UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-02958

T. Rowe Price International Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

Global High Income Bond Fund

This annual shareholder report contains important information about Global High Income Bond Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global High Income Bond Fund - Investor Class | $78 | 0.75% |

|---|

What drove fund performance during the past 12 months?

Global high yield bonds produced positive returns in 2024, helped by monetary policy easing by major central banks. However, rising geopolitical tensions and uncertainty about economic growth, future interest rate cuts, and the incoming Trump administration’s tariff plans tempered fourth-quarter gains.

Compared with the style-specific ICE BofA Global High Yield Index (hedged to USD), the fund’s off-benchmark allocation to bank loans—which outpaced high yield bonds over the past year—was a leading contributor to relative results, driven by holdings in Ascend Learning and LTI Boyd. Credit selection in the health care segment added value, partly due to Community Health Systems.

Selection among cable operators detracted, largely due to Altice France. In March, the company aggressively moved pending asset sales to an unrestricted subsidiary and threatened to withhold them from creditors unless they agreed to receive less in their claims. Within the media segment, iHeartMedia, which we eliminated from the portfolio in June, held back relative gains.

The fund seeks high income and some capital appreciation. We reduced our holdings in European high yield, as valuations became less attractive following recent outperformance. Additionally, we have decreased exposure to the automotive industry, a significant portion of which is based in Europe.

The portfolio maintained allocations to select types of derivatives for hedging purposes. The fund had a material exposure to currency forward contracts during the reporting period, which had a positive impact on performance.

How has the fund performed?

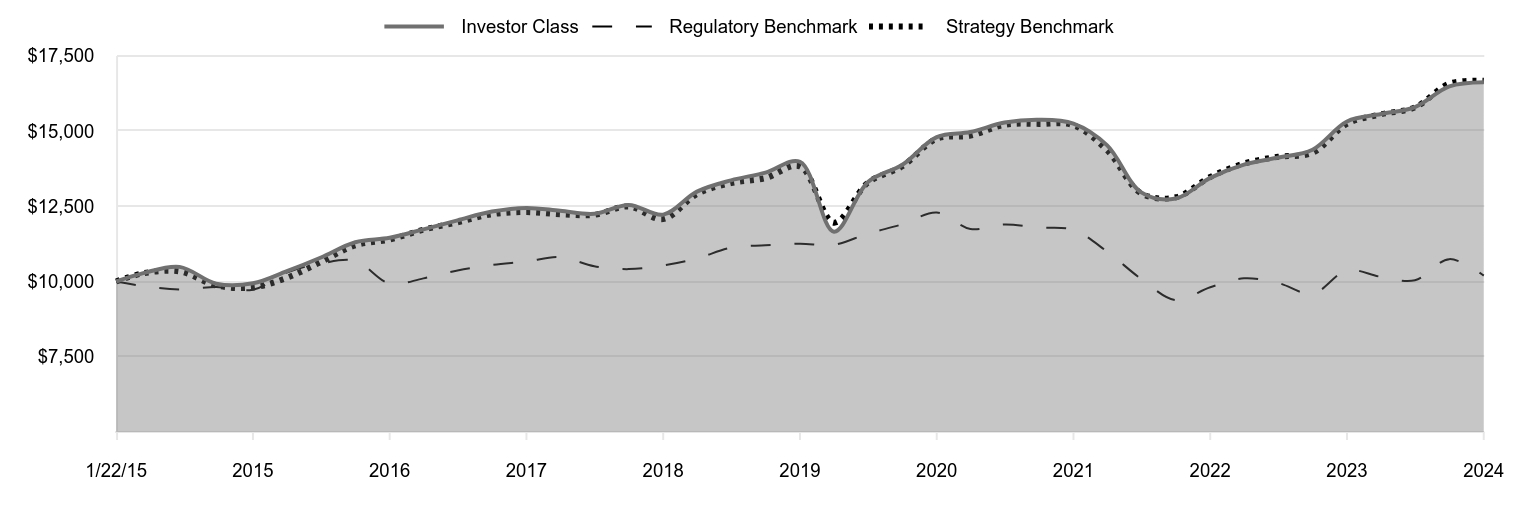

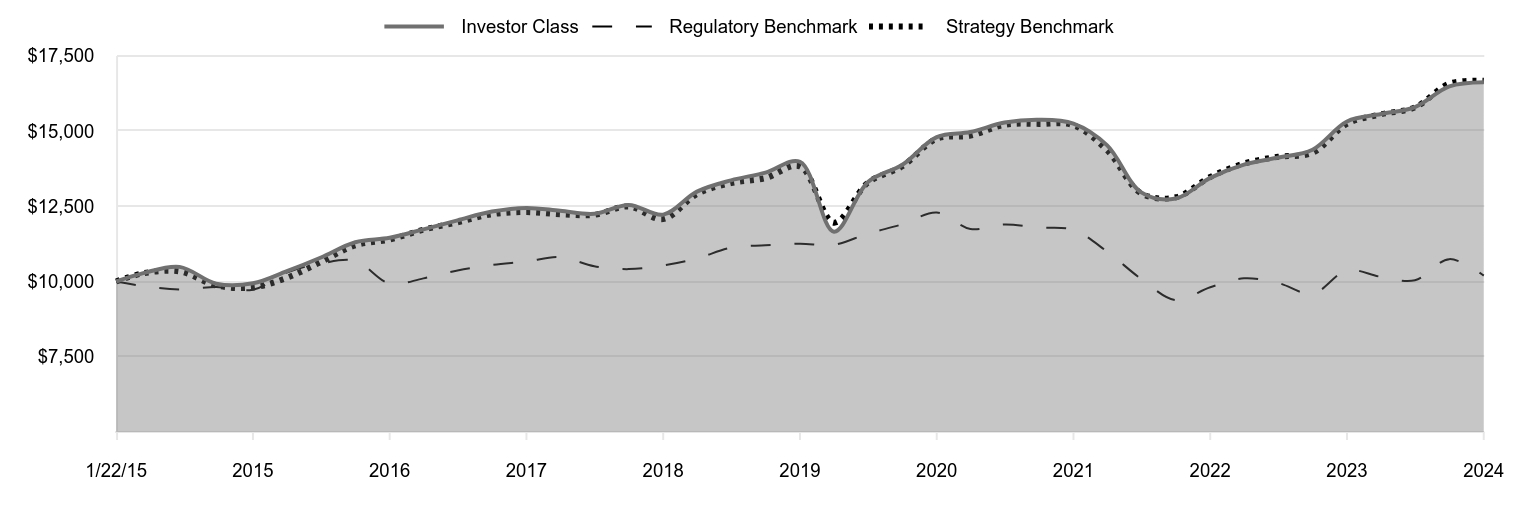

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 1/22/15 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/15 | 10,277 | 9,850 | 10,272 |

|---|

| 6/30/15 | 10,486 | 9,734 | 10,333 |

|---|

| 9/30/15 | 9,927 | 9,817 | 9,868 |

|---|

| 12/31/15 | 9,939 | 9,726 | 9,803 |

|---|

| 3/31/16 | 10,343 | 10,300 | 10,121 |

|---|

| 6/30/16 | 10,797 | 10,598 | 10,647 |

|---|

| 9/30/16 | 11,305 | 10,684 | 11,202 |

|---|

| 12/31/16 | 11,451 | 9,929 | 11,393 |

|---|

| 3/31/17 | 11,733 | 10,104 | 11,721 |

|---|

| 6/30/17 | 12,032 | 10,367 | 11,964 |

|---|

| 9/30/17 | 12,323 | 10,550 | 12,234 |

|---|

| 12/31/17 | 12,445 | 10,664 | 12,306 |

|---|

| 3/31/18 | 12,349 | 10,809 | 12,233 |

|---|

| 6/30/18 | 12,247 | 10,508 | 12,216 |

|---|

| 9/30/18 | 12,545 | 10,411 | 12,492 |

|---|

| 12/31/18 | 12,222 | 10,536 | 12,071 |

|---|

| 3/31/19 | 12,986 | 10,768 | 12,903 |

|---|

| 6/30/19 | 13,361 | 11,122 | 13,269 |

|---|

| 9/30/19 | 13,615 | 11,202 | 13,437 |

|---|

| 12/31/19 | 13,977 | 11,256 | 13,826 |

|---|

| 3/31/20 | 11,656 | 11,219 | 11,955 |

|---|

| 6/30/20 | 13,303 | 11,592 | 13,283 |

|---|

| 9/30/20 | 13,877 | 11,900 | 13,828 |

|---|

| 12/31/20 | 14,795 | 12,291 | 14,740 |

|---|

| 3/31/21 | 14,964 | 11,743 | 14,845 |

|---|

| 6/30/21 | 15,279 | 11,897 | 15,204 |

|---|

| 9/30/21 | 15,376 | 11,792 | 15,236 |

|---|

| 12/31/21 | 15,247 | 11,713 | 15,188 |

|---|

| 3/31/22 | 14,522 | 10,991 | 14,354 |

|---|

| 6/30/22 | 12,961 | 10,083 | 12,925 |

|---|

| 9/30/22 | 12,757 | 9,383 | 12,797 |

|---|

| 12/31/22 | 13,443 | 9,810 | 13,471 |

|---|

| 3/31/23 | 13,882 | 10,105 | 13,918 |

|---|

| 6/30/23 | 14,117 | 9,950 | 14,143 |

|---|

| 9/30/23 | 14,379 | 9,593 | 14,274 |

|---|

| 12/31/23 | 15,316 | 10,370 | 15,237 |

|---|

| 3/31/24 | 15,564 | 10,154 | 15,554 |

|---|

| 6/30/24 | 15,795 | 10,042 | 15,785 |

|---|

| 9/30/24 | 16,482 | 10,743 | 16,574 |

|---|

| 12/31/24 | 16,618 | 10,195 | 16,665 |

|---|

202501-4140694, 202502-4108537

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 1/22/15 |

|---|

| Global High Income Bond Fund (Investor Class) | 8.51% | 3.52% | 5.24% |

|---|

| Bloomberg Global Aggregate Bond Index (Regulatory Benchmark) | -1.69 | -1.96 | 0.19 |

|---|

| ICE BofA Global High Yield Index Hedged to USD (Strategy Benchmark) | 9.37 | 3.81 | 5.27 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$579,855

- Number of Portfolio Holdings310

- Investment Advisory Fees Paid (000s)$2,062

- Portfolio Turnover Rate45.6%

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Corporate Bonds | 86.1% |

| Bank Loans | 9.4 |

| Municipal Securities | 0.6 |

| Preferred Stocks | 0.4 |

| Common Stocks | 0.2 |

| Convertible Preferred Stocks | 0.2 |

| Asset-Backed Securities | 0.1 |

| Convertible Bonds | 0.0 |

| Short-Term and Other | 3.0 |

Top Ten Holdings (as a % of Net Assets)

| Petroleos Mexicanos | 2.4% |

| Venture Global LNG | 1.5 |

| CSC Holdings | 1.2 |

| Gruenenthal | 1.1 |

| Hilcorp Energy I | 1.1 |

| Cirsa Finance International | 1.0 |

| CVS Health | 1.0 |

| Cloud Software Group | 1.0 |

| Iliad Holding | 1.0 |

| Ziggo Bond | 1.0 |

How has the fund changed?

This is a summary of certain material changes to Global High Income Bond Fund. Effective March 1, 2025, the fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in bonds that are rated below investment grade. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg and ICE do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Global High Income Bond Fund

Investor Class (RPIHX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Global High Income Bond Fund

This annual shareholder report contains important information about Global High Income Bond Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global High Income Bond Fund - Advisor Class | $100 | 0.96% |

|---|

What drove fund performance during the past 12 months?

Global high yield bonds produced positive returns in 2024, helped by monetary policy easing by major central banks. However, rising geopolitical tensions and uncertainty about economic growth, future interest rate cuts, and the incoming Trump administration’s tariff plans tempered fourth-quarter gains.

Compared with the style-specific ICE BofA Global High Yield Index (hedged to USD), the fund’s off-benchmark allocation to bank loans—which outpaced high yield bonds over the past year—was a leading contributor to relative results, driven by holdings in Ascend Learning and LTI Boyd. Credit selection in the health care segment added value, partly due to Community Health Systems.

Selection among cable operators detracted, largely due to Altice France. In March, the company aggressively moved pending asset sales to an unrestricted subsidiary and threatened to withhold them from creditors unless they agreed to receive less in their claims. Within the media segment, iHeartMedia, which we eliminated from the portfolio in June, held back relative gains.

The fund seeks high income and some capital appreciation. We reduced our holdings in European high yield, as valuations became less attractive following recent outperformance. Additionally, we have decreased exposure to the automotive industry, a significant portion of which is based in Europe.

The portfolio maintained allocations to select types of derivatives for hedging purposes. The fund had a material exposure to currency forward contracts during the reporting period, which had a positive impact on performance.

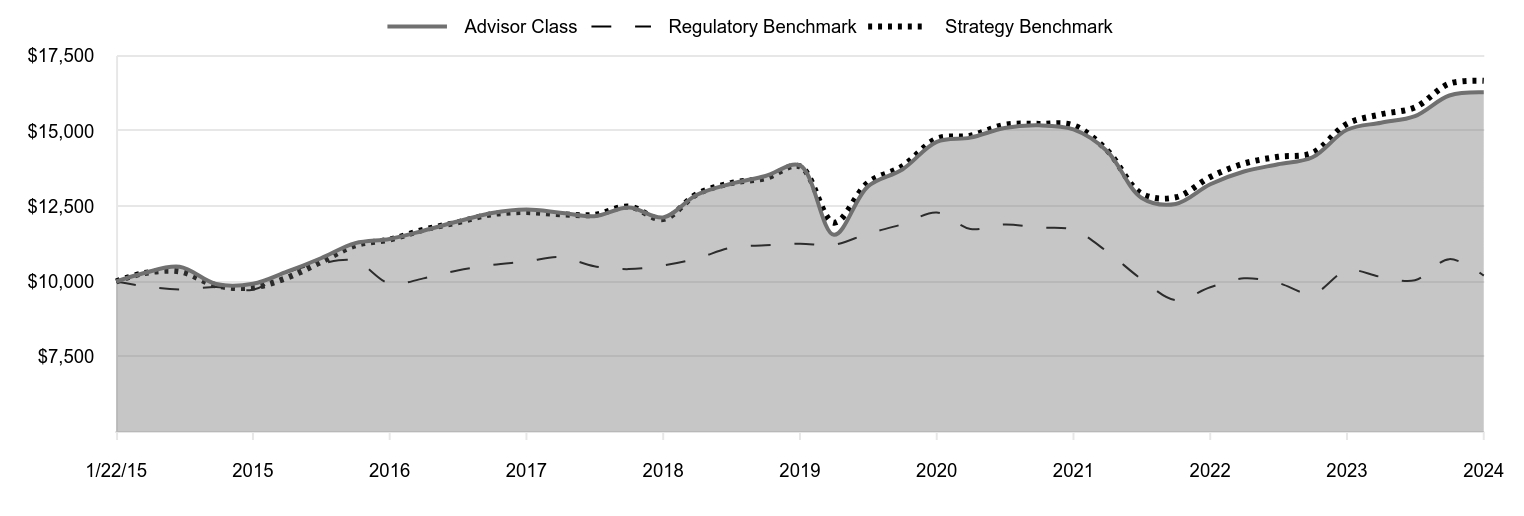

How has the fund performed?

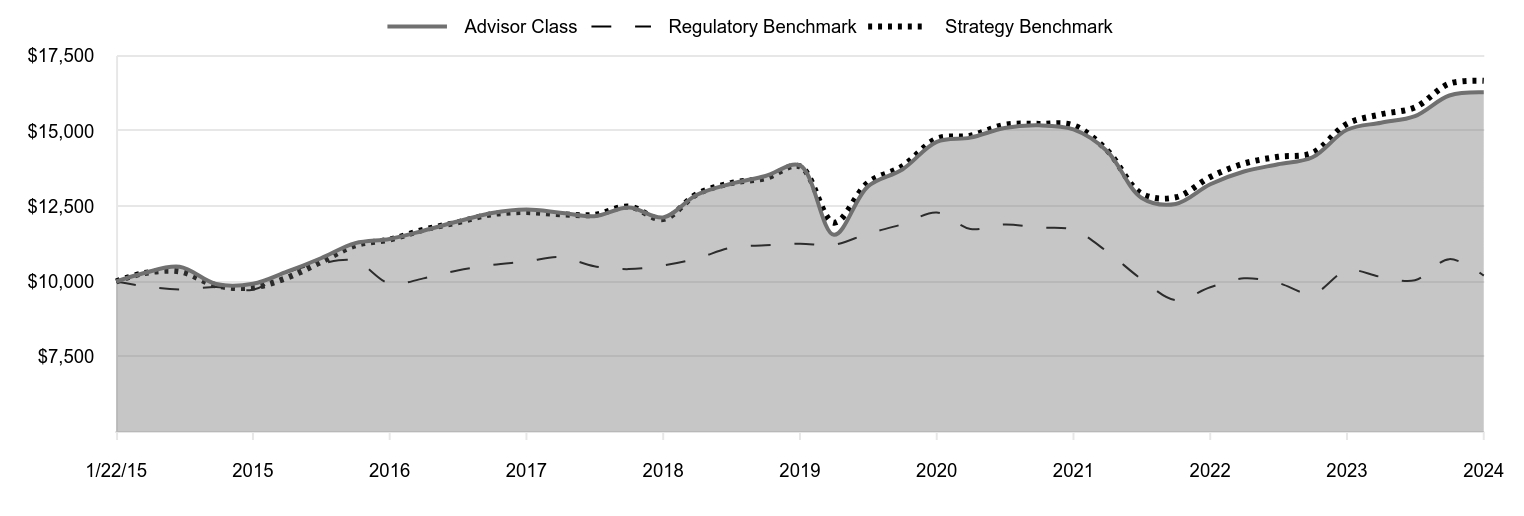

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Advisor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 1/22/15 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/15 | 10,274 | 9,850 | 10,272 |

|---|

| 6/30/15 | 10,489 | 9,734 | 10,333 |

|---|

| 9/30/15 | 9,916 | 9,817 | 9,868 |

|---|

| 12/31/15 | 9,924 | 9,726 | 9,803 |

|---|

| 3/31/16 | 10,324 | 10,300 | 10,121 |

|---|

| 6/30/16 | 10,773 | 10,598 | 10,647 |

|---|

| 9/30/16 | 11,273 | 10,684 | 11,202 |

|---|

| 12/31/16 | 11,413 | 9,929 | 11,393 |

|---|

| 3/31/17 | 11,687 | 10,104 | 11,721 |

|---|

| 6/30/17 | 11,993 | 10,367 | 11,964 |

|---|

| 9/30/17 | 12,276 | 10,550 | 12,234 |

|---|

| 12/31/17 | 12,388 | 10,664 | 12,306 |

|---|

| 3/31/18 | 12,287 | 10,809 | 12,233 |

|---|

| 6/30/18 | 12,167 | 10,508 | 12,216 |

|---|

| 9/30/18 | 12,456 | 10,411 | 12,492 |

|---|

| 12/31/18 | 12,129 | 10,536 | 12,071 |

|---|

| 3/31/19 | 12,881 | 10,768 | 12,903 |

|---|

| 6/30/19 | 13,246 | 11,122 | 13,269 |

|---|

| 9/30/19 | 13,503 | 11,202 | 13,437 |

|---|

| 12/31/19 | 13,855 | 11,256 | 13,826 |

|---|

| 3/31/20 | 11,550 | 11,219 | 11,955 |

|---|

| 6/30/20 | 13,160 | 11,592 | 13,283 |

|---|

| 9/30/20 | 13,721 | 11,900 | 13,828 |

|---|

| 12/31/20 | 14,636 | 12,291 | 14,740 |

|---|

| 3/31/21 | 14,780 | 11,743 | 14,845 |

|---|

| 6/30/21 | 15,098 | 11,897 | 15,204 |

|---|

| 9/30/21 | 15,187 | 11,792 | 15,236 |

|---|

| 12/31/21 | 15,051 | 11,713 | 15,188 |

|---|

| 3/31/22 | 14,329 | 10,991 | 14,354 |

|---|

| 6/30/22 | 12,784 | 10,083 | 12,925 |

|---|

| 9/30/22 | 12,577 | 9,383 | 12,797 |

|---|

| 12/31/22 | 13,229 | 9,810 | 13,471 |

|---|

| 3/31/23 | 13,653 | 10,105 | 13,918 |

|---|

| 6/30/23 | 13,894 | 9,950 | 14,143 |

|---|

| 9/30/23 | 14,128 | 9,593 | 14,274 |

|---|

| 12/31/23 | 15,040 | 10,370 | 15,237 |

|---|

| 3/31/24 | 15,276 | 10,154 | 15,554 |

|---|

| 6/30/24 | 15,495 | 10,042 | 15,785 |

|---|

| 9/30/24 | 16,179 | 10,743 | 16,574 |

|---|

| 12/31/24 | 16,285 | 10,195 | 16,665 |

|---|

202501-4140694, 202502-4108537

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 1/22/15 |

|---|

| Global High Income Bond Fund (Advisor Class) | 8.28% | 3.29% | 5.03% |

|---|

| Bloomberg Global Aggregate Bond Index (Regulatory Benchmark) | -1.69 | -1.96 | 0.19 |

|---|

| ICE BofA Global High Yield Index Hedged to USD (Strategy Benchmark) | 9.37 | 3.81 | 5.27 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$579,855

- Number of Portfolio Holdings310

- Investment Advisory Fees Paid (000s)$2,062

- Portfolio Turnover Rate45.6%

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Corporate Bonds | 86.1% |

| Bank Loans | 9.4 |

| Municipal Securities | 0.6 |

| Preferred Stocks | 0.4 |

| Common Stocks | 0.2 |

| Convertible Preferred Stocks | 0.2 |

| Asset-Backed Securities | 0.1 |

| Convertible Bonds | 0.0 |

| Short-Term and Other | 3.0 |

Top Ten Holdings (as a % of Net Assets)

| Petroleos Mexicanos | 2.4% |

| Venture Global LNG | 1.5 |

| CSC Holdings | 1.2 |

| Gruenenthal | 1.1 |

| Hilcorp Energy I | 1.1 |

| Cirsa Finance International | 1.0 |

| CVS Health | 1.0 |

| Cloud Software Group | 1.0 |

| Iliad Holding | 1.0 |

| Ziggo Bond | 1.0 |

How has the fund changed?

This is a summary of certain material changes to Global High Income Bond Fund. Effective March 1, 2025, the fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in bonds that are rated below investment grade. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg and ICE do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Global High Income Bond Fund

Advisor Class (PAIHX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Global High Income Bond Fund

This annual shareholder report contains important information about Global High Income Bond Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Global High Income Bond Fund - I Class | $64 | 0.61% |

|---|

What drove fund performance during the past 12 months?

Global high yield bonds produced positive returns in 2024, helped by monetary policy easing by major central banks. However, rising geopolitical tensions and uncertainty about economic growth, future interest rate cuts, and the incoming Trump administration’s tariff plans tempered fourth-quarter gains.

Compared with the style-specific ICE BofA Global High Yield Index (hedged to USD), the fund’s off-benchmark allocation to bank loans—which outpaced high yield bonds over the past year—was a leading contributor to relative results, driven by holdings in Ascend Learning and LTI Boyd. Credit selection in the health care segment added value, partly due to Community Health Systems.

Selection among cable operators detracted, largely due to Altice France. In March, the company aggressively moved pending asset sales to an unrestricted subsidiary and threatened to withhold them from creditors unless they agreed to receive less in their claims. Within the media segment, iHeartMedia, which we eliminated from the portfolio in June, held back relative gains.

The fund seeks high income and some capital appreciation. We reduced our holdings in European high yield, as valuations became less attractive following recent outperformance. Additionally, we have decreased exposure to the automotive industry, a significant portion of which is based in Europe.

The portfolio maintained allocations to select types of derivatives for hedging purposes. The fund had a material exposure to currency forward contracts during the reporting period, which had a positive impact on performance.

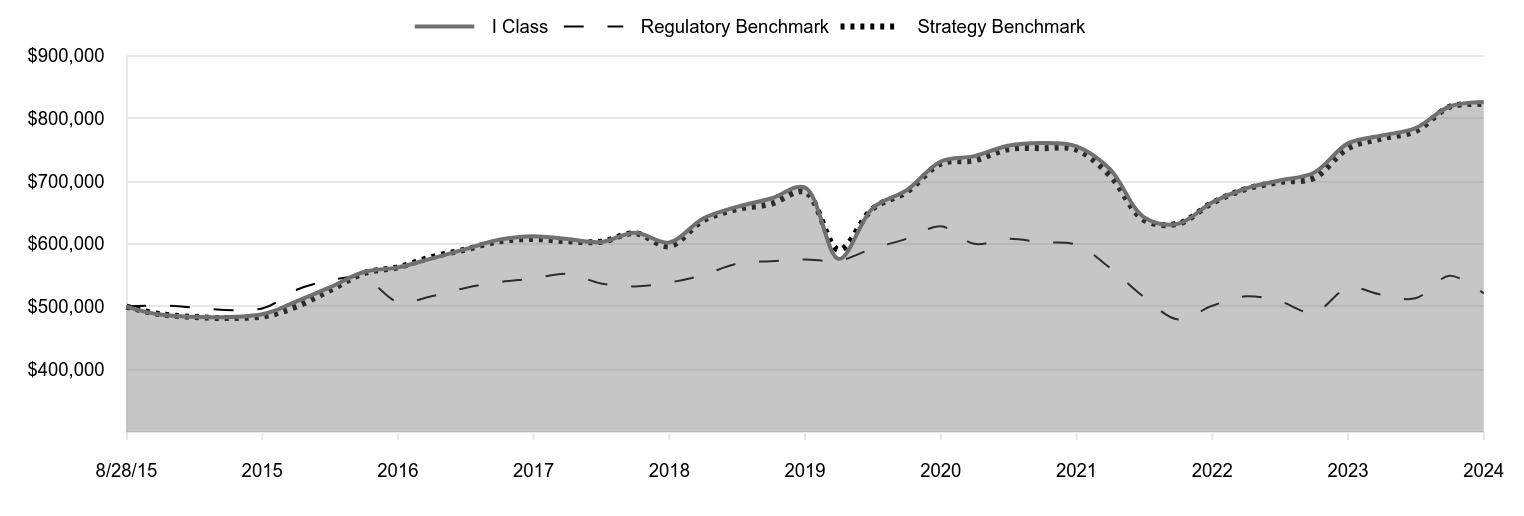

How has the fund performed?

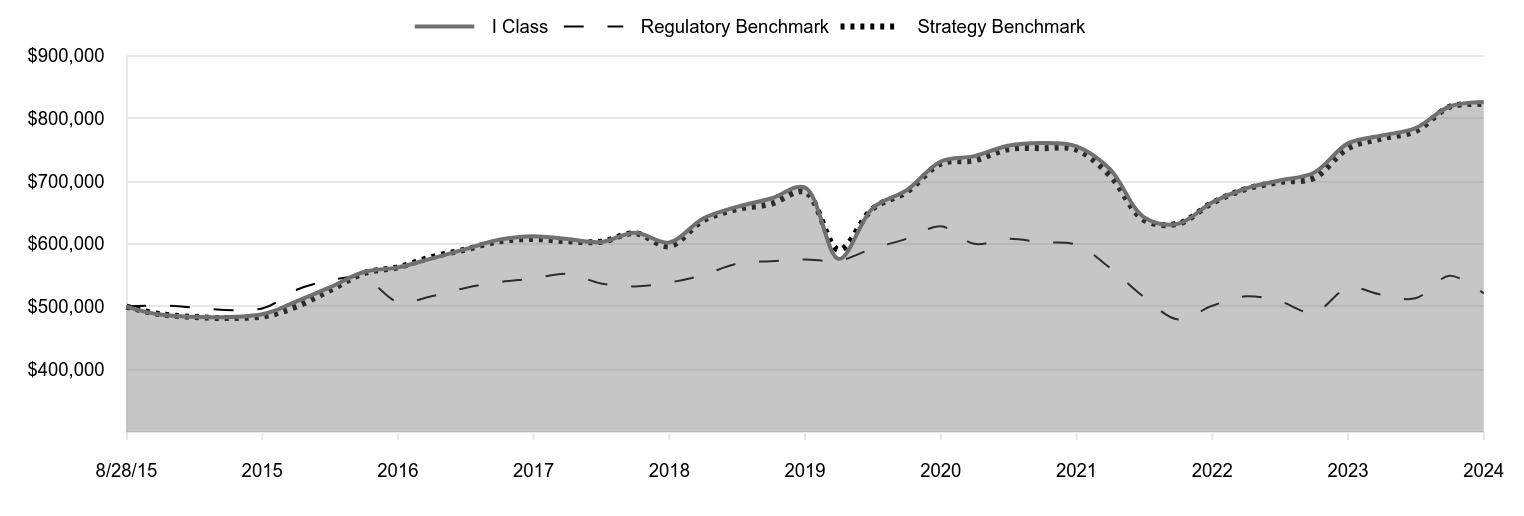

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 8/28/15 | 500,000 | 500,000 | 500,000 |

|---|

| 9/30/15 | 487,030 | 501,660 | 487,372 |

|---|

| 12/31/15 | 487,877 | 497,024 | 484,164 |

|---|

| 3/31/16 | 507,971 | 526,344 | 499,863 |

|---|

| 6/30/16 | 530,556 | 541,556 | 525,813 |

|---|

| 9/30/16 | 555,143 | 545,978 | 553,235 |

|---|

| 12/31/16 | 562,520 | 507,392 | 562,644 |

|---|

| 3/31/17 | 576,555 | 516,329 | 578,872 |

|---|

| 6/30/17 | 591,656 | 529,764 | 590,885 |

|---|

| 9/30/17 | 606,742 | 539,107 | 604,210 |

|---|

| 12/31/17 | 612,275 | 544,913 | 607,751 |

|---|

| 3/31/18 | 607,792 | 552,331 | 604,145 |

|---|

| 6/30/18 | 602,984 | 536,964 | 603,297 |

|---|

| 9/30/18 | 617,906 | 532,004 | 616,950 |

|---|

| 12/31/18 | 602,211 | 538,375 | 596,176 |

|---|

| 3/31/19 | 640,126 | 550,229 | 637,220 |

|---|

| 6/30/19 | 658,882 | 568,357 | 655,306 |

|---|

| 9/30/19 | 672,284 | 572,420 | 663,611 |

|---|

| 12/31/19 | 689,759 | 575,198 | 682,845 |

|---|

| 3/31/20 | 576,015 | 573,318 | 590,422 |

|---|

| 6/30/20 | 656,945 | 592,355 | 656,014 |

|---|

| 9/30/20 | 685,598 | 608,120 | 682,948 |

|---|

| 12/31/20 | 731,312 | 628,094 | 727,953 |

|---|

| 3/31/21 | 739,918 | 600,076 | 733,147 |

|---|

| 6/30/21 | 756,538 | 607,952 | 750,872 |

|---|

| 9/30/21 | 760,918 | 602,582 | 752,468 |

|---|

| 12/31/21 | 755,561 | 598,530 | 750,081 |

|---|

| 3/31/22 | 719,113 | 561,655 | 708,885 |

|---|

| 6/30/22 | 642,740 | 515,250 | 638,328 |

|---|

| 9/30/22 | 632,072 | 479,470 | 632,029 |

|---|

| 12/31/22 | 666,296 | 501,278 | 665,285 |

|---|

| 3/31/23 | 688,296 | 516,350 | 687,388 |

|---|

| 6/30/23 | 701,044 | 508,450 | 698,489 |

|---|

| 9/30/23 | 713,460 | 490,216 | 704,935 |

|---|

| 12/31/23 | 760,234 | 529,926 | 752,511 |

|---|

| 3/31/24 | 772,841 | 518,887 | 768,143 |

|---|

| 6/30/24 | 784,615 | 513,157 | 779,570 |

|---|

| 9/30/24 | 819,058 | 548,990 | 818,551 |

|---|

| 12/31/24 | 826,128 | 520,975 | 823,046 |

|---|

202501-4140694, 202502-4108537

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 8/28/15 |

|---|

| Global High Income Bond Fund (I Class) | 8.67% | 3.67% | 5.52% |

|---|

| Bloomberg Global Aggregate Bond Index (Regulatory Benchmark) | -1.69 | -1.96 | 0.44 |

|---|

| ICE BofA Global High Yield Index Hedged to USD (Strategy Benchmark) | 9.37 | 3.81 | 5.48 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$579,855

- Number of Portfolio Holdings310

- Investment Advisory Fees Paid (000s)$2,062

- Portfolio Turnover Rate45.6%

What did the fund invest in?

Security Allocation (as a % of Net Assets)

| Corporate Bonds | 86.1% |

| Bank Loans | 9.4 |

| Municipal Securities | 0.6 |

| Preferred Stocks | 0.4 |

| Common Stocks | 0.2 |

| Convertible Preferred Stocks | 0.2 |

| Asset-Backed Securities | 0.1 |

| Convertible Bonds | 0.0 |

| Short-Term and Other | 3.0 |

Top Ten Holdings (as a % of Net Assets)

| Petroleos Mexicanos | 2.4% |

| Venture Global LNG | 1.5 |

| CSC Holdings | 1.2 |

| Gruenenthal | 1.1 |

| Hilcorp Energy I | 1.1 |

| Cirsa Finance International | 1.0 |

| CVS Health | 1.0 |

| Cloud Software Group | 1.0 |

| Iliad Holding | 1.0 |

| Ziggo Bond | 1.0 |

How has the fund changed?

This is a summary of certain material changes to Global High Income Bond Fund. Effective March 1, 2025, the fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in bonds that are rated below investment grade. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Bloomberg and ICE do not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Global High Income Bond Fund

I Class (RPOIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | |

| | | | 2024 | | | | | | 2023 | |

| | Audit Fees | | $ | 39,999 | | | | | | | $ | 39,183 | |

| | Audit-Related Fees | | | - | | | | | | | | - | |

| | Tax Fees | | | - | | | | | | | | - | |

| | All Other Fees | | | - | | | | | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

RPIHX

Global

High

Income

Bond

Fund

PAIHX

Global

High

Income

Bond

Fund–

.

Advisor Class

RPOIX

Global

High

Income

Bond

Fund–

.

I Class

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

For

a

share

outstanding

throughout

each

period

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

8

.49

$

7

.97

$

9

.94

$

10

.17

$

10

.17

Investment

activities

Net

investment

income

(1)(2)

0

.57

0

.55

0

.48

0

.47

0

.54

Net

realized

and

unrealized

gain/loss

0

.13

0

.52

(

1

.64

)

(

0

.16

)

0

.01

(3)

Total

from

investment

activities

0

.70

1

.07

(

1

.16

)

0

.31

0

.55

Distributions

Net

investment

income

(

0

.57

)

(

0

.44

)

(

0

.49

)

(

0

.46

)

(

0

.55

)

Net

realized

gain

—

—

(

0

.32

)

(

0

.08

)

—

Tax

return

of

capital

—

(

0

.11

)

—

—

—

Total

distributions

(

0

.57

)

(

0

.55

)

(

0

.81

)

(

0

.54

)

(

0

.55

)

NET

ASSET

VALUE

End

of

period

$

8

.62

$

8

.49

$

7

.97

$

9

.94

$

10

.17

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

Ratios/Supplemental

Data

Total

return

(2)(4)

8

.51

%

13

.93

%

(

11

.83

)

%

3

.05

%

5

.86

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0

.86

%

0

.94

%

0

.96

%

0

.90

%

0

.94

%

Net

expenses

after

waivers/payments

by

Price

Associates

0

.75

%

0

.76

%

0

.75

%

0

.78

%

0

.79

%

Net

investment

income

6

.67

%

6

.76

%

5

.46

%

4

.61

%

5

.62

%

Portfolio

turnover

rate

45

.6

%

51

.7

%

45

.2

%

63

.2

%

81

.8

%

Net

assets,

end

of

period

(in

thousands)

$124,932

$57,997

$56,170

$122,550

$116,743

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

The

amount

presented

is

inconsistent

with

the

fund's

aggregate

gains

and

losses

because

of

the

timing

of

sales

and

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

For

a

share

outstanding

throughout

each

period

Advisor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

8

.49

$

7

.97

$

9

.95

$

10

.18

$

10

.18

Investment

activities

Net

investment

income

(1)(2)

0

.55

0

.53

0

.46

0

.45

0

.52

Net

realized

and

unrealized

gain/loss

0

.13

0

.52

(

1

.65

)

(

0

.16

)

0

.01

(3)

Total

from

investment

activities

0

.68

1

.05

(

1

.19

)

0

.29

0

.53

Distributions

Net

investment

income

(

0

.55

)

(

0

.43

)

(

0

.47

)

(

0

.44

)

(

0

.53

)

Net

realized

gain

—

—

(

0

.32

)

(

0

.08

)

—

Tax

return

of

capital

—

(

0

.10

)

—

—

—

Total

distributions

(

0

.55

)

(

0

.53

)

(

0

.79

)

(

0

.52

)

(

0

.53

)

NET

ASSET

VALUE

End

of

period

$

8

.62

$

8

.49

$

7

.97

$

9

.95

$

10

.18

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Advisor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

Ratios/Supplemental

Data

Total

return

(2)(4)

8

.28

%

13

.69

%

(

12

.11

)

%

2

.84

%

5

.64

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1

.59

%

1

.28

%

1

.25

%

1

.24

%

1

.25

%

Net

expenses

after

waivers/payments

by

Price

Associates

0

.96

%

0

.97

%

0

.96

%

0

.99

%

1

.00

%

Net

investment

income

6

.47

%

6

.54

%

5

.26

%

4

.41

%

5

.42

%

Portfolio

turnover

rate

45

.6

%

51

.7

%

45

.2

%

63

.2

%

81

.8

%

Net

assets,

end

of

period

(in

thousands)

$272

$321

$331

$614

$831

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

The

amount

presented

is

inconsistent

with

the

fund's

aggregate

gains

and

losses

because

of

the

timing

of

sales

and

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

For

a

share

outstanding

throughout

each

period

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

8

.48

$

7

.96

$

9

.94

$

10

.16

$

10

.16

Investment

activities

Net

investment

income

(1)(2)

0

.58

0

.56

0

.50

0

.48

0

.55

Net

realized

and

unrealized

gain/loss

0

.13

0

.52

(

1

.66

)

(

0

.14

)

0

.01

(3)

Total

from

investment

activities

0

.71

1

.08

(

1

.16

)

0

.34

0

.56

Distributions

Net

investment

income

(

0

.58

)

(

0

.45

)

(

0

.50

)

(

0

.48

)

(

0

.56

)

Net

realized

gain

—

—

(

0

.32

)

(

0

.08

)

—

Tax

return

of

capital

—

(

0

.11

)

—

—

—

Total

distributions

(

0

.58

)

(

0

.56

)

(

0

.82

)

(

0

.56

)

(

0

.56

)

NET

ASSET

VALUE

End

of

period

$

8

.61

$

8

.48

$

7

.96

$

9

.94

$

10

.16

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

Ratios/Supplemental

Data

Total

return

(2)(4)

8

.67

%

14

.10

%

(

11

.81

)

%

3

.32

%

6

.02

%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

0

.65

%

0

.69

%

0

.69

%

0

.72

%

0

.77

%

Net

expenses

after

waivers/payments

by

Price

Associates

0

.61

%

0

.61

%

0

.61

%

0

.62

%

0

.64

%

Net

investment

income

6

.79

%

6

.92

%

5

.72

%

4

.74

%

5

.74

%

Portfolio

turnover

rate

45

.6

%

51

.7

%

45

.2

%

63

.2

%

81

.8

%

Net

assets,

end

of

period

(in

thousands)

$454,651

$242,717

$203,565

$167,274

$87,283

0

%

0

%

0

%

0

%

0

%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

The

amount

presented

is

inconsistent

with

the

fund's

aggregate

gains

and

losses

because

of

the

timing

of

sales

and

redemptions

of

fund

shares

in

relation

to

fluctuating

market

values

for

the

investment

portfolio.

(4)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

December

31,

2024

Par/Shares

$

Value

(

Cost

and

value

in

$000s)

‡

BRAZIL 3.2%

Corporate

Bonds 3.2%

Aegea

Finance,

9.00%,

1/20/31

(USD) (1)

2,580,000

2,635

Braskem

Netherlands

Finance,

8.50%,

1/12/31

(USD) (1)

2,710,000

2,719

CSN

Resources,

8.875%,

12/5/30

(USD) (1)

2,750,000

2,741

Globo

Comunicacao

e

Participacoes

,

4.875%,

1/22/30

(USD) (1)

1,315,000

1,182

Globo

Comunicacao

e

Participacoes

,

4.875%,

1/22/30

(USD)

1,085,000

976

Globo

Comunicacao

e

Participacoes

,

5.50%,

1/14/32

(USD) (1)

2,515,000

2,245

Klabin

Austria,

3.20%,

1/12/31

(USD)

4,265,000

3,588

Suzano

Austria,

3.75%,

1/15/31

(USD)

2,875,000

2,539

Total

Brazil

(Cost

$19,424)

18,625

CANADA 2.6%

Common

Stocks 0.2%

Bausch

+

Lomb

(USD) (2)

46,000

831

831

Corporate

Bonds 2.4%

Husky

Injection

Molding

Systems,

9.00%,

2/15/29

(USD) (1)

2,830,000

2,957

Jones

Deslauriers

Insurance

Management,

8.50%,

3/15/30

(USD) (1)

3,275,000

3,439

Jones

Deslauriers

Insurance

Management,

10.50%,

12/15/30

(USD) (1)

730,000

786

South

Bow

Canadian

Infrastructure

Holdings,

VR,

7.50%,

3/1/55

(USD) (1)(3)

195,000

201

South

Bow

Canadian

Infrastructure

Holdings,

VR,

7.625%,

3/1/55

(USD) (1)(3)

2,555,000

2,616

Vermilion

Energy,

6.875%,

5/1/30

(USD) (1)

4,200,000

4,147

14,146

Total

Canada

(Cost

$14,954)

14,977

CHILE 2.2%

Corporate

Bonds 2.2%

AES

Andes,

VR,

6.35%,

10/7/79

(USD) (3)

1,016,000

1,012

AES

Andes,

VR,

8.15%,

6/10/55

(USD) (1)(3)

3,100,000

3,142

Agrosuper

,

4.60%,

1/20/32

(USD) (1)

2,505,000

2,243

Banco

de

Credito

e

Inversiones

,

VR,

7.50%

(USD) (1)(3)(4)

1,780,000

1,738

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Banco

de

Credito

e

Inversiones

,

VR,

8.75%

(USD) (1)(3)(4)

3,420,000

3,580

Mercury

Chile

Holdco,

6.50%,

1/24/27

(USD) (1)

1,030,000

1,025

Total

Chile

(Cost

$12,898)

12,740

COLOMBIA 1.6%

Corporate

Bonds 1.6%

Aris

Mining,

8.00%,

10/31/29

(USD) (1)

3,240,000

3,210

Bancolombia

,

VR,

8.625%,

12/24/34

(USD) (3)

2,945,000

3,086

Ecopetrol

,

4.625%,

11/2/31

(USD)

1,315,000

1,092

Ecopetrol

,

5.875%,

5/28/45

(USD)

875,000

604

Ecopetrol

,

8.375%,

1/19/36

(USD)

255,000

246

Ecopetrol

,

8.875%,

1/13/33

(USD)

1,205,000

1,229

Total

Colombia

(Cost

$9,569)

9,467

FRANCE 3.8%

Corporate

Bonds 3.8%

Altice

France,

4.25%,

10/15/29 (1)

885,000

690

Altice

France,

5.875%,

2/1/27

1,460,000

1,208

Banijay

Entertainment,

7.00%,

5/1/29 (1)

1,340,000

1,460

Banijay

Entertainment,

7.00%,

5/1/29

2,127,000

2,318

Banijay

Entertainment,

8.125%,

5/1/29

(USD) (1)

1,020,000

1,056

Forvia

,

5.50%,

6/15/31

1,050,000

1,082

Iliad

Holding,

5.375%,

4/15/30 (1)

2,690,000

2,858

Iliad

Holding,

8.50%,

4/15/31

(USD) (1)

2,895,000

3,065

IPD

3,

8.00%,

6/15/28 (1)

1,715,000

1,872

IPD

3,

8.00%,

6/15/28

650,000

710

IPD

3,

FRN,

3M

EURIBOR

+

3.375%,

6.224%,

6/15/31 (1)

853,000

883

IPD

3,

FRN,

3M

EURIBOR

+

3.375%,

6.261%,

6/15/31

1,695,000

1,757

Picard

Groupe

,

6.375%,

7/1/29 (1)

1,470,000

1,583

Picard

Groupe

,

6.375%,

7/1/29

1,375,000

1,480

Total

France

(Cost

$22,894)

22,022

GERMANY 3.3%

Corporate

Bonds 3.3%

Gruenenthal

,

4.625%,

11/15/31 (1)

5,980,000

6,246

ProGroup

,

5.375%,

4/15/31 (1)

2,515,000

2,537

ProGroup

,

5.375%,

4/15/31

950,000

958

TK

Elevator

Holdco,

6.625%,

7/15/28 (1)

724,500

751

TK

Elevator

Holdco,

6.625%,

7/15/28

247,500

256

TK

Elevator

U.S.

Newco

,

5.25%,

7/15/27

(USD) (1)

1,985,000

1,940

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

TUI

Cruises,

5.00%,

5/15/30 (1)

2,970,000

3,120

TUI

Cruises,

6.25%,

4/15/29

1,245,000

1,360

ZF

North

America

Capital,

6.875%,

4/14/28

(USD) (1)

1,735,000

1,724

Total

Germany

(Cost

$19,361)

18,892

GHANA 0.7%

Corporate

Bonds 0.7%

Kosmos

Energy,

7.75%,

5/1/27

(USD) (1)

740,000

718

Kosmos

Energy,

8.75%,

10/1/31

(USD) (1)

3,315,000

3,127

Total

Ghana

(Cost

$4,049)

3,845

GUATEMALA 0.6%

Corporate

Bonds 0.6%

CT

Trust,

5.125%,

2/3/32

(USD) (1)

1,210,000

1,084

CT

Trust,

5.125%,

2/3/32

(USD)

905,000

811

Millicom

International

Cellular,

7.375%,

4/2/32

(USD) (1)

1,520,000

1,523

Total

Guatemala

(Cost

$3,567)

3,418

HONG

KONG 0.1%

Bank

Loans 0.1% (5)

Fugue

Finance,

FRN,

1M

TSFR

+

3.25%,

12/5/31

(USD) (6)

630,000

635

Total

Hong

Kong

(Cost

$630)

635

INDIA 0.7%

Corporate

Bonds 0.7%

Greenko

Power

II,

4.30%,

12/13/28

(USD)

4,204,225

3,963

Total

India

(Cost

$3,815)

3,963

ISRAEL 0.9%

Corporate

Bonds 0.9%

Teva

Pharmaceutical

Finance

Netherlands

II,

4.375%,

5/9/30

(EUR)

735,000

778

Teva

Pharmaceutical

Finance

Netherlands

II,

7.375%,

9/15/29

(EUR)

965,000

1,148

Teva

Pharmaceutical

Finance

Netherlands

II,

7.875%,

9/15/31

(EUR)

2,525,000

3,174

Total

Israel

(Cost

$5,020)

5,100

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

ITALY 1.7%

Corporate

Bonds 1.7%

Golden

Goose,

FRN,

3M

EURIBOR

+

4.875%,

7.898%,

5/14/27

1,665,000

1,746

IMA

Industria

Macchine

Automatiche

,

3.75%,

1/15/28

2,265,000

2,302

IMA

Industria

Macchine

Automatiche

,

FRN,

3M

EURIBOR

+

3.75%,

6.929%,

4/15/29 (1)

2,050,000

2,133

IMA

Industria

Macchine

Automatiche

,

FRN,

3M

EURIBOR

+

3.75%,

6.929%,

4/15/29

730,000

760

Itelyum

Regeneration,

4.625%,

10/1/26 (1)

840,000

867

Itelyum

Regeneration,

4.625%,

10/1/26

2,060,000

2,126

Total

Italy

(Cost

$10,512)

9,934

LUXEMBOURG 0.3%

Bank

Loans 0.1% (5)

Albion

Financing

3,

FRN,

3M

TSFR

+

4.51%,

8.80%,

8/16/29

(USD)

422,875

427

427

Corporate

Bonds 0.2%

Altice

Financing,

5.00%,

1/15/28

(USD) (1)

1,995,000

1,551

1,551

Total

Luxembourg

(Cost

$2,179)

1,978

MAURITIUS 1.0%

Corporate

Bonds 1.0%

Axian

Telecom,

7.375%,

2/16/27

(USD) (1)

2,710,000

2,718

Axian

Telecom,

7.375%,

2/16/27

(USD)

3,000,000

3,008

Total

Mauritius

(Cost

$5,659)

5,726

MEXICO 4.1%

Corporate

Bonds 4.1%

Banco

Mercantil

del

Norte,

VR,

8.375%

(USD) (3)(4)

4,540,000

4,571

BBVA

Bancomer

,

VR,

5.875%,

9/13/34

(USD) (3)

1,785,000

1,695

BBVA

Bancomer

,

VR,

8.125%,

1/8/39

(USD) (1)(3)

2,850,000

2,910

BBVA

Bancomer

,

VR,

8.45%,

6/29/38

(USD) (1)(3)

730,000

757

Petroleos

Mexicanos

,

4.50%,

1/23/26

(USD)

635,000

613

Petroleos

Mexicanos

,

6.50%,

3/13/27

(USD)

2,475,000

2,395

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Petroleos

Mexicanos

,

6.50%,

1/23/29

(USD)

4,185,000

3,893

Petroleos

Mexicanos

,

6.75%,

9/21/47

(USD)

3,030,000

2,085

Petroleos

Mexicanos

,

7.69%,

1/23/50

(USD)

6,475,000

4,890

Total

Mexico

(Cost

$24,862)

23,809

MOROCCO 0.4%

Corporate

Bonds 0.4%

Vivo

Energy

Investments,

5.125%,

9/24/27

(USD)

2,425,000

2,352

Total

Morocco

(Cost

$2,337)

2,352

NETHERLANDS 1.3%

Corporate

Bonds 1.3%

UPCB

Finance

VII,

3.625%,

6/15/29

1,770,000

1,815

Ziggo

Bond,

3.375%,

2/28/30 (1)

710,000

668

Ziggo

Bond,

3.375%,

2/28/30

5,580,000

5,249

Total

Netherlands

(Cost

$8,142)

7,732

PANAMA 0.2%

Corporate

Bonds 0.2%

C&W

Senior

Finance,

6.875%,

9/15/27

(USD) (1)

1,090,000

1,081

Total

Panama

(Cost

$1,093)

1,081

PERU 0.7%

Corporate

Bonds 0.7%

Banco

Internacional

del

Peru

Interbank,

VR,

7.625%,

1/16/34

(USD) (1)(3)

2,615,000

2,786

Minsur

,

4.50%,

10/28/31

(USD) (1)

1,545,000

1,372

Total

Peru

(Cost

$4,216)

4,158

POLAND 0.2%

Corporate

Bonds 0.2%

InPost

,

2.25%,

7/15/27

(EUR)

955,000

967

Total

Poland

(Cost

$954)

967

ROMANIA 1.1%

Corporate

Bonds 1.1%

Banca

Transilvania

,

VR,

8.875%,

4/27/27

(EUR) (3)

2,770,000

3,039

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

RCS

&

RDS,

3.25%,

2/5/28

(EUR) (1)

800,000

802

RCS

&

RDS,

3.25%,

2/5/28

(EUR)

2,500,000

2,508

Total

Romania

(Cost

$6,508)

6,349

SERBIA 0.3%

Corporate

Bonds 0.3%

United

Group,

3.625%,

2/15/28

(EUR)

1,940,000

1,968

Total

Serbia

(Cost

$2,200)

1,968

SLOVENIA 1.6%

Corporate

Bonds 1.6%

Nova

Ljubljanska

Banka,

VR,

6.875%,

1/24/34 (3)

3,100,000

3,450

OTP

Banka,

VR,

7.375%,

6/29/26 (3)

2,100,000

2,218

Summer

BidCo

,

10.00%,

2/15/29,

(10.00%

Cash

or

10.75%

PIK) (1)(7)

803,060

851

Summer

BidCo

,

10.00%,

2/15/29,

(10.00%

Cash

or

10.75%

PIK) (7)

2,676,141

2,838

Total

Slovenia

(Cost

$9,734)

9,357

SPAIN 1.5%

Corporate

Bonds 1.5%

California

Buyer,

5.625%,

2/15/32 (1)

2,080,000

2,243

Cirsa

Finance

International,

4.50%,

3/15/27

685,000

705

Cirsa

Finance

International,

6.50%,

3/15/29 (1)

875,000

955

Cirsa

Finance

International,

6.50%,

3/15/29

2,395,000

2,614

Cirsa

Finance

International,

7.875%,

7/31/28 (1)

1,250,000

1,368

Cirsa

Finance

International,

10.375%,

11/30/27 (1)

315,000

344

Lorca

Telecom

Bondco

,

4.00%,

9/18/27

565,000

585

Total

Spain

(Cost

$8,878)

8,814

SWEDEN 0.9%

Corporate

Bonds 0.9%

Verisure

Holding,

3.25%,

2/15/27

(EUR)

1,810,000

1,846

Verisure

Holding,

7.125%,

2/1/28

(EUR) (1)

235,000

252

Verisure

Holding,

7.125%,

2/1/28

(EUR)

520,000

558

Verisure

Midholding

,

5.25%,

2/15/29

(EUR)

2,485,000

2,578

Total

Sweden

(Cost

$5,333)

5,234

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

TANZANIA 0.7%

Convertible

Bonds 0.0%

HTA

Group,

2.875%,

3/18/27

(USD)

200,000

182

182

Corporate

Bonds 0.7%

HTA

Group,

7.50%,

6/4/29

(USD) (1)

3,710,000

3,781

3,781

Total

Tanzania

(Cost

$3,923)

3,963

TÜRKIYE 0.2%

Corporate

Bonds 0.2%

Ford

Otomotiv

Sanayi

,

7.125%,

4/25/29

(USD) (1)

1,335,000

1,340

Total

Türkiye

(Cost

$1,337)

1,340

UNITED

KINGDOM 10.6%

Corporate

Bonds 10.6%

Belron

U.K.

Finance,

4.625%,

10/15/29

(EUR) (1)

3,370,000

3,580

Bracken

MidCo1,

6.75%,

11/1/27,

(6.75%

Cash

or

7.5%

PIK) (7)

3,975,000

4,865

Constellation

Automotive

Financing,

4.875%,

7/15/27

1,550,000

1,834

Deuce

Finco

,

5.50%,

6/15/27 (1)

1,185,000

1,448

Deuce

Finco

,

5.50%,

6/15/27

2,960,000

3,618

eG

Global

Finance,

12.00%,

11/30/28

(USD) (1)

2,350,000

2,624

Flutter

Treasury

DAC,

6.375%,

4/29/29

(USD) (1)

5,500,000

5,557

Iceland

Bondco

,

10.875%,

12/15/27 (1)

410,000

548

Iceland

Bondco

,

10.875%,

12/15/27

2,845,000

3,802

Iceland

Bondco

,

FRN,

3M

EURIBOR

+

5.50%,

8.523%,

12/15/27

(EUR) (1)

465,000

485

INEOS

Finance,

6.375%,

4/15/29

(EUR) (1)

1,915,000

2,078

INEOS

Finance,

6.375%,

4/15/29

(EUR)

725,000

787

Jerrold

Finco

,

5.25%,

1/15/27

2,005,000

2,471

Kane

Bidco

,

5.00%,

2/15/27

(EUR)

5,695,000

5,889

Miller

Homes

Group

Finco

,

FRN,

3M

EURIBOR

+

5.25%,

8.273%,

5/15/28

(EUR)

2,845,000

2,958

Motion

Finco

,

7.375%,

6/15/30

(EUR)

2,270,000

2,389

Odeon

Finco

,

12.75%,

11/1/27

(USD) (1)

1,410,000

1,477

Pinewood

Finco

,

3.625%,

11/15/27 (1)

1,075,000

1,273

Pinnacle

Bidco

,

8.25%,

10/11/28

(EUR) (1)

650,000

713

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Pinnacle

Bidco

,

8.25%,

10/11/28

(EUR)

2,685,000

2,947

Pinnacle

Bidco

,

10.00%,

10/11/28 (1)

655,000

869

RAC

Bond,

5.25%,

11/4/27 (1)

1,690,000

2,050

RAC

Bond,

5.25%,

11/4/27

1,015,000

1,231

Virgin

Media

Secured

Finance,

4.125%,

8/15/30

1,380,000

1,479

Vmed

O2

U.K.

Financing

I,

4.50%,

7/15/31 (1)

1,200,000

1,281

Vmed

O2

U.K.

Financing

I,

4.50%,

7/15/31

790,000

843

Zegona

Finance,

6.75%,

7/15/29

(EUR) (1)

1,350,000

1,486

Zegona

Finance,

6.75%,

7/15/29

(EUR)

750,000

826

Total

United

Kingdom

(Cost

$64,397)

61,408

UNITED

STATES 50.5%

Asset-Backed

Securities 0.1%

Frontier

Issuer,

Series

2023-1,

Class

C,

11.50%,

8/20/53 (1)

181,554

194

Frontier

Issuer,

Series

2024-1,

Class

C,

11.16%,

6/20/54 (1)

109,166

122

316

Bank

Loans 9.2% (5)

1440

Foods

Topco,

FRN,

1M

TSFR

+

5.00%,

9.357%,

11/26/31

1,420,000

1,351

AMC

Entertainment

Holdings,

FRN,

1M

TSFR

+

7.00%,

1/4/29 (6)

1,461,328

1,483

Ascend

Learning,

FRN,

1M

TSFR

+

5.75%,

10.207%,

12/10/29 (6)

4,520,000

4,475

AssuredPartners

,

FRN,

1M

TSFR

+

3.50%,

7.857%,

2/14/31

3,162,384

3,167

Asurion

,

FRN,

1M

TSFR

+

5.25%,

9.721%,

1/31/28

785,424

765

Asurion

,

FRN,

1M

TSFR

+

5.25%,

9.721%,

1/20/29

3,792,352

3,651

AthenaHealth

Group,

FRN,

1M

TSFR

+

3.25%,

7.607%,

2/15/29

2,374,620

2,377

Bausch

+

Lomb,

FRN,

1M

TSFR

+

3.25%,

7.689%,

5/10/27 (6)

1,865,304

1,871

Central

Parent,

FRN,

3M

TSFR

+

3.25%,

7.579%,

7/6/29

2,962,575

2,918

Chobani

,

FRN,

1M

TSFR

+

3.75%,

8.107%,

10/25/27

643,184

648

CMG

Media,

FRN,

1M

TSFR

+

3.50%,

7.929%,

6/18/29

1,127,996

1,008

CSC

Holdings,

FRN,

1M

TSFR

+

2.50%,

7.173%,

4/15/27

1,750,000

1,612

Engineered

Machinery

Holdings,

FRN,

3M

TSFR

+

6.00%,

10.59%,

5/21/29

3,882,726

3,877

Hightower

Holding,

FRN,

3M

TSFR

+

3.50%,

8.071%,

4/21/28

1,845,725

1,853

LTI

Holdings,

FRN,

1M

TSFR

+

4.75%,

9.107%,

7/29/29 (6)

4,209,450

4,212

Medline

Borrower,

FRN,

1M

TSFR

+

2.25%,

6.607%,

10/23/28

1,396,500

1,400

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

OneDigital

Borrower,

FRN,

1M

TSFR

+

3.25%,

7.607%,

7/2/31

820,875

822

OneDigital

Borrower,

FRN,

1M

TSFR

+

5.25%,

9.607%,

7/2/32

2,725,000

2,710

Pro

Mach

Group,

FRN,

1M

TSFR

+

3.50%,

7.857%,

8/31/28

493,763

497

Proampac

PG

Borrower,

FRN,

3M

TSFR

+

4.00%,

8.389%,

9/15/28

644,058

645

Project

Alpha

Intermediate

Holding,

FRN,

1M

TSFR

+

3.25%,

10/28/30 (6)

1,069,189

1,075

Project

Alpha

Intermediate

Holding,

FRN,

1M

TSFR

+

5.00%,

11/21/32 (6)

2,688,109

2,720

Radiology

Partners,

FRN,

3M

TSFR

+

3.50%,

1/31/29 (6)

2,094,771

2,065

RealPage

,

FRN,

1M

TSFR

+

3.75%,

8.079%,

4/24/28

1,695,000

1,699

Talen

Energy

Supply,

FRN,

1M

TSFR

+

2.50%,

7.023%,

12/11/31

1,495,000

1,499

Tegra118

Wealth

Solutions,

FRN,

3M

TSFR

+

4.00%,

8.521%,

2/18/27

2,443,603

2,337

TIH

Insurance

Holdings,

FRN,

1M

TSFR

+

2.75%,

7.079%,

5/6/31

361,060

362

Triton

Water

Holdings,

FRN,

3M

TSFR

+

4.00%,

8.329%,

3/31/28

514,800

519

53,618

Convertible

Preferred

Stocks 0.2%

Boeing,

6.00%,

10/15/27

23,666

1,441

1,441

Corporate

Bonds 40.0%

Aethon

United

BR,

7.50%,

10/1/29 (1)

1,936,000

1,975

Alliant

Holdings

Intermediate,

5.875%,

11/1/29 (1)

1,410,000

1,347

Alliant

Holdings

Intermediate,

6.75%,

10/15/27 (1)

830,000

822

Alliant

Holdings

Intermediate,

7.00%,

1/15/31 (1)

1,190,000

1,194

Allied

Universal

Holdco,

3.625%,

6/1/28

(EUR)

2,945,000

2,927

Alpha

Generation,

6.75%,

10/15/32 (1)

1,860,000

1,834

American

Finance

Trust,

4.50%,

9/30/28 (1)

1,280,000

1,170

AmeriGas

Partners,

9.375%,

6/1/28 (1)

4,165,000

3,998

Apollo

Commercial

Real

Estate

Finance,

4.625%,

6/15/29 (1)

5,015,000

4,338

Aretec

Group,

10.00%,

8/15/30 (1)

850,000

925

Arsenal

AIC

Parent,

11.50%,

10/1/31 (1)

2,205,000

2,459

AthenaHealth

Group,

6.50%,

2/15/30 (1)

1,730,000

1,644

Avis

Budget

Car

Rental,

8.25%,

1/15/30 (1)

2,395,000

2,449

Avis

Budget

Finance,

7.25%,

7/31/30

(EUR)

1,655,000

1,795

Bausch

+

Lomb,

8.375%,

10/1/28 (1)

1,860,000

1,934

T.

ROWE

PRICE

Global

High

Income

Bond

Fund

Par/Shares

$

Value

(Cost

and

value

in

$000s)

Carvana

,

14.00%,

6/1/31,

(14.00%

PIK) (1)(7)

3,764,000

4,503

CCO

Holdings,

4.25%,

2/1/31 (1)

2,470,000

2,152

CCO

Holdings,

4.50%,

8/15/30 (1)

2,410,000

2,157

CCO

Holdings,

6.375%,

9/1/29 (1)

280,000

277

Chobani

Holdco

II,

8.75%,

10/1/29,

(8.75%

Cash

or

9.5%

PIK) (1)(7)

930,000

983

CHS,

5.25%,

5/15/30 (1)

1,585,000

1,300

CHS,

6.875%,

4/1/28 (1)

1,430,000

1,037

CHS,

6.875%,

4/15/29 (1)

2,200,000

1,650

CHS,

10.875%,

1/15/32 (1)

1,475,000

1,517

Clear

Channel

Outdoor

Holdings,

5.125%,

8/15/27 (1)

990,000

954

Clear

Channel

Outdoor

Holdings,

7.50%,

6/1/29 (1)

900,000

785

Clear

Channel

Outdoor

Holdings,

9.00%,

9/15/28 (1)

475,000

498

Cloud

Software

Group,

6.50%,

3/31/29 (1)

858,000

841

Cloud

Software

Group,

8.25%,

6/30/32 (1)

3,270,000

3,372

Cloud

Software

Group,

9.00%,

9/30/29 (1)

1,710,000

1,734

Clydesdale

Acquisition

Holdings,

8.75%,

4/15/30 (1)

2,455,000

2,480

CMG

Media,

8.875%,

6/18/29 (1)

2,750,000

2,063

Comstock

Resources,

6.75%,

3/1/29 (1)

3,420,000

3,330

Constellium

,

3.125%,

7/15/29

(EUR)

995,000

977

Constellium

,

5.375%,

8/15/32

(EUR) (1)

1,435,000

1,505

Crescent

Energy

Finance,

7.375%,

1/15/33 (1)

2,445,000

2,378

Crescent

Energy

Finance,

7.625%,

4/1/32 (1)

2,345,000

2,330

CSC

Holdings,

5.50%,

4/15/27 (1)

1,790,000

1,600

CSC

Holdings,

6.50%,

2/1/29 (1)

690,000

578

CSC

Holdings,

7.50%,

4/1/28 (1)

1,350,000

921

CSC

Holdings,

11.25%,

5/15/28 (1)

770,000

757

CSC

Holdings,

11.75%,

1/31/29 (1)

1,230,000

1,213

CVR

Partners,

6.125%,

6/15/28 (1)

4,115,000

3,966

CVS

Health,

VR,

6.75%,

12/10/54 (3)

4,555,000

4,439

CVS

Health,

VR,

7.00%,