As filed with the Securities and Exchange Commission on February 26, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Stacey E. Hong, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2009 – December 31, 2009

| ITEM 1. | REPORT TO STOCKHOLDERS. |

ADAMS HARKNESS

SMALL CAP GROWTH FUND

ANNUAL REPORT

DECEMBER 31, 2009

ADAMS HARKNESS SMALL CAP GROWTH FUND

SHAREHOLDER LETTER

DECEMBER 31, 2009

Dear Shareholder,

2009 was a tale of two markets. For most of the first quarter, the stock market continued the decline precipitously. The Russell 2000 Growth Index (Russell 2000) bottomed on March 6th at a low of $190.78 and then rose 45% in the next eight weeks to close at $277. For the entire second quarter, the Russell 2000 rose 23.38%, closing June 30th at $285.18. Unfortunately our fund did not keep up with the Russell 2000 Growth Index in 2009. The fund was positioned in a fairly defensive manner as we went into the year: we had a significant weighting in healthcare and we were focused on companies that had very predictable earnings growth. As the market turned in mid-March our fund was still fairly defensively positioned and as such lost substantial ground as the market roared back in the April-May time frame. While we had begun to move to a more “procyclical” tilt as we began to see “green shoots” emerging from the 18 month recession that gripped the world and the fundamentals of many industries looked like they could start to improve, quite frankly we did not do it quickly enough and therefore missed most of the six to eight week rally. That rally was quick enough and powerful enough that missing most of it was of great detriment to the fund for the entire year. Why did we miss it? While our process is anticipatory, it is at its heart fundamentally based. While we do not need to see evidence of improvement, we do need to see signs that things can begin to improve before we are comfortable changing our investment tilt. In this case, the stocks seemed to move before it was apparent that things could be getting better, which was a bit problematic for our investment style. Additionally, the greatest move occurred in what we term the liquidity or solvency trade: those companies most close to bankruptcy or whose balance sheets were most impaired, rebounded the most. There were numerous small cap companies with severe fundamental business risks that became extremely depressed during the downturn, as many investors questioned whether they would survive. These low quality companies rebounded sharply as the ensuing economic recovery took hold, essentially saving these companies. Those kinds of companies are not names in which we would invest in given our investment discipline. During that initial rally we lost substantial performance in the industrials, healthcare, materials, and financials sectors that we simply couldn’t make up the rest of the year. From June on, when the fund was positioned offensively, and the solvency trade ran its course, the market started paying attention to fundamentals more than anything else, our fund started to outperform the benchmark. While the second half of the year showed much improved performance relative to the benchmark, we entered that period with enough of a deficit that we were not able to make up all of the difference between ourselves and the benchmark. We positioned the fund to take advantage of early cyclical market forces, and as such we started to gain back performance by being overweight in the technology, consumer discretionary, and energy sectors for the majority of that time frame, a position we still employ today.

While 2009 proved to be a frustrating year for us, we did have some things that went right. Among our stronger contributors to returns during the year were SXC Health Solutions Corp., which saw strong returns due to a transformational acquisition it made early in 2009; Green Mountain Coffee Roasters, Inc., which benefitted from strong adoption of its K-Cup single use coffee systems, Brigham Exploration Co., a smaller exploration and production company which is transitioning from a gas-focused company to an oil-focused company, and LuluLemon Athletica, Inc., which experienced a strong rebound in demand for its yoga and sports clothing as consumer spending began to pick up.

1

ADAMS HARKNESS SMALL CAP GROWTH FUND

SHAREHOLDER LETTER

DECEMBER 31, 2009

Among the top ten losers for 2009 we number four healthcare names: LHC Group, Inc., Biomarin Pharmaceutical, Inc., Thoratec Corp., and athenahealth, Inc. All of these companies suffered more from a general selloff in the group in the wake of Obama’s election and strong focus on healthcare reform, as opposed to any specific fundamental issues.

Our overall outlook for the market for 2010 is mildly positive. We believe we will continue to see positive Gross Domestic Product (GDP) growth which will be somewhat offset by high unemployment, slower state and local government spending, and federal policies that could have a slightly dampening affect on growth (such as raising taxes). Thus, we believe that although nominal GDP will look strong, the recovery will feel a bit like the one in the early 1990s — very slow and somewhat tentative. We have focused on particular companies and themes that we believe will do well even if the economic recovery is anemic. We remain slightly overweight in the consumer sector, focused on companies that have true growth prospects because of their small size and unique product offerings, such as J Crew, Inc. and LuluLemon Athletica, Inc.; companies that are transforming themselves due to new management, such as Chicos FAS, Inc. and companies, such as restaurants and sporting goods companies, which should benefit as employment stabilizes. We are not factoring into our analysis a pickup in consumer spending, as we believe that will remain muted for at least the next several years as the consumers repair their balance sheets. We have increased our weighting in healthcare slightly, and will look to continue to do so opportunistically, as we believe that as more clarity emerges with regards to healthcare reform sentiment will become less negative and investors will focus on identifying winners and losers in reform as opposed to avoiding the group entirely.

Our biggest over weights are in energy and information technology sectors and our biggest under weights are in consumer staples, financials and industrials sectors. We view energy, material and industrial sectors as a group and if treated as a group we are equal weight those sectors. Our underweight in industrials/overweight in energy and materials stems from the fact that many of the companies in the industrial space are tied to housing and construction in some way, shape or form and we are not positive on that sector at this time. Within those three sectors (energy/industrials/materials) we have a strong focus on rebuilding the energy infrastructure through developing the smart grid and furthering clean energy, as well as a focus on global growth. In the technology sector we are focused on several major themes: high value added semiconductors, as we believe semiconductor usage is at the beginning of a secular uptrend, given the smart phones, Windows 7, pc upgrade cycle, increasing use in autos and clean energy, and servers/storage/telecommunications as we move to cloud computing. Cloud computing is another very strong theme that we believe will be a major focus of corporate spending, as it has the potential to significantly lower IT costs. While we are currently underweight in financials, we expect to increase our weighting in that sector as we move through the year. The first phase of the Great Bank Bailout, we believe, was saving the mega banks, which according to analysts’ estimates account for as much as 50% of the lending in this country. We believe the second phase will be the focus of regulators in 2010, and we call it “Rebuilding the Core” (or the middle). This will be very similar to what occurred after the Savings & Loan collapse in 1990-1991: the FDIC will force consolidation of the banking system by closing “bad banks” and merging them into stronger banks, creating larger and stronger entities — in effect, rebuilding the major regional sector of the banking system, which had all but disappeared in the last few years. We view rebuilding this sector as key to the stability of the economic recovery — as that sector gets rebuilt, they will be in a position to lend, particularly to smaller and mid sized businesses, which

2

ADAMS HARKNESS SMALL CAP GROWTH FUND

SHAREHOLDER LETTER

DECEMBER 31, 2009

will eventually lift employment prospects. More importantly for your portfolio, we believe that out of this will come some financial companies that will have very strong prospects for renewed growth. We will be closely monitoring this sector for opportunities as we move through the year.

We are growth investors; the major risk to the portfolio in 2010 that we see at this point would be that the economy slips back into recession. If our view is accurate, that will not happen. While the recovery will be enough to sustain the market, corporate profit growth, while good, will not be strong enough to lift all stocks equally. That implies that 2010 could be a stockpicker’s market, which should be a better backdrop for our investment style than the 2008-2009 environments.

Sincerely,

Mary Lisanti, CFA

President & Portfolio Manager

The Adams Harkness Small Cap Growth Fund invests in smaller companies which generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources, and less liquid stock. Growth stocks emphasize companies that are believed to offer above-average prospects for capital growth due to their strong earnings and revenue potential. Growth stocks tend to offer relatively low dividend yields.

The recent growth in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

The views in this report were those of the Fund manager as of December 31, 2009, and may not reflect her views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments in the Fund and do not constitute investment advice.

3

ADAMS HARKNESS SMALL CAP GROWTH FUND

PERFORMANCE CHART AND ANALYSIS

DECEMBER 31, 2009

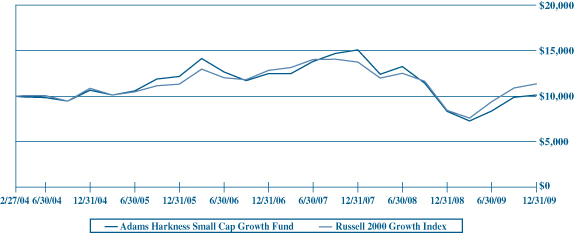

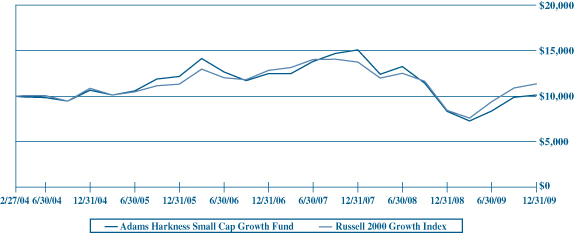

The following chart reflects the change in value of a hypothetical $10,000 investment in the Adams Harkness Small Cap Growth Fund (the “Fund”) since inception, including reinvested dividends and distributions. The result is compared with a broad-based securities market index. The Russell 2000 Growth Index (the “Index”), the Fund‘s primary performance benchmark, measures the performance of those Russell 2000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and does not reflect the expenses of the Fund. One cannot invest directly in an index.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value of an investment in the Fund will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The Fund’s annual operating expense ratio (gross) is 2.78%. Shares redeemed or exchanged within 30 days of purchase will be charged a 1.00% redemption fee. Returns greater than one year are annualized. During the period certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. For the most recent month-end performance, please call (800) 441-7031 or visit the Fund’s website at www.ahsmallcap.com. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | | | | | | |

Average Annual Total Return as of 12/31/09

| | 1 Year

| | 5 Year

| | Since

Inception

2/27/04

|

Adams Harkness Small Cap Growth Fund | | | 21.46% | | (1.00)% | | 0.22% |

Russell 2000 Growth Index | | | 34.47% | | 0.87 % | | 2.21% |

| | | |

Investment Value on 12/31/09

| | | | | | |

Adams Harkness Small Cap Growth Fund | | $ | 10,127 | | | | |

Russell 2000 Growth Index | | $ | 11,360 | | | | |

4

ADAMS HARKNESS SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2009

| | | | | |

Shares

| | Security Description

| | Value

|

| Common Stock - 99.2% |

| Communications Equipment - 5.9% |

| 5,030 | | Acme Packet, Inc.(a) | | $ | 55,330 |

| 16,155 | | Aruba Networks, Inc.(a) | | | 172,212 |

| 5,165 | | Blue Coat Systems, Inc.(a) | | | 147,409 |

| 6,480 | | DragonWave, Inc.(a) | | | 74,261 |

| 2,340 | | F5 Networks, Inc.(a) | | | 123,973 |

| 2,035 | | Fortinet, Inc.(a) | | | 35,755 |

| 5,390 | | Riverbed Technology, Inc.(a) | | | 123,808 |

| | | | |

|

|

| | | | | | 732,748 |

| | | | |

|

|

| Computers and Peripherals - 4.2% |

| 12,272 | | Compellent Technologies, Inc.(a) | | | 278,329 |

| 11,575 | | Rackspace Hosting, Inc.(a) | | | 241,339 |

| | | | |

|

|

| | | | | | 519,668 |

| | | | |

|

|

| Consumer Discretionary - 7.2% |

| 1,235 | | Archipelago Learning, Inc.(a) | | | 25,565 |

| 2,930 | | Buffalo Wild Wings, Inc.(a) | | | 117,991 |

| 1,280 | | Deckers Outdoor Corp.(a) | | | 130,202 |

| 3,325 | | FGX International Holdings, Ltd.(a) | | | 65,137 |

| 8,575 | | LuluLemon Athletica, Inc.(a) | | | 258,107 |

| 2,425 | | PF Chang’s China Bistro, Inc.(a) | | | 91,932 |

| 4,429 | | Shutterfly, Inc.(a) | | | 78,880 |

| 5,170 | | Tempur-Pedic International, Inc.(a) | | | 122,167 |

| | | | |

|

|

| | | | | | 889,981 |

| | | | |

|

|

| Consumer Retail - 12.6% |

| 7,850 | | AnnTaylor Stores Corp.(a) | | | 107,074 |

| 11,630 | | Chico’s FAS, Inc.(a) | | | 163,402 |

| 4,170 | | Dress Barn, Inc.(a) | | | 96,327 |

| 2,715 | | Fossil, Inc.(a) | | | 91,115 |

| 5,605 | | hhgregg, Inc.(a) | | | 123,478 |

| 2,715 | | J. Crew Group, Inc.(a) | | | 121,469 |

| 4,140 | | Kirkland’s, Inc.(a) | | | 71,912 |

| 7,240 | | Lumber Liquidators, Inc.(a) | | | 194,032 |

| 2,370 | | Rue21, Inc.(a) | | | 66,573 |

| 2,265 | | Steven Madden, Ltd.(a) | | | 93,409 |

| 8,030 | | Ulta Salon Cosmetics & Fragrance, Inc.(a) | | | 145,825 |

| 1,315 | | Under Armour, Inc., Class A(a) | | | 35,860 |

| 5,664 | | Vitamin Shoppe, Inc.(a) | | | 125,967 |

| 4,340 | | Williams-Sonoma, Inc. | | | 90,185 |

| 3,015 | | Zumiez, Inc.(a) | | | 38,351 |

| | | | |

|

|

| | | | | | 1,564,979 |

| | | | |

|

|

| Energy - 7.7% |

| 1,315 | | Arena Resources, Inc.(a) | | | 56,716 |

| 21,925 | | Brigham Exploration Co.(a) | | | 297,084 |

| 3,045 | | Carrizo Oil & Gas, Inc.(a) | | | 80,662 |

| 7,650 | | Complete Production Services, Inc.(a) | | | 99,450 |

| 6,184 | | GMX Resources, Inc.(a) | | | 84,968 |

| 9,205 | | Patriot Coal Corp.(a) | | | 142,309 |

| 9,910 | | Rosetta Resources, Inc.(a) | | | 197,506 |

| | | | |

|

|

| | | | | | 958,695 |

| | | | |

|

|

| | | | | |

Shares

| | Security Description

| | Value

|

| Financials - 0.6% |

| 3,320 | | Dollar Financial Corp.(a) | | $ | 78,551 |

| | | | |

|

|

| Health-Care - 8.2% |

| 6,474 | | Align Technology, Inc.(a) | | | 115,367 |

| 1,570 | | BioMarin Pharmaceutical, Inc.(a) | | | 29,532 |

| 14,150 | | DexCom, Inc.(a) | | | 114,332 |

| 9,045 | | GLG Life Tech Corp.(a) | | | 69,194 |

| 3,400 | | Orthofix International N.V.(a) | | | 105,298 |

| 5,385 | | Par Pharmaceutical Cos., Inc.(a) | | | 145,718 |

| 6,670 | | Thoratec Corp.(a) | | | 179,556 |

| 6,140 | | Wright Medical Group, Inc.(a) | | | 116,353 |

| 5,365 | | Zoll Medical Corp.(a) | | | 143,353 |

| | | | |

|

|

| | | | | | 1,018,703 |

| | | | |

|

|

| Health-Care Services -10.8% |

| 3,225 | | Air Methods Corp.(a) | | | 108,425 |

| 2,180 | | Almost Family, Inc.(a) | | | 86,175 |

| 2,030 | | athenahealth, Inc.(a) | | | 91,837 |

| 1,845 | | Emergency Medical Services Corp.(a) | | | 99,907 |

| 3,960 | | ev3, Inc.(a) | | | 52,826 |

| 635 | | HMS Holdings Corp.(a) | | | 30,918 |

| 4,405 | | IPC The Hospitalist Co., Inc.(a) | | | 146,466 |

| 4,400 | | LHC Group, Inc.(a) | | | 147,884 |

| 3,545 | | Natus Medical, Inc.(a) | | | 52,431 |

| 7,845 | | Nektar Therapeutics(a) | | | 73,115 |

| 9,710 | | Salix Pharmaceuticals, Ltd.(a) | | | 246,634 |

| 3,650 | | SXC Health Solutions Corp.(a) | | | 196,917 |

| | | | |

|

|

| | | | | | 1,333,535 |

| | | | |

|

|

| Industrials - 16.5% |

| 8,540 | | Aegean Marine Petroleum Network, Inc. | | | 234,679 |

| 3,030 | | American Superconductor Corp.(a) | | | 123,927 |

| 6,515 | | ArcSight, Inc.(a) | | | 166,654 |

| 1,675 | | Atlas Air Worldwide Holdings, Inc.(a) | | | 62,394 |

| 9,210 | | BE Aerospace, Inc.(a) | | | 216,435 |

| 2,430 | | Canadian Solar, Inc.(a) | | | 70,033 |

| 2,430 | | Echo Global Logistics, Inc.(a) | | | 30,837 |

| 4,700 | | EnerNOC, Inc.(a) | | | 142,833 |

| 6,270 | | Globe Specialty Metals, Inc.(a) | | | 58,938 |

| 7,330 | | GrafTech International, Ltd.(a) | | | 113,982 |

| 15,430 | | Horsehead Holding Corp.(a) | | | 196,733 |

| 1,715 | | Huron Consulting Group, Inc.(a) | | | 39,514 |

| 1,764 | | Itron, Inc.(a) | | | 119,193 |

| 3,365 | | Korn/Ferry International(a) | | | 55,522 |

| 2,505 | | MSC Industrial Direct Co. | | | 117,735 |

| 1,125 | | Portfolio Recovery Associates, Inc.(a) | | | 50,490 |

| 1,560 | | SYKES Enterprises, Inc.(a) | | | 39,733 |

| 5,305 | | Taleo Corp., Class A(a) | | | 124,774 |

| 6,475 | | UAL Corp.(a) | | | 83,592 |

| | | | |

|

|

| | | | | | 2,047,998 |

| | | | |

|

|

| Semiconductors and Semiconductor Equipment - 16.1% |

| 5,165 | | Atheros Communications, Inc.(a) | | | 176,850 |

| 7,980 | | Cavium Networks, Inc.(a) | | | 190,163 |

| 12,395 | | Cirrus Logic, Inc.(a) | | | 84,534 |

See Notes to Financial Statements. 5 |

ADAMS HARKNESS SMALL CAP GROWTH FUND

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2009

| | | | | |

Shares

| | Security Description

| | Value

|

| Semiconductors and Semiconductor Equipment - (Continued) |

| 8,315 | | Cypress Semiconductor Corp.(a) | | $ | 87,806 |

| 9,055 | | Mellanox Technologies, Ltd.(a) | | | 170,777 |

| 4,030 | | Netlogic Microsystems, Inc.(a) | | | 186,428 |

| 4,010 | | Power Integrations, Inc. | | | 145,804 |

| 14,655 | | RF Micro Devices, Inc.(a) | | | 69,904 |

| 4,535 | | Rubicon Technology, Inc.(a) | | | 92,106 |

| 3,230 | | Silicon Laboratories, Inc.(a) | | | 156,138 |

| 13,610 | | Skyworks Solutions, Inc.(a) | | | 193,126 |

| 15,110 | | Teradyne, Inc.(a) | | | 162,130 |

| 5,765 | | Veeco Instruments, Inc.(a) | | | 190,476 |

| 4,740 | | Volterra Semiconductor Corp.(a) | | | 90,629 |

| | | | |

|

|

| | | | | | 1,996,871 |

| | | | |

|

|

| Software - 5.6% |

| 3,915 | | CommVault Systems, Inc.(a) | | | 92,746 |

| 3,745 | | Concur Technologies, Inc.(a) | | | 160,099 |

| 4,755 | | Informatica Corp.(a) | | | 122,964 |

| 6,560 | | Rightnow Technologies, Inc.(a) | | | 113,947 |

| 2,265 | | SolarWinds, Inc.(a) | | | 52,118 |

| 1,860 | | Solera Holdings, Inc. | | | 66,979 |

| 2,215 | | Telvent GIT SA | | | 86,341 |

| | | | |

|

|

| | | | | | 695,194 |

| | | | |

|

|

| Technology - 3.8% |

| 3,336 | | Bottomline Technologies, Inc.(a) | | | 58,614 |

| 2,160 | | comScore, Inc.(a) | | | 37,908 |

| 3,365 | | GSI Commerce, Inc.(a) | | | 85,437 |

| 4,105 | | Plexus Corp.(a) | | | 116,992 |

| 6,140 | | Sapient Corp.(a) | | | 50,778 |

| 2,135 | | VistaPrint N.V.(a) | | | 120,969 |

| | | | |

|

|

| | | | | | 470,698 |

| | | | |

|

|

| Total Common Stock (Cost $10,270,454) | | | 12,307,621 |

| | | | |

|

|

| Total Investments - 99.2% | | | |

| | | (Cost $10,270,454)* | | $ | 12,307,621 |

| Other Assets and Liabilities, Net - 0.8% | | | 95,927 |

| | | | |

|

|

| Total Net Assets - 100.0% | | $ | 12,403,548 |

| | | | |

|

|

| (a) | | Non-income producing security. |

| * | | Cost of investments for Federal income tax purposes is $10,348,830, and net unrealized appreciation on investments consists of: |

| | | | |

Gross Unrealized Appreciation | | $ | 2,081,120 | |

Gross Unrealized Depreciation | | | (122,329 | ) |

| | |

|

|

|

Net Unrealized Appreciation | | $ | 1,958,791 | |

| | |

|

|

|

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2009:

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, refer to Note 2 — Security Valuation section in the accompanying Notes to Financial Statements.

| | | |

| Valuation Inputs | | Investments

in Securities |

Level 1 — Quoted Prices | | $ | 12,307,621 |

Level 2 — Other Significant Observable Inputs | | | – |

Level 3 — Significant Unobservable Inputs | | | – |

| | |

|

|

Total Investments | | $ | 12,307,621 |

| | |

|

|

The Level 1 inputs displayed in this table are Common Stock.

Refer to the Schedule of Investments for a further breakout of each security by type.

| | |

PORTFOLIO HOLDINGS | | |

% of Total Investments | | |

Communications Equipment | | 6.0% |

Computers and Peripherals | | 4.2% |

Consumer Discretionary | | 7.2% |

Consumer Retail | | 12.7% |

Energy | | 7.8% |

Financials | | 0.7% |

Health-Care | | 8.3% |

Health-Care Services | | 10.8% |

Industrials | | 16.6% |

Semiconductors and Semiconductor Equipment | | 16.2% |

Software | | 5.7% |

Technology | | 3.8% |

| | |

|

| | | 100.0% |

| | |

|

See Notes to Financial Statements. 6 |

ADAMS HARKNESS SMALL CAP GROWTH FUND

STATEMENT OF ASSETS AND LIABILITIES

DECEMBER 31, 2009

| | | | |

ASSETS | | | | |

Total investments, at value (Cost $10,270,454) | | $ | 12,307,621 | |

Cash | | | 116,136 | |

Receivables: | | | | |

Fund shares sold | | | 16,751 | |

Dividends and interest | | | 38 | |

Prepaid Expenses | | | 12,824 | |

| | |

|

|

|

| |

Total Assets | | | 12,453,370 | |

| | |

|

|

|

| |

LIABILITIES | | | | |

Payables: | | | | |

Fund shares redeemed | | | 2,598 | |

Accrued Liabilities: | | | | |

Investment adviser fees | | | 10,396 | |

Compliance services fees | | | 1,999 | |

Fund service fees | | | 3,623 | |

Trustees’ fees and expenses | | | 14 | |

Other expenses | | | 31,192 | |

| | |

|

|

|

| |

Total Liabilities | | | 49,822 | |

| | |

|

|

|

| |

NET ASSETS | | $ | 12,403,548 | |

| | |

|

|

|

| |

COMPONENTS OF NET ASSETS | | | | |

Paid-in capital | | $ | 17,390,740 | |

Accumulated net realized loss from investments | | | (7,024,359 | ) |

Unrealized appreciation on investments | | | 2,037,167 | |

| | |

|

|

|

| |

NET ASSETS | | $ | 12,403,548 | |

| | |

|

|

|

| |

NET ASSET VALUE, OFFERING PRICE PER SHARE | | | | |

Based on net assets of $12,403,548 and 1,327,478 shares outstanding at $0.000 par value (unlimited shares authorized) | | $ | 9.34 | |

| | |

|

|

|

See Notes to Financial Statements. 7 |

ADAMS HARKNESS SMALL CAP GROWTH FUND

STATEMENT OF OPERATIONS

YEAR ENDED DECEMBER 31, 2009

| | | | |

INVESTMENT INCOME | | | | |

Dividend income | | $ | 13,589 | |

Interest income | | | 51 | |

| | |

|

|

|

Total Investment Income | | | 13,640 | |

| | |

|

|

|

| |

EXPENSES | | | | |

Investment adviser fees | | | 119,228 | |

Fund service fees | | | 151,650 | |

Shareholder services fees | | | 29,807 | |

Custodian fees | | | 28,870 | |

Professional fees | | | 73,700 | |

Trustees’ fees and expenses | | | 458 | |

Compliance services fees | | | 28,722 | |

Registration fees | | | 15,585 | |

Reports to shareholders | | | 17,850 | |

Miscellaneous expenses | | | 12,723 | |

| | |

|

|

|

Total Expenses | | | 478,593 | |

Fees waived and expenses reimbursed | | | (110,958 | ) |

| | |

|

|

|

Net Expenses | | | 367,635 | |

| | |

|

|

|

| |

NET INVESTMENT LOSS | | | (353,995 | ) |

| | |

|

|

|

| |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

Net realized gain on investments | | | 1,230,533 | |

Net change in unrealized appreciation on investments | | | 1,170,832 | |

| | |

|

|

|

| |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 2,401,365 | |

| | |

|

|

|

| |

INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 2,047,370 | |

| | |

|

|

|

See Notes to Financial Statements. 8 |

ADAMS HARKNESS SMALL CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended

December 31, 2009

| | | Year Ended

December 31, 2008

| |

OPERATIONS | | | | | | | | |

Net investment loss | | $ | (353,995 | ) | | $ | (351,551 | ) |

Net realized gain (loss) on investments | | | 1,230,533 | | | | (8,175,439 | ) |

Net change in unrealized appreciation (depreciation)

on investments | | | 1,170,832 | | | | (3,687,980 | ) |

| | |

|

|

| |

|

|

|

Increase (Decrease) in Net Assets from Operations | | | 2,047,370 | | | | (12,214,970 | ) |

| | |

|

|

| |

|

|

|

| | |

DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | |

Net realized gain on investments | | | – | | | | (478,127 | ) |

| | |

|

|

| |

|

|

|

| | |

CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Sale of shares | | | 1,667,229 | | | | 5,587,220 | |

Reinvestment of distributions | | | – | | | | 474,064 | |

Redemption of shares | | | (5,288,742 | ) | | | (7,896,942 | ) |

Redemption fees | | | 40 | | | | 1,467 | |

| | |

|

|

| |

|

|

|

Decrease in Net Assets from Capital Share Transactions | | | (3,621,473 | ) | | | (1,834,191 | ) |

| | |

|

|

| |

|

|

|

| | |

Decrease in Net Assets | | | (1,574,103 | ) | | | (14,527,288 | ) |

| | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 13,977,651 | | | | 28,504,939 | |

| | |

|

|

| |

|

|

|

End of year (a) | | $ | 12,403,548 | | | $ | 13,977,651 | |

| | |

|

|

| |

|

|

|

| | |

SHARE TRANSACTIONS | | | | | | | | |

Sale of shares | | | 223,978 | | | | 486,173 | |

Reinvestment of distributions | | | – | | | | 62,957 | |

Redemption of shares | | | (714,991 | ) | | | (713,128 | ) |

| | |

|

|

| |

|

|

|

Decrease in Shares | | | (491,013 | ) | | | (163,998 | ) |

| | |

|

|

| |

|

|

|

| (a) | Amount includes undistributed net investment income of $0 and $0, respectively. |

See Notes to Financial Statements. 9 |

ADAMS HARKNESS SMALL CAP GROWTH FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding of the Fund throughout each year.

| | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended December 31,

| |

| | | 2009

| | | 2008

| | | 2007

| | | 2006

| | | 2005

| |

NET ASSET VALUE, Beginning of Year | | $ | 7.69 | | | $ | 14.38 | | | $ | 12.36 | | | $ | 12.03 | | | $ | 10.65 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

Net investment loss (a) | | | (0.23 | ) | | | (0.19 | ) | | | (0.23 | ) | | | (0.18 | ) | | | (0.16 | ) |

Net realized and unrealized gain/(loss) on investments | | | 1.88 | | | | (6.23 | ) | | | 2.77 | | | | 0.51 | (b) | | | 1.67 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total from Investment Operations | | | 1.65 | | | | (6.42 | ) | | | 2.54 | | | | 0.33 | | | | 1.51 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Redemption Fees (a) | | | – | (c) | | | – | (c) | | | – | (c) | | | – | (c) | | | – | (c) |

| | | | |

DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | |

Net realized gain on investments | | | – | | | | (0.27 | ) | | | (0.52 | ) | | | – | | | | (0.13 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

NET ASSET VALUE, End of Year | | $ | 9.34 | | | $ | 7.69 | | | $ | 14.38 | | | $ | 12.36 | | | $ | 12.03 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | |

TOTAL RETURN | | | 21.46 | % | | | (44.63 | %) | | | 20.54 | % | | | 2.74 | % | | | 14.18 | % |

| | | | | |

RATIO/SUPPLEMENTARY DATA: | | | | | | | | | | | | | | | | | | | | |

Net Assets at End of Year (000’s omitted) | | $ | 12,404 | | | $ | 13,978 | | | $ | 28,505 | | | $ | 27,212 | | | $ | 9,381 | |

Ratios to Average Net Assets : | | | | | | | | | | | | | | | | | | | | |

Net expenses | | | 3.08 | % | | | 1.90 | % | | | 1.82 | % | | | 1.65 | % | | | 1.65 | % |

Gross expenses (d) | | | 4.01 | % | | | 2.78 | % | | | 2.36 | % | | | 2.65 | % | | | 5.17 | % |

Net investment loss | | | (2.97 | )% | | | (1.68 | )% | | | (1.70 | )% | | | (1.41 | )% | | | (1.44 | )% |

| | | | | |

PORTFOLIO TURNOVER RATE | | | 381 | % | | | 521 | % | | | 380 | % | | | 497 | % | | | 307 | % |

| (a) | Calculated based on average shares outstanding during the period. |

| (b) | Per share amount does not reflect the actual net realized and unrealized gain/loss for the period because of the timing of sales of the fund shares and the amount of per share realized and unrealized gains and losses at such time |

| (c) | Less than $0.01 per share. |

| (d) | Reflects the expense ratio excluding any waivers. |

See Notes to Financial Statements. 10 |

ADAMS HARKNESS SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2009

Note 1. Organization

The Adams Harkness Small Cap Growth Fund (the “Fund”) is a diversified portfolio of Forum Funds (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended. As of December 31, 2009, the Trust had twenty-nine investment portfolios. Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund’s shares of beneficial interest without par value. The Fund commenced operations on February 27, 2004. The Fund seeks maximum capital appreciation.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increase and decrease in net assets from operations during the fiscal period. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Exchange traded securities and over-the-counter securities are valued using the last quoted sale or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and asked prices provided by independent pricing services. Non-exchange traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale at the mean of the last bid and asked prices provided by independent pricing services. Shares of open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust’s Board of Trustees (the “Board”) if (1) market quotations are insufficient or not readily available or (2) the adviser believes that the values available are unreliable. Fair valuation is based on subjective factors and as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

11

ADAMS HARKNESS SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2009

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The aggregate value by input level, as of December 31, 2009, for the Fund’s investments is included at the end of the Fund’s Schedule of Investments.

Securities Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as practical after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium and discount is amortized and accreted in accordance with GAAP. Identified cost of investments sold is used to determine the gain and loss for both financial statement and Federal income tax purposes.

Distributions to Shareholders – Distributions to shareholders of net investment income, if any, are declared and paid at least quarterly. Distributions to shareholders of capital gains, if any, are declared and paid at least annually. Distributions are based on amounts calculated in accordance with applicable Federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all its taxable income. In addition, by distributing in each calendar year substantially all its net investment income and capital gains, if any, the Fund will not be subject to a Federal excise tax. Therefore, no Federal income or excise tax provision is required.

As of December 31, 2009, there are no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund’s Federal tax returns filed in the three-year period ended December 31, 2009, remain subject to examination by the Internal Revenue Service.

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

12

ADAMS HARKNESS SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2009

Redemption Fees – A shareholder who redeems or exchanges shares within 30 days of purchase will incur a redemption fee of 1.00% of the current net asset value of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

Note 3. Advisory Fees, Servicing Fees and Other Transactions

Investment Adviser – AH Lisanti Capital Growth Fund, LLC (the “Adviser”) is the investment adviser of the Fund. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee from the Fund at an annual rate of 1.00% of the Fund’s average daily net assets.

Shareholder Service Plan – The Trust has adopted a shareholder service plan for the Fund under which the Fund may reimburse the Fund’s administrator for amounts paid by the administrator for providing shareholder service activities that are not otherwise provided by the Transfer Agent. The Fund’s administrator may make such payments to various financial institutions, including the Adviser, that provide shareholder servicing to their customers invested in the Fund in amounts up to 0.25% annually of the average daily net assets of the shares held by such customers.

Distribution – Foreside Fund Services, LLC serves as the Fund’s distributor (the “Distributor”). The Distributor receives no compensation from the Fund for its distribution services. The Distributor is not affiliated with the Adviser or with Atlantic Fund Administration, LLC (“Atlantic”) or their affiliates.

Other Service Providers – Atlantic provides fund accounting, fund administration and transfer agency services to the Fund. Pursuant to an Atlantic services agreement, the Fund pays Atlantic customary fees for its services.

Atlantic provides a Principal Executive Officer, Principal Financial Officer, Chief Compliance Officer, and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $40,000 for service to the Trust ($60,000 for the Chairman). In addition, the Chairman receives a monthly stipend of $500 to cover certain expenses incurred in connection with his duties to the Trust. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees’ fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

13

ADAMS HARKNESS SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2009

Note 4. Fees Waived

During the year, certain Fund service providers have voluntarily agreed to waive a portion of their fees. These voluntary waivers may be reduced or eliminated at any time. For the year ended December 31, 2009, fees waived were as follows:

| | | | | | | |

Fund Service Fees

Waived

| | Other

Waivers

| | Total Fees

Waived

|

| $ | 107,473 | | $ | 3,485 | | $ | 110,958 |

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments for the year ended December 31, 2009, were $44,694,089 and $48,652,611, respectively.

Note 6. Federal Tax Information and Investment Transactions

Distributions during the fiscal years ended as noted were characterized for tax purposes as follows:

| | | | | | |

| | | 2009

| | 2008

|

Ordinary Income | | $ | — | | $ | 401,233 |

Long-Term Capital Gain | | | — | | | 76,894 |

| | |

|

| |

|

|

| | | $ | — | | $ | 478,127 |

| | |

|

| |

|

|

As of December 31, 2009, accumulated loss on a tax basis were as follow:

| | | | |

Unrealized Appreciation (Depreciation) | | $ | 1,958,791 | |

Capital and Other Losses | | | (6,945,983 | ) |

| | |

|

|

|

Total | | $ | (4,987,192 | ) |

| | |

|

|

|

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales.

For tax purposes, the current year post-October loss was $29,165 (realized during the period November 1, 2009, through December 31, 2009). This loss will be recognized for tax purposes on the first business day of the Fund’s fiscal year, January 1, 2010.

As of December 31, 2009, the Fund had capital loss carryforwards to offset future capital gains of $4,100,613 expiring in 2016 and $2,816,205 expiring in 2017.

14

ADAMS HARKNESS SMALL CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2009

On the Statement of Assets and Liabilities, as a result of permanent book to tax differences, certain amounts have been reclassified for the year ended December 31, 2009. The following reclassification was the result of net operating losses, and has no impact on the net assets of the Fund.

| | | | |

Accumulated Net Investment Loss | | $ | 353,995 | |

Paid-in-Capital | | | (353,995 | ) |

Note 7. Recent Accounting Pronouncement

In June 2009, the Financial Accounting Standards Board (“FASB”) issued the “FASB Accounting Standard Codification TM and the Hierarchy of Generally Accepted Accounting Principles” (“Codification”). The FASB approved the Codification as the single source of authoritative U.S. accounting and reporting standards for nongovernmental entities, in addition to guidance issued by the Securities and Exchange Commission (the “SEC”). All guidance contained in the Codification carries an equal level of authority. The Codification supersedes all then-existing non-SEC accounting and reporting standards. All other non-grandfathered non-SEC accounting literature not included in the Codification has become nonauthoritative. The Codification is effective for financial statements issued for interim and annual periods ending after September 15, 2009. Management has evaluated the Codification and has determined that it did not have a significant impact on the reporting of the Fund’s financial statements.

In January 2010, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements.” ASU No. 2010-06 clarifies existing disclosure and requires additional disclosures regarding fair value measurements. Effective for interim and annual reporting periods beginning after December 15, 2009, entities will be required to disclose significant transfers into and out of Level 1 and 2 measurements in the fair value hierarchy and the reasons for those transfers. Effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years, entities will need to disclose information about purchases, sales, issuances and settlements of Level 3 securities on a gross basis, rather than as a net number as currently required. Management is currently evaluating the impact ASU No. 2010-06 will have on its financial statement disclosures.

Note 8. Subsequent Events

Subsequent events occurring after the date of this report have been evaluated for potential impact to this report through February 24, 2010, and the Fund has noted no such events.

15

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Forum Funds

and the Shareholders of Adams Harkness Small Cap Growth Fund

We have audited the accompanying statement of assets and liabilities of Adams Harkness Small Cap Growth Fund, a series of shares of beneficial interest in the Forum Funds, including the schedule of investments, as of December 31, 2009, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for each of the years in the two year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for each of the years in the three year period ended December 31, 2007 were audited by other auditors whose report dated February 26, 2008, expressed an unqualified opinion on such financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2009 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Adams Harkness Small Cap Growth Fund as of December 31, 2009, the results of its operations for the year then ended, and the changes in its net assets and its financial highlights for each of the years in the two year period then ended, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

February 24, 2010

16

ADAMS HARKNESS SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2009

Investment Advisory Approval

At the October 8, 2009, Board meeting, the Board, including the Independent Trustees, considered the approval of the continuance of the investment advisory agreement pertaining to the Fund (the “Advisory Agreement”). In evaluating the Advisory Agreement for the Fund, the Board reviewed materials furnished by the Adviser and Atlantic, including information regarding the Adviser, its personnel, operations and financial condition. Specifically, the Board considered, among other matters: (1) the nature, extent and quality of the services to be provided to the Fund by the Adviser, including information on the investment performance of the Adviser; (2) the costs of the services to be provided and profitability to the Adviser with respect to its relationship with the Fund; (3) the advisory fee and total expense ratio of the Fund compared to relevant peer groups of funds; (4) the extent to which economies of scale would be realized as the Fund grows and whether the advisory fee would enable the Fund’s investors to share in the benefits of economies of scale; and (5) other benefits received by the Adviser from its relationship with the Fund. In their deliberations, the Board did not identify any particular information that was all-important or controlling and attributed different weights to the various factors. In particular, the Board focused on the factors discussed below.

Nature, Extent and Quality of Services

In connection with a presentation from senior representatives of the Adviser, the Board considered the quality of services provided by the Adviser under the Advisory Agreement. In this regard, the Board considered information regarding the experience, qualifications and professional background of the portfolio managers and other personnel at the Adviser with principal investment responsibility for the Fund’s investments; the investment philosophy and decision-making processes of those professionals; the capability and integrity of the Adviser’s senior management and staff; the quality of the Adviser’s services with respect to regulatory compliance and compliance with client investment policies and restrictions; and the financial condition and operational stability of the Adviser. The Board also considered the adequacy of the Adviser’s resources and quality of services currently provided by the Adviser under the Advisory Agreement. The Board noted the Adviser’s representation that the firm is financially stable and able to provide investment advisory services to the Fund. The Board concluded that, overall, it was satisfied with the nature, extent and quality of services to be provided to the Fund under the Advisory Agreement.

Costs of Services and Profitability

The Board considered information provided by the Adviser regarding its costs of services and its profitability with respect to the Fund. The Board also considered the Adviser’s resources devoted to the Fund as well as an assessment of costs and profitability. Under those circumstances, the Board concluded that the Adviser’s profits attributable to management of the Fund were not excessive in light of the services provided by the Adviser on behalf of the Fund.

Performance

The Board reviewed performance of the Fund and the Adviser’s discussion of its investment philosophy. The Board noted that the Fund underperformed its benchmark for the 1-year period. The Board noted the Adviser’s

17

ADAMS HARKNESS SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2009

representation that it had outperformed its peers. The Board also noted the relatively difficult market faced by the Fund over the last year and the Fund’s performance during that period. Based on this review and all of the relevant facts and circumstances, the Board concluded that the Fund’s performance was reasonable relative to its peers and benchmark and that the Fund and its shareholders could benefit from the Adviser’s management of the Fund.

Compensation

The Board considered the compensation paid to the Adviser for providing advisory services to the Fund. The Board also analyzed comparative information regarding advisory fees and total expenses of mutual funds within its Lipper Inc. peer group. The Board noted that the Adviser’s actual advisory fee rate was the lowest of its Lipper Inc. peer group. The Board also noted that the Fund’s actual total expense ratio was above the median of its Lipper Inc. peer groups. The Board recognized, however, that it is difficult to compare advisory fees and expense ratios because of variations between the services provided by the Adviser and those provided for in the advisory fees paid by other funds. Based on the foregoing and on all of the information presented, the Board concluded that the Adviser’s advisory fee charged to the Funds was reasonable.

Economies of Scale

The Board considered whether the Fund would benefit from any economies of scale. In this respect, the Board noted the Adviser’s representation that fee breakpoints would be appropriate if there were significant growth in the assets of the Fund. Based on all of these considerations and other relevant factors, the Board concluded that it would not be necessary to consider the implementation of fee breakpoints until the time that assets under management were larger.

Other Benefits

The Board noted the Adviser’s representation that it does not benefit in a material way from its relationship with the Fund other than soft-dollar research benefits. The Board accordingly concluded that other benefits received by the Adviser from its relationship with the Fund were not a material factor to consider in approving the continuation of the Advisory Agreement.

Conclusion

The Board reviewed a memorandum from Trust Counsel discussing the legal standards applicable to its consideration of the Advisory Agreement. Based on its review, including consideration of each of the factors referenced above, the Board determined, in the exercise of its business judgment, that the advisory arrangement, as outlined in the Advisory Agreement, was fair and reasonable in light of the services performed, expenses incurred and such other matters as the Board considered relevant in the exercise of its reasonable business judgment.

18

ADAMS HARKNESS SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2009

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (800) 441-7031 and on the SEC’s website at www.sec.gov. The Fund’s proxy voting records for the twelve-month period ended June 30, is available, without charge and upon request, by calling (800) 441-7031, on the Fund’s website at www.ahsmallcap.com and on the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available, without charge and upon request on the SEC’s website at www.sec.gov or may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2009, through December 31, 2009.

Actual Expenses – The first line of the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

19

ADAMS HARKNESS SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2009

Please note that expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) for certain share classes, redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs had been included, your costs would have been higher.

| | | | | | | | | | | | |

| | | Beginning

Account Value

July 1, 2009

| | Ending

Account Value

December 31, 2009

| | Expenses

Paid

During Period*

| | Annualized

Expense Ratio*

| |

Actual | | $ | 1,000.00 | | $ | 1,209.80 | | $ | 18.08 | | 3.25 | % |

Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | $ | 1,008.80 | | $ | 16.43 | | 3.25 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year divided by 365 to reflect the half-year period. |

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust’s business affairs and of the exercise of all the Trust’s powers except those reserved for shareholders. The following table provides information about each Board member and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland, Maine, 04101, unless otherwise indicated. Each Trustee oversees twenty-nine portfolios in the Trust. Mr. Keffer is considered an Interested Trustee due to his affiliation with Atlantic. Mr. Keffer is also an Interested Director of Wintergreen Fund, Inc. The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (800) 441-7031.

20

ADAMS HARKNESS SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2009

| | | | | | |

Name and Year of Birth | | Position with the Trust | | Length of

Time Served | | Principal Occupation(s) During Past 5 Years |

| Independent Trustees | | | | | | |

J. Michael Parish Born: 1943 | | Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee | | Since 1989 (Chairman since 2004) | | Retired; Partner, Wolf, Block, Schorr and Solis-Cohen, LLP (law firm) 2002 – 2003. |

Costas Azariadis Born: 1943 | | Trustee; Chairman, Valuation Committee | | Since 1989 | | Professor of Economics, Washington University since 2006; Professor of Economics, University of California-Los Angeles 1992 – 2006. |

James C. Cheng Born: 1942 | | Trustee; Chairman, Audit Committee | | Since 1989 | | President, Technology Marketing Associates (marketing company for small- and medium-sized businesses in New England) since 1991. |

| Interested Trustee | | | | | | |

John Y. Keffer1 Born: 1942 | | Trustee | | Since 1989 | | Chairman, Atlantic since 2008; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company) since 1997; President, Citigroup Fund Services, LLC (“Citigroup”) 2003 – 2005. |

| 1 | Since 1997, John Y. Keffer has been president and owner of Forum Trust, LLC. Atlantic is a subsidiary of Forum Trust, LLC. |

21

ADAMS HARKNESS SMALL CAP GROWTH FUND

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2009

| | | | | | |

Name and Year of Birth | | Position with the Trust | | Length of

Time Served | | Principal Occupation(s) During Past 5 Years |

| Officers | | | | | | |

Stacey E. Hong Born: 1966 | | President; Principal Executive Officer | | Since 2008 | | President, Atlantic since 2008; Director, Consulting Services, Foreside Fund Services, 2007; Elder Care, 2005 – 2006; Director, Fund Accounting, Citigroup 2003 – 2005. |

Karen Shaw Born: 1972 | | Treasurer; Principal Financial Officer | | Since 2008 | | Senior Manager, Atlantic since 2008; Section Manager/Vice President, Enterprise Support Services, Citigroup 2003 – 2008. |

David Faherty Born: 1970 | | Vice President | | Since April 2009 | | Senior Counsel, Atlantic since 2009; Vice President, Citi Fund Services Ohio, Inc. 2007 – 2009; Associate Counsel, Investors Bank & Trust Company 2006 – 2007; employee of FDIC 2005. |

Michael J. McKeen Born: 1971 | | Vice President | | Since September 2009 | | Senior Manager, Atlantic since 2008; Vice President, Citigroup 2003 – 2008. |

Joshua LaPan Born: 1973 | | Vice President | | Since September 2009 | | Manager, Atlantic since 2008; Vice President, Citigroup 2003 – 2008. |

Timothy Bowden Born: 1969 | | Vice President | | Since September 2009 | | Manager, Atlantic since 2008; Vice President, Citigroup 2005 – 2008. |

Lina Bhatnagar Born: 1971 | | Secretary | | Since 2008 | | Senior Administration Specialist, Atlantic since 2008; Regulatory Administration Specialist, Citigroup, 2006 – 2008; Money Market/Short Term Trader, Wellington Management, 1996 – 2002. |

22

ADAMS HARKNESS SMALL CAP GROWTH FUND

P.O. BOX 588

PORTLAND, ME 04112

(800) 441-7031

WWW.AHSMALLCAP.COM

INVESTMENT ADVISER

AH LISANTI CAPITAL GROWTH, LLC

608 FIFTH AVENUE

SUITE 301

NEW YORK, NY 10020

DISTRIBUTOR

FORESIDE FUND SERVICES, LLC

THREE CANAL PLAZA

SUITE 100

PORTLAND, ME 04101

WWW.FORESIDE.COM

THISREPORTISSUBMITTEDFORTHEGENERALINFORMATIONOFTHESHAREHOLDERSOFTHE FUND. ITISNOTAUTHORIZEDFORDISTRIBUTIONTOPROSPECTIVEINVESTORSUNLESSPRECEDEDORACCOMPANIEDBYANEFFECTIVEPROSPECTUS,WHICHINCLUDESINFORMATIONREGARDINGTHE FUND’SRISKS,OBJECTIVES,FEESANDEXPENSES,EXPERIENCEOFITSMANAGEMENTANDOTHERINFORMATION.

228 - ANR - 1209

ANNUAL REPORT

December 31, 2009

http://www.polarisfunds.com

(888) 263-5594

TABLE OF CONTENTS

POLARIS GLOBAL VALUE FUND

A MESSAGE TO OUR SHAREHOLDERS

DECEMBER 31, 2009

Dear Fellow Shareholder,

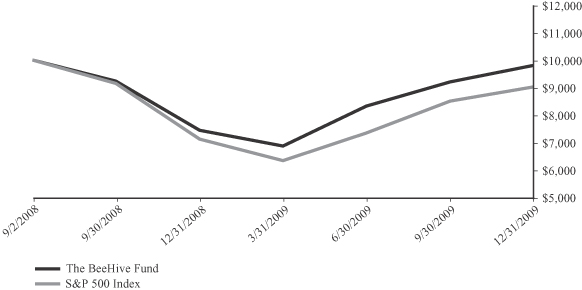

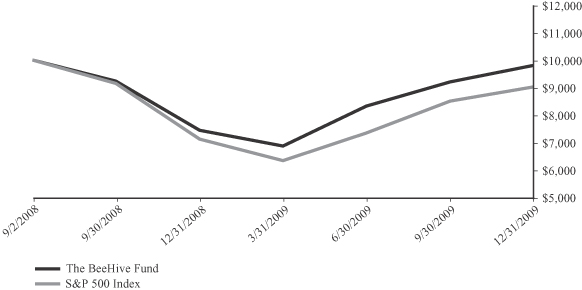

For the year ended December 31, 2009, the Polaris Global Value Fund (“the Fund”) returned 35.46%, outperforming the MSCI World Index, which returned 29.99%. Strong results can be attributed to pre-crisis stock picking and the decision to hold and add to investments in 2009, many of which had declined substantially in 2008. We maintained a calm, disciplined approach during the downturn, recognizing that declines in fundamentally strong portfolio companies with good cash flows and positive business conditions would not persist. During 2009, the majority of Fund holdings rebounded dramatically, with 21% of portfolio companies’ stock prices doubling in value.

The following table summarizes total returns through December 31, 2009.

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | As of December 31, 2009 |

| | | YTD | | QIV | | QIII | | QII | | QI | | 1 Yr | | 3 Yrs | | 5 Yrs | | 10 Yrs | | 15 Yrs | | ITD* |

Polaris Global Value Fund | | 35.46% | | 1.13% | | 21.98% | | 31.35% | | -16.40% | | 35.46% | | -11.21% | | -0.74% | | 5.76% | | 9.81% | | 8.78% |

MSCI World Index, net dividends reinvested | | 29.99% | | 4.07% | | 17.45% | | 20.75% | | -11.92% | | 29.99% | | -5.63% | | 2.01% | | -0.24% | | 6.02% | | 5.52% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Returns for more than one year are annualized. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. For the most recent month end performance, please call (888) 263-5594 or visit the Fund’s website at www.polarisfunds.com. As stated in the current prospectus dated May 1, 2009, the Fund’s annual operating expense ratio (gross) is 1.43%. Shares redeemed or exchanged within 180 days of purchase will be charged a 1.00% fee. Fund performance returns shown do not reflect this fee; if reflected, the returns would have been lower. See page 6 for additional disclosure.

The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

The table above shows that the Fund’s long-term performance has exceeded benchmark returns with lower market risk, as measured by the beta statistic of 0.91 since the Fund’s inception (volatility measurement relative to the MSCI World Index). It is worth noting that the Fund’s beta increased during 2007 and 2008 as the beta of many holdings increased substantially along with overall market volatility.

The year 2009 marked the end of the first decade of the new millennium. It was an inauspicious start as 2000-2009 was the worst decade since 1900 (110 years) for U.S. equities and the second worst for global equities. With annualized returns of 5.76% during the decade, the Fund outperformed the -0.24% return for the MSCI World Index. More indications of the Fund’s long-term outperformance versus various benchmarks are evident in the chart below. The Fund’s success may be credited to strong bottom-up stock picking, as our research identified fundamentally-strong industrials, materials, energy and other companies that not only weathered difficult operating conditions, but thrived by addressing demands from emerging markets.

1

POLARIS GLOBAL VALUE FUND

A MESSAGE TO OUR SHAREHOLDERS

DECEMBER 31, 2009

| | | | | | | | | | | | | | |

| | | US-CPI | | US-TBills | | US-Bonds | | US-Equity | | World-Equity | | EAFE-Equity | | Polaris Global

Value Fund |

| 1990 –1999 | | 2.9% | | 4.6% | | 8.1% | | 19.0% | | 12.0% | | 7.3% | | 12.4% |

| 2000 – 2009 | | 2.5% | | 2.7% | | 6.0% | | -1.5% | | -0.2% | | 1.4% | | 5.8% |

All returns are in nominal terms.

Source: US CPI: The Wall Street Journal; US TBills: The Wall Street Journal; US Bonds: Barclays Capital US Aggregate Bond Index; US Equity: MSCI USA Index; World Equity: MSCI World Index (gross dividends reinvested); EAFE Equity: MSCI EAFE Index

The BRIC countries (Brazil, Russia, India, China) played a larger role in the global markets. Many of these countries first entered the market economy at the end of the 1990s, starting from a low base and undervalued assets not priced by investors. The past 10 years saw these countries’ markets revalued upwards substantially from their debut, with China, India, Russia and most Latin American countries tipping into double-digit annualized returns.

2009 PERFORMANCE ANALYSIS:

Avoiding the pitfalls of investor panic and the drive to conservative investments, we carefully analyzed our portfolio by selling challenged companies in favor of long-standing fundamentally strong holdings. Maintaining our strict value strategy allowed us to execute purchases in a volatile first quarter 2009, many of which thrived by year-end.

Two examples of this purchase strategy were Novartis and Infosys Technologies. Novartis is a successful Swiss pharmaceutical and healthcare products company with a franchise in cardiovascular and oncology drugs. A high percentage of recent sales are from drugs developed in the past two years, and the influence of the faster growing emerging markets is having a favorable influence on results. Selling at an unusually low price to maintenance cash flow, the addition of Novartis added substantially to the diversification of the portfolio. Since purchasing the stock in the second quarter 2009, the stock has risen more than 30%.

Infosys is an Indian company that is a well known leader in global information technology solutions. Essentially a provider of outsourced IT services to hundreds of companies both large and small throughout the world, its IT services deal with the entire range of issues that confront large companies: conception, design, development, engineering, maintenance, integration, and operation. The company has enjoyed a fast rate of earnings and cash flow growth, but the worldwide economic crisis temporarily depressed revenue and earnings. An accompanying stock price decline provided an excellent opportunity to invest in a company likely to benefit from the resumption of growth expected in 2010 and beyond. Since purchasing the stock in the second quarter 2009, this holding has risen over 95%.

We continue to cultivate a diversified portfolio that may withstand volatility. For the year ended December 31, 2009, positive returns were broad-based, with sector benchmark outperformance in industrials, materials, consumer discretionary, consumer staples, energy, healthcare and IT.

In the materials sector, the Fund profited from its investment in commodities (copper, coal, iron ore), which have experienced a tighter supply/demand balance, partially due to increased demand from emerging markets.

2

POLARIS GLOBAL VALUE FUND

A MESSAGE TO OUR SHAREHOLDERS

DECEMBER 31, 2009

Stimulus packages in Asia and the U.S. fueled infrastructure activity in both regions, clearly benefitting the Fund’s holdings in CRH and other building supplies. Chemical companies, such as BASF, proved to be strong performers as demand renewed somewhat unexpectedly due to large scale production cutbacks in the industry.

Stimulus packages also proved a boon for industrials involved in infrastructure, such as CRH, YIT OYJ, Kone OYJ and Trevi Finanziaria, which won large dam repair contracts in the U.S. In addition, service-based industrial businesses proved resilient, retaining stable margins and sustainable free cash flows. U.S.-based Mac-Gray Corporation saw its stock price appreciate during the year, rebounding after the company’s annual meeting and conclusion of a proxy contest. Overall, industrials were the largest contributor to outperformance for the year, with the portfolio’s holdings contributing more than 11% to the Fund’s return.

Within consumer discretionary, U.K. homebuilders proved nimble in production schedules and reduced supply, which resulted in firmer U.K. housing prices. Additionally, many of these companies reinforced their financial strength to prepare for the resumption of the growth expected in the U.K. housing sector. Interestingly, the U.S. is in a multi-year correction process, but it has taken less than one year for the U.K. housing market to correct. Three of four U.K. homebuilders in the portfolio more than doubled in value during the year, rebounding from large declines in 2008.

When investors ignored consumer staples stocks in favor of cyclical companies in 2009, we saw the opportunity to buy good brand names with stable cash flows at exceptionally good values. Top names on our “watch list”, such as The J.M. Smucker Company and Heinz, were purchased in early 2009 and subsequently produced strong returns.

Financials detracted from even better performance, as smaller U.S. banks, not plagued by the mortgage crisis, have fallen in sympathy with the larger industry trends. We expect U.S. banks to be a source of outperformance based on bank valuations, after adjustment for normalized insurance premiums, repayment of high-cost TARP (Troubled Asset Relief Program) funding and post-peak loan losses. As the Fund’s holdings in industrials and materials companies have outperformed anticipating economic recovery, it is our belief that bank shares will experience normalized fundamentals long before they appear in reported results.

Defensive holdings, including telecommunications and utilities, proved to be low risk stocks that buffered market volatility in 2008. In 2009, however, investors began selling these off to take more risk in other sectors. Consequently, the Fund’s holdings in these sectors were negatively impacted. We will continue to opportunistically identify undervalued defensive names that offer diversification, reduced cyclical exposure and potentially strong returns over the long-term.

3

POLARIS GLOBAL VALUE FUND

A MESSAGE TO OUR SHAREHOLDERS

DECEMBER 31, 2009

The following table illustrates the Fund’s summary performance attribution by country and sector:

| | | | | | | | |

| Country | | Full Year 2009% | | | Sector | | Full Year 2009% | |

Finland | | 6.6 | | | Industrials | | 11.7 | |

United Kingdom | | 6.0 | | | Materials | | 10.0 | |

Ireland | | 5.0 | | | Consumer Discretionary | | 8.5 | |

France | | 3.8 | | | Energy | | 4.0 | |

United States | | 2.8 | | | Health Care | | 2.6 | |

Sweden | | 2.7 | | | Consumer Staples | | 2.2 | |

Germany | | 1.8 | | | Information Technology | | 1.3 | |

Canada | | 1.5 | | | Utilities | | (0.4 | ) |

Austria | | 1.4 | | | Telecommunications | | (0.4 | ) |

Australia | | 1.3 | | | Financials | | (4.0 | ) |

Italy | | 1.2 | | | | | | |

Thailand | | 1.1 | | | | | | |

South Africa | | 1.1 | | | | | | |

Belgium | | 1.0 | | | | | | |

India | | 0.8 | | | | | | |

South Korea | | 0.8 | | | | | | |

Norway | | 0.8 | | | | | | |

Switzerland | | 0.5 | | | | | | |

Spain | | (2.0 | ) | | | | | |

Japan | | (2.6 | ) | | | | | |

Cash & Equivalents | | 0.1 | | | Cash & Equivalents | | 0.1 | |

| | |

|

| | | |

|

|

| | | 35.5 | % | | | | 35.5 | % |

| | |

|

| | | |

|

|

Table may not foot due to rounding.

2009 ASSET ALLOCATION:

During the calendar year 2009, we trimmed holdings in financials, materials and industrials, where analysis revealed deterioration in fundamentals in relation to evolving market dynamics. The shares of geographically diverse banks in Spain and Ireland were liquidated as we remained concerned about worsening economic conditions in both regions. Additional sell decisions were executed throughout the year, as we identified companies expected to be challenged going forward, while retaining companies that suffered short-term cash flow reductions, but which have strong long-term fundamentals. Cash was allocated to new investment ideas and increased weightings in portfolio areas with strong growth potential.

We invested in three new financials, including an Indian bank, a Swedish bank and one eastern U.S. institution. In the materials sector, we added a German flavor and fragrance producer, which sells product to food processors, cosmetics and other consumer staples companies. Within industrials, a fourth quarter investment was made in the third largest chemical transportation company in the world based on number of vessels. The company was previously affected by reduced chemical demand and a new-build commitment that had to be renegotiated. The company sought new funds to bolster its cash reserves and the Fund bought shares at an opportune price. The shares advanced 47% since its discounted offering price on November 27th.

We also made initial investments in an Indian information technology company and two consumer staples companies. We continue to see better values overseas; consequently, the Fund remained underweight in North America relative to the World Index. The Fund’s Scandinavian and European holdings were weighted greater than the benchmark.

4