UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-02958

T. Rowe Price International Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

International Bond Fund (USD Hedged)

This annual shareholder report contains important information about International Bond Fund (USD Hedged) (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| International Bond Fund (USD Hedged) - Investor Class | $80 | 0.79% |

|---|

What drove fund performance during the past 12 months?

Global fixed income markets fell over the 12-month reporting period due to weaker currencies versus the dollar and rising bond yields at the end of the period, despite many central banks easing monetary policy.

The fund benefited from its exposure to euro-denominated government-related bonds and corporate credit relative to the Bloomberg Global Aggregate ex USD Bond (USD Hedged) Index. Additionally, the fund’s short currency exposure in the Chinese yuan and Taiwanese dollar, relative to the benchmark, added value amid U.S. dollar strength during the reporting period.

Against the USD hedged index, an underweighting duration in China dragged on performance as local yields fell over the reporting period, with China’s central bank maintaining mostly stimulative monetary policy. Long exposure in the Brazilian real detracted as the country suffered amid investor concerns over the government's spending plans and wide budget deficit.

The fund seeks to provide current income and capital appreciation primarily through a focus on non-U.S. dollar-denominated bonds. During the period, the fund shifted to a long position in the U.S. dollar due to the anticipation of near-term dollar strength.

The fund held material exposure to derivatives, including currency, interest rate, and credit derivatives. The fund’s derivatives exposure to currency forwards had a positive impact on absolute performance.

How has the fund performed?

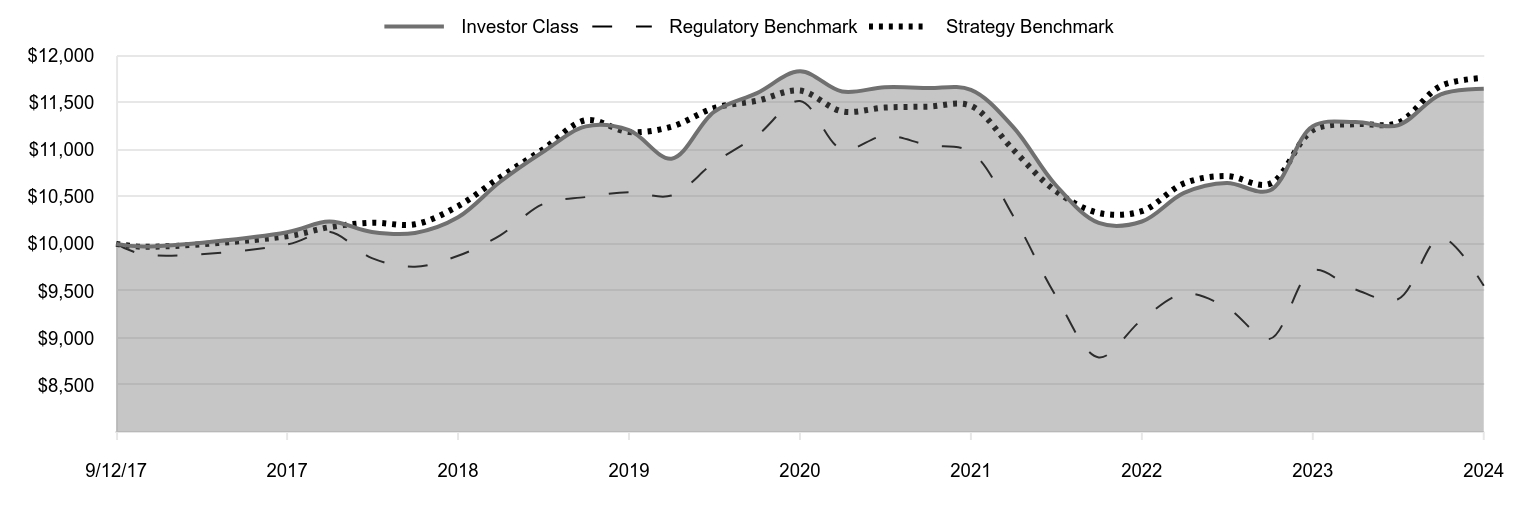

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 9/12/17 | 10,000 | 10,000 | 10,000 |

|---|

| 9/30/17 | 9,972 | 9,887 | 9,969 |

|---|

| 12/31/17 | 10,124 | 9,993 | 10,082 |

|---|

| 3/31/18 | 10,237 | 10,129 | 10,177 |

|---|

| 6/30/18 | 10,126 | 9,848 | 10,225 |

|---|

| 9/30/18 | 10,116 | 9,757 | 10,208 |

|---|

| 12/31/18 | 10,282 | 9,873 | 10,402 |

|---|

| 3/31/19 | 10,660 | 10,091 | 10,709 |

|---|

| 6/30/19 | 10,976 | 10,423 | 11,003 |

|---|

| 9/30/19 | 11,249 | 10,498 | 11,315 |

|---|

| 12/31/19 | 11,208 | 10,549 | 11,189 |

|---|

| 3/31/20 | 10,905 | 10,514 | 11,246 |

|---|

| 6/30/20 | 11,404 | 10,863 | 11,444 |

|---|

| 9/30/20 | 11,603 | 11,152 | 11,521 |

|---|

| 12/31/20 | 11,834 | 11,519 | 11,630 |

|---|

| 3/31/21 | 11,620 | 11,005 | 11,409 |

|---|

| 6/30/21 | 11,665 | 11,149 | 11,449 |

|---|

| 9/30/21 | 11,657 | 11,051 | 11,459 |

|---|

| 12/31/21 | 11,638 | 10,977 | 11,467 |

|---|

| 3/31/22 | 11,244 | 10,300 | 11,003 |

|---|

| 6/30/22 | 10,626 | 9,449 | 10,562 |

|---|

| 9/30/22 | 10,222 | 8,793 | 10,329 |

|---|

| 12/31/22 | 10,238 | 9,193 | 10,348 |

|---|

| 3/31/23 | 10,542 | 9,470 | 10,643 |

|---|

| 6/30/23 | 10,647 | 9,325 | 10,721 |

|---|

| 9/30/23 | 10,567 | 8,990 | 10,638 |

|---|

| 12/31/23 | 11,250 | 9,718 | 11,208 |

|---|

| 3/31/24 | 11,295 | 9,516 | 11,273 |

|---|

| 6/30/24 | 11,260 | 9,411 | 11,286 |

|---|

| 9/30/24 | 11,590 | 10,068 | 11,679 |

|---|

| 12/31/24 | 11,649 | 9,554 | 11,765 |

|---|

202501-4140694, 202502-4108520

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 9/12/17 |

|---|

| International Bond Fund (USD Hedged) (Investor Class) | 3.55% | 0.78% | 2.11% |

|---|

| Bloomberg Global Aggregate Bond Index (Regulatory Benchmark) | -1.69 | -1.96 | -0.62 |

|---|

| Bloomberg Global Aggregate ex USD Bond (USD Hedged) Index (Strategy Benchmark) | 4.97 | 1.01 | 2.25 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$7,116,341

- Number of Portfolio Holdings647

- Investment Advisory Fees Paid (000s)$7,381

- Portfolio Turnover Rate54.5%

What did the fund invest in?

Geographic Allocation (as a % of Net Assets)

| United States | 13.5% |

| Japan | 11.0 |

| Canada | 9.2 |

| China | 7.7 |

| France | 5.0 |

| Germany | 4.4 |

| United Kingdom | 4.4 |

| Malaysia | 3.3 |

| Indonesia | 3.0 |

| Other | 38.5 |

Top Ten Holdings (as a % of Net Assets)

| Government of Japan | 9.8% |

| People's Republic of China | 7.0 |

| U.S. Treasury Bills | 6.8 |

| Canadian Treasury Bill | 4.9 |

| Republic of France | 3.5 |

| Government of Malaysia | 3.3 |

| Republic of Indonesia | 2.8 |

| United Kingdom Gilt | 2.3 |

| Government of Canada Real Return Bond, Inflation-Indexed | 1.9 |

| Republic of Czech | 1.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

International Bond Fund (USD Hedged)

Investor Class (TNIBX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

International Bond Fund (USD Hedged)

This annual shareholder report contains important information about International Bond Fund (USD Hedged) (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| International Bond Fund (USD Hedged) - Advisor Class | $101 | 0.99% |

|---|

What drove fund performance during the past 12 months?

Global fixed income markets fell over the 12-month reporting period due to weaker currencies versus the dollar and rising bond yields at the end of the period, despite many central banks easing monetary policy.

The fund benefited from its exposure to euro-denominated government-related bonds and corporate credit relative to the Bloomberg Global Aggregate ex USD Bond (USD Hedged) Index. Additionally, the fund’s short currency exposure in the Chinese yuan and Taiwanese dollar, relative to the benchmark, added value amid U.S. dollar strength during the reporting period.

Against the USD hedged index, an underweighting duration in China dragged on performance as local yields fell over the reporting period, with China’s central bank maintaining mostly stimulative monetary policy. Long exposure in the Brazilian real detracted as the country suffered amid investor concerns over the government's spending plans and wide budget deficit.

The fund seeks to provide current income and capital appreciation primarily through a focus on non-U.S. dollar-denominated bonds. During the period, the fund shifted to a long position in the U.S. dollar due to the anticipation of near-term dollar strength.

The fund held material exposure to derivatives, including currency, interest rate, and credit derivatives. The fund’s derivatives exposure to currency forwards had a positive impact on absolute performance.

How has the fund performed?

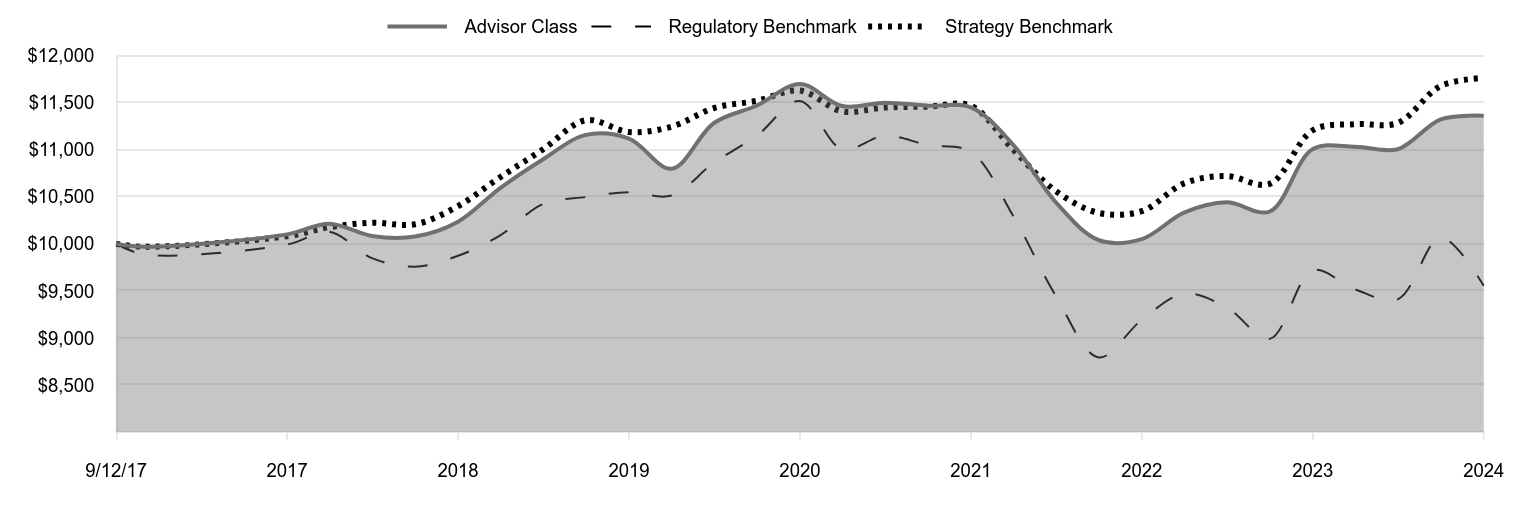

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Advisor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 9/12/17 | 10,000 | 10,000 | 10,000 |

|---|

| 9/30/17 | 9,970 | 9,887 | 9,969 |

|---|

| 12/31/17 | 10,101 | 9,993 | 10,082 |

|---|

| 3/31/18 | 10,215 | 10,129 | 10,177 |

|---|

| 6/30/18 | 10,084 | 9,848 | 10,225 |

|---|

| 9/30/18 | 10,078 | 9,757 | 10,208 |

|---|

| 12/31/18 | 10,236 | 9,873 | 10,402 |

|---|

| 3/31/19 | 10,593 | 10,091 | 10,709 |

|---|

| 6/30/19 | 10,897 | 10,423 | 11,003 |

|---|

| 9/30/19 | 11,159 | 10,498 | 11,315 |

|---|

| 12/31/19 | 11,119 | 10,549 | 11,189 |

|---|

| 3/31/20 | 10,798 | 10,514 | 11,246 |

|---|

| 6/30/20 | 11,285 | 10,863 | 11,444 |

|---|

| 9/30/20 | 11,471 | 11,152 | 11,521 |

|---|

| 12/31/20 | 11,699 | 11,519 | 11,630 |

|---|

| 3/31/21 | 11,465 | 11,005 | 11,409 |

|---|

| 6/30/21 | 11,500 | 11,149 | 11,449 |

|---|

| 9/30/21 | 11,469 | 11,051 | 11,459 |

|---|

| 12/31/21 | 11,451 | 10,977 | 11,467 |

|---|

| 3/31/22 | 11,056 | 10,300 | 11,003 |

|---|

| 6/30/22 | 10,444 | 9,449 | 10,562 |

|---|

| 9/30/22 | 10,040 | 8,793 | 10,329 |

|---|

| 12/31/22 | 10,051 | 9,193 | 10,348 |

|---|

| 3/31/23 | 10,332 | 9,470 | 10,643 |

|---|

| 6/30/23 | 10,442 | 9,325 | 10,721 |

|---|

| 9/30/23 | 10,344 | 8,990 | 10,638 |

|---|

| 12/31/23 | 11,008 | 9,718 | 11,208 |

|---|

| 3/31/24 | 11,033 | 9,516 | 11,273 |

|---|

| 6/30/24 | 11,006 | 9,411 | 11,286 |

|---|

| 9/30/24 | 11,324 | 10,068 | 11,679 |

|---|

| 12/31/24 | 11,362 | 9,554 | 11,765 |

|---|

202501-4140694, 202502-4108520

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 9/12/17 |

|---|

| International Bond Fund (USD Hedged) (Advisor Class) | 3.21% | 0.43% | 1.76% |

|---|

| Bloomberg Global Aggregate Bond Index (Regulatory Benchmark) | -1.69 | -1.96 | -0.62 |

|---|

| Bloomberg Global Aggregate ex USD Bond (USD Hedged) Index (Strategy Benchmark) | 4.97 | 1.01 | 2.25 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$7,116,341

- Number of Portfolio Holdings647

- Investment Advisory Fees Paid (000s)$7,381

- Portfolio Turnover Rate54.5%

What did the fund invest in?

Geographic Allocation (as a % of Net Assets)

| United States | 13.5% |

| Japan | 11.0 |

| Canada | 9.2 |

| China | 7.7 |

| France | 5.0 |

| Germany | 4.4 |

| United Kingdom | 4.4 |

| Malaysia | 3.3 |

| Indonesia | 3.0 |

| Other | 38.5 |

Top Ten Holdings (as a % of Net Assets)

| Government of Japan | 9.8% |

| People's Republic of China | 7.0 |

| U.S. Treasury Bills | 6.8 |

| Canadian Treasury Bill | 4.9 |

| Republic of France | 3.5 |

| Government of Malaysia | 3.3 |

| Republic of Indonesia | 2.8 |

| United Kingdom Gilt | 2.3 |

| Government of Canada Real Return Bond, Inflation-Indexed | 1.9 |

| Republic of Czech | 1.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

International Bond Fund (USD Hedged)

Advisor Class (TTABX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

International Bond Fund (USD Hedged)

This annual shareholder report contains important information about International Bond Fund (USD Hedged) (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| International Bond Fund (USD Hedged) - I Class | $55 | 0.54% |

|---|

What drove fund performance during the past 12 months?

Global fixed income markets fell over the 12-month reporting period due to weaker currencies versus the dollar and rising bond yields at the end of the period, despite many central banks easing monetary policy.

The fund benefited from its exposure to euro-denominated government-related bonds and corporate credit relative to the Bloomberg Global Aggregate ex USD Bond (USD Hedged) Index. Additionally, the fund’s short currency exposure in the Chinese yuan and Taiwanese dollar, relative to the benchmark, added value amid U.S. dollar strength during the reporting period.

Against the USD hedged index, an underweighting duration in China dragged on performance as local yields fell over the reporting period, with China’s central bank maintaining mostly stimulative monetary policy. Long exposure in the Brazilian real detracted as the country suffered amid investor concerns over the government's spending plans and wide budget deficit.

The fund seeks to provide current income and capital appreciation primarily through a focus on non-U.S. dollar-denominated bonds. During the period, the fund shifted to a long position in the U.S. dollar due to the anticipation of near-term dollar strength.

The fund held material exposure to derivatives, including currency, interest rate, and credit derivatives. The fund’s derivatives exposure to currency forwards had a positive impact on absolute performance.

How has the fund performed?

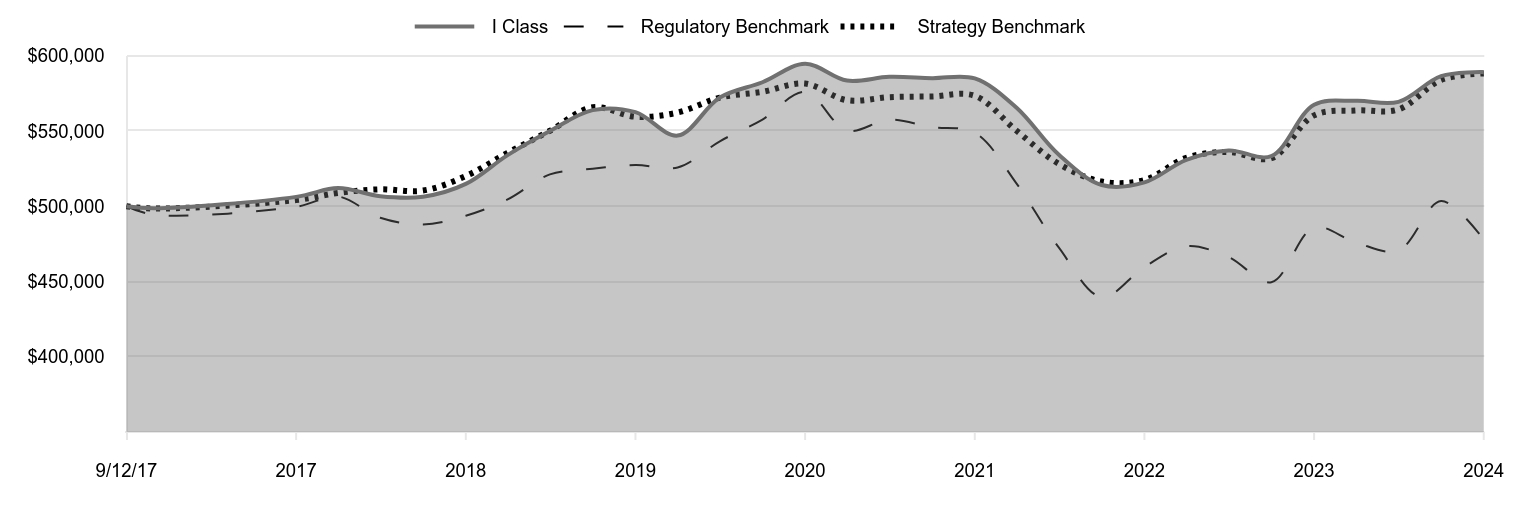

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 9/12/17 | 500,000 | 500,000 | 500,000 |

|---|

| 9/30/17 | 498,621 | 494,342 | 498,456 |

|---|

| 12/31/17 | 506,235 | 499,666 | 504,104 |

|---|

| 3/31/18 | 512,044 | 506,468 | 508,827 |

|---|

| 6/30/18 | 506,644 | 492,377 | 511,260 |

|---|

| 9/30/18 | 506,349 | 487,829 | 510,413 |

|---|

| 12/31/18 | 514,837 | 493,671 | 520,076 |

|---|

| 3/31/19 | 533,991 | 504,541 | 535,464 |

|---|

| 6/30/19 | 549,972 | 521,163 | 550,165 |

|---|

| 9/30/19 | 563,865 | 524,890 | 565,737 |

|---|

| 12/31/19 | 562,528 | 527,436 | 559,453 |

|---|

| 3/31/20 | 546,955 | 525,712 | 562,282 |

|---|

| 6/30/20 | 572,250 | 543,169 | 572,183 |

|---|

| 9/30/20 | 582,389 | 557,625 | 576,055 |

|---|

| 12/31/20 | 594,693 | 575,940 | 581,495 |

|---|

| 3/31/21 | 583,478 | 550,249 | 570,456 |

|---|

| 6/30/21 | 585,957 | 557,471 | 572,448 |

|---|

| 9/30/21 | 585,119 | 552,546 | 572,956 |

|---|

| 12/31/21 | 584,936 | 548,831 | 573,360 |

|---|

| 3/31/22 | 565,403 | 515,018 | 550,138 |

|---|

| 6/30/22 | 534,168 | 472,467 | 528,087 |

|---|

| 9/30/22 | 514,109 | 439,657 | 516,438 |

|---|

| 12/31/22 | 515,843 | 459,654 | 517,380 |

|---|

| 3/31/23 | 530,804 | 473,475 | 532,171 |

|---|

| 6/30/23 | 537,081 | 466,231 | 536,073 |

|---|

| 9/30/23 | 533,315 | 449,511 | 531,889 |

|---|

| 12/31/23 | 567,450 | 485,924 | 560,404 |

|---|

| 3/31/24 | 570,036 | 475,802 | 563,661 |

|---|

| 6/30/24 | 569,340 | 470,547 | 564,280 |

|---|

| 9/30/24 | 586,416 | 503,405 | 583,931 |

|---|

| 12/31/24 | 589,094 | 477,716 | 588,264 |

|---|

202501-4140694, 202502-4108520

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 9/12/17 |

|---|

| International Bond Fund (USD Hedged) (I Class) | 3.81% | 0.93% | 2.27% |

|---|

| Bloomberg Global Aggregate Bond Index (Regulatory Benchmark) | -1.69 | -1.96 | -0.62 |

|---|

| Bloomberg Global Aggregate ex USD Bond (USD Hedged) Index (Strategy Benchmark) | 4.97 | 1.01 | 2.25 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$7,116,341

- Number of Portfolio Holdings647

- Investment Advisory Fees Paid (000s)$7,381

- Portfolio Turnover Rate54.5%

What did the fund invest in?

Geographic Allocation (as a % of Net Assets)

| United States | 13.5% |

| Japan | 11.0 |

| Canada | 9.2 |

| China | 7.7 |

| France | 5.0 |

| Germany | 4.4 |

| United Kingdom | 4.4 |

| Malaysia | 3.3 |

| Indonesia | 3.0 |

| Other | 38.5 |

Top Ten Holdings (as a % of Net Assets)

| Government of Japan | 9.8% |

| People's Republic of China | 7.0 |

| U.S. Treasury Bills | 6.8 |

| Canadian Treasury Bill | 4.9 |

| Republic of France | 3.5 |

| Government of Malaysia | 3.3 |

| Republic of Indonesia | 2.8 |

| United Kingdom Gilt | 2.3 |

| Government of Canada Real Return Bond, Inflation-Indexed | 1.9 |

| Republic of Czech | 1.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

International Bond Fund (USD Hedged)

I Class (TNBMX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

International Bond Fund (USD Hedged)

This annual shareholder report contains important information about International Bond Fund (USD Hedged) (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| International Bond Fund (USD Hedged) - Z Class | $0 | 0.00% |

|---|

What drove fund performance during the past 12 months?

Global fixed income markets fell over the 12-month reporting period due to weaker currencies versus the dollar and rising bond yields at the end of the period, despite many central banks easing monetary policy.

The fund benefited from its exposure to euro-denominated government-related bonds and corporate credit relative to the Bloomberg Global Aggregate ex USD Bond (USD Hedged) Index. Additionally, the fund’s short currency exposure in the Chinese yuan and Taiwanese dollar, relative to the benchmark, added value amid U.S. dollar strength during the reporting period.

Against the USD hedged index, an underweighting duration in China dragged on performance as local yields fell over the reporting period, with China’s central bank maintaining mostly stimulative monetary policy. Long exposure in the Brazilian real detracted as the country suffered amid investor concerns over the government's spending plans and wide budget deficit.

The fund seeks to provide current income and capital appreciation primarily through a focus on non-U.S. dollar-denominated bonds. During the period, the fund shifted to a long position in the U.S. dollar due to the anticipation of near-term dollar strength.

The fund held material exposure to derivatives, including currency, interest rate, and credit derivatives. The fund’s derivatives exposure to currency forwards had a positive impact on absolute performance.

How has the fund performed?

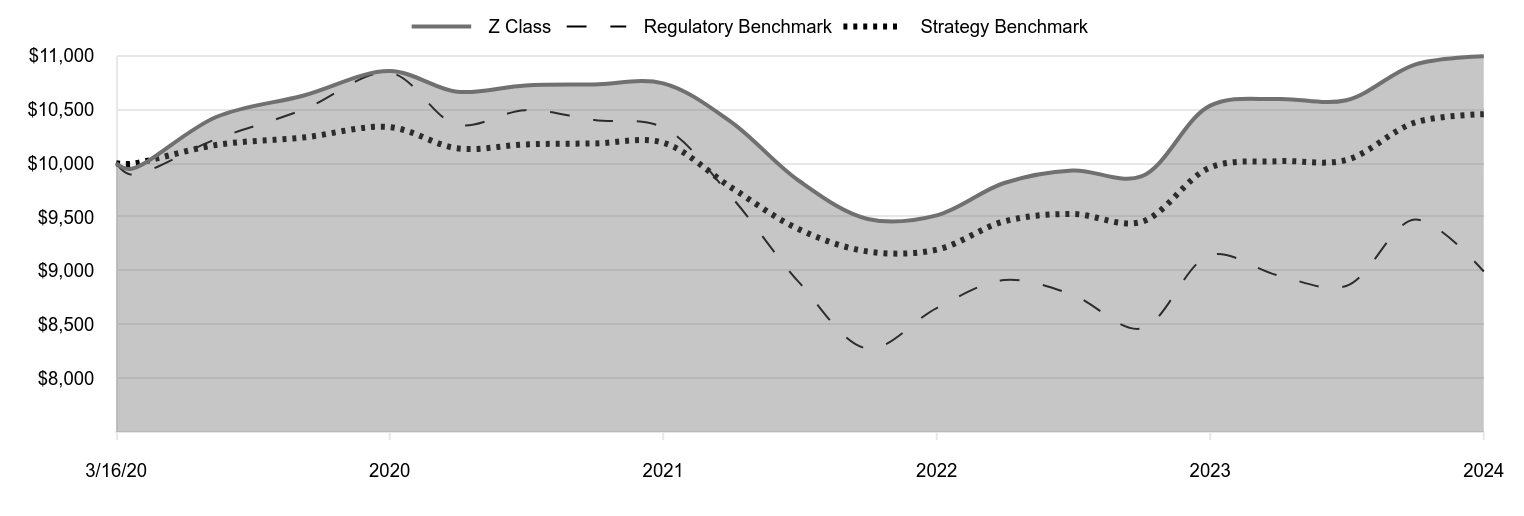

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Z Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 3/16/20 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/20 | 9,947 | 9,896 | 9,994 |

|---|

| 6/30/20 | 10,430 | 10,225 | 10,170 |

|---|

| 9/30/20 | 10,628 | 10,497 | 10,239 |

|---|

| 12/31/20 | 10,857 | 10,842 | 10,336 |

|---|

| 3/31/21 | 10,665 | 10,358 | 10,139 |

|---|

| 6/30/21 | 10,724 | 10,494 | 10,175 |

|---|

| 9/30/21 | 10,733 | 10,402 | 10,184 |

|---|

| 12/31/21 | 10,743 | 10,332 | 10,191 |

|---|

| 3/31/22 | 10,387 | 9,695 | 9,778 |

|---|

| 6/30/22 | 9,837 | 8,894 | 9,386 |

|---|

| 9/30/22 | 9,482 | 8,276 | 9,179 |

|---|

| 12/31/22 | 9,515 | 8,653 | 9,196 |

|---|

| 3/31/23 | 9,816 | 8,913 | 9,459 |

|---|

| 6/30/23 | 9,933 | 8,777 | 9,528 |

|---|

| 9/30/23 | 9,877 | 8,462 | 9,454 |

|---|

| 12/31/23 | 10,536 | 9,147 | 9,961 |

|---|

| 3/31/24 | 10,598 | 8,957 | 10,019 |

|---|

| 6/30/24 | 10,586 | 8,858 | 10,030 |

|---|

| 9/30/24 | 10,918 | 9,476 | 10,379 |

|---|

| 12/31/24 | 10,996 | 8,993 | 10,456 |

|---|

202501-4140694, 202502-4108520

Average Annual Total Returns

| | 1 Year | Since Inception 3/16/20 |

|---|

| International Bond Fund (USD Hedged) (Z Class) | 4.37% | 2.00% |

|---|

| Bloomberg Global Aggregate Bond Index (Regulatory Benchmark) | -1.69 | -2.19 |

|---|

| Bloomberg Global Aggregate ex USD Bond (USD Hedged) Index (Strategy Benchmark) | 4.97 | 0.93 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$7,116,341

- Number of Portfolio Holdings647

- Investment Advisory Fees Paid (000s)$7,381

- Portfolio Turnover Rate54.5%

What did the fund invest in?

Geographic Allocation (as a % of Net Assets)

| United States | 13.5% |

| Japan | 11.0 |

| Canada | 9.2 |

| China | 7.7 |

| France | 5.0 |

| Germany | 4.4 |

| United Kingdom | 4.4 |

| Malaysia | 3.3 |

| Indonesia | 3.0 |

| Other | 38.5 |

Top Ten Holdings (as a % of Net Assets)

| Government of Japan | 9.8% |

| People's Republic of China | 7.0 |

| U.S. Treasury Bills | 6.8 |

| Canadian Treasury Bill | 4.9 |

| Republic of France | 3.5 |

| Government of Malaysia | 3.3 |

| Republic of Indonesia | 2.8 |

| United Kingdom Gilt | 2.3 |

| Government of Canada Real Return Bond, Inflation-Indexed | 1.9 |

| Republic of Czech | 1.8 |

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

International Bond Fund (USD Hedged)

Z Class (TRMZX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | |

| | | | 2024 | | 2023 |

| | Audit Fees | | $39,999 | | $39,183 |

| | Audit-Related Fees | | - | | - |

| | Tax Fees | | - | | - |

| | All Other Fees | | - | | - |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TNIBX

International

Bond

Fund

(USD

Hedged)

TTABX

International

Bond

Fund

(USD

Hedged)–

.

Advisor Class

TNBMX

International

Bond

Fund

(USD

Hedged)–

.

I Class

TRMZX

International

Bond

Fund

(USD

Hedged)–

.

Z Class

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

For

a

share

outstanding

throughout

each

period

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

8.48

$

7.91

$

9.91

$

10.35

$

9.98

Investment

activities

Net

investment

income

(1)(2)

0.26

0.21

0.15

0.11

0.16

Net

realized

and

unrealized

gain/loss

0.04

0.56

(1.32)

(0.28)

0.39

Total

from

investment

activities

0.30

0.77

(1.17)

(0.17)

0.55

Distributions

Net

investment

income

(0.25)

(0.03)

(0.15)

(0.15)

(0.02)

Net

realized

gain

—

—

(0.68)

(0.12)

(0.06)

Tax

return

of

capital

—

(0.17)

—

—

(0.10)

Total

distributions

(0.25)

(0.20)

(0.83)

(0.27)

(0.18)

NET

ASSET

VALUE

End

of

period

$

8.53

$

8.48

$

7.91

$

9.91

$

10.35

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

Ratios/Supplemental

Data

Total

return

(2)(3)

3.55%

9.88%

(12.03)%

(1.66)%

5.59%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.79%

0.77%

0.75%

0.61%

0.64%

Net

expenses

after

waivers/payments

by

Price

Associates

0.79%

0.77%

0.75%

0.61%

0.64%

Net

investment

income

3.02%

2.59%

1.65%

1.04%

1.55%

Portfolio

turnover

rate

54.5%

68.9%

74.6%

35.3%

49.4%

Net

assets,

end

of

period

(in

millions)

$73

$82

$76

$218

$579

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Advisor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

8.46

$

7.90

$

9.90

$

10.35

$

9.98

Investment

activities

Net

investment

income

(1)(2)

0.24

0.19

0.13

0.10

0.11

Net

realized

and

unrealized

gain/loss

0.03

0.55

(1.32)

(0.32)

0.41

Total

from

investment

activities

0.27

0.74

(1.19)

(0.22)

0.52

Distributions

Net

investment

income

(0.23)

(0.02)

(0.13)

(0.11)

(0.02)

Net

realized

gain

—

—

(0.68)

(0.12)

(0.06)

Tax

return

of

capital

—

(0.16)

—

—

(0.07)

Total

distributions

(0.23)

(0.18)

(0.81)

(0.23)

(0.15)

NET

ASSET

VALUE

End

of

period

$

8.50

$

8.46

$

7.90

$

9.90

$

10.35

Ratios/Supplemental

Data

Total

return

(2)(3)

3.21%

9.52%

(12.23)%

(2.12)%

5.22%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.70%

0.99%

0.99%

1.08%

0.99%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.99%

0.99%

0.99%

0.99%

0.99%

Net

investment

income

2.80%

2.40%

1.46%

1.03%

1.08%

Portfolio

turnover

rate

54.5%

68.9%

74.6%

35.3%

49.4%

Net

assets,

end

of

period

(in

thousands)

$75

$212

$81

$102

$106

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

8.47

$

7.91

$

9.91

$

10.36

$

9.99

Investment

activities

Net

investment

income

(1)(2)

0.28

0.23

0.17

0.15

0.16

Net

realized

and

unrealized

gain/loss

0.04

0.55

(1.32)

(0.32)

0.41

Total

from

investment

activities

0.32

0.78

(1.15)

(0.17)

0.57

Distributions

Net

investment

income

(0.27)

(0.03)

(0.17)

(0.16)

(0.03)

Net

realized

gain

—

—

(0.68)

(0.12)

(0.06)

Tax

return

of

capital

—

(0.19)

—

—

(0.11)

Total

distributions

(0.27)

(0.22)

(0.85)

(0.28)

(0.20)

NET

ASSET

VALUE

End

of

period

$

8.52

$

8.47

$

7.91

$

9.91

$

10.36

Ratios/Supplemental

Data

Total

return

(2)(3)

3.81%

10.00%

(11.81)%

(1.64)%

5.72%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.54%

0.54%

0.53%

0.50%

0.51%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.54%

0.54%

0.53%

0.50%

0.51%

Net

investment

income

3.29%

2.84%

1.91%

1.48%

1.64%

Portfolio

turnover

rate

54.5%

68.9%

74.6%

35.3%

49.4%

Net

assets,

end

of

period

(in

millions)

$1,875

$1,488

$1,246

$555

$422

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

For

a

share

outstanding

throughout

each

period

Z

Class

(1)

..

Year

..

..

Ended

.

3/16/20

(1)

Through

12/31/20

12/31/24

12/31/23

12/31/22

12/31/21

NET

ASSET

VALUE

Beginning

of

period

$

8.48

$

7.91

$

9.92

$

10.36

$

9.73

Investment

activities

Net

investment

income

(2)(3)

0.32

0.27

0.22

0.21

0.16

Net

realized

and

unrealized

gain/loss

0.04

0.56

(1.33)

(0.32)

0.67

Total

from

investment

activities

0.36

0.83

(1.11)

(0.11)

0.83

Distributions

Net

investment

income

(0.31)

(0.03)

(0.22)

(0.21)

(0.03)

Net

realized

gain

—

—

(0.68)

(0.12)

(0.06)

Tax

return

of

capital

—

(0.23)

—

—

(0.11)

Total

distributions

(0.31)

(0.26)

(0.90)

(0.33)

(0.20)

NET

ASSET

VALUE

End

of

period

$

8.53

$

8.48

$

7.91

$

9.92

$

10.36

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Z

Class

(1)

..

Year

..

..

Ended

.

3/16/20

(1)

Through

12/31/20

12/31/24

12/31/23

12/31/22

12/31/21

Ratios/Supplemental

Data

Total

return

(3)(4)

4.37%

10.72%

(11.43)%

(1.05)%

8.57%

Ratios

to

average

net

assets:

(3)

Gross

expenses

before

waivers/payments

by

Price

Associates

0.50%

0.51%

0.51%

0.50%

0.50%

(5)

Net

expenses

after

waivers/payments

by

Price

Associates

0.00%

0.00%

0.00%

0.00%

0.00%

(5)

Net

investment

income

3.83%

3.37%

2.44%

2.10%

1.94%

(5)

Portfolio

turnover

rate

54.5%

68.9%

74.6%

35.3%

49.4%

Net

assets,

end

of

period

(in

millions)

$5,168

$4,488

$4,359

$5,334

$4,808

0%

0%

0%

0%

0%

(1)

Inception

date

(2)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(3)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

Total

return

is

not

annualized

for

periods

less

than

one

year.

(5)

Annualized

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

December

31,

2024

Par/Shares

$

Value

(

Cost

and

value

in

$000s)

‡

ALBANIA 0.4%

Government

Bonds 0.4%

Republic

of

Albania,

3.50%,

6/16/27

(EUR) (1)

4,085,000

4,176

Republic

of

Albania,

5.90%,

6/9/28

(EUR) (1)

15,580,000

16,792

Republic

of

Albania,

5.90%,

6/9/28

(EUR)

5,200,000

5,604

Total

Albania

(Cost

$27,021)

26,572

AUSTRALIA 2.8%

Corporate

Bonds 0.8%

APA

Infrastructure,

2.00%,

3/22/27

(EUR)

2,580,000

2,614

APA

Infrastructure,

3.50%,

3/22/30

(GBP)

5,500,000

6,311

AusNet

Services

Holdings,

1.50%,

2/26/27

(EUR)

2,615,000

2,633

Brambles

Finance,

4.25%,

3/22/31

(EUR)

7,660,000

8,382

NBN,

4.125%,

3/15/29

(EUR)

11,070,000

12,015

Sydney

Airport

Finance,

1.75%,

4/26/28

(EUR) (2)

2,630,000

2,625

Sydney

Airport

Finance,

4.375%,

5/3/33

(EUR)

8,150,000

8,923

Transurban

Finance,

1.75%,

3/29/28

(EUR)

2,620,000

2,612

Transurban

Finance,

3.00%,

4/8/30

(EUR)

11,250,000

11,562

57,677

Government

Bonds 2.0%

Commonwealth

of

Australia,

Series

140,

4.50%,

4/21/33

126,357,000

79,344

Commonwealth

of

Australia,

Series

150,

3.00%,

3/21/47

35,872,000

16,559

New

South

Wales

Treasury,

Series

26,

4.00%,

5/20/26

76,060,600

47,047

142,950

Total

Australia

(Cost

$233,359)

200,627

AUSTRIA 0.7%

Corporate

Bonds 0.1%

Mondi

Finance

Europe,

2.375%,

4/1/28

2,505,000

2,556

2,556

Government

Bonds 0.6%

Republic

of

Austria,

0.75%,

3/20/51 (1)

48,284,000

29,819

Republic

of

Austria,

3.15%,

10/20/53 (1)

14,055,000

14,723

44,542

Total

Austria

(Cost

$48,460)

47,098

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

BELGIUM 0.1%

Corporate

Bonds 0.1%

Anheuser-Busch

InBev,

1.15%,

1/22/27

2,600,000

2,616

Anheuser-Busch

InBev,

1.65%,

3/28/31

1,465,000

1,406

Total

Belgium

(Cost

$4,152)

4,022

BRAZIL 0.9%

Corporate

Bonds 0.1%

Braskem

Netherlands

Finance,

4.50%,

1/31/30

(USD)

3,114,000

2,639

MercadoLibre,

3.125%,

1/14/31

(USD)

3,470,000

3,009

5,648

Government

Bonds 0.8%

Brazil

Notas

do

Tesouro

Nacional,

Series

NTNF,

10.00%,

1/1/31

122,664,000

15,825

Brazil

Notas

do

Tesouro

Nacional,

Series

NTNF,

10.00%,

1/1/35

347,570,000

42,257

58,082

Total

Brazil

(Cost

$80,611)

63,730

BULGARIA 0.4%

Government

Bonds 0.4%

Republic

of

Bulgaria,

4.50%,

1/27/33

(EUR) (1)

8,790,000

9,903

Republic

of

Bulgaria,

4.50%,

1/27/33

(EUR)

14,433,000

16,261

Total

Bulgaria

(Cost

$24,894)

26,164

CANADA 9.2%

Asset-Backed

Securities 0.1%

Cologix

Canadian

Issuer,

Series

2022-1CAN,

Class

A2,

4.94%,

1/25/52 (1)

8,230,000

5,549

5,549

Corporate

Bonds 0.6%

Magna

International,

1.50%,

9/25/27

(EUR)

2,620,000

2,617

Royal

Bank

of

Canada,

4.125%,

7/5/28

(EUR)

2,385,000

2,575

TER

Finance

Jersey,

Series

21,

Zero

Coupon,

1/2/25

(USD) (1)(3)

17,400,000

17,396

Toronto-Dominion

Bank,

2.551%,

8/3/27

(EUR)

2,535,000

2,602

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Transcanada

Trust,

Series

17-B,

VR,

4.65%,

5/18/77 (4)

27,134,000

18,735

43,925

Government

Bonds 8.5%

Canadian

Treasury

Bill,

3.44%,

3/12/25

299,515,000

207,088

Canadian

Treasury

Bill,

3.451%,

2/27/25

200,000,000

138,437

Government

of

Canada,

Series

0318,

4.00%,

3/1/29

174,716,000

126,519

Government

of

Canada

Real

Return

Bond,

Inflation-Indexed,

Series

CPI,

4.00%,

12/1/31

161,448,567

132,604

Province

of

Ontario,

3.50%,

6/2/43

5,239,000

3,306

607,954

Total

Canada

(Cost

$691,038)

657,428

CHILE 0.7%

Corporate

Bonds 0.3%

Corp.

Nacional

del

Cobre

de

Chile,

6.30%,

9/8/53

(USD) (1)

14,659,000

14,371

Interchile,

4.50%,

6/30/56

(USD)

7,113,000

5,751

20,122

Government

Bonds 0.4%

Bonos

de

la

Tesoreria

de

la

Republica

en

pesos,

5.80%,

10/1/34 (1)

25,375,000,000

25,421

Republic

of

Chile,

4.125%,

7/5/34

(EUR)

6,420,000

6,867

32,288

Total

Chile

(Cost

$54,549)

52,410

CHINA 7.7%

Corporate

Bonds 0.2%

State

Grid

Overseas

Investment

BVI,

1.375%,

5/2/25

(EUR) (1)

10,000,000

10,288

10,288

Government

Bonds 7.5%

China

Development

Bank,

Series

1905,

3.48%,

1/8/29

250,000,000

36,866

People's

Republic

of

China,

Series

INBK,

2.28%,

3/25/31

135,000,000

19,259

People's

Republic

of

China,

Series

INBK,

2.47%,

7/25/54

228,000,000

34,530

People's

Republic

of

China,

Series

INBK,

2.60%,

9/1/32

914,200,000

133,554

People's

Republic

of

China,

Series

INBK,

2.62%,

4/15/28

110,000,000

15,717

People's

Republic

of

China,

Series

INBK,

2.69%,

8/15/32

765,000,000

112,630

People's

Republic

of

China,

Series

INBK,

3.02%,

5/27/31

45,000,000

6,715

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

People's

Republic

of

China,

Series

INBK,

3.13%,

11/21/29

370,000,000

54,871

People's

Republic

of

China,

Series

INBK,

3.32%,

4/15/52

399,000,000

69,471

People's

Republic

of

China,

Series

INBK,

3.53%,

10/18/51

217,000,000

38,921

People's

Republic

of

China,

Series

INBK,

4.00%,

6/24/69

64,000,000

13,864

536,398

Total

China

(Cost

$515,138)

546,686

COLOMBIA 1.1%

Government

Bonds 1.1%

Republic

of

Colombia,

Series

B,

6.00%,

4/28/28

79,667,000,000

15,917

Republic

of

Colombia,

Series

B,

7.00%,

3/26/31

146,658,800,000

27,338

Republic

of

Colombia,

Series

B,

7.25%,

10/18/34

74,967,300,000

12,682

Republic

of

Colombia,

Series

B,

13.25%,

2/9/33

90,056,200,000

22,112

Total

Colombia

(Cost

$81,976)

78,049

CYPRUS 0.4%

Government

Bonds 0.4%

Republic

of

Cyprus,

0.95%,

1/20/32

19,769,000

17,911

Republic

of

Cyprus,

1.50%,

4/16/27

2,130,000

2,157

Republic

of

Cyprus,

2.75%,

2/26/34

2,716,000

2,749

Republic

of

Cyprus,

2.75%,

5/3/49

2,832,000

2,507

Total

Cyprus

(Cost

$31,659)

25,324

CZECH

REPUBLIC 1.8%

Government

Bonds 1.8%

Republic

of

Czech,

Series

125,

1.50%,

4/24/40

3,004,200,000

84,435

Republic

of

Czech,

Series

151,

4.90%,

4/14/34

1,018,110,000

44,268

Total

Czech

Republic

(Cost

$134,700)

128,703

DENMARK 0.7%

Corporate

Bonds 0.7%

Carlsberg

Breweries,

0.375%,

6/30/27

(EUR)

2,735,000

2,676

Carlsberg

Breweries,

0.875%,

7/1/29

(EUR)

3,773,000

3,571

Danske

Bank,

VR,

0.75%,

6/9/29

(EUR) (4)

8,420,000

8,079

Danske

Bank,

VR,

1.375%,

2/17/27

(EUR) (4)

2,440,000

2,486

Danske

Bank,

VR,

1.375%,

2/12/30

(EUR) (4)

4,700,000

4,856

Danske

Bank,

VR,

4.50%,

11/9/28

(EUR) (4)

2,410,000

2,599

Orsted,

4.875%,

1/12/32

(GBP)

5,750,000

6,948

TDC

Net,

5.056%,

5/31/28

(EUR)

2,310,000

2,489

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

TDC

Net,

5.618%,

2/6/30

(EUR)

13,970,000

15,336

Total

Denmark

(Cost

$49,408)

49,040

EGYPT 0.8%

Government

Bonds 0.8%

Arab

Republic

of

Egypt,

6.375%,

4/11/31

(EUR)

19,560,000

17,905

Arab

Republic

of

Egypt

Treasury

Bills,

Series

364D,

28.499%,

3/11/25

293,200,000

5,495

Arab

Republic

of

Egypt

Treasury

Bills,

Series

364D,

28.60%,

3/4/25

506,600,000

9,546

Arab

Republic

of

Egypt

Treasury

Bills,

Series

364D,

30.248%,

3/18/25

1,408,400,000

26,260

Total

Egypt

(Cost

$61,003)

59,206

ESTONIA 0.5%

Government

Bonds 0.5%

Republic

of

Estonia,

3.25%,

1/17/34 (2)

32,500,000

34,054

Total

Estonia

(Cost

$35,375)

34,054

FINLAND 0.1%

Corporate

Bonds 0.1%

Elisa,

0.25%,

9/15/27

2,760,000

2,666

Metso,

0.875%,

5/26/28

2,775,000

2,667

Total

Finland

(Cost

$5,596)

5,333

FRANCE 5.0%

Corporate

Bonds 1.5%

Altice

France,

3.375%,

1/15/28 (1)

505,000

395

Altice

France,

5.875%,

2/1/27 (1)

1,305,000

1,080

Banque

Federative

du

Credit

Mutuel,

1.25%,

5/26/27

3,000,000

2,991

Banque

Federative

du

Credit

Mutuel,

1.375%,

7/16/28

3,100,000

3,038

Banque

Federative

du

Credit

Mutuel,

3.125%,

9/14/27

2,500,000

2,600

Banque

Federative

du

Credit

Mutuel,

5.125%,

1/13/33

5,400,000

5,932

Banque

Stellantis

France,

4.00%,

1/21/27

2,400,000

2,533

BNP

Paribas,

VR,

2.125%,

1/23/27 (4)

9,300,000

9,549

BNP

Paribas,

VR,

3.875%,

1/10/31 (4)

4,000,000

4,278

BPCE,

0.25%,

1/14/31

7,100,000

6,174

BPCE,

3.50%,

1/25/28

5,500,000

5,785

Credit

Agricole,

0.875%,

1/14/32

1,000,000

870

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Credit

Agricole,

1.875%,

12/20/26

5,200,000

5,273

Credit

Agricole

Assurances,

VR,

2.625%,

1/29/48 (4)

6,000,000

6,021

Electricite

de

France,

6.125%,

6/2/34

(GBP)

7,200,000

9,091

EssilorLuxottica,

0.375%,

11/27/27

2,700,000

2,620

Holding

d'Infrastructures

de

Transport,

1.475%,

1/18/31

8,600,000

7,907

IPD

3,

8.00%,

6/15/28 (1)

1,825,000

1,992

Loxam,

6.375%,

5/15/28

3,795,000

4,084

Orange,

3.25%,

1/15/32

(GBP)

6,500,000

7,266

RTE

Reseau

de

Transport

d'Electricite

SADIR,

0.75%,

1/12/34

7,200,000

5,949

Veolia

Environnement,

1.25%,

4/2/27

2,000,000

2,000

Veolia

Environnement,

1.94%,

1/7/30

5,700,000

5,603

103,031

Government

Bonds 3.5%

Republic

of

France,

Series

OAT,

1.25%,

5/25/36 (1)

86,453,000

72,484

Republic

of

France,

Series

OAT,

2.50%,

5/25/30 (1)

66,735,000

68,402

Republic

of

France,

Series

OAT,

2.75%,

2/25/30 (1)

69,977,000

72,594

Republic

of

France,

Series

OAT,

4.00%,

4/25/55 (1)

35,640,000

38,723

252,203

Total

France

(Cost

$378,752)

355,234

GERMANY 4.4%

Corporate

Bonds 1.1%

Daimler

Truck

International

Finance,

1.625%,

4/6/27

2,600,000

2,623

E.ON

International

Finance,

6.25%,

6/3/30

(GBP)

11,400,000

14,985

Fresenius,

1.625%,

10/8/27

2,635,000

2,657

Fresenius,

5.00%,

11/28/29

5,200,000

5,825

Gruenenthal,

3.625%,

11/15/26 (1)

990,000

1,023

Gruenenthal,

4.625%,

11/15/31 (1)

160,000

167

Gruenenthal,

6.75%,

5/15/30 (1)

530,000

586

Gruenenthal,

6.75%,

5/15/30

3,500,000

3,866

Hannover

Rueck,

1.125%,

4/18/28

2,600,000

2,563

Hannover

Rueck,

VR,

1.125%,

10/9/39 (4)

11,500,000

10,707

Hannover

Rueck,

VR,

1.75%,

10/8/40 (4)

4,800,000

4,527

Knorr-Bremse,

3.25%,

9/21/27

2,500,000

2,616

ProGroup,

5.375%,

4/15/31 (1)

2,755,000

2,779

TK

Elevator

Midco,

4.375%,

7/15/27 (1)(2)

2,745,000

2,836

Volkswagen

Bank,

4.375%,

5/3/28

2,400,000

2,564

Volkswagen

Financial

Services,

0.375%,

2/12/30

10,300,000

9,039

Volkswagen

International

Finance,

Series

10Y,

1.875%,

3/30/27

1,300,000

1,307

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Volkswagen

Leasing,

1.50%,

6/19/26

5,135,000

5,198

Volkswagen

Leasing,

1.625%,

8/15/25

5,350,000

5,492

81,360

Government

Bonds 3.3%

Bundesobligation,

Series

184,

0.00%,

10/9/26

56,436,000

56,406

Bundesrepublik

Deutschland

Bundesanleihe,

0.00%,

8/15/52

14,735,200

7,617

Bundesrepublik

Deutschland

Bundesanleihe,

2.50%,

8/15/54

37,696,000

38,234

Deutsche

Bundesrepublik,

Inflation-Indexed,

0.50%,

4/15/30

122,936,176

127,585

KfW,

4.70%,

6/2/37

(CAD)

5,202,000

3,824

233,666

Total

Germany

(Cost

$331,928)

315,026

GREECE 0.2%

Government

Bonds 0.2%

Hellenic

Republic,

0.75%,

6/18/31 (1)

17,599,000

15,995

Total

Greece

(Cost

$21,199)

15,995

HUNGARY 0.3%

Corporate

Bonds 0.1%

OTP

Bank,

VR,

7.35%,

3/4/26

(EUR) (4)

5,290,000

5,510

5,510

Government

Bonds 0.2%

Magyar

Export-Import

Bank,

6.00%,

5/16/29

(EUR)

4,370,000

4,899

Republic

of

Hungary,

Series

33/A,

2.25%,

4/20/33

2,496,670,000

4,608

Republic

of

Hungary,

Series

4Y,

5.00%,

2/22/27

(EUR)

8,464,000

9,099

18,606

Total

Hungary

(Cost

$24,131)

24,116

ICELAND 0.4%

Corporate

Bonds 0.1%

Landsbankinn,

0.375%,

5/23/25

(EUR)

8,060,000

8,271

8,271

Government

Bonds 0.3%

Republic

of

Iceland,

0.00%,

4/15/28

(EUR)

10,385,000

9,916

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Republic

of

Iceland,

3.50%,

3/21/34

(EUR)

8,096,000

8,770

18,686

Total

Iceland

(Cost

$30,379)

26,957

INDIA 1.2%

Government

Bonds 1.2%

Republic

of

India,

6.54%,

1/17/32

3,011,080,000

34,775

Republic

of

India,

7.26%,

8/22/32

4,449,100,000

53,479

Total

India

(Cost

$88,745)

88,254

INDONESIA 3.0%

Corporate

Bonds 0.2%

Freeport

Indonesia,

4.763%,

4/14/27

(USD) (2)

9,400,000

9,319

Minejesa

Capital,

5.625%,

8/10/37

(USD)

3,965,000

3,690

13,009

Government

Bonds 2.8%

Republic

of

Indonesia,

3.75%,

6/14/28

(EUR)

40,797,000

42,843

Republic

of

Indonesia,

Series

FR86,

5.50%,

4/15/26

473,000,000,000

28,833

Republic

of

Indonesia,

Series

FR91,

6.375%,

4/15/32

345,120,000,000

20,637

Republic

of

Indonesia,

Series

FR95,

6.375%,

8/15/28

153,888,000,000

9,382

Republic

of

Indonesia,

Series

FR96,

7.00%,

2/15/33

1,360,474,000,000

84,407

Republic

of

Indonesia,

Series

101,

6.875%,

4/15/29

290,698,000,000

17,988

204,090

Total

Indonesia

(Cost

$230,438)

217,099

IRELAND 0.1%

Corporate

Bonds 0.0%

Smurfit

Kappa

Treasury,

1.50%,

9/15/27

2,650,000

2,659

2,659

Government

Bonds 0.1%

Republic

of

Ireland,

1.50%,

5/15/50

2,696,000

2,111

Republic

of

Ireland,

2.00%,

2/18/45

5,630,000

5,012

7,123

Total

Ireland

(Cost

$13,442)

9,782

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

ISRAEL 0.3%

Government

Bonds 0.3%

State

of

Israel,

1.50%,

1/18/27

(EUR)

21,304,000

21,183

Total

Israel

(Cost

$25,076)

21,183

ITALY 2.3%

Corporate

Bonds 0.7%

Aeroporti

di

Roma,

1.625%,

6/8/27

2,575,000

2,596

Autostrade

per

l'Italia,

1.625%,

1/25/28 (2)

2,680,000

2,656

Autostrade

per

l'Italia,

2.00%,

12/4/28

6,245,000

6,174

Autostrade

per

l'Italia,

2.00%,

1/15/30

5,620,000

5,420

CA

Auto

Bank,

4.75%,

1/25/27

2,395,000

2,560

Inter

Media

&

Communication,

6.75%,

2/9/27

5,303,935

5,588

Intesa

Sanpaolo,

1.75%,

7/4/29

12,399,000

12,151

Italgas,

1.625%,

1/19/27

2,570,000

2,609

Snam,

0.875%,

10/25/26

6,950,000

6,968

46,722

Government

Bonds 1.6%

Italy

Buoni

Poliennali

Del

Tesoro,

Series

30Y,

4.50%,

10/1/53 (1)

30,122,000

33,240

Italy

Buoni

Poliennali

Del

Tesoro,

Series

50Y,

2.80%,

3/1/67

29,785,000

23,585

Italy

Buoni

Poliennali

Del

Tesoro,

Series

CPI,

1.30%,

5/15/28 (1)

54,449,493

56,964

113,789

Total

Italy

(Cost

$173,039)

160,511

IVORY

COAST 0.3%

Government

Bonds 0.3%

Republic

of

Ivory

Coast,

5.875%,

10/17/31

(EUR) (2)

22,575,000

21,946

Total

Ivory

Coast

(Cost

$21,409)

21,946

JAPAN 11.0%

Government

Bonds 11.0%

Government

of

Japan,

Series

16,

1.30%,

3/20/63

2,914,000,000

13,101

Government

of

Japan,

Series

20,

Inflation-Indexed,

0.10%,

3/10/25

10,570,530,000

67,452

T.

ROWE

PRICE

International

Bond

Fund

(USD

Hedged)

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Government

of

Japan,

Series

26,

Inflation-Indexed,

0.005%,

3/10/31

9,643,184,380

64,735

Government

of

Japan,

Series

27,

Inflation-Indexed,

0.005%,

3/10/32

4,551,429,400

30,430

Government

of

Japan,

Series

28,

Inflation-Indexed,

0.005%,

3/10/33

3,502,753,664

23,282

Government

of

Japan,

Series

29,

Inflation-Indexed,

0.005%,

3/10/34

18,993,399,864

125,516

Government

of

Japan,

Series

44,

1.70%,

9/20/44

14,906,150,000

92,128

Government

of

Japan,

Series

74,

1.00%,

3/20/52

14,495,300,000

69,960

Government

of

Japan,

Series

75,

1.30%,

6/20/52

10,616,750,000

55,177

Government

of

Japan,

Series

76,

1.40%,

9/20/52

9,384,900,000

49,832

Government

of

Japan,

Series

83,

2.20%,

6/20/54

3,454,650,000

21,772

Government

of

Japan,

Series

338,

0.40%,

3/20/25

13,396,000,000

85,180

Japan

Treasury

Discount

Bill,

Series

1273,

0.13%,

3/17/25

13,000,000,000

82,586

Total

Japan

(Cost

$957,315)

781,151

KUWAIT 0.2%