As filed with the Securities and Exchange Commission on June 2, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Stacey E. Hong, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: March 31

Date of reporting period: April 1, 2009 – March 31, 2010

| ITEM 1. | REPORT TO STOCKHOLDERS. |

ANNUAL REPORT

MARCH 31, 2010

Absolute Opportunities Fund, Absolute Strategies Fund, Absolute Funds and logo are registered service marks of Absolute Investment Advisers LLC; Absolute Investment Advisers (“AIA” and “Absolute”) and logo are registered service marks of AIA; and other marks referred to herein are the trademarks, service marks, registered trademarks or registered service marks of the respective owners thereof.

ABSOLUTE STRATEGIES FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2010

Dear Shareholder,

We are pleased to present the annual report for the Absolute Strategies Fund (the “Fund”) for the 12 months ended March 31, 2010. Before discussing the performance of our Fund, it is important to state that the past two years have been an extraordinary period of time for global capital markets. There have been large distortions of investment cycles with significant mis-pricings of assets and risk both to the upside and the downside. As such, the performance of the Absolute Strategies Fund over these periods (2008 & 2009) will likely be viewed as outliers.

The Fund (Institutional Shares) returned 22.95% for the twelve months ended March 31, 2010, versus 49.77% for the S&P 500 Index (“S&P 500”) and 14.46% for the HFRX Global Hedge Fund Index. More importantly, the Fund’s performance was achieved without taking meaningful risks and the Fund’s overall net exposure was held to modest levels throughout the past year. From inception through March 31, the Fund’s beta was 0.27, (beta measures the Fund’s sensitivity to the S&P 500) demonstrating that Fund returns were largely independent of this market index. The annualized standard deviation of the Fund’s returns, a measure of portfolio volatility, has been 6.5% vs. 21.7% for the S&P 500 and 6.3% for the HFRX Global Hedge Fund Index.

The Fund’s allocations and performance can be viewed across multiple dimensions. Overall holdings of the Fund, aggregated across sub-adviser strategies, are diversified across a wide range of industries and asset classes. As such, it is difficult to attribute performance to any small group of securities. The Fund held over 1,200 securities, including both long and short equity, fixed income, ETFs, options, cash and financial futures hedges. As stated in the schedule of investments, the Fund’s long and short securities, excluding short term investments, were approximately $1,852 million and $690 million, respectively. Long and short equity securities totaled approximately 39% and 26% of net assets, respectively. Our largest single long stock position was in PepsiCo, Inc., which represented 1% of net assets. Convertible bonds and asset backed obligations totaled approximately 19% and 7% of net assets, respectively; these securities are utilized primarily in convertible arbitrage and distressed debt strategies. Other fixed income securities, including corporate bonds, totaled approximately 10% of net assets. Cash held by our sub-advisers was approximately 7% of net assets; additional deposits with the custodian were held primarily as collateral for options, futures, and short positions.

We currently allocate assets to twelve sub-advisers. As of March 31, 2010, we allocated approximately 95% of the Fund’s assets; the remaining 5% was held in cash for future allocations and rebalancing. Of the sub-advisers who received assets, the largest allocation to a single manager strategy was approximately 15%; the smallest was roughly 1%. While we view each manager strategy as an independent risk/return profile, the

ABSOLUTE STRATEGIES FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2010

following chart illustrates a summary breakdown of our sub-adviser allocations by style, (each category may represent strategies used by multiple sub-advisers) for fiscal year end 2009 and 2010 respectively:

| | | | | | |

Sub-Adviser Strategy | | Allocations as of

March 31, 2009 | | | Allocations as of

March 31, 2010: | |

Distressed Debt | | 14 | % | | 14 | % |

Global Macro | | 10 | % | | 15 | % |

Discretionary Fixed Income | | 3 | % | | 2 | % |

Opportunistic Equity | | 14 | % | | 13 | % |

Long/Short Equity | | 18 | % | | 13 | % |

Market-Neutral Equity | | 16 | % | | 17 | % |

Convertible Arbitrage | | 23 | % | | 21 | % |

Unallocated | | 2 | % | | 5 | % |

For us, the only benchmark of significance is the amount of risk being taken to generate a return or expected return. As stated in prior commentaries, the Fund’s performance will vary based on risk/reward trade-offs and opportunities to exploit mis-pricings in an asymmetric manner. The portfolio is built from the bottom-up, but we think about systemic risks in the context of aggregated exposures as a result of manager allocations and positioning. This means that the Fund’s overall capital at risk will vary relative to potential expected payoffs vs. the potential for meaningful losses. In 2009, the Fund was able to generate strong risk-adjusted returns by adding exposures to our convertible arbitrage, opportunistic equity, distressed debt and global macro managers in early 2009, while reducing allocations to market neutral managers during that time. As preferred, the managers who we added were strong performance leaders over the past 12 months while laggard returns were attributable to the market neutral strategies.

Much of the re-pricing of risk has broadly occurred and opportunities have become more limited. As a result, we are now quite cautious. The Fund’s capital at risk has recently been dramatically reduced or hedged and our allocations are currently focused largely on our global macro, market neutral (including value-arbitrage), and convertible arbitrage managers. These managers may perform well in a more volatile environment. We have also recently increased our overlay hedge to mitigate the potential impact of large systemic risks while maintaining manager allocations. Currently, our net exposures are as low as they have been since inception; however, this could change if we see a re-pricing of risk in certain markets.

Why are we hedged? Simple. In our opinion, the potential for systemic risks continue to be very high, and we do not believe markets are currently pricing in the bad outcomes, only the optimistic ones; this is the opposite of a year ago when most investors were predicting Great Depression II. The past few market cycles have been highly compressed as investors appear to recognize risks only after they occur (For example: leverage and sub-prime problems were clear red flags in 2006, but investors did not react to them until the 2nd half of 2008). As such, the discounting mechanism of the markets has also become compressed as all assets go through stages of an escalator up and then an elevator back down (there are very few floors where you can get off).

ABSOLUTE STRATEGIES FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2010

The easiest way to understand how investors have mis-priced risk is to think back over the past few years. In 2006-2007, investors were moderately rewarded (in the short-term) for taking large risks when everyone else was also eagerly accepting risk. This turned out to be a huge error in judgment and resulted in enormous losses. Compare this to a year ago (1st quarter 2009) when investors were highly rewarded for taking risk when nobody was accepting risk. The environment today resembles the 2007 period as it relates to momentum-fueled investing and elevated expectations. Investors now feel comfortable taking risk again because it feels safe and they likely underperformed last year. For the Fund, early 2009 felt like a great time to increase capital at risk when assets were cheap and expectations were low, not after markets rally 80% and things sound safe.

As discussed in our 4th quarter commentary (visit www.absoluteadvisers.com for past commentaries), there are many risks that we believe are not adequately priced into the current equity and credit markets. Yes, earnings have improved and the economy has stabilized, but isn’t that what an 80% re-pricing of equities takes into account? (We also wonder, if pundits believe the economy is so strong, why are rates still at 0%, and what does the economy and fiscal debt look like at rates of 5%+?) The reality is that the core global problem (too much debt), has not been addressed and may have become worse as fiscal deficits have grown. Beyond the many other secular headwinds, deleveraging continues to be the key theme and it began to make headlines in the 1st quarter starting with Greece, and could stretch throughout much of Europe and beyond. It’s important to realize that we are not dealing with problems concerning liquidity this time around. We are dealing with global problems concerning debt servicing and solvency among numerous large public and private institutions that have highly similar issues, including the UK, Japan, and the US. Unfortunately, many world leaders and bullish investors somehow believe that the correct course of action for solving a serious debt burden is to add more debt. If smart people think this is a good idea, they are likely either in denial or they are fearful of making correct choices.

It is amazing how few people believe sovereign debt is a systemic risk and completely dismiss the possibility of contagion, similar to the reaction to Bear Stearns. Historically, sovereign and domestic debt crises are quite common following a financial crisis, (Reinhart & Rogoff, “This Time is Different,” 2009). While everything may turn out ok, we speculate about what happens if it doesn’t. Can you envision Greece getting bailed out (a la Bear Stearns), soothing the markets only to delay the credit crunch until the next country comes along (a la Lehman Brothers) that cannot be bailed out? Is this not the same recipe and process that the Federal Reserve has been experimenting with over the past 12 years since the Long Term Capital Management bailout in 1998? When/how does it end and what do we do when we cannot do any more bailouts? Aren’t we already there given 0% interest rates and the government’s potential lack of meaningful political and fiscal capital? At the very least, shouldn’t equity and credit risk premiums rise?

Throwing new money at bad investments is a highly unproductive use of capital that simply dilutes future growth and curbs long-term investment. We are essentially giving more money to the worst stewards of capital at the expense of other investors and savers who could invest in productive opportunities. From the perspective of an asset allocator, or for that matter Adam Smith, this is a recipe for disaster. Eventually the providers of capital will retaliate and withdraw (historically referred to as bond market vigilantes), leading to much higher costs of capital and potential defaults. If the process to inflate and monetize debt fails, the

ABSOLUTE STRATEGIES FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2010

deflationary forces become compounded and much more dangerous than before. Additionally, we believe that continuing to delay pain and forcing excessive risk taking may potentially create a pinnacle of moral hazard that could result in far more, or extended, pain in the future than was experienced in 2008. We also recognize this process could take years, and actually the US may benefit from a flight to ��relative safety” in the short term.

On the other hand, even if the economy begins to truly strengthen and labor markets improve in the short term, what will happen to asset prices in both equities and credit if the Fed simply hints at raising rates? We would argue that many investors who find equities attractive are rationalizing their decisions through the use of exceptionally low cost of equity capital being used to discount stock prices. If equity prices are highly levered to interest rates, then investors would need to adjust their “models” should risk-free rates move up. Bond prices may fare even worse in a rising interest rate environment. Additionally, could the US economy handle a 2-3% Fed Funds rate, or for that matter even a lack of stimulus? What would happen to the housing market? If one believes the economy cannot handle an increase in rates, then by definition it is not sustainable. (We are assuming the Fed doesn’t leave rates at 0% on the back of a strong economy. But, who knows, they’ve enabled bubbles before.)

Investor sentiment continues to swing vastly from fear and panic to risk-taking and euphoria. This herd-like behavior, combined with unnatural government and central bank interference in markets and economies, will likely lead to continued volatility, distortion and unusual short-term market effects. Given the many unknowns above, we are very comfortable with our current exposures and cautious positioning to protect capital, and we will not be disappointed or surprised to miss out on momentum and central bank-fueled risk-taking. In fact, that has been the trend for our Fund in the past when markets have ignored risk with short-term rallies that lacked sustainability. We will continue to be disciplined and exercise patience for accepting risk until times when others aren’t so eagerly willing to accept it and will vary our capital at risk accordingly. Given the potential for highly volatile market conditions, our exposures may change as opportunities to accept risk appear. These opportunities will be defined by the mis-pricing of risk, not by a flurry of great news headlines.

As a reminder, investors who measure performance quarter to quarter may have misaligned expectations as the Fund seeks performance over a full market cycle and is intended for long-term risk-conscious investors. Thank you for your investment in the Absolute Strategies Fund.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

ABSOLUTE OPPORTUNITIES FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2010

Dear Shareholder,

We are pleased to present the annual report for the Absolute Opportunities Fund (the “Fund”) for the period ended March 31, 2010. The Fund was launched on October 21, 2008, as a compliment to the Absolute Strategies Fund. The Fund was created to capture a variety of investment opportunities and market inefficiencies. The Fund utilizes relatively few managers with highly flexible investment strategies and thus, is intended to have a more concentrated, idiosyncratic risk profile compared to the Strategies Fund. As such, the Fund may expose investors to greater risks and should be utilized by patient, long-term investors seeking diversification away from traditional investments.

The Fund returned 19.00% for the twelve months ended March 31, 2010, versus 49.77% for the S&P 500 Index (“S&P 500”) and 14.46% for the HFRX Global Hedge Fund Index. Since inception (October 21, 2008), the Fund has returned 17.45% vs. 17.97% for the S&P 500 and 5.01% for the HFRX Global Hedge Fund Index. The Fund’s exposures have been well diversified and performance has been consistent through both up and down markets. From inception through March 31, 2010, the Fund’s beta was 0.19, (beta measures the Fund’s sensitivity to the S&P 500) demonstrating that Fund returns were largely independent of this market index.

As of March 31, 2010, 1-year and since inception annualized performance for the Fund was 19.00% and 17.45%, respectively. Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The recent opportunities in the capital markets have helped produce short-term returns that are not typical and may not continue in the future. For performance current to the most recent month-end, call the Fund at 888-99-ABSOLUTE. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) for Institutional Shares is 3.82%. Excluding the effect of expenses attributable to dividends on short sales, the Fund’s total annual operating expense ratio is 3.77%. Returns include the reinvestment of dividends and capital gains. Some of the Fund’s fees were waived or expenses reimbursed; otherwise, returns would have been lower.

Much of the Fund’s gains for the past year occurred early on in the equity and credit rally from mis-pricings in previously distressed securities. Performance has been driven by special situations and key events at specific companies that were largely unrelated to market momentum. Currently, the overall portfolio is positioned with a much more conservative or hedged stance seeking to exploit future volatility in both the equity and credit markets. There are few compelling risk/reward opportunities in distressed assets and managers are careful not to stretch for yield in the credit markets. However, opportunities will likely be more plentiful over the next few years as there is an enormous amount of maturing debt that may imply increased restructuring activity and defaults.

Some managers, whose strategies utilize short selling and were not designed for the enormous market rally over past 12 months, are now quite optimistic and feel well-positioned for their specific investment discipline. These managers, who consistently utilize short positions largely waited out the move in the markets, but are

ABSOLUTE OPPORTUNITIES FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2010

now looking to take advantage of elevated investor expectations. Their investment strategies are designed to be unique and in many cases may seek to add short exposure to specific companies that are poised for financial deterioration due to balance sheet and cash flow challenges. Specific to credit markets, the Fund has short positions targeting the compressed spreads of specific investment grade issuers that may be mis-priced fundamentally or are threatened by rising costs of capital. As such, these positions may not be specific to broad asset classes or markets. Given our comments in the Strategies Fund commentary, we are very comfortable with these positions and believe the Fund will be well positioned to capitalize on the continued uncertainty in the economy and the global capital markets.

As with the Strategies Fund, the Absolute Opportunities Fund seeks performance over a full market cycle and is intended for long-term risk-conscious investors. Thank you for your investment in our Fund.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

ABSOLUTE STRATEGIES FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2010

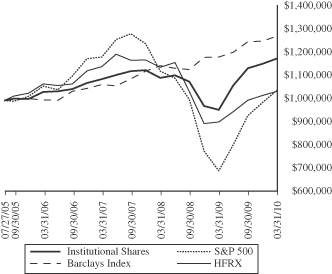

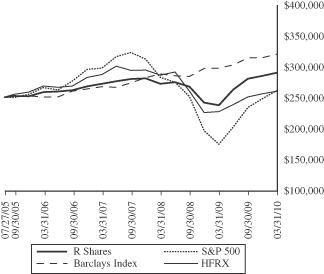

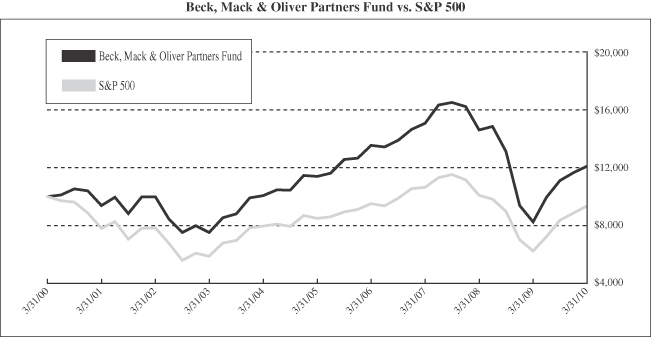

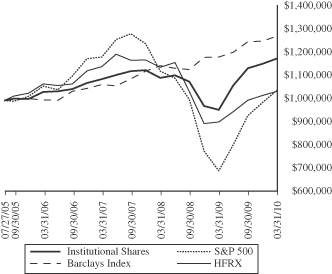

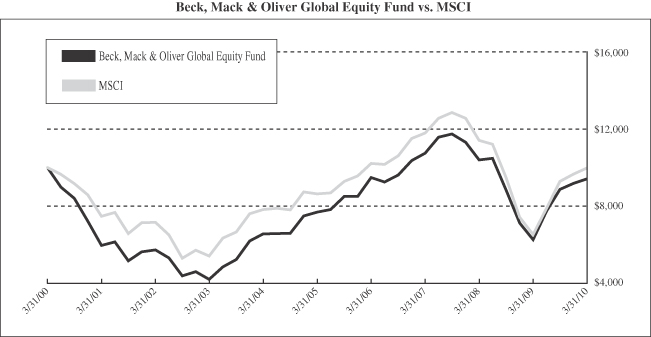

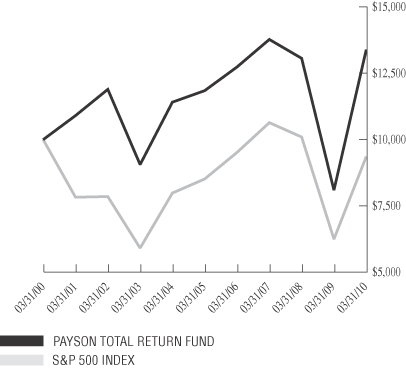

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares and a $250,000 investment in R Shares, including reinvested dividends and distributions, in the Absolute Strategies Fund (the “Fund”) compared with the performance of the Standard and Poor’s 500 Index (“S&P 500”), Barclays Capital U.S. Aggregate Bond Index (“Barclays Index”) and the HFRX Global Hedge Fund Index (“HFRX”), since inception. The S&P 500 is a market-value weighted index representing the performance of 500 widely held, publicly traded stocks. The Barclays Index covers the U.S. dollar-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies – convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The total return of the indices includes reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

ABSOLUTE STRATEGIES FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2010

Institutional and R Shares vs. S&P 500 Index and Barclays Capital U.S. Aggregate Bond Index and HFRX Global Hedge Fund Index

| | | | | | |

Average Annual Total Return as of 03/31/10 | | One Year | | | Commencement of Investment

Operations 07/27/05 | |

Absolute Strategies Fund — Institutional Shares | | 22.95 | % | | 3.61 | % |

Absolute Strategies Fund — R Shares | | 22.28 | % | | 3.19 | % |

S&P 500 Index | | 49.77 | % | | 0.93 | % |

Barclays Capital U.S. Aggregate Bond Index | | 7.69 | % | | 5.36 | % |

HFRX Global Hedge Fund Index | | 14.46 | % | | 0.81 | % |

| | | |

Investment Value as of 03/31/10 | | |

Absolute Strategies Fund — Institutional Shares | | $ | 1,180,589 |

S&P 500 Index | | $ | 1,044,081 |

Barclays Capital U.S. Aggregate Bond Index | | $ | 1,276,538 |

HFRX Global Hedge Fund Index | | $ | 1,038,536 |

ABSOLUTE STRATEGIES FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2010

| | | |

Investment Value as of 03/31/10 | | |

Absolute Strategies Fund — R Shares | | $ | 289,588 |

S&P 500 Index | | $ | 261,020 |

Barclays Capital U.S. Aggregate Bond Index | | $ | 319,134 |

HFRX Global Hedge Fund Index | | $ | 259,634 |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance please call (888) 992-2765. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Institutional Shares and R Shares are 2.32% and 2.73%, respectively. Excluding the effect of expenses attributable to dividends on short sales, the Fund’s total annual operating expense ratios would be 1.82% and 2.23% for Institutional Shares and R Shares, respectively. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

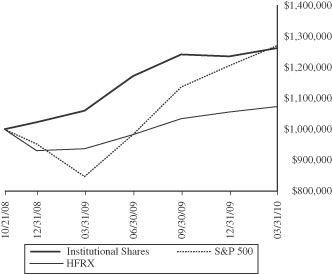

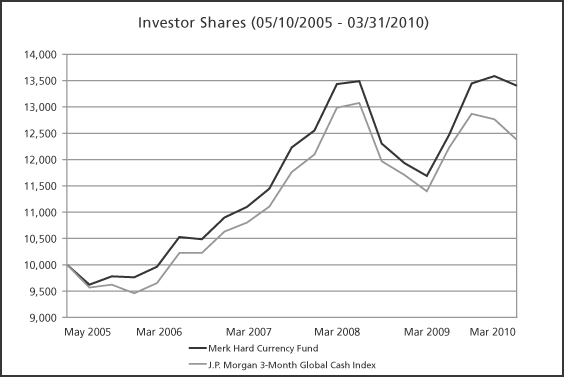

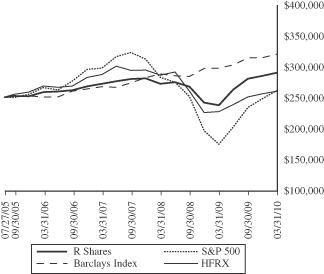

ABSOLUTE OPPORTUNITIES FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2010

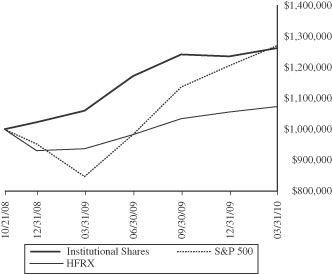

The following chart reflects the change in the value of a hypothetical $1,000,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Absolute Opportunities Fund (the “Fund”) compared with the performance of the Standard and Poor’s 500 Index (“S&P 500”) and the HFRX Global Hedge Fund Index (“HFRX”), since inception. The S&P 500 is a market-value weighted index representing the performance of 500 widely held, publicly traded stocks. HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies – convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The total return of the indices includes reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

ABSOLUTE OPPORTUNITIES FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2010

Absolute Opportunities Fund vs. S&P 500 Index and HFRX Global Hedge Fund Index

| | | | | | |

Average Annual Total Return as of 03/31/10 | | One Year | | | Commencement of Investment

Operations 10/21/08 | |

Absolute Opportunities Fund — Institutional Shares | | 19.00 | % | | 17.45 | % |

S&P 500 Index | | 49.77 | % | | 17.97 | % |

HFRX Global Hedge Fund Index | | 14.46 | % | | 5.01 | % |

| | | |

Investment Value as of 03/31/10 | | |

Absolute Opportunities Fund — Institutional Shares | | $ | 1,260,795 |

S&P 500 Index | | $ | 1,268,973 |

HFRX Global Hedge Fund Index | | $ | 1,072,938 |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance please call (888) 992-2765. As stated in the Fund’s prospectus, the annual operating expense ratio (gross) is 3.82%. Excluding the effect of expenses attributable to dividends on short sales, the Fund’s total annual operating expense ratio would be 3.77%. However, the Fund’s adviser has agreed to contractually waive a portion of its fees and to reimburse expenses such that total operating expenses do not exceed 2.95% (excluding all interest, taxes, portfolio transaction expenses, dividend on short sales and extraordinary expenses), which is in effect until July 31, 2010. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | |

| Shares | | Security Description | | Value |

| Long Positions - 84.4% | | | |

| Equity Securities - 39.0% | | | |

| Common Stock - 36.9% | | | |

| Consumer Discretionary - 8.6% | | | |

| 32,000 | | Abercrombie & Fitch Co. | | $ | 1,460,480 |

| 38,800 | | Aeropostale, Inc. (a)(b) | | | 1,118,604 |

| 378,000 | | Anhui Expressway Co., Class H (b) | | | 258,029 |

| 28,300 | | AnnTaylor Stores Corp. (a)(b) | | | 585,810 |

| 23,900 | | ATC Technology Corp. (a)(b) | | | 410,124 |

| 6,400 | | AutoZone, Inc. (a)(b) | | | 1,107,776 |

| 162,000 | | Bed Bath & Beyond, Inc. (a)(b)(c) | | | 7,089,120 |

| 45,400 | | Brinker International, Inc. (a) | | | 875,312 |

| 29,400 | | Career Education Corp. (a)(b) | | | 930,216 |

| 235,480 | | Carmax, Inc. (a)(b)(d) | | | 5,915,258 |

| 36,800 | | Choice Hotels International, Inc. (a) | | | 1,281,008 |

| 25,000 | | Church & Dwight Co., Inc. | | | 1,673,750 |

| 100,000 | | Cintas Corp. | | | 2,809,000 |

| 43,000 | | Coach, Inc. (a) | | | 1,699,360 |

| 75,000 | | Coinstar, Inc. (b) | | | 2,437,500 |

| 500,000 | | Comcast Corp., Special Class A (c) | | | 8,985,000 |

| 180,636 | | CVS Caremark Corp. (a)(c) | | | 6,604,052 |

| 7,300 | | Deckers Outdoor Corp. (a)(b) | | | 1,007,400 |

| 78,100 | | DIRECTV, Class A (a)(b) | | | 2,640,561 |

| 35,400 | | Domino’s Pizza, Inc. (a)(b) | | | 482,856 |

| 230,000 | | eBay, Inc. (b) | | | 6,198,500 |

| 33,300 | | Ennis, Inc. (a) | | | 541,791 |

| 109,600 | | Equifax, Inc. (a) | | | 3,923,680 |

| 14,300 | | Equinix, Inc. (a)(b) | | | 1,391,962 |

| 56,700 | | Expedia, Inc. (a) | | | 1,415,232 |

| 38,800 | | Ezcorp, Inc., Class A (a)(b) | | | 799,280 |

| 18,100 | | Factset Research Systems, Inc. (a) | | | 1,327,997 |

| 75,900 | | Ford Motor Co. (a)(b) | | | 954,063 |

| 29,100 | | Fossil, Inc. (a)(b) | | | 1,098,234 |

| 67,800 | | Genpact, Ltd. (a)(b) | | | 1,136,328 |

| 370 | | Google, Inc., Class A (b) | | | 209,794 |

| 250,000 | | H&R Block, Inc. | | | 4,450,000 |

| 13,000 | | Hewitt Associates, Inc., Class A (a)(b) | | | 517,140 |

| 50,000 | | Hillenbrand, Inc. | | | 1,099,500 |

| 34,900 | | HNI Corp. (a) | | | 929,387 |

| 13,200 | | Hospira, Inc. (a)(b) | | | 747,780 |

| 45,400 | | IAC/InterActiveCorp. (a)(b) | | | 1,032,396 |

| 50,000 | | International Game Technology | | | 922,500 |

| 25,200 | | International Speedway Corp., Class A (a) | | | 649,404 |

| 52,900 | | inVentiv Health, Inc. (a)(b) | | | 1,188,134 |

| 12,000 | | ITT Educational Services, Inc. (a)(b) | | | 1,349,760 |

| 190,000 | | Jiangsu Expressway Co., Ltd., Class H (b) | | | 179,373 |

| 12,673 | | Lear Corp. (b) | | | 1,005,602 |

| 27,700 | | Liberty Global, Inc., Class A (a)(b) | | | 807,732 |

| 520,000 | | Liberty Media Corp. — Interactive, Class A (b) | | | 7,961,200 |

| 50,000 | | Liberty Media Corp. — Starz, Class A (b) | | | 2,734,000 |

| 334,600 | | Lowe’s Cos., Inc. (a)(c) | | | 8,110,704 |

| 66,000 | | Ltd Brands, Inc. (a) | | | 1,624,920 |

| | | | | |

| Shares | | Security Description | | Value |

| 25,300 | | Lululemon Athletica, Inc. (a)(b) | | $ | 1,049,950 |

| 60,400 | | Macy’s, Inc. (a) | | | 1,314,908 |

| 18,600 | | MAXIMUS, Inc. (a) | | | 1,133,298 |

| 17,000 | | McDonald’s Corp. (a)(c) | | | 1,134,240 |

| 43,900 | | Meredith Corp. (a) | | | 1,510,599 |

| 150,000 | | Mobile Mini, Inc. (b) | | | 2,323,500 |

| 19,800 | | MWI Veterinary Supply, Inc. (a)(b) | | | 799,920 |

| 24,300 | | Navistar International Corp. (a)(b) | | | 1,087,668 |

| 11,200 | | Netflix, Inc. (a)(b) | | | 825,888 |

| 24,500 | | Netgear, Inc. (a)(b) | | | 639,450 |

| 160,000 | | Newell Rubbermaid, Inc. | | | 2,432,000 |

| 4,800 | | Nike, Inc., Class B | | | 352,800 |

| 65,700 | | PetSmart, Inc. (a) | | | 2,099,772 |

| 11,000 | | Polaris Industries, Inc. (a) | | | 562,760 |

| 34,500 | | Rent-A-Center, Inc. (a)(b) | | | 815,925 |

| 195,080 | | Robert Half International, Inc. (a) | | | 5,936,284 |

| 88,300 | | Rollins, Inc. (a) | | | 1,914,344 |

| 99,705 | | Royal Caribbean Cruises, Ltd. (a)(b)(d) | | | 3,289,268 |

| 27,100 | | RR Donnelley & Sons Co. (a) | | | 578,585 |

| 28,000 | | Scholastic Corp. (a) | | | 784,000 |

| 13,800 | | Scripps Networks Interactive, Inc., Class A (a) | | | 612,030 |

| 16,748 | | Sears Holdings Corp. (b) | | | 1,815,986 |

| 384,000 | | Shenzhen Expressway Co., Ltd., Class H | | | 201,786 |

| 810,000 | | Sichuan Expressway Co., Ltd., Class H | | | 479,892 |

| 49,800 | | Stage Stores, Inc. (a) | | | 766,422 |

| 55,200 | | Staples, Inc. (a) | | | 1,291,128 |

| 53,300 | | Starbucks Corp. (a) | | | 1,293,591 |

| 6,000 | | Starwood Hotels & Resorts Worldwide, Inc. | | | 279,840 |

| 2,900 | | Strayer Education, Inc. (a) | | | 706,208 |

| 36,700 | | The Cheesecake Factory, Inc. (a)(b) | | | 993,102 |

| 19,300 | | The Corporate Executive Board Co. (a) | | | 513,187 |

| 54,400 | | The Finish Line, Inc., Class A (a) | | | 887,808 |

| 36,200 | | The Gap, Inc. (a) | | | 836,582 |

| 2,692 | | The Steak N Shake Co. (a)(b) | | | 1,026,379 |

| 25,300 | | The Timberland Co., Class A (a)(b) | | | 539,902 |

| 100,950 | | The Walt Disney Co. (a)(c) | | | 3,524,164 |

| 72,200 | | TIBCO Software, Inc. (a)(b) | | | 779,038 |

| 16,400 | | Tim Hortons, Inc. (a) | | | 534,476 |

| 10,800 | | TJX Cos., Inc. (a)(b) | | | 459,216 |

| 38,200 | | Toro Co. (a) | | | 1,878,294 |

| 250,000 | | Total System Services, Inc. | | | 3,915,000 |

| 42,000 | | Universal Technical Institute, Inc. (a)(b) | | | 958,440 |

| 94,600 | | Valueclick, Inc. (a)(b) | | | 959,244 |

| 393,000 | | Viacom, Inc., Class B (b) | | | 13,511,340 |

| 36,300 | | WABCO Holdings, Inc. (a)(b) | | | 1,086,096 |

| 217,385 | | Walgreen Co. (a)(c) | | | 8,062,810 |

| 41,000 | | Wal-Mart Stores, Inc. (a)(c) | | | 2,279,600 |

| 54,642 | | Warner Music Group Corp. (b) | | | 378,123 |

| 37,600 | | Websense, Inc. (a)(b) | | | 856,152 |

| 21,900 | | Weight Watchers International, Inc. (a) | | | 559,107 |

| 17,900 | | WESCO International, Inc. (a)(b) | | | 621,309 |

| 11,300 | | Williams-Sonoma, Inc. | | | 297,077 |

| | | | |

| See Notes to Financial Statements. | | 12 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | |

| Shares | | Security Description | | Value |

| 23,900 | | WMS Industries, Inc. (a)(b) | | $ | 1,002,366 |

| 17,500 | | WW Grainger, Inc. (a) | | | 1,892,100 |

| 34,800 | | Wyndham Worldwide Corp. (a) | | | 895,404 |

| 236,000 | | Zhejiang Expressway Co., Ltd., Class H | | | 213,074 |

| | | | | |

| | | | | 191,169,041 |

| | | | | |

| Consumer Staples - 4.8% | | | |

| 31,800 | | Brown-Forman Corp., Class B (a) | | | 1,890,510 |

| 30,600 | | Campbell Soup Co. (a) | | | 1,081,710 |

| 160,000 | | Clorox Co. | | | 10,262,400 |

| 55,800 | | ConAgra Foods, Inc. (a) | | | 1,398,906 |

| 29,425 | | CSS Industries, Inc. | | | 591,443 |

| 117,600 | | Cypress Bioscience, Inc. (a)(b) | | | 576,240 |

| 47,000 | | Deluxe Corp. (a) | | | 912,740 |

| 83,900 | | Diageo PLC, ADR (a) | | | 5,659,055 |

| 43,200 | | Elizabeth Arden, Inc. (a)(b) | | | 777,600 |

| 19,700 | | Hansen Natural Corp. (a)(b) | | | 854,586 |

| 45,600 | | Herbalife, Ltd. (a) | | | 2,103,072 |

| 27,000 | | HJ Heinz Co. (a) | | | 1,231,470 |

| 9,400 | | J&J Snack Foods Corp. (a) | | | 408,618 |

| 120,500 | | Johnson & Johnson (a)(c) | | | 7,856,600 |

| 7,000 | | Kellogg Co. (a) | | | 374,010 |

| 200 | | Kraft Foods, Inc., Class A (a) | | | 6,048 |

| 84,300 | | Lancaster Colony Corp. (a) | | | 4,970,328 |

| 80,000 | | McCormick & Co., Inc. (Non-voting shares) | | | 3,068,800 |

| 340,000 | | PepsiCo, Inc. (c) | | | 22,494,400 |

| 100,700 | | Philip Morris International, Inc. (a) | | | 5,252,512 |

| 61,100 | | Prestige Brands Holdings, Inc. (a)(b) | | | 549,900 |

| 12,500 | | Ralcorp Holdings, Inc. (a)(b) | | | 847,250 |

| 150,000 | | SYSCO Corp. | | | 4,425,000 |

| 281,800 | | The Coca-Cola Co. (c) | | | 15,499,000 |

| 126,200 | | The Procter & Gamble Co. (a)(c) | | | 7,984,674 |

| 160,000 | | Toyota Industries Corp., ADR (Unsponsored) | | | 4,571,920 |

| 70,050 | | Viterra, Inc. (b) | | | 661,428 |

| | | | | |

| | | | | 106,310,220 |

| | | | | |

| Energy - 2.3% | | | |

| 7,900 | | Apache Corp. (a) | | | 801,850 |

| 5,000 | | Cabot Oil & Gas Corp. (a) | | | 184,000 |

| 23,204 | | Canadian Natural Resources, Ltd. | | | 1,718,024 |

| 27,128 | | Canadian Oil Sands Trust | | | 813,319 |

| 26,810 | | Canadian Oil Sands Trust | | | 804,657 |

| 18,627 | | Cenovus Energy, Inc. | | | 488,214 |

| 66,100 | | Chevron Corp. (a) | | | 5,012,363 |

| 2,945 | | China Petroleum & Chemical Corp., ADR | | | 242,197 |

| 3,172 | | CNOOC, Ltd., ADR | | | 523,634 |

| 33,400 | | Complete Production Services, Inc. (a)(b) | | | 385,770 |

| 283,900 | | ConocoPhillips (a) | | | 14,527,163 |

| 12,400 | | Contango Oil & Gas Co. (a)(b) | | | 634,260 |

| 25,900 | | Dawson Geophysical Co. (a)(b) | | | 757,316 |

| 75,600 | | El Paso Corp. (a) | | | 819,504 |

| 18,627 | | EnCana Corp. | | | 577,996 |

| | | | | |

| Shares | | Security Description | | Value |

| 26,000 | | EQT Corp. (a) | | $ | 1,066,000 |

| 39,400 | | Exterran Holdings, Inc. (a)(b) | | | 952,298 |

| 21,000 | | Exxon Mobil Corp. (a)(c) | | | 1,406,580 |

| 21,800 | | FMC Technologies, Inc. (a)(b) | | | 1,408,934 |

| 35,000 | | Forest Oil Corp. (a)(b) | | | 903,700 |

| 19,400 | | Hess Corp. | | | 1,213,470 |

| 7,600 | | Holly Corp. | | | 212,116 |

| 51,400 | | Imperial Oil, Ltd. (a) | | | 1,997,918 |

| 68,300 | | Key Energy Services, Inc. (a)(b) | | | 652,265 |

| 12,100 | | Lufkin Industries, Inc. (a) | | | 957,715 |

| 74,800 | | Marathon Oil Corp. (a) | | | 2,366,672 |

| 27,200 | | Murphy Oil Corp. (a) | | | 1,528,368 |

| 4,600 | | Occidental Petroleum Corp. (a) | | | 388,884 |

| 19,100 | | Oceaneering International, Inc. (a)(b) | | | 1,212,659 |

| 16,500 | | Oil States International, Inc. (a)(b) | | | 748,110 |

| 96,700 | | Patterson-UTI Energy, Inc. (a) | | | 1,350,899 |

| 3,683 | | PetroChina Co., Ltd., ADR | | | 431,721 |

| 53,000 | | Pioneer Drilling Co. (a)(b) | | | 373,120 |

| 22,400 | | Southwestern Energy Co. (a)(b) | | | 912,128 |

| 42,617 | | Suncor Energy, Inc. | | | 1,386,757 |

| 20,200 | | Ultra Petroleum Corp. (a)(b) | | | 941,926 |

| 62,900 | | W&T Offshore, Inc. (a) | | | 528,360 |

| | | | | |

| | | | | 51,230,867 |

| | | | | |

| Financial - 6.9% | | | |

| 9,540 | | ADFITECH, Inc. (b) | | | 20,988 |

| 3,900 | | Affiliated Managers Group, Inc. (a)(b) | | | 308,100 |

| 18,200 | | Aflac, Inc. (a) | | | 988,078 |

| 57,000 | | American Express Co. (c) | | | 2,351,820 |

| 260,000 | | AmeriCredit Corp. (b) | | | 6,177,600 |

| 8,800 | | Ameriprise Financial, Inc. (a) | | | 399,168 |

| 49,300 | | Apartment Investment & Management Co. REIT, Class A (a) | | | 907,613 |

| 120,000 | | Arthur J Gallagher & Co. | | | 2,946,000 |

| 22,300 | | Bancfirst Corp. (a) | | | 934,593 |

| 86,900 | | Banco Latinoamericano de Comerico Exterior, Class E (a) | | | 1,247,884 |

| 74,500 | | Bank of America Corp. | | | 1,329,825 |

| 47,400 | | Bank of Hawaii Corp. (a) | | | 2,130,630 |

| 32,700 | | Bank of the Ozarks, Inc. (a) | | | 1,150,713 |

| 126 | | Berkshire Hathaway, Inc., Class A (a)(b) | | | 15,346,837 |

| 49,790 | | Berkshire Hathaway, Inc., Class B (b) | | | 4,046,433 |

| 14,300 | | Brookfield Asset Management, Inc., Class A (a) | | | 363,506 |

| 17,000 | | Brookfield Properties Corp. | | | 261,120 |

| 18,400 | | CB Richard Ellis Group, Inc., Class A (b) | | | 291,640 |

| 34,300 | | Chubb Corp. (a)(c) | | | 1,778,455 |

| 37,700 | | City Holding Co. (a) | | | 1,292,733 |

| 8,652 | | CME Group, Inc. (a) | | | 2,734,984 |

| 32,025 | | Commerce Bancshares, Inc. (a) | | | 1,317,508 |

| 6,600 | | Credicorp, Ltd. (a) | | | 581,988 |

| 23,400 | | Cullen/Frost Bankers, Inc. (a) | | | 1,305,720 |

| 61,000 | | Dime Community Bancshares (a) | | | 770,430 |

| 29,900 | | Eaton Vance Corp. (a) | | | 1,002,846 |

| | | | |

| See Notes to Financial Statements. | | 13 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | |

| Shares | | Security Description | | Value |

| 33,300 | | Erie Indemnity Co., Class A | | $ | 1,436,229 |

| 470 | | Fairfax Financial Holdings, Ltd. | | | 176,269 |

| 19,300 | | Federated Investors, Inc., Class B (a) | | | 509,134 |

| 28,100 | | Forestar Group, Inc. (a)(b) | | | 530,528 |

| 54,930 | | Franklin Resources, Inc. (a) | | | 6,091,737 |

| 101,500 | | Fulton Financial Corp. (a) | | | 1,034,285 |

| 21,900 | | Global Payments, Inc. (a) | | | 997,545 |

| 2,615 | | HDFC Bank, Ltd., ADR | | | 364,505 |

| 49,100 | | Hong Kong Exchanges and Clearing, Ltd. | | | 819,572 |

| 163,300 | | Hudson City Bancorp, Inc. (a) | | | 2,312,328 |

| 35,943 | | Icahn Enterprises LP | | | 1,707,293 |

| 7,140 | | ICICI Bank, Ltd., ADR | | | 304,878 |

| 24,600 | | Infinity Property & Casualty Corp. (a) | | | 1,117,824 |

| 20,285 | | IntercontinentalExchange, Inc. (a)(b) | | | 2,275,571 |

| 75,400 | | International Bancshares Corp. (a) | | | 1,733,446 |

| 50,800 | | Janus Capital Group, Inc. (a) | | | 725,932 |

| 10,000 | | Jones Lang LaSalle, Inc. (a) | | | 728,900 |

| 96,000 | | Lender Processing Services, Inc. (a) | | | 3,624,000 |

| 30,500 | | Life Partners Holdings, Inc. (a) | | | 676,185 |

| 40,200 | | LTC Properties, Inc. REIT (a) | | | 1,087,812 |

| 6,005 | | Mastercard, Inc., Class A | | | 1,525,270 |

| 28,300 | | Montpelier Re Holdings, Ltd. (a) | | | 475,723 |

| 13,500 | | Moody’s Corp. (a) | | | 401,625 |

| 64,300 | | National Financial Partners Corp. (a)(b) | | | 906,630 |

| 49,900 | | National Health Investors, Inc. REIT (a) | | | 1,934,124 |

| 10,275 | | Nationwide Health Properties, Inc. REIT (a) | | | 361,166 |

| 36,900 | | NBT Bancorp, Inc. (a) | | | 843,165 |

| 102,300 | | Net 1 UEPS Technologies, Inc. (a)(b) | | | 1,881,297 |

| 35,900 | | NewAlliance Bancshares, Inc. (a) | | | 453,058 |

| 7,280 | | Northern Trust Corp. | | | 402,293 |

| 79,307 | | NYSE Euronext (a) | | | 2,348,280 |

| 26,400 | | optionsXpress Holdings, Inc. (a)(b) | | | 430,056 |

| 537,070 | | PrivateBancorp, Inc. (a) | | | 7,357,859 |

| 33,400 | | ProAssurance Corp. (a)(b) | | | 1,955,236 |

| 18,300 | | Prosperity Bancshares, Inc. (a) | | | 750,300 |

| 7,500 | | PS Business Parks, Inc. REIT (a) | | | 400,500 |

| 30,200 | | Realty Income Corp. REIT | | | 926,838 |

| 200,000 | | Resource America, Inc., Class A | | | 960,000 |

| 13,200 | | RLI Corp. (a) | | | 752,664 |

| 70,100 | | S&T Bancorp, Inc. (a) | | | 1,465,090 |

| 23,500 | | Safety Insurance Group, Inc. (a) | | | 885,245 |

| 18,400 | | Saul Centers, Inc. REIT (a) | | | 761,760 |

| 35,300 | | Selective Insurance Group (a) | | | 585,980 |

| 131,900 | | Singapore Exchange, Ltd. | | | 721,280 |

| 23,250 | | State Street Corp. (c) | | | 1,049,505 |

| 50,600 | | T Rowe Price Group, Inc. (a) | | | 2,779,458 |

| 47,100 | | Taubman Centers, Inc. REIT (a) | | | 1,880,232 |

| 301,160 | | The Bancorp, Inc. (b) | | | 2,680,324 |

| 253,777 | | The Bank of New York Mellon Corp. (a)(c) | | | 7,836,634 |

| 1,170 | | The Goldman Sachs Group, Inc. | | | 199,637 |

| 35,545 | | The NASDAQ OMX Group, Inc. (b) | | | 750,710 |

| 22,450 | | The Progressive Corp. | | | 428,570 |

| 160,400 | | Trustco Bank Corp. NY (a) | | | 989,668 |

| 15,300 | | Trustmark Corp. (a) | | | 373,779 |

| | | | | |

| Shares | | Security Description | | Value |

| 35,600 | | UMB Financial Corp. (a) | | $ | 1,445,360 |

| 19,700 | | United Bankshares, Inc. (a) | | | 516,534 |

| 44,600 | | Unitrin, Inc. (a) | | | 1,251,030 |

| 57,100 | | Universal American Corp. (a)(b) | | | 880,482 |

| 223,083 | | Urbana Corp., Non Voting Class A (b) | | | 344,844 |

| 60,070 | | US Global Investors, Inc., Class A | | | 594,092 |

| 246,000 | | Value Partners Group, Ltd. | | | 190,102 |

| 24,700 | | Ventas, Inc. REIT (a) | | | 1,172,756 |

| 23,950 | | Verisk Analytics, Inc., Class A (b) | | | 675,390 |

| 31,586 | | Visa, Inc., Class A (a) | | | 2,875,274 |

| 12,100 | | Waddell & Reed Financial, Inc., Class A (a) | | | 436,084 |

| 327,500 | | Wells Fargo & Co. (a)(c)(d) | | | 10,191,800 |

| 83,100 | | WesBanco, Inc. (a) | | | 1,351,206 |

| 15,900 | | Westamerica Bancorporation (a) | | | 916,635 |

| 15,500 | | Wright Express Corp. (a)(b) | | | 466,860 |

| | | | | |

| | | | | 152,003,590 |

| | | | | |

| Healthcare - 3.9% | | | |

| 76,600 | | Alkermes, Inc. (a)(b) | | | 993,502 |

| 51,300 | | Allscripts-Misys Healthcare Solutions, Inc. (a)(b) | | | 1,003,428 |

| 35,300 | | AMERIGROUP Corp. (a)(b) | | | 1,173,372 |

| 39,100 | | AmerisourceBergen Corp. (a) | | | 1,130,772 |

| 17,700 | | Amgen, Inc. (a)(b) | | | 1,057,752 |

| 74,800 | | Amsurg Corp. (a)(b) | | | 1,614,932 |

| 24,450 | | Baxter International, Inc. (c) | | | 1,422,990 |

| 60,800 | | Beckman Coulter, Inc. (a) | | | 3,818,240 |

| 43,600 | | Becton Dickinson and Co. | | | 3,432,628 |

| 11,500 | | Biogen Idec, Inc. (a)(b) | | | 659,640 |

| 9,200 | | Bio-Rad Laboratories, Inc., Class A (a)(b) | | | 952,384 |

| 425,000 | | Boston Scientific Corp. (b) | | | 3,068,500 |

| 15,000 | | Cerner Corp. (a)(b) | | | 1,275,900 |

| 16,800 | | Charles River Laboratories International, Inc. (a)(b) | | | 660,408 |

| 20,000 | | Covance, Inc. (b) | | | 1,227,800 |

| 30,000 | | Covidien PLC | | | 1,508,400 |

| 51,000 | | CR Bard, Inc. | | | 4,417,620 |

| 29,000 | | Dendreon Corp. (a)(b) | | | 1,057,630 |

| 241,000 | | Exelixis, Inc. (a)(b) | | | 1,462,870 |

| 12,700 | | Express Scripts, Inc. (a)(b) | | | 1,292,352 |

| 15,700 | | Forest Laboratories, Inc. (a)(b) | | | 492,352 |

| 32,000 | | Gentiva Health Services, Inc. (a)(b) | | | 904,960 |

| 35,575 | | Gilead Sciences, Inc. (a)(b) | | | 1,617,951 |

| 44,400 | | Healthspring, Inc. (a)(b) | | | 781,440 |

| 21,589 | | Henry Schein, Inc. (a)(b) | | | 1,271,592 |

| 67,100 | | Hill-Rom Holdings, Inc. (a) | | | 1,825,791 |

| 39,200 | | Hologic, Inc. (a)(b) | | | 726,768 |

| 43,000 | | IDEXX Laboratories, Inc. (a)(b) | | | 2,474,650 |

| 21,800 | | Invacare Corp. | | | 578,572 |

| 24,000 | | Kinetic Concepts, Inc. (a)(b) | | | 1,147,440 |

| 20,300 | | Life Technologies Corp. (a)(b) | | | 1,061,081 |

| 12,300 | | Lincare Holdings, Inc. (a)(b) | | | 552,024 |

| 20,800 | | Magellan Health Services, Inc. (a)(b) | | | 904,384 |

| | | | |

| See Notes to Financial Statements. | | 14 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | |

| Shares | | Security Description | | Value |

| 9,825 | | Medco Health Solutions, Inc. (a)(b) | | $ | 634,302 |

| 10,000 | | Medtronic, Inc. (a)(c) | | | 450,300 |

| 12,940 | | Mindray Medical International, Ltd., ADR | | | 471,275 |

| 12,600 | | Orthofix International NV (a)(b) | | | 458,388 |

| 35,000 | | Perrigo Co. | | | 2,055,200 |

| 560,000 | | Pfizer, Inc. (c) | | | 9,604,000 |

| 89,965 | | Quest Diagnostics, Inc. (a)(c) | | | 5,244,060 |

| 77,100 | | Quidel Corp. (a)(b) | | | 1,121,034 |

| 143,250 | | Shandong Weigao Group Medical Polymer Co., Ltd., Class H | | | 597,778 |

| 137,000 | | St Jude Medical, Inc. (a)(b)(c) | | | 5,623,850 |

| 16,800 | | Stryker Corp. (a) | | | 961,296 |

| 13,700 | | Techne Corp. (a) | | | 872,553 |

| 14,400 | | Teleflex, Inc. | | | 922,608 |

| 102,700 | | The Medicines Co. (a)(b) | | | 805,168 |

| 115,950 | | UnitedHealth Group, Inc. (a) | | | 3,788,086 |

| 51,700 | | Valeant Pharmaceuticals International (a)(b) | | | 2,218,447 |

| 36,800 | | WellPoint, Inc. (a)(b) | | | 2,369,184 |

| 15,300 | | Zimmer Holdings, Inc. (a)(b) | | | 905,760 |

| | | | | |

| | | | | 86,673,414 |

| | | | | |

| Industrial - 3.8% | | | |

| 32,600 | | 3M Co. (a) | | | 2,724,382 |

| 14,500 | | Actuant Corp., Class A | | | 283,475 |

| 46,600 | | Aptargroup, Inc. (a) | | | 1,833,710 |

| 17,400 | | Avnet, Inc. (a)(b) | | | 522,000 |

| 8,700 | | BE Aerospace, Inc. (a)(b) | | | 264,915 |

| 1,356,000 | | Beijing Capital International Airport Co., Ltd., Class H | | | 810,360 |

| 11,200 | | Canadian National Railway Co. (a) | | | 678,608 |

| 23,700 | | Carlisle Cos., Inc. (a) | | | 902,970 |

| 273,682 | | Cemex SAB de CV, ADR (a)(b) | | | 2,794,293 |

| 11,400 | | CH Robinson Worldwide, Inc. (a) | | | 636,690 |

| 10,000 | | CNH Global NV (a)(b) | | | 307,500 |

| 44,800 | | Continental Airlines, Inc., Class B (a)(b) | | | 984,256 |

| 21,545 | | CSX Corp. | | | 1,096,640 |

| 15,300 | | Deere & Co. (a) | | | 909,738 |

| 18,700 | | Dolby Laboratories, Inc., Class A (a)(b) | | | 1,097,129 |

| 25,500 | | Drew Industries, Inc. (a)(b) | | | 561,510 |

| 2,400 | | Flowserve Corp. | | | 264,648 |

| 23,400 | | Frontline, Ltd. (a) | | | 716,742 |

| 12,600 | | Gardner Denver, Inc. (a) | | | 554,904 |

| 12,900 | | Garmin, Ltd. (a) | | | 496,392 |

| 44,900 | | Gentex Corp. (a) | | | 871,958 |

| 13,400 | | Goodrich Corp. (a) | | | 944,968 |

| 81,800 | | Graco, Inc. (a) | | | 2,617,600 |

| 27,500 | | Graham Corp. (a) | | | 494,725 |

| 20,100 | | Greif, Inc., Class A (a) | | | 1,103,892 |

| 8,549 | | Guangshen Railway Co., Ltd., ADR | | | 171,322 |

| 15,600 | | Harsco Corp. (a) | | | 498,264 |

| 19,500 | | Illinois Tool Works, Inc. (a) | | | 923,520 |

| | | | | |

| Shares | | Security Description | | Value |

| 36,000 | | JB Hunt Transport Services, Inc. (a) | | $ | 1,291,680 |

| 347 | | Kansas City Southern (a)(b) | | | 12,551 |

| 55,600 | | Knightsbridge Tankers, Ltd. | | | 941,864 |

| 16,700 | | L-3 Communications Holdings, Inc. (a) | | | 1,530,221 |

| 47,700 | | Landstar System, Inc. (a) | | | 2,002,446 |

| 22,800 | | Layne Christensen Co. (a)(b) | | | 608,988 |

| 11,600 | | Lennox International, Inc. (a) | | | 514,112 |

| 11,300 | | Lincoln Electric Holdings, Inc. (a) | | | 613,929 |

| 107,800 | | Lockheed Martin Corp. (a) | | | 8,971,116 |

| 64,000 | | Methode Electronics, Inc. (a) | | | 633,600 |

| 48,500 | | Nalco Holding Co. (a) | | | 1,180,005 |

| 45,600 | | Nordson Corp. (a) | | | 3,097,152 |

| 15,240 | | Norfolk Southern Corp. | | | 851,764 |

| 29,200 | | Northrop Grumman Corp. (a) | | | 1,914,644 |

| 1,900 | | Precision Castparts Corp. | | | 240,749 |

| 38,900 | | Quanex Building Products Corp. (a) | | | 643,017 |

| 18,651 | | Quanta Services, Inc. (b) | | | 357,353 |

| 31,200 | | Raytheon Co. (a) | | | 1,782,144 |

| 15,800 | | Rockwell Collins, Inc. (a) | | | 988,922 |

| 32,200 | | Rogers Corp. (b) | | | 934,122 |

| 29,800 | | Sonoco Products Co. (a) | | | 917,542 |

| 14,300 | | SPX Corp. (a) | | | 948,376 |

| 10,700 | | Terex Corp. (a)(b) | | | 242,997 |

| 104,950 | | The Boeing Co. (a)(c)(d) | | | 7,620,420 |

| 110,000 | | The Brink’s Co. | | | 3,105,300 |

| 12,000 | | Thomas & Betts Corp. (a)(b) | | | 470,880 |

| 617,000 | | Tianjin Port Development Holdings, Ltd. (b) | | | 185,158 |

| 25,000 | | Towers Watson & Co., Class A | | | 1,187,500 |

| 12,000 | | TYCO International, Ltd. (a) | | | 459,000 |

| 14,521 | | Union Pacific Corp. | | | 1,064,389 |

| 74,850 | | United Parcel Service, Inc., Class B (a) | | | 4,821,089 |

| 8,300 | | United Technologies Corp. (a) | | | 610,963 |

| 165,540 | | USG Corp. (a)(b) | | | 2,840,666 |

| 14,200 | | Valmont Industries, Inc. (a) | | | 1,176,186 |

| 37,900 | | Waste Connections, Inc. (a)(b) | | | 1,287,084 |

| 71,900 | | Zebra Technologies Corp., Class A (a)(b) | | | 2,128,240 |

| | | | | |

| | | | | 84,243,280 |

| | | | | |

| Information Technology - 3.2% | | | |

| 120,500 | | Accenture PLC, Class A (a) | | | 5,054,975 |

| 38,900 | | ACI Worldwide, Inc. (a)(b) | | | 801,729 |

| 32,800 | | Adobe Systems, Inc. (a)(b) | | | 1,160,136 |

| 21,800 | | Advent Software, Inc. (a)(b) | | | 975,550 |

| 18,300 | | Alliance Data Systems Corp. (a)(b) | | | 1,171,017 |

| 41,600 | | Altera Corp. (a) | | | 1,011,296 |

| 13,500 | | ANSYS, Inc. (a)(b) | | | 582,390 |

| 228,420 | | Automatic Data Processing, Inc. (a) | | | 10,157,837 |

| 69,270 | | Broadridge Financial Solutions, Inc. (a) | | | 1,480,992 |

| 53,300 | | CGI Group, Inc., Class A (a)(b) | | | 794,703 |

| 26,900 | | Check Point Software Technologies (b) | | | 943,114 |

| 6,000 | | Citrix Systems, Inc. (b) | | | 284,820 |

| 96,750 | | Computershare, Ltd. | | | 1,111,559 |

| 15,400 | | Cree, Inc. (a)(b) | | | 1,081,388 |

| | | | |

| See Notes to Financial Statements. | | 15 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | |

| Shares | | Security Description | | Value |

| 120,000 | | Dell, Inc. (b) | | $ | 1,801,200 |

| 10,640 | | DST Systems, Inc. | | | 441,028 |

| 11,700 | | Dun & Bradstreet Corp. (a) | | | 870,714 |

| 65,100 | | Earthlink, Inc. (a) | | | 555,954 |

| 103,600 | | Epicor Software Corp. (a)(b) | | | 990,416 |

| 48,100 | | Fiserv, Inc. (a)(b) | | | 2,441,556 |

| 8,058 | | Hewlett-Packard Co. (a) | | | 428,282 |

| 185,400 | | Integrated Device Technology, Inc. (a)(b) | | | 1,136,502 |

| 31,500 | | Intel Corp. (a) | | | 701,190 |

| 3,391 | | International Business Machines Corp. (a)(c) | | | 434,896 |

| 62,100 | | Intersil Corp., Class A (a) | | | 916,596 |

| 60,000 | | Jack Henry & Associates, Inc. | | | 1,443,600 |

| 36,800 | | Logitech International SA (a)(b) | | | 601,312 |

| 16,000 | | Manhattan Associates, Inc. (a)(b) | | | 407,680 |

| 82,400 | | Micrel, Inc. (a) | | | 878,384 |

| 31,800 | | MICROS Systems, Inc. (a)(b) | | | 1,045,584 |

| 349,825 | | Microsoft Corp. (a) | | | 10,239,378 |

| 51,400 | | MKS Instruments, Inc. (a)(b) | | | 1,006,926 |

| 23,547 | | MSCI, Inc., Class A (b) | | | 850,047 |

| 83,800 | | NVIDIA Corp. (a)(b) | | | 1,456,444 |

| 21,675 | | Oracle Corp. (a) | | | 556,831 |

| 14,500 | | Progress Software Corp. (a)(b) | | | 455,735 |

| 39,700 | | Red Hat, Inc. (a)(b) | | | 1,162,019 |

| 10,400 | | Research In Motion, Ltd. (a)(b) | | | 769,080 |

| 7,800 | | Riverbed Technology, Inc. (a)(b) | | | 221,520 |

| 5,600 | | Salesforce.com, Inc. (a)(b) | | | 416,920 |

| 41,460 | | Scientific Learning Corp. (a)(b) | | | 199,008 |

| 51,000 | | Seagate Technology (a)(b) | | | 931,260 |

| 120,100 | | SEI Investments Co. (a) | | | 2,638,597 |

| 6,900 | | Solera Holdings, Inc. | | | 266,685 |

| 34,400 | | SRA International, Inc., Class A (a)(b) | | | 715,176 |

| 72,500 | | Symantec Corp. (a)(b) | | | 1,226,700 |

| 23,400 | | Teradata Corp. (a)(b) | | | 676,026 |

| 39,900 | | Texas Instruments, Inc. (a) | | | 976,353 |

| 5,400 | | Varian Semiconductor Equipment Associates, Inc. (b) | | | 178,848 |

| 25,300 | | VMWare, Inc., Class A (a)(b) | | | 1,348,490 |

| 24,900 | | Western Digital Corp. (a)(b) | | | 970,851 |

| 46,700 | | Xilinx, Inc. (a) | | | 1,190,850 |

| | | | | |

| | | | | 70,160,144 |

| | | | | |

| Materials - 1.2% | | | |

| 32,800 | | A Schulman, Inc. (a) | | | 802,616 |

| 49,262 | | Anglo American PLC, ADR (Unsponsored) (b) | | | 1,066,030 |

| 14,285 | | BHP Billiton, Ltd., ADR | | | 1,147,371 |

| 11,100 | | Carpenter Technology Corp. (a) | | | 406,260 |

| 35,000 | | Compass Minerals International, Inc. | | | 2,808,050 |

| 29,285 | | Franco-Nevada Corp. | | | 785,720 |

| 10,734 | | Freeport-McMoRan Copper & Gold, Inc. | | | 896,718 |

| 42,000 | | H.B. Fuller Co. (a) | | | 974,820 |

| 85,500 | | International Flavors & Fragrances, Inc. (a) | | | 4,075,785 |

| | | | | |

| Shares | | Security Description | | Value |

| 13,300 | | Kaiser Aluminum Corp. (a) | | $ | 512,981 |

| 33,400 | | Minerals Technologies, Inc. (a) | | | 1,731,456 |

| 17,300 | | Nucor Corp. (a) | | | 785,074 |

| 7,260 | | Potash Corp. of Saskatchewan, Inc. | | | 866,481 |

| 25,700 | | Potlatch Corp. (a) | | | 900,528 |

| 15,300 | | PPG Industries, Inc. (a) | | | 1,000,620 |

| 4,001 | | Rio Tinto PLC, ADR | | | 947,157 |

| 15,500 | | Schnitzer Steel Industries, Inc., Class A (a) | | | 814,215 |

| 17,900 | | Sigma-Aldrich Corp. (a) | | | 960,514 |

| 67,300 | | Southern Copper Corp. (a) | | | 2,131,391 |

| 4,600 | | The Mosaic Co. | | | 279,542 |

| 19,000 | | The Sherwin-Williams Co. (a) | | | 1,285,920 |

| 29,700 | | Valspar Corp. (a) | | | 875,556 |

| | | | | |

| | | | | 26,054,805 |

| | | | | |

| Telecommunication Services - 1.5% | | | |

| 20,400 | | Amdocs, Ltd. (a)(b) | | | 614,244 |

| 27,700 | | American Tower Corp., Class A (a)(b) | | | 1,180,297 |

| 21,800 | | BCE, Inc. (a) | | | 639,830 |

| 13,900 | | Harris Corp. (a) | | | 660,111 |

| 21,100 | | NeuStar, Inc., Class A (a)(b) | | | 531,720 |

| 1,430,000 | | News Corp., Class A | | | 20,606,300 |

| 14,000 | | Plantronics, Inc. (a) | | | 437,920 |

| 22,300 | | United States Cellular Corp. (a)(b) | | | 922,774 |

| 258,000 | | Vodafone Group PLC, ADR (a) | | | 6,008,820 |

| | | | | |

| | | | | 31,602,016 |

| | | | | |

| Utilities - 0.7% | | | |

| 19,100 | | Alliant Energy Corp. (a) | | | 635,266 |

| 70,380 | | Calpine Corp. (b) | | | 836,818 |

| 27,400 | | DPL, Inc. (a) | | | 745,006 |

| 121,250 | | Dynegy, Inc., Class A (b) | | | 152,775 |

| 39,500 | | Edison International (a) | | | 1,349,715 |

| 70,600 | | El Paso Electric Co. (a)(b) | | | 1,454,360 |

| 41,100 | | Energen Corp. (a) | | | 1,912,383 |

| 19,100 | | Entergy Corp. (a) | | | 1,553,785 |

| 10,000 | | Exelon Corp. | | | 438,100 |

| 35,900 | | IDACORP, Inc. | | | 1,242,858 |

| 21,700 | | ITC Holdings Corp. (a) | | | 1,193,500 |

| 55,095 | | Mirant Corp. (a)(b) | | | 598,332 |

| 8,245 | | NRG Energy, Inc. (b) | | | 172,320 |

| 40,000 | | PPL Corp. (a) | | | 1,108,400 |

| 60,000 | | Public Service Enterprise Group, Inc. (a) | | | 1,771,200 |

| 26,839 | | RRI Energy, Inc. (b) | | | 99,036 |

| | | | | |

| | | | | 15,263,854 |

| | | | | |

| Total Common Stock (Cost $686,314,034) | | | 814,711,231 |

| | | | | |

| | | | |

| See Notes to Financial Statements. | | 16 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | | | | | | |

| Shares | | Security

Description | | Rate | | | | | Value |

| Preferred Stock - 2.1% | | | | | | | | |

| Consumer Discretionary - 0.8% | | | | | | | | |

| 7,819 | | Callaway Golf Co., Series B (a)(e) | | 7.50 | % | | | | $ | 1,086,841 |

| 1,564 | | Callaway Golf Co., Series B (a) | | 7.50 | | | | | | 217,396 |

| 62,787 | | Ford Motor Co. Capital Trust II (a) | | 6.50 | | | | | | 2,931,368 |

| 323 | | Interpublic Group of Cos., Inc. (a)(e) | | 5.25 | | | | | | 263,326 |

| 11,377 | | Interpublic Group of Cos., Inc., Series B (a) | | 5.25 | | | | | | 10,125,530 |

| 62,259 | | Retail Ventures, Inc. (a) | | 6.63 | | | | | | 2,732,547 |

| | | | | | | | | | |

| | | | | | | | | | 17,357,008 |

| | | | | | | | | | |

| Consumer Staples - 0.0% | | | | | | | | |

| 2,514 | | Bunge, Ltd. (a) | | 5.13 | | | | | | 1,561,194 |

| | | | | | | | | | |

| Energy - 0.3% | | | | | | | | |

| 14,345 | | ATP Oil & Gas Corp. (a)(e) | | 8.00 | | | | | | 1,576,157 |

| 34,618 | | Goodrich Petroleum Corp., Series B (a) | | 5.38 | | | | | | 1,152,779 |

| 2,754 | | SandRidge Energy, Inc. (a) | | 8.50 | | | | | | 326,983 |

| 15,709 | | Whiting Petroleum Corp. (a) | | 6.25 | | | | | | 3,109,125 |

| | | | | | | | | | |

| | | | | | | | | | 6,165,044 |

| | | | | | | | | | |

| Financial - 0.7% | | | | | | | | |

| 87,199 | | 2009 Dole Food Automatic Common Exchange Security Trust (a)(e) | | 7.00 | | | | | | 1,073,638 |

| 118,122 | | Alexandria Real Estate Equities, Inc. REIT, Series D (a) | | 7.00 | | | | | | 2,702,041 |

| 65,428 | | AMG Capital Trust II (a) | | 5.15 | | | | | | 2,314,515 |

| 1,745 | | Bank of America Corp. (a) | | 7.25 | | | | | | 1,706,174 |

| 29,070 | | Hartford Financial Services Group, Inc. (a) | | 7.25 | | | | | | 769,192 |

| 49,398 | | SLM Corp., Series A | | 6.97 | | | | | | 1,894,907 |

| 5,485 | | SLM Corp., Series B (a) | | 7.25 | | | | | | 3,668,423 |

| 1,375 | | Wells Fargo & Co., Series L | | 7.50 | | | | | | 1,343,375 |

| | | | | | | | | | |

| | | | | | | | | | 15,472,265 |

| | | | | | | | | | |

| Healthcare - 0.2% | | | | | | | | |

| 70 | | Healthsouth Corp. (a)(e) | | 6.50 | | | | | | 60,480 |

| 2,528 | | Healthsouth Corp., Series A | | 6.50 | | | | | | 2,184,192 |

| 6,475 | | Inverness Medical Innovations, Inc., Series B (a) | | 3.00 | | | | | | 1,712,638 |

| 29,522 | | Omnicare Capital Trust II, Series B (a) | | 4.00 | | | | | | 1,225,163 |

| | | | | | | | | | |

| | | | | | | | | | 5,182,473 |

| | | | | | | | | | |

| Industrial - 0.1% | | | | | | | | |

| 1,607 | | Kansas City Southern (a) | | 5.13 | | | | | | 2,062,413 |

| | | | | | | | | | |

| Total Preferred Stock (Cost $37,102,587) | | | 47,800,397 |

| | | | | | | | | | |

| Total Equity Securities (Cost $723,416,621) | | | 862,511,628 |

| | | | | | | | | | |

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| | Fixed Income Securities - 35.7% | | | | | | |

| | Asset Backed Obligations - 7.2% | | | | | | |

| $ | 4,095,000 | | ACE Securities Corp., Series 2006-HE1 A2D (f) | | 0.55 | % | | 02/25/36 | | $ | 1,688,036 |

| | 148,522 | | Adjustable Rate Mortgage Trust, Series 2005-12 2A1 (a)(f) | | 5.58 | | | 03/25/36 | | | 99,016 |

| | 126,572 | | Adjustable Rate Mortgage Trust, Series 2006-1 3A3 (a)(f) | | 5.79 | | | 03/25/36 | | | 89,041 |

| | 1,392,660 | | Aerco, Ltd., Series 2A A3 (e)(f) | | 0.69 | | | 07/15/25 | | | 821,669 |

| | 228,465 | | Alliance Bancorp Trust, Series 2007-OA1 A1 (f) | | 0.49 | | | 07/25/37 | | | 110,922 |

| | 1,015,000 | | American Airlines Pass Through Trust, Series 2001-02 (a) | | 7.86 | | | 10/01/11 | | | 1,027,688 |

| | 620,695 | | American Airlines Pass Through Trust, Series 2009-1A | | 10.38 | | | 07/02/19 | | | 716,903 |

| | 990,000 | | American Home Mortgage Assets, Series 2007-4 A2 (f) | | 0.44 | | | 08/25/37 | | | 635,240 |

| | 1,055,000 | | Argent Securities, Inc., Series 2005-W5 A2D (f) | | 0.57 | | | 01/25/36 | | | 465,396 |

| | 390,000 | | Asset Backed Funding Certificates, Series 2006-HE1 M2 (f) | | 0.53 | | | 01/25/37 | | | 467 |

| | 1,875,000 | | Asset Backed Funding Certificates, Series 2007-NC1 M2 (e)(f) | | 1.50 | | | 05/25/37 | | | 69,512 |

| | 1,500,000 | | Asset Backed Funding Certificates, Series 2007-WMC1 A2B (f) | | 1.25 | | | 06/25/37 | | | 651,258 |

| | 1,200,000 | | Astoria Depositor Corp. (e) | | 8.14 | | | 05/01/21 | | | 1,170,750 |

| | | | |

| See Notes to Financial Statements. | | 17 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 382,282 | | Banc of America Alternative Loan Trust, Series 2005-8 2CB1 (a) | | 6.00 | % | | 09/25/35 | | $ | 284,542 |

| | 114,542 | | Banc of America Funding Corp., Series 2006-E 2A1 (a)(f) | | 5.76 | | | 06/20/36 | | | 74,760 |

| | 423,067 | | Banc of America Funding Corp., Series 2006-F 1A1 (a)(f) | | 5.13 | | | 07/20/36 | | | 361,445 |

| | 295,380 | | Banc of America Funding Corp., Series 2006-H 6A1 (f) | | 0.43 | | | 10/20/36 | | | 155,346 |

| | 620,024 | | Banc of America Funding Corp., Series 2007-8 2A1 | | 7.00 | | | 10/25/37 | | | 421,841 |

| | 225,757 | | Banc of America Funding Corp., Series 2007-E 4A1 (f) | | 5.71 | | | 07/20/47 | | | 146,757 |

| | 110,000 | | Bayview Financial Acquisition Trust, Series 2005-D AF3 (a)(f) | | 5.50 | | | 12/28/35 | | | 92,106 |

| | 357,624 | | Bear Stearns Adjustable Rate Mortgage Trust, Series 2007-5 1A1 (a)(f) | | 5.80 | | | 08/25/47 | | | 223,265 |

| | 1,297,432 | | Bear Stearns Alt-A Trust, Series 2005-4 21A1 (f) | | 3.21 | | | 05/25/35 | | | 871,539 |

| | 285,987 | | Bear Stearns Alt-A Trust, Series 2005-8 11A1 (a)(f) | | 0.52 | | | 10/25/35 | | | 162,817 |

| | 198,160 | | Bear Stearns Alt-A Trust, Series 2006-1 22A1 (f) | | 5.13 | | | 02/25/36 | | | 113,685 |

| | 282,460 | | Bear Stearns Alt-A Trust, Series 2006-2 23A1 (a)(f) | | 5.63 | | | 03/25/36 | | | 129,833 |

| | 2,850,013 | | Bear Stearns Asset Backed Securities Trust, Series 2006-SD4 3A1 (f) | | 1.44 | | | 10/25/36 | | | 1,156,184 |

| | 1,500,000 | | BNC Mortgage Loan Trust, Series 2007-3 A3 (f) | | 0.38 | | | 07/25/37 | | | 793,003 |

| | 528,999 | | BNC Mortgage Loan Trust, Series 2007-4 A3A (f) | | 0.50 | | | 11/25/37 | | | 484,891 |

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 1,300,000 | | Centex Home Equity Loan Trust, Series 2006-A AV4 (f) | | 0.50 | % | | 06/25/36 | | $ | 673,405 |

| | 806,009 | | Centex Home Equity, Series 2005-C AF6 (g) | | 4.64 | | | 06/25/35 | | | 777,823 |

| | 125,000 | | Chase Mortgage Finance Corp., Series 2005-A1 2A3 (a)(f) | | 5.23 | | | 12/25/35 | | | 98,676 |

| | 633,550 | | Chaseflex Trust, Series 2007-1 2A9 (a) | | 6.00 | | | 02/25/37 | | | 422,918 |

| | 1,200,000 | | Citicorp Residential Mortgage Securities, Inc., Series 2006-2 A5 (g) | | 6.04 | | | 09/25/36 | | | 985,171 |

| | 1,400,000 | | Citicorp Residential Mortgage Securities, Inc., Series 2007-1 A5 (g) | | 6.05 | | | 03/25/37 | | | 1,242,294 |

| | 75,000 | | Citigroup Commerical Mortgage Trust, Series 2007-C6 A4 (a)(f) | | 5.70 | | | 12/10/49 | | | 74,824 |

| | 1,462 | | Citigroup Mortgage Loan Trust, Inc., Series 2005-WF1 A2 (a)(f) | | 4.49 | | | 11/25/34 | | | 1,394 |

| | 1,300,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-AHL3 A3B (f) | | 0.42 | | | 07/25/45 | | | 529,647 |

| | 415,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-AMC2 M1 (f) | | 0.52 | | | 01/25/37 | | | 2,771 |

| | 195,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-AMC2 M2 (f) | | 0.54 | | | 01/25/37 | | | 816 |

| | 65,464 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-AMC4 A2A (a)(f) | | 0.31 | | | 05/25/37 | | | 57,670 |

| | 1,010,296 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-AR8 2A1A (f) | | 5.85 | | | 07/25/37 | | | 744,279 |

| | | | |

| See Notes to Financial Statements. | | 18 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 3,110,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH1 A4 (f) | | 0.45 | % | | 01/25/37 | | $ | 1,299,376 |

| | 1,397,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH2 A3 (f) | | 0.43 | | | 03/25/37 | | | 608,576 |

| | 1,250,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH2 M1 (f) | | 0.65 | | | 03/25/37 | | | 73,375 |

| | 925,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH3 A2 (f) | | 0.41 | | | 06/25/37 | | | 578,194 |

| | 1,000,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH3 M2 (f) | | 0.52 | | | 06/25/37 | | | 17,676 |

| | 1,000,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH4 A2B (f) | | 1.30 | | | 07/25/37 | | | 488,525 |

| | 285,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH4 A2C (a)(f) | | 1.55 | | | 07/25/37 | | | 116,470 |

| | 1,205,000 | | Citigroup/Deutsche Bank Commercial Mortgage Trust, Series 2007-CD4 A4 (a) | | 5.32 | | | 12/11/49 | | | 1,168,599 |

| | 160,000 | | Citigroup/Deutsche Bank Commercial Mortgage Trust, Series 2007-CD5 A4 (a)(f) | | 5.89 | | | 11/15/44 | | | 160,281 |

| | 227,576 | | Citimortgage Alternative Loan Trust, Series 2006-A7 1A12 | | 6.00 | | | 12/25/36 | | | 163,578 |

| | 88,303 | | Citimortgage Alternative Loan Trust, Series 2007-A4 1A6 (a) | | 5.75 | | | 04/25/37 | | | 66,174 |

| | 1,250,000 | | Conseco Finance, Series 2002-C BF1 (f) | | 8.00 | | | 06/15/32 | | | 1,066,980 |

| | 100,000 | | Continental Airlines, Inc., Series 2007-1 A | | 5.98 | | | 04/19/22 | | | 98,250 |

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 832,818 | | Continental Airlines, Inc., Series 2009-1 | | 9.00 | % | | 07/08/16 | | $ | 907,772 |

| | 1,072,424 | | Coso Geothermal Power Holdings (e) | | 7.00 | | | 07/15/26 | | | 1,017,383 |

| | 84,564 | | Countrywide Alternative Loan Trust, Series 2004-J10 4CB1 | | 6.50 | | | 10/25/34 | | | 72,403 |

| | 285,227 | | Countrywide Alternative Loan Trust, Series 2005-43 4A1 (f) | | 5.60 | | | 10/25/35 | | | 202,726 |

| | 108,068 | | Countrywide Alternative Loan Trust, Series 2005-50CB 1A1 (a) | | 5.50 | | | 11/25/35 | | | 78,004 |

| | 434,767 | | Countrywide Alternative Loan Trust, Series 2006-36T2 1A1 (a)(f) | | 0.57 | | | 12/25/36 | | | 210,352 |

| | 78,077 | | Countrywide Alternative Loan Trust, Series 2006-7CB 3A1 (a) | | 5.25 | | | 05/25/21 | | | 54,189 |

| | 2,240,083 | | Countrywide Alternative Loan Trust, Series 2006-OA10 1A1 (f) | | 1.36 | | | 08/25/46 | | | 1,176,219 |

| | 4,810,711 | | Countrywide Alternative Loan Trust, Series 2006-OA22 A1 (f) | | 0.41 | | | 02/25/47 | | | 2,579,167 |

| | 520,748 | | Countrywide Alternative Loan Trust, Series 2007-16CB 4A7 | | 6.00 | | | 08/25/37 | | | 358,239 |

| | 416,344 | | Countrywide Alternative Loan Trust, Series 2007-19 1A34 | | 6.00 | | | 08/25/37 | | | 283,129 |

| | 762,235 | | Countrywide Alternative Loan Trust, Series 2007-OH1 A1A (f) | | 0.34 | | | 04/25/47 | | | 648,990 |

| | 1,740,000 | | Countrywide Asset-Backed Certificates, Series 2007-10 2A2 (f) | | 0.37 | | | 06/25/47 | | | 1,220,483 |

| | 674,061 | | Countrywide Asset-Backed Certificates, Series 2007-13 2A1 (f) | | 1.15 | | | 10/25/47 | | | 451,860 |

| | | | |

| See Notes to Financial Statements. | | 19 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 1,027,000 | | Countrywide Asset-Backed Certificates, Series 2007-7 2A2 (f) | | 0.41 | % | | 10/25/47 | | $ | 827,174 |

| | 101,130 | | Countrywide Asset-Backed Certificates, Series 2007-9 2A1 (a)(f) | | 0.31 | | | 06/25/47 | | | 92,275 |

| | 1,835,183 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2004-HYB5 3A1 (f) | | 3.48 | | | 04/20/35 | | | 1,296,572 |

| | 1,067,499 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HY3 2A1 (a)(f) | | 5.49 | | | 06/25/47 | | | 760,797 |

| | 534,427 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HY3 4A1 (a)(f) | | 5.93 | | | 06/25/47 | | | 437,382 |

| | 145,802 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HY5 1A1 (a)(f) | | 5.85 | | | 09/25/47 | | | 107,450 |

| | 661,559 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HYB2 3A1 (a)(f) | | 5.27 | | | 02/25/47 | | | 392,612 |

| | 1,455,000 | | Credit - Based Asset Servicing and Securitization, LLC, Series 2006-CB4 AV3 (f) | | 0.40 | | | 05/25/36 | | | 782,009 |

| | 1,600,000 | | Credit - Based Asset Servicing and Securitization, LLC, Series 2006-CB8 A2B (f) | | 0.36 | | | 10/25/36 | | | 1,311,696 |

| | 1,600,000 | | Credit - Based Asset Servicing and Securitization, LLC, Series 2006-CB8 M2 (f) | | 0.55 | | | 10/25/36 | | | 10,683 |

| | 564,000 | | Credit - Based Asset Servicing and Securitization, LLC, Series 2006-CB9 A2 (f) | | 0.36 | | | 11/25/36 | | | 220,305 |

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 845,000 | | Credit - Based Asset Servicing and Securitization, LLC, Series 2006-CB9 A4 (f) | | 0.48 | % | | 11/25/36 | | $ | 297,846 |

| | 1,563,000 | | Credit - Based Asset Servicing and Securitization, LLC, Series 2007-CB4 M1 (f) | | 0.57 | | | 04/25/37 | | | 16,574 |

| | 1,500,000 | | Credit - Based Asset Servicing and Securitization, LLC, Series 2007-CB5 A3 (f) | | 0.50 | | | 04/25/37 | | | 592,721 |

| | 31,276 | | Credit Suisse First Boston Mortgage Securities Corp., Series 2003-AR24 2A4 (f) | | 3.05 | | | 10/25/33 | | | 26,127 |

| | 1,312,183 | | Credit Suisse Mortgage Capital Certificates, Series 2006-6 2A1 (a)(f) | | 0.85 | | | 07/25/36 | | | 566,541 |

| | 324,030 | | Credit Suisse Mortgage Capital Certificates, Series 2006-8 3A1 (a) | | 6.00 | | | 10/25/21 | | | 240,812 |

| | 1,930,000 | | Credit Suisse Mortgage Capital Certificates, Series 2006-C5 A3 (a) | | 5.31 | | | 12/15/39 | | | 1,825,259 |

| | 200,000 | | CS First Boston Mortgage Securities Corp., Series 2005-C5 A3 (a)(f) | | 5.10 | | | 08/15/38 | | | 208,499 |

| | 1,300,000 | | CW Capital Cobalt, Ltd., Series 2006-C1 A4 | | 5.22 | | | 08/15/48 | | | 1,243,426 |

| | 550,000 | | Delta Air Lines, Inc., Series 2000-A2 | | 7.57 | | | 11/18/10 | | | 566,500 |

| | 359,571 | | Deutsche ALT-A Securities Inc Alternate Loan Trust, Series 2006-AB2 A5B (g) | | 6.09 | | | 06/25/36 | | | 199,557 |

| | 1,447,199 | | Deutsche ALT-A Securities, Inc. Alternate Loan Trust, Series 2007-AR1 A4 (f) | | 0.41 | | | 01/25/47 | | | 480,354 |

| | | | |

| See Notes to Financial Statements. | | 20 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 2,174,555 | | Deutsche ALT-A Securities, Inc. Alternate Loan Trust, Series 2007-OA2 A1 (f) | | 1.02 | % | | 04/25/47 | | $ | 1,221,992 |

| | 325,968 | | Dynegy Roseton/Danskammer Pass Through Trust, Series A (a) | | 7.27 | | | 11/08/10 | | | 327,190 |

| | 995,000 | | Dynegy Roseton/Danskammer Pass Through Trust, Series B (a) | | 7.67 | | | 11/08/16 | | | 967,021 |

| | 4,500,000 | | Ellington Loan Acquisition Trust, Series 2007-2 A2C (e)(f) | | 1.35 | | | 05/25/37 | | | 2,229,663 |

| | 1,200,000 | | Equifirst Loan Securitization Trust, Series 2007-1 A2B (f) | | 0.44 | | | 04/25/37 | | | 611,883 |

| | 77,935 | | Equity One ABS, Inc., Series 2002-4 M1 (a)(f) | | 5.22 | | | 02/25/33 | | | 56,967 |

| | 2,800,000 | | First Franklin Mortgage Loan Asset Backed Certificates, Series 2006-FF11 2A3 (f) | | 0.40 | | | 08/25/36 | | | 1,239,349 |

| | 2,500,000 | | First Franklin Mortgage Loan Asset Backed Certificates, Series 2006-FF18 M1 (a)(f) | | 0.48 | | | 12/25/37 | | | 8,756 |

| | 930,000 | | First Franklin Mortgage Loan Asset Backed Certificates, Series 2007-FF1 A2C (f) | | 0.39 | | | 01/25/38 | | | 414,406 |

| | 1,326,451 | | First Horizon Alternative Mortgage Securities, Series 2005-AA3 2A1 (f) | | 2.64 | | | 05/25/35 | | | 923,567 |

| | 804,689 | | First Horizon Alternative Mortgage Securities, Series 2006-AA2 2A1 (a)(f) | | 6.08 | | | 05/25/36 | | | 411,223 |

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 721,222 | | First Horizon Alternative Mortgage Securities, Series 2006-FA8 1A1 | | 6.25 | % | | 02/25/37 | | $ | 510,465 |

| | 217,922 | | First Horizon Alternative Mortgage Securities, Series 2006-FA8 1A8 (a)(f) | | 0.62 | | | 02/25/37 | | | 107,564 |

| | 1,130,000 | | First Horizon Mortgage Pass-Through Trust, Series 2005-AR6 2A1B (a)(f) | | 5.53 | | | 01/25/36 | | | 766,483 |

| | 351,204 | | FPL Energy National Wind Portfolio, LLC (a)(e) | | 6.13 | | | 03/25/19 | | | 338,479 |

| | 272,435 | | FPL Energy Wind Funding, LLC (a)(e) | | 6.88 | | | 06/27/17 | | | 266,305 |

| | 200,000 | | GE Capital Commercial Mortgage Corp., Series 2006-C1 A3 (a)(f) | | 5.33 | | | 03/10/44 | | | 209,724 |

| | 370,989 | | Green Tree Home Improvement Loan Trust, Series 1997-D HEB1 | | 7.41 | | | 09/15/28 | | | 365,581 |

| | 1,305,000 | | Greenwich Capital Commercial Funding Corp., Series 2006-GG7 A4 (f) | | 5.89 | | | 07/10/38 | | | 1,332,525 |

| | 180,000 | | Greenwich Capital Commercial Funding Corp., Series 2007-GG9 A4 (a) | | 5.44 | | | 03/10/39 | | | 175,375 |

| | 1,015,346 | | GSAA Home Equity Trust, Series 2005-12 AF3 (f) | | 5.07 | | | 09/25/35 | | | 827,151 |

| | 1,630,000 | | GSAA Home Equity Trust, Series 2005-7 AF3 (f) | | 4.75 | | | 05/25/35 | | | 1,291,228 |

| | 1,500,000 | | GSAA Home Equity Trust, Series 2006-9 A4A (f) | | 0.49 | | | 06/25/36 | | | 660,250 |

| | 2,503,163 | | GSAA Home Equity Trust, Series 2007-3 1A1B (f) | | 0.35 | | | 03/25/47 | | | 199,278 |

| | 1,650,000 | | GSAA Home Equity Trust, Series 2007-5 2A3A (f) | | 0.57 | | | 04/25/47 | | | 837,870 |

| | | | |

| See Notes to Financial Statements. | | 21 | | ABSOLUTE FUNDS |

ABSOLUTE STRATEGIES FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2010

| | | | | | | | | | | |

| Principal | | Security

Description | | Rate | | | Maturity | | Value |

| $ | 568,346 | | GSR Mortgage Loan Trust, Series 2004-14 3A2 (f) | | 3.51 | % | | 12/25/34 | | $ | 379,131 |

| | 1,525,000 | | GSR Mortgage Loan Trust, Series 2004-9 5A7 (a)(f) | | 3.89 | | | 08/25/34 | | | 1,279,746 |

| | 389,047 | | GSR Mortgage Loan Trust, Series 2005-AR5 1A1 (f) | | 3.55 | | | 10/25/35 | | | 262,848 |

| | 22,244 | | Harborview Mortgage Loan Trust, Series 2004-8 2A4A (a)(f) | | 0.64 | | | 11/19/34 | | | 13,659 |

| | 230,843 | | Harborview Mortgage Loan Trust, Series 2006-3 2A1A (a)(f) | | 6.34 | | | 06/19/36 | | | 143,553 |

| | 2,082,845 | | Harborview Mortgage Loan Trust, Series 2007-5 A1A (f) | | 0.43 | | | 09/19/37 | | | 1,089,750 |

| | 313,255 | | Homebanc Mortgage Trust, Series 2004-1 2A (f) | | 1.11 | | | 08/25/29 | | | 195,700 |

| | 364,960 | | HSBC Asset Loan Obligation, Series 2007-AR2 2A1 (a)(f) | | 5.84 | | | 09/25/37 | | | 255,546 |