | ||||||||||||

| Total Distributions | (.054 | ) | (.097 | ) | (.114 | ) | (.095 | ) | (.056 | ) | (.168 | ) | ||||||||||||

| Net Asset Value, End of Period | $ | 3.61 | $ | 3.53 | $ | 3.250 | $ | 3.069 | $ | 3.480 | $ | 3.551 | ||||||||||||

| Total Return (Loss) (b) | 3.83 | % | 11.59 | % | 9.71 | % | (9.20 | %) | (0.37 | %) | (5.79 | %) | ||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||||||

| Net assets, end of period/year (in thousands) | $ | 11,980 | $ | 11,712 | $ | 11,437 | $ | 10,797 | $ | 12,557 | $ | 12,815 | ||||||||||||

Ratio of expenses to average net assets | .57 | % | 1.17 | % | 1.39 | % | 1.40 | % | 1.33 | %* | 8.62 | % | ||||||||||||

Ratio of net investment income (loss) to average net assets | 1.58 | % | 2.73 | % | 3.58 | % | 4.70 | % | 9.23 | % | (3.43 | %) | ||||||||||||

| portfolio turnover rate | 5.84 | % | 19.58 | % | 38.07 | % | 17.27 | % | 9.27 | % | 18.00 | % | ||||||||||||

(a) Per share net investment income(loss) has been determined using the average shares method.

(b) Assumes reinvestment of all dividends and distributions.

* Excludes the recovery of environmental claims and related costs.

The accompanying Notes are an integral part of these financial statements.

13

| NRM Investment Company |

| February 29, 2012 |

| Notes to Financial Statements |

| Note 1 - Nature of Business and Significant Accounting Policies |

| Nature of Business |

NRM Investment Company (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company. The investment objective of the Fund is to maximize and distribute income and gains on a current basis. Its secondary objective is preservation of capital. The Fund generally invests in both bond and equity markets and is subject to the risks and uncertainty inherent therein.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America.

| Valuation of Investments |

Investments in securities (other than debt securities maturing in 60 days or less) traded in the over-the-counter market, and listed securities for which no sale was reported on the last business day of the year, are valued based on prices furnished by a pricing service. This service determines the valuations using a matrix pricing system based on common bond features such as coupon rate, quality and expected maturity dates. Securities for which market quotations are not readily available are valued by the investment advisor under the supervision and responsibility of the Fund’s Board of Directors. Investments in securities that are traded on a national securities exchange are valued at the closing prices. Short-term investments are valued at amortized cost, which approximates fair value.

| Investment Transactions and Related Investment Income |

Investment transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on the basis of identified cost for both financial and federal income tax purposes. Interest income is recorded on the accrual basis for both financial and income tax reporting. Dividend income is recognized on the ex-dividend date. In computing investment income, the Fund amortizes premiums over the life of the security, unless said premium is in excess of any call price, in which case the excess is amortized to the earliest call date. Discounts are accreted over the life of the security. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

| Transactions with Shareholders |

Fund shares are sold and redeemed at the net asset value. Transactions of these shares are recorded on the trade date. Dividends and distributions are recorded by the Fund on the ex-dividend date.

| Federal Income Taxes |

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and distribute substantially all of its net investment income and realized net gain from investment transactions to its shareholders and, accordingly, no provision has been made for federal income taxes.

14

| NRM Investment Company |

| February 29, 2012 |

| Notes to Financial Statements |

| Note 1 - Nature of Business and Significant Accounting Policies - Continued |

| Federal Income Taxes - Continued |

Under ASC 740-10, Income Tax Risks, the Fund recognizes the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by authorities. GAAP requires management of the Fund to analyze all open tax years, fiscal years 2008-2011, as defined by IRS statute of limitations for all major industries, including federal tax authorities and certain state tax authorities. As of and during the period ended February 29, 2012, the Fund did not have a liability for any unrecognized tax benefits. The Fund has no examinations in progress and is not aware of any tax positions for which it is reasonably possible that the total tax amounts of unrecognized tax benefits will significantly change in the next twelve months.

| Estimates |

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

| Note 2 - Investment Advisor and Management Fees and Other Transactions with Affiliates |

Advisory Agreement - The Fund has an Investment Advisory Agreement with Haverford Financial Services, Inc. (“the Advisor”). The Advisor manages the Fund’s investments and business affairs subject to the supervision of the Board of Directors. Under the Investment Advisory Agreement, the Fund compensates the Advisor for its investment advisory services at the annual rate of 0.30% of the Fund’s net assets, payable in advance, on a quarterly basis, based upon the net assets of the Fund as of the last day of the previous calendar quarter. The Fund is responsible for its own operating expenses. The Advisor earned $37,063 in advisory fees for the period ended February 29, 2012 and the Fund owed the Advisor $5,667 at February 29, 2012.

Other Transactions with Affiliates - The Chief Executive Officer of the Advisor is on the Board of Directors of the Fund. The beneficial ownership, either directly or indirectly, or more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2 (a) (9) of the 1940 Act. As of February 29, 2012, the Fund’s President and Chairman of the Board held approximately 84.91% of the outstanding shares of the Fund and may be deemed to control the Fund.

| Note 3 - Purchases and Sales of Investment Securities |

Cost of purchases and proceeds from sales and maturities of investment securities, other than short-term investments, aggregated $724,714 and $668,349, respectively, during the period ended February 29, 2012.

15

| NRM Investment Company |

| February 29, 2012 |

| Notes to Financial Statements |

| Note 4 –Fair Value Measurements |

The Fund adopted guidance on fair value measurements, issued by the Financial Accounting Standards Board (FASB) ASC 820-10, “Fair Value Measurements”. ASC 820-10 establishes a fair value hierarchy that prioritizes the inputs to valuation methods used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of fair value hierarchy under ASC 820-10 are as follows:

Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical unrestricted assets or liabilities.

Level 2- Quoted prices in markets that are not active, or inputs that are observable either directly or indirectly, for substantially the full term of the asset or liability.

Level 3- Prices or valuation techniques that require inputs that are both significant to fair value measurement and unobservable (i.e. support with little or no market value activity).

For financial assets measured at fair value on a recurring basis, the fair value measurement by the level within the fair value hierarchy used as at February 29, 2012 are as follows:

| Description | Total | (Level 1- Quoted Prices in Active Markets for Identical Assets) | (Level 2- Significant Other Observable Inputs) | (Level 3- Significant Unobservable Inputs) | ||||||||||||

| Municipal Bonds | $ | 6,398,487 | $ | - | $ | 6,398,487 | $ | - | ||||||||

| Common Stocks | 3,271,874 | 3,271,874 | - | - | ||||||||||||

| Exchange Traded Funds | 1,101,701 | 1,101,701 | - | - | ||||||||||||

| Mutual Funds | 723,021 | 723,021 | - | - | ||||||||||||

| Real Estate Investment Trusts | 238,000 | 238,000 | - | - | ||||||||||||

| Short-Term Investments | 241,822 | 241,822 | - | - | ||||||||||||

Total | $ | 11,974,905 | $ | 5,576,418 | $ | 6,398,487 | $ | - | ||||||||

The Fund did not hold any Level 3 securities during the period.

16

| NRM Investment Company |

| February 29, 2012 |

Notes to Financial Statements

Note 5 - Environmental Liability

The Fund operated a steel processing factory between 1974 and 1979. During this period, it disposed of a relatively harmless chemical waste product consisting of a weak ferrous chloride solution. The independent transporters represented that its destination was at an approved site. Following various investigations beginning in the 1980’s and continuing to the present, the United States Environmental Protection Agency (EPA) determined that property on Broad Street in Doylestown, Pa. was used as an unapproved disposal site for many hazardous chemicals. In March 2008, it designated the site, called Chem-Fab, a National Priority “Super Fund” site requiring environmental remediation. Among the chemicals supposedly deposited there was ferrous chloride. Operations at Chem-Fab included ferrous chloride of greater strength than the Fund’s waste product. The EPA, supported by what it deems to be relevant documents and a witness statement, determined that the Fund and three others were responsible parties for disposal at Chem-Fab, and pursuant to statutory authorization, invited the four to participate in investigation and remediation. The expected cleanup cost for the site is uncertain but has been estimated at $5,000,000.

The Fund believes the EPA evidence of the Fund’s connection with the Chem-Fab site is weak and that any ferrous chloride of the kind the Fund produced and that may have been taken there caused no environmental harm. Based thereon, the Fund’s board of directors declined the invitation to remediate. On July 10, 2009, EPA acknowledged the refusal (as well as the refusals of the other three), indicating it would conduct an investigation and remediation study without outside participation. There has been no further contact from the EPA.

The EPA, if it persists in its position that the Fund was in any way responsible, may bring formal action for reimbursement. Although the Fund will defend vigorously any such action that might be brought, counsel, at this early stage of the investigation, is unable to evaluate the risk other than to say it is serious and for the indefinite future should be regarded as material.

Note 6 - Transactions in Capital Stock and Components of Net Assets

Transactions in fund shares were as follows:

| Period Ended | Year Ended | |||||||||||||||

| February 29, 2012 | August 31, 2011 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Shares issued | 0 | $ | 0 | 63 | $ | 216 | ||||||||||

| Shares issued in reinvestment of dividends | 9 | 31 | 12 | 41 | ||||||||||||

| Shares redeemed | (47 | ) | (165 | ) | (200,110 | ) | (658,383 | |||||||||

| Net (Decrease) Increase | (38 | ) | $ | (134 | ) | (200,035 | ) | $ | (658,126 | ) | ||||||

17

| NRM Investment Company |

| February 29, 2012 |

Notes to Financial Statements

Note 7 - Tax Matters

As of February 29, 2012, the tax basis components of distributable earnings, unrealized appreciation (depreciation) and tax cost of investment securities were as follows:

| Undistributed ordinary income | $ | 11,620 | ||

| Capital loss carry forward* | ||||

| Expiring 8/31/2017 | $ | (734,473 | ) | |

| Expiring 8/31/2018 | (985,719 | ) | ||

| $ | (1,720,192 | ) | ||

| Gross unrealized appreciation on investment securities | $ | 1,147,303 | ||

| Gross unrealized depreciation on investment securities | (559,223 | ) | ||

| Net unrealized appreciation on investment securities | $ | 588,080 | ||

| Cost of investment securities (including short-term investments) | $ | 11,386,825 |

* The capital loss carryforward will be used to offset any capital gains realized by the Fund in future years through the expiration date. The Fund will not make distributions from capital gains while a capital loss carryforward remains.

Permanent book and tax differences relating to shareholder distributions may result in reclassifications to paid in capital and may affect the per-share allocation between net investment income and realized and unrealized gain/loss. Undistributed net investment income and accumulated undistributed net realized gain/loss on investment transactions may include temporary book and tax differences which reverse in subsequent periods. Any taxable income or gain remaining at fiscal year end is distributed in the following year.

The tax character of distributions paid are as follows during the period year ended February 29, 2012 and August 31, 2011:

2/29/2012 | 08/31/2011 | |||||||

| Distributions paid from: | ||||||||

Tax-exempt interest and dividends | $ | 86,661 | $ | 173,638 | ||||

Taxable qualified dividends | 43,814 | 72,357 | ||||||

Taxable ordinary dividends | 48,717 | 65,938 | ||||||

Long-term capital gains | - | - | ||||||

| $ | 179,192 | $ | 401,100 | |||||

Note 8 - Subsequent Events

| Management has evaluated the impact of all subsequent events through the date the financial statements were issued and has determined that there were no subsequent events requiring recognition or disclosure in these financial statements. |

18

| NRM Investment Company |

| February 29, 2012 |

| Notes to Financial Statements |

Note 9 - Concentration of Credit Risk

During the current period, the Fund had cash balances in excess of federally insured limits.

| Note 10 - Cash and Cash Equivalents |

The Fund considers all short-term liquid investments with a maturity of three months or less when purchased to be cash equivalents.

In the normal course of business, the Fund’s marketable securities transactions, money balances and marketable security positions are transacted with a broker. The Fund is subject to credit risk to the extent any broker with which it conducts business is unable to fulfill contractual obligations on its behalf. The Fund monitors the financial condition of such brokers and does not anticipate any losses from these counterparties.

Note 11 - New Accounting Pronouncement

In May 2011 the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. Generally Accepted Accounting Principles (“GAAP”) and International Financial Reporting Standards (“IFRS”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose additional information for fair value measurements categorized within Level 3 of the fair value hierarchy. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. Management is currently evaluating the implications of ASU No. 2011-04 and its impact on the financial statements.

19

| NRM Investment Company |

| February 29, 2012 |

Fees and Expenses

The following table describes the fees and expenses you may pay if you by and hold shares of the Fund. As is the case with all mutual funds, transaction costs incurred by the Fund for buying and selling securities are not reflected in the table. Operating expenses, which are deducted from the Fund’s gross income, directly reduce the investment return of the Fund. The expenses shown in the following table are based on those incurred in the six months ended February 29, 2012:

Shareholder Fees

| (Fees paid directly from your investment) | |

| Sales Charge (Load) imposed on Purchases | None |

| Purchase Fee | None |

| Sales Charge (Load) imposed on Reinvested Dividends | None |

| Redemption Fees | None |

| Account Service Fees | None |

Annual Fund Operating Expenses

| (Expenses deducted from the Fund’s assets) | |

| Management Expenses | .15% |

Other Expenses | .42% |

Aquired Fund Fees and Expenses | .02% |

Total Annual Fund Operating Expenses | .59% |

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following example are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on the investment of $1,000 made at the beginning of the period shown and held to the end of the period.

The accompanying table illustrates your Fund’s costs in two ways:

| 1. | Based on actual Fund return. This helps you estimate the actual expenses you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with a $1,000 in the Fund. You may use the information here, together with the amount you invested to estimate the expenses that you paid over the period. |

To do so, simply divide your account value by $1,000 ( for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During the Period”

20

| NRM Investment Company |

| February 29, 2012 |

| 2. | Based on hypothetical 5% yearly return. This is intended to help you compare your Fund’s cost with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expenses ratio is unchanged. In this case, because the return used is not the Fund’s actual returns, the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing the hypothetical example with the hypothetical examples that appear in shareholder reports of other funds. |

Six Months Ended February 29, 2012

| Beginning | Ending | Expenses | ||||||||||

| Account Value | Account Value | Paid During | ||||||||||

| 08/31/11 | 02/29/12 | Period | ||||||||||

| Based on Actual Fund Return | $ | 1,000.00 | $ | 1,038.30 | $ | 5.98 | ||||||

| Based on Hypothetical 5% Yearly Return | $ | 1,000.00 | $ | 1,019.40 | $ | 6.01 | ||||||

The calculation assumes no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

This example should not be considered a representation of past or future expenses or performance. Actual expenses may be greater or less than those shown.

21

Statement Regarding Availability of Proxy Voting Policies and Procedures.

To meet all applicable fiduciary rules, the Company’s investment adviser employs a service to vote the proxies of the voting securities held for the Company. The footnote hereto contains the policies of the adviser.1 A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and the proxy voting record are available (i) without charge, upon request, by calling, collect, the Fund’s Assistant Secretary at 484 318 7979; and (ii) on the Commission’s website at http://www.sec.gov.

1 Intention of the Proxy Voting Policy

Haverford Financial Services (HFS) considers the power to vote on proposals presented to shareholders through the proxy solicitation process to be an integral part of an investment manager’s responsibility. HFS recognizes that certain proposals, if implemented, may have a substantial impact on the market valuation of portfolio securities and that in such situations the right to vote is considered an asset. The Proxy Voting Policy is designed to ensure that:

| 1. | Proxies for which HFS has ultimate voting authority are voted consistently and solely in the best economic interests of the beneficiaries of these equity investments, and not in the interests of HFS or any associated parties other than the clients. |

| 2. | Any real or perceived material conflicts that may arise between the interests of HFS or any of its associate parties and those of the clients are properly addressed and resolved. |

Third Party Proxy Voting Services

To assist the company in voting proxies, HFS has retained Egan-Jones Proxy Services (“Egan-Jones”). Egan-Jones is an independent adviser that specializes in providing a variety of fiduciary-level proxy-related services to institutional investment managers, plan sponsors, custodians, consultants, and other institutional investors. The services provided to HFS by Egan-Jones include in-depth research, voting recommendations (although HFS is not obligated to follow such recommendations), vote execution, and record keeping. Egan-Jones also assists HFS in its reporting and record keeping relating to proxy voting.

Proxy Voting Guidelines

HFS has adopted the following specific voting guidelines:

| 1. | HFS will vote client proxies in line with the recommendations made by Institutional Shareholder Services (Egan-Jones), except in circumstances detailed in (2) of this section. Institutional Shareholder Services’ recommendations focus on voting proxies in the best economic interest of shareholders, and as such align well with the goals of HFS’ clients. Institutional Shareholder Services’ specific proxy voting policies are available upon request. |

| 2. | HFS’ Investment Committee reserves the right to vote a proxy contrary to Egan-Jones’s recommendation with a majority vote. Issues that can trigger a review by the committee for the purpose of voting against Egan-Jones are (but are not limited to): |

| a. | Mergers and acquisitions |

| b. | Spin-offs, split-offs, or IPOs |

| c. | Significant alterations of the capital structure of the company |

| d. | Other significant corporate actions |

| e. | Employee compensation and benefits |

22

| 3. | Should any real or perceived material conflicts arise between the interests of HFS or any of its associated parties and those of its clients, HFS’ Investment Committee forgoes its right to vote a proxy contrary to Egan-Jones’s recommendation. |

Selection of Investment Advisor

After having determined that the retention of the advisor was in the best interest of the fund, the directors and shareholders of NRM Investment Co. renewed the Company’s investment advisory agreement with Haverford Financials Services (“HFS”) at the Company’s December 20, 2011 combined meeting. A major factor in their determination was the costs of HFS’s services for the size of the fund’s portfolio, and the market value of the services as measured by fees paid elsewhere for like services.

The directors also considered the nature, extent and quality of the services to be provided by HFS and its past investment performance. Specifically, the board considered the quality of the fund’s investment management over both the short and long term. Its personnel advised the Company since December 1992 to the board’s satisfaction. They also noted that the senior portfolio managers of the fund have decades of investment industry experience. In particular, they relied upon the adviser’s president in evaluating equities and its senior fixed income associate for its debt investments. Together, they have depth and stability. They concluded that the advisor’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory agreement.

No single factor determined the directors’ approval. Rather, it was the totality of the circumstances that drove the board’s decision as ratified by the shareholders. The board considers yearly whether to renew the adviser’s contract and submits it to a vote of the shareholders

23