As filed with the Securities and Exchange Commission on August 24, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Stacey E. Hong, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: June 30

Date of reporting period: July 1, 2009 – June 30, 2010

| ITEM 1. | REPORT TO STOCKHOLDERS. |

Annual Report

June 30, 2010

Fund Adviser:

Auxier Asset Management LLC

5285 Meadows Road

Suite 333

Lake Oswego, Oregon 97035

Toll Free: (877) 3AUXIER or (877) 328-9437

| |

| AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2010 |

AUXIER FOCUS FUND

PERFORMANCE UPDATE

June 30, 2010

AUXFX RETURNS VS. S&P 500 INDEX

| | Auxier Focus Fund | S&P 500 Index | Difference* |

| 03/31/10 – 06/30/10 | -9.04% | -11.43% | 2.39 |

| 12/31/09 – 06/30/10 | -3.99% | -6.65% | 2.66 |

| 12/31/08 – 12/31/09 | 24.76% | 26.46% | -1.70 |

| 12/31/07 – 12/31/08 | -24.52% | -37.00% | 12.48 |

| 12/31/06 – 12/31/07 | 5.71% | 5.49% | 0.22 |

| 12/31/05 – 12/31/06 | 11.75% | 15.79% | -4.04 |

| 12/31/04 – 12/31/05 | 4.58% | 4.91% | -0.33 |

| 12/31/03 – 12/31/04 | 10.73% | 10.87% | -0.14 |

| 12/31/02 – 12/31/03 | 26.75% | 28.69% | -1.94 |

| 12/31/01 – 12/31/02 | -6.79% | -22.10% | 15.31 |

| 12/31/00 – 12/31/01 | 12.67% | -11.88% | 24.55 |

| 12/31/99 – 12/31/00 | 4.05% | -9.10% | 13.15 |

| Since Inception 7/9/99 | 76.35% | -10.64% | 86.99 |

| | | * in percentage points |

Average Annual Returns for the period ended 06/30/2010 | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception |

| Auxier Focus Fund | 12.99% | -4.16% | 1.97% | 5.79% | 5.30% |

| (Investor Shares) | | | | | (7/9/99) |

| S&P 500 Index | 14.43% | -9.81% | -0.79% | -1.59% | -1.02% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.25%. The Fund’s adviser has contractually agreed to maintain annual operating expenses at 1.25%, which is in effect until October 31, 2010. The Fund charges a 2.00% redemption fee on shares redeemed within six months of purchase. For the most recent month-end performance, please call (877)328-9437 or visit the Fund’s website at www.auxierasset.com.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained by calling (877) 328-9437 or visiting the Fund’s website. Please read the prospectus carefully before you invest.

Fund returns (i) assume the reinvestment of all dividends and capital gain distributions and (ii) would have been lower during the period if certain fees and expenses had not been waived. Performance shown is for the Fund’s Investor Class shares; returns for other share classes will vary. Performance for Investor Class shares for periods prior to December 10, 2004 reflects performance of the applicable share class of Auxier Focus Fund, a series of Unified Series Trust (the “Predecessor Fund”). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds. The performance of the Fund’s Investor Class shares for the period prior to December 10, 2004, reflects the expenses of the Predecessor Fund.

The Fund may invest in value and/or growth stocks. Investments in value stocks are subject to risk that their intrinsic value may never be realized and investments in growth stocks may be susceptible to rapid price swings, especially during periods of economic uncertainty. In addition, the Fund may invest in smaller companies which generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. Moreover, if the Fund's portfolio is overweighted in a sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not overweighted in that sector. Foreside Fund Services, LLC, distributor.

| |

| AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2010 |

Summer 2010

Market Commentary

Auxier Focus Fund ended second quarter 2010 with a -9.04% return, outperforming the -11.43% return for Standard & Poor’s 500 Index (S&P) by 2.39 percentage points. Year-to-date the Fund is down -3.99% versus a -6.65% decline for the S&P. The Fund has outperformed the market (S&P) by 86.99 percentage points cumulatively since inception in 1999.

A Formula for Going Nowhere Fast

Velocity trading has followed in the footsteps of velocity banking1 as the latest easy shortcut to the arduous fundamentals of capital allocation. Like the parabolic rise of derivatives that enhance returns through leverage, commodity Exchange Traded Funds (ETFs) have grown fifty fold from $50 billion ten years ago to $277 billion (Bloomberg). These vehicles generate no cash flow and therefore are speculations. Many buyers apparently overlooked the unanticipated “contango” effect2 (the inability to deliver on the futures contract) and experienced losses when there should have been gains.

In addition, two-thirds of stock exchange volume has recently been tied to so-called algorithmic trading formulas. Computer models abound that can fail to factor in periodic bouts of emotional folly. This means a greater likelihood of material misappraisals and plum pickings for flexible bargain shoppers. There are no shortcuts to investing. The economy is too dynamic and competitive. It is time to get back to the basics of investing—the craft of the specific. That’s knowing more about what you own than the market; showing conviction to buy more at compelling price points; quantifying true risk to invest when odds are highly favorable. Just as velocity banking failed, speculation that is not grounded in cash flow and fundamental analysis could in time fail as well.

Beware of Politicians Bearing Bonds

Two great Warren Buffett sayings apply today. “If money is easy, grab your wallet and run the other way” and “most men would rather die than think; many do.” Like the heady, high-tech bubble that peaked in 2000, followed by comparable manias for real estate and private equity, the investing herd is stampeding into bond funds like never before. In the past 18 months, some $580 billion has been channeled into US taxable bond funds and $500 billion into municipal bonds at the highest prices in history (Dow Jones News). Never mind that estimates of off- balance sheet liabilities at the federal level run seven times our gross domestic product (GDP). Governments at all levels have made entitlement promises that are unsustainable and, if unchecked, would lead to bankruptcy. Good money continues to be allocated to Fannie Mae and Freddie Mac, a disreputable duo that has already cost taxpayers $300-$500 billion. Illinois and California face a solvency crisis. Worse, the failed leadership and policies of both states have now been transferred to Washington DC. Once deficits reach a certain point, the risk of a failed bond auction becomes closer to reality. Remember, in eight centuries only a handful of countries have honored their debts. James Grant (Grant’s Interest Rate Observer) recently noted

1 A term used to describe the rate at which money is exchanged from one transaction to another.

2 When the futures price is above the expected future spot price. Consequently, the price will decline to the spot price before the delivery date.

| |

| AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2010 |

how Illinois, back in the railroad boom of 1842, was forced to pay 42.75% interest on its municipal bonds. More recently, yields on two-year notes in Greece climbed from less than 4% to over 20% in a very short period. If policymakers don’t make adjustments the market will. Unfortunately, unlike Japan, the US does not have the savings to absorb the shortfall. I would bet that we could see a similar panic in government bonds, especially if current spending policies are not corrected. In the early 1980s, the biggest municipal bond default in history occurred when Washington Public Power Supply System (WPPSS), aptly nicknamed “whoops”, failed to pay on a number of partially constructed nuclear plants. We were able to profit from the gloom by buying senior secured notes yielding 16% tax free. The bonds had originally been rated AAA3 and paid puny interest. Examining the entire capital structure is so important when investing in stocks and bonds. It is difficult to survive over the long term with a weak balance sheet. As Jim Grant says, there is no such thing as a bad bond, just a bad price.

New Zealand’s Lesson for US Housing Subsidies

Back in 1985, New Zealand abolished all farm subsidies. Farmers’ income initially plunged as land and stock prices slumped. However, productivity soon recovered dramatically, boosting farming’s share of GDP from 14% to 16.6%. Farm products now comprise over 50% of all exports, and the rural population has grown. The move created a much more vibrant industry commanding a greater share of the overall economy. American policymakers should study this model to help reform Fannie Mae, Freddie Mac and our failed approach to housing subsidies.

Gateways to Emerging Market Middle Class

The US consumer and government face painful restructuring periods ahead. But many emerging economies learned their lessons the hard way back in 1998, and today have much better balance sheets. Global population is expected to grow from 6.8 billion to 9.2 billion by 2050. Chinese consumption of skin-care products, cosmetics and fragrances has quadrupled to $13 billion the last decade (Business Week). We like low-ticket necessity products that have a steady demand. Global austerity tends to favor our high-quality, self-funding businesses. Prime examples are multinational corporations, with powerful global distributions. Many of these stocks have sold off to price points where there is very little premium for the emerging market gateway these companies provide. Their high free-cash flow provides the needed flexibility to profit in times of distress.

Election Day 1994 Revisited?

The current US stock market feels like the early 1990s. Hillary Clinton was trying to socialize medicine. The country had endured one of the worst banking crises since the Great Depression. The 1994 midterm elections led to the biggest Republican sweep in fifty years, overtaking both the House and Senate. This catalyst helped fan favorable tailwinds in the market. Over the following six years, surviving small and midsized banks appreciated 400-800%. Healthcare stocks in general enjoyed meaningful upward valuations in price/earnings ratios4. Large blue chips had three consecutive years of above-average returns. It is rare to have the chance to buy high-quality businesses at ten times earnings. Currently, 13 of the top 25 S&P 500 stocks sell for 10-11 times estimated 2011 earnings. Neon Liberty Capital recently (July 2010) analyzed market performances after a decade in which the economy was in recession 25% or more of the time, as has our past decade. Guess

3 The highest rating given on bonds by bond rating agencies.

4 Price/earnings ratio is the value of a company’s stock price relative to company earnings.

| |

| AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS JUNE 30, 2010 |

what? Returns in comparable decades ending in 1955, 1958, 1975 and 1982 were well above average. The subsequent average gains over three, five and ten years were all above 14% annually.

Why Our Approach Can Win Over Time

We will always have to face crisis situations. Our approach is to work hard to anticipate potential areas of harm and irrational behavior. Then take advantage of the resulting bargains. Our edge? Managing through challenging environments demands rational, tenacious daily research effort that focuses on minimizing the downside. Seeking to identify durable investments is critical to outpace devaluations that result from the “easy path” politicians consistently follow. We are in times when you can’t depend on a rising market for returns.

We rely instead on our dedication to spot exceptional individual opportunities and moving when we believe the price is right.

Your trust and support is appreciated.

Jeff Auxier

As of June 30, 2010, the Fund held those securities mentioned in the letter as follows: Washington Public Power Supply System (WPPSS) 0%; The Federal National Mortgage Association 0%; Federal Home Loan Mortgage Corp 0%.

There can be no guarantee of success with any technique, strategy, or investment. All investing involves risk, including the loss of principal. The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 widely held common stocks. One cannot invest directly in an index.

The views in this shareholder letter were those of the Fund Manager as of the letter’s publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund’s investment methodology and do not constitute investment advice.

| |

AUXIER FOCUS FUNDPERFORMANCE CHART AND ANALYSIS JUNE 30, 2010 |

| | | | | | |

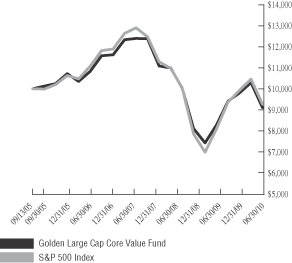

| COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT |

| | | | | | |

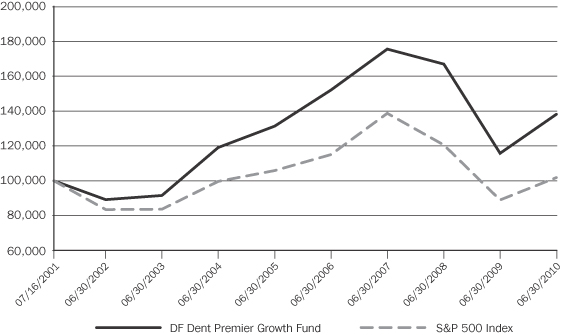

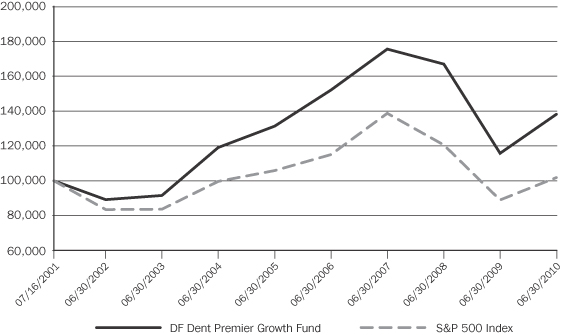

| The following chart reflects the change in the value of a hypothetical $10,000 investment in Investor Shares, including reinvested dividends and distributions, in the Auxier Focus Fund (the “Fund”) compared with the performance of the Standard & Poor's 500 Index ("S&P 500"), over the past ten fiscal years. The S&P 500 is a market-value weighted index representing the performance of 500 widely held, publicly traded stocks. The total return of the Fund's classes includes the maximum sales charge of 5.75% (A Shares only) and operating expenses that reduce returns, while the total return of the S&P 500 does not include the effect of sales charges and expenses. A Shares are subject to a 1.00% contingent deferred sales charge on shares purchased without an initial sales charge and redeemed less than one year after purchase. The total return of the S&P 500 includes reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the S&P 500 does not include expenses. The Fund is professionally managed while the S&P 500 is unmanaged and is not available for investment. |

| |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please visit the website of the Fund's investment adviser at www.auxierasset.com. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Investor Shares and A Shares are 1.25% and 1.50%, respectively. However, the Fund's adviser has agreed to contractually waive a portion of its fees and to reimburse expenses such that total operating expenses do not exceed 1.25% for Investor Shares and A Shares, which is in effect until October 31, 2010. Shares redeemed or exchanged within 180 days days of purchase will be charged a 2.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. |

| |

| Performance for Investor Shares for periods prior to December 10, 2004, reflects performance for and expenses of Auxier Focus Fund, a series of Unified Series Trust (the “Predecessor Fund”). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds. |

| | | | | | |

| Average Annual Total Return as of 06/30/10 | 1 Year | 5 Years | 10 Years | Since Inception (1) | |

| | | | | | |

| Investor Shares | 12.99% | 1.97% | 5.79% | 5.30% | |

| S&P 500 Index (since 07/09/99) | 14.43% | (0.79)% | (1.59)% | (1.02)% | |

A Shares (with sales charge) (2)(3) | 6.41% | 0.77% | 5.17% | 4.74% | |

| | | | | | |

| | | | | | |

| (1) Investor and A Shares commenced operations on July 9, 1999, and July 8, 2005, respectively. | | |

| | | | | | |

| (2) Due to shareholder redemptions on August 21, 2005, net assets of the class were zero from the close of business | |

| on that date until September 22, 2005. Financial information presented for the period August 21, 2005, to September 22, 2005 | |

| reflects perfomance of Investor Shares of the Fund. | | | | | |

| | | | | | |

| (3) For A Shares, performance for the 5-year, 10-year and the since inception periods are blended average annual returns | |

| which include the returns of the Investor Shares prior to the commencement of operations of the A Shares. | | |

| | | | | | |

| |

| AUXIER FOCUS FUND SCHEDULE OF INVESTMENTS JUNE 30, 2010 |

| Shares | | Security Description | | | | Value | |

| Common Stock - 69.2% | | | | | |

| Communications - 0.1% | | | | | |

| 6,000 | | News Corp., Class A | | | | $ 71,760 | |

| | | | | | | | |

| Consumer Discretionary - 19.0% | | | | | |

| 9,713 | | Apollo Group, Inc., Class A (a) | | | | 412,511 | |

| 26,250 | | Bridgepoint Education, Inc. (a) | | | | 415,013 | |

| 13,300 | | Career Education Corp. (a) | | | | 306,166 | |

| 57,100 | | Comcast Corp., Class A | | | | 991,827 | |

| 3,000 | | Costco Wholesale Corp. | | | | 164,490 | |

| 41,050 | | CVS Caremark Corp. | | | | 1,203,586 | |

| 2,297 | | Discovery Communications, Inc., Class A (a) | | | | 82,026 | |

| 2,297 | | Discovery Communications, Inc., Class C (a) | | | | 71,046 | |

| 14,800 | | D.R. Horton, Inc. | | | | 145,484 | |

| 100 | | Ecolab, Inc. | | | | 4,491 | |

| 3,000 | | Education Management Corp. (a) | | | | 45,750 | |

| 37,987 | | Gruma S.A.B. de C.V., ADR (a) | | | | 228,302 | |

| 18,250 | | Home Depot, Inc. | | | | 512,278 | |

| 82,150 | | H&R Block, Inc. | | | | 1,288,934 | |

| 8,700 | | ITT Educational Services, Inc. (a) | | | | 722,274 | |

| 20,197 | | Lincoln Educational Services Corp. (a) | | | | 415,856 | |

| 28,000 | | Lowe's Cos., Inc. | | | | 571,760 | |

| 12,800 | | McDonald's Corp. | | | | 843,136 | |

| 13,250 | | NIKE, Inc., Class B | | | | 895,037 | |

| 16,215 | | Palm Harbor Homes, Inc. (a) | | | | 28,863 | |

| 15,250 | | Sally Beauty Holdings, Inc. (a) | | | | 125,050 | |

| 67,885 | | Tesco PLC, ADR | | | | 1,149,293 | |

| 27,895 | | The Andersons, Inc. | | | | 909,098 | |

| 40,870 | | The Interpublic Group of Cos., Inc. (a) | | | | 291,403 | |

| 3,890 | | Time Warner Cable, Inc. | | | | 202,591 | |

| 15,500 | | Time Warner, Inc. | | | | 448,105 | |

| 44,700 | | Unilever NV, ADR | | | | 1,221,204 | |

| 17,058 | | Universal Technical Institute, Inc. (a) | | | | 403,251 | |

| 25,634 | | Value Line, Inc. | | | | 465,001 | |

| 49,550 | | Wal-Mart Stores, Inc. | | | | 2,381,868 | |

| 74,777 | | Weight Watchers International, Inc. | | | | 1,921,021 | |

| 8,600 | | Yum! Brands, Inc. | | | | 335,744 | |

| | | | | | | 19,202,459 | |

| Consumer Staples - 16.5% | | | | | |

| 376,600 | | Alliance One International, Inc. (a) | | | | 1,340,696 | |

| 35,150 | | Altria Group, Inc. | | | | 704,406 | |

| 15,100 | | British American Tobacco PLC, ADR | | | | 955,830 | |

| 19,532 | | Columbia Sportswear Co. | | | | 911,558 | |

| 16,800 | | Diageo PLC, ADR | | | | 1,054,032 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements. | 6 | | | | | |

| | | | | | |

| AUXIER FOCUS FUND | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | |

| JUNE 30, 2010 | | | | | | | |

| | | | | | | | |

| Shares | | Security Description | | | | Value | |

| 55,800 | | Dr. Pepper Snapple Group, Inc. | | | | $ 2,086,362 | |

| 2,000 | | Helen of Troy, Ltd. (a) | | | | 44,120 | |

| 16,862 | | Kraft Foods, Inc., Class A | | | | 472,136 | |

| 12,700 | | Manpower, Inc. | | | | 548,386 | |

| 1,000 | | Molson Coors Brewing Co., Class B | | | | 42,360 | |

| 8,760 | | National Beverage Corp. (a) | | | | 107,573 | |

| 3,000 | | Nestle SA, ADR | | | | 144,720 | |

| 44,372 | | Paychex, Inc. | | | | 1,152,341 | |

| 58,900 | | Philip Morris International, Inc. | | | | 2,699,976 | |

| 1,721 | | Ralcorp Holdings, Inc. (a) | | | | 94,311 | |

| 11,450 | | Safeway, Inc. | | | | 225,107 | |

| 37,250 | | The Coca-Cola Co. | | | | 1,866,970 | |

| 77,850 | | The Kroger Co. | | | | 1,532,867 | |

| 41,380 | | The Western Union Co. | | | | 616,976 | |

| | | | | | | 16,600,727 | |

| Energy - 4.5% | | | | | | | |

| 26,850 | | BP PLC, ADR | | | | 775,428 | |

| 16,750 | | Chevron Corp. | | | | 1,136,655 | |

| 15,600 | | ConocoPhillips | | | | 765,804 | |

| 11,200 | | Exxon Mobil Corp. | | | | 639,184 | |

| 1,200 | | Gazprom Neft JSC, ADR | | | | 22,500 | |

| 800 | | Lukoil OAO, ADR | | | | 41,200 | |

| 2,500 | | PetroChina Co., Ltd., ADR | | | | 274,325 | |

| 7,800 | | Petroleo Brasileiro SA, ADR | | | | 267,696 | |

| 2,750 | | Surgutneftegaz, ADR | | | | 24,062 | |

| 1,000 | | Transocean Ltd. (a) | | | | 46,330 | |

| 24,100 | | Valero Energy Corp. | | | | 433,318 | |

| 8,800 | | Willbros Group, Inc. (a) | | | | 65,120 | |

| | | | | | | 4,491,622 | |

| Financials - 7.2% | | | | | | | |

| 3,200 | | American Express Co. | | | | 127,040 | |

| 1,280 | | Ameriprise Financial, Inc. | | | | 46,246 | |

| 33,233 | | Bank of America Corp. | | | | 477,558 | |

| 16,000 | | Berkshire Hathaway, Inc., Class B (a) | | | | 1,275,040 | |

| 24,193 | | Citigroup, Inc. (a) | | | | 90,966 | |

| 77,850 | | Marsh & McLennan Cos., Inc. | | | | 1,755,518 | |

| 28,100 | | The Bank of New York Mellon Corp. | | | | 693,789 | |

| 38,418 | | The Travelers Cos., Inc. | | | | 1,892,086 | |

| 3,000 | | TNS, Inc. (a) | | | | 52,320 | |

| 10,324 | | Unum Group | | | | 224,031 | |

| 24,950 | | Waddell & Reed Financial, Inc., Class A | | | | 545,906 | |

| 7,646 | | Washington Federal, Inc. | | | | 123,712 | |

| 4,000 | | West Coast Bancorp | | | | 10,200 | |

| | | | | | | 7,314,412 | |

| Health Care - 9.9% | | | | | |

| 37,450 | | Alkermes, Inc. (a) | | | | 466,253 | |

| 5,750 | | Amgen, Inc. (a) | | | | 302,450 | |

| 85,226 | | BioScrip, Inc. (a) | | | | 446,584 | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements. | 7 | | | | | |

| | | | | | |

| AUXIER FOCUS FUND | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | |

| JUNE 30, 2010 | | | | | | | |

| | | | | | | | |

| Shares | | Security Description | | | | Value | |

| 13,449 | | Coventry Health Care, Inc. (a) | | | | $ 237,778 | |

| 5,820 | | Express Scripts, Inc. (a) | | | | 273,656 | |

| 31,300 | | GlaxoSmithKline PLC, ADR | | | | 1,064,513 | |

| 13,850 | | Johnson & Johnson | | | | 817,981 | |

| 7,070 | | LifePoint Hospitals, Inc. (a) | | | | 221,998 | |

| 17,150 | | Merck & Co., Inc. | | | | 599,736 | |

| 83,282 | | Pfizer, Inc. | | | | 1,187,601 | |

| 6,842 | | Quest Diagnostics, Inc. | | | | 340,526 | |

| 36,200 | | UnitedHealth Group, Inc. | | | | 1,028,080 | |

| 28,221 | | WellPoint, Inc. (a) | | | | 1,380,854 | |

| 30,600 | | Zimmer Holdings, Inc. (a) | | | | 1,653,930 | |

| | | | | | | 10,021,940 | |

| Industrials - 2.8% | | | | | |

| 21,550 | | AGCO Corp. (a) | | | | 581,204 | |

| 11,127 | | Blount International, Inc. (a) | | | | 114,274 | |

| 100 | | CF Industries Holdings, Inc. | | | | 6,345 | |

| 28,000 | | General Electric Co. | | | | 403,760 | |

| 11,150 | | Granite Construction, Inc. | | | | 262,917 | |

| 4,850 | | Illinois Tool Works, Inc. | | | | 200,208 | |

| 1,000 | | POSCO, ADR (a) | | | | 94,320 | |

| 100 | | Potash Corp. of Saskatchewan, Inc. | | | | 8,624 | |

| 3,500 | | Textainer Group Holdings, Ltd. | | | | 84,490 | |

| 3,550 | | The Boeing Co. | | | | 222,763 | |

| 100 | | The Mosaic Co. | | | | 3,898 | |

| 14,450 | | United Parcel Service, Inc., Class B | | | | 822,060 | |

| | | | | | | 2,804,863 | |

| Information Technology - 2.3% | | | | | |

| 28,750 | | Automatic Data Processing, Inc. | | | | 1,157,475 | |

| 37,350 | | Dell, Inc. (a) | | | | 450,441 | |

| 30,150 | | Microsoft Corp. | | | | 693,752 | |

| 5,000 | | MoneyGram International, Inc. (a) | | | | 12,275 | |

| 1,500 | | Verisk Analytics, Inc., Class A (a) | | | | 44,850 | |

| | | | | | | 2,358,793 | |

| Materials - 3.3% | | | | | | | |

| 11,200 | | Alcoa, Inc. | | | | 112,672 | |

| 28,700 | | E.I. du Pont de Nemours & Co. | | | | 992,733 | |

| 550 | | Plum Creek Timber Co., Inc., REIT | | | | 18,991 | |

| 7,100 | | Precision Castparts Corp. | | | | 730,732 | |

| 47,350 | | The Dow Chemical Co. | | | | 1,123,142 | |

| 14,000 | | Vale SA, ADR | | | | 340,900 | |

| | | | | | | 3,319,170 | |

| Telecommunications - 3.3% | | | | | |

| 27,300 | | AT&T, Inc. | | | | 660,387 | |

| 49,150 | | SK Telecom Co., Ltd., ADR | | | | 723,979 | |

| 60,750 | | Tele Norte Leste Participacoes SA, ADR | | | | 908,820 | |

| 30,300 | | Telefonos de Mexico SAB de CV, ADR | | | | 427,533 | |

| 21,650 | | Verizon Communications, Inc. | | | | 606,633 | |

| | | | | | | 3,327,352 | |

| Utilities - 0.3% | | | | | | | |

| 13,000 | | FirstService Corp. (a) | | | | 270,010 | |

| | | | | | | | |

| Total Common Stock (Cost $71,975,174) | | | | 69,783,108 | |

| | | | | | |

| | | | | | |

| See Notes to Financial Statements. | 8 | | | | | |

| | | | | | | | |

| AUXIER FOCUS FUND | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | |

| JUNE 30, 2010 | | | | | | | |

| | | | | | | | |

| Shares | | Security Description | | Rate | | | Value | |

| Preferred Stock - 0.5% | | | | | |

| Utilities - 0.5% | | | | | | | |

| 305 | | AEP Texas Central Co. | 4.00 | % | | $ 21,979 | |

| 1,600 | | FirstService Corp. | 7.00 | | | 37,680 | |

| 1,210 | | Great Plains Energy, Inc. | 4.50 | | | 98,161 | |

| 4,000 | | Hawaiian Electric Co., Inc., Series C | 4.25 | | | 66,625 | |

| 300 | | Indianapolis Power & Light Co. | 4.00 | | | 25,022 | |

| 78 | | MidAmerican Energy Co. | 3.30 | | | 4,792 | |

| 80 | | MidAmerican Energy Co. | 3.90 | | | 6,000 | |

| 200 | | NSTAR Electric Co. | 4.25 | | | 17,488 | |

| 1,000 | | Pacific Enterprises | 4.50 | | | 81,975 | |

| 400 | | Peco Energy Co., Series A | 3.80 | | | 30,040 | |

| 1,500 | | The Connecticut Light & Power Co., Series 1947 | 1.90 | | | 53,344 | |

| 1,000 | | The Connecticut Light & Power Co., Series 1947 | 2.00 | | | 37,438 | |

| 1,500 | | The Connecticut Light & Power Co., Series 1949 | 3.90 | | | 51,656 | |

| 300 | | Westar Energy, Inc. | 4.25 | | | 23,259 | |

| Total Preferred Stock (Cost $421,559) | | | | 555,459 | |

| | | | | | | | |

| Principal | | | | | | Maturity | | | |

| Asset Backed Obligations - 0.0% | | | | | |

| $ 2,154 | | Scotia Pacific Co., LLC, Series B (b) (c) (Cost $1,944) | 6.55 | | 07/20/28 | 0 | |

| | | | | | | | |

| Corporate Bonds - 22.1% | | | | | |

| Consumer Discretionary - 0.3% | | | | | |

| 315,000 | | Time Warner, Inc. | 6.88 | | 05/01/12 | 343,323 | |

| | | | | | | | |

| Consumer Staples - 6.1% | | | | | |

| 1,180,000 | | American Stores Co. | 7.90 | | 05/01/17 | 1,121,000 | |

| 50,000 | | Constellation Brands, Inc. | 7.25 | | 05/15/17 | 50,938 | |

| 1,110,000 | | Dr. Pepper Snapple Group, Inc. | 6.12 | | 05/01/13 | 1,235,911 | |

| 350,000 | | General Mills, Inc. | 5.70 | | 02/15/17 | 407,068 | |

| 535,000 | | Kraft Foods, Inc. | 5.63 | | 11/01/11 | 563,153 | |

| 1,225,000 | | Smithfield Foods, Inc., Series B | 7.75 | | 05/15/13 | 1,219,641 | |

| 115,000 | | SUPERVALU, Inc. | 7.50 | | 11/15/14 | 115,575 | |

| 375,000 | | SUPERVALU, Inc. | 8.00 | | 05/01/16 | 373,125 | |

| 985,000 | | Tyson Foods, Inc. | 8.25 | | 10/01/11 | 1,068,725 | |

| | | | | | | 6,155,136 | |

| | | | | | | | |

| Energy - 2.8% | | | | | | | |

| 1,170,000 | | Chesapeake Energy Corp. | 6.63 | | 01/15/16 | 1,194,862 | |

| 100,000 | | Constellation Energy Group, Inc. | 4.55 | | 06/15/15 | 105,328 | |

| 190,000 | | El Paso Corp. (c) | 6.70 | | 02/15/27 | 167,200 | |

| 1,270,000 | | El Paso Performance-Linked Trust (d) | 7.75 | | 07/15/11 | 1,315,444 | |

| | | | | | | 2,782,834 | |

| Financials - 3.5% | | | | | | | |

| 75,000 | | American Express Credit Corp., Series C | 7.30 | | 08/20/13 | 84,975 | |

| 455,000 | | Hartford Financial Services Group, Inc. | 5.25 | | 10/15/11 | 471,114 | |

| 2,370,000 | | Hartford Financial Services Group, Inc. | 5.50 | | 10/15/16 | 2,466,241 | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements. | 9 | | | | | |

| | | | | | |

| | | | | | |

| AUXIER FOCUS FUND | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | |

| JUNE 30, 2010 | | | | | | | |

| | | | | | | | |

| Principal | | Security Description | | Rate | | | Maturity | | Value | |

| 182,000 | | Hartford Financial Services Group, Inc. | 6.30 | | 03/15/18 | $ 188,855 | |

| 345,000 | | Janus Capital Group, Inc. | 6.95 | | 06/15/17 | 346,806 | |

| 156,396 | | The FINOVA Group, Inc. (b) | 7.50 | | 11/15/09 | 657 | |

| | | | | | | 3,558,648 | |

| Health Care - 1.7% | | | | | |

| 540,000 | | Health Management Associates, Inc. | 6.13 | | 04/15/16 | 514,350 | |

| 515,000 | | UnitedHealth Group, Inc. | 4.88 | | 03/15/15 | 548,466 | |

| 430,000 | | WellPoint, Inc. | 5.00 | | 12/15/14 | 467,652 | |

| 130,000 | | WellPoint, Inc. | 5.25 | | 01/15/16 | 142,500 | |

| | | | | | | 1,672,968 | |

| Industrials - 5.4% | | | | | |

| 2,832,000 | | Church & Dwight Co., Inc. | 6.00 | | 12/15/12 | 2,860,320 | |

| 740,000 | | General Electric Capital Corp., MTN | 5.63 | | 09/15/17 | 792,112 | |

| 180,000 | | Johnson Controls, Inc. | 5.25 | | 01/15/11 | 182,875 | |

| 495,000 | | Johnson Controls, Inc. | 4.88 | | 09/15/13 | 533,596 | |

| 94,000 | | Waste Management, Inc. | 7.38 | | 08/01/10 | 94,493 | |

| 71,000 | | Waste Management, Inc. | 7.65 | | 03/15/11 | 73,881 | |

| 835,000 | | Waste Management, Inc. | 6.38 | | 11/15/12 | 915,405 | |

| | | | | | | 5,452,682 | |

| | | | | | | | |

| Materials - 1.7% | | | | | |

| 895,000 | | The Dow Chemical Co. | 5.70 | | 05/15/18 | 945,008 | |

| 203,000 | | Weyerhaeuser Co. | 9.00 | | 10/01/21 | 233,760 | |

| 505,000 | | Weyerhaeuser Co. | 7.95 | | 03/15/25 | 532,641 | |

| | | | | | | 1,711,409 | |

| | | | | | | | |

| Utilities - 0.6% | | | | | | | |

| 255,000 | | Energy Future Holdings Corp. | 9.75 | | 10/15/19 | 240,706 | |

| 312,000 | | Energy Future Intermediate Holding Co., LLC | 9.75 | | 10/15/19 | 294,511 | |

| 27,000 | | Nevada Power Co., Series L | 5.88 | | 01/15/15 | 30,116 | |

| | | | | | | 565,333 | |

| | | | | | | | |

| Total Corporate Bonds (Cost $20,005,383) | | | | 22,242,333 | |

| | | | | | | | |

Foreign Municipal Bonds - 1.1% (e) | | | | | |

| 750,000 | | Ontario Hydro Generic Residual Strip (Canada), Series OC20 | 5.51 | | 10/01/20 | 455,087 | |

| 356,000 | | Ontario Hydro Generic Residual Strip (Canada) | 5.47-5.65 | | 11/27/20 | 214,058 | |

| 605,000 | | Ontario Hydro Generic Residual Strip (Canada) | 5.61 | | 10/15/21 | 345,826 | |

| 235,000 | | Ontario Hydro Generic Residual Strip (Canada) | 5.75 | | 08/18/22 | 127,717 | |

| Total Foreign Municipal Bonds (Cost $782,138) | | | | 1,142,688 | |

| Shares | | | | | | | |

| Money Market Fund - 0.0% | | | | | |

| 31 | | Schwab Government Money Fund 0.01% (f) (Cost $31) | | | | 31 | |

| | | | | | | | |

| Total Investments - 92.9% (Cost $93,186,229)* | | | | $ 93,723,619 | |

| Cash - 6.0% | | | | | | 6,075,058 | |

| Other Assets & Liabilities, Net - 1.1% | | | | 1,069,866 | |

| NET ASSETS - 100.0% | | | | $ 100,868,543 | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements. | 10 | | | | | |

| | | | | | | | |

| AUXIER FOCUS FUND | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | |

| JUNE 30, 2010 | | | | | | | |

| | | | | | | | |

| ADR American Depository Receipt. | | | | | |

| MTN Medium Term Note. | | | | | |

| PLC Public Limited Company. | | | | | |

| | | | | | | | |

| | | | | | | | |

| (a) Non-income producing security. | | | | | |

| (b) Security is currently in default on scheduled principal or interest payments. | | | | |

| (c) Security fair valued in accordance with procedures adopted by the Board of Trustees. | | | | |

| At the period end, the value of these securities amounted to $167,200 or 0.2% of net assets. | | | |

| (d) Security exempt from registration under Rule 144A under the Securities Act of 1933. | | | | |

| At the period end, the value of these securities amounted to $1,315,444 or 1.3% of net assets. | | | |

| (e) Zero coupon bonds. Interest rate presented is yield to maturity. | | | | | |

| (f) Represents 7-day effective yield as of June 30, 2010. | | | | | |

| | | | | | | | |

| | | | | | | | |

| * Cost for federal income tax purposes is $93,198,399 and net unrealized appreciation consists of: | | | |

| | | | | | | | |

| | Gross Unrealized Appreciation | $ 12,759,653 | | | | |

| | Gross Unrealized Depreciation | (12,234,433) | | | | |

| | Net Unrealized Appreciation | $ 525,220 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| The following is a summary of the inputs used to value the Fund's investments as of June 30, 2010. | | |

| The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those |

| securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, refer to Note 2 - |

| Security Valuation section in the accompanying Notes to Financial Statements. | | | | |

| | | | | | | | |

| | | | Level 1 | Level 2 | Level 3 | Total | |

| | | Common Stock | | | | | |

| | | Communications | $ 71,760 | $ - | $ - | $ 71,760 | |

| | | Consumer Discretionary | 19,202,459 | - | - | 19,202,459 | |

| | | Consumer Staples | 16,600,727 | - | - | 16,600,727 | |

| | | Energy | 4,491,622 | - | - | �� 4,491,622 | |

| | | Financials | 7,314,412 | - | - | 7,314,412 | |

| | | Health Care | 10,021,940 | - | - | 10,021,940 | |

| | | Industrials | 2,804,863 | - | - | 2,804,863 | |

| | | Information Technology | 2,358,793 | - | - | 2,358,793 | |

| | | Materials | 3,319,170 | - | - | 3,319,170 | |

| | | Telecommunications | 3,327,352 | - | - | 3,327,352 | |

| | | Utilities | 270,010 | - | - | 270,010 | |

| | | Preferred Stock - Utilities | 37,680 | 517,779 | - | 555,459 | |

| | | Asset Backed Obligations | - | - | 0 | 0 | |

| | | Corporate Bonds | - | 22,075,133 | 167,200 | 22,242,333 | |

| | | Foreign Municpal Bonds | - | 1,142,688 | - | 1,142,688 | |

| | | Money Market Fund | - | 31 | - | 31 | |

| | | TOTAL | $ 69,820,788 | $23,735,631 | $ 167,200 | $ 93,723,619 | |

| | | | | | |

| | | | | | |

| See Notes to Financial Statements. | 11 | | | | | |

| | | | | | |

| AUXIER FOCUS FUND | | | | | |

| SCHEDULE OF INVESTMENTS | | | | | |

| JUNE 30, 2010 | | | | | | | |

| | | | | | | | |

| The following is a reconciliation of Level 3 assets (at either the beginning or ending of the year) for which significant unobservable inputs | |

| were used to determine fair value. | | | | | |

| | | | Preferred Stock | Asset Backed Obligations | Corporate Bonds | Total | |

| | | | | | | | |

| | | Balance as of 06/30/09 | $ 18,681 | $ 1,982 | $ - | $ 20,663 | |

| | | Accrued Accretion / (Amortization) | - | - | - | - | |

| | | Realized Gain / (Loss) | - | - | - | - | |

| | | Change in Unrealized Appreciation / (Depreciation) | 3,298 | (1,982) | - | 1,316 | |

| | | Net Purchase / (Sales) | - | - | - | - | |

| | | Transfers In / (Out) | (21,979) | - | 167,200 | $ 145,221 | |

| | | Balance as of 06/30/10 | $ - | $ - | $ 167,200 | $ 167,200 | |

| | | Net Change in Unrealized Appreciation / (Depreciation) from Investments held as of 06/30/10** | $ - | $ (1,982) | $ - | $ (1,982) | |

| | | | | | | | |

| ** The unrealized appreciation / (depreciation) is included in net change in unrealized appreciation / (depreciation) of investments in the accompanying Statement of Operations. |

| | | | | | | | |

| | | PORTFOLIO HOLDINGS | | | | | |

| | | % of Net Assets | | | | | |

| | | Common Stock | | 69.2% | | | |

| | | Preferred Stock | | 0.5% | | | |

| | | Asset Backed Obligations | | 0.0% | | | |

| | | Corporate Bonds | | 22.1% | | | |

| | | Foreign Municipal Bonds | | 1.1% | | | |

| | | Money Market Fund | | 0.0% | | | |

| | | Cash and Other Net Assets | | 7.1% | | | |

| | | | | 100.0% | | | |

| | | | | | | | |

| See Notes to Financial Statements. | | 12 | | | | | |

| | | | | | |

| AUXIER FOCUS FUND | | |

| STATEMENT OF ASSETS AND LIABILITIES | | |

| JUNE 30, 2010 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| ASSETS | | |

| | Investments, at value (Cost $93,186,229) | $ 93,723,619 | |

| | Cash | 6,075,058 | |

| | Receivables: | | |

| | | Fund shares sold | 29,880 | |

| | | Investment securities sold | 642,638 | |

| | | Dividends and interest | 498,859 | |

| Total Assets | 100,970,054 | |

| | | | | | |

| LIABILITIES | | |

| | Payables: | | |

| | | Fund shares redeemed | 911 | |

| | Accrued Liabilities: | | |

| | | Investment adviser fees | 100,495 | |

| | | Trustees' fees and expenses | 72 | |

| | | Distribution fees | 33 | |

| Total Liabilities | 101,511 | |

| | | | | | |

| NET ASSETS | $ 100,868,543 | |

| | | | | | |

| COMPONENTS OF NET ASSETS | | |

| | Paid-in capital | $ 99,042,643 | |

| | Undistributed net investment income | 1,314,468 | |

| | Accumulated net realized loss | (25,958) | |

| | Net unrealized appreciation | 537,390 | |

| | | | | | |

| NET ASSETS | $ 100,868,543 | |

| | | | | | |

| SHARES OF BENEFICIAL INTEREST AT $0.000 PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | |

| | Investor Shares | 7,467,219 | |

| | A Shares | 11,638 | |

| | | | | | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | |

| | Investor Shares (based on net assets of $100,711,603) | $ 13.49 | |

| | A Shares (based on net assets of $156,940) | $ 13.49 | |

| | A Shares Maximum Public Offering Price Per Share (net asset value per share/94.25%) | $ 14.31 | |

| | | | | | |

| | | | | | |

| See Notes to Financial Statements. | 13 | | |

| | | | |

| AUXIER FOCUS FUND | | |

| STATEMENT OF OPERATIONS | | |

| YEAR ENDED JUNE 30, 2010 | | |

| | | | |

| | | | |

| INVESTMENT INCOME | | |

| | Dividend income (net of foreign taxes withheld of $22,657) | $ 1,900,908 | |

| | Interest income | 1,692,886 | |

| Total Investment Income | 3,593,794 | |

| | | | |

| EXPENSES | | |

| | Investment adviser fees | 1,300,953 | |

| | Distribution fees: | | |

| | A Shares | 401 | |

| | Trustees' fees and expenses | 3,231 | |

| Total Expenses | 1,304,585 | |

| | Expenses waived | (3,673) | |

| Net Expenses | 1,300,912 | |

| | | | |

| NET INVESTMENT INCOME | 2,292,882 | |

| | | | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | |

| | AND FOREIGN CURRENCY TRANSACTIONS | | |

| | Net realized gain on investments and foreign currency transactions | 696,183 | |

| | Net change in unrealized appreciation (depreciation) on investments | 7,745,953 | |

| | | | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | |

| | AND FOREIGN CURRENCY TRANSACTIONS | 8,442,136 | |

| | | | |

| INCREASE IN NET ASSETS FROM OPERATIONS | $ 10,735,018 | |

| | | | |

| | | | |

| See Notes to Financial Statements. | 14 | | |

| | | | | | | |

| AUXIER FOCUS FUND | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | | |

| | | | | | | |

| | | | | | | |

| | | | Year Ended | | Year Ended | |

| | | | June 30, 2010 | | June 30, 2009 | |

| | | | | | | |

| OPERATIONS | | | | | |

| | Net investment income | | $ 2,292,882 | | $ 1,324,441 | |

| | Net realized gain (loss) | | 696,183 | | (628,109) | |

| | Net change in unrealized appreciation (depreciation) | 7,745,953 | | (12,207,055) | |

| Increase (Decrease) in Net Assets from Operations | 10,735,018 | | (11,510,723) | |

| | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | |

| | Net investment income: | | | | | |

| | Investor Shares | | (1,836,778) | | (1,100,100) | |

| | A Shares | | (3,091) | | (2,270) | |

| | Net realized gains: | | | | | |

| | Investor Shares | | - | | (2,232,463) | |

| | A Shares | | - | | (4,702) | |

| Total Distributions to Shareholders | | (1,839,869) | | (3,339,535) | |

| | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | |

| | Sale of shares: | | | | | |

| | Investor Shares | | 19,500,648 | | 12,832,552 | |

| | A Shares | | 17,906 | | - | |

| | Contributions from share reclassification: | | | | |

| | Investor Shares (Note 1) | | - | | 38,065 | |

| | Reinvestment of distributions: | | | | | |

| | Investor Shares | | 1,798,747 | | 3,261,809 | |

| | A Shares | | 3,091 | | 6,972 | |

| | Redemption of shares: | | | | | |

| | Investor Shares | | (14,133,080) | | (20,340,642) | |

| | A Shares | | (27,077) | | (32,769) | |

| | C Shares | | - | | (59,684) | |

| | Redemptions from share reclassification: | | | | |

| | C Shares (Note 1) | | - | | (38,065) | |

| | Redemption fees | | 5,388 | | 13,358 | |

| Increase (Decrease) in Net Assets From Capital Transactions | 7,165,623 | | (4,318,404) | |

| Increase (Decrease) in Net Assets | | 16,060,772 | | (19,168,662) | |

| | | | | | | |

| NET ASSETS | | | | | |

| | Beginning of Year | | 84,807,771 | | 103,976,433 | |

| | End of Year (a) | | $ 100,868,543 | | $ 84,807,771 | |

| | | | | | | |

| | | | | | | |

| | (a) Amount includes undistributed net investment income | $ 1,314,468 | | $ 777,620 | |

| | | | | | | |

| | | | | | | |

| See Notes to Financial Statements. | 15 | | | | |

| | | | | | | | | | | | | | | | | | | | |

| AUXIER FOCUS FUND | | | | | | | | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| These financial highlights reflect selected per share data and ratios for a share outstanding throughout each period. | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning | | | | Net Realized | Total | | Distributions | | | | Ending | |

| | | Net Asset | | Net | | and | | from | | From Net | | From Net | | Total | | | | Net Asset | |

| | | Value Per | | Investment | | Unrealized | | Investment | Investment | Realized | | Distributions to | Redemption | | Value Per | |

| | | Share | | Income (b) | | Gain (Loss) | | Operations | | Income | | Gains | | Shareholders | | Fees (b) | | Share | |

| | | | | | | | | | | | | | | | | | | | |

| Investor Shares | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Year Ended June 30, 2010 | $ 12.16 | | $ 0.32 | | $ 1.27 | | $ 1.59 | | $ (0.26) | | $ - | | $ (0.26) | | $ - | (f) | $ 13.49 | |

| Year Ended June 30, 2009 (i) | 14.22 | | 0.19 | | (1.77) | | (1.58) | | (0.16) | | (0.32) | | (0.48) | | - | (f) | 12.16 | |

| Year Ended June 30, 2008 | 17.06 | | 0.18 | | (2.24) | | (2.06) | | (0.31) | | (0.47) | | (0.78) | | - | (f) | 14.22 | |

| Year Ended June 30, 2007 | 14.76 | | 0.38 | | 2.66 | | 3.04 | | (0.27) | | (0.47) | | (0.74) | | - | (f) | 17.06 | |

| Year Ended June 30, 2006 | 14.64 | | 0.21 | | 0.30 | | 0.51 | | (0.18) | | (0.21) | | (0.39) | | - | (f) | 14.76 | |

| | | | | | | | | | | | | | | | | | | | |

| A Shares | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Year Ended June 30, 2010 | 12.17 | | 0.32 | | 1.26 | | 1.58 | | (0.26) | | - - | | (0.26) | | - | (f) | 13.49 | |

| Year Ended June 30, 2009 | 14.22 | | 0.18 | | (1.75) | | (1.57) | | (0.16) | | (0.32) | | (0.48) | | - | (f) | 12.17 | |

| Year Ended June 30, 2008 | 17.07 | | 0.17 | | (2.24) | | (2.07) | | (0.31) | | (0.47) | | (0.78) | | - | (f) | 14.22 | |

| Year Ended June 30, 2007 | 14.77 | | 0.41 | | 2.63 | | 3.04 | | (0.27) | | (0.47) | | (0.74) | | - | | 17.07 | |

| July 8, 2005 through June 30, 2006 (g) (h) | 14.81 | | 0.21 | | 0.14 | | 0.35 | | (0.18) | | (0.21) | | (0.39) | | - | | 14.77 | |

| | | | | | | | | | | | | | | | | | | | |

| (a) | Annualized for periods less than one year. | | | | | | | | | | | | | | | | | |

| (b) | Calculated based on average shares outstanding for the period. | | | | | | | | | | | | | | | |

| (c) | Not annualized for periods less than one year. | | | | | | | | | | | | | | | | | |

| (d) | Total return does not include the effect of front-end sales charges or contingent deferred sales charges. | | | | | |

| (e) | Reflects the expense ratio excluding any waivers and/or reimbursements. | | | | | | | | | | | | | |

| (f) | Less than $0.01 per share. | | | | | | | | | | | | | | | | | | |

| (g) | Due to shareholder redemptions, on August 21, 2005, net assets of the class were zero from the close of business on | | | |

| | that date until September 22, 2005. Financial information presented is for the period July 8, 2005, through June 30, 2006. | | |

| (h) | A shares commenced operations on July 8, 2005. | | | | | | | | | | | | | | | | | |

| (i) | Effective November 1, 2008, C Shares were reclassified as Investor Shares. For the Period July 1, 2008, through November 1, 2008, | |

| | total return for C Shares was (12.68)%. For the aforementioned period, the annualized gross expenses and net expenses ratios | |

| | were 2.35% and 2.10%, respectively. | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | | | | | 16 | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| AUXIER FOCUS FUND | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS (continued) | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | Ratios to Average | | | | |

| | | | | | | Net Assets (a) | | | |

| | | | Net Assets at | | Net | | | | | | Portfolio |

| | Total | | End of Period | | Investment | | Net | | Gross | | Turnover |

| | Return (c) (d) | | (000's Omitted) | | Income | | Expenses | | Expenses (e) | | Rate (c) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Investor Shares | | | | | | | | | | | |

| | | | | | | | | | | | |

| Year Ended June 30, 2010 | 12.99% | | $ 100,712 | | 2.29% | | 1.30% | | 1.30% | | 15% |

| Year Ended June 30, 2009 (i) | (10.92)% | | 84,660 | | 1.53% | | 1.35% | | 1.35% | | 24% |

| Year Ended June 30, 2008 | (12.56)% | | 103,664 | | 1.10% | | 1.35% | | 1.36% | | 19% |

| Year Ended June 30, 2007 | 21.11% | | 116,774 | | 2.40% | | 1.35% | | 1.36% | | 16% |

| Year Ended June 30, 2006 | 3.44% | | 103,642 | | 1.44% | | 1.35% | | 1.36% | | 28% |

| | | | | | | | | | | | |

| A Shares | | | | | | | | | | | |

| | | | | | | | | | | | |

| Year Ended June 30, 2010 | 12.90% | | 157 | | 2.29% | | 1.30% | | 1.55% | | 15% |

| Year Ended June 30, 2009 | (10.85)% | | 148 | | 1.49% | | 1.35% | | 1.60% | | 24% |

| Year Ended June 30, 2008 | (12.61)% | | 208 | | 1.08% | | 1.35% | | 1.60% | | 19% |

| Year Ended June 30, 2007 | 21.10% | | 399 | | 2.59% | | 1.35% | | 1.60% | | 16% |

| July 8, 2005 through June 30, 2006 (g) (h) | 2.32% | | 392 | | 1.56% | | 1.35% | | 1.61% | | 28% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements. | | | 17 | | | | | | | | |

| |

| AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2010 |

Note 1. Organization

The Auxier Focus Fund (the “Fund”) is a diversified portfolio of Forum Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940 (the “Act”), as amended. As of June 30, 2010, the Trust had twenty-two investment portfolios. Under its Trust Instrument, the Trust is authorized to issue an unlimited number of each Fund’s shares of beneficial interest without par value. The Fund currently offers two classes of shares: Investor Shares and A Shares. A Shares are offered at net asset value plus a maximum sales charge of 5.75%. A Shares are also subject to contingent deferred sales charge (“CDSC”) of 1.00% on purchases without an initial sales charge and redeemed less than one year after they are purchased. Investor Shares are not subject to a sales charge. Investor Shares and A Shares commenced operations on July 9, 1999 and July 8, 2005, respectively. The Fund’s investment objective is to achieve long-term capital appreciation.

On August 27, 2008, the Board of Trustees of the Trust approved the conversion of the Fund’s C Shares into Investor Shares. On November 1, 2008, each shareholder of C Shares received Investor Shares in a dollar amount equal to their investment in C Shares as of that date.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increase and decrease in net assets from operations during the fiscal period. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted sale or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and asked price provided by independent pricing services. Non-exchange traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale at the mean of the last bid and asked prices provided by independent pricing services. Debt securities may be valued at prices supplied by a Fund’s pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics such as rating, interest rate and maturity. Shares of open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the adviser believes that the values available are unreliable. Fair valuation is based on subjective factors and as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The aggregate value by input level, as of June 30, 2010, for the Fund’s investments is included at the end of the

18

| |

| AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2010 |

Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium and discount is amortized and accreted in accordance with GAAP. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Foreign Currency Translations – Foreign currency amounts are translated into U.S. dollars as follows: (i) assets and liabilities at the rate of exchange at the end of the respective period; and (ii) purchases and sales of securities and income and expenses at the rate of exchange prevailing on the dates of such transactions. The portion of the results of operations arising from changes in the exchange rates and the portion due to fluctuations arising from changes in the market prices of securities are not isolated. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

The Fund may enter into transactions to purchase or sell foreign currencies to protect the U.S. dollar value of its underlying portfolio securities against the effect of possible adverse movements in foreign exchange rates. Principal risks associated with such transactions include the movement in value of the foreign currency relative to the U.S. dollar and the ability of the counterparty to perform. Fluctuations in the value of such forward currency transactions are recorded daily as unrealized gain or loss; realized gain or loss includes net gain or loss on transactions that have terminated by settlement or by the Fund entering into offsetting commitments. These instruments involve market risk, credit risk, or both kinds of risks, in excess of the amount recognized in the Statement of Assets and Liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates.

Distributions to Shareholders – Distributions to shareholders of net investment income and net capital gains, if any, are declared and paid at least annually. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required.

As of June 30, 2010, there are no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund’s federal tax returns filed in the three-year period ended June 30, 2010, remain subject to examination by the Internal Revenue Service.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

The Fund’s class specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class’ respective net assets to the total net assets of the Fund.

Redemption Fees – A shareholder who redeems or exchanges shares within 180 days of purchase will incur a redemption fee of 2.00% of the current net asset value of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to

19

| |

AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2010 |

modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 3. Advisory Fees, Servicing Fees and Other Transactions

Investment Adviser – Auxier Asset Management LLC (the “Adviser”), is the investment adviser to the Fund. Effective January 1, 2010, the advisory fee received by the Adviser from the fund is at an annual rate of 1.25% of the Fund’s average daily assets. Prior to January 1, 2010, the Adviser received an advisory fee from the Fund at an annual rate of 1.35% of the Fund’s average daily assets.

Under the terms of the Investment Advisory Agreement, the Adviser provides investment advisory services to the Fund and is obligated to pay all expenses of the Fund except any expenses it is authorized to pay under Rule 12b-1, brokerage fees and commissions, borrowing costs, taxes, certain compensation expenses of the Trustees, and extraordinary and non-recurring expenses.

Distribution – Foreside Fund Services, LLC serves as the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with the Adviser or with Atlantic Fund Administration, LLC (“Atlantic”) or their affiliates. The Fund has adopted a Distribution Plan (the “Plan”) for A Shares of the Fund in accordance with Rule 12b-1 of the Act. Under the Plan, the Fund pays the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of the average daily net assets of A Shares. The Distributor had no role in determining the investment policies or which securities are to be purchased or sold by the Trust or its Funds.

For the year ended June 30, 2010, there were $1,094 in front-end sales charges assessed on the sale of A Shares, no contingent deferred sales charges were assessed on the sale of A Shares. The distributor received $144 of the total front-end sales charges.

Other Service Providers – Atlantic provides fund accounting, fund administration, and transfer agency services to the Fund. Atlantic also provides certain shareholder report production and EDGAR conversion and filing services. Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $40,000 for service to the Trust ($60,000 for the Chairman). In addition, the Chairman receives a monthly stipend of $500 to cover certain expenses incurred in connection with his duties to the Trust. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees’ fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

Note 4. Expense Reimbursements and Fees Waived

Effective January 1, 2010, the Adviser has contractually agreed to waive a portion of its fees and reimburse expenses through October 31, 2010, to the extent necessary to maintain the total operating expenses at 1.25% of average daily net assets of the Investor Shares and A Shares. Prior to January 1, 2010, the Adviser had contractually agreed to waive a portion of its fees and reimburse expenses to maintain the total operating expenses at 1.35% of average daily net assets of the Investor Shares and A Shares. These contractual waivers may be changed or eliminated at any time with consent of the Board. For the year ended June 30, 2010, expenses waived were $3,673.

20

| |

| AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2010 |

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments for the year ended June 30, 2010, were $19,806,070 and $14,789,751, respectively.

Note 6. Federal Income Tax and Investment Transactions

Distributions during the fiscal years ended as noted were characterized for tax purposes as follows:

| | | 2010 | | 2009 |

| Ordinary Income | | $ | 1,839,869 | | $ | 1,275,234 |

| Long-Term Capital Gain | | | - | | | 2,064,301 |

| Total | | $ | 1,839,869 | | $ 3,339,535 |

As of June 30, 2010, distributable earnings (accumulated losses) on a tax basis were as follows:

| Undistributed Ordinary Income | | $ | 1,314,360 | |

| Capital and Other Losses | | | (13,680) | |

| Unrealized Appreciation | | | 525,220 | |

| Total | | $ | 1,825,900 | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales.

As of June 30, 2010, the Fund had capital loss carryforwards to offset future capital gains of $13,680, expiring in 2017.

On the Statement of Assets and Liabilities, as a result of permanent book to tax differences, certain amounts have been reclassified for the year ended June 30, 2010. The following reclassification was the result of currency gain (loss) and real estate investment trust and partnership adjustments and has no impact on the net assets of the Fund.

| Undistributed Net Investment Income (Loss) | | $ | 83,835 |

| Accumulated Net Realized Loss | | | (83,727) |

| Paid-in-Capital | | | (108) |

Note 7. Share Transactions

Share transactions for the Fund were as follows:

| | | Year Ended June 30, 2010 | | Year Ended June 30, 2009 | |

| Sale of shares: | | | | | |

| Investor Shares | | 1,392,563 | | 1,070,517 | |

| A Shares | | 1,257 | | - | |

| Reinvestment of distributions: | | | | | |

| Investor Shares | | 128,025 | | 283,722 | |

| A Shares | | 220 | | 605 | |

21

| |

| AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2010 |

| Contributions from share reclassification: | | | | |

| Investor Shares | | - | | 3,090 |

| Redemption of shares: | | | | |

| Investor Shares | | (1,013,829) | | (1,689,078) |

| A Shares | | (1,988) | | (3,064) |

| C Shares | | - | | (4,267) |

| Redemption from share reclassification: | | | | |

| C Shares | | - | | (3,051) |

| Increase (decrease) from share transactions | | 506,248 | | (341,526) |

Note 8. Recent Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements.” ASU No. 2010-06 clarifies existing disclosure and requires additional disclosures regarding fair value measurements. Effective for interim and annual reporting periods beginning after December 15, 2009, entities are required to disclose significant transfers into and out of Level 1 and 2 measurements in the fair value hierarchy and the reasons for those transfers. Effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years, entities will need to disclose information about purchases, sales, issuances and settlements of Level 3 securities on a gross basis, rather than as a net number as currently required. Management is currently evaluating the impact ASU No. 2010-06 will have on financial statement disclosures.

Note 9. Subsequent Events

Subsequent events occurring after the date of this report have been evaluated for potential impact and the Fund has had no such events.

22

| |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Trustees of Forum Funds

and the Shareholders of Auxier Focus Fund

We have audited the accompanying statement of assets and liabilities of the Auxier Focus Fund, a series of shares of beneficial interest in the Forum Funds, including the schedule of investments, as of June 30, 2010, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for each of the years in the two year period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for each of the years or period in the three-year period ended June 30, 2008, were audited by other auditors whose report dated August 25, 2008, expressed an unqualified opinion on such financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2010, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Auxier Focus Fund as of June 30, 2010, the results of its operations for the year then ended, and the changes in its net assets and its financial highlights for each of the years in the two year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

August 18, 2010

23

| |

| AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2010 |

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (877) 328-9437, on the Fund's website at www.auxierasset.com and on the SEC’s website at www.sec.gov. The Fund’s proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (877) 328-9437 and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees and CDSC fees, and (2) ongoing costs, including management fees, 12b-1 fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2010, through June 30, 2010.

Actual Expenses – The first line under each share class in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line under each share class of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees and CDSC fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs had been included, your costs would have been higher.

| | Beginning Account Value January 1, 2010 | | Ending Account Value June 30, 2010 | | Expenses Paid During Period * | | Annualized Expense Ratio * |

| Investor Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 960.14 | | $ | 6.08 | | | 1.25% |

Hypothetical (5% return before expenses) | $ | 1,000.00 | | $ | 1,018.60 | | $ | 6.26 | | | 1.25% |

| A Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 960.14 | | $ | 6.08 | | | 1.25% |

Hypothetical (5% return before expenses) | $ | 1,000.00 | | $ | 1,018.60 | | $ | 6.26 | | | 1.25% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

* Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the

24

| |

| AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2010 |

period, multiplied by the number of days in the most recent fiscal half-year divided by 365 to reflect the half-year period.

Federal Tax Status of Dividends Declared during the Tax Year

For federal income tax purposes, dividends from short-term capital gains are classified as ordinary income. The Fund designates 72.78% of its income dividend distributed as qualifying for the corporate dividends-received deduction (DRD) and 88.95% for the qualified dividend rate (QDI) as defined in Section 1(h)(11) of the Internal Revenue Code. The Fund also designates 40.02% as qualified interest income exempt from U.S. tax for foreign shareholders (QII).

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust’s business affairs and of the exercise of all the Trust’s powers except those reserved for the shareholders. The following table provides information about each Board member and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland, Maine 04101, unless otherwise indicated. Each Trustee oversees twenty-two portfolios in the Trust. Mr. Keffer is considered an Interested Trustee due to his affiliation with Atlantic. Mr. Keffer is also an Interested Director of Wintergreen Fund, Inc. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (877) 328-9437.

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past 5 Years |

| Independent Trustees | | | |

J. Michael Parish Born: 1943 | Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee | Since 1989 (Chairman since 2004) | Retired since 2003. |

Costas Azariadis Born: 1943 | Trustee; Chairman, Valuation Committee | Since 1989 | Professor of Economics, Washington University since 2006; Professor of Economics, University of California-Los Angeles 1992-2006. |

James C. Cheng Born: 1942 | Trustee; Chairman, Audit Committee | Since 1989 | President, Technology Marketing Associates (marketing company for small- and medium-sized businesses in New England) since 1991. |

John Y. Keffer1 Born: 1942 | Trustee; Vice Chairman | Since 1989 | Chairman, Atlantic since 2008; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company chartered in the State of Maine) since 1997. |

| | 1 Since 1997, John Y. Keffer has been president and owner of Forum Trust, LLC. Prior to January 1, 2010, Atlantic was a wholly owned subsidiary of Forum Trust, LLC. Effective January 1, 2010, Atlantic became a wholly owned subsidiary of Forum Holdings Corp., a Delaware corporation that is wholly owned by Mr. Keffer. |

25

| |

| AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2010 |

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past 5 Years |

| Officers | | | |

Stacey E. Hong Born: 1966 | President; Principal Executive Officer | Since 2008 | President, Atlantic since 2008; Director, Consulting Services, Foreside Fund Services 2007; Elder Care, 2005-2006; Director, Fund Accounting, Citigroup 2003-2005. |