UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-02958

T. Rowe Price International Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

October 31, 2024

This annual shareholder report contains important information about Emerging Europe Fund (the "fund") for the period of November 1, 2023 to October 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Emerging Europe Fund - Investor Class | $178 | 1.47% |

What drove fund performance during the past 12 months?

Stocks in Türkiye gained ground, with investors encouraged by the adoption of more orthodox economic and monetary policies by the government of President Recep Tayyip Erdogan. In Poland, the formation of a pro-European Union coalition government in late 2023 was supportive to sentiment, as was the announcement in February 2024 that the country would gain access to previously withheld European Union funds as a result of the new government implementing reforms to restore judicial independence.

Versus the MSCI Emerging Markets Europe Index Net, stock selection in Türkiye made the biggest contribution to relative performance. Shares in D-Market Elektronik Hizmetler (operating as Hepsiburada) soared after Kazakh fintech giant Kaspi acquired a majority stake in the online retailer. Our positions in supermarket chain BIM and mobile phone operator Turkcell added further value. On a sector basis, financials contributed significantly to portfolio returns, driven by the National Bank of Greece and Halyk Savings Bank of Kazakhstan.

On the negative side, the main detractors from relative performance were largely idiosyncratic individual stocks, rather than due to allocations to particular countries or sectors. In particular, our position in Akbank held back portfolio returns; shares in the Turkish bank came under pressure in the second half of the review period. The position in Poland’s Bank Pekao also detracted from portfolio returns.

The fund uses fundamental analysis to identify companies in Central and Eastern Europe that have sustainable, above-market earnings growth rates, while taking into account the relevant macroeconomic backdrop. Notable changes in positioning included higher allocations to Türkiye and Kazakhstan and a lower allocation to Greece.

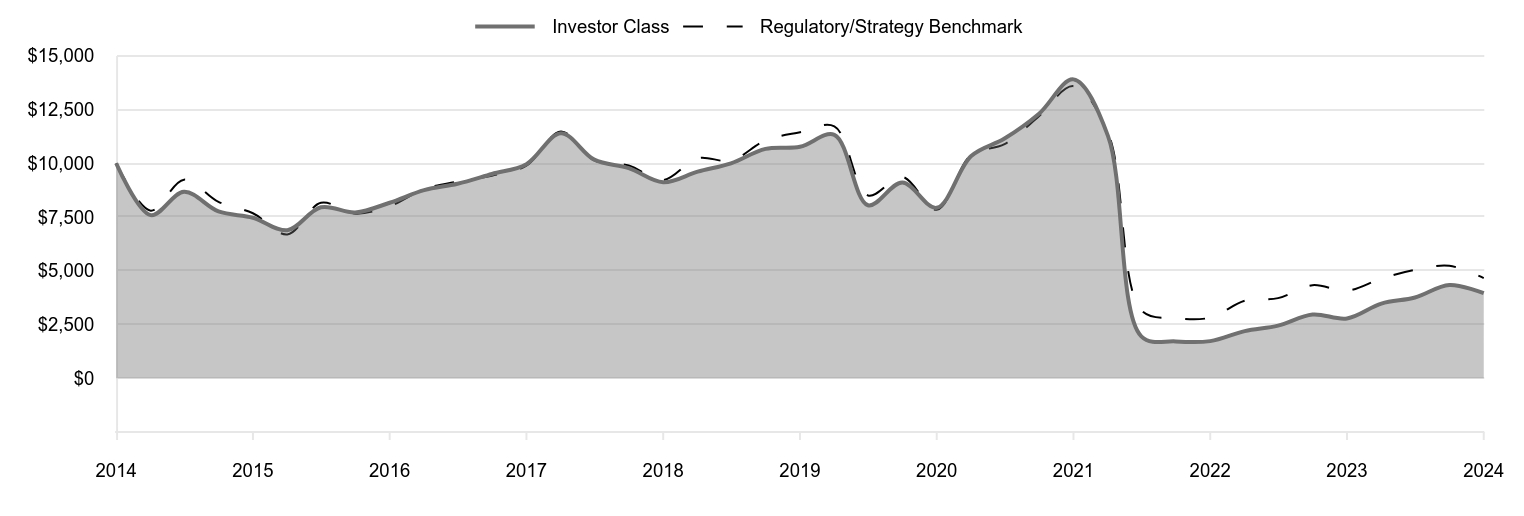

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of October 31, 2024

| Investor Class | Regulatory/Strategy Benchmark |

|---|

| 2014 | 10,000 | 10,000 |

| 2015 | 7,586 | 7,793 |

| 2015 | 8,671 | 9,237 |

| 2015 | 7,756 | 8,206 |

| 2015 | 7,466 | 7,673 |

| 2016 | 6,885 | 6,690 |

| 2016 | 7,951 | 8,161 |

| 2016 | 7,713 | 7,656 |

| 2016 | 8,163 | 8,004 |

| 2017 | 8,751 | 8,798 |

| 2017 | 9,044 | 9,153 |

| 2017 | 9,501 | 9,422 |

| 2017 | 9,958 | 9,892 |

| 2018 | 11,398 | 11,479 |

| 2018 | 10,167 | 10,130 |

| 2018 | 9,776 | 9,897 |

| 2018 | 9,115 | 9,218 |

| 2019 | 9,609 | 10,234 |

| 2019 | 9,998 | 10,121 |

| 2019 | 10,667 | 11,065 |

| 2019 | 10,763 | 11,446 |

| 2020 | 11,323 | 11,713 |

| 2020 | 8,047 | 8,503 |

| 2020 | 9,106 | 9,366 |

| 2020 | 7,927 | 7,835 |

| 2021 | 10,333 | 10,385 |

| 2021 | 11,147 | 10,884 |

| 2021 | 12,302 | 12,191 |

| 2021 | 13,901 | 13,585 |

| 2022 | 11,272 | 11,424 |

| 2022 | 1,949 | 3,164 |

| 2022 | 1,713 | 2,795 |

| 2022 | 1,727 | 2,819 |

| 2023 | 2,192 | 3,607 |

| 2023 | 2,449 | 3,726 |

| 2023 | 2,963 | 4,328 |

| 2023 | 2,782 | 4,069 |

| 2024 | 3,473 | 4,631 |

| 2024 | 3,756 | 5,038 |

| 2024 | 4,336 | 5,231 |

| 2024 | 3,954 | 4,661 |

202411-4029887, 202412-3916015

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Emerging Europe Fund (Investor Class) | 42.15% | -18.15% | -8.86% |

| MSCI Emerging Markets Europe Index Net (Regulatory/Strategy Benchmark) | 14.55 | -16.45 | -7.35 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$49,190

- Number of Portfolio Holdings43

- Investment Advisory Fees Paid (000s)$(166)

- Portfolio Turnover Rate15.4%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 44.9% |

| Consumer Discretionary | 21.3 |

| Industrials & Business Services | 15.8 |

| Consumer Staples | 8.1 |

| Communication Services | 5.9 |

| Health Care | 2.4 |

| Real Estate | 1.5 |

| Materials | 0.5 |

| Energy | 0.0 |

| Other | -0.4 |

Top Ten Holdings (as a % of Net Assets)

| D-MARKET Elektronik Hizmetler ve Ticaret | 14.6% |

| OTP Bank | 9.1 |

| National Bank of Greece | 7.9 |

| BIM Birlesik Magazalar | 7.5 |

| KOC Holding | 5.0 |

| Halyk Savings Bank of Kazakhstan | 4.6 |

| InPost | 4.4 |

| Kaspi.KZ | 4.3 |

| Eurobank Ergasias Services & Holdings | 4.2 |

| Akbank | 3.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Emerging Europe Fund

Investor Class (TREMX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

October 31, 2024

This annual shareholder report contains important information about Emerging Europe Fund (the "fund") for the period of November 1, 2023 to October 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Emerging Europe Fund - I Class | $139 | 1.14% |

What drove fund performance during the past 12 months?

Stocks in Türkiye gained ground, with investors encouraged by the adoption of more orthodox economic and monetary policies by the government of President Recep Tayyip Erdogan. In Poland, the formation of a pro-European Union coalition government in late 2023 was supportive to sentiment, as was the announcement in February 2024 that the country would gain access to previously withheld European Union funds as a result of the new government implementing reforms to restore judicial independence.

Versus the MSCI Emerging Markets Europe Index Net, stock selection in Türkiye made the biggest contribution to relative performance. Shares in D-Market Elektronik Hizmetler (operating as Hepsiburada) soared after Kazakh fintech giant Kaspi acquired a majority stake in the online retailer. Our positions in supermarket chain BIM and mobile phone operator Turkcell added further value. On a sector basis, financials contributed significantly to portfolio returns, driven by the National Bank of Greece and Halyk Savings Bank of Kazakhstan.

On the negative side, the main detractors from relative performance were largely idiosyncratic individual stocks, rather than due to allocations to particular countries or sectors. In particular, our position in Akbank held back portfolio returns; shares in the Turkish bank came under pressure in the second half of the review period. The position in Poland’s Bank Pekao also detracted from portfolio returns.

The fund uses fundamental analysis to identify companies in Central and Eastern Europe that have sustainable, above-market earnings growth rates, while taking into account the relevant macroeconomic backdrop. Notable changes in positioning included higher allocations to Türkiye and Kazakhstan and a lower allocation to Greece.

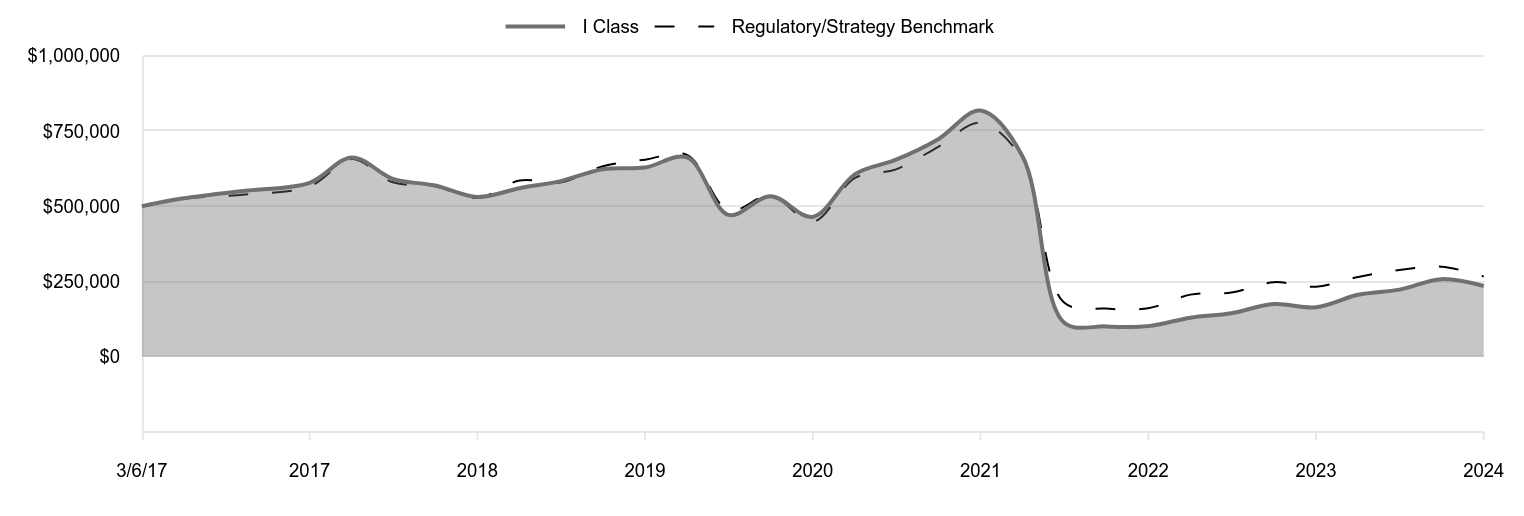

How has the fund performed?

Cumulative Returns of a Hypothetical $500,000 Investment as of October 31, 2024

| I Class | Regulatory/Strategy Benchmark |

|---|

| 3/6/17 | 500,000 | 500,000 |

| 4/30/17 | 524,584 | 523,590 |

| 7/31/17 | 551,437 | 538,991 |

| 10/31/17 | 577,912 | 565,896 |

| 1/31/18 | 662,291 | 656,663 |

| 4/30/18 | 590,796 | 579,479 |

| 7/31/18 | 568,886 | 566,147 |

| 10/31/18 | 530,833 | 527,311 |

| 1/31/19 | 560,025 | 585,448 |

| 4/30/19 | 583,509 | 578,954 |

| 7/31/19 | 622,913 | 632,981 |

| 10/31/19 | 628,884 | 654,755 |

| 1/31/20 | 661,934 | 670,034 |

| 4/30/20 | 471,340 | 486,432 |

| 7/31/20 | 533,499 | 535,806 |

| 10/31/20 | 464,753 | 448,224 |

| 1/31/21 | 606,668 | 594,056 |

| 4/30/21 | 654,574 | 622,642 |

| 7/31/21 | 722,829 | 697,410 |

| 10/31/21 | 817,793 | 777,113 |

| 1/31/22 | 663,755 | 653,485 |

| 4/30/22 | 114,739 | 181,015 |

| 7/31/22 | 100,884 | 159,897 |

| 10/31/22 | 101,750 | 161,259 |

| 1/31/23 | 129,772 | 206,361 |

| 4/30/23 | 144,641 | 213,129 |

| 7/31/23 | 175,282 | 247,608 |

| 10/31/23 | 164,467 | 232,763 |

| 1/31/24 | 205,736 | 264,895 |

| 4/30/24 | 223,071 | 288,208 |

| 7/31/24 | 257,740 | 299,240 |

| 10/31/24 | 234,931 | 266,638 |

202411-4029887, 202412-3916015

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 3/6/17 |

|---|

| Emerging Europe Fund (I Class) | 42.84% | -17.88% | -9.39% |

| MSCI Emerging Markets Europe Index Net (Regulatory/Strategy Benchmark) | 14.55 | -16.45 | -7.88 |

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$49,190

- Number of Portfolio Holdings43

- Investment Advisory Fees Paid (000s)$(166)

- Portfolio Turnover Rate15.4%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 44.9% |

| Consumer Discretionary | 21.3 |

| Industrials & Business Services | 15.8 |

| Consumer Staples | 8.1 |

| Communication Services | 5.9 |

| Health Care | 2.4 |

| Real Estate | 1.5 |

| Materials | 0.5 |

| Energy | 0.0 |

| Other | -0.4 |

Top Ten Holdings (as a % of Net Assets)

| D-MARKET Elektronik Hizmetler ve Ticaret | 14.6% |

| OTP Bank | 9.1 |

| National Bank of Greece | 7.9 |

| BIM Birlesik Magazalar | 7.5 |

| KOC Holding | 5.0 |

| Halyk Savings Bank of Kazakhstan | 4.6 |

| InPost | 4.4 |

| Kaspi.KZ | 4.3 |

| Eurobank Ergasias Services & Holdings | 4.2 |

| Akbank | 3.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Emerging Europe Fund

I Class (TTEEX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

October 31, 2024

This annual shareholder report contains important information about Emerging Europe Fund (the "fund") for the period of November 1, 2023 to October 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Emerging Europe Fund - Z Class | $7 | 0.06% |

What drove fund performance during the past 12 months?

Stocks in Türkiye gained ground, with investors encouraged by the adoption of more orthodox economic and monetary policies by the government of President Recep Tayyip Erdogan. In Poland, the formation of a pro-European Union coalition government in late 2023 was supportive to sentiment, as was the announcement in February 2024 that the country would gain access to previously withheld European Union funds as a result of the new government implementing reforms to restore judicial independence.

Versus the MSCI Emerging Markets Europe Index Net, stock selection in Türkiye made the biggest contribution to relative performance. Shares in D-Market Elektronik Hizmetler (operating as Hepsiburada) soared after Kazakh fintech giant Kaspi acquired a majority stake in the online retailer. Our positions in supermarket chain BIM and mobile phone operator Turkcell added further value. On a sector basis, financials contributed significantly to portfolio returns, driven by the National Bank of Greece and Halyk Savings Bank of Kazakhstan.

On the negative side, the main detractors from relative performance were largely idiosyncratic individual stocks, rather than due to allocations to particular countries or sectors. In particular, our position in Akbank held back portfolio returns; shares in the Turkish bank came under pressure in the second half of the review period. The position in Poland’s Bank Pekao also detracted from portfolio returns.

The fund uses fundamental analysis to identify companies in Central and Eastern Europe that have sustainable, above-market earnings growth rates, while taking into account the relevant macroeconomic backdrop. Notable changes in positioning included higher allocations to Türkiye and Kazakhstan and a lower allocation to Greece.

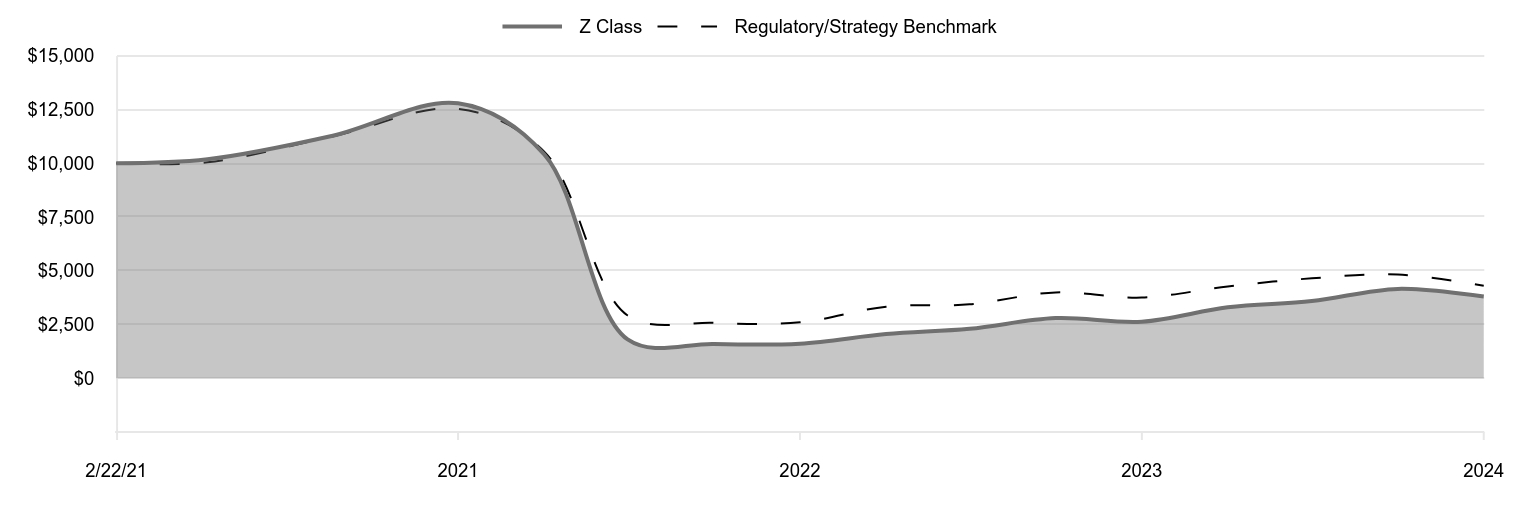

How has the fund performed?

Cumulative Returns of a Hypothetical $10,000 Investment as of October 31, 2024

| Z Class | Regulatory/Strategy Benchmark |

|---|

| 2/22/21 | 10,000 | 10,000 |

| 4/30/21 | 10,185 | 10,041 |

| 7/31/21 | 11,278 | 11,247 |

| 10/31/21 | 12,788 | 12,532 |

| 1/31/22 | 10,410 | 10,538 |

| 4/30/22 | 1,807 | 2,919 |

| 7/31/22 | 1,595 | 2,579 |

| 10/31/22 | 1,609 | 2,601 |

| 1/31/23 | 2,056 | 3,328 |

| 4/30/23 | 2,301 | 3,437 |

| 7/31/23 | 2,799 | 3,993 |

| 10/31/23 | 2,633 | 3,754 |

| 1/31/24 | 3,301 | 4,272 |

| 4/30/24 | 3,589 | 4,648 |

| 7/31/24 | 4,156 | 4,826 |

| 10/31/24 | 3,803 | 4,300 |

202411-4029887, 202412-3916015

Average Annual Total Returns

| | 1 Year | Since Inception 2/22/21 |

|---|

| Emerging Europe Fund (Z Class) | 44.43% | -23.06% |

| MSCI Emerging Markets Europe Index Net (Regulatory/Strategy Benchmark) | 14.55 | -20.45 |

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$49,190

- Number of Portfolio Holdings43

- Investment Advisory Fees Paid (000s)$(166)

- Portfolio Turnover Rate15.4%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 44.9% |

| Consumer Discretionary | 21.3 |

| Industrials & Business Services | 15.8 |

| Consumer Staples | 8.1 |

| Communication Services | 5.9 |

| Health Care | 2.4 |

| Real Estate | 1.5 |

| Materials | 0.5 |

| Energy | 0.0 |

| Other | -0.4 |

Top Ten Holdings (as a % of Net Assets)

| D-MARKET Elektronik Hizmetler ve Ticaret | 14.6% |

| OTP Bank | 9.1 |

| National Bank of Greece | 7.9 |

| BIM Birlesik Magazalar | 7.5 |

| KOC Holding | 5.0 |

| Halyk Savings Bank of Kazakhstan | 4.6 |

| InPost | 4.4 |

| Kaspi.KZ | 4.3 |

| Eurobank Ergasias Services & Holdings | 4.2 |

| Akbank | 3.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Emerging Europe Fund

Z Class (TRZEX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | |

| | | | | 2024 | | | 2023 | |

| | Audit Fees | | | $13,024 | | | | $12,815 | |

| | Audit-Related Fees | | | - | | | | - | |

| | Tax Fees | | | - | | | | - | |

| | All Other Fees | | | - | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $846,000 and $1,584,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TREMX

Emerging

Europe

Fund

TTEEX

Emerging

Europe

Fund–

.

I Class

TRZEX

Emerging

Europe

Fund–

.

Z Class

T.

ROWE

PRICE

Emerging

Europe

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

10/31/24

10/31/23

10/31/22

10/31/21

10/31/20

NET

ASSET

VALUE

Beginning

of

period

$

3

.68

$

2

.34

$

19

.13

$

11

.23

$

15

.76

Investment

activities

Net

investment

income

(1)(2)

0

.11

0

.06

0

.10

0

.25

0

.43

Net

realized

and

unrealized

gain/loss

1

.43

1

.34

(

16

.63

)

8

.08

(

4

.42

)

Total

from

investment

activities

1

.54

1

.40

(

16

.53

)

8

.33

(

3

.99

)

Distributions

Net

investment

income

(

0

.04

)

(

0

.06

)

(

0

.26

)

(

0

.43

)

(

0

.50

)

Net

realized

gain

—

—

—

—

(

0

.04

)

Total

distributions

(

0

.04

)

(

0

.06

)

(

0

.26

)

(

0

.43

)

(

0

.54

)

NET

ASSET

VALUE

End

of

period

$

5

.18

$

3

.68

$

2

.34

$

19

.13

$

11

.23

Ratios/Supplemental

Data

Total

return

(2)(3)

42

.15

%

61

.05

%

(

87

.57

)

%

75

.35

%

(

26

.34

)

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

2

.91

%

3

.63

%

2

.68

%

1

.67

%

1

.66

%

Net

expenses

after

waivers/

payments

by

Price

Associates

1

.47

%

1

.58

%

1

.42

%

1

.41

%

1

.41

%

Net

investment

income

2

.22

%

1

.70

%

1

.57

%

1

.59

%

3

.19

%

Portfolio

turnover

rate

15

.4

%

50

.9

%

65

.8

%

46

.0

%

31

.9

%

Net

assets,

end

of

period

(in

thousands)

$38,737

$32,913

$23,681

$162,619

$98,750

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Emerging

Europe

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

10/31/24

10/31/23

10/31/22

10/31/21

10/31/20

NET

ASSET

VALUE

Beginning

of

period

$

3

.65

$

2

.35

$

19

.29

$

11

.29

$

15

.80

Investment

activities

Net

investment

income

(1)(2)

0

.13

0

.07

0

.08

0

.32

0

.49

Net

realized

and

unrealized

gain/loss

1

.42

1

.34

(

16

.67

)

8

.12

(

4

.45

)

Total

from

investment

activities

1

.55

1

.41

(

16

.59

)

8

.44

(

3

.96

)

Distributions

Net

investment

income

(

0

.05

)

(

0

.11

)

(

0

.35

)

(

0

.44

)

(

0

.51

)

Net

realized

gain

—

—

—

—

(

0

.04

)

Total

distributions

(

0

.05

)

(

0

.11

)

(

0

.35

)

(

0

.44

)

(

0

.55

)

NET

ASSET

VALUE

End

of

period

$

5

.15

$

3

.65

$

2

.35

$

19

.29

$

11

.29

Ratios/Supplemental

Data

Total

return

(2)(3)

42

.84

%

61

.64

%

(

87

.56

)

%

75

.96

%

(

26

.10

)

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1

.85

%

2

.29

%

2

.59

%

1

.37

%

1

.33

%

Net

expenses

after

waivers/

payments

by

Price

Associates

1

.14

%

1

.26

%

1

.11

%

1

.08

%

1

.09

%

Net

investment

income

2

.58

%

2

.05

%

2

.17

%

1

.97

%

3

.57

%

Portfolio

turnover

rate

15

.4

%

50

.9

%

65

.8

%

46

.0

%

31

.9

%

Net

assets,

end

of

period

(in

thousands)

$6,367

$4,818

$3,146

$6,347

$3,284

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Emerging

Europe

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Z

Class

(1)

..

Year

..

..

Ended

.

2/22/21

(1)

Through

10/31/21

10/31/24

10/31/23

10/31/22

NET

ASSET

VALUE

Beginning

of

period

$

3

.65

$

2

.36

$

19

.31

$

15

.10

Investment

activities

Net

investment

income

(2)(3)

0

.18

0

.10

0

.20

0

.52

Net

realized

and

unrealized

gain/loss

1

.42

1

.34

(

16

.67

)

3

.69

Total

from

investment

activities

1

.60

1

.44

(

16

.47

)

4

.21

Distributions

Net

investment

income

(

0

.09

)

(

0

.15

)

(

0

.48

)

—

NET

ASSET

VALUE

End

of

period

$

5

.16

$

3

.65

$

2

.36

$

19

.31

Ratios/Supplemental

Data

Total

return

(3)(4)

44

.43

%

63

.65

%

(

87

.42

)

%

27

.88

%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

1

.81

%

2

.25

%

1

.81

%

1

.41

%

(5)

Net

expenses

after

waivers/payments

by

Price

Associates

0

.06

%

0

.17

%

0

.00

%

0

.00

%

(5)

Net

investment

income

3

.65

%

3

.16

%

2

.87

%

4

.42

%

(5)

Portfolio

turnover

rate

15

.4

%

50

.9

%

65

.8

%

46

.0

%

Net

assets,

end

of

period

(in

thousands)

$4,086

$2,832

$1,735

$14,642

0

%

0

%

0

%

0

%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(5)

Annualized

T.

ROWE

PRICE

Emerging

Europe

Fund

October

31,

2024

Shares

$

Value

(

Cost

and

value

in

$000s)

‡

CYPRUS 0.0%

Common

Stocks 0.0%

Galaxy

Cosmos

Mezz

13,255

10

Total

Cyprus

(Cost

$–)

10

GREECE 19.6%

Common

Stocks 19.6%

Alpha

Services

and

Holdings

357,887

539

Eurobank

Ergasias

Services

&

Holdings

1,000,871

2,071

JUMBO

43,435

1,159

LAMDA

Development (1)

91,521

735

National

Bank

of

Greece

494,360

3,873

OPAP

73,605

1,258

Total

Greece

(Cost

$4,267)

9,635

HUNGARY 11.8%

Common

Stocks 11.8%

OTP

Bank

89,621

4,462

Richter

Gedeon

40,682

1,176

Wizz

Air

Holdings

(GBP) (1)(2)

8,390

149

Total

Hungary

(Cost

$3,374)

5,787

KAZAKHSTAN 8.9%

Common

Stocks 8.9%

Halyk

Savings

Bank

of

Kazakhstan,

GDR

(USD)

122,309

2,262

Kaspi.KZ,

ADR

(USD)

19,289

2,124

Kazakhstan

Kagazy,

GDR

(USD) (1)(3)(4)(5)

327,395

—

Total

Kazakhstan

(Cost

$20,021)

4,386

LITHUANIA 2.7%

Common

Stocks 2.7%

Baltic

Classifieds

Group

(GBP)

323,535

1,320

Total

Lithuania

(Cost

$737)

1,320

T.

ROWE

PRICE

Emerging

Europe

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

POLAND 14.6%

Common

Stocks 14.6%

Allegro.eu (1)

102,804

905

Bank

Polska

Kasa

Opieki

21,162

740

InPost

(EUR) (1)

109,863

2,143

Powszechna

Kasa

Oszczednosci

Bank

Polski

124,914

1,736

Powszechny

Zaklad

Ubezpieczen

169,099

1,677

Total

Poland

(Cost

$6,311)

7,201

PORTUGAL 0.6%

Common

Stocks 0.6%

Jeronimo

Martins

15,623

303

Total

Portugal

(Cost

$329)

303

RUSSIA 0.0%

Common

Stocks 0.0%

Gazprom (1)(3)

3,658,844

—

GMK

Norilskiy

Nickel (3)

2,174,150

—

LUKOIL (3)

170,476

—

Magnit (3)

32,681

—

Moscow

Exchange (3)

207,430

—

Novatek (3)

230,520

—

Rosneft

Oil (3)

607,203

—

Sberbank

of

Russia (3)

10,373,360

—

Segezha

Group (1)(3)

11,000,000

—

Surgutneftegas (3)

2,584,700

—

Yandex,

Class

A (1)(3)

69,578

—

Total

Russia

(Cost

$57,533)

—

TüRKIYE 40.2%

Common

Stocks 40.2%

Akbank

1,253,543

1,853

BIM

Birlesik

Magazalar

268,633

3,666

D-MARKET

Elektronik

Hizmetler

ve

Ticaret,

ADR

(USD) (1)

2,257,733

7,202

Haci

Omer

Sabanci

Holding

550,200

1,338

KOC

Holding

495,811

2,445

TAV

Havalimanlari

Holding (1)

62,388

419

Turk

Hava

Yollari

AO (1)

156,896

1,248

T.

ROWE

PRICE

Emerging

Europe

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

Turkcell

Iletisim

Hizmetleri

639,128

1,580

Total

Türkiye

(Cost

$13,571)

19,751

UNITED

KINGDOM 2.0%

Common

Stocks 2.0%

Central

Asia

Metals

103,390

233

Georgia

Capital (1)

57,189

748

Total

United

Kingdom

(Cost

$621)

981

SHORT-TERM

INVESTMENTS 0.0%

Money

Market

Funds 0.0%

T.

Rowe

Price

Government

Reserve

Fund,

4.86% (5)(6)

17,578

18

Total

Short-Term

Investments

(Cost

$18)

18

SECURITIES

LENDING

COLLATERAL 0.3%

INVESTMENTS

IN

A

POOLED

ACCOUNT

THROUGH

SECURITIES

LENDING

PROGRAM

WITH

JPMORGAN

CHASE

BANK 0.3%

Money

Market

Funds 0.3%

T.

Rowe

Price

Government

Reserve

Fund,

4.86% (5)(6)

140,830

141

Total

Investments

in

a

Pooled

Account

through

Securities

Lending

Program

with

JPMorgan

Chase

Bank

141

Total

Securities

Lending

Collateral

(Cost

$141)

141

Total

Investments

in

Securities

100.7%

of

Net

Assets

(Cost

$106,923)

$

49,533

‡

Country

classifications

are

generally

based

on

MSCI

categories

or

another

unaffiliated

third

party

data

provider;

Shares

are

denominated

in

the

currency

of

the

country

presented

unless

otherwise

noted.

(1)

Non-income

producing

(2)

See

Note

3

.

All

or

a

portion

of

this

security

is

on

loan

at

October

31,

2024.

(3)

See

Note

2.

Level

3

in

fair

value

hierarchy.

(4)

Security

was

purchased

pursuant

to

Rule

144A

under

the

Securities

Act

of

1933

and

may

be

resold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers.

Total

value

of

such

securities

at

period-end

amounts

to

$0

and

represents

0.0%

of

net

assets.

(5)

Affiliated

Companies

T.

ROWE

PRICE

Emerging

Europe

Fund

.

.

.

.

.

.

.

.

.

.

(6)

Seven-day

yield

ADR

American

Depositary

Receipts

EUR

Euro

GBP

British

Pound

GDR

Global

Depositary

Receipts

USD

U.S.

Dollar

T.

ROWE

PRICE

Emerging

Europe

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

AFFILIATED

COMPANIES

($000s)

The

fund

may

invest

in

certain

securities

that

are

considered

affiliated

companies.

As

defined

by

the

1940

Act,

an

affiliated

company

is

one

in

which

the

fund

owns

5%

or

more

of

the

outstanding

voting

securities,

or

a

company

that

is

under

common

ownership

or

control.

The

following

securities

were

considered

affiliated

companies

for

all

or

some

portion

of

the

year

ended

October

31,

2024.

Net

realized

gain

(loss),

investment

income,

change

in

net

unrealized

gain/loss,

and

purchase

and

sales

cost

reflect

all

activity

for

the

period

then

ended.

Affiliate

Net

Realized

Gain

(Loss)

Change

in

Net

Unrealized

Gain/Loss

Investment

Income

Kazakhstan

Kagazy,

GDR

$

—

$

—

$

—

T.

Rowe

Price

Government

Reserve

Fund,

4.86%

—

—

33++

Totals

$

—#

$

—

$

33+

Supplementary

Investment

Schedule

Affiliate

Value

10/31/23

Purchase

Cost

Sales

Cost

Value

10/31/24

Kazakhstan

Kagazy,

GDR

$

—

$

—

$

—

$

—

T.

Rowe

Price

Government

Reserve

Fund,

4.86%

41

¤

¤

159

Total

$

159^

#

Capital

gain

distributions

from

underlying

Price

funds

represented

$0

of

the

net

realized

gain

(loss).

++

Excludes

earnings

on

securities

lending

collateral,

which

are

subject

to

rebates

and

fees

as

described

in

Note

3

.

+

Investment

income

comprised

$33

of

dividend

income

and

$0

of

interest

income.

¤

Purchase

and

sale

information

not

shown

for

cash

management

funds.

^

The

cost

basis

of

investments

in

affiliated

companies

was

$16,780.

T.

ROWE

PRICE

Emerging

Europe

Fund

October

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Assets

Investments

in

securities,

at

value

(cost

$106,923)

$

49,533

Foreign

currency

(cost

$19)

19

Due

from

affiliates

9

Other

assets

89

Total

assets

49,650

Liabilities

Payable

for

shares

redeemed

234

Obligation

to

return

securities

lending

collateral

141

Investment

management

fees

payable

43

Other

liabilities

42

Total

liabilities

460

Commitments

and

Contingent

Liabilities

(note

6

)

NET

ASSETS

$

49,190

Net

Assets

Consist

of:

Total

distributable

earnings

(loss)

$

(

95,285

)

Paid-in

capital

applicable

to

9,499,157

shares

of

$0.01

par

value

capital

stock

outstanding;

18,000,000,000

shares

of

the

Corporation

authorized

144,475

NET

ASSETS

$

49,190

NET

ASSET

VALUE

PER

SHARE

Investor

Class

(Net

assets:

$38,737;

Shares

outstanding:

7,472,037)

$

5.18

I

Class

(Net

assets:

$6,367;

Shares

outstanding:

1,235,292)

$

5.15

Z

Class

(Net

assets:

$4,086;

Shares

outstanding:

791,828)

$

5.16

T.

ROWE

PRICE

Emerging

Europe

Fund

Year

Ended

10/31/24

Investment

Income

(Loss)

Income

Dividend

(net

of

foreign

taxes

of

$53)

$

1,821

Securities

lending

4

Total

income

1,825

Expenses

Investment

management

511

Shareholder

servicing

Investor

Class

$

415

I

Class

2

417

Prospectus

and

shareholder

reports

Investor

Class

24

I

Class

1

Z

Class

1

26

Custody

and

accounting

218

Legal

and

audit

82

Registration

43

Miscellaneous

32

Waived

/

paid

by

Price

Associates

(

677

)

Total

expenses

652

Net

investment

income

1,173

T.

ROWE

PRICE

Emerging

Europe

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

Ended

10/31/24

Realized

and

Unrealized

Gain

/

Loss

–

Net

realized

gain

(loss)

Securities

832

Foreign

currency

transactions

(

622

)

Net

realized

gain

210

Change

in

net

unrealized

gain

/

loss

Securities

14,358

Other

assets

and

liabilities

denominated

in

foreign

currencies

622

Change

in

net

unrealized

gain

/

loss

14,980

Net

realized

and

unrealized

gain

/

loss

15,190

INCREASE

IN

NET

ASSETS

FROM

OPERATIONS

$

16,363

T.

ROWE

PRICE

Emerging

Europe

Fund

Statement

of

Changes

in

Net

Assets

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10/31/24

10/31/23

Increase

(Decrease)

in

Net

Assets

Operations

Net

investment

income

$

1,173

$

727

Net

realized

gain

(loss)

210

(

18,564

)

Change

in

net

unrealized

gain

/

loss

14,980

35,257

Increase

in

net

assets

from

operations

16,363

17,420

Distributions

to

shareholders

Net

earnings

Investor

Class

(

361

)

(

651

)

I

Class

(

68

)

(

138

)

Z

Class

(

70

)

(

111

)

Decrease

in

net

assets

from

distributions

(

499

)

(

900

)

Capital

share

transactions

*

Shares

sold

Investor

Class

59

4,499

I

Class

369

2,083

Distributions

reinvested

Investor

Class

347

629

I

Class

65

132

Z

Class

70

111

Shares

redeemed

Investor

Class

(

7,272

)

(

9,474

)

I

Class

(

875

)

(

2,492

)

Z

Class

–

(

7

)

Decrease

in

net

assets

from

capital

share

transactions

(

7,237

)

(

4,519

)

T.

ROWE

PRICE

Emerging

Europe

Fund

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10/31/24

10/31/23

Net

Assets

Increase

during

period

8,627

12,001

Beginning

of

period

40,563

28,562

End

of

period

$

49,190

$

40,563

*Share

information

(000s)

Shares

sold

Investor

Class

13

1,607

I

Class

73

748

Distributions

reinvested

Investor

Class

82

238

I

Class

15

50

Z

Class

17

43

Shares

redeemed

Investor

Class

(

1,568

)

(

3,033

)

I

Class

(

173

)

(

816

)

Z

Class

–

(

2

)

Decrease

in

shares

outstanding

(

1,541

)

(

1,165

)

T.

ROWE

PRICE

Emerging

Europe

Fund

NOTES

TO

FINANCIAL

STATEMENTS

T.

Rowe

Price

International

Funds,

Inc. (the

corporation) is

registered

under

the

Investment

Company

Act

of

1940

(the

1940

Act).

The

Emerging

Europe

Fund

(the

fund)

is a

nondiversified, open-end

management

investment

company

established

by

the

corporation. The

fund

seeks long-term

growth

of

capital

through

investments

primarily

in

the

common

stocks

of

companies

located

(or

with

primary

operations)

in

the

emerging

market

countries

of

Europe.

The

fund

has three classes

of

shares:

the

Emerging

Europe

Fund

(Investor

Class),

the

Emerging

Europe

Fund–I

Class

(I

Class)

and

the

Emerging

Europe

Fund–Z

Class

(Z

Class).

I

Class

shares

require

a

$500,000

initial

investment

minimum,

although

the

minimum

generally

is

waived

or

reduced

for

financial

intermediaries,

eligible

retirement

plans,

and

certain

other

accounts.

The

Z

Class

is

only

available

to

funds

advised

by

T.

Rowe

Price

Associates,

Inc.

and

its

affiliates

and

other

clients

that

are

subject

to

a

contractual

fee

for

investment

management

services. Each

class

has

exclusive

voting

rights

on

matters

related

solely

to

that

class;

separate

voting

rights

on

matters

that

relate

to

all

classes;

and,

in

all

other

respects,

the

same

rights

and

obligations

as

the

other

classes.

Effective

February

17,

2023,

the

fund

is

closed

to

all

purchases

from

new

and

existing

shareholders.

The

fund’s

closure

to

additional

purchases

does

not

restrict

existing

shareholders

from

redeeming

shares

of

the

fund.

NOTE

1

-

SIGNIFICANT

ACCOUNTING

POLICIES

Basis

of

Preparation

The fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

in

the

Financial

Accounting

Standards

Board

(FASB)

Accounting

Standards

Codification

Topic

946

(ASC

946).

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP),

including,

but

not

limited

to,

ASC

946.

GAAP

requires

the

use

of

estimates

made

by

management.

Management

believes

that

estimates

and

valuations

are

appropriate;

however,

actual

results

may

differ

from

those

estimates,

and

the

valuations

reflected

in

the

accompanying

financial

statements

may

differ

from

the

value

ultimately

realized

upon

sale

or

maturity.

Investment

Transactions,

Investment

Income,

and

Distributions

Investment

transactions

are

accounted

for

on

the

trade

date

basis.

Income

and

expenses

are

recorded

on

the

accrual

basis.

Realized

gains

and

losses

are

reported

on

the

identified

cost

basis. Income

tax-related

interest

and

penalties,

if

incurred,

are

recorded

as

income

tax

expense. Dividends

received

from other

investment

T.

ROWE

PRICE

Emerging

Europe

Fund

companies are

reflected

as

dividend income;

capital

gain

distributions

are

reflected

as

realized

gain/loss. Dividend

income and

capital

gain

distributions

are

recorded

on

the

ex-dividend

date. Non-cash

dividends,

if

any,

are

recorded

at

the

fair

market

value

of

the

asset

received. Proceeds

from

litigation

payments,

if

any,

are

included

in

either

net

realized

gain

(loss)

or

change

in

net

unrealized

gain/loss

from

securities. Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date. Income

distributions,

if

any,

are

declared

and

paid

by

each

class annually. A

capital

gain

distribution,

if

any, may

also

be

declared

and

paid

by

the

fund

annually.

Currency

Translation

Assets,

including

investments,

and

liabilities

denominated

in

foreign

currencies

are

translated

into

U.S.

dollar

values

each

day

at

the

prevailing

exchange

rate,

using

the

mean

of

the

bid

and

asked

prices

of

such

currencies

against

U.S.

dollars

as

provided

by

an

outside

pricing

service.

Purchases

and

sales

of

securities,

income,

and

expenses

are

translated

into

U.S.

dollars

at

the

prevailing

exchange

rate

on

the

respective

date

of

such

transaction.

The

effect

of

changes

in

foreign

currency

exchange

rates

on

realized

and

unrealized

security

gains

and

losses

is

not

bifurcated

from

the

portion

attributable

to

changes

in

market

prices.

Class

Accounting

Shareholder

servicing,

prospectus,

and

shareholder

report

expenses

incurred

by

each

class

are

charged

directly

to

the

class

to

which

they

relate.

Expenses

common

to

all

classes,

investment

income,

and

realized

and

unrealized

gains

and

losses

are

allocated

to

the

classes

based

upon

the

relative

daily

net

assets

of

each

class.

Capital

Transactions

Each

investor’s

interest

in

the

net

assets

of the

fund

is

represented

by

fund

shares. The

fund’s

net

asset

value

(NAV)

per

share

is

computed

at

the

close

of

the

New

York

Stock

Exchange

(NYSE),

normally

4

p.m.

Eastern

time,

each

day

the

NYSE

is

open

for

business.

However,

the

NAV

per

share

may

be

calculated

at

a

time

other

than

the

normal

close

of

the

NYSE

if

trading

on

the

NYSE

is

restricted,

if

the

NYSE

closes

earlier,

or

as

may

be

permitted

by

the

SEC.

Purchases

and

redemptions

of

fund

shares

are

transacted

at

the

next-computed

NAV

per

share,

after

receipt

of

the

transaction

order

by

T.

Rowe

Price

Associates,

Inc.,

or

its

agents.

New

Accounting

Guidance

In

November

2023,

the

FASB

issued

Accounting

Standards

Update

(ASU),

ASU

2023-07,

Segment

Reporting

(Topic

280)

–

Improvements

to

Reportable

Segment

Disclosures,

which

improves

reportable

segment

disclosure

requirements,

primarily

through

enhanced

disclosures

about

segment

expenses.

In

addition,

the

ASU

clarifies

that

a

public

entity

with

a

single

reportable

segment

provide

all

disclosures

required

by

the

ASU

and

all

T.

ROWE

PRICE

Emerging

Europe

Fund

existing

segment

disclosures

in

Topic

280.

The

amendments

under

this

ASU

are

effective

for

fiscal

years

beginning

after

December

15,

2023.

Management

expects

that

adoption

of

the

guidance

will

not

have

a

material

impact

on

the

fund’s

financial

statements.

Indemnification

In

the

normal

course

of

business, the

fund

may

provide

indemnification

in

connection

with

its

officers

and

directors,

service

providers,

and/or

private

company

investments. The

fund’s

maximum

exposure

under

these

arrangements

is

unknown;

however,

the

risk

of

material

loss

is

currently

considered

to

be

remote.

NOTE

2

-

VALUATION

Fair

Value

The

fund’s

financial

instruments

are

valued

at

the

close

of

the

NYSE

and

are

reported

at

fair

value,

which

GAAP

defines

as

the

price

that

would

be

received

to

sell

an

asset

or

paid

to

transfer

a

liability

in

an

orderly

transaction

between

market

participants

at

the

measurement

date. The fund’s

Board

of

Directors

(the

Board)

has

designated

T.

Rowe

Price

Associates,

Inc.

as

the

fund’s

valuation

designee

(Valuation

Designee).

Subject

to

oversight

by

the

Board,

the

Valuation

Designee

performs

the

following

functions

in

performing

fair

value

determinations:

assesses

and

manages

valuation

risks;

establishes

and

applies

fair

value

methodologies;

tests

fair

value

methodologies;

and

evaluates

pricing

vendors

and

pricing

agents.

The

duties

and

responsibilities

of

the

Valuation

Designee

are

performed

by

its

Valuation

Committee. The

Valuation

Designee provides

periodic

reporting

to

the

Board

on

valuation

matters.

Various

valuation

techniques

and

inputs

are

used

to

determine

the

fair

value

of

financial

instruments.

GAAP

establishes

the

following

fair

value

hierarchy

that

categorizes

the

inputs

used

to

measure

fair

value:

Level

1

–

quoted

prices

(unadjusted)

in

active

markets

for

identical

financial

instruments

that

the

fund

can

access

at

the

reporting

date

Level

2

–

inputs

other

than

Level

1

quoted

prices

that

are

observable,

either

directly

or

indirectly

(including,

but

not

limited

to,

quoted

prices

for

similar

financial

instruments

in

active

markets,

quoted

prices

for

identical

or

similar

financial

instruments

in

inactive

markets,

interest

rates

and

yield

curves,

implied

volatilities,

and

credit

spreads)

Level

3

–

unobservable

inputs

(including

the Valuation

Designee’s assumptions

in

determining

fair

value)

T.

ROWE

PRICE

Emerging

Europe

Fund

Observable

inputs

are

developed

using

market

data,

such

as

publicly

available

information

about

actual

events

or

transactions,

and

reflect

the

assumptions

that

market

participants

would

use

to

price

the

financial

instrument.

Unobservable

inputs

are

those

for

which

market

data

are

not

available

and

are

developed

using

the

best

information

available

about

the

assumptions

that

market

participants

would

use

to

price

the

financial

instrument.

GAAP

requires

valuation

techniques

to

maximize

the

use

of

relevant

observable

inputs

and

minimize

the

use

of

unobservable

inputs.

When

multiple

inputs

are

used

to

derive

fair

value,

the

financial

instrument

is

assigned

to

the

level

within

the

fair

value

hierarchy

based

on

the

lowest-level

input

that

is

significant

to

the

fair

value

of

the

financial

instrument.

Input

levels

are

not

necessarily

an

indication

of

the

risk

or

liquidity

associated

with

financial

instruments

at

that

level

but

rather

the

degree

of

judgment

used

in

determining

those

values.

Valuation

Techniques

Equity

securities,

including

exchange-traded

funds, listed

or

regularly

traded

on

a

securities

exchange

or

in

the

over-the-

counter

(OTC)

market

are

valued

at

the

last

quoted

sale

price

or,

for

certain

markets,

the

official

closing

price

at

the

time

the

valuations

are

made.

OTC

Bulletin

Board

securities

are

valued

at

the

mean

of

the

closing

bid

and

asked

prices.

A

security

that

is

listed

or

traded

on

more

than

one

exchange

is

valued

at

the

quotation

on

the

exchange

determined

to

be

the

primary

market

for

such

security.

Listed

securities

not

traded

on

a

particular

day

are

valued

at

the

mean

of

the

closing

bid

and

asked

prices

for

domestic

securities

and

the

last

quoted

sale

or

closing

price

for

international

securities.

The

last

quoted

prices

of

non-U.S.

equity

securities

may

be

adjusted

to

reflect

the

fair

value

of

such

securities

at

the

close

of

the

NYSE,

if

the Valuation

Designee

determines

that

developments

between

the

close

of

a

foreign

market

and

the

close

of

the

NYSE

will

affect

the

value

of

some

or

all

of

the

fund’s portfolio

securities.

Each

business

day,

the

Valuation

Designee uses

information

from

outside

pricing

services

to

evaluate

the

quoted

prices

of

portfolio

securities

and,

if

appropriate,

decide whether

it