As filed with the Securities and Exchange Commission on August 25, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Stacey E. Hong, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: June 30

Date of reporting period: July 1, 2010 – June 30, 2011

ITEM 1. REPORT TO STOCKHOLDERS.

Annual Report

June 30, 2011

Fund Adviser:

Auxier Asset Management LLC

5285 Meadows Road

Suite 333

Lake Oswego, Oregon 97035

Toll Free: (877) 3AUXIER or (877) 328-9437

| |

AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2011 |

| |

AUXIER FOCUS FUND

PERFORMANCE UPDATE

June 30, 2011

AUXFX (AUXIER FOCUS FUND INVESTOR SHARES) RETURNS VS. S&P 500® INDEX (“S&P 500”)

| Auxier Focus Fund (the “Fund) | S&P 500 | Difference* |

| 03/31/11 – 06/30/11 | 1.79% | 0.10% | 1.69 |

| 12/31/10 – 06/30/11 | 8.44% | 6.02% | 2.42 |

| 12/31/09 – 12/31/10 | 10.10% | 15.06% | -4.96 |

| 12/31/08 – 12/31/09 | 24.76% | 26.46% | -1.70 |

| 12/31/07 – 12/31/08 | -24.52% | -37.00% | 12.48 |

| 12/31/06 – 12/31/07 | 5.71% | 5.49% | 0.22 |

| 12/31/05 – 12/31/06 | 11.75% | 15.79% | -4.04 |

| 12/31/04 – 12/31/05 | 4.58% | 4.91% | -0.33 |

| 12/31/03 – 12/31/04 | 10.73% | 10.87% | -0.14 |

| 12/31/02 – 12/31/03 | 26.75% | 28.69% | -1.94 |

| 12/31/01 – 12/31/02 | -6.79% | -22.10% | 15.31 |

| 12/31/00 – 12/31/01 | 12.67% | -11.88% | 24.55 |

| 12/31/99 – 12/31/00 | 4.05% | -9.10% | 13.15 |

| Since Inception 07/09/99 | 119.42% | 16.79% | 102.50 |

*In Percentage Points

| |

AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2011 |

| |

Market Commentary

Auxier Focus Fund returned 1.79% in the second quarter 2011, while Standard & Poor’s 500 stock Index (S&P) gained 0.10%. For the first six months the Fund was up 8.44%, briskly outpacing the S&P’s 6.02%. The Fund also has outperformed the market by 102 percentage points cumulatively since inception in July 1999. We strive to match good markets and to excel materially in challenging, declining periods.

Negative macroeconomic headlines continue to overshadow positive underlying corporate performance. The financial media’s and public’s obsession with the “unknowable” has created opportunities to buy high-quality international franchises at attractive prices.

Many contributors to the Fund’s second quarter performance were businesses that improved from the “hopelessly out of favor” to merely unpopular. The Fund benefited from gains in downtrodden health insurers like WellPoint and UnitedHealth; education companies Apollo and ITT Educational; medical device companies Johnson & Johnson, Medtronic, and Zimmer, plus credit card processors Visa and MasterCard. These were a few industries in which proposed excessive regulation drove down price points to compelling levels a year ago. As the worst case failed to materialize and political compromise was reached, these stocks were revalued meaningfully higher. Others showing strong operational performance include Precision Castparts, McDonald’s, Weight Watchers, Nike and Phillip Morris. It is so important in today’s environment of austerity to search harder for exceptional buys. Going forward, an investor can’t depend on government stimulus or rising markets to bail out poor investment selections. We are putting added emphasis on businesses with high free cash flow and low or no mandatory capital spending.

Balance Sheet versus Inventory Slowdowns

Downturns resulting from extreme levels of borrowed money can be classified as “balance sheet” recessions, as contrasted with those driven by inventory adjustments. Recoveries following a balance sheet crisis like the one starting in 2008 tend to be choppy and shorter in duration (2-3 years) versus 5-7 years with an inventory recession. Easy money policies have stalled the traditional engines of recovery—housing and autos. As a result, the Fund has been more heavily weighted in companies that sell lower ticket necessity items and are thus less vulnerable to a slowdown. Advancing global austerity increases the appeal of powerful branded franchises that can self-finance expansion in new emerging markets. Greg Page, the CEO of Cargill, recently commented, “No matter where we do business in 66 countries we see per capita incomes rising and consumers electing to spend more on meat, milk, eggs and confection.”

“Facts are facts even in the height of emotion” -- Bernard Baruch

Gloom, fear and uncertainty are friends of fundamental, long-term investors. Remember, Carlos Slim, arguably the most successful investor on the planet today, made his mark buying good businesses in Mexico AFTER Mexico’s debt default in 1982. Recent negative news and partisan debate are obscuring some positives. Among them: growth in free markets, transparency and the peace dividend from winding down the Iraq and Afghanistan conflicts. In monitoring hundreds of stocks, we are amazed how customer-focused companies like McDonald’s deftly adapt to face challenges, innovate and continue to build value for shareholders, employees and communities. Many investors think a government bond issued at rock-bottom interest rates is safer than an exceptionally well-run business with a rock solid balance sheet. But that perception may prove to be very expensive in terms of lower purchasing power over the next several years...

Beware of Commodities’ Long Bull Run

The commodity boom now exceeds both the housing and tech bubbles in duration (114 and 113 months) and looks vulnerable as China and other emerging markets raise interest rates to combat inflation. The rapid build-up of credit in China between 2009 and 2010 exceeded the credit expansions that preceded the most recent housing bubble in the United States and the Japanese property bubble in the late 1980’s. Historically, quality stocks have bottomed as commodities speculation has reached fever levels. Another trend that looks very toppy is so-called high frequency exchange trading tied to mathematical formulas. Over the long run, when markets are free to function, they tend to be virtuous and eventually punish bad behavior. You can violate the laws of economics for only so long before paying the price of permanent capital loss.

| |

AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2011 |

| |

Why Risk Management Matters

I was saddened when Borders recently declared bankruptcy. Talk about ironic: our knowledge-based economy is liquidating the second largest bookstore chain. Who would have thought traditional newspapers would be risky. Or Eastman Kodak? Such are the casualties of the Digital Age. This underscores the need for meticulous research and capital allocation rooted in fact-finding, fundamentals, price and value. In today’s competitive global economy, appraising and pricing risk correctly has never been more important. We saw the devastating results in the misperceptions of “safe” housing investments. Government bonds and commodities may not be as safe as portrayed. The lesson: any class of investment, when flooded with supply, can become risky. To enjoy the long-term fruits of compounding, the importance of a diligent chief risk officer can’t be underestimated. As Warren Buffett commented at his annual meeting, “My role as chief risk officer is too important to be left to a committee.”

Your trust and support is appreciated.

Jeff Auxier

As of 06/30/2011, the Fund held those securities mentioned in the letter as follows: WellPoint, Inc., 1.3%; UnitedHealth Group, Inc.,1.0%; Apollo Group, 1.4%; ITT Educational Services, 0.7%; Johnson & Johnson, 1.7%; Medtronic, Inc., 1.9%; Zimmer Holdings, 1.2%; Visa, 0.5%; MasterCard, Inc., 1.4%; Precision Castparts Corp., 0.6%; McDonald’s Corp, 0.8%; Weight Watchers Int’l Inc., 1.0%; Nike Inc. Class B, 0.3%; Phillip Morris International, 2.4%; Borders, 0%; Eastman Kodak, 0%, Cargill, 0%.

There can be no guarantee of success with any technique, strategy, or investment. All investing involves risk, including the loss of principal. The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 widely held common stocks. One cannot invest directly in an index.

The views in this shareholder letter were those of the Fund Manager as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

| |

AUXIER FOCUS FUND PERFORMANCE CHART AND ANALYSIS JUNE 30, 2011 |

| |

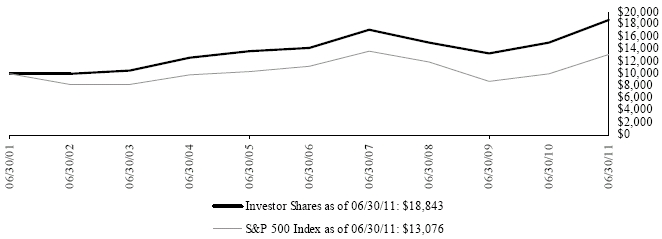

The following chart reflects the change in the value of a hypothetical $10,000 investment in Investor Shares, including reinvested dividends and distributions, in the Fund compared with the performance of the benchmark, S&P 500, over the past ten fiscal years. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The total return of the Fund's classes includes the maximum sales charge of 5.75% (A Shares only) and operating expenses that reduce returns, while the total return of the S&P 500 does not include the effect of sales charges and expenses. A Shares are subject to a 1.00% contingent deferred sales charge on shares purchased without an initial sales charge and redeemed less than one year after purchase. The total return of the S&P 500 includes reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the S&P 500 does not include expenses. The Fund is professionally managed while the S&P 500 is unmanaged and is not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please visit the website of the Fund's investment adviser at www.auxierasset.com. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Investor Shares and A Shares are 1.25% and 1.50%, respectively. However, the Fund's adviser has agreed to contractually waive a portion of its fees and to reimburse expenses such that total operating expenses do not exceed 1.25% for Investor Shares and A Shares, until October 31, 2011. Shares redeemed or exchanged within 180 days of purchase will be charged a 2.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

Performance for Investor Shares for periods prior to December 10, 2004, reflects performance and expenses of Auxier Focus Fund, a series of Unified Series Trust (the “Predecessor Fund”). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds.

| Average Annual Total Return as of 06/30/11: | | 1 Year | | 5 Years | | 10 Years | | Since Inception(1) |

| Investor Shares | | 24.35% | | 5.80% | | 6.54% | | 6.78% |

| S&P 500 Index (Since 07/09/99) | | 30.69% | | 2.94% | | 2.72% | | 1.30% |

A Shares (with sales charge)(2)(3) | | 17.20% | | 4.54% | | 5.91% | | 6.25% |

| (1) | Investor Shares and A Shares commenced operations on July 9, 1999, and July 8, 2005, respectively. |

| (2) | Due to shareholder redemptions on August 21, 2005, net assets of the class were zero from the close of business on that date until September 22, 2005. Financial information presented for the period August 21, 2005 to September 22, 2005 reflects performance of Investor Shares of the Fund. |

| (3) | For A Shares, performance for the 5-year, 10-year and since inception periods are blended average annual returns which include the returns of the Investor Shares prior to commencement of operations of the A Shares. |

| |

AUXIER FOCUS FUND SCHEDULE OF INVESTMENTS JUNE 30, 2011 |

| |

| | Shares | | Security Description | | Value | |

| Common Stock - 73.5% |

| Communications - 0.8% |

| | 1,000 | | America Movil SAB de CV, Series L, ADR | $ | 53,880 | |

| | 12,150 | | Motorola Solutions, Inc. (a) | | 559,386 | |

| | 10,000 | | News Corp., Class A | | 177,000 | |

| | 19,950 | | Telefonica SA, ADR | | 488,576 | |

| | | 1,278,842 | |

| Consumer Discretionary - 15.0% |

| | 52,863 | | Apollo Group, Inc., Class A (a) | | 2,309,056 | |

| | 1,000 | | Arcos Dorados Holdings, Inc., Class A | | 21,090 | |

| | 48,727 | | Bridgepoint Education, Inc. (a) | | 1,218,175 | |

| | 42,134 | | Career Education Corp. (a) | | 891,134 | |

| | 500 | | Coach, Inc. | | 31,965 | |

| | 57,100 | | Comcast Corp., Class A | | 1,446,914 | |

| | 3,000 | | Cooper-Standard Holding, Inc. (a) | | 138,000 | |

| | 2,000 | | Costco Wholesale Corp. | | 162,480 | |

| | 54,950 | | CVS Caremark Corp. | | 2,065,021 | |

| | 2,297 | | Discovery Communications, Inc., Class A (a) | | 94,085 | |

| | 2,297 | | Discovery Communications, Inc., Class C (a) | | 83,955 | |

| | 14,800 | | DR Horton, Inc. | | 170,496 | |

| | 37,987 | | Gruma S.A.B. de C.V., ADR (a) | | 313,013 | |

| | 131,400 | | H&R Block, Inc. | | 2,107,656 | |

| | 18,250 | | Home Depot, Inc. | | 661,015 | |

| | 14,850 | | ITT Educational Services, Inc. (a) | | 1,161,864 | |

| | 28,197 | | Lincoln Educational Services Corp. | | 483,579 | |

| | 28,000 | | Lowe's Cos., Inc. | | 652,680 | |

| | 15,800 | | McDonald's Corp. | | 1,332,256 | |

| | 4,900 | | NIKE, Inc., Class B | | 440,902 | |

| | 15,850 | | Sally Beauty Holdings, Inc. (a) | | 271,035 | |

| | 1,738 | | Strayer Education, Inc. | | 219,666 | |

| | 20,578 | | The Andersons, Inc. | | 869,420 | |

| | 33,870 | | The Interpublic Group of Cos., Inc. | | 423,375 | |

| | 3,890 | | Time Warner Cable, Inc. | | 303,576 | |

| | 15,500 | | Time Warner, Inc. | | 563,735 | |

| | 500 | | Toyota Motor Corp., ADR | | 41,210 | |

| | 13,808 | | Universal Technical Institute, Inc. | | 272,984 | |

| | 25,834 | | Value Line, Inc. | | 346,434 | |

| | 63,700 | | Wal-Mart Stores, Inc. | | 3,385,018 | |

| | 22,002 | | Weight Watchers International, Inc. | | 1,660,491 | |

| | 8,600 | | Yum! Brands, Inc. | | 475,064 | |

| | | 24,617,344 | |

| Consumer Staples - 15.8% |

| | 400,600 | | Alliance One International, Inc. (a) | | 1,293,938 | |

| | 35,150 | | Altria Group, Inc. | | 928,312 | |

| | 15,100 | | British American Tobacco PLC, ADR | | 1,328,800 | |

| | 3,404 | | Columbia Sportswear Co. | | 215,814 | |

| | 12,725 | | Diageo PLC, ADR | | 1,041,796 | |

| | 48,050 | | Dr. Pepper Snapple Group, Inc. | | 2,014,736 | |

| | 300 | | Fortune Brands, Inc. | | 19,131 | |

| | 16,862 | | Kraft Foods, Inc., Class A | | 594,048 | |

| | 9,250 | | Manpower, Inc. | | 496,263 | |

| | 5,760 | | National Beverage Corp. | | 84,384 | |

| | 3,000 | | Nestle SA, ADR | | 187,140 | |

| | 46,172 | | Paychex, Inc. | | 1,418,404 | |

| | 35,150 | | PepsiCo, Inc. | | 2,475,614 | |

| | 58,900 | | Philip Morris International, Inc. | | 3,932,753 | |

| | 89,229 | | PRGX Global, Inc. (a) | | 637,987 | |

| | 1,721 | | Ralcorp Holdings, Inc. (a) | | 149,004 | |

| | 11,450 | | Safeway, Inc. | | 267,587 | |

| | 4,000 | | SAIC, Inc. (a) | | 67,280 | |

| | 500 | | Sara Lee Corp. | | 9,495 | |

| | 67,885 | | Tesco PLC, ADR | | 1,330,546 | |

| | 37,250 | | The Coca-Cola Co. | | 2,506,552 | |

| | 500 | | The J.M. Smucker Co. | | 38,220 | |

| | 84,950 | | The Kroger Co. | | 2,106,760 | |

| | 7,750 | | The Procter & Gamble Co. | | 492,668 | |

| | 41,380 | | The Western Union Co. | | 828,841 | |

| | 45,300 | | Unilever NV, ADR | | 1,488,105 | |

| | | 25,954,178 | |

| Energy - 4.8% |

| | 44,600 | | BP PLC, ADR | | 1,975,334 | |

| | 16,750 | | Chevron Corp. | | 1,722,570 | |

| | 15,600 | | ConocoPhillips | | 1,172,964 | |

| | 11,200 | | Exxon Mobil Corp. | | 911,456 | |

| | 1,200 | | Gazprom Neft JSC, ADR | | 28,032 | |

| | 800 | | Lukoil OAO, ADR | | 51,000 | |

| | 2,500 | | PetroChina Co., Ltd., ADR | | 365,075 | |

| | 11,700 | | Petroleo Brasileiro SA, ADR | | 396,162 | |

| | 2,750 | | Surgutneftegas OJSC, ADR | | 26,950 | |

| | 9,250 | | Transocean, Ltd. | | 597,180 | |

| | 19,100 | | Valero Energy Corp. | | 488,387 | |

| | 13,800 | | Willbros Group, Inc. (a) | | 117,852 | |

| | | 7,852,962 | |

| Financials - 10.8% |

| | 25,700 | | Aflac, Inc. | | 1,199,676 | |

| | 13,500 | | American International Group, Inc. (a) | | 395,820 | |

| | 1,280 | | Ameriprise Financial, Inc. | | 73,830 | |

| | 1,000 | | Ashford Hospitality Trust, Inc. REIT | | 12,450 | |

| | 151,733 | | Bank of America Corp. | | 1,662,994 | |

| | 16,000 | | Berkshire Hathaway, Inc., Class B (a) | | 1,238,240 | |

| | 7,000 | | Central Pacific Financial Corp. (a) | | 98,000 | |

| | 9,090 | | Citigroup, Inc. | | 378,508 | |

| | 67,250 | | Marsh & McLennan Cos., Inc. | | 2,097,527 | |

| | 7,350 | | Mastercard, Inc., Class A | | 2,214,849 | |

| | 10,300 | | Mercury General Corp. | | 406,747 | |

| | 2,650 | | StanCorp Financial Group, Inc. | | 111,803 | |

| | 93,850 | | The Bank of New York Mellon Corp. | | 2,404,437 | |

| | 38,418 | | The Travelers Cos., Inc. | | 2,242,843 | |

| | 52,597 | | TNS, Inc. (a) | | 873,110 | |

| | 10,324 | | Unum Group | | 263,056 | |

| | 6,000 | | US Bancorp | | 153,060 | |

| | 9,500 | | Visa, Inc., Class A | | 800,470 | |

| | 24,950 | | Waddell & Reed Financial, Inc., Class A | | 906,932 | |

| | 7,646 | | Washington Federal, Inc. | | 125,624 | |

| | 4,380 | | West Coast Bancorp (a) | | 73,409 | |

| | | 17,733,385 | |

| Health Care - 14.5% |

| | 42,600 | | Abbott Laboratories | | 2,241,612 | |

| | 20,050 | | Alkermes, Inc. (a) | | 372,930 | |

| | 8,450 | | Amgen, Inc. (a) | | 493,058 | |

| | 81,376 | | BioScrip, Inc. (a) | | 528,130 | |

| | 500 | | CareFusion Corp. (a) | | 13,585 | |

| | 13,449 | | Coventry Health Care, Inc. (a) | | 490,485 | |

| | 5,820 | | Express Scripts, Inc. (a) | | 314,164 | |

| | 31,300 | | GlaxoSmithKline PLC, ADR | | 1,342,770 | |

| | 42,050 | | Johnson & Johnson | | 2,797,166 | |

| | 29,850 | | Medco Health Solutions, Inc. (a) | | 1,687,122 | |

| | 80,053 | | Medtronic, Inc. | | 3,084,442 | |

| | 72,660 | | Merck & Co., Inc. | | 2,564,171 | |

| | 87,782 | | Pfizer, Inc. | | 1,808,309 | |

| | 6,842 | | Quest Diagnostics, Inc. | | 404,362 | |

| | 31,129 | | UnitedHealth Group, Inc. | | 1,605,634 | |

| | 27,221 | | WellPoint, Inc. | | 2,144,198 | |

| | 30,600 | | Zimmer Holdings, Inc. (a) | | 1,933,920 | |

| | | 23,826,058 | |

| See Notes to Financial Statements. | 5 | |

| |

AUXIER FOCUS FUND SCHEDULE OF INVESTMENTS JUNE 30, 2011 |

| |

| | Shares | | Security Description | | Value | |

| Industrials - 2.6% |

| | 21,550 | | AGCO Corp. (a) | $ | 1,063,708 | |

| | 25,000 | | General Electric Co. | | 471,500 | |

| | 11,150 | | Granite Construction, Inc. | | 273,510 | |

| | 4,850 | | Illinois Tool Works, Inc. | | 273,976 | |

| | 300 | | ITT Corp. | | 17,679 | |

| | 1,000 | | POSCO, ADR | | 108,620 | |

| | 300 | | Potash Corp. of Saskatchewan, Inc. | | 17,097 | |

| | 12,500 | | Raytheon Co. | | 623,125 | |

| | 3,500 | | Textainer Group Holdings, Ltd. | | 107,590 | |

| | 3,550 | | The Boeing Co. | | 262,452 | |

| | 14,450 | | United Parcel Service, Inc., Class B | | 1,053,838 | |

| | | 4,273,095 | |

| Information Technology - 3.0% |

| | 16,650 | | Automatic Data Processing, Inc. | | 877,122 | |

| | 23,350 | | Dell, Inc. (a) | | 389,244 | |

| | 46,500 | | Intel Corp. | | 1,030,440 | |

| | 97,364 | | Microsoft Corp. | | 2,531,464 | |

| | 5,000 | | MoneyGram International, Inc. (a) | | 16,625 | |

| | 1,500 | | Verisk Analytics, Inc., Class A (a) | | 51,930 | |

| | | 4,896,825 | |

| Materials - 3.1% |

| | 28,700 | | E.I. du Pont de Nemours & Co. | | 1,551,235 | |

| | 7,000 | | LyondellBasell Industries NV, Class A | | 269,640 | |

| | 6,400 | | Precision Castparts Corp. | | 1,053,760 | |

| | 47,350 | | The Dow Chemical Co. | | 1,704,600 | |

| | 14,000 | | Vale SA, ADR | | 447,300 | |

| | | 5,026,535 | |

| Telecommunications - 3.0% |

| | 27,300 | | AT&T, Inc. | | 857,493 | |

| | 49,150 | | SK Telecom Co., Ltd., ADR | | 919,105 | |

| | 110,624 | | Tele Norte Leste Participacoes SA, ADR | | 1,719,097 | |

| | 30,300 | | Telefonos de Mexico SAB de CV, ADR, Class L | | 499,950 | |

| | 27,015 | | Verizon Communications, Inc. | | 1,005,768 | |

| | | 5,001,413 | |

| Utilities - 0.1% |

| | 6,616 | | FirstService Corp. (a) | | 228,517 | |

| | | | |

Total Common Stock (Cost $100,374,337) | | 120,689,154 | |

| | Principal | | Security Description | | Rate | | Maturity | | Value | |

| Corporate Bonds - 6.8% |

| Consumer Staples - 1.5% |

| $ | 1,180,000 | | American Stores Co. | | 7.90 | % | 05/01/17 | $ | 1,181,475 | |

| | 50,000 | | Constellation Brands, Inc. | | 7.25 | | 05/15/17 | | 54,625 | |

| | 654,000 | | Smithfield Foods, Inc., Series B | | 7.75 | | 05/15/13 | | 712,860 | |

| | 115,000 | | SUPERVALU, Inc. | | 7.50 | | 11/15/14 | | 115,575 | |

| | 375,000 | | SUPERVALU, Inc. | | 8.00 | | 05/01/16 | | 384,375 | |

| | | 2,448,910 | |

| Energy - 0.1% |

| | 190,000 | | El Paso Corp. | | 6.70 | | 02/15/27 | | 189,205 | |

| | | | |

| Financials - 2.6% |

| | 75,000 | | American Express Credit Corp., Series C | | 7.30 | | 08/20/13 | | 83,516 | |

| | 455,000 | | Hartford Financial Services Group, Inc. | | 5.25 | | 10/15/11 | | 460,543 | |

| | 2,370,000 | | Hartford Financial Services Group, Inc. | | 5.50 | | 10/15/16 | | 2,532,523 | |

| | 182,000 | | Hartford Financial Services Group, Inc. | | 6.30 | | 03/15/18 | | 198,179 | |

| | 260,000 | | Janus Capital Group, Inc. | | 6.70 | | 06/15/17 | | 285,378 | |

| | 620,000 | | Zions Bancorporation | | 5.50 | | 11/16/15 | | 639,020 | |

| | | 4,199,159 | |

| Health Care - 1.1% |

| | 540,000 | | Health Management Associates, Inc. | | 6.13 | | 04/15/16 | | 562,950 | |

| | 515,000 | | UnitedHealth Group, Inc. | | 4.88 | | 03/15/15 | | 563,328 | |

| | 430,000 | | WellPoint, Inc. | | 5.00 | | 12/15/14 | | 474,126 | |

| | 130,000 | | WellPoint, Inc. | | 5.25 | | 01/15/16 | | 145,128 | |

| | | 1,745,532 | |

| Materials – 1.1% |

| | 895,000 | | The Dow Chemical Co. | | 5.70 | | 05/15/18 | | 993,183 | |

| | 203,000 | | Weyerhaeuser Co. | | 9.00 | | 10/01/21 | | 246,711 | |

| | 505,000 | | Weyerhaeuser Co. | | 7.95 | | 03/15/25 | | 585,606 | |

| | | 1,825,500 | |

| Utilities - 0.4% |

| | 100,000 | | Constellation Energy Group, Inc. | | 4.55 | | 06/15/15 | | 106,517 | |

| | 255,000 | | Energy Future Holdings Corp. | | 9.75 | | 10/15/19 | | 259,071 | |

| | 312,000 | | Energy Future Intermediate Holding Co., LLC | | 9.75 | | 10/15/19 | | 316,980 | |

| | 27,000 | | Nevada Power Co., Series L | | 5.88 | | 01/15/15 | | 30,268 | |

| | | 712,836 | |

Total Corporate Bonds (Cost $9,306,459) | | 11,121,142 | |

| Foreign Municipal Bonds - 0.8% |

| | 750,000 | | Ontario Hydro Residual Strip (Canada), Series OC20 (b) | | 5.51 | | 10/01/20 | | 530,152 | |

| | 356,000 | | Ontario Hydro Residual Strip (Canada) (b) | | 5.47-5.65 | | 11/27/20 | | 251,265 | |

| See Notes to Financial Statements. | 6 | |

| |

AUXIER FOCUS FUND SCHEDULE OF INVESTMENTS JUNE 30, 2011 |

| |

| | Principal | | Security Description | | Rate | | Maturity | | Value | |

| $ | 605,000 | | Ontario Hydro Residual Strip (Canada) (b) | | 5.61 | % | 10/15/21 | $ | 405,663 | |

| | 235,000 | | Ontario Hydro Residual Strip (Canada) (b) | | 5.75 | | 08/18/22 | | 151,165 | |

| | | | |

Total Foreign Municipal Bonds (Cost $842,851) | | 1,338,245 | |

| Municipal Bonds - 0.2% |

| Ohio - 0.2% |

| | 550,000 | | Buckeye Tobacco Settlement Financing Authority | | 5.88 | | 06/01/47 | | 401,748 | |

| | | | |

Total Municipal Bonds (Cost $374,358) | | 401,748 | |

| Money Market Funds - 0.0% |

| | 31 | | Schwab Government Money Fund, 0.01% (c) (Cost $31) | | 31 | |

| | | | |

Total Investments - 81.3% (Cost $110,898,036)* | $ | 133,550,320 | |

| Other Assets & Liabilities, Net – 18.7% | | 30,808,707 | |

| Net Assets – 100.0% | $ | 164,359,027 | |

| ADR | American Depository Receipt |

| LLC | Limited Liability Company |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Zero coupon bond. Interest rate presented is yield to maturity. |

| (c) | Variable rate security. Rate presented is as of June 30, 2011. |

| | * Cost of investments for federal income tax purposes is $110,917,144 and net unrealized appreciation on investments consists of: |

| Gross Unrealized Appreciation | | $ | 28,068,394 | |

| Gross Unrealized Depreciation | | | (5,435,218 | ) |

| Net Unrealized Appreciation | | $ | 22,633,176 | |

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2011.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to Note 2 - Security Valuation section in the accompanying Notes to Financial Statements.

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Investments At Value |

| Common Stock | | | | | | | | | | | | | | | | |

| Communications | | $ | 1,278,842 | | | $ | - | | | $ | - | | | $ | 1,278,842 | |

| Consumer Discretionary | | | 24,617,344 | | | | - | | | | - | | | | 24,617,344 | |

| Consumer Staples | | | 25,954,178 | | | | - | | | | - | | | | 25,954,178 | |

| Energy | | | 7,852,962 | | | | - | | | | - | | | | 7,852,962 | |

| Financials | | | 17,733,385 | | | | - | | | | - | | | | 17,733,385 | |

| Health Care | | | 23,826,058 | | | | - | | | | - | | | | 23,826,058 | |

| Industrials | | | 4,273,095 | | | | - | | | | - | | | | 4,273,095 | |

| Information Technology | | | 4,896,825 | | | | - | | | | - | | | | 4,896,825 | |

| Materials | | | 5,026,535 | | | | - | | | | - | | | | 5,026,535 | |

| Telecommunications | | | 5,001,413 | | | | - | | | | - | | | | 5,001,413 | |

| Utilities | | | 228,517 | | | | - | | | | - | | | | 228,517 | |

| Corporate Bonds | | | - | | | | 11,121,142 | | | | - | | | | 11,121,142 | |

| Foreign Municipal Bonds | | | - | | | | 1,338,245 | | | | - | | | | 1,338,245 | |

| Municipal Bonds | | | - | | | | 401,748 | | | | - | | | | 401,748 | |

| Money Market Funds | | | - | | | | 31 | | | | - | | | | 31 | |

| Total Investments At Value | | $ | 120,689,154 | | | $ | 12,861,166 | | | $ | - | | | $ | 133,550,320 | |

The following is a reconciliation of Level 3 assets (at either the beginning or ending of the period) for which significant unobservable inputs were used to determine fair value.

| | | Corporate Bonds |

| Balance as of 06/30/10 | | $ | 167,200 | |

| Accretion | | | 703 | |

| Realized Gain (Loss) | | | - | |

| Change in Unrealized Appreciation (Depreciation) | | | 21,302 | |

| Purchase | | | - | |

| Sale | | | - | |

| Transfers Out | | | (189,205 | ) |

| Balance as of 06/30/11 | | $ | 0 | |

| Net change in unrealized appreciation from investments held as of 06/30/11** | | $ | 21,302 | |

| | | | | |

| | | | | |

| | ** The unrealized appreciation is included in net change in unrealized appreciation (depreciation) on investments in the accompanying Statement of Operations. |

| PORTFOLIO HOLDINGS | | |

| % of Net Assets | | |

| Common Stock | 73.5 | % |

| Corporate Bonds | 6.8 | % |

| Foreign Municipal Bonds | 0.8 | % |

| Municipal Bonds | 0.2 | % |

| Money Market Funds | 0.0 | % |

| Cash and Other Net Assets | 18.7 | % |

| | 100.0 | % |

| See Notes to Financial Statements. | 7 | |

| |

AUXIER FOCUS FUND STATEMENT OF ASSETS AND LIABILITIES JUNE 30, 2011 |

| |

| | | | | | | |

| ASSETS | | | | |

| | Total investments, at value (Cost $110,898,036) | | $ | 133,550,320 | |

| | Cash | | | 33,467,355 | |

| | Receivables: | | | | |

| | | Fund shares sold | | | 427,695 | |

| | | Dividends and interest | | | 348,424 | |

| Total Assets | | | 167,793,794 | |

| | | | | | | |

| LIABILITIES | | | | |

| | Payables: | | | | |

| | | Investment securities purchased | | | 3,259,179 | |

| | | Fund shares redeemed | | | 25,622 | |

| | Accrued Liabilities: | | | | |

| | Investment adviser fees | | | 149,768 | |

| | | Trustees’ fees and expenses | | | 64 | |

| | | Other expenses | | | 134 | |

| Total Liabilities | | | 3,434,767 | |

| | | | | | | |

| NET ASSETS | | $ | 164,359,027 | |

| | | | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| | Paid-in capital | | $ | 138,316,692 | |

| | Undistributed net investment income | | | 1,068,800 | |

| | Accumulated net realized gain | | | 2,321,251 | |

| | Net unrealized appreciation | | | 22,652,284 | |

| NET ASSETS | | $ | 164,359,027 | |

| | | | | | | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | | |

| | Investor Shares | | | 9,950,599 | |

| | A Shares | | | 40,140 | |

| | | | | | | |

NET ASSET VALUE, OFFERING AND REDEMPTION* PRICE PER SHARE | | | | |

| | Investor Shares (based on net assets of $163,698,725) | | $ | 16.45 | |

| | A Shares (based on net assets of $660,302) | | $ | 16.45 | |

| | A Shares Maximum Public Offering Price Per Share (net asset value per share/(100%-5.75%)) | | $ | 17.45 | |

| * | Shares redeemed or exchanged within 180 days of purchase are charged a 2.00% redemption fee. |

| See Notes to Financial Statements. | 8 | |

| |

AUXIER FOCUS FUND STATEMENT OF OPERATIONS YEAR ENDED JUNE 30, 2011 |

| |

| | | | | | | | |

| INVESTMENT INCOME | | | | | |

| | Dividend income (Net of foreign withholding taxes of $25,346) | | $ | 2,336,781 | | |

| | Interest income | | | 1,403,344 | | |

| Total Investment Income | | | 3,740,125 | | |

| | | | | | |

| EXPENSES | | | | | |

| | Investment adviser fees | | | 1,598,181 | | |

| | Distribution fees: | | | | | |

| | A Shares | | | 825 | | |

| | Trustees' fees and expenses | | | 3,973 | | |

| Total Expenses | | | 1,602,979 | | |

| | Fees waived and expenses reimbursed | | | (4,798 | ) | |

| Net Expenses | | | 1,598,181 | | |

| | | | | | | | |

| NET INVESTMENT INCOME | | | 2,141,944 | | |

| | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | |

| | Net realized gain on investments | | | 2,423,959 | | |

| | Net change in unrealized appreciation (depreciation) on: | | | | | |

| | Investments | | | 22,101,085 | | |

| | Foreign currency translations | | | 13,809 | | |

| NET REALIZED AND UNREALIZED GAIN | | | 24,538,853 | | |

| INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 26,680,797 | | |

| | | | | | | | |

| See Notes to Financial Statements. | 9 | |

| |

AUXIER FOCUS FUND STATEMENTS OF CHANGES IN NET ASSETS |

| |

| | | | | | | | | | | | |

| | | | | For The Years Ended June 30, |

| | | | | 2011 | | | 2010 |

| OPERATIONS | | | | | | | | | |

| | Net investment income | | $ | 2,141,944 | | | | $ | 2,292,882 | |

| | Net realized gain | | | 2,423,959 | | | | | 696,183 | |

| | Net change in unrealized appreciation | | | 22,114,894 | | | | | 7,745,953 | |

| Increase in Net Assets Resulting from Operations | | | 26,680,797 | | | | | 10,735,018 | |

| | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | |

| | Net investment income: | | | | | | | | | |

| | | Investor Shares | | | (2,383,997 | ) | | | | (1,836,778 | ) |

| | | A Shares | | | (2,623 | ) | | | | (3,091 | ) |

| | Net realized gain: | | | | | | | | | |

| | | Investor Shares | | | (77,655 | ) | | | | - | |

| | | A Shares | | | (87 | ) | | | | - | |

| Total Distributions to Shareholders | | | (2,464,362 | ) | | | | (1,839,869 | ) |

| | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | |

| | Sale of shares: | | | | | | | | | |

| | | Investor Shares | | | 52,157,159 | | | | | 19,500,648 | |

| | | A Shares | | | 495,798 | | | | | 17,906 | |

| | Reinvestment of distributions: | | | | | | | | | |

| | | Investor Shares | | | 2,420,510 | | | | | 1,798,747 | |

| | | A Shares | | | 2,710 | | | | | 3,091 | |

| | Redemption of shares: | | | | | | | | | |

| | | Investor Shares | | | (15,775,082 | ) | | | | (14,133,080 | ) |

| | | A Shares | | | (37,201 | ) | | | | (27,077 | ) |

| | Redemption fees | | | 10,155 | | | | | 5,388 | |

| Increase in Net Assets from Capital Share Transactions | | | 39,274,049 | | | | | 7,165,623 | |

| Increase in Net Assets | | | 63,490,484 | | | | | 16,060,772 | |

| | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | |

| | Beginning of Year | | | 100,868,543 | | | | | 84,807,771 | |

| | End of Year (Including line (a)) | | $ | 164,359,027 | | | | $ | 100,868,543 | |

| | | | | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | | |

| | Sale of shares: | | | | | | | | | |

| | | Investor Shares | | | 3,353,252 | | | | | 1,392,563 | |

| | | A Shares | | | 30,902 | | | | | 1,257 | |

| | Reinvestment of distributions: | | | | | | | | | |

| | | Investor Shares | | | 159,532 | | | | | 128,025 | |

| | | A Shares | | | 179 | | | | | 220 | |

| | Redemption of shares: | | | | | | | | | |

| | | Investor Shares | | | (1,029,404 | ) | | | | (1,013,829 | ) |

| | | A Shares | | | (2,579 | ) | | | | (1,988 | ) |

| Increase in Shares | | | 2,511,882 | | | | | 506,248 | |

| | | | | | | | | | | | |

| (a) | Undistributed net investment income. | | $ | 1,068,800 | | | | $ | 1,314,468 | |

| See Notes to Financial Statements. | 10 | |

| |

AUXIER FOCUS FUND FINANCIAL HIGHLIGHTS |

| |

These financial highlights reflect selected data for a share outstanding throughout each year. | | | | | | |

| | | For the Years Ended June 30, | |

| | | 2011 | | | | 2010 | | | | 2009(a) | | | | 2008 | | | | 2007 | | |

| INVESTOR SHARES | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Year | $ | 13.49 | | | $ | 12.16 | | | $ | 14.22 | | | $ | 17.06 | | | $ | 14.76 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (b) | | 0.26 | | | | 0.32 | | | | 0.19 | | | | 0.18 | | | | 0.38 | | |

| Net realized and unrealized gain (loss) | | 3.00 | | | | 1.27 | | | | (1.77 | ) | | | (2.24 | ) | | | 2.66 | | |

| Total from Investment Operations | | 3.26 | | | | 1.59 | | | | (1.58 | ) | | | (2.06 | ) | | | 3.04 | | |

| DISTRIBUTIONS TO | | | | | | | | | | | | | | | | | | | | |

| SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.29 | ) | | | (0.26 | ) | | | (0.16 | ) | | | (0.31 | ) | | | (0.27 | ) | |

| Net realized gains | | (0.01 | ) | | | — | | | | (0.32 | ) | | | (0.47 | ) | | | (0.47 | ) | |

| Total Distributions to Shareholders | | (0.30 | ) | | | (0.26 | ) | | | (0.48 | ) | | | (0.78 | ) | | | (0.74 | ) | |

REDEMPTION FEES (b) | | — | (c) | | | — | (c) | | — | (c) | | — | (c) | | — | (c) |

| NET ASSET VALUE, End of Year | $ | 16.45 | | | $ | 13.49 | | | $ | 12.16 | | | $ | 14.22 | | | $ | 17.06 | | |

| TOTAL RETURN | | 24.35 | % | | 12.99 | % | | (10.92 | )% | | (12.56 | )% | | 21.11 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $163,699 | | | $100,712 | | | $84,660 | | | $103,664 | | | $116,774 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 1.68 | % | | 2.29 | % | | 1.53 | % | | 1.10 | % | | 2.40 | % |

| Net expense | | 1.25 | % | | 1.30 | % | | 1.35 | % | | 1.35 | % | | 1.35 | % |

| Gross expense (d) | | 1.25 | % | | 1.30 | % | | 1.35 | % | | 1.36 | % | | 1.36 | % |

| PORTFOLIO TURNOVER RATE | | 20 | % | | 15 | % | | 24 | % | | 19 | % | | 16 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Effective November 1, 2008, C Shares were reclassified as Investor Shares. For the Period July 1, 2008, through November 1, 2008, total return for C Shares was (12.68)%. For the aforementioned period, the annualized gross expense and net expense ratios were 2.35% and 2.10%, respectively. |

| (b) | Calculated based on average shares outstanding during the year. |

| (c) | Less than $0.01 per share. |

| (d) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| See Notes to Financial Statements. | 11 | |

| |

AUXIER FOCUS FUND FINANCIAL HIGHLIGHTS |

| |

These financial highlights reflect selected data for a share outstanding throughout each year. | | | | | | |

| | | For the Years Ended June 30, | |

| | | 2011 | | | | 2010 | | | | 2009 | | | | 2008 | | | | 2007 | | |

| A SHARES | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Year | $ | 13.49 | | | $ | 12.17 | | | $ | 14.22 | | | $ | 17.07 | | | $ | 14.77 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | 0.25 | | | | 0.32 | | | | 0.18 | | | | 0.17 | | | | 0.41 | | |

| Net realized and unrealized gain (loss) | | 3.01 | | | | 1.26 | | | | (1.75 | ) | | | (2.24 | ) | | | 2.63 | | |

| Total from Investment Operations | | 3.26 | | | | 1.58 | | | | (1.57 | ) | | | (2.07 | ) | | | 3.04 | | |

| DISTRIBUTIONS TO | | | | | | | | | | | | | | | | | | | | |

| SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.29 | ) | | | (0.26 | ) | | | (0.16 | ) | | | (0.31 | ) | | | (0.27 | ) | |

| Net realized gains | | (0.01 | ) | | | — | | | | (0.32 | ) | | | (0.47 | ) | | | (0.47 | ) | |

| Total Distributions to Shareholders | | (0.30 | ) | | | (0.26 | ) | | | (0.48 | ) | | | (0.78 | ) | | | (0.74 | ) | |

REDEMPTION FEES (a) | | — | (b) | | | — | (b) | | — | (b) | | — | (b) | | — | (b) | |

| NET ASSET VALUE, End of Year | $ | 16.45 | | | $ | 13.49 | | | $ | 12.17 | | | $ | 14.22 | | | $ | 17.07 | | |

TOTAL RETURN (c) | | 24.35 | % | | 12.90 | % | | (10.85 | )% | | (12.61 | )% | | 21.10 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $660 | | | $157 | | | $148 | | | $208 | | | $399 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 1.61 | % | | 2.29 | % | | 1.49 | % | | 1.08 | % | | 2.59 | % |

| Net expense | | 1.25 | % | | 1.30 | % | | 1.35 | % | | 1.35 | % | | 1.35 | % |

| Gross expense (d) | | 1.50 | % | | 1.55 | % | | 1.60 | % | | 1.60 | % | | 1.60 | % |

| PORTFOLIO TURNOVER RATE | | 20 | % | | 15 | % | | 24 | % | | 19 | % | | 16 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Less than $0.01 per share. |

| (c) | Total return does not include the effect of front-end sales charges or contingent deferred sales charges. |

| (d) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| See Notes to Financial Statements. | 12 | |

| |

AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2011 |

| |

Note 1. Organization

The Auxier Focus Fund (the “Fund”) is a diversified portfolio of Forum Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940 (the “Act”), as amended. Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund’s shares of beneficial interest without par value. The Fund currently offers two classes of shares: Investor Shares and A Shares. A Shares are offered at net asset value plus a maximum sales charge of 5.75%. A Shares are also subject to contingent deferred sales charge (“CDSC”) of 1.00% on purchases without an initial sales charge and redeemed less than one year after they are purchased. Investor Shares are not subject to a sales charge. Investor Shares and A Shares commenced operations on July 9, 1999 and July 8, 2005, respectively. The Fund’s investment objective is to provide long-term capital appreciation.

On August 27, 2008, the Board of Trustees of the Trust approved the conversion of the Fund’s C Shares into Investor Shares. On November 1, 2008, each shareholder of C Shares received Investor Shares in a dollar amount equal to their investment in C Shares as of that date.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increase and decrease in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted sale or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and ask price provided by independent pricing services. Non-exchange traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale at the mean of the last bid and ask prices provided by independent pricing services. Debt securities may be valued at prices supplied by a fund’s pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics such as rating, interest rate and maturity. Shares of open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the adviser believes that the values available are unreliable. Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The aggregate value by input level, as of June 30, 2011, for the Fund’s investments is included at the end of the Fund’s Schedule of Investments.

| |

AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2011 |

| |

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted in accordance with GAAP. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Foreign Currency Translations – Foreign currency amounts are translated into U.S. dollars as follows: (i) assets and liabilities at the rate of exchange at the end of the respective period; and (ii) purchases and sales of securities and income and expenses at the rate of exchange prevailing on the dates of such transactions. The portion of the results of operations arising from changes in the exchange rates and the portion due to fluctuations arising from changes in the market prices of securities are not isolated. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

The Fund may enter into transactions to purchase or sell foreign currencies to protect the U.S. dollar value of its underlying portfolio securities against the effect of possible adverse movements in foreign exchange rates. Principal risks associated with such transactions include the movement in value of the foreign currency relative to the U.S. dollar and the ability of the counterparty to perform. Fluctuations in the value of such forward currency transactions are recorded daily as unrealized gain or loss; realized gain or loss includes net gain or loss on transactions that have terminated by settlement or by a fund entering into offsetting commitments. These instruments involve market risk, credit risk, or both kinds of risks, in excess of the amount recognized in the Statement of Assets and Liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates.

Distributions to Shareholders – Distributions to shareholders of net investment income and net capital gains, if any, are declared and paid at least annually. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required.

As of June 30, 2011, there are no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund’s federal tax returns filed in the three-year period ended June 30, 2011, remain subject to examination by the Internal Revenue Service.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

The Fund’s class specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class’ respective net assets to the total net assets of the Fund.

Redemption Fees – A shareholder who redeems or exchanges shares within 180 days of purchase will incur a redemption fee of 2.00% of the current net asset value of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general

| |

AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2011 |

| |

indemnifications by the Fund to the counterparty to the contract. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 3. Advisory Fees, Servicing Fees and Other Transactions

Investment Adviser – Auxier Asset Management LLC (the “Adviser”), is the investment adviser to the Fund. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee from the Fund at an annual rate of 1.25% of the Fund’s average daily assets.

Under the terms of the Investment Advisory Agreement, the Adviser provides investment advisory services to the Fund and is obligated to pay all expenses of the Fund except any expenses they are authorized to pay under Rule 12b-1, brokerage fees and commissions, borrowing costs, taxes, certain compensation expenses of the Trustees, and extraordinary and non-recurring expenses.

Distribution – Foreside Fund Services, LLC serves as the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) (“Atlantic”) or their affiliates. The Fund has adopted a Distribution Plan (the “Plan”) for A Shares of the Fund in accordance with Rule 12b-1 of the Act. Under the Plan, the Fund pays the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of the average daily net assets of A Shares. The Distributor had no role in determining the investment policies or which securities are to be purchased or sold by the Trust or its Funds.

For the year ended June 30, 2011, there were $14,202 in front-end sales charges assessed on the sale of A Shares and no contingent deferred sales charges were assessed on the sale of A Shares. The Distributor received $3,702 of the total front-end sales charges.

Other Service Providers – Atlantic provides fund accounting, fund administration, and transfer agency services to the Fund. Atlantic also provides certain shareholder report production, and EDGAR conversion and filing services. Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $45,000 for service to the Trust ($66,000 for the Chairman). In addition, the Chairman receives a monthly stipend of $500 to cover certain expenses incurred in connection with his duties to the Trust. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees’ fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

Note 4. Expense Reimbursements and Fees Waived

The Adviser has contractually agreed to waive a portion of its fees and reimburse expenses through October 31, 2011, to the extent necessary to maintain the total operating expenses at 1.25% of average daily net assets of the Investor Shares and A Shares. These contractual waivers may be changed or eliminated at any time with consent of the Board. For the year ended June 30, 2011, expenses waived were $4,798.

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments for the year ended June 30, 2011, were $38,271,339 and $23,195,285, respectively.

| |

AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2011 |

| |

Note 6. Federal Income Tax and Investment Transactions

Distributions during the fiscal year ended were characterized for tax purposes as follows:

| Ordinary Income | | $ | 2,464,362 | | $ | 1,839,869 |

As of June 30, 2011, distributable earnings on a tax basis were as follows:

| Undistributed Ordinary Income | | $ | 1,225,893 | |

| Undistributed Long-Term Gain | | | 2,183,266 | |

| Unrealized Appreciation | | | 22,633,176 | |

| Total | | $ | 26,042,335 | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales and passive foreign investment companies.

On the Statement of Assets and Liabilities, as a result of permanent book to tax differences, certain amounts have been reclassified for the year ended June 30, 2011. The following reclassification was the result of real estate investment trusts and partnership adjustments and has no impact on the net assets of the Fund.

| Accumulated Net Investment Income (Loss) | | $ | (992 | ) |

| Undistributed Net Realized Gain (Loss) | | | 992 | |

Note 7. Recent Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements.” ASU No. 2010-06 clarifies existing disclosure and requires additional disclosures regarding fair value measurements. Effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years, entities will need to disclose information about purchases, sales, issuances and settlements of Level 3 securities on a gross basis, rather than as a net number as currently required. Management is currently evaluating the impact ASU No. 2010-06 will have on financial statement disclosures.

In May 2011, FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs.” ASU No. 2011-04 establishes common requirements for measuring fair value and for disclosing information about fair value measurements in accordance with U.S. GAAP and International Financial Reporting Standards (“IFRSs”). ASU No. 2011-04 is effective for interim and annual periods beginning after December 15, 2011. Management is currently evaluating the impact ASU No. 2011-04 may have on financial statement disclosures.

Note 8. Subsequent Events

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact and the Fund has had no such events.

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| |

To the Board of Trustees of Forum Funds

and the Shareholders of Auxier Focus Fund

We have audited the accompanying statement of assets and liabilities of the Auxier Focus Fund, a series of shares of beneficial interest in the Forum Funds, including the schedule of investments, as of June 30, 2011, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two year period then ended and the financial highlights for each of the years in the three year period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for each of the years in the two year period ended June 30, 2008 were audited by other auditors whose report dated August 25, 2008, expressed an unqualified opinion on such financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2011 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Auxier Focus Fund as of June 30, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two year period then ended and its financial highlights for each of the years in the three year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

August 22, 2011

| |

AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2011 |

| |

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (877) 328-9437, on the Fund's website at www.auxierasset.com and on the SEC’s website at www.sec.gov. The Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (877) 328-9437 and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees, and CDSC fees, and (2) ongoing costs, including management fees, 12b-1 fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2011, through June 30, 2011.

Actual Expenses – The first line under each share class in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line under each share class of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees, and CDSC fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs had been included, your costs would have been higher.

| |

AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2011 |

| |

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | January 1, 2011 | | June 30, 2011 | | Period* | | Ratio* |

| Investor Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,084.38 | | $ | 6.46 | | 1.25 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,018.60 | | $ | 6.26 | | 1.25 | % |

| A Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,084.38 | | $ | 6.46 | | 1.25 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,018.60 | | $ | 6.26 | | 1.25 | % |

| | | | | | | | | | | | |

| | *Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 to reflect the half-year period. |

Federal Tax Status of Dividends Declared during the Tax Year

For federal income tax purposes, dividends from short-term capital gains are classified as ordinary income. The Fund designates 69.86% of its income dividend distributed as qualifying for the corporate dividends-received deduction (DRD) and 89.45% for the qualified dividend rate (QDI) as defined in Section 1(h)(11) of the Internal Revenue Code. The Fund also designates 41.48% of its income dividends as qualified interest income exempt from U.S. tax for foreign shareholders (QII) and 100% of its short-term capital gain dividends as exempt from U.S. tax for foreign shareholders (QSD).

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust’s business affairs and of the exercise of all the Trust’s powers except those reserved for the shareholders. The following table provides information about each Trustee and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland, Maine 04101, unless otherwise indicated. Each Trustee oversees twenty portfolios in the Trust. Mr. Keffer is considered an Interested Trustee due to his affiliation with Atlantic. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (877) 328-9437.

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years |

| Independent Trustees | | | |

J. Michael Parish Born: 1943 | Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee | Since 1989 (Chairman since 2004) | Retired since 2003. |

Costas Azariadis Born: 1943 | Trustee; Chairman, Valuation Committee | Since 1989 | Professor of Economics, Washington University since 2006; Professor of Economics, University of California-Los Angeles 1992-2006. |

James C. Cheng Born: 1942 | Trustee; Chairman, Audit Committee | Since 1989 | President, Technology Marketing Associates (marketing company for small- and medium-sized businesses in New England) since 1991. |

| |

AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2011 |

| |

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years |

| Interested Trustee | | | |

John Y. Keffer1 Born: 1942 | Trustee; Vice Chairman | Since 1989 | Chairman, Atlantic since 2008; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company chartered in the State of Maine) since 1997. |

| Officers | | | |

Stacey E. Hong Born: 1966 | President; Principal Executive Officer | Since 2008 | President, Atlantic since 2008; Director, Consulting Services, Foreside Fund Services 2007. |

Karen Shaw Born: 1972 | Treasurer; Principal Financial Officer | Since 2008 | Senior Manager, Atlantic since 2008; Section Manager/Vice President, Enterprise Support Services, Citigroup 2003-2008. |

David Faherty Born: 1970 | Vice President | Since 2009 | Senior Counsel, Atlantic since 2009; Vice President, Citi Fund Services Ohio, Inc. 2007-2009; Associate Counsel, Investors Bank & Trust Co. 2006-2007. |

Michael J. McKeen Born: 1971 | Vice President | Since 2009 | Senior Manager, Atlantic since 2008; Vice President, Citigroup 2003-2008. |

Joshua LaPan Born: 1973 | Vice President | Since 2009 | Manager, Atlantic since 2008; Vice President, Citigroup 2003-2008. |

Timothy Bowden Born: 1969 | Vice President | Since 2009 | Manager, Atlantic since 2008; Vice President, Citigroup 2005-2008. |

Lina Bhatnagar Born: 1971 | Secretary | Since 2008 | Senior Administration Specialist, Atlantic since 2008; Regulatory Administration Specialist, Citigroup 2006-2008. |

1 Atlantic is a subsidiary of Forum Holdings Corp. I, a Delaware corporation that is wholly owned by Mr. Keffer.

FOR MORE INFORMATION

P.O. Box 588

Portland, Maine 04112

(877) 3AUXIER

(877) 328-9437

INVESTMENT ADVISER

Auxier Asset Management LLC

5285 Meadows Road

Suite 333

Lake Oswego, Oregon 97035

TRANSFER AGENT

Atlantic Fund Services

P.O. Box 588

Portland, Maine 04112

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

www.foreside.com

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for

distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes

information regarding the Fund’s risks, objectives, fees and expenses, experience of its management, and other

information.

204-ANR-0611

| |

DF DENT PREMIER GROWTH FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2011 |

| |

Dear Fellow Shareholder,

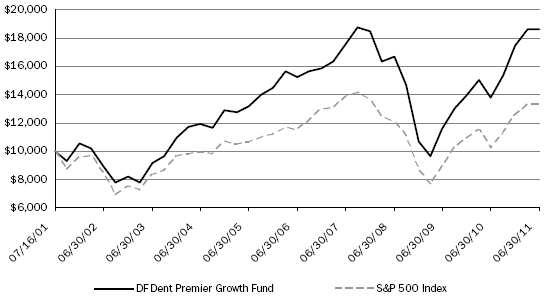

Performance

For the fiscal year ended June 30, 2011, the DF Dent Premier Growth Fund (the “Fund”) experienced a total return of +34.87% outperforming the total return of +30.69% for the S&P 500®Index (the “Index”), which is the Fund’s benchmark used for performance comparisons, by 4.18%. Your Fund has outperformed the Index in 8 of the 10 fiscal years since the Fund’s inception in July 2001 with a cumulative total return of +86.38% versus +33.05% for the Index. On a quarterly basis since the Fund’s inception, it has outperformed the Index in 28 of the 40 calendar quarters.

For a longer-term perspective, the Fund’s one-year, five-year and since inception average annual total return for the period ended June 30, 2011, were 34.87%, 4.15% and 6.45%, respectively. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (866) 233-3368. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.27%. However, the Fund’s Adviser has contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.10% on the first $150 million in Fund net assets and to 0.90% on net assets exceeding $150 million; otherwise, returns would have been lower. This agreement is in effect through October 31, 2012, per Board approval (prospectus to be updated fall, 2011). The contractual waivers may be changed or eliminated with the consent of the Board of Trustees at any time.

Expense Ratio Management

Your Fund’s Adviser, D.F. Dent & Company, Inc. (the “Adviser”), has again agreed to maintain your Fund’s expense ratio at a net 1.10% on the first $150 million of net assets and 0.90% on net assets exceeding $150 million through October 31, 2012, by reimbursing expenses and waiving management fees. The record of expense reimbursement and management fee waivers for the first ten years of your Fund is as follows:

| Year Ending | | Expense Reimbursement | | Management Fee Waived |

| 06/30/02 | | $ | 60,201 | | $ | 60,019 |

| 06/30/03 | | | 38,066 | | | 90,163 |

| 06/30/04 | | | 0 | | | 129,060 |

| 06/30/05 | | | 0 | | | 141,907 |

| 06/30/06 | | | 0 | | | 142,664 |

| 06/30/07 | | | 0 | | | 161,128 |

| 06/30/08 | | | 0 | | | 95,665 |

| 06/30/09 | | | 0 | | | 234,053 |

| 06/30/10 | | | 0 | | | 204,148 |

| 06/30/11 | | | 0 | | | 211,784 |

| Total | | $ | 98,267 | | $ | 1,470,591 |

| | 1 | DF DENT PREMIER GROWTH FUND |

| |

DF DENT PREMIER GROWTH FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2011 |

| |

Portfolio Turnover

Portfolio turnover for the year increased versus the prior two years. Involuntary turnover from sales pursuant to tender offers was 0.8% in 2008, 3.2% in 2009, 5.4% in 2010, and 4.5% in 2011. Therefore, excluding tender offers, voluntary portfolio turnover was still under 20% in the fiscal year 2011. Annual portfolio turnover since inception has been as follows:

| | | 2002* | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | Average |

| Portfolio Turnover** | | 0% | | 14% | | 20% | | 7% | | 25% | | 17% | | 21% | | 16% | | 8% | | 21% | | 15% |

We believe these low portfolio turnover rates are consistent with our investment strategy of holding positions for long periods and minimizing transaction expenses for shareholders. Brokerage expenses for the entire fiscal year’s trading amounted to less than $0.01 per share of your Fund. Thus, trading expense remained very low because of low portfolio turnover.

* The Fund commenced operations on July 16, 2001.

** Percentage calculated based on total value of investments.

Asset Allocation

Year-end asset allocation by market capitalization for the past five years was:

| | | 06/30/07 | | 06/30/08 | | 06/30/09 | | 06/30/10 | | 06/30/11 |

| Large Capitalization | | 36.1 | % | | 50.2 | % | | 36.8 | % | | 43.0 | % | | 50.2 | % |

| Mid Capitalization | | 43.5 | % | | 40.2 | % | | 52.9 | % | | 50.2 | % | | 40.6 | % |

| Small Capitalization | | 9.3 | % | | 9.4 | % | | 10.2 | % | | 6.3 | % | | 9.2 | % |

| Reserve Funds | | 11.1 | % | | 0.2 | % | | 0.1 | % | | 0.5 | % | | 0.0 | % |

| Total Fund | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

The Fund’s Prospectus has defined Mid Capitalization companies as those in the $1.5 billion to $7.0 billion market capitalization range, Large Capitalization companies as those with market capitalizations greater than $7.0 billion and Small Capitalization companies as those with market capitalizations under $1.5 billion.

Attribution

We have once again included in the Management Discussion of Fund Performance section later in this report, a bar graph of your Fund’s sector allocation versus the Index and a discussion of that allocation accompanied with commentary on stock selection within sectors of the Index.

Concentration

We have made an effort during the past four years to increase the position size in our favorite “core” holdings.

| | 2 | DF DENT PREMIER GROWTH FUND |

| |

DF DENT PREMIER GROWTH FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2011 |

| |

We do not consider this strategy to be “over concentrated”. In the past five years, our concentration in the top 10 holdings has been as follows:

| Top 10 Holdings | | 06/30/07 | | 06/30/08 | | 06/30/09 | | 06/30/10 | | 06/30/11 |

| % of Fund | | 25.5 | % | | 36.7 | % | | 55.82 | % | | 54.97 | % | | 52.46 | % |

| Average Position Size of Top 10 | | 2.6 | % | | 3.7 | % | | 5.6 | % | | 5.5 | % | | 5.2 | % |

We wrote in each of the past two years that we had reached the desired level of concentration and did not intend to increase concentration beyond the 06/30/09 level shown above. In each of these past two years your Fund has outperformed the Index by over 4% total return. We continue to believe that the current concentration in the top 10 positions is appropriate, at the desired level, and has enhanced performance.

Management Ownership of Fund

Employees, their families, and the Adviser’s retirement plan increased their ownership from 8.4% of the Fund two years ago to 10.0% one year ago and 11.0% of the Fund on 06/30/11. There were only management purchases and no redemptions during these periods.

A Domestic Fund?

Our Prospectus has always stated that the Fund invests primarily in domestic companies. Thus, it is a “domestic” fund. However, in recent years companies domiciled in the U.S. have invested overseas recognizing the growth opportunities in targeted emerging, developing and developed markets outside the U.S. (“OUS”). Consequently, the revenues of these domestic companies derived from OUS have increased as a result of these overseas investments, the growth of overseas markets, and the prolonged weakness in the U.S. dollar. In tracking the OUS revenues of the companies within the Fund based upon Bloomberg and Factset data we estimate that 37% of the Fund’s companies’ revenues are derived from OUS, while 63% come from domestic markets.

Today’s global economy is characterized by hundreds of trade lanes stretching in all directions around the world (an important reason for your Fund’s 7th largest holding and 3rd best 2011 fiscal year performance contributor- Expeditors International of Washington, Inc.): U.S. companies shipping to OUS, foreign companies shipping into the U.S., foreign companies shipping to foreign countries, U.S. companies with foreign plants shipping to foreign countries and back into the U.S., foreign companies shipping from their U.S. plants to U.S. and OUS, etc. It’s enough to give the poor mutual fund manager a migraine headache! Add to this the reporting, regulatory, ethical, and recently revealed accounting irregularities of foreign companies, and investing becomes even more challenging.

So, what does a “domestic” fund do? At your Fund we have always hitched our investment wagon to talented management teams with a track record of consistently executing high quality business models in these markets. We simply believe that these “best-in-class***” management teams, who understand their markets and trends far better than Wall Street analysts and portfolio managers, can continue to determine which markets to invest in and how to seek strong returns on invested capital.

| | 3 | DF DENT PREMIER GROWTH FUND |

| |

DF DENT PREMIER GROWTH FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2011 |

| |