As filed with the Securities and Exchange Commission on March 2, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Stacey E. Hong, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2010 – December 31, 2010

ITEM 1. REPORT TO STOCKHOLDERS.

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND DECEMBER 31, 2010 |

| |

Dear Shareholder,

A strong start to performance for the financial markets in the first quarter of 2010 gave way to a myriad of worries in the spring, as markets wrestled with European financial issues, China’s slowdown, and the Gulf Coast oil spill. The summer months of July and August were fairly volatile which gave way to a September that was one for the record books. The market exploded to the upside during September as investors began to respond to the potential positives of the economy getting better, a second go-around of quantitative easing by the Fed, and the possibility of having a more balanced Congress after the mid-term elections. The implementation of the second round of quantitative easing from the Fed coupled with the November elections that balanced the power between The Presid ent and Republicans ignited a rally in the markets in the fourth quarter that was, in our opinion, extremely robust in nature.

Due primarily to strong stockpicking, Adams Harkness Small Cap Growth Fund (the”Fund”) outperformed its benchmark, the Russell 2000 Growth Index. The Fund benefited from being overweight technology and consumer stocks. We were overweight these sectors because we believed that they would respond most favorably as the economy started to improve. We were also modestly underweight health-care stocks for most of 2010, which was also of benefit, although stockpicking in that sector contributed positively to performance. Among our best performers in 2010 were Riverbed Technology, whose products we believe significantly improve transmission speeds of data across wide area networks; Polypore International, which makes specialized membranes used in separation and filtration processes f or lithium batteries and electric drive vehicles; and Lululemon Athletica, a designer and retailer of technical athletic apparel primarily in North America. The Fund also benefitted from having a number of companies in which it had positions being taken over at premiums, such as EV 3 Corporation, Micrus Endovascular, and Netezza. While we did have stocks that did not live up to our expectations,--such as HH Gregg, DG FastChannel, Inc., a provider of digital technology services, and Intermune, a biotechnology company which had a negative decision from the FDA on a new product—these positions were not large positions in the Fund.

The portfolio was “procyclical”—which means it was positioned in sectors that could benefit from a recovering economy—for most of the year. We were overweight technology, consumer and energy sectors and increased our weighting in industrials as we moved through the year. We were underweight health-care and underweight financials. While we were “procyclical” with regard to sector weights, our discipline is to focus on companies that have, in our opinion, the strongest earnings prospects, driven in part by secular trends (which we call themes) and also in part by internal events such as strong new product cycles. Companies of this type, we believe, should be able to drive earnings growth despite economic headwinds or mounting concerns over the direction of policy, particularly when these concerns are more global than domestic in nature.

As you know, a thematic overlay is an integral part of our investment approach; we focus on those themes that we believe are secular as opposed to cyclical. While the broad themes we utilize do not change very often, the sub-themes within those broader themes can change more frequently. Within the technology sector, we have focused on several sub-themes of “virtualization—the move to the cloud”; “the second wave of networking”, and “smart phones and tablets take over the world”. While topical, it is important to note that all of these sub-themes, in our opinion, have at their heart a strong positive economic proposition that drives them

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND DECEMBER 31, 2010 |

| |

forward. For cloud computing, which is a general term for anything that involves delivering hosted services over the Internet, it is estimated that the move to the cloud can cut a corporation’s information technology costs in half; for networking—which in the information age is our new infrastructure—demand is driven by the growth of corporations’ businesses; and it is our belief that smart phones and tablets represent another evolution in making technology an integral part of our daily intellectual, emotional, and economic experience—an extension of ourselves, in essence. Within the consumer sector we are focused on a strong value proposition (which does not necessarily mean the cheapest) and the ability to connect with the consumer on an emotional level and provide a differentiated experience. We have similar themes across the industrial, energy and health-care sectors.

It is our belief that this will remain a stockpicker’s market for some time to come. It is our view that overall growth stocks are currently cheap on a price/earnings basis, as investor confidence in that earnings growth is extremely low. Our strategy therefore is to purchase those companies that we believe to be “the best of the best”, given the information we have in hand today. In our experience, while periods such as this one can be frustrating, over time the market tends to be reasonably efficient. We believe as we move through the next 12 months the market will once again begin paying for earnings growth by awarding premium multiples to those companies that can deliver earnings growth at above average rates.

The main risk to our investment strategy would be another significant global recession; while that is always a possibility, we think that possibility is diminished by the fact that all the government banks around the world seem to be dedicated to providing significant liquidity and preventing, to the extent possible, another economic recession. Normally, we would cite an increase in bond yields as presenting a risk. However, given the market’s strong fear of deflation, it does not appear certain to us that a slight rise in interest rates, were it driven by an increase in inflation, would be viewed by the market as a negative event. In regards to specific sectors, we are underweight financials, due to the poor outlook for earnings. We are watching the sector closely and will increas e our weighting if we see the outlook improving. Finally, the risk that is always present is that we pick the wrong stocks. Consqeuently, we remain focused on diligently employing our investment process to mitigate this risk.

Sincerely,

Mary Lisanti, CFA

President & Portfolio Manager

An investment in the Fund is subject to risk, including the possible loss of principal amount invested. Investments in small-sized companies pose greater risks than those typically associated with larger, more established companies such as increased volatility of earnings and prospects, higher failure rates, and limited markets, product lines or financial resources.

The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an index. Price-to-book ratio is used to compare a stock’s market

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND DECEMBER 31, 2010 |

| |

value to its book value. Book Value is the total asset of a company minus total liability. Price to earnings ratio is the valuation of a company’s current share price compared to its per-share earnings.

The views in this report were those of the Fund manager as of December 31, 2010, and may not necessarily reflect her views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding the Fund’s investment methodology and do not constitute investment advice.

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND DECEMBER 31, 2010 |

| |

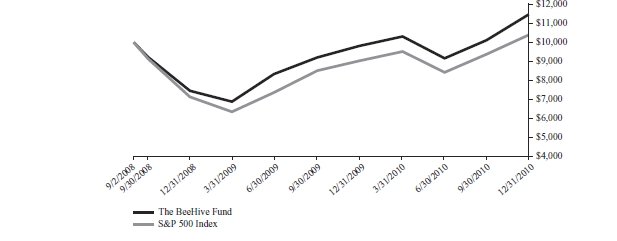

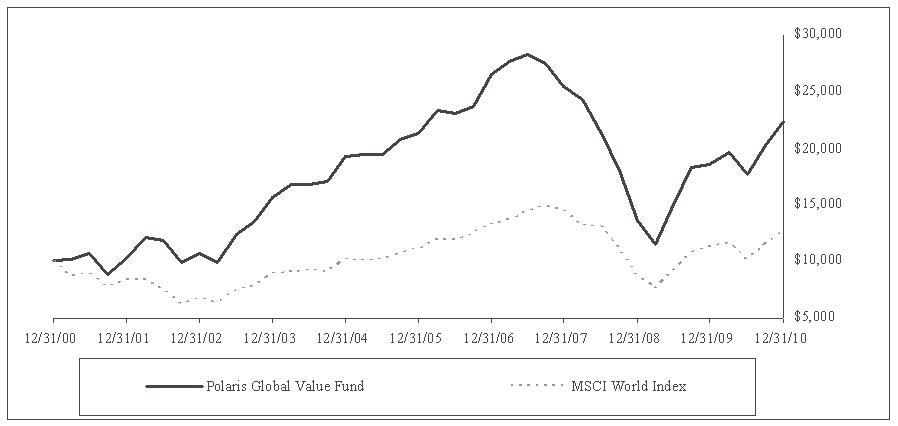

The following chart reflects the change in the value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in the Adams Harkness Small Cap Growth Fund (the “Fund”) compared with the performance of the benchmark Russell 2000 Growth Index ("Russell 2000 Growth"), since inception. The Russell 2000 Growth, the Fund‘s primary performance benchmark, measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. The total return of the Russell 2000 Growth includes reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the Russell 2000 Growth does not include expenses. The Fund is professionally managed while the Russell 2 000 Growth is unmanaged and is not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance please call (800) 441-7031, on the Fund's website at www.ahsmallcap.com. For the most recent month-end performance, please visit the website of the Fund's investment adviser at www.ahsmallcap.com. As stated in the Fund's prospectus, the annual operating expense ratio (gross) is 4.01%. Shares re deemed or exchanged within 30 days of purchase will be charged a 1.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| Average Annual Total Return as of 12/31/10 | One Year | Five Year | Since Inception 2/27/04 |

| Adams Harkness Small Cap Growth Fund | 34.80% | 2.34% | 4.65% |

| Russell 2000 Growth Index | 29.09% | 5.30% | 5.75% |

Investment Value as of 12/31/10

| Adams Harkness Small Cap Growth Fund | $13,651 |

| Russell 2000 Growth Index | $14,664 |

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND SCHEDULE OF INVESTMENTS DECEMBER 31, 2010 |

| |

| Shares | | Security Description | | Value | |

| Common Stock - 94.2% |

| Biotechnology - 3.8% |

| | 3,429 | | Alimera Sciences, Inc. (a) | $ | 35,593 | |

| | 2,997 | | Imris, Inc. (a) | | 17,113 | |

| | 3,350 | | InterMune, Inc. (a) | | 121,940 | |

| | 9,425 | | NPS Pharmaceuticals, Inc. (a) | | 74,457 | |

| | 1,700 | | Onyx Pharmaceuticals, Inc. (a) | | 62,679 | |

| | 3,080 | | Orexigen Therapeutics, Inc. (a) | | 24,886 | |

| | 1,660 | | Pharmasset, Inc. (a) | | 72,061 | |

| | 3,670 | | Theravance, Inc. (a) | | 92,007 | |

| | | 500,736 | |

| Business Services - 4.6% |

| | 835 | | American Public Education, Inc. (a) | | 31,095 | |

| | 3,030 | | Dice Holdings, Inc. (a) | | 43,480 | |

| | 457 | | Heidrick & Struggles International, Inc. | | 13,093 | |

| | 5,885 | | Kenexa Corp. (a) | | 128,234 | |

| | 3,560 | | Kforce, Inc. (a) | | 57,601 | |

| | 2,475 | | Korn/Ferry International (a) | | 57,197 | |

| | 1,570 | | Rackspace Hosting, Inc. (a) | | 49,314 | |

| | 3,985 | | SuccessFactors, Inc. (a) | | 115,406 | |

| | 2,155 | | The Advisory Board Co. (a) | | 102,643 | |

| | | 598,063 | |

| Chemicals - 2.1% |

| | 6,630 | | Polypore International, Inc. (a) | | 270,040 | |

| | | | | | | |

| Communications Equipment - 5.0% |

| | 5,680 | | Acme Packet, Inc. (a) | | 301,949 | |

| | 4,900 | | Aruba Networks, Inc. (a) | | 102,312 | |

| | 9,100 | | Ixia (a) | | 152,698 | |

| | 2,755 | | Riverbed Technology, Inc. (a) | | 96,893 | |

| | | 653,852 | |

| Consumer Discretionary - 10.4% |

| | 3,225 | | BJ's Restaurants, Inc. (a) | | 114,262 | |

| | 8,135 | | Bravo Brio Restaurant Group, Inc. (a) | | 155,948 | |

| | 5,210 | | CROCS, Inc. (a) | | 89,195 | |

| | 1,070 | | Deckers Outdoor Corp. (a) | | 85,322 | |

| | 1,405 | | Hibbett Sports, Inc. (a) | | 51,844 | |

| | 16,725 | | Krispy Kreme Doughnuts, Inc. (a) | | 116,740 | |

| | 1,340 | | Lululemon Athletica, Inc. (a) | | 91,683 | |

| | 895 | | OpenTable, Inc. (a) | | 63,079 | |

| | 5,830 | | Pinnacle Entertainment, Inc. (a) | | 81,737 | |

| | 4,690 | | Saks, Inc. (a) | | 50,183 | |

| | 2,554 | | Shutterfly, Inc. (a) | | 89,467 | |

| | 1,265 | | Steven Madden, Ltd. (a) | | 52,776 | |

| | 3,420 | | Texas Roadhouse, Inc. (a) | | 58,721 | |

| | 1,535 | | The Buckle, Inc. | | 57,977 | |

| | 8,060 | | THQ, Inc. (a) | | 48,844 | |

| | 4,615 | | Vera Bradley, Inc. (a) | | 152,295 | |

| | | 1,360,073 | |

| Consumer Retail - 4.8% |

| | 6,135 | | AnnTaylor Stores Corp. (a) | | 168,038 | |

| | 4,565 | | Chico's FAS, Inc. | | 54,917 | |

| | 3,325 | | Ulta Salon Cosmetics & Fragrance, Inc. (a) | | 113,050 | |

| | 3,835 | | Vitamin Shoppe, Inc. (a) | | 129,009 | |

| | 5,990 | | Zumiez, Inc. (a) | | 160,951 | |

| | | 625,965 | |

| Consumer Services - 1.4% |

| | 3,220 | | Ancestry.com, Inc. (a) | | 91,190 | |

| | 1,450 | | MWI Veterinary Supply, Inc. (a) | | 91,568 | |

| | | 182,758 | |

| Consumer Staples - 0.8% |

| | 8,025 | | SunOpta, Inc. (a) | | 62,756 | |

| | 880 | | The Fresh Market, Inc. (a) | | 36,256 | |

| | | 99,012 | |

| Energy - 10.3% |

| | 5,895 | | Approach Resources, Inc. (a) | | 136,174 | |

| | 5,790 | | Basic Energy Services, Inc. (a) | | 95,419 | |

| | 9,290 | | Brigham Exploration Co. (a) | | 253,060 | |

| | 4,130 | | Carrizo Oil & Gas, Inc. (a) | | 142,444 | |

| | 7,200 | | Complete Production Services, Inc. (a) | | 212,760 | |

| | 2,380 | | Lufkin Industries, Inc. | | 148,488 | |

| | 3,895 | | Northern Oil and Gas, Inc. (a) | | 105,983 | |

| | 4,930 | | Oasis Petroleum, Inc. (a) | | 133,702 | |

| | 2,880 | | Rosetta Resources, Inc. (a) | | 108,403 | |

| | | 1,336,433 | |

| Financial Services - 3.1% |

| | 4,695 | | Cardtronics, Inc. (a) | | 83,102 | |

| | 4,515 | | Dollar Financial Corp. (a) | | 129,264 | |

| | 6,941 | | Envestnet, Inc. (a) | | 118,413 | |

| | 1,300 | | Green Dot Corp., Class A (a) | | 73,762 | |

| | | 404,541 | |

| Health-Care - 5.7% |

| | 4,450 | | Cepheid, Inc. (a) | | 101,237 | |

| | 2,225 | | Cyberonics, Inc. (a) | | 69,020 | |

| | 4,930 | | DexCom, Inc. (a) | | 67,295 | |

| | 1,720 | | HeartWare International, Inc. (a) | | 150,620 | |

| | 4,180 | | MAKO Surgical Corp. (a) | | 63,620 | |

| | 4,420 | | Volcano Corp. (a) | | 120,710 | |

| | 4,486 | | Zoll Medical Corp. (a) | | 167,014 | |

| | | 739,516 | |

| Health-Care Services - 6.6% |

| | 1,355 | | athenahealth, Inc. (a) | | 55,528 | |

| | 2,685 | | Catalyst Health Solutions, Inc. (a) | | 124,826 | |

| | 1,020 | | Healthspring, Inc. (a) | | 27,061 | |

| | 1,830 | | HMS Holdings Corp. (a) | | 118,529 | |

| See Notes to Financial Statements. | 5 | |

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND SCHEDULE OF INVESTMENTS DECEMBER 31, 2010 |

| |

| Shares | | Security Description | | Value | |

| | 5,194 | | Medidata Solutions, Inc. (a) | $ | 124,033 | |

| | 3,750 | | Nektar Therapeutics (a) | | 48,187 | |

| | 9,380 | | NxStage Medical, Inc. (a) | | 233,374 | |

| | 2,615 | | Salix Pharmaceuticals, Ltd. (a) | | 122,800 | |

| | | 854,338 | |

| Industrials - 9.3% |

| | 2,605 | | Ameresco, Inc., Class A (a) | | 37,408 | |

| | 4,425 | | American Axle & Manufacturing Holdings, Inc. (a) | | 56,906 | |

| | 2,825 | | ArvinMeritor, Inc. (a) | | 57,969 | |

| | 11,100 | | Commercial Vehicle Group, Inc. (a) | | 180,375 | |

| | 6,315 | | Daktronics, Inc. | | 100,535 | |

| | 4,050 | | FleetCor Technologies, Inc. (a) | | 125,226 | |

| | 7,055 | | Globe Specialty Metals, Inc. | | 120,570 | |

| | 2,815 | | GrafTech International, Ltd. (a) | | 55,850 | |

| | 1,421 | | Haynes International, Inc. | | 59,440 | |

| | 1,075 | | HEICO Corp. | | 54,857 | |

| | 3,510 | | Maxwell Technologies, Inc. (a) | | 66,304 | |

| | 1,340 | | Portfolio Recovery Associates, Inc. (a) | | 100,768 | |

| | 2,350 | | Rush Enterprises, Inc. (a) | | 48,034 | |

| | 799 | | Stoneridge, Inc. (a) | | 12,616 | |

| | 3,925 | | Titan International, Inc. | | 76,694 | |

| | 5,140 | | Wabash National Corp. (a) | | 60,909 | |

| | | 1,214,461 | |

| Materials - 2.4% |

| | 11,910 | | Horsehead Holding Corp. (a) | | 155,306 | |

| | 2,800 | | Kronos Worldwide, Inc. | | 118,972 | |

| | 915 | | Rockwood Holdings, Inc. (a) | | 35,795 | |

| | | 310,073 | |

| Semiconductors and Semiconductor Equipment - 1.4% |

| | 4,715 | | Cavium Networks, Inc. (a) | | 177,661 | |

| Software - 5.0% |

| | 5,940 | | Ariba, Inc. (a) | | 139,531 | |

| | 5,655 | | BroadSoft, Inc. (a) | | 135,041 | |

| | 3,770 | | LogMeIn, Inc. (a) | | 167,162 | |

| | 2,535 | | TIBCO Software, Inc. (a) | | 49,965 | |

| | 3,335 | | Ultimate Software Group, Inc. (a) | | 162,181 | |

| | | 653,880 | |

| Technology - 17.5% |

| | 17,320 | | Anadigics, Inc. (a) | | 120,028 | |

| | 4,620 | | Aspen Technology, Inc. (a) | | 58,697 | |

| | 3,540 | | Atheros Communications, Inc. (a) | | 127,157 | |

| | 3,820 | | Calix, Inc. (a) | | 64,558 | |

| | 1,840 | | CommVault Systems, Inc. (a) | | 52,661 | |

| | 2,235 | | comScore, Inc. (a) | | 49,863 | |

| | 5,795 | | Cypress Semiconductor Corp. (a) | | 107,671 | |

| | 10,655 | | Entropic Communications, Inc. (a) | | 128,712 | |

| | 5,554 | | Finisar Corp. (a) | | 164,898 | |

| | 5,010 | | Fortinet, Inc. (a) | | 162,073 | |

| | 6,175 | | IntraLinks Holdings, Inc. (a) | | 115,534 | |

| | 2,565 | | Microsemi Corp. (a) | | 58,739 | |

| | 4,124 | | Motricity, Inc. (a) | | 76,583 | |

| | 3,525 | | Netlogic Microsystems, Inc. (a) | | 110,720 | |

| | 4,675 | | NetSuite, Inc. (a) | | 116,875 | |

| | 3,385 | | Newport Corp. (a) | | 58,797 | |

| | 3,895 | | Omnivision Technologies, Inc. (a) | | 115,331 | |

| | 1,850 | | Opnet Technologies, Inc. | | 49,525 | |

| | 2,285 | | QLIK Technologies, Inc. (a) | | 58,976 | |

| | 3,270 | | RealD, Inc. (a) | | 84,758 | |

| | 8,080 | | RF Micro Devices, Inc. (a) | | 59,388 | |

| | 2,135 | | SAVVIS, Inc. (a) | | 54,485 | |

| | 2,680 | | SemiLEDs Corp. (a) | | 77,854 | |

| | 6,275 | | Sierra Wireless, Inc. (a) | | 93,623 | |

| | 4,495 | | TriQuint Semiconductor, Inc. (a) | | 52,547 | |

| | 3,550 | | ValueClick, Inc. (a) | | 56,907 | |

| | | 2,276,960 | |

Total Common Stock (Cost $10,128,967) | | 12,258,362 | |

Total Investments - 94.2% (Cost $10,128,967)* | $ | 12,258,362 | |

| Other Assets & Liabilities, Net – 5.8% | | 748,937 | |

| Net Assets – 100.0% | $ | 13,007,299 | |

| (a) | Non-income producing security. |

| | *Cost of investments for federal income tax purposes is $10,186,752 and net unrealized appreciation on investments consists of: |

| Gross Unrealized Appreciation | | $ | 2,165,818 | |

| Gross Unrealized Depreciation | | | (94,208 | ) |

| Net Unrealized Appreciation | | $ | 2,071,610 | |

| See Notes to Financial Statements. | 6 | |

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND SCHEDULE OF INVESTMENTS DECEMBER 31, 2010 |

| |

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2010.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the tables below, please refer to Note 2 - Security Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs | | Investments in Securities |

| Level 1 – Quoted Prices | | $ | 12,258,362 |

| Level 2 – Other Significant Observable Inputs | | | – |

| Level 3 – Significant Unobservable Inputs | | | – |

| Total Investments | | $ | 12,258,362 |

The Level 1 inputs displayed in this table are Common Stock. Refer to the Schedule of Investments for a further breakout of each security by type.

| PORTFOLIO HOLDINGS | | |

| % of Total Investments | | |

| | | |

| Biotechnology | 4.1 | % |

| Business Services | 4.9 | % |

| Chemicals | 2.2 | % |

| Communications Equipment | 5.3 | % |

| Consumer Discretionary | 11.1 | % |

| Consumer Retail | 5.1 | % |

| Consumer Services | 1.5 | % |

| Consumer Staples | 0.8 | % |

| Energy | 10.9 | % |

| Financial Services | 3.3 | % |

| Health-Care | 6.0 | % |

| Health-Care Services | 7.0 | % |

| Industrials | 9.9 | % |

| Materials | 2.5 | % |

| Semiconductors and Semiconductor Equipment | 1.5 | % |

| Software | 5.3 | % |

| Technology | 18.6 | % |

| | 100.0 | % |

| See Notes to Financial Statements. | 7 | |

|

ADAMS HARKNESS SMALL CAP GROWTH FUND STATEMENT OF ASSETS AND LIABILITIES DECEMBER 31, 2010 |

| |

| | | | | | | |

| ASSETS | | | | |

| | Total investments, at value (Cost $10,128,967) | | $ | 12,258,362 | |

| | Cash | | | 378,348 | |

| | Receivables: | | | | |

| | | Fund shares sold | | | 396,698 | |

| | | Dividends and interest | | | 68 | |

| | Prepaid expenses | | | 12,030 | |

| Total Assets | | | 13,045,506 | |

| | | | | | | |

| LIABILITIES | | | | |

| | Accrued Liabilities: | | | | |

| | Investment adviser fees | | | 2,564 | |

| | | Trustees’ fees and expenses | | | 7 | |

| | | Fund service fees | | | 3,314 | |

| | | Compliance services fees | | | 2,083 | |

| | | Other expenses | | | 30,239 | |

| Total Liabilities | | | 38,207 | |

| | | | | | | |

| NET ASSETS | | $ | 13,007,299 | |

| | | | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| | Paid-in capital | | $ | 14,464,318 | |

| | Accumulated net realized loss | | | (3,586,414 | ) |

| | Net unrealized appreciation | | | 2,129,395 | |

| NET ASSETS | | $ | 13,007,299 | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | 1,032,881 | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE* PER SHARE | | $ | 12.59 | |

| * | Shares redeemed or exchanged within 30 days of purchase are charged a 1.00% redemption fee. | | | | |

| See Notes to Financial Statements. | 8 | |

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND STATEMENT OF OPERATIONS YEAR ENDED DECEMBER 31, 2010 |

| |

| | | | | | | | |

| INVESTMENT INCOME | | | | | |

| | Dividend income | | $ | 10,428 | | |

| | Interest income | | | 554 | | |

| Total Investment Income | | | 10,982 | | |

| EXPENSES | | | | | |

| | Investment adviser fees | | | 118,784 | | |

| | Fund service fees | | | 148,797 | | |

| | Shareholder service fees | | | 29,696 | | |

| | Custodian fees | | | 4,682 | | |

| | Registration fees | | | 17,552 | | |

| | Professional fees | | | 55,722 | | |

| | Trustees’ fees and expenses | | | 404 | | |

| | Compliance services fees | | | 28,001 | | |

| | Miscellaneous expenses | | | 27,038 | | |

| Total Expenses | | | 430,676 | | |

| | Fees waived | | | (152,329 | ) | |

| Net Expenses | | | 278,347 | | |

| | | | | | | | |

| NET INVESTMENT LOSS | | | (267,365 | ) | |

| | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN | | | | | |

| | Net realized gain on investments | | | 3,437,945 | | |

| | Net change in unrealized appreciation (depreciation) on investments | | | 92,228 | | |

| NET REALIZED AND UNREALIZED GAIN | | | 3,530,173 | | |

| INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 3,262,808 | | |

| | | | | | | | |

| See Notes to Financial Statements. | 9 | |

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND STATEMENT OF CHANGES IN NET ASSETS |

| |

| | | | | For the Year Ended December 31, 2010 | | | For the Year Ended December 31, 2009 | |

| OPERATIONS | | | | | | | | | | |

| | Net investment loss | | $ | (267,365 | ) | | | $ | (353,995 | ) | |

| | Net realized gain | | | 3,437,945 | | | | | 1,230,533 | | |

| | Net change in unrealized appreciation (depreciation) | | | 92,228 | | | | | 1,170,832 | | |

| Increase in Net Assets Resulting from Operations | | | 3,262,808 | | | | | 2,047,370 | | |

| | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | | |

| | Sale of shares | | | 3,348,366 | | | | | 1,667,229 | | |

| | Redemption of shares | | | (6,007,810 | ) | | | | (5,288,742 | ) | |

| | Redemption fees | | | 387 | | | | | 40 | | |

| Decrease in Net Assets from Capital Share Transactions | | | (2,659,057 | ) | | | | (3,621,473 | ) | |

| Increase (Decrease) in Net Assets | | | 603,751 | | | | | (1,574,103 | ) | |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | |

| | Beginning of Year | | | 12,403,548 | | | | | 13,977,651 | | |

| | End of Year | | $ | 13,007,299 | | | | $ | 12,403,548 | | |

| | | | | | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | | | |

| | Sale of shares | | | 305,740 | | | | | 223,978 | | |

| | Redemption of shares | | | (600,337 | ) | | | | (714,991 | ) | |

| Decrease in Shares | | | (294,597 | ) | | | | (491,013 | ) | |

| | | | | | | | | | | | | |

| See Notes to Financial Statements. | 10 | |

| |

ADAMS HARKNESS SMALL CAP GROWTH FUND FINANCIAL HIGHLIGHTS |

| |

These financial highlights reflect selected data for a share outstanding throughout each year.

| | | | | | | |

| | | For the Years Ended December 31, | |

| | | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Year | $ | 9.34 | | | $ | 7.69 | | | $ | 14.38 | | | $ | 12.36 | | | $ | 12.03 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment loss (a) | | (0.23 | ) | | | (0.23 | ) | | | (0.19 | ) | | | (0.23 | ) | | | (0.18 | ) | |

| Net realized and unrealized gain (loss) | | 3.48 | | | | 1.88 | | | | (6.23 | ) | | | 2.77 | | | | 0.51 | (d) |

| Total from Investment Operations | | 3.25 | | | | 1.65 | | | | (6.42 | ) | | | 2.54 | | | | 0.33 | | |

| DISTRIBUTIONS TO | | | | | | | | | | | | | | | | | | | | |

| SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | | | |

| Net realized gain | | — | | | | — | | | | (0.27 | ) | | | (0.52 | ) | | | — | | |

| REDEMPTION FEES (a) | | — | (b) | — | (b) | — | (b) | — | (b) | | — | (b) |

| NET ASSET VALUE, End of Year | $ | 12.59 | | | $ | 9.34 | | | $ | 7.69 | | | $ | 14.38 | | | $ | 12.36 | | |

| TOTAL RETURN | | 34.80 | % | | 21.46 | % | | (44.63 | )% | | 20.54 | % | | 2.74 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $13,007 | | | $12,404 | | | $13,978 | | | $28,505 | | | $27,212 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | (2.25 | )% | | (2.97 | )% | | (1.68 | )% | | (1.70 | )% | | (1.41 | )% |

| Net expense | | 2.34 | % | | 3.08 | % | | 1.90 | % | | 1.82 | % | | 1.65 | % |

| Gross expense (c) | | 3.63 | % | | 4.01 | % | | 2.78 | % | | 2.36 | % | | 2.65 | % |

| PORTFOLIO TURNOVER RATE | | 319 | % | | 381 | % | | 521 | % | | 380 | % | | 497 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during the year. |

| (b) | Less than $0.01 per share. |

| (c) | Reflects the expense ratio excluding any waivers or reimbursements. |

| (d) | Per share amount does not reflect the actual net realized and unrealized gain/loss for the period because of the timing of sales of the Fund shares and the amount of per share realized and unrealized gains and losses at such time. |

| See Notes to Financial Statements. | 11 | |

|

ADAMS HARKNESS SMALL CAP GROWTH FUND NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2010 |

| |

Note 1. Organization

The Adams Harkness Small Cap Growth Fund (the “Fund”) is a diversified portfolio of Forum Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940 (the “Act”), as amended. Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund’s shares of beneficial interest without par value. The Fund commenced operations on February 27, 2004. The Fund seeks to maximize capital appreciation.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increase and decrease in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted sale or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and ask price provided by independent pricing services. Non-exchange traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale at the mean of the last bid and ask prices provided by independent pricing servi ces. Shares of open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the adviser believes that the values available are unreliable. Fair valuation is based on subjective factors and as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value

|

ADAMS HARKNESS SMALL CAP GROWTH FUND NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2010 |

| |

of investments)

The aggregate value by input level, as of December 31, 2010, for the Fund’s investments is included at the end of the Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium and discount is amortized and accreted in accordance with GAAP. Identified cost of investments so ld is used to determine the gain and loss for both financial statement and federal income tax purposes.

Distributions to Shareholders – Distributions to shareholders of net investment income, if any, are declared and paid at least quarterly. Distributions to shareholders of net capital gains, if any, are declared and paid annually. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required.

As of December 31, 2010, there are no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund’s federal tax returns filed in the three-year period ended December 31, 2010, remain subject to examination by the Internal Revenue Service.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Redemption Fees – A shareholder who redeems or exchanges shares within 30 days of purchase will incur a redemption fee of 1.00% of the current net asset value of shares redeemed or exchanged, subject to certain

|

ADAMS HARKNESS SMALL CAP GROWTH FUND NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2010 |

| |

limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

Note 3. Advisory Fees, Servicing Fees and Other Transactions

Investment Adviser – AH Lisanti Capital Growth, LLC (the “Adviser”) is the investment adviser to the Fund. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee from the Fund at an annual rate of 1.00% of the Fund’s average daily net assets.

Shareholder Service Plan – The Trust has adopted a shareholder service plan for the Fund under which the Fund may reimburse the Fund’s administrator for amounts paid by the administrator for providing shareholder service activities that are not otherwise provided by the Transfer Agent. The Fund’s administrator may make such payments to various financial institutions, including the Adviser, that provide shareholder servicing to their customers invested in the Fund in amounts of up to 0.25% annually of the average daily net assets of the shares held by such customers.

Distribution – Foreside Fund Services, LLC serves as the Fund’s distributor (the “Distributor”). The Distributor receives no compensation from the Fund for its distribution services. The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) (“Atlantic”) or their affiliates.

Other Service Providers – Atlantic provides fund accounting, fund administration, and transfer agency services to the Fund. Atlantic also provides certain shareholder report production, and EDGAR conversion and filing services. Pursuant to an Atlantic services agreement, the Fund pays Atlantic customary fees for its services. Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $40,000 for service to the Trust ($60,000 for the Chairman). In addition, the Chairman receives a monthly stipend of $500 to cover certain expenses incurred in connection with his duties to the Trust. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees’ fees attri butable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

|

ADAMS HARKNESS SMALL CAP GROWTH FUND NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2010 |

| |

Note 4. Fees Waived

During the period, certain Fund service providers have voluntarily agreed to waive a portion of their fees. Effective July 1, 2010, the Fund’s Adviser has voluntarily agreed to waive a portion of its fees and/or reimburse expenses so to cap the expense ratio at 1.80%. These voluntary waivers may be reduced or eliminated at any time. For the fiscal year ended December 31, 2010, fees waived were as follows:

| Adviser Fees Waived | | Fund Service Fees Waived | | Compliance Service Fees Waived | | Total Fees Waived |

| $43,114 | | $106,436 | | $2,779 | | $152,329 |

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments for the fiscal year ended December 31, 2010, were $37,364,205 and $40,943,637, respectively.

Note 6. Federal Income Tax and Investment Transactions

As of December 31, 2010, distributable earnings (accumulated losses) on a tax basis were as follows:

| Unrealized Appreciation | | $ | 2,071,610 | |

| Capital Losses | | | (3,528,629 | ) |

| Total | | $ | (1,457,019 | ) |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales.

As of December 31, 2010, the Fund had capital loss carryforwards to offset future capital gains of $712,424 and $2,816,205, expiring in 2016 and 2017, respectively.

On the Statement of Assets and Liabilities, as a result of permanent book to tax differences, certain amounts have been reclassified for the year ended December 31, 2010. The following reclassification was the result of net operating losses and has no impact on the net assets of the Fund.

| Accumulated Net Investment Income (Loss) | | $ | 267,365 |

| Paid-in-Capital | | | (267,365) |

|

ADAMS HARKNESS SMALL CAP GROWTH FUND NOTES TO FINANCIAL STATEMENTS DECEMBER 31, 2010 |

| |

Note 7. Recent Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements.” ASU No. 2010-06 clarifies existing disclosure and requires additional disclosures regarding fair value measurements. Effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years, entities will need to disclose information about purchases, sales, issuances and settlements of Level 3 securities on a gross basis, rather than as a net number as currently required. Management is currently evaluating the impact ASU No. 2010-06 will have on financial statement disclosures.

Note 8. Subsequent Events

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact and the Fund has had no such events.

|

REPORT OF INDEPENDENT PUBLIC ACCOUNTING FIRM |

| |

To the Board of Trustees of Forum Funds

and the Shareholders of Adams Harkness Small Cap Growth Fund

We have audited the accompanying statement of assets and liabilities of Adams Harkness Small Cap Growth Fund (the “Fund”), a series of shares of beneficial interest in the Forum Funds, including the schedule of investments, as of December 31, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two year period then ended, and the financial highlights for each of the years in the three year period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for each of the years in the two-year period ended December 31, 2007 were audited by other auditors whose report dated February 26, 2008, expressed an unqualified opinion on such financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2010 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reason able basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Adams Harkness Small Cap Growth Fund as of December 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two year period then ended and its financial highlights for each of the years in the three year period then ended, in conformity with accounting principles generally accepted in the United States of America.

&# 160;

BBD, LLP

Philadelphia, Pennsylvania

February 18, 2011

|

ADAMS HARKNESS SMALL CAP GROWTH FUND ADDITIONAL INFORMATION (Unaudited) DECEMBER 31, 2010 |

| |

Investment Advisory Agreement Approval

At the September 10, 2010 Board meeting, the Board, including the Independent Trustees, considered the approval of the continuance of the investment advisory agreement pertaining to the Fund (the “Advisory Agreement”). In evaluating the Advisory Agreement, the Board reviewed materials furnished by the Adviser and the administrator, including information regarding the Adviser, its personnel, operations and financial condition. Specifically, the Board considered, among other matters: (1) the nature, extent and quality of the services to be provided to the Fund by the Adviser, including information on the investment performance of the Adviser; (2) the costs of the services to be provided and profitability to the Adviser with respect to its relationship with the Fund; (3) the advisory fee a nd total expense ratio of the Fund compared to relevant peer groups of funds; (4) the extent to which economies of scale would be realized as the Fund grows and whether the advisory fee would enable the Fund’s investors to share in the benefits of economies of scale; and (5) other benefits received by the Adviser from its relationship with the Fund. In their deliberations, the Board did not identify any particular information that was all-important or controlling and attributed different weights to the various factors. In particular, the Board focused on the factors discussed below.

Nature, Extent and Quality of Services

Based on a presentation from senior representatives of the Adviser and a discussion of the Adviser’s personnel, operations and financial condition, the Board considered the quality of services to be provided by the Adviser under the Advisory Agreement. In this regard, the Board considered information regarding the experience, qualifications and professional background of the portfolio managers and other personnel at the Adviser with principal investment responsibility for the Fund’s investments as well as the investment philosophy and decision-making processes of those professionals and the capability and integrity of the Adviser’s senior management and staff. The Board considered the adequacy of the Adviser’s resources and quality of services provided by the Adviser under t he Advisory Agreement between the Trust and the Adviser. The Board also considered the quality of the Adviser’s services with respect to regulatory compliance and compliance with client investment policies and restrictions as well as the financial condition and operational stability of the Adviser. The Board noted the Adviser’s representation that the firm is financially stable and able to provide investment advisory services to the Fund. The Board concluded that, overall, it was satisfied with the nature, extent and quality of services to be provided to the Fund under the Advisory Agreement.

Costs of Services and Profitability

The Board considered information provided by the Adviser regarding its costs of services and its profitability with respect to the Fund. The Board also considered the Adviser’s resources devoted to the Fund as well as the Adviser’s discussion of costs and profitability. Based on the foregoing and all other relevant facts, the Board concluded that the Adviser’s profits attributable to management of the Fund were not excessive in light of the services provided by the Adviser on behalf of the Fund.

Performance

The Board reviewed performance of the Fund and the Adviser’s discussion of its investment philosophy. The

|

ADAMS HARKNESS SMALL CAP GROWTH FUND ADDITIONAL INFORMATION (Unaudited) DECEMBER 31, 2010 |

| |

Board noted that the Fund underperformed its benchmark for the 1-year period but outperformed its benchmark for the quarter ended June 30, 2010. The Board concluded that the Fund’s performance was reasonable relative to its peers and benchmark and that the Fund and its shareholders could benefit from the Adviser’s management of the Fund.

Compensation

The Board considered the Adviser’s compensation for providing advisory services to the Fund and analyzed comparative information on fee rates, expenses and performance of similar mutual funds. The Board noted that the Adviser’s actual total expenses were the lowest of its Lipper Inc. peer group. The Board noted that the Adviser’s actual advisory fee rate was higher than the median advisory fee rate of its Lipper Inc. peer group. The Board also noted that the Fund’s actual total expense ratio was 1.23% above the median of its Lipper Inc. peer groups. The Board noted that the median actual total expense ratio of the Fund’s Lipper Inc. peer group was 1.85% and considered the Adviser’s representation that it plans to continue to limit, on a volu ntary basis, expenses of the Fund to 1.80%. The Board recognized that it was difficult to compare expense ratios because of variations between the services to be provided by the Adviser and by advisers within the Fund’s Lipper Inc. peer group funds. Based on the foregoing and on all of the information presented, the Board concluded that the Adviser’s advisory fee charged to the Fund was reasonable.

Economies of Scale

The Board considered whether the Fund would benefit from any economies of scale. The Board noted the Adviser’s representation that in the future it may experience economies of scale in connection with the provision of services to the Fund, but is not proposing breakpoints or changes in fees based on economies of scale at this time. Based on, among other things, the size of the Fund, the Board concluded that it would not be necessary to consider the implementation of fee breakpoints at this time.

Other Benefits

The Board noted the Adviser’s representation that the Adviser does not expect to receive any kind of benefit or compensation from its relationship with the Fund, other than its contractual advisory fees. Based on the foregoing representation, the Board concluded that other benefits received by the Adviser from its relationship with the Fund were not a material factor to consider in approving the continuation of the Advisory Agreement.

Conclusion

The Board reviewed a memorandum from Trust Counsel discussing the legal standards applicable to its consideration of the Advisory Agreement. Based on its review, including consideration of each of the factors referenced above, the Board determined, in the exercise of its business judgment, that the advisory arrangement, as outlined in the Advisory Agreement, was fair and reasonable in light of the services performed, expenses incurred and such other matters as the Board considered relevant in the exercise of its reasonable business judgment.

|

ADAMS HARKNESS SMALL CAP GROWTH FUND ADDITIONAL INFORMATION (Unaudited) DECEMBER 31, 2010 |

| |

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (800) 441-7031, on the Fund's website at www.ahsmallcap.com and on the SEC’s website at www.sec.gov. The Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (800) 441-7031, on the Fund's website at www.ahsmallcap.com and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800)-SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees, and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2010, through December 31, 2010.

Actual Expenses – The first line in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect

|

ADAMS HARKNESS SMALL CAP GROWTH FUND ADDITIONAL INFORMATION (Unaudited) DECEMBER 31, 2010 |

| |

any transactional costs, such as redemption fees and exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs had been included, your costs would have been higher.

| | Beginning Account Value July 1, 2010 | | Ending Account Value December 31, 2010 | | Expenses Paid During Period * | | Annualized Expense Ratio * |

| Actual | $ | 1,000.00 | | $ | 1,350.86 | | $ | 10.67 | | | 1.80% |

Hypothetical (5% return before expenses) | $ | 1,000.00 | | $ | 1,016.13 | | $ | 9.15 | | | 1.80% |

| | | | | | | | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 365 to reflect the half-year period.

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust’s business affairs and of the exercise of all the Trust’s powers except those reserved for the shareholders. The following table provides information about each Trustee and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland, Maine 04101, unless otherwise indicated. Each Trustee oversees twenty-three portfolios in the Trust. Mr. Keffer is considered an Interested Trustee due to his affiliation with Atlantic. Mr. K effer is also an Interested Director of Wintergreen Fund, Inc. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (800) 441-7031, on the Fund's website at www.ahsmallcap.com.

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years |

| Independent Trustees | | | |

J. Michael Parish Born: 1943 | Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee | Since 1989 (Chairman since 2004) | Retired since 2003. |

Costas Azariadis Born: 1943 | Trustee; Chairman, Valuation Committee | Since 1989 | Professor of Economics, Washington University since 2006; Professor of Economics, University of California-Los Angeles 1992-2006. |

James C. Cheng Born: 1942 | Trustee; Chairman, Audit Committee | Since 1989 | President, Technology Marketing Associates (marketing company for small- and medium-sized businesses in New England) since 1991. |

|

ADAMS HARKNESS SMALL CAP GROWTH FUND ADDITIONAL INFORMATION (Unaudited) DECEMBER 31, 2010 |

| |

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years |

| Interested Trustee | | | |

John Y. Keffer1 Born: 1942 | Trustee; Vice Chairman | Since 1989 | Chairman, Atlantic since 2008; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company chartered in the State of Maine) since 1997. |

| Officers | | | |

Stacey E. Hong Born: 1966 | President; Principal Executive Officer | Since 2008 | President, Atlantic since 2008; Director, Consulting Services, Foreside Fund Services 2007; Elder Care, 2005-2006. |

Karen Shaw Born: 1972 | Treasurer; Principal Financial Officer | Since 2008 | Senior Manager, Atlantic since 2008; Section Manager/Vice President, Enterprise Support Services, Citigroup 2003-2008. |

David Faherty Born: 1970 | Vice President | Since 2009 | Senior Counsel, Atlantic since 2009; Vice President, Citi Fund Services Ohio, Inc. 2007-2009; Associate Counsel, Investors Bank & Trust Co. 2006-2007. |

Michael J. McKeen Born: 1971 | Vice President | Since 2009 | Senior Manager, Atlantic since 2008; Vice President, Citigroup 2003-2008. |

Joshua LaPan Born: 1973 | Vice President | Since 2009 | Manager, Atlantic since 2008; Vice President, Citigroup 2003-2008. |

Timothy Bowden Born: 1969 | Vice President | Since 2009 | Manager, Atlantic since 2008; Vice President, Citigroup 2005-2008. |

Lina Bhatnagar Born: 1971 | Secretary | Since 2008 | Senior Administration Specialist, Atlantic since 2008; Regulatory Administration Specialist, Citigroup 2006-2008. |

| | 1 Since 1997, John Y. Keffer has been president and owner of Forum Trust, LLC. Prior to January 1, 2010, Atlantic was a wholly owned subsidiary of Forum Trust, LLC. Effective January 1, 2010, Atlantic became a wholly owned subsidiary of Forum Holdings Corp., a Delaware corporation that is wholly owned by Mr. Keffer. |

A Message to Our Shareholders............................................................................................1

Performance Chart and Analysis............................................................................................6

Schedule of Investments.........................................................................................................7

Statement of Assets and Liabilities.......................................................................................9

Statement of Operations........................................................................................................10

Statements of Changes in Net Assets................................................................................11

Financial Highlights...............................................................................................................12

Notes to Financial Statements..............................................................................................13

Report of Independent Registered Public Accounting Firm...........................................16

Additional Information (Unaudited)...................................................................................17

The views expressed in this report are those of the investment advisor of The BeeHive Fund (the “Fund”) as of December 31, 2010, and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders of the Fund in understanding their investments in the Fund and do not constitute investment advice. The Fund is subject to various forms of risk including the possible loss of principal. Investing in foreign securities entails risks not associated with domestic equities including economic and political instability and currency fluctuations. Investing in fixed income securities includes the risk that rising interest rates will cause a decline in values. Focused investments in particular industries or market sectors can entail increased volatility and gre ater market risk than is the case with more broadly diversified investments. Investments in securities of small and mid-capitalization companies involve the possibility of greater volatility than investments in larger capitalization companies. Investments in American Depository Receipts involve many of the same risks as investing in foreign securities.

| |

THE BEEHIVE FUND A MESSAGE TO OUR SHAREHOLDERS DECEMBER 31, 2010 |

| |

“One expects many things to happen that somehow never do.”

- James Grant

Dear Shareholder,

Once again, we find the end of the calendar year to be a convenient time for discussion and review, even if your capital does not care much about artificial time periods. We, as a firm, may be pleased with our 2010 performance, but that means nothing if losses loom on the horizon. The future is, and always has been, our focus – but historical reflection does fulfill a beneficial purpose.

The BeeHive Fund (the “Fund”), once again outperformed the S&P 500 in 2010 and, more satisfying to us, had a strong absolute gain of almost 17%. Individual standouts included Check Point Software Technologies, FMC Corp., Kinder Morgan and Oracle; laggards were Baxter, Microsoft, Unilever and Western Union. The Fund, after an untimely start date just before the September 2008 Lehman collapse, now has a sizeable gain since inception.

Our quarterly missives over the last year hold the keys to our positive performance. We remain conservative in our investing – but we do not invest to advance an inflexible ideological position; we invest to preserve purchasing power and to earn real returns.

All through this recovery, media face-time has been given chiefly to those who were correct in being negative prior to the crisis, but have also remained so throughout. Their incentives were clear; they achieved fame and fortune through doom saying, which was correct and prescient – but it has not been in their interest to turn moderate or sanguine. Instead, they have generally attempted to make the next great call for disaster. This left them fighting yesterday’s war, and not participating in the peace.

We, on the other hand, being free of a self-proscribed tilt or taint, were able to identify one important fact: that direction matters. No matter how tepid a recovery may be, a recovery – or even an abatement of decline – is positive for stock prices. We continue to believe that the recovery is building steam, albeit slowly. There is no need to look past the General Motors IPO and TARP repayments to understand that we are well beyond the crisis state that prevailed in 2008 and early 2009. Employment and housing continue to be a drag, and government spending restraints will be a headwind – but, as we consistently stated in 2010, recovery will likely continue. Our belief in this recovery is not only from macroeconomic analysis, but from our focus on the fundamentals of the businesses we analyze. Corporations are generally prospering.

Now turning to the question of whether stocks are valued appropriately. Ultimately the reason to own equities is that the future profits and/or cash flows provide an adequate return on today’s investment. The holdings in the Fund today, in our opinion, will provide such a return.

This does not fully answer the question of valuation for “the market,” but we feel no compunction to analyze a 500 stock portfolio subjectively selected by the good people at Standard and Poor’s1; we have no need to model our portfolio on theirs. If pressed, we would say that market overvaluation is hard to see when the recovery cycle remains in place, broad retail participation in stocks is still lacking, and valuations, again in our opinion, are compelling, even if not overwhelmingly so.

________________________

1 Despite conventional wisdom, the S&P 500 is not a purely passive index. Its constituents and criteria for inclusion are subjectively constructed by S&P. We quote from their published policies:

Standard & Poor’s U.S. indices are maintained by the U.S. Index Committee. All committee members are full-time professional members of Standard & Poor’s staff. The committee meets monthly. At each meeting, the Index Committee reviews pending corporate actions that may affect index constituents, statistics comparing the composition of the indices to the market, companies that are being considered as candidates for addition to an index, and any significant market events. In addition, the Index Committee may revise index policy covering rules for selecting companies, treatment of dividends, share counts or other matters.

Standard & Poor’s considers information about changes to its U.S. indices and related matters to be potentially market moving and material. Therefore, all Index Committee discussions are confidential.

| |

THE BEEHIVE FUND A MESSAGE TO OUR SHAREHOLDERS DECEMBER 31, 2010 |

| |

Notwithstanding our belief in economic recovery, the increased stock valuations will necessitate more than GDP growth to earn significant returns. In early 2009, stocks as an asset class were unusually cheap. We took the position that the prudent way to benefit from a recovery and minimize risk was to hold the best franchises available in necessary and important industries. While these firms still present attractive investments, we are beginning to find better opportunities in firms that have significant secular growth due to 1) disruptive business models or technologies, 2) competitive advantages that allow them to take market share, 3) unique or niche businesses that allow pricing ability, 4) businesses that are underpenetrated and therefore can grow faster than the global economy or 5) some combination of the above.

As a recent example, we sold our position in Johnson & Johnson. Similarly, and just subsequent to year-end, we took some of our gains in Nestlé. In both cases we sold high quality stocks with quality management. Despite these attributes, they were not cheap and have such a large presence in their respective industries that it will be hard for them to grow faster than general global economic activity, and due to strong operational management, hard to find additional operating leverage. New purchases in the quarter included IMAX Corp. (IMAX) and, following year-end, DG FastChannel (DGIT).

IMAX has a unique and niche technology and brand, as well as a new disruptive business model. At the same time, the company is underpenetrated in its potential markets – especially internationally. DGIT, likewise, has a dominant position in a niche industry that is undergoing a format shift that should provide strong profit growth. We hope you find our further discussion in the Appendix of interest. In addition to the recent purchases, we discuss our current holding in Thermo Fisher as their recent acquisition of Dionex Corp. was an important event for shareholders.

Recent Sale

In our quarterly letters we have tended to discuss our new purchases in detail, while dedicating just a line or two to our sales. In our practice of investment management, things are much more balanced and we spend as much time debating current holdings as we do new opportunities. Within our process, a sell discussion is typically initiated for one of three reasons: the investment thesis has changed or played out; market valuation more than compensates for our assessment of the future opportunity; or better investments exist. While this makes it sound like a science, selecting the right time to sell is rarely simple. It is difficult to know when to take the loss on a thesis that is not playing out the way it was initially anticipated, and equally difficult to recognize the right time to sell a good business that is performing well, but ha s become fairly (or over) valued. To illuminate the process, we provide a brief summary of our initial investment in Nestlé, along with our recent partial sale.

When we invested in Nestlé, market sentiment was tepid. After delivering organic revenue growth and operating margin expansion through good times and bad for over a decade, investors believed that there was no catalyst or potential for upside surprise – in other words Nestlé was too consistent and, frankly, too boring. We, on the other hand, were happy to have the opportunity to purchase shares in a great franchise at a valuation that was a discount to all of its peers. While timing was uncertain, we also believed that Nestlé had the potential to unlock hidden value through the sale of its stakes in Alcon, L’Oréal, or both.

Since our purchase, shares of Nestlé have performed well. But even great franchises can reach valuations that imply a muted future investment opportunity. Such is the case with Nestlé. We continue to view Nestlé as the operational gold standard in the packaged food industry and are confident that management will continue to invest the proceeds from the sale of the Alcon stake productively. However investor sentiment has shifted 180 degrees: the consistency of execution that resulted in a valuation discount at the time of purchase now earns a premium and the ambivalence concerning capital structure has shifted to enthusiasm – particularly in anticipation of share buy-backs. We fully agree that the market is accurately valuing the Nestlé franchise; unfortunately that means the upside opportunity is limited and we n ow need to look for other undervalued franchises.

Firm Update

Once again, we are pleased to announce the expansion of our partnership at Spears Abacus Advisors. John Raggio joined our fixed income team in 2008, and has been the lead analyst and portfolio manager for our fixed income securities since mid-2009. John has proven to be an invaluable asset during a volatile period in the credit markets. In addition to his bond responsibilities, his ability to analyze balance sheets and corporate liquidity has enhanced our work in convertible debt issues and preferred securities and even our common stock research effort. John is an integral part of our investment team, and effective January 1, 2011 we are proud to call him our partner.

| |

THE BEEHIVE FUND A MESSAGE TO OUR SHAREHOLDERS DECEMBER 31, 2010 |

| |

Concluding Thoughts

William Shakespeare once said, through the lips of Hamlet, “There is nothing either good or bad, but thinking makes it so.” We quote this not to delve into a debate about moral relativism. Rather as a succinct summary of the mistake our peers and, hopefully less so, we sometimes make. To begin the investment process with a bias, generally leads you to where you started. We respect those who continue to caution that dangers possibly lurk, even if they are not probable scenarios. We certainly build these views into our research, but ultimately follow where our own independent analysis leads.

If you want to be bearish, there is no lack of macroeconomic reasons to be so – municipalities may be set to collapse, Europe might implode, deficits appear unsustainable, the Fed will possibly debauch the currency, and the cost of capital is unnaturally low. But as the eminent Mr. Grant points out, you can work yourself up to heights of lather for things that remain unlikely. This DOES NOT mean we are complacent, only that we believe managing risk means not just protecting against high risk, but also low probability scenarios. Proper risk management means benefitting from the white swans, as well as protecting against the black.

We remain encouraged by developments within the Fund portfolio and throughout the economy, although there certainly are many conditions we would prefer did not exist. Given the rapidity of events and the interconnectedness of the global economy, we remain flexible in our beliefs and liquid in the portfolio. We have been pleased to serve you as The BeeHive Fund’s investment advisors over these last two years, and we continue to honor your trust.

Have a very healthy, happy and prosperous New Year.

Sincerely,

| |

THE BEEHIVE FUND A MESSAGE TO OUR SHAREHOLDERS DECEMBER 31, 2010 |

| |

Appendix

IMAX Corp.

Founded in 1967, IMAX opened its first large format screen in 1970. Until only recently, the company has catered primarily to the institutional market and, what the CEO affectionately calls whale, bear and seal movies. Recent success is due to a three-pronged strategy wholly different than the IMAX of old and aimed at replacing the high-cost, low-margin business model of the past, which depended on lumpy sales cycles of theater systems to museums, amusement parks, and a few specialty movie exhibitors.

The three important developments include:

1) Fast and economical digital re-mastering of 35mm into IMAX format to allow for theatrical release of Hollywood movies simultaneously with regular format theaters,

2) New technologies that allow less costly system installation (smaller screens for multiplexes) and more efficient film distribution (digital instead of film prints), and

3) A shift to joint ventures whereby IMAX contributes the system and then shares in box office receipts with the exhibitor, instead of one-time sales of systems.

The new business model creates a recurring revenue stream and a greater lifetime revenue per screen. Simply, IMAX can attract the best films due to the immersive experience and premium pricing, convert them at a low fixed cost, distribute them cheaply through a rapidly growing international network of theaters and collect a percentage of gross receipts from both the studio and the exhibitor.

IMAX is a small company and its share price has risen sharply since last summer. Nonetheless, our models indicate that significant upside remains as the network of theatres grows (currently at 375 globally compared to 1,300 identified addressable locations). This combination of household name recognition and untapped potential is rare; however, the large run-up in the stock has given us some pause, so we have only taken a partial position until the stock price – or the facts – become more compelling.

DG FastChannel, Inc.

Early in the first quarter of 2011, we added DG Fastchannel (DGIT) to the portfolio. DGIT provides content delivery and management services to the advertising industry using a proprietary network to electronically distribute content to media outlets. While DGIT provides solutions targeting multiple media formats, including television, radio, print or online, the distribution of television spots remains DG’s core business and accounts for the majority of revenue and profitability. DG’s growth over the past few years has been driven by the conversion of the “dub and ship” method of content distribution to digital.

While opportunity still remains from the shift from tape to electronic, a new more powerful transition is beginning in the shift from standard definition spots to high definition spots.

DGIT receives premium pricing on the delivery of an HD spot, and though HD deliveries comprised less than 10% of the spots delivered in 2010 they generated about 40% of total company revenue. While this price premium will certainly decline as penetration grows, the largely fixed cost nature of DGIT’s business means that incremental gross margins will continue to be very attractive.

We see additional opportunities for upside from the digitization of direct response distribution, expansion of DGIT’s network into international markets and growth of the online distribution channel. Though this opportunity does not come without risk, we think that the valuation at our purchase price provides a very favorable return asymmetry.

| |

THE BEEHIVE FUND A MESSAGE TO OUR SHAREHOLDERS DECEMBER 31, 2010 |

| |

Thermo Fisher Scientific Inc.

In the life science tools industry, Thermo Fisher is the largest market participant and its scale and breadth of product offering provide a competitive advantage. While internal development of new products is important (and is receiving renewed attention), we believe that a key component of Thermo Fisher’s business model is the ability to use excess free cash generation to acquire products and technologies that are complementary to their existing portfolio and to leverage their distribution infrastructure.

In aggregate these “bolt-on acquisitions” can add a couple of points to revenue growth each year but individually are generally too small to warrant comment. However, this quarter we want to highlight the recently announced acquisition of Dionex because of its size ($2.1 billion) as well as its strategic fit.

Dionex is the leading participant in ion chromatography and also a major participant in liquid chromatography. Both types of chromatography are frequently used in advance of mass spectrometry (mass spec) to separate the components of a mixture before identification and measurement. Instruments are often sold together and bringing these two strong franchises under the same roof should have a synergistic effect on both chromatography and mass spec sales. Although the purchase price was at a premium, the fact that Thermo Fisher shares traded up on the deal announcement tells us that we are not alone in our positive view of the transaction.

| |