As filed with the Securities and Exchange Commission on June 6, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03023

FORUM FUNDS

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: March 31

Date of reporting period: April 1, 2015 – March 31, 2016

ITEM 1. REPORT TO STOCKHOLDERS.

The views in this report were those of Absolute Strategies Fund, Absolute Credit Opportunities Fund and Absolute Capital Opportunities Fund's (each a "Fund" and collectively the "Funds") adviser as of March 31, 2016, and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice. None of the information presented should be construed as an offer to sell or recommendation of any security mentioned herein.

Since the Funds utilize multi-manager strategies with multiple sub-advisers, they may be exposed to varying forms of risk. These risks include, but are not limited to, general market risk, multi-manager risk, non-diversification risk, small company risk, foreign risk, interest rate risk, credit risk, prepayment risk, IPO risk, liquidity risk, high turnover risk, leverage risk, pooled investment vehicle risk, derivatives risk and cash and cash equivalents holdings risk. For a complete description of the Funds' principal investment risks, please refer to each Fund's prospectus.

Beta is a measure of an asset's sensitivity to broad market moves, as measured for instance by the S&P 500® Index. A fund with a realized beta of 0.5 with respect to the S&P 500®Index infers that about 50% of the fund's returns were explained by the performance of the index (the rest of the performance was independent of the index). Standard deviation indicates the volatility of a fund's total returns and is useful because it identifies the spread of a fund's short-term fluctuations. The HFR Indices are equally weighted performance indexes, utilized by numerous hedge fund managers as a benchmark for their own hedge funds. One cannot invest directly in an index.

Absolute Strategies Fund, Absolute Funds, and Absolute Investment Advisers are registered service marks of Absolute Investment Advisers LLC ("AIA" and "Absolute") and the respective logos and Absolute Credit Opportunities Fund and Absolute Capital Opportunities Fund are service marks of AIA; and other marks referred to herein are the trademarks, service marks or registered trademarks of their respective owners.

|

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

Dear Shareholder,

We are pleased to present the Annual Report for the Absolute Strategies Fund (the "Fund") for the year ended March 31, 2016. The Fund (Institutional Shares) returned 2.05% over the 12 months ended March 31. The Fund outperformed both the S&P 500 Index, which returned 1.78%, and the HFRX Global Hedge Fund Index, which returned negative 7.36%, over the period.

As a reminder, the Fund is designed with a high degree of flexibility to invest long and short across equity, credit, and/or commodity interests through a number of different managers/strategies. This flexibility allows the Fund to be constructed based on the most attractive risk-reward areas, whether they are long or short or relative value. It also allows for the Fund to be positioned more aggressively at times and more defensively at others.

This is very different than most traditional funds, and many alternative funds, that just maintain static (long) exposures to match a benchmark or peer group. Performance over the last twelve months particularly highlights how different the Fund's investment approach is than most hedge funds and other alternative funds. Broadly, we have noticed that many alternative funds have become very short term oriented and prone to chasing investment performance. We believe this could make them vulnerable to losses when markets change course. The Fund's approach can be viewed as somewhat contrarian. This has allowed the Fund to generate its best performance when markets have changed course or become volatile.

The Fund has remained in a defensive posture over the last year. Increased volatility did provide an opportunity to move exposures from a bit more or a bit less defensive during shorter periods. Net exposure has been towards the low end of its historical range and beta to traditional equity indices has been negative.

The Fund has preserved a balance of long and short exposures. Allocations continue to be mostly in equity related strategies. This is due in large part to the risks facing the credit markets, particularly liquidity risk. The Fund's credit exposure is limited to strategies where there is a natural hedge component (convertible arbitrage) or where the manager has the flexibility to run a portfolio with a low net exposure (credit long-short).

Aggregate positioning on the long side of the Fund has been dominated by large-cap companies with strong balance sheets and the ability to withstand a variety of different economic environments, particularly margin pressure. Smaller, more unique companies and situations have been increasing as a percentage of the Fund. Aggregate positioning on the short side of the Fund has been dominated by index hedges and single name equities based on companies with sensitivity to slowing global growth – financials, industrials, consumer cyclicals, and most recently aerospace. Some of the short exposure is derived by Sub-Advisers (single name equity, index related hedges); some short exposure has been derived by Absolute (index related hedges). We have also supplemented the portfolio with additional allocations to energy, mining, and precious metal securities. These areas may profit individually, or benefit if central banks pursue policies based on creating broad based asset inflation.

Short exposure to European and Asian financials was one area the Fund benefited from during the period. A sell-off in these equities is one example of how investors seem to be in the early stages of looking beyond central bank activity and focusing more on company/industry specific dynamics. It's not surprising then that they would shy away from some of these banks given exceptionally high leverage, significant credit risk, and increasing non-performing loans. We still think this is an attractive area that has not fully priced in these risks.

The market environment is evolving into one of the best we've seen since we started our business nearly 12 years ago. We believe that the "no risk" straight up buying frenzy from 2012-2014 is history. It appears as if we are entering an entirely new period that, at a minimum, has proven to be quite volatile from month to month and quarter to quarter. At worst, markets may be entering a lengthy bear market.

Regardless of whether markets are volatile and range bound or headed much lower, we believe this environment is well suited for the Fund's approach, as evidenced during the period as two of the Fund's best months came during flat months for the S&P 500 Index. There continue to be ample opportunities on both the long and short side and we expect the Fund to take advantage of volatility as much as possible while managing risk.

|

ABSOLUTE STRATEGIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

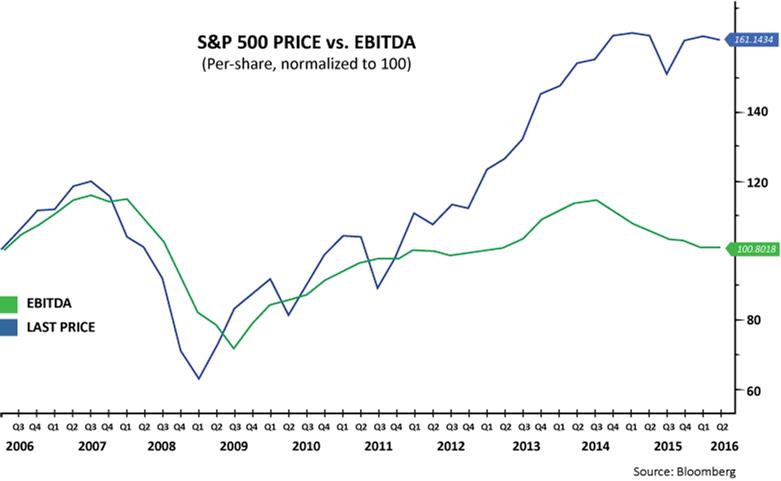

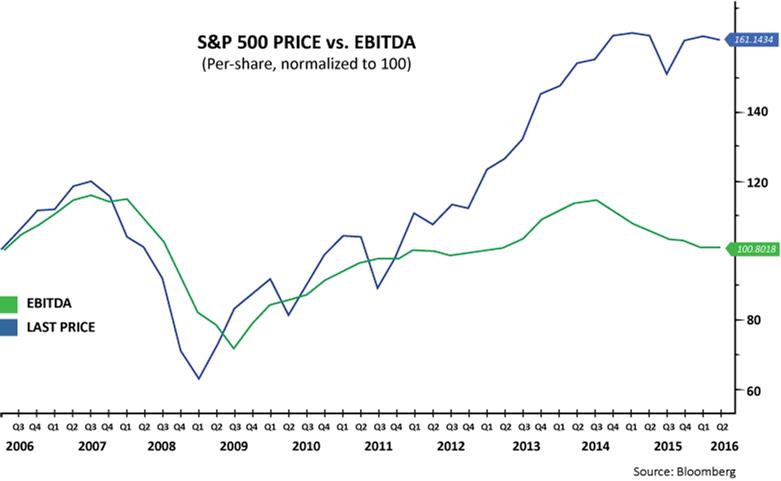

for the macro environment, we may be witnessing the largest divergence between market prices and fundamentals in history. Markets are trading near all-time highs while our analysis indicates that fundamentals continue to deteriorate. The S&P 500 has risen dramatically since 2011, almost entirely on the back of multiple expansion. Revenue and cash flow levels are actually well BELOW 2007 levels. This is quite remarkable. We believe that market appreciation has been driven by financial engineering, and also investors' willingness to speculate on hope at the expense of any fundamental analysis. As can be seen in the chart below, the growth in cash flow or earnings before interest, taxes, depreciation and amortization ("EBITDA") per share for the S&P 500 has actually been negative, while price has gone nearly parabolic. To put this into perspective, the ratio of price to EBITDA is at year 2000 bubble levels.

This is a picture of central banking in the mania phase and, in our view, probably the single greatest misallocation of capital in history: massive, unproductive leveraging of corporate America for the sole purpose of inflating per share earnings through stock buybacks. This would make sense if stocks were undervalued, but it does not make sense given the most expensive Price/EBITDA in history. If the return on investment (ROI) for buying back stock is negative, it does not matter how low the interest rate was on the newly issued debt. We believe most corporate stock buybacks at recent levels will incur ROIs of -20% or more.

In our opinion, the above analysis is old fashioned, unemotional common sense. We are simply attempting to point out what we believe will be obvious in hindsight. We believe that central bank policies are borrowing growth from the future. Yet we now have debt levels rising with no growth in operating cash flow. There's little funding for research and development or capital expenditures, just stock buybacks. Markets are very fragile and they also sense that there is no end game. Some markets are beginning to move contrary to central bank actions, as witnessed by recent stimulus attempts by both the Bank of Japan and the European Central Bank. As we've discussed for the past year, we believe markets are signaling that central bank credibility is breaking down and volatility lies ahead.

Looking forward, we believe this market environment may be highly advantageous for nimble, liquid strategies like ours. We expect the Fund to be very active when opportunities arise to either take or hedge risk.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

|

ABSOLUTE CREDIT OPPORTUNITIES FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

Dear Shareholder,

We are pleased to present the annual report for the Absolute Credit Opportunities Fund (the "Fund") for the 12 months ended March 31, 2016. During the period, the Fund was down 2.40% while the the HFRX Fixed Income Credit Index, the Fund's primary benchmark, was down 7.15% and the HFRX Global Hedge Fund Index was down 7.36%.

On October 1, 2014, the Fund name was changed from the Absolute Opportunities Fund to the Absolute Credit Opportunities Fund. The name was changed to reflect the Fund's shift from employing a multi-strategy approach to an approach focused specifically on credit strategies. The Fund currently utilizes two credit related strategies – convertible arbitrage and corporate long-short credit. The Fund's sub-advisers for these strategies have a great deal of flexibility to go long or short, and use cash to adapt to the various market conditions that emerge during the course of a complete market cycle.

We regard this flexibility as important because we believe that traditional bond markets currently face significant risks - including interest rate risk, credit risk and/or liquidity risk. We also believe that low yields (which have even become negative in some cases) do not compensate most long-only bond holders for these risks, yet funds that are tied to a benchmark or style box have a narrow ability to hedge such risks.

The Fund's flexible strategy, however, allows it to hedge as appropriate, and it has been positioned conservatively over the last year. Credit exposure has been limited to areas where there is a natural hedge component (convertible arbitrage) or where the manager has been running the portfolio with a low net exposure (corporate long-short credit). Over the period, corporate long-short credit fared slightly better than convertible arbitrage. Gains and losses were in a somewhat tight range, however, gross of fees.

In our view, investors attempting to create a balanced portfolio seem to be facing a diminishing set of options within credit and fixed income. As bond prices have risen and yields declined, the risks have gone up and the potential diversification opportunities have gone down. Many recent product launches, such as nontraditional bond funds and credit-oriented hedge funds, seem to trade reduced risk in one area (interest rate) for increased risk in another (credit risk). We have designed the Fund's current more conservative approach to provide better diversification for an overall portfolio and specifically the bond portion of a portfolio. The Fund however is maintaining "dry powder" to put to work on the long side in potential distressed areas should bond markets continue to weaken.

Sincerely,

Jay Compson

Portfolio Manager

Absolute Investment Advisers LLC

|

ABSOLUTE STRATEGIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2016 |

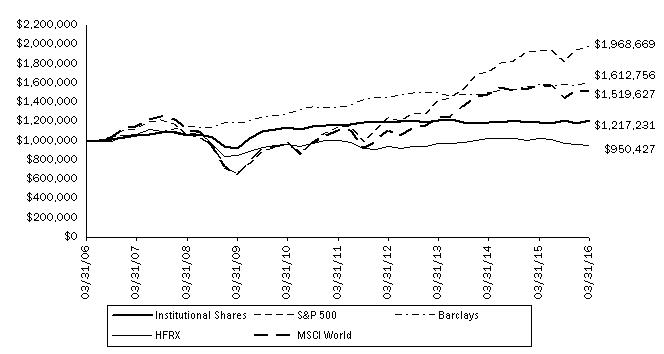

The following charts reflect the change in the value of a hypothetical $1,000,000 investment in Institutional Shares and a $250,000 investment in R Shares, including reinvested dividends and distributions, in Absolute Strategies Fund (the "Fund") compared with the performance of the benchmark, S&P 500 Index ("S&P 500"), Barclays Capital U.S. Aggregate Bond Index ("Barclays Index"), the HFRX Global Hedge Fund Index ("HFRX") and the MSCI World Index ("MSCI World"), since inception. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Barclays Index covers the U.S. dollar-denominated, investment-grade, fixed-rate, taxable bond market of SEC-registered securities. The HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The MSCI World measures the performance of a diverse range of 24 developed countries' stock markets including the United States, Canada, Europe, the Middle East and the Pacific. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $1,000,000 Investment

Absolute Strategies Fund - Institutional Shares vs. S&P 500 Index,

Barclays Capital U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| Average Annual Total Returns | | | | | | |

| Periods Ended March 31, 2016 | | One Year | | Five Years | | Ten Years |

| Absolute Strategies Fund - Institutional Shares | | 2.05 | % | | 0.98 | % | | 1.99 | % |

| S&P 500 Index | | 1.78 | % | | 11.58 | % | | 7.01 | % |

| Barclays Capital U.S. Aggregate Bond Index | | 1.96 | % | | 3.78 | % | | 4.90 | % |

| HFRX Global Hedge Fund Index | | -7.36 | % | | -1.18 | % | | -0.51 | % |

| MSCI World Index | | -3.45 | % | | 6.51 | % | | 4.27 | % |

|

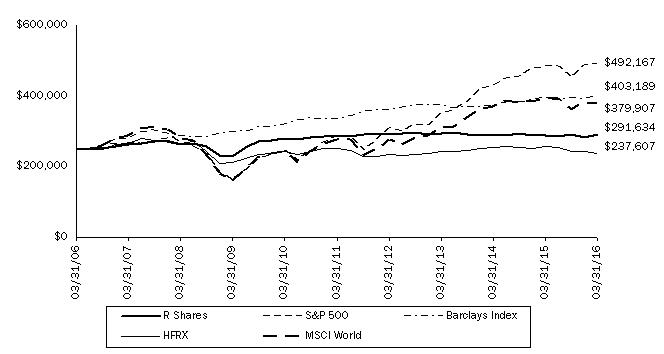

ABSOLUTE STRATEGIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2016 |

Comparison of Change in Value of a $250,000 Investment

Absolute Strategies Fund - R Shares vs. S&P 500 Index, Barclays Capital U.S. Aggregate Bond Index,

HFRX Global Hedge Fund Index and MSCI World Index

| Average Annual Total Returns | | | | | | |

| Periods Ended March 31, 2016 | | One Year | | Five Years | | Ten Years |

| Absolute Strategies Fund - R Shares | | 1.41 | % | | 0.48 | % | | 1.55 | % |

| S&P 500 Index | | 1.78 | % | | 11.58 | % | | 7.01 | % |

| Barclays Capital U.S. Aggregate Bond Index | | 1.96 | % | | 3.78 | % | | 4.90 | % |

| HFRX Global Hedge Fund Index | | -7.36 | % | | -1.18 | % | | -0.51 | % |

| MSCI World Index | | -3.45 | % | | 6.51 | % | | 4.27 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratios (gross) for Institutional Shares and R Shares are 2.60% and 3.11%, respectively. Excluding the effect of expenses attributable to dividends and interest on short sales and acquired fund fees and expenses, the Fund's total annual operating expense ratios would be 1.79% and 2.30% for Institutional Shares and R Shares, respectively. To the extent that the Fund invests in any investment company or exchange-traded fund sponsored by the Fund's adviser or its affiliates, the adviser may waive certain fees and expenses. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

|

ABSOLUTE CREDIT OPPORTUNITIES FUND PERFORMANCE CHART AND ANALYSIS (Unaudited) MARCH 31, 2016 |

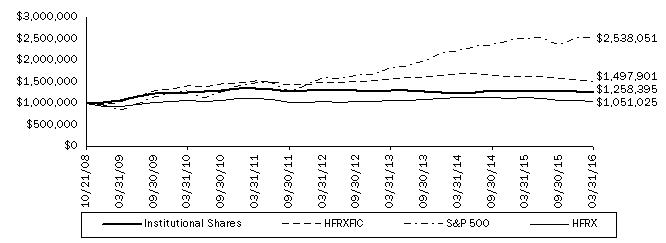

The following chart reflects the change in the value of a hypothetical $1,000,000 investment in Institutional Shares, including reinvested dividends and distributions, in Absolute Credit Opportunities Fund (the "Fund") compared with the performance of the benchmark, the HFRX Fixed Income Credit Index ("HFRXFIC"), the S&P 500 Index ("S&P 500") and the HFRX Global Hedge Fund Index ("HFRX"), since inception. The HFRXFIC includes strategies with exposure to credit across a broad continuum of credit sub-strategies, including Corporate, Sovereign, Distressed, Convertible, Asset Backed, Capital Structure Arbitrage, Multi-Strategy and other Relative Value and Event Driven sub-strategies. Investment thesis across all strategies is predicated on realization of a valuation discrepancy between the related credit instruments. Strategies may also include and utilize equity securities, credit derivatives, government fixed income, commodities, currencies or other hybrid securities. The S&P 500 is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The HFRX is designed to be representative of the overall composition of the hedge fund universe; it is comprised of eight strategies - convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset-weighted based on the distribution of assets in the hedge fund industry. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $1,000,000 Investment

Absolute Credit Opportunities - Institutional Shares vs. HFRX Fixed Income Credit Index,

S&P 500 Index, and HFRX Global Hedge Fund Index

| Average Annual Total Returns | | | | | | Since Inception |

| Periods Ended March 31, 2016 | | One Year | | Five Years | | 10/21/08 |

| Absolute Credit Opportunities Fund - Institutional Shares | | -2.40 | % | | -1.38 | % | | 3.14 | % |

| HFRX Fixed Income Credit Index | | -7.15 | % | | -0.11 | % | | 5.60 | % |

| S&P 500 Index | | 1.78 | % | | 11.58 | % | | 13.33 | % |

| HFRX Global Hedge Fund Index | | -7.36 | % | | -1.18 | % | | 0.67 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (888) 992-2765. As stated in the Fund's prospectus, the annual operating expense ratio (gross) is 2.71%. Excluding the effect of expenses attributable to dividends and interest on short sales, the Fund's total annual operating expense ratio would be 2.20%. However, the Fund's adviser has agreed to contractually waive a portion of its fees and to reimburse expenses such that total operating expenses do not exceed 1.95% (excluding all taxes, interest, portfolio transaction expenses, dividends and interest expense on short sales, acquired fund fees and expenses, proxy expenses, and extraordinary expenses), which is in effect through August 1, 2017. During the period, certain fees were waived and/or expenses reimbursed; otherwise returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

Beck, Mack & Oliver International Fund | |

A Message to Our Shareholders (Unaudited) | 2 |

Performance Chart and Analysis (Unaudited) | 6 |

Portfolio Profile (Unaudited) | 7 |

Schedule of Investments | 8 |

Statement of Assets and Liabilities | 12 |

Statement of Operations | 13 |

Statements of Changes in Net Assets | 14 |

Financial Highlights | 15 |

| |

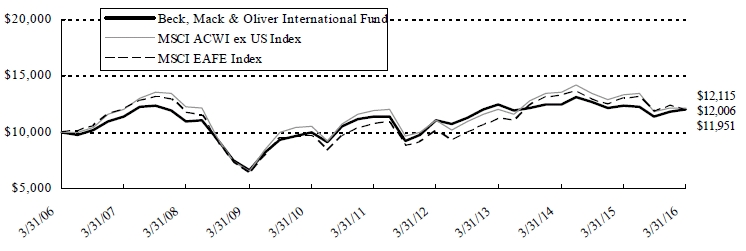

Beck, Mack & Oliver Partners Fund | |

A Message to Our Shareholders (Unaudited) | 16 |

Performance Chart and Analysis (Unaudited) | 20 |

Portfolio Profile (Unaudited) | 21 |

| Schedule of Investments | 22 |

Statement of Assets and Liabilities | 23 |

Statement of Operations | 24 |

Statements of Changes in Net Assets | 25 |

Financial Highlights | 26 |

| |

Notes to Financial Statements | 27 |

Report of Independent Registered Public Accounting Firm | 34 |

| Additional Information (Unaudited) | 35 |

|

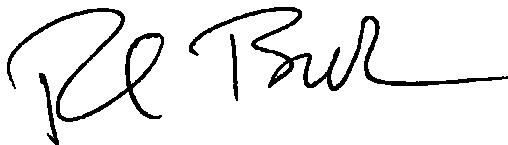

BECK, MACK & OLIVER INTERNATIONAL FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

Dear Shareholders:

The Beck, Mack & Oliver International Fund (the "International Fund") ended its fiscal year on March 31, 2016 (the "Fiscal Year" or the "Period") with a net asset value ("NAV") of $15.61 per share, realizing a return of -2.84% for the Period. The International Fund's fiscal return compares with a return of -9.19% for the International Fund's benchmark, the MSCI ACWI ex U.S. Index (the "MSCI ACWI ex U.S." or the "Benchmark") and a -8.27% return for the MSCI EAFE Index ("MSCI EAFE").1 For a longer term perspective, the International Fund's 3-, 5-, 10-year, and since inception average annual total returns as of March 31, 2016 were as follows:

| Average Annual Total Return as of 03/31/2016 | | One Year | | Three Years | | Five Years | | Ten Years | | Since Inception (12/08/93) |

| Beck, Mack & Oliver International Fund | | -2.84% | | -1.24% | | 1.11% | | 1.85% | | 6.62% |

MSCI ACWI ex U.S. Index1 | | -9.19% | | 0.32% | | 0.31% | | 1.94% | | N/A |

MSCI EAFE Index1 | | -8.27% | | 2.23% | | 2.29% | | 1.80% | | 4.98% |

(Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (800) 943-6786. Shares redeemed or exchanged within 60 days of purchase will be charged a 2.00% redemption fee. As stated in the current prospectus, the International Fund's annual operating expense ratio (gross) is 2.17%. However, the International Fund's adviser has agreed to contractually waive its fees and/or reimburse expenses to limit total operating expenses to 1.50% through at least July 31, 2016. During the period certain fees were waived and/or expenses reimbursed, otherwise returns would have been lower. Returns greater than one year are annualized.)

During the Period the International Fund outperformed its relevant benchmarks. Contributors to the International Fund's performance during the Fiscal Year included NIIT, Ltd (India) up 105.7% from the International Fund's first purchase in April 2015 through completion of its exit in November 2015, Tarkett SA (Russian Federation) up 33.9%, and Media Nusantara Citra Tbk PT (Indonesia) up 9.0% since the position was initiated in June 2015. Detractors from performance during the Period included Bank Pan Indonesia Tbk PT (Indonesia) down 50.9%, Panin Financial Tbk PT (Indonesia) down 50.6%, and Dewan Housing Finance Corp., Ltd. (India) down 13.0%.2

The following tables provide details of the International Fund's top 10 positions at the end of the Period as well as positions added and exited since our 9/30/15 semi-annual report. The decisions to exit positions resulted from a combination of the securities hitting our valuation targets or better opportunities elsewhere.

1 The MSCI ACWI ex U.S. is a stock market index that is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Net index data is not available prior to its inception on 01/01/01. The MSCI EAFE Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the United States and Canada. The total return of the MSCI EAFE includes the reinvestment of dividends and income. It is not possible to invest directly in any index.

2 Returns reflect the performance of the stock in local currency over the Fiscal Year unless the position was initiated or fully exited during the Period as reported by Bloomberg.

|

BECK, MACK & OLIVER INTERNATIONAL FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

| Top 10 Common Stock Holdings as of 03/31/16 | | Country | | Sector | | % of Net Assets |

| Dufry AG | | Switzerland | | Consumer Discretionary | | 6.3% |

| First Pacific Co., Ltd. | | Hong Kong | | Conglomerates | | 6.2% |

| Media Nusantara Citra Tbk PT | | Indonesia | | Consumer Discretionary | | 5.7% |

| Fairfax India Holdings Corp. | | India | | Financials | | 5.7% |

| GP Investments, Ltd. | | Brazil | | Asset Management | | 5.6% |

| Tarkett SA | | Russian Federation | | Consumer Discretionary | | 5.6% |

| Dewan Housing Finance Corp., Ltd. | | India | | Financials | | 5.6% |

| Genting Hong Kong, Ltd. | | Hong Kong | | Conglomerates | | 5.3% |

| Fairfax Fianancial Holdings, Ltd. | | Canada | | Insurance | | 5.2% |

| BBA Aviation PLC | | United States | | Transportation | | 3.1% |

| Total | | | | | | 54.3% |

| New Positions Established as of 03/31/16 | | % of Net Assets | | Portfolio Positions Eliminated | | % of Net Assets3 |

| CVC Brasil Operadora e Agencia de Viagens SA | | 0.7% | | Phoenix Satellite Television Holdings, Ltd. | | 1.5% |

| GS Home Shopping, Inc. | | 3.0% | | NIIT, Ltd. | | 4.5% |

| Liberty Global PLC | | 2.9% | | Coca-Cola Femsa SAB de CV | | 2.4% |

| | | | | Nestle SA | | 1.7% |

| | | | | Brightwood Capital Fund III-U, LP | | 0.7% |

| | | 6.6% | | | | 10.8% |

Securities markets were tumultuous during the Period as equity and fixed income markets exhibited volatility. Fund management remains focused on the underlying operating performance and growth potential of the portfolio companies, which are sound. We believe the portfolio is attractive both from a valuation and a growth standpoint. In line with our name and mandate change we have continued to restructure the portfolio over the past few quarters to reflect these changes and expose the International Fund primarily to companies domiciled outside of the U.S. The International Fund's assets are focused and concentrated on select, long-term investments. One might even consider the portfolio an "anti-index" fund as, in contrast to the International Fund, an index fund usually consists of a great number of securities within its structure. We believe the International Fund is a sound compliment to a broad indexed portfolio.

Contrary to current negative sentiment on investments outside the U.S., we believe the opportunity in international markets is in the purchase of securities with attractive growth prospects at reasonable prices. Our investment in Dufry AG exemplifies this. While short-term currency fluctuations as well as sentiment around the company's recent acquisitions weighed on its shares, we remained focused on the long-term benefits of its industry position and growth opportunity. Dufry has been able to make accretive acquisitions historically and is poised to realize growth from its recent transformative acquisitions, which place it as the largest travel retail company in the world as measured by market share. It has also become well-balanced from a geographic perspective, benefiting from ever-shifting terms of trade. We have confidence that management will continue to execute on plan. Dufry exemplifies what we look for in an investment: a good growth opportunity at reasonable cost. Dufry's growth is fostered by the continued increase in global air passenger traffic which positively impacts retail sales at its airline terminal facilities. In addition, we believe the investment will continue to benefit from the close alignment of Dufry's management with the interests of shareholders.

3 Percent of net asset value ("NAV") for exited positions reflect holdings at the previous reporting period ending 9/30/2015.

|

BECK, MACK & OLIVER INTERNATIONAL FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

We initiated three new investments recently in the International Fund including CVC Brasil Operadora e Agencia de Viagens SA ("CVC"). This portfolio acquisition was made despite a dour outlook for the Brazilian economy and country. At this writing the negative headlines continue. Our investment in CVC checked the key boxes of our research process: a very good business trading at what we believe is a bargain price (below 10x earnings at purchase) with a good financial profile and an owner-operated, highly motivated management team comprised of the company's founding family and Carlyle, the private equity group. Brazilians love to travel and CVC has a leading and profitable position to help them do so. Importantly, the company has very little debt and strong cash generation.

Of course, we did not solely invent the concept of having a checklist in an important decision-making situation; for that we have the writings of a surgeon articulating this extremely well. In his seminal book "The Checklist Manifesto" Atul Gawande writes of his experience at striving to be the best he and his hospital can be in the most crucial circumstances: "Good checklists, on the other hand are precise. They are efficient, to the point, and easy to use even in the most difficult situations. They do not try to spell out everything – a checklist cannot fly a plane. Instead they provide reminders of only the most critical and important steps – the one that even the highly skilled professional using them could miss. Good checklists are above all, practical."

We strive to check the boxes in our investment research process and will continue to do so on behalf of investors in the International Fund, including ourselves. We know that patience is a rare commodity especially in these days of "Insta – Gratification." We believe your patience will be rewarded. Thank you for investing alongside us as stewards of your capital in international markets.

Sincerely,

| | |

David E. Rappa Co-Manager | | Peter A Vlachos Co-Manager |

| | |

| Robert C. Beck Co-Manager | |

|

BECK, MACK & OLIVER INTERNATIONAL FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

IMPORTANT RISKS AND DISCLOSURE:

There is no assurance that the International Fund will achieve its investment objective. Investing overseas involves special risks, including the volatility of currency exchange rates and, in some cases, political and economic instability, and relatively illiquid markets. Emerging markets involve greater risks than more developed markets as they may be more volatile and less liquid. The International Fund's exposure to foreign currencies may not be fully hedged at all times. Private fund securities are typically illiquid and difficult to value. The International Fund may invest in small and mid-sized capitalization companies, meaning that these companies carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock.

The views in this report were those of the International Fund managers as of March 31, 2016 and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the International Fund and do not constitute investment advice. This letter may contain discussions about certain investments both held and not held in the portfolio. All current and future holdings are subject to risk and to change.

LMCG GLOBAL MARKET NEUTRAL FUND

LMCG GLOBAL MULTICAP FUND

Annual Report

March 31, 2016

|

LMCG GLOBAL MARKET NEUTRAL FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

Dear Shaerholder:

The LMCG Global Market Neutral Fund (the "Fund") was slightly down over the last twelve months, returning -0.36% over the period versus 0.08% for the Citigroup 3-Month U.S. T-Bill Index. Since its May 21, 2013 inception, the Fund has returned an annualized +3.49% versus +0.05% for the Citigroup 3-Month U.S. T-Bill Index. The Fund invests primarily in small-mid cap companies in the U.S. and large cap companies internationally. For the year, large cap equities in the U.S. outperformed their international peers with the Russell 1000 Index returning +0.5% while the MSCI EAFE Index fell -8.3%. Smaller cap companies in the U.S., which is where the Fund primarily invests, substantially underperformed large caps with a return of -9.8% for the period. While the Fund did not produce positive returns for the period, it did provide investors some protection versus many other asset classes.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call (877)591-4667.

The timing of the Fed's decision to raise interest rates combined with a volatile oil market created tremendous uncertainty and global equities struggled. Investors tended to focus more on macroeconomic news than company fundamentals, which is more challenging for active stock picking. The strategy is managed using a quantitative approach that seeks to add value primarily through stock selection while minimizing market risk. The strategy is centered on fundamental principles and reviews well-known investment metrics to evaluate securities in a quantitative framework that has four major components: Valuation, Earnings Revision, Price Momentum, and Earnings Quality.

Throughout the year, it was primarily a Price Momentum market but there were three sharp negative reversals – April, October and the last two months. In general, stocks that had good price performance were favored over cheap stocks which were perceived as more risky as economic concerns weighed heavily on stock markets. However, in periods when markets strengthened on positive economic news, Price Momentum suffered. Valuation tended to matter a bit more when Price Momentum wasn't working but was weak during the other months. In the U.S., there were only two months where both Price Momentum and Valuation were working at the same time. Internationally, there was only one month. When factors work strongly and in different directions, it is difficult to capitalize on the success of the one factor that is working if another is not working by the same magnitude. Earnings Quality and Estimate Revision did work in both universes but not strong enough to offset the volatility in Price Momentum and Valuation.

One of the key strengths of the strategy is the diversification in sources for absolute return. This is important as it helps provide a steadier stream of returns. The strategy achieves diversification through its investments in a broad universe of global stocks as well its ability to invest long and short. The strategy invests globally using customized stock selection models for the U.S. and developed market portions of the Fund. This year, the U.S. stock selection model was much more effective than the international model. Consequently, the U.S. stocks in the portfolio contributed more positively to return. Outside of the U.S., stock selection in France and Germany added most to returns while those in Japan detracted most. In terms of sectors, positive stock selection in Energy, Consumer Discretionary and Materials helped most to offset negative stock selection in Industrials and Information Technology. More of the Fund's performance came from our long holdings.

Outlook

Equity markets are off to a rocky start in 2016. In January and the first part of February, most major stock market indexes were down in the neighborhood of -10%. In mid-February, the Organization of the Petroleum Exporting Countries (OPEC) announced that it would work to freeze output in an effort to stabilize oil prices. Following this news, global equity markets became euphoric and posted strong returns, which essentially erased the earlier downdraft. This stark difference in market returns between the two periods coincided with a dramatic shift in strategy performance and the behavior of our stock selection factors. The most notable differences were related to Price Momentum and Valuation. For the first part of the quarter, Price Momentum was most effective while Valuation was additive but to a much lesser degree. During this time, the Fund posted strong results. In the later period, Price Momentum turned substantially negative and Valuation became more important. However, Valuation did not work well enough to offset such a sharp reversal to Price Momentum. The question going forward is whether the strong positive performance will continue, and if so, how best to position the strategy. Given the uncertainty, we continue to believe that it is important to balance the strategy across our stock selection factors so that the strategy has a better chance of outperforming in either an up or down market.

The Fund seeks capital appreciation regardless of equity market conditions. In an environment where the yield on the 10-year Treasury is below 2%, we believe that a Fund that has the potential to generate alpha on the long and short side – while also

|

LMCG GLOBAL MARKET NEUTRAL FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

maintaining a competitive risk level to the overall equity market – may serve an important role within an investment program.

Sincerely,

| | |

| Gordon Johnson | Shannon Ericson | |

| Co-Portfolio Manager | Co-Portfolio Manager | |

| LMCG Investments, LLC | LMCG Investments, LLC | |

INVESTMENT CONSIDERATIONS

Alpha - Alpha is the incremental return of a manager when the market is stationary. This risk-adjusted measurement takes into account both the performance of the market as a whole and the volatility of a manager. A positive alpha indicates that a selected portfolio has produced returns above the expected level at that level of risk, and vice versa for a negative alpha.

Diversification - Diversification is a method of reducing risk by investing in a variety of types of investments. Diversification does not guarantee a profit nor protect against a loss.

Long Position - Long positions involve buying a security outright and then selling it later, with the hope that the security price rises over time.

Short Position - To establish a short stock position, the Fund borrows shares of stock from another party, sells the shares and receives cash. The Fund is then obligated to buy the stock and return the shares at some point in the future. If the price falls after the short sale, the Fund can profit from buying the shares back at a lower price and returning the borrowed shares. However, if the price of the security rises after the short sale, the Fund will experience losses.

There can be no guarantee that any strategy (risk management or otherwise) will be successful. All investing involves risk, including potential loss of principal.

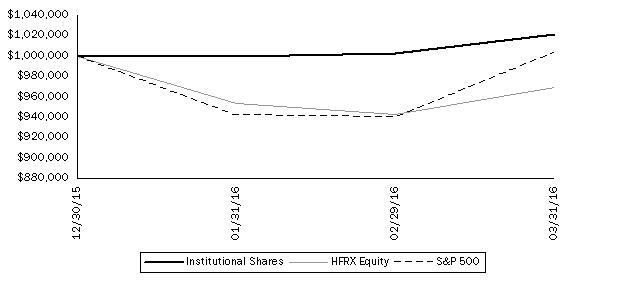

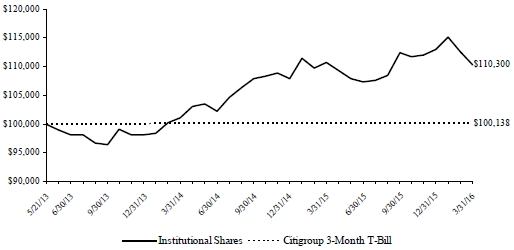

The following chart reflects the change in the value of a hypothetical $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in the LMCG Global Market Neutral Fund (the "Fund") compared with the performance of the benchmark, the Citigroup 3-Month U.S. T-Bill Index, since inception. The Citigroup 3-Month U.S. T-Bill Index measures return equivalents of yield averages that are not marked to market and consists of the last three three-month Treasury bill month-end rates. The total return of the Citigroup 3-Month U.S. T-Bill Index includes the reinvestment of distributions. The total return of the Fund includes operating expenses that reduce returns, while the total return of the Citigroup 3-Month U.S. T-Bill Index does not include expenses. The Fund is professionally managed while the Citigroup 3-Month U.S. T-Bill Index is unmanaged and is not available for investment.

Comparison of Change in Value of a $100,000 Investment

LMCG Global Market Neutral Fund - Institutional Shares vs. Citigroup 3-Month U.S. T-Bill Index

| Average Annual Total Returns | | | | |

| Periods Ended March 31, 2016 | | One Year | | Since Inception(1) |

| LMCG Global Market Neutral Fund — Institutional Shares | | -0.36 | % | | 3.49 | % |

LMCG Global Market Neutral Fund — Investor Shares(2) | | -0.63 | % | | 3.39 | % |

| Citigroup 3-Month U.S. T-Bill Index | | 0.08 | % | | 0.05 | % |

(1) Institutional Shares commenced operations on May 21, 2013, and Investor Shares commenced operations on December 18, 2014.

(2) Performance for the since inception period is a blended average annual return, which include the returns of the Institutional Shares prior to the commencement of the Investor Shares.

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call (877) 591-4667. As stated in the Fund's prospectus, the estimated annual operating expense ratio (gross) for Investor Shares and Institutional Shares is 5.73% and 4.63%, respectively. Excluding the effect of expenses attributable to dividends and interest on short sales, the estimated total annual operating expense ratio for Investor Shares and Institutional Shares would be 4.28% and 3.32%, respectively. However, LMCG Investments, LLC (the "Adviser") has agreed to contractually waive its fees and/or reimburse Fund expenses to limit total annual Fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, dividend and interest expenses on short sales, acquired fund fees and expenses, proxy expenses and extraordinary expenses) of Investor Shares and Institutional Shares to 1.85% and 1.60%, respectively through at least July 31, 2016. The Fund may repay the Adviser for fees waived and expenses reimbursed pursuant to the expense cap if such payment is made within three years of the fees waived or reimbursed and the reimbursement does not cause the Fund's total annual operating expenses to exceed 1.85% and 1.60% for Investor Shares and Institutional Shares, respectively. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized.

| Shares | | Security Description | | Value |

| Short Positions - (93.7)% |

| Common Stock - (93.7)% |

| Austria - (0.5)% |

| | (19,797) | | ams AG | | $ | (678,430) |

| Bermuda - (1.4)% |

| | (12,820) | | Axis Capital Holdings, Ltd. | | (710,997) |

| | (36,269) | | Golar LNG, Ltd. | | (651,754) |

| | (26,559) | | Hiscox, Ltd. | | (369,066) |

| | | | | | (1,731,817) |

| Canada - (0.6)% |

| | (10,627) | | lululemon athletica, Inc. | | (719,554) |

| Denmark - (0.8)% |

| | (9,810) | | Chr Hansen Holding A/S | | (657,871) |

| | (7,965) | | SimCorp A/S | | (367,155) |

| | | | | | (1,025,026) |

| Finland - (0.5)% |

| | (43,389) | | Fortum OYJ | | (656,198) |

| France - (3.5)% |

| | (5,224) | | Aeroports de Paris | | (645,150) |

| | (8,242) | | DBV Technologies SA | | (536,611) |

| | (7,985) | | Fonciere Des Regions REIT | | (753,028) |

| | (1,897) | | Hermes International | | (667,027) |

| | (6,516) | | Ingenico Group SA | | (746,940) |

| | (2,106) | | Virbac SA | | (365,365) |

| | (30,390) | | Zodiac Aerospace | | (606,915) |

| | | | | | (4,321,036) |

| Germany - (2.5)% |

| | (8,117) | | Beiersdorf AG | | (731,132) |

| | (5,220) | | Bertrandt AG | | (597,773) |

| | (24,674) | | Deutsche Post AG | | (684,799) |

| | (17,554) | | Leoni AG | | (604,113) |

| | (8,241) | | MorphoSys AG | | (396,728) |

| | | | | | (3,014,545) |

| Hong Kong - (1.1)% |

| | (65,000) | | Cheung Kong Infrastructure Holdings, Ltd. | | (635,651) |

| | (108,000) | | Henderson Land Development Co., Ltd. | | (664,115) |

| | | | | | (1,299,766) |

| Italy - (2.2)% |

| | (22,791) | | Atlantia SpA | | (631,474) |

| | (28,854) | | Azimut Holding SpA | | (663,559) |

| | (30,487) | | Interpump Group SpA | | (445,370) |

| | (90,438) | | Unione di Banche Italiane SpA | | (334,019) |

| | (21,714) | | Yoox Net-A-Porter Group SpA | | (665,371) |

| | | | | | (2,739,793) |

| Japan - (10.5)% |

| | (42,300) | | Coca-Cola East Japan Co., Ltd. | | (701,107) |

| | (24,600) | | Daiseki Co., Ltd. | | (402,137) |

| | (15,700) | | Denso Corp. | | (630,207) |

| | (16,800) | | Exedy Corp. | | (371,139) |

| | (80,700) | | F@N Communications, Inc. | | (605,620) |

| | (50,000) | | Fuji Kyuko Co., Ltd. | | (686,879) |

| | (9,400) | | GMO Payment Gateway, Inc. | | (635,102) |

| | (26,700) | | Hamamatsu Photonics KK | | (735,826) |

| | (15,800) | | Japan Tobacco, Inc. | | (657,638) |

| | (41,800) | | Kakaku.com, Inc. | | (775,023) |

| | (39,900) | | Kansai Paint Co., Ltd. | | (640,450) |

| | (27,500) | | MonotaRO Co., Ltd. | | (817,453) |

| | (9,500) | | Nidec Corp. | | (650,013) |

| | (37,500) | | Nippon Paint Holdings Co., Ltd. | | (829,465) |

| | (14,500) | | Nissin Foods Holdings Co., Ltd. | | (681,053) |

| | (31,300) | | Pigeon Corp. | | (815,583) |

| | (34,300) | | Seibu Holdings, Inc. | | (725,304) |

| | (11,600) | | SHO-BOND Holdings Co., Ltd. | | (440,831) |

| | (109,000) | | The Gunma Bank, Ltd. | | (450,206) |

| | (29,200) | | Unicharm Corp. | | (635,548) |

| | | (12,886,584) |

| Netherlands - (0.6)% |

| | (7,047) | | ASML Holding NV | | (709,171) |

| New Zealand - (0.6)% |

| | (119,722) | | Ryman Healthcare, Ltd. | | (690,842) |

| Norway - (1.1)% |

| | (47,938) | | Marine Harvest ASA | | (738,045) |

| | (19,324) | | Schibsted ASA, Class A | | (563,775) |

| | | | | | (1,301,820) |

| Spain - (0.5)% |

| | (52,902) | | Zardoya Otis SA | | (614,042) |

| Sweden - (3.4)% |

| | (42,688) | | Alfa Laval AB | | (697,222) |

| | (42,023) | | Betsson AB | | (651,162) |

| | (67,989) | | Hexpol AB | | (754,337) |

| | (45,079) | | Lundin Petroleum AB | | (761,985) |

| | (67,585) | | Skandinaviska Enskilda Banken AB, Class A | | (644,506) |

| | (50,435) | | Svenska Handelsbanken AB, Class A | | (639,824) |

| | | | | | (4,149,036) |

| Switzerland - (3.6)% |

| | (29,658) | | ABB, Ltd. | | (577,777) |

| | (5,928) | | Basilea Pharmaceutica AG | | (417,697) |

| | (115) | | Chocoladefabriken Lindt & Spruengli AG | | (712,544) |

| | (34,503) | | GAM Holding AG | | (498,538) |

| Shares | | Security Description | | Value |

| Switzerland - (continued) |

| | (13,172) | | LafargeHolcim, Ltd. | | $ | (618,552) |

| | (43,287) | | OC Oerlikon Corp. AG | | (446,442) |

| | (5,093) | | Sonova Holding AG | | (649,993) |

| | (8,217) | | Sunrise Communications Group AG | | (564,037) |

| | | | | | (4,485,580) |

| United Kingdom - (5.7)% |

| | (143,798) | | Aberdeen Asset Management PLC | | (570,816) |

| | (72,044) | | BHP Billiton PLC | | (806,775) |

| | (31,657) | | Big Yellow Group PLC REIT | | (350,753) |

| | (75,786) | | BTG PLC | | (675,518) |

| | (32,590) | | Burberry Group PLC | | (637,129) |

| | (93,459) | | ICAP PLC | | (635,660) |

| | (42,986) | | IMI PLC | | (587,136) |

| | (60,888) | | Rolls-Royce Holdings PLC | | (595,077) |

| | (229,907) | | Rotork PLC | | (602,739) |

| | (67,519) | | The Restaurant Group PLC | | (380,060) |

| | (203,015) | | Tullow Oil PLC | | (570,987) |

| | (10,015) | | Whitbread PLC | | (568,513) |

| | | | | | (6,981,163) |

| United States - (54.6)% |

| | (22,467) | | Aerojet Rocketdyne Holdings, Inc. | | (368,009) |

| | (15,135) | | Albemarle Corp. | | (967,581) |

| | (19,241) | | Ameris Bancorp | | (569,149) |

| | (25,378) | | Aqua America, Inc. | | (807,528) |

| | (23,323) | | Artisan Partners Asset Management, Inc., Class A | | (719,281) |

| | (4,794) | | athenahealth, Inc. | | (665,311) |

| | (24,458) | | AtriCure, Inc. | | (411,628) |

| | (13,154) | | Bank of Hawaii Corp. | | (898,155) |

| | (8,810) | | Banner Corp. | | (370,372) |

| | (84,271) | | BioDelivery Sciences International, Inc. | | (272,195) |

| | (8,651) | | Bio-Techne Corp. | | (817,693) |

| | (24,158) | | Bottomline Technologies de, Inc. | | (736,577) |

| | (25,647) | | Brown & Brown, Inc. | | (918,163) |

| | (5,134) | | Buffalo Wild Wings, Inc. | | (760,448) |

| | (14,831) | | Cabela's, Inc. | | (722,121) |

| | (34,833) | | Calgon Carbon Corp. | | (488,359) |

| | (37,847) | | Callidus Software, Inc. | | (631,288) |

| | (21,006) | | Cheniere Energy, Inc. | | (710,633) |

| | (16,013) | | Choice Hotels International, Inc. | | (865,503) |

| | (14,606) | | CLARCOR, Inc. | | (844,081) |

| | (25,337) | | Clifton Bancorp, Inc. | | (383,095) |

| | (30,183) | | ClubCorp Holdings, Inc. | | (423,769) |

| | (12,368) | | Cognex Corp. | | (481,734) |

| | (23,724) | | CommVault Systems, Inc. | | (1,024,165) |

| | (10,522) | | Compass Minerals International, Inc. | | (745,589) |

| | (19,138) | | comScore, Inc. | | (574,906) |

| | (25,438) | | Consolidated Communications Holdings, Inc. | | (655,283) |

| | (23,999) | | Cornerstone OnDemand, Inc. | | (786,447) |

| | (42,221) | | Covanta Holding Corp. | | (711,846) |

| | (39,917) | | Crocs, Inc. | | (384,002) |

| | (42,404) | | CVB Financial Corp. | | (739,950) |

| | (21,520) | | CyrusOne, Inc. REIT | | (982,388) |

| | (11,753) | | Deckers Outdoor Corp. | | (704,122) |

| | (51,143) | | Del Frisco's Restaurant Group, Inc. | | (847,951) |

| | (9,854) | | DexCom, Inc. | | (669,185) |

| | (14,506) | | Duluth Holdings, Inc. | | (282,722) |

| | (61,701) | | Endologix, Inc. | | (515,820) |

| | (20,766) | | Energen Corp. | | (759,828) |

| | (14,538) | | FARO Technologies, Inc. | | (468,269) |

| | (24,993) | | First Financial Bankshares, Inc. | | (739,293) |

| | (5,858) | | FleetCor Technologies, Inc. | | (871,377) |

| | (14,817) | | Fortune Brands Home & Security, Inc. | | (830,345) |

| | (70,457) | | GenMark Diagnostics, Inc. | | (371,308) |

| | (29,810) | | Greenhill & Co., Inc. | | (661,782) |

| | (24,554) | | Gulfport Energy Corp. | | (695,860) |

| | (22,636) | | Healthcare Services Group, Inc. | | (833,231) |

| | (43,080) | | Heartland Express, Inc. | | (799,134) |

| | (18,063) | | HomeStreet, Inc. | | (375,891) |

| | (39,547) | | Inovalon Holdings, Inc., Class A | | (732,410) |

| | (21,589) | | Kennametal, Inc. | | (485,537) |

| | (25,330) | | Keysight Technologies, Inc. | | (702,654) |

| | (49,883) | | Krispy Kreme Doughnuts, Inc. | | (777,676) |

| | (16,822) | | La Jolla Pharmaceutical Co. | | (351,748) |

| | (130,874) | | Lattice Semiconductor Corp. | | (743,364) |

| | (10,379) | | Macquarie Infrastructure Corp. | | (699,960) |

| | (19,921) | | Marketo, Inc. | | (389,854) |

| | (10,132) | | MEDNAX, Inc. | | (654,730) |

| | (15,117) | | Mercury General Corp. | | (838,993) |

| | (23,940) | | Mobile Mini, Inc. | | (790,499) |

| | (39,799) | | Momenta Pharmaceuticals, Inc. | | (367,743) |

| | (10,758) | | Monro Muffler Brake, Inc. | | (768,874) |

| | (17,465) | | Natural Grocers by Vitamin Cottage, Inc. | | (371,481) |

| | (41,778) | | Nektar Therapeutics | | (574,447) |

| | (9,525) | | NetSuite, Inc. | | (652,367) |

| | (71,865) | | Nimble Storage, Inc. | | (563,422) |

| | (14,957) | | Northwest Natural Gas Co. | | (805,434) |

| | (43,673) | | NOW, Inc. | | (773,886) |

| | (29,426) | | OneBeacon Insurance Group, Ltd., Class A | | (374,593) |

| | (71,187) | | ORBCOMM, Inc. | | (721,124) |

| | (29,696) | | Party City Holdco, Inc. | | (446,628) |

| | (43,811) | | Performance Sports Group, Ltd. | | (139,319) |

| | (61,700) | | PGT, Inc. | | (607,128) |

| | (90,905) | | Platform Specialty Products Corp. | | (781,783) |

| | (11,147) | | Proto Labs, Inc. | | (859,322) |

| | (11,194) | | Puma Biotechnology, Inc. | | (328,768) |

| | (17,115) | | QTS Realty Trust, Inc., Class A REIT | | (810,909) |

| Shares | | Security Description | | Value |

| United States - (continued) |

| | (32,958) | | Raven Industries, Inc. | | $ | (527,987) |

| | (8,390) | | Restoration Hardware Holdings, Inc. | | (351,541) |

| | (9,851) | | RLI Corp. | | (658,638) |

| | (20,675) | | Royal Gold, Inc. | | (1,060,421) |

| | (64,145) | | Ruckus Wireless, Inc. | | (629,262) |

| | (19,694) | | Rush Enterprises, Inc., Class A | | (359,219) |

| | (37,085) | | Select Comfort Corp. | | (719,078) |

| | (14,855) | | Southside Bancshares, Inc. | | (387,270) |

| | (8,672) | | Spectrum Brands Holdings, Inc. | | (947,676) |

| | (89,377) | | Synergy Resources Corp. | | (694,459) |

| | (15,841) | | TESARO, Inc. | | (697,479) |

| | (31,993) | | Textura Corp. | | (596,030) |

| | (40,499) | | TFS Financial Corp. | | (703,468) |

| | (36,407) | | The Spectranetics Corp. | | (528,630) |

| | (20,109) | | TowneBank/Portsmouth VA | | (385,892) |

| | (18,360) | | Trex Co., Inc. | | (879,995) |

| | (15,500) | | Tupperware Brands Corp. | | (898,690) |

| | (21,238) | | Ultratech, Inc. | | (463,838) |

| | (14,904) | | UMB Financial Corp. | | (769,494) |

| | (12,674) | | Universal Display Corp. | | (685,663) |

| | (85,549) | | Valley National Bancorp | | (816,137) |

| | (34,419) | | Varonis Systems, Inc. | | (628,147) |

| | (12,574) | | ViaSat, Inc. | | (923,938) |

| | (26,848) | | Waddell & Reed Financial, Inc., Class A | | (632,002) |

| | (107,528) | | WPX Energy, Inc. | | (751,621) |

| | (22,160) | | Zayo Group Holdings, Inc. | | (537,158) |

| | (11,092) | | Zebra Technologies Corp. | | (765,348) |

| | | | | | (66,977,101) |

Total Common Stock

(Proceeds $(115,674,546)) | | (114,981,504) |

Total Short Positions - (93.7)%

(Proceeds $(115,674,546)) | | $ | (114,981,504) |

See Notes to Financial Statements. | 9 | LMCG FUNDS |

|

LMCG GLOBAL MARKET NEUTRAL FUND NOTES TO SCHEDULES OF INVESTMENTS AND SECURITIES SOLD SHORT MARCH 31, 2016 |

|

| LLC | Limited Liability Company |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | All or portion of these securities are held as collateral for securities sold short. |

| (b) | Non-income producing security. |

| (c) | Variable rate security. Rate presented is as of March 31, 2016. |

* Cost for federal income tax purposes is $12,169,923 and net unrealized appreciation consists of:

| Gross Unrealized Appreciation | | $ | 16,745,348 | |

| Gross Unrealized Depreciation | | | (14,216,082 | ) |

| Net Unrealized Appreciation | | $ | 2,529,266 | |

The following is a summary of the inputs used to value the Fund's investments and liabilities as of March 31, 2016.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets |

| Investments At Value |

| Common Stock | | | | | | | | | | | | | | | | |

| Australia | | $ | - | | | $ | 1,158,806 | | | $ | - | | | $ | 1,158,806 | |

| Austria | | | - | | | | 655,898 | | | | - | | | | 655,898 | |

| Bermuda | | | 850,923 | | | | - | | | | - | | | | 850,923 | |

| Finland | | | - | | | | 1,893,543 | | | | - | | | | 1,893,543 | |

| France | | | - | | | | 3,670,077 | | | | - | | | | 3,670,077 | |

| Germany | | | - | | | | 5,750,834 | | | | - | | | | 5,750,834 | |

| Israel | | | - | | | | 512,507 | | | | - | | | | 512,507 | |

| Italy | | | - | | | | 957,955 | | | | - | | | | 957,955 | |

| Japan | | | - | | | | 14,583,902 | | | | - | | | | 14,583,902 | |

| Netherlands | | | - | | | | 1,967,862 | | | | - | | | | 1,967,862 | |

| Norway | | | - | | | | 2,645,573 | | | | - | | | | 2,645,573 | |

| Puerto Rico | | | 1,024,971 | | | | - | | | | - | | | | 1,024,971 | |

| Spain | | | - | | | | 668,114 | | | | - | | | | 668,114 | |

| Sweden | | | - | | | | 1,996,113 | | | | - | | | | 1,996,113 | |

| Switzerland | | | - | | | | 4,434,561 | | | | - | | | | 4,434,561 | |

| Thailand | | | 687,049 | | | | - | | | | - | | | | 687,049 | |

| United Kingdom | | | - | | | | 5,561,007 | | | | - | | | | 5,561,007 | |

| United States | | | 65,295,742 | | | | - | | | | - | | | | 65,295,742 | |

| Money Market Fund | | | - | | | | 15,365,256 | | | | - | | | | 15,365,256 | |

| Total Investments At Value | | $ | 67,858,685 | | | $ | 61,822,008 | | | $ | - | | | $ | 129,680,693 | |

| Total Assets | | $ | 67,858,685 | | | $ | 61,822,008 | | | $ | - | | | $ | 129,680,693 | |

See Notes to Financial Statements. | 10 | LMCG FUNDS |

|

LMCG GLOBAL MARKET NEUTRAL FUND NOTES TO SCHEDULES OF INVESTMENTS AND SECURITIES SOLD SHORT MARCH 31, 2016 |

|

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Liabilities | | | | | | | | | | | | | | | | |

| Securities Sold Short | | | | | | | | | | | | | | | | |

| Common Stock | | | | | | | | | | | | | | | | |

| Austria | | $ | - | | | $ | (678,430 | ) | | $ | - | | | $ | (678,430 | ) |

| Bermuda | | | (1,362,751 | ) | | | (369,066 | ) | | | - | | | | (1,731,817 | ) |

| Canada | | | (719,554 | ) | | | - | | | | - | | | | (719,554 | ) |

| Denmark | | | - | | | | (1,025,026 | ) | | | - | | | | (1,025,026 | ) |

| Finland | | | - | | | | (656,198 | ) | | | - | | | | (656,198 | ) |

| France | | | - | | | | (4,321,036 | ) | | | - | | | | (4,321,036 | ) |

| Germany | | | - | | | | (3,014,545 | ) | | | - | | | | (3,014,545 | ) |

| Hong Kong | | | - | | | | (1,299,766 | ) | | | - | | | | (1,299,766 | ) |

| Italy | | | - | | | | (2,739,793 | ) | | | - | | | | (2,739,793 | ) |

| Japan | | | - | | | | (12,886,584 | ) | | | - | | | | (12,886,584 | ) |

| Netherlands | | | - | | | | (709,171 | ) | | | - | | | | (709,171 | ) |

| New Zealand | | | - | | | | (690,842 | ) | | | - | | | | (690,842 | ) |

| Norway | | | - | | | | (1,301,820 | ) | | | - | | | | (1,301,820 | ) |

| Spain | | | - | | | | (614,042 | ) | | | - | | | | (614,042 | ) |

| Sweden | | | - | | | | (4,149,036 | ) | | | - | | | | (4,149,036 | ) |

| Switzerland | | | - | | | | (4,485,580 | ) | | | - | | | | (4,485,580 | ) |

| United Kingdom | | | - | | | | (6,981,163 | ) | | | - | | | | (6,981,163 | ) |

| United States | | | (66,977,101 | ) | | | - | | | | - | | | | (66,977,101 | ) |

| Total Securities Sold Short | | $ | (69,059,406 | ) | | $ | (45,922,098 | ) | | $ | - | | | $ | (114,981,504 | ) |

| Total Liabilities | | $ | (69,059,406 | ) | | $ | (45,922,098 | ) | | $ | - | | | $ | (114,981,504 | ) |

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the year ended March 31, 2016.

At March 31, 2016, foreign securities representing the following percentage of net assets of the Fund were fair valued by independent pricing services and are classified as using Level 2 inputs within the valuation inputs disclosure on the Fund's Schedule of Investments:

LMCG Global Market Neutral Fund

Long Securities 37.86%

Short Securities (37.43)%

See Notes to Financial Statements. | 11 | LMCG FUNDS |

|

LMCG GLOBAL MARKET NEUTRAL FUND NOTES TO SCHEDULES OF INVESTMENTS AND SECURITIES SOLD SHORT MARCH 31, 2016 |

|

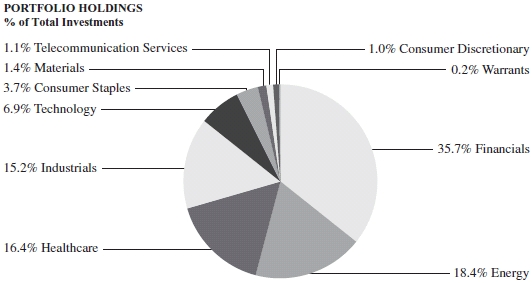

| PORTFOLIO HOLDINGS | | | | | |

| % of Total Investments | Long | | | Short | |

| Australia | 0.9 | % | | 0.0 | % |

| Austria | 0.5 | % | | 0.6 | % |

| Bermuda | 0.7 | % | | 1.5 | % |

| Canada | 0.0 | % | | 0.6 | % |

| Denmark | 0.0 | % | | 0.9 | % |

| Finland | 1.5 | % | | 0.6 | % |

| France | 2.9 | % | | 3.8 | % |

| Germany | 4.5 | % | | 2.6 | % |

| Hong Kong | 0.0 | % | | 1.1 | % |

| Israel | 0.4 | % | | 0.0 | % |

| Italy | 0.7 | % | | 2.4 | % |

| Japan | 11.4 | % | | 11.2 | % |

| Netherlands | 1.5 | % | | 0.6 | % |

| New Zealand | 0.0 | % | | 0.6 | % |

| Norway | 2.1 | % | | 1.1 | % |

| Puerto Rico | 0.8 | % | | 0.0 | % |

| Spain | 0.5 | % | | 0.5 | % |

| Sweden | 1.6 | % | | 3.6 | % |

| Switzerland | 3.4 | % | | 3.9 | % |

| Thailand | 0.5 | % | | 0.0 | % |

| United Kingdom | 4.3 | % | | 6.1 | % |

| United States | 61.8 | %* | | 58.3 | % |

| | 100.0 | % | | 100.0 | % |

* Includes Money Market Fund totaling 11.0%.

See Notes to Financial Statements. | 12 | LMCG FUNDS |

|

LMCG GLOBAL MARKET NEUTRAL FUND STATEMENT OF ASSETS AND LIABILITIES MARCH 31, 2016 |

|

| ASSETS | | | | |

| . | Total investments, at value (Cost $126,800,675) | | $ | 129,680,693 | |

| | Deposits with brokers | | | 104,764,509 | |

| | Cash | | | 2,151,023 | |

| | Foreign currency (Cost $6,001) | | | 6,350 | |

| | Receivables: | | | | |

| | | Fund shares sold | | | 1,047,635 | |

| | | Dividends | | | 287,231 | |

| | Prepaid expenses | | | 18,150 | |

| Total Assets | | | 237,955,591 | |

| | | | | | | |

| LIABILITIES | | | | |

| | Securities sold short, at value (Proceeds $115,674,546) | | | 114,981,504 | |

| | Payables: | | | | |

| | | Fund shares redeemed | | | 27,010 | |

| | | Dividends on securities sold short | | | 133,823 | |

| | Accrued Liabilities: | | | | |

| | | Investment adviser fees | | | 42,107 | |

| | | Trustees' fees and expenses | | | 75 | |

| | | Fund services fees | | | 14,894 | |

| | | Other expenses | | | 60,609 | |

| Total Liabilities | | | 115,260,022 | |

| | | | | | | |

| NET ASSETS | | $ | 122,695,569 | |

| | | | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| | Paid-in capital | | $ | 121,399,387 | |

| | Accumulated net investment loss | | | (625,956 | ) |

| | Accumulated net realized loss | | | (1,651,562 | ) |

| | Net unrealized appreciation | | | 3,573,700 | |

| NET ASSETS | | $ | 122,695,569 | |

| | | | | | | |

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | | | | |

| | Investor Shares | | | 1,406,767 | |

| | Institutional Shares | | | 9,722,387 | |

| | | | | | | |

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE | | | | |

| | Investor Shares (based on net assets of $15,467,880) | | $ | 11.00 | |

| | Institutional Shares (based on net assets of $107,227,689) | | $ | 11.03 | |

See Notes to Financial Statements. | 13 | LMCG FUNDS |

|

LMCG GLOBAL MARKET NEUTRAL FUND STATEMENT OF OPERATIONS YEAR ENDED MARCH 31, 2016 |

|

| INVESTMENT INCOME | | | | | |

| | Dividend income (Net of foreign withholding taxes of $102,157) | . | | $ | 1,322,559 | |

| | Interest income | | | 53,762 | |

| Total Investment Income | | | | 1,376,321 | |

| | | | | | |

| EXPENSES | | | | | |

| | Investment adviser fees | | | 851,695 | |

| | Fund services fees | | | 215,791 | |

| | Transfer agent fees: | | | | |

| | Investor Shares | | | 1,712 | |

| | Institutional Shares | | | 5,737 | |

| | Distribution fees: | | | | |

| | Investor Shares | | | 26,789 | |

| | Custodian fees | | | 565,830 | |

| | Registration fees: | | | | |

| | Investor Shares | | | 7,706 | |

| | Institutional Shares | | | 14,330 | |

| | Professional fees | | | 46,504 | |

| | Trustees' fees and expenses | | | 6,316 | |

| | Dividend expense on securities sold short | | | 1,318,757 | |

| | Miscellaneous expenses | | | 155,304 | |

| Total Expenses | | | | 3,216,471 | |

| | Fees waived | | | (508,217 | ) |

| Net Expenses | | | | 2,708,254 | |

| | | | | | | |

| NET INVESTMENT LOSS | | | | (1,331,933 | ) |

| | | | | | | |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | | | | |

| | Net realized gain (loss) on: | | | | |

| | Investments | | | (2,152,341 | ) |

| | Foreign currency transactions | | | (86,771 | ) |

| | Securities sold short | | | 1,330,524 | |

| | Net realized loss | | | (908,588 | ) |

| | Net change in unrealized appreciation (depreciation) on: | | | | |

| | Investments | | | (1,067,292 | ) |

| | Foreign currency translations | | | 2,486 | |

| | Securities sold short | | | 1,786,417 | |

| | Net change in unrealized appreciation (depreciation) | | | 721,611 | |

| NET REALIZED AND UNREALIZED LOSS | | | | (186,977 | ) |

| DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $ | (1,518,910 | ) |

| | | | | | | |

See Notes to Financial Statements. | 14 | LMCG FUNDS |

|

LMCG GLOBAL MARKET NEUTRAL FUND STATEMENTS OF CHANGES IN NET ASSETS |

|

| | | | | For the Year Ended March 31, 2016 | | | For the Year Ended March 31, 2015 |

| OPERATIONS | | | | | | | | | |

| | Net investment loss | | $ | (1,331,933 | ) | | | $ | (371,717 | ) |

| | Net realized gain (loss) | | | (908,588 | ) | | | | 35,228 | |

| | Net change in unrealized appreciation (depreciation) | | | 721,611 | | | | | 1,999,397 | |

| Increase (Decrease) in Net Assets Resulting from Operations | | | (1,518,910 | ) | | | | 1,662,908 | |

| | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | | |

| | Sale of shares: | | | | | | | | | |

| | | Investor Shares | | | 13,677,091 | | | | | 5,720,391 | |

| | | Institutional Shares | | | 58,496,549 | | | | | 46,594,732 | |

| | Redemption of shares: | | | | | | | | | |

| | | Investor Shares | | | (3,692,502 | ) | | | | (84,269 | ) |

| | | Institutional Shares | | | (8,269,340 | ) | | | | (1,291,828 | ) |

| | Redemption fees | | | - | | | | | 19 | |

| Increase in Net Assets from Capital Share Transactions | | | 60,211,798 | | | | | 50,939,045 | |

| Increase in Net Assets | | | 58,692,888 | | | | | 52,601,953 | |

| | | | | | | | | | | | |

| NET ASSETS | | | | | | | | | |

| | Beginning of Year | | | 64,002,681 | | | | | 11,400,728 | |

| | End of Year (Including line (a)) | | $ | 122,695,569 | | | | $ | 64,002,681 | |

| | | | | | | | | | | | |

| SHARE TRANSACTIONS | | | | | | | | | |

| | Sale of shares: | | | | | | | | | |

| | | Investor Shares | | | 1,224,668 | | | | | 521,198 | |

| | | Institutional Shares | | | 5,199,050 | | | | | 4,258,398 | |

| | Redemption of shares: | | | | | | | | | |

| | | Investor Shares | | | (331,429 | ) | | | | (7,670 | ) |

| | | Institutional Shares | | | (743,813 | ) | | | | (118,516 | ) |

| Increase in Shares | | | 5,348,476 | | | | | 4,653,410 | |

| | | | | | | | | | | | |

| (a) | Accumulated net investment loss | | $ | (625,956 | ) | | | $ | (214,742 | ) |

See Notes to Financial Statements. | 15 | LMCG FUNDS |

|

LMCG GLOBAL MARKET NEUTRAL FUND FINANCIAL HIGHLIGHTS |

|

These financial highlights reflect selected data for a share outstanding throughout each period. |

| | | For the Year Ended March 31, 2016 | | December 18, 2014 (a) Through March 31, 2015 | |

| INVESTOR SHARES | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 11.07 | | | $ | 10.87 | | |

| INVESTMENT OPERATIONS | | | | | | | | |

| Net investment loss (b) | | (0.20 | ) | | | (0.05 | ) | |

| Net realized and unrealized gain | | 0.13 | (c) | | 0.25 | | |

| Total from Investment Operations | | (0.07 | ) | | | 0.20 | | |

| NET ASSET VALUE, End of Period | $ | 11.00 | | | $ | 11.07 | | |

| TOTAL RETURN | | (0.63 | )% | | 1.84 | %(d) |

| | | | | | | | | |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | |

| Net Assets at End of Period (000's omitted) | $15,468 | | | $5,683 | | |

| Ratios to Average Net Assets: | | | | | | | | |

| Net investment loss | | (1.81 | )% | | (1.73 | )%(e) |

| Net expenses including dividend expenses | | 3.38 | % | | 3.30 | %(e) |

| Dividend expenses | | 1.53 | % | | 1.45 | %(e) |

| Net expenses without dividend expenses | | 1.85 | % | | 1.85 | %(e) |

| Gross expenses (f) | | 4.09 | % | | 5.73 | %(e) |

| PORTFOLIO TURNOVER RATE | | 124 | % | | 104 | %(d) |

| | | | | | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during each period. |

| (c) | Per share amount does not reflect the actual net realized and unrealized gain/(loss) for the year due to the timing of Fund share sales and the amount of per share realized and unrealized gains and losses at such time. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. | 16 | LMCG FUNDS |

|

LMCG GLOBAL MARKET NEUTRAL FUND FINANCIAL HIGHLIGHTS |

|

These financial highlights reflect selected data for a share outstanding throughout each period. |

| | | For the Year Ended March 31, 2016 | | For the Year Ended March 31, 2015 | | May 21, 2013 (a) Through March 31, 2014 | |

| INSTITUTIONAL SHARES | | | | | | | | | | | | |

| NET ASSET VALUE, Beginning of Period | $ | 11.07 | | | $ | 10.11 | | | $ | 10.00 | | |

| INVESTMENT OPERATIONS | | | | | | | | | | | | |

| Net investment loss (b) | | (0.17 | ) | | | (0.16 | ) | | | (0.11 | ) | |

| Net realized and unrealized gain | | 0.13 | (c) | | 1.12 | | | | 0.22 | | |

| Total from Investment Operations | | (0.04 | ) | | | 0.96 | | | | 0.11 | | |

| REDEMPTION FEES (b) | | — | | | | — | (d) | | — | | |

| NET ASSET VALUE, End of Period | $ | 11.03 | | | $ | 11.07 | | | $ | 10.11 | | |

| TOTAL RETURN | | (0.36 | )% | | 9.50 | % | | 1.10 | %(e) |

| | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTARY DATA | | | | | | | | | | | | |

| Net Assets at End of Period (000's omitted) | $107,228 | | | $58,320 | | | $11,401 | | |

| Ratios to Average Net Assets: | | | | | | | | | | | | |

| Net investment loss | | (1.53 | )% | | (1.49 | )% | | (1.27 | )%(f) |

| Net expenses including dividend expenses | | 3.15 | % | | 2.91 | % | | 2.94 | %(f) |

| Dividend expenses | | 1.55 | % | | 1.31 | % | | 1.34 | %(f) |

| Net expenses without dividend expenses | | 1.60 | % | | 1.60 | % | | 1.60 | %(f) |

| Gross expenses (g) | | 3.74 | % | | 4.63 | % | | 8.73 | %(f) |

| PORTFOLIO TURNOVER RATE | | 124 | % | | 104 | % | | 62 | %(e) |

| | | | | | | | | | | | | | |

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during each period. |

| (c) | Per share amount does not reflect the actual net realized and unrealized gain/(loss) for the year due to the timing of Fund share sales and the amount of per share realized and unrealized gains and losses at such time. |

| (d) | Less than $0.01 per share. |

| (e) | Not annualized. |

| (f) | Annualized. |

| (g) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements. | 17 | LMCG FUNDS |

|

LMCG GLOBAL MULTICAP FUND A MESSAGE TO OUR SHAREHOLDERS (Unaudited) MARCH 31, 2016 |

|

Dear Shareholder:

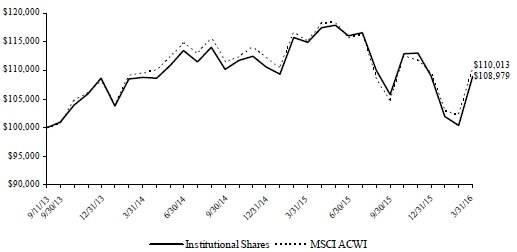

The last 12 months were extremely volatile for equity markets worldwide. A market surge in the second quarter of 2015 was abruptly reversed beginning in August, a possibility we discussed in our shareholder letter last year. The fall of global markets was severe, particularly in the December 2015 to February 2016 period, but reversed itself partially in the middle of the first quarter of 2016. In spite of a strong bounce back in equity markets from the low in February, the LMCG Global MultiCap Fund (the "Fund") finished the year ending March 31, 2016 down -5.11% versus -4.36% for its benchmark, the MSCI All Country World Investable Market Index.

The Fund strives to combine added value from both stock selection and asset allocation with the goal of producing more consistent and robust returns over time. This year, defense came from asset allocation while stock selection, particularly within the United States, produced stiff headwinds. Fortunately, the combination of the two offsetting forces prevented a significant lag during a year of decline, and we anticipate getting benefits from both approaches sooner rather than later.

The year was not without stock selection success stories. Information technology "beneficiaries" contributed significantly to the returns of the portfolio both in the United States and in Asia. Businesses that are technology beneficiaries include payroll processing, retail distribution, and financial services support applications; a number of stocks in these areas posted strong positive returns over the year. Companies that benefitted from lower energy and materials prices among American and European industrial conglomerates also posted strong gains. These businesses seem to be positioned well for a new, and long awaited, capital expenditure cycle. Low commodity prices will likely stimulate this economic activity in the medium term. However, near term, we sense that stress in the financial system is creating a great deal of uncertainty in stock and bond markets, and we are trying to balance our defense with our offense.

In contrast, the casualties of the collapse in energy and commodity prices were evident across the portfolio for the year. In last year's shareholder letter, we discussed the protection that non-U.S. investments provided against weaker oil prices. Additionally, fears of an economic decline in China created a simultaneous collapse of commodity prices along with oil and gas prices. This punished shares in Latin America, South Africa, Canada, Australia, and just about every region in the United States where extraction industries are based.

The fall in commodity prices likely created significant stress in credit markets as well. This not only impacted high yield bonds, but drove share prices of companies with high debt exposure sharply lower. Banks that lent to these industries suffered the double impact of debtor stress and falling interest rates.