As filed with the Securities and Exchange Commission on June 4, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: March 31

Date of reporting period: April 1, 2014 – March 31, 2015

ITEM 1. REPORT TO STOCKHOLDERS.

The views in this report were those of Absolute Strategies Fund and Absolute Credit Opportunities Fund’s (each a “Fund” and collectively the “Funds”) adviser as of March 31, 2015, and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice. None of the information presented should be construed as an offer to sell or recommendation of any security mentioned herein.

Since the Funds utilize multi-manager strategies with multiple sub-advisers, they may be exposed to varying forms of risk. These risks include, but are not limited to, general market risk, multi-manager risk, non-diversification risk, small company risk, foreign risk, interest rate risk, credit risk, prepayment risk, IPO risk, liquidity risk, high turnover risk, leverage risk, pooled investment vehicle risk and derivatives risk. For a complete description of the Funds’ principal investment risks, please refer to each Fund’s prospectus.

Beta is a measure of an asset’s sensitivity to broad market moves, as measured for instance by the S&P 500® Index. A fund with a realized beta of 0.5 with respect to the S&P 500®Index infers that about 50% of the fund’s returns were explained by the performance of the index (the rest of the performance was independent of the index). Standard deviation indicates the volatility of a fund’s total returns and is useful because it identifies the spread of a fund’s short-term fluctuations. The HFR Indices are equally weighted performance indexes, utilized by numerous hedge fund managers as a benchmark for their own hedge funds. One cannot invest directly in an index.

Absolute Strategies Fund, Absolute Funds, and Absolute Investment Advisers are registered service marks of Absolute Investment Advisers LLC (“AIA” and “Absolute”) and the respective logos and Absolute Credit Opportunities Fund are service marks of AIA; and other marks referred to herein are the trademarks, service marks or registered trademarks of their respective owners.

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2015 |

| |

Dear Shareholder,

We are pleased to present the Annual Report for the Absolute Strategies Fund (the “Fund”) for the year ended March 31, 2015. The Fund (Institutional Shares) was up 0.27% over the 12 months ended March 31 versus 0.36% for the HFRX Global Hedge Fund Index and 12.73% for the S&P 500 Index. The Fund’s performance over the period can be attributed to very conservative positioning. At the risk of sounding like a broken record, the Fund has maintained a balance of long and short exposures with an overall quality/value bias. During the period, there were times such as mid-October 2014 and January 2015, when this positioning was well rewarded. In fact, the Fund has done very well producing positive returns during each market selloff over the past year. However, we believe the overall period can be defined as a continuation of an unusually low volatility environment that has rewarded market risk and central bank directives more than value and security selection.

The Fund is positioned to isolate stock/bond selection, and take advantage of disconnects between security prices and fundamentals (long and short). Many of the largest disconnects currently appear to be on the short side. This exposure is meant to offer an alternative to the many traditional and non-traditional funds whose performance appears highly correlated to market risk (beta), stimulus programs, and ongoing central bank emphasis. It is worth noting that the Fund is not a static vehicle. It is designed to have a high degree of flexibility. It should be expected that long and short exposures will vary over time. Our net exposure is currently at the lowest end of our historical range and much lower than our desired exposure over time; there will be times when the Fund sees more opportunity to take on long exposure and higher beta. However, as mentioned previously, there are ample opportunities on the short side that we have not seen in some time. As such, we are very comfortable with our current positioning as contrarian as it may seem. Additionally, we believe that although the last few years have been difficult for our Fund, it is undoubtedly better than the large losses experienced by traditional investments when they experience difficult environments.

The Fund’s allocations continue to be mostly in equity related strategies, with smaller allocations to credit, arbitrage and special situations. This is primarily due to concerns regarding liquidity in the credit markets. The equity strategies as a group have a balance of long and short exposure. The long side has been dominated by mostly U.S. large-cap companies within consumer staples, health care, and “legacy” technology with strong brand names and competitive advantages. It also includes select new positions in energy and commodity related companies where our managers believe the businesses have less sensitivity to falling commodity prices than the market perceives. Our managers are starting to see potential opportunities in a variety of recently unloved equities.

The short side of the equity portfolio continues to be dominated by various index hedges (futures), industrial and consumer cyclicals, and financials in Europe and Asia. Overall these companies are trading at high valuations and/or are dependent on a high level of global economic growth (which has been absent). Taken in aggregate, this positioning may be viewed as quality vs. non-quality. Shorts in European and Asian financials are more special situation or catalyst driven. Several European banks have taken on leverage and credit risk that may make Lehman Brothers and Bear Stearns look like afterthoughts. They are also heavily exposed to European sovereign debt issues, which, by being packaged inside the Euro, are now the 2006 equivalent of AAA sub-prime Credit Default Obligations (except today it is in plain view). Many Asian banks are susceptible to large credit distortions and a potential bursting bubble in China; several banks are starting to see large increases in non-performing loans and have had to eliminate dividends.

The Fund’s overall hedging has performed as intended by reducing market beta and by enabling larger allocations to concentrated long positions. For the period, equity futures-related hedges benefited slightly by having a significant position in the Russell 2000; this was removed in October 2014. On the negative side, the Fund’s sub-advisers’ long value bias has slightly underperformed other index hedges. This is not unusual over short time periods. However, over a full market cycle we would expect our long exposure to outperform.

Over the period we have reduced allocations to distressed credit and convertible arbitrage strategies, while adding exposure to newer sub-advisers in long/short credit and special situations strategies. We are likely to continue moving away from unhedged fixed income due to price and liquidity concerns. We are also looking at a variety of

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2015 |

| |

short term inflation hedges (or guards against further policy maker intervention) that are both low-priced and potentially positioned for new bouts of money printing and currency wars. We have recently taken advantage of the large drop in commodity prices to add a modest amount of commodity-related exposure to the Fund’s positioning. For further information regarding our sub-advisers and their strategies, please visit our website.

The last few years have been the most difficult and frustrating for our strategy since our Fund’s inception almost 10 years ago. Our performance can be fairly assessed by our very conservative positioning over the past 2 years. We’ve been effectively market neutral, including a slightly negative beta bias over the past 18 months. Why has our positioning been so defensive? Following the initial recovery in asset prices and fundamentals (which we correctly positioned for), we did not believe that lofty expectations for global economic and fundamental growth would be met. We were correct. Global economic and revenue growth has been nowhere near expectations – every single year since 2011. Instead, investors have bid up asset prices (every single year), in hopes that growth would hit some escape velocity. In doing so, we believe asset prices have gone up over the past few years almost solely on the back of multiple expansion (asset inflation) that was fully promoted by the Federal Reserve and other central banks.

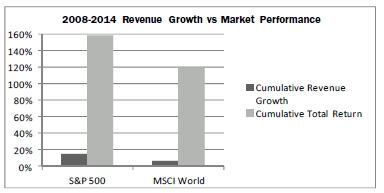

The cleanest way to put this “bull market” into fundamental context is to simply examine revenue growth vs. total return for the S&P 500 and MSCI World Index since the end of 2008:

For US markets, that’s a 159% return for 15% total revenue growth. US Real GDP growth averaged only 1.9% over this time. And, much of the economic growth came from the energy sector which is now under significant pressure. How many investors are truly aware of this picture?

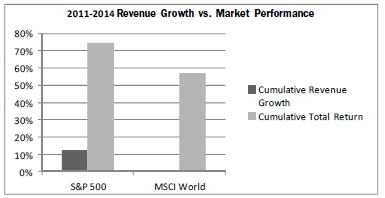

To be fair, much of the performance gain in equity markets since 2008 came from depressed prices which, we whole heartedly agree, was a great opportunity to be long risky assets. This is why our portfolio was positioned very aggressively (for our strategy) coming out of 2008, after being defensive going into 2008. However by the end of 2011, prices were no longer depressed and the S&P 500 was, at the time, up nearly 100% from the 2009 bottom to Dec. 31, 2011. This is the point at which we believe European Central Bank jaw-boning, Fed quantitative easing (QE), and corporate financial engineering started to prompt performance and yield chasing by much of the financial community. There was also continuous assurance from Wall Street, the Fed, and the government that the economic recovery was on an escape path for 3%-3.5% GDP growth. Putting all of that into fundamental context looks like this:

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2015 |

| |

In summary, since 2011, (and importantly post the initial 2008 rebound), global equity revenues have hardly grown at all; that’s less than 1% total revenue growth in 3 years. US Real GDP growth has only averaged 2.1% from 2011-2014, despite assurances of the “recovery.” The S&P 500 is up another 74.5% on the back of 12.3% total revenue growth. This includes any benefit of stock buybacks as the figures are per share.

Apparently math and finance have changed in this new era of QE inspiration. Markets today are not about investing; they are all about central banks. We’ve been punished for staying disciplined. We did not place a high probability on investor willingness to follow the Fed, chase momentum and drive financial markets into near bubble levels for the 3rd time in 15 years. After two historic episodes of driving unsustainable economic growth via excess liquidity in financial markets, it appears the financial community has decided that central banks are firmly in control. This is the same Fed whose recipe for liquidity-fueled asset inflation ended in complete bust multiple times. We ask ourselves, “How can we possibly be here, again?” It doesn’t matter. Our discipline cost us and we missed much of the last run up. Like every investment, there are times when your strategy is no match for certain short-term market environments. For many traditional strategies, a mis-match would mean significant losses. For us it has simply been significantly frustrating. But now what?

We’ve had 6 ½ years of continuous “emergency” assistance, including zero percent interest rates, over $24 trillion in global central bank stimulus, plus trillions more in deficit spending. Trillions of dollars in sovereign debt have traded at negative yields with trillions more under 2%. Some of the least credit worthy European sovereign debt is trading as investment grade and appears nearly risk-free simply because it is being “packaged” inside the Euro wrapper. Some very large European institutions also own a great deal of this debt, but supposedly they are not at risk either. Doesn’t that sound familiar? As for corporations, according to the Bank of International Settlements, dollar-denominated global corporate debt is up 250% since 2008; much of this may be significantly impacted by a rising US Dollar. US covenant-lite debt, which is generally the worst of the junk market, represents an astounding 2/3 of total debt issuance, up from 25-30% at the 2007 peak. This is just another massive central bank-induced credit expansion that has led to unsustainable asset inflation. If anyone has forgotten, 2007 was the granddaddy of all credit bubbles. What are we supposed to call this?

As for the equity markets, margin debt is at historic highs and margin debt to GDP has now reached 2000 levels. Valuations are now well beyond 2007 peak levels and nearing 2000 levels. Equity market capitalization to GDP is the highest in history outside of a couple of quarters around the 2000 bubble peak; it is over 2 standard deviations above the norm. The median price/revenue of the S&P 500 is the highest in history and above the 2000 bubble; it is also more than 2 standard deviations above the norm. If not for historically high corporate profit margins, the price/earnings ratio for the S&P 500 would be about 30x (using historical average margins). Even using the profit margin from the 1997-2000 bubble peak would give the S&P 500 a P/E of 26. The only way financial pundits can justify meaningful equity exposure is to compare valuations to the 2000 bubble; to require no cyclical adjustment to excessive profit margins; to make no assumptions interest rates will ever rebound; and to

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2015 |

| |

use some of the highest valuation multiples in history. They also need to completely ignore the lack of revenue growth.

At some point, both equities and bonds will reach exhaustion. At that point, the impact of liquidity on price and risk could be sudden and painful. To quote one of the Fund’s sub-advisers, Robert Mark of St. James Investment Co.,

“…liquidity provided by central banks simply perpetuates the illusion of maximum pricing and stability for stocks and bonds while shifting the risk curve to the point where any deviation from “perfection” – or loss of faith in the liquidity of its providers – will ultimately lead to a waterfall in price. When this moment materializes, there is essentially no market because the investor cannot sell.”

There will be no warning for investors before they start losing money. Whatever the eventual “cause,” we believe it is likely already working its way through the financial system. This was the case with the delayed reaction of equity prices in 2007-08, and with oil and commodity prices last year; there was also no debate of a bubble in either market before prices dropped 50%. It’s not a stretch to say the equity markets are at risk of dropping 40% or more over the next few years. It’s also not a stretch to put current upside risk at <10% given the Fed has spent a tremendous amount of goodwill trying to discuss rate tightening and regime change. A quick move back toward QE would seriously damage any remaining credibility.

As for the credit markets, investors who used to worry about duration risk while earning 6-7% are now taking on significant duration risk, credit risk, and liquidity risk to earn income that used to be considered risk-free and FDIC insured. We believe the chances of interest rates going back up from here are much greater than zero. This is not because we believe economic growth is going to rebound strongly, but because interest rates are so low that even the most complacent investor must be considering risk/reward. Trillions of dollars in debt is trading near zero interest rates; how much further does this secular bond bull need to go?

Additionally, we believe the Fed has really boxed themselves into a corner. They’ve had numerous opportunities to get off the zero bound. But now they are dealing with twin bubbles in bonds and stocks along with an economy that has slowed. However, the real problem may exist with their academic approach and their data dependence. The well-known data here is the unemployment rate and the inflation rate, both of which could easily force the Fed’s hand despite low economic growth or a decline in equity prices. The unemployment rate is already in the Fed’s target range, and a slight rebound in commodity prices along with modest rent or wage pressures could really cause mass confusion. It’s not at all impossible to imagine a rebound in inflation statistics, volatility in interest rates, a low growth economy, and a large drop in equity prices. This is not to say the Fed will or should raise rates. They have simply created bureaucratic targets that are easily identifiable and difficult to steer from. The Fed’s credibility could be put to the test sooner than anyone can imagine and it may only take a few months of data. At a minimum, the potential for volatility in bond prices, interest rates, and currencies could be extreme and is completely untested by decades of backward-looking financial models.

The entire risk management environment is completely surreal and quite bizarre. Only 6 years after many investors were nearly wiped out, a disciplined approach focused on managing risk is now outright mocked and punished as Fed-fueled markets reach historic heights. Many of those dismissing risk are the same ones caught naked during the financial crisis and swore they would never let that happen again. The S&P 500 is now considered the risk-free rate and the risk of loss is no longer applicable. Wall Street has once again reached mass delusion. Both fiduciary responsibility and “other people’s money” are firmly at risk as savers have been forced into risky assets to maintain basic income. And now, no asset class is without risk. GMO LLC, a Boston-based asset manager, recently posted their widely followed 7-yr real-return forecasts for asset classes. They estimate negative 7-yr real returns for every major asset class except US High Quality stocks, and Emerging Markets. Negative returns are forecast for US Large & Small stocks, International Large & Small stocks, US bonds, International bonds and US Inflation-linked bonds.

We have been very fortunate to work with disciplined and honest financial advisors. It certainly has not been easy for many of them to talk about risk when their clients see stock and bond prices hitting constant highs with no

| |

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2015 |

| |

volatility. It has probably been the most difficult era ever to maintain true diversification and not be tempted to chase performance. It’s hard to blame those who have given in to the circumstances. We understand the pressures and hope many can find a way to talk honestly with their clients without worrying them. However, there also may never be a more important time to consider the probability that markets eventually return to fair value. You cannot try to time an exit. Anyone who has survived the past 15 years knows there are times when you need to focus on defense. There is also a decent probability that a longer, 30-yr cycle driven by a continuous drop in interest rates that has manifested into enormous credit expansion and historical debt levels may be nearing its end. Given that certain global bond markets are nearing 0% yields, longer term investors should be giving this serious consideration. It is hard to imagine, but at some point the secular interest rate trend will reverse. Some asset classes such as REITs, private equity, and junk bonds actually have no experience with a sustained period of rising interest rates.

We do not know how all of this will end. Many statistics that measure risk or suggest highly overvalued markets are at very dangerous levels. These statistics are also highly cyclical and mean-reverting. Even though many of these same statistics have forewarned of frothiness in the past or are strongly correlated to negative future returns, they are again dismissed. That would suggest the markets are pricing in a very favorable outcome and it cannot end badly. We disagree. We think there will likely be a significant re-pricing of risk, tremendous volatility, and unique opportunities to invest both long and short. Although the past few years have been tough, we are incredibility optimistic about the future investing climate for our strategy. As for inflation vs. deflation, we expect both. It just may not be in the form most investors are prepared for; the stock, bond, and commodity trends of the past few years could be nearing a turning point. We also firmly agree with renowned hedge fund investor Stanley Druckenmiller who recently commented on Fed QE and on the current environment:

“I don’t know when it’s going to stop. And on inflation this could end up being inflationary. …but there is nothing more deflationary than creating a phony asset bubble, having a bunch of investors plow into it and then having it pop. That is deflationary.”

Thank you for trusting us with your assets. We believe your patience will be well rewarded.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

Sources:

Bloomberg and St. James Investment Co.

| |

ABSOLUTE CREDIT OPPORTUNITIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2015 |

| |

Dear Shareholder,

We are pleased to present the annual report for the Absolute Credit Opportunities Fund (the “Fund”) for the year ended March 31, 2015.

On October 1, 2014, the Absolute Opportunities Fund changed its strategy, reduced its advisory fee from 2.75% of net assets to 1.60% and was renamed the Absolute Credit Opportunities Fund. The Fund’s strong performance from 2008 to 2010 was primarily related to credit or distressed credit related investments and we recently decided to focus the Fund’s investments in that area. Over the 12 months ended March 31, 2015, the Fund was up 4.28% versus 0.36% for the HFRX Global Hedge Fund Index.

Since October 1, 2014, the Fund’s long positions, in particular its concentrated group of convertibles and high-yield securities, made a positive contribution to the Fund’s returns. The Fund’s short securities and/or hedges, on the other hand, detracted from the Fund’s performance.

We believe the Fund now provides an attractive credit or fixed income alternative to what is currently available in the marketplace. Investors are scrambling for yield after five years of short-term interest rates near zero and very suppressed intermediate and long–term interest rates. We believe traditional bond market risks, including interest-rate, credit and liquidity risk, are overpriced as a result of central bank actions. And there is no way of knowing whether the risks of rising interest rates or those surrounding credit and liquidity will be the primary risk going forward.

In our opinion, investors have been increasing credit risk at the expense of holding cash, CDs or Treasuries. We see nontraditional bond funds taking on increasing levels of exotic credit risk while sometimes hedging interest rate risk and, as a result, the traditional “ballast” (or capital preservation portion) of portfolios has been greatly diminished over the past five years.

More than ever, we believe the Fund provides diversification to an overall portfolio and specifically the bond portion of a portfolio. The traditional diversifying effects of coupon payments and declining interest rates are unlikely to provide much assistance today to the equity portion of a portfolio during times of volatility. We also believe investors are taking on significant credit risks even with shorter duration fixed income portfolios. The Fund is currently positioned to hedge credit risk and take advantage of bond market illiquidity. This can allow the Fund to adapt to various conditions throughout a market cycle making a portfolio allocator’s job easier since exposures are not static.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

| |

ABSOLUTE STRATEGIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2015 |

| |

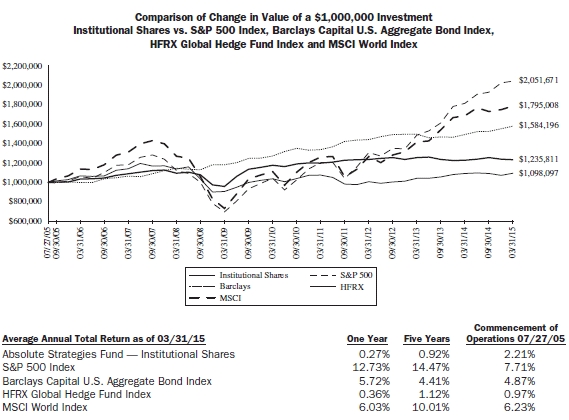

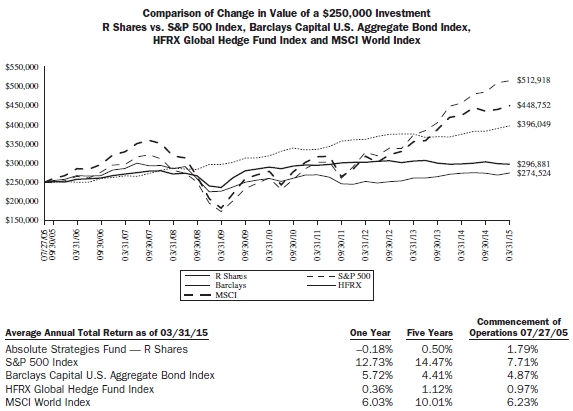

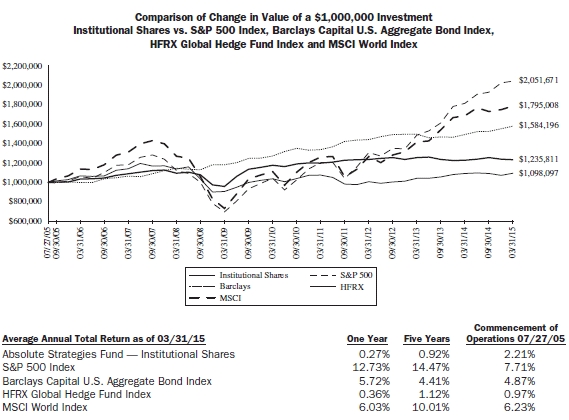

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares and a $250,000 investment in R Shares, including reinvested dividends and distributions, in Absolute Strategies Fund (the “Fund”) compared with the performance of the benchmarks, the S&P 500 Index ("S&P 500"), Barclays Capital U.S. Aggregate Bond Index ("Barclays Index"), the HFRX Global Hedge Fund Index ("HFRX") and the MSCI World Index ("MSCI World"), since inception. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Barclays Index covers the U.S. dollar-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The MSCI World measures the performance of a diverse range of 24 developed countries' stock markets including the United States, Canada, Europe, the Middle East and the Pacific. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

| |

ABSOLUTE STRATEGIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2015 |

| |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Institutional Shares and R Shares are 2.47% and 2.93%, respectively. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund’s total annual operating expense ratios would be 1.75% and 2.20% for Institutional Shares and R Shares, respectively. The Fund's adviser has agreed to contractually reduce its advisory fee to 1.55% on average net assets exceeding $4.5 billion but less than $5 billion and to 1.50% on the average net assets exeeeding $5 billion through August 1, 2015. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| |

ABSOLUTE CREDIT OPPORTUNITIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2015 |

| |

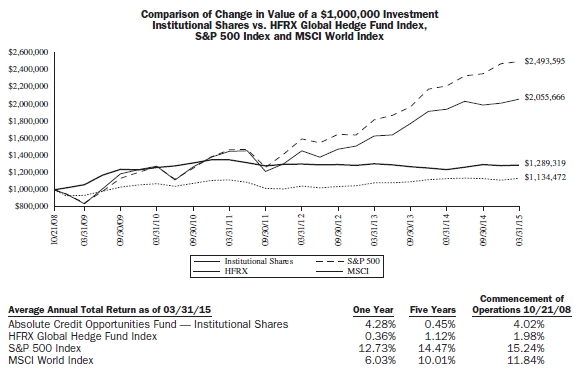

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Absolute Opportunities Fund (the “Fund”) compared with the performance of the benchmarks, the HFRX Global Hedge Fund Index ("HFRX"), the S&P 500 Index ("S&P 500"), and the MSCI World Index ("MSCI World"), since inception. On October 1, 2014, the HFRX will replace the S&P 500 as the Fund's primary benchmark. The Adviser believes that the HDRX is the best comparative benchmark for the Fund because it is comprised of all eligible hedge fund strategies, including, but not limited to, convertible arbitragem distressed securities, hedged equity, equity market neutral, event driven, macro, merrger arbitrage, and relative value arbitrage.The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The MSCI World measures the performance of a diverse range of 24 developed countries' stock markets including thet United States, Canada, Europe, the Middle East and the Pacific. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratio (gross) is 2.29%. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund’s total annual operating expense ratio would be 1.90%. However, the Fund's adviser has agreed to contractually waive a portion of its fees and to reimburse expenses to limit total annual operating expenses to 1.95% (excluding all interest, taxes, portfolio transaction expenses, dividends and interest on short sales, acquired fund fees and expenses, proxy expenses, and extraordinary expenses) through August 1, 2017. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| |

ABSOLUTE STRATEGIES FUND PORTFOLIO HOLDINGS SUMMARY (Unaudited) MARCH 31, 2015 |

| |

| Portfolio Breakdown (% of Net Assets) |

| Long Positions |

| Equity Securities | 32.0% | |

| Asset Backed Obligations | 3.5% | |

| Corporate Convertible Bonds | 14.3% | |

| Corporate Non-Convertible Bonds | 4.3% | |

| Exchange Traded Notes | 0.0% | |

| Interest Only Bonds | 0.2% | |

| Municipal Bonds | 0.3% | |

| Syndicated Loans | 0.9% | |

| U.S. Government & Agency Obligations | 2.6% | |

| Rights | 0.0% | |

| Warrants | 0.1% | |

| Investment Companies | 12.5% | |

| Money Market Funds | 6.8% | |

| Purchased Options | 1.2% | |

| Short Positions |

| Equity Securities | -30.7% | |

| Investment Companies | -3.4% | |

| Written Options | -1.1% | |

| Other Assets less Liabilities* | 56.5% | |

| | 100.0% | |

* Consists of deposits with the custodian and/or brokers for securities sold short, cash, foreign currency, prepaid expenses, receivables, payables and accrued liabilities. Deposits with the custodian and/or brokers for securities sold short represent 35.6% of net assets. See Note 2 of the accompanying Notes to Financial Statements.

| | (% of Equity Holdings) |

| Sector Breakdown | Long | Short |

| Consumer Discretionary | 11.3% | 15.7% | |

| Consumer Staples | 28.2% | 8.6% | |

| Energy | 9.3% | 5.9% | |

| Financial | 14.4% | 23.2% | |

| Healthcare | 2.9% | 2.7% | |

| Industrial | 9.2% | 17.0% | |

| Information Technology | 8.2% | 14.2% | |

| Materials | 5.6% | 5.7% | |

| Telecommunication Services | 9.3% | 6.8% | |

| Utilities | 1.6% | 0.2% | |

| | 100.0% | 100.0% | |

AFA

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2015 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Shares | | Description | | | | | | Value | | | Shares | | Description | | | | | | Value | |

| Long Positions - 78.7% | | | | | | | | | 150,000 | | Philip Morris International, Inc. | | | | | $ | 11,299,500 | |

| Equity Securities - 32.0% | | | | | | | | | 39,236 | | Post Holdings, Inc. (a) | | | | | | 1,837,814 | |

| Common Stock - 31.2% | | | | | | | | | 70,538 | | RPX Corp. (a) | | | | | | 1,015,042 | |

| Consumer Discretionary - 3.6% | | | | | | | | | 265,000 | | Sanofi, ADR | | | | | | 13,101,600 | |

| | 91,551 | | American Eagle Outfitters, Inc. | | | | | $ | 1,563,691 | | | 68,514 | | Select Medical Holdings Corp. | | | | | | 1,016,063 | |

| | 111,303 | | bebe stores, inc. | | | | | | 404,030 | | | 437,000 | | Sysco Corp. | | | | | | 16,488,010 | |

| | 57,320 | | Bed Bath & Beyond, Inc. (a)(b)(c)(d) | | | | | | 4,400,743 | | | 155,000 | | The Coca-Cola Co. (d) | | | | | | 6,285,250 | |

| | 12,970 | | Coach, Inc. | | | | | | 537,347 | | | 104,000 | | The Procter & Gamble Co. | | | | | | 8,521,760 | |

| | 31,465 | | CVS Health Corp. (b)(d) | | | | | | 3,247,503 | | | 894,715 | | TherapeuticsMD, Inc. (a) | | | | | | 5,413,026 | |

| | 32,000 | | eBay, Inc. (a) | | | | | | 1,845,760 | | | 87,332 | | Tyson Foods, Inc., Class A (b) | | | | | | 3,344,816 | |

| | 66,702 | | GameStop Corp., Class A (b) | | | | | | 2,532,008 | | | 88,589 | | Xueda Education Group, ADR | | | | | | 239,190 | |

| | 22,883 | | Gaming and Leisure Properties, Inc. REIT (b) | | | | | | 843,696 | | | 44,141 | | Zoetis, Inc. (b) | | | | | | 2,043,287 | |

| | 176,125 | | General Motors Co. (b)(c) | | | | | | 6,604,687 | | | | | | | | | | | 147,207,176 | |

| | 4,205 | | Google, Inc., Class A (a)(b) | | | | | | 2,332,513 | | Energy - 3.0% | | | | | | | |

| | 4,240 | | Google, Inc., Class C (a)(b)(c)(d) | | | | | | 2,323,520 | | | 45,145 | | Baker Hughes, Inc. (b) | | | | | | 2,870,319 | |

| | 24,523 | | Jack in the Box, Inc. (b) | | | | | | 2,352,246 | | | 36,867 | | Columbia Pipeline Partners LP (a) | | | | | | 1,020,847 | |

| | 69,425 | | Kohl's Corp. (b)(c)(d) | | | | | | 5,432,506 | | | 35,444 | | Cone Midstream Partners LP (b) | | | | | | 617,080 | |

| | 17,504 | | Lithia Motors, Inc., Class A (b) | | | | | | 1,740,073 | | | 20,000 | | ConocoPhillips | | | | | | 1,245,200 | |

| | 164,820 | | Luby's, Inc. (a) | | | | | | 855,416 | | | 14,429 | | Diamond Offshore Drilling, Inc. (b) | | | | | | 386,553 | |

| | 13,187 | | Mattress Firm Holding Corp. (a)(b) | | | | | | 918,343 | | | 24,500 | | Exxon Mobil Corp. | | | | | | 2,082,500 | |

| | 20,000 | | McDonald's Corp. (b)(c) | | | | | | 1,948,800 | | | 46,515 | | FMC Technologies, Inc. (a)(b) | | | | | | 1,721,520 | |

| | 4,429 | | Michael Kors Holdings, Ltd. (a) | | | | | | 291,207 | | | 128,595 | | Halliburton Co. (b)(d) | | | | | | 5,642,749 | |

| | 110,500 | | Office Depot, Inc. (a)(b) | | | | | | 1,016,600 | | | 18,156 | | Kinder Morgan, Inc. | | | | | | 763,641 | |

| | 8,841 | | Ralph Lauren Corp. | | | | | | 1,162,592 | | | 68,400 | | Noble Corp. PLC (b) | | | | | | 976,752 | |

| | 17,504 | | Red Robin Gourmet Burgers, Inc. (a)(c) | | | | | | 1,522,848 | | | 14,664 | | Plains GP Holdings LP | | | | | | 416,018 | |

| | 32,867 | | SeaWorld Entertainment, Inc. | | | | | | 633,676 | | | 109,625 | | Schlumberger, Ltd. (b)(c)(d) | | | | | | 9,147,110 | |

| | 27,360 | | The Walt Disney Co. (b)(d) | | | | | | 2,869,790 | | | 14,242 | | SemGroup Corp., Class A (b) | | | | | | 1,158,444 | |

| | 24,195 | | Tractor Supply Co. (b) | | | | | | 2,058,027 | | | 34,415 | | Southcross Energy Partners LP | | | | | | 481,810 | |

| | 90,905 | | Viacom, Inc., Class B (b)(c)(d) | | | | | | 6,208,811 | | | 515,000 | | Spectra Energy Corp. | | | | | | 18,627,550 | |

| | 29,163 | | Vitamin Shoppe, Inc. (a) | | | | | | 1,201,224 | | | 21,868 | | Tallgrass Energy Partners LP (b) | | | | | | 1,105,865 | |

| | 30,095 | | Wal-Mart Stores, Inc. (b)(d) | | | | | | 2,475,314 | | | 16,076 | | Valero Energy Partners LP (b) | | | | | | 778,078 | |

| | | | | | | | | | 59,322,971 | | | | | | | | | | | 49,042,036 | |

| Consumer Staples - 9.0% | | | | | | | | Financial - 4.4% | | | | | | | |

| | 36,000 | | Aggreko PLC | | | | | | 808,200 | | | 46,515 | | American Express Co. (b)(c)(d) | | | | | | 3,633,752 | |

| | 157,000 | | Avon Products, Inc. | | | | | | 1,254,430 | | | 191,730 | | American International Group, Inc. (b)(c)(d) | | | | | | 10,504,887 | |

| | 16,045 | | Bunge, Ltd. | | | | | | 1,321,466 | | | 12,600 | | Aon PLC (b) | | | | | | 1,211,112 | |

| | 32,089 | | Calavo Growers, Inc. | | | | | | 1,650,016 | | | 309,325 | | Bank of America Corp. (b)(c)(d) | | | | | | 4,760,512 | |

| | 48,000 | | Campbell Soup Co. (b) | | | | | | 2,234,400 | | | 12 | | Berkshire Hathaway, Inc., Class A (a)(b) | | | | | | 2,610,000 | |

| | 535,150 | | Cott Corp. (b) | | | | | | 5,014,356 | | | 25,565 | | Berkshire Hathaway, Inc., Class B (a)(b)(c)(d) | | | | | | 3,689,541 | |

| | 20,000 | | Diageo PLC, ADR | | | | | | 2,211,400 | | | 82,080 | | Citigroup, Inc. (b)(c) | | | | | | 4,228,761 | |

| | 60,489 | | Diamond Foods, Inc. (a)(b) | | | | | | 1,970,127 | | | 470 | | Fairfax Financial Holdings, Ltd. | | | | | | 262,547 | |

| | 190,000 | | Express Scripts Holding Co. (a)(d) | | | | | | 16,486,300 | | | 49,045 | | FNFV Group (a) | | | | | | 691,534 | |

| | 171,046 | | Great Lakes Dredge & Dock Corp. (a)(b) | | | | | | 1,027,986 | | | 326,736 | | Global Cash Access Holdings, Inc. (a)(b) | | | | | | 2,489,728 | |

| | 105,300 | | Hengan International Group Co., Ltd. | | | | | | 1,250,332 | | | 57,141 | | Gramercy Property Trust, Inc. REIT (b) | | | | | | 1,603,948 | |

| | 125,000 | | McCormick & Co., Inc., Non-Voting Shares | | | | | | 9,638,750 | | | 22,616 | | InfraREIT, Inc. REIT | | | | | | 646,591 | |

| | 220,000 | | Nestle SA, ADR | | | | | | 16,548,521 | | | 105,865 | | JPMorgan Chase & Co. (b)(c)(d) | | | | | | 6,413,302 | |

| | 112,000 | | PepsiCo, Inc. (b) | | | | | | 10,709,440 | | | 93,985 | | Leucadia National Corp. (b) | | | | | | 2,094,926 | |

| | 240,015 | | Pernix Therapeutics Holdings, Inc. (a) | | | | | | 2,565,760 | | | 33,774 | | Levy Acquisition Corp. (a) | | | | | | 444,128 | |

| | 53,949 | | Phibro Animal Health Corp., Class A (b) | | | | | | 1,910,334 | | | 77,012 | | Nationstar Mortgage Holdings, Inc. (a) | | | | | | 1,907,587 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 11 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Shares | | Description | | | | | | Value | | | Shares | | Description | | | | | | Value | |

| | 48,538 | | NorthStar Asset Management Group, Inc. (b) | | | | | $ | 1,132,877 | | | 9,596 | | Westlake Chemical Partners LP | | | | | $ | 257,365 | |

| | 37,595 | | NorthStar Realty Finance Corp. REIT | | | | | | 681,221 | | | | | | | | | | | 29,274,973 | |

| | 187,995 | | Ocwen Financial Corp. (a)(b) | | | | | | 1,550,959 | | Telecommunication Services - 3.0% | | | | | | | |

| | 41,000 | | The Bancorp, Inc. (a) | | | | | | 370,230 | | | 610,628 | | Aerohive Networks, Inc. (a)(b) | | | | | | 2,723,401 | |

| | 250,000 | | The Bank of New York Mellon Corp. (d) | | | | | | 10,060,000 | | | 229,877 | | Attunity, Ltd. (a)(b) | | | | | | 2,310,264 | |

| | 7,600 | | The Travelers Cos., Inc. (b) | | | | | | 821,788 | | | 66,233 | | Blucora, Inc. (a)(b) | | | | | | 904,743 | |

| | 220,000 | | WR Berkley Corp. | | | | | | 11,112,200 | | | 162,503 | | CBS Corp., Class B, Non-Voting Shares (b) | | | | | | 9,852,557 | |

| | | | | | | | | | 72,922,131 | | | 174,000 | | Cisco Systems, Inc. | | | | | | 4,789,350 | |

| Healthcare - 0.9% | | | | | | | | | 134,387 | | EVINE Live, Inc. (a)(b) | | | | | | 901,737 | |

| | 55,961 | | Alere, Inc. (a)(b) | | | | | | 2,736,493 | | | 162,662 | | Extreme Networks, Inc. (a) | | | | | | 514,012 | |

| | 40,000 | | Baxter International, Inc. | | | | | | 2,740,000 | | | 25,822 | | FTD Cos., Inc. (a) | | | | | | 773,111 | |

| | 20,000 | | Becton Dickinson and Co. (c) | | | | | | 2,871,800 | | | 14,600 | | Liberty Broadband Corp., Class A (a) | | | | | | 824,608 | |

| | 11,000 | | CR Bard, Inc. | | | | | | 1,840,850 | | | 846 | | Liberty Broadband Corp., Class C (a) | | | | | | 47,883 | |

| | 28,000 | | Johnson & Johnson (c) | | | | | | 2,816,800 | | | 328,688 | | Meru Networks, Inc. (a) | | | | | | 473,311 | |

| | 22,000 | | Stryker Corp. | | | | | | 2,029,500 | | | 173,021 | | News Corp., Class A (a)(b) | | | | | | 2,770,066 | |

| | | | | | | | | | 15,035,443 | | | 182 | | ParkerVision, Inc. (a) | | | | | | 151 | |

| Industrial - 2.9% | | | | | | | | | 155,826 | | Rightside Group, Ltd. (a) | | | | | | 1,581,634 | |

| | 80,197 | | Briggs & Stratton Corp. | | | | | | 1,647,246 | | | 307,928 | | Spark Networks, Inc. (a)(b) | | | | | | 1,244,029 | |

| | 27,341 | | Builders FirstSource, Inc. (a) | | | | | | 182,365 | | | 22,967 | | Time Warner, Inc. (d) | | | | | | 1,939,333 | |

| | 19,000 | | CH Robinson Worldwide, Inc. | | | | | | 1,391,180 | | | 240,000 | | Twenty-First Century Fox, Inc., Class B | | | | | | 7,891,200 | |

| | 220,000 | | Expeditors International of Washington, Inc. (d) | | | | | | 10,599,600 | | | 114,372 | | Ubiquiti Networks, Inc. (b) | | | | | | 3,379,693 | |

| | 151,260 | | Jacobs Engineering Group, Inc. (a)(b)(d) | | | | | | 6,830,902 | | | 300,309 | | Web.com Group, Inc. (a)(b) | | | | | | 5,690,855 | |

| | 71,260 | | KLX, Inc. (a)(b) | | | | | | 2,746,360 | | | | | | | | | | | 48,611,938 | |

| | 166,900 | | Quanta Services, Inc. (a)(b)(d) | | | | | | 4,761,657 | | Utilities - 0.5% | | | | | | | |

| | 366,081 | | Revolution Lighting Technologies, Inc. (a) | | | | | | 406,350 | | | 257 | | Dynegy, Inc. (a)(b) | | | | | | 8,078 | |

| | 15,536 | | Rock-Tenn Co., Class A (b) | | | | | | 1,002,072 | | | 230,000 | | ITC Holdings Corp. | | | | | | 8,608,900 | |

| | 64,310 | | The Boeing Co. (b)(d) | | | | | | 9,651,645 | | | | | | | | | | | 8,616,978 | |

| | 39,236 | | Trimble Navigation, Ltd. (a)(b) | | | | | | 988,747 | | Total Common Stock | | | | | | | |

| | 152,254 | | Tutor Perini Corp. (a)(b) | | | | | | 3,555,131 | | (Cost $410,090,093) | | | | | | 512,285,691 | |

| | 38,000 | | Valmont Industries, Inc. (b) | | | | | | 4,669,440 | | | | | | | Rate | | | | | |

| | | | | | | | | | 48,432,695 | | Preferred Stock - 0.8% | | | | | | | |

| Information Technology - 2.1% | | | | | | | | | | | | | | | | | | |

| | 35,265 | | Accenture PLC, Class A (b)(c)(d) | | | | | | 3,303,978 | | Consumer Staples - 0.0% | | | | | | | |

| | 63,559 | | Apple, Inc. (b)(c)(d) | | | | | | 7,908,646 | | | 6,500 | | Bunge, Ltd. | | 4.88 | % | | | 679,250 | |

| | 69,078 | | BroadSoft, Inc. (a)(b) | | | | | | 2,311,350 | | Financial - 0.2% | | | | | | | |

| | 19,400 | | Electronic Arts, Inc. (a)(b) | | | | | | 1,141,011 | | | 15,413 | | Lexington Realty Trust REIT, Series C | | 6.50 | | | | 762,943 | |

| | 313,000 | | Microsoft Corp. | | | | | | 12,725,015 | | | 1,375 | | Wells Fargo & Co., Series L | | 7.50 | | | | 1,681,625 | |

| | 149,000 | | Oracle Corp. | | | | | | 6,429,350 | | | | | | | | | | | 2,444,568 | |

| | | | | | | | | | 33,819,350 | | Information Technology - 0.6% | | | | | | | |

| Materials - 1.8% | | | | | | | | | 9,340 | | Samsung Electronics Co., Ltd. | | 2.00 | | | | 9,294,119 | |

| | 6,212 | | CF Industries Holdings, Inc. (b) | | | | | | 1,762,220 | | Total Preferred Stock | | | | | | | |

| | 108,746 | | Constellium NV, Class A (a)(b) | | | | | | 2,209,719 | | (Cost $12,134,027) | | | | | | 12,417,937 | |

| | 23,338 | | E.I. du Pont de Nemours & Co. (b) | | | | | | 1,667,967 | | Total Equity Securities | | | | | | | |

| | 160,000 | | Franco-Nevada Corp. | | | | | | 7,766,400 | | (Cost $422,224,120) | | | | | | 524,703,628 | |

| | 16,043 | | Monsanto Co. (b) | | | | | | 1,805,479 | | | | | | | | | | | | |

| | 45,000 | | Praxair, Inc. | | | | | | 5,433,300 | | | | | | | | | | | | |

| | 150,199 | | Rentech, Inc. (a) | | | | | | 168,223 | | | | | | | | | | | | |

| | 130,000 | | Royal Gold, Inc. | | | | | | 8,204,300 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 12 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| Fixed Income Securities - 26.1% | | | | | | | | $ | 202,591 | | Banc of America Funding Corp., Series 2006-F 1A1 (e) | 2.65 | % | 07/20/36 | $ | 199,019 | |

| Asset Backed Obligations - 3.5% | | | | | | | | | 3,721 | | Banc of America Funding Corp., Series 2006-G 2A3 (b)(e) | 0.35 | | 07/20/36 | | 3,729 | |

| $ | 460,097 | | ACE Securities Corp. Home Equity Loan Trust, Series 2007-HE1 A2A (e) | | 0.26 | % | 01/25/37 | $ | 324,321 | | | 164,978 | | Banc of America Funding Corp., Series 2006-H 6A1 (e) | 0.37 | | 10/20/36 | | 124,491 | |

| | 374,421 | | Adjustable Rate Mortgage Trust, Series 2005-11 2A41 (e) | | 2.62 | | 02/25/36 | | 367,476 | | | 92,475 | | Banc of America Funding Corp., Series 2007-E 4A1 (e) | 2.60 | | 07/20/47 | | 72,878 | |

| | 90,887 | | Adjustable Rate Mortgage Trust, Series 2005-12 2A1 (e) | | 2.76 | | 03/25/36 | | 71,111 | | | 632,876 | | Bayview Commercial Asset Trust, Series 2004-3 A1 (e)(f) | 0.54 | | 01/25/35 | | 588,387 | |

| | 96,152 | | Adjustable Rate Mortgage Trust, Series 2005-3 8A32 (b)(e) | | 0.49 | | 07/25/35 | | 93,592 | | | 29,422 | | Bayview Financial Mortgage Pass-Through Trust, Series 2005-D AF3 (b)(e) | 5.50 | | 12/28/35 | | 29,873 | |

| | 575,932 | | Adjustable Rate Mortgage Trust, Series 2006-1 2A1 (e) | | 3.08 | | 03/25/36 | | 431,184 | | | 75,124 | | Beacon Container Finance, LLC, Series 2012-1A A (b)(f) | 3.72 | | 09/20/27 | | 76,896 | |

| | 59,402 | | Adjustable Rate Mortgage Trust, Series 2006-1 3A3 (e) | | 2.88 | | 03/25/36 | | 44,634 | | | 181,926 | | Bear Stearns Adjustable Rate Mortgage Trust, Series 2007-5 1A1 (e) | 2.28 | | 08/25/47 | | 146,784 | |

| | 485,393 | | Alta Wind Holdings, LLC (f) | | 7.00 | | 06/30/35 | | 578,153 | | | 177,365 | | Bear Stearns ALT-A Trust, Series 2005-4 1A1 (e) | 0.61 | | 04/25/35 | | 166,384 | |

| | 70,000 | | American Money Management Corp. CLO, Series 2014-14A A1L (b)(e)(f) | | 1.71 | | 07/27/26 | | 69,758 | | | 176,668 | | Bear Stearns ALT-A Trust, Series 2005-8 11A1 (e) | 0.71 | | 10/25/35 | | 156,357 | |

| | 739,082 | | Asset Backed Funding Certificates, Series 2007-NC1 M2 (e)(f) | | 1.42 | | 05/25/37 | | 5,353 | | | 370,647 | | Bear Stearns ALT-A Trust, Series 2006-1 22A1 (e) | 2.43 | | 02/25/36 | | 290,820 | |

| | 80,080 | | AWAS Aviation Capital, Ltd. (f) | | 7.00 | | 10/17/16 | | 82,078 | | | 165,528 | | Bear Stearns ALT-A Trust, Series 2006-2 23A1 (e) | 2.70 | | 03/25/36 | | 126,667 | |

| | 60,000 | | Babson CLO, Ltd. Series 2014-IIA A (b)(e)(f) | | 1.66 | | 10/17/26 | | 59,805 | | | 1,186,330 | | Bear Stearns ALT-A Trust, Series 2006-4 11A1 (e) | 0.49 | | 08/25/36 | | 874,114 | |

| | 1,240,000 | | Babson CLO, Ltd., Series 2014-IA A1 (b)(e)(f) | | 1.75 | | 07/20/25 | | 1,240,555 | | | 27,707 | | Bear Stearns Asset Backed Securities Trust, Series 2005-TC2 A3 (b)(e) | 0.54 | | 08/25/35 | | 27,653 | |

| | 174,212 | | Banc of America Alternative Loan Trust, Series 2005-8 2CB1 | | 6.00 | | 09/25/35 | | 162,097 | | | | | | | | | | | | |

| | 140,899 | | Banc of America Commercial Mortgage Trust, Series 2007-2 A2 (b)(e) | | 5.60 | | 04/10/49 | | 141,086 | | | | | | | | | | | | |

| | 46,812 | | Banc of America Funding Corp., Series 2006-E 2A1 (e) | | 2.72 | | 06/20/36 | | 38,732 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 13 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 4,405 | | BNC Mortgage Loan Trust, Series 2007-1 A2 (b)(e) | | 0.23 | % | 03/25/37 | $ | 4,405 | | $ | 658,505 | | Conseco Finance Home Equity Loan Trust, Series 2002-C BF1 (e) | 8.00 | % | 06/15/32 | $ | 709,866 | |

| | 750,000 | | BNC Mortgage Loan Trust, Series 2007-3 A3 (e) | | 0.30 | | 07/25/37 | | 692,066 | | | 621,754 | | Conseco Finance Securitizations Corp., Series 2001-4 A4 (b) | 7.36 | | 08/01/32 | | 686,705 | |

| | 32,511 | | Centex Home Equity Loan Trust, Series 2005-C AF6 (g) | | 4.64 | | 06/25/35 | | 32,924 | | | 451,107 | | Continental Airlines Pass Through Trust, Series 2007-1 B (b) | 6.90 | | 04/19/22 | | 484,399 | |

| | 721,113 | | Chase Mortgage Finance Trust, Series 2007-A1 8A1 (e) | | 2.52 | | 02/25/37 | | 729,864 | | | 607,529 | | Continental Airlines Pass Through Trust, Series 2009-1 (b) | 9.00 | | 07/08/16 | | 657,650 | |

| | 271,226 | | ChaseFlex Trust, Series 2007-1 2A9 | | 6.00 | | 02/25/37 | | 239,345 | | | 54,777 | | Countrywide Alternative Loan Trust, Series 2004-J10 4CB1 | 6.50 | | 10/25/34 | | 58,593 | |

| | 100,000 | | CIFC Funding, Ltd., Series 2012-2A A1L (b)(e)(f) | | 1.67 | | 12/05/24 | | 99,719 | | | 56,492 | | Countrywide Alternative Loan Trust, Series 2005-50CB 1A1 | 5.50 | | 11/25/35 | | 53,977 | |

| | 845,656 | | CIT Education Loan Trust, Series 2007-1 A (e)(f) | | 0.36 | | 03/25/42 | | 811,153 | | | 192,818 | | Countrywide Alternative Loan Trust, Series 2005-73CB 1A8 | 5.50 | | 01/25/36 | | 183,282 | |

| | 600,000 | | Citicorp Residential Mortgage Trust, Series 2006-2 A5 (g) | | 6.04 | | 09/25/36 | | 607,577 | | | 539,706 | | Countrywide Alternative Loan Trust, Series 2005-J10 1A16 | 5.50 | | 10/25/35 | | 490,779 | |

| | 600,000 | | Citicorp Residential Mortgage Trust, Series 2007-1 A5 (g) | | 5.93 | | 03/25/37 | | 587,573 | | | 458,506 | | Countrywide Alternative Loan Trust, Series 2005-J12 2A1 (e) | 0.44 | | 08/25/35 | | 312,299 | |

| | 285,000 | | Citigroup Mortgage Loan Trust, Inc., Series 2007-WFH4 A2C (e) | | 1.47 | | 07/25/37 | | 266,613 | | | 232,521 | | Countrywide Alternative Loan Trust, Series 2006-36T2 1A1 (e) | 0.49 | | 12/25/36 | | 141,174 | |

| | 290,421 | | Citigroup Mortgage Loan Trust, Series 2006-WF1 A2D (g) | | 5.44 | | 03/25/36 | | 211,884 | | | 22,993 | | Countrywide Alternative Loan Trust, Series 2006-7CB 3A1 | 5.25 | | 05/25/21 | | 21,533 | |

| | 426,624 | | Citigroup Mortgage Loan Trust, Series 2007-AR8 2A1A (e) | | 2.69 | | 07/25/37 | | 399,705 | | | 241,745 | | Countrywide Alternative Loan Trust, Series 2007-16CB 4A7 | 6.00 | | 08/25/37 | | 235,856 | |

| | 113,849 | | CitiMortgage Alternative Loan Trust, Series 2006-A7 1A12 | | 6.00 | | 12/25/36 | | 98,465 | | | 198,367 | | Countrywide Alternative Loan Trust, Series 2007-19 1A34 | 6.00 | | 08/25/37 | | 167,866 | |

| | 44,880 | | CitiMortgage Alternative Loan Trust, Series 2007-A4 1A6 | | 5.75 | | 04/25/37 | | 38,863 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 14 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 83,044 | | Countrywide Asset-Backed Certificates, Series 2004-7 MV3 (b)(e) | | 1.22 | % | 12/25/34 | $ | 82,781 | | $ | 619,004 | | Credit-Based Asset Servicing and Securitization, LLC, Series 2007-CB5 A3 (e) | 0.42 | % | 04/25/37 | $ | 435,095 | |

| | 549,450 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2004-HYB5 3A1 (e) | | 2.47 | | 04/20/35 | | 485,739 | | | 833,532 | | CSAB Mortgage-Backed Trust, Series 2007-1 1A1A (e) | 5.90 | | 05/25/37 | | 480,785 | |

| | 179,495 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HY3 4A1 (e) | | 5.11 | | 06/25/47 | | 168,465 | | | 75,000 | | DBRR Trust, Series 2011-LC2 A4A (b)(e)(f) | | 4.54 | | 07/12/44 | | 83,765 | |

| | 76,161 | | Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-HY5 1A1 (e) | | 2.65 | | 09/25/47 | | 67,186 | | | 148,155 | | Delta Air Lines Pass Through Trust, Series 2002-1 G-1 | 6.72 | | 01/02/23 | | 172,045 | |

| | 15,656 | | Credit Suisse First Boston Mortgage Securities Corp., Series 2003-AR24 2A4 (e) | | 2.55 | | 10/25/33 | | 15,490 | | | 212,554 | | Deutsche Alt-B Securities, Inc. Mortgage Loan Trust, Series 2006-AB2 A5B (g) | 6.09 | | 06/25/36 | | 180,796 | |

| | 62,419 | | Credit Suisse First Boston Mortgage Securities Corp., Series 2005-6 8A1 (b) | | 4.50 | | 07/25/20 | | 63,417 | | | 1,000,000 | | Eaton Vance CLO, Ltd., Series 2014-1A A (e)(f) | 1.70 | | 07/15/26 | | 998,135 | |

| | 64,960 | | Credit Suisse Mortgage Capital Mortgage-Backed Trust, Series 2006-8 3A1 | | 6.00 | | 10/25/21 | �� | 63,492 | | | 53,178 | | Equity One Mortgage Pass-Through Trust, Series 2002-4 M1 (e) | 5.22 | | 02/25/33 | | 50,098 | |

| | 643,168 | | Credit Suisse Mortgage Capital Trust, Series 2013-3R 5A1 (e)(f) | | 2.50 | | 10/27/36 | | 643,954 | | | 1,307,586 | | First Franklin Mortgage Loan Trust, Series 2006-FF18 A2B (e) | 0.28 | | 12/25/37 | | 875,943 | |

| | 147,304 | | Credit-Based Asset Servicing and Securitization, LLC Mortgage Loan Trust, Series 2007-CB2 A2E (b)(g) | | 4.58 | | 02/25/37 | | 110,899 | | | 1,190,529 | | First Horizon Alternative Mortgage Securities Trust, Series 2005-AA3 2A1 (e) | 2.25 | | 05/25/35 | | 974,855 | |

| | 647,126 | | Credit-Based Asset Servicing and Securitization, LLC, Series 2006-CB7 A5 (e) | | 0.41 | | 10/25/36 | | 462,827 | | | 344,904 | | First Horizon Alternative Mortgage Securities Trust, Series 2006-FA8 1A1 | 6.25 | | 02/25/37 | | 296,734 | |

| | | | | | | | | | | | | 406,420 | | First Horizon Alternative Mortgage Securities Trust, Series 2006-FA8 1A8 (e) | 0.54 | | 02/25/37 | | 254,242 | |

| | | | | | | | | | | | | 10,000 | | Flagship CLO VII, Ltd., Series 2014-8A A (b)(e)(f) | 1.76 | | 01/16/26 | | 10,000 | |

| | | | | | | | | | | | | 90,000 | | Flatiron CLO, Ltd., Series 2014-1A A1 (b)(e)(f) | | 1.64 | | 07/17/26 | | 89,526 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 15 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 213,363 | | FNMA Aces, Series 2012-M15 A (b)(e) | | 2.66 | % | 10/25/22 | $ | 219,672 | | $ | 81,329 | | Higher Education Funding I, Series 2014-1 A (b)(e)(f) | 1.31 | % | 05/25/34 | $ | 82,358 | |

| | 22,806 | | FPL Energy National Wind Portfolio, LLC (f) | | 6.13 | | 03/25/19 | | 23,034 | | | 208,063 | | HomeBanc Mortgage Trust, Series 2004-1 2A (e) | 1.03 | | 08/25/29 | | 195,440 | |

| | 643,436 | | GCO Education Loan Funding Master Trust-II, Series 2006-2AR A1RN (b)(e)(f) | | 0.82 | | 08/27/46 | | 616,524 | | | 114,088 | | HSBC Home Equity Loan Trust, Series 2007-3 APT (b)(e) | 1.38 | | 11/20/36 | | 113,879 | |

| | 31,483 | | GE Business Loan Trust, Series 2004-1 A (b)(e)(f) | | 0.46 | | 05/15/32 | | 30,470 | | | 187,701 | | HSI Asset Loan Obligation Trust, Series 2007-AR2 2A1 (e) | 2.82 | | 09/25/37 | | 147,858 | |

| | 66,368 | | GE Business Loan Trust, Series 2005-1A A3 (b)(e)(f) | | 0.42 | | 06/15/33 | | 64,396 | | | 823,939 | | Indiantown Cogeneration LP, Series A-10 (b) | | 9.77 | | 12/15/20 | | 945,470 | |

| | 97,617 | | GE Business Loan Trust, Series 2005-2A A (b)(e)(f) | | 0.41 | | 11/15/33 | | 94,351 | | | 190,298 | | Indymac INDA Mortgage Loan Trust, Series 2007-AR7 1A1 (e) | 2.71 | | 11/25/37 | | 181,043 | |

| | 52,268 | | GE Capital Commercial Mortgage Corp., Series 2005-C4 A3A (b)(e) | | 5.49 | | 11/10/45 | | 52,242 | | | 528,648 | | Indymac Index Mortgage Loan Trust, Series 2004-AR12 A1 (e) | 0.95 | | 12/25/34 | | 447,813 | |

| | 854,000 | | Global SC Finance II SRL, Series 2014-1A A2 (f) | | 3.09 | | 07/17/29 | | 852,346 | | | 495,893 | | Indymac Index Mortgage Loan Trust, Series 2004-AR7 A2 (e) | 1.03 | | 09/25/34 | | 448,921 | |

| | 60,646 | | Goal Capital Funding Trust, Series 2006-1 A3 (b)(e) | | 0.38 | | 11/25/26 | | 60,389 | | | 277,692 | | Indymac Index Mortgage Loan Trust, Series 2005-AR5 1A1 (e) | 2.56 | | 05/25/35 | | 230,682 | |

| | 465,258 | | Green Tree, Series 2008-MH1 A2 (b)(e)(f) | | 8.97 | | 04/25/38 | | 490,208 | | | 74,743 | | Indymac Index Mortgage Loan Trust, Series 2006-AR25 3A1 (e) | 2.68 | | 09/25/36 | | 55,226 | |

| | 451,781 | | Green Tree, Series 2008-MH1 A3 (b)(e)(f) | | 8.97 | | 04/25/38 | | 476,009 | | | 138,184 | | Indymac Index Mortgage Loan Trust, Series 2006-AR29 A1 (e) | 0.34 | | 11/25/36 | | 107,896 | |

| | 302,088 | | GSR Mortgage Loan Trust, Series 2004-14 3A2 (e) | | 2.81 | | 12/25/34 | | 292,801 | | | 199,947 | | Indymac Index Mortgage Loan Trust, Series 2006-AR33 3A1 (e) | 2.89 | | 01/25/37 | | 184,039 | |

| | 192,371 | | GSR Mortgage Loan Trust, Series 2004-9 5A7 (e) | | 2.43 | | 08/25/34 | | 192,473 | | | 696,152 | | Indymac Index Mortgage Loan Trust, Series 2006-AR7 1A1 (e) | 2.88 | | 05/25/36 | | 523,245 | |

| | 174,264 | | GSR Mortgage Loan Trust, Series 2005-AR5 1A1 (e) | | 2.76 | | 10/25/35 | | 155,699 | | | | | | | | | | | | |

| | 14,036 | | HarborView Mortgage Loan Trust, Series 2004-8 2A4A (b)(e) | | 0.98 | | 11/19/34 | | 11,888 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 16 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 358,282 | | Indymac Index Mortgage Loan Trust, Series 2006-AR7 4A1 (e) | | 2.82 | % | 05/25/36 | $ | 259,168 | | $ | 1,110,000 | | JP Morgan Mortgage Acquisition Trust, Series 2007-CH4 A5 (e) | 0.41 | % | 05/25/37 | $ | 849,534 | |

| | 442,374 | | Indymac Index Mortgage Loan Trust, Series 2006-R1 A3 (e) | | 4.47 | | 12/25/35 | | 352,666 | | | 118,421 | | JP Morgan Mortgage Trust, Series 2005-A5 TA1 (e) | 5.03 | | 08/25/35 | | 115,519 | |

| | 367,145 | | Indymac Index Mortgage Loan Trust, Series 2007-FLX2 A1C (e) | | 0.36 | | 04/25/37 | | 268,326 | | | 447,756 | | JP Morgan Mortgage Trust, Series 2006-S2 2A2 | 5.88 | | 06/25/21 | | 448,453 | |

| | 522,776 | | Indymac Manufactured Housing Contract Pass Through Certificates, Series 1998-2 A4 (b)(e) | | 6.64 | | 08/25/29 | | 537,542 | | | 83,120 | | JP Morgan Mortgage Trust, Series 2007-A1 5A2 (b)(e) | 2.56 | | 07/25/35 | | 84,563 | |

| | 426,843 | | JetBlue Airways Pass Through Trust, Series 2004-2 G1 (e) | | 0.63 | | 08/15/16 | | 424,444 | | | 41,055 | | JP Morgan Mortgage Trust, Series 2007-A2 4A1M (e) | 4.69 | | 04/25/37 | | 37,468 | |

| | 130,141 | | JP Morgan Chase Commercial Mortgage Securities Trust, Series 2005-CIBC12 A4 (b) | | 4.90 | | 09/12/37 | | 130,648 | | | 7,956 | | LB-UBS Commercial Mortgage Trust, Series 2005-C3 A5 (b) | 4.74 | | 07/15/30 | | 7,965 | |

| | 4,133 | | JP Morgan Chase Commercial Mortgage Securities Trust, Series 2007-CIBC19 A3 (b)(e) | | 5.69 | | 02/12/49 | | 4,136 | | | 688,359 | | Lehman ABS Manufactured Housing Contract Trust, Series 2001-B A6 (b)(e) | 6.47 | | 04/15/40 | | 752,903 | |

| | 79,206 | | JP Morgan Chase Commercial Mortgage Securities Trust, Series 2007-LDP11 A3 (b)(e) | | 5.78 | | 06/15/49 | | 80,282 | | | 169,314 | | Lehman XS Trust, Series 2005-6 1A1 (e) | | 0.43 | | 11/25/35 | | 121,568 | |

| | 26,754 | | JP Morgan Chase Commercial Mortgage Securities Trust, Series 2011-C3 A2 (b)(f) | | 3.67 | | 02/15/46 | | 27,474 | | | 651,267 | | Lehman XS Trust, Series 2006-13 1A2 (e) | | 0.34 | | 09/25/36 | | 584,775 | |

| | 200,000 | | JP Morgan Mortgage Acquisition Trust, Series 2007-CH3 A4 (b)(e) | | 0.38 | | 03/25/37 | | 177,855 | | | 682,253 | | Lehman XS Trust, Series 2006-14N 3A2 (e) | | 0.29 | | 08/25/36 | | 530,111 | |

| | | | | | | | | | | | | 1,270,000 | | Limerock CLO II, Ltd., Series 2014-2A A (e)(f) | | 1.76 | | 04/18/26 | | 1,268,940 | |

| | | | | | | | | | | | | 20,000 | | Magnetite XII, Ltd., Series 2015-12A A (b)(e)(f) | 1.82 | | 04/15/27 | | 20,014 | |

| | | | | | | | | | | | | 274,040 | | MASTR Adjustable Rate Mortgages Trust, Series 2007-R5 A1 (e)(f) | 2.52 | | 11/25/35 | | 213,066 | |

| | | | | | | | | | | | | 11,875 | | MASTR Seasoned Securitization Trust, Series 2004-1 4A1 (b)(e) | 2.49 | | 10/25/32 | | 11,872 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 17 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 982,207 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-1 A2C (e) | | 0.42 | % | 04/25/37 | $ | 589,419 | | $ | 797,290 | | Oakwood Mortgage Investors, Inc., Series 1999-B A4 | 6.99 | % | 12/15/26 | $ | 836,052 | |

| | 56,666 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-1 A2D (e) | | 0.51 | | 04/25/37 | | 34,474 | | | 510,616 | | Origen Manufactured Housing Contract Trust, Series 2004-A M2 (b)(e) | 6.64 | | 01/15/35 | | 558,821 | |

| | 1,217,693 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-3 A2B (e) | | 0.30 | | 06/25/37 | | 833,326 | | | 220,000 | | Popular ABS Mortgage Pass-Through Trust, Series 2007-A A3 (e) | 0.48 | | 06/25/47 | | 147,765 | |

| | 1,212,031 | | Merrill Lynch First Franklin Mortgage Loan Trust, Series 2007-3 A2C (e) | | 0.35 | | 06/25/37 | | 834,940 | | | 456,820 | | Residential Accredit Loans, Inc., Series 2005-QO3 A1 (e) | 0.57 | | 10/25/45 | | 361,916 | |

| | 170,363 | | Morgan Stanley ABS Capital I, Inc. Trust, Series 2004-NC7 M2 (b)(e) | | 1.10 | | 07/25/34 | | 168,447 | | | 592,380 | | Residential Accredit Loans, Inc., Series 2005-QO5 A1 (b)(e) | 1.13 | | 01/25/46 | | 436,945 | |

| | 871,764 | | Morgan Stanley ABS Capital I, Inc. Trust, Series 2007-HE1 A2C (e) | | 0.32 | | 11/25/36 | | 559,365 | | | 383,401 | | Residential Accredit Loans, Inc., Series 2006-QS10 A1 | 6.00 | | 08/25/36 | | 325,206 | |

| | 30,590 | | Morgan Stanley Dean Witter Capital I Trust, Series 2001-TOP3 C (b) | | 6.79 | | 07/15/33 | | 31,356 | | | 197,118 | | Residential Accredit Loans, Inc., Series 2006-QS17 A4 | 6.00 | | 12/25/36 | | 163,822 | |

| | 192,155 | | Morgan Stanley Mortgage Loan Trust, Series 2007-13 6A1 | | 6.00 | | 10/25/37 | | 164,515 | | | 315,223 | | Residential Accredit Loans, Inc., Series 2007-QS1 1A1 | 6.00 | | 01/25/37 | | 270,657 | |

| | 170,000 | | Navient Student Loan Trust, Series 2014-1 A3 (b)(e) | | 0.68 | | 06/25/31 | | 169,301 | | | 153,002 | | Residential Accredit Loans, Inc., Series 2007-QS5 A1 | 5.50 | | 03/25/37 | | 120,622 | |

| | 85,000 | | Nelnet Student Loan Trust, Series 2014-4A A2 (b)(e)(f) | | 1.12 | | 11/25/43 | | 85,659 | | | 624,602 | | Residential Accredit Loans, Inc., Series 2007-QS8 A6 | 6.00 | | 06/25/37 | | 532,288 | |

| | 115,000 | | Nelnet Student Loan Trust, Series 2015-2A A2 (b)(e)(f) | | 0.82 | | 09/25/42 | | 115,208 | | | 376,730 | | Residential Asset Mortgage Products Trust, Series 2004-SL3 A4 | 8.50 | | 12/25/31 | | 343,272 | |

| | 315,761 | | Nomura Asset Acceptance Corp. Alternative Loan Trust, Series 2007-1 1A1A (g) | | 6.00 | | 03/25/47 | | 240,668 | | | 378,802 | | Residential Asset Securitization Trust, Series 2006-A10 A5 | 6.50 | | 09/25/36 | | 287,764 | |

| | 1,470,873 | | Nomura Home Equity Loan, Inc. Home Equity Loan Trust, Series 2005-HE1 M3 (e) | | 0.65 | | 09/25/35 | | 1,431,155 | | | 1,120,992 | | Residential Asset Securitization Trust, Series 2007-A5 1A2 (e) | 0.57 | | 05/25/37 | | 293,509 | |

| | | | | | | | | | | | | 100,000 | | Ruby Pipeline, LLC (b)(f) | | 6.00 | | 04/01/22 | | 107,808 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 18 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 680,000 | | Saxon Asset Securities Trust, Series 2007-1 A2C (e) | | 0.32 | % | 01/25/47 | $ | 541,464 | | $ | 265,000 | | SLM Student Loan Trust, Series 2008-8 B (b)(e) | 2.51 | % | 10/25/29 | $ | 276,179 | |

| | 1,044,925 | | Securitized Asset Backed Receivables, LLC Trust, Series 2007-BR5 A2C (e) | | 0.52 | | 05/25/37 | | 759,724 | | | 24,220 | | SLM Student Loan Trust, Series 2008-9 A (b)(e) | 1.76 | | 04/25/23 | | 24,859 | |

| | 207,220 | | Securitized Asset Backed Receivables, LLC Trust, Series 2007-NC1 A2B (e) | | 0.32 | | 12/25/36 | | 121,161 | | | 150,469 | | SLM Student Loan Trust, Series 2012-3 A (b)(e) | 0.82 | | 12/26/25 | | 150,955 | |

| | 513,764 | | SLC Student Loan Trust, Series 2004-1 B (e) | | 0.55 | | 08/15/31 | | 456,920 | | | 844,152 | | Soundview Home Loan Trust, Series 2006-EQ2 A4 (e) | 0.41 | | 01/25/37 | | 590,435 | |

| | 413,372 | | SLC Student Loan Trust, Series 2005-2 B (e) | | 0.55 | | 03/15/40 | | 374,319 | | | 716,159 | | Spirit Master Funding, LLC, Series 2014-1A A1 (b)(f) | 5.05 | | 07/20/40 | | 756,443 | |

| | 158,168 | | SLM Student Loan Trust, Series 2004-5A A5 (b)(e)(f) | | 0.86 | | 10/25/23 | | 158,765 | | | 754,591 | | Structured Adjustable Rate Mortgage Loan Trust, Series 2006-1 7A4 (e) | 4.96 | | 02/25/36 | | 626,224 | |

| | 33,612 | | SLM Student Loan Trust, Series 2004-8 B (b)(e) | | 0.72 | | 01/25/40 | | 30,027 | | | 59,907 | | Structured Adjustable Rate Mortgage Loan Trust, Series 2007-3 3A1 (e) | 2.70 | | 04/25/47 | | 47,565 | |

| | 144,982 | | SLM Student Loan Trust, Series 2004-8A A5 (b)(e)(f) | | 0.76 | | 04/25/24 | | 145,152 | | | 155,164 | | Structured Asset Securities Corp. Mortgage Loan Trust, Series 2005-4XS 2A1A (b)(e) | 1.92 | | 03/25/35 | | 155,038 | |

| | 350,000 | | SLM Student Loan Trust, Series 2006-2 A6 (e) | | 0.43 | | 01/25/41 | | 329,300 | | | 97,500 | | TAL Advantage, LLC, Series 2006-1A (b)(e)(f) | | 0.37 | | 04/20/21 | | 96,917 | |

| | 375,000 | | SLM Student Loan Trust, Series 2006-8 A6 (e) | | 0.42 | | 01/25/41 | | 351,368 | | | 287,126 | | UAL Pass Through Trust, Series 2009-1 | | 10.40 | | 11/01/16 | | 313,742 | |

| | 31,975 | | SLM Student Loan Trust, Series 2007-6 B (b)(e) | | 1.11 | | 04/27/43 | | 29,045 | | | 163,023 | | US Airways Pass Through Trust, Series 2012-2A | 4.63 | | 06/03/25 | | 175,462 | |

| | 305,000 | | SLM Student Loan Trust, Series 2008-2 B (b)(e) | | 1.46 | | 01/25/29 | | 274,953 | | | 90,000 | | Voya CLO, Ltd., Series 2014-2A A1 (b)(e)(f) | | 1.71 | | 07/17/26 | | 89,883 | |

| | 285,000 | | SLM Student Loan Trust, Series 2008-3 B (b)(e) | | 1.46 | | 04/25/29 | | 266,416 | | | 9,416 | | WaMu Mortgage Pass-Through Certificates, Series 2002-AR18 A (b)(e) | 2.51 | | 01/25/33 | | 9,524 | |

| | 255,000 | | SLM Student Loan Trust, Series 2008-4 B (b)(e) | | 2.11 | | 04/25/29 | | 248,867 | | | 242,947 | | WaMu Mortgage Pass-Through Certificates, Series 2006-AR12 2A3 (e) | 1.73 | | 10/25/36 | | 204,109 | |

| | 260,000 | | SLM Student Loan Trust, Series 2008-7 B (b)(e) | | 2.11 | | 07/25/29 | | 261,876 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 19 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| $ | 147,863 | | WaMu Mortgage Pass-Through Certificates, Series 2006-AR16 1A1 (e) | | 2.01 | % | 12/25/36 | $ | 129,931 | | $ | 115,000 | | WF-RBS Commercial Mortgage Trust, Series 2011-C5 A4 (b) | 3.67 | % | 11/15/44 | $ | 124,278 | |

| | 270,273 | | WaMu Mortgage Pass-Through Certificates, Series 2007-HY3 4A1 (e) | | 2.36 | | 03/25/37 | | 257,028 | | | | | | | | | | | | |

| | 421,747 | | Washington Mutual Mortgage Pass-Through Certificates, Series 2005-3 2A3 (e) | | 0.72 | | 05/25/35 | | 346,665 | | Total Asset Backed Obligations | | | | | | | |

| | 321,677 | | Washington Mutual Mortgage Pass-Through Certificates, Series 2005-4 CB13 (e) | | 0.67 | | 06/25/35 | | 252,217 | | (Cost $48,782,093) | | | | | | 57,493,845 | |

| | 441,882 | | Washington Mutual Mortgage Pass-Through Certificates, Series 2006-7 A1A (g) | | 4.68 | | 09/25/36 | | 252,429 | | Corporate Convertible Bonds - 14.3% | | | | | | | |

| | 879,409 | | Washington Mutual Mortgage Pass-Through Certificates, Series 2006-AR7 A1A (e) | | 1.05 | | 09/25/46 | | 608,017 | | Consumer Discretionary - 1.0% | | | | | | | |

| | 7,728 | | Wells Fargo Alternative Loan Trust, Series 2005-2 A4 (b)(e) | | 0.85 | | 10/25/35 | | 7,745 | | | 1,000,000 | | Exide Technologies (b)(e)(h)(i) | | 0.00 | | 09/18/13 | | 30,000 | |

| | 113,426 | | Wells Fargo Home Equity Asset-Backed Securities 2005-4 Trust, Series 2006-1 A4 (b)(e) | | 0.40 | | 05/25/36 | | 110,650 | | | 4,500,000 | | JAKKS Pacific, Inc. (b)(f) | | 4.25 | | 08/01/18 | | 4,317,187 | |

| | 184,978 | | Wells Fargo Home Equity Asset-Backed Securities Trust, Series 2006-3 A2 (e) | | 0.32 | | 01/25/37 | | 177,426 | | | 2,000,000 | | JAKKS Pacific, Inc. (b)(f) | | 4.88 | | 06/01/20 | | 1,767,500 | |

| | 26,350 | | WF-RBS Commercial Mortgage Trust, Series 2011-C2 A1 (b)(f) | | 2.50 | | 02/15/44 | | 26,432 | | | 2,850,000 | | M/I Homes, Inc. (b) | | 3.25 | | 09/15/17 | | 3,387,938 | |

| | | | | | | | | | | | | 2,500,000 | | Navistar International Corp. (b)(f) | | 4.75 | | 04/15/19 | | 2,270,313 | |

| | | | | | | | | | | | | 3,201,000 | | Wabash National Corp. (b) | | 3.38 | | 05/01/18 | | 4,361,362 | |

| | | | | | | | | | | | | | | | | | | | | 16,134,300 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Consumer Staples - 2.7% | | | | | | | |

| | | | | | | | | | | | | 2,500,000 | | Acorda Therapeutics, Inc. (b) | | 1.75 | | 06/15/21 | | 2,571,875 | |

| | | | | | | | | | | | | 4,500,000 | | Albany Molecular Research, Inc. (b) | | 2.25 | | 11/15/18 | | 5,751,562 | |

| | | | | | | | | | | | | 2,300,000 | | Array BioPharma, Inc. (b) | | 3.00 | | 06/01/20 | | 2,899,438 | |

| | | | | | | | | | | | | 2,000,000 | | Ascent Capital Group, Inc. (b) | | 4.00 | | 07/15/20 | | 1,518,750 | |

| | | | | | | | | | | | | 3,250,000 | | Carriage Services, Inc. (b)(f) | | 2.75 | | 03/15/21 | | 3,908,141 | |

| | | | | | | | | | | | | 2,500,000 | | Ctrip.com International, Ltd. | | 1.25 | | 10/15/18 | | 2,623,438 | |

| | | | | | | | | | | | | 3,500,000 | | Depomed, Inc. (b) | | 2.50 | | 09/01/21 | | 4,635,313 | |

| | | | | | | | | | | | | 4,693,000 | | Endologix, Inc. (b) | | 2.25 | | 12/15/18 | | 4,704,732 | |

| | | | | | | | | | | | | 4,500,000 | | Healthways, Inc. (b) | | 1.50 | | 07/01/18 | | 5,267,812 | |

| | | | | | | | | | | | | 3,750,000 | | Monster Worldwide, Inc. (b)(f) | | 3.50 | | 10/15/19 | | 5,116,406 | |

| | | | | | | | | | | | | 1,600,000 | | Protalix BioTherapeutics, Inc. (b) | | 4.50 | | 09/15/18 | | 1,202,000 | |

| | | | | | | | | | | | | 1,300,000 | | TESARO, Inc. (b) | | 3.00 | | 10/01/21 | | 2,323,750 | |

| | | | | | | | | | | | | 1,400,000 | | The Spectranetics Corp. (b) | | 2.63 | | 06/01/34 | | 1,817,375 | |

| | | | | | | | | | | | | | | | | | | | | 44,340,592 | |

| | | | | | | | | | | | | | | | | | | | | | |

| See Notes to Financial Statements. | 20 | ABSOLUTE FUNDS |

| |

ABSOLUTE STRATEGIES FUND SCHEDULE OF INVESTMENTS MARCH 31, 2015 |

| |

| | | | Security | | | | | | | | | | | Security | | | | | | | |

| | Principal | | Description | | Rate | | Maturity | | Value | | | Principal | | Description | | Rate | | Maturity | | Value | |

| Energy - 0.9% | | | | | | | | $ | 4,500,000 | | TTM Technologies, Inc. (b) | | 1.75 | % | 12/15/20 | $ | 4,947,188 | |

| $ | 920,000 | | Chesapeake Energy Corp. | | 2.50 | % | 05/15/37 | $ | 886,075 | | | 1,000,000 | | Vishay Intertechnology, Inc. (b)(f) | | 2.25 | | 06/01/42 | | 1,249,375 | |

| | 3,000,000 | | Clean Energy Fuels Corp. (f) | | 5.25 | | 10/01/18 | | 2,193,750 | | | | | | | | | | | 23,157,813 | |

| | 2,275,000 | | Energy XXI, Ltd. (b) | | 3.00 | | 12/15/18 | | 676,813 | | Information Technology - 1.9% | | | | | | | |

| | 3,000,000 | | Helix Energy Solutions Group, Inc. (b) | | 3.25 | | 03/15/32 | | 2,998,125 | | | 3,000,000 | | Cornerstone OnDemand, Inc. | | 1.50 | | 07/01/18 | | 2,926,875 | |

| | 1,075,000 | | InterOil Corp. | | 2.75 | | 11/15/15 | | 1,066,937 | | | 2,250,000 | | Envestnet, Inc. (b) | | 1.75 | | 12/15/19 | | 2,501,719 | |

| | 2,000,000 | | JinkoSolar Holding Co., Ltd. (b)(f) | | 4.00 | | 02/01/19 | | 1,873,750 | | | 2,500,000 | | GT Advanced Technologies, Inc. (b)(h) | | 3.00 | | 12/15/20 | | 812,500 | |

| | 695,000 | | Pengrowth Energy Corp. | | 6.25 | | 03/31/17 | | 522,395 | | | 1,625,000 | | inContact, Inc. (b)(f) | | 2.50 | | 04/01/22 | | 1,697,109 | |

| | 5,600,000 | | Renewable Energy Group, Inc. (b) | | 2.75 | | 06/15/19 | | 5,204,500 | | | 4,000,000 | | Mentor Graphics Corp. (b) | | 4.00 | | 04/01/31 | | 5,010,000 | |

| | | | | | | | | | 15,422,345 | | | 4,500,000 | | Photronics, Inc. (b) | | 3.25 | | 04/01/16 | | 4,680,000 | |

| Financial - 1.7% | | | | | | | | | 2,000,000 | | PROS Holdings, Inc. (b)(f) | | 2.00 | | 12/01/19 | | 2,065,000 | |

| | 5,000,000 | | CBIZ, Inc. (f) | | 4.88 | | 10/01/15 | | 6,440,625 | | | 5,600,000 | | Quantum Corp. (b) | | 4.50 | | 11/15/17 | | 6,559,000 | |

| | 500,000 | | Consolidated-Tomoka Land Co. (b)(f) | | 4.50 | | 03/15/20 | | 548,125 | | | 3,000,000 | | Rudolph Technologies, Inc. (b)(f) | | 3.75 | | 07/15/16 | | 3,196,875 | |

| | 5,900,000 | | Encore Capital Group Inc (b) | | 3.00 | | 07/01/20 | | 6,386,750 | | | 1,500,000 | | Take-Two Interactive Software, Inc. (b) | | 1.75 | | 12/01/16 | | 2,115,000 | |

| | 6,000,000 | | Forestar Group, Inc. (b) | | 3.75 | | 03/01/20 | | 5,662,500 | | | | | | | | | | | 31,564,078 | |

| | 2,500,000 | | FXCM, Inc. (b) | | 2.25 | | 06/15/18 | | 1,971,875 | | Materials - 0.8% | | | | | | | |

| | 5,500,000 | | Gain Capital Holdings, Inc. (b) | | 4.13 | | 12/01/18 | | 5,929,688 | | | 5,000,000 | | Horsehead Holding Corp. (b) | | 3.80 | | 07/01/17 | | 5,337,500 | |

| | | | | | | | | | 26,939,563 | | | 3,624,000 | | Primero Mining Corp. | | 6.50 | | 03/31/16 | | 3,623,275 | |

| Healthcare - 1.4% | | | | | | | | | 6,600,000 | | Silver Standard Resources, Inc. (b)(f) | | 2.88 | | 02/01/33 | | 4,694,250 | |

| | 3,500,000 | | Accuray, Inc. | | 3.75 | | 08/01/16 | | 3,898,125 | | | | | | | | | | | 13,655,025 | |

| | 2,750,000 | | AMAG Pharmaceuticals, Inc. (b) | | 2.50 | | 02/15/19 | | 5,721,719 | | Telecommunication Services - 2.2% | | | | | | | |

| | 4,000,000 | | Emergent Biosolutions, Inc. (b) | | 2.88 | | 01/15/21 | | 4,632,500 | | | 3,000,000 | | Alaska Communications Systems Group, Inc. | | 6.25 | | 05/01/18 | | 2,956,875 | |

| | 1,250,000 | | Insulet Corp. (b) | | 2.00 | | 06/15/19 | | 1,263,281 | | | 5,000,000 | | Blucora, Inc. (b) | | 4.25 | | 04/01/19 | | 4,671,875 | |

| | 2,000,000 | | Isis Pharmaceuticals, Inc. (b)(f) | | 1.00 | | 11/15/21 | | 2,332,500 | | | 3,000,000 | | Dealertrack Technologies, Inc. (b) | | 1.50 | | 03/15/17 | | 3,573,750 | |

| | 2,500,000 | | Quidel Corp. (b) | | 3.25 | | 12/15/20 | | 2,725,000 | | | 750,000 | | Global Eagle Entertainment, Inc. (b)(f) | | 2.75 | | 02/15/35 | | 736,875 | |

| | 1,000,000 | | VIVUS, Inc. (b)(f) | | 4.50 | | 05/01/20 | | 663,125 | | | 4,000,000 | | Infinera Corp. (b) | | 1.75 | | 06/01/18 | | 6,625,000 | |

| | 1,000,000 | | Wright Medical Group, Inc. (b)(f) | | 2.00 | | 02/15/20 | | 1,059,375 | | | 3,000,000 | | InterDigital, Inc. (b) | | 2.50 | | 03/15/16 | | 3,245,625 | |

| | | | | | | | | | 22,295,625 | | | | | | | | | | | | |

| Industrial - 1.4% | | | | | | | | | | | | | | | | | | |

| | 1,755,000 | | AAR Corp., Series B | | 2.25 | | 03/01/16 | | 1,864,688 | | | | | | | | | | | | |

| | 4,000,000 | | Altra Industrial Motion Corp.(b) | | 2.75 | | 03/01/31 | | 4,620,000 | | | | | | | | | | | | |