As filed with the Securities and Exchange Commission on August 30, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: June 30

Date of reporting period: July 1, 2015 – June 30, 2016

ITEM 1. REPORT TO STOCKHOLDERS.

Auxier Focus Fund

Annual Report

June 30, 2016

Fund Adviser:

Auxier Asset Management LLC

5285 Meadows Road

Suite 333

Lake Oswego, Oregon 97035

Toll Free: (877) 3AUXIER or (877) 328-9437

|

AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) JUNE 30, 2016 |

|

June's shocking vote by Great Britain to exit the European Union added to volatility for the second quarter. I remember like yesterday investing in the 1990s when negative headlines out of international markets were relentless. Japan's stock market crashed off an immense bubble that peaked in 1989. Mexico suffered a severe Peso devaluation in 1994. Russia defaulted after the energy bust in 1998. East Asia faced a severe financial crisis and meltdown at the same time. Despite such alarming headlines, the superior businesses we owned endured and thrived. And investment flows returned to the US as investors increasingly valued the integrity of our markets and rule of law. These inflows ultimately contributed to bubble valuations in US blue chips in the late 1990s, when we were forced to lighten up. A classic example was Coca Cola, then trading at 50 times earnings.

Today we have similar gloom out of China—the result of an extraordinary borrowing binge. Venezuela is bankrupt and should default. Brazil is in the worst economic downturn in 100 years. And the banking industry in Europe is severely undercapitalized. That is why we have focused not on predicting markets but on valuing individual companies. We strive to own businesses that survive and thrive even when faced with the most extreme macroeconomic challenges. We believe longer term it is more rewarding to be an exceptional business analyst as opposed to a market analyst. One with an eye on knowable fundamentals. To enjoy the fruits of compounding that high return businesses can provide, investors need to stay in the game and not be scared out by negative headlines. Central banks in the US, Japan and Europe continue to add to the distortion in asset values by driving interest rates negative. This is leading to rapid growth in debt accumulation and a "flight to safety" mentality rampant among many investors chasing for yield—often blindly.

At current interest rate levels, there is no chance to maintain purchasing power in the years ahead. Central banks have far too much power to print money and need to be checked. Regarding the misperception that bonds are currently "safe," author Jim Grant recently dusted off his copy of A History of Interest Rates, first published in 1963 by Sidney Homer and Richard Sylla. Grant figures that over $13 trillion in sovereign bonds globally now yield negative interest. This is a phenomenon that has never taken place in over 3000 years. So corresponding prices are dangerously expensive. Usually rates rise when corporate balance sheets deteriorate in a free market pricing environment. Central banks have interrupted and impeded the market through bond purchases (some estimates as high as 15% of global corporate and sovereign issues). In the past twenty years, we have seen extreme bubble valuations in tech-telecom, housing and commodities. Now the price extreme is in income vehicles perceived to be "safe." In order to maintain the compounding process, it is critical to identify bubble valuations and systemically sell into them to reduce exposure. Traveling throughout the country I see rents rising (9% annually in Portland and Seattle), home prices trending higher, healthcare premium renewals rising 12-18%, costs of maintenance, repair and property taxes surging, and wage gains as shortages abound among skilled workers. Traffic is jammed, airports are packed. This is not a depression environment that warrants zero interest rates. There is talk of instigating even more aggressive money printing policies (so-called helicopter money) in Japan. It is helpful to revisit such devastating policies during Germany's Weimar Republic after World War I. Then the bulk of German investors were hiding out in bonds during a recessionary economy. In 1921 the German currency stabilized at 90 marks to the US dollar. By November 1923, the American dollar was worth 4,210,500,000,000 marks. On a recent research trip, I saw a bumper sticker that read, "Sure You Can Trust The Government, Just Ask An Indian." When it comes to your investments you can trust a little, but you need to constantly verify the facts and fundamentals.

AUXIER FOCUS FUND

PERFORMANCE UPDATE

June 30, 2016

| ANNUALIZED |

| | Inception * | Ten Year | Five Year | Three Year | One Year |

Auxier Focus Fund Investor Class Shares | 6.94% | 6.57% | 7.34% | 6.39% | 1.58% |

| S&P 500 Index | 4.37% | 7.42% | 12.10% | 11.66% | 3.99% |

| CUMULATIVE |

| | Inception * | Ten Year | Five Year | Three Year | One Year |

Auxier Focus Fund Investor Class Shares | 212.47% | 88.88% | 42.49% | 20.41% | 1.58% |

| S&P 500 Index | 106.74% | 104.65% | 77.02% | 39.20% | 3.99% |

| * Fund inception: July 9, 1999 | | | | |

|

AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) JUNE 30, 2016 |

|

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's Investor Class Share's annual operating expense ratio (gross) is 1.27%. The Fund's adviser has contractually agreed to waive a portion of its fee and/or reimburse Fund expenses to limit total annual operating expenses to 1.14%, which is in effect until October 31, 2016. Other share classes may vary. The Fund charges a 2.0% redemption fee on shares redeemed within 180 days of purchase. For the most recent month-end performance, please call (877)328-9437 or visit the Advisor's website at www.auxierasset.com. The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future.

Portfolio Highlights

Auxier Focus Fund's equities returned 2.62% in second quarter 2016, with 15% in foreign stocks and 11% in cash and short-term cash equivalents. The total portfolio gained 2% for the second quarter and 2.55% year to date. The S&P 500 index returned 2.46% and 3.84% for the same periods, respectively. We continue to seek out bargains among businesses that sport strong balance sheets, historically high returns on invested capital and attractive and growing free cash flow yields. Such impressive companies tend to have the strength to raise dividends over time and survive the harshest economic conditions. When stock prices are too high, we park some of our cash in "market agnostic" short-term investments that we refer to as workouts. We track earnings, cash flow and mandatory capital spending closely for each business. If the earnings and cash flow decline over the next five years, the stock will surely be lower.

Where We're Finding Value in Volatile Times

We see attractive values in industry leading biotech companies like Biogen. It has a powerful research culture that dominates the field of multiple sclerosis drugs and is a potential leader in Alzheimer's with the drug Aducanumab. There are 5.4 million Americans suffering from Alzheimer's. Biogen recently went on sale for 13 times earnings, a steep discount to its five-year trading range with a free cash flow yield more than triple the prevailing ten-year government bond yield. That valuation also might prove enticing to cash rich competitors as a takeover prospect. Core Fund holdings like Medtronic project generating over $40 billion in free cash the next five years (Omar Ishrak, CEO). S&P Global Market Intelligence expects 2016 healthcare earnings to be up 6.5%—higher than all but one sector. Other top Fund holdings executing in healthcare include UnitedHealth, Johnson & Johnson, Zimmer Biomet, and CVS. Again, many of these holdings have recent free cash flow yields far in excess of the prevailing long bond yields. Merck is leading advances in immunotherapy for cancer cures with the drug Keytruda, where sales have increased from $110 million to over $314 million in the past year. I recently spent time visiting companies involved in medical marijuana. I strongly believe that the anti-inflammatory properties of Cannabinoid (the nondrug part of the plant) will be proved effective in replacing often-addictive painkillers. Twenty-five states in the US have legalized medicinal marijuana. Germany's Health Minister said the country will legalize in 2017 with health insurers reimbursing as well. Canada, Australia and Italy look as if they may follow within the next couple of years.

Lower energy prices ultimately are good for a US economy that is 70% consumption and 85% service oriented. There now is a glut of refined fuel partly due to the expansion of refinery capacity in Asia. This opens the door for a very palatable 10 cent gas tax that could fund badly needed infrastructure in the US as online shopping (and deliveries) continue to show greatest growth in retail spending. US construction spending on infrastructure (as a percentage of GDP) is running the lowest in over 30 years—and odds favor a big boost after the elections. Every energy crash that I have invested through has led to very strong fundamentals for our economy and higher interest rates. Low fuel prices and mobile technology are contributing to a travel boom as Americans have logged over 3 trillion road miles this past year. Convenience store purchases for foods and beverages continue to be strong. On the negative side, a flood of capital into big grocery chains has created excess capacity

|

AUXIER FOCUS FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) JUNE 30, 2016 |

|

and hypercompetitive pricing of goods. Improved data analytics make it easier to overproduce and oversupply. We see numerous businesses afflicted with gluts. These are problems of "abundance."

Fund holdings Molson Coors and Altria were beneficiaries of the buyout of SABMiller by AB InBev. This is a case where cumulative knowledge in an industry helped enhance returns in a flat market. Molson appreciated over 150% since our purchase four years ago as the industry has consolidated. Altria was a major shareholder of SABMiller, and Molson will be able to buy joint venture assets of Miller at attractive price levels as part of this buyout deal. We see the need for media content consolidation led by Liberty Media founder John Malone. We also see attractive valuations in companies like Discovery Communications (Malone is its largest individual shareholder). Discovery owns its content and trades at a steep discount to private market value. While domestic banks are very cheap, they continue to suffer from headwinds of souring energy loans, low net-interest margins and deteriorating subprime car loans. Look for more trouble for banks directly exposed to the oil patch as well as the farm belt. Insurers suffer with zero interest rates as investment portfolio "float" becomes worth less. I believe autonomous cars ultimately will pose a material risk for auto insurers as accident rates are sure to fall. Technology disruption ranks as one of the biggest risks to investing in today's markets. The growth of online shopping, mobile communications and data analytics is transforming entire industries. In highly valued stock markets, risk management becomes more critical to minimize the threat of "torpedoes." These are pricey stocks with very high investor expectations that can suddenly disappoint, crash and torpedo the portfolio. In allocating, we see a strong need to maintain cash and/or market agnostic positions to take advantage of bargain purchases that result when the electronic herd panics. Historically, market indices can be flat for decades. The Dow Jones Industrials rose one measly point between 1964-1981. For my money, I want to trust in a focused daily research effort to identify compelling opportunities. This process combines price discovery and cumulative industry knowledge to quantify and reduce risk while improving odds of success. Investing is the "craft of the specific." Our returns depend on carefully studied company selection, not the market. Life savings are too important to be left to chance. With regard to holding excess cash in portfolios, in market crashes there tends to be 85% correlation on the downside. So we view the cash in the portfolio as integral to make exceptional buys in times of panic.

We appreciate your trust.

Jeff Auxier

Fund returns (i) assume the reinvestment of all dividends and capital gain distributions and (ii) would have been lower during the period if certain fees and expenses had not been waived. Performance shown is for the Fund's Investor Class shares; returns for other share classes will vary. Performance for Investor Class shares for periods prior to December 10, 2004 reflects performance of the applicable share class of Auxier Focus Fund, a series of Unified Series Trust (the "Predecessor Fund"). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds. The performance of the Fund's Investor Class shares for the period prior to December 10, 2004 reflects the expenses of the Predecessor Fund.

The Fund may invest in value and/or growth stocks. Investments in value stocks are subject to risk that their intrinsic value may never be realized and investments in growth stocks may be susceptible to rapid price swings, especially during periods of economic uncertainty. In addition, the Fund may invest in mid-sized companies which generally carry greater risk than is customarily associated with larger companies. Moreover, if the Fund's portfolio is overweighted in a sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not overweighted in that sector. An increase in interest rates typically causes a fall in the value of a debt security (Fixed-Income Securities Risk) with corresponding changes to the Fund's value.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on 500 widely held common stocks. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq. One cannot invest directly in an index or average.

The views in this shareholder letter were those of the Fund Manager as of the letter's publication date and may not reflect his views on the date this letter is first distributed or anytime thereafter. These views are intended to assist readers in understanding the Fund's investment methodology and do not constitute investment advice.

|

AUXIER FOCUS FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) JUNE 30, 2016 |

|

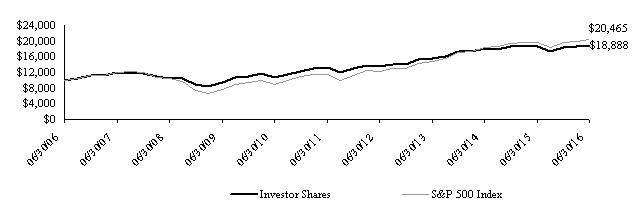

The following chart reflects the change in the value of a hypothetical $10,000 investment in Investor Shares, including reinvested dividends and distributions, in the Fund compared with the performance of the benchmark, the S&P 500 Index ("S&P 500"), over the past ten fiscal years. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The total return of the Fund's classes includes the maximum sales charge of 5.75% (A Shares only) and operating expenses that reduce returns, while the total return of the S&P 500 does not include the effect of sales charges and expenses. A Shares are subject to a 1.00% contingent deferred sales charge on shares purchased without an initial sales charge and redeemed less than one year after purchase. The total return of the S&P 500 includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the S&P 500 does not include expenses. The Fund is professionally managed, while the S&P 500 is unmanaged and is not available for investment.

Comparison of Change in Value of a $10,000 Investment

Investor Shares vs. S&P 500 Index

Average Annual Total Returns Periods Ended June 30, 2016: | | 1 Year | | 5 Years | | 10 Years | | Since Inception(1) |

| Investor Shares | | 1.58 | % | | 7.34 | % | | 6.57 | % | | 6.94 | % |

| S&P 500 Index (Since July 9, 1999) | | 3.99 | % | | 12.10 | % | | 7.42 | % | | 4.37 | % |

A Shares (with sales charge)(2)(3) | | -4.34 | % | | 6.05 | % | | 5.91 | % | | 6.56 | % |

Institutional Shares(3) | | 1.74 | % | | 7.53 | % | | 6.66 | % | | 7.00 | % |

| (1) | Investor, A Shares and Institutional Shares commenced operations on July 9, 1999, July 8, 2005, and May 9, 2012, respectively. |

| (2) | Due to shareholder redemptions on August 21, 2005, net assets of the class were zero from the close of business on that date until September 22, 2005. Financial information presented for the period August 21, 2005 to September 22, 2005 reflects performance of Investor Shares of the Fund. |

| (3) | For Institutional Shares, performance for the 5-year, 10-year and since inception periods are blended average annual returns which include the returns of the Investor Shares prior to commencement of operations of the Institutional Shares. For A Shares, performance for the since inception period is a blended average annual which includes the return of the Investor Shares prior to commencement of operations of the A Shares. |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please visit the website of the Fund's investment adviser at www.auxierasset.com or call (877) 328-9437. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Investor Shares, A Shares and Institutional Shares are 1.27%, 1.56% and 1.36%, respectively. However, the Fund's adviser has contractually agreed to waive a portion of its fees and/or to reimburse expenses to limit total annual fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, dividend expenses on short sales, and extraordinary expenses) to 1.14%, 1.25% and 1.00% for Investor Shares, A Shares and Institutional Shares, respectively through October 31, 2016. Shares redeemed or exchanged within 180 days of purchase will be charged a 2.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

Performance for Investor Shares for periods prior to December 10, 2004, reflects performance and expenses of Auxier Focus Fund, a series of Unified Series Trust (the "Predecessor Fund"). Prior to January 3, 2003, the Predecessor Fund was a series of Ameriprime Funds.

|

AUXIER FOCUS FUND SCHEDULE OF INVESTMENTS JUNE 30, 2016 |

|

| Shares | | Security Description | | Value | |

| Common Stock - 89.7% |

| Communications - 3.3% |

| | 289,525 | | America Movil SAB de CV, ADR | $ | 3,549,577 | |

| | 23,159 | | Cisco Systems, Inc. | | 664,432 | |

| | 1,100 | | eBay, Inc. (a) | | 25,751 | |

| | 249,738 | | Telefonica SA, ADR | | 2,367,516 | |

| | 37,860 | | Twenty-First Century Fox, Inc., Class A | | 1,024,113 | |

| | 11,845 | | Viacom, Inc., Class B | | 491,212 | |

| | | 8,122,601 | |

| Consumer Discretionary - 7.7% |

| | 47,475 | | Apollo Education Group, Inc., Class A (a) | | 432,972 | |

| | 18,000 | | Arcos Dorados Holdings, Inc., Class A (a) | | 85,860 | |

| | 119 | | Charter Communications, Inc., Class A (a) | | 27,208 | |

| | 37,860 | | Comcast Corp., Class A | | 2,468,093 | |

| | 16,020 | | CST Brands, Inc. | | 690,142 | |

| | 9,990 | | CVS Health Corp. | | 956,443 | |

| | 113,377 | | Discovery Communications, Inc., Class A (a) | | 2,860,502 | |

| | 4,641 | | Discovery Communications, Inc., Class C (a) | | 110,688 | |

| | 16,250 | | General Motors Co. | | 459,875 | |

| | 67,162 | | H&R Block, Inc. | | 1,544,726 | |

| | 230,433 | | Lincoln Educational Services Corp. (a) | | 345,649 | |

| | 18,550 | | Lowe's Cos., Inc. | | 1,468,603 | |

| | 7,656 | | McDonald's Corp. | | 921,323 | |

| | 2,100 | | Michael Kors Holdings, Ltd. (a) | | 103,908 | |

| | 1,160 | | Red Robin Gourmet Burgers, Inc. (a) | | 55,019 | |

| | 3,250 | | Sally Beauty Holdings, Inc. (a) | | 95,583 | |

| | 1,176 | | The Andersons, Inc. | | 41,795 | |

| | 4,725 | | The Home Depot, Inc. | | 603,335 | |

| | 12,650 | | Time Warner, Inc. | | 930,281 | |

| | 28,135 | | Vitamin Shoppe, Inc. (a) | | 860,087 | |

| | 50,050 | | Wal-Mart Stores, Inc. | | 3,654,651 | |

| | 7,050 | | Yum! Brands, Inc. | | 584,586 | |

| | | 19,301,329 | |

| Consumer Staples - 25.5% |

| | 62,500 | | Altria Group, Inc. | | 4,310,000 | |

| | 15,100 | | British American Tobacco PLC, ADR | | 1,955,148 | |

| | 5,351 | | Cal-Maine Foods, Inc. | | 237,156 | |

| | 13,200 | | Coca-Cola HBC AG, ADR (a) | | 265,188 | |

| | 48,435 | | ConAgra Foods, Inc. | | 2,315,677 | |

| | 8,785 | | Diageo PLC, ADR | | 991,651 | |

| | 30,050 | | Dr. Pepper Snapple Group, Inc. | | 2,903,732 | |

| | 20,100 | | Kelly Services, Inc., Class A | | 381,297 | |

| | 73,707 | | Molson Coors Brewing Co., Class B | | 7,453,989 | |

| | 12,100 | | Monster Beverage Corp. (a) | | 1,944,591 | |

| | 91,660 | | PepsiCo, Inc. | | 9,710,460 | |

| | 82,520 | | Philip Morris International, Inc. | | 8,393,934 | |

| | 449,921 | | Tesco PLC, ADR (a) | | 3,158,445 | |

| | 64,300 | | The Coca-Cola Co. | | 2,914,719 | |

| | 2,845 | | The JM Smucker Co. | | 433,606 | |

| | 203,368 | | The Kroger Co. | | 7,481,909 | |

| | 32,925 | | The Procter & Gamble Co. | | 2,787,760 | |

| | 109,720 | | The Western Union Co. | | 2,104,430 | |

| | 81,550 | | Unilever NV, ADR | | 3,827,957 | |

| | | 63,571,649 | |

| Energy - 3.4% |

| | 144,810 | | BP PLC, ADR | | 5,142,203 | |

| | 11,130 | | Chevron Corp. | | 1,166,758 | |

| | 15,600 | | ConocoPhillips | | 680,160 | |

| | 7,800 | | Phillips 66 | | 618,852 | |

| | 19,100 | | Valero Energy Corp. | | 974,100 | |

| | | 8,582,073 | |

| Financials - 16.5% |

| | 42,250 | | Aflac, Inc. | | 3,048,760 | |

| | 39,000 | | American International Group, Inc. | | 2,062,710 | |

| | 1,280 | | Ameriprise Financial, Inc. | | 115,008 | |

| | 213,649 | | Bank of America Corp. | | 2,835,122 | |

| | 16,415 | | Berkshire Hathaway, Inc., Class B (a) | | 2,376,728 | |

| | 70,374 | | Central Pacific Financial Corp. | | 1,660,826 | |

| | 23,650 | | Citigroup, Inc. | | 1,002,523 | |

| | 5,616 | | Colliers International Group, Inc. | | 191,730 | |

| | 132,268 | | Credit Suisse Group AG, ADR | | 1,415,268 | |

| | 5,616 | | FirstService Corp. | | 257,381 | |

| | 82,110 | | Franklin Resources, Inc. | | 2,740,011 | |

| | 24,900 | | Legg Mason, Inc. | | 734,301 | |

| | 10,525 | | Marsh & McLennan Cos., Inc. | | 720,541 | |

| | 60,150 | | MasterCard, Inc., Class A | | 5,296,809 | |

| | 1,100 | | PayPal Holdings, Inc. (a) | | 40,161 | |

| | 217,200 | | The Bank of New York Mellon Corp. | | 8,438,220 | |

| | 38,418 | | The Travelers Cos., Inc. | | 4,573,279 | |

| | 7,350 | | U.S. Bancorp | | 296,426 | |

| | 21,849 | | Unum Group | | 694,580 | |

| | 31,600 | | Visa, Inc., Class A | | 2,343,772 | |

| | 23,000 | | Waddell & Reed Financial, Inc., Class A | | 396,060 | |

| | 500 | | Wells Fargo & Co. | | 23,665 | |

| | | 41,263,881 | |

| Health Care - 23.1% |

| | 42,600 | | Abbott Laboratories | | 1,674,606 | |

| | 2,900 | | Alkermes PLC (a) | | 125,338 | |

| | 550 | | Allergan PLC (a) | | 127,100 | |

| | 23,591 | | Anthem, Inc. | | 3,098,442 | |

| | 17,200 | | Becton Dickinson and Co. | | 2,916,948 | |

| | 10,125 | | Biogen, Inc. (a) | | 2,448,428 | |

| | 13,580 | | Community Health Systems, Inc. (a) | | 163,639 | |

| | 47,424 | | Express Scripts Holding Co. (a) | | 3,594,739 | |

| | 525 | | Gilead Sciences, Inc. | | 43,796 | |

| | 44,300 | | GlaxoSmithKline PLC, ADR | | 1,919,962 | |

| | 59,240 | | Johnson & Johnson | | 7,185,812 | |

| | 1,100 | | Laboratory Corp. of America Holdings (a) | | 143,297 | |

| | 95,003 | | Medtronic PLC | | 8,243,410 | |

| | 105,169 | | Merck & Co., Inc. | | 6,058,786 | |

| | 13,582 | | Pfizer, Inc. | | 478,222 | |

| | 50,267 | | Quest Diagnostics, Inc. | | 4,092,236 | |

| | 1,303 | | Shire PLC, ADR | | 239,856 | |

| | 10,280 | | St. Jude Medical, Inc. | | 801,840 | |

| | 60,674 | | UnitedHealth Group, Inc. | | 8,567,169 | |

| | 47,400 | | Zimmer Biomet Holdings, Inc. | | 5,706,012 | |

| | | 57,629,638 | |

| Industrials - 3.3% |

| | 1,400 | | AGCO Corp. | | 65,982 | |

| | 256,341 | | Corning, Inc. | | 5,249,864 | |

| | 12,500 | | Raytheon Co. | | 1,699,375 | |

| | 5,675 | | Textainer Group Holdings, Ltd. | | 63,220 | |

| | 2,550 | | The Boeing Co. | | 331,168 | |

| | 8,515 | | United Parcel Service, Inc., Class B | | 917,236 | |

| | | 8,326,845 | |

| Information Technology - 3.9% |

| | 10,275 | | Intel Corp. | | 337,020 | |

| | 115,147 | | Microsoft Corp. | | 5,892,072 | |

| | 82,320 | | Oracle Corp. | | 3,369,358 | |

| | | 9,598,450 | |

| Materials - 2.7% |

| | 30,715 | | E.I. du Pont de Nemours & Co. | | 1,990,332 | |

See Notes to Financial Statements. | 5 | |

|

AUXIER FOCUS FUND SCHEDULE OF INVESTMENTS JUNE 30, 2016 |

|

| Shares | | Security Description | | Value | |

| | 25,870 | | LyondellBasell Industries NV, Class A | $ | 1,925,245 | |

| | 47,350 | | The Dow Chemical Co. | | 2,353,768 | |

| | 21,675 | | The Mosaic Co. | | 567,452 | |

| | | 6,836,797 | |

| Telecommunications - 0.2% |

| | 7,335 | | Verizon Communications, Inc. | | 409,586 | |

| | | | |

| Transportation - 0.1% |

| | 3,160 | | Union Pacific Corp. | | 275,710 | |

| | | | |

Total Common Stock (Cost $146,573,543) | | 223,918,559 | |

| | Principal | | | | Rate | | Maturity | | Value | |

| Corporate Non-Convertible Bonds - 0.3% |

| Energy - 0.0% |

| $ | 18,000 | | Devon Energy Corp. | | 2.25 | % | 12/15/18 | | 17,884 | |

| | | | |

| Financials - 0.3% |

| | 290,000 | | Bank of America Corp. (b) | | 8.00 | | 12/29/49 | | 288,550 | |

| | 500,000 | | Bank of America Corp., Series M (b) | | 8.13 | | 11/15/49 | | 501,875 | |

| | | 790,425 | |

Total Corporate Non-Convertible Bonds (Cost $801,594) | | 808,309 | |

Total Investments - 90.0% (Cost $147,375,137)* | $ | 224,726,868 | |

| Other Assets & Liabilities, Net – 10.0% | | 24,861,017 | |

| Net Assets – 100.0% | $ | 249,587,885 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| (a) | Non-income producing security. |

| (b) | Variable rate security. Rate presented is as of June 30, 2016. |

* Cost for federal income tax purposes is $147,393,109 and net unrealized appreciation consists of:

| Gross Unrealized Appreciation | | $ | 92,477,704 | |

| Gross Unrealized Depreciation | | | (15,143,945 | ) |

| Net Unrealized Appreciation | | $ | 77,333,759 | |

The following is a summary of the inputs used to value the Fund's investments as of June 30, 2016.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Investments At Value |

| Common Stock | | | | | | | | | | | | | | | | |

| Communications | | $ | 8,122,601 | | | $ | - | | | $ | - | | | $ | 8,122,601 | |

| Consumer Discretionary | | | 19,301,329 | | | | - | | | | - | | | | 19,301,329 | |

| Consumer Staples | | | 63,571,649 | | | | - | | | | - | | | | 63,571,649 | |

| Energy | | | 8,582,073 | | | | - | | | | - | | | | 8,582,073 | |

| Financials | | | 41,263,881 | | | | - | | | | - | | | | 41,263,881 | |

| Health Care | | | 57,629,638 | | | | - | | | | - | | | | 57,629,638 | |

| Industrials | | | 8,326,845 | | | | - | | | | - | | | | 8,326,845 | |

| Information Technology | | | 9,598,450 | | | | - | | | | - | | | | 9,598,450 | |

| Materials | | | 6,836,797 | | | | - | | | | - | | | | 6,836,797 | |

| Telecommunications | | | 409,586 | | | | - | | | | - | | | | 409,586 | |

| Transportation | | | 275,710 | | | | - | | | | - | | | | 275,710 | |

| Corporate Non-Convertible Bonds | | | - | | | | 808,309 | | | | - | | | | 808,309 | |

| Total Investments At Value | | $ | 223,918,559 | | | $ | 808,309 | | | $ | - | | | $ | 224,726,868 | |

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended June 30, 2016.

| PORTFOLIO HOLDINGS | | |

| % of Net Assets | | |

| Common Stock | 89.7 | % |

| Corporate Non-Convertible Bonds | 0.3 | % |

| Cash and Other Net Assets | 10.0 | % |

| | 100.0 | % |

See Notes to Financial Statements. | 7 | |

|

AUXIER FOCUS FUND STATEMENT OF OPERATIONS YEAR ENDED JUNE 30, 2016 |

|

| INVESTMENT INCOME | | | | | | |

| | Dividend income (Net of foreign withholding taxes of $55,372) | | | $ | 5,628,697 | | |

| | Interest income | | | 47,710 | | |

| Total Investment Income | | | | 5,676,407 | | |

| | | | | | | |

| EXPENSES | | | | | | |

| | Investment adviser fees | | | 2,535,612 | | |

| | Fund services fees | | | 330,763 | | |

| | Transfer agent fees: | | | | | |

| | Investor Shares | | | 72,083 | | |

| | A Shares | | | 1,516 | | |

| | Institutional Shares | | | 420 | | |

| | Distribution fees: | | | | | |

| | A Shares | | | 9,626 | | |

| | Custodian fees | | | 25,706 | | |

| | Registration fees: | | | | | |

| | Investor Shares | | | 20,308 | | |

| | A Shares | | | 4,055 | | |

| | Institutional Shares | | | 13,109 | | |

| | Professional fees | | | 43,222 | | |

| | Trustees' fees and expenses | | | 18,115 | | |

| | Miscellaneous expenses | | | 233,763 | | |

| Total Expenses | | | | 3,308,298 | | |

| | Fees waived and expenses reimbursed | | | (463,564 | ) | |

| Net Expenses | | | | 2,844,734 | | |

| | | | | | | | |

| NET INVESTMENT INCOME | | | | 2,831,673 | | |

| | | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | | |

| | Net realized gain on investments | | | 9,730,243 | | |

| | Net change in unrealized appreciation (depreciation) on investments | | | (8,819,697 | ) | |

| NET REALIZED AND UNREALIZED GAIN | | | | 910,546 | | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $ | 3,742,219 | | |

| | | | | | | | |

See Notes to Financial Statements. | 8 | |

|

AUXIER FOCUS FUND STATEMENTS OF CHANGES IN NET ASSETS |

|

| | | | | For the Year Ended June 30, 2016 | | For the Year Ended June 30, 2015 | |

| OPERATIONS | | | | | | Shares | | | | | | | Shares | | |

| | Net investment income | | $ | 2,831,673 | | | | | | $ | 2,442,638 | | | | | |

| | Net realized gain | | | 9,730,243 | | | | | | | 7,121,019 | | | | | |

| | Net change in unrealized appreciation (depreciation) | | | (8,819,697 | ) | | | | | | (1,503,747 | ) | | | | |

| Increase in Net Assets Resulting from Operations | | | 3,742,219 | | | | | | | 8,059,910 | | | | | |

| | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | |

| | Net investment income: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | (2,248,905 | ) | | | | | | (2,637,509 | ) | | | | |

| | | A Shares | | | (22,824 | ) | | | | | | (39,538 | ) | | | | |

| | | Institutional Shares | | | (385,094 | ) | | | | | | (70,657 | ) | | | | |

| | Net realized gain: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | (9,632,084 | ) | | | | | | (7,849,090 | ) | | | | |

| | | A Shares | | | (170,302 | ) | | | | | | (148,394 | ) | | | | |

| | | Institutional Shares | | | (1,612,577 | ) | | | | | | (238,876 | ) | | | | |

| Total Distributions to Shareholders | | | (14,071,786 | ) | | | | | | (10,984,064 | ) | | | | |

| | | | | | | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | | | | | | | |

| | Sale of shares: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | 20,810,841 | | | 1,061,055 | | | | 26,562,823 | | | 1,276,816 | | |

| | | A Shares | | | 11,861 | | | 568 | | | | 873,139 | | | 41,598 | | |

| | | Institutional Shares | | | 13,491,947 | | | 684,197 | | | | 21,941,682 | | | 1,039,287 | | |

| | Reinvestment of distributions: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | 11,337,657 | | | 585,561 | | | | 10,140,585 | | | 499,068 | | |

| | | A Shares | | | 172,938 | | | 8,861 | | | | 177,386 | | | 8,692 | | |

| | | Institutional Shares | | | 1,964,718 | | | 100,186 | | | | 309,533 | | | 15,098 | | |

| | Redemption of shares: | | | | | | | | | | | | | | | |

| | | Investor Shares | | | (50,933,072 | ) | | (2,604,822 | ) | | | (87,469,825 | ) | | (4,198,398 | ) | |

| | | A Shares | | | (2,827,075 | ) | | (142,309 | ) | | | (564,363 | ) | | (26,856 | ) | |

| | | Institutional Shares | | | (941,455 | ) | | (47,755 | ) | | | (443,719 | ) | | (21,158 | ) | |

| | Redemption fees | | | 11,282 | | | - | | | | 11,230 | | | - | | |

| Decrease in Net Assets from Capital Share Transactions | | | (6,900,358 | ) | | (354,458 | ) | | | (28,461,529 | ) | | (1,365,853 | ) | |

| Decrease in Net Assets | | | (17,229,925 | ) | | | | | | (31,385,683 | ) | | | | |

| | | | | | | | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | | | | | | | |

| | Beginning of Year | | | 266,817,810 | | | | | | | 298,203,493 | | | | | |

| | End of Year (Including line (a)) | | $ | 249,587,885 | | | | | | $ | 266,817,810 | | | | | |

| (a) | Undistributed net investment income | | $ | 1,407,648 | | | | | | $ | 1,232,798 | | | | | |

See Notes to Financial Statements. | 9 | |

|

AUXIER FOCUS FUND FINANCIAL HIGHLIGHTS |

|

These financial highlights reflect selected data for a share outstanding throughout each year. | | | | | | |

| | | For the Year Ended June 30, | |

| INVESTOR SHARES | | 2016 | | | | 2015 | | | | 2014 | | | | 2013 | | | | 2012 | | |

| NET ASSET VALUE, Beginning of Year | $ | 20.50 | | | $ | 20.75 | | | $ | 18.59 | | | $ | 16.49 | | | $ | 16.45 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | 0.21 | | | | 0.17 | | | | 0.20 | | | | 0.21 | | | | 0.22 | | |

| Net realized and unrealized gain | | 0.08 | | | | 0.38 | | | | 2.63 | | | | 2.23 | | | | 0.20 | (b) |

| Total from Investment Operations | | 0.29 | | | | 0.55 | | | | 2.83 | | | | 2.44 | | | | 0.42 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.20 | ) | | | (0.20 | ) | | | (0.22 | ) | | | (0.22 | ) | | | (0.16 | ) | |

| Net realized gain | | (0.90 | ) | | | (0.60 | ) | | | (0.45 | ) | | | (0.12 | ) | | | (0.23 | ) | |

| Total Distributions to Shareholders | | (1.10 | ) | | | (0.80 | ) | | | (0.67 | ) | | | (0.34 | ) | | | (0.39 | ) | |

| REDEMPTION FEES (a) | | — | (c) | | — | (c) | | — | (c) | | — | (c) | | 0.01 | | |

| NET ASSET VALUE, End of Year | $ | 19.69 | | | $ | 20.50 | | | $ | 20.75 | | | $ | 18.59 | | | $ | 16.49 | | |

| TOTAL RETURN | | 1.58 | % | | 2.69 | % | | 15.43 | % | | 15.06 | % | | 2.84 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $203,921 | | | $231,911 | | | $285,094 | | | $277,536 | | | $243,366 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 1.10 | % | | 0.83 | % | | 1.00 | % | | 1.22 | % | | 1.36 | % |

| Net expenses | | 1.14 | % | | 1.24 | % | | 1.24 | % | | 1.25 | % | | 1.25 | % |

| Gross expenses (d) | | 1.30 | % | | 1.27 | % | | 1.26 | % | | 1.28 | % | | 1.27 | % |

| PORTFOLIO TURNOVER RATE | | 6 | % | | 4 | % | | 9 | % | | 11 | % | | 8 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | The net realized and unrealized gain (loss) per share does not correlate to the aggregate of the net realized and unrealized loss in the Statement of Operations for the year ended June 30, 2012, primarily due to the timing of the sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (c) | Less than $0.01 per share. |

| (d) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. | 10 | |

|

AUXIER FOCUS FUND FINANCIAL HIGHLIGHTS |

|

These financial highlights reflect selected data for a share outstanding throughout each year. | | | | | | |

| | | For the Year Ended June 30, | |

| A SHARES | | 2016 | | | | 2015 | | | | 2014 | | | | 2013 | | | | 2012 | | |

| NET ASSET VALUE, Beginning of Year | $ | 20.64 | | | $ | 20.85 | | | $ | 18.63 | | | $ | 16.49 | | | $ | 16.45 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | 0.19 | | | | 0.18 | | | | 0.20 | | | | 0.21 | | | | 0.22 | | |

| Net realized and unrealized gain | | 0.09 | | | | 0.36 | | | | 2.64 | | | | 2.24 | | | | 0.21 | (b) |

| Total from Investment Operations | | 0.28 | | | | 0.54 | | | | 2.84 | | | | 2.45 | | | | 0.43 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.12 | ) | | | (0.15 | ) | | | (0.17 | ) | | | (0.19 | ) | | | (0.16 | ) | |

| Net realized gain | | (0.90 | ) | | | (0.60 | ) | | | (0.45 | ) | | | (0.12 | ) | | | (0.23 | ) | |

| Total Distributions to Shareholders | | (1.02 | ) | | | (0.75 | ) | | | (0.62 | ) | | | (0.31 | ) | | | (0.39 | ) | |

| REDEMPTION FEES (a) | | — | (c) | | — | (c) | | — | (c) | | — | (c) | | — | (c) |

| NET ASSET VALUE, End of Year | $ | 19.90 | | | $ | 20.64 | | | $ | 20.85 | | | $ | 18.63 | | | $ | 16.49 | | |

| TOTAL RETURN (d) | | 1.49 | % | | 2.63 | % | | 15.45 | % | | 15.06 | % | | 2.84 | % |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (000's omitted) | $2,698 | | | $5,541 | | | $5,108 | | | $2,158 | | | $1,694 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 0.94 | % | | 0.84 | % | | 1.02 | % | | 1.22 | % | | 1.39 | % |

| Net expenses | | 1.25 | % | | 1.25 | % | | 1.25 | % | | 1.25 | % | | 1.25 | % |

| Gross expenses (e) | | 1.61 | % | | 1.56 | % | | 1.62 | % | | 1.62 | % | | 1.52 | % |

| PORTFOLIO TURNOVER RATE | | 6 | % | | 4 | % | | 9 | % | | 11 | % | | 8 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | The net realized and unrealized gain (loss) per share does not correlate to the aggregate of the net realized and unrealized loss in the Statement of Operations for the year ended June 30, 2012, primarily due to the timing of the sales and repurchases of the Fund's shares in relation to fluctuating market values for the Fund's portfolio. |

| (c) | Less than $0.01 per share. |

| (d) | Total Return does not include the effect of front end sales charge or contingent deferred sales charge. |

| (e) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. | 11 | |

|

AUXIER FOCUS FUND FINANCIAL HIGHLIGHTS |

|

These financial highlights reflect selected data for a share outstanding throughout each period. | | | | | | |

| | | For the Year Ended June 30, | | May 9, 2012 (a) through | |

| INSTITUTIONAL SHARES | | 2016 | | | | 2015 | | | | 2014 | | | | 2013 | | | June 30, 2012 | |

| NET ASSET VALUE, Beginning of Period | $ | 20.74 | | | $ | 20.91 | | | $ | 18.66 | | | $ | 16.50 | | | $ | 16.27 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (b) | | 0.25 | | | | 0.24 | | | | 0.25 | | | | 0.26 | | | | 0.04 | | |

| Net realized and unrealized gain | | 0.08 | | | | 0.36 | | | | 2.64 | | | | 2.22 | | | | 0.19 | | |

| Total from Investment Operations | | 0.33 | | | | 0.60 | | | | 2.89 | | | | 2.48 | | | | 0.23 | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM | | | | | | | | | | | | | | | | | | |

| Net investment income | | (0.21 | ) | | | (0.17 | ) | | | (0.19 | ) | | | (0.20 | ) | | | — | | |

| Net realized gain | | (0.90 | ) | | | (0.60 | ) | | | (0.45 | ) | | | (0.12 | ) | | | — | | |

| Total Distributions to Shareholders | | (1.11 | ) | | | (0.77 | ) | | | (0.64 | ) | | | (0.32 | ) | | | — | | |

| REDEMPTION FEES (b) | | — | (c) | | | — | (c) | | — | (c) | | — | (c) | | — | (c) |

| NET ASSET VALUE, End of Period | $ | 19.96 | | | $ | 20.74 | | | $ | 20.91 | | | $ | 18.66 | | | $ | 16.50 | | |

| TOTAL RETURN | | 1.74 | % | | 2.93 | % | | 15.73 | % | | 15.28 | % | | 1.41 | %(d) |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Period (000's omitted) | $42,969 | | | $29,366 | | | $8,001 | | | $5,313 | | | $1,230 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | 1.27 | % | | 1.13 | % | | 1.25 | % | | 1.48 | % | | 1.62 | %(e) |

| Net expenses | | 1.00 | % | | 1.00 | % | | 1.00 | % | | 1.00 | % | | 1.10 | %(e) |

| Gross expenses (f) | | 1.31 | % | | 1.36 | % | | 1.47 | % | | 1.55 | % | | 1.50 | %(e) |

| PORTFOLIO TURNOVER RATE | | 6 | % | | 4 | % | | 9 | % | | 11 | % | | 8 | %(d) |

| | | | | | | | | | | | | | | | | | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during each period. |

| (c) | Less than $0.01 per share. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. | 12 | |

|

AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2016 |

|

Note 1. Organization

The Auxier Focus Fund (the "Fund") is a diversified portfolio of Forum Funds (the "Trust"). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the "Act"). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of the Fund's shares of beneficial interest without par value.

The Fund currently offers three classes of shares: Investor Shares, A Shares and Institutional Shares. A Shares are offered at net asset value plus a maximum sales charge of 5.75%. A Shares are also subject to contingent deferred sales charge ("CDSC") of 1.00% on purchases without an initial sales charge and redeemed less than one year after they are purchased. Investor Shares and Institutional Shares are not subject to a sales charge. Investor Shares, A Shares and Institutional Shares commenced operations on July 9, 1999, July 8, 2005 and May 9, 2012, respectively. The Fund's investment objective is to provide long-term capital appreciation.

Note 2. Summary of Significant Accounting Policies

These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of the Fund:

Security Valuation – Exchange-traded securities and over-the-counter securities are valued using the last quoted trade or official closing price, provided by independent pricing services as of the close of trading on the market or exchange for which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and ask price provided by independent pricing services. Non-exchange-traded securities for which quotations are available are valued using the last quoted sales price, or in the absence of a sale, at the mean of the last bid and ask prices provided by independent pricing services. Debt securities may be valued at prices supplied by a fund's pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics such as rating, interest rate and maturity. Shares of open-end mutual funds are valued at net asset value ("NAV"). Short-term investments that mature in 60 days or less may be valued at amortized cost.

The Fund values its investments at fair value pursuant to procedures adopted by the Trust's Board of Trustees (the "Board") if (1) market quotations are insufficient or not readily available or (2) the Adviser, as defined in Note 4, believes that the values available are unreliable. The Trust's Valuation Committee, as defined in the Fund's registration statement, performs certain functions as they relate to the administration and oversight of the Fund's valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad-hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the Adviser to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics which may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Adviser inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security's market price and may not be the price at which the asset may be sold. Fair valuation could result in a different Net Asset Value ("NAV") than a NAV determined by using market quotes.

The Fund has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various "inputs" used to determine the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1 — quoted prices in active markets for identical assets and liabilities

Level 2 — other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The aggregate value by input level, as of June 30, 2016, for the Fund's investments is included at the end of the Fund's Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Foreign Currency Translations – Foreign currency amounts are translated into U.S. dollars as follows: (1) assets and liabilities at the rate of exchange at the end of the respective period; and (2) purchases and sales of securities and income and expenses at the rate of exchange prevailing on the dates of such transactions. The portion of the results of operations arising from changes in the exchange rates and the portion due to fluctuations arising from changes in the market prices of securities are not isolated. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Distributions to Shareholders – Distributions to shareholders of net investment income and net capital gains, if any, are declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund.

Federal Taxes – The Fund intends to continue to qualify each year as a regulated investment company under Subchapter M of Chapter 1, Subtitle A, of the Internal Revenue Code of 1986, as amended ("Code"), and to distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all of its net investment income and capital gains, if any, the Fund will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required. The Fund files a U.S. federal income and excise tax return as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of June 30, 2016, there are no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

The Fund's class-specific expenses are charged to the operations of that class of shares. Income and expenses (other than expenses attributable to a specific class) and realized and unrealized gains or losses on investments are allocated to each class of shares based on the class' respective net assets to the total net assets of the Fund.

Redemption Fees – A shareholder who redeems shares within 180 days of purchase will incur a redemption fee of 2.00% of the current net asset value of shares redeemed, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to the Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. The Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee.

|

AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2016 |

|

Commitments and Contingencies – In the normal course of business, the Fund enters into contracts that provide general indemnifications by the Fund to the counterparty to the contract. The Fund's maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 3. Cash – Concentration in Uninsured Account

For cash management purposes the Fund may concentrate cash with the Fund's custodian. This typically results in cash balances exceeding the Federal Deposit Insurance Corporation ("FDIC") insurance limits. As of June 30, 2016, the Fund held $24,381,851 as cash reserves at MUFG Union Bank, N.A. that exceeded the FDIC insurance limit.

Note 4. Fees and Expenses

Investment Adviser – Auxier Asset Management LLC (the "Adviser"), is the investment adviser to the Fund. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee from the Fund at an annual rate of 1.00% of the Fund's average daily assets.

Distribution – Foreside Fund Services, LLC serves as the Fund's distributor (the "Distributor"). The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) ("Atlantic") or their affiliates. The Fund has adopted a Distribution Plan (the "Plan") for A Shares of the Fund in accordance with Rule 12b-1 of the Act. Under the Plan, the Fund pays the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of the average daily net assets of A Shares. The Distributor has no role in determining the investment policies or which securities are to be purchased or sold by the Trust or its Funds.

For the year ended June 30, 2016, there were $724 in front-end sales charges assessed on the sale of A Shares and no contingent deferred sales charges were assessed on the sale of A Shares. The Distributor received $94 of the total front-end sales charges. Such amounts are set aside by the Distributor and used solely for distribution-related expenses.

Other Service Providers – Atlantic provides fund accounting, fund administration, compliance and transfer agency services to the Fund. Atlantic also provides certain shareholder report production and EDGAR conversion and filing services. Atlantic provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer and an Anti-Money Laundering Officer to the Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each independent Trustee an annual retainer fee of $50,000 for service to the Trust ($66,000 for the Chairman). The Audit Committee Chairman and Vice Chairman receive an additional $6,000 annually. The Trustees and Chairman may receive additional fees for special Board meetings. Each Trustee is also reimbursed for all reasonable out-of-pocket expenses incurred in connection with his duties as a Trustee, including travel and related expenses incurred in attending Board meetings. The amount of Trustees' fees attributable to the Fund is disclosed in the Statement of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from the Fund.

Note 5. Expense Reimbursements and Fees Waived

The Adviser has contractually agreed to waive a portion of its fees and reimburse expenses through October 31, 2016, to the extent necessary to maintain the total operating expenses (excluding all taxes, interest, portfolio transaction expenses, dividend expenses on short sales, and extraordinary expenses) at 1.14%, 1.25% and 1.00% of average daily net assets of the Investor Shares, A Shares and Institutional Shares respectively. These contractual waivers may only be raised or eliminated with consent of the Board. Other fund service providers have voluntarily agreed to waive a portion of their fees. These voluntary reductions may be reduced or eliminated at any time. For the year ended June 30, 2016, fees waived and expenses reimbursed were as follows:

|

AUXIER FOCUS FUND NOTES TO FINANCIAL STATEMENTS JUNE 30, 2016 |

|

| Investment Adviser Fees Waived | | Investment Adviser Expenses Reimbursed | | Other Waivers | | Total Fees Waived |

| $ | 336,700 | $ | 61,613 | | $ | 65,251 | | $ | 463,564 |

| | | | | | | | | | |

Note 6. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments during the year ended June 30, 2016, were $13,930,062 and $31,225,987, respectively.

Note 7. Federal Income Tax

Distributions paid during the fiscal years ended as noted were characterized for tax purposes as follows:

| Ordinary Income | | $ | 2,683,607 | | $ | 2,785,128 |

| Long-Term Capital Gain | | | 11,388,179 | | | 8,198,936 |

| | | $ | 14,071,786 | | $ | 10,984,064 |

As of June 30, 2016, distributable earnings (accumulated loss) on a tax basis were as follows:

| Undistributed Ordinary Income | | $ | 1,794,306 | |

| Undistributed Long-Term Gain | | | 2,895,797 | |

| Unrealized Appreciation | | | 77,333,759 | |

| Total | | $ | 82,023,862 | |

The difference between components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales.

Note 8. Subsequent Events

Subsequent events occurring after the date of this report through the date these financial statements were issued have been evaluated for potential impact, and the Fund has had no such events.

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund's portfolio is available, without charge and upon request, by calling (877) 328-9437, on the Fund's website at www.auxierasset.com and on the U.S. Securities and Exchange Commission's (the "SEC") website at www.sec.gov. The Fund's proxy voting record for the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling (877) 328-9437 and on the SEC's website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. These filings are available, without charge and upon request on the SEC's website at www.sec.gov or may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees, and CDSC fees, and (2) ongoing costs, including management fees, 12b-1 fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2016, through June 30, 2016.

Actual Expenses – The first line under each share class of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes – The second line under each share class of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments on certain classes, redemption fees, exchange fees, and CDSC fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | January 1, 2016 | | June 30, 2016 | | Period* | | Ratio* |

| Investor Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,025.51 | | $ | 5.74 | | 1.14 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,019.19 | | $ | 5.72 | | 1.14 | % |

| A Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,024.71 | | $ | 6.29 | | 1.25 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,018.65 | | $ | 6.27 | | 1.25 | % |

|

AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2016 |

|

| | Beginning | | Ending | | Expenses | | Annualized |

| | Account Value | | Account Value | | Paid During | | Expense |

| | January 1, 2016 | | June 30, 2016 | | Period* | | Ratio* |

| Institutional Shares | | | | | | | | | | | |

| Actual | $ | 1,000.00 | | $ | 1,026.22 | | $ | 5.04 | | 1.00 | % |

| Hypothetical (5% return before taxes) | $ | 1,000.00 | | $ | 1,019.89 | | $ | 5.02 | | 1.00 | % |

| | | | | | | | | | | | |

| * | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by 366 to reflect the half-year period. |

Federal Tax Status of Dividends Declared during the Fiscal Year

For federal income tax purposes, dividends from short-term capital gains are classified as ordinary income. The Fund designates 100.00% of its income dividend distributed as qualifying for the corporate dividends-received deduction (DRD) and 100.00% for the qualified dividend rate (QDI) as defined in Section 1(h)(11) of the Internal Revenue Code. The Fund also designates 0.55% of its income dividends as qualified interest income exempt from U.S. tax for foreign shareholders (QII) and 1.00% of its income dividends as qualified short-term gain exempt from U.S. tax for foreign shareholders (QSD).

Trustees and Officers of the Trust

The Board is responsible for oversight of the management of the Trust's business affairs and of the exercise of all the Trust's powers except those reserved for the shareholders. The following table provides information about each Trustee and certain officers of the Trust. Each Trustee and officer holds office until the person resigns, is removed, or is replaced. Unless otherwise noted, the persons have held their principal occupations for more than five years. The address for all Trustees and officers is Three Canal Plaza, Suite 600, Portland, Maine 04101. Mr. Keffer is considered an Interested Trustee due to his affiliation with Atlantic. The Fund's Statement of Additional Information includes additional information about the Trustees and is available, without charge and upon request, by calling (877) 328-9437.

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Series of Fund Complex¹ Overseen by Trustee | Other Directorships Held by Trustee |

| Independent Trustees | | | | | |

J. Michael Parish Born: 1943 | Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee | Since 1989 (Chairman since 2004) | Retired since 2003; formerly, Partner, Wolf, Block, Schorr and Solis-Cohen, LLP (law firm) 2002-2003; Partner, Thelen Reid & Priest LLP (law firm) 1995-2002. | 24 | None |

Costas Azariadis Born: 1943 | Trustee | Since 1989 | Professor of Economics, Washington University since 2006. | 24 | None |

James C. Cheng Born: 1942 | Trustee; Chairman, Audit Committee | Since 1989 | President, Technology Marketing Associates (marketing company for small- and medium-sized businesses in New England) since 1991. | 24 | None |

David Tucker Born: 1958 | Trustee; Vice Chairman | Since 2011 (Vice Chairman since 2015) | Director, Blue Sky Experience (a charitable endeavor) since 2008; Senior Vice President & General Counsel, American Century Companies (an investment management firm) 1998-2008. | 46 | Trustee, Forum Funds II, Forum ETF Trust and U.S. Global Investors Funds |

1The Fund Complex includes the Trust, Forum Funds II, Forum ETF Trust and U.S. Global Investors Funds and is overseen by different Boards of Trustees. |

|

AUXIER FOCUS FUND ADDITIONAL INFORMATION (Unaudited) JUNE 30, 2016 |

|

| Name and Year of Birth | Position with the Trust | Length of Time Served | Principal Occupation(s) During Past Five Years | Number of Series of Fund Complex¹ Overseen by Trustee | Other Directorships Held by Trustee |

| Interested Trustee | | | | | |

John Y. Keffer2 Born: 1942 | Trustee; Vice Chairman | Since 1989 | Chairman, Atlantic since 2008; President, Forum Investment Advisors, LLC since 2011; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company chartered in the State of Maine) since 1997. | 46 | Director, Wintergreen Fund, Inc.; Trustee, Forum Funds II, Forum ETF Trust and U.S. Global Investors Funds |

| Officers | | | | | |

Jessica Chase Born: 1970 | President; Principal Executive Officer | Since 2015 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Karen Shaw Born: 1972 | Treasurer; Principal Financial Officer | Since 2008 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Zachary Tackett Born: 1988 | Vice President; Secretary; Anti-Money Laundering Compliance Officer | Since 2014 | Associate Counsel, Atlantic since 2014; Intern Associate, Coakley & Hyde, PLLC, 2010-2013. | N/A | N/A |

Michael J. McKeen Born: 1971 | Vice President | Since 2009 | Senior Vice President, Atlantic since 2008. | N/A | N/A |

Timothy Bowden Born: 1969 | Vice President | Since 2009 | Manager, Atlantic since 2008. | N/A | N/A |

Geoffrey Ney Born: 1975 | Vice President | Since 2013 | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. | N/A | N/A |

Todd Proulx Born: 1978 | Vice President | Since 2013 | Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013. | N/A | N/A |

1The Fund Complex includes the Trust, Forum Funds II, Forum ETF Trust and U.S. Global Investors Funds and is overseen by different Boards of Trustees. 2Atlantic is a subsidiary of Forum Holdings Corp. I, a Delaware corporation that is wholly owned by Mr. Keffer. |

Auxier Focus Fund

FOR MORE INFORMATION

P.O. Box 588

Portland, Maine 04112

(877) 3AUXIER

(877) 328-9437

INVESTMENT ADVISER

Auxier Asset Management LLC

5285 Meadows Road

Suite 333

Lake Oswego, Oregon 97035

TRANSFER AGENT

Atlantic Fund Services

P.O. Box 588

Portland, Maine 04112

www.atlanticfundservices.com

DISTRIBUTOR

Foreside Fund Services, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

www.foreside.com

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for

distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes

information regarding the Fund's risks, objectives, fees and expenses, experience of its management, and other

information.

204-ANR-0616

|

DF DENT GROWTH FUNDS TABLE OF CONTENTS JUNE 30, 2016 |

| |

DF DENT PREMIER GROWTH FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) JUNE 30, 2016 |

Dear Fellow Shareholder,

Performance for the three DF Dent Growth Funds "(Funds") is detailed in the below table.

Performance (for periods ending 06/30/2016)

| | | DF Dent Premier Growth | | DF Dent Midcap Growth | | DF Dent Small Cap Growth |

| Benchmark | | S&P 500 | | Russell Midcap Growth | | Russell 2000 Growth |

| 6 Months | | | | | | | | | | | | |

| Fund | | - | 0.85 | % | | + | 2.81 | % | | + | 7.99 | % |

| Benchmark | | + | 3.84 | % | | + | 2.15 | % | | - | 1.59 | % |

| Fund vs Benchmark | | - | 4.69 | % | | + | 0.66 | % | | + | 9.58 | % |

| | | | | | | | | | | | | |

| 12 Months | | | | | | | | | | | | |

| Fund | | - | 2.06 | % | | - | 2.49 | % | | - | 5.06 | % |

| Benchmark | | + | 3.99 | % | | - | 2.14 | % | | - | 10.75 | % |

| Fund vs Benchmark | | - | 6.05 | % | | - | 0.35 | % | | + | 5.69 | % |

| | | | | | | | | | | | | |

| 5 Years | | | | | | | | | | | | |

| Fund | | + | 9.52 | %* | | | N/A | | | | N/A | |

| Benchmark | | + | 12.10 | %* | | | N/A | | | | N/A | |

| Fund vs Benchmark | | - | 2.58 | %* | | | N/A | | | | N/A | |

| | | | | | | | | | | | | |

| Cumulative 5 Years | | | | | | | | | | | | |

| Fund | | + | 57.59 | % | | | N/A | | | | N/A | |

| Benchmark | | + | 77.02 | % | | | N/A | | | | N/A | |

| Fund vs Benchmark | | - | 19.43 | % | | | N/A | | | | N/A | |

| | | | | | | | | | | | | |

| 10 Years | | | | | | | | | | | | |

| Fund | | + | 6.80 | %* | | | N/A | | | | N/A | |

| Benchmark | | + | 7.42 | %* | | | N/A | | | | N/A | |

| Fund vs Benchmark | | - | 0.62 | %* | | | N/A | | | | N/A | |

| | | | | | | | | | | | | |

| Cumulative 10 Years | | | | | | | | | | | | |

| Fund | | + | 93.07 | % | | | N/A | | | | N/A | |

| Benchmark | | + | 104.65 | % | | | N/A | | | | N/A | |

| Fund vs Benchmark | | - | 11.58 | % | | | N/A | | | | N/A | |

| | | | | | | | | | | | | |

| Since Inception | | | | | | | | | | | | |

| Fund | | + | 7.47 | %* | | + | 11.39 | %* | | + | 6.09 | %* |

| Benchmark | | + | 5.90 | %* | | + | 9.64 | %* | | + | 3.47 | %* |

| Fund vs Benchmark | | + | 1.57 | %* | | + | 1.75 | %* | | + | 2.62 | %* |

| * annualized | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Cumulative Since Inception | | | | | | | | | | | | |

| Fund | | + | 193.71 | % | | + | 71.52 | % | | + | 17.04 | % |

| Benchmark | | + | 135.53 | % | | + | 58.43 | % | | + | 9.49 | % |

| Fund vs Benchmark | | + | 58.18 | % | | + | 13.09 | % | | + | 7.55 | % |

| Inception Date | | 07/16/2001 | | 07/01/2011 | | 11/01/2013 |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. For the

DF DENT PREMIER GROWTH FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) JUNE 30, 2016 |

most recent month-end performance, please call (866) 233-3368. As stated in the current prospectus, the DF Dent Premier Growth Fund's and DF Dent Midcap Growth Fund's annual operating expense ratios (gross) are 1.20% and 1.84%, respectively. However, D.F. Dent and Company, Inc., the Funds' investment adviser ("Adviser"), has contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expenses to 1.10% on the first $150 million in Fund net assets and to 0.90% on net assets exceeding $150 million. This agreement is in effect through October 31, 2019. As stated in the current prospectus, the DF Dent Small Cap Growth Fund's annual operating expense ratio (gross) is 5.16%. However, the Adviser has contractually agreed to waive a portion of its fees and/or reimburse certain expenses to limit total operating expense to 1.25% through October 31, 2019. These expense caps may be changed or eliminated prior to their expiration date only with the consent of the Board of Trustees. Both the DF Dent Midcap Growth Fund and DF Dent Small Cap Growth Fund charge a 2.00% redemption fee on shares redeemed within 60 days of purchase. Fund performance returns shown do not reflect fees; if reflected, the returns would have been lower. Returns greater than one year are annualized.

The DF Dent Premier Growth Fund's ( the "Fund" ) return for the fiscal year ending 06/30/2016 of -2.06% trailed the S&P 500's (the "Index") return of +3.99% by 6.05%. As a category, growth funds experienced negative returns on average during this period as reported by Arthur Lipper versus our Funds in the below comparison:

Clearly, each of our three mutual funds performed well within its Lipper peer group for the past 12 months. However, our Premier Growth Fund significantly underperformed its benchmark, our Mid-Cap Growth Fund slightly underperformed its benchmark, and our Small-Cap Growth Fund significantly outperformed its benchmark. The dispersion of results seems unusual.

How do we explain these results?

We believe the answer lies within the 2016 Investment Company Institute (ICI) Fact Book:

"Funds Indexed to the S&P 500 held 31 percent of Index Mutual Fund Assets"

The 2016 ICI Fact book goes on to state that "Index-based domestic equity ETFs (exchange traded funds) have grown particularly quickly - attracting almost twice the flows of index domestic equity funds." According to the ICI Fact Book indexing constitutes $2.2 trillion of US equity mutual funds and 94% of the $2.1 trillion of US ETFs. Flows into both these categories accelerated in 2015. While domestic equity mutual funds have experienced net outflows for 10 consecutive years, domestic index funds have experienced net inflows for 10 consecutive years. At the same time, ETFs have experienced a net inflow of $1.6 trillion, which has been almost entirely indexed. On a consolidated basis, mutual funds and ETFs have experienced massive positive flows of capital (now exceeding $4 trillion) with a very large portion going into the Index. In an article in the

DF DENT PREMIER GROWTH FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) JUNE 30, 2016 |

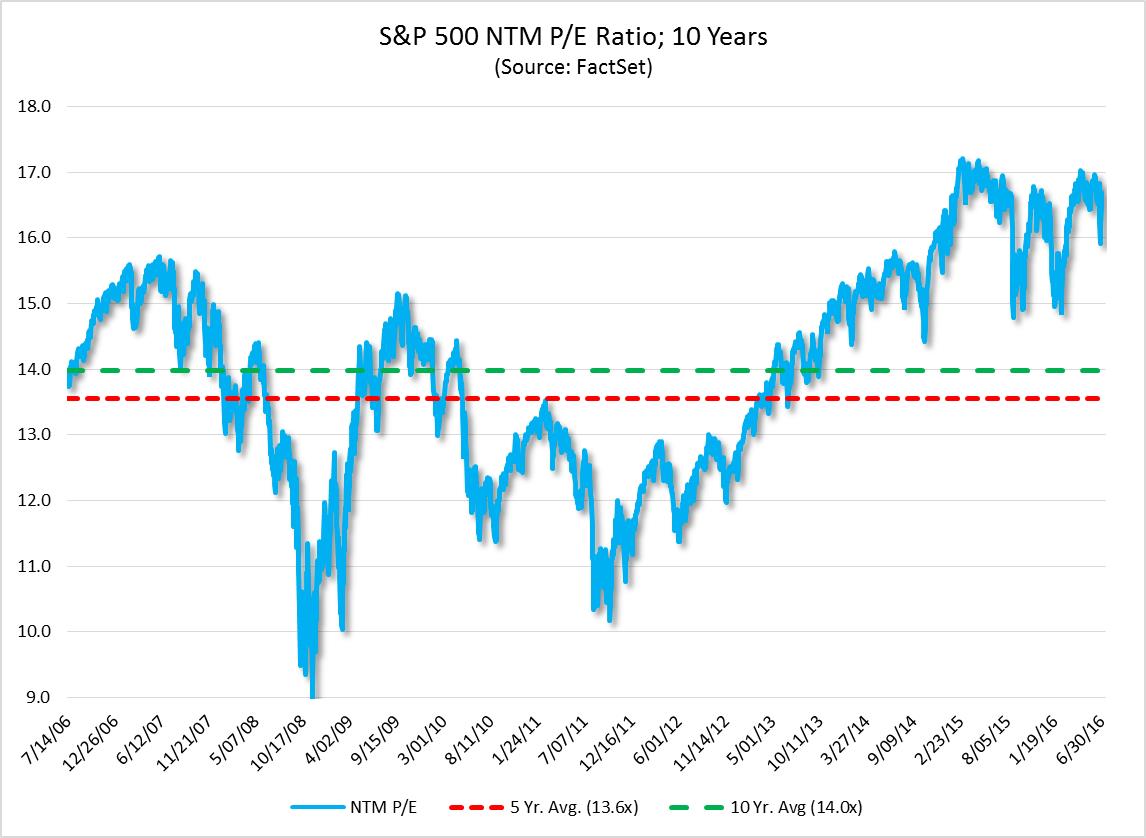

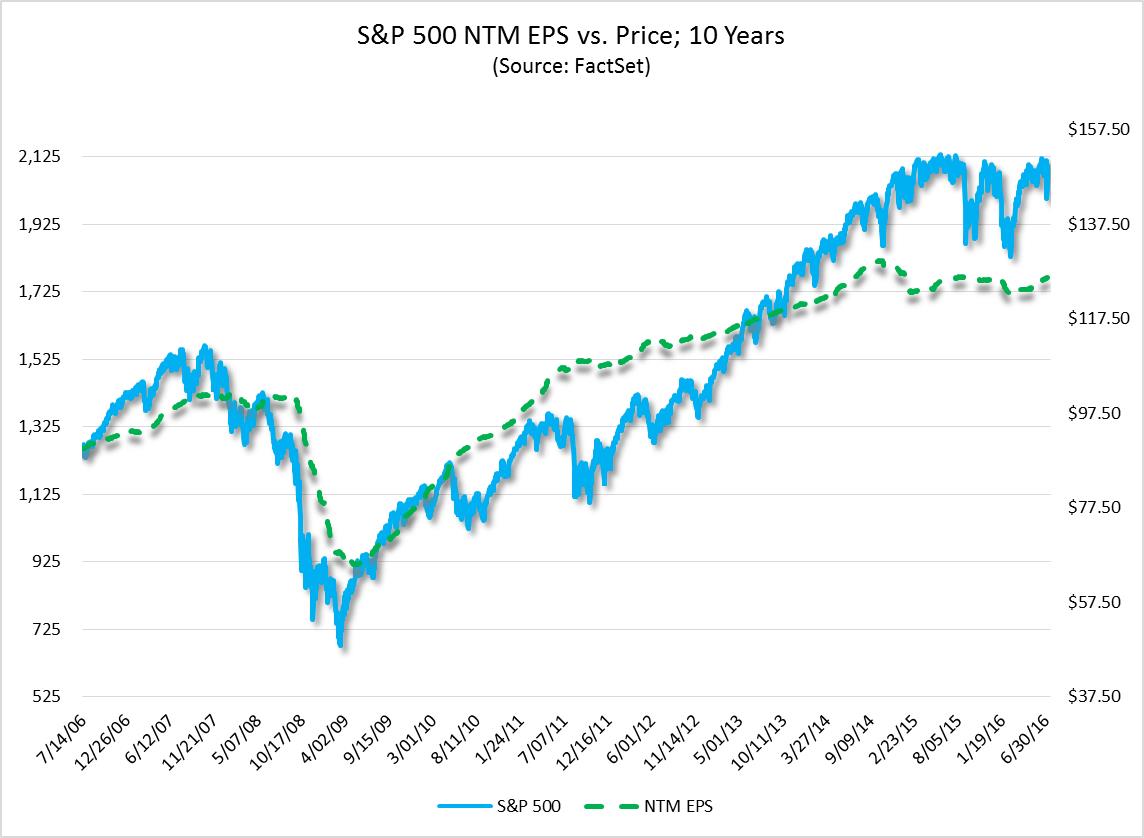

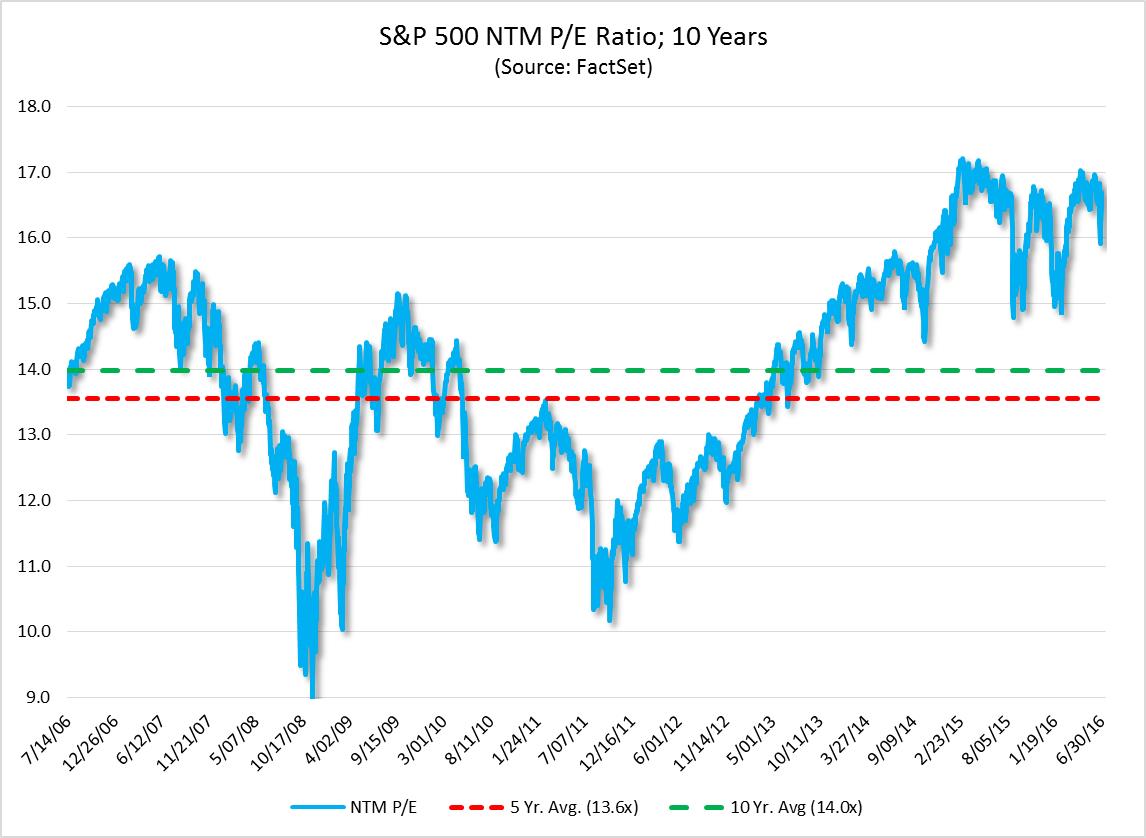

Wall Street Journal from November 9, 2015 titled 'The Ease of Index Funds Comes With Risk', David Blitzer, Chairman of the index committee of S&P Global, one of your Fund's holdings, has stated that being in the Index increases the value of a company in many ways. Inclusion of stocks in the Index has forced indexers to buy these stocks indiscriminately. Academic studies have concluded the inclusion of a stock has driven up the valuation of such stocks by as much as 9%. The point is that the Index has performed unusually well, but the Index has become a very "crowded trade" owing to the massive capital flows into the S&P 500 index funds and ETFs for the past 10 years resulting in a premium valuation if not overvaluation based on the underlying fundamentals of its component companies. Most market trends run in cycles, and one should consider the impact on the Index and index funds should the positive flow of the past ten years subside or perhaps reverse. It can happen, as happened in January and late June of this year during market sell offs.

Enough on the Index. Your Fund's performance in the fiscal year was helped by avoiding the Energy Sector but hurt by the absence of Telecommunication Services and Utilities, the two best performing Sectors in the Index. These two Sectors performed quite well as it appears that yield-hungry investors sought income in a low yield environment. The vast majority of stocks in these two sectors are income vehicles and not appropriate for a growth fund. We believe this is another factor behind the overall underperformance of the Lipper growth groups' averages versus the Index. Further comments on what helped and what hurt performance can be found in the Management Discussion of Fund Performance section found later in this Report.

Themes