UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02968-99

Name of Registrant: Vanguard Trustees’ Equity Fund

Address of Registrant:

P.O. Box 2600

Valley Forge, PA 19482

Name and address of agent for service:

Heidi Stam, Esquire

P.O. Box 876

Valley Forge, PA 19482

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2012 – October 31, 2013

Item 1: Reports to Shareholders

|

| Annual Report | October 31, 2013 |

| Vanguard International Value Fund |

|

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles,

grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds.

Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 8 |

| Fund Profile. | 12 |

| Performance Summary. | 14 |

| Financial Statements. | 16 |

| Your Fund’s After-Tax Returns. | 30 |

| About Your Fund’s Expenses. | 31 |

| Glossary. | 33 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: The ship's wheel represents leadership and guidance, essential qualities in navigating difficult seas. This one is a replica based on an 18th-century British vessel. The HMS Vanguard, another ship of that era, served as the flagship for Admiral Horatio Nelson when he defeated a French fleet at the Battle of the Nile.

Your Fund’s Total Returns

| Fiscal Year Ended October 31, 2013 | |

| Total | |

| Returns | |

| Vanguard International Value Fund | 27.94% |

| MSCI All Country World Index ex USA | 20.29 |

| International Funds Average | 22.79 |

| International Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

| Your Fund’s Performance at a Glance | ||||

| October 31, 2012, Through October 31, 2013 | ||||

| Distributions Per Share | ||||

| Starting | Ending | |||

| Share | Share | Income | Capital | |

| Price | Price | Dividends | Gains | |

| Vanguard International Value Fund | $29.78 | $37.12 | $0.819 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

International stocks turned in their strongest performance in five years over the past 12 months as optimism took hold that brighter days are ahead for the global economy. Many of the world’s largest markets, including those of Japan, Germany, France, Switzerland, and the Netherlands, returned more than 30%. Emerging-market stocks rose more modestly.

Vanguard International Value Fund returned nearly 28% for the fiscal year ended October 31, 2013. The fund easily outpaced its benchmark index, the MSCI All Country World Index ex USA, and the average return of its peers.

The U.S. stock market outpaced world markets in aggregate

Overall, stock markets worldwide returned about 23% for the 12 months through October, as measured by the MSCI All Country World Index. The broad U.S. stock market did better, rising about 29%. Investors’ growing appetite for risk drove the rise in domestic stocks, as corporate profit growth, in general, wasn’t particularly tantalizing.

The market overcame a number of challenges during the year, most notably the budget impasse that resulted in a partial federal government shutdown for 16 days in October. The period as a whole was marked by uncertainties about Federal Reserve monetary policy and concern about the U.S. economy’s patchy growth. Nonetheless, as Vanguard’s chief

2

economist, Joe Davis, noted, the U.S. economy has continued to expand, albeit at a modest and uneven pace.

The disparity between the performances of the U.S. economy and U.S. stocks may seem surprising, but Vanguard research has shown that over the long term, a nation’s economic growth has a weak relationship with its stock returns. (You can read more in The Outlook for Emerging Market Stocks in a Lower-Growth World, available at vanguard.com/research.)

U.S. bond returns suffered as investors worried about the Fed

With investors fretting about the Fed’s next move in its stimulative bond-buying program, bonds recorded negative results for the 12 months. The broad U.S. taxable bond market returned –1.08%. The yield of the 10-year Treasury note closed at 2.54%, down from 2.63% at September’s close, but up from 1.69% at the end of the last fiscal year. (Bond yields and prices move in opposite directions.) Municipal bonds returned –1.72%.

Outside the United States, bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned –1.95%.

The Fed’s target for short-term interest rates remained at 0%–0.25%, severely limiting returns of money market funds and savings accounts.

| Market Barometer | |||

| Average Annual Total Returns | |||

| Periods Ended October 31, 2013 | |||

| One | Three | Five | |

| Year | Years | Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 28.40% | 16.83% | 15.84% |

| Russell 2000 Index (Small-caps) | 36.28 | 17.69 | 17.04 |

| Russell 3000 Index (Broad U.S. market) | 28.99 | 16.89 | 15.94 |

| MSCI All Country World Index ex USA (International) | 20.29 | 6.04 | 12.48 |

| Bonds | |||

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | -1.08% | 3.02% | 6.09% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | -1.72 | 3.60 | 6.37 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.06 | 0.07 | 0.12 |

| CPI | |||

| Consumer Price Index | 0.96% | 2.21% | 1.52% |

3

For the fund, Japan’s bull market had a significant impact

Vanguard International Value Fund earned robust returns in most markets during the fiscal year, posting gains in 29 of 33 countries. The fund’s Japanese holdings made the largest contribution to the bottom line by returning 41%, well above the 34% gain of Japanese stocks in the fund’s MSCI benchmark.

The dramatic rise in Tokyo was triggered by the election last year of a new government bent on combating deflation through various fiscal and monetary policies. The advisors’ selections among Japanese information technology stocks did much to keep the fund ahead even as Japan’s market soared.

Japanese stocks made up about 17% of International Value’s assets on average, constituting the largest single country holding. Returns for U.S.-based investors would have been even higher if not for a 19% decline in the value of the Japanese yen, which fell as currency markets reacted to the Bank of Japan’s aggressive intervention in the nation’s fixed income market.

Among the other Pacific developed markets represented in the portfolio, Australia was the only one that underperformed; in fact, it was one of the few markets anywhere that lost ground for the fund. A 9% decline in the value of the Australian dollar contributed to the negative result.

| Expense Ratios | ||

| Your Fund Compared With Its Peer Group | ||

| Peer Group | ||

| Fund | Average | |

| International Value Fund | 0.41% | 1.33% |

The fund expense ratio shown is from the prospectus dated February 27, 2013, and represents estimated costs for the current fiscal year. For the fiscal year ended October 31, 2013, the fund’s expense ratio was 0.43%. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures information through year-end 2012.

Peer group: International Funds.

4

In the fund’s European portfolio, which made up a bit more than half of fund assets on average, notable gainers included stocks in the United Kingdom, France, and Switzerland. Recognizing that even economies struggling with historic challenges can witness a sharp stock market rebound, the fund’s advisors overweighted Greece and Ireland, and their selections reaped returns (+112% and +66%, respectively) that easily outperformed those nations’ markets in the benchmark index. Only in a few European markets, notably those in the Netherlands and Norway, did the fund’s holdings lag the counterpart returns in the benchmark.

International Value’s emerging-markets portfolio, while recording more modest returns than those seen in developed markets, also outperformed, particularly holdings in Brazil and South Africa. The advisors’ selections in Turkey and the Philippines were the most notable detractors.

A small U.S. position also provided welcome gains

The fund benefited from the advisors’ small portfolio of U.S. stocks. While accounting for only about 3% of fund assets on average, they rose 37%.

| Total Returns | |

| Ten Years Ended October 31, 2013 | |

| Average | |

| Annual Return | |

| International Value Fund | 8.48% |

| Spliced International Index | 6.97 |

| International Funds Average | 7.22 |

For a benchmark description, see the Glossary.

International Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

5

From an industry perspective, the fund notched gains in all ten sectors, with eight returning 20% or more. Industrials, materials, and information technology stocks were key outperformers. In only one sector, telecommunication services, did the fund turn in a performance below that of the index counterpart.

For more information on the fund’s investment strategies and positioning, please see the Advisors’ Report that follows this letter.

The fund’s long-term record continues to be gratifying

For the ten years ended October 31, Vanguard International Value Fund returned an average of 8.48% per year, more than a percentage point better than both the average return of its peer group and the gain of its benchmark index. That is a notable record for a volatile decade that saw markets set all-time highs, plunge during the global financial crisis, and then recover most or all of their bear-market losses.

The fund has led its benchmark index in eight of the last ten fiscal years, indicating that its advisors are skilled at identifying out-of-favor stocks that are poised to be more highly valued by investors. Importantly, the fund isn’t burdened by high expense ratios, which directly detract from investors’ returns.

The past decade has also offered a lesson in perseverance. When stocks worldwide suffered big losses in the middle of the period, many investors couldn’t resist the temptation to pull out of the market. Those who maintained their stock positions were rewarded. Of course, holding steady was easier for those who had balanced their portfolios with tamer investments, including bonds and cash, which provided some cushioning when the stock markets fell. That’s why we like to remind our clients of the perils of overconcentration in any one market or even one asset class.

Benefits of combining low costs with diversity of thought

Investors sometimes ask why Vanguard uses a multi-advisor approach for many of its actively managed equity funds. Just as we recommend diversification within and across asset classes for an investor’s overall portfolio, we think significant benefits can accrue from using multiple advisory firms for a single fund: diversity of investment process and style, thought, and holdings.

All of these elements can lead to less risk and better results. Because not all investment managers invest the same way, their returns relative to the benchmark don’t move in lockstep.

6

As with many investment topics, however, there are some misconceptions about the benefits of using a multi-manager approach. For example, it is often suggested that the best ideas of the advisors are diluted when they are combined in one portfolio. Recent Vanguard research has found otherwise.

Conventional wisdom also suggests that multi-manager funds tend to be expensive. At Vanguard, this is not the case: Low costs are a hallmark of all our offerings. And Vanguard research indicates that low costs can contribute greatly to investing success, helping investors keep more of a portfolio’s return. (You can read more in Analyzing Multi-Manager Funds: Does Management Structure Affect Performance? at vanguard.com/research.)

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 14, 2013

Advisors’ Report

For the 12 months ended October 31, 2013, Vanguard International Value Fund returned 27.94%. Your fund is managed by three independent advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct, yet complementary, investment approaches. It is not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The table below presents the advisors, the percentage and amount of fund assets that each manages, and brief descriptions of their investment strategies. Each advisor has also prepared a discussion of the investment environment during the fiscal period and of how the portfolio’s positioning reflects this assessment. These reports were prepared on November 18, 2013.

| Vanguard International Value Fund Investment Advisors | |||

| Fund Assets Managed | |||

| Investment Advisor | % | $ Million | Investment Strategy |

| Lazard Asset Management LLC | 38 | 3,030 | The advisor uses a research-driven, bottom-up, |

| relative-value approach in selecting stocks. The goal is | |||

| to identify individual stocks that offer an appropriate | |||

| trade-off between low relative valuation and high | |||

| financial productivity. | |||

| Edinburgh Partners Limited | 35 | 2,795 | The advisor employs a concentrated, low-turnover, |

| value-oriented investment approach that results in a | |||

| portfolio of companies with good long-term prospects | |||

| and below-market price/earnings ratios. In-depth | |||

| fundamental research on industries and companies is | |||

| central to this investment process. | |||

| ARGA Investment Management, | 25 | 1,984 | The advisor believes that investors overreact to |

| LP | short-term developments, leading to opportunities to | ||

| generate gains from investing in “good businesses at | |||

| great prices.” Its value-oriented process uses a | |||

| dividend discount model to select stocks that trade at a | |||

| discount to intrinsic value based on the company’s | |||

| long-term earnings power and dividend-paying | |||

| capability. | |||

| Cash Investments | 2 | 219 | These short-term reserves are invested by Vanguard in |

| equity index products to simulate investments in | |||

| stocks. Each advisor may also maintain a modest cash | |||

| position. | |||

8

Lazard Asset Management LLC

Portfolio Managers:

Michael G. Fry, Managing Director

Michael A. Bennett, CPA, Managing Director

The fiscal year ended with international equity markets rising significantly. A number of macroeconomic events moved markets higher during the period as investor confidence in the economic recovery improved despite a continued downward trend in earnings. The Eurozone’s economy finally expanded after six quarters of recession.

In the United Kingdom, the economy grew at a solid 3.2% annualized rate in the third calendar quarter of 2013. In the United States, the much-discussed taper of the Federal Reserve’s quantitative easing did not take place. In Japan, the central bank announced a 2% inflation target and committed to unlimited monetary easing, and Prime Minister Shinzo Abe’s structural reforms gained support following his party’s electoral success. Emerging markets, many of which suffered from the uncertainly about U.S. monetary policy, underperformed developed markets.

From a sector perspective, the market leaders were the traditionally cyclical consumer discretionary and industrial sectors; health care also performed notably well. In contrast, materials, energy, and utilities were among the worst-performing sectors. Within the materials sector, a combination of low exposure and stock selection benefited our portfolio.

Particularly helpful was avoiding stocks that were hurt by falling commodity prices and capital expenditures in the period.

In the consumer discretionary sector, stock selection boosted our portfolio’s relative returns; specifically, our holdings in French auto parts supplier Valeo and Macau casino operator Sands China performed well. Valeo rose as investors perceived a bottoming of the European car market. Sands China benefited as the company’s new Cotai Central casino continued to ramp up successfully.

Stock selection in emerging markets also supported relative returns. Notable performers included Baidu, the Chinese search engine company; Mediclinic, a South African private hospital group; and Cielo, a Brazilian credit card processor.

On the other hand, stock selection in the energy sector hurt our relative returns as positions in Tullow Oil and Petroleum Geo-Services underperformed. Shares of Tullow declined as some wells failed to find oil, while shares of PGS were hurt by weaker-than-expected surveying activity in the Gulf of Mexico.

Selection in the telecommunication services sector also dragged on performance as positions in China Mobile and Turkcell lagged the market. China Mobile showed weaker-than-expected profit growth; Turkcell was hurt by regulatory uncertainty.

9

Edinburgh Partners Limited

Portfolio Manager:

Sandy Nairn, Director and CEO

The world economy is out of intensive care and the potential for catastrophic collapse is remote. This is the new consensus in asset markets. As a consequence, the higher relative valuations attached to assets viewed as safer—meaning most likely to preserve short-term nominal capital—have begun to erode as investors begin to focus on the need for long-term real capital preservation and growth.

Bonds, bond equivalents, and “safe and predictable” equities therefore have begun to lose their luster. On the other hand, stocks whose earnings depended on economic recovery have begun to see their discounted valuations rise. We believe that this process is still in the early stages and that, while there will inevitably be bumps along the way, it has a degree of durability about it.

This view is reflected in our portfolio structure and holdings. European companies such as the shipping company A.P. Moeller-Maersk and the capital goods manufacturer ABB are direct beneficiaries of resumed economic growth and capital expenditure. Similarly, Fujitsu, which has struggled for years against a backdrop of domestic deflation in Japan, will see a transformation of outlook from increased domestic expenditures on information technology.

Our expectation is that wage inflation in the developed economies will remain subdued as the recovery takes hold. That will allow policymakers to maintain low short-term interest rates as they seek to provide time for economic growth to reduce the fiscal deficit. The danger to this outcome lies in an upsurge in inflation, which would cause policymakers to react or asset markets to take fright. However, the developed markets have a safety valve, which is that labor market tightness is occurring in the emerging markets, and it is they that face the policy dilemma.

The problem for emerging markets is that they do not control the levers that create the economic problems for them. As a consequence, they will have to live with some outcomes that are not helpful. This situation may partly explain why we have had trouble in recent years identifying many undervalued companies in emerging markets. We are now finding some companies whose valuations are closer to what we seek, but they are still not close enough.

This change in competitiveness is arguably simply part of the global rebalancing that is required. The developed markets need to become more competitive; the corollary is that the emerging markets need to become less so. Only when the inflation washes through to the developed economies will this become a policy problem, and that remains some years away.

10

In the meantime, we expect subdued growth and reasonable returns from international equities.

ARGA Investment Management, LP

Portfolio Managers:

A. Rama Krishna, CFA, Founder and Chief Investment Officer

Steven Morrow, CFA, Director of Research

International equity markets performed well over the fiscal year, rising in 9 of the 12 months. The most undervalued companies did particularly well. The market validated ARGA’s valuation-based investment approach of purchasing businesses at deep discounts to intrinsic value. Our strong results showed that exposure to deeply undervalued securities must occur before they display signs of improvement.

In our experience, significant valuation opportunity exists where fear and uncertainty are greatest. In the past few years, equity investors largely shunned companies perceived to have high risk. Valuation spreads between economically sensitive stocks and companies with stable earnings characteristics neared record highs last year.

The deepest valuation opportunities were in financials and other economically sensitive companies, especially in Europe. ARGA’s portfolio holdings were dominated by these companies. We did not know exactly when valuations would turn, but did know such a turn would be significant and swift. That was the case over the past year.

The major contributors to performance were, in fact, our significant weighting in the financial sector and our stock selection within that sector. High exposure to undervalued, economically sensitive companies in the industrial and consumer discretionary sectors also helped drive the portfolio’s favorable results.

Although the ARGA portfolio continues to be attractively valued, valuations are no longer as compelling as they were 12 months ago. We have broadened our sector exposures based on valuation, trimming financials and adding to consumer discretionary, consumer staples, industrials, and materials holdings.

Over the past year, the reversal in macroeconomic fundamentals and souring of sentiment toward many emerging-market countries has created new international valuation opportunities. In Japan, for example, we took advantage of the rally in equities early in the year to reduce exposure, and have only now begun to selectively uncover new opportunities.

We remain encouraged by the valuation opportunities available to us in many parts of the world. ARGA’s experience, investment history, and recent market action have all shown that, over time, it can be very profitable to own deeply undervalued businesses.

11

International Value Fund

Fund Profile

As of October 31, 2013

| Portfolio Characteristics | ||

| MSCI AC | ||

| World Index | ||

| Fund | ex USA | |

| Number of Stocks | 174 | 1,813 |

| Median Market Cap | $36.2B | $34.5B |

| Price/Earnings Ratio | 18.7x | 17.4x |

| Price/Book Ratio | 1.6x | 1.7x |

| Return on Equity | 12.3% | 14.7% |

| Earnings Growth | ||

| Rate | 10.7% | 6.8% |

| Dividend Yield | 2.5% | 2.9% |

| Turnover Rate | 52% | — |

| Ticker Symbol | VTRIX | — |

| Expense Ratio1 | 0.41% | — |

| Short-Term Reserves | 2.2% | — |

| Sector Diversification (% of equity exposure) | ||

| MSCI AC | ||

| World Index | ||

| Fund | ex USA | |

| Consumer Discretionary | 15.6% | 10.6% |

| Consumer Staples | 10.0 | 10.1 |

| Energy | 9.6 | 9.4 |

| Financials | 21.5 | 27.0 |

| Health Care | 5.6 | 7.7 |

| Industrials | 14.7 | 11.0 |

| Information Technology | 9.7 | 6.3 |

| Materials | 4.8 | 8.7 |

| Telecommunication Services | 6.9 | 5.8 |

| Utilities | 1.6 | 3.4 |

| Volatility Measures | |

| MSCI AC | |

| World Index | |

| ex USA | |

| R-Squared | 0.97 |

| Beta | 1.02 |

These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months.

| Ten Largest Holdings (% of total net assets) | ||

| Sumitomo Mitsui | ||

| Financial Group Inc. | Diversified Banks | 1.9% |

| SAP AG | Application Software | 1.8 |

| Royal Bank of Scotland | ||

| Group plc | Diversified Banks | 1.7 |

| Samsung Electronics Co. | ||

| Ltd. | Semiconductors | 1.5 |

| Unilever plc | Packaged Foods & | |

| Meats | 1.4 | |

| Seven & I Holdings Co. | ||

| Ltd. | Food Retail | 1.4 |

| HSBC Holdings plc | Diversified Banks | 1.3 |

| Novartis AG | Pharmaceuticals | 1.3 |

| Japan Tobacco Inc. | Tobacco | 1.3 |

| Eni SPA | Integrated Oil & Gas | 1.3 |

| Top Ten | 14.9% | |

The holdings listed exclude any temporary cash investments and equity index products.

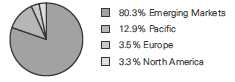

Allocation by Region (% of equity exposure)

1 The expense ratio shown is from the prospectus dated February 27, 2013, and represents estimated costs for the current fiscal year. For the fiscal year ended October 31, 2013, the expense ratio was 0.43%.

12

International Value Fund

| Market Diversification (% of equity exposure) | ||

| MSCI AC | ||

| World | ||

| Index | ||

| Fund | ex USA | |

| Europe | ||

| United Kingdom | 17.7% | 15.6% |

| Germany | 9.0 | 6.4 |

| France | 6.7 | 7.1 |

| Switzerland | 4.4 | 6.4 |

| Italy | 3.9 | 1.7 |

| Denmark | 2.8 | 0.8 |

| Netherlands | 2.6 | 1.9 |

| Spain | 2.2 | 2.4 |

| Sweden | 1.6 | 2.3 |

| Belgium | 1.0 | 0.8 |

| Other | 1.9 | 1.9 |

| Subtotal | 53.8% | 47.3% |

| Pacific | ||

| Japan | 18.9% | 15.0% |

| Hong Kong | 4.8 | 2.1 |

| South Korea | 4.2 | 3.4 |

| Singapore | 2.4 | 1.1 |

| Australia | 1.1 | 5.9 |

| Subtotal | 31.4% | 27.5% |

| Emerging Markets | ||

| China | 2.8% | 4.0% |

| Russia | 2.4 | 1.3 |

| Brazil | 2.3 | 2.5 |

| Thailand | 1.2 | 0.5 |

| Other | 3.8 | 9.5 |

| Subtotal | 12.5% | 17.8% |

| North America | ||

| United States | 2.3% | 0.0% |

| Other | 0.0 | 7.1 |

| Subtotal | 2.3% | 7.1% |

| Middle East | 0.0% | 0.3% |

13

International Value Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: October 31, 2003, Through October 31, 2013

Initial Investment of $10,000

| Average Annual Total Returns | ||||

| Periods Ended October 31, 2013 | ||||

| Final Value | ||||

| One | Five | Ten | of a $10,000 | |

| Year | Years | Years | Investment | |

| International Value Fund* | 27.94% | 11.99% | 8.48% | $22,559 |

| Spliced International Index | 20.29 | 10.45 | 6.97 | 19,610 |

| International Funds Average | 22.79 | 11.88 | 7.22 | 20,076 |

| MSCI All Country World Index ex | ||||

| USA | 20.29 | 12.48 | 8.48 | 22,564 |

For a benchmark description, see the Glossary.

International Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

See Financial Highlights for dividend and capital gains information.

14

International Value Fund

Fiscal-Year Total Returns (%): October 31, 2003, Through October 31, 2013

Average Annual Total Returns: Periods Ended September 30, 2013

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| Inception | One | Five | Ten | |

| Date | Year | Years | Years | |

| International Value Fund | 5/16/1983 | 23.65% | 5.98% | 8.86% |

15

International Value Fund

Financial Statements

Statement of Net Assets

As of October 31, 2013

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Common Stocks (95.2%)1 | |||

| Australia (0.7%) | |||

| BHP Billiton Ltd. | 1,437,738 | 50,829 | |

| Newcrest Mining Ltd. | 841,300 | 8,158 | |

| 58,987 | |||

| Belgium (1.0%) | |||

| Anheuser-Busch InBev NV | 770,794 | 79,904 | |

| Brazil (2.2%) | |||

| Cielo SA | 1,420,052 | 43,065 | |

| BB Seguridade | |||

| Participacoes SA | 3,385,200 | 36,977 | |

| Estacio Participacoes SA | 3,864,000 | 29,836 | |

| Vale SA Class B ADR | 1,588,600 | 25,434 | |

| Petroleo Brasileiro SA | |||

| ADR Type A | 983,300 | 17,857 | |

| Petroleo Brasileiro SA | |||

| ADR | 799,100 | 13,928 | |

| * | PDG Realty SA | ||

| Empreendimentos e | |||

| Participacoes | 11,090,968 | 9,963 | |

| 177,060 | |||

| China (2.7%) | |||

| China Construction Bank | |||

| Corp. | 79,943,800 | 62,198 | |

| China Mobile Ltd. ADR | 831,900 | 43,275 | |

| * | Baidu Inc. ADR | 232,050 | 37,337 |

| China Mobile Ltd. | 2,594,000 | 26,956 | |

| Zhongsheng Group | |||

| Holdings Ltd. | 5,663,500 | 9,066 | |

| * | China ZhengTong Auto | ||

| Services Holdings Ltd. | 12,635,500 | 8,798 | |

| *,^ | China Machinery | ||

| Engineering Corp. | 12,670,000 | 8,658 | |

| Industrial & Commercial | |||

| Bank of China Ltd. | 11,995,000 | 8,409 | |

| * | Lonking Holdings Ltd. | 33,419,000 | 6,813 |

| ^ | Dongyue Group Ltd. | 12,444,000 | 5,874 |

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Huabao International | |||

| Holdings Ltd. | 881,000 | 387 | |

| Kingboard Laminates | |||

| Holdings Ltd. | 605,500 | 249 | |

| 218,020 | |||

| Denmark (2.8%) | |||

| AP Moeller - Maersk | |||

| A/S Class B | 8,543 | 82,653 | |

| TDC A/S | 6,398,383 | 57,797 | |

| Novo Nordisk A/S Class B | 267,163 | 44,497 | |

| Carlsberg A/S Class B | 264,100 | 26,380 | |

| DSV A/S | 318,300 | 9,312 | |

| 220,639 | |||

| Finland (0.6%) | |||

| Sampo | 989,551 | 46,807 | |

| France (6.2%) | |||

| BNP Paribas SA | 1,106,284 | 81,614 | |

| Orange SA | 4,792,678 | 65,881 | |

| Valeo SA | 553,291 | 54,737 | |

| Sanofi | 398,937 | 42,536 | |

| Schneider Electric SA | 481,214 | 40,493 | |

| European Aeronautic | |||

| Defence and Space Co. | |||

| NV | 553,071 | 37,899 | |

| ArcelorMittal | 2,046,597 | 32,235 | |

| Total SA | 512,167 | 31,423 | |

| Vinci SA | 451,009 | 28,859 | |

| Technip SA | 228,082 | 23,889 | |

| GDF Suez | 869,200 | 21,542 | |

| Cap Gemini SA | 308,299 | 20,218 | |

| CNP Assurances | 1,026,998 | 18,092 | |

| 499,418 | |||

| Germany (8.5%) | |||

| SAP AG | 1,854,242 | 145,099 | |

| Bayer AG | 588,572 | 73,014 | |

| Volkswagen AG Prior Pfd. | 270,846 | 68,689 | |

16

International Value Fund

| Market | ||

| Value | ||

| Shares | ($000) | |

| Fresenius Medical Care | ||

| AG & Co. KGaA | 1,019,253 | 67,359 |

| Siemens AG | 499,905 | 63,884 |

| Bayerische Motoren | ||

| Werke AG | 552,303 | 62,509 |

| Deutsche Post AG | 1,667,799 | 56,324 |

| Metro AG | 935,194 | 43,848 |

| BASF SE | 385,882 | 40,060 |

| RWE AG | 640,802 | 23,609 |

| Allianz SE | 129,292 | 21,709 |

| Software AG | 527,320 | 19,525 |

| 685,629 | ||

| Greece (0.2%) | ||

| OPAP SA | 1,057,356 | 13,130 |

| Hong Kong (4.7%) | ||

| Swire Pacific Ltd. Class A | 7,306,850 | 84,449 |

| Hutchison Whampoa Ltd. | 5,838,000 | 72,745 |

| Sands China Ltd. | 8,923,800 | 63,449 |

| Cheung Kong Holdings | ||

| Ltd. | 2,741,000 | 42,806 |

| Li & Fung Ltd. | 28,678,000 | 40,544 |

| Wynn Macau Ltd. | 8,800,400 | 33,783 |

| ^ Luk Fook Holdings | ||

| International Ltd. | 5,332,000 | 19,035 |

| Esprit Holdings Ltd. | 8,372,934 | 15,374 |

| Jardine Matheson | ||

| Holdings Ltd. | 136,780 | 7,453 |

| 379,638 | ||

| India (0.3%) | ||

| Infosys Ltd. ADR | 369,100 | 19,584 |

| Indonesia (0.5%) | ||

| Telekomunikasi Indonesia | ||

| Persero Tbk PT ADR | 1,002,869 | 40,877 |

| Ireland (0.5%) | ||

| Ryanair Holdings plc ADR | 838,400 | 42,096 |

| Italy (3.7%) | ||

| Eni SPA | 3,988,064 | 101,245 |

| Intesa Sanpaolo SPA | ||

| (Registered) | 28,185,564 | 69,925 |

| Atlantia SPA | 2,424,402 | 53,136 |

| UniCredit SPA | 4,018,600 | 30,166 |

| Enel SPA | 5,560,903 | 24,535 |

| Saipem SPA | 880,301 | 20,593 |

| 299,600 | ||

| Japan (17.9%) | ||

| Sumitomo Mitsui | ||

| Financial Group Inc. | 3,094,200 | 149,561 |

| Seven & I Holdings Co. | ||

| Ltd. | 2,995,783 | 110,870 |

| Market | |||

| Value | |||

| Shares | ($000) | ||

| Japan Tobacco Inc. | 2,855,100 | 103,308 | |

| Omron Corp. | 2,189,200 | 83,543 | |

| Toyota Motor Corp. | 1,254,900 | 81,365 | |

| Panasonic Corp. | 7,365,300 | 75,490 | |

| KDDI Corp. | 1,390,700 | 75,315 | |

| Bridgestone Corp. | 2,169,400 | 74,373 | |

| Tokyo Electron Ltd. | 1,334,100 | 73,206 | |

| Mitsubishi Corp. | 3,537,200 | 71,561 | |

| Dai Nippon | |||

| Printing Co. Ltd. | 6,714,000 | 70,537 | |

| Fujikura Ltd. | 14,289,000 | 65,203 | |

| * | Fujitsu Ltd. | 14,044,000 | 60,336 |

| Daiwa House Industry | |||

| Co. Ltd. | 2,250,000 | 45,076 | |

| Asahi Group | |||

| Holdings Ltd. | 1,599,700 | 43,263 | |

| Makita Corp. | 847,000 | 42,832 | |

| LIXIL Group Corp. | 1,662,800 | 39,030 | |

| Nissan Motor Co. Ltd. | 3,761,800 | 37,773 | |

| Yahoo Japan Corp. | 7,750,500 | 36,162 | |

| Komatsu Ltd. | 1,269,600 | 27,856 | |

| Sumitomo Mitsui Trust | |||

| Holdings Inc. | 4,777,000 | 23,594 | |

| Daihatsu Motor Co. Ltd. | 993,000 | 19,280 | |

| Lintec Corp. | 851,900 | 17,669 | |

| Yamato Kogyo Co. Ltd. | 355,500 | 13,176 | |

| Miraca Holdings Inc. | 100 | 5 | |

| 1,440,384 | |||

| Netherlands (2.4%) | |||

| Akzo Nobel NV | 817,744 | 59,364 | |

| Unilever NV | 1,428,277 | 56,625 | |

| Heineken NV | 728,777 | 50,218 | |

| * | ING Groep NV | 2,318,169 | 29,459 |

| 195,666 | |||

| Norway (0.6%) | |||

| Petroleum Geo-Services | |||

| ASA | 2,021,204 | 24,513 | |

| TGS Nopec Geophysical | |||

| Co. ASA | 851,227 | 23,412 | |

| 47,925 | |||

| Philippines (0.7%) | |||

| Alliance Global Group | |||

| Inc. | 53,530,700 | 32,663 | |

| LT Group Inc. | 49,921,500 | 19,181 | |

| 51,844 | |||

| Russia (2.4%) | |||

| Gazprom OAO ADR | 10,102,649 | 94,434 | |

| Mobile Telesystems | |||

| OJSC ADR | 1,747,847 | 39,851 | |

| Sberbank of Russia | 9,672,430 | 31,036 | |

| VTB Bank OJSC GDR | 4,603,697 | 12,755 | |

17

International Value Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | X5 Retail Group NV | ||

| GDR | 520,470 | 8,461 | |

| VTB Bank OJSC | 2,200,502,714 | 3,061 | |

| 189,598 | |||

| Singapore (2.4%) | |||

| Genting Singapore plc | 58,872,000 | 72,030 | |

| DBS Group Holdings Ltd. | 4,684,000 | 63,147 | |

| Singapore | |||

| Telecommunications | |||

| Ltd. | 17,945,000 | 54,495 | |

| 189,672 | |||

| South Africa (0.7%) | |||

| Mediclinic International | |||

| Ltd. | 4,549,638 | 34,285 | |

| Mr Price Group Ltd. | 1,373,596 | 21,619 | |

| 55,904 | |||

| South Korea (4.1%) | |||

| Samsung Electronics Co. | |||

| Ltd. | 89,523 | 123,458 | |

| E-Mart Co. Ltd. | 349,627 | 83,664 | |

| Hyundai Mobis | 187,326 | 52,841 | |

| Hyundai Home Shopping | |||

| Network Corp. | 141,604 | 22,419 | |

| SK Innovation Co. Ltd. | 142,413 | 19,960 | |

| Hana Financial Group Inc. | 470,830 | 18,105 | |

| Daewoo International | |||

| Corp. | 301,100 | 11,090 | |

| 331,537 | |||

| Spain (2.0%) | |||

| * | Banco Santander SA | 6,520,394 | 57,805 |

| Red Electrica Corp. SA | 708,595 | 44,121 | |

| Banco Bilbao Vizcaya | |||

| Argentaria SA | 2,877,734 | 33,632 | |

| * | ACS Actividades de | ||

| Construccion y | |||

| Servicios SA | 823,188 | 27,005 | |

| 162,563 | |||

| Sweden (1.5%) | |||

| Assa Abloy AB Class B | 1,021,700 | 50,694 | |

| Swedbank AB Class A | 1,248,400 | 32,491 | |

| Securitas AB Class B | 2,162,594 | 24,660 | |

| ^ | Oriflame Cosmetics SA | 466,439 | 14,719 |

| 122,564 | |||

| Switzerland (4.3%) | |||

| Novartis AG | 1,354,885 | 105,170 | |

| ABB Ltd. | 2,756,144 | 70,220 | |

| Credit Suisse Group AG | 1,497,248 | 46,576 | |

| * | Cie Financiere | ||

| Richemont SA | 385,281 | 39,395 | |

| Swatch Group AG | |||

| (Bearer) | 49,700 | 31,743 | |

| Julius Baer Group Ltd. | 605,304 | 29,694 | |

| GAM Holding AG | 1,052,042 | 19,658 | |

| 342,456 | |||

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| Taiwan (0.9%) | |||

| Taiwan Semiconductor | |||

| Manufacturing Co. Ltd. | 18,526,704 | 68,282 | |

| Wistron Corp. | 106,907 | 100 | |

| 68,382 | |||

| Thailand (1.2%) | |||

| Bangkok Bank PCL | 9,876,200 | 65,543 | |

| Kasikornbank PCL | |||

| (Foreign) | 4,331,800 | 27,082 | |

| 92,625 | |||

| Turkey (0.8%) | |||

| * | Turkcell Iletisim | ||

| Hizmetleri AS | 6,906,220 | 42,857 | |

| KOC Holding AS | 4,658,988 | 22,819 | |

| 65,676 | |||

| United Kingdom (16.4%) | |||

| * | Royal Bank of Scotland | ||

| Group plc | 23,782,662 | 140,070 | |

| HSBC Holdings plc | 9,690,485 | 106,222 | |

| BG Group plc | 4,827,836 | 98,487 | |

| Prudential plc | 4,801,132 | 98,188 | |

| Vodafone Group plc | 22,498,386 | 82,407 | |

| WPP plc | 3,300,998 | 70,117 | |

| Carnival plc | 1,779,082 | 63,233 | |

| Unilever plc | 1,376,879 | 55,834 | |

| Rexam plc | 6,414,122 | 53,411 | |

| Smith & Nephew plc | 4,110,037 | 52,566 | |

| Informa plc | 5,751,898 | 51,528 | |

| Rio Tinto plc | 1,005,096 | 50,858 | |

| Royal Dutch Shell plc | |||

| Class A | 1,440,928 | 47,999 | |

| Signet Jewelers Ltd. | 622,697 | 46,504 | |

| Barclays plc | 10,904,207 | 45,880 | |

| * | Lloyds Banking Group | ||

| plc | 36,955,000 | 45,706 | |

| Wolseley plc | 725,736 | 39,067 | |

| Associated British | |||

| Foods plc | 901,700 | 32,782 | |

| British American | |||

| Tobacco plc | 573,204 | 31,625 | |

| BP plc ADR | 597,595 | 27,788 | |

| Petrofac Ltd. | 1,111,830 | 26,077 | |

| BAE Systems plc | 2,721,255 | 19,850 | |

| Tullow Oil plc | 1,256,925 | 18,999 | |

| Ladbrokes plc | 4,565,100 | 13,973 | |

| Inchcape plc | 21,654 | 221 | |

| 1,319,392 | |||

| United States (2.3%) | |||

| Ensco plc Class A | 271,900 | 15,675 | |

| RenaissanceRe Holdings | |||

| Ltd. | 168,600 | 15,800 | |

| TE Connectivity Ltd. | 379,377 | 19,534 | |

| *,^ | Ultra Petroleum Corp. | 2,429,105 | 44,598 |

18

International Value Fund

| Market | |||

| Value• | |||

| Shares | ($000) | ||

| * | Weatherford | ||

| International Ltd. | 5,318,900 | 87,443 | |

| 183,050 | |||

| Total Common Stocks | |||

| (Cost $6,447,360) | 7,640,627 | ||

| Temporary Cash Investments (5.2%)1 | |||

| Money Market Fund (5.1%) | |||

| 2,3 | Vanguard Market | ||

| Liquidity Fund, | |||

| 0.120% | 408,547,828 | 408,548 | |

| Face | |||

| Amount | |||

| ($000) | |||

| U.S. Government and Agency Obligations (0.1%) | |||

| 4,5 | Federal Home Loan Bank | ||

| Discount Notes, | |||

| 0.055%, 11/29/13 | 1,500 | 1,500 | |

| 4,5 | Federal Home Loan Bank | ||

| Discount Notes, | |||

| 0.045%, 12/27/13 | 1,500 | 1,499 | |

| 4,5 | Federal Home Loan Bank | ||

| Discount Notes, | |||

| 0.060%, 2/19/14 | 400 | 400 | |

| 4,5 | Federal Home Loan Bank | ||

| Discount Notes, | |||

| 0.090%, 2/21/14 | 8,400 | 8,395 | |

| 11,794 | |||

| Total Temporary Cash Investments | |||

| (Cost $420,345) | 420,342 | ||

| Total Investments (100.4%) | |||

| (Cost $6,867,705) | 8,060,969 | ||

| Market | |

| Value• | |

| ($000) | |

| Other Assets and Liabilities (-0.4%) | |

| Other Assets | 90,421 |

| Liabilities3 | (123,746) |

| (33,325) | |

| Net Assets (100%) | |

| Applicable to 216,243,587 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 8,027,644 |

| Net Asset Value Per Share | $37.12 |

| At October 31, 2013, net assets consisted of: | |

| Amount | |

| ($000) | |

| Paid-in Capital | 7,400,850 |

| Undistributed Net Investment Income | 119,548 |

| Accumulated Net Realized Losses | (694,855) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 1,193,264 |

| Futures Contracts | 7,691 |

| Forward Currency Contracts | 1,150 |

| Foreign Currencies | (4) |

| Net Assets | 8,027,644 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $23,708,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures

investments, the fund’s effective common stock and temporary cash investment positions represent 97.9% and 2.5%, respectively,

of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

3 Includes $25,260,000 of collateral received for securities on loan.

4 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the full

faith and credit of the U.S. government.

5 Securities with a value of $11,749,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

GDR—Global Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

19

International Value Fund

| Statement of Operations | |

| Year Ended | |

| October 31, 2013 | |

| ($000) | |

| Investment Income | |

| Income | |

| Dividends1 | 187,156 |

| Interest2 | 403 |

| Securities Lending | 4,249 |

| Total Income | 191,808 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 12,122 |

| Performance Adjustment | 726 |

| The Vanguard Group—Note C | |

| Management and Administrative | 15,448 |

| Marketing and Distribution | 1,230 |

| Custodian Fees | 1,102 |

| Auditing Fees | 39 |

| Shareholders’ Reports | 104 |

| Trustees’ Fees and Expenses | 23 |

| Total Expenses | 30,794 |

| Net Investment Income | 161,014 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 707,235 |

| Futures Contracts | 44,516 |

| Foreign Currencies and Forward Currency Contracts | (15,852) |

| Realized Net Gain (Loss) | 735,899 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 868,587 |

| Futures Contracts | 8,584 |

| Foreign Currencies and Forward Currency Contracts | 2,598 |

| Change in Unrealized Appreciation (Depreciation) | 879,769 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,776,682 |

| 1 Dividends are net of foreign withholding taxes of $9,553,000. | |

| 2 Interest income from an affiliated company of the fund was $388,000. | |

See accompanying Notes, which are an integral part of the Financial Statements.

20

International Value Fund

| Statement of Changes in Net Assets | ||

| Year Ended October 31, | ||

| 2013 | 2012 | |

| ($000) | ($000) | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net Investment Income | 161,014 | 174,901 |

| Realized Net Gain (Loss) | 735,899 | (352,829) |

| Change in Unrealized Appreciation (Depreciation) | 879,769 | 557,390 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 1,776,682 | 379,462 |

| Distributions | ||

| Net Investment Income | (174,874) | (189,240) |

| Realized Capital Gain | — | — |

| Total Distributions | (174,874) | (189,240) |

| Capital Share Transactions | ||

| Issued | 855,250 | 794,128 |

| Issued in Lieu of Cash Distributions | 166,322 | 179,201 |

| Redeemed1 | (1,060,870) | (1,251,764) |

| Net Increase (Decrease) from Capital Share Transactions | (39,298) | (278,435) |

| Total Increase (Decrease) | 1,562,510 | (88,213) |

| Net Assets | ||

| Beginning of Period | 6,465,134 | 6,553,347 |

| End of Period2 | 8,027,644 | 6,465,134 |

| 1 Net of redemption fees for fiscal 2012 of $63,000. Effective May 23, 2012, the redemption fee was eliminated. | ||

| 2 Net Assets—End of Period includes undistributed net investment income of $119,548,000 and $139,778,000. | ||

See accompanying Notes, which are an integral part of the Financial Statements.

21

International Value Fund

| Financial Highlights | |||||

| For a Share Outstanding | Year Ended October 31, | ||||

| Throughout Each Period | 2013 | 2012 | 2011 | 2010 | 2009 |

| Net Asset Value, Beginning of Period | $29.78 | $28.98 | $31.92 | $29.95 | $24.36 |

| Investment Operations | |||||

| Net Investment Income | .757 | .804 | .843 | .698 | .742 |

| Net Realized and Unrealized Gain (Loss) | |||||

| on Investments | 7.402 | .838 | (3.103) | 2.007 | 5.839 |

| Total from Investment Operations | 8.159 | 1.642 | (2.260) | 2.705 | 6.581 |

| Distributions | |||||

| Dividends from Net Investment Income | (.819) | (.842) | (. 680) | (.735) | (.991) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.819) | (.842) | (. 680) | (.735) | (.991) |

| Net Asset Value, End of Period | $37.12 | $29.78 | $28.98 | $31.92 | $29.95 |

| Total Return1 | 27.94% | 6.00% | -7.27% | 9.12% | 28.34% |

| Ratios/Supplemental Data | |||||

| Net Assets, End of Period (Millions) | $8,028 | $6,465 | $6,553 | $7,532 | $6,494 |

| Ratio of Total Expenses to | |||||

| Average Net Assets2 | 0.43% | 0.40% | 0.39% | 0.39% | 0.45% |

| Ratio of Net Investment Income to | |||||

| Average Net Assets | 2.24% | 2.77% | 2.59% | 2.41% | 2.93% |

| Portfolio Turnover Rate | 52% | 53% | 39% | 51% | 55% |

1 Total returns do not include transaction or account service fees that may have applied in the periods shown. Fund prospectuses provide

information about any applicable transaction and account service fees.

2 Includes performance-based investment advisory fee increases (decreases) of 0.01%, (0.03%), (0.05%), (0.04%), and (0.02%).

See accompanying Notes, which are an integral part of the Financial Statements.

22

International Value Fund

Notes to Financial Statements

Vanguard International Value Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of United States corporations.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures and Forward Currency Contracts: The fund may use index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearing-house, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

23

International Value Fund

The fund may enter into forward currency contracts to provide the appropriate currency exposure related to any open futures contracts or to protect the value of securities and related receivables and payables against changes in foreign exchange rates. The fund’s risks in using these contracts include movement in the values of the foreign currencies relative to the U.S. dollar and the ability of the counterparties to fulfill their obligations under the contracts. The fund mitigates its counterparty risk by entering into forward currency contracts only with a diverse group of prequalified counterparties, monitoring their financial strength, entering into master netting arrangements with its counterparties, and requiring its counterparties to transfer collateral as security for their performance. The master netting arrangements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate the forward currency contracts, determine the net amount owed by either party in accordance with its master netting arrangements, and sell or retain any collateral held up to the net amount owed to the fund under the master netting arrangements. The forward currency contracts contain provisions whereby a counterparty may terminate open contracts if the fund’s net assets decline below a certain level, triggering a payment by the fund if the fund is in a net liability position at the time of the termination. The payment amount would be reduced by any collateral the fund has pledged. Any assets pledged as collateral for open contracts are noted in the Statement of Net Assets. The value of collateral received or pledged is compared daily to the value of the forward currency contracts exposure with each counterparty, and any difference, if in excess of a specified minimum transfer amount, is adjusted and settled within two business days.

Futures contracts are valued at their quoted daily settlement prices. Forward currency contracts are valued at their quoted daily prices obtained from an independent third party, adjusted for currency risk based on the expiration date of each contract. The aggregate notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized gains (losses) on futures or forward currency contracts.

During the year ended October 31, 2013, the fund’s average investments in long and short futures contracts represented 2% and 0% of net assets, respectively, based on quarterly average aggregate settlement values. The fund’s average investment in forward currency contracts represented 2% of net assets, based on quarterly average notional amounts.

4. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (October 31, 2010–2013), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

5. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

6. Securities Lending: To earn additional income, the fund may lend its securities to qualified institutional borrowers. Security loans are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to

24

International Value Fund

the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the absence of a default the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. Lazard Asset Management LLC, Edinburgh Partners Limited, and ARGA Investment Management, LP, each provide investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee of Lazard Asset Management LLC is subject to quarterly adjustments based on performance for the preceding five years relative to the MSCI All Country World Index ex USA. The basic fee of Edinburgh Partners Limited is subject to quarterly adjustments based on performance for the preceding three years relative to the MSCI All Country World Index ex USA. The basic fee of ARGA Investment Management, LP, is subject to quarterly adjustments based on performance since October 31, 2012, relative to the MSCI All Country World Index ex USA. Until December 2012, a portion of the fund was managed by Hansberger Global Investors, Inc. The basic fee paid to Hansberger Global Investors, Inc., was subject to quarterly adjustments based on performance for the preceding three years relative to the MSCI Europe, Australasia, Far East Index for periods prior to February 1, 2011, and the MSCI All Country World Index ex USA, beginning February 1, 2011.

The Vanguard Group manages the cash reserves of the fund on an at-cost basis.

For the year ended October 31, 2013, the aggregate investment advisory fee represented an effective annual basic rate of 0.17% of the fund’s average net assets, before an increase of $726,000 (0.01%) based on performance.

C. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At October 31, 2013, the fund had contributed capital of $907,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.36% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

25

International Value Fund

The following table summarizes the market value of the fund’s investments as of October 31, 2013, based on the inputs used to value them:

| Level 1 | Level 2 | Level 3 | |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 491,077 | 7,149,550 | — |

| Temporary Cash Investments | 408,548 | 11,794 | — |

| Futures Contracts—Liabilities1 | (393) | — | — |

| Forward Currency Contracts—Assets | — | 1,711 | — |

| Forward Currency Contracts—Liabilities | — | (561) | — |

| Total | 899,232 | 7,162,494 | — |

| 1 Represents variation margin on the last day of the reporting period. |

Securities in certain countries may transfer between Level 1 and Level 2 due to differences in stock market closure times that may result from transitions between standard and daylight saving time in those countries and the U.S. Securities valued at $119,841,000 on October 31, 2013, based on Level 2 inputs were transferred from Level 1 during the fiscal year.

E. At October 31, 2013, the fair values of derivatives were reflected in the Statement of Net Assets as follows:

| Foreign | |||

| Equity | Exchange | ||

| Contracts | Contracts | Total | |

| Statement of Net Assets Caption | ($000) | ($000) | ($000) |

| Other Assets | — | 1,711 | 1,711 |

| Liabilities | (393) | (561) | (954) |

Realized net gain (loss) and the change in unrealized appreciation (depreciation) on derivatives for the year ended October 31, 2013, were:

| Foreign | |||

| Equity | Exchange | ||

| Contracts | Contracts | Total | |

| Realized Net Gain (Loss) on Derivatives | ($000) | ($000) | ($000) |

| Futures Contracts | 44,516 | — | 44,516 |

| Forward Currency Contracts | — | (9,482) | (9,482) |

| Realized Net Gain (Loss) on Derivatives | 44,516 | (9,482) | 35,034 |

| Change in Unrealized Appreciation (Depreciation) on Derivatives | |||

| Futures Contracts | 8,584 | — | 8,584 |

| Forward Currency Contracts | — | 2,384 | 2,384 |

| Change in Unrealized Appreciation (Depreciation) on Derivatives | 8,584 | 2,384 | 10,968 |

26

International Value Fund

At October 31, 2013, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| ($000) | ||||

| Aggregate | ||||

| Number of | Settlement | Unrealized | ||

| Long (Short) | Value | Appreciation | ||

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| FTSE 100 Index | December 2013 | 649 | 69,949 | 1,912 |

| Dow Jones EURO STOXX 50 Index | December 2013 | 1,633 | 67,912 | 3,459 |

| Topix Index | December 2013 | 426 | 52,083 | 1,261 |

| S&P ASX 200 Index | December 2013 | 225 | 28,849 | 1,059 |

Unrealized appreciation (depreciation) on open FTSE 100 Index and Dow Jones EURO STOXX 50 Index futures contracts is required to be treated as realized gain (loss) for tax purposes.

At October 31, 2013, the fund had open forward currency contracts to receive and deliver currencies as follows. Unrealized appreciation (depreciation) on open forward currency contracts is treated as realized gain (loss) for tax purposes.

| Unrealized | ||||||

| Contract | Appreciation | |||||

| Settlement | Contract Amount (000) | (Depreciation) | ||||

| Counterparty | Date | Receive | Deliver | ($000) | ||

| Morgan Stanley Capital Services Inc. | 12/27/13 | GBP | 23,273 | USD | 36,984 | 316 |

| Morgan Stanley Capital Services Inc. | 12/27/13 | EUR | 27,223 | USD | 36,352 | 613 |

| Morgan Stanley Capital Services Inc. | 12/27/13 | GBP | 19,226 | USD | 30,980 | (166) |

| Morgan Stanley Capital Services Inc. | 12/17/13 | JPY | 2,731,999 | USD | 27,218 | 575 |

| Morgan Stanley Capital Services Inc. | 12/27/13 | EUR | 19,910 | USD | 27,121 | (86) |

| Morgan Stanley Capital Services Inc. | 12/24/13 | AUD | 27,956 | USD | 26,118 | 207 |

| Morgan Stanley Capital Services Inc. | 12/17/13 | JPY | 2,218,085 | USD | 22,863 | (299) |

| Morgan Stanley Capital Services Inc. | 12/24/13 | AUD | 1,346 | USD | 1,278 | (10) |

| AUD—Australian dollar. | ||||||

| EUR—Euro. | ||||||

| GBP—British pound. | ||||||

| JPY—Japanese yen. | ||||||

| USD—U.S. dollar. | ||||||

At October 31, 2013, the counterparty had deposited in segregated accounts securities with a value of $3,150,000 in connection with amounts due to the fund for open forward currency contracts.

F. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

27

International Value Fund

During the year ended October 31, 2013, the fund realized net foreign currency losses of $6,370,000, which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized losses to undistributed net investment income.

For tax purposes, at October 31, 2013, the fund had $140,971,000 of ordinary income available for distribution. The fund used capital loss carryforwards of $750,557,000 to offset taxable capital gains realized during the year ended October 31, 2013. At October 31, 2013, the fund had available capital losses totaling $688,240,000 to offset future net capital gains through October 31, 2017.

At October 31, 2013, the cost of investment securities for tax purposes was $6,872,461,000. Net unrealized appreciation of investment securities for tax purposes was $1,188,508,000, consisting of unrealized gains of $1,439,461,000 on securities that had risen in value since their purchase and $250,953,000 in unrealized losses on securities that had fallen in value since their purchase.

G. During the year ended October 31, 2013, the fund purchased $3,592,449,000 of investment securities and sold $3,802,833,000 of investment securities, other than temporary cash investments.

H. Capital shares issued and redeemed were:

| Year Ended October 31, | ||

| 2013 | 2012 | |

| Shares | Shares | |

| (000) | (000) | |

| Issued | 26,152 | 28,299 |

| Issued in Lieu of Cash Distributions | 5,360 | 6,717 |

| Redeemed | (32,360) | (44,050) |

| Net Increase (Decrease) in Shares Outstanding | (848) | (9,034) |

I. Management has determined that no material events or transactions occurred subsequent to October 31, 2013, that would require recognition or disclosure in these financial statements.

28

Report of Independent Registered Public Accounting Firm

To the Trustees of Vanguard Trustees’ Equity Fund and the Shareholders of Vanguard International Value Fund:

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard International Value Fund (constituting a separate portfolio of Vanguard Trustees’ Equity Fund, hereafter referred to as the “Fund”) at October 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2013 by correspondence with the custodian and brokers and by agreement to the underlying ownership records of the transfer agent, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 12, 2013

Special 2013 tax information (unaudited) for Vanguard International Value Fund

This information for the fiscal year ended October 31, 2013, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $119,369,000 of qualified dividend income to shareholders during the fiscal year.

The fund designates to shareholders foreign source income of $159,851,000 and foreign taxes paid of $9,426,000. Shareholders will receive more detailed information with their Form 1099-DIV in January 2014 to determine the calendar-year amounts to be included on their 2013 tax returns.

29

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2013. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.)

Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| Average Annual Total Returns: International Value Fund | |||

| Periods Ended October 31, 2013 | |||

| One | Five | Ten | |

| Year | Years | Years | |

| Returns Before Taxes | 27.94% | 11.99% | 8.48% |

| Returns After Taxes on Distributions | 27.34 | 11.48 | 7.75 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 16.45 | 9.63 | 7.03 |

30

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

31

| Six Months Ended October 31, 2013 | |||

| Beginning | Ending | Expenses | |

| Account Value | Account Value | Paid During | |

| International Value Fund | 4/30/2013 | 10/31/2013 | Period |

| Based on Actual Fund Return | $1,000.00 | $1,112.04 | $2.29 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.04 | 2.19 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.43%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period.

32

Glossary